The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where an offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus Supplement Dated May 16, 2023

Filed Pursuant to Rule 424(b)(7)

Registration No. 333-271980

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated May 16, 2023)

2,000,000 Ordinary Shares

Tecnoglass Inc.

ENERGY HOLDING CORPORATION, the selling securityholder identified in this prospectus supplement, is offering 2,000,000 ordinary shares, par value $0.0001, par value per share, or the ordinary shares, of Tecnoglass Inc. We will not receive any proceeds from the ordinary shares sold by the selling securityholder. The underwriters may also exercise an option to purchase up to an additional 300,000 ordinary shares from the selling securityholder. This option is exercisable for a period of 30 days after the date of this prospectus supplement. See the section of this prospectus supplement entitled “Underwriting” for further information.

Our ordinary shares are listed on the New York Stock Exchange, or NYSE, under the symbol “TGLS.” On May 15, 2023, the last reported sales price of our ordinary shares, as reported by the NYSE, was $48.36 per share.

Investing in the ordinary shares involves risks that are described in the “Risk Factors” section beginning on page S-14 of this prospectus supplement and on page 2 of the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the prospectus to which it relates. Any representation to the contrary is a criminal offense.

| | | Per Share | | | Total | |

| Public offering price | | $ | | | | $ | | |

| Underwriting discounts and commissions(1) | | $ | | | | $ | | |

| Proceeds to the selling securityholder, before expenses | | $ | | | | $ | | |

| (1) | See “Underwriting” for additional information regarding the underwriting discounts and commissions and certain expenses payable to the underwriters, which will be paid by the selling securityholder. |

The underwriters expect to deliver the ordinary shares to purchasers on or about May __, 2023.

| | Joint Book-Running Managers | |

| | | |

| Baird | Raymond James | Stifel |

| | | |

| | | |

The date of this prospectus supplement is May __, 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are a part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act, using a “shelf” registration process. Under this “shelf” registration process, we or any selling securityholder may, from time to time, as applicable, sell or issue any of the combination of securities described in the accompanying prospectus in one or more offerings. The accompanying prospectus provides you with a general description of us and the securities we may offer, some of which do not apply to this offering. Each time we sell securities, we provide a prospectus supplement that contains specific information about the terms of that offering. A prospectus supplement may also add, update or change information contained in the accompanying prospectus.

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part is the accompanying prospectus, which describes more general information, some of which may not apply to this offering. If there is any inconsistency between the information in the accompanying prospectus and this prospectus supplement, you should rely on this prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus supplement and the accompanying prospectus, together with the documents incorporated by reference and the additional information described under the heading “Information Incorporated by Reference.”

Neither we, the selling securityholder nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus supplement, the accompanying prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, nor the selling securityholder nor the underwriters take any responsibility for or provide any assurance as to the reliability of any other information that others may give you. The selling securityholder and the underwriters are offering to sell the ordinary shares and seeking offers to buy the ordinary shares only in jurisdictions where such offers and sales are permitted.

The information contained in this prospectus supplement and the accompanying prospectus is accurate only as of the date on the front of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or any sale of our ordinary shares. Our business, financial condition, results of operations and prospects may have changed since that date. This prospectus supplement and the accompanying prospectus incorporate by reference, and any related free writing prospectus may contain or incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. See “Market and Industry Data”.

TRADEMARKS

Our registered trademarks include El Poder de la Calidad, Energia Solar, Tecnoglass, Alutions, Eswindows, Tecnobend, Tecnoair, Tecnosmart, ECOMAX by ESWINDOWS, ESWINDOWS Interiors, ESW Windows and Walls, Solartec by Tecnoglass, Prestige by ESWINDOWS, Eli by ESWINDOWS, Alessia by ESWINDOWS, Elite Line by ESWindows, ULTRAVIEW by Tecnoglass, and MULTIMAX by ESWIDOWS. Solely for our convenience, trademarks and trade names referred to in this prospectus supplement may appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name, or service mark of any other company appearing in this prospectus supplement is the property of its respective holder.

NON-GAAP FINANCIAL MEASURES

We prepare our audited financial statements on a yearly basis and quarterly unaudited financial statements, each in accordance with accounting principles generally accepted in the United States (“GAAP”). In accordance with Regulation G, we also disclose and discuss certain non-GAAP financial measures. Currently, the non-GAAP financial measures that we disclose are Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted Net Income Margin.

Adjusted EBITDA is calculated by adding net income (loss), income (loss) attributable to non-controlling interest, income taxes, interest expense, depreciation and amortization, extinguishment of debt, certain non-recurring expenses and foreign currency transaction losses (gains), as further adjusted for the other line items reflected in the reconciliation table set forth in footnote 2 of “Prospectus Supplement Summary—Summary Historical Consolidated Financial Data”. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by our net revenues.

Adjusted Net Income is calculated by adding net income (loss), income (loss) attributable to non-controlling interest, foreign currency transaction losses (gains), cashless deferred cost of financing, loss (gain) from change in fair value of warrant liability, certain non-recurring expenses and the tax impact of adjustments at statutory rates, as further adjusted for the other line items reflected in the reconciliation table set forth in footnote 3 of “Prospectus Supplement Summary—Summary Historical Consolidated Financial Data”. Adjusted Net Income Margin is calculated by dividing Adjusted Net Income by our net revenues.

Our use of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, and Adjusted Net Income Margin may not be comparable to similarly titled measures reported by other companies because not all companies and analysts calculate these metrics in the same manner. Also, in the future, we may disclose different non-GAAP financial measures in order to help our investors more meaningfully evaluate and compare our future results of operations to our previously reported results of operations.

We believe that the GAAP financial measure most directly comparable to Adjusted EBITDA and Adjusted Net Income is net income. In calculating Adjusted EBITDA and Adjusted Net Income, we exclude from net income the financial items that we believe should be separately identified to provide additional analysis of the financial components of the day-to-day operation of our business. We have outlined below the type and scope of these exclusions and the material limitations on the use of these non-GAAP financial measures as a result of these exclusions. Adjusted EBITDA and Adjusted Net Income are not measurements of financial performance under GAAP and should not be considered as a measure of liquidity, as an alternative to net income (loss), operating income, or as an indicator of any other measure of performance derived in accordance with GAAP. In addition, we urge investors and potential investors in our securities to carefully review the reconciliation of each of Adjusted EBITDA and Adjusted Net Income to net income set forth in footnotes 2 and 3 of “Prospectus Supplement Summary—Summary Historical Consolidated Financial Data”.

Adjusted EBITDA and Adjusted Net Income are used by management to internally measure our operating and management performance and by investors as a supplemental financial measure to evaluate the performance of our business that, when viewed with our GAAP results and the accompanying reconciliation, we believe provides additional information that is useful to gain an understanding of the factors and trends affecting our business. We believe the disclosure of Adjusted EBITDA and Adjusted Net Income helps investors meaningfully evaluate and compare our performance from quarter to quarter and from year to year. We also believe Adjusted EBITDA and Adjusted Net Income are measures of our ongoing operating performance because the isolation of non-cash charges, such as depreciation and amortization, and non-operating items, such as interest and income taxes, provides additional information about our cost structure, and, over time, helps track our operating progress. However, we believe these adjustments are appropriate because the amounts recognized can vary significantly from period to period, do not directly relate to the ongoing operations of our business and complicate comparisons of our internal operating results and operating results of other peer companies over time. In evaluating Adjusted EBITDA and Adjusted Net Income, you should be aware that in the future we may incur expenses such as those used in calculating Adjusted EBITDA and Adjusted Net Income in the future. In addition, investors, securities analysts and others have regularly relied on Adjusted EBITDA and Adjusted Net Income to provide a financial measure by which to compare our operating performance against that of other companies in our industry.

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted Net Income Margin have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of these limitations include:

| | ● | they do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments or foreign exchange gain/loss; |

| | ● | they do not reflect changes in, or cash requirements for, working capital; |

| | ● | they do not reflect significant interest expense or the cash requirements necessary to service interest or principal payments on our outstanding debt; |

| | ● | they do not reflect payments made or future requirements for income taxes; and |

| | ● | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced or paid in the future and Adjusted EBITDA and Adjusted EBITDA Margin do not reflect cash requirements for such replacements or payments. |

Investors are encouraged to evaluate each adjustment and the reasons we consider it appropriate for supplemental analysis.

Management compensates for the above-described limitations of using non-GAAP measures by using non-GAAP measures only to supplement our GAAP results and to provide additional information that is useful to gain an understanding of the factors and trends affecting our business. See our historical consolidated financial statements included and incorporated elsewhere in this prospectus supplement for our GAAP results.

MARKET AND INDUSTRY DATA

In this prospectus supplement and the accompanying prospectus, we refer to information and statistics regarding our industry, the size of certain markets and our position within the sectors in which we compete. Some of the market and industry data contained in this prospectus supplement and the accompanying prospectus is based on independent industry and trade publications or other publicly available information, or information published by our customers, that we believe to be reliable sources, while other information is based on our good-faith estimates, which are derived from our review of internal surveys, as well as independent sources listed in this prospectus supplement or the accompanying prospectus and the knowledge and experience of our management in the markets in which we operate. The estimates contained in this prospectus supplement and the accompanying prospectus have also been based on information obtained from our customers, suppliers and other contacts in the markets in which we operate. Although we believe that these independent sources and internal data are reliable as of their respective dates, the information contained in them has not been independently verified from the data obtained from our external sources, we cannot assure you as to the accuracy or completeness of this information and we have not sought consent to refer to these reports. As a result, you should be aware that the market and industry data and the market share estimates set forth in this prospectus supplement and the accompanying prospectus, and beliefs and estimates based thereon, may not be reliable. In addition, the market and industry data and forecasts are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus supplement and the accompanying prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus supplement and the accompanying prospectus. Accordingly, investors should not place undue reliance on this information.

Finally, we have made rounding adjustments to reach some of the figures included in this prospectus supplement and the accompanying prospectus for ease of presentation. As a result, amounts shown as totals in some tables may not be arithmetic aggregations of the amounts that precede them.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement contains statements that are forward-looking statements within the meaning of the federal securities laws, including statements about our expectations, beliefs, intentions and strategies for the future. We have identified some of these forward-looking statements with words such as “anticipate,” “believe,” “expect,” “project,” “plan,” “estimate,” “may,” “will,” “should” and “intend” and the negative of these words or other comparable terminology.

These forward-looking statements are primarily based on current expectations and projections about future events and financial trends that affect, or may affect, our business, financial condition, results of operations, liquidity and prospects, and include, without limitation, statements regarding our expectations and estimates concerning our future financial performance. These forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties that could cause our actual results to differ materially from results anticipated in these forward-looking statements. Although we believe that these forward-looking statements are based upon reasonable assumptions, because of these uncertainties, prospective investors should not rely on these forward-looking statements. Most of these factors are outside of our control and are difficult to predict or anticipate. As further discussed under “Risk Factors,” important factors that could cause actual results to differ materially from the forward-looking statements include but are not limited to:

Risks Related to Our Business Operations

| | ● | We operate in competitive markets and our business could suffer if we are unable to adequately address potential downward pricing pressures and other factors that may reduce operating margins. |

| | ● | Failure to maintain the performance, reliability and quality standards required by our customers could have a materially negative impact on our financial condition and results of operations. |

| | ● | The volatility of the cost of raw materials used to produce our products could materially adversely affect the results of our operations in the future. |

| | ● | We rely on third-party suppliers for raw materials and third-party transportation, each of which subjects us to risks and costs that we cannot control, and which risks and costs may materially adversely affect our operations. |

| | ● | We may not realize the anticipated benefit through our joint venture with Saint-Gobain and the planned construction of a new plant as part of the joint venture may not be completed as planned. |

| | ● | Our success depends upon our ability to develop new products and services, integrate acquired products and services and enhance existing products and services through product development initiatives and technological advances; any failure to make such improvements could harm our future business and prospects. |

| | ● | The homebuilding industry and the home repair and remodeling sector are regulated and any increased regulatory restrictions or changes in building codes could negatively affect our sales and results of operations. |

| | ● | Changes in building codes could lower the demand for our impact-resistant windows and doors. |

| | ● | Equipment failures, delays in deliveries and catastrophic loss at our manufacturing facility could lead to production curtailments or shutdowns that prevent us from producing our products. |

| | ● | Our reliance on a single facility subjects us to concentrated risks. |

| | ● | Customer concentration and related credit, commercial and legal risk may adversely impact our future earnings and cash flows. |

| | ● | If new construction levels and repair and remodeling markets decline, such market pressures could negatively affect the results of our operations. |

| | ● | Our business involves complex manufacturing processes that may cause personal injury or property damage, subjecting us to liabilities, possible losses and other disruptions of our operations in the future, which may not be covered by insurance. |

| | ● | The nature of our business exposes each of our subsidiaries to product liability and warranty claims that, if adversely determined, could negatively affect our financial condition and results of operations and the confidence of customers in our products. |

| | ● | We are subject to potential exposure to environmental liabilities and are subject to environmental regulation and any such liabilities or regulation may negatively affect our costs and results of operations in the future. |

| | ● | Weather can materially affect our business and we are subject to seasonality. |

| | ● | Our results of operations could be significantly affected by foreign currency fluctuations and currency regulations. |

| | ● | We are dependent on certain key personnel, the loss of whom could materially affect our financial performance and prospects in the future. |

| | ● | Certain of our officers and directors have been involved in litigation, investigations or other proceedings and may be so again in the future, and the defense or prosecution of such matters could be time-consuming and could divert our management’s attention and may have an adverse effect on us. |

| | ● | We have entered into significant transactions with affiliates or other related parties, which may result in conflicts of interest. |

| | ● | The interests of our controlling shareholders could differ from the interests of our other shareholders. |

| | ● | We conduct all of our operations through our subsidiaries, will rely on payments from our subsidiaries to meet all of our obligations and may fail to meet our obligations if our subsidiaries are unable to make payments to us. |

| | ● | Our indebtedness could adversely affect our financial health and prevent us from fulfilling our obligations. |

Risks Related to Colombia and Other Countries Where We Operate

| | ● | Our operations are located in Colombia, which may make it more difficult for U.S. investors to understand and predict how changing market and economic conditions will affect our financial results. It also may be difficult or impossible to enforce judgments of courts of the United States and other jurisdictions against our Colombian subsidiaries or any of their directors, officers and controlling persons. |

| | ● | Economic and political conditions in Colombia may have an adverse effect on our financial condition and results of operations. |

| | ● | The Colombian Government and the Central Bank exercise significant influence on the Colombian economy. |

| | ● | Factors such as Colombia’s growing public debt and fluctuating exchange rates could adversely affect the Colombian economy. |

| | ● | Economic instability in Colombia could negatively affect our ability to sell our products. |

| | ● | Government policies and actions and judicial decisions in Colombia could significantly affect the results of our operations and financial condition in the future. |

| | ● | We are dependent on sales to customers outside Colombia and any failure to make these sales may adversely affect our operating results in the future. |

Risks Related to Us and Our Securities

| | ● | Because we are incorporated under the laws of the Cayman Islands, you may face difficulties in protecting your interests and your ability to protect your rights through the U.S. Federal courts may be limited. |

| | ● | If we fail to maintain proper and effective internal controls, our ability to produce accurate financial statements could be impaired, which could adversely affect our business. |

| | ● | Anti-takeover provisions in our memorandum and articles of association and Cayman Islands law may discourage or prevent a change of control, even if an acquisition would be beneficial to our shareholders, which could depress the price of our ordinary shares and prevent attempts by our shareholders to replace or remove our current management. |

| | ● | We are a “controlled company,” controlled by the selling securityholder, ENERGY HOLDING CORPORATION, whose interest in our business may be different from ours or yours. |

| | ● | We cannot assure you that we will continue to pay dividends on our ordinary shares, and our indebtedness, future investments or cashflow generation could limit our ability to continue to pay dividends on our ordinary shares. |

| | ● | We have in the past and may in the future be subject to short selling strategies which could affect the trading price of our ordinary shares. |

| | ● | If a United States person is treated as owning at least 10% of the value or voting power of our shares, such holder may be subject to adverse U.S. federal income tax consequences. |

Risks Related to this Offering

| | ● | The selling securityholder’s sale of our ordinary shares in this offering could adversely affect the trading price of our ordinary shares. |

| | | |

| | ● | There may be future dilution of our ordinary shares, which could adversely affect the market price of our ordinary shares. |

We cannot assure you that these forward-looking statements, estimates, assumptions or intentions will prove to be correct or that the information, interpretations and understandings on which they are based will prove to be valid. Our actual results may depend on factors beyond our control.

We base our forward-looking statements on information currently available to us, and, except as required by law, we undertake no obligation to update these statements, whether as a result of changes in underlying factors, new information, future events or other developments. We do not, nor does any other person, assume responsibility for the accuracy and completeness of those statements. All of the forward-looking statements are qualified in their entirety by reference to the factors discussed above as well as those discussed under “Risk Factors.”

We undertake no obligation to release publicly any revisions to such forward-looking statements after completion of this offering to reflect later events or circumstances or to reflect the occurrence of unanticipated events even if new information, future events or other circumstances have made them incorrect or misleading. In light of the risks and uncertainties underlying these forward-looking statements, there can be no assurance that the events described or implied in the forward-looking statements contained in this prospectus supplement will in fact transpire. Accordingly, investors are cautioned not to place undue reliance on these forward-looking statements.

DISCLOSURE REGARDING FOREIGN EXCHANGE CONTROLS AND EXCHANGE RATES IN COLOMBIA

Since September 1999, the Central Bank of Colombia has allowed the Colombian peso to float freely, intervening only when there are steep variations in the Colombian peso’s value relative to the U.S. dollar. This intervention mechanism is only used to prevent undesirable fluctuations in the exchange rate and to accumulate or reduce the amount of the international reserves, in accordance with guidelines set forth by the Colombian Central Bank’s board of directors. The Colombian Superintendence of Finance, or SFC, calculates the representative market rate based on the weighted averages of the buy/sell foreign exchange rates quoted daily by certain financial institutions for the purchase and sale of foreign currency. Although the Colombian peso is allowed to float freely, the Central Bank of Colombia is authorized to intervene in the exchange market through the following mechanisms: buying and selling foreign currencies in the spot market or through call or put options at market rates through an auction process and selling foreign currencies through swap agreements through an auction process at the rates determined by the Central Bank.

The general principles of Colombia’s foreign exchange and international investment regulations are contained in Law 9 of 1991 (as amended from time to time), Decree 1068 of 2015, External Resolution 1 of 2018 from the Board of Directors of the Colombian Central Bank and External Circular DCIP – 83 of August 27, 2021, of the Central Bank. Law 9 of 1991 and External Resolution 1 of 2018 established two types of markets for foreign currency exchange: (1) the free market, which consists of all foreign currencies originated in sales of services, donations, remittances and all other inflows or outflows that do not need to be mandatorily channeled through the FX market (as defined below), and (2) the controlled market, or the FX market, which consists of (a) all foreign currencies originated in operations considered to be operations of the FX market, which may only be transacted through FX intermediaries (as defined below) or registered compensation accounts, or (b) foreign currencies voluntarily channeled through the FX market. Compensation accounts are accounts opened abroad by Colombian residents (individuals and legal entities), which are registered with the Central Bank in order to channel foreign currency originated in controlled operations of the FX market or to receive and/or pay in foreign currencies transactions between Colombian residents (individuals and legal entities).

Under Colombian foreign exchange regulations, FX intermediaries are entities authorized to enter into foreign exchange transactions to convert Colombian pesos into foreign currencies or foreign currencies into Colombian pesos. In addition, there are certain requirements and obligations established by Colombian law and by the board of directors of the Central Bank in order to transfer currency into or out of Colombia.

The Colombian government and the Central Bank of Colombia may also limit the remittance of dividends and/or investments of foreign currency received by Colombian residents whenever the international reserves fall below an amount equal to three months of imports or may impose certain mandatory deposit requirements in connection with foreign-currency denominated loans obtained by Colombian residents.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights selected information contained elsewhere in this prospectus supplement. Because this is only a summary, it does not contain all of the information you should consider before investing in our ordinary shares. You should carefully read the entire prospectus supplement and the accompanying prospectus, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as our consolidated financial statements and related notes included and incorporated elsewhere in this prospectus supplement, and the documents incorporated by reference herein, before making an investment decision.

Some of the statements in this prospectus supplement constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in “Risk Factors” and other sections of this prospectus supplement.

Unless otherwise stated in this prospectus supplement, references to Tecnoglass, our company, we, us, our, and similar references refer to Tecnoglass Inc. and its subsidiaries. References to TG are to Tecnoglass S.A.S. References to ES are to C.I. Energía Solar S.A.S E.S. Windows1. References to ESW are to ES Windows LLC. References to GM&P are to Giovanni Monti and Partners Consulting and Glazing Contractors, Inc.

Our Company

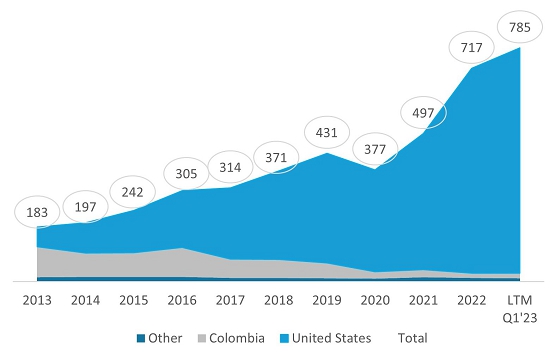

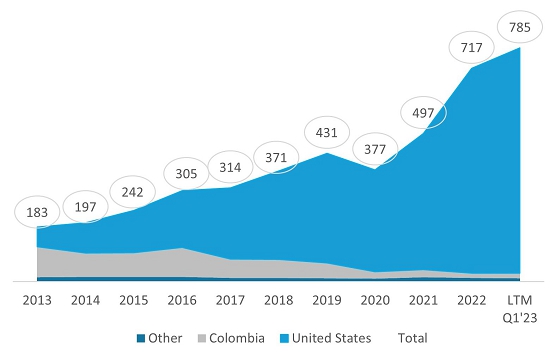

Tecnoglass is a leading vertically-integrated manufacturer, supplier and installer of architectural glass, windows, and associated aluminum products for the global commercial and residential construction industries. Tecnoglass was rated the third largest glass fabricator in 2022 by Glass Magazine. Headquartered in Barranquilla, Colombia, the company operates out of a 4.1 million square foot vertically-integrated, state-of-the-art manufacturing complex that provides easy access to the Americas, the Caribbean, and the Pacific. Tecnoglass supplies nearly 1,000 customers in North, Central and South America, with the United States accounting for 96% of total revenues. Tecnoglass’s tailored, high-end products are found on some of the world’s most distinctive properties, including One Thousand Museum (Miami), Paramount Miami Worldcenter (Miami), Hub50House (Boston), Via 57 West (New York), AE’O Tower (Honolulu), Salesforce Tower (San Francisco), Trump Plaza (Panama), and Departmental Legislative Assembly (Bolivia).

See the section entitled “Business” for further information relating to our business and the industry in which we operate.

Company History and Information

We are an exempted company incorporated under the laws of the Cayman Islands. We were incorporated in 2011 and consummated a business combination in 2013 between Andina Acquisition Corporation and TG and ES. TG and ES are corporations formed under the laws of Colombia and founded in 1994 and 1983, respectively, by José M. Daes, our Chief Executive Officer, or CEO, and Christian T. Daes, our Chief Operating Officer, or COO.

Our principal executive office is located at Avenida Circunvalar a 100 metros de la Via 40, Barrio Las Flores Barranquilla, Colombia and our telephone number is +57 (5) 373-4000. We maintain a corporate website at www.tecnoglass.com. The information contained on, or that can be accessed through, our website is not a part of, and should not be considered as being incorporated by reference into, this prospectus supplement.

The Offering

| Ordinary Shares Offered for Sale by the Selling Securityholder: | | 2,000,000 ordinary shares. |

| | | |

| Option to Purchase Additional Ordinary Shares from the Selling Securityholder: | | 300,000 ordinary shares. |

| | | |

| Number of Ordinary Shares to be Outstanding Both Before and After this Offering: | | 47,673,953 ordinary shares. |

| | | |

| Use of Proceeds: | | We will not receive any of the proceeds from the sale of our ordinary shares by the selling securityholder. See the section below entitled “Use of Proceeds” for additional information. The selling securityholder will pay all expenses in connection with the offering of the ordinary shares to be offered under this prospectus supplement and any underwriting fees, discounts, selling commissions, marketing costs, expenses of their and our counsel and certain transfer taxes incurred by them in connection with such sales. |

Selling Securityholder | | ENERGY HOLDING CORPORATION, our majority shareholder. |

| | | |

| NYSE Symbol: | | “TGLS.” |

| | | |

| Dividend Policy | | Since August 2016, we have paid regular quarterly dividends. We expect to continue to pay quarterly dividends in the future. However, the payment of any future dividends will be solely at the discretion of our board of directors and there can be no assurance that we will continue to pay dividends in the future. The credit agreements governing our outstanding indebtedness also currently restrict the type and amount of dividends we can make while the indebtedness is outstanding based on our ability to meet certain leverage amounts. The payment of dividends in the future, if any, will also be contingent upon limitations imposed by any other of our outstanding indebtedness. Because we are a holding company, our ability to pay dividends depends on our receipt of cash dividends from our operating subsidiaries, which may further restrict our ability to pay dividends as a result of the laws of their jurisdictions of organization, agreements of our subsidiaries or covenants under any existing and future outstanding indebtedness we or our subsidiaries incur. The ability of our subsidiaries in Colombia to declare dividends up to the total amount of their capital is not restricted by current laws, covenants in debt agreements or other agreements. See the section below entitled “Dividend Policy”. |

| | | |

| Controlled Company Exemption: | | Because of ENERGY HOLDING CORPORATION’s ownership of a majority of our ordinary shares, we meet the requirements to be deemed a “controlled company” for the purposes of the NYSE listing requirements. Status as a controlled company generally exempts a listed company from certain corporate governance requirements. However, we have determined not to take advantage of this designation and we currently comply with all the corporate governance rules applicable to listed companies that are not controlled companies. |

| | | |

| Risk Factors: | | An investment in our ordinary shares involves risks. You should carefully consider all of the information set forth in this prospectus supplement with respect to this offering, in the accompanying base prospectus and in the documents filed by us with the SEC and incorporated by reference in this prospectus supplement or the accompanying base prospectus. In particular, you should evaluate the specific risks set forth in the section entitled “Risk Factors” beginning on page S-14 and the other information included or incorporated by reference in this prospectus supplement and the accompanying base prospectus for a discussion of risk factors you should carefully consider before deciding to invest in our ordinary shares. |

Unless otherwise noted, all information in this prospectus supplement:

| | ● | assumes the underwriters do not exercise their option to purchase additional ordinary shares; |

| | | |

| | ● | is based on the number of ordinary shares outstanding as of May 16, 2023; and |

| | | |

| | ● | excludes an aggregate of 1,593,917 ordinary shares reserved for future issuance under our equity compensation plans. |

Summary Historical Consolidated Financial Data

The following table sets forth certain summary financial information as of the dates and for each of the periods indicated. The consolidated historical financial information as of and for each of the fiscal years ended December 31, 2022, 2021 and 2020 is derived from our audited consolidated financial statements for such periods and the notes thereto incorporated elsewhere in this prospectus supplement. The consolidated historical financial information as of and for the three months ended March 31, 2023 and 2022 is derived from our unaudited consolidated financial statements for such period and the notes thereto incorporated elsewhere in this prospectus supplement. Our historical results are not necessarily indicative of our future results. This information is only a summary and should be read in conjunction with the “Risk Factors,” “Capitalization,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus supplement and our financial statements and the notes thereto.

| ($ in thousands, other than per share data) | | Three months ended March 31, | | | Years ended December 31, | |

| | | 2023 | | | 2022 | | | 2022 | | | 2021 | | | 2020 | |

| | | | | | | | | | | | | | | | |

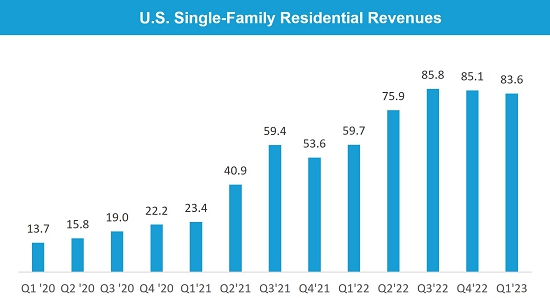

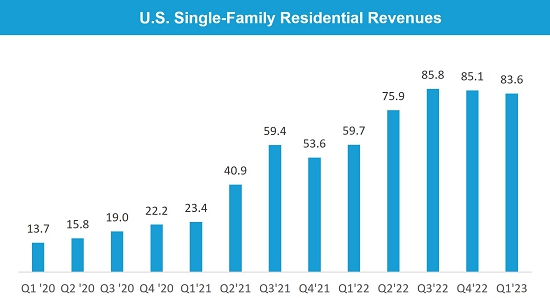

| Operating revenues | | $ | 202,639 | | | $ | 134,548 | | | $ | 716,570 | | | $ | 496,785 | | | $ | 376,607 | |

| Cost of sales | | | 94,884 | | | | 74,215 | | | | 367,071 | | | | 294,201 | | | | 237,166 | |

| Gross profit | | | 107,755 | | | | 60,333 | | | | 349,499 | | | | 202,584 | | | | 139,441 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Selling expense | | | (16,320 | ) | | | (13,368 | ) | | | (69,006 | ) | | | (49,768 | ) | | | (39,065 | ) |

| General and administrative expense | | | (17,755 | ) | | | (12,999 | ) | | | (54,078 | ) | | | (35,831 | ) | | | (34,669 | ) |

| Total operating expenses | | | (34,075 | ) | | | (26,367 | ) | | | (123,084 | ) | | | (85,599 | ) | | | (73,734 | ) |

| Operating income | | | 73,680 | | | | 33,966 | | | | 226,415 | | | | 116,985 | | | | 65,707 | |

| Non-operating income, net | | | 1,287 | | | | 342 | | | | 4,218 | | | | 608 | | | | 89 | |

| Equity method income | | | 1,449 | | | | 1,580 | | | | 6,680 | | | | 4,177 | | | | 1,387 | |

| Foreign currency transactions (losses) gains | | | (1,100 | ) | | | (2,909 | ) | | | 2,013 | | | | (4,308 | ) | | | (8,638 | ) |

| Interest expense and deferred cost of financing | | | (2,273 | ) | | | (1,468 | ) | | | (8,156 | ) | | | (9,850 | ) | | | (21,671 | ) |

| Extinguishment of Debt | | | - | | | | - | | | | - | | | | (10,699 | ) | | | - | |

| Income before taxes | | | 73,043 | | | | 31,511 | | | | 231,170 | | | | 96,913 | | | | 36,874 | |

| Income tax provision | | | (24,671 | ) | | | (10,558 | ) | | | (74,758 | ) | | | (28,485 | ) | | | (13,033 | ) |

| Net income | | $ | 48,372 | | | $ | 20,953 | | | $ | 156,412 | | | $ | 68,428 | | | $ | 23,841 | |

| (Income) Loss attributable to non-controlling interest | | | (137 | ) | | | (100 | ) | | | (669 | ) | | | (277 | ) | | | 34 | |

| Income attributable to parent | | $ | 48,235 | | | $ | 20,853 | | | $ | 155,743 | | | $ | 68,151 | | | $ | 23,875 | |

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 48,372 | | | $ | 20,953 | | | $ | 156,412 | | | $ | 68,428 | | | $ | 23,841 | |

| Foreign currency translation adjustments | | | 7,811 | | | | 13,635 | | | | (46,623 | ) | | | (25,080 | ) | | | (3,898 | ) |

| Change in fair value derivative contracts | | | (1,837 | ) | | | 2,622 | | | | 9,187 | | | | (159 | ) | | | (350 | ) |

| Total comprehensive (loss) income | | $ | 54,346 | | | $ | 37,210 | | | $ | 118,976 | | | $ | 43,189 | | | $ | 19,593 | |

| Comprehensive (income) loss attributable to non-controlling interest | | | (137 | ) | | | (100 | ) | | | (669 | ) | | | (277 | ) | | | 34 | |

| Total comprehensive (loss) income attributable to parent | | $ | 54,209 | | | $ | 37,110 | | | $ | 118,307 | | | $ | 42,912 | | | $ | 19,627 | |

| Basic (loss) income per share | | $ | 1.01 | | | $ | 0.44 | | | $ | 3.28 | | | $ | 1.44 | | | $ | 0.51 | |

| Diluted (loss) income per share | | $ | 1.01 | | | $ | 0.44 | | | $ | 3.28 | | | $ | 1.44 | | | $ | 0.51 | |

| Basic weighted average ordinary shares outstanding | | | 47,674,773 | | | | 47,674,773 | | | | 47,674,773 | | | | 47,674,773 | | | | 46,398,428 | |

| Diluted weighted average ordinary shares outstanding | | | 47,674,773 | | | | 47,674,773 | | | | 47,674,773 | | | | 47,674,773 | | | | 46,398,428 | |

| | | As of March 31, | | | As of December 31, | |

| Balance Sheet Data | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Cash and cash equivalents | | $ | 128,538 | | | $ | 103,671 | | | $ | 85,011 | | | $ | 67,668 | |

| Total assets | | | 819,457 | | | | 734,308 | | | | 591,563 | | | | 530,112 | |

| Total debt, including current portion | | | 169,895 | | | | 169,484 | | | | 199,055 | | | | 224,486 | |

| Stockholders’ equity | | $ | 400,380 | | | $ | 350,325 | | | $ | 244,698 | | | $ | 208,542 | |

| | | Three months ended March 31, | | | Years ended December 31, | |

| Cash Flow Data | | 2023 | | | 2022 | | | 2022 | | | 2021 | | | 2020 | |

| Cash provided by (Used in) | | | | | | | | | | | | | | | | | | | | |

| Operating Activities | | $ | 43,063 | | | $ | 27,135 | | | $ | 141,920 | | | $ | 117,253 | | | $ | 71,711 | |

| Investing Activities | | | (15,688 | ) | | | (10,394 | ) | | | (72,584 | ) | | | (50,761 | ) | | | (18,111 | ) |

| Financing Activities | | | (3,287 | ) | | | (18,318 | ) | | | (44,801 | ) | | | (43,789 | ) | | | (33,536 | ) |

| Effect of foreign currency exchange | | | 778 | | | | (2,893 | ) | | | (5,875 | ) | | | (5,360 | ) | | | (795 | ) |

| Total cash flows | | $ | 24,866 | | | $ | (4,470 | ) | | $ | 18,660 | | | $ | 17,343 | | | $ | 19,269 | |

| | | | | | | | | | | | | | | | | | | | | |

| Capital Expenditures | | | | | | | | | | | | | | | | | | | | |

| Assets acquired with cash | | $ | 15,554 | | | $ | 9,258 | | | $ | 71,327 | | | $ | 51,513 | | | $ | 18,323 | |

| Assets acquired with issuance of debt, and accounts payable | | | 4,790 | | | | 2,678 | | | | 11,800 | | | | 1,859 | | | | 2,242 | |

| Total capital expenditures | | $ | 20,344 | | | $ | 11,936 | | | $ | 83,127 | | | $ | 53,372 | | | $ | 20,565 | |

| Additional Operating Data | | Three months ended March 31, | | | Years ended December 31, | |

| | | 2023 | | | 2022 | | | 2022 | | | 2021 | | | 2020 | |

| Revenue by geography: | | | | | | | | | | | | | | | | | | | | |

| Colombia | | $ | 5,740 | | | $ | 4,025 | | | $ | 16,000 | | | $ | 26,375 | | | $ | 24,178 | |

| United States | | | 194,839 | | | | 126,984 | | | | 688,358 | | | | 456,327 | | | | 340,437 | |

| Panama | | | 270 | | | | 799 | | | | 2,738 | | | | 4,531 | | | | 2,713 | |

| Other | | | 1,790 | | | | 2,740 | | | | 9,474 | | | | 9,553 | | | | 9,279 | |

| Total revenues | | $ | 202,639 | | | $ | 134,548 | | | $ | 716,570 | | | $ | 496,785 | | | $ | 376,607 | |

| | | | | | | | | | | | | | | | | | | | | |

| Revenue by product | | | | | | | | | | | | | | | | | | | | |

| Glass and framing components | | $ | 16,075 | | | $ | 14,614 | | | $ | 71,479 | | | $ | 76,106 | | | $ | 73,443 | |

| Windows and architectural systems | | | 186,564 | | | | 119,934 | | | | 645,091 | | | | 420,679 | | | | 303,164 | |

| Total revenues | | $ | 202,639 | | | $ | 134,548 | | | $ | 716,570 | | | $ | 496,785 | | | $ | 376,607 | |

| Other Financial Data | | Three months ended March 31, | | | Years ended December 31, | |

| | | 2023 | | | 2022 | | | 2022 | | | 2021 | | | 2020 | |

| Gross profit margin (1) | | | 53.2 | % | | | 44.8 | % | | | 48.8 | % | | | 40.8 | % | | | 37.0 | % |

| Adjusted EBITDA (2) | | | 85,836 | | | | 45,351 | | | | 265,664 | | | | 150,252 | | | | 97,525 | |

| Adjusted EBITDA Margin (2) | | | 42.36 | % | | | 33.71 | % | | | 37.07 | % | | | 30.24 | % | | | 25.90 | % |

| Adjusted Net Income (3) | | | 51,506 | | | | 25,355 | | | | 158,470 | | | | 82,726 | | | | 36,516 | |

| Adjusted Net Income Margin (3) | | | 25.42 | % | | | 18.84 | % | | | 22.12 | % | | | 16.65 | % | | | 9.70 | % |

(1) Gross profit margin is calculated by dividing gross profit over operating revenues.

(2) Calculation of Adjusted EBITDA and Adjusted EBITDA Margin are set forth above in the section titled “Non-GAAP Financial Measures.” Adjusted EBITDA is calculated by adding net income, non-controlling interest, income taxes, interest expense, depreciation and amortization, loss (gain) from change in fair value of warrant liability, loss (gain) from change in fair value of warrant liability and earnout shares, extinguishment of debt, non recurring / non cash expenses and foreign currency transaction loss (gain). Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by our net revenues. The following table provides a reconciliation of our Net income (loss) to Adjusted EBITDA for the periods indicated:

| Reconciliation of Net income (loss) | | Three months ended March 31, | | | Years ended December 31, | |

| to Adjusted EBITDA | | 2023 | | | 2022 | | | 2022 | | | 2021 | | | 2020 | |

| Net income (loss) | | $ | 48,372 | | | $ | 20,953 | | | $ | 156,412 | | | $ | 68,428 | | | $ | 23,841 | |

| Less: Income (loss) attributable to non-controlling interest | | | (137 | ) | | | (100 | ) | | | (669 | ) | | | (277 | ) | | | 34 | |

| Net income (loss) attributable to parent | | | 48,235 | | | | 20,853 | | | | 155,743 | | | | 68,151 | | | | 23,875 | |

| Income taxes | | | 24,671 | | | | 10,558 | | | | 74,758 | | | | 28,485 | | | | 13,033 | |

| Interest expense | | | 2,273 | | | | 1,468 | | | | 8,156 | | | | 9,850 | | | | 21,671 | |

| Depreciation and Amortization | | | 4,767 | | | | 5,251 | | | | 19,686 | | | | 20,923 | | | | 20,623 | |

| Extinguishment of Debt | | | - | | | | - | | | | - | | | | 10,699 | | | | - | |

| Non Recurring / Non Cash expenses (a) | | | 3,275 | | | | 3,487 | | | | 5,857 | | | | 4,388 | | | | 6,109 | |

| Joint Venture Adjusted EBITDA adjustment (b) | | | 1,515 | | | | 825 | | | | 3,477 | | | | 3,448 | | | | 3,576 | |

| Foreign currency transaction loss (gain)(c) | | | 1,100 | | | | 2,909 | | | | (2,013 | ) | | | 4,308 | | | | 8,638 | |

| Adjusted EBITDA | | $ | 85,836 | | | $ | 45,351 | | | $ | 265,664 | | | $ | 150,252 | | | $ | 97,525 | |

(a) Includes certain items that management does not believe are related to our core operating performance and are non-recurring or non-cash.

(b) Includes our proportionate share of the joint venture with Saint-Gobain. This adjustment is done given that as a minority owner without control, it is not consolidated into our consolidated figures, but it provides an idea of the pro-forma EBITDA as if the consolidation was taking place

(c) Associated with the changes in value under our functional currency of monetary balance sheet accounts. These changes are mainly associated with foreign exchange fluctuations between the Colombian peso and the U.S. dollar and not associated with our operations. As a result, it is excluded from our Adjusted EBITDA.

(3) Calculation of Adjusted Net Income and Adjusted Net Income Margin are set forth above in the section titled “Non-GAAP Financial Measures.” Adjusted Net Income is calculated by adding net income (loss), income (loss) attributable to non-controlling interest, foreign currency transaction losses (gains), cashless deferred cost of financing, loss (gain) from change in fair value of warrant liability, certain non-recurring expenses and the tax impact of adjustments at statutory rates. Adjusted Net Income Margin is calculated by dividing Adjusted Net Income by our net revenues. The following table provides a reconciliation of Net income (loss) to Adjusted Net Income for the periods indicated:

| Reconciliation of Net income (loss) | | Three months ended March 31, | | | Years ended December 31, | |

| to Adjusted Net Income | | 2023 | | | 2022 | | | 2022 | | | 2021 | | | 2020 | |

| Net income (loss) | | | 48,372 | | | | 20,953 | | | | 156,412 | | | | 68,428 | | | | 23,841 | |

| Less: Income (loss) attributable to non-controlling interest | | | (137 | ) | | | (100 | ) | | | (669 | ) | | | (277 | ) | | | 34 | |

| Net income (loss) attributable to parent | | | 48,235 | | | | 20,853 | | | | 155,743 | | | | 68,151 | | | | 23,875 | |

| Foreign currency transactions losses (gains) (a) | | | 1,100 | | | | 2,909 | | | | (2,013 | ) | | | 4,308 | | | | 8,638 | |

| Extinguishment of debt | | | - | | | | - | | | | - | | | | 10,699 | | | | - | |

| Non Recurring / Non Cash expenses (b) | | | 3,275 | | | | 3,487 | | | | 5,857 | | | | 5,757 | | | | 8,009 | |

| Joint Venture Adjusted Net Income adjustments (b) | | | 435 | | | | 36 | | | | 52 | | | | 57 | | | | 1,943 | |

| Tax impact of adjustments at statutory rate | | | (1,539 | ) | | | (1,930 | ) | | | (1,169 | ) | | | (6,246 | ) | | | (5,949 | ) |

| Adjusted Net Income | | | 51,506 | | | | 25,355 | | | | 158,470 | | | | 82,726 | | | | 36,516 | |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted income per share | | $ | 1.01 | | | $ | 0.44 | | | $ | 3.28 | | | $ | 1.44 | | | $ | 0.51 | |

| Diluted Adjusted net income per share (d) | | $ | 1.08 | | | $ | 0.53 | | | $ | 3.32 | | | $ | 1.74 | | | $ | 0.79 | |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted weighted average ordinary shares outstanding | | | 47,674,773 | | | | 47,674,773 | | | | 47,674,773 | | | | 47,674,773 | | | | 46,398,428 | |

(a) Associated with the changes in value under our functional currency of monetary balance sheet accounts. These changes are mainly associated with foreign exchange fluctuations between the Colombian peso and the U.S. dollar and not associated with our operations. As a result, it is excluded from our Adjusted Net Income.

(b) Includes certain items that management does not believe are related to our core operating performance and are non-recurring or non-cash.

(c) Includes our proportionate share of the joint venture with Saint-Gobain. This adjustment is done given that as a minority owner without control, it is not consolidated into our consolidated figures, but it provides an idea of the pro-forma EBITDA as if the consolidation was taking place.

(d) Diluted Adjusted net income per share is calculated by dividing Adjusted net income by the diluted weighted average number of common shares outstanding.

RISK FACTORS

An investment in our ordinary shares involves significant risks. Before purchasing any ordinary shares, you should carefully consider and evaluate all of the information included in this prospectus supplement and the accompanying prospectus, including the risk factors and uncertainties set forth below, as updated by annual, quarterly and other reports and documents we file with the SEC after the date of this prospectus supplement. Our business, financial position, results of operations or liquidity could be adversely affected by any of these risks. The risks and uncertainties we describe are not the only ones facing us. Additional risks and uncertainties not presently known to us, which we cannot adequately evaluate or that we currently deem immaterial, may also impair our business or operations.

Risks Related to Our Business Operations

We operate in competitive markets and our business could suffer if we are unable to adequately address potential downward pricing pressures and other factors that may reduce operating margins.

The principal markets that we serve are highly competitive. Competition is based primarily on the precision and range of achievable tolerances, quality, price and the ability to meet delivery schedules dictated by customers. Our competition comes from companies of various sizes, some of which have greater financial and other resources than we do and some of which have more established brand names in the markets that we serve. We currently compete with companies such as Viracon (a subsidiary within the Apogee Enterprises Inc. Group), PGT, Cardinal Glass and Oldcastle Glass among others in the United States and companies such as Vitro, Vitelco and others in Colombia and Latin America. Any of these competitors may foresee the course of market development more accurately than we will, develop products that are superior to ours, have the ability to produce similar products at a lower cost than us or adapt more quickly than we can to new technologies or evolving customer requirements. Increased competition could force us to lower our prices or to offer additional services at a higher cost to us, which could reduce gross profit and net income. Accordingly, we may not be able to adequately address potential downward pricing pressures and other factors, which may adversely affect our financial condition and results of operations.

Failure to maintain the performance, reliability and quality standards required by our customers could have a materially negative impact on our financial condition and results of operations.

If our products or services have performance, reliability or quality problems, or products are installed with incompatible glazing materials, we may experience additional warranty and service expenses, reduced or canceled orders, diminished pricing power, higher manufacturing or installation costs or delays in the collection of accounts receivable. Additionally, performance, reliability, or quality claims from our customers, with or without merit, could result in costly and time-consuming litigation that could require significant time and attention of management and involve significant monetary damages that could negatively affect our financial results.

The volatility of the cost of raw materials used to produce our products could materially adversely affect the results of our operations in the future.

The cost of raw materials included in our products, including aluminum extrusion and polyvinyl butyral, are subject to significant fluctuations derived from changes in price or volume. A variety of factors over which we have no control, including global demand for aluminum, fluctuations in oil prices, speculation in commodities futures and the creation of new laminates or other products based on new technologies, impact the cost of raw materials which we purchase for the manufacture of our products.

We quote our prices of aluminum products based on the price of aluminum in the London Metal Exchange plus a premium, and our suppliers of glass and polyvinyl butyral provide us with price lists that are updated annually, thus reducing the risk of changing prices for orders in the short term. While we may attempt to minimize the risk from severe price fluctuations by entering into aluminum forward contracts to hedge these fluctuations in the purchase price of aluminum extrusion we use in production, substantial, prolonged upward trends in aluminum prices could significantly increase the cost of our aluminum needs and have an adverse impact on the results of our operations. If we are not able to pass on significant cost increases to our customers, our results in the future may be negatively affected including without limitation by a delay between the cost increases and price increases in our products. Accordingly, the price volatility of raw materials could adversely affect our financial condition and results of operations in the future.

We depend on third-party suppliers for our raw materials and any failure of such third-party suppliers in providing raw materials could negatively affect our ability to manufacture our products.

Our ability to offer a wide variety of products to our customers depends on our receipt of adequate material supplies from manufacturers and other suppliers. It is possible in the future that our competitors or other suppliers may create products based on new technologies that are not available to us or are more effective than our products at surviving hurricane-force winds and wind-borne debris or that they may have access to products of a similar quality at lower prices. Although in some instances we have agreements with our suppliers, these agreements are generally terminable by us or the supplier counterparties on limited notice. We have a fixed set of maximum price rates, and from those prices we negotiate with the supplier of the material depending on the project. We source raw materials and glass necessary to manufacture our products from a variety of domestic and foreign suppliers. During the year ended December 31, 2022, one supplier accounted for more than 10% of total raw material purchases, at 14% of total raw material purchases. Failures of third-party suppliers to provide raw materials to us in the future could have an adverse impact on our operating results or our ability to manufacture our products.

We rely on third-party transportation, which subjects us to risks and costs that we cannot control, and which risks and costs may materially adversely affect our operations.

We rely on third party trucking companies to transport raw materials to the manufacturing facilities used by each of our businesses and, to a lesser degree, to ship finished products to customers. These transport operations are subject to various hazards and risks, including extreme weather conditions, work stoppages and operating hazards, as well as interstate transportation regulations. In addition, the methods of transportation we utilize may be subject to additional, more stringent and more costly regulations in the future. If we are delayed or unable to ship finished products or unable to obtain raw materials as a result of any such new regulations or public policy changes related to transportation safety, or these transportation companies fail to operate properly, or if there were significant changes in the cost of these services due to new or additional regulations, or otherwise, we may not be able to arrange efficient alternatives and timely means to obtain raw materials or ship goods, which could result in a material adverse effect on our revenues and costs of operations. Transportation costs represent a significant part of our cost structure. If our transportation costs increased substantially, due to prolonged increases in fuel prices or otherwise, we may not be able to control them or pass the increased costs onto customers, and our profitability would be negatively impacted.

We may not realize the anticipated benefit through our joint venture with Saint-Gobain and the planned construction of a new plant as part of the joint venture may not be completed as planned.

On May 3, 2019, we acquired an approximately 25.8% minority interest in the float glass plant of Vidrio Andino Holdings S.A.S, or Vidrio Andino, a Colombia-based subsidiary of Compagnie de Saint-Gobain S.A., or Saint-Gobain, located in the outskirts of Bogota, Colombia in connection with our joint venture agreement with Saint-Gobain. We believe this joint venture has solidified our vertical integration strategy by providing us with an interest in the first stage of our production chain, while securing ample glass supply for our expected production needs. Although our glass supply has run smoothly through the date of this prospectus supplement, we may be unable to realize the planned synergies and fail to integrate some aspects of the facility’s production capacity into our manufacturing process, which may have a negative impact on our financial condition. Additionally, the joint venture agreement includes plans to build a new plant in Galapa, Colombia that will be located approximately 20 miles from our primary manufacturing facility in which we will also have a 25.8% interest. The new plant will be funded with the original cash contribution made by us, operating cash flows from the Bogota plant, and debt incurred at the joint venture level that will not consolidate into our company.

There can be no assurance that the anticipated joint venture cost synergies, increases in capacity or production and optimization of certain manufacturing processes associated with the reduction of raw material waste, and supply chain synergies, including purchasing raw materials at more advantageous prices, will be achieved, or that they might not be significantly and materially less than anticipated or that the completion of the joint venture with Saint-Gobain will be timely or effectively accomplished. In addition, our ability to realize the anticipated cost synergies and production capacity increases are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control, such as changes to government regulation governing or otherwise impacting our industry, operating difficulties, client preferences, changes in competition and general economic or industry condition.

Constructing a new manufacturing facility involves risks, including financial, construction and governmental approval risks. If Vidrio Andino’s plant fails to produce the anticipated cash flow, if we are unable to allocate the required capital to the new plant, if we are unable to secure the necessary permits, approvals or consents or if we are unable to enter into a contract for the construction of the plant on suitable terms, we will fail to realize the expected benefits of the joint venture.

The success of our business depends, in part, on our ability to execute our acquisition strategy, to successfully integrate acquisitions and to retain key employees of our acquired businesses and to retain key employees of our acquired businesses.

A portion of our historical growth has occurred through acquisitions, and we may enter into additional acquisitions in the future. We may at any time be engaged in discussions or negotiations with respect to possible acquisitions, including transactions that would be significant to us. We regularly make, and we expect to continue to make, acquisition proposals, and we may enter into letters of intent for acquisitions. We cannot predict the timing of any contemplated transactions. To successfully finance such acquisitions, we may need to raise additional equity capital and indebtedness, which could increase our leverage level above our current leverage level. We cannot assure you that we will enter into definitive agreements with respect to any contemplated transactions or that transactions contemplated by any definitive agreements will be completed on time or at all. Our growth has placed, and will continue to place, significant demands on our management and operational and financial resources. Acquisitions involve risks that the businesses acquired will not perform as expected and that business judgments concerning the value, strengths and weaknesses of acquired businesses will prove incorrect.

Acquisitions may require integration of acquired companies’ sales and marketing, distribution, purchasing, finance and administrative organizations, as well as exposure to different legal and regulatory regimes in jurisdictions in which we have not previously operated. We may not be able to successfully integrate any business we may acquire or have acquired into our existing business, and any acquired businesses may not be profitable or as profitable as we had expected. Our inability to complete the integration of new businesses in a timely and orderly manner could increase costs and lower profits. Factors affecting the successful integration of acquired businesses include, but are not limited to, the following:

| | ● | We may become liable for certain liabilities of any acquired business, whether or not known to us. These risks could include, among others, tax liabilities, product liabilities, asbestos liabilities, environmental liabilities, pension liabilities and liabilities for employment practices, and they could be significant. |

| | | |

| | ● | Substantial attention from our senior management and the management of the acquired business may be required, which could decrease the time that they have to service and attract customers. |

| | | |

| | ● | The complete integration of acquired companies depends, to a certain extent, on the full implementation of our financial systems and policies. |

| | | |

| | ● | We may actively pursue a number of opportunities simultaneously and we may encounter unforeseen expenses, complications and delays, including difficulties in employing sufficient staff and maintaining operational and management oversight. |

We may not be able to realize the expected return on our growth and efficiency capital expenditure plan.

In recent years, we have made significant capital expenditures which include:

| | ● | Automation of six window assembly production lines, increasing efficiencies, labor and material waste costs with an estimated reduction of on-site damage by 30%; |

| | | |

| | ● | Additional aluminum expansion project to increase capacity by approximately 750 tons/month; |

| | ● | Further automation of additional glass lines, increasing efficiencies on an end-to-end basis reducing lead times, headcount and on-site damage by approximately 40%; |

| | | |

| | ● | Upgrading vacuum magnetron sputter coating machinery to allow coating of glass before tempering; |

| | | |

| | ● | Construction of a 500,000 square foot warehouse with two numerical punching machines, two metal benders and a complete painting line; and |

| | | |

| | ● | Automation of two centralized aluminum warehouses for storing, sorting and delivering extrusion matrices and aluminum profiles to our internal production processes that reduce lead times for the assembly of architectural systems and reduce on-site damage to materials. |

There can be no assurance that the anticipated cost saving initiatives will be achieved, or that they will not be significantly and materially less than anticipated, or that the completion of such cost savings initiatives will be effectively accomplished. In addition, our ability to realize the anticipated cost savings are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control, such as changes to government regulation governing or otherwise impacting our industry, operating difficulties, client preferences, changes in competition and general economic or industry conditions. If we fail to realize the anticipated cost savings, it could have a negative impact on our financial position.

Our success depends upon our ability to develop new products and services, integrate acquired products and services and enhance existing products and services through product development initiatives and technological advances. Any failure to make such improvements could harm our future business and prospects.

We have continuing programs designed to develop new products and to enhance and improve our existing products. We are expending resources for the development of new products in all aspects of our business, including products that can reach a broader customer base. Some of these new products must be developed due to changes in legislative, regulatory or industry requirements or in competitive technologies that render certain of our existing products obsolete or less competitive. The successful development of our products and product enhancements are subject to numerous risks, both known and unknown, including unanticipated delays, access to significant capital, budget overruns, technical problems and other difficulties that could result in the abandonment or substantial change in the design, development and commercialization of these new products. The events could have a materially adverse impact on the results of our operations.

Given the uncertainties inherent with product development and introduction, including lack of market acceptance, we cannot provide assurance that any of our product development efforts will be successful on a timely basis or within budget, if at all. Failure to develop new products and product enhancements on a timely basis or within budget could harm our business and prospects. In addition, we may not be able to achieve the technological advances necessary for us to remain competitive, which could have a materially negative impact on our financial condition.

The homebuilding industry and the home repair and remodeling sector are regulated, and any increased regulatory restrictions could negatively affect our sales and results of operations.

The homebuilding industry and the home repair and remodeling sector are subject to various local, state, and federal statutes, ordinances, rules and regulations concerning zoning, building design and safety, hurricane and floods, construction, and similar matters, including regulations that impose restrictive zoning and density requirements in order to limit the number of homes that can be built within the boundaries of a particular area. Increased regulatory restrictions could limit demand for new homes and home repair and remodeling products, which could negatively affect our sales and results of operations. We may not be able to satisfy any future regulations, which consequently could have a negative effect on our sales and results of operations.

Changes in building codes could lower the demand for our impact-resistant windows and doors.

The market for our impact-resistant windows and doors depends in large part on our ability to satisfy state and local building codes that require protection from wind-borne debris. If the standards in such building codes are raised, we may not be able to meet such requirements, and demand for our products could decline. Conversely, if the standards in such building codes are lowered or are not enforced in certain areas, demand for impact-resistant products may decrease. If we are unable to satisfy future regulations, including building code standards, it could negatively affect our sales and results of operations. Further, if states and regions that are affected by hurricanes but do not currently have such building codes fail to adopt and enforce hurricane protection building codes, our ability to expand our business in such markets may be limited.

We are subject to labor, and health and safety regulations, and may be exposed to liabilities and potential costs for lack of compliance.

We are subject to labor and health and safety laws and regulations that govern among other things the relationship between us and our employees and the health and safety of our employees. If we are found to have violated any labor or health and safety laws, we may be exposed to penalties and sanctions including the payment of fines. In particular, most of our employees are hired through temporary staffing companies and are employed under one-year fixed-term employment contracts. According to applicable labor law regarding temporary staffing companies, if we exceed the limits for hiring temporary employees and the Colombian Ministry of Labor identifies the existence of illegal outsourcing, sanctions may be imposed along with probable lawsuits by employees claiming the existence of a labor relationship. Our subsidiaries could also be subject to work stoppages or closure of operations.

The above, could result in cancellation or suspension of governmental registrations, authorizations and licenses issued by other authorities, any one of which may result in interruption or discontinuity of business, and could consequently materially and adversely affect our business, financial condition or results of operations.

Equipment failures, delays in deliveries and catastrophic loss at our manufacturing facility could lead to production curtailments or shutdowns that prevent us from producing our products.

An interruption in production capabilities at any of our facilities because of equipment failure or other reasons could result in our inability to produce our products, which would reduce our sales and earnings for the affected period. In addition, we generally manufacture our products only after receiving the order from the customer and thus do not hold large inventories. If there is a stoppage in production at our manufacturing facilities, even if only temporarily, or if they experience delays because of events that are beyond our control, delivery times could be severely affected. Any significant delay in deliveries to our customers could lead to increased product returns, cancellations or delay damages and cause us to lose future sales. Our manufacturing facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, explosions, or violent weather conditions. If we experience plant shutdowns or periods of reduced production because of equipment failure, delays in deliveries or catastrophic loss, it could have a material adverse effect on the results of our operations or our financial condition. Further, we may not have adequate insurance to compensate for all losses that result from any of these events.

Our reliance on a single facility subjects us to concentrated risks.

We currently operate the vast majority of our business from a single production facility in Barranquilla, Colombia. Due to the lack of diversification in our assets and geographic location, and an interdependency related to our vertical integration, an adverse development at or impacting our facility or in local or regional economic or political conditions could have a significantly greater impact on the results of our operations and financial condition than if we maintained more diverse assets and locations. While we implement preventative and proactive maintenance at our facility, it is possible that we could experience prolonged periods of reduced production and increased maintenance and repair costs due to equipment failures. In addition, because of our single facility and location, in certain cases we rely on limited or single suppliers for significant inputs such as electricity. We are also reliant on the adequacy of the local skilled labor force to support our operations. Supply interruptions to or labor shortages or stoppages at our facility could be caused by any of the aforementioned factors, many of which are beyond our control, and would adversely affect our operations, and we would not have any ability to offset this concentrated impact with activities at any alternative facilities or locations.

Customer concentration and related credit, commercial and legal risk may adversely impact our future earnings and cash flows.

Our ten largest third-party customers worldwide collectively accounted for 32% of our total annual revenue for the year ended December 31, 2022, though no single customer accounted for more than 10% of annual revenues. We also do not have any long-term requirements contracts pursuant to which we would be required to fulfill customers on an as-needed basis.

Although the customary terms of our arrangements with customers in Latin America and the Caribbean typically require a significant upfront payment ranging between 30% and 50% of the cost of an order, if a large customer were to experience financial difficulty, or file for bankruptcy or similar protection, or if we were unable to collect amounts due from customers that are currently under bankruptcy or similar protection, it could adversely impact the results of our operations, cash flows and asset valuations. Therefore, the risk we face in doing business with these customers may increase. Financial problems experienced by our customers could result in the impairment of our assets and a decrease in our operating cash flows and may also reduce or curtail our customers’ future use of our products and services, which may have an adverse effect on our revenues.

Disagreements between parties can arise as a result of the scope and nature of the relationship and ongoing negotiations. Although we do not have any disputes with any major customers as of the date hereof that are expected to have a material adverse effect on our financial position, results of operations or cash flows, we cannot predict whether such disputes will arise in the future.

Our results may not match our provided guidance or the expectations of securities analysts or investors, which likely would have an adverse effect on the market price of our securities.