Letter of Transmittal

Regarding Shares in Blackstone Alternative Alpha Fund

For Clients of Hightower Securities, LLC, Fidelity Brokerage Services LLC,

RBC Capital Markets LLC, and Concert Wealth Management Inc.

Tendered Pursuant to the Offer to Purchase

Dated December 18, 2018

The Offer and withdrawal rights will expire on January 18, 2019

and this Letter of Transmittal must be received by

the Fund’s Administrator, either by mail or by fax, by 11:59 p.m.,

Eastern Time, on January 18, 2019, unless the Offer is extended

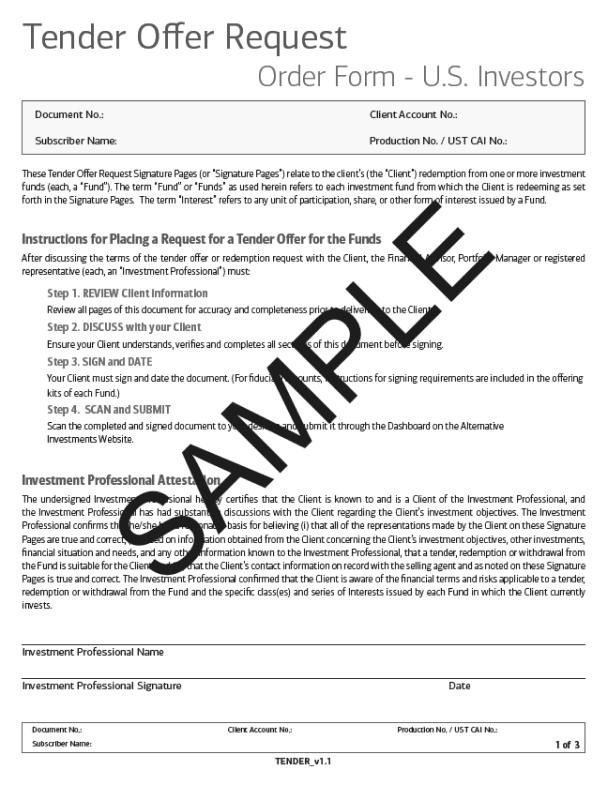

Should you wish to participate in the Offer, please contact your Financial Advisor/Portfolio Manager who will be responsible to forward to the appropriate custodian. The Letter of Transmittal generated for your account will need to be signed and returned or delivered to your Financial Advisor/Portfolio Manager.

For additional information call your Financial Advisor/Portfolio Manager.

Ladies and Gentlemen:

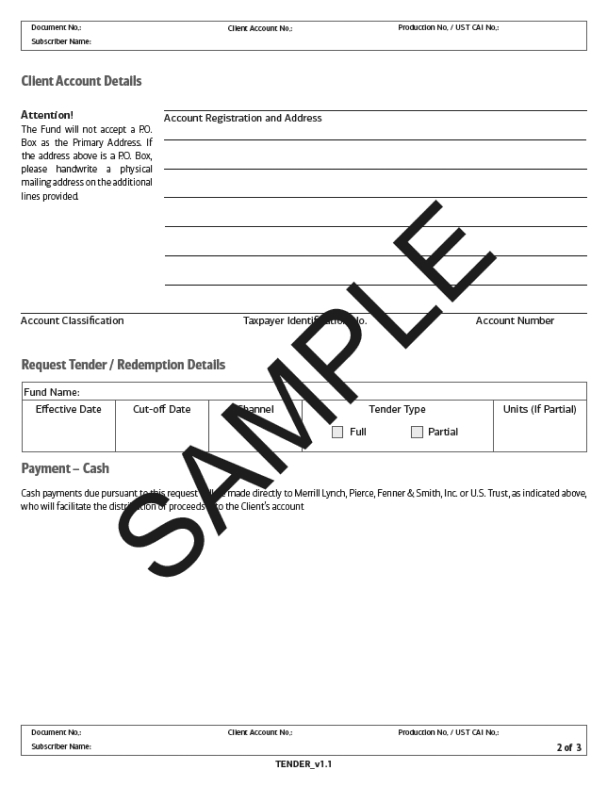

The undersigned hereby tenders to Blackstone Alternative Alpha Fund, aclosed-end,non-diversified, management investment company organized under the laws of The Commonwealth of Massachusetts (the “Fund”), the shares of beneficial interest in the Fund or portion thereof held by the undersigned, described and specified below, on the terms and conditions set forth in the Offer to Purchase dated December 18, 2018 (the “Offer to Purchase”), receipt of which is hereby acknowledged, and in this Letter of Transmittal (which together with the Offer to Purchase constitute the “Offer”).The Tender and this Letter of Transmittal are subject to all the terms and conditions set forth in the Offer to Purchase, including, but not limited to, the absolute right of the Fund to reject any and all tenders determined by it, in its sole discretion, not to be in the appropriate form.

The undersigned hereby sells to the Fund the shares of beneficial interest in the Fund or portion thereof tendered hereby pursuant to the Offer.

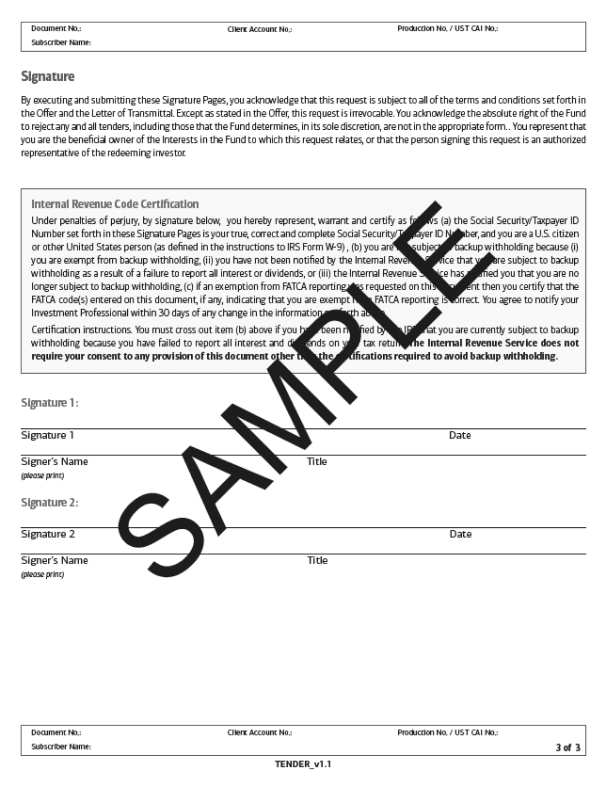

The undersigned hereby warrants that the undersigned has full authority to sell the shares of beneficial interest in the Fund or portion thereof tendered hereby and that the Fund will acquire good title thereto, free and clear of all liens, charges, encumbrances, conditional sales agreements or other obligations relating to the sale thereof, and not subject to any adverse claim, when and to the extent the same are purchased by it. Upon request, the undersigned will execute and deliver any additional documents necessary to complete the sale in accordance with the terms of the Offer. The undersigned recognizes that under certain circumstances set forth in the Offer, the Fund may not be required to purchase any of the beneficial shares of interest in the Fund or portions thereof tendered hereby.

Anon-transferable,non-interest bearing promissory note for the purchase price will be issued to the undersigned if the Fund accepts for purchase the shares tendered hereby. The undersigned acknowledges that State Street Bank and Trust Company, the Fund’s administrator, will hold the promissory note on behalf of the undersigned. The cash payment(s) of the purchase price for the shares of beneficial interest in the Fund or portion thereof of the undersigned, as described in Section 6 of the Offer to Purchase, shall be wired to the account at your financial intermediary from which your subscription funds were debited.

All authority herein conferred or agreed to be conferred shall survive the death or incapacity of the undersigned and the obligation of the undersigned hereunder shall be binding on the heirs, personal representatives, successors and assigns of the undersigned. Except as stated in Section 5 of the Offer to Purchase, this tender is irrevocable.

(PAGE 1 of 3)