- PSX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Phillips 66 (PSX) DEF 14ADefinitive proxy

Filed: 25 Mar 20, 5:20pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Phillips 66

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

March 25, 2020

To My Fellow Shareholders:

On behalf of the Board of Directors, I am pleased to invite you to Phillip 66’s 2020 Annual Meeting of Shareholders. Due to concerns regarding the coronavirus (COVID-19), and to assist in protecting the health and well-being of our shareholders and employees, we have decided to conduct this year’s meeting in a virtual meeting format only. The meeting will be held on Wednesday, May 6 at 9:00 a.m. Central Daylight Time at www.virtualshareholdermeeting.com/PSX2020.

The attached Notice of Annual Meeting of Shareholders and Proxy Statement provide you with information on how to join the meeting online and the business to be conducted at the meeting. Your vote is very important. Whether or not you plan to attend the meeting, and no matter how many shares you own, we encourage you to vote your shares.

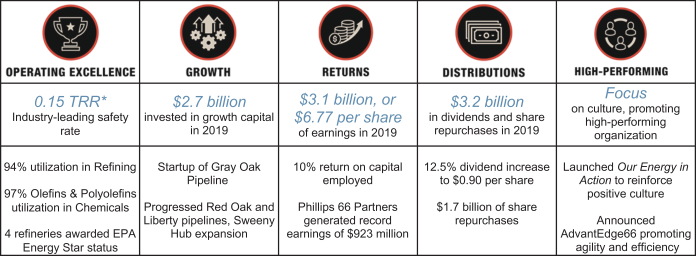

In 2019, we delivered earnings of $3.1 billion and earnings per share of $6.77. We achieved a total shareholder return of 34% during the year, exceeding our peer group average and the S&P 100. We increased our quarterly dividend by 12.5% in 2019 and returned $3.2 billion to shareholders through dividends and share repurchases. Additionally, our Board of Directors approved a new $3 billion share repurchase program. We executed and progressed major growth projects, including the Gray Oak Pipeline and other Midstream projects. All of this was accomplished in a safe and reliable manner. Our goal is zero incidents, zero accidents and zero injuries. In 2019, we again achieved industry-leading safety performance with a combined workforce total recordable rate of 0.15.

At Phillips 66, our strategy focuses on growth, returns and distributions, built on a strong foundation of operating excellence and a high-performing organization. We have executed our strategy well and have put in place programs aimed at continued successful execution. In 2019, we announced AdvantEdge66, a program designed to transform our company through technology and new ways of working. Our success begins with our employees, and in 2019 we also rolled outOur Energy in Action – a set of behaviors that preserves the best of who we are and challenges us to improve. We believe we have the right strategy in place and the right tools to help our employees continue to execute it well.

Phillips 66 is committed to safely and responsibly carrying out our vision of providing energy and improving lives. We remain focused on operational excellence, executing our growth projects, enhancing returns on existing assets and maintaining strong shareholder distributions.

Thank you for your continued support and investment in Phillips 66.

In safety, honor and commitment,

Greg C. Garland Chairman of the Board and Chief Executive Officer

|

| |

Driven to Make a Difference

| Meet Mansi Sanghvi. Engineer. Safety champion. Community pillar.

Mansi believes in purpose - at home, work, and in the community.

It is why she chose to join Phillips 66 nearly five years ago, first as an intern and later as an Instrumentation and Controls Engineer at the Bayway Refinery in Linden, New Jersey.

“I love being in the field, working with my peers and seeing the impact my work has,” Mansi says. “It drives me.”

So, too, does helping others. She recently helped organize a drive that raised funds to make salads for the homeless so they could enjoy a healthier lunch. She also spearheaded a project that distributed 700 dictionaries to area third-graders. |

And at work, she taught yoga classes, with all proceeds going to programs benefiting youth, people on the autism spectrum and disabled veterans.

“It’s one of the most fulfilling parts of my life,” Mansi says of her volunteerism.

All told, Mansi has logged or organized more than 1,000 volunteer hours and raised more than $25,000 through donations and volunteer grants during her time at Phillips 66.

She’s not alone. Every day, Phillips 66 employees around the world carry forth the Company’s vision of providing energy and improving lives.

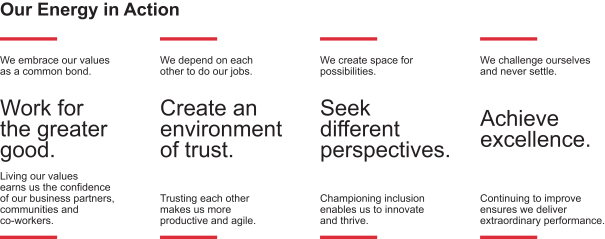

They do so by living out the Company’s values of safety, honor and commitment, and throughOur Energy in Action, a set of behaviors that empowers them to work for the greater good, create an environment of trust, seek different perspectives and achieve excellence.

Employee volunteers logged a record 88,000 hours in 2019. Since 2012, the Company has contributed $180 million to worthy causes, including nearly $40 million through gift-matching programs and volunteer grants.

At the refinery, Mansi designs and upgrades instrumentation critical to ensuring safe and reliable operations. Her work is key in helping Phillips 66 achieve operating excellence while remaining an industry leader in safety.

“People here are so genuinely smart and humble,” says Mansi. “They took the time to make sure I understood the technical learning curve. I feel like they are my family.”

In the community, she represents Phillips 66 on the boards of the local YMCA and the Rahway Community Action Organization, and in 2019 she became the youngest chairwoman of the Linden Rotary Satellite Club.

| ||

Mansi brings a unique perspective. Born and raised in western India, she immigrated to the U.S. as a teenager and went to high school in New Jersey before attending Rutgers University.

She was no stranger to volunteerism prior to joining Phillips 66, but it was at Bayway that she felt empowered to do more through the refinery’s employee resource groups and the support she found from both management and peers.

“It just ignited something,” Mansi says. “Millennials, we want to feel like we are making an impact, and I feel fully supported.”

“Good is needed in the world. Any little thing you can do can make a huge difference in a person’s life.” |  | |

2331 CityWest Blvd.

Houston, Texas 77042

NOTICE OF 2020 ANNUAL MEETING

OF SHAREHOLDERS

|

To Phillips 66 Shareholders: Phillips 66 will hold its 2020 Annual Meeting of Shareholders on Wednesday, May 6, 2020, at 9:00 a.m. Central Daylight Time. The meeting will be a completely “virtual meeting” of shareholders. You will be able to attend, vote, review a list of shareholders entitled to vote, and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/PSX2020 and entering the 16-digit control number included in our notice of internet availability of the proxy materials, on your proxy card or in the instructions that accompanies your proxy materials. At the meeting, you will hear a report on our business and will vote on the following items:

| • | Election of directors |

| • | Ratification of Ernst & Young LLP as independent auditors |

| • | Advisory vote to approve executive compensation |

| • | A shareholder proposal contained in this proxy statement |

In addition, we will transact any other business properly presented at the meeting, including any adjournment or postponement thereof, by or at the direction of the Board of Directors.

Who can vote: Shareholders at the close of business on March 11, 2020 (the record date). Each share of common stock is entitled to one vote for each director and one vote for each other proposal.

Your vote is important. We encourage you to submit your proxy as soon as possible by internet, by telephone, or by signing, dating and returning all proxy cards or instruction forms provided to you.

Please seeABOUT THE ANNUAL MEETING for information about how to join the meeting online and voting.

By Order of the Board of Directors

Paula A. Johnson

Corporate Secretary

March 25, 2020

The Company will provide the Notice of Internet Availability, electronic delivery of the proxy materials or mailing of the 2020 Proxy Statement, the 2019 Annual Report on Form10-K and a proxy card to shareholders beginning on March 25, 2020.

2020 PROXY STATEMENT 1

TABLE OF CONTENTS

2 2020 PROXY STATEMENT

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement before voting.

Voting Matters

| Proposals | Board Recommendation | |||

Item 1

|

Election of three director nominees

|

FOR (each nominee)

| ||

Item 2

|

Ratification of the appointment of our independent registered public accounting firm

|

FOR

| ||

Item 3

|

Approval, on an advisory basis, of compensation paid to our named executive officers

|

FOR

| ||

Item 4

|

Shareholder proposal, if properly presented

|

AGAINST

|

Your Company

Phillips 66 is a diversified energy manufacturing and logistics company. With a unique portfolio of assets in the midstream, chemicals, refining, and marketing and specialties businesses, we process, transport, store and market fuels and products globally. At Phillips 66, we provide energy that improves lives and contributes to meeting the world’s growing energy needs. Affordable, reliable and abundant energy is essential to sustaining human health and well-being and improving the global standard of living. We believe climate change is a global issue that requires long-term commitment, action by every segment of society, technology and free-market solutions. We accept the climate challenge and are making investments that advance a lower carbon future. We are advancing climate solutions through our operating excellence and environmental stewardship.

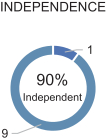

Governance and Board Highlights

We recognize that strong corporate governance contributes to long-term shareholder value. We are committed to sound governance practices, including those described below.

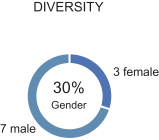

Percentage of independent directors | 90% | Oversight of corporate culture and human capital management | ✓ | |||

Percentage of female directors | 30% | Clawback policy for short- and long-term incentives | ✓ | |||

Directors attended at least 75% of meetings | ✓ | Commitment to diverse candidate pools | ✓ | |||

Majority voting for directors | ✓ | Risk oversight by the full Board and committees | ✓ | |||

Proxy access (3%, 3 years, 20%) | ✓ | Commitment to sustainability and social responsibility | ✓ | |||

Robust Lead Director duties | ✓ | Stock ownership guidelines for executives and directors | ✓ | |||

Regular executive sessions of independent directors | ✓ | Prohibition on pledging and hedging of Company stock | ✓ | |||

Annual Board and committee evaluations | ✓ | Annual evaluation of CEO by independent directors | ✓ |

Our directors exhibit an effective mix of diversity, experience and perspective:

2020 PROXY STATEMENT 1

PROXY SUMMARY

Snapshot of 2020 Director Nominees

The following table provides summary information about each director nominee. For more information about our directors, seePROPOSAL 1: ELECTION OF DIRECTORS.

Name | Director Since | Independent | Committee Memberships | Other Current Public Boards | ||||||||||||

AFC | HRCC | NGC | PPC | EC | ||||||||||||

Charles M. Holley

|

2019

|

✓

|

●

|

●

|

1

| |||||||||||

Glenn F. Tilton

|

2012

|

✓

|

●

|

|

●

|

●

|

2

| |||||||||

Marna C. Whittington

| 2012

|

✓

|

|

●

|

●

|

●

|

2

| |||||||||

AFC = Audit and Finance Committee HRCC = Human Resources and Compensation Committee NGC = Nominating and Governance Committee PPC = Public Policy Committee EC = Executive Committee |

● = Member |

| ||||||||||||||

2019 Performance Highlights

| * | TRR is total recordable rate. |

Executive Compensation Highlights

We link compensation to Company performance and use metrics that we believe will provide long-term shareholder value. Additionally, we align the interests of our executives with our shareholders through our equity compensation program. Below is a summary of some of the compensation best practices we follow:

✓ Target the majority of named executive officer (“NEO”) compensation to be performance based |

✓ Link NEO compensation to shareholder value creation by having a significant portion of compensation at risk |

✓ Apply multiple performance metrics aligned with our corporate strategy to measure our performance |

✓ Cap maximum payouts under our Variable Cash Incentive Program (“VCIP”) and equity programs |

✓ Employ a “double trigger” for severance benefits and equity awards under our Key Employee Change in Control Severance Plan |

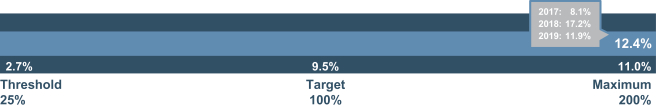

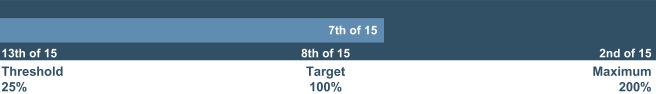

✓ Include absolute and relative metrics in our Long-Term Incentive (“LTI”) programs |

✓ Maintain stock ownership guidelines for executives—CEO 6x base salary; other NEOs3-5x base salary |

✓ Balance, monitor and manage compensation risk through regular assessments and robust clawback provisions |

✓ Have extended vesting periods on stock awards, with a minimumone-year vesting period |

✓ Maintain a fully independent Compensation Committee |

2 2020 PROXY STATEMENT

PROXY SUMMARY

✓ Retain an independent compensation consultant |

✓ Hold aSay-on-Pay vote annually |

Key Elements of Compensation Programs

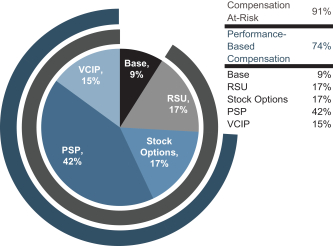

We provide our named executive officers with short- and long-term compensation opportunities that encourage performance to increase stockholder value while avoiding excessive risk-taking. Our compensation plans tie a substantial portion of our named executive officers’ overall target compensation to the achievement of performance goals and include equity-based compensation that aligns our executives’ interests with our shareholders.

Compensation Mix

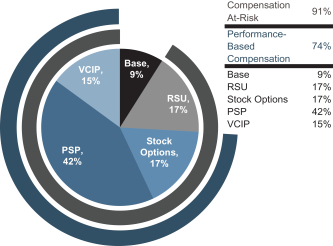

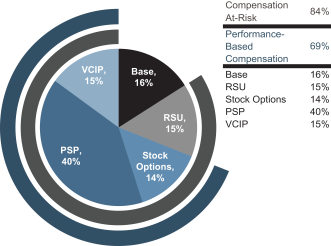

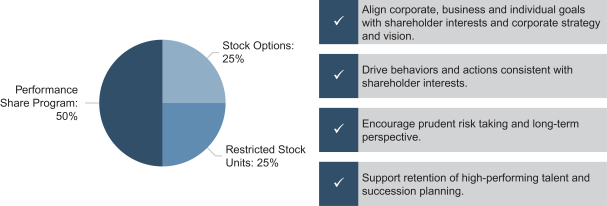

Our executives’ compensation includes base salary, an annual bonus opportunity under our Variable Compensation Incentive Plan (“VCIP”), and equity-based compensation comprised of stock options, restricted stock units (“RSUs”) and awards under our Performance Share Program (“PSP”).

CEO |

Other NEOs |

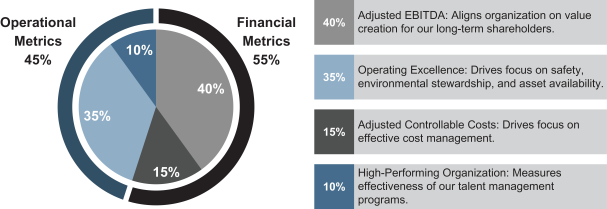

Variable Compensation Incentive Plan

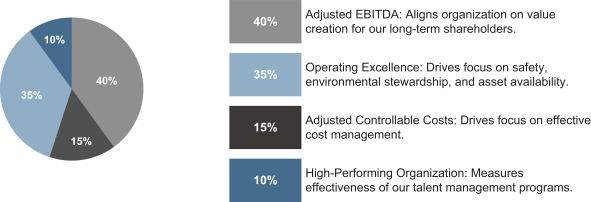

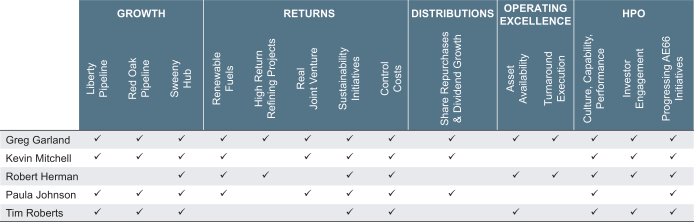

The VCIP program is designed to align annual bonus awards with shareholder interests and execution of our corporate strategy. Performance under the VCIP is based on both operational and financial metrics. In 2019, 45% of VCIP is weighted to operational metrics (high-performing organization and operating excellence) and 55% is weighted to financial metrics (adjusted EBITDA and adjusted controllable costs).

2020 PROXY STATEMENT 3

PROXY SUMMARY

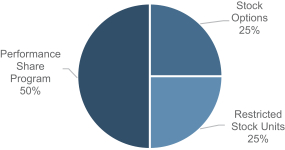

Long-Term Incentive Programs

Our long-term incentives include PSP awards, stock options and RSUs. We believe these equity-based awards, and the mix of awards, promote retention, drive behaviors and actions consistent with shareholder interests and are appropriate for the cyclical nature of our business.

Corporate Responsibility and Sustainability

Our vision is to provide energy in ways that improve lives, which we reinforce through our core company values of safety, honor and commitment. Operational, economic, social and environmental sustainability is at the heart of how we deliver on our vision. By maintaining strong operating excellence, we are committed to safety, reliability and environmental stewardship while protecting shareholder value. We also are committed to achieving a high-performing organization that is focused on culture, inclusion and diversity as well as building community through volunteerism, financial support, and engagement, including community awareness and education. More information can be found in theCORPORATE RESPONSIBILITY AND SUSTAINABILITYsection of this proxy statement.

4 2020 PROXY STATEMENT

PROPOSAL 1: ELECTION OF DIRECTORS

Our governing documents provide that directors are divided into three classes, with one class being elected each year for a three-year term. Based on the recommendation of the Nominating and Governance Committee, the Board has nominated each of the director nominees set forth below to stand for election at the Annual Meeting. The term for the directors to be elected this year will expire at the annual meeting of shareholders held in 2023. Each nominee requires the affirmative vote of a majority of the votes cast in person or by proxy at the meeting.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF CHARLES M. HOLLEY, GLENN F. TILTON AND MARNA C. WHITTINGTON.

Our Board of Directors

Each of our directors is elected to serve until his or her successor is duly elected and qualified. If a nominee is unavailable for election, proxy holders may vote for another nominee proposed by the Board of Directors or, as an alternative, the Board of Directors may reduce the number of directors to be elected at the Annual Meeting.

Any director vacancies created between annual shareholder meetings (such as by a current director’s death, resignation or removal for cause or an increase in the number of directors) may be filled by a majority vote of the remaining directors then in office. Any director appointed in this manner would hold office for a term expiring at the annual meeting of shareholders at which the term of office of the class to which he or she has been appointed expires. If a vacancy results from an action of our shareholders, only our shareholders would be entitled to elect a successor.

Director Biographies

Set forth below is information as of March 11, 2020, regarding the nominees for election. We have provided the most significant experiences and qualifications that led to the conclusion that each director or director nominee should serve as one of our directors. No family relationship exists among any of our directors, director nominees or executive officers. There is no arrangement between any director or director nominee and any other person pursuant to which he or she was, or is to be, selected as a director or director nominee.

Director Nominees

The following three directors will seek election at this year’s Annual Meeting for a term expiring in 2023.

Charles M. Holley

Age 63 Director since 2019 Board Committees: Audit and Finance, Public Policy |

• Executive Vice President and Chief Financial Officer of Walmart Inc. from 2010 to 2015

• Director of Amgen, Inc. since 2017

Director Qualifications: Mr. Holley has several years of experience as an executive at one of the largest U.S. corporations, providing him with expertise in finance, senior management, risk and asset management, strategic planning and capital markets. He also has extensive experience in international operations and technology platforms. |

2020 PROXY STATEMENT 5

PROPOSAL 1: ELECTION OF DIRECTORS

Glenn F. Tilton Lead Director

Age 71 Director since 2012 Board Committees: Human Resources and Compensation, Nominating and Governance (Chair), Public Policy, Executive |

• Chairman of the Midwest of JPMorgan Chase & Co. from 2011 to 2014

• Director of Abbott Laboratories since 2017

• Lead Director of AbbVie Inc. since 2013

• Non-Executive Chairman of the Board of United Continental Holdings Inc. from 2010 to 2013

Director Qualifications:Mr. Tilton has strong management experience overseeing complex multinational businesses operating in highly regulated industries. He also has extensive experience in the energy industry through his more than 30 years in increasingly senior roles with Texaco Inc., including Chairman and CEO in 2001, as well as expertise in finance and capital markets matters. | |

Marna C. Whittington

Age 72 Director since 2012 Board Committees: Human Resources and Compensation (Chair), Nominating and Governance, Public Policy, Executive |

• CEO of Allianz Global Investors Capital, a diversified global investment firm, from 2002 until 2012

• Director of Macy’s, Inc. since 1993

• Director of Oaktree Capital Group, LLC since 2012

• Director of Rohm & Haas Company from 1989 to 2009

Director Qualifications:Dr. Whittington has many years of leadership experience and expertise as a former senior executive in the investment management industry. She has extensive knowledge of and substantial experience in management, and in financial, investment and banking matters and provides valuable insight from her previous experience serving as a public company board member. |

Directors Whose Terms Expire at the 2021 Annual Meeting

J. Brian Ferguson

Age 65 Director since 2012 Board Committees: Audit and Finance (Chair), Nominating and Governance, Public Policy, Executive |

• Chairman of Eastman Chemical Company, a global chemical company engaged in the manufacture and sale of a broad portfolio of chemicals, plastics and fibers, from 2002 to 2010

• Director of Owens Corning since 2011

• Director of NextEra Energy, Inc. from 2005 to 2013

Director Qualifications: Mr. Ferguson joined Eastman in 1977 and led several of its businesses in the U.S. and Asia, which, in addition to his Chairman and CEO roles, provides him with over 30 years of leadership experience in international business, industrial operations, strategic planning and capital raising strategies. |

6 2020 PROXY STATEMENT

PROPOSAL 1: ELECTION OF DIRECTORS

Harold W. McGraw III

Age 71 Director since 2012 Board Committees: Human Resources and Compensation, Public Policy |

• Chairman of S&P Global Inc. (previously McGraw Hill Financial) from 1999 to 2015 and CEO of S&P Global from 1998 to 2013

• Honorary Chairman of the International Chamber of Commerce (ICC) since 2016

• Chairman of the ICC from 2013 to 2016

• Director of United Technologies Corporation since 2003

Director Qualifications:Mr. McGraw’s experience leading a large, global public company with a significant role in the financial reporting industry provides him with valuable global financial, corporate governance and operational expertise. | |

Victoria J. Tschinkel

Age 72 Director since 2012 Board Committees: Audit and Finance, Public Policy |

• Former Chair of 1000 Friends of Florida, anon-profit to promote a sustainable Florida by building better communities and supporting preservation and restoration activities

• State Director of the Florida Nature Conservancy from 2003 to 2006

• Senior environmental consultant to Landers & Parsons, a Tallahassee, Florida law firm, from 1987 to 2002

• Secretary of the Florida Department of Environmental Regulation from 1981 to 1987

• Former director of the National Fish and Wildlife Foundation

Director Qualifications:Ms. Tschinkel’s extensive environmental regulatory experience makes her well qualified to serve as a member of the Board. In addition, her relationships and experience working within the environmental community position her to advise the Board on the impact of our operations in sensitive areas. |

Directors Whose Terms Expire at the 2022 Annual Meeting

Greg C. Garland

Age 62 Director since 2012 Board Committees: Executive (Chair) |

• Chairman and CEO of Phillips 66 since 2012

• Senior Vice President, Exploration and Production-Americas for ConocoPhillips from 2010 to 2012

• President and CEO of Chevron Phillips Chemical Company LLC from 2008 to 2010

• Director of Amgen Inc. since 2013

• Director of Phillips 66 Partners GP LLC, the general partner of Phillips 66 Partners LP, since 2013

Director Qualifications: Mr. Garland has extensive knowledge of all aspects of our business. Through his years of service with the Company and more than 35 years of experience in the energy industry, Mr. Garland is well qualified to serve both as a director and Chairman of the Board. |

2020 PROXY STATEMENT 7

PROPOSAL 1: ELECTION OF DIRECTORS

Gary K. Adams

Age 69 Director since 2016 Board Committees: Human Resource and Compensation, Public Policy |

• Chief Advisor - Chemicals for IHSMarkit from 2011 to 2017

• President, CEO and Chairman of the Board of Chemical Market Associates, Inc. (CMAI) from 1997 until 2011

• Director of Trecora Resources since 2012

• Director of Westlake Chemical Partners LP from 2014 to 2016

• Director of Phillips 66 Partners LP from 2013 to 2016

Director Qualifications:Mr. Adams has a lengthy tenure and extensive experience in the energy industry, including leadership experience with operating responsibilities as well asin-depth knowledge of the global chemicals market, including 15 years at Union Carbide in various positions. | |

John E. Lowe

Age 61 Director since 2012 Board Committees: Audit and Finance, Public Policy (Chair), Executive |

• Assistant to the CEO of ConocoPhillips from 2008 until 2012

• Executive Vice President, Exploration and Production of ConocoPhillips from 2007 to 2008

• Senior Executive Advisor to Tudor, Pickering, Holt & Co. since 2012

• Director of TC Energy (formerly TransCanada) since 2015

• Director of Apache Corporation since 2013(Non-Executive Chairman since 2015)

• Director of Agrium Inc. from 2010 to 2015

Director Qualifications:Mr. Lowe has over 30 years of experience in the oil and gas industry. In addition to relevant industry financial expertise, he has extensive experience identifying, assessing and minimizing risks faced by companies in the energy industry. | |

Denise L. Ramos

Age 63 Director since 2016 Board Committees: Audit and Finance, Nominating and Governance, Public Policy |

• Chief Executive Officer, President and a director of ITT Inc., a diversified manufacturer of critical components and customized technology solutions, from 2011 to 2018

• Director of Bank of America Corporation since 2019

• Director of United Technologies Corporation since 2018

• Director of Praxair, Inc. from 2014 to 2016

Director Qualifications:Ms. Ramos has extensive experience in the oil and gas industry through her more than 20 years in various finance positions at Atlantic Richfield Company, as well as experience in retail and customer-centric industries. In addition to her financial expertise, she has extensive operational and manufacturing experience with industrial companies. |

8 2020 PROXY STATEMENT

CORPORATE GOVERNANCE AT PHILLIPS 66

Phillips 66 is committed to effective corporate governance and high ethical standards. We believe that corporate governance, including our values of safety, honor and commitment, is the foundation for financial integrity, investor confidence and sustainable performance. Our values guide how our 14,500 employees conduct business every day and how the Board of Directors oversees and counsels management in the long-term interest of the Company, our shareholders and other stakeholders. We continuously strive to meet our vision of providing energy and improving lives, guided by our four pillars of sustainability:

| • | Operational Excellence |

| • | Environmental Commitment |

| • | Social Responsibility |

| • | Economic Performance |

Our Board of Directors has adopted Corporate Governance Guidelines that establish a common set of expectations to assist the Board and its committees in performing their duties. The Board reviews the Guidelines and updates them as necessary to reflect changing regulatory requirements, evolving best practices and input from shareholders and other stakeholders. Our key corporate governance documents, including our Corporate Governance Guidelines, Charters of our Board’s committees, ourBy-Laws, and our Code of Business Ethics and Conduct, can be found on the Company’s website (www.phillips66.com) in the “Investors” section, under the“Corporate Governance” caption. We also disclose information about our environmental, social and governance (“ESG”) efforts on our website under the“Sustainability” caption. There, interested parties can find data and information on programs and projects that demonstrate how we fulfill our vision of providing energy and improving lives.

DIRECTOR QUALIFICATIONS AND NOMINATION PROCESS

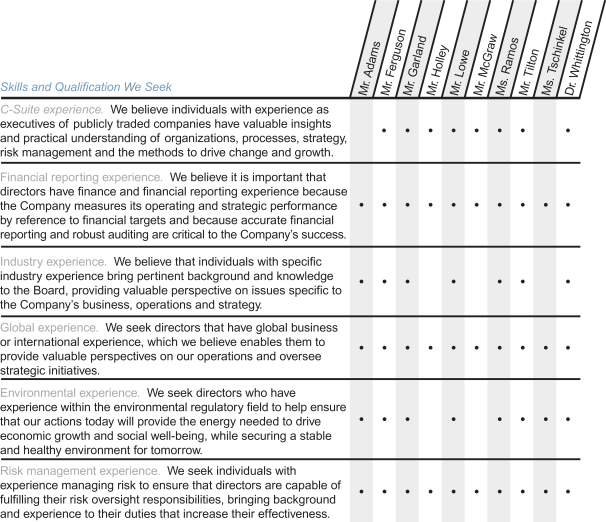

Skills and Qualifications We Seek in Directors

In evaluating potential candidates for nomination to the Board, as well as evaluating the Board’s overall composition, the Nominating and Governance Committee and the Board consider several factors. All directors are expected to possess the highest personal and professional ethics, integrity and values and be committed to representing the long-term interests of the Company’s shareholders. Directors also are expected to devote sufficient time and effort to their duties as a director.

The Nominating and Governance Committee believes that the Board should reflect a range of talents, ages, skills, experiences, diversity, and expertise sufficient to provide sound and prudent guidance with respect to the Company’s strategic and operational objectives. The Board has committed to seeking women and minority candidates, as well as candidates with diverse backgrounds, skills and experiences, as part of the search process for new directors.

The following are key skills and qualifications considered in evaluating director nominees and Board composition as a whole. The Board determined that a mix of these skills and qualifications provides the composition necessary to effectively oversee the Company’s execution of its strategy.

2020 PROXY STATEMENT 9

CORPORATE GOVERNANCE AT PHILLIPS 66

Board Refreshment

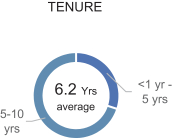

The Board strives to maintain an appropriate balance of tenure, turnover, diversity, skills and experience.

The Board does not maintain term limits, but our Governance Guidelines include a mandatory director retirement age of 75. The Board believes that continuity of service can provide stability and valuable insight, based on experience and understanding of the Company. The average tenure of all of our directors is 6.2 years and the average age of all of our directors is 66.9 years.

The Board ensures refreshment and continued effectiveness through evaluation, nomination, and other policies, processes and practices. For example:

| • | The Nominating and Governance Committee annually reviews with the Board the qualifications for Board members and the composition of the Board as a whole. |

| • | The Nominating and Governance Committee annually reviews each director nominee’s continuation on the Board and makes recommendations to the full Board. |

| • | The Company’s Corporate Governance Guidelines provide that any director whose principal outside responsibilities have changed since election to the Board should volunteer to resign to give the Board the opportunity to review the appropriateness of continued Board membership under the circumstances. |

10 2020 PROXY STATEMENT

CORPORATE GOVERNANCE AT PHILLIPS 66

| • | Additionally, each committee of the Board performs an annual self-assessment, and the Nominating and Governance Committee and Lead Director oversee an annual self-assessment of the full Board. The self-assessment includes an evaluation survey and individual discussions between the Lead Director and each other director. A summary of the results of each committee’s self-assessment is presented to the committee and discussed in executive session. The Lead Director presents a summary of the results of the Board evaluation to the Board in executive session. Any matters requiring further action are identified and action plans developed to address the matter. |

To further ensure continued Board effectiveness, the Nominating and Governance Committee periodically considers Board committee rotations, including in the event of a change in the composition of the Board. Additionally, the Nominating and Governance Committee’s charter provides that in all cases, committee rotations will be considered every three years for all committees other than Audit and Finance, the rotation of which will be considered every three to six years.

How We Select Our Director Nominees

The Board is responsible for nominating directors and filling vacancies that may occur between annual meetings, based upon the recommendation of the Nominating and Governance Committee. The Nominating and Governance Committee considers the Company’s current needs and long-term and strategic plans to determine the skills, experience and characteristics needed by our Board. The Nominating and Governance Committee identifies, considers and recommends director candidates to the Board of Directors with the goal of creating a balance of knowledge, experience and diversity. Generally, the Nominating and Governance Committee identifies candidates through the use of a search firm or the business and organizational contacts of directors and management. In 2018, the Board formalized its commitment to seeking women and minority candidates, as well as candidates with diverse backgrounds, skills and experiences, as part of the search process for new directors.

When evaluating candidates, the Nominating and Governance Committee takes into consideration the key qualifications and skills described above. The Nominating and Governance Committee also considers whether potential candidates will likely satisfy independence standards for service on the Board and its committees.

Shareholder Recommendation of Candidates and Nomination of Candidates

The Nominating and Governance Committee will consider director candidates recommended by shareholders. A shareholder wishing to recommend a candidate for nomination by the Nominating and Governance Committee should follow the same procedures referred to below for nominations to be made directly by a shareholder. In addition, the shareholder should provide such other information deemed relevant to the Nominating and Governance Committee’s evaluation. Candidates recommended by the Company’s shareholders are evaluated on the same basis as candidates recommended by the Company’s directors, management, third-party search firms or other sources.

OurBy-Laws permit proxy access for shareholders. Shareholders who wish to nominate directors for inclusion in our proxy statement or directly at an annual meeting in accordance with ourBy-Laws should follow the procedures described underSUBMISSION OF FUTURE SHAREHOLDER PROPOSALS AND DIRECTOR NOMINATIONS.

Majority Voting

To be elected, a director must receive a majority of the votes cast with respect to that director at the meeting. OurBy-Laws provide that if the number of shares voted “for” a nominee who is serving as a director (an incumbent) does not exceed 50% of the votes cast with respect to that director, he or she will tender his or her resignation to the Board of Directors. The Nominating and Governance Committee will then make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. Within 90 days of the certification of the shareholder vote, the Board is required to decide whether to accept the resignation and publicly disclose its decision-making process.

In a contested election, where the number of nominees exceeds the number of directors to be elected, the required vote would be a plurality of votes cast.

2020 PROXY STATEMENT 11

CORPORATE GOVERNANCE AT PHILLIPS 66

Director Independence

Our Corporate Governance Guidelines contain director independence standards, which are consistent with the standards set forth in the NYSE listing standards. These standards assist the Board of Directors in determining the independence of the Company’s directors. The Board of Directors has affirmatively determined that each director, except Mr. Garland, meets our independence standards. Mr. Garland is not considered independent because he is an executive officer of the Company.

In making independence determinations, the Board specifically considered the fact that many of our directors are directors or otherwise affiliated with companies with which we conduct business. Additionally, some of our directors may purchase products, such as gasoline from our retail sites, from the Company. In all cases, it was determined that the nature of the business conducted and the interest of the director by virtue of such position were immaterial both to the Company and to the director.

Executive Sessions of Independent Directors

The independent directors hold regularly scheduled executive sessions of the Board and its committees without Company management present. These executive sessions are chaired by the Lead Director at Board meetings or by the Committee Chairs at Committee meetings.

Chairman and CEO Roles

The Board of Directors believes that no single organizational model is the most effective in all circumstances. As a consequence, the Board periodically considers whether the offices of Chairman and CEO should continue to be combined and who should serve in such capacities.

Although the Board of Directors has the authority to separate the positions of Chairman and CEO if it deems appropriate, the Board believes it is in the best interest of the Company’s shareholders to combine them. Doing so enables one person to guide the Board in setting priorities for the Company and in addressing the risks and challenges the Company faces. The Board of Directors believes that, while itsnon-employee directors bring a diversity of skills and perspectives to the Board, the Company’s CEO, by virtue of hisday-to-day involvement in managing the Company, currently is best suited to serve as Chairman and perform this unified role.

Independent Director Leadership

Glenn Tilton has served as our Lead Director since February 2016. In appointing a Lead Director, the Board of Directors considered it useful and appropriate to designate an independent director to serve in a lead capacity to coordinate the activities of thenon-employee directors and to perform such other duties and responsibilities as the Board of Directors may determine. In his role as Lead Director, Mr. Tilton:

| • | advises the Chairman on an appropriate schedule of Board meetings, seeking to ensure that thenon-employee directors can perform their duties responsibly without interfering with operations; |

| • | provides the Chairman with input on the preparation of the agenda for each Board meeting and assures that there is sufficient time for discussion of all agenda items; |

| • | advises the Chairman on the quality, quantity and timeliness of the flow of information from management to thenon-employee directors in order that they may perform their duties effectively and responsibly, including specifically requesting certain materials be provided to the Board; |

| • | recommends to the Chairman the retention of consultants who report directly to the Board of Directors; |

| • | interviews all Board candidates and makes nomination recommendations to the Nominating and Governance Committee and the Board of Directors; |

| • | assists the Board of Directors and Company officers in assuring compliance with and implementation of the Corporate Governance Guidelines; |

12 2020 PROXY STATEMENT

CORPORATE GOVERNANCE AT PHILLIPS 66

| • | ensures that he, or another appropriate director, is available for engagement with shareholders when warranted; |

| • | calls meetings of thenon-employee directors as needed, develops the agenda for and moderates any such meetings and executive sessions of thenon-employee directors; |

| • | acts as principal liaison between thenon-employee directors and the Chairman on sensitive issues; |

| • | participates with the Human Resources and Compensation Committee (“Compensation Committee”) in the periodic discussion of CEO performance; |

| • | ensures the Board of Directors conducts an annual self-assessment and meeting with the CEO to discuss the results of the annual self-assessment; and |

| • | works with the Nominating and Governance Committee to recommend the membership of the various Board committees, as well as selection of the committee chairs. |

The Board of Directors believes that its current structure and processes encourage itsnon-employee directors to be actively involved in guiding its work. The chairs of the Board’s committees review their respective agendas and committee materials in advance of each meeting, communicating directly with other directors and members of management as each deems appropriate. Moreover, each director may suggest agenda items and raise matters that are not on the agenda at Board and committee meetings.

BOARD MEETINGS, COMMITTEES, AND MEMBERSHIP

The Board of Directors met six times in 2019. All of our directors attended at least 75% of the meetings of the Board and committees on which they served.

Recognizing that director attendance at the Company’s annual meeting can provide the Company’s shareholders with an opportunity to communicate with the directors about issues affecting the Company, the Company actively encourages directors to attend the annual meetings of Shareholders. All of our directors, other than Mr. Holley, who was not yet serving on the Board, attended the 2019 Annual Meeting of Shareholders.

BOARD COMMITTEE MEMBERSHIP

The table below shows the membership of each of the Board’s committees, as well as information about each committee’s primary responsibilities.

Audit and Finance

Met 9 times in 2019

Current Members:

J. Brian Ferguson (Chair) Charles M. Holley John E. Lowe Denise L. Ramos Victoria J. Tschinkel | Primary Responsibilities:

• Discusses, with management, the independent auditors and the internal auditors the integrity of the Company’s accounting policies, internal controls, financial statements, and financial reporting practices, and select financial matters, covering the Company’s capital structure, complex financial transactions, financial risk management, retirement plans and tax planning.

• Reviews significant corporate risk exposures and steps management has taken to monitor, control and report such exposures.

• Monitors the qualifications, independence and performance of our independent auditors and internal auditors.

• Monitors our compliance with legal and regulatory requirements, including our Code of Business Ethics and Conduct.

• Maintains open and direct lines of communication with the Board and our management, internal auditors and independent auditors.

Financial Expertise, Financial Literacy and Independence:

The Board has determined that Messrs. Ferguson, Holley, Lowe and Ms. Ramos satisfy the SEC’s criteria for “audit committee financial experts.” Additionally, the Board has determined that each member of the Audit and Finance Committee is independent pursuant to SEC and NYSE requirements and is financially literate within the meaning of the NYSE listing standards. |

2020 PROXY STATEMENT 13

CORPORATE GOVERNANCE AT PHILLIPS 66

Human Resources and Compensation

Met 6 times in 2019

Current Members:

Marna C. Whittington (Chair) Gary K. Adams Harold W. McGraw III Glenn F. Tilton | Primary Responsibilities:

• Oversees our executive compensation policies, plans, programs and practices.

• Assists the Board in discharging its responsibilities relating to the fair and competitive compensation of our executives and other key employees.

• Reviews at least annually the performance (together with the Lead Director) and sets the compensation of the CEO.

Independence:

The Board has determined that each member of the Compensation Committee is independent under the Company’s Corporate Governance Guidelines and the NYSE listing standards for directors and compensation committee members.

Additional information about the Compensation Committee can be found in theCOMPENSATION DISCUSSION AND ANALYSIS. | |

Nominating and Governance

Met 4 times in 2019

Current Members:

Glenn F. Tilton (Chair) J. Brian Ferguson Denise L. Ramos Marna C. Whittington | Primary Responsibilities:

• Selects and recommends director candidates to the Board to be submitted for election at annual meetings and to fill any vacancies on the Board.

• Recommends committee assignments to the Board.

• Reviews and recommends to the Board compensation and benefits policies for ournon-employee directors.

• Reviews and recommends to the Board appropriate corporate governance policies and procedures for our Company.

• Conducts an annual assessment of the qualifications and performance of the Board.

• Reviews and reports to the Board annually on succession planning for the CEO.

Independence:

The Board has determined that each member of the Nominating and Governance Committee is independent under the Company’s Corporate Governance Guidelines and the NYSE listing standards for directors. | |

Public Policy

Met 4 times in 2019

Current Members:

John E. Lowe (Chair) Gary K. Adams J. Brian Ferguson Charles M. Holley Denise L. Ramos Glenn F. Tilton Victoria J. Tschinkel Marna C. Whittington | Primary Responsibilities:

• Advises the Board on current and emerging domestic and international public policy issues.

• Assists the Board with the development, review and approval of policies and budgets for charitable and political contributions and activity.

• Advises the Board on compliance with policies, programs and practices regarding social risks and health, safety and environmental protection.

Independence:

The Board has determined that each member of the Public Policy Committee is independent under the Company’s Corporate Governance Guidelines and the NYSE listing standards for directors. | |

Executive

Did not meet in 2019

Current Members:

Greg C. Garland (Chair) J. Brian Ferguson John E. Lowe Glenn F. Tilton Marna C. Whittington | Primary Responsibilities:

• Exercises the authority of the full Board, if necessary, in intervals between regularly scheduled Board meetings.

• The power and authority of the committee does not extend to (1) those matters expressly delegated to another committee of the Board, (2) the adoption, amendment or repeal of any of ourBy-Laws and (3) those matters that cannot be delegated to a committee under statute or our Certificate of Incorporation orBy-Laws. |

14 2020 PROXY STATEMENT

CORPORATE GOVERNANCE AT PHILLIPS 66

The charters for our Audit and Finance Committee (the “Audit Committee”), Human Resources and Compensation Committee (the “Compensation Committee”), Nominating and Governance Committee, Public Policy Committee and Executive Committee can be found in the “Investors” section on the Phillips 66 website (www.phillips66.com) under the “CorporateGovernance” caption. Shareholders may also request printed copies of these charters by following the instructions located underAVAILABLE INFORMATION.

2020 PROXY STATEMENT 15

CORPORATE GOVERNANCE AT PHILLIPS 66

BOARD’S ROLE IN RISK OVERSIGHT

The Company’s management is responsible for theday-to-day conduct of our businesses and operations, including management of risks the Company faces. To fulfill this responsibility, our management has established an enterprise risk management (“ERM”) program. The program is designed to identify and facilitate the management of significant risks facing the Company as well as the approaches to addressing risks.

The Board of Directors has broad oversight responsibility over the Company’s ERM program and receives management updates on its development and implementation. In this oversight role, the Board of Directors is responsible for satisfying itself that the risk management processes designed and implemented by the Company’s management are functioning as intended, and that necessary steps are taken to foster a culture of risk-adjusted decision making throughout the organization.

The Board of Directors exercises its oversight responsibility for risk assessment and risk management directly and through its committees. However, the full Board maintains responsibility for oversight of strategic risks. Setting the strategic course of the Company and providing oversight of strategic risks involves a high level of constructive engagement between management and the Board. The Board regularly discusses the strategic priorities of the Company and the risks to the Company’s successful execution of its strategy, including global economic and other significant trends, as well as changes in the energy industry and regulatory initiatives.

The Board of Directors receives regular updates from its committees on individual areas of risk falling within each committee’s area of oversight and expertise, as outlined below.

Committee Risk Oversight Responsibilities

Audit and Finance Committee

The Audit Committee discusses the guidelines and policies to govern the process by which ERM is handled and has been delegated responsibility to facilitate coordination among the Board’s committees with respect to the Company’s risk management programs.

The Audit Committee is responsible for overseeing the integrity of the Company’s financial statements; the independent auditors’ qualifications and independence; the performance of the Company’s internal audit function; and its system of internal control over financial reporting. The Audit Committee also reviews and receives briefings concerning information technology (including cybersecurity), compliance with laws and regulatory requirements, and major financial exposures.

Human Resources and Compensation Committee

The Compensation Committee oversees the Company’s compensation and talent management programs. The Compensation Committee evaluates whether our compensation programs and practices create excessive risks and determines whether any changes to those programs and practices are warranted. The Compensation Committee also ensures that our compensation programs align with long-term interests of shareholders and are effective in retaining top talent. Finally, the Compensation Committee ensures the development of a diverse talent pool with respect to CEO and senior management succession planning.

Nominating and Governance Committee

The Nominating and Governance Committee reviews policies and practices in the areas of corporate governance and is responsible for overseeing Board composition and director qualifications through the nomination process. Additionally, the Committee is responsible for CEO succession planning.

Public Policy Committee

The Public Policy Committee assists the Board in identifying, evaluating and reviewing social, political and environmental trends and related risks. It also reviews management’s proposed actions to anticipate and adjust to such trends and manage risks to achieve the Company’s long-term business goals. The Public Policy Committee reviews and makes recommendations to the full Board on the Company’s policies, programs and practices relating to health, safety and environmental protection, government relations and political contributions, corporate philanthropy, and corporate responsibility.

16 2020 PROXY STATEMENT

CORPORATE GOVERNANCE AT PHILLIPS 66

Our Code of Business Ethics and Conduct requires all directors and executive officers to promptly report any transactions or relationships that reasonably could be expected to constitute a related party transaction. The transaction or relationship is reviewed by the Company’s management and the appropriate committee of the Board to ensure that it does not constitute a conflict of interest and is appropriately disclosed.

Additionally, the Nominating and Governance Committee conducts an annual review of related party transactions between each director and the Company and its subsidiaries in making recommendations to the Board regarding the continued independence of each director. Since January 1, 2019, there have been no related party transactions in which the Company or a subsidiary was a participant and in which any director, executive officer, or any of their immediate family members had a direct or indirect material interest.

The Nominating and Governance Committee also considered relationships that, while not constituting related party transactions where a director had a direct or indirect material interest, nonetheless involved transactions between the Company and an organization with which a director is affiliated, either directly or as a partner, shareholder or officer. The Nominating and Governance Committee determined that there were no transactions impairing the independence of any member of the Board.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee consists of Marna C. Whittington, Gary K. Adams, Harold W. McGraw III and Glenn F. Tilton, each of whom is an independent director. None of the members of the Compensation Committee during fiscal year 2019 or as of the date of this proxy statement is or has been an officer or employee of Phillips 66 and no executive officer of Phillips 66 served on the compensation committee or board of any company that employed any member of Phillips 66’s Compensation Committee or Board.

SHAREHOLDER AND COMMUNITY ENGAGEMENT

At Phillips 66, we believe that we succeed together as a team, leveraging our diverse experiences and thoughts in an environment that thrives on collaboration. We embrace engagement as an important tenet of good governance and value the views of our shareholders and other stakeholders. We believe that positive dialogue builds informed relationships that promote transparency and accountability. Although the Lead Director or other members of the Board are available to participate in meetings with shareholders as appropriate, management has the principal responsibility for shareholder communication.

The communities in which our assets are located and in which we operate are critical stakeholders. We consistently and regularly engage with our local communities and seek their feedback. Our refining operations have community advisory councils or panels that include both Company representatives and community members. These panels meet at least quarterly with refinery management to provide feedback, discuss topics of local concern and share insights on plans and activities. Our pipeline business units have year-round community awareness, education and listening panels to stay connected with those involved with and affected by our extensive pipeline network.

We also believe that engagement and good governance involve participating in political or public policy activities that advance the Company’s goals, are consistent with Company values, and improve the communities where we work and live. A number of federal, state and local laws govern corporate involvement in such activities, and we maintain policies, procedures and programs to comply with these laws. Additional information about our involvement in political or public policy activities is available on our website.

Shareholder Engagement

For several years, Phillips 66 has conducted a formal shareholder outreach program to listen to investor perspectives on our business strategy, corporate governance, executive compensation program, ESG, and other matters that are important to our investors. We solicit feedback from a range of investors, including institutional investors, asset managers, public and labor union pension funds, and socially responsible investors.

2020 PROXY STATEMENT 17

CORPORATE GOVERNANCE AT PHILLIPS 66

Information and feedback received through our engagement activities are shared with our executive leadership team and the Board of Directors, which help inform their decisions. In 2019, we engaged with representatives of many of our top institutional shareholders to discuss strategy, ESG, board composition, refreshment and tenure, risk management, climate change and sustainability efforts, governance practices, and executive compensation.

We are committed to continued engagement. Over the last few years, we have made changes and taken action in response to shareholder feedback as well as our commitment to ongoing improvement. Examples of these improvements include:

Year | Action Taken | |

| 2015 | Adopted proxy accessby-law giving shareholders holding at least 3% of our shares for at least 3 years the right to include in the proxy statement director nominees for up to 20% of the Board (but not less than two nominees). | |

2015, 2016, 2018 | Encouraged shareholders to approve charter amendment to eliminate classified board structure and permit all directors to be elected annually. Proposal did not receive the required vote to pass in any of the three years it was submitted to a vote. We continue to assess the proposal and its potential for adoption in the future. | |

| 2016 | Increased size of our Board and added two new independent directors, Mr. Adams and Ms. Ramos, further increasing the independence and diversity of the Board. | |

| 2017, 2019 | Published on our website a sustainability report to provide a comprehensive resource for interested parties to learn about our sustainability policies and programs, with links to a suite of Company information, including policies, positions, educational information, and other reports. The report is updated regularly. | |

| 2018 | Amended our Corporate Governance Guidelines to specify that the Board will seek women and minority candidates, as well as candidates with diverse backgrounds, skills and experiences, as part of the search process for new directors. | |

| 2018 | Published on our website a Task Force on Climate-related Disclosures (“TCFD”) informed report to help investors understand our risk management, scenario planning and assumptions on energy policy risks. We also published on our website our Inclusion and Diversity Brochure, outlining our commitment to an inclusive and diverse workplace. | |

| 2019 | LaunchedOur Energy in Action, a program to identify and shape our corporate culture for the greater good, built on trust, seeking diverse perspectives and achieving excellence. |

CORPORATE RESPONSIBILITY AND SUSTAINABILITY

Phillips 66 is dedicated to meeting the world’s energy needs responsibly, efficiently and sustainably. For us, sustainability means manufacturing and delivering affordable, clean products in a safe and environmentally sound manner. Our sustainability efforts are built on four pillars: operational excellence, environmental commitment, social responsibility and economic performance. Our Board of Directors oversees these efforts, including through the work of its committees. For more information, seeBOARD’S ROLE IN RISK OVERSIGHT.

We recognize the climate challenge and are making investments that advance a lower carbon future. We are focused on implementingbest-in-class sustainability practices today and into the future and are seeking solutions for tomorrow’s energy needs. We are conducting research on energy of the future, including renewable fuels, organic photovoltaics, current and next generation batteries, and solid oxide fuel cells. In addition, we have a portfolio of renewable fuel projects in development that comply withlow-carbon fuel standards. We are leveraging our existing infrastructure, supply network and capabilities. Below are some of the things we are doing today, as well as some of the projects we are pursuing to position Phillips 66 to be competitive long-term.

| • | Producing renewable diesel from used cooking oil at our Humber Refinery |

| • | Supplying the feedstock to make anodes and lithium ion batteries for electric vehicles and electronic devices |

| • | Testing alternative fuels at our franchise marketing sites on the U.S. West Coast |

| • | Installed our first hydrogen pump station in Switzerland, with plans to add two to three more per year |

| • | Manufacturing the next generation of low viscosity heavy duty engine oil to improve fuel economy by 1% to 2% |

| • | Providing supply and offtake for two third-party renewable diesel facilities under construction in Nevada |

18 2020 PROXY STATEMENT

CORPORATE GOVERNANCE AT PHILLIPS 66

| • | Developing a renewable diesel project at our San Francisco Refinery |

| • | Evaluating solar energy to power our pipelines and refineries |

| • | Progressing an industrial scale renewable hydrogen project at our Humber Refinery |

Corporate Culture

We believe that our success depends on our employees and that our people and our culture provide a significant strategic advantage in helping us achieve our objectives for our stakeholders. In 2019, we launchedOur Energy in Action, a set of behavioral expectations that preserve what make us great and challenge us to evolve in ways that make us better and keep us competitive.Our Energy in Action is how we treat each other, our customers and our communities.

We also believe that we must protect, nurture and celebrate our differences as a competitive advantage that positions us for success in our industry. The talented people who make up our Company are widely divergent in their visible and invisible differences: in gender, race, ethnicity, age, national origin, disability, sexual orientation, gender identity, veteran status, education and religion. Because of this diversity, it is critical that we have an environment where the experiences and perspectives of all employees are valued and respected. While both sides of the diversity and inclusion equation hold equal importance, it is our belief that in the absence of inclusion, diversity cannot thrive. For this reason, we lead withinclusion in our Inclusion & Diversity (I&D) efforts. In 2019 we established an Executive Inclusion and Diversity Council, chaired by our Chairman and CEO, to focus on advancing our strategic vision, evaluating progress and monitoring emerging topics that could influence where we prioritize our efforts. To further demonstrate leaderships’ commitment, we transitioned to an enterprise leadership structure for our Employee Resource Groups (“ERGs”), networks that focus on professional development, networking, raising cultural awareness and community involvement. Each of our ERGs now has an Executive Champion from our Executive Leadership Team.

Community Involvement

We are committed to creating value for our communities through economic development, philanthropy, volunteerism and advocacy, and by operating our business in a socially and environmentally responsible way. Phillips 66 provided $28 million in financial support to organizations promoting education, environmental sustainability, and community safety and preparedness. We value volunteerism, and to promote and support community service, we provide eligible employees two paid days for volunteering in the community. In 2019, our employees volunteered a record-breaking 88,000 hours to organizations in their local communities. We also support our employees’ causes through matching gift and volunteer grants, and provided $7.2 million in matching gifts, volunteer grants and dependent scholarships in 2019.

2020 PROXY STATEMENT 19

CORPORATE GOVERNANCE AT PHILLIPS 66

CODE OF BUSINESS ETHICS AND CONDUCT

Our values are our foundation—our guiding principles for how we conduct our business day in and day out. We also recognize that questions arise in today’s increasingly complex global business environment. We have adopted a Code of Business Ethics and Conduct designed to provide guidance on how to act legally and ethically while performing work for Phillips 66. Our Code of Business Ethics and Conduct covers topics including, but not limited to, conflicts of interest, insider trading, competition and fair dealing, discrimination and harassment, confidentiality, payments to government personnel, anti-boycott laws, U.S. embargoes and sanctions, compliance procedures and employee complaint procedures. All of our directors and employees are required to comply with the Code of Business Ethics and Conduct. We also have adopted an additional Code of Ethics that applies to senior financial officers. Both Codes can be found on our website and are available in print to any shareholder upon request. We intend to disclose any amendment to, or waiver from, either of the Codes by posting such information on our website.

To support shareholder engagement, the Company maintains a process for shareholders and interested parties to communicate with the Board of Directors. Shareholders and interested parties may communicate with thenon-employee directors or with the entire Board of Directors, as indicated by such shareholder or interested party, by contacting our Corporate Secretary, Paula A. Johnson, as provided below:

| Mailing Address: | Corporate Secretary Phillips 66 P.O. Box 421959 Houston, TX 77242-1959 | |

| Phone Number: | (281) 293-6600 | |

| Internet: | “Investors” section of the Company’s website (www.phillips66.com) under the“CorporateGovernance” caption | |

Communications to thenon-employee directors should be addressed to “Board of Directors (independent members)” in care of our Corporate Secretary as provided above.

Relevant communications are distributed to the Board of Directors or to any individual director or directors, as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, the Board has requested that certain items unrelated to its duties and responsibilities not be distributed, such as: business solicitations or advertisements; junk mail and mass mailings; new product suggestions; product complaints; product inquiries; résumés and other forms of job inquiries; spam; and surveys. In addition, material that is considered hostile, threatening, illegal or similarly unsuitable will be excluded.

20 2020 PROXY STATEMENT

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm retained to audit the Company’s financial statements. The Audit Committee has appointed Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for fiscal year 2020. Ernst & Young has acted as the Company’s independent registered public accounting firm continuously since 2011.

The Audit Committee annually considers the independence of the Company’s independent auditors prior to the firm’s engagement, and periodically considers whether a regular rotation of the independent auditors is necessary to assure continuing independence. The Audit Committee and its Chairman are directly involved in the selection of Ernst & Young’s lead engagement partner.

The Audit Committee and the Board of Directors believe that the continued retention of Ernst & Young is in the best interests of the Company and its shareholders. We are asking you to vote on a proposal to ratify the appointment of Ernst & Young.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP.

The submission of this matter for approval by shareholders is not legally required, but the Board and the Audit Committee believe it provides an opportunity for shareholders to vote on an important aspect of corporate governance. If the shareholders do not ratify the selection of Ernst & Young, the Audit Committee will reconsider the selection of that firm as the Company’s independent registered public accounting firm. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

Services Provided by the Independent Registered Public Accounting Firm

Audit services of Ernst & Young for fiscal year 2019 included an audit of our consolidated financial statements, an audit of the effectiveness of the Company’s internal control over financial reporting, and services related to periodic filings made with the SEC. Additionally, Ernst & Young provided certain other services as described below. In connection with the audit of the 2019 consolidated financial statements, we entered into an engagement agreement with Ernst & Young that set forth the terms by which Ernst & Young performed audit services for us.

The Audit Committee is responsible for negotiating the audit fee associated with its retention of Ernst & Young. Ernst & Young’s fees for professional services totaled $14.5 million for 2019 and $13.2 million for 2018, which consisted of the following:

Fees (in millions) | 2019 | 2018 | ||||||

Audit Fees(1) | $13.0 | $12.1 | ||||||

Audit-Related Fees(2) | 1.2 | 0.8 | ||||||

Tax Fees(3) | 0.1 | 0.1 | ||||||

All Other Fees | 0.2 | 0.2 | ||||||

Total | $14.5 | $13.2 | ||||||

| (1) | Fees for audit services related to the fiscal year consolidated audit, the audit of the effectiveness of internal controls over financial reporting, quarterly reviews, registration statements, comfort letters, statutory and regulatory audits and accounting consultations. Includes audit fees of Phillips 66 Partners LP of $1.3 million for each of 2019 and 2018, which were approved by the Audit Committee of the General Partner of Phillips 66 Partners LP. |

| (2) | Fees for audit-related services related to audits in connection with proposed or consummated dispositions, benefit plan audits, other subsidiary audits, special reports, and accounting consultations. |

| (3) | Fees for tax services related to tax compliance services and tax planning and advisory services. |

The Audit Committee has considered whether thenon-audit services provided to Phillips 66 by Ernst & Young impaired the independence of Ernst & Young and concluded they did not.

The Audit Committee has adopted apre-approval policy that provides guidelines for the audit, audit-related, tax and othernon-audit services that Ernst & Young may provide to the Company. All of the fees in the table above were approved in accordance with this policy. The policy (a) identifies the guiding principles that the Audit Committee must consider in approving services to ensure that Ernst & Young’s independence is not impaired; (b) describes the audit, audit-related, tax and other services that may be provided and thenon-audit services that are prohibited; and (c) sets forthpre-approval requirements for all permitted services. Under the policy, the Audit Committee mustpre-approve all services to be provided by Ernst & Young. The

2020 PROXY STATEMENT 21

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP

Audit Committee has delegated authority to approve permitted services to its Chair. Such approval must be reported to the entire Audit Committee at its next scheduled meeting.

One or more representatives of Ernst & Young are expected to be present at the Annual Meeting. The representatives will have an opportunity to make a statement if they desire and will be available to respond to appropriate questions from shareholders.

AUDIT AND FINANCE COMMITTEE REPORT

The Audit Committee assists the Board of Directors in fulfilling its responsibility to provide independent, objective oversight of the financial reporting functions and internal control systems of Phillips 66. The Audit Committee currently consists of fivenon-employee directors. The Board has determined that each member of the Audit Committee satisfies the requirements of the NYSE as to independence, financial literacy and expertise. The Board has further determined that each of J. Brian Ferguson, Charles M. Holley, John E. Lowe, and Denise L. Ramos is an audit committee financial expert as defined by the SEC. The responsibilities of the Audit Committee are set forth in the written charter adopted by the Board of Directors, which is available in the “Investors” section of the Company’s website under the caption “Corporate Governance.” One of the Audit Committee’s primary responsibilities is to assist the Board in its oversight of the integrity of the Company’s financial statements. The following report summarizes certain of the Audit Committee’s activities in this regard for 2019.

Review with Management. The Audit Committee has reviewed and discussed with management the audited consolidated financial statements of Phillips 66 included in the Company’s Annual Report onForm 10-K for the year ended December 31, 2019, and management’s assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2019, included therein.

Discussions with Independent Registered Public Accounting Firm. The Audit Committee has discussed with Ernst & Young LLP, independent registered public accounting firm for Phillips 66, the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC. The Audit Committee has received the written disclosures and the letter from Ernst & Young required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with that firm its independence from Phillips 66.

Recommendation to the Phillips 66 Board of Directors. Based on its review and discussions noted above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements of Phillips 66 be included in the Company’s Annual Report onForm 10-K for the year ended December 31, 2019.

AUDIT AND FINANCE COMMITTEE

J. Brian Ferguson, Chairman

Charles M. Holley

John E. Lowe

Denise L. Ramos

Victoria J. Tschinkel

22 2020 PROXY STATEMENT

PROPOSAL 3: ADVISORY APPROVAL OF EXECUTIVE COMPENSATION

In accordance with Section 14A of the Securities Exchange Act of 1934, as amended, shareholders are being asked to vote on the following advisory(non-binding) resolution:

RESOLVED, that the shareholders approve the compensation of Phillips 66’s Named Executive Officers (NEOs) as described in this proxy statement in theCOMPENSATION DISCUSSION AND ANALYSIS section and in theEXECUTIVE COMPENSATION TABLES (together with the accompanying narrative disclosures).

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ADVISORY APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS.

Approval of this proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote on the proposal.

As required by SEC rules, Phillips 66 is providing shareholders with the opportunity to vote on an advisory resolution, commonly known as“Say-on-Pay,” considering approval of the compensation of its NEOs.

The Compensation Committee, which is responsible for the compensation of our CEO and Senior Officers (as defined inROLE OF THE HUMAN RESOURCES AND COMPENSATION COMMITTEE), has overseen the development of compensation programs designed to attract, retain and motivate executives who enable us to achieve our strategic and financial goals. TheCOMPENSATION DISCUSSION AND ANALYSIS and theEXECUTIVE COMPENSATION TABLES, together with the accompanying narrative disclosures, allow you to view the trends in compensation and application of our compensation philosophies and practices for the years presented.