- PBF Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

PBF Energy (PBF) DEF 14ADefinitive proxy

Filed: 8 Apr 19, 4:00pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under § 240.14a-12 | |

PBF Energy Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid: | |||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Dear PBF Energy Stockholder,

On behalf of the Board of Directors and management team, I am pleased to invite you to attend our Annual Meeting of Stockholders, to be held at the Hilton Short Hills, 41 John F. Kennedy Parkway, Short Hills, New Jersey 07078 on Thursday, May 23, 2019, at 10 a.m. Eastern Daylight Time.

In 2018, we celebrated the tenth anniversary of our founding, which has included only a little more than six years as a public company. Since our humble beginnings in 2010, with a single office, no operating assets and under a dozen employees and the time of our initial public offering (IPO) in December 2012 as a private equity sponsored and controlled entity with three operating refineries, we have grown to five refineries, numerous terminals and pipelines and other assets providing meaningful opportunities to over 3,500 dedicated employees. Since the IPO, PBF has rewarded its stockholders with a regular annual dividend, paid quarterly, of $1.20 per share, which has returned an aggregate of approximately $745 million to stockholders through 2018.

We achieved a number of significant milestones and delivered strong operational and financial performance across the business in 2018. PBF generated EBITDA excluding special items (anon-GAAP financial measure) of approximately $1.1 billion and operating income of $718 million, representing a historical record financial performance. Our Refining segment had a strong year, particularly with respect to the performance of our Torrance refinery, which we acquired in 2016. Since acquiring the Torrance refinery two and a half years ago, we have improved the environmental and safety performance of the facility and taken significant steps to lower operating costs. Our Logistics segment, which primarily reflects the results of our sponsored master limited partnership, PBF Logistics LP (”PBFX”), was strengthened through two strategic third-party acquisitions and several sponsor-related acquisitions and development projects.

Our operational and financial successes are primarily driven by our core principles:

| • | safe, reliable and environmentally responsible operation of our assets; |

| • | production of the cleanest fuels possible; and |

| • | promotion of a culture of excellence that includes rigorous training and sharing of expertise across our sites. |

Under the guidance and stewardship of the Board of Directors, we have continued the evolution from our private equity origins to one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. Ongoing engagement with our stockholders is important to us and we regularly communicate with our stockholders through a variety of means, including direct interface, investor presentations, our website, and publications we issue. Beginning in 2019, as part of our engagement program, our senior management team will reach out to our largest stockholders for dialogue concerning their priorities relating to executive compensation and/or corporate governance. We value our stockholders’ views and your input is important.

This Proxy Statement provides you information you need to make informed decisions about the matters on which you are being asked to vote. I encourage you to read it, consider the Board’s recommendations and exercise your right to vote your ownership stake.

On behalf of the Board of Directors, thank you for your continuing support. We are working diligently to reward the trust you have placed in us.

Sincerely,

Tom Nimbley

Chairman and Chief Executive Officer

PBF ENERGY INC.

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

DATE

May 23, 2019

at 10:00 A.M. E.T.

|

LOCATION

Hilton Short Hills

41 John F. Kennedy Parkway Short Hills, New Jersey 07078

|

RECORD DATE

Stockholders of record on March 29, 2019 are entitled to vote at the meeting

| ||||||||||||||||

Items of Business:

| 1. | the election of directors; |

| 2. | the ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as independent auditor; |

| 3. | an advisory vote on the 2018 compensation of the named executive officers; |

| 4. | an advisory vote on the frequency of the advisory vote on executive compensation; and |

| 5. | the transaction of any other business properly brought before the meeting or any adjournment or postponement thereof. |

The Company’s 2018 Annual Report, which is not part of the proxy soliciting material, is enclosed. These materials are being delivered to stockholders on or about April 8, 2019.

Information with respect to the above matters is set forth in this proxy statement that accompanies this notice.

By order of the Board of Directors,

Trecia M. Canty

Senior Vice President, General Counsel and Secretary

April 8, 2019

YOUR VOTE IS IMPORTANT,PLEASE SIGN, DATE AND MAIL THE ACCOMPANYING PROXY CARD OR VOTING INSTRUCTION FORM PROMPTLY. YOU MAY ALSO VOTE VIA THE INTERNET OR BY TELEPHONE. PLEASE USE THE INTERNET ADDRESS OR TOLL-FREE NUMBER SHOWN ON YOUR PROXY CARD OR VOTING INSTRUCTION FORM.

YOU MAY REVOKE A PROXY AT ANY TIME PRIOR TO ITS EXERCISE BY GIVING WRITTEN NOTICE TO THAT EFFECT TO THE SECRETARY OR BY SUBMISSION OF A LATER-DATED PROXY OR SUBSEQUENT INTERNET OR TELEPHONIC PROXY. IF YOU ATTEND THE MEETING, YOU MAY REVOKE ANY PROXY PREVIOUSLY GRANTED AND VOTE IN PERSON. |  | |||||||

| i | ||||

| iv | ||||

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 6 | ||||

| 7 | ||||

Board Leadership Structure, Lead Director and Meetings ofNon-Management Directors | 7 | |||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 59 | ||||

Proposal No. 2 – Ratification of Appointment of Independent Auditor | 60 | |||

| 61 | ||||

| 62 | ||||

Proposal No. 3 – Advisory Vote on 2018 Named Executive Officer Compensation | 63 | |||

Proposal No. 4 – Advisory Vote on the Frequency of the Advisory Vote on Executive Compensation | 64 | |||

| 65 | ||||

| 65 | ||||

| 65 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

Our Board of Directors (the “Board”) is soliciting proxies to be voted at the Annual Meeting of Stockholders on May 23, 2019 (the “Annual Meeting”). The accompanying notice describes the time, place, and purposes of the Annual Meeting. Action may be taken at the Annual Meeting or on any date to which the meeting may be adjourned. Unless otherwise indicated the terms “PBF,” “the Company,” “we,” “our,” and “us” are used in this Notice of Annual Meeting and Proxy Statement to refer to PBF Energy Inc., to one or more of our consolidated subsidiaries, or to all of them taken as a whole.

In lieu of this proxy statement and the accompanying notice, we are mailing aNotice of Internet Availability of Proxy Materials(“Internet Availability Notice”) to certain stockholders on or about April 8, 2019. On this date, stockholders will be able to access all of our proxy materials on the website referenced in the Notice.

Record Date, Shares Outstanding, Quorum

Holders of record of our Class A Common Stock, par value $0.001 per share (“Class A Common Stock”) and Class B Common Stock, par value $0.001 per share (“Class B Common Stock”) are entitled to vote as a single class on the matters presented at the Annual Meeting. At the close of business on March 29, 2019 (the “record date”), 119,848,135 shares of Class A Common Stock were issued and outstanding and entitled to one vote per share and the holders of the Class A Common Stock have 99.0% of the voting power. On the record date, 20 shares of Class B Common Stock were issued and outstanding and each share of Class B Common Stock entitled the holder to one vote for each Series A limited liability company membership interest (“PBF LLC Series A Units”) of our subsidiary, PBF Energy Company LLC (“PBF LLC”), held by such holder as of the record date. On the record date, Class B Common Stock holders collectively held 1,206,325 of the PBF LLC Series A Units, which entitled them to an equivalent number of votes, representing approximately 1.0% of the combined voting interests of the Class A and Class B Common Stock. See “Corporate Governance—PBF’s Corporate Structure” below for more information.

Stockholders representing a majority of voting power, present in person or represented by properly executed proxy, will constitute a quorum. Abstentions and brokernon-votes count as being present or represented for purposes of determining the quorum.

Voting Requirements for the Proposals

Proposal No. 1, Election of Directors— An affirmative vote of the majority of the total number of votes cast “FOR” or “AGAINST” a director nominee is required for the election of a director in an uncontested election. A majority of votes cast means that the number of shares voted “FOR” a director nominee must exceed 50% of the votes cast with respect to that nominee (with “abstentions” and “brokernon-votes” not counted as votes cast either “FOR” or “AGAINST” that nominee’s election).

Proposal No. 2, Ratification of Independent Auditors— Ratification by stockholders of the selection of independent public accountants requires the affirmative vote of the majority of the votes cast. Abstentions have no effect on this proposal.

Proposal No. 3, Advisory Vote on 2018 Named Executive Officer Compensation — The affirmative vote of the majority of the votes cast on thisnon-binding proposal is required for the proposal to pass. A majority of the votes cast means the number of shares voted for “FOR” the proposal must exceed the number of shares voted “AGAINST” the proposal. Your broker may not vote your shares on this proposal unless you give voting instructions. Abstentions and brokernon-votes have no effect on the vote.

Proposal No. 4, Advisory Vote on the Frequency of the Advisory Vote on Executive Compensation — The affirmative vote of the majority of the votes cast on thisnon-binding proposal is required for the proposal to pass. A majority of the votes cast means the number of shares voted for “FOR” the proposal must exceed the number of shares voted “AGAINST” the proposal. Your broker may not vote your shares on this proposal unless you give voting instructions. Abstentions and brokernon-votes have no effect on the vote.

| 2019 Proxy Statement | i |

Attending the Annual Meeting

In order to enter the Annual Meeting you will need to provide proof of ownership of PBF stock. If your shares are held in the name of a broker, bank or other holder of record and you plan to attend the Annual Meeting, you must present proof of your ownership of PBF stock, such as a bank or brokerage account statement, to be admitted to the Meeting. Stockholders also must present a form of personal photo identification in order to be admitted to the Meeting. No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Annual Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered in your name directly with the Company or with PBF’s transfer agent, American Stock Transfer & Trust Company, LLC, you are the “stockholder of record” of those shares. This Notice of Annual Meeting and Proxy Statement and any accompanying documents have been provided directly to you by PBF.

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of those shares, and the Internet Availability Notice has been forwarded to you by your broker, bank or other holder of record.

As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote your shares by using the voting instruction card or by following their instructions for voting by telephone or on the Internet.

Voting by Mail, Telephone or Internet or in Person at the Meeting

You may vote using any of the following methods:

By mail

Complete, sign and date the proxy or voting instruction card and return it in the prepaid envelope. If you are a shareholder of record and you return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card will vote the shares represented by your proxy card as recommended by the Board of Directors. Mailed proxies must be received no later than the close of business on May 22, 2019 in order to be voted at the Annual Meeting.We urge you to use the other means of voting if there is a possibility your mailed proxy will not be timely received.

By telephone or on the Internet

We have established telephone and Internet voting procedures for stockholders of record. These procedures are designed to authenticate your identity, to allow you to give your voting instructions and to confirm that those instructions have been properly recorded.

You can vote by calling the toll-free telephone number1-800-PROXIES(1-800-776-9437) in the United States or1-718-921-8500 from foreign countries from any touch-tone telephone. Please have your proxy card handy when you call.Easy-to-follow voice prompts will allow you to vote your shares and confirm that your instructions have been properly recorded.

The website for Internet voting iswww.voteproxy.comfor stockholders of record. Please have your proxy card handy when you go to the website. As with telephone voting, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you also can request electronic delivery of future proxy materials.

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day until 11:59 p.m., Eastern Daylight Time, on May 22, 2019.

The availability of telephone and Internet voting for beneficial owners will depend on the voting processes of your broker, bank or other holder of record. Therefore, we recommend that you follow the voting instructions in the materials you receive. If you vote by telephone or on the Internet, you do not have to return your proxy or voting instruction card.

| ii | 2019 Proxy Statement |  |

In person at the Annual Meeting

If you attend the Annual Meeting and want to vote in person, we will give you a ballot at the meeting. If your shares are registered in your name, you are considered the “stockholder of record” and you have the right to vote the shares in person at the Annual Meeting. You may also be represented by another person at the Meeting by executing a proper proxy designating that person. If, however, your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the Annual Meeting, you will need to bring to the Annual Meeting a legal proxy from the “stockholder of record”(e.g., your broker) authorizing you to vote the shares.

Revocability of Proxies

You may revoke your proxy at any time before it is voted at the Annual Meeting by (i) submitting a written revocation to PBF, (ii) returning a subsequently dated proxy to PBF, or (iii) attending the Annual Meeting requesting that your proxy be revoked and voting in person at the Annual Meeting. If instructions to the contrary are not provided, shares will be voted as indicated on the proxy card.

Abstentions

Abstentions are counted for purposes of determining whether a quorum is present. Abstentions are not counted in the calculation of the votes “cast” with respect to any of the matters submitted to a vote of stockholders and will have no effect on the vote on any proposal. Directors will be elected by a majority vote of the votes cast at the meeting.

BrokerNon-Votes

Brokers holding shares must vote according to specific instructions they receive from the beneficial owners of the stock. If the broker does not receive specific instructions, in some cases the broker may vote the shares in the broker’s discretion. However, the New York Stock Exchange (the “NYSE”) precludes brokers from exercising voting discretion on certain proposals without specific instructions from the beneficial owner. This results in a “brokernon-vote” on the proposal. A brokernon-vote is treated as “present” for purposes of determining a quorum, has the effect of a negative vote when a majority of the voting power of the issued and outstanding shares is required for approval of a particular proposal, and has no effect when a majority of the voting power of the shares present in person or by proxy and entitled to vote or a majority of the votes cast is required for approval.

The ratification of the appointment of Deloitte as our independent auditor (Proposal No. 2) is deemed to be a routine matter under NYSE rules. A broker or other nominee generally may vote uninstructed shares on routine matters, and therefore no brokernon-votes are expected to occur with Proposal No. 2. Proposals 1, 3 and 4 are considerednon-routine under applicable rules. A broker or other nominee cannot vote without instructions onnon-routine matters, and therefore an undetermined number of brokernon-votes are expected to occur on this proposal. These brokernon-votes will not have any impact on the outcomes for these proposals as it requires the approval of a majority of the votes cast.

Solicitation of Proxies

PBF pays for the cost of soliciting proxies and the Annual Meeting. In addition to solicitation by mail, proxies may be solicited by personal interview, telephone, and similar means by directors, officers, or employees of PBF, none of whom will be specially compensated for such activities. Morrow Sodali LLC, 470 West Ave, Stamford, CT 06902, a proxy solicitation firm, will be assisting us for a fee of approximately $8,500 plusout-of-pocket expenses. PBF also intends to request that brokers, banks, and other nominees solicit proxies from their principals and will pay such brokers, banks, and other nominees certain expenses incurred by them for such activities.

| 2019 Proxy Statement | iii |

This summary highlights information contained elsewhere in this proxy statement. We encourage you to review the entire proxy statement. This proxy statement and our Annual Report for the year ended December 31, 2018 are first being mailed to the Company’s stockholders and made available on the internet at www.pbfenergy.com on or about April 8, 2019. Website addresses included throughout this proxy statement are for reference only. The information contained on our website is not incorporated by reference into this proxy statement.

MATTERS TO BE VOTED ON AT THE ANNUAL MEETING AND BOARD RECOMMENDATION

| 1. | Election of Directors(p. 9) |

Name | Years of Service | Independent | Board Recommendation | |||

Thomas Nimbley | 4 | No | For | |||

Spencer Abraham | 6 | Yes | For | |||

Wayne Budd | 5 | Yes | For | |||

S. Eugene Edwards | 5 | Yes | For | |||

William Hantke | 3 | Yes | For | |||

Edward Kosnik | 5 | Yes | For | |||

Robert Lavinia | 3 | Yes | For | |||

Kimberly Lubel | 1 | Yes | For | |||

George Ogden | 1 | Yes | For | |||

2. Ratification of Deloitte & Touche LLP as Independent Auditors(p. 60) | For | |||||

3. Advisory Vote on 2018 Named Executive Officer Compensation(p. 63) | For | |||||

4. Advisory Vote on the Frequency of the Advisory Vote on Executive Compensation(p. 64) | For | |||||

| iv | 2019 Proxy Statement |  |

Proxy Statement Summary |

COMPANY PERFORMANCE

We are one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. We sell our products throughout the Northeast, Midwest, Gulf Coast and West Coast of the United States, as well as in other regions of the United States, Canada and Mexico and are able to ship products to other international destinations. We own and operate five domestic oil refineries and related assets that have a combined processing capacity, known as throughput, of approximately 900,000 barrels per day (“bpd”), and a weighted-average Nelson Complexity Index of 12.2.

In 2018, we achieved a number of significant milestones and delivered strong operational and financial performance across the business. Our Refining segment had a strong year, particularly with respect to the performance of our Torrance refinery, which we acquired in 2016. Since acquiring the Torrance refinery two and a half years ago, we have improved the environmental and safety performance of the facility and taken significant steps to lower operating costs. Our Logistics segment, which primarily reflects the results of our sponsored master limited partnership, PBF Logistics LP (”PBFX”), was strengthened through two strategic third party acquisitions and several sponsor-related acquisitions and development projects.

2018 Milestones

| ● | Record Revenues. Our 2018 revenues reached a record level of $27.2 billion compared to $21.8 billion and $15.9 billion in 2017 and 2016, respectively and, EBITDA Excluding Special Items was $1.1 billion in 2018 compared to $723.4 million and $201.1 million in 2017 and 2016, respectively. EBITDA Excluding Special Items is a non-GAAP financial measure. For an explanation of how we use EBITDA Excluding Special Items and reconciliation to our net income, please see “Non-GAAP Financial Measures” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report onForm 10-K for the year ended December 31, 2018 (the “2018 Form 10-K”). |

2018 Revenues $27.2B

compared to $21.8B in 2017 and |

2018 EBITDA $1.1B

compared to $723.4M in 2017 and

| |||

| ● | Successful Credit Facility Refinancings. On May 2, 2018, our subsidiary, PBF Holding and certain of its wholly-owned subsidiaries, as borrowers or subsidiary guarantors, replaced its revolving credit facility. Among other things, the new revolving credit facility increased the maximum commitment available from $2.6 billion to $3.4 billion, extended the maturity date and included amendments that make more funding available for working capital and other general corporate purposes (the “PBFH Revolving Credit Agreement”). In addition, an accordion feature allows for commitments of up to $3.5 billion. On July 30, 2018, PBFX entered into a new Revolving Credit Facility that increased the maximum commitment available from $360.0 million to $500.0 million, and extended the maturity date to July 2023. PBFX has the ability to further increase the maximum availability by an additional $250.0 million to a total commitment of $750.0 million, subject to receiving increased commitments from lenders or other financial institutions and satisfaction of certain conditions (the “PBFX Revolving Credit Agreement”). |

| ● | PBF Energy Equity Offering. On August 14, 2018, we completed a public offering of an aggregate of 6,000,000 shares of Class A common stock for net proceeds of $287.3 million, after deducting underwriting discounts and commissions and other offering expenses (the “August 2018 Equity Offering”). |

| ● | Registered Direct Offering. On July 30, 2018, PBFX closed on a common unit purchase agreement with certain funds managed by Tortoise Capital Advisors, L.L.C. providing for the issuance and sale in a registered direct offering (the “Registered Direct Offering”) of an aggregate of 1,775,750 common units for gross proceeds of approximately $35.0 million. |

| 2019 Proxy Statement | v |

| Proxy Statement Summary

STOCK PERFORMANCE

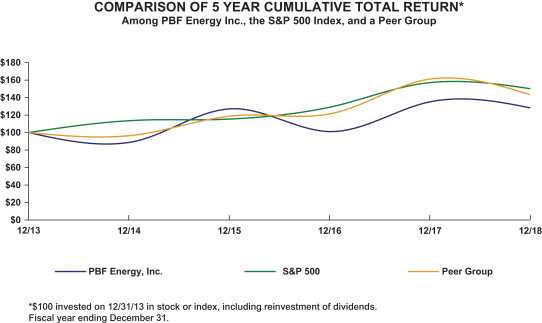

In accordance with SEC rules, the information contained in the Stock Performance Graph below shall not be deemed to be “soliciting material,” or to be “filed” with the SEC, or subject to the SEC’s Regulation 14A or 14C, other than as provided under Item 201(e) ofRegulation S-K, or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that we specifically request that the information be treated as soliciting material or specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended (the “Securities Act”). This performance graph and the related textual information are based on historical data and are not indicative of future performance.

The following line graph compares the cumulative total return on an investment in our common stock against the cumulative total return of the S&P 500 Composite Index and an index of peer companies (that we selected) for the periods commencing December 31, 2013 through December 31, 2018. Our peer group consists of the following companies that are engaged in refining operations in the U.S.: CVR Energy Inc.; Delek US Holdings, Inc.; HollyFrontier Corporation; Marathon Petroleum Corporation; Phillips 66; and Valero Energy Corporation.

| 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 | 12/31/2018 | |||||||||||||||||||

PBF Class A Common Stock | $ | 100.00 | $ | 88.58 | $ | 127.21 | $ | 101.07 | $ | 134.99 | $ | 128.32 | ||||||||||||

S&P 500 | 100.00 | 113.69 | 115.26 | 129.05 | 157.22 | 150.33 | ||||||||||||||||||

Peer group | 100.00 | 96.28 | 118.80 | 121.27 | 161.06 | 143.37 | ||||||||||||||||||

| vi | 2019 Proxy Statement |  |

Proxy Statement Summary |

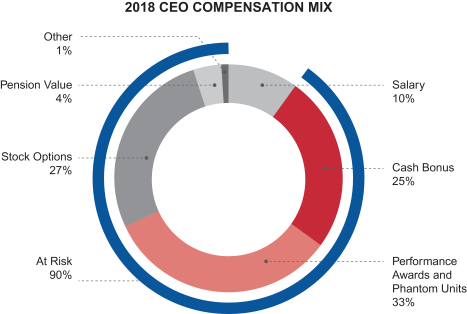

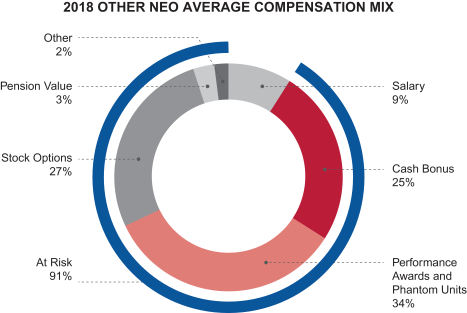

EXECUTIVE COMPENSATION

Detailed discussion and analysis of our Executive Compensation begins on page 20. Our Executive Compensation program uses a mix of base salary, annual cash incentives and equity-based awards and standard benefits to attract and retain highly qualified executives and maintain a strong relationship between executive pay and Company performance.

2018 KEY COMPENSATION COMMITTEE ACTIONS

In restructuring the executive compensation program in 2018, following a comprehensive review of peer data and feedback from investors, the Compensation Committee sought to balance the equally important imperatives of establishing a competitive, performance-driven compensation program with the need to retain our key executives. In particular, the Compensation Committee focused on establishing total compensation for our CEO that was competitive with his peer CEOs and recognized his significant contributions in growing the Company:

| Philosophy | Action | |

| CEO total compensation should be competitive with peer group CEO total compensation | In 2017, the total compensation of our Chief Executive Officer wasbelow the 25th percentile of total compensation of CEOs or equivalents of our peer group companies in 2016. In 2018, the Committee increased the total target compensation for our CEO to place him between the25th and the 50th percentile of the peer group CEO total compensation in 2017. The adjustment is attributable to an increase in long-term incentive awards as compared with the prior year and is aligned with our compensation philosophy and performance in 2018.As discussed below, 50% of his long-term incentives are now performance based and have been structured to cliff vest after three years to encourage retention.

| |

| Performance-Based Awards should be a Significant Component of Long-Term Incentive Compensation | Prior to 2018, the long-term incentives granted to the named executive officers consisted solely of time-based awards (options, restricted stock and phantom units) that were not performance based.

In 2018, the Committee reduced the percentage of PBF Energy time-based awards from 100% to 50%, keeping stock options and introducing performance share units and performance units with a multi-year performance cycle measuring Total Shareholder Return (TSR) as a replacement for time-vested restricted stock. To provide a balance of cash and equity-based compensation, the performance awards are equally allocated to performance share units that settle in stock and performance units that settle in cash. These performance-based awards have payouts that can range from0-200% and incentivize superior performance throughout the commodity price cycle. An emphasis on TSR preserves performance accountability in both strong and weak commodity price environments, and is aligned with stockholder interests.

| |

| 2019 Proxy Statement | vii |

| Proxy Statement Summary

| Philosophy | Action | |

| Alignment of Payouts under Performance Awards with Total Shareholder Return | The ultimate realized value of equity-based awards is determined by stock price performance over athree-year period and the Compensation Committee limits payout of performance awards to target if PBF’s TSR is negative over the performance period to align pay with performance.

| |

| Long-Term Incentives Designed for Retention of Key Executives | The Compensation Committee structured the vesting of the long-term incentives to encourage retention of key executives. Stock options continue to vest over a period of four years while the newly introduced performance awards cliff vest on the last day of the three-year performance cycle. The Committee believes the performance awards granted in 2018 provide a significant performance-based incentive for executives to remain with the Company despite the fact that, as compared with the prior grants of restricted stock, the vesting and actual income realized by our named executive officers will decrease in 2019 and 2020 for the 2018 long-term incentive grants as compared to the 2017 grants as shown below:

| |

| viii | 2019 Proxy Statement |  |

Proxy Statement Summary |

EXECUTIVE COMPENSATION PROGRAM HIGHLIGHTS

In addition to the key compensation actions described above, the executive compensation program for the named executive officers includes many best-practice features that align executive compensation with the interests of our stockholders:

| What We Do | What We Don’t Do | |||||

| ✔ | Annual Say on Pay Vote | ✘ | No guaranteed minimum cash bonus payments to any of our executive officers | |||

| ✔ | Majority of named executive officer compensation is variable and linked to performance | ✘ | No repricing of stock options | |||

| ✔ | Long-term incentives are largely contingent on performance | ✘ | Payout of performance awards is capped at target amount if PBF’s TSR is negative | |||

| ✔ | Objective TSR metric underlying the performance-based portion of the long-term incentive award aligned with stockholder interests | ✘ | No hedging or pledging of PBF stock | |||

| ✔ | Meaningful stock ownership guidelines for executive officers | ✘ | No excessive perquisites | |||

| ✔ | Change of control payment under employment agreements limited to 2.99 times base salary | ✘ | No excise taxgross-ups on any payments at a change of control | |||

| ✔ | Grant stock options only at fair market value as of the grant date | ✘ | No individual supplemental executive retirement arrangements | |||

| ✔ | Compensation consultant independent from management | |||||

| 2019 Proxy Statement | ix |

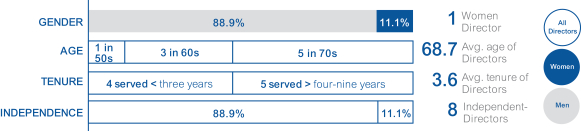

GOVERNANCE HIGHLIGHTS

PBF Energy is committed to meeting high standards of ethical behavior, corporate governance and business conduct in everything we do, every day. This commitment has led us to implement the following practices:

|

| Board Structure and Composition — Our directors are elected annually by vote of our stockholders and eight of our nine current directors are, and assuming election of the nine director nominees at the Annual Meeting, eight out of nine of the directors will be, independent. |

| Lead Director — Our independent directors are led by an independent Lead Director and regularly meet in executive session. |

| Majority Voting for Uncontested Director Elections — In February 2017, we adopted majority voting for uncontested elections of directors which requires that our directors must be elected by a majority of the votes cast with respect to such elections. |

| Absence of Rights Plan — We do not have a shareholder rights plan, commonly referred to as a ‘‘poison pill.’’ |

| Independent Compensation Consultant — Our Compensation Committee uses an independent compensation consultant, which performs no consulting or other services for the Company. |

| Stock Ownership Guidelines — In October 2016, we adopted stock ownership guidelines for our officers and directors. Most of our executive officers and some of our directors have a significant amount of equity in the Company and each of our executive officers and directors are partially compensated through annual equity awards to ensure a level of stock ownership to align their interests with those of our stockholders. |

| Chief Executive Officer (‘‘CEO’’) Succession Planning — Succession planning, which is conducted at least annually by our Board of Directors, addresses both an unexpected loss of our CEO and longer-term succession. |

| Transactions in Company Securities — Our insider trading policy prohibits all directors and employees from engaging in short sales and hedging transactions relating to our common stock. |

| x | 2019 Proxy Statement |  |

We are one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. We sell our products throughout the Northeast, Midwest, Gulf Coast and West Coast of the United States, as well as in other regions of the United States and Canada, and are able to ship products to other international destinations. We were formed in 2008 to pursue acquisitions of crude oil refineries and downstream assets in North America. As of December 31, 2018, we own and operate five domestic oil refineries and related assets. Our refineries have a combined processing capacity, known as throughput, of approximately 900,000 barrels per day (“bpd”), and a weighted-average Nelson Complexity Index of 12.2. We operate in two reportable business segments: Refining and Logistics.

PBF Energy was formed on November 7, 2011 and is a holding company whose primary asset is a controlling equity interest in PBF Energy Company LLC (“PBF LLC”). We are the sole managing member of PBF LLC and operate and control all of the business and affairs of PBF LLC. We consolidate the financial results of PBF LLC and its subsidiaries and record a noncontrolling interest in our consolidated financial statements representing the economic interests of the members of PBF LLC other than PBF Energy. PBF LLC is a holding company for the companies that directly or indirectly own and operate our business. PBF Holding Company LLC (“PBF Holding”) is a wholly-owned subsidiary of PBF LLC and is the parent company for our refining operations. PBF Energy, through its ownership of PBF LLC, also consolidates the financial results of PBF Logistics LP, afee-based, growth-oriented, publicly traded Delaware master limited partnership formed by PBF Energy to own or lease, operate, develop and acquire crude oil and refined petroleum products terminals, pipelines, storage facilities and similar logistics assets. As of March 29, 2019, PBF LLC held a 54.1% limited partner interest (consisting of 29,953,631 common units) in PBFX, with the remaining 45.9% limited partner interest held by the public unit holders. PBF LLC also owns anon-economic general partner interest in PBFX through its wholly-owned subsidiary, PBF Logistics GP LLC (“PBF GP”), the general partner of PBFX.

| • | Record Revenues.Our 2018 revenues reached a record level of $27.2 billion compared to $21.8 billion and $15.9 billion in 2017 and 2016, respectively, and, EBITDA Excluding Special Items was $1.1 billion in 2018 compared to $723.4 million and $201.1 million in 2017 and 2016, respectively. EBITDA Excluding Special Items is anon-GAAP financial measure. For an explanation of how we use EBITDA Excluding Special Items and a reconciliation to our net income, please see“Non-GAAP Financial Measures” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations in our 2018Form 10-K. |

| • | Successful Credit Facility Refinancings. On May 2, 2018, PBF Holding and certain of its wholly-owned subsidiaries, as borrowers or subsidiary guarantors, replaced the August 2014 Revolving Credit Agreement with the Revolving Credit Facility. Among other things, the Revolving Credit Facility increased the maximum commitment available from $2.6 billion to $3.4 billion, extended the maturity date to May 2023, and included amendments that make more funding available for working capital and other general corporate purposes. In addition, an accordion feature allows for commitments of up to $3.5 billion. On July 30, 2018, PBFX entered into a new Revolving Credit Facility that increased the maximum commitment available from $360.0 million to $500.0 million, and extended the maturity date to July 2023. PBFX has the ability to further increase the maximum availability by an additional $250.0 million to a total commitment of $750.0 million, subject to receiving increased commitments from lenders or other financial institutions and satisfaction of certain conditions. |

| • | PBF Energy Equity Offering. On August 14, 2018, PBF Energy completed a public offering of an aggregate of 6,000,000 shares of PBF Energy Class A common stock for net proceeds of $287.3 million, after deducting underwriting discounts and commissions and other offering expenses. |

| • | Registered Direct Offering. On July 30, 2018, PBFX closed on a common unit purchase agreement with certain funds managed by Tortoise Capital Advisors, L.L.C. providing for the issuance and sale in a registered direct offering of an aggregate of 1,775,750 common units for gross proceeds of approximately $35.0 million. |

| 2019 Proxy Statement | 1 |

| About PBF Energy

| • | Continued Growth of the MLP. |

| • | East Coast Storage Assets Acquisition. On July 16, 2018, PBFX entered into an agreement with Crown Point International, LLC, formerly known as Axeon Specialty Products LLC, to purchase its wholly-owned subsidiary, CPI Operations LLC (the “East Coast Storage Assets Acquisition”) for total consideration of $107 million, excluding working capital and contingent consideration, which was comprised of an initial payment at closing of $75 million with the balance being payable one year after closing. The East Coast Storage Assets Acquisition closed on October 1, 2018. |

| • | Development Asset Dropdown. On July 16, 2018, PBFX entered into four contribution agreements with PBF LLC (the “Development Assets Contribution Agreements”). Pursuant to the Development Asset Contribution Agreements, PBF LLC contributed all of the issued and outstanding limited liability company interests of: Toledo Rail Logistics Company LLC (“TRLC”), whose assets consist of a loading and unloading rail facility located at the Toledo refinery (the “Toledo Rail Products Facility”); Chalmette Logistics Company LLC (“CLC”), whose assets consist of a truck loading rack facility (the “Chalmette Truck Rack”) and a rail yard facility (the “Chalmette Rosin Yard”), both of which are located at the Chalmette refinery; Paulsboro Terminaling Company LLC (“PTC”), whose assets consist of a lube oil terminal facility located at the Paulsboro refinery (the “Paulsboro Lube Oil Terminal”); and DCR Storage and Loading Company LLC (“DSLC”), whose assets consist of an ethanol storage facility located at the Delaware City refinery (the “Delaware Ethanol Storage Facility” and collectively with the Toledo Rail Products Facility, the Chalmette Truck Rack, the Chalmette Rosin Yard, and the Paulsboro Lube Oil Terminal, the “Development Assets”) to PBFX Op Co effective July 31, 2018. In consideration for the Development Assets limited liability company interests, PBFX delivered to PBF LLC total consideration of $31.6 million, consisting of 1,494,134 common units of PBFX (the “Development Asset Acquisition”). |

| • | Knoxville Terminal Acquisition. On April 16, 2018, PBFX completed the purchase of Knoxville Terminals from Cummins Terminals, Inc. for total cash consideration of $58.0 million, excluding working capital adjustments (the “Knoxville Terminals Purchase”). The transaction was financed through a combination of cash on hand and borrowings under the PBFX Revolving Credit Facility. |

| 2 | 2019 Proxy Statement |  |

In December 2012, we completed an initial public offering (“IPO”) of our Class A Common Stock, which is listed on the NYSE. We have another class of common stock, Class B Common Stock, which has no economic rights but entitles the holder, without regard to the number of shares of Class B Common Stock held, to a number of votes on matters presented to our stockholders that is equal to the aggregate number of PBF LLC Series A Units held by such holder. The Class A Common Stock and the Class B Common Stock are referred to as our “common stock.” We were initially sponsored and controlled by funds affiliated with The Blackstone Group L.P., or Blackstone, and First Reserve Management, L.P., or First Reserve (collectively referred to as “our former sponsors”).

As of the March 29, 2019 record date, certain of our current and former executive officers, directors and employees and their affiliates beneficially owned 1,206,325 PBF LLC Series A Units (we refer to all of the holders of the PBF LLC Series A Units as“pre-IPO owners” of PBF LLC). Each of thepre-IPO owners of PBF LLC holds one share of Class B Common Stock entitling the holder to one vote for each PBF LLC Series A Unit they hold.

Certain of our current and former officers hold interests in PBF LLC, which are profits interests (which we refer to as the “PBF LLC Series B Units”) and certain of ourpre-IPO owners and other employees hold options and warrants to purchase PBF LLC Series A Units as well as options to purchase Class A Common Stock. As described under “Certain Relationships and Related Party Transactions—Summary of PBF LLC Series B Units,” holders of PBF LLC Series B Units, including certain officers of the Company, are entitled, in varying degrees on a scale of 0% to 10%, to share in all distributions and proceeds (other than return of amounts invested) to Blackstone and First Reserve related to PBF LLC Series A Units previously owned by Blackstone and First Reserve.

INFORMATION REGARDING THE BOARD OF DIRECTORS

PBF’s business is managed under the direction of our Board. As of December 31, 2018, our Board had nine (9) members, including our Chief Executive Officer, Thomas J. Nimbley. Our Board conducts its business through meetings of its members and its committees. During 2018, our Board held six (6) meetings and each member of the Board participated in at least 75% of the meetings held while they were in office. All of the directors then in office participated in the Annual Meeting of Stockholders in 2018. All Board members standing forre-election are expected to attend the 2019 Annual Meeting.

The Board’s Audit Committee, Compensation Committee, Health, Safety and Environment Committee and Nominating and Corporate Governance Committee are composed entirely of directors who meet the independence requirements of the NYSE listing standards and any applicable regulations of the Securities and Exchange Commission, or the SEC.

Under the NYSE’s listing standards, no director qualifies as independent unless the Board affirmatively determines that he or she has no material relationship with PBF. Based upon information requested from and provided by our directors concerning their background, employment, and affiliations, including commercial, banking, consulting, legal, accounting, charitable, and familial relationships, the Board has determined that, other than being a director and/or stockholder of PBF, each of the independent directors named below has either no relationship with PBF, either directly or as a partner, stockholder, or officer of an organization that has a relationship with PBF, or has only immaterial relationships with PBF, and is independent under the NYSE’s listing standards.

In accordance with NYSE listing standards, the Board has adopted categorical standards or guidelines to assist the Board in making its independence determinations regarding its directors. These standards are published in Article I of ourCorporate Governance Guidelinesand are available on our website at www.pbfenergy.com under the “Corporate Governance” tab in the “Investors” section. Under NYSE’s listing standards, immaterial relationships that fall within the guidelines are not required to be disclosed in this proxy statement. An immaterial relationship falls within the guidelines if it:

| • | is not a relationship that would preclude a determination of independence under Section 303A.02(b) of the NYSE Listed Company Manual; |

| 2019 Proxy Statement | 3 |

| Corporate Governance

| • | consists of charitable contributions by PBF to an organization in which a director is an executive officer and does not exceed the greater of $1 million or 2 percent of the organization’s gross revenue in any of the last three years; |

| • | consists of charitable contributions to any organization with which a director, or any member of a director’s immediate family, is affiliated as an officer, director, or trustee pursuant to a matching gift program of PBF and made on terms applicable to employees and directors; or is in amounts that do not exceed $1 million per year; and |

| • | is not required to be, and it is not otherwise, disclosed in this proxy statement. |

The Board has determined that all of the 2019non-management director nominees meet the independence requirements of the NYSE listing standards as set forth in the NYSE Listed Company Manual: Spencer Abraham, Wayne Budd, S. Eugene Edwards, William E. Hantke, Edward Kosnik, Robert J. Lavinia, Kimberly S. Lubel and George E. Ogden. Mr. Kosnik serves as the Lead Director.

PBF had these standing committees of the Board in 2018.

| • | Audit Committee; |

| • | Compensation Committee; |

| • | Nominating and Corporate Governance Committee; and |

| • | Health, Safety and Environment Committee (the “HS&E Committee”). |

We have adopted a charter setting forth the responsibilities of each of the committees. The committee charters are available on our website atwww.pbfenergy.comunder the “Corporate Governance” tab in the “Investors” section. The members of each committee, including the Chairperson, as well as the number of meetings held in 2018 is set forth in the table below:

| Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Health, Safety and Environment Committee | ||||

| Spencer Abraham |  |  | ||||||

| Edward F. Kosnik |  | |||||||

| Wayne A. Budd |  |  | ||||||

| Gene Edwards |  |  | ||||||

| Robert J. Lavinia |  | |||||||

| William Hantke |  |  | ||||||

| Kimberly Lubel |  | |||||||

| George Ogden |  | |||||||

| # of Meetings Held in 2018 | 5 | 3 | 3 | 4 | ||||

| 4 | 2019 Proxy Statement |  |

Corporate Governance |

Audit Committee

The Audit Committee reviews and reports to the Board on various auditing and accounting matters, including the quality, objectivity, and performance of our internal and external accountants and auditors, the adequacy of our financial controls, and the reliability of financial information reported to the public. In 2018, the members of the Audit Committee were Edward Kosnik (Chairman), William Hantke and George Ogden. Messrs. Kosnik, Hantke and Ogden were each determined by the Board to be an “Audit Committee financial expert” (as defined by the SEC).

In 2018, the Audit Committee met five (5) times and each meeting was attended by all of the members. The “Report of the Audit Committee for Fiscal Year 2018” appears in this proxy statement following the disclosures related to Proposal No. 2.

Compensation Committee

The Compensation Committee reviews and reports to the Board on matters related to compensation strategies, policies, and programs, including certain personnel policies and policy controls, management development, management succession, and benefit programs. The Compensation Committee also approves and administers our equity incentive compensation plan and cash incentive plan. The Compensation Committee’s duties are described more fully in the “Compensation Discussion and Analysis” section below.

In 2018, the members of the Compensation Committee are Spencer Abraham (Chairman), Wayne Budd and William Hantke. Each of the three current members of the Compensation Committee qualifies as independent under applicable SEC rules and regulations and the rules of the NYSE, as an “outside director” for the purposes of Section 162(m) of the Internal Revenue Code (the “Code”), as in effect in 2018, and as a“non-employee director” for the purposes ofRule 16b-3 under the Exchange Act.

In 2018, the Compensation Committee met three (3) times and the meetings were attended by all members. The “Compensation Committee Report” for Fiscal Year 2018 appears in this proxy statement immediately following “Executive Compensation”.

Compensation Committee Interlocks and Insider Participation

There are no Compensation Committee interlocking relationships. None of the members of the Compensation Committee has served as an officer or employee of PBF or had any relationship requiring disclosure by PBF under Item 404 of the SEC’sRegulation S-K, which addresses related person transactions.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee evaluates policies on the size and composition of the Board and criteria and procedures for director nominations, and considers and recommends candidates for election to the Board. The committee also evaluates, recommends, and monitors corporate governance guidelines, policies, and procedures, including our codes of business conduct and ethics. The members of the Nominating and Corporate Governance Committee are Wayne Budd (Chairman), Spencer Abraham, and S. Eugene Edwards. The committee met three (3) times in 2018 and the meetings were attended by all members.

The Nominating and Corporate Governance Committee recommended to the Board each presently serving director of PBF as nominees for election as directors at the Annual Meeting. The Committee also considered and recommended the appointment of a Lead Director (described below under “Board Leadership Structure, Lead Director and Meetings ofNon-Management Directors”) to preside at meetings of the independent directors without management, and recommended assignments for the Board’s committees. The full Board approved the recommendations of the Committee and adopted resolutions approving the slate of director nominees to stand for election at the Annual Meeting, the appointment of a Lead Director, and Board committee assignments.

| 2019 Proxy Statement | 5 |

| Corporate Governance

Health, Safety and Environment Committee

The HS&E Committee assists the Board of Directors in fulfilling its oversight responsibilities by assessing the effectiveness of programs and initiatives that support the Health, Safety and Environment and sustainability, innovation, and technology policies and programs of the Company. In 2018, the members of the HS&E Committee were S. Eugene Edwards (Chairman), Robert Lavinia and Kimberly Lubel. The committee met four (4) times in 2018 and the meetings were attended by all members.

SELECTION OF DIRECTOR NOMINEES

The Nominating and Corporate Governance Committee solicits recommendations for Board candidates from a number of sources, including our directors, our officers and individuals personally known to the members of the Board. The Committee will consider candidates submitted by stockholders when submitted in accordance with the procedures described in this proxy statement under the caption “Miscellaneous – Stockholder Nominations and Proposals.” The Committee will consider all candidates identified through the processes described above and will evaluate each of them on the same basis. The level of consideration that the Committee will extend to a stockholder’s candidate will be commensurate with the quality and quantity of information about the candidate that the nominating stockholder makes available to the Committee.

Evaluation of Director Candidates

The Nominating and Corporate Governance Committee is charged with assessing the skills and characteristics that candidates for election to the Board should possess and with determining the composition of the Board as a whole. The assessments include qualifications under applicable independence standards and other standards applicable to the Board and its committees, as well as consideration of skills and expertise in the context of the needs of the Board.

In evaluating each candidate, the Committee may consider among other factors it may deem relevant:

| • | whether or not the person has any relationships that might impair his or her independence, such as any business, financial or family relationships with the Company, its management or their affiliates; |

| • | whether or not the person serves on boards of, or is otherwise affiliated with, competing companies; |

| • | whether or not the person is willing to serve as, and willing and able to commit the time necessary for the performance of the duties of, a director of the Company; |

| • | the contribution which the person can make to the Board and the Company, with consideration being given to the person’s business and professional experience, education and such other factors as the Committee may consider relevant; |

| • | the diversity in gender, ethnic background and professional experience of a candidate; and |

| • | the integrity, strength of character, independent mind, practical wisdom and mature judgment of the person. |

| 6 | 2019 Proxy Statement |  |

Corporate Governance |

Based on this initial evaluation, the Committee will determine whether to interview a proposed candidate and, if warranted, will recommend that one or more of its members, other members of the Board, or senior management, as appropriate, interview the candidate. After completing this process, the Committee ultimately determines its list of nominees and submits the list to the full Board for consideration and approval. The following table sets forth certain criteria and skills we use to evaluate nominees as well as the qualification of our director nominees:

| Skill, Experience and Expertise | ||||||||||||||||||||||||||||||||||

Finance |

|

|

|

|

|

|

|

|

|

Industry Knowledge | ||||||||||||||||||||||||

Director / Nominee |

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||

Spencer Abraham | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

Wayne Budd | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Gene Edwards | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||

Bill Hantke | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

Edward Kosnik | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

Robert Lavinia | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

Kimberly Lubel | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||

Thomas Nimbley | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||

George Ogden | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

Our Nominating and Corporate Governance Committee oversees an annual Board and committee self-evaluation process providing each member of the Board the opportunity to complete detailed surveys designed to assess the effectiveness of both the Board as a whole and each of its committees. The surveys seek feedback on, among other things, Board and committee composition and organization, the frequency and content of Board and committee meetings, the quality of management presentations to the Board and its committees, the Board’s relationship to senior management and the performance of the Board and its committees in light of the responsibilities of each body as established in our Corporate Governance Guidelines and the respective committee charters.

Our Chairman and CEO and Lead Director lead a discussion of survey results with all of the directors as a group, and each committee chair leads a discussion of committee results within a committee meeting setting. Our Nominating and Corporate Governance Committee believes this process, which combines the opportunity for each director to individually reflect on Board and committee effectiveness with a collaborative discussion on performance, provides a meaningful assessment tool and a forum for discussing areas for improvement.

BOARD LEADERSHIP STRUCTURE, LEAD DIRECTOR AND MEETINGS OFNON-MANAGEMENT DIRECTORS

Following the retirement of our Executive Chairman in 2016, our Board of Directors determined that the most effective leadership structure at this time is to have a Chairman of the Board who is also the CEO. The Board may modify this structure in the future to ensure that the Board leadership structure for the Company remains effective and advances the best interests of our stockholders.

Our Board appoints a “Lead Director” whose responsibilities include leading the meetings of ournon-management directors outside the presence of management. Edward Kosnik is currently our Lead Director. The Lead Director acts as the chair of allnon-management director meetings sessions and is responsible for coordinating the activities of the other outside directors, as required by our Corporate Governance Guidelines and the NYSE listing standards. The

| 2019 Proxy Statement | 7 |

| Corporate Governance

Lead Director, working with committee chairpersons, sets agendas and leads the discussion of regular meetings of the Board outside the presence of management, provides feedback regarding these meetings to the Chairman, and otherwise serves as a liaison between the independent directors and the Chairman. The Lead Director is also responsible for receiving, reviewing, and acting upon communications from stockholders or other interested parties when those interests should be addressed by a person independent of management. The independent directors, to the extent not identical to thenon-management directors, are required to meet in executive session as appropriate matters for their consideration arise, but, in any event, at least once a year. The agenda of these executive sessions includes such topics as the participating directors shall determine.

The Board considers oversight of PBF’s risk management efforts to be a responsibility of the full Board. The Board’s role in risk oversight includes receiving regular reports from members of senior management on areas of material risk to PBF, or to the success of a particular project or endeavor under consideration, including operational, financial, legal, regulatory, strategic, and reputational risks. The full Board (or the appropriate Board committee) receives reports from management to enable the Board (or committee) to assess PBF’s risk identification, risk management and risk mitigation strategies. When a report is vetted at the committee level, the chairperson of that committee thereafter reports on the matter to the full Board. This enables the Board and its committees to coordinate the Board’s risk oversight role. The Board also believes that risk management is an integral part of PBF’s annual strategic planning process, which addresses, among other things, the risks and opportunities facing PBF.

| 8 | 2019 Proxy Statement |  |

(Item 1 on the Proxy Card)

All of PBF’s directors are subject to election each year at the annual meeting of stockholders. If elected at the Annual Meeting, all of the nominees for director listed below will serve aone-year term expiring at the 2020 Annual Meeting of Stockholders. On the proxy card, PBF has designated certain persons who will be voting the proxies submitted for the Annual Meeting and these persons will vote as directed by your proxy card. If your proxy card does not provide voting instructions, these persons will vote for the election of each of these nominees.

✓ | The Board recommends a vote“FOR” all nominees.

|

Under our bylaws, each director to be elected under this Proposal No. 1 must be elected by the vote of the majority of the votes cast “For” or “Against” the nominee. With respect to each nominee, the director must be elected by a majority vote, that means the number of shares voted “For” a director nominee must exceed 50% of the votes cast with respect to that nominee (with “abstentions” and “brokernon-votes” not counted as votes cast either “for” or “against” that nominee’s election).

If a director is not elected by a majority vote, such director must promptly offer to tender his or her irrevocable resignation to the Board. The Nominating and Governance Committee, or such other committee designated by the Board, will recommend to the Board whether to accept or reject the resignation. The Board will act on the Committee’s recommendation and publicly disclose its decision and the rationale behind it within ninety (90) days following the date of the certification of the election results.

If any nominee is unavailable as a candidate at the time of the Annual Meeting, either the number of directors constituting the full Board will be reduced to eliminate the resulting vacancy, or the persons named as proxies will use their best judgment in voting for an alternative nominee.

INFORMATION CONCERNING NOMINEES AND DIRECTORS

Our directors are listed in the following table. Each is a nominee for election as a director at the Annual Meeting.

The following table sets forth certain information regarding our directors as of the date of this proxy statement. Each director will hold office until a successor is elected and qualified or until his earlier death, resignation or removal.

| 2019 Proxy Statement | 9 |

| Proposal No. 1 – Election of Directors

| Thomas J. Nimbley | ||

Chairman of the Board and Chief Executive Officer

Age:67

Director Since: 2014 | Biography:

Mr. Nimbley has served as Chairman of the Board since June 30, 2016. He has served as our Chief Executive Officer since June 2010 and was our Executive Vice President, Chief Operating Officer from April 2010 through June 2010. In his capacity as PBF Energy Inc.’s Chief Executive Officer, Mr. Nimbley also serves as a director and the Chief Executive Officer of its subsidiaries, including PBF Logistics GP LLC, the general partner of PBF Logistics LP, a publicly traded master limited partnership, of which he is also Chairman of the Board. Prior to joining PBF Energy Inc., Mr. Nimbley served as a Principal for Nimbley Consultants LLC from June 2005 to March 2010, where he provided consulting services and assisted on the acquisition of two refineries. He previously served as Senior Vice President and head of Refining for Phillips and subsequently Senior Vice President and head of Refining for ConocoPhillips’ domestic refining system (13 locations) following the merger of Phillips and Conoco. Before joining Phillips at the time of its acquisition of Tosco in September 2001, Mr. Nimbley served in various positions with Tosco and its subsidiaries starting in April 1993.

Qualifications:

Mr. Nimbley’s extensive experience in and knowledge of the refining industry, as well as his proven leadership skills and management experience provides the Board with valuable leadership and, for these reasons, PBF Energy Inc. believes Mr. Nimbley is a valuable member of its Board of Directors. | |

| Spencer Abraham | ||

Director

Age:66

Director Since: 2012

Committees: Compensation Committee (Chair)

Nominating and Corporate Governance Committee | Biography:

Mr. Abraham was a director of PBF LLC from August 2012 to February 2013 and a director of Holding from August 2012 to October 2012. He is the chairman of our Compensation Committee and a member of our Nominating and Corporate Governance Committee. Mr. Abraham is the Chief Executive Officer and Chairman of the international strategic consulting firm The Abraham Group, which he founded in 2005. Prior to starting The Abraham Group, Mr. Abraham served as Secretary of Energy under President George W. Bush from 2001 through January 2005, and was a U.S. Senator for the State of Michigan from 1995 to 2001. Prior to serving as a U.S. Senator, Mr. Abraham held various other public and private sector positions in the public policy arena. Mr. Abraham serves as a director of Occidental Petroleum Corporation, where he is a member of the Compensation Committee and the Corporate Governance, Nominating & Social Responsibility Committee; NRG Energy, Inc., where he is a member of the Compensation Committee; and Two Harbors, a publicly traded REIT, where he is a member of the Compensation Committee and the Governance Committee. He is the Chairman of the Board of Uranium Energy Corporation. He was previously a director of ICx Technologies,non-executive Chairman of Areva Inc. and a member of the board and compensation committee of C3 IoT. Mr. Abraham is a trustee of the California Institute of Technology.

Qualifications:

Mr. Abraham’s extensive political and financial experience in the energy sector, including as the Secretary of Energy of the United States, as a U.S. Senator and as a board member of various public companies in the oil and gas sector, provides him with unique and valuable insights into the industry in which we operate and the markets that we serve and, for these reasons, PBF Energy Inc. believes that Mr. Abraham is a valuable member of its Board of Directors. |

| 10 | 2019 Proxy Statement |  |

Proposal No. 1 – Election of Directors |

| Wayne Budd | ||

Director

Age:77

Director Since: 2014

Committees: Nominating and Corporate

Compensation Committee | Biography:

Mr. Wayne Budd has served as a director of PBF Energy Inc. since February 2014 and he has served as the chairman of our Nominating and Corporate Governance Committee since April 2014 and as a member of the Compensation Committee since May 2017. He has over 40 years of legal experience in the public and private sectors, and since 2004 is a Senior Counsel of Goodwin Procter LLP. Prior to that, Mr. Budd served as a Senior Executive Vice President and General Counsel and a Director of John Hancock Financial Services Inc. from 2000 to 2004. Mr. Budd served as Group President, New England, of Bell Atlantic Corporation (now Verizon Communications Inc.) from 1996 to 2000. He served as a Senior Partner at Goodwin Procter LLP from 1993 to 1996. Mr. Budd also served on the U.S. Sentencing Commission, from 1994 to 1997, which he was appointed to by President Bill Clinton. From 1992 to 1993, Mr. Budd served as an Associate Attorney General of the United States, overseeing the Civil Rights, Environmental, Tax, Civil and Anti-Trust Divisions at the Department of Justice, as well as the Bureau of Prisons. From 1989 to 1992, he was the United States Attorney for the District of Massachusetts. Mr. Budd previously served as a director of Tosco and Premcor and as a director of McKesson Corporation, where he was a member of the Audit and Governance Committees. He is the past Chairman of the National Board of the American Automobile Association and formerly served as a director of the American Automobile Association of Southern New England. Mr. Budd earned a bachelor’s degree from Boston College and a Juris Doctorate from Wayne State University Law School.

Qualifications:

Mr. Budd’s extensive legal experience and board membership with public entities, including in the refining sector, provides our Board with a beneficial perspective and insight and, for these reasons, PBF Energy Inc. believes Mr. Budd is a valuable member of its Board of Directors. | |

| S. Eugene Edwards | ||

Director

Age:62

Director Since: 2014

Committees: HS&E Committee (Chair)

Nominating and Corporate Governance Committee | Biography:

Mr. Edwards has served as a director of PBF Energy Inc. since July 2014, has been a member of our Nominating and Corporate Governance Committee since August 2014, a member of the HS&E Committee since December 2016 and Chairman of the HS&E Committee since January 1, 2018. He has over 35 years of experience in the energy and refining sectors. Most recently he retired from Valero Energy Corp. (“Valero”) in April of 2014 where he was Executive Vice President and Chief Development Officer. Mr. Edwards began his career with Valero as an Analyst in Planning and Economics in 1982 and then served as Director of Business Development; Director of Petrochemical Products; Vice President of Planning and Business Development; Senior Vice President of Supply, Marketing & Transportation; Senior Vice President of Planning, Business Development and Risk Management and as Senior Vice President of Product Supply and Trading. Prior to joining Valero, he was an energy analyst with Pace Consultants and a refinery process engineer with Citgo Petroleum Corporation. He previously served as a director of CST Brands Inc., aspin-off of Valero, from May to December 2013. Mr. Edwards has served as a director of Green Plains Energy since June 2014 and is a member of its Audit and Compensation Committees. He has also served as a director of Cross America Limited Partners from September 2014 through March 2017. Mr. Edwards earned a bachelor’s degree in Chemical Engineering from Tulane University and a Masters of Business Administration from the University of Texas at San Antonio.

Qualifications:

Mr. Edwards’ decades of experience in all aspects of the refining sector provides the Board with additional industry-specific knowledge from an individual deeply connected with the independent refining sector and, for these reasons, PBF Energy Inc. believes Mr. Edwards is a valuable member of its Board of Directors. |

| 2019 Proxy Statement | 11 |

| Proposal No. 1 – Election of Directors

| William E. Hantke | ||

Director

Age:71

Director Since: 2016

Committees: Audit Committee

Compensation Committee | Biography:

Mr. Hantkehas served as a director of PBF Energy Inc. since February 8, 2016 and has served on our Audit Committee since May 2016 and as a member of the Compensation Committee since May 2017. Prior to his retirement in 2005, he served as the Executive Vice President and Chief Financial Officer of Premcor, Inc. from 2002. Prior to his tenure at Premcor, Mr. Hantke served as the Corporate Vice President of Development of Tosco Corporation from 1999 to 2001. From 1993 to 1999, Mr. Hantke served as the Corporate Controller of Tosco, and from 1990 to 1993, he served as the Chief Financial Officer of Seminole Fertilizer Corporation, a wholly owned subsidiary of Tosco. Mr. Hantke has served as a director of NRG Energy since 2006 and is the chair of its audit committee and he was formerly a member of its compensation committee. He has previously served as a director of Texas Genco, LLC, Process Energy Solutions (where he wasnon-executive chairman) and a director and vice-chairman of NTR Acquisition Co., an oil refiningstart-up. Mr. Hantke has a bachelor’s degree in accounting from Fordham University.

Qualifications:

Mr. Hantke’s experience as a financial expert and board member of public entities including in the refining sector, provides our Board with a beneficial perspective and insight and, for these reasons, PBF Energy Inc. believes Mr. Hantke is a valuable member of its Board of Directors. | |

| Edward Kosnik | ||

Lead Director

Age:74

Director Since: 2013

Committees: Audit Committee (Chair)

| Biography:

Mr. Kosnikhas served as a director of PBF Energy since February 20, 2013. Since May 2016, Mr. Kosnik has served as the Chairman of our Audit Committee and our Lead Director. For almost 30 years, he worked in various fields including banking, insurance, real estate, technology, manufacturing and energy, holding positions that included Chairman, President and CEO, and CFO. Before his retirement in 2001, he most recently served in positions including President and Chief Executive Officer of Berwind Corporation, a diversified, industrial real estate and financial services company, from 1997 until 2001. Previously he served as Executive Vice President and CFO of Alexander and Alexander Inc. from 1994 to 1997 and as Chairman, President and CEO of JWP Inc. from 1992 to 1994. In addition, Mr. Kosnik has served on the boards and audit committees of Steelpath MLP Funds Trust from January 2010 to December 2012, Semgroup Energy Partners LP from July 2008 to November 2009, Premcor Inc. from November 2004 to September 2005, and Buckeye Partners LP from December 1986 to September 2007. Mr. Kosnik also served on Marquette University’s Board of Trustees and its audit committee from September 2006 to September 2009.

Qualifications:

Mr. Kosnik’s experience as a financial expert and board member of public entities including in the refining and logistics sectors, provides our Board with a beneficial perspective and insight and, for these reasons, PBF Energy Inc. believes Mr. Kosnik is a valuable member of its Board of Directors. |

| 12 | 2019 Proxy Statement |  |

Proposal No. 1 – Election of Directors |

| Robert J. Lavinia | ||

Director

Age:72

Director Since: 2016

Committees: HS&E Committee | Biography:

Mr. Laviniahas served as a director of PBF Energy Inc. since February 8, 2016 and currently serves on our HS&E Committee. He served as a member of the Compensation Committee until May 2017. He began his career in 1970 at the Gulf Oil Corporation as a licensed officer in the United States flag tanker fleet. He transferred to Gulf International Trading Company, and after several promotions, left Gulf in 1980 to work for Phibro Energy Corporation. In 1985, he took over as President and Chief Executive Officer of Hill Petroleum Company, Phibro’s refining division. In 1992, he joined Tosco Corporation. During his tenure at Tosco, the Company made several acquisitions to include British Petroleum Northwest, Circle K Company and Union 76 Products Company, all of which were integrated into the Tosco Marketing Company. He served as President of Tosco Marketing with over 6,000 gas and convenience stores in 32 states with more than 20,000 employees. He was also Senior Vice President of Tosco Corporation. From 2002 to 2006, he served on the board of Transcor SA, a Belgium-based company with trading operations around the world. From 2005-2006, he served as Chairman of Pasadena Refining, a Transcor subsidiary. In 2007, he joined Petroplus Holdings AG, the largest European independent refining and wholesale marketing company. Mr. Lavinia became the CEO in March 2008. In September 2009, he retired from Petroplus and was elected to remain a board member until 2012. Mr. Lavinia previously served on the Board of Big West Oil.

Qualifications: