UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number: 811-22626

Salient Midstream & MLP Fund

(Exact name of registrant as specified in charter)

4265 San Felipe, 8th Floor

Houston, TX 77027

(Address of principal executive offices) (Zip code)

| | |

Gregory A. Reid, Principal Executive Officer Salient Midstream & MLP fund 4265 San Felipe, 8th Floor Houston, TX 77027 (Name and address of agent for service) | | With a Copy To: George J. Zornada K&L Gates LLP State Street Financial Center One Lincoln St. Boston, MA 02111-2950 (617) 261-3231 |

Registrant’s telephone number, including area code: (713) 993-4001

Date of fiscal year end: November 30

Date of reporting period: May 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission, not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Report to Stockholders. |

| | (a) | The following is a copy of the report transmitted to shareholders of the Salient Midstream & MLP Fund (the “Fund”), pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1). |

Table of Contents

| | |

| | Midstream & MLP Fund |

Shareholder Letter (Unaudited)

Dear Fellow Shareholders:1

We are pleased to provide the semi-annual report of the Salient Midstream & MLP Fund (the “Fund” or “SMM”) (NYSE: SMM) which contains updated data as of May 31, 2022.

As of May 31, 2022, the Fund had total assets of $233.8 million, net asset value of $9.72 per share and 17.7 million common shares outstanding. The Fund’s price per share was $8.50, which represents a 12.6% discount to its net asset value (“NAV”).2

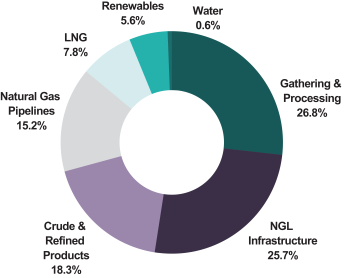

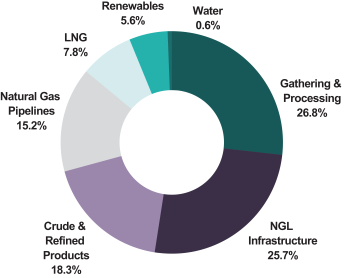

The Fund’s investment allocation is shown in the pie chart below:

For illustrative purposes only.

Source: Salient Capital Advisors, LLC (“Adviser”), May 31, 2022.

Figures are based on the Fund’s gross assets ex-cash.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value.

2 Past performance is not indicative of future results. Current performance may be higher or lower than the data shown. The data shown are unaudited. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares.

The Fund’s Top 10 holdings are shown below, as of May 31, 2022:3

| | | | | | | | | | | | |

| No. | | Symbol | | Name | | Country | | Asset Type | | % of Gross

Assets | |

| 1 | | ET | | Energy Transfer L.P. | | United States | | MLP | | | 9.4 | % |

| 2 | | TRGP | | Targa Resources Corp. | | United States | | C-Corp | | | 6.9 | % |

| 3 | | LNG | | Cheniere Energy, Inc. | | United States | | C-Corp | | | 5.8 | % |

| 4 | | PPL CN | | Pembina Pipeline Corp. | | Canada | | C-Corp | | | 5.7 | % |

| 5 | | ENB | | Enbridge, Inc. | | United States | | C-Corp | | | 5.6 | % |

| 6 | | – | | EMG Utica I Offshore Co-Investment L.P. | | United States | | C-Corp | | | 5.5 | % |

| 7 | | WMB | | The Williams Companies, Inc. | | United States | | C-Corp | | | 4.8 | % |

| 8 | | MPLX | | MPLX L.P. | | United States | | MLP | | | 4.6 | % |

| 9 | | PAGP | | Plains GP Holdings L.P. | | United States | | C-Corp | | | 4.5 | % |

| 10 | | OKE | | ONEOK, Inc. | | United States | | C-Corp | | | 4.4 | % |

| | | | | | | | | | | | |

| | | | | | | | | | | 57.2 | % |

| | | | | | | | | | | | |

Source: Salient Capital Advisors, LLC (“Adviser”), May 31, 2022.

For illustrative purposes only. Current and future holdings are subject to change and risk. Figures are based on the Fund’s gross assets ex-cash.

During the reporting period (December 1, 2021 – May 31, 2022), the Fund’s NAV and market price total return were 32.2% and 36.4%, respectively, compared to 28.8% for the Alerian Midstream Energy Select Index (AMEI) during the same period.4,5

Performance Snapshot

as of May 31, 2022 (Unaudited)

| | | | | | | | | | |

| Price Per Share | | 12/01/21-05/31/22

Total Return* | | Since Inception*

(Annualized) |

$9.72 (NAV) | | | | 32.2 | % | | | | 0.1 | % |

$8.50 (Market Price) | | | | 36.4 | % | | | | -1.2 | % |

Source: Salient Capital Advisors, LLC (“Adviser”), May 31, 2022.

For illustrative purposes only. All figures represent past performance and are not indicative of future results. No investment strategy can guarantee performance results.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses, including management fees, operating expenses and other Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors may pay on distributions or the sale of shares. Total return assumes the reinvestment of all distributions. Inception date of the Fund was May 25, 2012.

3 Fund shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency. Data are based on total market value of Fund investments unless otherwise indicated. The data provided are for informational purposes only and are not intended for trading purposes.

4 Source: Alerian, May 31, 2022. “Alerian Midstream Energy Select Index,” “Alerian Midstream Energy Select Total Return Index,” “AMEI” and “AMEIX” are trademarks of Alerian and their use is granted under a license from Alerian. Past performance is not indicative of how the index will perform in the future. The index reflects the reinvestment of dividends and income and does not reflect deductions for fees, expenses or taxes. The index is unmanaged and is not available for direct investment. Alerian Midstream Energy Select Index (AMEI) is a composite of North American midstream energy infrastructure companies that are engaged in activities involving energy commodities. The capped, float-adjusted, capitalization-weighted index is disseminated in real time on a price-return basis. Inception date of the AMEI is April 1, 2013.

5 Past performance is not indicative of future results.

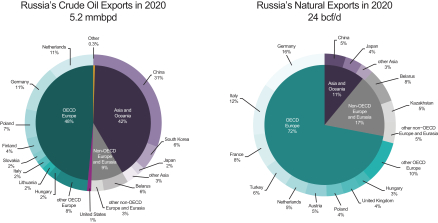

Market Review

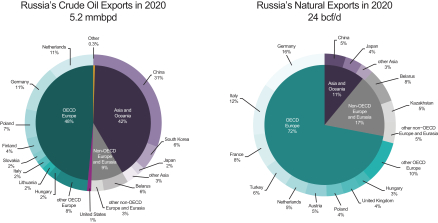

Russia’s invasion of Ukraine in February is a massive geopolitical event that we believe will have long-term reverberations throughout the global energy landscape. Since the war started, we have seen a shift in focus among global leaders from decarbonization/energy transition to energy security, with Europe taking center stage. Some quick facts: Russia was the second-largest producer globally of both crude oil and natural gas in 2020, with crude oil production of more than 10 million barrels per day (mmbpd) and natural gas production of almost 62 billion cubic feet per day (bcf/d).6 It was also the fourth-largest exporter of liquefied natural gas (LNG) at 3.9 bcf/d.6 On the crude oil front, Russia exports north of 5 mmbpd with roughly half of those exports going to Europe.6 Natural gas exports are roughly 40% of Russia’s production, with Europe receiving 72% of those exports.6

Source: EIA and BP Statistical Review of World Energy 2021. For illustrative purposes only.

Europe’s biggest concern is that it consumes ~52 bcf/d of natural gas but only produces around 20 bcf/d, thus requiring 32 bcf/d of imports—and Russia currently meets more than half of those needs (~18 bcf/d ).6 This is why we have not seen meaningful European sanctions on Russian commodity exports to date, and it is also why Europe will likely have to wean itself from Russian supply over time. The European Union (EU) is acutely aware of the need and announced a joint action plan in early March known as “REPowerEU,” which aims to make Europe free of Russian fossil fuels “well before 2030.”7 Among the initiatives: import ~5 bcf/d more LNG immediately from the likes of the U.S., Qatar, Egypt and West Africa; increase pipeline deliveries by ~1 bcf/d immediately from countries such as Azerbaijan, Algeria and Norway; increase biomethane production by ~3.5 bcf/d by 2030; triple solar and wind capacity by 2030; and increase energy efficiency across the board.8 This may be achievable by 2030, but we are skeptical that the near-term LNG import goals can be met due to current LNG market tightness.

Long term, the U.S. is in a good position to supply additional LNG to Europe with 10.8 bcf/d of current export capacity (averaging ~10.5 bcf/d of actual exports) and an additional 17.6 bcf/d of approved capacity.9 However, it typically takes 31⁄2 to 4 years to permit and build projects of this scale and there is only 4.2 bcf/d currently in progress, with only 0.7 bcf/d of that total coming online before 2025 (an additional 2 bcf/d in mid-2025 and 1.5 bcf/d in mid-2027).9 It is a similar situation with global facilities as only 3.1 bcf/d of capacity is expected to come online before 2025 based on projects currently underway.9

We believe Russia’s crude oil exports—if reduced through either production losses or sanctions—could be mitigated more easily than natural gas by pulling some levers across the global supply chain. One lever has already been pulled—a globally coordinated release from the Strategic Petroleum Reserve (SPR).10 SPRs are meant to be used in times of true supply disruption (not just when prices are high) and there were ~1.4 billion barrels of oil stored in global SPRs in late March.6 President Biden authorized a release of 1 mmbpd for six months (a total of 180 million barrels) on April 1, 2022, and 31 other member countries of the International Energy Agency (IEA) announced a combined release of 60 million barrels on April 6, 2022 (though daily amounts and length of time were not specified). These actions may help prices in the short term, but stockpiles eventually need to be

6 International Energy Agency (IEA), March 2022. The International Energy Agency works with countries around the world to shape energy policies for a secure and sustainable future.

7 European Commission and the White House, March 2022.

8 Liquefied natural gas (LNG) is natural gas that has been converted to a liquid form for the ease and safety of natural gas transport. Crude oil is a naturally occurring yellowish-black liquid mixture of mainly hydrocarbons and is found in geological formations. Natural gas is flammable gas, consisting largely of methane and other hydrocarbons, occurring naturally underground (often in association with petroleum) and used as fuel.

9 Morgan Stanley, March 2022.

10 The Strategic Petroleum Reserve is an emergency stockpile of petroleum maintained by the United States Department of Energy.

replaced, which will help support crude oil prices in the future as nations refill these reserves through open market purchases. Another lever is production: The Organization of the Petroleum Exporting Countries (OPEC) currently has somewhere between 1.5 and 2.0 mmbpd of spare production capacity that could ramp up fairly quickly and U.S. production is expected to grow by 600,000–800,000 bpd in 2022 and perhaps more in 2023.11 As potential wild cards, if sanctions are rolled back on both Iran and Venezuela, we could see another 1.5 mmbpd of production come online, although it may take a year or longer for production to ramp up given years of underinvestment in those countries.

What does this mean for North American energy infrastructure? Our current view is that Russian supplies will not be meaningfully reduced in the very near term, but it will happen over time as Europe diversifies its supply sources. As a result, we believe that North American production will continue to increase and effectively set a higher baseline level, which would be positive for midstream volumes. The biggest expansion opportunities will likely be for natural gas infrastructure related to LNG projects along the Gulf Coast and Florida (all approved and proposed LNG plants are in this area).

Inflation, Higher Interest Rates & Recession Fears

Performance over the past six months has certainly been supported by the firming of crude oil and natural gas prices following the onset of the Russia-Ukraine war. Inflation measures have moved to levels not seen since the early 1980s, and while this is supportive for inflation-linked contracts that are common in the energy infrastructure space, it has also brought concerns over meaningful interest rate hikes by the Federal Reserve that could lead to recession, which would thus lead to lower energy demand.12

Historically, energy demand has not typically declined in absolute terms during a recession—the growth rate has merely slowed (the notable exceptions have been the two most recent recessions that were spurred by global crises: the financial crisis of 2007–2009 and the COVID-19 pandemic in 2020). At this juncture, we believe that demand destruction would have to be immense—in the realm of 3.5 mmbpd or higher—to offset the global supply losses from both crude oil production and refining capacity. If we merely experience a “garden variety” recession, we do not believe that demand destruction will more than offset the lost capacity.13

We would also point out that energy infrastructure has a positive (albeit somewhat low) relationship with interest rates, as the long-term correlation with the yield on the 10-year U.S. Treasury Note has been +0.2 to +0.3.14 In other words, energy infrastructure stocks have tended to increase as yields increase. It’s a very intuitive relationship: rates (along with inflation) typically rise due to economic strength, which implies higher energy demand and thus more volumes moving through energy infrastructure assets. As such, we do not believe that investors should be overly concerned with the impact of interest rates on the Fund’s holdings.

As always, we sincerely appreciate your confidence and trust in us to manage your energy infrastructure allocation. Please call us with any questions.

Sincerely,

Gregory A. Reid

President

MLP Business, Salient Capital Advisors, LLC

11 Energy Information Administration (EIA), March 2022. The Organization of the Petroleum Exporting Countries (OPEC) refers to a group of 13 of the world’s major oil-exporting nations.

12 Inflation-linked contracts are contracts with rates that move up with inflation. Energy infrastructure companies are companies that own and operate assets that are used in the energy sector, including assets used in exploring, developing, producing, generating, transporting (including marine), transmitting, terminal operation, storing, gathering, processing, refining, distributing, mining or marketing of natural gas, natural gas liquids, crude oil, refined products, coal or electricity, or that provide energy-related services.

13 Garden variety is an expression meaning the usual or ordinary type; commonplace.

14 Correlation is a statistical term describing the degree to which two variables move in coordination with one another. Yield refers to the earnings generated and realized on an investment over a particular period of time.

Performance (Unaudited)

| | | | | | | | | | | | | | | |

| Average Annual Total Returns as of May 31, 2022 | | 1 Year | | 5 Year | | Since

Inception(a) |

Salient Midstream & MLP Fund—NAV(b) | | 35.07% | | | | 1.50 | % | | | | 0.11 | % |

Salient Midstream & MLP Fund—Market Price(c) | | 56.58% | | | | -0.34 | % | | | | -1.22 | % |

Alerian Midstream Energy Select Total Return Index | | 30.80% | | | | 7.28 | % | | | | 6.88 | % |

(a) The Fund commenced operations on May 24, 2012 and Alerian Midstream Energy Select Total Return Index commenced operations on December 31, 2012.

(b) Performance returns are net of management fees and other Fund expenses.

(c) Market price is the value at which the Fund trades on an exchange. This market price can be more or less than its NAV.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientpartners.com. Total return is assuming the reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Key Financial Data (Unaudited)

We supplement the reporting of our financial information determined under United States generally accepted accounting principles (“GAAP”) with certain non-GAAP financial measures: distributable cash flow and distributable cash flow coverage ratio. We believe these non-GAAP measures provide meaningful information to assist shareholders in understanding our financial results and assessing our performance. We pay distributions to our shareholders, funded in part by distributable cash flow generated from our portfolio investments. Distributable cash flow is the amount of income received by us from our portfolio investments less operating expenses, subject to certain adjustments as described below. Other companies with similar measures may calculate these measures differently, and as a result, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. These adjusted financial measures should not be considered in isolation or as a substitute for reported net investment income. These non-GAAP financial measures reflect an additional way of viewing an aspect of our operations that, when viewed with our GAAP results and the below reconciliation to the corresponding GAAP financial measures, provide a more complete understanding of our Fund. We strongly encourage shareholders to review our financial statements in their entirety and not rely on any single financial measure.

The table below reconciles the non-GAAP financial measures, distributable cash flow and distributable cash flow coverage ratio, by starting with the most directly comparable GAAP financial measure, net investment income.

| | | | | |

| | | Period Ended

May 31, 2022 |

Net investment loss | | | $ | (612,371 | ) |

Reconciling items: | | | | | |

Return of capital of distributions(a) | | | | 3,622,502 | |

Net realized gain on written options(b) | | | | 435,549 | |

| |

Distributable cash flow (non-GAAP) | | | $ | 3,445,680 | |

Distributions paid on common stock | | | $ | 3,101,428 | |

Distributable cash flow coverage ratio (non-GAAP) | | | | 1.11x | |

(a) GAAP recognizes that a significant portion of the cash distributions received from MLPs is characterized as a return of capital and therefore excluded from net investment income, whereas the distributable cash flow calculation includes the return of capital portion of such distributions.

(b) We may sell covered call option contracts to generate income or to reduce our ownership of certain securities that we hold. In some cases, we are able to repurchase these call option contracts at a price less than the fee that we received, thereby generating a profit. The amount we received from selling call options, less the amount that we pay to repurchase such call option contracts is included in distributable cash flow. For GAAP purposes, “income” from call option contracts sold is not included in net investment income. See Note 2—Summary of Significant Accounting Policies and Practices for a full discussion of the GAAP treatment of option contracts.

Schedule of Investments (Unaudited)

Salient Midstream & MLP Fund

May 31, 2022

| | | | | | | | | | |

| | | Shares/Units | | Fair Value |

Master Limited Partnerships—32.5% | | | | | | |

Crude & Refined Products—10.2% | | | | | | | | | | |

United States—10.2% | | | | | | | | | | |

Genesis Energy LP(b) | | | | 45,532 | | | | $ | 557,312 | |

Magellan Midstream Partners LP(b)(c) | | | | 67,234 | | | | | 3,475,998 | |

MPLX LP(b)(c) | | | | 326,829 | | | | | 10,769,015 | |

NuStar Energy LP(b)(c) | | | | 99,041 | | | | | 1,589,608 | |

Shell Midstream Partners LP(b) | | | | 79,245 | | | | | 1,120,524 | |

| | | | | | | | | | |

| | | | | | | | | 17,512,457 | |

| | | | | | | | | | |

Gathering & Processing—5.0% | | | | | | | | | | |

United States—5.0% | | | | | | | | | | |

Crestwood Equity Partners LP(b)(c) | | | | 81,301 | | | | | 2,369,111 | |

Western Midstream Partners LP(b)(c) | | | | 228,178 | | | | | 6,309,122 | |

| | | | | | | | | | |

| | | | | | | | | 8,678,233 | |

| | | | | | | | | | |

Natural Gas Liquids Infrastructure—17.3% | | | | | | | | | | |

United States—17.3% | | | | | | | | | | |

Energy Transfer LP(b)(c) | | | | 1,869,963 | | | | | 21,803,769 | |

Enterprise Products Partners LP(b)(c) | | | | 293,370 | | | | | 8,044,205 | |

| | | | | | | | | | |

| | | | | | | | | 29,847,974 | |

| | | | | | | | | | |

Total Master Limited Partnerships

(Cost $27,671,886) | | | | | | | | | 56,038,664 | |

| | | | | | | | | | |

MLP Related Companies—102.8% | | | | | | |

Crude & Refined Products—14.6% | | | | | | | | | | |

Canada—8.6% | | | | | | | | | | |

Enbridge, Inc.(b)(c) | | | | 285,258 | | | | | 13,164,657 | |

Gibson Energy, Inc. (CAD) | | | | 76,073 | | | | | 1,611,255 | |

| | | | | | | | | | |

| | | | | | | | | 14,775,912 | |

| | | | | | | | | | |

United States—6.0% | | | | | | | | | | |

Plains GP Holdings LP, Class A(b)(c) | | | | 870,489 | | | | | 10,411,048 | |

| | | | | | | | | | |

Energy—6.8% | | | | | | | | | | |

United States—6.8% | | | | | | | | | | |

Archaea Energy, Inc., Class A(a)(b) | | | | 404,919 | | | | | 8,074,085 | |

Excelerate Energy, Inc.(a)(b) | | | | 37,077 | | | | | 988,102 | |

Heliogen, Inc.(a) | | | | 76,900 | | | | | 297,603 | |

Kinetik Holdings, Inc.(b) | | | | 27,374 | | | | | 2,300,511 | |

| | | | | | | | | | |

| | | | | | | | | 11,660,301 | |

| | | | | | | | | | |

Gathering & Processing—29.9% | | | | | | | | | | |

United States—29.9% | | | | | | | | | | |

Antero Midstream Corp.(b)(c) | | | | 795,883 | | | | | 8,643,289 | |

EMG Utica I Offshore Co-Investment LP(d)(e) | | | | 16,000,000 | | | | | 12,841,593 | |

EnLink Midstream LLC(b)(c) | | | | 755,785 | | | | | 8,615,949 | |

Hess Midstream LP, Class A(b) | | | | 160,000 | | | | | 5,214,400 | |

Targa Resources Corp.(b)(c) | | | | 224,242 | | | | | 16,149,909 | |

| | | | | | | | | | |

| | | | | | | | | 51,465,140 | |

| | | | | | | | | | |

| | | | |

| See accompanying Notes to Financial Statements. | | 7 | | |

Schedule of Investments (Unaudited)

Salient Midstream & MLP Fund

May 31, 2022

| | | | | | | | | | |

| | | Shares/Units | | Fair Value |

Liquefied Natural Gas—10.0% | | | | | | | | | | |

United States—10.0% | | | | | | | | | | |

Cheniere Energy, Inc.(b)(c) | | | | 98,767 | | | | $ | 13,508,363 | |

Tellurian, Inc.(a)(b) | | | | 765,600 | | | | | 3,651,912 | |

| | | | | | | | | | |

| | | | | | | | | 17,160,275 | |

| | | | | | | | | | |

Natural Gas Liquids Infrastructure—17.4% | | | | | | | | | | |

Canada—11.5% | | | | | | | | | | |

Keyera Corp. (CAD) | | | | 249,503 | | | | | 6,649,600 | |

Pembina Pipeline Corp.(b)(c) | | | | 260,125 | | | | | 10,467,430 | |

Pembina Pipeline Corp. (CAD)(b)(c) | | | | 67,252 | | | | | 2,711,667 | |

| | | | | | | | | | |

| | | | | | | | | 19,828,697 | |

| | | | | | | | | | |

United States—5.9% | | | | | | | | | | |

ONEOK, Inc.(c) | | | | 154,543 | | | | | 10,176,656 | |

| | | | | | | | | | |

Natural Gas Pipelines—20.6% | | | | | | | | | | |

Canada—5.6% | | | | | | | | | | |

TC Energy Corp.(b)(c) | | | | 167,712 | | | | | 9,700,462 | |

| | | | | | | | | | |

United States—15.0% | | | | | | | | | | |

Equitrans Midstream Corp.(b)(c) | | | | 684,166 | | | | | 5,384,386 | |

Kinder Morgan, Inc.(b)(c) | | | | 468,449 | | | | | 9,223,761 | |

The Williams Companies, Inc.(b)(c) | | | | 301,414 | | | | | 11,170,403 | |

| | | | | | | | | | |

| | | | | | | | | 25,778,550 | |

| | | | | | | | | | |

Renewable Energy Infrastructure—2.7% | | | | | | | | | | |

Great Britain—0.7% | | | | | | | | | | |

Atlantica Sustainable Infrastructure PLC(b)(c) | | | | 39,077 | | | | | 1,275,864 | |

| | | | | | | | | | |

United States—2.0% | | | | | | | | | | |

Microvast Holdings Inc.(a)(d) | | | | 297,400 | | | | | 1,487,000 | |

NextEra Energy Partners LP(b)(c) | | | | 26,792 | | | | | 1,919,647 | |

| | | | | | | | | | |

| | | | | | | | | 3,406,647 | |

| | | | | | | | | | |

Water—0.8% | | | | | | | | | | |

United States—0.8% | | | | | | | | | | |

Rattler Midstream LP(c) | | | | 82,280 | | | | | 1,406,165 | |

| | | | | | | | | | |

Total MLP Related Companies

(Cost $119,279,096) | | | | | | | | | 177,045,717 | |

| | | | | | | | | | |

Special Purpose Acquisition Companies—0.0%(f) | | | | | | |

United States—0.0%(f) | | | | | | | | | | |

TortoiseEcofin Acquisition Corp III—Founder Shares(a)(d)(e) | | | | 41,550 | | | | | 125 | |

| | | | | | | | | | |

Total Special Purpose Acquisition Companies

(Cost $125) | | | | | | | | | 125 | |

| | | | | | | | | | |

Total Investments—135.3% (Cost $146,951,107) | | | | | | | | | 233,084,506 | |

Credit Facility—(35.2%) | | | | | | | | | (60,600,000 | ) |

Other Assets and Liabilities—(0.1)% | | | | | | | | | (224,329 | ) |

| | | | | | | | | | |

Total Net Assets Applicable to Common Shareholders—100.0% | | | | $ | 172,260,177 | |

| | | | | | | | | | |

| | | | |

| See accompanying Notes to Financial Statements. | | 8 | | |

Schedule of Investments (Unaudited)

Salient Midstream & MLP Fund

May 31, 2022

All percentages disclosed are calculated by dividing the indicated amounts by net assets applicable to common shareholders.

(a) The security is considered a non-income producing security as any distributions received during the period (if applicable) are treated as return of capital per the Generally Accepted Accounting Principles.

(b) All or a portion of these securities are held as collateral for the written call options. As of May 31, 2022, the total fair value of securities held as collateral for the written call options is $72,293,075.

(c) All or a portion of these securities are held as collateral for the line of credit agreement. As of May 31, 2022, the total fair value of securities held as collateral for the line of credit agreement is $132,307,401.

(d) These securities are exempt from registration under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration, normally to qualified institutional buyers, or to the public if the securities are subsequently registered. See footnote 2(g) in the Notes to Financial Statements for further information.

(e) These investments are classified as Level 3 assets and such classification was a result of the unavailability of other significant observable inputs. At period end, the aggregate value of these securities was $12,841,718, representing 7.45% of net assets. See Note 3 in the Notes to Financial Statements for further information.

Written Call Options:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Counterparty | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Value | | Fair Value | | Unrealized

Appreciation

(Depreciation) |

Archaea Energy, Inc. | | | | Morgan Stanley & Co. LLC | | | | $ | 25.00 | | | | | June 2022 | | | | | 250 | | | | $ | 498,500 | | | | $ | (1,875 | ) | | | $ | 16,555 | |

Excelerate Energy, Inc. | | | | Morgan Stanley & Co. LLC | | | | | 30.00 | | | | | June 2022 | | | | | 74 | | | | | 197,210 | | | | | (3,330 | ) | | | | 1,034 | |

Hess Midstream LP | | | | Morgan Stanley & Co. LLC | | | | | 35.00 | | | | | June 2022 | | | | | 320 | | | | | 1,042,880 | | | | | (8,800 | ) | | | | 2,154 | |

Targa Resources Corp. | | | | Morgan Stanley & Co. LLC | | | | | 77.50 | | | | | June 2022 | | | | | 112 | | | | | 806,624 | | | | | (6,160 | ) | | | | 1,537 | |

Tellurian, Inc. | | | | Morgan Stanley & Co. LLC | | | | | 6.00 | | | | | June 2022 | | | | | 2,581 | | | | | 1,231,137 | | | | | (32,263 | ) | | | | 7,022 | |

Williams Cos., Inc. | | | | Morgan Stanley & Co. LLC | | | | | 39.00 | | | | | June 2022 | | | | | 86 | | | | | 318,716 | | | | | (1,290 | ) | | | | 793 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | $ | 4,095,067 | | | | $ | (53,718 | ) | | | $ | 29,095 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Salient Midstream & MLP Fund invested in the following industries as of May 31, 2022:

| | | | | | | | | | |

| | | Value | | % of

Total Investments |

Crude & Refined Products | | | $ | 42,699,417 | | | | | 18.3 | % |

Energy | | | | 11,660,301 | | | | | 5.0 | % |

Gathering & Processing | | | | 60,143,373 | | | | | 25.8 | % |

Liquefied Natural Gas | | | | 17,160,275 | | | | | 7.4 | % |

Natural Gas Liquids Infrastructure | | | | 59,853,327 | | | | | 25.7 | % |

Natural Gas Pipelines | | | | 35,479,012 | | | | | 15.2 | % |

Renewable Energy Infrastructure | | | | 3,195,511 | | | | | 1.4 | % |

Renewables | | | | 1,487,000 | | | | | 0.6 | % |

Special Purpose Acquisition Companies | | | | 125 | | | | | — | % |

Water | | | | 1,406,165 | | | | | 0.6 | % |

| | | | | | | | | | |

Total | | | $ | 233,084,506 | | | | | 100.0 | % |

| | | | | | | | | | |

| | | | |

| See accompanying Notes to Financial Statements. | | 9 | | |

Schedule of Investments (Unaudited)

Salient Midstream & MLP Fund

May 31, 2022

Salient Midstream & MLP Fund invested in securities with exposure to the following countries as of May 31, 2022:

| | | | | | | | | | |

| | | Value | | % of

Total Investments |

Canada | | | $ | 44,305,071 | | | | | 19.0 | % |

Great Britain | | | | 1,275,864 | | | | | 0.6 | % |

United States | | | | 187,503,571 | | | | | 80.4 | % |

| | | | | | | | | | |

Total | | | $ | 233,084,506 | | | | | 100.0 | % |

| | | | | | | | | | |

Currency Abbreviations:

CAD—The security is traded in Canadian Dollars. The Fair Value in the Schedule of Investments is expressed in US Dollars at the conversion rate on May 31, 2022.

| | | | |

| See accompanying Notes to Financial Statements. | | 10 | | |

Statement of Assets, Liabilities and Shareholders’ Equity (Unaudited)

Salient Midstream & MLP Fund

May 31, 2022

| | | | | |

Assets: | | | | | |

Investments, at value (cost $146,951,107) | | | $ | 233,084,506 | |

Cash and cash equivalents | | | | 293,897 | |

Foreign currency, at value (cost $104,773) | | | | 106,747 | |

Dividends receivable | | | | 255,082 | |

Prepaids and other assets | | | | 18,597 | |

| | | | | |

Total Assets | | | | 233,758,829 | |

| | | | | |

Liabilities: | | | | | |

Credit facility | | | | 60,600,000 | |

Written options, at fair value (premiums received $82,812) | | | | 53,718 | |

Payable for investments purchased | | | | 171,836 | |

Payable to advisor | | | | 242,345 | |

Interest payable | | | | 102,243 | |

Commitment fees payable | | | | 1,200 | |

Accounts payable and accrued expenses | | | | 327,310 | |

| | | | | |

Total Liabilities | | | | 61,498,652 | |

| | | | | |

Net Assets applicable to common shareholders | | | $ | 172,260,177 | |

| | | | | |

Net Assets Applicable to Common Shareholders: | |

Capital stock, $0.01 par value; 17,722,448 shares issued and outstanding (unlimited shares authorized) | | | $ | 177,224 | |

Paid-in capital | | | | 337,333,001 | |

Total distributable earnings | | | | (165,250,048 | ) |

| | | | | |

Net assets applicable to common shareholders | | | $ | 172,260,177 | |

| | | | | |

Net Asset Value: | | | | | |

Net assets applicable to common shareholders | | | $ | 172,260,177 | |

Common shares outstanding | | | | 17,722,448 | |

Net asset value per common share outstanding | | | $ | 9.72 | |

| | | | |

| See accompanying Notes to Financial Statements. | | 11 | | |

Statement of Operations (Unaudited)

Salient Midstream & MLP Fund

For the Six Months Ended May 31, 2022

| | | | | |

Investment Income: | |

Distributions from master limited partnerships | | | $ | 2,123,211 | |

Less return of capital on distributions | | | | (2,123,211 | ) |

| | | | | |

Net investment income from master limited partnerships | | | | — | |

Dividends from master limited partnership related companies | | | | 3,477,828 | |

Less return of capital on dividends | | | | (1,499,291 | ) |

| | | | | |

Net investment income from master limited partnership related companies | | | | 1,978,537 | |

Foreign taxes withheld | | | | (167,145 | ) |

| | | | | |

Total Investment Income | | | | 1,811,392 | |

| | | | | |

Operating Expenses: | |

Investment advisory fee | | | | 1,246,679 | |

Management fee | | | | 79,782 | |

Administration fees | | | | 74,161 | |

Custodian fees | | | | 10,392 | |

Interest expense | | | | 384,836 | |

Commitment fees | | | | 2,205 | |

Professional fees | | | | 461,243 | |

Transfer agent fees | | | | 13,420 | |

Compliance fees | | | | 50,084 | |

Other expenses | | | | 100,961 | |

| | | | | |

Total Expenses | | | | 2,423,763 | |

| | | | | |

Net Investment Loss | | | | (612,371 | ) |

| | | | | |

Realized and Unrealized Gain (Loss): | | | | | |

Net realized gain on investments | | | | 4,105,760 | |

Net realized gain on written options | | | | 435,549 | |

Net realized loss on foreign currency | | | | (10,373 | ) |

| | | | | |

Net realized gain | | | | 4,530,936 | |

| | | | | |

Change in unrealized appreciation/depreciation on: | | | | | |

Investments | | | | 38,234,919 | |

Written options | | | | (90,569 | ) |

| | | | | |

Change in unrealized appreciation/depreciation from investments and written options | | | | 38,144,350 | |

| | | | | |

Net Realized and Unrealized Gain from Investments and Written options | | | | 42,675,286 | |

| | | | | |

Net Increase in Net Assets Applicable to Common Shareholders Resulting from Operations | | | $ | 42,062,915 | |

| | | | | |

| | | | |

| See accompanying Notes to Financial Statements. | | 12 | | |

Statements of Changes in Net Assets

Salient Midstream & MLP Fund

| | | | | | | | | | |

| | | Six Months Ended

May 31, 2022

(Unaudited) | | Year Ended

November 30, 2021 |

Operations: | |

Net investment loss | | | $ | (612,371 | ) | | | $ | (174,162 | ) |

Net realized gain | | | | 4,530,936 | | | | | 11,408,456 | |

Change in unrealized appreciation | | | | 38,144,350 | | | | | 26,712,178 | |

| | | | | | | | | | |

Net increase in net assets applicable to common shareholders resulting from operations | | | | 42,062,915 | | | | | 37,946,472 | |

| | | | | | | | | | |

Distributions: | | | | | | | | | | |

From distributable earnings | | | | (3,101,428 | ) | | | | — | |

From return of capital | | | | — | | | | | (4,607,836 | ) |

| | | | | | | | | | |

Total distributions to common shareholders | | | | (3,101,428 | ) | | | | (4,607,836 | ) |

| | | | | | | | | | |

Net increase in net assets applicable to common shareholders | | | $ | 38,961,487 | | | | $ | 33,338,636 | |

| | | | | | | | | | |

Net Assets: | |

Beginning of period | | | | 133,298,690 | | | | | 99,960,054 | |

| | | | | | | | | | |

End of period | | | $ | 172,260,177 | | | | $ | 133,298,690 | |

| | | | | | | | | | |

| | | | |

| See accompanying Notes to Financial Statements. | | 13 | | |

Statement of Cash Flows (Unaudited)

Salient Midstream & MLP Fund

For the Six Months Ended May 31, 2022

| | | | | |

Cash Flows from Operating Activities: | | | | | |

Net increase in net assets resulting from operations | | | $ | 42,062,915 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities | | | | | |

Purchase of investments | | | | (39,794,323 | ) |

Proceeds from disposition of investments | | | | 34,685,432 | |

Premiums from written options | | | | 557,238 | |

Proceeds paid to cover written options | | | | (123,705 | ) |

Premiums paid on exercised written options | | | | (46,028 | ) |

Amortization of premium and accretion of discount on investments | | | | — | |

Net realized loss on investments | | | | (3,382,244 | ) |

Net realized gain on written options | | | | (435,549 | ) |

Change in unrealized appreciation/depreciation from investments | | | | (35,335,933 | ) |

Change in unrealized appreciation/depreciation from affliated investments | | | | — | |

Change in unrealized appreciation/depreciation from written options | | | | 90,569 | |

Change in operating assets and liabilities: | | | | | |

Dividends receivable | | | | (8,689 | ) |

Interest receivable | | | | 20 | |

Prepaids and other assets | | | | (13,298 | ) |

Interest payable | | | | 54,258 | |

Payable to Advisor | | | | 43,331 | |

Unrealized gain on unfuded SPAC PIPE commitments | | | | (769 | ) |

Commitment fees payable | | | | 875 | |

Accounts payable and accrued expenses | | | | (141,633 | ) |

| | | | | |

Net cash used in operating activities | | | | (1,787,533 | ) |

| | | | | |

Cash Flows from Financing Activities: | | | | | |

Advances from credit facility | | | | 4,500,000 | |

Repayments on credit facility | | | | — | |

Distributions paid to common shareholders, net of reinvestments | | | | (3,101,428 | ) |

| | | | | |

Net cash provided by financing activities | | | | 1,398,572 | |

| | | | | |

Effect of Exchange Rates on Cash | | | | 1,974 | |

Net increase in cash and cash equivalents | | | | (386,987 | ) |

Cash and cash equivalents at beginning of year | | | | 787,631 | |

| | | | | |

Cash and cash equivalents at end of period | | | $ | 400,644 | |

| | | | | |

Supplemental Schedule of Cash Activity: | | | | | |

Cash paid for interest during the period | | | $ | 332,783 | |

Cash paid for commitment fees during the period | | | | 875 | |

| | | | |

| See accompanying Notes to Financial Statements. | | 14 | | |

Financial Highlights

Salient Midstream & MLP Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

May 31, 2022

(Unaudited) | | Year Ended

November 30,

2021 | | Year Ended

November 30,

2020 | | Year Ended

November 30,

2019 | | Year Ended

November 30,

2018 | | Year Ended

November 30,

2017 |

Per Common Share Data:(a) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, beginning of period | | | $ | 7.52 | | | | $ | 5.64 | | | | $ | 8.39 | | | | $ | 10.04 | | | | $ | 11.23 | | | | $ | 14.37 | |

Income/(loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(b) | | | | (0.03 | ) | | | | (0.01 | ) | | | | 0.12 | | | | | (0.05 | ) | | | | (0.12 | ) | | | | 0.00 | (c) |

Net realized and unrealized gain/(loss) from investments | | | | 2.40 | | | | | 2.15 | | | | | (2.52 | ) | | | | (0.91 | ) | | | | (0.31 | ) | | | | (2.16 | ) |

Net increase (decrease) resulting from operations | | | | 2.37 | | | | | 2.14 | | | | | (2.40 | ) | | | | (0.96 | ) | | | | (0.43 | ) | | | | (2.16 | ) |

Distributions paid from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | (0.17 | ) | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | |

In excess of net investment income | | | | — | | | | | — | | | | | — | | | | | (0.12 | ) | | | | (0.06 | ) | | | | — | |

Return of capital | | | | — | | | | | (0.26 | ) | | | | (0.35 | ) | | | | (0.57 | ) | | | | (0.70 | ) | | | | (0.98 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, end of period | | | $ | 9.72 | | | | $ | 7.52 | | | | $ | 5.64 | | | | $ | 8.39 | | | | $ | 10.04 | | | | $ | 11.23 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per common share market value, end of period | | | $ | 8.50 | | | | $ | 6.37 | | | | $ | 4.22 | | | | $ | 7.09 | | | | $ | 8.41 | | | | $ | 10.22 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total investment return based on market value(d)(e) | | | | 36.43 | % | | | | 57.95 | % | | | | (36.19 | )% | | | | (8.23 | )% | | | | (11.05 | )% | | | | (17.08 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios to Average Net Assets:(f) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss) | | | | (0.80 | )% | | | | (0.14 | )% | | | | 1.87 | % | | | | (0.49 | )% | | | | (1.09 | )% | | | | 0.01 | % |

Net operating expenses (including tax expense/benefit) | | | | 3.17 | % | | | | 2.75 | % | | | | 2.97 | % | | | | 3.49 | % | | | | 3.26 | % | | | | 2.40 | % |

Net operating expenses (excluding tax benefit/expense) | | | | 3.17 | % | | | | 2.75 | % | | | | 2.97 | % | | | | 3.49 | % | | | | 3.26 | % | | | | 2.87 | % |

Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets applicable to common shareholders, end of period (in 000s) | | | $ | 172,260 | | | | $ | 133,299 | | | | $ | 99,960 | | | | $ | 148,693 | | | | $ | 177,877 | | | | $ | 199,045 | |

Average net assets (000s) | | | $ | 153,201 | | | | $ | 128,076 | | | | $ | 109,424 | | | | $ | 173,820 | | | | $ | 200,269 | | | | $ | 236,834 | |

Portfolio turnover(e) | | | | 16.97 | % | | | | 86.03 | % | | | | 155.52 | % | | | | 44.75 | % | | | | 45.27 | % | | | | 23.72 | % |

Asset coverage per $1,000 unit of senior indebtedness(g) | | | $ | 3,843 | | | | $ | 3,376 | | | | $ | 5,760 | | | | $ | 4,804 | | | | $ | 3,402 | | | | $ | 3,585 | |

Short-term borrowings, end of period (000s) | | | $ | 60,600 | | | | $ | 56,100 | | | | $ | 21,000 | | | | $ | 39,089 | | | | $ | 74,039 | | | | $ | 76,989 | |

(a) Information presented relates to a common share outstanding for periods indicated.

(b) Per share net investment income/(loss) has been calculated using the average daily shares method.

(c) Amount represents less than $0.01 per share.

(d) Total investment return is calculated assuming a purchase of common shares at the current market price on the first day of the period and a sale at the closing market price on the last day of the period reported (excluding brokerage commissions). Dividends and distributions are assumed for the purpose of this calculation to be reinvested at prices obtained under the Dividend Reinvestment Plan (“DRIP”).

(e) Not annualized for periods less than one year.

(f) Annualized for periods less than one year.

(g) Calculated by subtracting the Fund’s total liabilities (not including borrowings) from the Fund’s total assets and dividing by the total number of senior indebtedness units, where one unit equals $1,000 of senior indebtedness.

| | | | |

| See accompanying Notes to Financial Statements. | | 15 | | |

Notes to Financial Statements

May 31, 2022

(1) ORGANIZATION

Salient Midstream & MLP Fund (the “Fund”), a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), commenced operations on May 24, 2012 as a non-diversified, closed-end management investment company. The Fund is authorized to issue an unlimited number of common shares of beneficial interest (“Common Shares”), which may be issued in more than one class or series. The Fund’s Common Shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “SMM”.

The Fund’s objective is to provide a high level of total return with an emphasis on making quarterly cash distributions to its common shareholders. The Fund seeks to achieve its investment objective by investing at least 80% of its total assets in securities of midstream companies and master limited partnerships (“MLPs”).

The board of trustees of the Fund (each member thereof a “Trustee” and collectively, the “Board”) is authorized to engage an investment advisor, and pursuant to an investment management agreement (the “Investment Management Agreement”), it has selected Salient Capital Advisors, LLC (the “Advisor”) to manage the Fund’s portfolio and operations. The Advisor is a Texas limited liability company that is registered as an investment advisor under the Investment Advisers Act of 1940, as amended. Under the Investment Management Agreement, the Advisor is responsible for the establishment of an investment committee (the “Investment Committee”), which is responsible for developing, implementing, and supervising the Fund’s investment program subject to the ultimate supervision of the Board.

The Fund owns 100% of the limited partnership interests of EMG Utica I Offshore Co-Investment, LP (“EMG Utica”). EMG Utica holds a non-controlling underlying interest in Mark West Utica EMG, L.L.C., which is a joint venture between Mark West Energy Partners, L.P. (“Mark West”) and The Energy and Minerals Group (“EMG”). Mark West is owned by MPLX LP (NYSE: MPLX), which is a U.S. domiciled publicly traded master limited partnership that owns, operates, develops, and acquires midstream energy infrastructure assets. EMG is a private investment firm that targets equity investments in the energy and minerals sector. EMG Utica is considered a variable interest entity (“VIE”) as it is a partnership and the Fund, as the limited partner, lacks the ability to remove the general partner and does not have any substantive participating rights, as these reside with EMG Utica Co-Investment GP, LLC, the general partner for EMG Utica. This means the general partner of EMG Utica has full, exclusive and unilateral power and authority to manage, control, administer and operate the assets and business affairs of EMG Utica. Under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 810, “Consolidation”, prior to the adoption of ASC update 2015-02, management believed the Fund was the primary beneficiary as it owned 100% of EMG Utica and had the right to receive the

economic benefit from the investment, and therefore consolidated EMG Utica in the Fund’s financial statements for the year ended November 30, 2016. Under ASC Update 2015-02, which the Fund adopted effective the year ended November 30, 2017, consolidation of a VIE’s financial statements would occur if a limited partner has the power to direct the activities and the right to receive the benefits from the entity considered for consolidation. EMG Utica is no longer consolidated within the Fund’s financial statements, effective the year ended November 30, 2017.

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES

(a) BASIS OF ACCOUNTING

The financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America (“U.S. GAAP”). The accompanying financial statements reflect the financial position of the Fund. The Fund is an investment company and follows the investment company accounting and reporting guidance under FASB ASC Topic 946, “Financial Services-Investment Companies”.

(b) CASH EQUIVALENTS

The Fund considers all unpledged temporary cash investments with a maturity date at the time of purchase of three months or less to be cash equivalents.

(c) PORTFOLIO SECURITIES TRANSACTIONS

Security transactions are accounted for on a trade date basis. Realized gains and losses are reported using the specific identification cost basis.

(d) INVESTMENT VALUATION

The valuation of the Fund’s investments is determined each day based on the most recent close of regular session trading on the NYSE and reported by ALPS Fund Services, Inc., the Fund’s independent administrator (the “Administrator” or “ALPS”). The Fund’s valuation policies are discussed in further detail in Note 3.

The Board has formed a valuation committee (the “Board Valuation Committee”) that is responsible for overseeing the Fund’s valuation policies, making recommendations to the Board on valuation-related matters, and overseeing implementation by the Advisor of the Fund’s valuation policies.

The Board has authorized the Advisor to establish a valuation committee of the Advisor (the “Advisor Valuation Committee”). The Advisor Valuation Committee’s function, subject to oversight of the Board

Notes to Financial Statements, continued

May 31, 2022

Valuation Committee and the Board, is generally to review the Fund’s valuation methodologies, valuation determinations, and any information provided to the Advisor Valuation Committee by the Advisor or the Administrator.

To the extent that the price of a security cannot be determined applying the methods described below, the Advisor Valuation Committee in conjunction with the Administrator will determine the price of the security pursuant to the fair value procedures approved by the Board.

Investments held by the Fund are valued as follows:

| | • | | SECURITIES LISTED ON A SECURITIES EXCHANGE OR OVER-THE-COUNTER EXCHANGES—In general, the Fund values those securities at their last sales price on the exchange or over-the-counter market or a market’s official closing price on the valuation date. If the security is listed on more than one exchange, the Fund uses the price from the exchange that it considers to be the principal exchange on which the security is traded. If there have been no sales for that day on the exchange where the security is principally traded, then the price of the security will be valued at the mean between the closing “bid” and “ask” prices on the valuation date. |

| | • | | PUBLICLY-TRADED EQUITY SECURITIES ACQUIRED IN A DIRECT PLACEMENT TRANSACTION—Such securities may be subject to restrictions on resale that can affect the security’s liquidity and fair value. Such securities that are convertible or otherwise will become freely tradable will be valued based on the market value of the freely tradable security less an applicable restriction discount. Generally, the discount will initially be equal to the discount at which the Fund purchased the securities and thereafter will be periodically reassessed and likely reduced over the anticipated restricted period. |

| | • | | DERIVATIVES—Exchange traded futures contracts are valued using quoted final settlement prices from the national exchange on which they are principally traded. If no such price is reported by such exchange on the valuation date, the Advisor Valuation Committee will determine the fair value in good faith using information that is available at such time. |

Options that are listed on a securities exchange are generally valued on the valuation date at the mean of the closing bid and ask prices of the posted market on the exchange on which they are listed. If on the valuation date the primary exchange is closed, the prior day price will be used. If no such price is reported, the fair value of such options will be determined in good faith using industry standard pricing models utilizing publicly available input information on the valuation date.

Options traded on an over-the-counter market are generally valued using the mean of the closing bid and ask prices provided by an independent pricing service. If a quotation is not available from the independent pricing service, the price is obtained from a broker (typically counterparty to the option) on the valuation date. If no such price is available on the valuation date, the Advisor Valuation Committee in conjunction with the Administrator will determine the fair value of such options in good faith using information that is available at such time.

Non exchange-traded derivatives, such as swap agreements, are valued based on procedures approved by the Board. Credit default swaps and total return swaps are generally fair valued using evaluated quotes provided by an independent pricing service. If a quotation is not available from the independent pricing service, the price is obtained from a broker (typically the counterparty to the swap agreement) on the valuation date.

| | • | | SECURITIES NOT ACTIVELY TRADED—The value of securities, derivatives or synthetic securities that are not actively traded on an exchange are determined by obtaining quotes from brokers that normally deal in such securities or by an unaffiliated pricing service that may use actual trade data or procedures using market indices, matrices, yield curves, specific trading characteristics of certain groups of securities, pricing models or a combination of these procedures. Securities for which independent pricing services are not available are valued pursuant to the valuation procedures approved by the Board. |

| | • | | INVESTMENT FUNDS—Investments in investment limited partnerships and shares in unregistered investment funds (“Investment Funds”) for which a market value is not available will generally be valued using the partners’ capital or net asset value (the “NAV”) as a practical expedient, as reported by the Investment Fund managers or the administrators of such Investment Funds. These Investment Funds value their underlying investments in accordance with policies established by such Investment Funds. Prior to investing in any Investment Fund, the Adviser Valuation Committee, as part of the due diligence process, conducts a review of the valuation methodologies employed by the Investment Fund to determine whether such methods are appropriate for the asset types. The Adviser Valuation Committee will consider whether it is appropriate, in light of the relevant circumstances, to value shares at NAV as reported by an Investment Fund for valuation purposes, or whether to adjust such reported value to reflect an adjusted fair value. Because of the inherent uncertainty of valuation, fair value may differ significantly from the value that would have been used had |

Notes to Financial Statements, continued

May 31, 2022

| | | readily available markets for the investments in Investment Funds existed. The Fund’s investments in Investment Funds are subject to the terms and conditions of the respective operating agreements and offering memoranda of such Investment Funds. |

| | • | | OTHER—Investments in private placement securities and other securities for which market quotations are not readily available will be valued in good faith by using fair value procedures approved by the Board. Such fair value procedures may consider among other factors discounts to publicly traded issues, time until conversion date, securities with similar yields, quality, type of issue, coupon, duration and rating, and an analysis of the issuer’s financial statements and reports. Valuation techniques such as the market approach and/or income approach may be used when sufficient and reliable data is available. If events occur that affect the value of the Fund’s securities before the NAV has been calculated, the securities so affected will generally be priced using fair value procedures. |

| | • | | SPECIAL PURPOSE ACQUISITION COMPANIES—The Fund may invest in stock, warrants, and other securities of special purpose acquisition companies (“SPACs”) or similar special purpose entities that pool funds to seek potential acquisition opportunities. The Fund may enter into a commitment with a SPAC for a private investment in a public equity (“PIPE”) which will be satisfied if and when the SPAC completes its merger or acquisition. PIPEs are illiquid and restricted, and unfunded SPAC PIPE commitments are marked-to-market with the unrealized appreciation/depreciation separately presented in the Statement of Assets and Liabilities and Statement of Operations. As of May 31, 2022, the Fund did not hold any unfunded SPAC PIPE Commitments. |

(e) FOREIGN CURRENCY

The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts and investments denominated in a foreign currency, if any, are translated into U.S. dollar amounts at current exchange rates on the valuation date. Purchases and sales of investments denominated in foreign currencies are translated into U.S. dollar amounts at the exchange rate on the respective dates of such transactions. The Fund does not isolate the portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains on investments.

(f) MASTER LIMITED PARTNERSHIPS

Entities commonly referred to as MLPs are generally organized under state law as limited partnerships or limited liability companies. The Fund invests in MLPs receiving partnership taxation treatment under the Internal Revenue Code of 1986, as amended (the “Code”), and whose interests or “units” are traded on securities exchanges like shares of corporate stock. To be treated as a partnership for U.S. federal income tax purposes, an MLP whose units are traded on a securities exchange must receive at least 90% of its income from qualifying sources such as interest, dividends, real property rents, gains on dispositions of real property, income and gains from mineral or natural resources activities, income and gains from the transportation or storage of certain fuels, and, in certain circumstances, income and gains from commodities or futures, forwards and options on commodities. Mineral or natural resources activities include exploration, development, production, processing, mining, refining, marketing and transportation (including pipelines) of oil and gas, minerals, geothermal energy, fertilizer, timber or industrial source carbon dioxide. An MLP consists of a general partner and limited partners (or in the case of MLPs organized as limited liability companies, a managing member and members).

The general partner or managing member typically controls the operations and management of the MLP and has an ownership stake in the partnership or limited liability company. The limited partners or members, through their ownership of limited partner or member interests, provide capital to the entity, are intended to have no role in the operation and management of the entity and receive cash distributions. The Fund’s investments in MLPs consist only of limited partner or member interest ownership. The MLPs themselves generally do not pay U.S. federal income taxes. Thus, unlike investors in corporate securities, direct MLP investors are generally not subject to double taxation (i.e., corporate level tax and tax on corporate dividends). Currently, most MLPs operate in the energy and/or natural resources sector.

(g) RESTRICTED SECURITIES

The Fund may invest up to 30% of its total assets in unregistered or otherwise restricted securities of which up to 10% may be in securities of privately held companies. The percentage limitations applicable to the Fund’s portfolio described above apply only at the time of investment and the Fund is not required to sell securities due to subsequent changes in the value of securities it owns. A restricted security is a security which has been purchased through a private offering and cannot be resold to the general public without prior registration under the Securities Act of 1933 (the “1933 Act”) or pursuant to the resale limitations provided by Rule 144 under the 1933 Act, or an exemption from the registration requirements of the 1933 Act. Certain restricted securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

Notes to Financial Statements, continued

May 31, 2022

The restricted securities held at May 31, 2022 are identified below and are also presented in the Fund’s Schedule of Investments.

| | | | | | | | | | | | | | | | | | | | | | | | | |

Security | | % of Net

Assets | | Acquisition

Date | | Shares/Units | | Cost | | Fair Value |

EMG Utica I Offshore Co-Investment, LP | | | | 7.45 | % | | | | 2/22/2013 | | | | | 16,000,000 | | | | $ | 13,489,733 | | | | $ | 12,841,593 | |

Microvast Holdings, Inc. | | | | 0.86 | % | | | | 7/22/2021 | | | | | 297,400 | | | | $ | 3,026,045 | | | | $ | 1,487,000 | |

TortoiseEcofin Acquisition Corp. III - Founder Shares | | | | 0.00 | % | | | | 7/21/2021 | | | | | 41,550 | | | | $ | 125 | | | | $ | 125 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total Restricted Securities | | | | 8.32 | % | | | | | | | | | | | | | $ | 16,515,903 | | | | $ | 14,328,718 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

(h) INVESTMENT INCOME

Interest income is recognized on the accrual basis. Distributions are recorded on the ex-dividend date. Distributions received from the Fund’s investments in MLPs generally are composed of ordinary income, capital gains and return of capital from the MLPs.

(i) USE OF ESTIMATES

The financial statements have been prepared in conformity with U.S. GAAP, which requires management to make estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results may differ from those estimates and such differences may be significant.

(j) DERIVATIVE INSTRUMENTS

The Fund may invest in derivatives in order to meet its investment objectives. The risk in using derivatives varies depending upon the structure of the instruments. All open derivative positions at period end, if any, are presented in the Fund’s Schedule of Investments. The following is a description of the derivative instruments that the Fund has utilized as part of its investment strategy, including the primary underlying risk exposures related to each instrument type.

OPTIONS—The Fund may write equity call options with the purpose of generating realized gains from premiums as a means to enhance distributions to the Fund’s common shareholders. Options are secured by investments, as detailed in the Fund’s Schedule of Investments. A call option on a security is a contract that gives the holder of such call option the right to buy the security underlying the call option from the writer of such call option at a specified price at any time during the term of the option. At the time the call option is sold, the writer of a call option receives a premium from the buyer of such call option. If the Fund writes a call option, it will have the obligation upon exercise of such call option to deliver the underlying security upon payment of the exercise price. As the writer of a covered call option, during the option’s life, the Fund gives up the opportunity to profit from increases in the market

value of the security covering the call option above the sum of the premium and the strike price of the call, but the Fund retains the risk of loss should the price of the underlying security decline.

FUTURES CONTRACTS—The Fund may invest in futures contracts as a part of its hedging strategy to manage exposure to interest rate, equity and market price movements, and commodity prices. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date. The underlying asset is not physically delivered. Futures contracts are valued at their quoted daily settlement prices. Upon entering into a futures contract, the Fund is required to segregate liquid assets in accordance with the initial margin requirements of the clearinghouse to secure the Fund’s performance. The clearinghouse also requires daily settlement of variation margin representing changes in the value of each contract. Fluctuations in the value of the contracts are recorded as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as net realized gain (loss) on futures contracts. The primary risks associated with the use of futures contracts are imperfect correlation between changes in fair values of the underlying assets and the prices of futures contracts, and the possibility of an illiquid market. With exchange-traded futures, there is minimal counterparty credit risk to the Fund since the exchange is a regulated clearinghouse and is a counterparty to all exchange-traded futures which guarantees payment of the futures contract.

SWAP AGREEMENTS—The Fund may invest in swap agreements, including credit default and total return swap agreements, in connection with its hedging strategy to manage market risks.

A total return swap is a bilateral financial contract agreement where one party (the payer) agrees to pay the other (the receiver) the total return on a specified asset or index in exchange for a fixed or floating rate of return. A total return swap allows the receiver or payer to derive the economic benefit of owning or having short exposure to an asset without owning or shorting the underlying asset directly. The receiver is entitled to the amount, if any, by which the notional amount of the total return swap would have increased in value had it been invested in the particular instruments, plus an amount equal to any dividends or interest that would have been received on those instruments. In return, the payer is entitled to an amount equal to a fixed or floating rate of interest

Notes to Financial Statements, continued

May 31, 2022

(e.g., a reference rate based on the average interest rate at which major global banks can borrow from one another) on the notional amount of the swap plus the amount, if any, by which the notional amount would have decreased in value had it been invested in such instruments, less any dividends or interest. The amounts to which each party is entitled are normally netted against each other at periodic settlement dates, resulting in a single amount that is either due to or from each party.

A credit default swap gives one party (the buyer) the right to recoup the economic value of a decline in the value of debt securities of the reference issuer if a credit event (a downgrade, bankruptcy or default) occurs. This value is obtained by delivering a debt security of the reference issuer to the party in return for a previously agreed upon payment from the other party (frequently, the par value of the debt security) or receive a net amount equal to the par value of the defaulted reference entity less its recovery value. The Fund is usually a net buyer of credit default swaps.

The Fund as a buyer of a credit default swap would have the right to deliver a referenced debt obligation and receive the par (or other agreed-upon) value of such debt obligation from the counterparty in the event of a default or other credit event by the reference issuer with respect to its debt obligations. In return, the Fund would pay the counterparty a periodic stream of payments over the term of the agreement provided that no event of default or other credit event has occurred. If no default or other credit event occurs, the counterparty would keep the stream of payments and would have no further obligations to the Fund.

In addition to being exposed to the credit risk of the underlying reference entity, swap agreements are subject to counterparty risk, market risk and interest rate risk. Swap agreements utilized by the Fund may not perform as expected. Risks may arise as a result of the failure of the counterparty to perform under the agreement. The loss incurred by the failure of a counterparty is generally limited to the market value and premium amounts recorded. The Fund considers the creditworthiness of each counterparty to a swap agreement in evaluating potential credit risk, and will not enter into any swap agreement unless the Advisor believes the counterparty to the transaction is creditworthy. Additionally, risks may arise from the unanticipated movements in interest rates or in the value of the underlying reference assets. The Fund may use various techniques to minimize credit risk including early termination or reset and payment. Collateral, in the form of cash, is held in broker segregated accounts for swap agreements.

The following is a summary of the effect of derivative instruments on the Statement of Operations for the period ended May 31, 2022:

| | | | | | | | | | |

| | | Net Realized

Gain on

Written Options | | Change in

Unrealized

Appreciation/

Depreciation

on Written Options |

Equity Risk Exposure: | | | | | | | | | | |

Written Call Options | | | $ | 435,549 | | | | $ | (90,569 | ) |

As described above, the Fund utilized derivative instruments to achieve its investment objective during the period ended May 31, 2022. The Fund may enter into International Swaps and Derivatives Association, Inc. Master Agreements (“ISDA Master Agreement”) or similar agreements with its derivative contract counterparties whereby the Fund may, under certain circumstances, offset with the counterparty certain derivative financial instruments’ payables and/or receivables with collateral held and/or posted and create one single net payment. There were no derivative financial instruments that are subject to enforceable netting arrangements or other similar agreements as of May 31, 2022.

The following is a summary of the average monthly notional value of written options during the period ended May 31, 2022:

| | | | | | | | | | |

| | | Average Monthly

Notional Value | | Notional Value

Outstanding at

May 31, 2022 |

Written Call Options | | | $ | 1,976,333 | | | | $ | 4,095,067 | |

(k) DISTRIBUTIONS TO SHAREHOLDERS

The Fund intends to continue to comply with the requirements under Subchapter M of the Code in order to continue to qualify as a regulated investment company (“RIC”). If so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and net capital gains to its shareholders.

The Fund generally makes quarterly distributions to shareholders. Net realized capital gains, if any, are distributed annually. Distributions from net realized gains may include short-term capital gains. All net short term capital gains are included in ordinary income for tax purposes. Distributions to shareholders are recorded on the ex-dividend date. The Fund may also pay, at the end of the calendar year, a special distribution to comply with requirements under the Code.

Each shareholder will automatically be a participant under the Fund’s Dividend Reinvestment Plan (“DRIP”) and have all income distributions and capital gains distributions automatically reinvested in Shares, unless a shareholder otherwise elects to receive distributions in cash. Generally, for U.S. federal income tax purposes, shareholders receiving Shares under the DRIP will be treated as having received a distribution

Notes to Financial Statements, continued

May 31, 2022

equal to the amount of cash they would have received had the shareholder not participated in the DRIP.

The character of distributions made during the period from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes.

The amount of distributions is determined in accordance with federal income tax regulations which may differ from U.S. GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., return of capital and differing treatment on partnership investments), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences (e.g., wash sales, differing treatment on partnership investments, late year ordinary loss deferrals and capital loss carryforwards) do not require a reclassification. Distributions which exceed net investment income and net realized gains for financial reporting purposes but not for tax purposes are reported as distributions in excess of net investment income or net realized gains. To the extent they exceed net investment income and net realized gains for tax purposes, they are reported as return of capital.

(l) CFTC REGULATION

The Commodity Futures Trading Commission (“CFTC”) adopted rules to harmonize conflicting United States Securities and Exchange Commission (the “SEC”) and CFTC disclosure, reporting and recordkeeping requirements for registered investment companies that do not meet an exemption from the definition of commodity pool. The harmonization rules provide that the CFTC will accept the SEC’s disclosure, reporting, and recordkeeping regime as substituted compliance for substantially all of the otherwise applicable CFTC regulations as long as such investment companies meet the applicable SEC requirements. With respect to the Fund, the Advisor has claimed an exemption from the definition of the term “commodity pool operator” under CFTC Regulation 4.5 of the Commodity Exchange Act (“CEA”). As such, the Fund is not currently subject to registration or regulation as a commodity pool under the CEA. Effective November 18, 2019, the Advisor is no longer registered with the CFTC as a commodity pool operator and commodity trading adviser, and is no longer a member of the National Futures Association given the current activities.

(m) RETURN OF CAPITAL ESTIMATES

Distributions received from the Fund’s investments in MLPs generally are composed of income, capital gains and return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based

on information received from MLPs after their tax reporting periods are concluded.

For the period ended May 31, 2022, the Fund estimated that approximately 100% of the MLP distributions received and certain distributions received from master limited partnership related companies would be treated as a return of capital. The Fund recorded as return of capital the amount of $3,662,502 of dividends and distributions received from its investments.

(3) FAIR VALUE MEASUREMENTS

The Fund defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions.

The valuation techniques employed by the Fund, as described below, maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used to determine the fair value of the Fund’s investments are summarized in the three broad levels listed below:

| | • | | Level 1—unadjusted quoted prices in active markets for identical investments |

| | • | | Level 2—investments with other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3—investments with significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) that are developed based on the best information available |