UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or |

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-35462

Vantiv, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 26-4532998 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

8500 Governor’s Hill Drive

Symmes Township, OH 45249

(Address of principal executive offices)

Registrant's telephone number, including area code: (513) 900-5250

Securities registered pursuant to 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Class A Common Stock, $0.00001 par value | | New York Stock Exchange |

Securities registered pursuant to 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | |

Large accelerated filer x | | Accelerated filer o |

Non-accelerated filer o | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 28, 2013 (the last business day of the registrant's most recently completed second fiscal quarter), the aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant was $2.4 billion.

As of December 31, 2013, there were 141,758,681 shares of the registrant’s Class A common stock outstanding and 48,822,826 shares of the registrant’s Class B common stock outstanding.

|

|

| |

| Documents Incorporated by Reference: |

Portions of the registrant's definitive Proxy Statement for the 2014 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K as indicated. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant's fiscal year ended December 31, 2013.

VANTIV, INC.

FORM 10-K

For the Fiscal Year Ended December 31, 2013

TABLE OF CONTENTS

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including the sections entitled "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and "Risk Factors," contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, our objectives for future operations, and any statements of a general economic or industry specific nature, are forward-looking statements. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. Words such as "anticipate," "estimate," "expect," "project," "plan," "intend," "believe," "may," "will," "continue," "could," "should," "can have," "likely," or the negative or plural of these words and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe, based on information currently available to our management, may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the "Risk Factors" section of this report. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations and assumptions reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We undertake no obligation to publicly update any forward-looking statement after the date of this report, whether as a result of new information, future developments or otherwise, or to conform these statements to actual results or revised expectations, except as may be required by law.

PART I

Item 1. Business

Vantiv, Inc., a Delaware corporation, is a holding company that conducts its operations through its majority-owned subsidiary, Vantiv Holding, LLC ("Vantiv Holding"). Vantiv, Inc., Vantiv Holding and their subsidiaries are referred to collectively as the "Company," "Vantiv," "we," "us" or "our," unless the context requires otherwise.

Business Description

Vantiv is a leading, integrated payment processor differentiated by a single, proprietary technology platform. According to the Nilson Report, we are the third largest merchant acquirer and the largest PIN debit acquirer by transaction volume in the United States. We efficiently provide a suite of comprehensive services to merchants and financial institutions of all sizes. Our technology platform offers our clients a single point of service that is easy to connect to and use in order to access a broad range of payment services and solutions. Our integrated business and single platform also enable us to innovate, develop and deploy new services and provide us with significant economies of scale. Our varied and broad distribution provides us with diverse client base and referral partner relationships. We believe this combination of attributes provides us with competitive advantages and has enabled us to generate strong growth and profitability.

We believe our single, proprietary technology platform is differentiated from our competitors' multiple platform architectures. Because of our single point of service and ability to collect, manage and analyze data across the payment processing value chain, we can identify and develop new services more efficiently. Once developed, we can more cost-effectively deploy new solutions to our clients through our single platform. Our single scalable platform also enables us to efficiently manage, update and maintain our technology, increase capacity and speed and realize significant operating leverage.

We offer a broad suite of payment processing services that enable our clients to meet their payment processing needs through a single provider. We enable merchants of all sizes to accept and process credit, debit and prepaid payments and provide them supporting services, such as information solutions, interchange management and fraud management, as well as vertical-specific solutions in sectors such as grocery, pharmacy, retail and restaurants/quick service restaurants or QSRs. We also provide mission critical payment services to financial institutions, such as card issuer processing, payment network processing, fraud protection, card production, prepaid program management, ATM driving and network gateway and switching services that utilize our proprietary Jeanie PIN debit payment network.

We provide small and mid-sized clients with the comprehensive solutions that we have developed to meet the extensive requirements of our large merchant and financial institution clients. We then tailor these solutions to the unique needs of our small and mid-sized clients. In addition, we take a consultative approach to providing services that helps our clients enhance their payments-related services.

Our capabilities differentiate us from other payment processors that focus primarily on just merchant acquiring, card issuer processing or network services and those that operate multiple businesses on disparate technology platforms. Through our integrated business, we believe we can manage our business more efficiently, benefiting both our merchant and financial institution clients and resulting in increased profitability. We are also well positioned to provide payment solutions for high growth markets, such as ecommerce, mobile payment offerings and prepaid because we process payment transactions across the entire payment processing value chain on a single platform.

We distribute our services through diversified distribution channels using a unified sales approach that enables us to efficiently and effectively target merchants and financial institutions of all sizes. These channels include a national sales force that targets financial institutions and national merchants, regional and mid-market sales teams that sell solutions to merchants and third-party reseller clients and a telesales operation that targets small and mid-sized merchants. In addition, we have relationships with a broad range of referral partners, such as merchant banks; technology partners, which include independent software vendors, or ISVs, value-added resellers, or VARs and payment facilitators; independent sales organizations, or ISOs, and trade associations that target a broad range of merchants, including difficult to reach small and mid-sized merchants. We also have relationships with third-party resellers and core processors that target financial institutions.

We have a broad and diversified merchant and financial institution client base. Our merchant client base includes over 400,000 merchant locations, has low client concentration and is heavily weighted in non-discretionary everyday spend categories, such as grocery and pharmacy, and includes large national retailers, including eight of the top 25 national retailers by revenue in 2012. Our financial institution client base is also well diversified and includes approximately 1,400 financial institutions.

Our History and Separation from Fifth Third Bank

We have a 40 year history of providing payment processing services. We operated as a business unit of Fifth Third Bank until June 2009 when certain funds managed by Advent International Corporation, or Advent, acquired a majority interest in Fifth Third Bank's payment processing business unit with the goal of creating a separate stand-alone company. Since the separation, we established our own organization, headquarters, brand, growth strategy and completed our initial public offering in March 2012. As a stand-alone company, we have made substantial investments to enhance our single, proprietary technology platform, recruit additional executives with significant payment processing and operating experience, expand our sales force, reorganize our business to better align it with our market opportunities and broaden our geographic footprint beyond the markets traditionally served by Fifth Third Bank. In addition, since the separation, we have made five strategic acquisitions. We acquired NPC Group, Inc., or NPC, to substantially enhance our access to small to mid-sized merchants, Town North Bank, N.A., or TNB, to broaden our market position with credit unions, and Springbok Services, Inc., or Springbok, to expand our prepaid processing capabilities. In November 2012, we acquired Litle & Co., LLC, or Litle, to increase the Company's capabilities in the ecommerce business, expand its customer base of online merchants, and allow the delivery of Litle's innovative ecommerce solutions to our merchant and financial institution clients. In July 2013, we acquired Element Payment Services, Inc., or Element, which provides us strategic capabilities to partner with ISVs and to increase our presence in the integrated payments market.

We continue to benefit from our relationship with Fifth Third Bank. Fifth Third Bank is one of our largest financial institution clients, one of our sponsor banks for network membership and one of our most significant merchant bank referral partners. Our client contract with Fifth Third Bank as well as our sponsorship and referral agreements with Fifth Third Bank have terms through June 2019.

Industry Background

Electronic Payments

Over the past 60 years, electronic payments in the United States have evolved into a large and growing market with favorable secular trends that continue to increase the adoption and use of card-based payment services, such as those for credit, debit and prepaid cards. Electronic payments have historically involved (i) financial institutions that issue cards, (ii) merchants that accept cards for payment (iii) payment networks that route card transactions between the merchant's bank and the issuing financial institution, and (iv) payment processors that provide payment transaction processing services to merchants and financial institutions.

According to The Nilson Report, personal consumption expenditures in the United States using cards and other electronic payments reached $5.7 trillion in 2012 and are projected to reach $8.6 trillion in 2017, representing a compound annual growth rate of approximately 8.5% during that period. This growth will be driven by the shift from cash and checks towards card-based and other electronic payments due to their greater convenience, security, enhanced services and rewards and loyalty features. We believe changing demographics and emerging trends, such as the adoption of new technologies and business models, including ecommerce, mobile commerce and prepaid services, will also continue to drive growth in electronic payments.

Payment Processing Industry

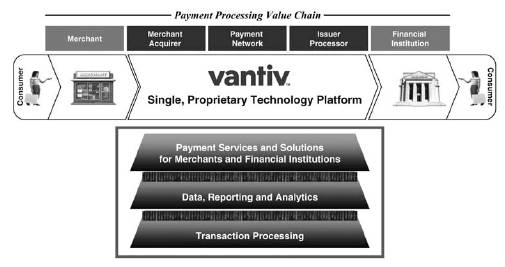

The payment processing industry is comprised of various processors that create and manage the technology infrastructure that enables electronic payments. Payment processors help merchants and financial institutions develop and offer electronic payment solutions to their customers, facilitate the routing and processing of electronic payment transactions and manage a range of supporting security, value-added and back office services. In addition, many large banks manage and process their card accounts in-house. This is collectively referred to as the payment processing value chain and is illustrated below:

The payment processing value chain encompasses three key types of processing:

| |

| • | Merchant Acquiring Processing. Merchant acquiring processors sell electronic payment acceptance, processing and supporting services to merchants and third-party resellers. These processors route transactions originated at the point of sale at a merchant location or on a website to the appropriate payment networks for authorization, known as "front-end" processing, and then ensure that each transaction is appropriately cleared and settled into the merchant's bank account, known as "back-end" processing. Many of these processors also provide specialized reporting, back office support, risk management and other value-added services to merchants. Merchant acquirers charge merchants based on a percentage of the value of each transaction or per transaction. Merchant acquirers pay the payment network processors a routing fee per transaction and pass through interchange fees to the issuing financial institution. |

| |

| • | Payment Network Processing. Payment network processors, such as Visa, MasterCard and PIN debit payment networks, sell electronic payment network routing and support services to financial institutions that issue cards and merchant acquirers that provide transaction processing. Depending on their market position and network capabilities, these providers route credit, debit and prepaid card transactions from merchant acquiring processors to the financial institution that issued the card, and they ensure that the financial institution's authorization approvals are routed back to the merchant acquiring processor and that transactions are appropriately settled between the merchant's bank and the card-issuing financial institution. These providers also provide specialized risk management and other value-added services to financial institutions. Payment networks charge merchant acquiring processors and issuing financial institutions routing fees per transaction and monthly or annual maintenance fees and assessments. |

| |

| • | Issuer Card Processing. Issuer card processors sell electronic payment issuing, processing and supporting services to financial institutions. These providers authorize transactions received from the payment networks and ensure that each transaction is appropriately cleared and settled from the originating card account. These companies also provide specialized program management, reporting, outsourced customer service, back office support, risk management and other value-added services to financial institutions. Card processors charge issuing financial institutions fees based on the number of transactions processed and the number of cards that are managed. |

Many payment processors specialize in providing services in discrete areas of the payment processing value chain, which can result in merchants and financial institutions using payment processing services from multiple providers. A limited number of payment processors have capabilities or offer services in multiple parts of the payment processing value chain. Many processors that provide solutions targeting more than one part of the payment processing value chain utilize multiple, disparate technology platforms requiring their clients to access payment processing services through multiple points of contact. In contrast, we provide solutions across the payment processing value chain primarily utilizing a single integrated technology platform that enables clients to easily access a broad range of payment processing services through a single point of service.

Emerging Trends and Opportunities in the Payment Processing Industry

The payment processing industry will continue to adopt new technologies, develop new products and services, evolve new business models and experience new market entrants and changes in the regulatory environment. In the near-term, we believe merchants and financial institutions will seek services that help them enhance their own offerings to consumers, provide additional information solution services to help them run their businesses more efficiently and develop new products and services that provide tangible, incremental revenue streams. To meet these demands, we believe that payment processors may seek to develop additional capabilities and expand across the payment processing value chain to capture additional data and provide additional value per transaction. To facilitate this expansion and deliver more robust service offerings, we believe that payment processors will need to develop and seek greater control over and integration of their proprietary technology processing platforms, to enable them to deliver and differentiate their offerings from other providers.

Over the medium- to long-term, we believe that emerging, alternative payment technologies, such as mobile payments, electronic wallets, mobile marketing offers and incentives and rewards services, will be adopted by merchants and other businesses. As a result, non-financial institution enterprises, such as mobile payment providers, internet, retail and social media companies, could become more active participants in the development of alternative electronic payments and facilitate the convergence of retail, online, mobile and social commerce applications, representing an attractive growth opportunity for the industry. We believe that payment processors that have an integrated business, provide solutions across the payment processing value chain and utilize broad distribution capabilities will have a significant market advantage, because they will be better able to provide processing services for emerging alternative electronic payment technologies and to successfully partner with new market entrants.

Our Business

We are a leading provider of payment processing services to merchants and financial institutions across the payment processing value chain. We provide our solutions through our single, proprietary technology platform. Set forth below is a description of our technology platform and our merchant and financial institution clients and services.

Single, Proprietary Technology Platform

Our technology platform provides a single point of service to access our broad suite of solutions, is easy to connect to and use and enables us to innovate, develop and deploy new services and to produce our value-added information solutions, all while providing economies of scale.

| |

| • | Single Point of Service. We provide our clients with a single point of service through which they can access our comprehensive suite of solutions across the payment processing value chain. For example, our financial |

institution clients can utilize our payment processing solutions, our information solutions and our prepaid solutions all from a single Vantiv interface, which distinguishes us from our multi-platform competitors.

| |

| • | Ease of Connection and Delivery. Both our merchant and financial institution clients can easily connect to and interact with our technology platform, which facilitates our ability to deliver services to our clients. In addition, we provide our technology partners the ability to connect and access and manage our services, which facilitates the delivery of our solutions to their customers. Our platform allows all of our clients to seamlessly add new services. |

| |

| • | Ability to Innovate. Our technology platform enhances our ability to identify and develop new services. For example, our platform allows us to identify client needs and inefficiencies in payment processing and then to quickly develop and bring solutions to those problems to market. Our technology platform also enables the development of new services for clients spanning the payment processing value chain, including in high growth segments and verticals, such as ecommerce, gaming, mobile, prepaid and information solutions. |

| |

| • | Value-added Information Solutions. Our technology platform allows us to collect, manage and analyze data across our Merchant and Financial Institution Services segments. We provide reporting and management tools to all of our clients through Vantiv Direct, our proprietary on-line interactive system for reporting, reconciliation, interfacing and exception processing. We provide data, reports and analytical tools to our financial institution clients to assist with card account, customer relationship, marketing program and fraud management. As the payment processing industry evolves and our clients require more data to serve their customers, we plan to use our single technology platform to provide information solutions and other data-rich services, such as marketing incentives, offers and loyalty programs to our clients. |

| |

| • | Operating Leverage. Our single, proprietary technology platform is highly scalable and efficient and provides strong operating margins. In connection with our separation from Fifth Third Bank in 2009, we made a substantial investment to enhance our single, proprietary technology platform. Through these enhancements, we increased the processing speed, efficiency and capacity of our platform and optimized our operations. We believe the scale and efficiency of our single platform is a key differentiator between us and our competitors who operate on multiple non-integrated platforms. For example, it enables us to make enhancements and regulatory updates across our platform simultaneously and with lower execution risk. |

Our technology platform is reliable and secure. We have developed our technology platform to be highly resilient with redundant applications and servers and robust network connectivity and storage capacity. We have real-time synchronization between our primary and secondary data centers. Our four-tiered operating model is certified as PCI compliant and is secured through technical controls, policy controls, physical controls and asset protection. We have implemented additional security measures for our systems and data, such as end-to-end encryption and monitoring and logging all activity 24 hours a day seven days a week. These measures are evaluated regularly through internal and third party assessments.

Financial Highlights

Revenue for the year ended December 31, 2013, increased 13% to $2,108.1 million from $1,863.2 million in 2012. Income from operations for the year ended December 31, 2013, increased 16% to $352.8 million from $304.9 million in 2012. Net income for the year ended December 31, 2013, increased 88% to $208.1 million from $110.8 million in 2012. Net income attributable to Vantiv, Inc. for the year ended December 31, 2013, increased 132% to $133.6 million from $57.6 million in 2012.

The following tables provide a summary of the results for our two segments, Merchant Services and Financial Institution Services, for the years ended December 31, 2013, 2012 and 2011.

|

| | | | | | | | | | | |

| | Year Ended

December 31, |

| | 2013 | | 2012 | | 2011 |

| | (dollars in thousands) |

| Merchant Services | |

| | |

| | |

|

| Total revenue | $ | 1,639,157 |

| | $ | 1,409,158 |

| | $ | 1,185,253 |

|

| Network fees and other costs | 801,463 |

| | 709,341 |

| | 620,852 |

|

| Net revenue | 837,694 |

| | 699,817 |

| | 564,401 |

|

| Sales and marketing | 286,200 |

| | 255,887 |

| | 211,062 |

|

| Segment profit | $ | 551,494 |

| | $ | 443,930 |

| | $ | 353,339 |

|

| Non-financial data: | |

| | |

| | |

|

| Transactions (in millions) | 13,333 |

| | 11,912 |

| | 9,591 |

|

|

| | | | | | | | | | | |

| | Year Ended

December 31, |

| | 2013 | | 2012 | | 2011 |

| | (dollars in thousands) |

| Financial Institution Services | |

| | |

| | |

|

| Total revenue | $ | 468,920 |

| | $ | 454,081 |

| | $ | 437,168 |

|

| Network fees and other costs | 133,978 |

| | 131,256 |

| | 135,883 |

|

| Net revenue | 334,942 |

| | 322,825 |

| | 301,285 |

|

| Sales and marketing | 25,844 |

| | 24,757 |

| | 24,046 |

|

| Segment profit | $ | 309,098 |

| | $ | 298,068 |

| | $ | 277,239 |

|

| Non-financial data: | |

| | |

| | |

|

| Transactions (in millions) | 3,613 |

| | 3,450 |

| | 3,344 |

|

Refer to "Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations" for more details.

Merchant Services

Clients

According to The Nilson Report, we are the third largest merchant acquirer and the largest PIN debit acquirer by transaction volume in the United States, serving a diverse set of merchants across a variety of end-markets, sizes and geographies. We authorize, clear, settle and provide reporting for electronic payment transactions for our merchant services clients. For the year ended December 31, 2013, we processed sales volume of approximately $611 billion.

Our client base includes over 400,000 merchant locations, with a concentration in non-discretionary everyday spend categories where spending has been more resilient during economic downturns, such as grocery and pharmacy. We serve clients large and small, off-line and on-line, across many industries, including grocery, pharmacy, retail, and others. Our long-term client relationships, low client concentration and everyday spend merchant services clients make us less sensitive to changing economic conditions in the industries and regions in which our clients operate.

We have long-term relationships with many large national retailers, including eight of the top 25 by revenue in 2012. Due to the large transaction volume that they generate, these merchants provide us with significant operating scale efficiencies and recurring revenues. Smaller merchants are more difficult to reach on an individual basis, but generally generate higher per transaction fees. Our acquisition of NPC in 2010 has expanded our small to mid-sized merchant client base.

We plan to grow our client base over the course of the next few years, depending on market conditions, primarily by broadening and deepening our distribution channels and expanding into high growth segments and verticals. We have developed relationships with a broad range of referral partners, such as merchant banks; technology partners, which include ISVs, VARs and payment facilitators; ISOs and trade associations that target a broad range of merchants, including difficult to reach small and mid-sized merchants. While we will continue to serve virtually all major merchant categories, we are

increasing our focus on several high growth segments and verticals, including business-to-business, ecommerce, healthcare, gaming, government and education. We intend to focus on these high growth segments and verticals by continuing to enhance our offering of services, establishing relationships with technology partners and tailoring our sales approach for each vertical on a region-by-region basis.

Services

We provide a comprehensive suite of payment processing services to merchants across the United States. We authorize, clear, settle and provide reporting for electronic payment transactions for our merchant services clients, as discussed below.

Integrated Acquiring and Processing. We provide merchants with a full range of credit, debit and prepaid payment processing services. We give them the ability to accept and process Visa, MasterCard, American Express, Discover and PIN debit network card transactions originated both at the point of sale and for on-line transactions. This service includes all aspects of card processing, including authorization and settlement, customer service, chargeback and retrieval processing and interchange management. We take a consultative approach to providing these services and help our merchants minimize their interchange costs and integrate their settlement systems. We offer merchants the ability to customize routing preferences that help them minimize costs. We utilize a single message format for both credit and debit transactions, which simplifies the storage and processing of data and reduces costs for merchants. We also store data for settlement for all PIN debit transactions, which simplifies the settlement process for merchants and provides the flexibility to route transactions through a merchant's desired network, allowing for lower transaction costs.

Value-added Services. We offer value-added services that help our clients operate and manage their businesses, generating additional revenue from their customers and enhancing our client retention. For example, we offer merchants mobile acceptance, prepaid services and gift card solutions, enabling them to retain a greater share of their customers' transaction volume while building a more loyal customer base. We also provide security solutions such as point-to-point encryption and tokenization both at the point of sale and for on-line transactions that help to protect our merchant services clients and their customers and minimize their losses. Our on-line data and reports provide merchants with detailed transaction information that allows them to perform customer analytics to better understand their business.

Financial Institution Services

Clients

We serve a diverse set of financial institutions, including regional banks, community banks, credit unions and regional PIN debit networks. We focus on small to mid-sized institutions with less than $15 billion in assets. Smaller financial institutions, including many of our clients, generally do not have the scale or infrastructure typical of large institutions and are more likely to outsource their payment processing needs. We provide a turnkey solution to such institutions to enable them to offer payment processing solutions. In 2013, we processed approximately 3.6 billion transactions for approximately 1,400 financial institutions.

Services

We provide integrated card issuer processing, payment network processing and value-added services to financial institutions. Our services include a comprehensive suite of transaction processing capabilities, including fraud protection, card production, prepaid cards, ATM driving, portfolio optimization, data analytics and card program marketing and allow financial institutions to offer electronic payments solutions to their customers on a secure and reliable technology platform at a competitive cost. We provide these services using a consultative approach that helps our financial institution clients enhance their payments-related businesses. These services are discussed further below.

Integrated Card Issuer and Processing. We process and service credit, debit, ATM and prepaid transactions. We process and provide statement production, collections and inbound/outbound call centers for credit transactions. Our card processing solution includes processing and other services such as card portfolio analytics, program strategy and support, fraud and security management and chargeback and dispute services. We also offer processing for specialized types of debit cards, such as business cards, home equity lines of credit and health savings accounts. We provide authorization support in the form of online or batch settlement, as well as real-time transaction research capability and archiving and daily and monthly cardholder reports for statistical analysis. Our call center handles inbound and outbound calls and billing issues for customers of our financial institution clients.

Value-added Services. We provide additional services to our financial institution clients that complement our issuing and processing services. We offer ATM support and software protocols, as well as foreign currency dispensing, mini statements, ATM cardholder preferences, image capture, electronic journal upload and software distribution. We also provide fraud detection services for credit, signature and PIN transactions and cardholder alerts that help to minimize fraud losses for our clients and their customers. Our prepaid card solutions include incentive, rebate and reward programs, general purpose reloadable cards and gift cards. Our prepaid card solutions allow our clients to offer prepaid cards to their customers and generate additional revenue. We offer a service known as Vantiv Direct, which is a proprietary on-line interactive system for reporting, reconciliation, interfacing and exception processing. We also provide other services, including ATM enhancement, card production and activation and surcharging services. As part of our consultative approach, we provide value-added services such as information solutions, campaign development and delivery, rewards and loyalty programs, and prewards or merchant funded loyalty programs, that help our clients to enhance revenue and profitability. We also provide network gateway and switching services that utilize our Jeanie PIN network.

Our Jeanie network offers real-time electronic payment, network bill payment, single point settlement, shared deposit taking and customer select PINs. Our Jeanie network includes over 6,800 ATMs, 20 million active cardholders and 650 member financial institution clients.

Merchant Services for Financial Institutions. In partnership with our financial institution clients, we offer our financial institutions a full suite of merchant services they can make available to their merchant customers. Depending on the need of the financial institution, we offer a referral option as well as a full white-label option. The referral option allows the financial institution to simply refer their small businesses and merchant services customers to us, and we contract and provide services to the merchant while providing the financial institution referral revenue. Our white-label option allows the financial institution to provide their small business and merchant customers a fully branded merchant services offering that we manage.

Sales and Marketing

We distribute our services through diversified distribution channels using a unified sales approach that enables us to efficiently and effectively target merchants and financial institutions of all sizes. We believe our sales structure provides us with broad geographic coverage and access to various industries and verticals.

Our Merchant Services sales force is comprised of a team that targets large national merchants, a regional and mid-market sales team that sells solutions to merchants and third-party reseller clients and a telesales operation that targets small and mid-sized merchants. Our regional sales teams in our Merchant Services business are responsible for our referral channel, including referrals from Fifth Third Bank and other banks. Our Financial Institution Services sales force focuses on small to mid-sized institutions with less than $15 billion in assets because smaller financial institutions typically do not have similar scale, breadth of services or infrastructure as large banks to process payment transactions as efficiently as large banks and are more likely to outsource their payment processing needs. In addition to generating new sales, we have in-house sales personnel who are responsible for managing key relationships, promoting client retention and generating cross-selling opportunities for both our merchant and financial institution clients. Our sales teams are paid a combination of base salary and commission. As of December 31, 2013, we had over 800 full-time employees participating in sales and marketing, including sales support personnel.

In addition, we have relationships with a broad range of referral partners, such as merchant banks; technology partners, which include ISVs, VARs and payment facilitators; ISOs and trade associations that target a broad range of merchants, including difficult to reach small and mid-sized merchants. Our merchant bank referral program, which consisted of over 1,500 branch locations as of December 31, 2013, enables us to be the preferred processor for those banks, and the banks receive a referral fee. Through our relationships with technology partners, we seek to expand our presence in high growth segments and verticals, such as business-to-business, ecommerce, healthcare, gaming, government and education.

Commissions paid to our sales force are based upon a percentage of revenue from new business and cross-selling to existing clients. Residual payments to our referral partners, including merchant banks, technology partners, ISOs and trade associations are based upon a percentage of revenues earned from referred business. For the year ended December 31, 2013, combined sales force commissions and residual payments represent approximately 67% of total sales and marketing expenses, or $210.2 million.

We also utilize a diverse group of referral partners in our Financial Institution Services segment. This distribution channel utilizes multiple distribution strategies and leverages relationships with reseller partners and arrangements with core processors that sell our solutions to small and mid-sized financial institutions. We offer certain of our services on a white-label

basis which enables them to be marketed under our client's brand. We select resellers that enhance our distribution channels and augment our services with complementary offerings. Our relationships with core processors are necessary for developing the processing environments required by our financial institution clients. Many of our core processing relationships are non-contractual and continue for so long as an interface between us and the core processor is needed to accommodate one or more common financial institution customers. As of December 31, 2013, we had relationships with approximately 60 core processing companies and 140 core processing platforms.

Competition

Merchant Services

Our Merchant Services segment competitors include Bank of America Merchant Services, Chase Paymentech Solutions, Elavon Inc. (a subsidiary of U.S. Bancorp), First Data Corporation, Global Payments, Inc., Heartland Payment Systems, Inc., Total System Services, Inc. and WorldPay US, Inc.

The most significant competitive factors in this segment are price, breadth of features and functionality, data security, system performance and reliability, scalability, service capability and brand. Our Merchant Services segment has been and is expected to continue to be impacted by large merchant and large bank consolidation, as larger clients may demand lower fees, card association business model expansion and the expansion of new payment methods and devices. In addition, Advent, through one of its private equity investments, owns an equity interest in WorldPay US, Inc., which may result in their being provided with business opportunities through their relationship with Advent instead of us.

Financial Institution Services

Our Financial Institution Services segment competitors include Fidelity National Information Services, Inc., First Data Corporation, Fiserv, Inc., Total System Services, Inc. and Visa Debit Processing Service. In addition to competition with direct competitors, we also compete with larger potential clients that have historically developed their key payment processing applications in-house, and therefore weigh whether they should develop these capabilities in-house or acquire them from a third party.

The most significant competitive factors in this segment are price, system performance and reliability, breadth of services and functionality, data security, scalability, flexibility of infrastructure and servicing capability. Our Financial Institution Services segment has been and could continue to be impacted by financial institution consolidation, which in addition to the above, provides more opportunities for clients to bring all or a portion of the services we provide in-house or allows our competitors the opportunity to gain business if our clients consolidate with a financial institution served by a competitor of ours.

Our Competitive Strengths

We believe we have attributes that differentiate us from our competitors and have enabled us to become a leading payment processor in the United States. Our key competitive strengths include:

Single, Proprietary Technology Platform

Our single, proprietary technology platform provides our merchant and financial institution clients with differentiated payment processing solutions and provides us with significant strategic and operational benefits. Our clients access our processing solutions primarily through a single point of service, which is easy to use and enables our clients to acquire additional services as their business needs evolve. Small and mid-sized merchants are able to easily connect to our technology platform using our application process interfaces, or APIs, software development kits, or SDKs, and other tools we make available to technology partners, which we believe enhances our capacity to sell to such merchants. Our platform allows us to collect, manage and analyze data across both our Merchant Services and our Financial Institution Services segments that we can then package into information solutions for our clients. It also provides insight into market trends and opportunities as they emerge, which enhances our ability to innovate and develop new value-added services. Our single platform allows us to more easily deploy new solutions that span the payment processing value chain, such as ecommerce, mobile and prepaid, which are high growth market opportunities. Our single scalable platform also enables us to efficiently manage, update and maintain our technology, increase capacity and speed, and realize significant operating leverage. We believe our single, proprietary technology platform is a key differentiator from payment processors that operate on multiple technology platforms and provides us with a significant competitive advantage.

Integrated Business

We operate as a single integrated business using a unified sales and product development approach. Our integrated business and established client relationships across the payment processing value chain provide us with insight into our clients' needs. We believe this insight combined with our industry knowledge and experience with both merchants and financial institutions enables us to continuously develop new payment processing services and deliver substantial value to our clients. In addition, we believe this insight, knowledge and experience enhances our ability to cross-sell our services to existing clients. By operating as a single business, we believe we can manage our business more efficiently resulting in increased profitability. We believe our integrated business allows us to deliver better solutions and differentiates us from payment processors that are focused on discrete areas of the payment processing value chain or that operate multiple payment processing businesses.

Comprehensive Suite of Services

We offer a broad suite of payment processing services that enable our merchant and financial institution clients to address their payment processing needs through a single provider. Our solutions include traditional processing services as well as a range of innovative value-added services. We provide small and mid-sized clients with the comprehensive solutions originally developed for our large clients that we have adapted to meet the specific needs of our small and mid-sized clients. We have also developed industry specific merchant solutions with features and functionality to meet the specific requirements of various industry verticals, including grocery, pharmacy, restaurant and retail. We offer our financial institutions a broad range of card issuing, processing and information solutions. As financial institutions seek to generate additional revenue, for example, we offer our full suite of merchant acquiring solutions to banks and credit unions on a referral basis or as a customized white-label service marketed under our client's brand. In addition, our broad range of services provides us with numerous opportunities to generate additional revenues by cross-selling solutions to our existing clients.

Diverse Distribution Channels

We distribute our services through diversified distribution channels using a unified sales approach that enables us to efficiently and effectively target merchants and financial institutions of all sizes. These channels include a national sales force that targets financial institutions and national merchants, regional and mid-market sales teams that sell solutions to merchants and third-party reseller clients and a telesales operation that targets small and mid-sized merchants. In addition, we have relationships with a broad range of referral partners, such as merchant banks; technology partners, including ISVs, VARs and payment facilitators; ISOs and trade associations that target a broad range of merchants, including difficult to reach small and mid-sized merchants. We also have relationships with third-party resellers and core processors that target financial institutions. Through our diversified distribution channels, we have developed a broad client base, which has resulted in low client concentration, consisting of over 400,000 merchant locations and approximately 1,400 financial institutions.

Strong Execution Capabilities

Our management team has significant experience in the payment processing industry and has demonstrated strong execution capabilities. Since we created a stand-alone company in 2009, we have invested substantial resources to enhance our technology platform, deepened our management organization, expanded our sales force to align it with our market opportunities, completed strategic acquisitions to expand our product offerings and distribution channels, introduced several new services, launched the Vantiv brand and built out and moved into our new corporate headquarters. We executed all of these projects while delivering substantial revenue growth and strong profitability.

Our Strategy

We plan to grow our business over the course of the next few years, depending on market conditions, by continuing to execute on the following key strategies:

Increase Small to Mid-Sized Client Base

We are focused on increasing our small to mid-sized client base to capitalize on the growth and margin opportunities provided by smaller merchants and financial institutions. Our small and mid-sized merchants and financial institutions are generally more profitable on a per transaction basis. In addition, smaller banks and credit unions generally do not have the scale or the internal technology infrastructure to manage and process their own card programs and consequently, outsource all or a significant portion of their payment processing requirements. We plan to continue to identify and reach these small to mid-sized merchants and financial institutions through our direct sales force, referral partners, third-party resellers and core processors.

Develop New Services

By leveraging our single technology platform, industry knowledge and client relationships across the payment processing value chain, we seek to develop additional payment processing services that address evolving client demands and provide additional cross-selling opportunities. For example, this includes significant investment in emerging technologies such as mobile and further investment into the ecommerce space. In addition, we seek to expand our fraud management services to financial institutions and have developed a program that allows our clients to outsource this function to us. In the future, we intend to enhance our information solutions by analyzing data we capture across our platform and provide our clients with new opportunities to generate incremental revenue.

Expand Into High Growth Segments and Verticals

We believe there is a substantial opportunity for us to expand further into high growth payment segments, such as ecommerce, demonstrated by the acquisition of Litle, mobile and information solutions, prepaid and attractive industry verticals, such as business-to-business, ecommerce, healthcare, gaming, government and education. To facilitate this expansion and capture market share within these high growth segments and verticals, we intend to further develop our technology capabilities to handle specific processing requirements for these segments and verticals, add new services that address their needs and broaden and deepen our distribution channels to reach these potential clients, including through the addition of new referral partners, such as technology partners. We believe that introducing new, complementary solutions that differentiate and enhance the value of our existing services can accelerate our expansion into these segments and verticals. Further, we will seek to penetrate these markets by leveraging our existing distribution channels and entering into new arrangements with complementary referral partners.

Broaden and Deepen Our Distribution Channels

We intend to continue to broaden and deepen our distribution channels to reach potential clients and sell new services to our existing clients. We plan to grow our sales force, including telesales, and add new referral partners, such as merchant banks; technology partners, as demonstrated through our acquisition of Element, which include ISVs, VARs and payment facilitators; ISOs; trade associations; third-party resellers and core processors. By enhancing our referral network and relationships with our partners, we will be able to reach more potential clients, enter into or increase our presence in various markets, segments and industry verticals, such as ecommerce and mobile, and expand into new geographic markets. To establish new relationships and strengthen our existing relationships with various referral partners and drive the implementation of our payment services, we will continue to develop web service APIs, SDKs and documentation in common development languages. We will also continue to develop additional support services for our distribution channels, provide sales and product incentives and increase our business development resources dedicated to growing and promoting our distribution channels.

Enter New Geographic Markets

When we operated as a business unit of Fifth Third Bank we had a strong market position with large national merchants, and we focused on serving small to mid-sized merchants in Fifth Third Bank's core market in the Midwestern United States. We are expanding our distribution channels and leveraging our technology platform to target additional regions. In the future, we will also look to augment our U.S. business by selectively expanding into international markets through strategic partnerships or acquisitions that enhance our distribution channels, client base and service capabilities.

Pursue Acquisitions

We intend to continue to seek acquisitions that provide attractive opportunities. Acquisitions provide us with opportunities to increase our small to mid-sized client base, enhance our service offerings, target high growth segments and verticals, enter into new geographic markets and broaden and deepen our distribution channels. We also will consider acquisitions of discrete merchant portfolios that we believe would enhance our scale and client base and strengthen our market position in the payment processing industry. We believe our single technology platform and integrated business enhances our ability to successfully integrate acquisitions.

Regulation

Various aspects of our business are subject to U.S. federal, state and local regulation. Failure to comply with regulations may result in the suspension or revocation of licenses or registrations, the limitation, suspension or termination of services and/or the imposition of civil and criminal penalties, including fines. Certain of our services are also subject to rules set by various payment networks, such as Visa and MasterCard, as more fully described below.

Dodd-Frank Act

In July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 was signed into law in the United States. The Dodd-Frank Act has resulted in significant structural and other changes to the regulation of the financial services industry. Among other things, the Dodd-Frank Act established the Consumer Financial Protection Bureau, or CFPB, to regulate consumer financial services, including many offered by our clients.

The Dodd-Frank Act provided two self-executing statutory provisions limiting the ability of payment card networks to impose certain restrictions that became effective in July 2010. The first provision allows merchants to set minimum dollar amounts (not to exceed $10) for the acceptance of a credit card (and allows federal governmental entities and institutions of higher education to set maximum amounts for the acceptance of credit cards). The second provision allows merchants to provide discounts or incentives to entice consumers to pay with cash, checks, debit cards or credit cards, as the merchant prefers.

Separately, the so-called Durbin Amendment to the Dodd-Frank Act provided that interchange fees that a card issuer or payment network receives or charges for debit transactions will now be regulated by the Federal Reserve and must be "reasonable and proportional" to the cost incurred by the card issuer in authorizing, clearing and settling the transaction. Payment network fees, such as switch fees assessed by our Jeanie network, may not be used directly or indirectly to compensate card issuers in circumvention of the interchange transaction fee restrictions. In July 2011, the Federal Reserve published the final rules governing debit interchange fees. Effective in October 2011, debit interchange rates for card issuing financial institutions with more than $10 billion of assets are capped at $0.21 per transaction with an additional component of five basis points of the transaction's value to reflect a portion of the issuer's fraud losses plus, for qualifying issuing financial institutions, an additional $0.01 per transaction in debit interchange for fraud prevention costs. The debit interchange fee would be $0.24 per transaction on a $38 debit card transaction, the average transaction size for debit card transactions. In July 2013, the U.S. District Court for the District of Columbia determined that the Federal Reserve's regulations implementing the Durbin Amendment were invalid. The Federal Reserve has appealed the decision. Regardless of the outcome of the litigation, the cap on interchange fees is not expected to have a material direct impact on our results of operations.

In addition, the new rules contain prohibitions on network exclusivity and merchant routing restrictions. Beginning in October 2011, (i) a card payment network may not prohibit a card issuer from contracting with any other card payment network for the processing of electronic debit transactions involving the issuer's debit cards and (ii) card issuing financial institutions and card payment networks may not inhibit the ability of merchants to direct the routing of debit card transactions over any card payment networks that can process the transactions. Since April 2012, most debit card issuers have been required to enable at least two unaffiliated card payment networks on each debit card. We do not expect the prohibition on network exclusivity to impact our ability to pass on network fees and other costs to our clients. These regulatory changes create both opportunities and challenges for us. Increased regulation may add to the complexity of operating a payment processing business, creating an opportunity for larger competitors to differentiate themselves both in product capabilities and service delivery. The ban on network exclusivity also will enhance competition to allow us, through our Jeanie network, and certain of our competitors through their networks, to compete for additional business. At the same time, these regulatory changes may cause operating costs to increase as we adjust our activities in light of compliance costs and client requirements. The Dodd-Frank Act's overall impact on us is difficult to estimate as it will take some time for the market to react and adjust to the new regulations.

Banking Regulation

Fifth Third Bank beneficially owns an equity interest representing approximately 25.6% of Vantiv Holding's voting power and equity interests (through their ownership of Vantiv Holding Class B units), 18.5% of our voting interests (through their ownership of our Class B common stock) and have significant consent rights. Fifth Third Bank is an Ohio state-chartered bank and a member of the Federal Reserve System and is supervised and regulated by the Federal Reserve and the Ohio Division of Financial Institutions, or ODFI. Fifth Third Bank is a wholly-owned indirect subsidiary of Fifth Third Bancorp, which is a bank holding company, or BHC, which has elected to be treated as a financial holding company, or FHC, and is supervised and regulated by the Federal Reserve under the Bank Holding Company Act of 1956, as amended, or BHC Act.

Because of the foregoing, and in particular, Fifth Third Bank's interest in us, it may be difficult for us to engage in activities abroad or invest in a non-U.S. company. We and Fifth Third Bank may seek to engage in offshore activities through various entities and structures, each of which may require prior regulatory approval, the receipt of which cannot be assured. The Federal Reserve and the ODFI have substantial discretion in this regard. In addition to the initial filing and application requirements, the chosen entity or structure may subject Fifth Third Bank, and to a lesser extent us, to several banking law requirements and limitations.

We may not receive regulatory authority to create such an entity, or, if created, we may be unable to comply with all requirements. We will need Fifth Third Bank's cooperation to form and operate any such entity for offshore activities, and the regulatory burdens imposed upon Fifth Third Bank may be too extensive to justify its establishment or continuation. If, after the entity is formed, we or Fifth Third Bank are at any time unable to comply with any applicable regulatory requirements, the Federal Reserve or ODFI may impose additional limitations or restrictions on Fifth Third Bank's or our operations, which could potentially force us to limit the activities or dispose of the entity.

In light of the foregoing, there can be no assurance that we will be able to successfully engage in activities abroad or invest in a non-U.S. company.

We continue to be deemed to be controlled by Fifth Third Bancorp and Fifth Third Bank for bank regulatory purposes and, therefore, we will continue to be subject to supervision and regulation by the Federal Reserve under the BHC Act by the Federal Reserve and the ODFI under applicable federal and state banking laws. We will remain subject to this regulatory regime until Fifth Third Bancorp and Fifth Third Bank are no longer deemed to control us for bank regulatory purposes, which we do not generally have the ability to control and which will generally not occur until Fifth Third Bank has significantly reduced its equity interest in us, as well as certain other factors, including the extent to which we continue to maintain material business relationships with Fifth Third Bancorp and Fifth Third Bank. The ownership level at which the Federal Reserve would consider us no longer controlled by Fifth Third Bank for bank regulatory purposes will generally depend on the circumstances at that time and could be less than 5%. The circumstances and other factors that the Federal Reserve will consider will include, among other things, the extent of our relationships with Fifth Third Bank, including the various agreements entered into at the time of the separation from Fifth Third Bank and the Amended and Restated Vantiv Holding Limited Liability Company Agreement.

Given our current business model, regulation by the Federal Reserve and the ODFI has not historically had a material effect on our operations, our ability to make acquisitions or the implementation of our business strategy more generally. Nevertheless, there can be no assurance that this will continue going forward, especially if we wish to make certain changes to our business model and related strategy. See "Item 1A - Risk Factors" below. The supervision and regulation of Fifth Third Bancorp, Fifth Third Bank and their subsidiaries under applicable banking laws is intended primarily for the protection of Fifth Third Bank's depositors, the deposit insurance fund of the Federal Deposit Insurance Corporation, or FDIC, and the banking system as a whole, rather than for the protection of our stockholders, creditors or customers or the stockholders, creditors or customers of Fifth Third Bancorp or Fifth Third Bank.

For as long as we are deemed to be controlled by Fifth Third Bancorp and Fifth Third Bank for bank regulatory purposes, we are subject to regulation, supervision, examination and potential enforcement action by the Federal Reserve and the ODFI and to most banking laws, regulations and orders that apply to Fifth Third Bancorp and Fifth Third Bank. Fifth Third Bancorp and Fifth Third Bank are required to file reports with the Federal Reserve and the ODFI on our behalf, and we are subject to examination by the Federal Reserve and the ODFI for the purposes of determining, among other things, our financial condition, the adequacy of our risk management and the financial and operational risks that we pose to the safety and soundness of Fifth Third Bank and Fifth Third Bancorp, and our compliance with federal and state banking laws applicable to us and our relationship and transactions with Fifth Third Bancorp and Fifth Third Bank. The Federal Reserve has broad authority to take enforcement actions against us if it determines that we are engaged in or are about to engage in unsafe or unsound banking practices or are violating or are about to violate a law, rule or regulation, or a condition imposed by or an agreement with, the Federal Reserve. Enforcement actions can include a variety of informal and formal supervisory actions. The formal actions include cease and desist and other orders, enforceable written agreements, and removal and prohibition orders, which can remove certain management officials from office or disallow them from further involvement in the affairs of any regulated entity. Informal actions, which in many cases will not be publicly available, include memoranda of understanding, supervisory letters, and board resolutions. For the most serious violations under federal banking laws, the Federal Reserve may impose civil money penalties and criminal penalties. Moreover, any enforcement actions taken against Fifth Third Bancorp or Fifth Third Bank may result in regulatory actions being applied to us or our activities in certain circumstances, even if the enforcement actions are unrelated to our conduct or business.

As a subsidiary of Fifth Third Bank for bank regulatory purposes, our activities are generally limited to those that are permissible for a national bank. These activities are generally limited to those that are part of, or incidental to, the business of banking. Payment and information processing services are expressly authorized for a national bank. Further, as a condition to Fifth Third Bank's investment in us, we are required under the Amended and Restated Vantiv Holding Limited Liability Company Agreement to limit our activities to those activities permissible for a national bank. Accordingly, under the Amended and Restated Vantiv Holding Limited Liability Company Agreement: (i) we are required to notify Fifth Third Bank before we engage in any activity, by acquisition, investment, organic growth or otherwise, that may reasonably require Fifth Third Bank

or an affiliate of Fifth Third Bank to obtain regulatory approval, so that Fifth Third Bank can determine whether the new activity is permissible, permissible subject to regulatory approval or impermissible; and (ii) if a change in the scope of our business activities causes the ownership of our equity not to be legally permissible for Fifth Third Bank without first obtaining regulatory approvals, then we must use reasonable best efforts to assist Fifth Third Bank in obtaining the regulatory approvals, and if the change in the scope of our business activities is impermissible for Fifth Third Bank, then we will not engage in such activity.

In certain circumstances, prior approval of the Federal Reserve or the ODFI may be required before Fifth Third Bancorp, Fifth Third Bank or their subsidiaries for bank regulatory purposes, including us, can engage in permissible activities. The Federal Reserve has broad powers to approve, deny or refuse to act upon applications or notices for us to conduct new activities, acquire or divest businesses or assets, or reconfigure existing operations. Federal Reserve approval may also be required before any subsidiary for bank regulatory purposes of Fifth Third Bancorp or Fifth Third Bank, including us, engages in activities abroad or invests in a non-U.S. company.

The CFPB, created by the Dodd-Frank Act, assumed most of the regulatory responsibilities previously exercised by the federal banking regulators and other agencies with respect to consumer financial products and services and has additional powers granted by the Dodd-Frank Act. In addition to rulemaking authority over several enumerated federal consumer financial protection laws, the CFPB is authorized to issue rules prohibiting unfair, deceptive or abusive acts or practices by persons offering consumer financial products or services and those, such as us, who are service providers to such persons, and has authority to enforce these consumer financial protection laws and CFPB rules. We are subject to regulation and enforcement by the CFPB because we are an affiliate of Fifth Third Bank (which is an insured depository institution with greater than $10 billion in assets) for bank regulatory purposes and because we are a service provider to insured depository institutions with assets of $10 billion or more in connection with their consumer financial products and to entities that are larger participants in markets for consumer financial products and services such as prepaid cards. CFPB rules, examinations and enforcement actions may require us to adjust our activities and may increase our compliance costs.

Collection Services State Licensing

Ancillary to our credit card processing business, we are subject to the Fair Debt Collection Practices Act and various similar state laws. We are authorized in 19 states to engage in debt administration and debt collection activities on behalf of some of our card issuing financial institution clients through calls and letters to the debtors in those states. We may seek licenses in other states to engage in similar activities in the future.

Association and Network Rules

While not legal or governmental regulation, we are subject to the network rules of Visa, MasterCard and other payment networks. The payment networks routinely update and modify their requirements. On occasion, we have received notices of non-compliance and fines, which have typically related to excessive chargebacks by a merchant or data security failures. Our failure to comply with the networks' requirements or to pay the fines they impose could cause the termination of our registration and require us to stop providing payment processing services.

Privacy and Information Security Regulations

We provide services that may be subject to privacy laws and regulations of a variety of jurisdictions. Relevant federal privacy laws include the Gramm-Leach-Bliley Act of 1999, which applies directly to a broad range of financial institutions and indirectly, or in some instances directly, to companies that provide services to financial institutions. These laws and regulations restrict the collection, processing, storage, use and disclosure of personal information, require notice to individuals of privacy practices and provide individuals with certain rights to prevent the use and disclosure of protected information. These laws also impose requirements for safeguarding and proper destruction of personal information through the issuance of data security standards or guidelines. In addition, there are state laws restricting the ability to collect and utilize certain types of information such as Social Security and driver's license numbers. Certain state laws impose similar privacy obligations as well as obligations to provide notification of security breaches of computer databases that contain personal information to affected individuals, state officers and consumer reporting agencies and businesses and governmental agencies that own data.

Processing and Back-Office Services

As a provider of electronic data processing and back-office services to financial institutions we are also subject to regulatory oversight and examination by the Federal Financial Institutions Examination Council, an interagency body of the FDIC, the Office of the Comptroller of the Currency, the Federal Reserve, the National Credit Union Administration and the

CFPB. In addition, independent auditors annually review several of our operations to provide reports on internal controls for our clients' auditors and regulators. We are also subject to review under state laws and rules that regulate many of the same activities that are described above, including electronic data processing and back-office services for financial institutions and use of consumer information.

Anti-Money Laundering and Counter Terrorist Regulation

Our business is subject to U.S. federal anti-money laundering laws and regulations, including the Bank Secrecy Act, as amended by the USA PATRIOT Act of 2001, which we refer to collectively as the BSA. The BSA, among other things, requires money services businesses to develop and implement risk-based anti-money laundering programs, report large cash transactions and suspicious activity and maintain transaction records.

We are also subject to certain economic and trade sanctions programs that are administered by the Treasury Department's Office of Foreign Assets Control, or OFAC, that prohibit or restrict transactions to or from or dealings with specified countries, their governments and, in certain circumstances, their nationals, narcotics traffickers, and terrorists or terrorist organizations.

Similar anti-money laundering, counter terrorist financing and proceeds of crime laws apply to movements of currency and payments through electronic transactions and to dealings with persons specified on lists maintained by organizations similar to OFAC in several other countries and which may impose specific data retention obligations or prohibitions on intermediaries in the payment process.

We have developed and are enhancing compliance programs to monitor and address legal and regulatory requirements and developments.

Federal Trade Commission Act and Other Laws Impacting our Customers' Business

All persons engaged in commerce, including, but not limited to, us and our merchant and financial institution customers are subject to Section 5 of the Federal Trade Commission Act prohibiting unfair or deceptive acts or practices, or UDAP. In addition, there are other laws, rules and or regulations, including the Telemarketing Sales Act, that may directly impact the activities of our merchant customers and in some cases may subject us, as the merchant's payment processor, to investigations, fees, fines and disgorgement of funds in the event we are deemed to have aided and abetted or otherwise provided the means and instrumentalities to facilitate the illegal activities of the merchant through our payment processing services. Various federal and state regulatory enforcement agencies including the Federal Trade Commission, or FTC, and the states' attorneys general have authority to take action against nonbanks that engage in UDAP or violate other laws, rules and regulations and to the extent we are processing payments for a merchant that may be in violation of laws, rules and regulations, we may be subject to enforcement actions and as a result may incur losses and liabilities that may impact our business.

Prepaid Services

Prepaid card programs managed by us are subject to various federal and state laws and regulations, which may include laws and regulations related to consumer and data protection, licensing, consumer disclosures, escheat, anti-money laundering, banking, trade practices and competition and wage and employment. For example, most states require entities engaged in money transmission in connection with the sale of prepaid cards to be licensed as a money transmitter with, and subject to examination by, that jurisdiction's banking department. In the future, we may have to obtain state licenses to expand our distribution network for prepaid cards, which licenses we may not be able to obtain. Furthermore, the Credit Card Accountability Responsibility and Disclosure Act of 2009 and the Federal Reserve's Regulation E impose requirements on general-use prepaid cards, store gift cards and electronic gift certificates. These laws and regulations are evolving, unclear and sometimes inconsistent and subject to judicial and regulatory challenge and interpretation, and therefore the extent to which these laws and rules have application to, and their impact on, us, financial institutions, merchants or others is in flux. At this time we are unable to determine the impact that the clarification of these laws and their future interpretations, as well as new laws, may have on us, financial institutions, merchants or others in a number of jurisdictions. Prepaid services may also be subject to the rules and regulations of Visa, MasterCard and other payment networks with which we and the card issuers do business. The programs in place to process these products generally may be modified by the payment networks in their discretion and such modifications could also impact us, financial institutions, merchants and others.