UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________

FORM 10-K

__________________________________________________________

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-35938

__________________________________________________________

GLOBAL BRASS AND COPPER HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

__________________________________________________________

|

| | |

| Delaware | | 06-1826563 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | |

475 N. Martingale Road Suite 1050 Schaumburg, IL | | 60173 |

| (Address of principal executive offices) | | (Zip Code) |

(847) 240-4700

(Registrant’s telephone number, including area code)

__________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

| Large accelerated filer | ¨ | Accelerated filer | x |

| | | | |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

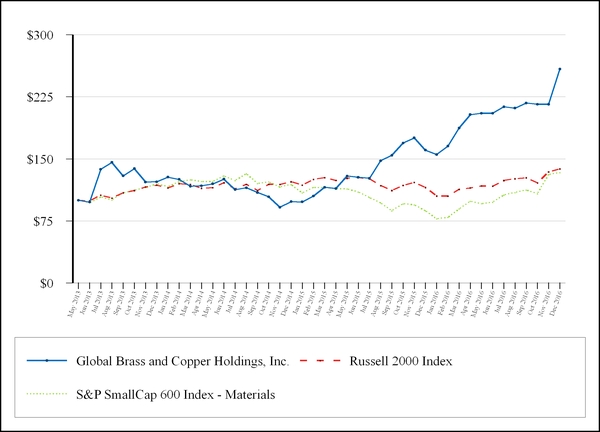

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant on June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $575.3 million (based upon the closing price per share of the registrant’s common stock on the New York Stock Exchange on that date).

On February 23, 2017, there were 21,671,338 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement, which will be filed with the Securities and Exchange Commission within 120 days after December 31, 2016, are incorporated by reference in Part III of this Form 10-K.

Table of Contents

|

| | |

|

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

|

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | | |

|

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

|

| Item 15. | | |

| Item 16. | | |

| |

PART I

Item 1. Business.

Our Company

Global Brass and Copper Holdings, Inc. (“Holdings,” the “Company,” “we,” “us,” or “our”) was incorporated in Delaware on October 10, 2007. Holdings, through its wholly-owned principal operating subsidiary, Global Brass and Copper, Inc. (“GBC”), commenced commercial operations on November 19, 2007 following the acquisition of the metals business from Olin Corporation. The majority of our operations are managed through three reportable operating segments: Olin Brass, Chase Brass and A.J. Oster. We also have a Corporate entity which includes certain administrative costs and expenses and the elimination of intercompany balances. Our sales activities are primarily focused in North America under the Olin Brass, Chase Brass and A.J. Oster brand names.

We are a leading, value-added converter, fabricator, processor and distributor of specialized non-ferrous products, including a wide range of sheet, strip, foil, rod, tube and fabricated metal component products. While we primarily process copper and copper alloys, we also reroll and form certain other metals such as stainless steel, carbon steel and aluminum. Using processed scrap, virgin metals and other refined metals, we engage in metal melting and casting, rolling, drawing, extruding, welding and stamping to fabricate finished and semi-finished alloy products. Key attributes of copper and copper alloys are conductivity, corrosion resistance, strength, malleability, cosmetic appearance and bactericidal properties.

Our products are used in a variety of applications across diversified markets, including the building and housing, munitions, automotive, transportation, coinage, electronics / electrical components, industrial machinery and equipment and general consumer markets. We access these markets through direct mill sales, our captive distribution network and third-party distributors. We hold the exclusive production and distribution rights in North America for a lead-free brass rod product, which we sell under the Green Dot® and Eco Brass® brand names. The vertical integration of Olin Brass’s manufacturing capabilities and A.J. Oster’s distribution capabilities allows us to access customers with a wide variety of volume and service needs.

We service nearly 1,600 customers in 28 countries across four continents. We employ approximately 1,850 people and operate 11 manufacturing facilities and distribution centers across the United States (“U.S.”), Puerto Rico and Mexico.

We own 80% of a value-added service center in Guangzhou, China (“Olin Luotong Metals” or “OLM”); the other 20% is owned by Chinalco Luoyang Copper Co. Ltd. (“Chinalco”). Through Olin Luotong Metals, together with our sales offices in China and Singapore, we supply our products in China and throughout Asia.

Unlike traditional metals companies, in particular those that engage in mining, smelting and refining activities, we are purely a metal converter, fabricator, processor and distributor, and we do not attempt to generate profits from fluctuations in metal prices. Our financial performance is primarily driven by metal conversion economics, not by the underlying movements in the price of copper and the other metals we use. Through our “balanced book” approach (as further described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Principles Affecting Our Results of Operations —Balanced Book”), we strive to match the timing, quantity and price of our metal sales with the timing, quantity and price of our replacement metal purchases. This practice, along with our toll processing operations and last-in, first-out (“LIFO”) inventory accounting methodology, substantially reduces the financial impact of metal price movements on our earnings and operating margins.

All of our segments sell to the building and housing market. While demand within this market is affected by new residential housing, existing home sales and commercial construction, all of which are seasonal and dependent on overall economic conditions, the correlation between housing statistics and our sales is not entirely direct. Our key products are typically installed near the completion of construction, meaning there is an inherent lag time compared to housing starts, and sales of our building and housing products can be affected by factors such as housing mix (unit size, unit price point and the mix of multi-family versus single-family construction). Sales of our products can also be impacted by changes in the composition of materials and fixtures used in construction as well as import and export dynamics.

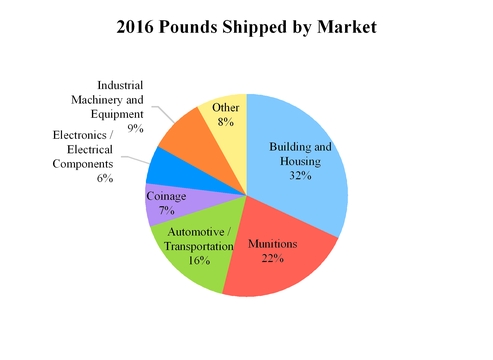

The following charts show the percentage of our shipments by segment, as well as the primary markets for our products and the percentage of shipments. Pounds shipped by market represent management’s estimate of the markets in which our customers participate. Additionally, pounds shipped by market reflect our allocation of Chase Brass shipments to distributors, job shops and forging shops. See Item 1, “Business—Chase Brass.”

Segments Overview

We have three reportable operating segments: Olin Brass, Chase Brass and A.J. Oster.

|

| | | |

| | | | |

| Description | ● Leading manufacturer, fabricator and converter of specialized copper and brass sheet, strip, foil, tube, and fabricated products | ● Leading manufacturer and supplier of brass rod | ● Leading processor and distributor of copper and brass products |

| Key Markets | ● Building and Housing | ● Building and Housing | ● Building and Housing |

| | ● Automotive | ● Transportation | ● Automotive |

| | ● Electronics / Electrical Components | ● Electronics / Electrical Components | ● Electronics / Electrical Components |

| | ● Munitions | ● Industrial Machinery and Equipment | |

| | ● Coinage | | |

Further information about our business segments and the geographic areas of our operations can be found in “Note 4, Segment Information.”

Olin Brass

In addition to manufacturing, fabricating and converting specialized copper and brass sheet, strip, foil, tube and fabricated products, the Olin Brass segment also rerolls and forms other alloys such as stainless steel, carbon steel and aluminum. Sheet and strip is generally manufactured from copper and copper-alloy scrap.

Olin Brass manufactures its wide variety of products through four sites in North America. It is not uncommon for Olin Brass to produce 50 different alloys, approximately 30% of which could be high performance alloys (“HPAs”).

Olin Brass’s integrated brass mill in East Alton, Illinois is its main operating facility, which melts metal and produces strip products that are either sold directly to external customers, sold to its affiliate, A.J. Oster, or shipped to Olin Brass’s downstream operations for further value-added processing. Olin Brass’s downstream operations include:

| |

| • | a stamping operation located in East Alton; |

| |

| • | a rolling mill in Waterbury, Connecticut with rolling, annealing, leveling, plating and slitting capabilities for various products (“Somers Thin Strip”), including stainless steel thin strip; |

| |

| • | a manufacturing facility in Bryan, Ohio specializing in products sold in the automotive and electronics / electrical components markets; and |

| |

| • | a manufacturing facility in Cuba, Missouri that produces high frequency welded copper-alloy tube for heat transfer, utility, decorative, automotive and plumbing applications. |

Olin Brass’s products are sold to original equipment manufacturers (“OEMs”), other external customers, distributors / rerollers or to its affiliate, A.J. Oster. In 2016, approximately 18% of Olin Brass’s products were shipped to distribution customers, which includes its affiliate A.J. Oster, of which management estimates that approximately 55% were directly associated with the building and housing and automotive sectors. In 2016, approximately 15% of Olin Brass’s domestic copper-based shipments were to A.J. Oster.

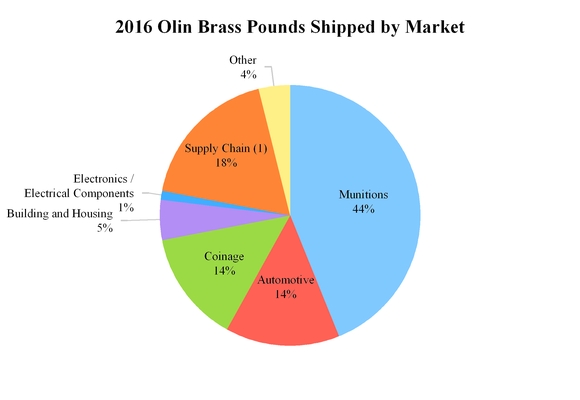

The following chart shows the primary markets for Olin Brass’s products and the percentage of shipments.

| |

| (1) | Approximately 55% of supply chain customer shipments are directly associated with the building and housing and automotive markets according to management estimates. Shipments to A.J. Oster are reflected in the supply chain market and are eliminated in consolidation. |

Munitions Market

Olin Brass manufactures products utilized in both the military and commercial munitions markets, such as strip and cups, that are used to produce shot shells, bullet jackets, centerfire, rimfire and small caliber military munitions.

Customers in this market include major munitions producers in the U.S., including those producing small caliber ammunition for the U.S. military. Demand within this market is affected by the U.S. government’s security policies and troop size, as well as consumer demand for firearms and munitions. While munitions demand is predominantly domestic, occasional opportunities arise to supply U.S. alliance partners with these products.

Coinage Market

Olin Brass supplies strip for use in the production of dollar coins, quarters, dimes and nickels. Customers in this market include the United States Mint, for which we are a key supplier contracted into 2017. This long-term contract has typically been renewed as Olin Brass has been a highly regarded and valued supplier to the United States Mint for over 40 years.

The demand within this market is affected by the level of activities in retail transactions, the use of vending machines, and the trends affecting forms of payment.

Automotive Market

Olin Brass manufactures both strip and fabricated products used as electronic and electrical connectors for use in automobiles. These products are made with HPAs, suitable for applications requiring high reliability, high temperature and low insertion force. For example, these electrical connectors, along with lead frames manufactured by us, are used in junction boxes, wiring harnesses, ignition systems, lighting and automotive entertainment systems.

Customers in this market include primary automotive connector suppliers in the U.S. Historically the business in this market remained largely regional in the U.S. Demand within this market is affected by the level of consumer spending on automobiles, which is significantly dependent on overall economic conditions and the amount of electrical components contained within automobiles.

Building and Housing Market

Olin Brass manufactures a variety of strip, welded tube and stamped parts used in commercial and residential buildings, such as faucets, locksets, decorative door hardware and hinges, which require workability, corrosion resistance and attractive appearance. Olin Brass also manufactures strip for products requiring high electrical conductivity, such as plug outlets, switches, lamp shells, other wiring devices, industrial controls, circuit breakers and switchgears. These products are generally manufactured with copper and copper-alloy sheet and strip, both HPAs and standard alloys, as well as copper-alloy welded tube.

Customers in this market are OEMs producing building and housing products. Olin Brass also supplies building and housing products in China through Olin Luotong Metals.

Electronics / Electrical Components Market

Olin Brass manufactures strip used in integrated circuit sockets for circuit boards, electrical connectors for laptop computers and similar devices, consumer electronics and appliances, and foils for flexible circuit applications. The strip manufactured in this market is high in HPA content and is sold directly to end-use customers and distributors.

Customers in this market are primarily electronics manufacturers that operate globally. A portion of these customers is serviced through A.J. Oster, and the remainder is supplied directly by Olin Brass, with its Somers Thin Strip facility providing the foil products on a global scale.

Demand within this market is affected by consumer spending on electronics, which may fluctuate significantly as a result of economic conditions.

International

The Olin Brass segment sold 18.3 million pounds into non-U.S. markets that primarily serve the building and housing, automotive and electronics / electrical components markets.

Asia

Included within our Olin Brass business, our Asian operations provide service, distribution and sales activities to meet the growing demand for copper alloys in that region. These activities are conducted through two of our subsidiaries, Olin Luotong Metals (“OLM”) in China and GBC Metals Asia Pacific PTE (“GMAP”) in Singapore. These operations source materials from Olin Brass, as well as other copper and brass mills, such as Chinalco and DOWA Metaltech Co. LTD (“Dowa Metaltech”). In 2016, these Asian operations generated $37.1 million of net sales, or 6% of the Olin Brass segment’s net sales. On a pounds basis, our Asian operations sold 9.8 million pounds (4% of the Olin Brass segment’s sales) of product into Asia through OLM and GMAP, primarily into key electronics markets.

Others

The remainder of Olin Brass’s international sales are primarily to Mexico, Canada and European countries and were 8.5 million pounds (3% of the Olin Brass segment’s sales) in 2016.

Chase Brass

Chase Brass primarily manufactures brass rod, including round, hexagonal and other shapes, ranging from 1/4 inch to 4 1/2 inches in diameter. Its customers machine or otherwise process the rod for various applications used in various markets. Brass rod is primarily used for forging and machining products, such as valves and fittings. Key attributes of brass rod include its machinability, corrosion resistance and moderate strength. Brass rod is generally manufactured from copper or copper-alloy scrap and all of Chase Brass’s rod is manufactured at its Montpelier, Ohio facility.

Chase Brass has been able to capitalize on opportunities arising from regulation limiting lead content in potable water plumbing fixtures. The green product portfolio has grown significantly over the past few years as customers switch from leaded to non or low-leaded products in certain applications. We expect increased demand in the building and housing market to drive growth in our green product portfolio, including Eco Brass®, given the enactment of these regulations.

The following chart shows the primary markets for Chase Brass’s products and the percentage of shipments for each. Note that substantially all of the electronics / electrical components shipments below are associated with the building and housing and transportation markets.

Building and Housing Market

Chase Brass manufactures brass rod for use in faucets, valves and fittings used in residential and commercial construction.

Chase Brass produces a number of low-lead and lead-free products, or “green portfolio” products, which comply with state laws in California and Vermont as well as federal standards (patterned after legislation enacted in California and Vermont) that became effective in January 2014. This legislation defines the allowed level of lead content in products used in plumbing and drinking water applications. Chase Brass’s Green Dot® rod, Eco Brass® rod and Eco Brass® ingot products are part of the green portfolio, and Chase Brass is the exclusive licensee of the intellectual property rights for their production, sale and distribution in North America. Chase Brass also manufactures other non-patented green portfolio products. Green portfolio products accounted for approximately 21% of pounds shipped by Chase Brass in 2016.

Industrial Machinery and Equipment Market

Chase Brass manufactures brass rod used in industrial valves and fittings. Demand within this market is affected by capital spending levels, U.S. gross domestic product (“GDP”) growth and industrial production growth in the U.S.

Customers in this market include various major diversified manufacturers and a variety of screw machine companies supporting OEMs.

Transportation Market

Chase Brass manufactures brass rod for uses in heavy trucks and automobiles. Specific applications include heavy truck braking systems, tire valves, temperature sensors and various truck and automotive fittings. Demand within this market is affected by levels of transportation activity, levels of maintenance capital spending by transportation companies and the level of commercial truck fleet replacement activity, all of which are affected significantly by overall economic conditions. Customers in this market include major OEMs in the transport industry and customers who support domestic automotive production.

Electronics / Electrical Components Market

Chase Brass manufactures brass rod used for telecommunication applications, including products such as coaxial connectors and traps and filters for cable television, as well as larger connectors supporting the cell tower industry. Demand within this market is affected by consumer spending, new home construction, and technologies affecting communication devices and methods. Customers within this market include major manufacturers of specialty products for use in home and commercial construction, both of which are very dependent on overall economic conditions. Management believes that a significant portion of shipments in this market segment are directly associated with the building and housing market and transportation markets.

International

Chase Brass primarily supplies products within North America. Chase Brass generated $45.2 million in net sales (9% of the Chase Brass segment’s net sales) to Canada and Mexico in 2016. Sales to Canada and Mexico were 24.9 million pounds (11% of the Chase Brass segment’s sales) in 2016.

A.J. Oster

A.J. Oster is a processor and distributor of primarily copper and copper-alloy sheet, strip and foil, operating six strategically-located service centers in the U.S., Puerto Rico and Mexico. Key A.J. Oster competitive advantages are short lead-times with high reliability, high level of service, small-quantity deliveries and a wide range of high-quality, copper-based products. These capabilities, combined with A.J. Oster’s operations of precision slitting, hot tinning, traverse winding, cutting and special packaging, provide value to a broad customer base.

In 2016, Olin Brass provided A.J. Oster with 51% of its copper-based products. Aurubis AG (“Aurubis”) is A.J. Oster’s second largest supplier after Olin Brass, supplying approximately 30% of A.J. Oster’s copper-based products in 2016. Many of the coils purchased from Olin Brass and Aurubis are full-width and require slitting.

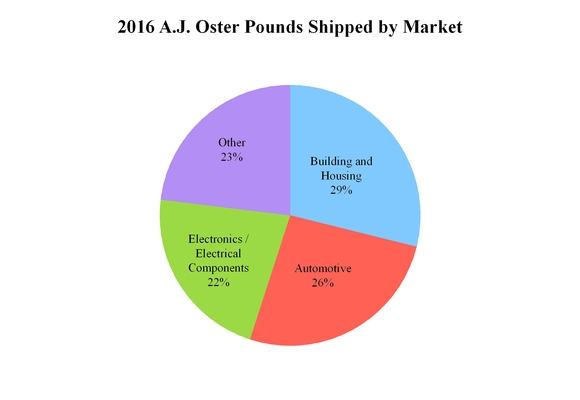

The following chart shows the primary markets for A.J. Oster’s products and the percentage of shipments for each.

Building and Housing Market

A.J. Oster distributes copper-alloy strip and aluminum foil used for products in commercial and residential buildings. The two primary applications are electrical and hardware.

Electrical products are primarily for wiring devices. Other applications include switchgears, switches, controls and circuit breakers. Several of our customers for these products are in Puerto Rico or Mexico. A.J. Oster’s capabilities are well-suited for these geographic locations and the stringent service requirements of the electrical market because A.J. Oster is able to provide customers with high-quality metals, in less-than-truckload quantities, and can deliver products shortly after receiving orders.

Hardware products include products such as faucets, window trim, locksets, hinges and kick plates.

Automotive Market

A.J. Oster distributes copper-alloy strip and aluminum foil used in automobile production. Primary customer products are electrical connectors, automotive trim and heat exchangers.

A.J. Oster’s subsidiary in Queretaro, Mexico is well-positioned to take advantage of the growing number of second-tier automobile component suppliers in Mexico.

Demand within this market is affected by the level of consumer spending on automobiles, which is significantly dependent on overall economic conditions.

Electronics / Electrical Components Market

A.J. Oster distributes copper-alloy strip used for electrical connectors in computers, consumer electronics and automobiles.

The demand within this market is affected by consumer spending and trends in electronics, which may fluctuate significantly as a result of economic conditions.

International

A.J. Oster operates a service center in central Mexico. The facility is located in Queretaro in the center of Mexico’s industrial triangle marked by Mexico City, Monterey and Guadalajara and is easily accessible by highway connections to the U.S.

Automotive sub-suppliers that consume copper-alloy strip are now locating facilities in central Mexico in order to support primary automotive manufacturing.

Net sales from A.J. Oster Mexico were $39.8 million during 2016 (14% of A.J. Oster segment’s net sales). Pounds shipped from A.J. Oster Mexico were 10.4 million and comprised 14% of the A.J. Oster segment’s sales.

Raw Materials and Supply

We manufacture our products from scrap metal (both internally generated and externally sourced) or virgin raw materials. During 2016, 91% of our metal came from scrap metal, and the remainder came from virgin raw materials.

Virgin raw materials, including copper cathode, are purchased at a premium on the London Metal Exchange (“LME”) or Commodities Exchange (“COMEX”) or directly from key dealers that support producers around the world. Although virgin raw materials are more expensive compared to scrap, we use them to produce HPAs and other products that require exact specifications.

Customers

Our customer base is broadly diversified, spanning various North American markets, including building and housing, munitions, automotive, transportation, coinage, electronics / electrical components, industrial machinery and equipment and general consumer markets. In 2016, we sold approximately 14,000 different stock keeping units (“SKUs”) to nearly 1,600 customers.

Also in 2016, net sales from our foreign entities were $76.9 million, or 6% of our net sales. We have long-term relationships with our customers, many of which are secured through short-term contracts. Our relationships with many of our significant customers have lasted more than 30 years.

All three of our operating segments had customers to whom sales activity constituted more than 10% of net sales during 2016. Olin Brass generated 23% of its total net sales from one customer and 11% of its total net sales from another customer. A.J. Oster generated 18% of its total net sales from one customer. Chase Brass generated 21% of its total net sales from one customer. On a consolidated basis, we did not generate more than 10% of our net sales from any one customer in 2016.

Competition

We compete with other companies on price, service, quality, breadth, and availability of product. We believe we have been able to compete effectively because of our high levels of service, breadth of product offering, knowledgeable and trained sales force, modern equipment, numerous locations, geographic dispersion and economies of scale.

The North American market for brass and copper strip and sheet and brass rod consists of a few large participants and a few smaller competitors for Olin Brass and Chase Brass. A.J. Oster’s competition consists of a number of smaller competitors. Our international competitors are based principally in Europe and Asia.

Our largest competitors in each of the markets in which we operate are the following:

| |

| • | Aurubis and PMX Industries, Inc.: manufacturers of copper and copper-alloys in the form of strip, sheet and plate (Olin Brass competitor); |

| |

| • | ThyssenKrupp Materials NA, Copper and Brass Sales Division: processor and distributor of copper, brass, stainless and aluminum products; Wieland Metals, Inc.: re-roll mill and service center for copper and copper-alloy strip (A.J. Oster competitor); and |

| |

| • | Mueller Industries, Inc.: manufacturer of brass rod (Chase Brass competitor). |

We use data published by independent industry associations and management estimates to determine our market share. Using this information, in 2016:

| |

| • | Olin Brass accounted for 32% of North American shipments (including shipments to A.J. Oster) of copper and brass alloys in the form of sheet, strip and plate; |

| |

| • | A.J. Oster accounted for 35% of North American shipments of copper and brass, sheet and strip products from distribution centers and rerolling facilities; and |

| |

| • | Chase Brass accounted for 54% of North American shipments of brass rod, not including imports. |

Corporate

Our Corporate expenditures include compensation for corporate executives and officers, corporate office and administrative salaries, and professional fees for accounting, tax and legal services. Corporate also includes interest expense, state and federal income taxes, overhead costs that management has not allocated to the operating segments, share-based compensation expense, gains and losses associated with certain acquisitions and dispositions and the elimination of intercompany sales and balances.

Government Regulation and Environmental Matters

Bactericidal Products

Through its membership in the Copper Development Association Inc. (“CDA”), Olin Brass has completed the required Federal Environmental Protection Agency (“EPA”) and applicable state registration processes that allow it to market its CuVerro® products with certain approved bactericidal claims. Laboratory testing has shown that bactericidal copper touch surfaces made with CuVerro® kill more than 99.9% of bacteria within two hours. We believe that Olin Brass’s copper-based CuVerro® materials are in compliance, in all material respects, with EPA standards for products recognized by the EPA as having bactericidal properties.

In connection with these EPA registrations, the CDA is required to implement a “stewardship” plan that is designed to ensure that bactericidal copper-alloys are properly used and marketed. The stewardship requirement reflects the EPA’s concern that the improper marketing of bactericidal copper-alloys could lead users to mistakenly believe that the use of

these products is a simple solution to fight infections. The stewardship efforts are intended to emphasize that all marketing statements are consistent with the approved EPA product label, including the need to state clearly that the alloys are intended as a supplement to, but are not a substitute for, standard cleaning and sanitization procedures. These standards also apply to marketing by our customers who use CuVerro® in their products.

Even though the marketing of copper products as bactericidal started in 2008, the manufacturers of such products are still in the process of determining what specific bactericidal claims may be made in compliance with the EPA’s and Federal Insecticide, Fungicide and Rodenticide Act’s (“FIFRA”) requirements. Therefore, there remains some uncertainty when determining whether a particular marketing approach is consistent with the EPA registration requirements. Accordingly, it is possible that we or other manufacturers may be found to be non-compliant by the EPA for current, past or future marketing claims and activities. The EPA can impose administrative, criminal or judicial sanctions and penalties against those violating federal registrations. Any failure by us or our customers who use CuVerro® in their products to comply with FIFRA’s requirements with respect to CuVerro® could therefore expose us to various enforcement actions or other claims or adverse impacts to our reputation. The stewardship program required under the EPA registration is an industry-wide activity, and the actions of other CDA members could jeopardize the marketing of all bactericidal copper products registered through the CDA (including CuVerro®). If the EPA were to determine that the stewardship program is not being implemented effectively, the EPA may initiate a variety of corrective actions, which could adversely affect us and other CDA members, including cancelling all CDA registrations. If the EPA were to initiate an enforcement action that affects us or our customers, it may have a material adverse effect on our ability to market CuVerro® as a bactericidal product.

Lead-free and Low-lead Plumbing Products

New regulations designed to reduce lead content in drinking water plumbing devices provide an opportunity for future growth. Chase Brass is a premier provider of specialized lead-free products and low-lead alloys. Federal legislation in the United States (the Reduction of Lead in Drinking Water Act, which was patterned after legislation enacted in California and Vermont) required the reduction of lead content in all drinking water plumbing devices beginning in January 2014. This legislation presents a significant growth opportunity for Chase Brass. Our Eco Brass® products meet federal, California and Vermont standards and can be used to produce cast, machined and forged faucet parts. We currently supply major faucet, valve and fitting manufacturers who produce multiple products using machined Eco Brass® parts.

Environmental

Our operations are subject to a number of federal, state and local laws and regulations relating to the protection of the environment and to workplace health and safety. In particular, our operations are subject to extensive federal, state and local laws and regulations governing the creation, transportation, use, release and disposal of wastes, air and water emissions, the storage and handling of hazardous substances, environmental protection, remediation, workplace exposure and other matters. Hazardous materials used in our operations include general commercial lubricants, cleaning solvents and cutting oils. Among the regulated activities that occur at some of our facilities are: the accumulation of scrap metal; and the generation of hazardous waste, solid wastes and wastewaters, such as water from burning tables operated at some of our facilities. The generation, storage, and disposal of these wastes are done in accordance with the Federal Water Pollution Control Act, the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”) and the Resource Conservation and Recovery Act, and we use third-party commercial disposal services as permitted by these laws for the removal and disposal of these wastes. The storage, handling and use of lubricating and cutting oils and small quantities of maintenance-related products and chemicals are also regulated under environmental laws, and the health hazards of these materials are communicated to employees pursuant to the Occupational Safety and Health Act.

In general, our facilities’ operations do not involve the types of emissions of air pollutants, discharges of pollutants to land or surface water, or treatment, storage or disposal of hazardous waste which would ordinarily require federal or state environmental permits. Some of our facilities possess authorizations under the Clean Air Act for air emissions from paints and coatings. At some locations, we also possess hazardous materials storage permits under local fire codes or ordinances for the storage of combustible materials such as oils or paints. At some facilities we possess state or local permits for on-site septic systems. Our cost of obtaining and complying with such permits has not been, and is not anticipated to be, material.

We believe that we are in substantial compliance with all applicable environmental and workplace health and safety laws and do not currently anticipate that we will be required to expend any substantial amounts in the foreseeable future in order to meet such requirements. We have a number of properties located in or near heavy industrial or light industrial use areas; accordingly, these properties may have been contaminated by pollutants which may have migrated from neighboring facilities or have been released by prior occupants for which we may become liable under various laws and regulations. Some of our properties have been affected by releases of cutting oils and similar materials and we are investigating and

remediating such known contamination pursuant to applicable environmental laws. The costs of these clean-ups have not been material in the past. We are not currently subject to any material claims or notices with respect to clean-up or remediation under CERCLA or similar laws for contamination at our leased or owned properties or at any off-site location. However, we could be notified of such claims in the future. It is also possible that we could be identified by the EPA, a state agency, or one or more third parties as a potentially responsible party under federal or state laws and regulations.

Pursuant to the agreement, dated November 19, 2007, by which we purchased our current operating locations from Olin Corporation, Olin Corporation agreed to retain responsibility for a wide range of liabilities under environmental laws arising out of existing contamination on our properties, and agreed to indemnify us without limitation with respect to these liabilities. Specifically, Olin Corporation retained responsibility for:

| |

| • | compliance with all obligations to perform investigations and remedial action required under the Connecticut Real Property Transfer Act at properties in Connecticut; |

| |

| • | pending corrective action / compliance obligations under the Federal Resource Conservation and Recovery Act for certain areas of concern at our East Alton, Illinois facility; and |

| |

| • | all obligations under environmental laws arising out of 24 additional specifically identified areas of concern on various of our properties. |

Olin Corporation also retained complete responsibility for all liabilities arising out of then pending governmental inquiries relating to environmental matters; for “any liability or obligation in connection with a facility of the Business to the extent related to pre-Closing human exposure to Hazardous Materials, including asbestos-containing materials”; and for “any liability or obligation in connection with the off-site transportation or disposal of Hazardous Materials arising out of any pre-Closing operations of the Business.”

Since 2007, Olin Corporation has continued to perform environmental remedial actions on our properties, including the East Alton, Illinois and Waterbury, Connecticut properties, and continues to work closely with us to address matters covered by the indemnity. Because of the Olin Corporation indemnity, we have not been required to engage in any significant environmental cleanup activity on our properties and do not currently have any material reserves established to address environmental remedial requirements.

Employees

The following table shows the composition of our workforce by operating segment and Corporate as of December 31, 2016.

|

| | | | | | |

| | | Employees | | % of Total |

| Olin Brass | | 1,222 |

| | 66 | % |

| A.J. Oster | | 294 |

| | 16 | % |

| Chase Brass | | 319 |

| | 17 | % |

| Corporate | | 22 |

| | 1 | % |

| Total | | 1,857 |

| | 100 | % |

As of December 31, 2016, 1,130, or approximately 61%, of our employees at various sites were members of unions. We have generally maintained good relationships with all unions and employees, which has been an important aspect of our ability to be competitive in our industry. Generally, our various agreements with unions in the United States have contractual terms which range from 1 to 5 years.

Historically, we have succeeded in negotiating new collective bargaining agreements without a strike and we have not experienced any work stoppages at any of our facilities. In particular, our union agreements governing a substantial portion of our employees at Chase Brass and Olin Brass expire in 2017. We believe we will continue to be able to renew the outstanding collective bargaining agreements upon acceptable terms.

Research and Development

Our staff of scientists in metallurgy and electrochemistry intends to continue to invest in research and development to develop new products and expand our value-added services to meet our customers’ needs.

Our research and development expenditures were not material during 2016, 2015 or 2014.

Risk Management and Insurance

The primary risks in our operations are personal injury, property damage, transportation, criminal acts, risks associated with international operations, directors’ and officers’ liability and general commercial liabilities. We are insured against general commercial liabilities (including business interruption), workers’ compensation liabilities, automobile accidents (including injury to employees and physical damage of goods and property and employer liabilities), directors’ and officers’ liability, crime, foreign risks, environmental liability, ocean cargo liability and flood through insurance policies provided by various insurance companies up to amounts we consider sufficient to protect against losses due to claims associated with these risks.

We also maintain bonds with certain federal, state and international authorities to insure against risks relating to, among other things, delays due to customs clearances, compliance with certain laws and regulations and import and export of goods.

Safety

Consistent with other strategic initiatives, we strive to achieve a ‘Best in Class’ performance status for employee safety. A number of our locations participate in the Occupational Safety and Health Administration (“OSHA”) sponsored Voluntary Protection Program, or VPP. The Safety Excellence / VPP initiative shifts the safety paradigm to an aggressive proactive approach that stresses strong employee participation and collaboration, management accountability, employee training and hazard elimination as core foundational elements. In 2016, our A.J. Oster facility in Yorba Linda, California was recognized as a VPP Star site. This recognition reflects the facility’s achievement in the development, implementation and continuous improvement of their safety and health management system resulting in injury and illness rates that are below the national averages for the industry.

Patents, Trademarks and Other Intellectual Property Rights

Chase Brass has exclusive intellectual property licenses, the longest of which extends to 2027, to produce and sell Eco Brass® rod and ingot in North America, granted by Mitsubishi Shindoh Company, Ltd., the Japanese company that owns the relevant intellectual property rights. The most popular versions of Eco Brass® are protected through May 2019. We have sublicensed our rights to three sublicensees, none of which is currently a competitor of any of our subsidiaries or segments. These sublicensing arrangements are valid until the expiration of the relevant patents in North America.

We have alloy licensing arrangements with companies in Germany, Japan and China.

We own a number of other U.S. and foreign patents, trademarks and licenses relating to certain of our products and processes. We actively protect our proprietary rights by the use of trademark, copyright, and patent registrations. Additionally, we license the marks OLIN BRASS and OLIN METALS for metal products from Olin Corporation. These licenses continue unless we breach the license agreement. We also license stylized versions of these marks from Olin Corporation and the license to the stylized version includes an annual termination option by either party.

We license the intellectual property rights related to certain proprietary alloy systems to other major brass mills around the world, including Dowa Metaltech.

Government Contract

The United States Mint is and has been a significant customer of Olin Brass since 1969. We have a contractual arrangement to supply nickel and brass coinage strip to multiple United States Mint facilities. As has been the case for a long time, we expect to renew this contract when it expires in 2017. However, the United States Mint can terminate our contract in whole or in part when it is in the best interest of the United States Mint to do so and any damages payable to us by the United States Mint for such termination would not include lost profits.

Seasonality

There is a slight decrease in our net sales in the fourth quarter as a result of the decrease in demand due to customer shutdowns for the holidays and year-end maintenance of plants and inventory by customers. We also typically experience slight working capital increases in the first fiscal quarter as our customers build inventory to serve the seasonal building and housing market.

Available Information

Our website address is http://www.gbcholdings.com. We make available on our website, free of charge, the periodic reports that we file with or furnish to the Securities and Exchange Commission (“SEC”), as well as all amendments to these reports, as soon as reasonably practicable after such reports are filed with or furnished to the SEC. We also make available on our website or in printed form upon request, free of charge, our Corporate Governance Guidelines, Code of Business Conduct and Ethics, charters for the standing committees of our Board of Directors and other information related to the Company. We are not including the information contained on our website as a part of, or incorporating it by reference into, this report.

The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. The public may obtain information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information related to issuers that file electronically with the SEC.

Item 1A. Risk Factors.

We are exposed to various risks as we operate our businesses. To provide a framework to understand our operating environment, we are providing a brief explanation of the more significant risks associated with our businesses. Although we have tried to identify and discuss key risk factors, others could emerge in the future.

Risks Related to Our Business

Our business, financial condition and results of operations or cash flows could be negatively affected by downturns in economic cycles in general or cyclicality in our markets, both inside and outside of the U.S. Our future growth also depends, to a significant extent, on improvements in general economic conditions and in conditions in our markets.

Many of our products are used in industries that are, to varying degrees, cyclical and have historically experienced periodic downturns due to factors such as economic conditions, energy prices, the availability of credit, consumer sentiment, demand and other factors beyond our control. These economic and industry downturns have resulted in diminished product demand and excess capacity for our products. The significant deterioration in economic conditions that occurred during the second half of 2008 and continued into 2009 resulted in disruptions in a number of our markets. Any future economic disruptions may negatively impact our markets or the consumers served by those markets, which would adversely affect our operating results.

Future disruptions in the commercial credit markets may impact liquidity in the global credit market, and we are not able to predict the impact any such worsening conditions would have on our customers in general, and our results of operations specifically. Businesses in one or more of the markets that we serve, or consumers in one or more of the markets that our customers serve, may postpone or choose not to make purchases in response to economic uncertainty, tighter credit, negative financial news, unemployment, interest rates, adverse consumer sentiment and declines in housing prices or other asset values.

A significant amount of our volume is tied to the building and housing sector. If the housing, remodeling and residential and commercial construction markets stagnate or deteriorate, demand from such markets for our products, especially our brass rod products, is likely to be adversely affected. Any recovery in such markets will not necessarily directly correlate with increased sales or profitability. Our key products are typically installed late in the housing construction cycle, meaning there is an inherent lag in volumes, and sales of our building and housing products can be affected by factors such as housing mix (unit size, unit price point and the mix of multi-family versus single-family construction). Sales of our products can also be impacted by the actual timing of housing starts and completions as well as to changes in the materials and fixtures used in construction that may contain fewer copper products or materials and fixtures than were used in the past. In addition, competition from imports and other sources may also dampen the effects of any such recovery on our results of operations.

Similarly, the automotive market has in the past experienced significant downturns in connection with, or in anticipation of, declines in general economic conditions. Demand for vehicles depends largely on the strength of the economy, employment levels, consumer confidence levels, the availability and cost of credit and the cost of fuel. Negative economic developments could reduce demand for new vehicles, causing our customers to reduce their vehicle and automotive component part production in North America.

The coinage and general consumer markets are also affected by economic cycles. Demand for coinage-related products generally increases with the number of cash transactions that occur, and the number of cash transactions generally increases during periods of economic growth. Demand for consumer goods is also very sensitive to economic conditions and drives demand in our electronics / electrical components market.

The munitions market is cyclical and is not correlated to any general economic indicators and thus, has a high degree of volatility.

As a result, cyclicality in economic conditions and in the markets that we serve could have a material adverse effect on our business, financial condition, results of operations and cash flows. Our growth prospects also depend, to a significant extent, on the degree by which general economic conditions and conditions in the markets that we serve continue to improve.

Failure to maintain our balanced book approach would cause increased volatility in our profitability and our operating results and may result in significant losses.

We use our balanced book approach to substantially reduce the impact of metal price movements, specifically fluctuations in the availability and price of copper scrap and cathode, which represent the largest component of our cost of sales. Such fluctuations can significantly affect our operating margins from our non-toll sales, which are sales for which we assume responsibility for metal procurement and then recover the metal replacement cost from the customer. Non-toll sales represented approximately 75% of our unit sales volume over the last three years. Under our balanced book approach, we seek to match the timing, quantity and price of the metal component of net sales with the timing, quantity and price of replacement metal purchases on all of our non-toll sales. We use a combination of matching price date of shipment terms, firm price terms and derivatives transactions to achieve our balanced book. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Principles Affecting Our Results of Operations—Balanced Book.”

We may not be able to maintain our balanced book approach if our customers become unwilling to bear metal price risk through the matching of price date of shipment terms. We may also not be able to find counterparties for the derivatives transactions entered into in connection with firm price terms, and the cost of those derivatives transactions may increase such that entering into such transactions is no longer cost-effective to us. If we fail to maintain our balanced book approach, we may be forced to accept higher replacement prices, which could generate losses and would increase volatility in our results of operations.

Although we maintain our balanced book approach, metal costs still affect our profitability through “shrinkage” and inventory valuation adjustments.

Shrinkage loss, which is primarily the loss of raw metal that occurs in the melting and casting operations, is an inherent part of a metal fabrication and conversion business. Despite our use of our balanced book approach to mitigate the impact of metal price fluctuations, we must bear the cost of any shrinkage during production, which may increase the volatility of our results of operations. Because we process a large amount of metal in our operations, a small increase in our shrinkage rates can have a significant effect on our margins and profitability. In addition, if metal prices increase, the same amount of shrinkage will have a greater effect on our manufacturing costs and have a more significant negative impact on our margins and profitability.

The market price of metals and related scrap used in production is subject to significant volatility. During periods when open-market prices decline below net book value, we may need to record a provision to reduce the carrying value of our inventory and increase cost of sales. Additionally, the cost of our inventories is primarily determined using the LIFO method. Under the LIFO inventory valuation method, changes in the cost of raw materials and production activities are recognized in cost of sales in the current period. In a period of rising raw material prices, cost of sales expense recognized under LIFO is generally higher than the cash costs incurred to acquire the inventory sold. Conversely, in a period of declining raw material prices, cost of sales recognized under LIFO is generally lower than cash costs incurred to acquire the inventory sold. The impact of LIFO accounting on our financial results may be significant with respect to period-to-period comparisons. During 2016, certain domestic metal inventory quantities were reduced, resulting in a liquidation of LIFO inventory layers carried at higher costs prevailing in prior years as compared with metal prices prevailing in the market at the time of the inventory depletion and the effect of this reduction of inventory increased cost of sales by $1.9 million. See “Management’s Discussion and Analysis of Operating Results and Financial Condition—Key Business Principles Affecting Our Results of Operations —Metal Cost.”

Because our balanced book approach does not reduce the effects of fluctuations in metal prices on our working capital requirements, higher metal prices could have a negative effect on our liquidity.

Our balanced book approach does not reduce the impact of the volatility in metal prices on our working capital requirements. Metal prices impact our investment in working capital because our collection terms with our customers are longer than our payment terms to our suppliers. As a result, when metal prices are rising, even if the number of pounds of metal we process does not change, we tend to use more cash or draw more on our asset-based revolving loan facility (“2016 ABL Facility”) to cover the cash flow delay from material replacement purchase to cash collection. Thus, when metal prices increase, our working capital may be negatively affected as we are required to draw more on our cash or available financing sources to pay for raw materials. As a result, our liquidity may be negatively affected by increasing metal prices. Metal price volatility may also require us to draw on working capital sources more quickly and unpredictably, and therefore at higher cost. See “Management’s Discussion and Analysis of Operating Results and Financial Condition—Key Business Principles Affecting Our Results of Operations—Metal Cost.”

Limited access to raw materials, infrastructure or fuel could negatively affect our business, financial condition or results of operations or cash flows.

Our ability to fulfill our customer orders in a timely and cost-effective manner depends on our ability to secure a sufficient and constant supply of raw materials and fuel and access to infrastructure adequate to fulfill our business needs. Although we often seek to source our copper from scrap, including internally generated scrap and repurchases of our customers’ scrap, where scrap is either not available or is not appropriate for use, we use virgin raw materials such as copper cathode, which are generally more expensive than scrap. We depend on natural gas for our manufacturing operations and source natural gas through open-market purchases.

We depend on scrap for our operations and acquire our scrap inventory from numerous sources. These suppliers generally are not bound by long-term contracts and have no obligation to sell scrap metals to us. The supply of scrap metal available to us could be adversely impacted at any time due to slowdowns in industrial production or consumer consumption. If an adequate supply of scrap metal is not available to us, we would be unable to use scrap as a source of supply at desired volumes, forcing us to use a larger amount of more expensive virgin raw materials and our results of operations and financial condition would be materially and adversely affected. The acquisition of copper cathode by physically backed copper exchange traded funds and other similar entities may materially decrease or interrupt the availability of copper for immediate delivery in the United States, which could materially increase our cost of copper and copper scrap, result in potential supply shortages, and increase price volatility for copper and copper scrap. All of the above factors may affect our ability to secure the necessary raw materials in a cost-effective manner for production of our products.

We may experience disruptions in the supply of natural gas as a result of delivery curtailments to industrial customers due to extremely cold weather. We may also experience disruptions or increases in cost with respect to our access to water, electrical power, transport and wastewater treatment services and other infrastructure (including those subject to our transition services agreement with the parent of our predecessor). We may also experience other delays or shortages in the supply of raw materials. An inability to find an adequate and timely supply of raw materials or adequate and cost-effective access to infrastructure could have a material adverse effect on our profit margin, and in turn on our business, financial condition, results of operations or cash flows.

Increases in the cost of energy could cause our cost of sales to increase, thereby reducing operating results and limiting our operating flexibility.

In 2016, the cost of energy and utilities represented approximately 6% of our non-metal cost of sales and prices can be volatile. As a result, our energy and utility costs may fluctuate dramatically, and we may not be able to mitigate the effect of higher energy and utility costs on our cost of sales. A substantial increase in energy costs could cause our operating costs to increase and our business, financial condition, results of operations and cash flows may be materially and adversely affected. Although we attempt to mitigate short-term volatility in energy and utility costs through the use of derivatives contracts, we may not be able to eliminate the long-term effects of such cost volatility. Furthermore, in an effort to offset the effect of increasing costs, we may have also limited our potential benefit from declining costs.

Our substantial leverage and debt service obligations may adversely affect our financial condition and restrict our operating flexibility, including our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting our obligations under our indebtedness.

We are highly leveraged. As of December 31, 2016, our total indebtedness was $316.0 million (net of debt issuance costs). We also had an additional $197.9 million available for borrowing under the 2016 ABL Facility as of that date. Based on the amount of indebtedness outstanding and applicable interest rates at December 31, 2016, our annualized cash interest expense would be $17.0 million, which includes $0.3 million of interest expense related to our capital lease obligations. Additionally, we may potentially borrow under the 2016 ABL Facility, which is a floating-rate obligation, and thus, the related interest expense is subject to increase in the event interest rates were to rise.

Our substantial indebtedness and debt service obligations could have important consequences for investors, including:

| |

| • | they may impose, along with the financial and other restrictive covenants under our credit agreements, significant operating and financial restrictions, including our ability to borrow money, dispose of assets or raise equity for our working capital, capital expenditures, dividend payments, debt service requirements, strategic initiatives or other purposes; |

| |

| • | they may limit our flexibility in planning for, or reacting to, changes in our operations or business; |

| |

| • | we may be more highly leveraged than some of our competitors, which may place us at a competitive disadvantage; and |

| |

| • | they may make us more vulnerable to downturns in our business or the economy. |

Any of these consequences could have a material adverse effect on our business, financial condition, results of operations, prospects and ability to satisfy our obligations under our indebtedness. In addition, there would be a material adverse effect on our business, financial condition, results of operations and cash flows if we were unable to service our indebtedness or obtain additional financing, as needed.

Covenants under our debt agreements impose operating and financial restrictions. Failure to comply with these covenants could have a material adverse effect on our business, financial condition, results of operations or cash flows.

The agreement governing the 2016 ABL Facility and the agreement covering our term loan facility that matures on July 18, 2023 (“Term Loan B Facility”) contain various covenants that limit or prohibit our ability, among other things, to:

| |

| • | incur or guarantee additional indebtedness; |

| |

| • | pay dividends on our capital stock or redeem, repurchase, retire or make distributions in respect of our capital stock or subordinated indebtedness or make certain other restricted payments; |

| |

| • | make certain loans, acquisitions, capital expenditures or investments; |

| |

| • | sell certain assets, including stock of our subsidiaries; |

| |

| • | enter into certain sale and leaseback transactions; |

| |

| • | create or incur certain liens; |

| |

| • | consolidate, merge, sell, transfer or otherwise dispose of all or substantially all of our assets; |

| |

| • | enter into certain transactions with our affiliates; and |

| |

| • | engage in certain business activities. |

The agreement governing the 2016 ABL Facility also contains a financial covenant that requires us to maintain a fixed charge coverage ratio that is tested whenever excess availability, as defined in such agreement, falls below a certain level. For more information regarding these covenants, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Outstanding Indebtedness.”

The agreement governing the Term Loan B Facility also contains a financial covenant that requires us to maintain a total debt leverage ratio that is tested quarterly.

A violation of covenants may result in default or an event of default under our debt agreements.

Upon the occurrence of an event of default under the agreement governing the 2016 ABL Facility or the Term Loan B Facility, the requisite lenders under the 2016 ABL Facility or the Term Loan B Facility, as applicable, could elect to declare all amounts of such indebtedness outstanding to be immediately due and payable and, in the case of the 2016 ABL Facility, terminate any commitments to extend further credit. If we are unable to repay those amounts, the lenders under such facilities may proceed against the collateral granted to them to secure such indebtedness. Substantially all of our assets are pledged as collateral under the 2016 ABL Facility and the Term Loan B Facility. If the lenders under either facility, as applicable, accelerate the repayment of borrowings, such acceleration would have a material adverse effect on our business, financial condition, results of operations or cash flows. Furthermore, cross-default provisions in the 2016 ABL Facility and the Term Loan B Facility provide that any default under the other facility or other significant debt agreements could trigger a cross-default under the 2016 ABL Facility or the Term Loan B Facility, as applicable. If we are unable to repay the amounts outstanding under these agreements or obtain replacement financing on acceptable terms, which ability will depend in part upon the impact of economic conditions on the liquidity of credit markets, our creditors may exercise their rights and remedies against us and the assets that serve as collateral for the debt, including initiating a bankruptcy proceeding.

Although the terms of the credit agreement governing the 2016 ABL Facility and the Term Loan B Facility contain restrictions on our ability to incur additional indebtedness, these restrictions are subject to a number of important qualifications and exceptions, which would allow us to borrow additional indebtedness. Additional leverage could have a material adverse effect on our business, financial condition and results of operations and could increase other risks harmful to our financial condition and results of operations.

For a more detailed description on the limitations on our ability to incur additional indebtedness and our compliance with financial covenants, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Outstanding Indebtedness.”

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash and the availability of our cash to service our indebtedness depends on many factors beyond our control, and any failure to meet our debt service obligations could harm our business, financial condition and results of operations.

If we do not generate sufficient cash flow from operations to satisfy our debt service obligations, including payments required to be made on the 2016 ABL Facility and the Term Loan B Facility, we may have to undertake alternative financing plans, such as refinancing or restructuring our indebtedness, selling assets, reducing or delaying capital investments or seeking to raise additional capital. Our ability to restructure or refinance our indebtedness will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our indebtedness could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. The terms of existing or future debt instruments (including the 2016 ABL Facility and the Term Loan B Facility) may restrict us from adopting some of these alternatives, which in turn could exacerbate the effects of any failure to generate sufficient cash flow to satisfy our debt service obligations. In addition, any failure to make payments of interest and principal on our outstanding indebtedness on a timely basis would likely result in a reduction of our credit ratings, which could harm our ability to incur additional indebtedness or refinance our indebtedness on acceptable terms. Furthermore, we might not be able to fulfill our cash needs if one or more of the financial institutions that are lenders under the 2016 ABL Facility were to default on its obligations to provide available borrowings under the 2016 ABL Facility, and such a default could have a material adverse effect on our liquidity and ability to operate our business.

Our inability to generate sufficient cash flow to satisfy our debt service obligations, or to refinance our obligations at all or on commercially reasonable terms, would have an adverse effect, which could be material, on our business, financial condition and results of operations, may restrict our current and future operations, particularly our ability to respond to business changes or to take certain actions, as well as on our ability to satisfy our obligations in respect of the 2016 ABL Facility and the Term Loan B Facility.

If we were to lose order volumes from any of our largest customers, our sales volumes, revenues and cash flows could be reduced.

Our business is exposed to risks related to customer concentration. Our five largest customers were responsible for approximately 30% of our net sales in 2016. A loss of order volumes from, or a loss of industry share by, any major customer could negatively affect our business, financial condition or results of operations by lowering sales volumes, increasing costs and lowering profitability. In addition, adverse economic and market conditions could also harm our business by negatively affecting our customers, which could impair their ability to pay for products they have purchased from our Company. Our balance sheet reflected an allowance for doubtful accounts totaling $0.5 million at December 31, 2016. If adverse economic and market conditions impair the ability of our customers to pay us in the future, our allowance for doubtful accounts and write-offs of accounts receivable from the Company’s customers may increase in the future, which could materially and adversely affect our financial condition and results of operations.

We do not have long-term contractual arrangements with a substantial number of our customers, and our sales volumes and net sales could be reduced if our customers switch some or all of their business with us to other suppliers.

In 2016, a majority of our net sales were generated from customers who do not have long-term contractual arrangements with us, including several of our largest customers. These customers purchase products and services from us on a purchase order basis and may choose not to continue to purchase our products and services. A significant loss of these customers or a significant reduction in their purchase orders could have a material negative impact on our sales volume and business, or cause us to reduce our prices, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our business could be disrupted if our customers shift either their manufacturing or sourcing offshore.

Much of our business depends on maintaining close geographical proximity to our customers because the costs of transporting metals across large distances can be prohibitive. If the general trend in relocating or contracting manufacturing capacity to foreign countries continues, especially those in the automotive parts, electrical connectors, and building and housing components industries, such relocations or contracting may disrupt or end our relationships with some customers and could lead to losing business to foreign competitors. In addition, some customers may seek to source their finished products offshore, thereby also increasing the amount of manufacturing offshore and thereby reducing demand for brass rod in the United States. These risks would increase to the extent we are unable to expand internationally when our customers do so.

Decreased demand from the United States Mint could have a material adverse effect on our business, financial condition and results of operations.

The United States Mint is a significant customer of Olin Brass. Olin Brass has a contractual arrangement to supply nickel and brass coinage strip to the two United States Mint locations. Our supply agreement with the United States Mint runs through 2017. The United States Mint can also terminate the contract in whole or in part for convenience, and the damages payable to us by the United States Mint for such a termination do not include lost profits. The loss or reduction of any authorized supplier arrangement with the United States Mint for coin manufacture could have a material adverse effect on our business, financial condition and results of operations. In addition, the United States Government contracting and procurement cycle can be affected by the timing of, and delays in, the legislative process. As a result, our net sales and operating income may fluctuate, causing us to occasionally experience declines in net sales or earnings as compared to the immediately preceding quarter, and comparisons of our operating results on a period-to-period basis may not be meaningful.

Additionally, trends in electronic commerce indicate a potential future reduction in demand for coinage strip, which could have a material adverse effect on our business, financial condition and results of operations. The U.S. Treasury department announced in December 2011 a halt in the production of Presidential dollar coins for circulation due to a lack of demand (which is primarily the result of the U.S. continuing the use of the dollar bill).

Although their production will continue for the collectibles market, it is uncertain when their production for circulation will be resumed. This action has adversely impacted our business and is expected to adversely impact our business over the next several years. Further actions to curtail coin production could have an adverse effect on our business, financial condition or results of operations.

Decreased demand from Orbital ATK, Inc. (“ATK”) could have a material adverse effect on our business, financial condition and results of operations.

Currently, a sizeable share of the production of our Olin Brass segment supports ATK, a supplier of munitions to the U.S. Army. ATK uses our product to service its contract with the U.S. Army to supply the U.S. Army’s arsenal located at Independence, Missouri. ATK is under contract with the U.S. Army to supply it with small-caliber ammunition and Olin Brass is under contract to supply ATK. In spite of these contractual arrangements, any decrease in demand from ATK or other disruption of our relationship with ATK could have a material adverse effect on our business, financial condition and results of operations.

Competition in our industry could adversely affect our business, financial condition and results of operations.

We are engaged in a highly competitive industry. Each of our segments competes with a limited number of companies. The Olin Brass segment competes with domestic and foreign manufacturers of copper and brass alloys in the form of strip, sheet and foil. The Chase Brass segment competes with domestic as well as foreign manufacturers of brass rod and beginning in 2013, encountered increased competition from foreign rod suppliers. The A.J. Oster segment primarily competes with distributors, mills and processors of copper and brass products. Furthermore, we believe that domestic sales to customers that are not made by major companies, including us, are fragmented among many smaller companies. In the future, these smaller companies may choose to combine, creating a more significant domestic competitor against our business. We may be required to explore additional initiatives in each of our segments in order to maintain our sales volume at a competitive level. Increased competition in any of the fields in which our segments operate could adversely affect our business, financial condition and results of operations.

Currently, anti-dumping orders impose import duties on copper and brass products from France, Germany, Italy and Japan which allow us and our domestic competitors to compete more fairly against French, German, Italian and Japanese producers in the U.S. copper and brass product market. On March 21, 2012, the International Trade Commission (“ITC”) Commissioners voted to continue anti-dumping orders for brass sheet and strip from Germany, Italy, France and Japan. While domestic manufacturers lobby for the continued extension of these orders, if they expire, import duties on metal products from these countries will be significantly reduced, increasing the ability of such foreign producers to compete with our products domestically. Additionally, on March 15, 2012, the United States-Korea Free Trade Agreement (“KORUS FTA”) became effective, which largely eliminates tariffs on Korean industrial products imported to the United States. The reduction in prices of Korean products resulting from the KORUS FTA has increased the ability of Korean manufacturers to compete with our products and has had a negative effect on our business. Furthermore, the termination of any anti-dumping orders or other changes to international trade regimes could adversely affect our business, financial condition and results of operations.

Adverse developments in our relationship with our employees could have a material adverse effect on our business, financial condition, results of operations and cash flows.