UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| x | | Soliciting Material Pursuant to §240.14a-12 |

COMMONWEALTH REIT

(Name of the Registrant as Specified In Its Charter)

CORVEX MANAGEMENT LP

KEITH MEISTER

RELATED FUND MANAGEMENT, LLC

RELATED REAL ESTATE RECOVERY FUND GP-A, LLC

RELATED REAL ESTATE RECOVERY FUND GP, L.P.

RELATED REAL ESTATE RECOVERY FUND, L.P.

RRERF ACQUISITION, LLC

JEFF T. BLAU

RICHARD O’TOOLE

DAVID R. JOHNSON

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

|

The Case for Change Now at CWH Update on Recent Events December 18, 2013 |

|

2 Disclaimer This presentation does not constitute either an offer to sell or a solicitation of an offer to buy any interest in any fund associated with Corvex Management LP (“Corvex”) or Related Fund Management, LLC (“Related”). Any such offer would only be made at the time a qualified offeree receives a confidential offering memorandum and related subscription documentation. The information in this presentation is based on publicly available information about CommonWealth REIT (the “Company”). This document includes certain forward-looking statements, estimates and projections prepared with respect to, among other things, general economic and market conditions, changes in management, changes in the composition of the Company’s Board of Trustees, actions of the Company and its subsidiaries or competitors, and the ability to implement business strategies and plans and pursue business opportunities. Such forward-looking statements, estimates, and projections reflect various assumptions concerning anticipated results that are inherently subject to significant uncertainties and contingencies and have been included solely for illustrative purposes, including those risks and uncertainties detailed in the continuous disclosure and other filings of the Company, copies of which are available on the U.S. Securities and Exchange Commission website at www.sec.gov/edgar. No representations, express or implied, are made as to the accuracy or completeness of such forward-looking statements, estimates or projections or with respect to any other materials herein. Corvex and Related may buy, sell, cover or otherwise change the form of their investment in the Company for any reason at any time, without notice, and there can be no assurances that they will take any of the actions described in this document. Corvex and Related disclaim any duty to provide any updates or changes to the analyses contained in this document, except as may be required by law. Shareholders and others should conduct their own independent investigation and analysis of the Company. Except where otherwise indicated, the information in this document speaks only as of the date set forth on the cover page. Permission to quote third party reports in this presentation has been neither sought nor obtained. Additional Information Regarding the Consent Solicitation In connection with their solicitation, Corvex and Related have filed a preliminary solicitation statement with the U.S. Securities and Exchange Commission (the “SEC”) to (1) solicit written consents from shareholders of the Company to remove the entire board of trustees of the Company (the “Removal Proposal”) and (2) solicit proxies to elect five new trustees at a special meeting of shareholders that must be promptly called in the event that the Removal Proposal is successful. Investors and security holders are urged to read the definitive written consent solicitation statement and other relevant documents when they become available, because they contain important information regarding the consent solicitation. The preliminary and definitive solicitation statement and all other relevant documents will be available, free of charge, on the SEC’s website at www.sec.gov. The following persons are participants in the solicitation of the Company’s shareholders: Corvex Management LP, Keith Meister, Related Fund Management, LLC, Related Real Estate Recovery Fund GP-A, LLC, Related Real Estate Recovery Fund GP, L.P., Related Real Estate Recovery Fund, L.P., RRERF Acquisition, LLC, Jeff T. Blau, Richard O’Toole and David R. Johnson. Information regarding the participants in the solicitation and a description of their direct and indirect interests, by security holdings or otherwise, to the extent applicable, is available in the preliminary solicitation statement filed with the SEC on December 3, 2013. |

|

3 Agenda CommonWealth REIT Update on recent events CWH corporate governance discussion Side-by-side comparison of CWH and Corvex/Related governance proposals Update on Strategic Plan We appreciate this opportunity to meet with you and provide an update on CommonWealth (“CWH” or the “Company”) |

|

4 Update on Recent Events The Arbitration Panel Has Spoken On November 18, 2013, the Arbitration Panel (“Panel”) issued an award that ruled in our favor on virtually all of our requests, striking down the illegal bylaws that stripped shareholders of their right to vote through a consent solicitation We were further vindicated when the Panel also ordered a clearly defined set of procedures for a new consent solicitation and: After two weeks of live testimony and reviewing hundreds of exhibits, we believe the Panel plainly agreed with our view that the Portnoys are highly incentivized and capable of continuing their campaign of shareholder disenfranchisement Prohibited any action intended to impede or frustrate the new solicitation, and Declared it would remain available to resolve any issues or disputes in the new consent solicitation - Arbitration Panel, November 18, 2013 “There is no question that CWH’s Bylaws…erect a complex wall of procedural hurdles to any consent solicitation.” |

|

5 Update on Recent Events The Arbitration Panel Has Spoken Contested Bylaws 3%/3yr holding requirement to request a record date All shares must be held in certificated form to request a record date 30 day period to respond to a record date request 60 day period to set a record date 90 day period to certify the results of the consent solicitation Selected details of the November 18 Arbitration Panel ruling: Ruling INVALID AS A MATTER OF LAW INVALID AS A MATTER OF LAW INVALID AS A MATTER OF LAW INVALID AS A MATTER OF LAW INVALID AS A MATTER OF LAW The Panel also ruled that: – Corvex/Related had satisfied onerous “red tape” bylaw requirements – Opting into Section 3-803 of the Maryland Unsolicited Takeovers Act (“MUTA”) does not revoke the right of shareholders to remove Trustees without cause, as claimed by the Portnoys Clearly highlights the Portnoys’ motivation for secretly lobbying the Maryland legislature to amend this law under the guise of a “clarification” |

|

6 Update on Recent Events The Arbitration Panel Has Spoken The Trustees’ misconduct over the past year is startling: Approved a massively dilutive equity offering, Passed unprecedented, illegal bylaw amendments, Lobbied to amend Maryland law under the cover of darkness, and Wasted over $30 million of shareholder money on year-long litigation process In our view, the Trustees accomplished nothing – But their actions say more about their true intentions than their promises ever can We and the Company are in the same position we would be in to begin with had the Portnoys simply allowed for the shareholder vote that was granted to shareholders in the Company’s Declaration of Trust 27 years ago The Panel recognized that shareholders have the right to vote in a consent solicitation to remove Trustees without cause “at any time” The Panel has implemented a clearly defined set of procedures to hold a new consent solicitation These actions were taken to prevent shareholders from simply holding a vote, but what did they accomplish? Shareholders are finally poised to take back CommonWealth and decide its future |

|

7 CommonWealth Corporate Governance Discussion The Accountability Vacuum and Underperformance Some of the extraordinary powers the Portnoys and their hand-picked board members have include the ability to: As a result, RMR is held accountable by no one and, in our view, enjoys complete immunity from shareholders Given the “Accountability Vacuum”, it is no wonder CWH shares have underperformed its peers by such a wide margin for so long In our opinion, rampant conflicts create an “Accountability Vacuum” at CWH; and underperformance thrives in an “Accountability Vacuum” We believe that, by definition, there can be no accountability when a manager controls its own “employer” – Purportedly require that two RMR employees always be on the five-member board, even though RMR owns virtually no equity in CWH and in our opinion have incentives diametrically opposed to those of shareholders – Exclusively amend the bylaws while shareholders cannot – Unilaterally stagger the board under MUTA, without shareholder approval – Require a shareholder vote of 75% in order to pass proposals not recommended by the Trustees – Reinstate hand-picked Trustees who fail to be re-elected by shareholders |

|

8 CommonWealth Corporate Governance Discussion But the Conflicts of Interest at CWH Underlie Another Basic Truth We believe the Portnoys harbor a deep commitment to protecting its “Perpetual Fee Streams” and will attempt to mislead shareholders with “Check-the-Box” reform rather than true accountability Given the staggering value of its “Perpetual Fee Streams”, we believe the Portnoys will always choose “Check-the-Box” corporate governance reform, rather than voluntarily agree to true accountability RMR’s business model, in our view, is founded on creating and preserving the conflict of interest at its externally managed REITs in order to manufacture “Perpetual Fee Streams”, regardless of the impact on CWH’s share price In our opinion, the profits from RMR’s “Perpetual Fee Streams” could be valued at ~20x cash flow (but for the ability of the Board to terminate RMR management contracts), given the highly recurring and practically infinite, growing nature of the cash flow streams under the protection of the “Accountability Vacuum” The Portnoys own 100% of RMR |

|

9 CommonWealth Corporate Governance Discussion The Portnoys’ Governance Proposals Are A Case Study in “Check-the-Box” After the countless tactics it has employed over the past year, would the Portnoys really now implement meaningful corporate governance enhancements and subject themselves to true accountability knowing full well they have severely underperformed for years? Would they really put at risk their invaluable “Perpetual Fee Stream”? Is it appropriate for Joseph Morea, a Trustee who was reinstated after receiving the vote of only 14% of the outstanding shares, to be “spearheading” corporate governance reform? What impact might losing the consent solicitation have on the Portnoys’ other, much larger and more lucrative externally managed REITs? Are the Portnoys aware that they may only need to propose misleading “Check-the-Box” governance changes just to win votes from some shareholders and remain in power with zero real improvement in corporate governance or accountability? On the following pages, we review and highlight the realities of the Portnoys’ “Check-the-Box” governance proposals from September 23, 2013, and compare them to Corvex/Related’s proposals which would effect tangible change on CWH’s governance The Portnoys’ “Check-the-Box” proposals create the illusion of reform, but bring zero incremental accountability Questions shareholders should ask themselves while conducting such a review: |

|

10 The Portnoys’ Corporate Governance Proposals Why It’s All Smoke and Mirrors Reality Our Proposal Annual Elections • Requires a total of four annual meetings with a full de-staggering not taking place until May 2017 • Remaining Trustees are still empowered to reinstate a trustee, such as Joseph Morea, who was not re-elected but reinstated earlier this year • Bylaws still require two Managing Trustees to be employees of RMR • Current Managing Trustees are in our opinion responsible for the poor state of CWH • MUTA allows RMR to unilaterally re- stagger its board at any time • The Portnoys refuse to answer whether they will insist on impossible procedural requirements to nominate Trustees, including twice-rejected 3%/3-year rule • Does not clarify when they deem current disputes to be resolved or whether future disputes with other shareholders will also delay implementation of their proposals Portnoys’ Proposal Annual election of Trustees will begin in 2015 following a shareholder vote at the 2014 Annual Meeting and resolution of the pending disputes with Corvex/Related Annual Elections at the next (2014) Annual Meeting |

|

11 The Portnoys’ Corporate Governance Proposals Why It’s All Smoke and Mirrors (cont.) Reality Our Proposal Board Composition • New Trustees to be nominated by a committee of current Trustees, while shareholders continue to be burdened by a nearly impossible nomination process • We believe the Portnoys have already revealed their true intentions by refusing to answer simple questions regarding the nomination process for the 2014 Annual Meeting • In our opinion, the Portnoys’ definition of independent trustee does not conform to any respected definition of the term, nor does their 27-year history convince us that New Trustees will be truly independent • With no material changes to corporate governance, new Trustees will be no more accountable to shareholders than current Trustees Portnoys’ Proposal • Size of board is to be increased such that the ratio of independent Trustees to total Trustees will increase from the current 60% to at least 75%, (i.e. three new Trustees) • Lead independent trustee will be designated after the new Trustees join the board • Existing Managing Trustees will remain • Any shareholder can nominate or bring business at an annual meeting (regardless of level of ownership or holding period) • No preferential treatment for RMR (which currently gets two board seats with virtually no equity interest in CWH) • No requirement that nominating shareholder owns ALL shares in record certificated form • Plurality vote for contested elections |

|

12 The Portnoys’ Corporate Governance Proposals Why It’s All Smoke and Mirrors (cont.) Reality Our Proposal RMR Management Agreement • Continues to primarily incentivize RMR to grow assets at the expense of shareholders when the company resumes equity issuance • Fees still structured to maintain downside protection for RMR while providing upside as assets grow • Incentive Fee benchmarks are to be determined by the same board that reinstated a trustee who only received support from 14% of the outstanding shares annually and can therefore be manipulated • Stock component is not meaningful • CWH will still be externally advised by a conflicted outside party that is not subject to accountability by its shareholders and owns virtually no stock in the Company Portnoys’ Proposal • Beginning in 2014, base business management fee to be based on the lower of: (i) gross historical cost of real estate assets or (ii) CWH’s total market capitalization • 10% of base business management fees will be paid in stock • Annual incentive fees will be based upon total returns realized by shareholders (i.e., appreciation plus dividends) in excess of benchmarks Truly independent board of Trustees will: • Form an independent compensation committee • Retain independent outside advisors • Set compensation policy to properly align incentives with shareholder returns in accordance with industry-accepted benchmarks |

|

13 The Portnoys’ Corporate Governance Proposals Why It’s All Smoke and Mirrors (cont.) Reality Our Proposal Poison Pill • Company will continue to have a poison pill built into its charter and bylaws that prohibit stock acquisitions over 9.8 percent • Still no response to our letter request for a waiver despite resolution of disputes by the Arbitration Panel • Company can always unilaterally implement a new poison pill overnight without shareholder approval • Does not clarify when they deem current disputes to be resolved or whether future disputes with other shareholders will also delay implementation of their proposals Portnoys’ Proposal • Waiver for shareholders who demonstrate no threat to REIT tax status • No new poison pills without a shareholder vote Expiration of poison pill to be accelerated from October 17, 2014 to a date soon after resolution of the pending disputes with Corvex/Related |

|

14 The Portnoys Continue to Show Their True Intentions The 2014 Annual Meeting On December 6, 2013, after the November 18 Panel ruling, we wrote a letter to the board requesting formal clarification of the procedures for nominating directors at the 2014 Annual Meeting, and inquired as to the following: Will nominating shareholders be required to comply with the 3%/3-year requirement that the Arbitration Panel decisively struck down on two separate occasions? Will nominating shareholders be required to comply with unreasonable information requirements such as presenting all of their shares in certificated form? Will the board insist that two members of the five-member board must be RMR employees thereby limiting the board seats up for election in 2014 to just one seat? Shouldn’t the answer to each question be an obvious “no” in light of both the Panel’s November 18 ruling as well as the Portnoys’ purported claim to “understand the views of” shareholders and make “meaningful governance” changes? Would shareholders find themselves in a repeat of the events of the past year if they were to attempt to nominate directors at the 2014 Annual Meeting? In the past year, the existence of the “Silent Bylaw” at CWH has been revealed: shareholders must expend exorbitant sums to litigate against the current Trustees in order to exercise their fundamental right to vote Why not simply seek minority board representation at the Annual Meeting? Regrettably, the Trustees refused to answer these simple questions |

|

15 The Portnoys Continue to Show Their True Intentions Inescapable Conclusions from the Portnoys’ Actions The Portnoys have not demonstrated a genuine interest in true governance reform and remarkably continue, to this day, to generate evidence to the contrary We also have little faith that that the Portnoys have “turned over a new leaf” The Board’s supposed gradual journey down the winding road to true governance reform is a red herring, in our view designed to mislead shareholders into voting for them in the upcoming consent solicitation We believe what drives the Portnoys’ actions is that they view control of CWH as binary, either they have dominant control or they do not In other words, either the “Perpetual Fee Stream” built over the past 27 years is secure, or it is not In our view: the Portnoys’ governance proposals are not real, the Portnoys’ intentions are not genuine, and the board has demonstrated once again, with actions taken as recently as last week, the basic truth at CWH: “Perpetual Fee Streams” are a powerful motivator for dodging accountability We do not believe that, at the 2014 Annual Meeting and at Annual Meetings to follow, shareholders will be afforded a fair and unfettered election process |

|

16 The Portnoys Continue to Show Their True Intentions Inescapable Conclusions from the Portnoys’ Actions (cont.) Underperformance as undisputedly poor as it is at CWH is rare Existing governance policies as egregious as they are at CWH is rare How often do ISS and Glass Lewis support removal of an entire board? Entrenchment tactics (e.g., secretly lobbying to amend the law) as appalling as they are at CWH is rare In how many other instances has a shareholder been forced to expend exorbitant sums in order to exercise a right plainly written in the company’s charter for 27 years? Traditional channel of change via minority board representation highly unlikely to succeed Management actions from as recently as last week belie “turned leaf” intentions, implying another contentious battle would be likely at the Annual Meeting – the “Silent Bylaw” “Perpetual Fee Streams” a powerful incentive to maintain “Accountability Vacuum” In the meantime, shareholders will likely continue suffering from the same operating, strategic planning, and share price underperformance under the same management team that has plagued CWH for years We believe the negative outcome of pursuing the traditional channel of change is already knowable given the Portnoys’ long-term history and their most recent actions While the removal of an entire board is not a decision to be taken lightly, the case for removal could not be easier to make than it is at CWH |

|

17 Corvex/Related’s True Intentions Track Record Provides Compelling Insight Out of all the investments in public companies Corvex made since inception, including the 8 in which 13-D’s were filed, none have resulted in a proxy battle, litigation, or even a public dispute, with the exception of CWH On the other hand, none of the companies in which Corvex has ever invested has attempted to take away a shareholder right that is plainly written into its charter The share prices of the companies as to which Corvex filed 13-D’s have on average experienced substantial appreciation during the period of Corvex’s involvement Corvex prefers constructive engagement Related’s core business lies in real estate investment and operations and it has never previously engaged in a hostile proxy battle Related prefers constructive engagement Corvex and Related prefer constructive engagement, but as shareholders must insist on true accountability and genuine corporate governance reform Corvex has no history of hostile proxy battles or litigation with companies in its portfolio and, instead, works collaboratively with management to create value |

|

18 Corvex/Related’s Strategic Plan Key Tenets of Plan Will Create Substantial Value The fair and unfettered election of a new board consisting solely of truly independent Trustees – New board to have experience overseeing an internally managed public REIT – We welcome and are actively seeking out candidates from other large shareholders Best-in-Class corporate governance to fill the “Accountability Vacuum” – Amend existing Declaration of Trust and bylaws to conform to ISS and Glass Lewis best practices Internalize management and align management compensation with shareholder returns “Right the ship” with basic operating strategies – We believe proper staffing levels and reinvestment in CWH’s existing portfolio can harvest a substantial amount of “low hanging fruit” No poison pill – Adoption of a policy against new pills without shareholder approval Cease all acquisition activity and dilutive capital raises until stock price exceeds its NAV Cease all related party transactions not approved by a vote of disinterested shareholders Corvex and Related continue to propose the following Strategic Plan: Although dramatically different from CWH’s existing plan, the implementation of these principals will simply make CWH look like virtually every other member of the S&P 500 |

|

19 Corvex/Related’s Strategic Plan Our Key Principals of Best-in-Class Corporate Governance Annual elections for all Trustees beginning at the next Annual Meeting (no staggered board) – Plurality vote for contested elections A conventional notification process for trustee nominations and other important Company business – i.e., elimination of unreasonably burdensome ownership/holding period requirements and other procedural roadblocks No changes to these provisions without a shareholder vote Corvex/Related simply propose to grant shareholders the most basic of shareholder rights: Without each of these simple but powerful changes to CWH’s governance, there cannot be permanent accountability, and shareholders will be resigned to the continuation of the downward spiral of CWH under Portnoy control |

|

20 Corvex/Related’s Strategic Plan Operating Strategies: Updated Findings from the Field Based on repeated feedback from tenants, brokers and owner/operators across CWH’s markets regarding their experience with RMR, we believe: Many leasing brokers representing tenants across CWH’s markets steer tenants away from RMR-managed properties because of a lack of attention from RMR personnel RMR often fails to execute simple asset and property management functions, such as responding to tenant work requests, and challenging real estate tax assessments “Blake Schreck, president and economic development director for the Lenexa Chamber of Commerce, didn't sound unhappy about Southlake Technology Park changing hands. He echoed multiple local commercial real estate brokers, who indicated that CommonWealth's slow response to requests for lease proposals from prospective tenants had likely cost the 933,0000-square-foot office park deals and contributed to its 48 percent occupancy rate.” Kansas City Business Journal, October 23, 2013 Over the past six months, representatives from Corvex and/or Related have independently performed detailed site visits on approximately 85% of the portfolio |

|

21 Corvex/Related’s Strategic Plan Operating Strategies: Updated Findings from the Field (cont.) RMR employees appear to service assets for CWH, SIR, GOV, HPT, SNH and the Portnoys’ privately owned real estate, encompassing office, retail, hospitality, senior housing, land and other property types Leasing staff is half the appropriate level and a true asset management department is non- existent, in our opinion It appears that the deficient staffing levels are kept low not because RMR’s staff are the most efficient in the REIT universe, but in order to generate profits for the Portnoys, a problem that other, internally-managed REITs do not have Clearly, assets that are suffering from poor management should only be sold after first maximizing value for CWH shareholders Opportunistic funds with expensive capital (such as Oaktree Capital and Garrison Investment Group) were among the largest buyers of assets in the last round of CWH dispositions We believe there are too few employees spread over too many assets and product types: A key tenet of our Strategic Plan continues to be the implementation of basic operating strategies that “right the ship” and harvest a substantial amount of “low hanging fruit” for CWH shareholders, not opportunity funds But implementation is impossible under the current externally managed structure |

|

22 Corvex/Related’s Strategic Plan Peaceful Transition of Authority – “Plan A” To eliminate the already miniscule risks, the board members could implement the following to protect CommonWealth and its shareholders: We also point out that the Arbitration Panel will remain available for resolving disputes even after the removal of the Trustees and during the transition to a newly elected board While we wholeheartedly dismiss the scare tactics employed by the Portnoys, that a removal of Trustees will cause the business material harm, we ironically point out that the sitting board members could easily preclude any of their imagined disruptions from occurring by acting responsibly in advance of a consent solicitation If shareholders are concerned that the Portnoys and the incumbent board will work against shareholder interests, perhaps that will make the upcoming vote an even easier one to decide Agree to allow nominations of replacement Trustees concurrently with the removal of existing Trustees Request waivers under existing financing agreements regarding a change in control or arrange for replacement facilities RMR could remove language or simply agree not to immediately terminate its management of the assets in the event of a change in control |

|

23 Corvex/Related’s Strategic Plan Disruptive Transition of Authority – “Plan B” In the event the Trustees are not cooperative in transitioning authority, Related and Corvex, clearly incentivized to minimize disruption as one of CWH’s largest shareholders, have a plan to protect the Company Shareholders should not be coerced into voting for the current board out of fear that the existing Trustees will “burn down the house” on the way out the door Jim Lozier, a 30+ year industry veteran, can be retained to lead the company on an interim basis Mr. Lozier served as co-founder and CEO of the Archon Group L.P., a subsidiary of Goldman Sachs, from its formation in 1996 until 2012 During Mr. Lozier’s tenure at Archon, the company grew from 320 employees to 8,500 employees managing 36,000 assets with a gross value of approximately $59 billion CBRE, one of the world’s largest integrated real estate services firms, has agreed to provide interim property management services Successfully managed transition of leasing / management services for 1.2 billion square feet of commercial properties in the U.S. over the previous nine years, including transitions done under significant time pressure Related and Corvex have agreed to purchase up to 51% of the bank debt in order to prevent acceleration of the Company’s debt |

|

24 The Choice is Clear Summarizing the Key Issues Rampant conflicts • A company controlled by its managers, who own little stock and interested primarily in fees Accountability vacuum • A manager that answers only to itself Worst-in-class corporate governance • *All out efforts to deny shareholders their fundamental right to vote Underperformance • Long term downward spiral driven by conflicts, “Accountability Vacuum” and poor governance Illusions • “Check-the-box” governance proposals that effect zero real change False hope • Board’s track record belie the notion that they have embarked on a journey of true governance reform Retaining the current board will doom CWH to repeat its tortured history Removing the current board will enable CWH to begin a new chapter as a new, truly independent company Alignment of incentives • Like virtually all companies in the S&P500, CWH should have its own internal management team, compensated to increase shareholder value Accountability • Annual elections to hold the board and management team accountable for performance Best-in-class corporate governance • We support a new board that will implement ISS/Glass Lewis best practices Real, tangible change • We support a new board that would commit to implement the changes above immediately • We support a CWH that is truly independent and would cease all related party transactions not approved by disinterested shareholders |

|

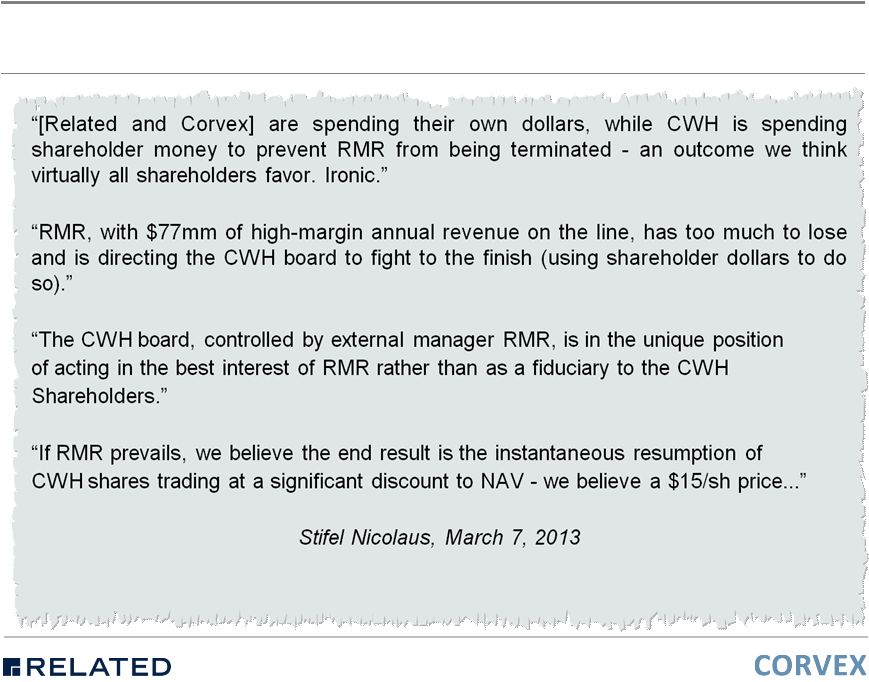

26 The Portnoys’ September 23 rd Proposals Wall Street’s View “Our sense is RMR is making the structure ‘less bad’ and more palatable to investors ahead of a possible second consent solicitation vote… CWH’s externally managed structure is a relic that has long been shunned by REIT investors. It should not have taken this long. We would prefer a full internalization. Also, there are too many executives wearing too many hats. Adam Portnoy is President of RMR and CEO of CWH. Our sense is a dedicated CWH CEO is a possibility in the future, but that internalization is “off the table” likely due to inherent conflicts in negotiating a deal and valuing the manager.” Citigroup, September 23, 2013 |

|

27 Flawed RMR Structure and Poor Corporate Governance “Acting in the best interest of RMR rather than as a fiduciary” |

|

28 CommonWealth Corporate Governance Review The Consequences of External Management and Poor Governance Fees paid to RMR continue to grow, while CWH shareholder value is destroyed CWH paid out $395 million in fees to RMR during 2007-2012 (nearly 30% of CWH’s market cap as of 2/25/13 (1) ), while CWH’s share price plummeted 68% during this time '07-'12 2007 2008 2009 2010 2011 2012 Total Fees Paid Out to RMR $59.7 $63.2 $62.6 $62.2 $69.5 $77.3 $394.6 RMR Fees % Growth -- 5.9% (1.0%) (0.5%) 11.7% 11.2% 29.5% RMR Fees as % of: CWH Market Cap 4.5% 4.8% 4.7% 4.7% 5.2% 5.8% 29.7% CWH Market Cap, Cumulative 4.5% 9.3% 14.0% 18.6% 23.9% 29.7% 29.7% CWH Cumulative Stock Price Return (37.4%) (74.7%) (46.0%) (48.4%) (66.3%) (67.9%) (67.9%) (1) Market cap of $1.3 billion based on a closing price of $15.85 on February 25, 2013, the day prior to Related and Corvex’s first public filing. (2) RMR fees paid per CWH public filings. |

|

29 History of Underperformance Track Record CWH has in our view performed poorly in absolute terms and underperformed its peers (1) on almost any metric over any relevant time period -17%, -45%, -43%, -45%, and -53% CWH stock price return over the last 1 year, 2 years, 3 years, 5 years, and 10 years, respectively (2) Recent valuation nearly 40% below peers on unlevered cap rate basis (3) 53% and 41% discount to peers on a price / forward FFO multiple basis for last year and 3 years, respectively -23% cash available for distribution per share (CAD / share) growth since 2010, the worst performance of its peers $2.7 billion of net acquisitions and capex since 2007 (over 2x CWH’s recent market cap (3) ), while CWH book value per share is essentially flat In our view, there is absolutely no way to slice and dice the data in favor of the Portnoys – their performance has been horrible (1) Select peers include Piedmont Office Realty (PDM), Highwoods Properties (HIW), Mack-Cali Realty (CLI), Brandywine Realty (BDN), and Parkway Properties (PKY). (2) Returns data calculated through February 25, 2013, the day prior to Related and Corvex’s first public filing. (3) Based on a closing price of $15.85 on February 25, 2013, the day prior to Corvex and Related’s first public filing. |

|

30 History of Underperformance Share Price Performance – 3 years CWH has underperformed its peers over the last three years Source: Factset 1 year 3 year PKY 60.2% (0.7%) BDN 19.1% 15.4% HIW 9.8% 21.4% PDM 10.1% 16.1% CLI (5.0%) (18.9%) Average 18.8% 6.6% CWH (16.9%) (42.9%) CWH – Avg. 35.7% 49.5% HIW: 21.4% PDM: 15.4% CWH: (42.9%) PKY: (0.7%) CLI: (18.9%) BDN: 16.1% |

|

31 Dilutive Equity Offering A Prime Example of RMR’s Conflict of Interest Despite protests from some of its largest shareholders, a bona fide offer for $27.00 per share, and in our view no need to issue equity, on March 5, 2013 CWH sold 34.5 million shares at $19.00 – Transaction increased CWH’s share count by 41% and diluted CWH’s NAV by over $6 per share Why did CWH sell its $240 million minority stake in GOV only after issuing new CWH shares at a 48% discount to book value? – Trustees insulated themselves from questioning and ignored shareholder demands to stop offering – Canceled investor lunch and did not hold Q&A on their earnings call CWH’s use of proceeds for the equity offering, at a massive discount, was to repay debt trading at prices ranging from 102% to 111% of par – Remarkably, CWH did not have any upcoming maturities or liquidity issues associated with this debt or any debt – However, equity offering increases Company’s equity base, creating additional capacity to do acquisitions and thereby pay more management fees to RMR We believe the equity offering completed in March 2013 serves as a clear example of poor management, skewed incentives, and terrible capital allocation |

|

32 Failed Maryland House Bill Amendment A Desperate Tactic from an “All or Nothing” Adversary Proposed amendment would have opened door to make it impossible to remove Trustees without cause in many Maryland companies (regardless of voting threshold), even if shareholders had explicit right to do so in a company’s charter Similar to March 1st bylaw amendment, CWH couched proposed amendment as a “clarification” We believe notion that amendment was a “clarification” is absurd, a view confirmed by the Arbitration Panel, as existing Maryland law expressly contemplates removal of staggered board without cause when provided for in a company’s charter – as is unequivocally done in CWH’s Declaration of Trust CWH used deceptive letters (which were later withdrawn) from a conflicted attorney in an attempt to mislead Maryland senators into believing amendment had broad legal support and was ministerial, when in fact it had not even been discussed by key Maryland bar committee (1) Fortunately for CWH shareholders and all shareholders of Maryland-based corporations and trusts, the amendment quickly died once legislators became aware of CWH’s manipulative behavior and the clear fact that the amendment was substantive and not at all a “clarification” Current Trustees would rather manipulate the Maryland legislative process and change the law than face their own shareholders The Portnoys made a secret attempt (likely using CWH money) to insert an 11th hour amendment into a Maryland House Bill (1) The proposed amendment was not even discussed by the Corporation Law Committee of the Business Law Section of the Maryland State Bar Association, a group which typically reviews and comments on all changes to Maryland corporate and REIT law before changes are heard by the General Assembly. |

|

33 Corvex/Related’s Corporate Governance Proposals A Simple Blueprint for Change CommonWealth can then elect a board of Trustees that: – Is truly independent (per ISS’s definition) – Implements and can describe to shareholders the procedures designed to ensure its independent Trustees can continue to operate independently – Is accountable to shareholders – Hires its own independent advisors when necessary – Systematically sets performance goals for the management team, measures its performance, and holds it accountable for its failures – Objectively benchmarks its corporate governance policies against peers – Challenges management’s thinking on material strategic issues when appropriate In short, shareholders can elect an experienced, independent board charged with being their advocate, a right that virtually all other public shareholders in the S&P 500 enjoy When control of CommonWealth is returned to shareholders the conflict of interest between manager and owner will be eliminated, allowing CWH to join the ranks of nearly every other company in the S&P 500 |