Table of Contents

As filed with the Securities and Exchange Commission on October 7, 2013

Registration No. 333-190725

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PBF ENERGY INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 2911 | 45-3763855 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) | ||

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

Telephone: (973) 455-7500

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Jeffrey Dill, Esq.

Senior Vice President, General Counsel

PBF Energy Inc.

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

Telephone: (973) 455-7500

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Todd E. Lenson, Esq.

Jordan M. Rosenbaum, Esq.

Stroock & Stroock & Lavan LLP

180 Maiden Lane

New York, New York 10038

Telephone: (212) 806-5400

Approximate date of commencement of proposed sale of the securities to the public:As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer ¨ | Accelerated Filer ¨ | Non-accelerated Filer þ | Smaller Reporting Company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offering is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 7, 2013

Prospectus

6,427,702 Shares

Class A Common Stock

We are registering the resale from time to time by the selling stockholders identified in this prospectus or a supplement hereto of up to 6,427,702 shares of our Class A common stock, of which 6,424,167 shares of our Class A common stock are issuable upon the exchange of an equivalent number of Series A LLC Units of PBF Energy Company LLC and 3,535 shares of our Class A common stock are currently held by certain of the selling stockholders.

The selling stockholders may offer the shares from time to time as each selling stockholder may determine through public or private transactions or through other means described in the section entitled “Plan of Distribution” or in a supplement to this prospectus. Each selling stockholder may also sell shares under Rule 144 under the Securities Act of 1933, as amended, if available, rather than under this prospectus. The registration of these shares for resale does not necessarily mean that the selling stockholders will sell any of their shares.

We will not receive any of the proceeds from the sale of these shares by the selling stockholders.

Our Class A common stock is listed on the New York Stock Exchange under the symbol “PBF”. The last reported sale price of our Class A common stock on the New York Stock Exchange on October 7, 2013 was $22.19 per share.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities nor passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated , 2013

Table of Contents

Page | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 5 | ||||

| 8 | ||||

| 15 | ||||

| 17 | ||||

| 17 | ||||

Page | ||||

| 20 | ||||

| 26 | ||||

Certain U.S. Federal Income and Estate Tax Consequences to Non-U.S. Holders | 28 | |||

| 32 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus, any prospectus supplement or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the selling stockholders have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell, or solicitation of an offer to buy, these securities in any jurisdiction where such offer, sale or solicitation is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

For investors outside the United States: we have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Class A common stock and the distribution of this prospectus outside the United States.

Unless otherwise indicated or the context otherwise requires, all financial data presented or incorporated by reference in this prospectus reflects the consolidated business and operations of PBF Energy Inc. and its consolidated subsidiaries, and has been prepared in accordance with generally accepted accounting principles in the United States of America, or GAAP.

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using a “shelf” registration or continuous offering process. Under this shelf process, the selling stockholders may from time to time sell the shares of Class A common stock covered by this prospectus in one or more offerings. Additionally, under the shelf process, in certain circumstances, we may provide a prospectus supplement that will contain certain specific information about the terms of a particular offering by one or more of the selling stockholders. We may also provide a prospectus supplement to add information to, or update or change information contained in this prospectus. This prospectus incorporates by reference important information. You should read this prospectus and the information incorporated by reference before deciding to invest in shares of our Class A common stock. You may obtain this information without charge by following the instructions under “Where You Can Find More Information” appearing elsewhere in this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC allows us to “incorporate by reference” information into this prospectus. This means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be part of this prospectus, except for any information that is superseded by information that is included directly in this document.

This prospectus incorporates by reference the documents listed below that we have previously filed with the SEC and that are not included in or delivered with this document. They contain important information about us and our financial condition.

| • | Our annual report on Form 10-K for the year ended December 31, 2012, filed with the SEC on February 28, 2013 (our “Form 10-K”); |

| • | Our quarterly report on Form 10-Q for the quarters ended March 31, 2013 and June 30, 2013, filed with the SEC on May 9, 2013 and August 8, 2013, respectively (our “Form 10-Qs”); |

| • | Our current reports on Form 8-K, filed with the SEC on January 2, 2013, February 1, 2013, February 22, 2013, April 15, 2013, May 15, 2013, May 16, 2013 (including Exhibit 99.1 thereto), May 22, 2013 (including Exhibit 99.1 thereto), June 11, 2013 (including Exhibit 99.1 thereto), July 1, 2013, and September 12, 2013 (including Exhibit 99.1 thereto); |

| • | The description of our Class A common stock, which is contained in Item 1 of our registration statement on Form 8-A filed with the SEC on December 13, 2012; and |

| • | Our definitive proxy statement on Schedule 14A for our 2013 annual meeting of stockholders, filed with the SEC on March 29, 2013. |

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the reports or documents that have been incorporated by reference in this prospectus but not delivered with the prospectus free of charge upon written or oral request. Our filings with the SEC are available on our website atwww.pbfenergy.com, in the “SEC Filings” subsection of the “Investors” section, as soon as reasonably practicable after they are filed with the SEC. The information that is contained on, or is or becomes accessible through, our website is not part of this prospectus. You may also obtain a copy of these filings at no cost by writing to us at the following address: PBF Energy Inc., One Sylvan Way, Second Floor, Parsippany, New Jersey 07054, Attn: Secretary, or telephoning us at (973) 455-7500.

ii

Table of Contents

This prospectus and the documents incorporated by reference herein include industry data and forecasts that we obtained from industry publications and surveys, public filings and internal company sources. Statements as to our ranking, market position and market estimates are based on independent industry publications, government publications, third party forecasts and management’s good faith estimates and assumptions about our markets and our internal research. Although industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, we have not independently verified such third party information. While we are not aware of any misstatements regarding our market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings “Forward-Looking Statements” and “Risk Factors” in this prospectus and the documents incorporated by reference herein.

This prospectus and the documents incorporated by reference herein contains certain information regarding refinery complexity as measured by the Nelson Complexity Index, which is calculated on an annual basis by data from the Oil and Gas Journal. Certain data presented in this prospectus and the documents incorporated by reference herein is from the Oil and Gas Journal Report dated December 5, 2011.

iii

Table of Contents

This summary highlights selected information about our business and this offering and may not contain all of the information that may be important to you. You should read this entire prospectus and the information incorporated by reference into this prospectus carefully, including the information set forth under the section entitled “Risk Factors” in this prospectus and in our Form 10-K and Form 10-Qs filed with the SEC under the Securities Exchange Act of 1934, as well as our financial statements and related notes incorporated by reference in this prospectus and the documents incorporated by reference herein, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set forth in “Risk Factors” and “Forward-Looking Statements” in this prospectus and the documents incorporated by reference herein.

In this prospectus, unless the context otherwise requires, references to the “Company,” “we,” “our,” “us” or “PBF” refer to PBF Energy Inc., or PBF Energy, and, in each case, unless the context otherwise requires, its consolidated subsidiaries, including PBF Energy Company LLC, or PBF LLC, PBF Holding Company LLC, or PBF Holding, PBF Investments LLC, or PBF Investments, Toledo Refining Company LLC, or Toledo Refining, Paulsboro Refining Company LLC, or Paulsboro Refining, Delaware City Refining Company LLC, or Delaware City Refining and PBF Logistics LP.

Our Company

We are one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. We sell our products throughout the Northeast and Midwest of the United States, as well as in other regions of the United States and Canada, and are able to ship products to other international destinations. We were formed in 2008 to pursue acquisitions of crude oil refineries and downstream assets in North America. We currently own and operate three domestic oil refineries and related assets, which we acquired in 2010 and 2011. Our refineries have a combined processing capacity, known as throughput, of approximately 540,000 barrels per day (“bpd”), and a weighted average Nelson Complexity Index of 11.3.

Our three refineries are located in Toledo, Ohio, Delaware City, Delaware and Paulsboro, New Jersey. Our Midcontinent refinery at Toledo processes light, sweet crude, has a throughput capacity of 170,000 bpd and a Nelson Complexity Index of 9.2. The majority of Toledo’s WTI based crude is delivered via pipelines that originate in both Canada and the United States. Since our acquisition of Toledo in 2011, we have added additional truck and rail crude unloading capabilities that provide feedstock sourcing flexibility for the refinery and enables Toledo to run a more cost-advantaged crude slate. Our East Coast refineries at Delaware City and Paulsboro have a combined refining capacity of 370,000 bpd and Nelson Complexity Indices of 11.3 and 13.2, respectively. These high conversion refineries process primarily medium and heavy, sour crudes and have historically received the bulk of their feedstock via ships and barges on the Delaware River. In May 2012 we commenced crude shipments via rail into a newly developed crude rail unloading facility at our Delaware City refinery. Crude delivered to this facility is consumed at our Delaware City refinery and our Paulsboro refinery. The Delaware City rail unloading facility allows our East Coast refineries to source WTI based crudes from Western Canada and the Midcontinent, which provides significant cost advantages versus traditional Brent based international crudes.

Our Corporate History and Structure

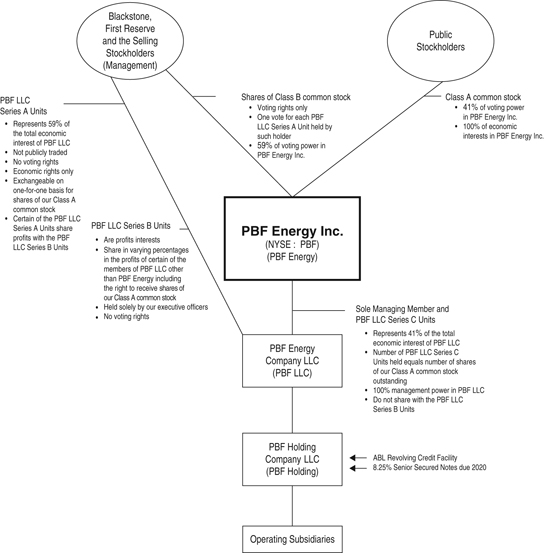

We are a holding company and our primary asset is an equity interest in PBF LLC. As of September 30, 2013, this interest represented approximately 41% of the outstanding economic interests in PBF LLC. We are

1

Table of Contents

the sole managing member of PBF LLC and operate and control all of the business and affairs and consolidate the financial results of PBF LLC and its subsidiaries. PBF LLC is a holding company for the companies that directly or indirectly own and operate our business.

As of September 30, 2013, funds affiliated with The Blackstone Group L.P., or Blackstone, and First Reserve Management, L.P., or First Reserve, and our executive officers and directors and certain employees held 57,237,488 PBF LLC Series A Units (we refer to all of the holders of the PBF LLC Series A Units as “the members of PBF LLC other than PBF Energy”) and we owned 39,581,613 PBF LLC Series C Units, and the members of PBF LLC other than PBF Energy through their holdings of Class B common stock have approximately 59% of the voting power in us, and the holders of our issued and outstanding shares of our Class A common stock have approximately 41% of the voting power in us. As a result of their current ownership of the Class B common stock and the PBF LLC Series A Units, Blackstone and First Reserve continue to control us, and we in turn, as the sole managing member of PBF LLC, control PBF LLC and its subsidiaries.Certain of our officers hold PBF LLC Series B Units, which are profits interests that had no taxable value at the date of issuance, have no voting rights and are designed to increase in value only after our financial sponsors achieve certain levels of return on their investment in PBF LLC Series A Units. In addition, certain of the members of PBF LLC other than PBF Energy and other employees hold options and warrants to purchase PBF LLC Series A Units.

2

Table of Contents

The diagram below depicts our ownership and organizational structure as of September 30, 2013 and without giving effect to any exchanges by the selling stockholders and subsequent sales of shares of Class A common stock in this offering:

See “Certain Relationships and Related Transactions—Our Initial Public Offering” and “—IPO Related Agreements” in our 2013 Proxy Statement, for further information.

3

Table of Contents

Recent Developments

As of July 1, 2013, we terminated our product offtake agreements with Morgan Stanley Capital Group Inc. (“MSCG”) for the Paulsboro and Delaware City refineries (the “Refineries”). We entered into two separate Inventory Intermediation Agreements with J. Aron on June 26, 2013 (the “Intermediation Agreements”) which commenced upon the termination of our product offtake agreements with MSCG. Pursuant to the Intermediation Agreements, J. Aron purchased all of the finished and intermediate products (collectively the “Products”) located at the Refineries immediately subsequent to the termination of the product offtake agreements. We entered into the Intermediation Agreements for the purpose of managing the Products inventory at the Refineries, which provides financial flexibility and improves our liquidity by allowing us to monetize Products inventory in our tanks as they are produced prior to being sold to third parties.

Thereafter, throughout the terms of the Intermediation Agreements which expire on July 1, 2015, J. Aron agrees to purchase the Products produced and delivered into the Refineries’ storage tanks on a daily basis. J. Aron further agreed to sell to us on a daily basis the Products delivered out of the Refineries’ storage tanks. The net amount of all J. Aron daily purchases and sales with us will be provisionally invoiced weekly with a monthly true-up invoice issued for any price, volume, or fee adjustments ten business days after the calendar month end. Furthermore, upon the termination or expiration of the Intermediation Agreements, we are obligated to purchase from J. Aron all volumes of Products located in the Refineries’ storage tanks. All purchase and sale transactions under the Intermediation Agreements are consummated at a benchmark market price adjusted for a specified product type differential. Title to Products purchased by J. Aron passes upon delivery into the Refineries’ storage tanks and title to Products purchased by us passes upon discharge out of the Refineries’ storage tanks. J. Aron owns and has title to all of the Products stored in the tanks (or in other locations agreed upon by both parties) while custody remains with us.

The sale and purchase transactions under the Intermediation Agreements are considered to be made in contemplation of each other and, accordingly, do not result in the recognition of a sale when title passes to J. Aron. The Products inventory remains on our balance sheet at cost and the net cash receipts result in a liability that is recorded at market price for the volume of Products inventory held in our Refineries’ storage tanks with any change in the market price recorded in costs of sales.

Risk Factors

An investment in our Class A common stock involves a number of risks, including changes in industry-wide refining margins and crude oil price differentials, competition and other material factors, that could materially affect our business, financial condition and results of operations, and cause the trading price of our Class A common stock to decline. For a discussion of these risks and other considerations that could negatively affect us, including risks related to this offering and our Class A common stock, see “Risk Factors” and “Forward-Looking Statements” in this prospectus and the documents incorporated by reference into this prospectus.

Company Information

We are a Delaware corporation incorporated on November 7, 2011 with our principal executive offices located at One Sylvan Way, Second Floor, Parsippany, NJ 07054 and our telephone number is(973) 455-7500. Our website address ishttp://www.pbfenergy.com. The information contained on our website or that is or becomes accessible through our website neither constitutes part of this prospectus nor is incorporated by reference into this prospectus.

4

Table of Contents

Class A common stock to be offered by the selling stockholders | Up to 6,427,702 shares, of which 6,424,167 are issuable by us to the selling stockholders upon the exchange of an equivalent number of PBF LLC Series A Units. |

Class A common stock outstanding immediately after this offering | 46,005,780 shares, assuming the exchange of 6,424,167 PBF LLC Series A Units for an equivalent number of shares of our Class A common stock. |

Ownership of PBF LLC Units immediately after this offering | 51,804,653 PBF LLC Series A Units held by the members of PBF LLC other than PBF Energy, and 46,005,780 PBF LLC Series C Units held by PBF Energy, assuming the exchange of 6,424,167 PBF LLC Series A Units for an equivalent number of shares of our Class A common stock. See “—Exchange Rights” below. |

Exchange rights | The members of PBF LLC other than PBF Energy have the right pursuant to an exchange agreement to cause PBF LLC to exchange their PBF LLC Series A Units for shares of our Class A common stock on a one-for-one basis, subject to equitable adjustment for stock splits, stock dividends and reclassifications, and further subject to the rights of the holders of PBF LLC Series B Units to share in a portion of the profits realized by Blackstone and First Reserve upon the sale of the shares of our Class A common stock received by them upon such exchange. |

Voting rights | Each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. |

| The holders of PBF LLC Series A Units hold all of the shares of Class B common stock. The shares of Class B common stock have no economic rights but entitle the holder, without regard to the number of shares of Class B common stock held, to a number of votes on matters presented to stockholders of PBF Energy that is equal to the aggregate number of PBF LLC Series A Units held by such holder. As the members of PBF LLC other than PBF Energy exchange their PBF LLC Series A Units for shares of our Class A common stock pursuant to the exchange agreement, the voting power afforded to them by their shares of Class B common stock will be automatically and correspondingly reduced. |

5

Table of Contents

| Holders of our Class A common stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law. |

| As ofSeptember 30, 2013 and giving pro forma effect for the offering by the selling stockholders, our public stockholders would have approximately 47% of the voting power in PBF Energy Inc., and the members of PBF LLC other than PBF Energy (including Blackstone and First Reserve) by virtue of their shares of Class B common stock would have the remaining voting power in PBF Energy Inc. |

Use of proceeds | We will not receive any proceeds from the sale of shares of our Class A common stock by the selling stockholders. The selling stockholders will receive all of the net proceeds and bear all commissions and discounts, if any, from the sales of our Class A common stock offered by them pursuant to this prospectus. |

Dividend policy | We currently intend to pay quarterly cash dividends of approximately $0.30 per share on our Class A common stock. The declaration, timing and amount of any such dividends will be at the sole discretion of our board of directors and will depend on a variety of factors, including general economic conditions, our financial condition and operating results, our available cash and current and anticipated cash needs, capital requirements, plans for expansion, tax, legal, regulatory and contractual restrictions and implications, including under our tax receivable agreement and our subsidiaries’ outstanding debt documents, and such other factors as our board of directors may deem relevant. |

| Because we are a holding company, our cash flow and ability to pay dividends depends upon the financial results and cash flows of our operating subsidiaries and the distribution or other payment of cash to us in the form of dividends or otherwise from PBF LLC. |

New York Stock Exchange symbol | “PBF” |

Unless we specifically state otherwise, all information in this prospectus:

| • | reflects (a) 39,581,613 shares of our Class A common stock and (b) 57,237,488 PBF LLC Series A Units outstanding as of September 30, 2013; |

6

Table of Contents

| • | gives pro forma effect to the exchange by the selling stockholders of 6,424,167 PBF LLC Series A Units for an equivalent number of shares of our Class A common stock, assuming the exercise for cash of all outstanding options and warrants to purchase 991,332 PBF LLC Series A Units, at a weighted average exercise price of $10.47 per unit, of which 694,665 are currently vested and exercisable; |

| • | does not reflect an additional 51,804,653 shares of Class A common stock issuable upon exchange of PBF LLC Series A Units outstanding immediately following this offering; and |

| • | excludes (a) outstanding options to purchase 825,000 shares of Class A common stock, at a weighted average exercise price of $27.51 per share, none of which are currently vested or exercisable, (b) includes 60,392 restricted shares of Class A common stock held by certain of our directors and officers, none of which are currently vested, and (c) an additional 4,114,608 shares currently authorized and reserved for issuance for future awards under our 2012 equity incentive plan. |

7

Table of Contents

An investment in our Class A common stock involves a number of risks. Please see the risk factors described below and under the heading “Risk Factors” in our Form 10-K and Form 10-Qs filed with the SEC under the Exchange Act, which are incorporated by reference in this prospectus. You should carefully consider, in addition to the other information contained in this prospectus and any prospectus supplement and the information incorporated by reference herein, these risks before investing in our Class A common stock. These risks could materially affect our business, financial condition and results of operations, and cause the trading price of our Class A common stock to decline. You could lose part or all of your investment. You should bear in mind, in reviewing this prospectus, the information incorporated by reference herein and any prospectus supplement, that past experience is no indication of future performance. You should read the section titled “Forward-Looking Statements” for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus and any prospectus supplement.

Risks Related to Our Organizational Structure and Our Class A Common Stock

Our only material asset is our interest in PBF LLC. Accordingly, we depend upon distributions from PBF LLC and its subsidiaries to pay our taxes, meet our other obligations and/or pay dividends in the future.

We are a holding company and all of our operations are conducted through subsidiaries of PBF Holding. We have no independent means of generating revenue and no material assets other than our ownership interest in PBF LLC. Therefore, we depend on the earnings and cash flow of our subsidiaries to meet our obligations, including our indebtedness, tax liabilities and obligations to make payments under our tax receivable agreement. If we or PBF LLC do not receive such cash distributions, dividends or other payments from our subsidiaries, we and PBF LLC may be unable to meet our obligations and/or pay dividends.

We intend to cause PBF LLC to make distributions to its members in an amount sufficient to enable us to cover all applicable taxes at assumed tax rates, make payments owed by us under the tax receivable agreement, and to pay other obligations and dividends, if any, declared by us. To the extent we need funds and PBF LLC or any of its subsidiaries is restricted from making such distributions under applicable law or regulation or under the terms of our financing or other contractual arrangements, or is otherwise unable to provide such funds, such restrictions could materially adversely affect our liquidity and financial condition.

Our ABL Revolving Credit Facility, PBF Holding Senior Secured Notes and certain of our other outstanding debt arrangements include a restricted payment covenant, which restricts the ability of PBF Holding to make distributions to us, and we anticipate our future debt will contain a similar restriction. In addition, there may be restrictions on payments by our subsidiaries under applicable laws, including laws that require companies to maintain minimum amounts of capital and to make payments to stockholders only from profits. For example, PBF Holding is generally prohibited under Delaware law from making a distribution to a member to the extent that, at the time of the distribution, after giving effect to the distribution, liabilities of the limited liability company (with certain exceptions) exceed the fair value of its assets. As a result, we may be unable to obtain that cash to satisfy our obligations and make payments to our stockholders, if any.

We are a “controlled company” within the meaning of the NYSE rules. As a result, we qualify for, and may rely on, exemptions from certain corporate governance requirements.

Blackstone and First Reserve control a majority of the combined voting power of all classes of our voting stock. As a result, we are a “controlled company” within the meaning of the NYSE corporate governance standards. Under the NYSE rules, a company of which more than 50% of the voting power is held by another company is a “controlled company” and may elect not to comply with certain NYSE corporate governance requirements, including (1) the requirement that a majority of the board of directors consist of independent directors, (2) the requirement that we have a corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities, (3) the requirement that we have a compensation committee that is composed entirely of independent directors

8

Table of Contents

with a written charter addressing the committee’s purpose and responsibilities and (4) the requirement that there be an annual performance evaluation of the corporate governance and compensation committees. We might utilize certain of these exemptions. Accordingly, our stockholders do not have the same protections afforded to stockholders of companies that are subject to all of the corporate governance requirements of the NYSE.

The requirements of being a public company may strain our resources and distract our management.

As a public company, we are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, and requirements of the Sarbanes-Oxley Act of 2002. These requirements may place a strain on our systems and resources. We are required to file annual, quarterly and current reports with respect to our business and financial condition and to maintain effective disclosure controls and procedures and internal controls over financial reporting. We are implementing additional procedures and processes for the purpose of addressing the standards and requirements applicable to public companies. In addition, sustaining our growth also will require us to commit additional management, operational and financial resources to identify new professionals to join our firm and to maintain appropriate operational and financial systems to adequately support expansion. These activities may divert management’s attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. We expect to incur significant additional annual expenses related to these steps and other public company expenses.

Our internal controls over financial reporting have not been audited and may not meet all of the standards contemplated by Section 404 of the Sarbanes-Oxley Act, and failure to achieve and maintain effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and Class A common stock price.

Beginning with the year ending December 31, 2013, pursuant to Section 404 of the Sarbanes-Oxley Act, we will be required to furnish a report by our management on our internal control over financial reporting, and our auditors will be required to deliver an attestation report on the operating effectiveness of our internal control over financial reporting. The report by our management must contain, among other things, an assessment of the effectiveness of our internal control over financial reporting as of the end of our fiscal year. This assessment must include disclosure of any material weaknesses in our internal control over financial reporting identified by management.

As an organization that recently exited the development stage and has grown rapidly through the acquisition of significant operations, we are currently in the process of developing our internal controls over financial reporting and establishing formal policies, processes and practices related to financial reporting and to the identification of key financial reporting risks, assessment of their potential impact and linkage of those risks to specific areas and activities within our organization. Our internal controls over financial reporting have not been audited and we may not meet all of the standards contemplated by Section 404 of the Sarbanes-Oxley Act that we will eventually be required to meet.

In connection with the preparation of our financial statements during 2012, we identified significant deficiencies regarding the design and implementation of certain commercial transaction controls and management review controls as part of our financial closing process. Management continues to take steps to remediate these issues. We retained a nationally recognized certified public accounting firm to assist us with designing, documenting and implementing our internal control procedures to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act. In addition, we are developing our internal audit function and continue to invest in information technology systems in order to support and enhance our internal control environment.

We may not be able to successfully remediate these matters on or before December 31, 2013, the date by which we must comply with Section 404 of the Sarbanes-Oxley Act, and we may have additional deficiencies or material weaknesses in the future. We have not yet determined the costs directly associated with these remediation activities, but they could be substantial.

9

Table of Contents

If we are not able to complete our initial assessment of our internal controls and otherwise implement the requirements of Section 404 of the Sarbanes-Oxley Act in a timely manner or with adequate compliance, management may not be able to certify as to the adequacy of our internal controls over financial reporting. Matters impacting our internal controls may cause us to be unable to report our financial information on a timely basis and thereby subject us to adverse regulatory consequences, including sanctions by the SEC or violations of applicable stock exchange listing rules, and result in a breach of the covenants under our debt agreements. There also could be a negative reaction in the financial markets due to a loss of investor confidence in us and the reliability of our financial statements. Confidence in the reliability of our financial statements also could suffer if our independent registered public accounting firm were to report a material weakness in our internal controls over financial reporting in the future. This could materially adversely affect us and lead to a decline in our Class A common stock price.

We are controlled by Blackstone and First Reserve through their ownership of units of PBF LLC, and their interests may differ from those of our public stockholders.

We are controlled by Blackstone and First Reserve, who as of September 30, 2013, collectively possess in the aggregate approximately 53.5% of the combined voting power of our outstanding common stock. As a result, Blackstone and First Reserve have the ability to elect all of our directors and thereby control our policies and operations, including the appointment of management, future issuances of securities, the incurrence of debt by us, amendments to our organizational documents and the entering into of extraordinary transactions, and their interests may not in all cases be aligned with our Class A common stockholders’ interests.

For example, Blackstone and First Reserve and the selling stockholders named herein may have different tax positions which could influence their decisions regarding whether and when to dispose of assets, whether and when to incur new or refinance existing indebtedness, especially in light of the existence of the tax receivable agreement described below. In addition, the structuring of future transactions may take into consideration these tax or other considerations even where no similar benefit would accrue to our Class A common stockholders or us. See “Certain Relationships and Related Transactions” in our 2013 Proxy Statement.

Blackstone and First Reserve may have an interest in pursuing acquisitions, divestitures and other transactions that, in their judgment, could enhance their equity investment, even though such transactions might involve risks to our Class A common stockholders. For example, they could cause us to make acquisitions that increase our indebtedness or to sell revenue-generating assets. So long as they continue to beneficially own a majority of the combined voting power of us and PBF LLC, they will have the ability to control the vote in any election of directors. In addition, pursuant to the stockholders agreement we entered into with Blackstone and First Reserve, Blackstone and First Reserve have the ability to nominate a number of our directors, including a majority of our directors, so long as certain ownership thresholds are maintained. See “Certain Relationships and Related Transactions—IPO Related Agreements—Stockholders Agreement” in our 2013 Proxy Statement. This concentration of ownership may have the effect of delaying, preventing or deterring a change of control of our company. Lastly, Blackstone and First Reserve are in the business of making investments in companies and may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. Our certificate of incorporation contains a provision renouncing our interest and expectancy in certain corporate opportunities identified by Blackstone or First Reserve. They may also pursue acquisition opportunities that are complementary to our business and, as a result, those acquisition opportunities may not be available to us.

We will be required to pay the members of PBF LLC other than PBF Energy for certain tax benefits we may claim arising in connection with our initial public offering, the June 2013 public offering, this offering and future exchanges of PBF LLC Series A Units for shares of our Class A Common Stock and related transactions, and the amounts we may pay could be significant.

We are party to a tax receivable agreement that provides for the payment from time to time by PBF Energy to the members of PBF LLC other than PBF Energy of 85% of the benefits, if any, that PBF Energy is deemed to

10

Table of Contents

realize as a result of (i) the increases in tax basis resulting from its acquisitions of PBF LLC Series A Units, including such acquisitions in connection with our initial public offering and the June 2013 public offering, this offering or in the future and (ii) certain other tax benefits related to our entering into the tax receivable agreement, including tax benefits attributable to payments under the tax receivable agreement. See “Certain Relationships and Related Transactions—IPO Related Agreements—Tax Receivable Agreement” in our 2013 Proxy Statement.

We expect that the payments that we may make under the tax receivable agreement will be substantial. As of June 30, 2013, we have recognized a liability for the tax receivable agreement of $291.0 million reflecting our estimate of the undiscounted amounts that we expect to pay under the agreement due to exchanges that occurred prior to that date, and to range over the next five years from approximately $1.0 million to $31.7 million per year and decline thereafter. Assuming no material changes in the relevant tax law, that the market value of a share of our Class A common stock equals $22.45 (the closing price on September 30, 2013), and that we earn sufficient taxable income to realize all tax benefits that are subject to the tax receivable agreement, we expect that additional future payments under the tax receivable agreement relating to the exchange by the selling stockholders in connection with this offering to aggregate $41.1 million and to range over the next five years up to an additional $5.2 million per year and decline thereafter. Future payments by us in respect of subsequent exchanges of PBF LLC Series A Units would be in addition to these amounts and are expected to be substantial as well. The foregoing numbers are merely estimates based on assumptions that are subject to change due to various factors, including, among other factors, the timing of exchanges by the members of PBF LLC other than PBF Energy of their PBF LLC Series A Units for shares of PBF Energy’s Class A common stock as contemplated by the tax receivable agreement, the price of PBF Energy’s Class A common stock at the time of such exchanges, the extent to which such exchanges are taxable, and the amount and timing of PBF Energy’s income. The actual payments could differ materially. It is possible that future transactions or events could increase or decrease the actual tax benefits realized and the corresponding tax receivable agreement payments. There may be a material negative effect on our liquidity if, as a result of timing discrepancies or otherwise, (i) the payments under the tax receivable agreement exceed the actual benefits we realize in respect of the tax attributes subject to the tax receivable agreement, and/or (ii) distributions to PBF Energy by PBF LLC are not sufficient to permit PBF Energy, after it has paid its taxes and other obligations, to make payments under the tax receivable agreement after it has paid its taxes and other obligations. The payments under the tax receivable agreement are not conditioned upon any recipient’s continued ownership of us.

In certain cases, payments by us under the tax receivable agreement may be accelerated and/or significantly exceed the actual benefits we realize in respect of the tax attributes subject to the tax receivable agreement. These provisions may deter a change in control of our company.

The tax receivable agreement provides that upon certain changes of control, or if, at any time, PBF Energy elects an early termination of the tax receivable agreement, PBF Energy’s (or its successor’s) obligations with respect to exchanged or acquired PBF LLC Series A Units (whether exchanged or acquired before or after such transaction) would be based on certain assumptions, including (i) that PBF Energy would have sufficient taxable income to fully utilize the deductions arising from the increased tax deductions and tax basis and other benefits related to entering into the tax receivable agreement and (ii) that the subsidiaries of PBF LLC will sell certain nonamortizable assets (and realize certain related tax benefits) no later than a specified date. Moreover, in each of these instances, we would be required to make an immediate payment equal to the present value (at a discount rate equal to LIBOR plus 100 basis points) of the anticipated future tax benefits (based on the foregoing assumptions). Accordingly, payments under the tax receivable agreement may be made years in advance of the actual realization, if any, of the anticipated future tax benefits and may be significantly greater than the actual benefits we realize in respect of the tax attributes subject to the tax receivable agreement. Assuming that the market value of a share of our Class A common stock equals $22.45 (the closing price on September 30, 2013) and that LIBOR were to be 1.85%, we estimate as of September 30, 2013 that the aggregate amount of these accelerated payments would have been approximately $532.8 million if triggered immediately on such date. In these situations, our obligations under the tax receivable agreement could have a substantial negative impact on our liquidity. We may not be able to finance our obligations under the tax receivable agreement and our existing

11

Table of Contents

indebtedness may limit our subsidiaries’ ability to make distributions to us to pay these obligations. These provisions may deter a potential sale of our Company to a third party and may otherwise make it less likely a third party would enter into a change of control transaction with us.

Moreover, payments under the tax receivable agreement will be based on the tax reporting positions that we determine in accordance with the tax receivable agreement. We will not be reimbursed for any payments previously made under the tax receivable agreement if the Internal Revenue Service subsequently disallows part or all of the tax benefits that gave rise to such prior payments. As a result, in certain circumstances, payments could be made under the tax receivable agreement that are significantly in excess of the benefits that we actually realize in respect of (i) the increases in tax basis resulting from our purchases or exchanges of PBF LLC Series A Units and (ii) certain other tax benefits related to our entering into the tax receivable agreement, including tax benefits attributable to payments under the tax receivable agreement.

We cannot assure you that we will continue to declare dividends or have the available cash to make dividend payments.

Although we currently intend to continue to pay quarterly cash dividends on our Class A common stock, the declaration, amount and payment of any dividends will be at the sole discretion of our board of directors. We are not obligated under any applicable laws, our governing documents or any contractual agreements with our existing owners or otherwise to declare or pay any dividends or other distributions (other than the obligations of PBF LLC to make tax distributions to its members). Our board of directors may take into account, among other things, general economic conditions, our financial condition and operating results, our available cash and current and anticipated cash needs, capital requirements, plans for expansion, tax, legal, regulatory and contractual restrictions and implications, including under our outstanding debt documents, and such other factors as our board of directors may deem relevant in determining whether to declare or pay any dividend. Because PBF Energy is a holding company with no material assets (other than the equity interests of its direct subsidiary), its cash flow and ability to pay dividends is dependent upon the financial results and cash flows of its indirect subsidiary PBF Holding and its operating subsidiaries and the distribution or other payment of cash to it in the form of dividends or otherwise. The direct and indirect subsidiaries of PBF Energy are separate and distinct legal entities and have no obligation to make any funds available to it. As a result, if we do not declare or pay dividends you may not receive any return on an investment in our Class A common stock unless you sell our Class A common stock for a price greater than that which you paid for it.

Anti-takeover and certain other provisions in our certificate of incorporation and bylaws and Delaware law may discourage or delay a change in control.

Our certificate of incorporation and bylaws contain provisions which could make it more difficult for stockholders to effect certain corporate actions. Among other things, these provisions:

| • | authorize the issuance of undesignated preferred stock, the terms of which may be established and the shares of which may be issued without stockholder approval; |

| • | prohibit stockholder action by written consent after the date on which Blackstone and First Reserve collectively cease to beneficially own at least a majority of all of the outstanding shares of our capital stock entitled to vote; |

| • | restrict certain business combinations with stockholders who obtain beneficial ownership of a certain percentage of our outstanding common stock after the date Blackstone and First Reserve and their affiliates collectively cease to beneficially own at least 5% of all of the outstanding shares of our capital stock entitled to vote; |

| • | provide that special meetings of stockholders may be called only by the chairman of the board of directors, the chief executive officer or the board of directors, or Blackstone or First Reserve, for so long as Blackstone or First Reserve, in its individual capacity as the party calling the meeting, continues to beneficially own at least 25% of the total voting power of all the then outstanding shares |

12

Table of Contents

of our capital stock, and establish advance notice procedures for the nomination of candidates for election as directors or for proposing matters that can be acted upon at stockholder meetings; and |

| • | provide that on and after the date Blackstone and First Reserve collectively cease to beneficially own a majority of all of the outstanding shares of our capital stock entitled to vote, our stockholders may only amend our bylaws with the approval of 75% or more of all of the outstanding shares of our capital stock entitled to vote. |

These anti-takeover provisions and other provisions of Delaware law may have the effect of delaying or deterring a change of control of our company. Certain provisions could also discourage proxy contests and make it more difficult for you and other stockholders to elect directors of your choosing and to cause us to take other corporate actions you desire. These provisions could limit the price that certain investors might be willing to pay in the future for shares of our Class A common stock.

In addition, in connection with our initial public offering, we entered into a stockholders agreement with Blackstone and First Reserve pursuant to which they are entitled to nominate a number of directors so long as certain ownership thresholds are maintained. See “Certain Relationships and Related Transactions—IPO Related Agreements—Stockholders Agreement” in our 2013 Proxy Statement.

Our Class A common stock has only traded since December 13, 2012. The market price of our Class A common stock may be volatile, which could cause the value of your investment to decline.

Our Class A common stock has only traded since December 13, 2012. The stock markets generally may experience significant volatility, often unrelated to the operating performance of the individual companies whose securities are publicly traded. The market price of our Class A common stock may be highly volatile and could be subject to wide fluctuations due to a number of factors including:

| • | variations in actual or anticipated operating results or dividends, if any, to stockholders; |

| • | changes in, or failure to meet, earnings estimates of securities analysts; |

| • | market conditions in the oil refining industry; |

| • | litigation and government investigations; |

| • | changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry; |

| • | general economic and stock market conditions; and |

| • | the availability for sale, or sales, of a significant number of shares of our Class A common stock in the public market. |

These and other factors may cause the market price of our Class A common stock to decrease significantly, which in turn would adversely affect the value of your investment.

In the past, following periods of volatility in the market price of a company’s securities, stockholders have often instituted class action securities litigation against those companies. Such litigation, if instituted, could result in substantial costs and a diversion of management’s attention and resources, which could significantly harm our profitability and reputation.

If securities or industry analysts do not publish research or reports about our business, or if they downgrade their recommendations regarding our Class A common stock, our stock price and trading volume could decline.

The trading market for our Class A common stock is influenced by the research and reports that industry or securities analysts publish about us or our business. If any of the analysts who cover us downgrade our Class A common stock or publish inaccurate or unfavorable research about our business, our Class A common stock price

13

Table of Contents

may decline. If analysts cease coverage of us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our Class A common stock price or trading volume to decline and our Class A common stock to be less liquid.

Future sales of our shares of Class A common stock could cause our stock price to decline.

The market price of our Class A common stock could decline as a result of sales of a large number of shares of Class A common stock in the market or the perception that such sales could occur. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell shares of Class A common stock in the future at a time and at a price that we deem appropriate. In addition, any shares of Class A common stock that we issue, including under any equity incentive plans, would dilute the percentage ownership of the holders of our Class A common stock.

The 6,427,702 shares of Class A common stock the selling stockholders are offering under this prospectus, as well as the 39,517,686 shares sold in our prior public offerings and the shares issuable under our 2012 equity incentive plan, will be freely tradable without restriction in the United States, unless purchased or held by one of our affiliates. We are also party to a registration rights agreement with the members of PBF LLC other than PBF Energy pursuant to which we continue to be required to register under the Securities Act and applicable state securities laws the resale of the shares of Class A common stock issuable to them upon exchange of PBF LLC Series A Units. Our shares also may be sold under Rule 144 under the Securities Act depending on the holding period and subject to restrictions in the case of shares held by persons deemed to be our affiliates.

We also may issue our shares of common stock or securities convertible into our common stock from time to time in connection with a financing, acquisition, investments or otherwise. Any such issuance could result in substantial dilution to our existing stockholders. If we register additional shares, the market price of our stock could decline if the holders of restricted shares sell them or are perceived by the market as intending to sell them.

14

Table of Contents

This prospectus and documents incorporated by reference into this prospectus contain “forward-looking statements” that involve risks and uncertainties. You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” or “anticipates” or similar expressions that relate to our strategy, plans or intentions. All statements we make in this prospectus or the documents incorporated herein by reference relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to our expectations regarding future industry trends and the information referred to under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 10-K and “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 10-Qs are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. These forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those that we expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results.

Important factors that could cause actual results to differ materially from our expectations, which we refer to as “cautionary statements,” are disclosed under “Risk Factors” in this prospectus and under the heading “Risk Factors” in our Form 10-K and Form 10-Q’s filed with the SEC under the Exchange Act and elsewhere in this prospectus and documents incorporated by reference into this prospectus, including, without limitation, in conjunction with the forward-looking statements included in this prospectus. All forward-looking information in this prospectus and documents incorporated by reference into this prospectus and subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Some of the factors that we believe could affect our results include:

| • | supply, demand, prices and other market conditions for our services; |

| • | the effects of competition in our markets; |

| • | changes in currency exchange rates, interest rates and capital costs; |

| • | adverse developments in our relationship with both our key employees and unionized employees; |

| • | our ability to operate our businesses efficiently, manage capital expenditures and costs (including general and administrative expenses) tightly and generate earnings and cash flow; |

| • | our substantial indebtedness, described in our periodic reports filed with the SEC under the Exchange Act; |

| • | our arrangements with J. Aron exposes us to J. Aron related credit and performance risk; |

| • | termination of our Inventory Intermediation Agreements with J. Aron could have a material adverse effect on our liquidity, as we would be required to finance our refined products inventory covered by the agreements. Additionally, we are obligated to repurchase from J. Aron all volumes of products located at the refineries’ storage tanks upon termination of these agreements; |

| • | restrictive covenants in our indebtedness that may adversely affect our operational flexibility; |

| • | payments to the holders of PBF LLC Series A Units and PBF LLC Series B Units under our tax receivable agreement for certain tax benefits we may claim, and our assumptions regarding payments arising under the tax receivable agreement and other arrangements relating to our organizational structure; |

| • | our expectations with respect to our acquisition activity; |

15

Table of Contents

| • | our expectations with respect to our capital improvement projects including the development and expansion of our Delaware City crude unloading facilities and status of an air permit to transfer crude to Paulsboro; |

| • | the possibility that we might reduce or not make further dividend payments; |

| • | adverse impacts from changes in our regulatory environment or actions taken by environmental interest groups; |

| • | the costs of being a public company, including Sarbanes-Oxley Act compliance; |

| • | any decisions we make with respect to our energy-related logistical assets that could qualify for an MLP structure, including future opportunities that we may determine present greater potential value to stockholders than the planned MLP initial public offering, as described in our periodic reports filed with the SEC under the Exchange Act; |

| • | the timing and structure of the planned MLP may change; |

| • | unanticipated developments may delay or negatively impact the planned MLP; |

| • | receipt of regulatory approvals and compliance with contractual obligations required in connection with the planned MLP; |

| • | the impact of the planned MLP on our relationships with our employees, customers and vendors and our credit rating and cost of funds; |

| • | the possibility that the interests of Blackstone and First Reserve will conflict with ours; and |

| • | the impact of any offerings pursuant to this prospectus or otherwise, including resulting tax implications. |

We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this prospectus and documents incorporated by reference into this prospectus may not in fact occur. Accordingly, investors should not place undue reliance on those statements.

Our forward-looking statements also include estimates of the total amount of payments, including annual payments, under our tax receivable agreement. These estimates are based on assumptions that are subject to change due to various factors, including, among other factors, the timing of exchanges by the members of PBF LLC other than PBF Energy of their PBF LLC Series A Units for shares of our Class A common stock as contemplated by the tax receivable agreement, the price of our Class A common stock at the time of such exchanges, the extent to which such exchanges are taxable, and the amount and timing of our income. See “Risk Factors—Risks Related to Our Organizational Structure and Our Class A Common Stock—We will be required to pay the members of PBF LLC other than PBF Energy for certain tax benefits we may claim arising in connection with our initial public offering, the June 2013 public offering, this offering and future exchanges of PBF LLC Series A Units for shares of our Class A common stock and related transactions, and the amounts we may pay could be significant” and “—In certain cases, payments by us under the tax receivable agreement may be accelerated and/or significantly exceed the actual benefits we realize in respect of the tax attributes subject to the tax receivable agreement. These provisions may deter a change in control of our company.”

Our forward-looking statements in this prospectus or the documents incorporated herein by reference speak only as of the date of this prospectus or as of the date as of which they are made. Except as required by applicable law, including the securities laws of the United States, we do not intend to update or revise any forward-looking statements.

16

Table of Contents

The selling stockholders will receive all of the net proceeds from the sales of shares of Class A common stock offered by them pursuant to this prospectus. We will not receive any proceeds from the sale of these shares of our Class A common stock, but we will bear the costs associated with this registration in accordance with the registration rights agreement. The selling stockholders will bear any underwriting commissions and discounts attributable to their sale of shares of our Class A common stock.

PRICE RANGE OF COMMON STOCK AND DIVIDEND POLICY

Our Class A common stock has traded on the New York Stock Exchange under the symbol “PBF” since December 13, 2012. Prior to that date, there was no public market for our Class A common stock. The following table sets forth, for the periods indicated, the high and low sales prices per share of our Class A common stock, as reported by the New York Stock Exchange, since December 13, 2012, and dividends declared per share of Class A common stock.

| Price Range | Dividends per share of Class A Common Stock | |||||||||||

2013 | High | Low | ||||||||||

First Quarter ended March 31, 2013 | $ | 42.50 | $ | 27.10 | $ | 0.30 | ||||||

Second Quarter ended June 30, 2013 | $ | 39.00 | $ | 23.54 | $ | 0.30 | ||||||

Third Quarter ended September 30, 2013 | $ | 26.66 | $ | 20.15 | $ | 0.30 | ||||||

Fourth Quarter through October 7, 2013 | $ | 22.97 | $ | 22.01 | — | |||||||

2012 | ||||||||||||

Fourth Quarter ended December 31, 2012(1) | $ | 29.05 | $ | 26.25 | — | |||||||

| (1) | Our Class A common stock began trading on December 13, 2012. |

The closing sale price of our Class A common stock, as reported by the New York Stock Exchange, on October 7, 2013, was $22.19 per share. As of October 7, 2013, there were 8 holders of record of our Class A common stock.

Dividend Policy

We paid a quarterly cash dividend of $0.30 per share on our outstanding Class A common stock on each of March 15, 2013, June 7, 2013 and August 21, 2013. Subject to the following paragraphs, we currently intend to continue to pay quarterly cash dividends of approximately $0.30 per share on our Class A common stock.

The declaration, amount and payment of this and any other future dividends on shares of Class A common stock will be at the sole discretion of our board of directors, and we are not obligated under any applicable laws, our governing documents or any contractual agreements with our existing owners or otherwise to declare or pay any dividends or other distributions (other than the obligations of PBF LLC to make tax distributions to its members). Our board of directors may take into account, among other things, general economic conditions, our financial condition and operating results, our available cash and current and anticipated cash needs, capital requirements, plans for expansion, tax, legal, regulatory and contractual restrictions and implications, including under our tax receivable agreement and our subsidiaries’ outstanding debt documents, and such other factors as our board of directors may deem relevant in determining whether to declare or pay any dividend. In addition, we expect that to the extent we declare a dividend for a particular quarter, our cash flow from operations for that quarter will substantially exceed any dividend payment for such period. Because any future declaration or payment of dividends will be at the sole discretion of our board of directors, we do not expect that any such dividend payments will have a material adverse impact on our liquidity or otherwise limit our ability to fund capital expenditures or otherwise pursue our business strategy over the long-term. Although we have the ability

17

Table of Contents

to borrow funds and sell assets to pay future dividends (subject to certain limitations in our ABL Revolving Credit Facility and the PBF Holding Senior Secured Notes), we intend to fund any future dividends out of our cash flow from operations and, as a result, we do not expect to incur any indebtedness or to use the proceeds from equity offerings to fund such payments.

We are a holding company and have no material assets other than our ownership interests of PBF LLC. In order for us to pay any dividends, we will need to cause PBF LLC to make distributions to us and the holders of PBF LLC Series A Units, and PBF LLC will need to cause PBF Holding to make distributions to it, in an amount sufficient to cover cash dividends, if any, declared by us. PBF Holding is generally prohibited under Delaware law from making a distribution to a member to the extent that, at the time of the distribution, after giving effect to the distribution, liabilities of the limited liability company (with certain exceptions) exceed the fair value of its assets. As a result, PBF LLC may be unable to obtain cash from PBF Holding to satisfy our obligations and make payments to our stockholders, if any. If PBF LLC makes such distributions to us, the holders of PBF LLC Series A Units will also be entitled to receive distributions pro rata in accordance with the number of units held by them and us.

The ability of PBF Holding to pay dividends and make distributions to PBF LLC is and in the future may be limited by covenants in our ABL Revolving Credit Facility, the PBF Holding Senior Secured Notes and other debt instruments. Subject to certain exceptions, our ABL Revolving Credit Facility and the indenture governing the PBF Holding Senior Secured Notes prohibit PBF Holding from making distributions to PBF LLC if certain defaults exist. In addition, both the indenture and our ABL Revolving Credit Facility contain additional restrictions limiting PBF Holding’s ability to make distributions to PBF LLC. Subject to certain exceptions, the restricted payment covenant under the indenture restricts PBF Holding from making cash distributions unless its fixed charge coverage ratio, as defined in the indenture, is at least 2.0 to 1.0 after giving pro forma effect to such distributions and such cash distributions do not exceed an amount equal to the aggregate net equity proceeds received by it (either as a result of certain capital contributions or from the sale of certain equity or debt securities) plus 50% of its consolidated net income (or less 100% of consolidated net loss) which is defined to exclude certain non-cash charges, such as impairment charges, plus certain other items. Two important exceptions to the foregoing are (i) a permission to pay up to the greater of $100.0 million and 1% of PBF Holding’s total assets and (ii) a permission to pay an additional $200.0 million subject to compliance with a total debt ratio of 2 to 1. Our ABL Revolving Credit Facility generally restricts PBF Holding’s ability to make cash distributions if (x) the aggregate amount of such distributions exceeds the then existing available amount basket (as defined by the ABL Revolving Credit Facility) and (y) before and after giving effect to any such distribution, (a) it fails to have pro forma excess availability under the facility greater than an amount equal to 17.5% of the lesser of (1) the then existing borrowing base and (2) the then current aggregate revolving commitment amount, which as of June 30, 2013 was $1.575 billion or (b) it fails to maintain on a pro forma basis a fixed charge coverage ratio, as defined by the ABL Revolving Credit Facility, of at least 1.1 to 1.0. As a result, we cannot assure you that PBF Holding will be able to make distributions to PBF LLC in order for PBF LLC to make distributions to us. If that is the case, it is unlikely that we will be able to declare dividends as contemplated herein.

Based upon our operating results for the year ended December 31, 2012, PBF Holding would have been permitted under its ABL Revolving Credit Facility and indenture to pay distributions to PBF LLC so that PBF LLC could make distributions to its members, including us, in amounts sufficient to enable us to pay a quarterly dividend at the rate specified above. The ability of PBF Holding to comply with the foregoing limitations and restrictions is, to a significant degree, subject to its operating results, which is dependent on a number of factors outside of our control. As a result, we cannot assure you that we will be able to declare dividends as contemplated herein. See “Risk Factors—Risks Related to Our Indebtedness—Restrictive Covenants in our debt instruments may limit our ability to undertake certain types of transactions” in our Form 10-K and “Risk Factors—Risks Related to Our Organizational Structure and Our Class A Common Stock—We cannot assure you that we will continue to declare dividends or have the available cash to make dividend payments” in this prospectus.

We did not pay any dividends on our Class A common stock during 2012.

18

Table of Contents

PBF LLC made pre-IPO cash distributions to its members in the amount of $161.0 million during 2012. PBF Holding paid $155.8 million in distributions to PBF LLC during the six months ended June 30, 2013. PBF LLC used $58.0 million of this amount ($0.30 per unit) to make nontax distributions to its members, of which $14.2 million was distributed to PBF Energy and the balance was distributed to its other members. PBF Energy used this $14.2 million to pay two separate equivalent cash dividends of $0.30 per share of Class A common stock on March 15, 2013 and June 7, 2013. PBF LLC used the remaining $97.8 million from PBF Holding’s distributions to make tax distributions to its members, with $19.7 million distributed to PBF Energy, of which $567 was paid by PBF LLC directly to the applicable taking authorities on behalf of PBF Energy.

PBF LLC will continue to make tax distributions to its members in accordance with its amended and restated limited liability company agreement.

Assuming approximately 97,810,433 PBF LLC Series A Units and PBF LLC Series C Units outstanding immediately following the offering, the aggregate annual distributions which are anticipated to be required to be made by PBF Holding to PBF LLC, such that PBF LLC may make an equivalent distribution to its members (including PBF Energy) in order for PBF Energy to pay the anticipated $0.30 per quarter cash dividend on its Class A common stock would be approximately $117.4 million. If PBF Energy had paid an equivalent $0.30 per share quarterly cash dividend on its Class A common stock during the year ended December 31, 2012, this would have represented the equivalent of approximately 11.2% of its Adjusted EBITDA for such period. As of December 31, 2012, PBF Holding had cash and cash equivalents of $285.9 million and approximately $313.3 million of unused borrowing availability under its ABL Revolving Credit Facility to fund its operations, if necessary. Accordingly, as of December 31, 2012, PBF Holding had sufficient cash and cash equivalents available to it to make distributions to PBF LLC, in order for PBF LLC to make pro rata distributions to its members, including PBF Energy, necessary to fund in excess of one year’s cash dividend payments by PBF Energy. We believe our and our subsidiaries’ available cash and cash equivalents, other sources of liquidity to operate our business and operating performance provides us with a reasonable basis for our assessment that we can support our intended dividend policy.

19

Table of Contents