Exhibit 3(b)

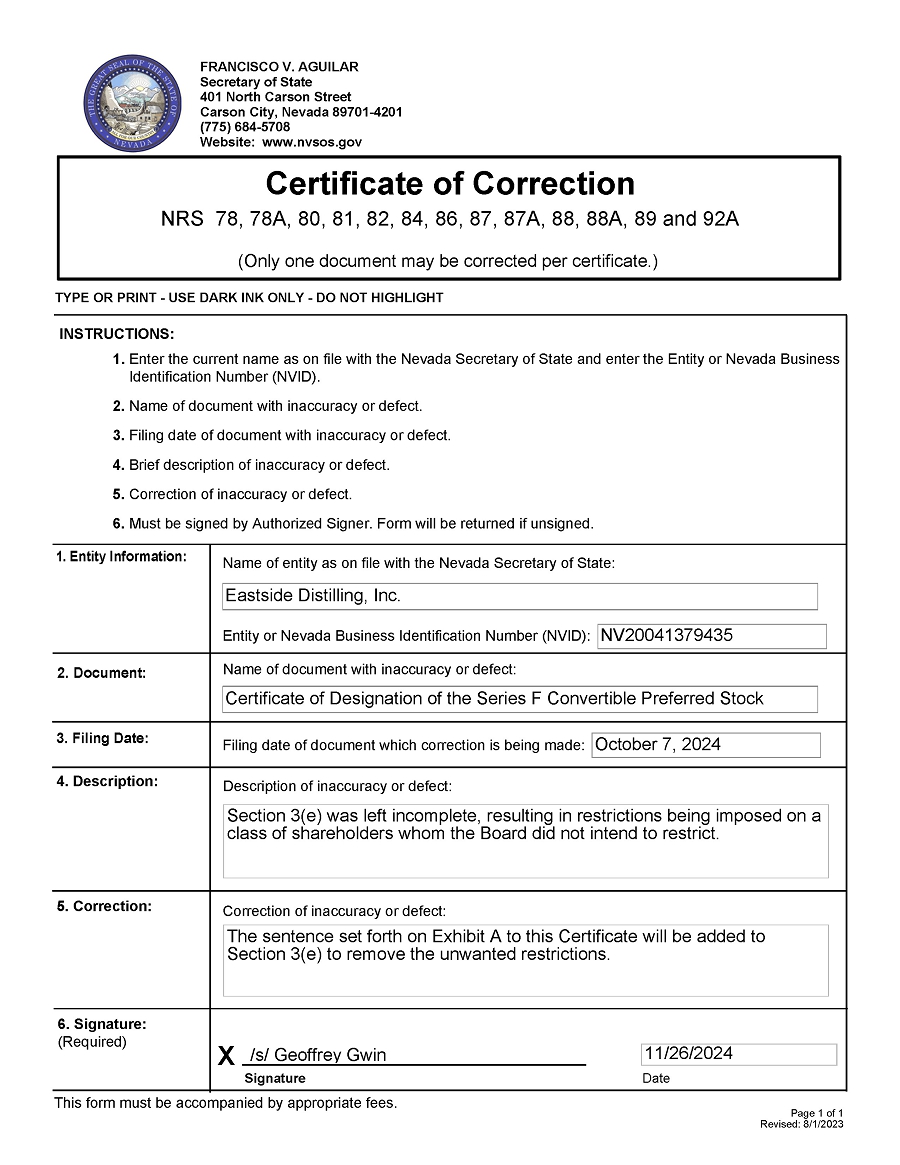

EXHIBIT A TO

the Certificate of Correction to the

Certificate of Designations, Preferences and Rights of the

Series F Convertible Preferred Stock of

Eastside Distilling, Inc.

November 26, 2024

WHEREAS, pursuant to the authority expressly conferred upon the Board of Directors (the “Board”) of Eastside Distilling, Inc., a Nevada corporation (the “Company”) and by the Company’s Articles of Incorporation, as amended (the “Articles of Incorporation”), the Board previously designated the Series F Convertible Preferred Stock and the number of shares constituting such series, and fixed the rights, powers, preferences, privileges, limitations and restrictions relating to such series in addition to any set forth in the Articles of Incorporation, and the Company filed the Certificate of Designations, Preferences and Rights of the Series F Convertible Preferred Stock (the “Certificate of Designations”) on October 7, 2024. Capitalized words and phrases used and not defined herein shall have the meanings set forth in in the Certificate of Designations; and

WHEREAS, Section 3 of the Certificate of Designations contained a scrivener’s error with respect to the voting rights of the Holders.

NOW, THEREFORE, the Certificate of Designations is hereby corrected as follows:

Section 3(e) of the Certificate of Designations is hereby corrected by adding the following to the end of that Section:

Notwithstanding anything herein to the contrary, in the event a Holder is or becomes subject to Section 16(a) of the 1934 Act by virtue of being an executive officer or director of the Company, then, beginning 61 days after such Holder became subject to Section 16(a) of the 1934 Act and continuing for as long as such Holder remains subject to Section 16(a) of the 1934 Act by virtue of being an executive officer or director of the Company, the Maximum Percentage shall not apply to such Holder for all purposes of this Certificate of Designations and the Preferred Shares held by such Holder.

* * * * *