Investor Presentation January 2018

2 Safe Harbor Statements This presentation contains forward-looking statements made by PBF Logistics LP (“PBFX”), PBF Energy Inc. (“PBF Energy” and together with PBFX, the “Companies”), PBF Holding Company LLC, and their subsidiaries, and their management teams. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Companies’ actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement and successful closing of any potential acquisitions and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; unforeseen liabilities associated with any acquisition; inability to successfully integrate any acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Companies assume no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date. See the Appendix for reconciliations of the differences between the non-GAAP financial measures used in this presentation, including various estimates of EBITDA, and their most directly comparable GAAP financial measures.

3 Over 90% of revenue supported by long-term, take- or-pay agreements No direct commodity price exposure Highly integrated assets Focused on movement and storage of refinery feedstocks and finished products Strong alignment with PBF Energy Financial Flexibility Long-term capital structure with ample liquidity for growth Solid growth potential Pipeline of organic projects Target independent assets that complement existing relationships Partner with PBF Energy to maximize value of embedded logistics assets PBF Logistics LP Overview

4 $10.2 $65.5 Revenue Growth Revenue Growth and Diversification Storage Transportation and Terminaling Storage Transportation and Terminaling 2014 Segment Revenue Current Segment Revenue

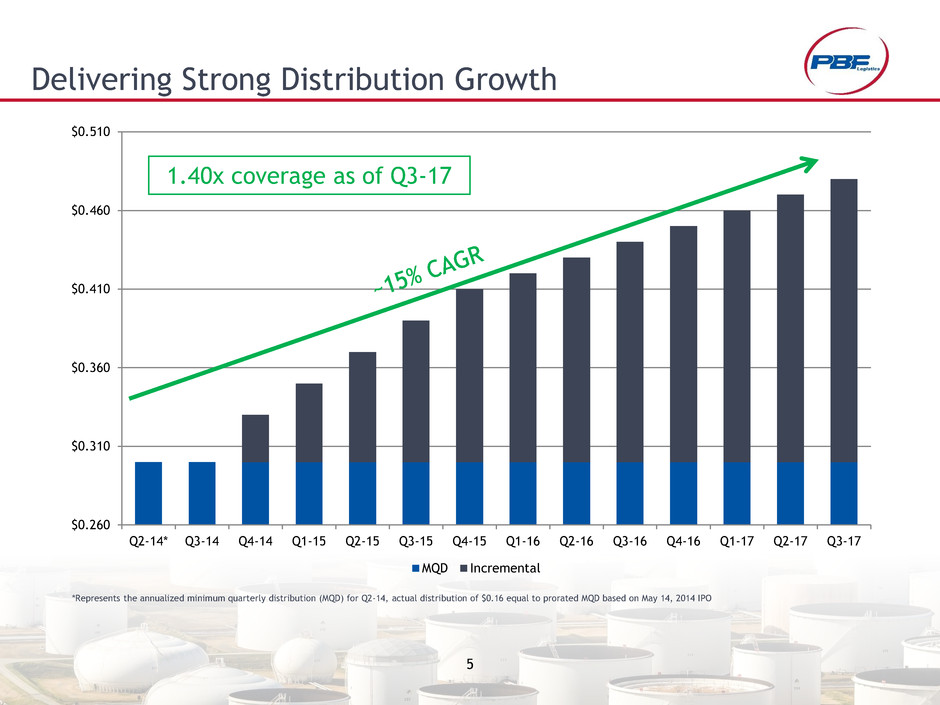

5 $0.260 $0.310 $0.360 $0.410 $0.460 $0.510 Q2-14* Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 MQD Incremental Delivering Strong Distribution Growth *Represents the annualized minimum quarterly distribution (MQD) for Q2-14, actual distribution of $0.16 equal to prorated MQD based on May 14, 2014 IPO 1.40x coverage as of Q3-17

6 PBFX Growing Asset Base is Ideally Situated PBFX is targeting logistics assets for feedstock movement and product distribution that complement its existing operations Developing organic growth opportunities to enhance asset base and diversify revenue streams Strategic third-party acquisitions allow PBF Logistics to independently grow its revenue base Drop-downs from PBF Energy, as it grows, remain a valuable source of future growth Mid-Continent Assets Toledo Storage Facility Toledo LPG Truck Rack Toledo Truck Terminal Toledo Terminal East Coast Assets Paulsboro NG Pipeline East Coast Terminals DC Products Pipeline DC Truck Rack (Products) DC Truck Rack (LPG) DC Rail Terminal DC West Rack Paulsboro Toledo Chalmette Torrance PADD 2 PADD 3 PADD 5 Delaware City PADD 4 PADD 1 West Coast Assets Torrance Valley Pipeline Gulf Coast Assets Chalmette Storage Facility

7 Organic Projects Deliver Incremental Growth Two organic projects Total project costs of ~$82 million Expected to contribute ~$12 million in annualized EBITDA 625,000 barrel crude oil storage tank being constructed at PBF Energy’s Chalmette Refinery In service as of November 1, 2017 24-inch Paulsboro natural gas pipeline (“PNGPL”) will connect PBF Energy’s Paulsboro Refinery to natural gas sourced from Marcellus and Utica regions In-service as of August 2017

8 Third-party transactions diversify PBFX asset and customer base Provide synergy opportunities with PBF Energy Extends PBF Logistics growth path by supplementing drop-down inventory Acquired the East Coast Terminals from Plains All American in April 2016 at a pro forma EBITDA multiple of ~7x Purchase price of $100 million, plus an upfront capital investment of ~$5 million Acquired the Toledo Terminal from Sunoco Logistics in April 2017 at a pro forma EBITDA multiple of less than ~3x Purchase price of $10 million, with approximately ~$1 million of additional capital investment Directly linked to and supplied by PBF Energy’s Toledo Refinery Third-Party Acquisitions Expand Asset Base

9 Drop-down transactions remain one of the pillars of PBF Logistics future growth trajectory Completed acquisition of a controlling 50% interest in the Torrance Valley Pipeline Company LLC (“TVPC”) from PBF Energy at a pro forma EBITDA multiple of ~8.75x Purchase price of ~$175 million partially financed through a successful ~$80 million public equity offering Primary crude gathering and transportation lines that feed PBF Energy’s Torrance Refinery TVPC owns: 189-mile San Joaquin Valley Pipeline system with a throughput capacity of approximately 110,000 barrels per day 11 pipeline stations positioned between Belridge and the Torrance Refinery with heavy crude heating, pumping and storage capabilities Torrance Valley Pipeline Drop-Down Acquisition

10 PBF's core strategy is to operate safely and responsibly and grow and diversify through acquisitions Fifth largest and second most complex independent refiner in the United States Diversified asset base with five refineries and 884,000 barrels per day of processing capacity PBF indirectly owns 100% of the general partner and ~44% of the limited partner interests of PBF Logistics LP (NYSE: PBFX), and 100% of the PBFX incentive distribution rights (“IDRs”) Region Throughput Capacity (bpd) Nelson Complexity Mid-continent 170,000 9.2 East Coast 370,000 12.2 Gulf Coast 189,000 12.7 West Coast 155,000 14.9 Total 884,000 12.2 Paulsboro Toledo Chalmette Torrance PADD 2 PADD 3 PADD 5 Delaware City PADD 4 PADD 1 PBF Energy as Sponsor

11 Strong Connection with PBF Energy Fee-based, long-term contracts provide PBFX with stable earnings Conservative financial profile with strong liquidity provides flexibility to grow Demonstrated access to capital markets Experienced management team Focused on safety and operational excellence PBFX’s assets are integrated with PBF’s refineries Strategic Midstream growth is a key component of PBF’s strategy PBF owns ~44% of PBF Logistics and 100% of the GP PBFX provides PBF with an additional growth vehicle to enhance investor returns Financial Operational

12 PBFX’s Investment Highlights Focus on Stable, Take-or-Pay Business Maintain stable cash flow generation through predominantly long-term contracts with minimum volume commitments Commitment to safe and reliable operations No direct commodity price exposure Target 1.15x annual coverage ratio Financial flexibility for continued distribution growth Maintain attractive long-term distribution growth rate Financial Flexibility Distributable Cash Flow Grow the Business Pursue third-party acquisitions focused on traditional MLP assets Invest in organic projects and asset optimization Support growth of PBF through additional drop-down transactions Conservative financial profile with an emphasis on liquidity Demonstrated ability to access capital markets Long-term net debt-to-EBITDA target of between 3x and 4x

Appendix

14 PBFX 2018 Initial Guidance Initial guidance provided constitutes forward-looking information and is based on current PBF Logistics operating plans using minimum volume commitments, assumptions and configuration. Revenues, operating expenses, general and administrative expenses, depreciation and amortization and interest expense figures include amounts related to the portion of the Torrance Valley Pipeline Company that are currently owned by a subsidiary of PBF Energy Inc. These amounts are consolidated in the PBF Logistics financial statements and the ownership interest of PBF Energy is reflected in non-controlling Interest. All figures are subject to change based on market and macroeconomic factors, as well as management’s strategic decision-making and overall Partnership performance. ($ in millions) FY 2018 Initial Guidance Revenues $276.2 Operating expenses $86.5 SG&A (includes stock-based comp. expense for outstanding awards) $16.2 D&A $26.0 Interest expense, net $39.4 Net Income $108.1 EBITDA attributable to non-controlling interest $22.7 EBITDA to the Partnership $150.8 Maintenance capital expenditures $11.0 Regulatory capital expenditures $5.9 Units outstanding(1) 42.5 million ___________________________ 1. Units outstanding at 12/31/2017 represents the fully-diluted number of units issued during the IPO, subsequent transactions and under partnership compensation programs

15 Non-GAAP Financial Measures The Partnership defines EBITDA as net income (loss) before net interest expense, income tax expense, depreciation and amortization expense. We define EBITDA attributable to PBFX as net income (loss) attributable to PBFX before net interest expense, income tax expense, depreciation and amortization expense attributable to PBFX, which excludes the results attributable to noncontrolling interests and acquisitions from affiliate companies under common control prior to the effective dates of such transactions. EBITDA is a non-GAAP supplemental financial measure that management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, may use to assess: • our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or financing methods; • the ability of our assets to generate sufficient cash flow to make distributions to our unit holders; • our ability to incur and service debt and fund capital expenditures; and • the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. The Partnership’s management believes that the presentation of EBITDA and EBITDA attributable to PBFX provides useful information to investors in assessing our financial condition and results of operations. These measures should not be considered an alternative to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with GAAP. EBITDA has important limitations as an analytical tool because it excludes some but not all items that affect net income. Additionally, because EBITDA may be defined differently by other companies in our industry, our definition of EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. Due to the forward-looking nature of forecasted EBITDA, information to reconcile forecasted EBITDA to forecasted cash flow from operating activities is not available as management is unable to project working capital changes for future periods at this time. Management also utilizes net debt as a metric in assessing our leverage. Net debt is a non-GAAP measure calculated by subtracting cash and cash equivalents and marketable securities from total debt, including our affiliate note payable. We believe this measurement is also useful to investors since our marketable securities fully collateralize our Term Loan and we have the ability to and may decide to use a portion of our cash and cash equivalents to retire or pay down our debt. This non-GAAP financial measure should not be considered in isolation or as a substitute for analysis of our debt levels as reported under U.S. GAAP. Our definition of net debt may not be comparable to similarly titled measures of other partnerships, because it may be defined differently by other partnerships in our industry, thereby limiting its utility.

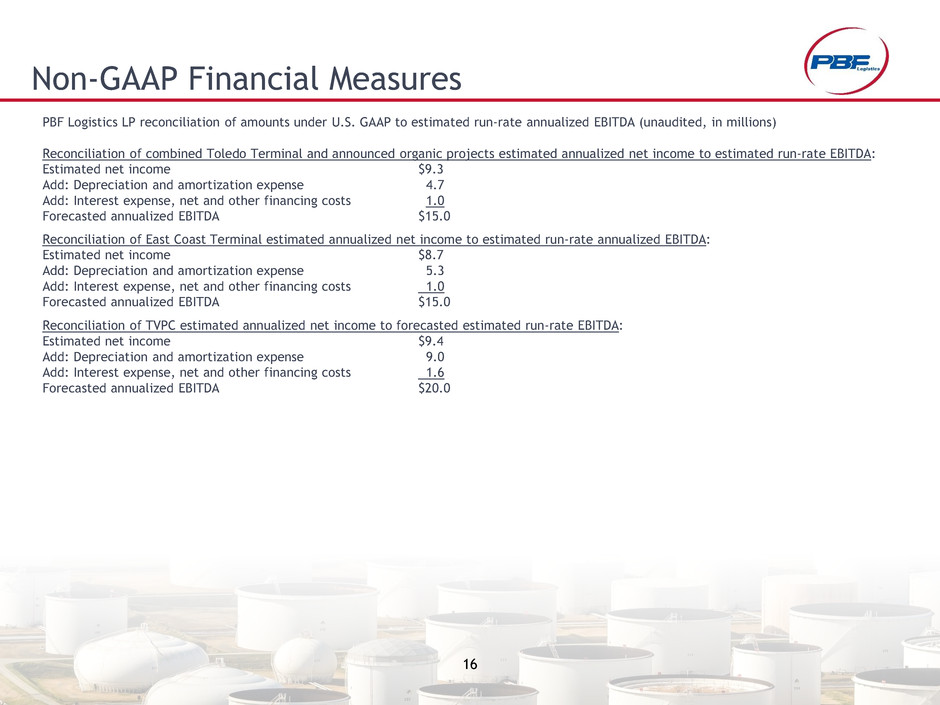

16 Non-GAAP Financial Measures PBF Logistics LP reconciliation of amounts under U.S. GAAP to estimated run-rate annualized EBITDA (unaudited, in millions) Reconciliation of combined Toledo Terminal and announced organic projects estimated annualized net income to estimated run-rate EBITDA: Estimated net income $9.3 Add: Depreciation and amortization expense 4.7 Add: Interest expense, net and other financing costs 1.0 Forecasted annualized EBITDA $15.0 Reconciliation of East Coast Terminal estimated annualized net income to estimated run-rate annualized EBITDA: Estimated net income $8.7 Add: Depreciation and amortization expense 5.3 Add: Interest expense, net and other financing costs 1.0 Forecasted annualized EBITDA $15.0 Reconciliation of TVPC estimated annualized net income to forecasted estimated run-rate EBITDA: Estimated net income $9.4 Add: Depreciation and amortization expense 9.0 Add: Interest expense, net and other financing costs 1.6 Forecasted annualized EBITDA $20.0

17 Segment Assets Transportation and Terminaling Capacity Products Handled DCR Rail Terminal 130,000 bpd unloading capacity Crude Toledo Truck Terminal 22,500 bpd unloading capacity Crude DCR West Rack 40,000 bpd throughput capacity Crude Toledo Storage Facility - loading facility 11,000 bpd throughput capacity Propane Delaware City Products Pipeline 125,000 bpd pipeline capacity Petroleum products Delaware City Truck Rack 76,000 bpd throughput capacity Gasoline, distillates and LPGs East Coast Terminals ~4.2 million barrel aggregate shell capacity Refined products Torrance Valley Pipeline 110,000 bpd pipeline capacity Crude Toledo Terminal 10-bay truck rack and ~110,000 barrels of storage Petroleum products Paulsboro Natural Gas Pipeline 60,000 dthpd 24” natural gas pipeline Natural gas Storage Capacity Products Handled Toledo Storage Facility ~3.9 million barrel aggregate shell capacity (a) Crude, refined products and intermediates Chalmette Storage Tank 625,000 barrel shell capacity Crude (a) Of the approximately 3.9 million barrel aggregate shell capacity, approximately 1.3 million barrels are dedicated to crude and approximately 2.6 million barrels are allocated to refined products and intermediates

18 Commercial Agreements with PBF Energy (a) PBF Holding has the option to extend the agreements for up to two additional five-year terms (b) The Toledo Storage Facility Storage and Terminaling Services Agreement- Terminaling Facility and the Toledo Storage Facility Storage and Terminaling Services Agreement- Storage Facility are referred to herein collectively as the “Toledo Storage Facility Storage and Terminaling Services Agreement” (c) The Delaware City Truck Loading Services Agreement- Gasoline and the Delaware City Truck Loading Services Agreement- LPGs are referred to herein collectively as the “Delaware City Truck Loading Services Agreement” (d) Reflects the overall capacity of the storage facility. The storage MVC is subject to effective operating capacity of each tank which can be impacted by routine tank maintenance and other factors (e) Maximum daily quantity of 60,000 dekatherm per day Service Agreements Initiation Date Initial Term Renewals (a) MVC Transportation and Terminaling Delaware City Rail Terminaling Services Agreement 5/8/2014 7 years, 8 months 2 x 5 85,000 bpd Toledo Truck Unloading & Terminaling Services Agreement 5/8/2014 7 years, 8 months 2 x 5 5,500 bpd Delaware West Ladder Rack Terminaling Services Agreement 10/1/2014 7 years, 3 months 2 x 5 40,000 bpd Toledo Storage Facility Storage and Terminaling Services Agreement- Terminaling Facility (b) 12/12/2014 10 years 2 x 5 4,400 bpd Delaware Pipeline Services Agreement 5/15/2015 10 years, 8 months 2 x 5 50,000 bpd Delaware Pipeline Services Agreement- Magellan Connection 11/1/2016 2 years, 5 months N/A 14,500 bpd Delaware City Truck Loading Services Agreement- Gasoline (c) 5/15/2015 10 years, 8 months 2 x 5 30,000 bpd Delaware City Truck Loading Services Agreement- LPGs (c) 5/15/2015 10 years, 8 months 2 x 5 5,000 bpd Torrance Valley Pipeline Transportation Services Agreement- North Pipeline 8/31/2016 10 years 2 x 5 50,000 bpd Torrance Valley Pipeline Transportation Services Agreement- South Pipeline 8/31/2016 10 years 2 x 5 70,000 bpd Torrance Valley Pipeline Transportation Services Agreement- Midway Storage Tank 8/31/2016 10 years 2 x 5 55,000 barrels (d) Torrance Valley Pipeline Transportation Services Agreement- Emido Storage Tank 8/31/2016 10 years 2 x 5 900,000 barrels per month Torrance Valley Pipeline Transportation Services Agreement- Belridge Storage Tank 8/31/2016 10 years 2 x 5 770,000 barrels per month Paulsboro Natural Gas Pipeline Services Agreement 8/3/2017 15 years Evergreen Note (e) Toledo Terminal Services Agreement 5/1/2016 1 year Evergreen N/A Storage Toledo Storage Facility Storage and Terminaling Services Agreement- Storage Facility (b) 12/12/2014 10 years 2 x 5 3,849,271 barrels (d) Chalmette Storage Agreement 2/15/2017 10 years 2 x 5 625,000 barrels