July 6, 2012

H. Roger Schwall

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Re: Northern Tier Energy LP

Dear Mr. Schwall:

Pursuant to discussions with the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”), Northern Tier Energy LP (the “Partnership”) hereby submits the proposed offering terms of its initial public offering (the “IPO”), including the bona fide price range pursuant to Item 503(b)(3) of Regulation S-K. The Partnership intends to include these pricing terms in Amendment No. 5 to Registration Statement on Form S-1, File No. 333-178457 (the “IPO Registration Statement”), to be filed with the Commission on or about July 11, 2012. The provided terms are a bona fide estimate of the range of the minimum and maximum offering price and the maximum number of securities to be offered as of July 5, 2012. Should the bona fide estimates of these terms change between today and July 11, 2012, the figures presented in Amendment No. 5 may increase or decrease accordingly.

The Partnership proposes to price the IPO with a bona fide price range of $19 to $21, with a midpoint of $20. In the IPO, the Partnership proposes to sell up to 18,687,500 common units representing limited partner interests in the Partnership. As discussed with members of the Staff, this range is initially being provided for your consideration by correspondence given the Partnership’s and the underwriters’ concern regarding providing such information significantly in advance of the launch of the offering given recent market volatility as well as our desire to provide all information necessary for the Staff to complete its review on a timely basis.

Additionally, the Partnership is enclosing its proposed marked copy of those pages of the IPO Registration Statement that will be affected by the offering terms set forth herein. These marked changes will be incorporated into Amendment No. 5, to be filed with the Commission on or about July 11, 2012. The Partnership also attaches

herein for the Staff’s review and comment Vinson & Elkins LLP’s Exhibit 5.1 Opinion to the Partnership, to be filed as an exhibit to Amendment No. 5.

The Partnership seeks confirmation from the Staff that it may launch its IPO with the price range specified herein and include such price range in Amendment No. 5, to be filed with the Commission on or about July 11, 2012.

Should the Staff have any questions or comments, please contact the undersigned at (203) 244-6550 or Brenda K. Lenahan of Vinson & Elkins L.L.P. at (212) 237-0133.

| Very truly yours, | ||

| Northern Tier Energy LP | ||

| By: | Northern Tier Energy GP LLC, | |

| its general partner | ||

| By: | /s/ Peter T. Gelfman | |

| Peter T. Gelfman | ||

Vice President, General Counsel and Secretary | ||

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated July , 2012

16,250,000 Common Units

Representing Limited Partner Interests

Northern Tier Energy LP

This is the initial public offering of our common units representing limited partner interests. Prior to this offering, there has been no public market for our common units. We anticipate that the initial public offering price of our common units will be between $19.00 and $21.00 per common unit.

Our common units have been approved for listing on the New York Stock Exchange under the symbol “NTI.”

See “Risk Factors” on page 26 to read about factors you should consider before buying our common units. These risks include the following:

| • | We may not have sufficient available cash to pay any quarterly distribution on our units. |

| • | The amount of our quarterly distributions, if any, will vary significantly both quarterly and annually and will be directly dependent on the performance of our business. Unlike most publicly traded partnerships, we will not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time. |

| • | Restrictions in the agreements governing our indebtedness could limit our ability to make distributions to our unitholders. |

| • | The price volatility of crude oil, other feedstocks, refined products and fuel and utility services may have a material adverse effect on our earnings, profitability, cash flows and liquidity, and our ability to make distributions to our unitholders. |

| • | Our results of operations are affected by crude oil differentials, which may fluctuate substantially. |

| • | Our general partner, the indirect owners of which include ACON Refining Partners, L.L.C., TPG Refining, L.P., and certain members of our management team, has fiduciary duties to its owners, and the interests of its owners may differ significantly from, or conflict with, the interests of our public common unitholders. |

| • | Our unitholders have limited voting rights and are not entitled to elect our general partner or our general partner’s directors. |

| • | You will incur immediate and substantial dilution in the net tangible book value of your common units. |

| • | Our tax treatment depends on our status as a partnership for federal income tax purposes, as well as our not being subject to a material amount of entity-level taxation by individual states. If the IRS were to treat us as a corporation for federal income tax purposes or we were to become subject to material additional amounts of entity-level taxation for state tax purposes, then our cash available for distribution to you could be substantially reduced. |

| • | You will be required to pay taxes on your share of our income even if you do not receive any cash distributions from us. |

Neither the Securities and Exchange Commission nor any state securities regulators has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

PRICE $ PER COMMON UNIT

| Per Common Unit | Total | |||||||

Initial public offering price | $ | $ | ||||||

Underwriting discount | $ | $ | ||||||

Proceeds, before expenses, to Northern Tier Energy LP | $ | $ | ||||||

To the extent that the underwriters sell more than 16,250,000 common units, the underwriters have the option to purchase up to an additional 2,437,500 common units at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the common units against payment in New York, New York on or about , 2012.

| Goldman, Sachs & Co. | Barclays | BofA Merrill Lynch |

| Credit Suisse | Deutsche Bank Securities | UBS Investment Bank | ||

J.P. Morgan Macquarie Capital

Prospectus dated , 2012. | ||||

This summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements and notes thereto included elsewhere in this prospectus. Because it is abbreviated, this summary is not complete and does not contain all of the information that you should consider before investing in our common units. You should read the entire prospectus carefully before making an investment decision, including the information presented under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the notes thereto included elsewhere in this prospectus. Unless otherwise indicated, the information presented in this prospectus assumes (i) an initial public offering price of $20.00 per common unit, which represents the midpoint of the price range set forth on the cover of this prospectus, and (ii) that the underwriters’ option to purchase additional common units is not exercised. We have provided definitions for certain terms used in this prospectus in the “Glossary of Industry Terms Used in this Prospectus” beginning on page B-1 of this prospectus.

Unless the context otherwise requires, the terms “we,” “us,” “our,” “Successor” and “Company,” when used in the context of the period (i) prior to the completion of the transactions described in “—IPO Transactions,” refer to Northern Tier Energy LLC and its subsidiaries, which will be contributed to Northern Tier Energy LP in connection with the closing of this offering, and (ii) after the completion of the transactions described in “—IPO Transactions,” refer to Northern Tier Energy LP and its subsidiaries. References to our “general partner” refer to Northern Tier Energy GP LLC. References to “Northern Tier Holdings” refers to Northern Tier Holdings LLC, the owner of our general partner. References to “ACON Refining” refer to ACON Refining Partners, L.L.C. and certain of its affiliates and to “TPG Refining” refer to TPG Refining, L.P. and certain of its affiliates. References to “Marathon Oil” refer to Marathon Oil Corporation, references to “Marathon Petroleum” refer to Marathon Petroleum Corporation, a wholly owned subsidiary of Marathon Oil until June 30, 2011, and references to “Marathon” refer to Marathon Petroleum Company LP, an indirect, wholly owned subsidiary of Marathon Petroleum, and certain affiliates of Marathon Petroleum Company LP. References to the “Marathon Acquisition” refer to the acquisition by us of our St. Paul Park, Minnesota refinery, a 17% interest in the Minnesota Pipe Line Company, our convenience stores and related assets from Marathon, completed in December 2010. We refer to the assets acquired in the Marathon Acquisition as the “Marathon Assets.” The Marathon Acquisition is described in greater detail, including certain related transactions in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Comparability of Historical Results—Marathon Acquisition.”

Northern Tier Energy LP

We are an independent downstream energy limited partnership with refining, retail and pipeline operations that serves the PADD II region of the United States. We operate our assets in two business segments: the refining business and the retail business. For the three months ended March 31, 2012, we had total revenues of approximately $1.0 billion, operating income of $2.7 million, a net loss of $193.6 million and Adjusted EBITDA of $81.5 million. For the year ended December 31, 2011, we had total revenues of $4.3 billion, operating income of $422.6 million, net earnings of $28.3 million and Adjusted EBITDA of $430.7 million. For a definition, and reconciliation, of Adjusted EBITDA to net earnings, see “—Summary Historical Condensed Consolidated Financial and Other Data.”

Refining Business

Our refining business primarily consists of a 74,000 barrels per calendar day (“bpd”) (84,500 barrels per stream day) refinery located in St. Paul Park, Minnesota. Our refinery has a Nelson

1

Distributions”) we generate each quarter. We do not intend to maintain excess distribution coverage in order to stablize our quarterly distributions or to otherwise reserve cash for future distributions. In addition, our general partner has a non-economic interest and no incentive distribution rights, and, accordingly, our unitholders will receive 100% of our cash distributions. See “Distribution Policy and Restrictions on Distributions.” |

| Ÿ | Focus on Growth Opportunities. We intend to pursue opportunities to grow our business both organically and through acquisitions within the refining, logistics and retail marketing industries. |

| • | Organic Growth Projects. We plan to continue to make investments to enhance the operating flexibility of our refinery, to improve our crude oil sourcing advantage and to grow our retail business. We intend to pursue organic growth projects at the refinery to improve the yield of light products we produce and the efficiency of our operations, which we believe should improve profitability. We also plan to make investments in logistics operations, including trucking, terminal and pipeline facilities, to enhance our crude oil sourcing flexibility and to reduce related crude oil purchasing and delivery costs. We also intend to invest in the growth of our retail business with the ultimate objective of having a dedicated outlet for all of our refinery’s gasoline production. We believe that this retail strategy should allow our refinery to reduce its reliance on the wholesale market, improve the capacity utilization of our refinery and increase our profitability. |

| • | Evaluate Accretive Acquisition Opportunities. We will selectively pursue accretive acquisitions within our refining and retail business segments, both in our existing areas of operations as well as in new geographic regions that would diversify our operating footprint. In evaluating acquisitions within the refining industry, we will consider, among other factors, sustainable performance of the targeted assets through the refining cycle, access to advantageous sources of crude oil supplies, attractive demand and supply market fundamentals, access to distribution and logistics infrastructure, and potential operating synergies. |

| Ÿ | Focus on Optimizing Crude Oil Supply. We are focused on optimizing our crude oil purchases for our refining operations and minimizing our crude oil feedstock costs. Our strategic location and the refinery’s complexity allow us to receive and process a variety of light, heavy, sweet and sour crude oils from Western Canada and the United States, many of which have historically priced at a discount to the NYMEX WTI price benchmark. |

| Ÿ | Maintain Significant Liquidity in Our Business. We benefit from a number of sources of liquidity that provide us with financial flexibility during periods of volatile commodity prices, including cash on hand, our $300 million revolving credit facility, trade credit from our crude oil supplies and other mechanisms. For example, in December 2010, we entered into a crude oil supply and logistics agreement with J.P. Morgan Commodities Canada Corporation (“JPM CCC”), which was later amended and restated in March 2012, to supply our refinery’s crude oil feedstock requirements, which helps reduce the amount of working capital required in our refinery operations. We manage our operations prudently with a focus on maintaining sufficient liquidity to meet unforeseen capital needs. On a pro forma basis for this offering, as of March 31, 2012, we estimate that we would have had approximately $179.8 million of available liquidity comprised of cash on hand and amounts available for borrowing under our $300 million revolving credit facility. Our actual available liquidity may vary from our estimated amount depending on several factors, including fluctuations in inventory and accounts receivable values as well as cash reserves. |

4

and its wholly-owned subsidiary, High Prairie Pipeline, LLC (“High Prairie”). This agreement sets forth a proposed non-binding shipping commitment and equity investment by us in a 150,000 bpd pipeline spanning from McKenzie County, North Dakota to Clearbrook, Minnesota. The pipeline will be constructed and maintained by High Prairie. Our proposed commitment contemplates a ten-year, 50,000 bpd shipping commitment on the High Prairie pipeline at a tariff of $2.49 per barrel (or as otherwise approved by the Federal Energy Regulatory Commission (“FERC”)) and an equity investment in High Prairie proportional to our throughput commitment as a percentage of total commitments on the High Prairie pipeline. Saddle Butte and High Prairie have granted certain exclusivity rights to us with respect to the High Prairie Pipeline project. Upon satisfaction of certain conditions, we have agreed to grant exclusivity rights to Saddle Butte and High Prairie during the negotiation of definitive agreements. There can be no assurance that definitive agreements with Saddle Butte and High Prairie will be reached regarding the proposed shipping commitment and equity investment.

Risk Factors

Investing in our common units involves risks that include the volatility of crude oil and other refinery feedstocks, competition, our partnership structure, the tax characteristics of our common units and other material factors. For a discussion of these risks and other considerations that could negatively affect us, see “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

Our Relationship with ACON Refining and TPG Refining

Following this offering, ACON Refining and TPG Refining will indirectly control and own a substantial majority of the economic interests in Northern Tier Holdings. Following this offering, Northern Tier Holdings will own 100% of our general partner and 82.3% of our units (including 100% of our PIK units).

ACON Investments, L.L.C., an affiliate of ACON Refining, and certain other of its affiliates (“ACON Investments”) manage private equity funds and special purpose investment partnerships. ACON Investments has executed investments in upstream and midstream oil and gas companies as well as in energy infrastructure and energy services. TPG Global LLC (together with its affiliates, “TPG”), an affiliate of TPG Refining, is a leading private investment firm with approximately $51.5 billion of assets under management as of March 31, 2012. TPG has extensive global experience with investments in the energy sector. We believe we will benefit from ACON Investments’ and TPG’s collective experience in the energy industry.

At the closing of this offering, ACON Funds Management L.L.C. (“ACON Management”), an affiliate of ACON Investment, and TPG VI Management, LLC, an affiliate of TPG (“TPG Management”), will receive a one time, aggregate success fee of $7.5 million pursuant to the management services agreement that will terminate in connection with the closing of this offering. The success fee will be divided equally between ACON Management and TPG Management. In addition, ACON Refining and TPG Refining will receive an aggregate distribution of $73.1 million from the net proceeds of this offering.

Our Management

We are managed and operated by the board of directors and executive officers of our general partner, which is owned by Northern Tier Holdings. Following this offering, 82.3% of our units (including 100% of our PIK units) will be owned by Northern Tier Holdings. Northern Tier Holdings, as the owner of our general partner, will have the right to appoint all members of the board of directors of our general partner, including the independent directors. Our unitholders will not be entitled to elect our general partner or its directors or otherwise directly participate in our management or operation. For more information about the executive officers and directors of our general partner, please read “Management.”

9

Following the consummation of this offering, neither our general partner nor its affiliates will receive any management fee, but we will reimburse our general partner and its affiliates for all expenses they incur and payments they make on our behalf. Our partnership agreement provides that our general partner will determine in good faith the expenses that are allocable to us.

Our operations will be conducted through, and our operating assets will be owned by, our wholly owned subsidiary, Northern Tier Energy LLC, and its subsidiaries. All of the employees who conduct our business will be employed by Northern Tier Energy LLC and its subsidiaries. Northern Tier Energy LP does not have any employees.

Conflicts of Interest and Fiduciary Duties

Our general partner has a legal duty to manage us in good faith. However, the officers and directors of our general partner also have fiduciary duties to manage our general partner in a manner beneficial to its indirect owners, which include ACON Refining, TPG Refining and certain members of our management team. As a result, conflicts of interest may arise in the future between us and our unitholders, on the one hand, and our general partner and its owners, on the other hand. Our partnership agreement limits the liability and reduces the duties owed by our general partner to our unitholders. Our partnership agreement also restricts the remedies available to our unitholders for actions that might otherwise constitute a breach of our general partner’s duties. By purchasing a common unit, the purchaser agrees to be bound by the terms of our partnership agreement, and each unitholder is treated as having consented to various actions and potential conflicts of interest contemplated in the partnership agreement that might otherwise be considered a breach of fiduciary or other duties under Delaware law.

For a more detailed description of the conflicts of interest and the fiduciary duties of our general partner, see “Conflicts of Interest and Fiduciary Duties.” For a description of other relationships with our affiliates, see “Certain Relationships and Related Person Transactions.”

The IPO Transactions

In connection with the closing of this offering, the following transactions will occur:

| Ÿ | The settlement agreement with Marathon with respect to the contingent consideration arrangements that we entered into in connection with the Marathon Acquisition will become effective. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Comparability of Historical Results—Marathon Acquisition and Related Transactions;” |

| Ÿ | Our management services agreement with ACON Management and TPG Management will terminate. See “Certain Relationships and Related Person Transactions—Agreements with Affiliates of Our General Partner—Management Services Agreement;” |

| Ÿ | Northern Tier Holdings LLC will contribute all of its membership interests in Northern Tier Energy LLC to Northern Tier Energy LP in exchange for 57,282,000 common units and 18,383,000 PIK units and the right to receive additional cash or common units as described below; |

| Ÿ | Northern Tier Energy LP will issue 16,250,000 common units to the public, representing a 17.7% limited partner interest in us, and will use the net proceeds from this offering as described under “Use of Proceeds;” |

10

| Ÿ | Northern Tier Retail Holdings LLC, a wholly-owned subsidiary of Northern Tier Energy LLC that holds all of the ownership interests in Northern Tier Retail LLC and Northern Tier Bakery LLC, through which we conduct our retail business, will elect to be treated as a corporation for federal income tax purposes, subjecting that subsidiary to corporate-level tax; and |

| Ÿ | Northern Tier Energy Holdings LLC, a wholly-owned subsidiary of Northern Tier Energy LP, will elect to be treated as a corporation for federal income tax purposes, subjecting that subsidiary to corporate-level tax. Northern Tier Energy Holdings LLC will not have any independent operations. |

We have granted the underwriters a 30-day option to purchase up to an aggregate of 2,437,500 additional common units. Any net proceeds received from the exercise of this option will be distributed to Northern Tier Holdings. If the underwriters do not exercise this option in full or at all, the common units that would have been sold to the underwriters had they exercised the option in full will be issued to Northern Tier Holdings at the expiration of the option period. Accordingly, the exercise of the underwriters’ option will not affect the total number of common units outstanding.

We refer to the above transactions as the “IPO Transactions.”

11

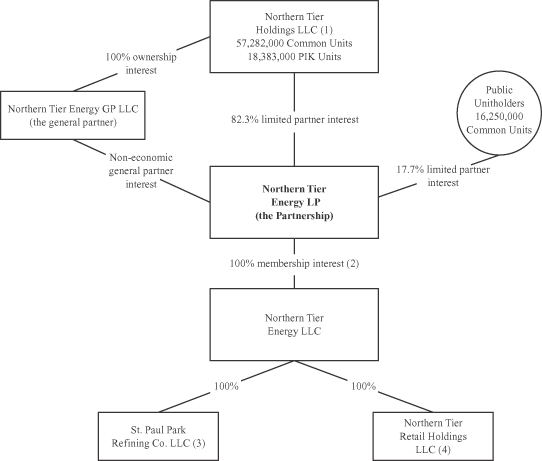

Organizational Structure

The following chart provides a simplified overview of our organizational structure after giving effect to the IPO Transactions (assuming the underwriter’s option to purchase additional common units is not exercised):

| (1) | All of the common interests in Northern Tier Holdings are owned by Northern Tier Investors, LLC, a Delaware limited liability company, the sole member of which is Northern Tier Investors LP, a Delaware limited partnership. All of the Class A Common Units in Northern Tier Investors LP are held by ACON Refining (48.75%), TPG Refining (48.75%) and entities in which Mario E. Rodriguez and Hank Kuchta have an ownership interest (2.5%). All of the limited liability company interests in the general partner of Northern Tier Investors LP, NTI GenPar LLC, a Delaware limited liability company, are held equally by ACON Refining and TPG Refining. Marathon will hold a $45 million preferred interest in Northern Tier Holdings. All of our PIK units will initially be owned by Northern Tier Holdings. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Comparability of Historical Results—Marathon Acquisition And Related Transactions.” |

| (2) | Northern Tier Energy Holdings LLC, which will elect to be treated as a corporation for federal income tax purposes in connection with the closing of this offering, will be a wholly-owned subsidiary of Northern Tier Energy LP and will hold a 0.01% membership interest in Northern Tier Energy LLC. |

12

The Offering

Issuer | Northern Tier Energy LP, a Delaware limited partnership. |

Common units offered to the public | 16,250,000 common units. |

Option to purchase additional common units | We have granted the underwriters a 30-day option to purchase up to an aggregate of 2,437,500 additional common units. |

Units outstanding after this offering | 73,532,000 common units and 18,383,000 PIK units. |

| We have granted the underwriters a 30-day option to purchase up to an aggregate of 2,437,500 additional common units. If the underwriters do not exercise this option in full or at all, the common units that would have been sold to the underwriters had they exercised the option in full will be issued to Northern Tier Holdings at the expiration of the option period. Accordingly, the exercise of the underwriters’ option will not affect the total number of common units outstanding. |

Use of proceeds | We expect to receive approximately $288.2 million of net proceeds from the sale of the common units offered by us, based upon the assumed initial public offering price of $20.00 per common unit (the midpoint of the price range set forth on the cover page of this prospectus), after deducting the underwriting discount of $20.3 million (or $23.4 million if the underwriters exercise in full their option to purchase additional common units) and estimated offering expenses of $16.5 million. Each $1.00 increase (decrease) in the public offering price would increase (decrease) our net proceeds by approximately $15.2 million (assuming no exercise of the underwriters’ option to purchase additional common units). |

| We intend to use the net proceeds received from this offering and cash-on-hand to: |

| • | redeem $29 million of our senior secured notes at a redemption price of 103% of the principal amount thereof, for an estimated $30 million; |

| • | pay $40 million to Marathon, which represents the cash component of a settlement agreement we entered into with Marathon related to a contingent consideration agreement that was entered into at the time of the Marathon Acquisition; |

| • | pay $92 million to J. Aron & Company, an affiliate of Goldman, Sachs & Co., for losses incurred during the three months ended June 30, 2012 as a result of resetting the price of certain derivative contracts; and |

14

| • | distribute approximately $167.2 million to Northern Tier Holdings, of which $92.2 million will be used to redeem Marathon’s existing preferred interest in Northern Tier Holdings and $73.1 million will be distributed to ACON Refining and TPG Refining and $1.9 million will be distributed to entities in which Mario E. Rodriguez and Hank Kuchta have an ownership interest. |

| For additional information see “Use of Proceeds.” |

| Any net proceeds received from the exercise of the underwriters’ option to purchase additional common units will be distributed to Northern Tier Holdings. |

Distribution policy | We expect within 60 days after the end of each quarter, beginning with the quarter ending September 30, 2012, to make distributions to unitholders of record on the applicable record date. We expect our first distribution will include available cash (as described below) for the period from the closing of this offering through September 30, 2012. |

| The board of directors of our general partner will adopt a policy pursuant to which distributions for each quarter (including the distributions of additional PIK units on outstanding PIK units) will be in an amount equal to the available cash we generate in such quarter. Distributions on our units will be in cash, but during the PIK period described below, the board of directors of our general partner will cause distributions on the PIK units to be payable by Northern Tier Energy LP in the form of additional PIK units to PIK unitholders of record on the applicable record date as described below. Available cash for each quarter will be determined by the board of directors of our general partner following the end of such quarter. We expect that available cash for each quarter will generally equal our cash flow from operations for the quarter, less cash needed for maintenance capital expenditures, accrued but unpaid expenses, reimbursement of expenses incurred by our general partner and its affiliates, debt service and other contractual obligations and reserves for future operating or capital needs that the board of directors of our general partner deems necessary or appropriate, including reserves for our turnaround and related expenses. |

We do not intend to maintain excess distribution coverage for the purpose of maintaining stability or growth in our quarterly distribution or to otherwise reserve cash for distributions, and we do not intend to incur debt to pay quarterly distributions. We expect to |

15

this offering and the May 2012 equity distribution, as of December 31, 2011 and March 31, 2012, our restricted payments basket under the indenture would have been equal to approximately $169.3 million and $168.8 million, respectively. Our revolving credit facility generally restricts our ability to make cash distributions if (a) we fail to have excess availability under the facility at least equal to the greater of (1) 25% of the lesser of (x) the $300 million commitment amount and (y) the then applicable borrowing base and (2) $37.5 million or (b) we fail to maintain a fixed charge coverage ratio, as defined by the revolving credit facility, after giving pro forma effect to such distributions of at least 1.1 to 1.0. |

| Based upon our forecasted results, we expect that available cash for the twelve months ending June 30, 2013 will be approximately $245.9 million. The following table sets forth our forecast of available cash on a quarterly basis for the twelve months ending June 30, 2013: |

Three Months Ending | Available Cash | |||

| (in millions) | ||||

September 30, 2012 | $ | 92.7 | ||

December 31, 2012 | 73.3 | |||

March 31, 2013 | 57.1 | |||

June 30, 2013 | 22.8 | |||

The forecasted available cash as of June 30, 2013 is projected to be unfavorably impacted by a planned turnaround which we currently expect to occur during the second quarter of 2013. We expect that available cash for the three months ending September 30, 2013 will be approximately $61.8 million.

Distribution of the full amount in cash for each period is projected to be permitted under the restricted payments basket of the indenture. See “Distribution Policy and Restrictions on Distributions—Forecasted Available Cash.” Unanticipated events may occur which could materially adversely affect the actual results we achieve during the forecast periods.

Consequently, our actual results of operations, cash flows, financial condition and our need for cash reserves during the forecast periods may vary from the forecast, and such variations may be material. Prospective investors are cautioned not to place undue reliance on our forecast and should make their own independent assessment of our future results of operations, cash flows and financial condition. In addition, the board of directors of our general partner may be required to, or elect to, reduce or eliminate our distributions at any time during periods of high prices for refinery feedstocks, such as |

17

restrictive covenant contained in such indenture that requires us to meet a specified fixed charge coverage ratio (or similar ratio) in order to make cash distributions shall not be deemed to restrict our ability to pay cash distributions for purposes of our general partner’s determination. |

| Immediately following the end of the PIK period, each outstanding PIK unit will be automatically converted into a common unit and entitled to receive any distributions in cash. The purpose of this feature is to support the payment of cash distributions to our common unitholders during periods in which we expect that certain of the provisions of the existing notes indenture may restrict the ability of Northern Tier Energy LLC, our operating subsidiary, to distribute cash to us and thus our ability to distribute all available cash in accordance with our distribution policy. |

Incentive distribution rights | None. |

Subordination period | None. |

Issuance of additional units | Our partnership agreement authorizes us to issue an unlimited number of additional units, including PIK units, units with rights to distributions or in liquidation that are senior to our common units, and rights to buy units for the consideration and on the terms and conditions determined by the board of directors of our general partner, without the approval of our unitholders. See “Common Units Eligible for Future Sale” and “The Partnership Agreement—Issuance of Additional Partnership Interests.” |

Limited voting rights | Our general partner manages and operates us. Unlike the holders of common stock in a corporation, our unitholders will have only limited voting rights on matters affecting our business. Unitholders will have no right to elect our general partner or our general partner’s directors on an annual or other continuing basis. Our general partner may be removed by a vote of the holders of at least two-thirds of the outstanding units (with holders of the common units and holders of the PIK units voting together as a single class), including any units owned by our general partner and its affiliates (including Northern Tier Holdings). Upon the completion of this offering, Northern Tier Holdings will own an aggregate of approximately 82.3% of our outstanding units (approximately 79.7% if the underwriters exercise their option to purchase additional common units in full). This will give Northern Tier Holdings the ability to prevent removal of our general partner. See “The Partnership Agreement—Voting Rights.” |

19

are forecasting available cash of $92.7 million for the three months ending September 30, 2012 as compared to $22.8 million for the three months ending June 30, 2013. See “Distribution Policy and Restrictions on Distributions.”

The amount of cash we have available for distribution to unitholders depends primarily on our cash flow and not solely on profitability.

The amount of cash we have available for distribution depends primarily upon our cash flow and not solely on profitability, which may be affected by non-cash items. For example, we may have working capital changes as well as extraordinary capital expenditures and major maintenance expenses in the future. See “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Liquidity and Capital Resources—Capital Spending.” While these items may not affect our profitability in a quarter, they would reduce the amount of cash available for distribution with respect to such quarter. As a result, we may make cash distributions during periods when we report losses and may not make cash distributions during periods when we report net income.

For the year ended December 31, 2011 and the three months ended March 31, 2012, in each case on a pro forma basis, we would not have generated sufficient available cash to have paid the quarterly distributions that we project that we will be able to pay for the twelve months ending June 30, 2013 and for the three months ending September 30, 2013.

We project that we will be able to pay aggregate distributions of $2.65 per unit for the twelve months ending June 30, 2013 and a distribution of $0.65 per unit for the three months ending September 30, 2013. In order to pay these projected distributions, we must generate approximately $245.9 million of available cash in the twelve months ending June 30, 2013 and $61.8 million of available cash in the three months ending September 30, 2013. However, for the years ended December 31, 2011 and March 31, 2012, on a pro forma basis, we would have generated $11.7 million and $9.1 million, respectively, of available cash. The increases in projected available cash compared to the forecasted available cash for the twelve months ending June 30, 2013 is primarily driven by the lower projected realized losses from derivative activities. There can therefore be no assurance that we will generate enough available cash to pay distributions of $2.65 per unit or $0.65 per unit, respectively, or any distribution at all, with respect to the twelve months ending June 30, 2013 and the three months ending September 30, 2013, or any future period. We have a limited operating history upon which to rely in evaluating whether we will have sufficient cash to allow us to pay distributions on our common units. For a description of the price assumptions upon which we have based our projected per unit distribution for the twelve months ending June 30, 2013 and the three months ending September 30, 2013, see “Distribution Policy and Restrictions on Distributions—Assumptions and Considerations.”

The board of directors of our general partner may modify or revoke our distribution policy at any time at its discretion. Our partnership agreement does not require us to pay any distributions at all.

The board of directors of our general partner will adopt a distribution policy pursuant to which we will distribute an amount equal to the available cash we generate each quarter. However, the board may change such policy at any time at its discretion and could elect not to pay distributions for one or more quarters. See “Distribution Policy and Restrictions on Distributions.”

Our partnership agreement does not require us to pay any distributions at all. Accordingly, investors are cautioned not to place undue reliance on the permanence of such a policy in making an investment decision. Any modification or revocation of our distribution policy could substantially reduce or eliminate the amounts of distributions to our unitholders. The amount of distributions we make, if any, and the decision to make any distribution at all will be determined by the board of directors of our general partner, whose interests may differ from those of our public unitholders. Our general partner

29

partner is not obligated to obtain a fairness opinion regarding the value of the units to be repurchased by it upon exercise of the call right. There is no restriction in our partnership agreement that prevents our general partner from issuing additional units and then exercising its call right. Our general partner may use its own discretion, free of fiduciary duty restrictions, in determining whether to exercise this right. See “The Partnership Agreement—Call Right.”

Our unitholders have limited voting rights and are not entitled to elect our general partner or our general partner’s directors.

Unlike the holders of common stock in a corporation, our unitholders have only limited voting rights on matters affecting our business and, therefore, limited ability to influence management’s decisions regarding our business. Unitholders will have no right to elect our general partner or our general partner’s board of directors on an annual or other continuing basis. The board of directors of our general partner, including the independent directors, will be chosen entirely by Northern Tier Holdings as the direct owner of the general partner and not by our common unitholders. Unlike publicly traded corporations, we will not hold annual meetings of our unitholders to elect directors or conduct other matters routinely conducted at annual meetings of stockholders. Furthermore, even if our unitholders are dissatisfied with the performance of our general partner, they will have no practical ability to remove our general partner. These limitations could adversely affect the price at which the common units will trade.

Our public unitholders will not have sufficient voting power to remove our general partner without Northern Tier Holdings’ consent.

Our general partner may only be removed by a vote of the holders of at least two-thirds of the outstanding units, including any units owned by our general partner and its affiliates (including Northern Tier Holdings). Following the closing of this offering, Northern Tier Holdings will own approximately 82.3% of our units (or approximately 79.7% of our units if the underwriters exercise their option to purchase additional common units in full), which means holders of common units purchased in this offering will not be able to remove the general partner, under any circumstances, unless Northern Tier Holdings sells some of the units that it owns or we sell additional units to the public.

Our partnership agreement restricts the voting rights of unitholders owning 20% or more of our common units (other than our general partner and its affiliates and permitted transferees).

Our partnership agreement restricts unitholders’ voting rights by providing that any units held by a person that owns 20% or more of any class of units then outstanding, other than our general partner, its affiliates, their transferees and persons who acquired such units with the prior approval of the board of directors of our general partner, may not vote on any matter. Our partnership agreement also contains provisions limiting the ability of common unitholders to call meetings or to acquire information about our operations, as well as other provisions limiting the ability of our common unitholders to influence the manner or direction of management.

Cost reimbursements due to our general partner and its affiliates will reduce cash available for distribution to you.

Prior to making any distribution on our outstanding units, we will reimburse our general partner for all expenses it incurs on our behalf including, without limitation, salary, bonus, incentive compensation and other amounts paid to its employees and executive officers who perform services for us. There are no limits contained in our partnership agreement on the amounts or types of expenses for which our general partner and its affiliates may be reimbursed. The payment of these amounts, including allocated overhead, to our general partner and its affiliates could adversely affect our ability to make

56

internal control over financial reporting are complex and require significant documentation, testing and possible remediation. During the course of its testing, our management may identify material weaknesses, which may not be remedied in time to meet the deadline imposed by the SEC rules implementing Section 404. If our management cannot favorably assess the effectiveness of our internal control over financial reporting, or our auditors identify material weaknesses in our internal control, investor confidence in our financial results may weaken, and the price of our common units may suffer.

You will incur immediate and substantial dilution in net tangible book value per common unit.

The initial public offering price of our common units is substantially higher than the pro forma net tangible book value of our outstanding units. As a result, if you purchase common units in this offering, you will incur immediate and substantial dilution in the amount of $17.72 per common unit. See “Dilution.”

We may issue additional common units and other equity interests without your approval, which would dilute your existing ownership interests.

Under our partnership agreement, we are authorized to issue an unlimited number of additional interests without a vote of the unitholders. For example, we will issue additional PIK units, in lieu of making cash distributions, to the holders of the PIK units during the PIK period. In addition, at the end of the PIK period, the PIK units will convert into common units. The issuance by us of additional common units or other equity interests of equal or senior rank will have the following effects:

| Ÿ | the proportionate ownership interest of unitholders immediately prior to the issuance will decrease; |

| Ÿ | the amount of cash distributions on each unit will decrease; |

| Ÿ | the ratio of our taxable income to distributions may increase; |

| Ÿ | the relative voting strength of each previously outstanding unit will be diminished; and |

| Ÿ | the market price of the common units may decline. |

In addition, our partnership agreement does not prohibit the issuance of equity interests by our subsidiary, which may effectively rank senior to the common units.

Our general partner may redeem, retire, repurchase or otherwise refinance the senior secured notes or otherwise amend the indenture in a manner that terminates the PIK period, and may cause us to repurchase PIK units at any time with the approval of the conflicts committee.

At any time, our general partner may, in its sole discretion and on terms determined in its sole discretion, redeem, retire, repurchase or otherwise refinance the senior secured notes resulting in the termination of the PIK period. Following the termination of the PIK period, distributions in respect of any outstanding PIK units will be paid in cash (and any PIK units will automatically convert into an equal number of common units). Under our partnership agreement, such a decision will explicitly be deemed not to be a violation of the fiduciary duties that might otherwise be owed by our general partner to our unitholders. At any time, our general partner may also amend the indenture in a manner that terminates the PIK period. The redemption, retirement, repurchase or refinancing of the senior secured notes or any amendment to the indenture may be at a substantial expense to us. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Description of Our Indebtedness—Senior Secured Notes” for a discussion of our ability to redeem the senior secured notes and the redemption price related thereto.

59

Additionally, our general partner may cause us or our subsidiaries to purchase PIK units at any time during the PIK period, so long as such purchase is approved by the conflicts committee of the board of directors of our general partner. Our public unitholders will not be entitled to vote on any such purchase of PIK units from affiliates of our general partner or otherwise.

Units eligible for future sale may cause the price of our common units to decline.

Sales of substantial amounts of our common units in the public market, or the perception that these sales may occur, could cause the market price of our common units to decline. This could also impair our ability to raise additional capital through the sale of our equity interests.

There will be 91,915,000 units outstanding following this offering. 16,250,000 common units are being sold to the public in this offering (or 18,687,500 common units if the underwriters exercise their option to purchase additional common units in full) and an aggregate of 75,665,000 common and PIK units will be owned by Northern Tier Holdings (or an aggregate of 73,227,500 common and PIK units if the underwriters exercise their option to purchase additional common units in full). The common units sold in this offering will be freely transferable without restriction or further registration under the Securities Act of 1933, as amended (the “Securities Act”), by persons other than “affiliates,” as that term is defined in Rule 144 under the Securities Act.

In addition, we are party to a registration rights agreement with Northern Tier Holdings and certain of its indirect owners pursuant to which we may be required to register the sale of the units they hold under the Securities Act and applicable state securities laws.

In connection with this offering, we, Northern Tier Holdings, our general partner and our general partner’s directors and executive officers will enter into lock-up agreements, pursuant to which they will agree, subject to certain exceptions, not to sell or transfer, directly or indirectly, any of our units until 180 days from the date of this prospectus, subject to extension in certain circumstances. Following termination of these lockup agreements, all units held by Northern Tier Holdings, our general partner and our general partner’s directors and executive officers will be freely tradable under Rule 144, subject to the volume and other limitations of Rule 144. See “Common Units Eligible for Future Sale.”

We will incur increased costs as a result of being a publicly traded partnership.

As a publicly traded partnership, we will incur significant legal, accounting and other expenses that we did not incur prior to this offering. In addition, the Sarbanes-Oxley Act and the Dodd-Frank Act, as well as rules implemented by the SEC and the NYSE, require, or will require, publicly traded entities to adopt various corporate governance practices that will further increase our costs. Before we are able to pay distributions to our unitholders, we must first pay our expenses, including the costs of being a public company and other operating expenses. As a result, the amount of cash we have available for distribution to our unitholders will be affected by our expenses, including the costs associated with being a publicly traded partnership. We estimate that we will incur approximately $3.5 million of estimated incremental costs per year, some of which will be direct charges associated with being a publicly traded partnership and some of which will be allocated to us by our general partner and its affiliates; however, it is possible that our actual incremental costs of being a publicly traded partnership will be higher than we currently estimate.

Prior to this offering, we have not filed reports with the SEC. Following this offering, we will become subject to the public reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We expect these requirements will increase our legal and financial compliance costs and make compliance activities more time-consuming and costly. For example, as a result of becoming a

60

We expect to receive approximately $288.2 million of net proceeds from the sale of the common units offered by us, based upon the assumed initial public offering price of $20.00 per unit (the midpoint of the price range set forth on the cover page of this prospectus), after deducting the underwriting discount of approximately $20.3 million (or approximately $23.4 million if the underwriters exercise in full their option to purchase additional common units) and estimated offering expenses of $16.5 million (including a $7.5 million fee payable to ACON Management and TPG Management pursuant to a management services agreement entered into at the time of the Marathon Acquisition). Each $1.00 increase (decrease) in the public offering price would increase (decrease) our net proceeds by approximately $15.2 million (assuming no exercise of the underwriters’ option to purchase additional common units).

We intend to use the net proceeds and cash-on-hand to:

| Ÿ | redeem $29 million of our senior secured notes at a redemption price of 103% of the principal amount thereof, for an estimated $30 million; |

| Ÿ | pay $40 million to Marathon, which represents the cash component of a settlement agreement we entered into with Marathon related to a contingent consideration agreement that was entered into at the time of the Marathon Acquisition; |

| Ÿ | pay $92 million to J. Aron & Company, an affiliate of Goldman, Sachs & Co., for losses incurred during the three months ended June 30, 2012 as a result of resetting the price of certain derivative contracts; and |

| Ÿ | distribute approximately $167.2 million to Northern Tier Holdings, of which $92.2 million will be used to redeem Marathon’s existing preferred interest in Northern Tier Holdings and $73.1 million will be distributed to ACON Refining and TPG Refining and $1.9 million will be distributed to entities in which Mario E. Rodriguez and Hank Kuchta have an ownership interest. |

The senior secured notes were issued in December 2010 in connection with the consummation of the Marathon Acquisition. The senior secured notes mature in December 2017 and bear an annual interest rate of 10.5%. $261 million of our senior secured notes will remain outstanding after the application of proceeds from this offering. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Description of Our Indebtedness—Senior Secured Notes.”

We have granted the underwriters a 30-day option to purchase up to an aggregate of 2,437,500 additional common units. If the underwriters do not exercise this option in full or at all, the common units that would have been sold to the underwriters had they exercised the option in full will be issued to Northern Tier Holdings at the expiration of the option period. Any net proceeds received from the exercise of the underwriters’ option to purchase additional common units will be distributed to Northern Tier Holdings.

69

The following table sets forth cash and cash equivalents and capitalization as of March 31, 2012:

| Ÿ | on an actual basis for Northern Tier Energy LLC; and |

| Ÿ | on an as adjusted basis for Northern Tier Energy LP, after giving effect to this offering, the use of proceeds and the other transactions described in “Prospectus Summary—The IPO Transactions.” |

You should read the following table in conjunction with “Prospectus Summary—The IPO Transactions,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes thereto appearing elsewhere in this prospectus.

| As of March 31, 2012 | ||||||||

| Northern Tier Energy LLC | Northern Tier Energy LP | |||||||

| Actual | As adjusted | |||||||

| (in millions) | ||||||||

Cash and cash equivalents(1) | $ | 64.1 | $ | 23.1 | ||||

|

|

|

| |||||

Long-term debt, including current maturities: | ||||||||

Senior secured notes | $ | 290.0 | $ | 261.0 | ||||

Revolving credit facility(2) | — | — | ||||||

Lease financing obligation(3) | 11.9 | 11.9 | ||||||

|

|

|

| |||||

Total long-term debt, including current maturities | 301.9 | 272.9 | ||||||

|

|

|

| |||||

Member’s/Partners’ interest: | ||||||||

Member’s/partners’ interest(4) | 119.0 | — | ||||||

Common units: none issued and outstanding; 73,532,000 issued and outstanding, pro forma | — | 196.3 | ||||||

PIK units: none issued and outstanding; 18,383,000 issued and outstanding, pro forma | — | 49.1 | ||||||

|

|

|

| |||||

Total member’s/partners’ interest | 119.0 | 245.4 | ||||||

|

|

|

| |||||

Total capitalization | $ | 420.9 | $ | 518.3 | ||||

|

|

|

| |||||

| (1) | As of June 30, 2012, cash and cash equivalents were approximately $170 million. |

| (2) | As of June 30, 2012, we had no borrowings outstanding under our revolving credit facility and had approximately $62 million in outstanding letters of credit. |

| (3) | Relates to specific properties that did not qualify for operating lease treatment under the sale leaseback of 135 SuperAmerica convenience stores with Realty Income, a third party equity real estate investment trust. |

| (4) | On May 22, 2012 we paid an equity distribution to Northern Tier Holdings in the amount of $40 million. |

70

Dilution is the amount by which the offering price paid by the purchasers of units sold in this offering will exceed the pro forma net tangible book value per unit after the offering. On a pro forma basis as of March 31, 2012, after giving effect to the offering of common units and the application of the related net proceeds, and assuming the underwriters’ option to purchase additional common units is not exercised, our net tangible book value was $210.0 million, or $2.28 per unit. Net tangible book value excludes $35.4 million of net intangible assets. Purchasers of common units in this offering will experience immediate and substantial dilution in net tangible book value perunit for financial accounting purposes, as illustrated in the following table:

Assumed initial public offering price per unit | $ | 20.00 | ||||||

Pro forma net tangible book value per unit before the offering(1) | $ | 1.10 | ||||||

Increase in net tangible book value per unit attributable to purchasers in the offering | 1.18 | |||||||

|

|

|

| |||||

Less: Pro forma net tangible book value per unit after the offering(2) | $ | 2.28 | ||||||

|

| |||||||

Immediate dilution in net tangible book value per unit to purchasers in the offering(3) | $ | 17.72 | ||||||

|

|

| (1) | Determined by dividing the net tangible book value of the contributed assets and liabilities by the total number of units (57,282,000 common units and 18,383,000 PIK units) to be issued to Northern Tier Holdings. |

| (2) | Determined by dividing our pro forma net tangible book value, after giving effect to the application of the expected net proceeds of the offering by the total number of units (73,532,000 common units and 18,383,000 PIK units) to be outstanding after the offering. |

| (3) | If the initial public offering price were to increase or decrease by $1.00 per common unit, then dilution in net tangible book value per unit would equal $18.55 and $16.88, respectively. |

The following table sets forth the number of units that we will issue and the total consideration contributed to us by Northern Tier Holdings and by the purchasers of common units in this offering upon consummation of the transactions contemplated by this prospectus ($ amounts in millions):

| Units Acquired | Total Consideration | |||||||||||||||

| Number | Percent | Amount | Percent | |||||||||||||

Northern Tier Holdings(1)(2) | 75,665,000 | 82.3 | % | $ | 119.0 | 26.8 | % | |||||||||

Purchasers in this offering(2) | 16,250,000 | 17.7 | % | 325.0 | 73.2 | % | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Total | 91,915,000 | 100.0 | % | $ | 444.0 | 100.0 | % | |||||||||

|

|

|

|

|

|

|

| |||||||||

| (1) | The assets contributed by Northern Tier Holdings were recorded at historical cost in accordance with GAAP. Book value of the consideration provided by Northern Tier Holdings, as of March 31, 2012, equals parent net investment, which was $119 million and is not affected by this offering. |

| (2) | Assumes the underwriters’ option to purchase additional common units is not exercised. |

71

secured notes restricts us from making cash distributions unless our fixed charge coverage ratio, as defined in the indenture, is at least 2.0 to 1.0 after giving pro forma effect to such distributions and such cash distributions do not exceed an amount equal to the aggregate net proceeds received by us (either as a result of capital contributions or from the sale of equity or certain debt securities) plus 50% of our consolidated net income (or less 100% of consolidated net loss), which is defined to exclude certain non-cash charges, such as net unrealized gains or losses from hedging obligations and impairment charges, accrued on a cumulative basis, plus certain other items. Our revolving credit facility generally restricts our ability to make cash distributions if (a) we fail to have excess availability under the facility at least equal to the greater of (1) 25% of the lesser of (x) the $300 million commitment amount and (y) the then applicable borrowing base and (2) $37.5 million or (b) we fail to maintain a fixed charge coverage ratio, as defined in the revolving credit facility, after giving pro forma effect to such distributions of at least 1.1 to 1.0. |

| Ÿ | As of December 31, 2011 and March 31, 2012 (and thus before giving effect to a $40.0 million equity distribution to Northern Tier Holdings in May 2012), our restricted payments basket under the indenture was equal to approximately $58.9 million and $58.3 million, respectively. On a pro forma basis for this offering and the May 2012 equity distribution, as of December 31, 2011 and March 31, 2012, our restricted payments basket under the indenture would have been equal to approximately $169.3 million and $168.8 million, respectively. These financial tests and covenants are described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Description of Our Indebtedness.” Should we be unable to satisfy the restrictions described above or if we are otherwise in default under our revolving credit facility or the indenture, we may be required to reduce or eliminate cash distributions to you notwithstanding our distribution policy. |

| Ÿ | Unlike most publicly traded partnerships, we will not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase quarterly distributions over time. Furthermore, none of our limited partner interests will be subordinate in right of distributions to the common units sold in this offering. |

| Ÿ | Our general partner will have the authority to establish cash reserves for the prudent conduct of our business, and the establishment of or increase in those reserves could result in a reduction in cash distributions to our unitholders. Our partnership agreement does not set a limit on the amount of cash reserves that our general partner may establish. Any decision to establish cash reserves made by our general partner in good faith will be binding on our unitholders. |

| Ÿ | Prior to making any distributions on our units, we will reimburse our general partner and its affiliates for all direct and indirect expenses they incur on our behalf. Our partnership agreement provides that our general partner will determine in good faith the expenses that are allocable to us, but does not limit the amount of expenses for which our general partner and its affiliates may be reimbursed. The reimbursement of expenses and payment of fees, if any, to our general partner and its affiliates will reduce the amount of cash to pay distributions to our unitholders. |

| Ÿ | We may lack sufficient cash to make distributions to our unitholders due to a number of factors that would adversely affect us, including but not limited to decreases in sales or increases in operating expenses, principal and interest payments on debt, working capital requirements, capital expenditures, disruptions in the operations of our refinery or anticipated cash needs. See “Risk Factors” for information regarding these factors. |

| Ÿ | Under Section 17-607 of the Delaware Act, we may not make a distribution to our limited partners if the distribution would cause our liabilities to exceed the fair value of our assets. |

74

We have a limited operating history upon which to rely in evaluating our ability to make distributions on our common units. While we believe, based on our financial forecast and related assumptions, that we should have sufficient cash to enable us to pay the forecasted aggregate distribution in cash on all of our units for the twelve months ending June 30, 2013 and for the three months ending September 30, 2013, we may be unable to pay the forecasted distribution or any amount on our units.

We expect to generally distribute a significant percentage of our cash from operations to our unitholders on a quarterly basis, after, among other things, the establishment of cash reserves and payment of our expenses. Therefore, our growth, if any, may not be comparable to those businesses that reinvest most or all of their cash to expand ongoing operations. Moreover, any future growth may be slower than our historical growth. We expect that we will rely upon external financing sources in large part, including bank borrowings and issuances of debt and equity interests, to fund our expansion capital expenditures. To the extent we are unable to finance growth externally, our distribution policy could significantly impair our ability to grow.

Unaudited Pro Forma Available Cash

The following table illustrates, on a pro forma basis for the year ended December 31, 2011 and for the twelve months ended March 31, 2012, our available cash assuming that the IPO Transactions had occurred as of January 1, 2011.

If we had completed the IPO Transactions on January 1, 2011, our unaudited pro forma available cash for the year ended December 31, 2011 and the twelve months ended March 31, 2012 would have been $11.7 million and $9.1 million, respectively. This amount would have enabled us to make an annualized distribution of approximately $0.12 and $0.09 per unit on all of our outstanding units for the year ended December 31, 2011 and the twelve months ended March 31, 2012, respectively (assuming that distributions on the PIK units are made in cash and not in additional PIK units).Our pro forma available cash for the year ended December 31, 2011 and the twelve months ended March 31, 2012 includes a realized loss from derivative activities of $310.3 million and $311.0 million, respectively. The hedge positions resulting in this realized loss were established at the time of the Marathon Acquisition. Our plan going forward is to hedge a lesser amount of production than we hedged at the time of the acquisition. Consequently, we plan to increase our exposure to the gross refining margins that we would realize at our refinery on an unhedged basis.

Available cash is a cash accounting concept, while our consolidated financial statements have been prepared on an accrual basis. The amount of pro forma available cash should only be viewed as a general indication of the amount of available cash that we might have generated had we been formed and completed the IPO Transactions in earlier periods.

75

| Year Ended December 31, 2011 | Twelve Months Ended March 31, 2012 | |||||||

| (in millions except per unit and ratio data) | ||||||||

Adjusted EBITDA(a) | $ | 430.7 | $ | 429.0 | ||||

Adjustments to reconcile Adjusted EBITDA to pro forma available cash: | ||||||||

Less: | ||||||||

Pro forma incremental general and administrative expenses(b) | 3.5 | 3.5 | ||||||

Pro forma income tax paid(c) | 5.7 | 6.6 | ||||||

Cash interest paid | 37.9 | 38.0 | ||||||

Minnesota Pipeline proportionate EBITDA | 2.8 | 2.6 | ||||||

Actual turnaround and related expenses | 22.6 | 22.8 | ||||||

Maintenance capital expenditures | 45.9 | 45.3 | ||||||

Turnaround and related expenses reserve(d) | 18.0 | 18.0 | ||||||

Realized losses on derivative activities | 310.3 | 311.0 | ||||||

Plus: | ||||||||

Pro forma interest expense(e) | 3.0 | 3.0 | ||||||

Pro forma management fee(f) | 2.1 | 2.1 | ||||||

Use of cash reserves or borrowings to fund actual turnaround and related expenses | 22.6 | 22.8 | ||||||

|

|

|

| |||||

Pro forma available cash | $ | 11.7 | $ | 9.1 | ||||

|

|

|

| |||||

Actual and implied cash distributions based on pro forma available cash(g): | ||||||||

Aggregate pro forma available cash per unit | $ | 0.12 | $ | 0.09 | ||||

Cash distributions to common unitholders | $ | 9.4 | $ | 7.3 | ||||

Available cash attributable to PIK units(h) | $ | 2.3 | $ | 1.8 | ||||

Indenture(i): | ||||||||

Restricted payments basket(j) | $ | 58.9 | $ | 58.3 | ||||

Fixed charge coverage ratio | 3.3x | 3.0x | ||||||

Revolving credit facility: | ||||||||

Fixed charge coverage ratio(k) | 1.2x | 1.1x | ||||||

| (a) | For a definition of Adjusted EBITDA, see “Prospectus Summary—Summary Historical Condensed Consolidated Financial and Other Data.” |

| (b) | Represents an adjustment for estimated incremental general and administrative expenses that we expect we will incur as a publicly traded partnership, including costs associated with SEC reporting requirements, annual and quarterly reports to unitholders, tax return and Schedule K-1 preparation and distribution, independent auditor fees, investor relations activities, registrar and transfer agent fees, incremental director and officer liability insurance costs and director compensation. |

| (c) | Represents the estimated income tax provision resulting from Northern Tier Retail Holdings LLC, our subsidiary that conducts our retail business, and Northern Tier Energy Holdings LLC electing to be treated as corporations for federal income tax purposes. |

| (d) | Represents a reserve of cash to fund expenditures associated with scheduled turnarounds of our refinery. We estimate total turnaround and related expenses at our St. Paul Park refinery of approximately $110 million over a six-year turnaround cycle. Therefore, we estimate reserving approximately $18 million of available cash per year for turnaround and related expenses. |

77

| (e) | Reflects the reduction in interest expense related to the redemption of $29 million of our senior secured notes with a portion of the proceeds of this offering. |

| (f) | Represents the reduction in management fees paid to ACON Management and TPG Management pursuant to the management services agreement which will terminate in connection with the closing of this offering. At the closing of this offering, ACON Management and TPG Management will receive a success fee of $7.5 million pursuant to the management services agreement. See “Certain Relationships and Related Person Transactions—Agreements with Affiliates of Our General Partner—Management Services Agreement.” |

| (g) | Based on 73,532,000 common units and 18,383,000 PIK units outstanding and assumes no dilution with respect to distributions of additional PIK units on outstanding PIK units for each quarter in the period presented. |

| (h) | Available cash represented by distributions of additional PIK units on outstanding PIK units for any quarter is to be retained for general partnership purposes. |

| (i) | Subject to certain exceptions, the restricted payment covenant under the indenture governing our senior secured notes restricts us from making cash distributions unless our fixed charge coverage ratio, as defined in the indenture, is at least 2.0 to 1.0 and such cash distributions do not exceed an amount equal to the aggregate net proceeds received by us (either as a result of capital contributions or from the sale of equity or certain debt securities) plus 50% of our consolidated net income (or less 100% of consolidated net loss) accrued on a cumulative basis plus certain other items. |

| (j) | Represents the amount of the restricted payments basket before giving effect to the reduction in the basket as a result of the distributions assumed to be paid in respect of the common units as contemplated above. |

| (k) | Our revolving credit facility generally restricts our ability to make cash distributions if (a) we fail to have excess availability under the facility at least equal to the greater of (1) 25% of the lesser of (x) the $300 million commitment amount and (y) the then applicable borrowing base and (2) $37.5 million or (b) we fail to maintain a fixed charge coverage ratio, as defined in the revolving credit facility, after giving pro forma effect to such distributions of at least 1.1 to 1.0. |

Forecasted Available Cash

We do not as a matter of course make projections as to future sales, earnings or other results. However, we have prepared the prospective financial information set forth below for the twelve months ending June 30, 2013 and the three months ending September 30, 2013 to supplement the historical consolidated financial information included elsewhere in this prospectus. The table presents our expectations regarding our ability to generate $245.9 million of available cash for the twelve months ending June 30, 2013 and $61.8 million for the three months ending September 30, 2013. These expectations of available cash do not include any incremental capital expenditures or available cash generated as a result of the proposed pipeline initiative described in “Prospectus Summary—Recent Developments—Proposed Pipeline Initiative” and “Business—Recent Developments—Proposed Pipeline Initiative” or the execution of any other growth projects. The accompanying prospective financial information was not prepared with a view toward complying with the guidelines established by the American Institute of Certified Public Accountants with respect to prospective financial information, but, in the view of our management, was prepared on a reasonable basis, reflects the best currently available estimates and judgments, and presents, to the best of management’s knowledge and belief, the expected course of action and our expected future financial performance. However, this information is not fact and should not be relied upon as being indicative of future results, and readers of this prospectus are cautioned not to place undue reliance on the prospective financial information. The prospective financial information included in this prospectus has been prepared by, and is the responsibility of, our management. Neither PricewaterhouseCoopers LLP nor any other independent accountants, has examined, compiled, or performed any procedures with respect to the accompanying prospective financial information and, accordingly, PricewaterhouseCoopers LLP does not express an

78

| For the Three Months Ending | For the Twelve Months Ending June 30, 2013 | For the Three Months Ending September 30, 2013 | ||||||||||||||||||||||

| September 30, 2012 | December 31, 2012 | March 31, 2013 | June 30, 2013 | |||||||||||||||||||||

| (dollars in millions except per unit data) | ||||||||||||||||||||||||

Net earnings | $ | 94.8 | $ | 74.7 | $ | 47.8 | $ | (11.2 | ) | $ | 206.1 | $ | 69.7 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Adjustments to reconcile net earnings to Adjusted EBITDA: | ||||||||||||||||||||||||

Interest expense | 9.0 | 8.9 | 8.9 | 8.8 | 35.6 | 8.9 | ||||||||||||||||||

Depreciation & amortization | 8.0 | 8.0 | 8.8 | 8.8 | 33.6 | 8.8 | ||||||||||||||||||

Income tax provision | 1.7 | 0.9 | 0.6 | 1.6 | 4.8 | 1.7 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

EBITDA subtotal | $ | 113.5 | $ | 92.5 | $ | 66.1 | $ | 8.0 | $ | 280.1 | $ | 89.1 | ||||||||||||

Minnesota Pipeline proportionate EBITDA | 0.7 | 0.7 | 0.7 | 0.7 | 2.8 | 0.7 | ||||||||||||||||||

Turnaround and related expenses | 5.5 | 2.7 | 10.0 | 40.0 | 58.2 | – | ||||||||||||||||||

Stock based compensation | 0.6 | 0.6 | 0.6 | 0.6 | 2.4 | 0.6 | ||||||||||||||||||

Unrealized gains from derivative activities | 1.1 | 1.4 | 2.3 | 3.4 | 8.2 | 2.2 | ||||||||||||||||||

Realized losses from derivative activities | (1.1 | ) | (1.4 | ) | (2.3 | ) | (3.4 | ) | (8.2 | ) | (2.2 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Adjusted EBITDA(a) | $ | 120.3 | $ | 96.5 | $ | 77.4 | $ | 49.3 | $ | 343.5 | $ | 90.4 | ||||||||||||

Adjustments to reconcile Adjusted EBITDA to available cash: | ||||||||||||||||||||||||

Less: | ||||||||||||||||||||||||

Cash interest paid | 7.9 | 7.8 | 7.8 | 7.7 | 31.2 | 7.8 | ||||||||||||||||||

Income tax provision | 1.7 | 0.9 | 0.6 | 1.6 | 4.8 | 1.7 | ||||||||||||||||||

Minnesota Pipeline proportionate EBITDA | 0.7 | 0.7 | 0.7 | 0.7 | 2.8 | 0.7 | ||||||||||||||||||

Actual turnaround and related expenses | 5.5 | 2.7 | 10.0 | 40.0 | 58.2 | – | ||||||||||||||||||

Maintenance capital expenditures | 11.7 | 7.9 | 4.4 | 8.6 | 32.6 | 11.7 | ||||||||||||||||||

Turnaround and related expenses reserve | 4.5 | 4.5 | 4.5 | 4.5 | 18.0 | 4.5 | ||||||||||||||||||

Realized losses from derivative activities | 1.1 | 1.4 | 2.3 | 3.4 | 8.2 | 2.2 | ||||||||||||||||||

Plus: | ||||||||||||||||||||||||

Use of cash reserves or borrowings to fund actual turnaround and related expenses | 5.5 | 2.7 | 10.0 | 40.0 | 58.2 | – | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Available cash | $ | 92.7 | $ | 73.3 | $ | 57.1 | $ | 22.8 | $ | 245.9 | $ | 61.8 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Actual and implied cash distributions based on available cash(b): | ||||||||||||||||||||||||

Available cash per unit | $ | 1.01 | $ | 0.79 | $ | 0.61 | $ | 0.24 | $ | 2.65 | $ | 0.65 | ||||||||||||

Cash distributions to common unitholders | 74.1 | 58.1 | 44.9 | 17.8 | 194.9 | 48.1 | ||||||||||||||||||

Available cash attributable to PIK units(c) | 18.6 | 15.2 | 12.2 | 5.0 | 51.0 | 13.7 | ||||||||||||||||||

Common units outstanding as of the distribution date for the period presented (in millions) | 73.5 | 73.5 | 73.5 | 73.5 | 73.5 | 73.5 | ||||||||||||||||||