Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement Nos.333-234614 and333-234614-01

November 12, 2019

Brookfield Renewable Corporation (“BEPC”) November 2019

We are giving investors the flexibility to invest in Brookfield Renewable either through the current Partnership or a newly-created Canadian corporation

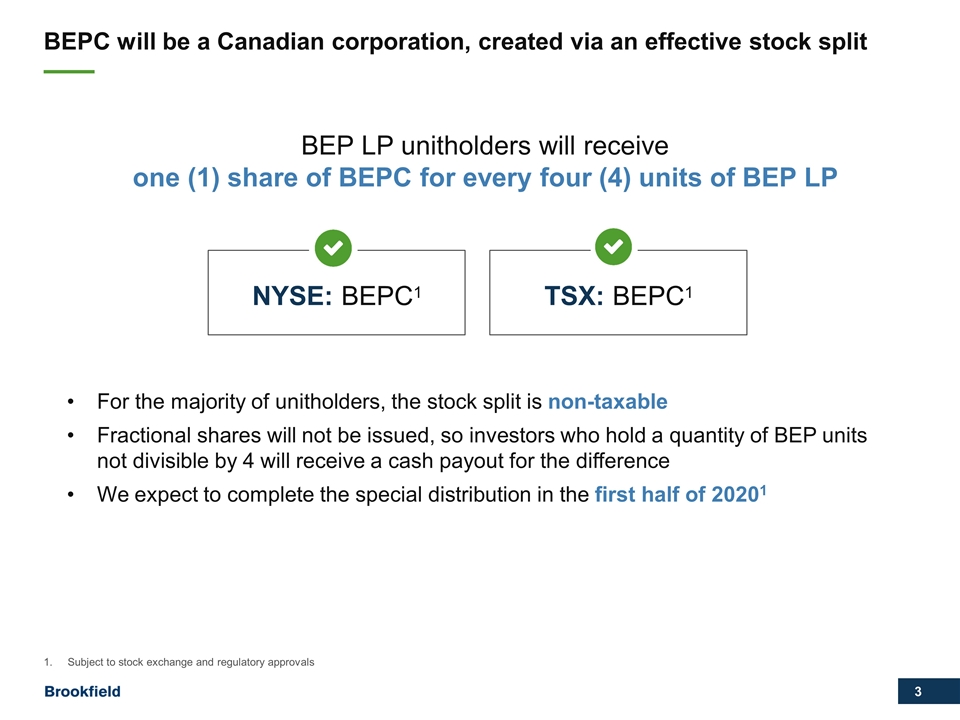

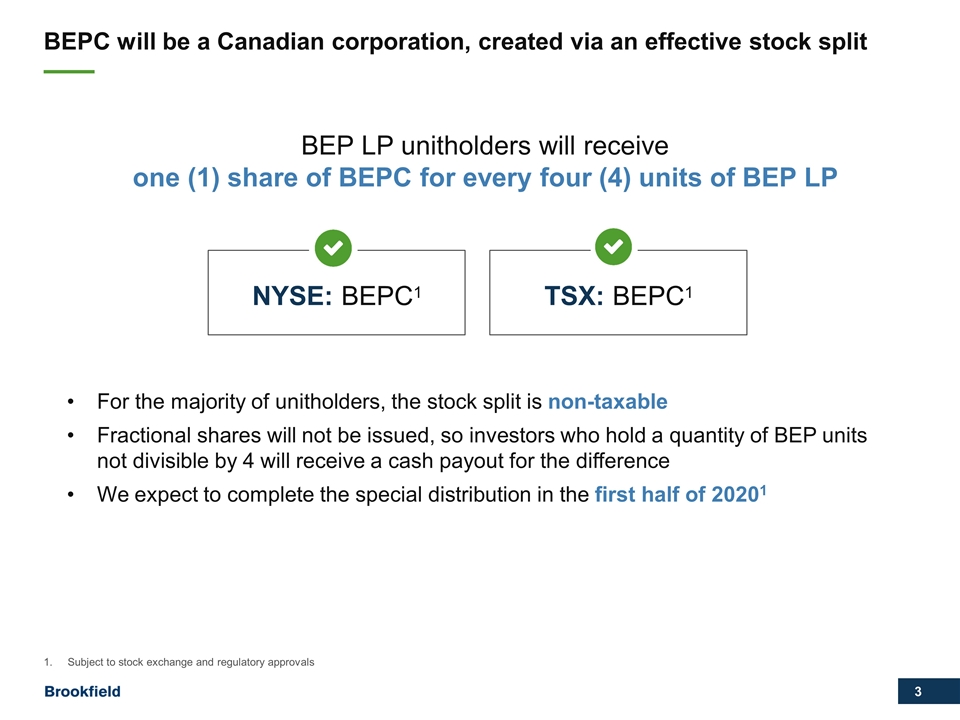

BEPC will be a Canadian corporation, created via an effective stock split BEP LP unitholders will receive one (1) share of BEPC for every four (4) units of BEP LP NYSE: BEPC1 TSX: BEPC1 Subject to stock exchange and regulatory approvals For the majority of unitholders, the stock split is non-taxable Fractional shares will not be issued, so investors who hold a quantity of BEP units not divisible by 4 will receive a cash payout for the difference We expect to complete the special distribution in the first half of 20201

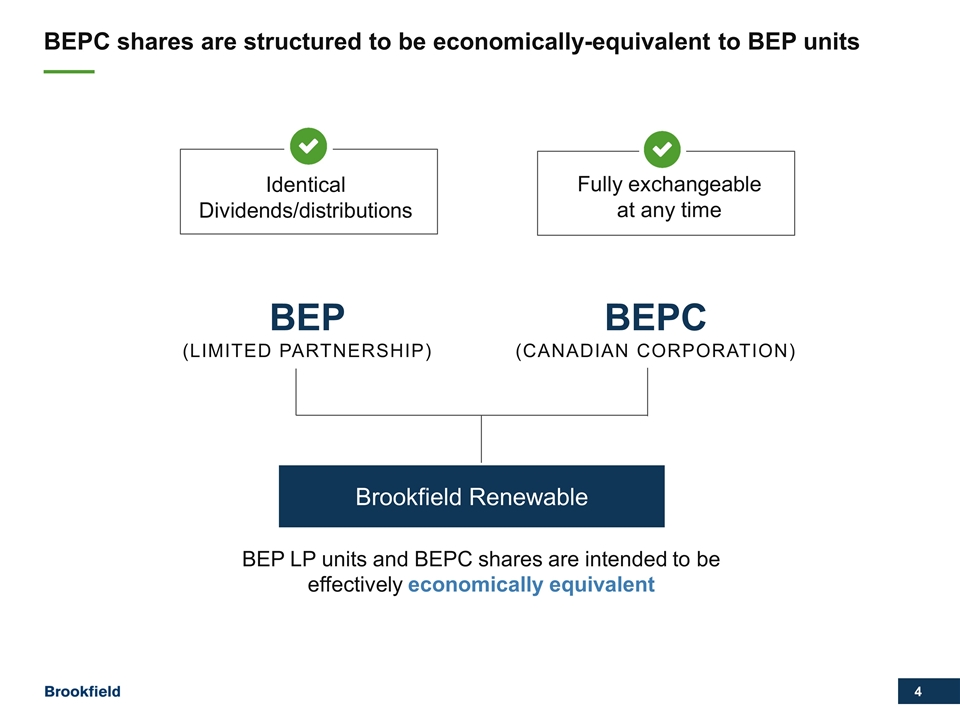

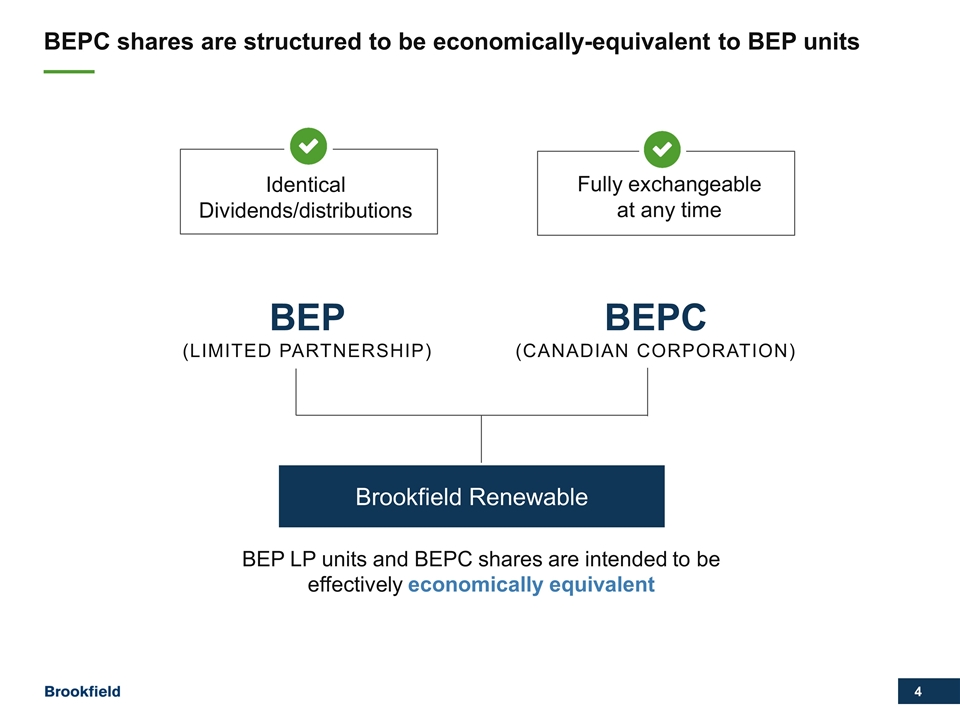

BEPC shares are structured to be economically-equivalent to BEP units Identical Dividends/distributions Fully exchangeable at any time BEP (LIMITED PARTNERSHIP) Brookfield Renewable BEPC (CANADIAN CORPORATION) BEP LP units and BEPC shares are intended to be effectively economically equivalent

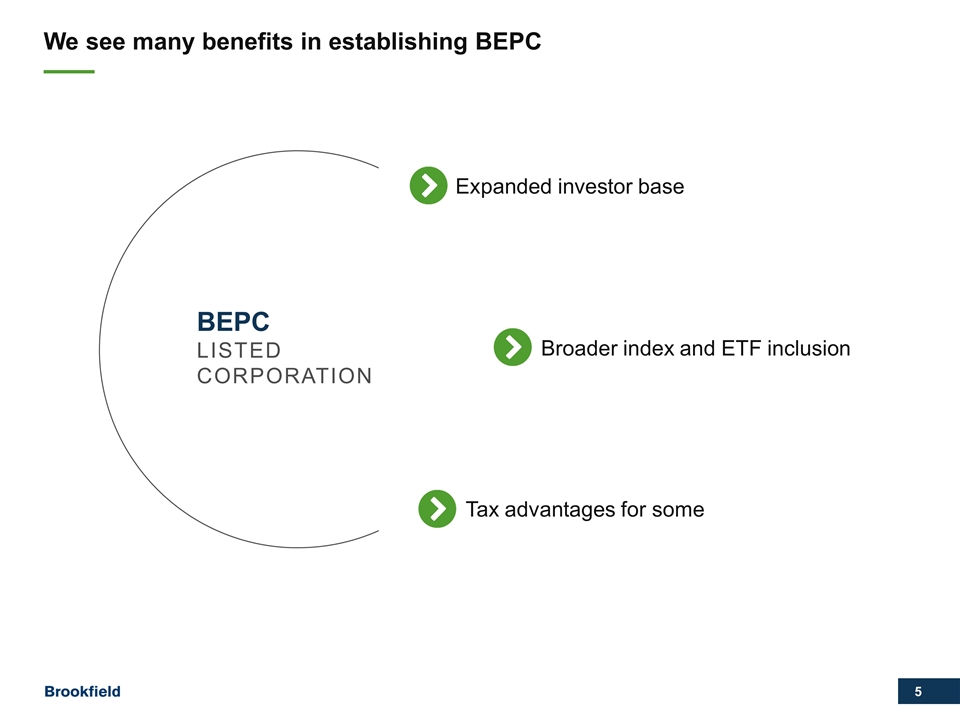

We see many benefits in establishing BEPC Broader index and ETF inclusion Tax advantages for some Expanded investor base BEPC LISTED CORPORATION

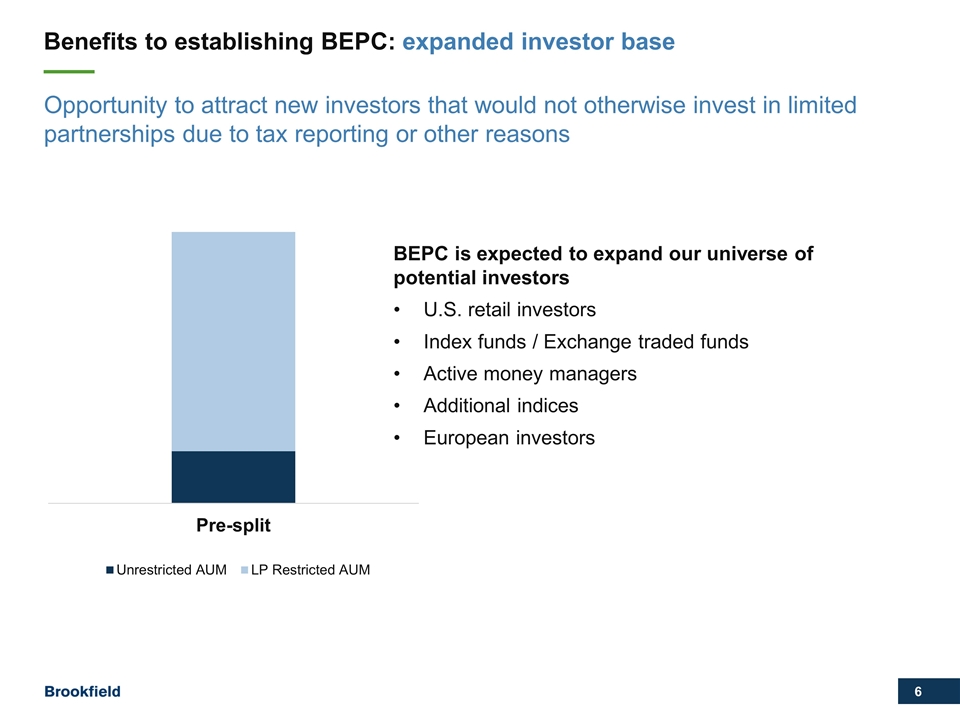

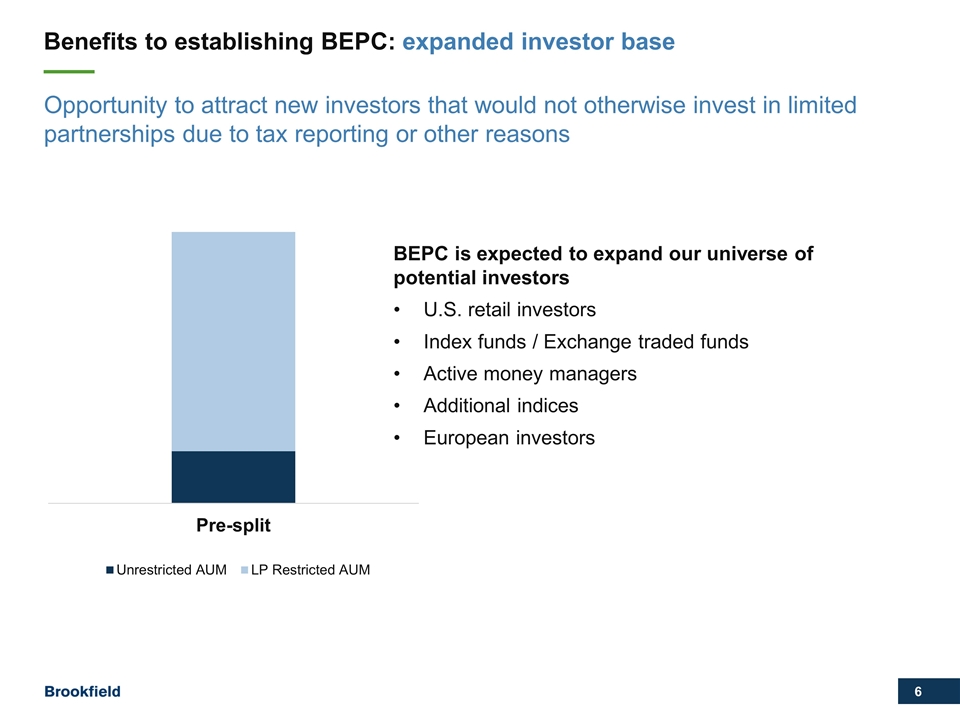

Benefits to establishing BEPC: expanded investor base Opportunity to attract new investors that would not otherwise invest in limited partnerships due to tax reporting or other reasons BEPC is expected to expand our universe of potential investors U.S. retail investors Index funds / Exchange traded funds Active money managers Additional indices European investors

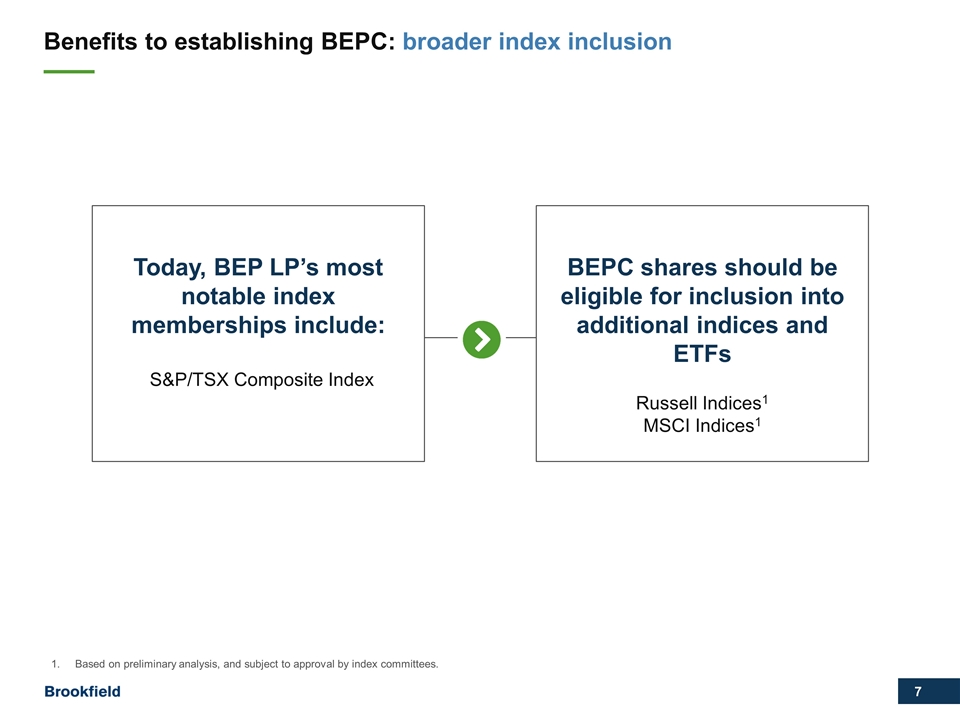

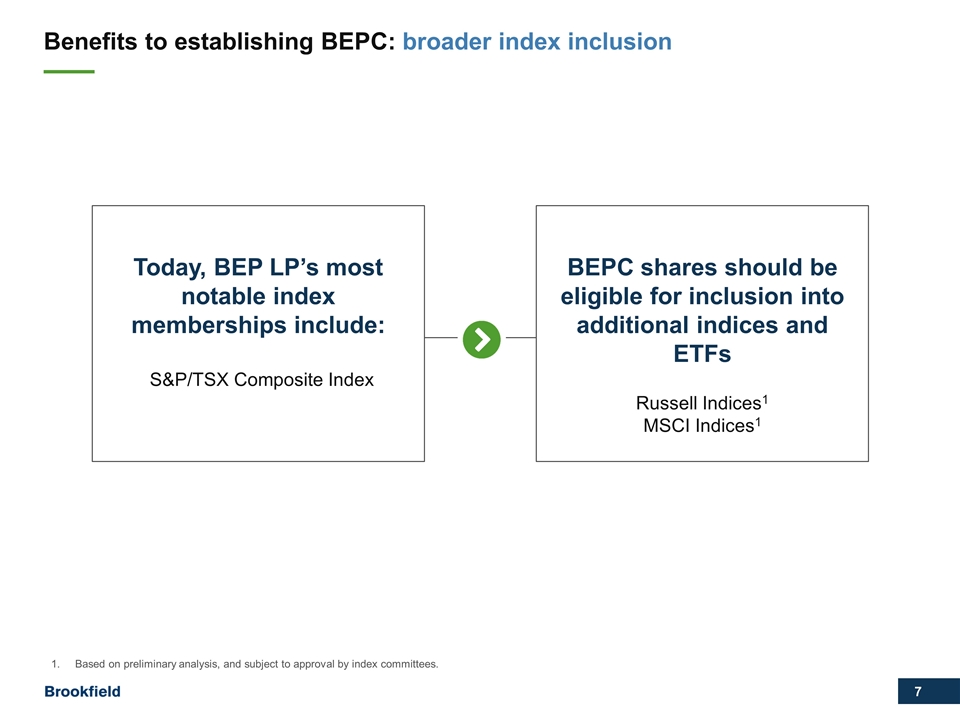

Benefits to establishing BEPC: broader index inclusion Based on preliminary analysis, and subject to approval by index committees. Today, BEP LP’s most notable index memberships include: S&P/TSX Composite Index BEPC shares should be eligible for inclusion into additional indices and ETFs Russell Indices1 MSCI Indices1

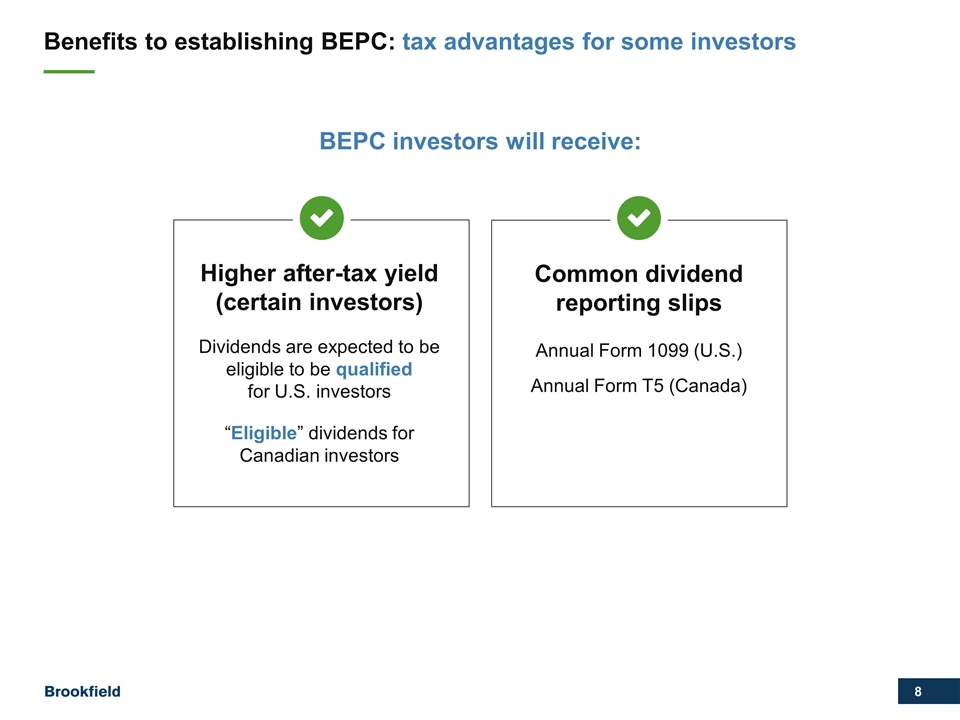

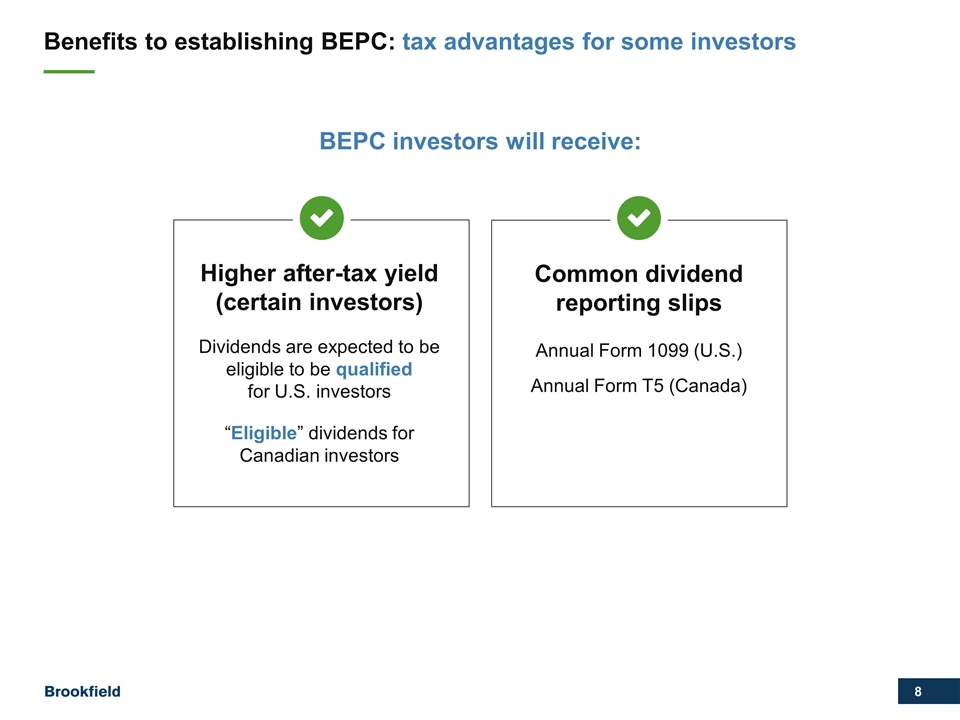

Benefits to establishing BEPC: tax advantages for some investors BEPC investors will receive: Higher after-tax yield (certain investors) Dividends are expected to be eligible to be qualified for U.S. investors “Eligible” dividends for Canadian investors Common dividend reporting slips Annual Form 1099 (U.S.) Annual Form T5 (Canada)

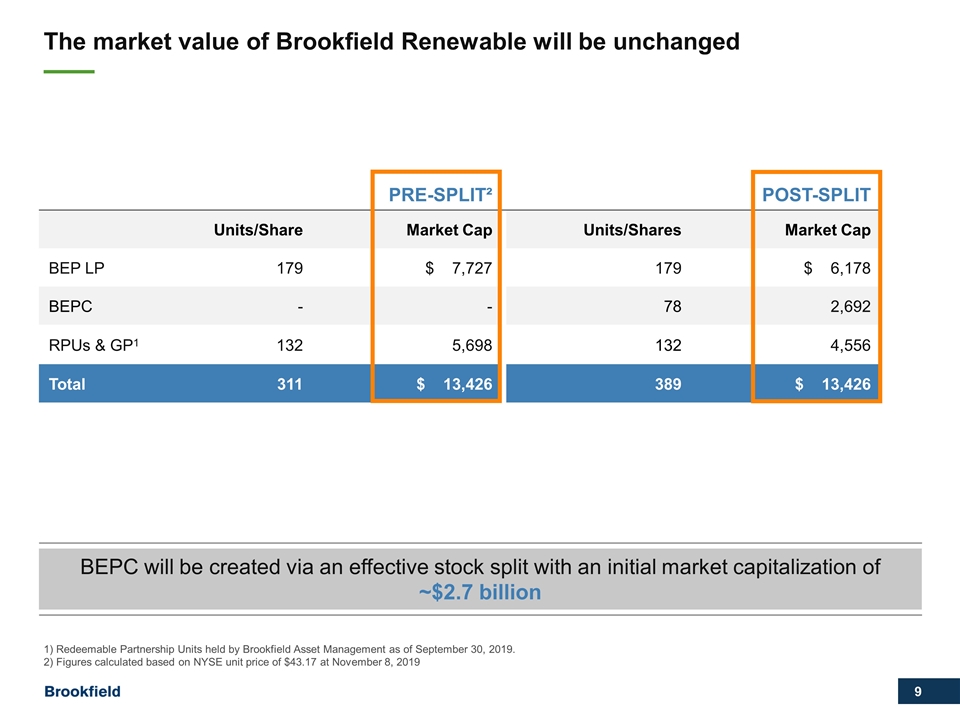

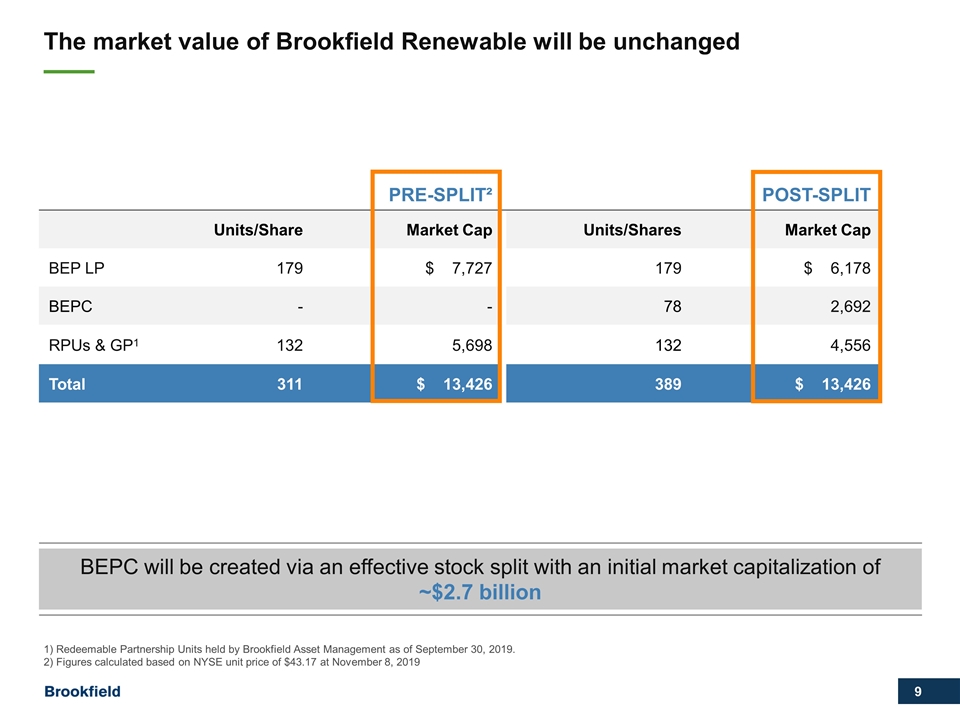

The market value of Brookfield Renewable will be unchanged BEPC will be created via an effective stock split with an initial market capitalization of ~$2.7 billion 1) Redeemable Partnership Units held by Brookfield Asset Management as of September 30, 2019. 2) Figures calculated based on NYSE unit price of $43.17 at November 8, 2019 Pre-Split² Post-Split Units/Share Market Cap Units/Shares Market Cap BEP LP 179 $ 7,727 179 $ 6,178 BEPC - - 78 2,692 RPUs & GP1 132 5,698 132 4,556 Total 311 $ 13,426 389 $ 13,426

BEPC expected to have minimal impact on Brookfield Renewable No incremental tax consequences No change in management oversight or governance No impact to credit ratings expected Immaterial administrative costs to maintain Minimal financial reporting implications

FFO No change BEP LP through its control of BEPC will consolidate results going forward NAV No change on combined basis Market Cap No change on combined basis Dividends/Distributions No change on combined basis Fees to BAM No change on combined basis No impact to BEP’s financial statements and metrics

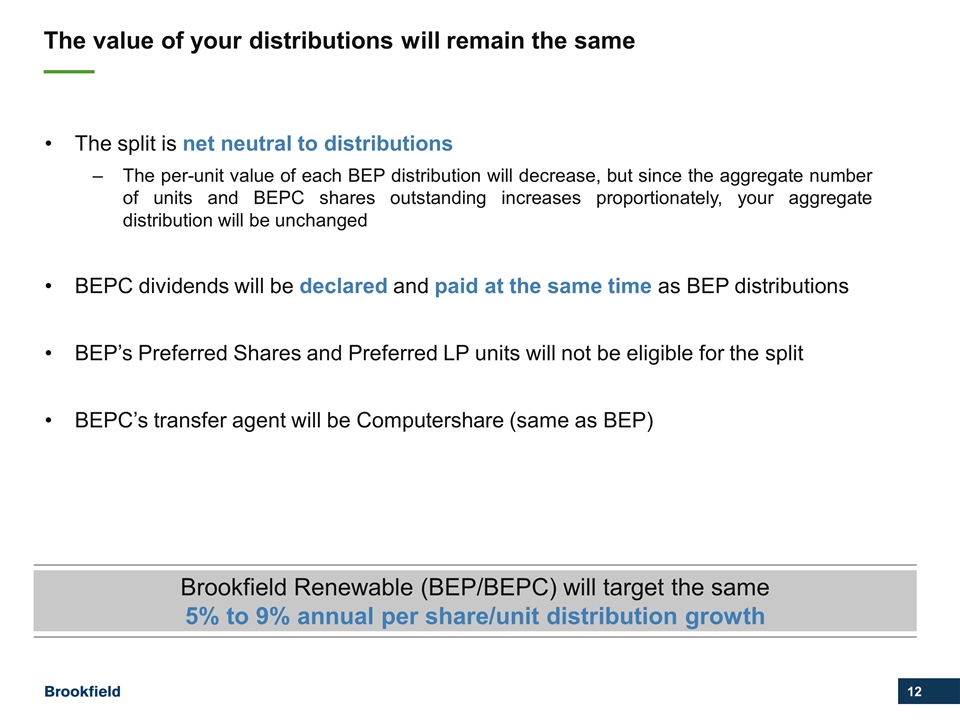

The value of your distributions will remain the same The split is net neutral to distributions The per-unit value of each BEP distribution will decrease, but since the aggregate number of units and BEPC shares outstanding increases proportionately, your aggregate distribution will be unchanged BEPC dividends will be declared and paid at the same time as BEP distributions BEP’s Preferred Shares and Preferred LP units will not be eligible for the split BEPC’s transfer agent will be Computershare (same as BEP) Brookfield Renewable (BEP/BEPC) will target the same 5% to 9% annual per share/unit distribution growth

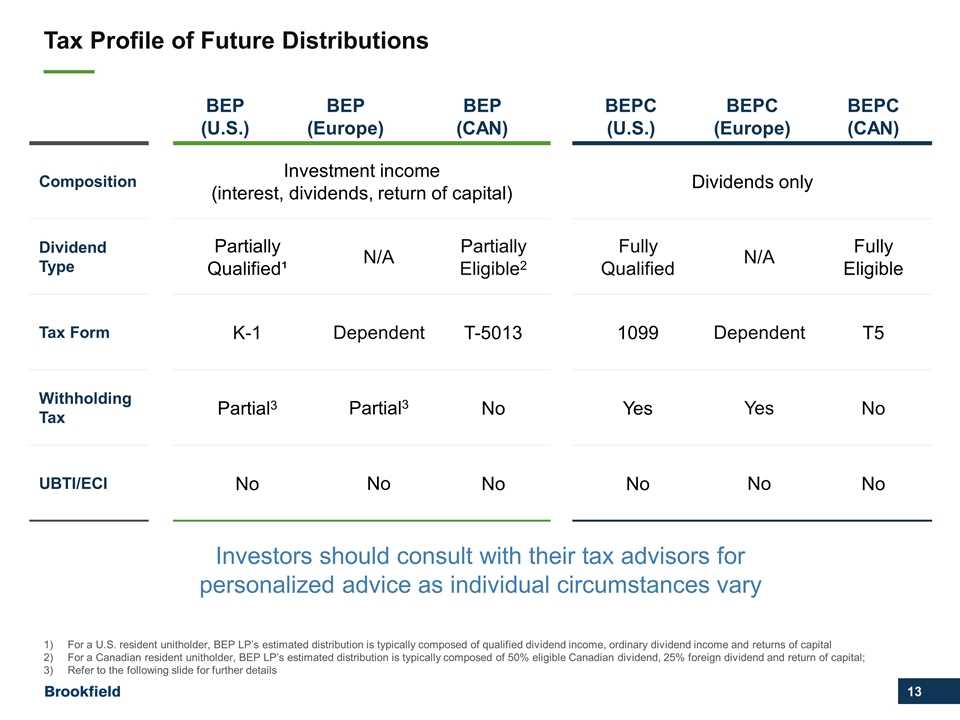

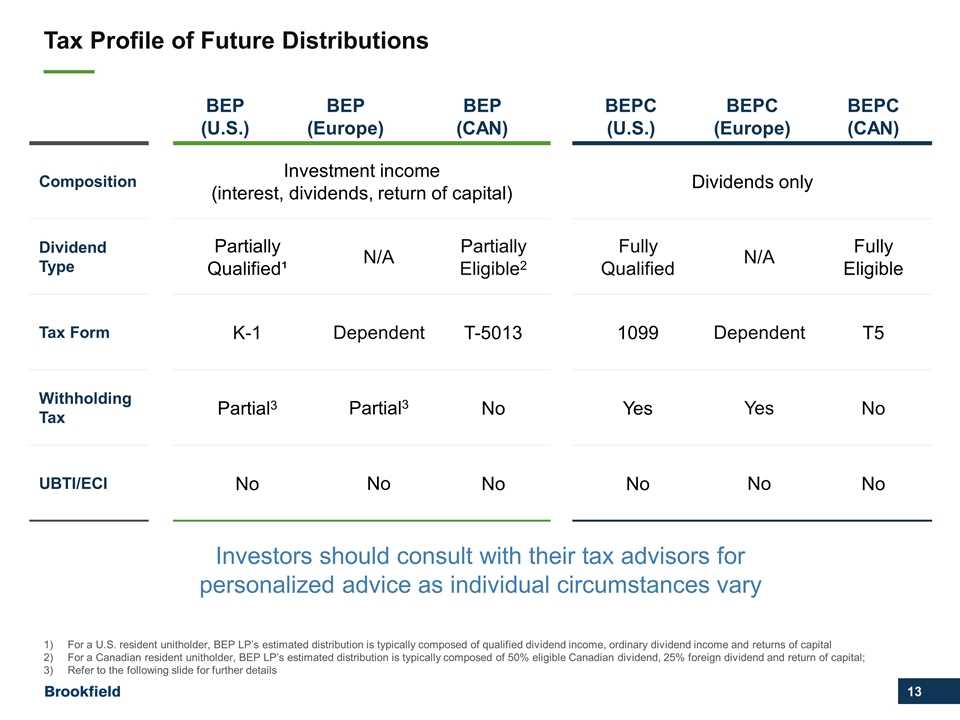

Tax Profile of Future Distributions Investors should consult with their tax advisors for personalized advice as individual circumstances vary For a U.S. resident unitholder, BEP LP’s estimated distribution is typically composed of qualified dividend income, ordinary dividend income and returns of capital For a Canadian resident unitholder, BEP LP’s estimated distribution is typically composed of 50% eligible Canadian dividend, 25% foreign dividend and return of capital; Refer to the following slide for further details BEP (U.S.) BEP (Europe) BEP (CAN) BEPC (U.S.) BEPC (Europe) BEPC (CAN) Composition Investment income (interest, dividends, return of capital) Dividends only Dividend Type Partially Qualified¹ N/A N/A Eligible, ROC Partially Eligible2 Fully Qualified N/A N/A Fully Eligible Tax Form K-1 Dependent Dependent T-5013 T-5013 1099 Dependent Dependent T5 Withholding Tax Partial3 Partial2 Partial3 No No Yes Yes Yes No UBTI/ECI No No No No No No No No No

Dividends from Canada are generally subject to Canadian withholding tax. For most taxable1 U.S. and European investors such dividends are withheld at a rate of 15% We expect European and U.S. investors would be able to claim a foreign tax credit on their return, but this should be confirmed with an individual’s tax advisor Distribution % Withholding Tax1 Dividend % Withholding Tax1 Canadian Dividend 50% 15% 100% 15% Return of Capital (Canada or Bermuda) 25% 0% - - Bermuda Dividend 25% 0% - - Total 100% 7.5%2 100% 15% Based on withholding tax rates for taxable U.S. holders eligible for the benefits of the U.S.-Canada double tax treaty and most European treaty-eligible investors (UK, Ireland, Switzerland, Netherlands) Weighted based on estimated distribution profile BEP BEPC Estimated Withholding Tax Distribution Profile: U.S. and European Investors

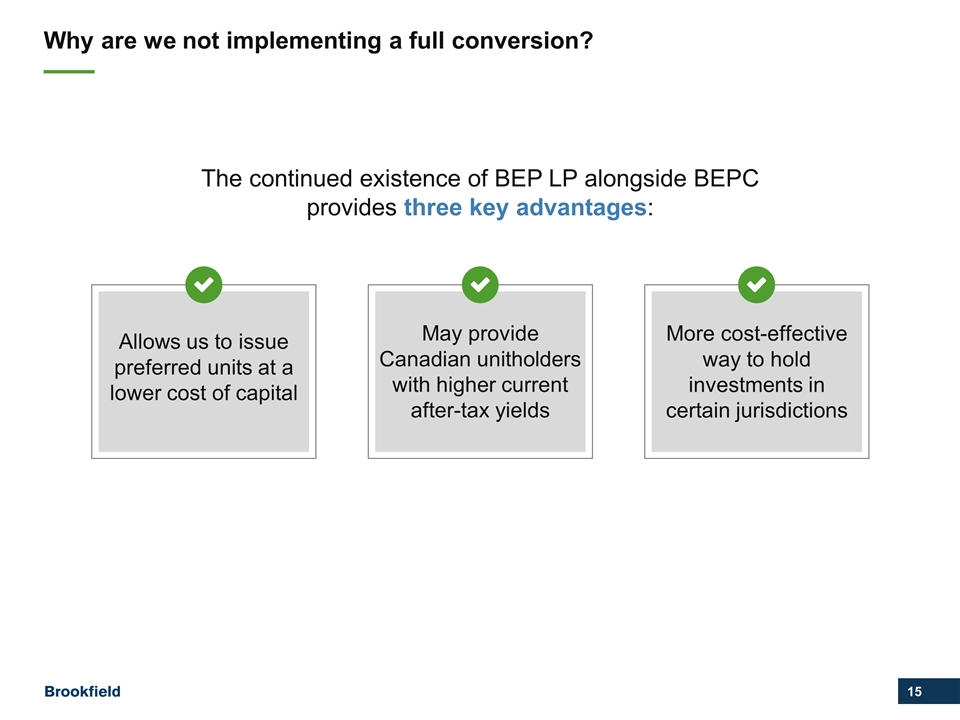

Why are we not implementing a full conversion? The continued existence of BEP LP alongside BEPC provides three key advantages: May provide Canadian unitholders with higher current after-tax yields More cost-effective way to hold investments in certain jurisdictions Allows us to issue preferred units at a lower cost of capital

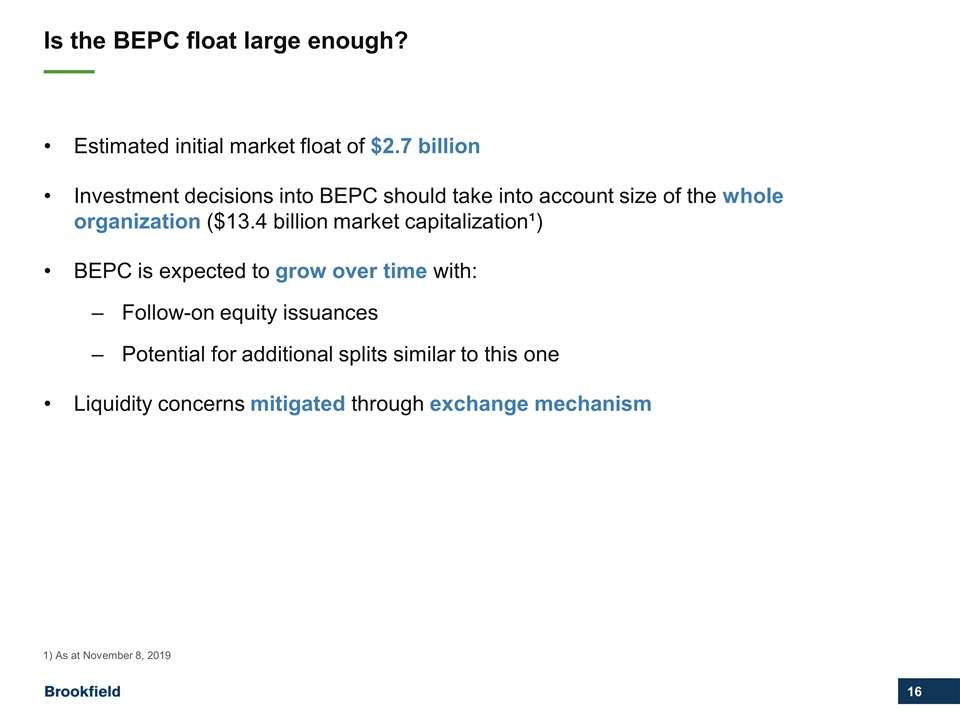

Is the BEPC float large enough? 1) As at November 8, 2019 Estimated initial market float of $2.7 billion Investment decisions into BEPC should take into account size of the whole organization ($13.4 billion market capitalization¹) BEPC is expected to grow over time with: Follow-on equity issuances Potential for additional splits similar to this one Liquidity concerns mitigated through exchange mechanism

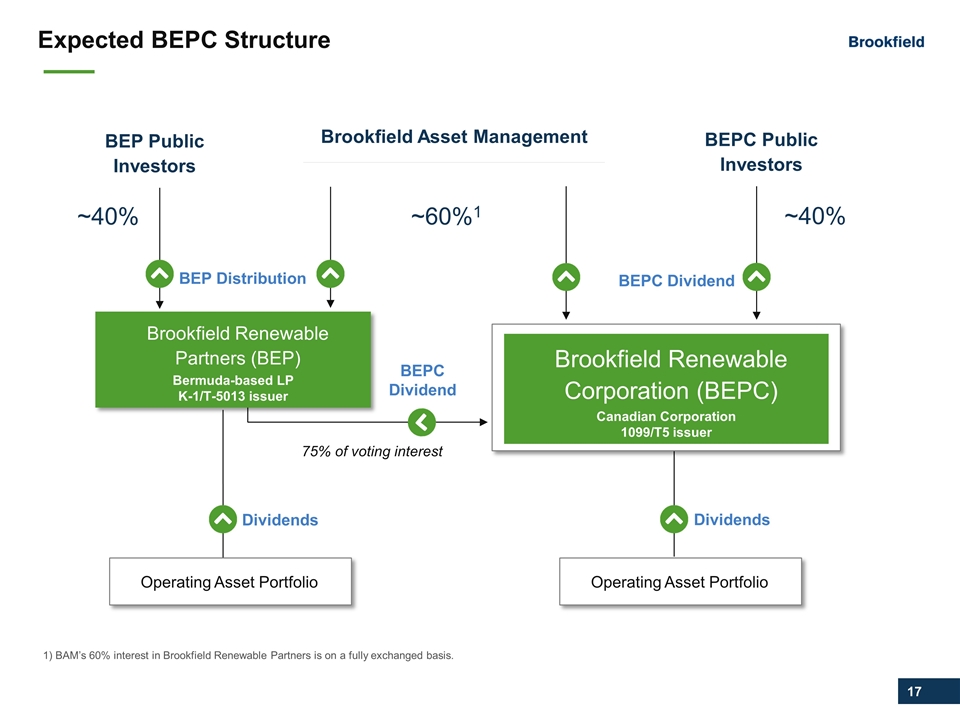

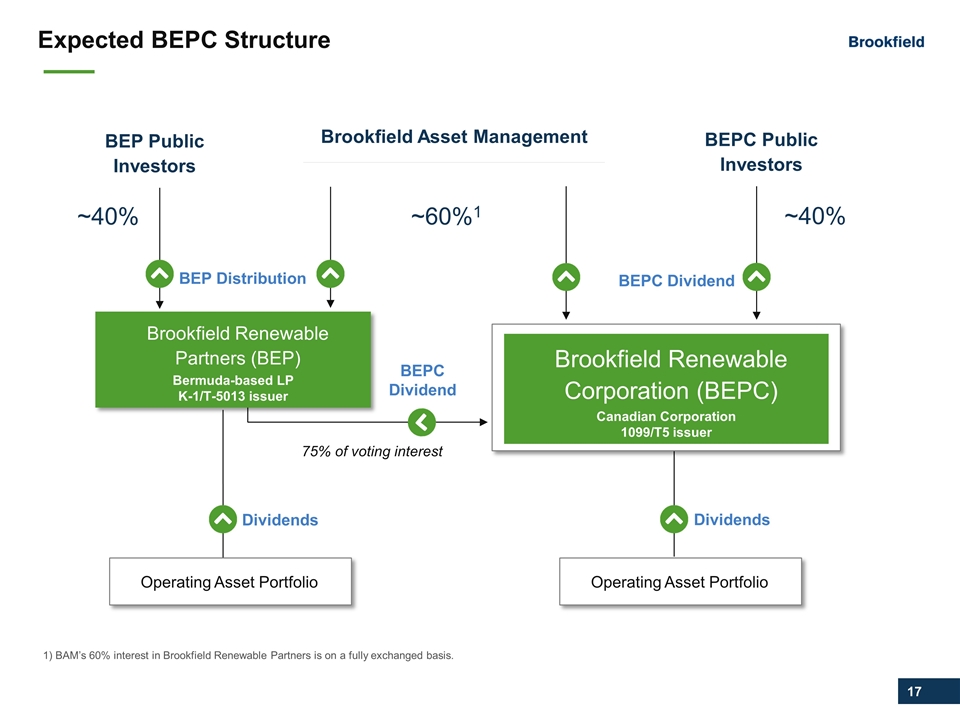

Expected BEPC Structure Brookfield Renewable Corporation (BEPC) Brookfield Renewable Partners (BEP) Bermuda-based LP K-1/T-5013 issuer 75% of voting interest BEPC Public Investors BEPC Dividend Dividends Canadian Corporation 1099/T5 issuer BEP Public Investors BEP Distribution Dividends Operating Asset Portfolio BEPC Dividend Brookfield Asset Management ~40% ~60%1 ~40% Operating Asset Portfolio 1) BAM’s 60% interest in Brookfield Renewable Partners is on a fully exchanged basis.

Notice to Recipients All amounts are in U.S. dollars unless otherwise specified. Unless otherwise indicated, the statistical and financial data in this presentation is presented as of November 6, 2019, and on a consolidated basis. CAUTIONARY STATEMENT REGARDING FORWARD- LOOKING STATEMENTS AND INFORMATION This presentation contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of applicable U.S. and Canadian securities law. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, and include statements regarding our and our subsidiaries’ operations, business, financial condition, expected financial results, performance, growth prospects and distribution profile, expected liquidity, priorities, targets, ongoing objectives, strategies, dividends and distributions and outlook, and include, but are not limited to, statements regarding the special distribution of BEPC’s class A shares, BEPC’s eligibility for index inclusion, BEPC’s ability to attract new investors as well as the future performance and prospects of BEPC and Brookfield Renewable following the distribution of BEPC’s class A shares the expected tax treatment of the BEPC structure and tax profile of future dividends and distributions made to holders of BEP units and BEPC shares, the expected proceeds from opportunistically recycling capital, as well as the benefits from acquisitions and Brookfield Renewable’s global scale and resource diversity. In some cases, forward-looking statements can be identified by terms such as “expects,” “plans,” “estimates,” “seeks,” “targets,” “projects,” “grow” or negative versions thereof and other similar expressions, or future or conditional verbs such as “may,” “will,” “should,” “would” and “could.” Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward- looking statements and information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause our and our subsidiaries’ actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements and information. Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to, the following: changes to hydrology at our hydroelectric facilities, to wind conditions at our wind energy facilities, to irradiance at our solar facilities or to weather generally as a result of climate change or otherwise at any of our facilities; volatility in supply and demand in the energy markets; our inability to re-negotiate or replace expiring power purchase agreements on similar terms; increases in water rental costs (or similar fees) or changes to the regulation of water supply; advances in technology that impair or eliminate the competitive advantage of our projects; an increase in the amount of uncontracted generation in our portfolio; industry risks relating to the power markets in which we operate; the termination of, or a change to, the MRE hydrological balancing pool in Brazil; increased regulation of our operations; concessions and licenses expiring and not being renewed or replaced on similar terms; increases in the cost of operating our plants; our failure to comply with conditions in, or our inability to maintain, governmental permits; equipment failures, including relating to wind turbines and solar panels; dam failures and the costs and potential liabilities associated with such failures; force majeure events; uninsurable losses and higher insurance premiums; adverse changes in currency exchange rates and our inability to effectively manage foreign currency exposure; availability and access to interconnection facilities and transmission systems; health, safety, security and environmental risks; disputes, governmental and regulatory investigations and litigation; counterparties to our contracts not fulfilling their obligations; the time and expense of enforcing contracts against nonperforming counter-parties and the uncertainty of success; our operations being affected by local communities; fraud, bribery, corruption, other illegal acts or inadequate or failed internal processes or systems; our reliance on computerized business systems, which could expose us to cyber-attacks; newly developed technologies in which we invest not performing as anticipated; labor disruptions and economically unfavorable collective bargaining agreements; our inability to finance our operations due to the status of the capital markets; operating and financial restrictions imposed on us by our loan, debt and security agreements; changes to our credit ratings; our inability to identify sufficient investment opportunities and complete transactions; the growth of our portfolio and our inability to realize the expected benefits of our transactions or acquisitions; our inability to develop greenfield projects or find new sites suitable for the development of greenfield projects; delays, cost overruns and other problems associated with the construction and operation of generating facilities and risks associated with the arrangements we enter into with communities and joint venture partners; Brookfield Asset Management’s election not to source acquisition opportunities for us and our lack of access to all renewable power acquisitions that Brookfield Asset Management identifies; we do not have control over all our operations or investments; political instability, changes in government policy, or unfamiliar cultural factors could adversely impact the value of our investments; foreign laws or regulation to which we become subject as a result of future acquisitions in new markets; changes to government policies that provide incentives for renewable energy; a decline in the value of our investments in securities, including publicly traded securities of other companies; we are not subject to the same disclosure requirements as a U.S. domestic issuer; the separation of economic interest from control within our organizational structure; the incurrence of debt at multiple levels within our organizational structure; being deemed an “investment company” under the U.S. Investment Company Act of 1940; the effectiveness of our internal controls over financial reporting; our dependence on Brookfield Asset Management and Brookfield Asset Management’s significant influence over us; the departure of some or all of Brookfield Asset Management’s key professionals; changes in how Brookfield Asset Management elects to hold its ownership interests in Brookfield Renewable; and Brookfield Asset Management acting in a way that is not in the best interests of Brookfield Renewable or our unitholders. We caution that the foregoing list of important factors that may affect future results is not exhaustive. The forward-looking statements represent our views as of the date of this presentation and should not be relied upon as representing our views as of any subsequent date. While we anticipate that subsequent events and developments may cause our views to change, we disclaim any obligation to update the forward-looking statements, other than as required by applicable law. For further information on these known and unknown risks, please see “Risk Factors” included in our Form 20-F for the year ended December 31, 2018, and the prospectus qualifying the special distribution of BEPC shares. The creation of BEPC is subject to stock exchange and regulatory approvals that have not yet been received and there can be no assurances that the stock exchanges on which BEPC intends to apply to list its shares will approve the listing of BEPC’s shares or that BEPC will be included in any indices. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise. CAUTIONARY STATEMENT REGARDING USE OF NON-IFRS MEASURES This presentation contains references to financial metrics that are not calculated in accordance with, and do not have any standardized meaning prescribed by, International Financial Reporting Standards (“IFRS”). We believe such non-IFRS measures including, but not limited to, funds from operations (“FFO”) and FFO per unit, are useful supplemental measures that may assist investors and others in assessing our financial performance and the financial performance of our subsidiaries. As these non-IFRS measures are not generally accepted accounting measures under IFRS, references to FFO and FFO per unit, as examples, are therefore unlikely to be comparable to similar measures presented by other issuers and entities. These non-IFRS measures have limitations as analytical tools. They should not be considered as the sole measure of our performance and should not be considered in isolation from, or as a substitute for, analysis of our financial statements prepared in accordance with IFRS. For a reconciliation of FFO and FFO per Unit to the most directly comparable IFRS measure, please see “Financial Performance Review on Proportionate Information – Reconciliation of Non-IFRS Measures” included in our annual report on Form 20-F and “Part 4 - Financial Performance Review on Proportionate Information – Reconciliation of non-IFRS measures” in our management’s discussion and analysis for the three and nine months ended September 30, 2019. References to Brookfield Renewable, “me”, “us” or “our” are to Brookfield Renewable Partners L.P. together with its subsidiary and operating entities unless the context reflects otherwise. In connection with the transaction described in this presentation, a registration statement (including a prospectus) has been filed with the U.S. Securities and Exchange Commission (the “SEC”). You should read the prospectus and any other documents that have been or will be filed with the SEC for more complete information about the transaction. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, a copy of the prospectus can be sent to you at no cost, upon request, by contacting enquiries@brookfieldrenewable.com No securities regulatory authority has either approved or disapproved of the contents of this presentation. This presentation is for information purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.