Exhibit 99.2

Quarterly Investor Supplement

March 31, 2014

This report should be read in conjunction Voya Financial, Inc.’s Quarterly Report on Form 10-Q for the three months ended March 31, 2014. Voya Financial’s Annual Reports on Form 10-K, and Quarterly Reports on Form 10-Q, can be accessed upon filing at the Securities and Exchange Commission’s website at www.sec.gov, and at our website at investors.voya.com. All information is unaudited.

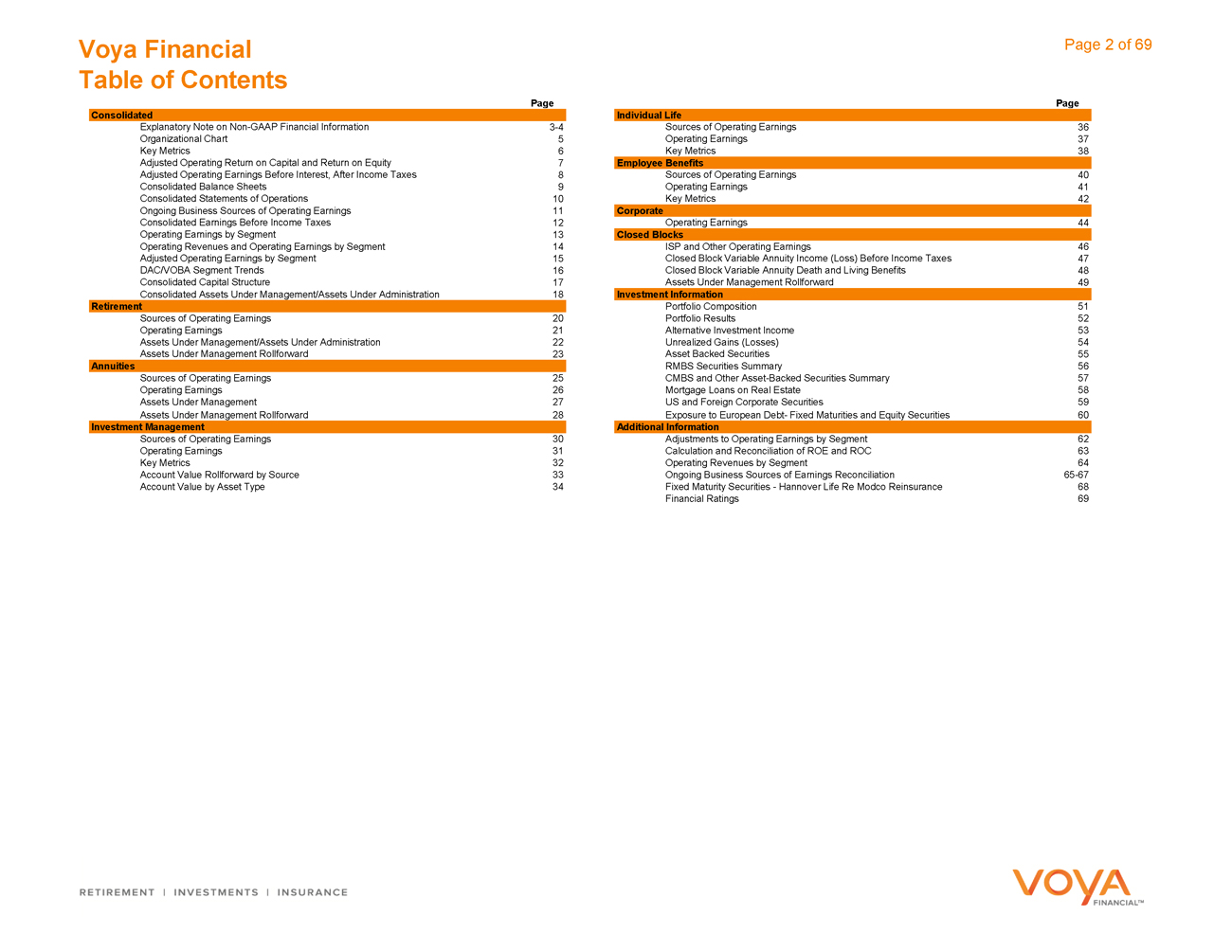

Voya Financial Page 2 of 69

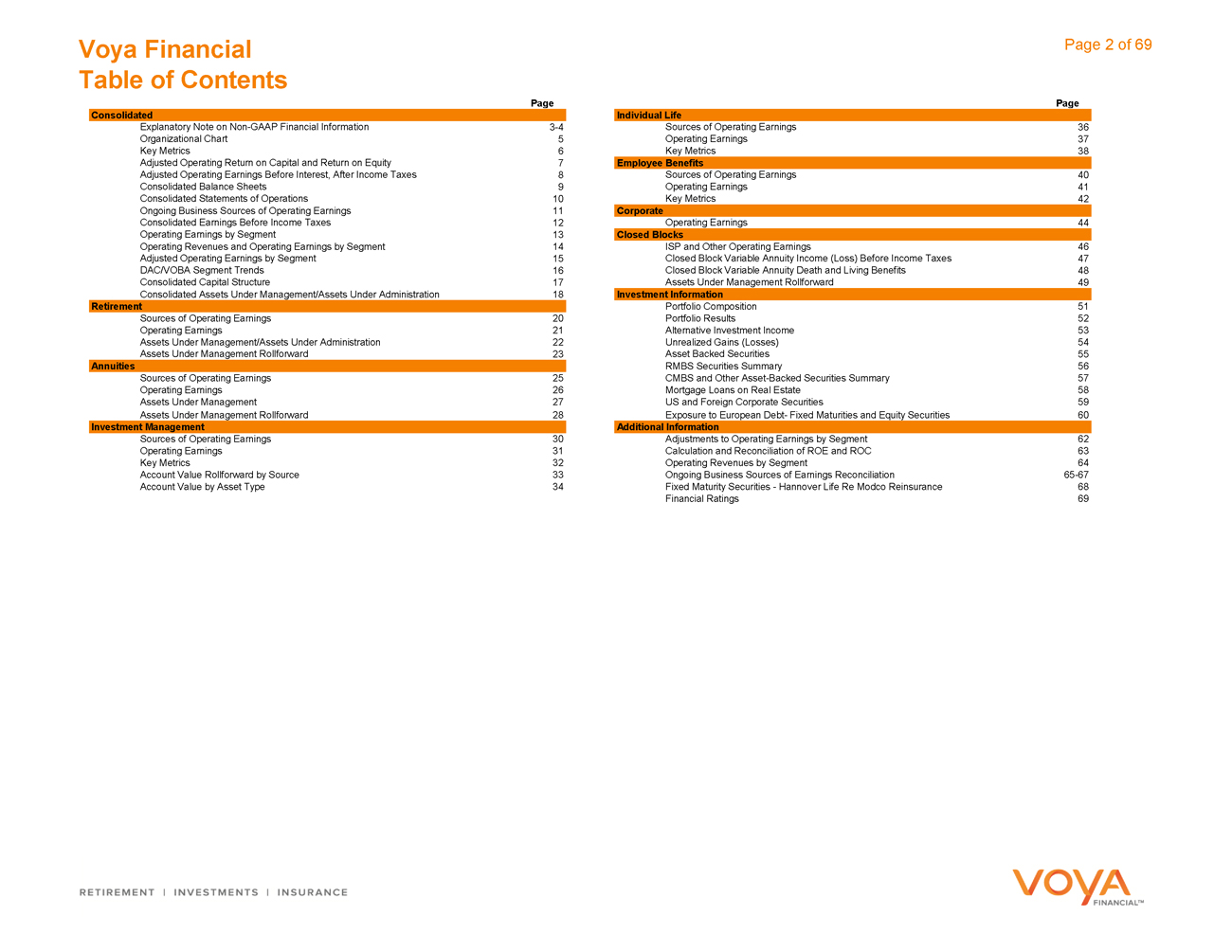

Table of Contents

Page Page

Consolidated Individual Life

Explanatory Note on Non-GAAP Financial Information 3-4 Sources of Operating Earnings 36

Organizational Chart 5 Operating Earnings 37

Key Metrics 6 Key Metrics 38

Adjusted Operating Return on Capital and Return on Equity 7 Employee Benefits

Adjusted Operating Earnings Before Interest, After Income Taxes 8 Sources of Operating Earnings 40

Consolidated Balance Sheets 9 Operating Earnings 41

Consolidated Statements of Operations 10 Key Metrics 42

Ongoing Business Sources of Operating Earnings 11 Corporate

Consolidated Earnings Before Income Taxes 12 Operating Earnings 44

Operating Earnings by Segment 13 Closed Blocks

Operating Revenues and Operating Earnings by Segment 14 ISP and Other Operating Earnings 46

Adjusted Operating Earnings by Segment 15 Closed Block Variable Annuity Income (Loss) Before Income Taxes 47

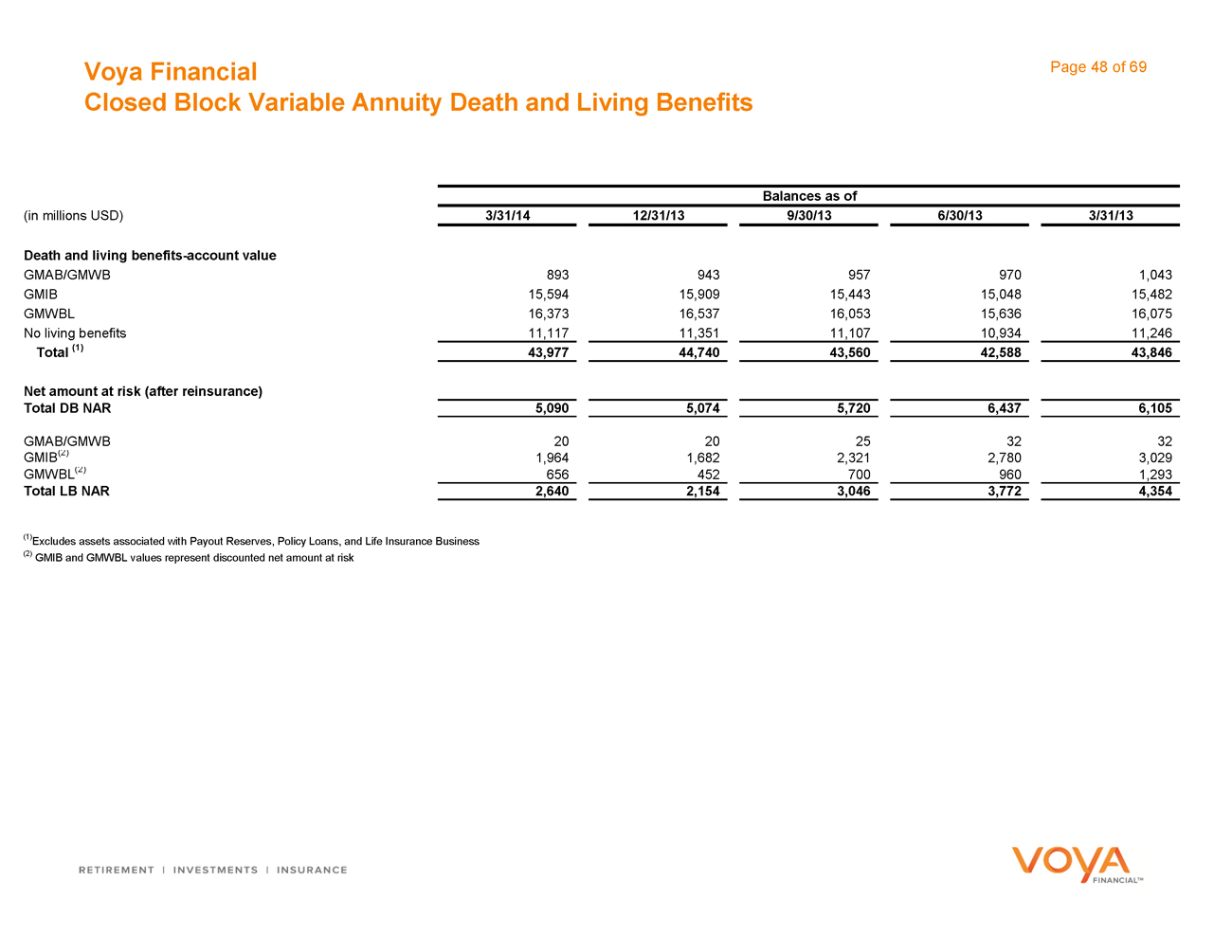

DAC/VOBA Segment Trends 16 Closed Block Variable Annuity Death and Living Benefits 48

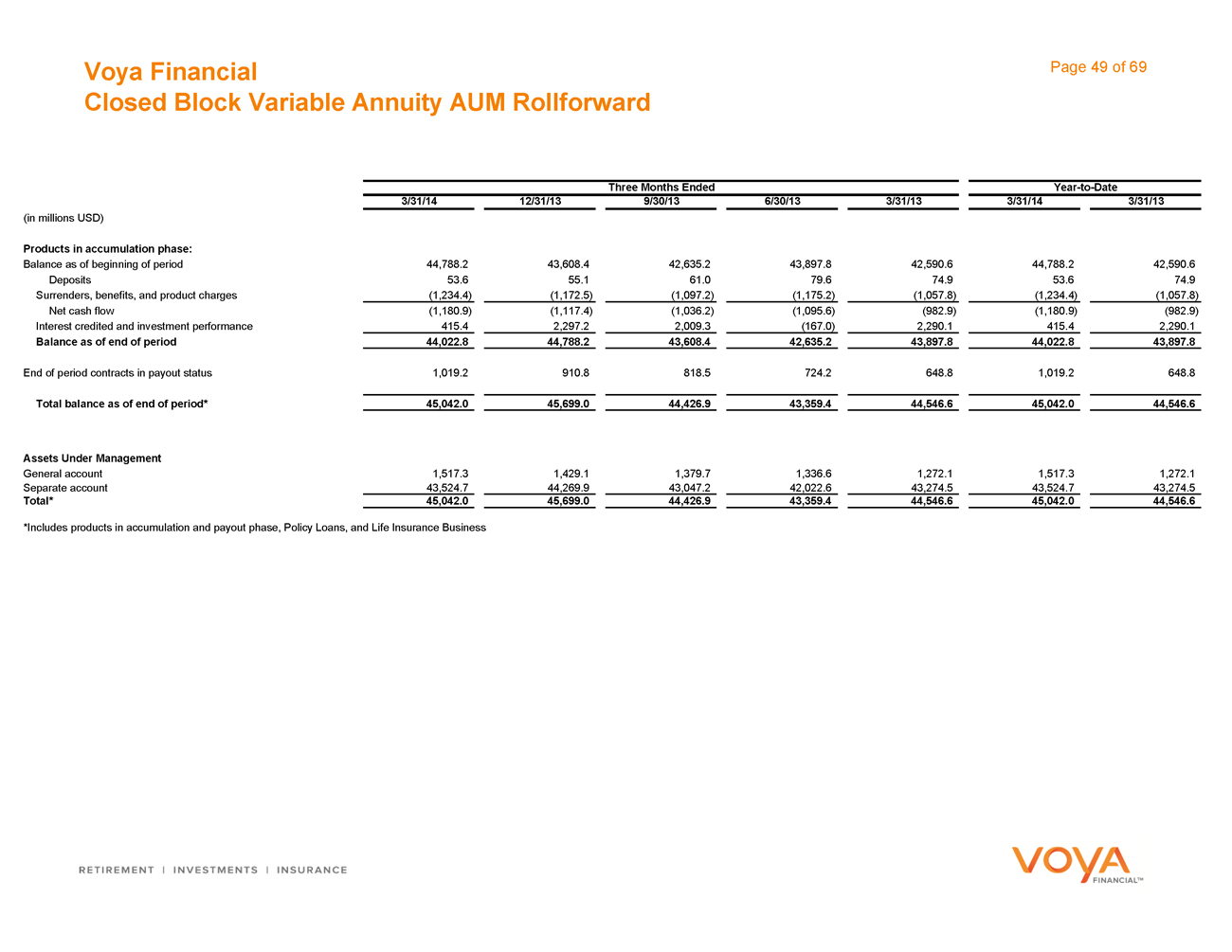

Consolidated Capital Structure 17 Assets Under Management Rollforward 49

Consolidated Assets Under Management/Assets Under Administration 18 Investment Information

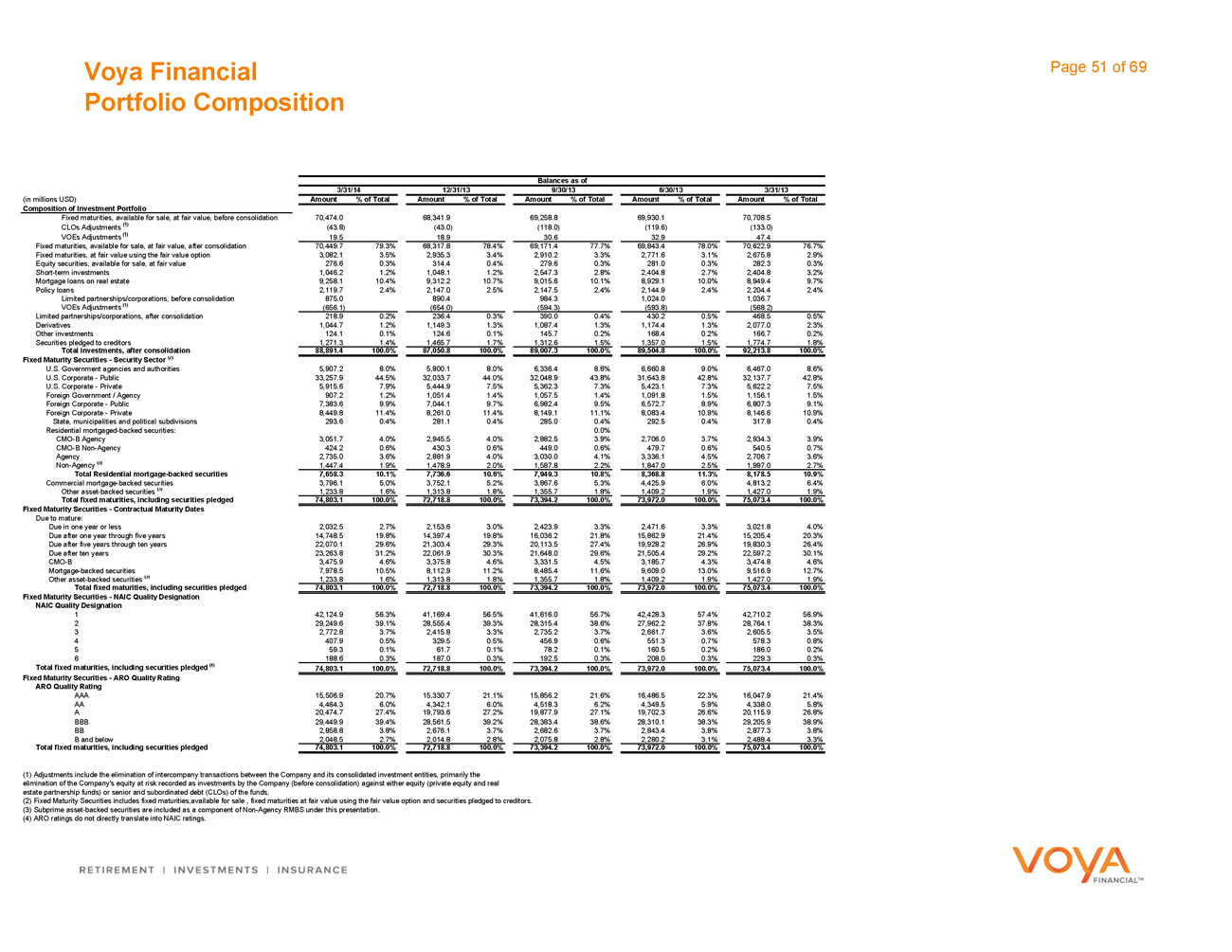

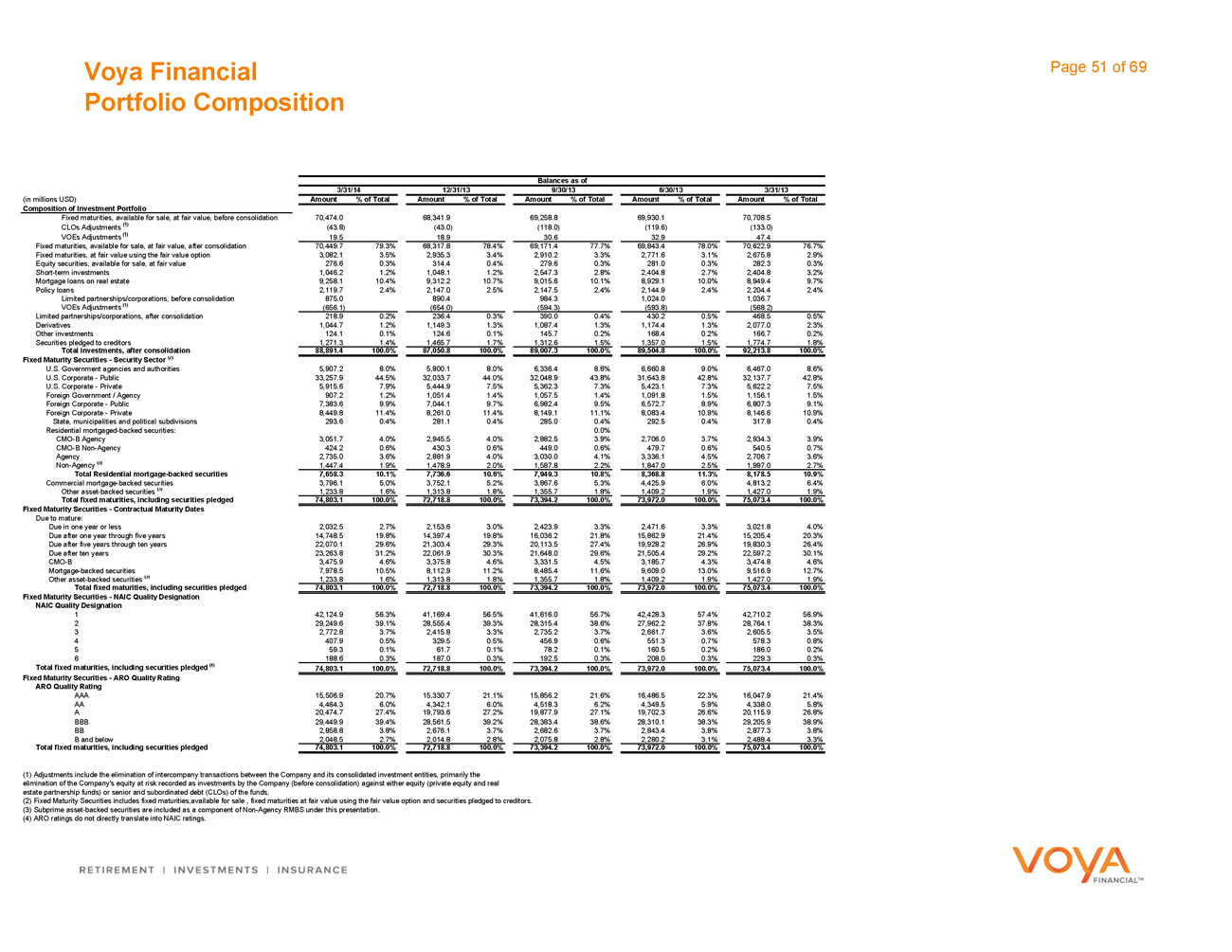

Retirement Portfolio Composition 51

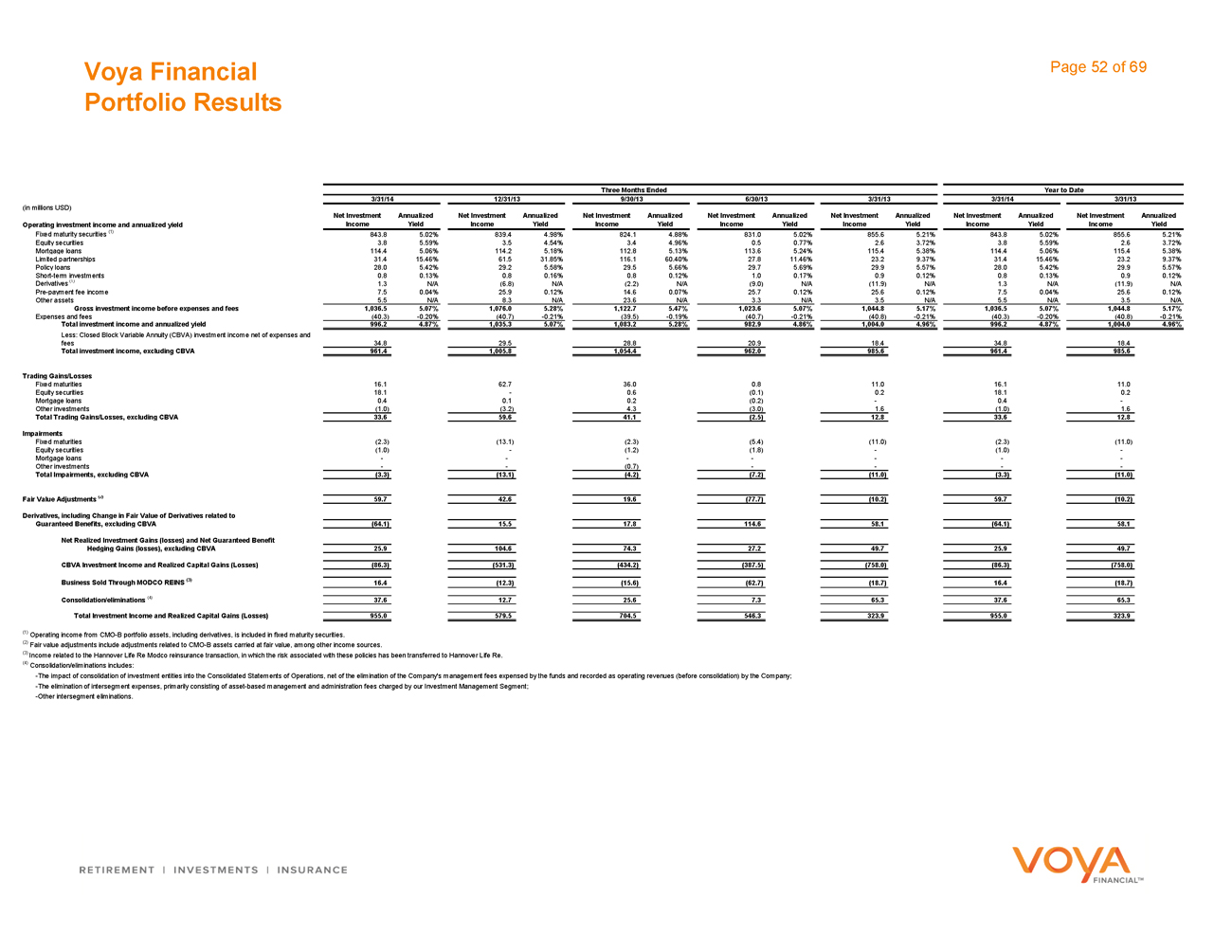

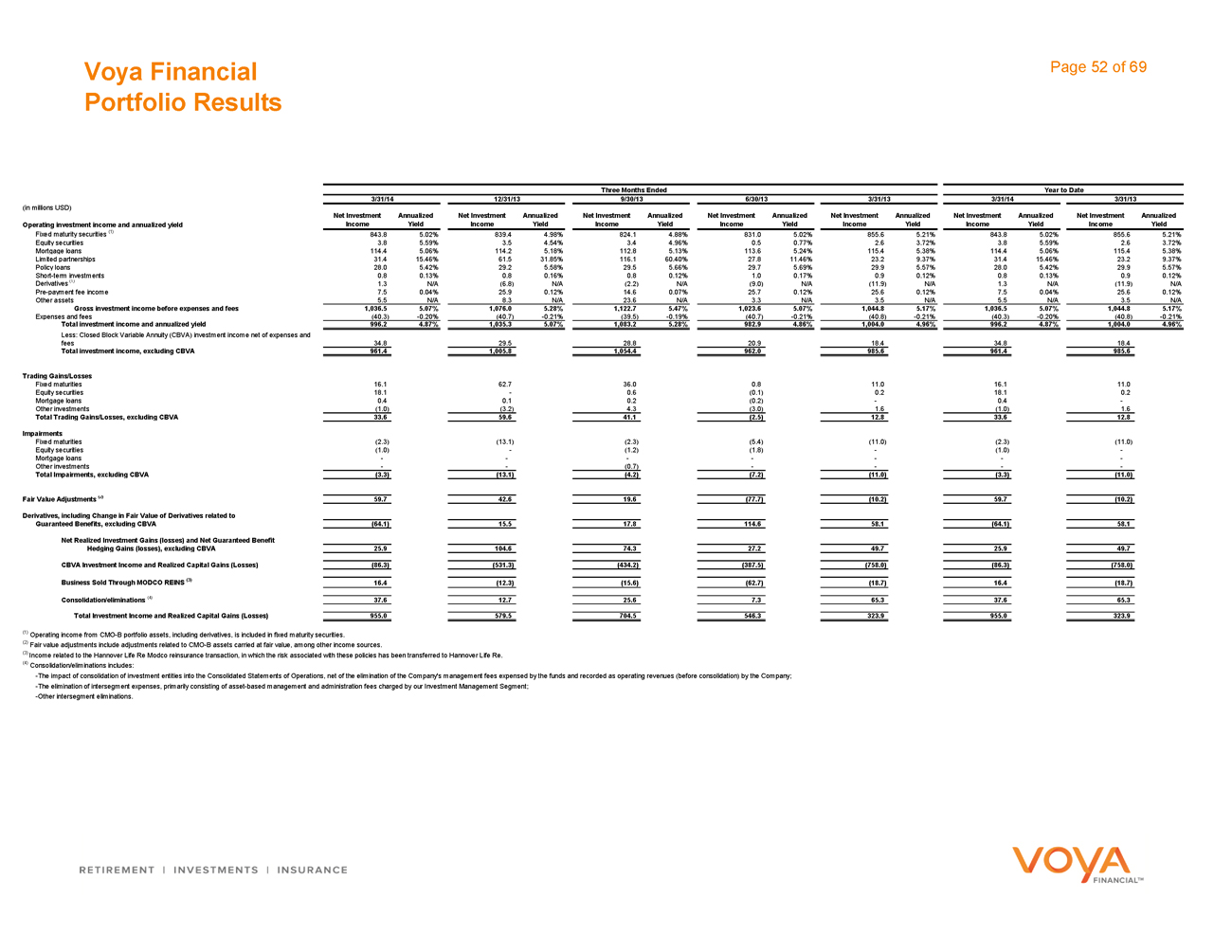

Sources of Operating Earnings 20 Portfolio Results 52

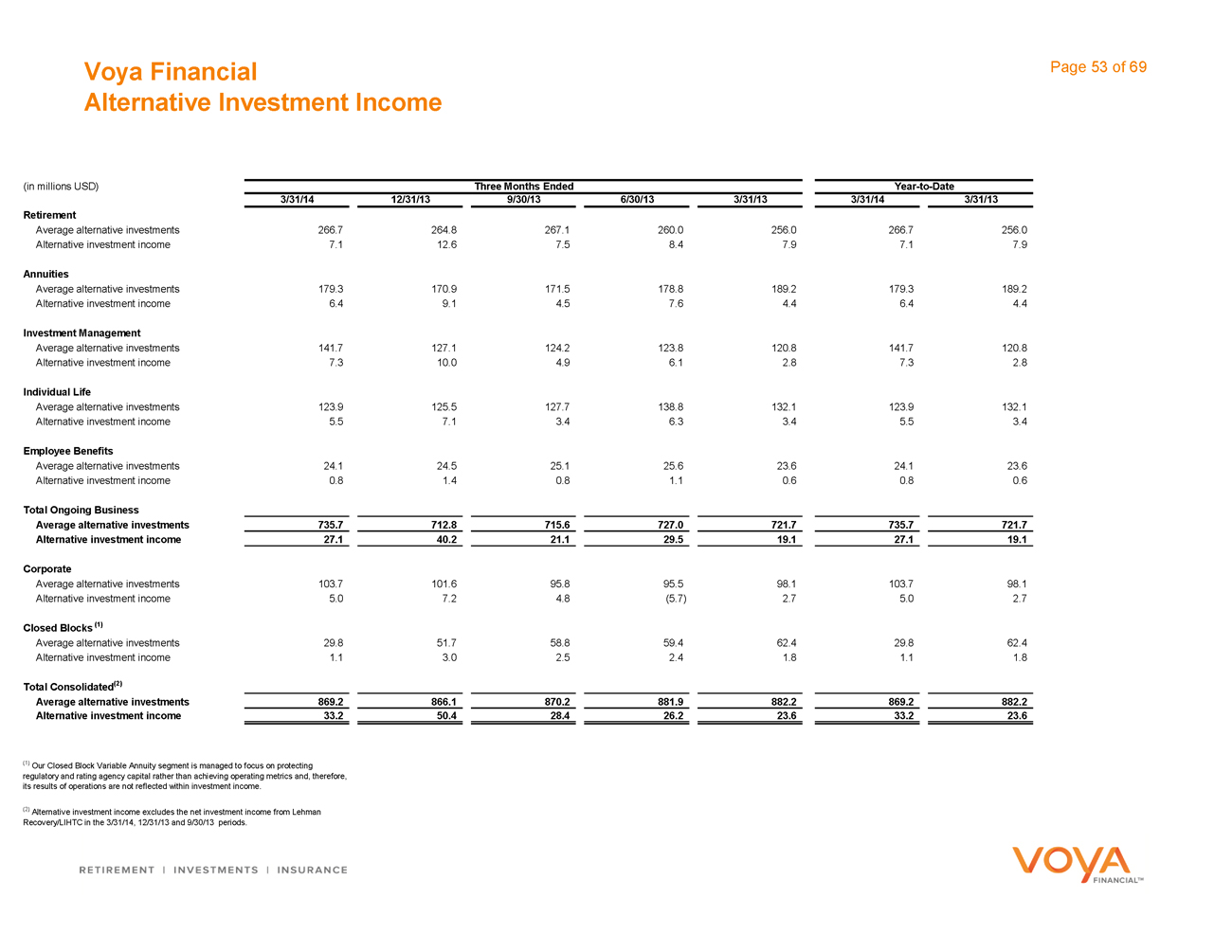

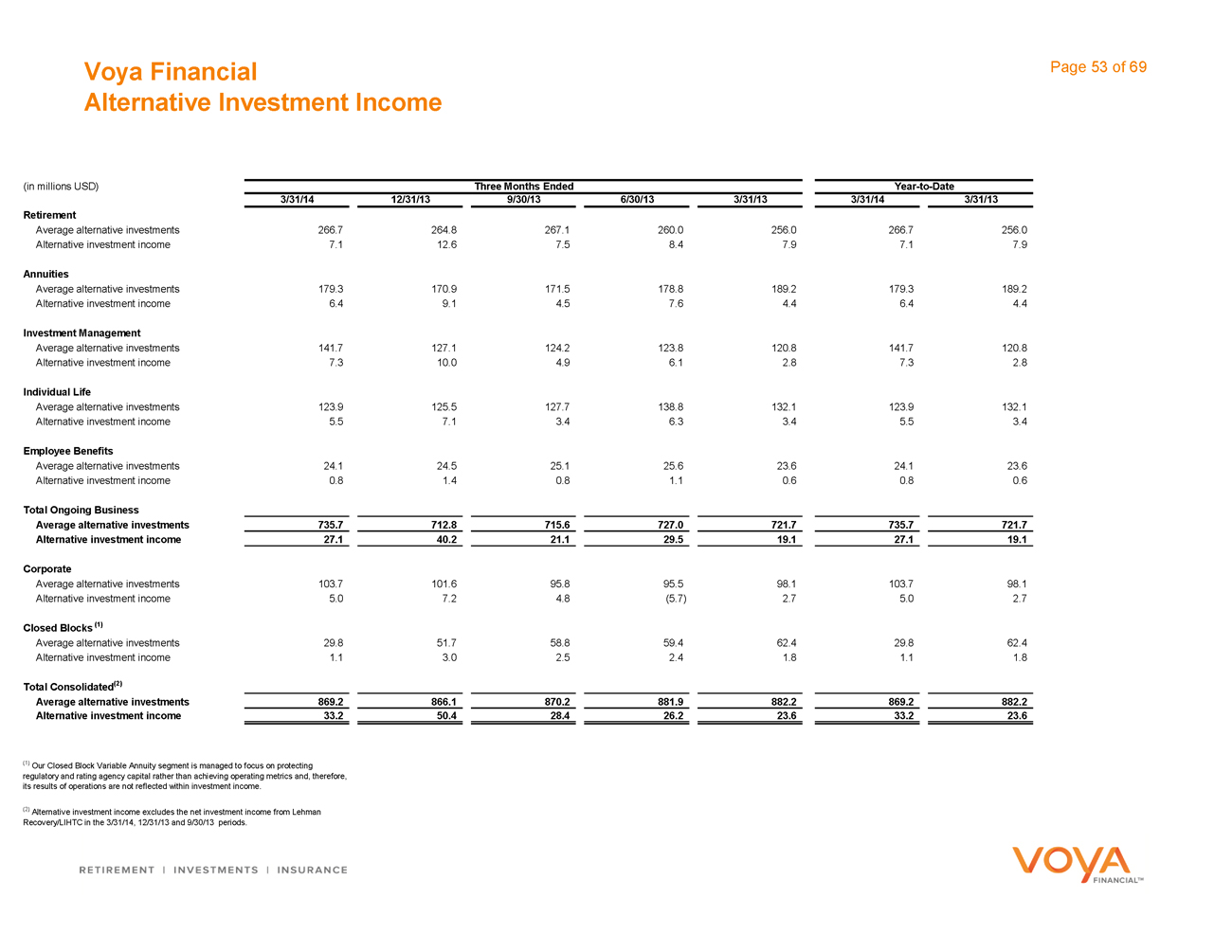

Operating Earnings 21 Alternative Investment Income 53

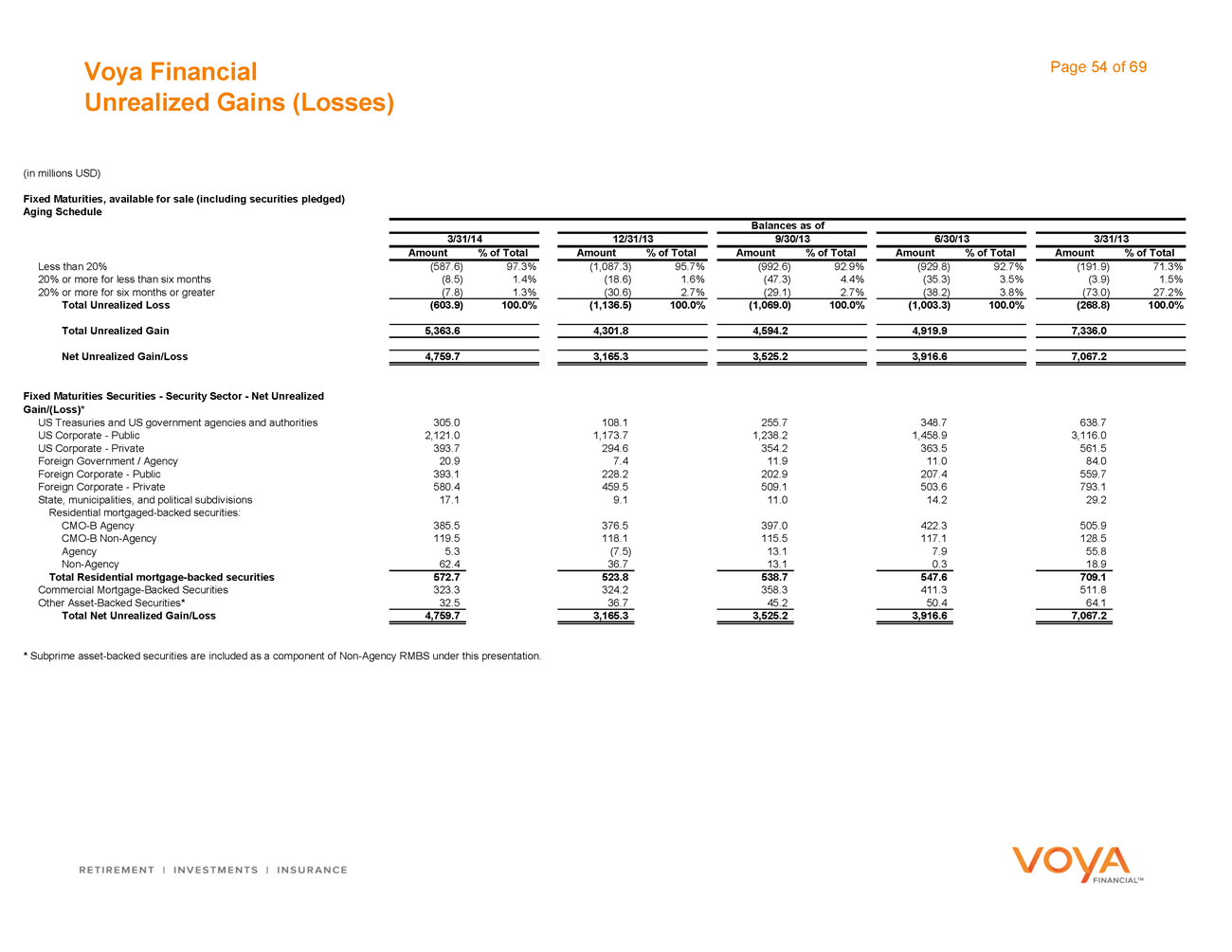

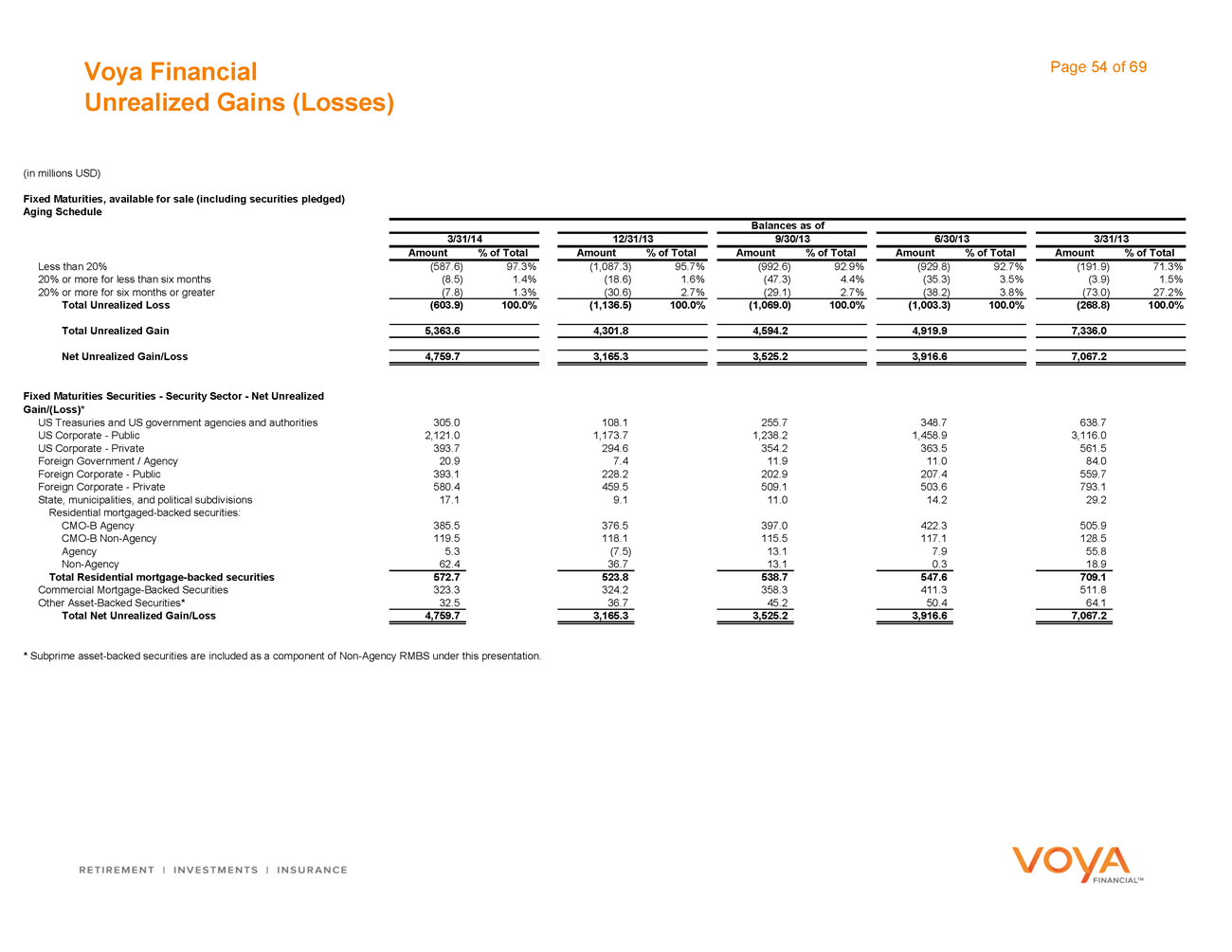

Assets Under Management/Assets Under Administration 22 Unrealized Gains (Losses) 54

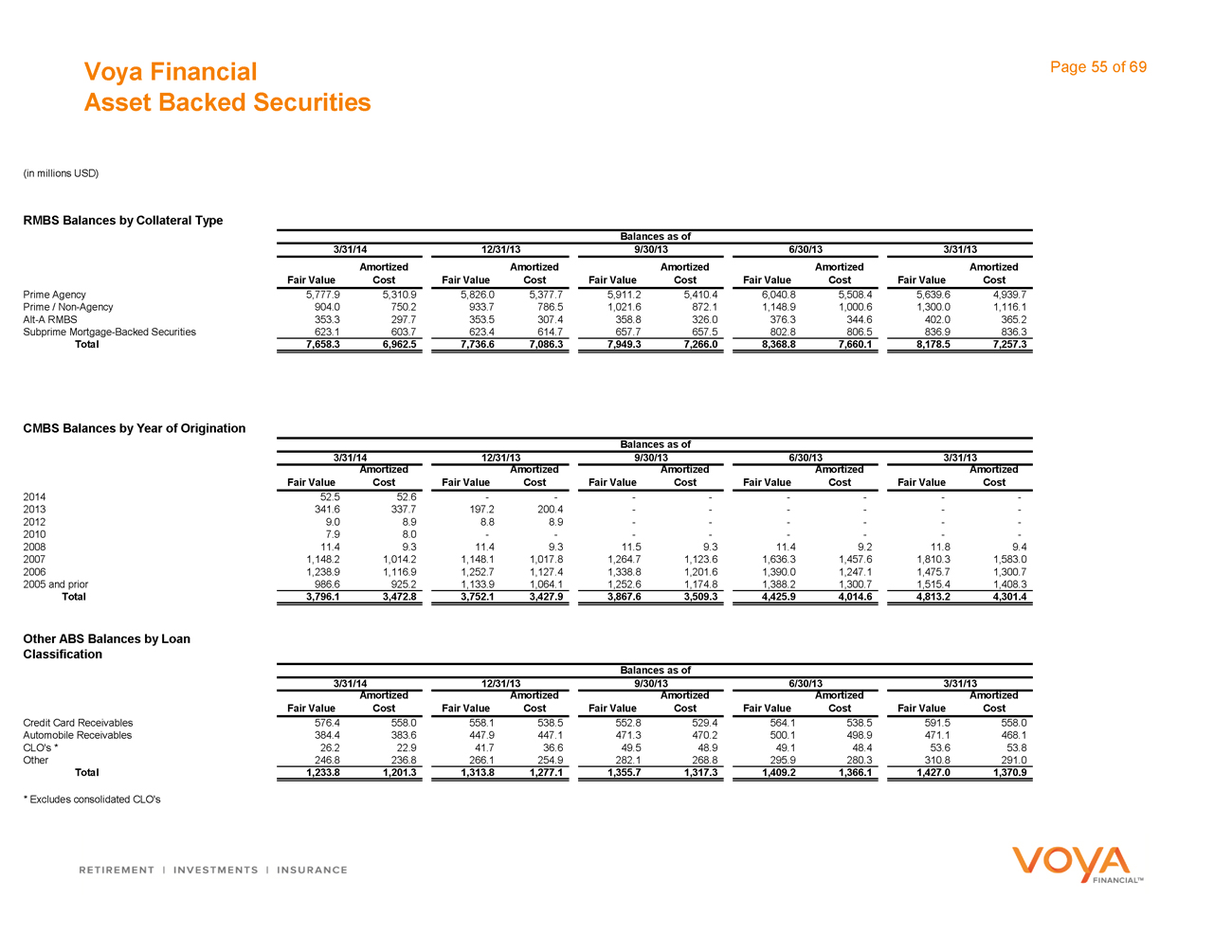

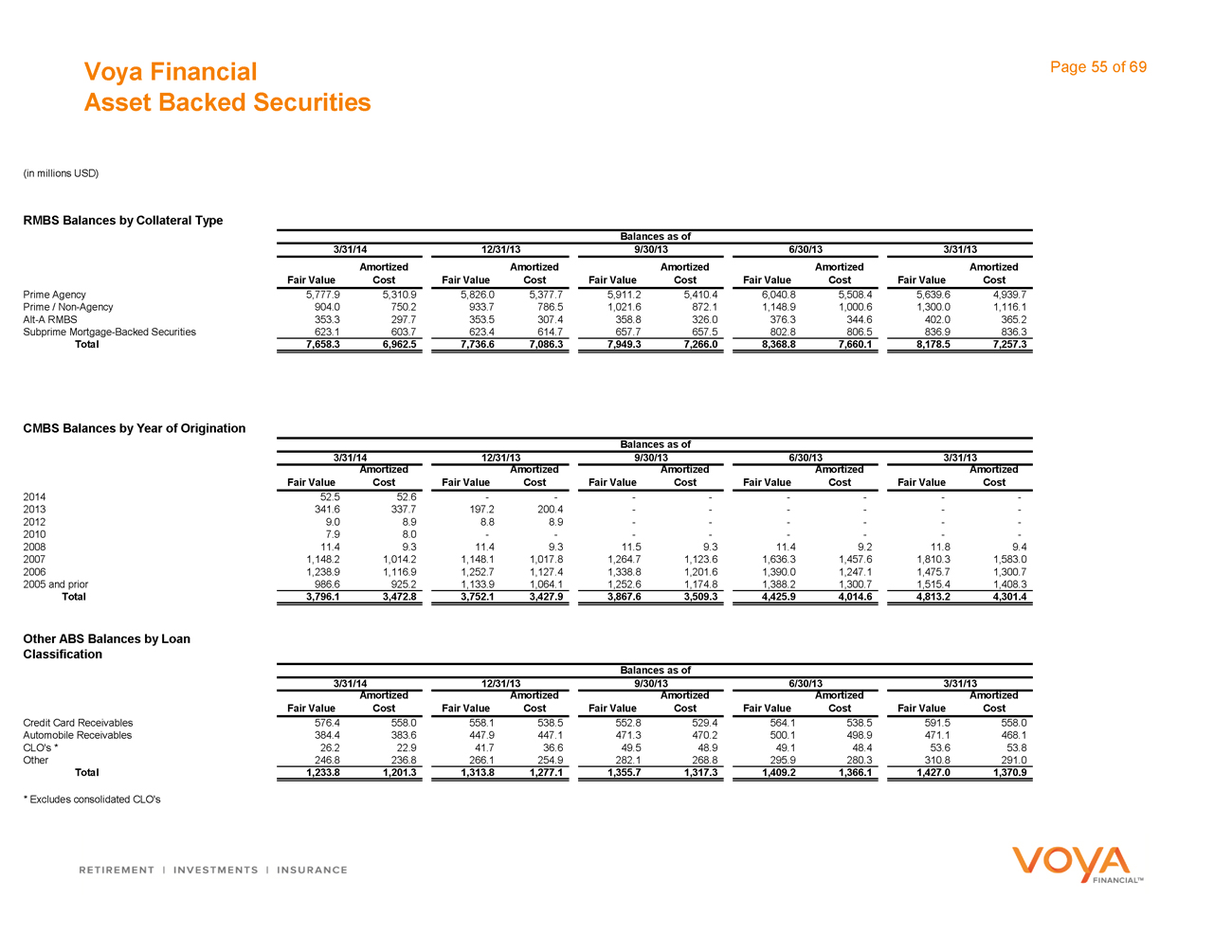

Assets Under Management Rollforward 23 Asset Backed Securities 55

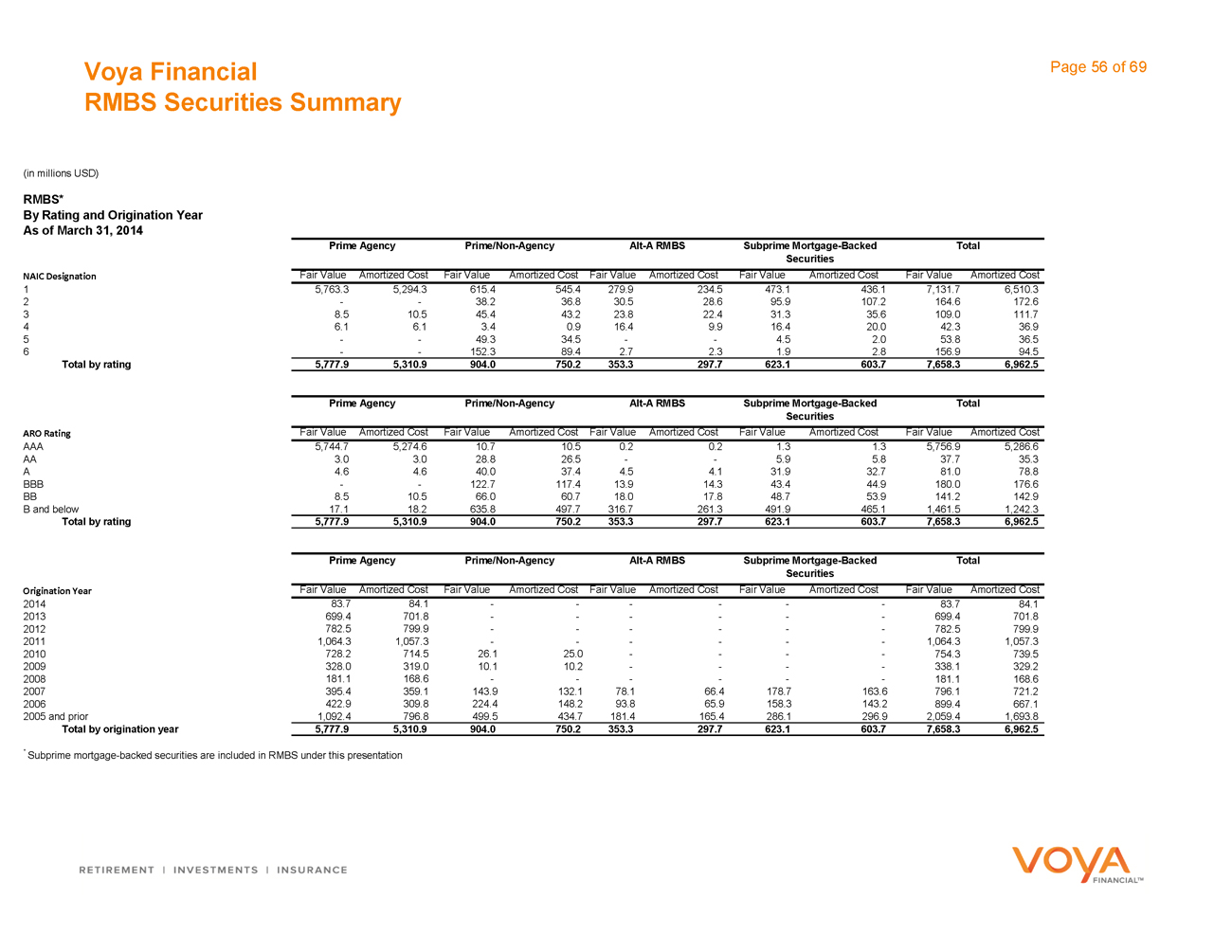

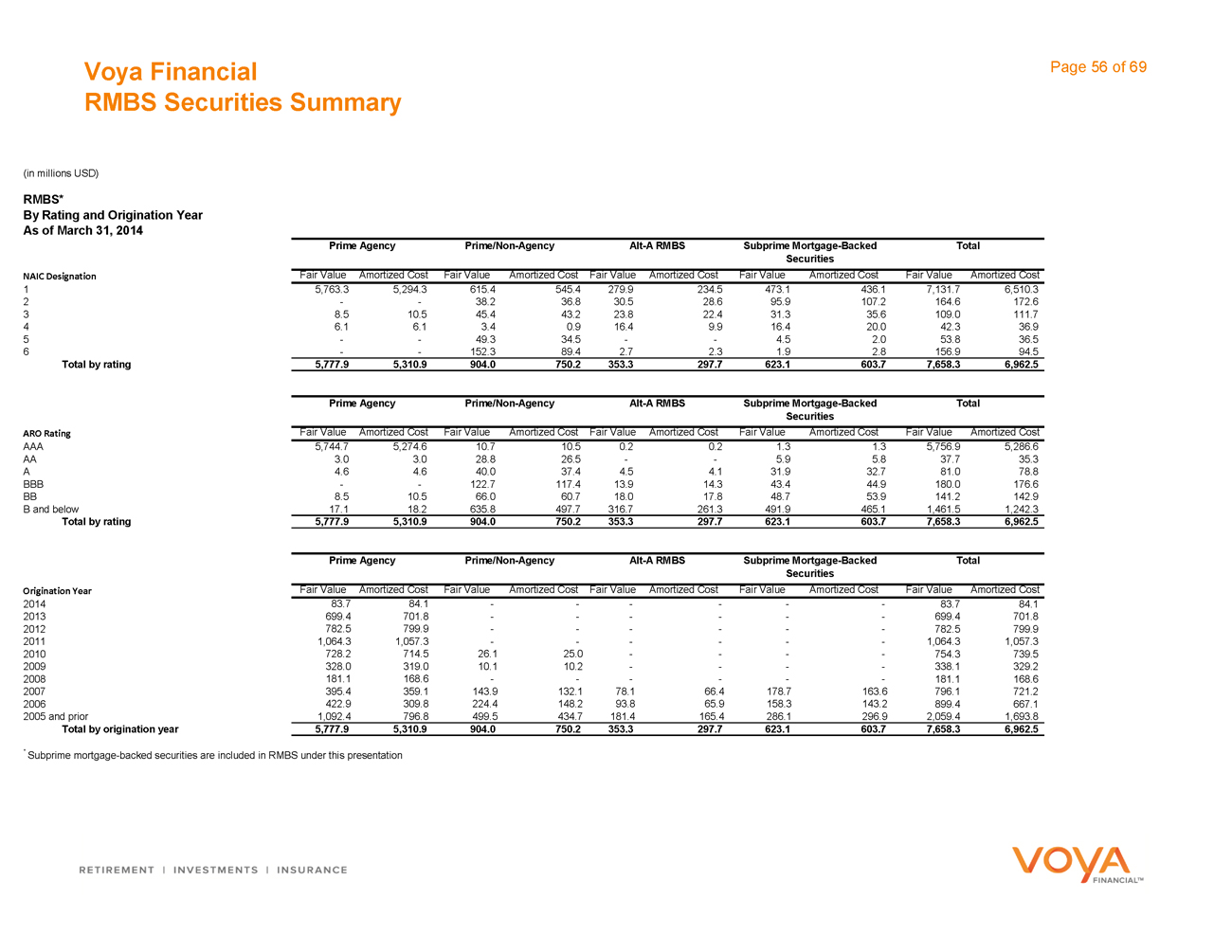

Annuities RMBS Securities Summary 56

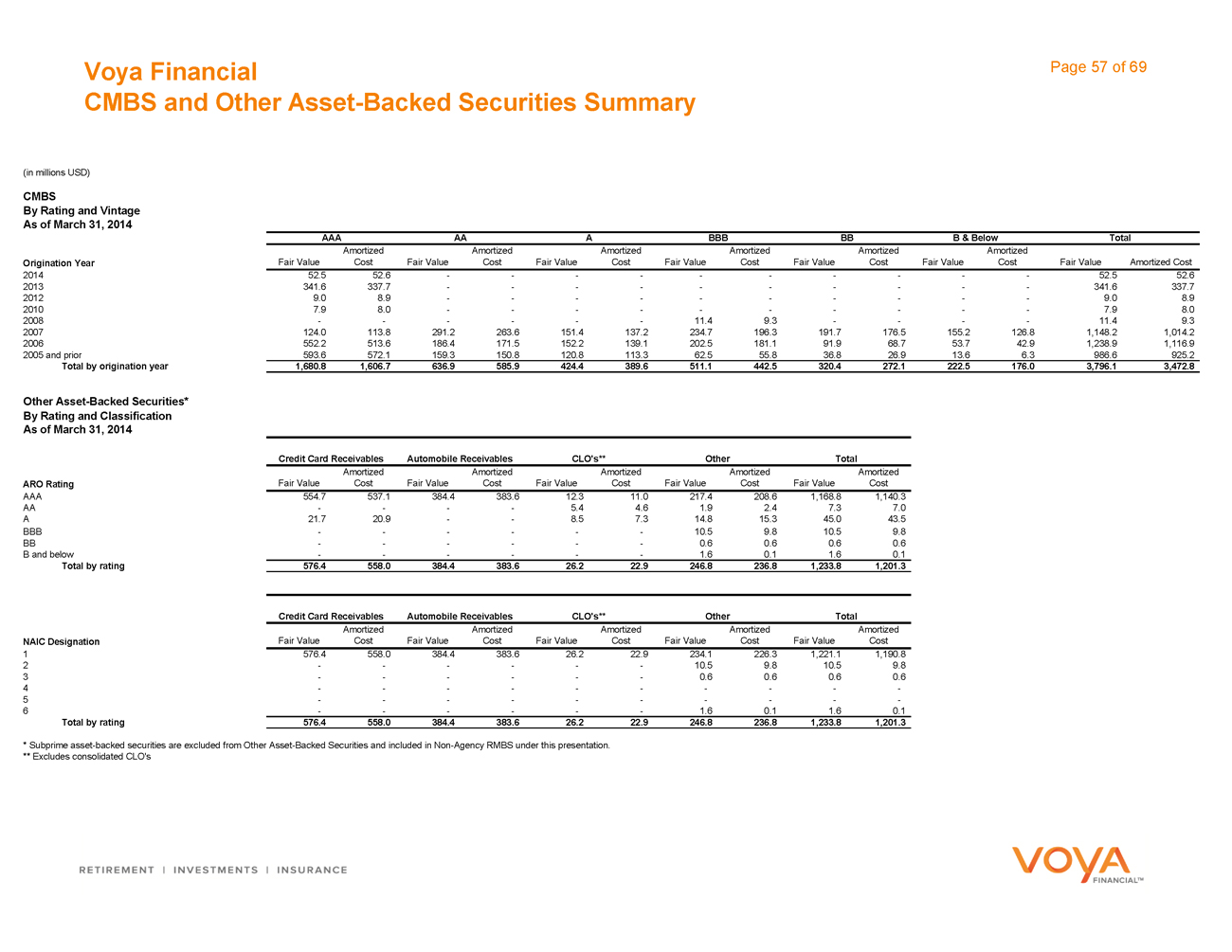

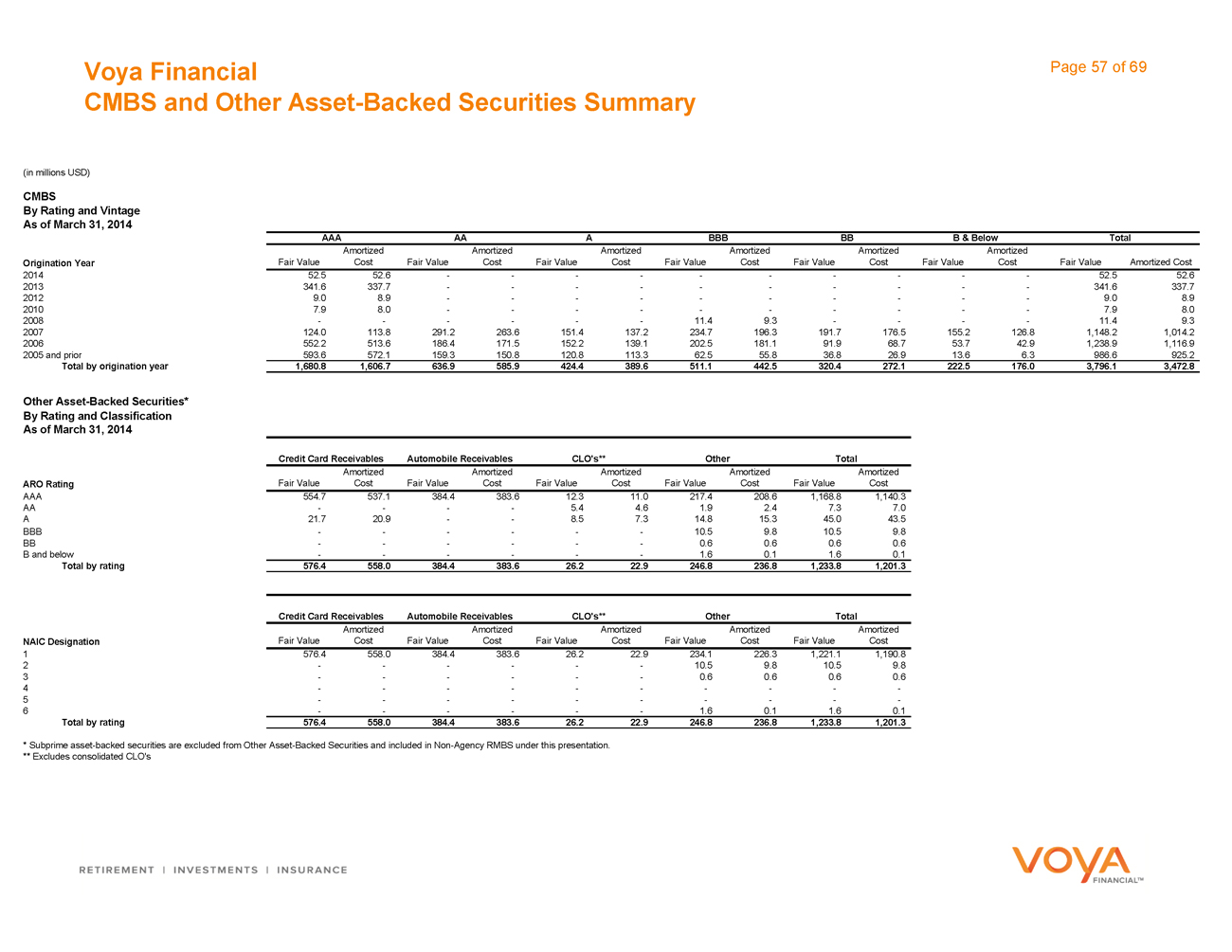

Sources of Operating Earnings 25 CMBS and Other Asset-Backed Securities Summary 57

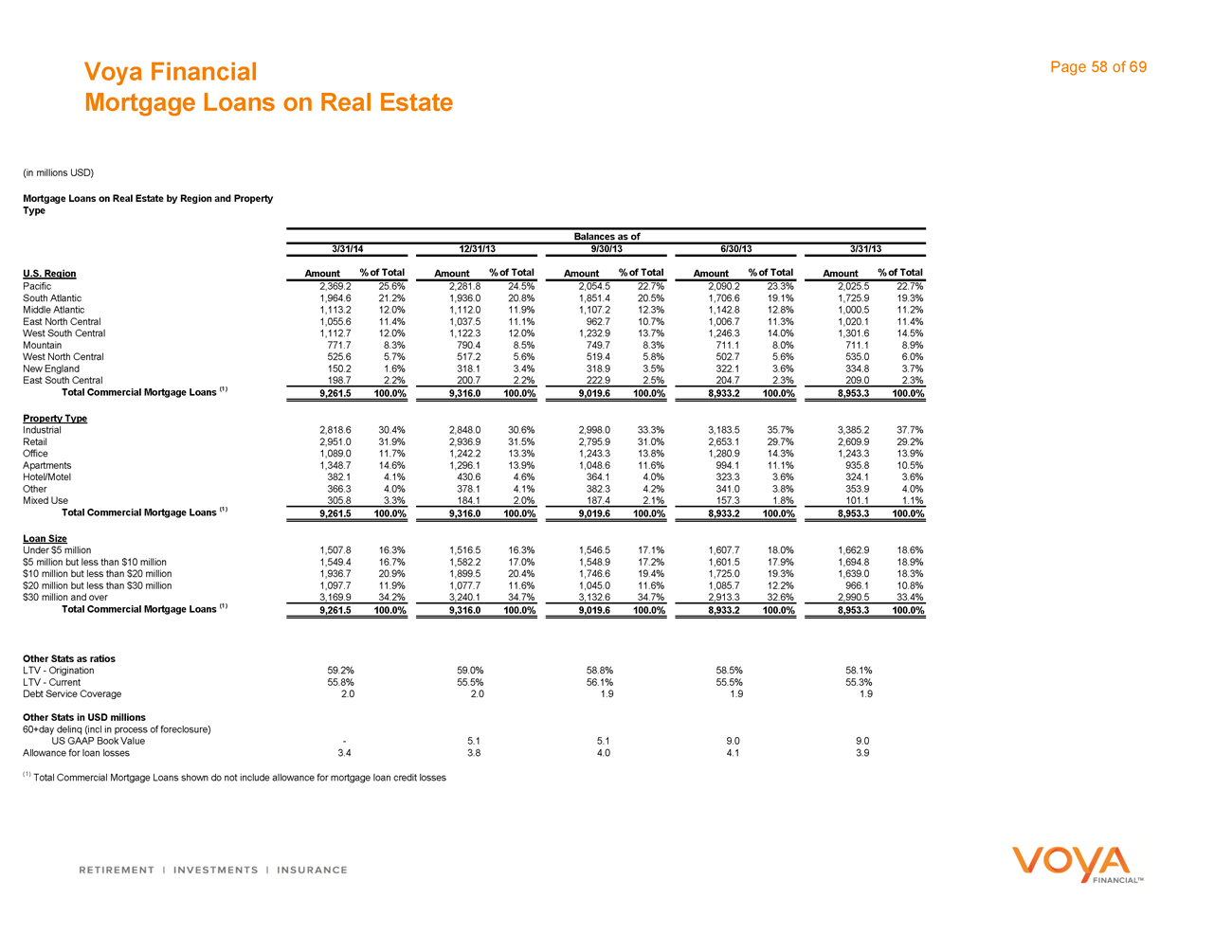

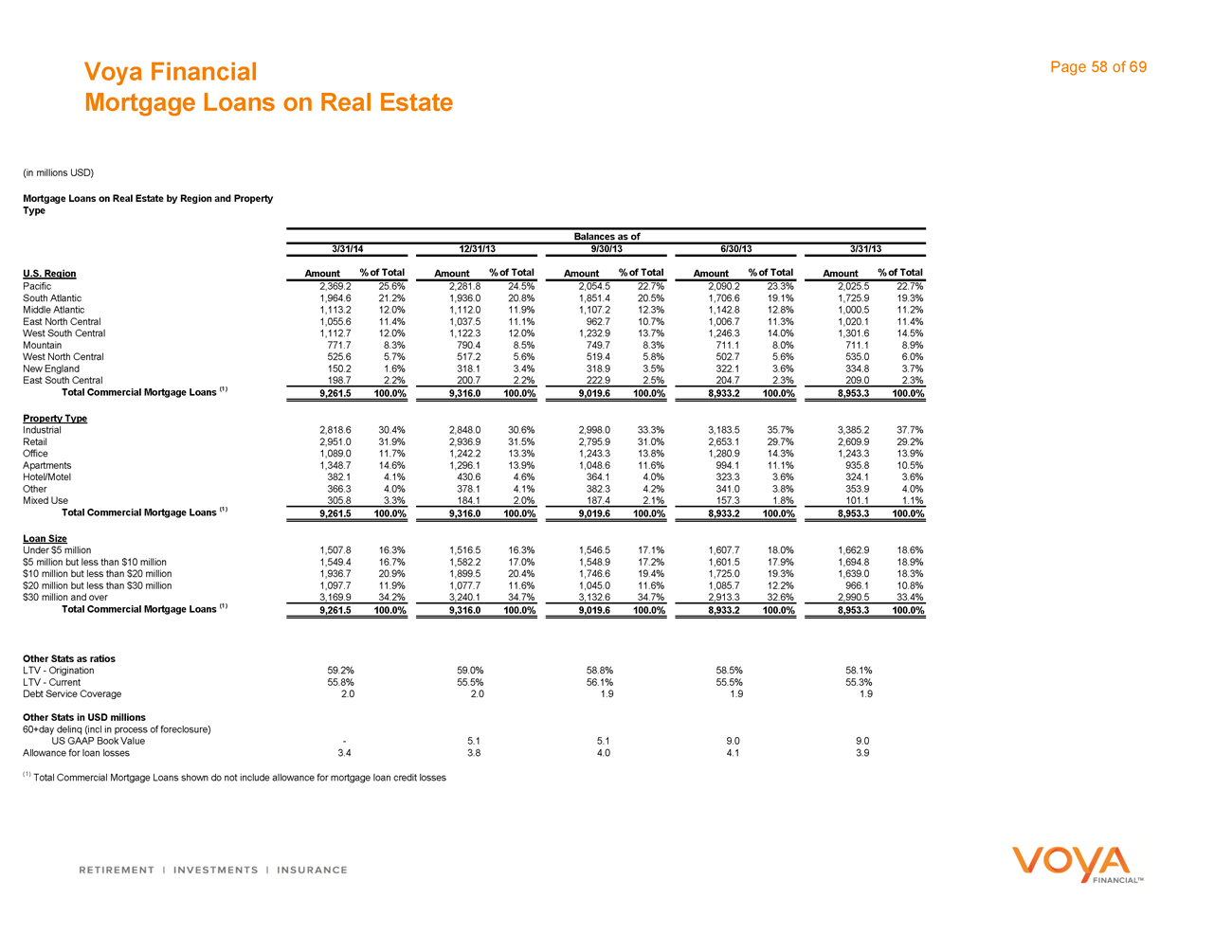

Operating Earnings 26 Mortgage Loans on Real Estate 58

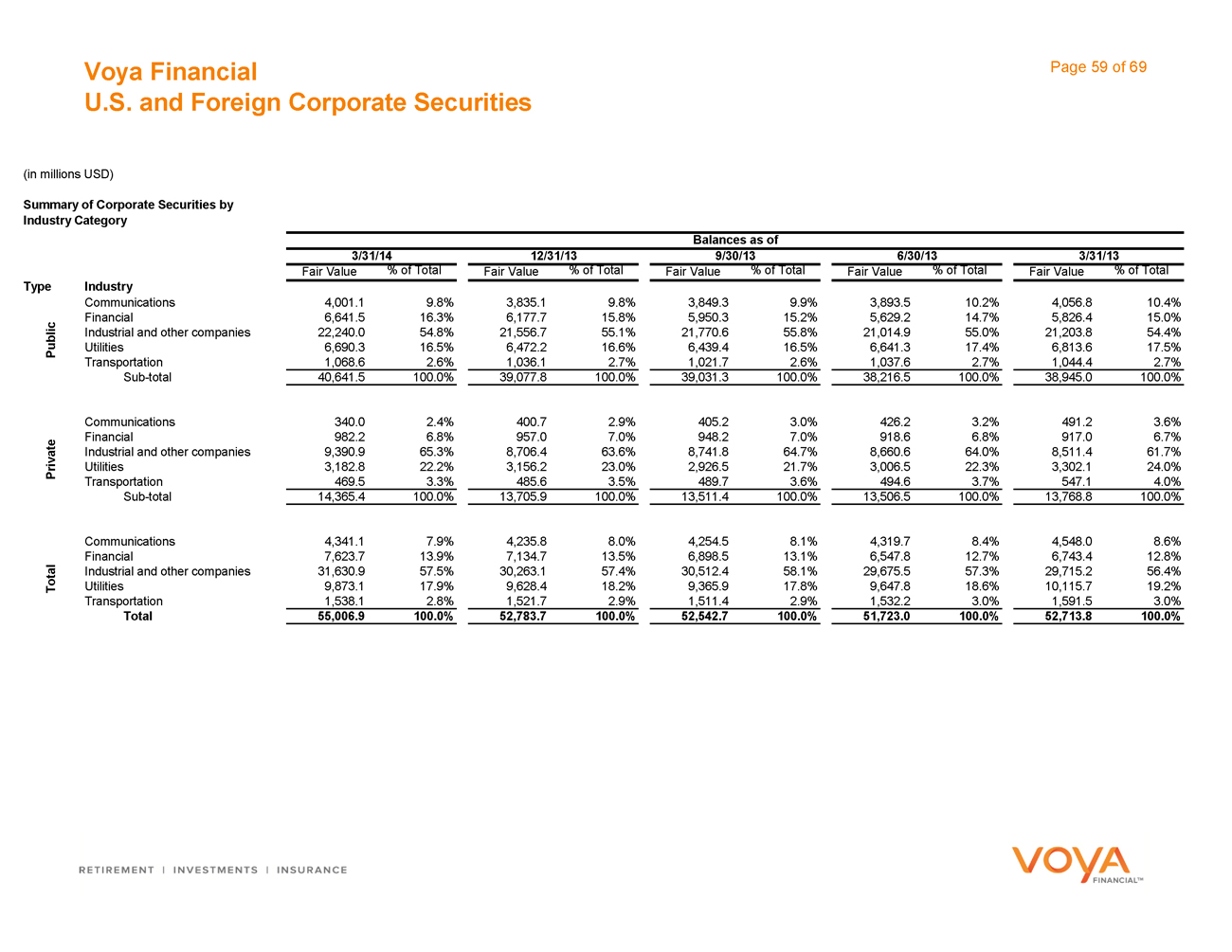

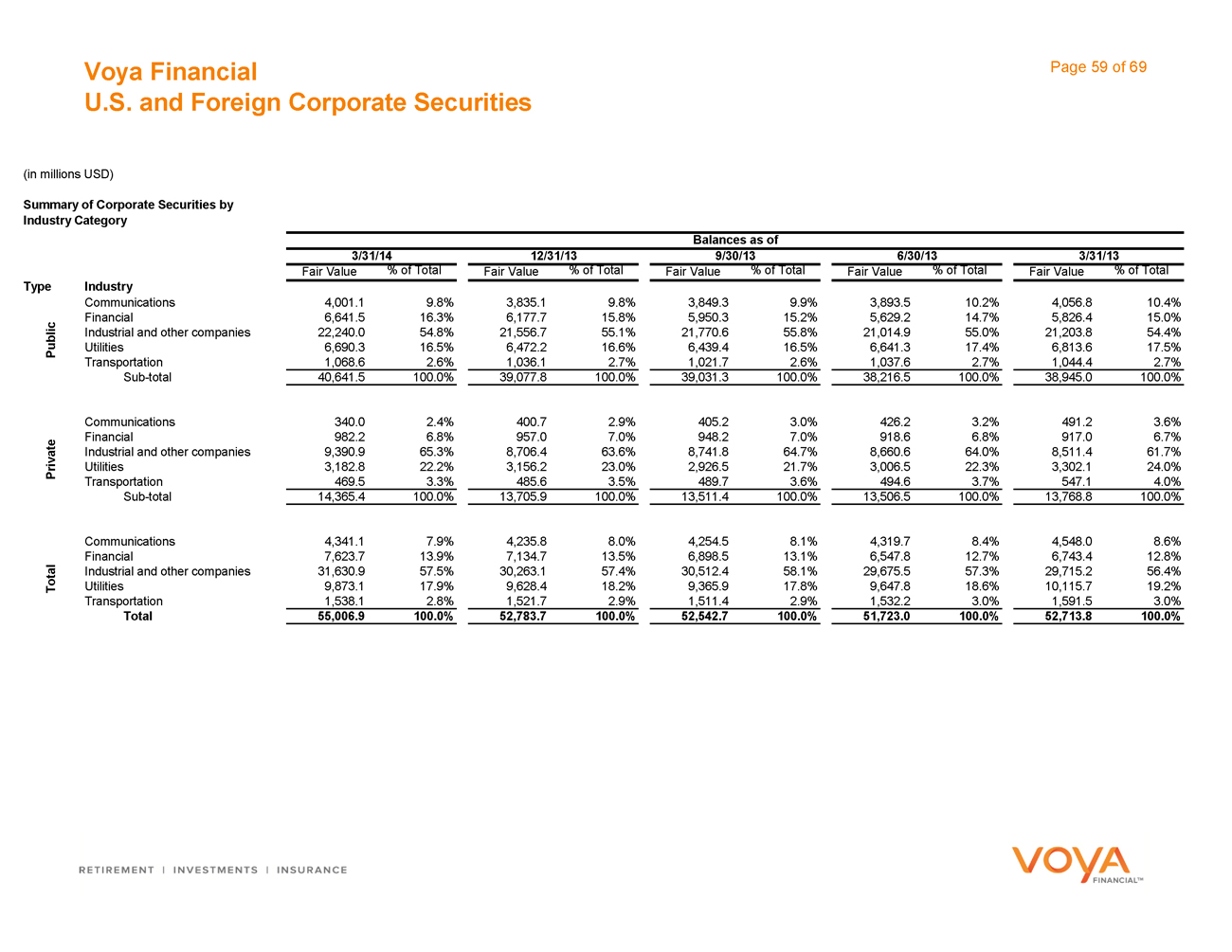

Assets Under Management 27 US and Foreign Corporate Securities 59

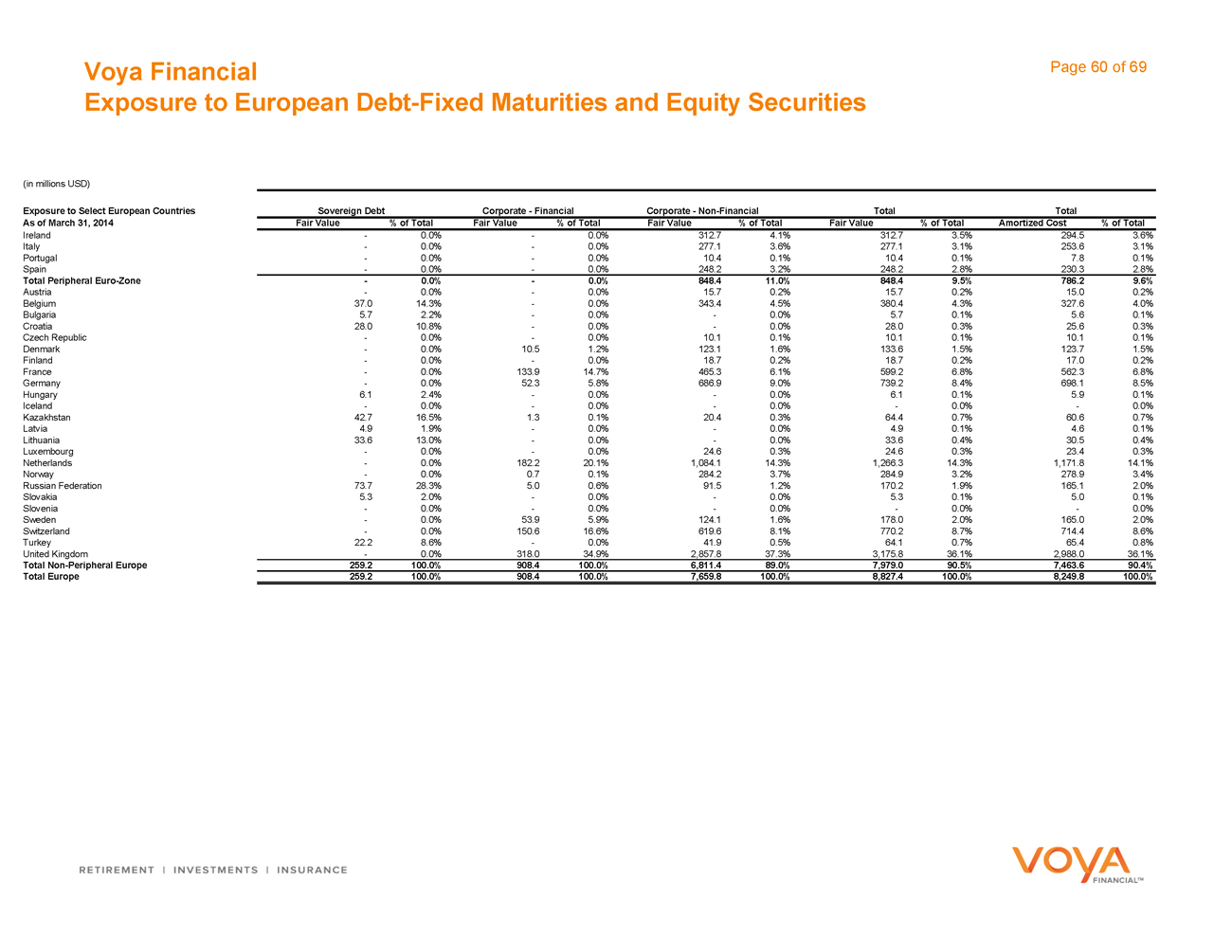

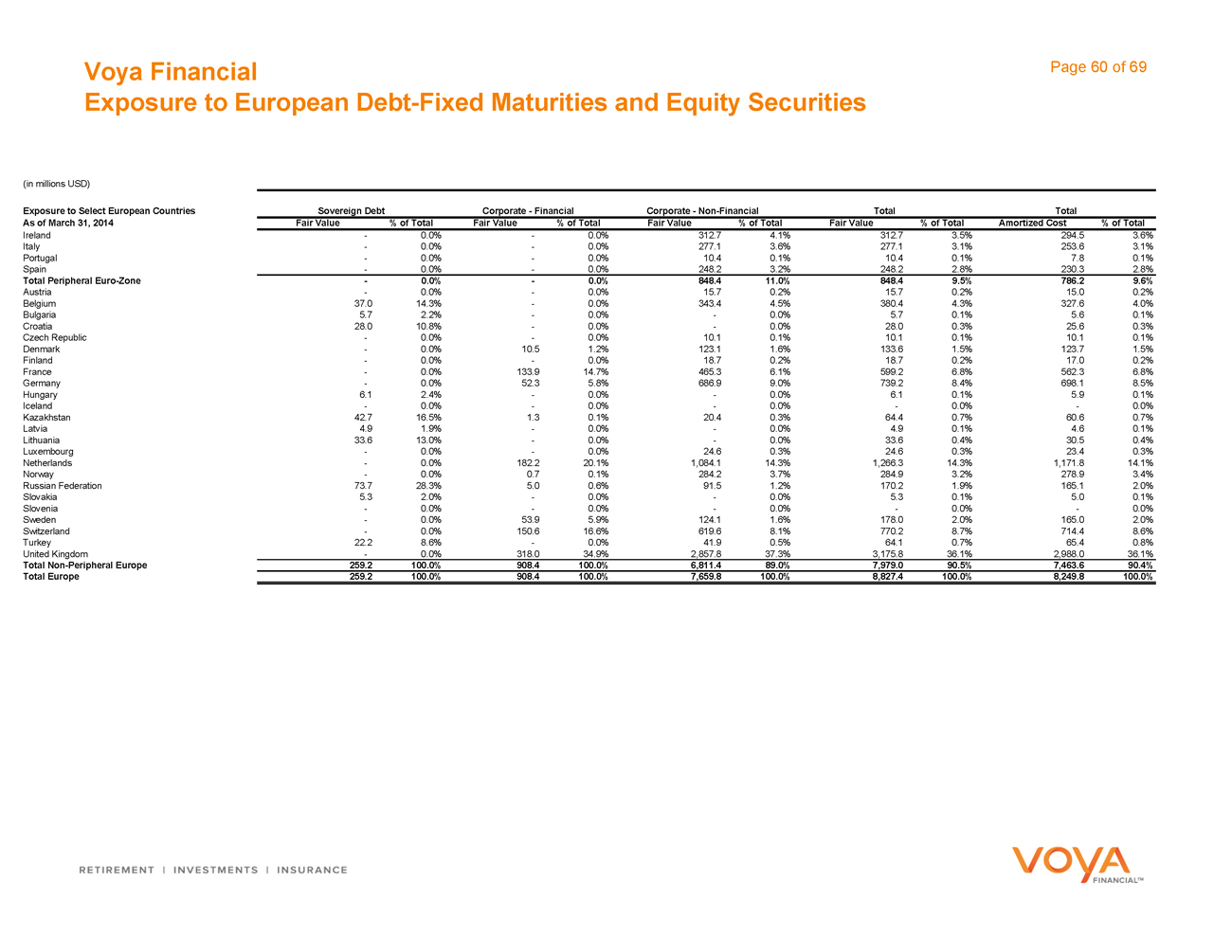

Assets Under Management Rollforward 28 Exposure to European Debt- Fixed Maturities and Equity Securities 60

Investment Management Additional Information

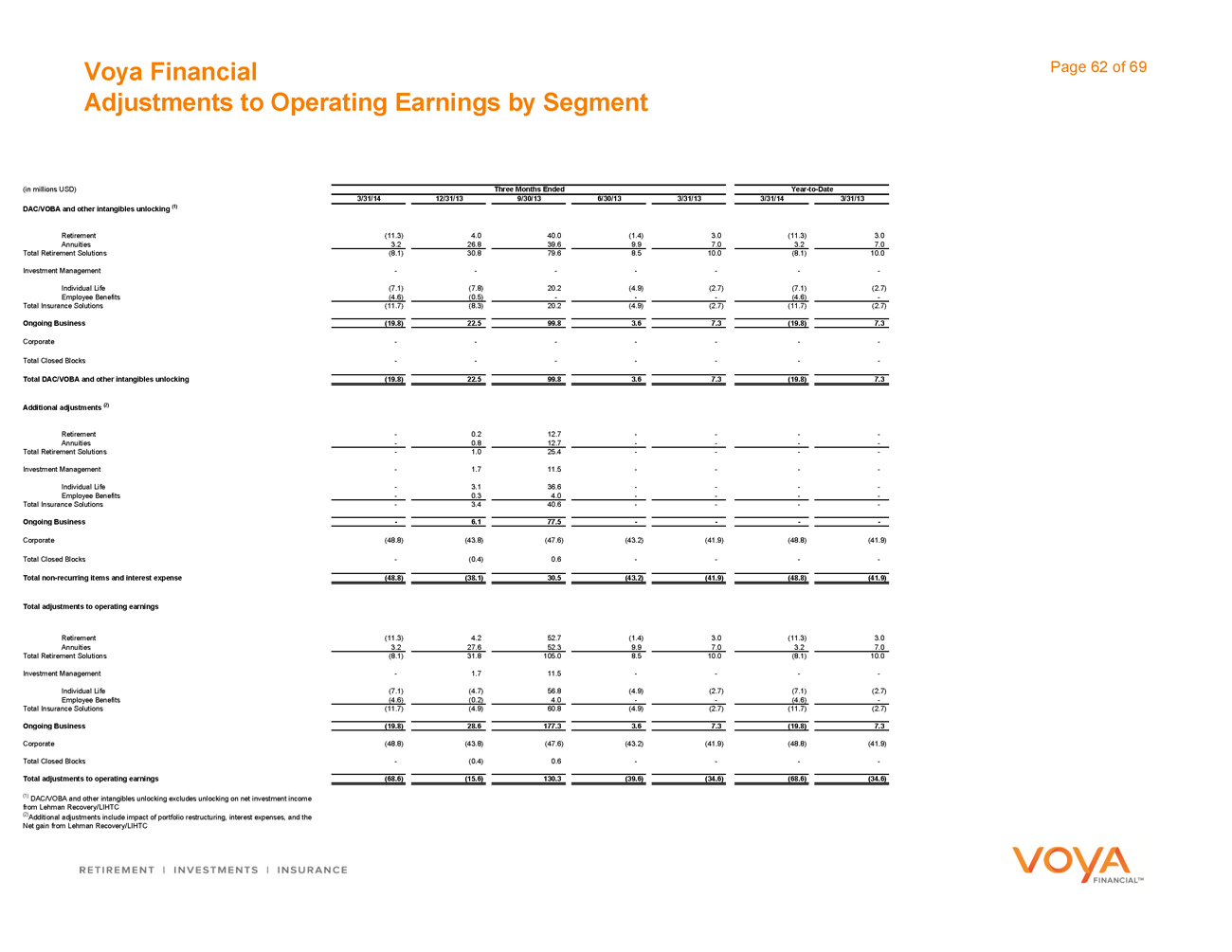

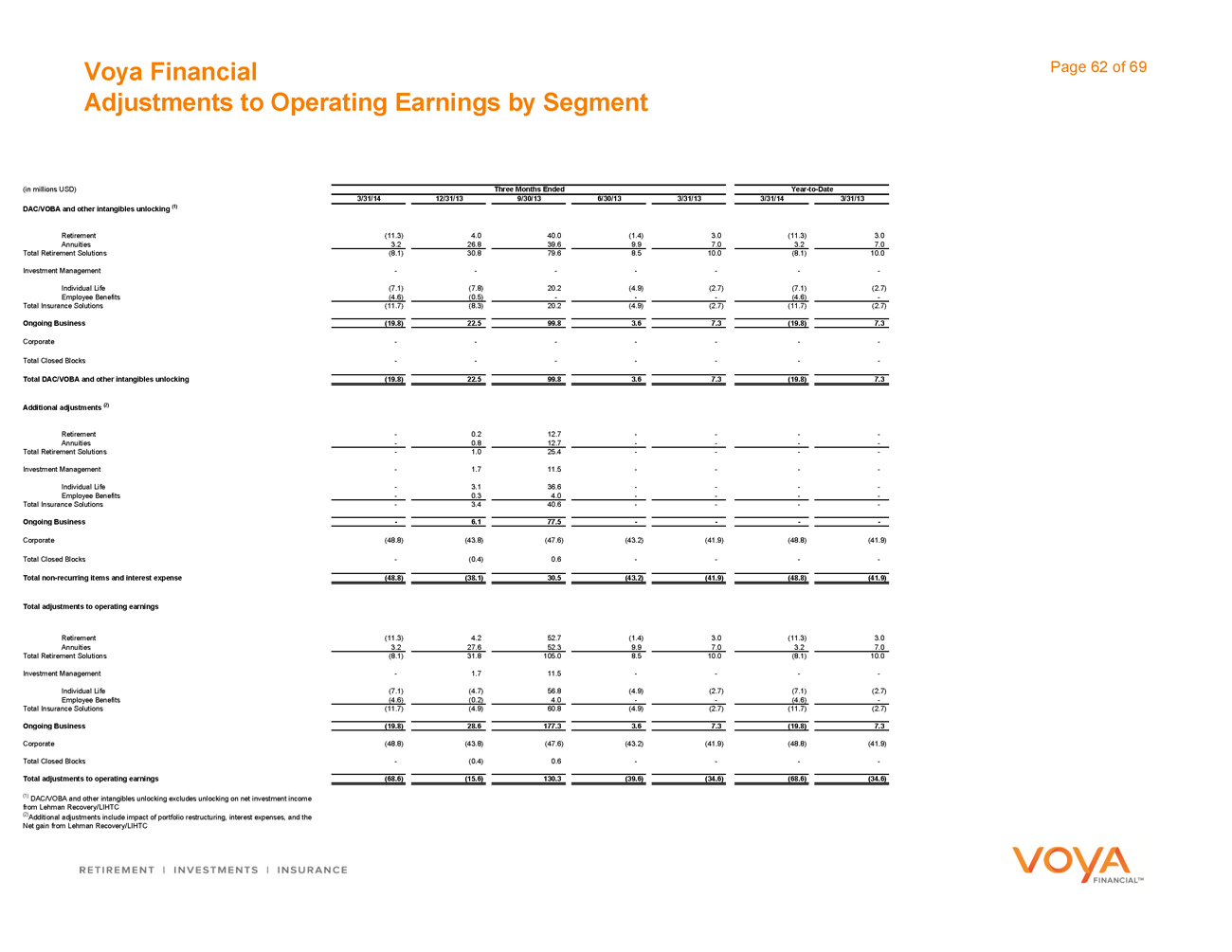

Sources of Operating Earnings 30 Adjustments to Operating Earnings by Segment 62

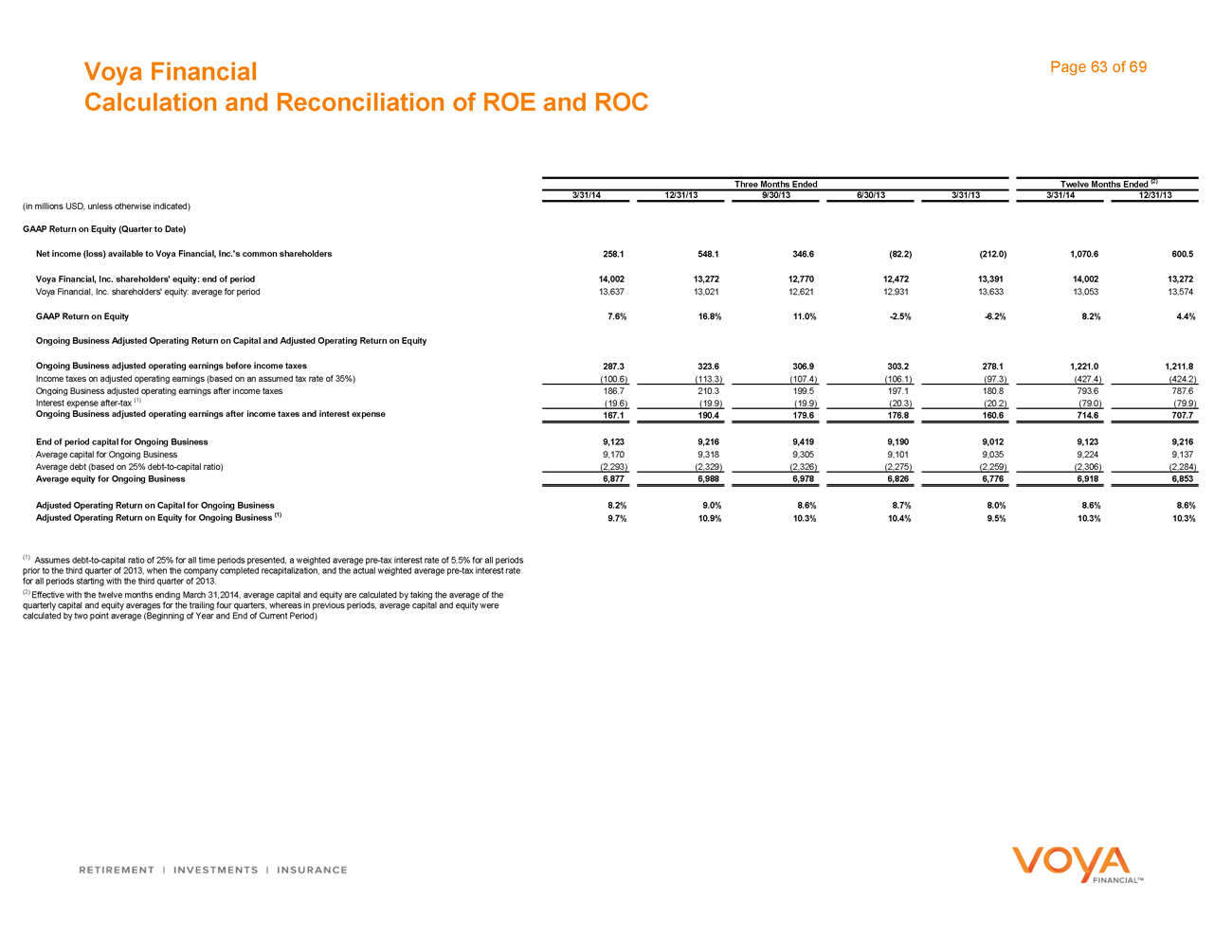

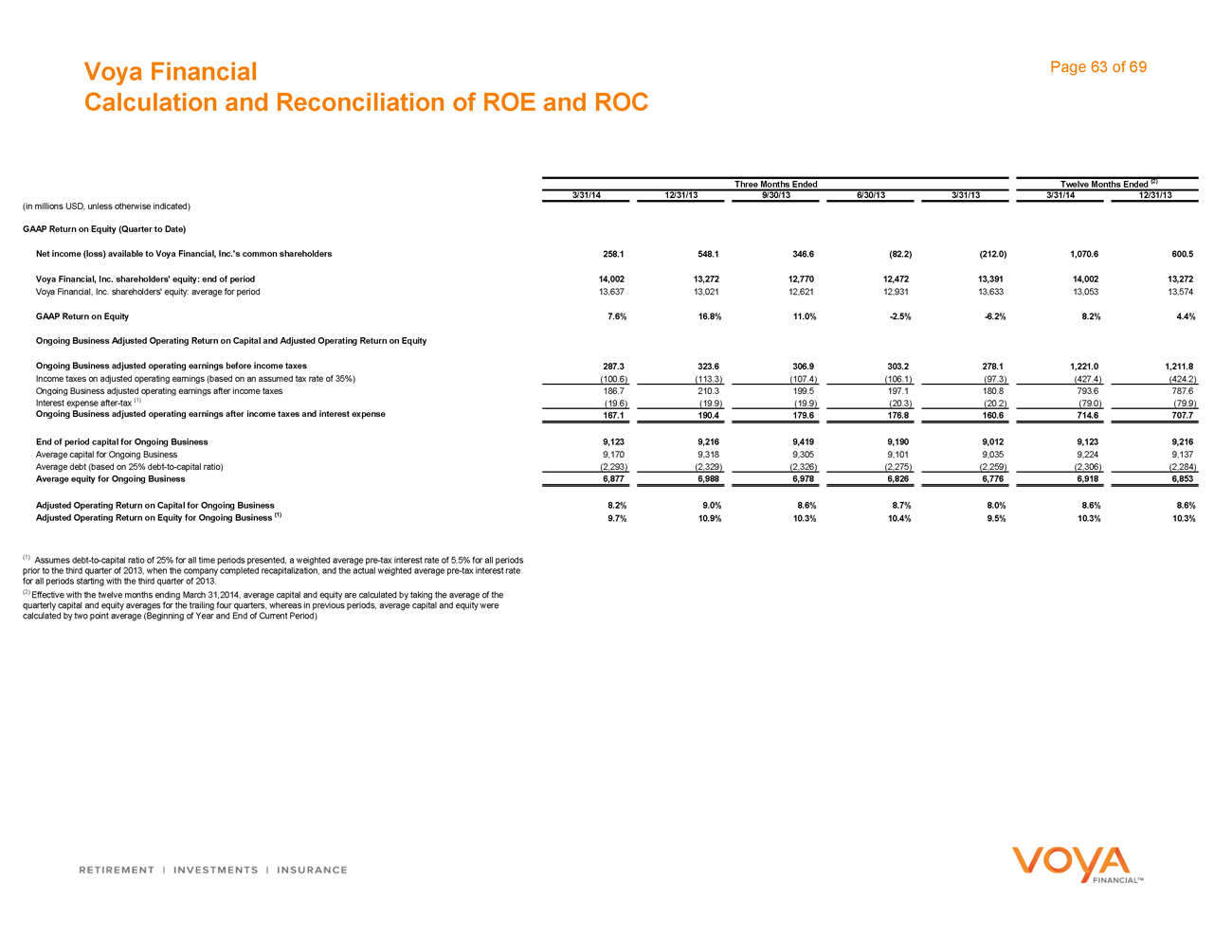

Operating Earnings 31 Calculation and Reconciliation of ROE and ROC 63

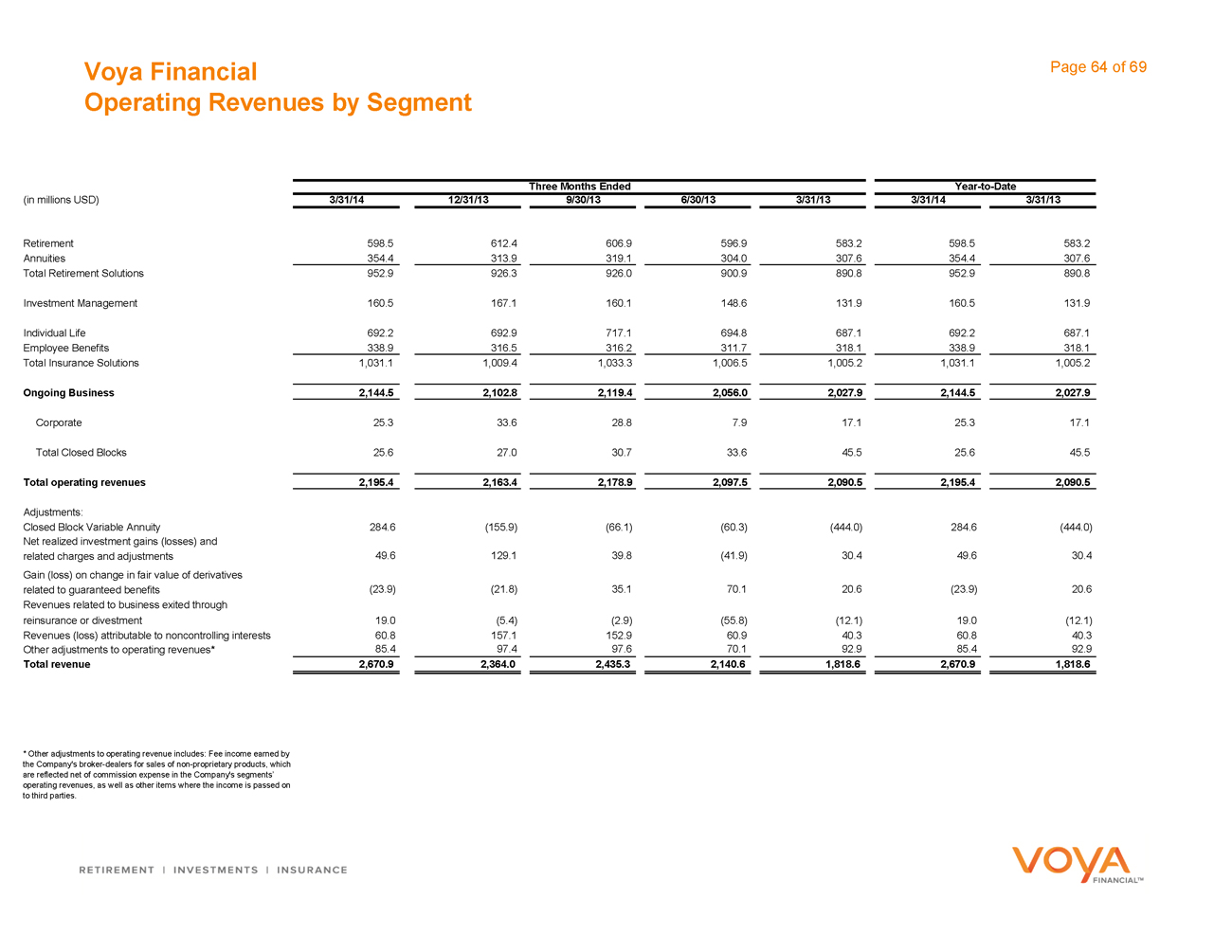

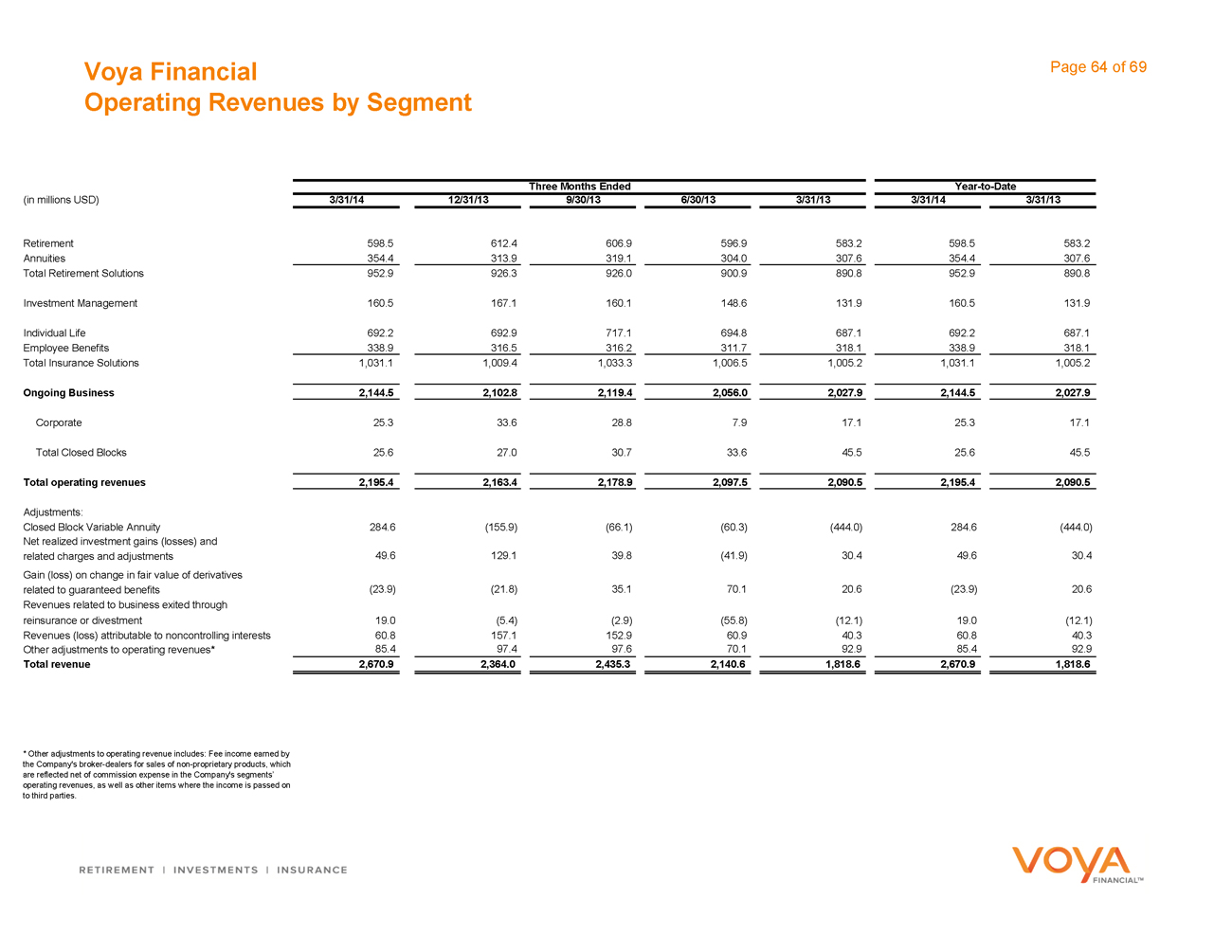

Key Metrics 32 Operating Revenues by Segment 64

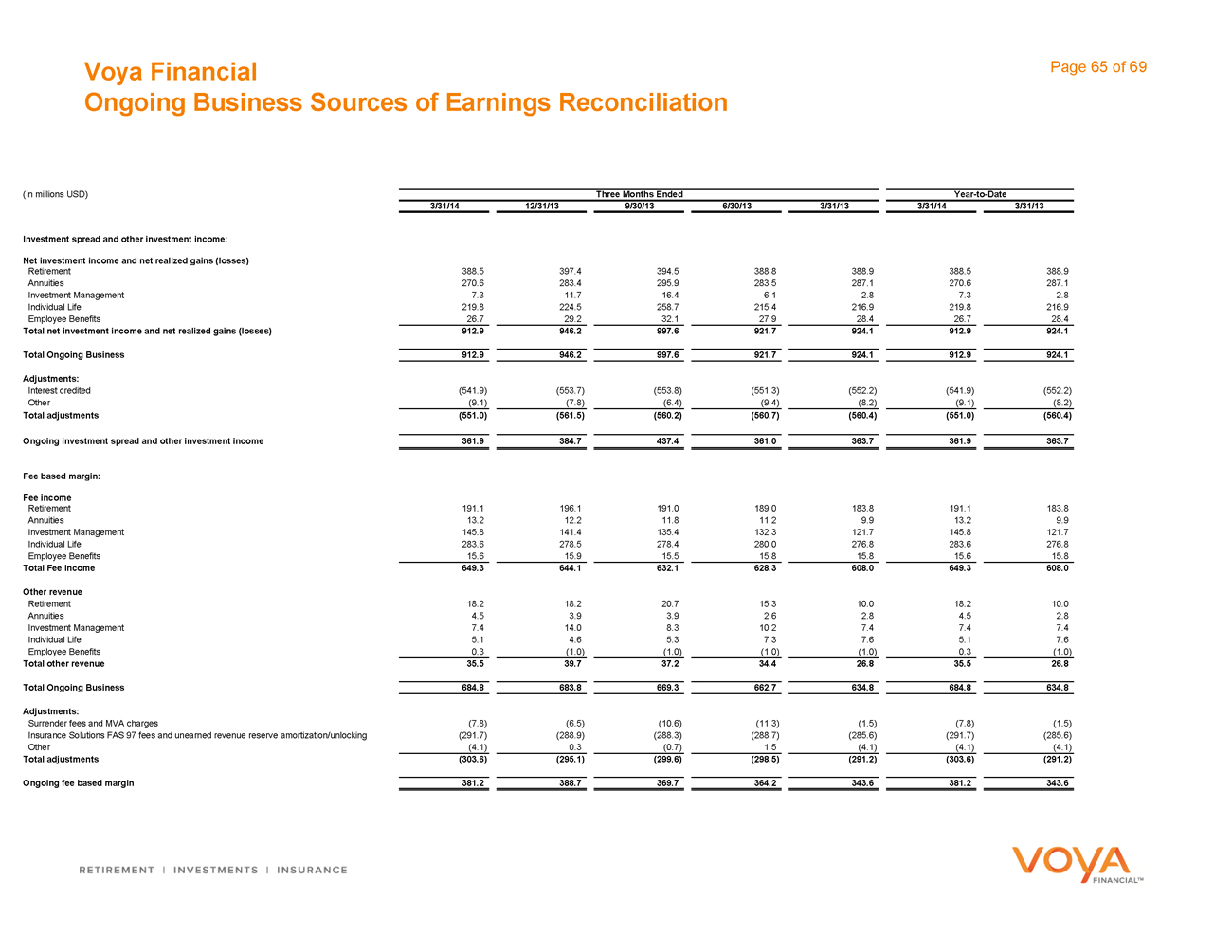

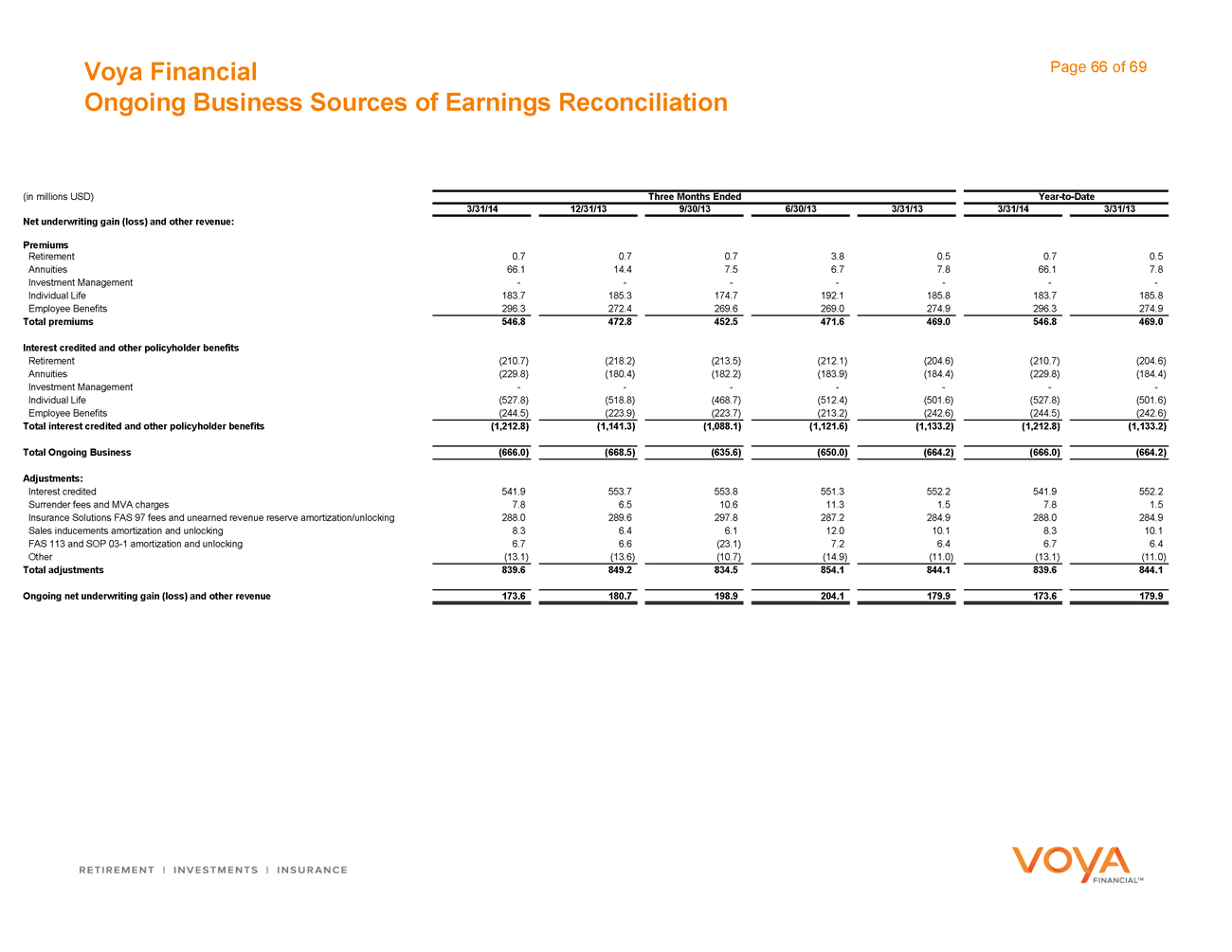

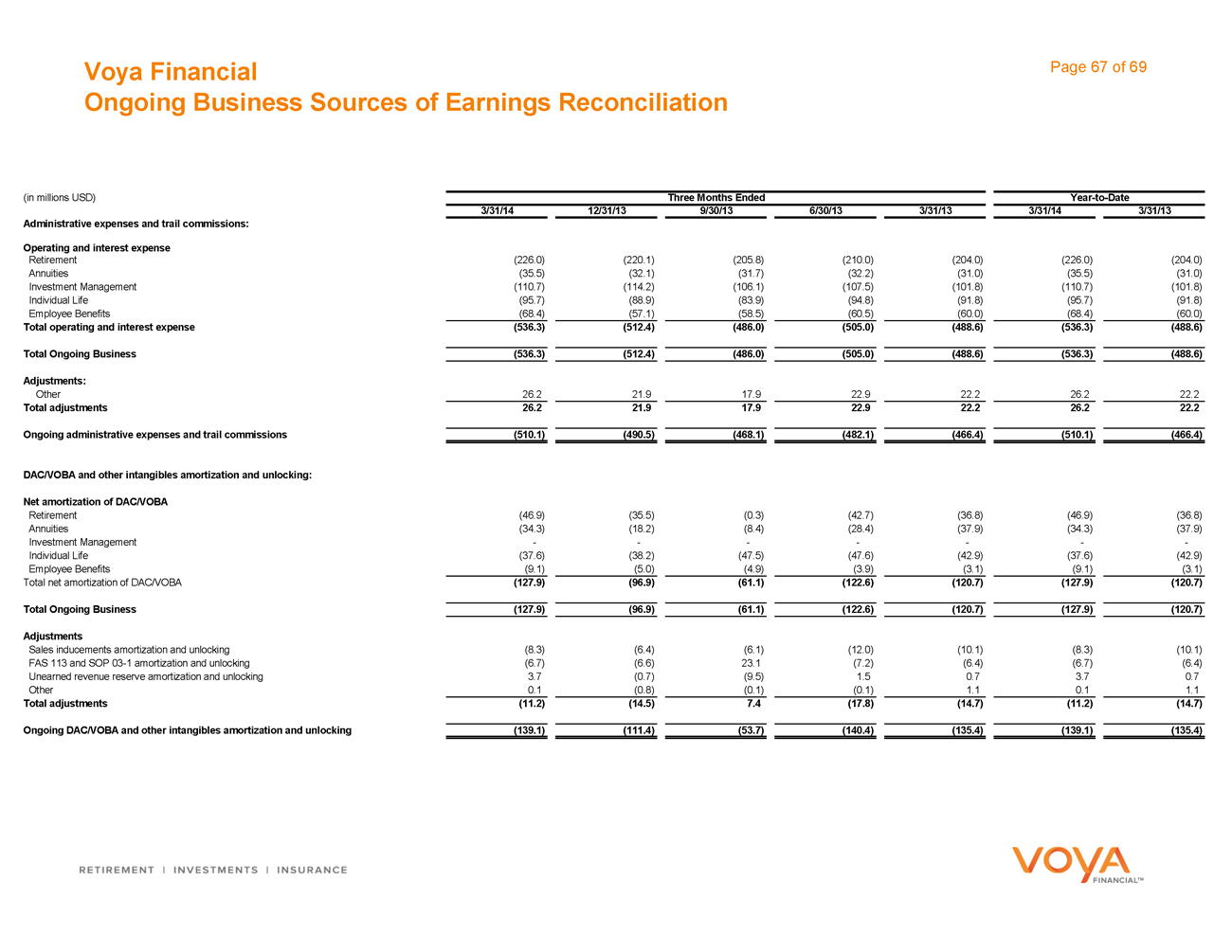

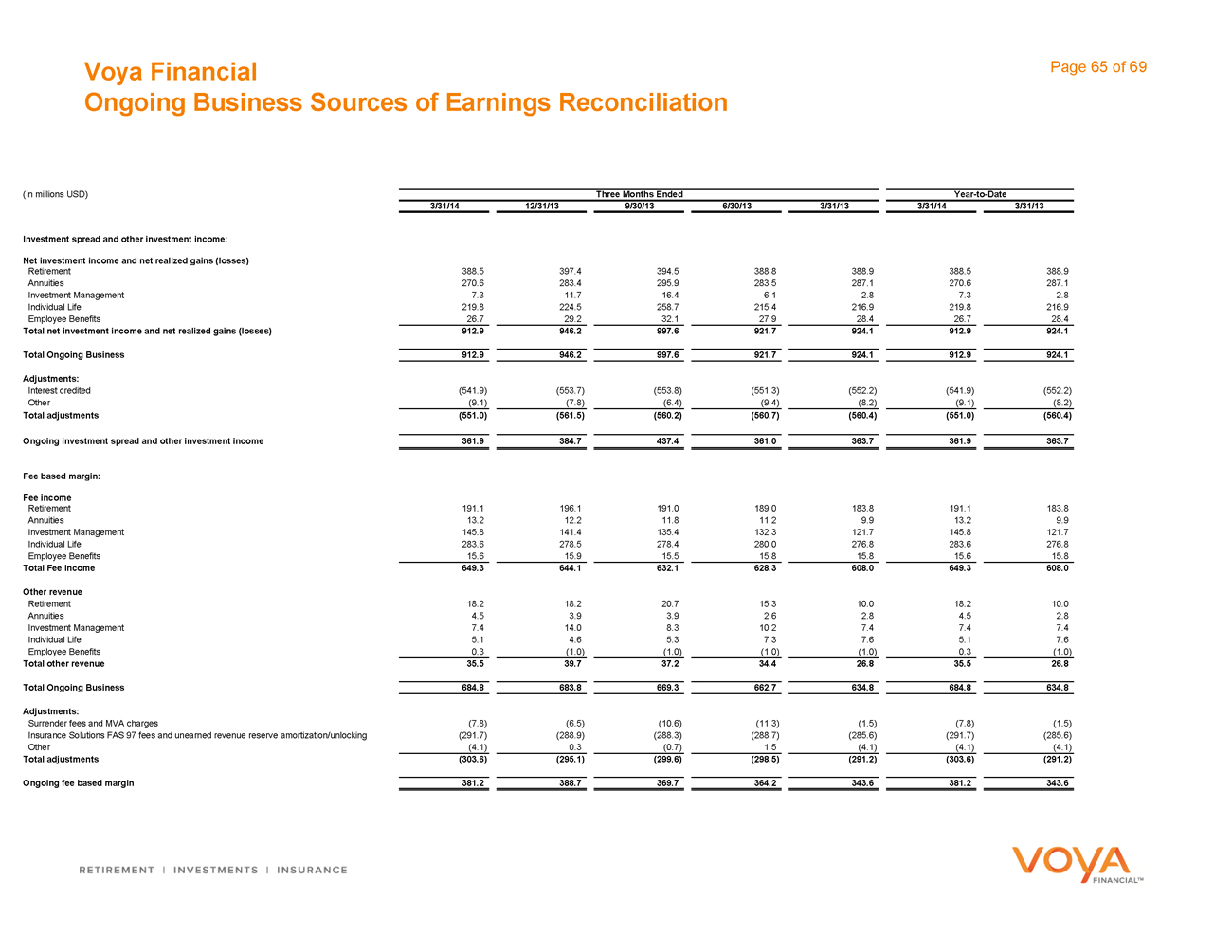

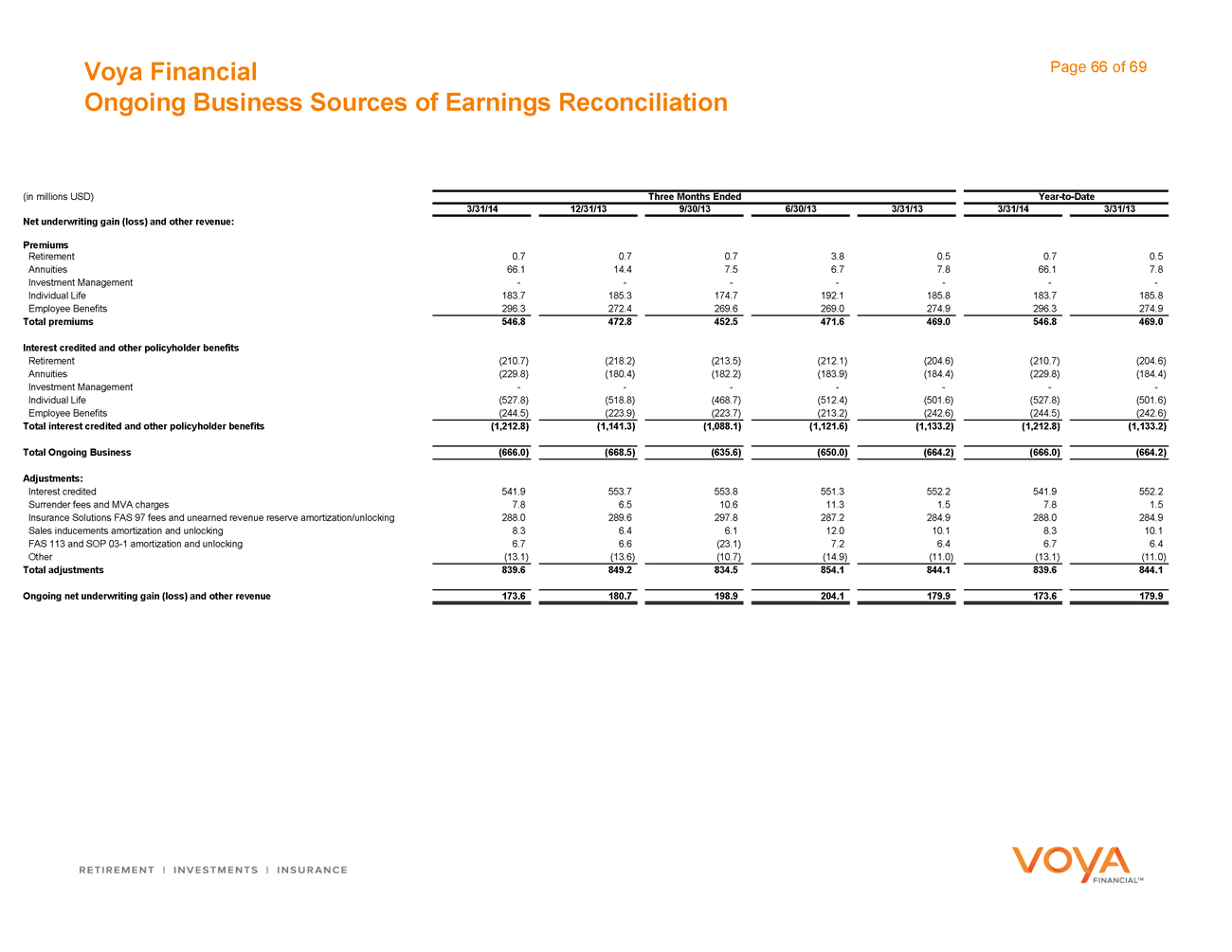

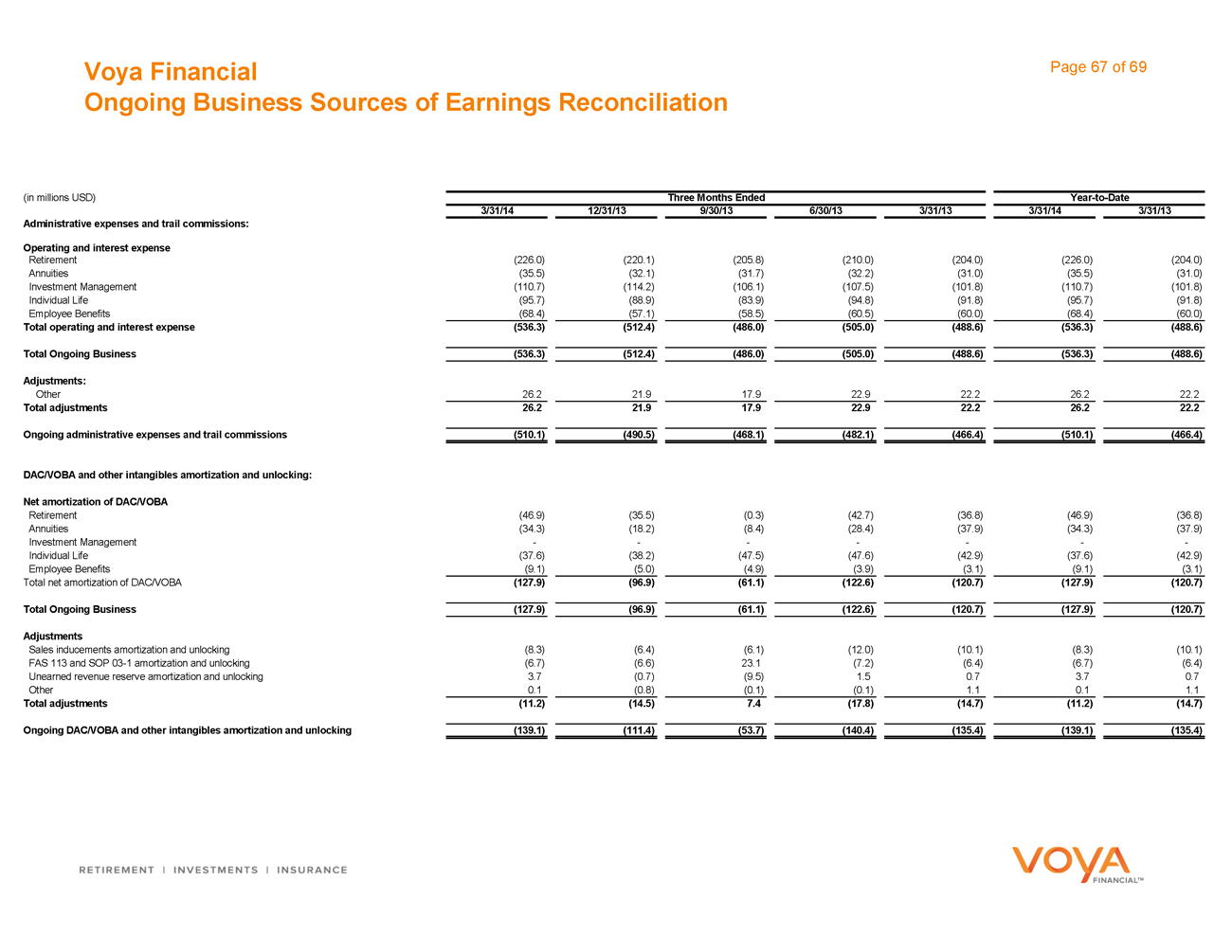

Account Value Rollforward by Source 33 Ongoing Business Sources of Earnings Reconciliation 65-67

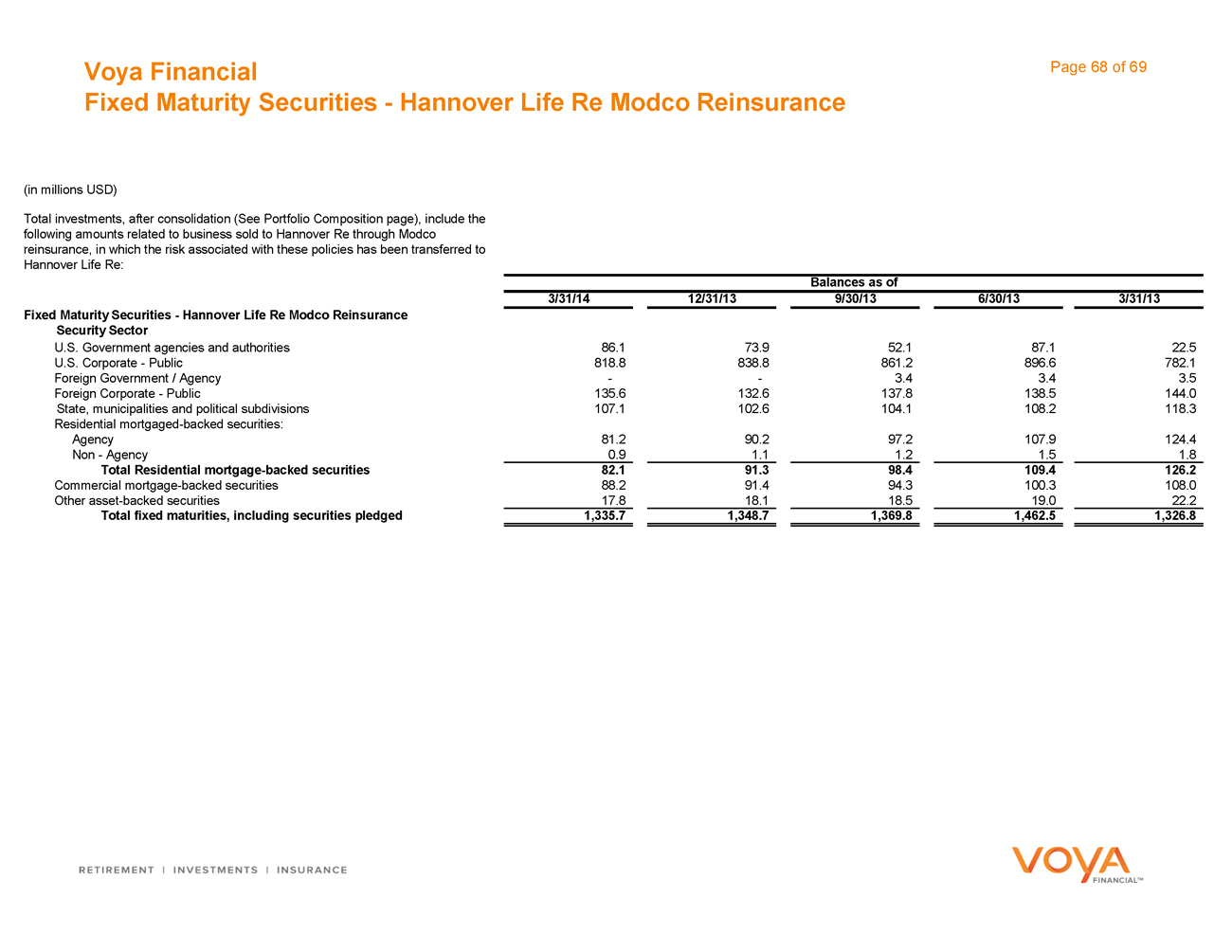

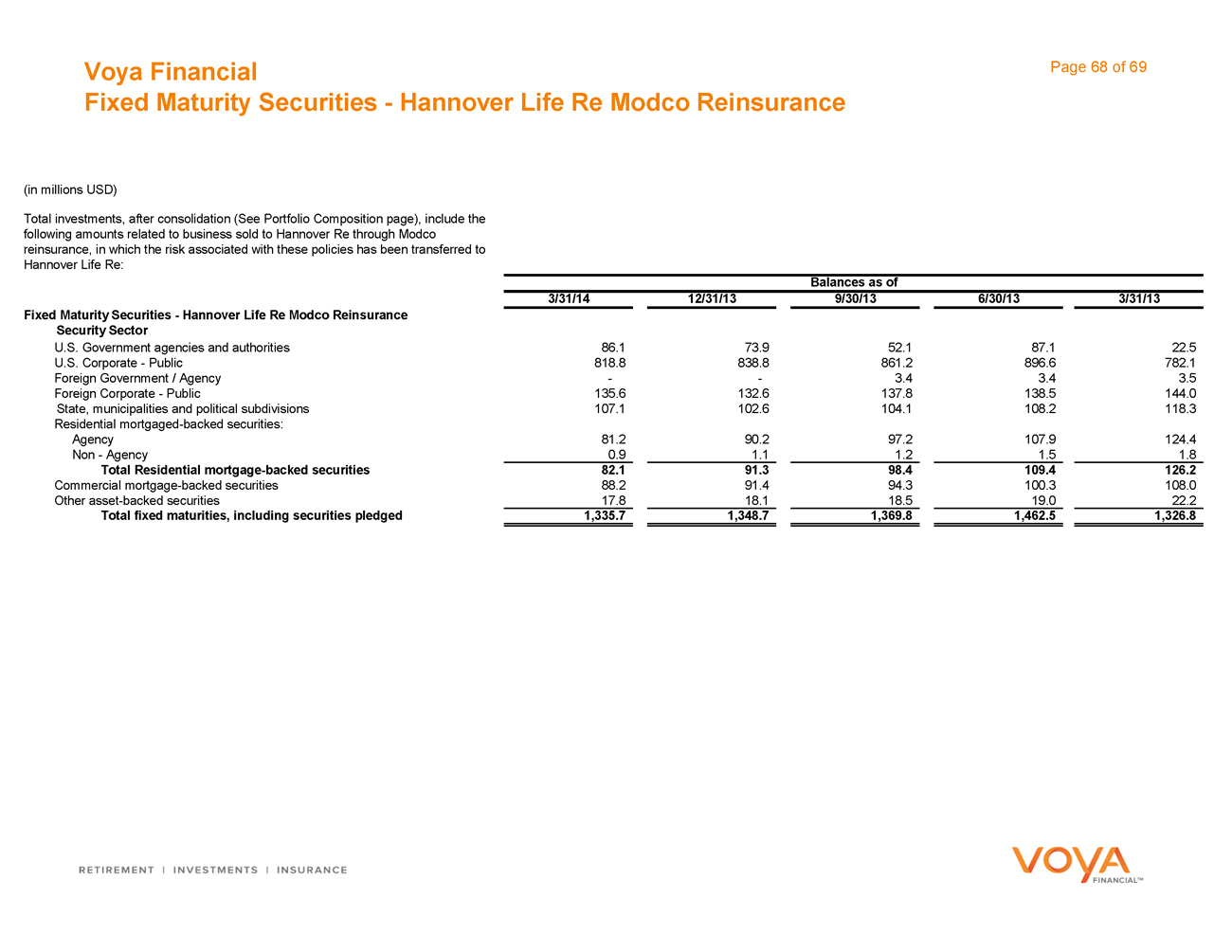

Account Value by Asset Type 34 Fixed Maturity Securities-Hannover Life Re Modco Reinsurance 68

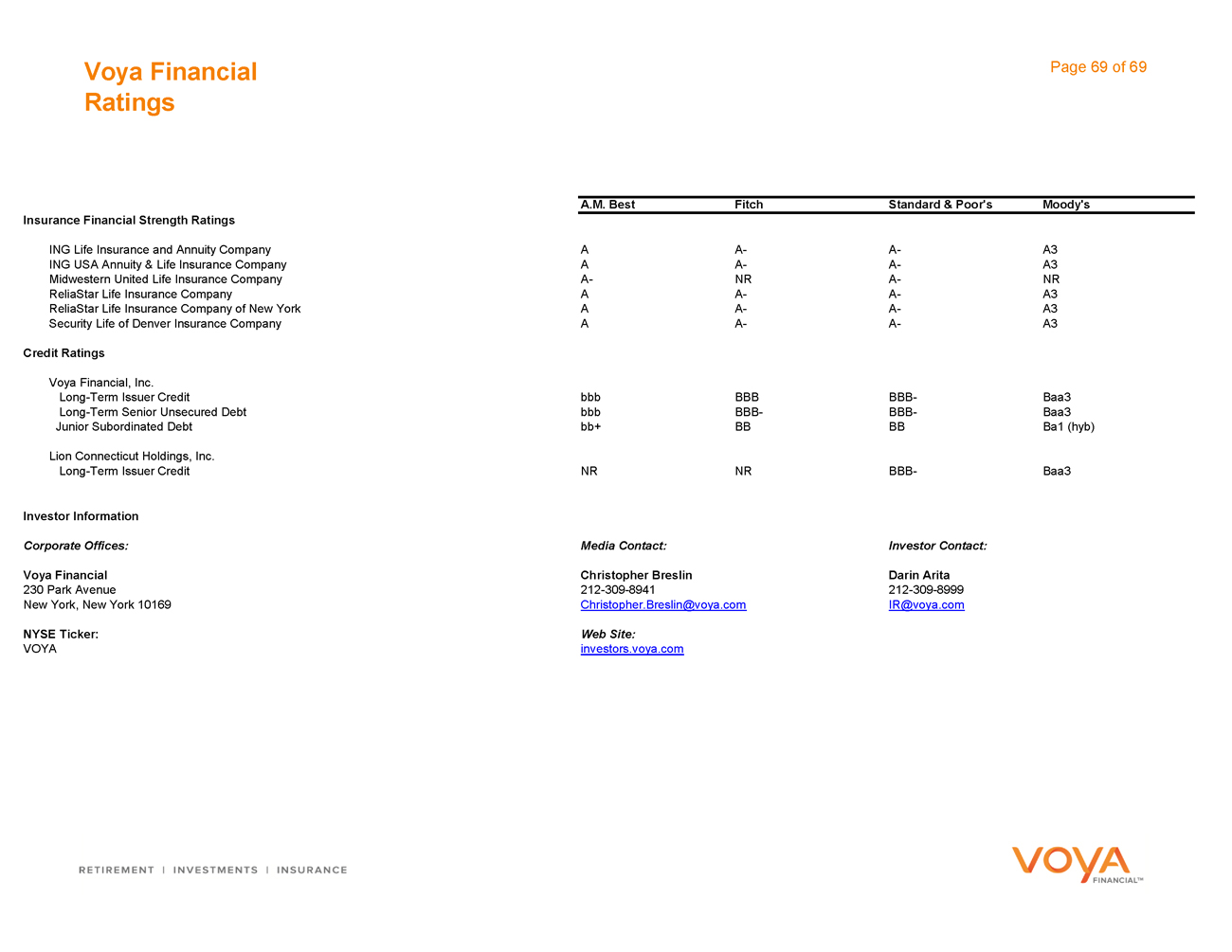

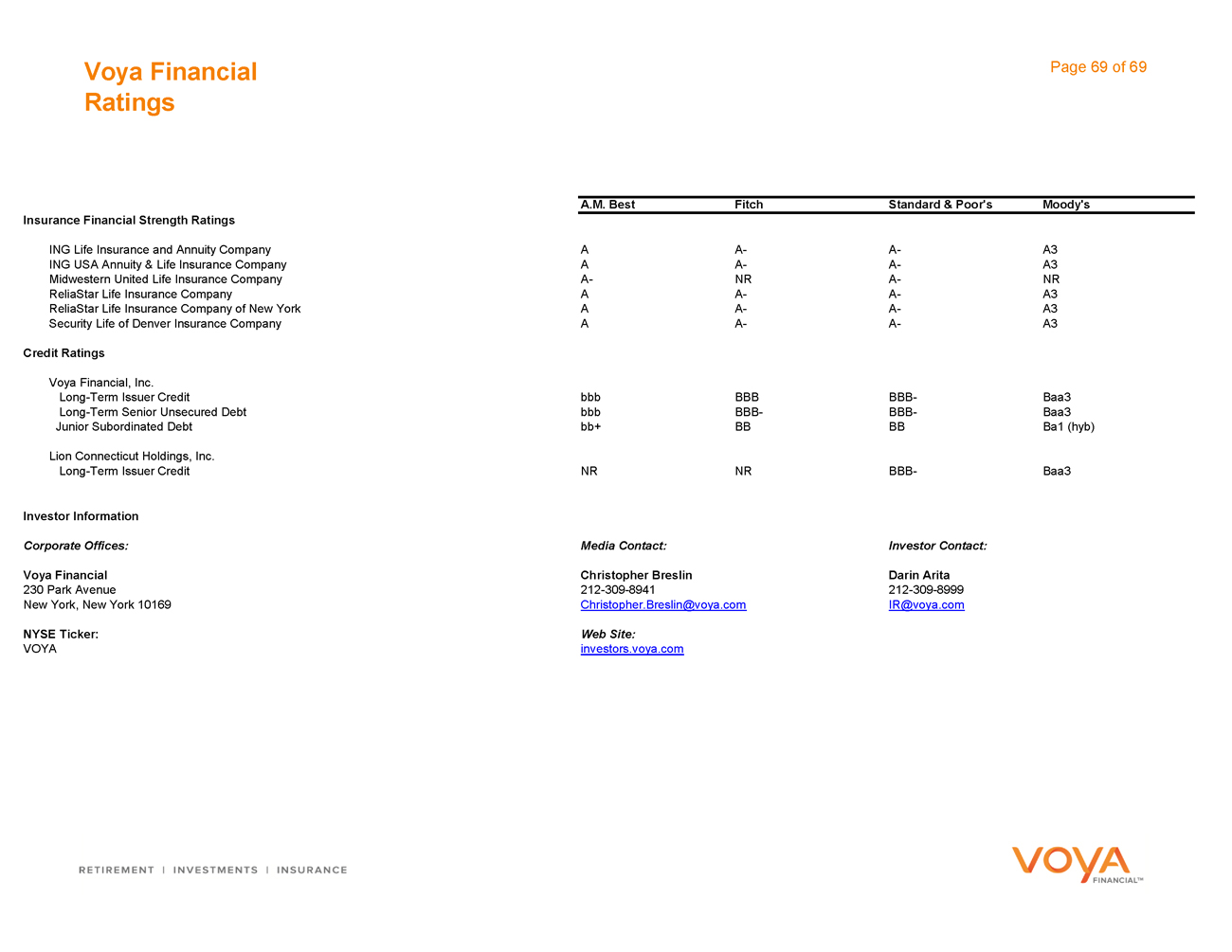

Financial Ratings 69

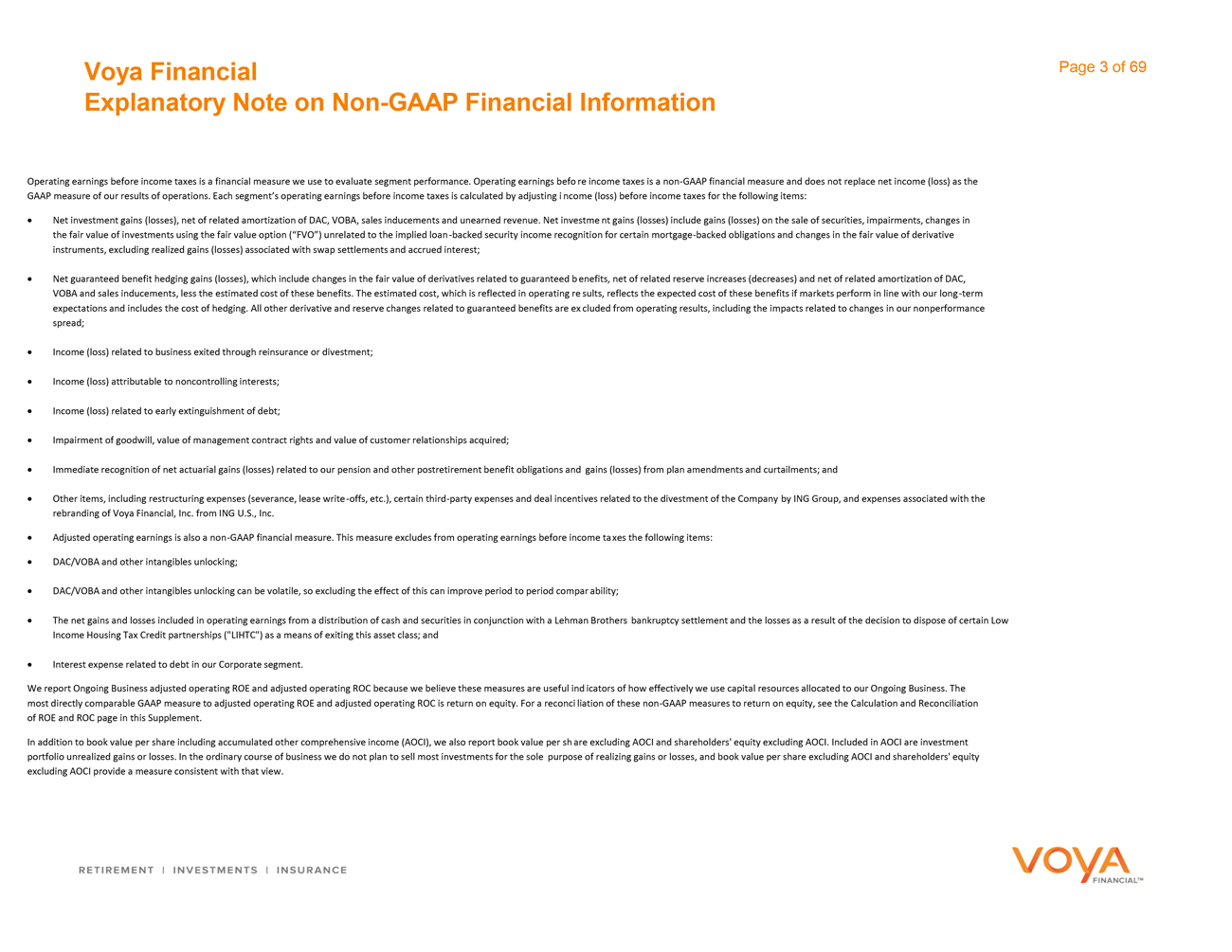

Voya Financial Page 3 of 69 Explanatory Note on Non-GAAP Financial Information

Operating earnings before income taxes is a financial measure we use to evaluate segment performance. Operating earnings befo re income taxes is a non-GAAP financial measure and does not replace net income (loss) as the

GAAP measure of our results of operations. Each segment’s operating earnings before income taxes is calculated by adjusting i ncome (loss) before income taxes for the following items:

· Net investment gains (losses), net of related amortization of DAC, VOBA, sales inducements and unearned revenue. Net investme nt gains (losses) include gains (losses) on the sale of securities, impairments, changes in the fair value of investments using the fair value option (“FVO”) unrelated to the implied loan-backed security income recognition for certain mortgage-backed obligations and changes in the fair value of derivative instruments, excluding realized gains (losses) associated with swap settlements and accrued interest;

· Net guaranteed benefit hedging gains (losses), which include changes in the fair value of derivatives related to guaranteed benefits, net of related reserve increases (decreases) and net of related amortization of DAC, VOBA and sales inducements, less the estimated cost of these benefits. The estimated cost, which is reflected in operating re sults, reflects the expected cost of these benefits if markets perform in line with our long-term expectations and includes the cost of hedging. All other derivative and reserve changes related to guaranteed benefits are ex cluded from operating results, including the impacts related to changes in our nonperformance spread;

· Income (loss) related to business exited through reinsurance or divestment; · Income (loss) attributable to noncontrolling interests; · Income (loss) related to early extinguishment of debt;

· Impairment of goodwill, value of management contract rights and value of customer relationships acquired;

· Immediate recognition of net actuarial gains (losses) related to our pension and other postretirement benefit obligations and gains (losses) from plan amendments and curtailments; and

· Other items, including restructuring expenses (severance, lease write-offs, etc.), certain third-party expenses and deal incentives related to the divestment of the Company by ING Group, and expenses associated with the rebranding of Voya Financial, Inc. from ING U.S., Inc.

· Adjusted operating earnings is also a non-GAAP financial measure. This measure excludes from operating earnings before income taxes the following items: · DAC/VOBA and other intangibles unlocking; · DAC/VOBA and other intangibles unlocking can be volatile, so excluding the effect of this can improve period to period compar ability;

· The net gains and losses included in operating earnings from a distribution of cash and securities in conjunction with a Lehman Brothers bankruptcy settlement and the losses as a result of the decision to dispose of certain Low Income Housing Tax Credit partnerships (“LIHTC”) as a means of exiting this asset class; and

· Interest expense related to debt in our Corporate segment.

We report Ongoing Business adjusted operating ROE and adjusted operating ROC because we believe these measures are useful ind icators of how effectively we use capital resources allocated to our Ongoing Business. The most directly comparable GAAP measure to adjusted operating ROE and adjusted operating ROC is return on equity. For a reconci liation of these non-GAAP measures to return on equity, see the Calculation and Reconciliation of ROE and ROC page in this Supplement.

In addition to book value per share including accumulated other comprehensive income (AOCI), we also report book value per sh are excluding AOCI and shareholders’ equity excluding AOCI. Included in AOCI are investment portfolio unrealized gains or losses. In the ordinary course of business we do not plan to sell most investments for the sole purpose of realizing gains or losses, and book value per share excluding AOCI and shareholders’ equity excluding AOCI provide a measure consistent with that view.

Voya Financial Page 4 of 69

Explanatory Note on Non-GAAP Financial Information

Our Closed Block Variable Annuity segment is managed to focus on protecting regulatory and rating agency capital rather than achieving operating metrics and, therefore, we exclude its results of operations from operating earnings before income taxes. When we present the adjustments to Net Income (loss) before income taxes on a consolidated basis, each adjustment excludes the relative portions attributable to our Closed Block Variable Annuity segment.

The most directly comparable GAAP measure to operating earnings before income taxes is net income (loss) before income taxes. For a reconciliation of operating earnings before income taxes to income (loss) before income taxes, refer to the “Consolidated Earnings Before Income Taxes” page in this document. In addition, please refer to “Adjusted Operating Earnings by Segment” for reconciliation from Total operating earnings before income taxes to Total adjusted operating earnings before income taxes.

Operating revenues is a measure of our segment revenues and a non-GAAP financial measure. We calculate operating revenues by adjusting each segment’s total revenue for the following items:

Net realized investment gains (losses) and related charges and adjustments, which include gains (losses) on the sale of securities, impairments, changes in the fair value of investments using the FVO unrelated to the implied loan-backed security income recognition for certain mortgage-backed obligations and changes in the fair value of derivative instruments, excluding realized gains (losses) associated with swap settlements and accrued interest. These items are net of related amortization of unearned revenue;

Gain (loss) on change in fair value of derivatives related to guaranteed benefits, which include changes in the fair value of derivatives related to guaranteed benefits, less the estimated cost of these benefits. The estimated cost, which is reflected in operating results, reflects the expected cost of these benefits if markets perform in line with our long-term expectations and includes the cost of hedging. All other derivative and reserve changes related to guaranteed benefits are excluded from operating revenues, including the impacts related to changes in our nonperformance spread;

Revenues related to businesses exited through reinsurance or divestment;

Revenues attributable to noncontrolling interests; and

Other adjustments to operating revenues primarily reflect fee income earned by our broker dealers for sales of non-proprietary products, which are reflected net of commission expense in our segments’ operating revenues, as well as other items where the income is passed on to third parties.

Operating revenues also excludes the revenues of our Closed Block Variable Annuity segment, since this segment is managed to focus on protecting regulatory and rating agency capital rather than generating operating earnings. When we present the adjustments to Total revenues on a consolidated basis, each adjustment excludes the relative portions attributable to our Closed Block Variable Annuity segment.

The most directly comparable GAAP measure to operating revenues is total revenues. For a reconciliation of operating revenue to total revenues, please refer to the “Operating Revenues by Segment” page in this document.

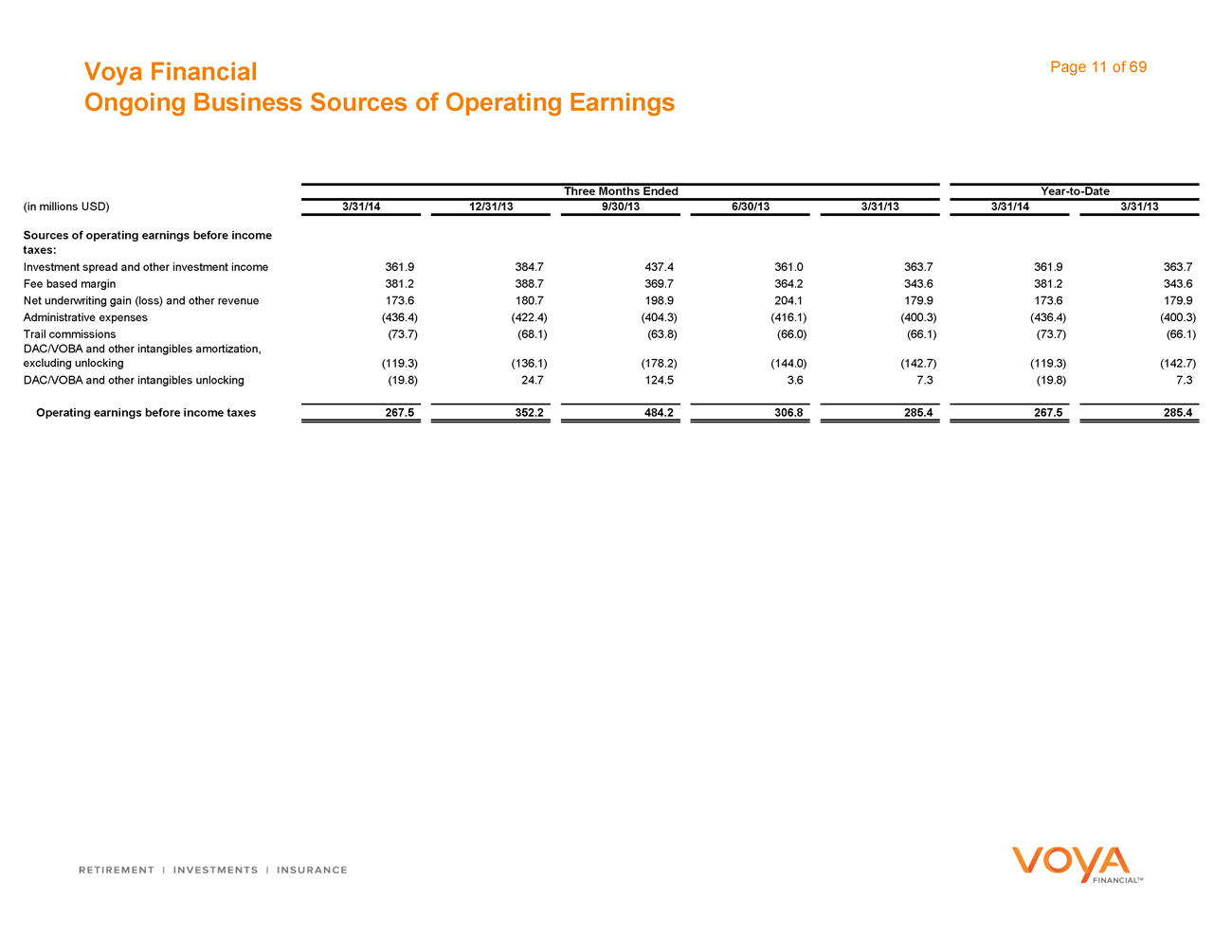

We analyze our Ongoing Business performance based on the sources of earnings. We believe this supplemental information is useful in order to gain a better understanding of our operating earnings (loss) before income taxes for the following reasons: (1) we analyze our business using this information and (2) this presentation can be helpful for investors to understand the main drivers of operating earnings (loss) before income taxes of our ongoing businesses. The sources of earnings are defined as such:

Investment spread and other investment income consists of net investment income and net realized investment gains (losses) associated with swap settlements and accrued interest, less interest credited to policyholder reserves.

Fee based margin consists primarily of fees earned on AUM, AUA, and transaction based recordkeeping fees.

Net underwriting gain (loss) and other revenue contains the following: the difference between fees charged for insurance risks and incurred benefits, including mortality, morbidity, and surrender results, contractual charges for universal life and annuity contracts, the change in the unearned revenue reserve for universal life contracts, and that portion of traditional life insurance premiums intended to cover expenses and profits. Certain contract charges for universal life insurance are not recognized in income immediately, but are deferred as unearned revenues and are amortized into income in a manner similar to the amortization of DAC.

Administrative expenses are general expenses, net of amounts capitalized as acquisition expenses and exclude commission expenses and fees on letters of credit.

Trail commissions are commissions paid that are not deferred and thus recorded directly to expense.

For a detail explanation of DAC/VOBA and other intangibles amortization/unlocking see “Unlocking of DAC/VOBA and other Contract Owner/Policyholder Intangibles” in our SEC filings.

For a reconciliation of the sources of earnings presentation to the line items within operating revenues and operating benefits and expenses, please refer to the “Ongoing Business Sources of Earnings Reconciliation” pages in this document.

Voya Financial Page 5 of 69

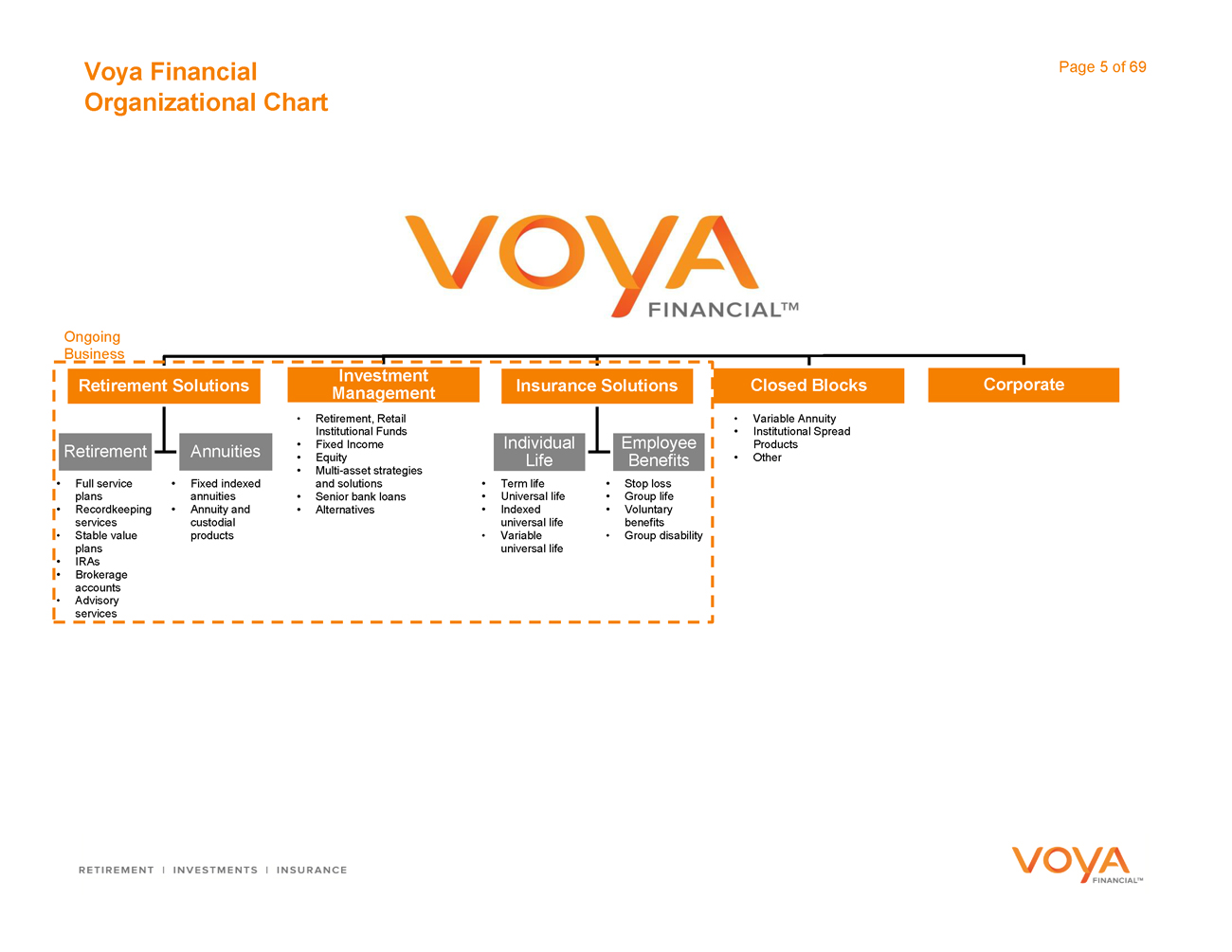

Organizational Chart

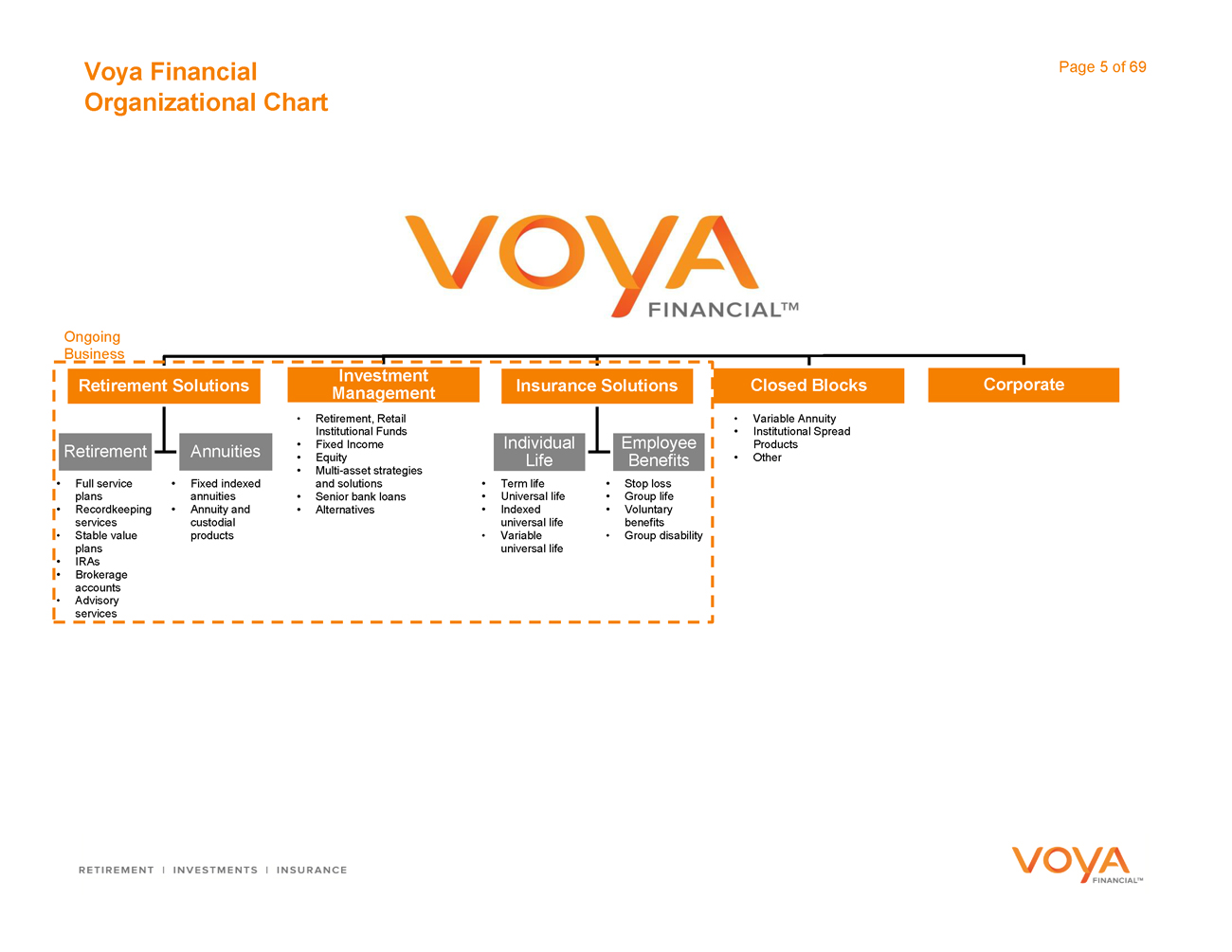

Ongoing Business

Investment

Retirement Solutions Insurance Solutions Closed Blocks Corporate Management

Retirement, Retail Variable Annuity Institutional Funds Institutional Spread

Retirement Annuities Fixed Income Individual Employee Products

Equity Life Benefits Other

Multi-asset strategies

Full service Fixed indexed and solutions Term life Stop loss plans annuities Senior bank loans Universal life Group life

Recordkeeping Annuity and Alternatives Indexed Voluntary services custodial universal life benefits

Stable value products Variable Group disability plans universal life

IRAs

Brokerage accounts

Advisory services

Voya Financial Page 6 of 69

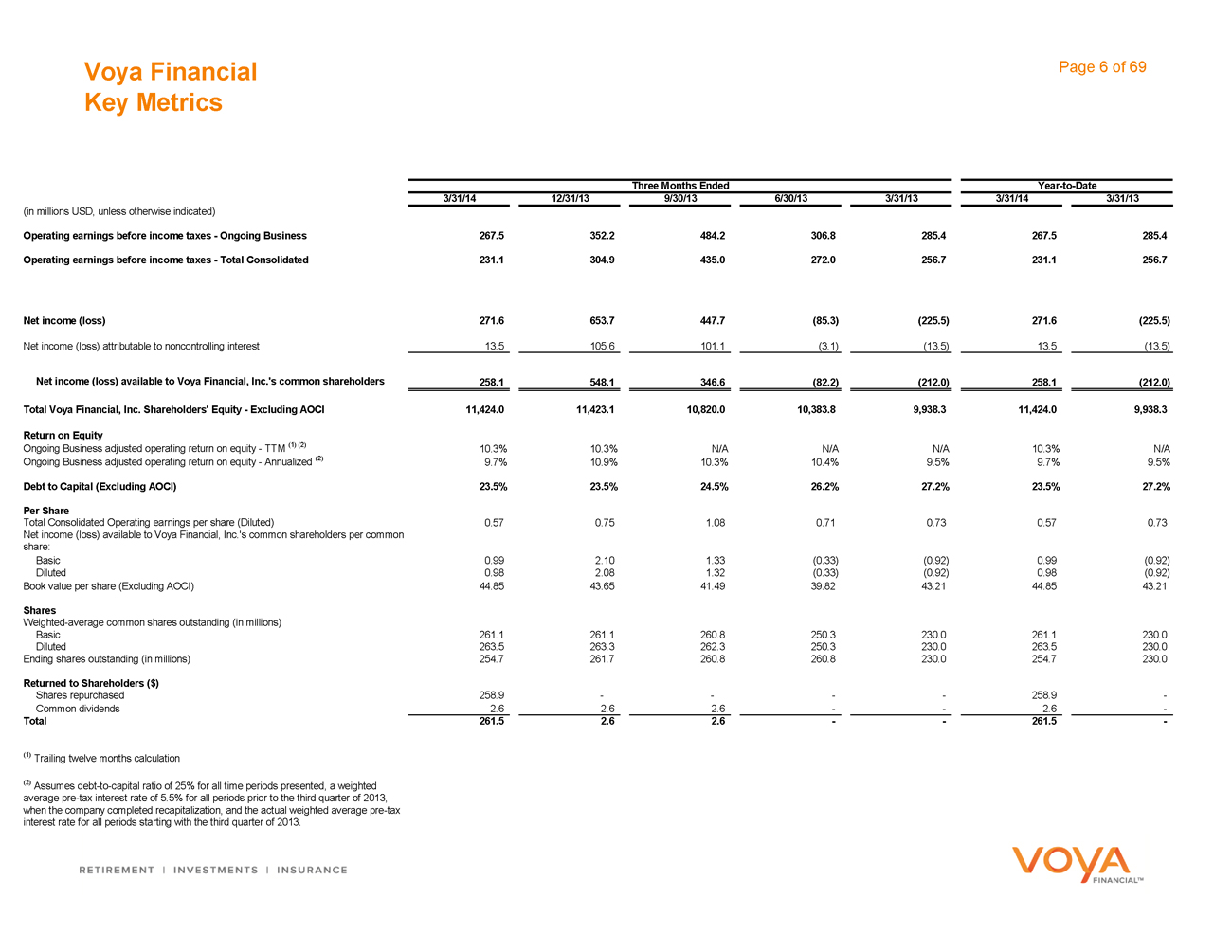

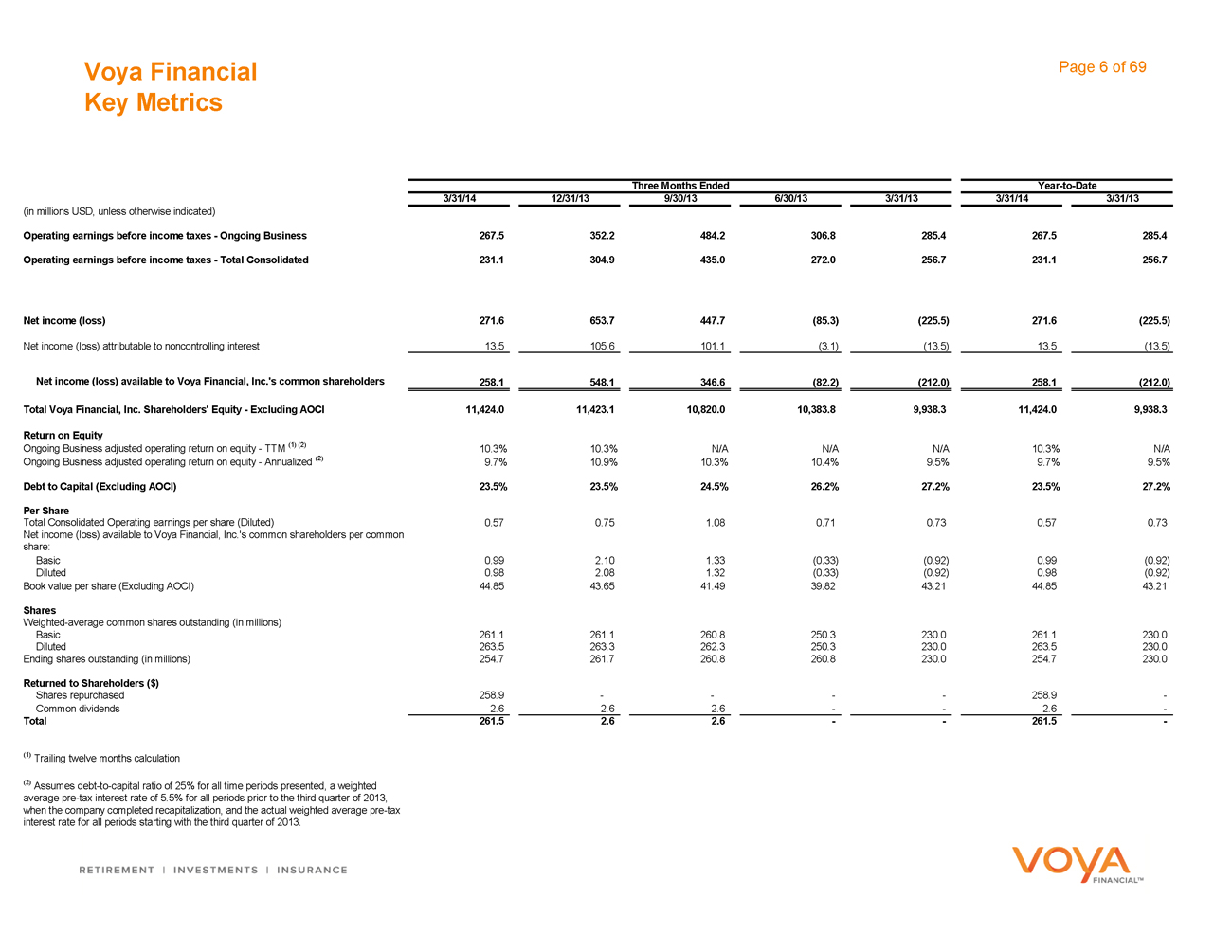

Key Metrics

Three Months Ended Year-to-Date

3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

(in millions USD, unless otherwise indicated)

Operating earnings before income taxes - Ongoing Business 267.5 352.2 484.2 306.8 285.4 267.5 285.4

Operating earnings before income taxes - Total Consolidated 231.1 304.9 435.0 272.0 256.7 231.1 256.7

Net income (loss) 271.6 653.7 447.7 (85.3) (225.5) 271.6 (225.5)

Net income (loss) attributable to noncontrolling interest 13.5 105.6 101.1 (3.1) (13.5) 13.5 (13.5)

Net income (loss) available to Voya Financial, Inc.’s common shareholders 258.1 548.1 346.6 (82.2) (212.0) 258.1 (212.0)

Total Voya Financial, Inc. Shareholders’ Equity - Excluding AOCI 11,424.0 11,423.1 10,820.0 10,383.8 9,938.3 11,424.0 9,938.3

Return on Equity

Ongoing Business adjusted operating return on equity - TTM (1) (2) 10.3% 10.3% N/A N/A N/A 10.3% N/A

Ongoing Business adjusted operating return on equity - Annualized (2) 9.7% 10.9% 10.3% 10.4% 9.5% 9.7% 9.5%

Debt to Capital (Excluding AOCI) 23.5% 23.5% 24.5% 26.2% 27.2% 23.5% 27.2%

Per Share

Total Consolidated Operating earnings per share (Diluted) 0.57 0.75 1.08 0.71 0.73 0.57 0.73

Net income (loss) available to Voya Financial, Inc.’s common shareholders per common

share:

Basic 0.99 2.10 1.33 (0.33) (0.92) 0.99 (0.92)

Diluted 0.98 2.08 1.32 (0.33) (0.92) 0.98 (0.92)

Book value per share (Excluding AOCI) 44.85 43.65 41.49 39.82 43.21 44.85 43.21

Shares

Weighted-average common shares outstanding (in millions)

Basic 261.1 261.1 260.8 250.3 230.0 261.1 230.0

Diluted 263.5 263.3 262.3 250.3 230.0 263.5 230.0

Ending shares outstanding (in millions) 254.7 261.7 260.8 260.8 230.0 254.7 230.0

Returned to Shareholders ($)

Shares repurchased 258.9 - - - - 258.9 -

Common dividends 2.6 2.6 2.6 - - 2.6 -

Total 261.5 2.6 2.6 - - 261.5 -

(1) Trailing twelve months calculation

(2) Assumes debt-to-capital ratio of 25% for all time periods presented, a weighted

average pre-tax interest rate of 5.5% for all periods prior to the third quarter of 2013,

when the company completed recapitalization, and the actual weighted average pre-tax

interest rate for all periods starting with the third quarter of 2013.

Voya Financial Page 7 of 69

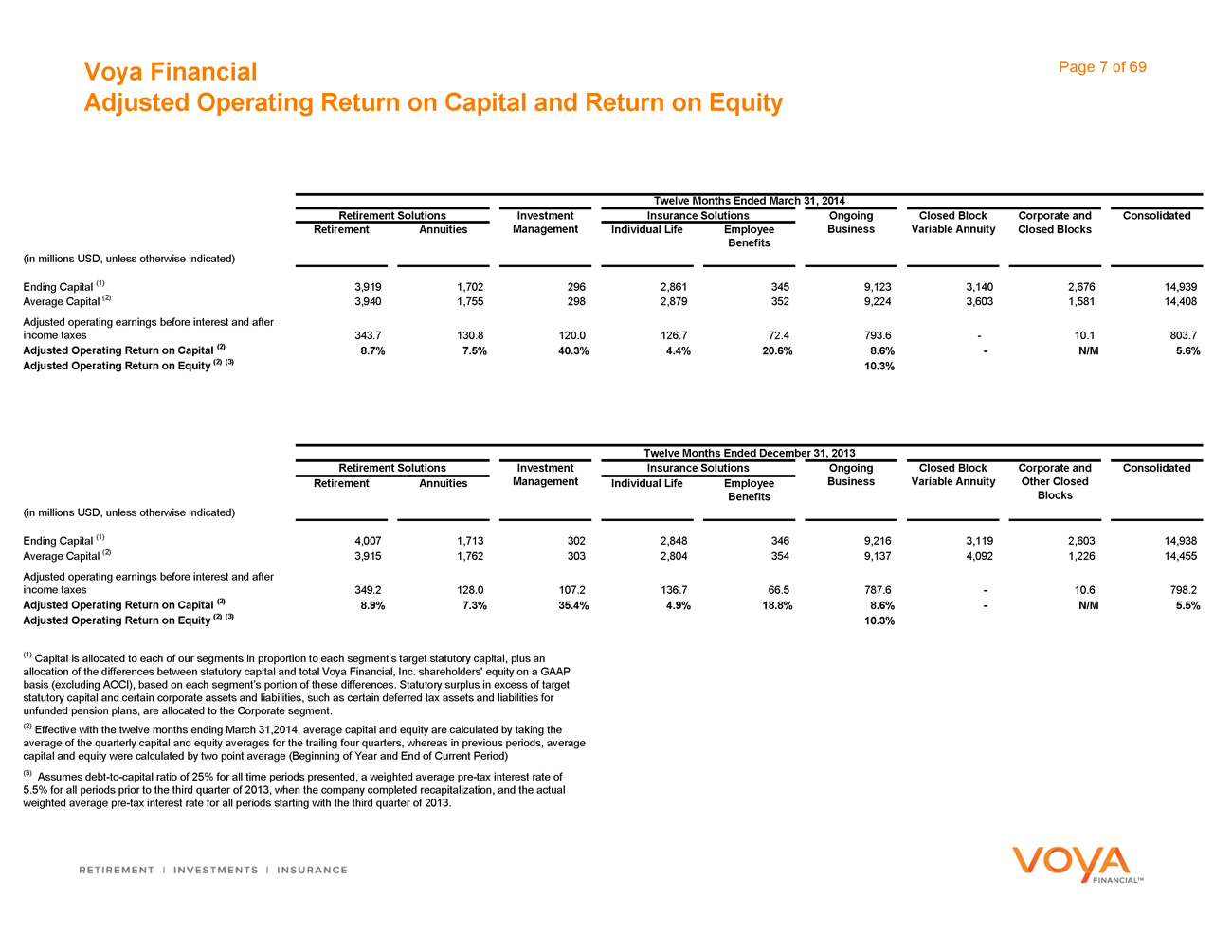

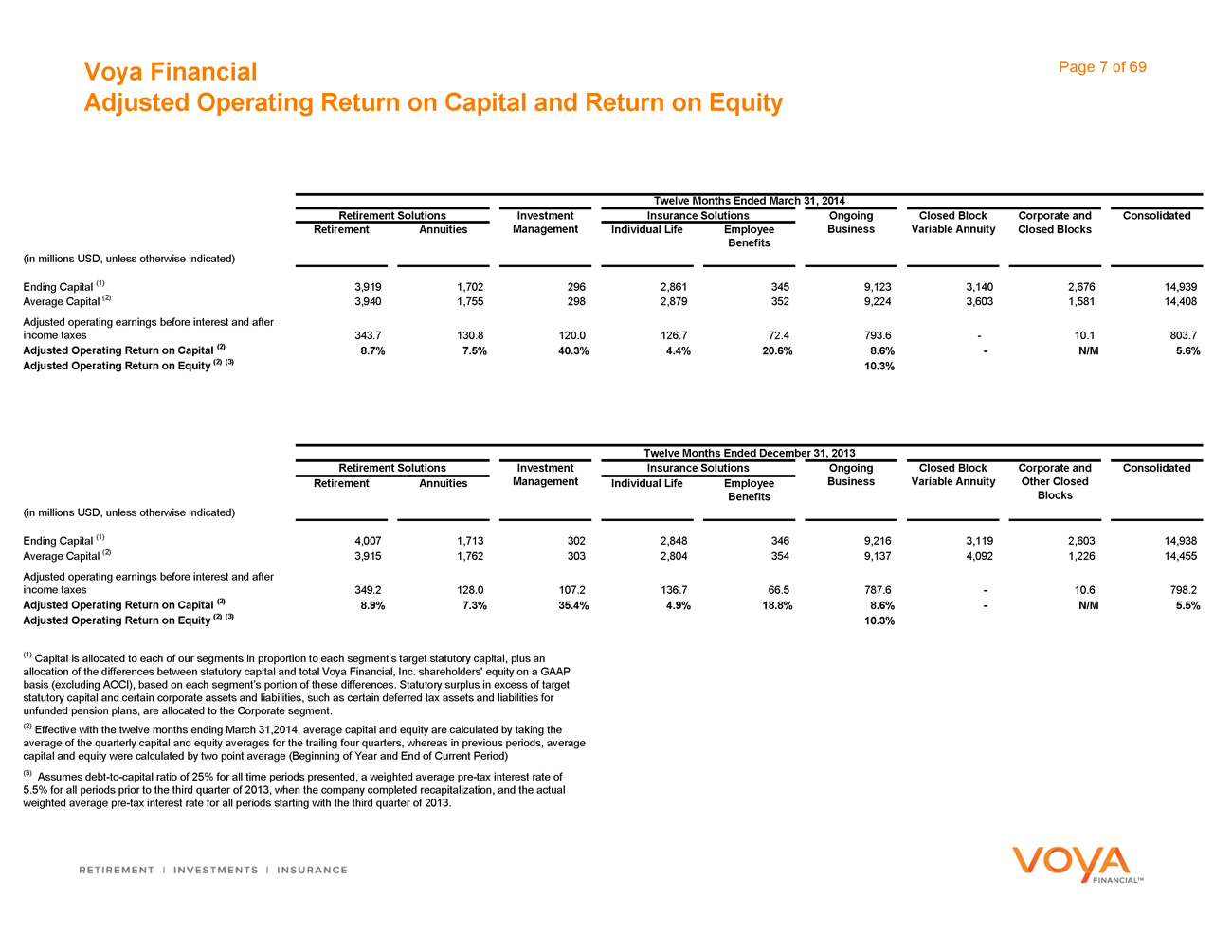

Adjusted Operating Return on Capital and Return on Equity

Twelve Months Ended March 31, 2014

Retirement Solutions Investment Insurance Solutions Ongoing Closed Block Corporate and Consolidated

Retirement Annuities Management Individual Life Employee Business Variable Annuity Closed Blocks

Benefits

(in millions USD, unless otherwise indicated)

Ending Capital (1) 3,919 1,702 296 2,861 345 9,123 3,140 2,676 14,939

Average Capital (2) 3,940 1,755 298 2,879 352 9,224 3,603 1,581 14,408

Adjusted operating earnings before interest and after

income taxes 343.7 130.8 120.0 126.7 72.4 793.6 - 10.1 803.7

Adjusted Operating Return on Capital (2) 8.7% 7.5% 40.3% 4.4% 20.6% 8.6% - N/M 5.6%

Adjusted Operating Return on Equity (2) (3) 10.3%

Twelve Months Ended December 31, 2013

Retirement Solutions Investment Insurance Solutions Ongoing Closed Block Corporate and Consolidated

Retirement Annuities Management Individual Life Employee Business Variable Annuity Other Closed

Benefits Blocks

(in millions USD, unless otherwise indicated)

Ending Capital (1) 4,007 1,713 302 2,848 346 9,216 3,119 2,603 14,938

Average Capital (2) 3,915 1,762 303 2,804 354 9,137 4,092 1,226 14,455

Adjusted operating earnings before interest and after

income taxes 349.2 128.0 107.2 136.7 66.5 787.6 - 10.6 798.2

Adjusted Operating Return on Capital (2) 8.9% 7.3% 35.4% 4.9% 18.8% 8.6% - N/M 5.5%

Adjusted Operating Return on Equity (2) (3) 10.3%

(1) Capital is allocated to each of our segments in proportion to each segment’s target statutory capital, plus an allocation of the differences between statutory capital and total Voya Financial, Inc. shareholders’ equity on a GAAP basis (excluding AOCI), based on each segment’s portion of these differences. Statutory surplus in excess of target statutory capital and certain corporate assets and liabilities, such as certain deferred tax assets and liabilities for unfunded pension plans, are allocated to the Corporate segment.

(2) Effective with the twelve months ending March 31,2014, average capital and equity are calculated by taking the average of the quarterly capital and equity averages for the trailing four quarters, whereas in previous periods, average capital and equity were calculated by two point average (Beginning of Year and End of Current Period)

(3) Assumes debt-to-capital ratio of 25% for all time periods presented, a weighted average pre-tax interest rate of 5.5% for all periods prior to the third quarter of 2013, when the company completed recapitalization, and the actual weighted average pre-tax interest rate for all periods starting with the third quarter of 2013.

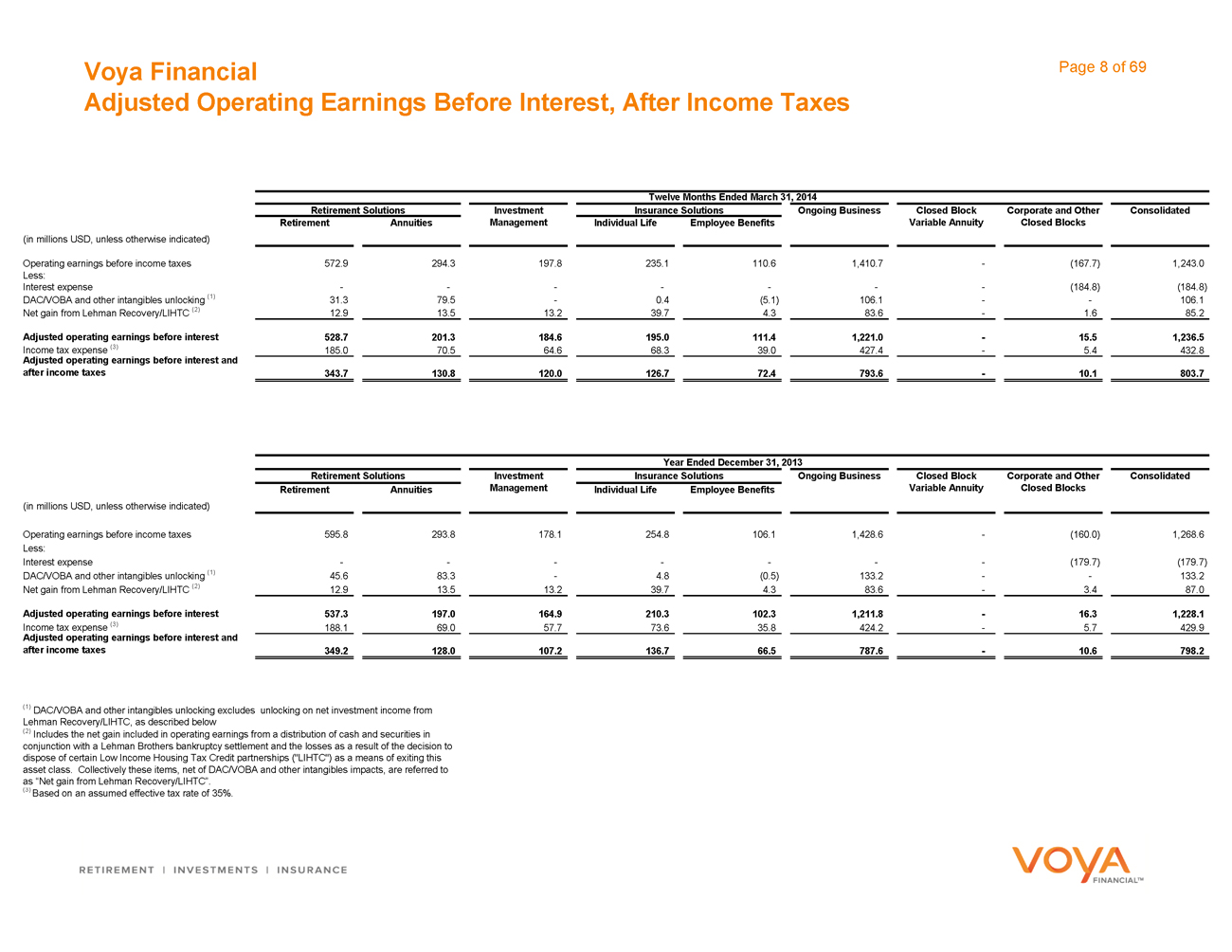

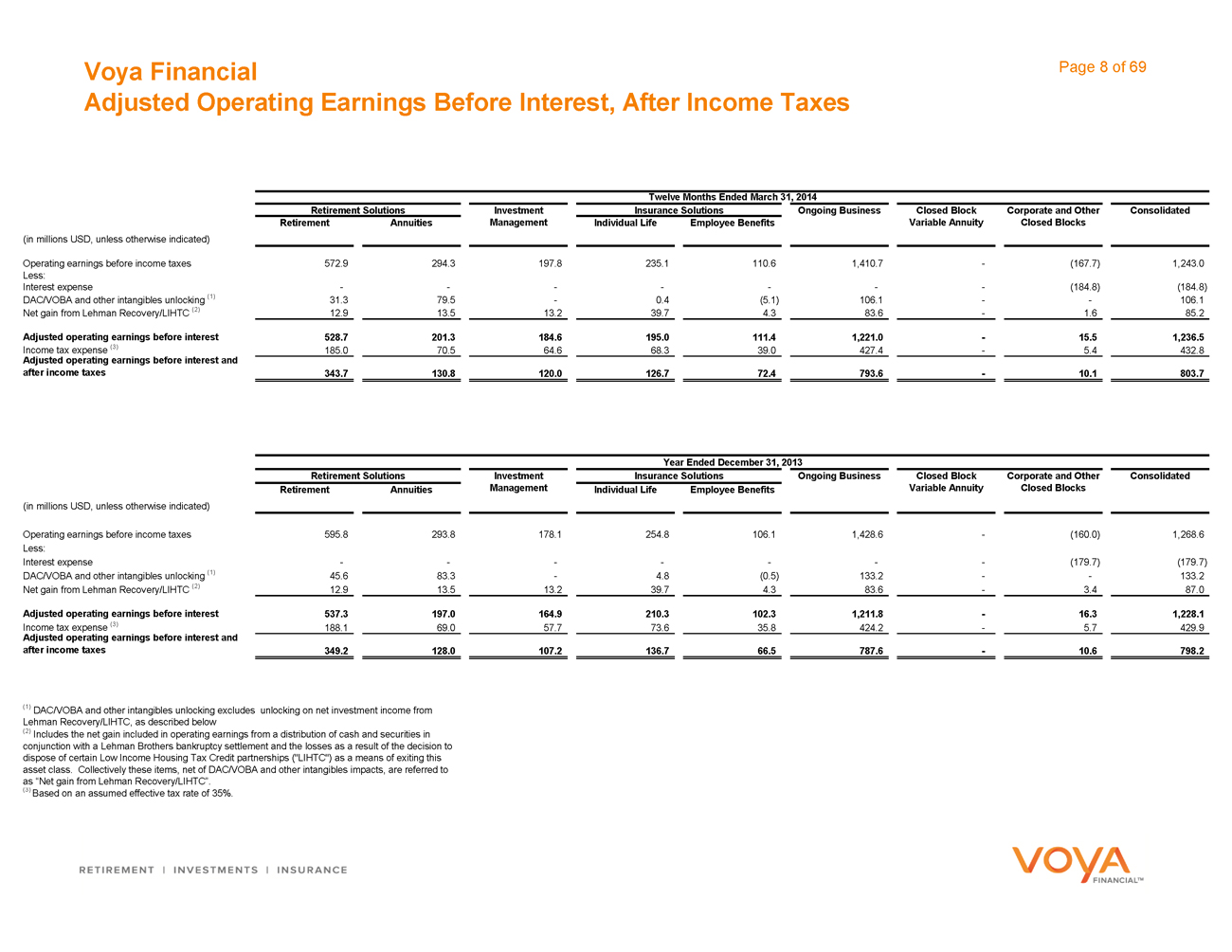

Voya Financial Page 8 of 69

Adjusted Operating Earnings Before Interest, After Income Taxes

Twelve Months Ended March 31, 2014

Retirement Solutions Investment Insurance Solutions Ongoing Business Closed Block Corporate and Other Consolidated

Retirement Annuities Management Individual Life Employee Benefits Variable Annuity Closed Blocks

(in millions USD, unless otherwise indicated)

Operating earnings before income taxes 572.9 294.3 197.8 235.1 110.6 1,410.7 - (167.7) 1,243.0

Less:

Interest expense - - - - - - - (184.8) (184.8)

DAC/VOBA and other intangibles unlocking (1) 31.3 79.5 - 0.4 (5.1) 106.1 - - 106.1

Net gain from Lehman Recovery/LIHTC (2) 12.9 13.5 13.2 39.7 4.3 83.6 - 1.6 85.2

Adjusted operating earnings before interest 528.7 201.3 184.6 195.0 111.4 1,221.0 — 15.5 1,236.5

Income tax expense (3) 185.0 70.5 64.6 68.3 39.0 427.4 - 5.4 432.8

Adjusted operating earnings before interest and

after income taxes 343.7 130.8 120.0 126.7 72.4 793.6 - 10.1 803.7

Year Ended December 31, 2013

Retirement Solutions Investment Insurance Solutions Ongoing Business Closed Block Corporate and Other Consolidated Retirement Annuities Management Individual Life Employee Benefits Variable Annuity Closed Blocks

(in millions USD, unless otherwise indicated)

Operating earnings before income taxes 595.8 293.8 178.1 254.8 106.1 1,428.6 - (160.0) 1,268.6

Less:

Interest expense - - - - - - - (179.7) (179.7)

DAC/VOBA and other intangibles unlocking (1) 45.6 83.3 - 4.8 (0.5) 133.2 -- 133.2

Net gain from Lehman Recovery/LIHTC (2) 12.9 13.5 13.2 39.7 4.3 83.6 - 3.4 87.0

Adjusted operating earnings before interest 537.3 197.0 164.9 210.3 102.3 1,211.8 - 16.3 1,228.1

Income tax expense (3) 188.1 69.0 57.7 73.6 35.8 424.2 - 5.7 429.9

Adjusted operating earnings before interest and

after income taxes 349.2 128.0 107.2 136.7 66.5 787.6 - 10.6 798.2

(1) DAC/VOBA and other intangibles unlocking excludes unlocking on net investment income from Lehman Recovery/LIHTC, as described below

(2) Includes the net gain included in operating earnings from a distribution of cash and securities in conjunction with a Lehman Brothers bankruptcy settlement and the losses as a result of the decision to dispose of certain Low Income Housing Tax Credit partnerships (“LIHTC”) as a means of exiting this asset class. Collectively these items, net of DAC/VOBA and other intangibles impacts, are referred to as “Net gain from Lehman Recovery/LIHTC”.

(3) Based on an assumed effective tax rate of 35%.

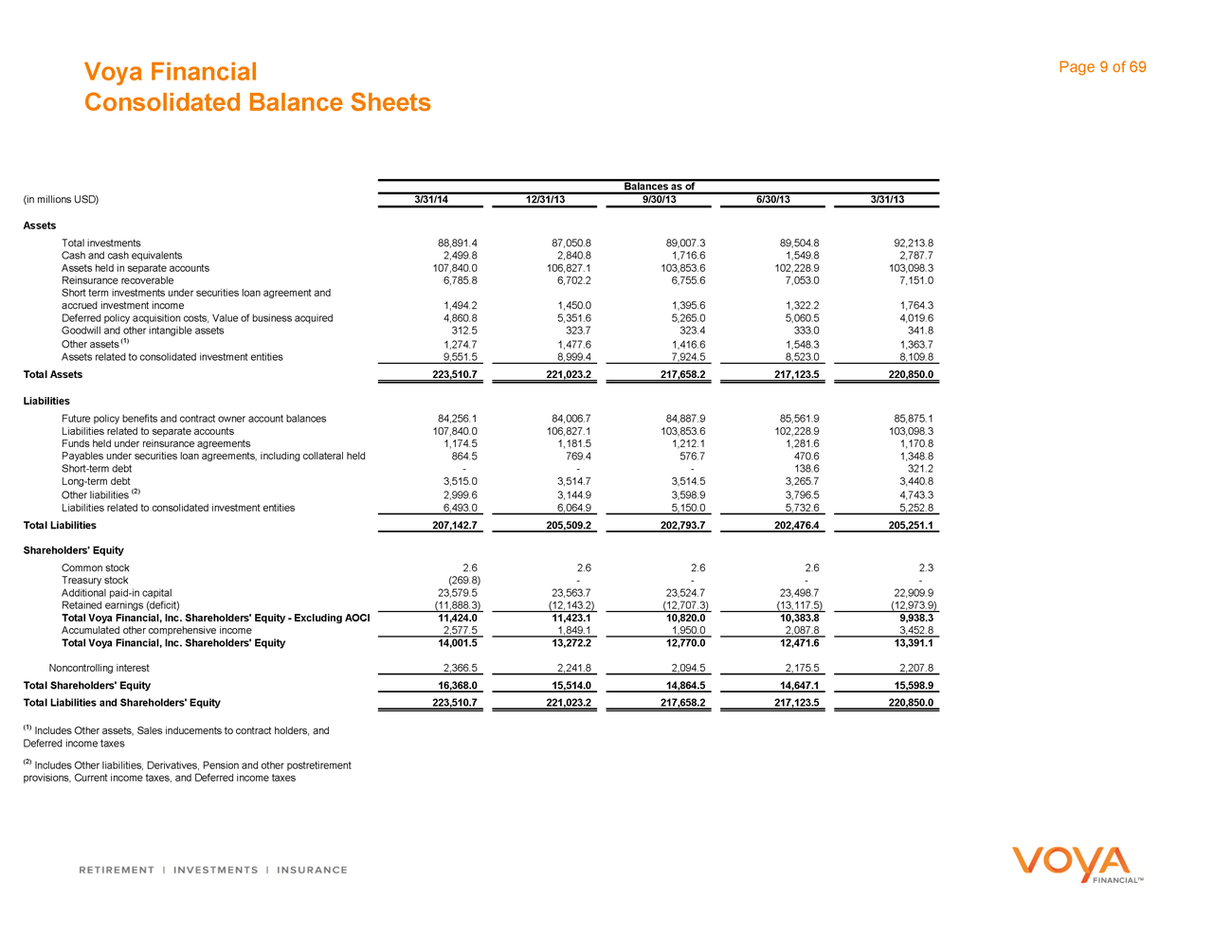

Voya Financial Page 9 of 69

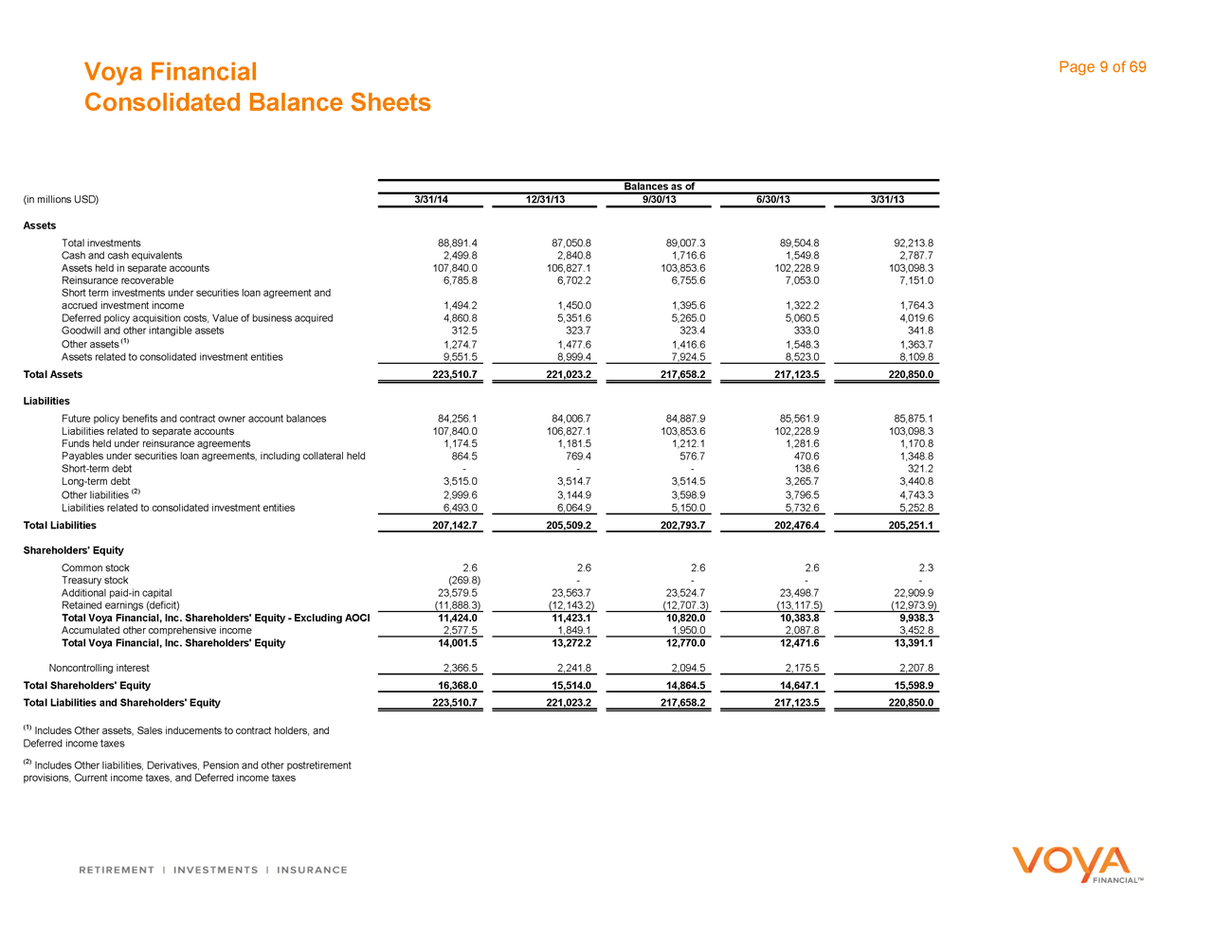

Consolidated Balance Sheets

Balances as of

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13

Assets

Total investments 88,891.4 87,050.8 89,007.3 89,504.8 92,213.8

Cash and cash equivalents 2,499.8 2,840.8 1,716.6 1,549.8 2,787.7

Assets held in separate accounts 107,840.0 106,827.1 103,853.6 102,228.9 103,098.3

Reinsurance recoverable 6,785.8 6,702.2 6,755.6 7,053.0 7,151.0

Short term investments under securities loan agreement and

accrued investment income 1,494.2 1,450.0 1,395.6 1,322.2 1,764.3

Deferred policy acquisition costs, Value of business acquired 4,860.8 5,351.6 5,265.0 5,060.5 4,019.6

Goodwill and other intangible assets 312.5 323.7 323.4 333.0 341.8

Other assets (1) 1,274.7 1,477.6 1,416.6 1,548.3 1,363.7

Assets related to consolidated investment entities 9,551.5 8,999.4 7,924.5 8,523.0 8,109.8

Total Assets 223,510.7 221,023.2 217,658.2 217,123.5 220,850.0

Liabilities

Future policy benefits and contract owner account balances 84,256.1 84,006.7 84,887.9 85,561.9 85,875.1

Liabilities related to separate accounts 107,840.0 106,827.1 103,853.6 102,228.9 103,098.3

Funds held under reinsurance agreements 1,174.5 1,181.5 1,212.1 1,281.6 1,170.8

Payables under securities loan agreements, including collateral held 864.5 769.4 576.7 470.6 1,348.8

Short-term debt - - - 138.6 321.2

Long-term debt 3,515.0 3,514.7 3,514.5 3,265.7 3,440.8

Other liabilities (2) 2,999.6 3,144.9 3,598.9 3,796.5 4,743.3

Liabilities related to consolidated investment entities 6,493.0 6,064.9 5,150.0 5,732.6 5,252.8

Total Liabilities 207,142.7 205,509.2 202,793.7 202,476.4 205,251.1

Shareholders’ Equity

Common stock 2.6 2.6 2.6 2.6 2.3

Treasury stock (269.8) - - - -

Additional paid-in capital 23,579.5 23,563.7 23,524.7 23,498.7 22,909.9

Retained earnings (deficit) (11,888.3) (12,143.2) (12,707.3) (13,117.5) (12,973.9)

Total Voya Financial, Inc. Shareholders’ Equity - Excluding AOCI 11,424.0 11,423.1 10,820.0 10,383.8 9,938.3

Accumulated other comprehensive income 2,577.5 1,849.1 1,950.0 2,087.8 3,452.8

Total Voya Financial, Inc. Shareholders’ Equity 14,001.5 13,272.2 12,770.0 12,471.6 13,391.1

Noncontrolling interest 2,366.5 2,241.8 2,094.5 2,175.5 2,207.8

Total Shareholders’ Equity 16,368.0 15,514.0 14,864.5 14,647.1 15,598.9

Total Liabilities and Shareholders’ Equity 223,510.7 221,023.2 217,658.2 217,123.5 220,850.0

(1) Includes Other assets, Sales inducements to contract holders, and Deferred income taxes

(2) Includes Other liabilities, Derivatives, Pension and other postretirement provisions, Current income taxes, and Deferred income taxes

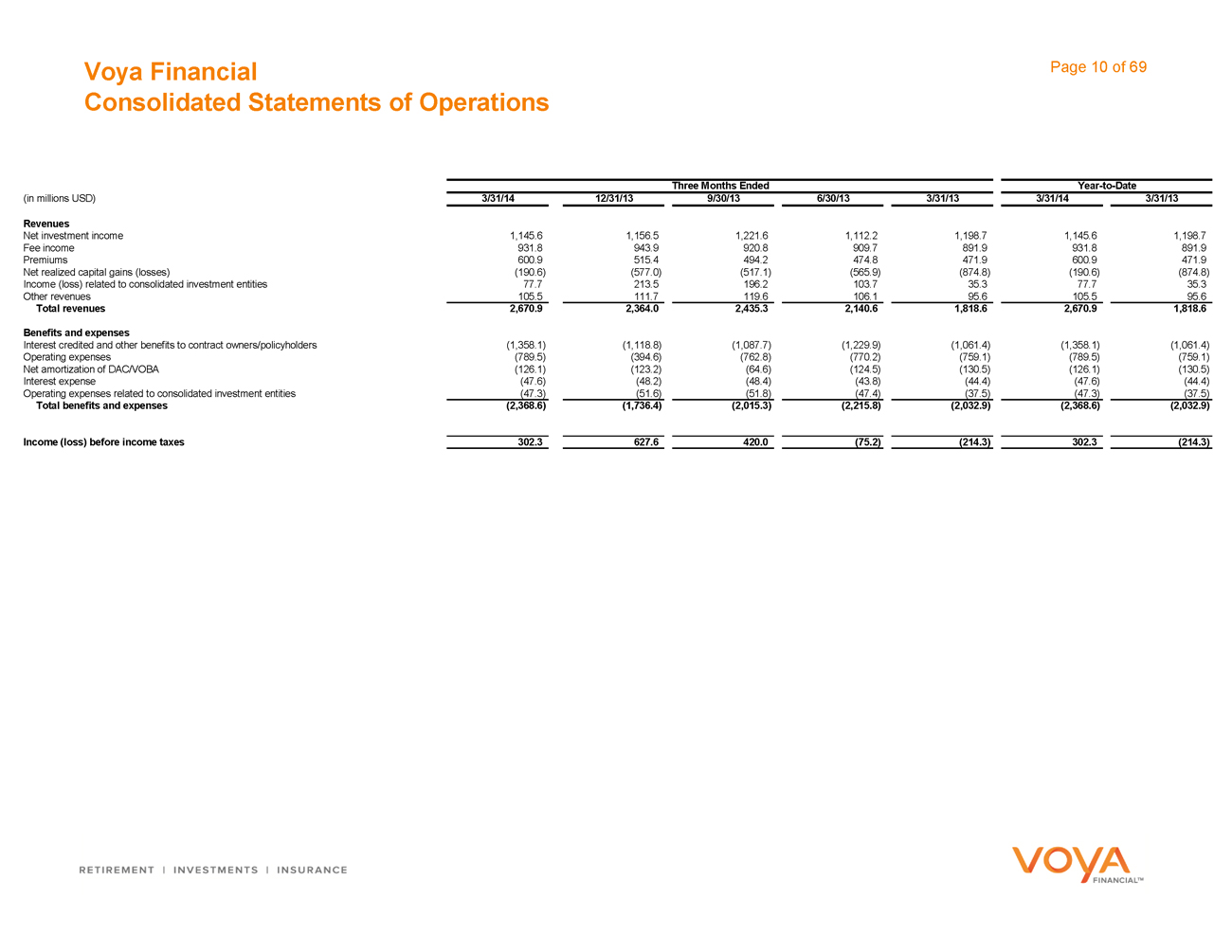

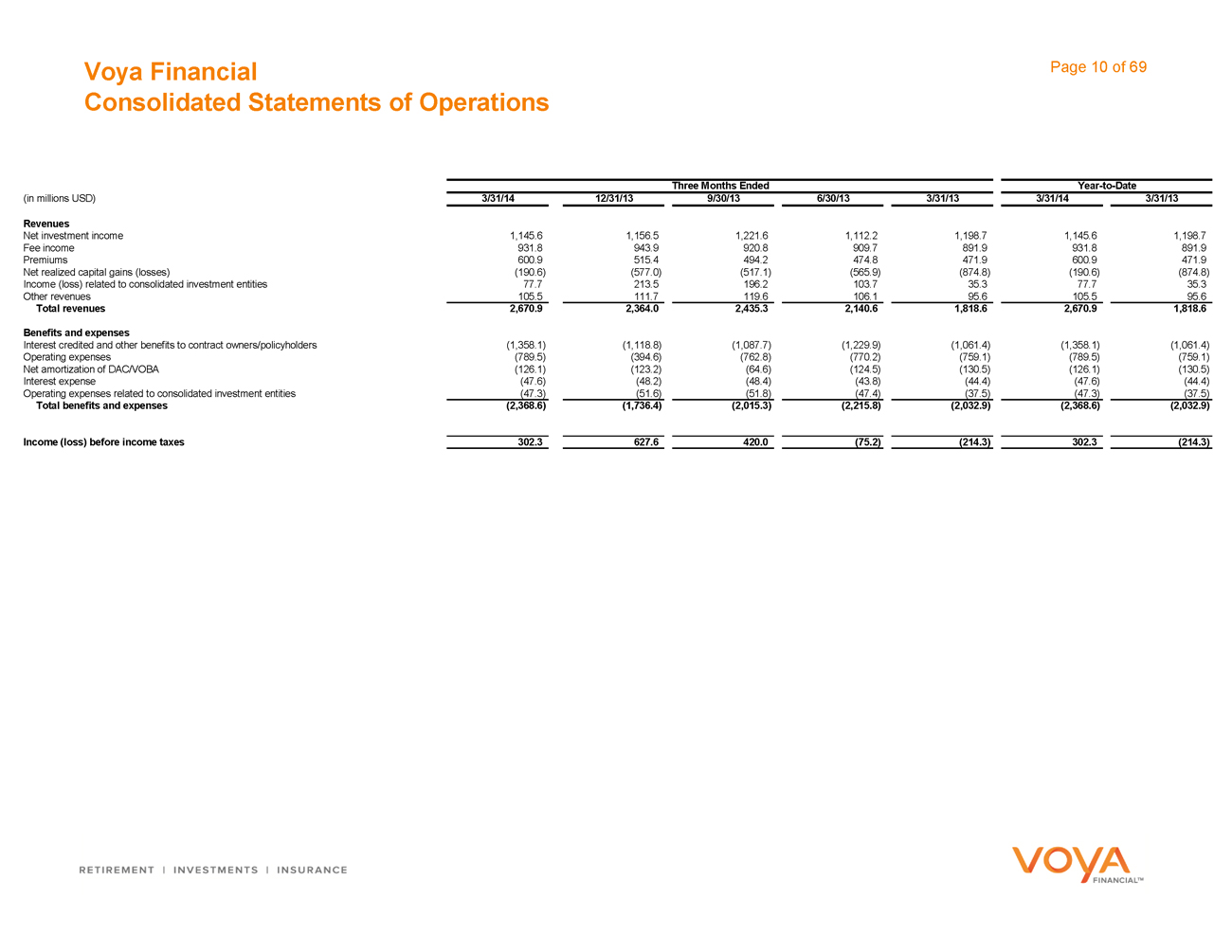

Voya Financial Page 10 of 69

Consolidated Statements of Operations

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Revenues

Net investment income 1,145.6 1,156.5 1,221.6 1,112.2 1,198.7 1,145.6 1,198.7

Fee income 931.8 943.9 920.8 909.7 891.9 931.8 891.9

Premiums 600.9 515.4 494.2 474.8 471.9 600.9 471.9

Net realized capital gains (losses) (190.6) (577.0) (517.1) (565.9) (874.8) (190.6) (874.8)

Income (loss) related to consolidated investment entities 77.7 213.5 196.2 103.7 35.3 77.7 35.3

Other revenues 105.5 111.7 119.6 106.1 95.6 105.5 95.6

Total revenues 2,670.9 2,364.0 2,435.3 2,140.6 1,818.6 2,670.9 1,818.6

Benefits and expenses

Interest credited and other benefits to contract owners/policyholders (1,358.1) (1,118.8) (1,087.7) (1,229.9) (1,061.4) (1,358.1) (1,061.4)

Operating expenses (789.5) (394.6) (762.8) (770.2) (759.1) (789.5) (759.1)

Net amortization of DAC/VOBA (126.1) (123.2) (64.6) (124.5) (130.5) (126.1) (130.5)

Interest expense (47.6) (48.2) (48.4) (43.8) (44.4) (47.6) (44.4)

Operating expenses related to consolidated investment entities (47.3) (51.6) (51.8) (47.4) (37.5) (47.3) (37.5)

Total benefits and expenses (2,368.6) (1,736.4) (2,015.3) (2,215.8) (2,032.9) (2,368.6) (2,032.9)

Income (loss) before income taxes 302.3 627.6 420.0 (75.2) (214.3) 302.3 (214.3)

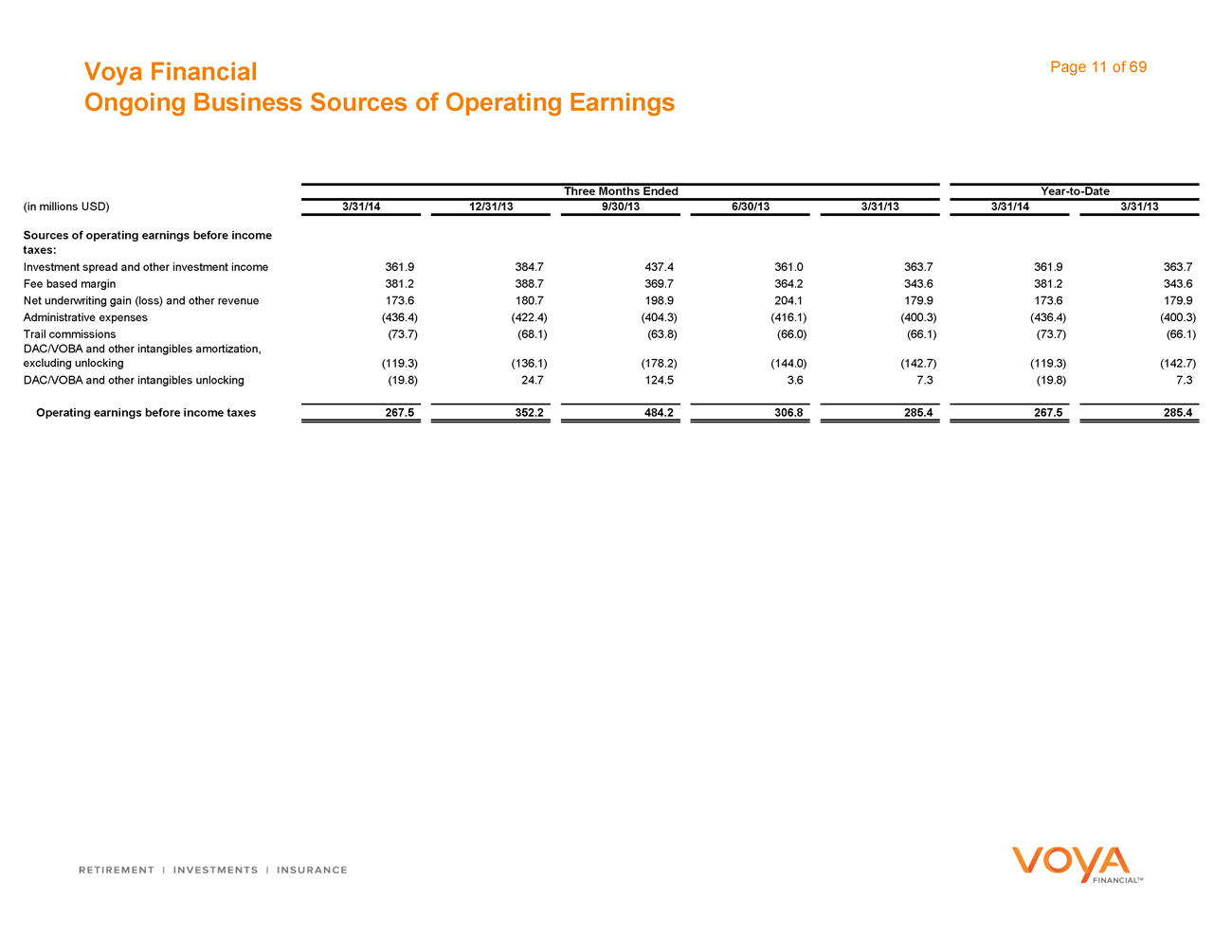

Voya Financial Page 11 of 69

Ongoing Business Sources of Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Sources of operating earnings before income

taxes:

Investment spread and other investment income 361.9 384.7 437.4 361.0 363.7 361.9 363.7

Fee based margin 381.2 388.7 369.7 364.2 343.6 381.2 343.6

Net underwriting gain (loss) and other revenue 173.6 180.7 198.9 204.1 179.9 173.6 179.9

Administrative expenses (436.4) (422.4) (404.3) (416.1) (400.3) (436.4) (400.3)

Trail commissions (73.7) (68.1) (63.8) (66.0) (66.1) (73.7) (66.1)

DAC/VOBA and other intangibles amortization,

excluding unlocking (119.3) (136.1) (178.2) (144.0) (142.7) (119.3) (142.7)

DAC/VOBA and other intangibles unlocking (19.8) 24.7 124.5 3.6 7.3 (19.8) 7.3

Operating earnings before income taxes 267.5 352.2 484.2 306.8 285.4 267.5 285.4

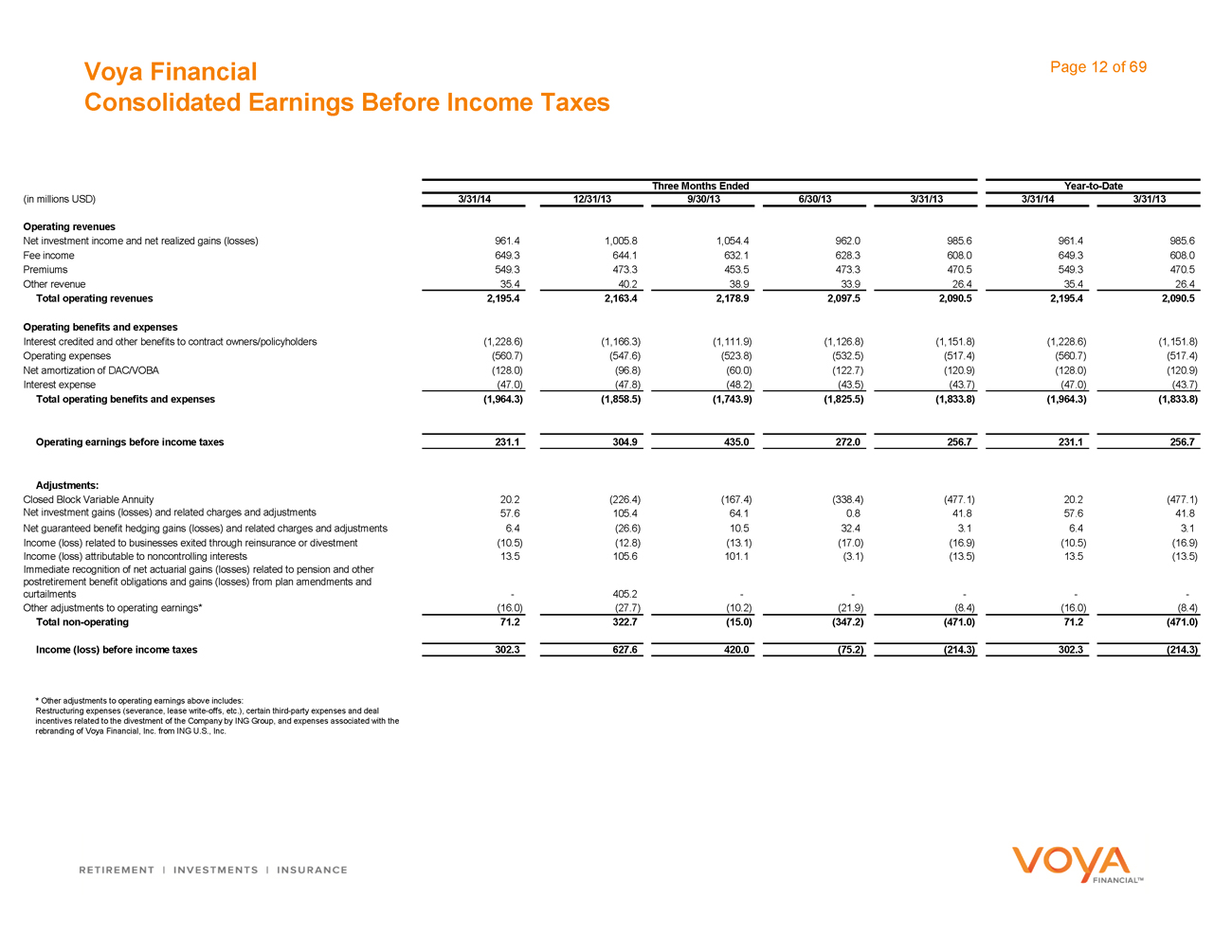

Voya Financial Page 12 of 69

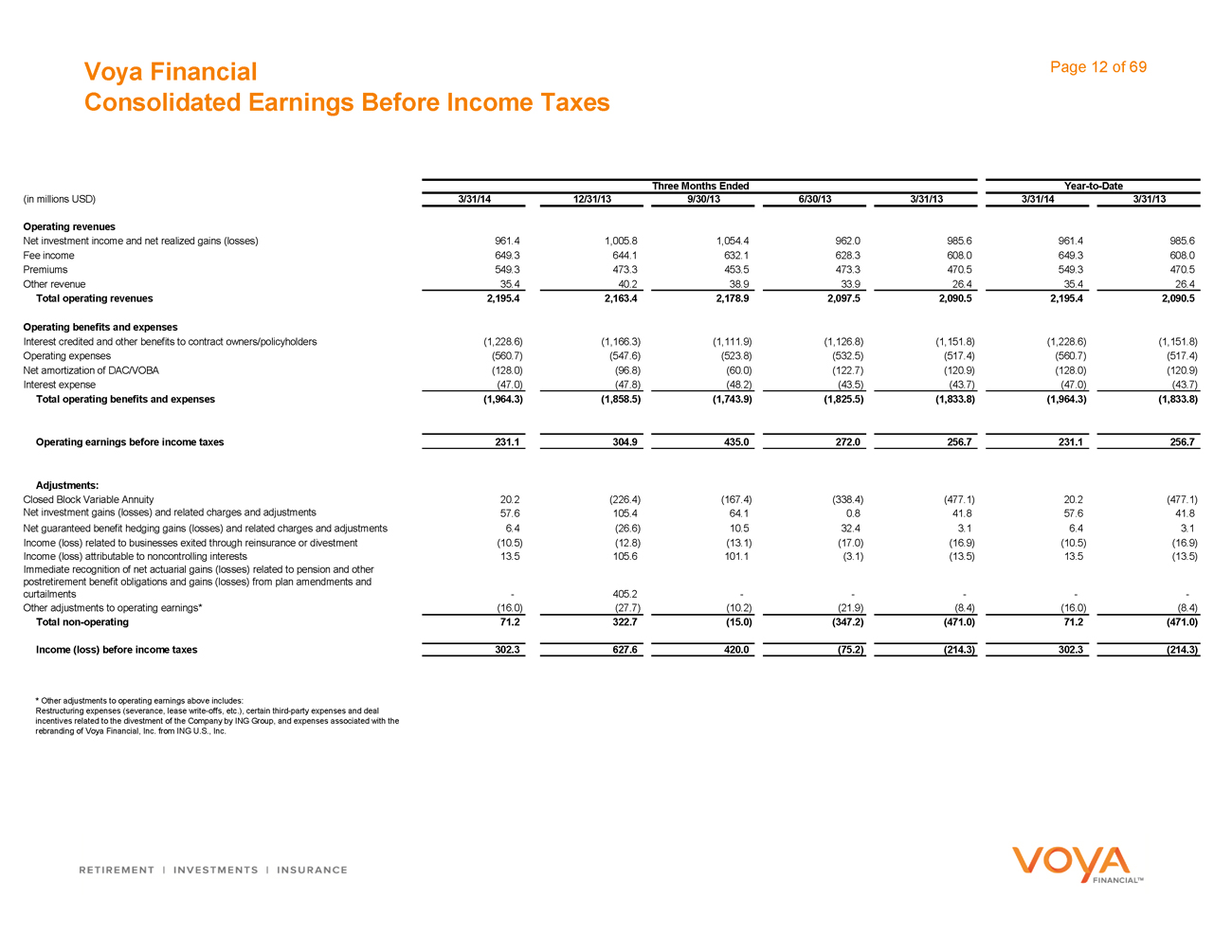

Consolidated Earnings Before Income Taxes

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Operating revenues

Net investment income and net realized gains (losses) 961.4 1,005.8 1,054.4 962.0 985.6 961.4 985.6

Fee income 649.3 644.1 632.1 628.3 608.0 649.3 608.0

Premiums 549.3 473.3 453.5 473.3 470.5 549.3 470.5

Other revenue 35.4 40.2 38.9 33.9 26.4 35.4 26.4

Total operating revenues 2,195.4 2,163.4 2,178.9 2,097.5 2,090.5 2,195.4 2,090.5

Operating benefits and expenses

Interest credited and other benefits to contract owners/policyholders (1,228.6) (1,166.3) (1,111.9) (1,126.8) (1,151.8) (1,228.6) (1,151.8)

Operating expenses (560.7) (547.6) (523.8) (532.5) (517.4) (560.7) (517.4)

Net amortization of DAC/VOBA (128.0) (96.8) (60.0) (122.7) (120.9) (128.0) (120.9)

Interest expense (47.0) (47.8) (48.2) (43.5) (43.7) (47.0) (43.7)

Total operating benefits and expenses (1,964.3) (1,858.5) (1,743.9) (1,825.5) (1,833.8) (1,964.3) (1,833.8)

Operating earnings before income taxes 231.1 304.9 435.0 272.0 256.7 231.1 256.7

Adjustments:

Closed Block Variable Annuity 20.2 (226.4) (167.4) (338.4) (477.1) 20.2 (477.1)

Net investment gains (losses) and related charges and adjustments 57.6 105.4 64.1 0.8 41.8 57.6 41.8

Net guaranteed benefit hedging gains (losses) and related charges and adjustments 6.4 (26.6) 10.5 32.4 3.1 6.4 3.1

Income (loss) related to businesses exited through reinsurance or divestment (10.5) (12.8) (13.1) (17.0) (16.9) (10.5) (16.9)

Income (loss) attributable to noncontrolling interests 13.5 105.6 101.1 (3.1) (13.5) 13.5 (13.5)

Immediate recognition of net actuarial gains (losses) related to pension and other

postretirement benefit obligations and gains (losses) from plan amendments and

curtailments — 405.2 ———— -

Other adjustments to operating earnings* (16.0) (27.7) (10.2) (21.9) (8.4) (16.0) (8.4)

Total non-operating 71.2 322.7 (15.0) (347.2) (471.0) 71.2 (471.0)

Income (loss) before income taxes 302.3 627.6 420.0 (75.2) (214.3) 302.3 (214.3)

* Other adjustments to operating earnings above includes:

Restructuring expenses (severance, lease write-offs, etc.), certain third-party expenses and deal

incentives related to the divestment of the Company by ING Group, and expenses associated with the

rebranding of Voya Financial, Inc. from ING U.S., Inc.

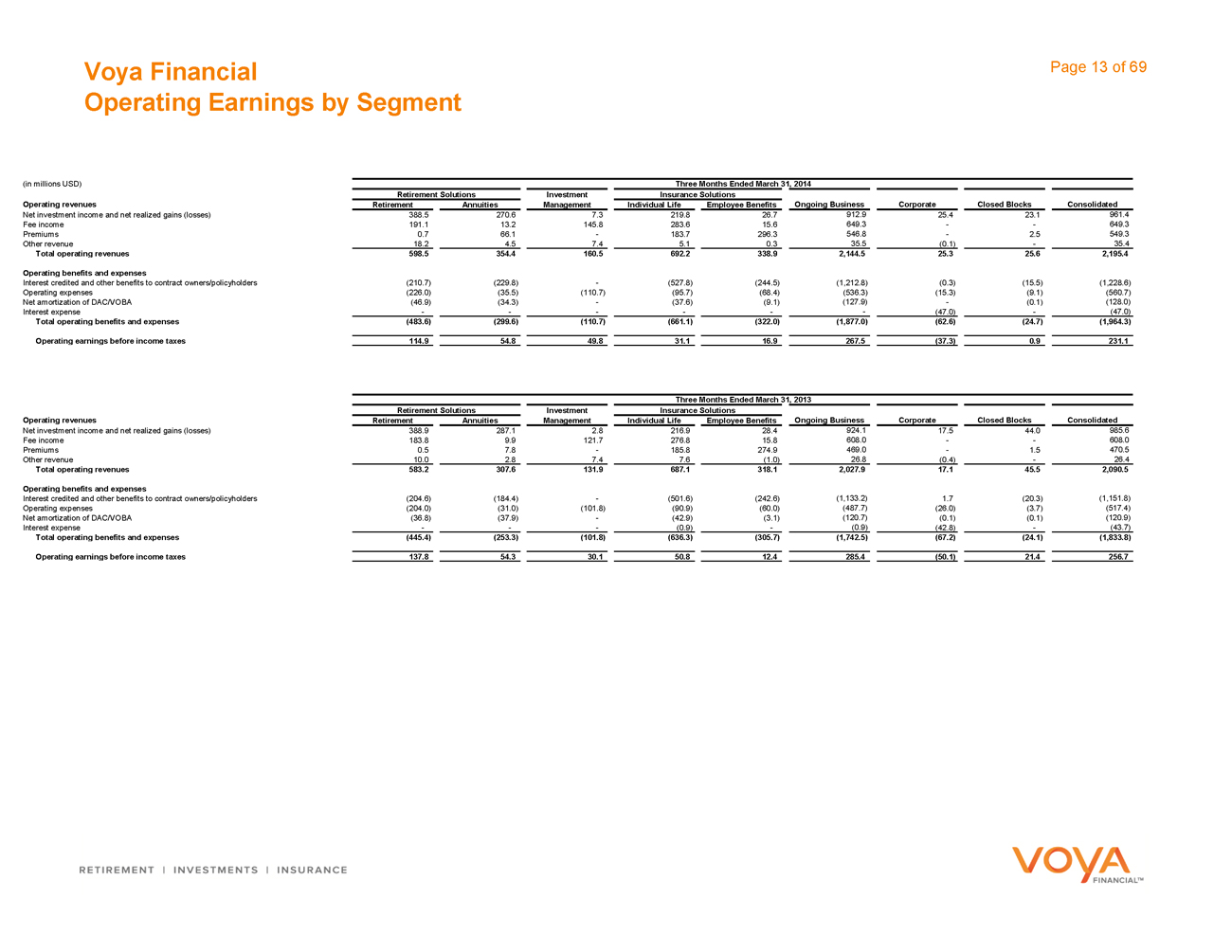

Voya Financial Page 13 of 69

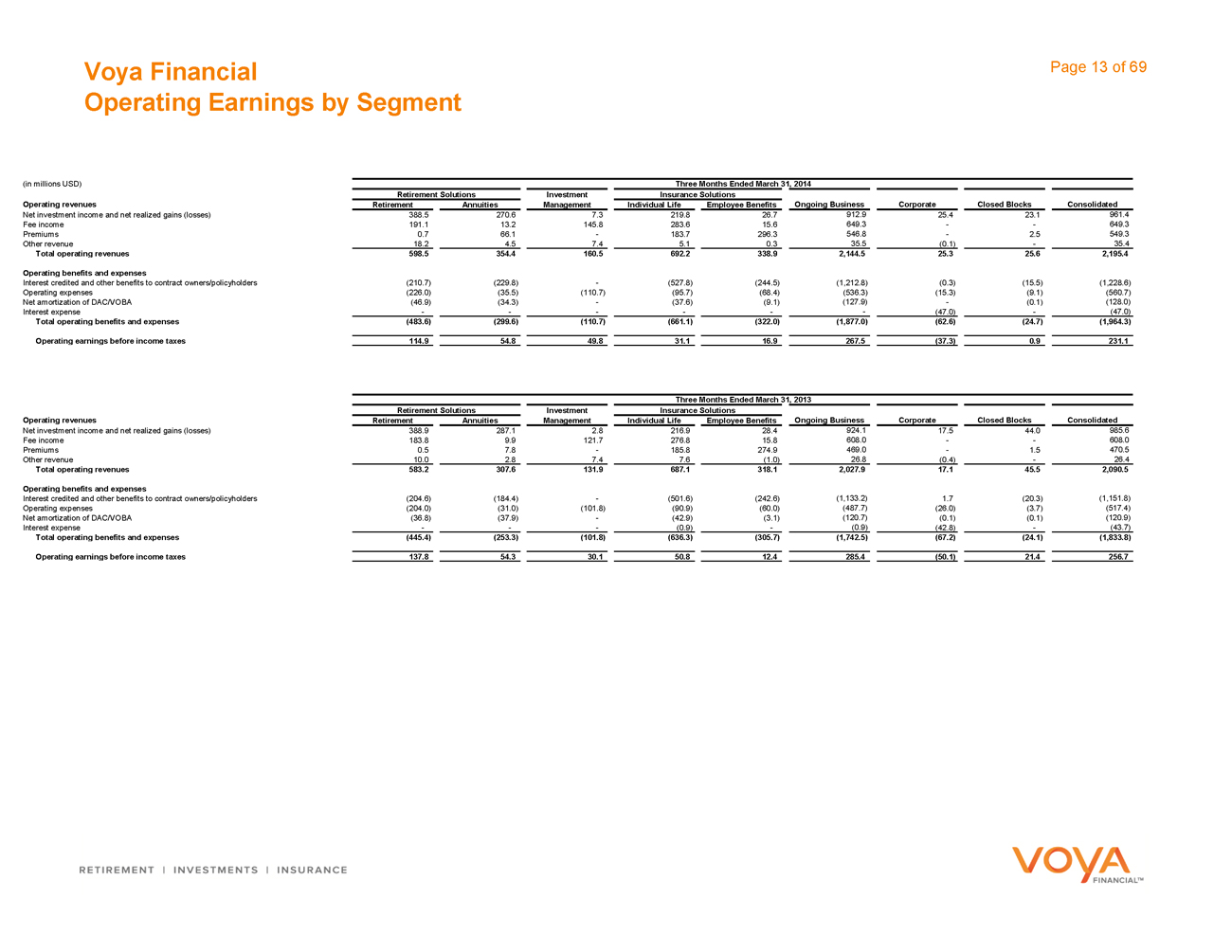

Operating Earnings by Segment

(in millions USD) Three Months Ended March 31, 2014

Retirement Solutions Investment Insurance Solutions

Operating revenues Retirement Annuities Management Individual Life Employee Benefits Ongoing Business Corporate Closed Blocks Consolidated

Net investment income and net realized gains (losses) 388.5 270.6 7.3 219.8 26.7 912.9 25.4 23.1 961.4

Fee income 191.1 13.2 145.8 283.6 15.6 649.3 —— 649.3

Premiums 0.7 66.1 — 183.7 296.3 546.8 — 2.5 549.3

Other revenue 18.2 4.5 7.4 5.1 0.3 35.5 (0.1) — 35.4

Total operating revenues 598.5 354.4 160.5 692.2 338.9 2,144.5 25.3 25.6 2,195.4

Operating benefits and expenses

Interest credited and other benefits to contract owners/policyholders (210.7) (229.8) — (527.8) (244.5) (1,212.8) (0.3) (15.5) (1,228.6)

Operating expenses (226.0) (35.5) (110.7) (95.7) (68.4) (536.3) (15.3) (9.1) (560.7)

Net amortization of DAC/VOBA (46.9) (34.3) — (37.6) (9.1) (127.9) — (0.1) (128.0)

Interest expense —————— (47.0) — (47.0)

Total operating benefits and expenses (483.6) (299.6) (110.7) (661.1) (322.0) (1,877.0) (62.6) (24.7) (1,964.3)

Operating earnings before income taxes 114.9 54.8 49.8 31.1 16.9 267.5 (37.3) 0.9 231.1

Three Months Ended March 31, 2013

Retirement Solutions Investment Insurance Solutions

Operating revenues Retirement Annuities Management Individual Life Employee Benefits Ongoing Business Corporate Closed Blocks Consolidated

Net investment income and net realized gains (losses) 388.9 287.1 2.8 216.9 28.4 924.1 17.5 44.0 985.6

Fee income 183.8 9.9 121.7 276.8 15.8 608.0 —— 608.0

Premiums 0.5 7.8 — 185.8 274.9 469.0 — 1.5 470.5

Other revenue 10.0 2.8 7.4 7.6 (1.0) 26.8 (0.4) — 26.4

Total operating revenues 583.2 307.6 131.9 687.1 318.1 2,027.9 17.1 45.5 2,090.5

Operating benefits and expenses

Interest credited and other benefits to contract owners/policyholders (204.6) (184.4) — (501.6) (242.6) (1,133.2) 1.7 (20.3) (1,151.8)

Operating expenses (204.0) (31.0) (101.8) (90.9) (60.0) (487.7) (26.0) (3.7) (517.4)

Net amortization of DAC/VOBA (36.8) (37.9) — (42.9) (3.1) (120.7) (0.1) (0.1) (120.9)

Interest expense ——— (0.9) — (0.9) (42.8) — (43.7)

Total operating benefits and expenses (445.4) (253.3) (101.8) (636.3) (305.7) (1,742.5) (67.2) (24.1) (1,833.8)

Operating earnings before income taxes 137.8 54.3 30.1 50.8 12.4 285.4 (50.1) 21.4 256.7

Voya Financial Page 14 of 69

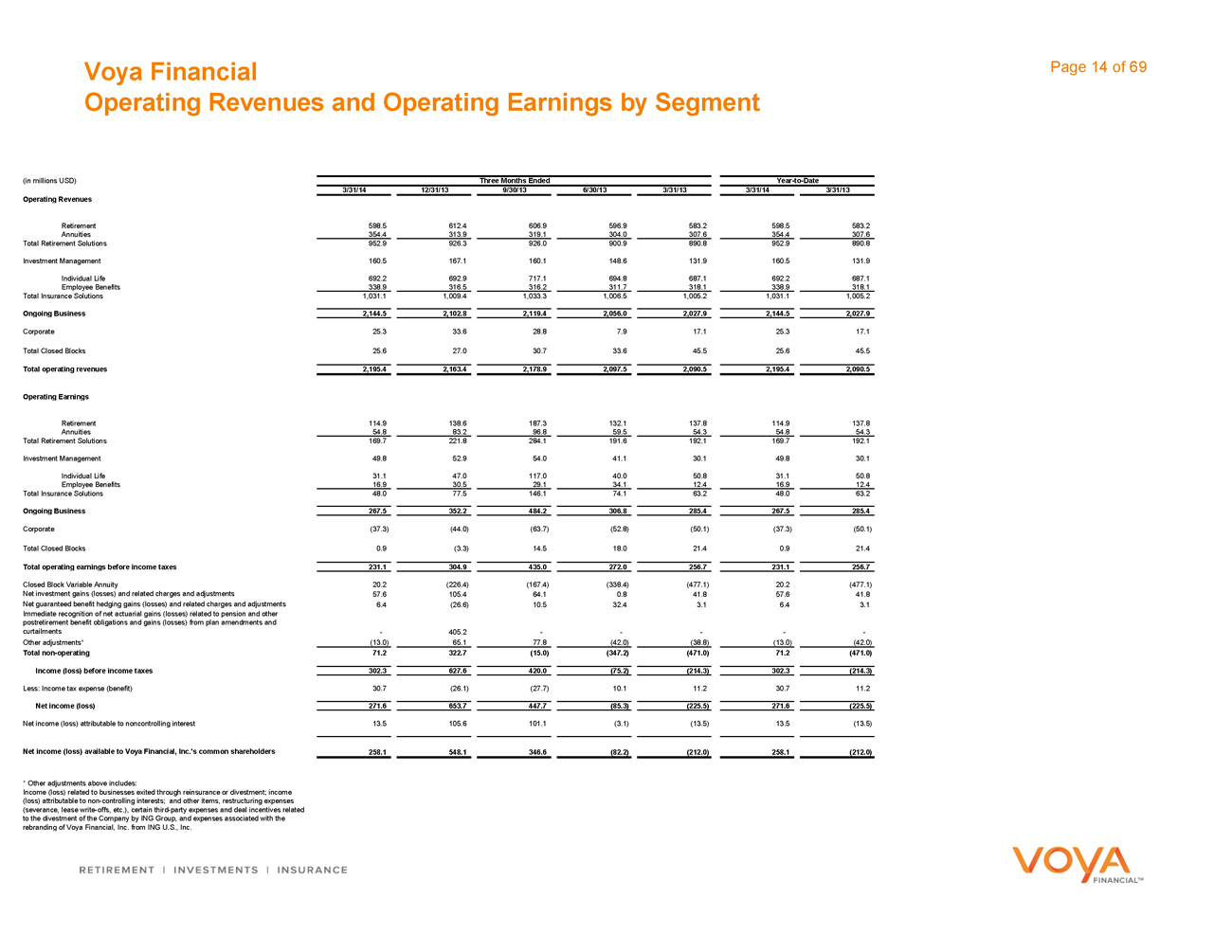

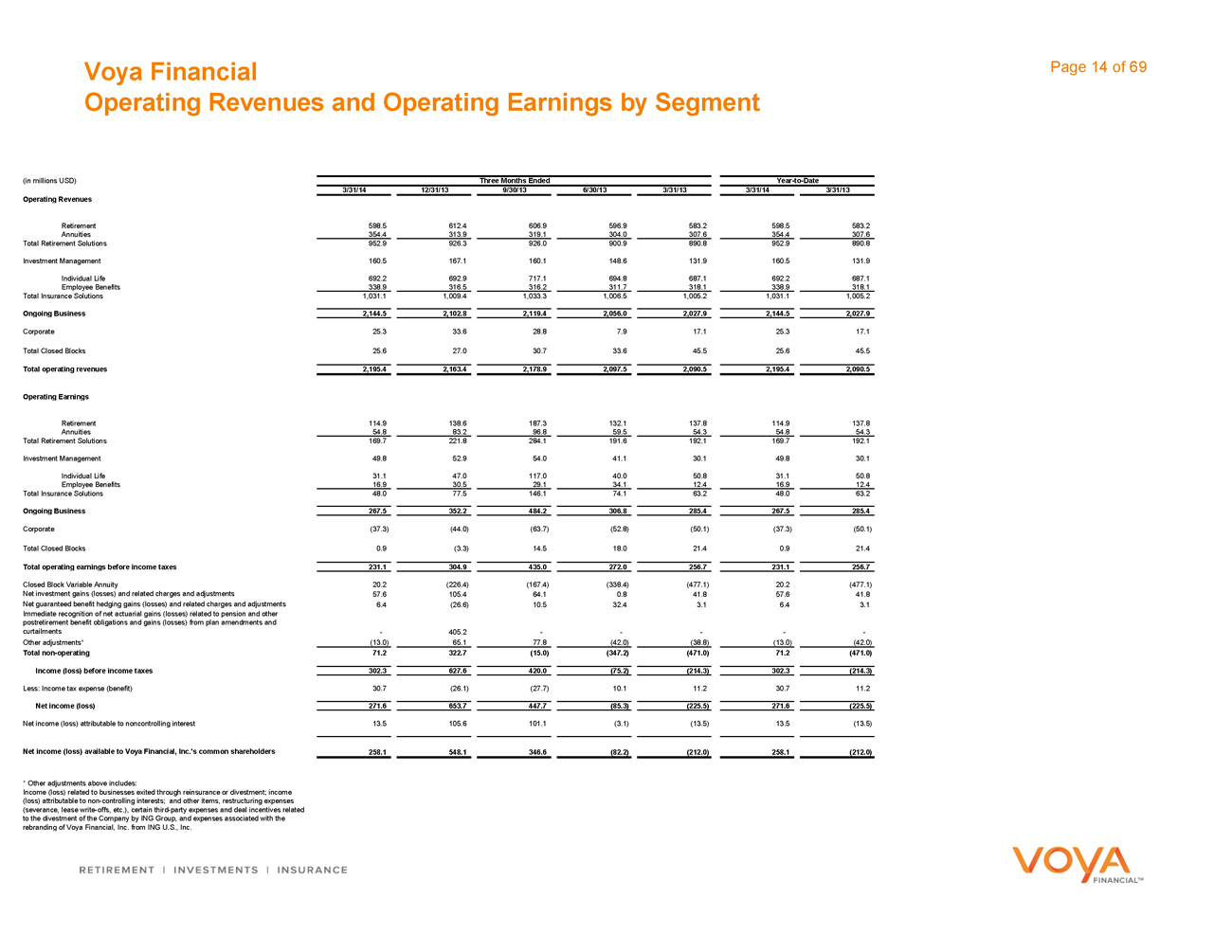

Operating Revenues and Operating Earnings by Segment

(in millions USD) Three Months Ended Year-to-Date

3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Operating Revenues

Retirement 598.5 612.4 606.9 596.9 583.2 598.5 583.2

Annuities 354.4 313.9 319.1 304.0 307.6 354.4 307.6

Total Retirement Solutions 952.9 926.3 926.0 900.9 890.8 952.9 890.8

Investment Management 160.5 167.1 160.1 148.6 131.9 160.5 131.9

Individual Life 692.2 692.9 717.1 694.8 687.1 692.2 687.1

Employee Benefits 338.9 316.5 316.2 311.7 318.1 338.9 318.1

Total Insurance Solutions 1,031.1 1,009.4 1,033.3 1,006.5 1,005.2 1,031.1 1,005.2

Ongoing Business 2,144.5 2,102.8 2,119.4 2,056.0 2,027.9 2,144.5 2,027.9

Corporate 25.3 33.6 28.8 7.9 17.1 25.3 17.1

Total Closed Blocks 25.6 27.0 30.7 33.6 45.5 25.6 45.5

Total operating revenues 2,195.4 2,163.4 2,178.9 2,097.5 2,090.5 2,195.4 2,090.5

Operating Earnings

Retirement 114.9 138.6 187.3 132.1 137.8 114.9 137.8

Annuities 54.8 83.2 96.8 59.5 54.3 54.8 54.3

Total Retirement Solutions 169.7 221.8 284.1 191.6 192.1 169.7 192.1

Investment Management 49.8 52.9 54.0 41.1 30.1 49.8 30.1

Individual Life 31.1 47.0 117.0 40.0 50.8 31.1 50.8

Employee Benefits 16.9 30.5 29.1 34.1 12.4 16.9 12.4

Total Insurance Solutions 48.0 77.5 146.1 74.1 63.2 48.0 63.2

Ongoing Business 267.5 352.2 484.2 306.8 285.4 267.5 285.4

Corporate (37.3) (44.0) (63.7) (52.8) (50.1) (37.3) (50.1)

Total Closed Blocks 0.9 (3.3) 14.5 18.0 21.4 0.9 21.4

Total operating earnings before income taxes 231.1 304.9 435.0 272.0 256.7 231.1 256.7

Closed Block Variable Annuity 20.2 (226.4) (167.4) (338.4) (477.1) 20.2 (477.1)

Net investment gains (losses) and related charges and adjustments 57.6 105.4 64.1 0.8 41.8 57.6 41.8

Net guaranteed benefit hedging gains (losses) and related charges and adjustments 6.4 (26.6) 10.5 32.4 3.1 6.4 3.1

Immediate recognition of net actuarial gains (losses) related to pension and other

postretirement benefit obligations and gains (losses) from plan amendments and

curtailments — 405.2 ———— -

Other adjustments* (13.0) 65.1 77.8 (42.0) (38.8) (13.0) (42.0)

Total non-operating 71.2 322.7 (15.0) (347.2) (471.0) 71.2 (471.0)

Income (loss) before income taxes 302.3 627.6 420.0 (75.2) (214.3) 302.3 (214.3)

Less: Income tax expense (benefit) 30.7 (26.1) (27.7) 10.1 11.2 30.7 11.2

Net income (loss) 271.6 653.7 447.7 (85.3) (225.5) 271.6 (225.5)

Net income (loss) attributable to noncontrolling interest 13.5 105.6 101.1 (3.1) (13.5) 13.5 (13.5)

Net income (loss) available to Voya Financial, Inc.‘s common shareholders 258.1 548.1 346.6 (82.2) (212.0) 258.1 (212.0)

* Other adjustments above includes:

Income (loss) related to businesses exited through reinsurance or divestment; income

(loss) attributable to non-controlling interests; and other items, restructuring expenses

(severance, lease write-offs, etc.), certain third-party expenses and deal incentives related

to the divestment of the Company by ING Group, and expenses associated with the

rebranding of Voya Financial, Inc. from ING U.S., Inc.

Voya Financial Page 15 of 69

Adjusted Operating Earnings by Segment

(in millions USD) Three Months Ended Year-to-Date

3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Operating Earnings

Retirement 114.9 138.6 187.3 132.1 137.8 114.9 137.8

Annuities 54.8 83.2 96.8 59.5 54.3 54.8 54.3

Total Retirement Solutions 169.7 221.8 284.1 191.6 192.1 169.7 192.1

Investment Management 49.8 52.9 54.0 41.1 30.1 49.8 30.1

Individual Life 31.1 47.0 117.0 40.0 50.8 31.1 50.8

Employee Benefits 16.9 30.5 29.1 34.1 12.4 16.9 12.4

Total Insurance Solutions 48.0 77.5 146.1 74.1 63.2 48.0 63.2

Ongoing Business 267.5 352.2 484.2 306.8 285.4 267.5 285.4

Corporate (37.3) (44.0) (63.7) (52.8) (50.1) (37.3) (50.1)

Total Closed Blocks 0.9 (3.3) 14.5 18.0 21.4 0.9 21.4

Total operating earnings before income taxes 231.1 304.9 435.0 272.0 256.7 231.1 256.7

Adjustments to operating earnings

Retirement (11.3) 4.2 52.7 (1.4) 3.0 (11.3) 3.0

Annuities 3.2 27.6 52.3 9.9 7.0 3.2 7.0

Total Retirement Solutions (8.1) 31.8 105.0 8.5 10.0 (8.1) 10.0

Investment Management — 1.7 11.5 — — — -

Individual Life (7.1) (4.7) 56.8 (4.9) (2.7) (7.1) (2.7)

Employee Benefits (4.6) (0.2) 4.0 — — (4.6) -

Total Insurance Solutions (11.7) (4.9) 60.8 (4.9) (2.7) (11.7) (2.7)

Ongoing Business (19.8) 28.6 177.3 3.6 7.3 (19.8) 7.3

Corporate (48.8) (43.8) (47.6) (43.2) (41.9) (48.8) (41.9)

Total Closed Blocks — (0.4) 0.6 — — — -

Total adjustments to operating earnings (68.6) (15.6) 130.3 (39.6) (34.6) (68.6) (34.6)

Adjusted Operating Earnings

Retirement 126.2 134.4 134.6 133.5 134.8 126.2 134.8

Annuities 51.6 55.6 44.5 49.6 47.3 51.6 47.3

Total Retirement Solutions 177.8 190.0 179.1 183.1 182.1 177.8 182.1

Investment Management 49.8 51.2 42.5 41.1 30.1 49.8 30.1

Individual Life 38.2 51.7 60.2 44.9 53.5 38.2 53.5

Employee Benefits 21.5 30.7 25.1 34.1 12.4 21.5 12.4

Total Insurance Solutions 59.7 82.4 85.3 79.0 65.9 59.7 65.9

Ongoing Business 287.3 323.6 306.9 303.2 278.1 287.3 278.1

Corporate 11.5 (0.2) (16.1) (9.6) (8.2) 11.5 (8.2)

Total Closed Blocks 0.9 (2.9) 13.9 18.0 21.4 0.9 21.4

Total adjusted operating earnings before interest and income taxes 299.7 320.5 304.7 311.6 291.3 299.7 291.3

Voya Financial Page 16 of 69

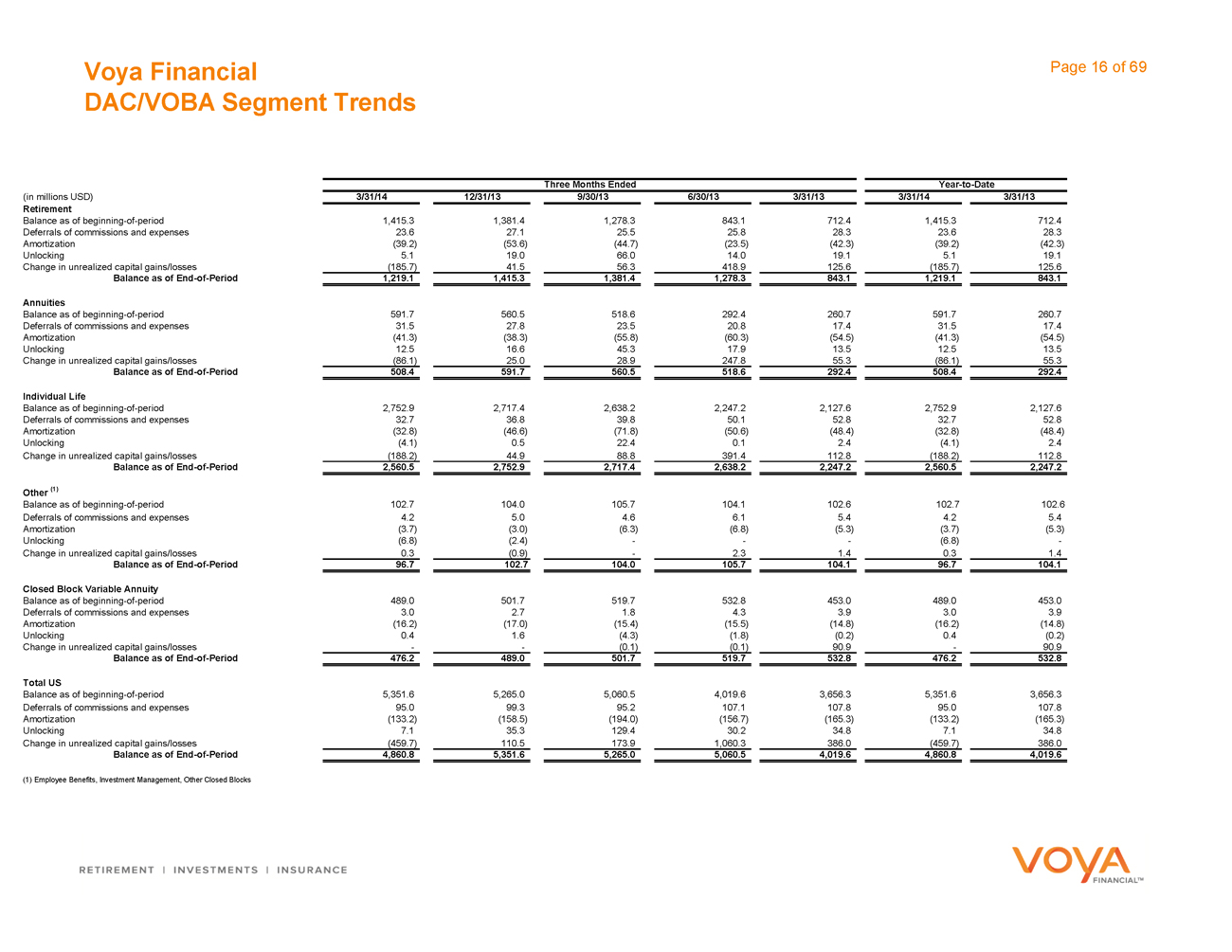

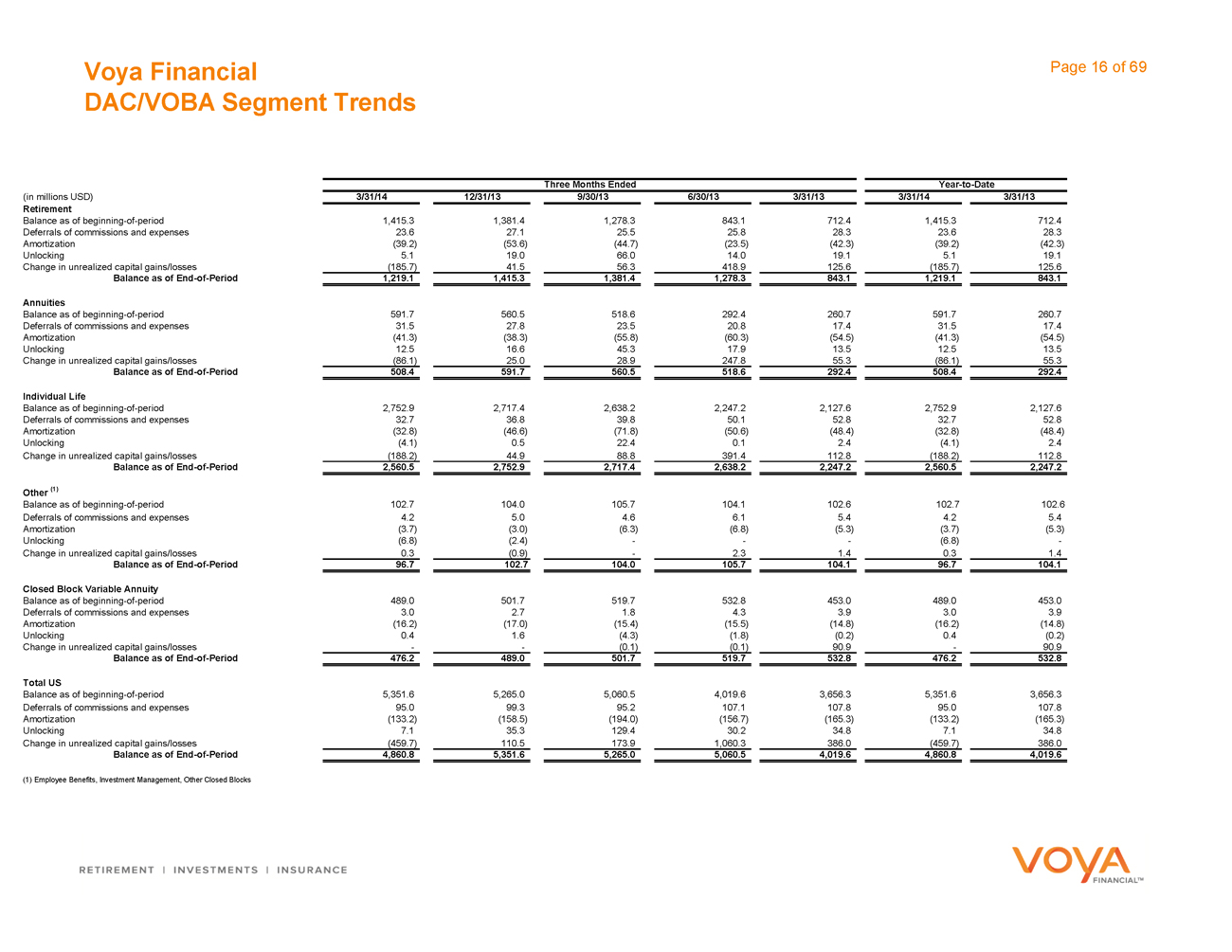

DAC/VOBA Segment Trends

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Retirement

Balance as of beginning-of-period 1,415.3 1,381.4 1,278.3 843.1 712.4 1,415.3 712.4

Deferrals of commissions and expenses 23.6 27.1 25.5 25.8 28.3 23.6 28.3

Amortization (39.2) (53.6) (44.7) (23.5) (42.3) (39.2) (42.3)

Unlocking 5.1 19.0 66.0 14.0 19.1 5.1 19.1

Change in unrealized capital gains/losses (185.7) 41.5 56.3 418.9 125.6 (185.7) 125.6

Balance as of End-of-Period 1,219.1 1,415.3 1,381.4 1,278.3 843.1 1,219.1 843.1

Annuities

Balance as of beginning-of-period 591.7 560.5 518.6 292.4 260.7 591.7 260.7

Deferrals of commissions and expenses 31.5 27.8 23.5 20.8 17.4 31.5 17.4

Amortization (41.3) (38.3) (55.8) (60.3) (54.5) (41.3) (54.5)

Unlocking 12.5 16.6 45.3 17.9 13.5 12.5 13.5

Change in unrealized capital gains/losses (86.1) 25.0 28.9 247.8 55.3 (86.1) 55.3

Balance as of End-of-Period 508.4 591.7 560.5 518.6 292.4 508.4 292.4

Individual Life

Balance as of beginning-of-period 2,752.9 2,717.4 2,638.2 2,247.2 2,127.6 2,752.9 2,127.6

Deferrals of commissions and expenses 32.7 36.8 39.8 50.1 52.8 32.7 52.8

Amortization (32.8) (46.6) (71.8) (50.6) (48.4) (32.8) (48.4)

Unlocking (4.1) 0.5 22.4 0.1 2.4 (4.1) 2.4

Change in unrealized capital gains/losses (188.2) 44.9 88.8 391.4 112.8 (188.2) 112.8

Balance as of End-of-Period 2,560.5 2,752.9 2,717.4 2,638.2 2,247.2 2,560.5 2,247.2

Other (1)

Balance as of beginning-of-period 102.7 104.0 105.7 104.1 102.6 102.7 102.6

Deferrals of commissions and expenses 4.2 5.0 4.6 6.1 5.4 4.2 5.4

Amortization (3.7) (3.0) (6.3) (6.8) (5.3) (3.7) (5.3)

Unlocking (6.8) (2.4) ——— (6.8) -

Change in unrealized capital gains/losses 0.3 (0.9) — 2.3 1.4 0.3 1.4

Balance as of End-of-Period 96.7 102.7 104.0 105.7 104.1 96.7 104.1

Closed Block Variable Annuity

Balance as of beginning-of-period 489.0 501.7 519.7 532.8 453.0 489.0 453.0

Deferrals of commissions and expenses 3.0 2.7 1.8 4.3 3.9 3.0 3.9

Amortization (16.2) (17.0) (15.4) (15.5) (14.8) (16.2) (14.8)

Unlocking 0.4 1.6 (4.3) (1.8) (0.2) 0.4 (0.2)

Change in unrealized capital gains/losses —— (0.1) (0.1) 90.9 — 90.9

Balance as of End-of-Period 476.2 489.0 501.7 519.7 532.8 476.2 532.8

Total US

Balance as of beginning-of-period 5,351.6 5,265.0 5,060.5 4,019.6 3,656.3 5,351.6 3,656.3

Deferrals of commissions and expenses 95.0 99.3 95.2 107.1 107.8 95.0 107.8

Amortization (133.2) (158.5) (194.0) (156.7) (165.3) (133.2) (165.3)

Unlocking 7.1 35.3 129.4 30.2 34.8 7.1 34.8

Change in unrealized capital gains/losses (459.7) 110.5 173.9 1,060.3 386.0 (459.7) 386.0

Balance as of End-of-Period 4,860.8 5,351.6 5,265.0 5,060.5 4,019.6 4,860.8 4,019.6

(1) | | Employee Benefits, Investment Management, Other Closed Blocks |

Voya Financial Page 17 of 69

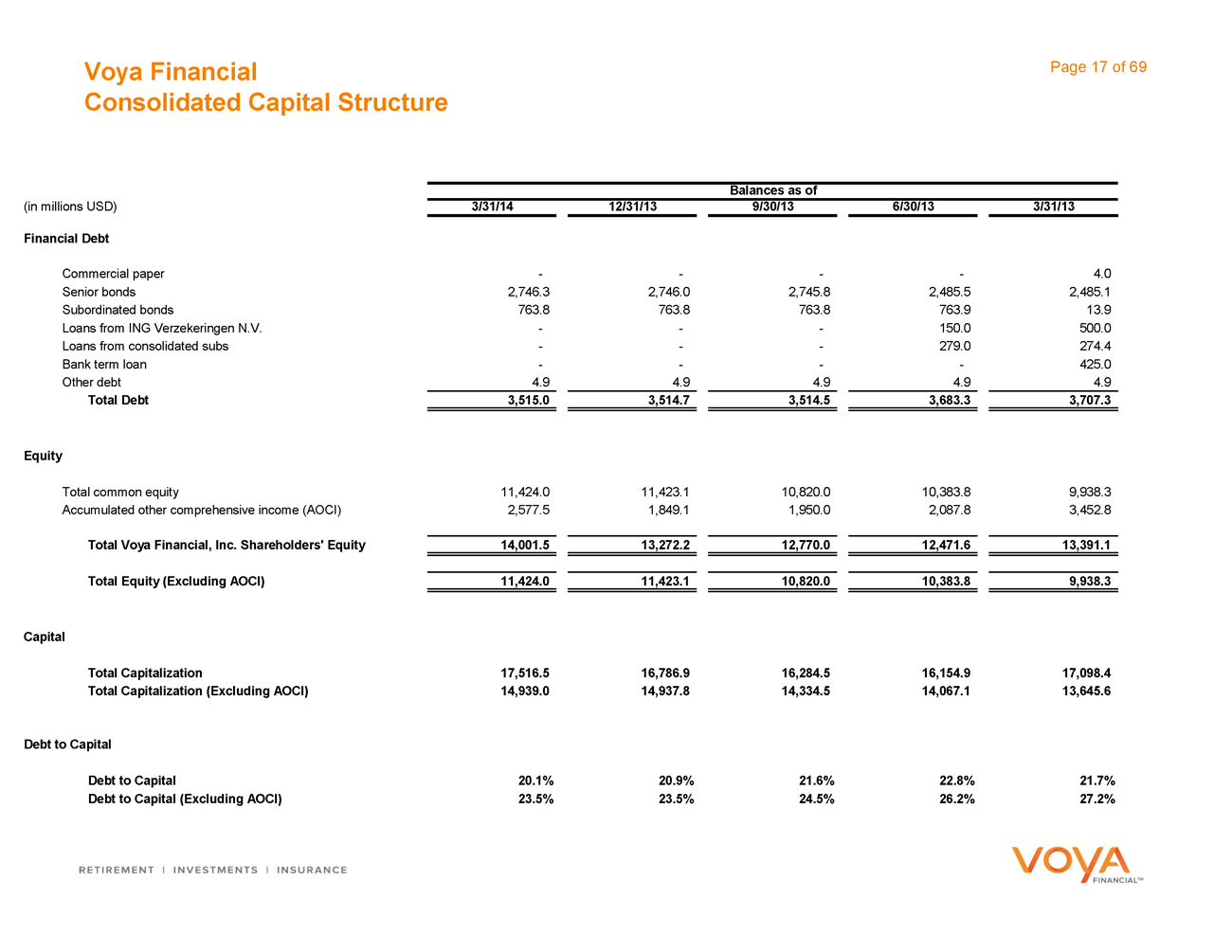

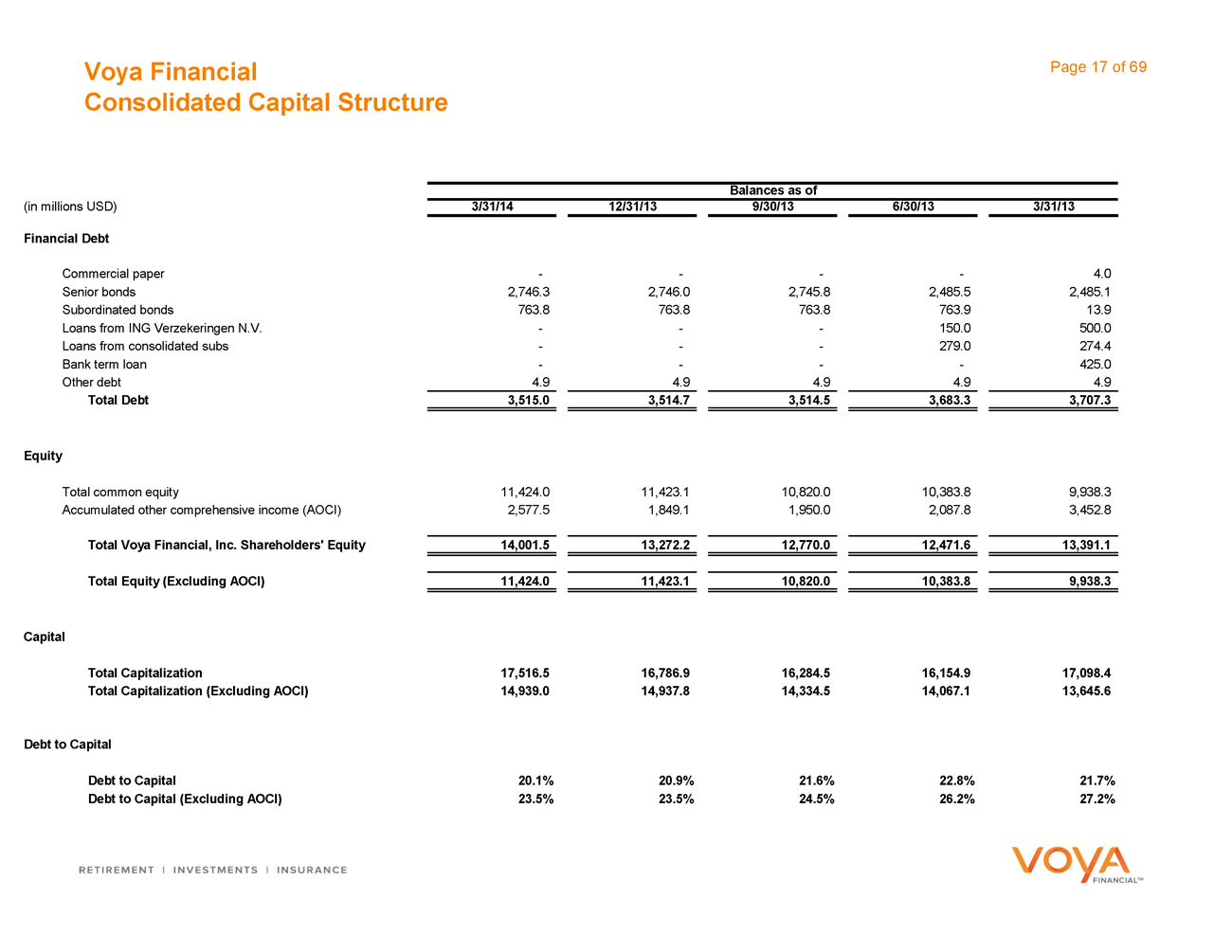

Consolidated Capital Structure

Balances as of

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13

Financial Debt

Commercial paper ———— 4.0

Senior bonds 2,746.3 2,746.0 2,745.8 2,485.5 2,485.1

Subordinated bonds 763.8 763.8 763.8 763.9 13.9

Loans from ING Verzekeringen N.V. ——— 150.0 500.0

Loans from consolidated subs ——— 279.0 274.4

Bank term loan ———— 425.0

Other debt 4.9 4.9 4.9 4.9 4.9

Total Debt 3,515.0 3,514.7 3,514.5 3,683.3 3,707.3

Equity

Total common equity 11,424.0 11,423.1 10,820.0 10,383.8 9,938.3

Accumulated other comprehensive income (AOCI) 2,577.5 1,849.1 1,950.0 2,087.8 3,452.8

Total Voya Financial, Inc. Shareholders’ Equity 14,001.5 13,272.2 12,770.0 12,471.6 13,391.1

Total Equity (Excluding AOCI) 11,424.0 11,423.1 10,820.0 10,383.8 9,938.3

Capital

Total Capitalization 17,516.5 16,786.9 16,284.5 16,154.9 17,098.4

Total Capitalization (Excluding AOCI) 14,939.0 14,937.8 14,334.5 14,067.1 13,645.6

Debt to Capital

Debt to Capital 20.1% 20.9% 21.6% 22.8% 21.7%

Debt to Capital (Excluding AOCI) 23.5% 23.5% 24.5% 26.2% 27.2%

Voya Financial Page 18 of 69

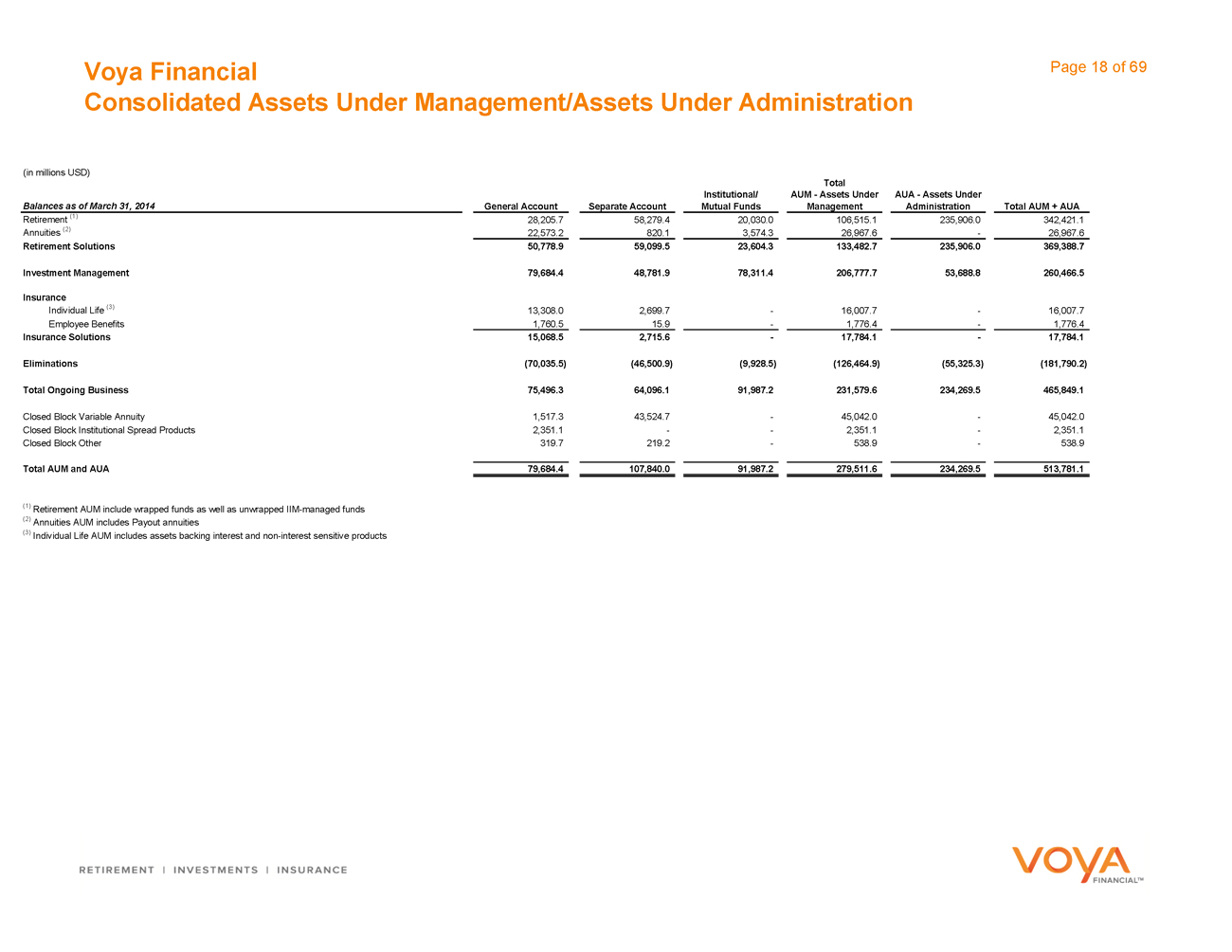

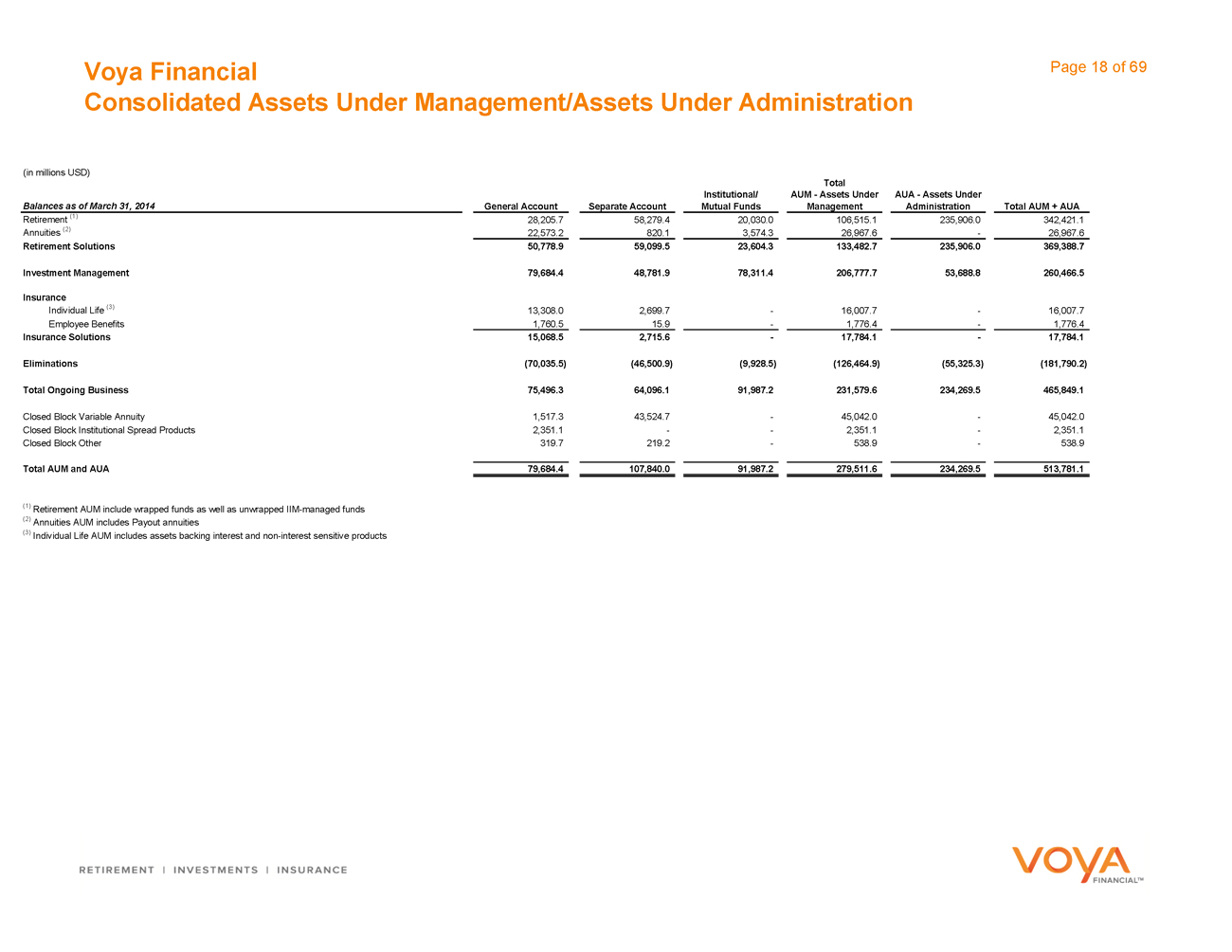

Consolidated Assets Under Management/Assets Under Administration

(in millions USD)

Total

Institutional/ AUM—Assets Under AUA—Assets Under

Balances as of March 31, 2014 General Account Separate Account Mutual Funds Management Administration Total AUM + AUA

Retirement (1) 28,205.7 58,279.4 20,030.0 106,515.1 235,906.0 342,421.1

Annuities (2) 22,573.2 820.1 3,574.3 26,967.6 — 26,967.6

Retirement Solutions 50,778.9 59,099.5 23,604.3 133,482.7 235,906.0 369,388.7

Investment Management 79,684.4 48,781.9 78,311.4 206,777.7 53,688.8 260,466.5

Insurance

Individual Life (3) 13,308.0 2,699.7 — 16,007.7 — 16,007.7

Employee Benefits 1,760.5 15.9 — 1,776.4 — 1,776.4

Insurance Solutions 15,068.5 2,715.6 — 17,784.1 — 17,784.1

Eliminations (70,035.5) (46,500.9) (9,928.5) (126,464.9) (55,325.3) (181,790.2)

Total Ongoing Business 75,496.3 64,096.1 91,987.2 231,579.6 234,269.5 465,849.1

Closed Block Variable Annuity 1,517.3 43,524.7 — 45,042.0 — 45,042.0

Closed Block Institutional Spread Products 2,351.1 —— 2,351.1 — 2,351.1

Closed Block Other 319.7 219.2 — 538.9 — 538.9

Total AUM and AUA 79,684.4 107,840.0 91,987.2 279,511.6 234,269.5 513,781.1

(1) Retirement AUM include wrapped funds as well as unwrapped IIM-managed funds

(2) Annuities AUM includes Payout annuities

(3) Individual Life AUM includes assets backing interest and non-interest sensitive products

Retirement

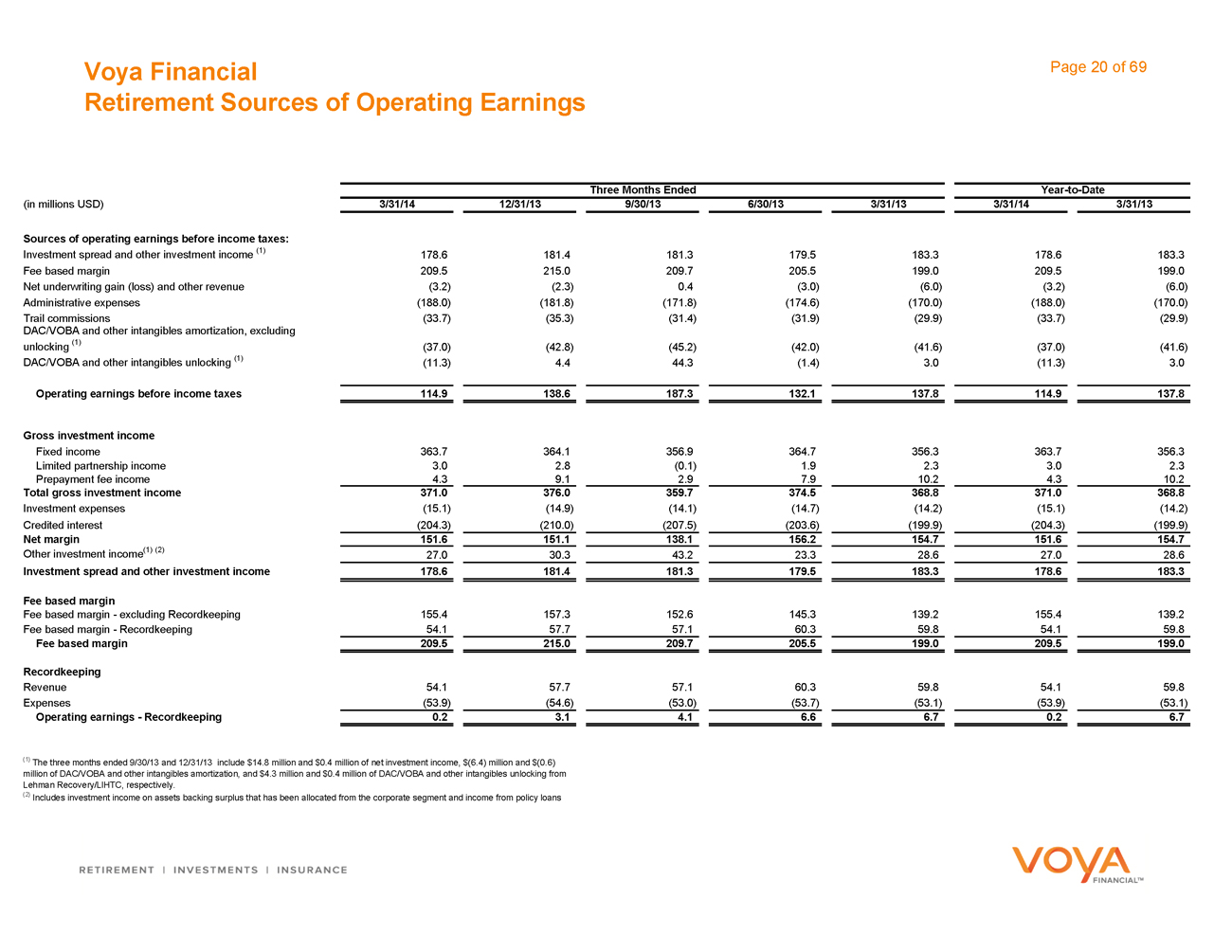

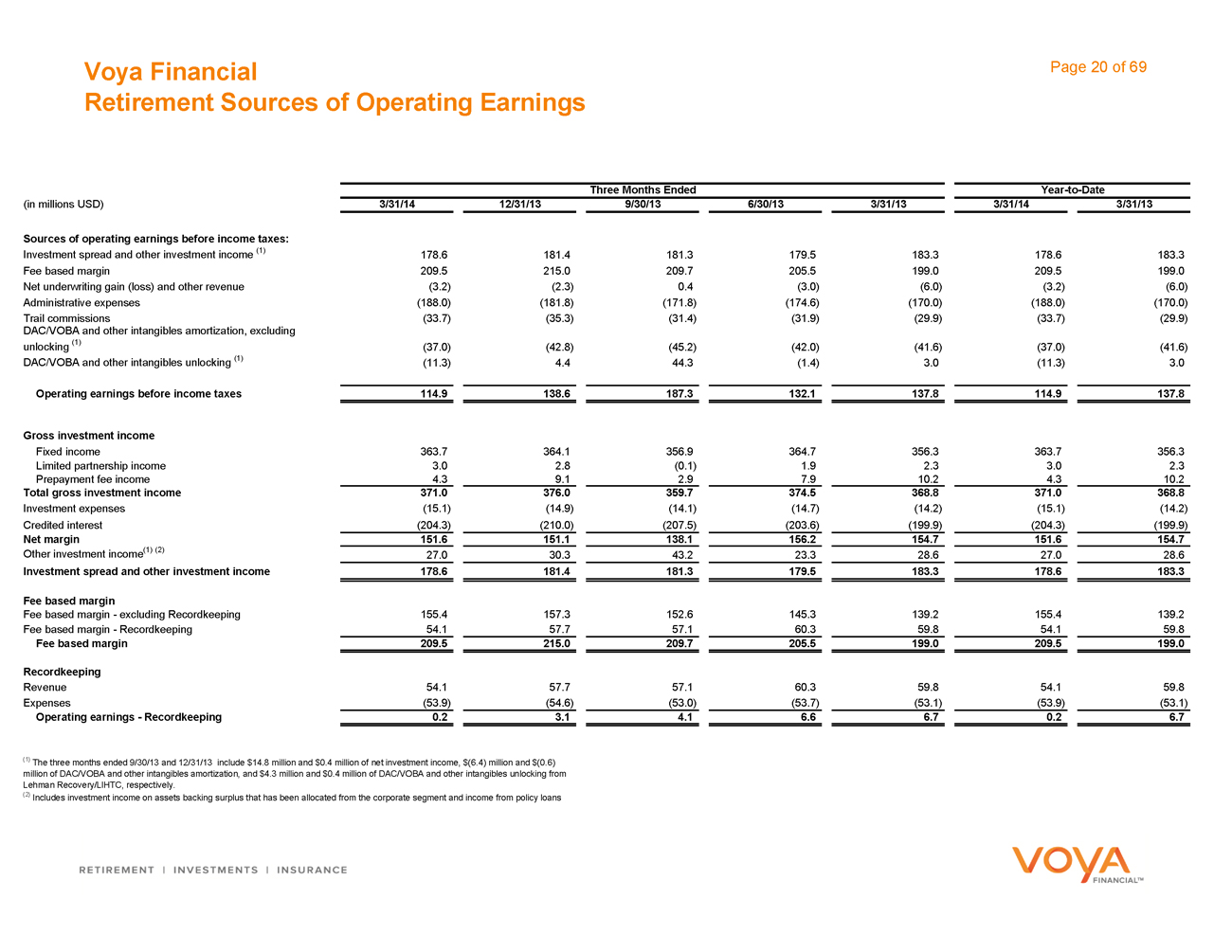

Voya Financial Page 20 of 69

Retirement Sources of Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Sources of operating earnings before income taxes:

Investment spread and other investment income (1) 178.6 181.4 181.3 179.5 183.3 178.6 183.3

Fee based margin 209.5 215.0 209.7 205.5 199.0 209.5 199.0

Net underwriting gain (loss) and other revenue (3.2) (2.3) 0.4 (3.0) (6.0) (3.2) (6.0)

Administrative expenses (188.0) (181.8) (171.8) (174.6) (170.0) (188.0) (170.0)

Trail commissions (33.7) (35.3) (31.4) (31.9) (29.9) (33.7) (29.9)

DAC/VOBA and other intangibles amortization, excluding

unlocking (1) (37.0) (42.8) (45.2) (42.0) (41.6) (37.0) (41.6)

DAC/VOBA and other intangibles unlocking (1) (11.3) 4.4 44.3 (1.4) 3.0 (11.3) 3.0

Operating earnings before income taxes 114.9 138.6 187.3 132.1 137.8 114.9 137.8

Gross investment income

Fixed income 363.7 364.1 356.9 364.7 356.3 363.7 356.3

Limited partnership income 3.0 2.8 (0.1) 1.9 2.3 3.0 2.3

Prepayment fee income 4.3 9.1 2.9 7.9 10.2 4.3 10.2

Total gross investment income 371.0 376.0 359.7 374.5 368.8 371.0 368.8

Investment expenses (15.1) (14.9) (14.1) (14.7) (14.2) (15.1) (14.2)

Credited interest (204.3) (210.0) (207.5) (203.6) (199.9) (204.3) (199.9)

Net margin 151.6 151.1 138.1 156.2 154.7 151.6 154.7

Other investment income(1) (2) 27.0 30.3 43.2 23.3 28.6 27.0 28.6

Investment spread and other investment income 178.6 181.4 181.3 179.5 183.3 178.6 183.3

Fee based margin

Fee based margin—excluding Recordkeeping 155.4 157.3 152.6 145.3 139.2 155.4 139.2

Fee based margin—Recordkeeping 54.1 57.7 57.1 60.3 59.8 54.1 59.8

Fee based margin 209.5 215.0 209.7 205.5 199.0 209.5 199.0

Recordkeeping

Revenue 54.1 57.7 57.1 60.3 59.8 54.1 59.8

Expenses (53.9) (54.6) (53.0) (53.7) (53.1) (53.9) (53.1)

Operating earnings—Recordkeeping 0.2 3.1 4.1 6.6 6.7 0.2 6.7

(1) The three months ended 9/30/13 and 12/31/13 include $14.8 million and $0.4 million of net investment income, $(6.4) million and $(0.6)

million of DAC/VOBA and other intangibles amortization, and $4.3 million and $0.4 million of DAC/VOBA and other intangibles unlocking from

Lehman Recovery/LIHTC, respectively.

(2) Includes investment income on assets backing surplus that has been allocated from the corporate segment and income from policy loans

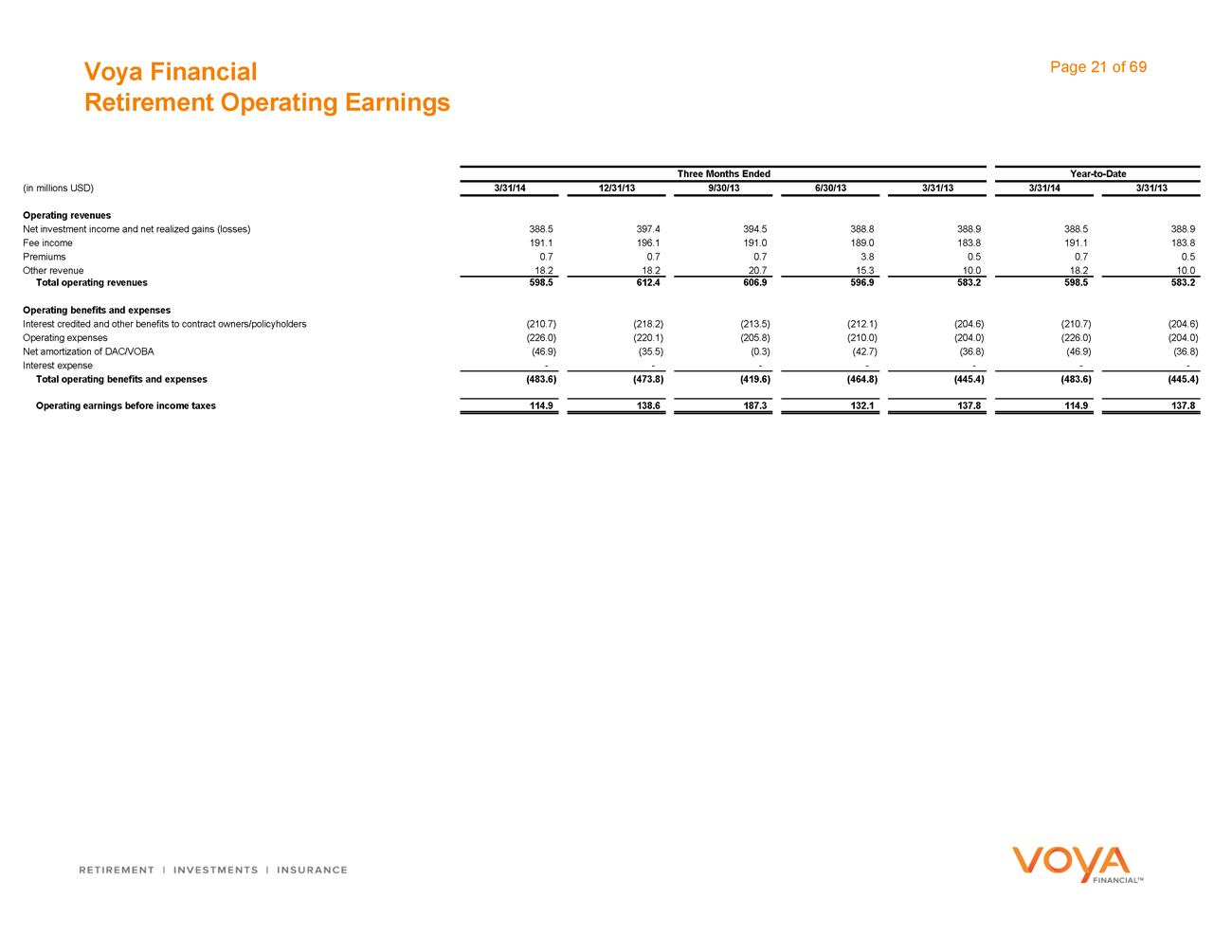

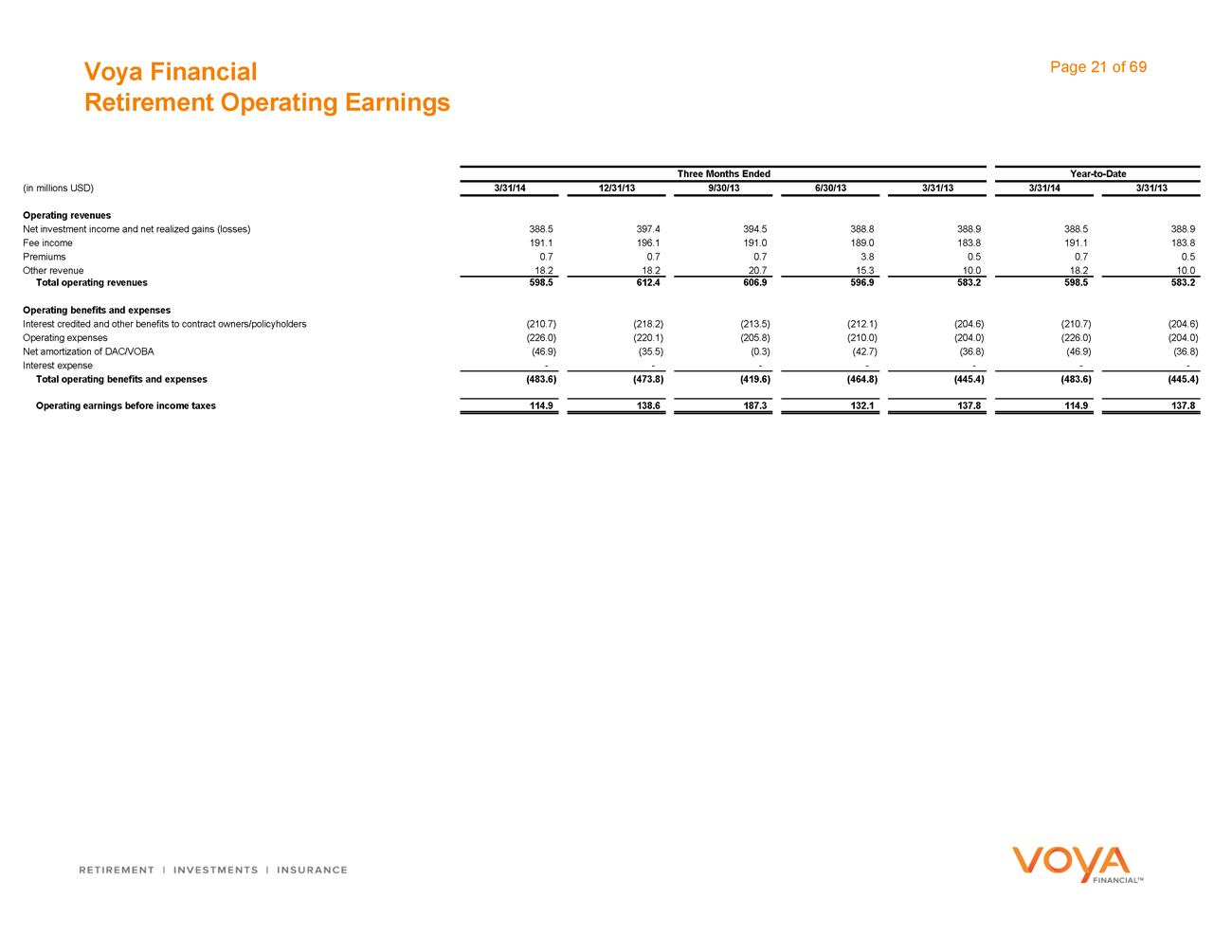

Voya Financial Page 21 of 69

Retirement Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Operating revenues

Net investment income and net realized gains (losses) 388.5 397.4 394.5 388.8 388.9 388.5 388.9

Fee income 191.1 196.1 191.0 189.0 183.8 191.1 183.8

Premiums 0.7 0.7 0.7 3.8 0.5 0.7 0.5

Other revenue 18.2 18.2 20.7 15.3 10.0 18.2 10.0

Total operating revenues 598.5 612.4 606.9 596.9 583.2 598.5 583.2

Operating benefits and expenses

Interest credited and other benefits to contract owners/policyholders (210.7) (218.2) (213.5) (212.1) (204.6) (210.7) (204.6)

Operating expenses (226.0) (220.1) (205.8) (210.0) (204.0) (226.0) (204.0)

Net amortization of DAC/VOBA (46.9) (35.5) (0.3) (42.7) (36.8) (46.9) (36.8)

Interest expense - - - - - - -

Total operating benefits and expenses (483.6) (473.8) (419.6) (464.8) (445.4) (483.6) (445.4)

Operating earnings before income taxes 114.9 138.6 187.3 132.1 137.8 114.9 137.8

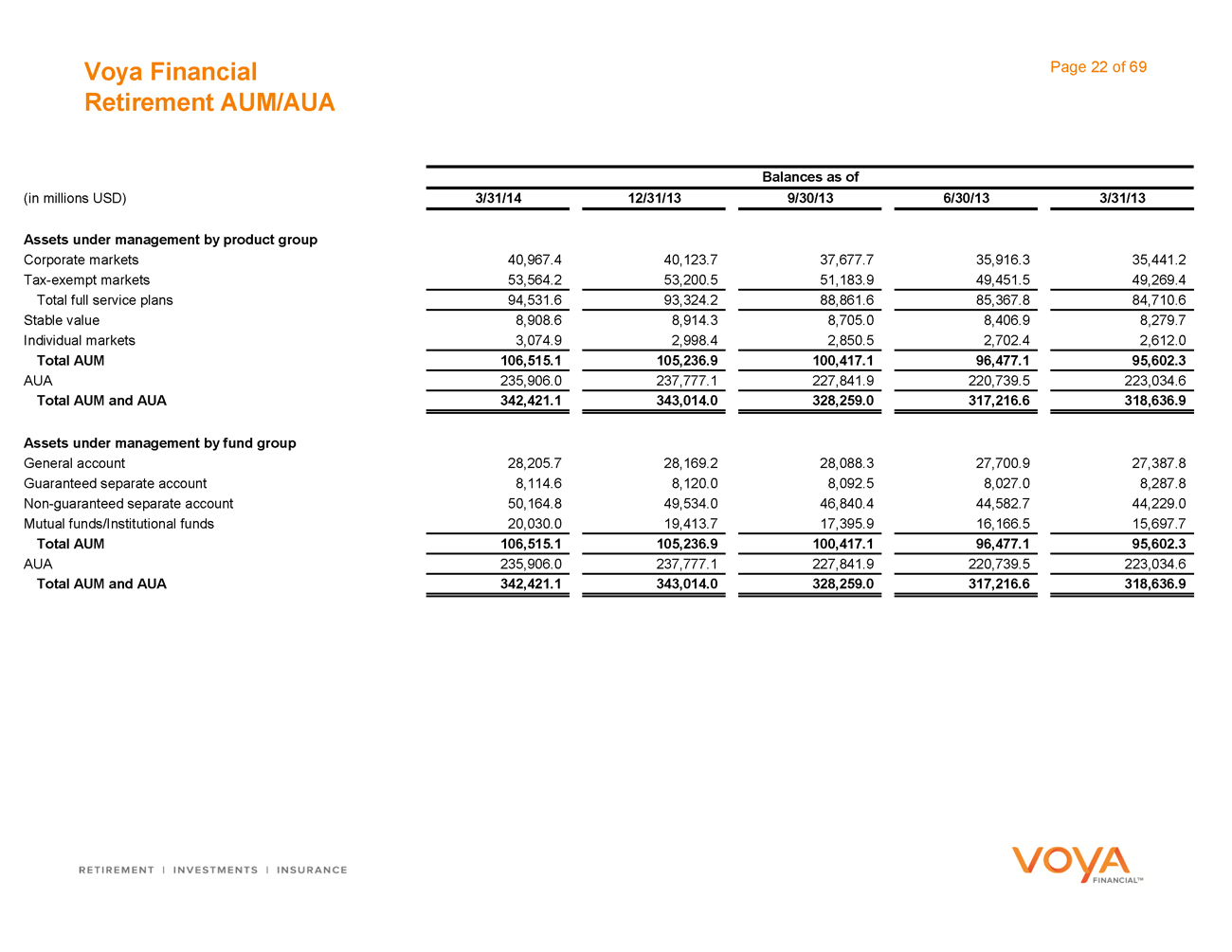

Voya Financial Page 22 of 69

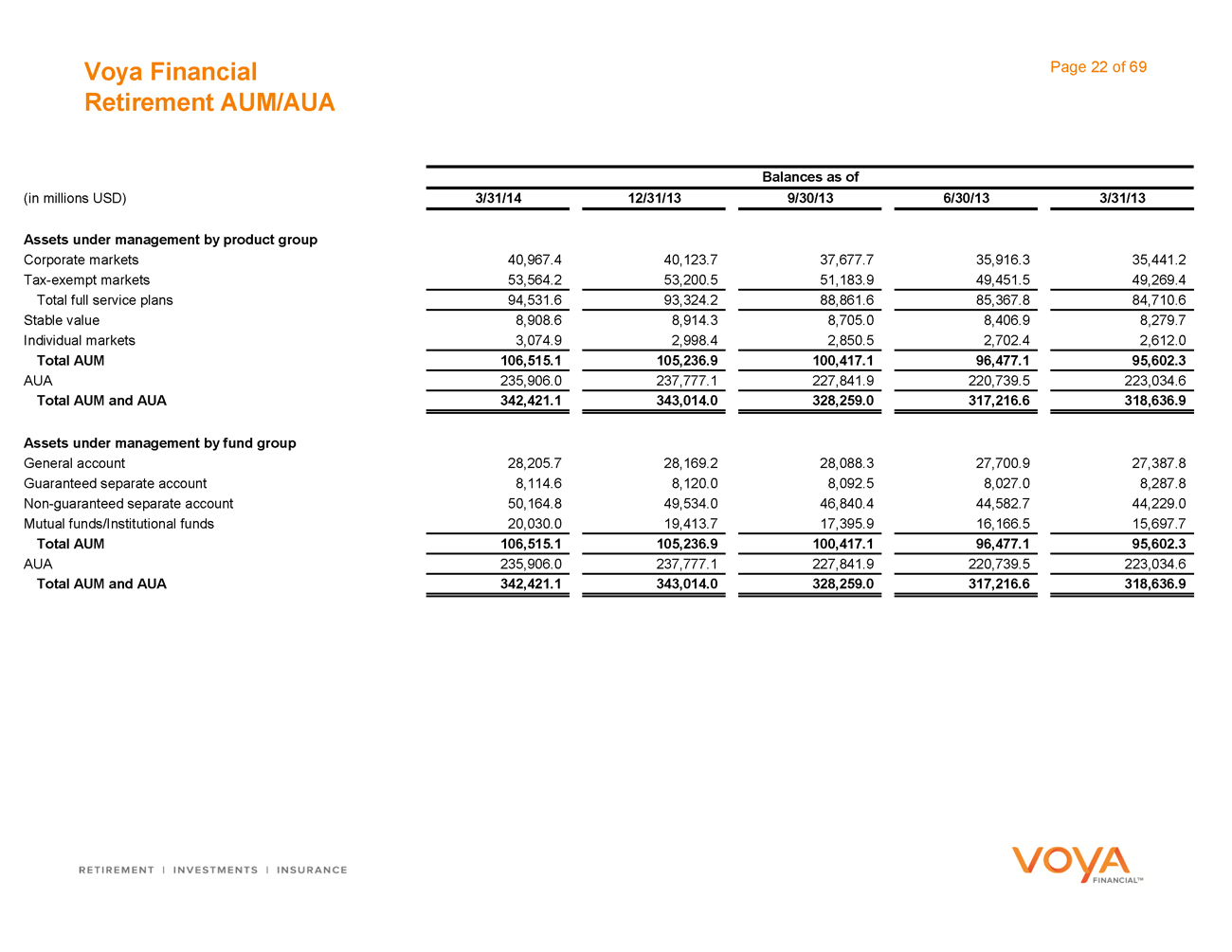

Retirement AUM/AUA

Balances as of

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13

Assets under management by product group

Corporate markets 40,967.4 40,123.7 37,677.7 35,916.3 35,441.2

Tax-exempt markets 53,564.2 53,200.5 51,183.9 49,451.5 49,269.4

Total full service plans 94,531.6 93,324.2 88,861.6 85,367.8 84,710.6

Stable value 8,908.6 8,914.3 8,705.0 8,406.9 8,279.7

Individual markets 3,074.9 2,998.4 2,850.5 2,702.4 2,612.0

Total AUM 106,515.1 105,236.9 100,417.1 96,477.1 95,602.3

AUA 235,906.0 237,777.1 227,841.9 220,739.5 223,034.6

Total AUM and AUA 342,421.1 343,014.0 328,259.0 317,216.6 318,636.9

Assets under management by fund group

General account 28,205.7 28,169.2 28,088.3 27,700.9 27,387.8

Guaranteed separate account 8,114.6 8,120.0 8,092.5 8,027.0 8,287.8

Non-guaranteed separate account 50,164.8 49,534.0 46,840.4 44,582.7 44,229.0

Mutual funds/Institutional funds 20,030.0 19,413.7 17,395.9 16,166.5 15,697.7

Total AUM 106,515.1 105,236.9 100,417.1 96,477.1 95,602.3

AUA 235,906.0 237,777.1 227,841.9 220,739.5 223,034.6

Total AUM and AUA 342,421.1 343,014.0 328,259.0 317,216.6 318,636.9

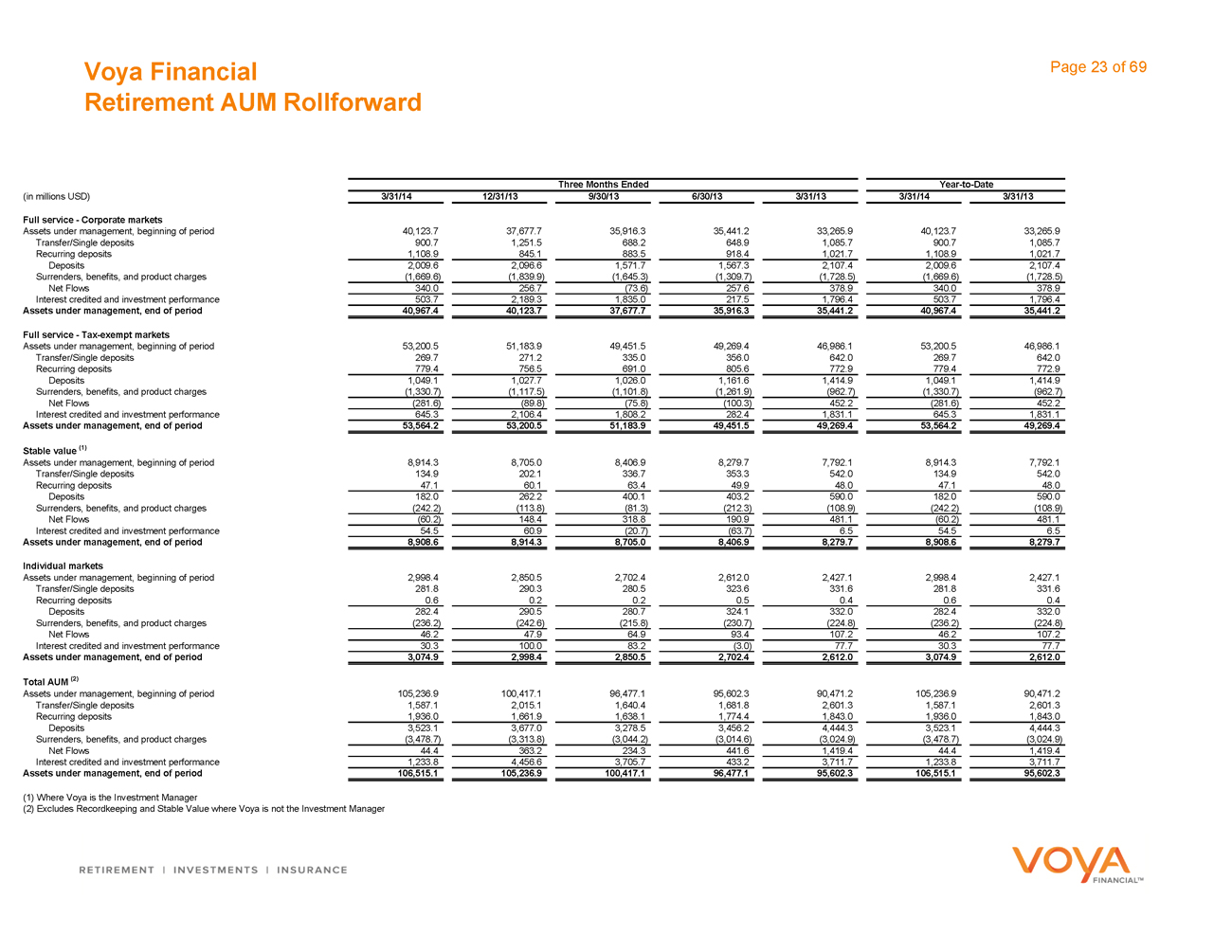

Voya Financial Page 23 of 69

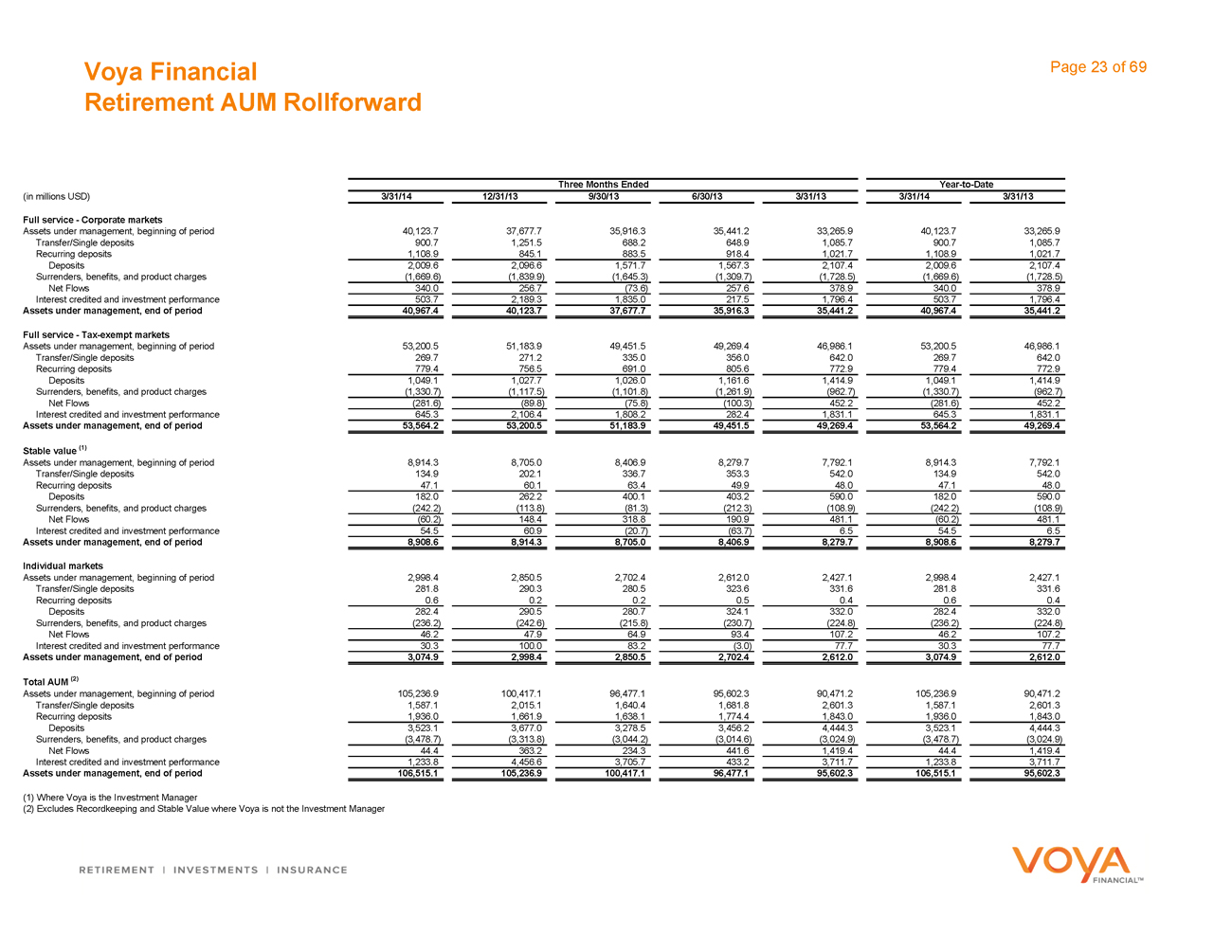

Retirement AUM Rollforward

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Full service - Corporate markets

Assets under management, beginning of period 40,123.7 37,677.7 35,916.3 35,441.2 33,265.9 40,123.7 33,265.9

Transfer/Single deposits 900.7 1,251.5 688.2 648.9 1,085.7 900.7 1,085.7

Recurring deposits 1,108.9 845.1 883.5 918.4 1,021.7 1,108.9 1,021.7

Deposits 2,009.6 2,096.6 1,571.7 1,567.3 2,107.4 2,009.6 2,107.4

Surrenders, benefits, and product charges (1,669.6) (1,839.9) (1,645.3) (1,309.7) (1,728.5) (1,669.6) (1,728.5)

Net Flows 340.0 256.7 (73.6) 257.6 378.9 340.0 378.9

Interest credited and investment performance 503.7 2,189.3 1,835.0 217.5 1,796.4 503.7 1,796.4

Assets under management, end of period 40,967.4 40,123.7 37,677.7 35,916.3 35,441.2 40,967.4 35,441.2

Full service - Tax-exempt markets

Assets under management, beginning of period 53,200.5 51,183.9 49,451.5 49,269.4 46,986.1 53,200.5 46,986.1

Transfer/Single deposits 269.7 271.2 335.0 356.0 642.0 269.7 642.0

Recurring deposits 779.4 756.5 691.0 805.6 772.9 779.4 772.9

Deposits 1,049.1 1,027.7 1,026.0 1,161.6 1,414.9 1,049.1 1,414.9

Surrenders, benefits, and product charges (1,330.7) (1,117.5) (1,101.8) (1,261.9) (962.7) (1,330.7) (962.7)

Net Flows (281.6) (89.8) (75.8) (100.3) 452.2 (281.6) 452.2

Interest credited and investment performance 645.3 2,106.4 1,808.2 282.4 1,831.1 645.3 1,831.1

Assets under management, end of period 53,564.2 53,200.5 51,183.9 49,451.5 49,269.4 53,564.2 49,269.4

Stable value (1)

Assets under management, beginning of period 8,914.3 8,705.0 8,406.9 8,279.7 7,792.1 8,914.3 7,792.1

Transfer/Single deposits 134.9 202.1 336.7 353.3 542.0 134.9 542.0

Recurring deposits 47.1 60.1 63.4 49.9 48.0 47.1 48.0

Deposits 182.0 262.2 400.1 403.2 590.0 182.0 590.0

Surrenders, benefits, and product charges (242.2) (113.8) (81.3) (212.3) (108.9) (242.2) (108.9)

Net Flows (60.2) 148.4 318.8 190.9 481.1 (60.2) 481.1

Interest credited and investment performance 54.5 60.9 (20.7) (63.7) 6.5 54.5 6.5

Assets under management, end of period 8,908.6 8,914.3 8,705.0 8,406.9 8,279.7 8,908.6 8,279.7

Individual markets

Assets under management, beginning of period 2,998.4 2,850.5 2,702.4 2,612.0 2,427.1 2,998.4 2,427.1

Transfer/Single deposits 281.8 290.3 280.5 323.6 331.6 281.8 331.6

Recurring deposits 0.6 0.2 0.2 0.5 0.4 0.6 0.4

Deposits 282.4 290.5 280.7 324.1 332.0 282.4 332.0

Surrenders, benefits, and product charges (236.2) (242.6) (215.8) (230.7) (224.8) (236.2) (224.8)

Net Flows 46.2 47.9 64.9 93.4 107.2 46.2 107.2

Interest credited and investment performance 30.3 100.0 83.2 (3.0) 77.7 30.3 77.7

Assets under management, end of period 3,074.9 2,998.4 2,850.5 2,702.4 2,612.0 3,074.9 2,612.0

Total AUM (2)

Assets under management, beginning of period 105,236.9 100,417.1 96,477.1 95,602.3 90,471.2 105,236.9 90,471.2

Transfer/Single deposits 1,587.1 2,015.1 1,640.4 1,681.8 2,601.3 1,587.1 2,601.3

Recurring deposits 1,936.0 1,661.9 1,638.1 1,774.4 1,843.0 1,936.0 1,843.0

Deposits 3,523.1 3,677.0 3,278.5 3,456.2 4,444.3 3,523.1 4,444.3

Surrenders, benefits, and product charges (3,478.7) (3,313.8) (3,044.2) (3,014.6) (3,024.9) (3,478.7) (3,024.9)

Net Flows 44.4 363.2 234.3 441.6 1,419.4 44.4 1,419.4

Interest credited and investment performance 1,233.8 4,456.6 3,705.7 433.2 3,711.7 1,233.8 3,711.7

Assets under management, end of period 106,515.1 105,236.9 100,417.1 96,477.1 95,602.3 106,515.1 95,602.3

(1) Where Voya is the Investment Manager

(2) Excludes Recordkeeping and Stable Value where Voya is not the Investment Manager

Annuities

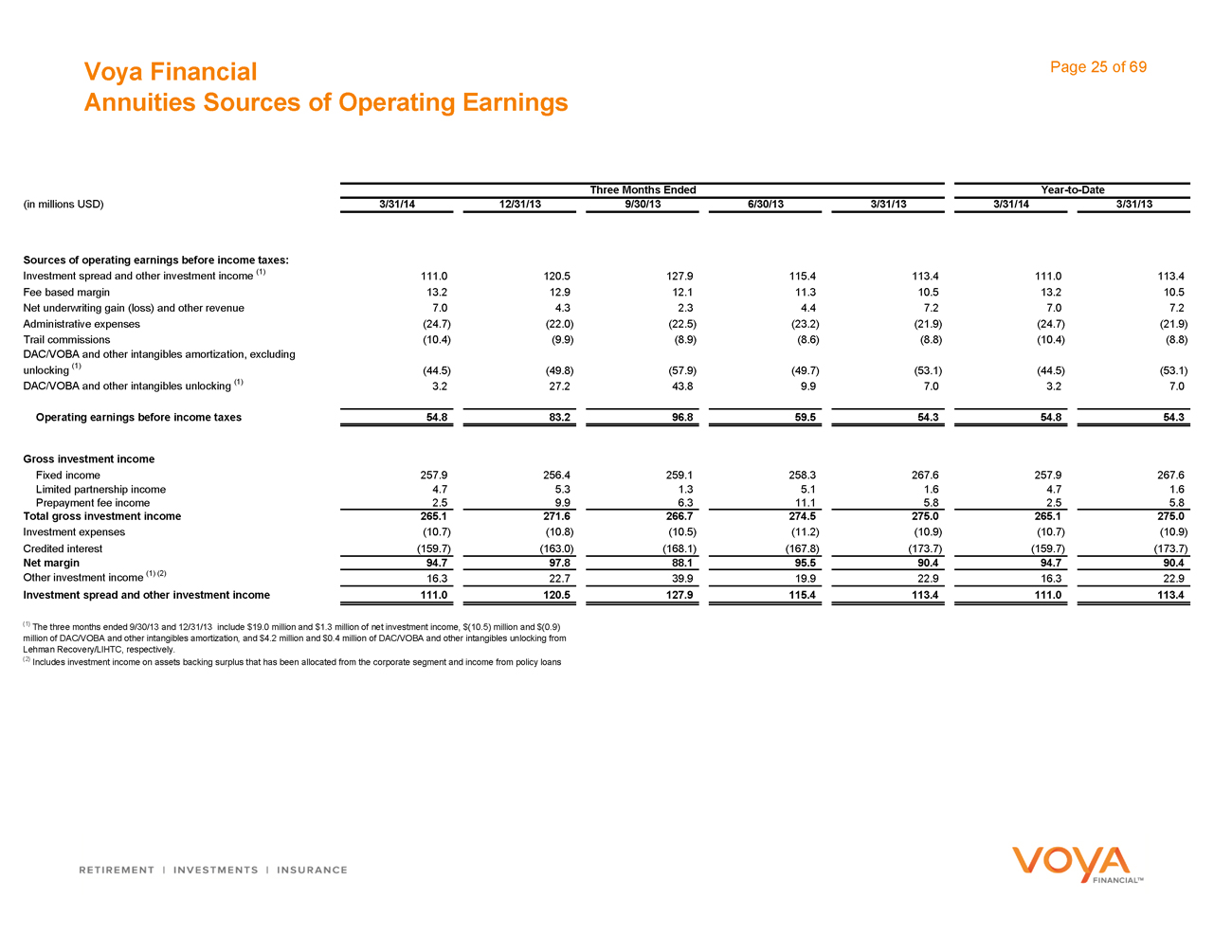

Voya Financial Page 25 of 69

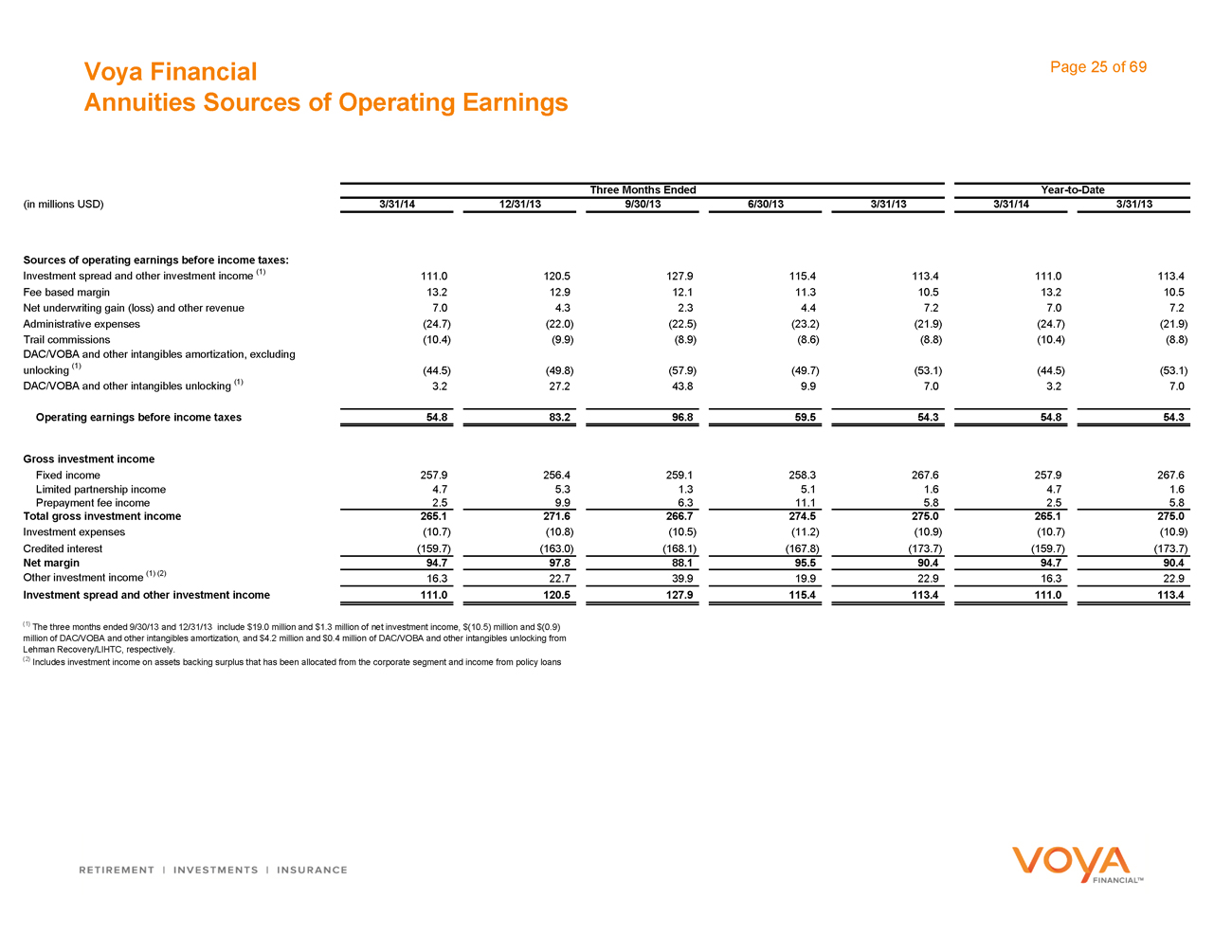

Annuities Sources of Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Sources of operating earnings before income taxes:

Investment spread and other investment income (1) 111.0 120.5 127.9 115.4 113.4 111.0 113.4

Fee based margin 13.2 12.9 12.1 11.3 10.5 13.2 10.5

Net underwriting gain (loss) and other revenue 7.0 4.3 2.3 4.4 7.2 7.0 7.2

Administrative expenses (24.7) (22.0) (22.5) (23.2) (21.9) (24.7) (21.9)

Trail commissions (10.4) (9.9) (8.9) (8.6) (8.8) (10.4) (8.8)

DAC/VOBA and other intangibles amortization, excluding

unlocking (1) (44.5) (49.8) (57.9) (49.7) (53.1) (44.5) (53.1)

DAC/VOBA and other intangibles unlocking (1) 3.2 27.2 43.8 9.9 7.0 3.2 7.0

Operating earnings before income taxes 54.8 83.2 96.8 59.5 54.3 54.8 54.3

Gross investment income

Fixed income 257.9 256.4 259.1 258.3 267.6 257.9 267.6

Limited partnership income 4.7 5.3 1.3 5.1 1.6 4.7 1.6

Prepayment fee income 2.5 9.9 6.3 11.1 5.8 2.5 5.8

Total gross investment income 265.1 271.6 266.7 274.5 275.0 265.1 275.0

Investment expenses (10.7) (10.8) (10.5) (11.2) (10.9) (10.7) (10.9)

Credited interest (159.7) (163.0) (168.1) (167.8) (173.7) (159.7) (173.7)

Net margin 94.7 97.8 88.1 95.5 90.4 94.7 90.4

Other investment income (1) (2) 16.3 22.7 39.9 19.9 22.9 16.3 22.9

Investment spread and other investment income 111.0 120.5 127.9 115.4 113.4 111.0 113.4

(1) The three months ended 9/30/13 and 12/31/13 include $19.0 million and $1.3 million of net investment income, $(10.5) million and $(0.9)

million of DAC/VOBA and other intangibles amortization, and $4.2 million and $0.4 million of DAC/VOBA and other intangibles unlocking from

Lehman Recovery/LIHTC, respectively.

(2) Includes investment income on assets backing surplus that has been allocated from the corporate segment and income from policy loans

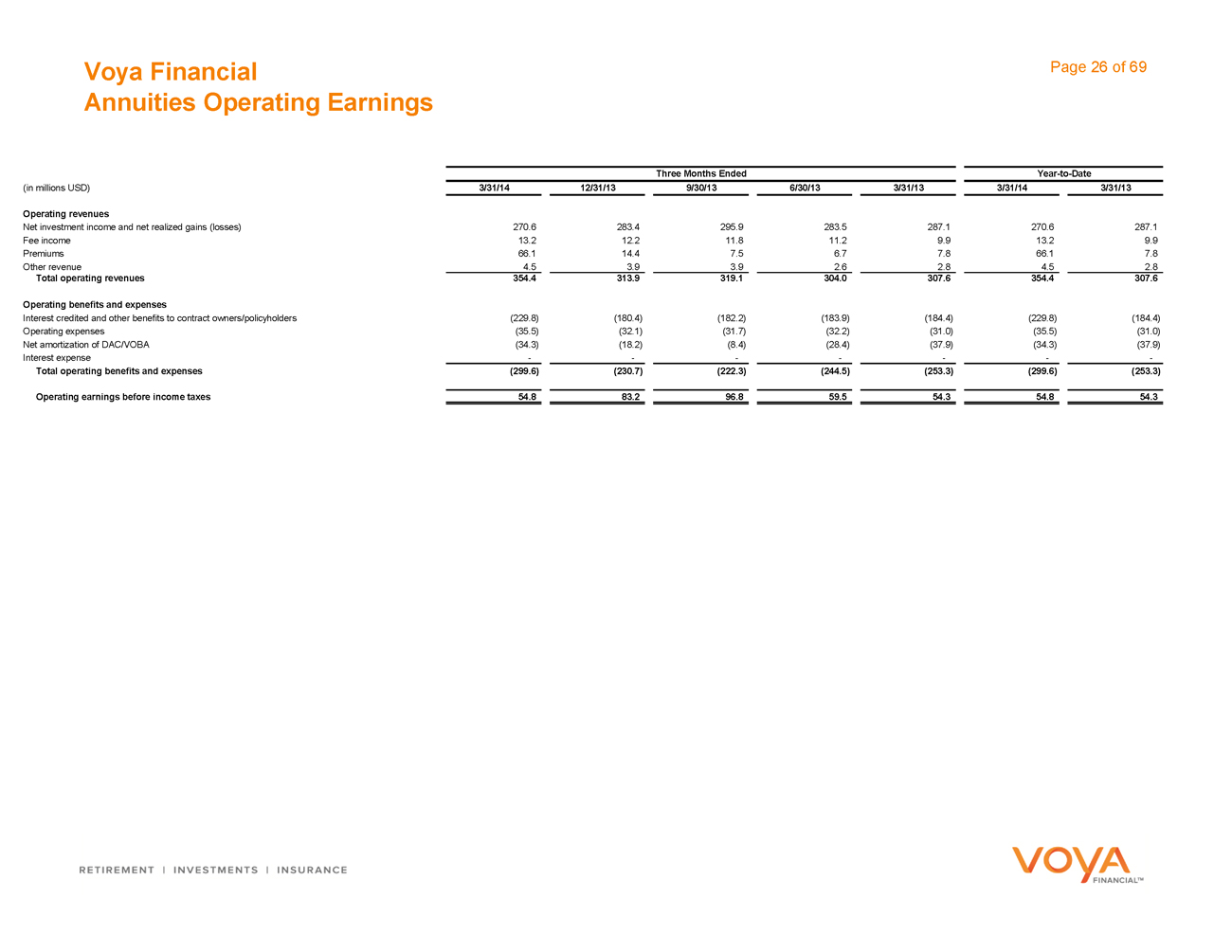

Voya Financial Page 26 of 69

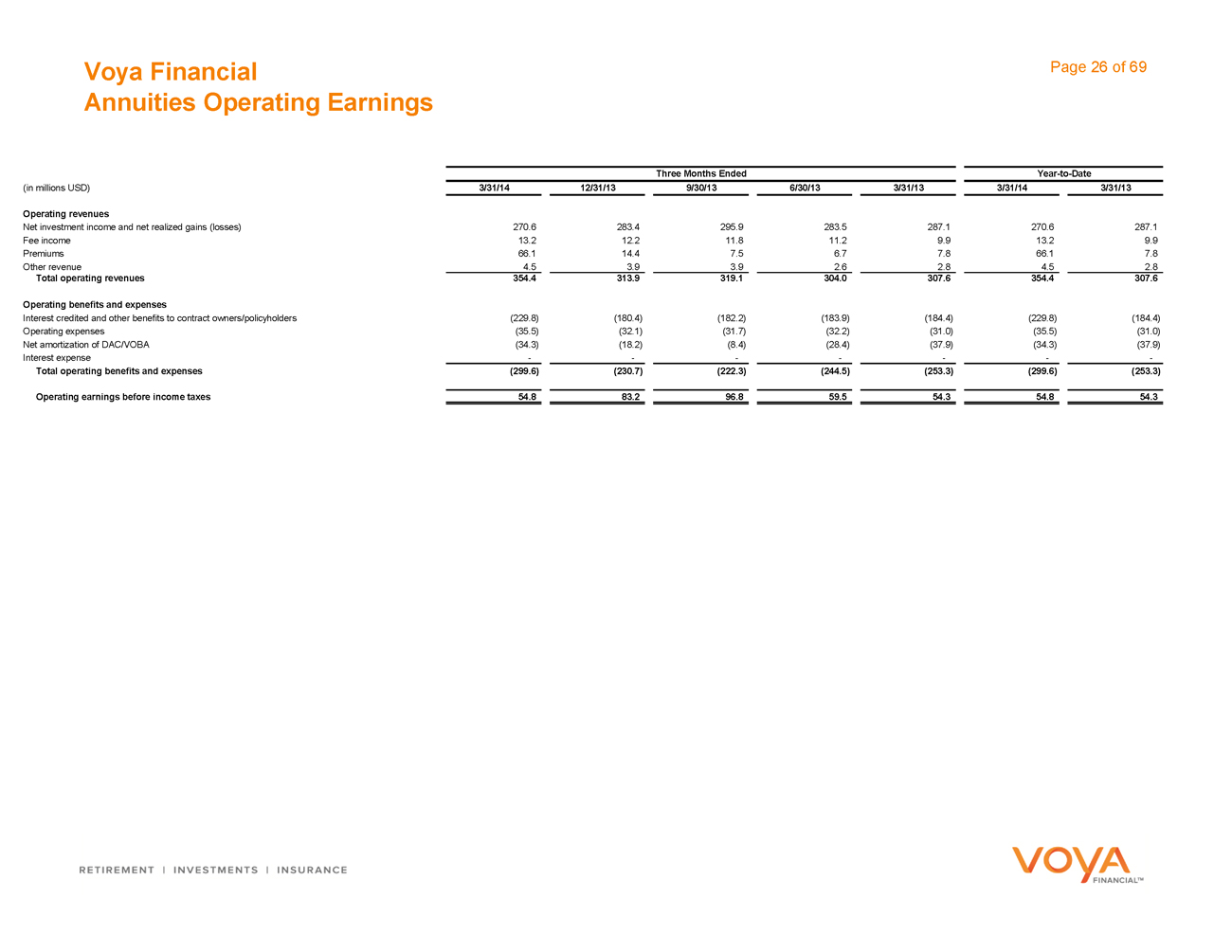

Annuities Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Operating revenues

Net investment income and net realized gains (losses) 270.6 283.4 295.9 283.5 287.1 270.6 287.1

Fee income 13.2 12.2 11.8 11.2 9.9 13.2 9.9

Premiums 66.1 14.4 7.5 6.7 7.8 66.1 7.8

Other revenue 4.5 3.9 3.9 2.6 2.8 4.5 2.8

Total operating revenues 354.4 313.9 319.1 304.0 307.6 354.4 307.6

Operating benefits and expenses

Interest credited and other benefits to contract owners/policyholders (229.8) (180.4) (182.2) (183.9) (184.4) (229.8) (184.4)

Operating expenses (35.5) (32.1) (31.7) (32.2) (31.0) (35.5) (31.0)

Net amortization of DAC/VOBA (34.3) (18.2) (8.4) (28.4) (37.9) (34.3) (37.9)

Interest expense - - - - - - -

Total operating benefits and expenses (299.6) (230.7) (222.3) (244.5) (253.3) (299.6) (253.3)

Operating earnings before income taxes 54.8 83.2 96.8 59.5 54.3 54.8 54.3

Voya Financial Page 27 of 69

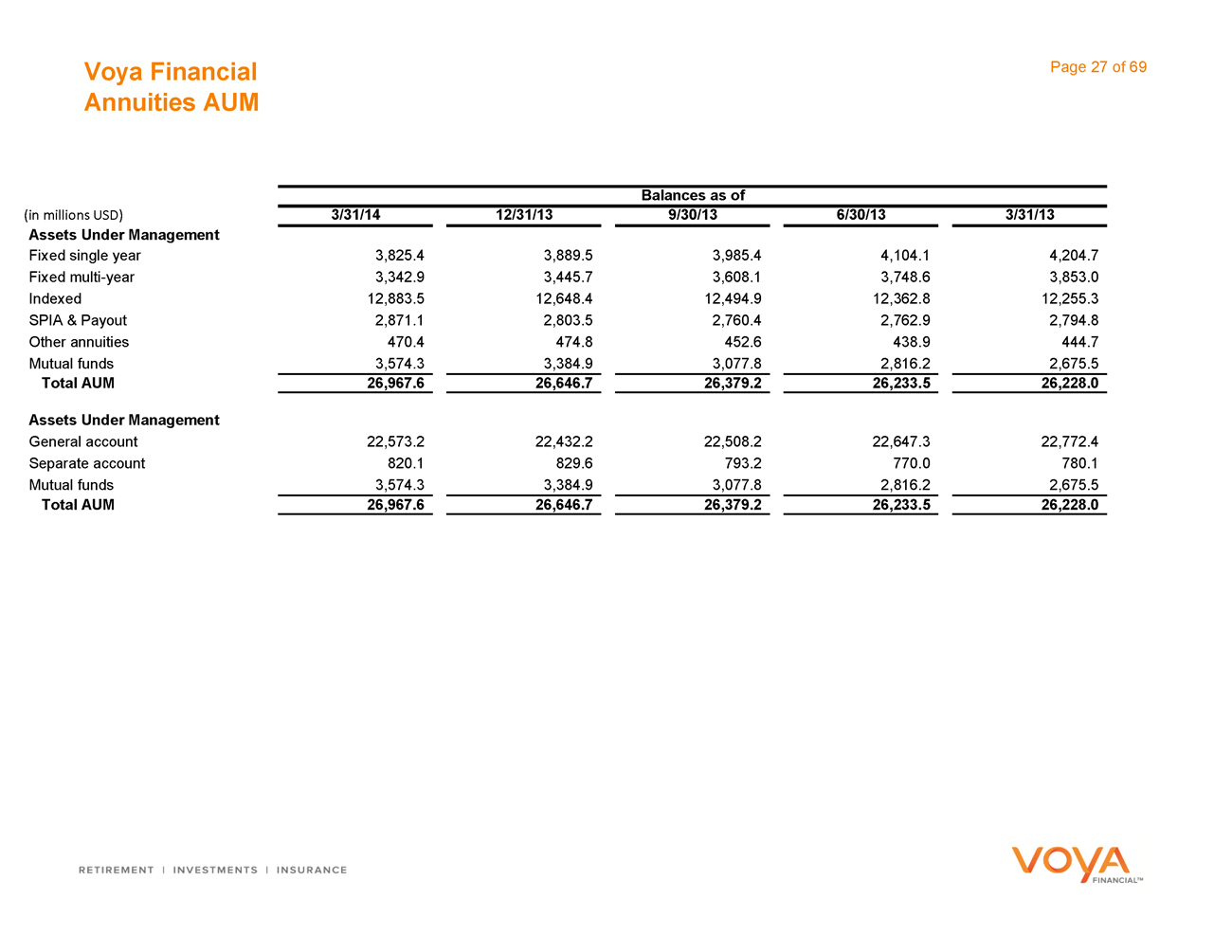

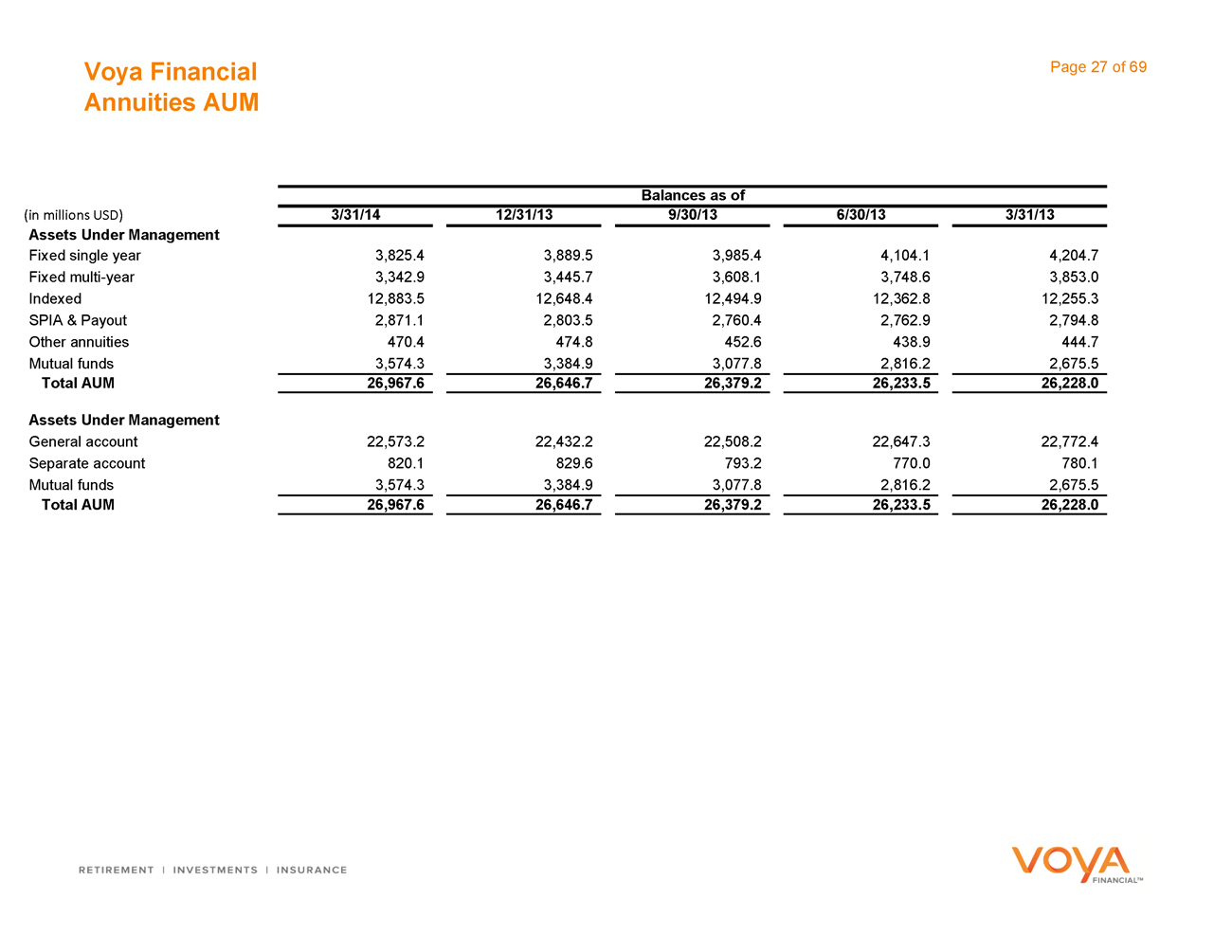

Annuities AUM

Balances as of

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13

Assets Under Management

Fixed single year 3,825.4 3,889.5 3,985.4 4,104.1 4,204.7

Fixed multi-year 3,342.9 3,445.7 3,608.1 3,748.6 3,853.0

Indexed 12,883.5 12,648.4 12,494.9 12,362.8 12,255.3

SPIA & Payout 2,871.1 2,803.5 2,760.4 2,762.9 2,794.8

Other annuities 470.4 474.8 452.6 438.9 444.7

Mutual funds 3,574.3 3,384.9 3,077.8 2,816.2 2,675.5

Total AUM 26,967.6 26,646.7 26,379.2 26,233.5 26,228.0

Assets Under Management

General account 22,573.2 22,432.2 22,508.2 22,647.3 22,772.4

Separate account 820.1 829.6 793.2 770.0 780.1

Mutual funds 3,574.3 3,384.9 3,077.8 2,816.2 2,675.5

Total AUM 26,967.6 26,646.7 26,379.2 26,233.5 26,228.0

Voya Financial Page 28 of 69

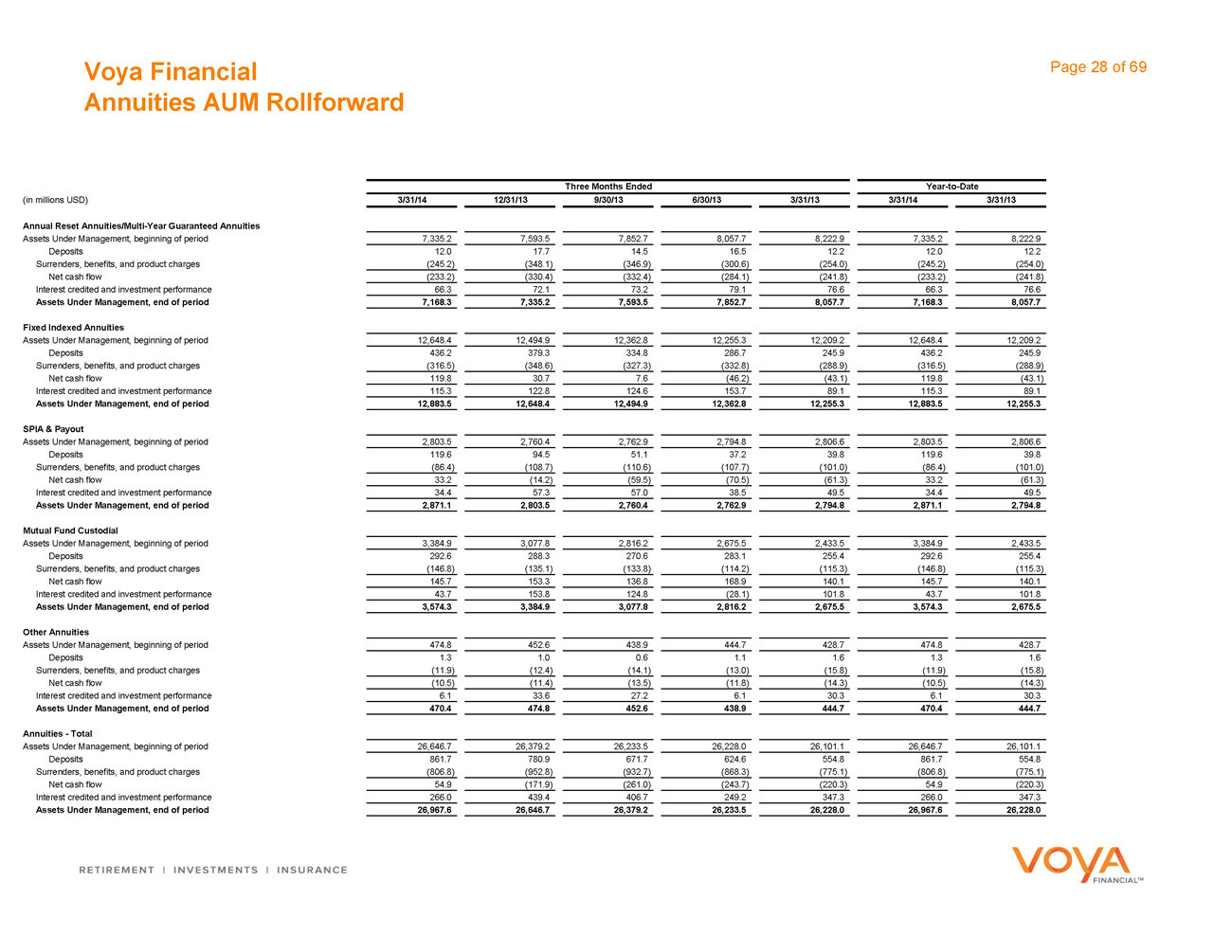

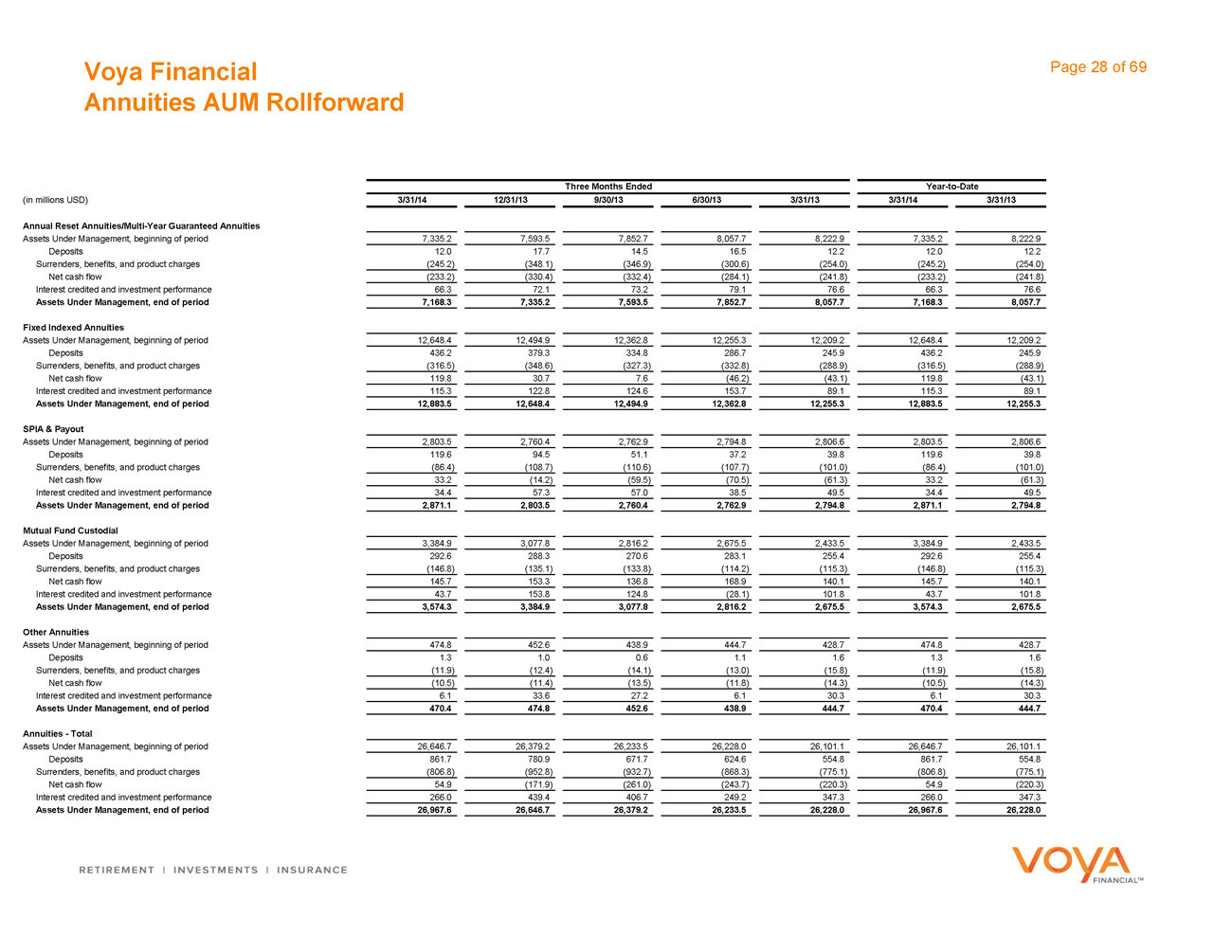

Annuities AUM Rollforward

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Annual Reset Annuities/Multi-Year Guaranteed Annuities

Assets Under Management, beginning of period 7,335.2 7,593.5 7,852.7 8,057.7 8,222.9 7,335.2 8,222.9

Deposits 12.0 17.7 14.5 16.5 12.2 12.0 12.2

Surrenders, benefits, and product charges (245.2) (348.1) (346.9) (300.6) (254.0) (245.2) (254.0)

Net cash flow (233.2) (330.4) (332.4) (284.1) (241.8) (233.2) (241.8)

Interest credited and investment performance 66.3 72.1 73.2 79.1 76.6 66.3 76.6

Assets Under Management, end of period 7,168.3 7,335.2 7,593.5 7,852.7 8,057.7 7,168.3 8,057.7

Fixed Indexed Annuities

Assets Under Management, beginning of period 12,648.4 12,494.9 12,362.8 12,255.3 12,209.2 12,648.4 12,209.2

Deposits 436.2 379.3 334.8 286.7 245.9 436.2 245.9

Surrenders, benefits, and product charges (316.5) (348.6) (327.3) (332.8) (288.9) (316.5) (288.9)

Net cash flow 119.8 30.7 7.6 (46.2) (43.1) 119.8 (43.1)

Interest credited and investment performance 115.3 122.8 124.6 153.7 89.1 115.3 89.1

Assets Under Management, end of period 12,883.5 12,648.4 12,494.9 12,362.8 12,255.3 12,883.5 12,255.3

SPIA & Payout

Assets Under Management, beginning of period 2,803.5 2,760.4 2,762.9 2,794.8 2,806.6 2,803.5 2,806.6

Deposits 119.6 94.5 51.1 37.2 39.8 119.6 39.8

Surrenders, benefits, and product charges (86.4) (108.7) (110.6) (107.7) (101.0) (86.4) (101.0)

Net cash flow 33.2 (14.2) (59.5) (70.5) (61.3) 33.2 (61.3)

Interest credited and investment performance 34.4 57.3 57.0 38.5 49.5 34.4 49.5

Assets Under Management, end of period 2,871.1 2,803.5 2,760.4 2,762.9 2,794.8 2,871.1 2,794.8

Mutual Fund Custodial

Assets Under Management, beginning of period 3,384.9 3,077.8 2,816.2 2,675.5 2,433.5 3,384.9 2,433.5

Deposits 292.6 288.3 270.6 283.1 255.4 292.6 255.4

Surrenders, benefits, and product charges (146.8) (135.1) (133.8) (114.2) (115.3) (146.8) (115.3)

Net cash flow 145.7 153.3 136.8 168.9 140.1 145.7 140.1

Interest credited and investment performance 43.7 153.8 124.8 (28.1) 101.8 43.7 101.8

Assets Under Management, end of period 3,574.3 3,384.9 3,077.8 2,816.2 2,675.5 3,574.3 2,675.5

Other Annuities

Assets Under Management, beginning of period 474.8 452.6 438.9 444.7 428.7 474.8 428.7

Deposits 1.3 1.0 0.6 1.1 1.6 1.3 1.6

Surrenders, benefits, and product charges (11.9) (12.4) (14.1) (13.0) (15.8) (11.9) (15.8)

Net cash flow (10.5) (11.4) (13.5) (11.8) (14.3) (10.5) (14.3)

Interest credited and investment performance 6.1 33.6 27.2 6.1 30.3 6.1 30.3

Assets Under Management, end of period 470.4 474.8 452.6 438.9 444.7 470.4 444.7

Annuities - Total

Assets Under Management, beginning of period 26,646.7 26,379.2 26,233.5 26,228.0 26,101.1 26,646.7 26,101.1

Deposits 861.7 780.9 671.7 624.6 554.8 861.7 554.8

Surrenders, benefits, and product charges (806.8) (952.8) (932.7) (868.3) (775.1) (806.8) (775.1)

Net cash flow 54.9 (171.9) (261.0) (243.7) (220.3) 54.9 (220.3)

Interest credited and investment performance 266.0 439.4 406.7 249.2 347.3 266.0 347.3

Assets Under Management, end of period 26,967.6 26,646.7 26,379.2 26,233.5 26,228.0 26,967.6 26,228.0

Investment Management

Voya Financial Page 30 of 69

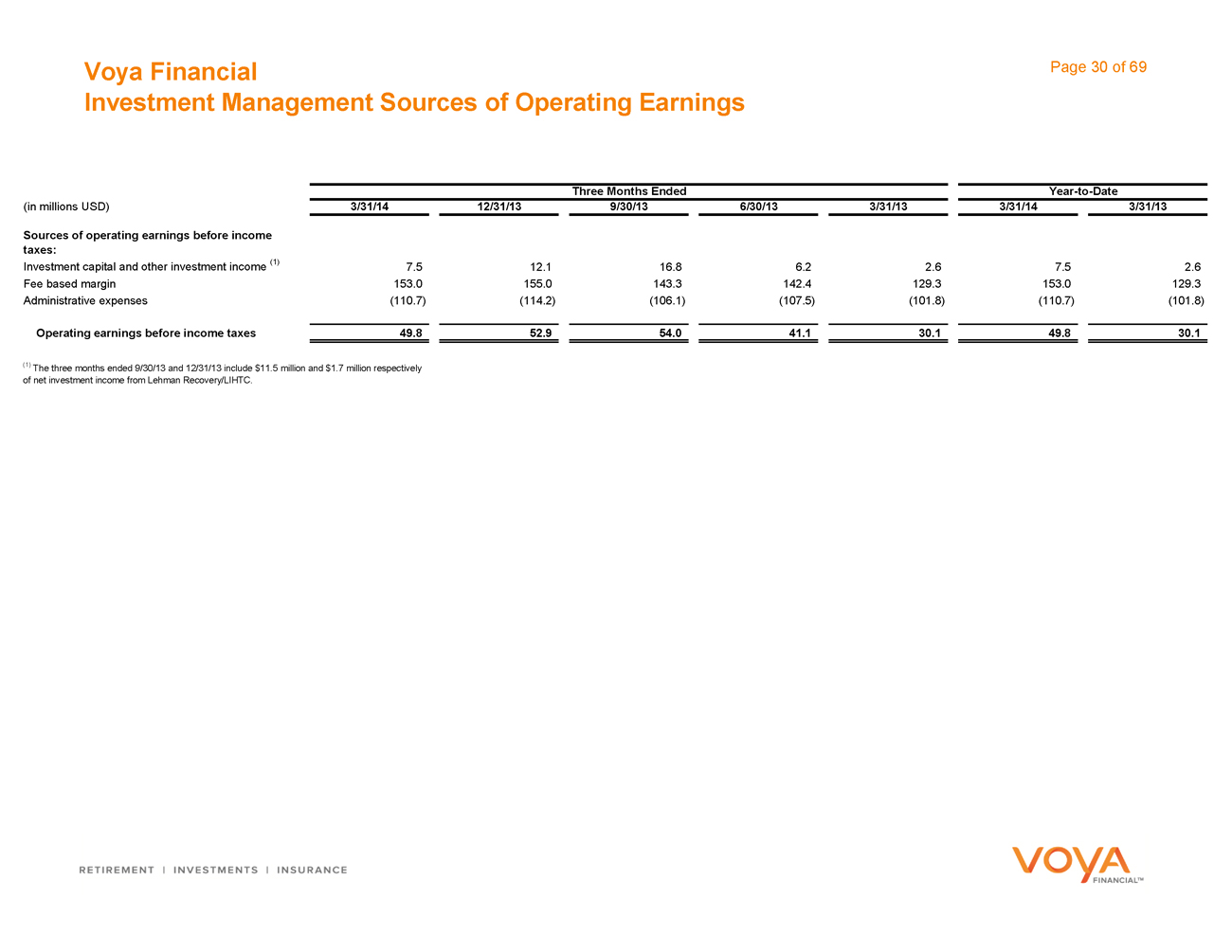

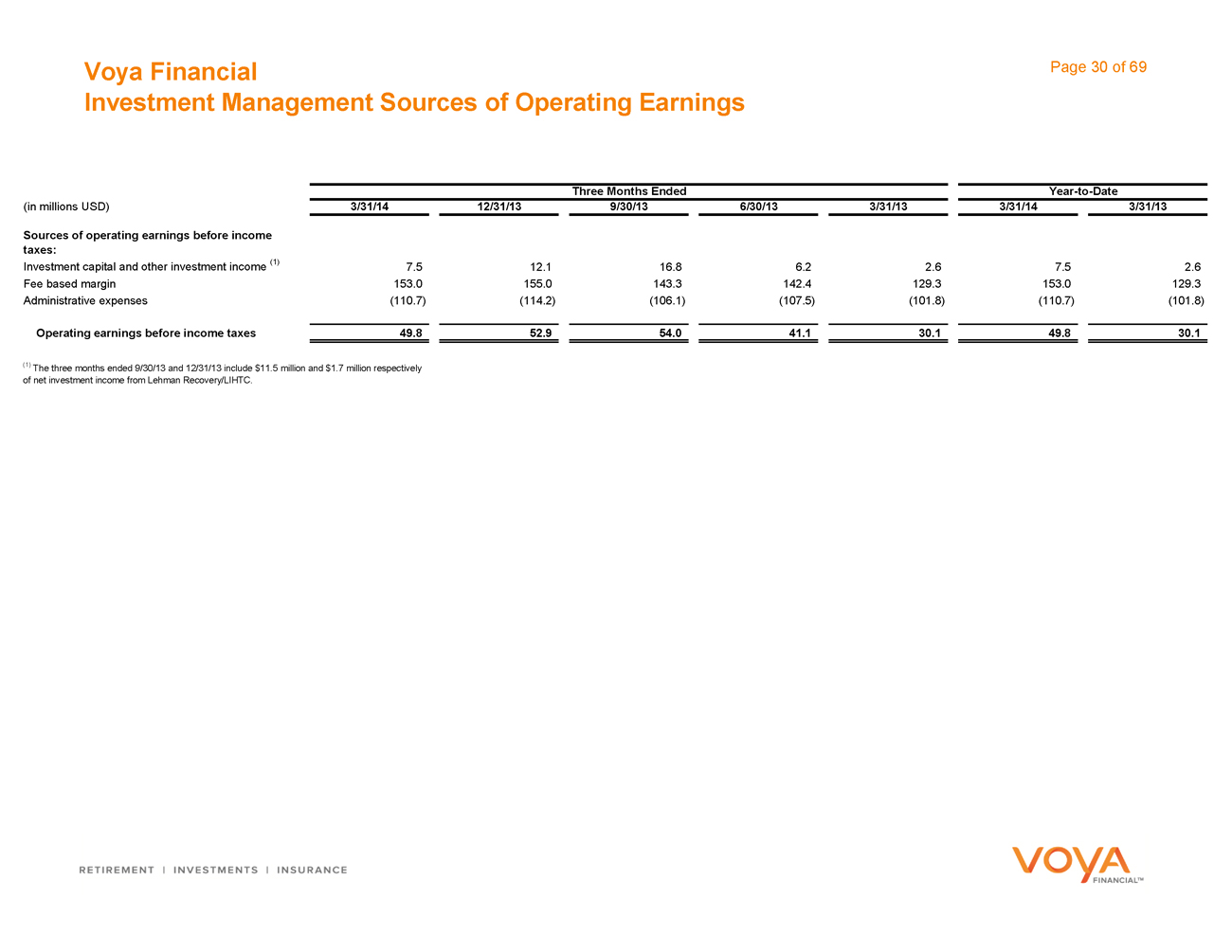

Investment Management Sources of Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Sources of operating earnings before income

taxes:

Investment capital and other investment income (1) 7.5 12.1 16.8 6.2 2.6 7.5 2.6

Fee based margin 153.0 155.0 143.3 142.4 129.3 153.0 129.3

Administrative expenses (110.7) (114.2) (106.1) (107.5) (101.8) (110.7) (101.8)

Operating earnings before income taxes 49.8 52.9 54.0 41.1 30.1 49.8 30.1

(1) The three months ended 9/30/13 and 12/31/13 include $11.5 million and $1.7 million respectively

of net investment income from Lehman Recovery/LIHTC.

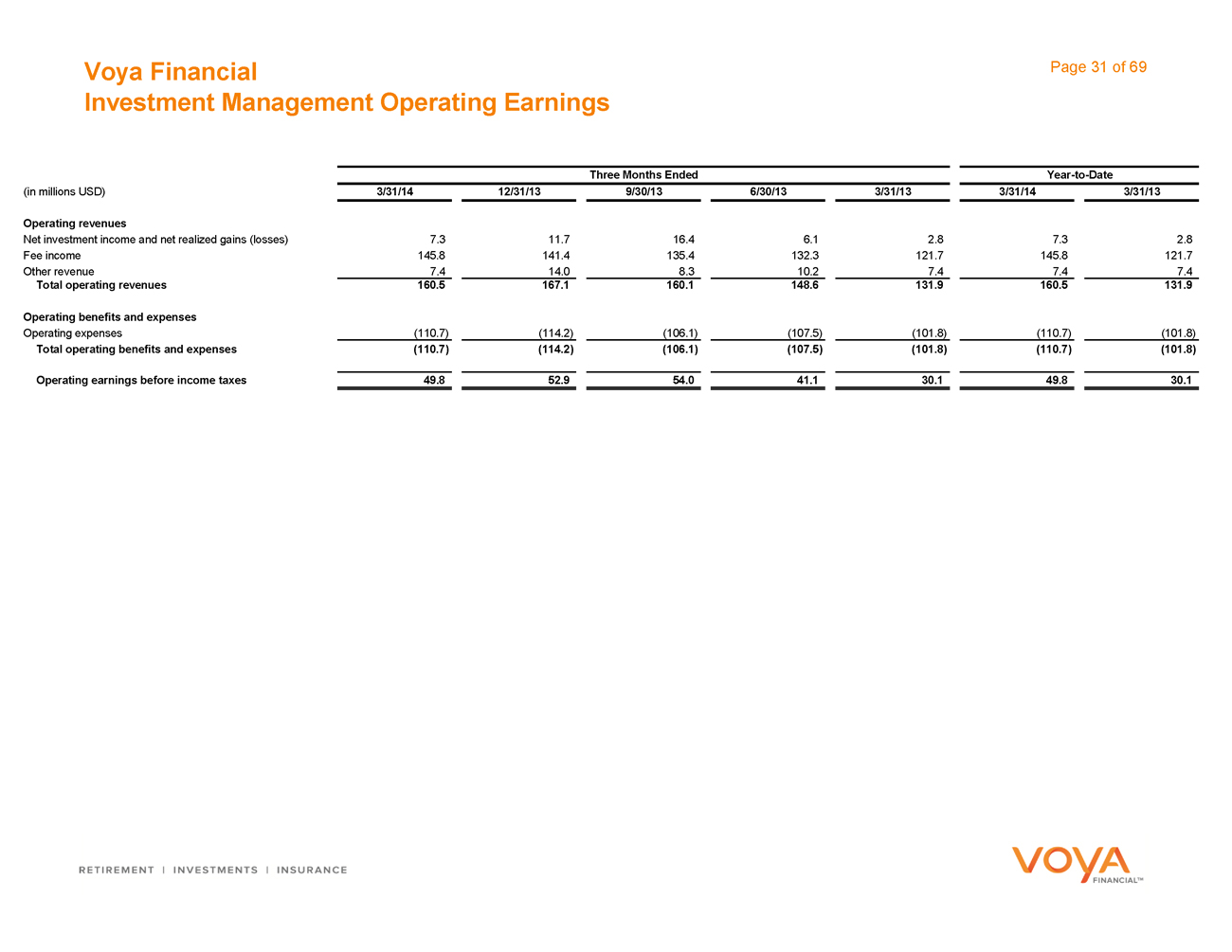

Voya Financial Page 31 of 69

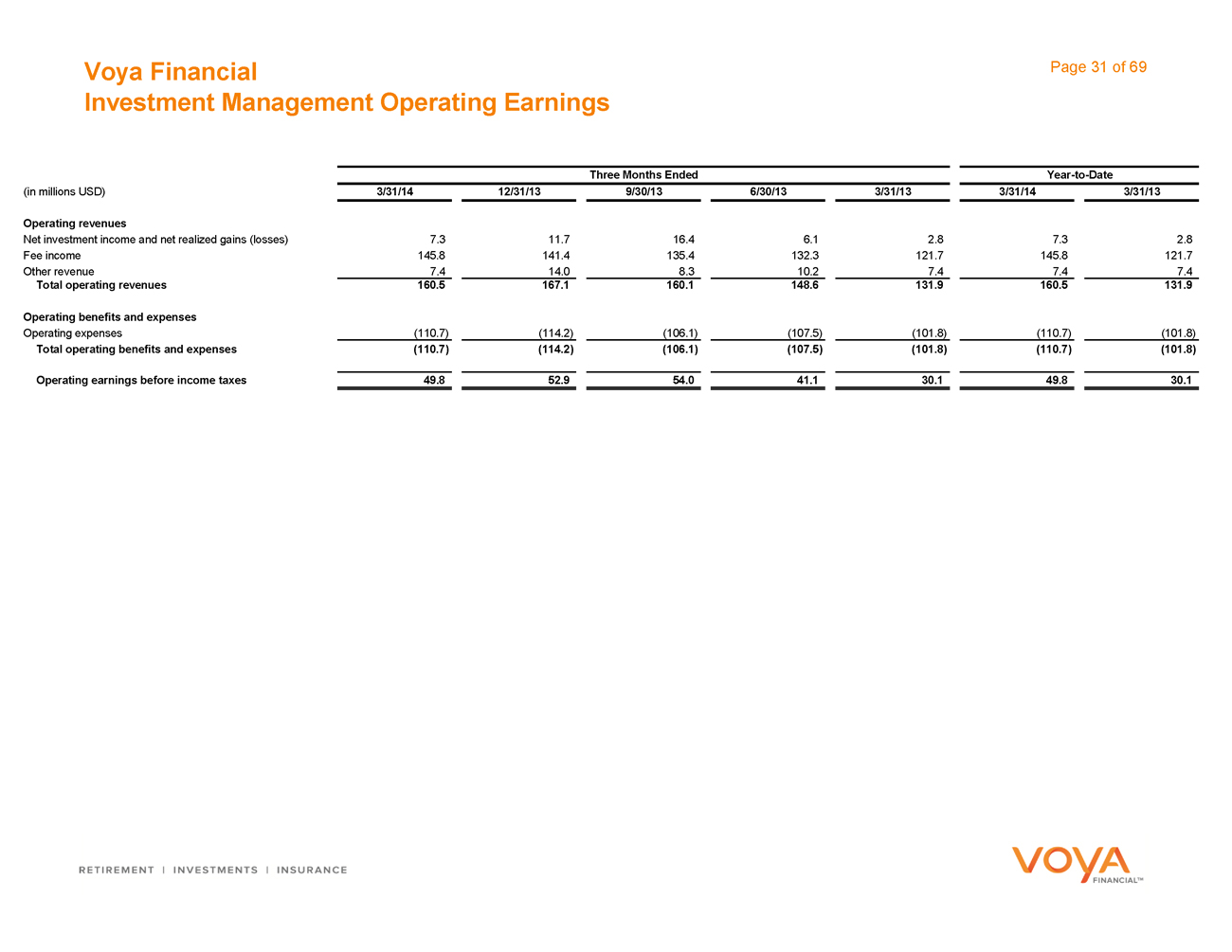

Investment Management Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Operating revenues

Net investment income and net realized gains (losses) 7.3 11.7 16.4 6.1 2.8 7.3 2.8

Fee income 145.8 141.4 135.4 132.3 121.7 145.8 121.7

Other revenue 7.4 14.0 8.3 10.2 7.4 7.4 7.4

Total operating revenues 160.5 167.1 160.1 148.6 131.9 160.5 131.9

Operating benefits and expenses

Operating expenses (110.7) (114.2) (106.1) (107.5) (101.8) (110.7) (101.8)

Total operating benefits and expenses (110.7) (114.2) (106.1) (107.5) (101.8) (110.7) (101.8)

Operating earnings before income taxes 49.8 52.9 54.0 41.1 30.1 49.8 30.1

Voya Financial Page 32 of 69

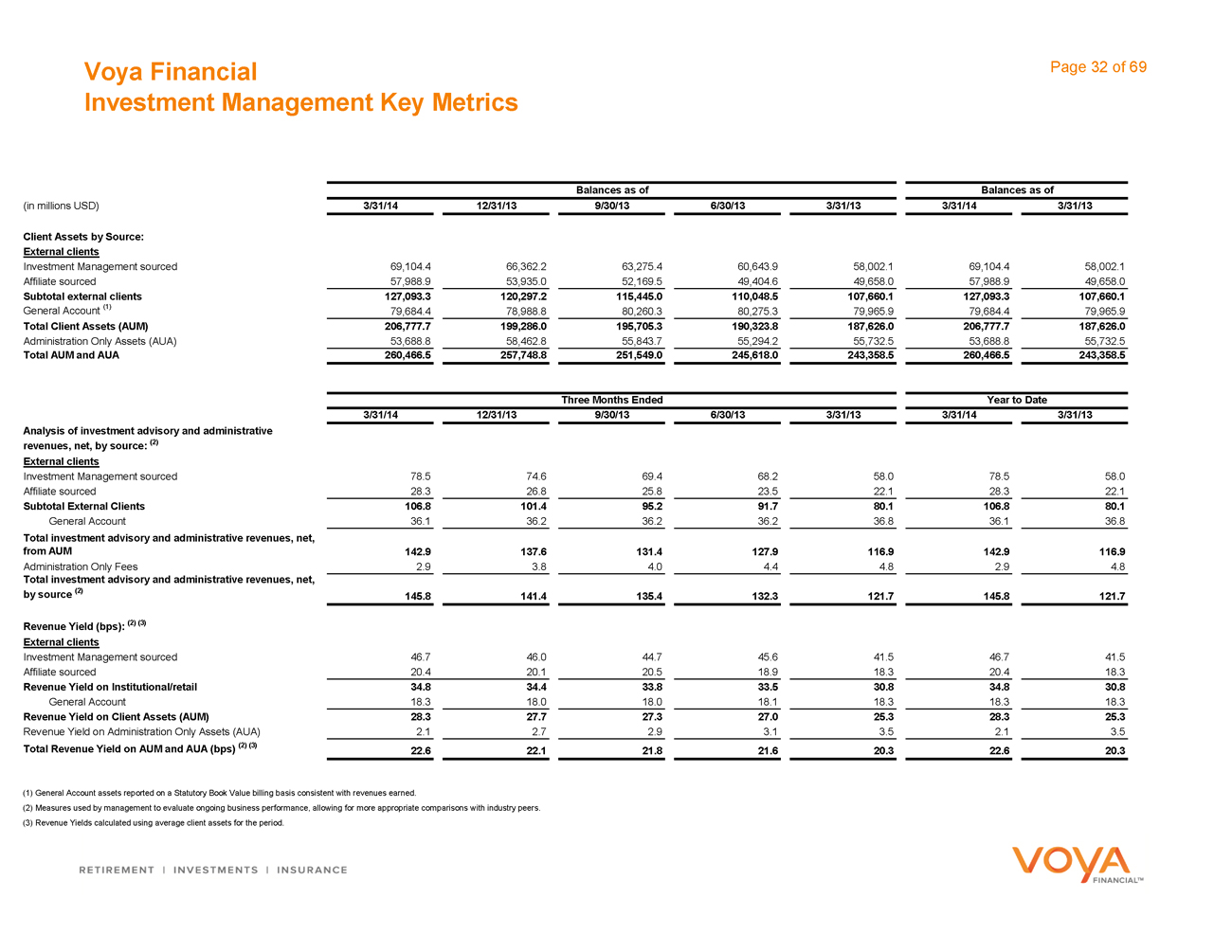

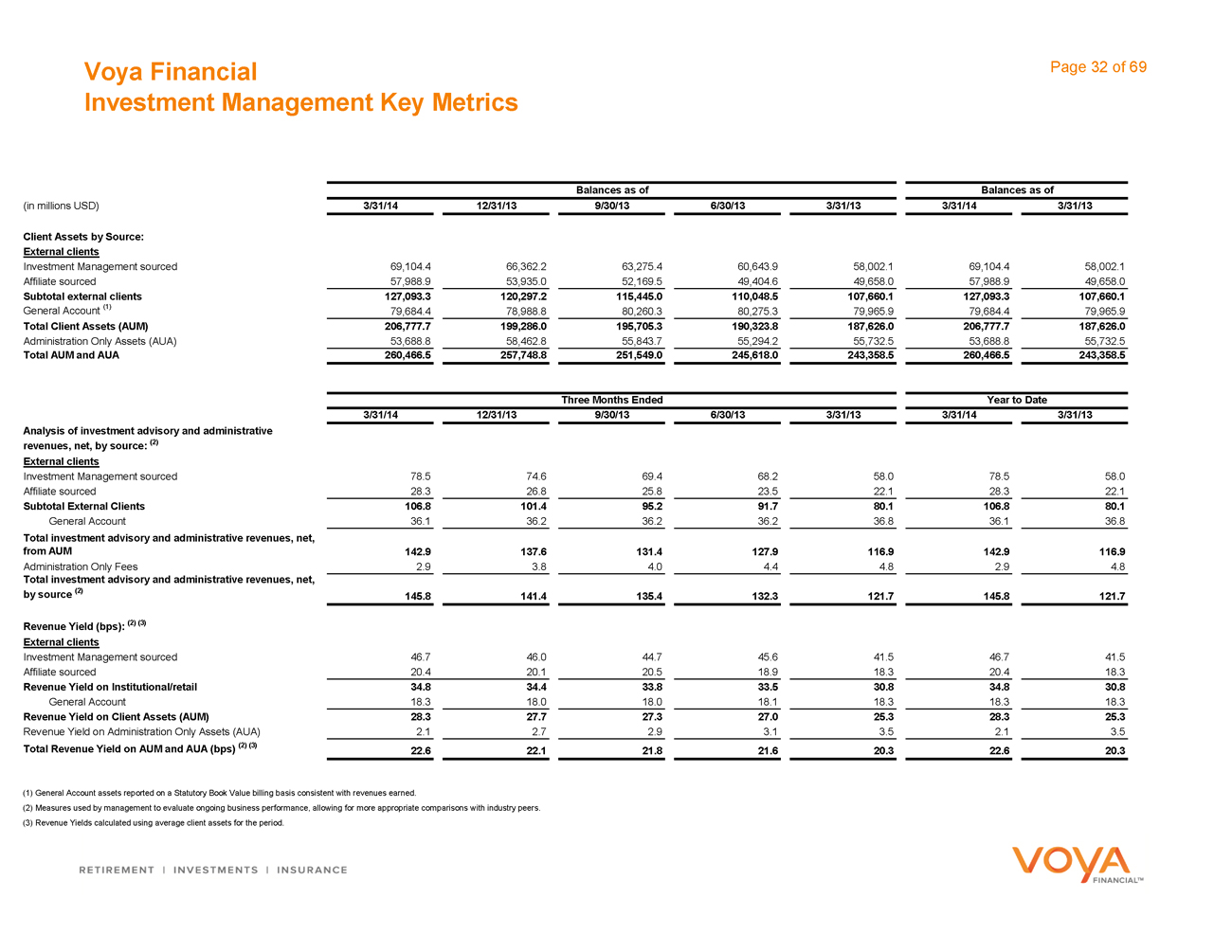

Investment Management Key Metrics

Balances as of Balances as of

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Client Assets by Source:

External clients

Investment Management sourced 69,104.4 66,362.2 63,275.4 60,643.9 58,002.1 69,104.4 58,002.1

Affiliate sourced 57,988.9 53,935.0 52,169.5 49,404.6 49,658.0 57,988.9 49,658.0

Subtotal external clients 127,093.3 120,297.2 115,445.0 110,048.5 107,660.1 127,093.3 107,660.1

General Account (1) 79,684.4 78,988.8 80,260.3 80,275.3 79,965.9 79,684.4 79,965.9

Total Client Assets (AUM) 206,777.7 199,286.0 195,705.3 190,323.8 187,626.0 206,777.7 187,626.0

Administration Only Assets (AUA) 53,688.8 58,462.8 55,843.7 55,294.2 55,732.5 53,688.8 55,732.5

Total AUM and AUA 260,466.5 257,748.8 251,549.0 245,618.0 243,358.5 260,466.5 243,358.5

Three Months Ended Year to Date

3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Analysis of investment advisory and administrative

revenues, net, by source: (2)

External clients

Investment Management sourced 78.5 74.6 69.4 68.2 58.0 78.5 58.0

Affiliate sourced 28.3 26.8 25.8 23.5 22.1 28.3 22.1

Subtotal External Clients 106.8 101.4 95.2 91.7 80.1 106.8 80.1

General Account 36.1 36.2 36.2 36.2 36.8 36.1 36.8

Total investment advisory and administrative revenues, net,

from AUM 142.9 137.6 131.4 127.9 116.9 142.9 116.9

Administration Only Fees 2.9 3.8 4.0 4.4 4.8 2.9 4.8

Total investment advisory and administrative revenues, net,

by source (2) 145.8 141.4 135.4 132.3 121.7 145.8 121.7

Revenue Yield (bps): (2) (3)

External clients

Investment Management sourced 46.7 46.0 44.7 45.6 41.5 46.7 41.5

Affiliate sourced 20.4 20.1 20.5 18.9 18.3 20.4 18.3

Revenue Yield on Institutional/retail 34.8 34.4 33.8 33.5 30.8 34.8 30.8

General Account 18.3 18.0 18.0 18.1 18.3 18.3 18.3

Revenue Yield on Client Assets (AUM) 28.3 27.7 27.3 27.0 25.3 28.3 25.3

Revenue Yield on Administration Only Assets (AUA) 2.1 2.7 2.9 3.1 3.5 2.1 3.5

Total Revenue Yield on AUM and AUA (bps) (2) (3) 22.6 22.1 21.8 21.6 20.3 22.6 20.3

(1) General Account assets reported on a Statutory Book Value billing basis consistent with revenues earned.

(2) Measures used by management to evaluate ongoing business performance, allowing for more appropriate comparisons with industry peers.

(3) Revenue Yields calculated using average client assets for the period.

Voya Financial Page 33 of 69

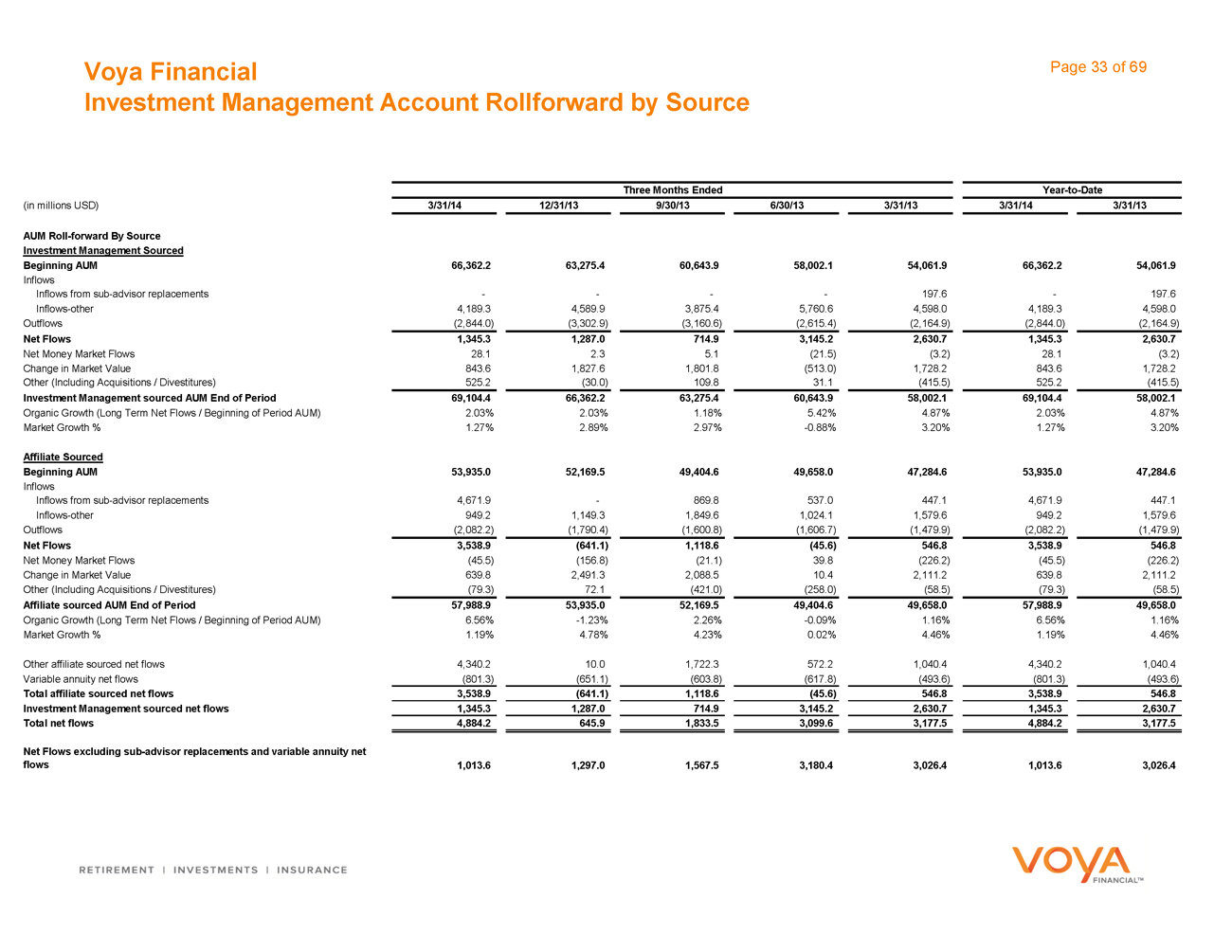

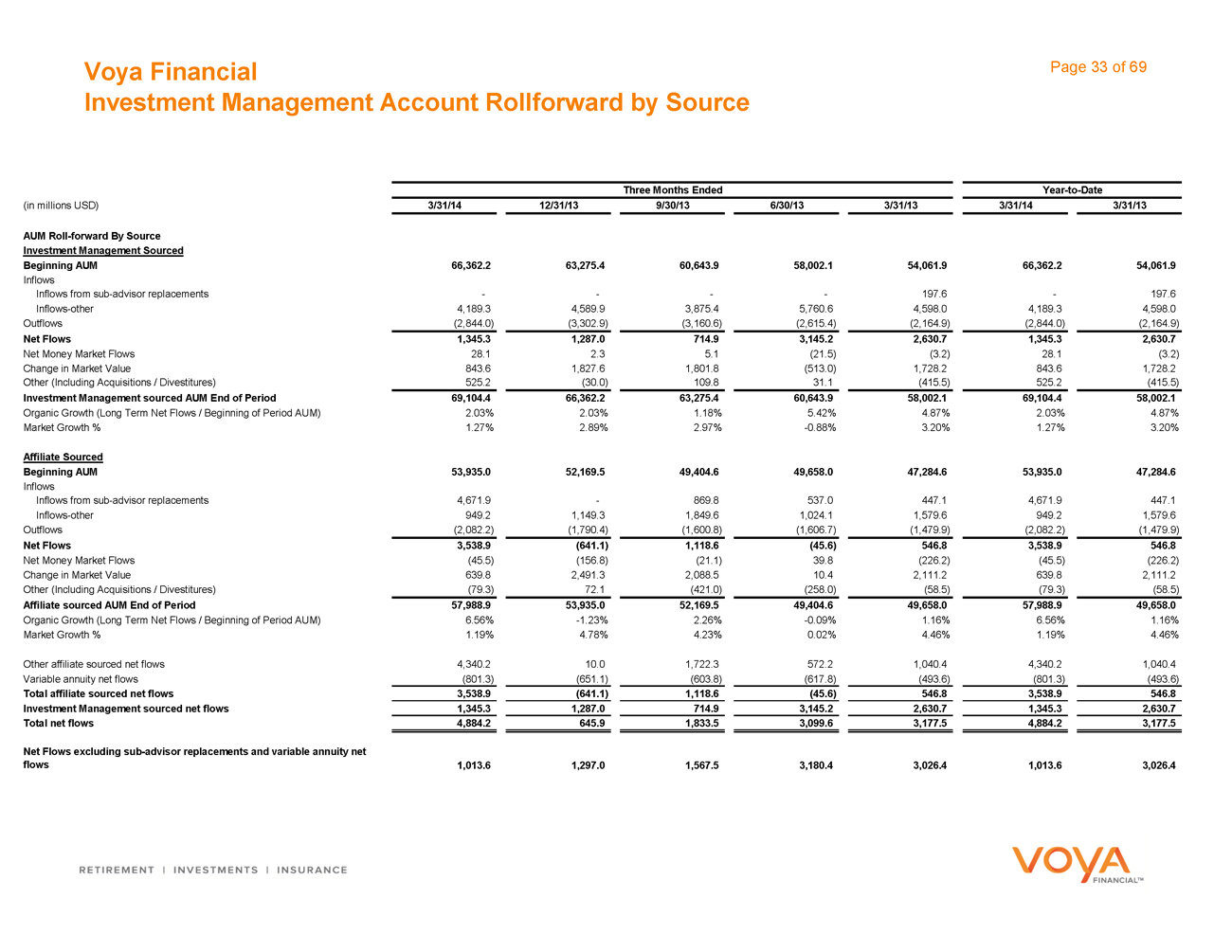

Investment Management Account Rollforward by Source

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

AUM Roll-forward By Source

Investment Management Sourced

Beginning AUM 66,362.2 63,275.4 60,643.9 58,002.1 54,061.9 66,362.2 54,061.9

Inflows

Inflows from sub-advisor replacements - - - - 197.6 - 197.6

Inflows-other 4,189.3 4,589.9 3,875.4 5,760.6 4,598.0 4,189.3 4,598.0

Outflows (2,844.0) (3,302.9) (3,160.6) (2,615.4) (2,164.9) (2,844.0) (2,164.9)

Net Flows 1,345.3 1,287.0 714.9 3,145.2 2,630.7 1,345.3 2,630.7

Net Money Market Flows 28.1 2.3 5.1 (21.5) (3.2) 28.1 (3.2)

Change in Market Value 843.6 1,827.6 1,801.8 (513.0) 1,728.2 843.6 1,728.2

Other (Including Acquisitions / Divestitures) 525.2 (30.0) 109.8 31.1 (415.5) 525.2 (415.5)

Investment Management sourced AUM End of Period 69,104.4 66,362.2 63,275.4 60,643.9 58,002.1 69,104.4 58,002.1

Organic Growth (Long Term Net Flows / Beginning of Period AUM) 2.03% 2.03% 1.18% 5.42% 4.87% 2.03% 4.87%

Market Growth % 1.27% 2.89% 2.97% -0.88% 3.20% 1.27% 3.20%

Affiliate Sourced

Beginning AUM 53,935.0 52,169.5 49,404.6 49,658.0 47,284.6 53,935.0 47,284.6

Inflows

Inflows from sub-advisor replacements 4,671.9 - 869.8 537.0 447.1 4,671.9 447.1

Inflows-other 949.2 1,149.3 1,849.6 1,024.1 1,579.6 949.2 1,579.6

Outflows (2,082.2) (1,790.4) (1,600.8) (1,606.7) (1,479.9) (2,082.2) (1,479.9)

Net Flows 3,538.9 (641.1) 1,118.6 (45.6) 546.8 3,538.9 546.8

Net Money Market Flows (45.5) (156.8) (21.1) 39.8 (226.2) (45.5) (226.2)

Change in Market Value 639.8 2,491.3 2,088.5 10.4 2,111.2 639.8 2,111.2

Other (Including Acquisitions / Divestitures) (79.3) 72.1 (421.0) (258.0) (58.5) (79.3) (58.5)

Affiliate sourced AUM End of Period 57,988.9 53,935.0 52,169.5 49,404.6 49,658.0 57,988.9 49,658.0

Organic Growth (Long Term Net Flows / Beginning of Period AUM) 6.56% -1.23% 2.26% -0.09% 1.16% 6.56% 1.16%

Market Growth % 1.19% 4.78% 4.23% 0.02% 4.46% 1.19% 4.46%

Other affiliate sourced net flows 4,340.2 10.0 1,722.3 572.2 1,040.4 4,340.2 1,040.4

Variable annuity net flows (801.3) (651.1) (603.8) (617.8) (493.6) (801.3) (493.6)

Total affiliate sourced net flows 3,538.9 (641.1) 1,118.6 (45.6) 546.8 3,538.9 546.8

Investment Management sourced net flows 1,345.3 1,287.0 714.9 3,145.2 2,630.7 1,345.3 2,630.7

Total net flows 4,884.2 645.9 1,833.5 3,099.6 3,177.5 4,884.2 3,177.5

Net Flows excluding sub-advisor replacements and variable annuity net

flows 1,013.6 1,297.0 1,567.5 3,180.4 3,026.4 1,013.6 3,026.4

Voya Financial Page 34 of 69

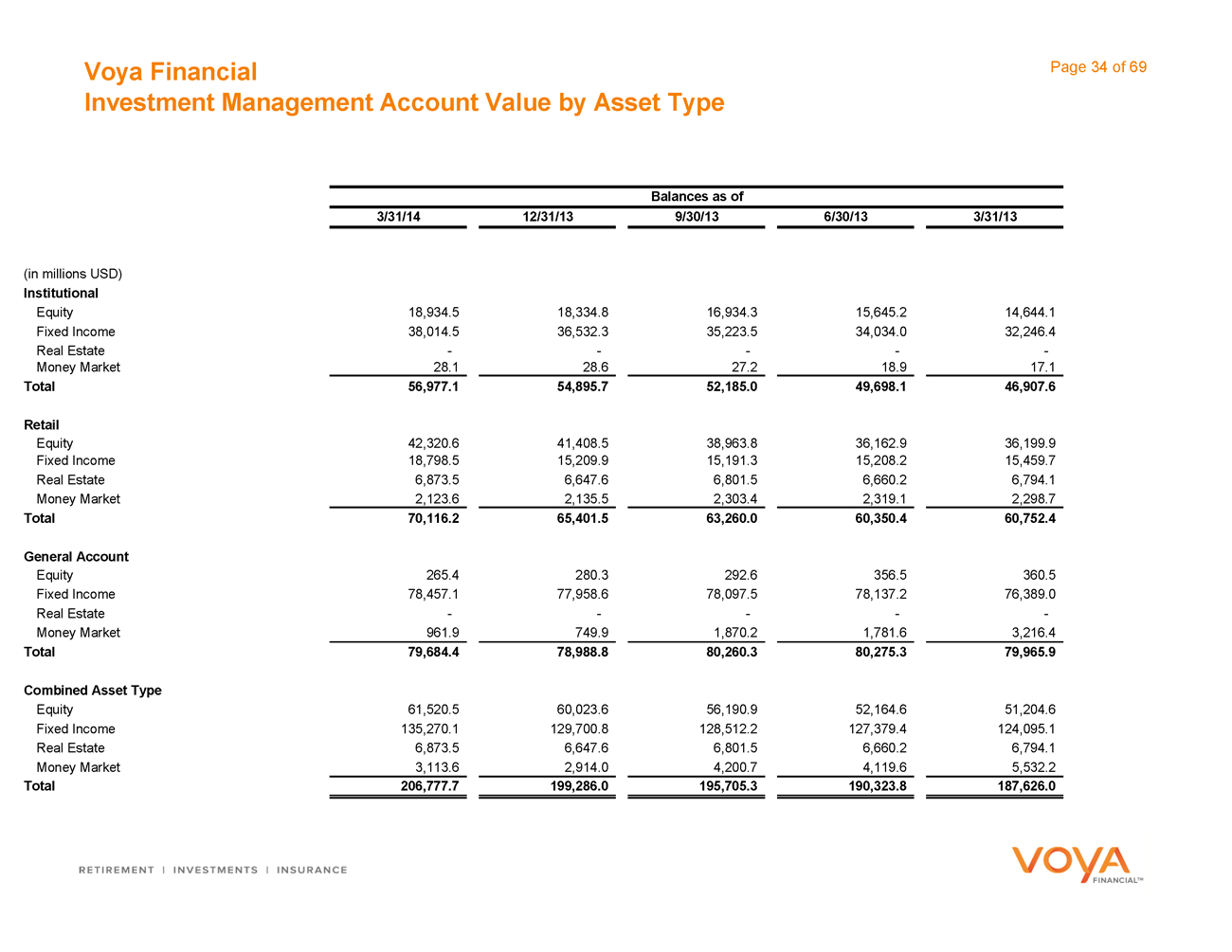

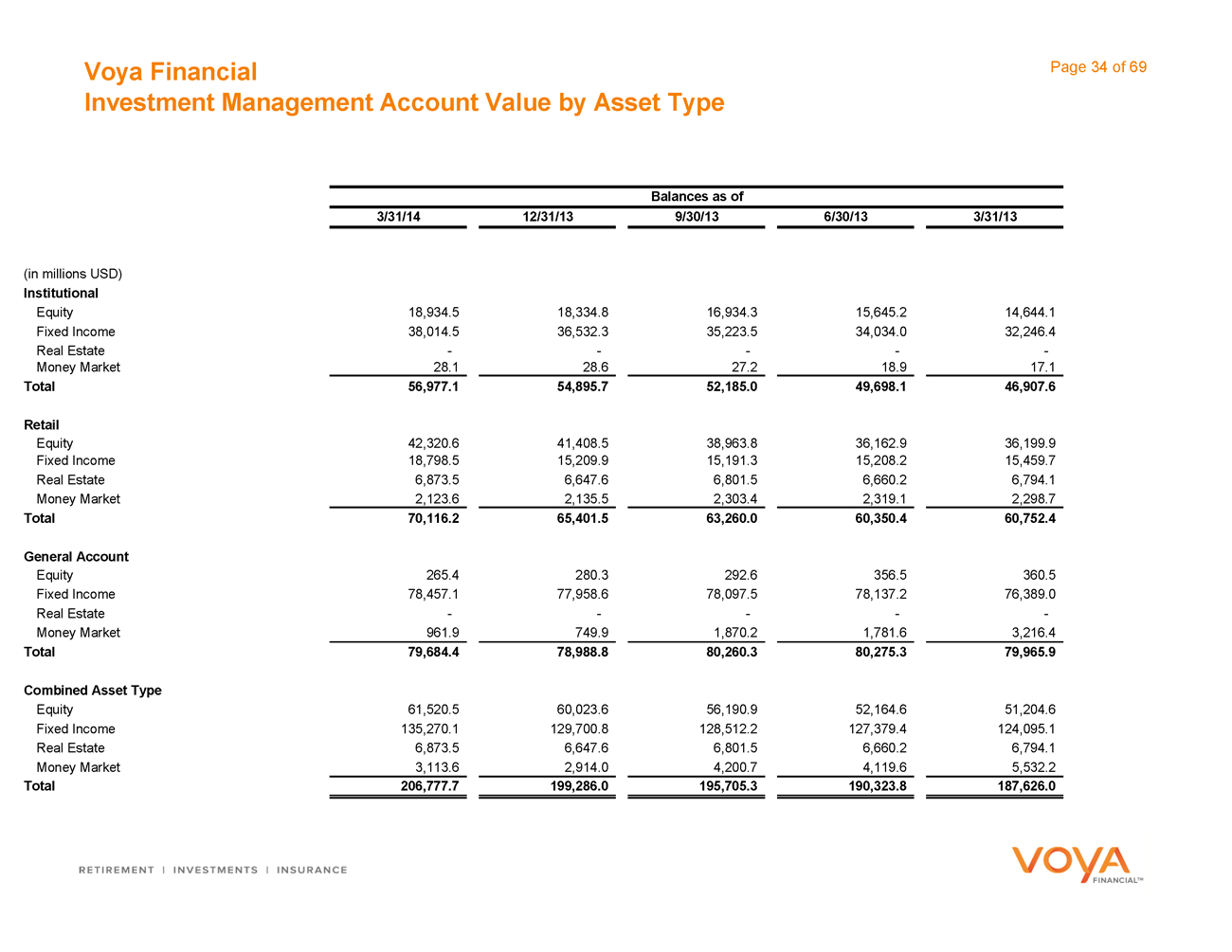

Investment Management Account Value by Asset Type

Balances as of

3/31/14 12/31/13 9/30/13 6/30/13 3/31/13

(in millions USD)

Institutional

Equity 18,934.5 18,334.8 16,934.3 15,645.2 14,644.1

Fixed Income 38,014.5 36,532.3 35,223.5 34,034.0 32,246.4

Real Estate - - - - -

Money Market 28.1 28.6 27.2 18.9 17.1

Total 56,977.1 54,895.7 52,185.0 49,698.1 46,907.6

Retail

Equity 42,320.6 41,408.5 38,963.8 36,162.9 36,199.9

Fixed Income 18,798.5 15,209.9 15,191.3 15,208.2 15,459.7

Real Estate 6,873.5 6,647.6 6,801.5 6,660.2 6,794.1

Money Market 2,123.6 2,135.5 2,303.4 2,319.1 2,298.7

Total 70,116.2 65,401.5 63,260.0 60,350.4 60,752.4

General Account

Equity 265.4 280.3 292.6 356.5 360.5

Fixed Income 78,457.1 77,958.6 78,097.5 78,137.2 76,389.0

Real Estate - - - - -

Money Market 961.9 749.9 1,870.2 1,781.6 3,216.4

Total 79,684.4 78,988.8 80,260.3 80,275.3 79,965.9

Combined Asset Type

Equity 61,520.5 60,023.6 56,190.9 52,164.6 51,204.6

Fixed Income 135,270.1 129,700.8 128,512.2 127,379.4 124,095.1

Real Estate 6,873.5 6,647.6 6,801.5 6,660.2 6,794.1

Money Market 3,113.6 2,914.0 4,200.7 4,119.6 5,532.2

Total 206,777.7 199,286.0 195,705.3 190,323.8 187,626.0

Individual Life

Voya Financial Page 36 of 69

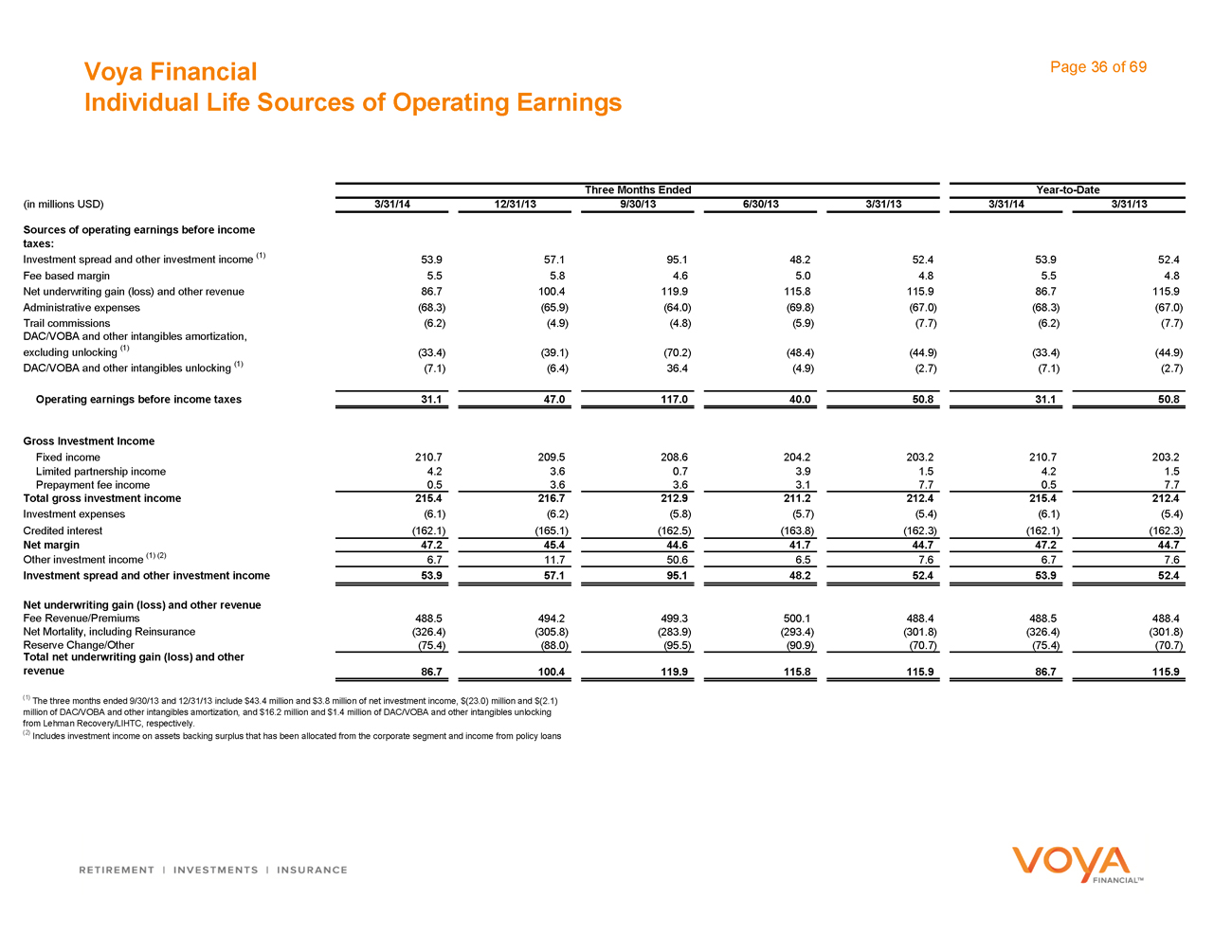

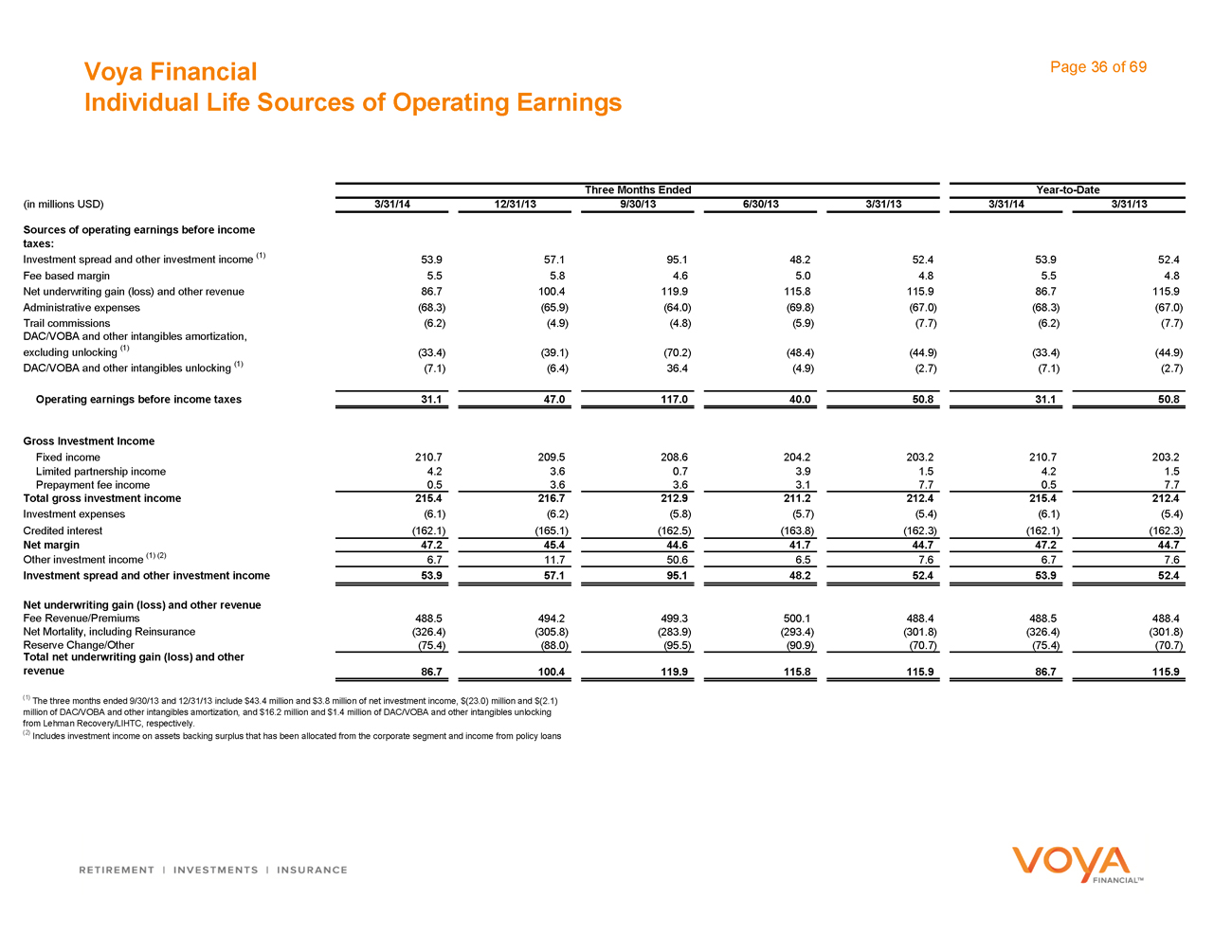

Individual Life Sources of Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Sources of operating earnings before income

taxes:

Investment spread and other investment income (1) 53.9 57.1 95.1 48.2 52.4 53.9 52.4

Fee based margin 5.5 5.8 4.6 5.0 4.8 5.5 4.8

Net underwriting gain (loss) and other revenue 86.7 100.4 119.9 115.8 115.9 86.7 115.9

Administrative expenses (68.3) (65.9) (64.0) (69.8) (67.0) (68.3) (67.0)

Trail commissions (6.2) (4.9) (4.8) (5.9) (7.7) (6.2) (7.7)

DAC/VOBA and other intangibles amortization,

excluding unlocking (1) (33.4) (39.1) (70.2) (48.4) (44.9) (33.4) (44.9)

DAC/VOBA and other intangibles unlocking (1) (7.1) (6.4) 36.4 (4.9) (2.7) (7.1) (2.7)

Operating earnings before income taxes 31.1 47.0 117.0 40.0 50.8 31.1 50.8

Gross Investment Income

Fixed income 210.7 209.5 208.6 204.2 203.2 210.7 203.2

Limited partnership income 4.2 3.6 0.7 3.9 1.5 4.2 1.5

Prepayment fee income 0.5 3.6 3.6 3.1 7.7 0.5 7.7

Total gross investment income 215.4 216.7 212.9 211.2 212.4 215.4 212.4

Investment expenses (6.1) (6.2) (5.8) (5.7) (5.4) (6.1) (5.4)

Credited interest (162.1) (165.1) (162.5) (163.8) (162.3) (162.1) (162.3)

Net margin 47.2 45.4 44.6 41.7 44.7 47.2 44.7

Other investment income (1) (2) 6.7 11.7 50.6 6.5 7.6 6.7 7.6

Investment spread and other investment income 53.9 57.1 95.1 48.2 52.4 53.9 52.4

Net underwriting gain (loss) and other revenue

Fee Revenue/Premiums 488.5 494.2 499.3 500.1 488.4 488.5 488.4

Net Mortality, including Reinsurance (326.4) (305.8) (283.9) (293.4) (301.8) (326.4) (301.8)

Reserve Change/Other (75.4) (88.0) (95.5) (90.9) (70.7) (75.4) (70.7)

Total net underwriting gain (loss) and other

revenue 86.7 100.4 119.9 115.8 115.9 86.7 115.9

(1) The three months ended 9/30/13 and 12/31/13 include $43.4 million and $3.8 million of net investment income, $(23.0) million and $(2.1)

million of DAC/VOBA and other intangibles amortization, and $16.2 million and $1.4 million of DAC/VOBA and other intangibles unlocking

from Lehman Recovery/LIHTC, respectively.

(2) Includes investment income on assets backing surplus that has been allocated from the corporate segment and income from policy loans

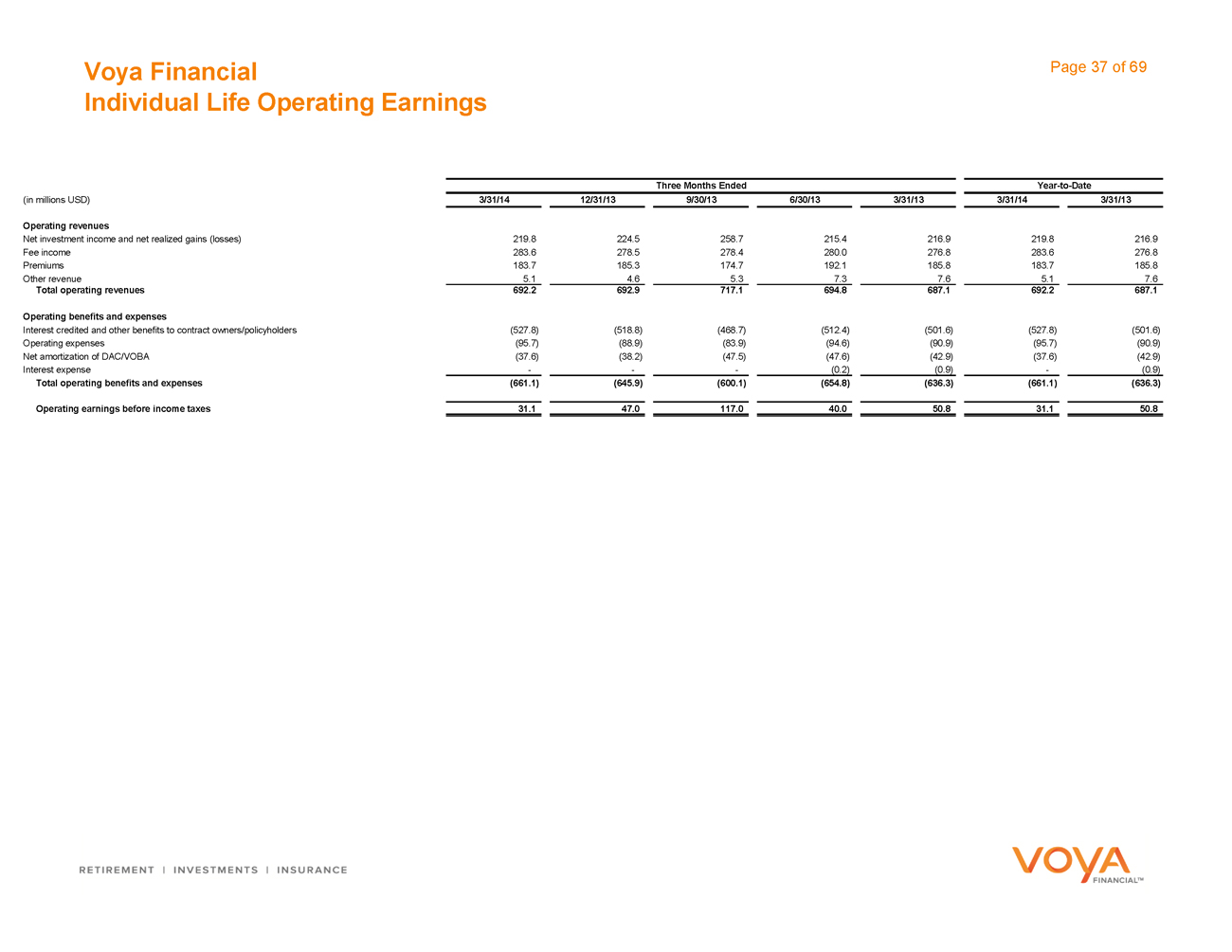

Voya Financial Page 37 of 69

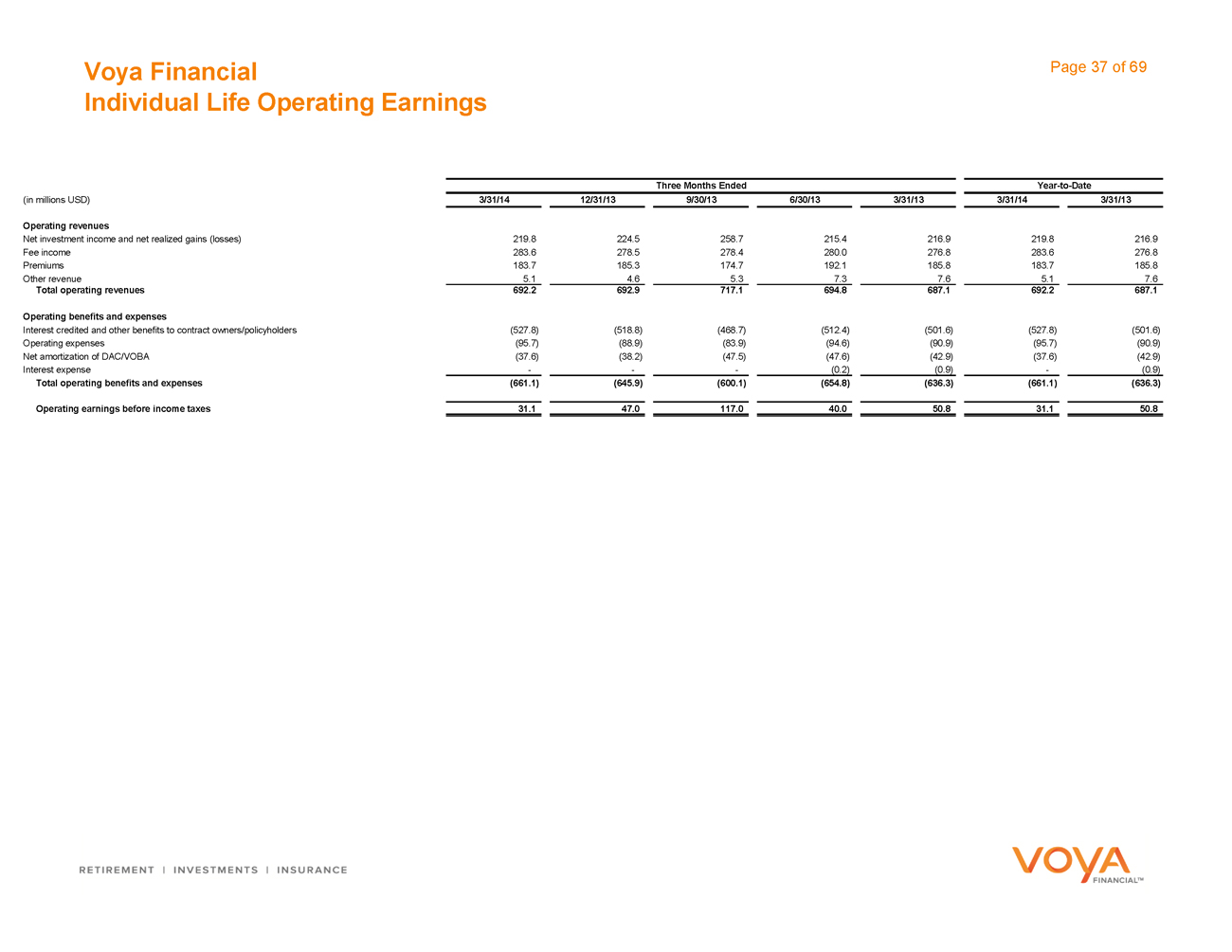

Individual Life Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Operating revenues

Net investment income and net realized gains (losses) 219.8 224.5 258.7 215.4 216.9 219.8 216.9

Fee income 283.6 278.5 278.4 280.0 276.8 283.6 276.8

Premiums 183.7 185.3 174.7 192.1 185.8 183.7 185.8

Other revenue 5.1 4.6 5.3 7.3 7.6 5.1 7.6

Total operating revenues 692.2 692.9 717.1 694.8 687.1 692.2 687.1

Operating benefits and expenses

Interest credited and other benefits to contract owners/policyholders (527.8) (518.8) (468.7) (512.4) (501.6) (527.8) (501.6)

Operating expenses (95.7) (88.9) (83.9) (94.6) (90.9) (95.7) (90.9)

Net amortization of DAC/VOBA (37.6) (38.2) (47.5) (47.6) (42.9) (37.6) (42.9)

Interest expense - - - (0.2) (0.9) - (0.9)

Total operating benefits and expenses (661.1) (645.9) (600.1) (654.8) (636.3) (661.1) (636.3)

Operating earnings before income taxes 31.1 47.0 117.0 40.0 50.8 31.1 50.8

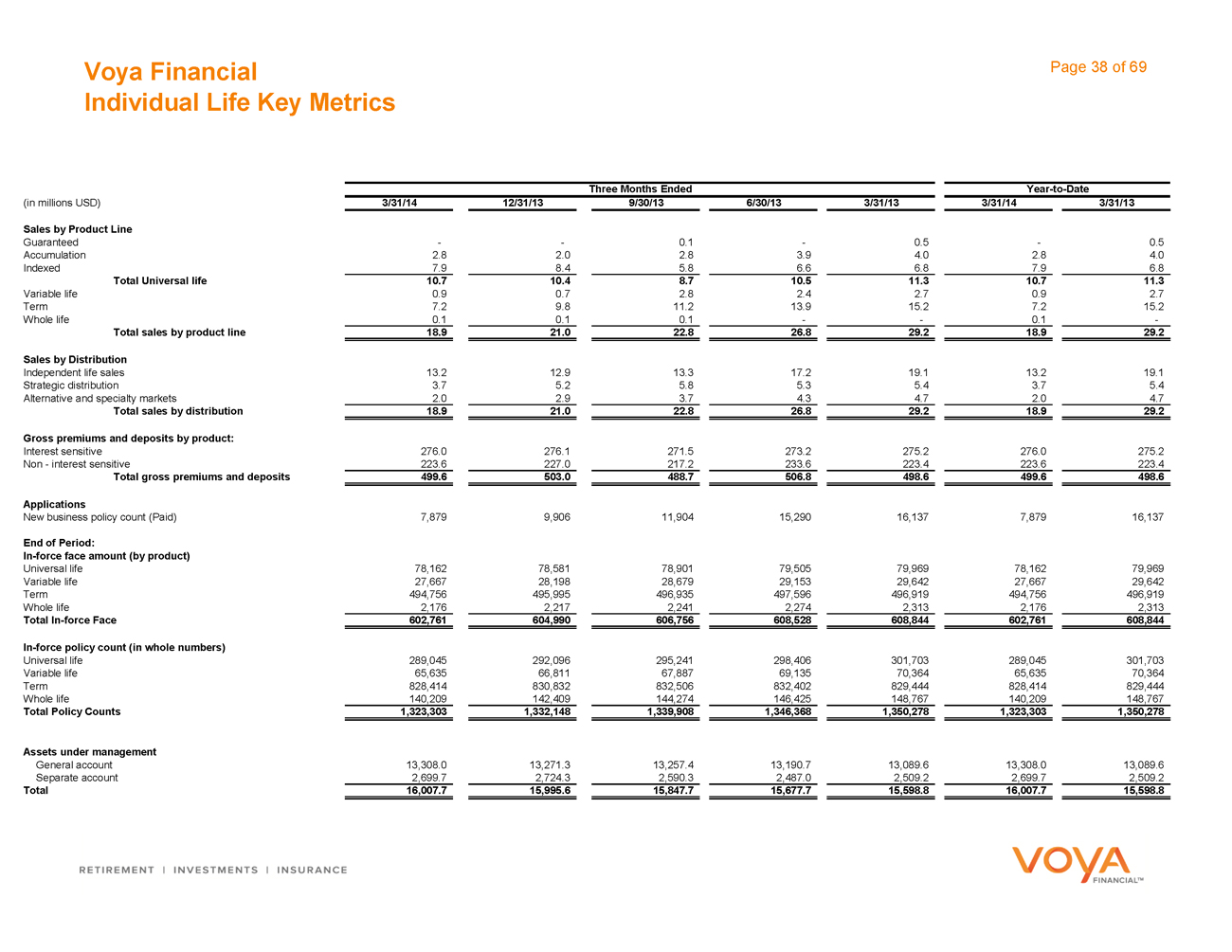

Voya Financial Page 38 of 69

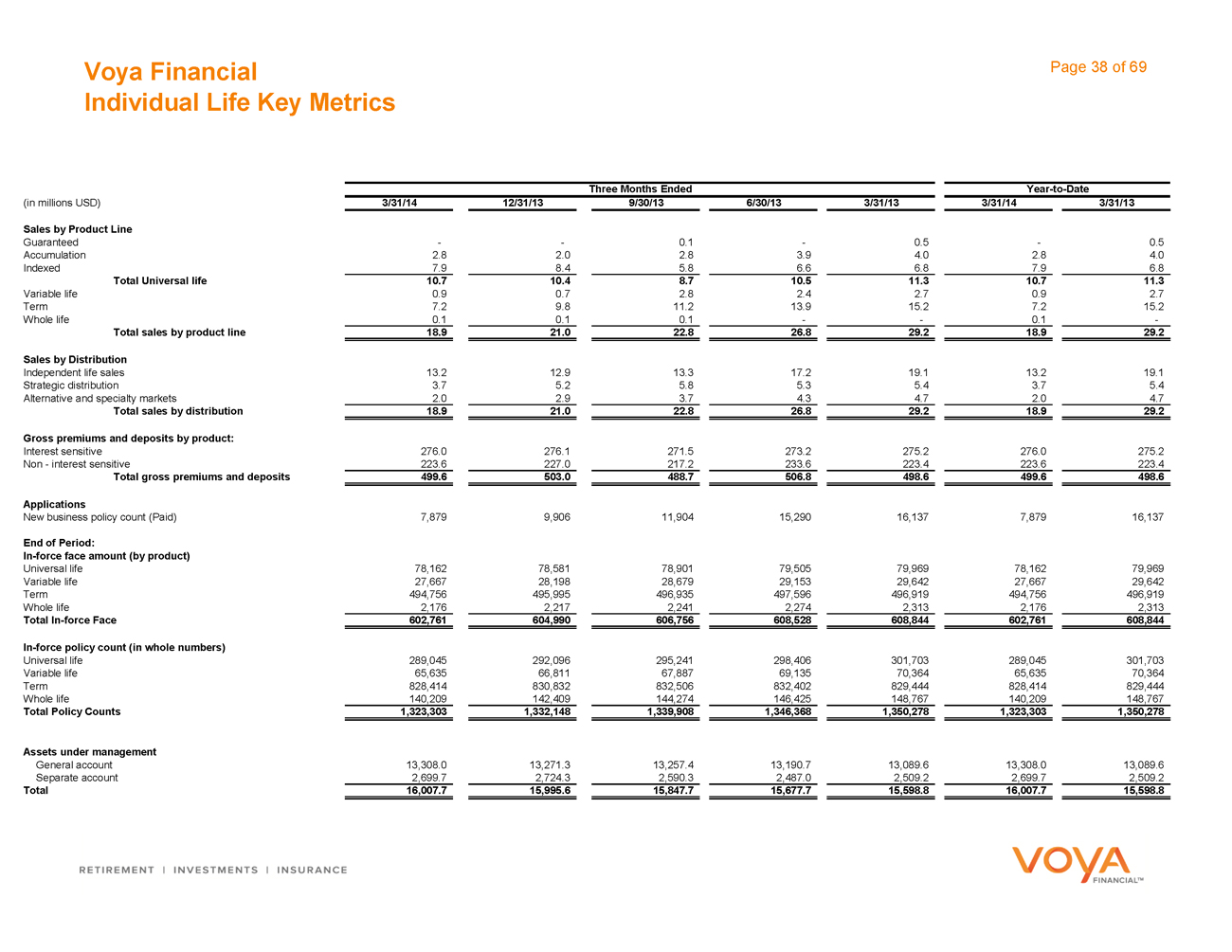

Individual Life Key Metrics

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Sales by Product Line

Guaranteed - - 0.1 - 0.5 - 0.5

Accumulation 2.8 2.0 2.8 3.9 4.0 2.8 4.0

Indexed 7.9 8.4 5.8 6.6 6.8 7.9 6.8

Total Universal life 10.7 10.4 8.7 10.5 11.3 10.7 11.3

Variable life 0.9 0.7 2.8 2.4 2.7 0.9 2.7

Term 7.2 9.8 11.2 13.9 15.2 7.2 15.2

Whole life 0.1 0.1 0.1 - - 0.1 -

Total sales by product line 18.9 21.0 22.8 26.8 29.2 18.9 29.2

Sales by Distribution

Independent life sales 13.2 12.9 13.3 17.2 19.1 13.2 19.1

Strategic distribution 3.7 5.2 5.8 5.3 5.4 3.7 5.4

Alternative and specialty markets 2.0 2.9 3.7 4.3 4.7 2.0 4.7

Total sales by distribution 18.9 21.0 22.8 26.8 29.2 18.9 29.2

Gross premiums and deposits by product:

Interest sensitive 276.0 276.1 271.5 273.2 275.2 276.0 275.2

Non - interest sensitive 223.6 227.0 217.2 233.6 223.4 223.6 223.4

Total gross premiums and deposits 499.6 503.0 488.7 506.8 498.6 499.6 498.6

Applications

New business policy count (Paid) 7,879 9,906 11,904 15,290 16,137 7,879 16,137

End of Period:

In-force face amount (by product)

Universal life 78,162 78,581 78,901 79,505 79,969 78,162 79,969

Variable life 27,667 28,198 28,679 29,153 29,642 27,667 29,642

Term 494,756 495,995 496,935 497,596 496,919 494,756 496,919

Whole life 2,176 2,217 2,241 2,274 2,313 2,176 2,313

Total In-force Face 602,761 604,990 606,756 608,528 608,844 602,761 608,844

In-force policy count (in whole numbers)

Universal life 289,045 292,096 295,241 298,406 301,703 289,045 301,703

Variable life 65,635 66,811 67,887 69,135 70,364 65,635 70,364

Term 828,414 830,832 832,506 832,402 829,444 828,414 829,444

Whole life 140,209 142,409 144,274 146,425 148,767 140,209 148,767

Total Policy Counts 1,323,303 1,332,148 1,339,908 1,346,368 1,350,278 1,323,303 1,350,278

Assets under management

General account 13,308.0 13,271.3 13,257.4 13,190.7 13,089.6 13,308.0 13,089.6

Separate account 2,699.7 2,724.3 2,590.3 2,487.0 2,509.2 2,699.7 2,509.2

Total 16,007.7 15,995.6 15,847.7 15,677.7 15,598.8 16,007.7 15,598.8

Employee Benefits

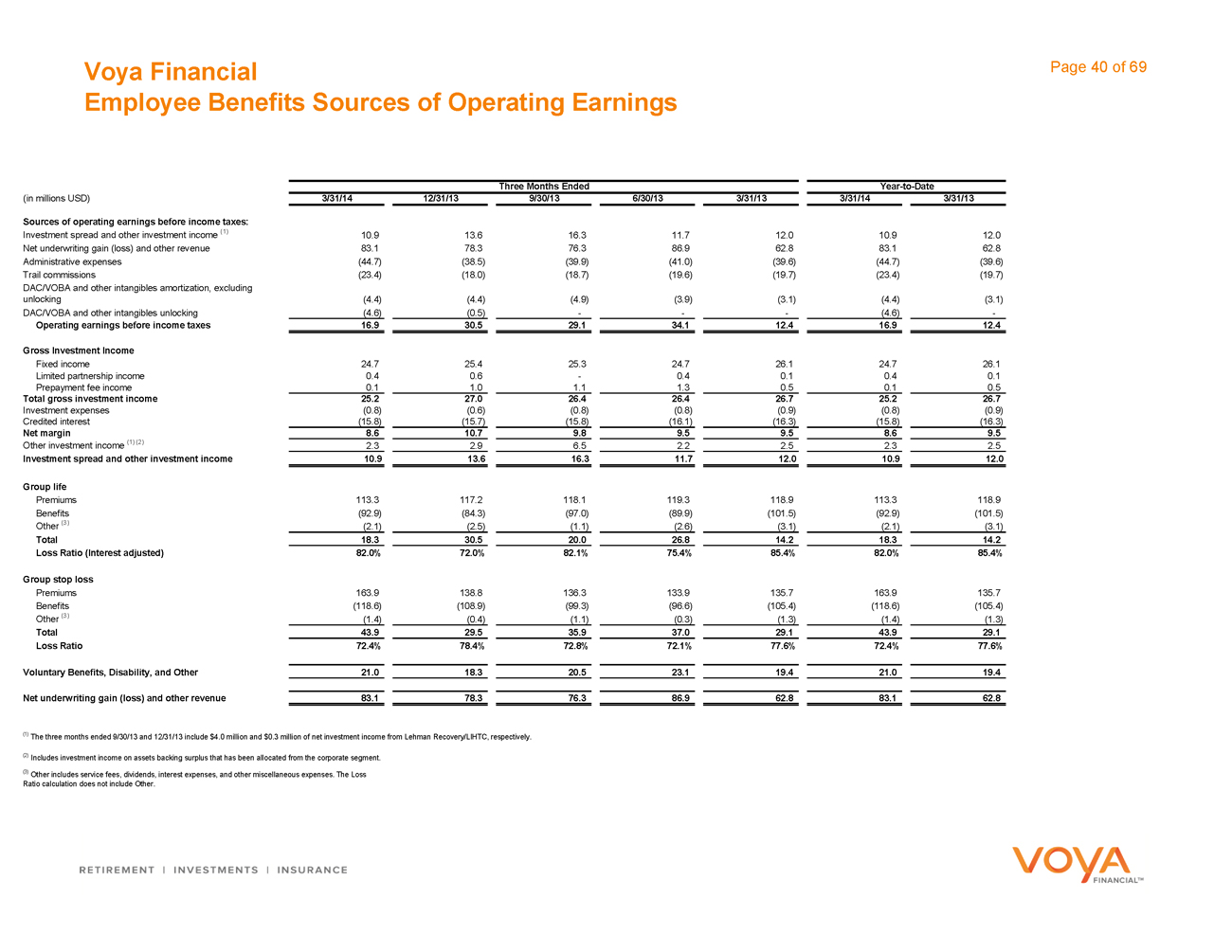

Voya Financial Page 40 of 69

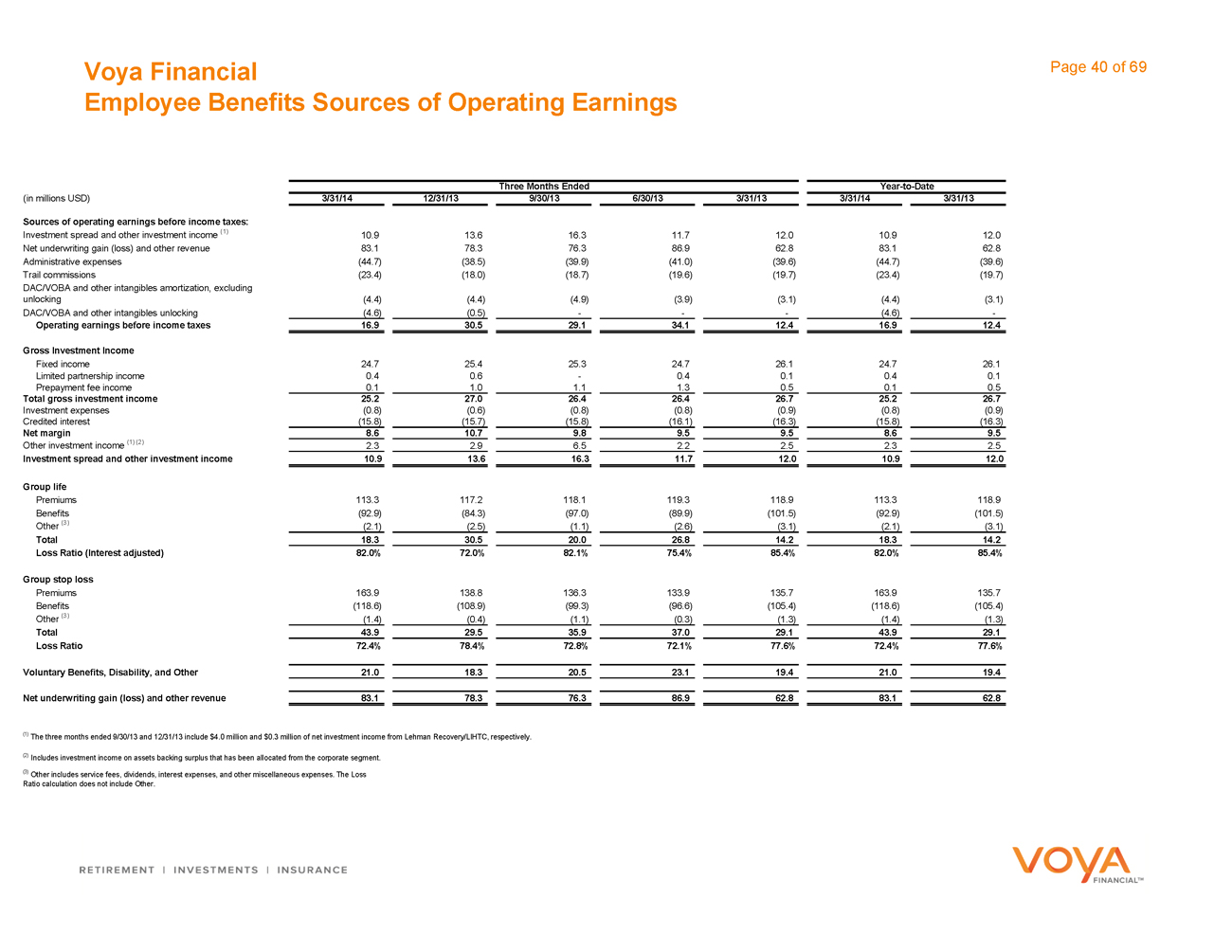

Employee Benefits Sources of Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Sources of operating earnings before income taxes:

Investment spread and other investment income (1) 10.9 13.6 16.3 11.7 12.0 10.9 12.0

Net underwriting gain (loss) and other revenue 83.1 78.3 76.3 86.9 62.8 83.1 62.8

Administrative expenses (44.7) (38.5) (39.9) (41.0) (39.6) (44.7) (39.6)

Trail commissions (23.4) (18.0) (18.7) (19.6) (19.7) (23.4) (19.7)

DAC/VOBA and other intangibles amortization, excluding

unlocking (4.4) (4.4) (4.9) (3.9) (3.1) (4.4) (3.1)

DAC/VOBA and other intangibles unlocking (4.6) (0.5) - - - (4.6) -

Operating earnings before income taxes 16.9 30.5 29.1 34.1 12.4 16.9 12.4

Gross Investment Income

Fixed income 24.7 25.4 25.3 24.7 26.1 24.7 26.1

Limited partnership income 0.4 0.6 - 0.4 0.1 0.4 0.1

Prepayment fee income 0.1 1.0 1.1 1.3 0.5 0.1 0.5

Total gross investment income 25.2 27.0 26.4 26.4 26.7 25.2 26.7

Investment expenses (0.8) (0.6) (0.8) (0.8) (0.9) (0.8) (0.9)

Credited interest (15.8) (15.7) (15.8) (16.1) (16.3) (15.8) (16.3)

Net margin 8.6 10.7 9.8 9.5 9.5 8.6 9.5

Other investment income (1) (2) 2.3 2.9 6.5 2.2 2.5 2.3 2.5

Investment spread and other investment income 10.9 13.6 16.3 11.7 12.0 10.9 12.0

Group life

Premiums 113.3 117.2 118.1 119.3 118.9 113.3 118.9

Benefits (92.9) (84.3) (97.0) (89.9) (101.5) (92.9) (101.5)

Other (3) (2.1) (2.5) (1.1) (2.6) (3.1) (2.1) (3.1)

Total 18.3 30.5 20.0 26.8 14.2 18.3 14.2

Loss Ratio (Interest adjusted) 82.0% 72.0% 82.1% 75.4% 85.4% 82.0% 85.4%

Group stop loss

Premiums 163.9 138.8 136.3 133.9 135.7 163.9 135.7

Benefits (118.6) (108.9) (99.3) (96.6) (105.4) (118.6) (105.4)

Other (3) (1.4) (0.4) (1.1) (0.3) (1.3) (1.4) (1.3)

Total 43.9 29.5 35.9 37.0 29.1 43.9 29.1

Loss Ratio 72.4% 78.4% 72.8% 72.1% 77.6% 72.4% 77.6%

Voluntary Benefits, Disability, and Other 21.0 18.3 20.5 23.1 19.4 21.0 19.4

Net underwriting gain (loss) and other revenue 83.1 78.3 76.3 86.9 62.8 83.1 62.8

(1) The three months ended 9/30/13 and 12/31/13 include $4.0 million and $0.3 million of net investment income from Lehman Recovery/LIHTC, respectively.

(2) Includes investment income on assets backing surplus that has been allocated from the corporate segment.

(3) Other includes service fees, dividends, interest expenses, and other miscellaneous expenses. The Loss Ratio calculation does not include Other.

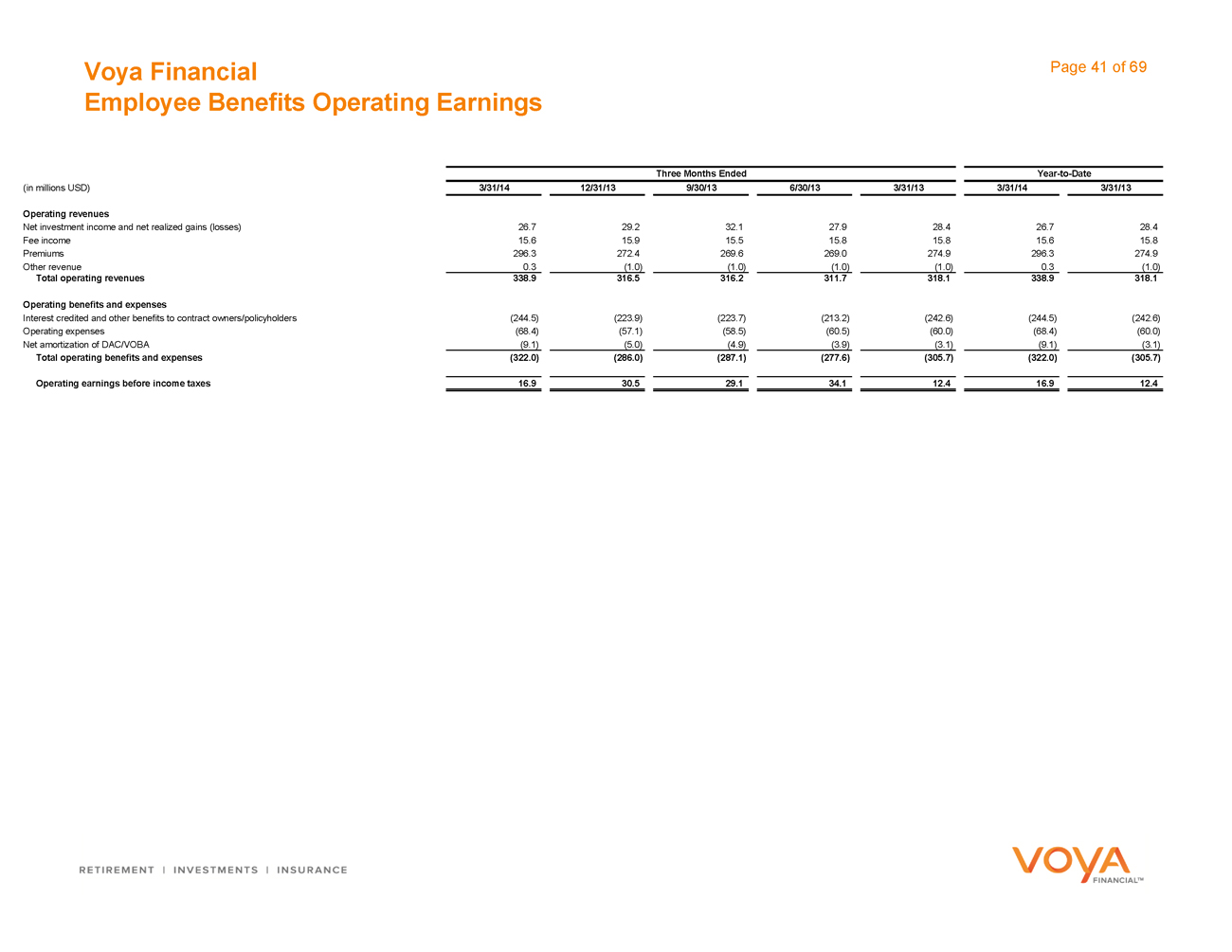

Voya Financial Page 41 of 69

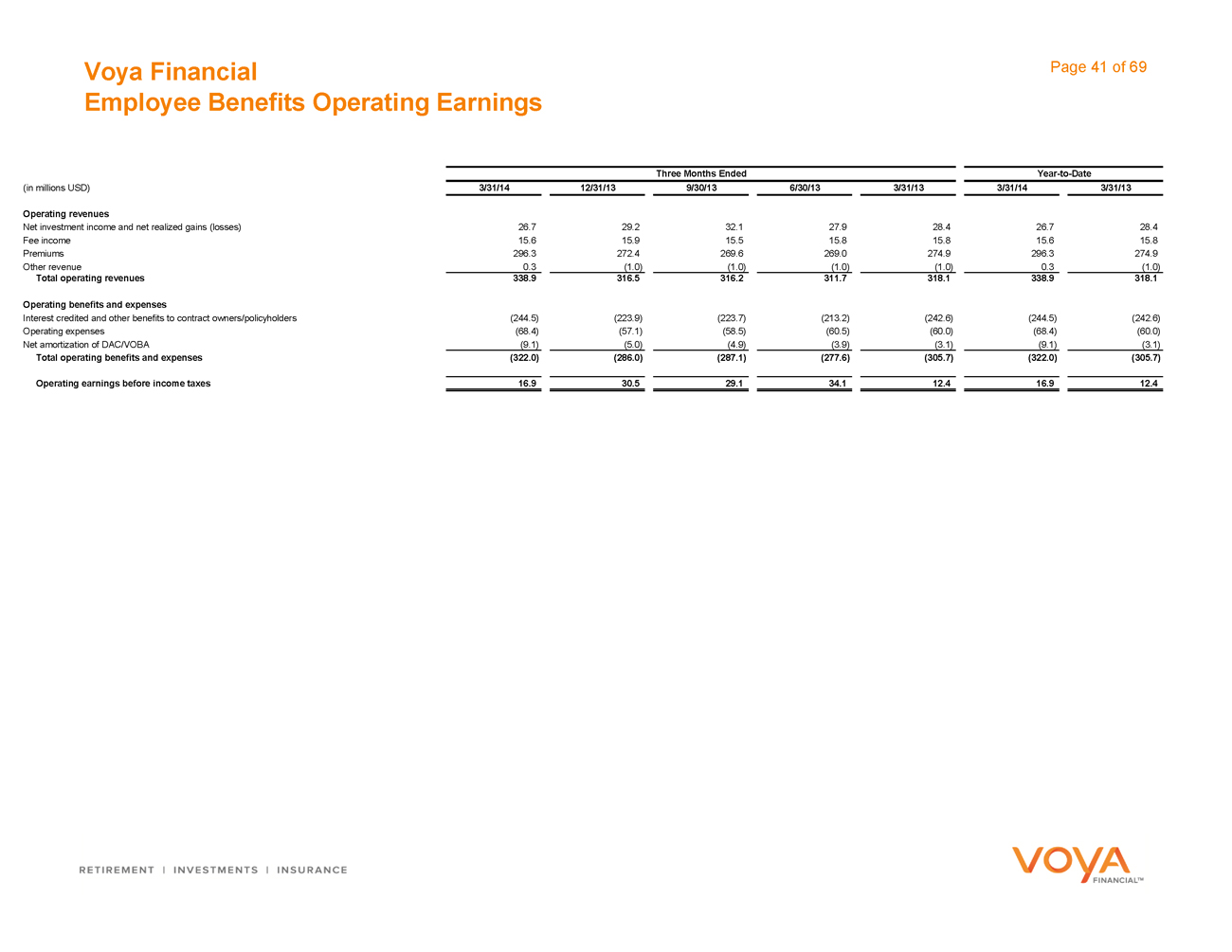

Employee Benefits Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Operating revenues

Net investment income and net realized gains (losses) 26.7 29.2 32.1 27.9 28.4 26.7 28.4

Fee income 15.6 15.9 15.5 15.8 15.8 15.6 15.8

Premiums 296.3 272.4 269.6 269.0 274.9 296.3 274.9

Other revenue 0.3 (1.0) (1.0) (1.0) (1.0) 0.3 (1.0)

Total operating revenues 338.9 316.5 316.2 311.7 318.1 338.9 318.1

Operating benefits and expenses

Interest credited and other benefits to contract owners/policyholders (244.5) (223.9) (223.7) (213.2) (242.6) (244.5) (242.6)

Operating expenses (68.4) (57.1) (58.5) (60.5) (60.0) (68.4) (60.0)

Net amortization of DAC/VOBA (9.1) (5.0) (4.9) (3.9) (3.1) (9.1) (3.1)

Total operating benefits and expenses (322.0) (286.0) (287.1) (277.6) (305.7) (322.0) (305.7)

Operating earnings before income taxes 16.9 30.5 29.1 34.1 12.4 16.9 12.4

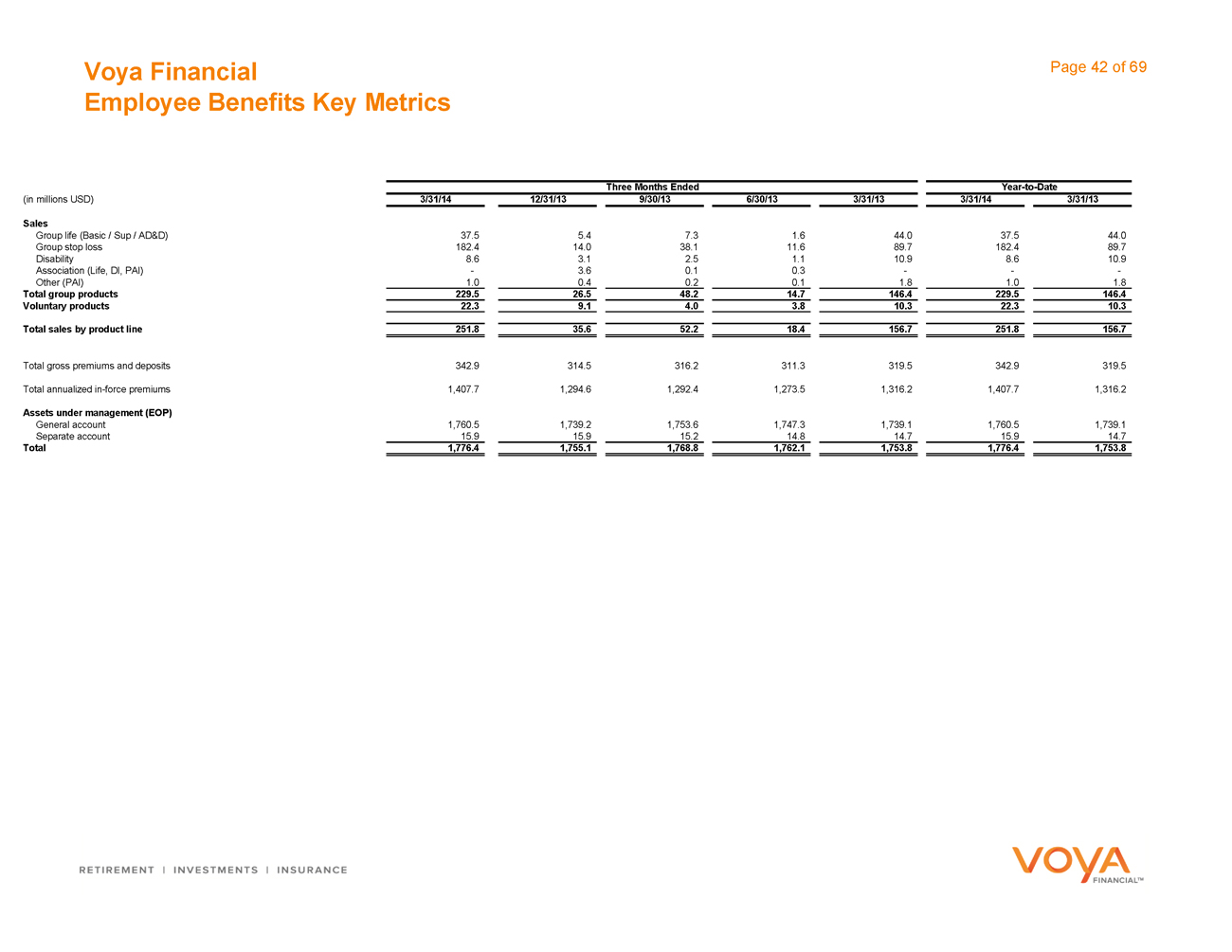

Voya Financial Page 42 of 69

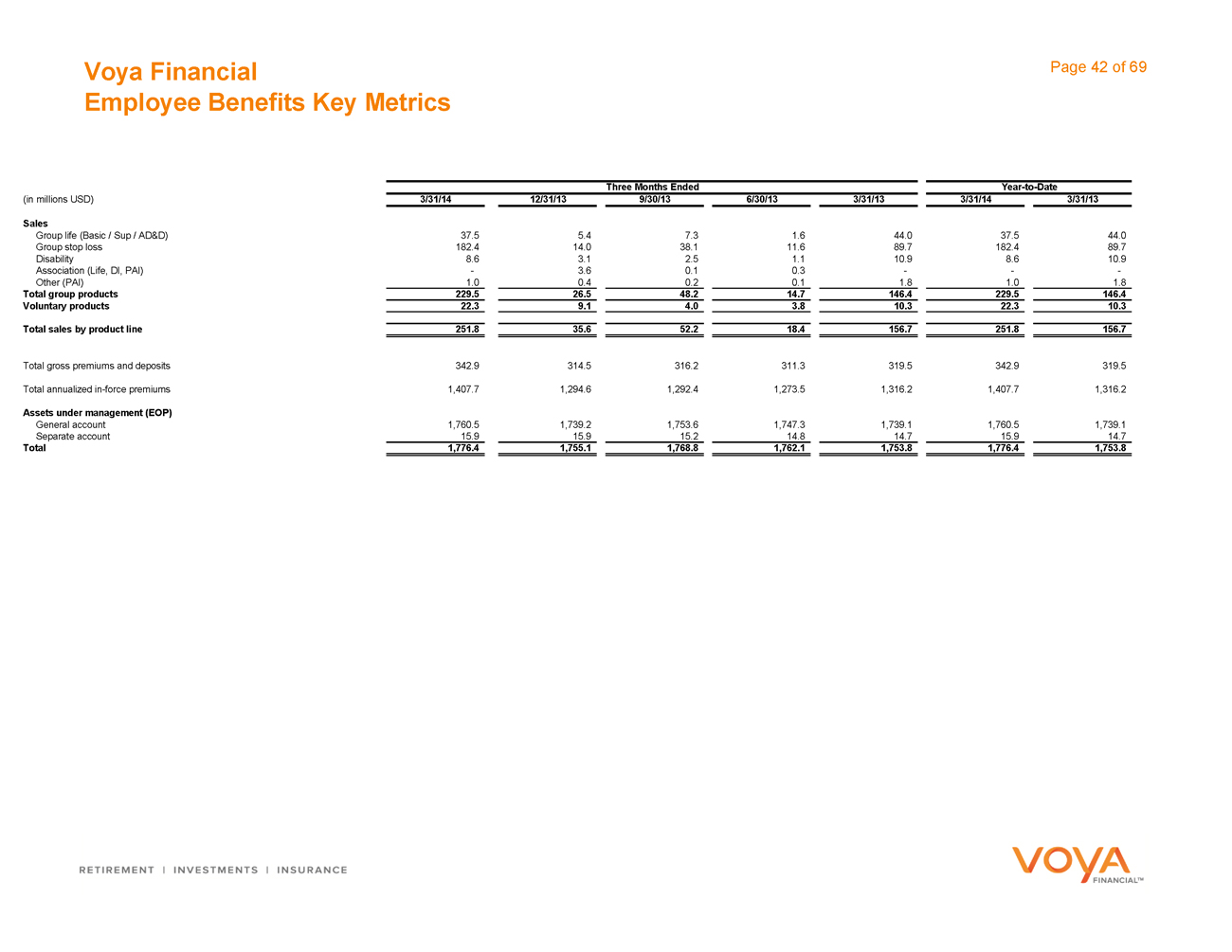

Employee Benefits Key Metrics

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Sales

Group life (Basic / Sup / AD&D) 37.5 5.4 7.3 1.6 44.0 37.5 44.0

Group stop loss 182.4 14.0 38.1 11.6 89.7 182.4 89.7

Disability 8.6 3.1 2.5 1.1 10.9 8.6 10.9

Association (Life, DI, PAI) — 3.6 0.1 0.3 —— -

Other (PAI) 1.0 0.4 0.2 0.1 1.8 1.0 1.8

Total group products 229.5 26.5 48.2 14.7 146.4 229.5 146.4

Voluntary products 22.3 9.1 4.0 3.8 10.3 22.3 10.3

Total sales by product line 251.8 35.6 52.2 18.4 156.7 251.8 156.7

Total gross premiums and deposits 342.9 314.5 316.2 311.3 319.5 342.9 319.5

Total annualized in-force premiums 1,407.7 1,294.6 1,292.4 1,273.5 1,316.2 1,407.7 1,316.2

Assets under management (EOP)

General account 1,760.5 1,739.2 1,753.6 1,747.3 1,739.1 1,760.5 1,739.1

Separate account 15.9 15.9 15.2 14.8 14.7 15.9 14.7

Total 1,776.4 1,755.1 1,768.8 1,762.1 1,753.8 1,776.4 1,753.8

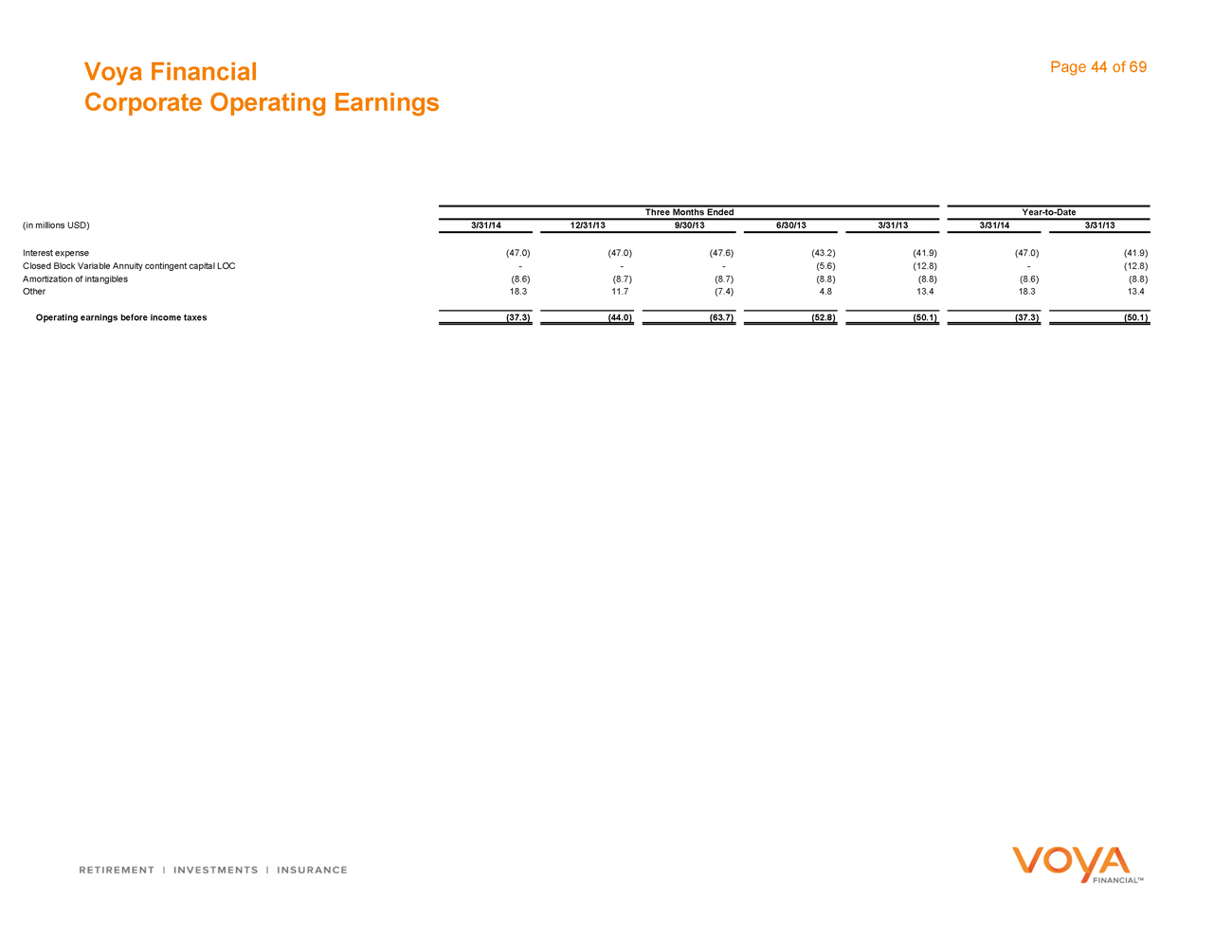

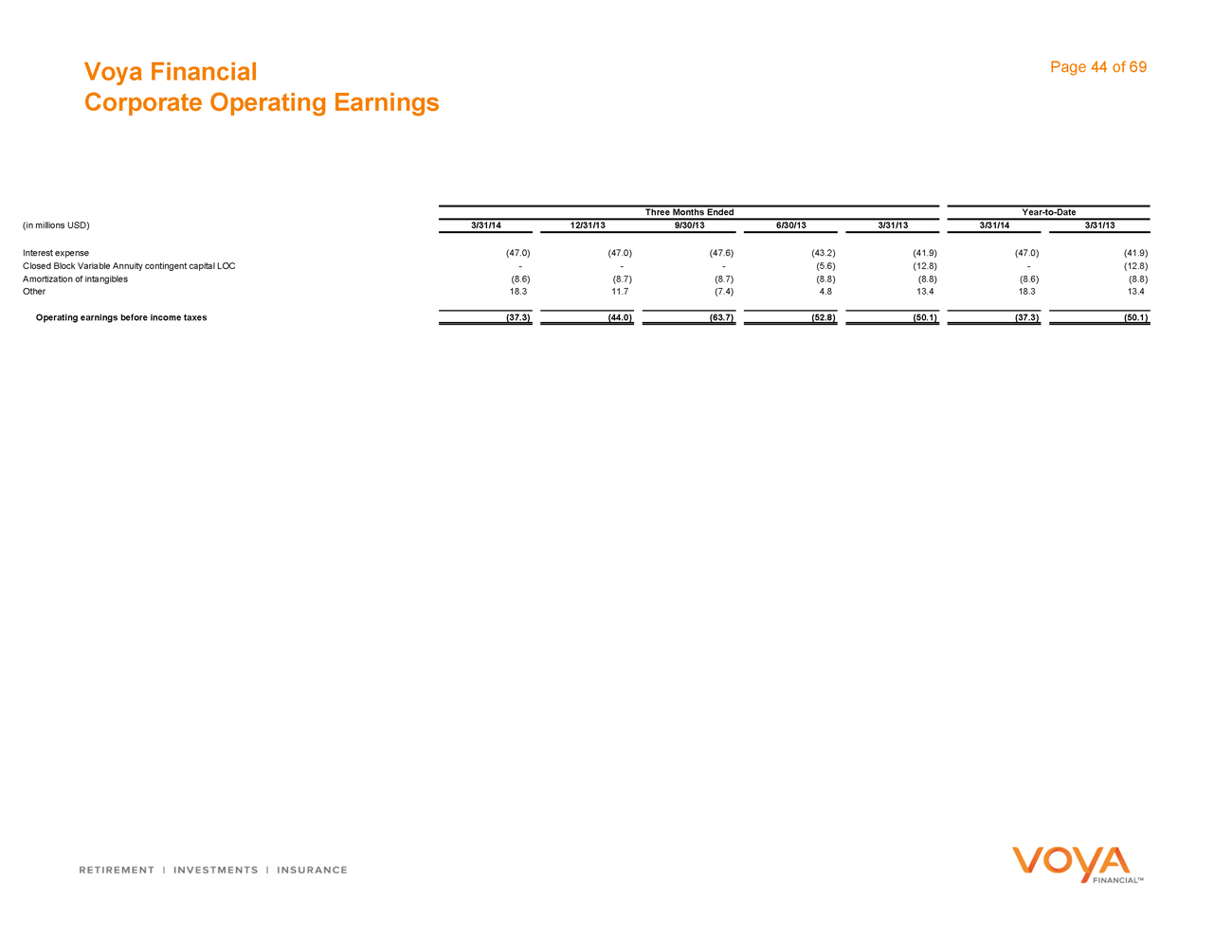

Corporate

Voya Financial Page 44 of 69

Corporate Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13

Interest expense (47.0) (47.0) (47.6) (43.2) (41.9) (47.0) (41.9)

Closed Block Variable Annuity contingent capital LOC — —— (5.6) (12.8) — (12.8)

Amortization of intangibles (8.6) (8.7) (8.7) (8.8) (8.8) (8.6) (8.8)

Other 18.3 11.7 (7.4) 4.8 13.4 18.3 13.4

Operating earnings before income taxes (37.3) (44.0) (63.7) (52.8) (50.1) (37.3) (50.1)

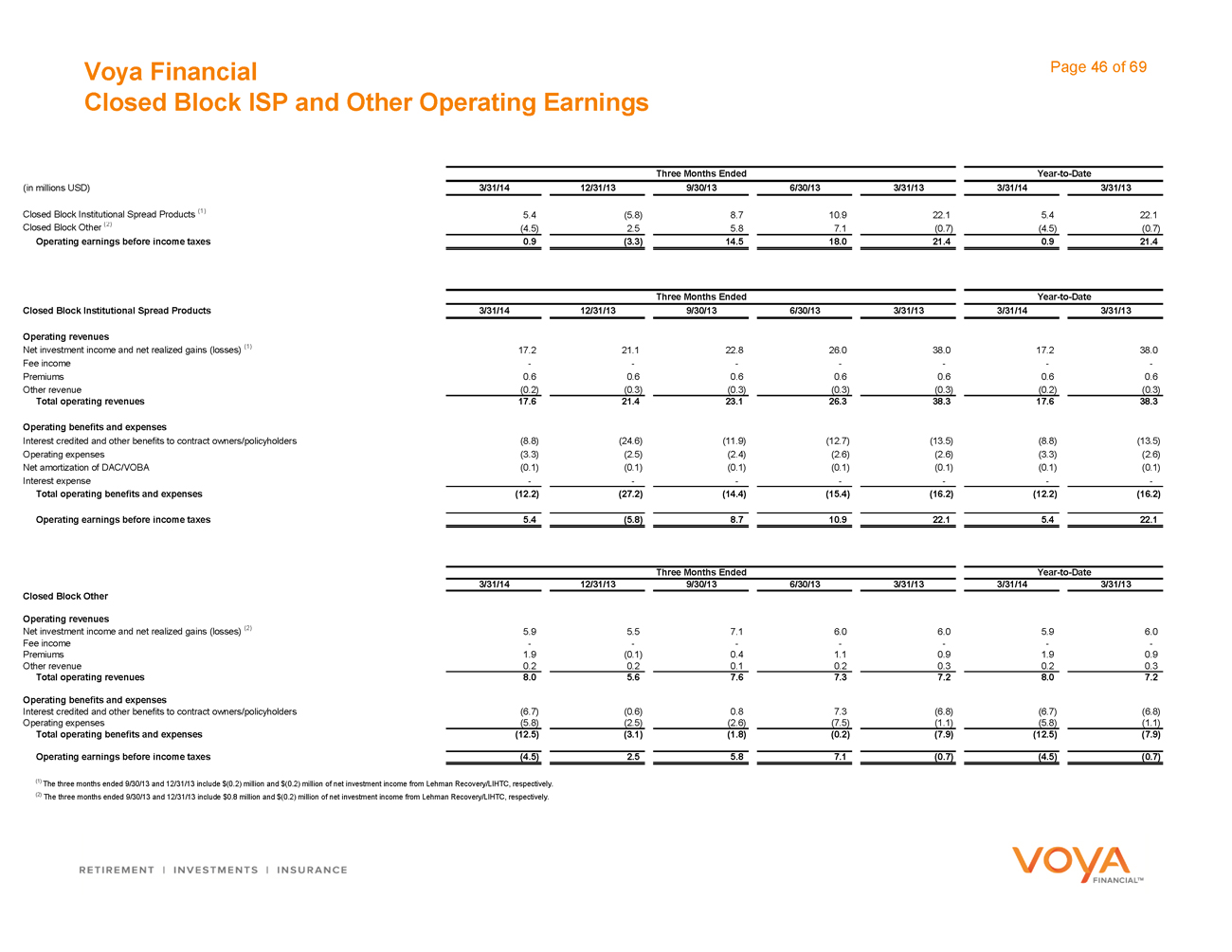

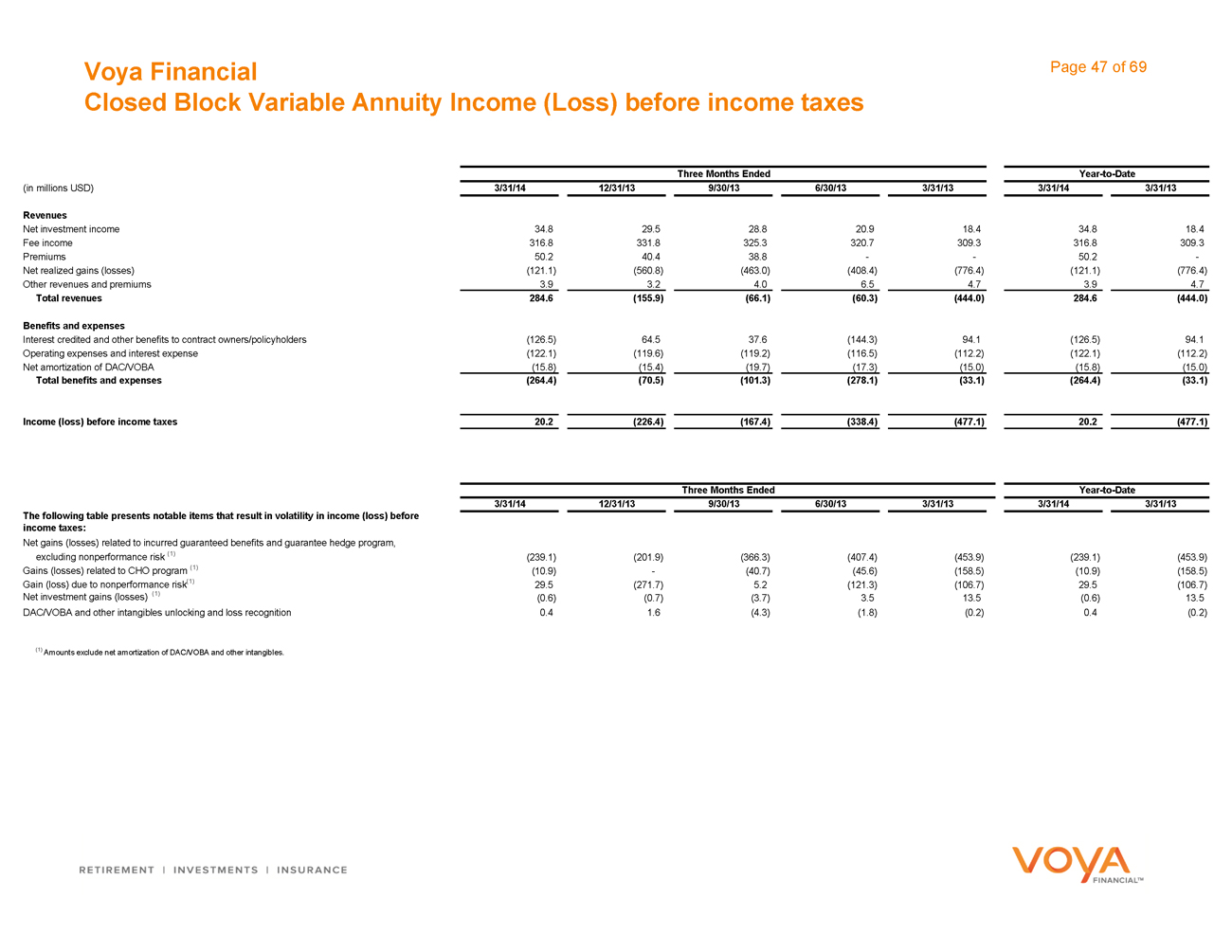

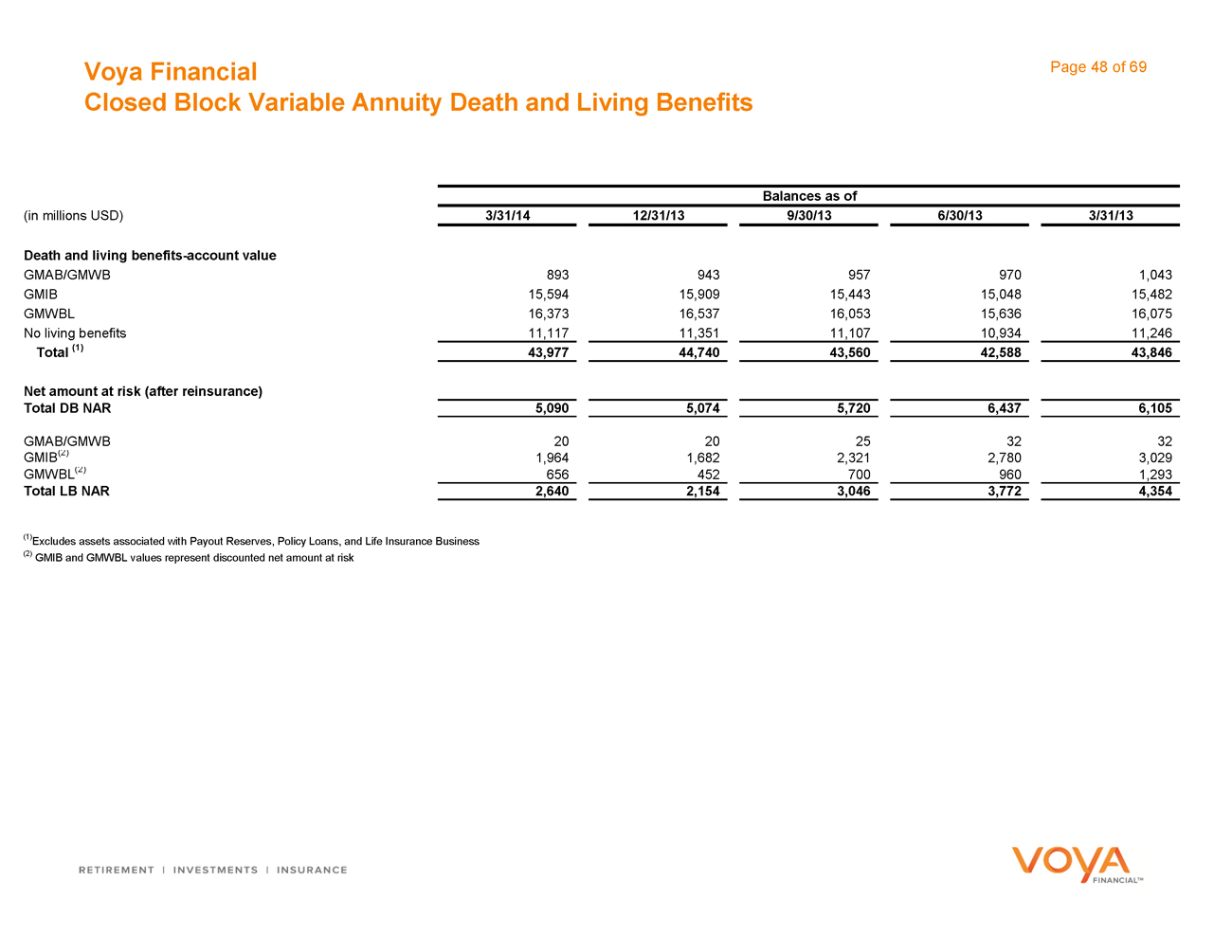

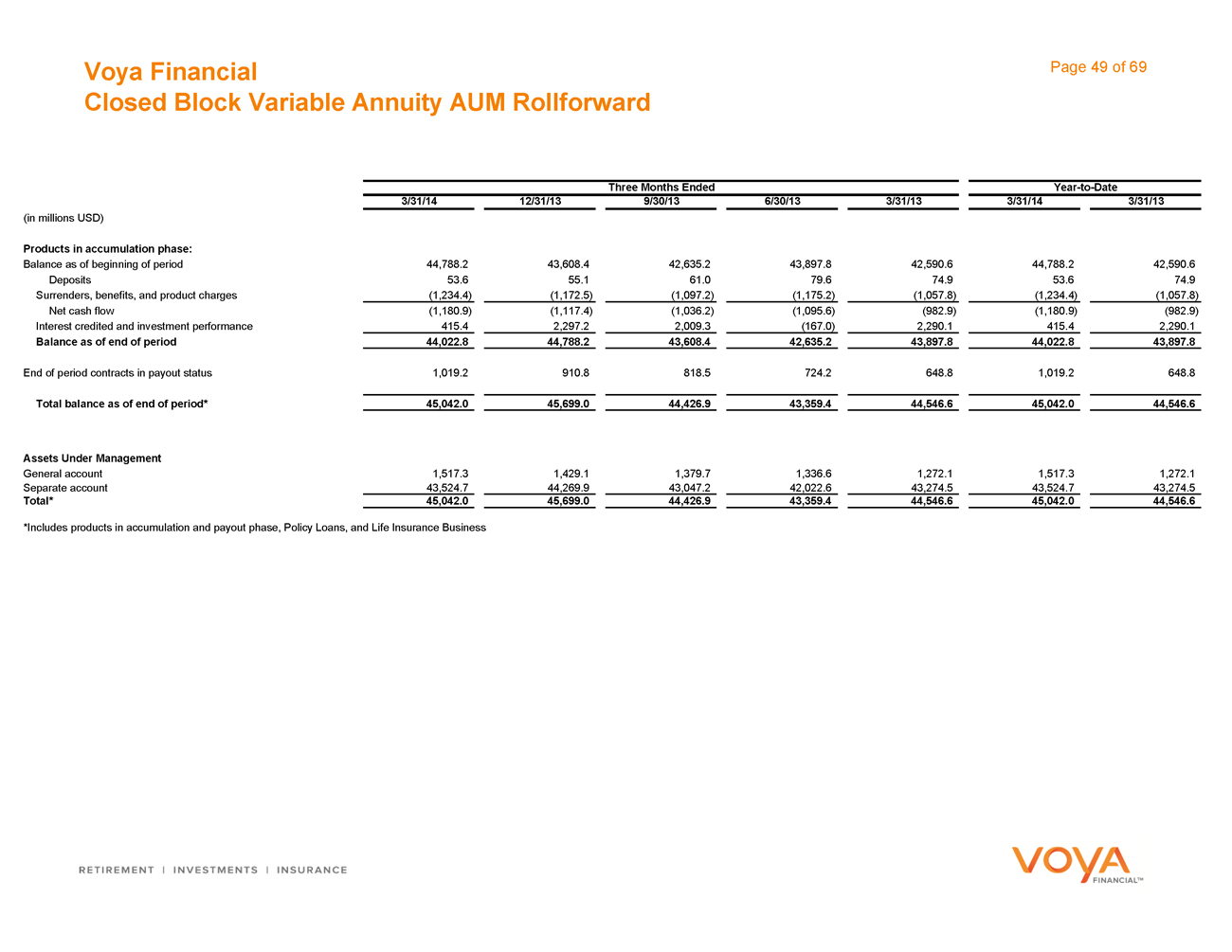

Closed Blocks (Variable Annuity and Other)

Voya Financial Page 46 of 69

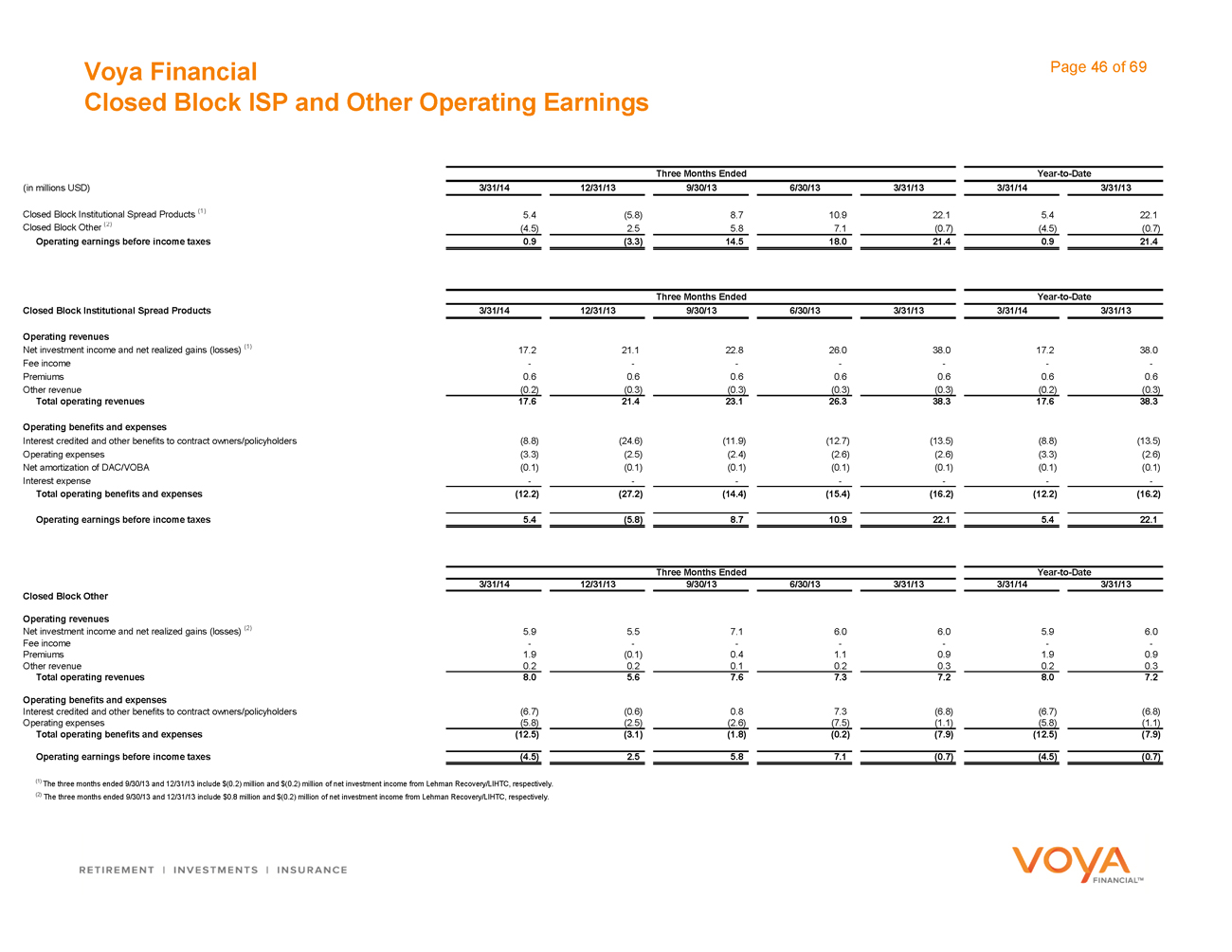

Closed Block ISP and Other Operating Earnings

Three Months Ended Year-to-Date

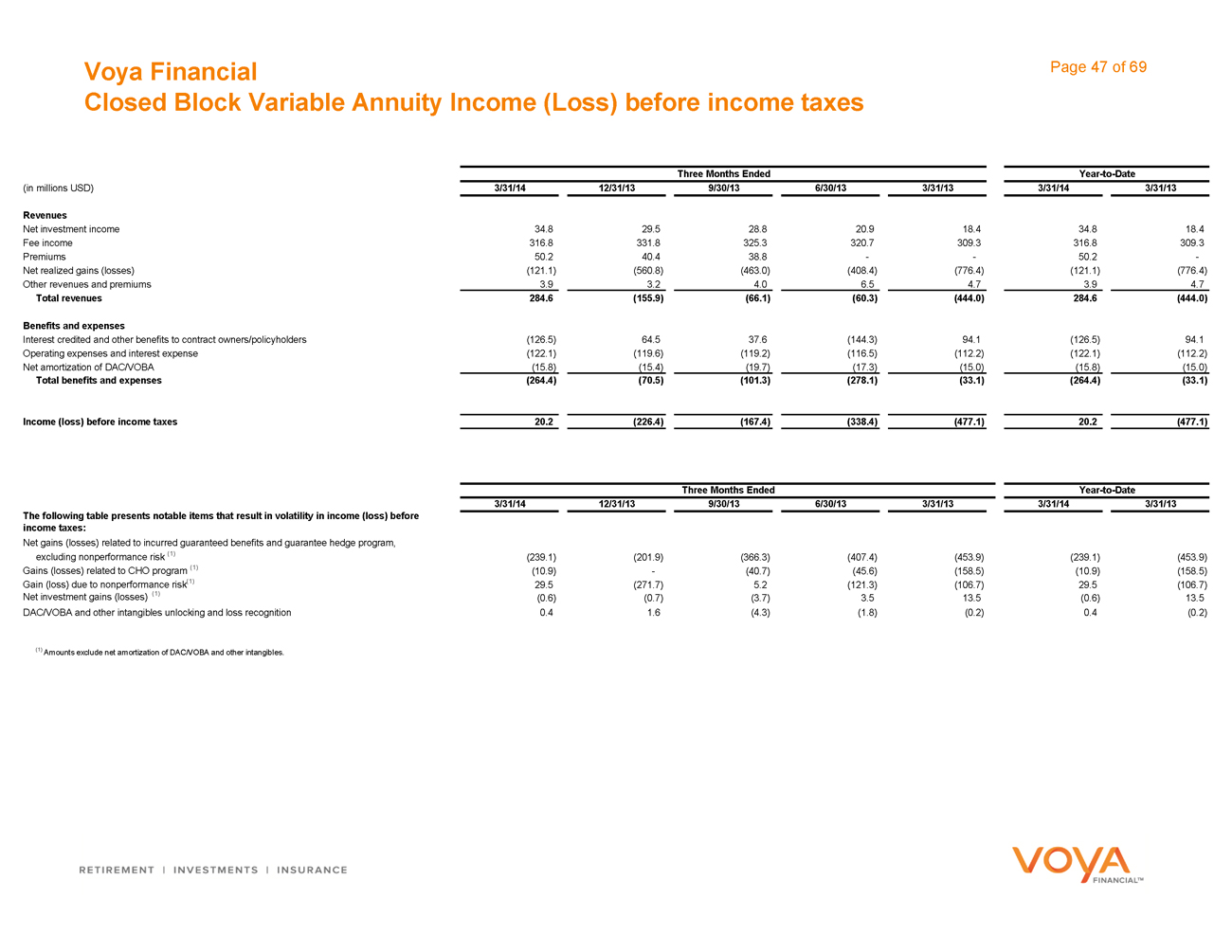

(in millions USD) 3/31/14 12/31/13 9/30/13 6/30/13 3/31/13 3/31/14 3/31/13