UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

COMMONWEALTH REIT

(Name of the Registrant as Specified In Its Charter)

CORVEX MANAGEMENT LP

KEITH MEISTER

RELATED FUND MANAGEMENT, LLC

RELATED REAL ESTATE RECOVERY FUND GP-A, LLC

RELATED REAL ESTATE RECOVERY FUND GP, L.P.

RELATED REAL ESTATE RECOVERY FUND, L.P.

RRERF ACQUISITION, LLC

JEFF T. BLAU

RICHARD O’TOOLE

DAVID R. JOHNSON

JAMES CORL

EDWARD GLICKMAN

PETER LINNEMAN

JIM LOZIER

KENNETH SHEA

EGI-CW HOLDINGS, L.L.C.

DAVID HELFAND

SAMUEL ZELL

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

|

The Portnoys Unsuccessfully Try To Change Maryland Law A Case Study On The Portnoys’ True Intentions And The Pernicious Effects Of External Management |

|

2 Introduction • One of the most outrageous tactics the Portnoys employed to preserve their fee stream was a clandestine lobbying effort to amend a Maryland statute during the 2013 legislative session • The effort was intended to permanently eliminate the ability of shareholders to remove CommonWealth trustees without cause by a two-thirds vote and was spearheaded by Barry Portnoy, who hired lobbying firms and visited with selected legislators without any public disclosure to CommonWealth shareholders • We believe this is a quintessential example of the fundamental conflict of interest plaguing CWH: – Why was an external service provider who holds virtually no shares in CWH actively lobbying the government to short-circuit the Company’s 28-year charter and strip the only right shareholders have to hold this Board accountable? – Why has there been no disclosure regarding the amount of shareholder funds spent by CWH to eliminate a key right of its own shareholders? – Why has there been no disclosure regarding who authorized RMR to undertake these actions and which lobbying firms have been retained? • Equally appalling was the manner in which the Portnoys attempted to change the law: by grossly mischaracterizing their proposal as a mere “clarification” of existing Maryland law and quietly inserting the proposal at the 11 hour of the legislative session – Why did the Portnoys attempt to railroad their proposal through the Assembly at the last minute rather than process it through the Assembly’s standard, open legislative process? – Had we not been fortunate enough to hear from an assembly staffer on the day prior to the last minute hearing, shareholders would have never been able to present their case regarding the “clarification” th |

|

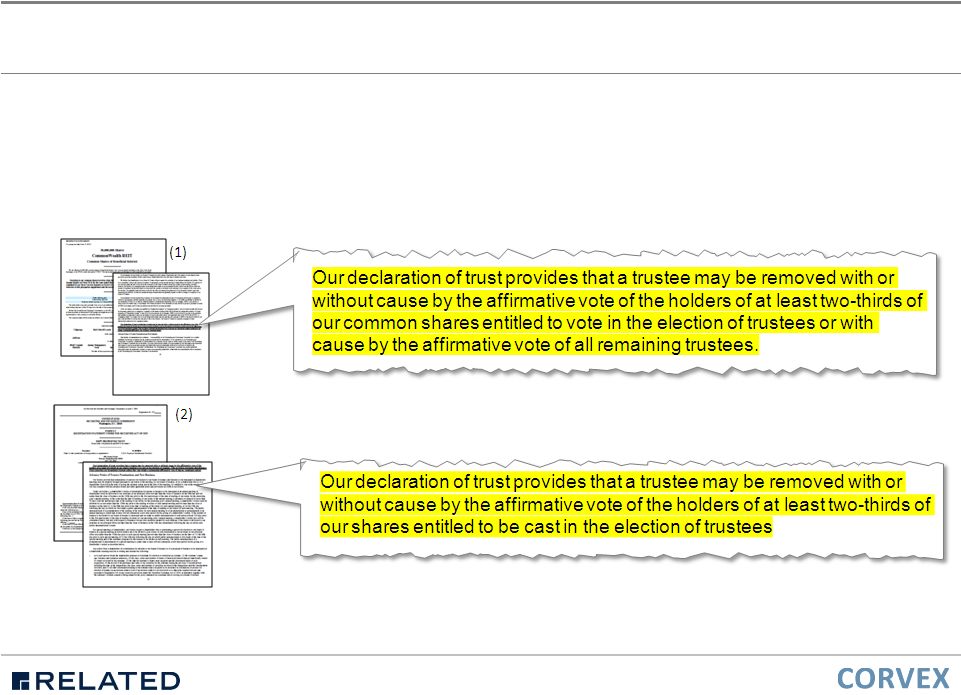

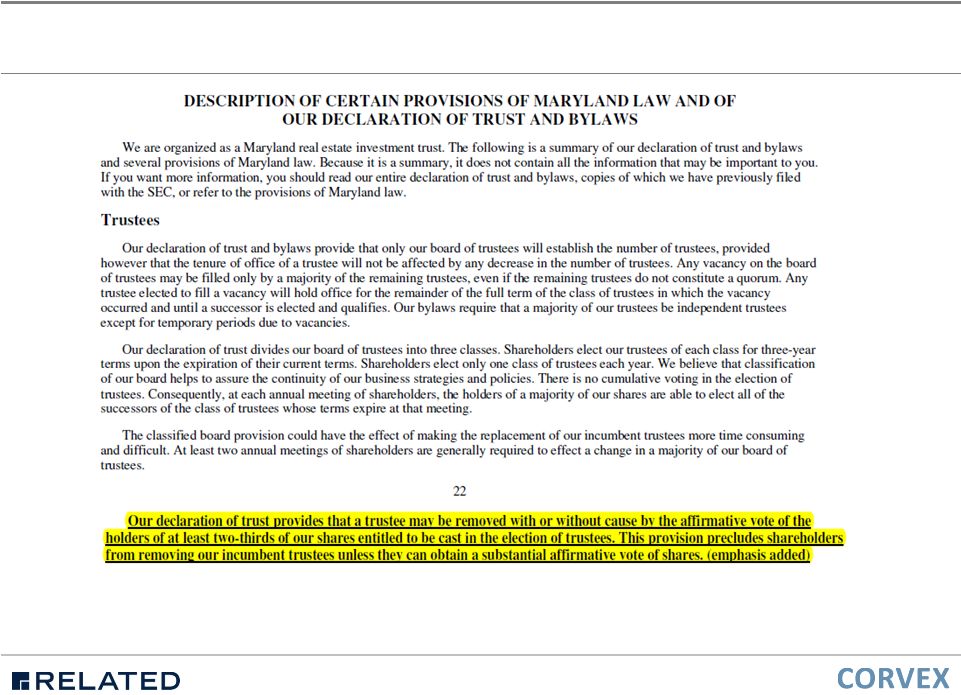

3 CommonWealth’s Charter Always Allowed Removal Of Trustees Without Cause • Since CommonWealth’s IPO in 1986, its charter has unambiguously stated that trustees of the Company can be removed by shareholders without cause with the affirmative vote of holders of 2/3 of the outstanding shares • This fact had been consistently reflected in CommonWealth’s public filings with the Securities and Exchange Commission for almost three decades (1) Prospectus Supplement filed by CommonWealth REIT, dated February 27, 2013 (See Appendix A) (2) S-3 Registration Statement filed by CommonWealth REIT (HRPT Properties Trust at that time) on April 7, 2004 (See Appendix B) |

|

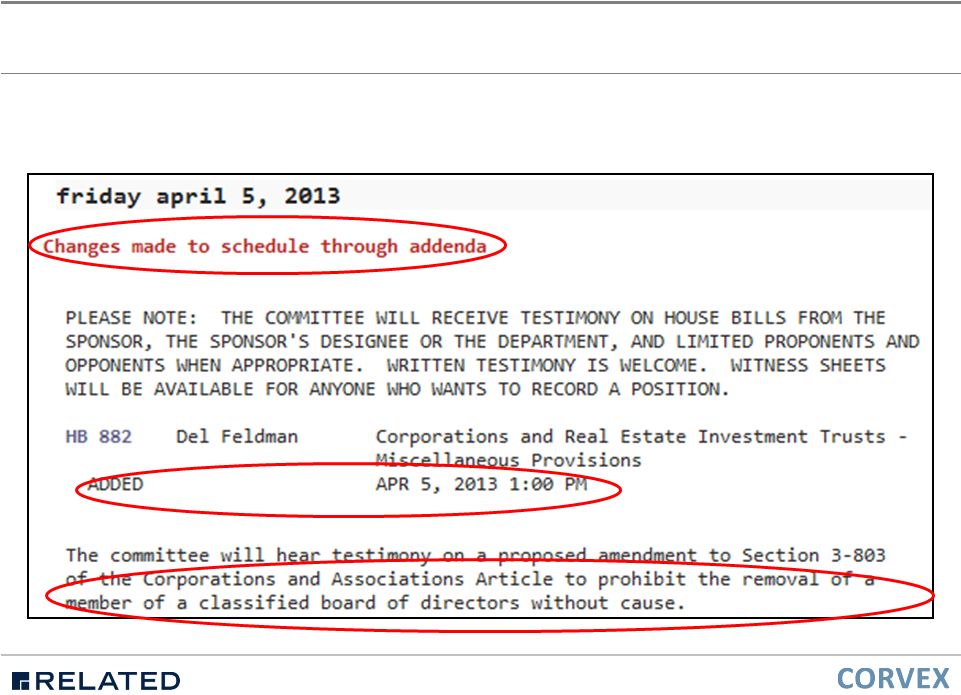

4 • On April 4, 2013, it first came to our attention that Barry Portnoy and RMR had hired a lobbying firm in Annapolis, and had secretly been lobbying selected members of the Maryland General Assembly to introduce a last minute change to a pending Senate Bill to amend various provisions of the Maryland corporate code • The proposed amendment, if approved, would have enabled Barry Portnoy and his beholden Trustees to unilaterally remove the “without cause” removal provision from the charter, eliminating the right of CommonWealth shareholders to remove the Board with an affirmative 2/3 vote – Effectively, the Portnoys were attempting to rewrite the charter to finally cement their control over CommonWealth for good • Barry Portnoy, with the assistance of CommonWealth’s conflicted Maryland counsel, grossly mischaracterized the amendment as a “clarification” of existing law • Appendix C contains a copy of the letter submitted by RMR itself to the Maryland Senate Judicial Proceedings Committee If a critical shareholder right could be unilaterally wiped from the charter by the Board, why was this highly material governance risk never disclosed in SEC filings? The Portnoys’ Legislative “Clarification” |

|

5 • A hearing was held by the Senate Judicial Proceedings Committee on the Portnoy amendment on April 5, 2013, one day after we first learned of RMR’s lobbying efforts The Portnoys’ Legislative “Clarification” |

|

6 Maryland Senators Saw Through The Portnoys’ “Clarification” • At the hearing a number of Senators recognized the RMR-sponsored amendment for what it was: a substantive change in Maryland law, not a “clarification” (1) Judicial Proceedings Committee of the Senate of the Maryland General Assembly on April 5, 2013 Senator Christopher B. Shank: “…We do clean-up bills all the time. We’ve had several bills dealing with, you know, dotting some T’s and – or dotting some I’s and crossing some T’s, it happens all the time. But I keep hearing clarification from the proponents here. This bill originally passed in 1999. It’s now 2013. It seems to me if you clarify something, you do it, oh, hey, we forgot about this, we probably ought to do it a year later. What we’re really talking about here is it goes beyond clarification, it is addressing what is a contemporary situation and possibly circumventing a court’s jurisdiction on it. And if we need to do that, and I’m open to that idea, that we need to do it, but I think this goes well beyond a clarification…” (1) Chairman Brian E. Frosh: “... Well, I mean the reasons we are having a hearing is because we know it is a substantive change in the law and we want to get the two different sides on that...” (1) Senator Jamin B. (Jamie) Raskin: “...I mean I certainly agree it is a substantive change they are looking for without it necessarily being a complete reversal.” (1) |

|

7 The Portnoy Amendment Was Not Approved – Shareholder Rights Are Preserved The Maryland Senate Judicial Proceedings Committee did not approve the Portnoy amendment and the Maryland corporate statute was not amended |

|

8 Despite Their Defeat In The Senate, The Portnoys Weren’t Done Distorting The Truth • Despite their legislative defeat, on April 12, 2013, CommonWealth “opted-in” anyway to Section 3-803 of the Maryland Unsolicited Takeovers Act – the same statute that they had just failed to “clarify” – In CommonWealth’s view, “opting-in” eliminated the right of CommonWealth shareholders to remove the Trustees without cause – But if this were true, why did CommonWealth lobby the legislature to “clarify” the law and why did this attempt fail? • The Portnoys’ newly found interpretation of Section 3-803 was in our view preposterous – especially in light of decades of public disclosure by CommonWealth (which nowhere discussed Section 3-803) and the fact that the Portnoys’ “clarifying” amendment had just been defeated at the legislative level • In fact, in its November 2013 ruling, the Arbitration Panel agreed with us: – “According to CWH’s Declaration of Trust, the Trustees can be removed at any time with or without cause by two-thirds of the shareholders. The Panel concludes that CWH’s election to opt into Section 3-803 of MUTA does not alter the CWH shareholders’ explicit ability under the Declaration of Trust to remove Trustees without cause.” |

|

9 Inescapable Conclusions Regarding The Portnoys’ True Intentions The Portnoys’ intentions are revealed in their actions, not in their promises or what is written in their governing documents • In attempting to change the law in order to short-circuit the Company’s charter and avoid subjecting themselves to accountability, the Portnoys have demonstrated they are not the typical self-interested market participant • The Portnoys’ extraordinary undertaking in Maryland provides perhaps the clearest evidence possible of both their true intentions as well as the pernicious effects of the conflicted external management structure at CWH – No party whose interests were truly aligned with that of shareholders would have sponsored secret legislation to eviscerate shareholder rights If the Portnoys could so brazenly break a promise written in the Company’s charter for 28 years, how easy will it be to break promises made a mere 3 months ago? Nothing stops the Portnoys and RMR from sponsoring a new legislative “clarification” in 2015 |

|

Appendices Appendix A: CWH Prospectus Supplement, Dated February 27, 2013 Appendix B: CWH S-3 Registration Statement, Dated April 7, 2004 Appendix C: Letter From RMR To Maryland Senate Judicial Proceedings Committee 10 |

|

11 Appendix A: CWH Prospectus Supplement Dated February 27, 2013 |

|

12 Appendix B: CWH S-3 Registration Statement Dated April 7, 2004 |

|

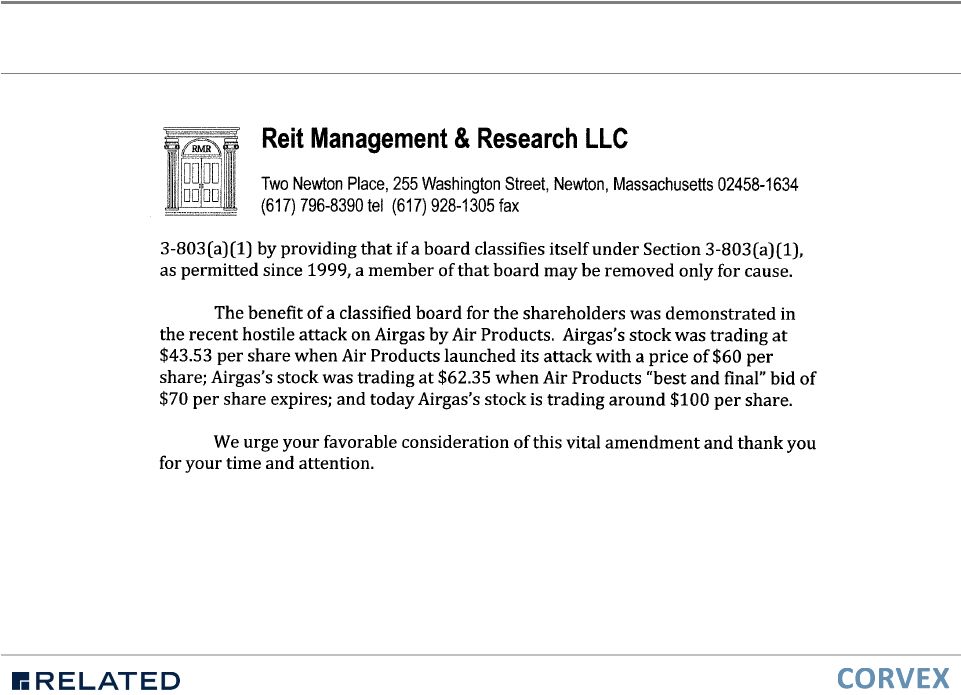

13 Appendix C: Letter From RMR To Maryland Senate Judicial Proceedings Committee |

|

14 Appendix C: Letter From RMR To Maryland Senate Judicial Proceedings Committee |

|

15 Appendix C: Letter From RMR To Maryland Senate Judicial Proceedings Committee |

|

Additional Information Regarding The Corvex/Related Solicitation 16 Corvex Management LP and Related Fund Management, LLC have filed a definitive solicitation statement with the Securities and Exchange Commission (the “SEC”) to (1) solicit consents to remove the entire board of trustees of CommonWealth REIT (the “Removal Proposal”), and (2) elect a slate of new trustees at a special meeting of shareholders that must be promptly called in the event that the Removal Proposal is successful. Investors and security holders are urged to read the definitive solicitation statement and other relevant documents because they contain important information regarding the solicitation. The definitive solicitation statement and all other relevant documents are available, free of charge, on the SEC’s website at www.sec.gov. The following persons are participants in connection with the solicitation of CommonWealth REIT shareholders: Corvex Management LP, Keith Meister, Related Fund Management, LLC, Related Real Estate Recovery Fund GP-A, LLC, Related Real Estate Recovery Fund GP, L.P., Related Real Estate Recovery Fund, L.P., RRERF Acquisition, LLC, Jeff T. Blau, Richard O’Toole, David R. Johnson, James Corl, Edward Glickman, Peter Linneman, Jim Lozier, Kenneth Shea, EGI-CW Holdings, L.L.C., David Helfand and Samuel Zell. Information regarding the participants in the solicitation and a description of their direct and indirect interests, by security holdings or otherwise, to the extent applicable, is available in the definitive solicitation statement filed with the SEC on January 28, 2014 and Supplement No. 1 thereto filed on February 13, 2014. |