PBF Energy Inc. January 2014 PBF Energy Inc. January 2014 Exhibit 99.1 |

2 Legal Notice / Forward-Looking Statements Legal Notice / Forward-Looking Statements This presentation contains forward-looking statements made by PBF Energy Inc. (the “Company” or “PBF”) and its management. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Company’s actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement of any potential acquisitions and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Company assumes no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date. |

3 U.S. Refining Industry Strengths U.S. Refining Industry Strengths Inexpensive Natural Gas Growth in supply driving decline in U.S. natural gas pricing U.S. natural gas currently priced more than 60% below Europe ~$0.10 / bbl benefit to domestic refiners for every $1 / MMBtu difference in natural gas price North American Crude Oil Production Secular growth in North American crude oil production Favorable price dislocations between North American crude and rest of world Complex Refineries U.S. average refinery Nelson Complexity of 10.8 versus Western European average refinery Nelson Complexity of 7.8 Product Exports Cost and technological advantages have spurred export opportunities East Coast to Europe, West Africa, and Latin America Why will the U.S. refining industry prosper for the next 5 years? |

4 PBF owns three oil refineries located in Ohio, Delaware and New Jersey Aggregate throughput capacity of approximately 540,000 barrels per day Weighted average Nelson Complexity of 11.3 Fifth largest U.S. independent refiner East Coast rail infrastructure results in the entire system having access to WTI-based, cost-advantaged crude supply Summary Company Profile Region Throughput Capacity (bpd) Date Acquired Nelson Complexity Replacement Cost Benchmark Crack Spread Mid-Continent 170,000 3/1/2011 9.2 $2.4 billion WTI (Chicago) 4-3-1 East Coast 370,000 2010 12.2 $5.8 billion Dated Brent (NYH) 2-1-1 Total 540,000 11.3 (1) $8.2 billion (1) Represents weighted average Nelson Complexity for PBF’s three refineries Cushing Toledo Paulsboro Delaware City |

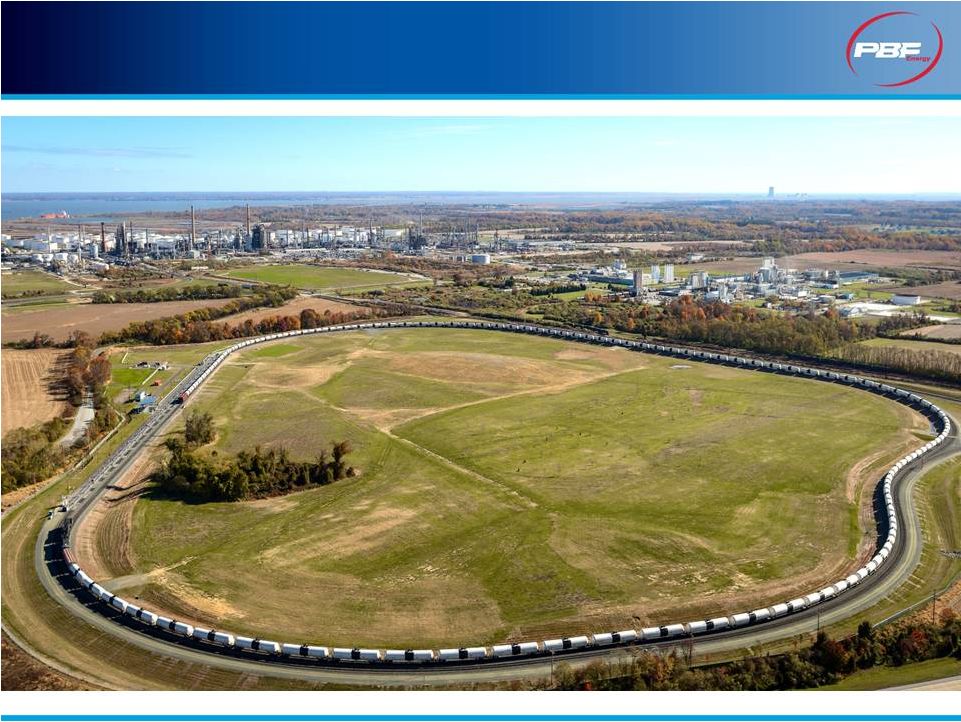

5 Increasing East Coast access to currently cost-advantaged North American crude oil Increasing East Coast access to currently cost-advantaged North American crude oil PBF’s onsite rail-infrastructure at Delaware City provides the opportunity to save approximately $3/bbl on delivered Bakken barrels versus using 3 party facilities rd |

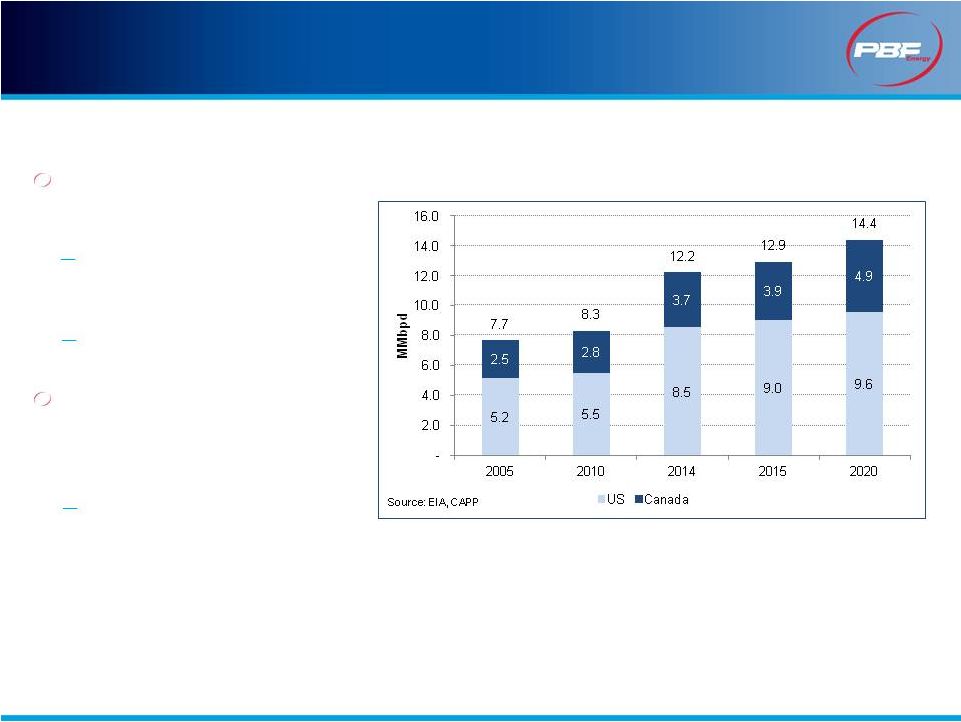

North American Crude Production North American Crude Production U.S. crude production is estimated to grow by 55% (3 million bpd) from 2010 through 2014 Pushes barrels South (via water, pipeline and rail), East and West (primarily by rail) Ultimately displaces USGC imports Canadian crude production is expected to grow by 32% (900 kbpd) from 2010 through 2014 Bitumen by rail advantaged versus pipeline transportation of diluted crudes 6 |

PBF Rail Deliveries of Light Crude to East Coast PBF Rail Deliveries of Light Crude to East Coast Light crude discharge capacity is over 100,000 bpd with a project to increase capacity to 120,000 – 130,000 bpd by Q3-2014 PBF is able to deliver Bakken barrels to Delaware City at a cost of approximately $12 per barrel 7 |

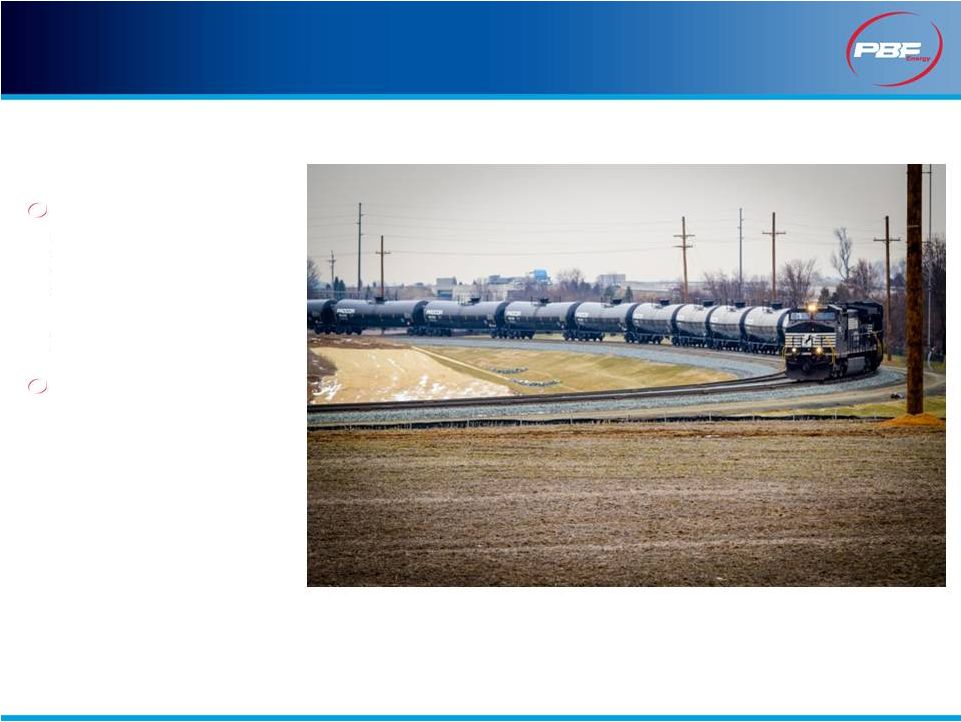

PBF Rail Deliveries of Canadian Heavy Crude to East Coast PBF Rail Deliveries of Canadian Heavy Crude to East Coast PBF’s heavy crude unloading capacity is expected to double from approximately 40,000 bpd to approximately 80,000 bpd by Q3-2014 as PBF completes its ongoing rail expansion project and infrastructure projects are completed in Canada Deliveries of Canadian heavy crude are dependent on access to coiled and insulated railcars as well as rail transloading facilities in Canada Transportation costs for Canadian-heavy are expected to decline from above $20 per barrel to below $17 per barrel as PBF- controlled railcar fleet expands and the benefits of unit-train economics are realized 8 |

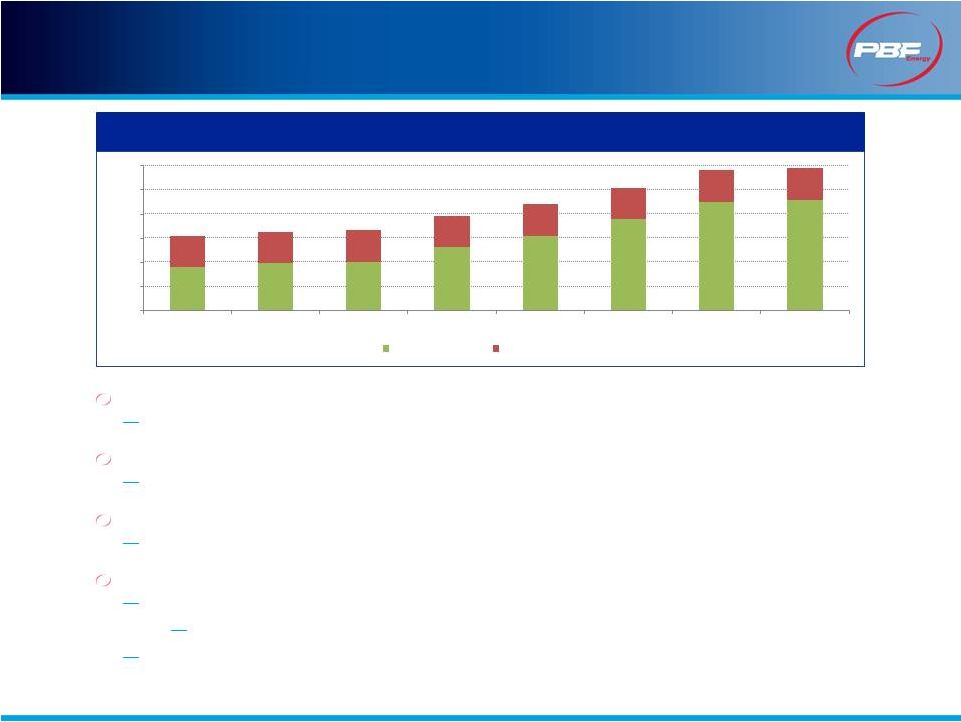

9 Crude-by-Rail Pipeline Planned Leased or Owned Railcars Note: Schedule is subject to change based on current company plans and on current third party railcar manufacturer delivery schedules Longer-term focus on logistics Rail services agreements with Norfolk Southern and BNSF Increased ability to load unit trains Transloading agreement with Savage in Trenton, ND Advantageous commercial arrangements with crude producers Supply agreement with Continental Resources for Bakken Ensuring delivery Agreement with Trinity for delivery of rail cars PBF’s fleet of new railcars meet the highest DOT-111A standards Increased availability of “delivered” deals 1,808 1,966 2,023 2,625 3,100 3,800 4,516 4,600 1,283 1,300 1,300 1,300 1,300 1,300 1,300 1,300 - 1,000 2,000 3,000 4,000 5,000 6,000 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 Coiled & Insulated General Purpose |

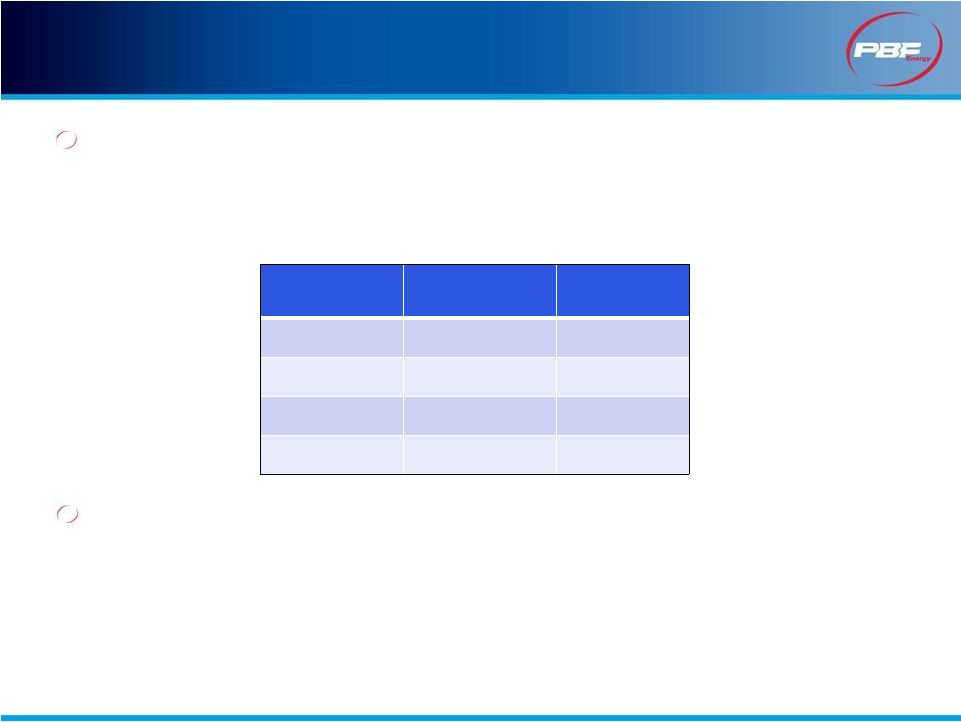

10 Widening Crude Differentials Widening Crude Differentials Crude differentials widened out during the fourth quarter of 2013 and PBF expects to realize the benefits of the wider differentials as crude purchased during the fourth quarter is processed at our refineries in the latter part of Q4-13 and the beginning of Q1-14 $/bbl Q1 – Q3-2103 Average Q4-2013 Average WCS-Brent (32.67) (43.15) Bakken-Brent (13.05) (22.72) ASCI-Brent (4.30) (13.53) Syncrude-WTI 2.26 (9.35) Increasing North American production, North American crude oil distribution logistics, seasonality and other events will continue to impact differentials and PBF expects differentials to remain volatile but favorable for US refiners |

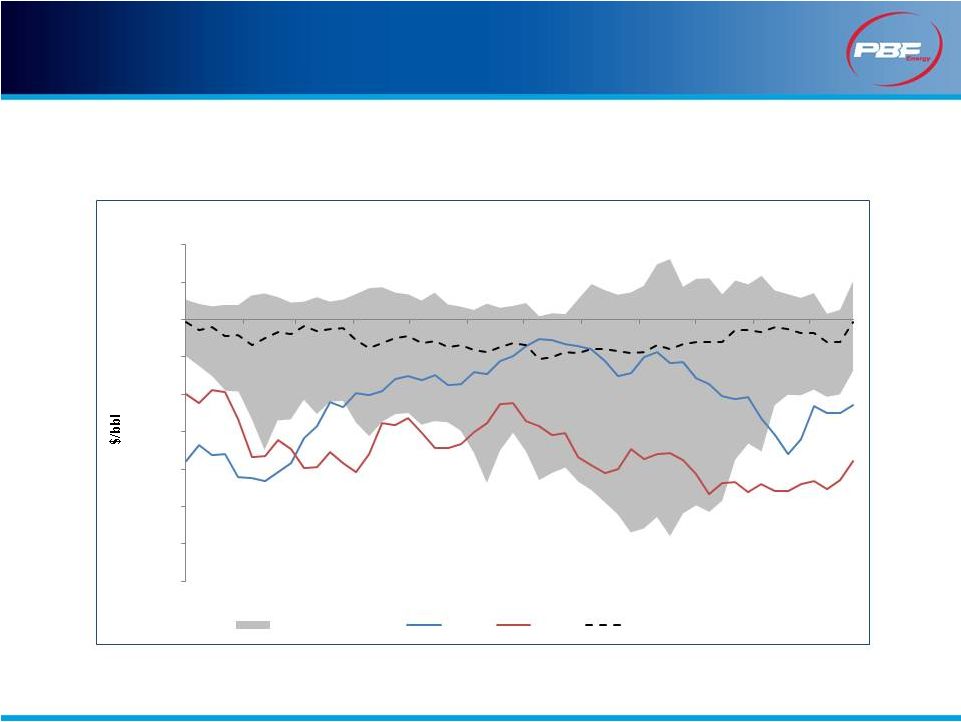

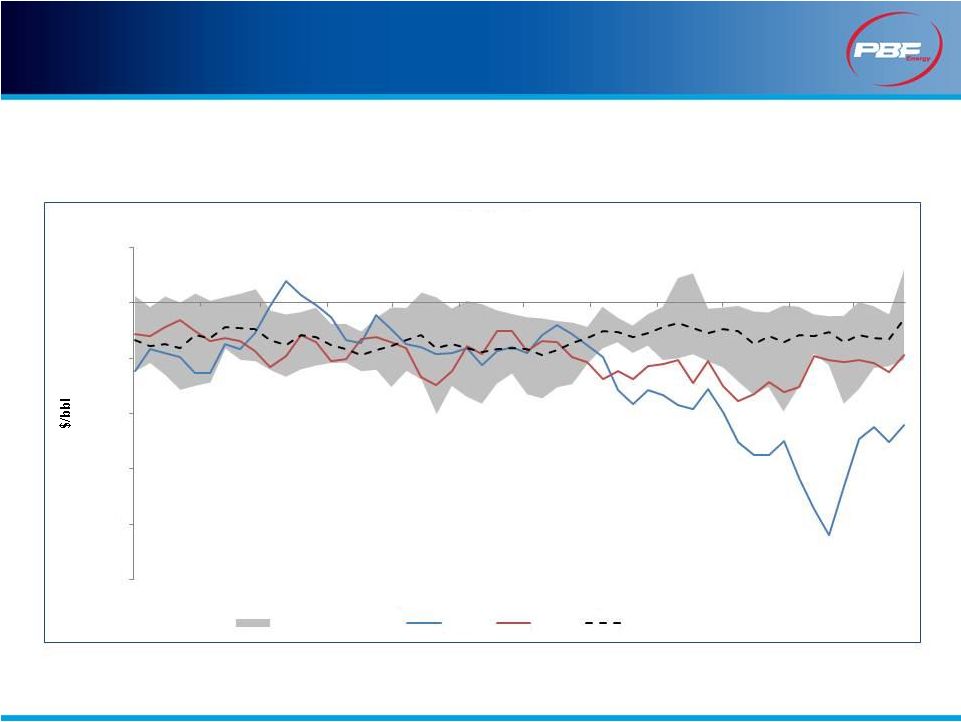

11 Brent versus WTI Brent versus WTI Widening Brent – WTI differential positively impacts cost-advantage of North American produced crude oils (35.00) (30.00) (25.00) (20.00) (15.00) (10.00) (5.00) - 5.00 10.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec WTI - Brent Min Max (07 to 11) 2013 2012 Average (07 to 11) Source: Platts |

12 WCS versus Brent WCS versus Brent Expanding differentials positively impact rail economics for Canadian Heavy crude oil processed at PBF’s East Coast refineries (70.00) (60.00) (50.00) (40.00) (30.00) (20.00) (10.00) - 10.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec WCS - Brent Min Max (07 to 11) 2013 2012 Average (07 to 11) Source: Platts |

Bakken versus Brent Bakken versus Brent 13 Note: Prior to May 2010 Bakken pricing is unavailable Expanding differentials positively impact rail economics for Mid-continent light-sweet crude oil processed at PBF’s East Coast refineries (50.00) (45.00) (40.00) (35.00) (25.00) (20.00) (15.00) (10.00) (5.00) - Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Bakken - Brent Min Max (10 to 12) 2013 Average (10 to 12) Source: Platts (30.00) |

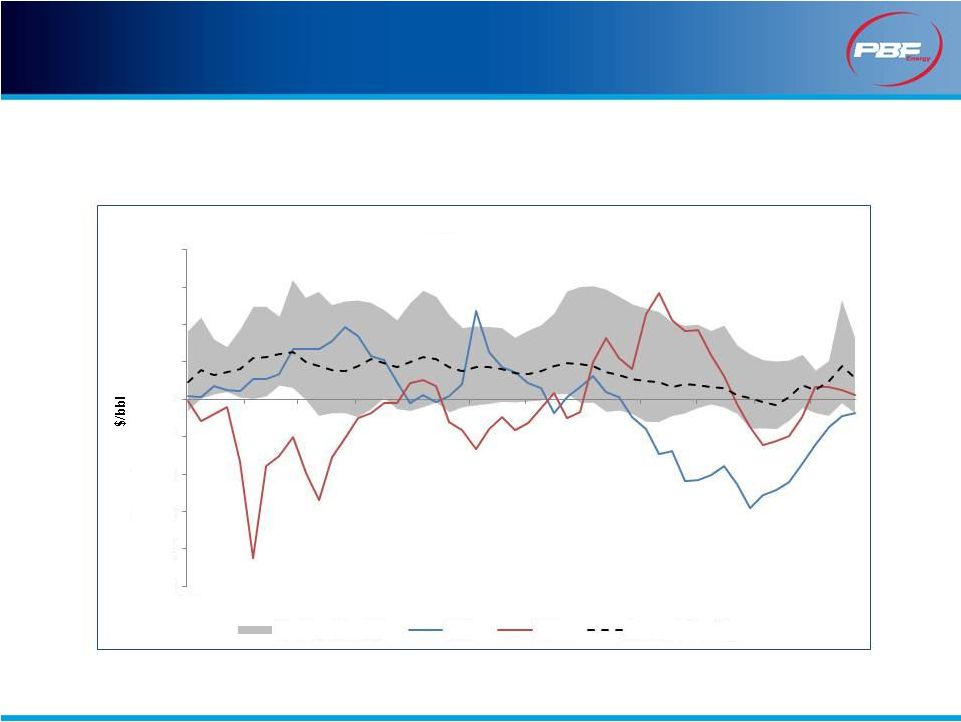

14 ASCI Differential versus Brent ASCI Differential versus Brent ASCI is an indicator for medium-sour barrels processed at PBF’s East Coast facilities (25.00) (20.00) (15.00) (10.00) (5.00) - 5.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ASCI - Brent Min Max (07 to 11) 2013 2012 Average (07 to 11) Source: Platts, Argus |

15 PBF’s Key Mid-continent differential versus WTI PBF’s Key Mid-continent differential versus WTI Toledo processes approximately 35% to 40% Syncrude (25.00) (20.00) (15.00) (10.00) (5.00) - 5.00 10.00 15.00 20.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Syncrude - WTI Min Max (07 to 11) 2013 Average (07 to 11) Source: Platts |

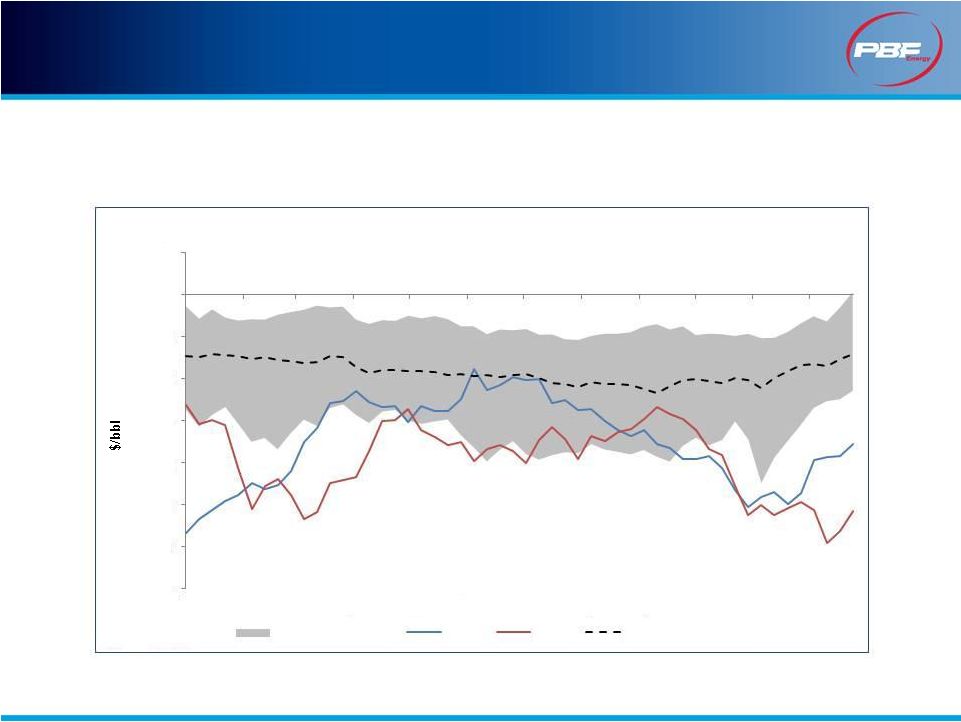

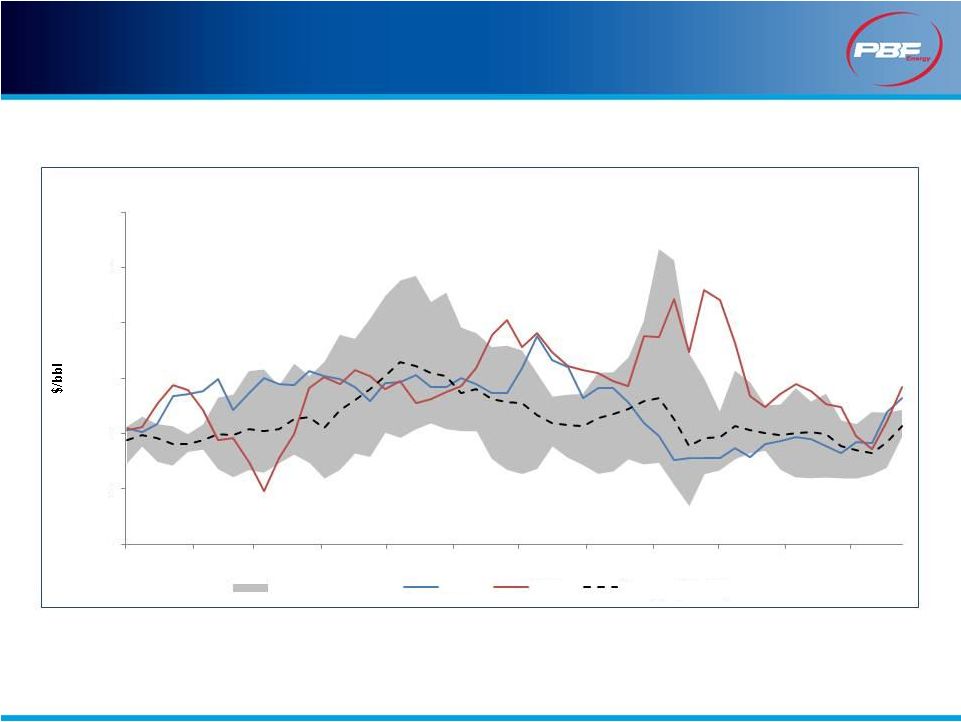

PBF’s East Coast Benchmark Crack PBF’s East Coast Benchmark Crack 16 NYH 2:1:1 = ((–2*Dated Brent) + (1*NY RBOB) + (1*NO.2 Heating Oil))/2 - 5.00 10.00 15.00 20.00 25.00 30.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec NYH 2:1:1 Min Max (07 to 11) 2013 2012 Average (07 to 11) Source: Platts |

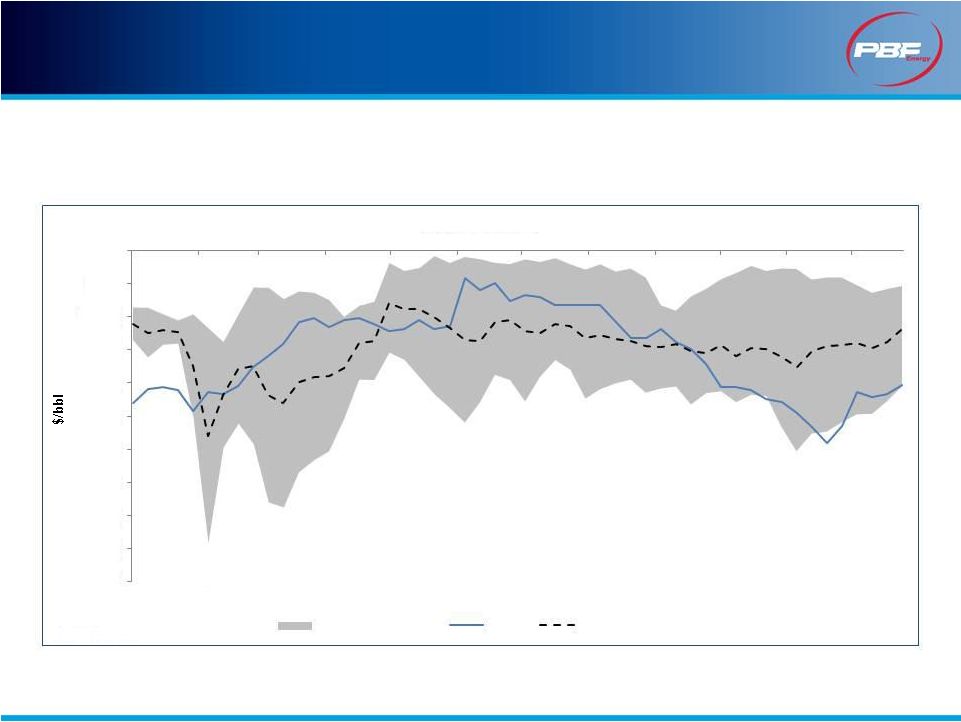

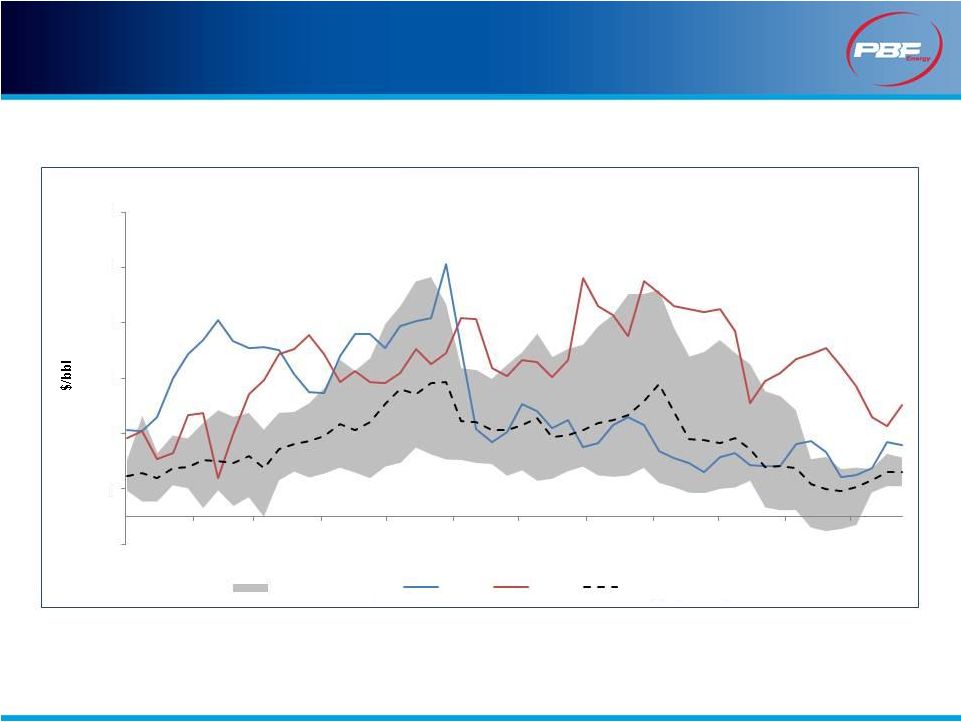

PBF’s Mid-continent Benchmark Crack PBF’s Mid-continent Benchmark Crack Chicago 4:3:1 = ((–4*WTI) + (3*Chic CBOB pipe) + (0.5*Chic ULSD Pipe) + (0.5*USGC Jet Kero 54))/4 17 Note: Prior to September 2009 Rul87 Chicago Pipe is used for substitution of CBOB Chicago Pipe, which is unavailable prior to this period (5.00) 5.00 15.00 25.00 35.00 45.00 55.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Chicago 4:3:1 Min Max (07 to 11) 2013 2012 Average (07 to 11) Source: Platts |

18 PBF MLP PBF MLP Submitted confidential registration statement in August 2013 PBF has identified a pool of assets that could be contributed to a logistics-focused Master Limited Partnership (MLP) Possible MLP assets include but are not limited to: Rail terminals and railcars Refinery truck terminals Pipeline assets Tank storage facilities |

No near-term debt maturities $675.5 million 8.25% Senior Secured Notes due 2020 Net Debt/Net Cap was approximately 29% as of September 30, 2013 Liquidity $1.575 billion Asset-based Facility (with an accordion up to $1.8 billion) Approximately $600 million of liquidity as of September 30, 2013 19 PBF’s Strong Financial Position PBF’s Strong Financial Position PBF Financial Snapshot – September 30, 2013 ($MM, Unless Otherwise Noted) Capitalization Table Actual Cash and Cash Equivalents $57.4 Debt Long-Term Debt 722.6 Total Debt 738.6 Net Debt 681.2 Total Equity 1,648.8 Net Capitalization 2,330.0 |

20 PBF’s Fourth Quarter 2013 Cash Highlights PBF’s Fourth Quarter 2013 Cash Highlights PBF’s Q4-2013 Cash Highlights ($MM, Unless Otherwise Noted) Est. Cash and Cash Equivalents as of December 31, 2013 $75 Est. Total Debt outstanding as of December 31, 2013 $745 – $755 Est. Net Debt at December 31, 2013 $670 – $680 Est. Uses of cash in Q4-2013 Est. Decrease in Net Debt from September 30, 2013 $0 – $10 Est. Q4 Capital Expenditures $85 – $100 Dividend Payments $30 Est. Cash Interest Expense $10 Est. Cash generated from Operations/Working Capital $125 – $150 All figures displayed below are estimates, unaudited, subject to change, are provided for information purposes only and are not indicative of the actual earnings of the company for the period In Q4-13, PBF generated an estimated $125-$150 million of cash from operations and working capital |

21 2014 Full Year Guidance 2014 Full Year Guidance Guidance provided constitutes forward-looking information and is based on current PBF Energy operating plans, company assumptions and company configuration. All figures are subject to change based on market and macroeconomic factors, as well as company strategic decision-making and overall company performance Throughput, based on current plans, is expected to be 315,000 to 335,000 barrels per day for the East Coast including the impact of turnarounds 140,000 to 150,000 barrels per day for the Mid-continent including the impact of turnarounds Operating expenses are expected to be $4.50 – $4.75 per barrel across all three refineries SG&A expense is expected to be approximately $75 – $85 million D&A expense is expected to be approximately $140 – $150 million Interest expense is expected to be approximately $100 – $110 million Capital expenditures, including projects and turnarounds, are expected to be approximately $250 million |

|