- AUID Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

authID (AUID) 8-KResults of Operations and Financial Condition

Filed: 12 Feb 25, 4:15pm

Exhibit 99.1

© 2025 authID Inc. All Rights Reserved. cARR bARR 2024 Preliminary Estimates Remaining Performance Obligation ($M) Cash Balance ($M) Adjusted EBITDA ($M) Gross Bookings ($M) Revenue ($M) 0.19M 0.8 - 0.9M 2.9M 1.3M 9.0M 4.7M (8.7M) (11.8 - 12.0M) $4.0 M $14.0 - 14.5M 10.2M 8.5M ‘23 ’24 ‘23 '24 ‘23 ’24 ‘23 ’24 ‘23 ’24 ‘23 ’24 Note: See Appendix for reconciliation of these Non - GAAP Measures and more information regarding the Company’s calculation of bAR R. Final results for the three months and twelve months ended December 31, 2024 could vary significantly from these preliminary estimates as a result of the completion of our customary year - end closing, review and audit procedures and other developments arising between now and the time that our financial results are finalized.

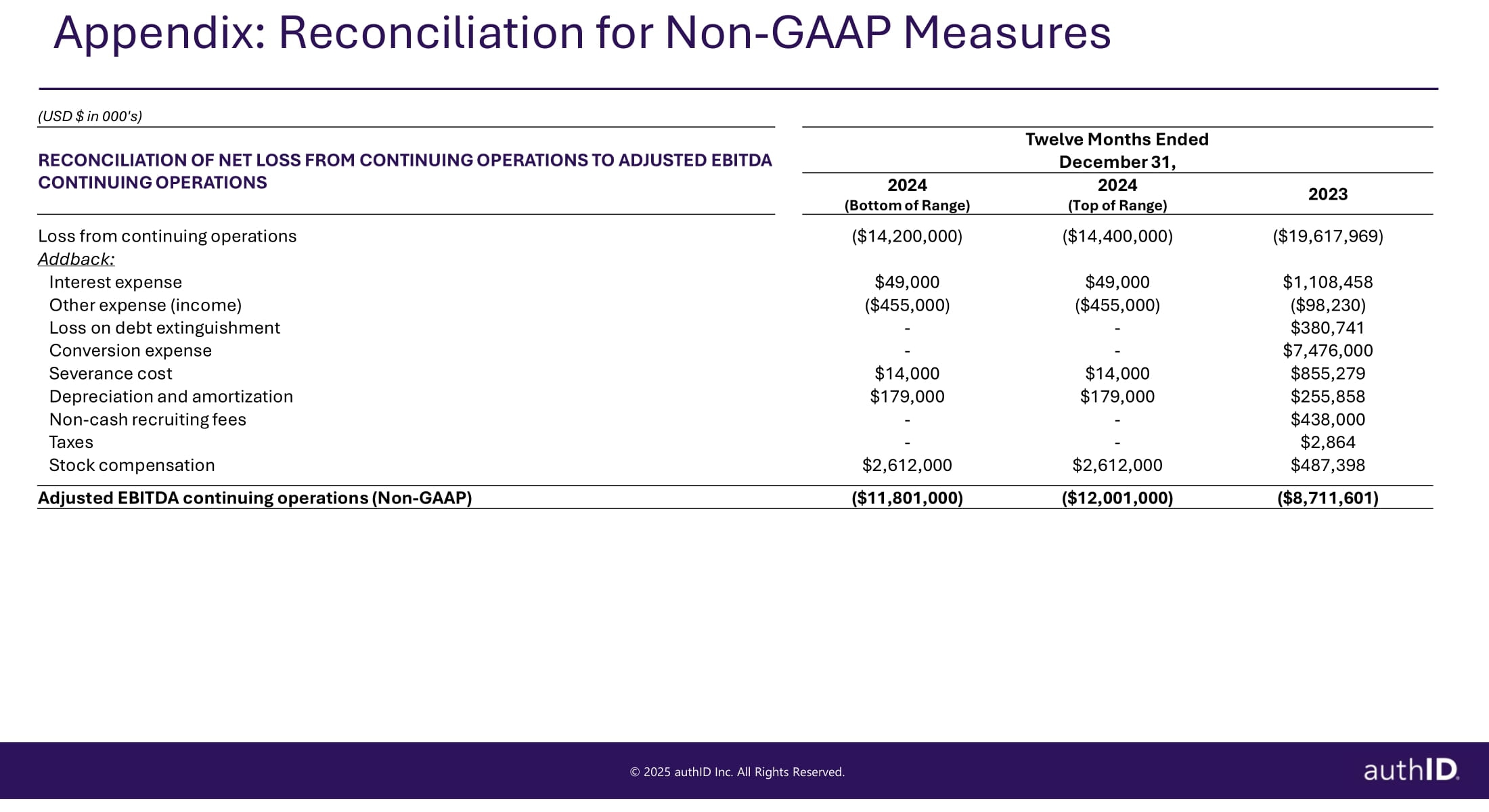

© 2025 authID Inc. All Rights Reserved. Appendix: Reconciliation for Non - GAAP Measures (USD $ in 000's) Twelve Months Ended RECONCILIATION OF NET LOSS FROM CONTINUING OPERATIONS TO ADJUSTED EBITDA CONTINUING OPERATIONS December 31, 2023 2024 (Top of Range) 2024 (Bottom of Range) ($19,617,969) ($14,400,000) ($14,200,000) Loss from continuing operations Addback: $1,108,458 $49,000 $49,000 Interest expense ($98,230) ($455,000) ($455,000) Other expense (income) $380,741 - - Loss on debt extinguishment $7,476,000 - - Conversion expense $855,279 $14,000 $14,000 Severance cost $255,858 $179,000 $179,000 Depreciation and amortization $438,000 - - Non - cash recruiting fees $2,864 - - Taxes $487,398 $2,612,000 $2,612,000 Stock compensation ($8,711,601) ($12,001,000) ($11,801,000) Adjusted EBITDA continuing operations (Non - GAAP)

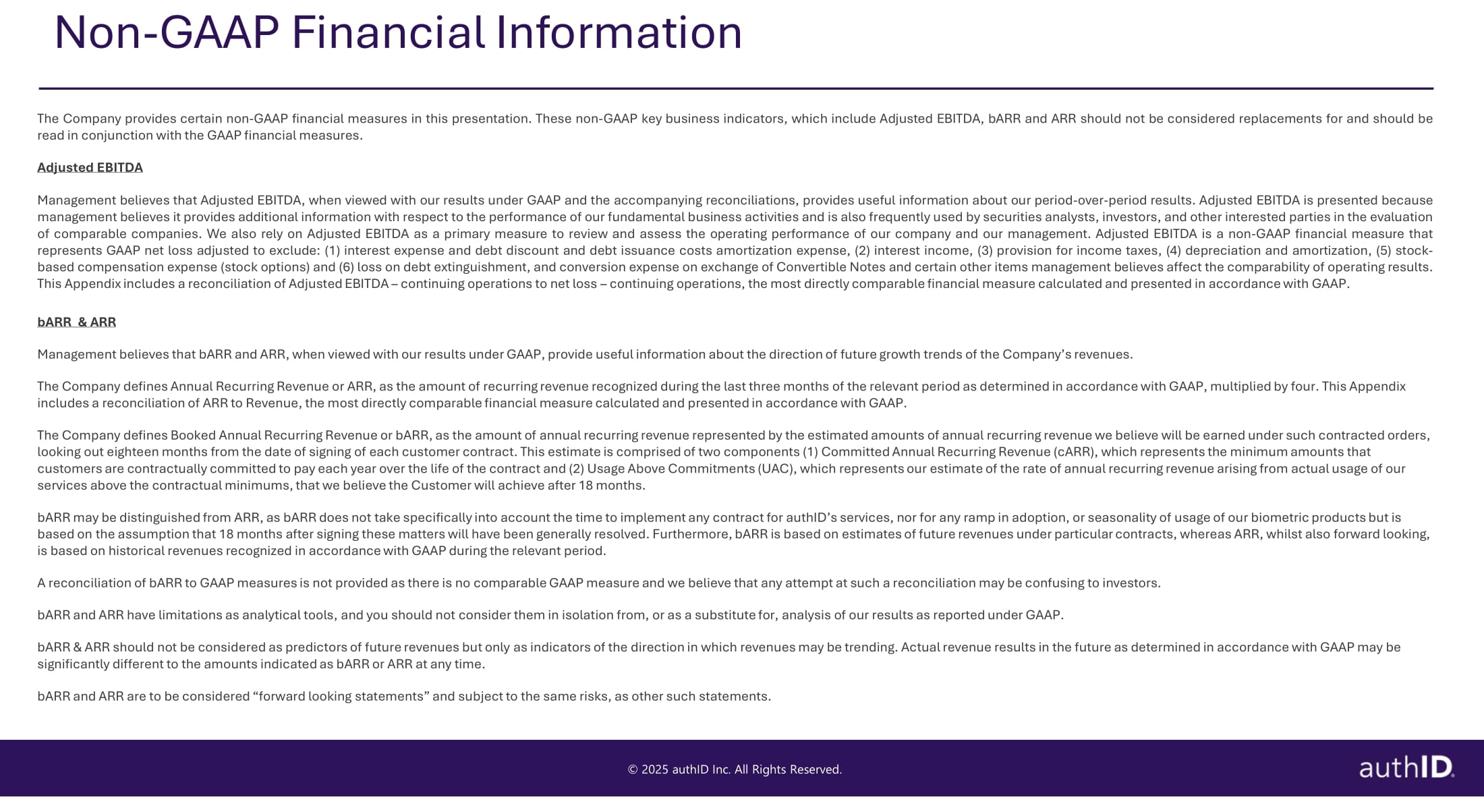

© 2025 authID Inc. All Rights Reserved. Non - GAAP Financial Information The Company provides certain non - GAAP financial measures in this presentation . These non - GAAP key business indicators, which include Adjusted EBITDA, bARR and ARR should not be considered replacements for and should be read in conjunction with the GAAP financial measures . Adjusted EBITDA Management believes that Adjusted EBITDA, when viewed with our results under GAAP and the accompanying reconciliations, provides useful information about our period - over - period results . Adjusted EBITDA is presented because management believes it provides additional information with respect to the performance of our fundamental business activities and is also frequently used by securities analysts, investors, and other interested parties in the evaluation of comparable companies . We also rely on Adjusted EBITDA as a primary measure to review and assess the operating performance of our company and our management . Adjusted EBITDA is a non - GAAP financial measure that represents GAAP net loss adjusted to exclude : ( 1 ) interest expense and debt discount and debt issuance costs amortization expense, ( 2 ) interest income, ( 3 ) provision for income taxes, ( 4 ) depreciation and amortization, ( 5 ) stock - based compensation expense (stock options) and ( 6 ) loss on debt extinguishment, and conversion expense on exchange of Convertible Notes and certain other items management believes affect the comparability of operating results . This Appendix includes a reconciliation of Adjusted EBITDA – continuing operations to net loss – continuing operations, the most directly comparable financial measure calculated and presented in accordance with GAAP . bARR & ARR Management believes that bARR and ARR, when viewed with our results under GAAP, provide useful information about the directio n o f future growth trends of the Company’s revenues. The Company defines Annual Recurring Revenue or ARR, as the amount of recurring revenue recognized during the last three mont hs of the relevant period as determined in accordance with GAAP, multiplied by four. This Appendix includes a reconciliation of ARR to Revenue, the most directly comparable financial measure calculated and presented in accor dan ce with GAAP. The Company defines Booked Annual Recurring Revenue or bARR, as the amount of annual recurring revenue represented by the est ima ted amounts of annual recurring revenue we believe will be earned under such contracted orders, looking out eighteen months from the date of signing of each customer contract. This estimate is comprised of two components (1) Committed Annual Recurring Revenue ( cARR ), which represents the minimum amounts that customers are contractually committed to pay each year over the life of the contract and (2) Usage Above Commitments (UAC), w hic h represents our estimate of the rate of annual recurring revenue arising from actual usage of our services above the contractual minimums, that we believe the Customer will achieve after 18 months. bARR may be distinguished from ARR, as bARR does not take specifically into account the time to implement any contract for authID’s services, nor for any ramp in adoption, or seasonality of usage of our biometric products but is based on the assumption that 18 months after signing these matters will have been generally resolved. Furthermore, bARR is ba sed on estimates of future revenues under particular contracts, whereas ARR, whilst also forward looking, is based on historical revenues recognized in accordance with GAAP during the relevant period. A reconciliation of bARR to GAAP measures is not provided as there is no comparable GAAP measure and we believe that any atte mpt at such a reconciliation may be confusing to investors. bARR and ARR have limitations as analytical tools, and you should not consider them in isolation from, or as a substitute for , a nalysis of our results as reported under GAAP. bARR & ARR should not be considered as predictors of future revenues but only as indicators of the direction in which revenue s m ay be trending. Actual revenue results in the future as determined in accordance with GAAP may be significantly different to the amounts indicated as bARR or ARR at any time. bARR and ARR are to be considered “forward looking statements” and subject to the same risks, as other such statements.