|

Exhibit 99.2

|

Exhibit 99.2

SPIN-OFF ROADSHOW

JUNE 2014

CONFIDENTIAL

SEVENTY SEVEN ENERGY

ASSUMPTIONS AND FORWARD-LOOKING STATEMENTS

This presentation contains a number of projections and assumptions. While we believe that these projections and assumptions are reasonable in light of management’s current expectations concerning future events, the estimates underlying these projections and assumptions are inherently uncertain and are subject to significant business, economic, regulatory, environmental and competitive risks and uncertainties that could cause actual results to differ materially from those we anticipate.

When reviewing this presentation, you should keep in mind the cautionary statements described under the “Forward-Looking Statements” and “Risk Factors” sections in Chesapeake Oilfield Operating, L.L.C.’s (COO) Securities and Exchange Commission filings. Any of the risks referenced in the “Forward-Looking Statements” and “Risk Factors” sections could cause our actual results to vary significantly from our estimates.

Nothing in this presentation shall be deemed an offer to sell or a solicitation of an offer to buy any securities of COO or SSE

SEVENTY SEVEN ENERGY

AGENDA

Executive Summary and Transaction Overview

Industry Update and Business Overview

Business segment detail

Financial review and business outlook

SEVENTY SEVEN ENERGY

EXECUTIVE SUMMARY AND TRANSACTION OVERVIEW

SEVENTY SEVEN ENERGY

OVERVIEW

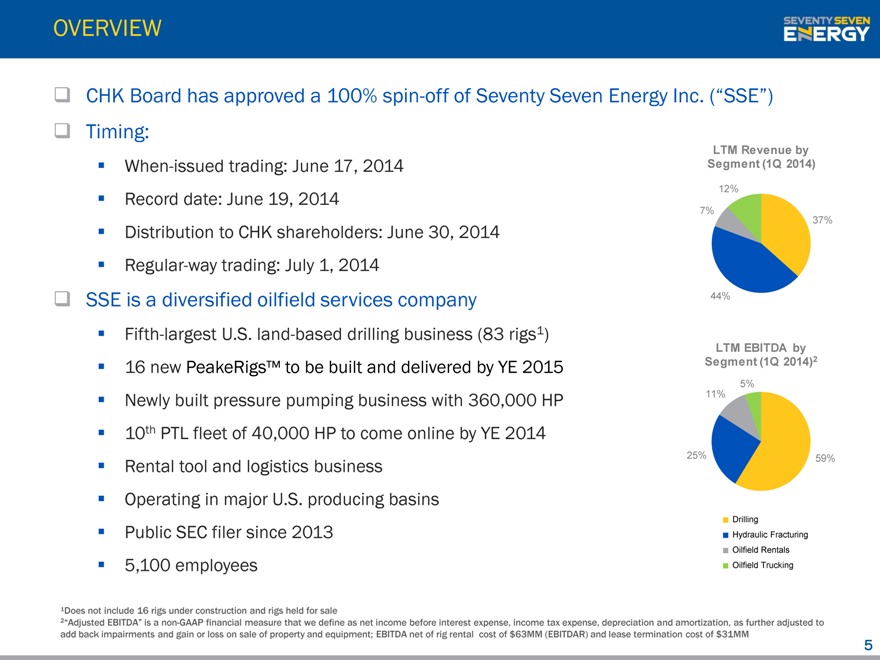

CHK Board has approved a 100% spin-off of Seventy Seven Energy Inc. (“SSE”)

Timing:

When-issued trading: June 17, 2014

Record date: June 19, 2014

Distribution to CHK shareholders: June 30, 2014

Regular-way trading: July 1, 2014

SSE is a diversified oilfield services company

Fifth-largest U.S. land-based drilling business (83 rigs1)

16 new PeakeRigs™ to be built and delivered by YE 2015

Newly built pressure pumping business with 360,000 HP

10th PTL fleet of 40,000 HP to come online by YE 2014

Rental tool and logistics business

Operating in major U.S. producing basins

Public SEC filer since 2013

5,100 employees

¹Does not include 16 rigs under construction and rigs held for sale

2“Adjusted EBITDA” is a non-GAAP financial measure that we define as net income before interest expense, income tax expense, depreciation and amortization, as further adjusted to add back impairments and gain or loss on sale of property and equipment; EBITDA net of rig rental cost of $63MM (EBITDAR) and lease termination cost of $31MM

Drilling

Hydraulic Fracturing

Oilfield Rentals

Oilfield Trucking

LTM Revenue by

Segment (1Q 2014)

12%

7%

37%

44%

LTM EBITDA by

Segment (1Q 2014)

5%

11%

25%

59%

5 2

SEVENTY SEVEN ENERGY

SSE MANAGEMENT TEAM

CEO: Jerry Winchester

Served for thirteen years as the President and CEO of Boots & Coots International Well Control, Inc. which was acquired by Halliburton in September 2010

Started his career with Halliburton in 1981 as a fracturing equipment operator and served in positions of increasing responsibility, most recently as Global Manager over Well Control, Coil Tubing and Special Services

29 years of industry experience

CFO: Cary D. Baetz

Served as Senior Vice President and Chief Financial Officer of Atrium Companies, Inc. From November 2010 to December 2011

Served with Mr. Winchester as Chief Financial Officer of Boots & Coots from August 2008 to September 2010

Served as Vice President of Finance, Treasurer, and Assistant Secretary of Chaparral Steel Company from 2005 to 2008

26 years of industry experience

Nomac Drilling President: Jay G. Minmier

Joined COS as President of NOMAC Drilling, a wholly-owned subsidiary of COS in June of 2011

Previously served as Vice President and General Manager for Precision Drilling Corporation

More than 20 years experience with drilling contractors, notably Grey Wolf Inc. and Helmerich & Payne, Inc.

Thunder Oilfield Services President: Zac M. Graves

President of Thunder Oilfield Services, a wholly owned subsidiary of COS, with operations that include oilfield tool rental, rig mobilization and oil and salt water transportation, and handling

Joined COS through his role as Chief Operating Officer of Bronco Drilling Company, acquired in June 2011 by Nomac

Previously served as Chief Financial Officer of Bronco Drilling Company

11 years of industry experience

Great Plains Oilfield Rental President: Jerome Loughridge

President of Great Plains Oilfield Rental since September 2012

Previously served as President of Black Mesa Energy Services, the oilfield investment arm of private equity firm Ziff Brothers Ventures; Executive Chairman of completions service provider Legend Energy Services; and Chief Operating Officer of Great White Energy Services

Eight years of oilfield management experience

Performance Technologies President: William R. Stanger

President of Performance Technologies, LLC (PTL), a wholly-owned subsidiary of COS since 2011

Joined Chesapeake Energy in January 2010 as President of Great Plains Oilfield Rentals

A former Vice President of Schlumberger with more than twenty-five years experience in oilfield service technologies

6

SEVENTY SEVEN ENERGY

SSE IS AMONG THE LEADING NORTH AMERICAN SERVICE COMPANIES

SSE has significant scale to effectively compete with its North American-centric peers

2013 Revenue

$Bn

6.5

5.2

3.9

2.6

1.3

0.0

NBR

SPN

HP

PTEN

SSE

TCW

TSX:ESI

PD

RES

KEG

CFW

BAS

CJES

PES

PKD

TSX:TDG

TSX:FRC

6.2

4.6

3.4

2.7

2.2

2.0

2.0

1.9

1.9

1.6

1.5

1.3

1.1

1.0

0.9

0.8

0.3

SEVENTY SEVEN ENERGY

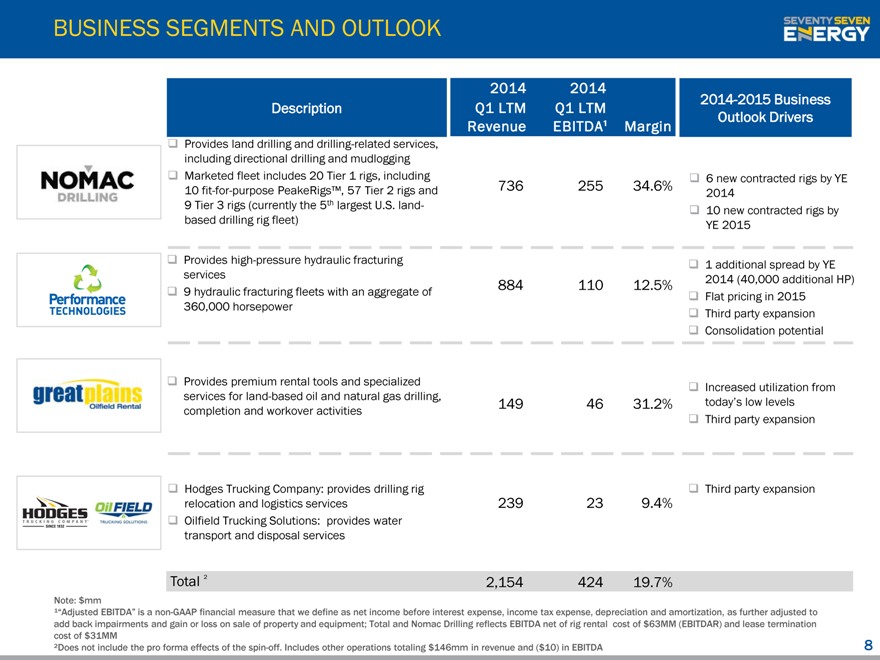

BUSINESS SEGMENTS AND OUTLOOK

Description

2014-2015 Business Outlook Drivers

Provides land drilling and drilling-related services, including directional drilling and mudlogging

Marketed fleet includes 20 Tier 1 rigs, including 10 fit-for-purpose PeakeRigs™, 57 Tier 2 rigs and 9 Tier 3 rigs (currently the 5th largest U.S. land-based drilling rig fleet)

Provides high-pressure hydraulic fracturing services

9 hydraulic fracturing fleets with an aggregate of 360,000 horsepower

Provides premium rental tools and specialized services for land-based oil and natural gas drilling, completion and workover activities

Hodges Trucking Company: provides drilling rig relocation and logistics services

Oilfield Trucking Solutions: provides water transport and disposal services

Total ²

Note: $mm

¹“Adjusted EBITDA” is a non-GAAP financial measure that we define as net income before interest expense, income tax expense, depreciation and amortization, as further adjusted to add back impairments and gain or loss on sale of property and equipment; Total and Nomac Drilling reflects EBITDA net of rig rental cost of $63MM (EBITDAR) and lease termination cost of $31MM

²Does not include the pro forma effects of the spin-off. Includes other operations totaling $146mm in revenue and ($10) in EBITDA

6 new contracted rigs by YE 2014

10 new contracted rigs by YE 2015

1 additional spread by YE 2014 (40,000 additional HP)

Flat pricing in 2015

Third party expansion

Consolidation potential

Increased utilization from today’s low levels

Third party expansion

Third party expansion

2014

Q1 LTM

Revenue

2014

Q1 LTM

EBITDA

1 Margin

736

255

34.6%

884

110

12.5%

149

46

31.2%

239

23

9.4%

2,154

424

19.7%

8

SEVENTY SEVEN ENERGY

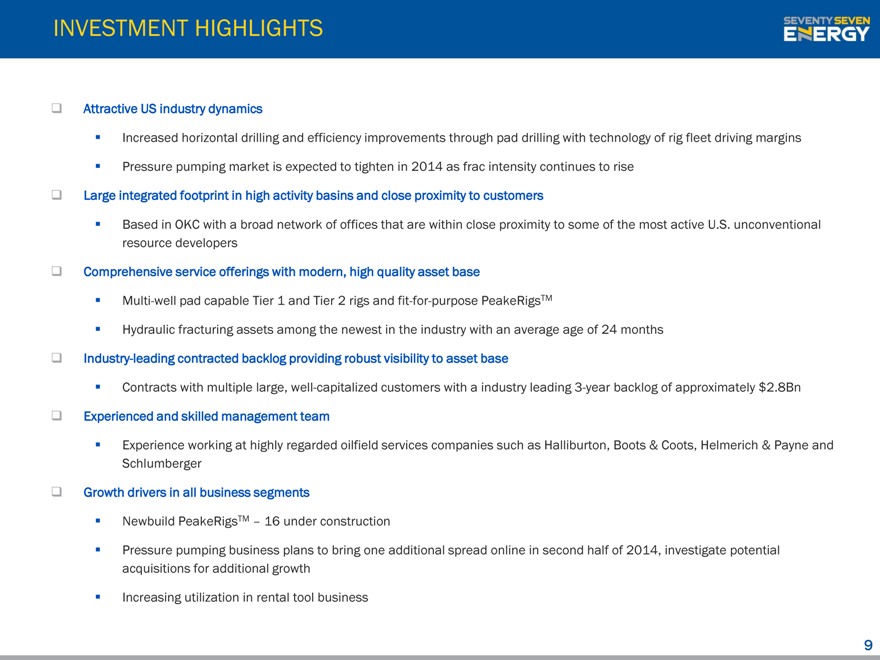

INVESTMENT HIGHLIGHTS

Attractive US industry dynamics

Increased horizontal drilling and efficiency improvements through pad drilling with technology of rig fleet driving margins

Pressure pumping market is expected to tighten in 2014 as frac intensity continues to rise

Large integrated footprint in high activity basins and close proximity to customers

Based in OKC with a broad network of offices that are within close proximity to some of the most active U.S. unconventional resource developers

Comprehensive service offerings with modern, high quality asset base

Multi-well pad capable Tier 1 and Tier 2 rigs and fit-for-purpose PeakeRigsTM

Hydraulic fracturing assets among the newest in the industry with an average age of 24 months

Industry-leading contracted backlog providing robust visibility to asset base

Contracts with multiple large, well-capitalized customers with a industry leading 3-year backlog of approximately $2.8Bn

Experienced and skilled management team

Experience working at highly regarded oilfield services companies such as Halliburton, Boots & Coots, Helmerich & Payne and Schlumberger

Growth drivers in all business segments

Newbuild PeakeRigsTM – 16 under construction

Pressure pumping business plans to bring one additional spread online in second half of 2014, investigate potential acquisitions for additional growth

Increasing utilization in rental tool business

9

SEVENTY SEVEN ENERGY

INDUSTRY UPDATE AND BUSINESS OVERVIEW

SEVENTY SEVEN ENERGY

SSE IS WELL POSITIONED FOR CURRENT INDUSTRY TRENDS

Current Industry Trend

SSE Positioning

Full scale development plans of large shale resources (existing and emerging)

Increased drilling efficiencies through modern equipment and integrated operations

Trend towards “factory style” development

Increasing focus on safety and regulatory

Large, integrated footprint in 8 basins

Shale development expertise (“it’s in our DNA”)

Modern, efficient land fleet of 91 operating rigs by year end

Upgrading tiers as we speak

Newest pressure pumping fleet in the industry

Modern well-maintained rentals fleet

Highly efficient, integrated service model providing single-source D&C solutions

Customer base of large acreage holders that are pioneering factory-style approach

Winning integrated contracts

Industry leading safety performance

11

SEVENTY SEVEN ENERGY

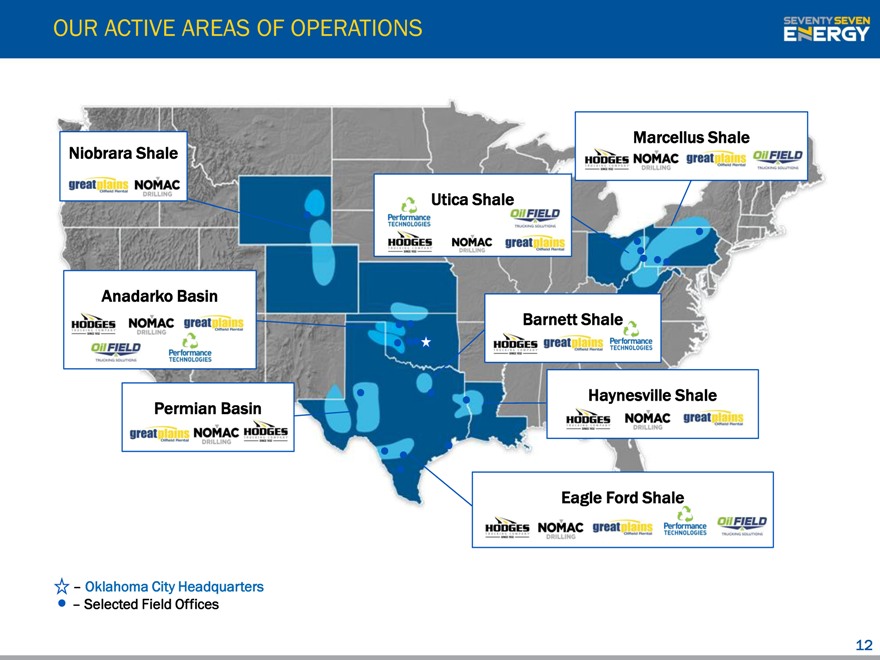

OUR ACTIVE AREAS OF OPERATIONS

Niobrara Shale

Utica Shale

Marcellus Shale

Anadarko Basin

Permian Basin

Barnett Shale

Haynesville Shale

Eagle Ford Shale

Oklahoma City Headquarters

Selected Field Offices

12

SEVENTY SEVEN ENERGY

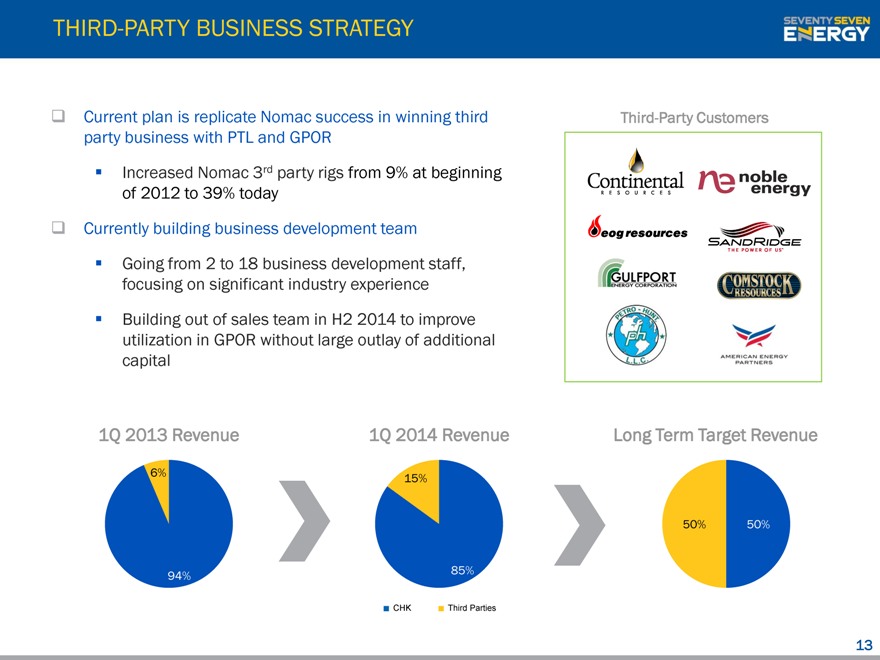

THIRD-PARTY BUSINESS STRATEGY

Current plan is replicate Nomac success in winning third party business with PTL and GPOR

Increased Nomac 3rd party rigs from 9% at beginning of 2012 to 39% today

Currently building business development team

Going from 2 to 18 business development staff, focusing on significant industry experience

Building out of sales team in H2 2014 to improve utilization in GPOR without large outlay of additional capital

Third-Party Customers

1Q 2013 Revenue

1Q 2014 Revenue

Long Term Target Revenue

6%

94%

15%

85%

50%

50%

Third Parties

CHK

13

SEVENTY SEVEN ENERGY

BACKLOG AND SERVICE CONTRACT SUMMARY

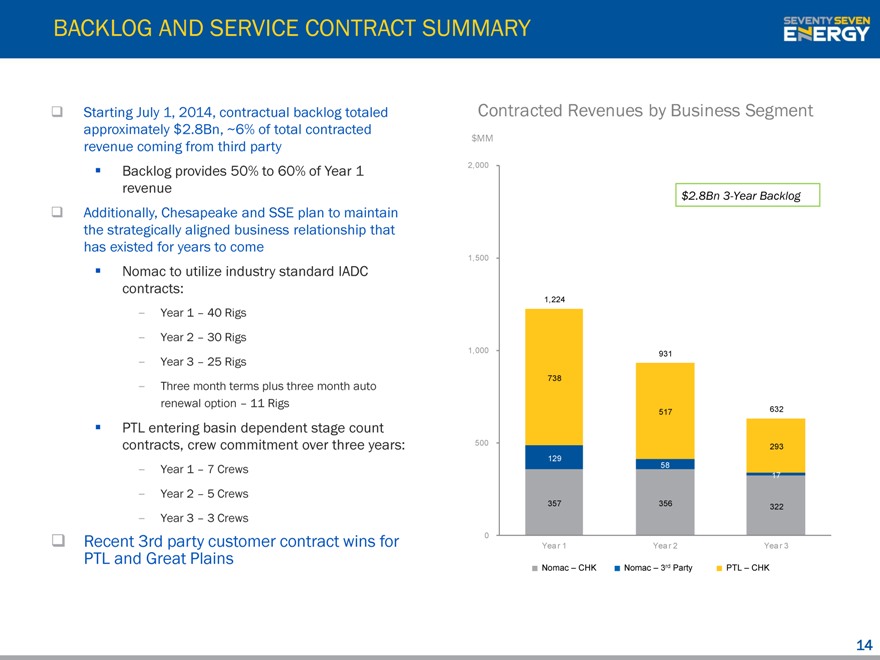

Starting July 1, 2014, contractual backlog totaled approximately $2.8Bn, ~6% of total contracted revenue coming from third party

Backlog provides 50% to 60% of Year 1 revenue

Additionally, Chesapeake and SSE plan to maintain the strategically aligned business relationship that has existed for years to come

Nomac to utilize industry standard IADC contracts:

Year 1 – 40 Rigs

Year 2 – 30 Rigs

Year 3 – 25 Rigs

Three month terms plus three month auto renewal option – 11 Rigs

PTL entering basin dependent stage count contracts, crew commitment over three years:

Year 1 – 7 Crews

Year 2 – 5 Crews

Year 3 – 3 Crews

Recent 3rd party customer contract wins for PTL and Great Plains

$2.8Bn 3-Year Backlog

Contracted Revenues by Business

Segment

$MM

2,000

1,500

1,000

500

0

1,224

738

129

357

931

517

58

356

632

293

17

322

Year 1

Year 2

Year 3

Nomac – CHK

Nomac – 3rd Party

PTL – CHK

14

SEVENTY SEVEN ENERGY

BUSINESS SEGMENTS DETAIL

SEVENTY SEVEN ENERGY

NOMAC DRILLING

SEVENTY SEVEN ENERGY

NOMAC DRILLING

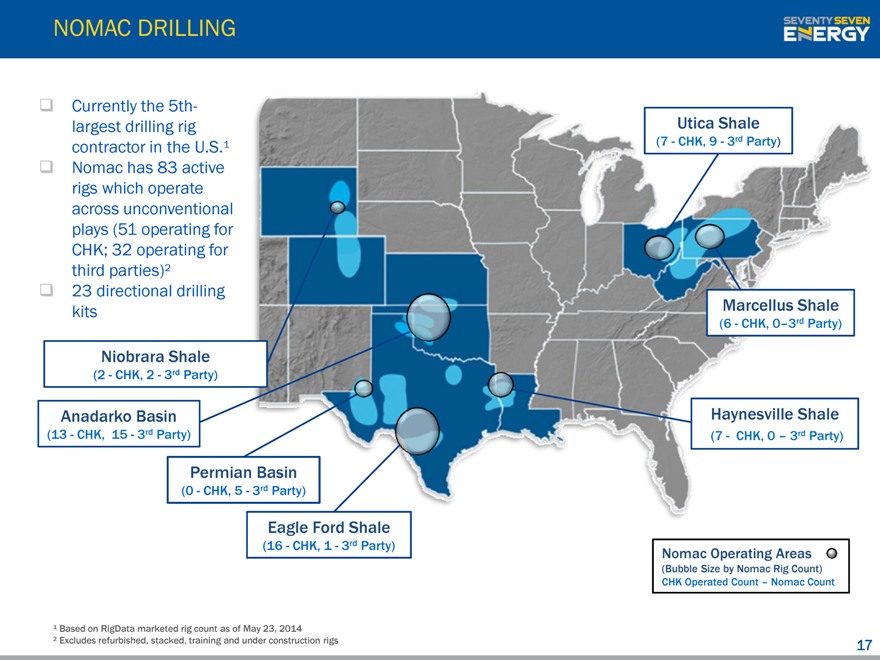

Currently the 5th-largest drilling rig contractor in the U.S.¹

Nomac has 83 active rigs which operate across unconventional plays (51 operating for CHK; 32 operating for third parties)²

23 directional drilling kits

Utica Shale

(7 -CHK, 9- 3rd Party)

Niobrara Shale

(2-CHK, 2- 3rd Party)

Anadarko Basin

(13-CHK, 15-3rd Party)

Permian Basin

(0-CHK, 5-3rd Party)

Eagle Ford Shale

(16-CHK, 1-3rd Party)

Marcellus Shale

(6-CHK, 0–3rd Party)

Haynesville Shale

(7- CHK, 0 – 3rd Party)

Nomac Operating Areas

(Bubble Size by Nomac Rig Count)

CHK Operated Count – Nomac Count

¹ Based on RigData marketed rig count as of May 23, 2014

² Excludes refurbished, stacked, training and under construction rigs

17

SEVENTY SEVEN ENERGY

OVERVIEW OF NOMAC RIG FLEET BY AREA

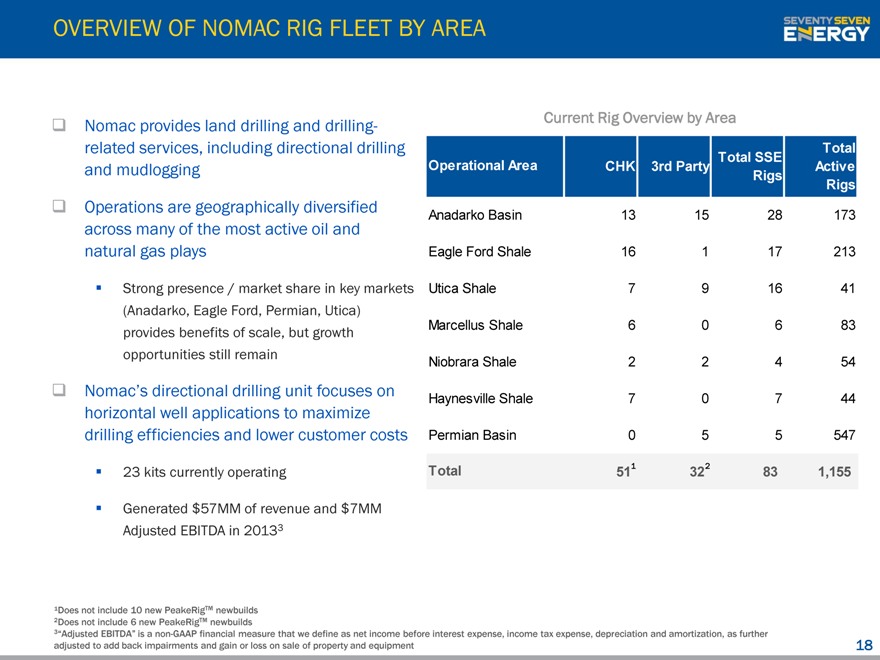

Nomac provides land drilling and drilling-related services, including directional drilling and mudlogging

Operations are geographically diversified across many of the most active oil and natural gas plays

Strong presence / market share in key markets (Anadarko, Eagle Ford, Permian, Utica) provides benefits of scale, but growth opportunities still remain

Nomac’s directional drilling unit focuses on horizontal well applications to maximize drilling efficiencies and lower customer costs

23 kits currently operating

Generated $57MM of revenue and $7MM Adjusted EBITDA in 20133

Current Rig Overview by Area

Operational Area

CHK

3rd Party Total SSE

Rigs

Total

Active

Rigs Anadarko Basin Eagle Ford Shale Utica Shale

Marcellus Shale

Niobrara Shale

Haynesville Shale

Permian Basin

Total

13 16 7 6 2 7

0

51

32 5 0 2 0 9 1

15

28

17

16

83

173

213

41

83

54

44

547

1,155

1 2

¹Does not include 10 new PeakeRigTM newbuilds

2Does not include 6 new PeakeRigTM newbuilds

3“Adjusted EBITDA” is a non-GAAP financial measure that we define as net income before interest expense, income tax expense, depreciation and amortization, as further adjusted to add back impairments and gain or loss on sale of property and equipment

18

SEVENTY SEVEN ENERGY

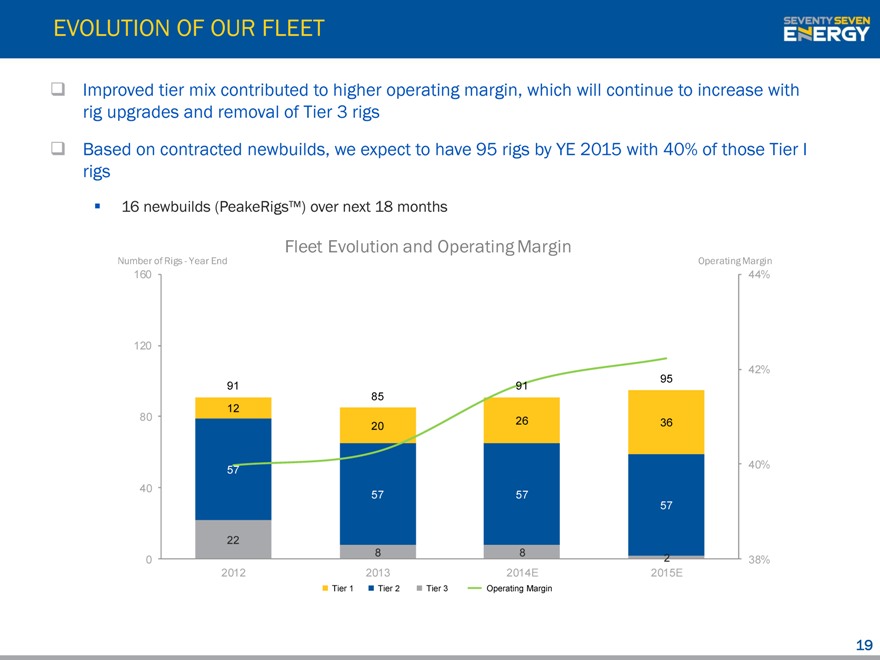

EVOLUTION OF OUR FLEET

Improved tier mix contributed to higher operating margin, which will continue to increase with rig upgrades and removal of Tier 3 rigs

Based on contracted newbuilds, we expect to have 95 rigs by YE 2015 with 40% of those Tier I rigs

16 newbuilds (PeakeRigs™) over next 18 months

Fleet Evolution and Operating Margin

Number of Rigs—Year End Operating Margin

160 44%

120

42%

91 91 95

85

12

80

20 26 36

57 40%

40 57 57

57

22

8 8

0 2 38%

2012 2013 2014E 2015E

Tier 1 Tier 2 Tier 3 Operating Margin

19

SEVENTY SEVEN ENERGY

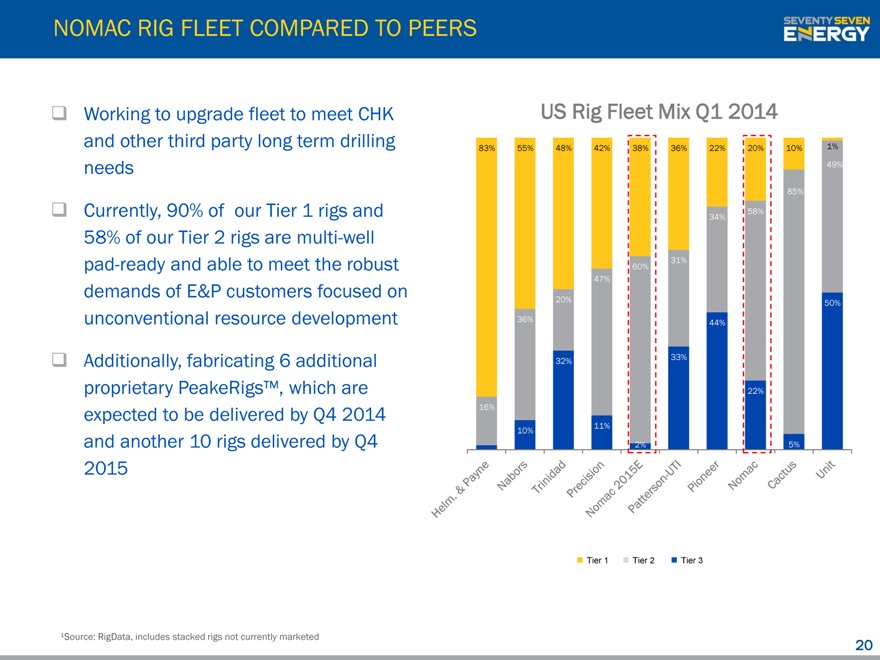

NOMAC RIG FLEET COMPARED TO PEERS

Working to upgrade fleet to meet CHK and other third party long term drilling needs

Currently, 90% of our Tier 1 rigs and 58% of our Tier 2 rigs are multi-well pad-ready and able to meet the robust demands of E&P customers focused on unconventional resource development

Additionally, fabricating 6 additional proprietary PeakeRigs™, which are expected to be delivered by Q4 2014 and another 10 rigs delivered by Q4 2015

US Rig Fleet Mix Q1 2014

83% 55% 48% 42% 38% 36% 22% 20% 10% 1%

49%

85%

34% 58%

31%

60%

47%

20% 50%

36% 44%

32% 33%

22%

16%

10% 11%

2% 5%

Tier 1 Tier 2 Tier 3

¹Source: RigData, includes stacked rigs not currently marketed

SEVENTY SEVEN ENERGY

20

Helm. & Payne Nabors Trinidad Precision Nomac 2015E Patterson-UTI Pioneer Nomac Cactus Unit

PERFORMANCE TECHNOLOGIES

(PTL)

SEVENTY SEVEN ENERGY

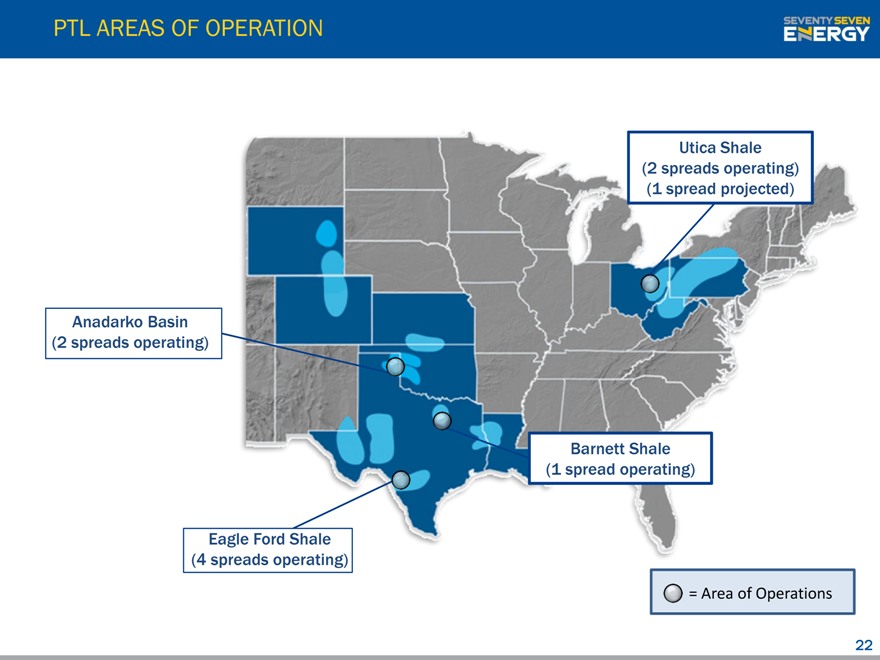

PTL AREAS OF OPERATION

Utica Shale

(2 spreads operating)

(1 spread projected)

Anadarko Basin

(2 spreads operating)

Barnett Shale

(1 spread operating)

Eagle Ford Shale

(4 spreads operating)

= Area of Operations

22

SEVENTY SEVEN ENERGY

OPERATIONS OVERVIEW

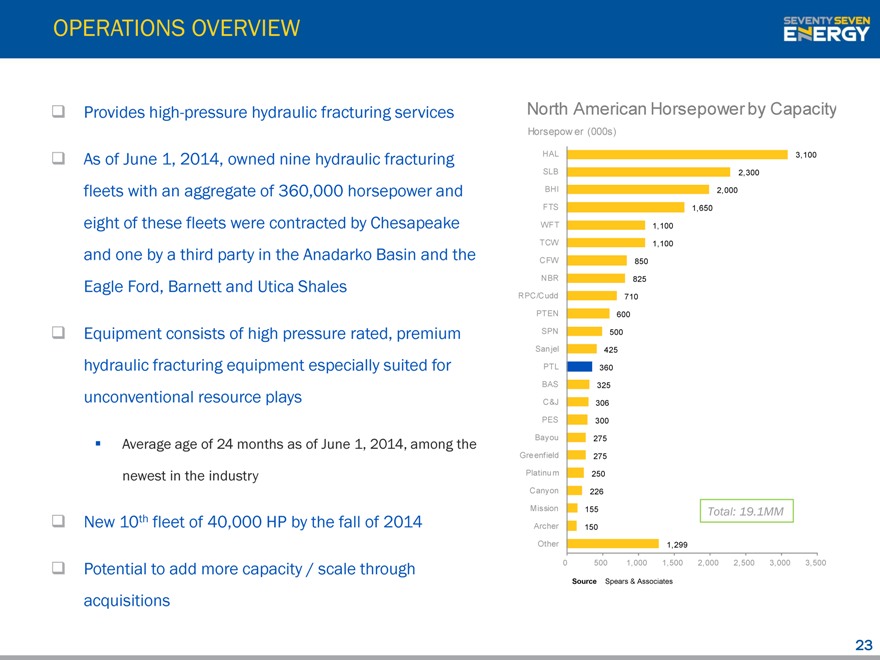

Provides high-pressure hydraulic fracturing services

As of June 1, 2014, owned nine hydraulic fracturing fleets with an aggregate of 360,000 horsepower and eight of these fleets were contracted by Chesapeake and one by a third party in the Anadarko Basin and the Eagle Ford, Barnett and Utica Shales

Equipment consists of high pressure rated, premium hydraulic fracturing equipment especially suited for unconventional resource plays

Average age of 24 months as of June 1, 2014, among the

newest in the industry

New 10th fleet of 40,000 HP by the fall of 2014

Potential to add more capacity / scale through acquisitions

North American Horsepower by Capacity

Horsepow er (000s)

HAL 3,100

SLB 2,300

BHI 2,000

FTS 1,650

WFT 1,100

TCW 1,100

CFW 850

NBR 825

RPC/Cudd 710

PTEN 600

SPN 500

San jel 425

PTL 360

BAS 325

C&J 306

PES 300

Bayou 275

Greenfield 275

Platinum 250

Canyon 226

Mission 155 Total: 19.1MM

Archer 150

Other 1,299

0 500 1,000 1,500 2,000 2,500 3,000 3,500

Source Spears & Associates

23

SEVENTY SEVEN ENERGY

HYDRAULIC FRACTURING SUPPLY CHAIN INTEGRATION

Possess and operate two strategically positioned sand storage and

Storage and Distribution trans load facilities, one in Oklahoma with storage capacity of 140

Facilities million pounds and one in south Texas with 80 million pound capacity

The South Texas facility is capable of multi unit train acceptance

Transloading Facilities which secures us more favorable rail rates and significantly

reduces the number of rail car leases required to manage

activity demand inventory

Executed a JV with a dedicated hydraulic fracturing sand carrier to

ensure adequate truck transportation services for hauling our

hydraulic fracturing sand from our regional distribution points to the

well site

Long term rail car leases procured for the bulk transportation of

Rail Cars hydraulic fracturing sand by rail from the mine origins to our regional

distribution hubs

Own mineral mining leases at multiple sand mining sites in Wisconsin

Sand Reserves and plan to self source a majority of our sand supply by 2016, helping

to mitigate future impact of sand price volatility

24

SEVENTY SEVEN ENERGY

GREAT PLAINS (GPOR)

SEVENTY SEVEN ENERGY

GPOR AREAS OF OPERATION

Utica Shale

Marcellus Shale

Niobrara Shale

Anadarko Basin Haynesville Shale

Permian Basin Barnett Shale

Eagle Ford Shale

= Area of Operations

26

SEVENTY SEVEN ENERGY

GPOR CURRENT AND POTENTIAL SERVICE LINES

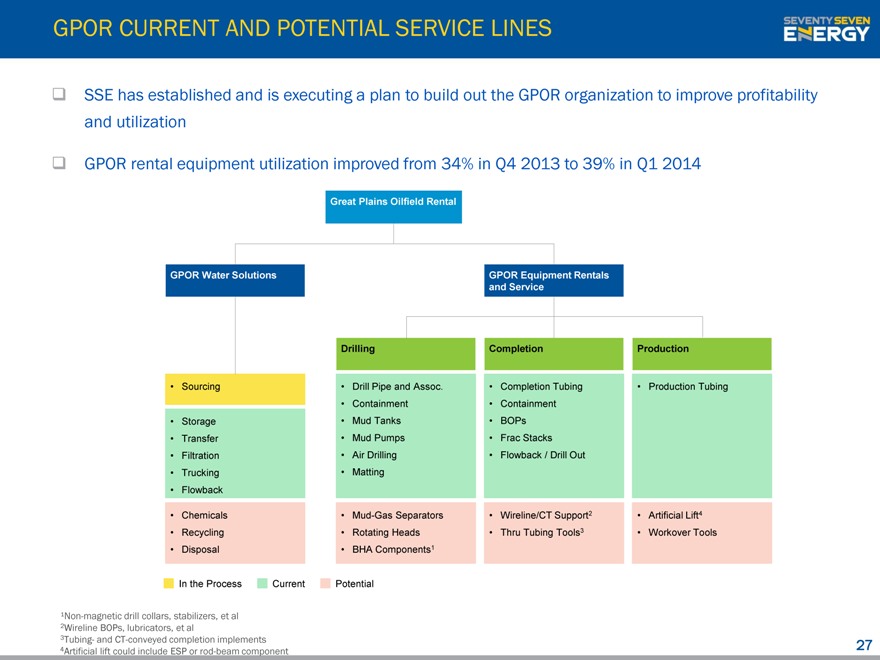

SSE has established and is executing a plan to build out the GPOR organization to improve profitability and utilization

GPOR rental equipment utilization improved from 34% in Q4 2013 to 39% in Q1 2014

Great Plains Oilfield Rental

GPOR Water Solutions GPOR Equipment Rentals

and Service

Drilling Completion Production

Sourcing Drill Pipe and Assoc. Completion Tubing Production Tubing

Containment Containment

Storage Mud Tanks BOPs

Transfer Mud Pumps Frac Stacks

Filtration Air Drilling Flowback / Drill Out

Trucking Matting

Flowback

Chemicals Mud-Gas Separators Wireline/CT Support2 Artificial Lift4

Recycling Rotating Heads Thru Tubing Tools3 Workover Tools

Disposal BHA Components1

In the Process Current Potential

¹Non-magnetic drill collars, stabilizers, et al 2Wireline BOPs, lubricators, et al 3Tubing- and CT-conveyed completion implements 4Artificial lift could include ESP or rod-beam component

27

SEVENTY SEVEN ENERGY

CURRENT GPOR ASSET BASE AND SERVICES

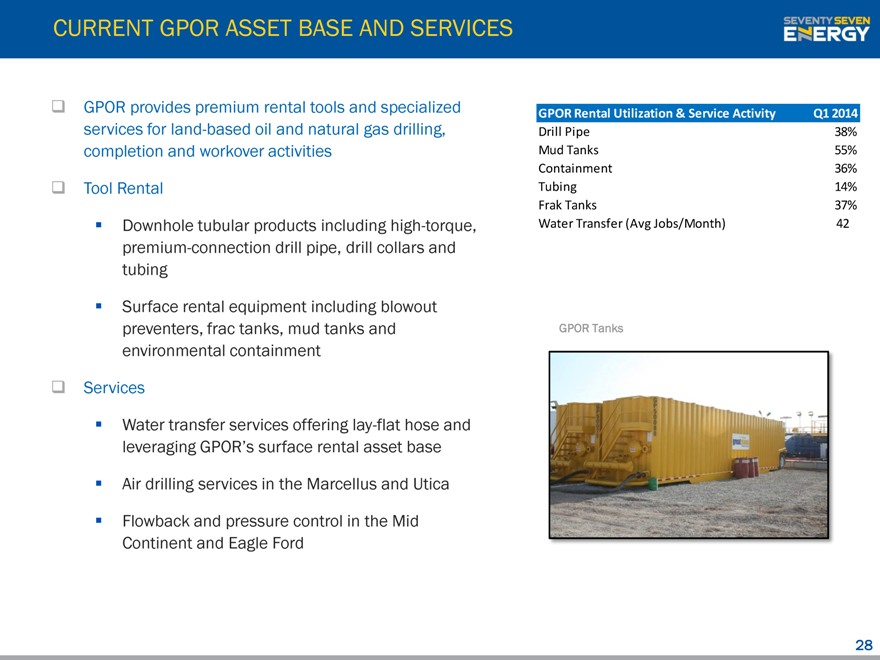

GPOR provides premium rental tools and specialized

services for land-based oil and natural gas drilling,

completion and workover activities

Tool Rental

Downhole tubular products including high-torque,

premium-connection drill pipe, drill collars and

tubing

Surface rental equipment including blowout

preventers, frac tanks, mud tanks and

environmental containment

Services

Water transfer services offering lay-flat hose and

leveraging GPOR’s surface rental asset base

Air drilling services in the Marcellus and Utica

Flowback and pressure control in the Mid

Continent and Eagle Ford

GPOR Rental Utilization & Service Activity Q1 2014

Drill Pipe 38%

Mud Tanks 55%

Containment 36%

Tubing 14%

Frak Tanks 37%

Water Transfer (Avg Jobs/Month) 42

GPOR Tanks

28

SEVENTY SEVEN ENERGY

OILFIELD TRUCKING

SEVENTY SEVEN ENERGY

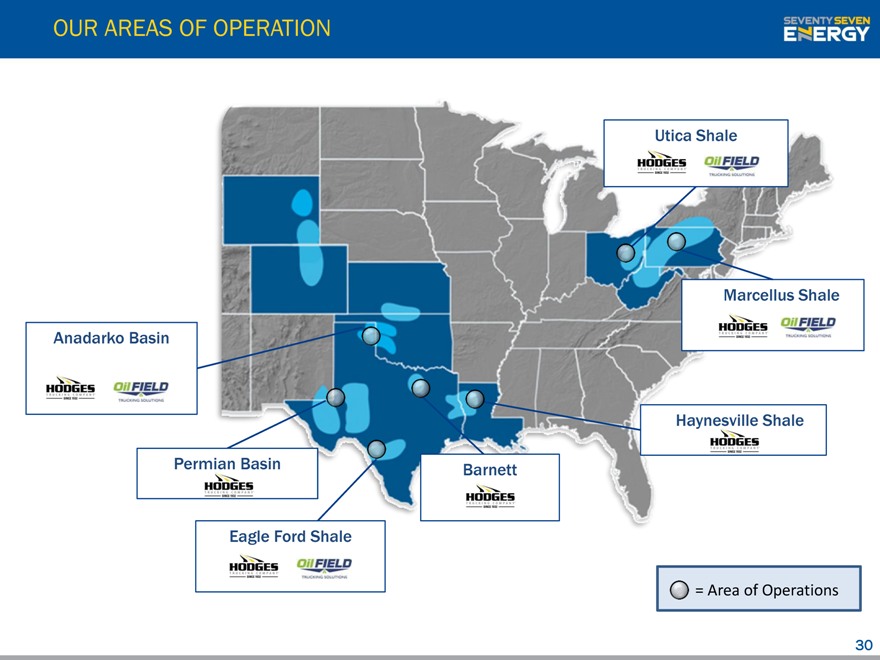

OUR AREAS OF OPERATION

Utica Shale

Marcellus Shale

Anadarko Basin

Haynesville Shale

Permian Basin Barnett

Eagle Ford Shale

= Area of Operations

30

SEVENTY SEVEN ENERGY

CURRENT ASSETS

OTS Water Truck

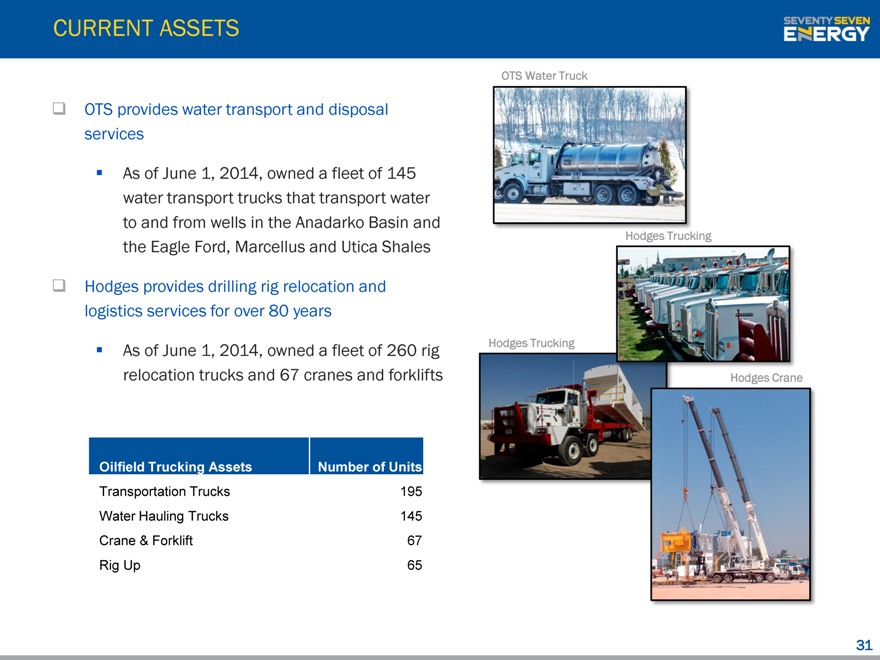

OTS provides water transport and disposal

services

As of June 1, 2014, owned a fleet of 145

water transport trucks that transport water

to and from wells in the Anadarko Basin and

Hodges Trucking

the Eagle Ford, Marcellus and Utica Shales

Hodges provides drilling rig relocation and

logistics services for over 80 years

As of June 1, 2014, owned a fleet of 260 rig Hodges Trucking

relocation trucks and 67 cranes and forklifts Hodges Crane

Oilfield Trucking Assets Number of Units

Transportation Trucks 195

Water Hauling Trucks 145

Crane & Forklift 67

Rig Up 65

31

SEVENTY SEVEN ENERGY

FINANCIAL REVIEW AND BUSINESS

OUTLOOK

SEVENTY SEVEN ENERGY

PRO FORMA SSE CORPORATE STRUCTURE AND CAPITALIZATION

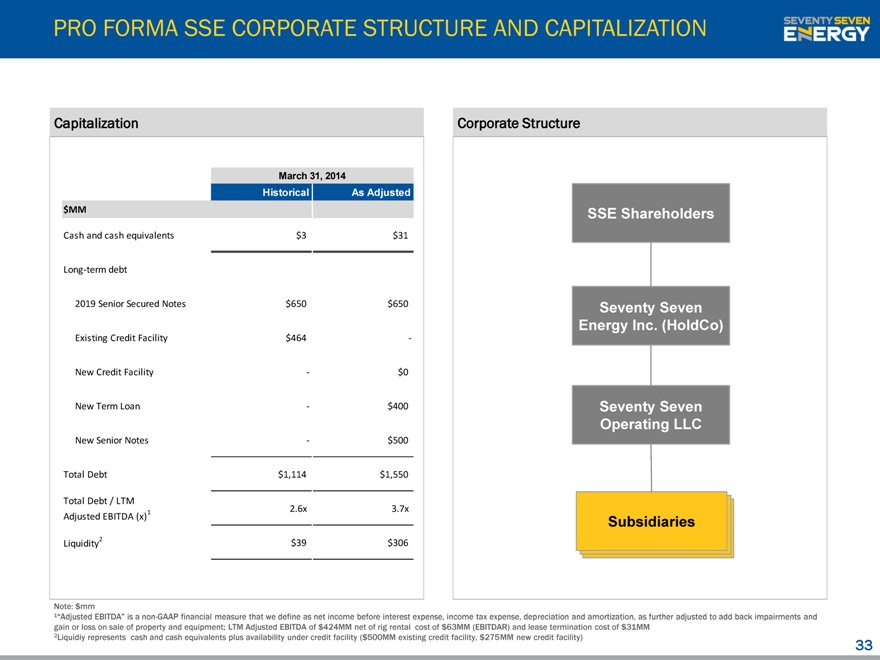

Capitalization Corporate Structure

March 31, 2014

Historical As Adjusted

$MM SSE Shareholders

Cash and cash equivalents $3 $31

Long-term debt

2019 Senior Secured Notes $650 $650 Seventy Seven

Energy Inc. (HoldCo)

Existing Credit Facility $464 —

New Credit Facility — $0

New Term Loan — $400 Seventy Seven

Operating LLC

New Senior Notes — $500

Total Debt $1,114 $1,550

Total Debt / LTM

Adjusted EBITDA (x) Subsidiaries

Liquidity2 $39 $306

Note: $mm

“Adjusted EBITDA” is a non-GAAP financial measure that we define as net income before interest expense, income tax expense, depreciation and amortization, as further adjusted to add back impairments and gain or loss on sale of property and equipment; LTM Adjusted EBITDA of $424MM net of rig rental cost of $63MM (EBITDAR) and lease termination cost of $31MM

2Liquidiy represents cash and cash equivalents plus availability under credit facility ($500MM existing credit facility, $275MM new credit facility)

33

SEVENTY SEVEN ENERGY

HISTORICAL BUSINESS PERFORMANCE

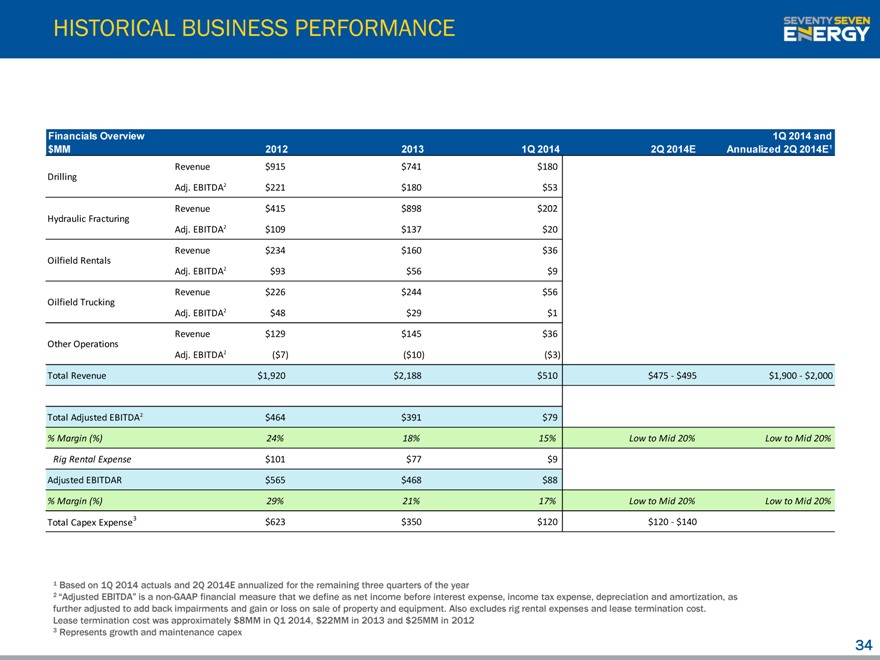

Financials Overview 1Q 2014 and

$MM 2012 2013 1Q 2014 2Q 2014E Annualized 2Q 2014E1

Revenue $915 $741 $180

Drilling

Adj. EBITDA2 $221 $180 $53

Revenue $415 $898 $202

Hydraulic Fracturing

Adj. EBITDA2 $109 $137 $20

Revenue $234 $160 $36

Oilfield Rentals

Adj. EBITDA2 $93 $56 $9

Revenue $226 $244 $56

Oilfield Trucking

Adj. EBITDA2 $48 $29 $1

Revenue $129 $145 $36

Other Operations

Adj. EBITDA2 ($7) ($10) ($3)

Total Revenue $1,920 $2,188 $510 $475-$495 $1,900-$2,000

Total Adjusted EBITDA2 $464 $391 $79

% Margin (%) 24% 18% 15% Low to Mid 20% Low to Mid 20%

Rig Rental Expense $101 $77 $9

Adjusted EBITDAR $565 $468 $88

% Margin (%) 29% 21% 17% Low to Mid 20% Low to Mid 20%

Total Capex Expense3 $623 $350 $120 $120-$140

¹ Based on 1Q 2014 actuals and 2Q 2014E annualized for the remaining three quarters of the year

2 “Adjusted EBITDA” is a non-GAAP financial measure that we define as net income before interest expense, income tax expense, depreciation and amortization, as further adjusted to add back impairments and gain or loss on sale of property and equipment. Also excludes rig rental expenses and lease termination cost.

Lease termination cost was approximately $8MM in Q1 2014, $22MM in 2013 and $25MM in 2012

3 Represents growth and maintenance capex

34

SEVENTY SEVEN ENERGY

OUTLOOK AND OPERATING ASSUMPTIONS

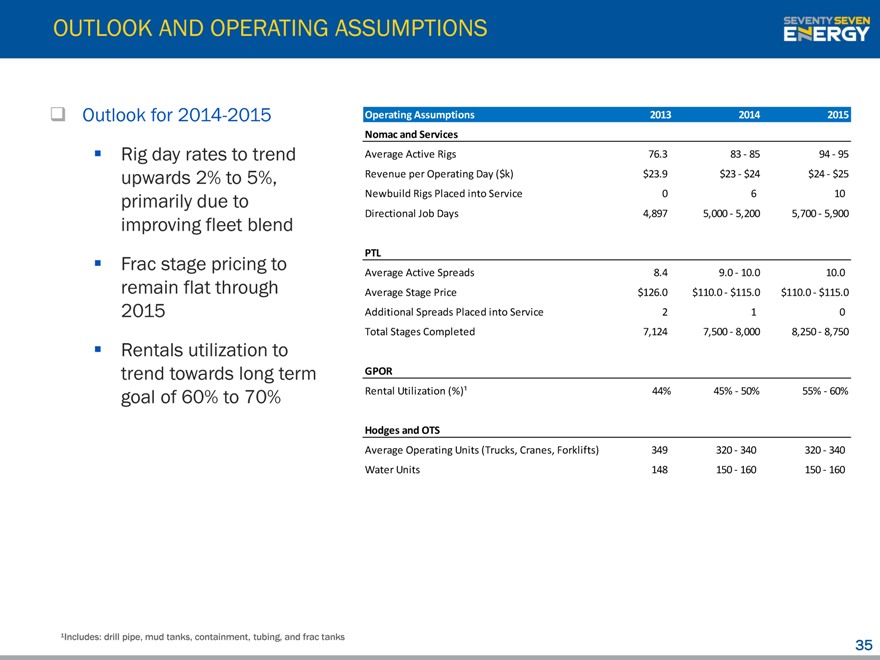

Outlook for 2014-2015 Operating Assumptions 2013 2014 2015

Nomac and Services

Rig day rates to trend Average Active Rigs 76.3 83- 85 94 - 95

upwards 2% to 5%, Revenue per Operating Day ($k) $23.9 $23 - $24 $24 -$25

primarily due to Newbuild Rigs Placed into Service 0 6 10

Directional Job Days 4,897 5,000 - 5,200 5,700 - 5,900

improving fleet blend

PTL

Frac stage pricing to Average Active Spreads 8.4 9.0 - 10.0 10.0

remain flat through Average Stage Price $126.0 $110.0 - $115.0 $110.0 - $115.0

2015 Additional Spreads Placed into Service 2 1 0

Total Stages Completed 7,124 7,500 -8,000 8,250 - 8,750

Rentals utilization to

trend towards long term GPOR

goal of 60% to 70% Rental Utilization (%)¹ 44% 45%-50% 55%-60%

Hodges and OTS

Average Operating Units (Trucks, Cranes, Forklifts) 349 320-340 320 -340

Water Units 148 150-160 150 -160

¹Includes: drill pipe, mud tanks, containment, tubing, and frac tanks

35

SEVENTY SEVEN ENERGY

APPENDIX

SEVENTY SEVEN ENERGY

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDAR

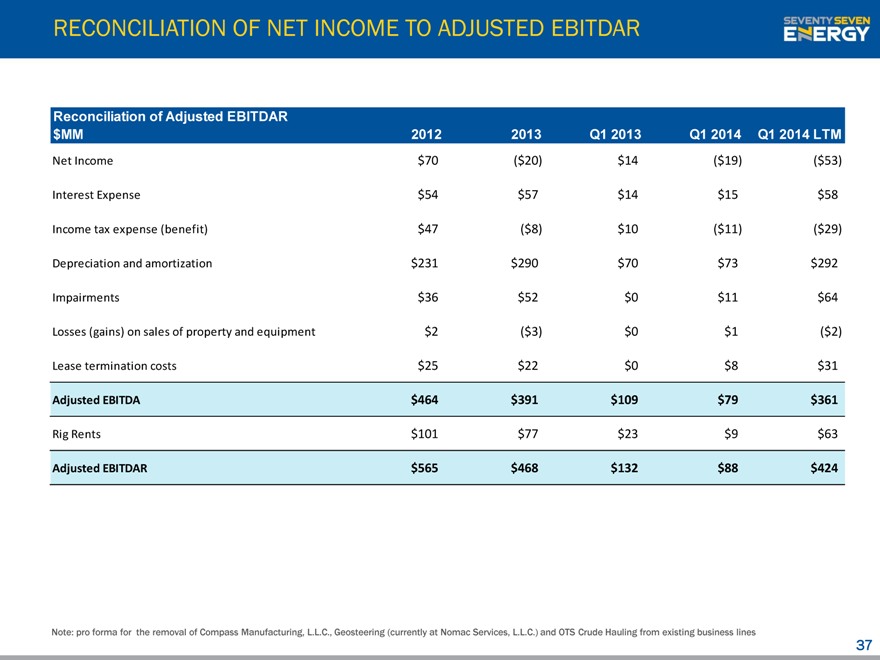

Reconciliation of Adjusted EBITDAR

$MM 2012 2013 Q1 2013 Q1 2014 Q1 2014 LTM

Net Income $70 ($20) $14 ($19) ($53)

Interest Expense $54 $57 $14 $15 $58

Income tax expense (benefit) $47 ($8) $10 ($11) ($29)

Depreciation and amortization $231 $290 $70 $73 $292

Impairments $36 $52 $0 $11 $64

Losses (gains) on sales of property and equipment $2 ($3) $0 $1 ($2)

Lease termination costs $25 $22 $0 $8 $31

Adjusted EBITDA $464 $391 $109 $79 $361

Rig Rents $101 $77 $23 $9 $63

Adjusted EBITDAR $565 $468 $132 $88 $424

Note: pro forma for the removal of Compass Manufacturing, L.L.C., Geosteering (currently at Nomac Services, L.L.C.) and OTS Crude Hauling from existing business lines

37

SEVENTY SEVEN ENERGY

SEVENTY SEVEN ENERGY