10-K 1 sse2015123110-k.htm 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File No. 333-187766

Seventy Seven Energy Inc.

(Exact name of registrant as specified in its charter)

|

| | |

| Oklahoma | | 45-3338422 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

777 N.W. 63rd Street Oklahoma City, Oklahoma | | 73116 |

| (Address of principal executive offices) | | (Zip Code) |

(405) 608-7777

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, non-accelerated filer, or smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | | | | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the common equity held by non-affiliates as of June 30, 2015 was approximately $226.0 million. At February 15, 2016, there were 59,311,401 shares of our $0.01 par value common stock outstanding.

TABLE OF CONTENTS

|

| | |

| | | Page |

| | | |

| |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| |

| Item 15. | | |

| | |

| |

EXPLANATORY NOTE

Seventy Seven Energy Inc. filed its Form 10-K for the year ended December 31, 2015 (the “2015 Form 10-K”) with the U.S. Securities and Exchange Commission on February 17, 2016. Pursuant to General Instruction G(3) to Form 10-K, the Company incorporated by reference the information required by Part III of Form 10-K from its definitive proxy statement for the 2016 Annual Meeting of Shareholders (the “2016 Proxy Statement”), which the Company expected to file with the Commission not later than 120 days after the end of the fiscal year covered by the 2015 Form 10-K. Because the definitive 2016 Proxy Statement will not be filed with the Commission before such date, the Company is filing this Amendment No. 1 to the 2015 Form 10-K (the “Form 10-K/A”) to provide the additional information required by Part III of Form 10-K, to file updated certifications as exhibits as required by the Sarbanes Oxley Act of 2002, and to file Exhibits 4.9 and 21.1, which were listed under Item 15 in the 2015 Form 10-K, but were inadvertently left out of the filing. This Form 10-K/A does not modify the previously reported financial statements or update any of the other disclosures contained in Part I, Part II or Part IV for subsequent events or otherwise. References to “SSE,” “us,” “we,” “Company” and “our” in this report refer to Seventy Seven Energy Inc., together with its subsidiaries.

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Corporate Governance

Board of Directors

The Board is elected by the shareholders to direct the business and affairs of the Company. The Board serves as the ultimate decision-making body of the Company, except for those matters reserved to or shared with the shareholders. The Board selects and oversees the members of senior management, who are charged by the Board with conducting the business of the Company.

The Board has adopted Corporate Governance Guidelines regarding the Board’s role and responsibilities, director qualifications and determination of director independence and other matters, as well as charters for each of the Board committees. The Board has also adopted a Code of Business Conduct and Ethics applicable to all directors, officers and employees of the Company, including our principal executive officer, principal financial officer and principal accounting officer. These documents, along with the Company’s Certificate of Incorporation and Bylaws, provide the framework for the functioning of the Board. The Corporate Governance Guidelines, as well as the Code of Business Conduct and Ethics and all committee charters, are available on the Company’s website at www.77nrg.com in the Corporate Governance sub-section of the section entitled “Investors”. Waivers of provisions of the Code of Business Conduct and Ethics as to any director or executive officer may be made only by the Audit Committee or the Board and amendments to the Code of Business Conduct and Ethics must be approved by the Board. We will post required disclosure about any such waiver or amendment on our website within four business days of such approval. The content of our website is not incorporated into, and does not form a part of, this report.

Board Committees

The Board currently has three standing committees: Audit, Compensation, and Nominating and Governance. The current members of our standing committees and the principal functions of each committee are shown below. Those persons identified as a "Financial Expert" have been found by the Board to be an audit committee financial expert within the meaning of SEC rules. The charter for each committee can be found on our website at www.77nrg.com in the Corporate Governance sub-section of the section entitled “Investors”.

|

| |

Name of Committee and Current Members | Principal Functions |

AUDIT: Tucker Link (Chairman/Financial Expert) Alvin Bernard Krongard Marran Ogilvie (Financial Expert) | Ÿ Oversee our financial reporting process and internal control system Ÿ Oversee the integrity of our financial statements Ÿ Oversee our compliance with legal and regulatory requirements Ÿ Oversee the independent auditor’s qualifications, independence and performance Ÿ Oversee the performance of our internal audit function |

COMPENSATION: Bob Alexander (Chairman) Ronnie Irani Marran Ogilvie | Ÿ Establish and monitor our executive officer compensation program objectives and components Ÿ Evaluate the CEO’s performance in light of corporate goals and objectives and determining and approving and/or making recommendations to the Board with respect to the CEO’s compensation level based on the evaluation Ÿ Review and approve and/or make recommendations to the Board with respect to incentive-compensation and equity-based plans that are subject to Board approval |

NOMINATING AND GOVERNANCE: Alvin Bernard Krongard (Chairman) Ronnie Irani Tucker Link | Ÿ Identify and recommend qualified candidates to the board of directors for nomination as directors Ÿ Make recommendations respecting the composition and size of the board of directors and its committees Ÿ Oversee the evaluation of the board, including director independence, and management Ÿ Review and assess the board’s role in risk oversight |

Directors

The individuals listed below (with their ages as of April 15, 2016) serve as our directors. Our Certificate of Incorporation provides that all directors will be elected annually, each to hold office for a term ending at the next succeeding annual meeting and until a successor is elected and qualified or until the director’s earlier death, resignation, retirement, disqualification or removal from office.

Bob G. Alexander

|

| | |

| | Independent Director |

| | Age: 82 Director since: 2014 Board Committee: Compensation (Chair) Other current public directorships: CVR Energy, Inc. and Transatlantic Petroleum Corporation |

| | |

Bob G. Alexander has been a member of our Board of Directors since June 2014. Mr. Alexander, a founder of Alexander Energy Corporation, served as its Chairman of the Board and Chief Executive Officer from 1980 until its sale to National Energy Group, Inc. in 1996, at which time he became a director of National Energy Group. He served as Chairman of the Board and Chief Executive Officer of National Energy Group from 1998 until its sale in 2006 to SandRidge Energy, Inc. Earlier in his career Mr. Alexander was Vice President and General Manager of the Northern Division of Reserve Oil, Inc. and President of Basin Drilling Corporation, both subsidiaries of Reserve Oil and Gas Company. Mr. Alexander currently serves on the Board of Directors of CVR Energy, Inc. and is a member of its Audit Committee. He also currently serves on the Board of Directors of Transatlantic Petroleum Corporation and is the Chairman of its Compensation Committee. He previously served on the Board of Directors of Quest Resource Corporation from June to August 2008 and Chesapeake Energy Corporation from June 2012 to June 2014. Mr. Alexander has served on numerous committees with the Independent Petroleum Association of America, the Oklahoma Independent Petroleum Association and the State of Oklahoma Energy Commission. He holds a Bachelor of Science degree in Geological Engineering from the University of Oklahoma. Mr. Alexander’s qualifications to serve on our board include his experience as Chief Executive Officer of two public energy companies and service as a director of several other public energy companies. |

Edward J. DiPaolo

|

| | |

| | Independent Director |

| | Age: 63 Director since: 2014 Board Committee: None Other current public directorships: Evolution Petroleum Corporation and Willbros Group, Inc. |

| | |

Edward J. DiPaolo has been a member of our Board of Directors since June 2014. He is currently Chairman and CEO of JNDI Corporation, a private international consulting firm that he founded in 2003. Mr. DiPaolo has also served as a Duff & Phelps Senior Advisor since July 2011. Prior to joining Duff & Phelps, he was a Partner at Growth Capital Partners, L.P. from 2003 to June 2011. Prior to that, he worked for more than 27 years at Halliburton Company where he held several managerial and technical positions, including Group Senior Vice President of Global Business Development, North American Regional Vice President and Far East Regional Vice President. Mr. DiPaolo currently serves on the Board of Directors of several private companies and the following public companies: Evolution Petroleum Corporation, where he is the Lead Director, a member of the Audit and Compensation Committees and Chairman of the Nominating Committee, and Willbros Group, Inc., where he is the Chairman of the Nominating/Governance Committee and a member of the Audit Committee. He also currently serves on the Advisory Board for the West Virginia University College of Engineering and is a member of the Society of Petroleum Engineers. He previously served on the Boards of Directors of Eurasia Drilling Company Ltd., Superior Well Services, Inc., Boots & Coots, Inc. (where he also served as interim Chairman of the Board), Innicor Subsurface Technologies Inc., and Edgen Murray Corporation. Mr. DiPaolo holds a Bachelor of Science degree in Agricultural Engineering as well as an honorary doctorate degree from West Virginia University. Mr. DiPaolo’s qualifications to serve on our board include his engineering background, executive leadership and energy industry experience, as well as service on numerous public and private company boards of directors. |

Ronnie Irani

|

| | |

| | Independent Director |

| | Age: 59 Director since: 2014 Board Committees: Compensation, Nominating & Governance Other current public directorships: None |

| | |

Ronnie Irani has been a member of our Board of Directors since June 2014. Mr. Irani, the founder of RKI Exploration & Production, LLC, served as its President and Chief Executive Officer and a director from 2005 until the sale of the company in August 2015. Prior to forming RKI, he served as Senior Vice President and General Manager of the Western US Business Unit for Dominion Resources, Inc., a Fortune 500 power and energy company. Mr. Irani also previously served in executive positions at Louis Dreyfus Natural Gas Corp. and Woods Petroleum Corporation, both formerly NYSE-listed energy companies. Mr. Irani serves in leadership positions with numerous energy industry groups, including the Oklahoma Energy Resources Board, the Interstate Oil & Gas Compact Commission and the Oklahoma Independent Petroleum Association. He also serves on the board of the University of Oklahoma Mewbourne School of Petroleum & Geological Engineering and the Mewbourne College of Earth and Energy. Mr. Irani holds a Bachelor of Science degree in Chemistry from Bombay University, India, Bachelor and Master of Science degrees in Petroleum Engineering from the University of Oklahoma and a Master of Business Administration degree from Oklahoma City University.

Mr. Irani’s qualifications to serve on our board include his executive leadership and energy industry experience, including his service as the founder and Chief Executive Officer of RKI Exploration & Production, LLC, as well as his technical and operational background. |

Alvin Bernard Krongard

|

| | |

| | Independent Director |

| | Age: 79 Director since: 2014 Board Committees: Audit, Nominating and Governance (Chair) Other current public directorships: Under Armour, Inc., Iridium Communications Inc., and Apollo Global Management, LLC |

| | |

Alvin Bernard Krongard has been a member of our Board of Directors since June 2014. From 2001 to 2004, Mr. Krongard served as an Executive Director of the Central Intelligence Agency and also served as a Counselor to the Director of the Central Intelligence from 1998 to 2001. Prior to such time, he served in various capacities at investment banking firm Alex.Brown, Incorporated, including as Chief Executive Officer and Chairman of the Board. Upon the merger of Alex.Brown with Bankers Trust Corporation in 1997, Mr. Krongard became Vice Chairman of the Board of Bankers Trust Corporation and served in such capacity until joining the Central Intelligence Agency in 2001. Mr. Krongard has served on the Board of Directors of Under Armour, Inc. since 2005, has been its Lead Director since 2006 and currently serves as Chairman of its Audit Committee. He has served on the Board of Directors of Iridium Communications Inc. since 2006, and currently serves as Chairman of its Nominating & Corporate Governance Committee and on its Government Advisory Board. He has also served on the Board of Directors of Apollo Global Management, LLC since 2011, and currently serves on its Audit Committee. He also currently serves as a member of the Board of Trustees of In-Q-Tel, Inc. and as Vice Chairman of the Johns Hopkins Health System. Mr. Krongard holds a Juris Doctorate degree from the University of Maryland School of Law and an A.B. degree from Princeton University. Mr. Krongard’s qualifications to serve on our board include his past leadership experience with Alex.Brown, including as Chief Executive Officer and Chairman of the Board, and his past leadership experience with the Central Intelligence Agency, including serving as Executive Director responsible for overall operations of the agency. |

Tucker Link

|

| | |

| | Independent Director |

| | Age: 66 Director since: 2014 Board Committees: Audit (Chair), Nominating and Governance Other current public directorships: None |

| | |

Tucker Link has been a member of our Board of Directors since June 2014. Mr. Link, the founder of Knightsbridge Investments Limited, has served as its Chairman since July 2004. He has also represented Knightsbridge interests in the following capacities: Chairman of Knightsbridge Chemicals, LTD since July 2004, Chairman of Knightsbridge Biofuels, LLC since September 2007, and Chairman and Chief Executive Officer of Ecogy Biofuels, LLC since September 2007. He also served from March 2001 to July 2004 as President and Chief Operating Officer of Nimir Group Limited, an international oil and petrochemical company with operations in South America, the Middle East, northern Africa and Kazakhstan. Mr. Link previously served in the roles of President and Chief Operating Officer of several financial institutions, the largest having $3.5 billion in assets. Early in his career he was a certified public accountant and audit division supervisor for KPMG. Mr. Link currently serves as a Member of the Board of Regents for Oklahoma Agricultural and Mechanical Colleges, one of which is Oklahoma State University. He holds a Certified Public Accountant designation (currently inactive) in the State of Oklahoma. He also holds a Bachelor of Science degree in Accounting from Oklahoma State University. Mr. Link’s qualifications to serve on our board include his executive leadership and energy industry experience, financial background, as well as service on numerous boards of directors. |

Marran H. Ogilvie

|

| | |

| | Independent Director |

| | Age: 47 Director since: 2014 Board Committees: Audit, Compensation Other current public directorships: Zais Financial Corporation, LSB Industries Inc., Four Corners Property Trust, Inc. and The Korea Fund, Inc. |

| | |

Marran H. Ogilvie has been a member of our Board of Directors since June 2014. Ms. Ogilvie has also served as an Advisor to the Creditors Committee for the Lehman Brothers International (Europe) Administration since June 2010. Prior to that, she was a member of Ramius, LLC, an alternative investment management firm, where she served in various capacities from 1994 to 2009, including as Chief Operating Officer from 2007 to 2009 and General Counsel from 1997 to 2007. In 2009, Ramius, LLC merged with Cowen Group, Inc., a diversified financial services firm, when she became Chief of Staff at Cowen Group, Inc. until June 2010. She currently serves on the Board of Directors of the following public companies: Zais Financial Corporation, an externally managed and advised real estate investment trust, where she is Chair of the Compensation Committee and member of the Audit Committee, LSB Industries Inc., a manufacturer of heating and air conditioning products, where she serves on the Nominating and Corporate Governance Committee, Four Corners Property Trust, Inc., a real estate investment trust, where she is the Chair of the Nominating and Governance Committee and a member of the Compensation Committee, and The Korea Fund, a non-diversified, closed-end investment company which invests in Korean companies, where she is a member of the Audit Committee. She previously served on the Board of Directors of Southwest Bancorp, Inc., a commercial bank with branches in Oklahoma, Texas and Kansas, from January 2012 to April 2015. Ms. Ogilvie holds a Bachelor of Arts degree from the University of Oklahoma and a Juris Doctorate degree from St. John’s University. Ms. Ogilvie’s qualifications to serve on our board include her executive leadership experience, financial and legal background, as well as service on other public company boards. |

Jerry Winchester

|

| | |

| | Management Director |

| | President and Chief Executive Officer Age: 57 Director since: 2014 Board Committee: None Other current public directorships: None |

| | |

Jerry Winchester has served as our Chief Executive Officer since September 2011 and has been a member of our Board of Directors and served as our President since June 2014. From November 2010 to June 2011, Mr. Winchester served as the Vice President—Boots & Coots of Halliburton. From July 2002 to September 2010, Mr. Winchester served as the President and Chief Executive Officer of Boots & Coots International Well Control, Inc. (Boots & Coots), a NYSE-listed oilfield services company specializing in providing integrated pressure control and related services. In addition, from 1998 until September 2010, Mr. Winchester served as a director of Boots & Coots and, from 1998 until 2008, served as Chief Operating Officer of Boots & Coots. Mr. Winchester started his career with Halliburton in 1981. He holds a Bachelor of Science degree from Oklahoma State University. Mr. Winchester’s qualifications to serve on our board include his over 30 years of technical and managerial experience, including chief executive experience, in the oilfield services industry. |

Executive Officers

The individuals listed in the table below (with their ages as of April 15, 2016) serve as our executive officers, and for the year ended December 31, 2015 were our named executive officers, or NEOs. Biographical information for each of our executive officers (other than Mr. Winchester whose biographical information is included above) follows the table.

|

| | | | |

| Name | | Age | | Position |

| Jerry Winchester | | 57 | | President and Chief Executive Officer |

| Cary Baetz | | 51 | | Chief Financial Officer and Treasurer |

| Karl Blanchard | | 56 | | Chief Operating Officer |

| James Minmier | | 52 | | President-Nomac Drilling, L.L.C. |

| William Stanger | | 62 | | President-Performance Technologies, L.L.C. |

Cary Baetz

|

| | |

| | |

| | Mr. Baetz has served as our Chief Financial Officer since January 2012 and as our Treasurer since June 2014. From November 2010 to December 2011, he served as Senior Vice President and Chief Financial Officer of Atrium Companies, Inc. and from August 2008 to September 2010, served as Chief Financial Officer of Boots & Coots International Well Control, Inc. From 2005 to 2008, Mr. Baetz served as Vice President of Finance, Treasurer and Assistant Secretary of Chaparral Steel Company. Prior to joining Chaparral, he had been employed since 1996 with Chaparral’s parent company, Texas Industries Inc. From 2002 to 2005, he served as Director of Corporate Finance of Texas Industries Inc. Mr. Baetz holds a Bachelor of Science degree from Oklahoma State University and a Master of Business Administration degree from the University of Arkansas. |

Karl Blanchard

|

| | |

| | |

| | Mr. Blanchard has served as our Chief Operating Officer since June 2014. Previously, from November 2012 to June 2014, he served as Vice President of Production Enhancement of Halliburton Company. From January 2011 to October 2012, he was Vice President of Cementing for Halliburton. Mr. Blanchard also served as Vice President of Testing and Subsea from October 2008 to December 2010 and President Director of PT Halliburton Indonesia from 2006-2008. Mr. Blanchard began his career at Halliburton in 1981. Before serving as an executive at Halliburton, he held leadership positions in engineering, marketing, sales and operations and has gained experience in mergers, acquisitions and divestitures. Mr. Blanchard holds a Bachelor of Science degree in engineering from Texas A&M University and is a member of the Society of Petroleum Engineers. |

Jay Minmier

|

| | |

| | |

| | Mr. Minmier has served as President of Nomac Drilling, L.L.C., which operates our drilling business, since June 2011. Prior to joining our company, from December 2008 to June 2011, Mr. Minmier served as Vice President and General Manager for Precision Drilling Corporation. From August 2005 to December 2008, he served as Vice President of Grey Wolf Inc. Mr. Minmier has more than 20 years’ experience with drilling contractors, notably Grey Wolf Inc. and Helmerich & Payne, Inc. Mr. Minmier holds a Bachelor of Science degree from the University of Texas at Arlington and a Master of Business Administration degree from the University of West Florida. |

William Stanger

|

| | |

| | |

| | Mr. Stanger has served as the President of Performance Technologies, L.L.C., which operates our hydraulic fracturing business, since January 2011. Mr. Stanger joined our company in January 2010 as President of Great Plains Oilfield Rentals, L.L.C. Prior to joining our company, from 1987 to January 2010, he served in various domestic and international management capacities with Schlumberger Limited, including Well Services Vice President of Operations North America and Well Services Vice President of Global Sales. Mr. Stanger holds a Bachelor of Science degree from the University of Tulsa. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, requires our directors and executive officers and persons who beneficially own more than 10% of the Company’s common stock to file reports of ownership and subsequent changes with the SEC. Based only on a review of copies of such reports and written representations delivered to the Company by such persons, no such person filed a late report under Section 16(a) during 2015.

Item 11. Executive Compensation

Compensation Discussion and Analysis

In this section, we describe the material components of our executive compensation program for the Company’s named executive officers, whose compensation is set forth in the Summary Compensation Table and other compensation tables contained in this Item 11.

Executive Compensation Program

Objectives of our Executive Compensation Program

The objectives of our compensation program are as follows:

|

| | | | |

| Ÿ | Attract and retain high performing executives | | Ÿ | Align compensation with shareholder interests while incentivizing long-term value creation

|

| Ÿ | Discourage excessive risk by rewarding both short-term and long-term performance | | Ÿ | Maintain flexibility to respond to the dynamic and cyclical energy industry |

| Ÿ | Pay for performance and thus tie a meaningful portion of realized compensation to business and stock price performance | | | |

Checklist of Compensation Practices

|

| | | | | |

| þ | | Objective annual incentive program with pre-determined performance measures | þ | | Minimal perquisites |

| þ | | Representative peer group | þ | | Use of independent compensation consultant |

| þ | | Double trigger upon change of control | þ | | Margining and speculative transactions prohibited |

| þ | | No tax gross-ups for executive officers | þ | | 2015 incentive plan intended to qualify for Section 162(m) tax deductibility |

Response to 2015 Shareholder Advisory Vote on Named Executive Officer Compensation

At our 2015 Annual Meeting of Shareholders, our say-on-pay proposal received support from 61% of our shareholders who voted at the meeting. Although the Company received majority support for the proposal, our Board desires to win greater shareholder support in the future, and as a result we embarked on a broad-based shareholder outreach program to directly seek feedback, understand concerns and consider appropriate actions. Our Non-Executive Chairman and management reached out to shareholders representing approximately 41% of our outstanding common stock and had constructive conversations with many of them. The key concern we heard involved the Company's long-term incentive awards; in particular, the magnitude of the awards granted in connection with our spin-off from Chesapeake Energy Corporation in 2014, and a desire for inclusion over time of awards that utilize objective performance measures. As a result of the continuing challenges the Company is facing due to the broader energy industry downturn, the Board and Compensation Committee have not yet made a decision with respect to 2016 long-term compensation. The Compensation Committee, however, will evaluate the Company's executive compensation program to ensure alignment with the objectives described above while considering feedback received from shareholders.

Role of the Compensation Committee

The Compensation Committee has responsibility for overseeing the compensation of the Company’s executives. In particular, the Compensation Committee has authority to annually review and approve corporate goals and objectives relevant to CEO compensation, evaluate the CEO’s performance in light of those goals and objectives, determine and approve the CEO’s compensation based on this evaluation, and make appropriate recommendations to the full Board. In doing so, the Compensation Committee will review all elements of the CEO’s compensation. The Compensation Committee also has authority to approve non-CEO executive compensation and together with the full Board approve and administer incentive compensation and equity-based plans. Pursuant to its charter, the Compensation Committee has the authority to retain and terminate compensation consultants as well as legal, accounting and other advisors, including authority to approve the advisors’ fees and other engagement terms.

Role of the CEO in Compensation Decisions

Mr. Winchester periodically reviews the performance of each of the named executive officers, excluding himself, develops preliminary recommendations regarding salary adjustments and annual and long-term award amounts, and provides these recommendations to the Compensation Committee. The Compensation Committee takes these recommendations into account in

making final compensation decisions within its authority or subsequent recommendations to the full Board. Ultimately, all compensation decisions are within the discretion of either our Compensation Committee or our Board.

Role of the Compensation Consultant

Pearl Meyer & Partners (“Pearl Meyer”) has been retained by the Compensation Committee as its independent compensation consultant. Pearl Meyer provides advice and analysis on the design and level of named executive officer compensation. In connection with their services, Pearl Meyer periodically works with senior management and the Non-Executive Chairman to formalize proposals for the Compensation Committee and the full Board. The Compensation Committee has assessed the independence of Pearl Meyer pursuant to NYSE and SEC rules and concluded that Pearl Meyer’s work for the Compensation Committee does not raise any conflict of interest.

Benchmarking

Following the Company's spin-off from Chesapeake Energy Corporation in June 2014, the Compensation Committee conducted a comprehensive review of the Company’s executive compensation program for purposes of approving post-spin-off compensation, including 2015 compensation. As part of this review, the Committee adopted a peer group with input from management and Pearl Meyer. The peer group was developed based on several attributes including:

| |

| • | Companies competing for business in the same space, products and/or services; |

| |

| • | Companies that compete with us for talented management, operational employees and staff; |

| |

| • | Companies in similar SIC code or sector; |

| |

| • | Companies that generally are subject to the same market conditions; and |

| |

| • | Companies that are tracked similarly or as comparable investments by equity analysts. |

Consideration was also given to other factors, including comparable revenues, the optimal number of peers and market demographics. Due to the relatively small number of comparable publicly-traded diversified oilfield services companies, in order to create a sufficient sample of companies against which compensation could be compared, the peer group was broadened to include companies in similar industries with which the Company competes for executive talent.

The peer group that the Committee selected in 2014, and which remained unchanged for 2015, consisted of the following companies:

|

| | |

| Company Name | Ticker Symbol | Primary SIC Description |

Basic Energy Services | BAS | Oil & Gas Field Services |

C&J Energy Services | CJES | Oil & Gas Field Services |

Exterran Holdings | EXH | Oil & Gas Field Machinery |

FMC Technologies | FTI | Oil & Gas Field Machinery |

Helmerich & Payne | HP | Drilling Oil & Gas Wells |

Key Energy Services | KEG | Oil & Gas Field Services |

Nabors Industries | NBR | Drilling Oil & Gas Wells |

Oceaneering International | OII | Oil & Gas Field Services |

Oil States International | OIS | Oil & Gas Field Machinery |

Patterson-UTI Energy | PTEN | Drilling Oil & Gas Wells |

Pioneer Energy Services | PES | Drilling Oil & Gas Wells |

Superior Energy Services | SPN | Oil & Gas Field Services |

TETRA Technologies | TTI | Oil & Gas Field Services |

Unit Corporation | UNT | Crude Petroleum & Natural Gas |

As part of the Compensation Committee’s benchmarking analysis, base salary, total cash, long term incentive and total target direct compensation levels for each of the Company’s named executive officers was compared to the 25th, 50th and 75th percentile of the benchmark data, which included peer proxy data where available and several executive compensation benchmark surveys, to determine whether the Company’s compensation practices aligned with benchmark data. The mix of total direct compensation components for each of the Company’s named executive officers was also compared to benchmark data. While the Compensation Committee intends for the Company’s compensation practices to align with the median of the market, as reflected in the benchmark data, the Compensation Committee believes that such decisions require a deliberate review of market competition for a particular position as well as each individual’s possession of a unique skill or knowledge set, proven leadership capabilities or experience, and Company performance. Based on such factors, the Compensation Committee may determine in respect of one or more individuals that it is appropriate for compensation to meet, exceed, or fall below the median of the benchmark data with respect to a particular compensation element or total compensation.

2015 Named Executive Officer Compensation

The purpose and key characteristics of each material element of our program are described below:

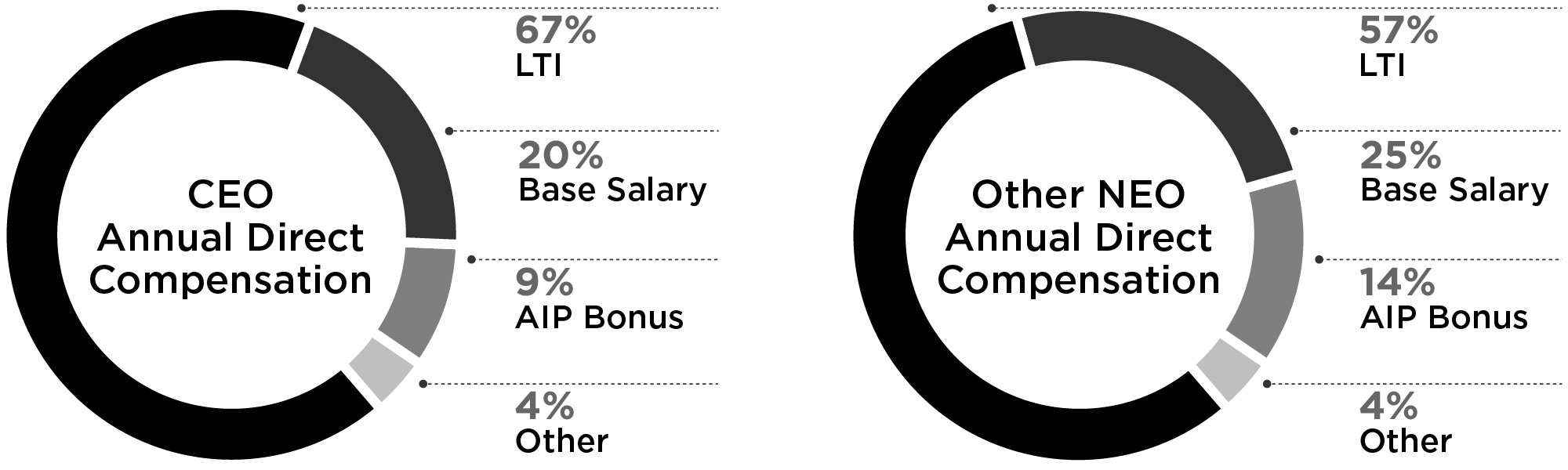

Percentages reflected above are based on amounts reported in the Summary Compensation Table, except that Mr. Blanchard's cash bonus was included in the total AIP Bonus amount for the Other NEO Annual Direct Compensation chart.

Base Salary. Base salaries reflect each named executive officer’s base level of responsibility, leadership, tenure and contribution to the success and profitability of the Company and the competitive marketplace for executive talent specific to its

industry. The Board of Directors initially held base salaries for each named executive officer flat in 2015 compared to 2014. In addition, consistent with the CEO's recommendation, the Board approved a 5% reduction to the base salaries of each named executive officer, effective September 13, 2015, as part of an initiative to reduce cash costs in light of industry conditions.

|

| | | | |

| Name | | Base Salary as of January 1, 2015 | | Base Salary as of December 31, 2015 |

| | | | | |

Jerry Winchester | | $890,000 | | $845,500 |

Karl Blanchard | | $600,000 | | $570,000 |

Cary Baetz | | $475,000 | | $451,250 |

James Minmier | | $450,000 | | $427,500 |

William Stanger | | $400,000 | | $380,000 |

Annual Incentive Program Compensation. The Company’s performance-based annual incentive plan, or AIP, for 2015 was approved by the Compensation Committee on March 30, 2015, and is intended to motivate and reward NEOs for achieving goals based on predetermined strategic, financial, and operating performance objectives. Incentive compensation target amounts under the AIP for the named executive officers were the same for 2015 as they were for 2014 and are set forth in the table below.

|

| | | | |

| Name | | Target as Percent of Base Salary | | Target |

| | | | | |

Jerry Winchester | | 100% | | $890,000 |

Karl Blanchard | | 85% | | $510,000 |

Cary Baetz | | 71% | | $337,500 |

James Minmier | | 70% | | $315,000 |

William Stanger | | 65% | | $260,000 |

How the AIP Works. To determine the bonus earned by each named executive officer, the Compensation Committee used the following methodology:

| |

| • | A score between 0% and 200% was assigned for each objective as follows: |

| |

| - | If performance was equal to the minimum and up to the target, a score of 0% up to 100% was assigned using linear interpolation between the minimum and the target. |

| |

| - | If performance was equal to the target and up to the stretch target, a score of 100% up to 200% was assigned using linear interpolation between the target and the maximum. |

| |

| • | The score for each objective was then multiplied by the respective target weighting for that objective to determine its actual weighting. |

| |

| • | The actual weighting for each objective within each category was then totaled to determine the total category weighting for each category. |

The following table sets forth the minimum, target and stretch objectives for 2015, the target weighting for each objective, the score and the actual weighting for each objective based on actual Company performance.

|

| | | | | | |

Objective | Minimum | Target | Stretch | Target Weighting | Score | Actual Weighting |

SSE Consolidated | | | | | | |

| Revenue (millions) | $1,380 | $1,533 | $1,629 | 10% | 0% | 0% |

| Gross Margin (millions) | $313 | $348 | $377 | 40% | 0% | 0% |

| 2015 total recordable incident rate (TRIR) | 1.50 | 1.30 | 1.11 | 25% | 200% | 50% |

Total shareholder return(1) | | Top 50% of peer group | Top 20% of peer group | 25% | 0% | 0% |

| Total Category Weighting | — | — | — | 100% | | 50% |

| Drilling | | | | | | |

NOMAC(2) | | | | | | |

| Revenue ($millions) | $449 | $499 | $596 | 16% | 0% | 0% |

| Gross Margin ($Millions) | $191 | $212 | $240 | 30% | 68.1% | 20.4% |

| Service / Reliability (IADC Code 8) | 1.5% | 1.2% | 1.0% | 24% | 200% | 48% |

| 2015 TRIR | 1.013 | 0.8811 | 0.7489 | 24% | 78.1% | 18.8% |

| NOMAC DIRECTIONAL | | | | | | |

| Revenue ($millions) | $27 | $30 | $31 | 1% | 0% | 0% |

| Gross Margin ($millions) | $0 | $0 | $0.30 | 3% | 0% | 0% |

| 2015 TRIR | 1.0 | 0.67 | 0.033 | 2% | 0% | 0% |

| Total Category Weighting | — | — | — | 100% | | 87.2% |

|

| | | | | | |

Hydraulic Fracturing | | | | | | |

| Revenue ($millions) | $702 | $780 | $791 | 12% | 0% | 0% |

Adjusted EBITDA ($millions)(3) | $90 | $100 | $106 | 63% | 0% | 0% |

| 2015 TRIR | 1.67 | 1.45 | 1.23 | 25% | 200% | 50% |

| Total Category Weighting | | | | 100% | | 50% |

| Oilfield Rentals | | | | | | |

| Revenue ($millions) | $90 | $100 | $110 | 35% | 0% | 0% |

| Gross Margin ($millions) | $21 | $24 | $27 | 45% | 0% | 0% |

| 2015 TRIR | 1.84 | 1.60 | 1.36 | 20% | 91.7% | 18.3% |

| Total Category Weighting | — | — | — | 100% | — | 18.3% |

| Oilfield Trucking | | | | | | |

| Revenue ($millions) | $64 | $71 | $79 | 35% | 0% | 0% |

| Gross Margin ($millions) | $1 | $3 | $4 | 35% | 0% | 0% |

| 2015 TRIR | 1.96 | 1.70 | 1.45 | 30% | 0% | 0% |

| Total Category Weighting | — | — | — | 100% | — | —% |

| |

| (1) | Total shareholder return is determined by calculating the change in the closing price of SSE’s common stock on December 31, 2015 compared to the closing price of SSE’s common stock on December 31, 2014. |

| |

| (2) | Excludes the results of the Company’s directional drilling business, which is shown separately. |

| |

| (3) | We define Adjusted EBITDA as net income before interest expense, income tax expense, depreciation and amortization, as further adjusted to add back gains on early extinguishment of debt, impairment of goodwill, impairments and other, loss on sale of a business and exit costs, gain or loss on sale of property and equipment, non-cash stock compensation, severance-related costs, impairment of equity method investment, interest income and certain other non-recurring items, such as the sale of our drilling rig relocation and logistics business and the sale of our water hauling assets to a third party.. |

| |

| • | The total category weighting for each category was then multiplied by the respective weighting set forth opposite each NEO’s name in the table below and then such scores were totaled to determine each NEO’s total weighted score. |

|

| | | | | | | | | | | | | | | |

Name | | | SSE Consolidated

| | | Drilling

| | | Hydraulic Fracturing

| | | Oilfield Rentals | | | Other |

Jerry Winchester | | | 80% | | | 5% | | | 5% | | | 5% | | | 5% |

Karl Blanchard | | | 70% | | | 7.5% | | | 7.5% | | | 7.5% | | | 7.5% |

Cary Baetz | | | 80% | | | 5% | | | 5% | | | 5% | | | 5% |

James Minmier | | | 30% | | | 70% | | | — | | | — | | | — |

William Stanger | | | 30% | | | — | | | 70% | | | — | | | — |

| |

| • | Each NEO’s respective target payment was then multiplied by their total weighted score to determine the bonus earned, as set forth opposite each NEO’s name in the table below. |

|

| | | | | | | | | |

Name | | | Target | | | Total Weighted Score | | | Bonus Earned |

Jerry Winchester | | | $890,000 | | | 47.8% | | | $425,204 |

Karl Blanchard | | | $510,000 | | | 46.7% | | | $237,985 |

Cary Baetz | | | $337,500 | | | 47.8% | | | $161,243 |

James Minmier | | | $315,000 | | | 76.0% | | | $239,486 |

William Stanger | | | $260,000 | | | 50.0% | | | $130,000 |

Cash Bonus. None of the named executive officers received a cash bonus in 2015 other than through the AIP, except Mr. Blanchard. In addition to the amount earned by Mr. Blanchard under the AIP, he was awarded a cash bonus of $362,015 to meet the Company's 2015 contractual obligation to Mr. Blanchard under his employment agreement with the Company.

Long-Term Incentive Compensation (LTI). Total target compensation for named executive officers is weighted heavily toward long-term incentive compensation. This approach is intended to motivate our named executive officers to focus on creating long-term value and reinforce the link between the interests of our shareholders and named executive officers. The grant date dollar value of the LTI awards granted to the NEOs in 2015 are set forth in the table below. The Board substantially reduced the value of awards for each NEO compared to 2014 to reflect normalized levels in 2015 consistent with the Compensation Committee's benchmarking analysis. The grant date values of the 2015 LTI awards made to our NEOs were at or near the market median of our peer group.

|

| | | |

Name | | | Value of Award |

Jerry Winchester | | | $3,149,000 |

Karl Blanchard | | | $1,697,000 |

Cary Baetz | | | $1,114,000 |

James Minmier | | | $1,000,000 |

William Stanger | | | $717,000 |

Other Compensation Arrangements. The Company also provides to our named executive officers compensation in the form of personal benefits that are generally available on a non-discriminatory basis to all employees, including health and welfare insurance benefits, and matching contributions of common stock under the company’s 401(k) Plan and Nonqualified Deferred Compensation Plan, or DCP, which for 2015 was up to 6% of an employee’s annual base salary and cash bonus compensation. The Company also purchases season tickets to sporting events for business outings with customers and vendors. If the tickets are not being used for business purposes, the named executive officers and other employees have opportunities to use these tickets at no incremental cost to the Company.

2016 Named Executive Officer Compensation

On March 9, 2016, the Board of Directors approved the terms of the Seventy Seven Energy Inc. 2016 Performance Incentive Compensation Plan (the “Plan”). Pursuant to the terms of the Plan, the named executive officers and other officers of the Company and its wholly-owned subsidiaries are eligible to receive performance-based cash awards on a quarterly basis.

The Plan is administered by the Compensation Committee of the Board (the “Committee”). A participant’s target award opportunity under the Plan is equal to 150% of the participant’s annual base salary, and, depending on the level of achievement of performance goals, a participant’s final award may be as little as zero or as much as 150% of the target award opportunity. Awards are earned under the Plan based on the Company’s achievement during each calendar quarter in 2016 of performance goals related to the Company’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), weighted at 80%, and the Company’s total recordable injury rate, weighted at 20%. The Committee determines the achievement of the performance goals after the end of each calendar quarter, and, to the extent earned for a quarter, a participant’s award under the Plan is paid in a lump sum in cash soon after the end of the calendar quarter.

Unless otherwise provided in an employment agreement with the Company, a participant will forfeit any unpaid portions of an award under the Plan upon termination of the participant’s employment. Awards under the Plan are in lieu of annual target bonus awards that would otherwise be granted under the Company’s Amended and Restated 2014 Incentive Plan and are deemed to be an annual target bonus for purposes of any employment agreement between the Company and a participant.

Compensation Committee Report

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis set forth above. Based on the review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s 2015 Form 10-K.

Members of the Compensation Committee:

Bob A. Alexander, Chairman

Ronnie Irani

Marran H. Ogilvie

Executive Compensation Tables

The following tables provide information regarding the compensation awarded to our named executive officers during the periods set forth in the tables. Prior to our separation from Chesapeake on June 30, 2014, our named executive officers were employees of Chesapeake and were compensated under Chesapeake’s compensation programs. All such compensation was earned in connection with our named executive officers’ roles with respect to our business.

Realized Compensation Table

Because the vast majority of reported pay represents potential pay, to supplement the Securities and Exchange Commission (“SEC”) required disclosure, we have included the table set forth below to show the compensation the named executive officers actually realized in 2014 and 2015. Realized compensation was determined using actual salary paid, actual cash bonus earned for performance in the relevant year (even if paid in the subsequent year), the value of long term incentive awards that vested during the relevant year, and the value of 401(k) and deferred compensation company matching contributions received during the relevant year. Reported total compensation determined in accordance with SEC rules includes several items driven by accounting assumptions, and as a result may differ substantially from the compensation actually realized by our named executives in a particular year.

|

| | | | |

Name | | | 2014 Realized Compensation(1) | 2015 Realized Compensation(1) |

Jerry Winchester | | | $3,436,076 | $2,200,949 |

Karl Blanchard | | | $1,072,509 | $1,376,526 |

Cary Baetz | | | $1,394,243 | $1,105,666 |

James Minmier | | | $1,654,723 | $1,176,794 |

William Stanger | | | $1,405,181 | $921,903 |

| |

| (1) | The value of long term incentive awards that vested were calculated (i) for restricted stock and company matching contributions using the closing price of the Company’s common stock on the NYSE on the date of vesting; (ii) for options using the “spread” between the exercise price and the closing price of the Company’s common stock on the NYSE on the date of vesting, whether or not exercised on such date, which did not result in any value as the exercise price was greater than the closing price, and (iii) excluding the value of cash payments made by Chesapeake to Mr. Winchester in satisfaction of released performance share unit awards. |

Summary Compensation Table

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | | Year | | Salary(a) | | Bonus(b) | | Stock Awards(c) | | Option Awards(d) | | Non-Equity Incentive Plan Compensation(e) | | All Other Compensation(f) | | Total |

Jerry Winchester President and Chief Executive Officer | | | 2015 | | $ | 910,536 |

| | — |

| | $ | 3,149,000 |

| | — |

| | $ | 425,204 |

| | $ | 191,480 |

| | $ | 4,676,220 |

|

| | 2014 | | $ | 710,230 |

| | $ | 796,000 |

| | $ | 13,063,784 |

| | $ | 500,006 |

| | $ | 912,321 |

| | $ | 345,335 |

| | $ | 16,327,676 |

|

| | 2013 | | $ | 500,000 |

| | — |

| | $ | 1,875,061 |

| | $ | 1,801,004 |

| | $ | 796,000 |

| | $ | 100,500 |

| | $ | 5,072,565 |

|

Cary Baetz Chief Financial Officer and Treasurer | | | 2015 | | $ | 485,966 |

| | — |

| | $ | 1,114,004 |

| | — |

| | $ | 161,243 |

| | $ | 63,881 |

| | $ | 1,825,094 |

|

| | 2014 | | $ | 435,001 |

| | $ | 250,000 |

| | $ | 8,060,724 |

| | — |

| | $ | 343,988 |

| | $ | 162,750 |

| | $ | 9,252,463 |

|

| | 2013 | | $ | 369,230 |

| | $ | 553,500 |

| | $ | 295,014 |

| | — |

| |

|

| | $ | 77,885 |

| | $ | 1,295,629 |

|

Karl Blanchard Chief Operating Officer | | | 2015 | | $ | 613,845 |

| | $ | 362,015 |

| | $ | 1,697,004 |

| | — |

| | $ | 237,985 |

| | $ | 69,607 |

| | $ | 2,980,456 |

|

| | 2014 | | $ | 312,308 |

| | $ | 200,000 |

| | $ | 1,600,010 |

| | — |

| | $ | 546,277 |

| | $ | 113,925 |

| | $ | 2,772,520 |

|

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

James Minmier President-Nomac Drilling | | | 2015 | | $ | 460,389 |

| | — |

| | $ | 1,000,004 |

| | |

| | $ | 239,486 |

| | $ | 94,538 |

| | $ | 1,794,417 |

|

| | 2014 | | $ | 414,232 |

| | $ | 200,000 |

| | $ | 6,902,457 |

| | — |

| | $ | 446,097 |

| | $ | 122,135 |

| | $ | 8,084,921 |

|

| | 2013 | | $ | 344,500 |

| | $ | 400,800 |

| | $ | 390,047 |

| | — |

| |

|

| | $ | 110,175 |

| | $ | 1,245,522 |

|

William Stanger President-Performance Technologies | | | 2015 | | $ | 409,232 |

| | — |

| | $ | 717,003 |

| | |

| | $ | 130,000 |

| | $ | 55,035 |

| | $ | 1,311,270 |

|

| | 2014 | | $ | 382,116 |

| | $ | 200,000 |

| | $ | 5,786,129 |

| | — |

| | $ | 281,159 |

| | $ | 117,317 |

| | $ | 6,766,721 |

|

| | 2013 | | $ | 344,500 |

| | $ | 390,000 |

| | $ | 380,036 |

| | — |

| | — |

| | $ | 99,175 |

| | $ | 1,213,711 |

|

__________

| |

| (a) | The Company generally pays all salaried employees bi-weekly on the last Friday of each pay period. The salary amounts shown for 2015 reflect an incremental paycheck that would have been paid in 2016, but instead was paid to all salaried employees on December 31, 2015, in accordance with the Company's customary payroll practices, because the last Friday of the pay period fell on January 1, 2016, which was a bank holiday. |

| |

| (b) | The bonus amount shown as earned in 2015 by Mr. Blanchard was paid to meet the Company's 2015 contractual obligation to Mr. Blanchard under his employment agreement with the Company.The bonus amounts shown as earned in 2014 reflect, with respect to Mr. Blanchard, a $200,000 signing bonus, and with respect to the other NEOs, the spin-off bonus. The bonus amounts shown as earned in 2013 include (i) discretionary performance cash and holiday bonuses and (ii) fitness bonuses for which all employees were eligible. |

| |

| (c) | The amounts with respect to 2015 represent the aggregate grant date fair value of restricted stock granted to the NEOs by the Company based on the grant date closing price of the Company’s stock on the NYSE of $4.55 per share, excluding the effect of estimated forfeitures during the applicable vesting periods. The amounts with respect to 2014 and 2013 represent: (i) the aggregate grant date fair value of restricted stock granted to the NEOs and PSU awards granted to Mr. Winchester by Chesapeake prior to the spin-off, (ii) the incremental expense the Company incurred in connection with replacement awards, computed in accordance with FASB Topic 718, and (iii) the aggregate grant date fair value of restricted stock granted to the NEOs by the Company in 2014 following the spin-off based on the grant date closing price of the Company’s stock on the NYSE of $23.80 per share, excluding the effect of estimated forfeitures during the applicable vesting periods. The value ultimately realized by the NEO upon the actual vesting of the awards may be more or less than the grant date fair value. The PSUs are settled by Chesapeake at the end of the three year performance period in cash. |

| |

| (d) | Represents the grant date fair value of option awards computed in accordance with FASB Topic 718, excluding the effect of estimated forfeitures during the applicable vesting periods. |

| |

| (e) | Messrs. Baetz, Blanchard, Minmier and Stanger did not participate in the Chesapeake AIP in 2013. |

| |

| (f) | See the All Other Compensation Table below for additional information. |

All Other Compensation Table

|

| | | | | | | | | | | | | | | |

| Name | | | Year | | Company Matching Contributions to Retirement Plans(1) | | Perquisites and Other Personal Benefits(2) | | Total |

| Jerry Winchester | | | 2015 | | $ | 191,480 |

| | — |

| | $ | 191,480 |

|

| | 2014 | | $ | 345,335 |

| | — |

| | $ | 345,335 |

|

| | 2013 | | $ | 97,500 |

| | $ | 3,000 |

| | $ | 100,500 |

|

| Cary Baetz | | | 2015 | | $ | 63,881 |

| | — |

| | $ | 63,881 |

|

| | 2014 | | $ | 162,750 |

| | — |

| | $ | 162,750 |

|

| | 2013 | | $ | 77,885 |

| | — |

| | $ | 77,885 |

|

| Karl Blanchard | | | 2015 | | $ | 69,607 |

| | — |

| | $ | 69,607 |

|

| | 2014 | | $ | 13,925 |

| | $ | 100,000 |

| | $ | 113,925 |

|

| | 2013 | | — |

| | — |

| |

|

| James Minmier | | | 2015 | | $ | 94,538 |

| | — |

| | $ | 94,538 |

|

| | 2014 | | $ | 122,135 |

| | — |

| | $ | 122,135 |

|

| | 2013 | | $ | 110,175 |

| | — |

| | $ | 110,175 |

|

| William Stanger | | | 2015 | | $ | 55,035 |

| | — |

| | $ | 55,035 |

|

| | 2014 | | $ | 117,317 |

| | — |

| | $ | 117,317 |

|

| | 2013 | | $ | 99,175 |

| | — |

| | $ | 99,175 |

|

__________

| |

| (1) | Represents matching contributions made by Chesapeake and the Company with respect to 2014 and 2013 and by the Company with respect to 2015 for the benefit of our NEOs under the 401(k) Plan and Nonqualified Deferred Compensation Plan. |

| |

| (2) | Represents the value of other benefits provided to our NEOs. Amounts for Mr. Winchester in 2013 represent fees paid for financial advisory services. Amounts for Mr. Blanchard in 2014 represent relocation expenses. |

Grants of Plan-Based Awards Table for 2015

|

| | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | | Type of Award | | Grant Date | | Approval Date | | Number of Shares of Restricted Stock(a) | | Number of Options Awards | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards Threshold / Target /Maximum(b) | | Estimated Future Payouts Under Equity Incentive Plan Awards Threshold / Target / Maximum | | Grant Date Fair Value(c) |

| Jerry Winchester | | | RSA | | 3/3/2015 | | 2/26/2015 | | 692,088 |

| | | | | | | | $ | 3,149,000 |

|

| | | | AIP | | | | | | | | | | $0/890,000/

$1,780,000 | | | | |

| Cary Baetz | | | RSA | | 3/3/2015 | | 2/26/2015 | | 244,836 |

| | | | | | | | $ | 1,114,004 |

|

| | | | AIP | | | | | | | | | | $0/337,500/

$675,000 | | | | |

Karl Blanchard | | | RSA | | 3/3/2015 | | 2/26/2015 | | 372,968 |

| | | | | | | | $ | 1,697,004 |

|

| | | | AIP | | | | | | | | | | $0/510,000/

$1,020,000 | | | | |

| James Minmier | | | RSA | | 3/3/2015 | | 2/26/2015 | | 219,781 |

| | | | | | | | $ | 1,000,004 |

|

| | | | AIP | | | | | | | | | | $0/315,000/

$630,000 | | | | |

William Stanger | | | RSA | | 3/3/2015 | | 2/26/2015 | | 157,583 |

| | | | | | | | $ | 717,003 |

|

| | | | AIP | | | | | | | | | | $0/260,000/

$520,000 | | | | |

__________

| |

| (a) | The restricted stock awards vest ratably over three years from the grant date of the award. |

| |

| (b) | The actual amount earned in 2015 was paid in February 2016 and is shown in the Non-Equity Incentive Plan Compensation column of the Summary Compensation Table. |

| |

| (c) | These amounts represent the aggregate grant date fair value of restricted stock awards, determined in accordance with FASB ASC Topic 718, excluding the effect of estimated forfeitures during the applicable vesting periods. The value ultimately realized by the executive upon the actual vesting of the awards may be significantly more or less than the grant date fair value. For restricted stock awards, values are based on the closing price of the Company’s common stock on the grant date of $4.55. |

Outstanding Equity Awards at Fiscal Year-End 2015 Table

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Option Awards(a) | | Stock Awards |

Name and Principal Position | | | Number of Securities Underlying Unexercised Options— Unexercisable | | | Number of Securities Underlying Unexercised Options— Exercisable | | Option Exercise Price | | Option Expiration Date | | Number of Shares of Stock That Have Not Vested(b) | | Market Value of Shares of Stock That Have Not Vested(c) | | Equity Incentive Plan Awards: Number of Unearned Units That Have Not Vested(d) | | Equity Incentive Plan Awards: Value of Unearned Units That Have Not Vested(e) |

Jerry Winchester | | | 38,256 | | | 19,129 | | $ | 20.72 |

| | 1/10/2024 | | | | | | — | | — |

| | 34,928 | | | 69,858 | | $ | 15.29 |

| | 1/29/2023 | | — | | — | | — | | — |

| | 186,098 | | | — | | $ | 15.29 |

| | 1/29/2023 | | — | | — | | — | | — |

| | | | | — | | — | | — | | 1,101,019 | | $ | 1,156,070 |

| | — | | — |

| | | | | | | | | | | — | | — | | 44,401 | | $ | 189,037 |

|

| Cary Baetz | | | | | | — | | — | | — | | 515,548 |

| | $ | 541,325 |

| | — | | — |

| Karl Blanchard | | | | | | — | | — | | — | | 418,591 |

| | $ | 439,521 |

| | — | | — |

| James Minmier | | | | | | — | | — | | — | | 456,827 |

| | $ | 479,668 |

| | — | | — |

| William Stanger | | | | | | — | | — | | — | | 359,113 |

| | $ | 377,069 |

| | — | | — |

| |

| (a) | The option awards consist of replacement option awards granted by the Company in connection with the spin-off. |

| |

| (b) | Consists of grants of restricted shares of the Company’s common stock. |

| |

| (c) | The values shown in this column are based on the closing price of the Company’s stock on the NYSE as of December 31, 2015 of $1.05 per share. |

| |

| (d) | Includes target 2013 and 2014 PSU awards for Mr. Winchester granted on January 29, 2013 and January 10, 2014, respectively, by Chesapeake prior to the spin-off. The PSUs vest ratably over a three-year performance period beginning on the first anniversary of the grant date. |

| |

| (e) | The values shown in this column are based on the 20-day average closing price of Chesapeake's stock ending on December 31, 2015, $4.2575 per share, in accordance with the 2013 and 2014 PSU award agreements. The final value of PSUs earned will be determined and settled in cash by Chesapeake at the end of the three-year performance period and may differ from the values reported. |

Option Exercises and Stock Vested Table for 2015

|

| | | | | | | | | | | |

| Name and Principal Position | | | Number of Shares Acquired on Exercise | | Value Realized on Exercise | | Number of Shares Acquired on Vesting(a) | | Value Realized on Vesting(b) |

| Jerry Winchester | | | — | | — | | 162,937 | | $ | 673,729 |

|

| Cary Baetz | | | — | | — | | 96,188 | | $ | 394,576 |

|

| Karl Blanchard | | | — | | — | | 22,812 | | $ | 93,073 |

|

| James Minmier | | | — | | — | | 94,378 | | $ | 382,381 |

|

| Bill Stanger | | | — | | — | | 78,087 | | $ | 327,636 |

|

| |

| (a) | Consists of shares of Company common stock. With respect to Mr. Winchester, the amount excludes 20,043 2013 PSUs and 12,179 2014 PSUs that vested in 2015, assuming target performance. The PSUs have a three-year performance period and vest one-third per year over three years. The final number of PSUs earned will be determined by Chesapeake at the end of the three-year performance period. |

| |

| (b) | The values realized upon vesting for restricted stock are based on the closing price of the Company’s common stock on the vesting dates. With respect to Mr. Winchester, the aggregate value of the portion of 2013 and 2014 PSUs that vested in 2015 was $137,729, based on the 20-day average closing price of Chesapeake's stock ending on December 31, 2015, $4.2575 per share, multiplied by the target number of 2013 and 2014 PSUs that vested during the year. The final value of PSUs earned will be determined and settled in cash by Chesapeake at the end of the three-year performance period and may differ from the values reported in this footnote. |

Pension Benefits

We do not have a pension plan or any other retirement plan other than the Seventy Seven Energy 401(k) Plan and the DCP.

Nonqualified Deferred Compensation Table for 2015

We maintain the Seventy Seven Energy Deferred Compensation Plan, or the DCP, a nonqualified deferred compensation plan. The NEOs are permitted to participate in the DCP. The DCP allows certain employees to voluntarily defer receipt of a portion of their salary and/or their semi-annual bonus payments.

|

| | | | | | | | | | | | | | | | | | | | |

| Name | | Executive Contribution in Last Fiscal Year(a) | | Company Contribution in Last Fiscal Year(b) | | Aggregate Earnings in Last Fiscal Year | | Aggregate Withdrawals/ Distributions | | Aggregate Balance at Last Fiscal Year-End(c) |

| Jerry Winchester | | $ | 284,766 |

| | $ | 175,580 |

| | $ | (149,736 | ) | | $ | — |

| | $ | 1,612,216 |

|

Cary Baetz | | $ | 67,718 |

| | $ | 47,981 |

| | $ | (115,007 | ) | | $ | — |

| | $ | 357,354 |

|

| Karl Blanchard | | $ | 61,385 |

| | $ | 53,707 |

| | $ | (302 | ) | | $ | — |

| | $ | 114,790 |

|

James Minmier | | $ | 296,492 |

| | $ | 78,638 |

| | $ | (174,825 | ) | | $ | — |

| | $ | 912,351 |

|

William Stanger | | $ | 96,482 |

| | $ | 39,135 |

| | $ | (21,142 | ) | | $ | — |

| | $ | 464,480 |

|

__________

| |

| (a) | Executive contributions are included as compensation in the Salary, Bonus or Non-Equity Incentive Plan Compensation columns of the Summary Compensation Table. |

| |

| (b) | Company matching contributions are included in the All Other Compensation column of the Summary Compensation Table. |

| |

| (c) | The aggregate balances shown in this column include amounts that were reported in previous years as compensation to the executive officers. |

In 2015, the Company matched employee-participant contributions to the DCP, on an annual basis, and for the 401(k) on a quarterly basis, in arrears dollar for dollar for up to 6% of the employee-participant’s base salary and bonus in the aggregate for the 401(k) Plan and the DCP. Each matching contribution to the DCP vests at the rate of 25% per year over four years from the date of each contribution. At age 55 with at least 10 years of service with the Company (including service prior to the spin-off), unvested and future matching contributions may be subject to accelerated vesting, in the Company's sole discretion.

Participant contributions to the DCP are held in “Rabbi trusts.” Notional earnings on participant contributions are credited to each participant’s account based on the market rate of return of the available benchmark investment alternatives offered under the DCP. The benchmark investments are indexed to traded mutual funds and each participant allocates his or her contributions among the investment alternatives. Participants may change the asset allocation of their contribution balance or make changes to the allocation for future contributions at any time. Any unallocated portion of a participant’s account is deemed to be invested in the money market fund.

Employees participating in the DCP who retire or terminate employment after attainment of age 55 with at least 10 years of service can elect to receive distributions of their vested account balances in full or partial lump sum payments or in installments up to a maximum of 20 annual payments. Upon retirement or termination of employment prior to the attainment of age 55 and at least 10 years of service with the company, the employee will receive his or her entire account balance in a single lump sum. Participants can modify the distribution schedule for a retirement/termination distribution from lump sum to annual installments or from installments to lump sum if such modification requires that payments commence at least five years after retirement/termination and the modification is filed with the plan administrator at least twelve months prior to retirement/termination. Distributions from the DCP upon the death of a participant will be made in a single lump sum and upon a participant’s disability, as defined in the DCP, based on the participant’s retirement/termination distribution election.

The Company has sole discretion to accelerate vesting of unvested company matching contributions upon a participant’s retirement, death or disability.

Any assets placed in trust by the company to fund future obligations of the DCP are subject to the claims of creditors in the event of insolvency or bankruptcy, and participants are general creditors of SSE as to their deferred compensation in the DCP.

Employment Agreements

Following in the spin-off in June 2014, the Company entered into employment agreements with each of the named executive officers. The employment agreements govern the terms and conditions of each NEO’s employment, including his duties and responsibilities, compensation and benefits, and applicable severance terms.

Each of the employment agreements is for an initial term of three years commencing July 1, 2014 and ending July 1, 2017, subject to extension by mutual agreement and an automatic extension in the event of a change in control of the Company to the later of the last day of the then current employment term or 24 months following the change in control. Under the terms of the employment agreements, each named executive officer is entitled to receive an annual base salary that is subject to adjustment by the Board from time to time.

In addition, the named executive officers will be eligible to receive an annual cash bonus and grants of long-term incentives including equity or equity based awards from the Company’s various equity compensation plans, as determined by the Compensation Committee of the Board and subject to such performance criteria as they may establish, and each is entitled to participate in all of the Company’s employee benefit plans and programs and to receive any fringe benefits or perquisites that the Company may provide to similarly situated executives. Mr. Blanchard’s employment agreement provides that, among other things, he will receive a minimum cash bonus payment and a minimum value of restricted stock awards, each of which escalate annually, which mirror provisions in the employment agreement the Company previously entered into with Mr. Blanchard.

If a named executive officer’s employment is terminated for any reason, the named executive officer will be entitled to any accrued and unpaid portion of the named executive officer’s base salary, bonus and benefits. In the event of the named executive officer’s termination of employment due to death, all of his outstanding equity awards will be fully vested. In the event of the named executive officer’s termination of employment due to disability, termination by the Company without cause (as defined in the employment agreements), or termination by the named executive officer for good reason (as defined in the agreements) and subject to compliance with restrictive covenants (including prohibitions on competition, soliciting customers of the Company, soliciting of the Company’s employees and disclosure of confidential information) and the execution of a release in favor of the Company, all of his equity awards will become fully vested and he will receive cash severance benefits, outplacement services in an amount not to exceed $25,000 for six months after termination and subsidized COBRA benefits for up to 24 months following termination. The amount of the cash severance payable to the individual named executive officers is as follows: an amount for Messrs. Winchester, Baetz and Blanchard that is equal to two times his base salary as then in effect, and in the case of Messrs. Minmier and Stanger, 1.75 times his base salary as then in effect, and, for each named executive officer, one times the greater of his annual bonus for the prior year or his target bonus for the current year; in the event of termination due to disability, the amount of the cash severance for each named executive officer is one times his base salary as then in effect.

The employment agreements also have a "double-trigger" change of control provision such that in the event of a termination without cause or by the named executive officer for good reason within a twenty-four month period following a change in control (as defined in the employment agreement), and subject to compliance with restrictive covenants and release described in the paragraph above, all of his equity awards will become fully vested and he will receive cash severance benefits and subsidized COBRA benefits for up to 24 months following termination. The amount of the cash severance payable to the individual named executive officers is as follows: an amount for Mr. Winchester that is three times his base salary as then in effect, in the case of Messrs. Baetz and Blanchard an amount that is two times his base salary as then in effect, and in the case of Messrs. Minmier and Stanger an amount that is 1.75 times his base salary as then in effect, and, for each named executive officer, one times the greater of his annual bonus for the prior year or his target bonus for the current year.

The employment agreements also provide that if a named executive officer’s employment terminates due to a qualified retirement on or after the third anniversary of the effective date of the employment agreement, he will be eligible for continued post-retirement vesting of unvested equity awards.

Post Employment Compensation

Potential Payments Upon Termination and Change of Control

The following table presents estimated amounts that would have been payable to the applicable named executive officer if the described event had occurred on December 31, 2015, the last trading day of the fiscal year. In addition to the amounts shown below, our named executive officers would have been entitled to receive the distributions reflected in the Aggregate Balance at Last Fiscal Year-End column of the Nonqualified Deferred Compensation Table for 2015 (payments of which may be deferred to satisfy the provisions of Section 409A or made over time pursuant to individual elections).

Jerry Winchester

|

| | | | | | | | | | | | | | | | |

| Executive Benefits and Payments Upon Separation | | Termination without Cause/ Good Reason Termination | | Change of Control(a) | | Disability of Executive | | Death of Executive |

| | | | | | | | | |

| Compensation: | | | | | | | | |

Cash Severance(b) | | $ | 2,628,321 |

| | $ | 3,448,821 |

| | $ | 845,500 |

| | — |

|

| Acceleration of Equity-based Compensation: | | | | | | | | |

Restricted Stock Awards(c) | | $ | 1,156,070 |

| | $ | 1,156,070 |

| | $ | 1,156,070 |

| | $ | 1,156,070 |

|

Options(d) | | — |

| | — |

| | — |

| | — |

|

PSU Awards(e) | | $ | 189,037 |

| | $ | 189,037 |

| | $ | 189,037 |

| | $ | 189,037 |

|

401(k) Plan and DCP Matching(f) | | $ | 486,072 |

| | $ | 486,072 |

| | $ | 486,072 |

| | $ | 486,072 |

|

| Total | | $ | 4,459,500 |

| | $ | 5,280,000 |

| | $ | 2,676,679 |

| | $ | 1,831,179 |

|

Karl Blanchard

|

| | | | | | | | | | | | | | | | |

| Executive Benefits and Payments Upon Separation | | Termination without Cause /Good Reason Termination | | Change of Control(a) | | Disability of Executive | | Death of Executive |

| | | | | | | | | |

| Compensation: | | | | | | | | |

Cash Severance(b) | | $ | 1,711,277 |

| | $ | 1,686,277 |

| | $ | 570,000 |

| | — |

|

| Acceleration of Equity-based Compensation: | | | | | | | | |

Restricted Stock Awards(c) | | $ | 439,521 |

| | $ | 439,521 |

| | $ | 439,521 |

| | $ | 439,521 |

|

401(k) Plan and DCP Matching(f) | | $ | 56,629 |

| | $ | 56,629 |

| | $ | 56,629 |

| | $ | 56,629 |

|

| Total | | $ | 2,207,427 |

| | $ | 2,182,427 |

| | $ | 1,066,150 |

| | $ | 496,150 |

|

Cary Baetz

|

| | | | | | | | | | | | | | | | |

| Executive Benefits and Payments Upon Separation | | Termination without Cause/ Good Reason Termination | | Change of Control(a) | | Disability of Executive | | Death of Executive |

| | | | | | | | | |

| Compensation: | | | | | | | | |

Cash Severance(b) | | $ | 1,271,488 |

| | $ | 1,246,488 |

| | $ | 451,250 |

| | — |

|

| Acceleration of Equity-based Compensation: | | | | | | | | |

Restricted Stock Awards(c) | | $ | 541,325 |

| | $ | 541,325 |

| | $ | 541,325 |

| | $ | 541,325 |

|

401(k) Plan and DCP Matching(f) | | $ | 79,978 |

| | $ | 79,978 |

| | $ | 79,978 |

| | $ | 79,978 |

|

| Total | | $ | 1,892,791 |

| | $ | 1,867,791 |

| | $ | 1,072,553 |

| | $ | 621,303 |

|

James Minmier

|

| | | | | | | | | | | | | | | | |

| Executive Benefits and Payments Upon Separation | | Termination without Cause/ Good Reason Termination | | Change of Control(a) | | Disability of Executive | | Death of Executive |

| | | | | | | | | |

| Compensation: | | | | | | | | |

Cash Severance(b) | | $ | 1,219,222 |

| | $ | 1,194,222 |

| | $ | 427,500 |

| | — |

|

| Acceleration of Equity-based Compensation: | | | | | | | | |

Restricted Stock Awards(c) | | $ | 479,668 |

| | $ | 479,668 |

| | $ | 479,668 |

| | $ | 479,668 |

|

401(k) Plan and DCP Matching(f) | | $ | 112,357 |

| | $ | 112,357 |

| | $ | 112,357 |

| | $ | 112,357 |

|

| Total | | $ | 1,811,247 |

| | $ | 1,786,247 |

| | $ | 1,019,525 |

| | $ | 592,025 |

|

William Stanger

|

| | | | | | | | | | | | | | | | |