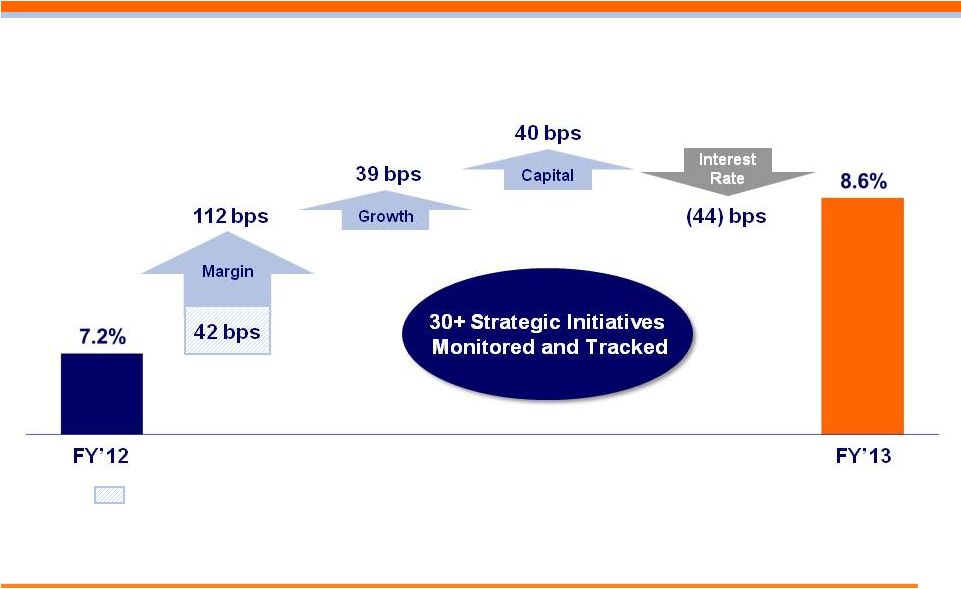

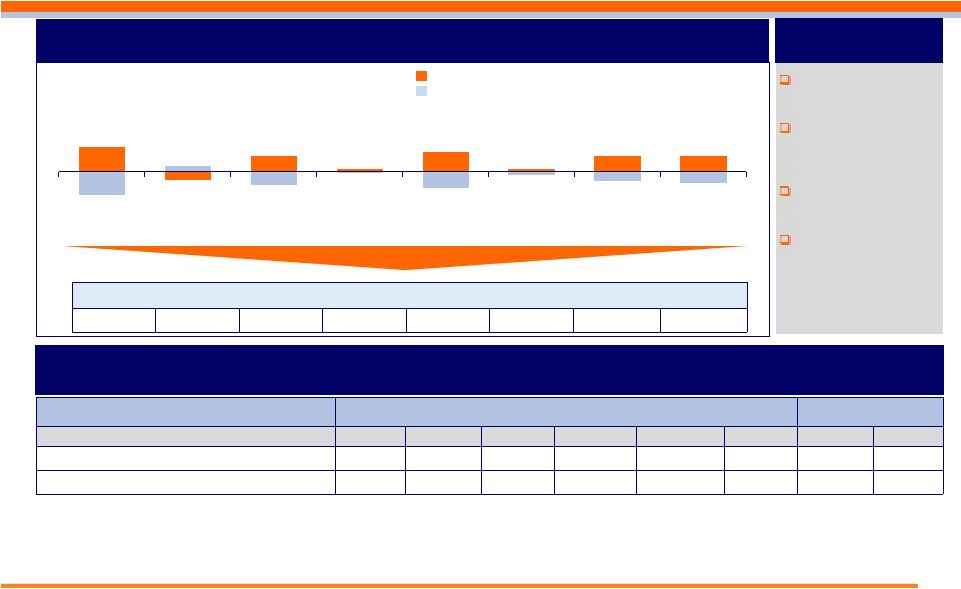

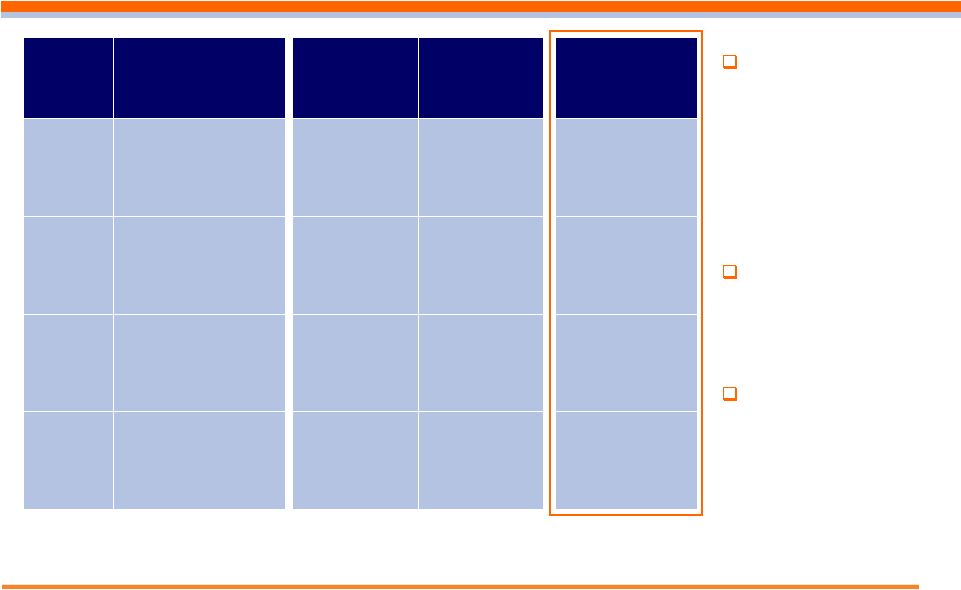

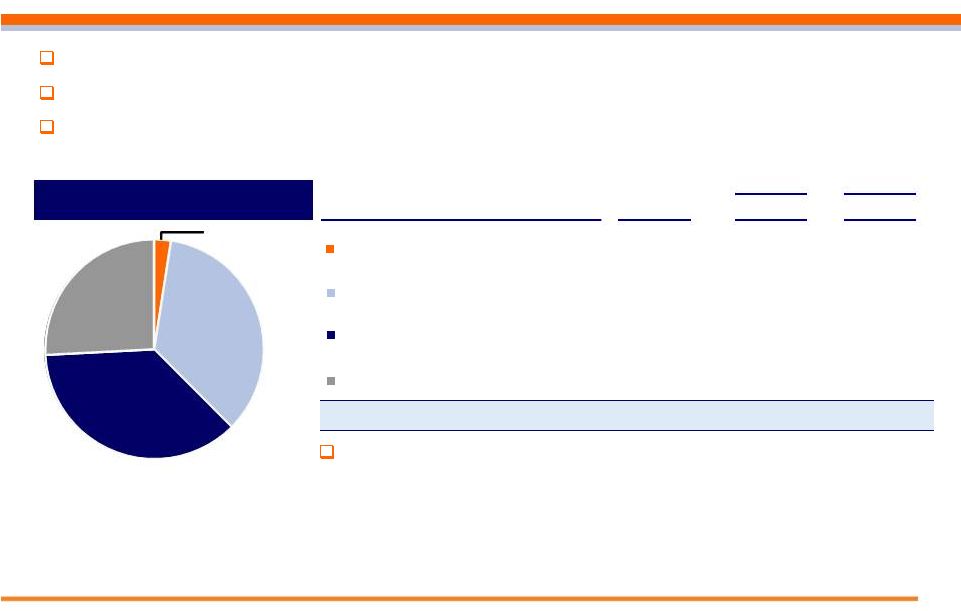

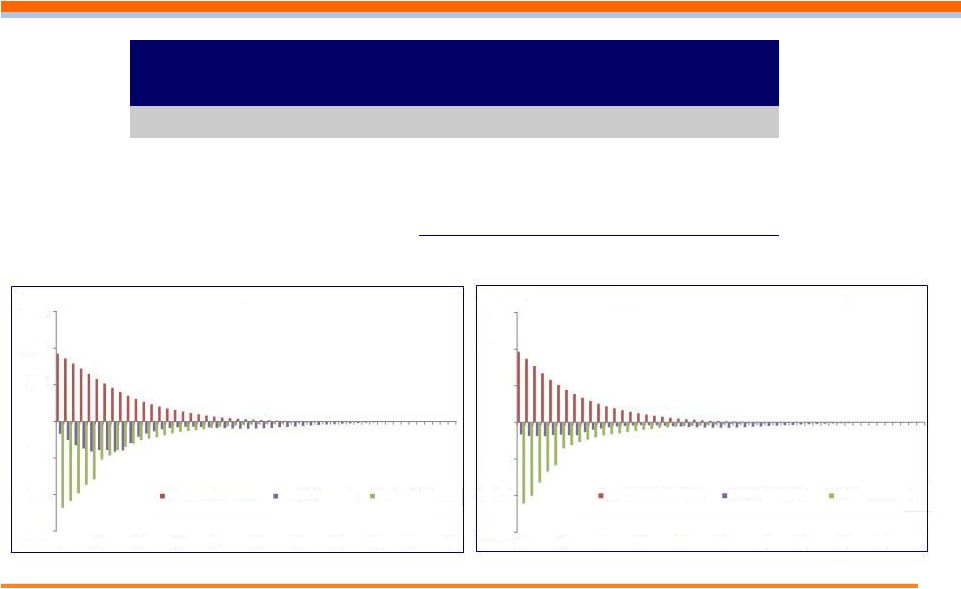

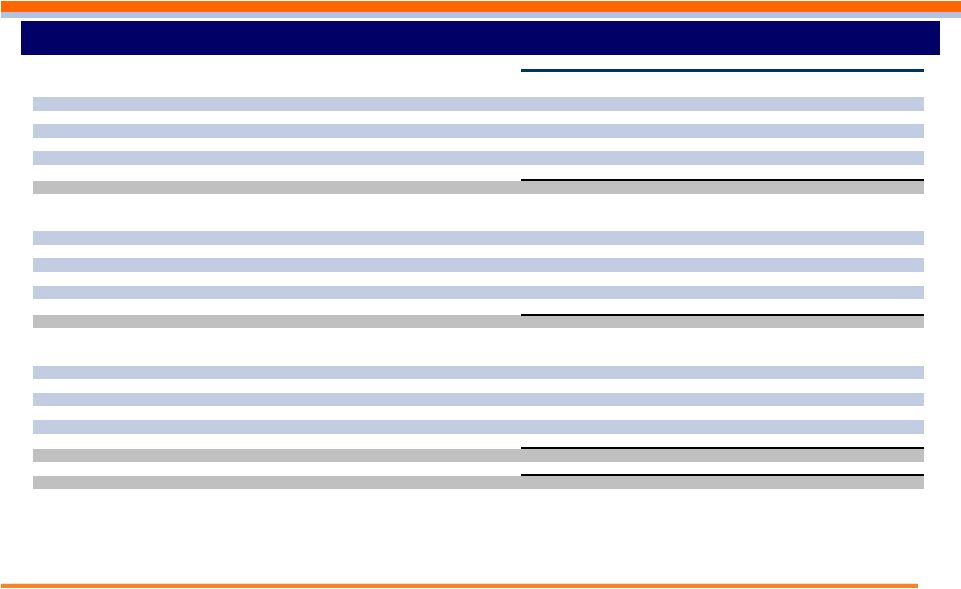

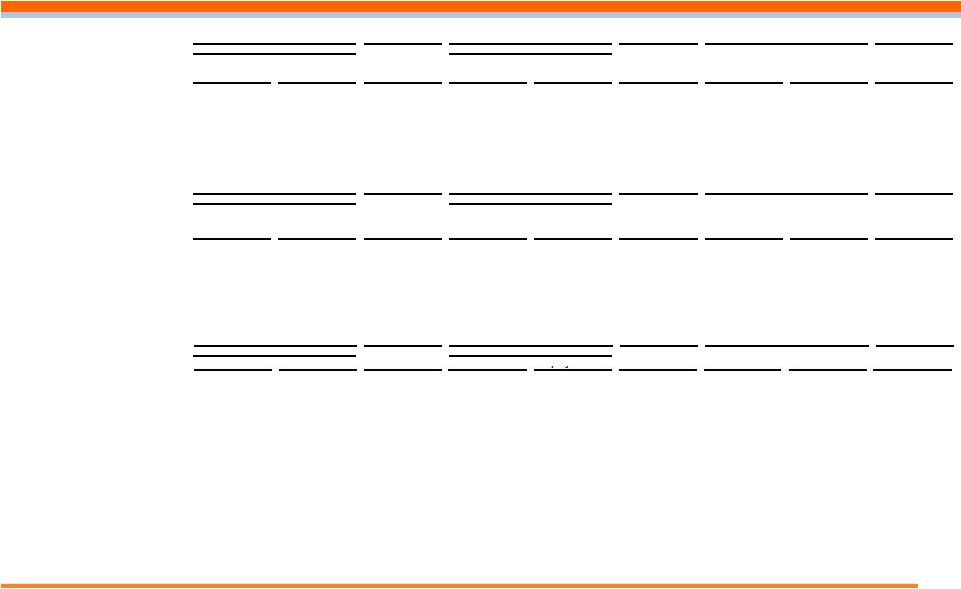

37 Reconciliation of Adjusted Operating Return on Capital and Return on Equity Retirement • Investments • Insurance (in millions USD, unless otherwise indicated) Retirement Annuities Individual Life Employee Benefits Beginning Capital (1)(2) 3,822 1,810 303 2,760 362 9,057 5,066 (150) 13,973 Ending Capital (2) 4,007 1,713 302 2,848 346 9,216 3,119 2,603 14,938 Average Capital (3) 3,915 1,762 303 2,804 354 9,137 4,092 1,226 14,456 Adjusted operating earnings before interest and after income taxes 349.2 128.0 107.2 136.7 66.5 787.6 - 10.6 798.2 Adjusted Operating Return on Capital 8.9% 7.3% 35.4% 4.9% 18.8% 8.6% - N/M 5.5% Adjusted Operating Return on Equity (4) 10.3% (in millions USD, unless otherwise indicated) Retirement Annuities Individual Life Employee Benefits Beginning Capital (2) 4,333 2,471 275 2,545 413 10,037 3,452 311 13,800 Ending Capital (2) 4,284 1,949 303 2,858 429 9,823 3,262 888 13,973 Average Capital (3) 4,308 2,210 289 2,702 421 9,930 3,357 599 13,886 Adjusted operating earnings before interest and after income taxes 308.1 129.7 86.0 115.7 71.0 710.5 - 39.6 750.1 Adjusted Operating Return on Capital 7.2% 5.9% 29.8% 4.3% 16.9% 7.2% - 6.6% 5.4% Adjusted Operating Return on Equity (4) 8.3% (in millions USD, unless otherwise indicated) Retirement Annuities Individual Life Employee Benefits Beginning Capital (2) 4,087 2,288 336 2,172 408 9,291 3,010 1,076 13,377 Ending Capital (2) 4,333 2,471 275 2,545 413 10,037 3,452 311 13,800 Average Capital (3) 4,210 2,380 306 2,359 410 9,665 3,231 693 13,589 Adjusted operating earnings before interest and after income taxes 258.5 79.1 56.9 185.7 54.1 634.3 - 61.5 695.8 Operating Return on Capital 6.1% 3.3% 18.6% 7.9% 13.2% 6.6% - 8.9% 5.1% Ongoing Business Operating Return on Equity (4) 7.6% (3) (2) (4) (1) Year Ended December 31, 2012 Retirement Solutions Investment Management Insurance Solutions Ongoing Business Closed Block Variable Annuity Corporate and Other Closed Blocks Consolidated Year Ended December 31, 2013 Retirement Solutions Investment Management Insurance Solutions Ongoing Business Closed Block Variable Annuity Corporate and Other Closed Blocks Consolidated Year Ended December 31, 2011 Retirement Solutions Investment Management Insurance Solutions Ongoing Business Closed Block Variable Annuity Corporate and Other Closed Blocks Consolidated Capital is allocated to each of our segments in proportion to each segment’s target statutory capital, plus an allocation of the differences between statutory capital and total ING U.S., Inc. shareholders' equity on a GAAP basis (excluding AOCI), based on each segment’s portion of these differences. Statutory surplus in excess of target statutory capital and certain corporate assets and liabilities, such as certain deferred tax assets and liabilities for unfunded pension plans, are allocated to the Corporate segment. Capital excludes "operating leverage". See "Average Capital and Financial Leverage" in the Statistical Supplement. Calculated as Beginning Capital plus Ending Capital, divided by 2. Assumes debt-to-capital ratio of 25% for all time periods presented, a weighted average pre-tax interest rate of 5.5% for all periods prior to the third quarter of 2013, when the company completed recapitalization, and the actual weighted average pre-tax interest rate for all periods starting with the third quarter of 2013. The 1/1/13 beginning capital is different than the 12/31/12 ending capital at the segment level due to certain reallocations of capital, primarily due to recapitalization activity (completed and anticipated). |