| Amplify Energy Corp. Rockies Transaction January 15, 2025 NYSE: AMPY |

| NYSE: AMPY Forward Looking Statements This presentation includes “forward-looking statements.” All statements, other than statements of historical fact, included in this presentation that addresses activities, events or developments that the Amplify Energy Corp. (the "Company") expects, believes or anticipates will or may occur in the future are forward-looking statements. Terminology such as “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements about the Company's expectations of plans, goals, strategies (including measures to implement strategies), objectives and anticipated results with respect thereto. These statements address activities, events or developments that we expect or anticipate will or may occur in the future, including things such as projections of results of operations, plans for growth, goals, future capital expenditures, competitive strengths, references to future intentions and other such references. These forward-looking statements involve risks and uncertainties and other factors that could cause the Company's actual results or financial condition to differ materially from those expressed or implied by forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this presentation specifically include the expectations of plans, strategies, objectives and growth and anticipated financial and operational performance of the Company and its affiliates, including whether the conditions to the proposed transaction can be satisfied, whether the proposed transaction will be completed, as expected or at all, and the timing of the closing of the transaction. Please read the Company's filings with the Securities and Exchange Commission (the “SEC”), including “Risk Factors” in the Company's Annual Report on Form 10-K, and if applicable, the Company's Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, which are available on the Company's Investor Relations website at https://www.amplifyenergy.com/investor- relations/default.aspx or on the SEC's website at http://www.sec.gov, for a discussion of risks and uncertainties that could cause actual results to differ from those in such forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. All forward-looking statements in this presentation are qualified in their entirety by these cautionary statements. Except as required by law, the Company undertakes no obligation and does not intend to update or revise any forward-looking statements, whether as a result of new information, future results or otherwise. Cautionary Note on Reserves and Resource Estimates The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves. Any reserve estimates provided in this presentation that are not specifically designated as being estimates of proved reserves may include estimated reserves or locations not necessarily calculated in accordance with, or contemplated by, the SEC’s latest reserve reporting guidelines. You are urged to consider closely the oil and gas disclosures in the Company’s 2023 Annual Report on Form 10-K and our other reports and filings with the SEC. 2 |

| Non-GAAP Disclosure This presentation includes non-GAAP (generally accepted accounting principles) financial measures, including projections of the non-GAAP financial measures of free cash flow and PV10. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the components of the calculations being inherently unpredictable, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward-looking non-GAAP financial measures is included. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of results as reported under GAAP. For additional disclosure regarding the Company's historical non-GAAP measures, including how we define such measures, please refer to the Company's third-quarter 2024 earnings materials and related Form 10-Q filed with the SEC. Additional Information and Where to Find it This presentation relates to the proposed Transaction between Amplify and Juniper. In connection with the proposed Transaction, Amplify will file with the SEC a proxy statement on Schedule 14A (the “Proxy Statement”). Amplify will also file other documents regarding the proposed Transaction with the SEC. The Proxy Statement will be sent or given to the Amplify's stockholders and will contain important information about the Transaction and related matters. INVESTORS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION WITH RESPECT TO THE TRANSACTION AND THE OTHER AGREEMENTS CONTEMPLATED BY THE MERGER AGREEMENT. You may obtain a free copy of the Proxy Statement (if and when it becomes available) and other relevant documents filed by Amplify with the SEC at the SEC's website at www.sec.gov. You may also obtain Amplify's documents on its website at https://www.amplifyenergy.com/investor- relations/default.aspx. Participants in the Solicitation Amplify, Juniper and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with certain matters related to the Transaction and may have direct or indirect interests in the Transaction. Information about Amplify's directors and executive officers is set forth in Amplify's Proxy Statement on Schedule 14A for its 2024 Annual Meeting of Stockholders, filed with the SEC on April 5, 2024, its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 7, 2024, and its other documents filed with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Investors should read the Proxy Statement carefully when it becomes available before making any voting or investment decisions. Investors may obtain free copies of these documents using the sources indicated above. NYSE: AMPY Disclosures 3 |

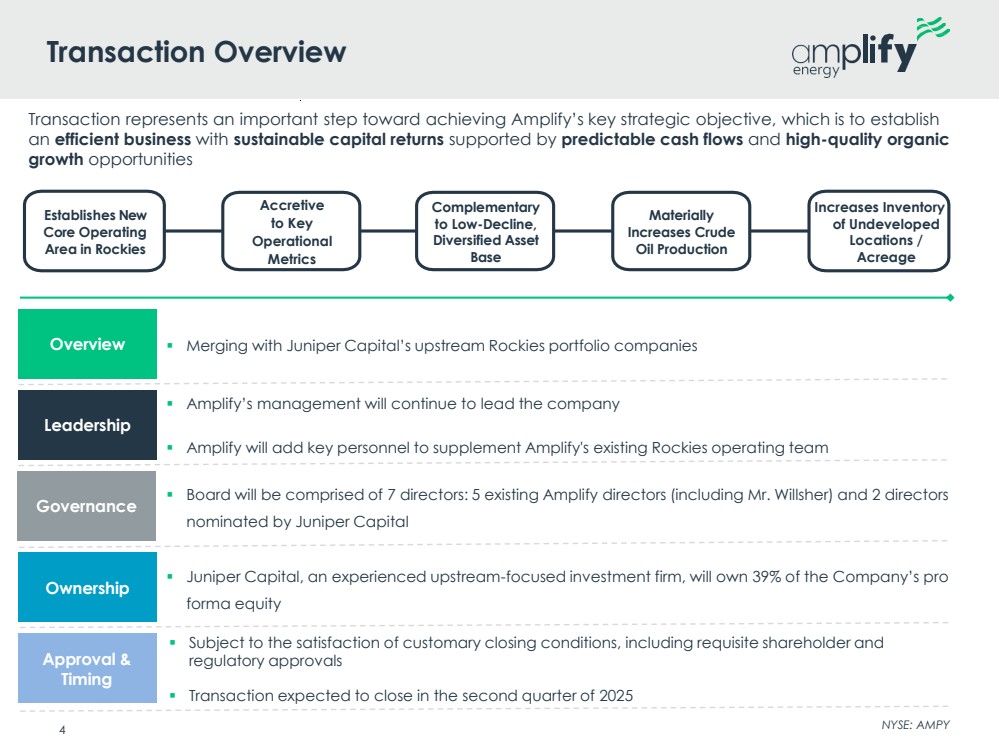

| ▪ Amplify’s management will continue to lead the company ▪ Amplify will add key personnel to supplement Amplify's existing Rockies operating team Transaction Overview ▪ Board will be comprised of 7 directors: 5 existing Amplify directors (including Mr. Willsher) and 2 directors nominated by Juniper Capital ▪ Juniper Capital, an experienced upstream-focused investment firm, will own 39% of the Company’s pro forma equity ▪ Subject to the satisfaction of customary closing conditions, including requisite shareholder and regulatory approvals ▪ Transaction expected to close in the second quarter of 2025 Establishes New Core Operating Area in Rockies Complementary to Low-Decline, Diversified Asset Base Materially Increases Crude Oil Production Accretive to Key Operational Metrics Increases Inventory of Undeveloped Locations / Acreage ▪ Merging with Juniper Capital’s upstream Rockies portfolio companies Transaction represents an important step toward achieving Amplify’s key strategic objective, which is to establish an efficient business with sustainable capital returns supported by predictable cash flows and high-quality organic growth opportunities NYSE: AMPY Overview Leadership Governance Ownership Approval & Timing 4 |

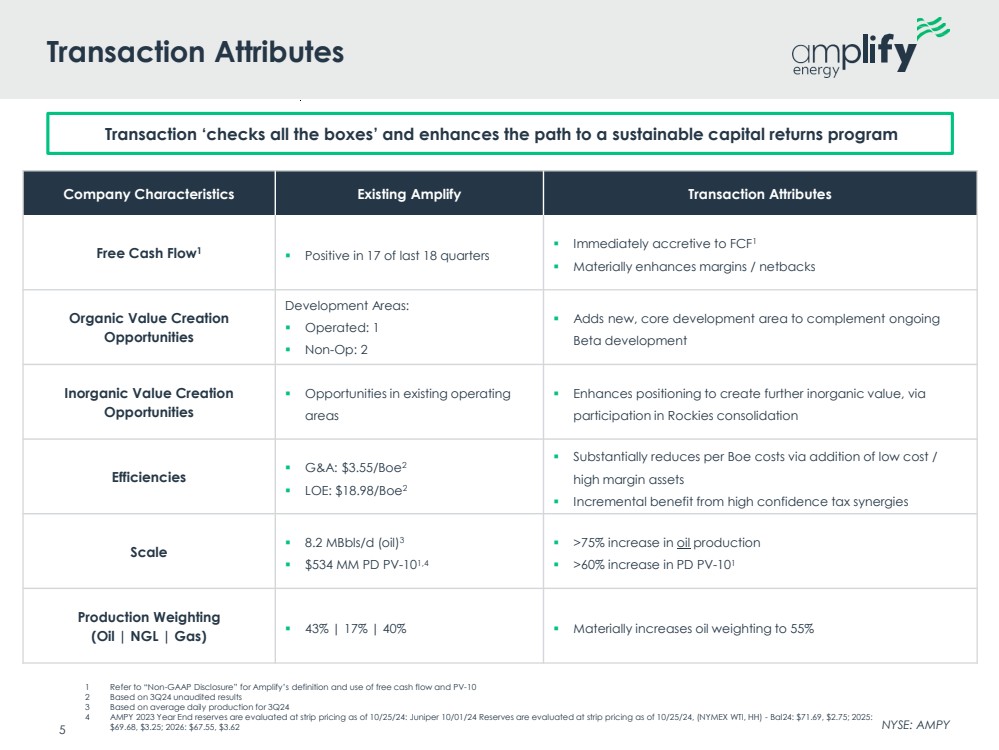

| Transaction Attributes Company Characteristics Existing Amplify Transaction Attributes Free Cash Flow1 ▪ Positive in 17 of last 18 quarters ▪ Immediately accretive to FCF1 ▪ Materially enhances margins / netbacks Organic Value Creation Opportunities Development Areas: ▪ Operated: 1 ▪ Non-Op: 2 ▪ Adds new, core development area to complement ongoing Beta development Inorganic Value Creation Opportunities ▪ Opportunities in existing operating areas ▪ Enhances positioning to create further inorganic value, via participation in Rockies consolidation Efficiencies ▪ G&A: $3.55/Boe2 ▪ LOE: $18.98/Boe2 ▪ Substantially reduces per Boe costs via addition of low cost / high margin assets ▪ Incremental benefit from high confidence tax synergies Scale ▪ 8.2 MBbls/d (oil)3 ▪ $534 MM PD PV-101,4 ▪ >75% increase in oil production ▪ >60% increase in PD PV-101 Production Weighting (Oil | NGL | Gas) ▪ 43% | 17% | 40% ▪ Materially increases oil weighting to 55% NYSE: AMPY 1 Refer to “Non-GAAP Disclosure” for Amplify’s definition and use of free cash flow and PV-10 2 Based on 3Q24 unaudited results 3 Based on average daily production for 3Q24 4 AMPY 2023 Year End reserves are evaluated at strip pricing as of 10/25/24: Juniper 10/01/24 Reserves are evaluated at strip pricing as of 10/25/24, (NYMEX WTI, HH) - Bal24: $71.69, $2.75; 2025: $69.68, $3.25; 2026: $67.55, $3.62 5 Transaction ‘checks all the boxes’ and enhances the path to a sustainable capital returns program |

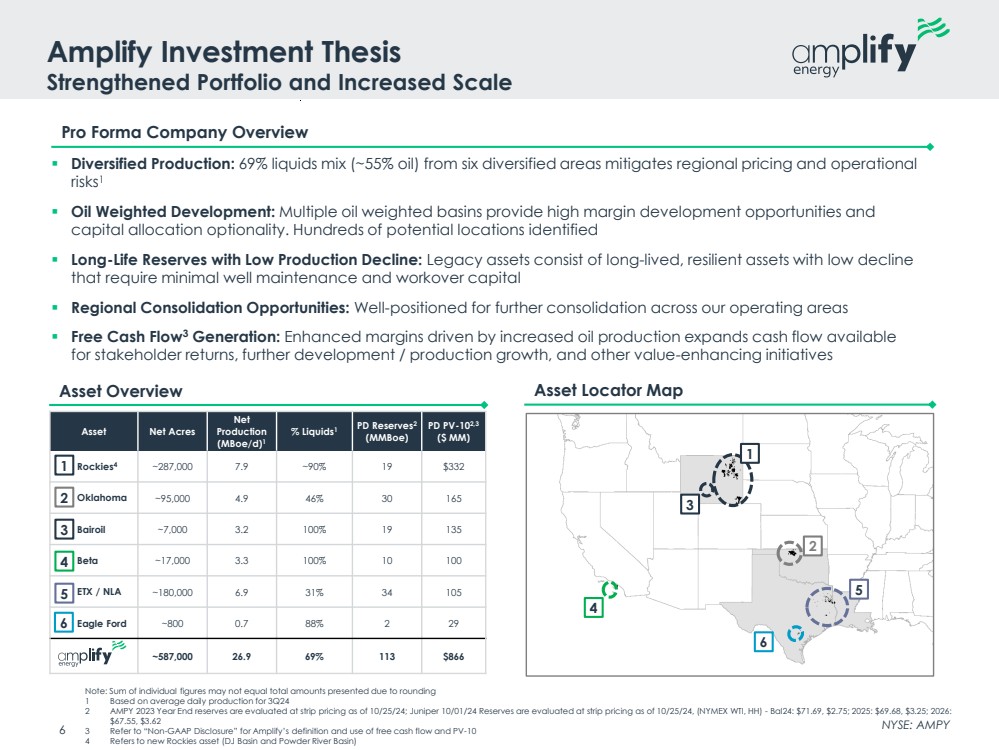

| ▪ Diversified Production: 69% liquids mix (~55% oil) from six diversified areas mitigates regional pricing and operational risks1 ▪ Oil Weighted Development: Multiple oil weighted basins provide high margin development opportunities and capital allocation optionality. Hundreds of potential locations identified ▪ Long-Life Reserves with Low Production Decline: Legacy assets consist of long-lived, resilient assets with low decline that require minimal well maintenance and workover capital ▪ Regional Consolidation Opportunities: Well-positioned for further consolidation across our operating areas ▪ Free Cash Flow3 Generation: Enhanced margins driven by increased oil production expands cash flow available for stakeholder returns, further development / production growth, and other value-enhancing initiatives 4 3 5 6 Pro Forma Company Overview Asset Overview 2 1 Asset Net Acres Net Production (MBoe/d)1 % Liquids1 PD Reserves2 (MMBoe) PD PV-102,3 ($ MM) Rockies4 ~287,000 7.9 ~90% 19 $332 Oklahoma ~95,000 4.9 46% 30 165 Bairoil ~7,000 3.2 100% 19 135 Beta ~17,000 3.3 100% 10 100 ETX / NLA ~180,000 6.9 31% 34 105 Eagle Ford ~800 0.7 88% 2 29 ~587,000 26.9 69% 113 $866 2 4 3 5 1 6 Asset Locator Map NYSE: AMPY Note: Sum of individual figures may not equal total amounts presented due to rounding 1 Based on average daily production for 3Q24 2 AMPY 2023 Year End reserves are evaluated at strip pricing as of 10/25/24; Juniper 10/01/24 Reserves are evaluated at strip pricing as of 10/25/24, (NYMEX WTI, HH) - Bal24: $71.69, $2.75; 2025: $69.68, $3.25; 2026: $67.55, $3.62 3 Refer to “Non-GAAP Disclosure” for Amplify’s definition and use of free cash flow and PV-10 4 Refers to new Rockies asset (DJ Basin and Powder River Basin) Amplify Investment Thesis Strengthened Portfolio and Increased Scale 6 |

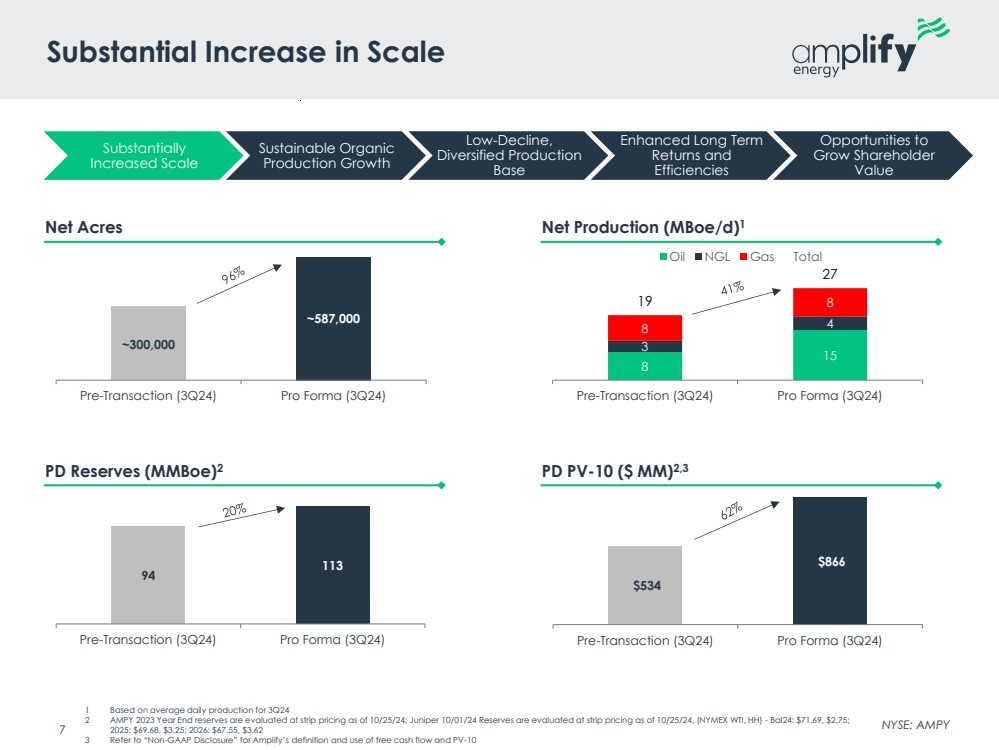

| 8 15 3 4 8 19 8 27 Pre-Transaction (3Q24) Pro Forma (3Q24) Oil NGL Gas Total 94 113 Pre-Transaction (3Q24) Pro Forma (3Q24) $534 $866 Pre-Transaction (3Q24) Pro Forma (3Q24) ~300,000 ~587,000 Pre-Transaction (3Q24) Pro Forma (3Q24) NYSE: AMPY Substantial Increase in Scale Net Acres 7 Substantially Increased Scale Sustainable Organic Production Growth Low-Decline, Diversified Production Base Enhanced Long Term Returns and Efficiencies Opportunities to Grow Shareholder Value Net Production (MBoe/d)1 PD Reserves (MMBoe) 2 PD PV-10 ($ MM)2,3 1 Based on average daily production for 3Q24 2 AMPY 2023 Year End reserves are evaluated at strip pricing as of 10/25/24; Juniper 10/01/24 Reserves are evaluated at strip pricing as of 10/25/24, (NYMEX WTI, HH) - Bal24: $71.69, $2.75; 2025: $69.68, $3.25; 2026: $67.55, $3.62 3 Refer to “Non-GAAP Disclosure” for Amplify’s definition and use of free cash flow and PV-10 |

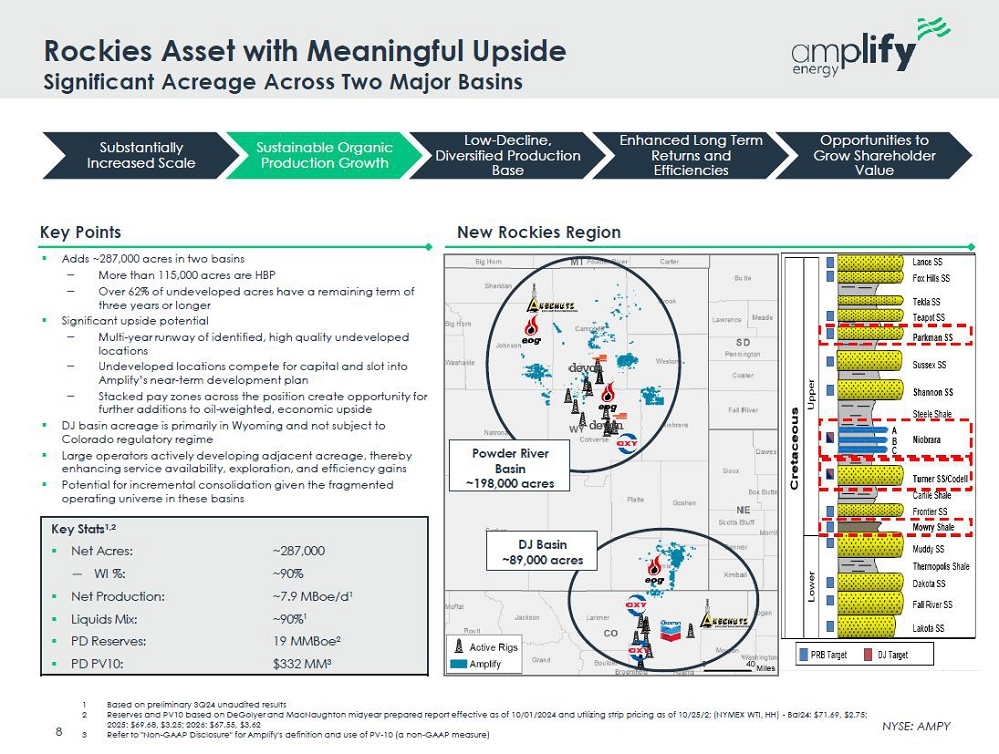

| 1 Based on preliminary 3Q24 unaudited results 2 Reserves and PV10 based on DeGolyer and MacNaughton midyear prepared report effective as of 10/01/2024 and utilizing strip pricing as of 10/25/2; (NYMEX WTI, HH) - Bal24: $71.69, $2.75; 2025: $69.68, $3.25; 2026: $67.55, $3.62 3 Refer to "Non-GAAP Disclosure" for Amplify's definition and use of PV-10 (a non-GAAP measure) Key Stats1,2 ▪ Net Acres: ~287,000 ─ WI %: ~90% ▪ Net Production: ~7.9 MBoe/d1 ▪ Liquids Mix: ~90%1 ▪ PD Reserves: 19 MMBoe2 ▪ PD PV10: $332 MM3 Key Points ▪ Adds ~287,000 acres in two basins – More than 115,000 acres are HBP – Over 62% of undeveloped acres have a remaining term of three years or longer ▪ Significant upside potential – Multi-year runway of identified, high quality undeveloped locations – Undeveloped locations compete for capital and slot into Amplify’s near-term development plan – Stacked pay zones across the position create opportunity for further additions to oil-weighted, economic upside ▪ DJ basin acreage is in Wyoming and not subject to Colorado regulatory regime ▪ Large operators actively developing adjacent acreage, thereby enhancing service availability, exploration, and efficiency gains ▪ Potential for incremental consolidation given the fragmented operating universe in these basins New Rockies Region Powder River Basin ~198,000 acres DJ Basin ~89,000 acres NYSE: AMPY Rockies Asset with Meaningful Upside Significant Acreage Across Two Major Basins Substantially Increased Scale Sustainable Organic Production Growth Low-Decline, Diversified Production Base Enhanced Long Term Returns and Efficiencies Opportunities to Grow Shareholder Value 8 |

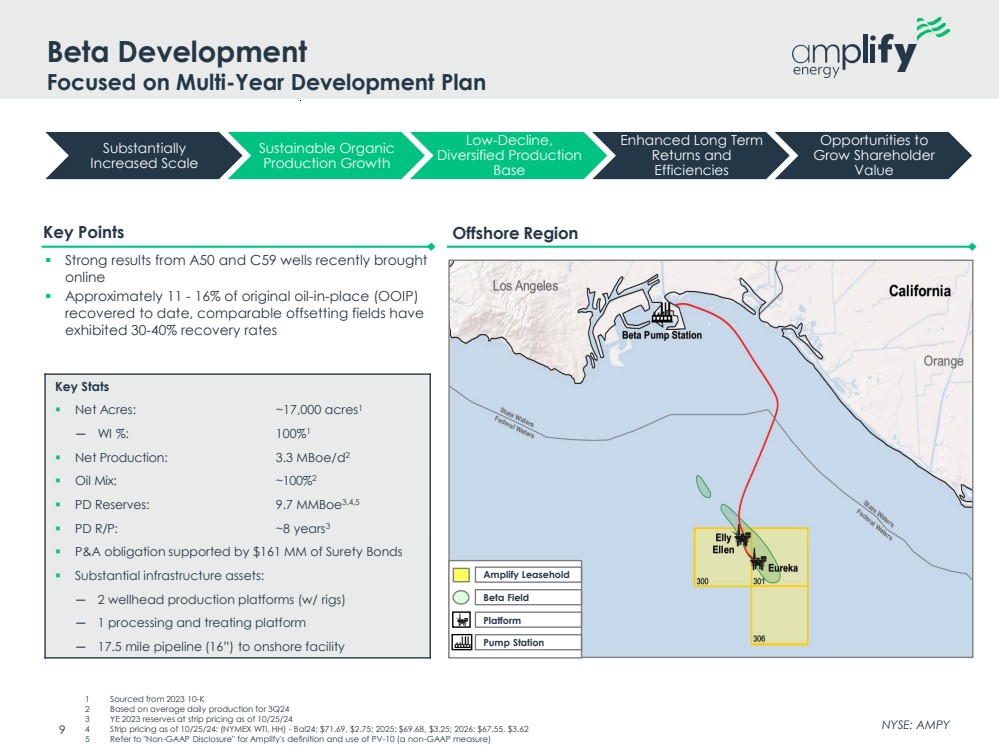

| Key Points Amplify Leasehold Beta Field Platform Pump Station Offshore Region NYSE: AMPY Beta Development Focused on Multi-Year Development Plan 1 Sourced from 2023 10-K 2 Based on average daily production for 3Q24 3 YE 2023 reserves at strip pricing as of 10/25/24 4 Strip pricing as of 10/25/24: (NYMEX WTI, HH) - Bal24: $71.69, $2.75; 2025: $69.68, $3.25; 2026: $67.55, $3.62 5 Refer to "Non-GAAP Disclosure" for Amplify's definition and use of PV-10 (a non-GAAP measure) ▪ Strong results from A50 and C59 wells recently brought online ▪ Approximately 11 - 16% of original oil-in-place (OOIP) recovered to date, comparable offsetting fields have exhibited 30-40% recovery rates Key Stats ▪ Net Acres: ~17,000 acres1 ─ WI %: 100%1 ▪ Net Production: 3.3 MBoe/d2 ▪ Oil Mix: ~100%2 ▪ PD Reserves: 9.7 MMBoe3,4,5 ▪ PD R/P: ~8 years3 ▪ P&A obligation supported by $161 MM of Surety Bonds ▪ Substantial infrastructure assets: ─ 2 wellhead production platforms (w/ rigs) ─ 1 processing and treating platform ─ 17.5 mile pipeline (16”) to onshore facility 9 Substantially Increased Scale Sustainable Organic Production Growth Low-Decline, Diversified Production Base Enhanced Long Term Returns and Efficiencies Opportunities to Grow Shareholder Value |

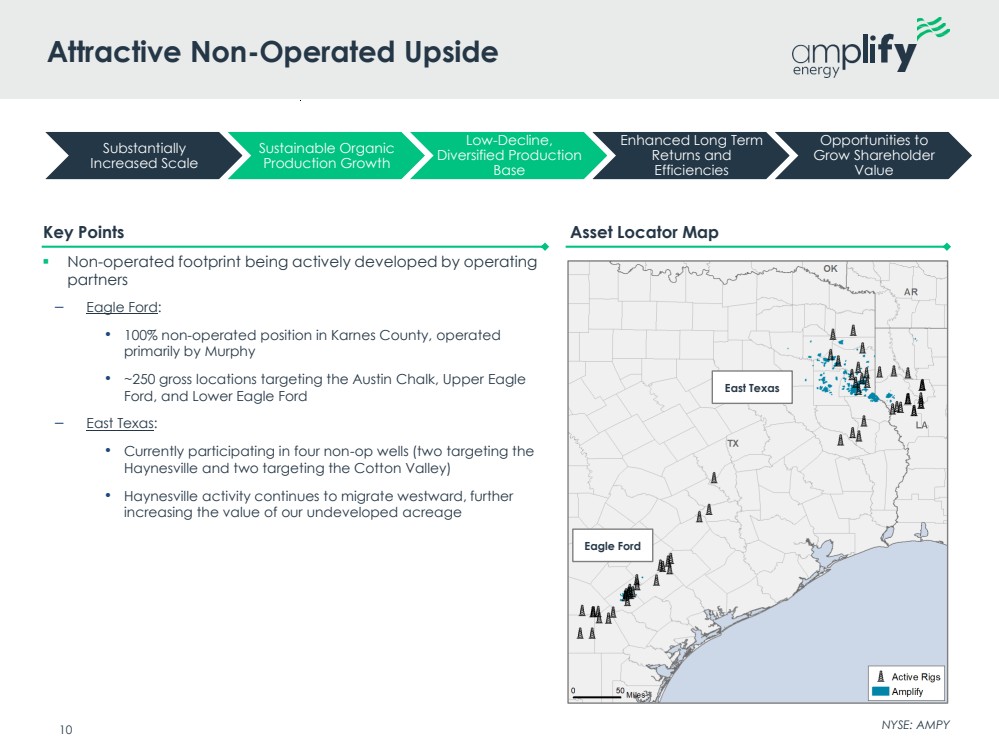

| Asset Locator Map ▪ Non-operated footprint being actively developed by operating partners – Eagle Ford: • 100% non-operated position in Karnes County, operated primarily by Murphy • ~250 gross locations targeting the Austin Chalk, Upper Eagle Ford, and Lower Eagle Ford – East Texas: • Currently participating in four non-op wells (two targeting the Haynesville and two targeting the Cotton Valley) • Haynesville activity continues to migrate westward, further increasing the value of our undeveloped acreage NYSE: AMPY Attractive Non-Operated Upside Key Points Eagle Ford East Texas 10 Substantially Increased Scale Sustainable Organic Production Growth Low-Decline, Diversified Production Base Enhanced Long Term Returns and Efficiencies Opportunities to Grow Shareholder Value |

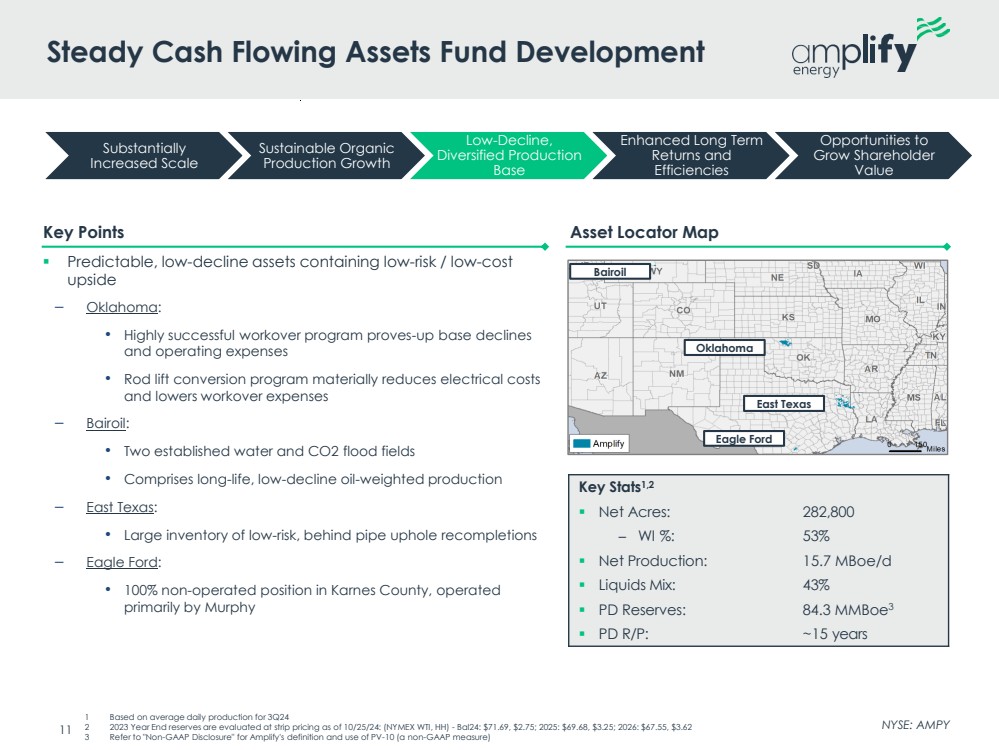

| Asset Locator Map NYSE: AMPY Steady Cash Flowing Assets Fund Development 1 Based on average daily production for 3Q24 2 2023 Year End reserves are evaluated at strip pricing as of 10/25/24: (NYMEX WTI, HH) - Bal24: $71.69, $2.75; 2025: $69.68, $3.25; 2026: $67.55, $3.62 3 Refer to "Non-GAAP Disclosure" for Amplify's definition and use of PV-10 (a non-GAAP measure) Key Points ▪ Predictable, low-decline assets containing low-risk / low-cost upside – Oklahoma: • Highly successful workover program proves-up base declines and operating expenses • Rod lift conversion program materially reduces electrical costs and lowers workover expenses – Bairoil: • Two established water and CO2 flood fields • Comprises long-life, low-decline oil-weighted production – East Texas: • Large inventory of low-risk, behind pipe uphole recompletions – Eagle Ford: • 100% non-operated position in Karnes County, operated primarily by Murphy Bairoil Oklahoma East Texas Eagle Ford Key Stats1,2 ▪ Net Acres: 282,800 ─ WI %: 53% ▪ Net Production: 15.7 MBoe/d ▪ Liquids Mix: 43% ▪ PD Reserves: 84.3 MMBoe3 ▪ PD R/P: ~15 years 11 Substantially Increased Scale Sustainable Organic Production Growth Low-Decline, Diversified Production Base Enhanced Long Term Returns and Efficiencies Opportunities to Grow Shareholder Value |

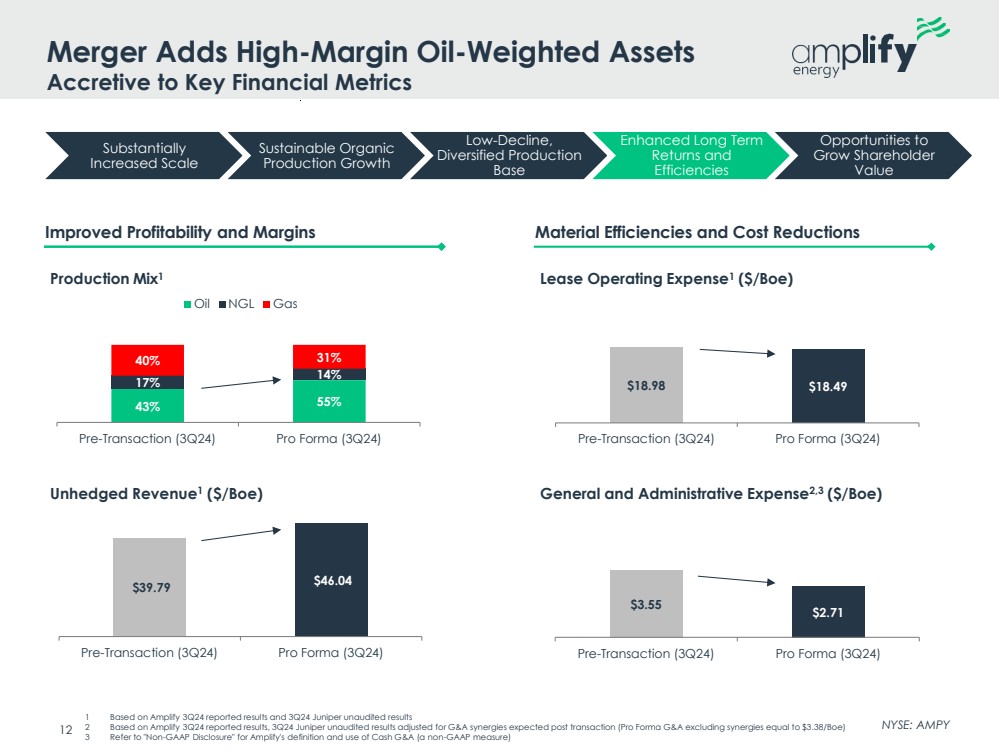

| $3.55 $2.71 Pre-Transaction (3Q24) Pro Forma (3Q24) $39.79 $46.04 Pre-Transaction (3Q24) Pro Forma (3Q24) $18.98 $18.49 Pre-Transaction (3Q24) Pro Forma (3Q24) Lease Operating Expense1 Production Mix ($/Boe) 1 General and Administrative Expense2,3 Unhedged Revenue ($/Boe) 1 ($/Boe) Material Efficiencies and Cost Reductions NYSE: AMPY Merger Adds High-Margin Oil-Weighted Assets Accretive to Key Financial Metrics 1 Based on Amplify 3Q24 reported results and 3Q24 Juniper unaudited results 2 Based on Amplify 3Q24 reported results, 3Q24 Juniper unaudited results adjusted for G&A synergies expected post transaction (Pro Forma G&A excluding synergies equal to $3.38/Boe) 3 Refer to "Non-GAAP Disclosure" for Amplify's definition and use of Cash G&A (a non-GAAP measure) Improved Profitability and Margins 12 Substantially Increased Scale Sustainable Organic Production Growth Low-Decline, Diversified Production Base Enhanced Long Term Returns and Efficiencies Opportunities to Grow Shareholder Value 43% 55% 17% 14% 40% 31% Pre-Transaction (3Q24) Pro Forma (3Q24) Oil NGL Gas |

| Sustainable Cash Flow Enhanced by Organic Growth ▪ Predictable and diversified portfolio of low-decline assets ▪ Substantial organic value-creation opportunities across multiple regions and commodities – Rockies addition adds long-term development potential (as well as current production) – Beta upside value has been demonstrated by recent development successes – Attractive non-op development opportunities in East Texas and Eagle Ford ▪ Disciplined approach to development activities—targeting strong cash flow returns and IRRs ▪ Continue to improve scale and efficiencies via targeted, value-accretive A&D program – Rockies addition provides a natural focus for incremental consolidation given the fragmented operating universe in those basins – Existing, core operating areas represent additional opportunities for accretive acquisitions and portfolio optimization ▪ Management team has deep experience operating diverse assets across the Lower 48 Well-Positioned for Inorganic Value Creation NYSE: AMPY 13 Positioned to Grow Shareholder Value Substantially Increased Scale Sustainable Organic Production Growth Low-Decline, Diversified Production Base Enhanced Long Term Returns and Efficiencies Opportunities to Grow Shareholder Value |

| ✓ Enhances near-term and long-term free cash flow ✓ Increases scale and operational / G&A efficiency ✓ Increases high-quality, economic inventory ✓ Positions the Company for further strategic consolidation opportunities NYSE: AMPY 14 Creating Compelling Value For Shareholders Disciplined Approach to Sustainable Returns |

| NYSE: AMPY |