UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material Pursuant to §240.14a-12 | |

GLOBAL BRASS AND COPPER HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

The Wieland Group & Global Brass and CopperErwin Mayr, CEOMichael Demmer, SVP Strategy & Business Development May 2019

Additional Information and Where to Find ItThis communication may be deemed to be solicitation material in respect of the proposed acquisition of the Company by Wieland. In connection with the proposed transaction, the Company intends to file with the Securities and Exchange Commission (SEC) and furnish to its stockholders a proxy statement and other relevant documents which will be mailed or otherwise disseminated to its stockholders when it becomes available. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE ADVISED TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. Investors may obtain a free copy of the proxy statement (when it becomes available) and other relevant documents filed by the Company with the SEC at the SEC’s Web site at http://www.sec.gov. The proxy statement and such other documents once filed by the Company with the SEC may also be obtained for free from the Investor Relations section of the Company’s web site (https://ir.gbcholdings.com/) or by directing a request to: Global Brass and Copper Holdings, Inc., 475 N. Martingale Road, Suite 1200, Schaumburg, IL 60173, Attention: Investor Relations. Participants in SolicitationThe Company and its officers and directors may be deemed to be participants in the solicitation of proxies from the stockholders of the Company in connection with the proposed transaction. Information about the Company’s executive officers and directors is set forth in its Annual Report on Form 10-K, which was filed with the SEC on February 28, 2019, and the proxy statements for its 2019 annual meeting of stockholders, which was filed with the SEC on March 29, 2019. Investors may obtain more detailed information regarding the direct and indirect interests of the Company and its executive officers and directors in the acquisition by reading the preliminary and definitive proxy statement regarding the proposed transaction when it is filed with the SEC. When available, you may obtain free copies of these documents as described in the preceding paragraph. Forward-Looking Statements Certain statements contained in this document constitute forward-looking statements as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe harbor provided by the same. When used in this document, the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions are intended to identify forward-looking statements. Statements regarding whether and when the proposed transaction will be consummated and the anticipated benefits thereof, among others, may be forward-looking. This document contains forward-looking statements that involve risks and uncertainties concerning Wieland’s proposed acquisition of the Company, the Company’s expected financial performance, as well as the Company’s strategic and operational plans. Actual events or results may differ materially from those described in this document due to a number of risks and uncertainties. The potential risks and uncertainties include, among others, the possibility that the Company may be unable to obtain required stockholder approval or that other conditions to closing the proposed transaction may not be satisfied, such that the proposed transaction will not close or that the closing may be delayed; general economic conditions; the proposed transaction may involve unexpected costs, liabilities or delays; risks that the transaction disrupts current plans and operations of the Company; the outcome of any legal proceedings related to the transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement. For more details on these and other potential risks and uncertainties, please refer to the proxy statement when filed and the documents that the Company files with the SEC on Forms 10-K, 10-Q and 8-K. All forward-looking statements speak only as of the date of this document or, in the case of any document incorporated by reference, the date of that document. The Company is under no duty to update any of the forward-looking statements after the date of this document to conform to actual results, except as required by applicable law. May 2019

Agenda Wieland Company Presentation 1 Wieland Vision & Strategy Development 2 The Wieland Group & Global Brass and Copper 3 Growth History Management & Organization 1.1 1.2 Key Performance Indicators 1.3 Products & Innovation 1.4 May 2019

From art and bell foundry to premium copper alloy products and innovative solutions Founded in 1820 – Almost 200 years ago “Ever since, Wieland has been a family owned business with a long-term orientation of its shareholders.” - Approximately 80 shareholders as of 2019- Majority ownership by the German family Schleicher May 2019

A history of growth Wieland Group – Historical milestones 1820 1828 1865 1901 Foundation of the company in Ulm (GER) Start production of rolled brass material Opening of Vöhringen Plant (GER) First extrusion of tubes 1999 1988 1987 1982 2003 2007 New plant & administration site in Ulm (GER) Acquisition of Langenberg site & participation in Schwermetall, Stolberg (GER) Opening of Rolling Mill in Singapore Acquisition Mason & Son, Birmingham (GB) JV with Kobe Steel U.S. (today Wieland Copper Products, Pine Hall, NC) Majority Participation in Austria Buntmetall 2008 Participation in Wolverine Tube Shanghai (CN) 2013 Acquisition of tube mill Wolverine Portugal (P) Participation in UrbanGold (AUT) Acquisition of Diversified Metals (U.S.) Participation in EJ Brookes (U.S.) Acquisition of Kessler Sales & Distribution, Woodbridge (U.S.) Take-over of Wolverine Tube Inc. Business (U.S.) JV Wieland Microcool (U.S.) Envisaged merger with Global Brass and Copper (U.S.) “German Roots” “International Growth” “Global Industry Footprint” 2018 2018 2018 2017 2017 2019 2019 May 2019 Europe North America Asia

Global player with German origins More than 70 locations to provide superior customer service 1SOUTH AMERICA 13NORTH AMERICA 31OTHER EUROPEAN COUNTRIES 19GERMANY 9ASIA May 2019

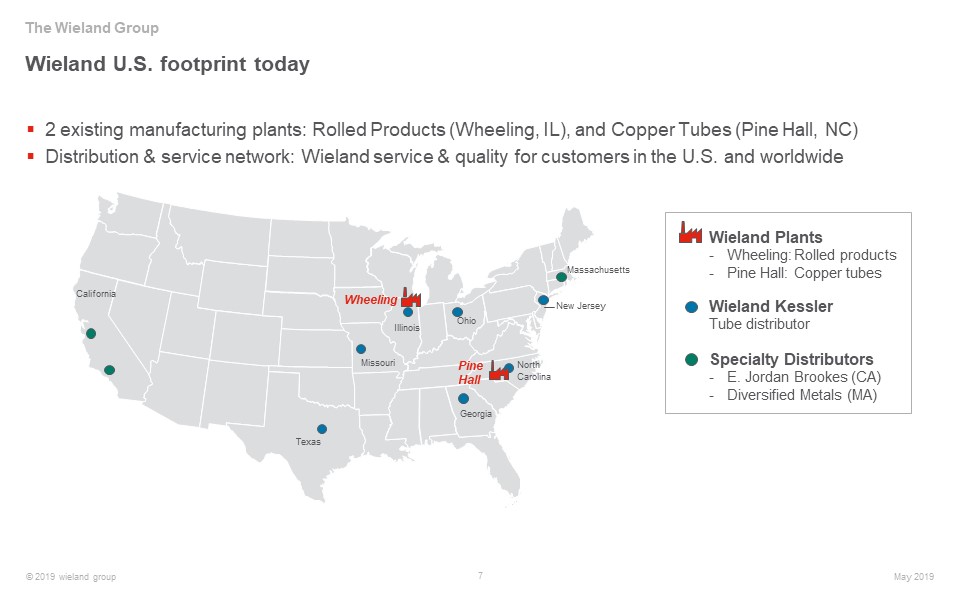

Wieland U.S. footprint today The Wieland Group Wieland KesslerTube distributor 1) California Texas Georgia Illinois Missouri Ohio NorthCarolina Massachusetts New Jersey Wieland PlantsWheeling: Rolled productsPine Hall: Copper tubes Pine Hall Wheeling 2 existing manufacturing plants: Rolled Products (Wheeling, IL), and Copper Tubes (Pine Hall, NC)Distribution & service network: Wieland service & quality for customers in the U.S. and worldwide May 2019 Specialty DistributorsE. Jordan Brookes (CA) Diversified Metals (MA)

Manufacturing plants around the world Proximity to customers and markets Ulm, Germany Vöhringen, Germany Villingen, Germany Langenberg, Germany Ulm (MSU), Germany Stolberg, Germany Esposende, Portugal Amstetten, Austria Pine Hall, NC, USA Wheeling, Il, USA Singapore Shanghai, China Birmingham, UK Enzesfeld, Austria Shanghai, China May 2019

Global Business Units drive Wieland’s product portfolio in line with customers’ needs Products range from strips, rods, and high performance tubes to engineered products for electric vehicles Rolled Products Extruded Products Tinned strip Tubes and Bars Structured strip Wires eMobility Bearings Engineered Products Thermal Solutions Heat exchanger Finned tubes May 2019

979Mio. €Equity Success story with strong growth of results and high level of investments Wieland Group – Key performance indicators 3,376 Mio. €Revenue 304 Mio. €Operating EBITDA 306 Mio. €Net Income 6,860Employees 62Mio. €CAPEX May 2019

Capital expenditures at consistently high levels of about 70 Mio. € or 80 Mio. USD every yearSafety, proactive maintenance, automation, state-of-the-are equipment, innovations Investments in plants and equipment – maintenance & strategic projects Major investments Wieland Group Investments [in Mio. €] May 2019

Various major projects under construction Investments in plants and equipment – two examples Major investments May 2019 New plant to double our production capacity for high performance tubes in Wheeling, IL, U.S. Investment in a new pickling line to increase capacity and productivity for HPAs in Vöhringen, Germany

Research, Development & Innovation (RD&I) Research and Innovation RD&I organization Wieland Innovation Research & DevelopmentWieland Ventures & alliance managementPrototypingAccredited Laboratory DIN EN ISO / IEC17025>100 employees empowering success May 2019

Powerful e-Mobility Solutions The electrification of the drivetrain is gathering speed all over the world Wieland – as co-engineer and one stop shop partner for the automotive industry – is at the heart of these developments and manufactures highly developed components for e-Mobility Wieland Solutions Precision Shunts & Laser Cladding Connector Rings Cu Rotors and Cu Finished Parts Cell Connecting Customized solutions for stators in synchronous motors High Voltage Parts For the connection between e-motor and power electronics For high performance and high speed induction motors Customized battery components for cell connecting Laser cladding hybrid materials & shunts for battery management Motor Components HV-Connection Battery System May 2019

Agenda Wieland Company Presentation 1 Wieland Vision & Strategy Development 2 Wieland & Global Brass and Copper – Embarking on an exciting journey 3 Growth History Management & Organization 1.1 1.2 Key Performance Indicators 1.3 Products & Innovation 1.4 May 2019

Framework: Vision and Strategy Development Wieland Vision & Strategy Development WielandToday Vision Megatrends Opportunities Challenges Challenges Competitive dynamics Opportunities

Megatrends impacting our business strategy Wieland Vision & Strategy Development eMobility Depleting Resources Global Warming Sustainability Growth in Asia Urbanization Down-gauging Connectivity & IoT … … … High End Cu-solutions Expansion inNorth Americaand Asia Aqua-culture Heat exchanger Growth Recycling Eng. products for e-mobility TechnologyVentures May 2019 Global availability, local service

Global growth strategy Wieland Vision & Strategy Development North America Europe Asia Today 2020 Future 2020 Future 2020 Future Today Today Strengthening the core business through internationalization Maximizing opportunities and reducing risk for Wieland through global presenceExpansion of the U.S. metal service center networkDevelopment of a recycling strategy at the intersection of sustainability and profitabilityForward integration & internationalization in Engineered Products / E-Mobility Wieland global footprint: May 2019

Wieland recycling vision Wieland Vision & Strategy Development Recycling as the ideal combination of profitability and sustainabilityCopper scrap recycling can be a profitable business model Secured access to conflict-free "green" raw materials, tightening legal and customer requirementsUrbanGold participationMinority interest in UrbanGold, an innovative start-up for the recycling of metal-containing scrap (incl. electronic waste)Strengthening Wieland competencies in copper recycling as an important first step in our recycling strategyJoint development of tailor-made recycling concepts May 2019

Vision Wieland Vision & Strategy Development 5. Great place to work 1. Benchmark in Environmental, Health & Safety 4. Industry leader in profitability 3. Culture of excellence & innovation Empowering successONE Wieland 2. Pioneer in quality & service May 2019

wieland one app – always up-to-date, worldwide Wieland Vision & Strategy Development wieland fudickar The Wieland One App is an important step on the way to lively global internal communication and the digital workplace News from the Wieland world are available using the One App:Safety alertsLatest news, internal and externalEvent announcementsEmployee directoryJob openingsKnowledge network wiknowMeal plans for various locationsMore to come… May 2019

wiknow is an internal knowledge platform which is available to all employees to ask questions from their working environment to the employee network at Wieland The goal of wiknow is that questions from employees are answered within a short time wiknow – the knowledge network Wieland Vision & Strategy Development May 2019

Agenda Wieland Company Presentation 1 Wieland Vision & Strategy Development 2 Wieland & Global Brass and Copper – Embarking on an exciting journey 3 May 2019 Growth History Management & Organization 1.1 1.2 Key Performance Indicators 1.3 Products & Innovation 1.4

GBC leadership team will lead “Wieland North America”Wieland North America will include “Global Brass and Copper” and current Wieland North America entitiesEstablishment of joint regional Wieland North America headquartersFuture combination of GBC and Wieland shall provide for business continuity while also allowing for global interaction, learning and growth Best practice exchange (technology, processes, systems) in both directionsExcellence in operations & functions world-wideGlobal talent management and related opportunities Preliminary Organizational Considerations Wieland – GBC

Thank you for your attention! Q&A May 2019

Empowering Success.