Exhibit 99.2

Quarterly Investor Supplement June 30, 2016 This report should be read in conjunction with Voya Financial, Inc.‘s Quarterly Report on Form 10-Q for the six months ended June 30, 2016. Voya Financial’s Annual Reports on Form 10-K, and Quarterly Reports on Form 10-Q, can be accessed upon filing at the Securities and Exchange Commission’s website at www.sec.gov, and at our website at investors.voya.com. All information is unaudited. Certain reclassifications have been made to prior period financial information to conform to current period classification.

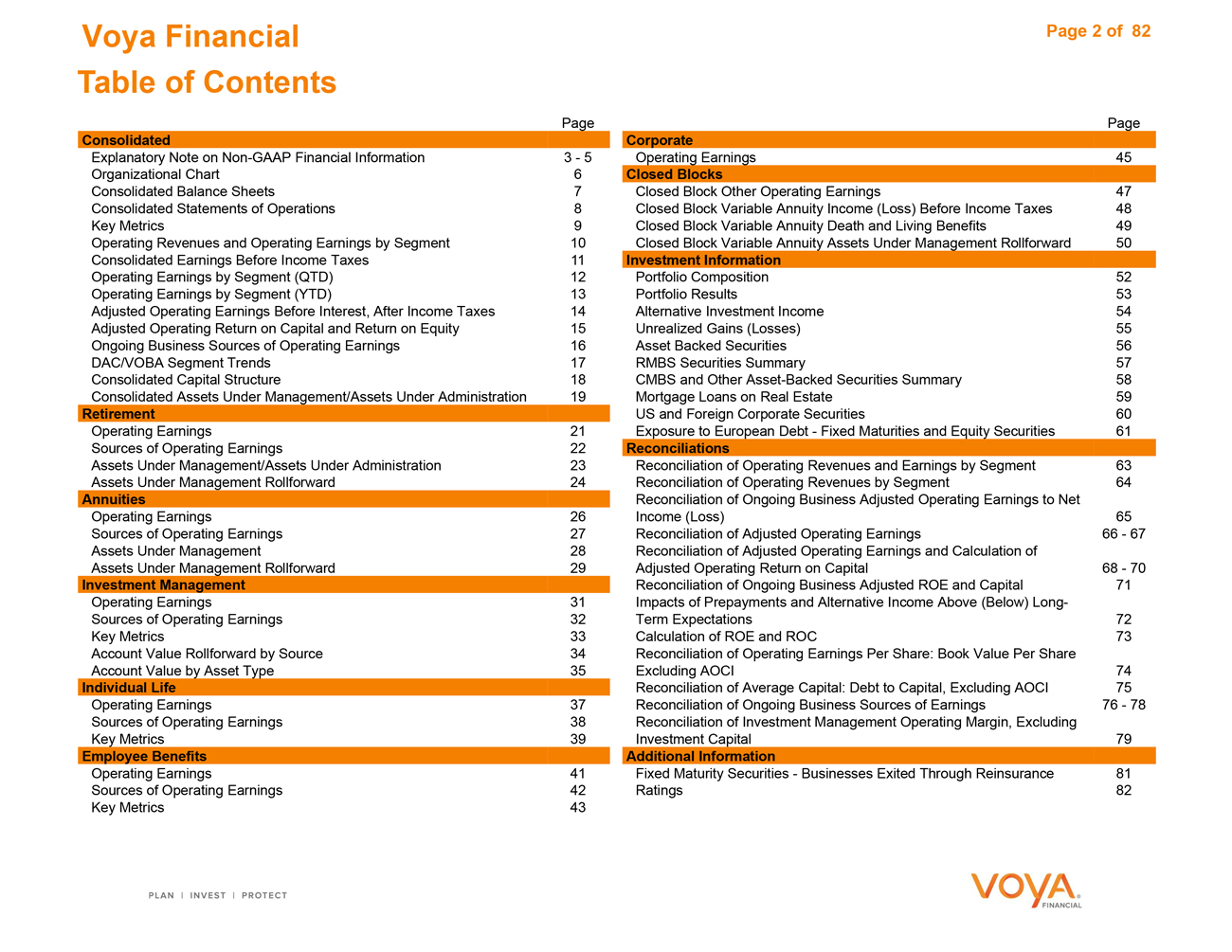

Page 2 of 82

Voya Financial

Table of Contents

Page

Consolidated

Explanatory Note on Non-GAAP Financial Information 3—5

Organizational Chart 6

Consolidated Balance Sheets 7

Consolidated Statements of Operations 8

Key Metrics 9

Operating Revenues and Operating Earnings by Segment 10

Consolidated Earnings Before Income Taxes 11

Operating Earnings by Segment (QTD) 12

Operating Earnings by Segment (YTD) 13

Adjusted Operating Earnings Before Interest, After Income Taxes 14

Adjusted Operating Return on Capital and Return on Equity 15

Ongoing Business Sources of Operating Earnings 16

DAC/VOBA Segment Trends 17

Consolidated Capital Structure 18

Consolidated Assets Under Management/Assets Under Administration 19

Retirement

Operating Earnings 21

Sources of Operating Earnings 22

Assets Under Management/Assets Under Administration 23

Assets Under Management Rollforward 24

Annuities

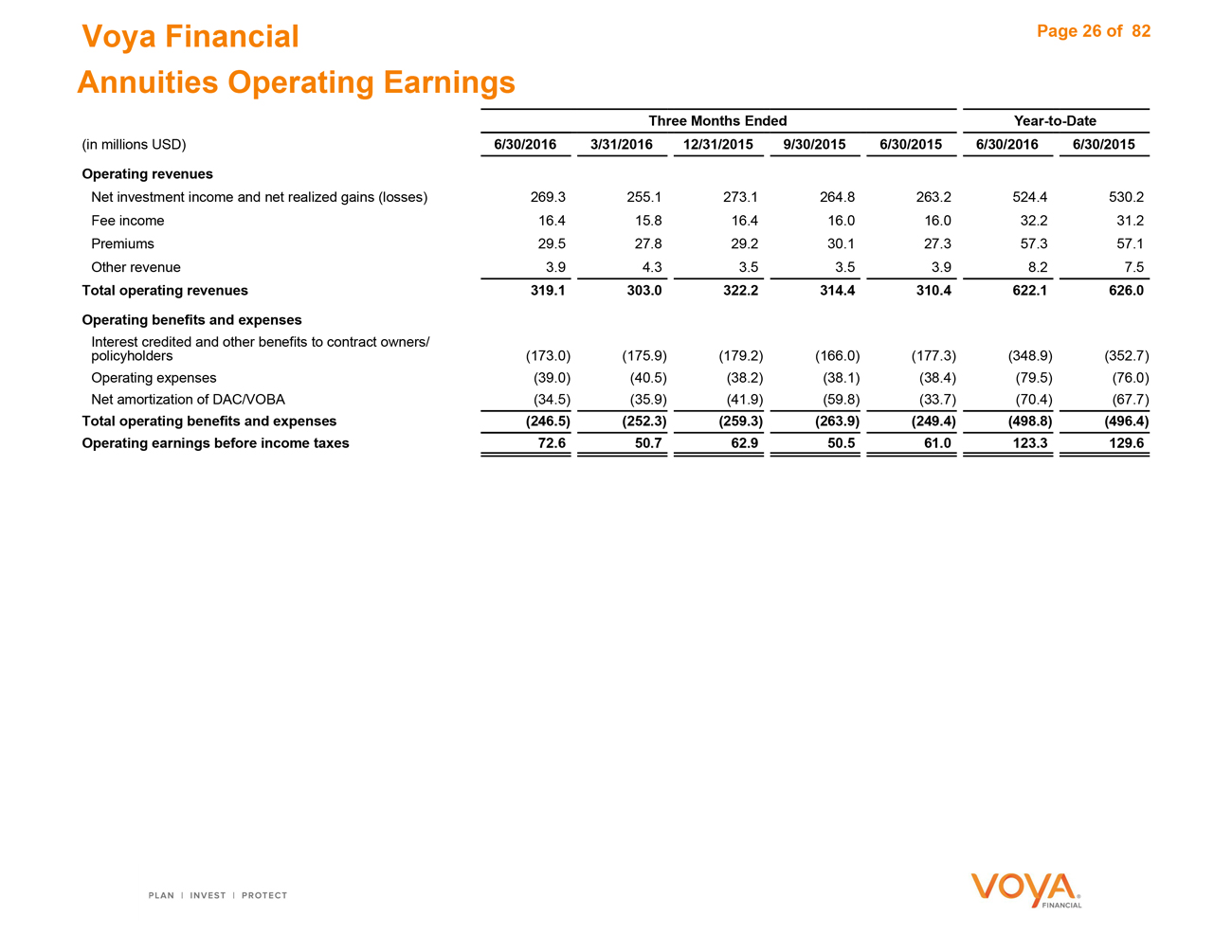

Operating Earnings 26

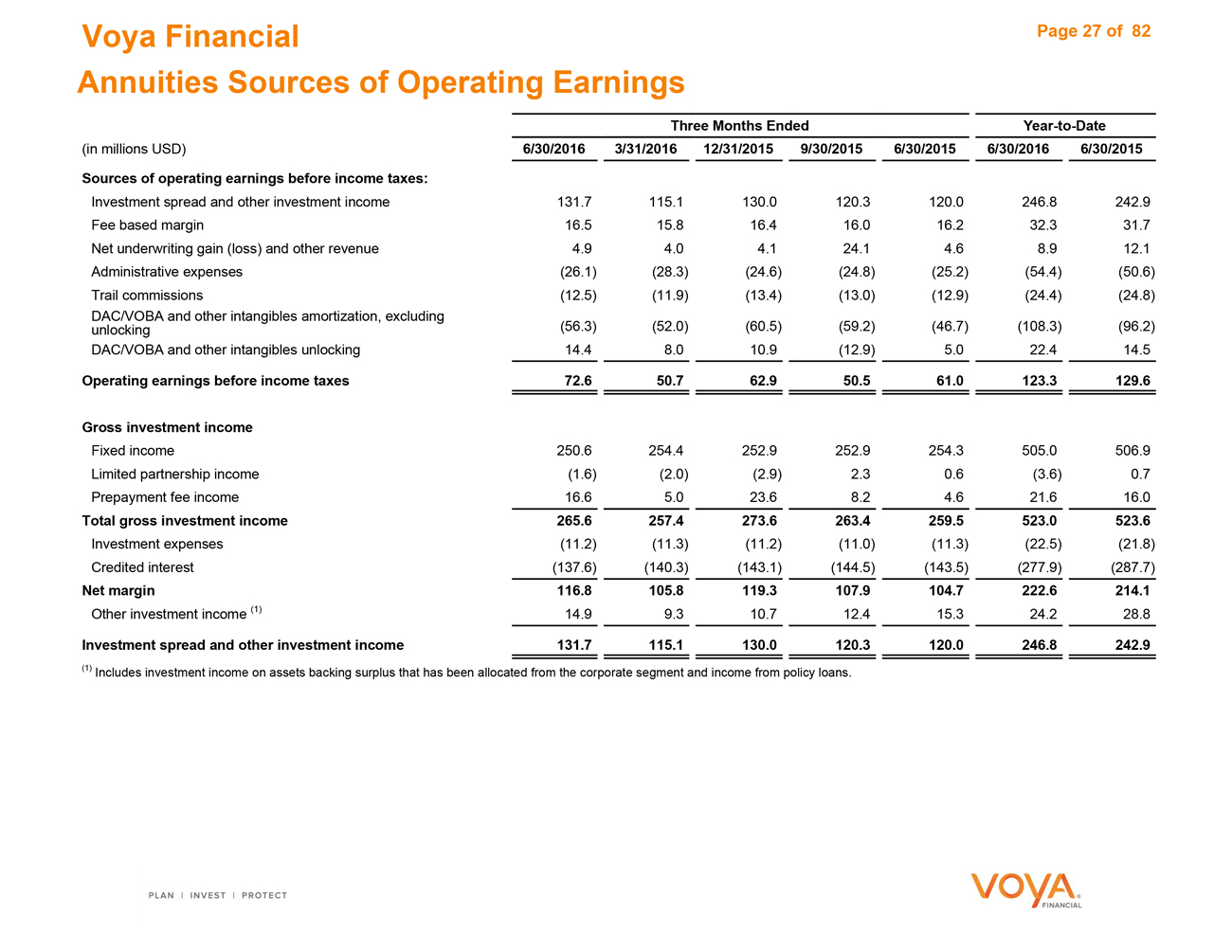

Sources of Operating Earnings 27

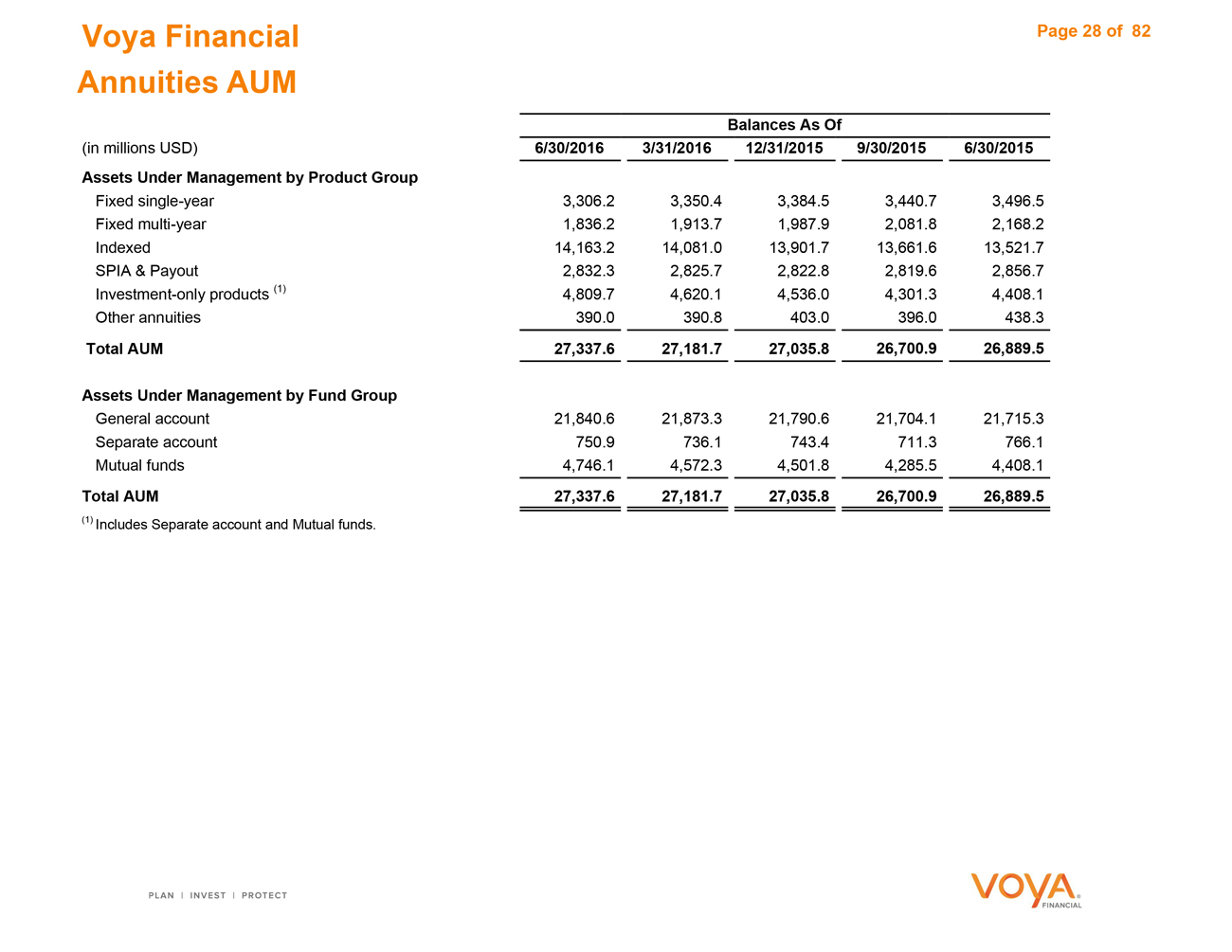

Assets Under Management 28

Assets Under Management Rollforward 29

Investment Management

Operating Earnings 31

Sources of Operating Earnings 32

Key Metrics 33

Account Value Rollforward by Source 34

Account Value by Asset Type 35

Individual Life

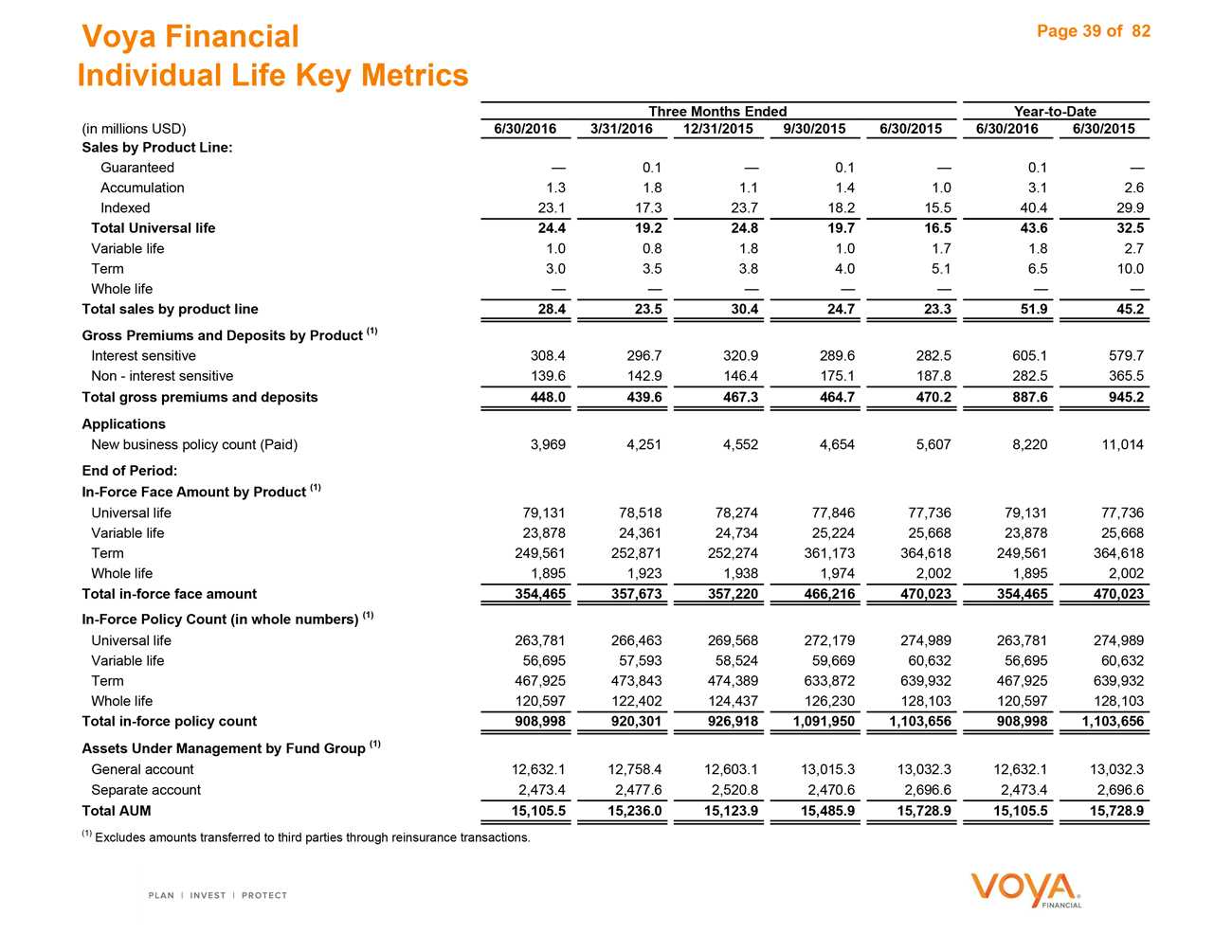

Operating Earnings 37

Sources of Operating Earnings 38

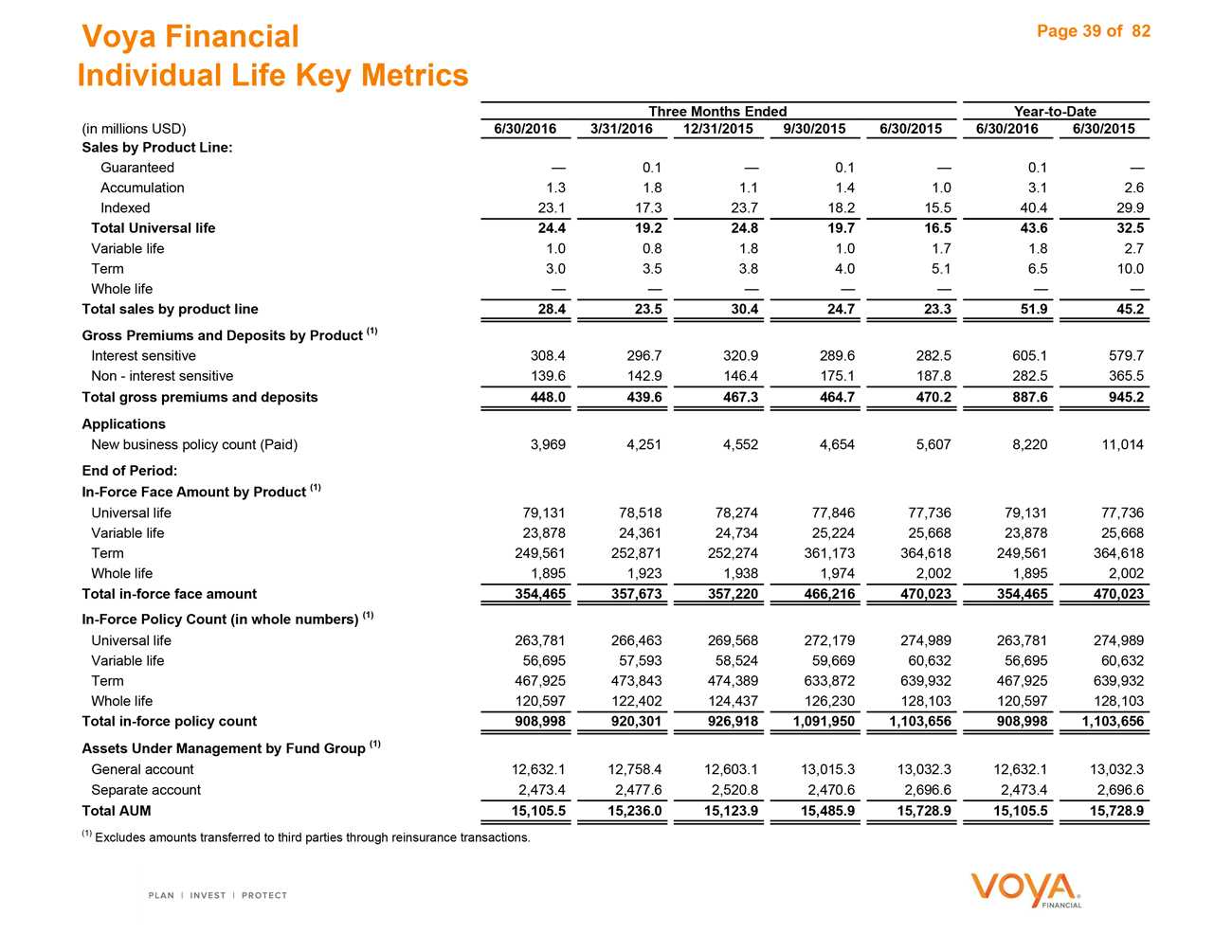

Key Metrics 39

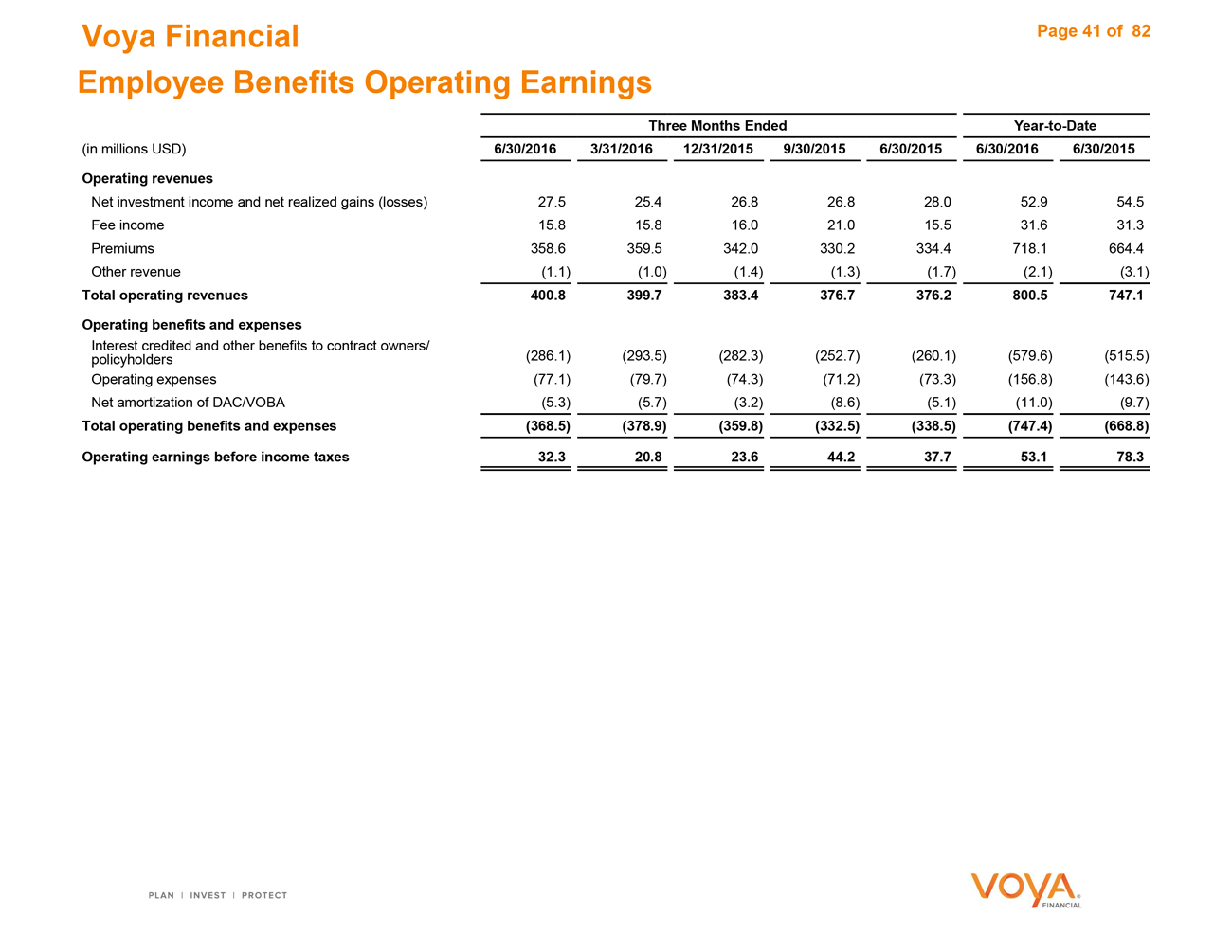

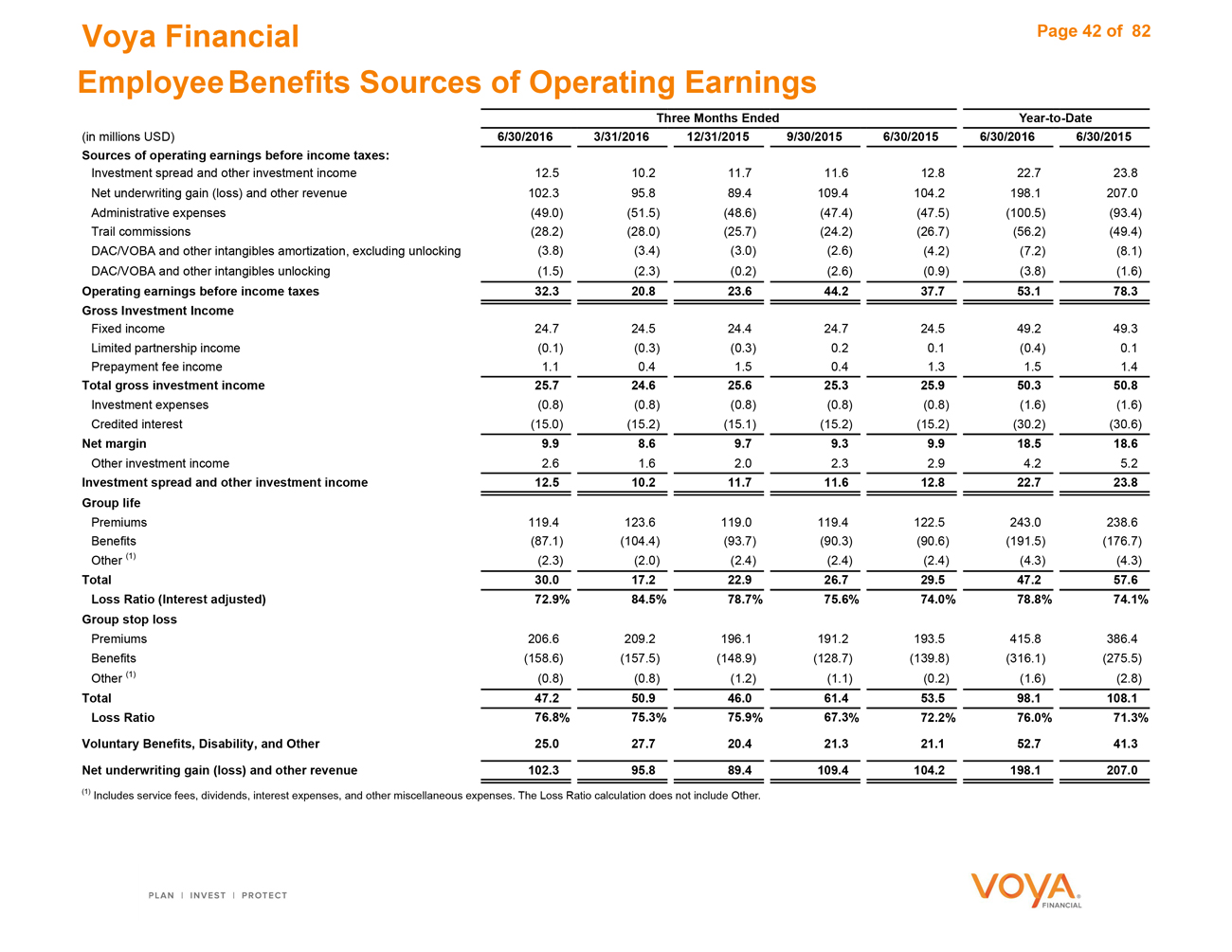

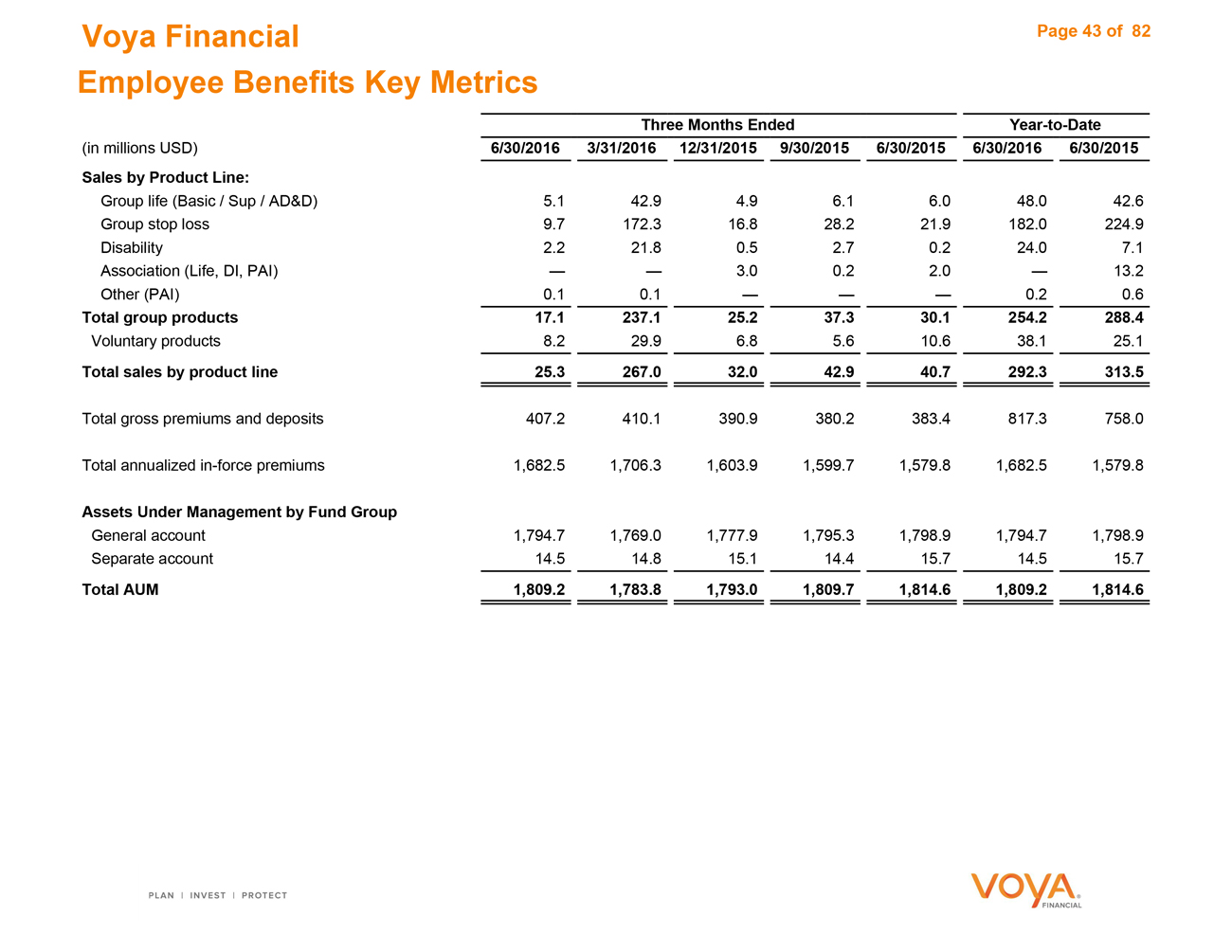

Employee Benefits

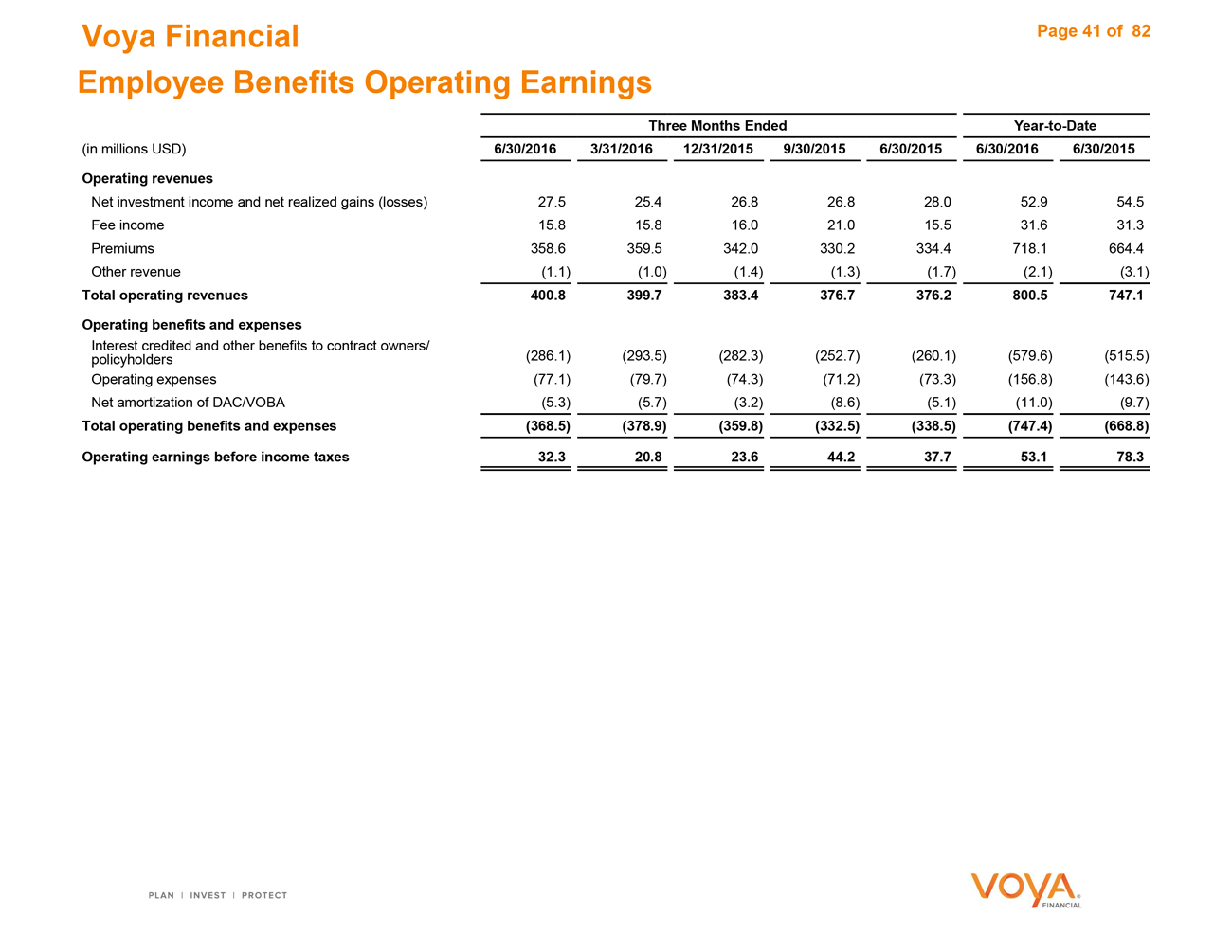

Operating Earnings 41

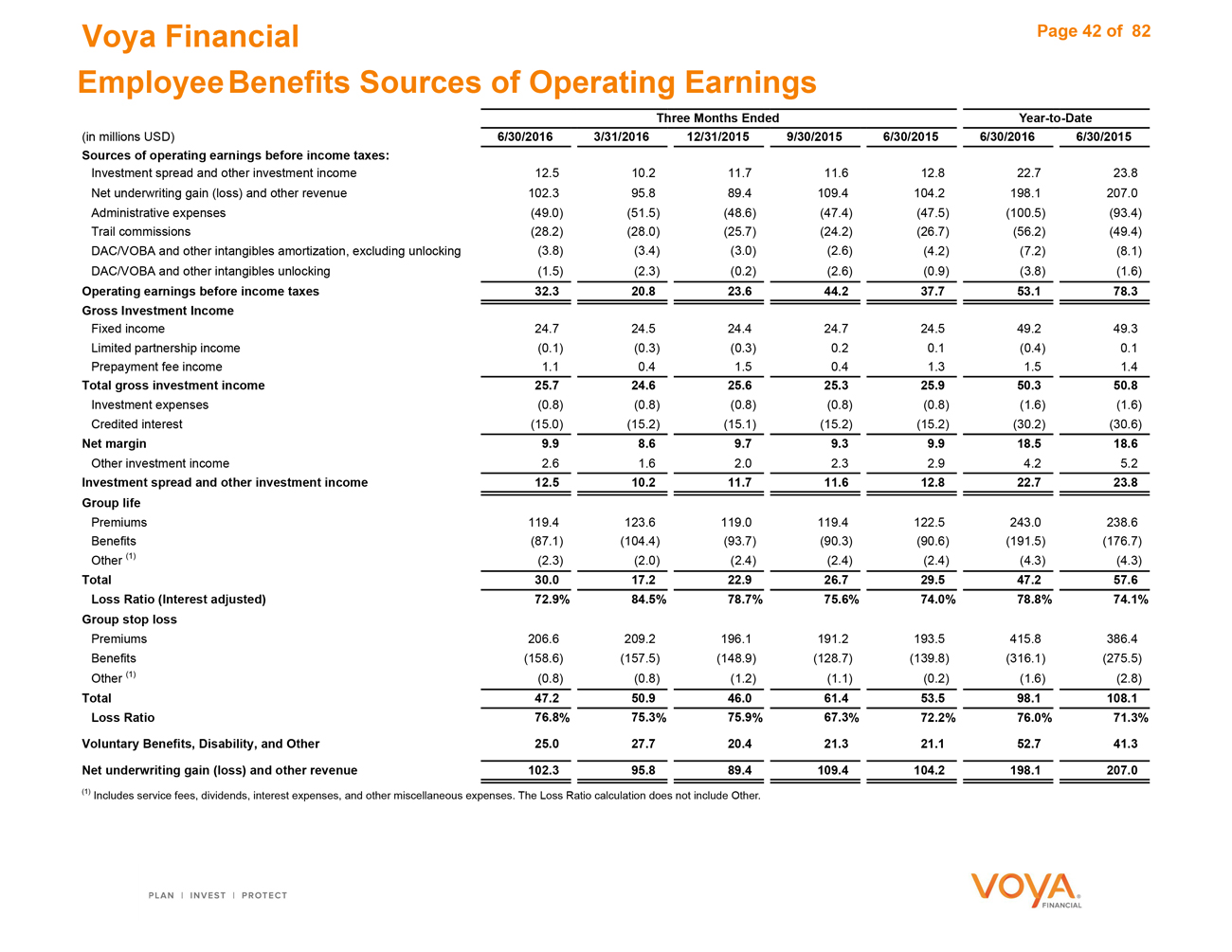

Sources of Operating Earnings 42

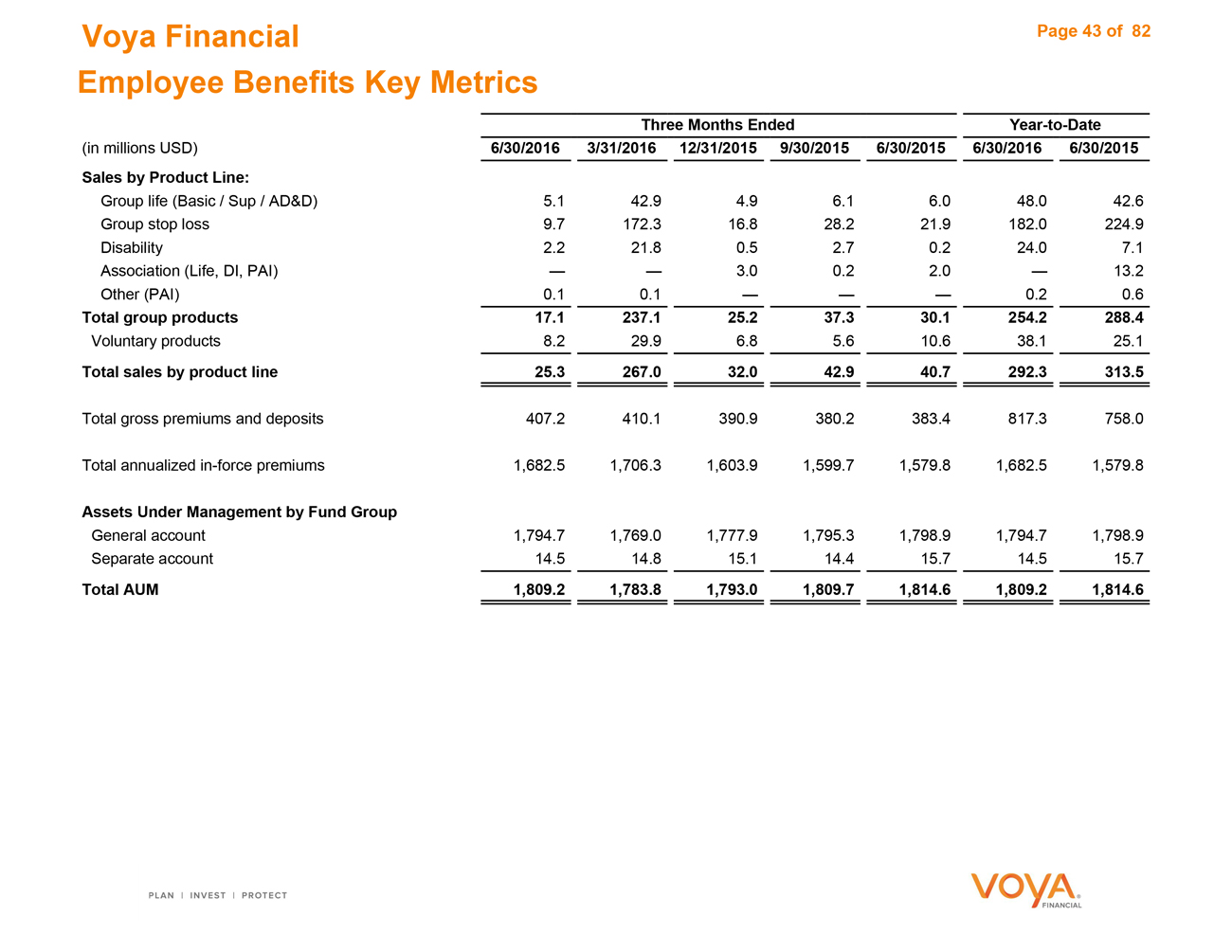

Key Metrics 43

Page

Corporate

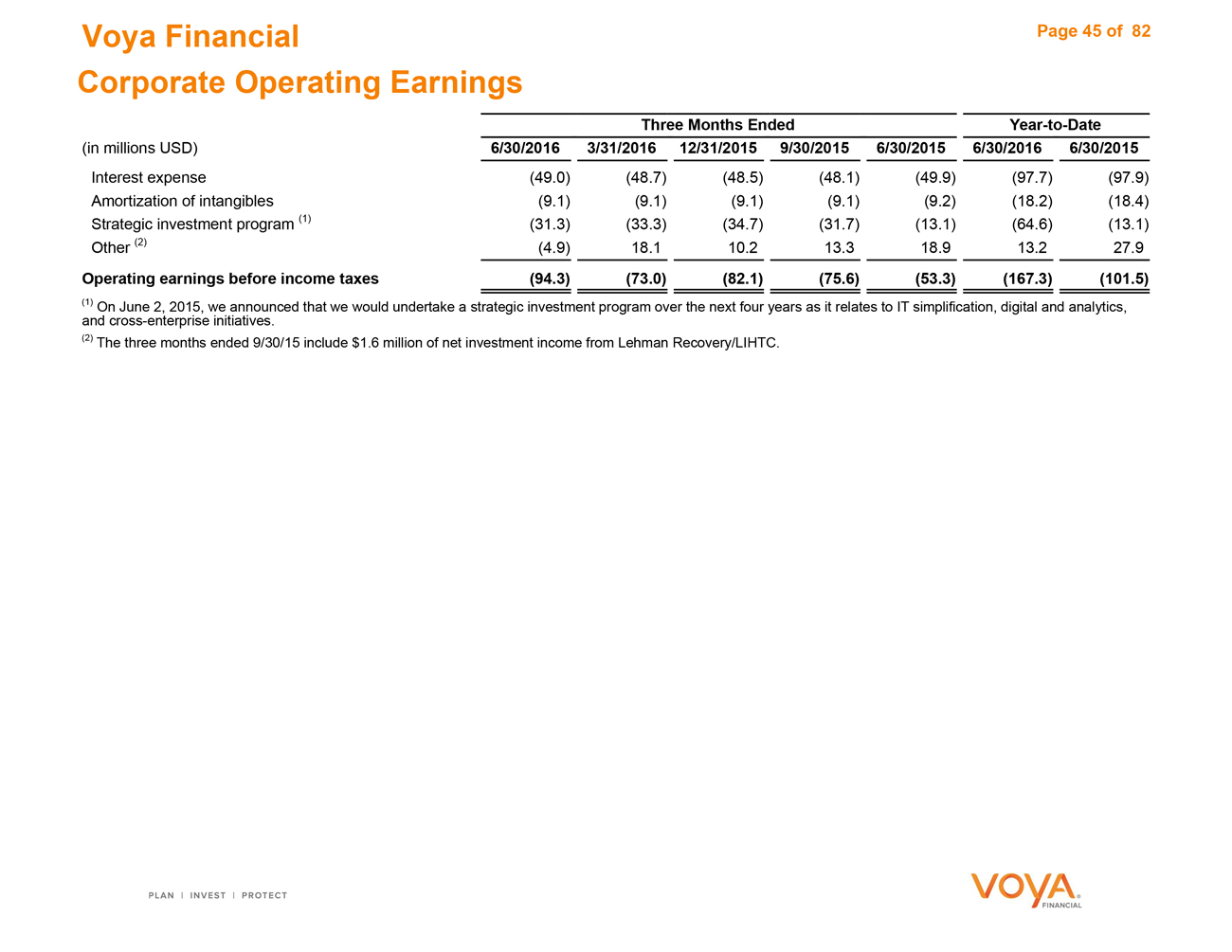

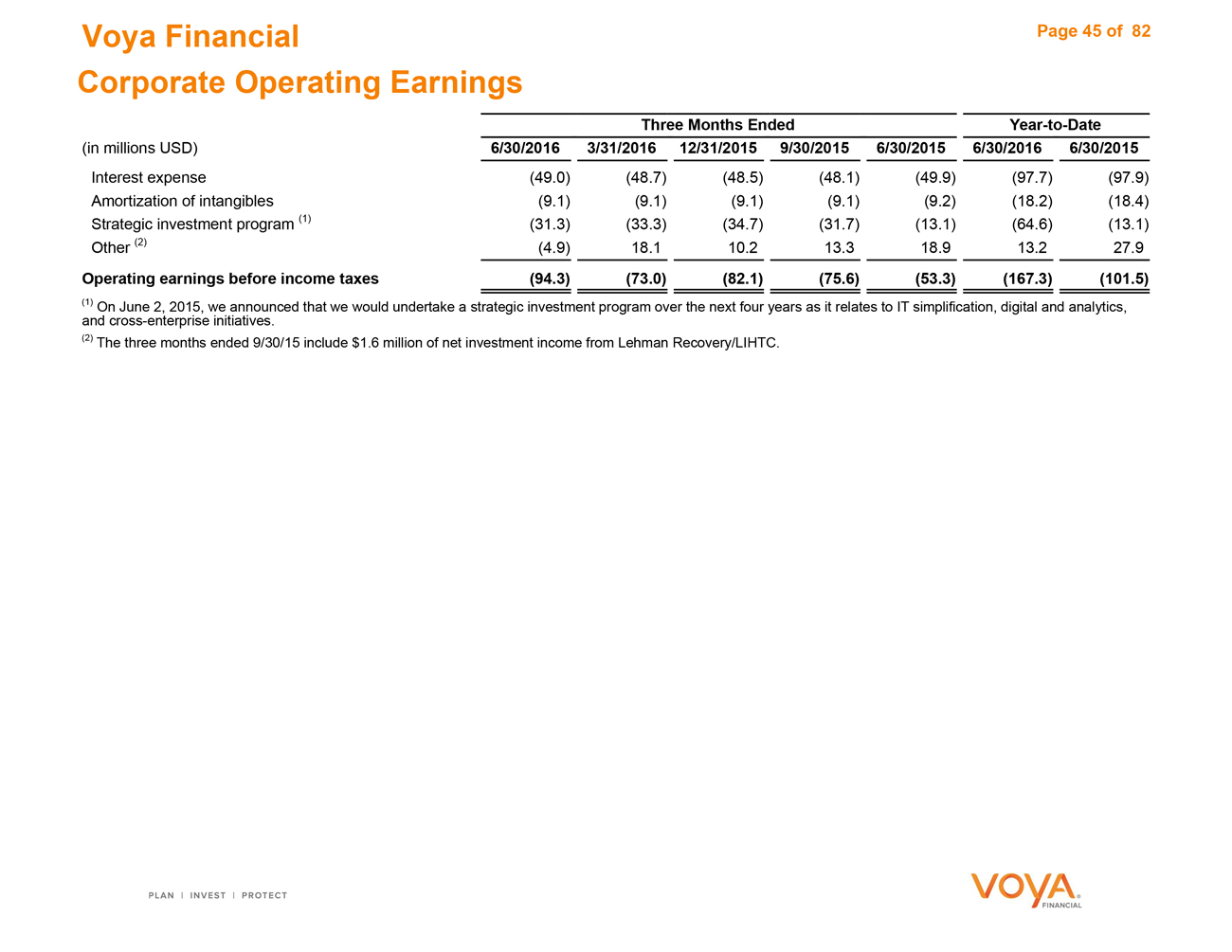

Operating Earnings 45

Closed Blocks

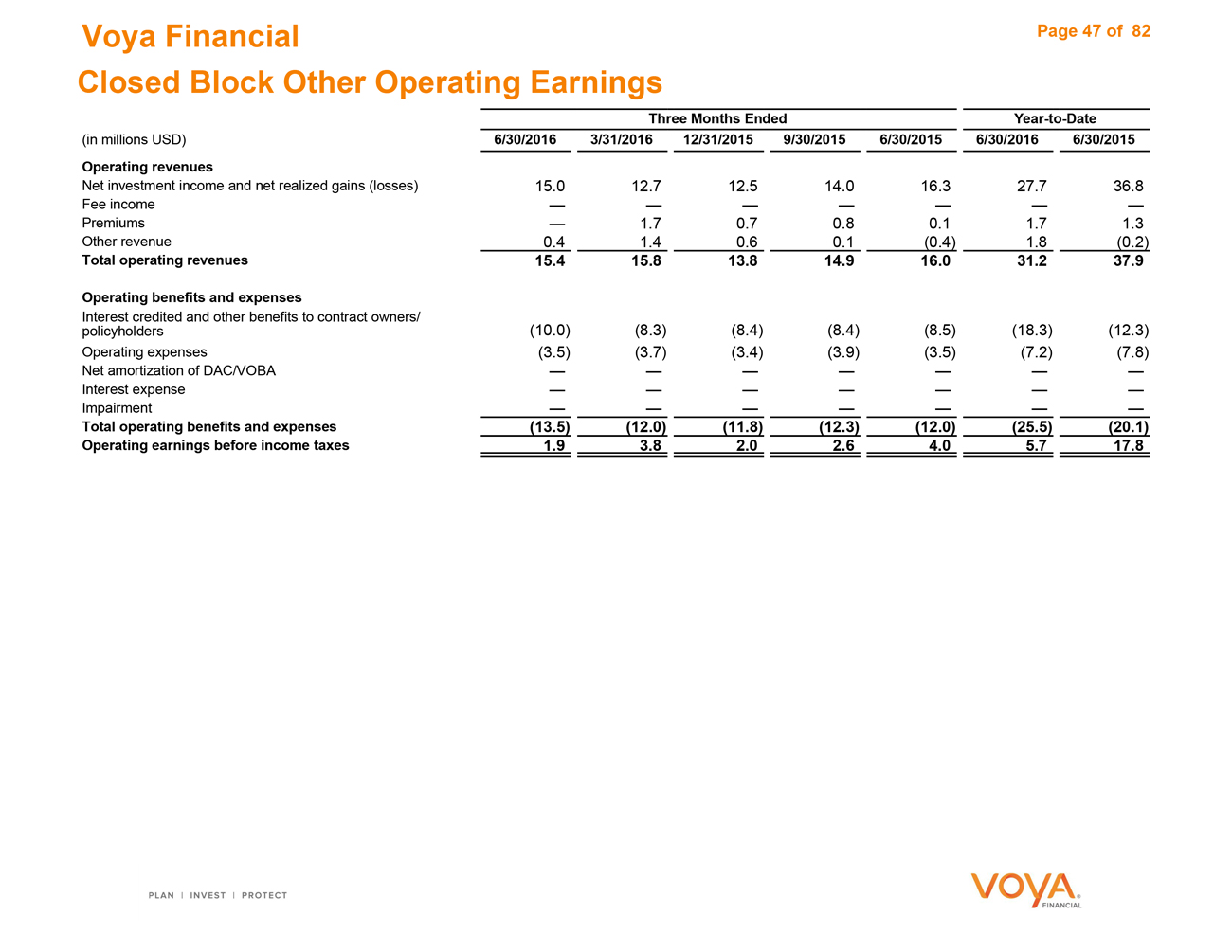

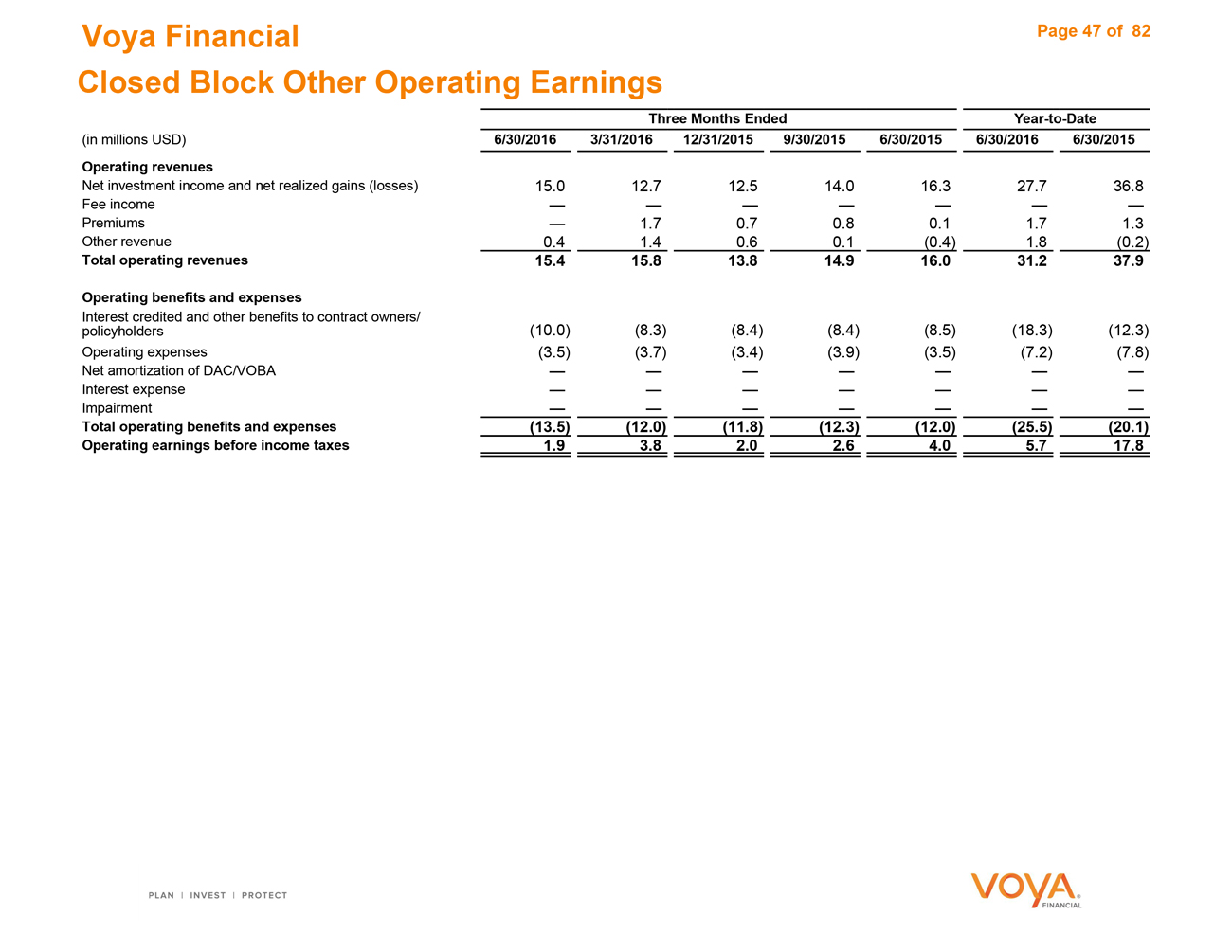

Closed Block Other Operating Earnings 47

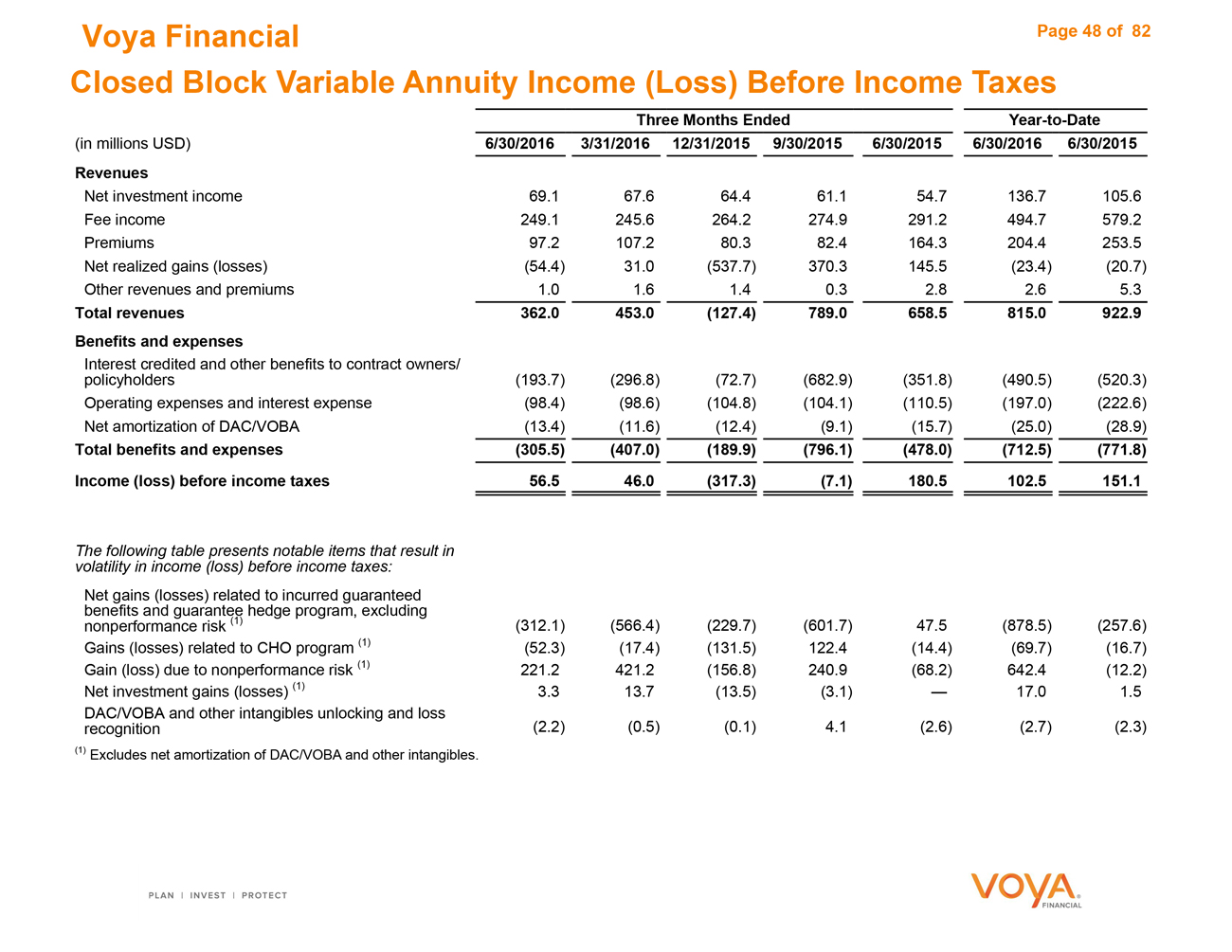

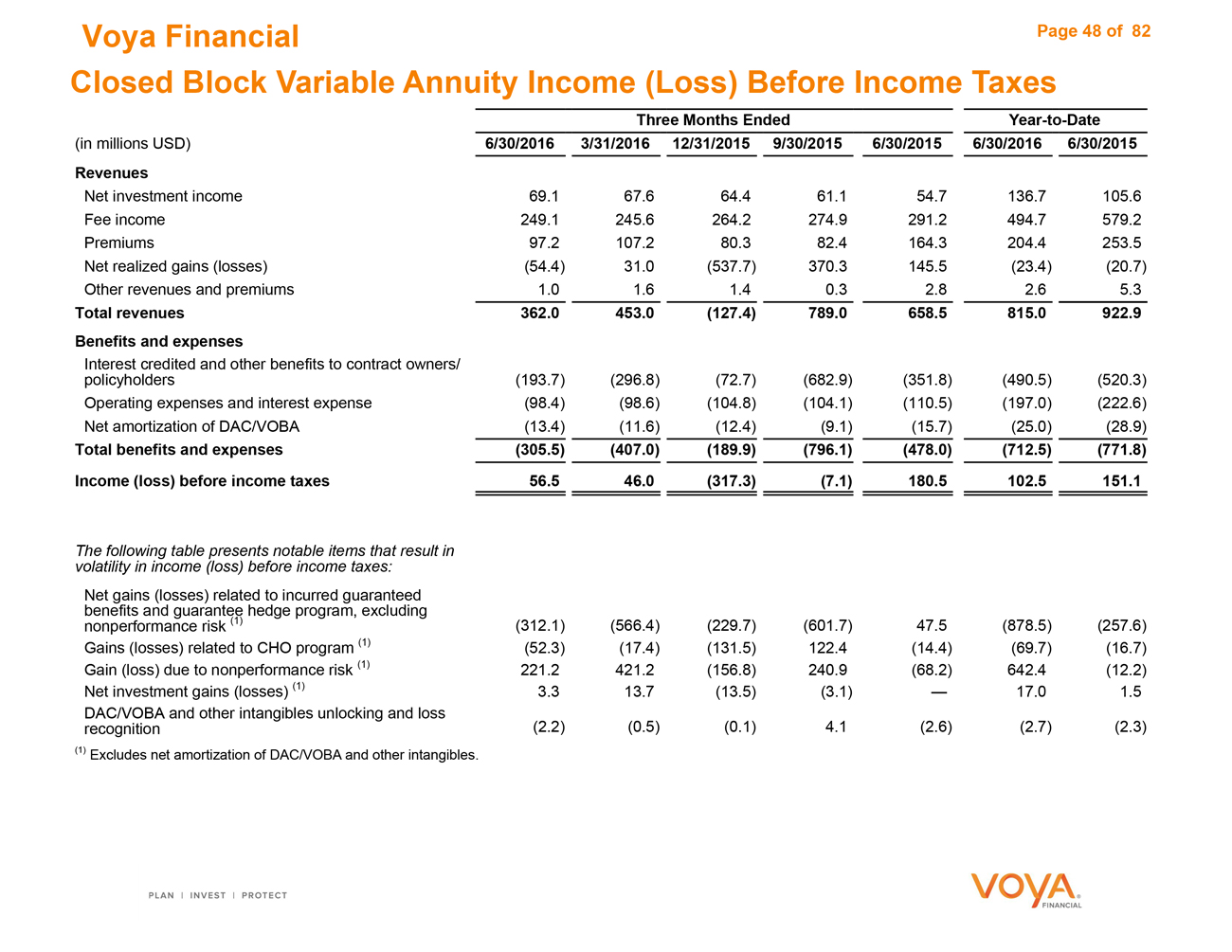

Closed Block Variable Annuity Income (Loss) Before Income Taxes 48

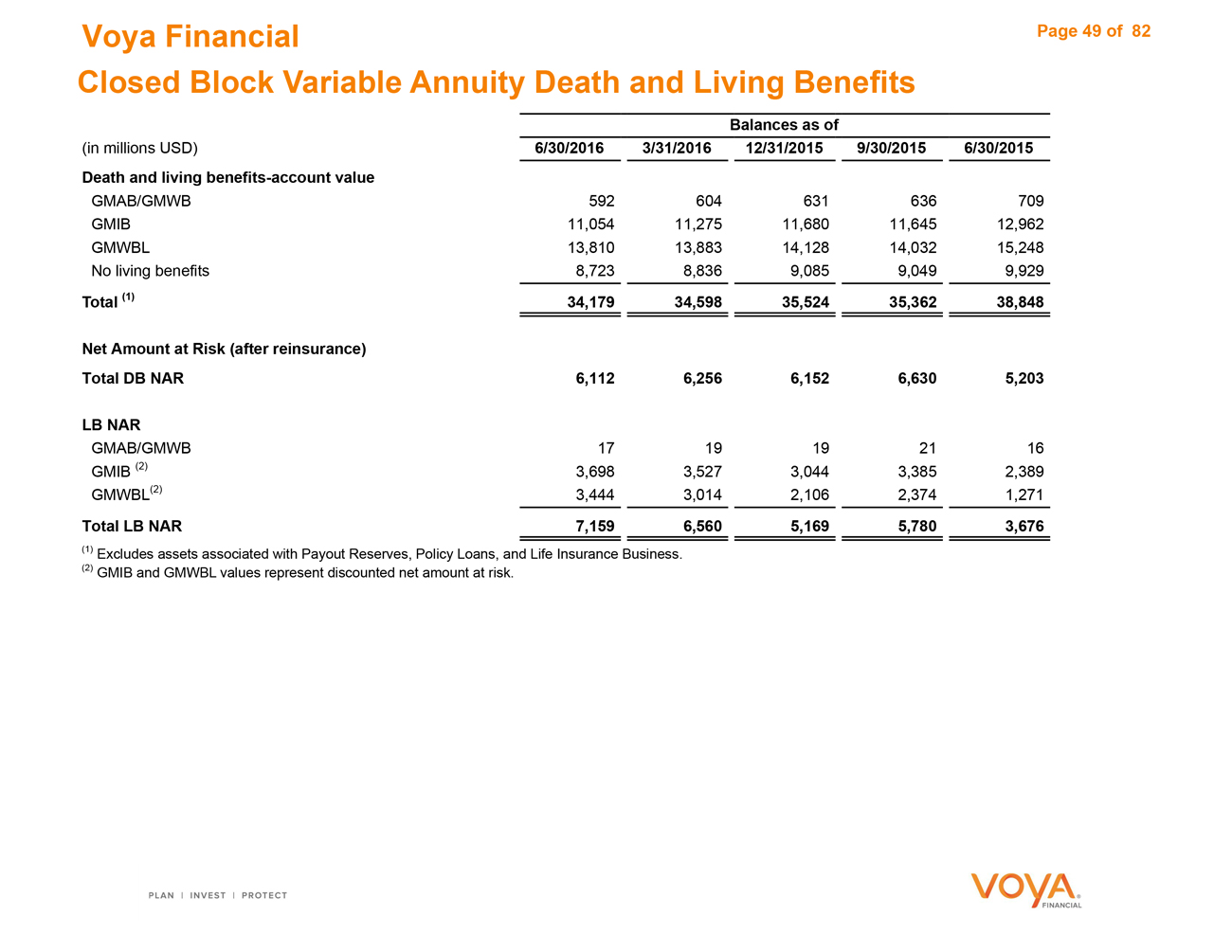

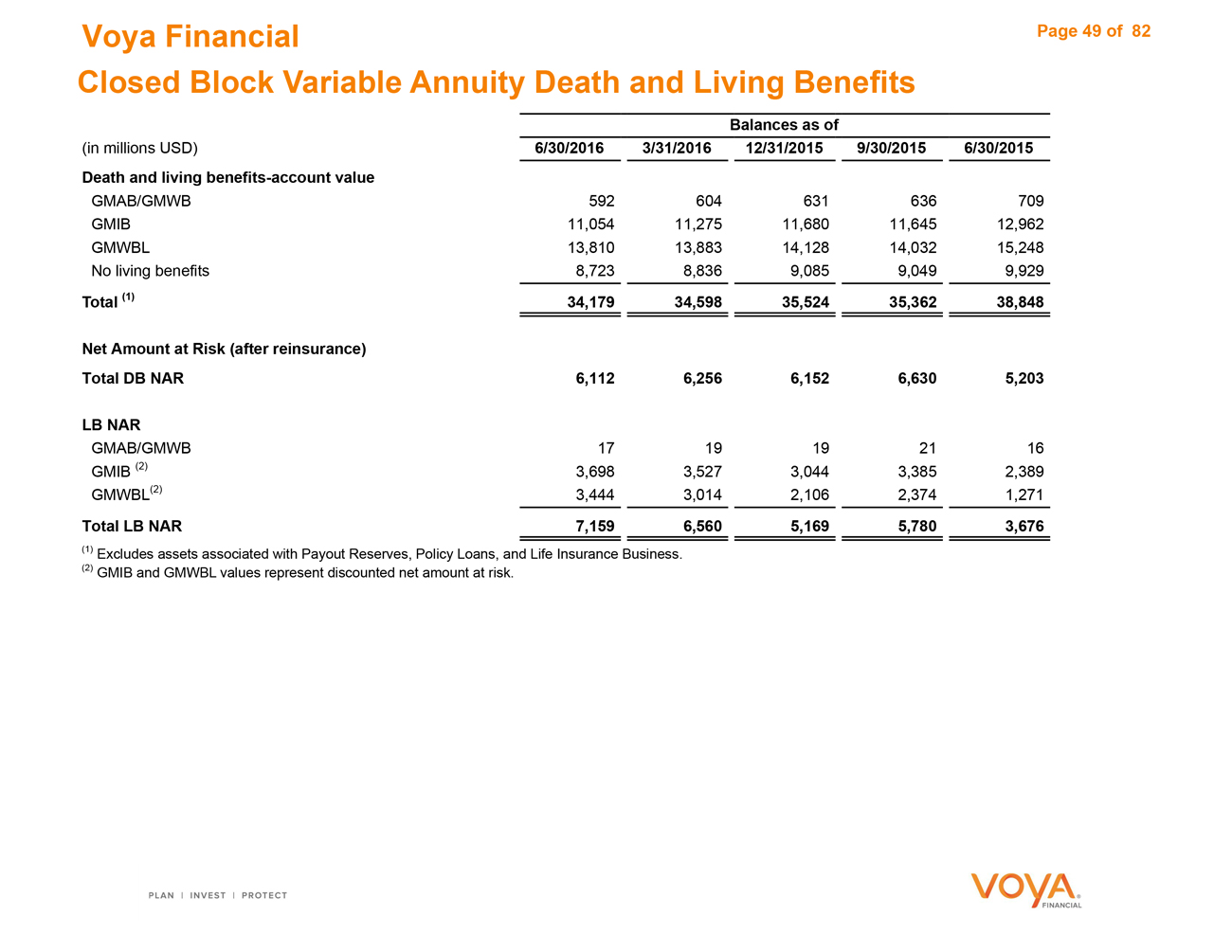

Closed Block Variable Annuity Death and Living Benefits 49

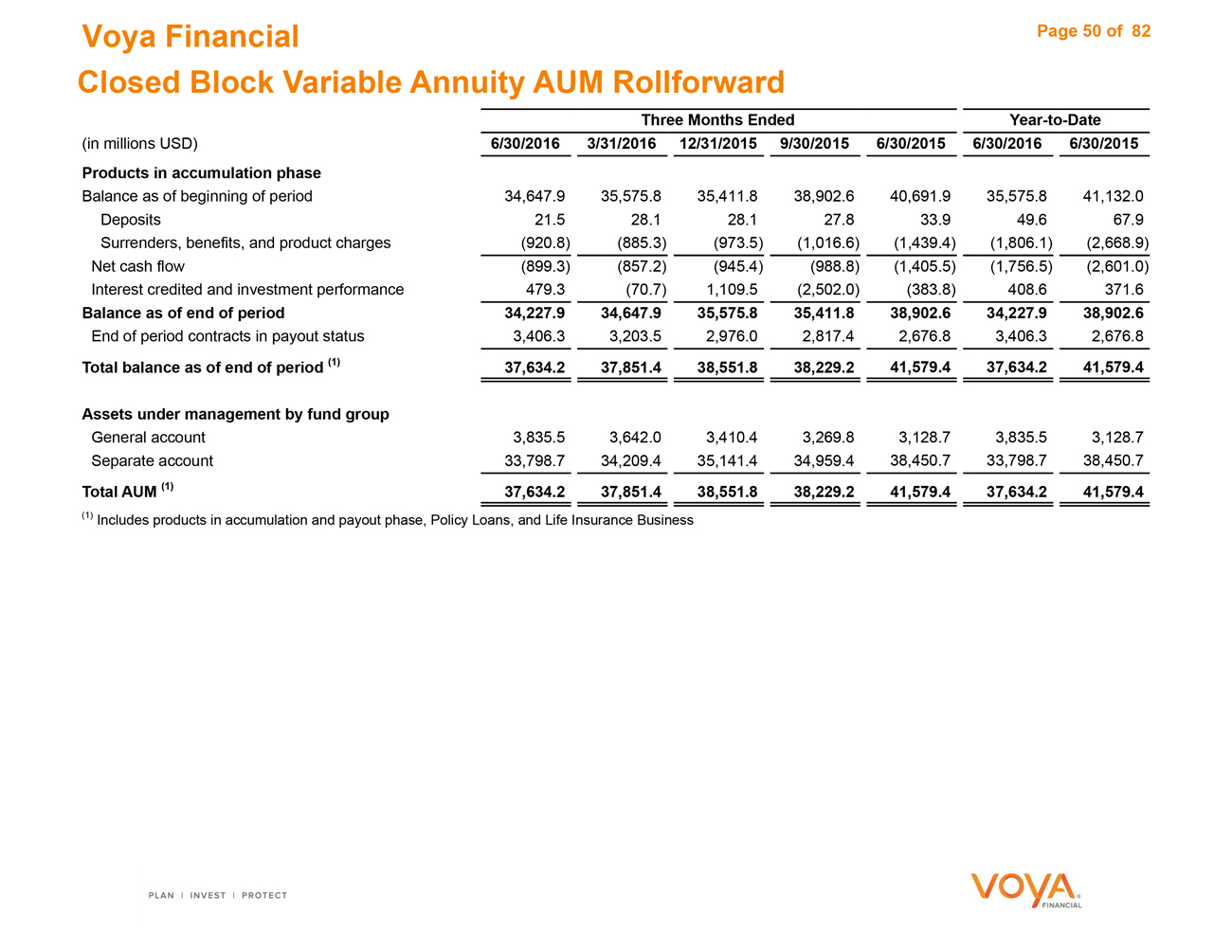

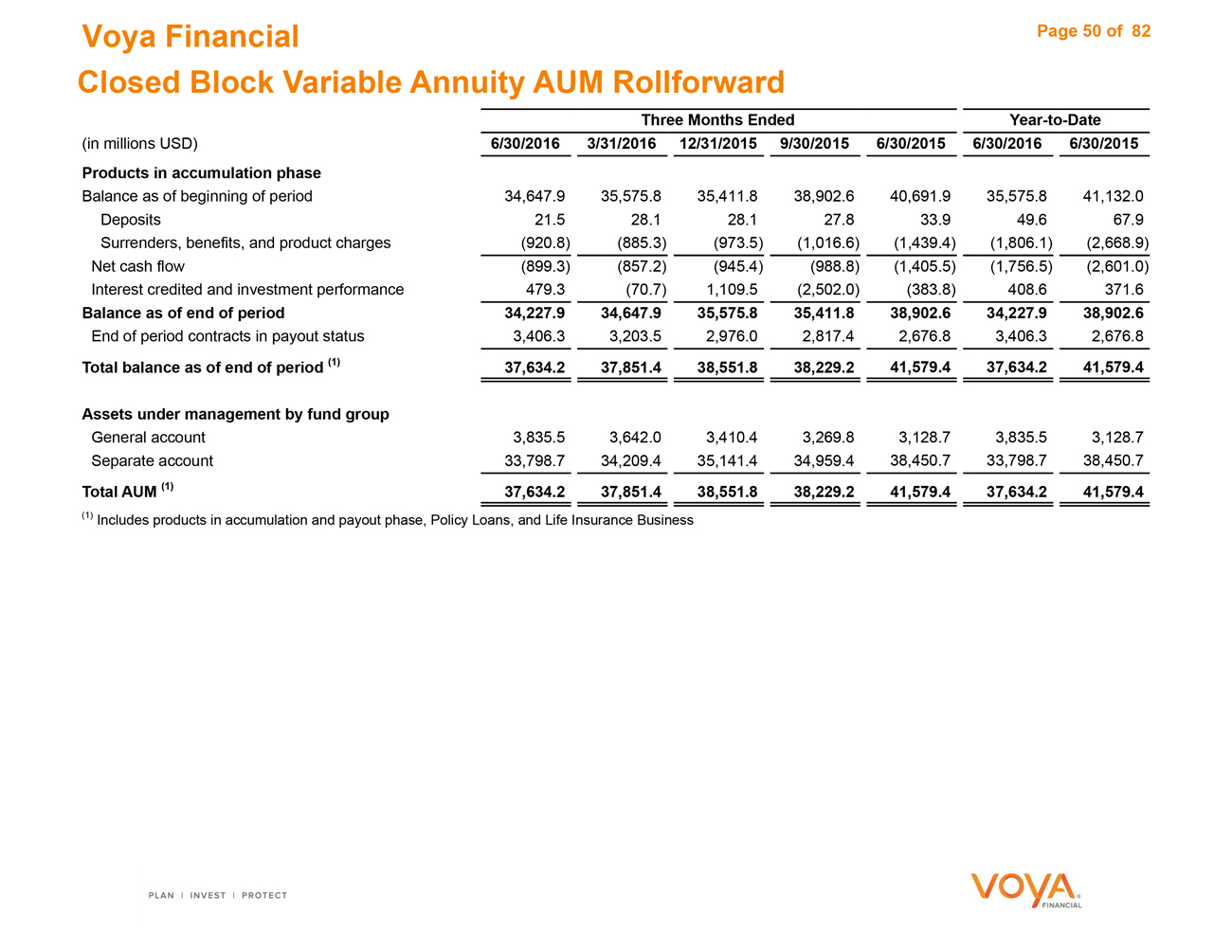

Closed Block Variable Annuity Assets Under Management Rollforward 50

Investment Information

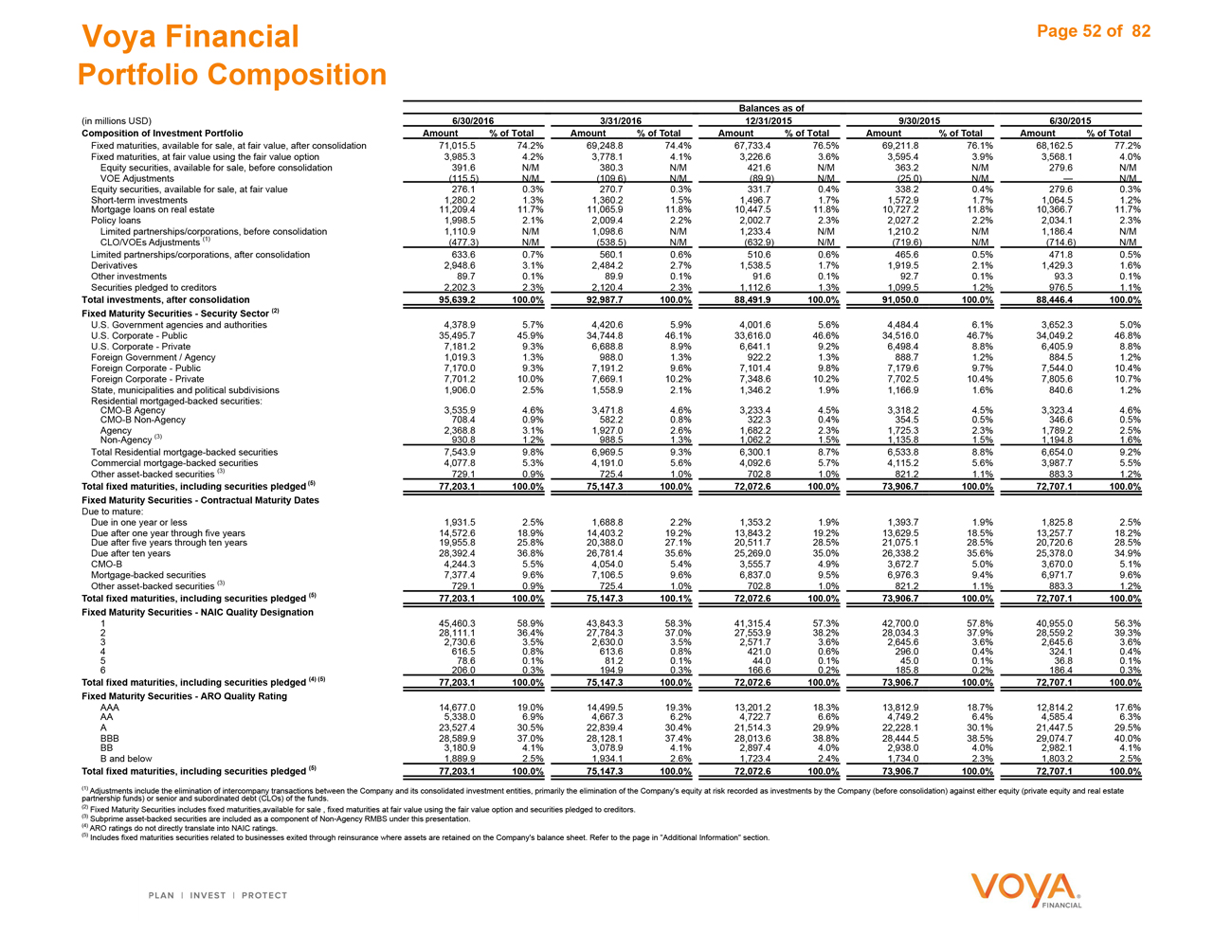

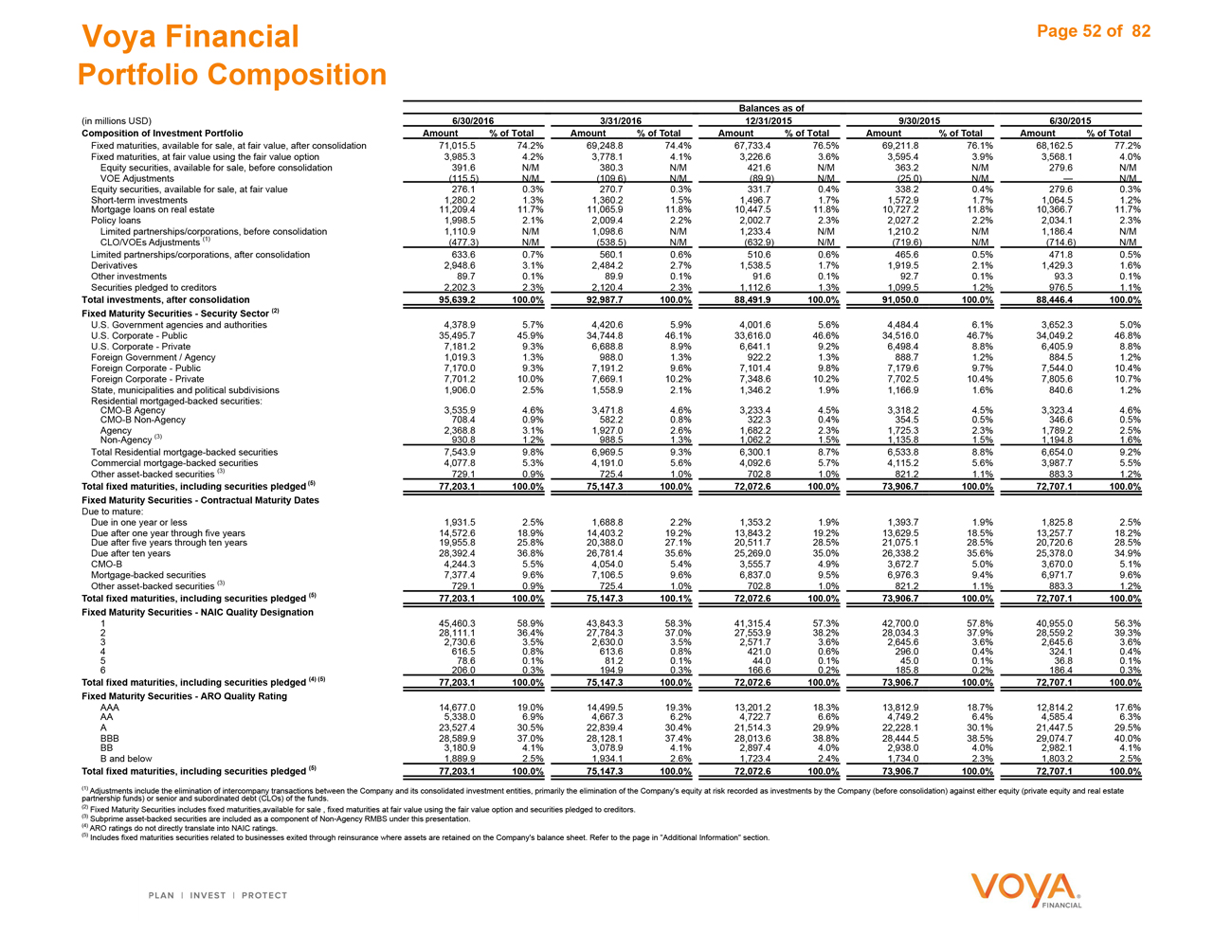

Portfolio Composition 52

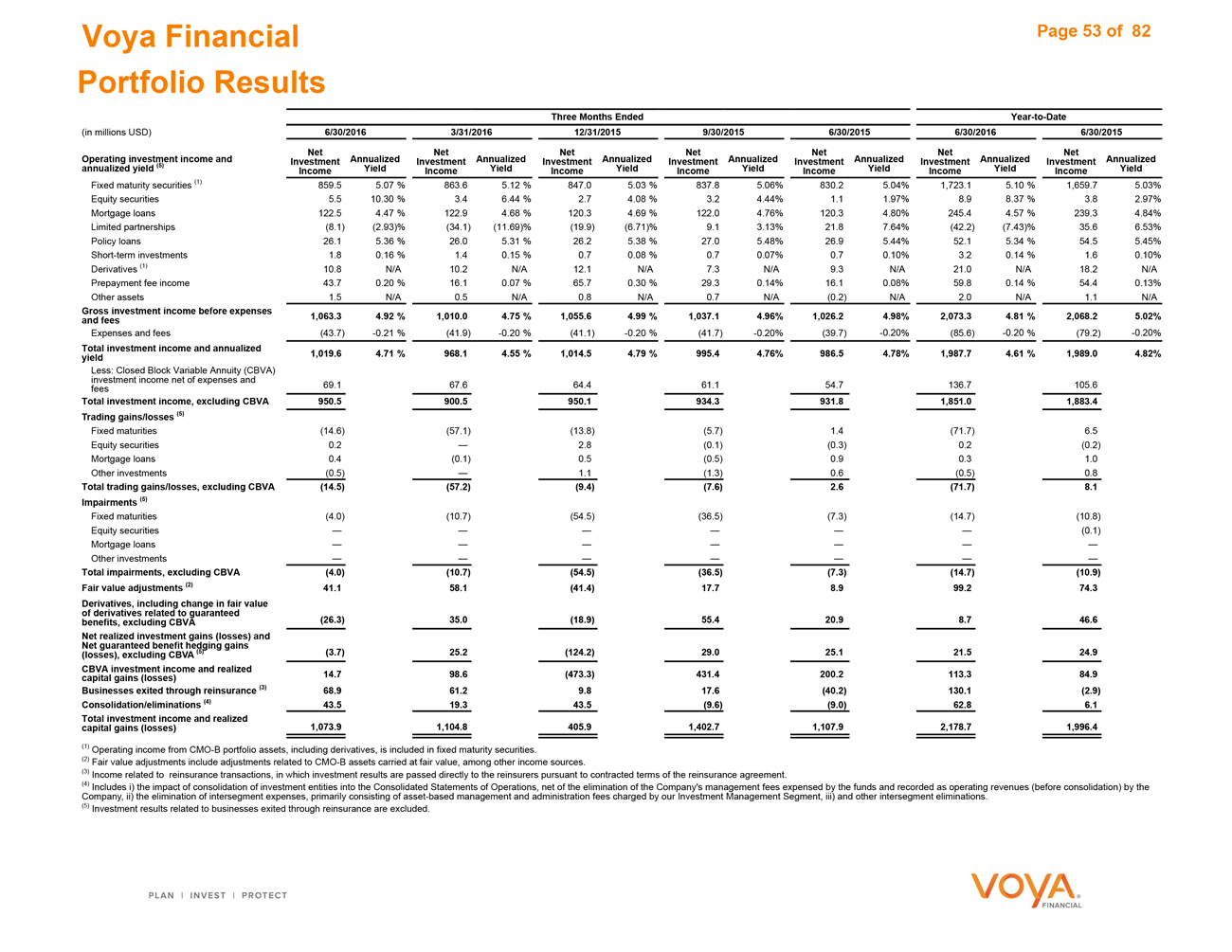

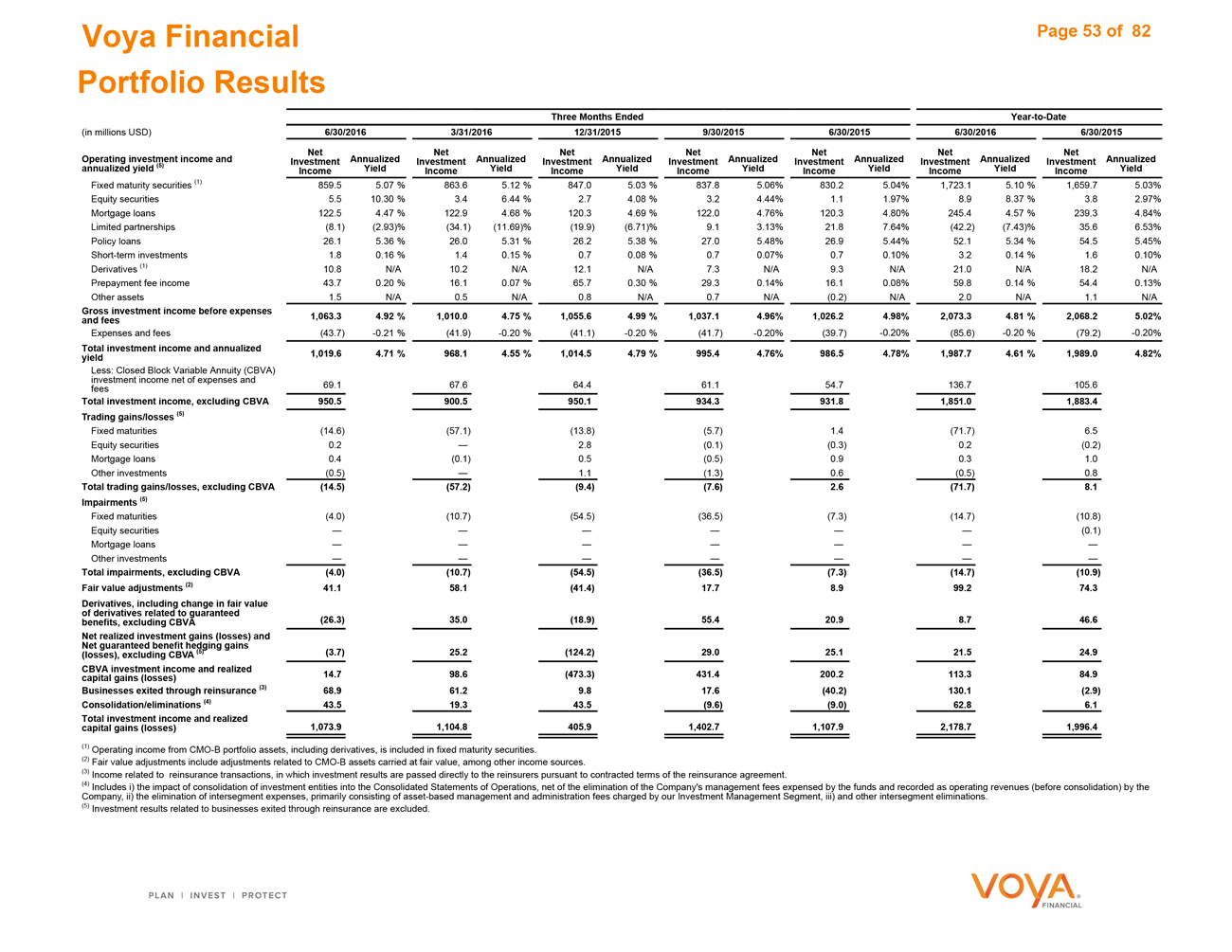

Portfolio Results 53

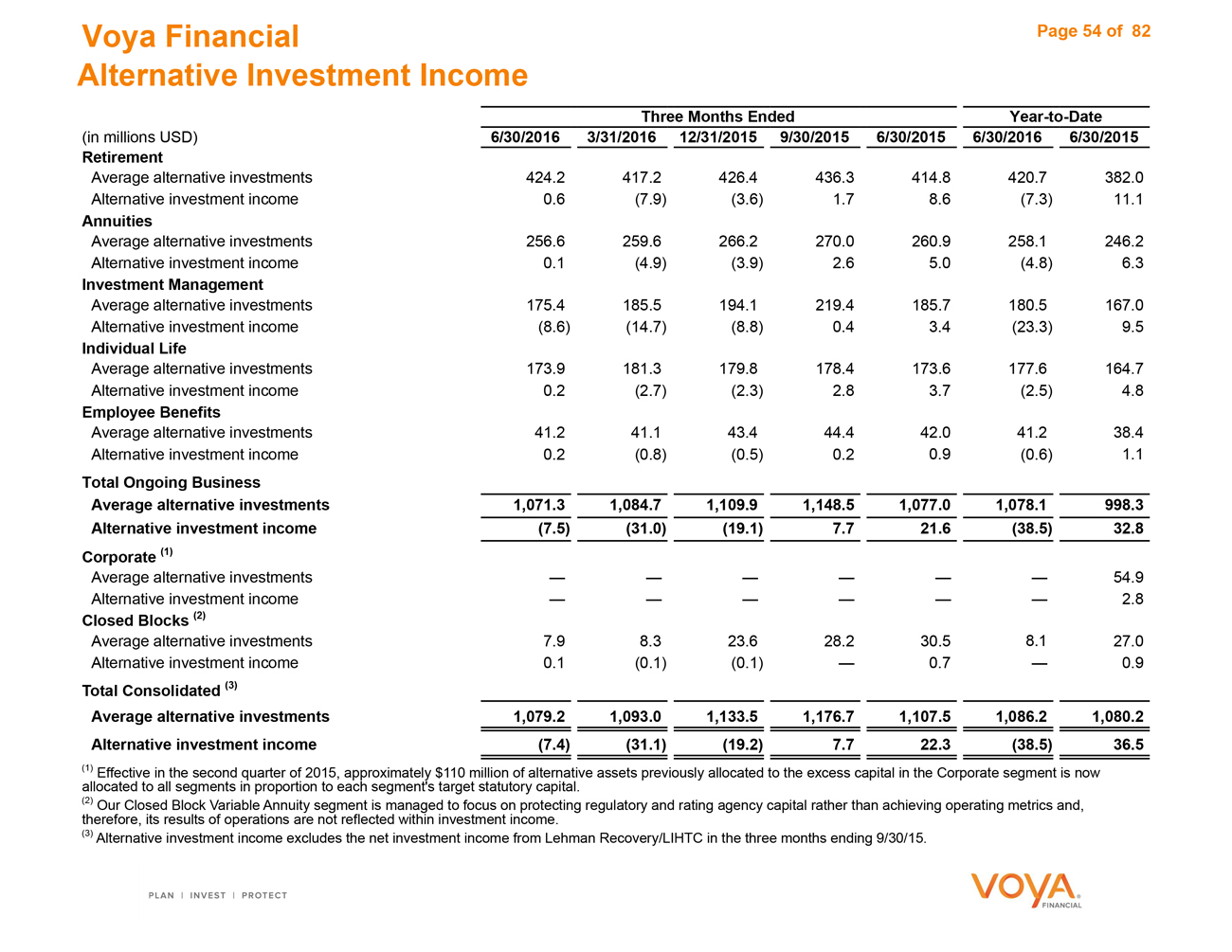

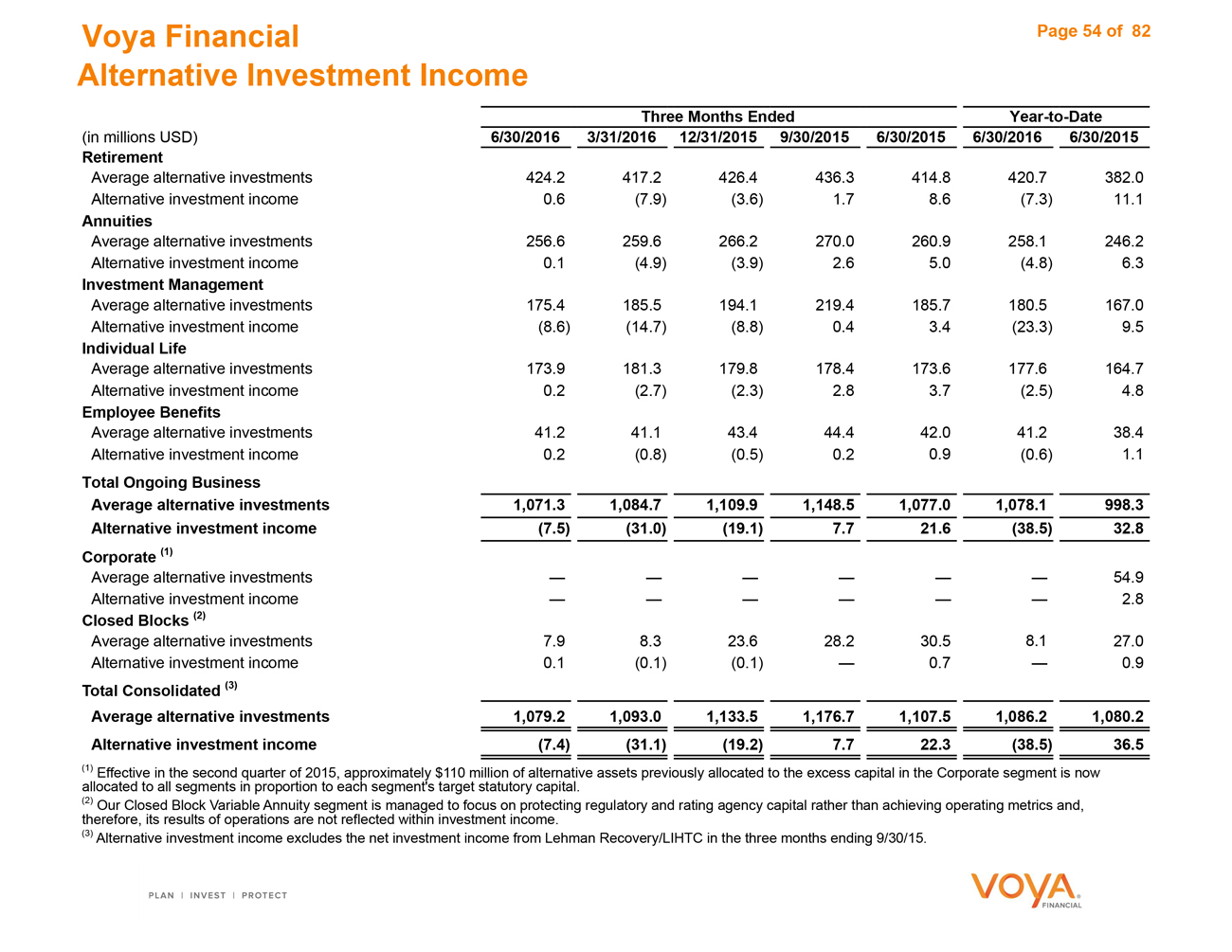

Alternative Investment Income 54

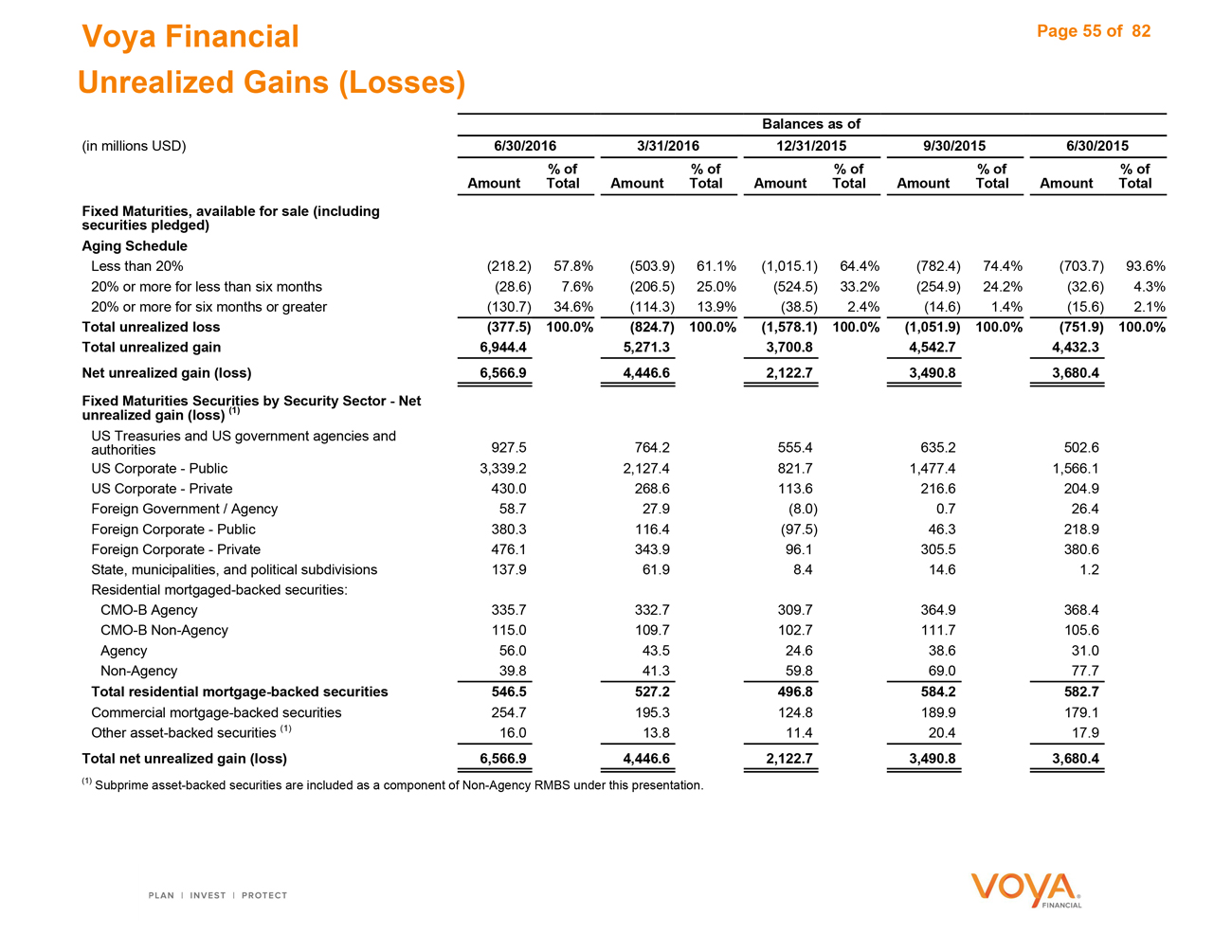

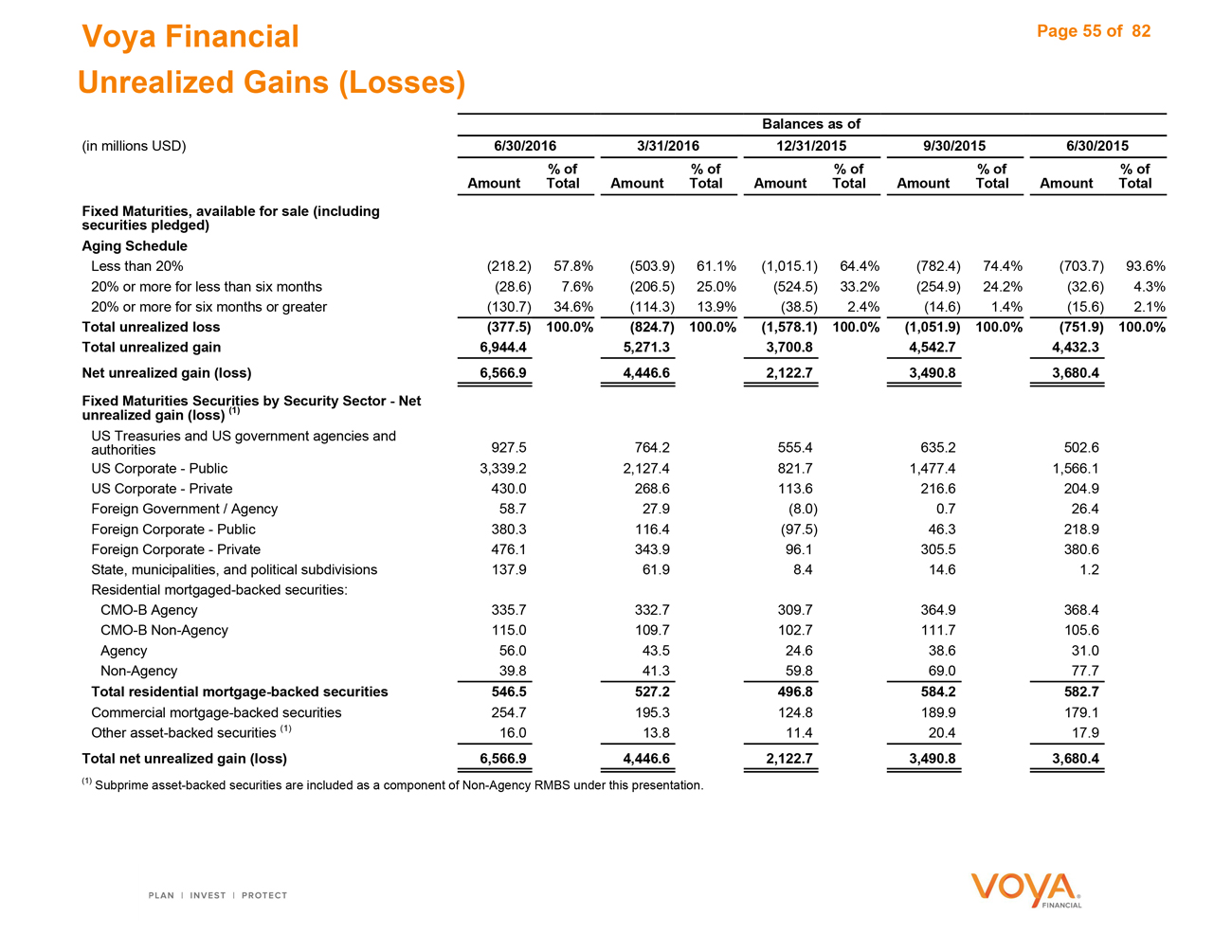

Unrealized Gains (Losses) 55

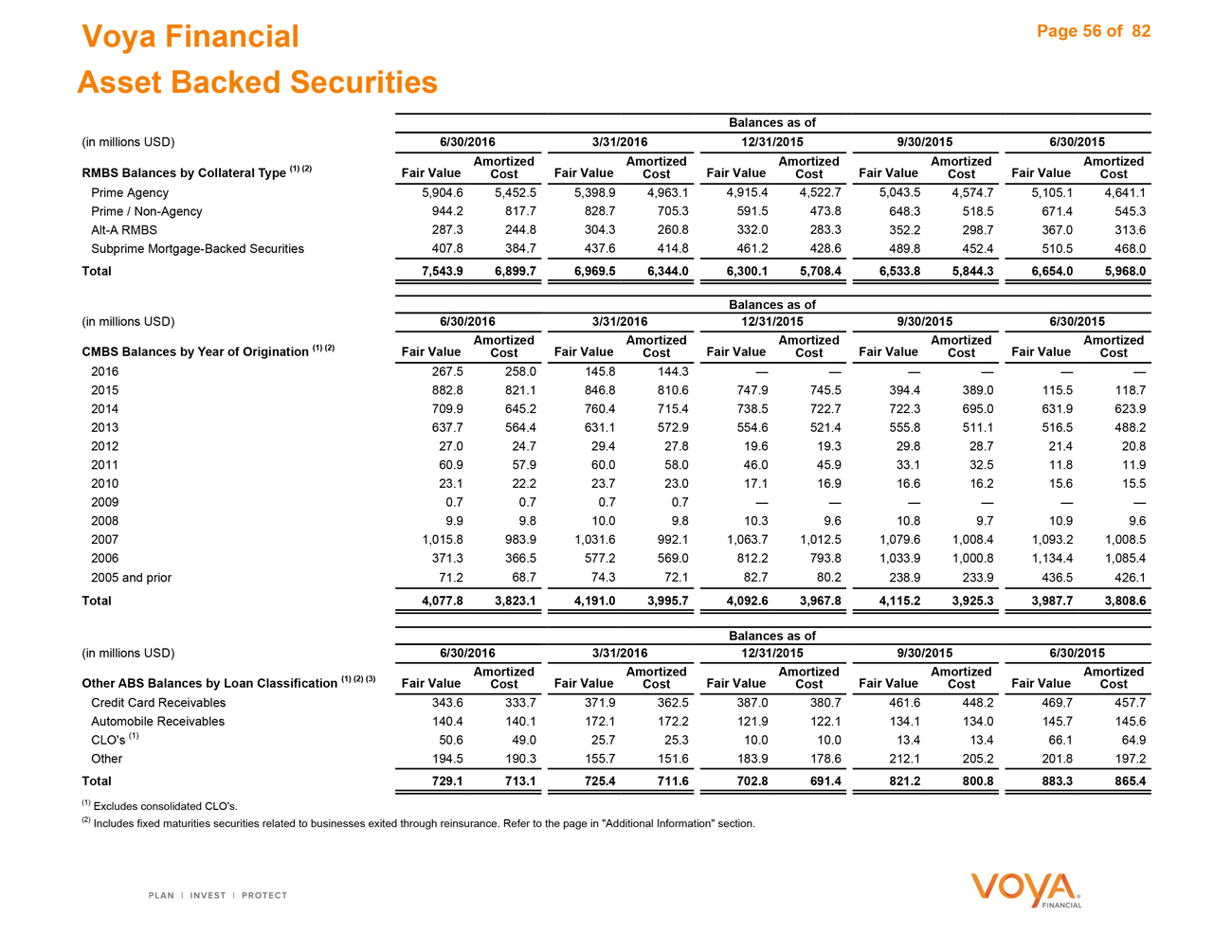

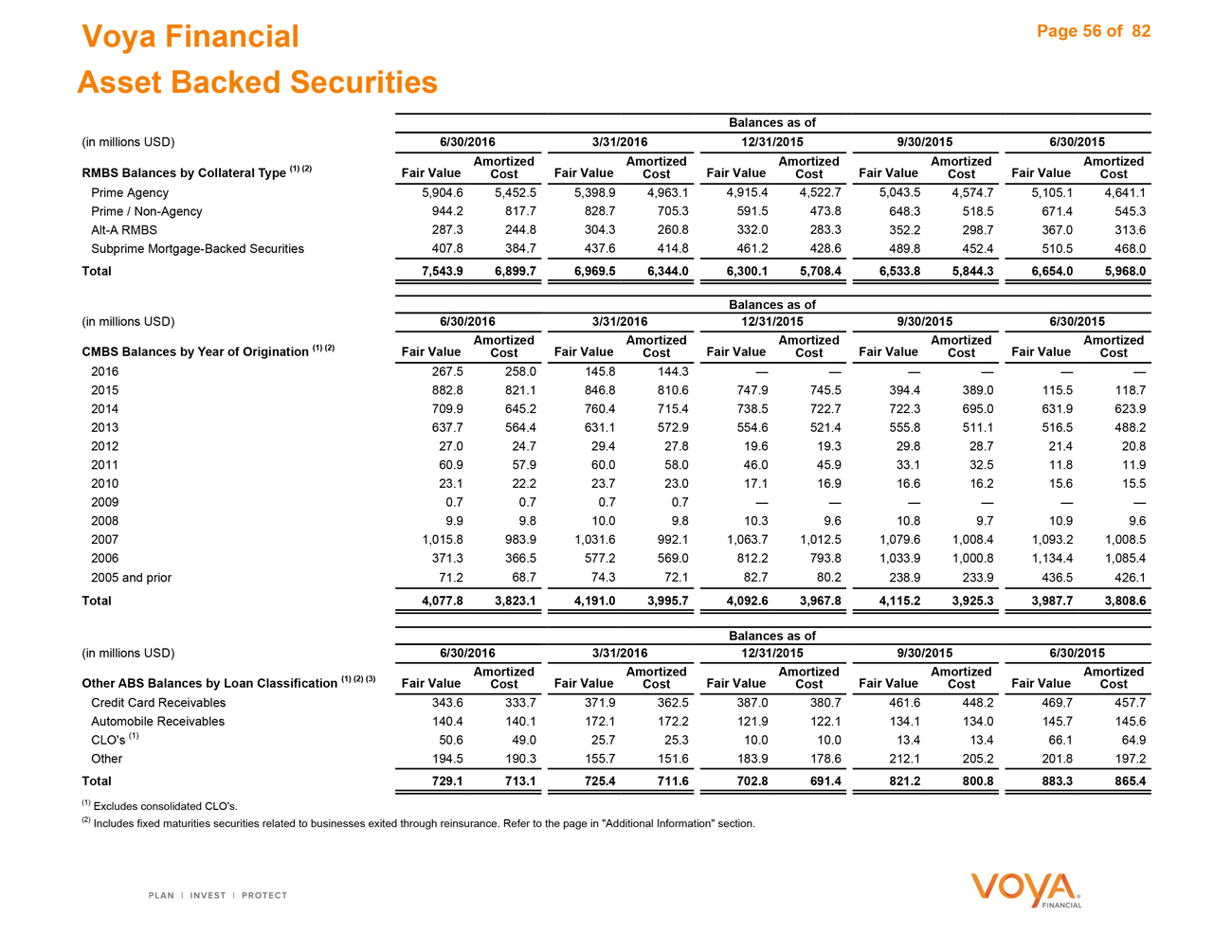

Asset Backed Securities 56

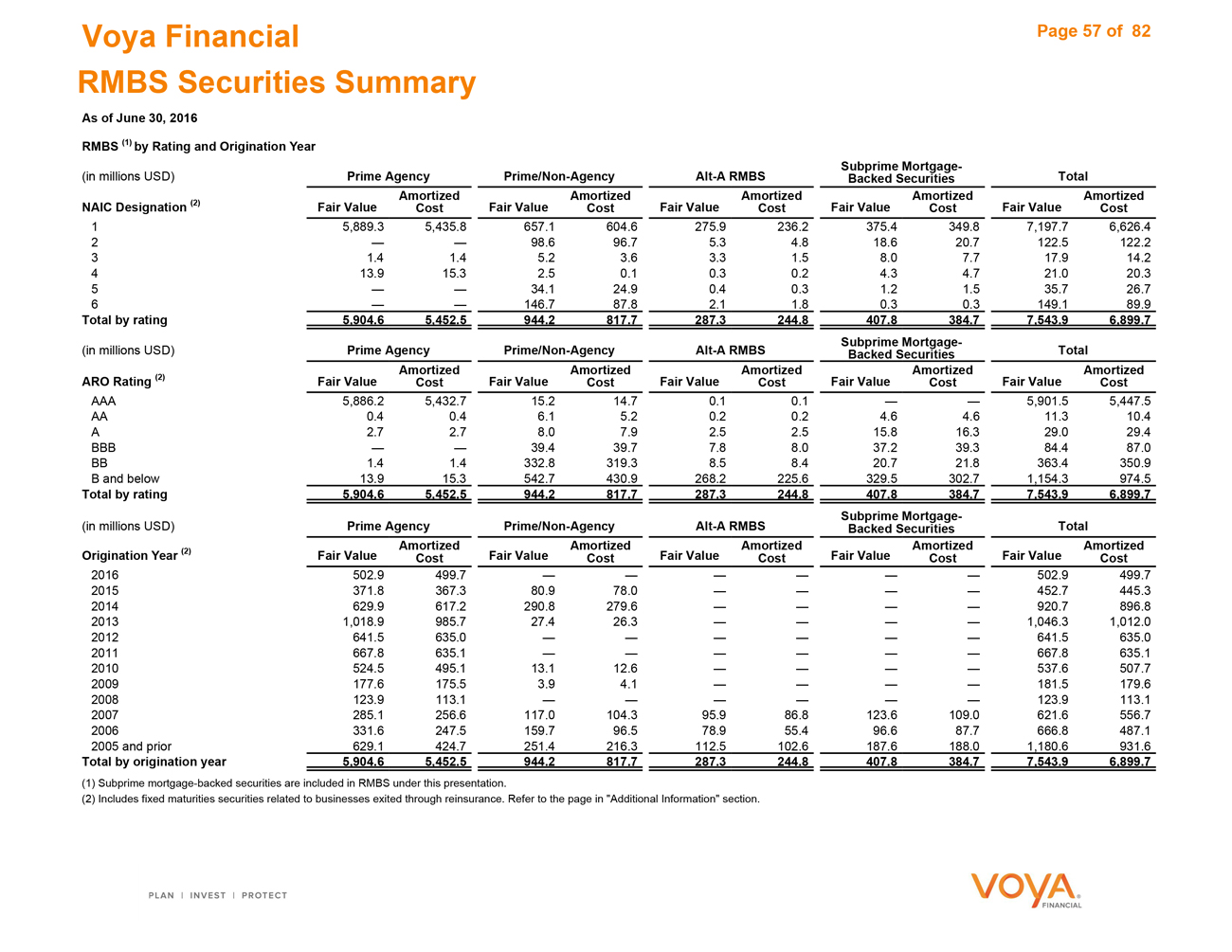

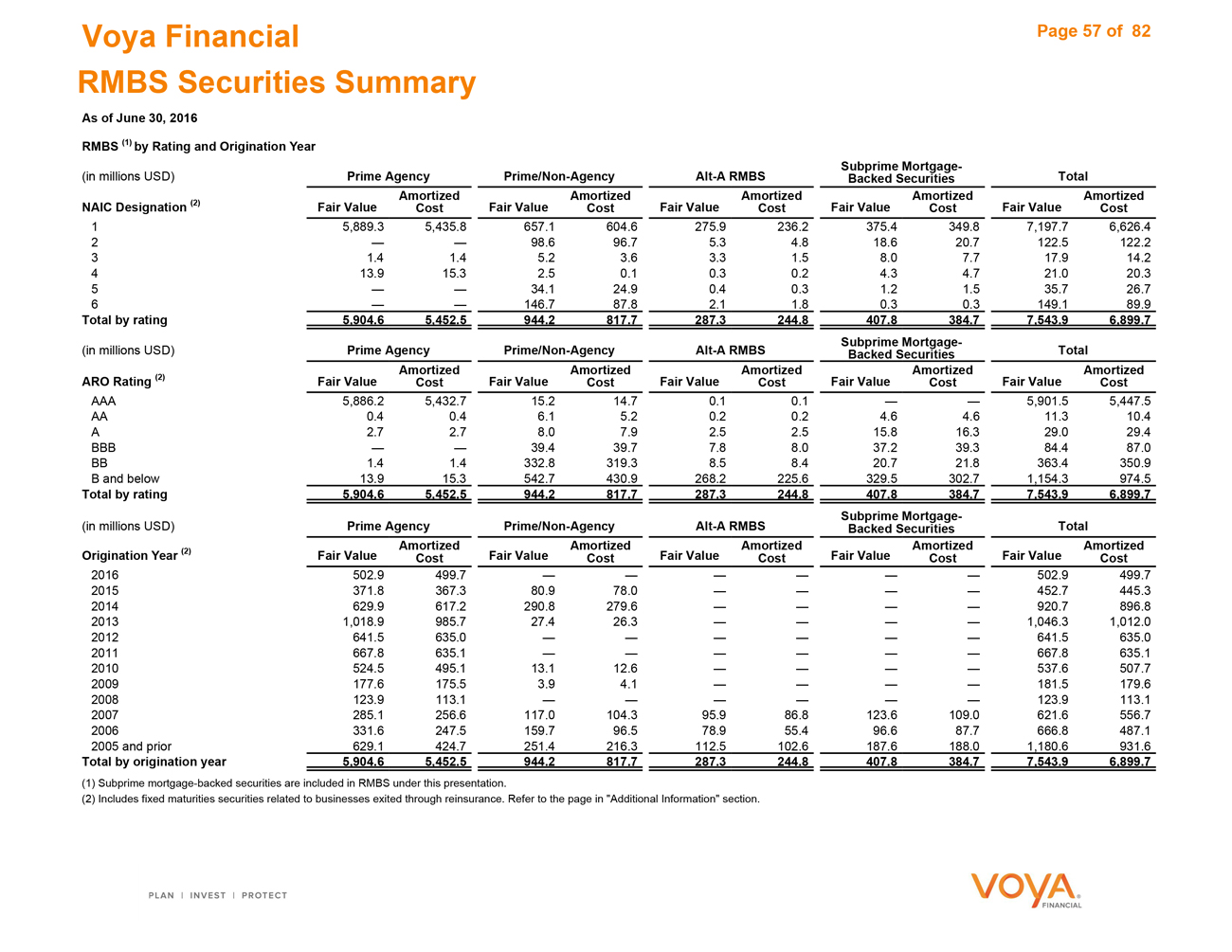

RMBS Securities Summary 57

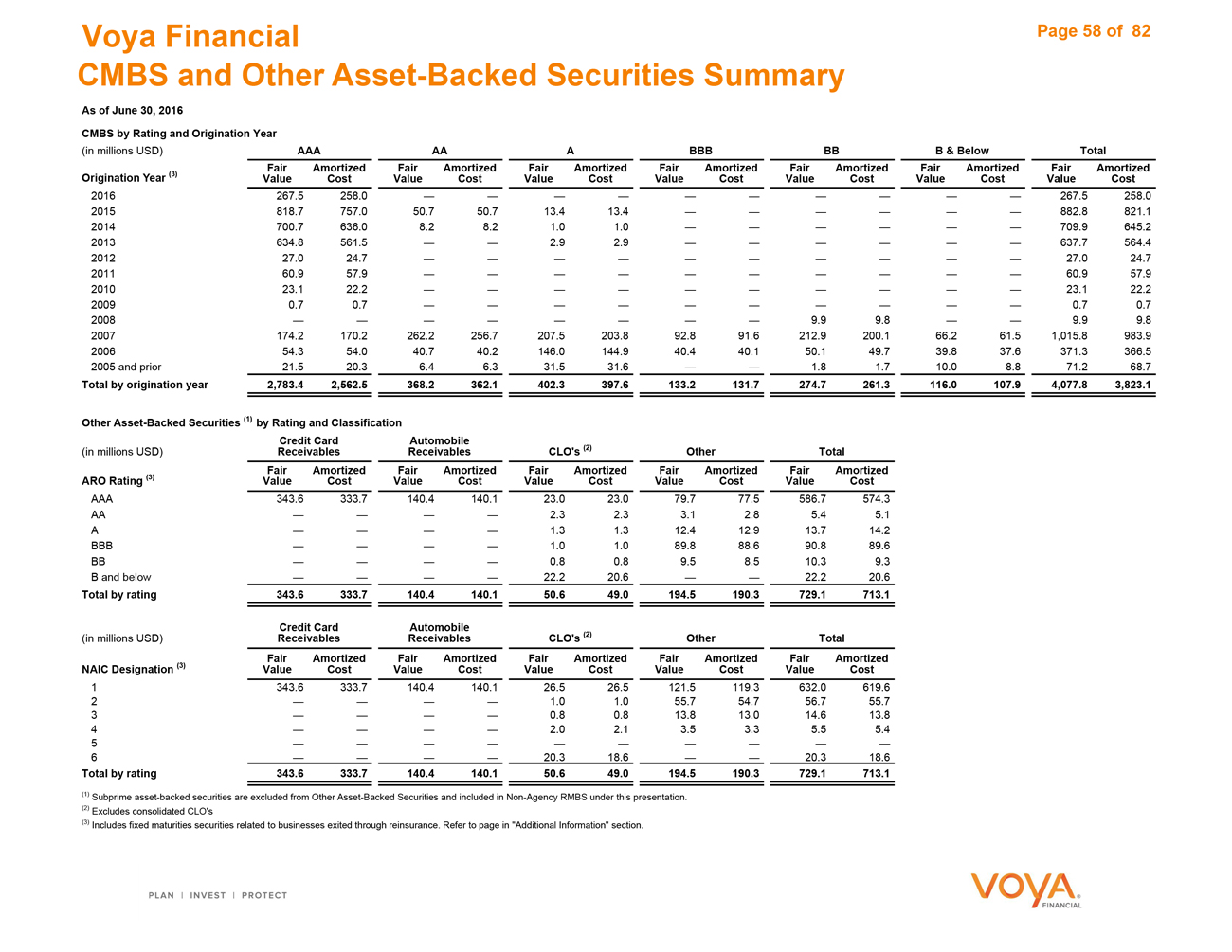

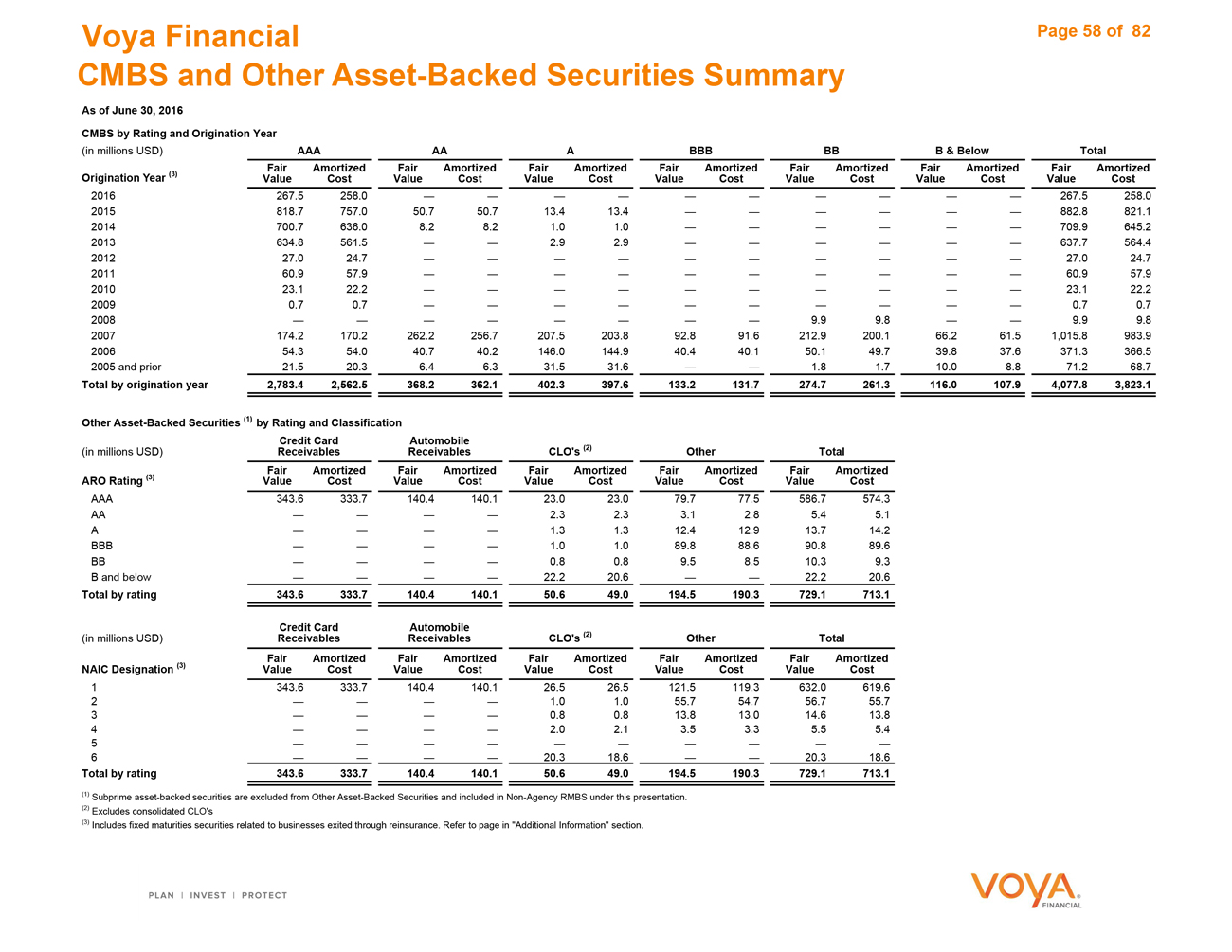

CMBS and Other Asset-Backed Securities Summary 58

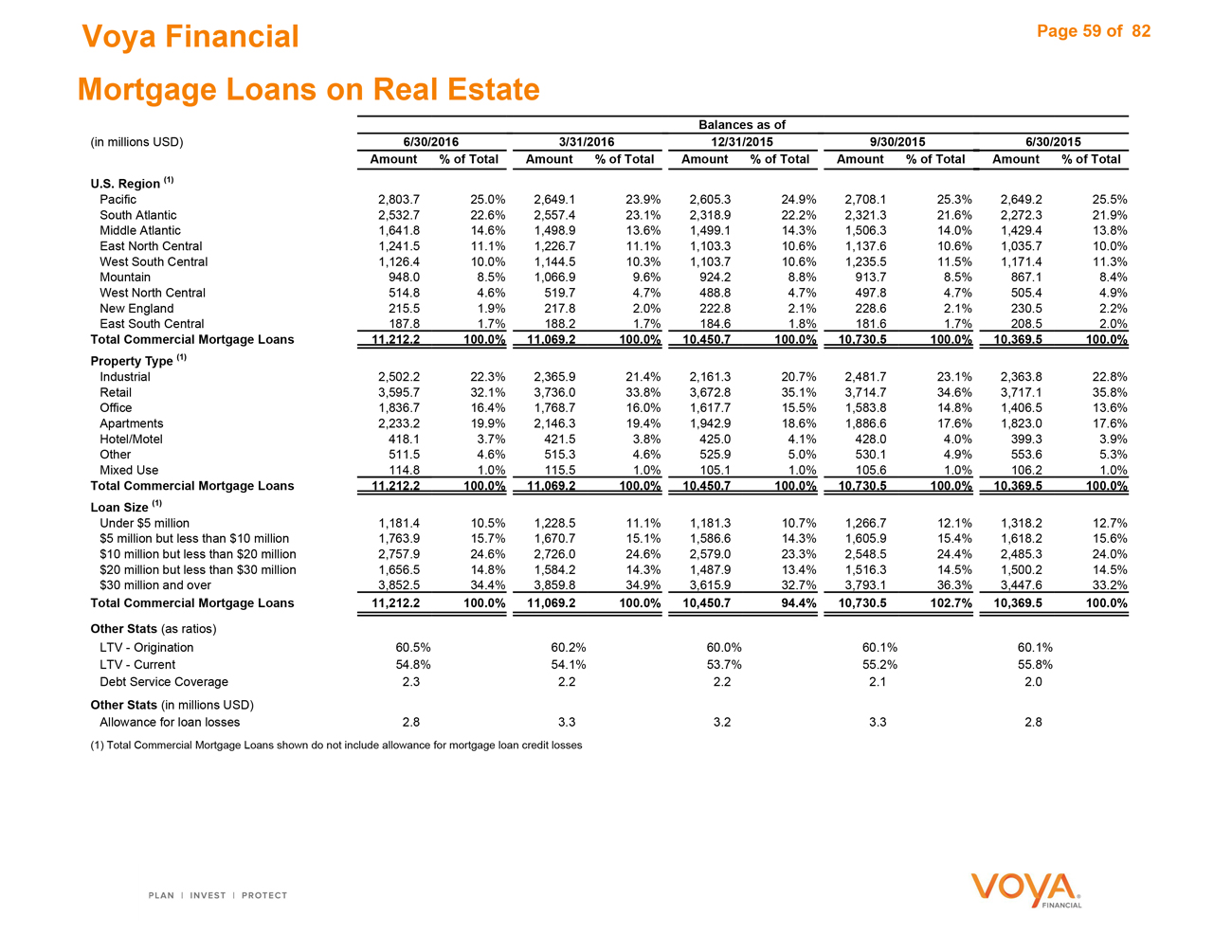

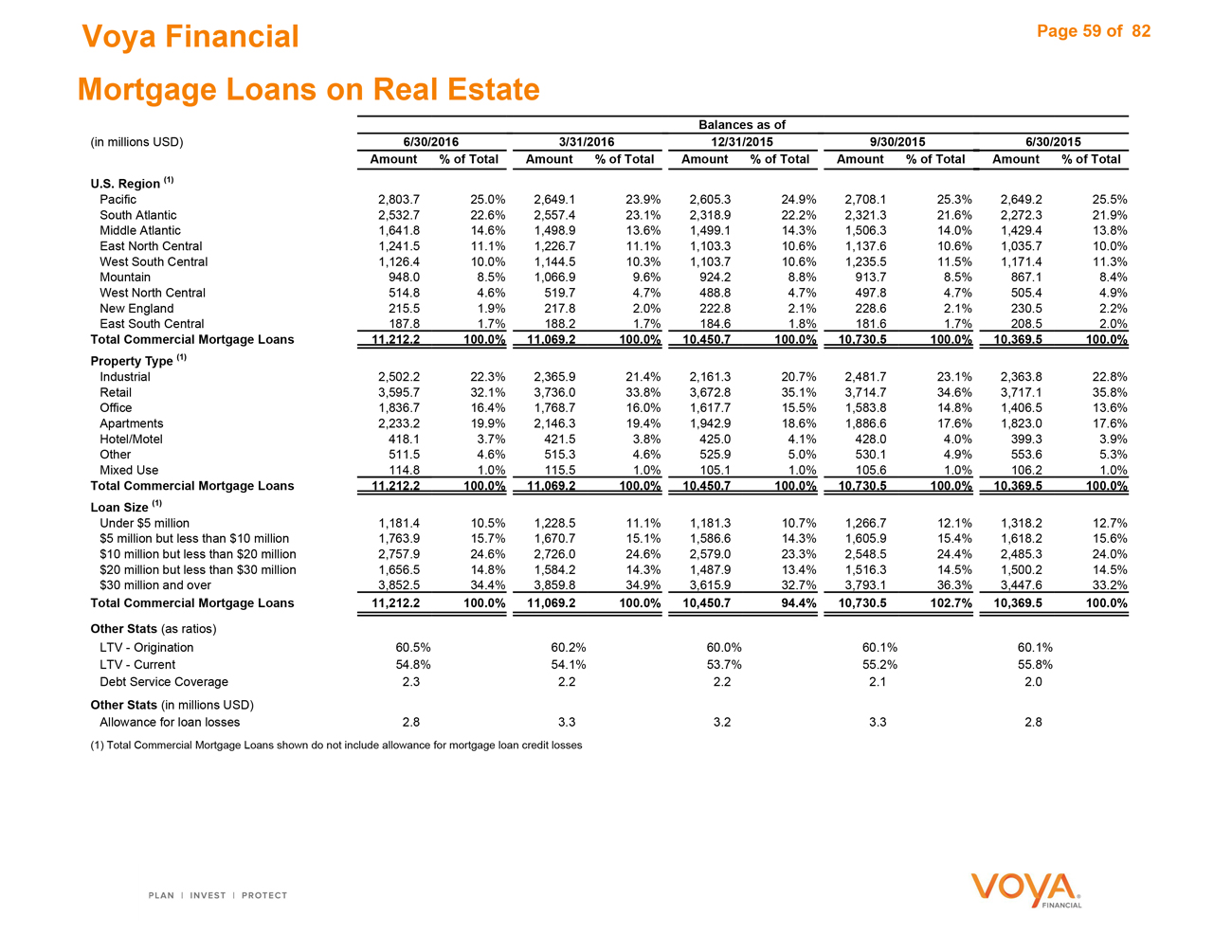

Mortgage Loans on Real Estate 59

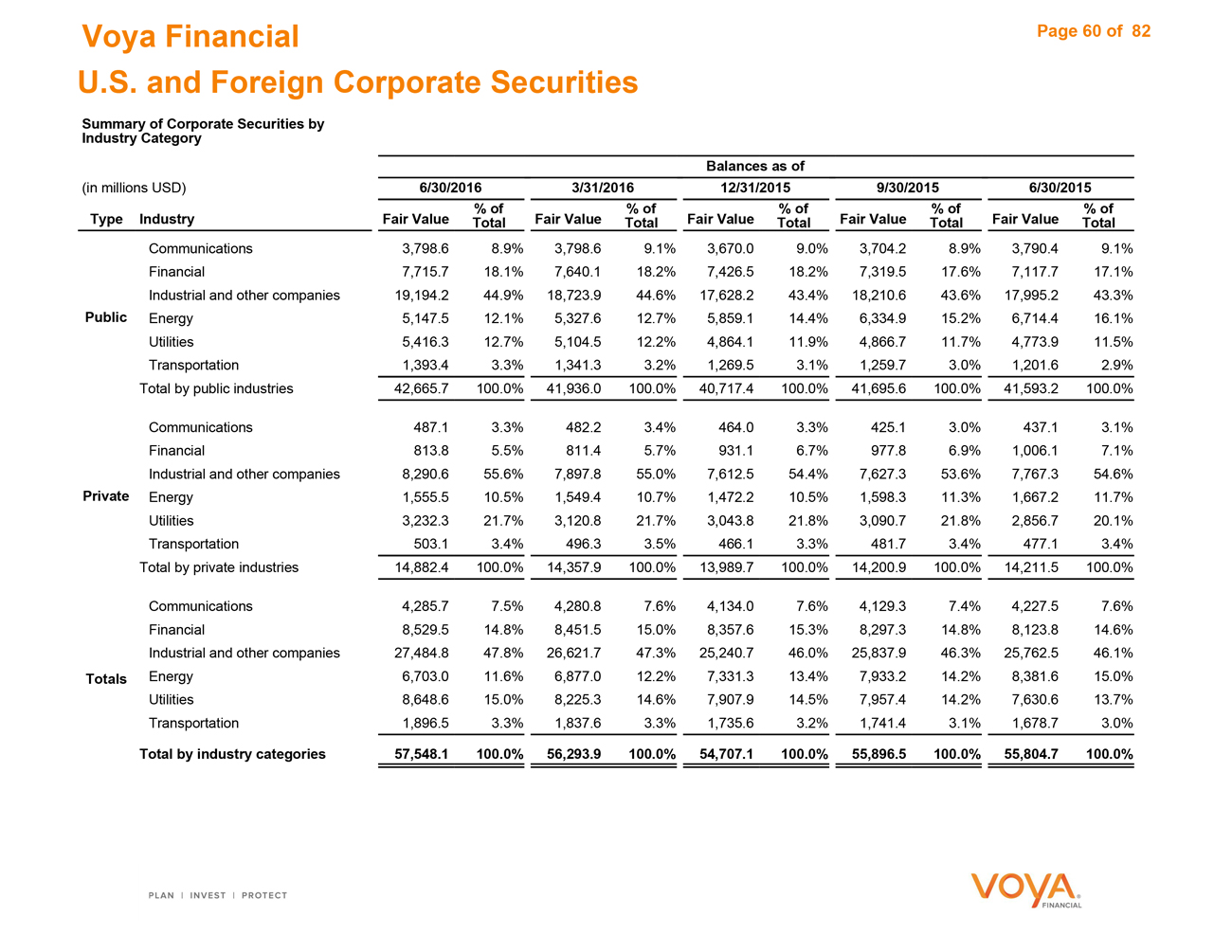

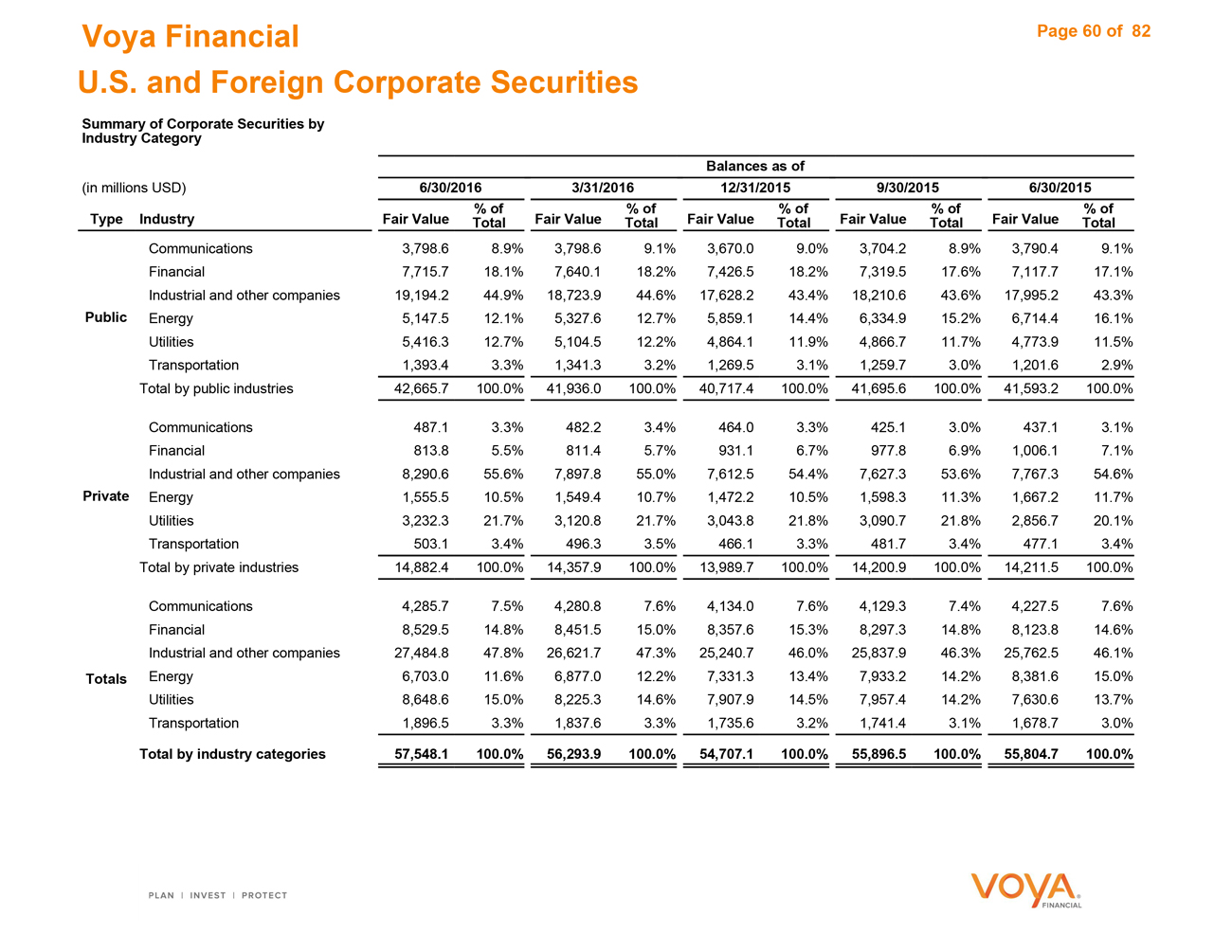

US and Foreign Corporate Securities 60

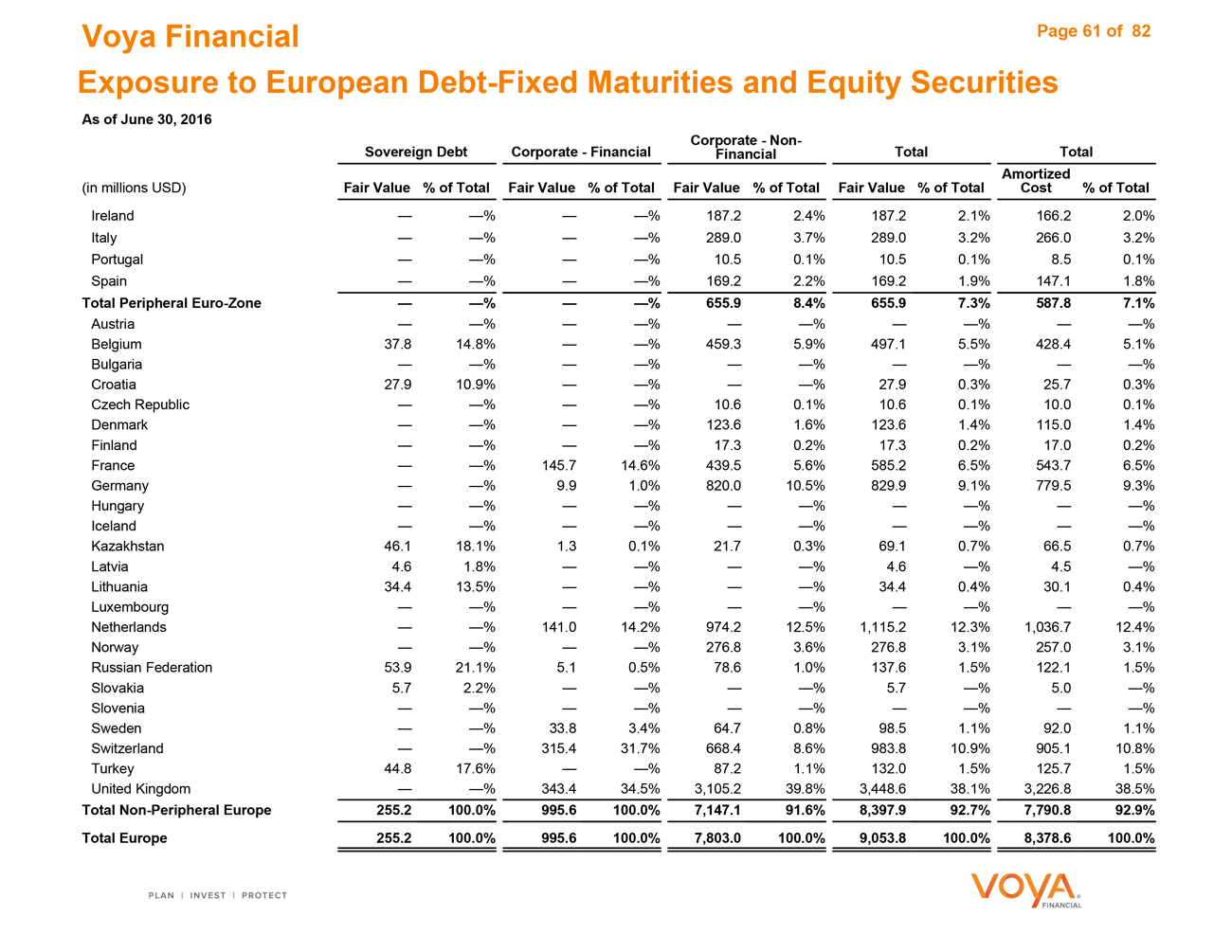

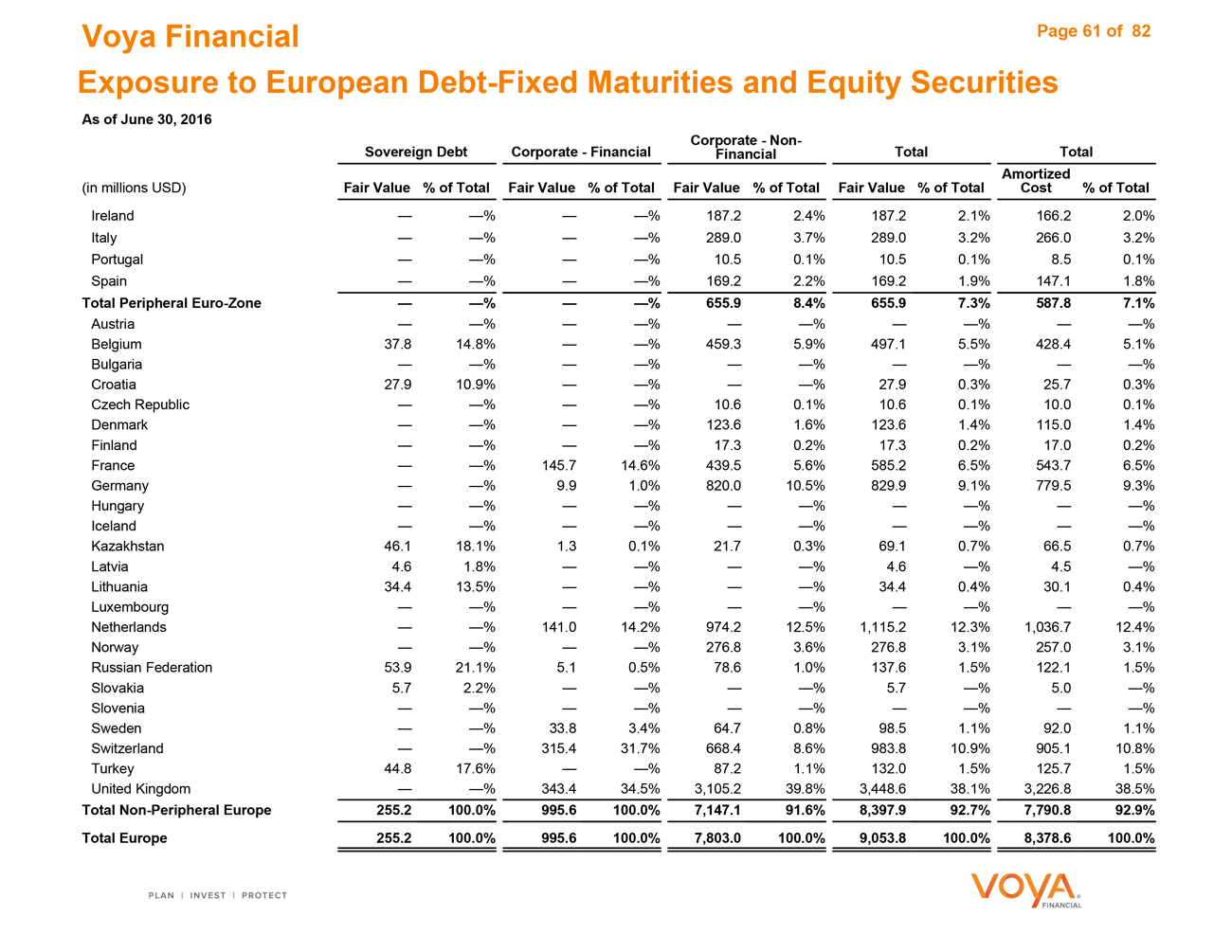

Exposure to European Debt—Fixed Maturities and Equity Securities 61

Reconciliations

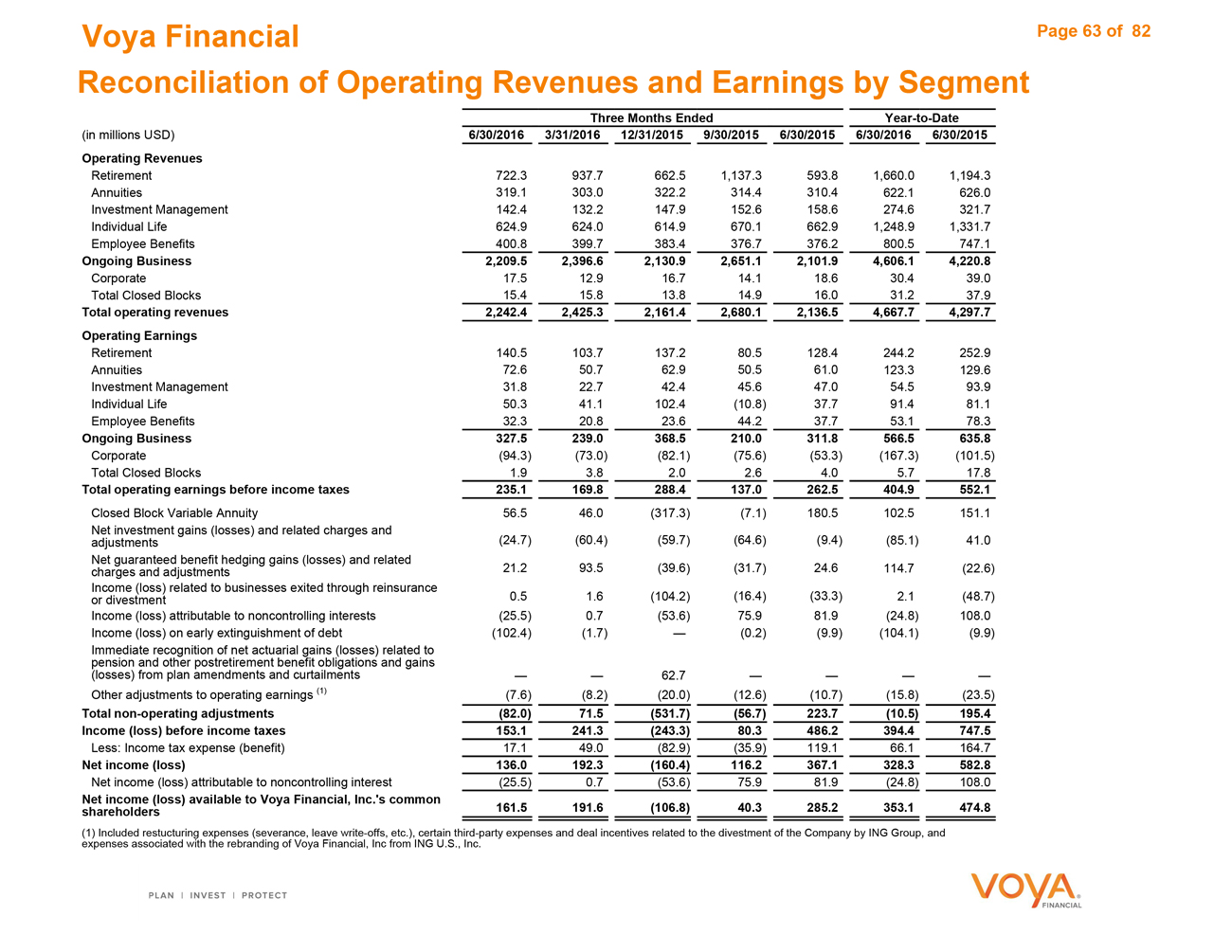

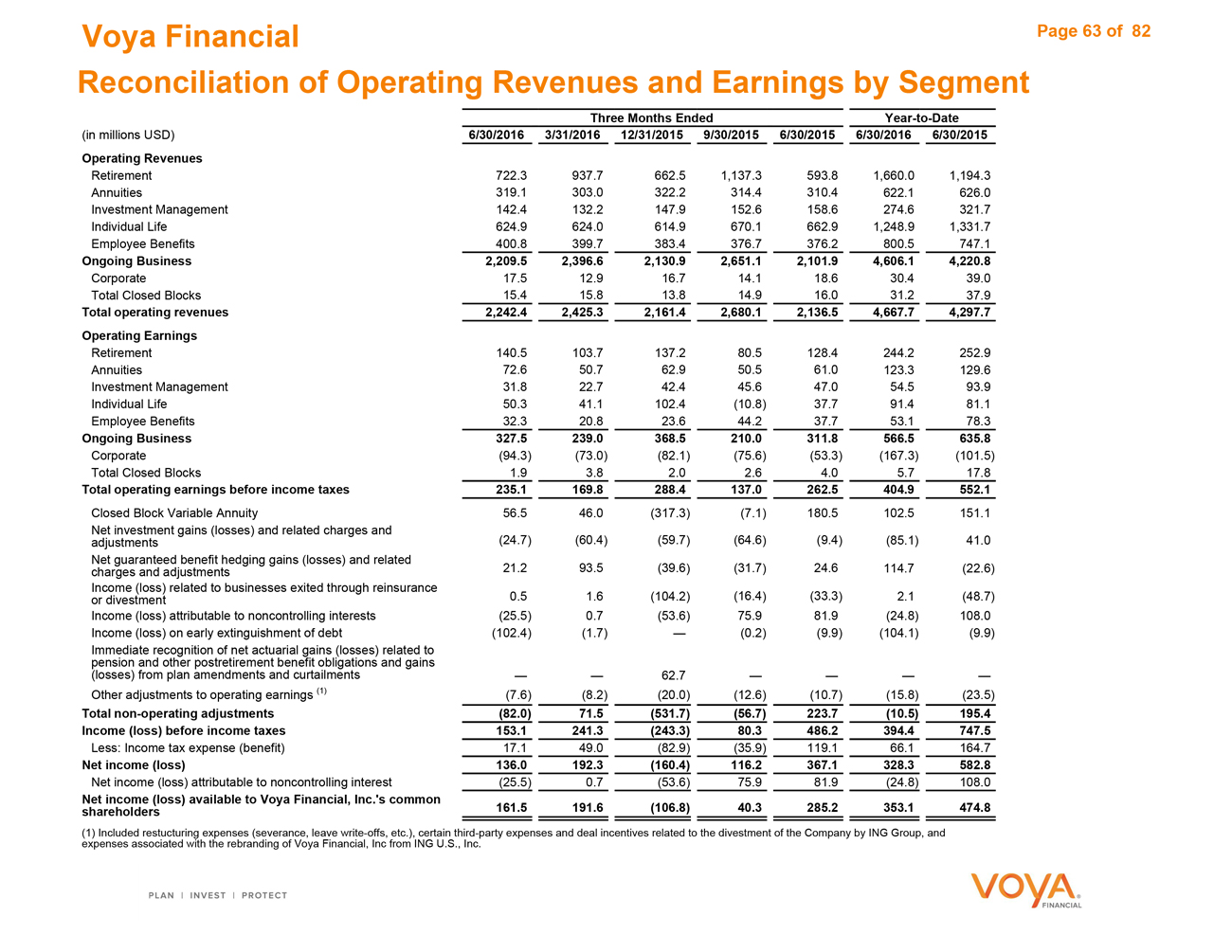

Reconciliation of Operating Revenues and Earnings by Segment 63

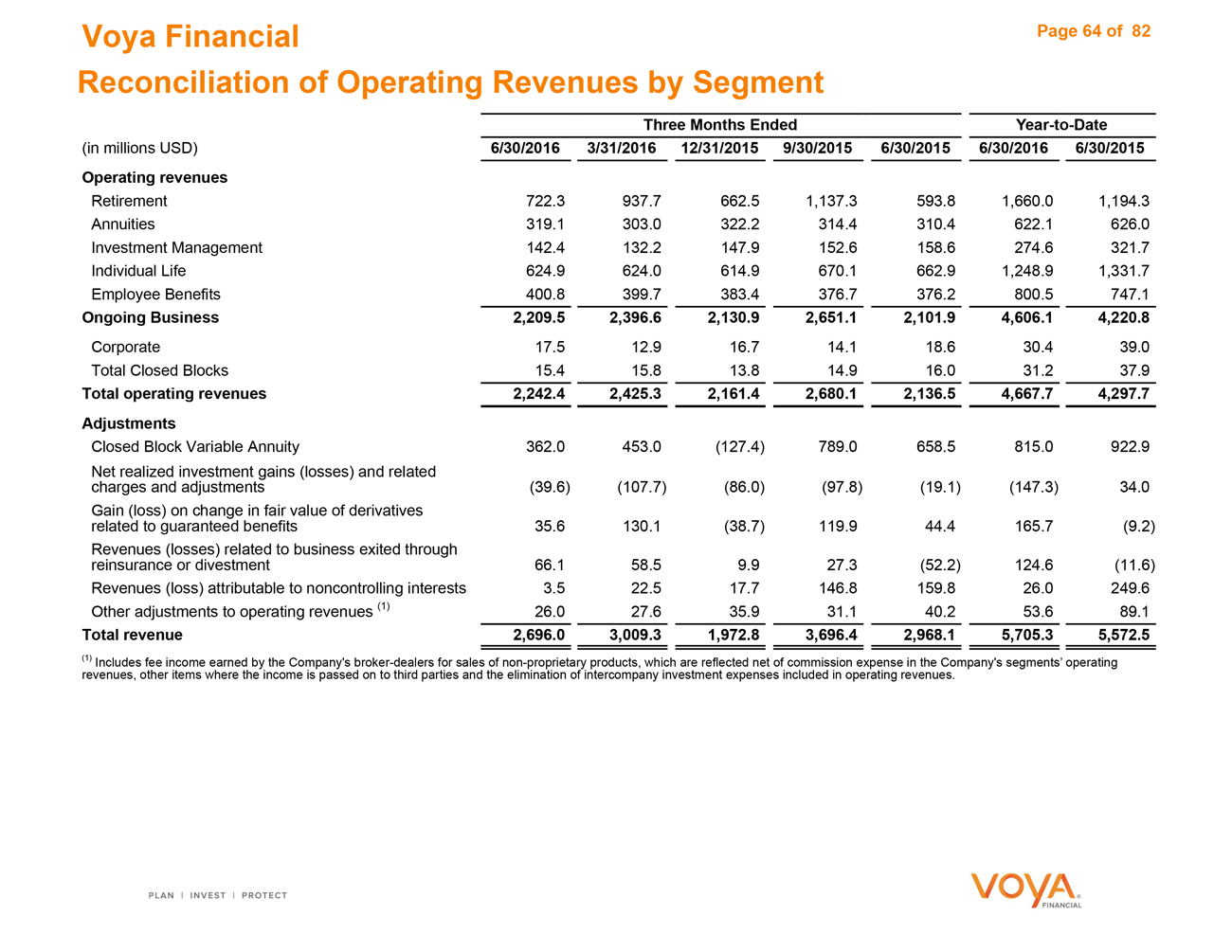

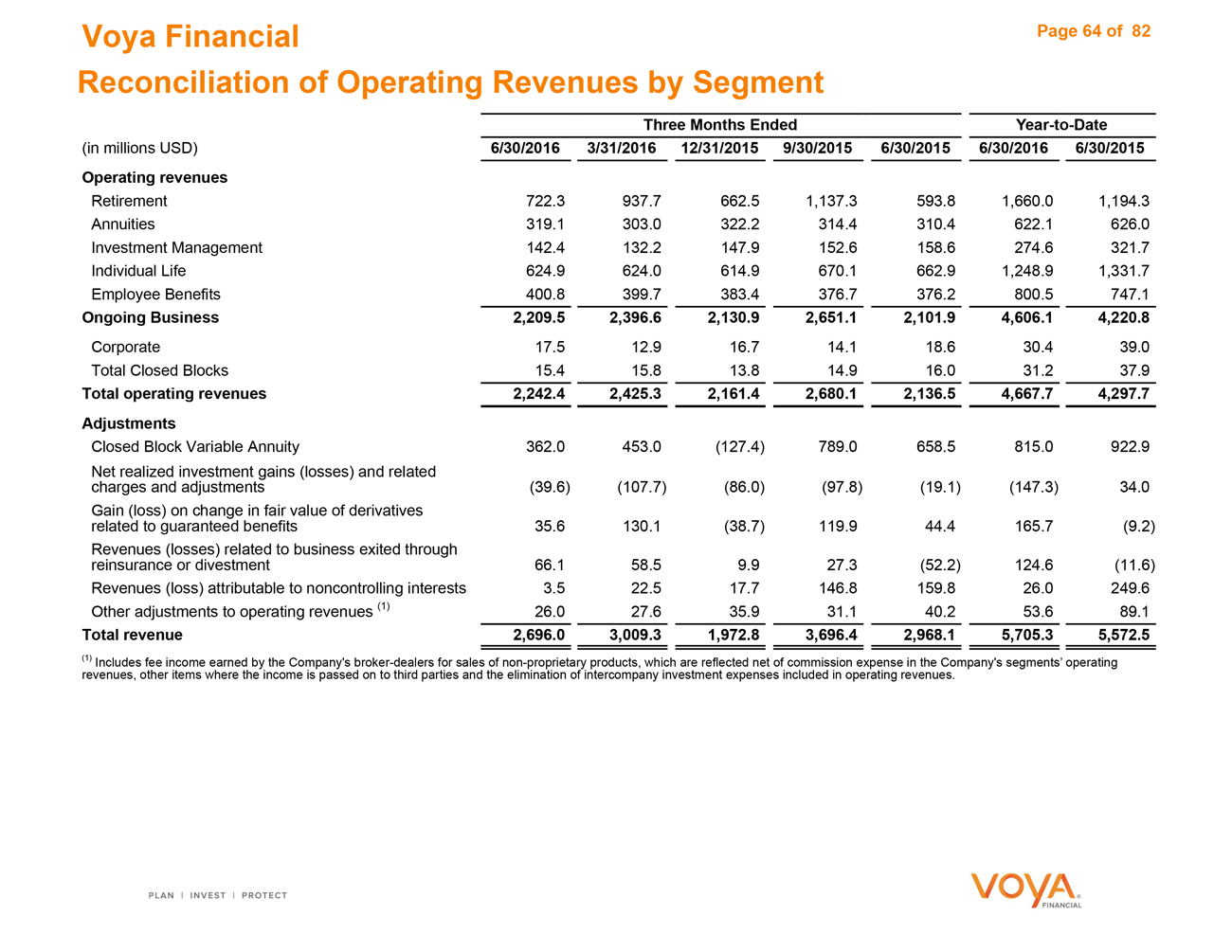

Reconciliation of Operating Revenues by Segment 64

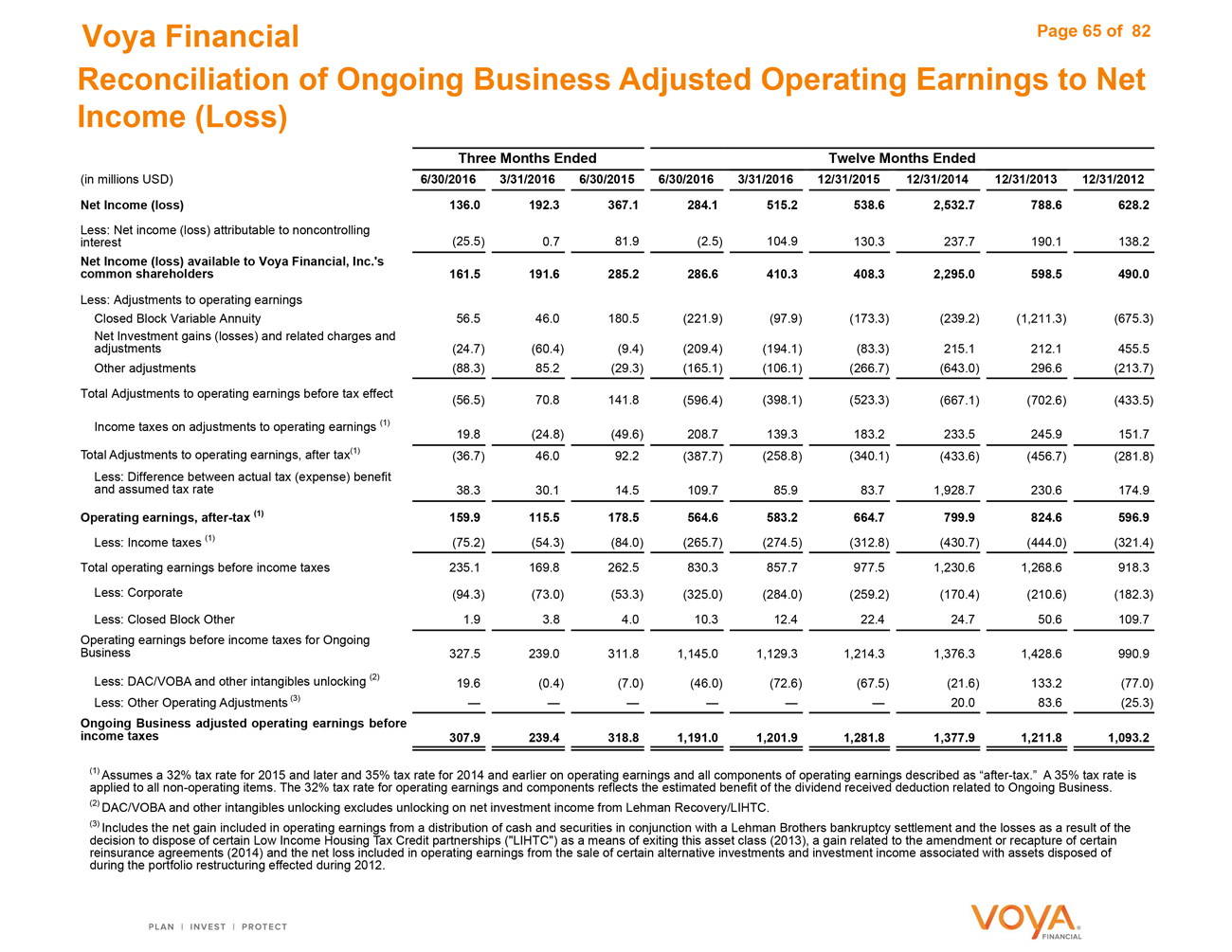

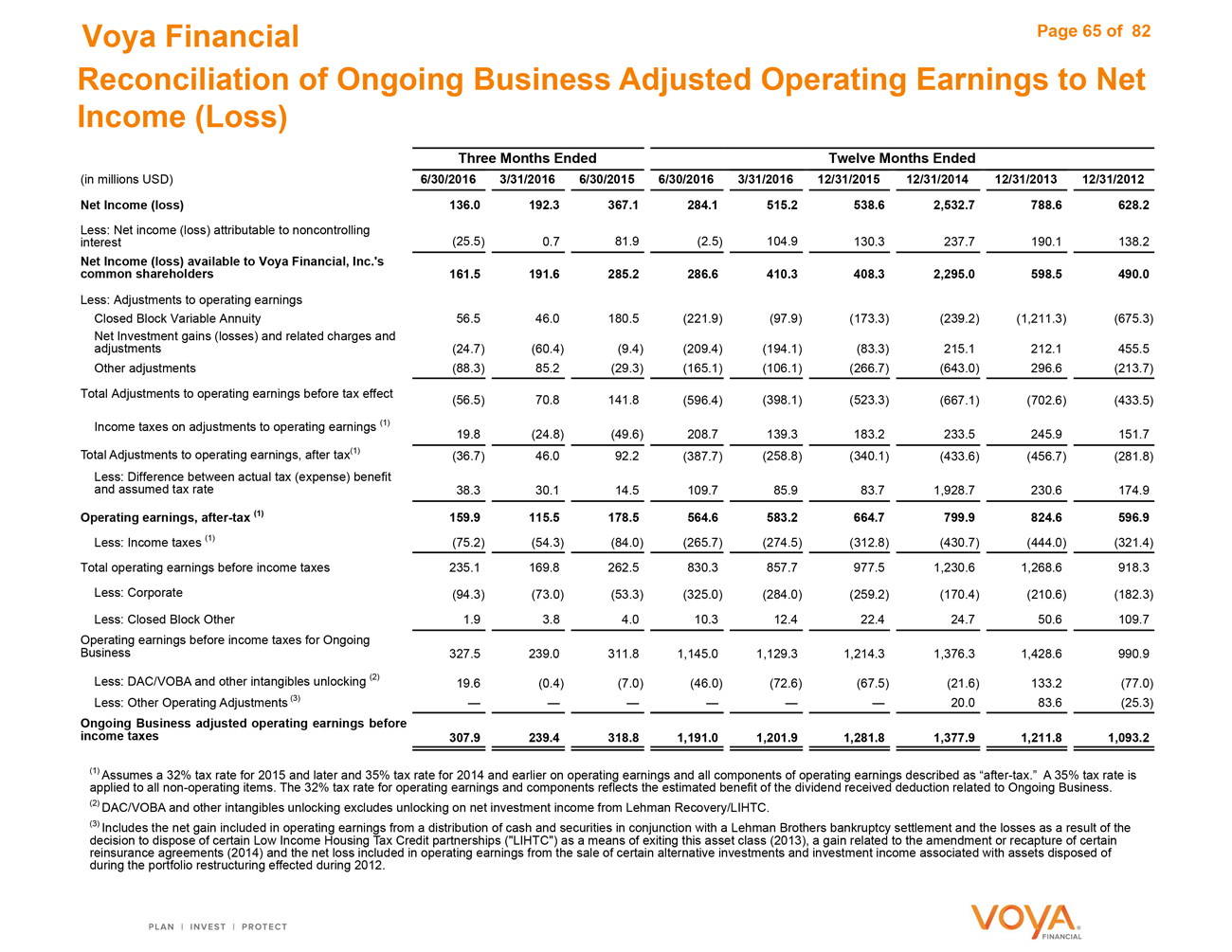

Reconciliation of Ongoing Business Adjusted Operating Earnings to Net

Income (Loss) 65

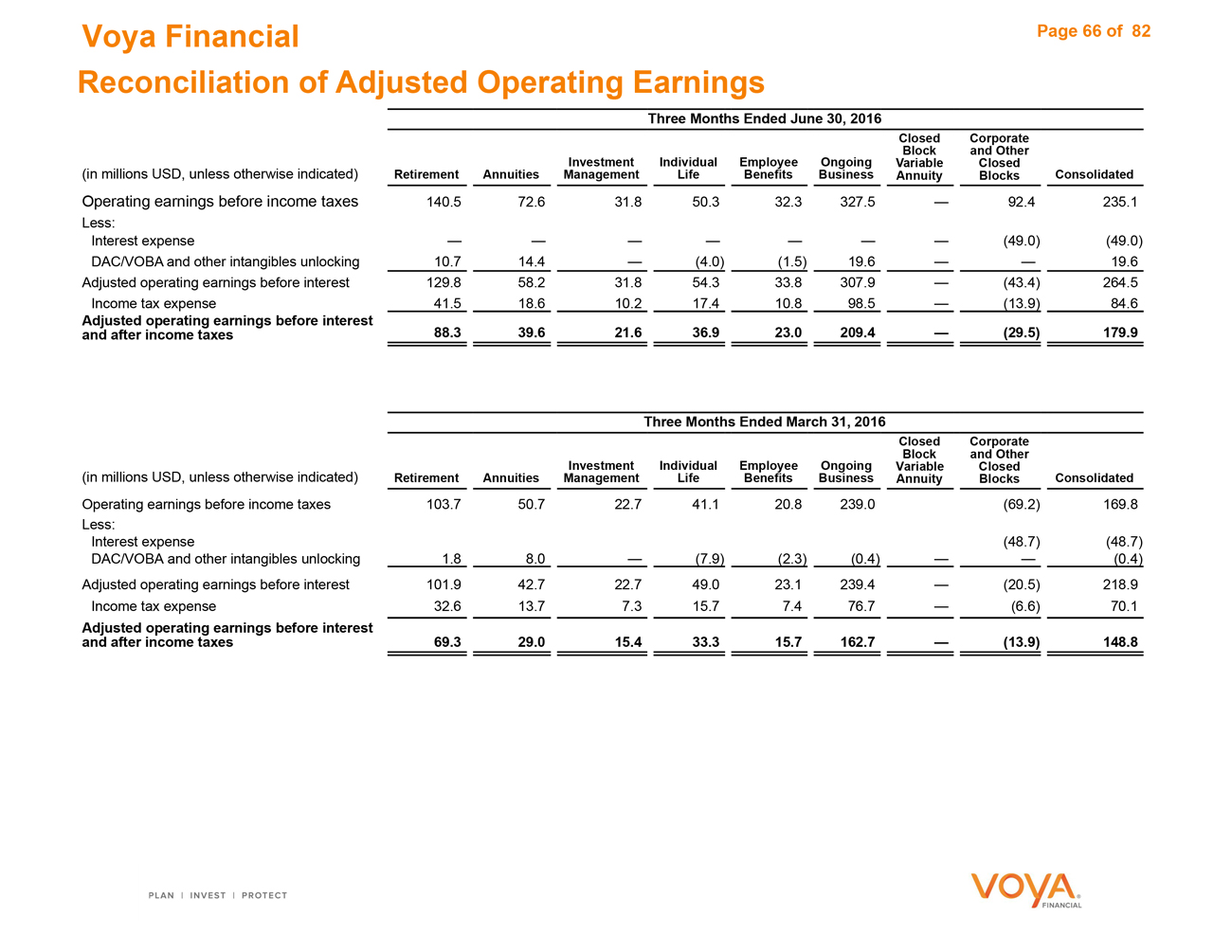

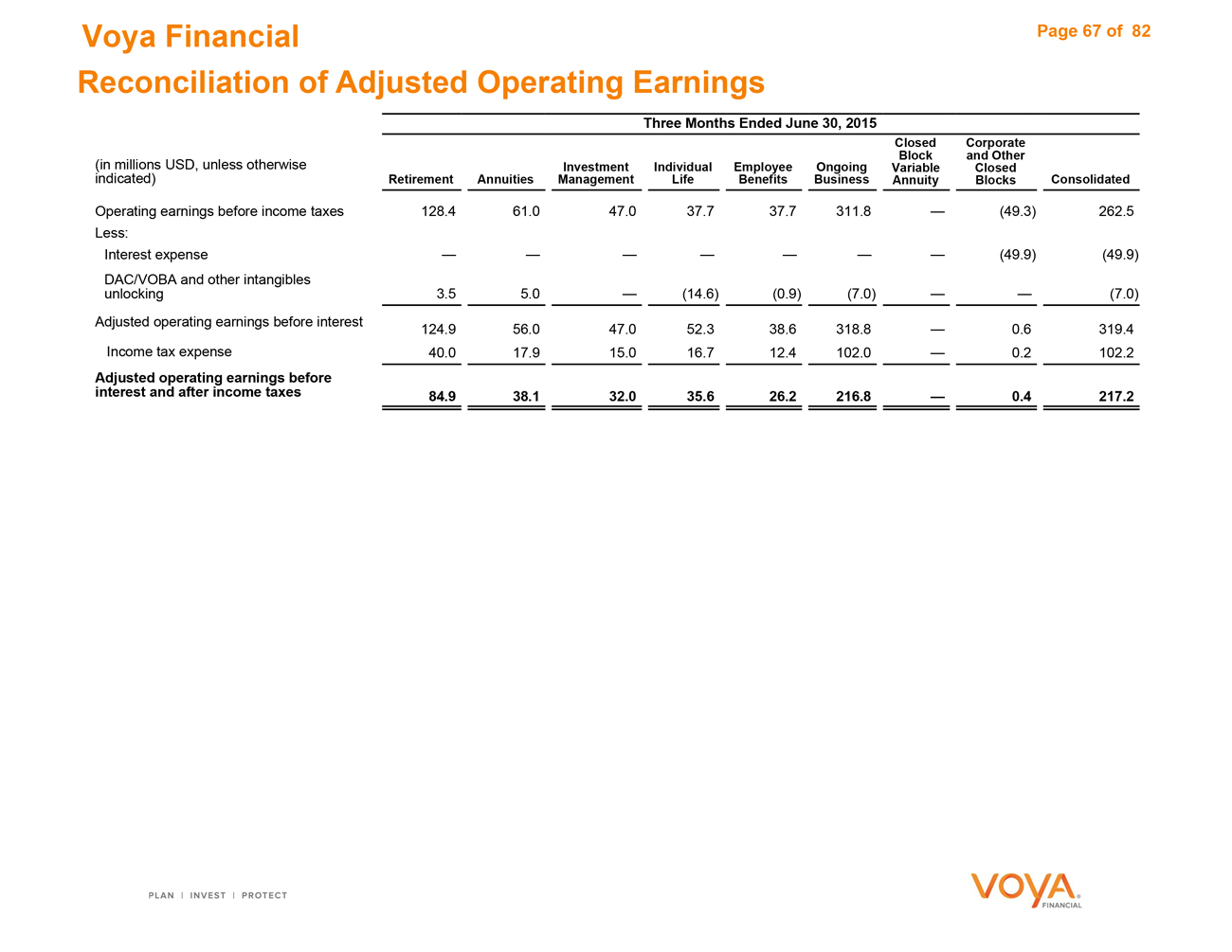

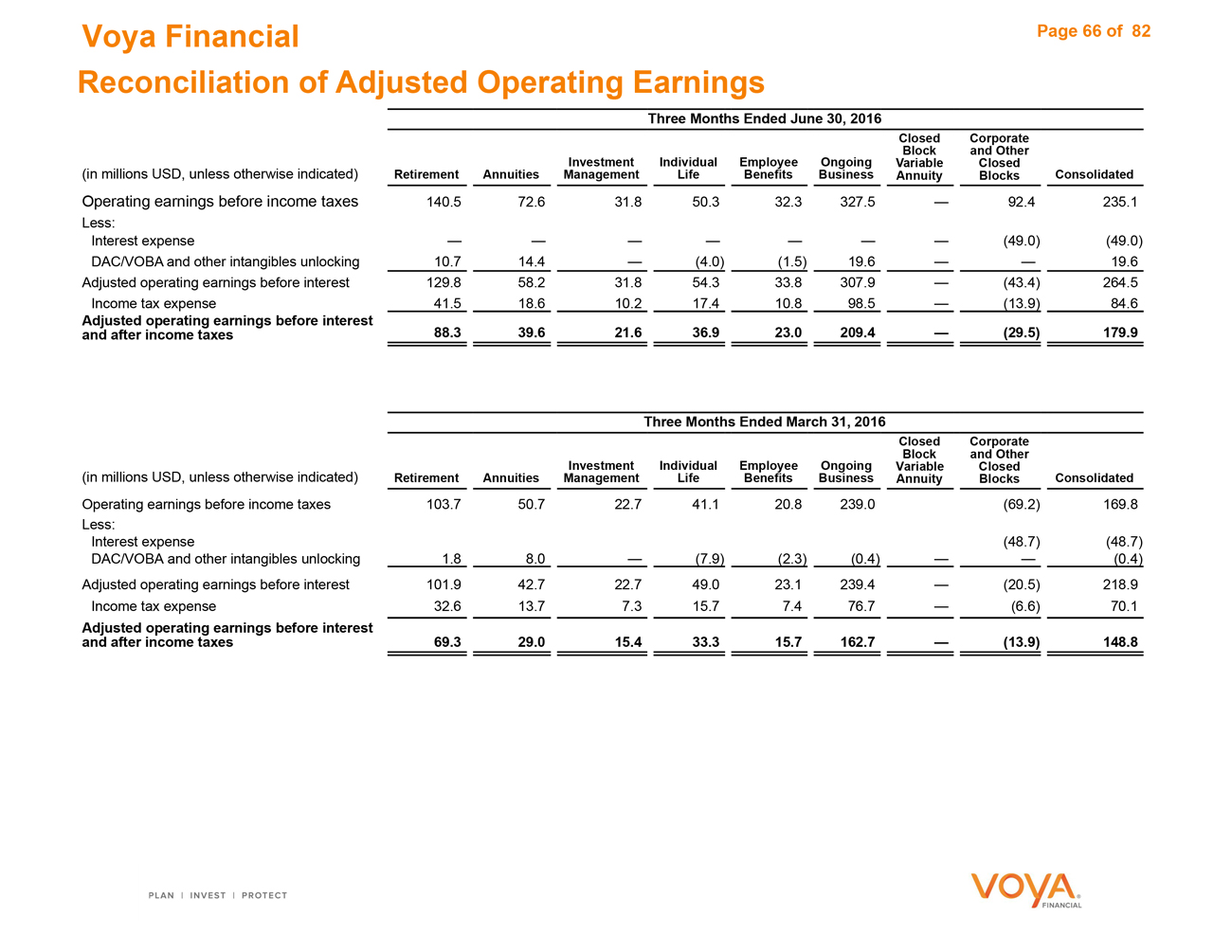

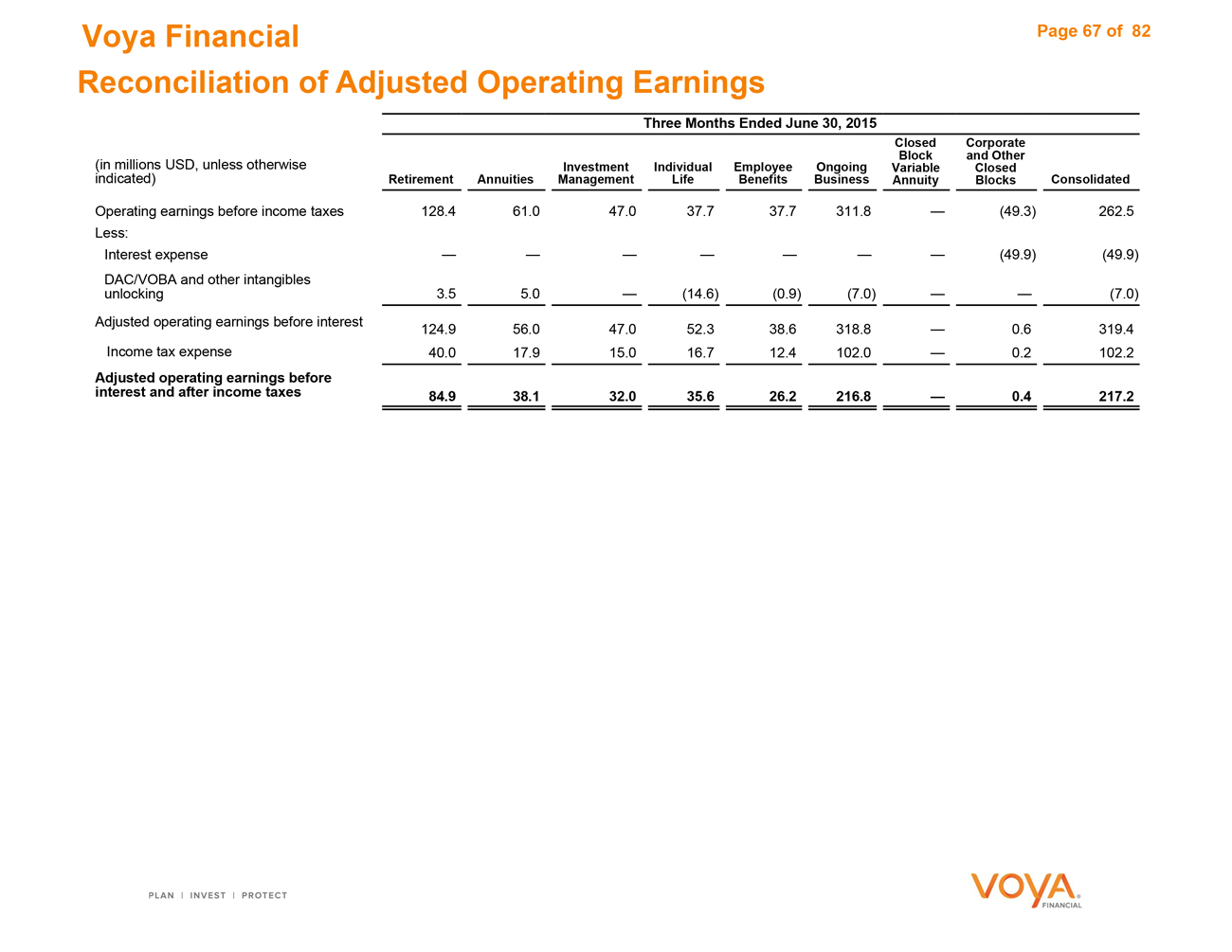

Reconciliation of Adjusted Operating Earnings 66—67

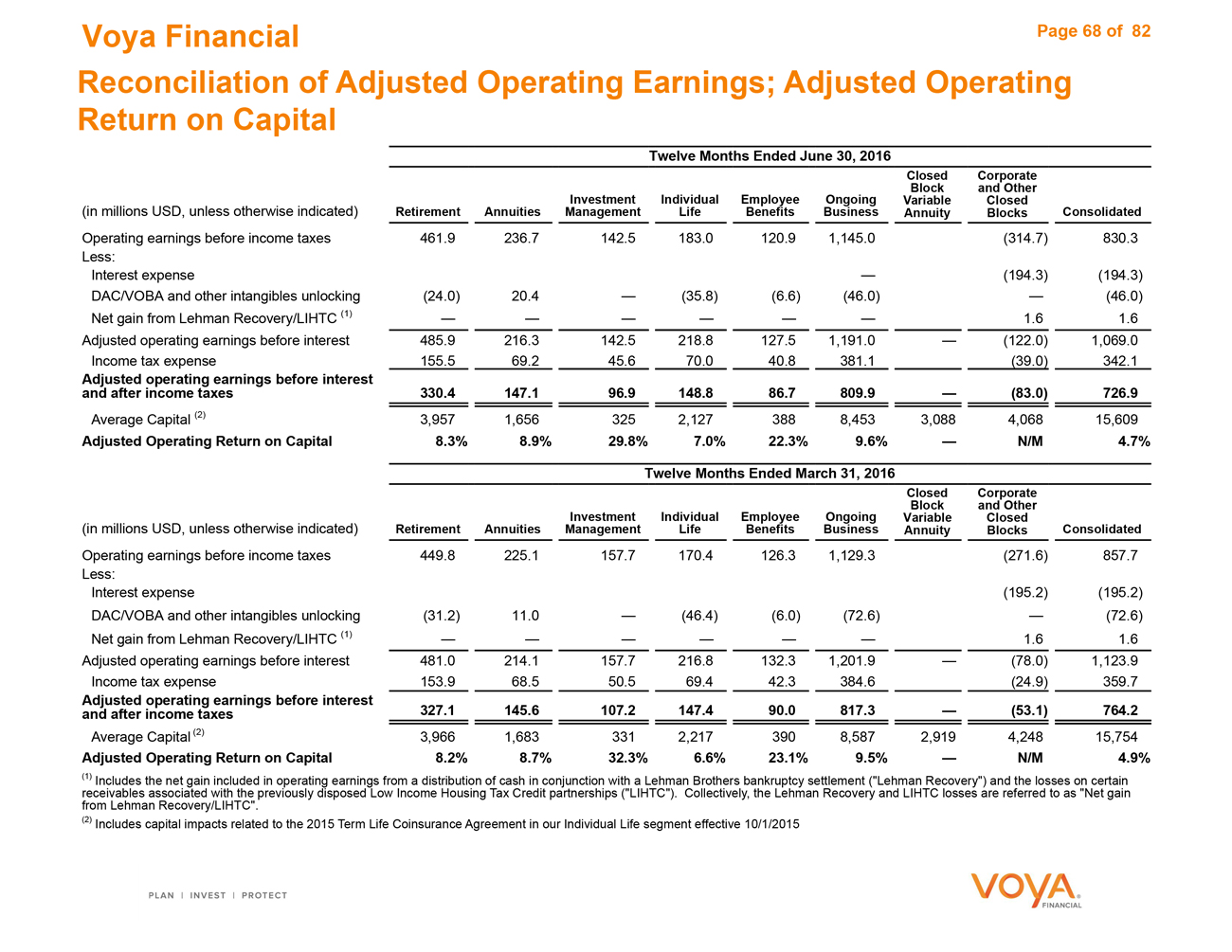

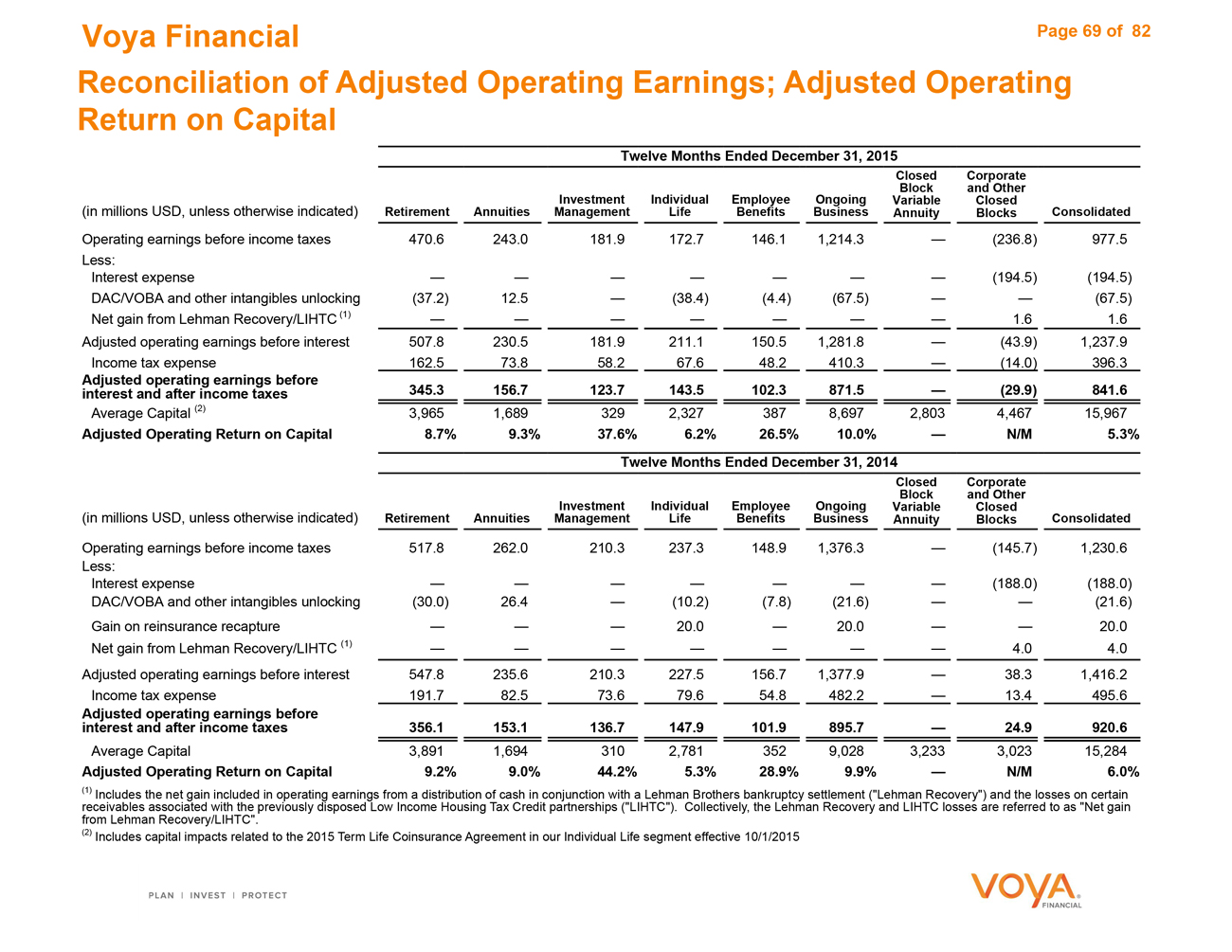

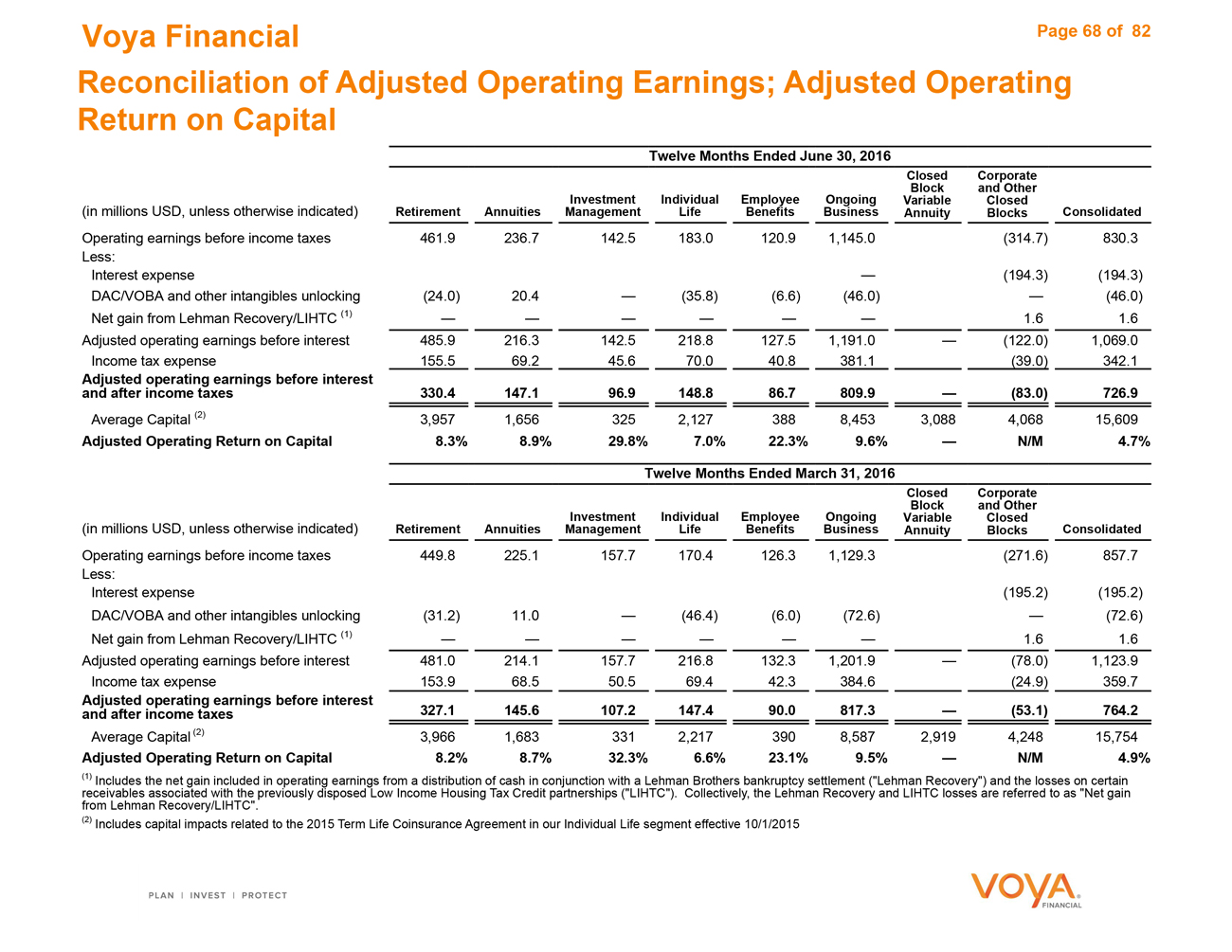

Reconciliation of Adjusted Operating Earnings and Calculation of

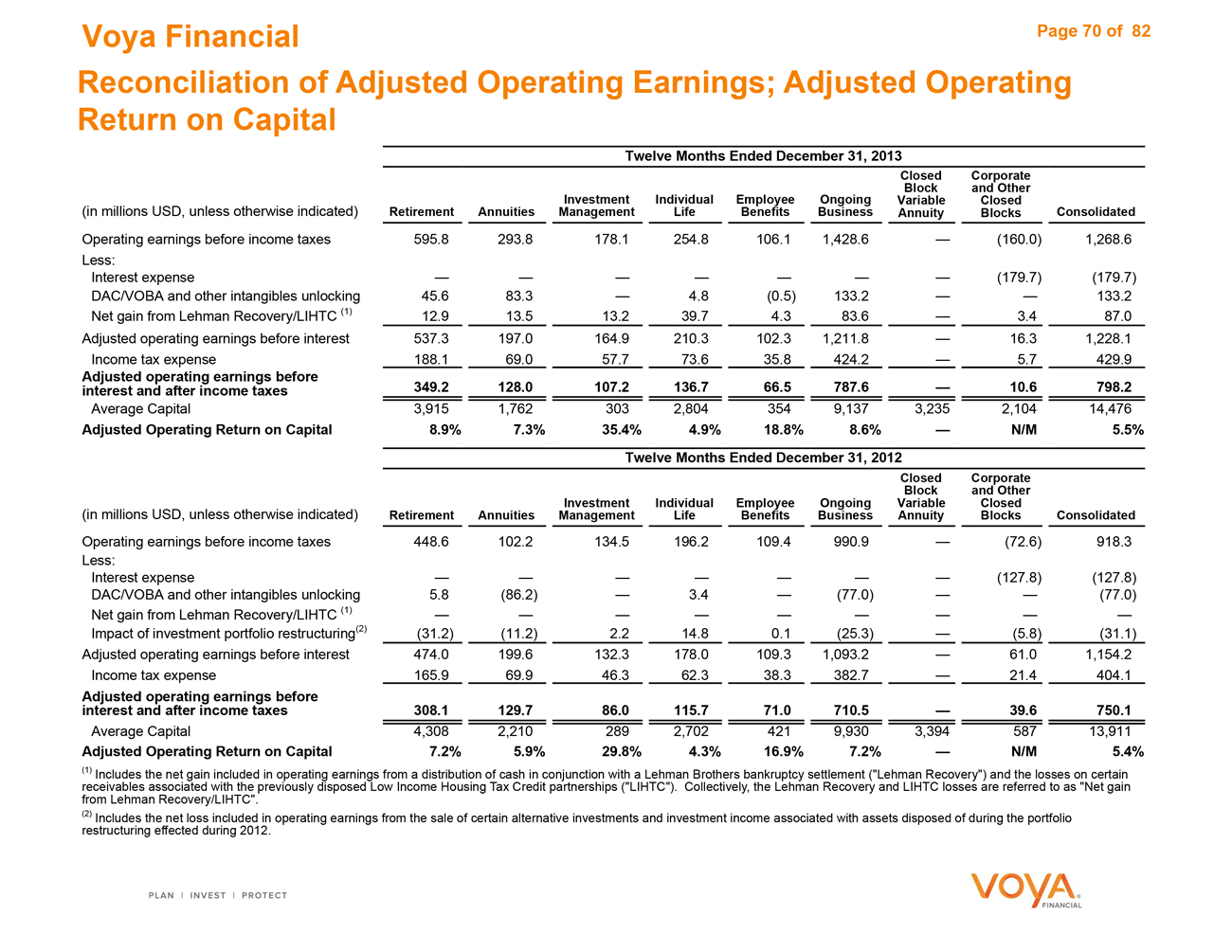

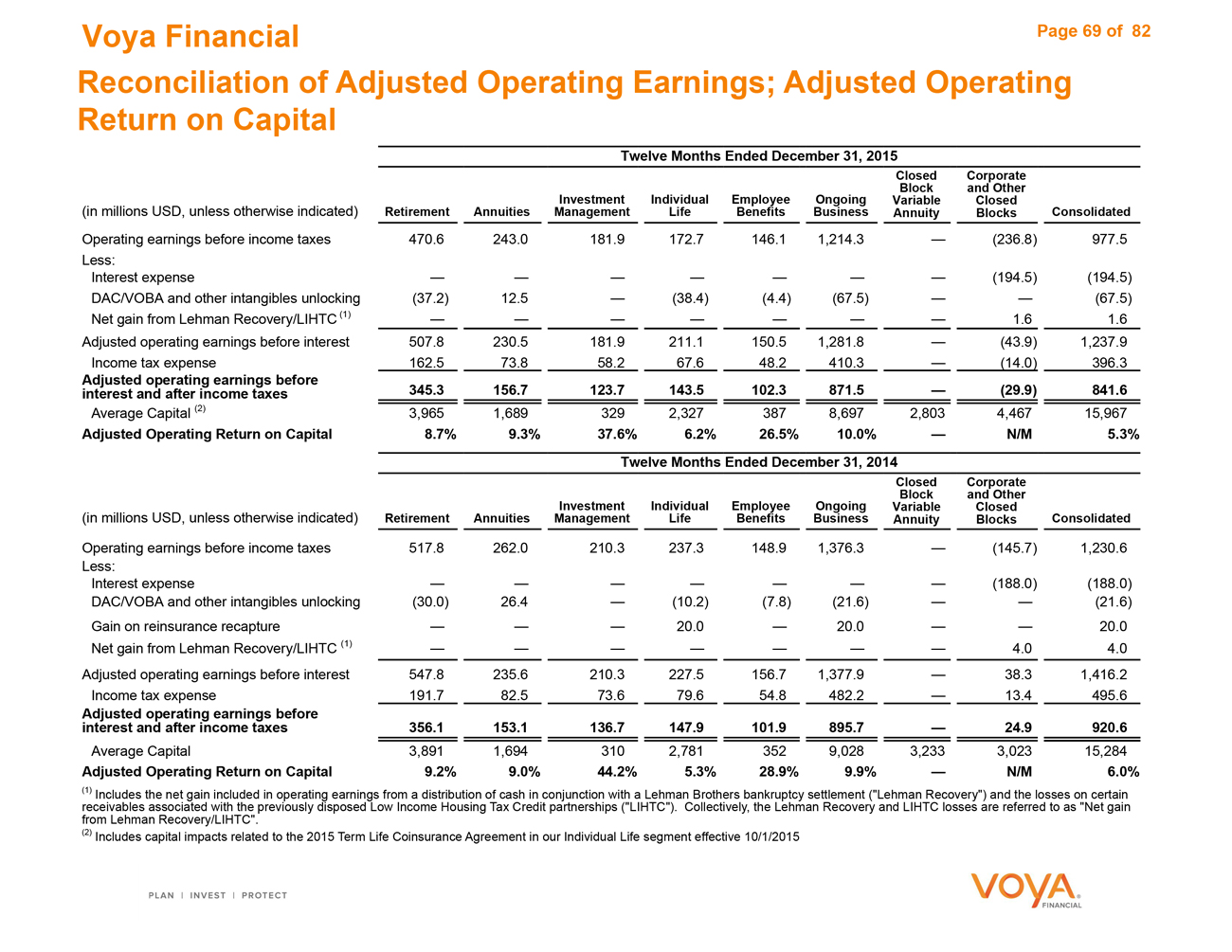

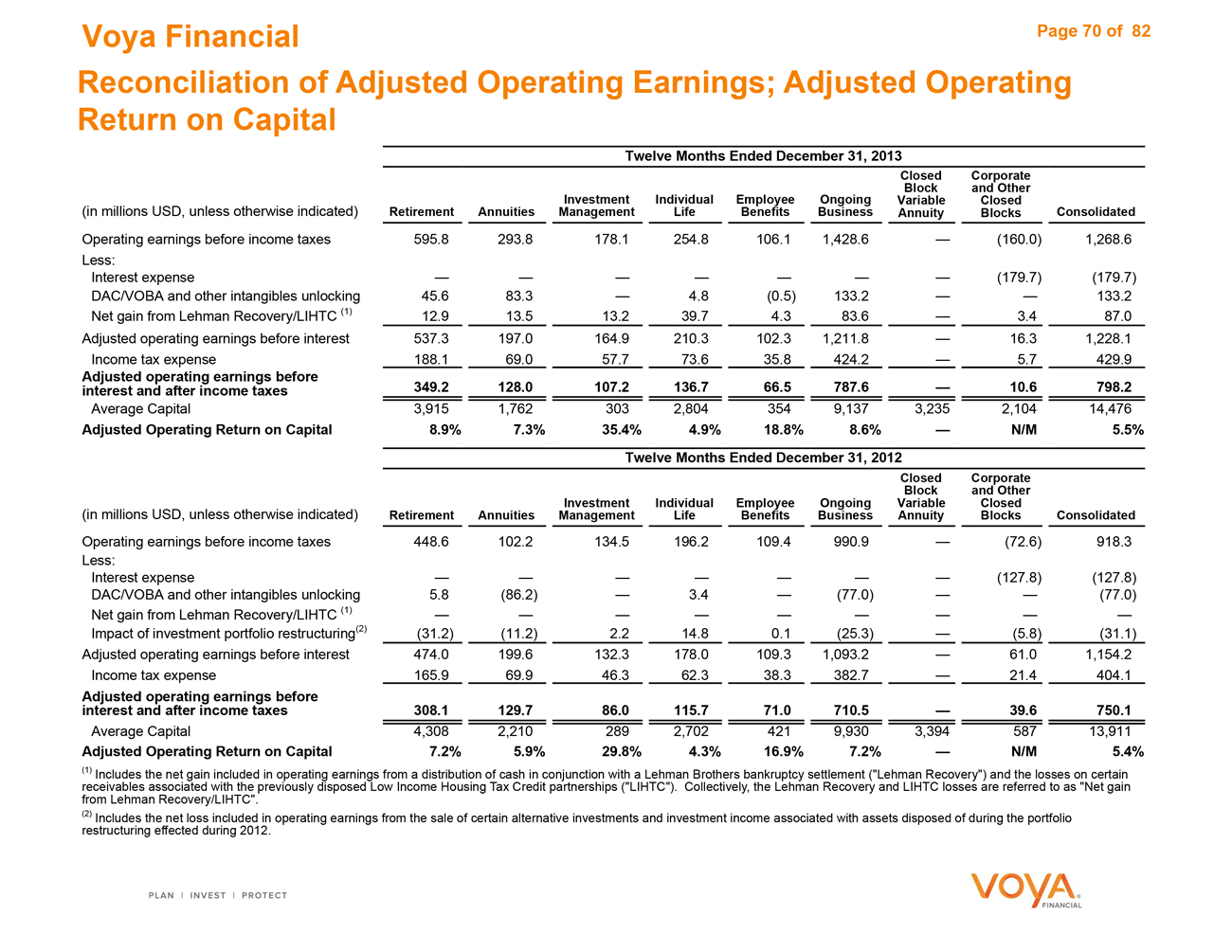

Adjusted Operating Return on Capital 68—70

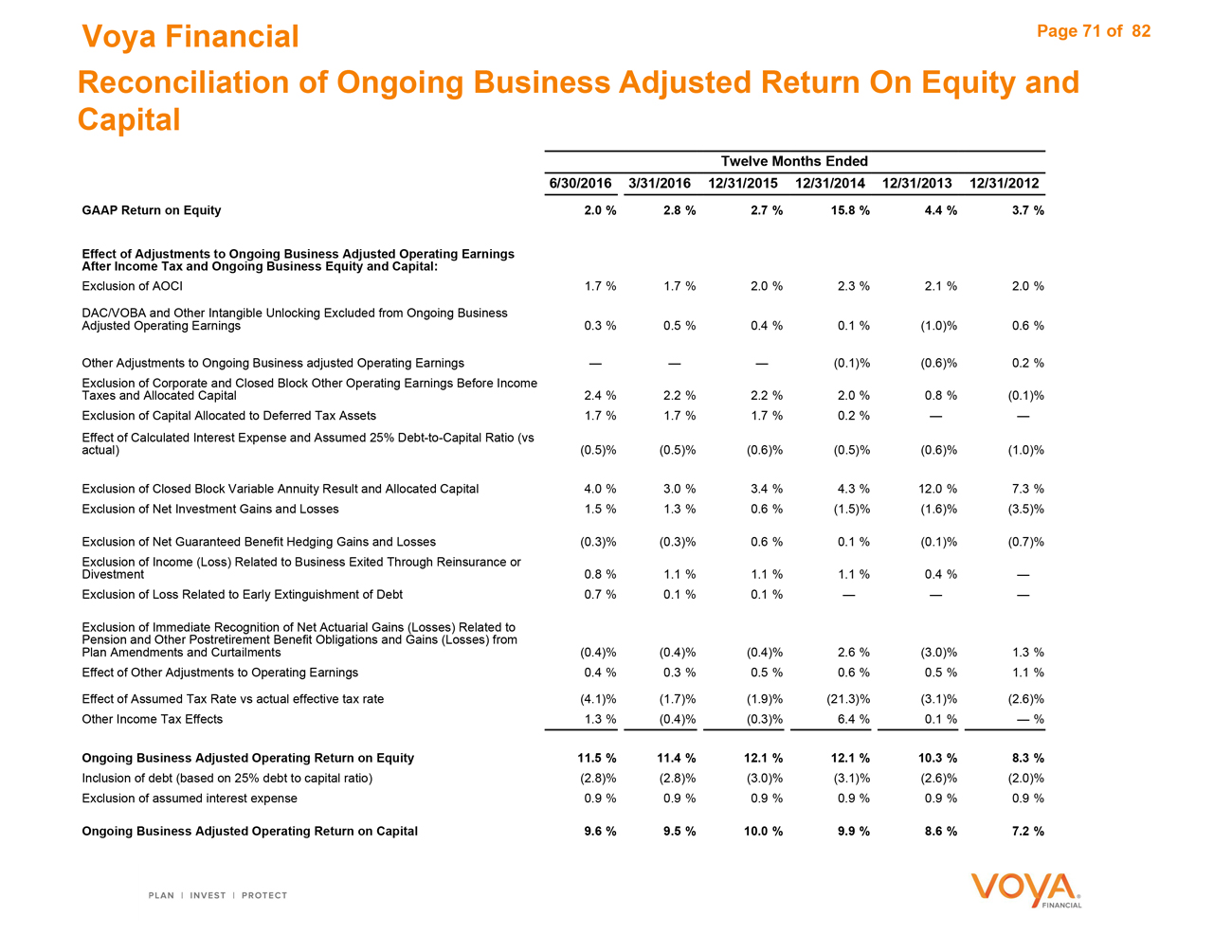

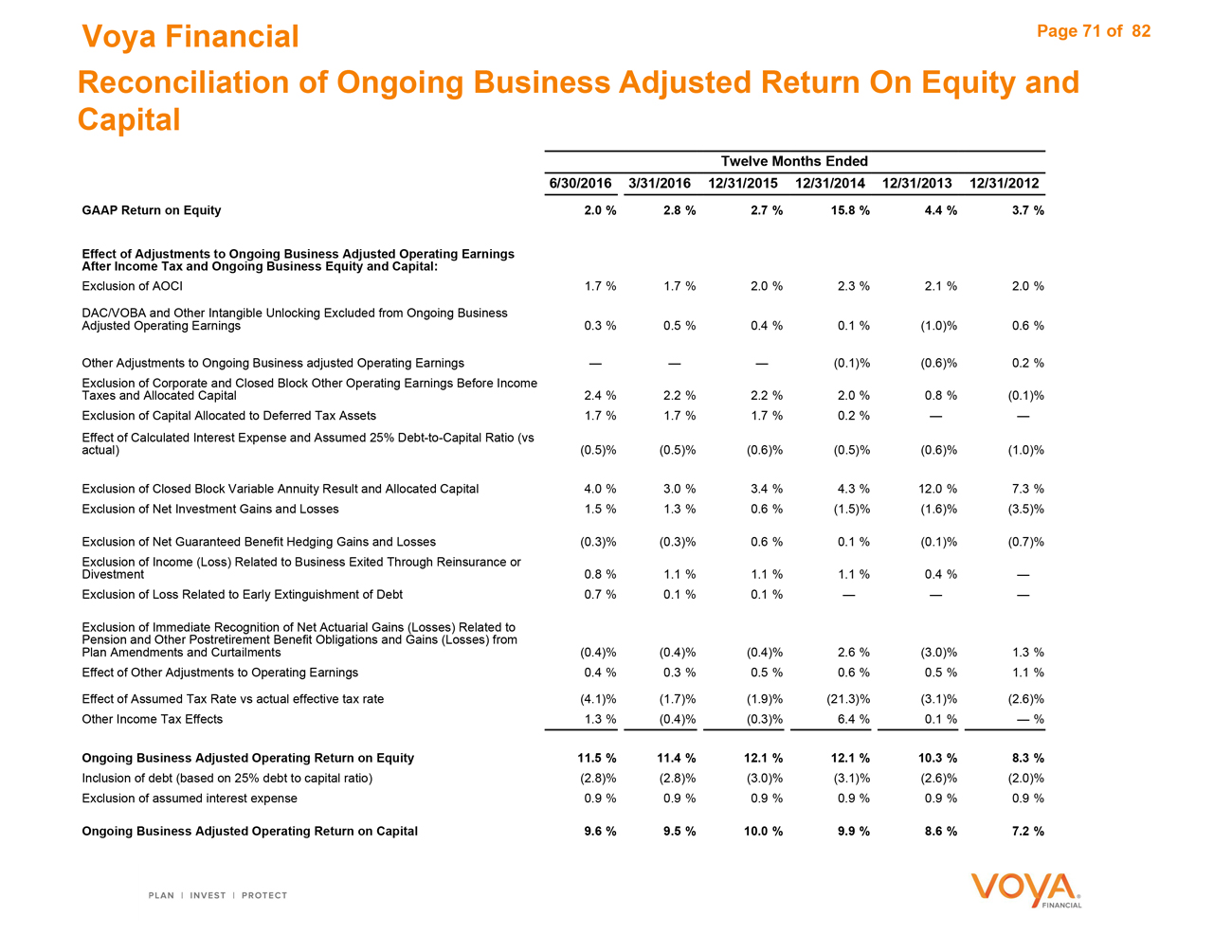

Reconciliation of Ongoing Business Adjusted ROE and Capital 71

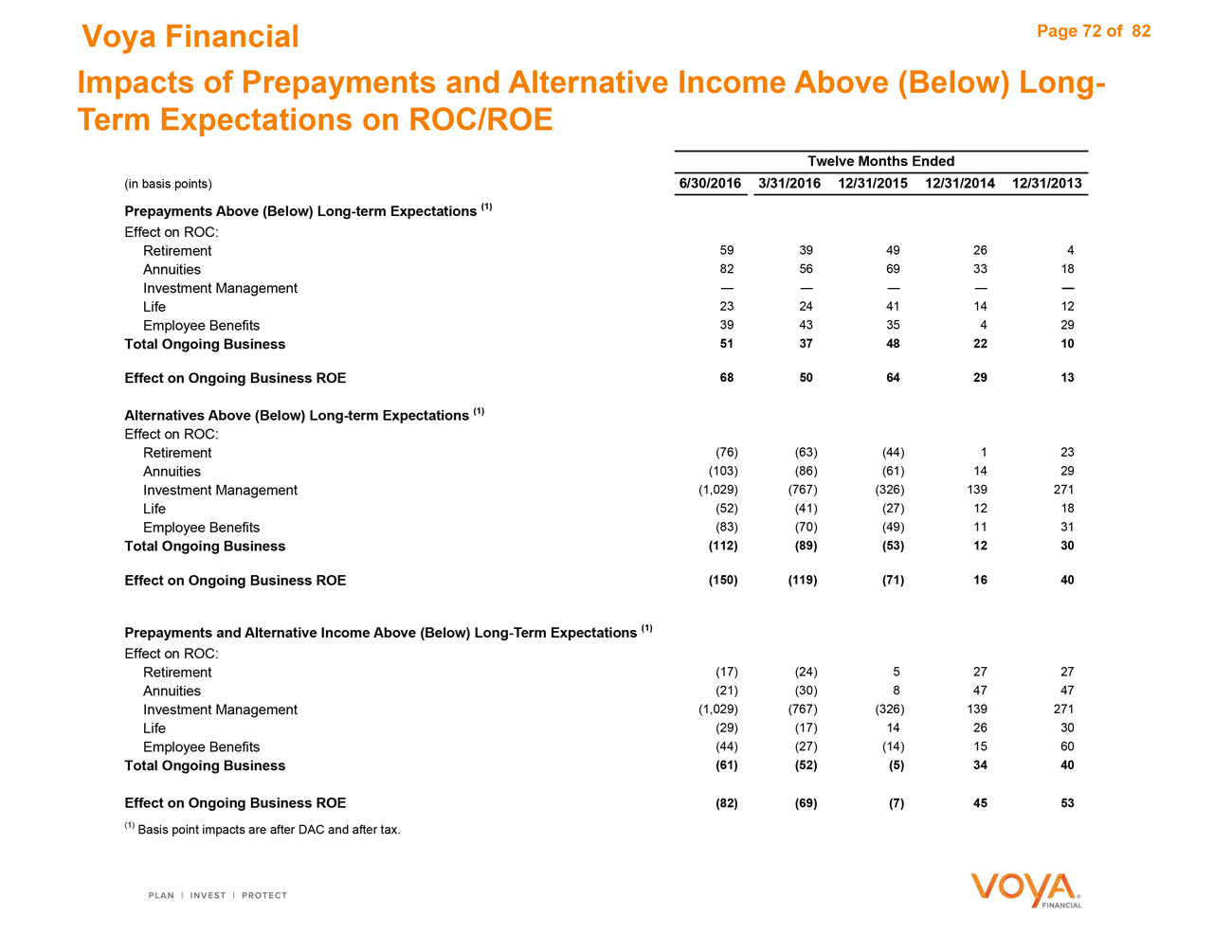

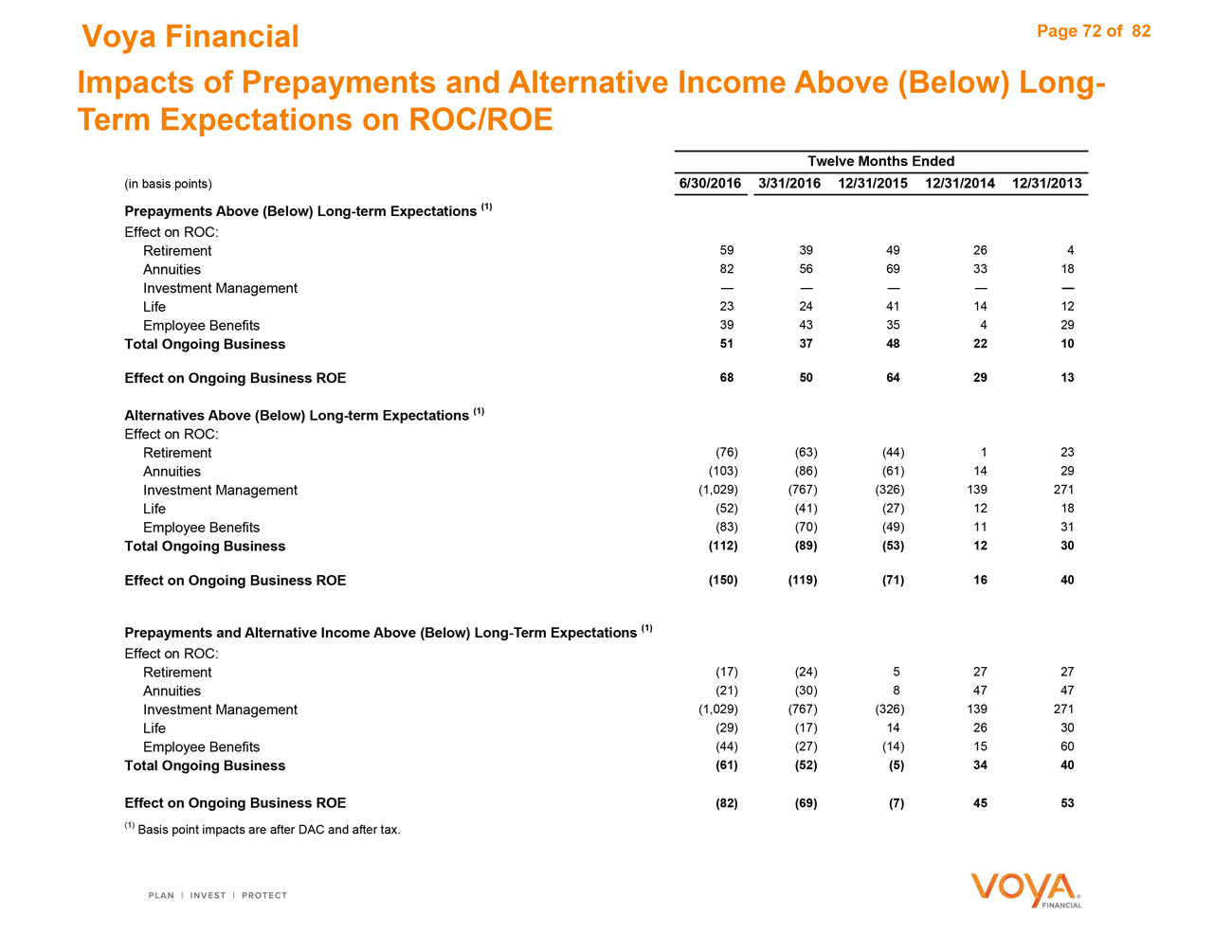

Impacts of Prepayments and Alternative Income Above (Below) Long-

Term Expectations 72

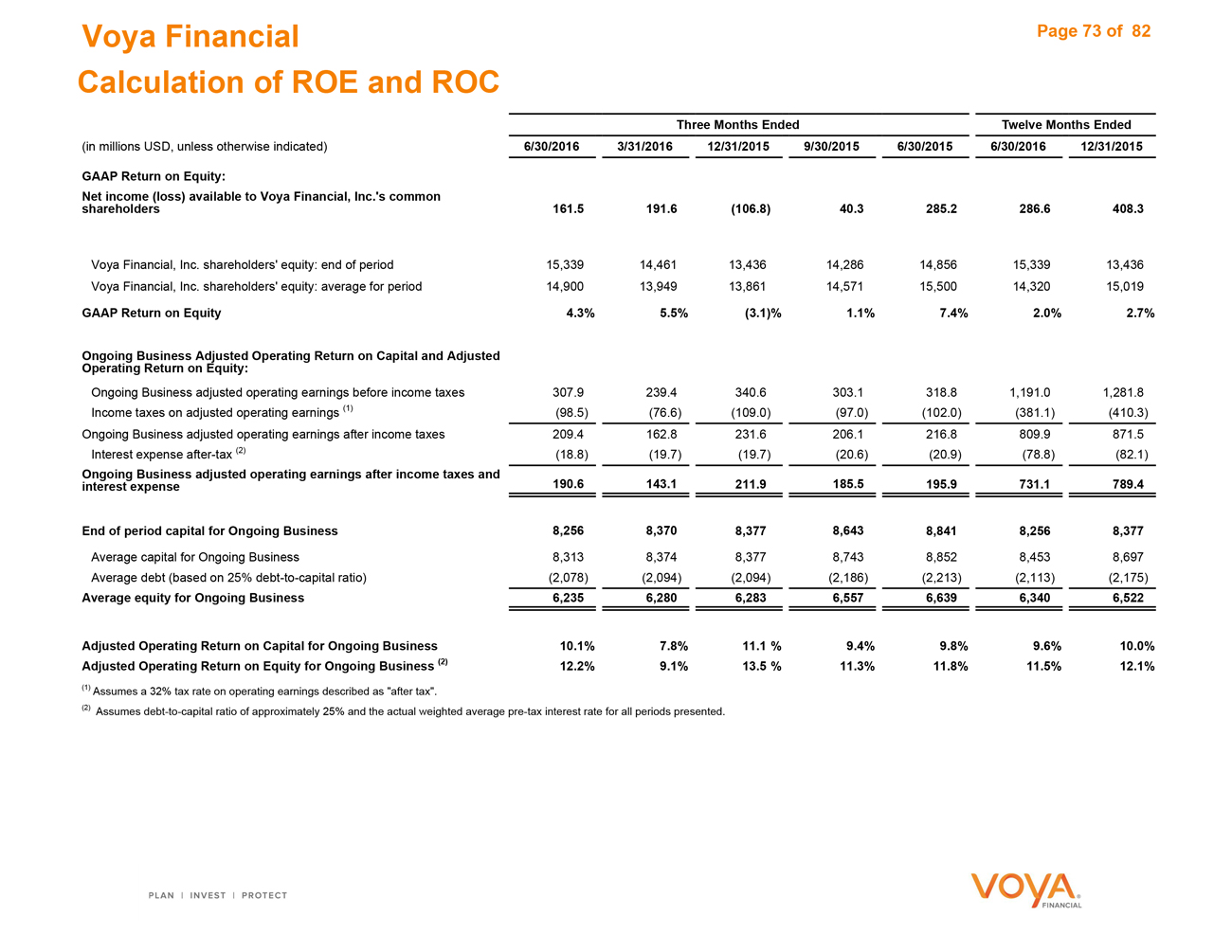

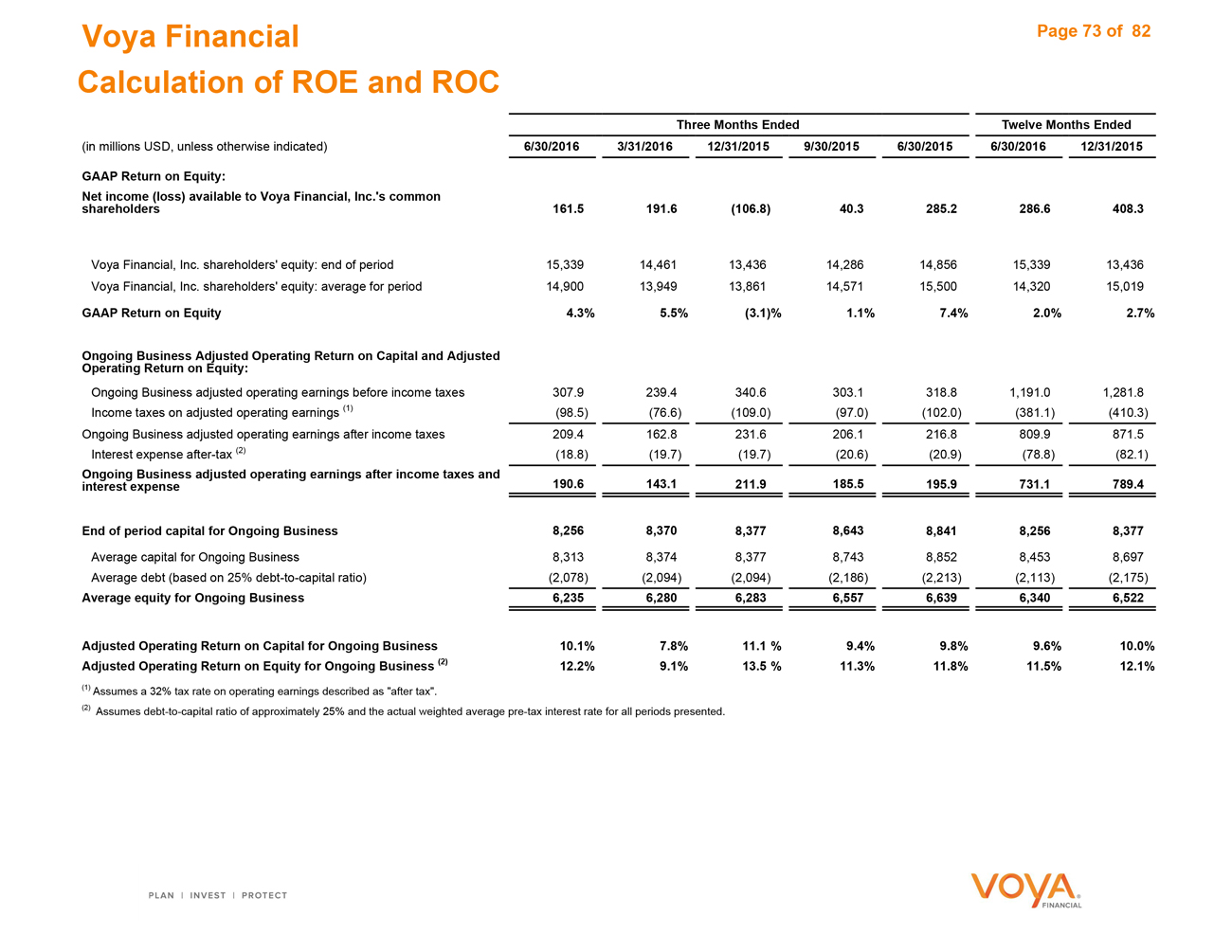

Calculation of ROE and ROC 73

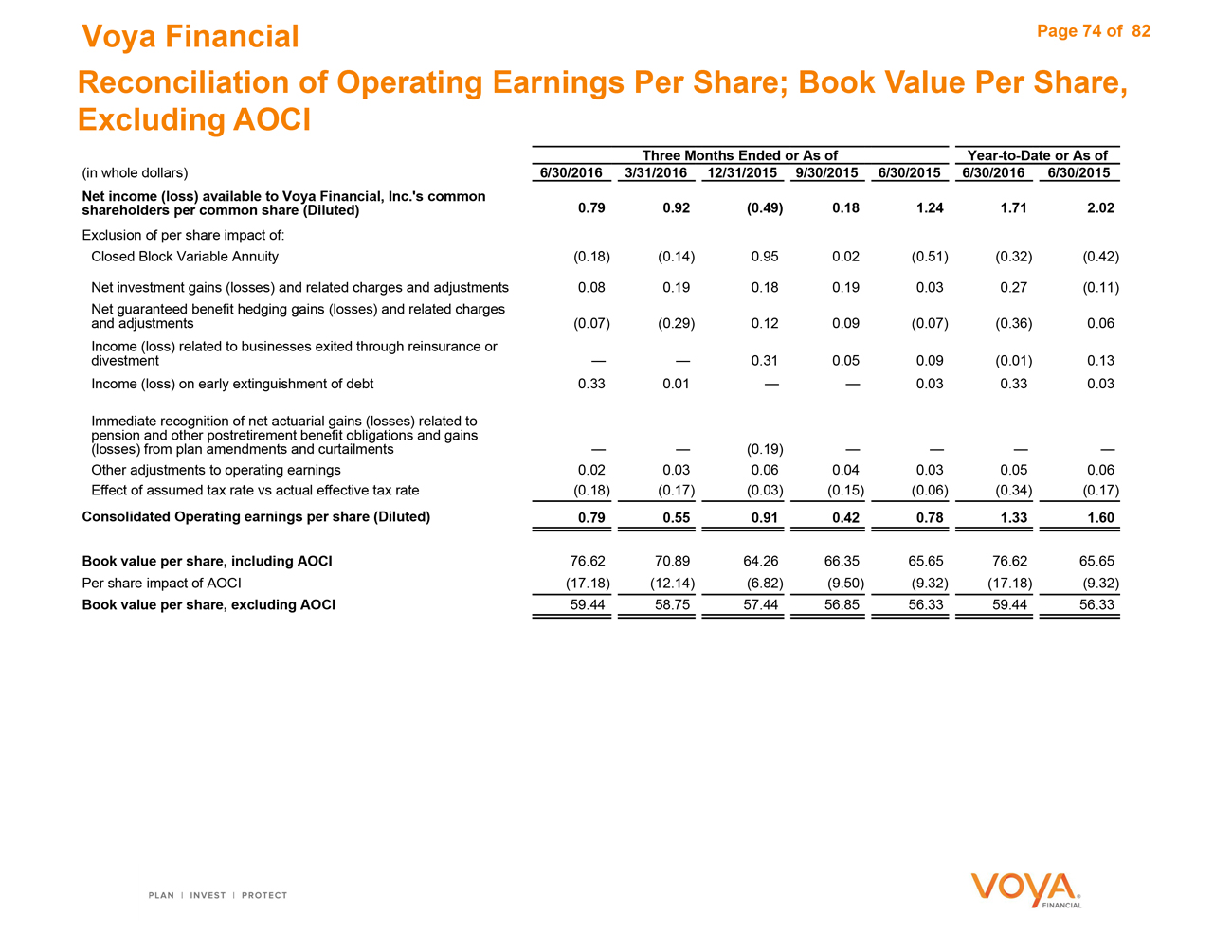

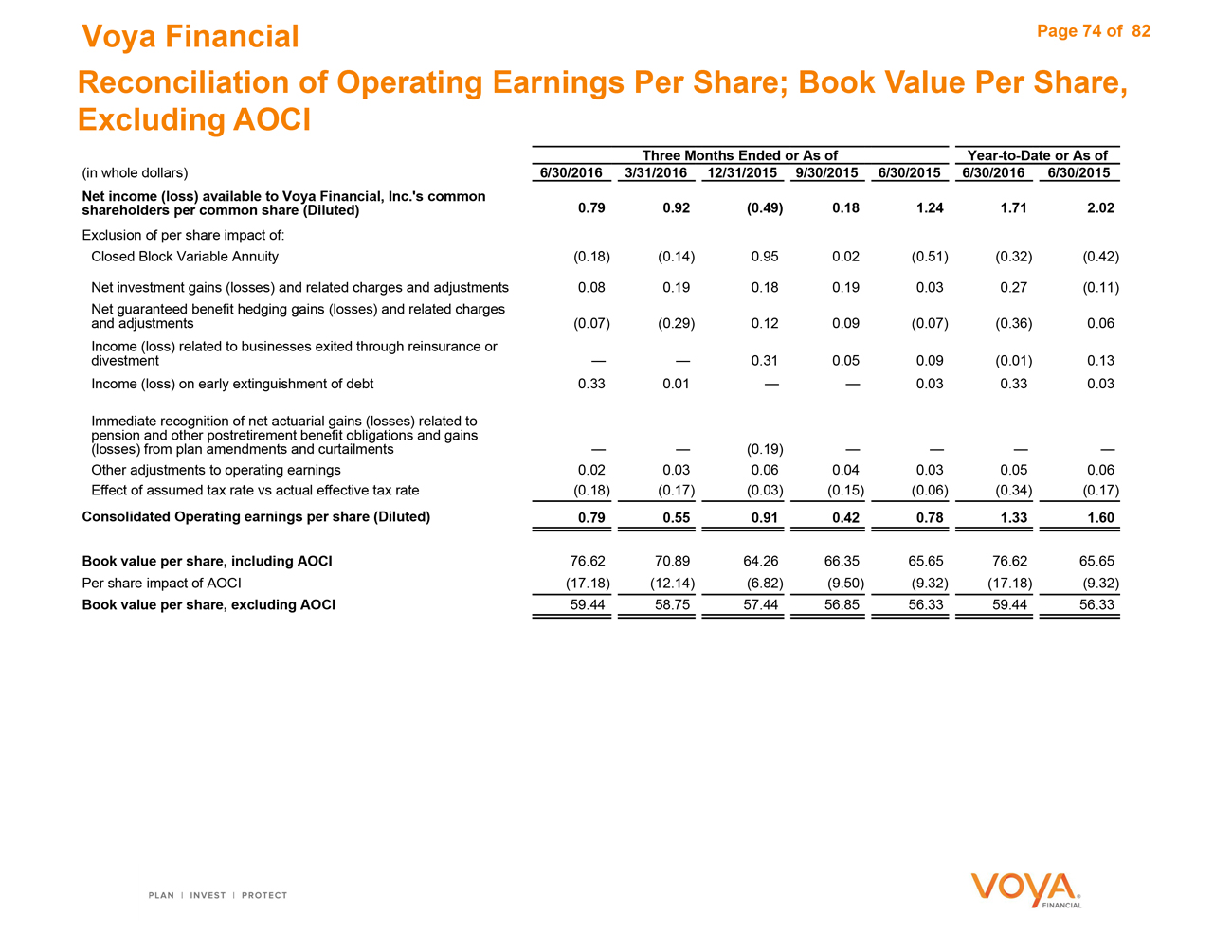

Reconciliation of Operating Earnings Per Share: Book Value Per Share

Excluding AOCI 74

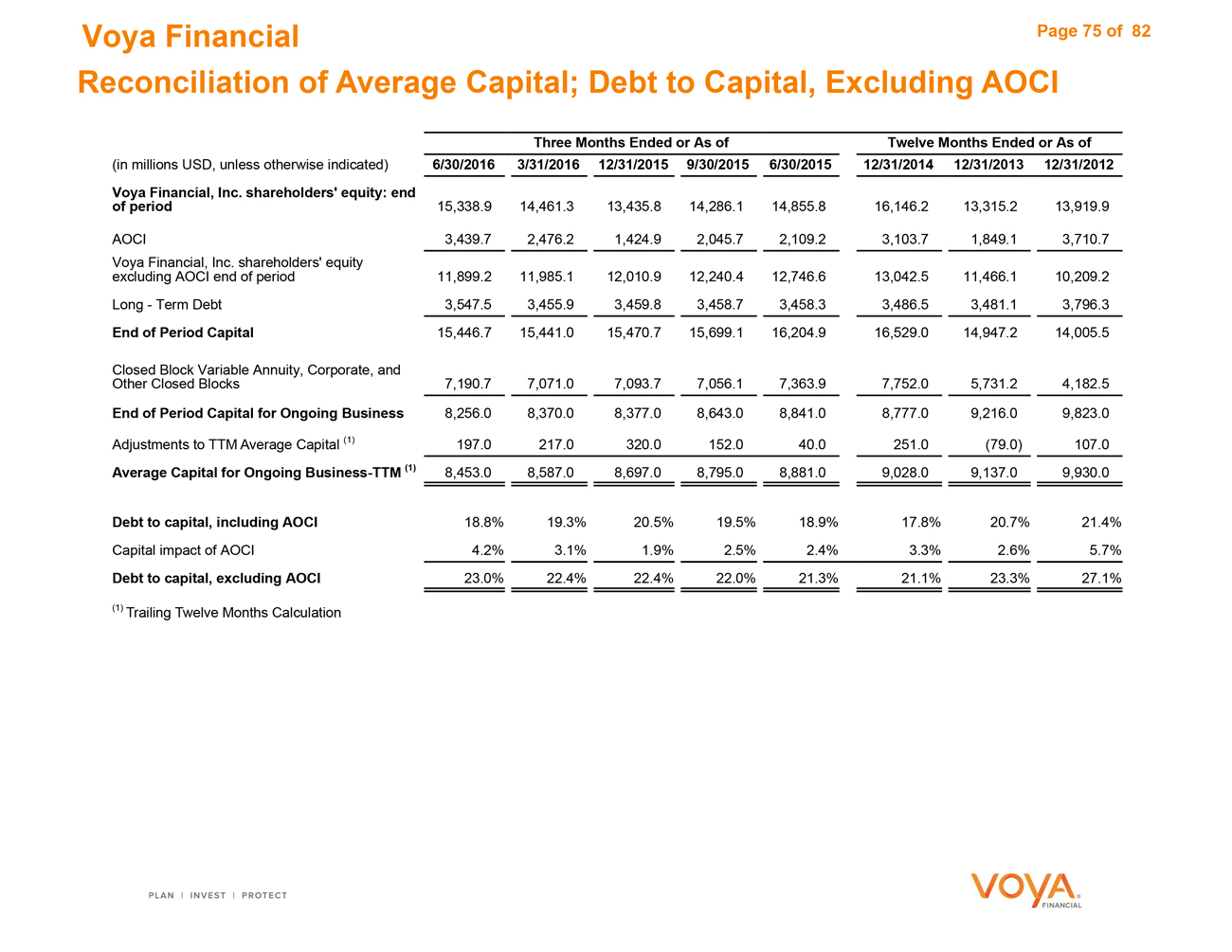

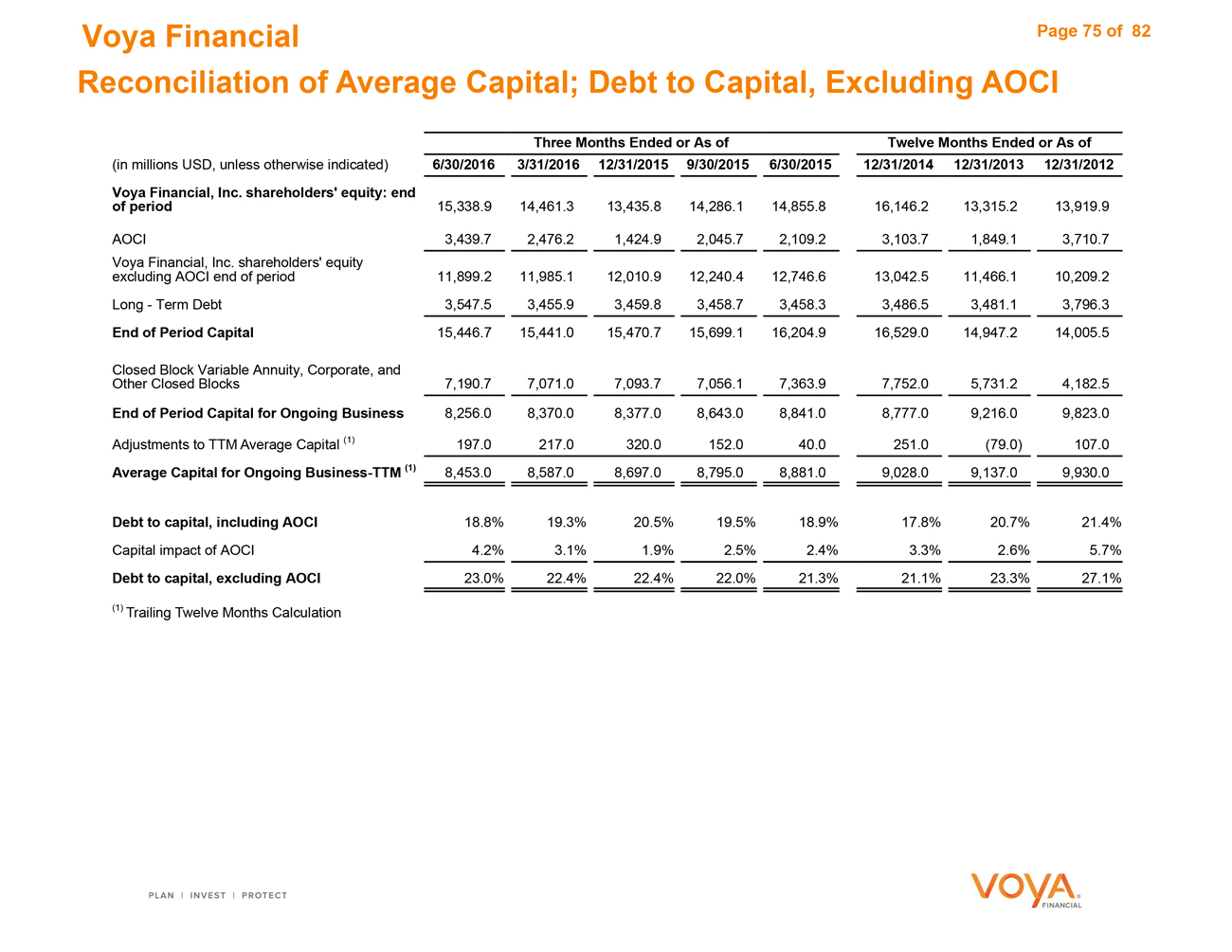

Reconciliation of Average Capital: Debt to Capital, Excluding AOCI 75

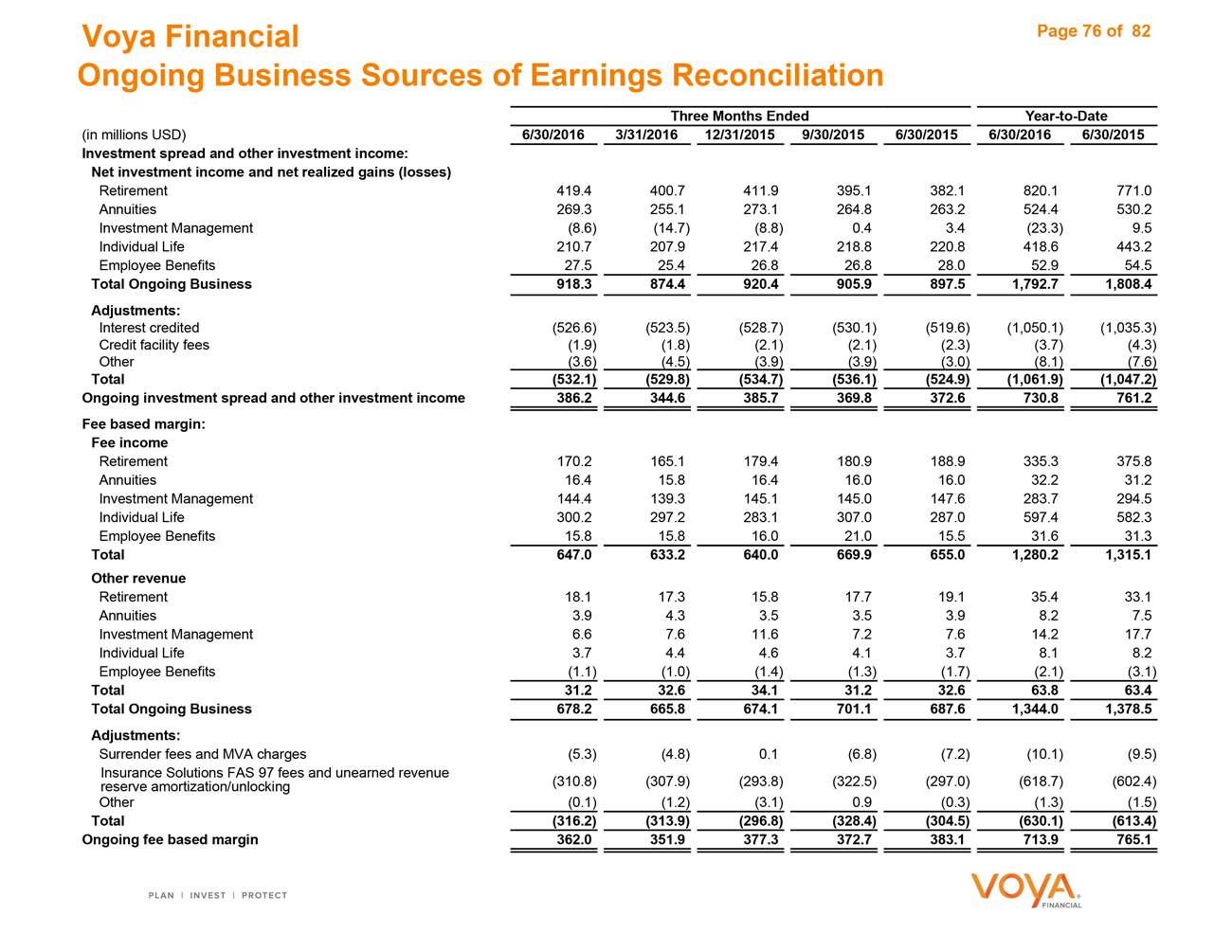

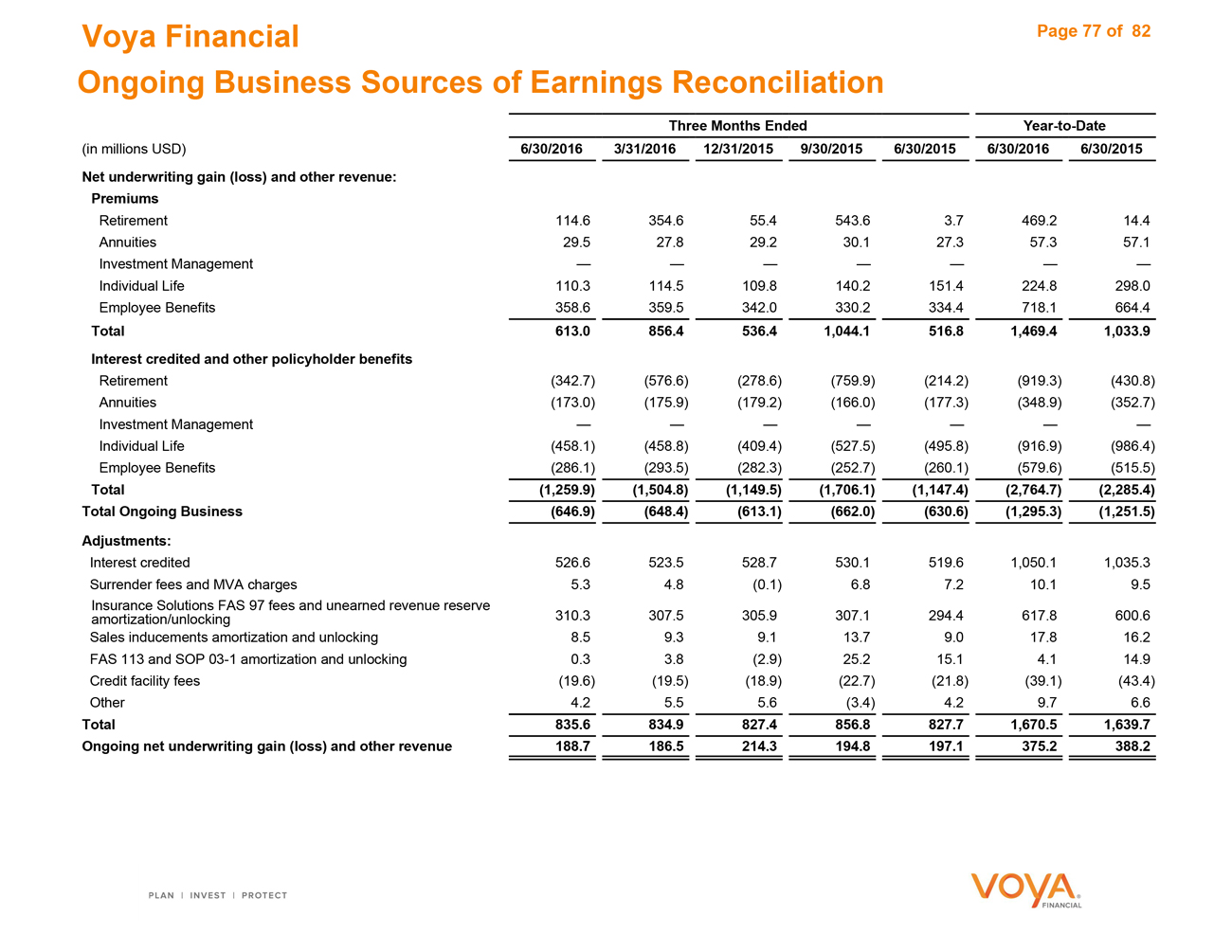

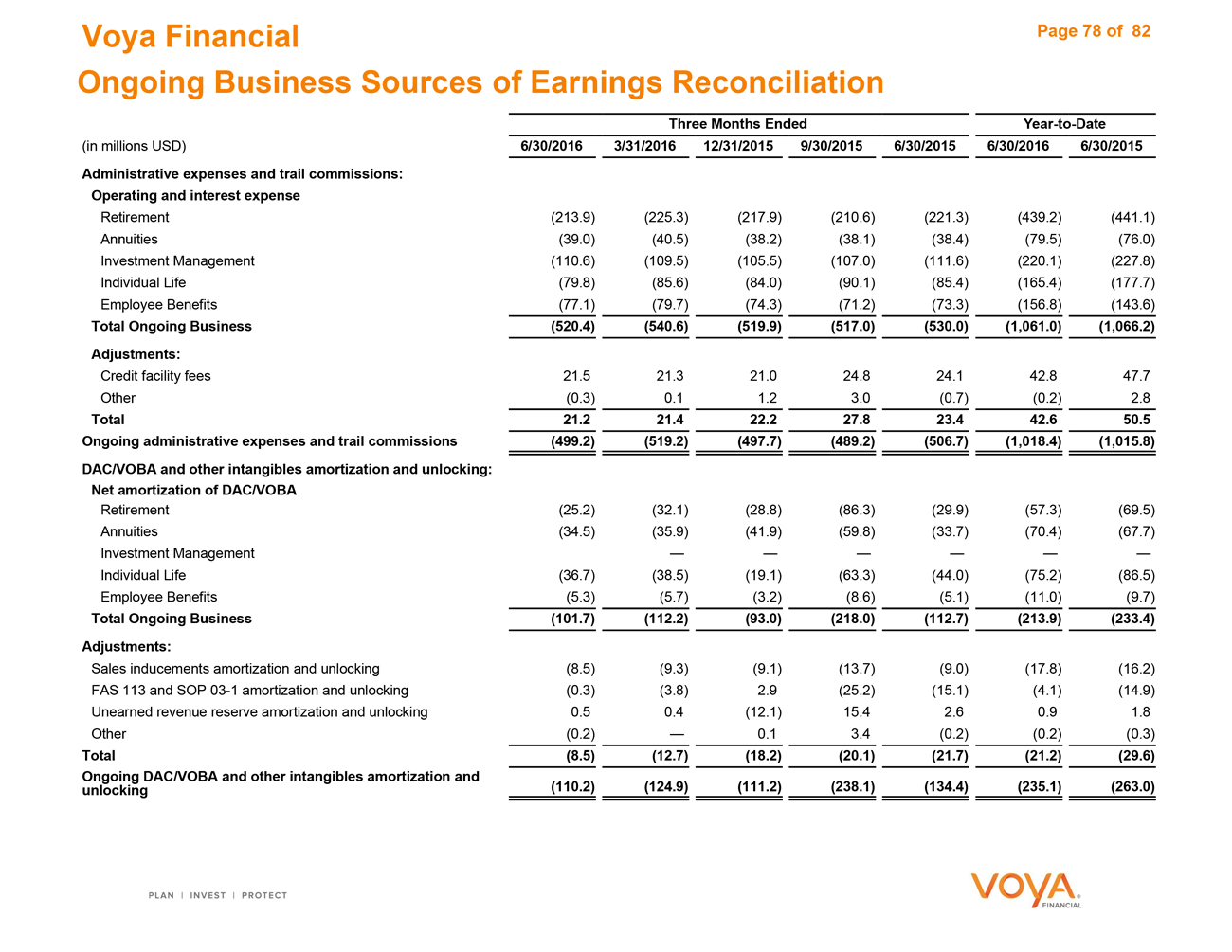

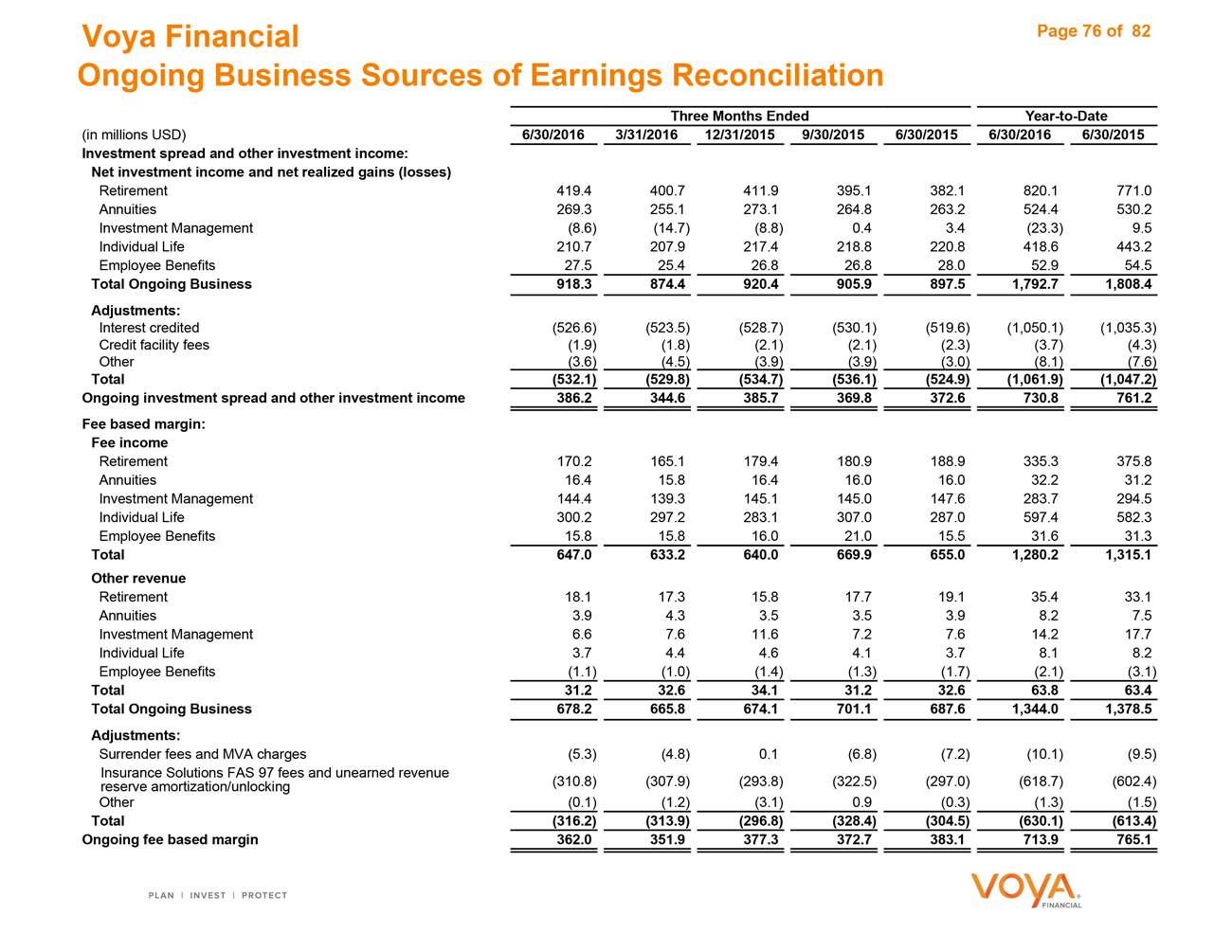

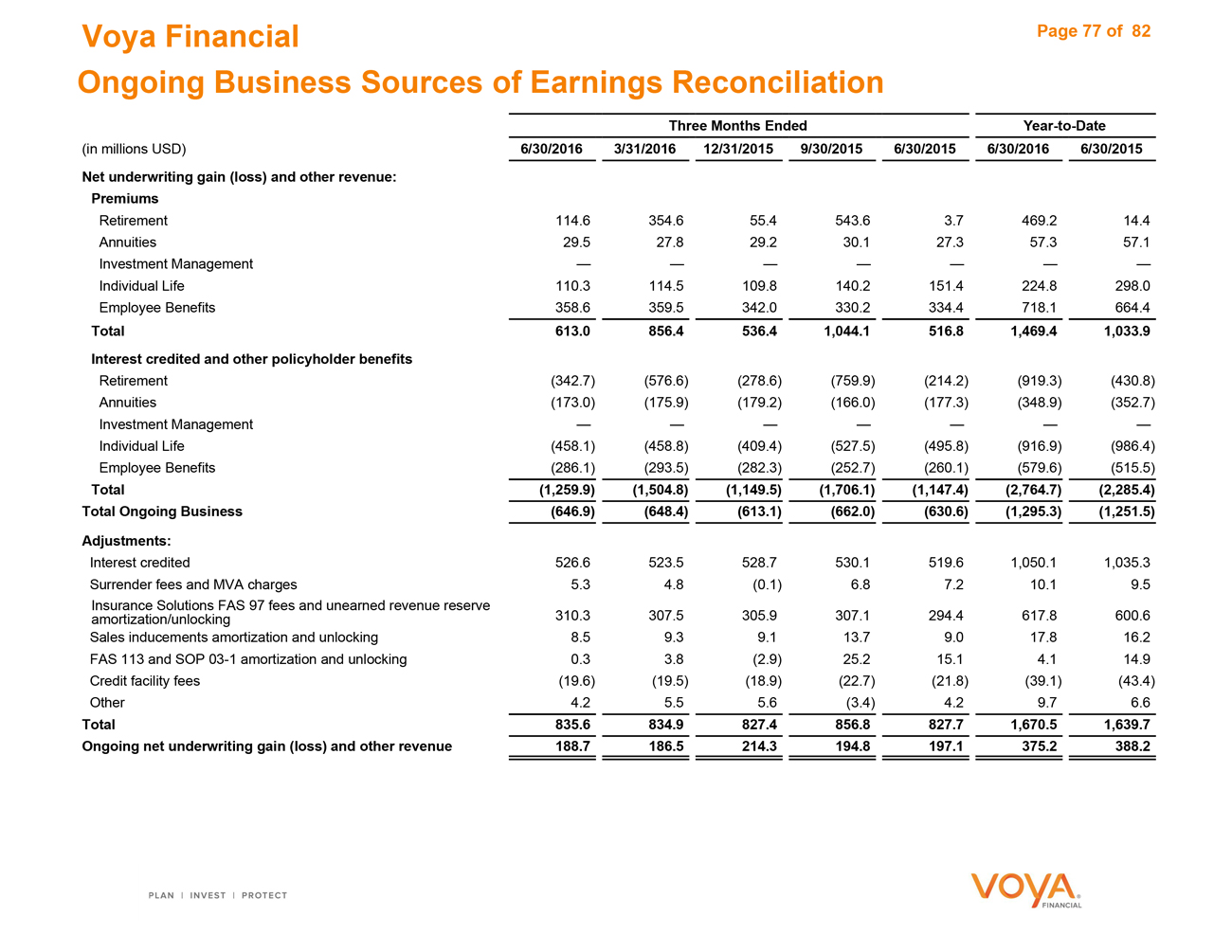

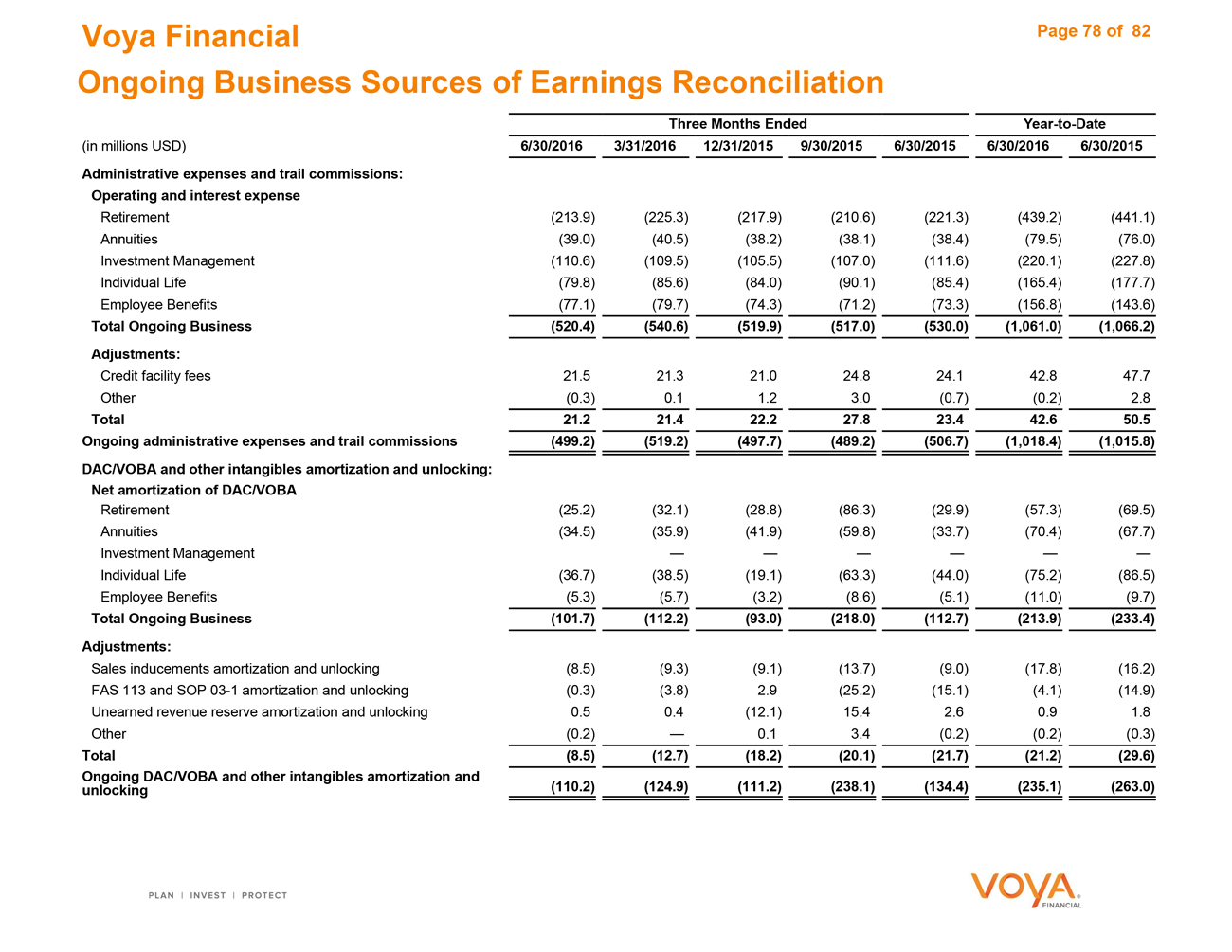

Reconciliation of Ongoing Business Sources of Earnings 76—78

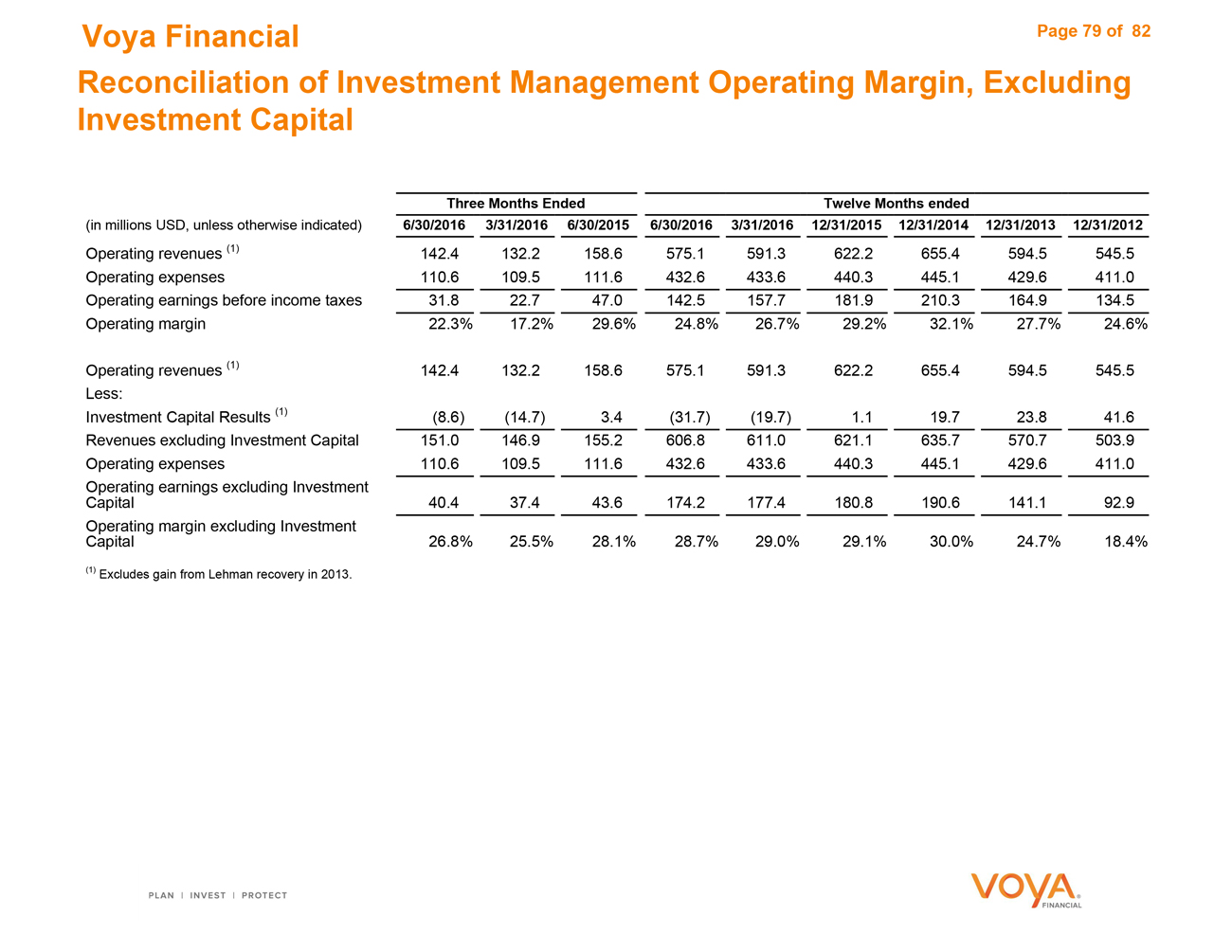

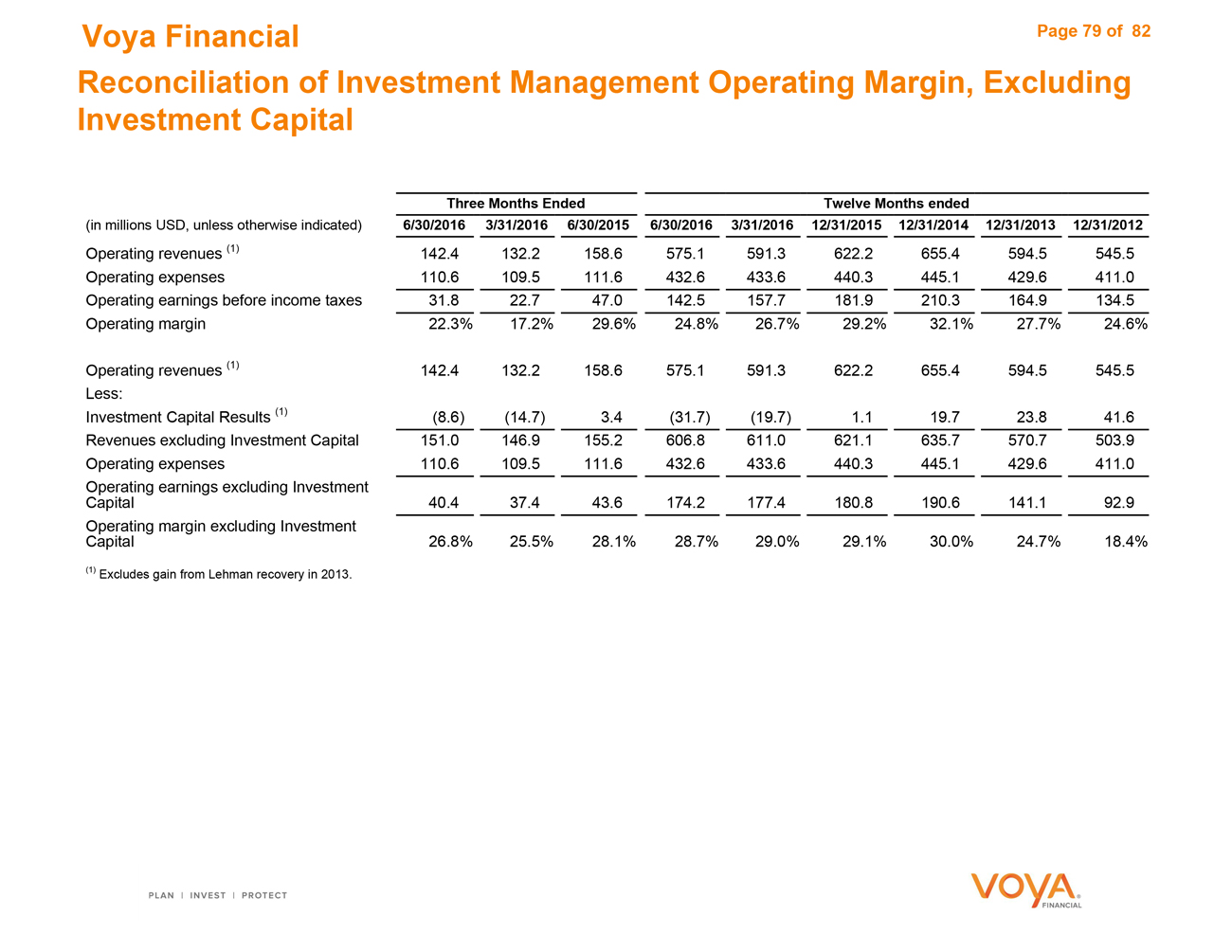

Reconciliation of Investment Management Operating Margin, Excluding

Investment Capital 79

Additional Information

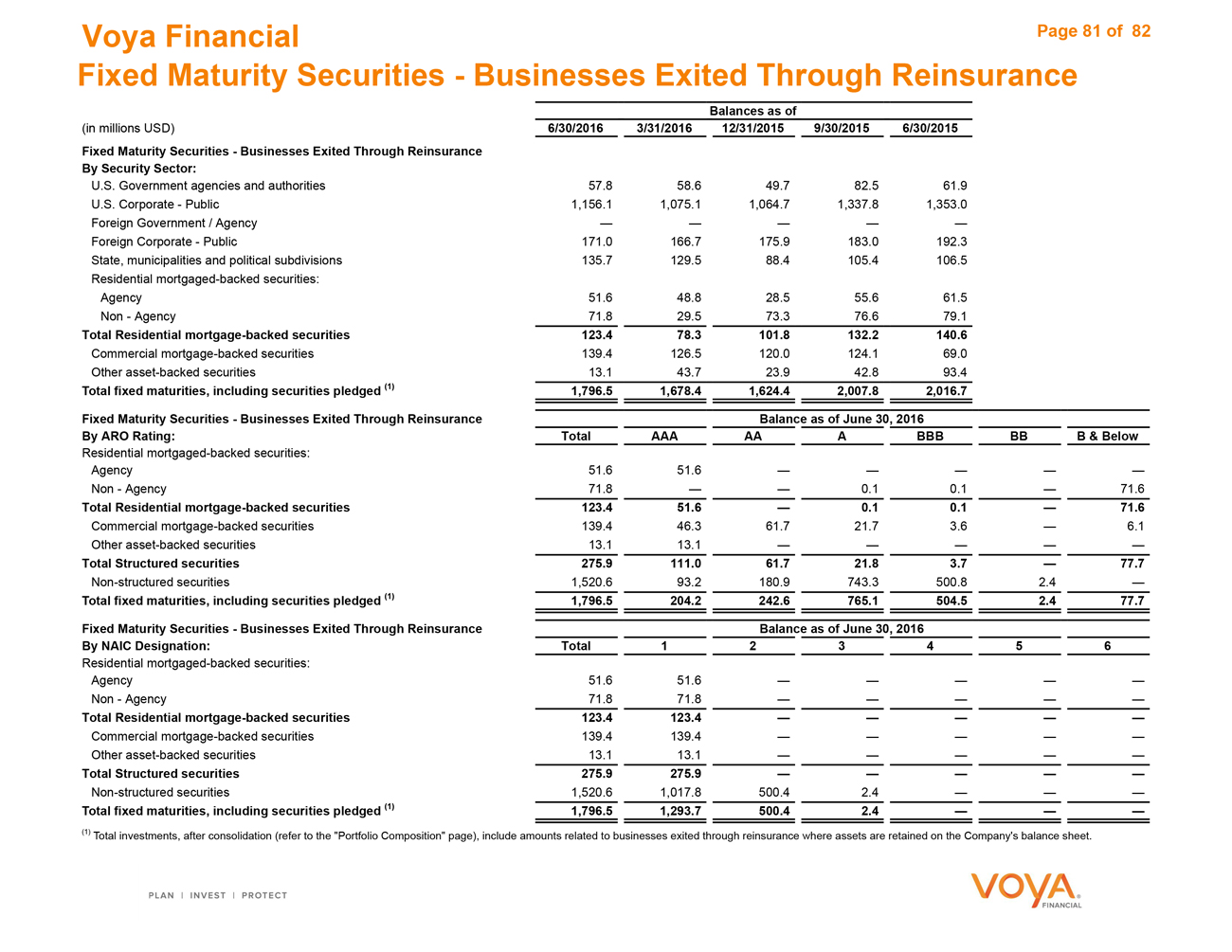

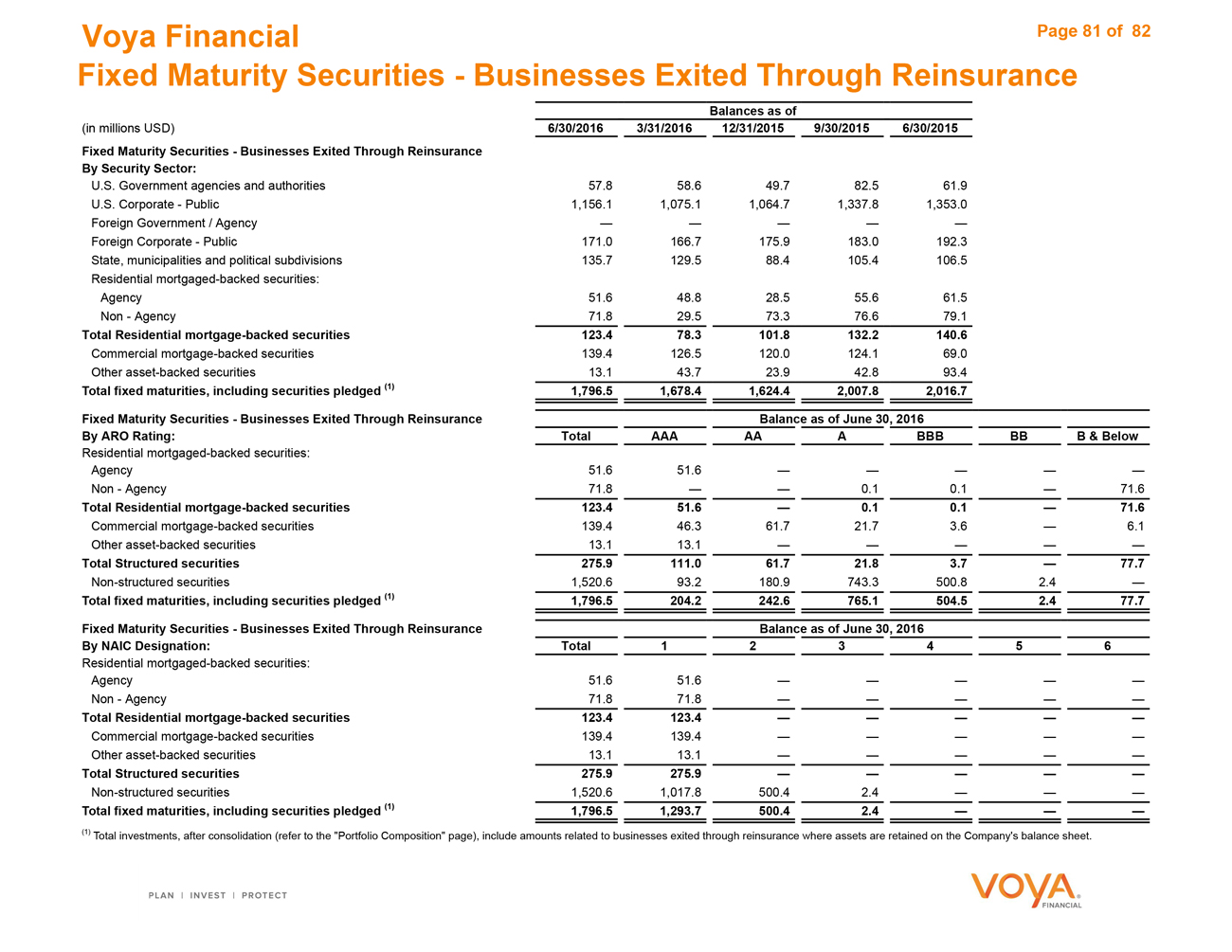

Fixed Maturity Securities—Businesses Exited Through Reinsurance 81

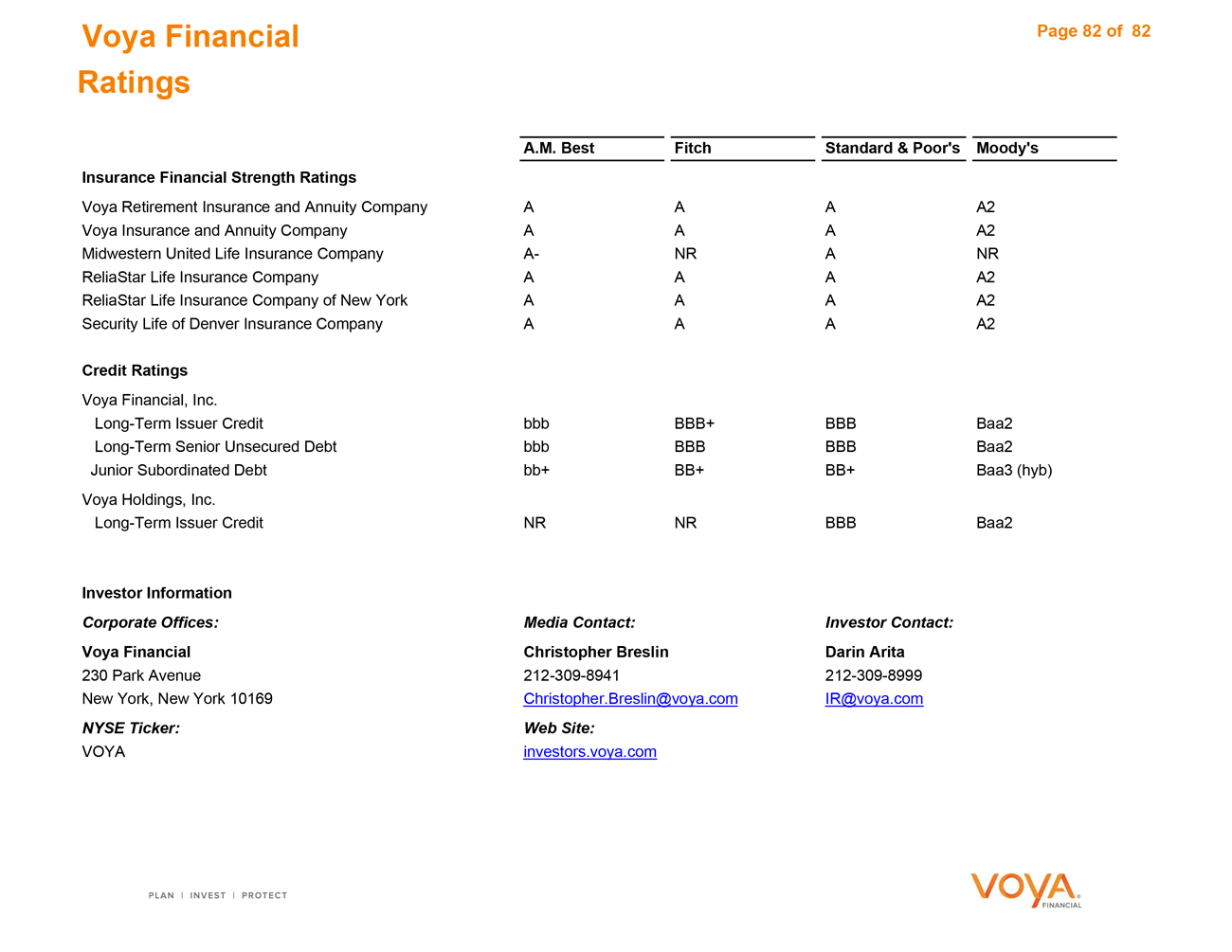

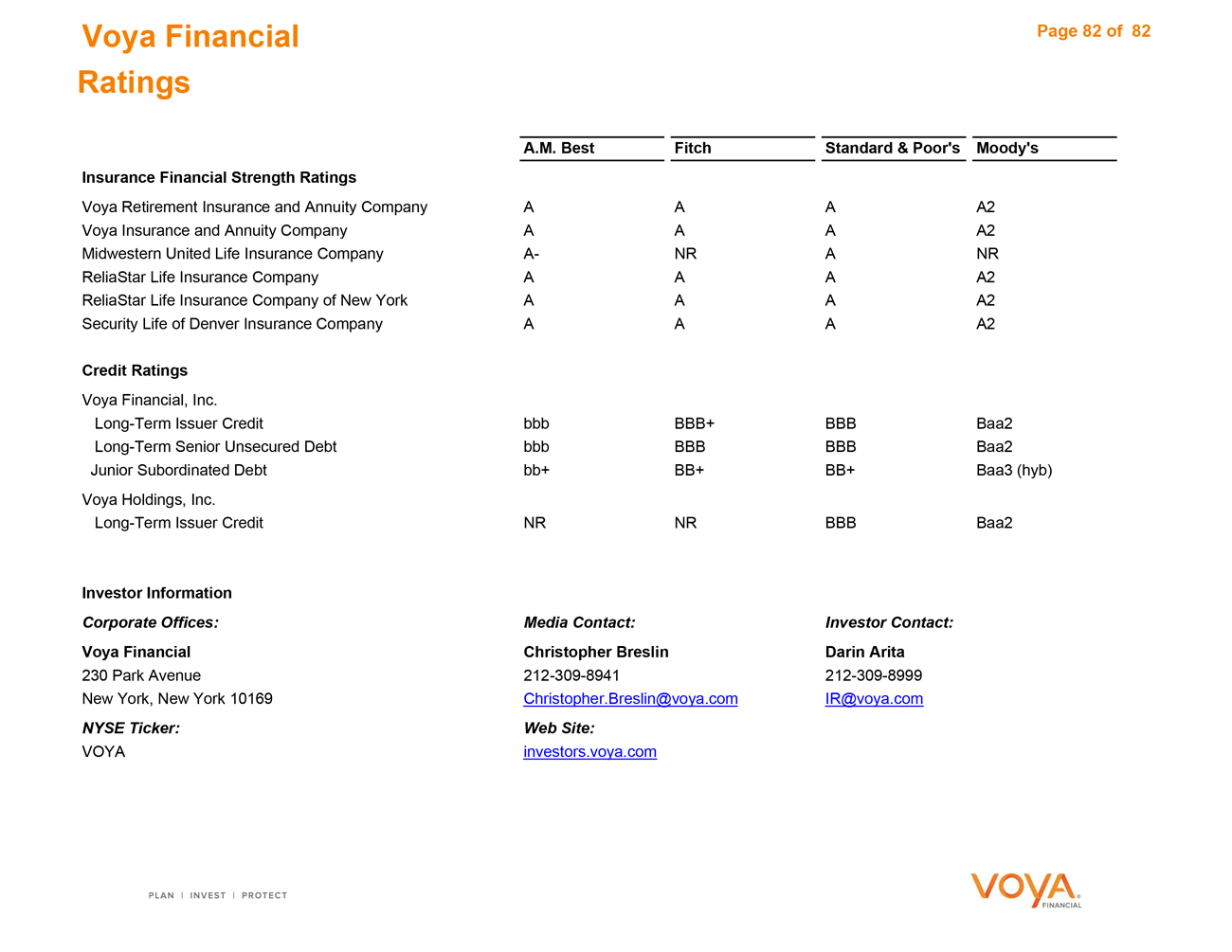

Ratings 82

Voya Financial

Page 3 of 82

Explanatory Note on Non-GAAP Financial Information

Operating Earning Before Income Taxes

Operating earnings before income taxes is a financial measure we use to evaluate segment performance. We believe that operating earnings before income taxes provides a meaningful measure of our business and segment performances and enhances the understanding of our financial results by focusing on the operating performance and trends of our underlying business segments and excluding items that tend to be highly variable from period to period based on capital market conditions and/or other factors. We use the same accounting policies and procedures to measure segment operating earnings before income taxes as we do for consolidated Net income (loss). We also report operating earnings on an aggregate basis (both before and after income taxes) for both our Ongoing Business and for our Company as a whole.

Operating earnings before income taxes does not replace Net income (loss) as the U.S. GAAP measure of our consolidated results of operations. Therefore, we believe that it is useful to evaluate both Net income (loss) and Operating earnings before income taxes when reviewing our financial and operating performance. Each segment’s operating earnings before income taxes is calculated by adjusting Income (loss) before income taxes for the following items:

• Net investment gains (losses), net of related amortization of deferred policy acquisition costs (“DAC”), value of business acquired (“VOBA”), sales inducements and unearned revenue, which are significantly influenced by economic and market conditions, including interest rates and credit spreads. Net investment gains (losses) include gains (losses) on the sale of securities, impairments, changes in the fair value of investments using the fair value option (“FVO”) unrelated to the implied loan-backed security income recognition for certain mortgage-backed obligations and changes in the fair value of derivative instruments, excluding realized gains (losses) associated with swap settlements and accrued interest;

• Net guaranteed benefit hedging gains (losses), which are significantly influenced by economic and market conditions, include changes in the fair value of derivatives related to guaranteed benefits, net of related reserve increases (decreases) and net of related amortization of DAC, VOBA and sales inducements, less the estimated cost of these benefits. The estimated cost, which is reflected in operating results, reflects the expected cost of these benefits if markets perform in line with our long-term expectations and includes the cost of hedging. Other derivative and reserve changes related to guaranteed benefits are excluded from operating results, including the impacts related to changes in our nonperformance spread;

• Income (loss) related to businesses exited through reinsurance or divestment (including net investment gains (losses) on securities sold and expenses directly related to these transactions);

• Income (loss) attributable to noncontrolling interest;

• Income (loss) related to early extinguishment of debt;

• Impairment of goodwill, value of management contract rights and value of customer relationships acquired;

• Immediate recognition of net actuarial gains (losses) related to our pension and other postretirement benefit obligations and gains (losses) from plan amendments and curtailments; and

• Other items, including restructuring expenses (severance, lease write-offs, etc.), certain third-party expenses and deal incentives related to the divestment of the Company by ING Group, and expenses associated with the rebranding of Voya Financial, Inc. from ING U.S., Inc.

Operating earnings before income taxes, when presented on a consolidated basis, also does not reflect the results of operations of our CBVA segment because this segment is managed to focus on protecting regulatory and rating agency capital rather than achieving operating metrics or generating net income. As a result of this focus on regulatory and rating agency capital, the financial results of the CBVA segment presented in accordance with GAAP tend to exhibit a high degree of volatility based on factors, such as the asymmetry between the accounting for certain liabilities and the corresponding hedging assets, and gains and losses due to changes in nonperformance risk, that are not necessarily reflective of the economic costs and benefits of our CBVA business. When we present the adjustments to Income (loss) before income taxes on a consolidated basis, each adjustment excludes the relative portions attributable to our CBVA segment.

Income (loss) related to businesses exited through reinsurance or divestment (including net investment gains (losses) on securities sold and expenses directly related to these transactions) is excluded from the results of operations from Operating earnings before income taxes. When we present the adjustments to Net Income (loss) before income taxes on a consolidated basis, each adjustment excludes the relative portions attributable to businesses exited through reinsurance or divestment.

Effective April 1, 2015, we disposed of, via reinsurance, retained group reinsurance policies. Consistent with our practice to exclude business (including blocks of business) exited via reinsurance or divestment from Operating earnings before income taxes and from Operating revenues, beginning in the second quarter of 2015, the revenues and expenses of this reinsured block of business are excluded from these metrics.

Effective October 1, 2015, we disposed of, via reinsurance, a block of in-force term life contracts. Consistent with our practice to exclude business (including blocks of business) exited via reinsurance or divestment from operating earnings before income taxes and from operating revenues, beginning in the fourth quarter of 2015, the revenues and expenses of these reinsured blocks of business are excluded from these metrics.

The most directly comparable U.S. GAAP measure to Operating earnings before income taxes is Net income (loss) before income taxes. For a reconciliation of Operating earnings before Net income taxes to Net income (loss) before income taxes, and from Total Operating earnings before income taxes to Total adjusted operating earnings before income taxes, refer to the “Reconciliations” section in this document.

Voya Financial Explanatory Note on Non-GAAP Financial Information Adjusted Operating Earnings and Ongoing Business Adjusted Operating Earnings Adjusted operating earnings is also a non-GAAP financial measure. This measure excludes from Operating earnings before income taxes the following items: • DAC/VOBA and other intangibles unlocking; • The net gains included in operating earnings from a distribution of cash in conjunction with a Lehman Brothers bankruptcy settlement for assets held in a partnership owned by the Company, and losses on certain receivables associated with the previously disposed Low Income Housing Tax Credit partnerships (“LIHTC”); • A gain related to the amendment or recapture of certain reinsurance agreements during 2014; • The net loss included in operating earnings from the sale of certain alternative investments and investment income associated with assets disposed of during the portfolio restructuring effected during 2012; and • Interest expense related to debt in our Corporate segment. Because DAC/VOBA and other intangibles unlocking can be volatile, excluding the effect of this item can improve period to period comparability. The net gain from the Lehman Brothers bankruptcy settlement, loss from the disposition of low-income housing tax credit partnerships, gain on reinsurance recapture, and impact of investment portfolio restructuring affected run-rate results and we believe that this effect is not reflective of our ongoing performance. We report Ongoing Business operating earnings before income taxes (both adjusted and unadjusted as described above) because we believe this measure is a useful indicator of the business performance for our Ongoing Business segments, excluding the effect of our Closed Blocks and Corporate segments. Adjusted operating earnings before income taxes and Ongoing Business adjusted operating earnings before income taxes are each non-GAAP measures. For a reconciliation of each of these non-GAAP measures to the most directly comparable U.S. GAAP measure, refer to the “Reconciliations” section in this document. Ongoing Business Adjusted Operating ROE/ROC We report Ongoing Business adjusted operating ROE and adjusted operating ROC because we believe these measures are useful indicators of how effectively we use capital resources allocated to our Ongoing Businesses. The most directly comparable U.S. GAAP measure to Ongoing Business adjusted operating ROE and adjusted operating ROC is return on equity. For a reconciliation of these non-GAAP measures to return on equity, refer to the “Reconciliations” section in this document. Operating Earnings per Share; Shareholders’ Equity/Book Value per Share, Excluding AOCI In addition to Net income (loss) per share, we report Operating Earnings per Share because we believe that operating earnings before income taxes provides a meaningful measure of its business and segment performances and enhances the understanding of our financial results by focusing on the operating performance and trends of the underlying business segments and excluding items that tend to be highly variable from period to period based on capital market conditions and/or other factors. In addition to book value per share including accumulated other comprehensive income (AOCI), we also report book value per share excluding AOCI and shareholders’ equity excluding AOCI. Included in AOCI are investment portfolio unrealized gains or losses. In the ordinary course of business we do not plan to sell most investments for the sole purpose of realizing gains or losses, and book value per share excluding AOCI and shareholders’ equity excluding AOCI provide a measure consistent with that view. For a reconciliation of these non-GAAP measures to Net income (loss) per share and book value per share, refer to the “Reconciliations” section in this document. Page 4 of 82 PLAN INVEST PROJECT VOYA FINANCIAL

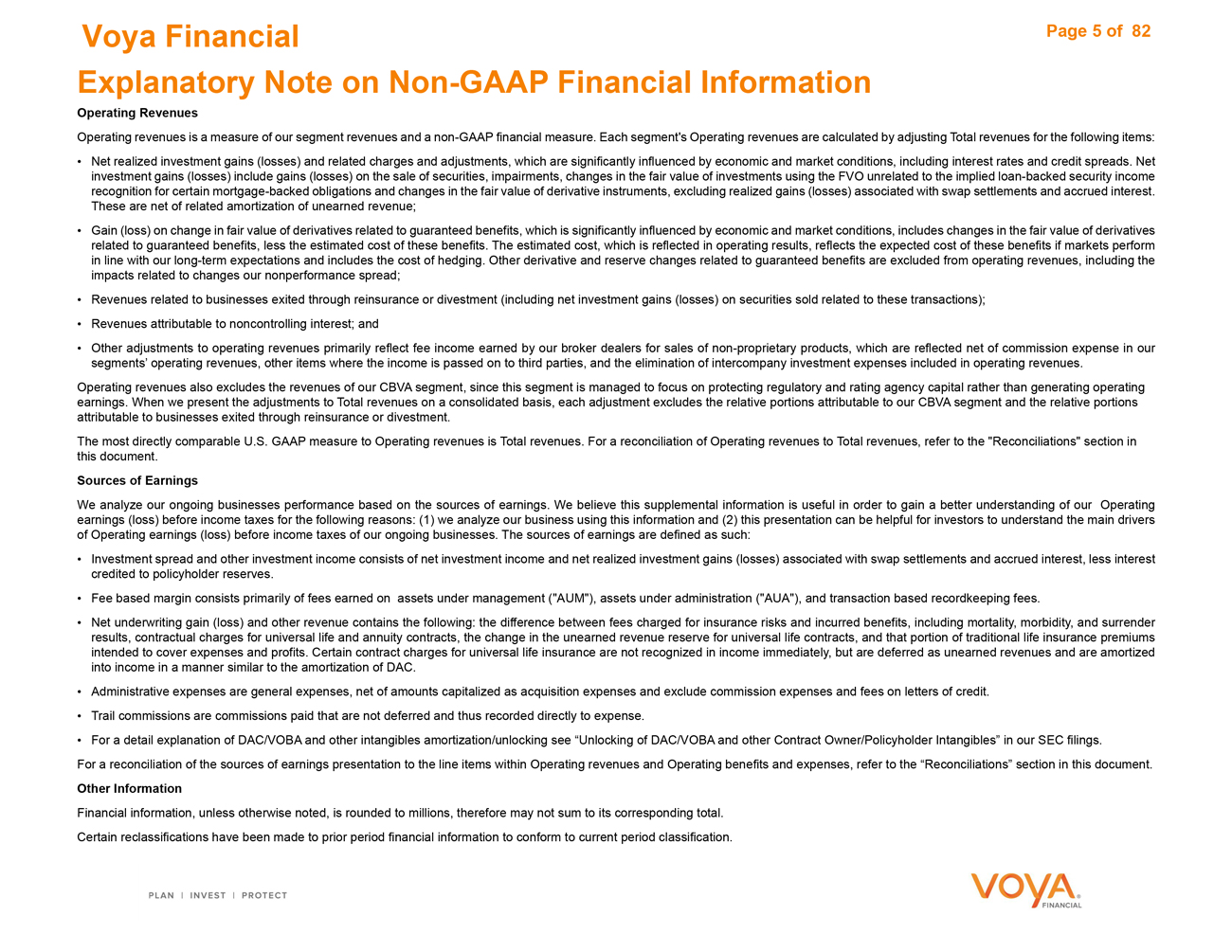

Voya Financial Page 5 of 82 Explanatory Note on Non-GAAP Financial Information

Operating Revenues

Operating revenues is a measure of our segment revenues and a non-GAAP financial measure. Each segment’s Operating revenues are calculated by adjusting Total revenues for the following items:

• Net realized investment gains (losses) and related charges and adjustments, which are significantly influenced by economic and market conditions, including interest rates and credit spreads. Net investment gains (losses) include gains (losses) on the sale of securities, impairments, changes in the fair value of investments using the FVO unrelated to the implied loan-backed security income recognition for certain mortgage-backed obligations and changes in the fair value of derivative instruments, excluding realized gains (losses) associated with swap settlements and accrued interest. These are net of related amortization of unearned revenue;

• Gain (loss) on change in fair value of derivatives related to guaranteed benefits, which is significantly influenced by economic and market conditions, includes changes in the fair value of derivatives related to guaranteed benefits, less the estimated cost of these benefits. The estimated cost, which is reflected in operating results, reflects the expected cost of these benefits if markets perform in line with our long-term expectations and includes the cost of hedging. Other derivative and reserve changes related to guaranteed benefits are excluded from operating revenues, including the impacts related to changes our nonperformance spread;

• Revenues related to businesses exited through reinsurance or divestment (including net investment gains (losses) on securities sold related to these transactions);

• Revenues attributable to noncontrolling interest; and

• Other adjustments to operating revenues primarily reflect fee income earned by our broker dealers for sales of non-proprietary products, which are reflected net of commission expense in our segments’ operating revenues, other items where the income is passed on to third parties, and the elimination of intercompany investment expenses included in operating revenues.

Operating revenues also excludes the revenues of our CBVA segment, since this segment is managed to focus on protecting regulatory and rating agency capital rather than generating operating earnings. When we present the adjustments to Total revenues on a consolidated basis, each adjustment excludes the relative portions attributable to our CBVA segment and the relative portions attributable to businesses exited through reinsurance or divestment.

The most directly comparable U.S. GAAP measure to Operating revenues is Total revenues. For a reconciliation of Operating revenues to Total revenues, refer to the “Reconciliations” section in this document.

Sources of Earnings

We analyze our ongoing businesses performance based on the sources of earnings. We believe this supplemental information is useful in order to gain a better understanding of our Operating earnings (loss) before income taxes for the following reasons: (1) we analyze our business using this information and (2) this presentation can be helpful for investors to understand the main drivers of Operating earnings (loss) before income taxes of our ongoing businesses. The sources of earnings are defined as such:

• Investment spread and other investment income consists of net investment income and net realized investment gains (losses) associated with swap settlements and accrued interest, less interest credited to policyholder reserves.

• Fee based margin consists primarily of fees earned on assets under management (“AUM”), assets under administration (“AUA”), and transaction based recordkeeping fees.

• Net underwriting gain (loss) and other revenue contains the following: the difference between fees charged for insurance risks and incurred benefits, including mortality, morbidity, and surrender results, contractual charges for universal life and annuity contracts, the change in the unearned revenue reserve for universal life contracts, and that portion of traditional life insurance premiums intended to cover expenses and profits. Certain contract charges for universal life insurance are not recognized in income immediately, but are deferred as unearned revenues and are amortized into income in a manner similar to the amortization of DAC.

• Administrative expenses are general expenses, net of amounts capitalized as acquisition expenses and exclude commission expenses and fees on letters of credit.

• Trail commissions are commissions paid that are not deferred and thus recorded directly to expense.

• For a detail explanation of DAC/VOBA and other intangibles amortization/unlocking see “Unlocking of DAC/VOBA and other Contract Owner/Policyholder Intangibles” in our SEC filings.

For a reconciliation of the sources of earnings presentation to the line items within Operating revenues and Operating benefits and expenses, refer to the “Reconciliations” section in this document.

Other Information

Financial information, unless otherwise noted, is rounded to millions, therefore may not sum to its corresponding total. Certain reclassifications have been made to prior period financial information to conform to current period classification.

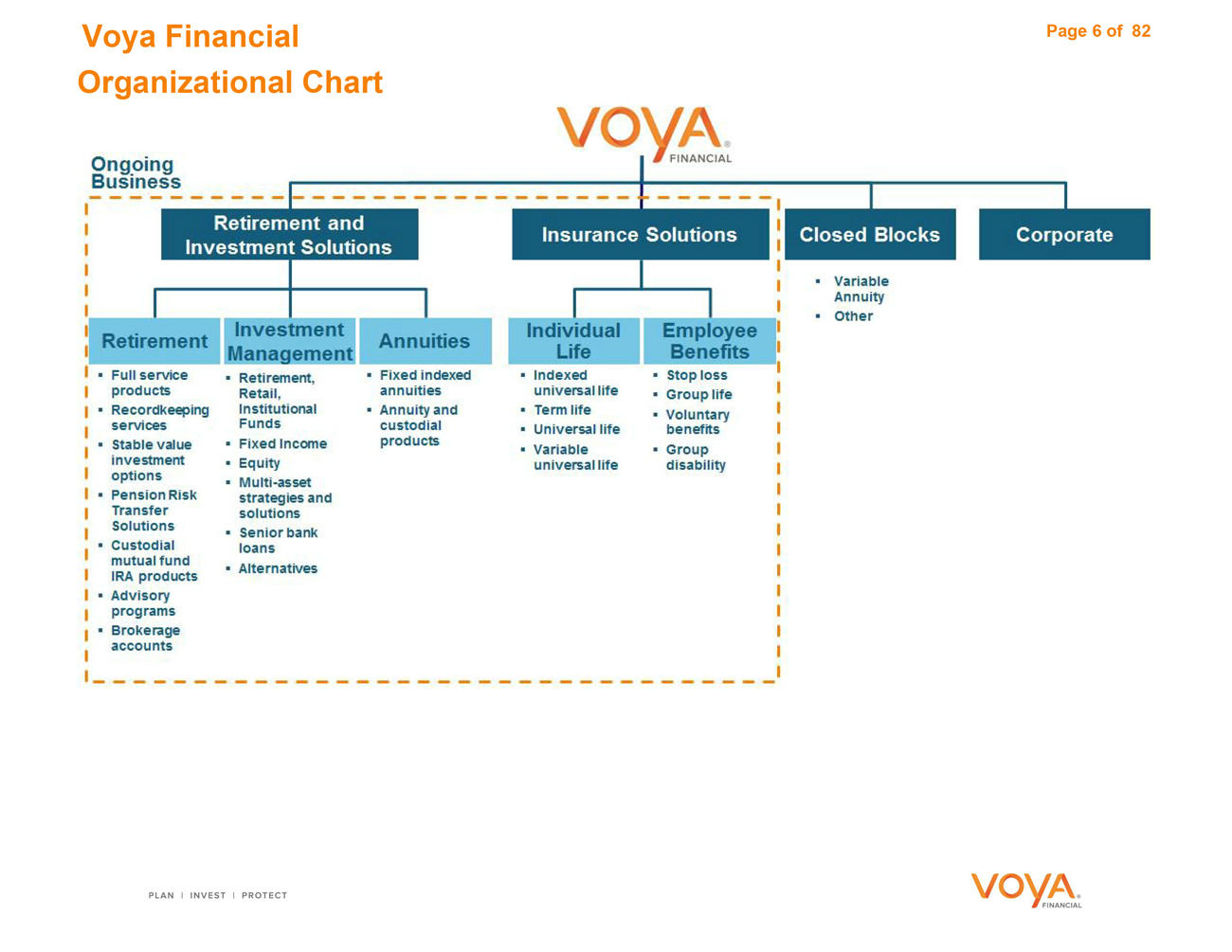

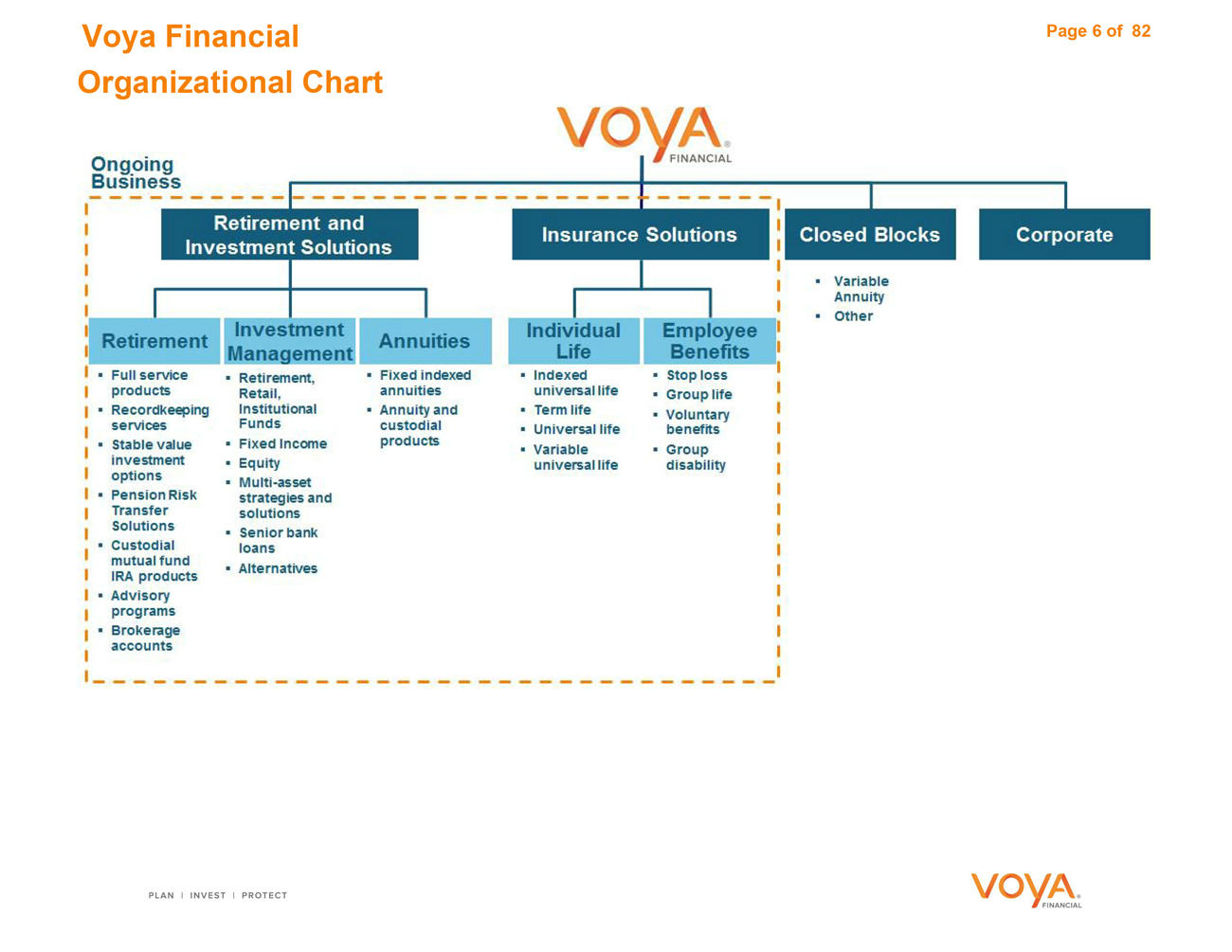

Voya Financial Organizational Chart

Page 6 of 82

Voya Financial

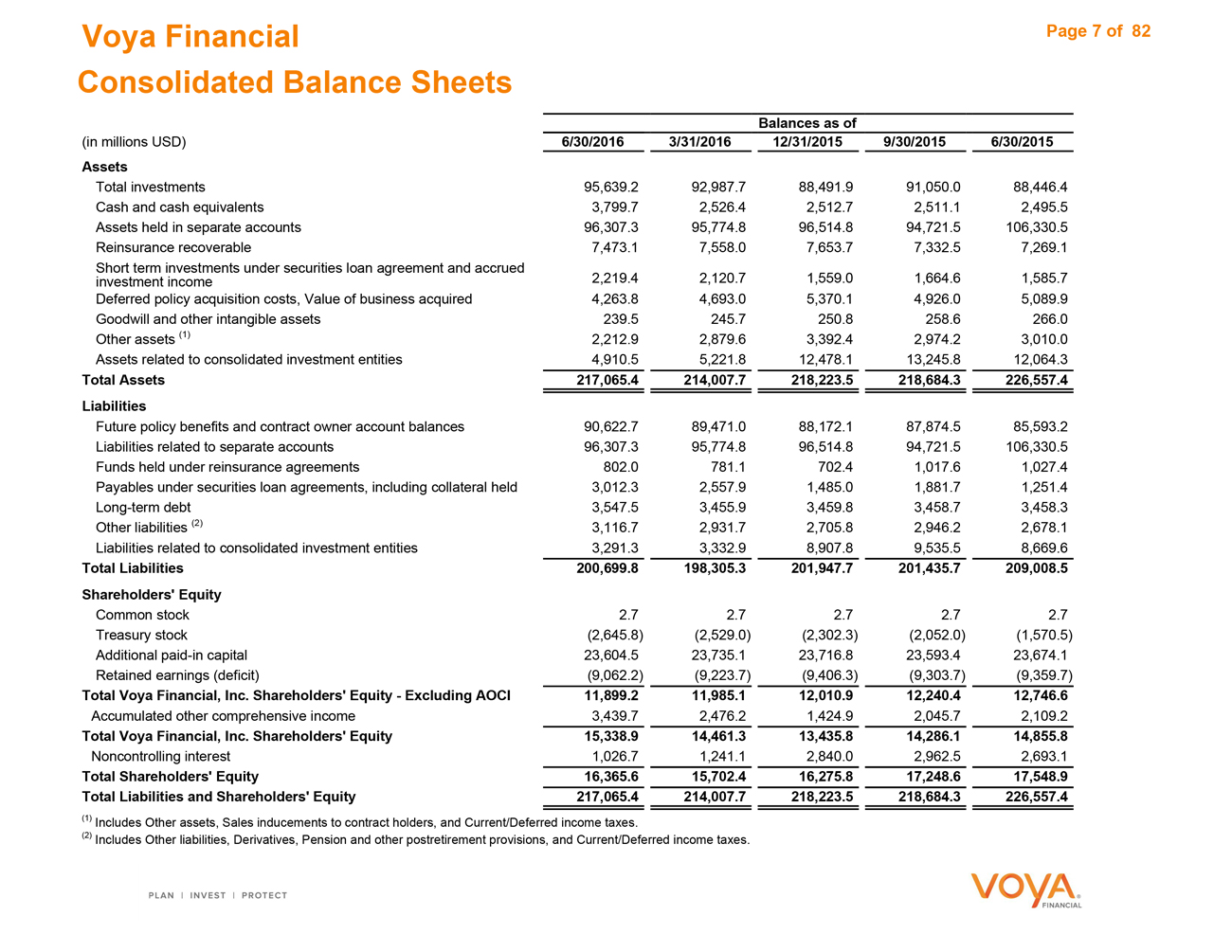

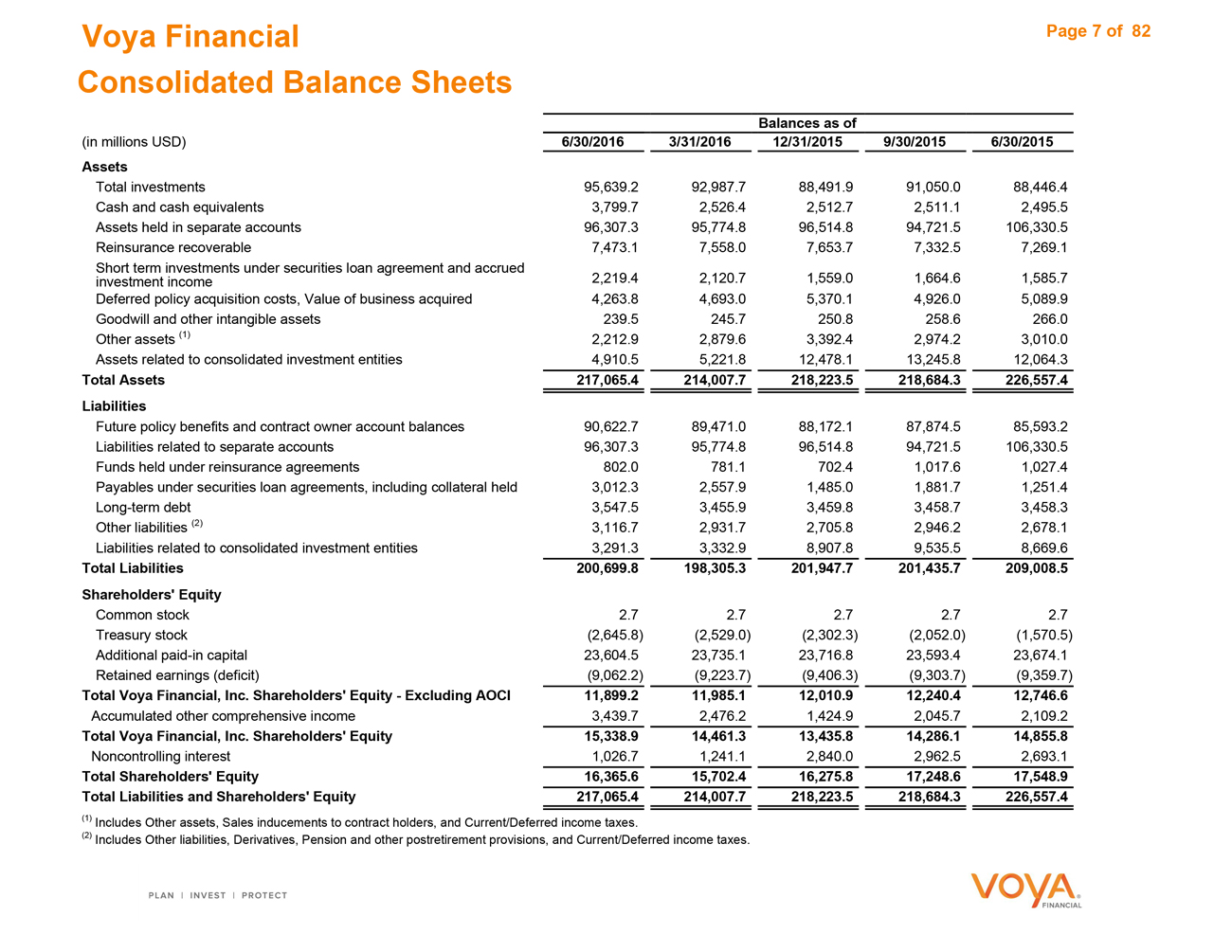

Consolidated Balance Sheets Page 7 of 82

Balances as of

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015

Assets

Total investments 95,639.2 92,987.7 88,491.9 91,050.0 88,446.4

Cash and cash equivalents 3,799.7 2,526.4 2,512.7 2,511.1 2,495.5

Assets held in separate accounts 96,307.3 95,774.8 96,514.8 94,721.5 106,330.5

Reinsurance recoverable 7,473.1 7,558.0 7,653.7 7,332.5 7,269.1

Short term investments under securities loan agreement and accrued

investment income 2,219.4 2,120.7 1,559.0 1,664.6 1,585.7

Deferred policy acquisition costs, Value of business acquired 4,263.8 4,693.0 5,370.1 4,926.0 5,089.9

Goodwill and other intangible assets 239.5 245.7 250.8 258.6 266.0

Other assets (1) 2,212.9 2,879.6 3,392.4 2,974.2 3,010.0

Assets related to consolidated investment entities 4,910.5 5,221.8 12,478.1 13,245.8 12,064.3

Total Assets 217,065.4 214,007.7 218,223.5 218,684.3 226,557.4

Liabilities

Future policy benefits and contract owner account balances 90,622.7 89,471.0 88,172.1 87,874.5 85,593.2

Liabilities related to separate accounts 96,307.3 95,774.8 96,514.8 94,721.5 106,330.5

Funds held under reinsurance agreements 802.0 781.1 702.4 1,017.6 1,027.4

Payables under securities loan agreements, including collateral held 3,012.3 2,557.9 1,485.0 1,881.7 1,251.4

Long-term debt 3,547.5 3,455.9 3,459.8 3,458.7 3,458.3

Other liabilities (2) 3,116.7 2,931.7 2,705.8 2,946.2 2,678.1

Liabilities related to consolidated investment entities 3,291.3 3,332.9 8,907.8 9,535.5 8,669.6

Total Liabilities 200,699.8 198,305.3 201,947.7 201,435.7 209,008.5

Shareholders’ Equity

Common stock 2.7 2.7 2.7 2.7 2.7

Treasury stock(2,645.8)(2,529.0)(2,302.3)(2,052.0)(1,570.5)

Additional paid-in capital 23,604.5 23,735.1 23,716.8 23,593.4 23,674.1

Retained earnings (deficit)(9,062.2)(9,223.7)(9,406.3)(9,303.7)(9,359.7)

Total Voya Financial, Inc. Shareholders’ Equity—Excluding AOCI 11,899.2 11,985.1 12,010.9 12,240.4 12,746.6

Accumulated other comprehensive income 3,439.7 2,476.2 1,424.9 2,045.7 2,109.2

Total Voya Financial, Inc. Shareholders’ Equity 15,338.9 14,461.3 13,435.8 14,286.1 14,855.8

Noncontrolling interest 1,026.7 1,241.1 2,840.0 2,962.5 2,693.1

Total Shareholders’ Equity 16,365.6 15,702.4 16,275.8 17,248.6 17,548.9

Total Liabilities and Shareholders’ Equity 217,065.4 214,007.7 218,223.5 218,684.3 226,557.4

(1) Includes Other assets, Sales inducements to contract holders, and Current/Deferred income taxes.

(2) Includes Other liabilities, Derivatives, Pension and other postretirement provisions, and Current/Deferred income taxes.

Page 8 of 82

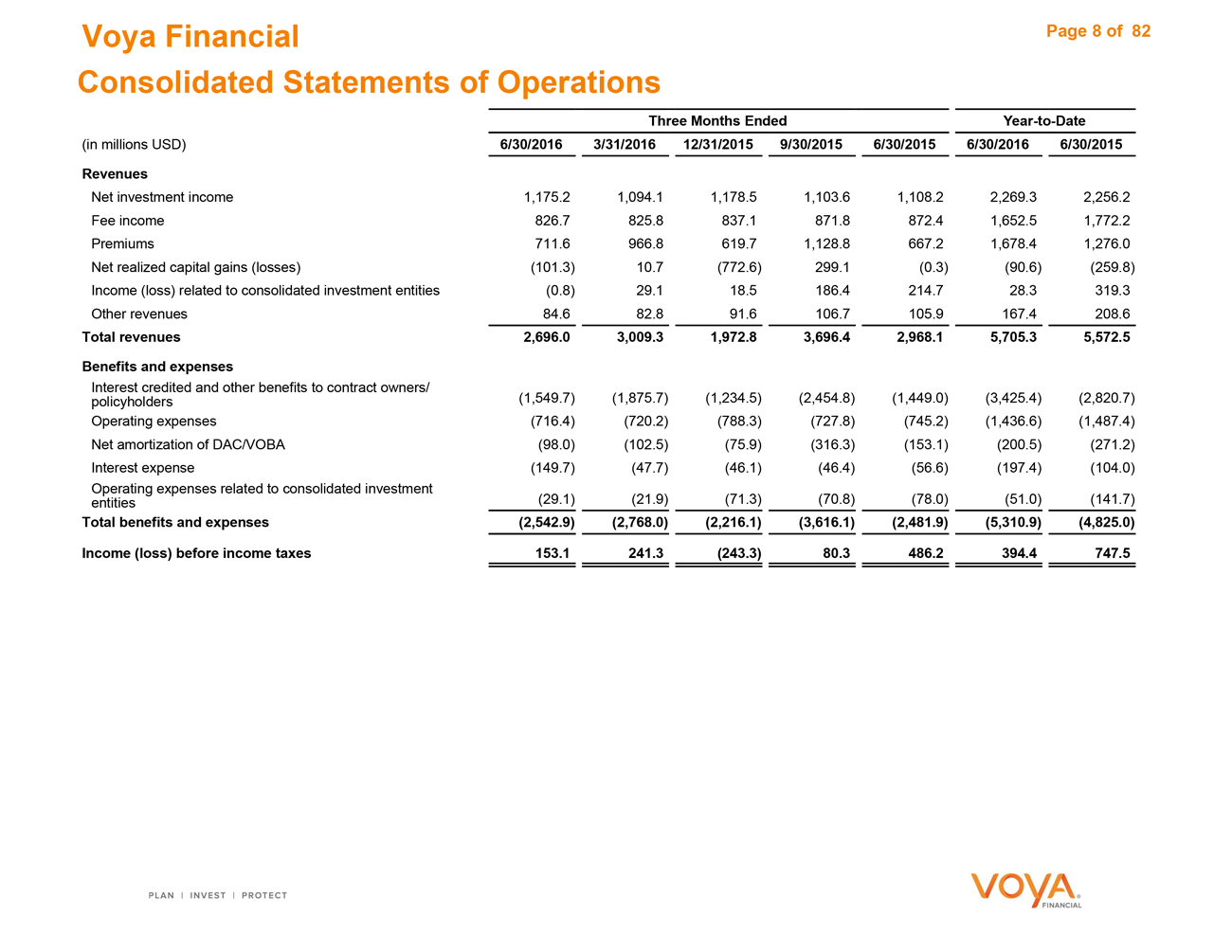

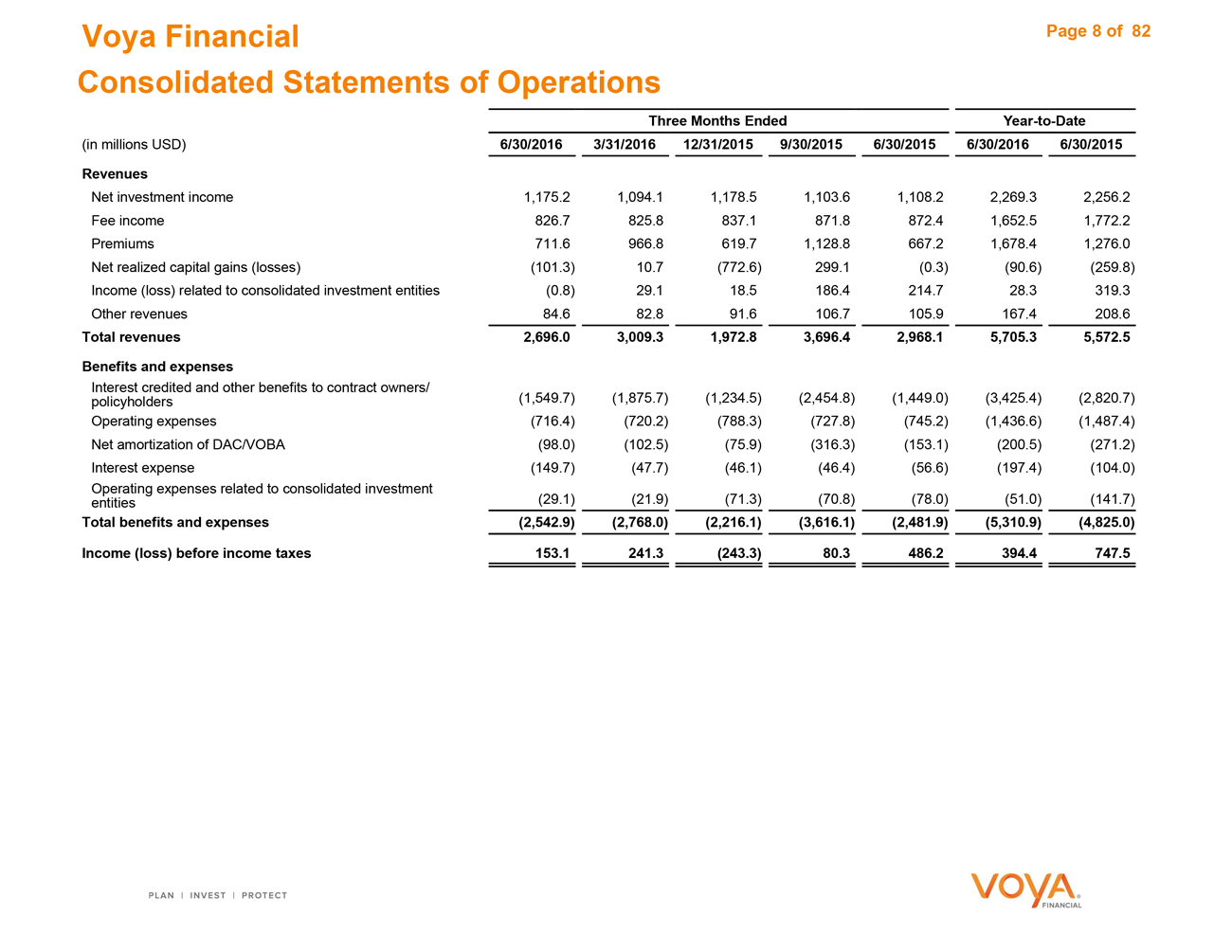

Voya Financial Consolidated Statements of Operations

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Revenues

Net investment income 1,175.2 1,094.1 1,178.5 1,103.6 1,108.2 2,269.3 2,256.2

Fee income 826.7 825.8 837.1 871.8 872.4 1,652.5 1,772.2

Premiums 711.6 966.8 619.7 1,128.8 667.2 1,678.4 1,276.0

Net realized capital gains (losses)(101.3) 10.7(772.6) 299.1(0.3)(90.6)(259.8)

Income (loss) related to consolidated investment entities(0.8) 29.1 18.5 186.4 214.7 28.3 319.3

Other revenues 84.6 82.8 91.6 106.7 105.9 167.4 208.6

Total revenues 2,696.0 3,009.3 1,972.8 3,696.4 2,968.1 5,705.3 5,572.5

Benefits and expenses

Interest credited and other benefits to contract owners/

policyholders(1,549.7)(1,875.7)(1,234.5)(2,454.8)(1,449.0)(3,425.4)(2,820.7)

Operating expenses(716.4)(720.2)(788.3)(727.8)(745.2)(1,436.6)(1,487.4)

Net amortization of DAC/VOBA(98.0)(102.5)(75.9)(316.3)(153.1)(200.5)(271.2)

Interest expense(149.7)(47.7)(46.1)(46.4)(56.6)(197.4)(104.0)

Operating expenses related to consolidated investment

entities(29.1)(21.9)(71.3)(70.8)(78.0)(51.0)(141.7)

Total benefits and expenses(2,542.9)(2,768.0)(2,216.1)(3,616.1)(2,481.9)(5,310.9)(4,825.0)

Income (loss) before income taxes 153.1 241.3(243.3) 80.3 486.2 394.4 747.5

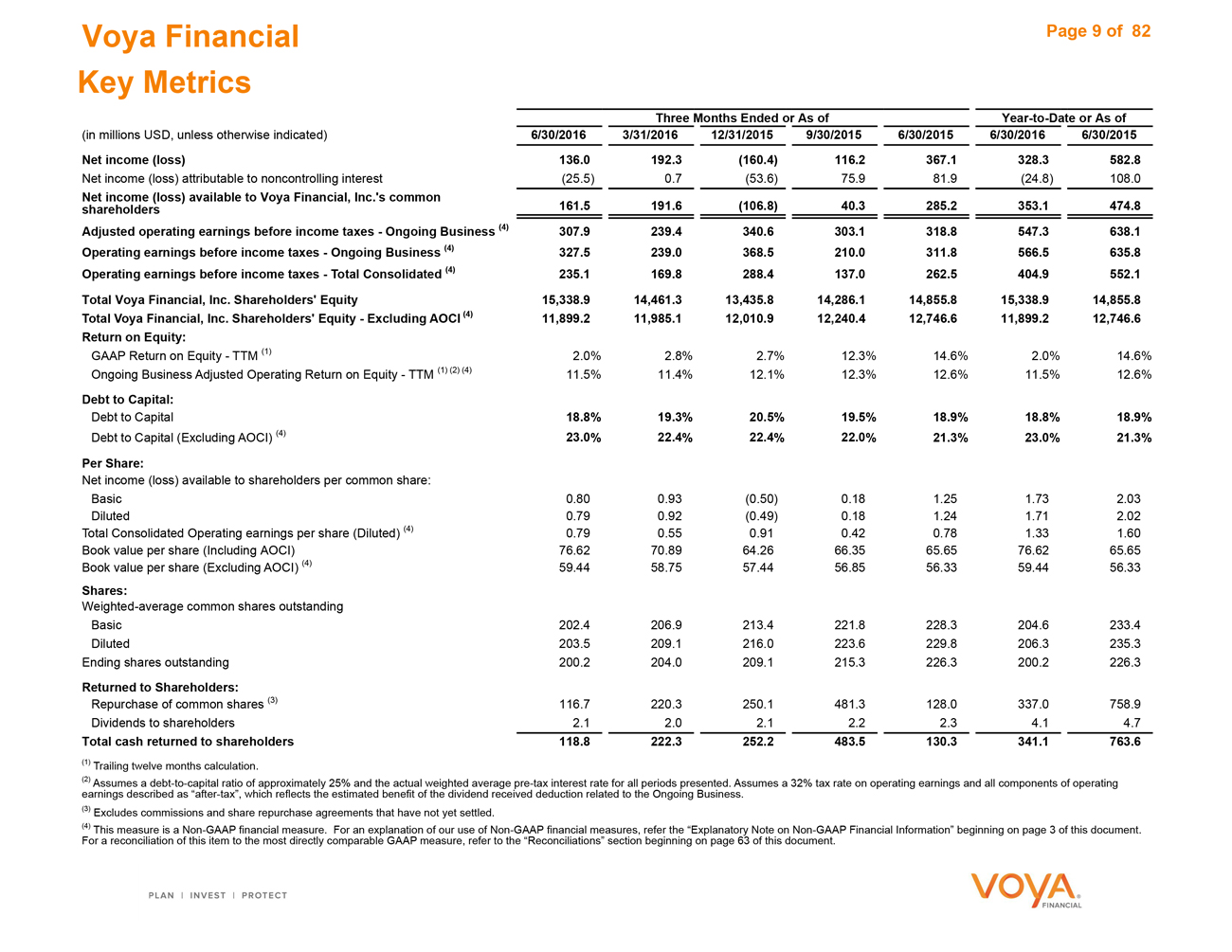

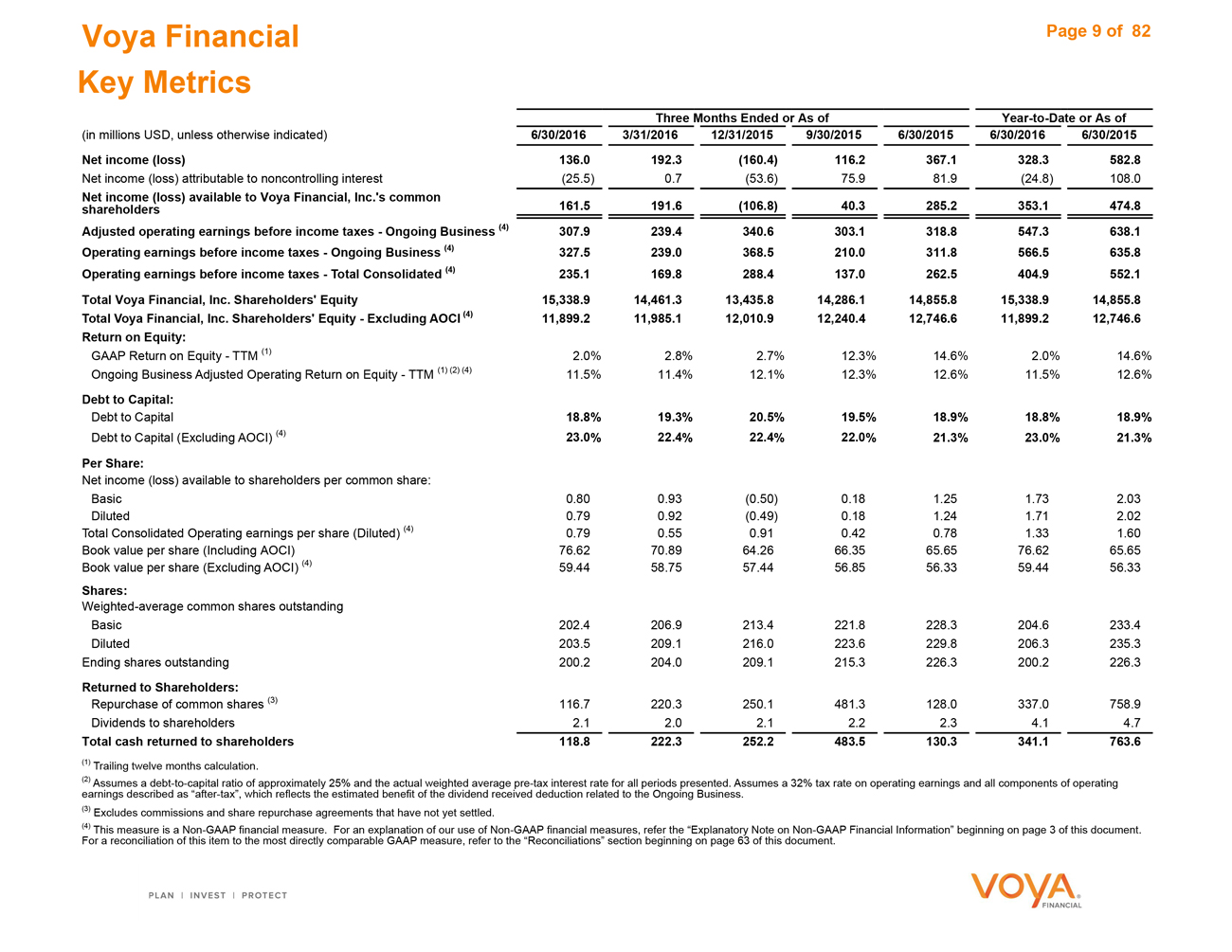

Voya Financial Page 9 of 82 Key Metrics Three Months Ended or As of Year-to-Date or As of (in millions USD, unless otherwise indicated) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015 Net income (loss) 136.0 192.3 (160.4) 116.2 367.1 328.3 582.8 Net income (loss) attributable to noncontrolling interest (25.5) 0.7 (53.6) 75.9 81.9 (24.8) 108.0 Net income (loss) available to Voya Financial, Inc.’s common 161.5 191.6 shareholders (106.8) 40.3 285.2 353.1 474.8 Adjusted operating earnings before income taxes - Ongoing Business (4) 307.9 239.4 340.6 303.1 318.8 547.3 638.1 Operating earnings before income taxes - Ongoing Business (4) 327.5 239.0 368.5 210.0 311.8 566.5 635.8 Operating earnings before income taxes - Total Consolidated (4) 235.1 169.8 288.4 137.0 262.5 404.9 552.1 Total Voya Financial, Inc. Shareholders’ Equity 15,338.9 14,461.3 13,435.8 14,286.1 14,855.8 15,338.9 14,855.8 Total Voya Financial, Inc. Shareholders’ Equity - Excluding AOCI (4) 11,899.2 11,985.1 12,010.9 12,240.4 12,746.6 11,899.2 12,746.6 Return on Equity: GAAP Return on Equity - TTM (1) 2.0% 2.8% 2.7% 12.3% 14.6% 2.0% 14.6% Ongoing Business Adjusted Operating Return on Equity - TTM (1) (2) (4) 11.5% 11.4% 12.1% 12.3% 12.6% 11.5% 12.6% Debt to Capital: Debt to Capital 18.8% 19.3% 20.5% 19.5% 18.9% 18.8% 18.9% Debt to Capital (Excluding AOCI) (4) 23.0% 22.4% 22.4% 22.0% 21.3% 23.0% 21.3% Per Share: Net income (loss) available to shareholders per common share: Basic 0.80 0.93 (0.50) 0.18 1.25 1.73 2.03 Diluted 0.79 0.92 (0.49) 0.18 1.24 1.71 2.02 Total Consolidated Operating earnings per share (Diluted) (4) 0.79 0.55 0.91 0.42 0.78 1.33 1.60 Book value per share (Including AOCI) 76.62 70.89 64.26 66.35 65.65 76.62 65.65 Book value per share (Excluding AOCI) (4) 59.44 58.75 57.44 56.85 56.33 59.44 56.33 Shares: Weighted-average common shares outstanding Basic 202.4 206.9 213.4 221.8 228.3 204.6 233.4 Diluted 203.5 209.1 216.0 223.6 229.8 206.3 235.3 Ending shares outstanding 200.2 204.0 209.1 215.3 226.3 200.2 226.3 Returned to Shareholders: Repurchase of common shares (3) 116.7 220.3 250.1 481.3 128.0 337.0 758.9 Dividends to shareholders 2.1 2.0 2.1 2.2 2.3 4.1 4.7 Total cash returned to shareholders 118.8 222.3 252.2 483.5 130.3 341.1 763.6 (1) Trailing twelve months calculation. (2) Assumes a debt-to-capital ratio of approximately 25% and the actual weighted average pre-tax interest rate for all periods presented. Assumes a 32% tax rate on operating earnings and all components of operating earnings described as “after-tax”, which reflects the estimated benefit of the dividend received deduction related to the Ongoing Business. (3) Excludes commissions and share repurchase agreements that have not yet settled. (4) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 63 of this document.

Voya Financial

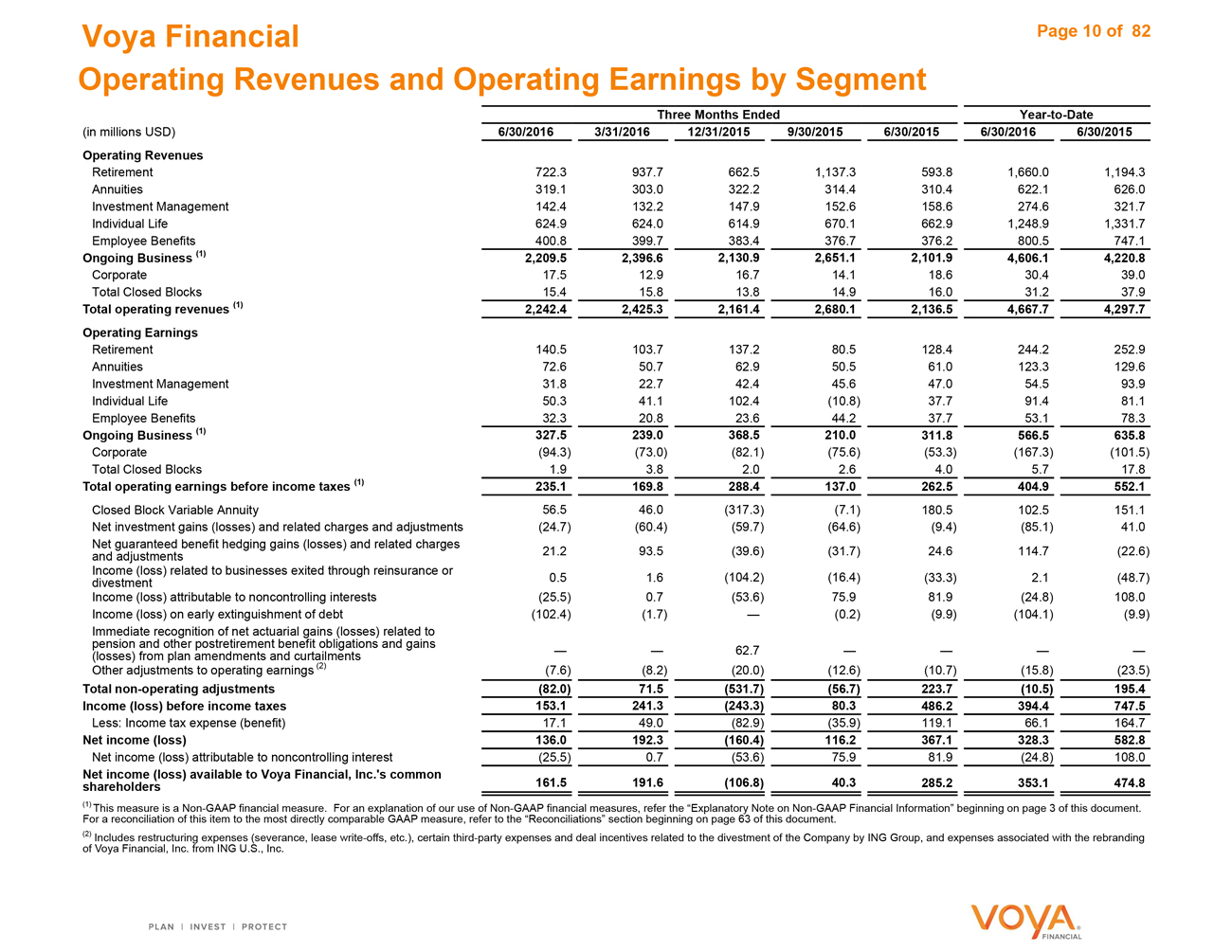

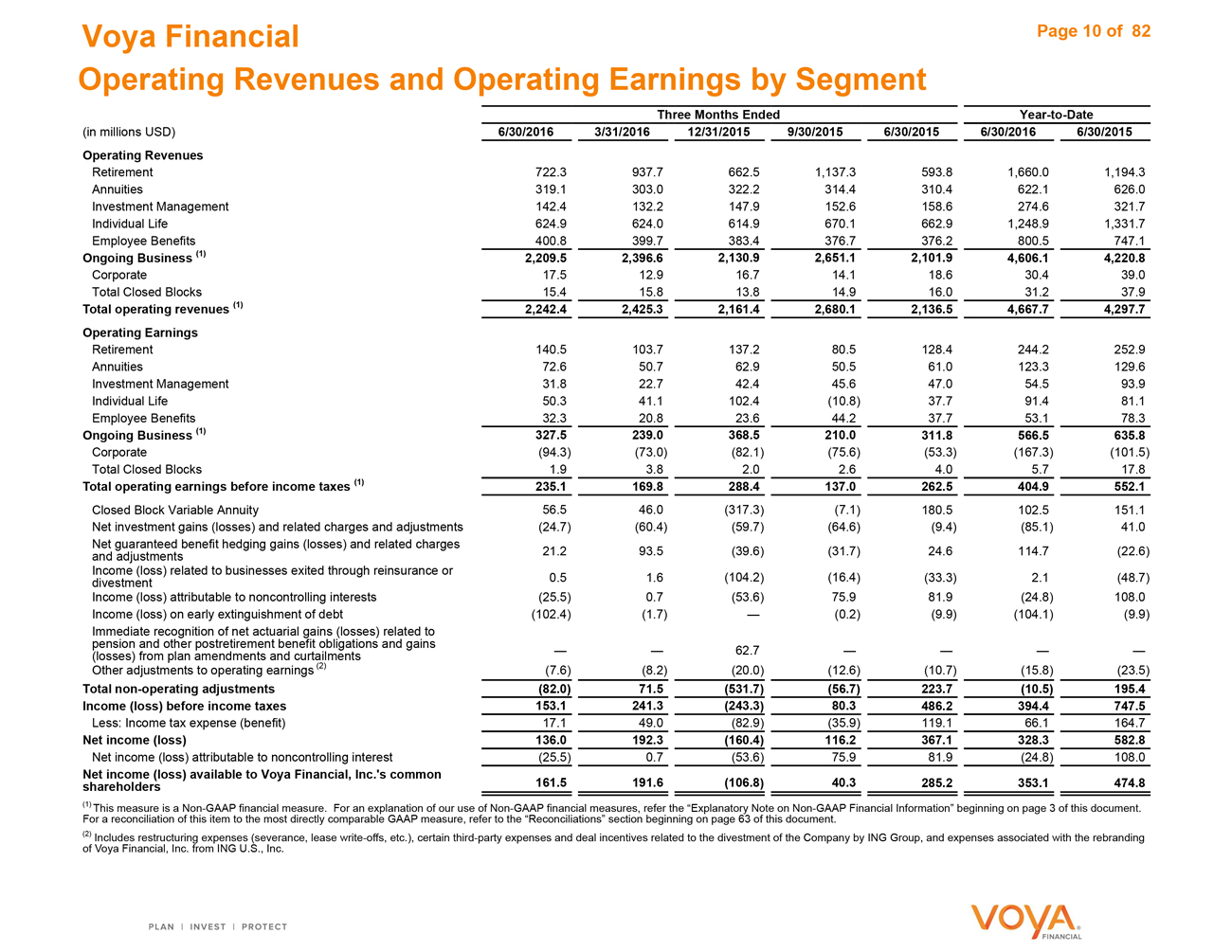

Operating Revenues and Operating Earnings by Segment

Page 10 of 82

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Operating Revenues

Retirement 722.3 937.7 662.5 1,137.3 593.8 1,660.0 1,194.3

Annuities 319.1 303.0 322.2 314.4 310.4 622.1 626.0

Investment Management 142.4 132.2 147.9 152.6 158.6 274.6 321.7

Individual Life 624.9 624.0 614.9 670.1 662.9 1,248.9 1,331.7

Employee Benefits 400.8 399.7 383.4 376.7 376.2 800.5 747.1

Ongoing Business (1) 2,209.5 2,396.6 2,130.9 2,651.1 2,101.9 4,606.1 4,220.8

Corporate 17.5 12.9 16.7 14.1 18.6 30.4 39.0

Total Closed Blocks 15.4 15.8 13.8 14.9 16.0 31.2 37.9

Total operating revenues (1) 2,242.4 2,425.3 2,161.4 2,680.1 2,136.5 4,667.7 4,297.7

Operating Earnings

Retirement 140.5 103.7 137.2 80.5 128.4 244.2 252.9

Annuities 72.6 50.7 62.9 50.5 61.0 123.3 129.6

Investment Management 31.8 22.7 42.4 45.6 47.0 54.5 93.9

Individual Life 50.3 41.1 102.4(10.8) 37.7 91.4 81.1

Employee Benefits 32.3 20.8 23.6 44.2 37.7 53.1 78.3

Ongoing Business (1) 327.5 239.0 368.5 210.0 311.8 566.5 635.8

Corporate(94.3)(73.0)(82.1)(75.6)(53.3)(167.3)(101.5)

Total Closed Blocks 1.9 3.8 2.0 2.6 4.0 5.7 17.8

Total operating earnings before income taxes (1) 235.1 169.8 288.4 137.0 262.5 404.9 552.1

Closed Block Variable Annuity 56.5 46.0(317.3)(7.1) 180.5 102.5 151.1

Net investment gains (losses) and related charges and adjustments(24.7)(60.4)(59.7)(64.6)(9.4)(85.1) 41.0

Net guaranteed benefit hedging gains (losses) and related charges

and adjustments 21.2 93.5(39.6)(31.7) 24.6 114.7(22.6)

Income (loss) related to businesses exited through reinsurance or

divestment 0.5 1.6(104.2)(16.4)(33.3) 2.1(48.7)

Income (loss) attributable to noncontrolling interests(25.5) 0.7(53.6) 75.9 81.9(24.8) 108.0

Income (loss) on early extinguishment of debt(102.4)(1.7) —(0.2)(9.9)(104.1)(9.9)

Immediate recognition of net actuarial gains (losses) related to

pension and other postretirement benefit obligations and gains

(losses) from plan amendments and curtailments — — 62.7 — — — —

Other adjustments to operating earnings (2)(7.6)(8.2)(20.0)(12.6)(10.7)(15.8)(23.5)

Total non-operating adjustments(82.0) 71.5(531.7)(56.7) 223.7(10.5) 195.4

Income (loss) before income taxes 153.1 241.3(243.3) 80.3 486.2 394.4 747.5

Less: Income tax expense (benefit) 17.1 49.0(82.9)(35.9) 119.1 66.1 164.7

Net income (loss) 136.0 192.3(160.4) 116.2 367.1 328.3 582.8

Net income (loss) attributable to noncontrolling interest(25.5) 0.7(53.6) 75.9 81.9(24.8) 108.0

Net income (loss) available to Voya Financial, Inc.‘s common 161.5 191.6(106.8

shareholders ) 40.3 285.2 353.1 474.8

(1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 63 of this document.

(2) Includes restructuring expenses (severance, lease write-offs, etc.), certain third-party expenses and deal incentives related to the divestment of the Company by ING Group, and expenses associated with the rebranding of Voya Financial, Inc. from ING U.S., Inc.

Voya Financial

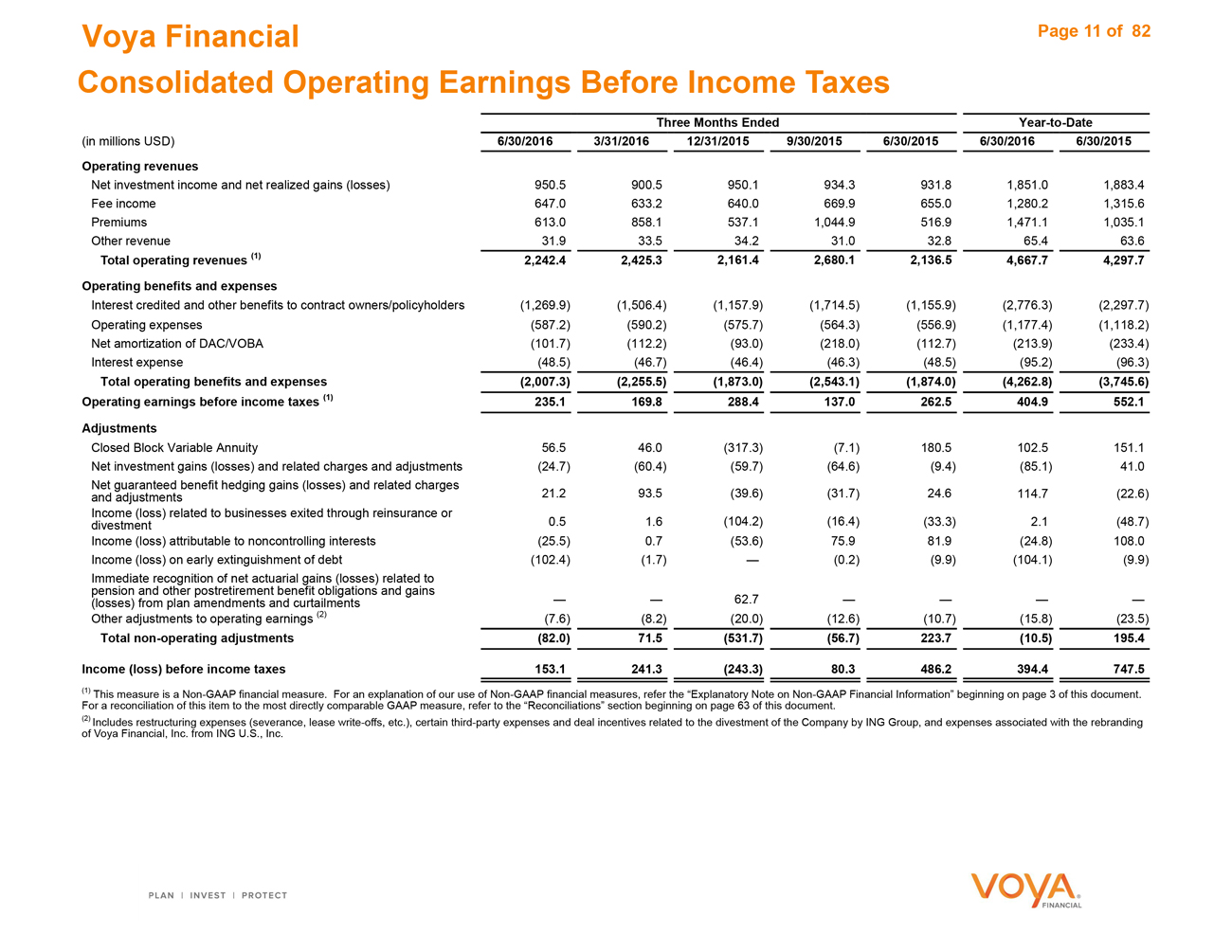

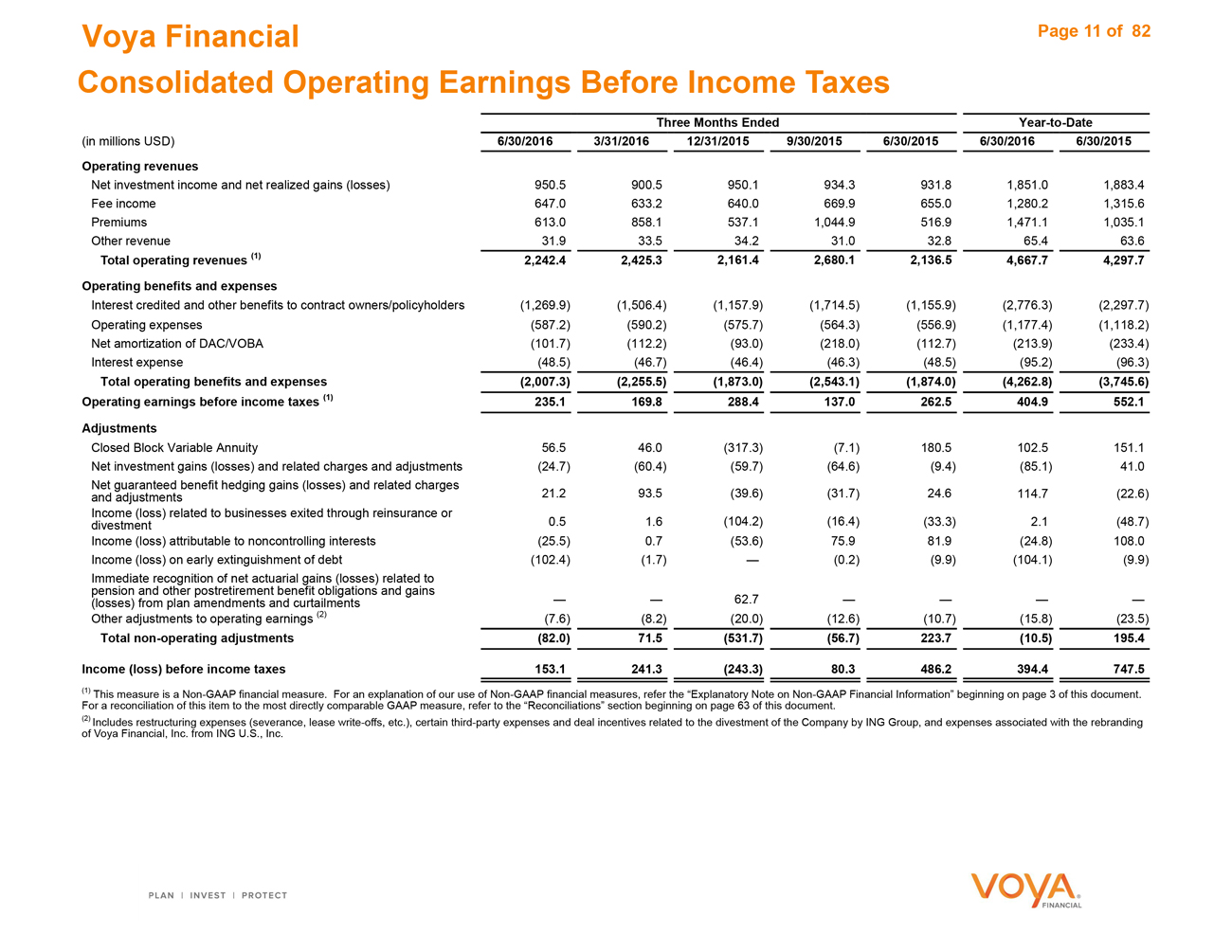

Consolidated Operating Earnings Before Income Taxes

Page 11 of 82

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Operating revenues

Net investment income and net realized gains (losses) 950.5 900.5 950.1 934.3 931.8 1,851.0 1,883.4

Fee income 647.0 633.2 640.0 669.9 655.0 1,280.2 1,315.6

Premiums 613.0 858.1 537.1 1,044.9 516.9 1,471.1 1,035.1

Other revenue 31.9 33.5 34.2 31.0 32.8 65.4 63.6

Total operating revenues (1) 2,242.4 2,425.3 2,161.4 2,680.1 2,136.5 4,667.7 4,297.7

Operating benefits and expenses

Interest credited and other benefits to contract owners/policyholders(1,269.9)(1,506.4)(1,157.9)(1,714.5)(1,155.9)(2,776.3)(2,297.7)

Operating expenses(587.2)(590.2)(575.7)(564.3)(556.9)(1,177.4)(1,118.2)

Net amortization of DAC/VOBA(101.7)(112.2)(93.0)(218.0)(112.7)(213.9)(233.4)

Interest expense(48.5)(46.7)(46.4)(46.3)(48.5)(95.2)(96.3)

Total operating benefits and expenses(2,007.3)(2,255.5)(1,873.0)(2,543.1)(1,874.0)(4,262.8)(3,745.6)

Operating earnings before income taxes (1) 235.1 169.8 288.4 137.0 262.5 404.9 552.1

Adjustments

Closed Block Variable Annuity 56.5 46.0(317.3)(7.1) 180.5 102.5 151.1

Net investment gains (losses) and related charges and adjustments(24.7)(60.4)(59.7)(64.6)(9.4)(85.1) 41.0

Net guaranteed benefit hedging gains (losses) and related charges 21.2 93.5(39.6)(31.7) 24.6

and adjustments 114.7(22.6)

Income (loss) related to businesses exited through reinsurance or

divestment 0.5 1.6(104.2)(16.4)(33.3) 2.1(48.7)

Income (loss) attributable to noncontrolling interests(25.5) 0.7(53.6) 75.9 81.9(24.8) 108.0

Income (loss) on early extinguishment of debt(102.4)(1.7) —(0.2)(9.9)(104.1)(9.9)

Immediate recognition of net actuarial gains (losses) related to

pension and other postretirement benefit obligations and gains

(losses) from plan amendments and curtailments — — 62.7 — — — —

Other adjustments to operating earnings (2)(7.6)(8.2)(20.0)(12.6)(10.7)(15.8)(23.5)

Total non-operating adjustments(82.0) 71.5(531.7)(56.7) 223.7(10.5) 195.4

Income (loss) before income taxes 153.1 241.3(243.3) 80.3 486.2 394.4 747.5

(1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 63 of this document.

(2) Includes restructuring expenses (severance, lease write-offs, etc.), certain third-party expenses and deal incentives related to the divestment of the Company by ING Group, and expenses associated with the rebranding of Voya Financial, Inc. from ING U.S., Inc.

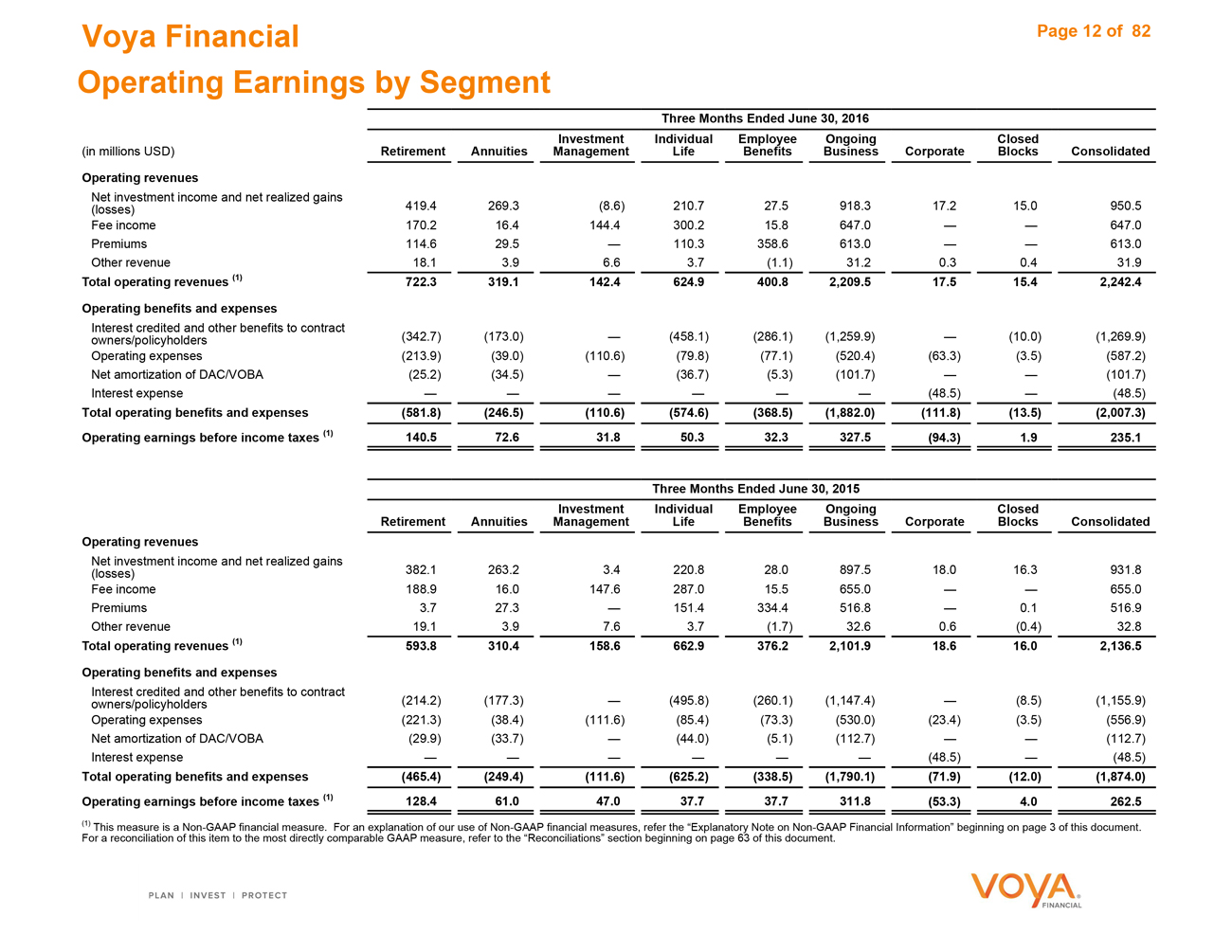

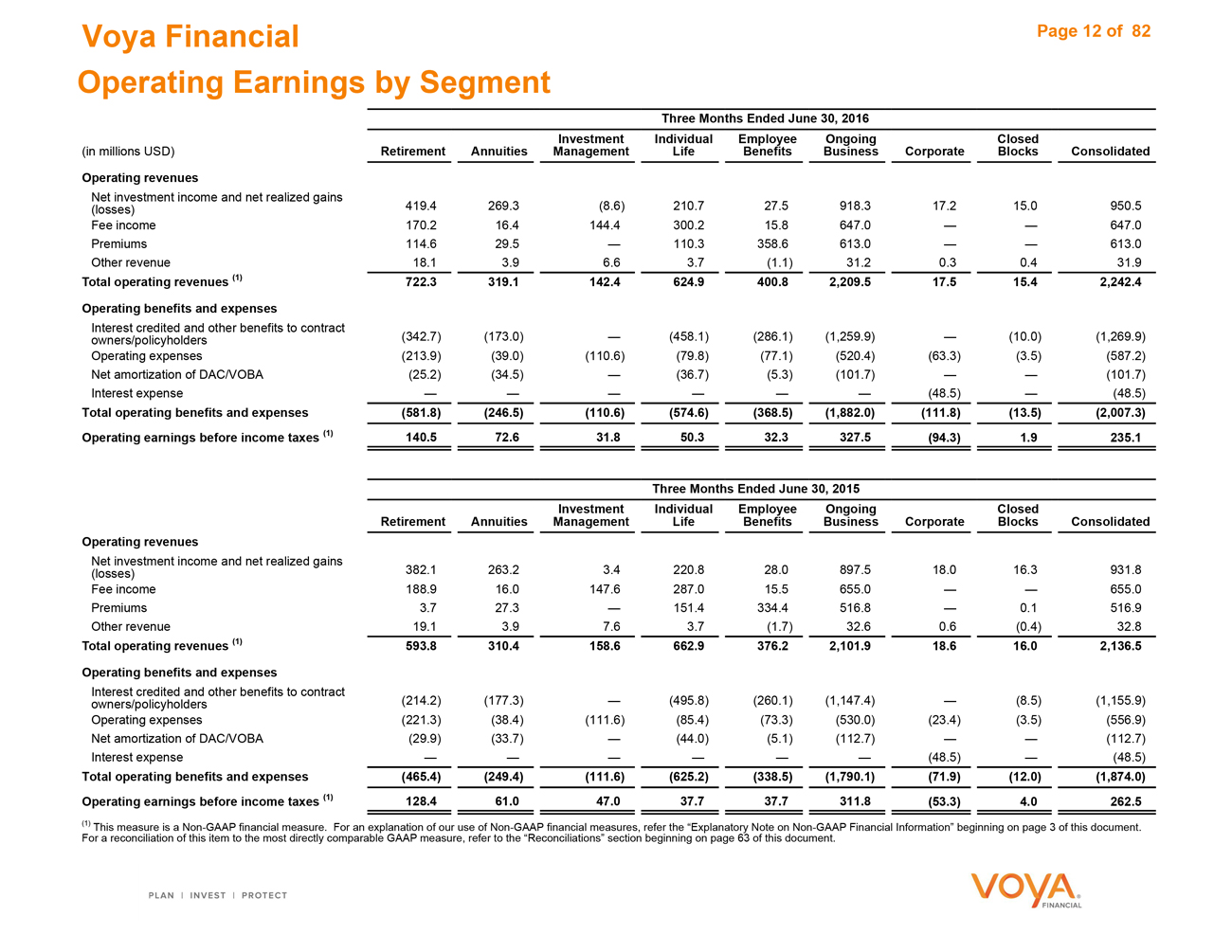

Voya Financial Page 12 of 82 Operating Earnings by Segment

Three Months Ended June 30, 2016

Investment Individual Employee Ongoing Closed

(in millions USD) Retirement Annuities Management Life Benefits Business Corporate Blocks Consolidated

Operating revenues

Net investment income and net realized gains 419.4 269.3(8.6) 210.7 27.5 918.3

(losses) 17.2 15.0 950.5

Fee income 170.2 16.4 144.4 300.2 15.8 647.0 — — 647.0

Premiums 114.6 29.5 — 110.3 358.6 613.0 — — 613.0

Other revenue 18.1 3.9 6.6 3.7(1.1) 31.2 0.3 0.4 31.9

Total operating revenues (1) 722.3 319.1 142.4 624.9 400.8 2,209.5 17.5 15.4 2,242.4

Operating benefits and expenses

Interest credited and other benefits to contract

owners/policyholders(342.7)(173.0) —(458.1)(286.1)(1,259.9) —(10.0)(1,269.9)

Operating expenses(213.9)(39.0)(110.6)(79.8)(77.1)(520.4)(63.3)(3.5)(587.2)

Net amortization of DAC/VOBA(25.2)(34.5) —(36.7)(5.3)(101.7) — —(101.7)

Interest expense — — — — — —(48.5) —(48.5)

Total operating benefits and expenses(581.8)(246.5)(110.6)(574.6)(368.5)(1,882.0)(111.8)(13.5)(2,007.3)

Operating earnings before income taxes (1) 140.5 72.6 31.8 50.3 32.3 327.5(94.3) 1.9 235.1

Three Months Ended June 30, 2015

Investment Individual Employee Ongoing Closed

Retirement Annuities Management Life Benefits Business Corporate Blocks Consolidated

Operating revenues

Net investment income and net realized gains 382.1 263.2

(losses) 3.4 220.8 28.0 897.5 18.0 16.3 931.8

Fee income 188.9 16.0 147.6 287.0 15.5 655.0 — — 655.0

Premiums 3.7 27.3 — 151.4 334.4 516.8 — 0.1 516.9

Other revenue 19.1 3.9 7.6 3.7(1.7) 32.6 0.6(0.4) 32.8

Total operating revenues (1) 593.8 310.4 158.6 662.9 376.2 2,101.9 18.6 16.0 2,136.5

Operating benefits and expenses

Interest credited and other benefits to contract

owners/policyholders(214.2)(177.3) —(495.8)(260.1)(1,147.4) —(8.5)(1,155.9)

Operating expenses(221.3)(38.4)(111.6)(85.4)(73.3)(530.0)(23.4)(3.5)(556.9)

Net amortization of DAC/VOBA(29.9)(33.7) —(44.0)(5.1)(112.7) — —(112.7)

Interest expense — — — — — —(48.5) —(48.5)

Total operating benefits and expenses(465.4)(249.4)(111.6)(625.2)(338.5)(1,790.1)(71.9)(12.0)(1,874.0)

Operating earnings before income taxes (1) 128.4 61.0 47.0 37.7 37.7 311.8(53.3) 4.0 262.5

(1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 63 of this document.

Voya Financial

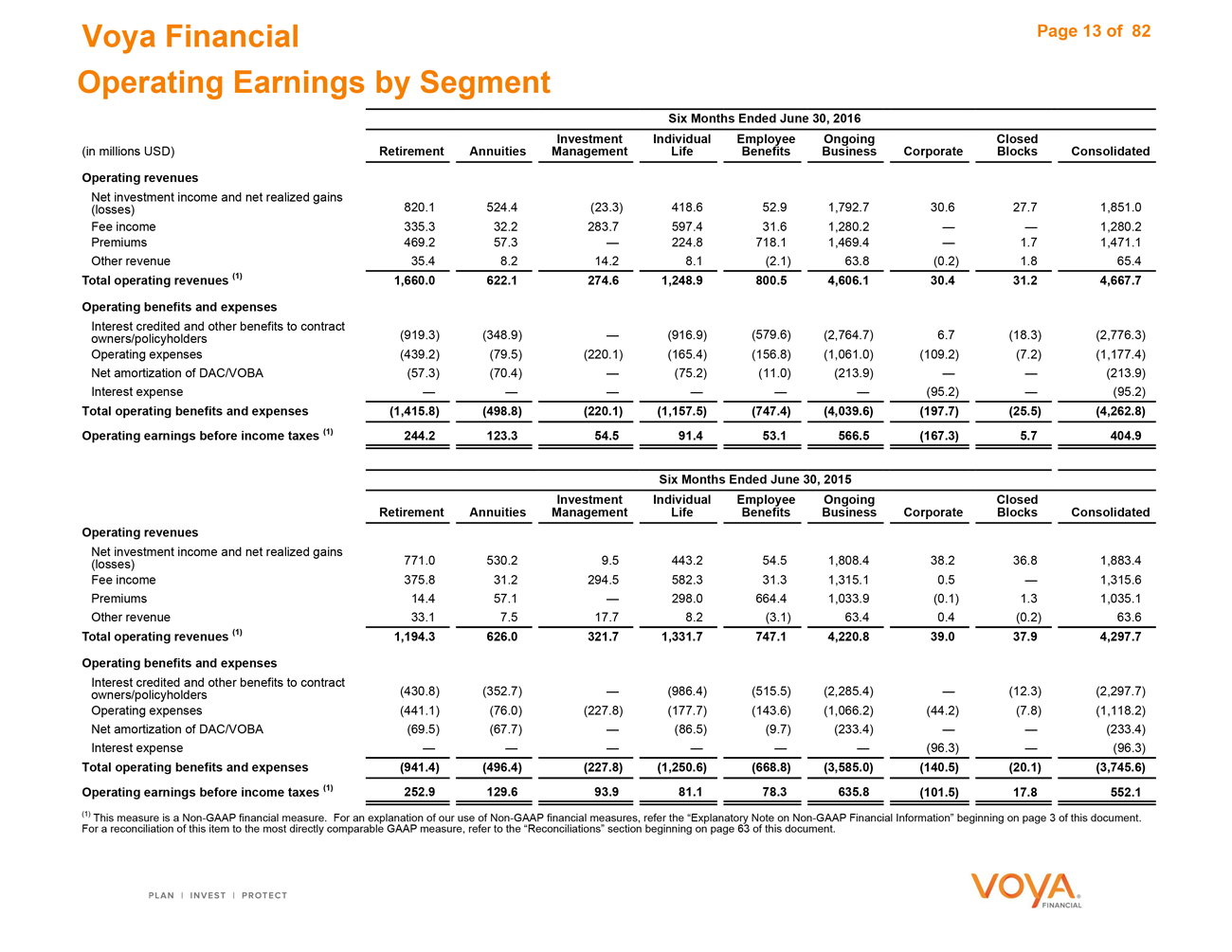

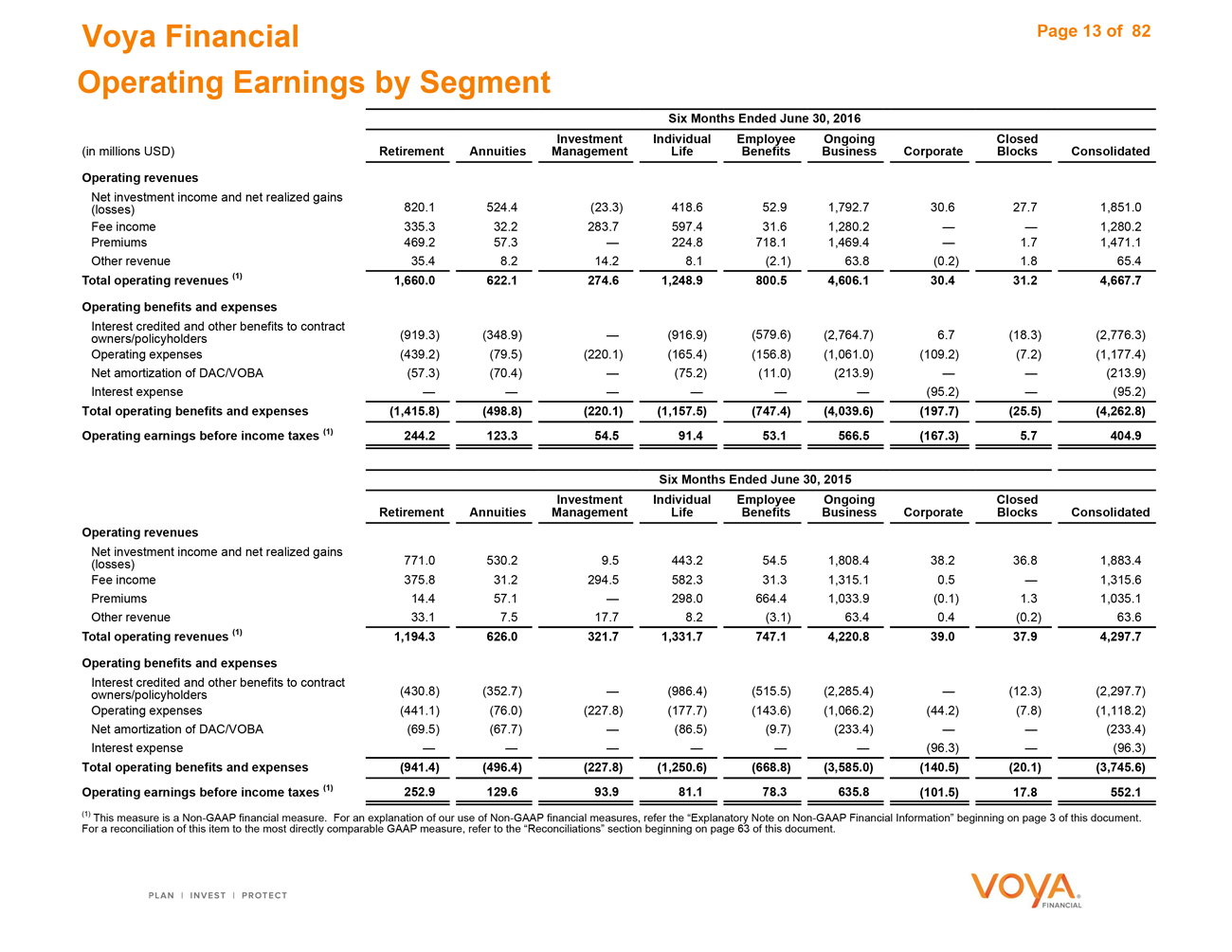

Operating Earnings by Segment Page 13 of 82

Six Months Ended June 30, 2016

Investment Individual Employee Ongoing Closed

(in millions USD) Retirement Annuities Management Life Benefits Business Corporate Blocks Consolidated

Operating revenues

Net investment income and net realized gains

(losses) 820.1 524.4(23.3) 418.6 52.9 1,792.7 30.6 27.7 1,851.0

Fee income 335.3 32.2 283.7 597.4 31.6 1,280.2 — — 1,280.2

Premiums 469.2 57.3 — 224.8 718.1 1,469.4 — 1.7 1,471.1

Other revenue 35.4 8.2 14.2 8.1(2.1) 63.8(0.2) 1.8 65.4

Total operating revenues (1) 1,660.0 622.1 274.6 1,248.9 800.5 4,606.1 30.4 31.2 4,667.7

Operating benefits and expenses

Interest credited and other benefits to contract

owners/policyholders(919.3)(348.9) —(916.9)(579.6)(2,764.7) 6.7(18.3)(2,776.3)

Operating expenses(439.2)(79.5)(220.1)(165.4)(156.8)(1,061.0)(109.2)(7.2)(1,177.4)

Net amortization of DAC/VOBA(57.3)(70.4) —(75.2)(11.0)(213.9) — —(213.9)

Interest expense — — — — — —(95.2) —(95.2)

Total operating benefits and expenses(1,415.8)(498.8)(220.1)(1,157.5)(747.4)(4,039.6)(197.7)(25.5)(4,262.8)

Operating earnings before income taxes (1) 244.2 123.3 54.5 91.4 53.1 566.5(167.3) 5.7 404.9

Six Months Ended June 30, 2015

Investment Individual Employee Ongoing Closed

Retirement Annuities Management Life Benefits Business Corporate Blocks Consolidated

Operating revenues

Net investment income and net realized gains 771.0 530.2

(losses) 9.5 443.2 54.5 1,808.4 38.2 36.8 1,883.4

Fee income 375.8 31.2 294.5 582.3 31.3 1,315.1 0.5 — 1,315.6

Premiums 14.4 57.1 — 298.0 664.4 1,033.9(0.1) 1.3 1,035.1

Other revenue 33.1 7.5 17.7 8.2(3.1) 63.4 0.4(0.2) 63.6

Total operating revenues (1) 1,194.3 626.0 321.7 1,331.7 747.1 4,220.8 39.0 37.9 4,297.7

Operating benefits and expenses

Interest credited and other benefits to contract

owners/policyholders(430.8)(352.7) —(986.4)(515.5)(2,285.4) —(12.3)(2,297.7)

Operating expenses(441.1)(76.0)(227.8)(177.7)(143.6)(1,066.2)(44.2)(7.8)(1,118.2)

Net amortization of DAC/VOBA(69.5)(67.7) —(86.5)(9.7)(233.4) — —(233.4)

Interest expense — — — — — —(96.3) —(96.3)

Total operating benefits and expenses(941.4)(496.4)(227.8)(1,250.6)(668.8)(3,585.0)(140.5)(20.1)(3,745.6)

Operating earnings before income taxes (1) 252.9 129.6 93.9 81.1 78.3 635.8(101.5) 17.8 552.1

(1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 63 of this document.

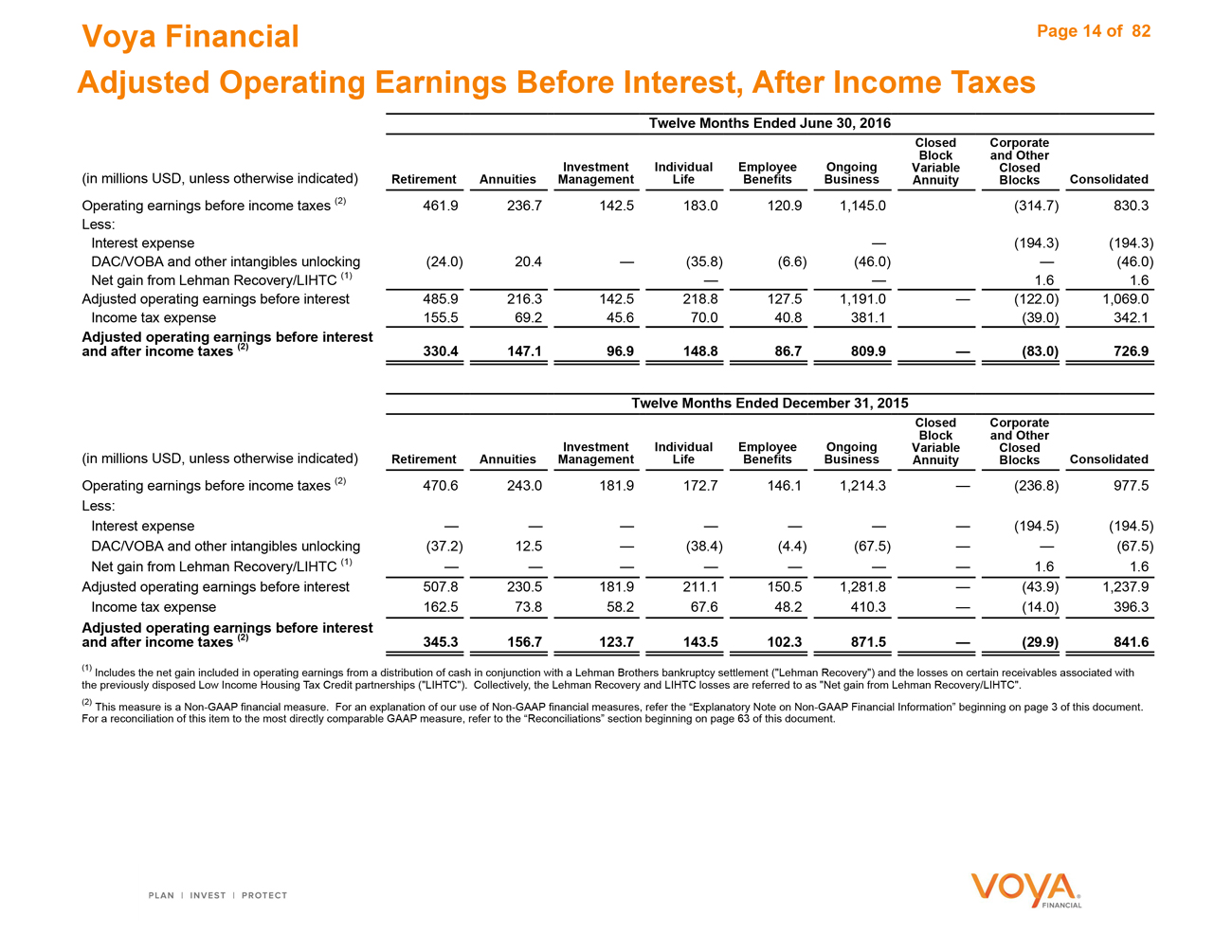

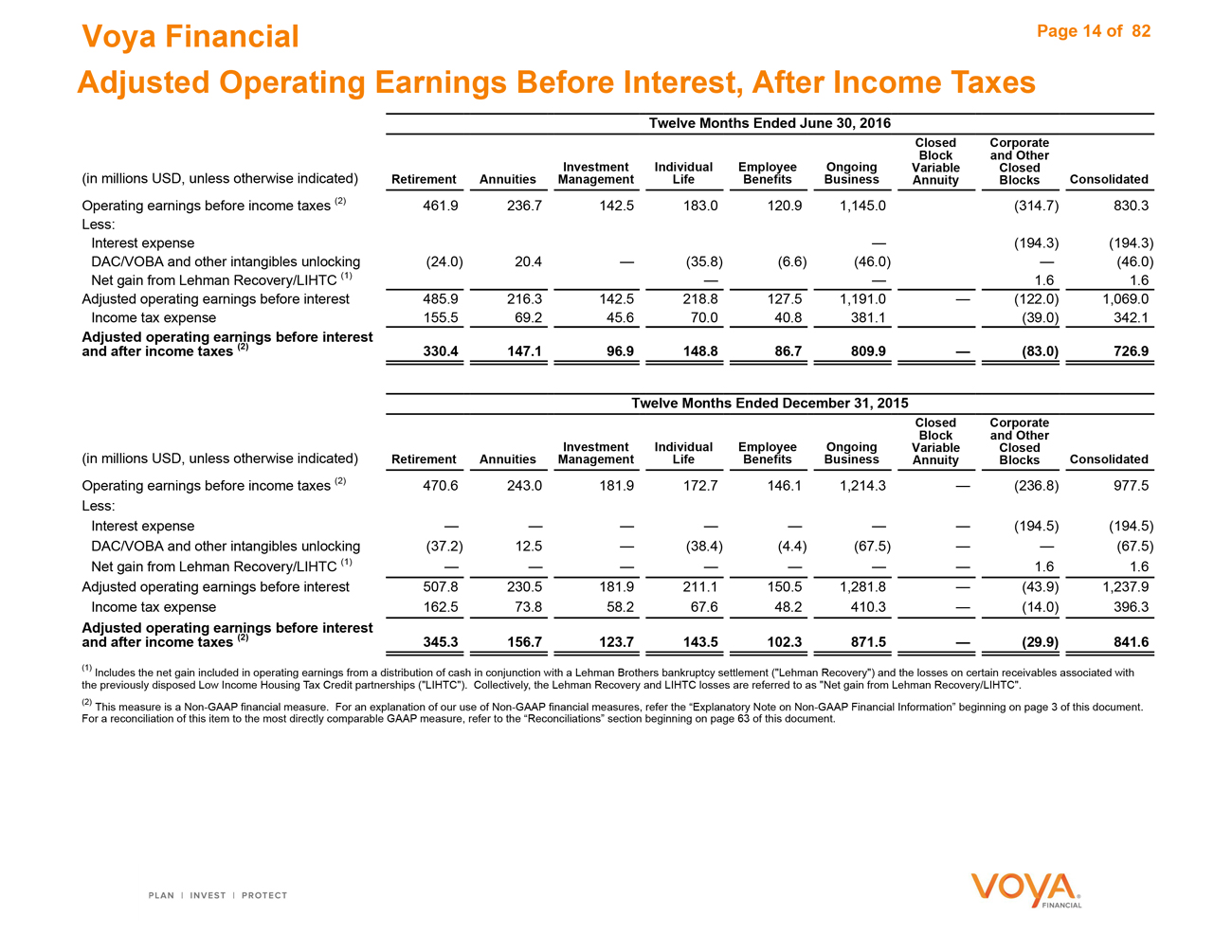

Voya Financial

Adjusted Operating Earnings Before Interest, After Income Taxes

Page 14 of 82

Twelve Months Ended June 30, 2016

Closed Corporate

Block and Other

Investment Individual Employee Ongoing Variable Closed

(in millions USD, unless otherwise indicated) Retirement Annuities Management Life Benefits Business Annuity Blocks Consolidated

Operating earnings before income taxes (2) 461.9 236.7 142.5 183.0 120.9 1,145.0(314.7) 830.3

Less:

Interest expense —(194.3)(194.3)

DAC/VOBA and other intangibles unlocking(24.0) 20.4 —(35.8)(6.6)(46.0) —(46.0)

Net gain from Lehman Recovery/LIHTC (1) — — 1.6 1.6

Adjusted operating earnings before interest 485.9 216.3 142.5 218.8 127.5 1,191.0 —(122.0) 1,069.0

Income tax expense 155.5 69.2 45.6 70.0 40.8 381.1(39.0) 342.1

Adjusted operating earnings before interest

and after income taxes (2) 330.4 147.1 96.9 148.8 86.7 809.9 —(83.0) 726.9

Twelve Months Ended December 31, 2015

Closed Corporate

Block and Other

Investment Individual Employee Ongoing Variable Closed

(in millions USD, unless otherwise indicated) Retirement Annuities Management Life Benefits Business Annuity Blocks Consolidated

Operating earnings before income taxes (2) 470.6 243.0 181.9 172.7 146.1 1,214.3 —(236.8) 977.5

Less:

Interest expense — — — — — — —(194.5)(194.5)

DAC/VOBA and other intangibles unlocking(37.2) 12.5 —(38.4)(4.4)(67.5) — —(67.5)

Net gain from Lehman Recovery/LIHTC (1) — — — — — — — 1.6 1.6

Adjusted operating earnings before interest 507.8 230.5 181.9 211.1 150.5 1,281.8 —(43.9) 1,237.9

Income tax expense 162.5 73.8 58.2 67.6 48.2 410.3 —(14.0) 396.3

Adjusted operating earnings before interest

and after income taxes (2) 345.3 156.7 123.7 143.5 102.3 871.5 —(29.9) 841.6

(1) Includes the net gain included in operating earnings from a distribution of cash in conjunction with a Lehman Brothers bankruptcy settlement (“Lehman Recovery”) and the losses on certain receivables associated with the previously disposed Low Income Housing Tax Credit partnerships (“LIHTC”). Collectively, the Lehman Recovery and LIHTC losses are referred to as “Net gain from Lehman Recovery/LIHTC”.

(2) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 63 of this document.

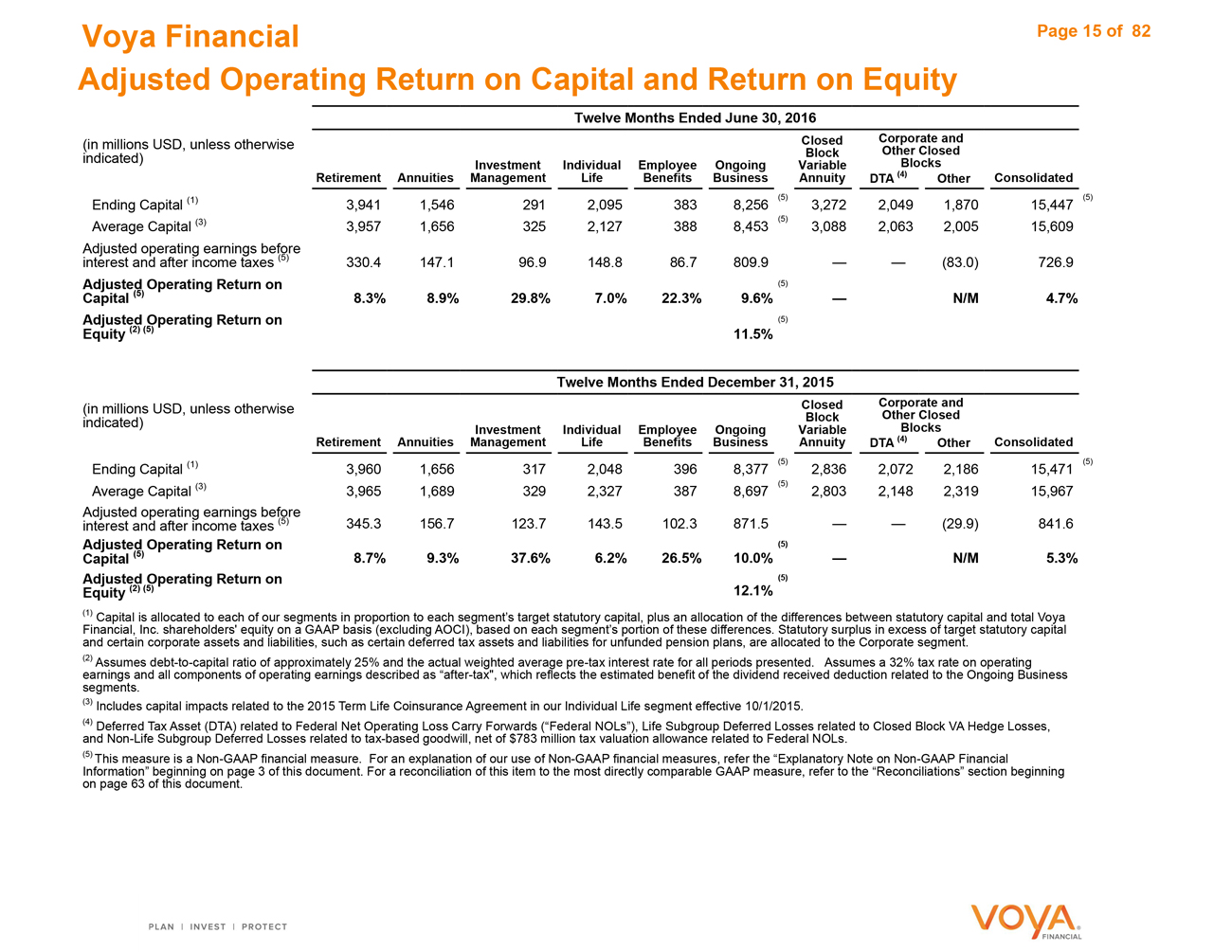

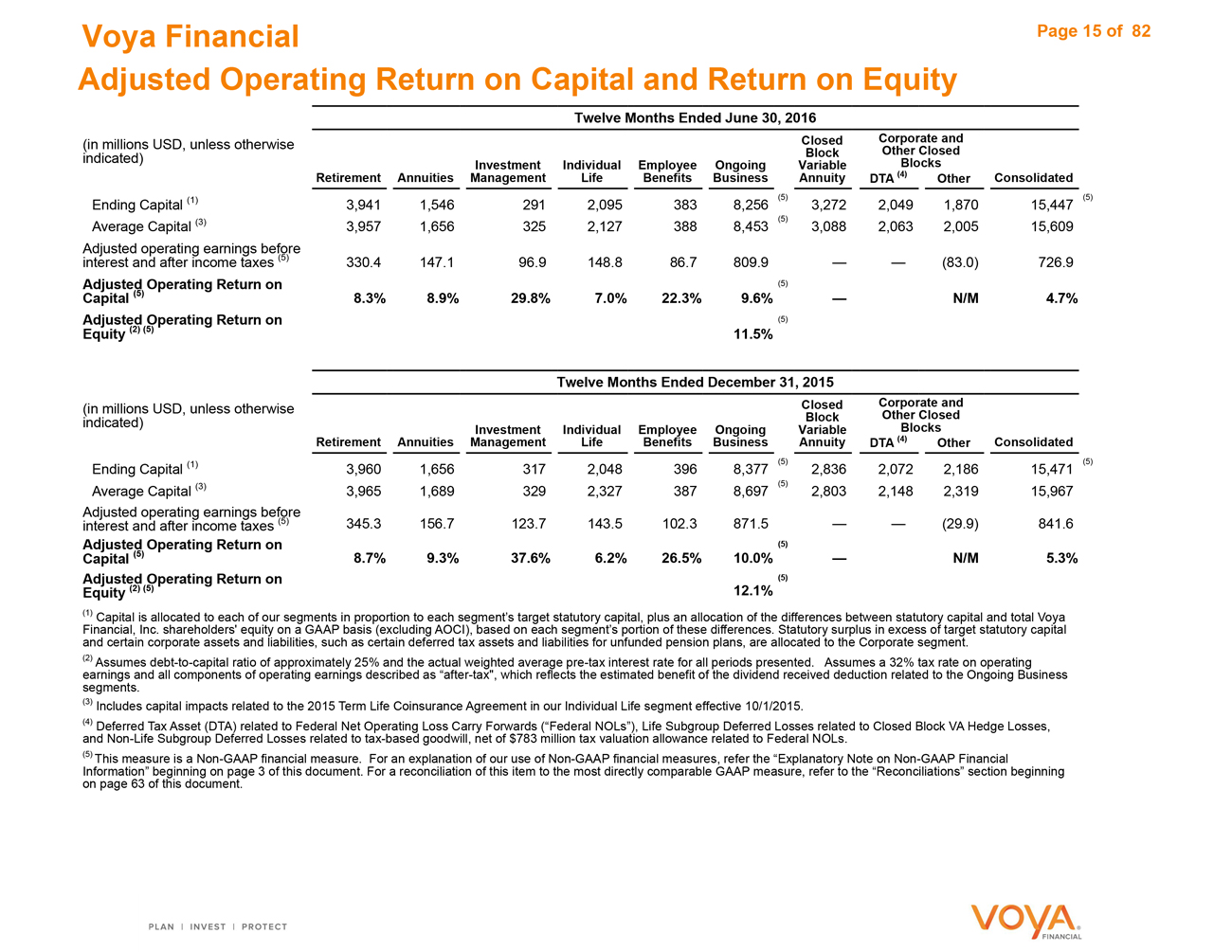

Voya Financial

Adjusted Operating Return on Capital and Return on Equity

Page 15 of 82

Twelve Months Ended June 30, 2016

(in millions USD, unless otherwise Closed Corporate and

Block Other Closed

indicated) Investment Individual Employee Ongoing Variable Blocks

Retirement Annuities Management Life Benefits Business Annuity DTA (4) Other Consolidated

Ending Capital (1) 3,941 1,546 291 2,095 383 8,256(5) 3,272 2,049 1,870 15,447(5)

Average Capital (3) 3,957 1,656 325 2,127 388 8,453(5) 3,088 2,063 2,005 15,609

Adjusted operating earnings before

interest and after income taxes (5) 330.4 147.1 96.9 148.8 86.7 809.9 — —(83.0) 726.9

Adjusted Operating Return on(5)

Capital (5) 8.3% 8.9% 29.8% 7.0% 22.3% 9.6% — N/M 4.7%

Adjusted Operating Return on(5)

Equity (2) (5) 11.5%

Twelve Months Ended December 31, 2015

(in millions USD, unless otherwise Closed Corporate and

Block Other Closed

indicated) Investment Individual Employee Ongoing Variable Blocks

Retirement Annuities Management Life Benefits Business Annuity DTA (4) Other Consolidated

Ending Capital (1) 3,960 1,656 317 2,048 396 8,377(5) 2,836 2,072 2,186 15,471(5)

Average Capital (3) 3,965 1,689 329 2,327 387 8,697(5) 2,803 2,148 2,319 15,967

Adjusted operating earnings before

interest and after income taxes (5) 345.3 156.7 123.7 143.5 102.3 871.5 — —(29.9) 841.6

Adjusted Operating Return on(5)

Capital (5) 8.7% 9.3% 37.6% 6.2% 26.5% 10.0% — N/M 5.3%

Adjusted Operating Return on(5)

Equity (2) (5) 12.1%

Capital is allocated to each of our segments in proportion to each segment’s target statutory capital, plus an allocation of the differences between statutory capital and total Voya Financial, Inc. shareholders’ equity on a GAAP basis (excluding AOCI), based on each segment’s portion of these differences. Statutory surplus in excess of target statutory capital and certain corporate assets and liabilities, such as certain deferred tax assets and liabilities for unfunded pension plans, are allocated to the Corporate segment.

(2) Assumes debt-to-capital ratio of approximately 25% and the actual weighted average pre-tax interest rate for all periods presented. Assumes a 32% tax rate on operating earnings and all components of operating earnings described as “after-tax”, which reflects the estimated benefit of the dividend received deduction related to the Ongoing Business segments.

(3) Includes capital impacts related to the 2015 Term Life Coinsurance Agreement in our Individual Life segment effective 10/1/2015.

(4) Deferred Tax Asset (DTA) related to Federal Net Operating Loss Carry Forwards (“Federal NOLs”), Life Subgroup Deferred Losses related to Closed Block VA Hedge Losses, and Non-Life Subgroup Deferred Losses related to tax-based goodwill, net of $783 million tax valuation allowance related to Federal NOLs.

(5) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial

Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 63 of this document.

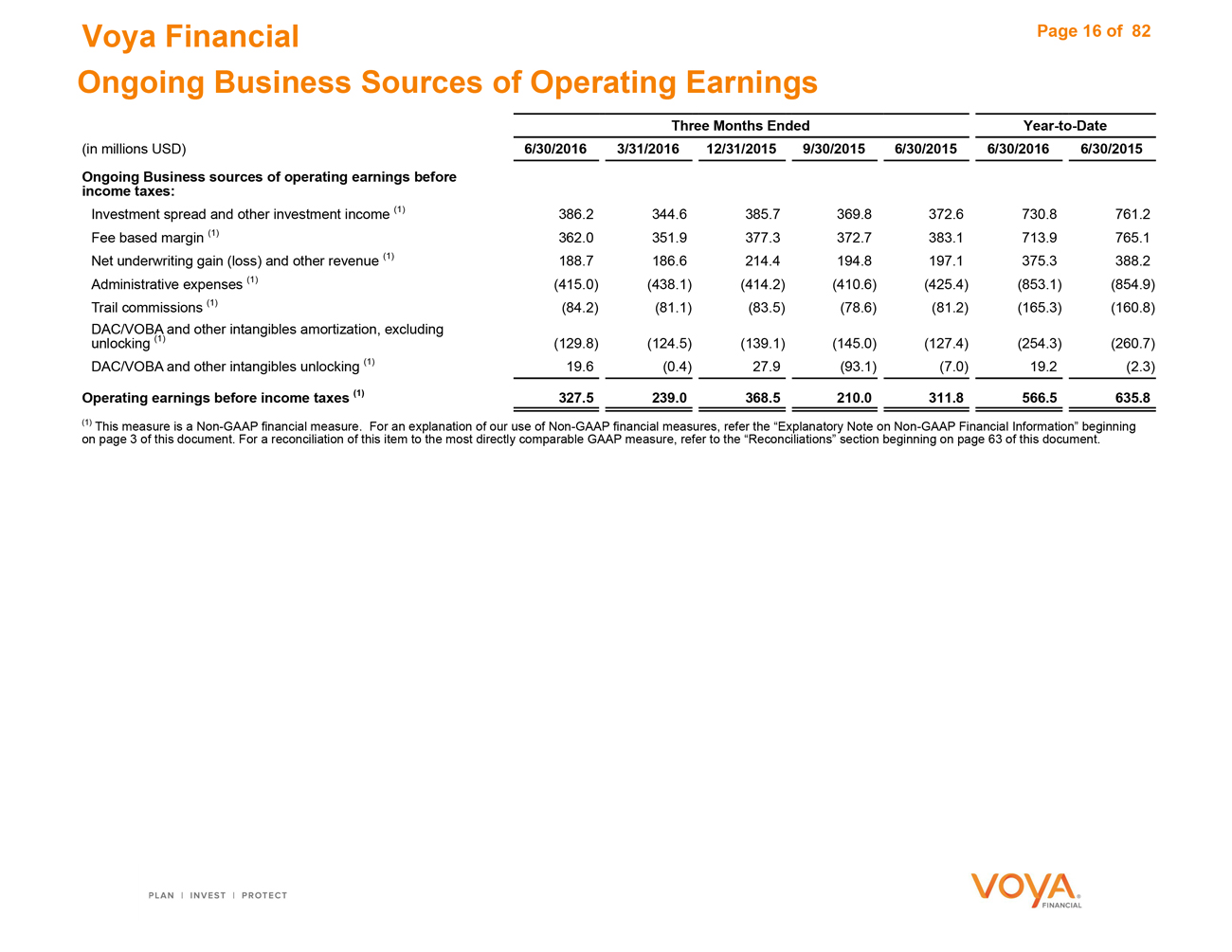

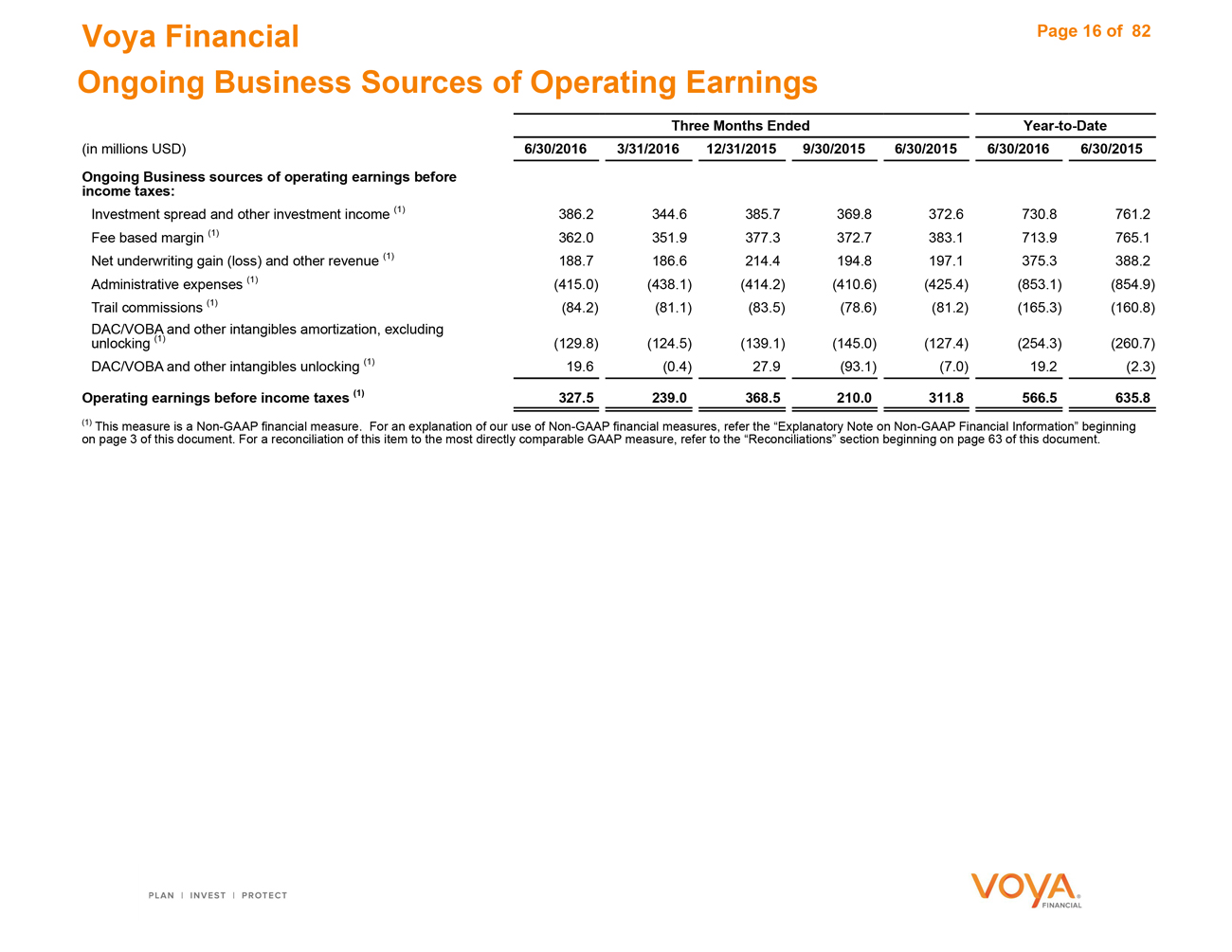

Voya Financial

Ongoing Business Sources of Operating Earnings

Page 16 of 82

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Ongoing Business sources of operating earnings before

income taxes:

Investment spread and other investment income (1) 386.2 344.6 385.7 369.8 372.6 730.8 761.2

Fee based margin (1) 362.0 351.9 377.3 372.7 383.1 713.9 765.1

Net underwriting gain (loss) and other revenue (1) 188.7 186.6 214.4 194.8 197.1 375.3 388.2

Administrative expenses (1)(415.0)(438.1)(414.2)(410.6)(425.4)(853.1)(854.9)

Trail commissions (1)(84.2)(81.1)(83.5)(78.6)(81.2)(165.3)(160.8)

DAC/VOBA and other intangibles amortization, excluding

unlocking (1)(129.8)(124.5)(139.1)(145.0)(127.4)(254.3)(260.7)

DAC/VOBA and other intangibles unlocking (1) 19.6(0.4) 27.9(93.1)(7.0) 19.2(2.3)

Operating earnings before income taxes (1) 327.5 239.0 368.5 210.0 311.8 566.5 635.8

(1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 63 of this document.

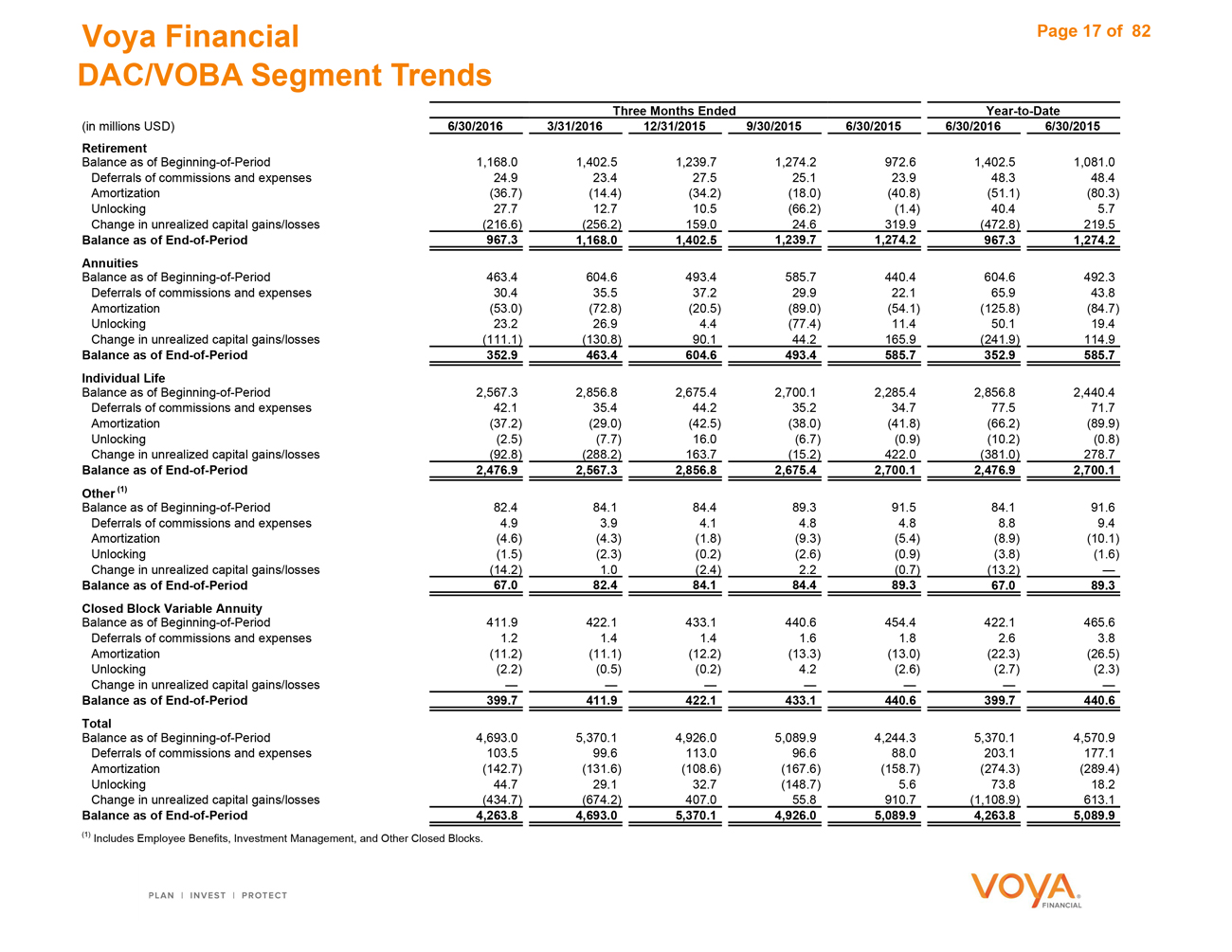

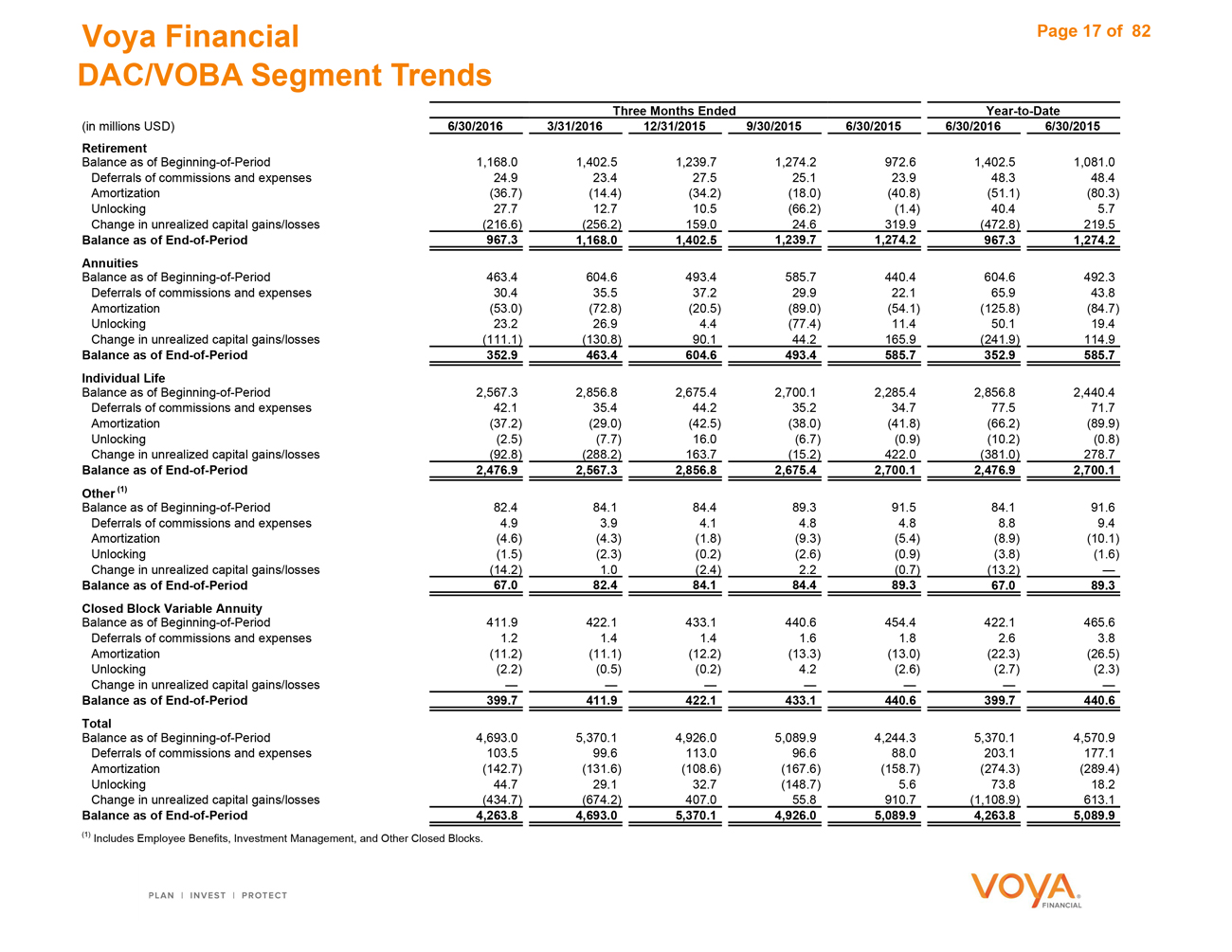

Voya Financial

DAC/VOBA Segment Trends

Page 17 of 82

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Retirement

Balance as of Beginning-of-Period 1,168.0 1,402.5 1,239.7 1,274.2 972.6 1,402.5 1,081.0

Deferrals of commissions and expenses 24.9 23.4 27.5 25.1 23.9 48.3 48.4

Amortization(36.7)(14.4)(34.2)(18.0)(40.8)(51.1)(80.3)

Unlocking 27.7 12.7 10.5(66.2)(1.4) 40.4 5.7

Change in unrealized capital gains/losses(216.6)(256.2) 159.0 24.6 319.9(472.8) 219.5

Balance as of End-of-Period 967.3 1,168.0 1,402.5 1,239.7 1,274.2 967.3 1,274.2

Annuities

Balance as of Beginning-of-Period 463.4 604.6 493.4 585.7 440.4 604.6 492.3

Deferrals of commissions and expenses 30.4 35.5 37.2 29.9 22.1 65.9 43.8

Amortization(53.0)(72.8)(20.5)(89.0)(54.1)(125.8)(84.7)

Unlocking 23.2 26.9 4.4(77.4) 11.4 50.1 19.4

Change in unrealized capital gains/losses(111.1)(130.8) 90.1 44.2 165.9(241.9) 114.9

Balance as of End-of-Period 352.9 463.4 604.6 493.4 585.7 352.9 585.7

Individual Life

Balance as of Beginning-of-Period 2,567.3 2,856.8 2,675.4 2,700.1 2,285.4 2,856.8 2,440.4

Deferrals of commissions and expenses 42.1 35.4 44.2 35.2 34.7 77.5 71.7

Amortization(37.2)(29.0)(42.5)(38.0)(41.8)(66.2)(89.9)

Unlocking(2.5)(7.7) 16.0(6.7)(0.9)(10.2)(0.8)

Change in unrealized capital gains/losses(92.8)(288.2) 163.7(15.2) 422.0(381.0) 278.7

Balance as of End-of-Period 2,476.9 2,567.3 2,856.8 2,675.4 2,700.1 2,476.9 2,700.1

Other (1)

Balance as of Beginning-of-Period 82.4 84.1 84.4 89.3 91.5 84.1 91.6

Deferrals of commissions and expenses 4.9 3.9 4.1 4.8 4.8 8.8 9.4

Amortization(4.6)(4.3)(1.8)(9.3)(5.4)(8.9)(10.1)

Unlocking(1.5)(2.3)(0.2)(2.6)(0.9)(3.8)(1.6)

Change in unrealized capital gains/losses(14.2) 1.0(2.4) 2.2(0.7)(13.2) —

Balance as of End-of-Period 67.0 82.4 84.1 84.4 89.3 67.0 89.3

Closed Block Variable Annuity

Balance as of Beginning-of-Period 411.9 422.1 433.1 440.6 454.4 422.1 465.6

Deferrals of commissions and expenses 1.2 1.4 1.4 1.6 1.8 2.6 3.8

Amortization(11.2)(11.1)(12.2)(13.3)(13.0)(22.3)(26.5)

Unlocking(2.2)(0.5)(0.2) 4.2(2.6)(2.7)(2.3)

Change in unrealized capital gains/losses — — — — — — —

Balance as of End-of-Period 399.7 411.9 422.1 433.1 440.6 399.7 440.6

Total

Balance as of Beginning-of-Period 4,693.0 5,370.1 4,926.0 5,089.9 4,244.3 5,370.1 4,570.9

Deferrals of commissions and expenses 103.5 99.6 113.0 96.6 88.0 203.1 177.1

Amortization(142.7)(131.6)(108.6)(167.6)(158.7)(274.3)(289.4)

Unlocking 44.7 29.1 32.7(148.7) 5.6 73.8 18.2

Change in unrealized capital gains/losses(434.7)(674.2) 407.0 55.8 910.7(1,108.9) 613.1

Balance as of End-of-Period 4,263.8 4,693.0 5,370.1 4,926.0 5,089.9 4,263.8 5,089.9

(1) Includes Employee Benefits, Investment Management, and Other Closed Blocks.

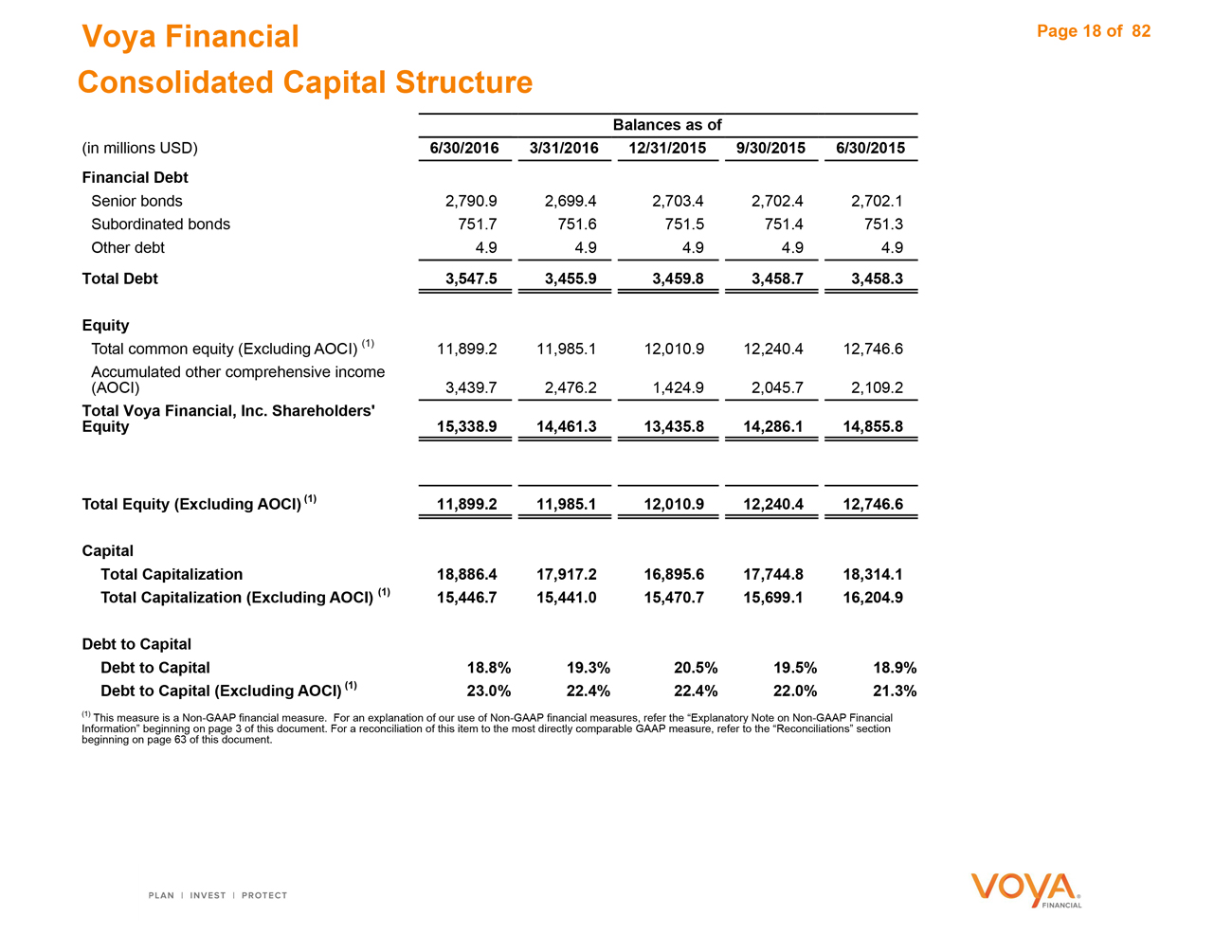

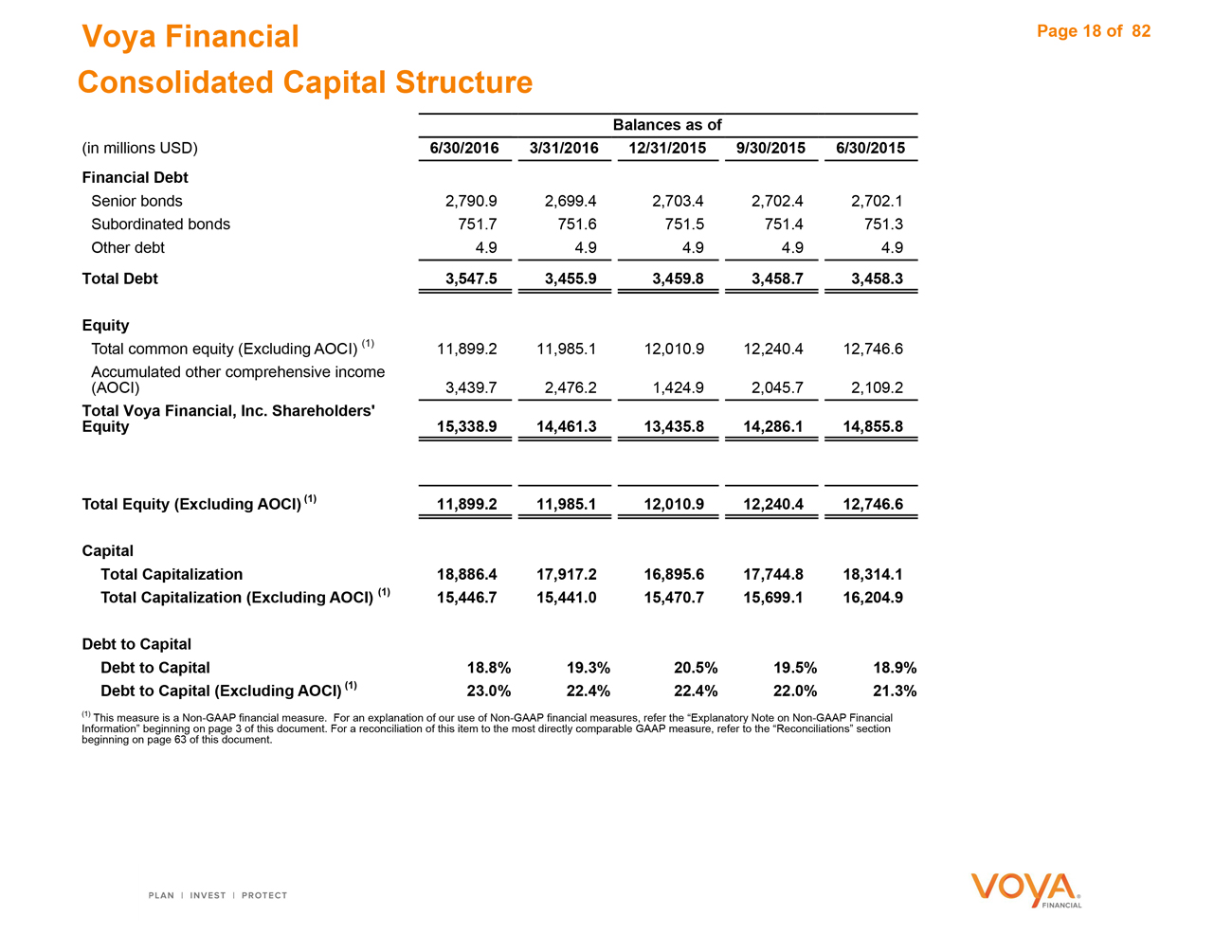

Voya Financial

Consolidated Capital Structure

Page 18 of 82

Balances as of

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015

Financial Debt

Senior bonds 2,790.9 2,699.4 2,703.4 2,702.4 2,702.1

Subordinated bonds 751.7 751.6 751.5 751.4 751.3

Other debt 4.9 4.9 4.9 4.9 4.9

Total Debt 3,547.5 3,455.9 3,459.8 3,458.7 3,458.3

Equity

Total common equity (Excluding AOCI) (1) 11,899.2 11,985.1 12,010.9 12,240.4 12,746.6

Accumulated other comprehensive income

(AOCI) 3,439.7 2,476.2 1,424.9 2,045.7 2,109.2

Total Voya Financial, Inc. Shareholders’

Equity 15,338.9 14,461.3 13,435.8 14,286.1 14,855.8

Total Equity (Excluding AOCI) (1) 11,899.2 11,985.1 12,010.9 12,240.4 12,746.6

Capital

Total Capitalization 18,886.4 17,917.2 16,895.6 17,744.8 18,314.1

Total Capitalization (Excluding AOCI) (1) 15,446.7 15,441.0 15,470.7 15,699.1 16,204.9

Debt to Capital

Debt to Capital 18.8% 19.3% 20.5% 19.5% 18.9%

Debt to Capital (Excluding AOCI) (1) 23.0% 22.4% 22.4% 22.0% 21.3%

(1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 63 of this document.

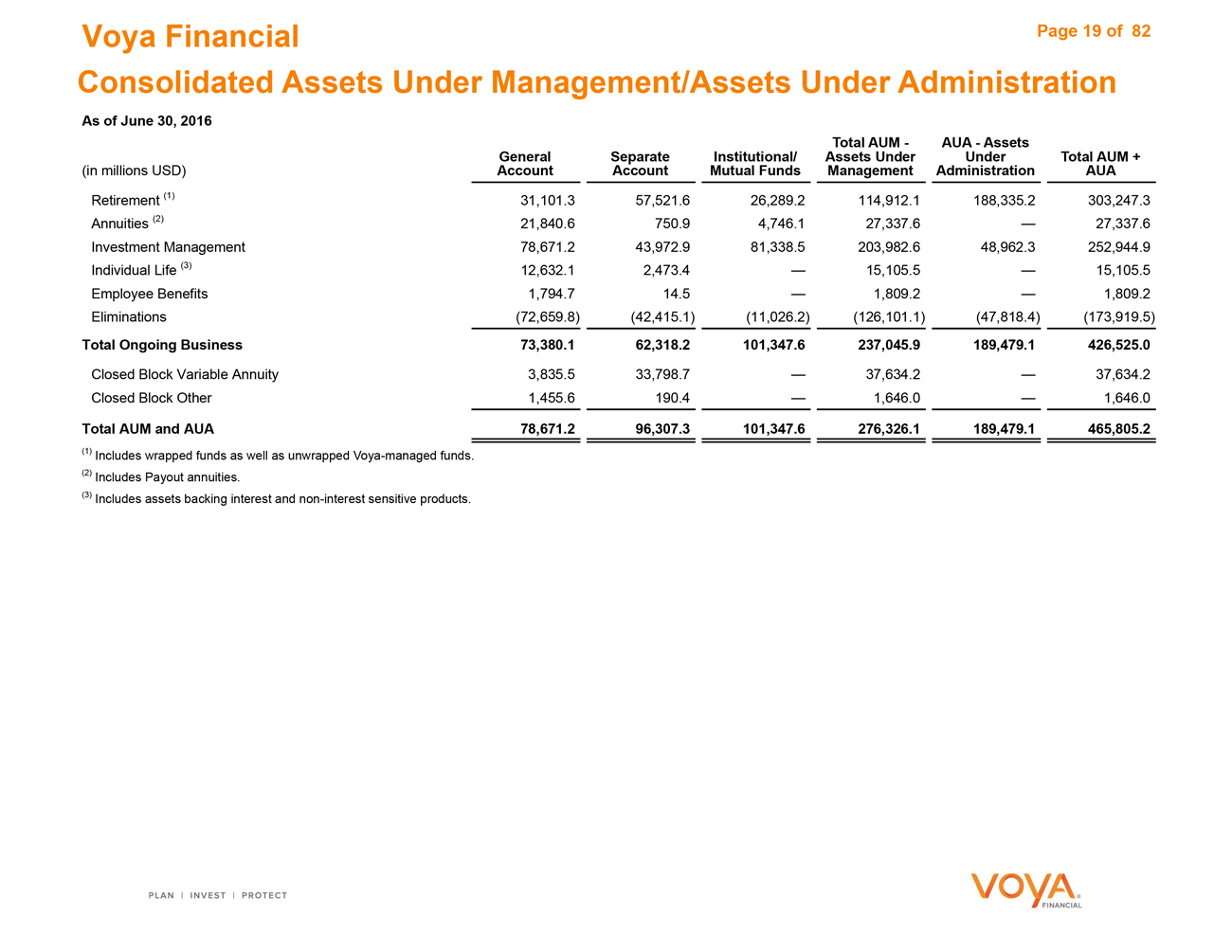

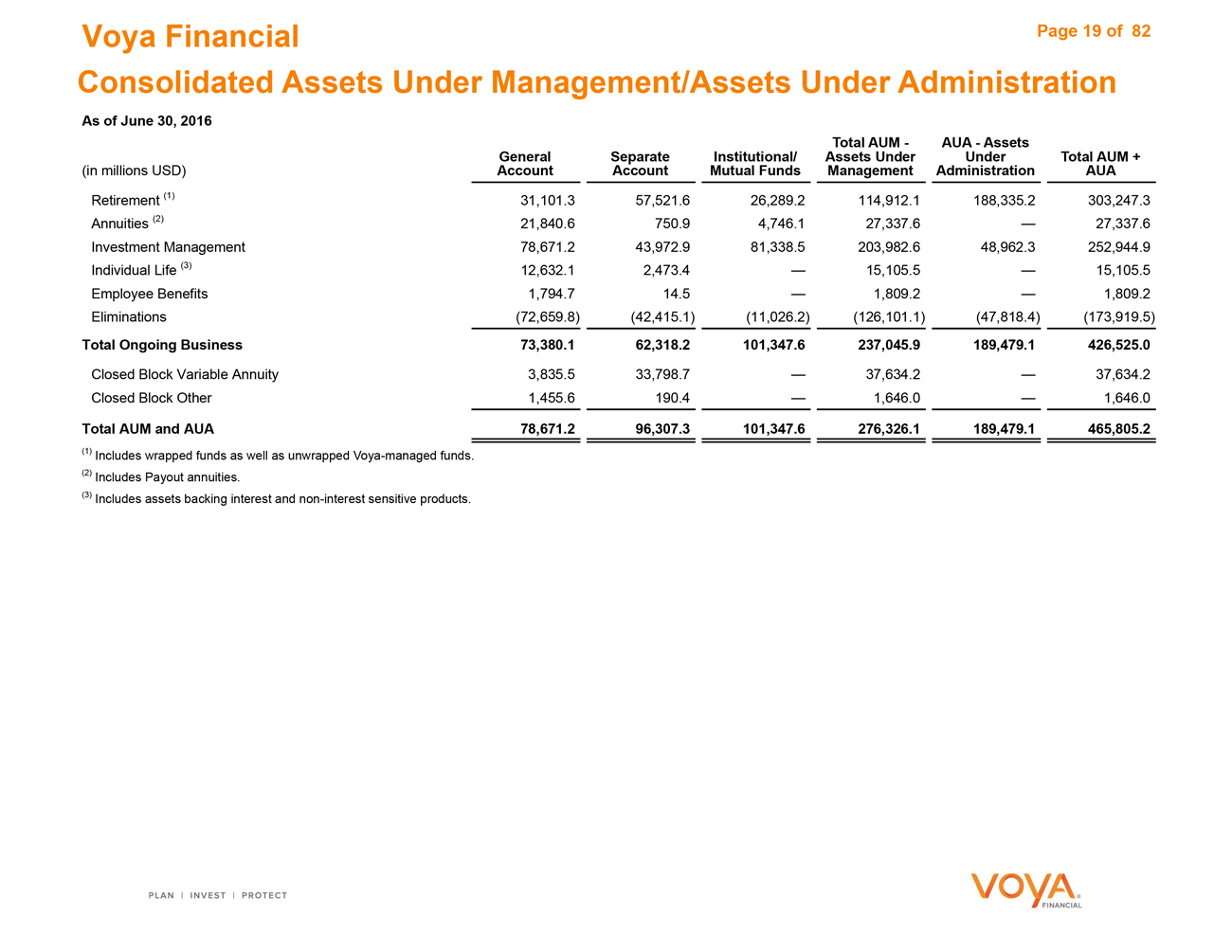

Voya Financial Page 19 of 82 Consolidated Assets Under Management/Assets Under Administration

As of June 30, 2016

Total AUM—AUA—Assets

General Separate Institutional/ Assets Under Under Total AUM +

(in millions USD) Account Account Mutual Funds Management Administration AUA

Retirement (1) 31,101.3 57,521.6 26,289.2 114,912.1 188,335.2 303,247.3

Annuities (2) 21,840.6 750.9 4,746.1 27,337.6 — 27,337.6

Investment Management 78,671.2 43,972.9 81,338.5 203,982.6 48,962.3 252,944.9

Individual Life (3) 12,632.1 2,473.4 — 15,105.5 — 15,105.5

Employee Benefits 1,794.7 14.5 — 1,809.2 — 1,809.2

Eliminations(72,659.8)(42,415.1)(11,026.2)(126,101.1)(47,818.4)(173,919.5)

Total Ongoing Business 73,380.1 62,318.2 101,347.6 237,045.9 189,479.1 426,525.0

Closed Block Variable Annuity 3,835.5 33,798.7 — 37,634.2 — 37,634.2

Closed Block Other 1,455.6 190.4 — 1,646.0 — 1,646.0

Total AUM and AUA 78,671.2 96,307.3 101,347.6 276,326.1 189,479.1 465,805.2

(1) Includes wrapped funds as well as unwrapped Voya-managed funds. (2) Includes Payout annuities.

(3) Includes assets backing interest and non-interest sensitive products.

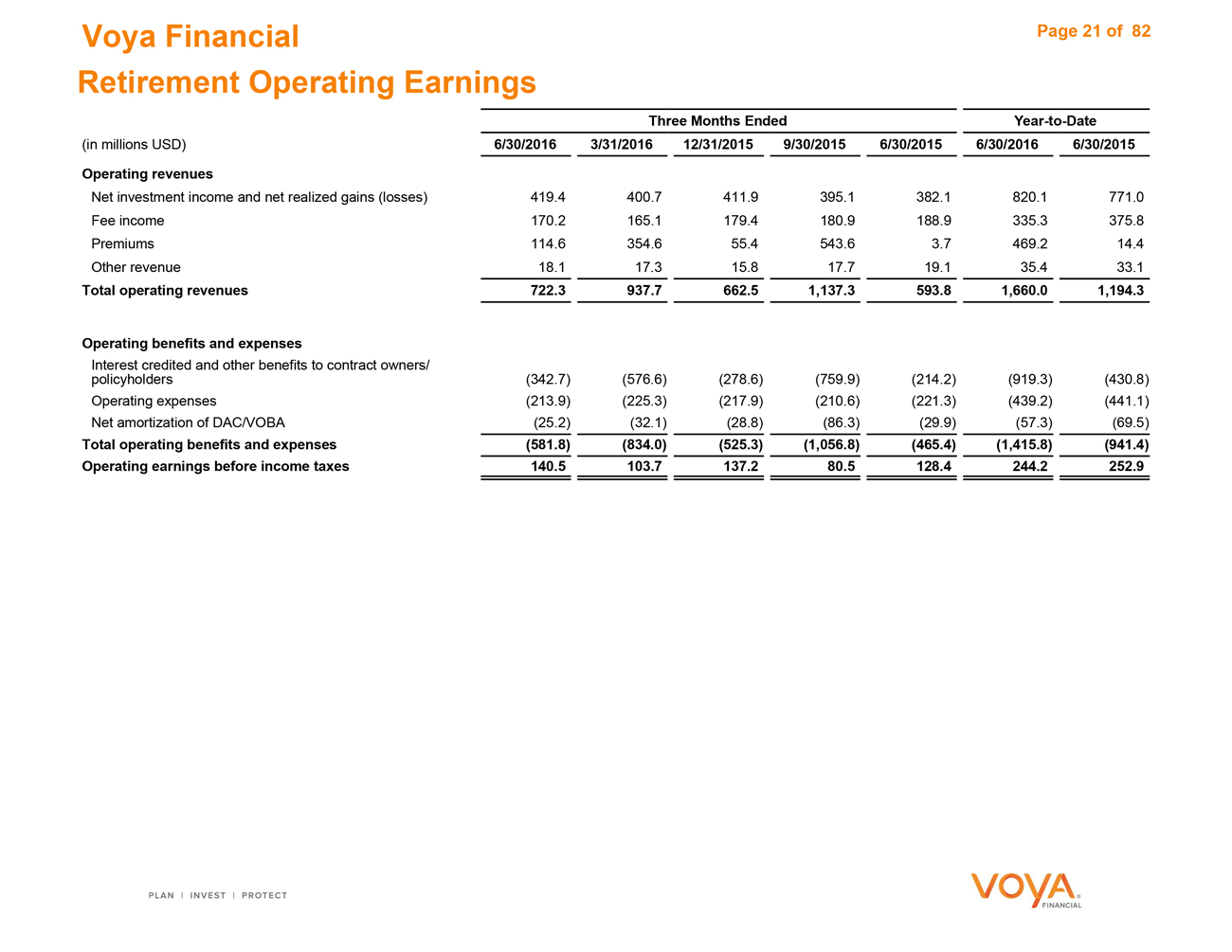

Retirement

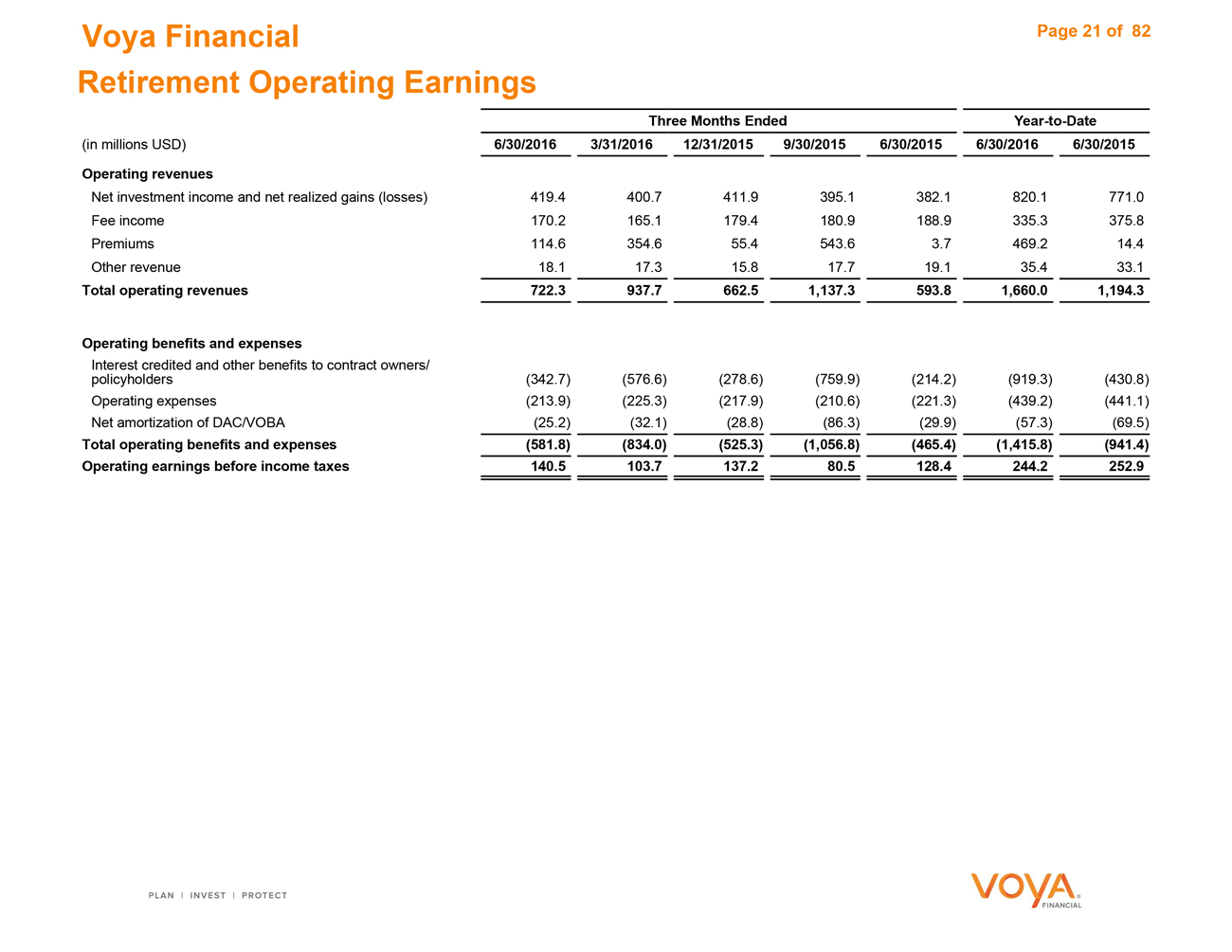

Voya Financial Page 21 of 82 Retirement Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Operating revenues

Net investment income and net realized gains (losses) 419.4 400.7 411.9 395.1 382.1 820.1 771.0

Fee income 170.2 165.1 179.4 180.9 188.9 335.3 375.8

Premiums 114.6 354.6 55.4 543.6 3.7 469.2 14.4

Other revenue 18.1 17.3 15.8 17.7 19.1 35.4 33.1

Total operating revenues 722.3 937.7 662.5 1,137.3 593.8 1,660.0 1,194.3

Operating benefits and expenses

Interest credited and other benefits to contract owners/

policyholders(342.7)(576.6)(278.6)(759.9)(214.2)(919.3)(430.8)

Operating expenses(213.9)(225.3)(217.9)(210.6)(221.3)(439.2)(441.1)

Net amortization of DAC/VOBA(25.2)(32.1)(28.8)(86.3)(29.9)(57.3)(69.5)

Total operating benefits and expenses(581.8)(834.0)(525.3)(1,056.8)(465.4)(1,415.8)(941.4)

Operating earnings before income taxes 140.5 103.7 137.2 80.5 128.4 244.2 252.9

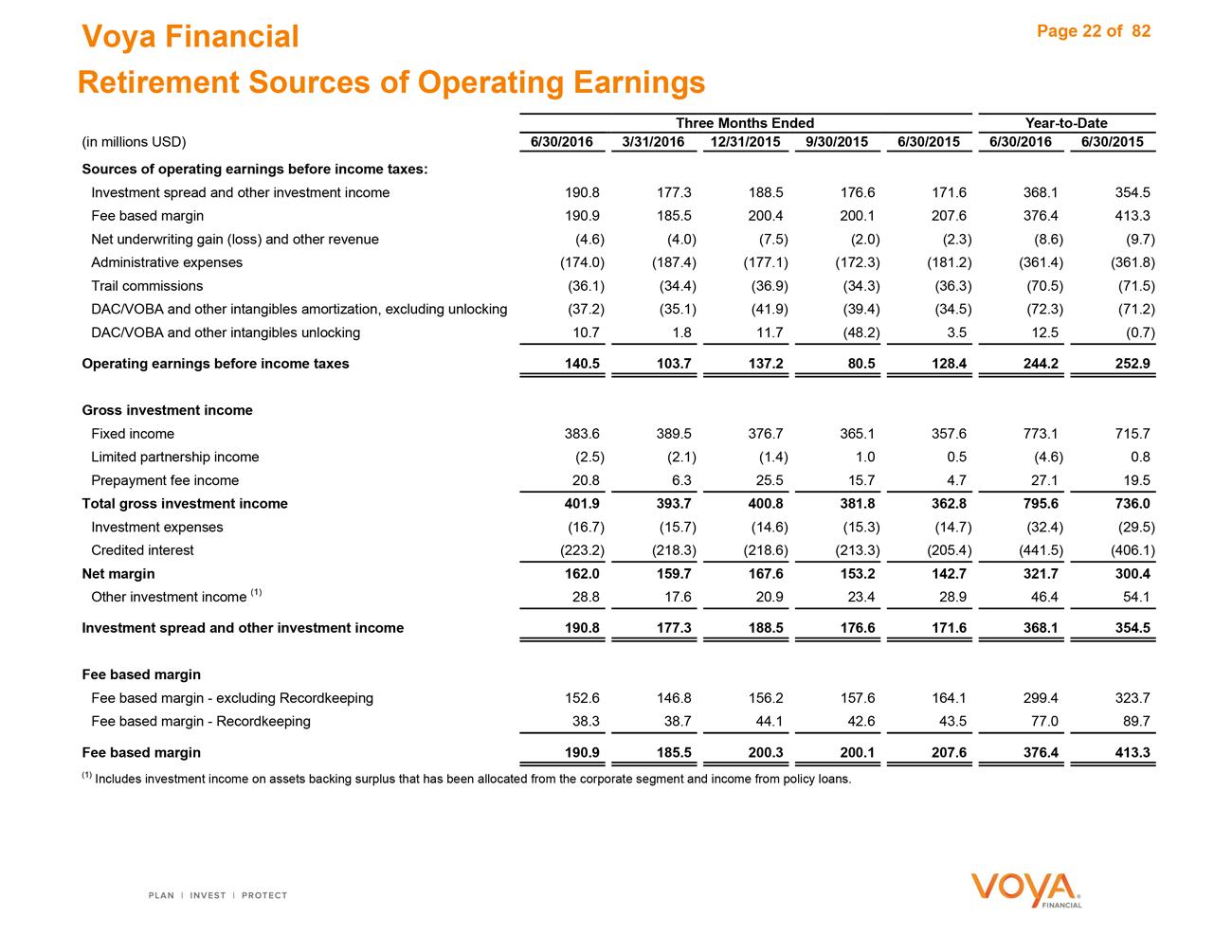

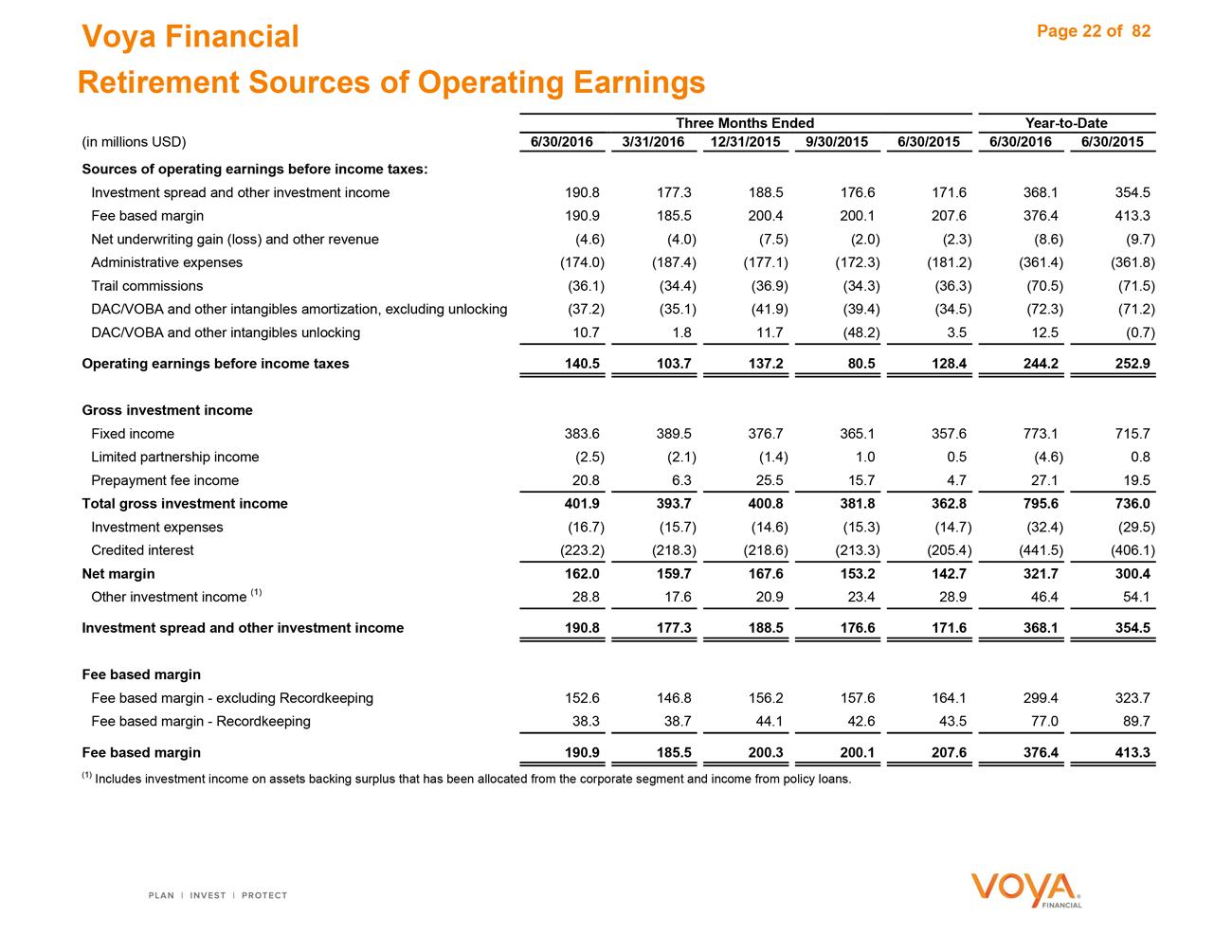

Voya Financial Page 22 of 82 Retirement Sources of Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Sources of operating earnings before income taxes:

Investment spread and other investment income 190.8 177.3 188.5 176.6 171.6 368.1 354.5

Fee based margin 190.9 185.5 200.4 200.1 207.6 376.4 413.3

Net underwriting gain (loss) and other revenue(4.6)(4.0)(7.5)(2.0)(2.3)(8.6)(9.7)

Administrative expenses(174.0)(187.4)(177.1)(172.3)(181.2)(361.4)(361.8)

Trail commissions(36.1)(34.4)(36.9)(34.3)(36.3)(70.5)(71.5)

DAC/VOBA and other intangibles amortization, excluding unlocking(37.2)(35.1)(41.9)(39.4)(34.5)(72.3)(71.2)

DAC/VOBA and other intangibles unlocking 10.7 1.8 11.7(48.2) 3.5 12.5(0.7)

Operating earnings before income taxes 140.5 103.7 137.2 80.5 128.4 244.2 252.9

Gross investment income

Fixed income 383.6 389.5 376.7 365.1 357.6 773.1 715.7

Limited partnership income(2.5)(2.1)(1.4) 1.0 0.5(4.6) 0.8

Prepayment fee income 20.8 6.3 25.5 15.7 4.7 27.1 19.5

Total gross investment income 401.9 393.7 400.8 381.8 362.8 795.6 736.0

Investment expenses(16.7)(15.7)(14.6)(15.3)(14.7)(32.4)(29.5)

Credited interest(223.2)(218.3)(218.6)(213.3)(205.4)(441.5)(406.1)

Net margin 162.0 159.7 167.6 153.2 142.7 321.7 300.4

Other investment income (1) 28.8 17.6 20.9 23.4 28.9 46.4 54.1

Investment spread and other investment income 190.8 177.3 188.5 176.6 171.6 368.1 354.5

Fee based margin

Fee based margin—excluding Recordkeeping 152.6 146.8 156.2 157.6 164.1 299.4 323.7

Fee based margin—Recordkeeping 38.3 38.7 44.1 42.6 43.5 77.0 89.7

Fee based margin 190.9 185.5 200.3 200.1 207.6 376.4 413.3

(1) Includes investment income on assets backing surplus that has been allocated from the corporate segment and income from policy loans.

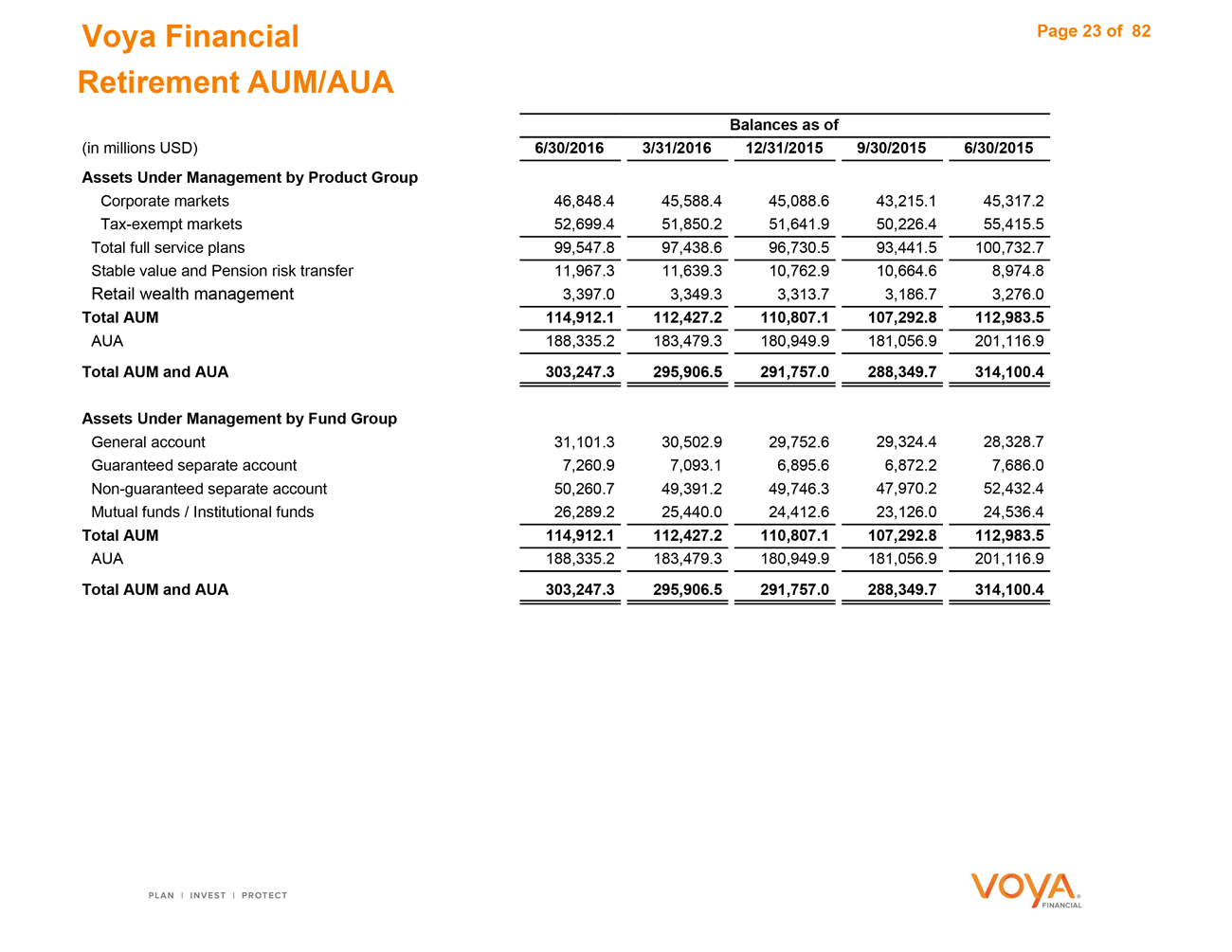

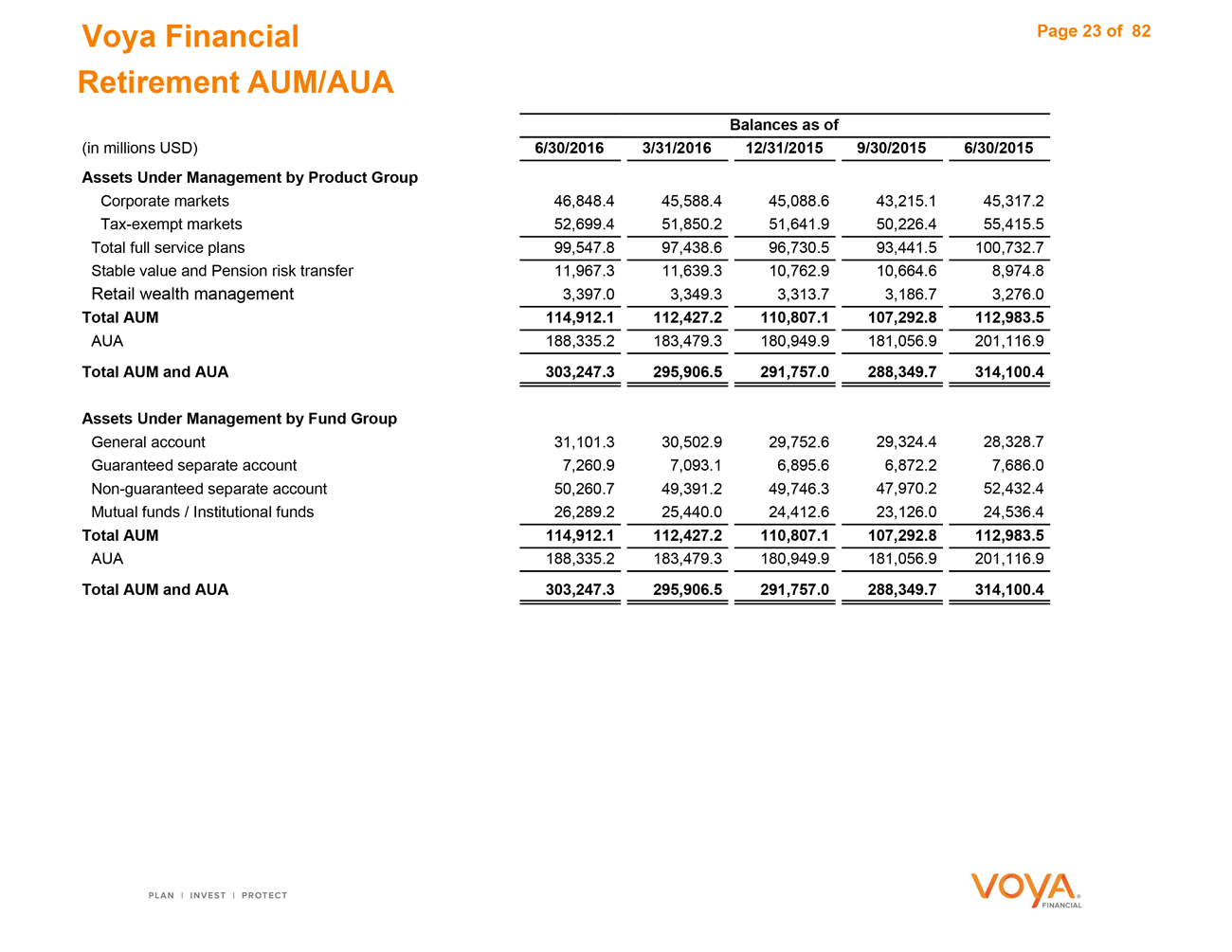

Voya Financial Page 23 of 82

Retirement AUM/AUA

Balances as of

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015

Assets Under Management by Product Group

Corporate markets 46,848.4 45,588.4 45,088.6 43,215.1 45,317.2

Tax-exempt markets 52,699.4 51,850.2 51,641.9 50,226.4 55,415.5

Total full service plans 99,547.8 97,438.6 96,730.5 93,441.5 100,732.7

Stable value and Pension risk transfer 11,967.3 11,639.3 10,762.9 10,664.6 8,974.8

Retail wealth management 3,397.0 3,349.3 3,313.7 3,186.7 3,276.0

Total AUM 114,912.1 112,427.2 110,807.1 107,292.8 112,983.5

AUA 188,335.2 183,479.3 180,949.9 181,056.9 201,116.9

Total AUM and AUA 303,247.3 295,906.5 291,757.0 288,349.7 314,100.4

Assets Under Management by Fund Group

General account 31,101.3 30,502.9 29,752.6 29,324.4 28,328.7

Guaranteed separate account 7,260.9 7,093.1 6,895.6 6,872.2 7,686.0

Non-guaranteed separate account 50,260.7 49,391.2 49,746.3 47,970.2 52,432.4

Mutual funds / Institutional funds 26,289.2 25,440.0 24,412.6 23,126.0 24,536.4

Total AUM 114,912.1 112,427.2 110,807.1 107,292.8 112,983.5

AUA 188,335.2 183,479.3 180,949.9 181,056.9 201,116.9

Total AUM and AUA 303,247.3 295,906.5 291,757.0 288,349.7 314,100.4

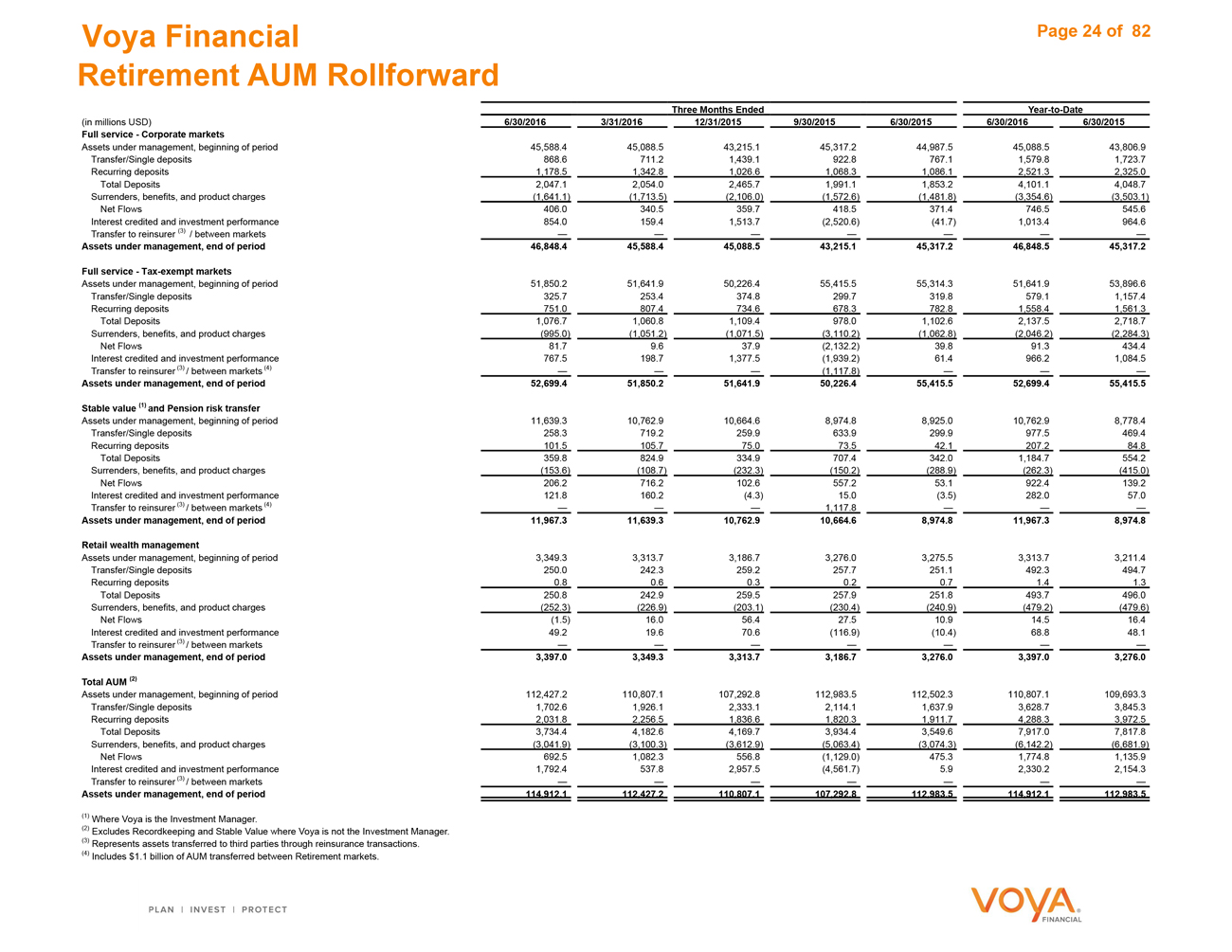

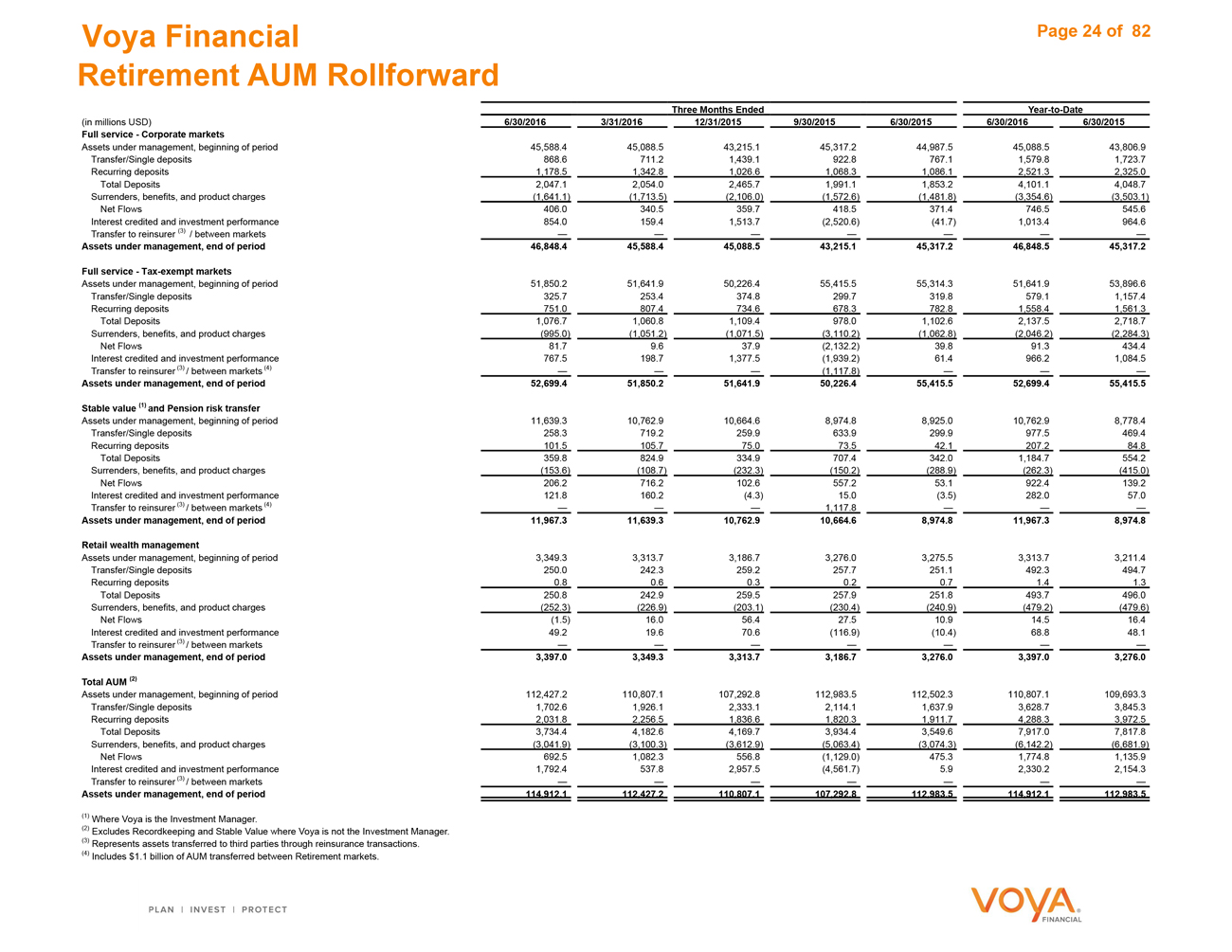

Voya Financial Page 24 of 82 Retirement AUM Rollforward

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Full service—Corporate markets

Assets under management, beginning of period 45,588.4 45,088.5 43,215.1 45,317.2 44,987.5 45,088.5 43,806.9

Transfer/Single deposits 868.6 711.2 1,439.1 922.8 767.1 1,579.8 1,723.7

Recurring deposits 1,178.5 1,342.8 1,026.6 1,068.3 1,086.1 2,521.3 2,325.0

Total Deposits 2,047.1 2,054.0 2,465.7 1,991.1 1,853.2 4,101.1 4,048.7

Surrenders, benefits, and product charges(1,641.1)(1,713.5)(2,106.0)(1,572.6)(1,481.8)(3,354.6)(3,503.1)

Net Flows 406.0 340.5 359.7 418.5 371.4 746.5 545.6

Interest credited and investment performance 854.0 159.4 1,513.7(2,520.6)(41.7) 1,013.4 964.6

Transfer to reinsurer (3) / between markets — — — — — — —

Assets under management, end of period 46,848.4 45,588.4 45,088.5 43,215.1 45,317.2 46,848.5 45,317.2

Full service—Tax-exempt markets

Assets under management, beginning of period 51,850.2 51,641.9 50,226.4 55,415.5 55,314.3 51,641.9 53,896.6

Transfer/Single deposits 325.7 253.4 374.8 299.7 319.8 579.1 1,157.4

Recurring deposits 751.0 807.4 734.6 678.3 782.8 1,558.4 1,561.3

Total Deposits 1,076.7 1,060.8 1,109.4 978.0 1,102.6 2,137.5 2,718.7

Surrenders, benefits, and product charges(995.0)(1,051.2)(1,071.5)(3,110.2)(1,062.8)(2,046.2)(2,284.3)

Net Flows 81.7 9.6 37.9(2,132.2) 39.8 91.3 434.4

Interest credited and investment performance 767.5 198.7 1,377.5(1,939.2) 61.4 966.2 1,084.5

Transfer to reinsurer (3) / between markets (4) — — —(1,117.8) — — —

Assets under management, end of period 52,699.4 51,850.2 51,641.9 50,226.4 55,415.5 52,699.4 55,415.5

Stable value (1) and Pension risk transfer

Assets under management, beginning of period 11,639.3 10,762.9 10,664.6 8,974.8 8,925.0 10,762.9 8,778.4

Transfer/Single deposits 258.3 719.2 259.9 633.9 299.9 977.5 469.4

Recurring deposits 101.5 105.7 75.0 73.5 42.1 207.2 84.8

Total Deposits 359.8 824.9 334.9 707.4 342.0 1,184.7 554.2

Surrenders, benefits, and product charges(153.6)(108.7)(232.3)(150.2)(288.9)(262.3)(415.0)

Net Flows 206.2 716.2 102.6 557.2 53.1 922.4 139.2

Interest credited and investment performance 121.8 160.2(4.3) 15.0(3.5) 282.0 57.0

Transfer to reinsurer (3) / between markets (4) — — — 1,117.8 — — —

Assets under management, end of period 11,967.3 11,639.3 10,762.9 10,664.6 8,974.8 11,967.3 8,974.8

Retail wealth management

Assets under management, beginning of period 3,349.3 3,313.7 3,186.7 3,276.0 3,275.5 3,313.7 3,211.4

Transfer/Single deposits 250.0 242.3 259.2 257.7 251.1 492.3 494.7

Recurring deposits 0.8 0.6 0.3 0.2 0.7 1.4 1.3

Total Deposits 250.8 242.9 259.5 257.9 251.8 493.7 496.0

Surrenders, benefits, and product charges(252.3)(226.9)(203.1)(230.4)(240.9)(479.2)(479.6)

Net Flows(1.5) 16.0 56.4 27.5 10.9 14.5 16.4

Interest credited and investment performance 49.2 19.6 70.6(116.9)(10.4) 68.8 48.1

Transfer to reinsurer (3) / between markets — — — — — — —

Assets under management, end of period 3,397.0 3,349.3 3,313.7 3,186.7 3,276.0 3,397.0 3,276.0

Total AUM (2)

Assets under management, beginning of period 112,427.2 110,807.1 107,292.8 112,983.5 112,502.3 110,807.1 109,693.3

Transfer/Single deposits 1,702.6 1,926.1 2,333.1 2,114.1 1,637.9 3,628.7 3,845.3

Recurring deposits 2,031.8 2,256.5 1,836.6 1,820.3 1,911.7 4,288.3 3,972.5

Total Deposits 3,734.4 4,182.6 4,169.7 3,934.4 3,549.6 7,917.0 7,817.8

Surrenders, benefits, and product charges(3,041.9)(3,100.3)(3,612.9)(5,063.4)(3,074.3)(6,142.2)(6,681.9)

Net Flows 692.5 1,082.3 556.8(1,129.0) 475.3 1,774.8 1,135.9

Interest credited and investment performance 1,792.4 537.8 2,957.5(4,561.7) 5.9 2,330.2 2,154.3

Transfer to reinsurer (3) / between markets — — — — — — —

Assets under management, end of period 114,912.1 112,427.2 110,807.1 107,292.8 112,983.5 114,912.1 112,983.5

(1) Where Voya is the Investment Manager.

(2) Excludes Recordkeeping and Stable Value where Voya is not the Investment Manager. (3) Represents assets transferred to third parties through reinsurance transactions. (4) Includes $1.1 billion of AUM transferred between Retirement markets.

Annuities

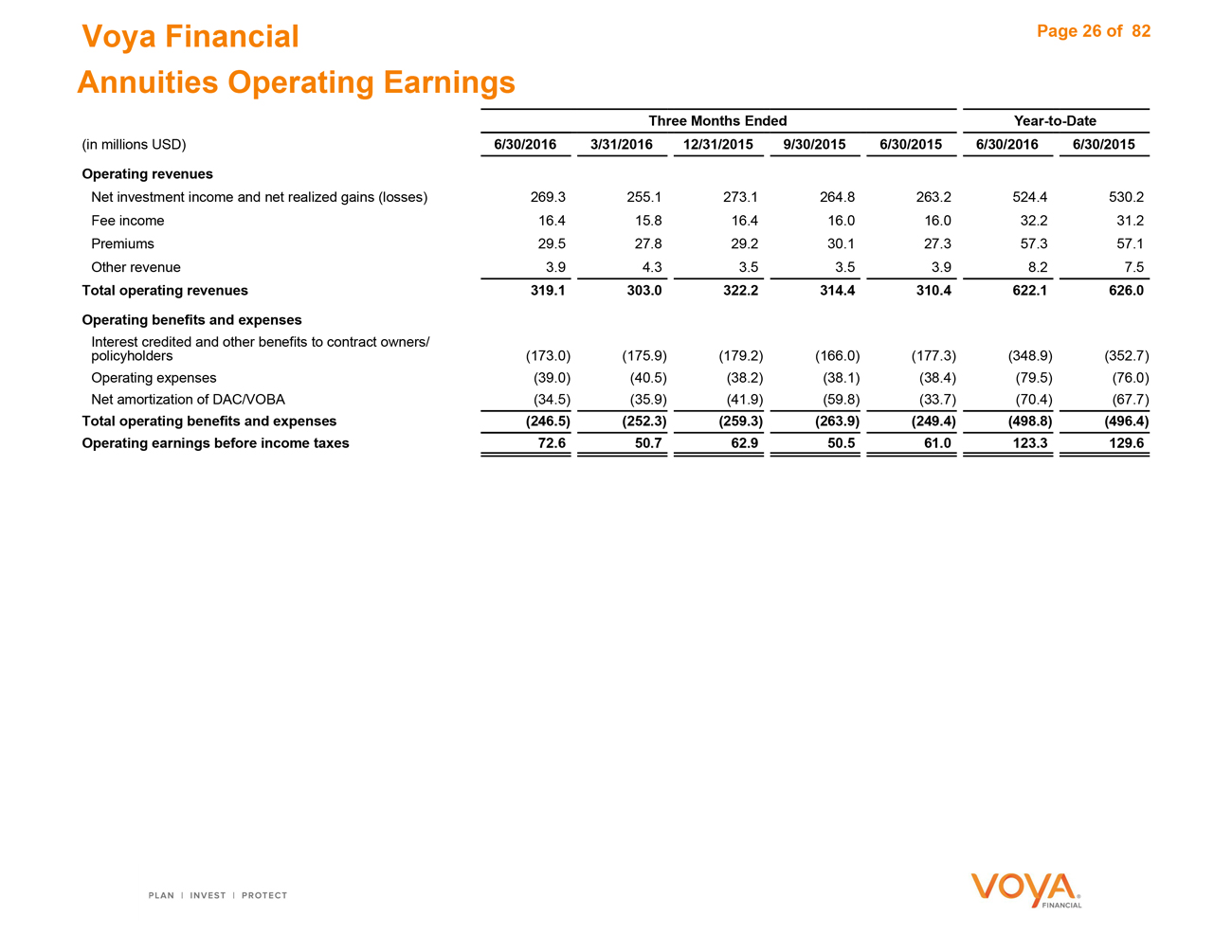

Voya Financial Page 26 of 82 Annuities Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Operating revenues

Net investment income and net realized gains (losses) 269.3 255.1 273.1 264.8 263.2 524.4 530.2

Fee income 16.4 15.8 16.4 16.0 16.0 32.2 31.2

Premiums 29.5 27.8 29.2 30.1 27.3 57.3 57.1

Other revenue 3.9 4.3 3.5 3.5 3.9 8.2 7.5

Total operating revenues 319.1 303.0 322.2 314.4 310.4 622.1 626.0

Operating benefits and expenses

Interest credited and other benefits to contract owners/

policyholders(173.0)(175.9)(179.2)(166.0)(177.3)(348.9)(352.7)

Operating expenses(39.0)(40.5)(38.2)(38.1)(38.4)(79.5)(76.0)

Net amortization of DAC/VOBA(34.5)(35.9)(41.9)(59.8)(33.7)(70.4)(67.7)

Total operating benefits and expenses(246.5)(252.3)(259.3)(263.9)(249.4)(498.8)(496.4)

Operating earnings before income taxes 72.6 50.7 62.9 50.5 61.0 123.3 129.6

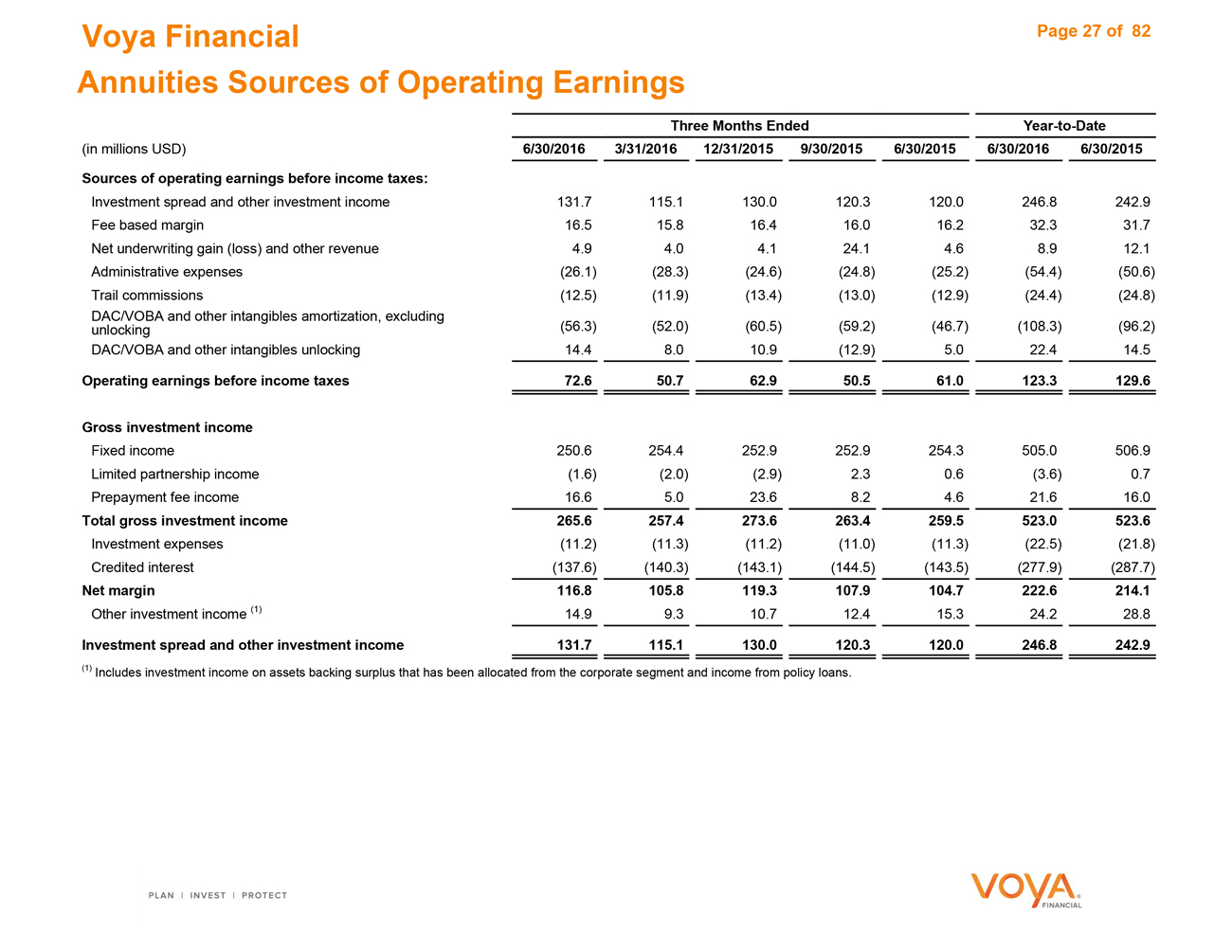

Voya Financial Page 27 of 82 Annuities Sources of Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Sources of operating earnings before income taxes:

Investment spread and other investment income 131.7 115.1 130.0 120.3 120.0 246.8 242.9

Fee based margin 16.5 15.8 16.4 16.0 16.2 32.3 31.7

Net underwriting gain (loss) and other revenue 4.9 4.0 4.1 24.1 4.6 8.9 12.1

Administrative expenses(26.1)(28.3)(24.6)(24.8)(25.2)(54.4)(50.6)

Trail commissions(12.5)(11.9)(13.4)(13.0)(12.9)(24.4)(24.8)

DAC/VOBA and other intangibles amortization, excluding

unlocking(56.3)(52.0)(60.5)(59.2)(46.7)(108.3)(96.2)

DAC/VOBA and other intangibles unlocking 14.4 8.0 10.9(12.9) 5.0 22.4 14.5

Operating earnings before income taxes 72.6 50.7 62.9 50.5 61.0 123.3 129.6

Gross investment income

Fixed income 250.6 254.4 252.9 252.9 254.3 505.0 506.9

Limited partnership income(1.6)(2.0)(2.9) 2.3 0.6(3.6) 0.7

Prepayment fee income 16.6 5.0 23.6 8.2 4.6 21.6 16.0

Total gross investment income 265.6 257.4 273.6 263.4 259.5 523.0 523.6

Investment expenses(11.2)(11.3)(11.2)(11.0)(11.3)(22.5)(21.8)

Credited interest(137.6)(140.3)(143.1)(144.5)(143.5)(277.9)(287.7)

Net margin 116.8 105.8 119.3 107.9 104.7 222.6 214.1

Other investment income (1) 14.9 9.3 10.7 12.4 15.3 24.2 28.8

Investment spread and other investment income 131.7 115.1 130.0 120.3 120.0 246.8 242.9

(1) Includes investment income on assets backing surplus that has been allocated from the corporate segment and income from policy loans.

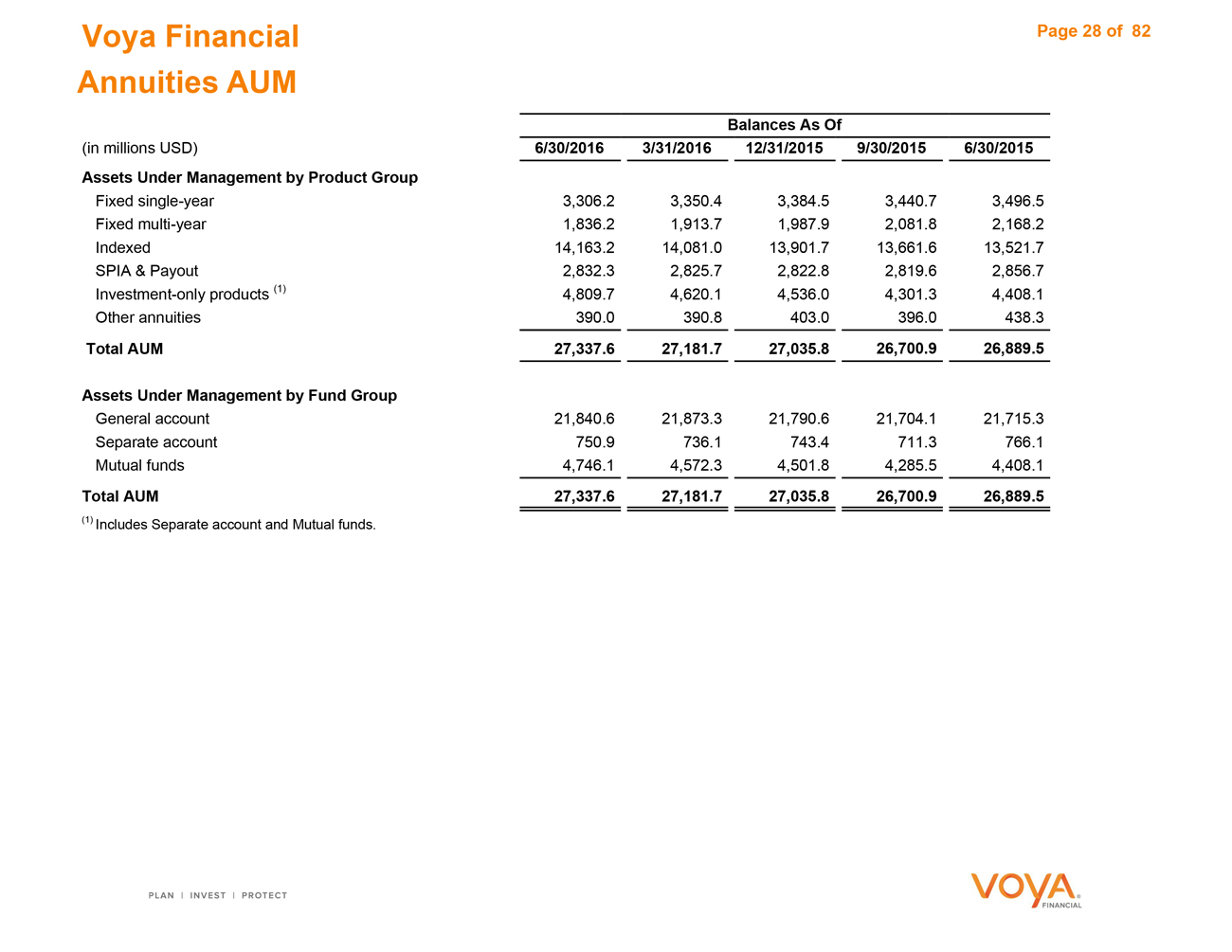

Voya Financial Annuities AUM

Page 28 of 82

Balances As Of

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015

Assets Under Management by Product Group

Fixed single-year 3,306.2 3,350.4 3,384.5 3,440.7 3,496.5

Fixed multi-year 1,836.2 1,913.7 1,987.9 2,081.8 2,168.2

Indexed 14,163.2 14,081.0 13,901.7 13,661.6 13,521.7

SPIA & Payout 2,832.3 2,825.7 2,822.8 2,819.6 2,856.7

Investment-only products (1) 4,809.7 4,620.1 4,536.0 4,301.3 4,408.1

Other annuities 390.0 390.8 403.0 396.0 438.3

Total AUM 27,337.6 27,181.7 27,035.8 26,700.9 26,889.5

Assets Under Management by Fund Group

General account 21,840.6 21,873.3 21,790.6 21,704.1 21,715.3

Separate account 750.9 736.1 743.4 711.3 766.1

Mutual funds 4,746.1 4,572.3 4,501.8 4,285.5 4,408.1

Total AUM 27,337.6 27,181.7 27,035.8 26,700.9 26,889.5

(1) Includes Separate account and Mutual funds.

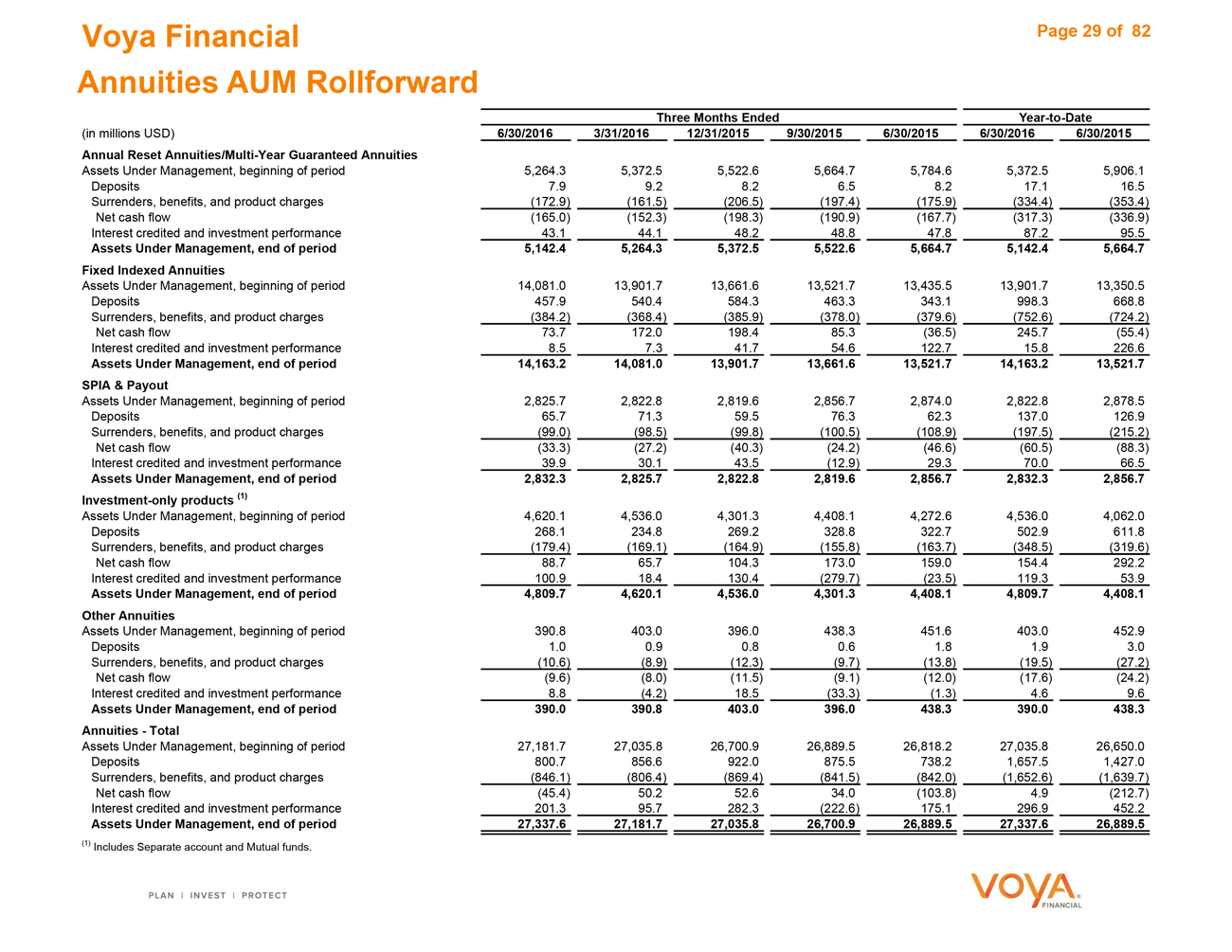

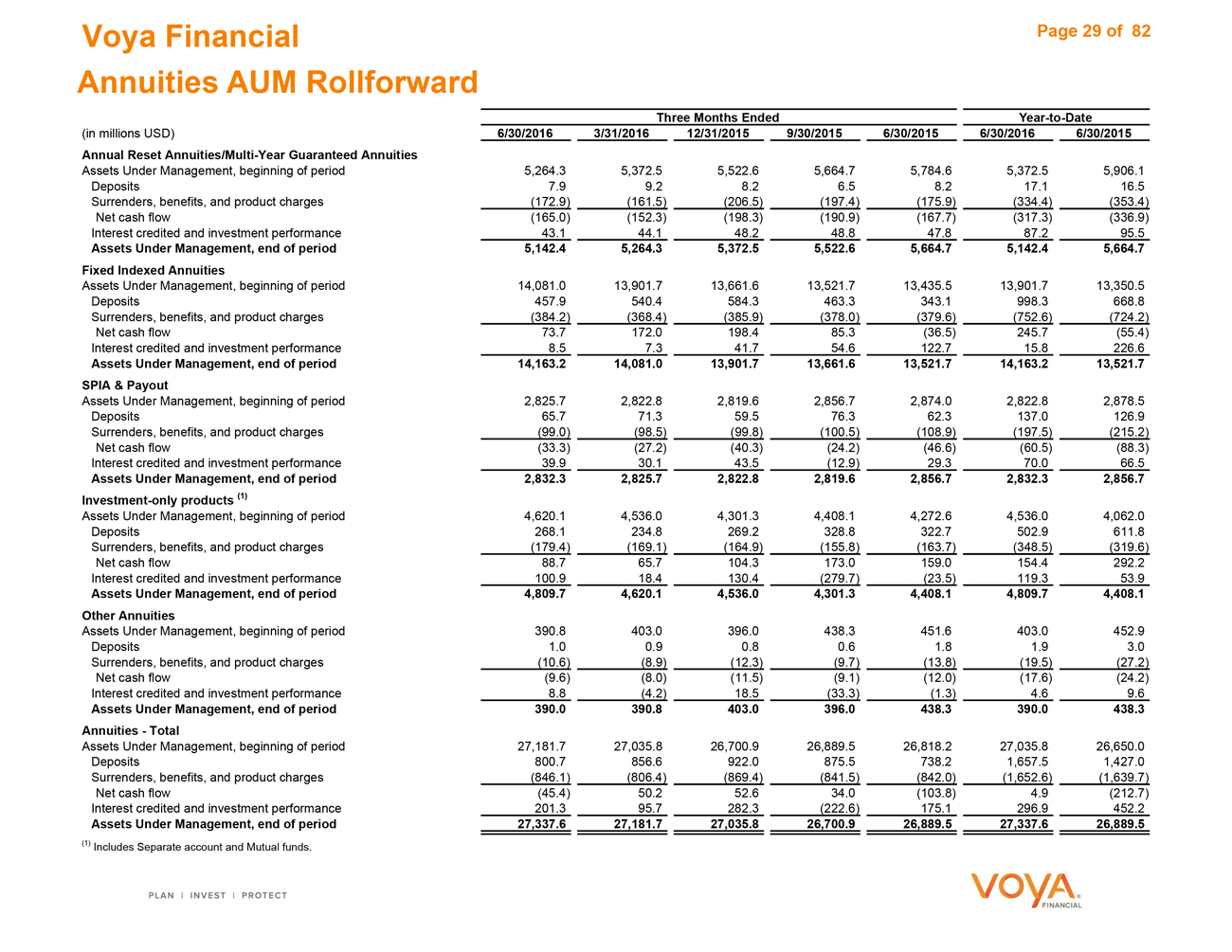

Voya Financial Page 29 of 82 Annuities AUM Rollforward

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Annual Reset Annuities/Multi-Year Guaranteed Annuities

Assets Under Management, beginning of period 5,264.3 5,372.5 5,522.6 5,664.7 5,784.6 5,372.5 5,906.1

Deposits 7.9 9.2 8.2 6.5 8.2 17.1 16.5

Surrenders, benefits, and product charges(172.9)(161.5)(206.5)(197.4)(175.9)(334.4)(353.4)

Net cash flow(165.0)(152.3)(198.3)(190.9)(167.7)(317.3)(336.9)

Interest credited and investment performance 43.1 44.1 48.2 48.8 47.8 87.2 95.5

Assets Under Management, end of period 5,142.4 5,264.3 5,372.5 5,522.6 5,664.7 5,142.4 5,664.7

Fixed Indexed Annuities

Assets Under Management, beginning of period 14,081.0 13,901.7 13,661.6 13,521.7 13,435.5 13,901.7 13,350.5

Deposits 457.9 540.4 584.3 463.3 343.1 998.3 668.8

Surrenders, benefits, and product charges(384.2)(368.4)(385.9)(378.0)(379.6)(752.6)(724.2)

Net cash flow 73.7 172.0 198.4 85.3(36.5) 245.7(55.4)

Interest credited and investment performance 8.5 7.3 41.7 54.6 122.7 15.8 226.6

Assets Under Management, end of period 14,163.2 14,081.0 13,901.7 13,661.6 13,521.7 14,163.2 13,521.7

SPIA & Payout

Assets Under Management, beginning of period 2,825.7 2,822.8 2,819.6 2,856.7 2,874.0 2,822.8 2,878.5

Deposits 65.7 71.3 59.5 76.3 62.3 137.0 126.9

Surrenders, benefits, and product charges(99.0)(98.5)(99.8)(100.5)(108.9)(197.5)(215.2)

Net cash flow(33.3)(27.2)(40.3)(24.2)(46.6)(60.5)(88.3)

Interest credited and investment performance 39.9 30.1 43.5(12.9) 29.3 70.0 66.5

Assets Under Management, end of period 2,832.3 2,825.7 2,822.8 2,819.6 2,856.7 2,832.3 2,856.7

Investment-only products (1)

Assets Under Management, beginning of period 4,620.1 4,536.0 4,301.3 4,408.1 4,272.6 4,536.0 4,062.0

Deposits 268.1 234.8 269.2 328.8 322.7 502.9 611.8

Surrenders, benefits, and product charges(179.4)(169.1)(164.9)(155.8)(163.7)(348.5)(319.6)

Net cash flow 88.7 65.7 104.3 173.0 159.0 154.4 292.2

Interest credited and investment performance 100.9 18.4 130.4(279.7)(23.5) 119.3 53.9

Assets Under Management, end of period 4,809.7 4,620.1 4,536.0 4,301.3 4,408.1 4,809.7 4,408.1

Other Annuities

Assets Under Management, beginning of period 390.8 403.0 396.0 438.3 451.6 403.0 452.9

Deposits 1.0 0.9 0.8 0.6 1.8 1.9 3.0

Surrenders, benefits, and product charges(10.6)(8.9)(12.3)(9.7)(13.8)(19.5)(27.2)

Net cash flow(9.6)(8.0)(11.5)(9.1)(12.0)(17.6)(24.2)

Interest credited and investment performance 8.8(4.2) 18.5(33.3)(1.3) 4.6 9.6

Assets Under Management, end of period 390.0 390.8 403.0 396.0 438.3 390.0 438.3

Annuities—Total

Assets Under Management, beginning of period 27,181.7 27,035.8 26,700.9 26,889.5 26,818.2 27,035.8 26,650.0

Deposits 800.7 856.6 922.0 875.5 738.2 1,657.5 1,427.0

Surrenders, benefits, and product charges(846.1)(806.4)(869.4)(841.5)(842.0)(1,652.6)(1,639.7)

Net cash flow(45.4) 50.2 52.6 34.0(103.8) 4.9(212.7)

Interest credited and investment performance 201.3 95.7 282.3(222.6) 175.1 296.9 452.2

Assets Under Management, end of period 27,337.6 27,181.7 27,035.8 26,700.9 26,889.5 27,337.6 26,889.5

(1) Includes Separate account and Mutual funds.

Investment Management

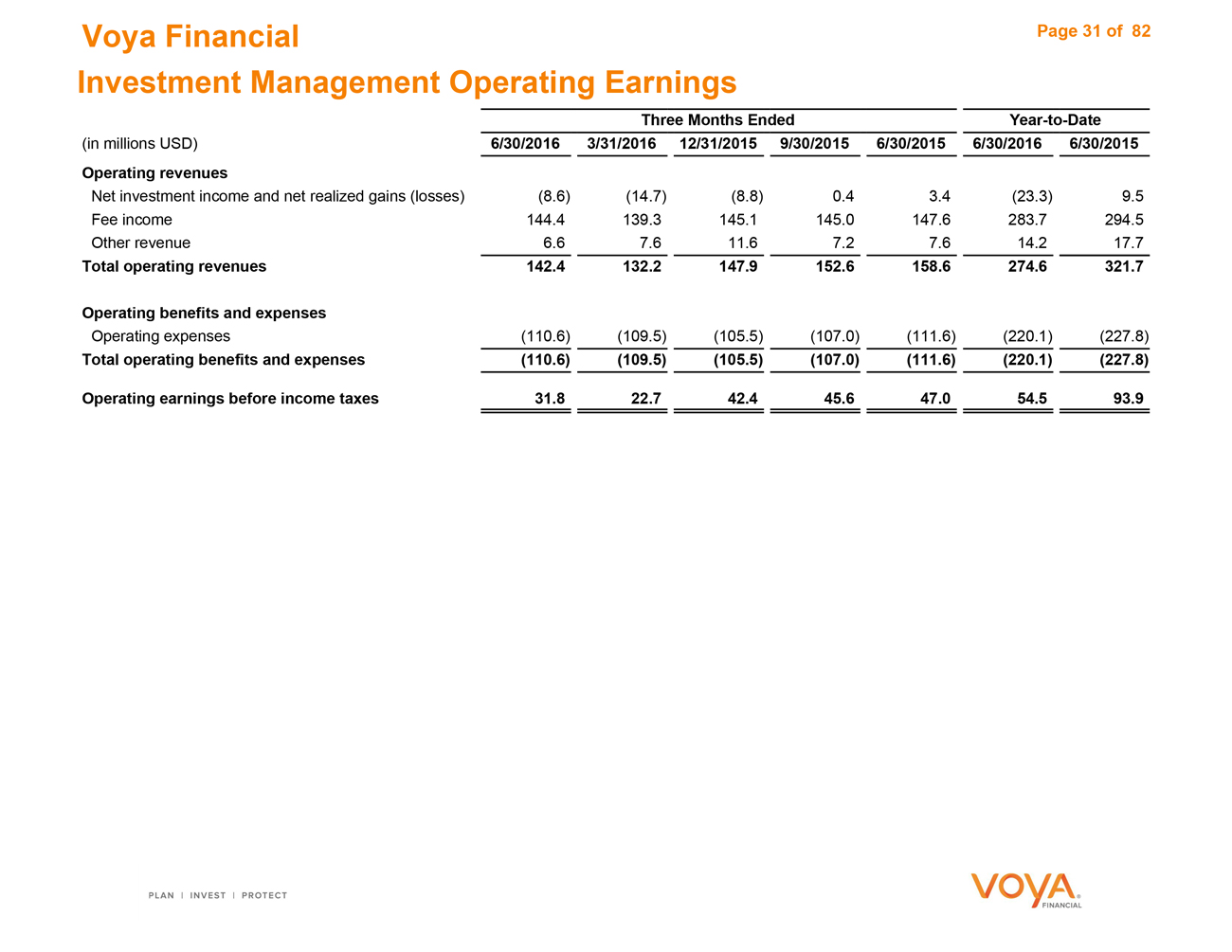

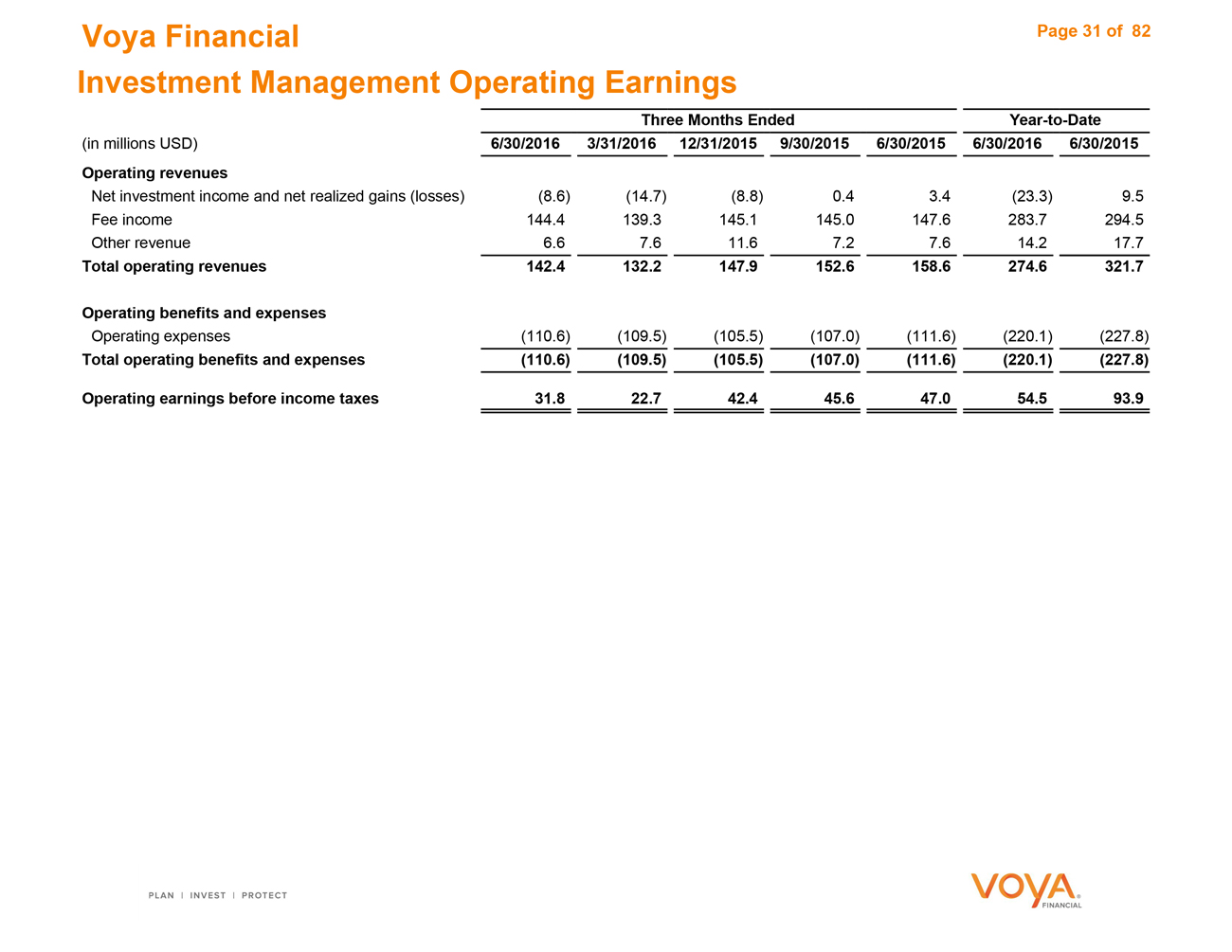

Voya Financial Page 31 of 82 Investment Management Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Operating revenues

Net investment income and net realized gains (losses)(8.6)(14.7)(8.8) 0.4 3.4(23.3) 9.5

Fee income 144.4 139.3 145.1 145.0 147.6 283.7 294.5

Other revenue 6.6 7.6 11.6 7.2 7.6 14.2 17.7

Total operating revenues 142.4 132.2 147.9 152.6 158.6 274.6 321.7

Operating benefits and expenses

Operating expenses(110.6)(109.5)(105.5)(107.0)(111.6)(220.1)(227.8)

Total operating benefits and expenses(110.6)(109.5)(105.5)(107.0)(111.6)(220.1)(227.8)

Operating earnings before income taxes 31.8 22.7 42.4 45.6 47.0 54.5 93.9

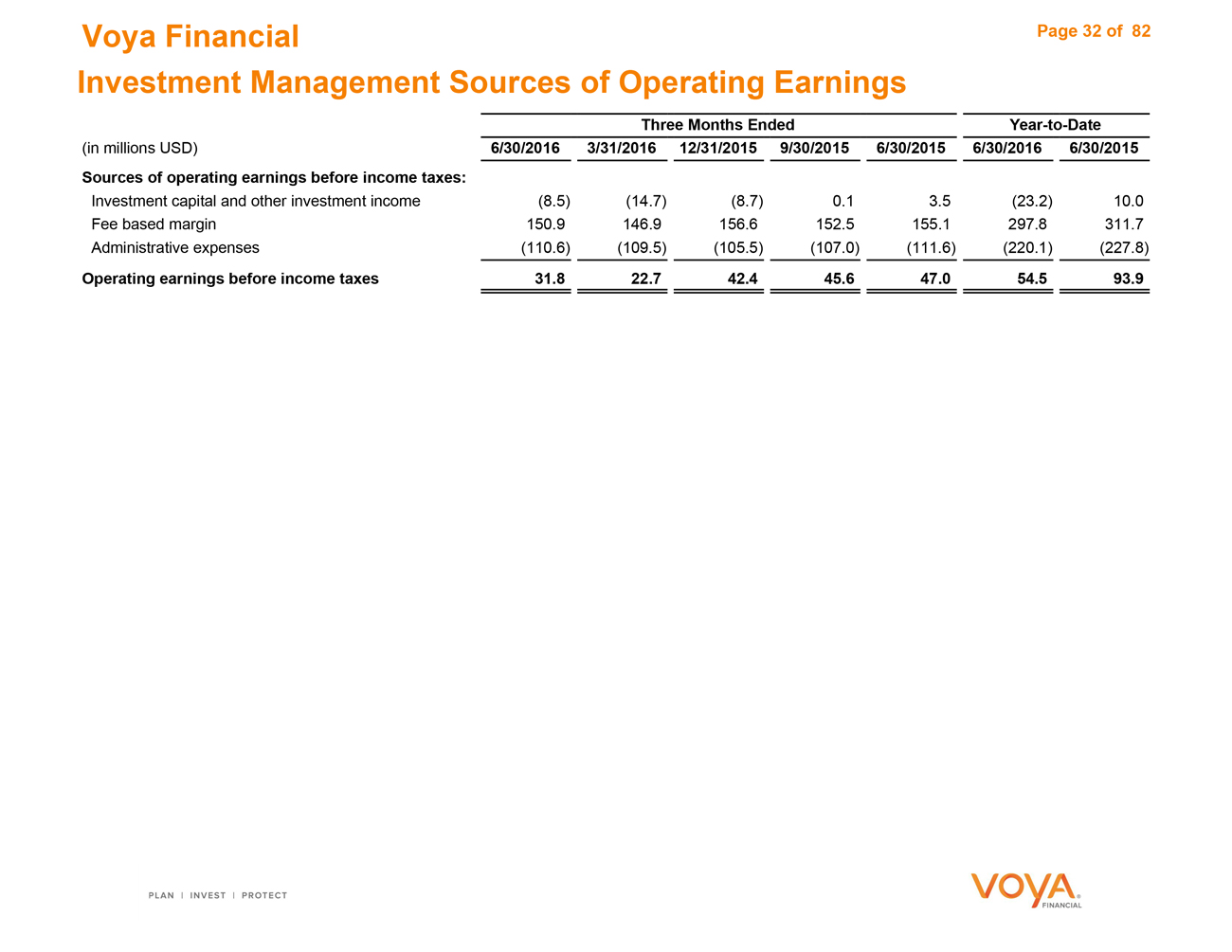

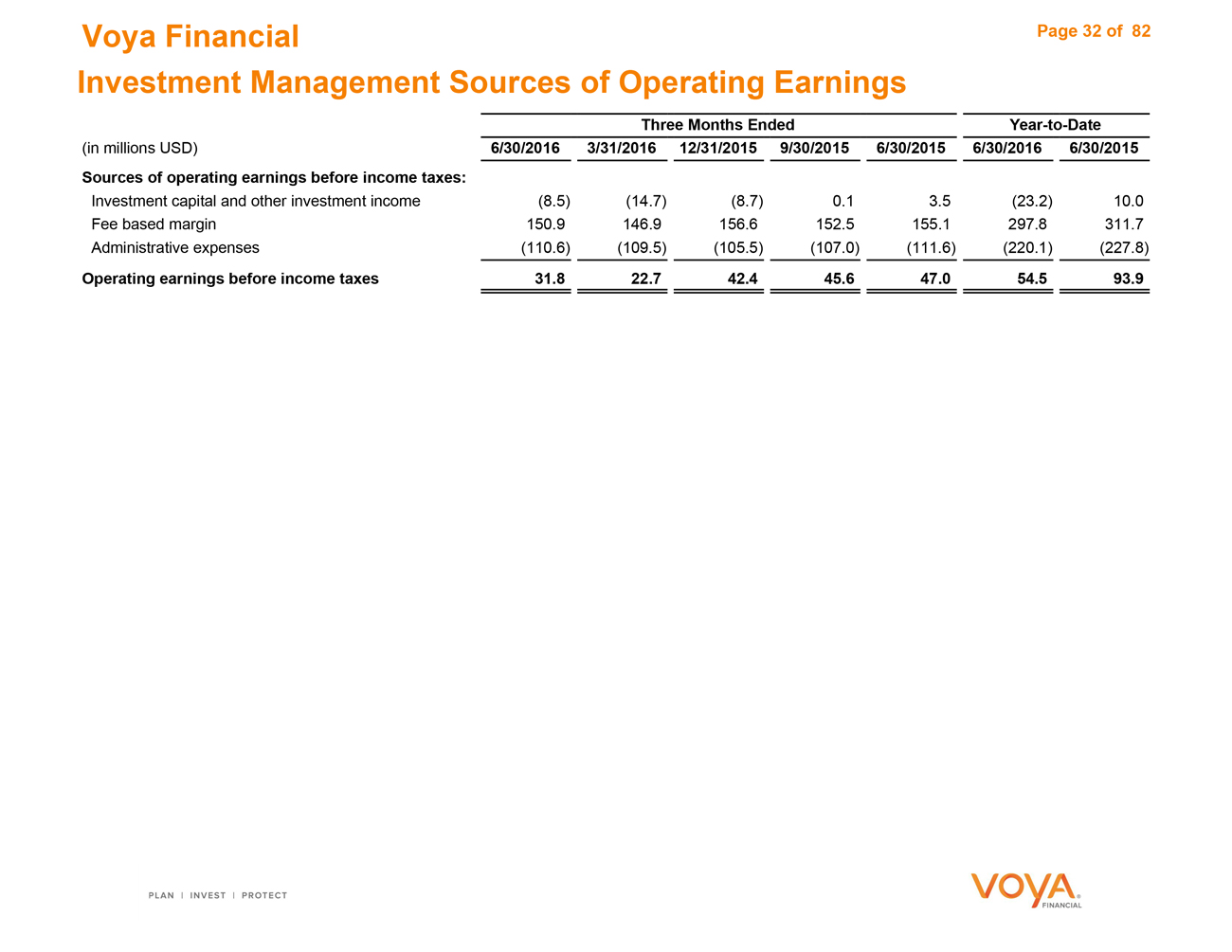

Voya Financial Page 32 of 82 Investment Management Sources of Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Sources of operating earnings before income taxes:

Investment capital and other investment income(8.5)(14.7)(8.7) 0.1 3.5(23.2) 10.0

Fee based margin 150.9 146.9 156.6 152.5 155.1 297.8 311.7

Administrative expenses(110.6)(109.5)(105.5)(107.0)(111.6)(220.1)(227.8)

Operating earnings before income taxes 31.8 22.7 42.4 45.6 47.0 54.5 93.9

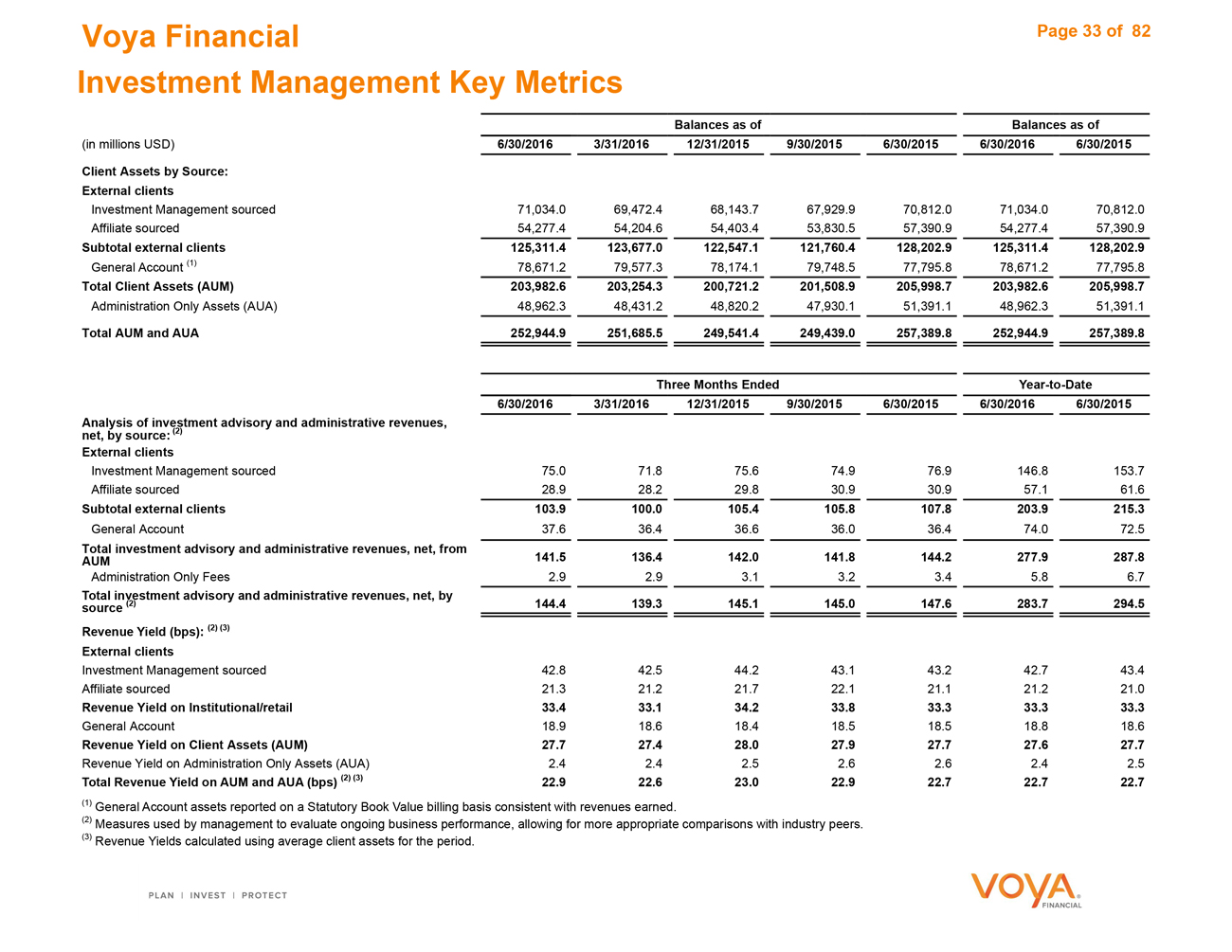

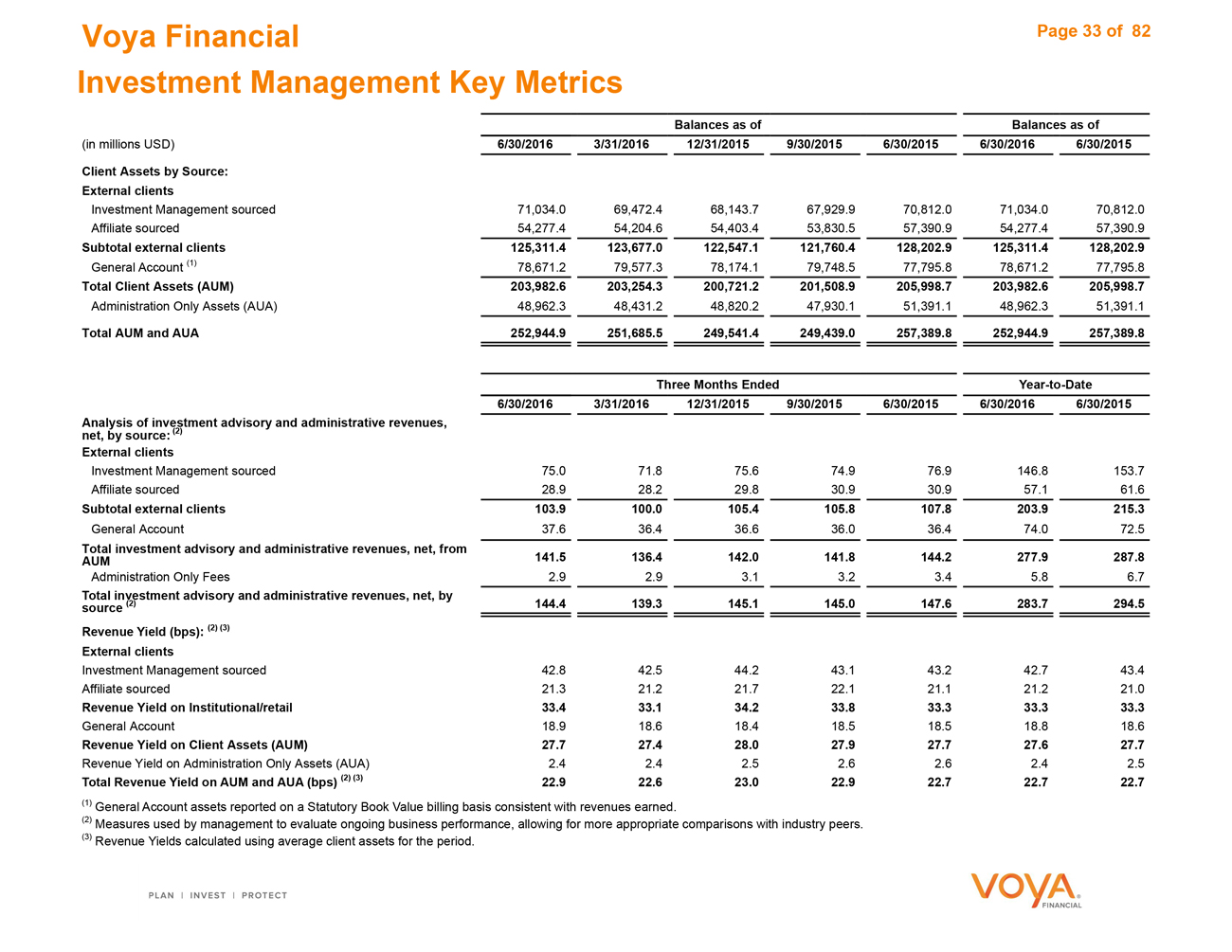

Voya Financial Page 33 of 82 Investment Management Key Metrics

Balances as of Balances as of

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Client Assets by Source:

External clients

Investment Management sourced 71,034.0 69,472.4 68,143.7 67,929.9 70,812.0 71,034.0 70,812.0

Affiliate sourced 54,277.4 54,204.6 54,403.4 53,830.5 57,390.9 54,277.4 57,390.9

Subtotal external clients 125,311.4 123,677.0 122,547.1 121,760.4 128,202.9 125,311.4 128,202.9

General Account (1) 78,671.2 79,577.3 78,174.1 79,748.5 77,795.8 78,671.2 77,795.8

Total Client Assets (AUM) 203,982.6 203,254.3 200,721.2 201,508.9 205,998.7 203,982.6 205,998.7

Administration Only Assets (AUA) 48,962.3 48,431.2 48,820.2 47,930.1 51,391.1 48,962.3 51,391.1

Total AUM and AUA 252,944.9 251,685.5 249,541.4 249,439.0 257,389.8 252,944.9 257,389.8

Three Months Ended Year-to-Date

6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Analysis of investment advisory and administrative revenues,

net, by source: (2)

External clients

Investment Management sourced 75.0 71.8 75.6 74.9 76.9 146.8 153.7

Affiliate sourced 28.9 28.2 29.8 30.9 30.9 57.1 61.6

Subtotal external clients 103.9 100.0 105.4 105.8 107.8 203.9 215.3

General Account 37.6 36.4 36.6 36.0 36.4 74.0 72.5

Total investment advisory and administrative revenues, net, from 141.5 136.4 142.0 141.8

AUM 144.2 277.9 287.8

Administration Only Fees 2.9 2.9 3.1 3.2 3.4 5.8 6.7

Total investment advisory and administrative revenues, net, by

source (2) 144.4 139.3 145.1 145.0 147.6 283.7 294.5

Revenue Yield (bps): (2) (3)

External clients

Investment Management sourced 42.8 42.5 44.2 43.1 43.2 42.7 43.4

Affiliate sourced 21.3 21.2 21.7 22.1 21.1 21.2 21.0

Revenue Yield on Institutional/retail 33.4 33.1 34.2 33.8 33.3 33.3 33.3

General Account 18.9 18.6 18.4 18.5 18.5 18.8 18.6

Revenue Yield on Client Assets (AUM) 27.7 27.4 28.0 27.9 27.7 27.6 27.7

Revenue Yield on Administration Only Assets (AUA) 2.4 2.4 2.5 2.6 2.6 2.4 2.5

Total Revenue Yield on AUM and AUA (bps) (2) (3) 22.9 22.6 23.0 22.9 22.7 22.7 22.7

(1) General Account assets reported on a Statutory Book Value billing basis consistent with revenues earned.

(2) Measures used by management to evaluate ongoing business performance, allowing for more appropriate comparisons with industry peers.

(3) Revenue Yields calculated using average client assets for the period.

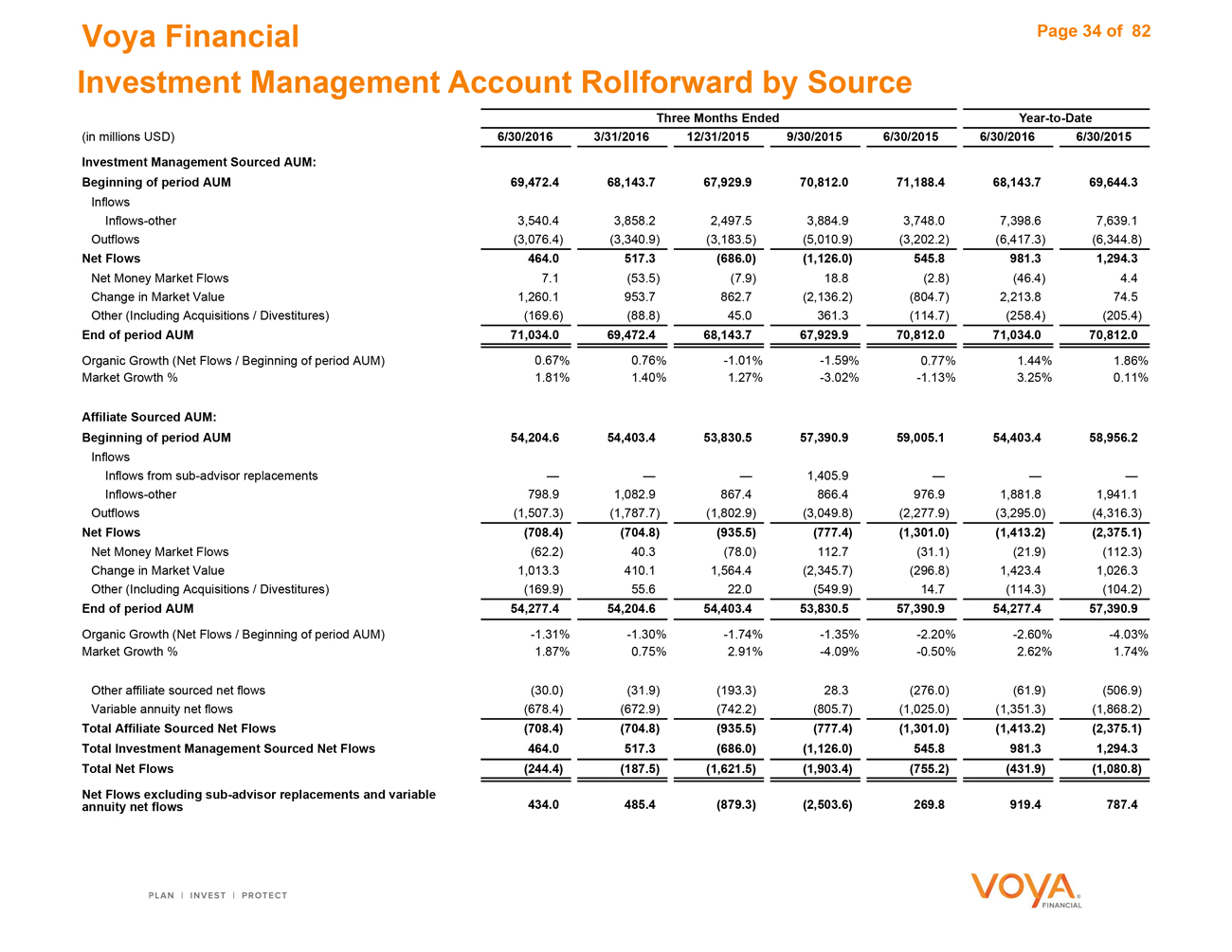

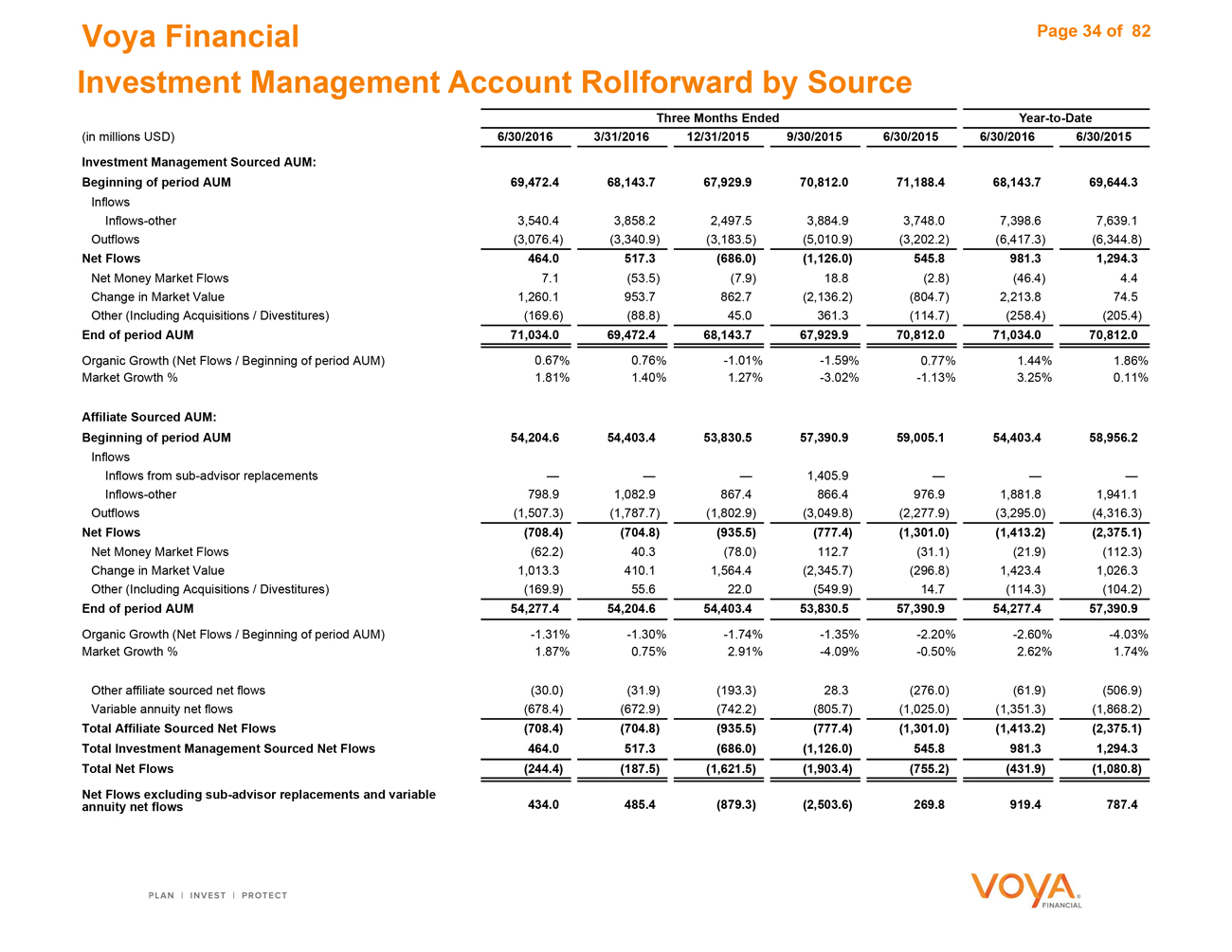

Voya Financial Page 34 of 82 Investment Management Account Rollforward by Source

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Investment Management Sourced AUM:

Beginning of period AUM 69,472.4 68,143.7 67,929.9 70,812.0 71,188.4 68,143.7 69,644.3

Inflows

Inflows-other 3,540.4 3,858.2 2,497.5 3,884.9 3,748.0 7,398.6 7,639.1

Outflows(3,076.4)(3,340.9)(3,183.5)(5,010.9)(3,202.2)(6,417.3)(6,344.8)

Net Flows 464.0 517.3(686.0)(1,126.0) 545.8 981.3 1,294.3

Net Money Market Flows 7.1(53.5)(7.9) 18.8(2.8)(46.4) 4.4

Change in Market Value 1,260.1 953.7 862.7(2,136.2)(804.7) 2,213.8 74.5

Other (Including Acquisitions / Divestitures)(169.6)(88.8) 45.0 361.3(114.7)(258.4)(205.4)

End of period AUM 71,034.0 69,472.4 68,143.7 67,929.9 70,812.0 71,034.0 70,812.0

Organic Growth (Net Flows / Beginning of period AUM) 0.67% 0.76% -1.01% -1.59% 0.77% 1.44% 1.86%

Market Growth % 1.81% 1.40% 1.27% -3.02% -1.13% 3.25% 0.11%

Affiliate Sourced AUM:

Beginning of period AUM 54,204.6 54,403.4 53,830.5 57,390.9 59,005.1 54,403.4 58,956.2

Inflows

Inflows from sub-advisor replacements — — — 1,405.9 — — —

Inflows-other 798.9 1,082.9 867.4 866.4 976.9 1,881.8 1,941.1

Outflows(1,507.3)(1,787.7)(1,802.9)(3,049.8)(2,277.9)(3,295.0)(4,316.3)

Net Flows(708.4)(704.8)(935.5)(777.4)(1,301.0)(1,413.2)(2,375.1)

Net Money Market Flows(62.2) 40.3(78.0) 112.7(31.1)(21.9)(112.3)

Change in Market Value 1,013.3 410.1 1,564.4(2,345.7)(296.8) 1,423.4 1,026.3

Other (Including Acquisitions / Divestitures)(169.9) 55.6 22.0(549.9) 14.7(114.3)(104.2)

End of period AUM 54,277.4 54,204.6 54,403.4 53,830.5 57,390.9 54,277.4 57,390.9

Organic Growth (Net Flows / Beginning of period AUM) -1.31% -1.30% -1.74% -1.35% -2.20% -2.60% -4.03%

Market Growth % 1.87% 0.75% 2.91% -4.09% -0.50% 2.62% 1.74%

Other affiliate sourced net flows(30.0)(31.9)(193.3) 28.3(276.0)(61.9)(506.9)

Variable annuity net flows(678.4)(672.9)(742.2)(805.7)(1,025.0)(1,351.3)(1,868.2)

Total Affiliate Sourced Net Flows(708.4)(704.8)(935.5)(777.4)(1,301.0)(1,413.2)(2,375.1)

Total Investment Management Sourced Net Flows 464.0 517.3(686.0)(1,126.0) 545.8 981.3 1,294.3

Total Net Flows(244.4)(187.5)(1,621.5)(1,903.4)(755.2)(431.9)(1,080.8)

Net Flows excluding sub-advisor replacements and variable

annuity net flows 434.0 485.4(879.3)(2,503.6) 269.8 919.4 787.4

Voya Financial Page 35 of 82 Investment Management Account Value by Asset Type

Balances as of

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015

Institutional

Equity 19,134.5 17,984.0 17,524.6 17,101.8 17,992.4

Fixed Income 40,292.0 39,616.6 38,341.8 38,621.6 39,689.6

Real Estate — — — — —

Money Market — — — — 24.5

Total 59,426.5 57,600.6 55,866.4 55,723.4 57,706.5

Retail

Equity 38,629.8 39,107.5 39,978.6 39,148.2 42,992.0

Fixed Income 19,997.6 19,378.9 18,963.6 18,874.6 19,070.4

Real Estate 5,520.2 5,788.2 5,910.0 6,099.6 6,656.3

Money Market 1,737.5 1,801.8 1,828.5 1,914.6 1,777.7

Total 65,885.1 66,076.4 66,680.7 66,037.0 70,496.4

General Account

Equity 313.1 319.2 339.4 292.0 201.4

Fixed Income 78,265.7 78,727.6 77,662.4 78,156.8 76,741.9

Real Estate — — — — —

Money Market 92.4 530.5 172.3 1,299.7 852.5

Total 78,671.2 79,577.3 78,174.1 79,748.5 77,795.8

Combined Asset Type

Equity 58,077.3 57,410.8 57,842.6 56,542.0 61,185.8

Fixed Income 138,555.3 137,723.0 134,967.8 135,653.0 135,501.9

Real Estate 5,520.2 5,788.2 5,910.0 6,099.6 6,656.3

Money Market 1,829.8 2,332.3 2,000.8 3,214.3 2,654.7

Total 203,982.6 203,254.3 200,721.2 201,508.9 205,998.7

Individual Life

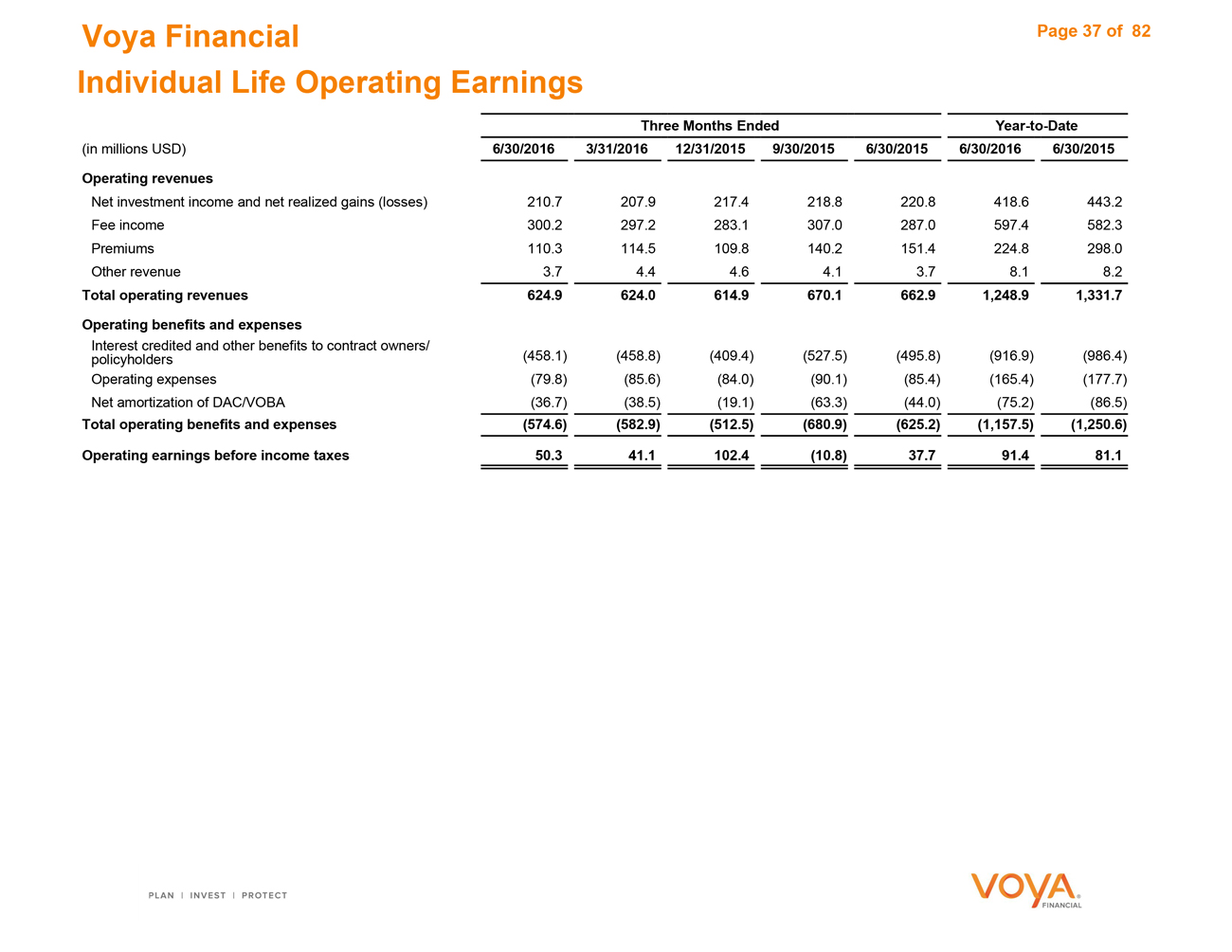

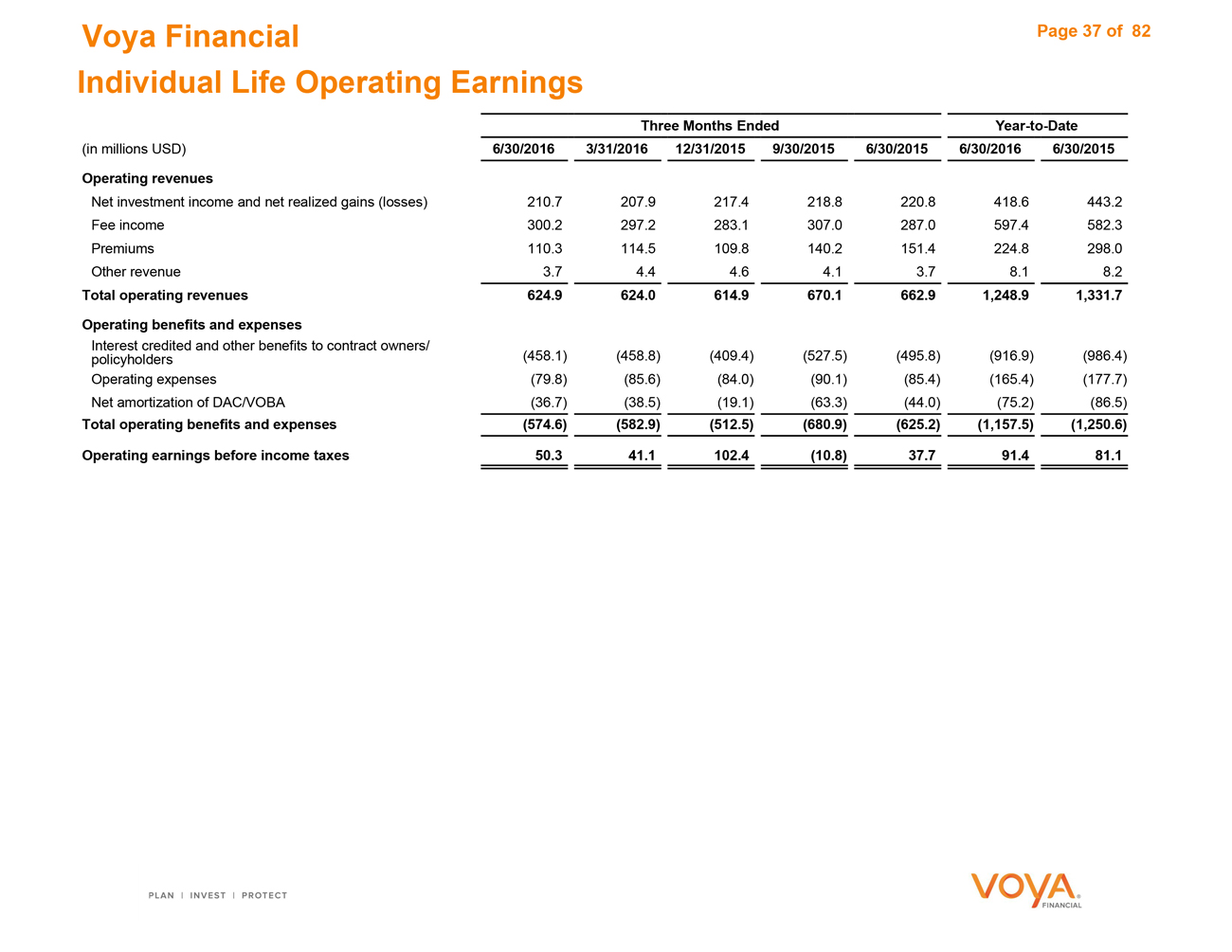

Voya Financial Page 37 of 82 Individual Life Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Operating revenues

Net investment income and net realized gains (losses) 210.7 207.9 217.4 218.8 220.8 418.6 443.2

Fee income 300.2 297.2 283.1 307.0 287.0 597.4 582.3

Premiums 110.3 114.5 109.8 140.2 151.4 224.8 298.0

Other revenue 3.7 4.4 4.6 4.1 3.7 8.1 8.2

Total operating revenues 624.9 624.0 614.9 670.1 662.9 1,248.9 1,331.7

Operating benefits and expenses

Interest credited and other benefits to contract owners/

policyholders(458.1)(458.8)(409.4)(527.5)(495.8)(916.9)(986.4)

Operating expenses(79.8)(85.6)(84.0)(90.1)(85.4)(165.4)(177.7)

Net amortization of DAC/VOBA(36.7)(38.5)(19.1)(63.3)(44.0)(75.2)(86.5)

Total operating benefits and expenses(574.6)(582.9)(512.5)(680.9)(625.2)(1,157.5)(1,250.6)

Operating earnings before income taxes 50.3 41.1 102.4(10.8) 37.7 91.4 81.1

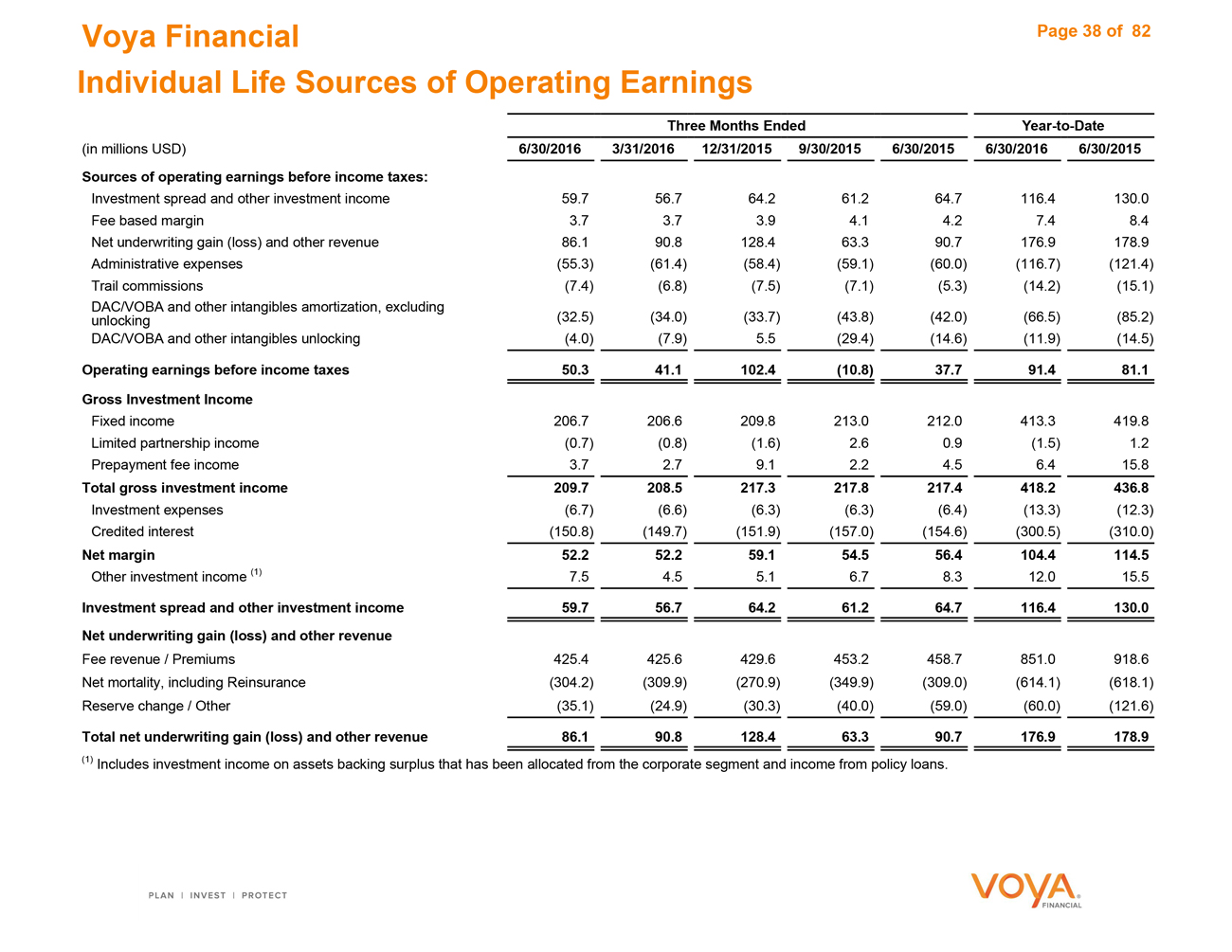

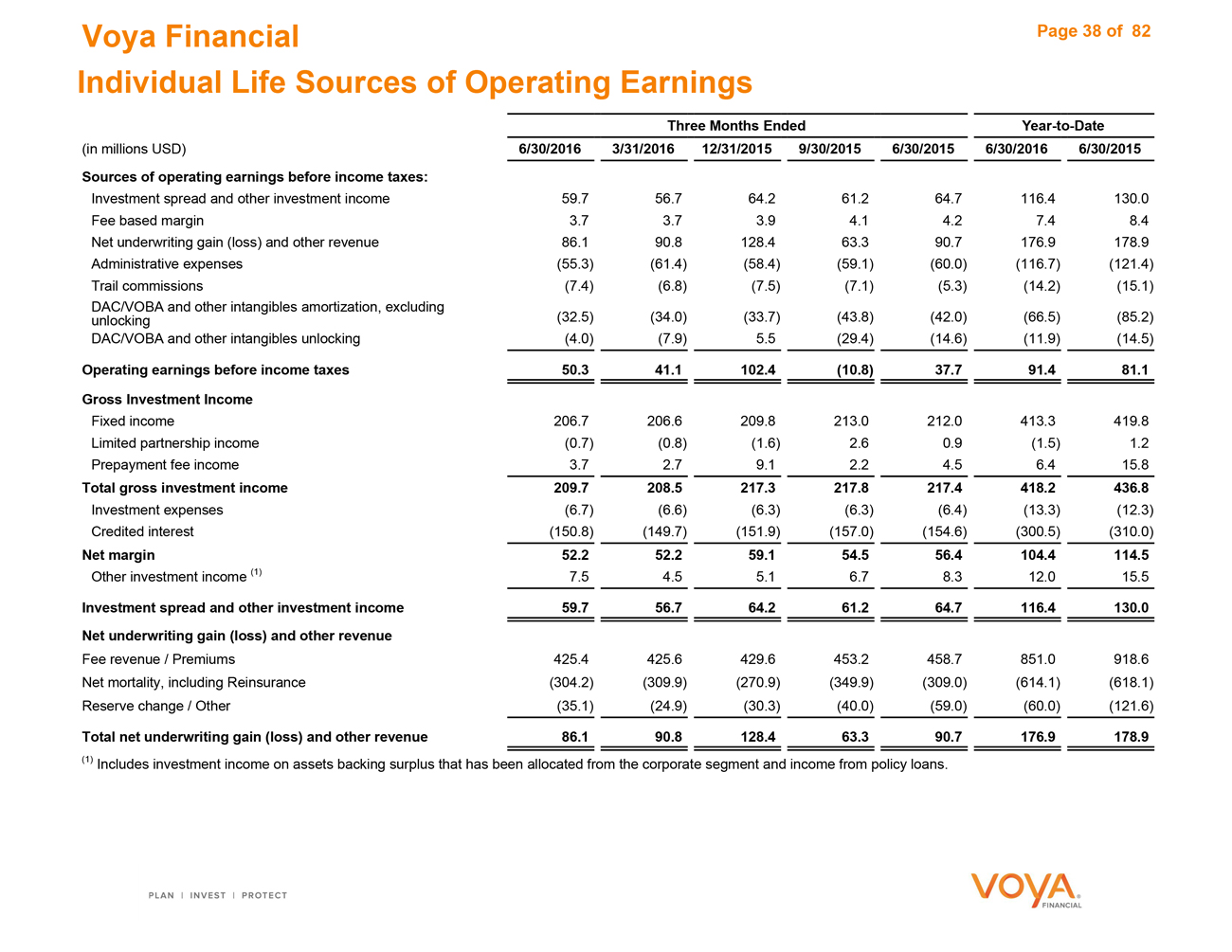

Voya Financial Page 38 of 82 Individual Life Sources of Operating Earnings

Three Months Ended Year-to-Date

(in millions USD) 6/30/2016 3/31/2016 12/31/2015 9/30/2015 6/30/2015 6/30/2016 6/30/2015

Sources of operating earnings before income taxes:

Investment spread and other investment income 59.7 56.7 64.2 61.2 64.7 116.4 130.0

Fee based margin 3.7 3.7 3.9 4.1 4.2 7.4 8.4

Net underwriting gain (loss) and other revenue 86.1 90.8 128.4 63.3 90.7 176.9 178.9

Administrative expenses(55.3)(61.4)(58.4)(59.1)(60.0)(116.7)(121.4)

Trail commissions(7.4)(6.8)(7.5)(7.1)(5.3)(14.2)(15.1)

DAC/VOBA and other intangibles amortization, excluding

unlocking(32.5)(34.0)(33.7)(43.8)(42.0)(66.5)(85.2)

DAC/VOBA and other intangibles unlocking(4.0)(7.9) 5.5(29.4)(14.6)(11.9)(14.5)

Operating earnings before income taxes 50.3 41.1 102.4(10.8) 37.7 91.4 81.1

Gross Investment Income

Fixed income 206.7 206.6 209.8 213.0 212.0 413.3 419.8

Limited partnership income(0.7)(0.8)(1.6) 2.6 0.9(1.5) 1.2

Prepayment fee income 3.7 2.7 9.1 2.2 4.5 6.4 15.8

Total gross investment income 209.7 208.5 217.3 217.8 217.4 418.2 436.8

Investment expenses(6.7)(6.6)(6.3)(6.3)(6.4)(13.3)(12.3)

Credited interest(150.8)(149.7)(151.9)(157.0)(154.6)(300.5)(310.0)

Net margin 52.2 52.2 59.1 54.5 56.4 104.4 114.5

Other investment income (1) 7.5 4.5 5.1 6.7 8.3 12.0 15.5

Investment spread and other investment income 59.7 56.7 64.2 61.2 64.7 116.4 130.0

Net underwriting gain (loss) and other revenue

Fee revenue / Premiums 425.4 425.6 429.6 453.2 458.7 851.0 918.6

Net mortality, including Reinsurance(304.2)(309.9)(270.9)(349.9)(309.0)(614.1)(618.1)

Reserve change / Other(35.1)(24.9)(30.3)(40.0)(59.0)(60.0)(121.6)