Exhibit 1

ESSEX RENTAL CORP. NASDAQ: ESSX Presentation by Casey Capital, LLC Dated May 13, 2015 1

Disclaimer On May 7, 2015, Casey Capital, LLC (“Casey Capital”) and Lee D. Keddie , filed a definitive proxy statement with the Securities and Exchange Commission (the “SEC”) in connection with the 2015 Annual Meeting of stockholders of Essex Rental Corp. (“ Essx ” or the “Company”). The definitive proxy statement is available at no charge on the SEC’s web site at www.sec.gov and contains information related to the participants and a description of the participant’s direct or indirect interests, by security holdings. In addition, Casey Capital will provide copies of the definitive proxy statement and accompanying proxy card without charge upon request. Casey Capital and Lee D. Keddie intend to use the proxy card accompanying the definitive proxy statement to solicit proxies from the stockholders of the Company. 2

Disclaimer (cont’d) Casey Capital, Lee D. Keddie and their respective affiliates do not assume responsibility for investment decisions. This presentation does not recommend the purchase or sale of any security. Under no circumstances is this presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security. This document includes certain forward - looking statements, estimates and projects prepared with respect to, among other things, general economic and market conditions, changes in management, changes in the composition of the Company’s board, actions of the Company and its subsidiaries or competitors and the ability to implement business strategies and plans and pursue business opportunities. Such forward - looking statements, estimates and projections reflect various assumptions concerning anticipated results that are inherently subject to significant uncertainties and contingencies and have been included solely for illustrative purposes, including those risks and uncertainties detailed in the continues disclosure and other filings of the Company, copies of which are available on the SEC’s website at www.sec.gov. No representations, express or implied, are made as to the accuracy of completeness of such forward - looking statements, estimate or projects or with respect to any other materials herein. Casey Capital and Lee D. Keddie reserve the right to change any of the opinions expressed herein at any time as they deem appropriate. Casey Capital, Lee D. Keddie and their respective affiliates may buy, sell, cover or otherwise change the form of their investment in the Company for any reason at any time, without notice, and there can be no assurances that they will take any of the actions described in this document. Casey Capital and Lee D. Keddie disclaim any duty to provide any updates or changes to the analyses contained in this document, except as may be required by law. Casey Capital and Lee D. Keddie disclaim any obligation to update the information contained herein. Casey Capital and Lee D. Keddie have not sought or obtained consent from any third party to use any statements or information indicated in this presentation as having been obtained or derived from statements made or published by third parties. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein. 3

Disclaimer (cont’d) Casey Capital and Lee D. Keddie may have relied upon certain quantitative and qualitative assumptions when preparing the analysis which may not be articulated as part of the analysis. The realization of the assumptions on which the analysis was based are subject to significant uncertainties, variabilities , and contingencies and may change materially in response to small changes in the elements that comprise the assumptions, including the interaction of such elements. Furthermore, the assumptions on which the analysis was based may be necessarily arbitrary, may be made as of the date of the analysis, do not necessarily reflect historical experience with respect to securities similar to those that may be contained in the analysis, and do not constitute a precise prediction as to future events. Because of the uncertainties and subjective judgments inherent in selecting the assumptions on which the analysis was based and because future events and circumstances cannot be predicted, the actual results realized may differ materially from those projected in the analysis. 4

Disclaimer (cont’d) The information that is contained in the analysis should not be construed as financial, legal, investment, tax, or other advice. You ultimately must rely upon your own examination and that of your professional advisors, including legal counsel and accountants as to the legal, economic, tax, regulatory, or accounting treatment, suitability, and other aspects of the analysis. Casey Capital asks that you refrain from sending this document to any other party under any circumstances. 5

About ESSX ( formerly Hyde Park Acquisition Corp.) Essex Crane (acquired in 2008) Leading provider of lattice - boom crawler crane and attachment rental services Regions – mainly US and Canada Coast Crane (acquired in 2010) Leading provider of lattice - boom crawler crane and attachment rental services Regions – mainly Western North America, Alaska, Hawaii and the South Pacific 6

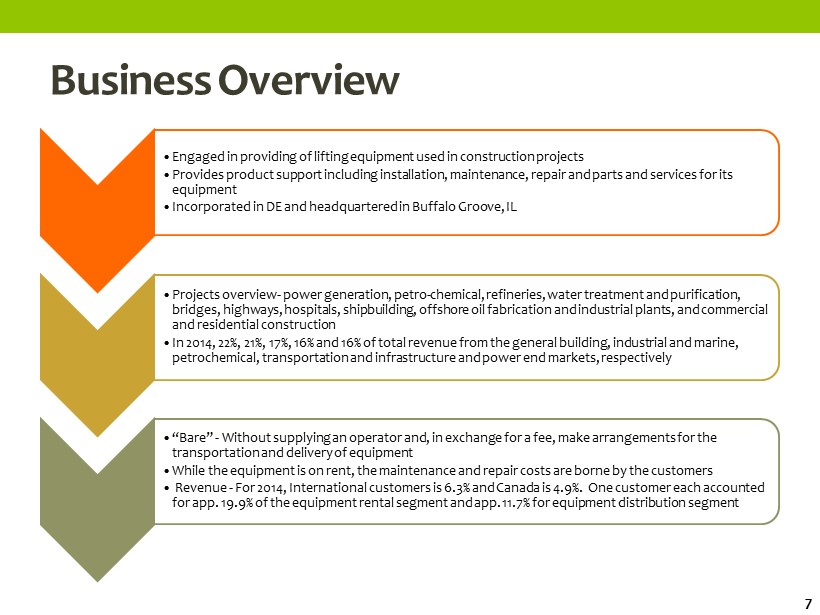

Business Overview • Engaged in providing of lifting equipment used in construction projects • Provides product support including installation, maintenance, repair and parts and services for its equipment • Incorporated in DE and headquartered in Buffalo Groove, IL • Projects overview - power generation, petro - chemical, refineries, water treatment and purification, bridges, highways, hospitals, shipbuilding, offshore oil fabrication and industrial plants, and commercial and residential construction • In 2014, 22%, 21%, 17%, 16% and 16% of total revenue from the general building, industrial and marine, petrochemical, transportation and infrastructure and power end markets, respectively • “Bare” - Without supplying an operator and, in exchange for a fee, make arrangements for the transportation and delivery of equipment • While the equipment is on rent, the maintenance and repair costs are borne by the customers • Revenue - For 2014, International customers is 6.3% and Canada is 4.9%. One customer each accounted for app. 19.9% of the equipment rental segment and app. 11.7% for equipment distribution segment 7

Operating Segments Equipment Rentals Segment Essex Crane Equipment Rentals Segment Coast Crane Equipment Rentals Segment Equipment Distribution Segment Parts and Service Segment 2014 Revenue = $73.2M 2014 Revenue = $9.9M 2014 Revenue = $20.3M 8

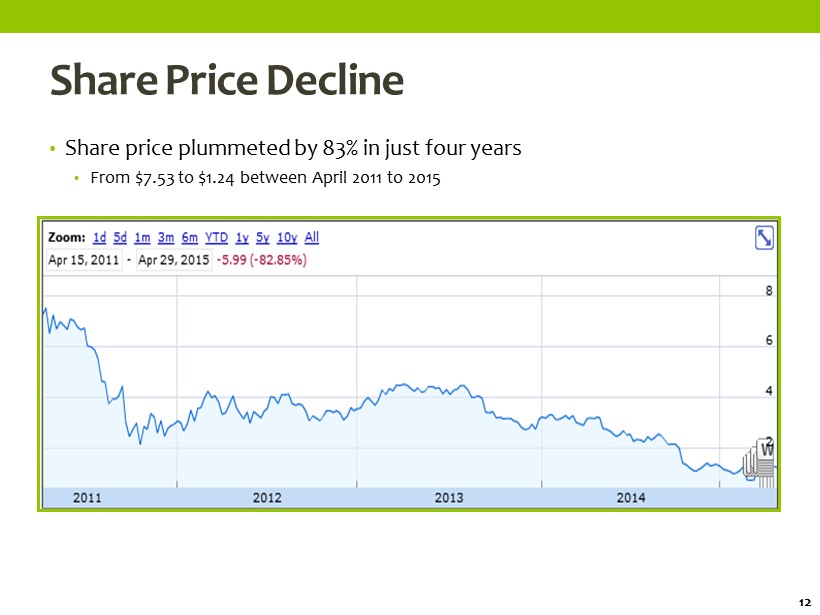

Executive Summary • Share price has plummeted by 83% in just four years: • $7.53 (April 2011) to $1.24 (April 2015) • Company has been funding most of its operations through high interest loans and this is reflected in its declining Book Value/Share, which has declined from a high of 5.25 in 2009 to 2.24 in 2014. • Company’s debt burden is quite high and the company could be in serious trouble if remedial action is not taken immediately. • ESSX has experienced various financial irregularities the last few quarters. • Company has conducted various related party transactions. These transactions are concerning from a corporate governance perspective. • Directors and executive receive very high compensation, which in no way reflects the declining operating performance and financial condition of the company. 9

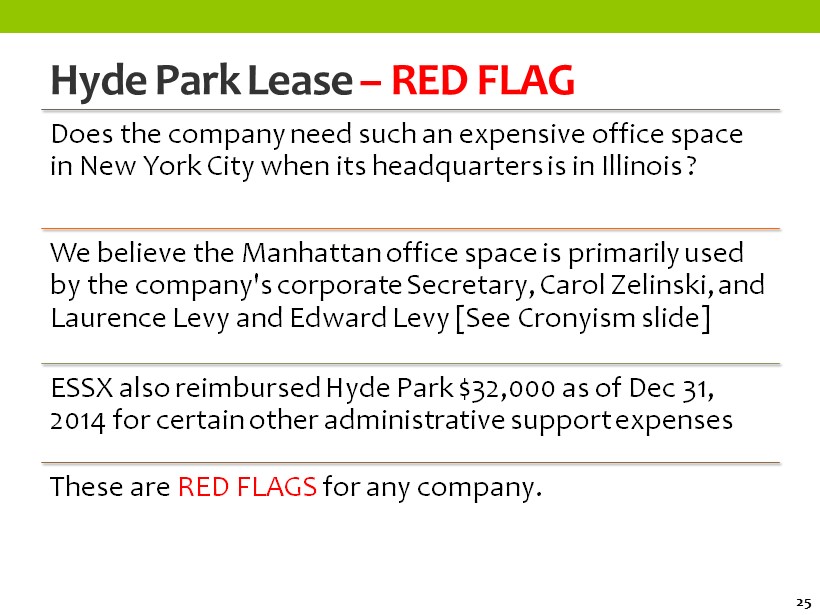

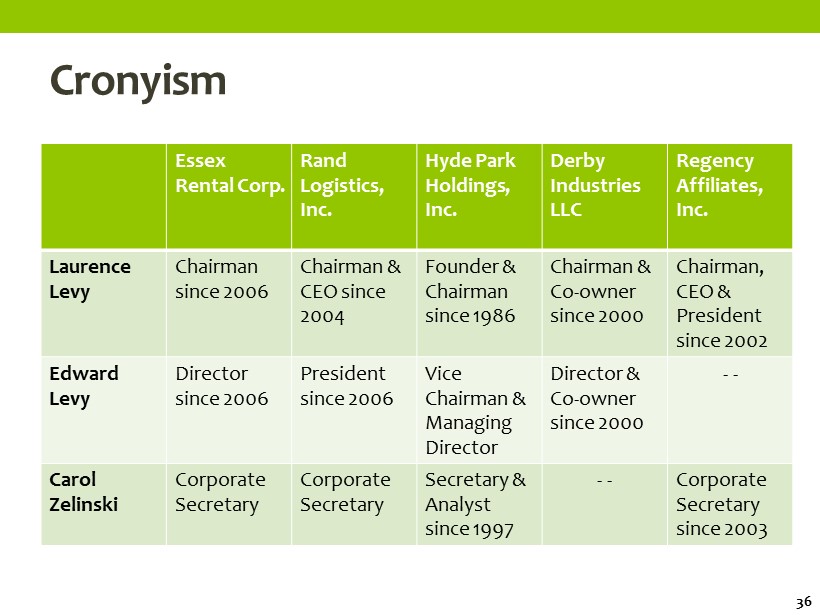

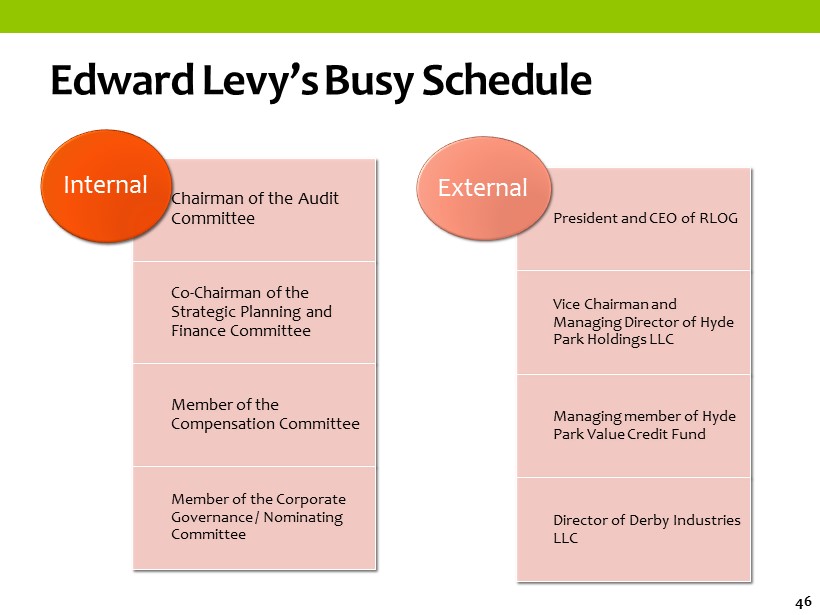

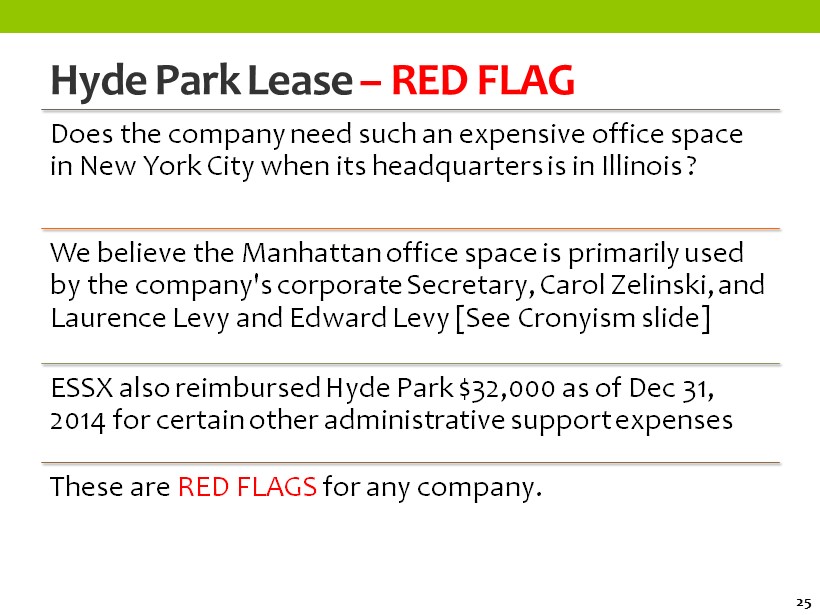

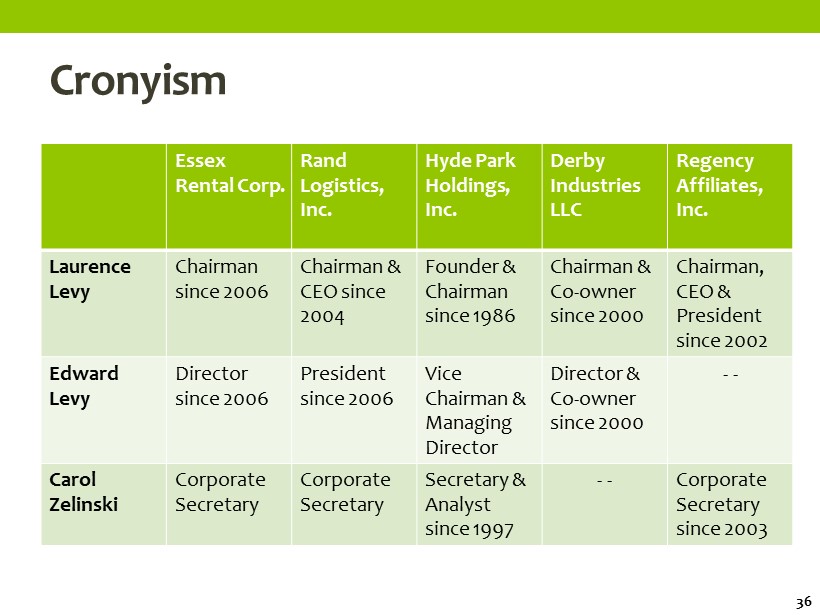

Executive Summary • Company leases office space in pricey New York City paying $11,000 per month. This office space is affiliated to Laurence Levy, Chairman of the Board and we believe it is mainly used by Laurence Levy [Chairman], Edward Levy [Director] and Carol Zelinski [Company Secretary] . • Company’s board independence appears to be seriously compromised due to a culture of cronyism. • Laurence Levy and Edward Levy have a poor performance history while dealing with previous companies. • They also hold board and executive positions at various companies. This results in their schedules being stretched far to thin for them to contribute effectively to ESSX. • Our strategy is to elect new directors effective immediately who have substantial industry experience, reduce compensation, renegotiate debt terms and explore strategic alternatives. 10

AGENDA Shareholder Value Erosion at ESSX Compensation Analysis Financial Irregularities Strategic Alternatives Our Nominees vs. Incumbents 11

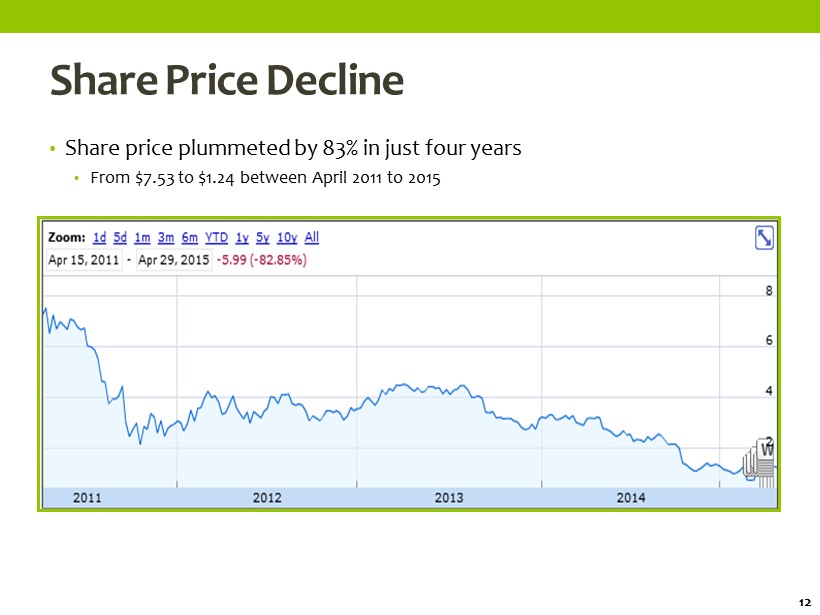

Share Price Decline • Share price plummeted by 83% in just four years • From $7.53 to $1.24 between April 2011 to 2015 12

Share Price Decline • In the last 12 months alone, the decline was 62% 13

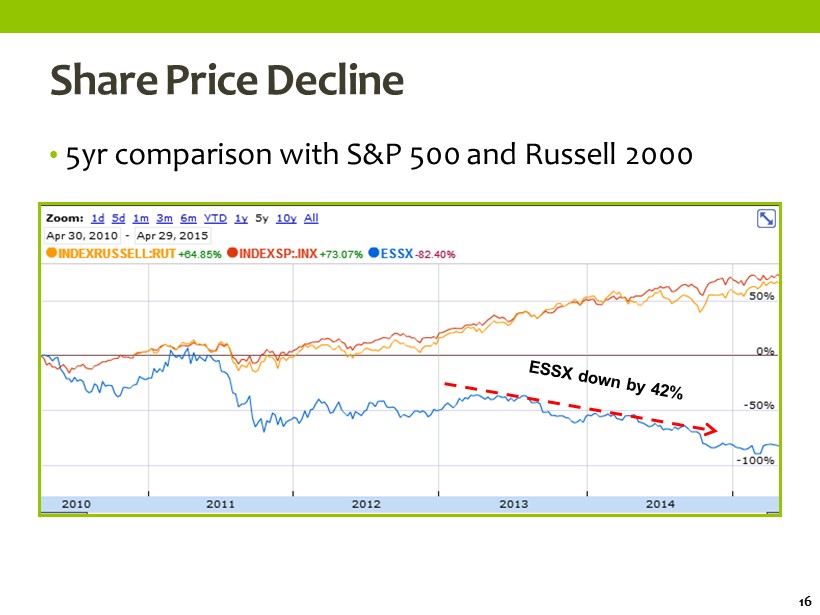

Share Price Decline • Past 5 years – declined by 82% 14

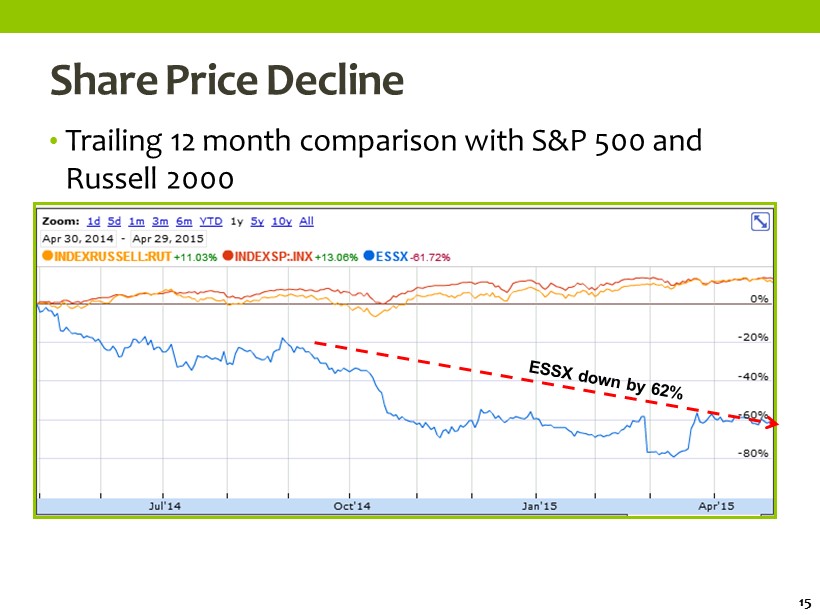

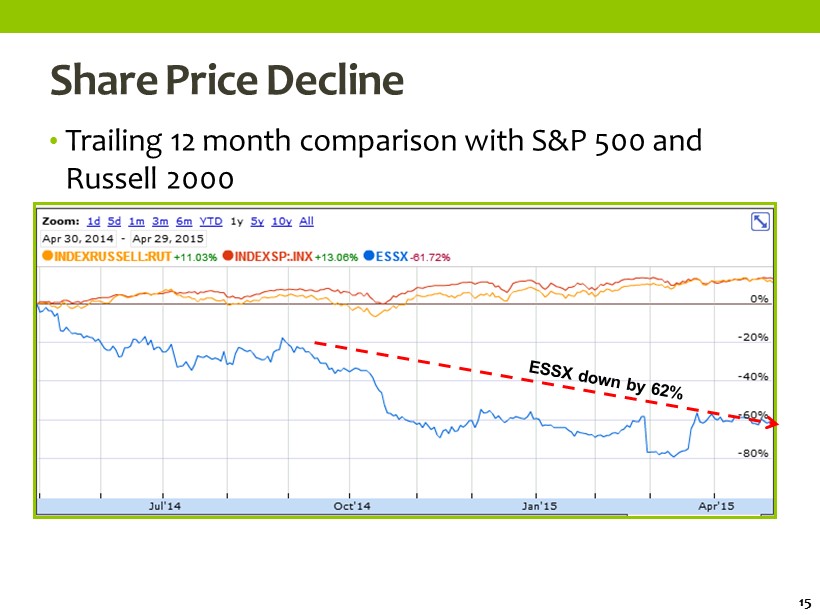

Share Price Decline • Trailing 12 month comparison with S&P 500 and Russell 2000 15

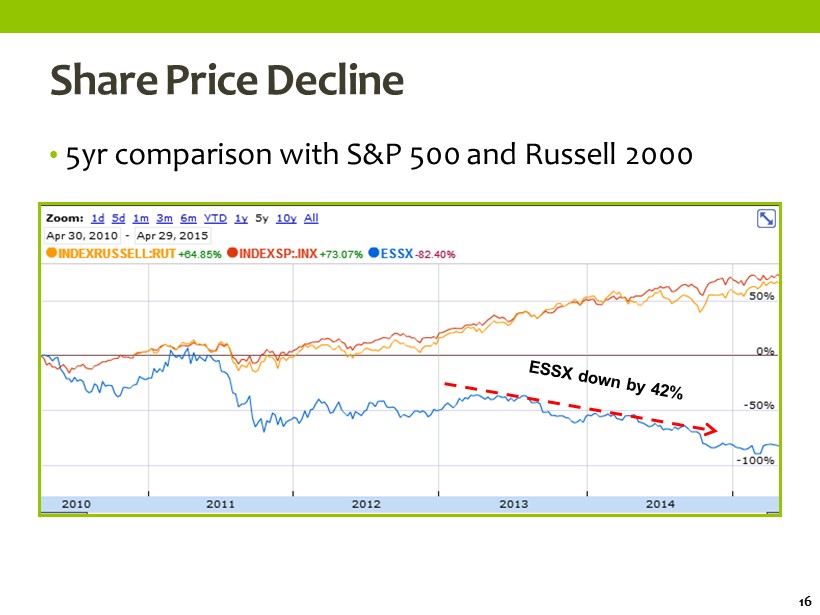

Share Price Decline • 5yr comparison with S&P 500 and Russell 2000 16

Declining Book Value • Book Value/Share has declined continuously since 2009 • Declining Book Value due to operating losses • Book Value would be further adjusted if we consider capitalized costs, off balance sheet operating leases, goodwill ($0.18) $5.11 $5.25 $3.83 $3.44 $3.02 $2.67 $2.24 2007 2008 2009 2010 2011 2012 2013 2014 Book Value/Share 17

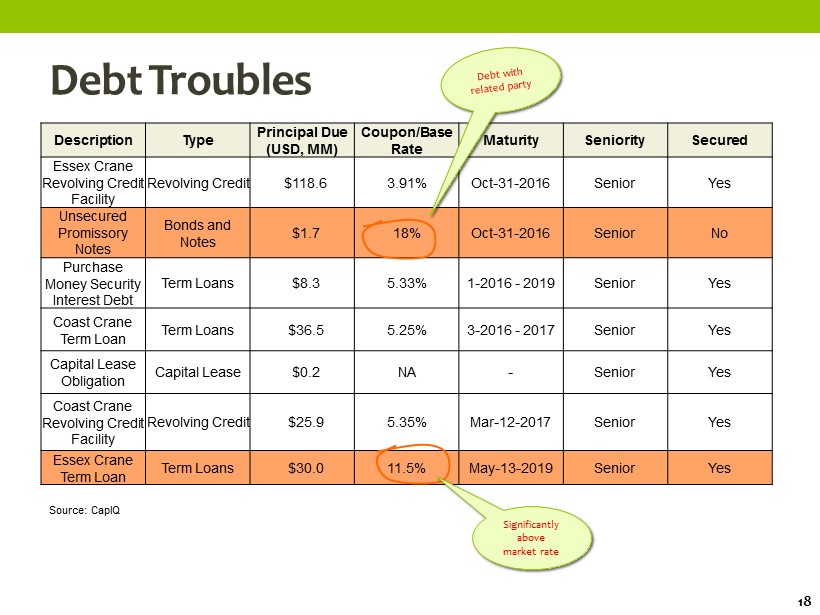

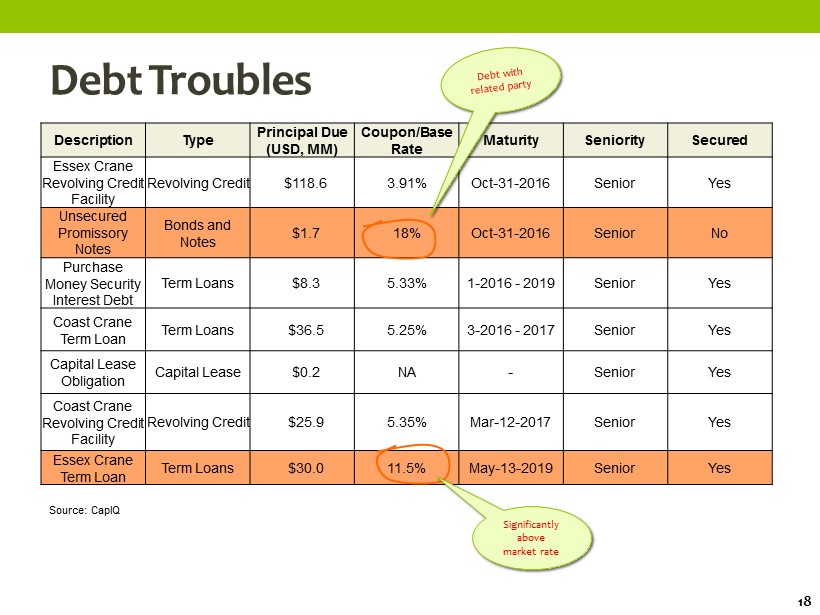

Debt Troubles Description Type Principal Due ( USD, MM) Coupon/Base Rate Maturity Seniority Secured Essex Crane Revolving Credit Facility Revolving Credit $118.6 3.91% Oct - 31 - 2016 Senior Yes Unsecured Promissory Notes Bonds and Notes $1.7 18% Oct - 31 - 2016 Senior No Purchase Money Security Interest Debt Term Loans $8.3 5.33% 1 - 2016 - 2019 Senior Yes Coast Crane Term Loan Term Loans $36.5 5.25% 3 - 2016 - 2017 Senior Yes Capital Lease Obligation Capital Lease $0.2 NA - Senior Yes Coast Crane Revolving Credit Facility Revolving Credit $25.9 5.35% Mar - 12 - 2017 Senior Yes Essex Crane Term Loan Term Loans $30.0 11.5% May - 13 - 2019 Senior Yes Source: CapIQ 18 Significantly above market rate

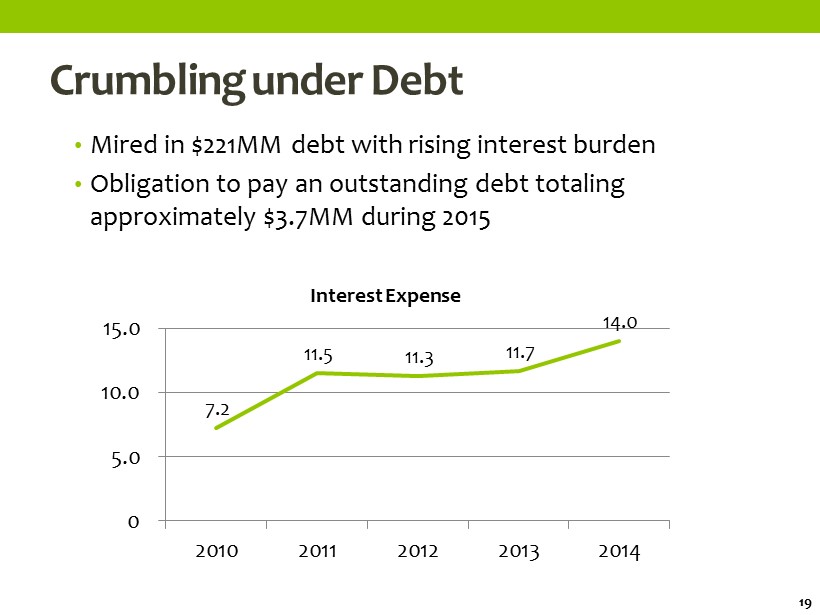

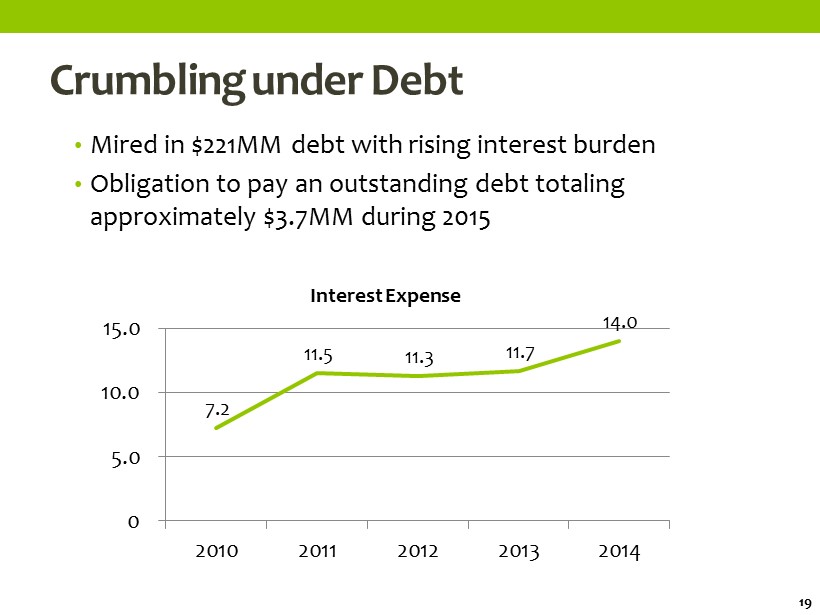

Crumbling under Debt • Mired in $221MM debt with rising interest burden • Obligation to pay an outstanding debt totaling approximately $3.7MM during 2015 7.2 11.5 11.3 11.7 14.0 0 5.0 10.0 15.0 2010 2011 2012 2013 2014 Interest Expense 19

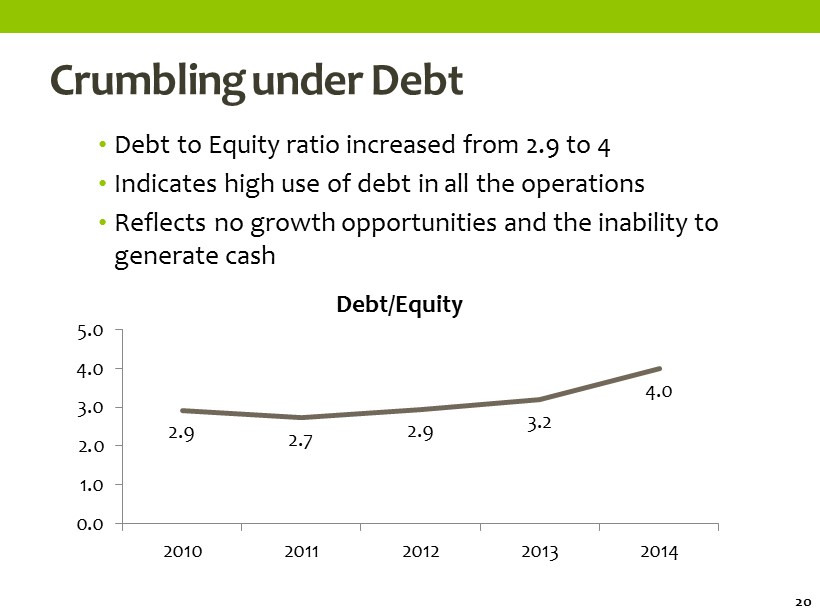

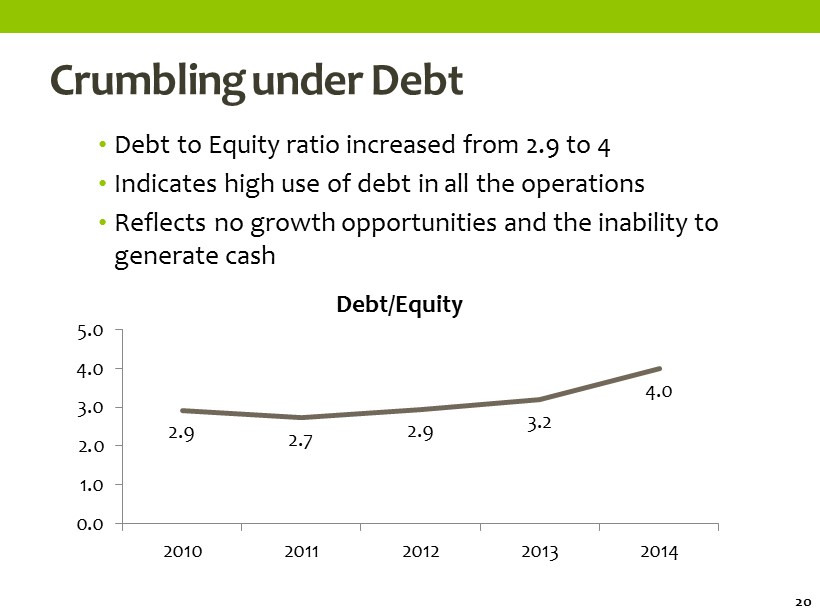

Crumbling under Debt • Debt to Equity ratio increased from 2.9 to 4 • Indicates high use of debt in all the operations • Reflects no growth opportunities and the inability to generate cash 2.9 2.7 2.9 3.2 4.0 0.0 1.0 2.0 3.0 4.0 5.0 2010 2011 2012 2013 2014 Debt/Equity 20

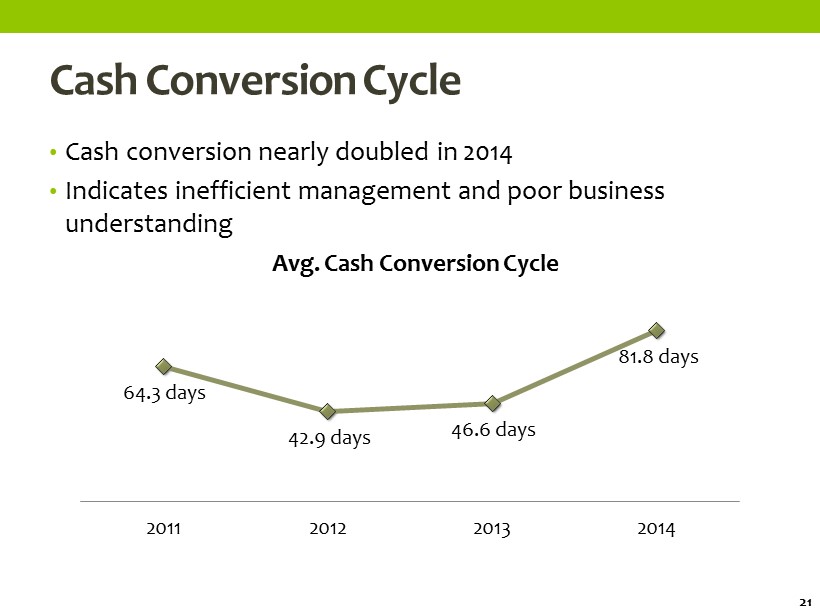

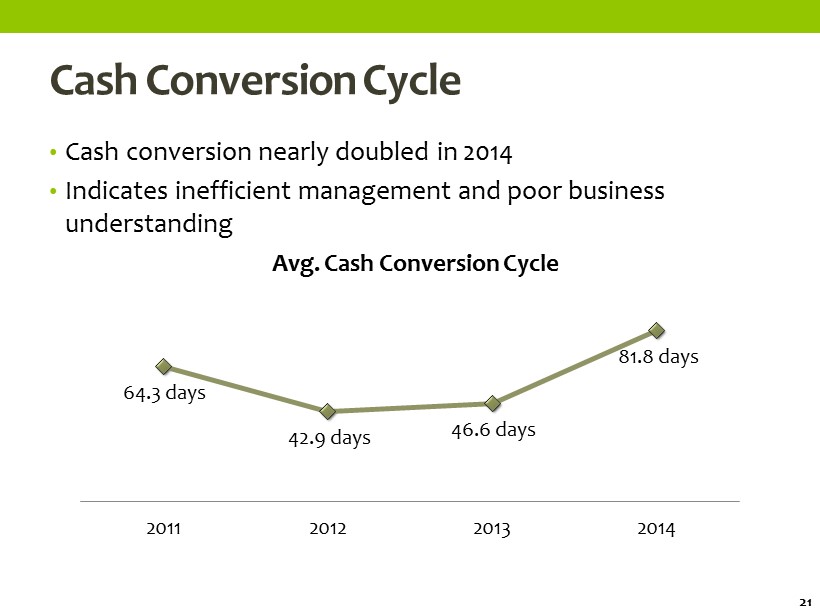

Cash Conversion Cycle • Cash conversion nearly doubled in 2014 • Indicates inefficient management and poor business understanding 64.3 days 42.9 days 46.6 days 81.8 days 2011 2012 2013 2014 Avg. Cash Conversion Cycle 21

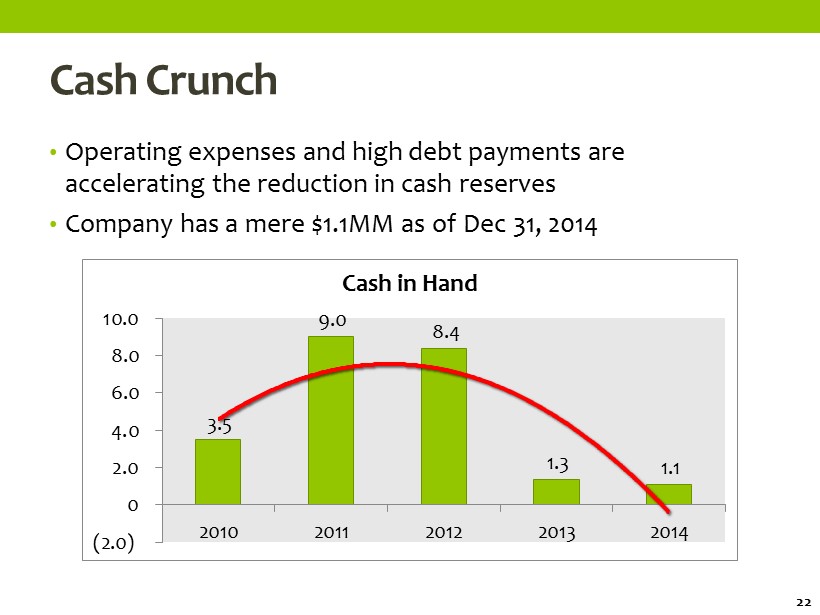

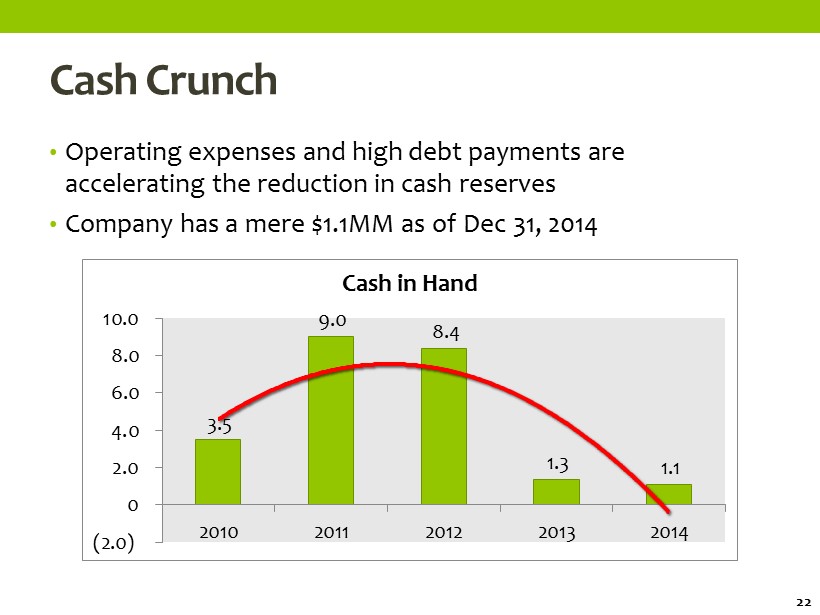

Cash Crunch • Operating expenses and high debt payments are accelerating the reduction in cash reserves • Company has a mere $1.1MM as of Dec 31, 2014 3.5 9.0 8.4 1.3 1.1 (2.0) 0 2.0 4.0 6.0 8.0 10.0 2010 2011 2012 2013 2014 Cash in Hand 22

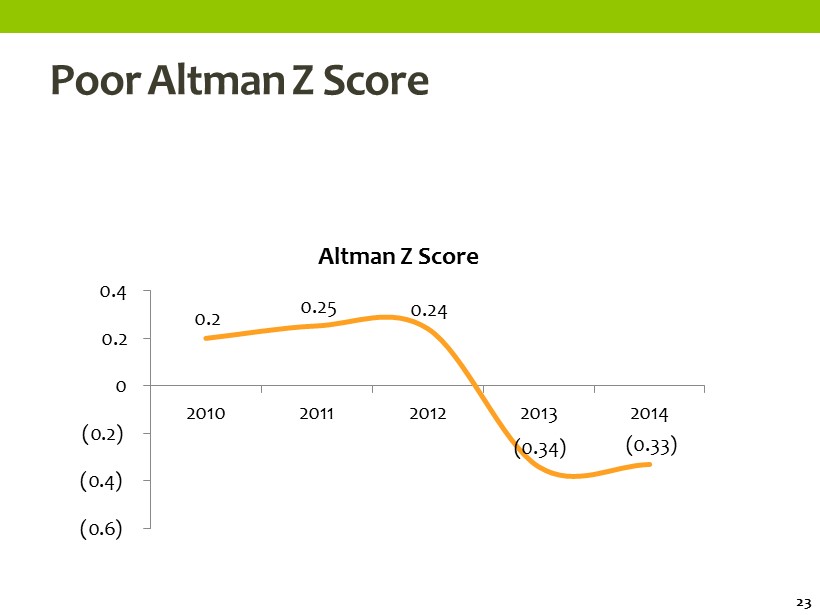

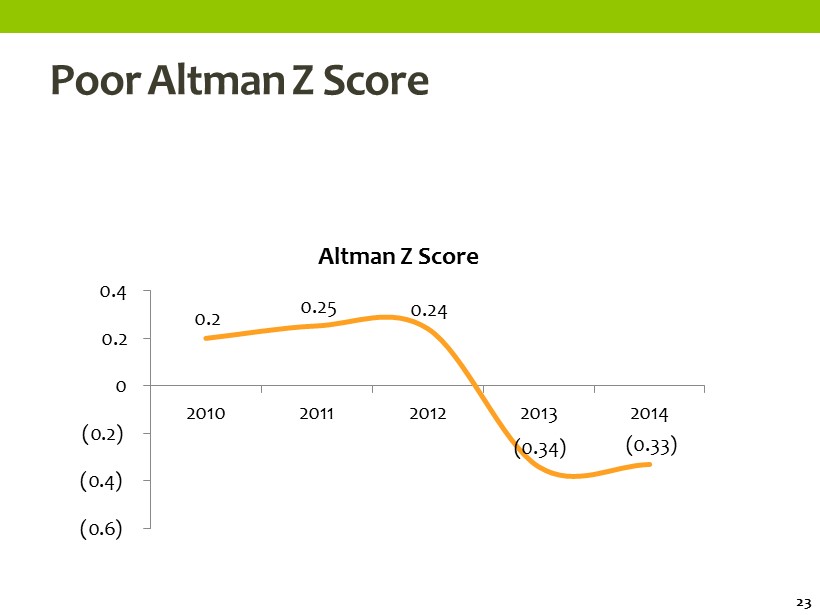

Poor Altman Z Score 0.2 0.25 0.24 (0.34) (0.33) (0.6) (0.4) (0.2) 0 0.2 0.4 2010 2011 2012 2013 2014 Altman Z Score 23

Hyde Park Lease – RED FLAG • Company has leased office space in NY since March 2007 from an entity that is affiliated with Laurence Levy • It appears that the Company has paid more than $700,000 to an entity affiliated with Lawrence Levy in order to rent Manhattan office space 75,000 90,000 90,000 96,000 96,000 96,000 96,000 104,000 132,000 0 50,000 100,000 150,000 200,000 Dec 2007 Dec 2008 Dec 2009 Dec 2010 Dec 2011 Dec 2012 Dec 2013 Dec 2014 Feb 2016 [E] Lease Chart shows per year lease amount Lease commenced in March 2007 E - Estimate 24 Dec 2015 [E]

Hyde Park Lease – RED FLAG Does the company need such an expensive office space in New York City when its headquarters is in Illinois ? We believe the Manhattan office space is primarily used by the company's corporate Secretary, Carol Zelinski , and Laurence Levy and Edward Levy [See Cronyism slide] ESSX also reimbursed Hyde Park $32,000 as of Dec 31, 2014 for certain other administrative support expenses These are RED FLAGS for any company. 25

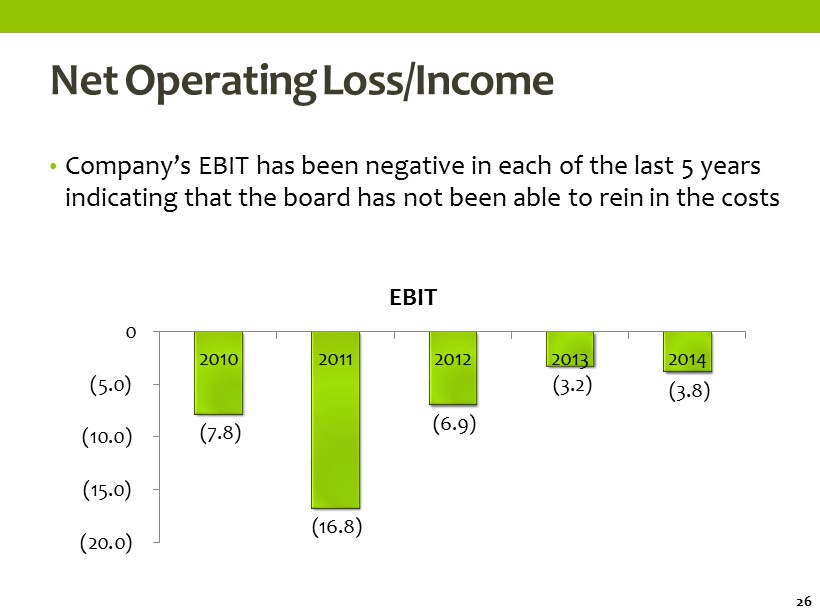

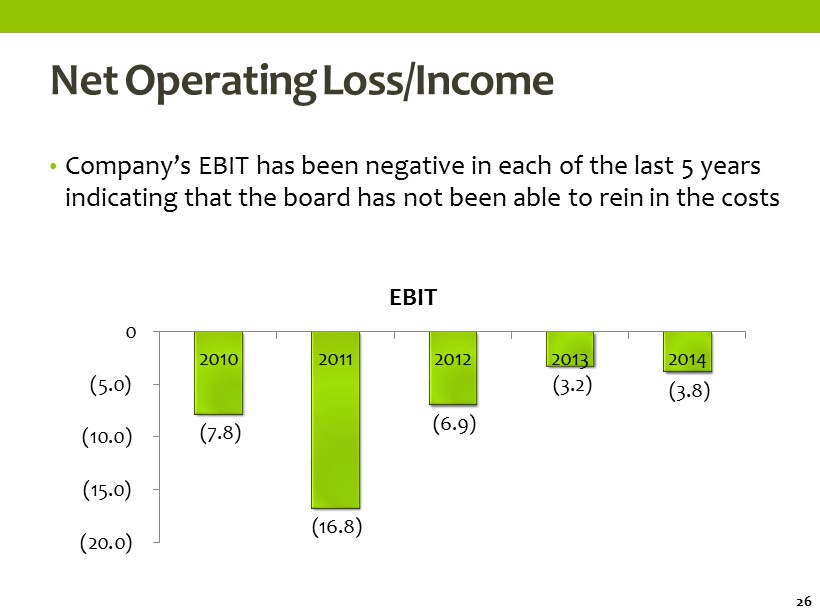

Net Operating Loss/Income • Company’s EBIT has been negative in each of the last 5 years indicating that the board has not been able to rein in the costs (7.8) (16.8) (6.9) (3.2) (3.8) (20.0) (15.0) (10.0) (5.0) 0 2010 2011 2012 2013 2014 EBIT 26

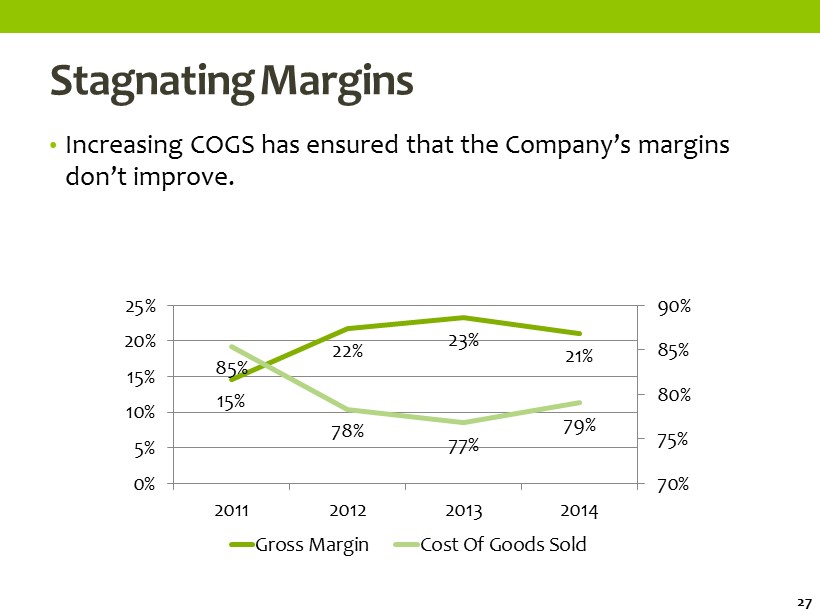

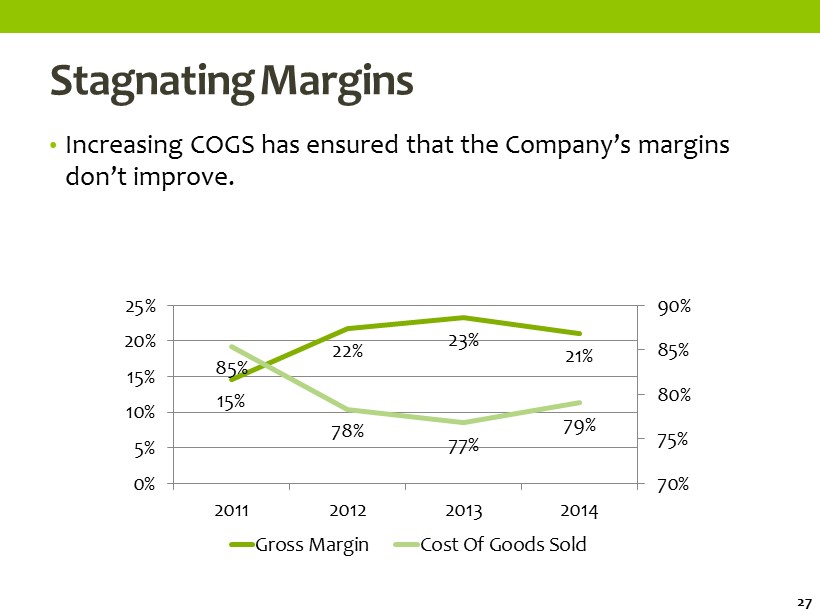

Stagnating Margins • Increasing COGS has ensured that the Company’s margins don ’ t improve. 15% 22% 23% 21% 85% 78% 77% 79% 70% 75% 80% 85% 90% 0% 5% 10% 15% 20% 25% 2011 2012 2013 2014 Gross Margin Cost Of Goods Sold 27

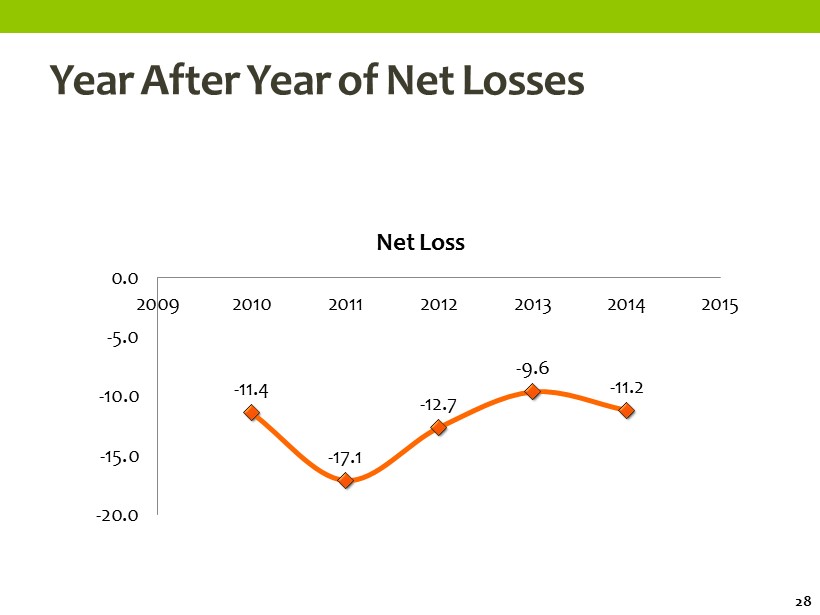

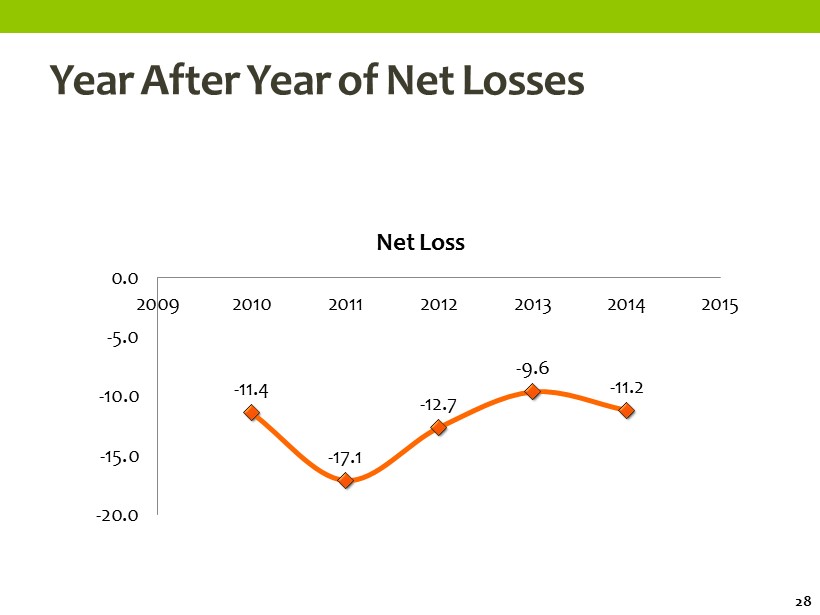

Year After Year of Net Losses - 11.4 - 17.1 - 12.7 - 9.6 - 11.2 -20.0 -15.0 -10.0 -5.0 0.0 2009 2010 2011 2012 2013 2014 2015 Net Loss 28

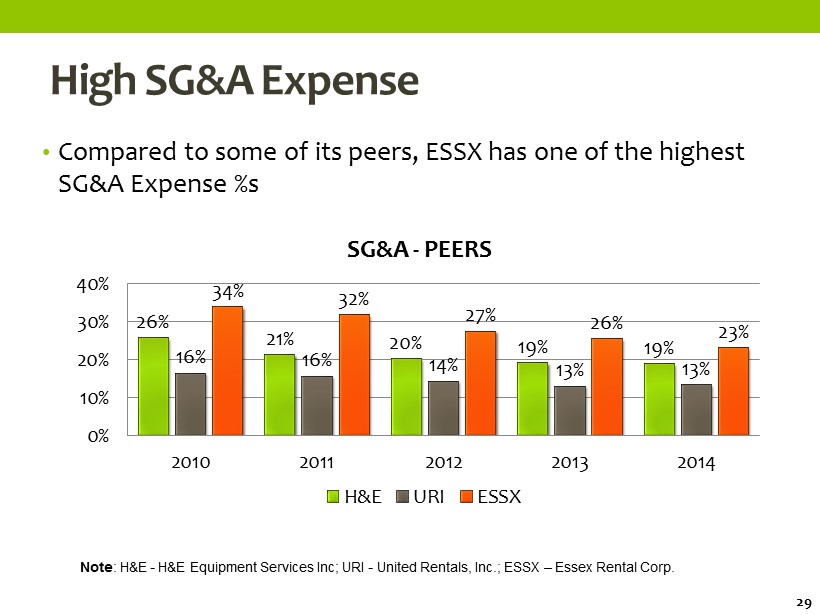

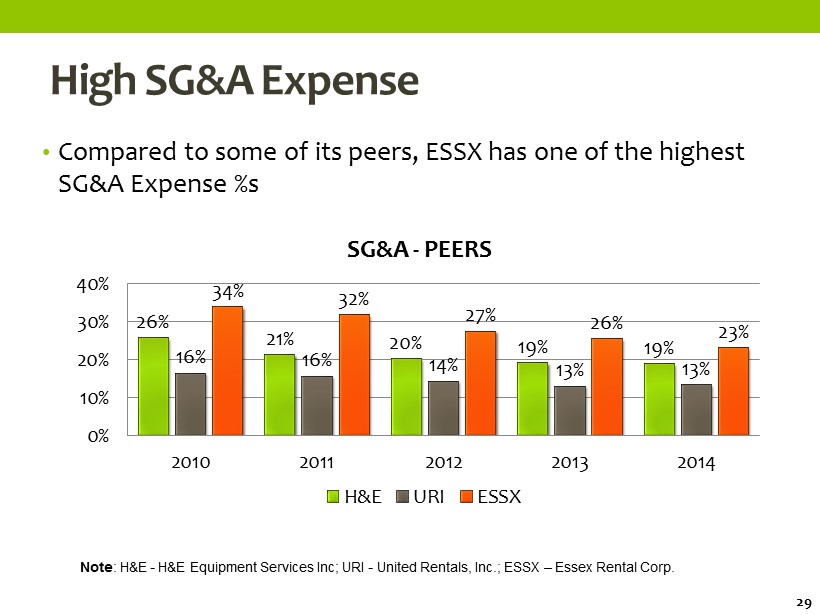

High SG&A Expense • Compared to some of its peers, ESSX has one of the highest SG&A Expense %s 26% 21% 20% 19% 19% 16% 16% 14% 13% 13% 34% 32% 27% 26% 23% 0% 10% 20% 30% 40% 2010 2011 2012 2013 2014 SG&A - PEERS H&E URI ESSX Note : H&E - H&E Equipment Services Inc; URI - United Rentals, Inc.; ESSX – Essex Rental Corp. 29

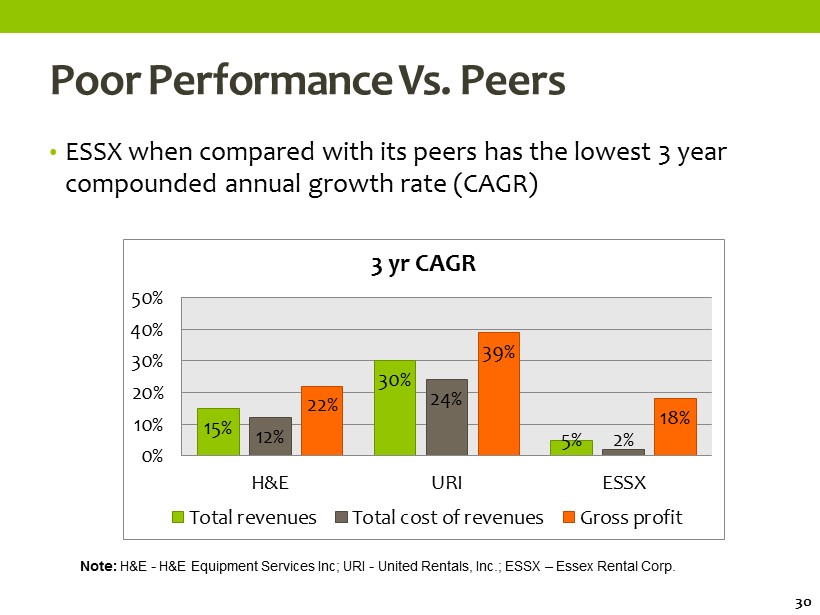

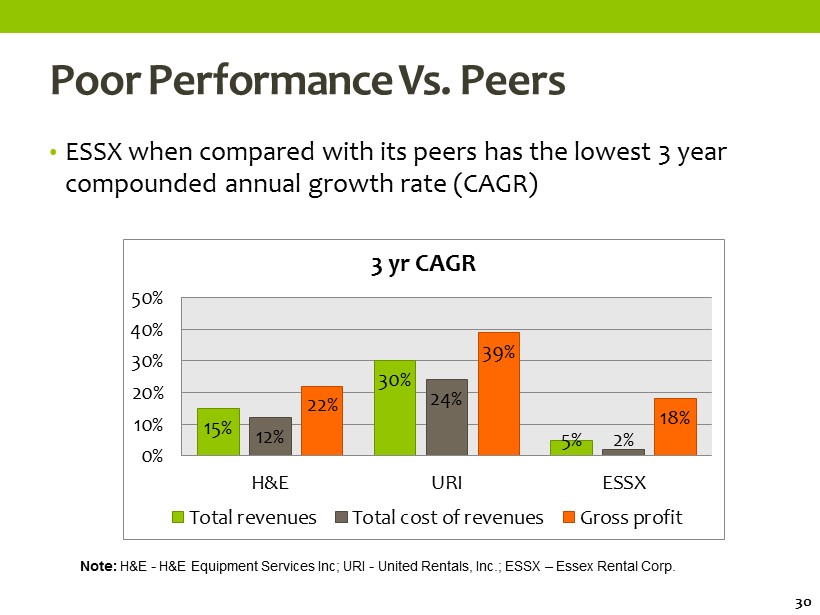

Poor P erformance Vs. Peers • ESSX when compared with its peers has the lowest 3 year compounded annual growth rate (CAGR) 15% 30% 5% 12% 24% 2% 22% 39% 18% 0% 10% 20% 30% 40% 50% H&E URI ESSX 3 yr CAGR Total revenues Total cost of revenues Gross profit Note: H&E - H&E Equipment Services Inc; URI - United Rentals, Inc.; ESSX – Essex Rental Corp. 30

AGENDA Shareholder Value Erosion at ESSX Compensation Analysis Financial Irregularities Strategic Alternatives Our Nominees vs. Incumbents 31

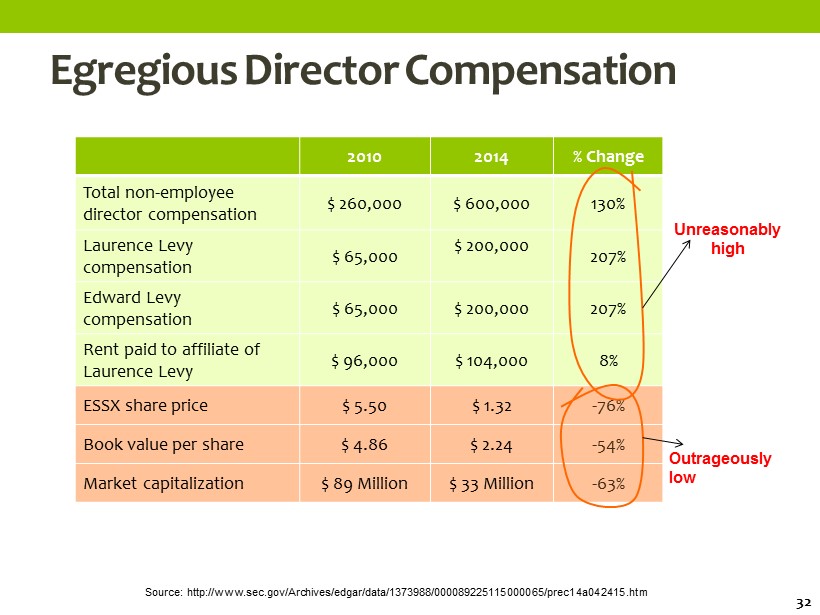

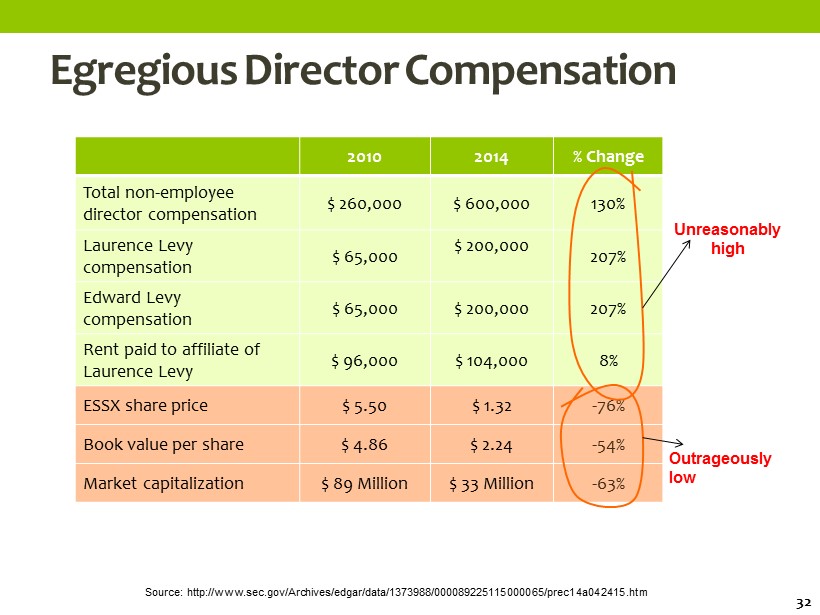

Egregious Director Compensation 2010 2014 % Change Total non - employee director compensation $ 260,000 $ 600,000 130% Laurence Levy compensation $ 65,000 $ 200,000 207% Edward Levy compensation $ 65,000 $ 200,000 207% Rent paid to affiliate of Laurence Levy $ 96,000 $ 104,000 8% ESSX share price $ 5.50 $ 1.32 - 76% Book value per share $ 4.86 $ 2.24 - 54% Market capitalization $ 89 Million $ 33 Million - 63% Unreasonably high Outrageously low Source: http://www.sec.gov/Archives/edgar/data/1373988/000089225115000065/prec14a042415.htm 32

Justify the Board Compensation Company’s FY2011 EBIT dropped $10.2 MM to ten year low of $ - 16.8 MM From FY2010 to FY2011 each of Laurence Levy’s and Edward Levy’s compensation rose over 185% 33

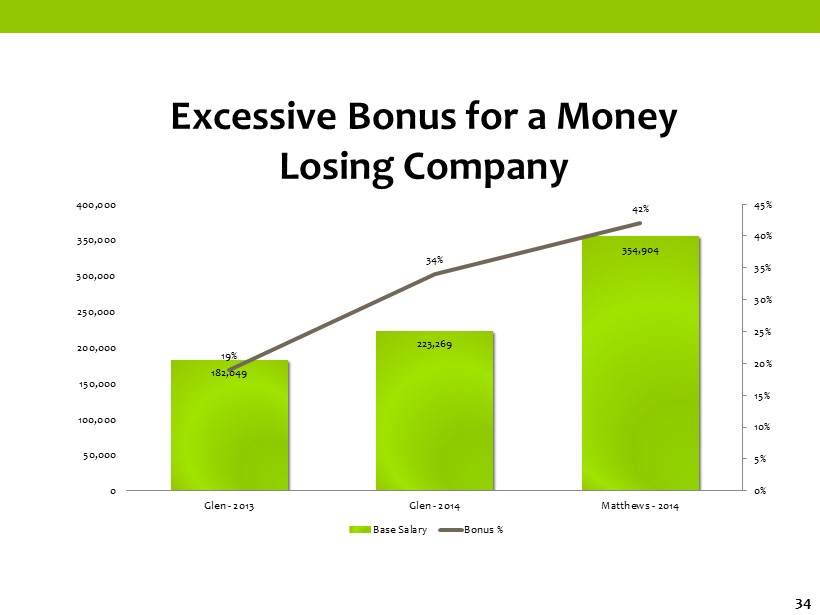

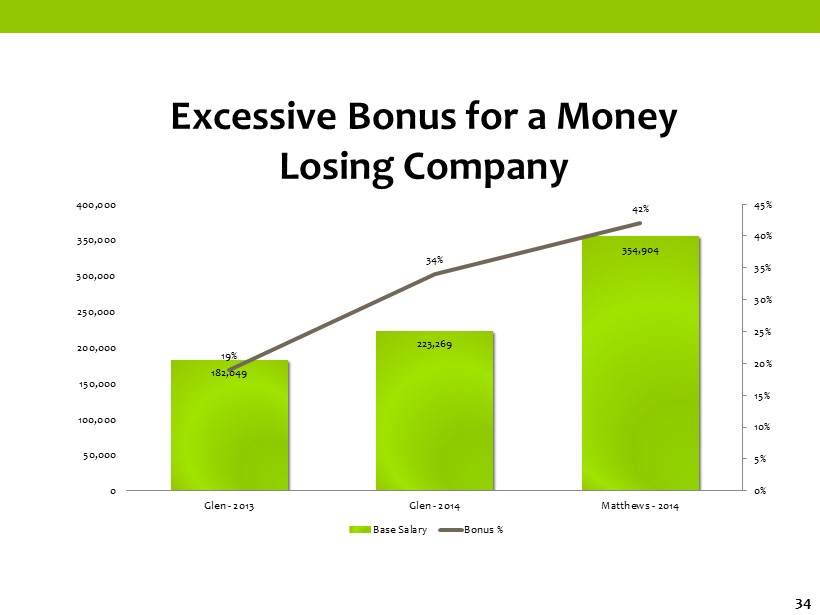

182,049 223,269 354,904 19% 34% 42% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 Glen - 2013 Glen - 2014 Matthews - 2014 Excessive Bonus for a Money Losing Company Base Salary Bonus % 34

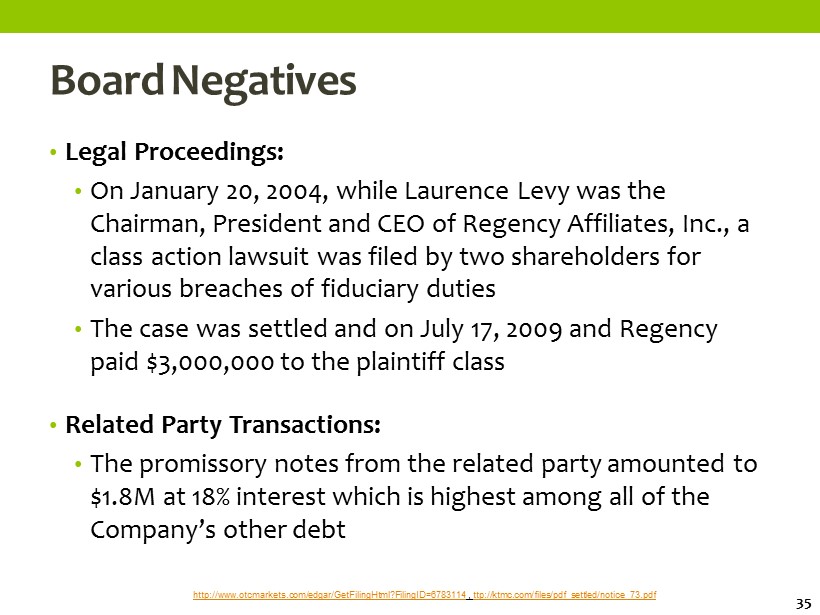

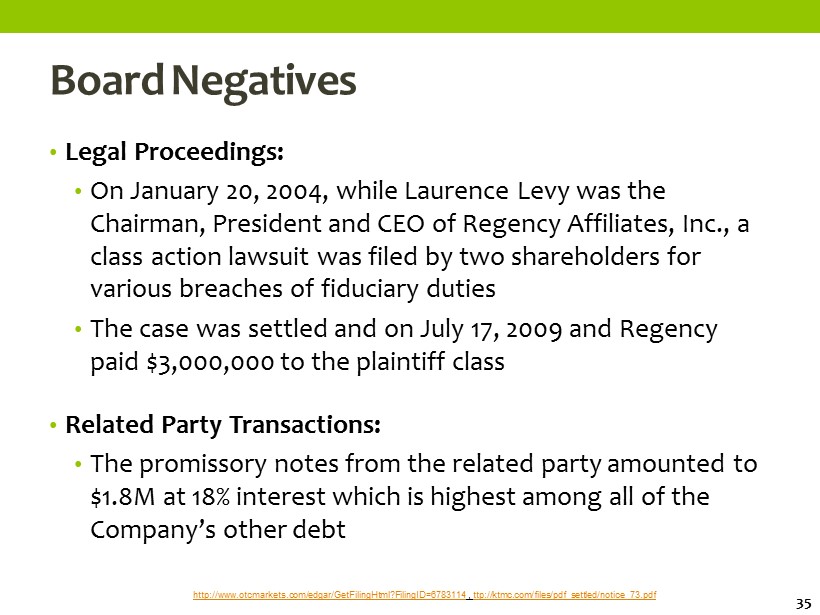

Board Negatives • Legal Proceedings: • On January 20, 2004, while Laurence Levy was the Chairman, President and CEO of Regency Affiliates, Inc., a class action lawsuit was filed by two shareholders for various breaches of fiduciary duties • The case was settled and on July 17, 2009 and Regency paid $3,000,000 to the plaintiff class http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=6783114 , ttp://ktmc.com/files/pdf_settled/notice_73.pdf • Related Party Transactions: • The promissory notes from the related party amounted to $1.8M at 18% interest which is highest among all of the Company’s other debt 35

Cronyism Essex Rental Corp. Rand Logistics, Inc. Hyde Park Holdings, Inc. Derby Industries LLC Regency Affiliates, Inc. Laurence Levy Chairman since 2006 Chairman & CEO since 2004 Founder & Chairman since 1986 Chairman & Co - owner since 2000 Chairman, CEO & President since 2002 Edward Levy Director since 2006 President since 2006 Vice Chairman & Managing Director Director & Co - owner since 2000 - - Carol Zelinski Corporate Secretary Corporate Secretary Secretary & Analyst since 1997 - - Corporate Secretary since 2003 36

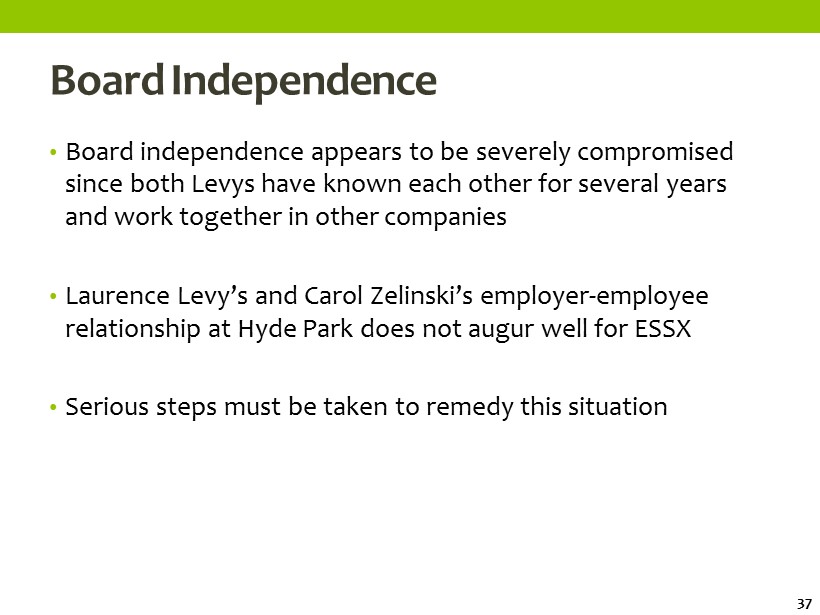

Board Independence • Board independence appears to be severely compromised since both Levys have known each other for several years and work together in other companies • Laurence Levy’s and Carol Zelinski’s employer - employee relationship at Hyde Park does not augur well for ESSX • Serious steps must be taken to remedy this situation 37

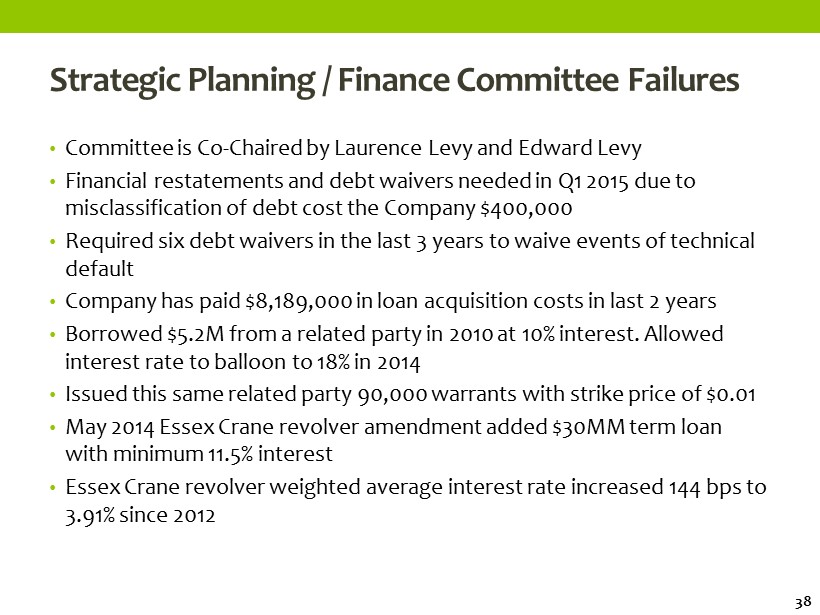

Strategic Planning / Finance Committee Failures • Committee is Co - Chaired by Laurence Levy and Edward Levy • Financial restatements and debt waivers needed in Q1 2015 due to misclassification of debt cost the Company $400,000 • Required six debt waivers in the last 3 years to waive events of technical default • Company has paid $8,189,000 in loan acquisition costs in last 2 years • Borrowed $5.2M from a related party in 2010 at 10% interest. Allowed interest rate to balloon to 18% in 2014 • Issued this same related party 90,000 warrants with strike price of $0.01 • May 2014 Essex Crane revolver amendment added $30MM term loan with minimum 11.5% interest • Essex Crane revolver weighted average interest rate increased 144 bps to 3.91% since 2012 38

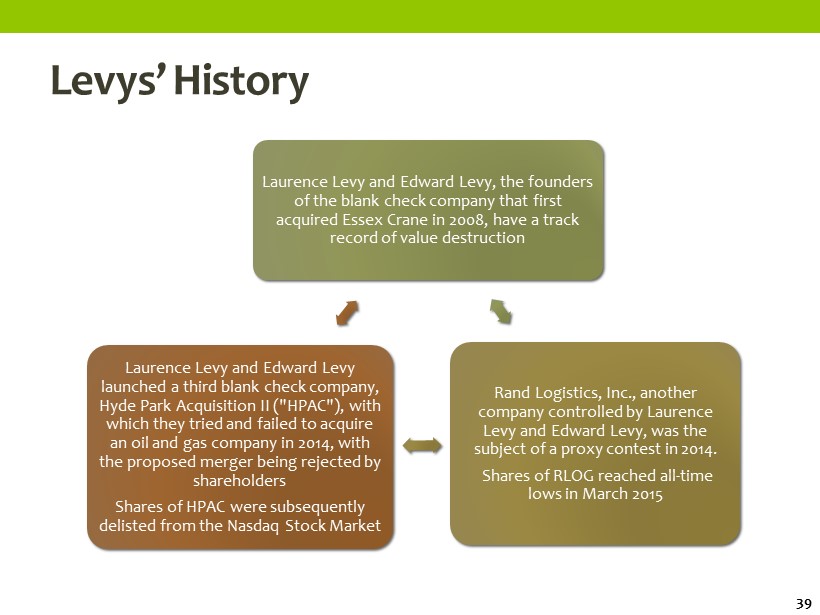

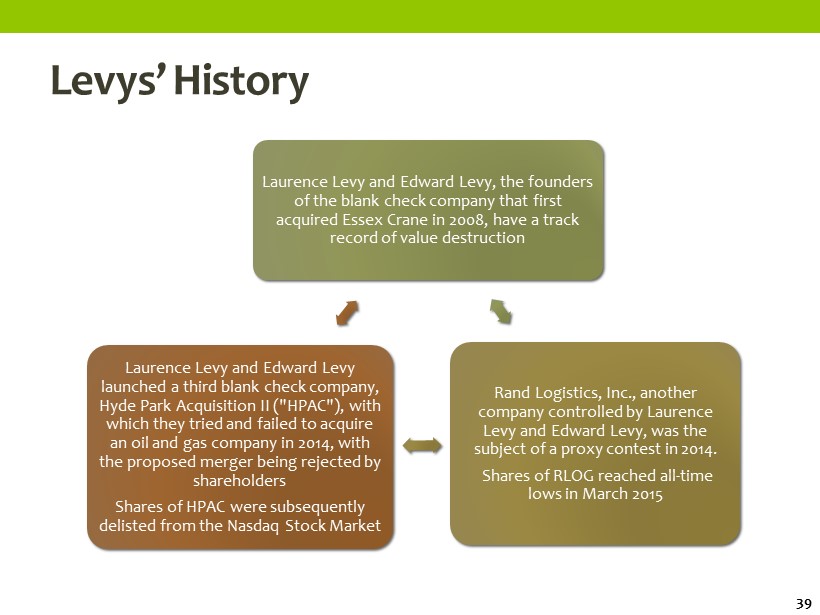

Levys ’ History Laurence Levy and Edward Levy, the founders of the blank check company that first acquired Essex Crane in 2008, have a track record of value destruction Rand Logistics, Inc., another company controlled by Laurence Levy and Edward Levy, was the subject of a proxy contest in 2014. Shares of RLOG reached all - time lows in March 2015 Laurence Levy and Edward Levy launched a third blank check company, Hyde Park Acquisition II ("HPAC"), with which they tried and failed to acquire an oil and gas company in 2014, with the proposed merger being rejected by shareholders Shares of HPAC were subsequently delisted from the Nasdaq Stock Market 39

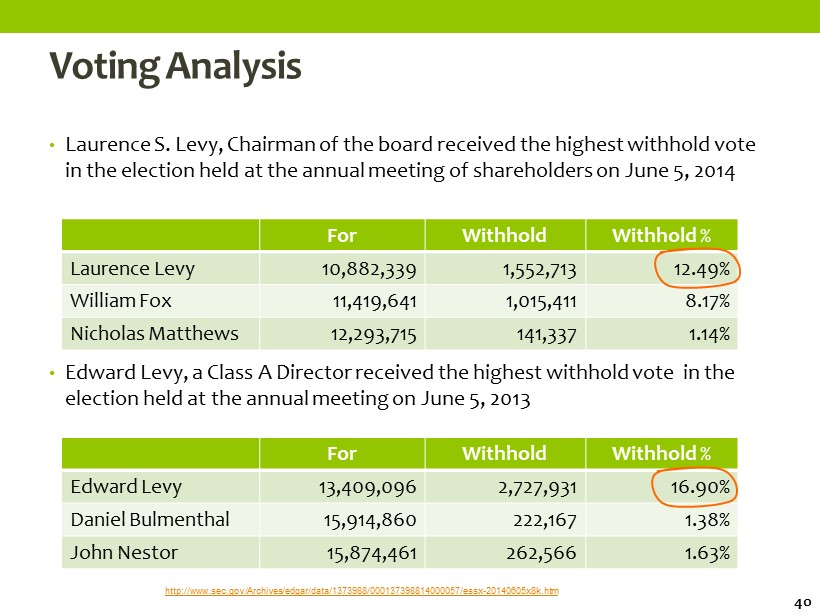

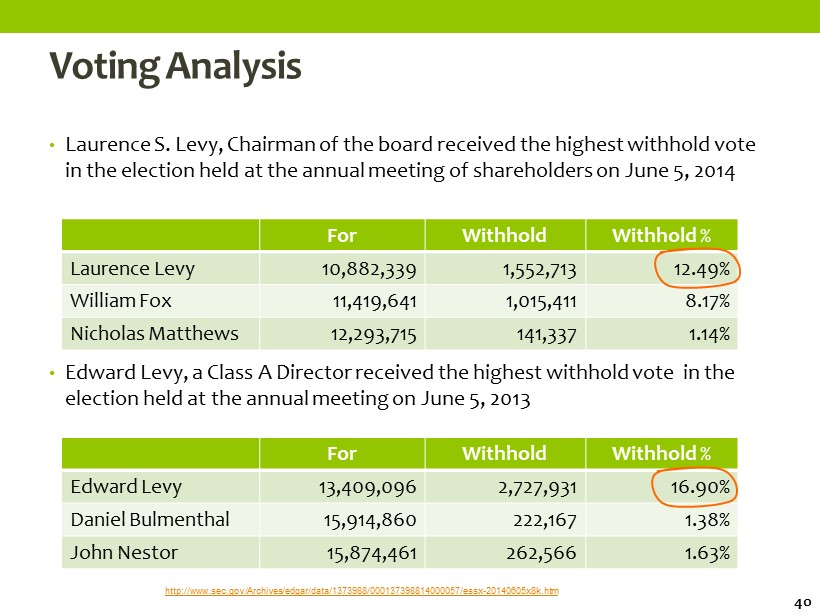

Voting Analysis • Laurence S. Levy, Chairman of the board received the highest withhold vote in the election held at the annual meeting of shareholders on June 5, 2014 • Edward Levy, a Class A Director received the highest withhold vote in the election held at the annual meeting on June 5, 2013 For Withhold Withhold % Laurence Levy 10,882,339 1,552,713 12.49% William Fox 11,419,641 1,015,411 8.17% Nicholas Matthews 12,293,715 141,337 1.14% For Withhold Withhold % Edward Levy 13,409,096 2,727,931 16.90% Daniel Bulmenthal 15,914,860 222,167 1.38% John Nestor 15,874,461 262,566 1.63% http://www.sec.gov/Archives/edgar/data/1373988/000137398814000057/essx - 20140605x8k.htm 40

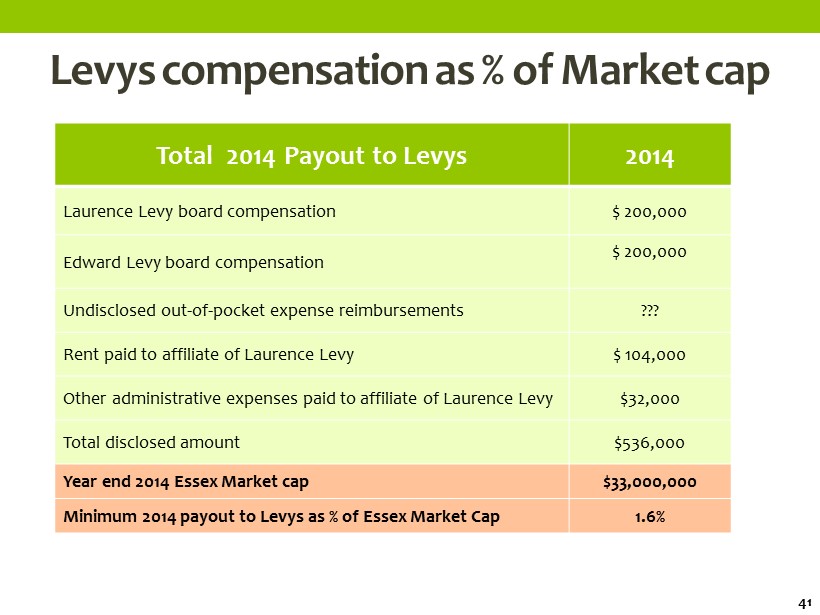

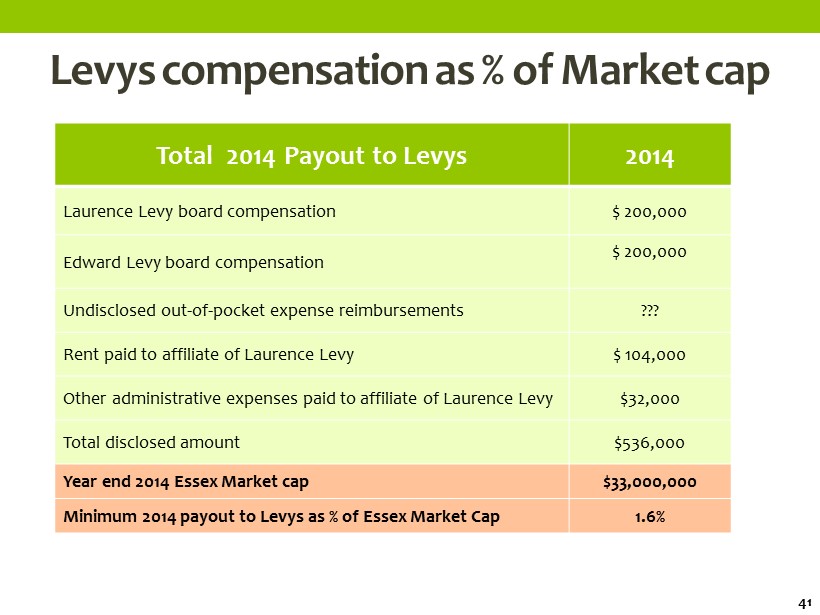

Levys compensation as % of Market cap Total 2014 Payout to Levys 2014 Laurence Levy board compensation $ 200,000 Edward Levy board compensation $ 200,000 Undisclosed out - of - pocket expense reimbursements ??? Rent paid to affiliate of Laurence Levy $ 104,000 Other administrative expenses paid to affiliate of Laurence Levy $32,000 Total disclosed amount $536,000 Year end 2014 Essex Market cap $33,000,000 Minimum 2014 payout to Levys as % of Essex Market Cap 1.6% 41

Entrenched Directors • Some proxy advisory services consider directors who serve for more than seven years to be insiders • Both Laurence Levy and Edward Levy have been directors at Essx for nine years, since 2006 • Both Laurence Levy and Edward Levy collect $200,000 in board fees. In addition, they collect in the aggregate $100,000 in related party transactions and reimbursements • Finally, they collect an “undisclosed amount” of reimbursement expenses??? 42

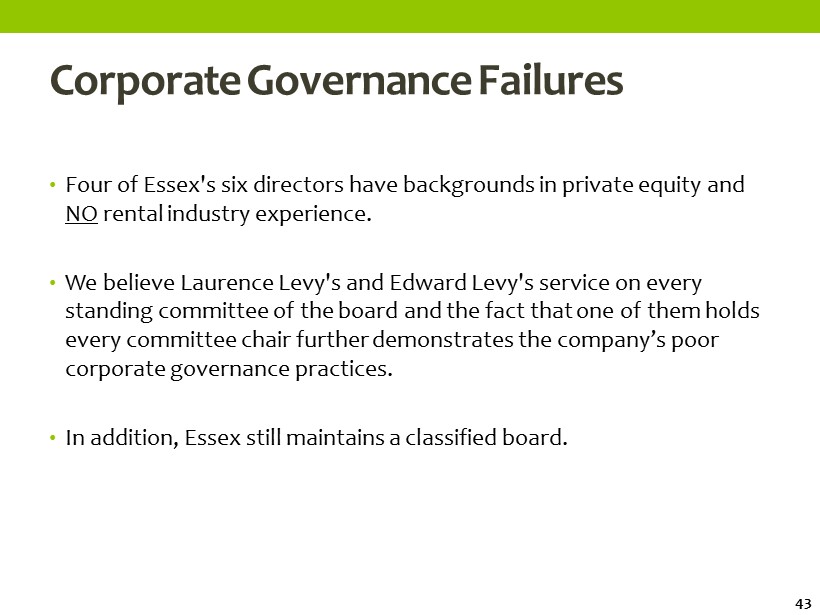

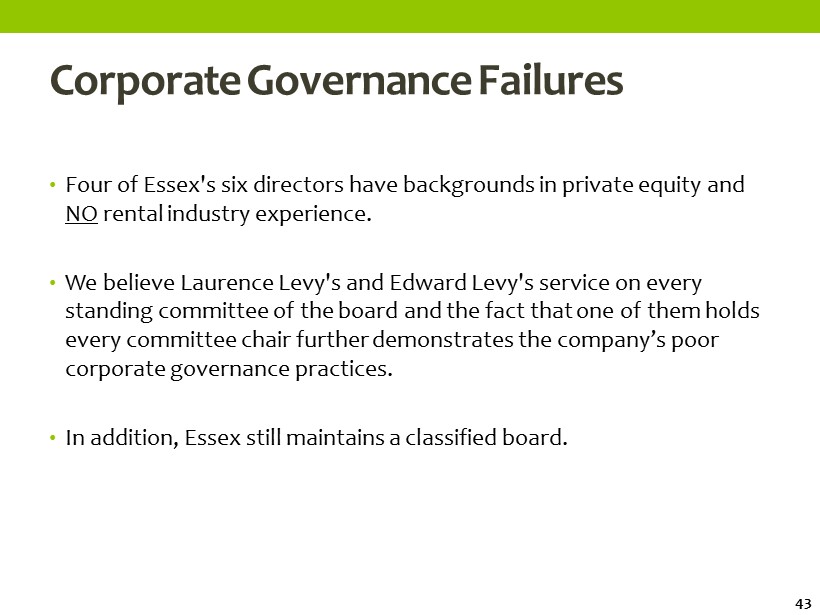

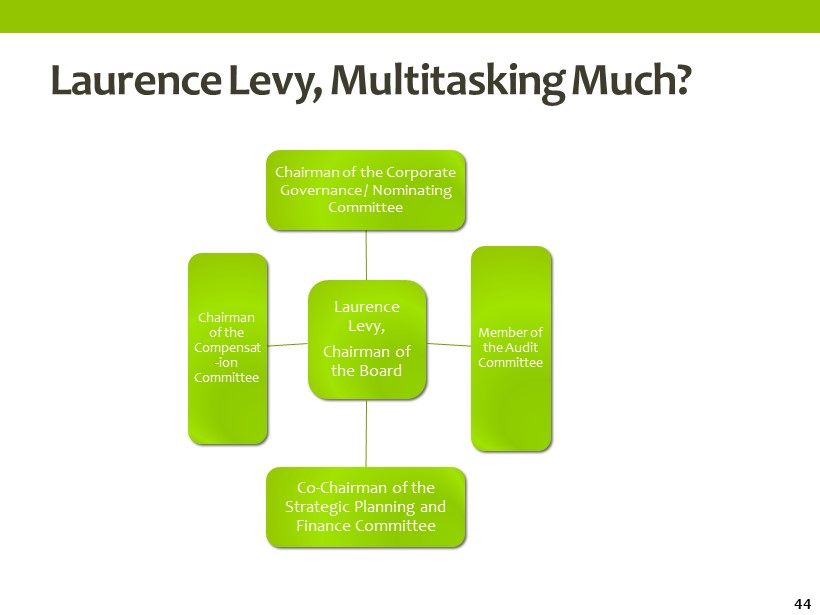

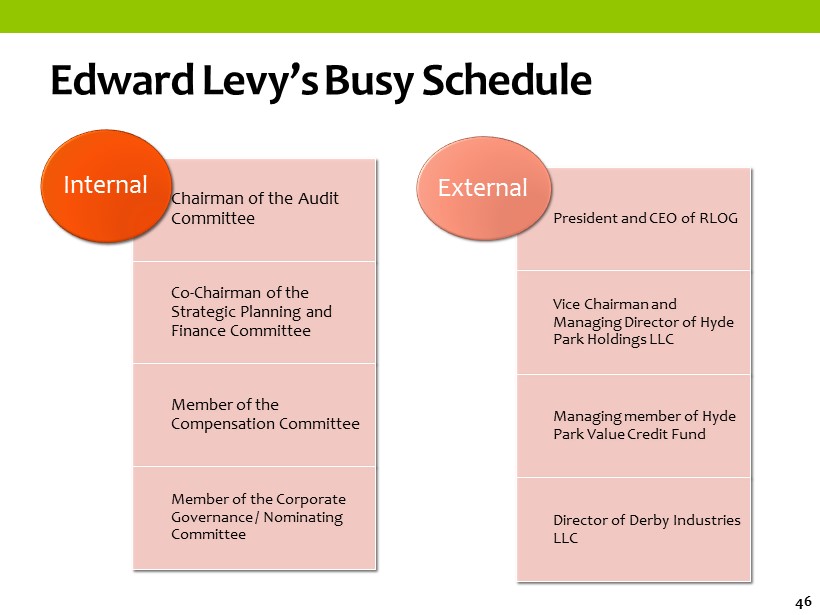

Corporate Governance Failures • Four of Essex's six directors have backgrounds in private equity and NO rental industry experience. • We believe Laurence Levy's and Edward Levy's service on every standing committee of the board and the fact that one of them holds every committee chair further demonstrates the company’s poor corporate governance practices. • In addition, Essex still maintains a classified board. 43

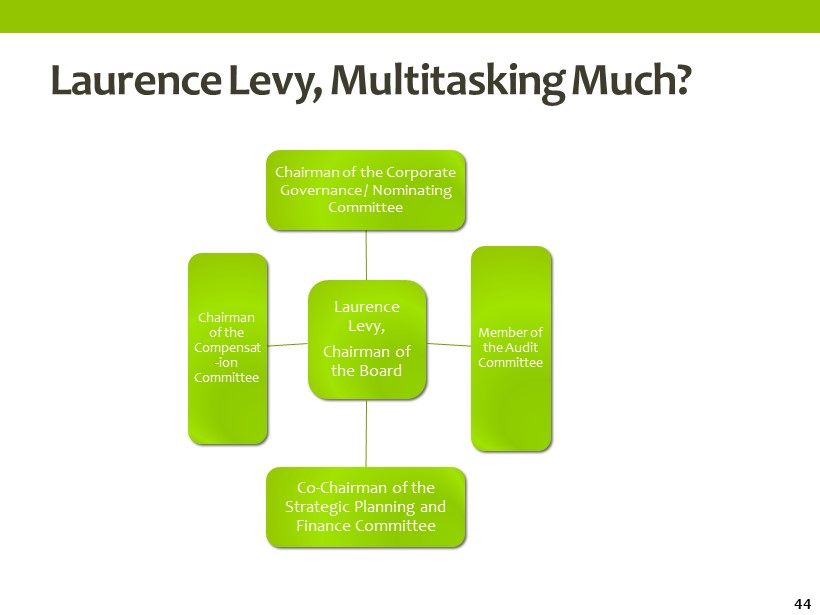

Laurence Levy, Multitasking Much ? Laurence Levy, Chairman of the Board Chairman of the Corporate Governance / Nominating Committee Member of the Audit Committee Co - Chairman of the Strategic Planning and Finance Committee Chairman of the Compensat - ion Committee 44

Laurence Levy, Multitasking Much ? Laurence Levy Executive Vice Chairman of RLOG Chairman of Derby Industries LLC Manager of PFI Resource Manageme nt LP director of Ozburn - Hessey Logistics LLC director of Sunbelt Holdings Inc Chairman and CEO of Regency Affiliates Inc Chairman of Warehouse Associates LP Chairman of Hyde Park Holdings LLC 45

Edward Levy’s Busy Schedule Chairman of the Audit Committee Co - Chairman of the Strategic Planning and Finance Committee Member of the Compensation Committee Member of the Corporate Governance / Nominating Committee Internal President and CEO of RLOG Vice Chairman and Managing Director of Hyde Park Holdings LLC Managing member of Hyde Park Value Credit Fund Director of Derby Industries LLC External 46

AGENDA Shareholder Value Erosion at ESSX Compensation Analysis Financial Irregularities Strategic Alternatives Our Nominees vs. Incumbents 47

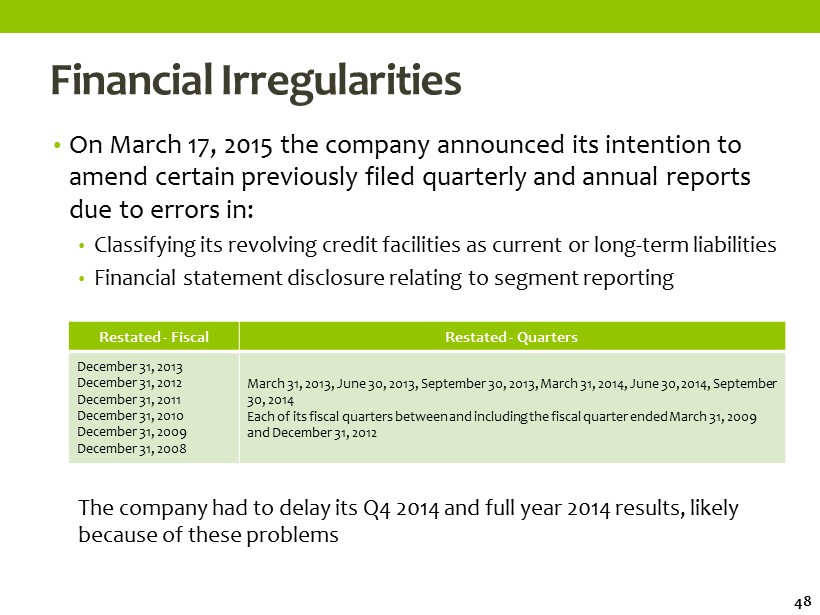

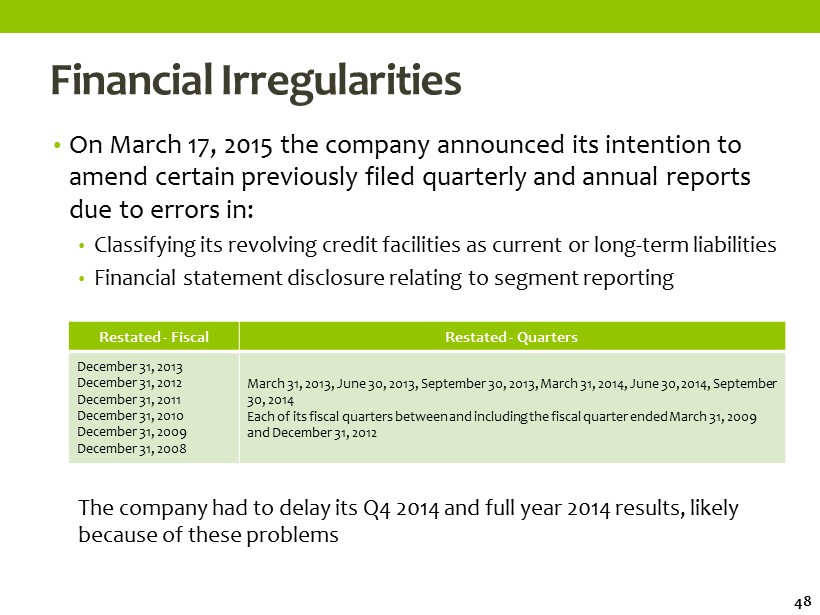

Financial Irregularities • On March 17, 2015 the company announced its intention to amend certain previously filed quarterly and annual reports due to errors in: • Classifying its revolving credit facilities as current or long - term liabilities • Financial statement disclosure relating to segment reporting The company had to delay its Q4 2014 and full year 2014 results, likely because of these problems Restated - Fiscal Restated - Quarters December 31, 2013 December 31, 2012 December 31, 2011 December 31, 2010 December 31, 2009 December 31, 2008 March 31, 2013, June 30, 2013, September 30, 2013, March 31, 2014, June 30, 2014 , September 30, 2014 Each of its fiscal quarters between and including the fiscal quarter ended March 31, 2009 and December 31, 2012 48

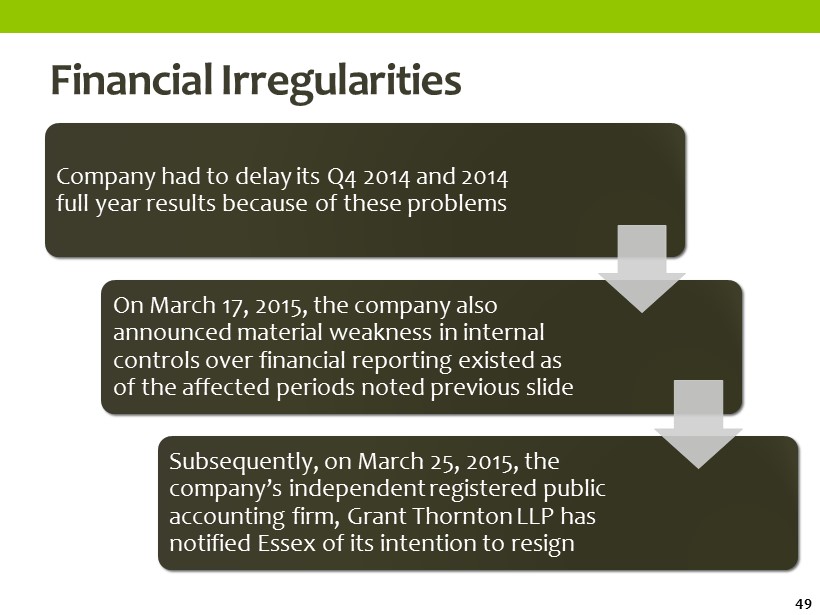

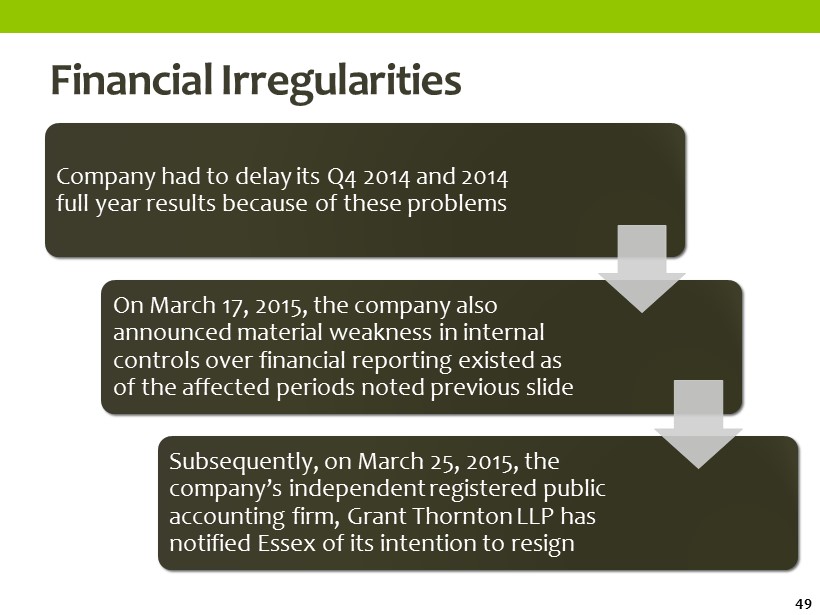

Financial Irregularities Company had to delay its Q4 2014 and 2014 full year results because of these problems On March 17, 2015, the company also announced material weakness in internal controls over financial reporting existed as of the affected periods noted previous slide Subsequently, on March 25, 2015, the company’s independent registered public accounting firm, Grant Thornton LLP has notified Essex of its intention to resign 49

Audit Committee Failure – RED FLAG Board together with Audit Committee failed to notice the various accounting irregularities Laurence S. Levy, Edward Levy and Daniel H. Blumenthal form the audit committee and appear to have delayed taking appropriate actions to remedy it These inaccuracies were identified by the Company’s independent auditors and not by the committee which appears to indicate failure to keep shareholders’ best interests in mind 50

Investors Lose Confidence Delayed earnings release and debt classification issue disappointed shareholders Share price crashed by 44% on Feb 26, 2015 when the company made these announcements and further to a record low of $0.64 on March 10, 2015 It took the company 3 weeks to clear some of the initial confusion on accounting restatements! No response was received from company during this dramatic drop of share price 51

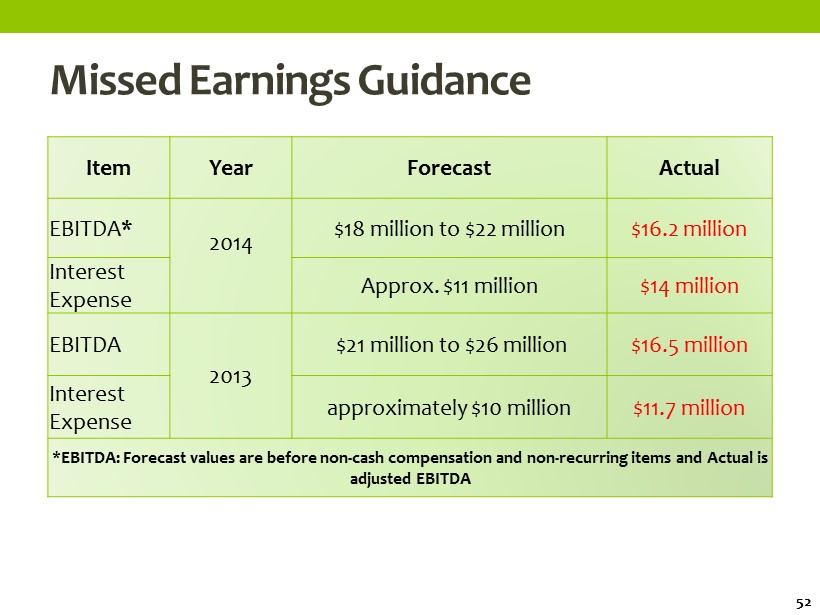

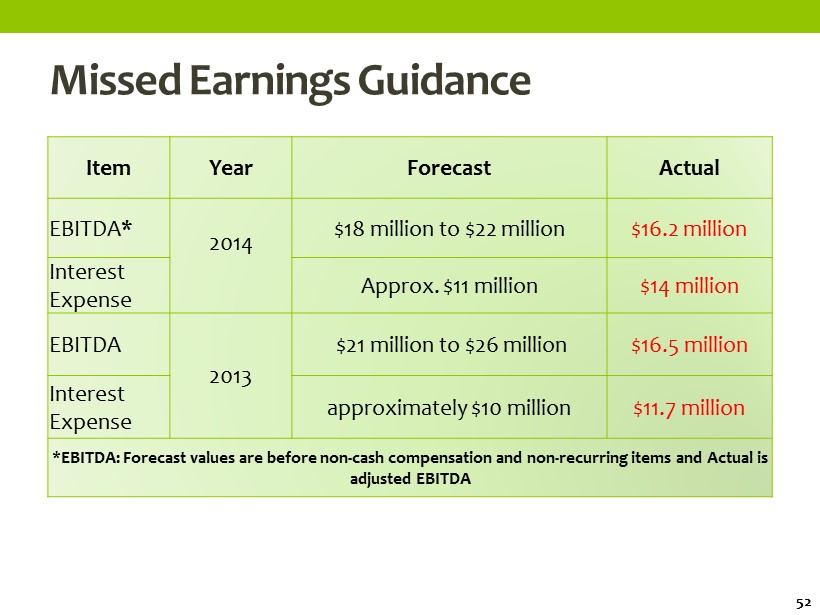

Missed Earnings Guidance Item Year Forecast Actual EBITDA* 2014 $18 million to $22 million $16.2 million Interest Expense Approx. $11 million $14 million EBITDA 2013 $21 million to $26 million $16.5 million Interest E xpense approximately $10 million $11.7 million *EBITDA: Forecast values are before non - cash compensation and non - recurring items and Actual is adjusted EBITDA 52

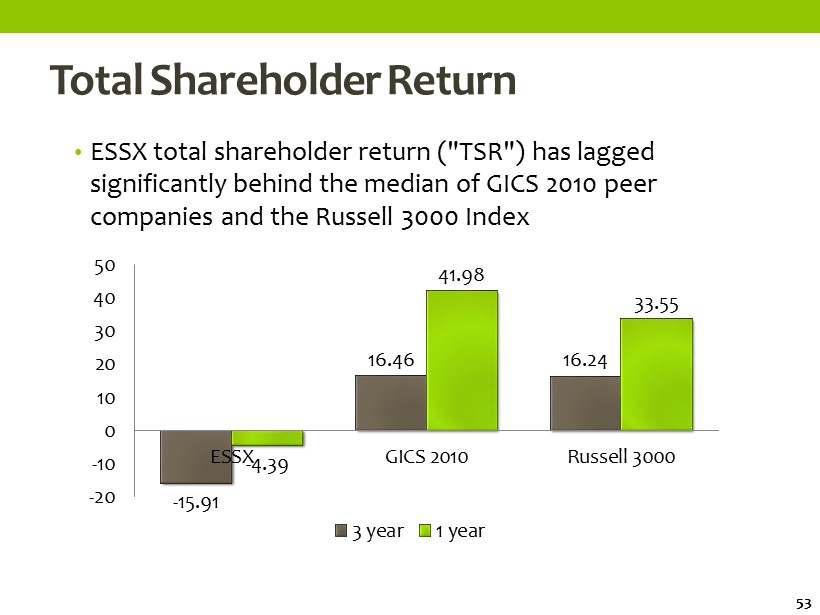

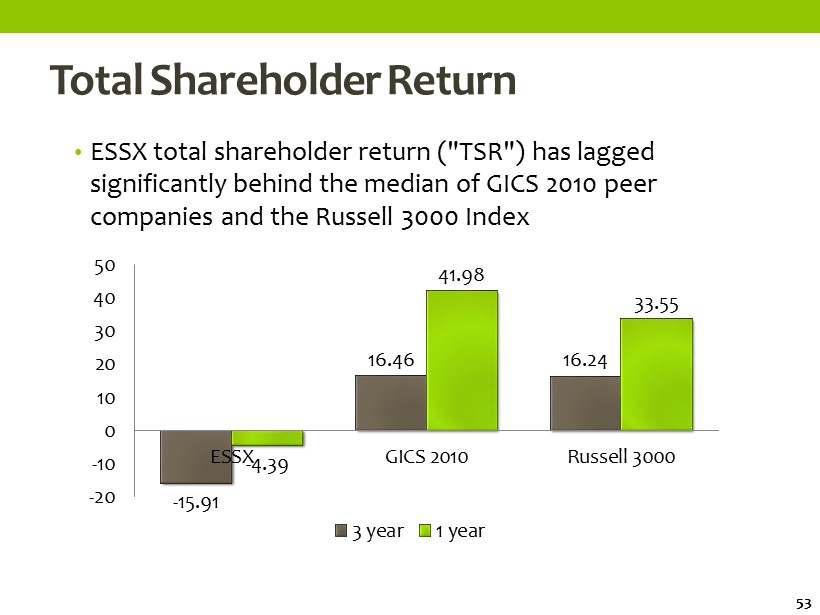

Total Shareholder Return • ESSX total shareholder return ("TSR") has lagged significantly behind the median of GICS 2010 peer companies and the Russell 3000 Index - 15.91 16.46 16.24 - 4.39 41.98 33.55 -20 -10 0 10 20 30 40 50 ESSX GICS 2010 Russell 3000 3 year 1 year 53

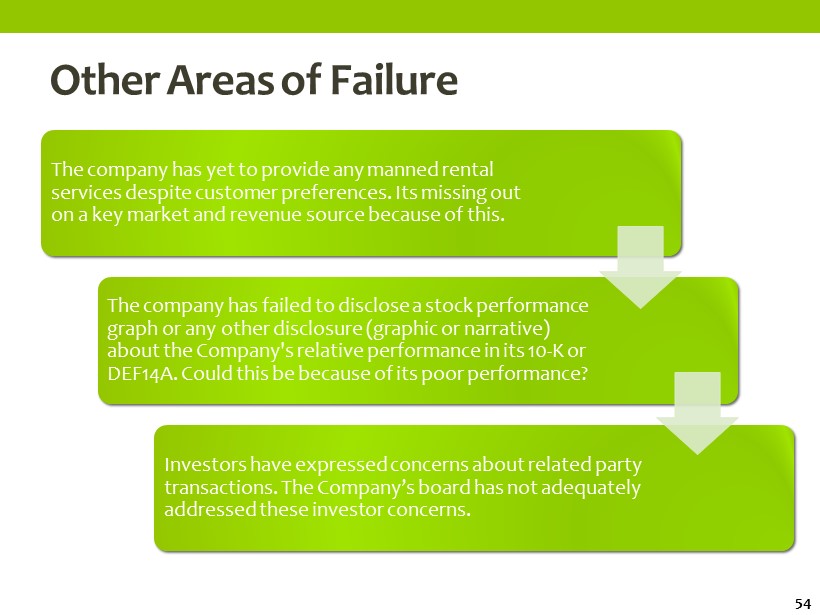

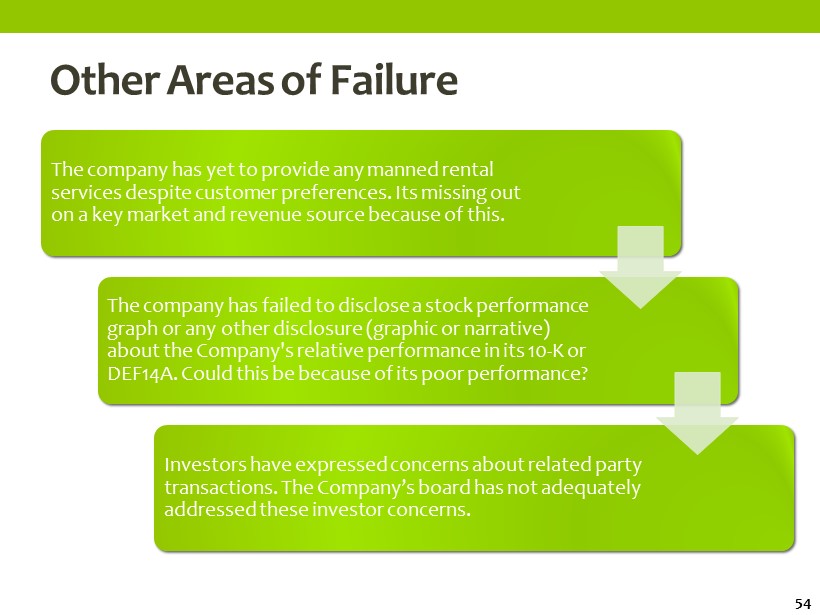

Other Areas of Failure The company has yet to provide any manned rental services despite customer preferences. Its missing out on a key market and revenue source because of this. The company has failed to disclose a stock performance graph or any other disclosure (graphic or narrative) about the Company's relative performance in its 10 - K or DEF14A. Could this be because of its poor performance? Investors have expressed concerns about related party transactions. The Company’s board has not adequately addressed these investor concerns. 54

AGENDA Shareholder Value Erosion at ESSX Compensation Analysis Financial Irregularities Strategic Alternatives Our Nominees vs. Incumbents 55

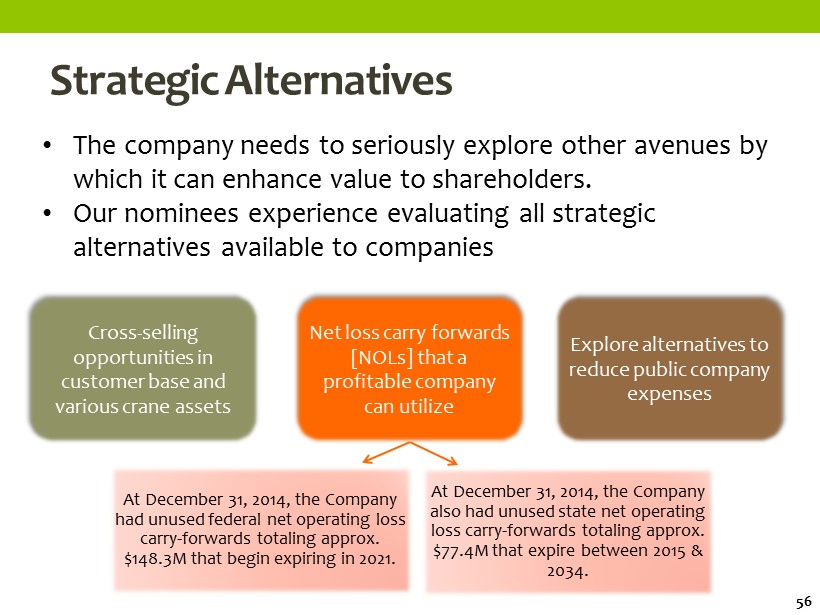

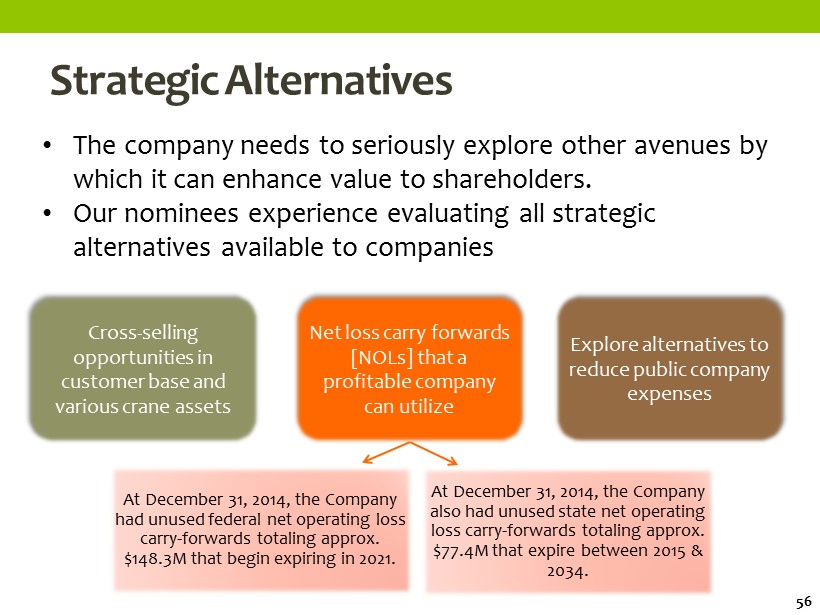

Strategic Alternatives • The company needs to seriously explore other avenues by which it can enhance value to shareholders. • Our nominees experience evaluating all strategic alternatives available to companies Cross - selling opportunities in customer base and various crane assets Explore alternatives to reduce public company expenses Net loss carry forwards [NOLs] that a profitable company can utilize At December 31, 2014, the Company had unused federal net operating loss carry - forwards totaling approx. $148.3M that begin expiring in 2021. At December 31, 2014, the Company also had unused state net operating loss carry - forwards totaling approx. $77.4M that expire between 2015 & 2034. 56

Company undervalued The company’s value is severely discounted when compared to its orderly liquidation value [OLV]. As of Dec 31, 2014, ESSX’s OLV of the rental equipment fleet was approximately $330.1M as shown in the 2014 10 - K. In an ESSX investor presentation released in Dec 2014, the company puts per share value at $5.27 [based on OLV of $347M as of Sept 2014] Pg 6, http://www.sec.gov/Archives/edgar/data/1373988/000137398814000081/a20141201investorpresent.htm 57

Our Strategy Appoint new board members with industry experience and board independence Renegotiate debt terms, improve top - line growth Initiate overhead cost cutting and control measures Develop constructive strategies Declassify board 58

AGENDA Shareholder Value Erosion at ESSX Compensation Analysis Financial Irregularities Strategic Alternatives Our Nominees vs. Incumbents 59

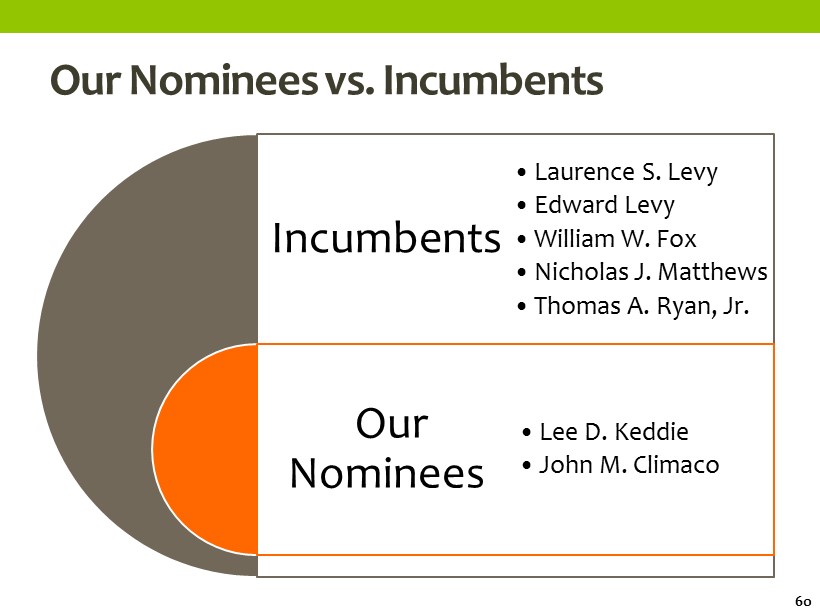

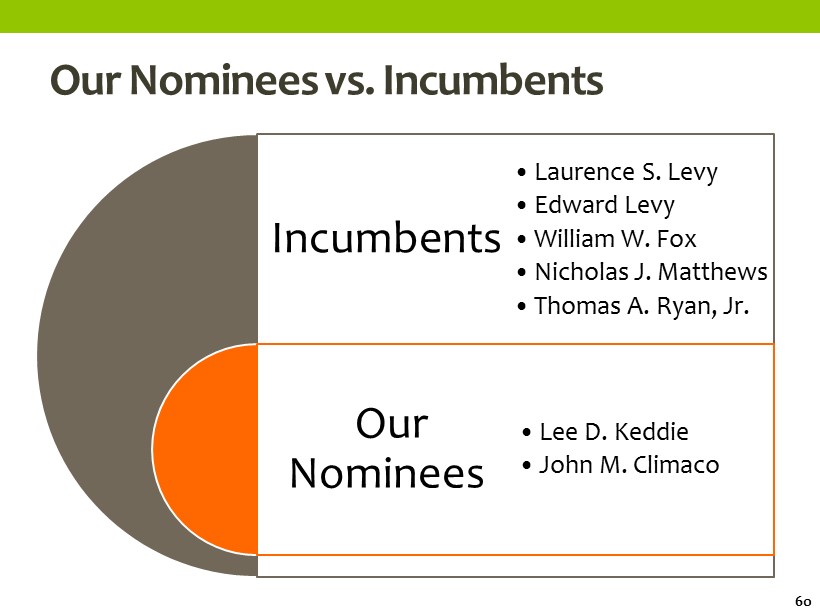

Our Nominees vs. Incumbents Incumbents Our Nominees • Laurence S. Levy • Edward Levy • William W. Fox • Nicholas J. Matthews • Thomas A. Ryan, Jr. • Lee D. Keddie • John M. Climaco 60

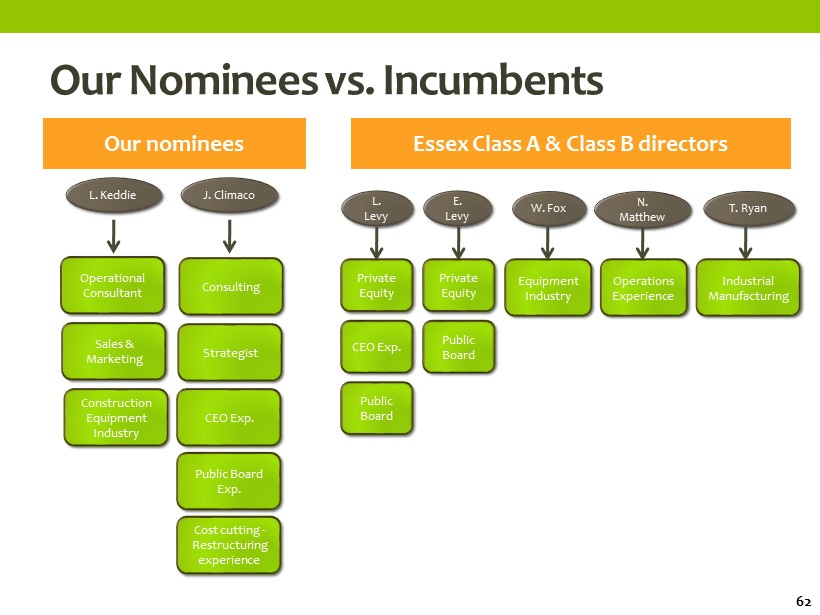

Our Nominees vs. Incumbent Our Nominees 61 Lee D. Keddie John M. Climaco Experience Construction Equipment - Over 12 Years Mobile Heavy Equipment Experience, developing OEM agreements and relationships with major Equipment Manufacturers Cost Cutting – When John M. Climaco joined the board of Digirad , Digirad had been losing money every year for more than seven years in a row . Climaco implemented a dramatic cost - cutting program at Digirad Profit Optimization – Grew Business to 24% profitability, with positive earnings over each of the 12 years, even through 2009 recession Governance – Chairman, Strategic Advisory Committee of Digirad , Director , PESI; Former Director, PDI, Inc. ; Former Director, INFU Recession Recovery/Turnaround – Used disciplined cost control to successfully navigate 60% Construction Industry downturn Close Relationship with Management – Worked cooperatively and constructively with incumbent Digirad management. Management suggested moving the HQ from expensive California to inexpensive Georgia. Climaco championed management’s idea and got the HQ moved. Business Growth and Expansion – Grew construction equipment revenue 8X over 12 years through organic business expansion Returning Cash to Shareholders - After Climaco’s plans at Digirad were fully implemented, Digirad was solidly cash flow positive. Climaco pushed for returning cash to shareholders through a regular quarterly dividend. The dividend was implemented and shareholders reaped the benefit.

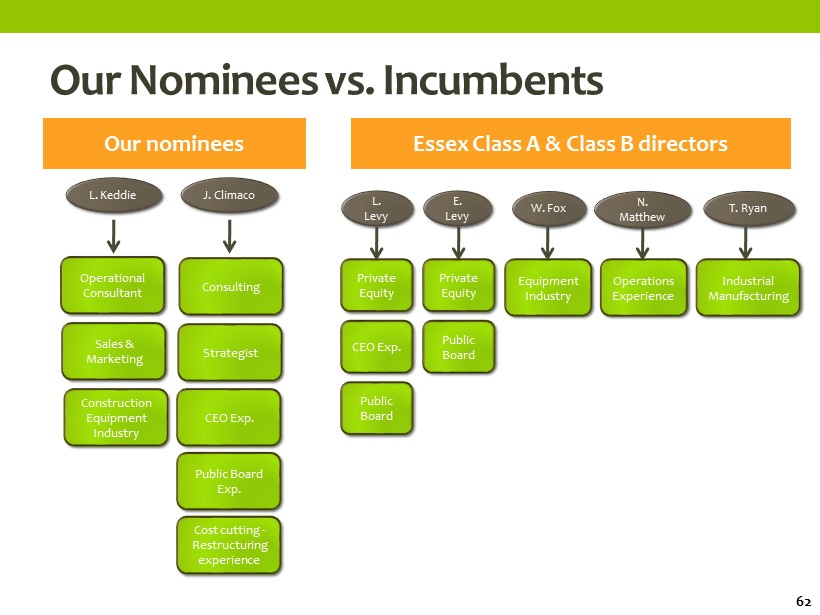

Our Nominees vs. Incumbents Private Equity Our nominees L. Levy Essex Class A & Class B directors E. Levy W. Fox N. Matthew T. Ryan CEO Exp. Public Board Private Equity Public Board Equipment Industry Operations Experience Industrial Manufacturing L. Keddie Operational Consultant Sales & Marketing Construction Equipment Industry J. Climaco Consulting Strategist Public Board Exp. CEO Exp. Cost cutting - Restructuring experience 62

APPENDIX & SOURCES 63

Source • http://rermag.com/mergers - acquisitions • http://www.equipmentfa.com/news/category/4/3/mergers - acquisitions • http://rermag.com/rer - 100/rer - 100 - top - rental - equipment - companies - 2013 • https://www.aem.org/Construction/CINN/?C=5 • http://www.enermech.com/latest - news/item/691 - diversified - acquisition - gives - enermech - cranes - lift - off - in - usa 64

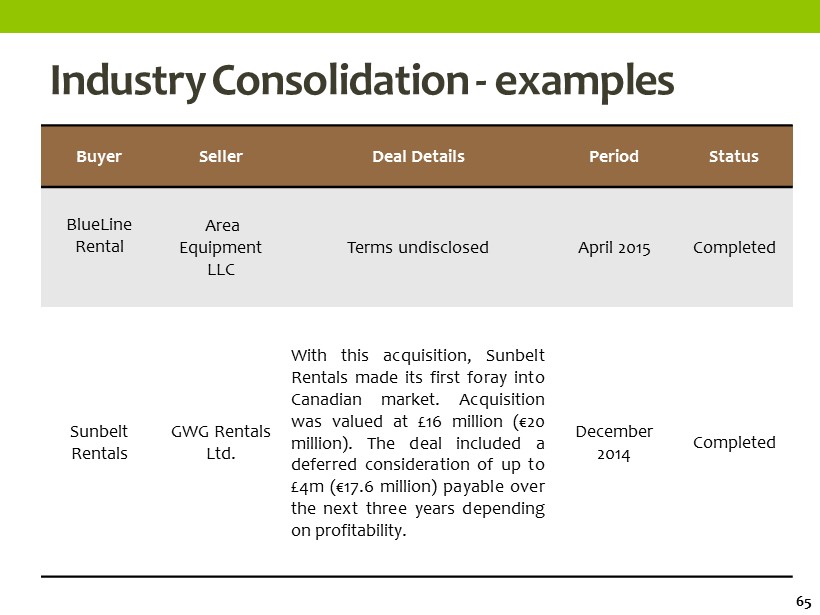

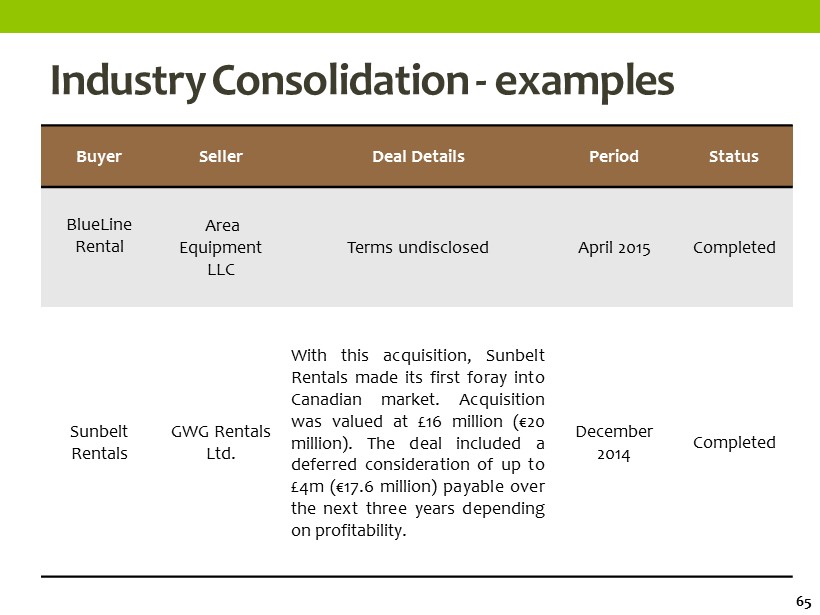

Industry Consolidation - examples Buyer Seller Deal Details Period Status BlueLine Rental Area Equipment LLC Terms undisclosed April 2015 Completed Sunbelt Rentals GWG Rentals Ltd. With this acquisition, Sunbelt Rentals made its first foray into Canadian market . Acquisition was valued at £ 16 million ( € 20 million) . The deal included a deferred consideration of up to £ 4 m ( € 17 . 6 million) payable over the next three years depending on profitability . December 2014 Completed 65

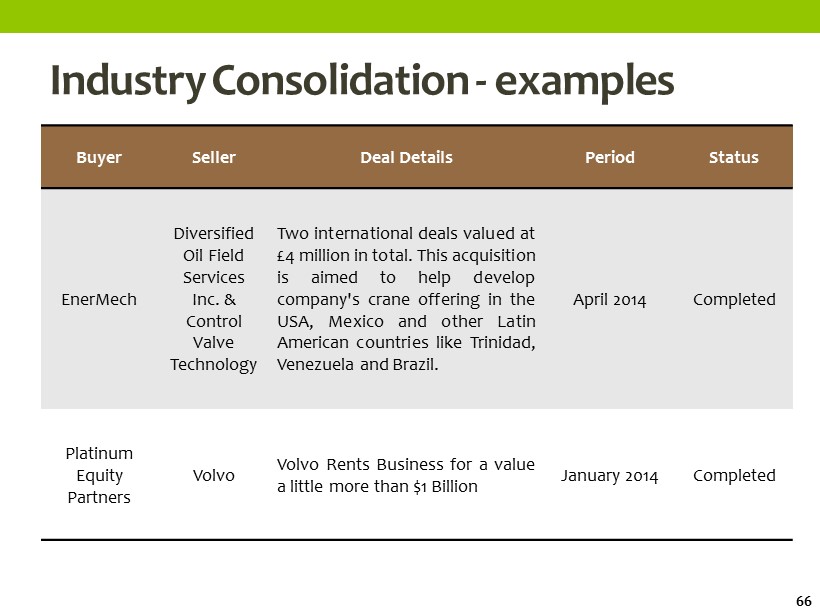

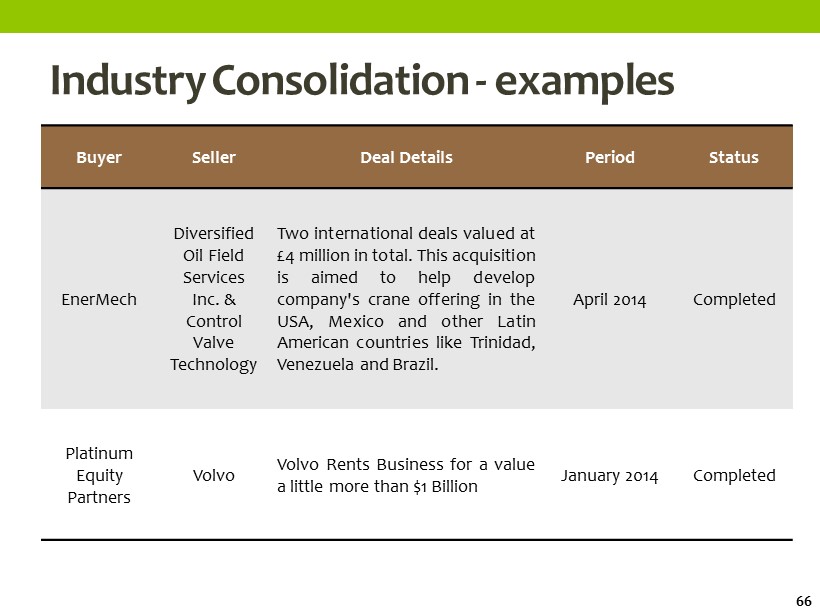

Industry Consolidation - examples Buyer Seller Deal Details Period Status EnerMech Diversified Oil Field Services Inc. & Control Valve Technology Two international deals valued at £ 4 million in total . This acquisition is aimed to help develop company's crane offering in the USA, Mexico and other Latin American countries like Trinidad, Venezuela and Brazil . April 2014 Completed Platinum Equity Partners Volvo Volvo Rents Business for a value a little more than $ 1 Billion January 2014 Completed 66

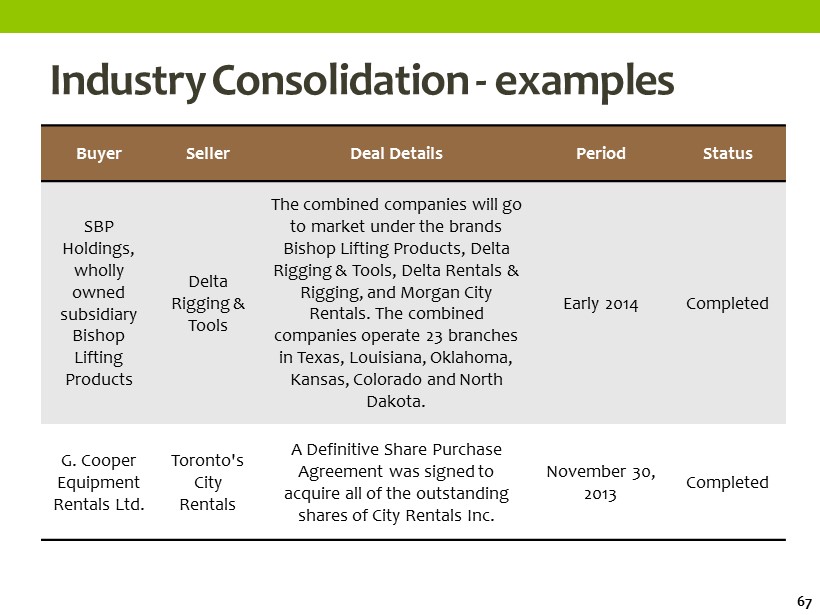

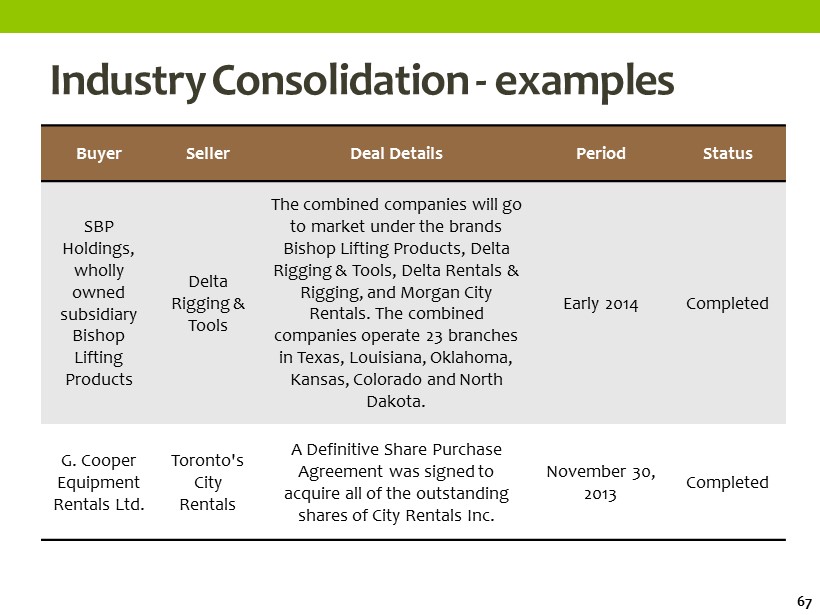

Industry Consolidation - examples Buyer Seller Deal Details Period Status SBP Holdings, wholly owned subsidiary Bishop Lifting Products Delta Rigging & Tools The combined companies will go to market under the brands Bishop Lifting Products, Delta Rigging & Tools, Delta Rentals & Rigging, and Morgan City Rentals. The combined companies operate 23 branches in Texas, Louisiana, Oklahoma, Kansas, Colorado and North Dakota. Early 2014 Completed G. Cooper Equipment Rentals Ltd. Toronto's City Rentals A Definitive Share Purchase Agreement was signed to acquire all of the outstanding shares of City Rentals Inc. November 30, 2013 Completed 67

Industry Consolidation - examples Buyer Seller Deal Details Time/Period Status First Reserve TNT Crane & Rigging Terms undisclosed November 2013 Completed NES Rentals Holdings Inc. West Georgia Aerial Lift Inc. At the time of acquisition, West Georgia had 17 employees and 300 pieces of equipment. Co - Owners of West Georgia continued with the organization. October 2013 Completed 68