August 20, 2020

VIA EDGAR TRANSMISSION

United States Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 3030

Washington, D.C. 20549

| | | | | |

| ATTN: | Brittany Ebbertt, Senior Staff Accountant |

| Melissa Kindelan, Senior Staff Accountant |

| | | | | |

| Re: | Cloudera, Inc. |

| Form 10-K for the fiscal year ended January 31, 2020 |

| Filed March 27, 2020 |

| File No. 001-38069 |

Dear Mss. Ebbertt and Kindelan:

On behalf of Cloudera, Inc., a Delaware corporation (the “Company”), we hereby submit this letter in response to comments made by the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in a letter from the Staff dated July 31, 2020 (the “Staff Letter”) regarding the above-referenced Annual Report on Form 10-K for the fiscal year ended January 31, 2020.

The following responses are numbered in accordance with the comments in the Staff Letter. For your convenience, we restate the comment from the Staff Letter in bold before each response.

Form 10-K for the fiscal year ended January 31, 2020

Item 7. Management's Discussion and Analysis of Financial Condition and Results Operations, page 48

1. You indicate that the success of your business depends, in part, on your ability to sell renewals of subscriptions and expand the deployment of your platform to existing customers. Tell us, and revise to disclose, the renewal rate of your subscriptions or explain what other measure management uses to monitor customer retention. Further, tell us what measure(s) management uses to monitor the expansion of your platform to existing customers, or the “land and expand” strategy as explained here, and revise to disclose and discuss these measures for each period presented. Refer to Section III.B.1 of SEC Release 33-8350.

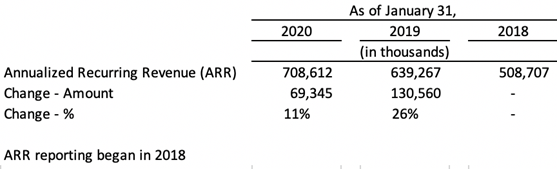

Response: In response to the Staff’s comment, we believe that Annualized Recurring Revenue (or ARR), is the most appropriate metric to share with our investors to allow them to understand our ability to retain customers, sell renewals and expand deployments of our platform.

ARR equals the annualized value of all recurring subscription contracts with active entitlements as of the end of the applicable period. ARR provides a normalized and composite view of customer retention, renewal and expansion as well as growth from new customers, that is a supplement to reported revenue.

ARR is the primary metric that management uses to monitor customer retention and growth and to make operational decisions related to our business. It is used extensively inside Cloudera because it adjusts for the non-economic effects of ASC 606 accounting and merger accounting.

When considering SEC Release 33-8350, Section III.B.1, we believe ARR gives readers of the financial statements a view of the company through the eyes of management and helps provide an understanding of our financial condition and results of operations.

ARR attainment is a key non-GAAP performance metric presented in our quarterly earnings announcement, prominently presented in the Recent Business and Financial Highlights section.

We believe that disclosing a discrete renewal rate would not be useful to our investors and could be misleading, since it is an evolving metric. Cloudera’s business is in transition across a number of dimensions, as a result of the recent merger with Hortonworks and the roll-out of a new cloud offering with new pricing models. Given the nature of a subscription business, coupled with such transitions, we evaluate renewals using different measures that are not always calculated or presented to senior management on a consistent basis.

We believe that disclosing a discrete expansion metric would not be useful to investors for the same reasons that a discrete renewal rate metric would not be useful.

Finally, we do not believe that it is appropriate to expose investors to immature renewal rate or expansion measures that may need to be modified frequently. We believe that our approach is consistent with industry practice.

We respectfully advise the Staff we will revise future filings to disclose and discuss the Annualized Recurring Revenue metric for each period presented in our Quarterly Report on Form 10-Q or our Annual Report on Form 10-K as follows:

The increase in ARR from January 31, 2019 to January 31, 2020 was primarily due to existing customers expanding their use of Cloudera products.

Consolidated Statements of Operations, page. 67

2. Tell us how you considered presenting product revenue earned from the sale of software licenses as a separate line item on the Consolidated Statement of Operations. Refer to Rule 5-03(b)(1)(a) of Regulation S-X.

Response: In response to the Staff’s comment, considering Rule 5-03 of Regulation S-X, revenue from software licenses is less than 10% of our total revenue for all periods presented, and accordingly is not separately presented on the face of the Consolidated Statement of Operations. Revenue from sale of software licenses represented approximately 3.1% ($24.8 million), 5.9% ($28.2 million), and 7.6% ($28.3 million) of our total revenue for the years ended January 31, 2020, 2019, and 2018, respectively. We provide revenue disclosures to illustrate revenue from our software subscription and services operating segments, as well as geographical disclosures of revenue. We believe that the disclosure of our revenue in these forms, along with the disclosures regarding the nature and source of our revenue in the footnote disclosures, provides readers with sufficient information to understand our operations. We will continue to assess the percentages attributable to the relevant subcaptions in Rule 5-03, and to the extent relevant revenue exceeds 10% of total revenue in the future, we will modify the presentation accordingly.

Notes to Consolidated Financial Statements

Note 2. Summary of Significant Accounting Policies

Revenue Recognition, page 76

3. Please describe for us the nature of your open source and proprietary software as well as the support services that are included in your subscription arrangements, and clarify whether this software is the functional intellectual property you refer to in your disclosures. Also tell us, and revise to disclose, each of the performance obligations included in these arrangements and how the respective revenue for each is recognized. In this regard, you state that your subscription is viewed as a stand-ready performance obligation and is satisfied over time; however,

it appears a subscription may include functional intellectual property that is recognized at a point in time.

Response: We sell subscriptions and services for an integrated suite of data analytics and management products. Our subscription offerings are based predominantly on open source software including Spark, Impala, Hive, HBase, Kafka, Hadoop, and more. The open source software is available from the Apache Software Foundation ("ASF”) or available through an Affero General Public License (“AGPL“). Certain subscriptions also include licenses of proprietary software that provide additional features and functionality not included in the open source software. Approximately 90% of the software components in our subscription offerings are open source. The proprietary software licenses referred to in our disclosures reflect functional intellectual property.

Nearly all of our subscription arrangements include open source software and, sometimes, proprietary software, and related support. We do have limited instances of subscription arrangements that include only proprietary software and related support, which represent less than 1% of all subscription arrangements. Subscriptions include internet, email and phone support, bug fixes, and the right to receive unspecified software updates and upgrades released when and if available during the subscription term.

Within our subscription arrangements, Cloudera accounts for the proprietary software license, if any, and support as two separate performance obligations. As the open source software is publicly available at no cost to the customer, Cloudera has determined that there is no value to be assigned to the open source software in its subscription arrangements. The proprietary software license represents a promise to provide a license to use functional intellectual property that we recognize at a point in time on the date access to the software is made available to the customer and the license period has begun as per ASC 606-10-55-58C. We have concluded the support is a stand-ready performance obligation and consists of a series of distinct days of service that are satisfied ratably over time as the services are provided. We use a time-based output method to measure progress because our efforts are expended evenly throughout the period given the nature of the promise is a stand-ready service.

As noted in the response to comment 2, revenue from the sale of proprietary software licenses to use functional intellectual property represented approximately 3.1% ($24.8 million), 5.9% ($28.2 million), and 7.6% ($28.3 million) of our total revenue for the years ended January 31, 2020, 2019, and 2018, respectively. This percentage has decreased year over year and we expect this percentage to continue to decrease as a result of the Hortonworks merger in the year ended January 31, 2019, as the Hortonworks products are exclusively open source, and as we anticipate moving towards a nearly 100% open source model, which we expect to be substantially complete in the next calendar year.

We respectfully advise the Staff we will revise future filings to provide enhanced revenue recognition disclosure in our Quarterly Report on Form 10-Q and our Annual Report on Form 10-K similar to the following:

Subscription revenue

We sell subscriptions and services for an integrated suite of data analytics and management products. Our subscription offerings are based predominantly on open source software including Spark, Impala, Hive, HBase, Kafka, Hadoop, and more. The open source software is available from the Apache Software Foundation ("ASF”) or available through an Affero General Public License (“AGPL“). Certain subscriptions also include licenses of proprietary software that provide additional features and functionality not included in the open source software.

Subscription revenue relates to term (or time-based) subscriptions to our platform, which can includes both open source and proprietary software and related support. Subscriptions include internet, email and phone support, bug fixes, and the right to receive unspecified software updates and upgrades released when and if available during the subscription term. Revenue for subscription arrangements is recognized ratably beginning on the later of the date access is made available to the customer or the start of the contractual term of the arrangement. Subscription revenue also includes revenue related to functional intellectual property that is generally recognized on the date access is made available to the customer. Within our subscription arrangements, we account for the license to the proprietary software, if any, and support as two separate performance obligations. As the open source software is publicly available at no cost to the customer, we have determined that there is no value to be assigned to the open source software in our subscription arrangements. The proprietary software license represents a promise to provide a license to use functional intellectual property that is recognized at a point in time on the date access to the software is made available to the customer and the license period has begun. We have concluded the support is a stand-ready performance obligation that consists of a series of distinct days of service that are satisfied ratably over time as the services are provided. We use a time-based output method to measure progress because our efforts are expended evenly throughout the period given the nature of the promise is a stand-ready service. We recognize support revenue ratably, typically beginning on the start of the contractual term of the arrangement.

As part of our support offered under a subscription, we stand ready to help customers resolve technical issues related to the installed platform. The subscriptions are designed to assist throughout a customer’s lifecycle from development to proof-of-concept, to quality assurance and testing, to production and development. Our subscriptions are generally offered under renewable, fixed fee contracts where payments are typically due annually in advance and may have a term of one year or multiple years. The contracts generally do not contain refund provisions for fees earned related to services performed. A subscription is viewed as a stand-ready performance obligation comprised of a series of distinct days of service that is satisfied ratably over time as the services are provided. A time-elapsed output method is used to measure progress because our efforts are expended evenly throughout the period given the nature of the promise is a stand-ready service. Unearned subscription revenue is included in deferred revenue and other contract liabilities. On occasion, we may sell engineering services and/or a premium

subscription agreement that provides a customer with development input and the opportunity to work more closely with our developers.

4. In your Form 10-K for the year ended January 31, 2019, you state that a vast majority of subscription revenue is allocated to a stand ready obligation to provide support; therefore, it appears, a small amount of the transaction price in your subscription arrangements is allocated to the software licenses. Please further explain this allocation and specifically address why only a small amount is allocated to the software licenses while the vast majority of the value is allocated to support services in these arrangements.

Response: Cloudera recognizes the vast majority of its subscription revenue over-time as a stand ready obligation to provide support and a portion of subscription revenue at the point in time when functional intellectual property is made available to the customer and the license term has begun. As noted in the response to comment 2 above, license revenue from the sale of proprietary software licenses, treated as functional intellectual property, represented approximately 3.7% ($24.8 million), 6.9% ($28.2 million), and 9.4% ($28.3 million) of our subscription revenue for the years ended January 31, 2020, 2019, and 2018, respectively. Accordingly, we have allocated the substantial majority of the transaction price in our subscription arrangements to support with a much smaller amount allocated to software licenses.

The allocation of our subscription arrangements between support and the proprietary software license reflects that all or almost all of our software in subscription arrangements is open source software and not proprietary software. We have determined that the open source software licenses have no value attributed to them as they are made freely available, while proprietary software licenses are determined to have value based on standalone selling price.

We determined that there are no relevant observable prices for our proprietary software licenses, which we treat as functional intellectual property, as these licenses are not sold separately from the open source components of our software solutions nor sold separately from support. To determine the standalone selling price for the proprietary software we considered several methods for estimating unobservable standalone selling price, including an adjusted market approach, an expected cost plus margin approach and the residual approach. Based on the nature of our subscriptions, and the fact that we always sell support with software, we don’t have access to competitor pricing, the variability in our product margins, the open source nature of software development costs and that there is no observable standalone selling price for other performance obligations in our subscriptions, we determined that none of these methods were appropriate for estimating standalone selling price. Therefore, we had to determine an appropriate method based on the nature of our software subscriptions. Our method leverages a value relationship based on our established pricing practices, which yields the related standalone selling price for allocation between the proprietary software and stand ready support performance obligations, pursuant to AICPA Revenue Recognition Guide, Chapter 9, Software Entities, Considerations in Estimating Stand-Alone Selling Prices paragraphs 9.4.43,

9.4.44 and 9.4.51. To determine this value relationship, we evaluated each of our product offerings and determined the incremental value of each offering from the addition of the proprietary software and support based on the number of proprietary software components. Once we determined the incremental value related to the proprietary software component and support, we determined the allocation amongst the proprietary software and the support performance obligations. In arriving at this allocation, we first considered the software industry average split for software and support as well as peer group companies’ approach to software and support. The resulting amount reflects the estimated standalone selling price for the proprietary software components.

As noted in the response to comment 3, our subscription offerings are based predominantly on open source software components and not proprietary components. For these open source software components, we have assigned a zero standalone selling price as they are freely available.

The result of this allocation, given that the majority of our software is comprised of open source components, is that a majority of the transaction price of our subscription arrangements is allocated to support and a much smaller amount of the transaction price of our subscription arrangements is allocated to proprietary software.

We have determined that the allocation of transaction price between software license and support is reasonable as all or most of the software is open source, which has zero standalone selling price. As noted in the response to comment 3, approximately 90% of the software components in our subscription offerings are open source. As such, the substantial majority of support relates to the open source portion of our subscription arrangements.

Further, we have determined that the allocation of transaction price between software license and support is reasonable as our customers view support as the primary item of value in the subscription arrangement. This view of support is evident in that approximately 85% of our support cases logged are related to open source software, which has no corresponding license value. This view of support is also based on a company culture that focuses on consistently delivering value for our customers and ensuring their success and satisfaction through support covering both the open source software as well as the proprietary software. We deliver exceptional support to ensure our customers get the most out of the technology. We offer technical assistance through our large and experienced global support organization. Built on powerful predictive analytics using our own technology, we proactively monitor our customers’ platforms to prevent issues before they arise, avoid common cluster misconfigurations, and suggest optimization based on similar cases at other customers. Our predictive analytics allow us to proactively initiate a substantial portion of our support engagements for customers, before they realize that they have a problem themselves.

Lastly, as disclosed in the Form 10-K for the fiscal year ended January 31, 2020, we indicated our move towards adoption of a 100% open source model. As part of adopting this model, the proprietary software components contained within our subscription

arrangements will continue to decrease over time, thereby resulting in even less license revenue as a percentage of subscription revenue and total revenue in the future. We now expect our anticipated move towards a nearly 100% open source model to be substantially complete in the next calendar year.

Because (i) all or most of the software in our subscription arrangements is open source and not proprietary and (ii) customers view support as the primary value driver in the subscription arrangement, we have allocated the substantial majority of the transaction price in our subscription arrangements to support with a much smaller amount allocated to software licenses, resulting in license revenue that is less than 10% of total revenue.

Note 11. Income Taxes, page 98

5. We note the line item “Change in U.S. tax status of foreign entities” in your tax rate reconciliation table. Please tell us and revise to describe the nature of this significant reconciling item. Refer to ASC 740-10-50-12. Further, to the extent your current effective tax rate is not indicative of future results, tell us and revise to include a discussion in MD&A of the impact such shift may have on your future results of operations. Refer to Item 303(a)(3) of Regulation S-K and Section III.B. of SEC Release 33-8350.

Response: In response to the Staff’s comment, the significant reconciling item disclosed in our tax reconciliation table pertains to our merger with Hortonworks in January 2019, whereby all international distribution facilities and related intellectual property were transitioned to the United States in fiscal 2020. As part of the transition, certain foreign entities became disregarded for U.S. tax purposes. This transition required the remeasurement of certain deferred taxes at tax rates different to those outside of the United States and the establishment of new deferred taxes for the disregarded entities, resulting in a one-time increase in our effective tax rate. This one-time tax provision impact was fully offset by a valuation allowance. Given the nature of this transaction, we believe that our current effective tax rate is indicative of future results, and therefore, that no further disclosure in the MD&A is therefore necessary.

We respectfully advise the Staff we will revise future filings to provide enhanced tax table disclosure in our Annual Report on Form 10-K.

Item 9A. Controls and Procedures, page 103

6. Please amend to specifically state whether or not management concluded that internal control over financial reporting is effective as of January 31, 2020. Refer to guidance in Item 308(a)(3) of Regulation S-K.

Response: In response to the Staff’s comment, Cloudera will amend its Annual Report on Form 10-K for the year ended January 31, 2020 (once the Staff confirms it has no further comments requiring further amendment) to provide the requested disclosure. Set forth below is the pertinent part of our proposed additional disclosure to Item 9A required by

Item 308(a)(3) of Regulation S-K which indicates that our internal control over financial reporting was effective as of the end of the fiscal year covered by the report. “Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our internal control over financial reporting, as of the end of the period covered by this Annual Report on Form 10-K, was effective.”

* * *

We hope the foregoing is responsive to your comments. Please feel free to contact me if you have any questions regarding this correspondence.

| | | | | |

| Very truly yours, | |

| |

| /s/ Jim Frankola | |

| |

| Jim Frankola | |

| Chief Financial Officer | |

| Cloudera, Inc. | |

| | | | | |

| cc: | David Howard, Cloudera |

| Tad J. Freese, Latham & Watkins LLP |

| Philip S. Stoup, Latham & Watkins LLP |