Exhibit 10.1

REAL PROPERTY’s PURCHASE OF DEVELOPMENT RIGHTS AND SALE AGREEMENT

THIS REAL PROPERTY PURCHASE AND SALE AGREEMENT (this “Agreement”) is made as of the 29th day of October 2021 (the “Effective Date”), by and between Jewel’s Real Estate 1086 MASTER LLLP Pennsylvania partnership AND Ameri Metro, Infrastructure Cryptocurrency Inc., a Delaware company (“Seller”), and Ameri Metro, Inc., a Delaware company (“Buyer”). In consideration of the mutual covenants and agreements contained in this Agreement, Buyer and Seller agree as follows:

BASIC TERMS

Acknowledgment: These agreements supersede all other written or oral agreement(s) if any buyer acknowledges that its officers and director were anticipating this transaction and had full inspection of the site, permits, and plans, and has accepted this site to the extent necessary to enter into this agreement.

Property. The date hereof, Seller and Buyer entered this agreement dated as of the 29th day of October 2021 (the “Agreement”), pursuant to which Seller gave Buyer all rights (“for development”) to develop and acquire easements and other rights that relate to certain real property located in San Bernardino County, California. The real property, together with all other property that is the subject of this Agreement, is defined more fully in Article 2 below. Buyer has the right to exercise the purchase and in accordance with this Agreement, Seller and Buyer now are entering into this Agreement.

Purchase Price and Deposit. The purchase price for the Property (the “Purchase Price”) is Five Hundred Forty-One Million Three Hundred Sixty-Nine Thousand and 00/100 Dollars ($541,369,000.00). Pursuant to this Agreement, Buyer paid to Seller an Option Fee in the form of shares of stock of Ameri Metro, Inc., a Delaware, corporation, as described further in the Agreement equal to Thirty Million Dollars ($30,000,000.00) of such Option Fee shall be in form of class B shares (6,383 shares (Est)) @ 4,700 per share

1.1 Due Diligence Period. During the period between the Effective Date and the thirtieth (30th) day after the Effective Date (the “Due Diligence Period”), Buyer shall have the right to complete all of its inspections, investigations and reviews of the property (including title reviews, structural, mechanical and engineering inspections, environmental inspections, financial and feasibility studies, and all other inspections, investigations and reviews), all in accordance with Article 4 below.

1.2 Closing Date. Escrow shall close not later than one hundred eighty (180) days after the Effective Date, as further described in Section 3.2. As used in this Agreement,

“Closing” means the recordation of the “Deed” (as defined below) in the Official Records of San Bernardino County, California, and the completion of the other matters required by this Agreement to be done contemporaneously. The date on which the Closing occurs shall be referred to as the “Closing Date.”

1.3 Seller’s Address for Notices. All notices to be provided to Seller shall be sent to the following addresses:

Ameri Metro, Infrastructure Cryptocurrency Inc

2575 Eastern Blvd.

Suite 105

York, Pa 17402

Jewel’s Real Estate 1086 Master LLLP

P.O. Box 124

Red Lion, PA 17356

1.4 Buyer’s Address for Notices. All notices to be provided to Buyer shall be sent to the following addresses:

Ameri Metro, Inc.

2575 Eastern Blvd.

Suite 102

York pa 17402

With a Copy to:

Slater & West Inc.

2575 Eastern Blvd.

Suite 101

York pa 17402

1.5 Brokers. The parties have not used the services of any brokers in this transaction.

2. AGREEMENT OF SALE AND PURCHASE. Subject to all the terms and conditions of this Agreement, Seller agrees to sell, transfer, and convey, and Buyer agrees to purchase, the following:

2.1 Real Property. The parcels of land legally described in Exhibit A attached hereto, together with all rights, privileges and easements appurtenant thereto, including without limitation all minerals, oil, gas and other hydrocarbon substances thereon, all development rights,

air rights, water, water rights and water stock relating thereto, and any easements, rights-of-way, or other rights appurtenant thereto or used in conjunction therewith (the “Land”),

2.2 All improvements, structures, and amenities which may be located on the Land (collectively, the “Improvements”). Buyer acknowledges that the Improvements (such as a golf course and related amenities) have not been completed and may be partially constructed, and Seller makes no representations or warranties relating to the condition of the Improvements. The Improvements and Land are collectively referred to as the “Real Property.”

2.3 Personalty. All right, title, and interest of Seller, if any, in and to all personal property and other tangible property located on the Real Property and used in connection with the operation of the Real Property (all the above personal property in which Seller has any right, title, or interest is collectively referred to as the “Personalty”).

2.4 Contracts. All service contracts that are to be assumed by Buyer as provided in Section 4.1 below, together with all supplements, amendments and modifications (the “Contracts”).

2.5 Other Property Rights. All of Seller’s right, title and interest in and to, and obligations under, all of the following, if any, to the extent assignable: (a) all licenses and permits held by Seller in connection with the Land, Improvements or Personalty (“Licenses”); (b) all easements for the benefit of the Land (“Easements”); (c) all applications, governmental approvals, parcel maps and other entitlements relating to the Real Property and the proposed development thereof (the “Entitlements”); and (d) all plans, drawings, specifications, surveys, engineering reports, and other technical information in the possession of Seller, if any, pertaining to the Land, Building, Improvements or Personalty (“Plans”) (such Licenses, Easements, Entitlements and Plans are referred to collectively as “Other Property Rights”).

2.6 Property. The Land, Improvements, Personalty, Contracts and Other Property Rights are sometimes collectively referred to as the “Property.”

3. PURCHASE PRICE.

3.1 Deposit. Prior to the date hereof, Buyer paid the Deposit to Seller, and Seller acknowledges that Seller currently holds the Deposit. Except as otherwise stated in this Agreement, if Buyer does not elect to terminate this Agreement on or before the last day of the Due Diligence Period, the Deposit shall be nonrefundable to Buyer after the end of the Due Diligence Period in accordance with the provisions of Section 4 below. The Deposit shall be applied to the Purchase Price at Closing.

3.2 SEC Approval. If Buyer does not terminate this Agreement as provided in Section 4 below prior to the expiration of the Due Diligence Period, Buyer will file with the Securities and Exchange Commission (the “SEC”) such notices as may be necessary to consummate this Agreement. If, within sixty (60) days after the expiration of the Due Diligence Period, the SEC issues a letter indicating no objection to this Agreement, and if no appeal is filed with respect to such SEC letter within thirty (30) days thereafter, Buyer shall deliver to Seller the cryptocurrency tokens described in Section 3.3 below and Closing shall occur within forty-five

(45) days after the expiration of such 30-day appeal period but not later than 180 days after the Effective Date. If either (a) the SEC objects to this Agreement, or does not issue a letter indicating no objection, within sixty (60) days after the expiration of the Due Diligence Period, or (b) the SEC issues a no-objection letter but an appeal is filed within the 30-day appeal period described above, this Agreement shall automatically terminate, in which case Seller shall retain the Deposit as liquidated damages pursuant to Section 6.6 and the parties shall have no further rights or obligations under this Agreement.

3.3 Balance of Purchase Price. If this Agreement is not terminated pursuant to Section 3.2 or Section 4.4, then at least thirty (30) days before the Closing Date, Buyer shall deliver to Seller cryptocurrency tokens issued by Ameri Metro, Infrastructure Cryptocurrency Inc, which will have a value of Five Hundred Eleven Million Three Hundred Sixty-Nine Thousand Dollars ($511,369,000.00). Seller shall have the right to sell such tokens prior to the Closing Date. If Seller obtains sale proceeds from the sale of such tokens in an amount equal to or greater than $511,369,000.00, Buyer’s obligation to pay the Purchase Price hereunder will be deemed satisfied.

4. DUE DILIGENCE PERIOD.

4.1 Seller’s Deliveries. Within ten (10) days after the date of execution hereof, Seller shall deliver or cause to be delivered to Buyer the following: (a) copy of a current standard coverage preliminary title report issued by the Title Company showing the condition of title to the Property, accompanied by copies of all documents referred to in the report (collectively, the “PTR”); (b) a rent roll describing all Leases for the Property, together with a copy of all of the Leases; (c) all third-party service contracts relating to the Property; (d) real property tax statements for the past three (3) tax years for the Property; (e) the most recent ALTA survey of the Property that is in Seller’s possession or control (if any) (the “Survey”) (and if Buyer has need for a more recent survey, it shall be Buyer’s obligation to obtain such new survey at Buyer’s sole cost and expense); (f) any environmental assessments of the Property or other environmental reports of the Property that were prepared by or for Seller (or are otherwise in Seller’s possession or control); (g) a Natural Hazards Disclosure Report (which Seller shall cause Escrow Holder to prepare and deliver to Buyer); and (h) other non-privileged documents and materials that materially relate to the Property that are in Seller’s possession or the possession of Seller’s property manager, if any. Seller makes no representation or warranty as to the truth, accuracy, or completeness of any such delivered materials, and Buyer agrees notwithstanding the delivery of such materials, Buyer shall rely solely on its own investigations of the Property in determining, prior to the end of the Due Diligence Period, whether to purchase the Property.

4.2 Title Review. Not later than five (5) days before the end of the Due Diligence Period, Buyer shall deliver to Seller a written notice stating that Buyer either (a) approves the condition of title as shown on the PTR, or (b) disapproves any specific exceptions to title showing on the PTR. If Buyer fails to provide such written notice on or before such date, Buyer shall be deemed to have approved the condition of title as shown on the PTR. If Buyer delivers a timely written notice in which Buyer disapproves any specific exceptions to title, Seller shall either cause such exceptions to be removed on or before the Closing Date or shall

notify Buyer in writing on or before the end of the Due Diligence Period that Seller will not cause such exceptions to be removed. If Seller notifies Buyer in writing on or before the end of the Due Diligence Period that it will not cause such exceptions to be removed, Buyer may either terminate this Agreement prior to the end of the Due Diligence Period as provided in Section 4.4 below, or waive its disapproval to such exceptions and proceed to Closing, in which case Seller shall have no obligation to cause such exceptions to be removed from title. Seller’s failure to provide such notice shall be deemed Seller’s election not to cause such exceptions to be removed. Notwithstanding the foregoing, Seller agrees to extinguish on the Closing Date all monetary liens or encumbrances affecting title to the Property (excluding the lien for real property taxes and assessments that are not yet delinquent, and any liens caused by Buyer). If Buyer does not terminate this Agreement before the end of the Due Diligence Period, Buyer shall irrevocably be deemed to have elected to waive its disapproval to such title exceptions, to have approved the condition of title to the Property, and to have elected to proceed to Closing.

4.3 Buyer’s Inspections. During the Due Diligence Period, Buyer shall have the right to conduct and make such feasibility studies as Buyer deems necessary, including but not limited to engineering studies, building inspections, books and records inspections, environmental studies, zoning studies, mechanical studies, economic studies, utility studies, and Lease review, subject to the terms and conditions of this Section. During the Due Diligence Period, on at least two (2) days’ prior written notice to Seller, Buyer, its agents, and representatives (subject to the rights of Tenants) shall be entitled to enter upon the Property, accompanied by representatives or agents of Seller, to perform inspections and tests of the Property. Buyer may not perform any intrusive testing without giving Seller a plan describing the intrusive testing at least five (5) days before the intrusive testing and obtaining Seller’s and any affected Tenant’s written consent to perform such intrusive testing. Buyer shall repair any damage caused by such studies, inspections, tests, and investigations. Buyer hereby agrees to indemnify, defend, and hold harmless Seller and Tenants from and against any and all damages, liabilities, losses, costs, expenses, causes of action, and liens, including but not limited to reasonable attorneys’ fees, resulting from, arising out of, or in connection with such studies, inspections, tests, and investigations. Prior to performing any intrusive testing or any physical studies, inspections, tests, and investigations, Buyer will give Seller a certificate of insurance naming Seller and its agents and representatives and any affected Tenant as additional insureds, issued by an insurance company authorized to do business in the State of California insuring against all claims, demands, or actions for injury or death to persons or damage to property in an amount of not less than $2,000,000.00 per occurrence. The duty to repair and the indemnification contained in this Paragraph 4.3 shall survive termination of this Agreement and shall survive the Closing Date.

4.4 Termination Right. If, prior to the expiration of the Due Diligence Period, Buyer has determined in Buyer’s judgment that the Property is not suitable for Buyer’s intended use, Buyer may terminate this Agreement by written notice delivered to Seller before the expiration of the Due Diligence Period, whereupon this Agreement shall become null and void and of no further force or effect, the parties hereto shall have no further obligations to one another (except as expressly stated otherwise in this Agreement), and the Deposit shall be returned to Buyer. Buyer’s failure to notify Seller before the expiration of the Due Diligence Period shall constitute a waiver of the right to terminate this Agreement pursuant to this Article

4, in which case the Deposit shall be non-refundable. If Buyer terminates this Agreement, Buyer will give Seller copies of all tests and studies received by Buyer and return the Seller Deliveries to Seller.

5. REPRESENTATIONS, WARRANTIES, AND COVENANTS OF SELLER.

5.1 Seller represents, warrants, and covenants to Buyer that as of the date hereof and the Closing Date:

5.1.1 After the end of the Due Diligence Period, Seller will not enter into any leases for the Property without the prior written consent of Buyer.

5.1.2 Seller does not have any actual knowledge of any condemnation proceedings which are pending or threatened against Seller, the Property, or any part thereof.

5.1.3 Seller has not received any written notice of any claim or litigation, threatened or pending, by any private or government person or entity which could affect the Property.

5.1.4 Seller’s execution of and performance under this Agreement do not and shall not constitute a breach of any agreement, understanding, order, judgment, or decree, written or oral, to which Seller is a party, or to which any part of the Property may be subject, or by which Seller may be bound.

5.1.5 Seller has full power and authority to execute, deliver, and consummate this Agreement.

5.1.6 Seller is not a “foreign person” as defined in Section 1445 of the Internal Revenue Code of 1986, as amended, and the income tax regulations issued thereunder.

5.1.7 Seller is not, and to Seller’s knowledge, each person or entity owning an interest in Seller is not, nor prior to Closing or the earlier termination of this Agreement, will become, a person or entity with whom a United States citizen, entity organized under the laws of the United Sates or its territories or entity having its principal place of business within the United States or any of its territories (each a “U.S. Person”) is prohibited from transacting business of the type contemplated by this Agreement, whether such prohibition arises under United States laws, regulations, executive orders, lists published by the Office of Foreign Assets Control, Department of the Treasury (“OFAC”) including those executive orders and lists published by OFAC with respect to persons or entities that have been designated by executive order or by the sanction regulations of OFAC as persons or entities with whom U.S. persons may not transact business or must limit their interactions to types approved by OFAC or otherwise. Seller is not, and to Seller’s knowledge, each person or entity owning an interest in Seller is not, an Embargoed Person (as defined below) and to Seller’s knowledge, none of the funds or other assets of Seller constitute property of, or are beneficially owned, directly or indirectly, by any Embargoed Person. The term “Embargoed Person” means any person, entity, or government subject to trade restrictions under U.S. law, including but not limited to, the International

Emergency Economic Powers Act, 50 U.S.C. §1701 et seq., The Trading with the Enemy Act, 50 U.S.C. App. 1 et seq., and any Executive Orders or regulations promulgated thereunder.

5.2 The representations, warranties and covenants of Seller under this Article 5 shall survive the Closing Date for a period of six (6) months.

6. REPRESENTATIONS, WARRANTIES, AND COVENANTS OF BUYER.

6.1 Buyer represents, warrants, and covenants to Seller that as of the date hereof and the Closing Date:

6.1.1 Buyer’s execution of and performance under this Agreement do not and shall not constitute a breach of any agreement, understanding, order, judgment, or decree, written or oral, to which Buyer is a party or by which Buyer may be bound.

6.1.2 Buyer has full power and authority to execute, deliver, and consummate this Agreement.

6.1.3 Buyer is not, and to Buyer’s knowledge, each person or entity owning an interest in Buyer is not, nor prior to Closing or the earlier termination of this Agreement, will become, a person or entity with whom a U.S. Person is prohibited from transacting business of the type contemplated by this Agreement, whether such prohibition arises under United States laws, regulations, executive orders, lists published by OFAC, including those executive orders and lists published by OFAC with respect to persons or entities that have been designated by executive order or by the sanction regulations of OFAC as persons or entities with whom U.S. persons may not transact business or must limit their interactions to types approved by OFAC or otherwise. Buyer is not, and to Buyer’s knowledge, each person or entity owning an interest in Buyer is not, an Embargoed Person) and to Buyer’s knowledge, none of the funds or other assets of Buyer constitute property of, or are beneficially owned, directly or indirectly, by any Embargoed Person.

6.1.4 Buyer has inspected, or will have inspected, the Property and is or will become thoroughly familiar with its condition. Buyer acknowledges and agrees that Seller has not made and does not hereby make any representations, warranties, or covenants of any kind or character whatsoever with respect to the Property, whether express or implied, except as expressly set forth in this Agreement. In purchasing the Property, Buyer is not relying upon any warranties, promises, guarantees, or representations made by Seller, Broker (as hereinafter defined), or anyone acting or claiming to act on behalf of Seller or Broker, except as otherwise expressly set forth in this Agreement.

6.2 The representations, warranties and covenants of Buyer under this Article 6 shall survive the Closing Date for a period of six (6) months.

7. AS-IS SALE; RELEASE.

7.1 As-Is. EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, SELLER HAS NOT MADE AND DOES NOT HEREBY MAKE ANY

REPRESENTATIONS, WARRANTIES, OR COVENANTS OF ANY KIND OR CHARACTER WHATSOEVER WITH RESPECT TO THE PROPERTY, WHETHER EXPRESS OR IMPLIED. IN ADDITION TO THE FOREGOING BUT NOT IN LIMITATION OR DEROGATION THEREOF, EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, SELLER HEREBY DISCLAIMS AND DENIES ANY REPRESENTATIONS, WARRANTIES, OR COVENANTS OF ANY KIND OR CHARACTER WITH RESPECT TO (A) THE CONDITION OF ANY IMPROVEMENTS ON THE PROPERTY, OR THE COST TO COMPLETE ANY SUCH IMPROVEMENTS, (B) THE EFFECTIVENESS OF ANY ENTITLEMENTS, OR WHETHER ANY ENTITLEMENTS HAVE EXPIRED OR NEED TO BE RENEWED, OR WHETHER THE ENTITLEMENTS ARE SUITABLE OR SUFFICIENT FOR BUYER’S INTENDED DEVELOPMENT OR USE OF THE PROPERTY, (C) THE WATER, SOIL, GEOLOGY, AND SUITABILITY OF THE PROPERTY FOR ANY AND ALL ACTIVITIES AND USES WHICH BUYER MAY ELECT TO PERFORM OR CONDUCT THEREON; (D) THE EXISTENCE OR ABSENCE OF ANY ENVIRONMENTAL HAZARDS OR CONDITIONS THEREON OR COMPLIANCE OF THE PROPERTY OR ITS OPERATION WITH ALL APPLICABLE LAWS, RULES, OR REGULATIONS; (E) THE CONDITION OR STATE OF REPAIR OF THE PROPERTY; (F) VISIBLE OR HIDDEN DEFECTS IN MATERIAL, WORKMANSHIP, OR CAPACITY OF THE PROPERTY, AND (G) TENANTABILITY, MERCHANTABILITY, OR FITNESS OF THE PROPERTY FOR A PARTICULAR PURPOSE. BUYER REPRESENTS THAT IT IS A KNOWLEDGEABLE, EXPERIENCED AND SOPHISTICATED BUYER OF REAL ESTATE AND ASSETS SIMILAR TO THE PROPERTY AND THAT, EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, IT IS RELYING SOLELY ON ITS OWN EXPERTISE AND THAT OF BUYER’S CONSULTANTS IN PURCHASING THE PROPERTY AND SHALL MAKE AN INDEPENDENT VERIFICATION OF THE ACCURACY OF ANY DOCUMENTS AND INFORMATION PROVIDED BY SELLER. BUYER WILL CONDUCT SUCH INVESTIGATIONS OF THE PROPERTY AS BUYER DEEMS NECESSARY, INCLUDING, BUT NOT LIMITED TO, THE PHYSICAL AND ENVIRONMENTAL CONDITIONS THEREOF, AND SHALL RELY UPON SAME. BY FAILING TO TERMINATE THIS AGREEMENT PRIOR TO THE EXPIRATION OF THE DUE DILIGENCE PERIOD, BUYER ACKNOWLEDGES THAT SELLER HAS AFFORDED BUYER A FULL OPPORTUNITY TO CONDUCT SUCH INVESTIGATIONS OF THE PROPERTY AS BUYER DEEMED NECESSARY TO SATISFY ITSELF AS TO THE CONDITION OF THE PROPERTY, AND BUYER WILL RELY SOLELY UPON SAME AND NOT UPON ANY INFORMATION PROVIDED BY OR ON BEHALF OF SELLER OR ITS AGENTS OR EMPLOYEES WITH RESPECT THERETO, OTHER THAN SUCH REPRESENTATIONS, WARRANTIES AND COVENANTS OF SELLER AS ARE EXPRESSLY SET FORTH IN THIS AGREEMENT. UPON CLOSING, BUYER SHALL ASSUME THE RISK THAT ADVERSE MATTERS, INCLUDING, BUT NOT LIMITED TO, ADVERSE PHYSICAL OR CONSTRUCTION DEFECTS OR ADVERSE ENVIRONMENTAL, HEALTH OR SAFETY CONDITIONS, MAY NOT HAVE BEEN REVEALED BY BUYER’S INVESTIGATIONS. BUYER ACKNOWLEDGES THAT SELLER IS UNDER NO OBLIGATION TO ALTER, REPAIR, OR IMPROVE ANY PART OF THE PROPERTY. BUYER AGREES TO ACCEPT THE PROPERTY “AS IS”, “WHERE IS”, AND “WITH ALL FAULTS.” BUYER ACKNOWLEDGES THAT ANY AND ALL INFORMATION OF ANY TYPE THAT BUYER HAS RECEIVED OR MAY RECEIVE FROM SELLER OR SELLER’S EMPLOYEES OR

AGENTS IS FURNISHED ON THE EXPRESS CONDITION THAT BUYER SHALL OR WOULD MAKE AN INDEPENDENT VERIFICATION OF THE ACCURACY OF ANY AND ALL SUCH INFORMATION, ALL SUCH INFORMATION BEING FURNISHED WITHOUT ANY REPRESENTATION OR WARRANTY AS TO ACCURACY OR COMPLETENESS WHATSOEVER. BUYER AGREES THAT NO WARRANTY HAS ARISEN THROUGH TRADE, CUSTOM, OR COURSE OF DEALING WITH SELLER AND AGREES THAT ALL DISCLAIMERS OF WARRANTIES SHALL BE CONSTRUED LIBERALLY IN FAVOR OF SELLER.

7.2 Release. Subject to the covenants, representations and warranties of Seller expressly contained in this Agreement, effective as of Closing, Buyer on behalf of itself and its shareholders, members, investors or partners of each of them and any permitted assignees of Buyer hereunder and its successors and assigns waives its right to recover from, and forever releases and discharges, Seller and its affiliates, property manager, partners, trustees, beneficiaries, owners, members, managers, officers, employees and agents and representatives, and its respective heirs, successors, personal representatives and assigns from any and all causes of action, claims, costs, damages, demands, expenses (including reasonable legal expenses), liabilities and suits (collectively, whether first-party or third-party, “Claims”), whether direct or indirect, known or unknown, suspected or unsuspected, foreseen or unforeseen, that may arise on account of or in any way be connected with: (i) the physical condition of the Property, including, without limitation, all structural and seismic elements; the condition, valuation, or utility of the Property or any Improvements thereon; title and survey matters with respect to the Property; the environmental condition of the Property and the presence of any hazardous substances or materials on, under or about the Property; and the status of Entitlements; and (ii) any law or regulation applicable to the Property, including, without limitation, any federal, state or local laws relating to or regulating hazardous materials or substances, and any other federal, state or local law, unless such Claims are based on fraud. In connection therewith, Buyer specifically waives the provision of California Civil Code Section 1542, which provides as follows:

“A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.”

8. CLOSING.

8.1 Seller’s Deposits Into Escrow. At least one (1) business day prior to the Closing Date, Seller shall deliver the following documents to the Escrow Holder:

8.1.1 A Grant Deed conveying title to the Property to Buyer (the “Deed”).

8.1.2 A Bill of Sale conveying the Personalty to Buyer without warranty (the “Bill of Sale”).

8.1.3 An Assignment and Assumption transferring the Contracts and Other Property Rights to Buyer without warranty, with an assumption thereof by Buyer (the “Assignment”).

8.1.4 An affidavit or qualifying statement which satisfies the requirements of Section 1445 of the Internal Revenue Code of 1986, as amended, and the related regulations (the “Non-Foreign Affidavit”).

8.1.5 A Withholding Exemption Certificate, Form 593, or in the event that Seller is a non-California resident, a certificate issued by the California Franchise Tax Board, pursuant to the Revenue and Taxation Code Sections 18805 and 26131, stating either the amount of withholding required from Seller’s proceeds or that Seller is exempt from the withholding requirement (the “Withholding Certificate”).

8.2 Buyer’s Deposits Into Escrow. At least one (1) business day prior to the Closing Date, Buyer shall deliver the following to the Escrow Holder:

8.2.1 Funds in accordance with Section 3.3, by wire transfer.

8.2.2 A counterpart of the Assignment.

8.2.3 A counterpart of the Withholding Certificate.

8.3 Additional Deposits. Seller and Buyer shall each deposit such other instruments and funds as are reasonably required by Escrow Holder or otherwise required to close Escrow and consummate the sale of the Property in accordance with the terms of this Agreement.

8.4 Prorations and Adjustments. The following items shall be prorated and adjusted as of the Closing Date:

8.4.1 All non-delinquent real estate taxes and assessments shall be prorated as of the Closing on the basis of the most recent tax statement for the Property. Any delinquent taxes on the Real Property shall be paid at Closing from funds accruing to Seller. If, after the Closing, supplemental real estate taxes are assessed against the Real Property by reason of any event occurring prior to the Closing Date, Buyer and Seller shall promptly adjust the proration of real estate taxes with Seller responsible for all taxes attributable to the period prior to the date of Closing and Buyer responsible for all taxes attributable to the period on or after the date of Closing (it being agreed that Buyer shall be solely responsible for any increase in real estate taxes resulting from the sale of the Property to Buyer pursuant to this Agreement).

8.4.2 All prorations which can be reasonably estimated as of the Closing Date shall be made in Escrow on the Closing Date. Seller shall make available for review by Buyer such financial documents as may be appropriate in connection with the estimated amounts proposed by Seller in connection with the preparation of the estimated schedule. As soon as reasonably practicable following the Closing, upon obtaining the necessary information any required adjustments to the prorations made pursuant to the schedule as of the Closing shall be

made by Seller and Buyer. In connection with any such adjustments Seller and Buyer shall each make available to the other for review such financial documents as may be appropriate in connection with the preparation of any adjustments. The net credit due from one party to the other as a result of such post-Closing prorations and adjustments shall be paid to the other in cash immediately upon the parties’ written agreement pursuant to a final schedule of post-closing adjustments. All post-closing adjustments shall be made within 90 days of Closing or shall have been deemed waived.

8.5 Payment of Closing Costs.

8.5.1 Closing Costs Borne by Seller. Seller shall bear and Escrow Holder shall discharge on Seller’s behalf out of the sums payable to Seller the portion of the costs associated with the standard coverage premium for the title policy to be obtained by Buyer (the “Owner’s Policy”), equal to the premium on a CLTA owner’s policy of title insurance in the amount of the Purchase Price, the documentary and transfer taxes and the sums necessary to obtain and the cost of recording any reconveyance required, including, without limitation, one-half of Escrow Holder’s fee, and any additional costs and charges customarily charged to sellers in accordance with common escrow practices in San Bernardino County, California.

8.5.2 Closing Costs Borne by Buyer. Buyer shall deposit with Escrow Holder for disbursement by Escrow Holder one-half of Escrow Holder’s fee, all costs and expenses of the Owner’s Policy in excess of the premium to be borne by Seller (including any additional premium charged for any extended coverage policy or endorsements requested by Buyer and the cost of any survey which may be required by the Title Company), the recording fees required in connection with the transfer of the Property to Buyer, all sales and use taxes required in connection with the transfer of the Property to Buyer, and any additional charges customarily charged to buyers in accordance with common escrow practices in San Bernardino County, California.

8.6 Closing of Escrow.

8.6.1 Escrow Holder if any shall hold the Closing on the Closing Date if: (i) it has received in a timely manner all the funds and materials required to be delivered into Escrow by Buyer and Seller; and (ii) it has received assurances satisfactory to it that, effective as of the Closing, the Title Company will issue the Owner’s Policy to end Buyer(s)

8.6.2 To Close the Escrow, Escrow Holder shall (a) cause the Deed to be recorded and then mailed to Buyer, and deliver to Buyer the title policy, Bill of Sale, Assignment, Non-Foreign Affidavit and Withholding Certificate; and (b) deliver to Seller the Bill of Sale, the Assignment and Assumption Agreement and by wire transfer of federal funds, funds in the amount of the Purchase Price and plus or less any net debit or credit to Seller by reason of the prorations and allocations of closing costs provided for in this Agreement.

8.6.3 Pursuant to Section 6045 of the Internal Revenue Code, Escrow Holder shall be designated the closing agent hereunder and shall be solely responsible for complying with the tax reform act of 1986 with regard to reporting all settlement information to the Internal Revenue Service.

8.7 Failure to Close; Cancellation. If the Escrow Holder is not in a position to Close the Escrow on the Closing Date, then, except in the event that the provisions of Section 9 or 10 are applicable, Escrow Holder shall return to the depositor thereof any funds or other materials previously placed in Escrow. No such return shall relieve either party of liability for any failure to comply with the terms of this Agreement.

8.8 Possession. Possession of the Property shall be delivered to Buyer on the Closing Date, subject to the rights of Tenants.

9. LIQUIDATED DAMAGES. THE PARTIES HAVE DETERMINED THAT IF THE BUYER BREACHES THIS AGREEMENT AND FAILS TO PURCHASE THE PROPERTY AS CONTEMPLATED HEREIN, THE DAMAGE TO THE SELLER WILL BE EXTREMELY DIFFICULT AND IMPRACTICABLE TO ASCERTAIN, SUCH DAMAGE INCLUDING COSTS OF NEGOTIATING AND DRAFTING THIS AGREEMENT, COSTS OF COOPERATING IN SATISFYING CONDITIONS TO CLOSING, COSTS OF SEEKING ANOTHER BUYER UPON THE BUYER’S DEFAULT, OPPORTUNITY COSTS IN KEEPING THE PROPERTY OUT OF THE MARKETPLACE, AND OTHER COSTS INCURRED IN CONNECTION HEREWITH. IN ADDITION, THE BUYER WISHES TO LIMIT ITS LIABILITY IN EVENT OF ITS BREACH OF THIS AGREEMENT AND FAILURE TO PURCHASE THE PROPERTY AS CONTEMPLATED IN THIS AGREEMENT, AND THE SELLER HAS AGREED TO SUCH A LIMITATION. THE PARTIES THUS AGREE THAT SHOULD THIS AGREEMENT FAIL TO CLOSE DUE TO THE BUYER’S BREACH OF THIS AGREEMENT OR ITS WRONGFUL REFUSAL OR FAILURE TO PURCHASE THE PROPERTY CONTEMPLATED IN THIS AGREEMENT, THE SOLE AND EXCLUSIVE REMEDY OF THE SELLER SHALL BE TO RECOVER THE DEPOSIT FROM THE BUYER; ALL OTHER CLAIMS FOR DAMAGES OR CAUSES OF ACTION ARE HEREBY EXPRESSLY WAIVED BY THE SELLER. SAID AMOUNT WILL BE THE FULL, AGREED AND LIQUIDATED DAMAGES FOR THE BREACH OF THIS AGREEMENT BY THE BUYER. THE PAYMENT OF SUCH AMOUNT AS LIQUIDATED DAMAGES IS NOT INTENDED AS A FORFEITURE OR PENALTY WITHIN THE MEANING OF CALIFORNIA CIVIL CODE SECTIONS 3275 OR 3369, BUT IS INTENDED TO CONSTITUTE LIQUIDATED DAMAGES TO THE SELLER PURSUANT TO CALIFORNIA CIVIL CODE SECTIONS 1671, 1676 AND 1677.

10. BUYER’S REMEDIES. IF AT CLOSING, BUYER IS READY, WILLING AND ABLE TO PURCHASE THE PROPERTY AND HAS COMPLIED WITH ALL OF ITS OBLIGATIONS UNDER THIS AGREEMENT (INCLUDING, BUT NOT LIMITED TO, BY DEPOSITING ALL REQUIRED FUNDS AND DOCUMENTS WITH ESCROW), BUT THE SELLER FAILS TO CONVEY THE PROPERTY IN BREACH OF ITS OBLIGATIONS UNDER THIS AGREEMENT, THE BUYER’S SOLE AND EXCLUSIVE REMEDY SHALL BE TO EITHER (A) TERMINATE THIS AGREEMENT, OBTAIN A REFUND OF THE DEPOSIT, AND OBTAIN A

REIMBURSEMENT FROM THE SELLER OF THE BUYER’S ACTUAL OUT-OF-POCKET COSTS INCURRED IN CONNECTION WITH THE BUYER’S INVESTIGATION OF THE PROPERTY (INCLUDING LEGAL FEES, COSTS OF ENVIRONMENTAL TESTING, INSPECTION COSTS AND OTHER SIMILAR THIRD-PARTY COSTS), IN AN AMOUNT NOT TO EXCEED FIFTY THOUSAND DOLLARS ($50,000.00), OR (B) TO ENFORCE, AS BUYER’S SOLE AND EXCLUSIVE REMEDY, SPECIFIC PERFORMANCE OF SELLER’S OBLIGATION TO CONVEY THE PROPERTY TO BUYER IN ACCORDANCE WITH THE TERMS OF THIS AGREEMENT. BUYER SHALL BE DEEMED TO HAVE ELECTED TO TERMINATE THIS AGREEMENT AND RECEIVE BACK THE DEPOSIT AND ITS REIMBURSABLE COSTS IF BUYER FAILS TO FILE SUIT FOR A SPECIFIC PERFORMANCE AGAINST SELLER IN A COURT HAVING JURISDICTION IN THE COUNTY AND STATE IN WHICH THE PROPERTY IS LOCATED ON OR BEFORE NINETY (90) DAYS FOLLOWING THE DATE ON WHICH THE CLOSING WAS TO HAVE OCCURRED. IF BUYER ELECTS TO ENFORCE SPECIFIC PERFORMANCE OF SELLER’S OBLIGATIONS PURSUANT TO CLAUSE (B) ABOVE, BUYER SHALL BE DEEMED TO HAVE WAIVED (AND HEREBY DOES WAIVE) ITS RIGHT TO OBTAIN A REFUND OF THE DEPOSIT, REIMBURSEMENT OF ITS COSTS DESCRIBED IN CLAUSE (A) ABOVE, OR ANY OTHER MONETARY DAMAGES. BUYER HEREBY WAIVES THE BENEFIT OF ANY LAW WHICH WOULD ALLOW BUYER ANY RIGHT OR REMEDY INCONSISTENT WITH THIS SECTION 10

11.1 If, prior to the Closing Date, a material portion of the Property is destroyed by fire or other casualty (such that repairs would cost in excess of $300,000), or if any material portion of the Property is taken or made subject to eminent domain proceedings, Seller shall immediately notify Buyer. Thereupon Buyer shall, at its option, have the right to either:

11.1.1 Terminate this Agreement and receive a refund of any monies paid to Seller or Escrow Holder; or

11.1.2 Complete this transaction, in which event Seller shall deliver to Buyer a duly executed assignment of all insurance proceeds or condemnation awards payable as a result of such fire, casualty, or condemnation, in form and substance reasonably satisfactory to Buyer.

11.2 If Buyer does not elect within ten (10) days after notice of such fire, casualty or condemnation, then Buyer shall be deemed to have elected to complete this transaction in accordance with Section 11.1.2 above.

12. NO BROKERS. Each of the parties represents and warrants to the other that it has not incurred and will not incur any other liability for finder’s or brokerage fees or

commissions in connection with this Agreement. It is agreed that if any claims for finder’s or brokerage fees or commissions are ever made against Seller or Buyer in connection with this transaction, all such claims shall be handled and paid by the party (the “Committing Party”) whose actions or alleged commitments form the basis of such claim. The Committing Party further agrees to indemnify, defend, and hold the other harmless from and against any and all claims or demands with respect to any finder’s or brokerage fees or commissions asserted by any person, firm, or corporation in connection with this Agreement or the transaction contemplated hereby. Notwithstanding any provision of this Agreement to the contrary, the obligations of the parties pursuant to this Paragraph 12 shall survive any termination of this Agreement and shall survive closing. The indemnification and other provisions of this Paragraph 12 shall not be subject to the liquidated damages provision in Paragraph 9.

13. NOTICES. All notices required or desired to be made or given hereunder shall be in writing and delivered (a) personally, (b) by facsimile transmission, (c) by overnight courier such as Federal Express, or (d) by certified or registered mail, addressed to the addresses stated in Sections 1.3 and 1.4 above, or to such other address as any party may from time to time designate by written notice to the other parties. Any notice so given, (a) if delivered personally, shall be deemed to be delivered when received, (b) if sent by facsimile transmission with proof of transmission, shall be deemed to be delivered or made on the same day when so sent before 4:30 p.m. at the place of receipt, (c) if sent by overnight courier, shall be deemed delivered or made when delivered, unless such delivery is refused, in which case it shall be deemed delivered or made on the next business day after so deposited with the overnight courier, and (d) if mailed, shall be deposited, postage prepaid, in the United States Post Office facilities and shall be deemed delivered when so received or refused by the addressee.

14. MISCELLANEOUS.

14.1 Successors and Assigns. This Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective successors and assigns, except as follows: Buyer may not assign any of its rights under this Agreement, voluntarily or involuntarily, whether by merger, consolidation, dissolution, operation of law, or any other manner, except to a single purpose entity controlled by Buyer. For purposes of this Paragraph 14.1, a change of control is deemed an assignment of rights. Any assignment in violation of this Paragraph 14.1 is void

14.2 Amendments. The parties may amend this Agreement only by a written agreement of the parties that identifies itself as an amendment to this Agreement.

14.3 Counterparts. This Agreement may be executed in any numbers of counterparts; each such counterpart hereof shall be deemed to be an original document, but all such counterparts together shall constitute but one Agreement. The signatures of all of the parties need not appear on the same counterpart, and delivery of an executed counterpart signature page by facsimile is as effective as executing and delivering this Agreement in the presence of the other party to this Agreement. This Agreement is effective upon delivery of one executed counterpart from one party to the other party. In proving this Agreement, a party must produce or account only for the executed counterpart of the party to be charged.

14.4 Time Of Essence. Time is of the essence of this Agreement.

14.5 Provisions Severable. If any provision of this Agreement is determined to be invalid, illegal, or unenforceable, the remaining provisions of this Agreement shall remain in full force if the essential provisions of this Agreement for each party remain valid, binding, and enforceable.

14.6 Captions. The captions at the beginning of the several paragraphs are for convenience only and shall not control or affect the meaning or construction of any provision of this Agreement. Seller and Buyer have both conferred with counsel in negotiating this Agreement; and accordingly, this Agreement shall be construed neither for nor against Seller or

Buyer, but shall be given a fair and reasonable interpretation in accordance with the meaning of its terms.

14.7 Governing Law. This Agreement and all matters arising under or relating to this Agreement shall be governed by and construed in accordance with the laws of the State of California, without giving effect to its choice-of-law principles.

14.8 Entire Agreement. This Agreement embodies and constitutes the entire agreement and understanding between the parties hereto with respect to the transaction contemplated herein, and all prior or contemporaneous agreements, understandings, representations, and warranties are merged into this Agreement. Seller and Buyer expressly acknowledge that they have not relied on any prior or contemporaneous oral or written representations or statements by the other party in connection with the subject matter of this Agreement except as expressly set forth in this Agreement. There are no conditions precedent to the effectiveness of this Agreement other than those expressly stated in this Agreement.

14.9 Closing Date and Deadline Dates. If the Closing Date or any other deadline date or date for notice described in this Agreement falls on a weekend or a holiday, the Closing Date or other deadline date or date for notice shall be deemed to be the next business day.

14.10 Confidentiality. Buyer agree to keep the terms, covenants, and conditions of this Agreement and the documents reviewed or examined by Buyer during the Due Diligence Period in strict confidence, and may only release such terms, covenants, and conditions to its beneficiaries, related parties, employees, attorneys, accountants, and lenders.

14.11 Tax-Deferred Exchange. Either Seller or Buyer, or both, may, at its option, elect to have the Property transferred as part of a tax-deferred exchange pursuant to U.S. Internal Revenue Code Section 1031 (the “Code”). The completion of the exchange is not a condition to the Closing. In order to facilitate the exchange, each party shall cooperate with the other, at the requesting party’s sole cost and expense, and shall execute, acknowledge and deliver any and all documents that the requesting party may reasonably request to any intermediary that the requesting party may direct; provided, however, that neither party shall have any obligation whatsoever to (a) incur any escrow, title, brokerage or any other costs, expenses or any liability whatsoever, directly or indirectly, in connection with or arising out of the other party’s exchange, or (b) take title to any property. Each party shall indemnify, defend and hold the other harmless

from any and all costs, expenses, liability and all other claims, whatever the nature thereof, that the other party may incur or be subject to as a result of participating in the requesting party’s exchange. In no event shall the Closing be delayed as a result of the exchange. It shall be each party’s sole responsibility to determine whether the property exchanged qualifies as “like-kind” within the meaning of the Code. Each party shall be solely responsible for the tax consequences of its own exchange and neither party shall have any obligation or liability to the other party in connection the other party’s exchange.

14.12 Non-Offer. The submission of this Agreement for examination or for execution by Buyer, and the negotiation of the transaction described herein do not constitute an offer to sell by Seller, and this Agreement confers no rights upon Buyer and does not impose any obligations on Seller, and does not constitute a binding contract unless and until Buyer and Seller shall have executed this Agreement and Buyer has deposited the Initial Deposit with Escrow Holder as required by this Agreement.

14.13 No Waiver. The waiver by either party of the performance of any covenant, condition, or promise shall not invalidate this Agreement, and a waiver of any covenant, condition, or promise shall not be construed as a waiver of any other covenant, condition, or promise herein. The waiver by either party of the time for performing any act shall not constitute a waiver of the time for performing any other act or any incidental act required to be performed at a later time. The delay or forbearance by either party in exercising any remedy or right, the time for the exercise of which is not specifically and expressly limited or specified in this Agreement, shall not be considered a waiver of or an estoppel against the later exercise of such remedy or right.

14.14 Attorney Fees. If any legal action or other proceeding is brought under this Agreement, in addition to any other relief to which the successful or prevailing party (the “Prevailing Party”) is entitled, the Prevailing Party is entitled to recover, and the non-Prevailing Party shall pay, all (a) reasonable attorneys’ fees of the Prevailing Party, (b) court costs, and (c) expenses, even if not recoverable by law as court costs (including, without limitation, all fees, taxes, costs, and expenses incident to appellate, bankruptcy, and post-judgment proceedings), incurred in that action or proceeding and all appellate proceedings. For purposes of this paragraph, the term “attorneys’ fees” includes, without limitation, paralegal fees, investigative fees, expert witness fees, administrative costs, disbursements, and all other charges billed by the attorney to the Prevailing Party.

SIGNATURES APPEAR ON THE FOLLOWING PAGE

IN WITNESS WHEREOF, Seller and Buyer have executed this Agreement as of the date first above written.

SELLER:

Jewel’s Real Estate 1086 MASTER LLLP

By: Managing Partner

Name: SARAH A MATHIAS

Title: PARTNER

Date of Signature: /s/ Sarah A. Mathias 10/29/21

SELLER:

Ameri Metro, Infrastructure Cryptocurrency Inc

By: /s/ Shah Mathias CEO

Name: Shah Mathias

Title: CEO

Date of Signature: 10-29-2021

BUYER:

AMERI METRO, INC.

By: /s/ Robert Choiniere

Name: Robert Choiniere

Title: Chief Financial Officer

Date of Signature: 10.29.2021

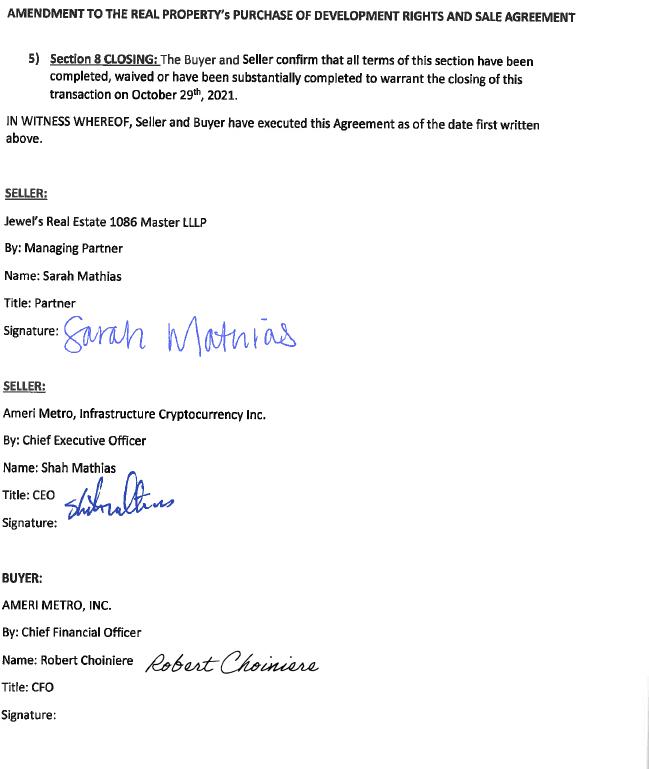

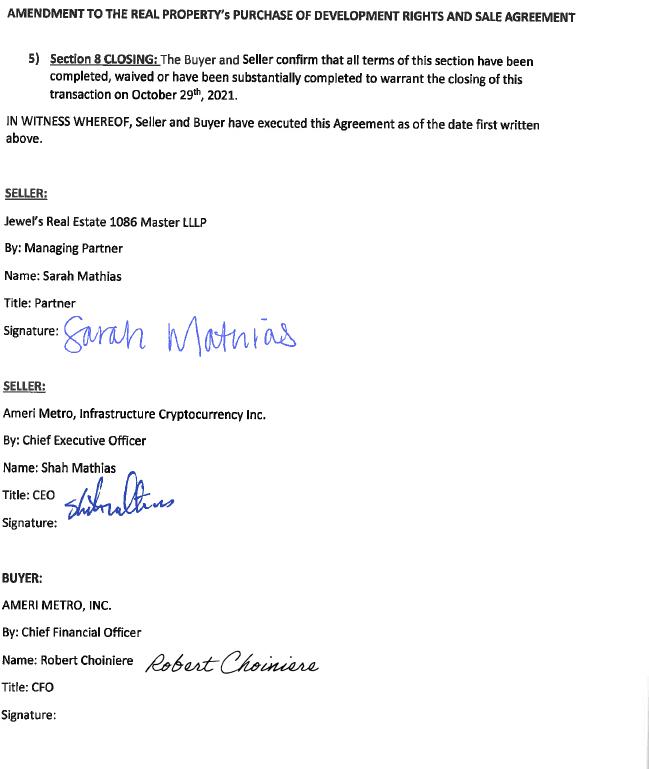

AMENDMENT TO THE REAL PROPERTY’s PURCHASE OF DEVELOPMENT RIGHTS AND SALE AGREEMENT

This amendment to the REAL PROPERTY’s PURCHASE AND DEVELOPMENT RIGHTS SALE AGREEMENT (“Agreement”) dated the 29th day of October 2021 is to confirm that the transaction has “Closed” on the “Effective Date” of October 29th, 2021.

Please reference the signed Agreement dated October 29th, 2021 for any all terms and definitions.

This amendment is to confirm that the transaction has closed and both Buyer and Seller agree that:

| 1) | Section 1.1 Due Diligence: That all due diligence by Buyer and Seller is completed. |

| 2) | Section 1.2 Closing Date: The Closing Date is October 29th, 2021. |

| 3) | Section 3.2 SEC Approval: The Buyer and Seller agree that there is no requirement for SEC approval to close this transaction on the Closing Date. |

| 4) | Section 4 DUE DILIGENCE PERIOD: The Buyer and Seller confirm that all conditions of this section have been met or substantially met to confirm closing of the transaction on October 29th, 2021. |

AMENDMENT TO THE REAL PROPERTY’s PURCHASE OF DEVELOPMENT RIGHTS AND SALE AGREEMENT

| 5) | Section 8 CLOSING: The Buyer and Seller confirm that all terms of this section have been completed, waived or have been substantially completed to warrant the closing of this transaction on October 29th, 2021. |

IN WITNESS WHEREOF, Seller and Buyer have executed this Agreement as of the date first written above.