Brookfield Renewable Partners & TerraForm Power DEFINITIVE MERGER AGREEMENT Investor presentation March 2020 Exhibit 99.1

Transaction Summary On March 16, 2020 Brookfield Renewable Partners L.P. (“Brookfield Renewable” or “BEP”) and TerraForm Power Inc. (“TerraForm Power” or “TERP”) entered into a definitive agreement for BEP to acquire all of the outstanding shares of Class A common stock of TERP, other than the 62% currently owned by Brookfield Renewable and its affiliates Each Class A common share of TerraForm Power will be acquired for consideration equivalent to 0.381 of a BEP unit TERP shareholders will be entitled to receive for each TERP share, at their election, either Class A shares of Brookfield Renewable Corporation (“BEPC shares”) or limited partnership units of Brookfield Renewable (“BEP units”) Allows TERP shareholders to choose how to most efficiently participate in the transaction, either through a partnership or corporate structure The Special Committee of TERP’s Board of Directors – comprised of solely independent directors – unanimously recommends the transaction to TERP shareholders

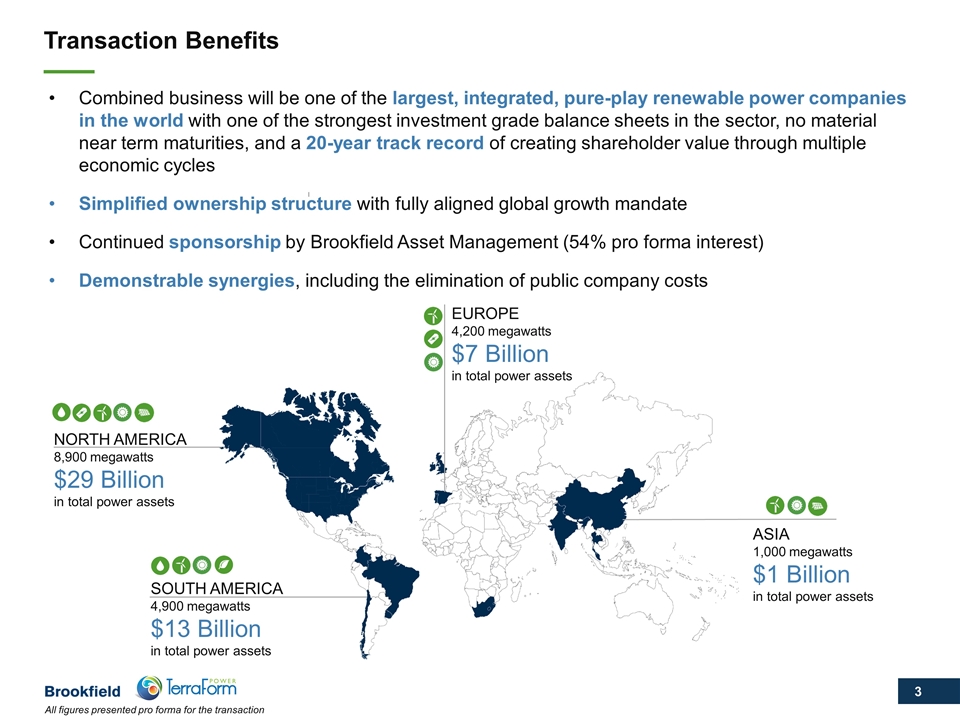

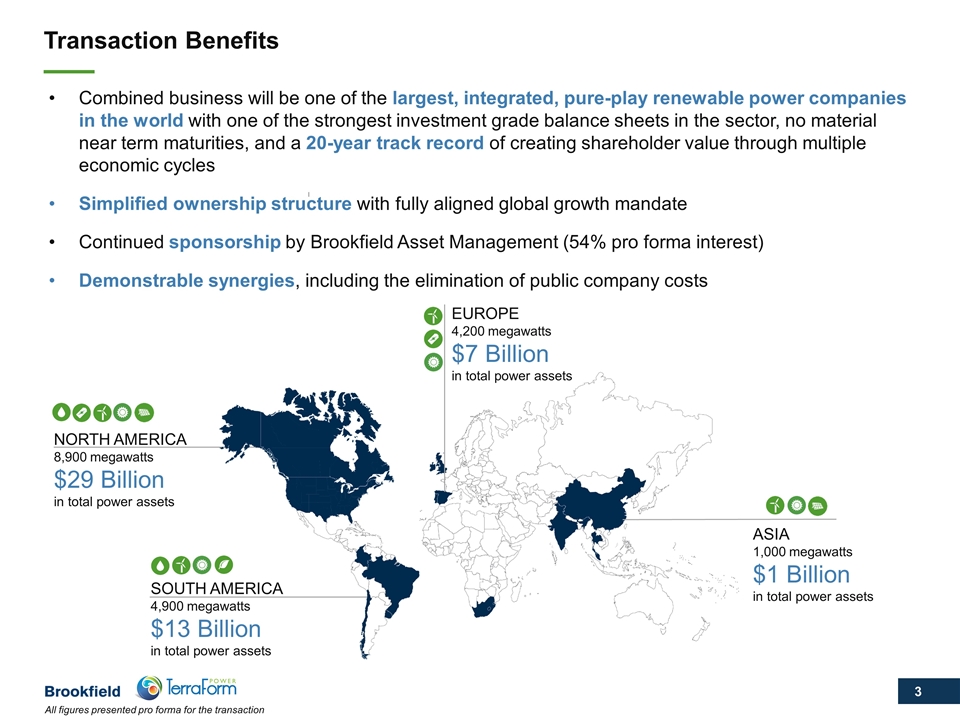

Transaction Benefits Combined business will be one of the largest, integrated, pure-play renewable power companies in the world with one of the strongest investment grade balance sheets in the sector, no material near term maturities, and a 20-year track record of creating shareholder value through multiple economic cycles Simplified ownership structure with fully aligned global growth mandate Continued sponsorship by Brookfield Asset Management (54% pro forma interest) Demonstrable synergies, including the elimination of public company costs NORTH AMERICA 8,900 megawatts $29 Billion in total power assets SOUTH AMERICA 4,900 megawatts $13 Billion in total power assets ASIA 1,000 megawatts $1 Billion in total power assets EUROPE 4,200 megawatts $7 Billion in total power assets All figures presented pro forma for the transaction

Transaction Benefits (cont’d) Accretive to FFO Further expands BEP’s portfolio in North America and Western Europe Strengthens BEP’s contract profile Increases public float and enhances the liquidity of BEPC shares Strong premium of 17% to TERP’s unaffected trading price1 Ability to participate in the ongoing growth of a global leader in renewables with a track record of success Access to a broader growth mandate, that includes the acquisition of global, multi-technology renewable power assets and development opportunities Greater technological and geographic diversification Benefit from increased access to capital and liquidity, underpinned by an investment grade balance sheet Benefits to BEP Unitholders Benefits to TERP Shareholders Based on unaffected trading prices of $15.60/share and $48.07/unit for TERP and BEP, respectively, at market close on January 10, 2020

Why BEP?

Ability to Participate in a Global Leader in Renewable Generation… 5,274 power generating facilities $50 billion TOTAL POWER ASSETS 27 markets in 17 countries 19,000 MEGAWATTS OF CAPACITY Situated on 84 river systems 74% HYDROELECTRIC GENERATION One of the largest public pure-play renewable businesses globally 120 years of experience in power generation Full operating, development and power marketing capabilities Over 2,800 operating employees

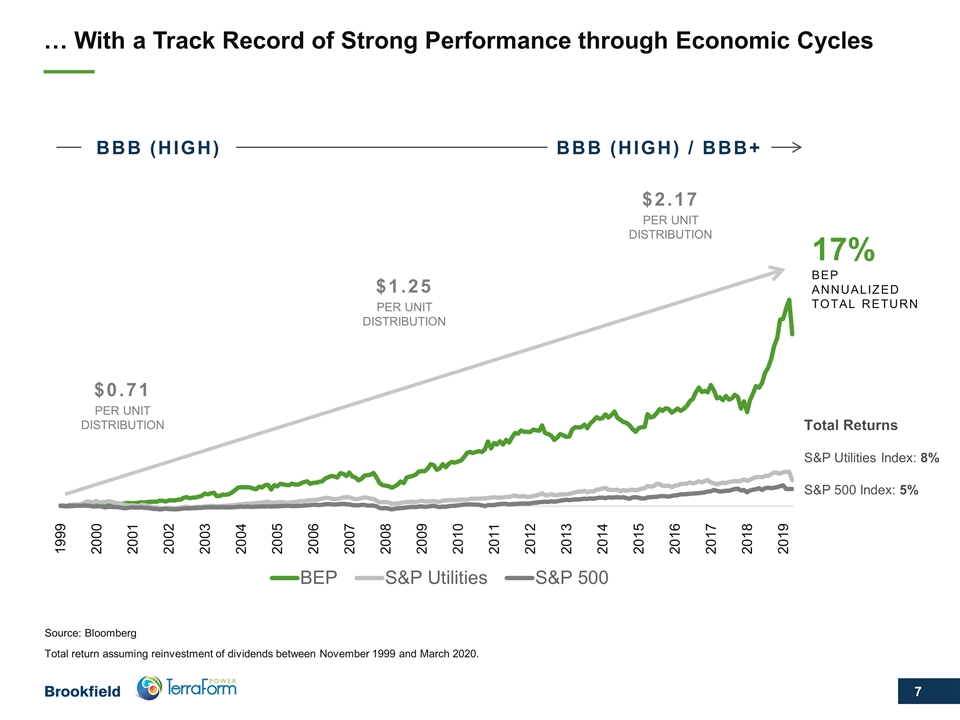

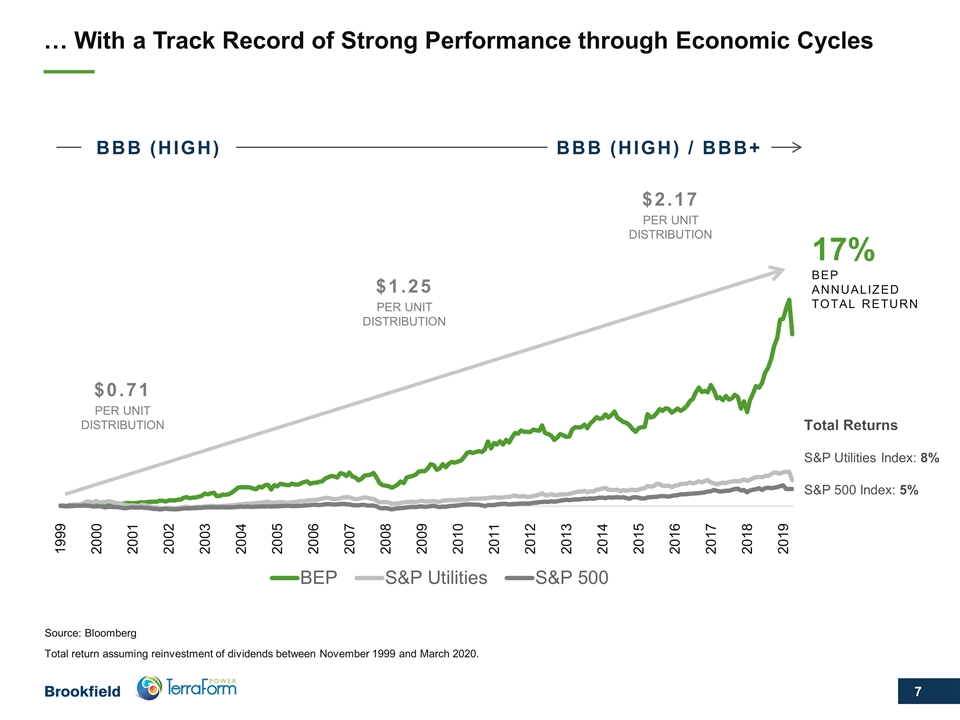

… With a Track Record of Strong Performance through Economic Cycles Source: Bloomberg Total return assuming reinvestment of dividends between November 1999 and March 2020. 17% BEP ANNUALIZED TOTAL RETURN BBB (high) BBB (high) / BBB+ $0.71 per unit distribution $1.25 per unit distribution $2.17 PER UNIT DISTRIBUTION Total Returns S&P Utilities Index: 8% S&P 500 Index: 5%

Access to a Consistent, Proven and Repeatable Growth Strategy Value-oriented investors who seek opportunities where we can differentiate ourselves using something other than cost of capital ENDURING COMPETITIVE ADVANTAGES CONSISTENT RETURN TARGETS size Global Reach Operational Capabilities Remain disciplined in our 12% to 15% return targets

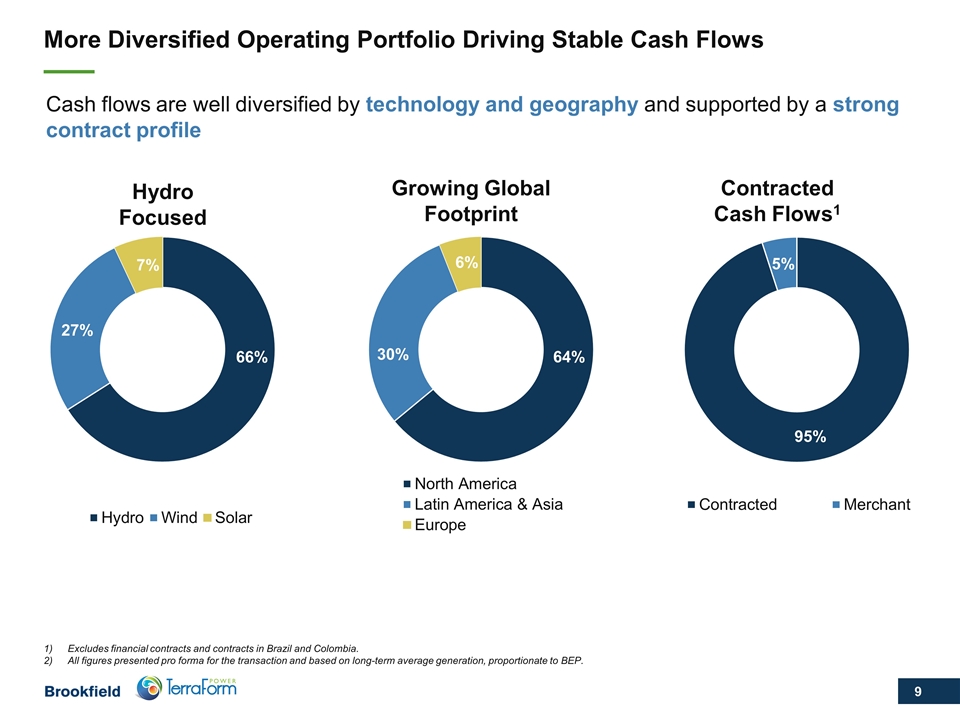

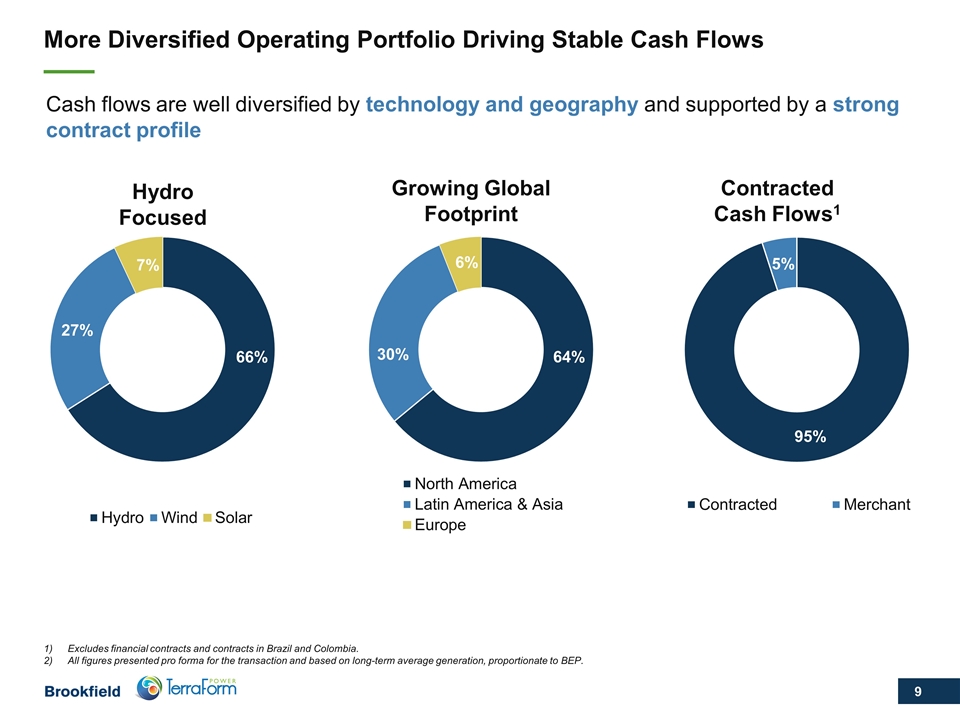

More Diversified Operating Portfolio Driving Stable Cash Flows 66% Hydro Focused Growing Global Footprint Contracted Cash Flows1 7% Excludes financial contracts and contracts in Brazil and Colombia. All figures presented pro forma for the transaction and based on long-term average generation, proportionate to BEP. 6% 64% Cash flows are well diversified by technology and geography and supported by a strong contract profile

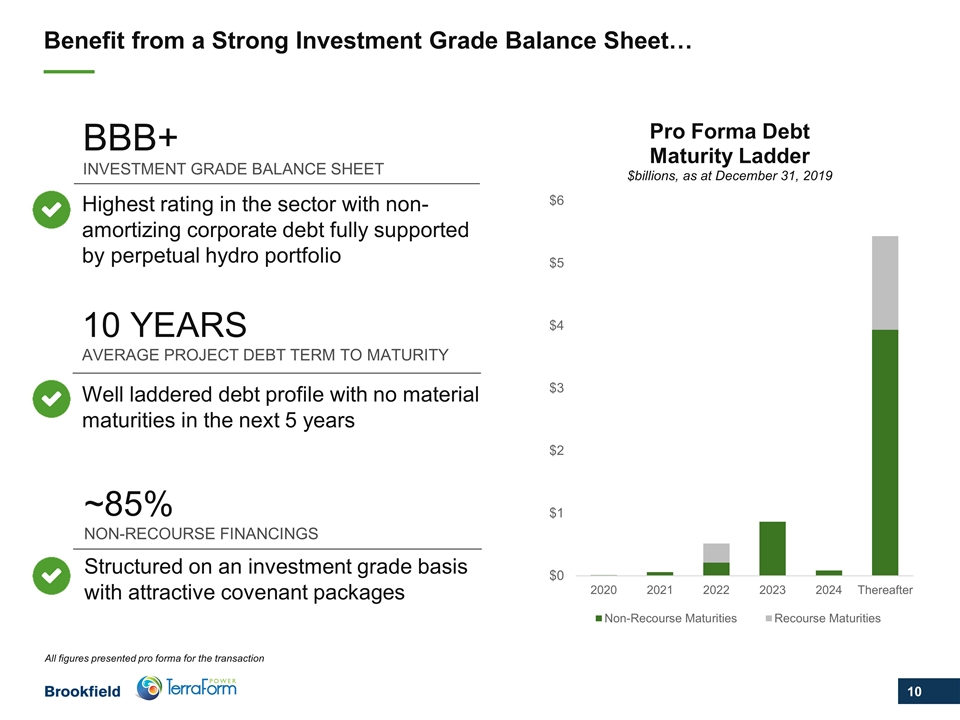

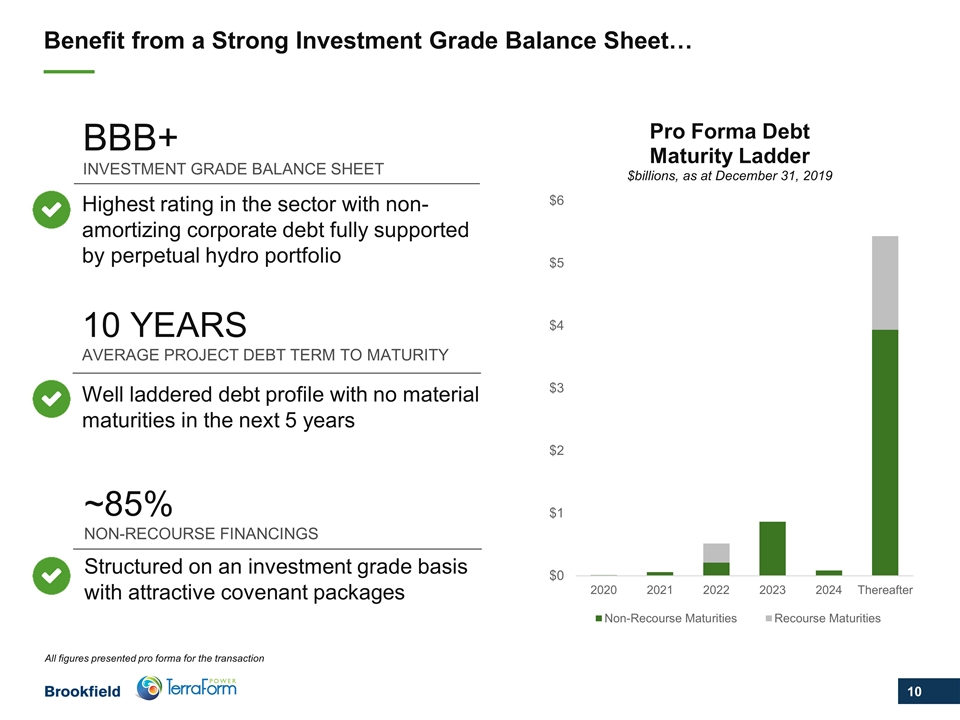

Benefit from a Strong Investment Grade Balance Sheet… BBB+ INVESTMENT GRADE BALANCE SHEET 10 YEARS AVERAGE PROJECT DEBT TERM TO MATURITY Highest rating in the sector with non-amortizing corporate debt fully supported by perpetual hydro portfolio Well laddered debt profile with no material maturities in the next 5 years ~85% NON-RECOURSE FINANCINGS Structured on an investment grade basis with attractive covenant packages All figures presented pro forma for the transaction

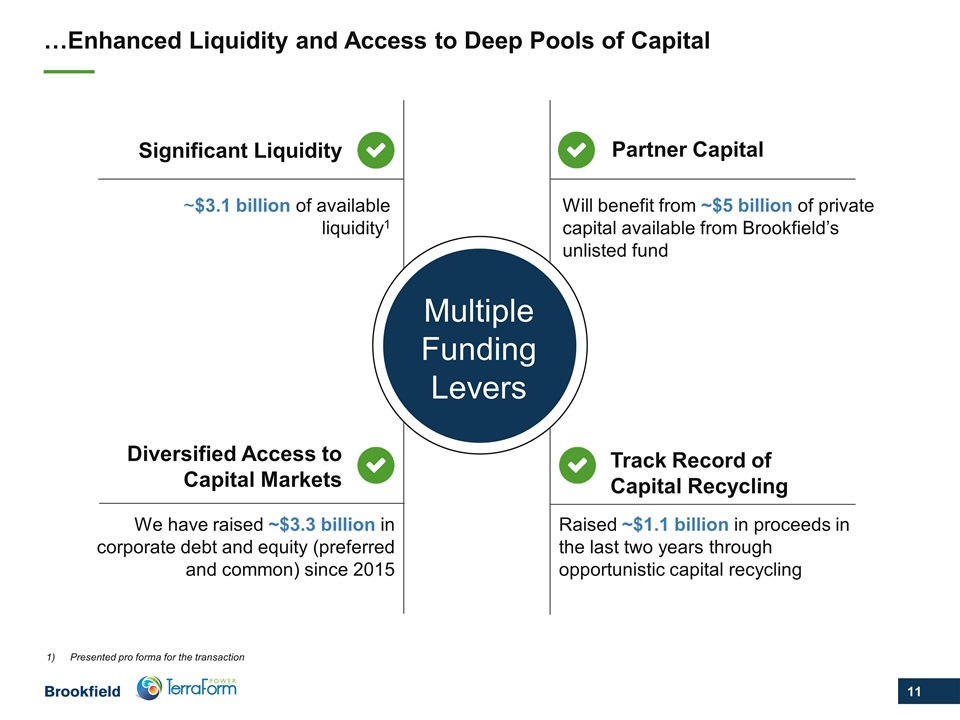

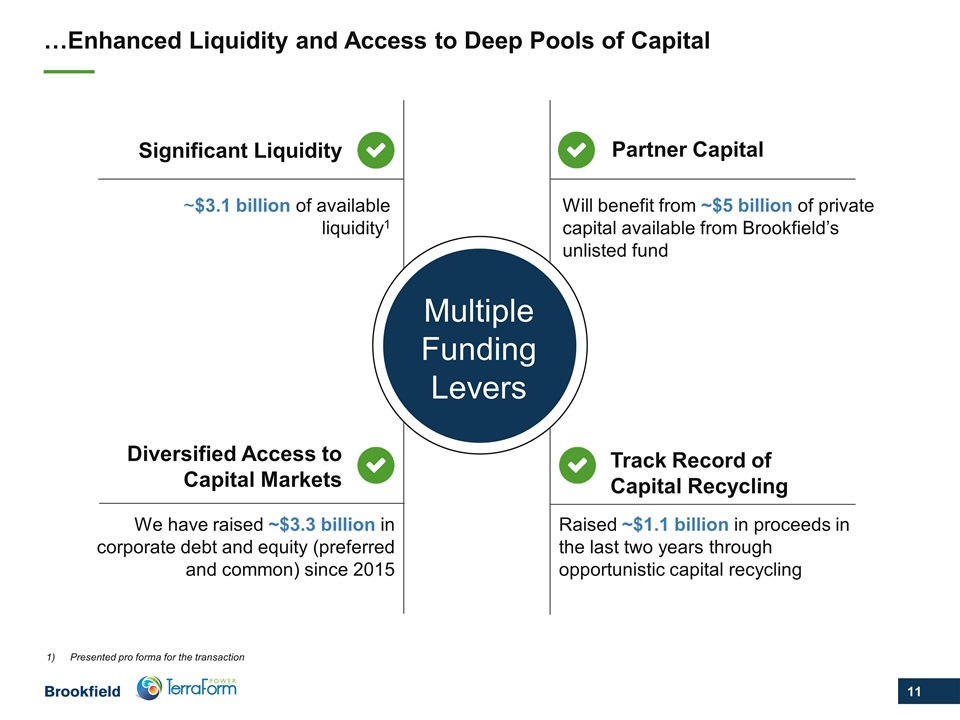

…Enhanced Liquidity and Access to Deep Pools of Capital Significant Liquidity Partner Capital Diversified Access to Capital Markets Track Record of Capital Recycling ~$3.1 billion of available liquidity1 Will benefit from ~$5 billion of private capital available from Brookfield’s unlisted fund We have raised ~$3.3 billion in corporate debt and equity (preferred and common) since 2015 Raised ~$1.1 billion in proceeds in the last two years through opportunistic capital recycling Multiple Funding Levers Presented pro forma for the transaction

Brookfield Renewable Corporation (“BEPC”)

Form of Consideration – BEPC shares or BEP units 1) Subject to BEPC’s election to provide one BEP unit or the cash equivalent of one BEP unit BEPC offers TERP shareholders the optionality to own Brookfield Renewable through a corporate structure TERP shareholders can elect to receive consideration in the form of Class A shares of BEPC or BEP units TERP shareholders who do not make any election will receive BEPC shares As previously announced, BEP intends to make a special distribution of BEPC shares to its unitholders BEPC will be a Canadian corporation, listed on the TSX and NYSE, and structured with the intention of being economically equivalent to BEP units BEPC shares will be fully exchangeable, at the option of the holder, on a one-for-one basis, into units of BEP1, and A dividend that is identical to the distribution paid on BEP units Provides investors the flexibility to invest in Brookfield Renewable either through the existing partnership or a corporate structure Special distribution is expected to close concurrently with the closing of the transaction with TERP Exchange ratio will be adjusted on a proportional basis to reflect the special distribution

We see many benefits in establishing BEPC Broader index and ETF inclusion Tax advantages for some Expanded investor base BEPC LISTED CORPORATION

Notice to Recipients All amounts are in U.S. dollars unless otherwise specified. CAUTIONARY STATEMENT REGARDING FORWARD- LOOKING STATEMENTS AND INFORMATION This presentation contains forward-looking statements and information within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, Section 21E of the U.S. Securities Exchange Act of 1934, as amended, “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and in any applicable Canadian securities regulations. The words “will”, “intend”, “should”, “could”, “target”, “growth”, “expect”, “believe”, “plan”, derivatives thereof and other expressions which are predictions of or indicate future events, trends or prospects and which do not relate to historical matters identify the above mentioned and other forward-looking statements. Forward-looking statements in this presentation include statements regarding the transaction, the prospects and benefits of the combined company, including certain information regarding the combined company’s expected cash flow profile and liquidity, the special distribution of BEPC shares and any other statements regarding BEP and TERP’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance. Although BEP and TERP believe that these forward-looking statements and information are based upon reasonable assumptions and expectations, you should not place undue reliance on them, or any other forward-looking statements or information in this presentation. The future performance and prospects of BEP and TERP is subject to a number of known and unknown risks and uncertainties. Factors that could cause actual results of Brookfield Renewable and TerraForm Power to differ materially from those contemplated or implied by the statements in this communication include uncertainties as to whether TerraForm Power’s Special Committee will continue to recommend any transaction with BEP to the TERP stockholders; uncertainties as to whether TerraForm Power stockholders not affiliated with Brookfield Renewable will approve any transaction; uncertainties as to whether the other conditions to the transaction will be satisfied or satisfied on the anticipated schedule; the timing of the transaction and whether the transaction will be completed, including as a result of potential litigation in connection with the transaction; failure to realize contemplated benefits from the transaction, including the possibility that the expected synergies and value creation from the transaction will not be realized; the inability to retain key personnel; and incurrence of significant costs in connection with the transaction. For further information on these known and unknown risks, please see “Risk Factors” included in TerraForm Power’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the Securities and Exchange Commission (“SEC”) and in Brookfield Renewable’s Form 20-F and other risks and factors that are described therein and that are described in Brookfield Renewable’s and BEPC’s joint preliminary Form F-1 and prospectus filed with the SEC and the securities regulators in Canada. The foregoing list of important factors that may affect future results is not exhaustive. The forward-looking statements represent our views as of the date of this presentation and should not be relied upon as representing our views as of any subsequent date. While we anticipate that subsequent events and developments may cause our views to change, we disclaim any obligation to update the forward-looking statements, other than as required by applicable law. Additional Information and Where to Find It This presentation is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Any solicitation will only be made through materials filed with the SEC. Nonetheless, this presentation may be deemed to be solicitation material in respect of the transaction by BEP and TERP. BEP and BEPC expect to file relevant materials with SEC, including a registration statement on Form F-4 that may include a proxy statement of TerraForm Power that also constitutes a prospectus of BEP and BEPC (the “F-4”). This presentation is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that BEP, BEPC or TerraForm Power may file with the SEC or send to shareholders in connection with the transaction. SHAREHOLDERS OF TERRAFORM POWER ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC (IF AND WHEN THEY BECOME AVAILABLE), INCLUDING THE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION. Investors and security holders will be able to obtain copies of the F-4, including the proxy statement/prospectus, and other documents filed with the SEC (if and when available) free of charge at the SEC’s website, http://www.sec.gov. Copies of documents filed with the SEC by Terraform Power will be made available free of charge on Terraform Power’s website at http://www.terraform.com/. Copies of documents filed with the SEC by BEP and BEPC will be made available free of charge on BEP’s website at http://bep.brookfield.com/. Such documents are not currently available. Participants in Solicitation TerraForm Power and its directors and executive officers, BEPC and its directors and executive officers, and BEP and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of TerraForm Power common stock in respect of the transaction. Information about the directors and executive officers of TerraForm Power is set forth on its website at http://www.terraformpower.com/. Information about the directors and executive officers of BEP is set forth on its website at http://bep.brookfield.com/. Information about the directors and executive officers of BEPC is set forth on its preliminary Form F-1. Investors may obtain additional information regarding the interests of such participants by reading the proxy statement/prospectus regarding the transaction when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph. Non Solicitation No securities regulatory authority has either approved or disapproved of the contents of this presentation. This presentation shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.