- BLNE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Eastside Distilling (BLNE) DEF 14ADefinitive proxy

Filed: 5 Feb 25, 4:59pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Eastside Distilling, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Eastside Distilling, Inc.

YOUR VOTE IS VERY IMPORTANT

Dear Eastside Shareholder:

You are invited to attend a special meeting (the “Special Meeting”) of shareholders of Eastside Distilling, Inc., a Nevada corporation (“Eastside,” the “Company,” “we,” “us,” or “our”) to be held on March 3, 2025 at 2:00 pm Eastern time. There will be no in person meeting; instead we will hold a virtual meeting via the listen-only conference call by calling 877-407-3088 (Toll Free). If you encounter any technical difficulties with the virtual meeting platform on the meeting day, please call 877-804-2062 (toll free) or email proxy@equitystock.com. For details see the Notice of Meeting which follows.

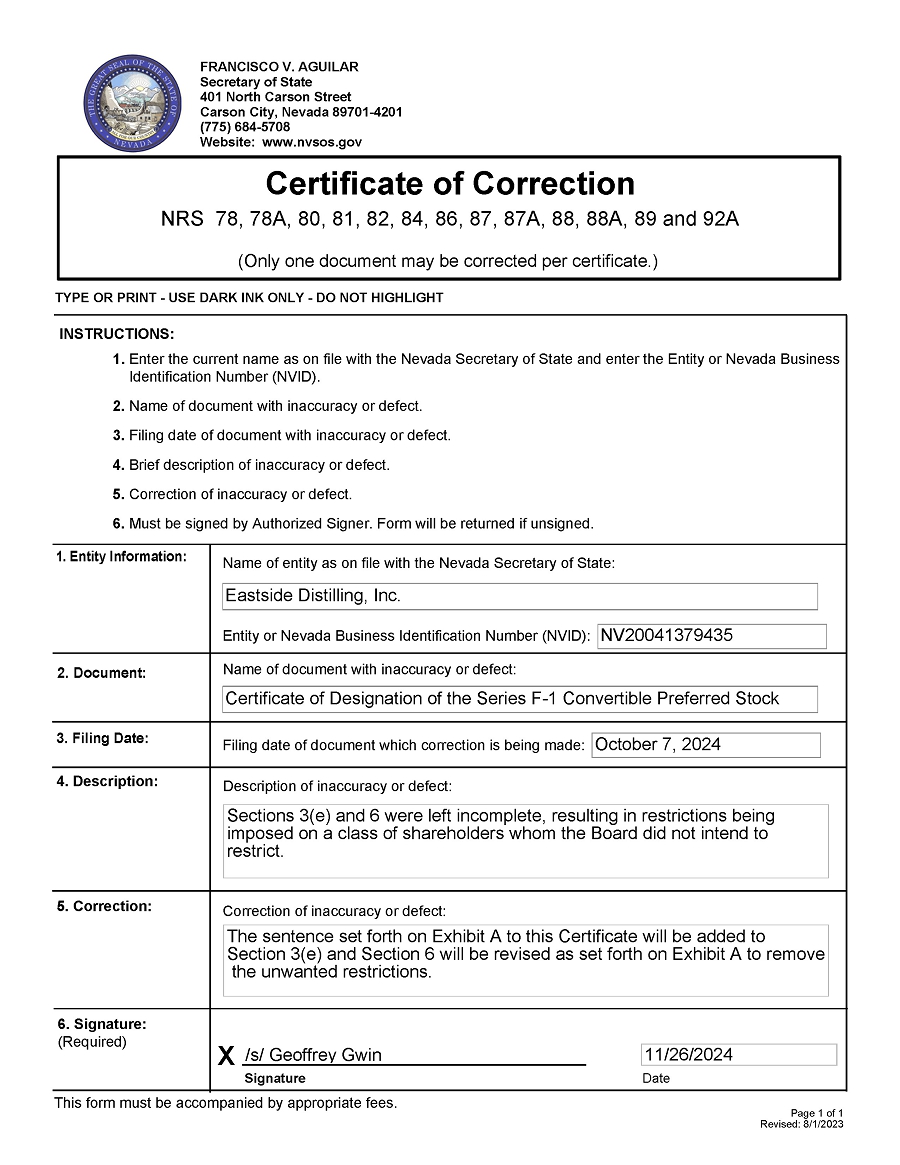

The board of directors of Eastside (the “Board”) has approved, and on October 7, 2024 Eastside completed, transactions pursuant to an Agreement and Plan of Merger and Reorganization, as amended (the “Merger Agreement”) by and among the Eastside, East Acquisition Sub, Inc., a wholly-owned subsidiary of Eastside (“Merger Sub”) and Beeline Financial Holdings, Inc., a Delaware corporation (“Beeline”). The Merger Agreement, as amended, is attached as Annex A to the accompanying Proxy Statement. Under the terms of the Merger Agreement, Beeline merged with and into Merger Sub and became a wholly-owned subsidiary of the Company (the “Merger”). In the Merger, Eastside issued to the former shareholders of Beeline a total of 517,775 shares of a newly designated Series F-1 Convertible Preferred Stock (the “Series F”) and a total of 69,482,229 shares of a newly designated Series F Convertible Preferred Stock (the “Series F,” and together with the Series F-1, the “Merger Shares”). Subject to certain limitations, including approval of Eastside’s shareholders of the Merger and transactions related thereto including full conversion of the Merger Shares, the Merger Shares are convertible into a total of 69,603,337 shares of Eastside common stock, representing approximately 82.5% of the Company’s common stock after giving effect to the full conversion thereof and certain other issuances, subject to certain adjustments. Beeline is a fintech mortgage lender and title provider. In connection with the Merger, Eastside also agreed to issue stock options and warrants to former holders of Beeline stock options and warrants (the “Derivatives”).

Following the closing of the Merger, the Company has raised capital through the issuance of stock and derivative securities convertible or exercisable into common stock (the “Subsequent Securities,” and together with the Merger Shares and the Derivatives, the “Securities”) for purposes of raising the necessary capital to fund the Company’s ongoing operations, among other uses, including based on the capital needs of Beeline following the Merger in subsequent transactions. In order to ensure compliance with the rules of The Nasdaq Stock Market, LLC (“Nasdaq”), the Subsequent Securities issued in the subsequent transactions including issuance of the Derivatives are also subject to shareholder approval as outlined in detail in the accompanying Proxy Statement.

The Company has also entered into agreements contemplating an equity line of credit transaction with an institutional investor (the “Purchaser”) pursuant to which the Company agreed to issue and sell, and the Purchase agreed to purchase, up to $20 million of the Company’s common stock, subject to Nasdaq rules (such transaction, the “Equity Line of Credit” or the “ELOC”). The issuances of shares of common stock and related rights and terms under the Merger Share Issuance Proposal are referred to as the “Merger Share Issuance,” the issuances of shares of common stock and related rights and terms under the Equity Line of Credit Proposal are referred to as the “ELOC Share Issuance,” and the Merger Share Issuance and the ELOC Share Issuance are together collectively referred to as the “Share Issuances.”

| 2 |

In connection with the Merger, the Company is also seeking to change its name to “Beeline Holdings, Inc.” to reflect a shift in and align our focus to the Beeline business following the Merger (the “Name Change”).

Eastside’s common stock is listed on The Nasdaq Capital Market (“Nasdaq”). Because the former Beeline shareholders will, if the Merger Share Issuance Proposal is approved, own upon conversion approximately 82.5% of the number of shares of a sum consisting of (i) common stock outstanding on October 7, 2024 or 3,730,625 shares, plus (ii) shares issuable upon conversion of the Series B Convertible Preferred Stock (the “Series B”) or 40,323 shares, shares issuable upon conversion of the Series D Convertible Preferred Stock (the “Series D”) or 1,419,300 shares, and shares issuable upon conversion of the Series E Convertible Preferred Stock (the “Series E”) or 1,000,000 shares, (iii) shares issuable on conversion of securities issued in the initial financing of the post-Merger company of at least $1.5 million and less than $3.25 million and (iv) shares issued to settle pre-existing liabilities, which other shares can add up to 14,848,485 shares without resulting in an increase in shares underling the Series F and F-1. This 82.5% is equal to approximately 70,000,000 shares of common stock.

Following approval of the Merger Share Issuances, we expect that Nicholas Liuzza, the Chief Executive Officer of Beeline, will be appointed as Chief Executive Officer of Eastside and Geoffrey Gwin, our current Chief Executive Officer, will be appointed as Executive Vice President or some other senior officer position and remain as Chairman of the Board.

The matters being brought before the shareholders, and certain other material information relating thereto, are described in the enclosed Proxy Statement being mailed to Eastside’s shareholders of record in connection with the Special Meeting.

As required by the Nasdaq rules, the Merger and the Merger Share Issuances involve a change of control which means under Nasdaq rules, a new listing application must be submitted to Nasdaq even though our common stock is currently listed on Nasdaq. Accordingly, we are submitting a new listing application to Nasdaq to reflect the new status of the combined company for Nasdaq purposes resulting therefrom. If that application is approved and the Merger Share Issuance Proposal is approved, Eastside common stock will continue to trade on Nasdaq under the symbol “BLNE.” On January 28, 2025, the closing price per share of Eastside common stock as reported by Nasdaq was $0.83. We urge you to obtain current market information for Eastside common stock. Based upon the shares of our common stock outstanding on October 7, 2024 when the Merger closed, we were limited by Nasdaq rules to only issuing 745,752 shares which represented 19.99% of the Company’s common stock as of that date without getting shareholder approval. Proposal 1 not only seeks approval of the shares of common stock underlying the Merger Shares and the Derivatives pursuant to the Merger; in addition, we are seeking approval of our shareholders to also approve the shares of common stock issuable upon conversion of preferred stock and exercise of warrants we issued subsequent after October 7th. This is covered under Proposal 1.

| 3 |

Proposal 2 relates to the ELOC Share issuance. While it is difficult to predict the total number of shares of common stock we may issue under the ELOC, using the hypothetical purchase price of $0.51 as the lowest price at which we will issue shares of common stock to the Purchaser, we estimate that we may issue as many as 39,215,686 shares. We use the $0.51 price since any issuances below that price will permit holders of our Series G Convertible Preferred Stock (the “Series G”) to get more shares under anti-dilution protections.

We will hold the Special Meeting of our shareholders to vote on these matters. The Board also asks that you vote to change our corporate name to Beeline Holdings, Inc., ratify the appointment of Salberg & Company, P.A., the Company’s independent registered public accounting firm, and approve a proposal to approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies in favor of the foregoing proposals.

Whether or not you plan to attend the Special Meeting, please take the time to cause your shares to be voted by completing and mailing the enclosed proxy card or submitting your proxy through the Internet, by email or fax using the procedures in the proxy voting instructions included with your proxy card. Even if you return the proxy, you may attend the Special Meeting and vote your shares online at the meeting.

YOUR VOTE IS IMPORTANT.

The Proxy Statement describes the Merger Agreement, the Merger Shares, the Subsequent Securities and Merger Share Issuance, the ELOC and ELOC Share Issuance, and other matters to be considered at the Special Meeting in more detail. You should read this entire document carefully, including the Merger Agreement and other documents related to the Securities which are included as annexes to this Proxy Statement.

We look forward to seeing you at the Special Meeting and to the successful completion of the matters to be addressed therein.

| /s/ Geoffrey Gwin | |

| Geoffrey Gwin | |

| Chief Executive Officer and Chairman of the Board | |

| Eastside Distilling, Inc. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the matters described in this Proxy Statement or determined if this Proxy Statement is accurate or adequate. Any representation to the contrary is a criminal offense.

The Proxy Statement is dated February 5, 2025, and, together with the accompanying proxy card, is first being mailed or otherwise delivered on or about February 5, 2025 to Eastside shareholders of record as of January 23, 2025 which is the Record Date for the Special Meeting.

| 4 |

SUBMITTING A PROXY ELECTRONICALLY, BY INTERNET, OR BY MAIL

Eastside shareholders of record on January 23, 2025 may submit their proxies as follows:

| ● | Through the Internet, by visiting the website established for that purpose at www.EAST.vote by 11:59 p.m. Eastern Time on March 2, 2025 and following the instructions; |

| ● | By email to proxy@equitystock.com, Attention: Shareholder Services; |

| ● | By mail, by marking, signing, and dating the enclosed proxy card and returning it in the postage-paid envelope provided or returning it pursuant to the instructions provided in the proxy card; or |

| ● | By fax to (347)-584-3644, Attention: Shareholder Services. |

If you are a beneficial owner, please refer to your proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available to you.

EASTSIDE DISTILLING, INC.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held On March 3, 2025

Dear Eastside Shareholder:

Eastside Distilling, Inc. (“Eastside,” the “Company,” “we,” “us,” or “our”) is pleased to invite you to attend a special meeting (the “Special Meeting”) of the shareholders of Eastside which will be held on March 3, 2025 at 2:00 pm Eastern time. There will be no in person meeting. Instead the Special Meeting will be virtual and conducted as a listen-only conference call by calling 877-407-3088 (Toll Free). There will not be a physical meeting location. If you encounter any technical difficulties with the virtual meeting platform on the meeting day, please call 877-804-2062 (toll free) or email proxy@equitystock.com.

The purpose of the Special Meeting is to consider and to vote upon the following proposals:

| 1. | Merger Share Issuance Proposal — a proposal to approve the conversion, exercise and voting rights and issuances of shares of common stock underlying securities in excess of 19.99% of the Company’s outstanding common stock as of October 7, 2024 in connection with and following the Merger which closed on such date, which Merger is described in the Proxy Statement. In the Merger we issued former Beeline shareholders Series F-1 and Series F Convertible Preferred Stock convertible into a minimum of 69,603,337 shares of common stock issued as a part of the Merger, and agreed to issue options and warrants to purchase a total of 4,165,941 shares of common stock issuable to former holders of Beeline’s warrants and stock options. In addition, we are asking our shareholders to approve the issuance of 16,863,602 shares of common stock issuable upon conversion of convertible preferred stock and exercise of warrants issued or issuable primarily in financing transactions after the Merger closing, for an estimated total of 90,632,880 shares, all in accordance with the rules of Nasdaq, as such securities are described in the Proxy Statement (all of such common stock is collectively referred to as the “Merger Share Issuance Proposal”); |

| 5 |

| 2. | Equity Line of Credit Proposal — a proposal to approve the Equity Line of Credit, or ELOC, transaction pursuant to which the Company will issue and sell up to $20 million of common stock to the Purchaser or up to 39,215,686 shares of common stock as described in the Proxy Statement; |

| 3. | Name Change Proposal — a proposal to approve an amendment to the Company’s Articles of Incorporation to change the name of the Company to “Beeline Holdings, Inc.” (the “Name Change Proposal”); |

| 4. | Auditor Ratification Proposal — a proposal to ratify the selection of Salberg & Company, P.A. to serve as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2024 (the “Auditor Ratification Proposal”); |

| 5. | Adjournment Proposal — a proposal to approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies in favor of the foregoing proposals (the “Adjournment Proposal”). |

The Eastside Board of Directors (the “Board”) approved the Agreement and Plan of Merger and Reorganization dated September 4, 2024, as amended on October 7, 2024, by and among Eastside, East Acquisition Sub, Inc., a wholly-owned subsidiary of Eastside (“Merger Sub”) and Beeline Financial Holdings, Inc. (“Beeline), as amended (the “Merger Agreement”) and the other agreements and transactions contemplated by the Merger Agreement pursuant to which, among other things, Beeline merged with and into Merger Sub and became a wholly-owned subsidiary of the Company in exchange for the issuance of convertible preferred stock to former Beeline shareholders (the “Merger”), as well as subsequent transactions pursuant to which the Company has issued or agreed to issue, subject to Nasdaq rules, stock and derivative securities which as and when convertible or exercisable, together with the shares of Series F and F-1 issued to former Beeline shareholders in the Merger (the “Merger Shares”), will result in the issuance of shares of the Company’s common stock and voting rights in excess of 19.99% of the Company’s common stock outstanding as of the closing of the Merger.

The Board has also approved, and the Company has entered into agreements contemplating an equity line of credit transaction with an accredited investor (the “Purchaser”) pursuant to which the Company agreed to issue and sell, and the Purchaser agreed to purchase, up to $20 million of the Company’s common stock, subject to Nasdaq rules (such transaction, the “Equity Line of Credit” or the “ELOC”). The ELOC proposal is Proposal 2 and seeks shareholder approval for the issuance up to 39,215,686 shares of common stock as described in more detail in the Proxy Statement.

In connection with the Merger, the Company is also seeking to change its name to “Beeline Holdings, Inc.” to reflect a shift in and align our focus to the Beeline business following the Merger (the “Name Change”). The remaining proposals are asking our shareholders to ratify the appointment of our auditors and adjourn the meeting if necessary to permit us to seek additional votes.

The Board determined that each of the foregoing proposals are advisable and in the best interests of Eastside and its shareholders and unanimously recommends that Eastside shareholders vote “FOR” each such proposal.

| 6 |

Your vote is very important. Eastside shareholders must approve the Proposals in order for the Company to complete certain transactions following the Merger, including capital raising transactions and other matters which are critical to the Company’s ongoing operations, business plan and future success.

THE BOARD UNANIMOUSLY RECOMMENDS THAT EASTSIDE SHAREHOLDERS APPROVE EACH OF THE PROPOSALS LISTED ABOVE.

The close of business on January 23, 2025 has been fixed as the record date for the Special Meeting (the “Record Date”). Only holders of record of Eastside shareholders on the Record Date are entitled to notice of, and to vote at, the Special Meeting or any adjournments or postponements of the Special Meeting.

The Proxy Statement accompanying this notice provides for more detailed information regarding the matters to be acted upon at the Special Meeting. You are encouraged to read the entire Proxy Statement carefully, including the Merger Agreement, which is included as Annex A to the Proxy Statement.

SO THAT YOUR SHARES WILL BE REPRESENTED WHETHER OR NOT YOU ATTEND THE SPECIAL MEETING, PLEASE SUBMIT A PROXY AS SOON AS POSSIBLE BY MAIL, FAX, E-MAIL OR THROUGH THE INTERNET. INSTRUCTIONS ON THESE DIFFERENT WAYS TO SUBMIT YOUR PROXY ARE FOUND ON THE ENCLOSED PROXY CARD. YOU MAY REVOKE YOUR PROXY AT ANY TIME BEFORE IT IS VOTED AT THE SPECIAL MEETING. REMEMBER, YOUR VOTE IS IMPORTANT, SO PLEASE ACT TODAY!

| By Order of the Board of Directors, |

| Geoffrey Gwin |

| Chief Executive Officer and Chairman of the Board |

| February 5, 2025 |

| 7 |

TABLE OF CONTENTS

| 8 |

For the ease of our shareholders, we use the following definitions in this Proxy Statement:

“Beeline” means Beeline Financial Holdings, Inc., a Delaware corporation.

“Board” means the Company’s Board of Directors.

“C/M” means C/M Capital Master Fund LP.

“Company” or “Eastside” means Eastside Distilling, Inc., a Nevada corporation.

“Derivatives” means the stock options and warrants Eastside agreed to issue to former holders of Beeline stock options and warrants.

“ELOC” or “Equity Line of Credit” means the transaction pursuant to which the Company will issue and sell up to $20 million of common stock to the Purchaser or up to 39,215,686 shares of common stock, as such terms are defined below and as further described in the Proxy Statement.

“ELOC Agreement” means the Common Stock Purchase Agreement and related agreements pursuant to which the Company and C/M agreed to engage in the ELOC.

“Merger” means the merger whereby Beeline merged with and into Merger Sub and become a wholly-owned subsidiary of the Company.

“Merger Agreement” means the Agreement and Plan of Merger and Reorganization, as amended by and among the Eastside, East Acquisition Sub, Inc., a wholly-owned subsidiary of Eastside (“Merger Sub”) and Beeline Financial Holdings, Inc., a Delaware corporation (“Beeline”).

“Merger Share Issuance Proposal” means the issuances of shares of common stock and related rights and terms under the Merger Share Issuance Proposal.

“Merger Sub” means East Acquisition Sub, Inc., a wholly-owned subsidiary of Eastside prior to the closing of the Merger.

“Name Change” means the changing of the name of the Company to “Beeline Holdings, Inc.” in connection with the Merger.

“Nasdaq” means The Nasdaq Capital Market.

| 9 |

“Note Warrants” means the warrants issued in connection with the November 14, 2024, sale of $1,938,000 in aggregate principal amount of Notes and Warrants in which the company received gross proceeds of $1,615,000 in connection with a private placement offering, as provided in Annex E.

“Purchaser” and “C/M” means the institutional investor that the Company entered into agreements with contemplating the Equity Line Of Credit and for which has agreed purchase up to $20 million of the Company’s common stock, subject to Nasdaq rules.

“Record Date” means the close of business on January 23, 2025, that has been fixed as the record date for the Special Meeting.

“SEC” means U.S. Securities and Exchange Commission.

“Series B” means the Series B Convertible Preferred Stock of the Company.

“Series D” means the Series D Convertible Preferred Stock of the Company.

“Series E” means the Series E Convertible Preferred Stock of the Company.

“Series F” means the Series F Convertible Preferred Stock of the Company having the rights and designations as provided in the certificate of designation, as amended, as provided in Annex C.

“Series F-1” means the Series F-1 Convertible Preferred Stock of the Company having the rights and designations as provided in the certificate of designation, as amended, as provided in Annex B.

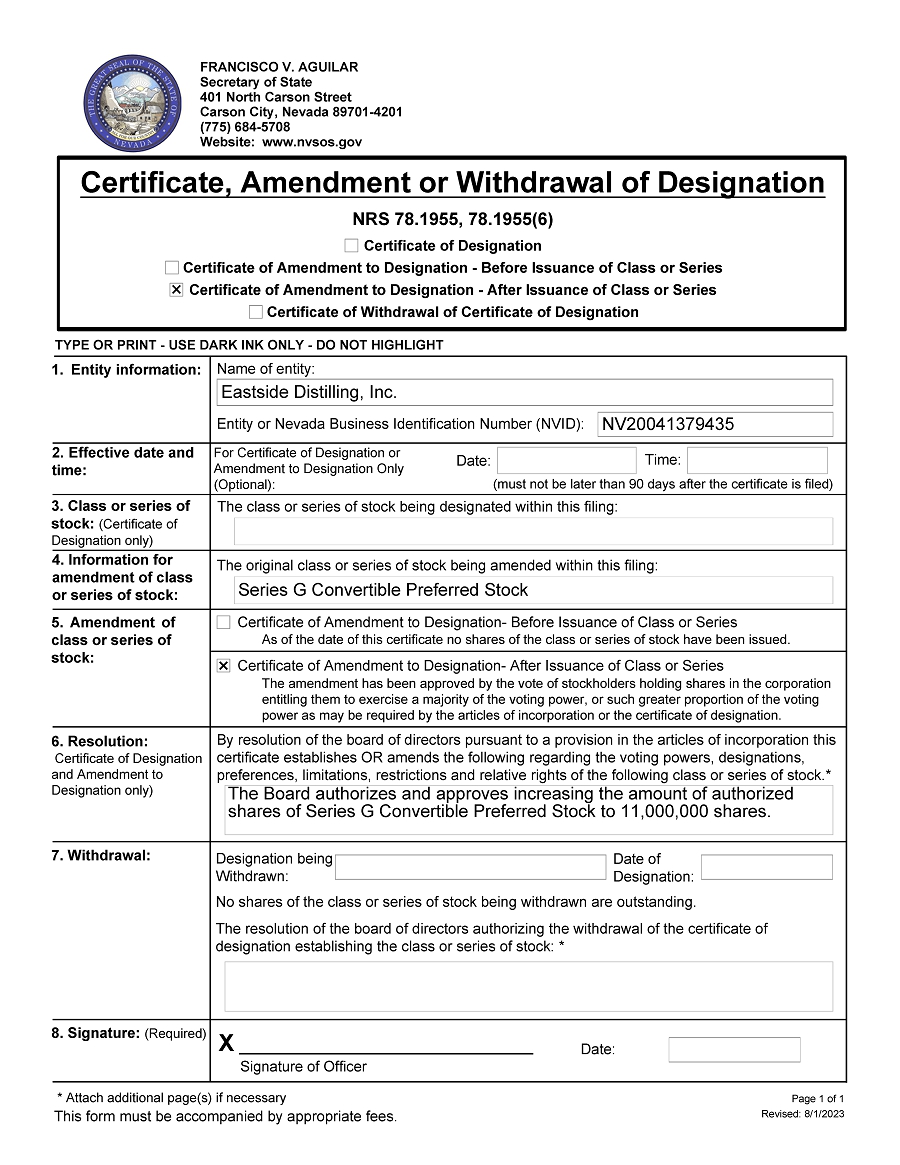

“Series G” means the Series G Convertible Preferred Stock having the rights and designations as provided in the certificate of designation, as amended, as provided in Annex D.

“Series G Warrants” or “G Warrants” means the Warrants issued in connection with the Series G Convertible Preferred Stock having the terms and conditions as provided in the Form of Warrant as provided in Annex F.

“Subsequent Securities” means the shares of common stock and derivative securities issued by the Company in the closing of the Merger in connection with subsequent transactions.

| 10 |

Eastside’s common stock has been listed on The Nasdaq Capital Market (“Nasdaq”). In 2024, Eastside received two letters from Nasdaq which required Eastside to come into compliance with the Nasdaq rules in the future. One letter related to Eastside falling below the continued listing requirements of Nasdaq which required us to have at least $2,500,000 in shareholders’ equity. Because Eastside had substantial indebtedness, it began negotiations with the holders of its indebtedness which ultimately resulted in holders of the indebtedness entering into certain transactions including a debt exchange agreement where the indebtedness was exchanged for, among other things, preferred stock and common stock. This debt exchange agreement closed on October 7, 2024, which permitted us to meet the Nasdaq shareholders’ equity requirement. Following this and related to the former indebtedness we sold our label printing business to these former debt holders, one of which is a director and another of which is the spouse of one of our directors. See “Related Party Transactions” later in this Proxy Statement.

We also closed the Merger on October 7th, which we believe also eliminated the shareholders’ equity deficiency.

Nasdaq also advised us in a subsequent letter that our common stock bid price fell below the required $1.00 price, which is the minimum bid price requirement under Nasdaq rules. As of January 28, 2025, the closing price of our common stock was $0.83. If our stock price does not increase materially before the deadline of February 15, 2025, we can alleviate the Nasdaq non-compliance by effecting a reverse stock split. In December 2024, our shareholders approved a reverse stock split authorizing our board of directors (the “Board”) to implement a reverse stock split in the range of 1-for 2 to 1-for-10. Most often the market capitalization decreases following a reverse split. Assuming we regain compliance with the Nasdaq minimum bid price, we must also comply with certain continued Nasdaq listing requirements including:

| ● | One of the following |

| ○ | $2.5 million of shareholders’ equity; |

| ○ | $35 million in market value of listed securities; or |

| ○ | $500,000 in net income from continuing operations (in the latest fiscal year or tin two of the last three fiscal years). |

| ● | 500,000 publicly held shares. |

| ● | $1 million in market value of publicly held securities. |

| ● | $1 bid price. |

| ● | 300 public holders. |

| ● | Two market makers. |

| 11 |

Assuming our shareholders approve the issuance of all of the common stock issuable under Proposal 1, such Proposal and the resulting issuances involve a change of control for Nasdaq purposes with former Beeline shareholders acquiring 82.5% of outstanding common stock and certain preferred stock up to the limit explained on page 29 of this Proxy Statement. Under Nasdaq rules, we are filing a new listing application. In addition to Nasdaq using its qualitative requirements which give it discretion to approve or not approve the new listing application, we must comply with the following new listing requirements:

| ● | $5 million in shareholders’ equity |

| ● | $15 million in market value of unrestricted publicly held shares |

| ● | 1 million in unrestricted publicly held shares |

| ● | 300 unrestricted round lot shareholders1 |

| ● | Bid price of $4. |

1Beginning on April 7, 2025, the Series F and F-1 shares may be sold under Rule 144 subject to compliance with the current public information requirements; the Series F and F-1 are also subject to shareholder approval. As soon as the Form 10-K is filed these shares may then be sold under Rule 144 through May 19th when the next Form 10-Q is due. Shares held by insiders are also subject to other Rule 144 compliance requirements including volume limitations.

If Nasdaq refuses to approve the new listing application, our common stock will then trade on one of the markets operated by OTC Markets Group, Inc. If that were to occur, our common stock may be less liquid and we may encounter difficulty in raising capital. If our shareholders refuse to approve Proposal 1, we may have no alternative to voluntarily delist form Nasdaq where these adverse consequences outlined in this paragraph would likely occur.

This summary highlights selected information from this Proxy Statement and may not contain all the information that is important to you. We urge you to read carefully this entire document, and the documents referenced herein, for a more complete understanding of the Merger Agreement, the Securities, the transactions contemplated therein and the other proposals that will be presented to Eastside shareholders at the Special Meeting.

Important Note:

With respect to Proposals 1 and 2, shareholders are being asked to approve the issuance of shares of common stock underlying, and the related conversion, exercise and voting rights of, securities issued in or following the Merger, in excess of 20% of the Company’s common stock outstanding as of the closing of the Merger in accordance with Nasdaq rules, including in connection with the Merger, subsequent capital raising transactions, and the Equity Line of Credit. Other than the foregoing, shareholders are not being asked to vote on the Merger, which closed on October 7, 2024. However, descriptions of the material terms of the Merger, the subsequent transactions and the Equity Line of Credit are included in this Proxy Statement to assist shareholders in making an informed voting decision with respect to Proposals 1 and 2.

| 12 |

Business Overview

The Company currently operates through two subsidiaries. Bridgetown Spirits Corp. (“Spirits”) manufactures, blends, bottles, markets and sells a wide variety of alcoholic beverages, including whiskey, vodka, rum and tequila, under recognized brands in 30 U.S. states. We sell our products on a wholesale basis to distributors through open states, and brokers in control states. We currently own 53% of Spirits.

In the Merger on October 7, 2024 Beeline became our second subsidiary. Beeline is a fintech mortgage lender and title provider aimed at transforming the home loan process into a shorter, easier path than conventional mortgage lending for millions of Americans seeking a digital experience. Beeline has built a proprietary mortgage platform leveraging advanced technical tools with sophisticated language learning models and combining an appropriate amount of human interaction to create a better outcome for mortgage borrowers. Beeline was founded in 2019 with principal offices located in Providence, Rhode Island. An Australian subsidiary has offices in Burleigh Heads, Australia. Beeline also has executive office suites in three locations in the United States.

For more information, see the following sections of this Proxy Statement. The page numbers refer to where each section begins in this Proxy Statement. Business page 65, Management’s Discussion and Analysis of Financial Condition page 84, Principal Shareholders page 51, Related Party Transactions page 96, Description of Securities page 99, Unaudited Pro Forma Financial Statements page F-1, and Financial Statements page F-86.

The Merger

On October 7, 2024, Eastside closed the Merger contemplated by the Merger Agreement with Merger Sub and Beeline, a fintech mortgage lender and title provider. Pursuant to the closing Beeline merged into Merger Sub and became a wholly-owned subsidiary of Eastside, with the name of the surviving corporation being changed to Beeline Financial Holdings, Inc. (the “Merger”). Also on October 7, 2024, Eastside also completed a debt exchange transaction with certain of its existing lenders and sold the largest segment of its business. This debt exchange eliminated $12,763,396 of indebtedness and permitted Eastside to come into compliance with the shareholders’ equity required by Nasdaq. Nasdaq deadline for compliance was that day – October 7th. See “The Merger” under Proposal 1 beginning on page 29.

As a result of the Merger, Eastside’s current corporate structure is as follows:

Anticipated Accounting Treatment

After careful review of ASC 805, we have determined that the Merger should be treated as a forward merger. In a forward merger, the accounting treatment typically involves the “purchase method” under U.S. generally accepted accounting principles (GAAP), where the acquiring company records the target company’s assets and liabilities at their fair market value on the acquisition date, resulting in the recognition of goodwill if the purchase price exceeds the net fair value of identifiable assets acquired, effectively “absorbing” the target company and reflecting its assets and liabilities on the acquirer’s balance sheet. See “Anticipated Accounting Treatment” on page 45 for more information.

Merger Shares (page 39)

Series F Convertible Preferred Stock

The Company issued former Beeline shareholders a total of 69,482,229 shares of Series F in the Merger. Presently, there are 69,085,562 shares of Series F outstanding following certain cancellations and new issuances of the Series F following the Merger. Each share of Series F votes and converts into common stock on a 1-for-1 basis, subject to shareholder approval.

| 13 |

Series F-1 Convertible Preferred Stock

The Company issued former Beeline shareholders a total of 517,775 shares of Series F-1 in the Merger, all of which remain outstanding. Each share of Series F-1 votes and converts into common stock on a 1-for-1 basis.

Special Adjustment Provisions

Each of the Series F and Series F-1 contain special adjustment provisions providing that the number of underlying shares will be subject to potential adjustment to maintain a percentage of 82.5% of the Company’s common stock on a fully-diluted basis, subject to certain exceptions and limitations, including a maximum increase limitation on the resulting increase in underlying shares of 70 million shares. See “Description of Securities – Series F and F-1 Special Adjustment Feature” at page 99 for more information.

Subsequent Transactions and Subsequent Securities (page 41)

November 2024 PIPE – Notes and Warrants

On November 14, 2024, the Company sold $1,938,000 in aggregate principal amount of Notes and Warrants (the “Note Warrants”) and received gross proceeds of $1,615,000 in connection with a private placement offering. The Notes and Note Warrants were sold pursuant to a Securities Purchase Agreement with the investors. The Note Warrants are exercisable into a total of 363,602 shares of the Company’s common stock, beginning upon shareholder approval of such exercises. The Notes are not convertible and are due 120 days after issuance or on February 11, 2025.

November 2024 – January 2025 PIPE – Series G and Warrants

From November 26, 2024 to January 14, 2025, the Company sold 5,850,183 shares of Series G and five-year Warrants (the “G Warrants”) to purchase a total of 2,925,091 shares of common stock for total gross proceeds of $2,983,593. Each of the Series G and Warrants only become convertible and exercisable upon shareholder approval.

The foregoing issuances are part of an ongoing offering of Series G and accompanying G Warrants, for which we are seeking shareholder approval of those amounts at this Special Meeting. Because the offering is ongoing, we are asking shareholders to approve the issuance of shares of common stock underlying a total of up to 11,000,000 shares of Series G and 5,500,000 accompanying Series G Warrants, which includes the total of 6,938,615 Series G and 2,925,091 G Warrants presently outstanding.

| 14 |

Gunnar Termination Agreement – Series G

On December 31, 2024, the Company issued to Joseph Gunnar & Co., LLC, its former investment banker, 250,000 shares of Series G as consideration for the waiver and release of certain contractual rights under which the Company also paid $100,000 and provided registration rights with respect to the shares of common stock issuable upon conversion of the Series G.

Other Series G Issuances

We issued C/M Capital Master Fund LP (“C/M” or the “Purchaser”) 573,925 shares of Series G pursuant to the ELOC. The Series G were issued as “commitment shares” pursuant to the ELOC Agreement and a subsequent side letter agreement, and the shares underlying the Series G issued to the Purchaser are included in the Merger Share Issuance Proposal because such Series G were issued following the Merger in a subsequent transaction.

On December 31, 2024, an affiliate of the Purchaser purchased 294,118 shares of Series G and 147,059 G Warrants in the Series G and G Warrant offering in exchange for $150,000.

In January 2025, we issued a consultant 264,796 shares of Series G as payment for past services, and may issue the consultant $10,000 per month of Series G or common stock (subject to shareholder approval) in lieu of cash payments.

Equity Line of Credit

On December 31, 2024 the Company entered into a common stock Purchase Agreement and related Registration Rights Agreement (collectively, the “ELOC Agreement”) with C/M Capital Master Fund LP (“C/M”) pursuant to which the Company agreed to sell, and C/M agreed to purchase, up to $35 million of the Company’s common stock (which was later reduced to $20 million), subject to a sale limit of 19.99% of the outstanding shares of the Company’s common stock prior to shareholder approval in accordance with Nasdaq rules, which limitation is referred to in this Proxy Statement as the “Exchange Cap”. In connection with entering into the ELOC Agreement, the Company agreed to issue C/M shares of Series G having a value of 1.5% of the maximum ELOC amount. The Company and C/M also entered into a side letter agreement pursuant to which the parties agreed to certain future changes to the ELOC Agreement as may be requested based on the Company and its counsel’s review of the ELOC Agreement and as are reasonably acceptable to C/M. The ability of C/M to convert the underlying common stock or comply with the terms of the ELOC Agreement is subject to receiving shareholder approval as required by the rules of Nasdaq. If we issue any shares of common stock under the ELOC, we do not expect that we will issue more than 39,215,686 shares of common stock since if we issue any shares below $0.51 per share, the holders of our Series G get the benefit of anti-dilution rights and get more shares of common stock. Because we are not under an obligation to sell any shares under the ELOC, management believes the above estimated maximum is a reasonable estimate of the maximum number of shares we may issue in the ELOC. The actual number may be substantially less and will be dependent upon our future common stock price under a complex formula tied to the market prices, volume, volume weighted average prices, and various other factors as of applicable future dates as provided under the ELOC Agreement.

| 15 |

Share Issuance Proposals

Each of the securities described above contain voting and conversion rights for which shareholder approval is being sought under Proposals 1 and 2. In addition, most of the securities contain beneficial ownership limitations, as well as adjustment provisions which could result in an increase in the shares of common stock underlying such securities, subject in the case of the ELOC Share Issuance to the ELOC limit discussed in the above paragraph. See “Subsequent Transactions and Subsequent Securities” under Proposal 1 beginning at page 41 and “Principal Shareholders” beginning at page 51 for more information.

It is estimated that the number of shares of common stock issuable under Proposal 1 is as follows:

| ● | Series F and F-1 - 69,603,337 shares |

| ● | Note Warrants - 363,602 shares |

| ● | Series G - 11,000,000 shares |

| ● | G Warrants - 5,500,000 shares |

| ● | Options to former Beeline option holders - 3,878,847 shares |

| ● | Warrants to former Beeline warrant holders 287,094 shares (however, because the warrants will be exercisable at an exercise price of $4.72 per share and expire in October 2026, we do not expect any of these warrants will be exercised before their expiration). |

The above estimates assume we do not issue common stock or other securities at quantities and at a per-share price which triggers price protection and adjustment provisions of the Securities. For example, the special adjustment provision provided for under the Series F and F-1 could result in the issuance of up to an additional 70 million shares.

Thus, we estimate that, without giving effect to any anti-dilution provisions in the above securities, 90,632,880 shares of common stock will be issued or issuable under the securities listed above assuming shareholder approval of Proposal 1.

As noted above, the estimated maximum number of shares we may issue if Proposal 2 (the ELOC Proposal) is approved is 39,215,686.

We currently have authorized common stock of 6,000,000 shares, of which 4,689,503 shares are outstanding as of January 23, 2025 and the balance of our shares are reserved for conversion of outstanding preferred stock including the Series B and D and the securities to which Proposal 1 relates. We believe that depending upon the size of our reverse split and the outcome of a special shareholders meeting scheduled for January 27, 2025, at which we are asking our shareholders to increase our authorized common stock to 100 million shares, we may have sufficient common stock for Proposal 1 and part of Proposal 2. If necessary in the future we will seek additional shareholder approval to further increase our common stock. If our shareholders do not approve the increase in authorized common stock on January 21st, our only remedy is to seek shareholder approval at a later meeting.

| 16 |

The transactions outlined above under Proposals 1 and 2 were entered into with accredited investors and were exempt from registration under the Securities Act of 1933 (the “Securities Act”) pursuant to Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated thereunder.

Principal Shareholders (page 51)

As of January 23, 2025, there were 4,689,503 shares of Eastside common stock outstanding, 2,500,000 shares of Series B are outstanding representing 40,323 votes, for a total combined voting power of 4,729,826 shares.

The following tables set forth our capitalization, on fully-diluted basis, both (i) currently, without including issuances and rights underlying securities and transactions contemplated by Proposals 1 and 2, and (ii) giving effect to issuances and rights underlying securities and transactions contemplated by Proposals 1 and 2.

Current Fully-Diluted Capitalization

As of January 23, 2025, our common stock and preferred stock and derivative securities outstanding, on a fully-diluted basis (other than those securities which are not entitled to vote and for which shareholder approval is being sought at the Special Meeting), consists of the following:

| Class, Series or Type | Number of Shares of Common Stock * | Percentage on as Converted Basis | ||||||

| Common Stock | 4,689,503 | 60.9 | % | |||||

| Series B | 40,323 | 0.5 | % | |||||

| Series D | 1,419,300 | 18.4 | % | |||||

| Series E | 1,000,000 | 13.0 | % | |||||

| Prior Warrants | 544,803 | 7.1 | % | |||||

| Prior Options | 1,042 | 0.0 | % | |||||

*Does not give effect to price protection or anti-dilution provisions in the securities.

| 17 |

As described elsewhere in this Proxy Statement none of the Securities to which Proposals 1 and 2 relate are presently convertible or exercisable nor do they hold voting rights prior to shareholder approval.

Estimated Fully-Diluted Capitalization After Approval of Proposals 1 and 2

Assuming shareholder approval of both Proposals 1 and 2, and no further capital raising, our common stock and preferred stock and derivative securities outstanding, on a fully-diluted basis (which includes the securities for which shareholder approval is being sought at the Special Meeting), will consist of the following:

| Class, Series or Type | Number of Shares of Common Stock | Percentage on as Converted Basis | ||||||

| Common Stock | 4,689,503 | 3.4 | % | |||||

| Series B | 40,323 | 0.0 | % | |||||

| Series D | 1,419,000 | 1.0 | % | |||||

| Series E | 1,000,000 | 0.7 | % | |||||

| Series F* | 69,085,562 | 50.2 | % | |||||

| Series F-1* | 517,775 | 0.4 | % | |||||

| Series G* | 11,000,000 | (1) | 8.0 | % | ||||

| G Warrants* | 5,500,000 | (1) | 4.0 | % | ||||

| Note Warrants* | 363,602 | 0.3 | % | |||||

| Prior Warrants | 544,803 | 0.4 | % | |||||

| Prior Options | 1,042 | 0.0 | % | |||||

| Former Beeline Options* | 3,878,847 | 2.8 | % | |||||

| Former Beeline Warrants* | 287,094 | 0.2 | % | |||||

| ELOC Share Issuances* | 39,215,686 | 28.5 | % | |||||

*Issuances and related rights (including conversion, exercise and voting rights, as applicable) are subject to shareholder approval. Does not give effect to potential increases due to adjustment provisions contained in certain of these securities.

(1) Assumes the maximum amount of Series G and G Warrants are sold in that offering.

| 18 |

As stated above, if our shareholders approve Proposal 2 and we have sufficient authorized common stock, under the ELOC we expect we can issue up to 39,215,686 shares of common stock using the $0.51 price as the absolute minimum floor for issuances under the ELOC. Whatever number we issue under the ELOC will dilute our common shareholders including those as of the Record Date and subsequent shares issued.

Interests of Executive Officers and Directors in the Proposals (page 45)

When you consider the Board’s recommendations that shareholders vote in favor of the proposals described in this Proxy Statement, you should be aware that some of our executive officers and directors may have interests that may be different from, or in addition to, Eastside shareholders’ interests. For additional information see “Interests of Executive Officers and Directors in the Proposals” at page 45.

Securities Ownership

One of our directors and Nicholas Liuzza, the Beeline Chief Executive Officer hold Series G and Series F and F-1, and therefore their conversion, exercise and voting rights with respect to the securities they hold are implicated by the Merger Share Issuance Proposal. See “Principal Shareholders” at page 51.

Employment Matters

As described above, Nicholas Liuzza, Beeline’s Chief Executive Officer, is expected to become the Company’s Chief Executive Officer if the shareholders vote to approve the Merger Share Issuance Proposal.

Executive Officers and Board of Directors of Eastside After Approval of Proposal 1 (page 46)

Pursuant to the Merger Agreement, at the closing of the Merger on October 7, 2024, Joseph Freedman and Joseph Caltabiano were appointed as directors of the Company as designees of Beeline. On the annual shareholder meeting of Eastside held on December 23, 2024, Eastside’s shareholders voted to elect each director of the Company, including Messrs. Freedman and Caltabiano. In addition, Christopher Moe, the Chief Financial Officer of Beeline, was appointed as the Chief Financial Officer of Eastside on October 7th.

If we obtain shareholder approval of Proposal 1, we anticipate that Nicholas Liuzza, the Chief Executive Officer and a principal shareholder of Beeline pre-Merger and Eastside post-Merger, will be appointed as Chief Executive Officer of Eastside to replace Geoffrey Gwin in such role, and Mr. Gwin will be appointed as Executive Vice President or some other senior officer position and will remain as Chairman of the Board. as stated elsewhere in this Proxy Statement, this is dependent upon Nasdaq approving the new listing application.

Name Change

In connection with the Merger, at the Special Meeting the Company is also seeking to change its name to “Beeline Holdings, Inc.” to reflect a shift in and align our focus to the Beeline business following the Merger.

| 19 |

Auditor Ratification

At the Special Meeting the Company is also seeking to ratify the selection of Salberg & Company, P.A. to serve as the Company’s auditors for the fiscal year ended December 31, 2024 (the “Auditor Ratification Proposal”).

The Special Meeting (page 59)

The Special Meeting will be held on March 3, 2025 at 2:00 pm, Eastern Time. The Special Meeting will be a virtual meaning which means it will only be held via audio conference call at 1-877-407-3088, with no in person meeting. At the Special Meeting, Eastside shareholders will be asked to:

| 1. | Merger Share Issuance Proposal — approve the issuances of common stock and voting rights underlying the Securities issued or issuable in connection with the Merger and subsequent transactions in excess of 745,752 shares, which represents 19.99% of the Company’s common stock outstanding as of October 7, 2024; |

| 2. | Equity Line of Credit Proposal – approve the issuance of up to $20 million of shares of the Company’s common stock thereunder, or up to 39,215,686 shares of common stock; |

| 3. | Name Change Proposal – approve an amendment to the Company’s Articles of Incorporation changing the name of the Company to “Beeline Holdings, Inc.” |

| 4. | Auditor Ratification Proposal – ratify the selection of Salberg & Company, P.A. as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2024; and |

| 5. | Adjournment Proposal - approve a proposal to adjournment of the Special Meeting, if necessary, to solicit additional proxies in favor of any of the foregoing proposals. |

Voting at the Special Meeting

Record Date; Votes. We have fixed the close of business on January 23, 2025 as the Record Date for determining the Eastside shareholders entitled to receive notice of and to vote at the Special Meeting. Only holders of record of Eastside common stock and preferred stock on the Record Date are entitled to receive notice of and vote at the Special Meeting and any adjournment or postponement thereof.

Each share of common stock is entitled to one vote on each matter brought before the Special Meeting. There are also 2,500,000 shares of Series B outstanding with voting power totaling 40,323 votes. On the Record Date, there were 4,689,503 shares of common stock issued and outstanding and 40,323 votes underling Series B preferred stock issued and outstanding, representing total voting power of 4,729,826 votes.

| 20 |

Required Vote.

Approval of the Merger Share Issuance Proposal, the Equity Line of Credit Proposal, the Auditor Ratification Proposal and the Adjournment Proposal requires the affirmative vote of a majority of the votes cast on each such proposal. Abstentions and broker non-votes are not considered votes cast and have no effect on the foregoing Proposals, but will have the effect of a vote “Against” the Name Change Proposal.

None of the preferred shares on which we seek shareholder approval are permitted to vote on Proposals 1 and 2 due to Nasdaq. In addition, CM will not be entitled to vote on the Equity Line of Credit Proposal (Proposal 2).

For the Name Change Proposal (Proposal 3), we will need the approval of a majority of outstanding voting power as of the Record Date. However, if the Merger Share Issuance Proposal (Proposal 1) is approved and the Name Change Proposal (Proposal 3) is not approved, the Board intends to nonetheless approve and effect the Name Change in accordance with Nevada law, Nasdaq rules and the Company’s Articles of Incorporation.

Because each of the Proposals with the exception of the Auditor Ratification Proposal and the Adjournment Proposal is a non-routine matter under applicable rules, your bank, broker or other nominee cannot vote without instructions from you. For more information regarding the effect of abstentions, a failure to vote, or broker non-votes, see “The Special Meeting — Votes Required to Approve Proposals.”

Revocation of Proxies. With respect to shares of Eastside common stock that you hold of record, you have the power to revoke your proxy at any time before the proxy is voted at the Special Meeting. You can revoke your proxy in one of four ways:

| ● | you can send a signed notice of revocation of proxy; |

| ● | you can grant a new, valid proxy bearing a later date; |

| ● | you can revoke the proxy in accordance with the proxy submission procedures described in the proxy voting instructions attached to the proxy card; or |

| ● | if you are a holder of record, you can attend the Special Meeting online and vote online, which will automatically cancel any proxy previously given, but your attendance alone will not revoke any proxy that you have previously given. |

If you choose either of the first two methods to revoke your proxy, you must submit your notice of revocation or your new proxy to our Corporate Secretary at: 755 Main Street, Building 4, Suite 3, Monroe, CT 06468, Attention: Corporate Secretary, so that it is received no later than the beginning of the business day prior to the Special Meeting.

If you are a beneficial owner of Eastside common stock and your common stock is held by a broker, bank or other nominee, you must follow the instructions of your broker, bank or other nominee to revoke or change your voting instructions.

| 21 |

Stock Ownership of Directors and Executive Officers. On the Record Date, our directors and executive officers and their respective affiliates owned and were entitled to vote 742,626 shares of common stock, or approximately 15.8% of the voting power of Eastside stock outstanding on the Record Date. To our knowledge, our directors and executive officers and their respective affiliates intend to vote their voting power in favor of all proposals presented at the Special Meeting, and any adjournment or postponement thereof, except that holders of the Series F, F-1 and G are not permitted to vote under Nasdaq rules.

Recommendations of the Board

YOUR VOTE IS IMPORTANT. Eastside shareholders must approve the Share Issuance Proposals in order for the Company to complete certain transactions following the Merger, including capital raising transactions and other matters which are critical to the Company’s ongoing operations, business plan and future success.

The Board unanimously recommends that Eastside shareholders vote “FOR” each Proposal being brought before the shareholders at the Special Meeting. Without approval of Proposals 1 and 2, Eastside will be unable to raise capital while its common stock is listed on Nasdaq. It will be able to raise capital if it is delisted, but in recent years it has become increasingly difficult for unlisted companies to raise capital.

In making its recommendation that the shareholders vote to approve the Proposals including 1 and 2, the Board considered, among other matters, the Company’s and Beeline’s capital needs, the value and benefits for continued listing of the Company’s common stock on Nasdaq, and contractual obligations to which the Company is committed.

For additional information see “The Special Meeting — Board Recommendations” at page 59.

The following are some questions you may have regarding the Proposals and the Special Meeting. We urge you to read carefully this entire proxy statement, including the annexes attached hereto and the other documents to which this Proxy Statement refers or which it incorporates by reference because the information in this section may not provide all the information that is important to you.

Questions and Answers About the Share Issuance Proposals

Q: What is the purpose of the Share Issuance Proposals?

A: Nasdaq Rule 5635(b) requires that the issuance of 20% or more of the Company’s common stock in connection with a change of control transaction such as the Merger must be approved by the shareholders of the Company. While the Merger has closed, the Merger Shares issued thereunder are subject to limitations on conversion, exercise and voting unless and until shareholder approval is obtained in accordance with Nasdaq rules. Additionally, following the Merger, the Company entered into and engaged in certain subsequent transactions under which it issued or agreed to issue the Subsequent Securities. The purpose of the Share Issuance Proposals are to obtain shareholder approval of the issuances of common stock in excess of the Exchange Cap of 19.99% of the Company’s common stock as of October 7, 2024, the closing date of the Merger, in order to comply with Nasdaq rules. Shareholders are not being asked to approve any terms of the Merger, the subsequent transactions or the Equity Line of Credit, other than the issuances of common stock in excess of the 19.99% limitation.

| 22 |

Because Proposals 1 and 2 implicate or potentially implicate the foregoing Nasdaq rules, the issuance of common stock and related rights in connection with each of the Merger Shares, the other securities listed under Proposal 1 at page 29 and the Equity Line of Credit, which are referred to throughout this Proxy Statement as the “Share Issuances” are being brought before the shareholder for approval. Other than the issuances of shares of common stock and related rights and terms in connection with or underlying the Securities issued connection with the Merger and subsequent transactions, our shareholders are not being asked to approve the Merger and subsequent transactions, including the Merger which closed on October 7, 2024.

This Proxy Statement contains important information about the Merger and subsequent transactions, the Securities, the Proposals and the Special Meeting. You should read it carefully before deciding how to vote on any of the Proposals.

Q: What are the consequences if the Share Issuance Proposals are not approved?

A: Unless and until shareholder approval is obtained for the Merger Share Issuance Proposal, holders of Securities will be unable to convert, exercise or vote their Securities, and we will be unable to proceed with the sales of common stock contemplated by the ELOC Agreement.

If we are unable to obtain shareholder approval for the Share Issuance Proposal at the Special Meeting, we will seek to adjourn the Special Meeting to allow for more time to solicit votes to approve the proposal. If we are unable to obtain approval for the Share Issuance Proposal or if we are delayed in doing so, it could have negative consequences on our Company, including by limiting our ability to raise capital by precluding us from issuing additional shares of common stock in accordance with Nasdaq rules, jeopardizing our continued listing on Nasdaq as a result, and potentially resulting in defaults under existing contractual obligations under which we agreed to obtain shareholder approval by a specified date.

For example, we require additional capital to service existing debt obligations and to meet our ongoing working capital needs and growth objectives, particularly given our recent acquisition of Beeline in the Merger and the funding needs of that business. One potential source of such capital will be the up to $20 million ELOC Agreement with C/M, as described in more detail elsewhere in this Proxy Statement, and in order to proceed with that transaction and other capital raising transactions involving the issuance of common stock and funding for Beeline, we must first obtain shareholder approval for the Share Issuance Proposal. For these and other reasons, our Board has recommended that our shareholders vote “FOR” the Merger Share Issuance Proposal and the ELOC Proposal (Proposals 1 and 2), and we urge our shareholders to carefully review and consider the information contained and referenced in this Proxy Statement in order to make an informed decision in voting on this matter.

| 23 |

Q: Will the Share Issuances be affected if the shareholders do not vote to approve the Share Issuance Proposals?

A: The Merger closed on October 7, 2024, and the Merger Shares were issued at that time. While conversions and voting rights of the Series F and Series F-1 are limited absent shareholder approval, if shareholder approval is not obtained, it will not effect the Merger because it has already occurred.

The Securities and the Share Issuances cannot result in the issuance of over the Exchange Cap of 19.99% of the Company’s outstanding common stock in violation of Nasdaq rules. Therefore, as long as the Company’s common stock remains listed on Nasdaq, issuances in connection with the Merger and subsequent transactions will be limited by that threshold. In addition, we submitted a new listing application in connection with the Special Meeting and the Merger. If we fail to obtain shareholder approval, that application may not be approved, and we could be subject to delisting by Nasdaq for failure to comply with Nasdaq Rule 5635(b) or other rules and regulations imposed by Nasdaq.

Q: What will happen following approval of the Share Issuance Proposals?

A: If the shareholders vote to approve the Share Issuance Proposals (Proposals 1 and 2), all Series F-1, F and G will become convertible and the Note and G Warrants will be exercisable by the respective holders thereof, and any voting rights in connection therewith will take effect, subject to beneficial ownership limitations set forth therein. While there are anti-dilution adjustment provisions in our outstanding preferred stock which could result in additional shares of common stock issuable upon conversion or exercise of the securities, the estimated amounts as the Share Issuances does not give effect to such issuances since we do not expect that we will engage in lower price issuances which could trigger the anti-dilution features. As of the date of this Proxy Statement, the securities in Proposal 1 could result in the issuance of a total of 90,632,880 underlying shares of common stock, without giving effect to beneficial ownership limitations or potential adjustments thereof. Additionally, the Equity Line of Credit may result in the issuance of up to 39,215,686 shares of common stock using the assumed floor of $0.51 per share. However, we may need to obtain shareholder approval to increase our authorized common stock to permit us to use the full ELOC. Based on the foregoing, the estimated number of shares being approved for issuance under Proposals 1 and 2 is 129,848,567 shares.

After giving effect to these issuances under Proposals 1 and 2 (and assuming we have the authorized capital), this amount would reflect a total of approximately 94% of the Company’s outstanding common stock issued or issuable to the holders of the Securities, compared to approximately 2.7% and 3.4% of the Company’s outstanding common stock held by Eastside shareholders as of October 7, 2024, the closing date of the Merger and the Record Date, respectively. As such, Eastside shareholders will experience substantial dilution if Proposals 1 and 2, or either of them, are approved.

Approval of Proposal 2 gives the Company the opportunity to raise capital in the future to support its operations assuming the shares of common stock issuable under the ELOC are subject to a registration statement we will later file with the SEC and the SEC declares such registration statement effective.

In addition, effective immediately upon approval of Proposal 1 at the Special Meeting, the holders of the Series F, F-1 and G, representing a total of approximately 76 million votes as of the Record Date, will become entitled to vote, and those votes will be counted towards the other Proposals being brought at the Special Meeting and at any future meetings of the shareholders, subject to any applicable beneficial ownership limitations.

| 24 |

Q: When will shares of common stock underlying Proposals 1 and 2 be issued?

A: In most instances, the holders of the various series of preferred stock and warrants will decide if, when and in what quantities to exercise their rights and receive shares of common stock. With respect to the ELOC Agreement, the Company will have the right to sell shares of common stock to C/M, in an amount of up to $20 million, in accordance with the ELOC Agreement entered into for that purpose. Conversions and exercises of the series of preferred stock and warrants are subject to beneficial ownership limitations ranging from 1% to 9.99% depending upon the type of security. Because of these differences and contingencies, and the holders’ discretion, we cannot predict with certainty whether and when and the number of shares of common stock that will be issued following shareholder approval of issuances under the Proposals 1 and 2.

As stated above, the ELOC Proposal (Proposal 2) will be dependent upon registering the transaction though which C/M will publicly sell the common stock it acquires from us. Further the ELOC sales will be dependent upon our common stock trading actively in the future. We cannot assure you the market for our common stock will be liquid enough for us to raise material capital under the ELOC. Finaly, we must have authorized capital or we will have to seek further shareholder approval in the future to continue utilizing the ELOC.

Q: Do I have dissenters’ or appraisal rights with respect to the Share Issuance Proposals?

A: Eastside shareholders do not have dissenters’ or appraisal rights in connection with the Share Issuances or the Securities.

Questions and Answers About the Name Change Proposal

Q: What is the purpose of the Name Change Proposal?

A: As we state in this Proxy Statement, if Proposal 1 passes, it will result in a change of control under Nasdaq rules since more than 19.99% of our common stock will be issuable to holders of the Series F and F-1. Since former Beeline shareholders will become our largest block of shareholders and following the Merger our strategic focus has shifted to furthering the Beeline business, changing our name to Beeline Holdings, Inc. gives effect to that reality. It will also assist us in our marketing of the Beeline brand.

However, if the Merger Share Issuance Proposal (Proposal 1) is approved and the Name Change Proposal (Proposal 3) is not approved, the Board intends to nonetheless approve and effect the Name Change in accordance with Nevada law, Nasdaq rules and the Company’s Articles of Incorporation.

| 25 |

Questions and Answers About the Special Meeting

Q: When and where is the Special Meeting?

A: A Special Meeting of shareholders will be held on March 3, 2025 at 2:00 pm Eastern time. For the Special Meeting, we will not hold an in person meeting but will instead conduct a virtual meeting online. See the Notice of Meeting for the details on how to attend.

Q: What proposals are being submitted at the Special Meeting?

A: The proposals to be submitted at the Special Meeting are summarized as follows:

| 1. | Merger Share Issuance Proposal — approve the issuances of common stock and voting rights underlying the Securities issued or issuable in connection with the Merger and subsequent transactions in excess of 745,752 shares, which represents 19.99% of the Company’s common stock outstanding as of October 7, 2024; | |

| 2. | Equity Line of Credit Proposal – approve the issuance of up to $20 million of shares of the Company’s common stock thereunder. Without further shareholder approval at a later meeting, we will not issue more than 39,215,686 shares of common stock under Proposal 2; | |

| 3. | Name Change Proposal – approve an amendment to the Company’s Articles of Incorporation changing the name of the Company to “Beeline Holdings, Inc.” | |

| 4. | Auditor Ratification Proposal – ratify the selection of Salberg as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2024; and | |

| 5. | Adjournment Proposal - approve a proposal to adjournment of the Special Meeting, if necessary, to solicit additional proxies in favor of any of the foregoing proposals. |

Q. What are the quorum requirements for the Special Meeting?

A: Under Nevada law and our Bylaws, a quorum of Eastside’s shareholders at the Special Meeting is necessary to transact business. One-third of the shares entitled to vote must be present at the meeting or represented by proxy in order to constitute a quorum for the transaction of any business at the Special Meeting.

Q: Why is my vote important?

A: The approval of Proposal 1 by the requisite vote of Eastside shareholders is required to allow for the shares of common stock underlying the Series F, F-1 and G and the Note Warrants and G Warrants, as well as the shares underlying the options and warrants to be issued to former Beelie option and warrant holders, to be issued in accordance with Nasdaq rules. If shareholder approval is not obtained, the Company will be at risk of being unable to allow conversions of its securities and being in breach of certain contractual obligations, or of failing to comply with the continued listing requirements of Nasdaq. The Company strongly believes it is in the interest of all of its shareholders to remain listed on Nasdaq. Delisting from Nasdaq will not be in the interest of our current common shareholders or other holders of our securities and will make capital raising a substantially more risky and challenging undertaking. In addition, the Company needs to raise additional capital to service its debt obligations and fund its operations and growth objectives, which requires the issuance of additional shares of common stock including under the ELOC Agreement (Proposal 2). See also the Question and Answer above beginning with “What are the consequences if the Merger Share Issuance Proposal is not approved?”

| 26 |

Q: What is the difference between holding shares as a shareholder of record and as a beneficial owner?

A: If your shares of Eastside common stock are registered directly in your name with our transfer agent, you are considered the shareholder of record with respect to those shares. As the shareholder of record, you have the right to vote or to grant a proxy for your vote directly to us, or to a third party to vote at the Special Meeting.

If your shares are held by a bank, brokerage firm or other nominee, you are considered the beneficial owner of shares held in “street name,” and your bank, brokerage firm or other nominee is considered the shareholder of record with respect to those shares. Your bank, brokerage firm or other nominee will send you, as the beneficial owner, a package describing the procedure for voting your shares. You should follow the instructions provided by them to vote your shares. You will only be able vote your shares at the Special Meeting if you obtain a legal proxy from your bank, broker, or other nominee.

Q: How does the Board recommend that I vote?

A: After careful consideration, the Board unanimously recommends that the Eastside shareholders vote “FOR” all of the proposals described in this Proxy Statement.

Q: If my shares are held in “street name” by my broker, will my broker vote my shares for me?

A: Your broker is not permitted to vote on the non-routine proposals unless you provide your broker with voting instructions on that proposal. Each proposal other than Proposals 4 and 5 are considered non-routine. You should instruct your broker to vote your shares by following the directions your broker provides you. Please review the voting information form used by your broker to see if you can submit your voting instructions by Internet. We expect that your broker, bank or other nominee will be permitted to vote in favor of the Auditor Ratification Proposal if you do not vote but your broker is not obligated to do so. You should check with the broker that holds your shares.

Q: What if I abstain from voting or fail to instruct my broker with respect to the Proposals?

A: A broker non-vote occurs when a beneficial owner fails to provide voting instructions to his or her broker as to how to vote the shares held by the broker in street name and the broker does not have discretionary authority to vote without instructions. For additional information, see “The Special Meeting.”

An abstention or a broker non-vote is the same as a vote “Against” Proposal 3, and has no effect on the other Proposals since they are not votes cast. For additional information, see “The Special Meeting.”

Q: How do I vote my shares?

A: If you are a shareholder of record as of the record date, you can give a proxy to be voted at the meeting in any of the following ways:

| ● | electronically, using the Internet; or | |

| ● | by completing, signing, and mailing, faxing or emailing a printed proxy card (which may be downloaded and printed or that you separately request from us). |

The Internet voting procedures have been set up for your convenience. We encourage you to reduce corporate expenses by submitting your vote by Internet. The procedures have been designed to authenticate your identity, to allow you to give voting instructions, and to confirm that those instructions have been recorded properly. If you are a shareholder of record and you would like to submit your proxy by Internet, please refer to the specific instructions provided on the enclosed proxy card. If you wish to submit your proxy by mail, please access a proxy card in the materials available on the Internet or request a proxy card from us and return your signed proxy card to us before the special meeting.

If the shares you own are held in street name, your broker, bank, trust, or other nominee, as the record holder of your shares, is required to vote your shares according to your instructions. Your broker, bank, trust, or other nominee is required to send you directions on how to vote those shares. If you do not give instructions to your broker, bank, trust, or other nominee, it will still be able to vote your shares with respect to certain “discretionary” items but will not be allowed to vote your shares with respect to certain “non-discretionary” items. In the case of non-discretionary items, the shares that do not receive voting instructions will be treated as “broker non-votes.” Proposal one will be considered a “non-discretionary” item.

Shareholders will not be able to attend the Special Meeting in person. If you were a shareholder of record as of the Record Date, you may access the virtual meeting by calling 1-877-407-3088 (Toll Free) and presenting the unique 12-digit control number on the proxy card.

If you were a beneficial owner of record as of the Record Date (i.e., you held your shares in an account at a brokerage firm, bank or other similar agent), you will need to obtain a legal proxy from your broker, bank or other agent. Once you have received a legal proxy from your broker, bank or other agent, it should be emailed to our inspector of election for the special meeting, Equity Stock Transfer, LLC, at proxy@equitystock.com and should be labeled “Legal Proxy” in the subject line. Please include proof from your broker, bank or other agent of your legal proxy (e.g., a forwarded email from your broker, bank or other agent with your legal proxy attached, or an image of your valid proxy attached to your email). Requests for registration must be received by Equity Stock Transfer, LLC no later than 5:00 p.m. Eastern Time, on March 2, 2025 (unless the meeting has been adjourned in which case a new date will be announced). You will then receive a confirmation of your registration, with a control number, by email from Equity Stock Transfer, LLC. At the time of the meeting, access the live audio conference call at 1-877-407-3088 and present your unique 12-digit control number.

Online access to the Special Meeting will open at 2:00 p.m. Eastern Time to allow time for shareholders to call-in prior to the start of the Special Meeting. You may vote during the Special Meeting by dialing 1-877-407-3088 and following the instructions.

Whether or not shareholders plan to participate in the virtual-only Special Meeting, the Company urges shareholders to vote and submit their proxies in advance of the meeting by one of the methods described in the proxy materials for the Special Meeting.

| 27 |

Q: What do I do if I want to change my vote?

A: You can change your vote at any time before the Special Meeting. You can do this in one of four ways:

| ● | you can send a signed notice of revocation of proxy; | |

| ● | you can grant a new, valid proxy bearing a later date; | |

| ● | you can submit a proxy again by the proxy submission procedures; or | |

| ● | if you are a holder of record, you can attend the applicable Special Meeting and vote. By attending online, but your attendance alone will not revoke any proxy that you have previously given. |

If you choose either of the first two methods to revoke your proxy, you must submit your notice of revocation or your new proxy to Eastside at 755 Main Street, Building 4, Suite 3, Monroe, CT 06468, Attention: Corporate Secretary, so that it is received no later than the last business day prior to the Special Meeting. If you are a shareholder, you can find further details on how to revoke your proxy in “The Special Meeting — Revocation of Proxies.”

If you are a beneficial owner of Eastside common stock as of the close of business on the Record Date, you must follow the instructions of your broker, bank or other nominee to revoke or change your voting instructions.

Q: What do I do now?

A: Carefully read and consider the information contained in and incorporated by reference into this Proxy Statement, including its annexes. Then, complete and return your proxy or submit your vote in advance of or at the Special Meeting based on the instructions included in this Proxy Statement and on your proxy card.

Beneficial owner. If you are a beneficial owner, please refer to the instructions provided by your bank, brokerage firm or other nominee to see which of the above choices are available to you. Please note that if you are a beneficial owner and you wish to vote at the Special Meeting, you will need to obtain a legal proxy from your bank, broker, or other nominee.

See “How do I vote my shares” for more information on poxy and voting procedures for the Special Meeting.

Q: Whom should I contact with questions?

A: If you have additional questions about the Proposals or the Special Meeting, you should contact us at:

Eastside Distilling, Inc., 755 Main Street, Building 4, Suite 3, Monroe, Connecticut, 06468, or by phone at +1 458-800-9154.

| 28 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS