PAZOO, INC.

January 31, 2012

Via EDGAR

Christopher Chase

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: Pazoo, Inc.

Amendment to Registration Statement on Form S-1

Filed December 14, 2011

File No. 333-178037

Dear Mr. Chase:

I write in response to your letter dated January 11, 2012 seeking comments and/or information with regard to the above-referenced filing.

As requested in your letter please find our written responses below. Additionally, today we have filed a substantive amendment (Amendment No. 3) to the previously filed Form S-1. For ease of review of the Form S-1/A, we have attached to this letter a copy of the Form S-1/A which highlights the changes to address the comments noted in your letter.

General

| 1. | Given the nature of the offering and the size of the offering relative to the number of shares outstanding held by non-affiliates, it appears that these securities are being offered by or on behalf of the registrant. Therefore, the offering is not eligible to be conducted on a continuous or delayed basis pursuant to Rule 415(a)(1)(i) of Regulation C. Further, the company is not eligible to make an at-the-market offering under Rule 415(a)(4) of Regulation C because it is not eligible to make an offering under Rule 415(a)(1)(x) of Regulation C. Please revise your registration statement to state that the Selling Security Holders will offer their securities at a fixed price for the duration of the offering and identify the Selling Security Holders as underwriters, and make conforming changes to your prospectus accordingly, including your cover page, summary and plan of distribution sections. For guidance, refer to Compliance and Disclosure Interpretations, Securities Act Rules, 612.09, available on our website at www.sec.gov. The Officers and Directors of the Company have agreed to remove from the registration statement all but a nominal amount of the shares they beneficially own. We have also removed the shares issuable upon conversion of the Series A Preferred Stock by Integrated Capital Partners inasmuch as the company has no obligation under the Investment Agreement to register any shares which may be issuable upon conversion of the Series A Preferred Stock. Therefore, we are effectively registering only 212,000 shares of common stock. |

| 2. | Please revise your filing to consistently refer to securities being quoted on the OTCBB as opposed to traded. For example, we note that you refer to securities being “traded” on the OTCBB on pages 1, 25, and 32. The required corrections have been made in Amendment No. 3. |

| 3. | Please note that you should avoid repeating disclosure in different sections of your filing that increases the size of the document but does not enhance the quality of information. For example, we note that the second full paragraph of your first risk factor on page 15 is largely duplicative of disclosure on pages 26 and 31 regarding DTC eligibility. Please review your entire document, eliminate unnecessary duplicative disclosure or advise us why you believe the duplicative disclosure is appropriate. Refer to Note 4 to Rule 421(b) of Regulation C under the Securities Act of 1933, as amended, and Instruction to paragraph 503(a) of Regulation S-K. The required corrections have been made in Amendment No. 3. |

| 4. | Please provide the disclosure required by Item 102 of Regulation S-K regarding your property(ies). In this regard, we note that you reference the location of your headquarters in Cedar Knolls, New Jersey, but this is not sufficient disclosure pursuant to the requirements of Item 102. The required corrections have been made in Amendment No. 3. |

Registration Statement Cover Page

| 5. | Please revise your registration statement cover page to include the applicable amendment number. See Rule 470 of Regulation C under the Securities Act of 1933. The required corrections have been made in Amendment No. 3. |

Cover Page, page 1

| 6. | Please revise the second paragraph on page 1 to clarify that a market maker, as opposed to you, must apply for quotation of your common stock on the OTCBB. Please also disclose, as you do on page 25, that you do not currently have an agreement with a market maker to file an application on your behalf. The required corrections have been made in Amendment No. 3. |

The Offering, page 4

| 7. | Please expand your disclosure in the first paragraph under “The Offering” on page 4 to explain why the Selling Security Holders’ ability to sell their shares, once registered, is “contingent upon the Company being traded on any market or securities exchange.” In this regard, we note your disclosure elsewhere that prior to being quoted on the OTCBB, the Selling Security Holders may sell their shares at a fixed price. This disclosure suggests that a Selling Security Holder’s ability to sell its shares once registered is not, as you indicate on page 4, contingent upon the company being traded on a market or securities exchange. The sale of the shares into the secondary market by the Selling Security Holders is not contingent upon the Company’s stock being quoted on the OTCBB. The required corrections have been made in Amendment No. 3 to make the referenced provisions consistent. |

| 8. | We note your disclosure in the last sentence of the first paragraph on page 4 that “[i]n the event no conversion takes place, or less than the reserved amount of common stock is issued upon conversion, the remainder of any reserved shares will be retired.” Based on this disclosure, it appears that you may have limited the time periods during which the preferred stock may be converted and/or you contemplate scenarios where the preferred stock would convert at a different ratio than disclosed. Please expand your disclosure to provide additional clarity with respect to any limitations on the conversion of common stock and/or any potential changes to the conversion ratio of your Series A Preferred stock. |

| | The comment is moot as the shares issuable upon conversion of the Series A Preferred Stock have been removed from the registration statement. The foregoing notwithstanding, conversion of the Series A Preferred Stock is at the sole discretion of the holder(s) thereof, provided that such holder may not be a holder of more than 4.99% of the Company’s common stock. The holder may choose to never convert its Series A Convertible Preferred Stock, or convert its Series A Convertible Preferred Stock into restricted common stock. The required corrections have been made in Amendment No. 3. |

| 9. | Your disclosure under “Offering Period” and “Termination of the Offering” in the table on page 4 is inconsistent. Please revise. Please also revise your disclosure to clarify that it is your obligation, not the Selling Security Holders’ as indicated under “Termination of the offering”, to take the necessary steps to terminate this offering. The required corrections have been made in Amendment No. 3 to make these provisions consistent. |

| 10. | Please revise your disclosure under “Terms of the Offering” in the table on page 4 to be consistent with your disclosure under “Offering Price per share…” with respect to the manner and price at which the Selling Security Holders will offer their shares. The required corrections have been made in Amendment No. 3 to make these provisions consistent. |

| 11. | Please revise your disclosure under “Use of Proceeds” on page 4 to state, as you do on page 25, that you will pay all expenses incidental to the registration of the shares in this registration statement. The required corrections have been made in Amendment No. 3. |

Risk Factors, page 6

We are in the early stages of development, page 6

| 12. | Please expand your risk factor, or provide a separate risk factor, explaining why you believe maintenance of key personnel is a risk to your company. If applicable, please identify the specific personnel to which you are referring. In this regard, please note that Item 503(c) of Regulation S-K states that you should not present risks that could apply to any issuer or any offering. The required corrections have been made in Amendment No. 3. |

Indemnification and Undertakings, page 43

| 13. | Please revise your filing to move your undertaking and indemnification disclosure required by Items 512 and 702 of Regulation S-K to Part II of your registration statement, as opposed to its current location in your prospectus. See Items 14 and 17 of Form S-1. The required corrections have been made in Amendment No. 3. |

Dilution, page 18

| 14. | We note that it appears that you issued at least 47,500,000 common shares to your officers at no cost. In comparison, the initial offering price of your common stock being offered by the Selling Security Holders pursuant to this registration statement is $0.005. Therefore, please provide a comparison of the public contribution of individuals purchasing your shares in this offering, assuming an offering price of $0.005, to the effective cash contribution of your officers, directors, promoters and affiliated persons that were previously granted shares. See Item 506 of Regulation S-K. The required corrections have been made in Amendment No. 3. |

Selling Security Holders, page 19

| 15. | We note your disclosure in the second paragraph on page 19 that you intend to apply for listing on a “public exchange” as soon as you meet the listing requirements. This is inconsistent with your disclosure elsewhere that you intend to obtain a market maker to apply for quotation of your common stock on the OTCBB. Please revise. The required corrections have been made in Amendment No. 3. |

| 16. | Please revise the third paragraph on page 19 to be consistent with your disclosure on page 4 that the offer will terminate 90 days after effectiveness of your registration statement. The required corrections have been made in Amendment No. 3 to make these provisions consistent. |

| 17. | We note footnote (2) to your Selling Security Holder table wherein you state that a total of 1 million shares that were issued to Mr. Basloe were titled in the names of his children. Please note that Mr. Basloe’s beneficial ownership should be calculated pursuant to Rule 13d-3 under the Securities Exchange Act of 1934. As such, it appears that the shares titled in the names of Mr. Basloe’s children may also be beneficially owned by him. Please revise your table accordingly, or if you do not believe that Mr. Basloe is the beneficial owner of his children’s shares pursuant to Rule 13d-3, please revise footnote (2) to your table to provide the basis of this conclusion. Finally, if Mr. Basloe’s beneficial ownership includes those shares titled in his children’s names, please ensure that you update all references in your filing to reflect Mr. Basloe’s accurate beneficial ownership, including the disclosure in your beneficial ownership table on page 44. The required corrections have been made Completed in Amendment No. 3. |

| 18. | Please revise your Selling Security Holder table to include the shares to be offered by Integrated Capital Partners, Inc. upon conversion of the Series A Preferred stock. In this regard, we would not object to footnote disclosure explaining that the common stock beneficially owned by Integrated Capital is not currently outstanding. Please also update your beneficial ownership table on page 44 to reflect Integrated Capital’s beneficial ownership. See Rule 13d-3 under the Securities Exchange Act of 1934. We have removed the shares into which Integrated Capital Partners’ Series A Convertible Preferred Stock may be converted, from the registration statement. We are registering only 212,000 shares of the 48,182,000 shares common stock issued and outstanding. |

Plan of Distribution, page 24

| 19. | Please revise the first sentence of your Plan of Distribution section to clarify that you are also registering the offer of 20,000,000 shares of common stock that will be issued upon conversion of outstanding Series A Preferred stock. We have removed the shares into which Integrated Capital Partners’ Series A Convertible Preferred Stock may be converted, from the registration statement. We are effectively registering only 212,000 shares of the 48,182,000 shares common stock issued and outstanding. |

| 20. | We note that you are registering the offer by the Selling Security Holders of 100% of your issued and outstanding common stock, but your disclosure in the first paragraph under “Plan of Distribution” indicates that you are only offering 3.5% of your issued and outstanding common stock. Please revise. |

| | The required corrections have been made Completed in Amendment No. 3. We are effectively registering only 212,000 shares of the 48,182,000 shares common stock issued and outstanding, which represents 0.4% of the issued and outstanding common stock. |

| 21. | In the sixth full paragraph on page 25 you state that your securities will only be traded “in the over-the-counter markets.” We note that this is inconsistent with references on pages 19, 23 and 24 to the possibility of your securities trading on exchanges. Please revise for consistency. The required corrections have been made in Amendment No. 3. |

Market for Securities, page 30

| 22. | Please provide us with a detailed legal analysis that is the basis for your statement on page 32 that Pazoo, Inc. “is exempt from ‘shell company’ rules and regulations.” In this regard, we note that it appears you meet the definition of a shell company as set forth in Rule 405 under the Securities Act of 1933. The reference on page 32 was in relation to the requirements under Rule 144 in the event holders of restricted securities seek to have the restriction pursuant to that Rule. Additional disclosures and clarifications have been made in Amendment No. 3. |

Registration Rights, page 32

| 23. | The last paragraph under the subheading “Registration Rights” on page 32 appears to contain contradictory disclosure. You state that you will need to raise additional capital “in the near future”, but then state that you have secured sufficient capital to fund your “development activities for the next 24 months….” Please revise for clarity and consistency. The required corrections have been made in Amendment No. 3. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 32

| 24. | Your existing discussion merely recites data from your statements of operations with little analysis as to the reason(s) for such amounts. Please note the requirements of Item 303 of Regulation S-K in discussing results of operations. When a comparative period of equal length is not presented for comparison purposes, then the analysis may focus on the results within a period in relation to other line items within results of operations or whatever discussion competently addresses the actual results as presented in the statement of operations. The required corrections have been made in Amendment No. 3. |

| 25. | Please revise your disclosure to identify your critical accounting estimates relating to material and significant estimates, judgments or assumptions made by management during the preparation of the financial statements each period. Refer to Section V of SEC Release No. 33-8350 and Item 303(a) of Regulation S-K. The required corrections have been made in Amendment No. 3. |

Liquidity and Capital Resources, page 33

| 26. | Please tell us whether you consider the Investment Agreement between the Company and Integrated Capital Partners, Inc. dated January 3, 2011 to be a source of liquidity. If so, advise why the remaining commitment to invest in IUCSS has not been discussed as a source of liquidity. The required corrections have been made in Amendment No. 3. |

| 27. | Please disclose whether there exist any material commitments for capital expenditures relating to the next twelve months. Refer to Item 303 (a) (2) of Regulation S-K. If none, please advise. The Company has no material commitments for capital expenditures over the next twelve months. The required corrections have been made in Amendment No. 3. |

Description of Business, page 34

| 28. | Please expand your disclosure in the second full paragraph on page 34 to provide the status of your “product line using magnetic technology to increase its therapeutic effect.” See Item 101(h)(4)(iii) of Regulation S-K. The Company has placed a hold on its pursuit of the magnetic technology bracelets and accordingly all references have been deleted from the registration statement. |

| 29. | We note your disclosure on page 35 regarding your intent to implement “Brick and Mortar Marketing and Promotion.” Considering your disclosure elsewhere indicating that you do not have and do not intend to have brick and mortar operations, please expand this disclosure to provide sufficient context so that an investor may understand how these marketing efforts will be implemented. Please see Note 2 to Rule 421(b) under Regulation C of the Securities Act of 1933 which states that you should avoid “Vague ‘boilerplate’ explanations that are imprecise and readily subject to different interpretations.” The required corrections have been made in Amendment No. 3. |

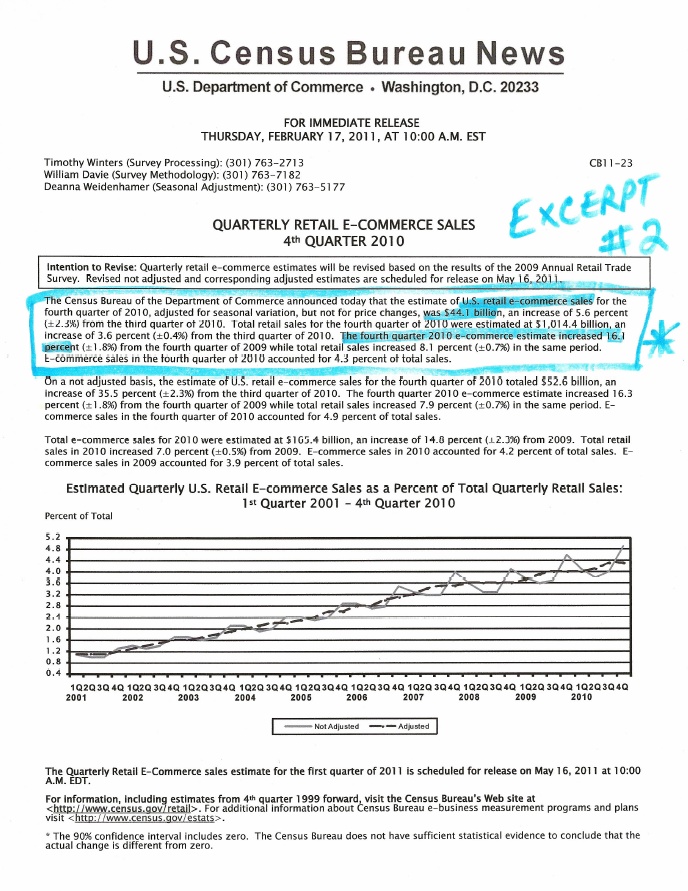

Industry Overview, page 35

| 30. | We note footnote 2 to your disclosure on page 35 under the subheading Industry Overview which references the source of the statistics contained in your disclosure. Please supplementally provide us with a copy of this source, tabbed and marked so as to clearly identify the specific locations within the source of the referenced statistics. The required corrections have been made in Amendment No. 3. Supplemental information is enclosed as Excerpt #1 and #2. |

Directors, Executive Officers, Promoters and Control Persons, page 38

| 31. | Please revise your disclosure to clearly state the business experience of each of your executive officers and directors during the past five years. We note that you discuss some business experience for each officer and director, but you do not provide relative time periods. See Item 401(e) of Regulation S-K. The required corrections have been made in Amendment No. 3. |

| 32. | For each of your directors, please briefly discuss the specific experience, qualifications, attributes or skills that led to the conclusion that the person should serve as a director in light of your business and structure. See Item 401(e) of Regulation S-K. The required corrections have been made in Amendment No. 3. |

PAZOO, INC.

Board of Directors, page 40

| 33. | We note that your disclosure in the first paragraph under “Board of Directors” on page 40 states that your directors’ terms have already expired as of November 16, 2011. Please revise to provide current information. The required corrections have been made in Amendment No. 3. |

Security Ownership of Certain Beneficial Owners and Management, page 42

| 34. | Please revise your filing so that the beneficial ownership table follows your initial paragraph under the above subheading. The required corrections have been made in Amendment No. 3. |

Audited Financial Statements – Fiscal Year Ended December 31, 2010

Balance Sheet, page 47

| 35. | Please revise your presentation of stockholders’ equity to include a caption that indentifies the existence of authorized but unissued Preferred Stock. Such caption should be on the face of the balance sheet and identify the authorized number of shares and any related per share values such as preference, liquidation or other. In 2010, there were no authorized shares of Preferred Stock. When filed on November 16, 2010, the Company’s Articles of Incorporation provided for only one class of stock, common stock, and 75,000,000 shares authorized. In 2011 the Company’s Articles of Incorporation were amended to provide for three classes of Preferred Stock Series A, B & C in addition to the previously authorized common stock. |

Notes to Financial Statements

| 36. | We note the Investment Agreement (“the Agreement”) dated January 3, 2011 between the Company and Integrated Capital, Inc. (“ICPI”) filed on November 18, 2011 a Exhibit 99.1 to Form S-1. Please tell us why your interim financial statements do not include footnote disclosure of the significant details regarding the terms of the Agreement. In 2010, there were no authorized shares of Preferred Stock. When filed on November 16, 2010, the Company’s Articles of Incorporation provided for only one class of stock, common stock, and 75,000,000 shares authorized. In 2011 the Company’s Articles of Incorporation were amended to provide for three classes of Preferred Stock Series A, B & C in addition to the previously authorized common stock. |

| 37. | Please indicate the date in which your subsequent events review was completed in accordance with FASB ASC 855-10-50-1. Please also revise your disclosure to provide similar disclosure in the notes to the unaudited financial statements as applicable. The required corrections have been made in Amendment No. 3. |

PAZOO, INC.

Note 1 – Description of Business and Accounting Policies, page 49

| 38. | We note your website appears to be operational. If so, please disclose your accounting policy for costs relating to enhancements and upgrades to your website and related software. Refer to FASB ASC 350-40-25-7 and ASC 350-50-25 if applicable. The Company’s “mini website” went live in August of 2011. Further disclosures have been made with regard to the development and launch of the Company’s main web site and the accounting for the costs associated therewith. The required corrections have been made in Amendment No. 3. |

Note 3 – Stockholders’ Equity, page 50

| 39. | We note your disclosure on page 3 that the Company is authorized to issue three classes of preferred stock. Please revise your disclosure to state the title of each issue, the number of shares authorized. Your disclosure should also state the significant and pertinent rights and privileges of these securities along with the terms and conditions for the preferred stock that is convertible into shares of common. If any issue is redeemable or has mandatory redemption requirements, please disclose the description and nature of the redemption features, maturity date and any obligations of the Company to the holders to transfer assets. Explain whether redemption is at the option of the holder and whether there are any conditions for redemption that are not solely within the control of the Company. Please also revise your disclosure to provide the information currently omitted from the unaudited financial statements. Please refer to the guidance in Rule 5-02.28 of Regulation S-X and FASB ASC 505-10-50-3. In 2010, there were no authorized shares of Preferred Stock. When filed on November 16, 2010, the Company’s Articles of Incorporation provided for only one class of stock, common stock, and 75,000,000 shares authorized. In 2011 the Company’s Articles of Incorporation were amended to provide for three classes of Preferred Stock Series A, B & C) in addition to the previously authorized common stock.The required corrections have been made in Amendment No. 3. |

Unaudited Financial Statements – From Inception (on November 16, 2010) to September 30, 2011

Notes for the Nine-Months Ended September 30, 2011 (Unaudited)

Note 1 – Description of Business and Accounting Policies, page 57

Stock Based Compensation, page 58

| 40. | Please revise your disclosure to include the total compensation cost for share-based payment arrangements. Refer to FASB ASC 718-10-50-2(h). If you believe you provided such disclosure in elsewhere in the financial statements, please advise. Please also explain why the statements of cash flows indicates an adjustment to net income for the stock issued for services that agrees with the statement of stockholders’ equity for the period ended September 30, 2011 but there is no similar item for stock issued for services for the preceding inception-to December 31, 2010 period. The required corrections have been made in Amendment No. 3. |

Recent Sales of Unregistered Securities, page 62

| 41. | We note that your disclosure on page 62 regarding the sale of unregistered securities does not reflect any of the private issuances of securities you reference on page 3 of your filing. It appears that all of these transactions must be set forth in your disclosure on page 62 pursuant to the disclosure requirements of Item 701 of Regulation S-K. Please note that the fact that many of these shares were granted “with no cost basis” does not alleviate your disclosure requirements under Item 701. In providing the required disclosure, please ensure that you provide all information required by Item 701 including the date of the sale, consideration received, and exemption for registration claimed including the facts relied upon to make the exemption available. The required corrections have been made in Amendment No. 3. |

PAZOO, INC.

Signatures, page 64

| 42. | As stated in our letter dated December 9, 2011, in addition to signing on behalf of the company, your Chief Executive Officer must also sign in his individual capacity. For reference, we note that your Chief Financial Officer, President and Chief Operating Officer have signed in their individual capacities. Please revise. The required corrections have been made in Amendment No. 3 to provide that all officers have sign in both their corporate and individual capacities. |

Exhibit 5.1 Legal Opinion

| 43. | Please have counsel revise the first paragraph of its opinion to include all of the shares that are being offered pursuant to this registration statement and make conforming changes throughout the opinion. In this regard, we note that the opinion does not reference the 20 million shares of common stock that will be offered upon conversion of Series A Preferred stock. The comment is moot as the shares issuable upon conversion of the Series A Preferred Stock have been removed from the registration statement. |

| 44. | Please have counsel revise the second paragraph of its opinion to represent that in issuing its opinion it has reviewed all documents it deems necessary, and to remove any indication that it is under no obligation to verify the adequacy of such documents. It is inappropriate for counsel to base its opinion on the review of a limited set of documents, and for counsel to disclaim the responsibility to verify the adequacy of such documents and records. Please refer to the guidance set forth in Staff Legal Bulletin No. 19, Legality and Tax Opinions in Registered Offerings (October 14, 2011) available on our website at www.sec.gov/interps/legal/cfslb19.htm. The required corrections have been made in Amendment No. 3. |

We look forward to working with you to resolve any comments the Commission may have in hopes of obtaining a Notice of Effectiveness of our Form S-1.

Please feel free to e-mail me at Greg@Pazoo.com with any further communications.

| | Yours sincerely, | |

| | | |

| | | |

| | /s/ Gregory Jung | |

| | | |

| | Gregory Jung | |

| | Chief Financial Officer | |

cc: Wolfgang Heimerl, Esq.

| 15A Saddle Road, Cedar Knolls, NJ 07927 | Direct: 973-455-0970 | www.pazoo.com |