| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-207340-11 | ||

May 11, 2018 FREE WRITING PROSPECTUS COLLATERAL TERM SHEET $730,421,807 (Approximate Total Mortgage Pool Balance) UBS 2018-C10 UBS Commercial Mortgage Securitization Corp. Depositor UBS AG Société Générale Cantor Commercial Real Estate Lending, L.P. KeyBank National Association Ladder Capital Finance LLC CIBC Inc. Sponsors and Mortgage Loan Sellers UBS Securities LLC Société Générale Cantor Fitzgerald & Co. Co-Lead Managers and Joint Bookrunners KeyBanc Capital Markets CIBC World Markets Drexel Hamilton Academy Securities Co-Managers The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-207340) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-877-713-1030 (8 a.m. – 5 p.m. EST). The offered certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale and ultimately by the final prospectus relating to the offered certificates. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) that have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of the offered certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the offered certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of UBS Securities LLC, SG Americas Securities, LLC, Cantor Fitzgerald & Co., KeyBanc Capital Markets Inc., CIBC World Markets Corp., Drexel Hamilton, LLC or Academy Securities, Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the offered certificates. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The offered certificates described herein are not suitable investments for all investors. In particular, you should not purchase any class of offered certificates unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with such class of certificates. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered certificates are subject to material variability from period to period and give rise to the potential for significant loss over the life of such certificates. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered certificates involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the certificates. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered certificates described in this free writing prospectus.

This free writing prospectus is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this free writing prospectus may not pertain to any securities that will actually be sold. The information contained in this free writing prospectus may be based on assumptions regarding market conditions and other matters as reflected in this free writing prospectus. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this free writing prospectus should not be relied upon for such purposes. The Underwriters and their respective affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this free writing prospectus may, from time to time, have long or short positions in, and buy or sell, the offered certificates mentioned in this free writing prospectus or derivatives thereof (including options). Information contained in this free writing prospectus is current as of the date appearing on this free writing prospectus only. None of UBS Securities LLC, SG Americas Securities, LLC, Cantor Fitzgerald & Co., KeyBanc Capital Markets Inc., CIBC World Markets Corp., Drexel Hamilton, LLC or Academy Securities, Inc. provides accounting, tax or legal advice.

2

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Other Risks Relating to the Certificates—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

3

UBS 2018-C10

Capitalized terms used but not defined herein have the meanings assigned to them in the preliminary prospectus expected to be dated May 16, 2018 relating to the offered certificates (hereinafter referred to as the “Preliminary Prospectus”).

| KEY FEATURES OF SECURITIZATION |

| Offering Terms: | ||

| Co-Lead Managers and Joint Bookrunners: | UBS Securities LLC SG Americas Securities, LLC Cantor Fitzgerald & Co. | |

| Co-Managers: | KeyBanc Capital Markets Inc. CIBC World Markets Corp. Drexel Hamilton, LLC Academy Securities, Inc. | |

| Mortgage Loan Sellers: | UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York (“UBS AG”) (25.9%), KeyBank National Association (“KeyBank”) (23.2%), Ladder Capital Finance LLC (“LCF”) (14.4%), Société Générale (“SG”) (13.9%), Cantor Commercial Real Estate Lending, L.P. (“CCRE”) (11.8%), and CIBC Inc. (“CIBC”) (10.7%) | |

| Master Servicer: | Wells Fargo Bank, National Association | |

| Operating Advisor: | Park Bridge Lender Services LLC | |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC | |

| Special Servicer: | Rialto Capital Advisors LLC | |

| Trustee: | Wilmington Trust, National Association | |

| Certificate Administrator: | Wells Fargo Bank, National Association | |

| Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc. and Moody’s Investors Service, Inc. | |

| U.S. Credit Risk Retention: | UBS AG is expected to act as the “retaining sponsor” for this securitization and intends to satisfy the U.S. credit risk retention requirement through the purchase by RREF III-D AIV RR H, LLC or an affiliate, as a “third party purchaser” (as defined in Regulation RR), from the initial purchasers, on the Closing Date, of an “eligible horizontal residual interest”. The aggregate estimated fair value of the “eligible horizontal residual interest” will equal at least 5% of the estimated fair value of all of the certificates issued by the issuing entity. The pooling and servicing agreement will include the required provisions applicable to an operating advisor necessary for the securitization to comply with the credit risk retention rules utilizing the “third party purchaser” option. For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. | |

| EU Credit Risk Retention: | The transaction isnot structured to satisfy the EU risk retention and due diligence requirements. | |

| Closing Date: | On or about May 30, 2018 | |

| Clean-up Call: | 1.0%

| |

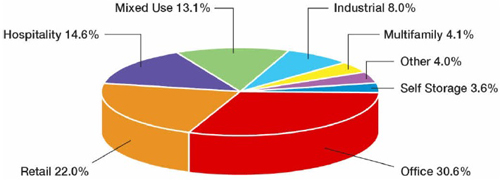

| Distribution of Collateral by Property Type | ||

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 4 |

UBS 2018-C10

| TRANSACTION HIGHLIGHTS |

| Distribution of Collateral by Property Type |

| Mortgage Loan Sellers | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate Cut-Off Date Balance | % of Initial Outstanding Pool Balance(1) |

| UBS AG | 14 | 24 | $189,535,174 | 25.9% |

| KeyBank National Association | 12 | 31 | $169,581,225 | 23.2% |

| Ladder Capital Finance LLC | 12 | 12 | $105,035,344 | 14.4% |

| Société Générale | 5 | 6 | $101,437,500 | 13.9% |

| Cantor Commercial Real Estate Lending, L.P. | 5 | 5 | $86,447,564 | 11.8% |

| CIBC Inc. | 9 | 9 | $78,385,000 | 10.7% |

| Total | 57 | 87 | $730,421,807 | 100.0% |

| Pooled Collateral Facts: | |

| Initial Outstanding Pool Balance: | $730,421,807 |

| Number of Mortgage Loans: | 57 |

| Number of Mortgaged Properties: | 87 |

| Number of Crossed Loans(2): | 2 |

| Crossed Mortgage Loans as a % of Pool Balance(2): | 1.7% |

| Average Mortgage Loan Cut-off Date Balance: | $12,814,418 |

| Average Mortgaged Property Cut-off Date Balance: | $8,395,653 |

| Weighted Average Mortgage Rate: | 5.115% |

| Weighted Average Mortgage Loan Original Term to Maturity Date or ARD (months)(3)(4): | 118 |

| Weighted Average Mortgage Loan Remaining Term to Maturity Date or ARD (months)(3)(4): | 118 |

| Weighted Average Mortgage Loan Seasoning (months)(4): | 0 |

| % of Mortgage Loans Secured by a Property or a Portfolio of Mortgaged Properties Leased to a Single Tenant: | 17.6% |

| Credit Statistics | |

| Weighted Average Mortgage Loan U/W NCF DSCR(2): | 1.73x |

| Weighted Average Mortgage Loan Cut-off Date LTV(2)(5): | 60.3% |

| Weighted Average Mortgage Loan Maturity Date or ARD LTV(2)(3)(5): | 55.2% |

| Weighted Average U/W NOI Debt Yield(2)(5): | 11.0% |

| Amortization Overview | |

| % Mortgage Loans which pay Interest Only through Maturity Date or ARD(3): | 45.5% |

| % Mortgage Loans with Amortization through Maturity Date or ARD(3): | 27.7% |

| % Mortgage Loans which pay Interest Only followed by Amortization through Maturity Date or ARD(3)(4): | 26.8% |

| Weighted Average Remaining Amortization Term (months)(6): | 350 |

| Loan Structural Features | |

| % Mortgage Loans with Upfront or Ongoing Tax Reserves: | 83.8% |

| % Mortgage Loans with Upfront or Ongoing Replacement Reserves(7): | 75.2% |

| % Mortgage Loans with Upfront or Ongoing Insurance Reserves: | 60.9% |

| % Mortgage Loans with Upfront or Ongoing TI/LC Reserves(8): | 78.3% |

| % Mortgage Loans with Upfront Engineering Reserves: | 33.7% |

| % Mortgage Loans with Upfront or Ongoing Other Reserves: | 55.2% |

| % Mortgage Loans with In Place Hard Lockboxes: | 55.9% |

| % Mortgage Loans with Cash Traps Triggered at DSCR Levels ≥ 1.05x: | 93.0% |

| % Mortgage Loans with Defeasance Only After a Lockout Period and Prior to an Open Period: | 73.4% |

| % Mortgage Loans with Prepayment with a Yield Maintenance Charge Only After a Lockout Period and Prior to an Open Period: | 26.3% |

| % Mortgage Loans with Prepayment with a Yield Maintenance Charge or Defeasance After a Prepayment with a Yield Maintenance Charge Period Prior to an Open Period: | 0.2% |

Please see footnotes on the following page.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 5 |

UBS 2018-C10

| TRANSACTION HIGHLIGHTS |

| (1) | Unless otherwise indicated, all references to “% of Outstanding Pool Balance” in this Term Sheet reflect a percentage of the aggregate principal balance of the mortgage pool as of the Cut-off Date, after application of all payments of principal due during or prior to May 2018. |

| (2) | With respect to any mortgage loan that is part of a whole loan, unless otherwise indicated, LTV, DSCR and Debt Yield calculations in this Term Sheet include any relatedpari passu companion loans and exclude any subordinate companion loans, as applicable. Additionally, LTV, DSCR and Debt Yield figures in this Term Sheet are calculated for mortgage loans without regard to any additional indebtedness that may be incurred at a future date. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with one or more other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable LTV, DSCR and Debt Yield calculations for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property securing such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher LTV, lower DSCR and/or lower Debt Yield than is presented herein. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (3) | For any mortgage loan with an anticipated repayment date, calculated to or as of, as applicable, that anticipated repayment date. |

| (4) | The Seasoning, Original Term and Stated Remaining Term (Mos.) includes an interest-only payment in June 2018 for any mortgage loan that has a scheduled first payment date in July 2018. |

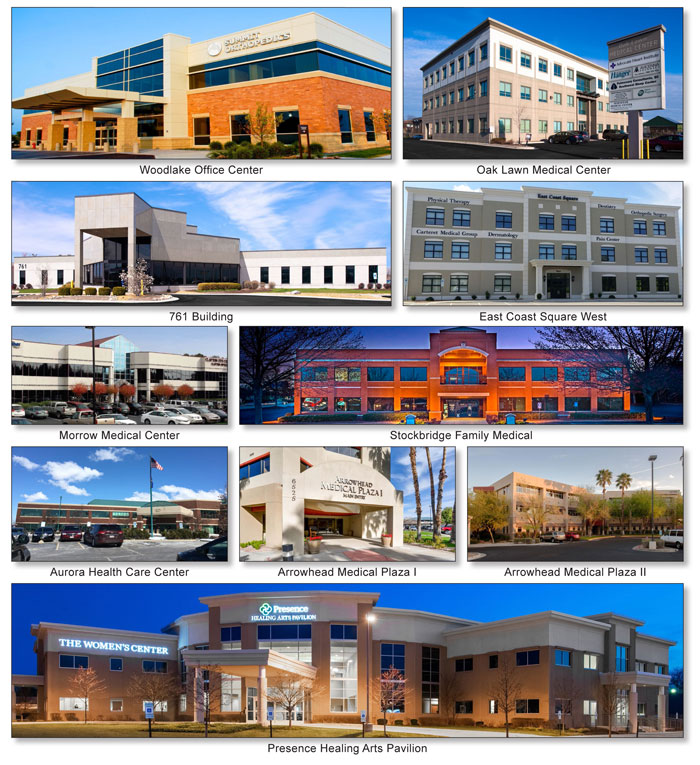

| (5) | With respect to the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as HTI Medical Office Portfolio, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the “As-Is Portfolio Value” conclusion of $207,000,000, which includes a portfolio premium to the portfolio properties if sold together on a bulk basis. The sum of the “As-Is” appraised values on a stand-alone basis is $199,775,000. The Cut-off Date LTV and Maturity Date or ARD LTV based on the appraised value representing the sum of the “As-Is” appraised values are 59.4% and 59.4%, respectively. With respect to the mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Island Pass Shopping Center, an earnout reserve in the amount of $205,000 was escrowed at origination. On any date occurring after origination, the lender is required to release the funds in the earnout reserve upon the borrower’s request provided that, at such time, among other things, the debt yield is equal to or greater than 8.4%. The Cut-off Date LTV, Maturity Date or ARD LTV, U/W NOI Debt Yield, and U/W NCF Debt Yield are net of the $205,000 holdback. The Cut-off Date LTV, Maturity Date or ARD LTV, U/W NOI Debt Yield, and U/W NCF Debt Yield are 64.1%, 53.4%, 8.5%, and 8.1%, respectively, based on the total mortgage loan amount without regard to the earnout reserve, respectively. |

| (6) | Excludes mortgage loans that are interest-only for the full loan term to maturity or anticipated repayment date. |

| (7) | Includes FF&E Reserves. |

| (8) | Represents the percent of the allocated aggregate principal balance of the mortgage pool as of the Cut-off Date of only the office, retail, industrial, and mixed use properties and the mortgaged property identified on the Annex A-1 as Drake Plaza Apartments. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 6 |

UBS 2018-C10

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Distribution of Cut-off Date Balances | ||||||||||

| Weighted Averages(1) | ||||||||||

| Range of Cut-off Date Balances | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) | ||

| $882,000 | - | $5,000,000 | 19 | $60,735,090 | 8.3% | 5.479% | 116 | 1.63x | 61.0% | 52.4% |

| $5,000,001 | - | $10,000,000 | 13 | $95,073,068 | 13.0% | 5.187% | 119 | 1.69x | 62.9% | 54.3% |

| $10,000,001 | - | $15,000,000 | 7 | $85,574,331 | 11.7% | 5.250% | 118 | 1.65x | 62.5% | 55.4% |

| $15,000,001 | - | $20,000,000 | 5 | $86,725,000 | 11.9% | 5.451% | 107 | 1.73x | 61.5% | 55.9% |

| $20,000,001 | - | $25,000,000 | 4 | $90,150,000 | 12.3% | 5.036% | 120 | 1.87x | 59.1% | 53.1% |

| $25,000,001 | - | $30,000,000 | 5 | $136,614,318 | 18.7% | 5.139% | 120 | 1.57x | 59.2% | 53.7% |

| $30,000,001 | - | $40,000,000 | 2 | $75,550,000 | 10.3% | 5.018% | 120 | 1.78x | 59.9% | 59.9% |

| $40,000,001 | - | $50,000,000 | 2 | $100,000,000 | 13.7% | 4.529% | 120 | 1.93x | 57.1% | 57.1% |

| Total/Weighted Average | 57 | $730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% | ||

| Distribution of Mortgage Rates | ||||||||||

| Weighted Averages(1) | ||||||||||

| Range of Mortgage Rates | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) | ||

| 4.3500% | - | 4.6000% | 6 | $136,287,500 | 18.7% | 4.534% | 120 | 2.02x | 58.8% | 57.3% |

| 4.6001% | - | 4.8000% | 4 | $85,377,000 | 11.7% | 4.704% | 119 | 1.83x | 60.6% | 57.7% |

| 4.8001% | - | 5.0000% | 7 | $73,390,000 | 10.0% | 4.921% | 119 | 1.86x | 59.8% | 56.5% |

| 5.0001% | - | 5.2000% | 7 | $98,515,000 | 13.5% | 5.074% | 120 | 1.64x | 59.5% | 56.6% |

| 5.2001% | - | 5.4000% | 11 | $172,606,107 | 23.6% | 5.307% | 120 | 1.50x | 60.9% | 53.2% |

| 5.4001% | - | 5.6000% | 9 | $74,621,344 | 10.2% | 5.496% | 119 | 1.64x | 60.1% | 51.9% |

| 5.6001% | - | 5.8000% | 5 | $26,464,000 | 3.6% | 5.659% | 120 | 1.41x | 68.7% | 58.2% |

| 5.8001% | - | 6.2680% | 8 | $63,160,856 | 8.6% | 6.008% | 98 | 1.79x | 59.5% | 51.7% |

| Total/Weighted Average | 57 | $730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% | ||

| Property Type Distribution(1) | |||||||||||

| Weighted Averages(1) | |||||||||||

| Property Type | Number of Mortgage Properties | Aggregate Cut-Off Date Balance | % of Initial Outstanding Pool Balance(1) | Number of Units/Rooms/Pads/ NRA/Beds/Spaces(7) | Cut-off Date Balance per Unit/Room/Pads NRA/Beds/Spaces(2) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | Occupancy | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) |

| Office | 38 | $223,475,000 | 30.6% | 2,809,719 | $180 | 5.082% | 115 | 92.6% | 1.76x | 59.0% | 57.3% |

| Suburban | 16 | $122,225,000 | 16.7% | 1,644,407 | $173 | 5.350% | 111 | 91.8% | 1.68x | 59.1% | 57.2% |

| CBD | 2 | $51,250,000 | 7.0% | 379,365 | $223 | 4.972% | 119 | 98.0% | 1.79x | 60.5% | 57.5% |

| Medical | 20 | $50,000,000 | 6.8% | 785,947 | $151 | 4.541% | 120 | 89.1% | 1.94x | 57.3% | 57.3% |

| Retail | 15 | $160,483,765 | 22.0% | 1,667,299 | $123 | 5.083% | 118 | 95.4% | 1.59x | 64.6% | 57.7% |

| Anchored | 9 | $136,919,564 | 18.7% | 1,535,578 | $104 | 5.002% | 119 | 94.8% | 1.62x | 65.5% | 58.6% |

| Single Tenant | 4 | $15,014,000 | 2.1% | 58,071 | $294 | 5.419% | 120 | 100.0% | 1.48x | 53.1% | 47.7% |

| Unanchored | 2 | $8,550,201 | 1.2% | 73,650 | $120 | 5.781% | 93 | 96.1% | 1.34x | 70.7% | 62.2% |

| Hospitality | 11 | $106,301,224 | 14.6% | 1,237 | $109,245 | 5.453% | 120 | 77.0% | 1.97x | 61.1% | 50.5% |

| Limited Service | 7 | $65,439,880 | 9.0% | 629 | $116,695 | 5.435% | 120 | 83.1% | 1.88x | 64.1% | 53.7% |

| Full Service | 3 | $29,486,344 | 4.0% | 503 | $93,064 | 5.738% | 120 | 60.4% | 2.11x | 53.0% | 42.3% |

| Extended Stay | 1 | $11,375,000 | 1.6% | 105 | $108,333 | 4.823% | 120 | 85.0% | 2.16x | 65.0% | 53.1% |

| Mixed Use | 5 | $95,730,000 | 13.1% | 167,087 | $1,106 | 4.757% | 120 | 98.7% | 1.77x | 55.0% | 54.6% |

| Office/Parking Garage/Retail | 1 | $44,610,000 | 6.1% | 58,750 | $759 | 4.516% | 120 | 100.0% | 1.92x | 56.8% | 56.8% |

| Multifamily/Retail | 2 | $31,395,000 | 4.3% | 31,773 | $1,028 | 5.037% | 120 | 100.0% | 1.44x | 52.7% | 52.7% |

| Office/Retail | 1 | $15,400,000 | 2.1% | 76,053 | $202 | 4.730% | 119 | 94.1% | 2.16x | 49.7% | 49.7% |

| Self Storage/MHC | 1 | $4,325,000 | 0.6% | 511 | $8,464 | 5.310% | 119 | 92.2% | 1.35x | 71.9% | 62.7% |

| Industrial | 7 | $58,706,818 | 8.0% | 1,193,516 | $87 | 5.316% | 119 | 96.3% | 1.72x | 63.0% | 54.5% |

| Flex | 2 | $33,156,818 | 4.5% | 423,661 | $126 | 5.160% | 119 | 93.5% | 1.80x | 67.7% | 56.8% |

| Manufacturing | 2 | $18,565,000 | 2.5% | 464,738 | $40 | 5.335% | 120 | 100.0% | 1.69x | 57.1% | 54.5% |

| Warehouse/Distribution | 3 | $6,985,000 | 1.0% | 305,117 | $28 | 6.006% | 120 | 100.0% | 1.41x | 56.2% | 43.5% |

| Multifamily | 4 | $30,020,000 | 4.1% | 510 | $72,596 | 5.114% | 119 | 95.5% | 1.46x | 67.4% | 61.3% |

| Garden | 3 | $26,340,000 | 3.6% | 432 | $76,147 | 5.054% | 119 | 96.3% | 1.47x | 68.0% | 62.6% |

| Mid Rise | 1 | $3,680,000 | 0.5% | 78 | $47,179 | 5.540% | 120 | 89.7% | 1.40x | 62.4% | 52.2% |

| Other | 2 | $29,390,000 | 4.0% | 1,370 | $21,527 | 5.222% | 120 | 18.3% | 1.54x | 49.9% | 40.4% |

| Parking Garage | 2 | $29,390,000 | 4.0% | 1,370 | $21,527 | 5.222% | 120 | 18.3% | 1.54x | 49.9% | 40.4% |

| Self Storage | 5 | $26,315,000 | 3.6% | 261,782 | $115 | 4.953% | 119 | 92.5% | 1.59x | 57.4% | 53.6% |

| Total/Weighted Average | 87 | $730,421,807 | 100.0% | 5.115% | 118 | 89.2% | 1.73x | 60.3% | 55.2% | ||

Please see footnotes on page 10.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 7 |

UBS 2018-C10

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Geographic Distribution(1) | ||||||||

| Weighted Averages(1) | ||||||||

| State/Location | Number of Mortgage Properties | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) |

| New York | 15 | $145,785,000 | 20.0% | 4.858% | 120 | 1.82x | 57.4% | 55.7% |

| Florida | 8 | $82,438,990 | 11.3% | 5.252% | 116 | 1.72x | 64.7% | 55.3% |

| Illinois | 5 | $51,413,810 | 7.0% | 4.787% | 120 | 2.09x | 54.6% | 51.0% |

| Texas | 10 | $51,104,040 | 7.0% | 5.581% | 98 | 1.61x | 59.0% | 54.4% |

| Michigan | 5 | $46,297,000 | 6.3% | 5.365% | 120 | 1.57x | 53.2% | 45.1% |

| Missouri | 4 | $41,166,344 | 5.6% | 5.245% | 120 | 1.75x | 59.3% | 55.8% |

| New Jersey | 1 | $40,000,000 | 5.5% | 5.318% | 120 | 1.60x | 63.0% | 63.0% |

| California | 5 | $39,644,396 | 5.4% | 5.115% | 119 | 1.71x | 56.1% | 50.6% |

| California – Northern(4) | 2 | $29,743,529 | 4.1% | 5.187% | 119 | 1.52x | 56.2% | 50.8% |

| California – Southern(4) | 3 | $9,900,866 | 1.4% | 4.898% | 119 | 2.28x | 55.9% | 49.9% |

| Washington | 2 | $38,157,331 | 5.2% | 5.424% | 120 | 1.35x | 65.6% | 54.8% |

| Colorado | 2 | $37,137,937 | 5.1% | 4.675% | 119 | 1.99x | 56.5% | 56.5% |

| Other | 30 | $157,276,960 | 21.5% | 5.106% | 119 | 1.67x | 65.1% | 58.0% |

| Total/Weighted Average | 87 | 730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% |

| Distribution of Cut-off Date LTV Ratios(2)(3) | ||||||||||

| Weighted Averages(1) | ||||||||||

| Range of Cut-off Date LTV Ratios | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) | ||

| 38.7% | - | 50.0% | 6 | $60,243,325 | 8.2% | 5.197% | 119 | 1.80x | 48.0% | 41.2% |

| 50.1% | - | 55.0% | 9 | $116,696,344 | 16.0% | 5.248% | 120 | 1.79x | 53.8% | 50.5% |

| 55.1% | - | 60.0% | 8 | $195,549,225 | 26.8% | 4.888% | 114 | 1.85x | 57.1% | 55.4% |

| 60.1% | - | 65.0% | 14 | $177,092,564 | 24.2% | 5.118% | 120 | 1.72x | 63.1% | 58.1% |

| 65.1% | - | 70.0% | 14 | $123,475,149 | 16.9% | 5.274% | 119 | 1.63x | 68.0% | 57.7% |

| 70.1% | - | 72.5% | 6 | $57,365,201 | 7.9% | 5.179% | 115 | 1.34x | 71.7% | 64.1% |

| Total/Weighted Average | 57 | $730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% | ||

| Distribution of Maturity Date or ARD LTV Ratios or ARD(2)(3)(5) | ||||||||||

| Weighted Averages(1) | ||||||||||

| Range of LTV Ratios at Maturity or ARD | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) | ||

| 36.7% | - | 40.0% | 5 | $44,893,325 | 6.1% | 5.450% | 120 | 1.60x | 47.6% | 37.7% |

| 40.1% | - | 50.0% | 12 | $103,510,568 | 14.2% | 5.331% | 119 | 1.84x | 54.3% | 47.0% |

| 50.1% | - | 55.0% | 10 | $129,437,564 | 17.7% | 5.137% | 120 | 1.63x | 58.4% | 53.6% |

| 55.1% | - | 60.0% | 19 | $323,191,149 | 44.2% | 4.967% | 116 | 1.83x | 62.2% | 57.4% |

| 60.1% | - | 65.0% | 6 | $97,275,000 | 13.3% | 5.243% | 119 | 1.58x | 64.4% | 62.8% |

| 65.1% | - | 70.0% | 5 | $32,114,201 | 4.4% | 4.955% | 112 | 1.37x | 72.2% | 66.8% |

| Total/Weighted Average | 57 | $730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% | ||

| Distribution of Underwritten NCF Debt Service Coverage Ratios(2) | ||||||||||

| Weighted Averages(1) | ||||||||||

| Range of Underwritten NCF Debt Service Coverage Ratios | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) | ||

| 1.20x | - | 1.30x | 2 | $29,822,564 | 4.1% | 5.253% | 120 | 1.26x | 63.4% | 52.5% |

| 1.31x | - | 1.40x | 15 | $129,655,201 | 17.8% | 5.278% | 118 | 1.34x | 64.8% | 58.3% |

| 1.41x | - | 1.50x | 5 | $71,200,000 | 9.7% | 5.268% | 119 | 1.46x | 54.3% | 46.0% |

| 1.51x | - | 1.60x | 9 | $85,326,331 | 11.7% | 5.376% | 119 | 1.58x | 64.7% | 60.7% |

| 1.61x | - | 1.70x | 4 | $54,744,318 | 7.5% | 5.573% | 99 | 1.65x | 64.4% | 57.1% |

| 1.71x | - | 1.80x | 4 | $61,181,225 | 8.4% | 5.099% | 119 | 1.75x | 60.6% | 56.9% |

| 1.81x | - | 1.90x | 3 | $17,986,344 | 2.5% | 5.340% | 119 | 1.87x | 52.6% | 46.8% |

| 1.91x | - | 2.00x | 4 | $144,550,000 | 19.8% | 4.623% | 120 | 1.95x | 57.7% | 57.0% |

| 2.01x | - | 2.25x | 6 | $84,775,000 | 11.6% | 4.936% | 120 | 2.09x | 57.1% | 53.1% |

| 2.26x | - | 2.50x | 4 | $48,680,825 | 6.7% | 5.147% | 120 | 2.35x | 58.5% | 49.9% |

| 2.51x | - | 2.90x | 1 | $2,500,000 | 0.3% | 4.350% | 117 | 2.90x | 49.0% | 49.0% |

| Total/Weighted Average | 57 | $730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% | ||

Please see footnotes on page 10.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 8 |

UBS 2018-C10

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Distribution of Original Terms to Maturity or ARD(5)(6) | ||||||||||

| Weighted Averages(1) | ||||||||||

| Range of Original Terms to Maturity or ARD | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) | ||

| 60 | 2 | $22,375,201 | 3.1% | 6.224% | 60 | 1.59x | 61.4% | 60.6% | ||

| 120 | - | 121 | 55 | $708,046,606 | 96.9% | 5.080% | 120 | 1.73x | 60.2% | 55.0% |

| Total/Weighted Average | 57 | $730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% | ||

| Distribution of Remaining Terms to Maturity or ARD(5)(6) | ||||||||||

| Weighted Averages(1) | ||||||||||

| Range of Remaining Terms to Maturity or ARD | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) | ||

| 59 | - | 60 | 2 | $22,375,201 | 3.1% | 6.224% | 60 | 1.59x | 61.4% | 60.6% |

| 116 | - | 121 | 55 | $708,046,606 | 96.9% | 5.080% | 120 | 1.73x | 60.2% | 55.0% |

| Total/Weighted Average | 57 | $730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% | ||

| Distribution of Underwritten NOI Debt Yields(2)(3) | ||||||||||

| Weighted Averages(1) | ||||||||||

| Range of Underwritten NOI Debt Yields | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) | ||

| 6.9% | - | 8.5% | 3 | $41,795,000 | 5.7% | 5.032% | 119 | 1.42x | 57.4% | 57.4% |

| 8.6% | - | 9.0% | 10 | $159,901,564 | 21.9% | 4.958% | 120 | 1.57x | 62.0% | 58.6% |

| 9.1% | - | 9.5% | 4 | $43,565,000 | 6.0% | 5.163% | 120 | 1.62x | 64.4% | 61.1% |

| 9.6% | - | 10.0% | 5 | $51,300,000 | 7.0% | 5.406% | 119 | 1.37x | 65.7% | 56.9% |

| 10.1% | - | 10.5% | 5 | $105,245,201 | 14.4% | 4.800% | 117 | 1.89x | 57.2% | 56.7% |

| 10.6% | - | 11.0% | 4 | $62,375,000 | 8.5% | 5.459% | 102 | 1.69x | 53.3% | 48.2% |

| 11.1% | - | 11.5% | 6 | $79,020,000 | 10.8% | 5.102% | 120 | 1.75x | 57.1% | 52.8% |

| 11.6% | - | 12.0% | 4 | $56,503,649 | 7.7% | 5.282% | 118 | 1.64x | 67.4% | 56.4% |

| 12.1% | - | 13.0% | 1 | $2,500,000 | 0.3% | 4.350% | 117 | 2.90x | 49.0% | 49.0% |

| 13.1% | - | 13.5% | 2 | $8,600,000 | 1.2% | 5.583% | 120 | 1.63x | 66.5% | 50.8% |

| 13.6% | - | 20.2% | 13 | $119,616,393 | 16.4% | 5.219% | 120 | 2.12x | 60.0% | 50.7% |

| Total/Weighted Average | 57 | $730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% | ||

| Amortization Types(6) | ||||||||

| Weighted Averages(1) | ||||||||

| Amortization Type | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) |

| Full IO | 14 | $317,970,000 | 43.5% | 4.909% | 116 | 1.83x | 57.5% | 57.5% |

| Amortizing | 23 | $202,508,307 | 27.7% | 5.468% | 119 | 1.66x | 60.1% | 49.0% |

| Partial IO | 17 | $195,914,500 | 26.8% | 5.052% | 119 | 1.63x | 65.4% | 58.0% |

| Full IO, ARD | 3 | $14,029,000 | 1.9% | 5.554% | 120 | 1.70x | 54.6% | 54.6% |

| Total/Weighted Average | 57 | $730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% |

| Loan Purposes | ||||||||

| Weighted Averages(1) | ||||||||

| Loan Purpose | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(5)(6) | U/W NCF DSCR(2) | Cut-off Date LTV Ratio(2)(3) | Maturity Date or ARD LTV Ratio(2)(3)(5) |

| Refinance | 38 | $519,538,211 | 71.1% | 5.212% | 117 | 1.69x | 60.1% | 54.5% |

| Acquisition | 17 | $148,618,596 | 20.3% | 4.943% | 117 | 1.80x | 62.8% | 57.3% |

| Recapitalization | 2 | $62,265,000 | 8.5% | 4.716% | 120 | 1.88x | 55.9% | 55.9% |

| Total/Weighted Average | 57 | $730,421,807 | 100.0% | 5.115% | 118 | 1.73x | 60.3% | 55.2% |

Please see footnotes on page 10.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 9 |

UBS 2018-C10

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| (1) | All numerical information concerning the mortgage loans is approximate and, in the case of mortgage loans secured by multiple properties, is based on allocated loan amounts with respect to such properties. All weighted average information regarding the mortgage loans reflects the weighting of the mortgage loans based on their outstanding principal balances as of the Cut-off Date or, in the case of mortgage loans secured by multiple properties, allocated loan amounts. The sum of numbers and percentages in columns may not match the “Total” due to rounding. |

| (2) | With respect to any mortgage loan that is part of a whole loan, unless otherwise indicated, Balance per Unit/Room/Pad/NRA/Spaces, LTV, DSCR and Debt Yield calculations in this Term Sheet include any relatedpari passu companion loans and exclude any subordinate companion loans, as applicable. Additionally, Balance per Unit/Room/Pad/NRA/Spaces, LTV, DSCR and Debt Yield figures in this Term Sheet are calculated for mortgage loans without regard to any additional indebtedness that may be incurred at a future date. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with one or more other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable LTV, DSCR and Debt Yield calculations for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property securing such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher LTV, lower DSCR and/or lower Debt Yield than is presented herein. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (3) | With respect to the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as HTI Medical Office Portfolio, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the "As-Is Portfolio Value" conclusion of $207,000,000, which includes a portfolio premium to the portfolio properties if sold together on a bulk basis. The sum of the “As-Is” appraised values on a stand-alone basis is $199,775,000. The Cut-off Date LTV and Maturity Date or ARD LTV based on the appraised value representing the sum of the “As-Is” appraised values are 59.4% and 59.4%, respectively. With respect to the mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Island Pass Shopping Center, an earnout reserve in the amount of $205,000 was escrowed at origination. On any date occurring after origination, the lender is required to release the funds in the earnout reserve upon the borrower’s request provided that, at such time, among other things, the debt yield is equal to or greater than 8.4%. The Cut-off Date LTV, Maturity Date or ARD LTV, U/W NOI Debt Yield, and U/W NCF Debt Yield are net of the $205,000 holdback. The Cut-off Date LTV, Maturity Date or ARD LTV, U/W NOI Debt Yield, and U/W NCF Debt Yield are 64.1%, 53.4%, 8.5%, and 8.1%, respectively, based on the total mortgage loan amount without regard to the earnout reserve, respectively. |

| (4) | “California—Northern” includes zip codes above 93600, and “California—Southern” includes zip codes at or below 93600. |

| (5) | With respect to an ARD loan, refers to the term through the related anticipated repayment date. |

| (6) | The Original Term and Stated Remaining Term (Mos.) includes an interest-only payment in June 2018 for any mortgage loan that has a scheduled first payment date in July 2018. |

| (7) | With respect to the mortgaged property identified on Annex A-1 as ICON Parking Garage that is part of the NYC REIT Mixed-Use Portfolio Mortgage Loan, the Balance per Unit/Room/Pad/NRA/Beds/Spaces is based off of 284 parking spaces while the mortgaged property was underwritten to 61,475 sq. ft. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 10 |

UBS 2018-C10

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Ten Largest Mortgage Loans | |||||||||||

| Mortgage Loan | Mortgage Loan Seller | City, State | Property Type | Cut-off Date Balance | % of Initial Outstanding Pool Balance | Cut-off Date Balance per Unit/Room/ Pad/NRA/Spaces(1)(3) | Cut-off Date LTV Ratio(1)(2) | U/W NCF DSCR(1) | U/W NOI Debt Yield(1) | ||

| NYC REIT Mixed-Use Portfolio | SG | New York, NY | Various | $50,000,000 | 6.8% | Various | 56.8% | 1.92x | 8.8% | ||

| HTI Medical Office Portfolio | KeyBank | Various, Various | Office | $50,000,000 | 6.8% | $151 | 57.3% | 1.94x | 10.3% | ||

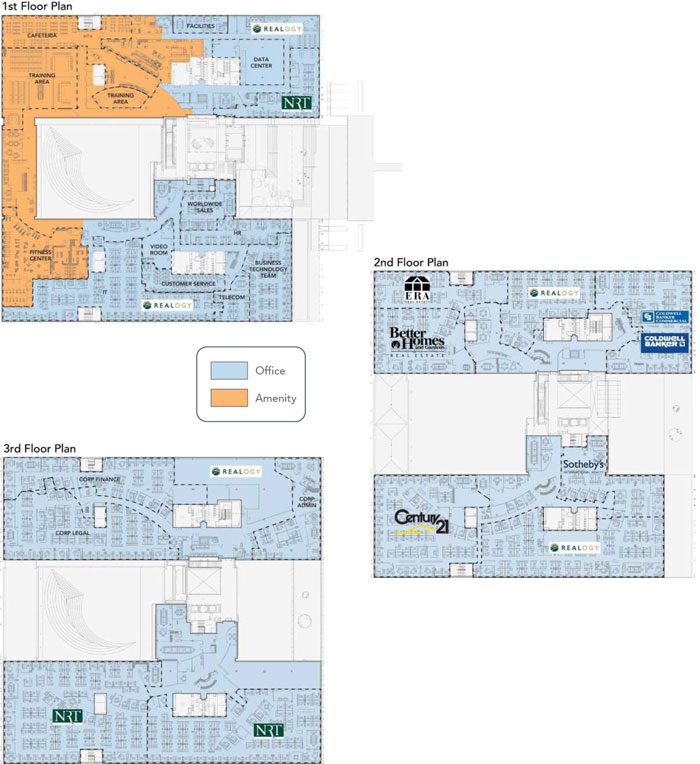

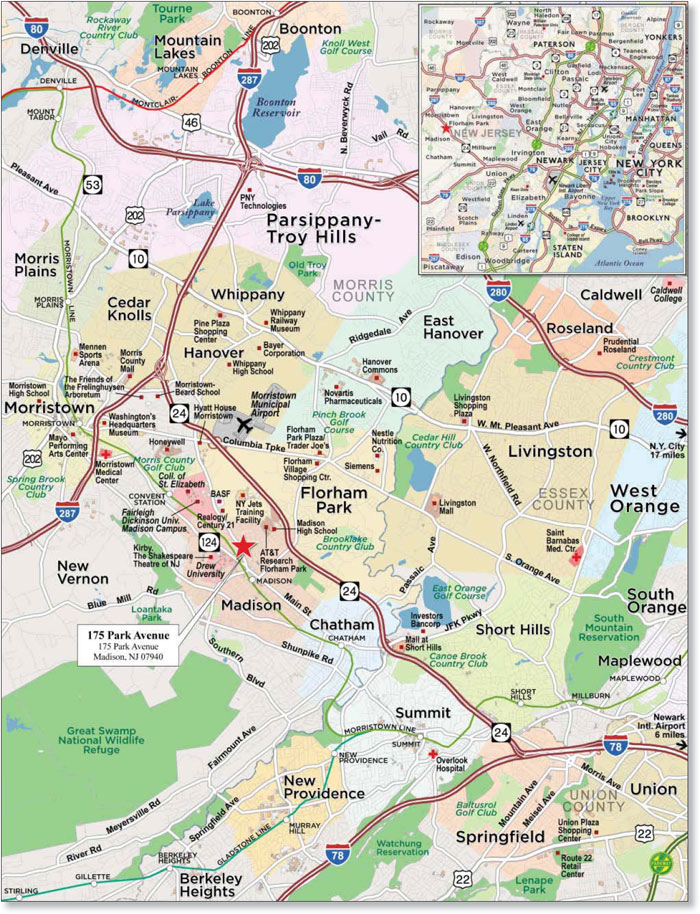

| 175 Park Avenue | CCRE | Madison, NJ | Office | $40,000,000 | 5.5% | $315 | 63.0% | 1.60x | 8.9% | ||

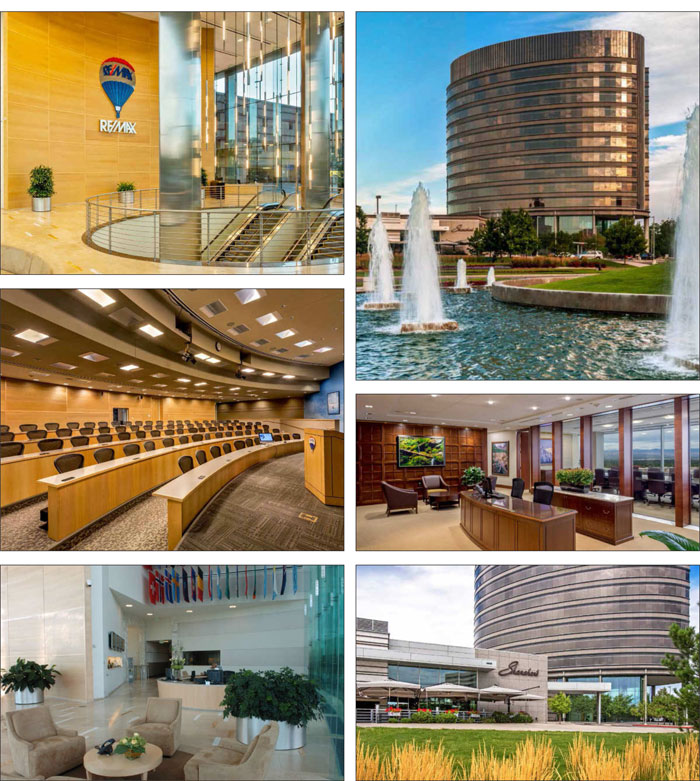

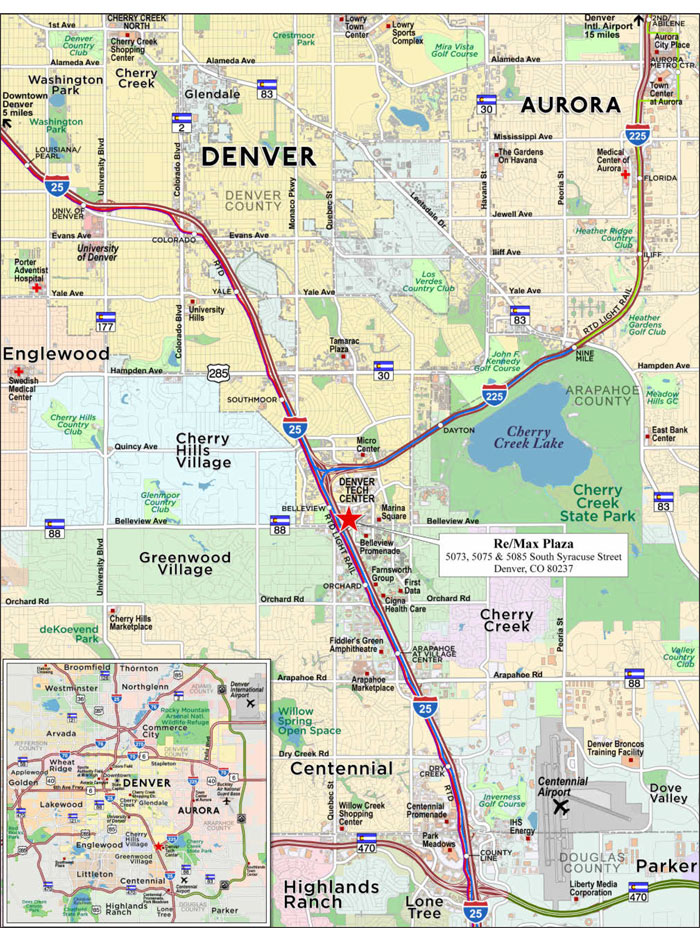

| Re/Max Plaza | LCF | Denver, CO | Office | $35,550,000 | 4.9% | $270 | 56.5% | 1.99x | 10.1% | ||

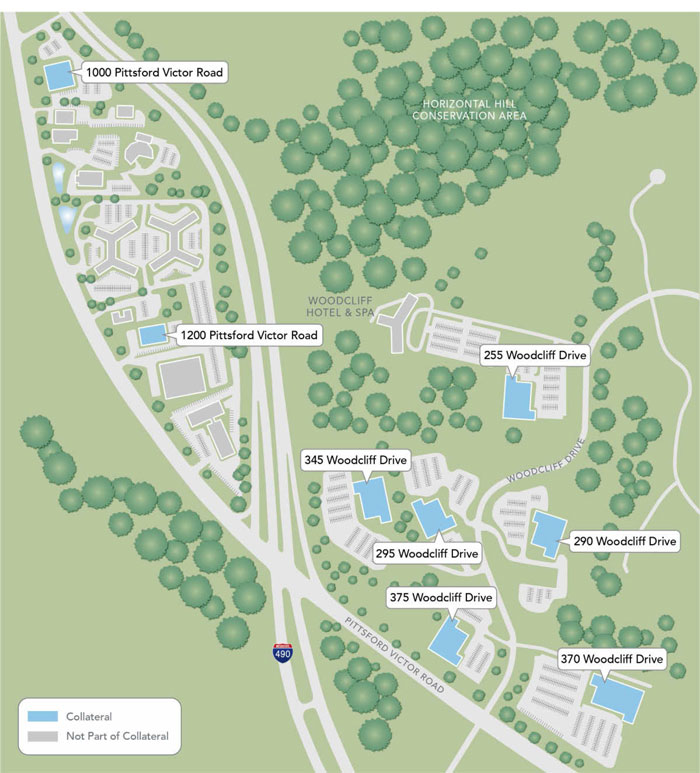

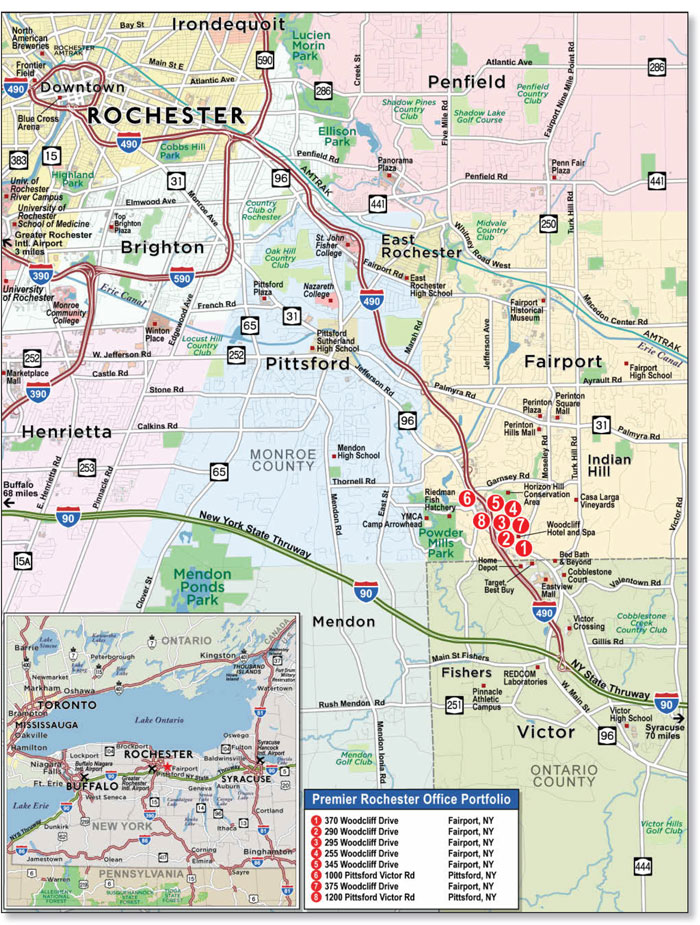

| Premier Rochester Office Portfolio | UBS AG | Various, NY | Office | $30,000,000 | 4.1% | $88 | 54.6% | 2.07x | 11.1% | ||

| 130 Orchard Street | CCRE | New York, NY | Mixed Use | $27,795,000 | 3.8% | $1,085 | 54.5% | 1.34x | 6.9% | ||

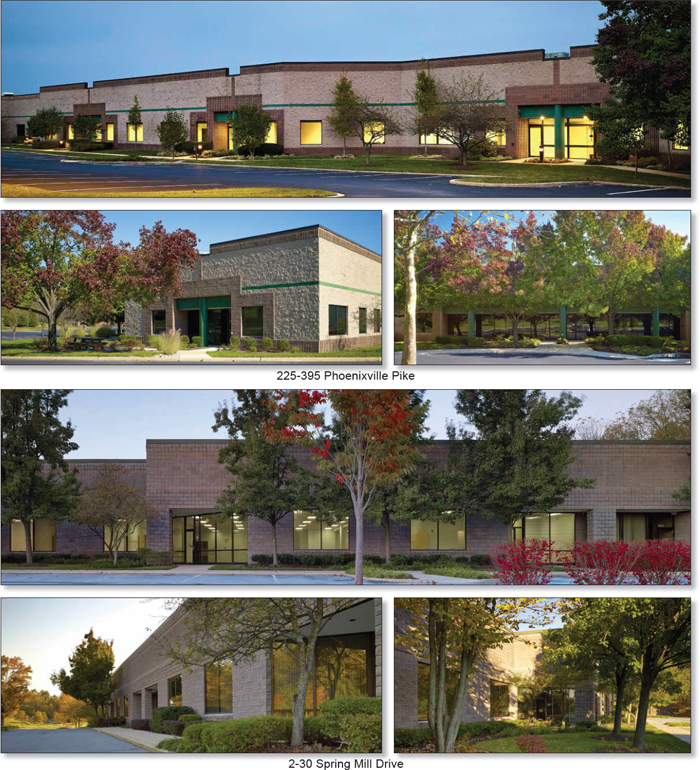

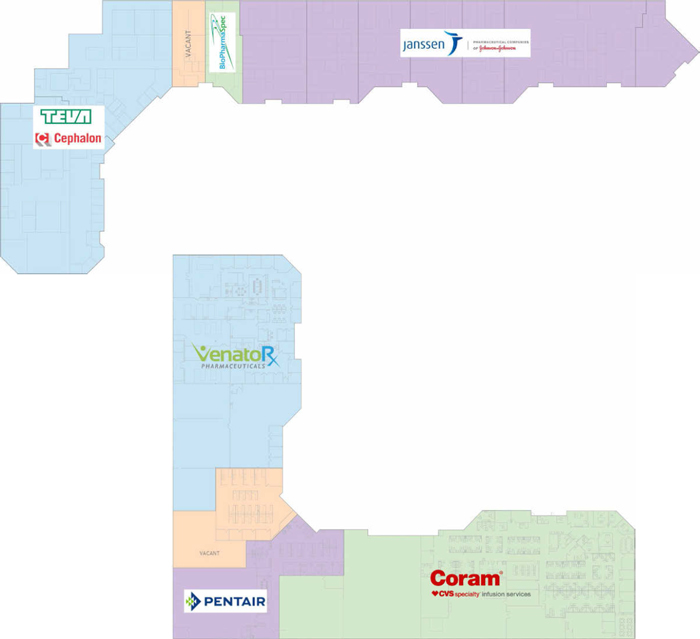

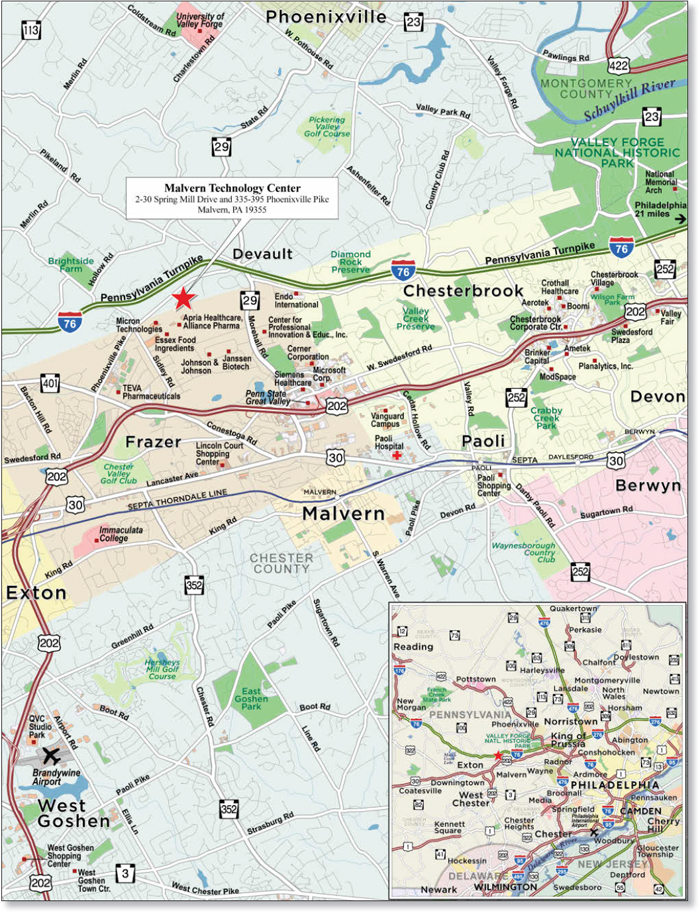

| Malvern Technology Center | UBS AG | Malvern, PA | Industrial | $26,969,318 | 3.7% | $149 | 67.8% | 1.65x | 12.0% | ||

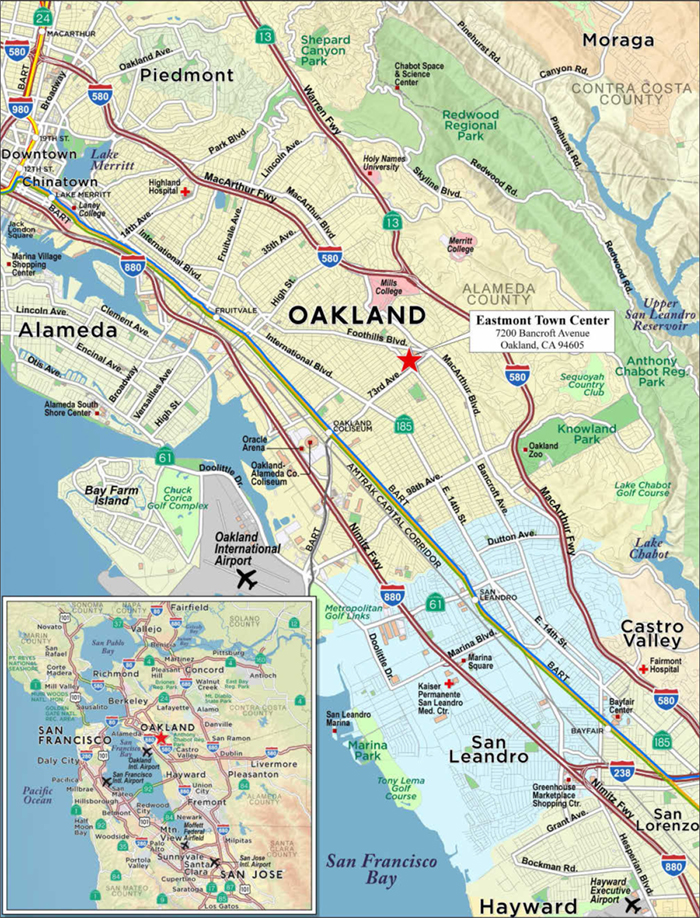

| Eastmont Town Center | UBS AG | Oakland, CA | Office | $26,000,000 | 3.6% | $108 | 56.0% | 1.46x | 11.1% | ||

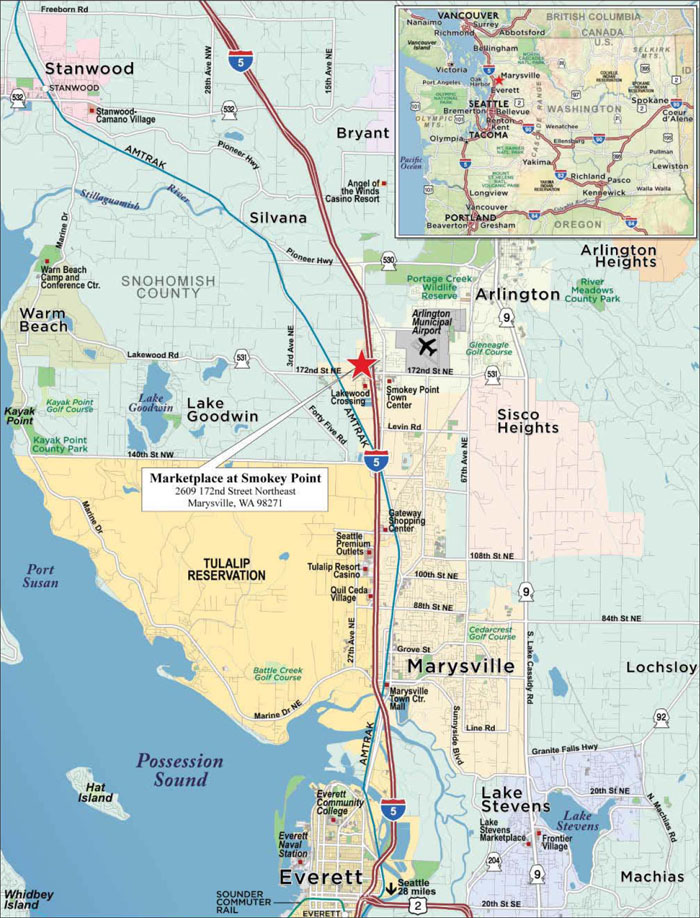

| Marketplace at Smokey Point | KeyBank | Marysville, WA | Retail | $25,850,000 | 3.5% | $139 | 63.8% | 1.27x | 9.0% | ||

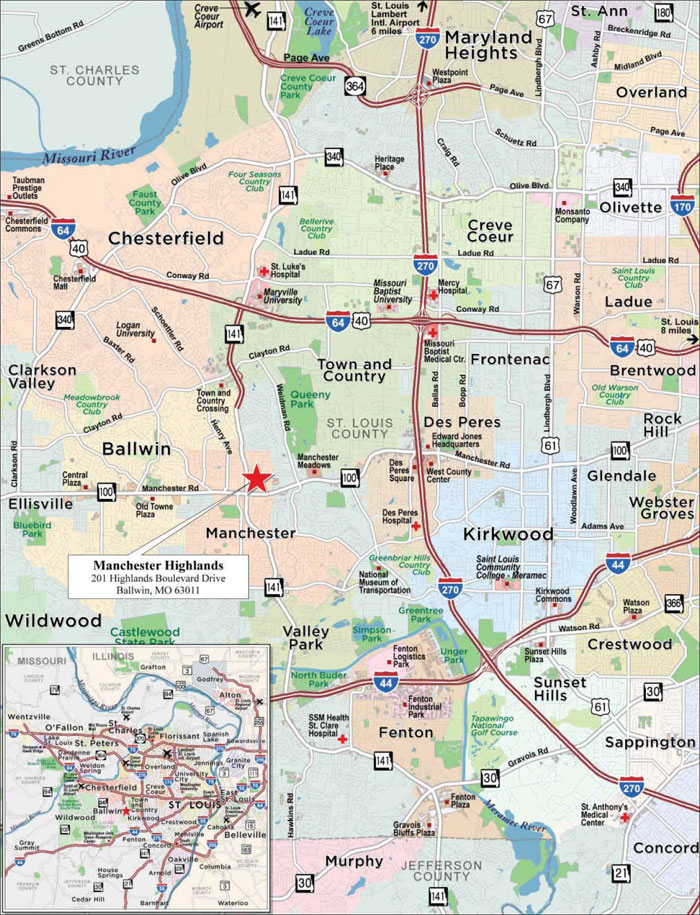

| Manchester Highlands | CIBC | Ballwin, MO | Retail | $25,000,000 | 3.4% | $99 | 62.7% | 1.73x | 9.4% | ||

| Total/Weighted Average | $337,164,318 | 46.2% | 59.0% | 1.74x | 9.7% | ||||||

| (1) | With respect to any mortgage loan that is part of a whole loan, unless otherwise indicated, all LTV Ratio, U/W NCF DSCR, Debt Yield and Balance per Unit/Room/Pad/NRA/Spaces calculations in this Term Sheet include any relatedpari passu companion loans and exclude any subordinate companion loans, as applicable. Additionally, LTV Ratio, U/W NCF DSCR, Debt Yield and Balance per Unit/Room/Pad/NRA figures in this Term Sheet are calculated for mortgage loans without regard to any additional indebtedness that may be incurred at a future date. |

| (2) | With respect to the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as HTI Medical Office Portfolio, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the "As-Is Portfolio Value" conclusion of $207,000,000, which includes a portfolio premium to the portfolio properties if sold together on a bulk basis. The sum of the “As-Is” appraised values on a stand-alone basis is $199,775,000. The Cut-off Date LTV and Maturity Date or ARD LTV based on the appraised value representing the sum of the “As-Is” appraised values are 59.4% and 59.4%, respectively. |

| (3) | With respect to the mortgage loan secured by the portfolio of mortgaged properties NYC REIT Mixed-Use Portfolio, the Cut-off Date Balance per Unit/Room/Pad/NRA/Spaces was calculated using square footage for the Laurel property and parking spaces for the ICON Parking Garage property. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 11 |

UBS 2018-C10

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Pari Passu Companion Loan Summary | ||||||

| Mortgage Loan | Note(s) | Original Balance | Holder of Note(1) | Lead Servicer for Whole Loan (Y/N) | Master Servicer Under Lead Securitization | Special Servicer Under Lead Securitization |

| HTI Medical Office Portfolio(2) | A-2 | $50,000,000 | UBS 2018-C10 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-1 (controlling), A-3 | $68,700,000 | KeyBank | Yes | |||

| 175 Park Avenue(3) | A-2, A-3, A-4, | $40,000,000 | UBS 2018-C10 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-1 (controlling), A-5, A-6 | $45,000,000 | CCRE | Yes | |||

| Re/Max Plaza | A-1 (controlling) | $35,550,000 | UBS 2018-C10 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-2, A-3 | $30,000,000 | WFCM 2018-C44(4) | No | |||

| Premier Rochester Office Portfolio | A-1 (controlling), A-3, | $30,000,000 | UBS 2018-C10 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors LLC |

| A-2, A-4 | $24,000,000 | UBS AG | No | |||

| Eastmont Town Center | A-3, A-4, A-5, A-6 | $26,000,000 | UBS 2018-C10 | No | Midland Loan Services, a Division of PNC Bank, National Association | Rialto Capital Advisors, LLC |

| A-1 (controlling), A-2 | $30,000,000 | UBS 2018-C9 | Yes | |||

| Manchester Highlands | A-1 (controlling) | $25,000,000 | UBS 2018-C10 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-2 | $10,000,000 | CIBC | No | |||

| Hilton Branson Convention Center(5) | A-2 | $7,100,000 | UBS 2018-C10 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-1 (controlling) | $10,650,000 | LCF | Yes | |||

| Hilton Branson Promenade(5) | A-2 | $5,400,000 | UBS 2018-C10 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-1 (controlling) | $8,100,000 | LCF | Yes | |||

| (1) | Identifies the expected holder as of the Closing Date. |

| (2) | The HTI Medical Office Portfolio Whole Loan is expected to initially be serviced under the UBS 2018-C10 pooling and servicing agreement until the securitization of the related controlling pari passu Note A-1, after which the HTI Medical Office Portfolio Whole Loan will be serviced under the pooling and servicing agreement related to the securitization of the related controllingpari passu Note A-1 (the “HTI Medical Office Portfolio Servicing Shift PSA”). The master servicer and special servicer under the HTI Medical Office Portfolio Servicing Shift PSA will be identified in a notice, report or statement to holders of the UBS 2018-C10 certificates after the securitization of the related controllingpari passu Note A-1. |

| (3) | The 175 Park Avenue Whole Loan is expected to initially be serviced under the UBS 2018-C10 pooling and servicing agreement until the securitization of the related controlling pari passu Note A-1, after which the 175 Park Avenue Whole Loan will be serviced under the pooling and servicing agreement related to the securitization of the related controlling pari passu Note A-1 (the “175 Park Avenue Servicing Shift PSA”). The master servicer and special servicer under the 175 Park Avenue Servicing Shift PSA will be identified in a notice, report or statement to holders of the UBS 2018-C10 certificates after the securitization of the related controlling pari passu Note A-1. |

| (4) | The WFCM 2018-C44 securitization is expected to close on or about May 17, 2018. |

| (5) | The Hilton Branson Convention Center and Hilton Branson Promenade Whole Loans are cross-collateralized and cross-defaulted with each other and are currently subject to a single Intercreditor Agreement that effectively treats them as a single Whole Loan. The Hilton Branson Convention Center Whole Loan and the Hilton Branson Promenade Whole Loan are each expected to initially be serviced under the UBS 2018-C10 pooling and servicing agreement until the securitization of the Hilton Branson Convention Center controlling pari passu Note A-1, after which the Hilton Branson Convention Center Whole Loan and the Hilton Branson Promenade Whole Loan will each be serviced under the pooling and servicing agreement related to the securitization of the Hilton Branson Convention Center controlling pari passu Note A-1 (the “Hilton Branson Convention Center and Hilton Branson Promenade Servicing Shift PSA”). The master servicer and special servicer under the Hilton Branson Convention Center and Hilton Branson Promenade Servicing Shift PSA will be identified in a notice, report or statement to holders of the UBS 2018-C10 certificates after the securitization of the Hilton Branson Convention Center controlling pari passu Note A-1. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 12 |

UBS 2018-C10

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Previous Securitization History(1) | ||||||

| Mortgage Loan | Mortgage Loan Seller | City, State | Property Type | Cut-off Date Balance | % of Initial Outstanding Pool Balance | Previous Securitization(s) |

| 175 Park Avenue | CCRE | Madison, NJ | Office | $40,000,000 | 5.5% | COMM 2013-CCRE8 |

| Malvern Technology Center | UBS AG | Malvern, PA | Industrial | $26,969,318 | 3.7% | BSPRT 2017-FL1 |

| Eastmont Town Center | UBS AG | Oakland, CA | Office | $26,000,000 | 3.6% | CGCMT 2015 GC-29; JPMBB 2015 C-32 |

| Kinzie Design Center | KeyBank | Chicago, IL | Mixed Use | $15,400,000 | 2.1% | DBUBS 2011-LC3A |

| River Place Shopping Center | UBS AG | Sevierville, TN | Retail | $13,950,000 | 1.9% | WBCMT 2007-C34 |

| (1) | Includes mortgage loans for which all or a portion of the previously existing debt was most recently securitized in one or more conduit securitizations, based on information provided by the related borrower or obtained through searches of a third-party database. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 13 |

| New York, NY | Collateral Asset Summary – Loan No. 1 NYC REIT Mixed-Use Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $50,000,000 56.8% 1.92x 8.8% |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 14 |

| New York, NY | Collateral Asset Summary – Loan No. 1 NYC REIT Mixed-Use Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $50,000,000 56.8% 1.92x 8.8% |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 15 |

| New York, NY | Collateral Asset Summary – Loan No. 1 NYC REIT Mixed-Use Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $50,000,000 56.8% 1.92x 8.8% |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 16 |

| New York, NY | Collateral Asset Summary – Loan No. 1 NYC REIT Mixed-Use Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $50,000,000 56.8% 1.92x 8.8% |

| Mortgage Loan Information | Property Information | ||||||

| Mortgage Loan Seller: | Société Générale | Single Asset/Portfolio: | Portfolio | ||||

| Credit Assessment (Fitch/KBRA/Moody’s): | NR/NR/NR | Location: | New York, NY | ||||

| General Property Type: | Mixed Use | ||||||

| Original Balance: | $50,000,000 | Detailed Property Type: | Office/Parking Garage/Retail | ||||

| Cut-off Date Balance: | $50,000,000 | Title Vesting: | Fee | ||||

| % of Initial Pool Balance: | 6.8% | Year Built/Renovated: | Various/N/A | ||||

| Loan Purpose(1): | Recapitalization | Size(4): | 120,225 SF | ||||

| Borrower Sponsor: | New York City Operating Partnership, L.P. | Cut-off Date Balance per SF(4): | $416 | ||||

| Mortgage Rate: | 4.5160% | Maturity Date Balance per SF(4): | $416 | ||||

| Note Date: | 4/13/2018 | Property Manager: | New York City Properties, LLC (borrower-related) | ||||

| First Payment Date: | 6/1/2018 | ||||||

| Maturity Date: | 5/1/2028 | ||||||

| Original Term to Maturity: | 120 months | ||||||

| Original Amortization Term: | 0 months | ||||||

| IO Period: | 120 months | Underwriting and Financial Information | |||||

| Seasoning: | 0 months | UW NOI: | $4,415,970 | ||||

| Prepayment Provisions(2): | LO (11); YM1 (107); O (2) | UW NOI Debt Yield: | 8.8% | ||||

| Lockbox/Cash Mgmt Status: | Hard/Springing | UW NOI Debt Yield at Maturity: | 8.8% | ||||

| Additional Debt Type: | N/A | UW NCF DSCR: | 1.92x | ||||

| Additional Debt Balance: | N/A | Most Recent NOI: | $4,524,223 (12/31/2017) | ||||

| Future Debt Permitted (Type): | No (N/A) | 2nd Most Recent NOI: | $4,517,522 (12/31/2016) | ||||

| Reserves(3) | 3rd Most Recent NOI: | $4,485,414 (12/31/2015) | |||||

| Type | Initial | Monthly | Cap | Most Recent Occupancy: | 100.0% (2/12/2018) | ||

| RE Tax: | $349,317 | $69,863 | N/A | 2nd Most Recent Occupancy: | 100.0% (12/31/2017) | ||

| Insurance: | $8,215 | $705 | N/A | 3rd Most Recent Occupancy: | 100.0% (12/31/2016) | ||

| Replacements: | $0 | Springing | N/A | Appraised Value (as of): | $88,100,000 (3/2/2018) | ||

| TI/LC: | $0 | Springing | N/A | Cut-off Date LTV Ratio: | 56.8% | ||

| Common Charges Reserve: | $70,000 | $0 | N/A | Maturity Date LTV Ratio: | 56.8% | ||

| Sources and Uses | ||||||

| Sources | Proceeds | % of Total | Uses | Proceeds | % of Total | |

| Loan Amount: | $50,000,000 | 100.0% | Return of Equity(1): | $46,984,743 | 94.0% | |

| Closing Costs: | $2,587,726 | 5.2% | ||||

| Reserves: | $427,532 | 0.9% | ||||

| Total Sources: | $50,000,000 | 100.0% | Total Uses: | $50,000,000 | 100.0% | |

| (1) | Loan proceeds were used to recapitalize the borrower sponsor’s acquisition of the NYC REIT Mixed-Use Portfolio Properties (as defined below) in 2014. |

| (2) | Partial release ispermitted. See “Release of Property” below for further discussion of release requirements. |

| (3) | See “Escrows and Reserves”below for further discussion of reserve requirements. |

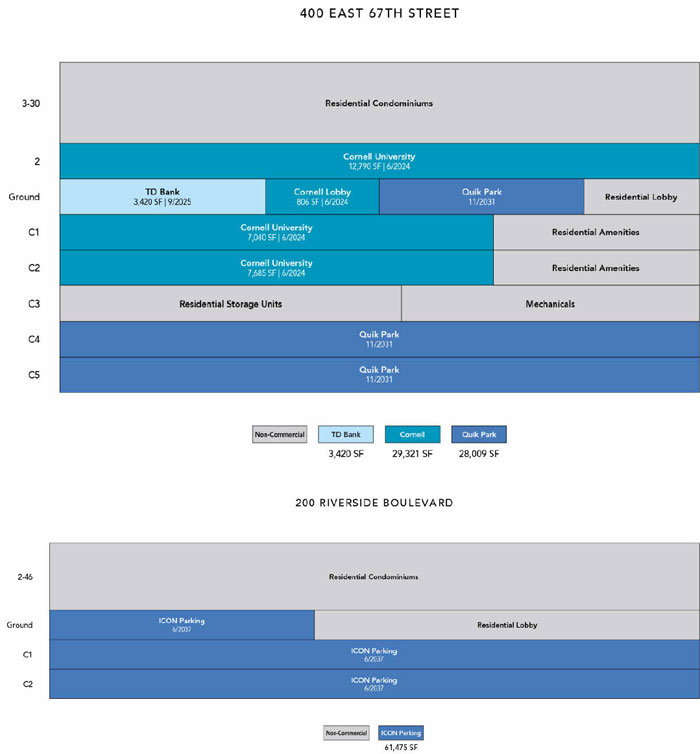

| (4) | The Size, Cut-off Date Balance per SF and Maturity Date Balance per SF reflects the Laurel Property (as defined below) and ICON Parking Garage Property (as defined below) SF totaling 58,750 SF and 61,475 SF, respectively. The Laurel Property’s allocated SF for the Quik Park tenant is 26,009 SF and is comprised of 142 parking spaces. The ICON Parking Garage Property’s sole tenant, ICON Parking, is 61,475 SF and is comprised of 284 parking spaces. |

The Mortgage Loan. The largest mortgage loan (the “NYC REIT Mixed-Use Portfolio Mortgage Loan”) is evidenced by a single promissory note with an original principal balance of $50,000,000 and is secured by a first priority fee mortgage encumbering two cross-collateralized properties subject to commercial condominiums totaling 120,225 SF located in New York, New York (collectively, the “NYC REIT Mixed-Use Portfolio Properties”). The proceeds of the NYC REIT Mixed-Use Portfolio Mortgage Loan were used to recapitalize the borrower sponsor acquisition of the NYC REIT Mixed-Used Properties, fund reserves and pay closing costs.

The Borrowers and the Borrower Sponsor. The borrowers are ARC NYC200RIVER01, LLC and ARC NYC400E67, LLC (collectively, the “NYC REIT Mixed-Use Portfolio Borrowers”), each a single-purpose Delaware limited liability company structured to be bankruptcy remote with two independent directors. The NYC REIT Mixed-Use Portfolio Borrowers are 100.0% owned by the borrower sponsor and non-recourse carveout guarantor, New York City Operating Partnership, L.P. (the “Guarantor”). A non-consolidation opinion has been delivered in connection with the origination of the NYC REIT Mixed-Use Portfolio Mortgage Loan.

The Guarantor is the operating partnership within American Realty Capital New York City REIT, Inc. ("NYC REIT"). NYC REIT is a public non-traded REIT that invests in properties located in the five boroughs of New York City, with a focus on Manhattan. As of September 30, 2017, NYC REIT reported assets of approximately $775.3 million, equity of approximately $496.0 million and liquidity of approximately $30.5 million. NYC REIT is externally managed by AR Global Investments, LLC, which has raised and invested over $30.0 billion in capital, served over 150,000 shareholders and grown to one of the largest external managers of direct investment programs in the United States.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 17 |

| New York, NY | Collateral Asset Summary – Loan No. 1 NYC REIT Mixed-Use Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $50,000,000 56.8% 1.92x 8.8% |

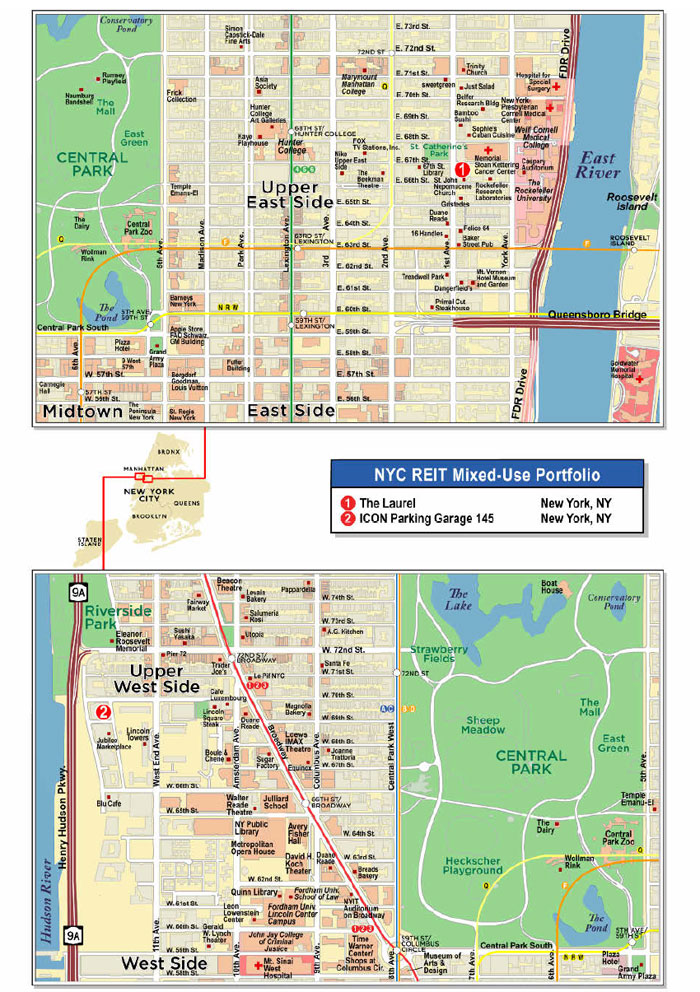

The Properties. The NYC REIT Mixed-Use Portfolio Properties consist of two cross-collateralized properties subject to commercial condominiums totaling 120,225 SF located in New York, New York. Three of the four commercial condominium units are located at 400 East 67th Street in the Upper East Side neighborhood of Manhattan and consist of 58,750 SF across the ground floor, second floor and four sub-grade levels (collectively, the “Laurel Property”). The Laurel Property was constructed in 2007 and is situated on a 0.26-acre site. The Laurel Property’s design, from architects Costas Kondylis & Partners, features glass and Indiana limestone and has over 100 feet of frontage on both First Avenue and East 67th Street. The residential condominium units are not collateral for the NYC REIT Mixed-Use Portfolio Mortgage Loan. However, they serve as demand drivers for the commercial condominiums. The office condominium at the Laurel Property, which is utilized by Cornell University as a research lab, is 29,321 SF and consists of a ground floor lobby, second floor office and two sub-grade office spaces. The retail condominium at the Laurel Property, which is occupied by TD Bank, is 3,420 SF of ground level space located at the corner of First Avenue and East 67th Street. The garage condominium operated by Quik Park at the Laurel Property is 26,009 SF, consisting of 142 licensed parking spaces between ground level and two sub-grade levels. The fourth condominium unit is located in the Upper West Side neighborhood of Manhattan and consists of a parking garage at the base of a residential building at 200 Riverside Boulevard between Riverside Boulevard and Freedom Place (the “ICON Parking Garage Property”). The ICON Parking Garage Property was constructed in 1997 and is situated on a 0.88-acre site. The ICON Parking Garage Property is a 61,475 SF parking garage condominium unit with three floors of parking totaling 284 licensed spaces, which encompass the ground level and two sub-grade levels. As of February 12, 2018, the NYC REIT Mixed-Use Portfolio Properties were 100.0% leased.

| NYC REIT Mixed-Use Portfolio Summary | |||||||||

| Property Name | Address | Property Sub-Type | Year Built | Allocated Loan Amount | % of Allocated Loan Amount(1) | Net Rentable Area (SF)(1)(2) | Allocated Loan Amount PSF | Occupancy(1) | Appraised Value |

| Laurel Property | 400 East 67th Street New York, NY 10065 | Office/Parking Garage/Retail | 2007 | $44,610,000 | 89.2% | 58,750 | $759 | 100.0% | $78,600,000 |

| ICON Parking Garage Property | 200 Riverside Boulevard New York, NY 10069 | Parking Garage | 1997 | $5,390,000 | 10.8% | 61,475 | $88 | 100.0% | $9,500,000 |

| Total / Wtd. Avg. | $50,000,000 | 100.0% | 120,225 | $416 | 100.0% | $88,100,000 | |||

| (1) | Information is based on the underwritten rent roll. |

| (2) | The Laurel Property’s allocated SF for the Quik Park tenant is 26,009 SF and is comprised of 142 parking spaces. The ICON Parking Garage Property’s sole tenant, ICON Parking, is 61,475 SF and is comprised of 284 parking spaces. |

Major Tenants.

Cornell University (29,321 SF, 24.4% of NRA, 50.8% of underwritten base rent). Cornell University (rated NR/Aa1/AA by Fitch/Moody’s/S&P), founded in 1865, is a privately endowed research university with an endowment of approximately $6.8 billion. As of the 2017 fall semester, Cornell University had an enrollment of approximately 21,904 students. Cornell is a federal land-grant Ivy League institution in New York State whose main campus is located in Ithaca, New York. In addition to their main campus, Cornell University also has locations across all five boroughs of New York City, with many of these satellite locations emphasized on Weill Cornell Medicine and Cornell Tech. Cornell University leases its commercial unit at the Laurel Property on behalf of Weil Cornell Medical College, where its Department of Environmental Health and Safety office is located. Cornell University has been in occupancy at the Laurel Property since October 2007 with a lease expiration of June 2024 and three, five-year extension options with no termination options. Cornell University may, without consent of the lender, mortgage its leasehold estate and give an assignment of its interest in the lease to the mortgagee as collateral. See “Description of the Mortgage Pool—Fee & Leasehold Estates; Ground Leases” in the Preliminary Prospectus.

TD Bank (3,420 SF, 2.8% of NRA, 21.4% of underwritten base rent). TD Bank (rated AA-/Aa2/AA- by Fitch/Moody’s/S&P) is one of the ten largest banks in the United States with approximately 26,000 employees and 1,300 locations. TD Bank is a member of TD Bank Group and a subsidiary of The Toronto-Dominion Bank, which together with its subsidiaries provides personal and commercial banking services in Canada and the United States. TD bank operates three segments: Canadian Retail, U.S. Retail and Wholesale Banking. TD Bank has been in occupancy at the Laurel Property since March 2010 with a lease expiration of September 2025 and three, five-year extension options with no termination options.

Quik Park (26,009 SF, 21.6% of NRA, 17.8% of underwritten base rent) & ICON Parking (61,475 SF, 51.1% of NRA; 10.0% of underwritten base rent). Quik Park, along with ICON Parking, forms the largest parking operator in Manhattan with 50 years of experience. Together, Quik Park and ICON Parking service over 40,000 cars daily across 300 locations. Quik Park and ICON Parking are both members of Citizens Parking. Created in 2014, Citizens Parking is a leader in branded parking services with five brands, approximately 8,000 associates and approximately 1,200 locations. Quik Park has been in occupancy at the Laurel Property since March 2009 with a lease expiration of November 2031 and two, five-year extension options with no termination options. ICON Parking has an original lease date of September 2014 and a lease expiration of September 2037 with no termination options.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 18 |

| New York, NY | Collateral Asset Summary – Loan No. 1 NYC REIT Mixed-Use Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $50,000,000 56.8% 1.92x 8.8% |

The following table presents certain information relating to the leases at the NYC REIT Mixed-Use Portfolio Properties:

| Tenant Summary(1) | |||||||

| Tenant Name | Credit Rating (Fitch/Moody’s/S&P)(2) | Tenant SF | Approximate % of SF | Annual UW Base Rent | % of Total Annual UW Base Rent | Annual UW Base Rent PSF | Lease Expiration |

| Commercial Tenants | |||||||

| Cornell University | NR/Aa1/AA | 29,321 | 24.4% | $2,576,000 | 50.8% | $87.86 | 6/30/2024(3) |

| TD Bank | AA-/Aa2/AA- | 3,420 | 2.8% | $1,083,937 | 21.4% | $316.94 | 9/30/2025(4) |

| Subtotal/Wtd. Avg. | 32,741 | 27.2% | $3,659,937 | 72.2% | $111.78 | ||

| Parking Tenants(5) | |||||||

| Quik Park | NR/NR/NR | 26,009 | 21.6% | $900,000 | 17.8% | $34.60 | 11/30/2031(6) |

| ICON Parking | NR/NR/NR | 61,475 | 51.1% | $506,915 | 10.0% | $8.25 | 9/30/2037 |

| Subtotal/Wtd. Avg. | 87,484 | 72.8% | $1,406,915 | 27.8% | $16.08 | ||

| Vacant Space | 0 | 0.0% | $0 | 0.0% | $0.00 | ||

| Total/Wtd. Avg. | 120,225 | 100.0% | $5,066,852 | 100.0% | $42.14 | ||

| (1) | Information is based on the underwritten rent roll. |

| (2) | Certain ratings are those of the parent company whether or not the parent guarantees the lease. |

| (3) | Cornell University has three, five-year renewal options. |

| (4) | TD Bank has three, five-year renewal options. |

| (5) | The Laurel Property’s allocated SF for the Quik Park tenant is 26,009 SF and is comprised of 142 parking spaces. The ICON Parking Garage Property’s sole tenant, ICON Parking, is 61,475 SF and is comprised of 284 parking spaces. |

| (6) | Quik Park has two, five-year renewal options. |

The following table presents certain information relating to the lease rollover schedule at the NYC REIT Mixed-Use Portfolio Properties:

| Lease Rollover Schedule(1)(2) | ||||||||

| Year | # of Leases Rolling | SF Rolling | Approx. % of Total SF Rolling | Approx. Cumulative % of SF Rolling | UW Base Rent PSF Rolling | Total UW Base Rent Rolling | Approx. % of Total Base Rent Rolling | Approx. Cumulative % of Total Base Rent Rolling |

| MTM | 0 | 0 | 0% | 0.0% | $0.00 | $0 | 0.0% | 0.0% |

| 2018 | 0 | 0 | 0% | 0.0% | $0.00 | $0 | 0.0% | 0.0% |

| 2019 | 0 | 0 | 0% | 0.0% | $0.00 | $0 | 0.0% | 0.0% |

| 2020 | 0 | 0 | 0% | 0.0% | $0.00 | $0 | 0.0% | 0.0% |

| 2021 | 0 | 0 | 0% | 0.0% | $0.00 | $0 | 0.0% | 0.0% |

| 2022 | 0 | 0 | 0% | 0.0% | $0.00 | $0 | 0.0% | 0.0% |

| 2023 | 0 | 0 | 0% | 0.0% | $0.00 | $0 | 0.0% | 0.0% |

| 2024 | 1 | 29,321 | 24.4% | 24.4% | $87.86 | $2,576,000 | 50.8% | 50.8% |

| 2025 | 1 | 3,420 | 2.8% | 27.2% | $316.94 | $1,083,937 | 21.4% | 72.2% |

| 2026 | 0 | 0 | 0.0% | 27.2% | $0.00 | $0 | 0.0% | 72.2% |

| 2027 | 0 | 0 | 0.0% | 27.2% | $0.00 | $0 | 0.0% | 72.2% |

| 2028 | 0 | 0 | 0.0% | 27.2% | $0.00 | $0 | 0.0% | 72.2% |

| 2029 & Beyond(3) | 2 | 87,484 | 72.8% | 100.0% | $16.08 | $1,406,915 | 27.8% | 100.0% |

| Vacant | 0 | 0 | 0.0% | 100.0% | $0.00 | $0 | 0.0% | 100.0% |

| Total/Wtd. Avg. | 4 | 120,225 | 100.0% | $42.14 | $5,066,852 | 100.0% | ||

| (1) | Information is based on the underwritten rent roll. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the originally stated expiration date of the subject lease that are not considered in the lease rollover schedule. |

| (3) | The Laurel Property’s allocated SF for the Quik Park tenant is 26,009 SF and is comprised of 142 parking spaces. The ICON Parking Garage Property’s sole tenant, ICON Parking, is 61,475 SF and is comprised of 284 parking spaces. |

The Market. The NYC REIT Mixed-Use Portfolio Properties are located in New York, New York in the borough of Manhattan within the New York City-Jersey City-White Plains Metropolitan Statistical Area (“New York City MSA”).

The Laurel Property is located in the Upper East Side neighborhood of Manhattan, which is bound by Fifth Avenue to the west, the East River to the east, 96th Street to the north and 59th Street to the south. Land use in the neighborhood consists primarily of residential development, along with a significant presence of cultural facilities, medical facilities and educational facilities. The immediate area surrounding the Laurel Property consists of a mix of office buildings, ground floor retail, restaurants and hotels. According to the appraisal, the area surrounding the Laurel Property has the highest concentration of major medical research and treatment facilities in Manhattan. Memorial Sloan Kettering, one of the leading cancer centers in the world, and New York Presbyterian Hospital, an affiliate of Weill Cornell, anchor an area that also features Manhattan Eye, Ear and Throat, Hospital for Special Surgery, Gracie Square Hospital, Lenox Hill Hospital, Rockefeller University Hospital and the Rogosin Institute.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 19 |

| New York, NY | Collateral Asset Summary – Loan No. 1 NYC REIT Mixed-Use Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $50,000,000 56.8% 1.92x 8.8% |

According to the appraisal, while the Laurel Property is not located within an office submarket, it is one block north of the East Side office submarket and approximately two blocks west of the New York-Presbyterian / Weill Cornell Medical College. As of the fourth quarter of 2017, the average asking rate in the East Side office submarket was $68.82 PSF MG with a vacancy rate of 6.8%. Based on the appraiser lease comparables, the appraiser concluded to a market rent of $85.00 PSF MG, which is 8.4% higher than Cornell University’s in-place rent of $78.44 PSF MG. According to a third party research provider, the Laurel Property is located in the Upper East Side retail submarket. As of the fourth quarter of 2017, the Upper East Side retail submarket consisted of approximately 3.3 million SF of rentable area within 370 buildings with average rental rates of $49.74 PSF NNN and a vacancy rate of 2.6%. Based on the appraiser lease comparables, the concluded market rent of $325.00 PSF MG is 14.0% higher than TD Bank’s in-place rent of $285.21 PSF MG.

The appraisal noted that the major demand generators for the Laurel Property’s parking garage are residential and transient demand from the surrounding hospitals. The Laurel Property’s demand generators combined with limited new parking facilities in the area lead the appraisal to determine that the Laurel Property will continue to benefit from significant demand for the foreseeable future. The appraisal concluded to a stabilized vacancy rate of 2.0% and credit loss of 1.0%. Based on the appraiser lease comparables, the market rent of $7,500 per space or $40.95 PSF MG is 23.5% higher than the Quik Park’s in-place rent of $33.16 PSF MG. The appraiser’s overall market rent conclusion of $79.47 PSF MG is 12.8% higher than the Laurel Property’s blended contract rent of $70.43 PSF MG.

The ICON Parking Garage Property is located in the Upper West Side neighborhood of Manhattan, which is bound by Central Park West to the east, the Hudson River to the west, 110th street to the north and 59th street to the south. New York City’s attractions located in the Upper West Side include Central Park, Lincoln Center, the Museum of Natural History and Columbus Circle. According to the appraisal, the ICON Parking Garage Property is located in the Lincoln Square area, where the median price for residential condominiums is approximately $1.8 million or $2,000 PSF. Demand for parking from local residents is enhanced by the approximately 23.0 million annual visitors to the area. The ICON Parking Garage Property benefits from its linkages to the rest of Manhattan and to major transportation hubs including the Columbus Circle subway complex (A, B, C, D, and 1 lines), New York Penn Station, the Port Authority Bus Terminal and is immediately adjacent to the West Side Highway, which provides access to the entire West Side of Manhattan, the George Washington Bridge and access to Westchester, New York. The appraisal noted that the major demand generator for the ICON Parking Garage Property is primarily driven by residential demand with limited exposure to transient business. Due to the lack of proposed parking facilities coupled with the existing demand drivers, the appraisal concluded to vacancy rate of 0.5% and credit loss of 0.5%. According to the appraisal, the market rent for the ICON Parking Garage Property of $3,750 per space or $17.32 PSF MG is 5.7% higher than the ICON Parking’s in-place rent of $16.39 PSF MG.

According to a third party statistics provider, the total 2017 population within NYC REIT Mixed-Use Portfolio Properties zip codes (10065 & 10069) was 42,629 with an average median household income of $123,827.

The following table presents recent leasing data at competitive office buildings with respect to the NYC REIT Mixed-Use Portfolio Properties:

| Comparable Office Properties | |||||||||

| Address | Tenant Name | Lease Size (SF) | Proximity | Floor | Lease Date | Lease Term (Yrs.) | Initial Rent PSF | Lease Type | Adjusted Rental Rate PSF(1) |

400 East 67th Street New York, NY | Cornell University(2) | 29,321(2) | -- | C1, C2, Ground, 2 | October 2007(2) | 17(2) | $78.44(2) | Modified Gross | -- |

130 East 59th Street, New York, NY | Northwell Health | 33,371 | 0.8 miles | 3, 7, 15, 16 | September 2017 | 5 | $62.00 | Modified Gross | $58.90 |

200 East 72nd Street, New York, NY | Victoria Rubinoff DDS, PC | 2,700 | 0.5 miles | 1 | July 2017 | 15 | $90.00 | Modified Gross | $81.00 |

200 West 57th Street, New York, NY | Frangella Dental | 1,903 | 1.5 miles | 14 | January 2016 | 15 | $72.00 | Modified Gross | $61.20 |

418 East 71st Street, New York, NY | Asking | 5,625 | 0.3 miles | 2, 4 | N/A | 10 | $85.00 | Modified Gross | $76.71 |

220 East 42nd Street, New York, NY | St Jude Medical | 6,500 | 1.4 miles | 3 | November 2015 | 10 | $63.00 | Modified Gross | $62.84 |

444 Madison Avenue, New York, NY | Dr. Dennis Gross | 7,471 | 1.4 miles | 10 | June 2015 | 10 | $68.00 | Modified Gross | $64.26 |

635 Madison Avenue, New York, NY | NY Physicians P.C. | 27,074 | 0.9 miles | 7, 8 | June 2015 | 15 | $97.00 | Modified Gross | $96.76 |

170 East 77th Street, New York, NY | North Shore LIJ | 5,500 | 0.8 miles | 5 | September 2014 | 5 | $87.50 | Modified Gross | $91.44 |

Source:Appraisal

| (1) | Adjusted Rental Rate PSF is based on appraisal adjustments to lease term, location, size and floor level. |

| (2) | Based on the underwritten rent roll. |