Exhibit 99.1

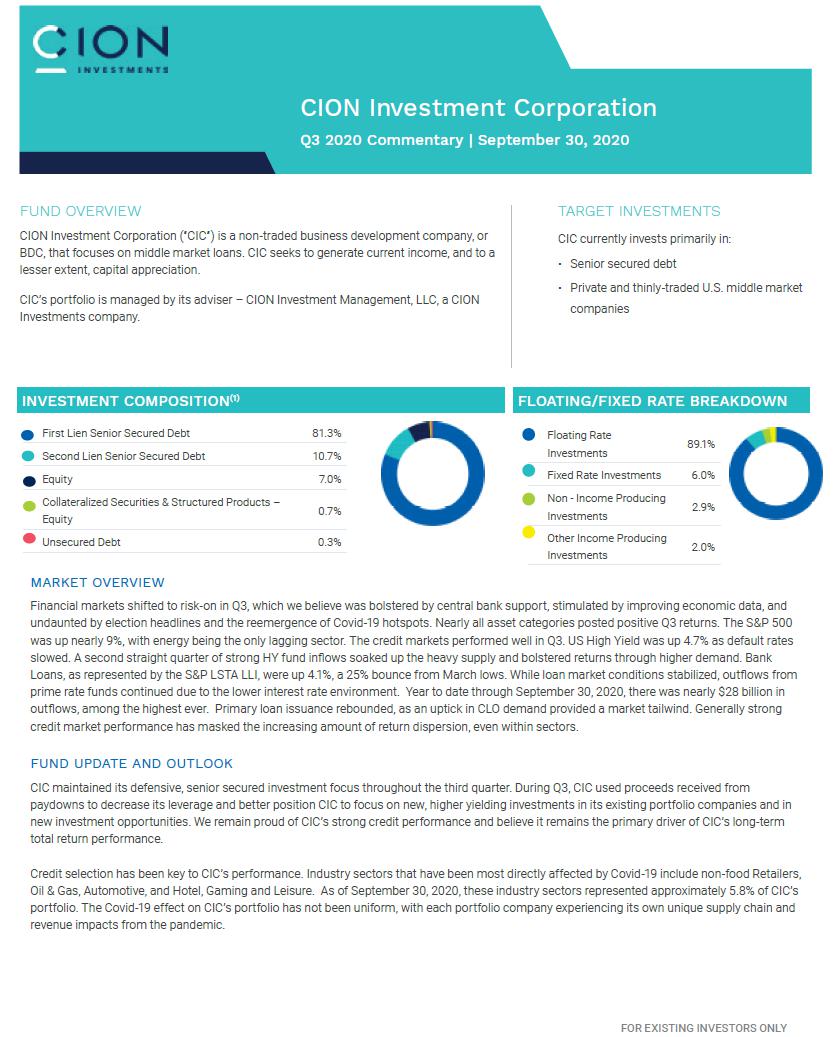

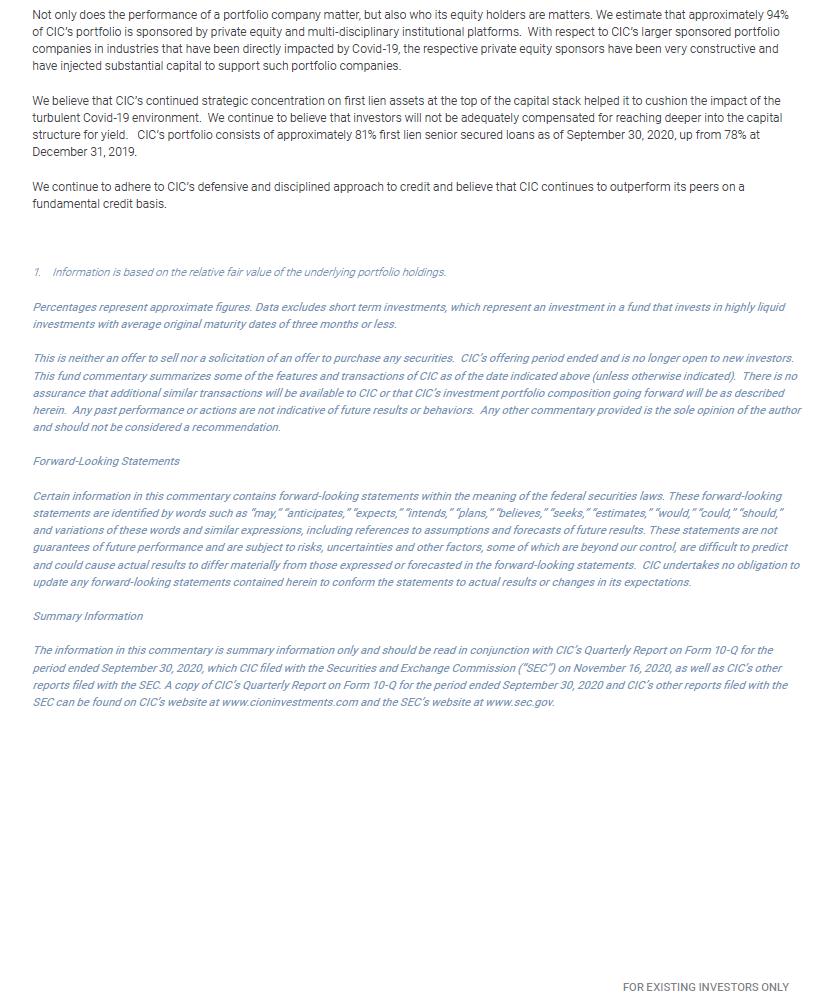

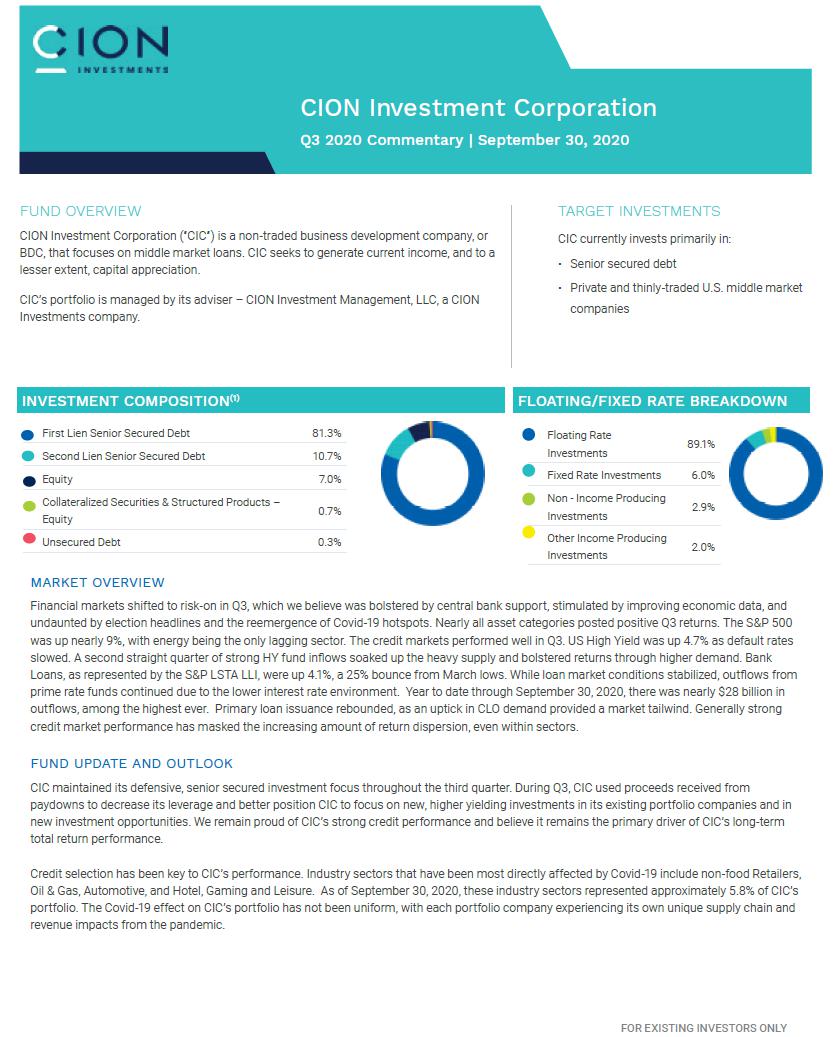

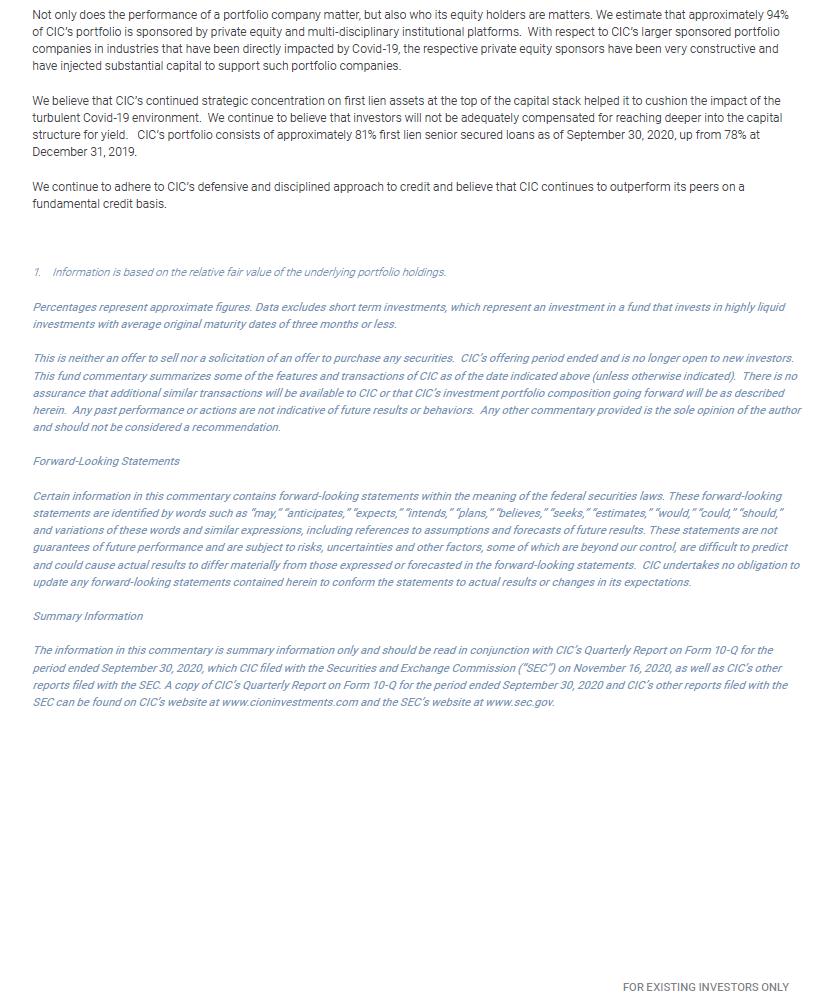

FOR EXISTING INVESTORS ONLY CION Investment Corporation Q3 2020 Commentary | September 30, 2020 MARKET OVERVIEW Financial markets shifted to risk-on in Q3, which we believe was bolstered by central bank support, stimulated by improving economic data, and undaunted by election headlines and the reemergence of Covid-19 hotspots. Nearly all asset categories posted positive Q3 returns. The S&P 500 was up nearly 9%, with energy being the only lagging sector. The credit markets performed well in Q3. US High Yield was up 4.7% as default rates slowed. A second straight quarter of strong HY fund inflows soaked up the heavy supply and bolstered returns through higher demand. Bank Loans, as represented by the S&P LSTA LLI, were up 4.1%, a 25% bounce from March lows. While loan market conditions stabilized, outflows from prime rate funds continued due to the lower interest rate environment. Year to date through September 30, 2020, there was nearly $28 billion in outflows, among the highest ever. Primary loan issuance rebounded, as an uptick in CLO demand provided a market tailwind. Generally strong credit market performance has masked the increasing amount of return dispersion, even within sectors. FUND UPDATE AND OUTLOOK CIC maintained its defensive, senior secured investment focus throughout the third quarter. During Q3, CIC used proceeds received from paydowns to decrease its leverage and better position CIC to focus on new, higher yielding investments in its existing portfolio companies and in new investment opportunities. We remain proud of CIC’s strong credit performance and believe it remains the primary driver of CIC’s long-term total return performance. Credit selection has been key to CIC’s performance. Industry sectors that have been most directly affected by Covid-19 include non-food Retailers, Oil & Gas, Automotive, and Hotel, Gaming and Leisure. As of September 30, 2020, these industry sectors represented approximately 5.8% of CIC’s portfolio. The Covid-19 effect on CIC’s portfolio has not been uniform, with each portfolio company experiencing its own unique supply chain and revenue impacts from the pandemic. FUND OVERVIEW CION Investment Corporation (“CIC”) is a non-traded business development company, or BDC, that focuses on middle market loans. CIC seeks to generate current income, and to a lesser extent, capital appreciation. CIC’s portfolio is managed by its adviser – CION Investment Management, LLC, a CION Investments company. TARGET INVESTMENTS CIC currently invests primarily in: • Senior secured debt • Private and thinly-traded U.S. middle market companies INVESTMENT COMPOSITION(1) FLOATING/FIXED RATE BREAKDOWN First Lien Senior Secured Debt 81.3% Second Lien Senior Secured Debt 10.7% Equity 7.0% Collateralized Securities & Structured Products – Equity 0.7% Unsecured Debt 0.3% Floating Rate Investments 89.1% Fixed Rate Investments 6.0% Non - Income Producing Investments 2.9% Other Income Producing Investments 2.0%

FOR EXISTING INVESTORS ONLY Not only does the performance of a portfolio company matter, but also who its equity holders are matters. We estimate that approximately 94% of CIC’s portfolio is sponsored by private equity and multi-disciplinary institutional platforms. With respect to CIC’s larger sponsored portfolio companies in industries that have been directly impacted by Covid-19, the respective private equity sponsors have been very constructive and have injected substantial capital to support such portfolio companies. We believe that CIC’s continued strategic concentration on first lien assets at the top of the capital stack helped it to cushion the impact of the turbulent Covid-19 environment. We continue to believe that investors will not be adequately compensated for reaching deeper into the capital structure for yield. CIC’s portfolio consists of approximately 81% first lien senior secured loans as of September 30, 2020, up from 78% at December 31, 2019. We continue to adhere to CIC’s defensive and disciplined approach to credit and believe that CIC continues to outperform its peers on a fundamental credit basis. 1. Information is based on the relative fair value of the underlying portfolio holdings. Percentages represent approximate figures. Data excludes short term investments, which represent an investment in a fund that invests in highly liquid investments with average original maturity dates of three months or less. This is neither an offer to sell nor a solicitation of an offer to purchase any securities. CIC’s offering period ended and is no longer open to new investors. This fund commentary summarizes some of the features and transactions of CIC as of the date indicated above (unless otherwise indicated). There is no assurance that additional similar transactions will be available to CIC or that CIC’s investment portfolio composition going forward will be as described herein. Any past performance or actions are not indicative of future results or behaviors. Any other commentary provided is the sole opinion of the author and should not be considered a recommendation. Forward-Looking Statements Certain information in this commentary contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are identified by words such as “may,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” and variations of these words and similar expressions, including references to assumptions and forecasts of future results. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. CIC undertakes no obligation to update any forward-looking statements contained herein to conform the statements to actual results or changes in its expectations. Summary Information The information in this commentary is summary information only and should be read in conjunction with CIC’s Quarterly Report on Form 10-Q for the period ended September 30, 2020, which CIC filed with the Securities and Exchange Commission (“SEC”) on November 16, 2020, as well as CIC’s other reports filed with the SEC. A copy of CIC’s Quarterly Report on Form 10-Q for the period ended September 30, 2020 and CIC’s other reports filed with the SEC can be found on CIC’s website at www.cioninvestments.com and the SEC’s website at www.sec.gov.