- AUID Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

authID (AUID) 8-KCompletion of Acquisition or Disposition of Assets

Filed: 7 Nov 24, 4:10pm

Exhibit 99.2

© 2024 authID Inc. All Rights Reserved. authID Ǫ 3 20 24 Resu l t s C on f e r e nce C a ll N o v e m b e r 7 , 2024

© 2024 authID Inc. All Rights Reserved. This Presentation and information provided at a webcast or meeting at which it is presented (the “Presentation") has been prepared on the basis of information furnished by the management of authID Inc . (“authID” or the “Company”) and has not been independently verified by any third party . This Presentation is provided for information purposes only . This Presentation is not an offer to sell nor a solicitation of an offer to buy any securities . While the Company is not aware of any inaccuracies, no warranty or representation is made by the Company or its employees and representatives as to the completeness or accuracy of the information contained herein . This Presentation also contains estimates and other statistical data made by independent parties and us relating to market size and other data about our industry . This data involves a number of assumptions and limitations, and you should not give undue weight to such data and estimates . Information contained in this Presentation or presented during this meeting includes “forward - looking statements . ” All statements other than statements of historical facts included herein, including, without limitation, those regarding the future results of operations, growth and sales, revenue guidance for 2024 , booked Annual Recurring Revenue (bARR) (and its components cARR and UAC), Annual Recurring Revenue (ARR), cash flow, cash position and financial position, business strategy, plans and objectives of management for future operations of both authID Inc . and its business partners, are forward - looking statements . Such forward - looking statements are based on a number of assumptions regarding authID’s present and future business strategies, and the environment in which authID expects to operate in the future, which assumptions may or may not be fulfilled in practice . Actual results may vary materially from the results anticipated by these forward - looking statements as a result of a variety of risk factors, including the Company’s ability to attract and retain customers ; successful implementation of the services to be provided under new customer contracts and their adoption by customers' users ; the Company’s ability to compete effectively ; changes in laws, regulations and practices ; changes in domestic and international economic and political conditions, the as yet uncertain impact of the wars in Ukraine and the Middle East, inflationary pressures, increases in interest rates, and others . See the Company’s Annual Report on Form 10 - K for the Fiscal Year ended December 31 , 2023 , filed at www . sec . gov and other documents filed with the SEC for other risk factors which investors should consider . These forward - looking statements speak only as to the date of this presentation and cannot be relied upon as a guide to future performance . authID expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward - looking statements contained in this presentation to reflect any changes in its expectations with regard thereto or any change in events, conditions, or circumstances on which any statement is based . This Presentation contains references to the Company’s and other entities’ trademarks . Such trademarks are the property of their respective owner . The Company does not intend its use or the display of other companies’ trade names or trademarks to imply a relationship with or endorsement of the Company by any other entity . By reading this Presentation or attending a webcast or meeting at which it is presented you accept and agree to these terms, disclaimers and limitations . Di s claim e r & F o rw ard L oo k i n g S t a t e m e nt s - 2 -

© 2024 authID Inc. All Rights Reserved. Ǫ 3 2024 B u s i n e s s H i g hl i g ht s

W e a r e f o c u sed o n a cc ele r a t i n g a n d d i v e r si f y i n g r ev e n u e g r o w t h • Added new Chief Product Officer, Erick Soto with experience building a unicorn identity verification company • Secured a $10M contract commitment over 3 years with an AI company specializing in custom solutions for global multi - national companies 1 • Acquired new customers including another $1M+ booking with an OEM partner • E x pa n d e d i n t o N e w V e r t i c als – T e l e c o m a n d R e t ai l T e c hn o l o g y • For the second consecutive quarter, took four new customers into Production Go - Live 2 - two of which both signed and went live within the third quarter • Added key personnel additions to our product, engineer and sales functions - 4 - © 2024 authID Inc. All Rights Reserved. B u s i n e s s H i g h l i g h t s authID Fat 100 ($1M+) bookings are now closing and we are taking customers live faster 1. Occurred in the fourth quarter of 2024. 2. Production Go - Live defined as revenue generating use of our services.

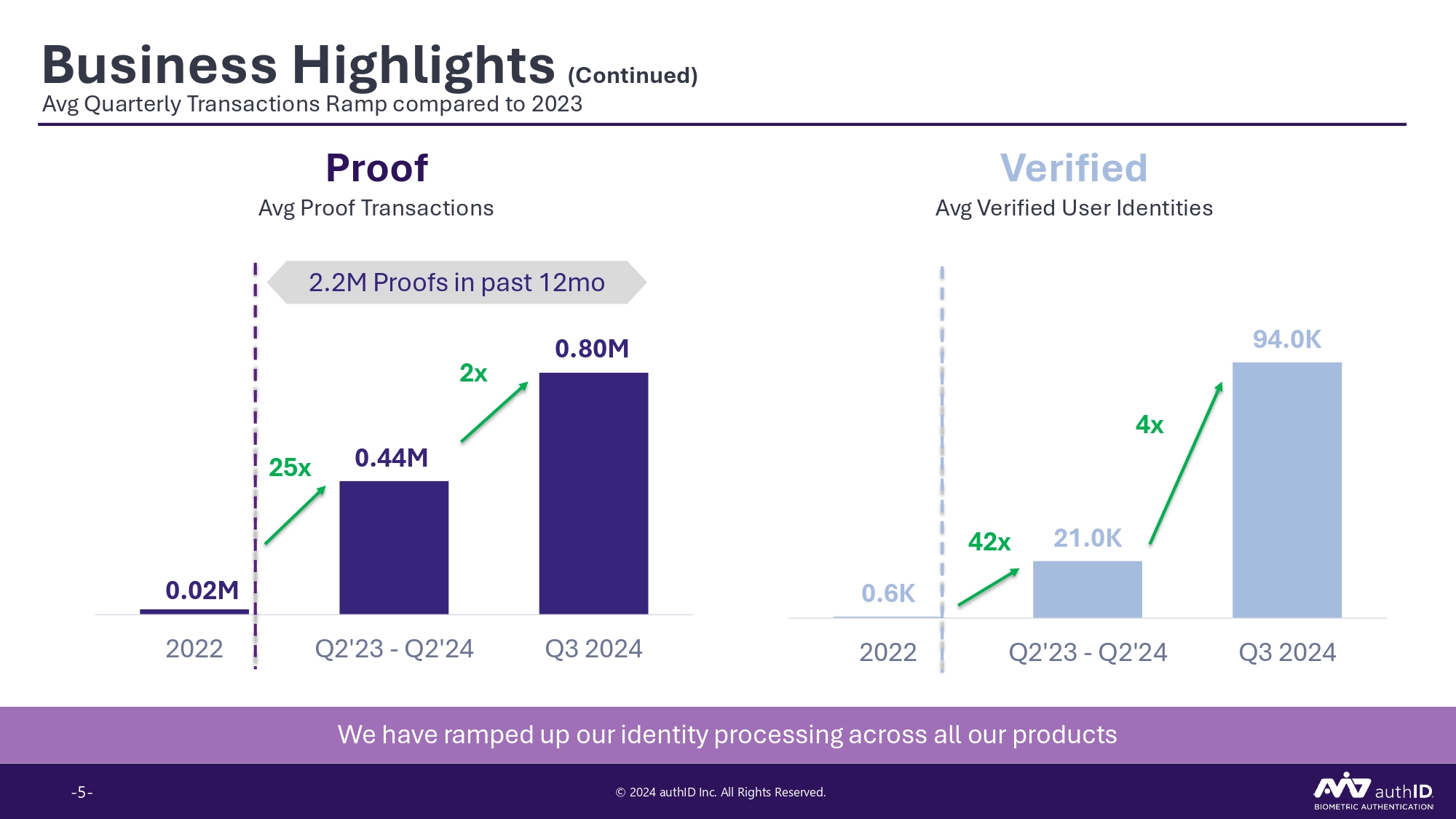

B u s i n e s s H i g h l i g h t s (C ont i n u ed) 0. 44 M 0. 80 M 0.02M 202 2 Ǫ 2 ' 2 3 - Ǫ 2 ' 2 4 Ǫ 3 2 024 21. 0 K 94. 0 K 0.6K 202 2 Ǫ 2 ' 2 3 - Ǫ 2 ' 2 4 Ǫ 3 2 024 Proof A v g P r oo f T r a n s a c t i on s Verified A v g V e r i f ie d U s e r I d e n t i t i e s 2 . 2 M P r oo f s i n p a s t 12 m o 25x 2x 42x 4x We have ramped up our identity processing across all our products - 5 - © 2024 authID Inc. All Rights Reserved. Avg Ǫuarterly Transactions Ramp compared to 2023

We invested in and drastically improved our biometric identity verification platform • Released new PrivacyKey feature which allows customers to "use biometrics without having to store biometrics" • Released 1:1B False Match Rate accuracy for near perfection • Continuing to make improvements to speed up processing time to under 700ms to deliver the best user experience • Enhanced liveness detection to combat AI and Deepfakes • Enhanced algorithms for document capture leading to increased user completion rates in onboarding • Enhanced Deduplication capabilities to clean up identity records where fraudulent accounts could exist • Completed new integrations with major platforms: OneLogin, Zendesk, ServiceNow - 6 - © 2024 authID Inc. All Rights Reserved. B u s i n e s s H i g h l i g h t s (C ont i n u ed) AuthID announces General Availability of authID Version 4.0 with PrivacyKey

Ǫ 3 202 4 G A A P F i n a n c i a l R e s u l t s 3 and 9 months Ended September 30, 2024 * 2023 Operating Expenses reflect a $3.4M one - time, non - cash reversal of stock - based compensation from Ǫ1’23 terminations et L o ss f r o m N o n - Ca sh & O n e - Time nu i n g Ope r a ti o n s S e v e r a n c e C h a r g es Net L o ss P er S h a r e ( $M ) ( $M ) C o n ti nu i n g Ope r a ti o ns N Re v e n u e Ope r a ti n g E xpe n ses* C o n ti ($M) ($M) $3.05 $0.97 $0.4 7 $0.31 ‘23 ’24 ‘23 '24 3 mo n t hs 9 mo n t hs 10.4M 2.2M 1.6M 0.6M ‘23 ’24 ‘23 '24 3 mo n t hs 9 mo n t hs 16.4M 9.7M 3.4M 3.7M 10.7M 7.6M 3.8M 3.8M ‘23 ’24 ‘23 '24 3 mo n t hs 9 mo n t hs 0.69M 0.25M 0.12M 0.04M ‘23 ’24 ‘23 '24 3 mo n t hs 9 mo n t hs ’24 ‘23 '24 n t hs 9 mo n t hs ‘23 3 m o - 7 - © 2024 authID Inc. All Rights Reserved.

R ev en u e M e t r i cs Brea k do w n R P O , c A RR , U A C & R e v e n u e Revenue Re c o g n i z e d i n a cc o r d a n c e w i t h G AA P $3. 3M $5. 0M F i x ed c u s t o m er f ees ( e . g. l i c e n s e f ees ) + u s a ge c o mm i t m e n t s ( e . g . a nnu a l u s a ge m i n i m u m ) a g r eed t o i n c u s t o m e r c o n t r a c t s . • E s ti m a te d c u s to me r u s a g e which exceeds contractual commitments • E x pe c t ed t o be a pp r ox i m a t e l y 50 % o f m o n t hl y r e v e nu e b y f u ll u s a g e ra m p a t 18 m o f ro m signing • At s i g n i n g , e q ua l t o th e s u m o f a l l c om m i tt ed r ev e n u e ov er t h e te r m o f t h e c o n t r a c t • e . g . $3.33 M c A RR x 3 y r te r m = $10.0 M R P O • B a l a n c e i s r ed u c ed o v er t i m e ( $3.3M / y r i llu s t r a t e d a b o v e ) a s c ommi tme n ts a r e r e c o g n i z e d as re v e n u e UAC cARR RPO Us a g e a b o v e C o mmit t ed A nnu a l Rem a i n i n g P e r f o r m a n c e Commitment Re curr i n g Re v e n u e Obligation $10.0M 2024 Yr0 - $3.3M $6.7M 2025 Yr1 $1.7M $3.3M $3.3M 2026 Yr2 $3.3M $3.3M - 2027 Yr3 Component Illustration using a $10M RPO / $6.6M bARR Booking in Ǫ4 2024 $6.6M b A R R = A nnu a l Recurring R e v e n u e a t fu ll usa g e r am p - 8 - © 2024 authID Inc. All Rights Reserved.

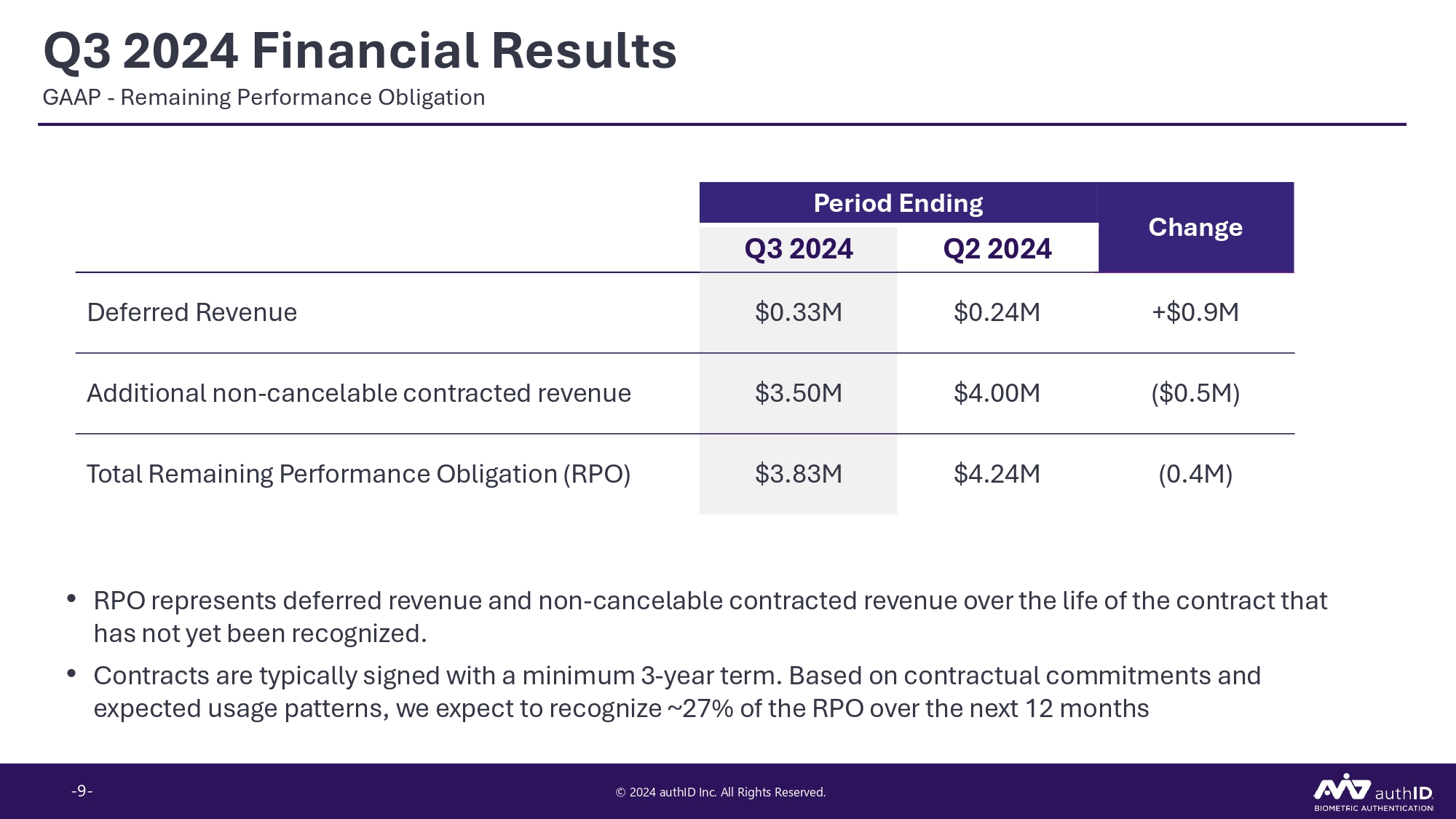

Ǫ 3 202 4 F i n a n c i a l R e s u l t s G AA P - R e m a i n i n g P e r f orm a n c e O b l i g a t i on - 9 - © 2024 authID Inc. All Rights Reserved. • RPO represents deferred revenue and non - cancelable contracted revenue over the life of the contract that has not yet been recognized. • Contracts are typically signed with a minimum 3 - year term. Based on contractual commitments and expected usage patterns, we expect to recognize ~27% of the RPO over the next 12 months Change P eri od End i ng Ǫ 2 2024 Ǫ 3 2024 +$0.9M $0.24M $0.33M De f e r r ed Re v enue ($0.5M) $4.00M $3.50M Add i t ional non - c anc el a bl e con t r ac t e d r e v e nue (0.4M) $4.24M $3.83M Total Remaining Performance Obligation (RPO)

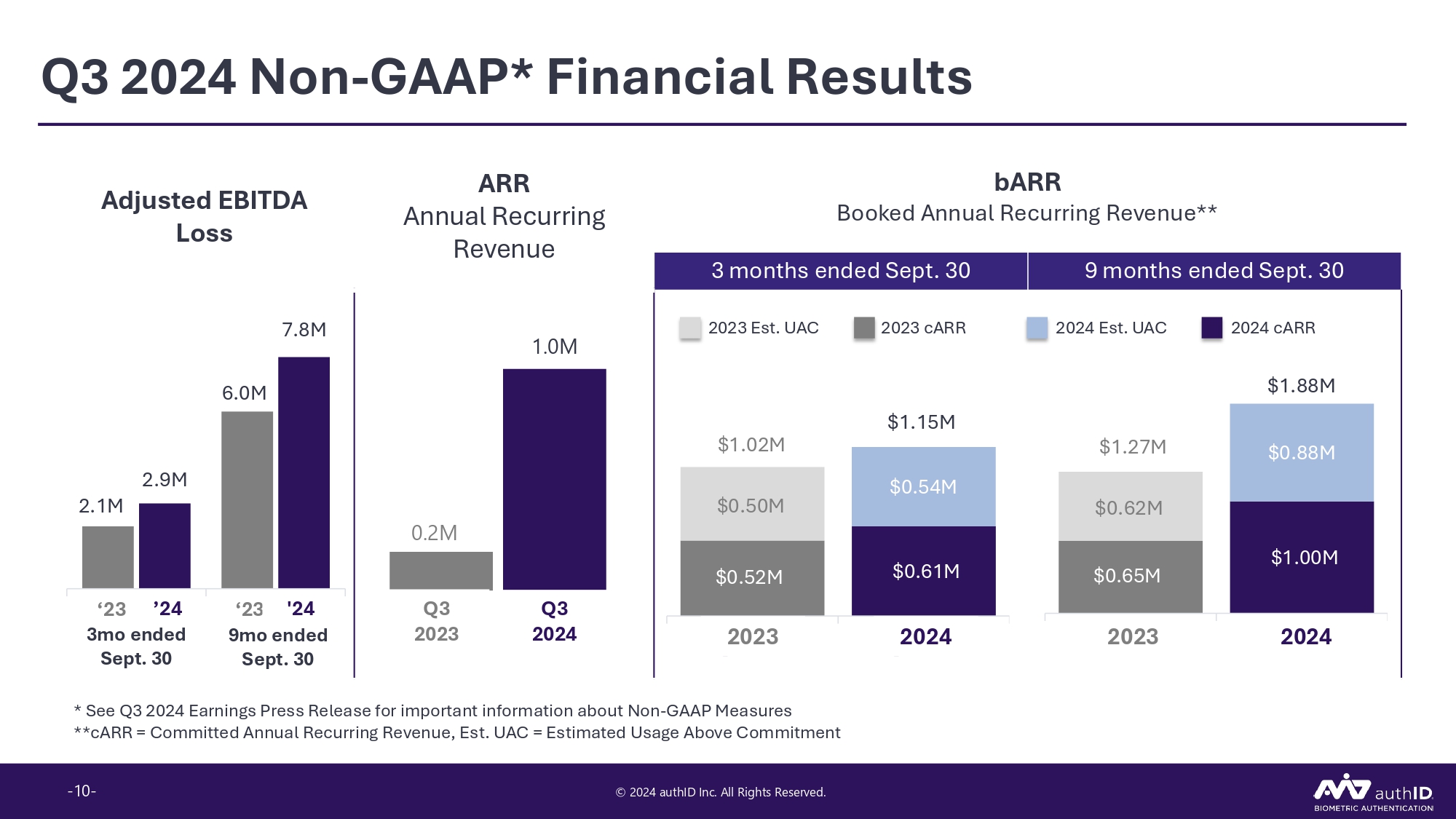

Ǫ 3 202 4 N o n - G AA P * F i nanc i a l R es u l t s Q3 2023 Q3 2024 * See Ǫ3 2024 Earnings Press Release for important information about Non - GAAP Measures **cARR = Committed Annual Recurring Revenue, Est. UAC = Estimated Usage Above Commitment Q2 2023 Q2 2024 3 m o 9 m o bARR Boo k e d Annu al R e c u rr i n g R e v enue ** ARR A nnual R e cu rr ing Revenue A d ju st e d EB I T D A Loss 9 m onth s en d e d Se p t . 30 3 m onth s en d e d Se p t . 30 202 4 c ARR $1.88M $0.88M $1.00M 2024 202 4 E s t . U A C $1.27M $0.62M $0.65M 2023 202 3 c ARR $1.15M $0.54M $0.61M 2024 202 3 E s t . U A C $1.02M $0.50M $0.52M 2023 1.0M 7.8M 6.0M 2.9M 0.2M 2.1M Ǫ3 Ǫ3 ‘23 '24 ‘23 ’24 2024 2023 9 m o e n de d S ept . 30 3 m o e n de d S ept . 30 - 10 - © 2024 authID Inc. All Rights Reserved.

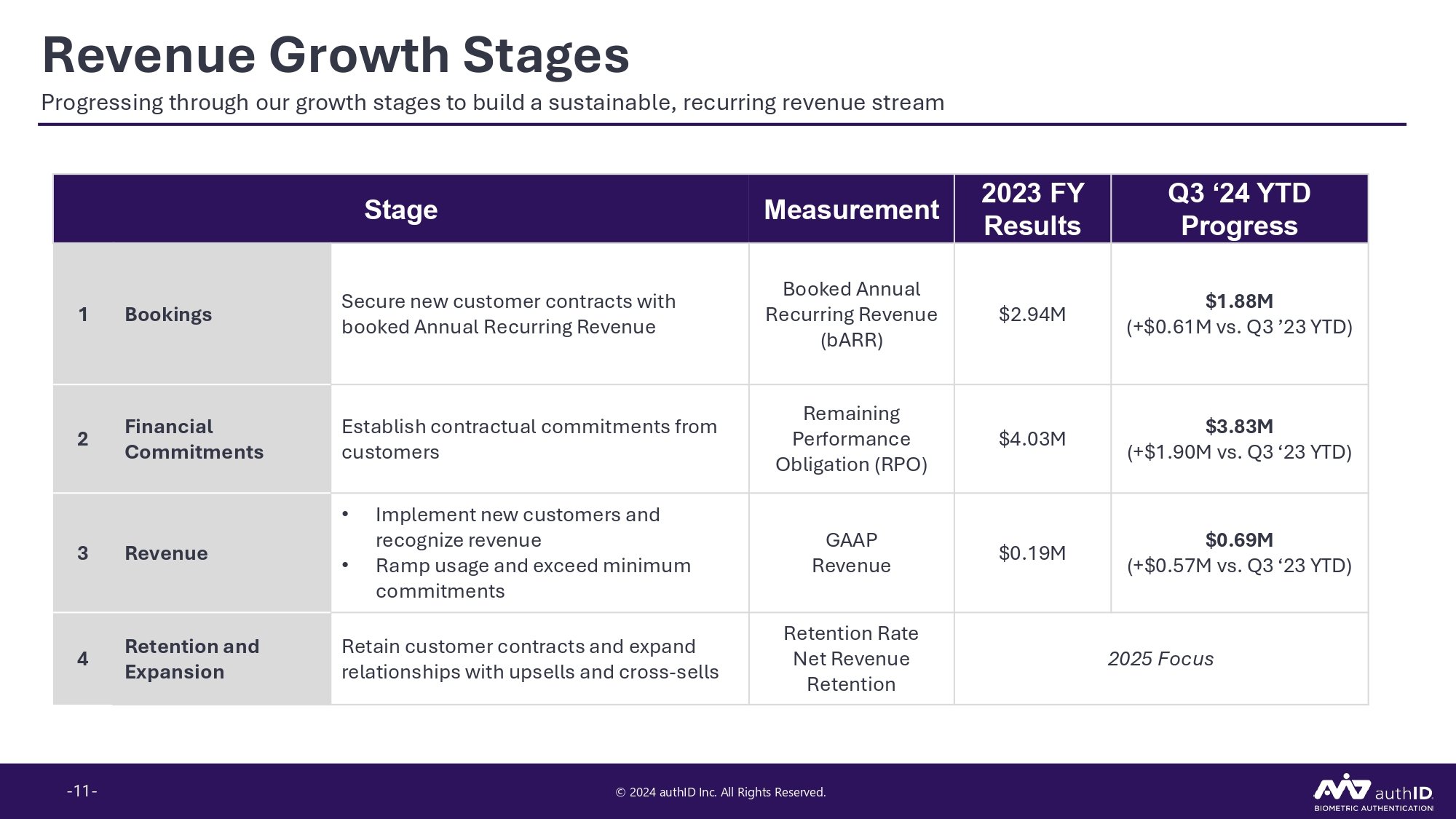

R ev en u e G ro w th S t a g es Progressing through our growth stages to build a sustainable, recurring revenue stream - 11 - © 2024 authID Inc. All Rights Reserved. Q3 ‘24 YTD Progress 2023 FY Results Measurement Stage $1.88M ( +$0.61 M v s . Ǫ3 ’ 2 3 Y T D ) $2.94M B oo k ed A nnu a l Re curr i n g Re v e n u e (bARR) S e cu r e n ew cu s t o mer c o n t r a c ts w ith bo o k ed A nn ua l Re curr i n g Re v e n u e Bookings 1 $3.83M ( +$1.90 M v s . Ǫ3 ‘ 2 3 Y T D ) $4.03M Remaining Performance Ob l i g a ti o n ( R P O) E s t a b l ish c o n t r a c t u a l c o mmitme n ts f r o m customers Financial C ommi t me n t s 2 $0.69M ( +$0.57 M v s . Ǫ3 ‘ 2 3 Y T D ) $0.19M GAAP Revenue • I mp l eme n t n ew cu s t o me r s a nd r e c o g n i z e r e v e n u e • R a mp u s a g e a n d e x c eed mi n im u m commitments Revenue 3 202 5 F o c us Re t e n ti o n R ate Net Re v e n u e Retention Retain customer contracts and expand r e l a ti o n s h ips w ith u pse ll s a n d c r o ss - se lls Re t e nt io n a nd Expansion 4

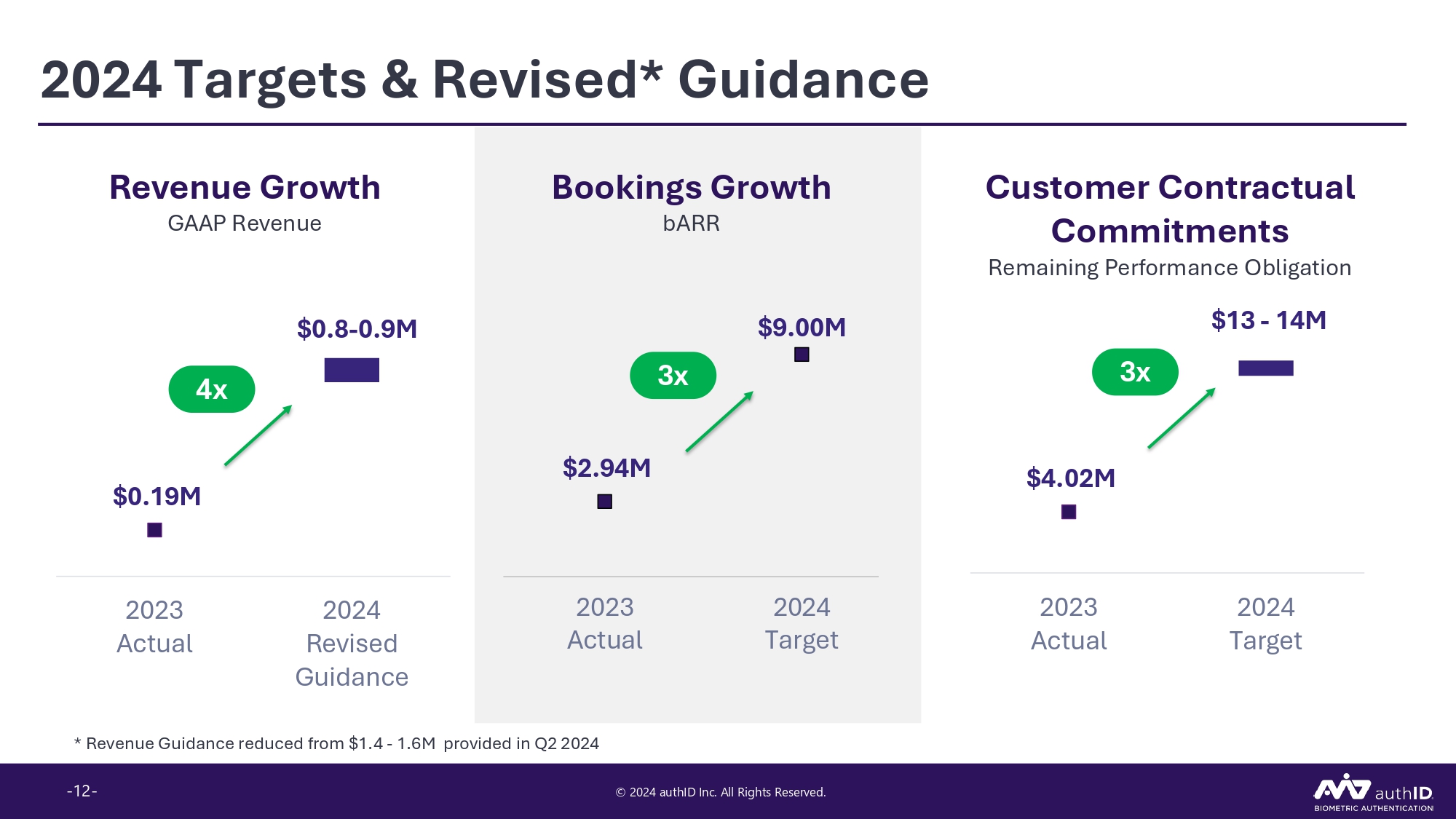

202 4 T a r g e t s & R ev i s e d * G u i d a n c e $0.8 - 0.9M 4x R e v e n u e G r o w th G AA P R e v e n ue $2. 94M $9. 00M Bo o ki ng s G r o w th bARR 3x $4. 02M $0.19M 2024 2023 2024 2023 2024 2023 Target Actual Target Actual Revised G ui d a n ce Actual C u s t o m e r C o nt r a c tu a l Commitments R e m a i n i n g P e r f orm a n c e O b l i g a t i on $1 3 - 14M 3x * R e v e n ue G u i da n c e r edu c ed f r o m $1. 4 - 1 . 6 M p ro v i de d i n Ǫ 2 2024 - 12 - © 2024 authID Inc. All Rights Reserved.

© 2024 authID Inc. All Rights Reserved. N AS D A Ǫ : AU ID © 2024 authID Inc. All Rights Reserved. Ǫ & A