|

Exhibit 99.2

|

Quarterly Investor Supplement

December 31, 2016

This report should be read in conjunction with Voya Financial, Inc.‘s Annual Report on Form10-K for the twelve months ended December 31, 2016. Voya Financial’s Annual Reports on Form10-K, and Quarterly Reports on Form10-Q, can be accessed upon filing at the Securities and Exchange Commission’s website at www.sec.gov, and at our website at investors.voya.com. All information is unaudited.

|

|

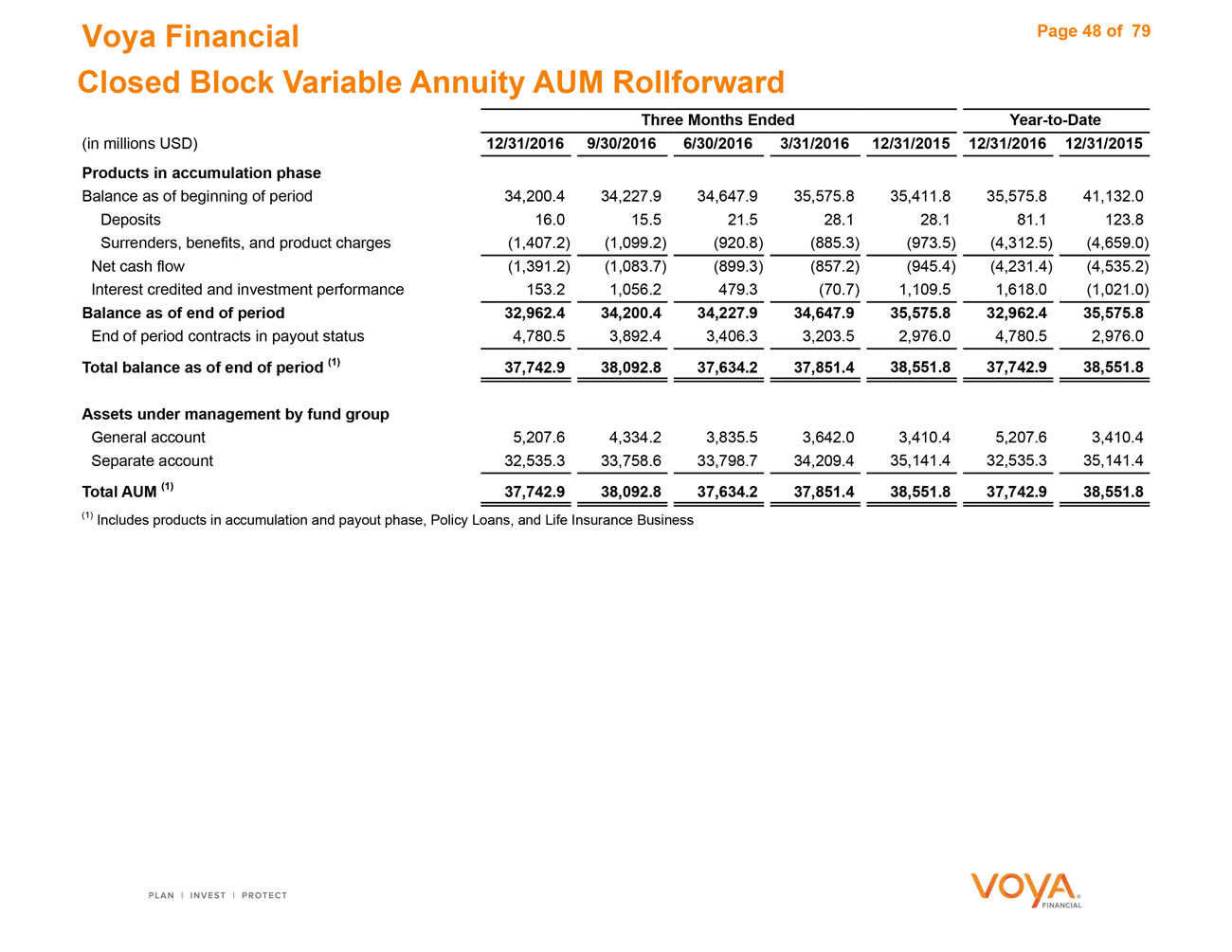

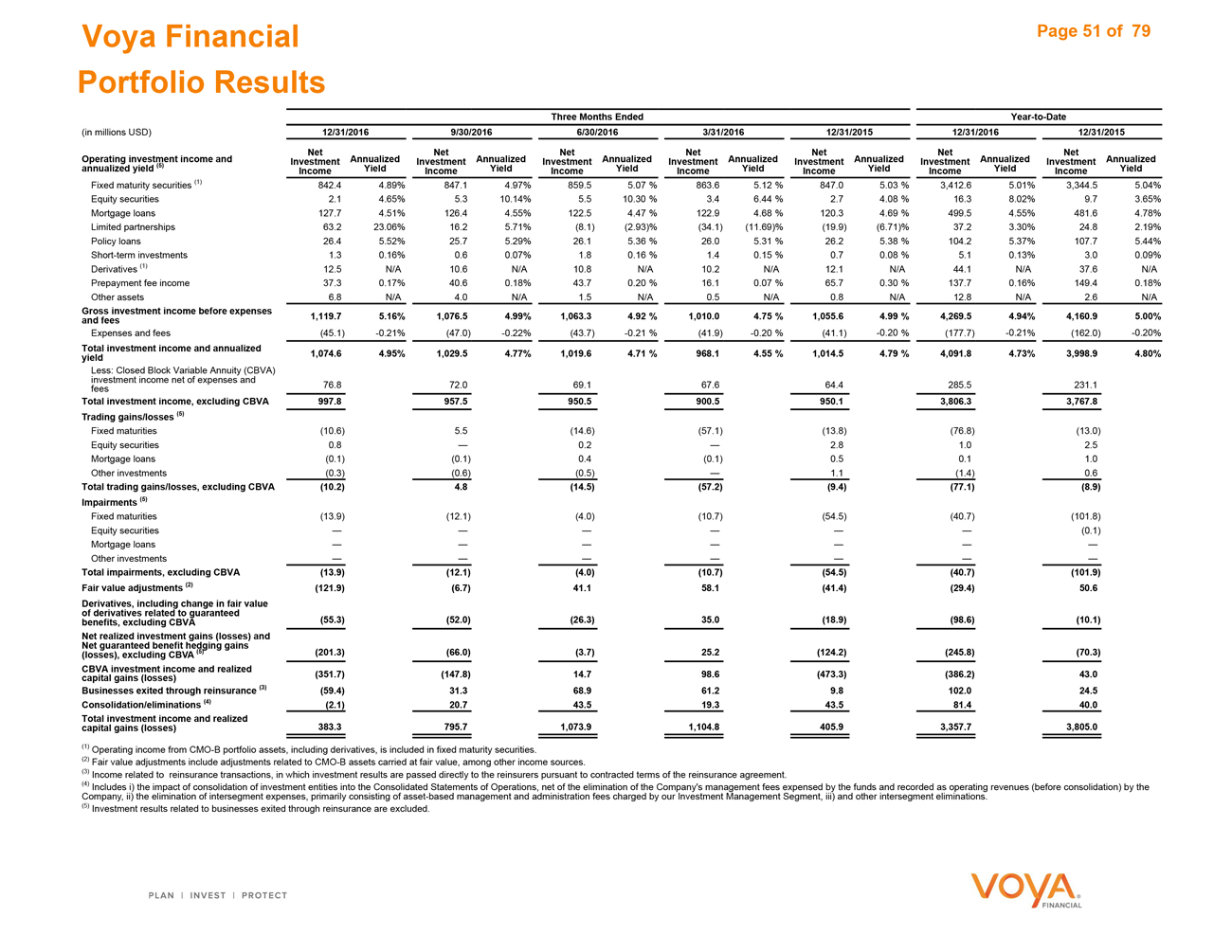

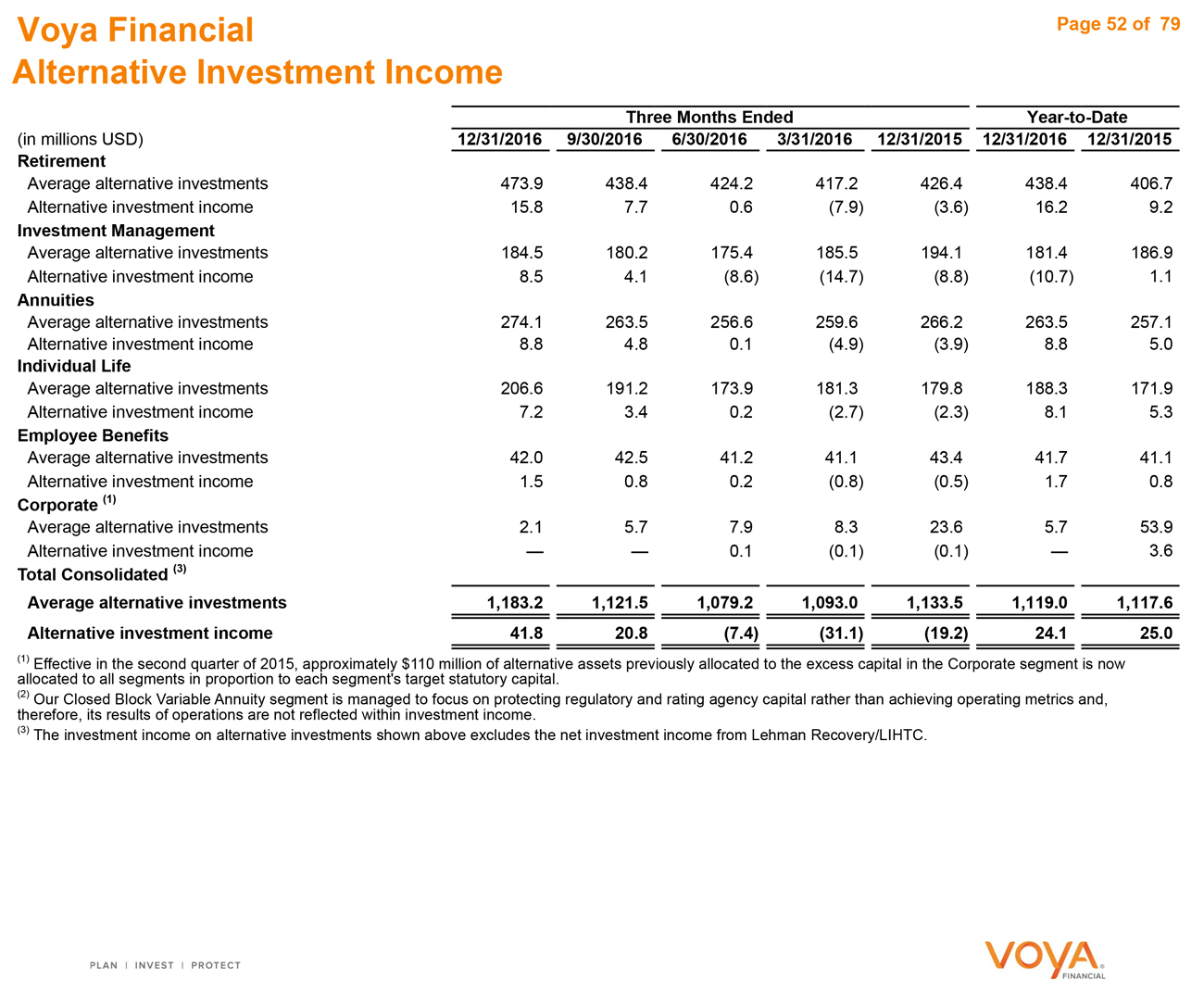

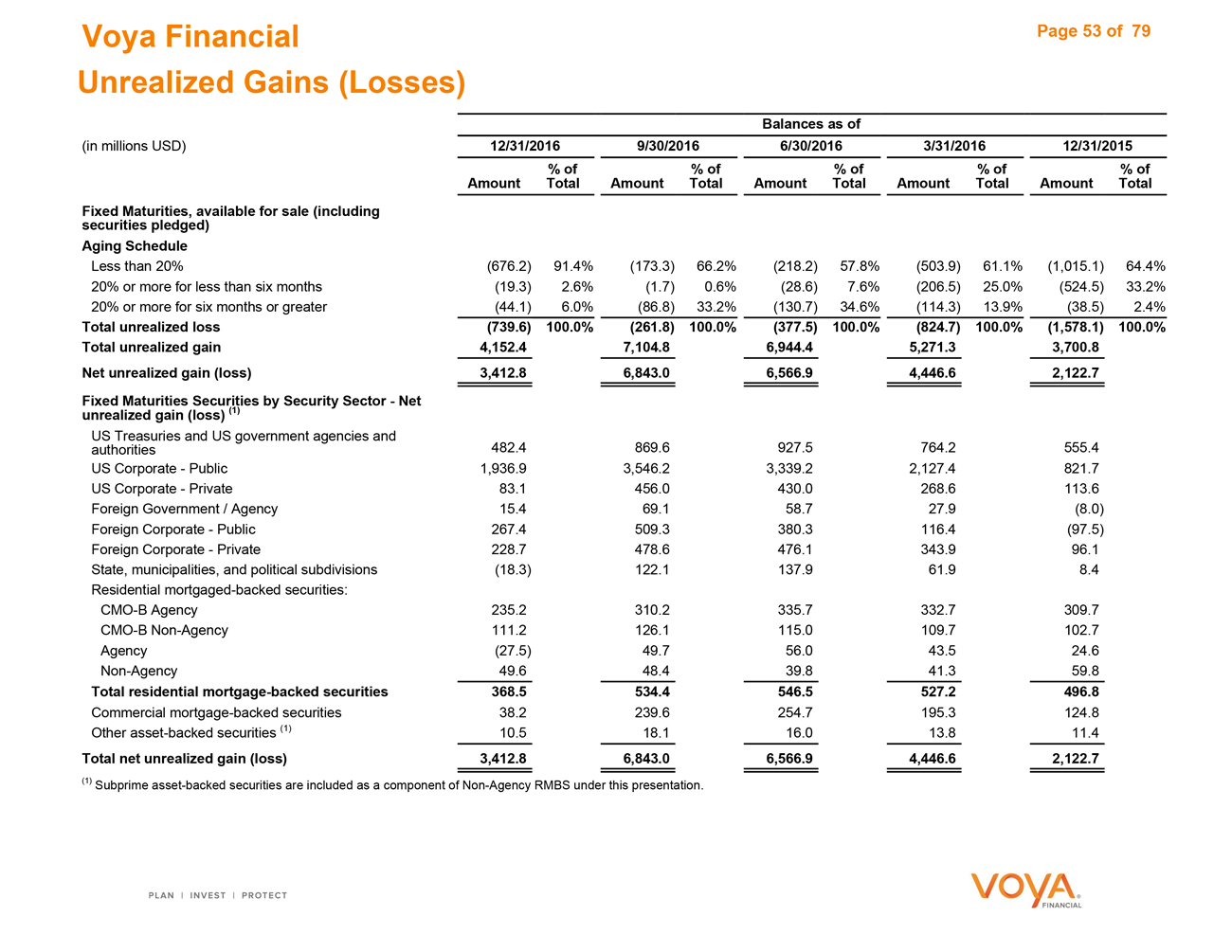

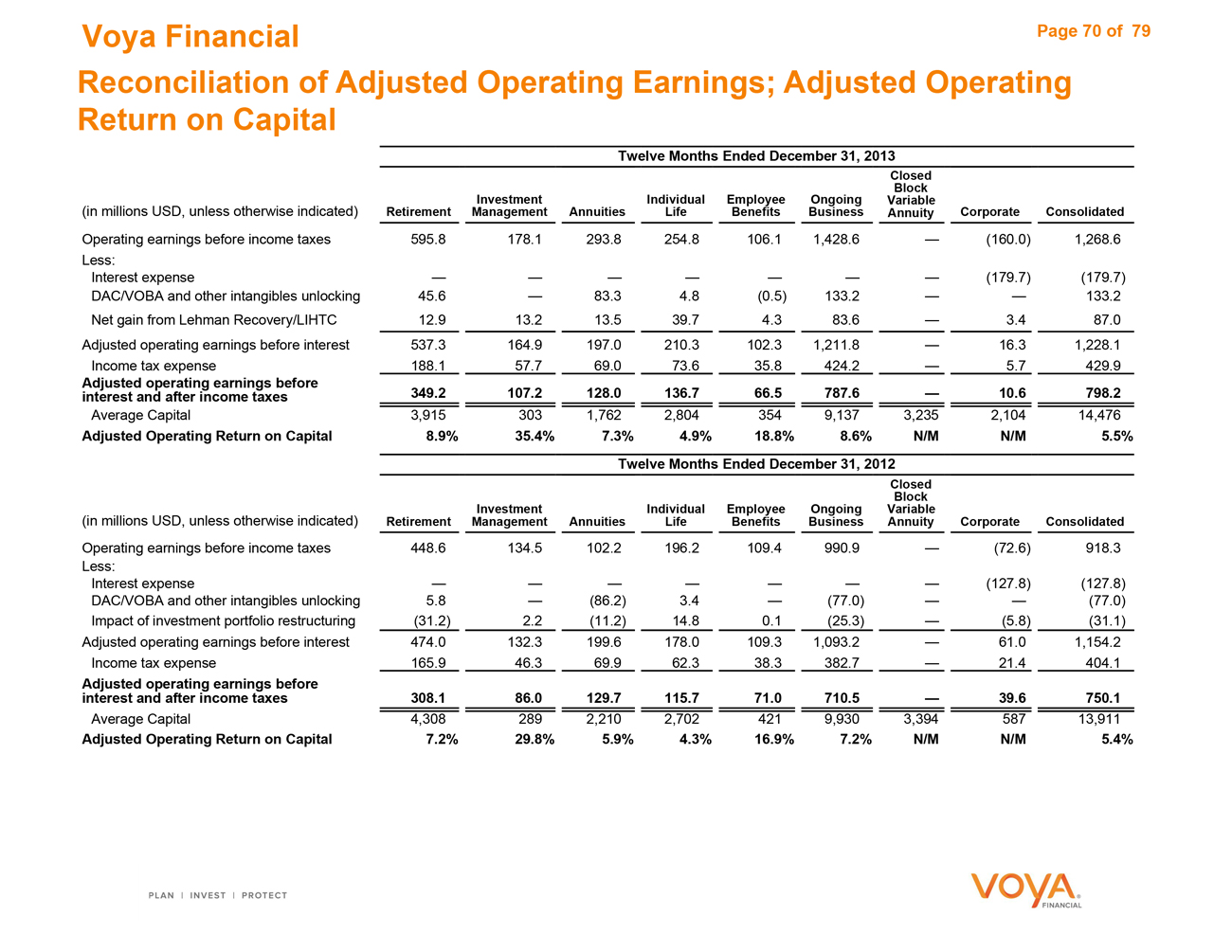

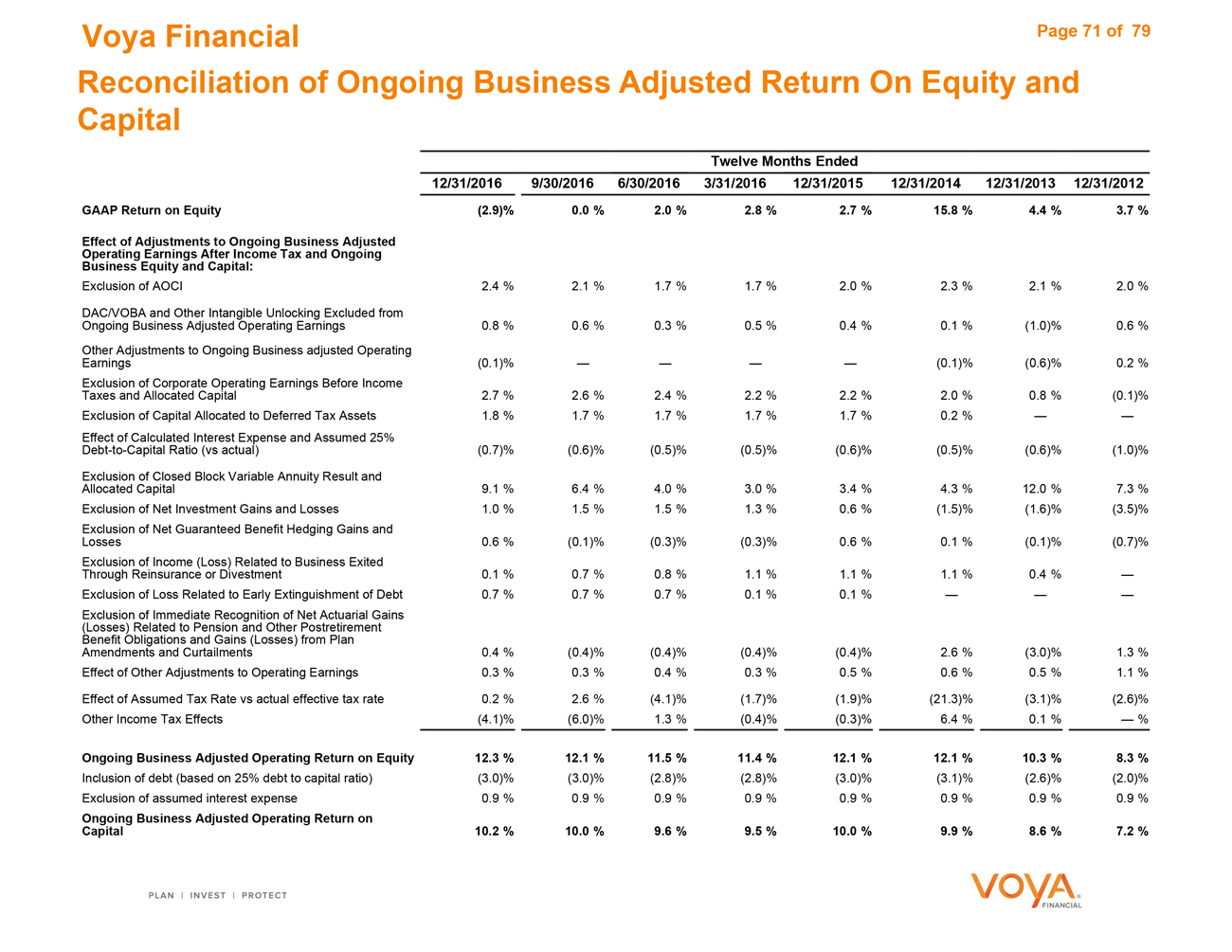

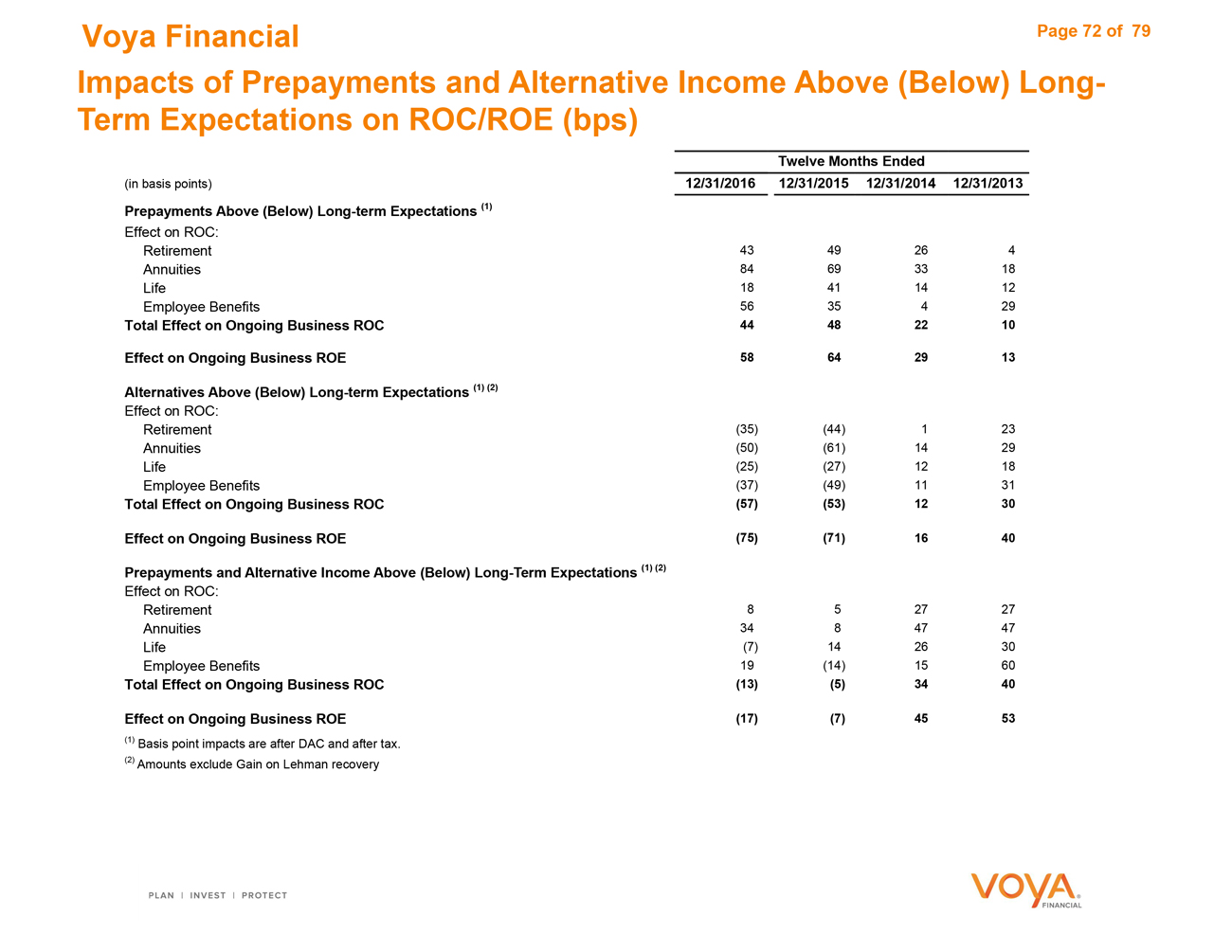

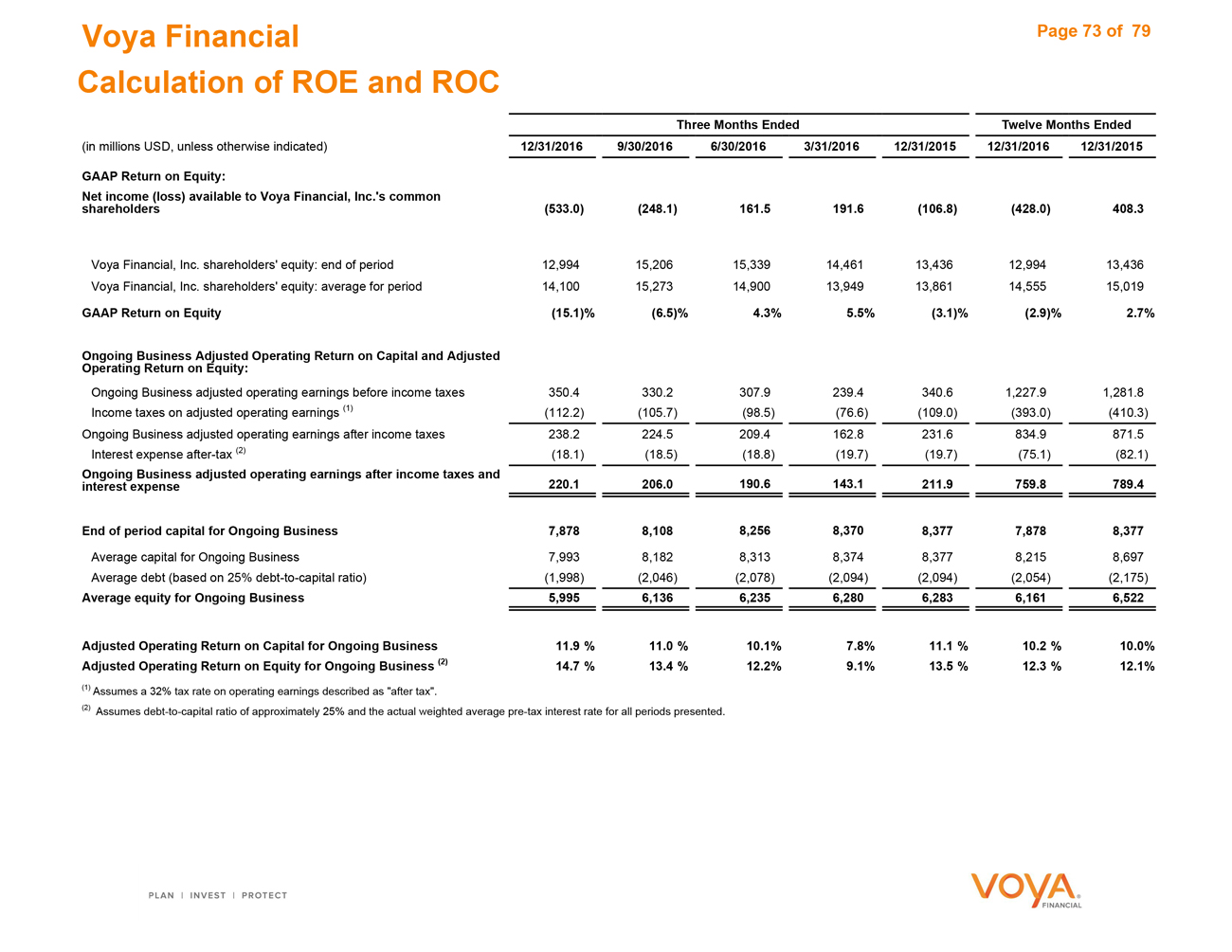

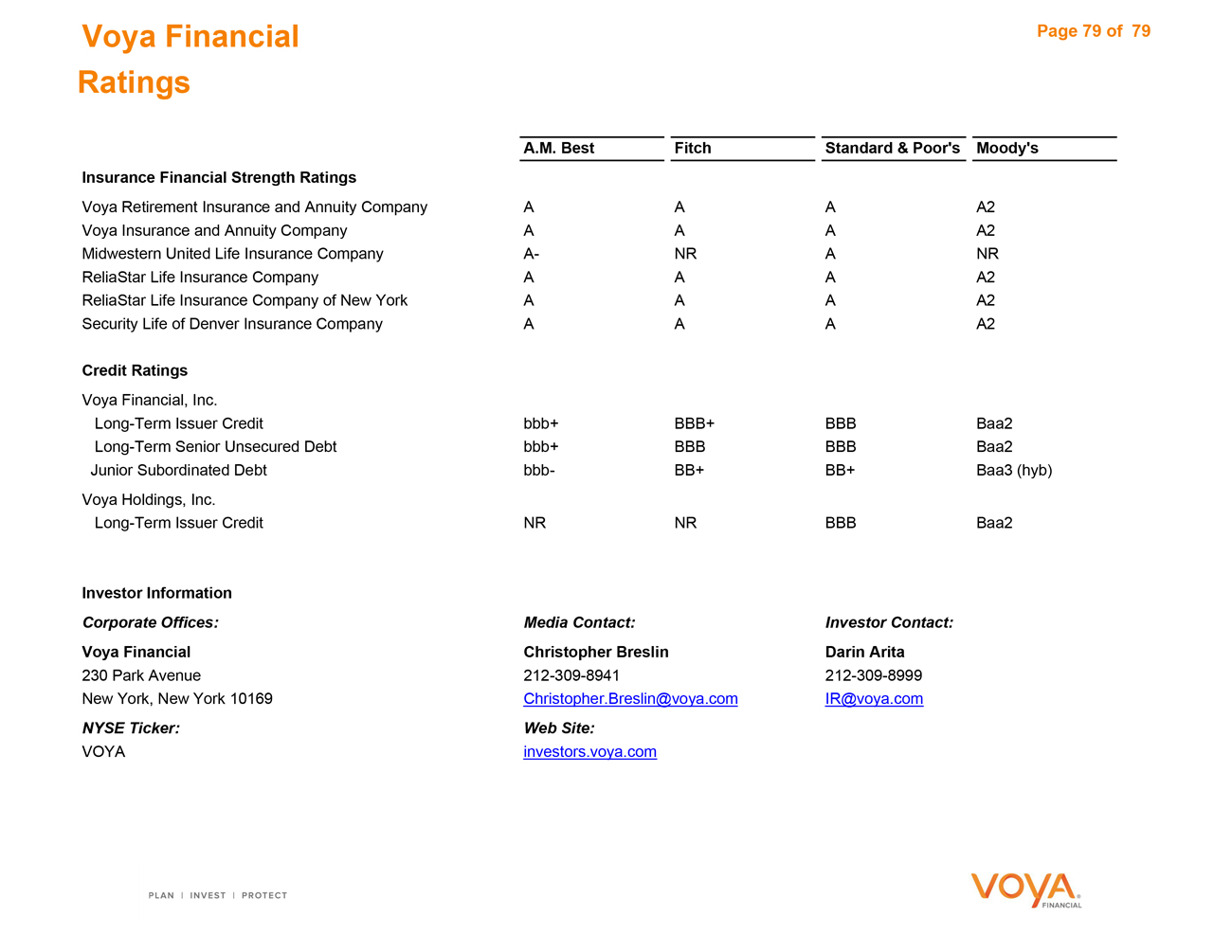

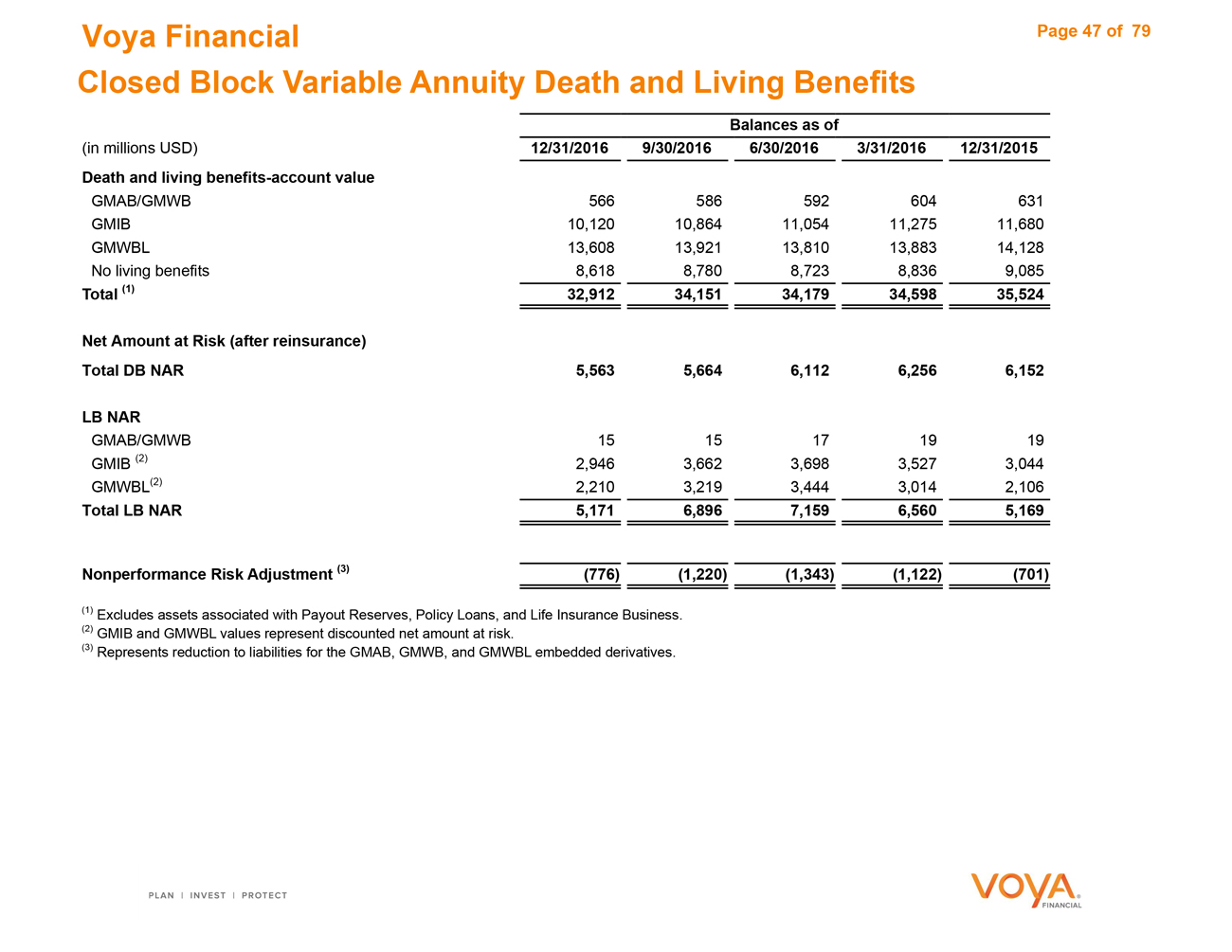

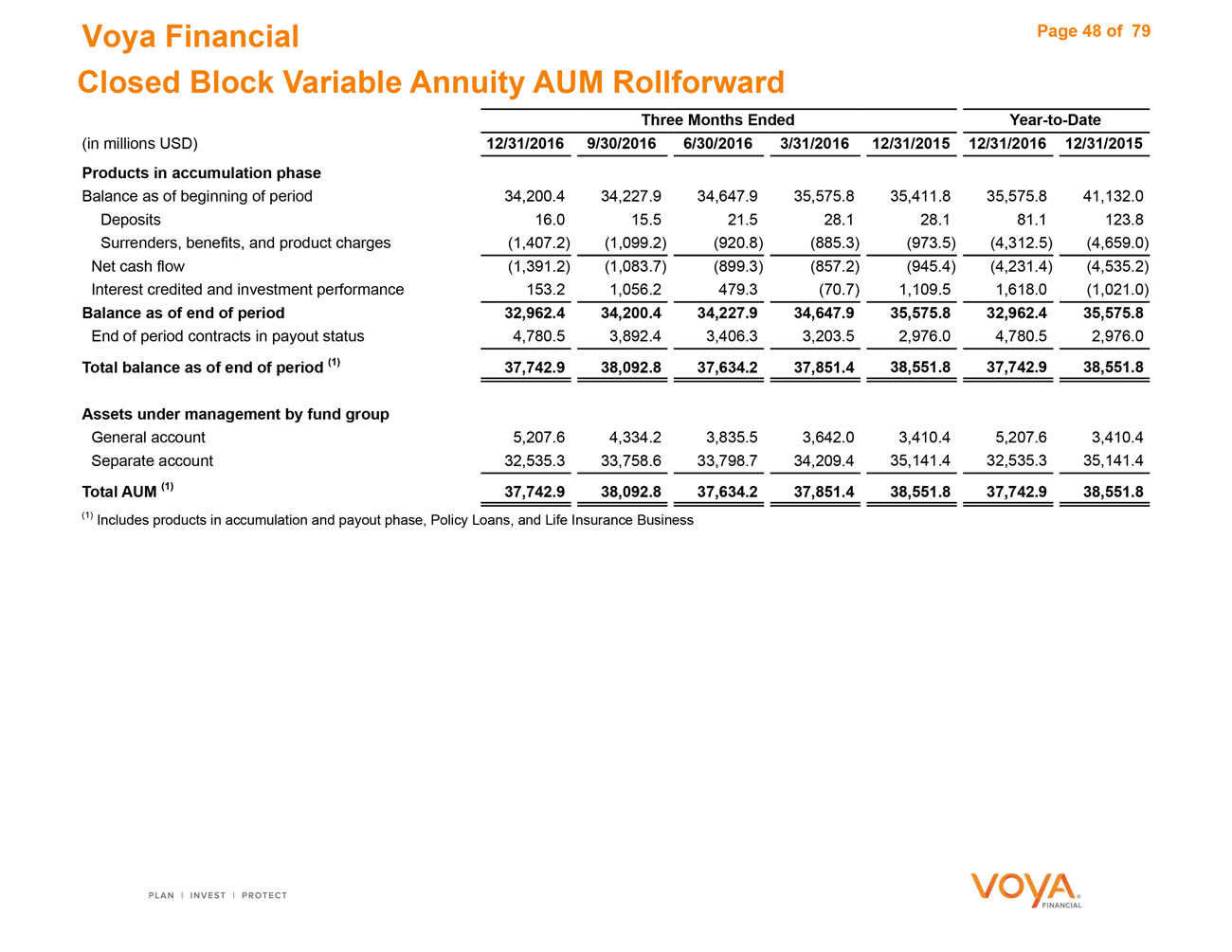

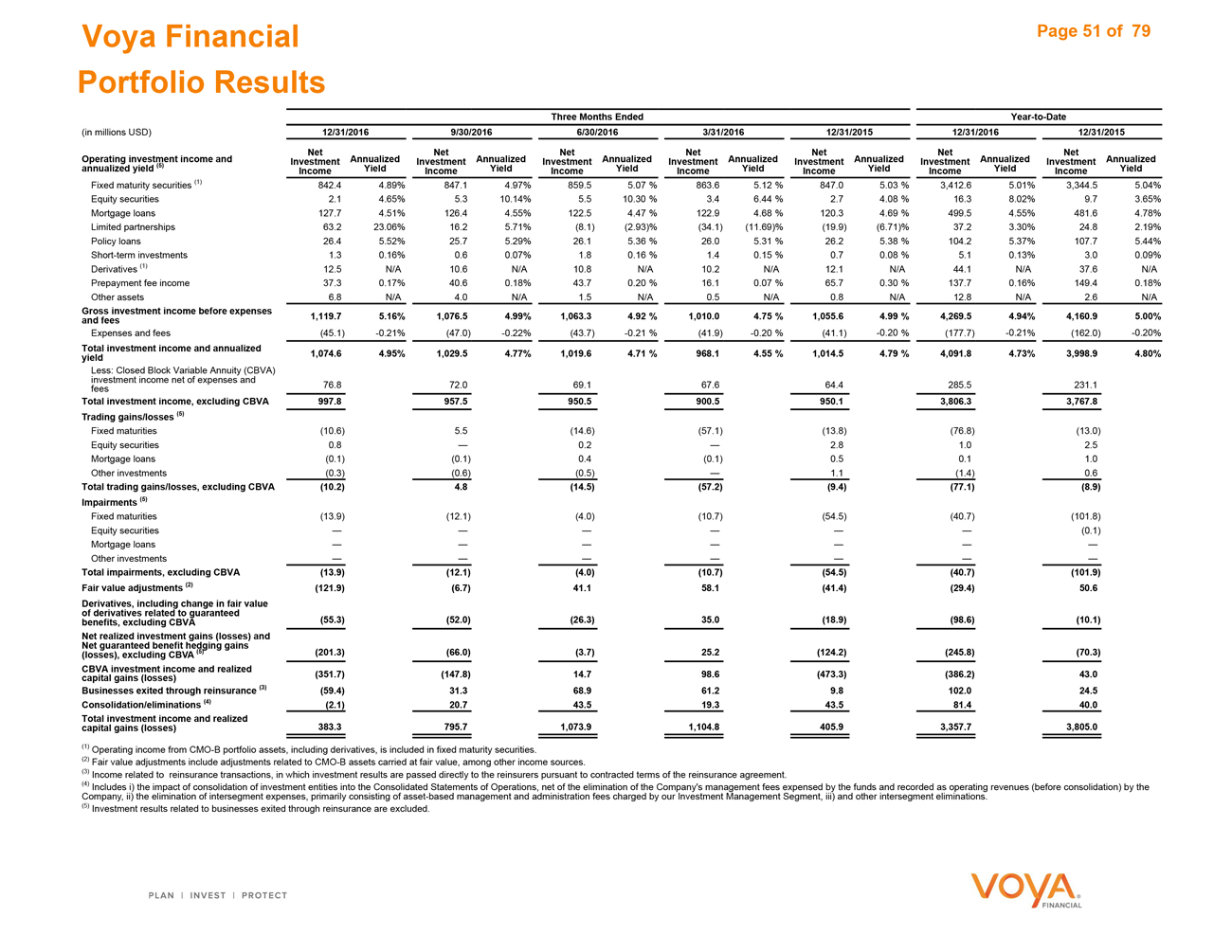

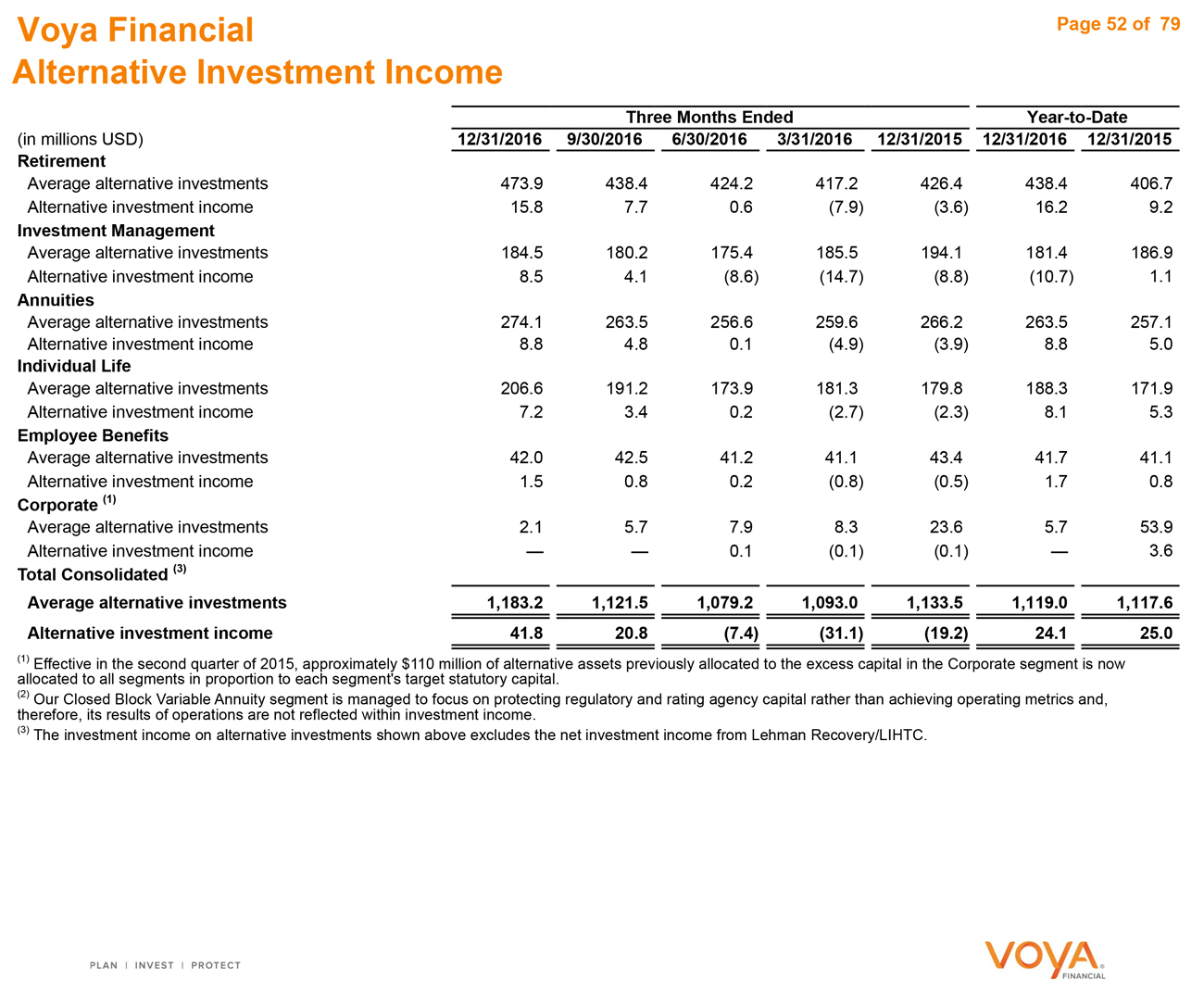

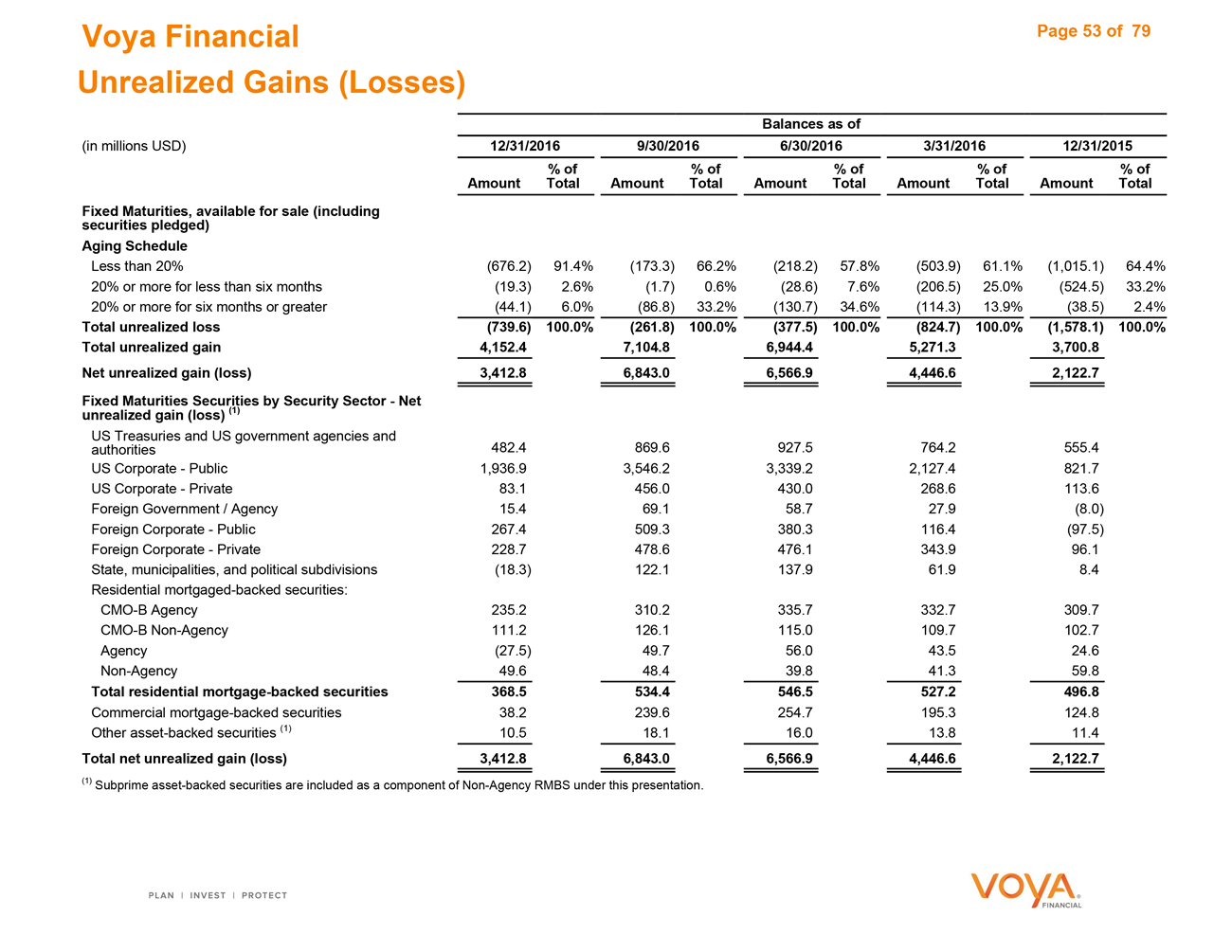

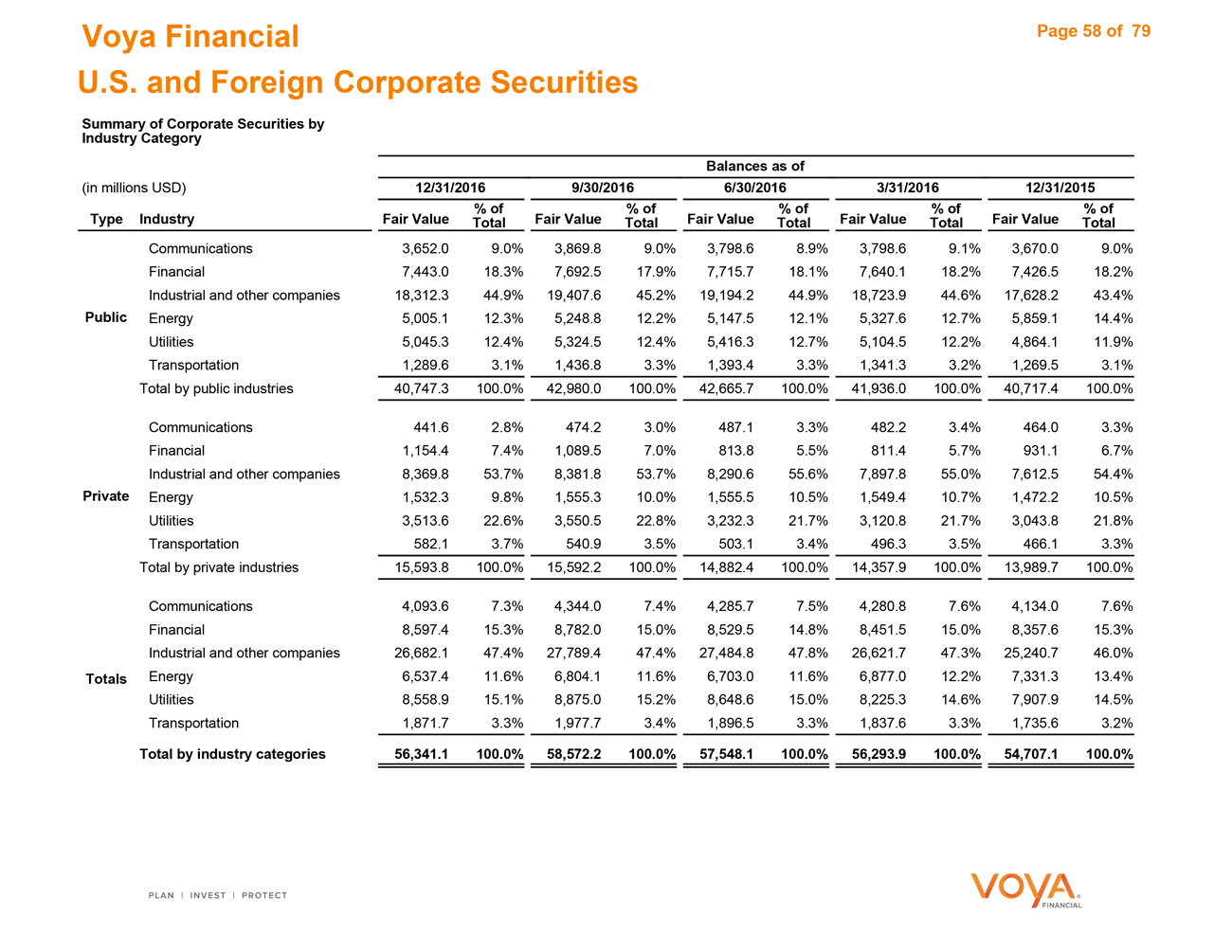

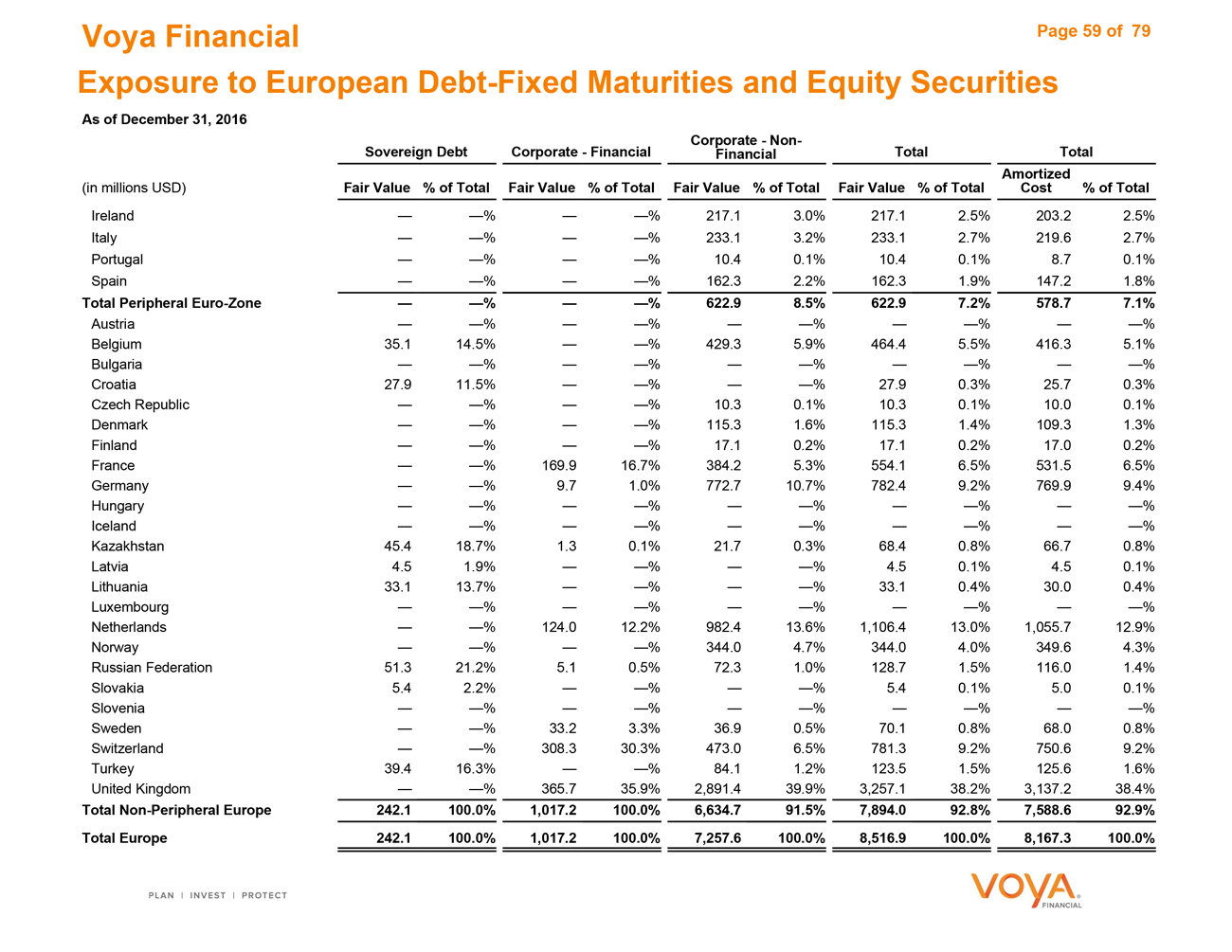

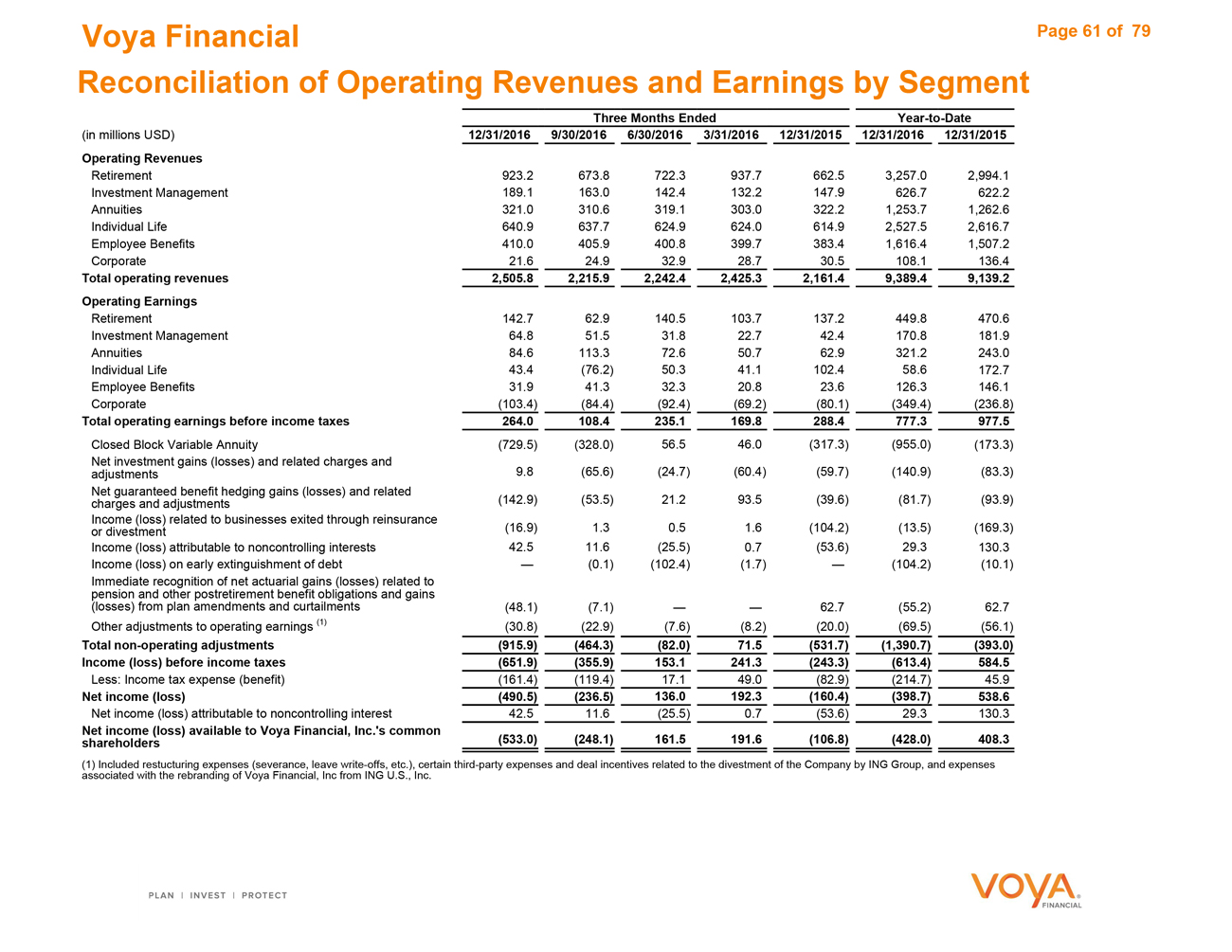

Table of Contents Page Consolidated Explanatory Note on Non-GAAP Financial Information 3—5 Organizational Chart 6 Consolidated Balance Sheets 7 Consolidated Statements of Operations 8 Key Metrics 9 Operating Revenues and Operating Earnings by Segment 10 Consolidated Earnings Before Income Taxes 11 Operating Earnings by Segment (QTD) 12 Operating Earnings by Segment (YTD) 13 Adjusted Operating Earnings Before Interest, After Income Taxes 14 Adjusted Operating Return on Capital and Return on Equity 15 DAC/VOBA Segment Trends 16 Consolidated Capital Structure 17 Consolidated Assets Under Management/Assets Under Administration 18 Retirement Operating Earnings 20 Sources of Operating Earnings 21 Assets Under Management/Assets Under Administration 22 Assets Under Management Rollforward 23 Investment Management Operating Earnings 25 Sources of Operating Earnings 26 Key Metrics 27 Account Value Rollforward by Source 28 Account Value by Asset Type 29 Annuities Operating Earnings 31 Sources of Operating Earnings 32 Assets Under Management 33 Assets Under Management Rollforward 34 Individual Life Operating Earnings 36 Sources of Operating Earnings 37 Key Metrics 38 Employee Benefits Operating Earnings 40 Sources of Operating Earnings 41 Key Metrics 42 Page Corporate Operating Earnings 44 Closed Block Variable Annuity Closed Block Variable Annuity Income (Loss) Before Income Taxes 46 Closed Block Variable Annuity Death and Living Benefits 47 Closed Block Variable Annuity Assets Under Management Rollforward 48 Investment Information Portfolio Composition 50 Portfolio Results 51 Alternative Investment Income 52 Unrealized Gains (Losses) 53 Asset Backed Securities 54 RMBS Securities Summary 55 CMBS and Other Asset-Backed Securities Summary 56 Mortgage Loans on Real Estate 57 US and Foreign Corporate Securities 58 Exposure to European Debt—Fixed Maturities and Equity Securities 59 Reconciliations Reconciliation of Operating Revenues and Earnings by Segment 61 Reconciliation of Operating Revenues by Segment 62 Reconciliation of Ongoing Business Adjusted Operating Earnings to Net Income (Loss) 63 - 64 Reconciliation of Adjusted Operating Earnings 65—66 Reconciliation of Adjusted Operating Earnings and Calculation of Adjusted Operating Return on Capital 67—70 Reconciliation of Ongoing Business Adjusted ROE and Capital 71 Impacts of Prepayments and Alternative Income Above (Below) Long-Term Expectations 72 Calculation of ROE and ROC 73 Reconciliation of Operating Earnings Per Share: Book Value Per Share Excluding AOCI 74 Reconciliation of Average Capital: Debt to Capital, Excluding AOCI 75 Reconciliation of Investment Management Operating Margin, Excluding Investment Capital 76 Additional Information Fixed Maturity Securities—Businesses Exited Through Reinsurance 78 Ratings 79

|

|

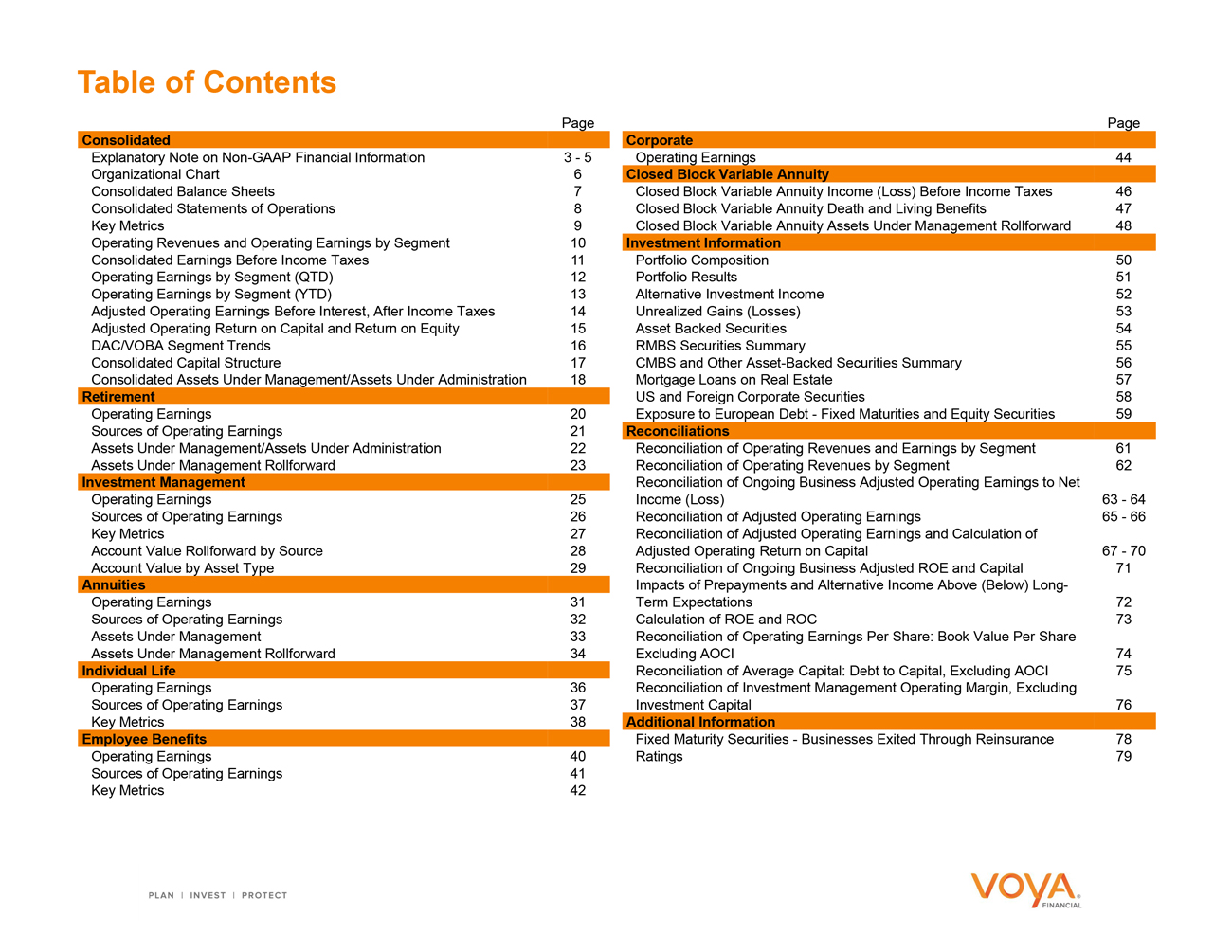

Voya Financial Page 3 of 79 Explanatory Note onNon-GAAP Financial Information

Operating Earning Before Income Taxes

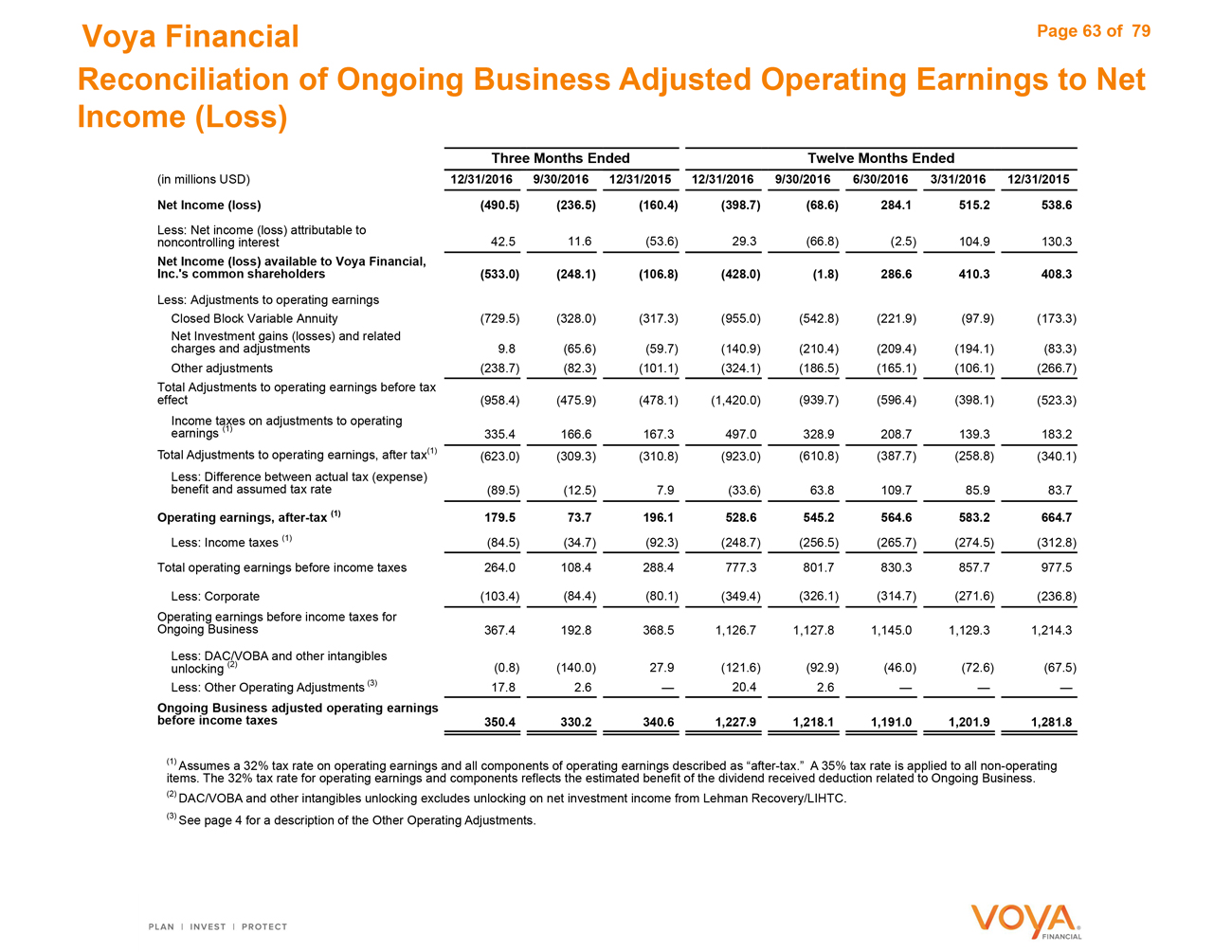

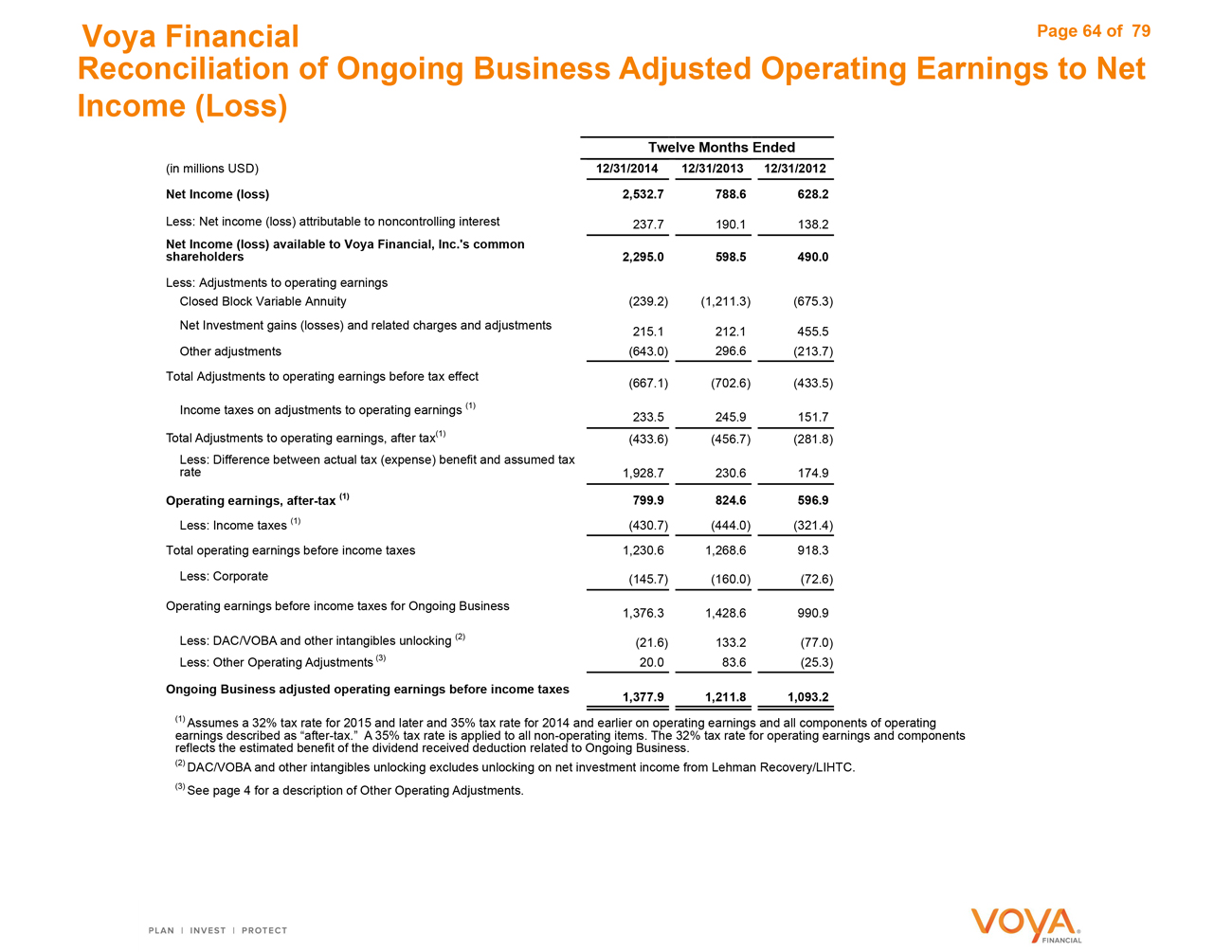

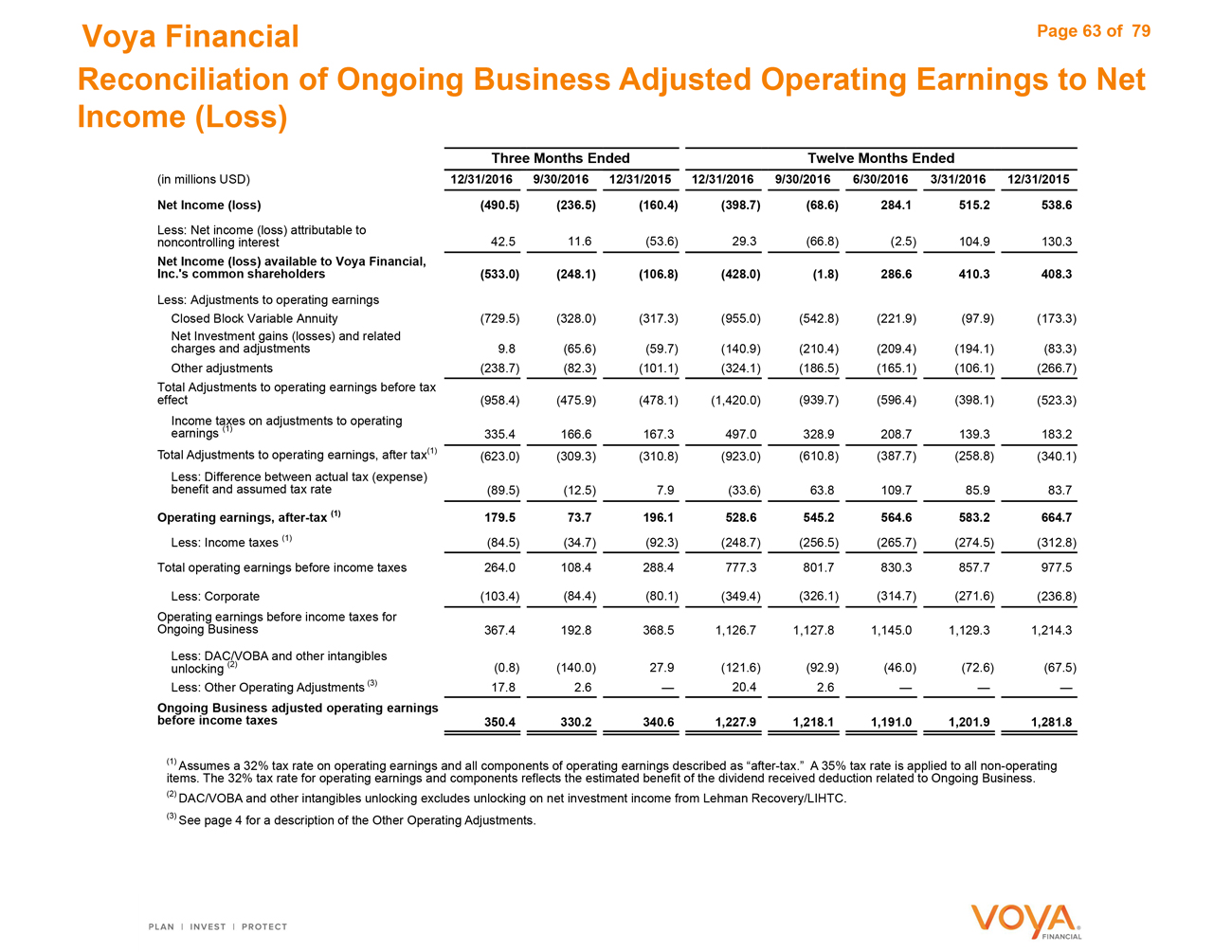

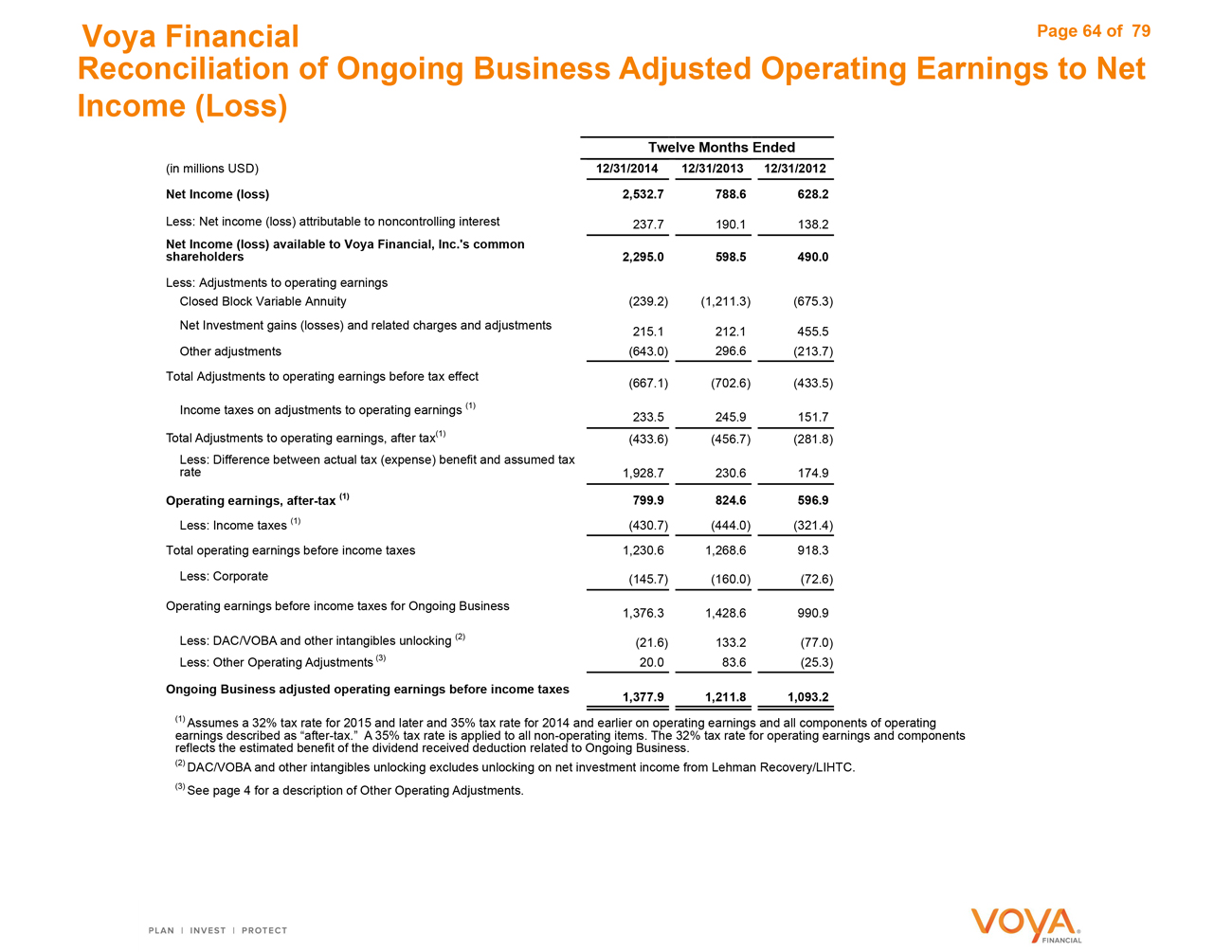

Operating earnings before income taxes is a financial measure we use to evaluate segment performance. We believe that operating earnings before income taxes provides a meaningful measure of our business and segment performances and enhances the understanding of our financial results by focusing on the operating performance and trends of our underlying business segments and excluding items that tend to be highly variable from period to period based on capital market conditions and/or other factors. We use the same accounting policies and procedures to measure segment operating earnings before income taxes as we do for consolidated Net income (loss).

Operating earnings before income taxes does not replace Net income (loss) as the U.S. GAAP measure of our consolidated results of operations. Therefore, we believe that it is useful to evaluate both Net income (loss) and Operating earnings before income taxes when reviewing our financial and operating performance. Each segment’s operating earnings before income taxes is calculated by adjusting Income (loss) before income taxes for the following items:

• Net investment gains (losses), net of related amortization of deferred policy acquisition costs (“DAC”), value of business acquired (“VOBA”), sales inducements and unearned revenue, which are significantly influenced by economic and market conditions, including interest rates and credit spreads. Net investment gains (losses) include gains (losses) on the sale of securities, impairments, changes in the fair value of investments using the fair value option (“FVO”) unrelated to the implied loan-backed security income recognition for certain mortgage-backed obligations and changes in the fair value of derivative instruments, excluding realized gains (losses) associated with swap settlements and accrued interest;

• Net guaranteed benefit hedging gains (losses), which are significantly influenced by economic and market conditions, include changes in the fair value of derivatives related to guaranteed benefits, net of related reserve increases (decreases) and net of related amortization of DAC, VOBA and sales inducements, less the estimated cost of these benefits. The estimated cost, which is reflected in operating results, reflects the expected cost of these benefits if markets perform in line with our long-term expectations and includes the cost of hedging. Other derivative and reserve changes related to guaranteed benefits are excluded from operating results, including the impacts related to changes in our nonperformance spread;

• Income (loss) related to businesses exited through reinsurance or divestment (including net investment gains (losses) on securities sold and expenses directly related to these transactions);

• Income (loss) attributable to noncontrolling interest;

• Income (loss) related to early extinguishment of debt;

• Impairment of goodwill, value of management contract rights and value of customer relationships acquired;

• Immediate recognition of net actuarial gains (losses) related to our pension and other postretirement benefit obligations and gains (losses) from plan amendments and curtailments; and

• Other items, including restructuring expenses (severance, lease write-offs, etc.), certain third-party expenses and deal incentives related to the divestment of the Company by ING Group, and expenses associated with the rebranding of Voya Financial, Inc. from ING U.S., Inc.

Operating earnings before income taxes, when presented on a consolidated basis, also does not reflect the results of operations of our CBVA segment because this segment is managed to focus

on protecting regulatory and rating agency capital rather than achieving operating metrics or generating net income. As a result of this focus on regulatory and rating agency capital, the financial results of the CBVA segment presented in accordance with GAAP tend to exhibit a high degree of volatility based on factors, such as the asymmetry between the accounting for certain liabilities and the corresponding hedging assets, and gains and losses due to changes in nonperformance risk, that are not necessarily reflective of the economic costs and benefits of our CBVA business. When we present the adjustments to Income (loss) before income taxes on a consolidated basis, each adjustment excludes the relative portions attributable to our CBVA segment.

Income (loss) related to businesses exited through reinsurance or divestment (including net investment gains (losses) on securities sold and expenses directly related to these transactions) is excluded from the results of operations from Operating earnings before income taxes. When we present the adjustments to Net Income (loss) before income taxes on a consolidated basis, each adjustment excludes the relative portions attributable to businesses exited through reinsurance or divestment.

Effective April 1, 2015, we disposed of, via reinsurance, retained group reinsurance policies. Consistent with our practice to exclude business (including blocks of business) exited via reinsurance or divestment from Operating earnings before income taxes and from Operating revenues, beginning in the second quarter of 2015, the revenues and expenses of this reinsured block of business are excluded from these metrics.

Effective October 1, 2015, we disposed of, via reinsurance, a block ofin-force term life contracts. Consistent with our practice to exclude business (including blocks of business) exited via reinsurance or divestment from operating earnings before income taxes and from operating revenues, beginning in the fourth quarter of 2015, the revenues and expenses of these reinsured blocks of business are excluded from these metrics.

The most directly comparable U.S. GAAP measure to Operating earnings before income taxes is Net income (loss) before income taxes. For a reconciliation of Operating earnings before Net income taxes to Net income (loss) before income taxes, and from Total Operating earnings before income taxes to Total adjusted operating earnings before income taxes, refer to the “Reconciliations” section in this document.

|

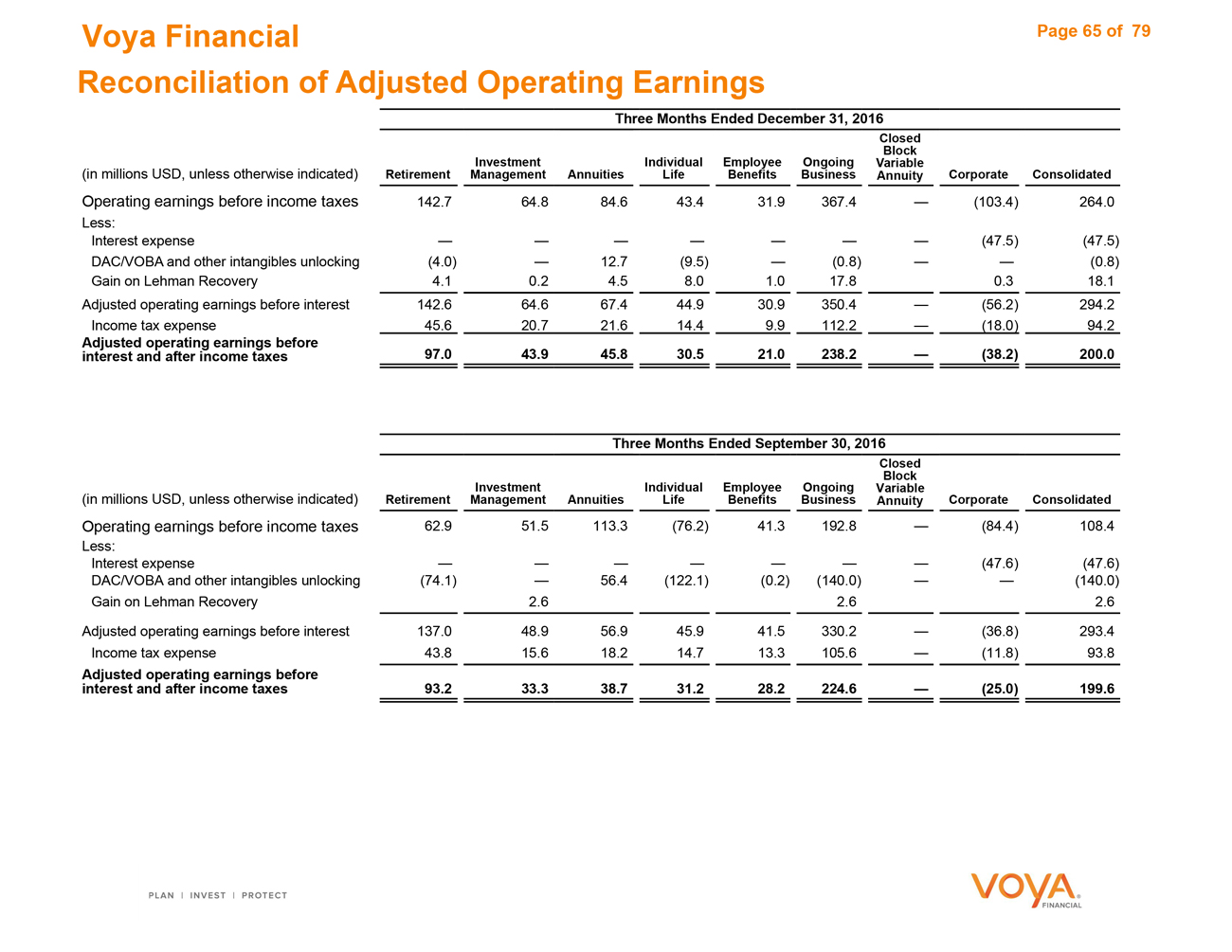

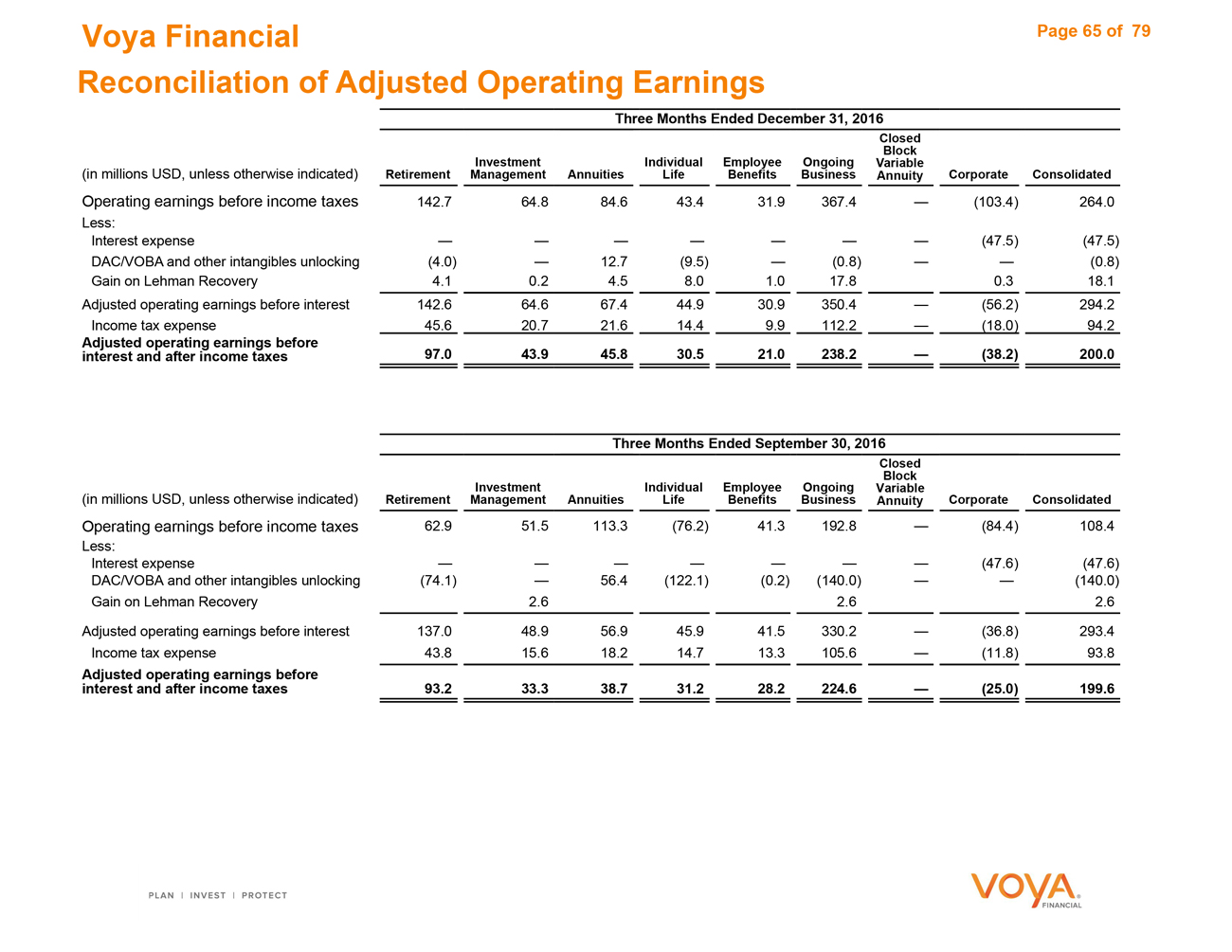

|

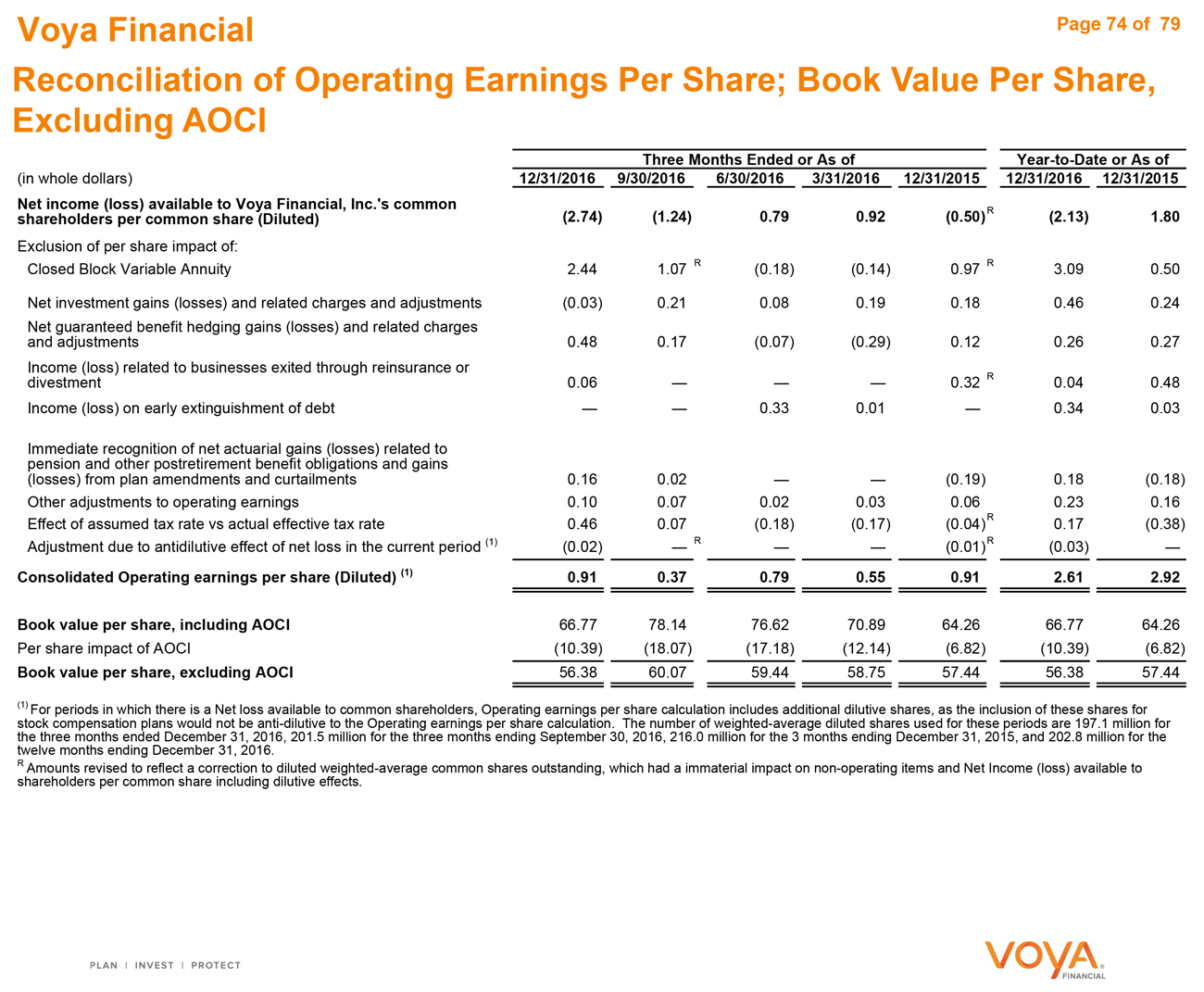

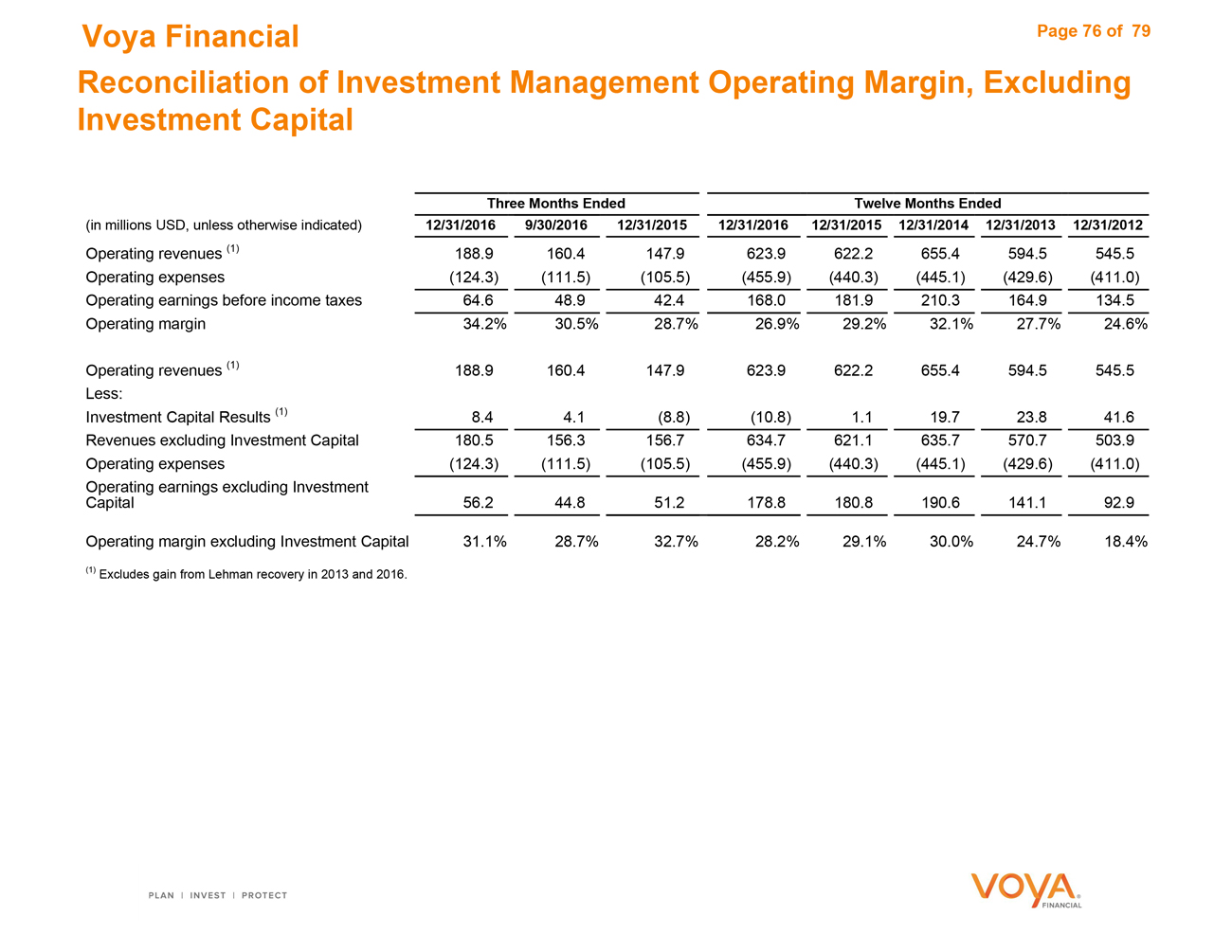

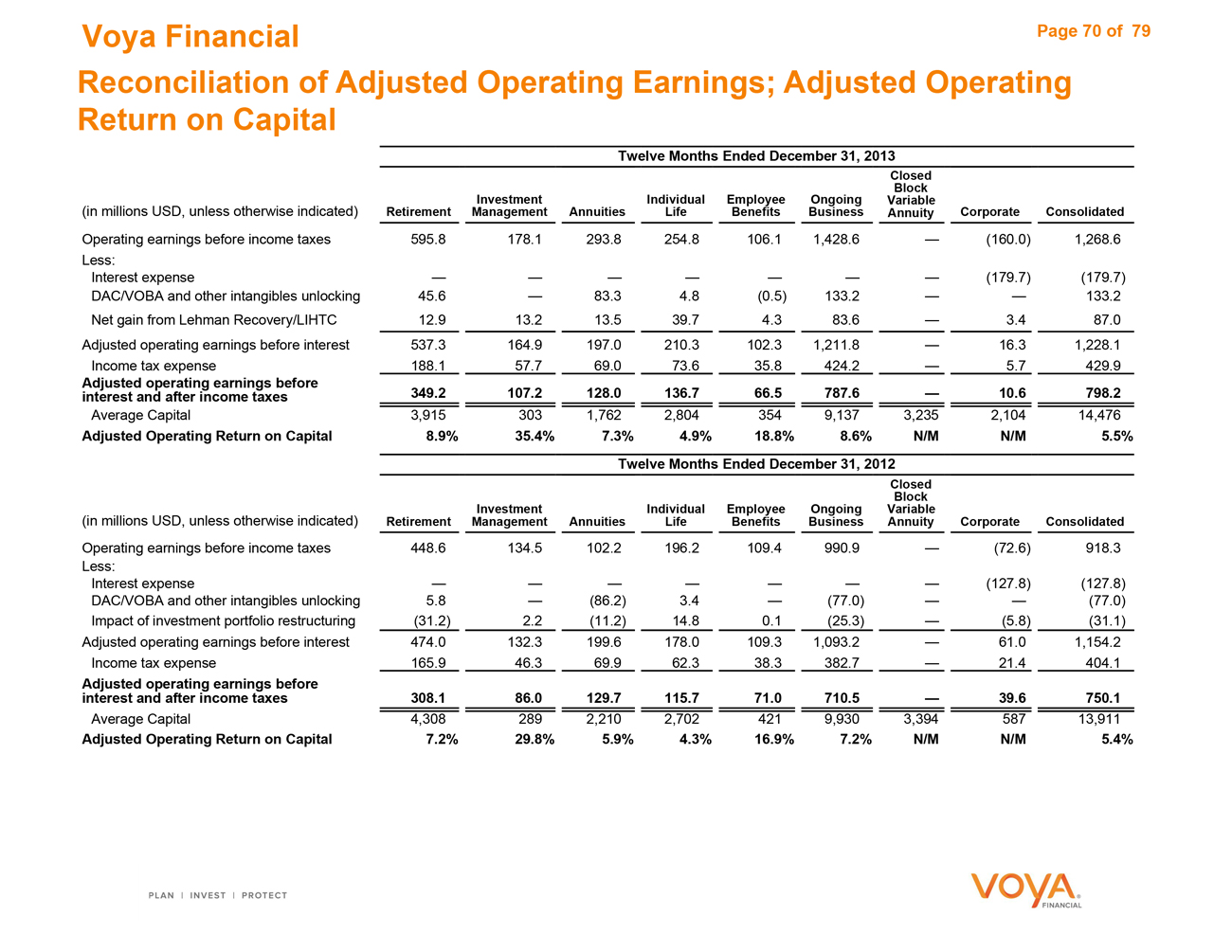

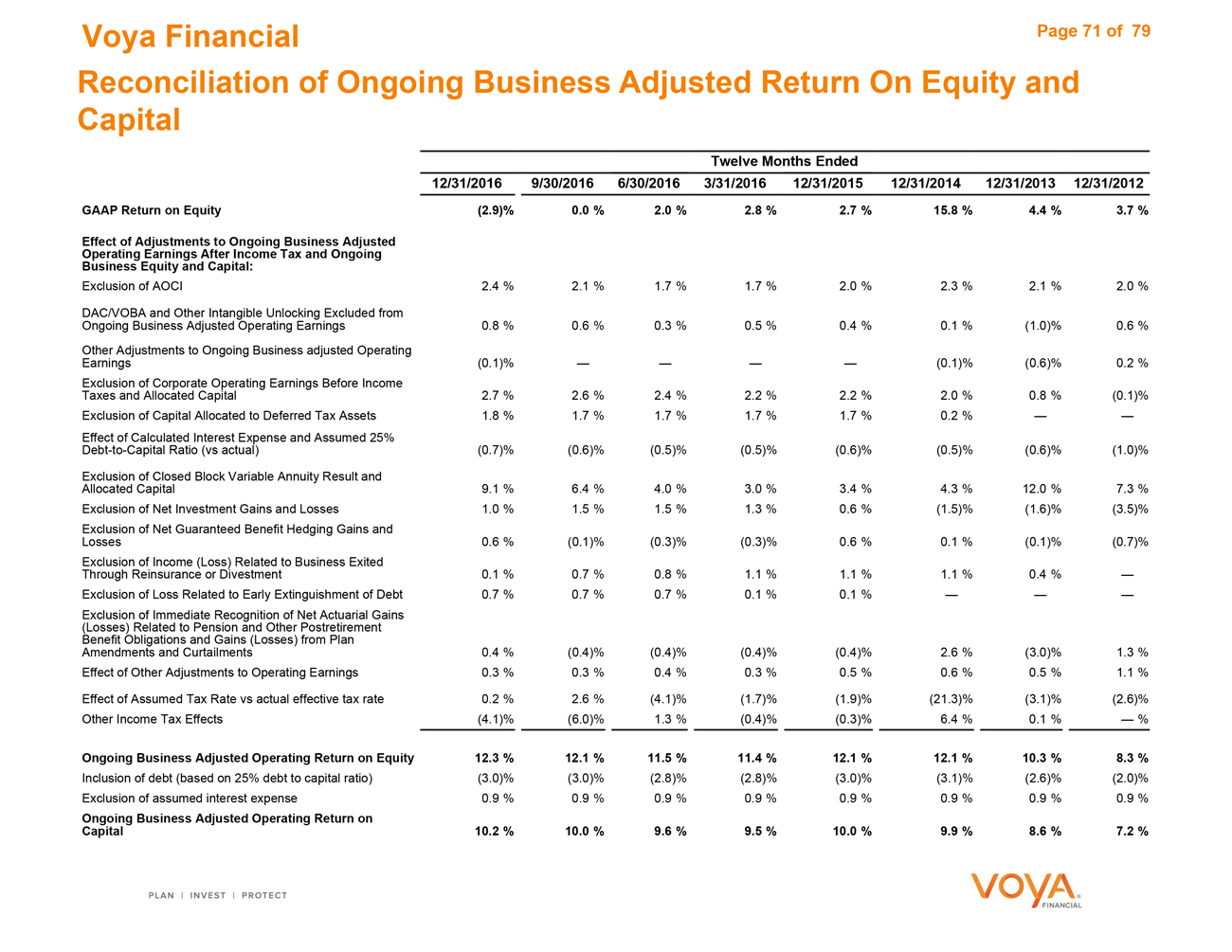

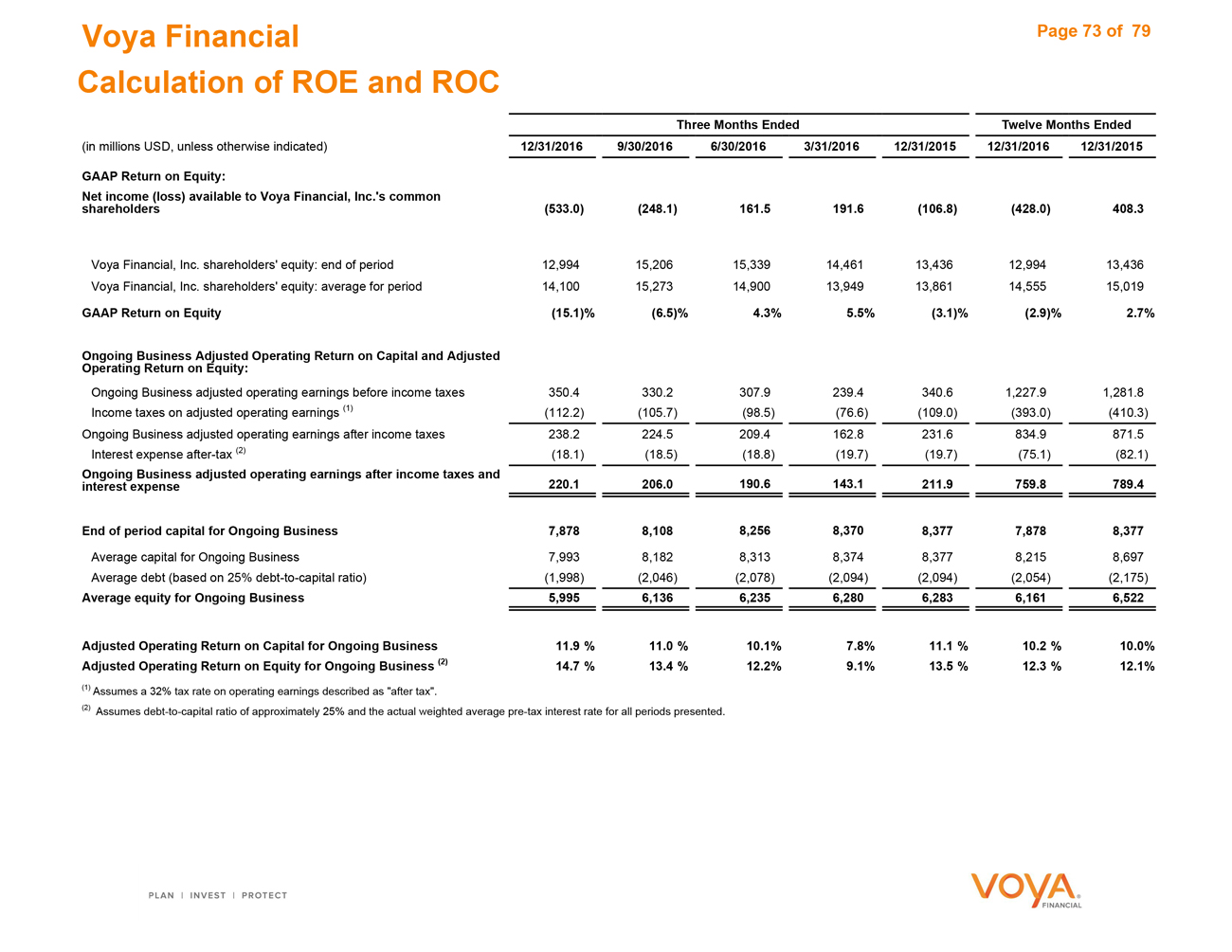

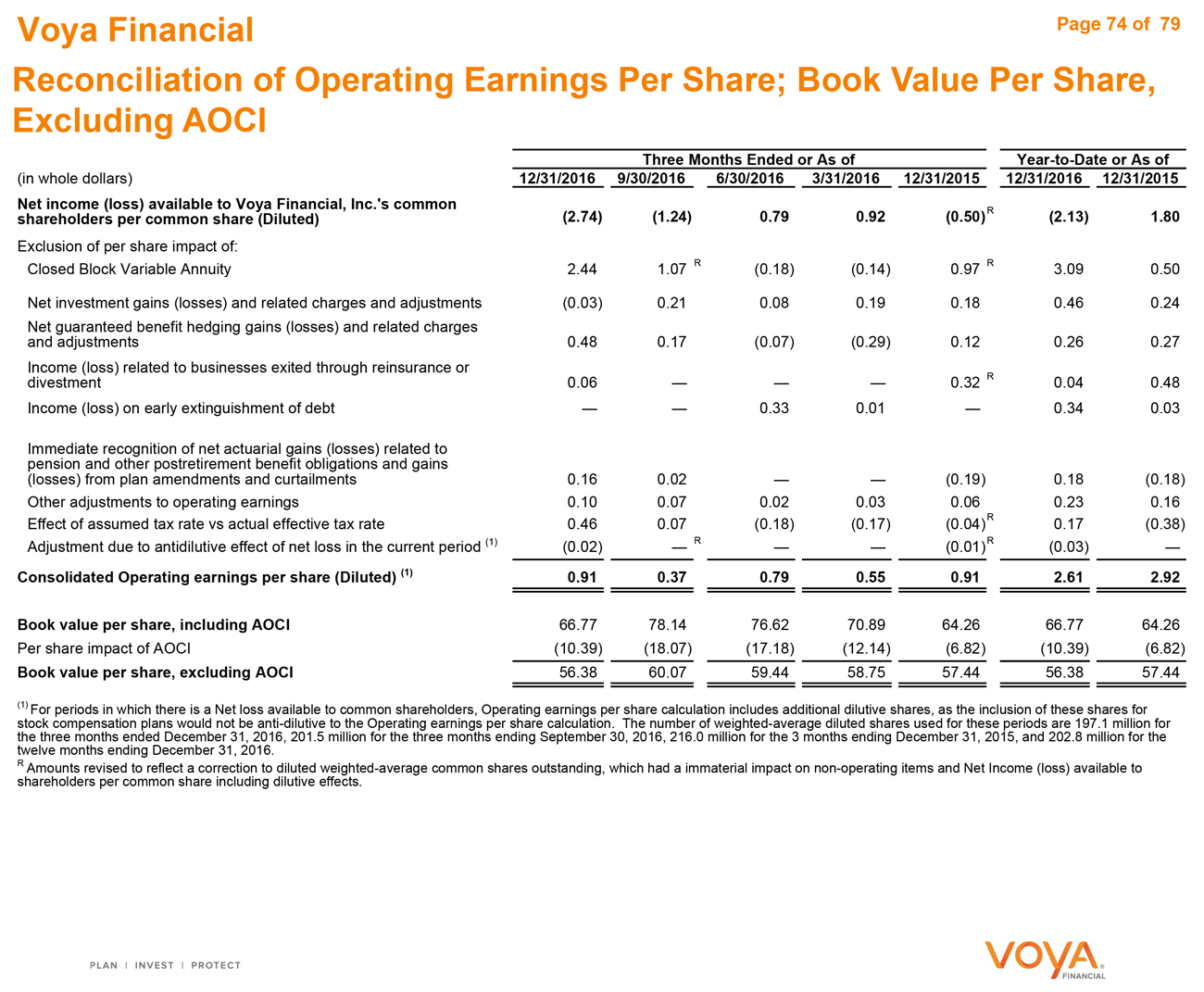

Voya Financial Page 4 of 79 Explanatory Note on Non-GAAP Financial Information Ongoing Business Adjusted Operating ROE/ROC We report Ongoing Business adjusted operating ROE and adjusted operating ROC because we believe these measures are useful indicators of how effectively we use capital resources allocated to our ongoing businesses apart from corporate and closed block activities, which include our Retirement, Investment Management, Annuities, Individual Life and Employee Benefits segments. The most directly comparable U.S. GAAP measure to Ongoing Business adjusted operating ROE and adjusted operating ROC is return on equity. For a reconciliation of these non-GAAP measures to return on equity, refer to the “Reconciliations” section in this document. Adjusted Operating Earnings Adjusted operating earnings is also a non-GAAP financial measure. This measure excludes from Operating earnings before income taxes the following items: DAC/VOBA and other intangibles unlocking; The net gains included in operating earnings from a distribution of cash and securities in conjunction with a Lehman Brothers bankruptcy settlement (“Lehman Recovery”), and losses as a result of the decision to dispose of certain Low Income Housing Tax Credit partnerships (“LIHTC”) as a mean of exiting this asset class; A gain related to the amendment or recapture of certain reinsurance agreements during 2014; The net loss included in operating earnings from the sale of certain alternative investments and investment income associated with assets disposed of during the portfolio restructuring effected during 2012; and Interest expense related to debt in our Corporate segment. Because DAC/VOBA and other intangibles unlocking can be volatile, excluding the effect of this item can improve period to period comparability. The net gain from the Lehman Brothers bankruptcy settlement, loss from the disposition of low-income housing tax credit partnerships, gain on reinsurance recapture, and impact of investment portfolio restructuring affected run-rate results and we believe that this effect is not reflective of our ongoing performance. Operating Earnings per Share; Shareholders’ Equity/Book Value per Share, Excluding AOCI In addition to Net income (loss) per share, we report Operating Earnings per Share because we believe that operating earnings before income taxes provides a meaningful measure of its business and segment performances and enhances the understanding of our financial results by focusing on the operating performance and trends of the underlying business segments and excluding items that tend to be highly variable from period to period based on capital market conditions and/or other factors. In addition to book value per share including accumulated other comprehensive income (AOCI), we also report book value per share excluding AOCI and shareholders’ equity excluding AOCI. Included in AOCI are investment portfolio unrealized gains or losses. In the ordinary course of business we do not plan to sell most investments for the sole purpose of realizing gains or losses, and book value per share excluding AOCI and shareholders’ equity excluding AOCI provide a measure consistent with that view. For a reconciliation of these non-GAAP measures to Net income (loss) per share and book value per share, refer to the “Reconciliations” section in this document.

|

|

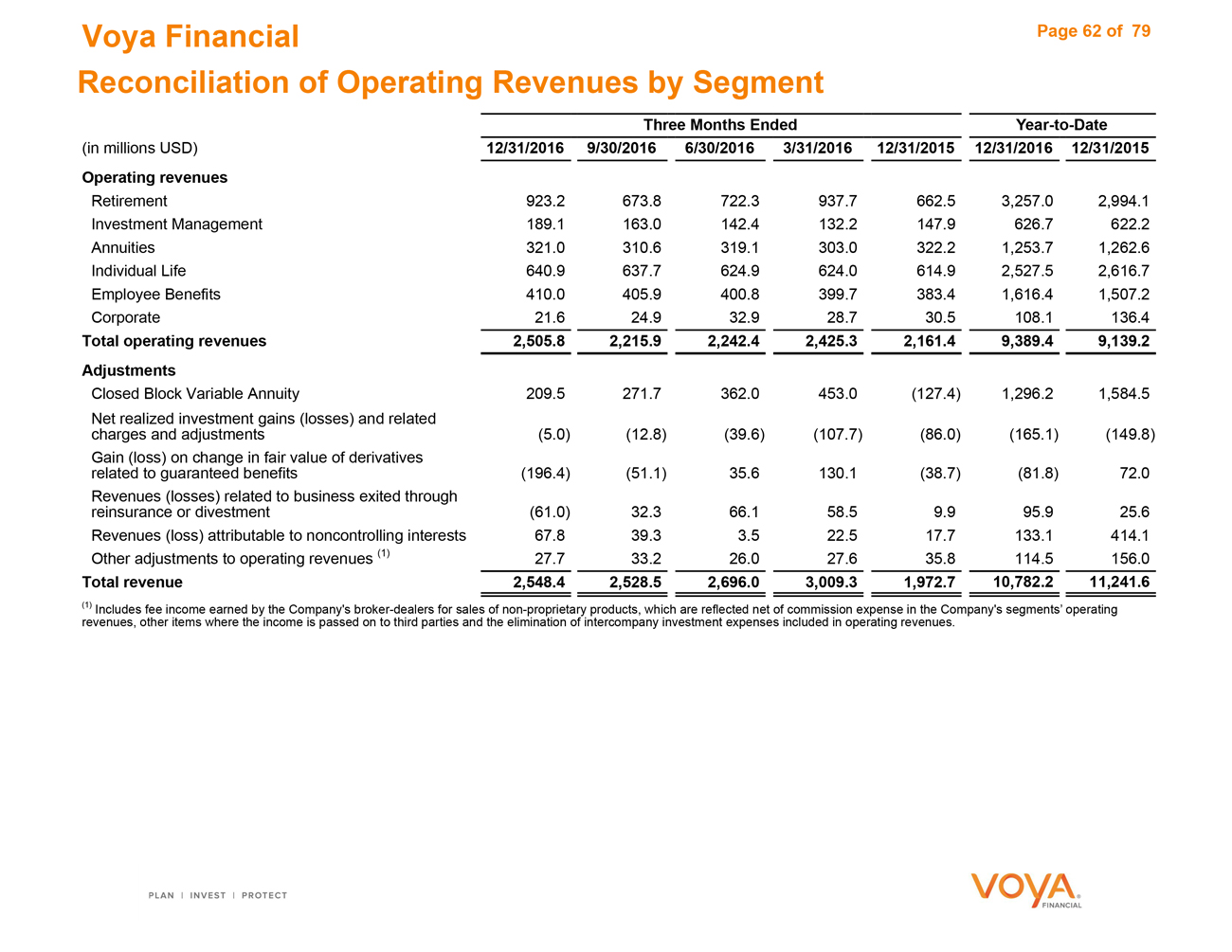

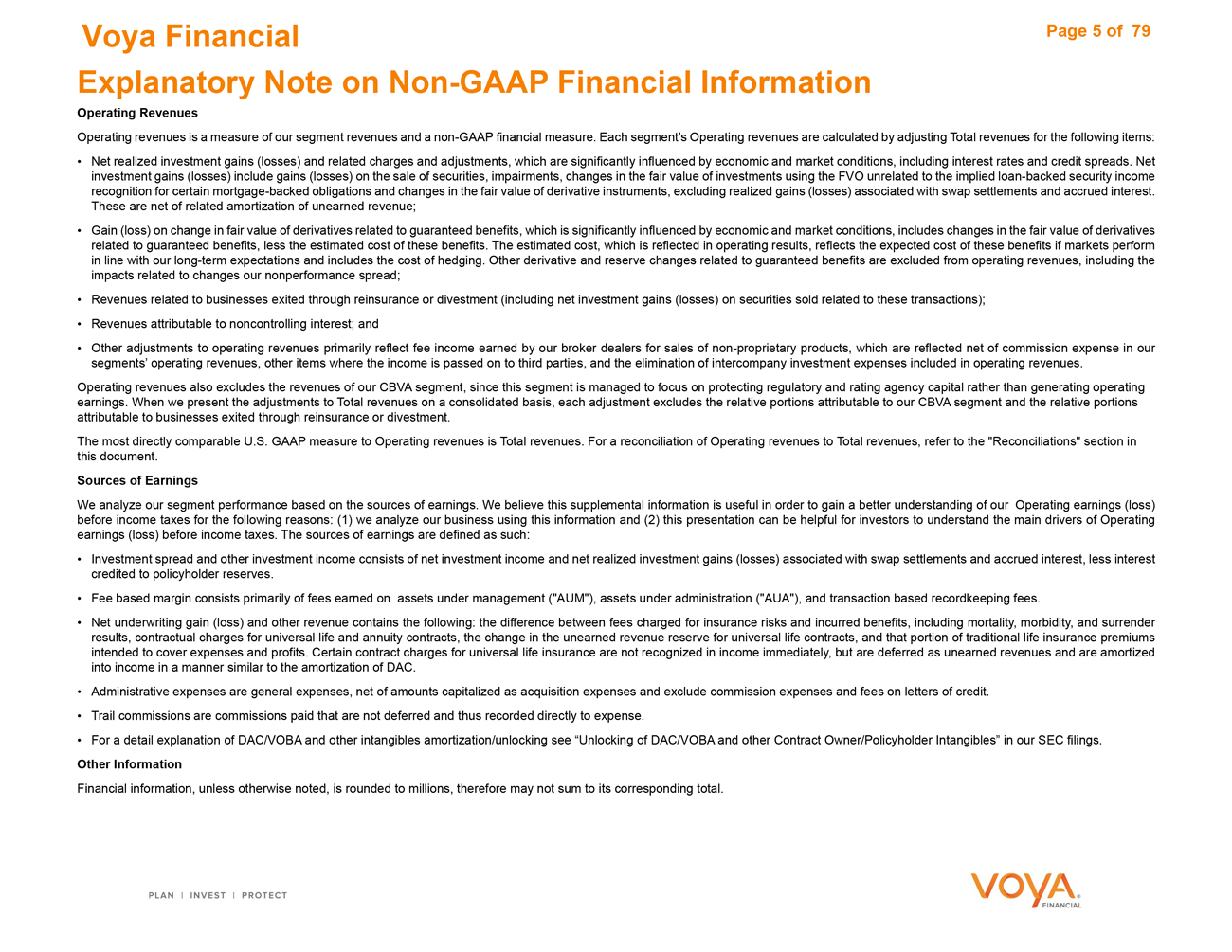

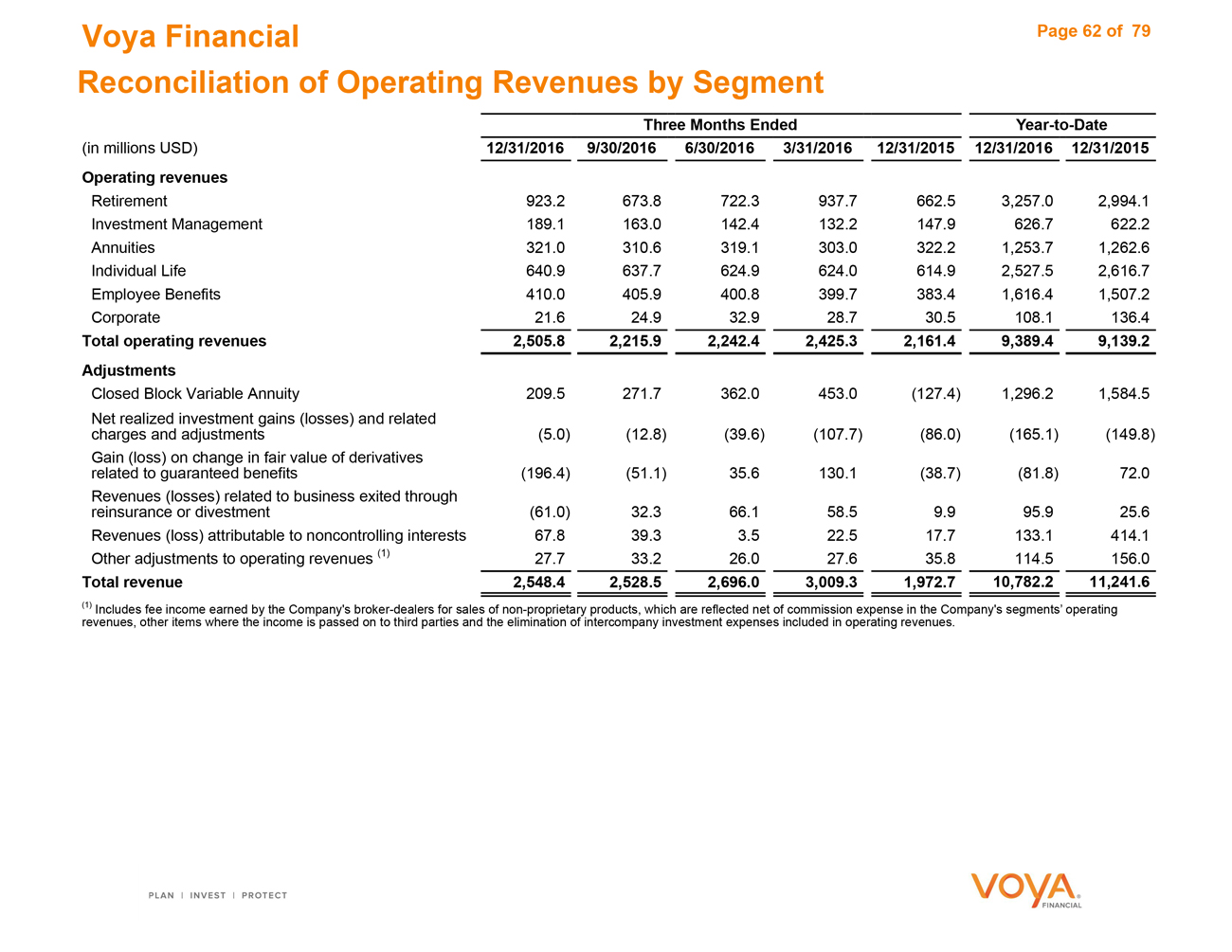

Voya Financial Page 5 of 79 Explanatory Note on Non-GAAP Financial Information Operating Revenues Operating revenues is a measure of our segment revenues and a non-GAAP financial measure. Each segment’s Operating revenues are calculated by adjusting Total revenues for the following items: Net realized investment gains (losses) and related charges and adjustments, which are significantly influenced by economic and market conditions, including interest rates and credit spreads. Net investment gains (losses) include gains (losses) on the sale of securities, impairments, changes in the fair value of investments using the FVO unrelated to the implied loan-backed security income recognition for certain mortgage-backed obligations and changes in the fair value of derivative instruments, excluding realized gains (losses) associated with swap settlements and accrued interest. These are net of related amortization of unearned revenue; Gain (loss) on change in fair value of derivatives related to guaranteed benefits, which is significantly influenced by economic and market conditions, includes changes in the fair value of derivatives related to guaranteed benefits, less the estimated cost of these benefits. The estimated cost, which is reflected in operating results, reflects the expected cost of these benefits if markets perform in line with our long-term expectations and includes the cost of hedging. Other derivative and reserve changes related to guaranteed benefits are excluded from operating revenues, including the impacts related to changes our nonperformance spread; Revenues related to businesses exited through reinsurance or divestment (including net investment gains (losses) on securities sold related to these transactions); Revenues attributable to noncontrolling interest; and Other adjustments to operating revenues primarily reflect fee income earned by our broker dealers for sales of non-proprietary products, which are reflected net of commission expense in our segments’ operating revenues, other items where the income is passed on to third parties, and the elimination of intercompany investment expenses included in operating revenues. Operating revenues also excludes the revenues of our CBVA segment, since this segment is managed to focus on protecting regulatory and rating agency capital rather than generating operating earnings. When we present the adjustments to Total revenues on a consolidated basis, each adjustment excludes the relative portions attributable to our CBVA segment and the relative portions attributable to businesses exited through reinsurance or divestment. The most directly comparable U.S. GAAP measure to Operating revenues is Total revenues. For a reconciliation of Operating revenues to Total revenues, refer to the “Reconciliations” section in this document. Sources of Earnings We analyze our segment performance based on the sources of earnings. We believe this supplemental information is useful in order to gain a better understanding of our Operating earnings (loss) before income taxes for the following reasons: (1) we analyze our business using this information and (2) this presentation can be helpful for investors to understand the main drivers of Operating earnings (loss) before income taxes. The sources of earnings are defined as such: Investment spread and other investment income consists of net investment income and net realized investment gains (losses) associated with swap settlements and accrued interest, less interest credited to policyholder reserves. Fee based margin consists primarily of fees earned on assets under management (“AUM”), assets under administration (“AUA”), and transaction based recordkeeping fees. Net underwriting gain (loss) and other revenue contains the following: the difference between fees charged for insurance risks and incurred benefits, including mortality, morbidity, and surrender results, contractual charges for universal life and annuity contracts, the change in the unearned revenue reserve for universal life contracts, and that portion of traditional life insurance premiums intended to cover expenses and profits. Certain contract charges for universal life insurance are not recognized in income immediately, but are deferred as unearned revenues and are amortized into income in a manner similar to the amortization of DAC. Administrative expenses are general expenses, net of amounts capitalized as acquisition expenses and exclude commission expenses and fees on letters of credit. Trail commissions are commissions paid that are not deferred and thus recorded directly to expense. For a detail explanation of DAC/VOBA and other intangibles amortization/unlocking see “Unlocking of DAC/VOBA and other Contract Owner/Policyholder Intangibles” in our SEC filings. Other Information Financial information, unless otherwise noted, is rounded to millions, therefore may not sum to its corresponding total.

|

|

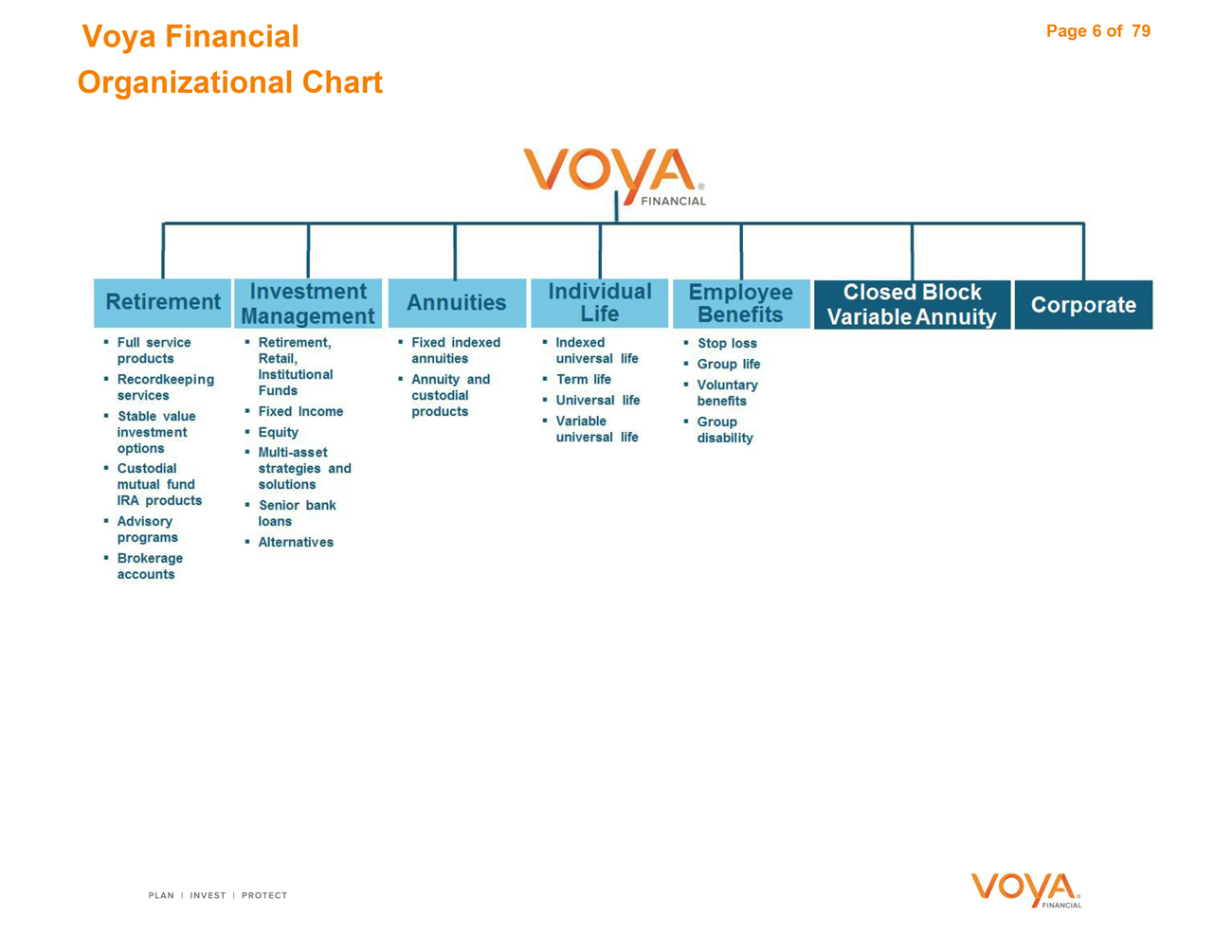

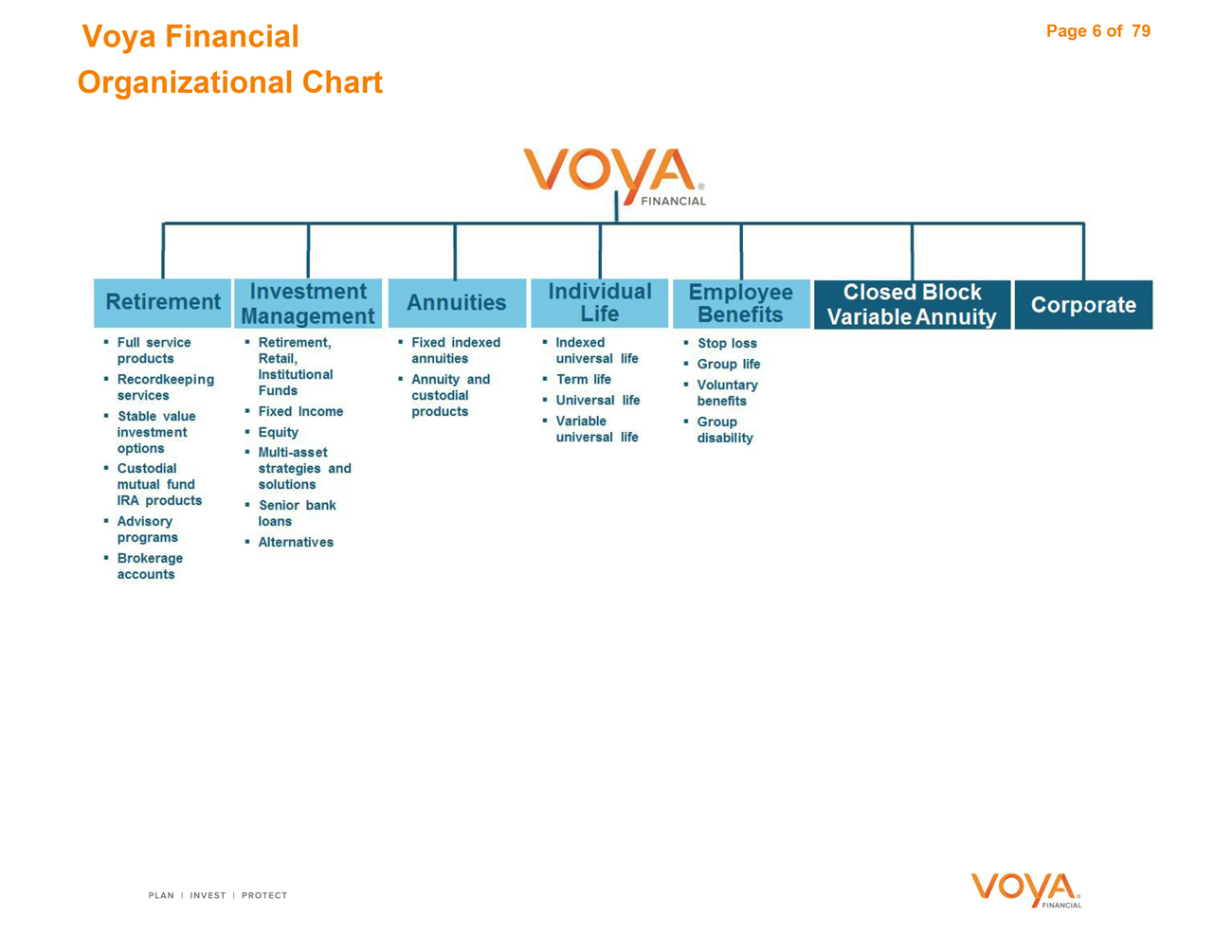

Voya Financial Page 6 of 79 Organizational Chart

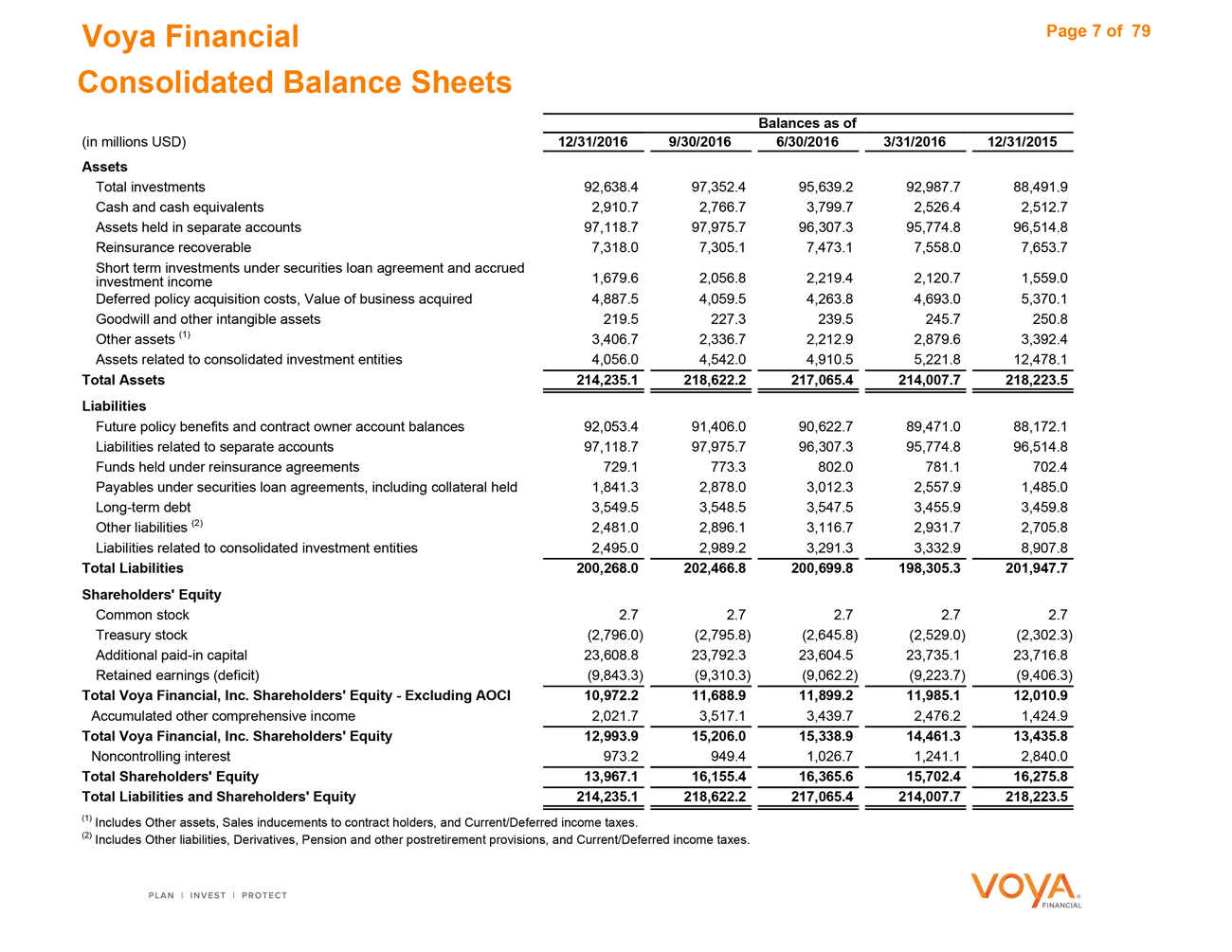

Voya Financial Page 7 of79

Consolidated Balance Sheets

Balances as of

(in millions USD) 12/31/2016 9/30/20166/30/20163/31/201612/31/2015

Assets

Total investments 92,638.4 97,352.495,639.292,987.788,491.9

Cash and cash equivalents 2,910.7 2,766.73,799.72,526.42,512.7

Assets held in separate accounts 97,118.7 97,975.796,307.395,774.896,514.8

Reinsurance recoverable 7,318.0 7,305.17,473.17,558.07,653.7

Short term investments under securities loan agreement and accrued

investment income 1,679.6 2,056.82,219.42,120.71,559.0

Deferred policy acquisition costs, Value of business acquired 4,887.5 4,059.54,263.84,693.05,370.1

Goodwill and other intangible assets 219.5 227.3239.5245.7250.8

Other assets (1) 3,406.7 2,336.72,212.92,879.63,392.4

Assets related to consolidated investment entities 4,056.0 4,542.04,910.55,221.812,478.1

Total Assets 214,235.1 218,622.2217,065.4214,007.7218,223.5

Liabilities

Future policy benefits and contract owner account balances 92,053.4 91,406.090,622.789,471.088,172.1

Liabilities related to separate accounts 97,118.7 97,975.796,307.395,774.896,514.8

Funds held under reinsurance agreements 729.1 773.3802.0781.1702.4

Payables under securities loan agreements, including collateral held 1,841.3 2,878.03,012.32,557.91,485.0

Long-term debt 3,549.5 3,548.53,547.53,455.93,459.8

Other liabilities (2) 2,481.0 2,896.13,116.72,931.72,705.8

Liabilities related to consolidated investment entities 2,495.0 2,989.23,291.33,332.98,907.8

Total Liabilities 200,268.0 202,466.8200,699.8198,305.3201,947.7

Shareholders’ Equity

Common stock 2.7 2.72.72.72.7

Treasury stock (2,796.0) (2,795.8)(2,645.8)(2,529.0)(2,302.3)

Additionalpaid-in capital 23,608.8 23,792.323,604.523,735.123,716.8

Retained earnings (deficit) (9,843.3) (9,310.3)(9,062.2)(9,223.7)(9,406.3)

Total Voya Financial, Inc. Shareholders’ Equity—Excluding AOCI 10,972.2 11,688.911,899.211,985.112,010.9

Accumulated other comprehensive income 2,021.7 3,517.13,439.72,476.21,424.9

Total Voya Financial, Inc. Shareholders’ Equity 12,993.9 15,206.015,338.914,461.313,435.8

Noncontrolling interest 973.2 949.41,026.71,241.12,840.0

Total Shareholders’ Equity 13,967.1 16,155.416,365.615,702.416,275.8

Total Liabilities and Shareholders’ Equity 214,235.1 218,622.2217,065.4214,007.7218,223.5

(1) Includes Other assets, Sales inducements to contract holders, and Current/Deferred income taxes.

(2) Includes Other liabilities, Derivatives, Pension and other postretirement provisions, and Current/Deferred income taxes.

|

|

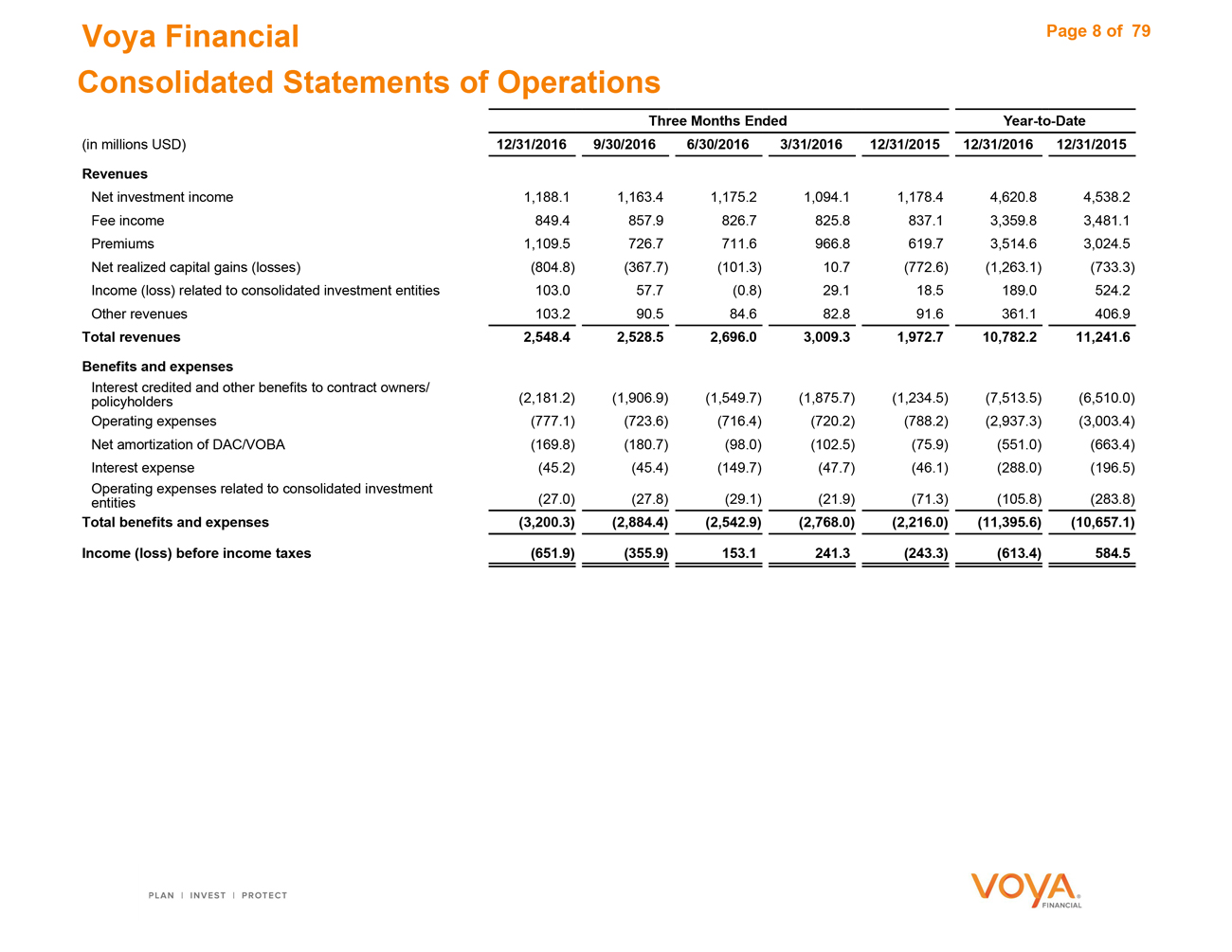

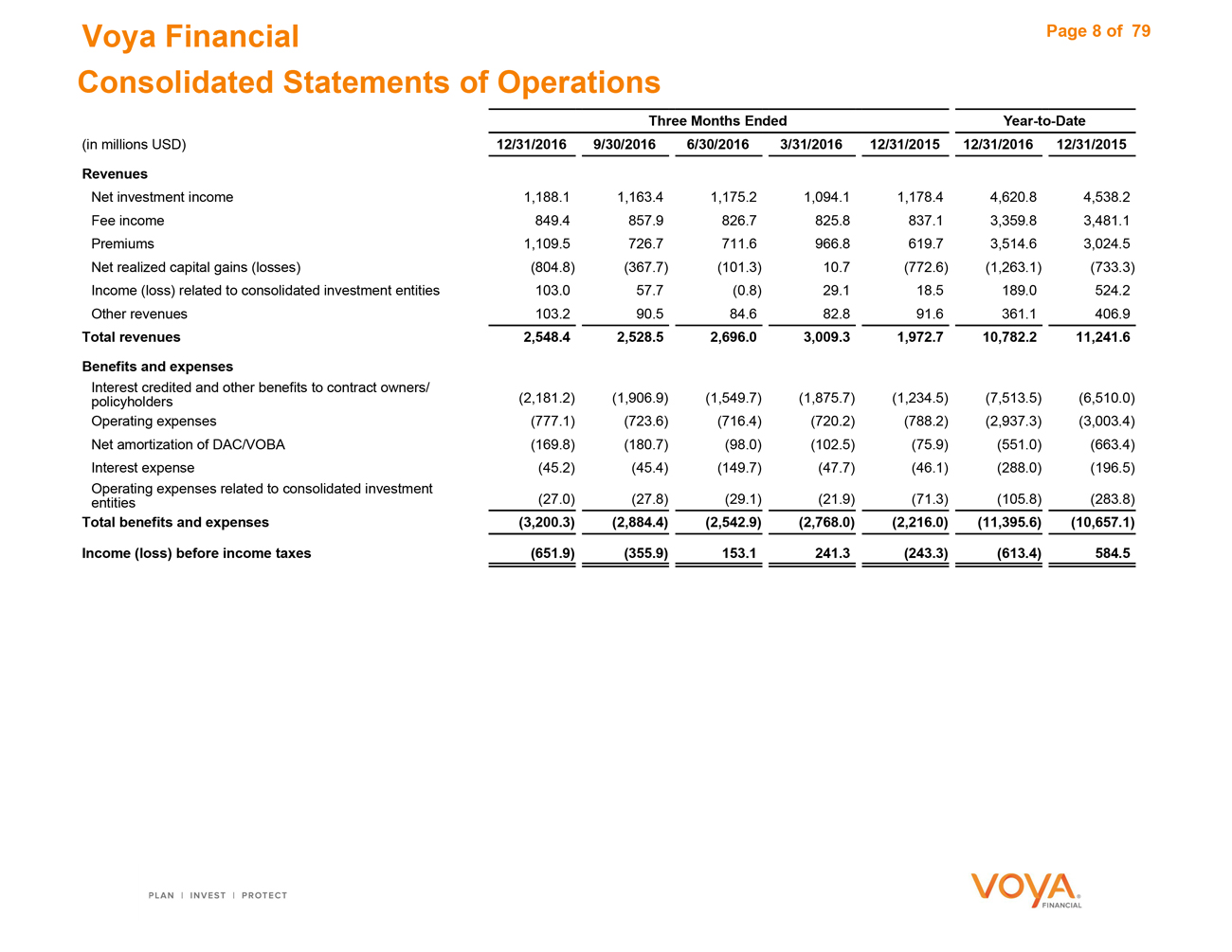

Voya Financial Page 8 of 79 Consolidated Statements of Operations Three Months EndedYear-to-Date (in millions USD)12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Revenues Net investment income1,188.1 1,163.41,175.21,094.11,178.44,620.84,538.2 Fee income849.4 857.9826.7825.8837.13,359.83,481.1 Premiums1,109.5 726.7711.6966.8619.73,514.63,024.5 Net realized capital gains (losses)(804.8) (367.7)(101.3)10.7(772.6)(1,263.1)(733.3) Income (loss) related to consolidated investment entities103.0 57.7(0.8)29.118.5189.0524.2 Other revenues103.2 90.584.682.891.6361.1406.9 Total revenues2,548.4 2,528.52,696.03,009.31,972.710,782.211,241.6 Benefits and expenses Interest credited and other benefits to contract owners/ policyholders(2,181.2) (1,906.9)(1,549.7)(1,875.7)(1,234.5)(7,513.5)(6,510.0) Operating expenses(777.1) (723.6)(716.4)(720.2)(788.2)(2,937.3)(3,003.4) Net amortization of DAC/VOBA(169.8) (180.7)(98.0)(102.5)(75.9)(551.0)(663.4) Interest expense(45.2) (45.4)(149.7)(47.7)(46.1)(288.0)(196.5) Operating expenses related to consolidated investment entities(27.0) (27.8)(29.1)(21.9)(71.3)(105.8)(283.8) Total benefits and expenses(3,200.3) (2,884.4)(2,542.9)(2,768.0)(2,216.0)(11,395.6)(10,657.1) Income (loss) before income taxes(651.9) (355.9)153.1241.3(243.3)(613.4)584.5 Voya Financial

|

|

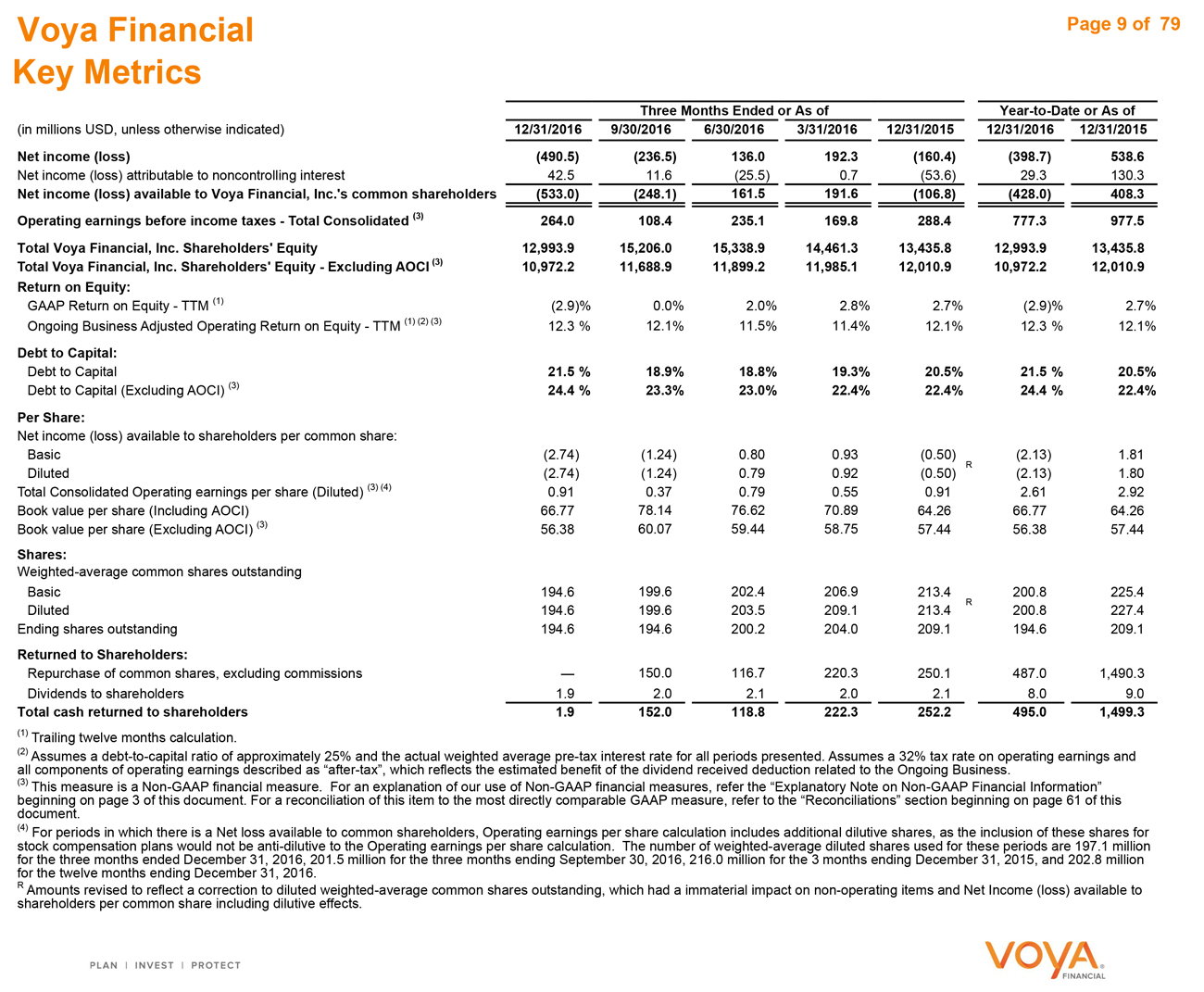

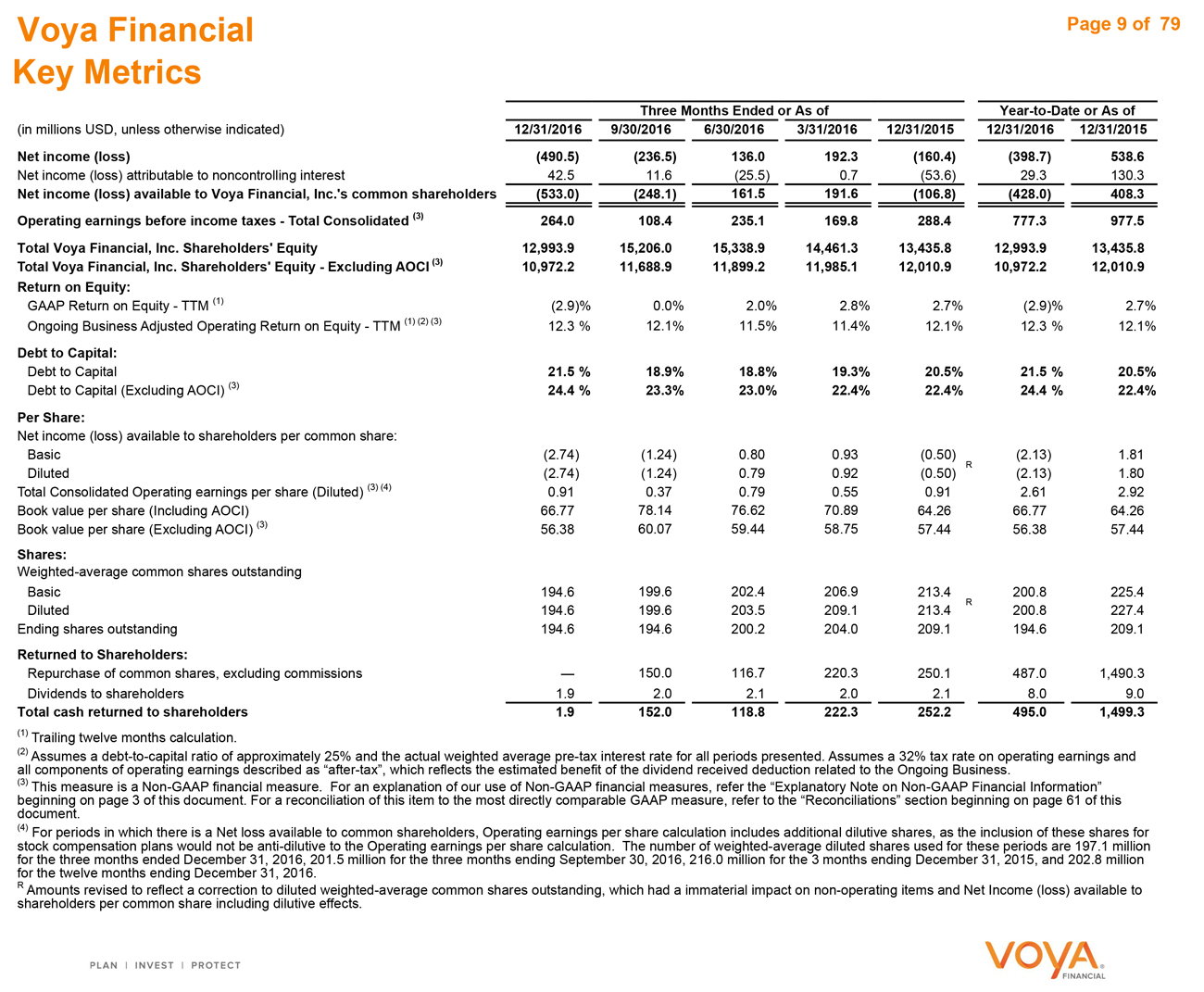

Voya Financial Key Metrics Page 9 of 79 Three Months Ended or As of Year-to-Date or As of (in millions USD, unless otherwise indicated) 12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 12/31/2016 12/31/2015 Net income (loss) (490.5) (236.5) 136.0 192.3 (160.4) (398.7) 538.6 Net income (loss) attributable to noncontrolling interest 42.5 11.6 (25.5) 0.7 (53.6) 29.3 130.3 Net income (loss) available to Voya Financial, Inc.’s common shareholders (533.0) (248.1) 161.5 191.6 (106.8) (428.0) 408.3 Operating earnings before income taxes - Total Consolidated (3) 264.0 108.4 235.1 169.8 288.4 777.3 977.5 Total Voya Financial, Inc. Shareholders’ Equity 12,993.9 15,206.0 15,338.9 14,461.3 13,435.8 12,993.9 13,435.8 Total Voya Financial, Inc. Shareholders’ Equity - Excluding AOCI (3) 10,972.2 11,688.9 11,899.2 11,985.1 12,010.9 10,972.2 12,010.9 Return on Equity: GAAP Return on Equity - TTM (1) (2.9)% 0.0% 2.0% 2.8% 2.7% (2.9)% 2.7% Ongoing Business Adjusted Operating Return on Equity - TTM (1) (2) (3) 12.3 % 12.1% 11.5% 11.4% 12.1% 12.3 % 12.1% Debt to Capital: Debt to Capital 21.5 % 18.9% 18.8% 19.3% 20.5% 21.5 % 20.5% Debt to Capital (Excluding AOCI) (3) 24.4 % 23.3% 23.0% 22.4% 22.4% 24.4 % 22.4% Per Share: Net income (loss) available to shareholders per common share: Basic (2.74) (1.24) 0.80 0.93 (0.50) (2.13) 1.81 Diluted (2.74) (1.24) 0.79 0.92 (0.50) R (2.13) 1.80 Total Consolidated Operating earnings per share (Diluted) (3) (4) 0.91 0.37 0.79 0.55 0.91 2.61 2.92 Book value per share (Including AOCI) 66.77 78.14 76.62 70.89 64.26 66.77 64.26 Book value per share (Excluding AOCI) (3) 56.38 60.07 59.44 58.75 57.44 56.38 57.44 Shares: Weighted-average common shares outstanding Basic 194.6 199.6 202.4 206.9 213.4 200.8 225.4 R Diluted 194.6 199.6 203.5 209.1 213.4 200.8 227.4 Ending shares outstanding 194.6 194.6 200.2 204.0 209.1 194.6 209.1 Returned to Shareholders: Repurchase of common shares, excluding commissions — 150.0 116.7 220.3 250.1 487.0 1,490.3 Dividends to shareholders 1.9 2.0 2.1 2.0 2.1 8.0 9.0 Total cash returned to shareholders 1.9 152.0 118.8 222.3 252.2 495.0 1,499.3 (1) Trailing twelve months calculation. (2) Assumes a debt-to-capital ratio of approximately 25% and the actual weighted average pre-tax interest rate for all periods presented. Assumes a 32% tax rate on operating earnings and all components of operating earnings described as “after-tax”, which reflects the estimated benefit of the dividend received deduction related to the Ongoing Business. (3) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 61 of this document. (4) For periods in which there is a Net loss available to common shareholders, Operating earnings per share calculation includes additional dilutive shares, as the inclusion of these shares for stock compensation plans would not be anti-dilutive to the Operating earnings per share calculation. The number of weighted-average diluted shares used for these periods are 197.1 million for the three months ended December 31, 2016, 201.5 million for the three months ending September 30, 2016, 216.0 million for the 3 months ending December 31, 2015, and 202.8 million for the twelve months ending December 31, 2016. R Amounts revised to reflect a correction to diluted weighted-average common shares outstanding, which had a immaterial impact on non-operating items and Net Income (loss) available to shareholders per common share including dilutive effects.

|

|

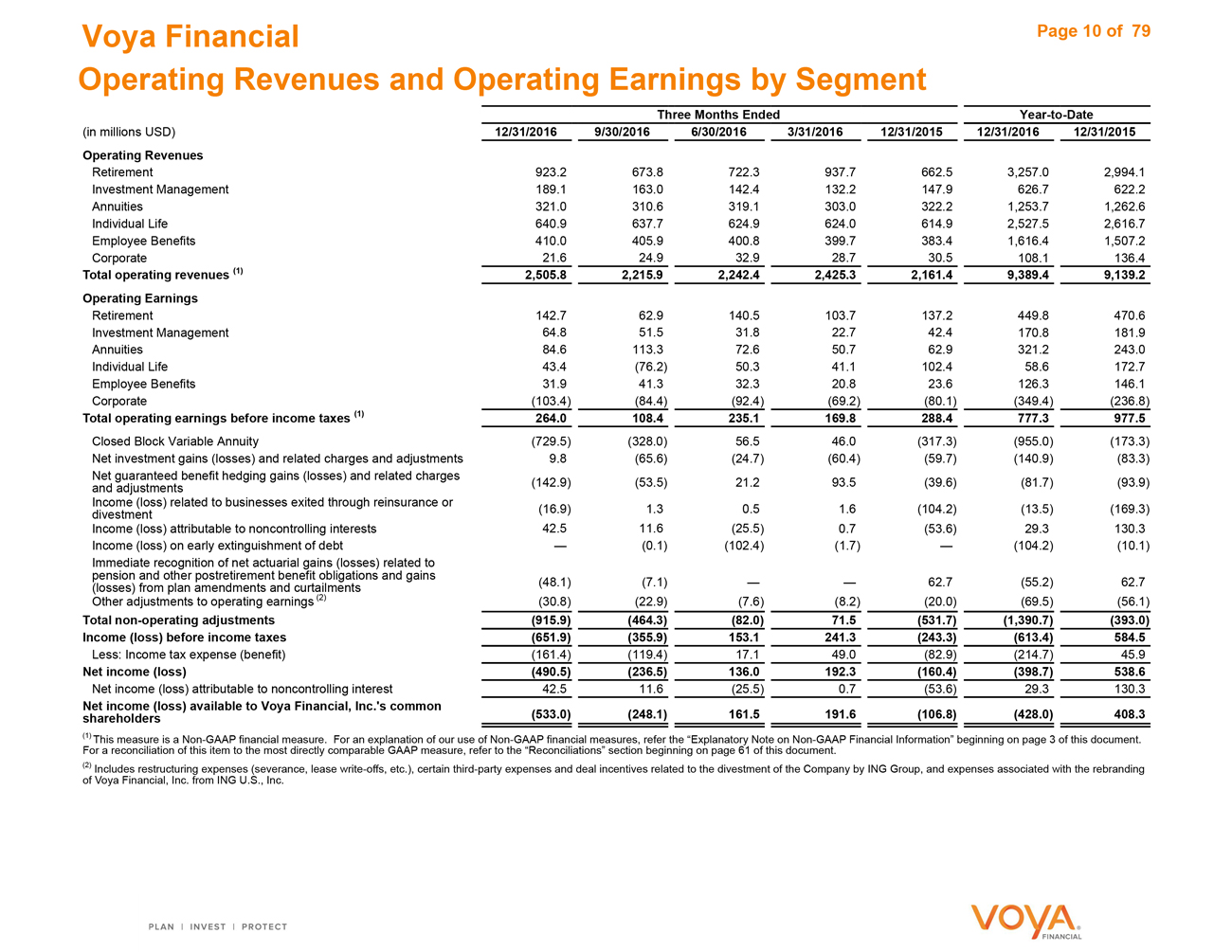

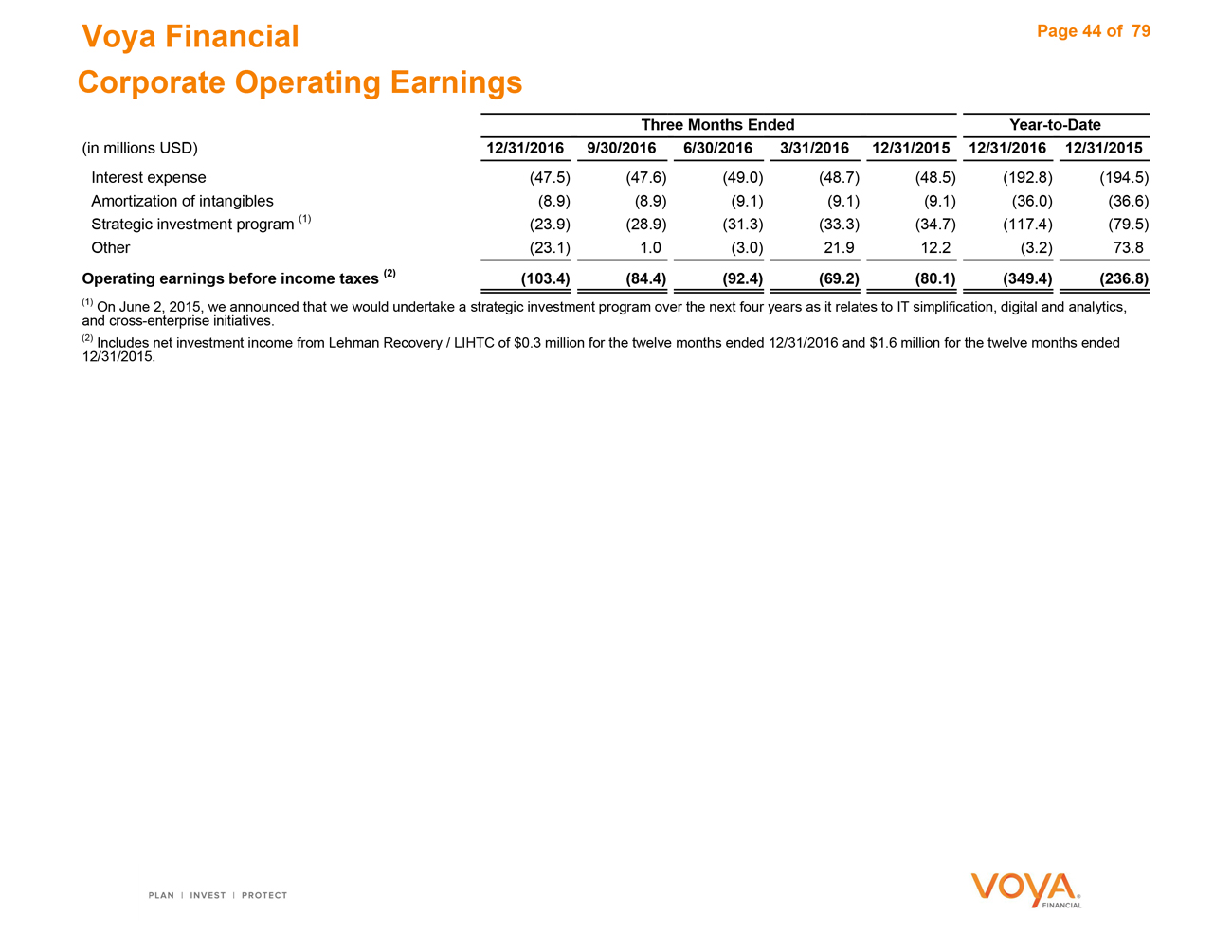

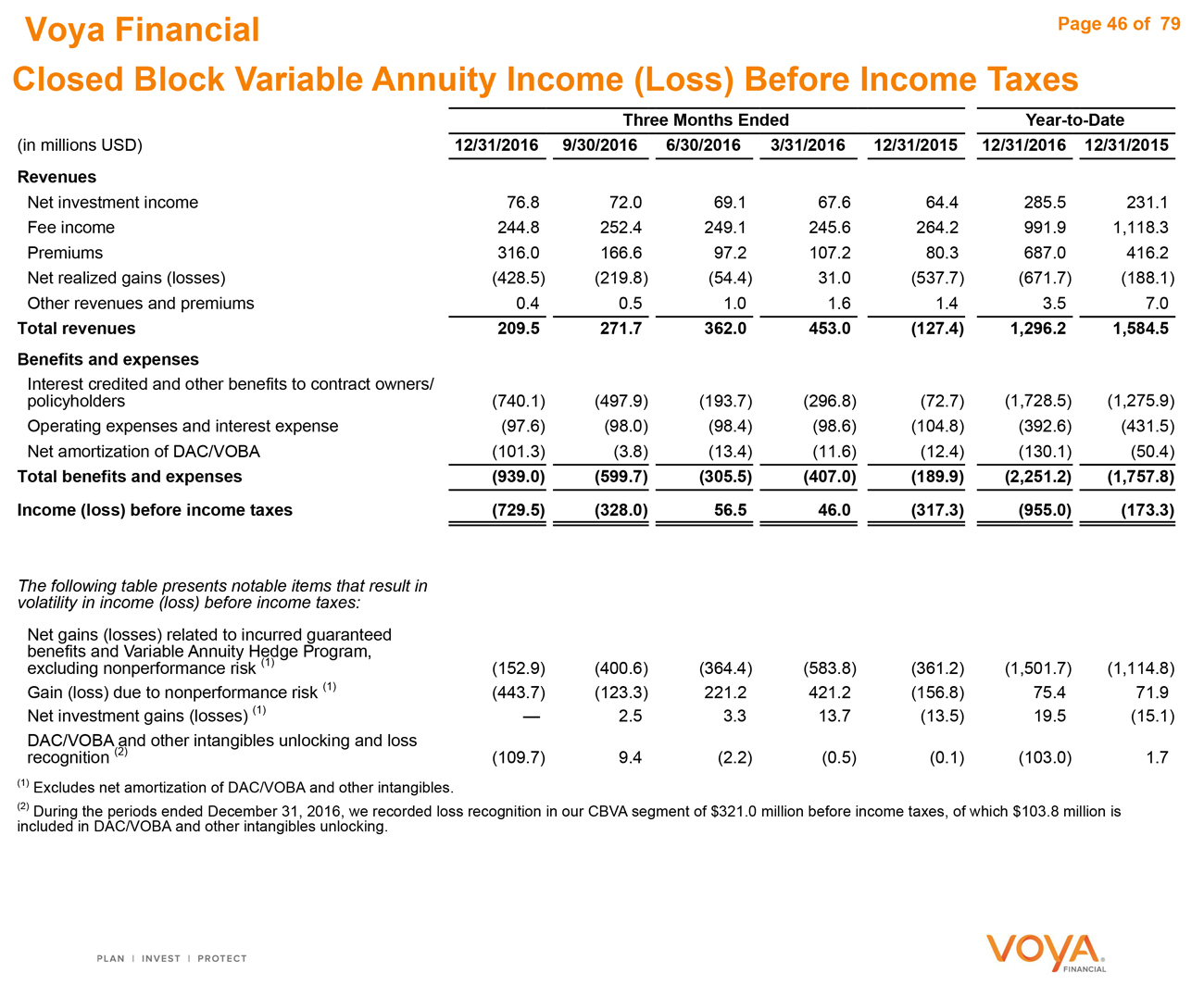

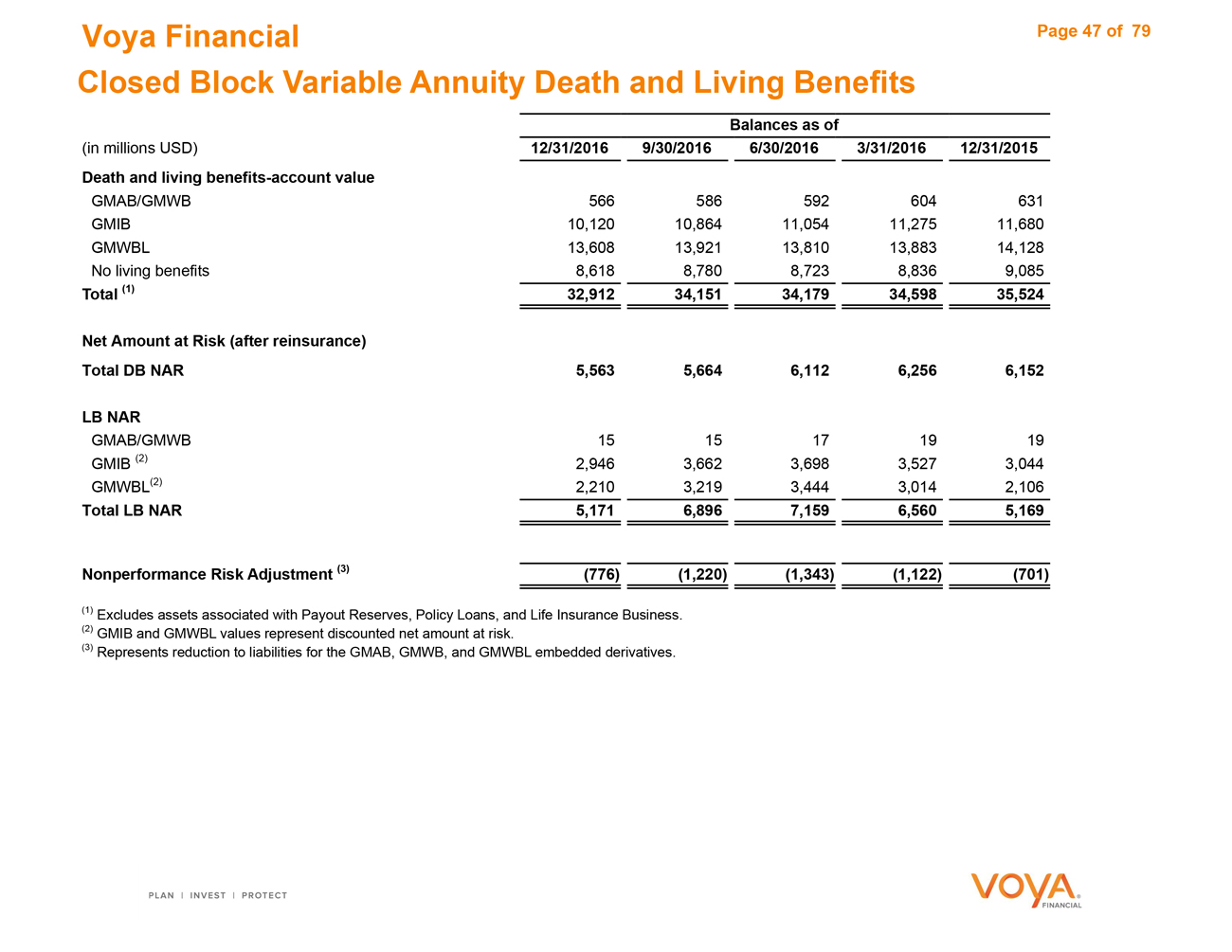

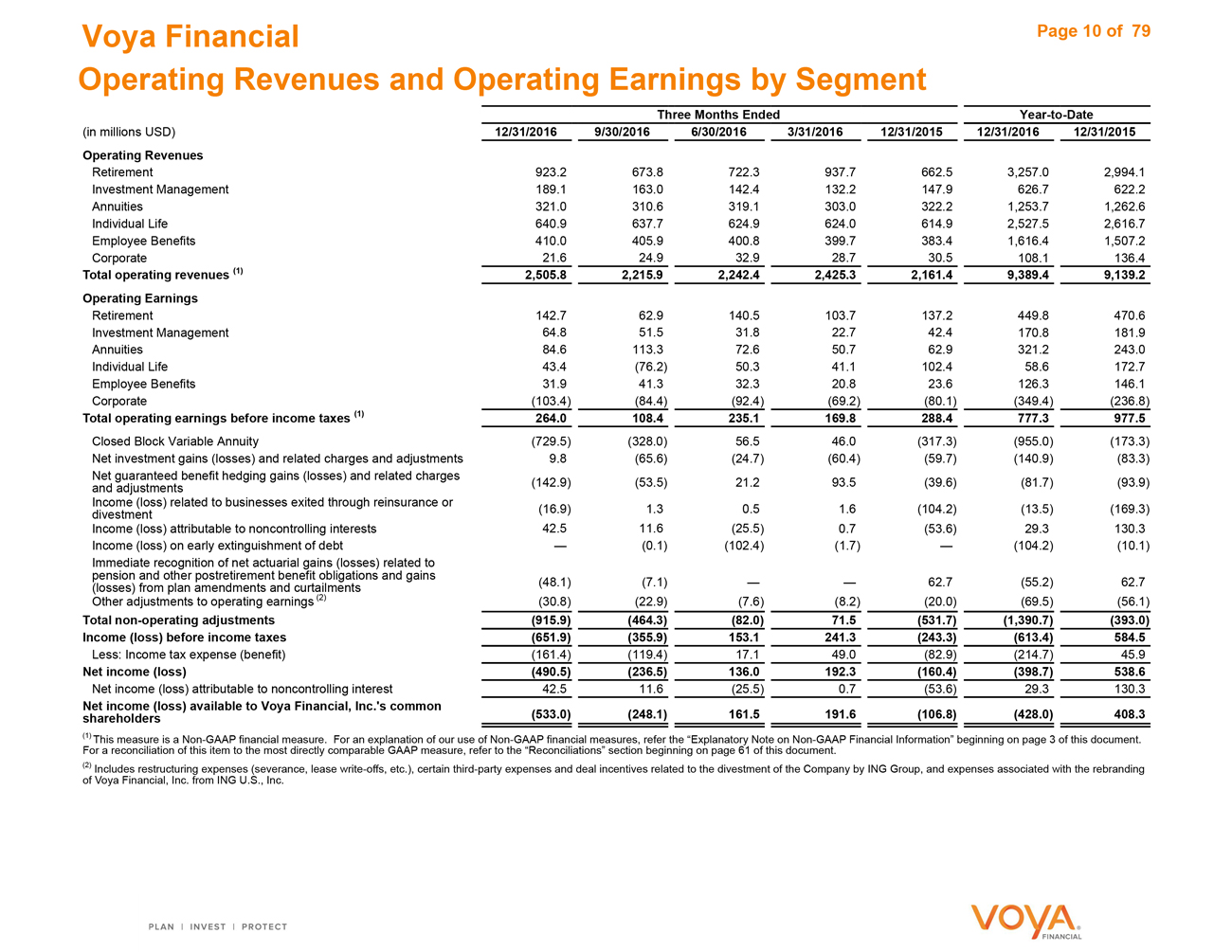

Voya Financial Page 10 of 79 Operating Revenues and Operating Earnings by Segment Three Months Ended Year-to-Date (in millions USD) 12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 12/31/2016 12/31/2015 Operating Revenues Retirement 923.2 673.8 722.3 937.7 662.5 3,257.0 2,994.1 Investment Management 189.1 163.0 142.4 132.2 147.9 626.7 622.2 Annuities 321.0 310.6 319.1 303.0 322.2 1,253.7 1,262.6 Individual Life 640.9 637.7 624.9 624.0 614.9 2,527.5 2,616.7 Employee Benefits 410.0 405.9 400.8 399.7 383.4 1,616.4 1,507.2 Corporate 21.6 24.9 32.9 28.7 30.5 108.1 136.4 Total operating revenues (1) 2,505.8 2,215.9 2,242.4 2,425.3 2,161.4 9,389.4 9,139.2 Operating Earnings Retirement 142.7 62.9 140.5 103.7 137.2 449.8 470.6 Investment Management 64.8 51.5 31.8 22.7 42.4 170.8 181.9 Annuities 84.6 113.3 72.6 50.7 62.9 321.2 243.0 Individual Life 43.4 (76.2) 50.3 41.1 102.4 58.6 172.7 Employee Benefits 31.9 41.3 32.3 20.8 23.6 126.3 146.1 Corporate (103.4) (84.4) (92.4) (69.2) (80.1) (349.4) (236.8) Total operating earnings before income taxes (1) 264.0 108.4 235.1 169.8 288.4 777.3 977.5 Closed Block Variable Annuity (729.5) (328.0) 56.5 46.0 (317.3) (955.0) (173.3) Net investment gains (losses) and related charges and adjustments 9.8 (65.6) (24.7) (60.4) (59.7) (140.9) (83.3) Net guaranteed benefit hedging gains (losses) and related charges and adjustments (142.9) (53.5) 21.2 93.5 (39.6) (81.7) (93.9) Income (loss) related to businesses exited through reinsurance or divestment (16.9) 1.3 0.5 1.6 (104.2) (13.5) (169.3) Income (loss) attributable to noncontrolling interests 42.5 11.6 (25.5) 0.7 (53.6) 29.3 130.3 Income (loss) on early extinguishment of debt —— (0.1) (102.4) (1.7) —— (104.2) (10.1) Immediate recognition of net actuarial gains (losses) related to pension and other postretirement benefit obligations and gains (losses) from plan amendments and curtailments (48.1) (7.1) —— —— 62.7 (55.2) 62.7 Other adjustments to operating earnings (2) (30.8) (22.9) (7.6) (8.2) (20.0) (69.5) (56.1) Total non-operating adjustments (915.9) (464.3) (82.0) 71.5 (531.7) (1,390.7) (393.0) Income (loss) before income taxes (651.9) (355.9) 153.1 241.3 (243.3) (613.4) 584.5 Less: Income tax expense (benefit) (161.4) (119.4) 17.1 49.0 (82.9) (214.7) 45.9 Net income (loss) (490.5) (236.5) 136.0 192.3 (160.4) (398.7) 538.6 Net income (loss) attributable to noncontrolling interest 42.5 11.6 (25.5) 0.7 (53.6) 29.3 130.3 Net income (loss) available to Voya Financial, Inc.’s common shareholders (533.0) (248.1) 161.5 191.6 (106.8) (428.0) 408.3 (1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 61 of this document. (2) Includes restructuring expenses (severance, lease write-offs, etc.), certain third-party expenses and deal incentives related to the divestment of the Company by ING Group, and expenses associated with the rebranding of Voya Financial, Inc. from ING U.S., Inc.

|

|

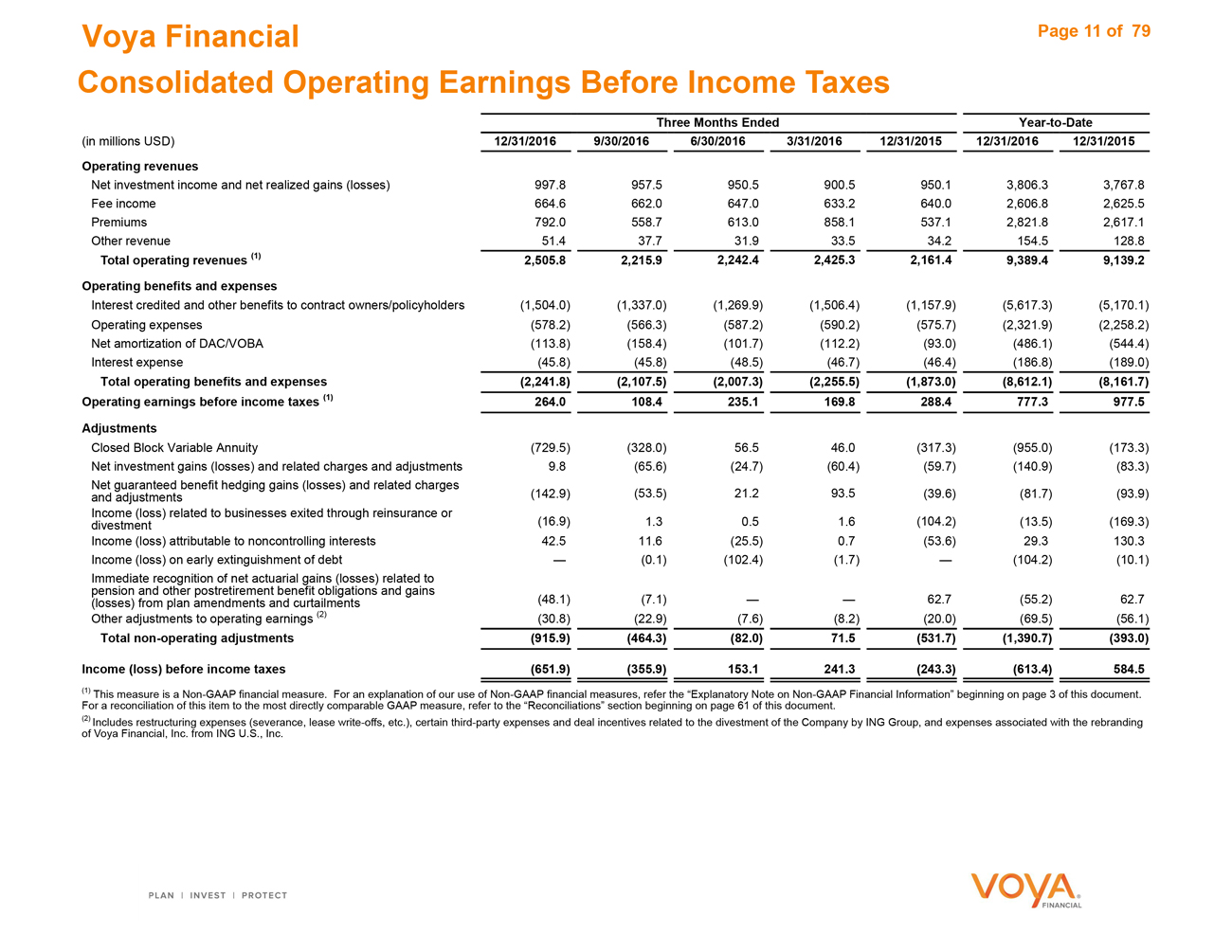

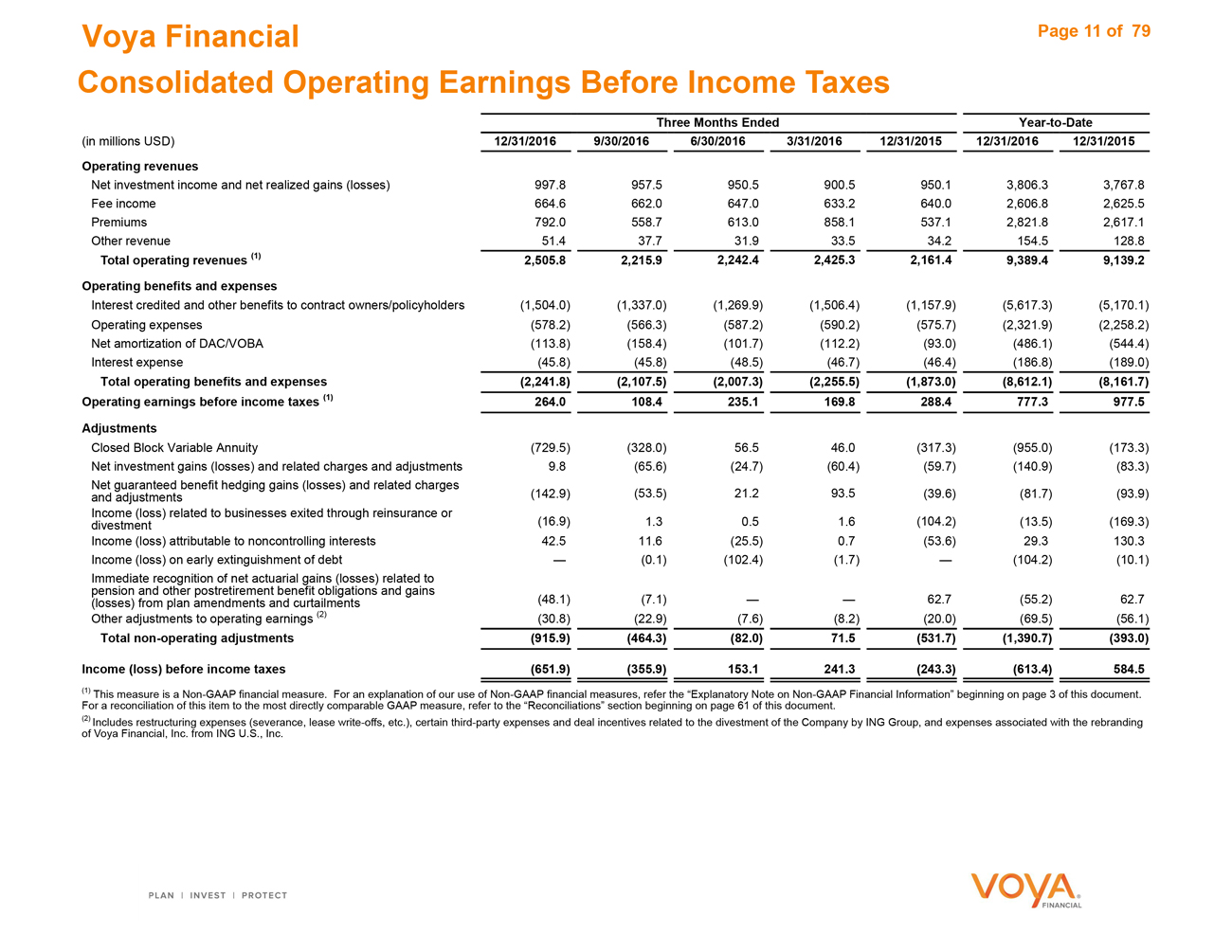

Voya Financial Page 11 of 79 Consolidated Operating Earnings Before Income Taxes Three Months Ended Year-to-Date (in millions USD) 12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 12/31/2016 12/31/2015 Operating revenues Net investment income and net realized gains (losses) 997.8 957.5 950.5 900.5 950.1 3,806.3 3,767.8 Fee income 664.6 662.0 647.0 633.2 640.0 2,606.8 2,625.5 Premiums 792.0 558.7 613.0 858.1 537.1 2,821.8 2,617.1 Other revenue 51.4 37.7 31.9 33.5 34.2 154.5 128.8 Total operating revenues (1) 2,505.8 2,215.9 2,242.4 2,425.3 2,161.4 9,389.4 9,139.2 Operating benefits and expenses Interest credited and other benefits to contract owners/policyholders (1,504.0) (1,337.0) (1,269.9) (1,506.4) (1,157.9) (5,617.3) (5,170.1) Operating expenses (578.2) (566.3) (587.2) (590.2) (575.7) (2,321.9) (2,258.2) Net amortization of DAC/VOBA (113.8) (158.4) (101.7) (112.2) (93.0) (486.1) (544.4) Interest expense (45.8) (45.8) (48.5) (46.7) (46.4) (186.8) (189.0) Total operating benefits and expenses (2,241.8) (2,107.5) (2,007.3) (2,255.5) (1,873.0) (8,612.1) (8,161.7) Operating earnings before income taxes (1) 264.0 108.4 235.1 169.8 288.4 777.3 977.5 Adjustments Closed Block Variable Annuity (729.5) (328.0) 56.5 46.0 (317.3) (955.0) (173.3) Net investment gains (losses) and related charges and adjustments 9.8 (65.6) (24.7) (60.4) (59.7) (140.9) (83.3) Net guaranteed benefit hedging gains (losses) and related charges and adjustments (142.9) (53.5) 21.2 93.5 (39.6) (81.7) (93.9) Income (loss) related to businesses exited through reinsurance or (16.9) divestment 1.3 0.5 1.6 (104.2) (13.5) (169.3) Income (loss) attributable to noncontrolling interests 42.5 11.6 (25.5) 0.7 (53.6) 29.3 130.3 Income (loss) on early extinguishment of debt —— (0.1) (102.4) (1.7) —— (104.2) (10.1) Immediate recognition of net actuarial gains (losses) related to pension and other postretirement benefit obligations and gains (48.1 (losses) from plan amendments and curtailments ) (7.1) —— —— 62.7 (55.2) 62.7 Other adjustments to operating earnings (2) (30.8) (22.9) (7.6) (8.2) (20.0) (69.5) (56.1) Total non-operating adjustments (915.9) (464.3) (82.0) 71.5 (531.7) (1,390.7) (393.0) Income (loss) before income taxes (651.9) (355.9) 153.1 241.3 (243.3) (613.4) 584.5 (1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 61 of this document. (2) Includes restructuring expenses (severance, lease write-offs, etc.), certain third-party expenses and deal incentives related to the divestment of the Company by ING Group, and expenses associated with the rebranding of Voya Financial, Inc. from ING U.S., Inc.

|

|

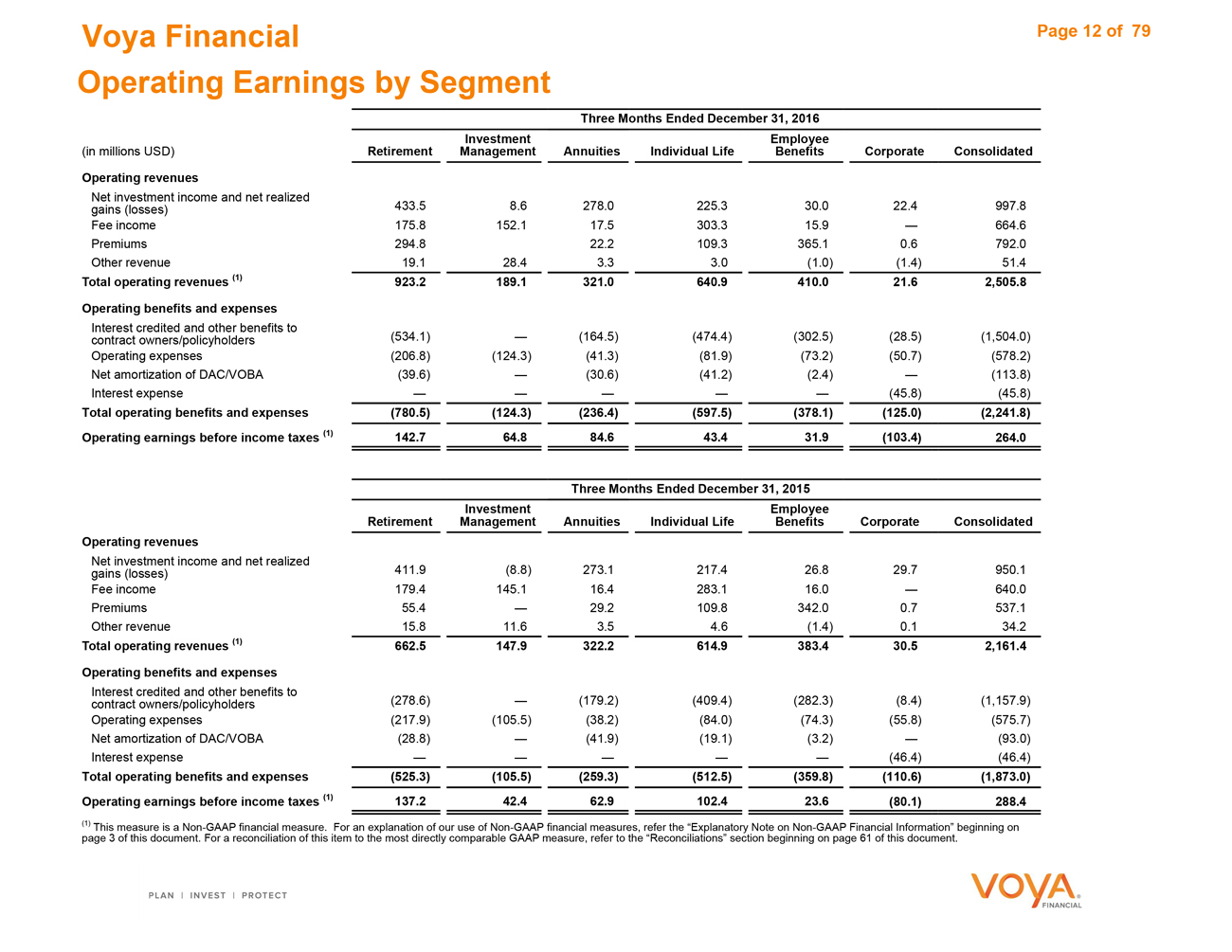

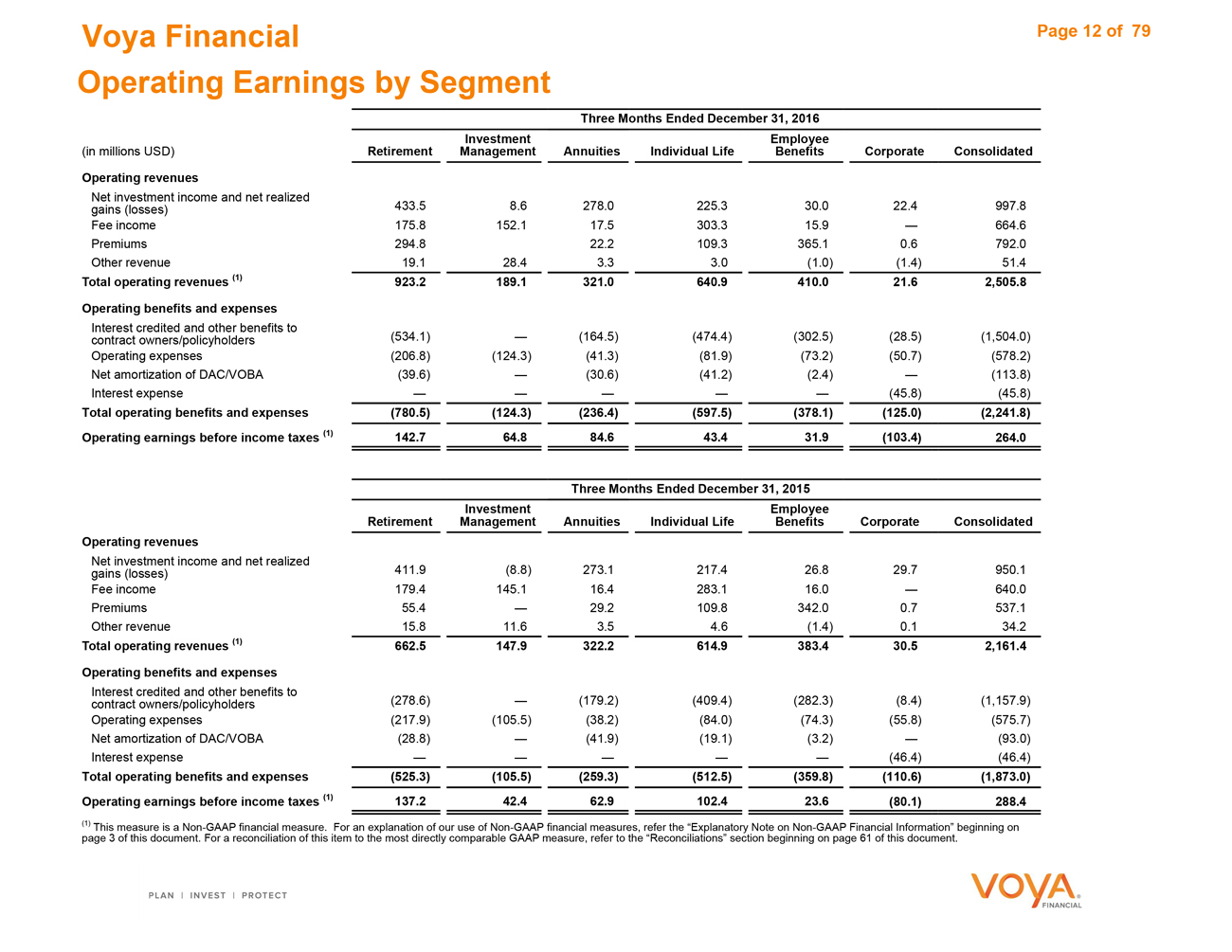

Voya Financial Page 12 of79 Operating Earnings by Segment Three Months Ended December 31, 2016 InvestmentEmployee (in millions USD)Retirement ManagementAnnuitiesIndividual LifeBenefitsCorporateConsolidated Operating revenues Net investment income and net realized433.5 gains (losses) 8.6278.0225.330.022.4997.8 Fee income175.8 152.117.5303.315.9—664.6 Premiums294.8 22.2109.3365.10.6792.0 Other revenue19.1 28.43.33.0(1.0)(1.4)51.4 Total operating revenues (1)923.2 189.1321.0640.9410.021.62,505.8 Operating benefits and expenses Interest credited and other benefits to contract owners/policyholders(534.1) —(164.5)(474.4)(302.5)(28.5)(1,504.0) Operating expenses(206.8) (124.3)(41.3)(81.9)(73.2)(50.7)(578.2) Net amortization of DAC/VOBA(39.6) —(30.6)(41.2)(2.4)—(113.8) Interest expense— ————(45.8)(45.8) Total operating benefits and expenses(780.5) (124.3)(236.4)(597.5)(378.1)(125.0)(2,241.8) Operating earnings before income taxes (1)142.7 64.884.643.431.9(103.4)264.0 Three Months Ended December 31, 2015 InvestmentEmployee RetirementManagementAnnuitiesIndividual LifeBenefitsCorporateConsolidated Operating revenues Net investment income and net realized411.9 (8.8 gains (losses) )273.1217.426.829.7950.1 Fee income179.4 145.116.4283.116.0—640.0 Premiums55.4 —29.2109.8342.00.7537.1 Other revenue15.8 11.63.54.6(1.4)0.134.2 Total operating revenues (1)662.5 147.9322.2614.9383.430.52,161.4 Operating benefits and expenses Interest credited and other benefits to contract owners/policyholders(278.6) —(179.2)(409.4)(282.3)(8.4)(1,157.9) Operating expenses(217.9) (105.5)(38.2)(84.0)(74.3)(55.8)(575.7) Net amortization of DAC/VOBA(28.8) —(41.9)(19.1)(3.2)—(93.0) Interest expense— ————(46.4)(46.4) Total operating benefits and expenses(525.3) (105.5)(259.3)(512.5)(359.8)(110.6)(1,873.0) Operating earnings before income taxes (1)137.2 42.462.9102.423.6(80.1)288.4 (1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 61 of this document.

|

|

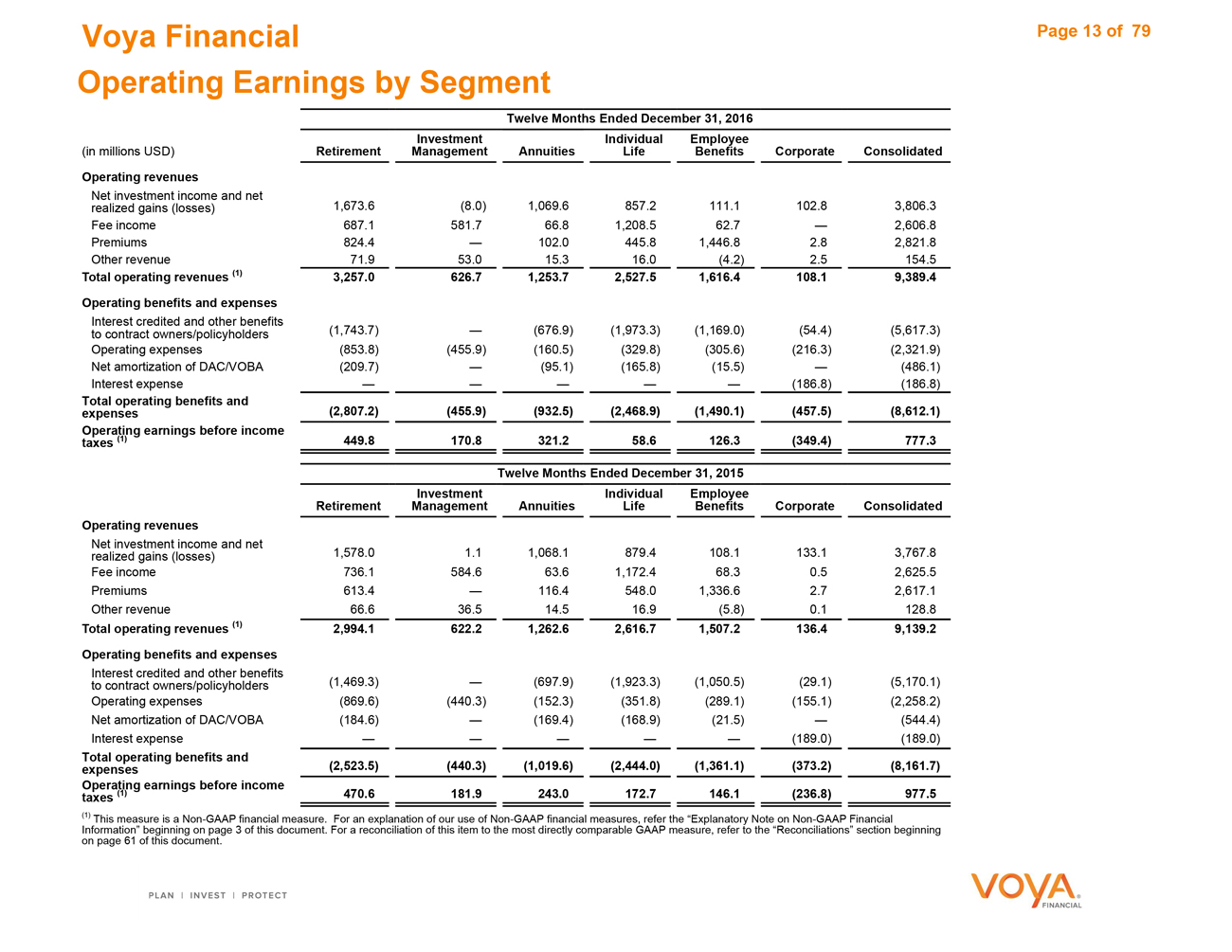

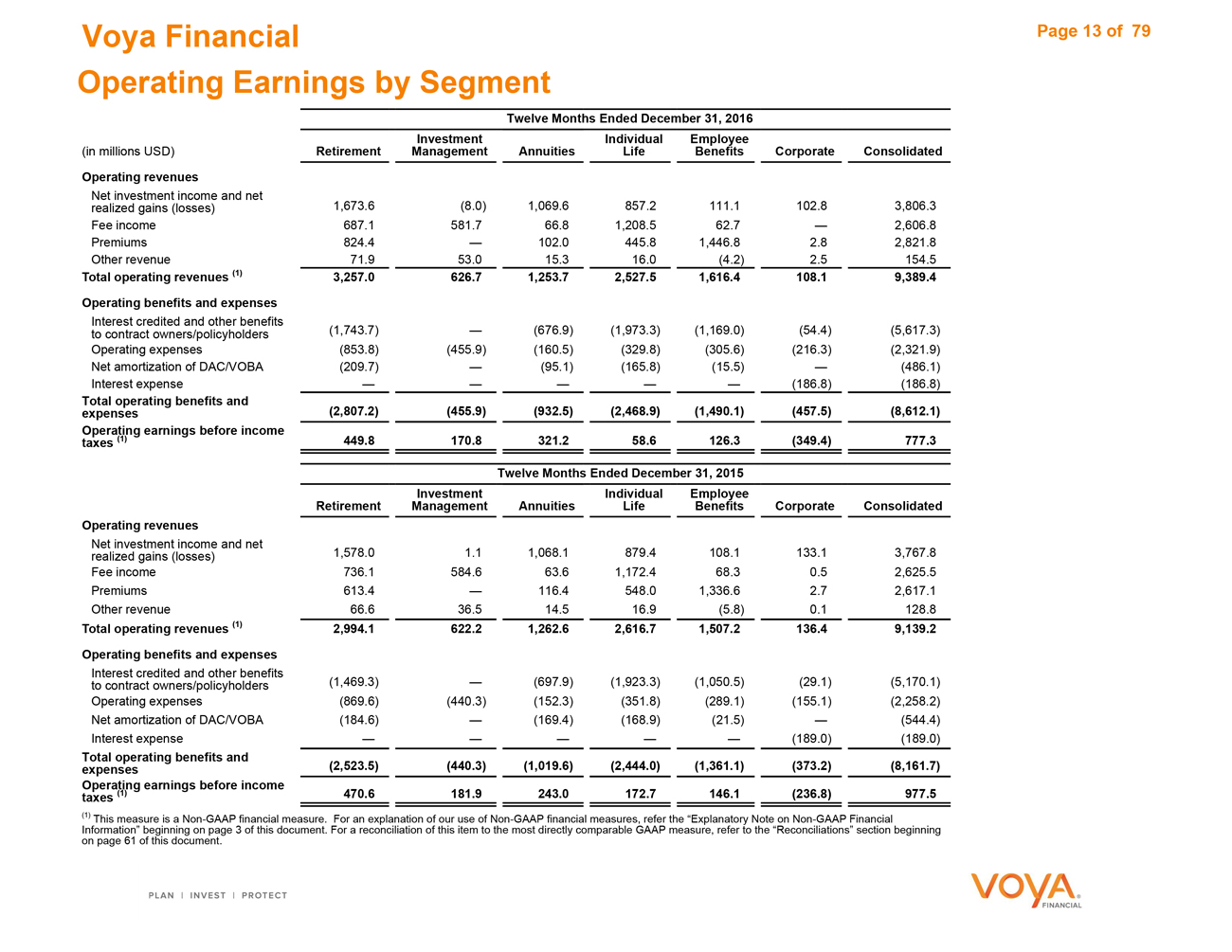

Voya Financial Page 13 of79 Operating Earnings by Segment Twelve Months Ended December 31, 2016 InvestmentIndividualEmployee (in millions USD)Retirement ManagementAnnuitiesLifeBenefitsCorporateConsolidated Operating revenues Net investment income and net realized gains (losses)1,673.6 (8.0)1,069.6857.2111.1102.83,806.3 Fee income687.1 581.766.81,208.562.7—2,606.8 Premiums824.4 —102.0445.81,446.82.82,821.8 Other revenue71.9 53.015.316.0(4.2)2.5154.5 Total operating revenues (1)3,257.0 626.71,253.72,527.51,616.4108.19,389.4 Operating benefits and expenses Interest credited and other benefits to contract owners/policyholders(1,743.7) —(676.9)(1,973.3)(1,169.0)(54.4)(5,617.3) Operating expenses(853.8) (455.9)(160.5)(329.8)(305.6)(216.3)(2,321.9) Net amortization of DAC/VOBA(209.7) —(95.1)(165.8)(15.5)—(486.1) Interest expense— ————(186.8)(186.8) Total operating benefits and expenses(2,807.2) (455.9)(932.5)(2,468.9)(1,490.1)(457.5)(8,612.1) Operating earnings before income taxes (1)449.8 170.8321.258.6126.3(349.4)777.3 Twelve Months Ended December 31, 2015 InvestmentIndividual Employee RetirementManagementAnnuitiesLifeBenefitsCorporate Consolidated Operating revenues Net investment income and net realized gains (losses)1,578.0 1.11,068.1879.4108.1133.13,767.8 Fee income736.1 584.663.61,172.468.30.52,625.5 Premiums613.4 —116.4548.01,336.62.72,617.1 Other revenue66.6 36.514.516.9(5.8)0.1128.8 Total operating revenues (1)2,994.1 622.21,262.62,616.71,507.2136.49,139.2 Operating benefits and expenses Interest credited and other benefits to contract owners/policyholders(1,469.3) —(697.9)(1,923.3)(1,050.5)(29.1)(5,170.1) Operating expenses(869.6) (440.3)(152.3)(351.8)(289.1)(155.1)(2,258.2) Net amortization of DAC/VOBA(184.6) —(169.4)(168.9)(21.5)—(544.4) Interest expense— ————(189.0)(189.0) Total operating benefits and expenses(2,523.5) (440.3)(1,019.6)(2,444.0)(1,361.1)(373.2)(8,161.7) Operating earnings before income taxes (1)470.6 181.9243.0172.7146.1(236.8)977.5 (1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 61 of this document.

|

|

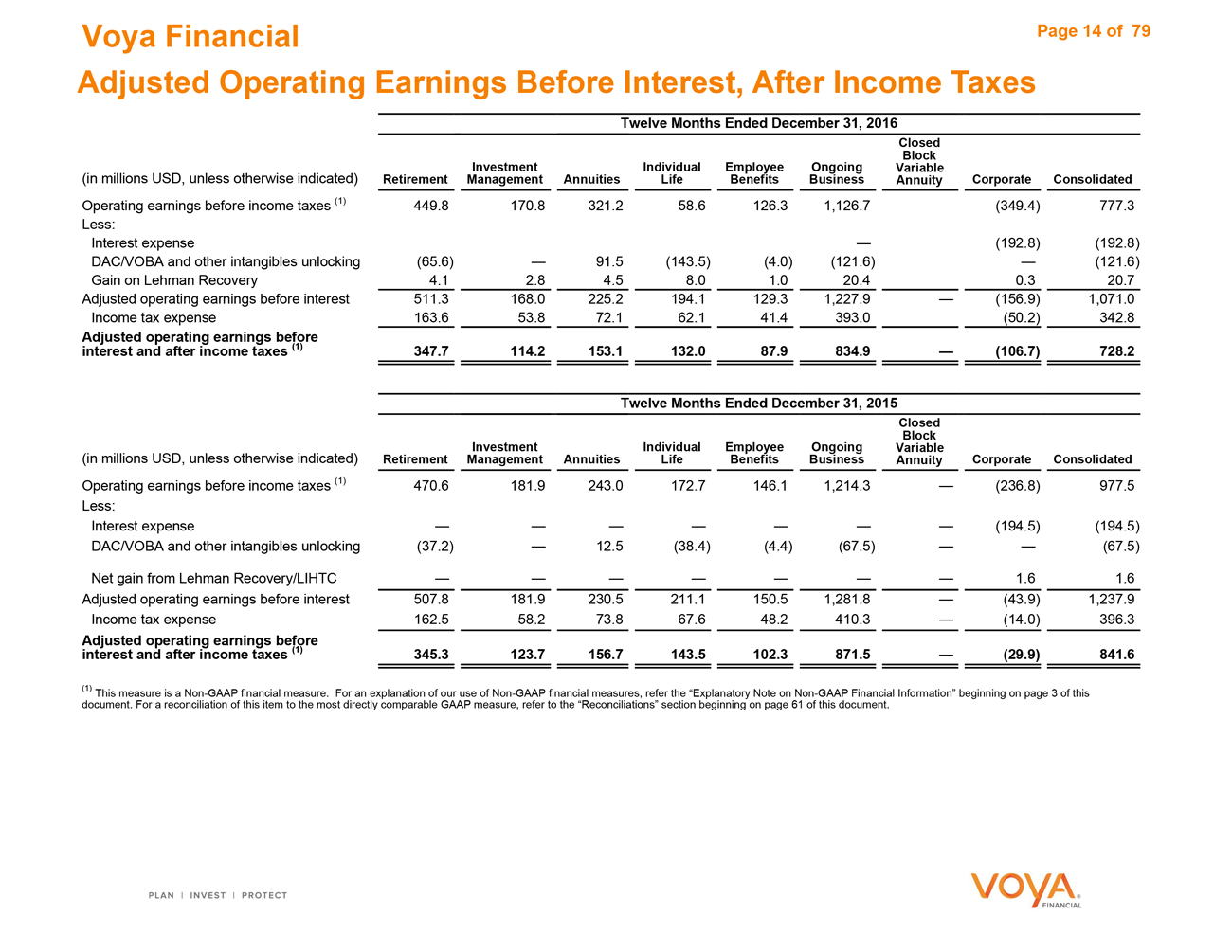

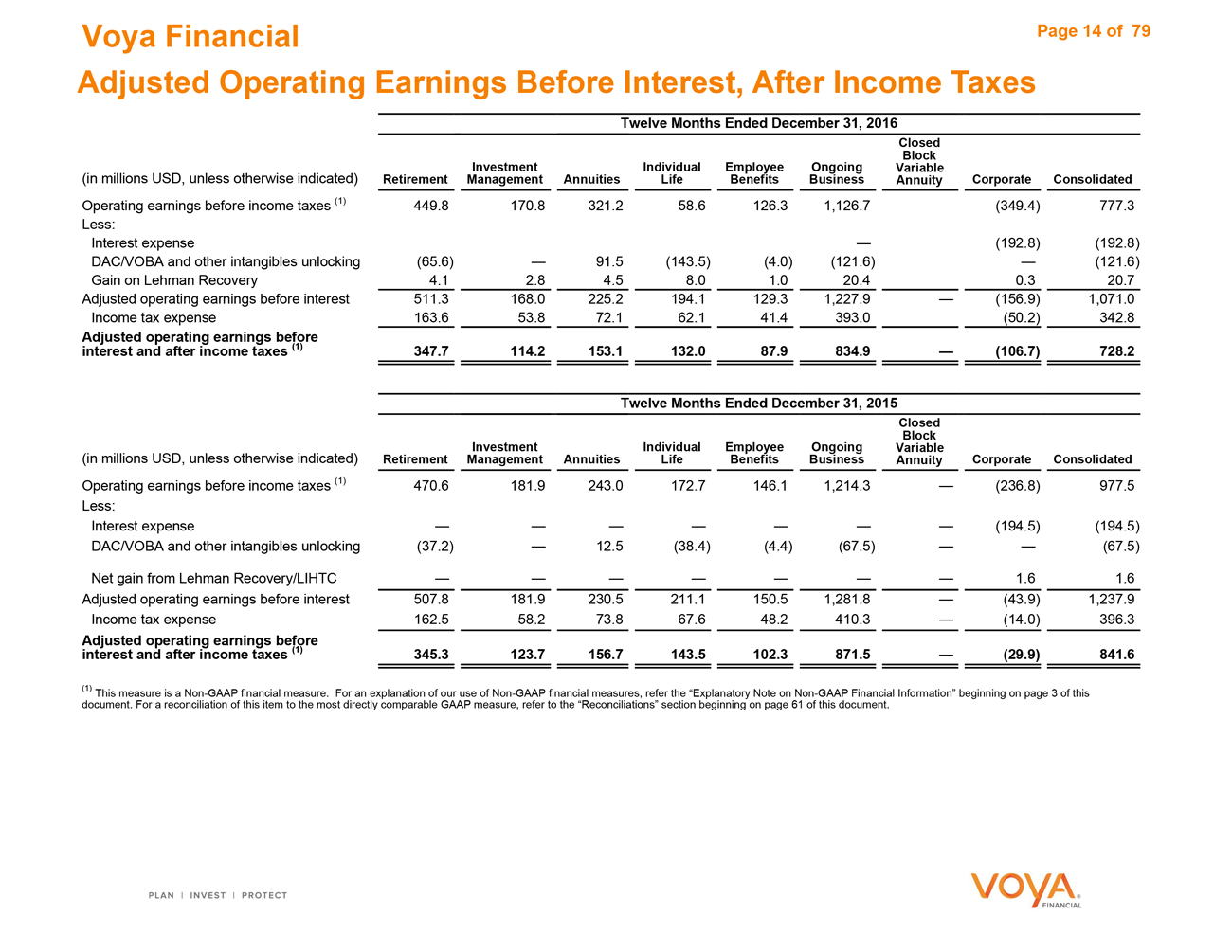

Voya Financial Page 14 of 79 Adjusted Operating Earnings Before Interest, After Income Taxes Twelve Months Ended December 31, 2016 Closed Block InvestmentIndividualEmployeeOngoingVariable (in millions USD, unless otherwise indicated)Retirement ManagementAnnuitiesLifeBenefitsBusinessAnnuityCorporateConsolidated Operating earnings before income taxes (1)449.8 170.8321.258.6126.31,126.7(349.4)777.3 Less: Interest expense —(192.8)(192.8) DAC/VOBA and other intangibles unlocking(65.6) —91.5(143.5)(4.0)(121.6)—(121.6) Gain on Lehman Recovery4.1 2.84.58.01.020.40.320.7 Adjusted operating earnings before interest511.3 168.0225.2194.1129.31,227.9—(156.9)1,071.0 Income tax expense163.6 53.872.162.141.4393.0(50.2)342.8 Adjusted operating earnings before interest and after income taxes (1)347.7 114.2153.1132.087.9834.9—(106.7)728.2 Twelve Months Ended December 31, 2015 Closed Block InvestmentIndividualEmployeeOngoingVariable (in millions USD, unless otherwise indicated)Retirement ManagementAnnuitiesLifeBenefitsBusinessAnnuityCorporateConsolidated Operating earnings before income taxes (1)470.6 181.9243.0172.7146.11,214.3—(236.8)977.5 Less: Interest expense— ——————(194.5)(194.5) DAC/VOBA and other intangibles unlocking(37.2) —12.5(38.4)(4.4)(67.5)——(67.5) Net gain from Lehman Recovery/LIHTC— ——————1.61.6 Adjusted operating earnings before interest507.8 181.9230.5211.1150.51,281.8—(43.9)1,237.9 Income tax expense162.5 58.273.867.648.2410.3—(14.0)396.3 Adjusted operating earnings before interest and after income taxes (1)345.3 123.7156.7143.5102.3871.5—(29.9)841.6 (1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 61 of this document.

|

|

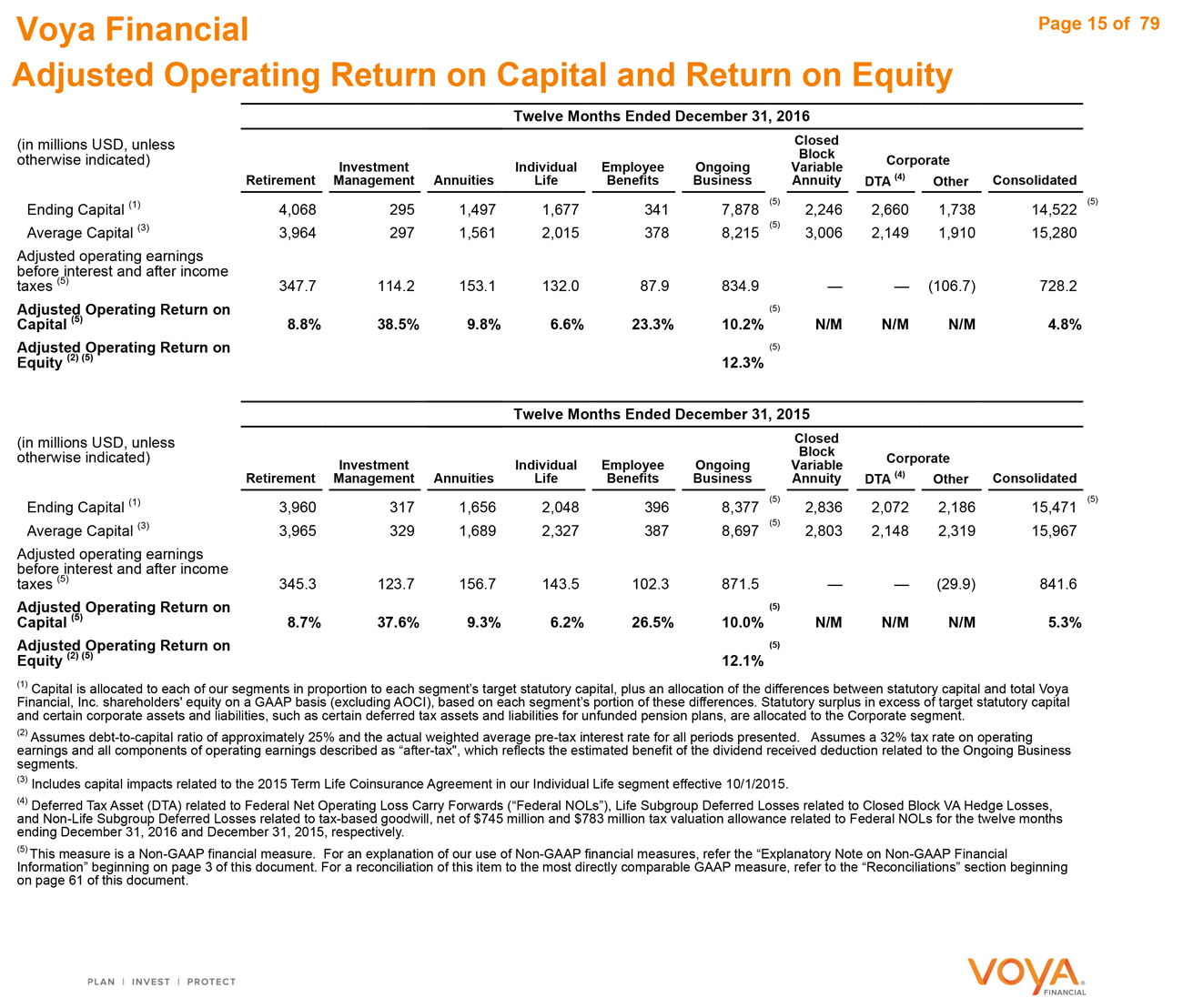

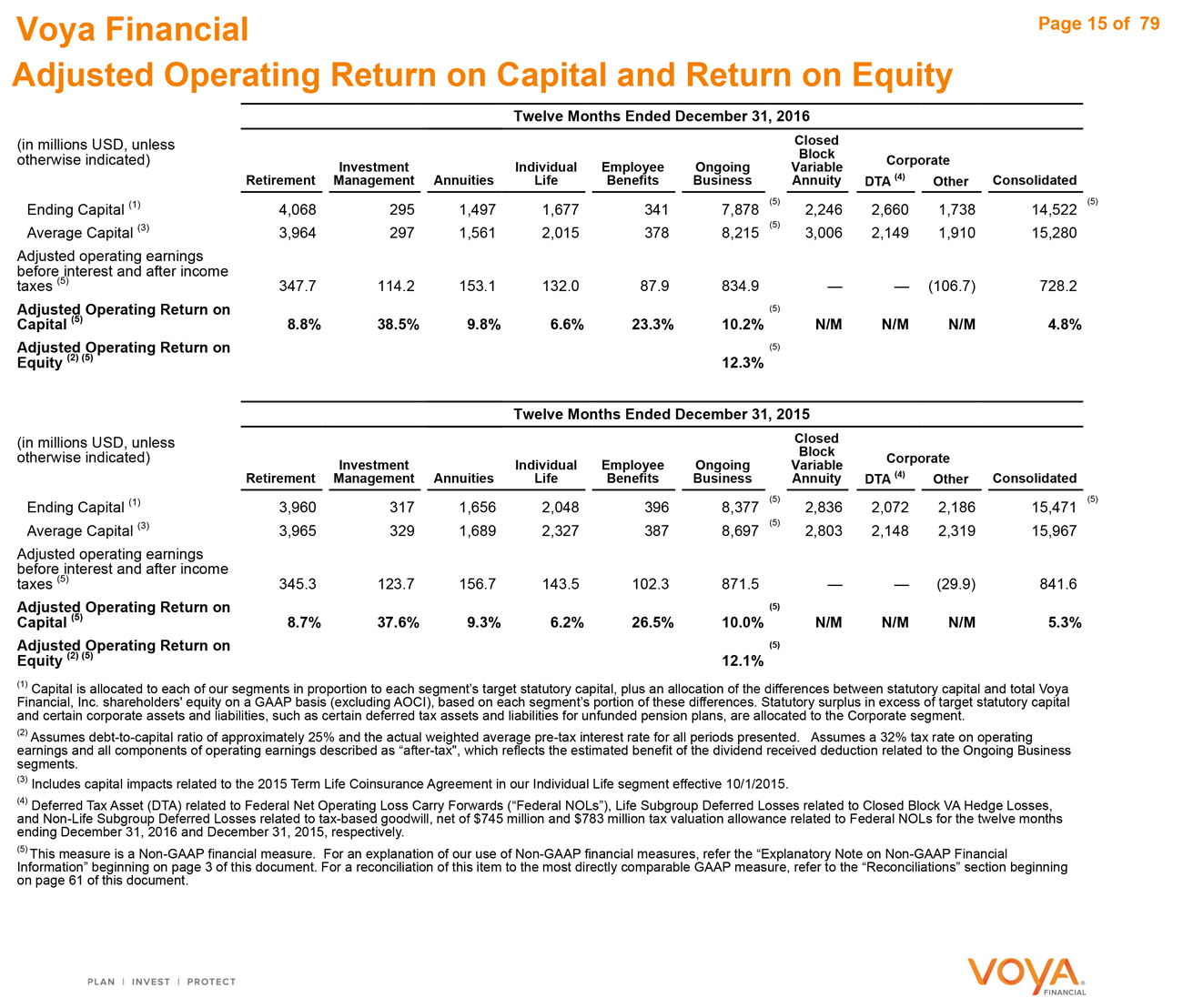

Voya Financial Adjusted Operating Return on Capital and Return on Equity Page 15 of 79 Twelve Months Ended December 31, 2016 (in millions USD, unless Closed otherwise indicated) Block Corporate Investment Individual Employee Ongoing Variable Retirement Management Annuities Life Benefits Business Annuity DTA (4) Other Consolidated Ending Capital (1) 4,068 295 1,497 1,677 341 7,878 (5) 2,246 2,660 1,738 14,522 (5) Average Capital (3) 3,964 297 1,561 2,015 378 8,215 (5) 3,006 2,149 1,910 15,280 Adjusted operating earnings before interest and after income taxes (5) 347.7 114.2 153.1 132.0 87.9 834.9 — — (106.7) 728.2 Adjusted Operating Return on (5) Capital (5) 8.8% 38.5% 9.8% 6.6% 23.3% 10.2% N/M N/M N/M 4.8% Adjusted Operating Return on (5) Equity (2) (5) 12.3% Twelve Months Ended December 31, 2015 (in millions USD, unless Closed otherwise indicated) Block Corporate Investment Individual Employee Ongoing Variable Retirement Management Annuities Life Benefits Business Annuity DTA (4) Other Consolidated Ending Capital (1) 3,960 317 1,656 2,048 396 8,377 (5) 2,836 2,072 2,186 15,471 (5) Average Capital (3) 3,965 329 1,689 2,327 387 8,697 (5) 2,803 2,148 2,319 15,967 Adjusted operating earnings before interest and after income taxes (5) 345.3 123.7 156.7 143.5 102.3 871.5 — — (29.9) 841.6 Adjusted Operating Return on (5) Capital (5) 8.7% 37.6% 9.3% 6.2% 26.5% 10.0% N/M N/M N/M 5.3% Adjusted Operating Return on (5) Equity (2) (5) 12.1% (1) Capital is allocated to each of our segments in proportion to each segment’s target statutory capital, plus an allocation of the differences between statutory capital and total Voya Financial, Inc. shareholders’ equity on a GAAP basis (excluding AOCI), based on each segment’s portion of these differences. Statutory surplus in excess of target statutory capital and certain corporate assets and liabilities, such as certain deferred tax assets and liabilities for unfunded pension plans, are allocated to the Corporate segment. (2) Assumes debt-to-capital ratio of approximately 25% and the actual weighted average pre-tax interest rate for all periods presented. Assumes a 32% tax rate on operating earnings and all components of operating earnings described as “after-tax”, which reflects the estimated benefit of the dividend received deduction related to the Ongoing Business segments. (3) Includes capital impacts related to the 2015 Term Life Coinsurance Agreement in our Individual Life segment effective 10/1/2015. (4) Deferred Tax Asset (DTA) related to Federal Net Operating Loss Carry Forwards (“Federal NOLs”), Life Subgroup Deferred Losses related to Closed Block VA Hedge Losses, and Non-Life Subgroup Deferred Losses related to tax-based goodwill, net of $745 million and $783 million tax valuation allowance related to Federal NOLs for the twelve months ending December 31, 2016 and December 31, 2015, respectively. (5) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 61 of this document.

|

|

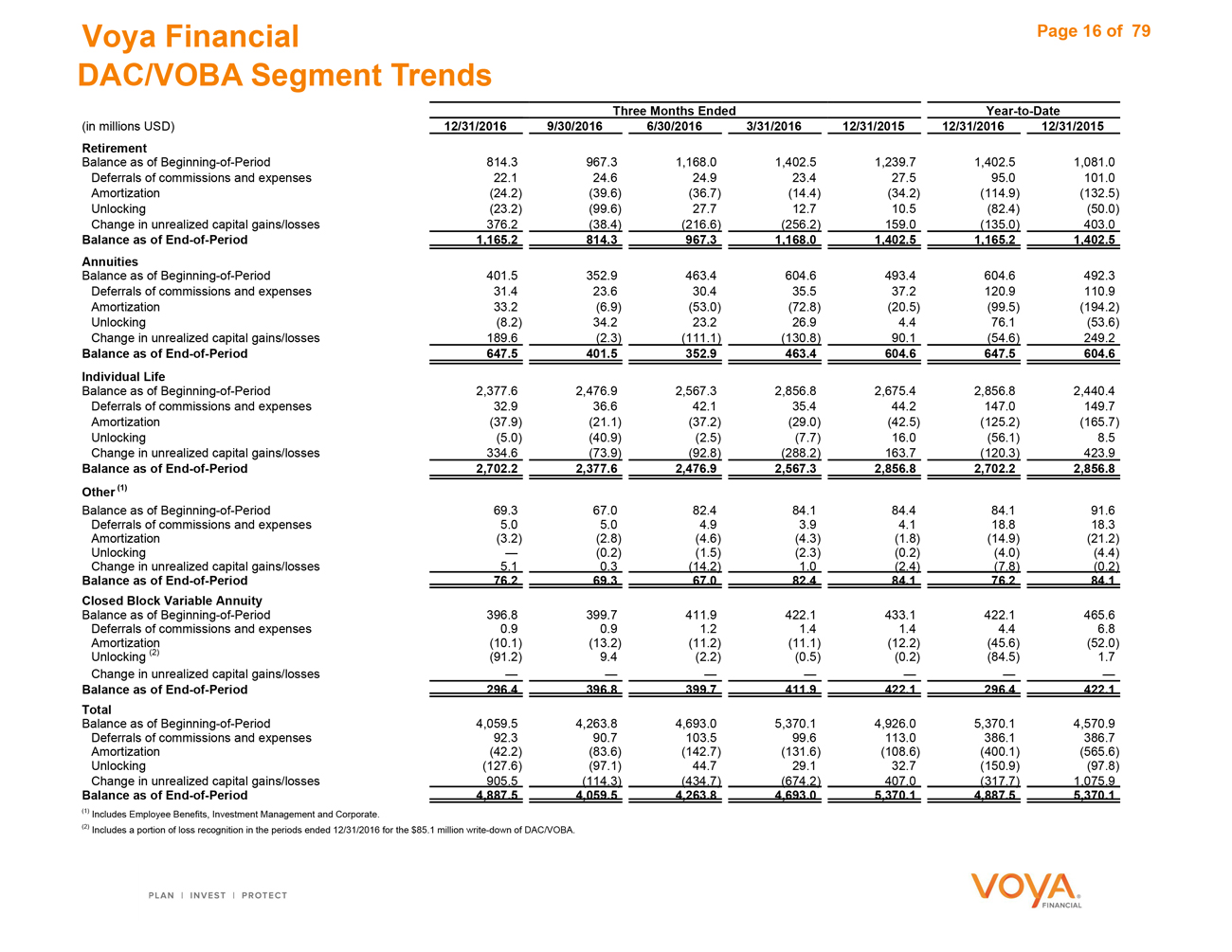

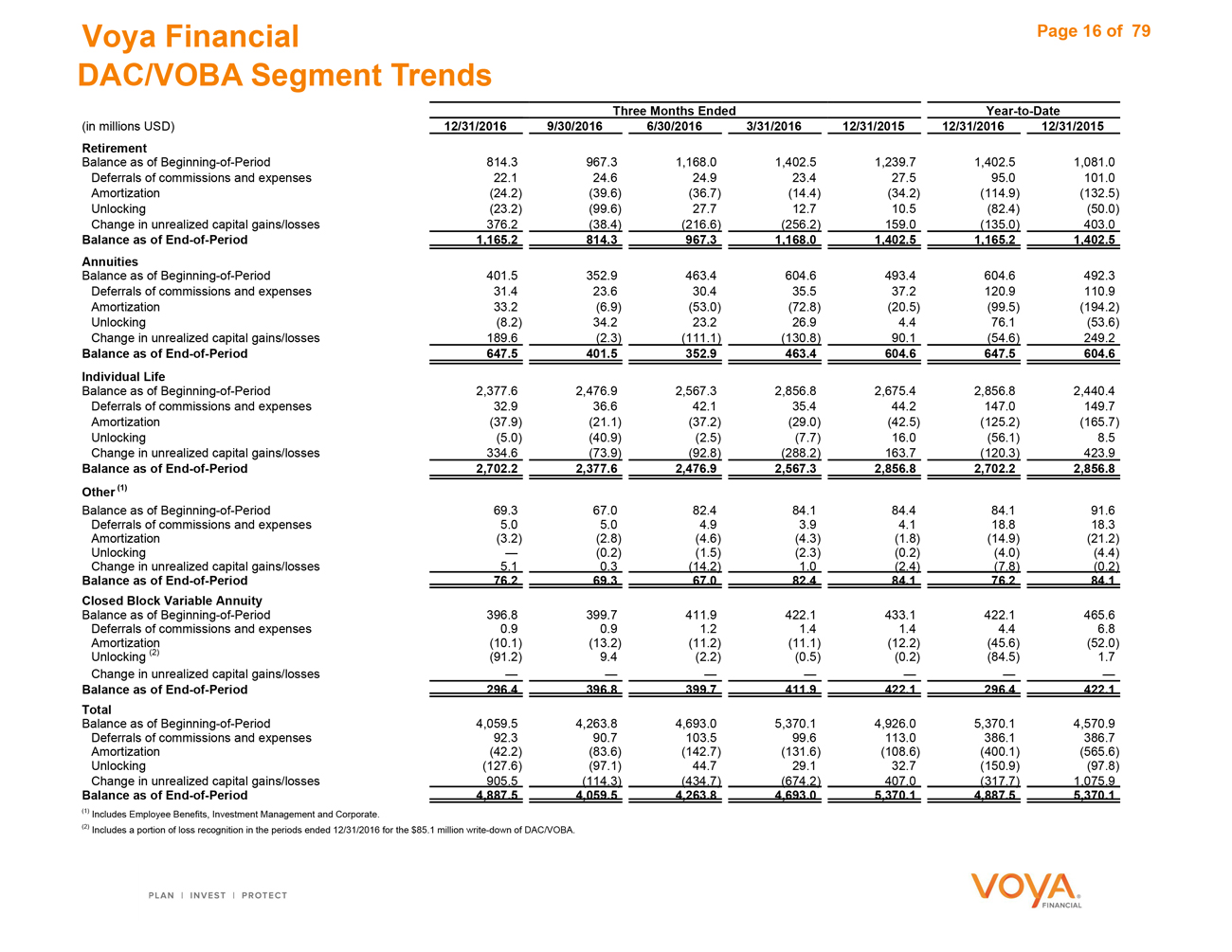

Voya Financial Page 16 of79 DAC/VOBA Segment Trends Three Months EndedYear-to-Date (in millions USD)12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Retirement Balance as of Beginning-of-Period814.3 967.31,168.01,402.51,239.71,402.51,081.0 Deferrals of commissions and expenses22.1 24.624.923.427.595.0101.0 Amortization(24.2) (39.6)(36.7)(14.4)(34.2)(114.9)(132.5) Unlocking(23.2) (99.6)27.712.710.5(82.4)(50.0) Change in unrealized capital gains/losses376.2 (38.4)(216.6)(256.2)159.0(135.0)403.0 Balance as of End-of-Period1,165.2 814.3967.31,168.01,402.51,165.21,402.5 Annuities Balance as of Beginning-of-Period401.5 352.9463.4604.6493.4604.6492.3 Deferrals of commissions and expenses31.4 23.630.435.537.2120.9110.9 Amortization33.2 (6.9)(53.0)(72.8)(20.5)(99.5)(194.2) Unlocking(8.2) 34.223.226.94.476.1(53.6) Change in unrealized capital gains/losses189.6 (2.3)(111.1)(130.8)90.1(54.6)249.2 Balance as of End-of-Period647.5 401.5352.9463.4604.6647.5604.6 Individual Life Balance as of Beginning-of-Period2,377.6 2,476.92,567.32,856.82,675.42,856.82,440.4 Deferrals of commissions and expenses32.9 36.642.135.444.2147.0149.7 Amortization(37.9) (21.1)(37.2)(29.0)(42.5)(125.2)(165.7) Unlocking(5.0) (40.9)(2.5)(7.7)16.0(56.1)8.5 Change in unrealized capital gains/losses334.6 (73.9)(92.8)(288.2)163.7(120.3)423.9 Balance as of End-of-Period2,702.2 2,377.62,476.92,567.32,856.82,702.22,856.8 Other (1) Balance as of Beginning-of-Period69.3 67.082.484.184.484.191.6 Deferrals of commissions and expenses5.0 5.04.93.94.118.818.3 Amortization(3.2) (2.8)(4.6)(4.3)(1.8)(14.9)(21.2) Unlocking— (0.2)(1.5)(2.3)(0.2)(4.0)(4.4) Change in unrealized capital gains/losses5.1 0.3(14.2)1.0(2.4)(7.8)(0.2) Balance as of End-of-Period76.2 69.367.082.484.176.284.1 Closed Block Variable Annuity Balance as of Beginning-of-Period396.8 399.7411.9422.1433.1422.1465.6 Deferrals of commissions and expenses0.9 0.91.21.41.44.46.8 Amortization(10.1) (13.2)(11.2)(11.1)(12.2)(45.6)(52.0) Unlocking (2)(91.2) 9.4(2.2)(0.5)(0.2)(84.5)1.7 Change in unrealized capital gains/losses— — Balance as of End-of-Period296.4 396.8399.7411.9422.1296.4422.1 Total Balance as of Beginning-of-Period4,059.5 4,263.84,693.05,370.14,926.05,370.14,570.9 Deferrals of commissions and expenses92.3 90.7103.599.6113.0386.1386.7 Amortization(42.2) (83.6)(142.7)(131.6)(108.6)(400.1)(565.6) Unlocking(127.6) (97.1)44.729.132.7(150.9)(97.8) Change in unrealized capital gains/losses905.5 (114.3)(434.7)(674.2)407.0(317.7)1,075.9 Balance as of End-of-Period4,887.5 4,059.54,263.84,693.05,370.14,887.55,370.1 (1) Includes Employee Benefits, Investment Management and Corporate. (2) Includes a portion of loss recognition in the periods ended 12/31/2016 for the $85.1 million write-down of DAC/VOBA.

|

|

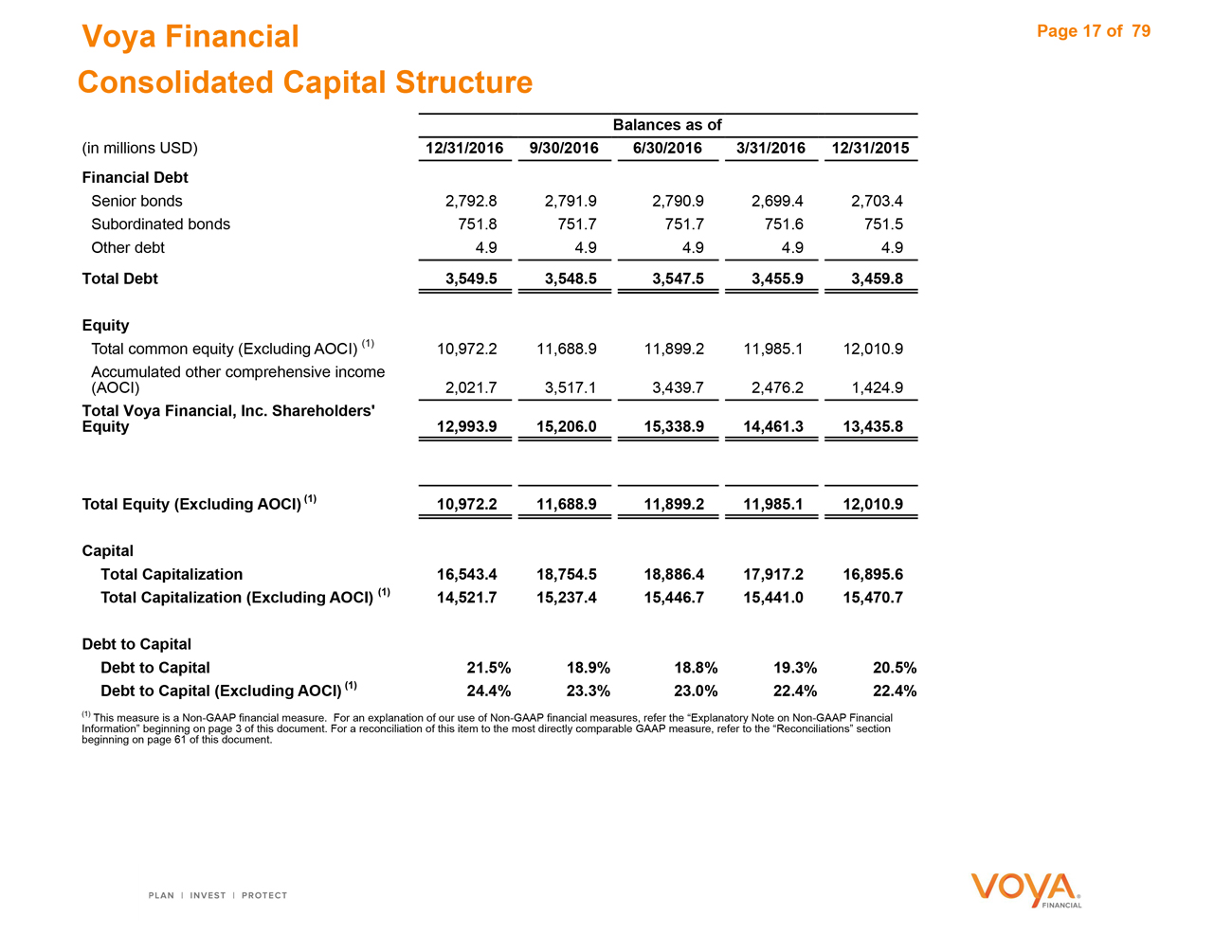

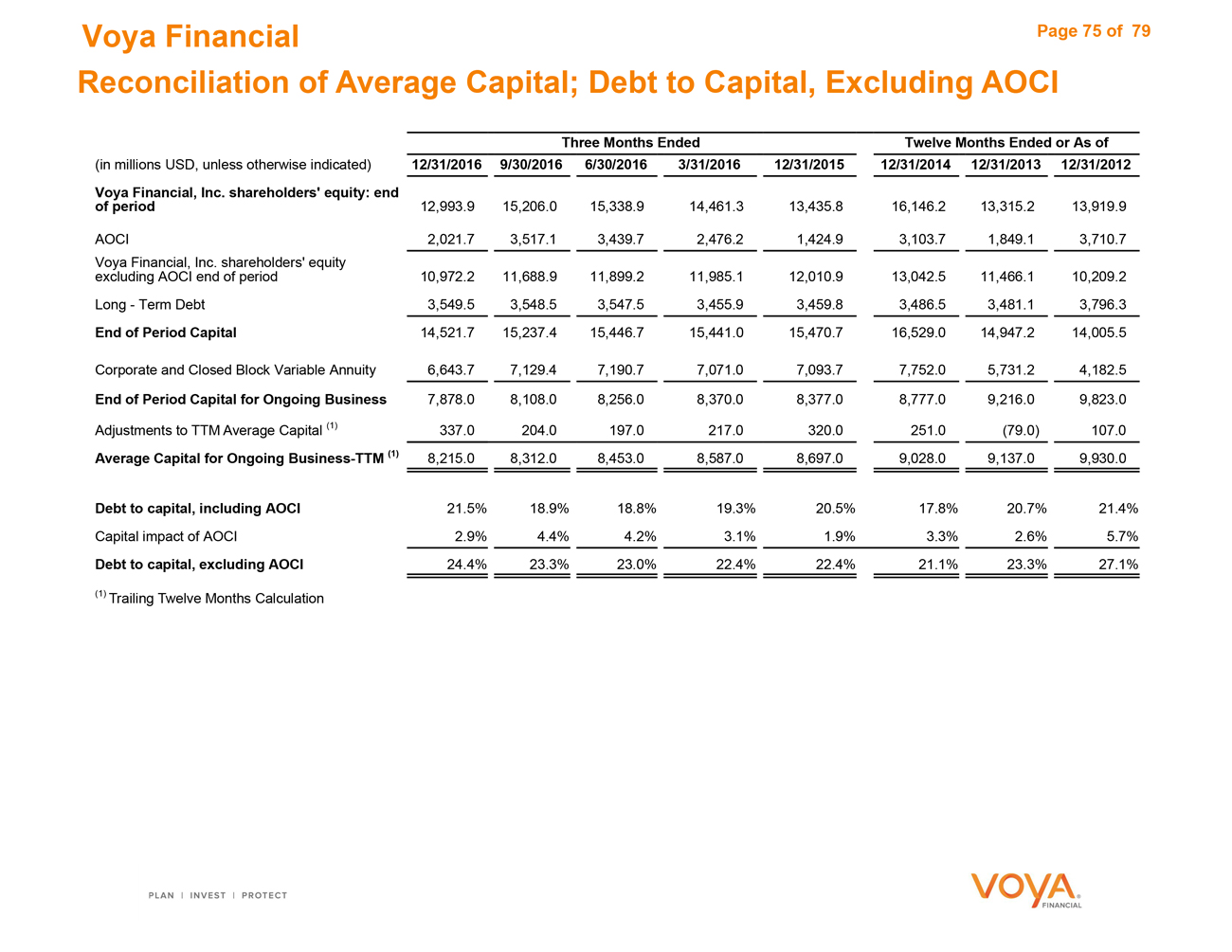

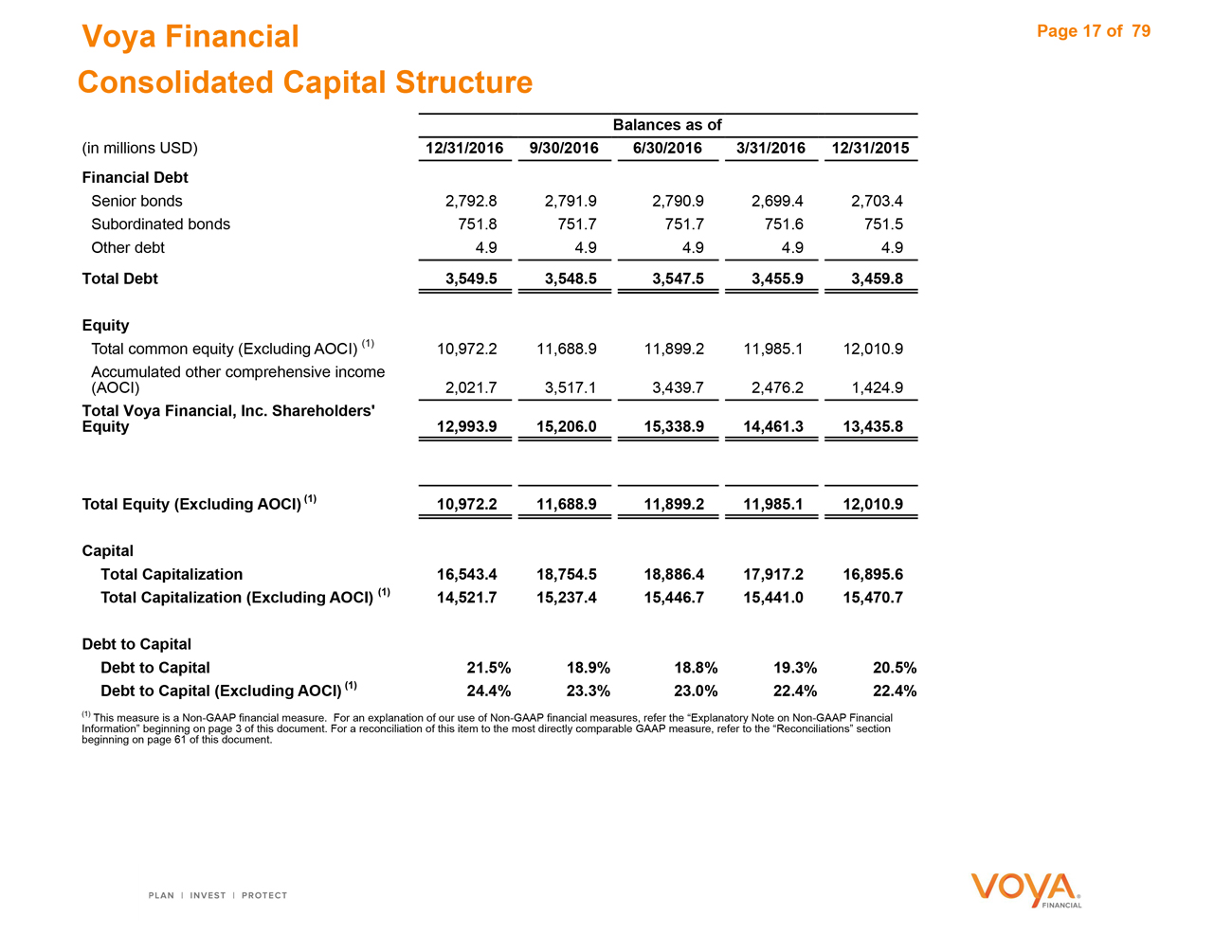

Voya Financial Page 17 of79 Consolidated Capital Structure Balances as of (in millions USD)12/31/2016 9/30/20166/30/20163/31/201612/31/2015 Financial Debt Senior bonds2,792.8 2,791.92,790.92,699.42,703.4 Subordinated bonds751.8 751.7751.7751.6751.5 Other debt4.9 4.94.94.94.9 Total Debt3,549.5 3,548.53,547.53,455.93,459.8 Equity Total common equity (Excluding AOCI) (1)10,972.2 11,688.911,899.211,985.112,010.9 Accumulated other comprehensive income (AOCI)2,021.7 3,517.13,439.72,476.21,424.9 Total Voya Financial, Inc. Shareholders’ Equity12,993.9 15,206.015,338.914,461.313,435.8 Total Equity (Excluding AOCI) (1)10,972.2 11,688.911,899.211,985.112,010.9 Capital Total Capitalization16,543.4 18,754.518,886.417,917.216,895.6 Total Capitalization (Excluding AOCI) (1)14,521.7 15,237.415,446.715,441.015,470.7 Debt to Capital Debt to Capital21.5% 18.9%18.8%19.3%20.5% Debt to Capital (Excluding AOCI) (1)24.4% 23.3%23.0%22.4%22.4% (1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer the “Explanatory Note on Non-GAAP Financial Information” beginning on page 3 of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Reconciliations” section beginning on page 61 of this document.

|

|

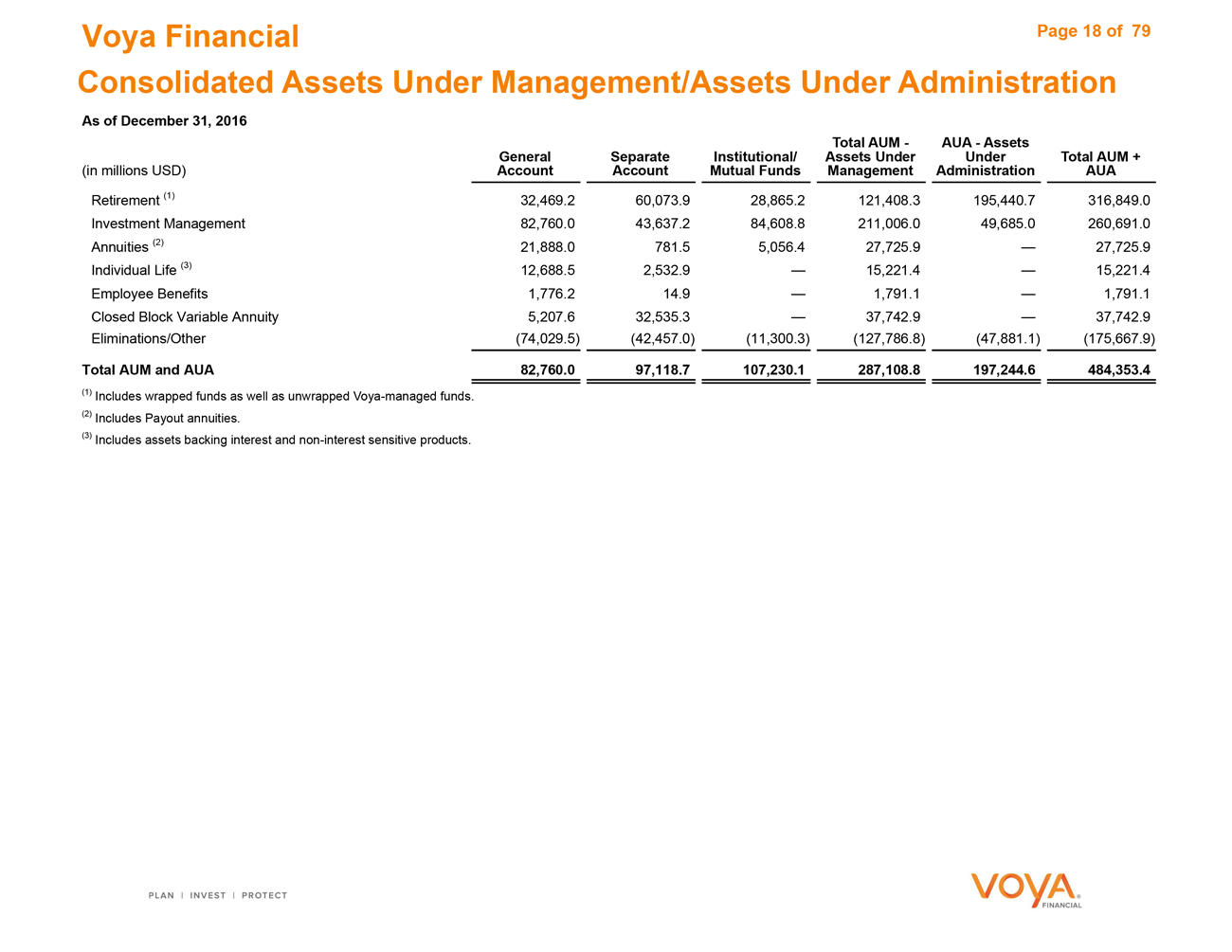

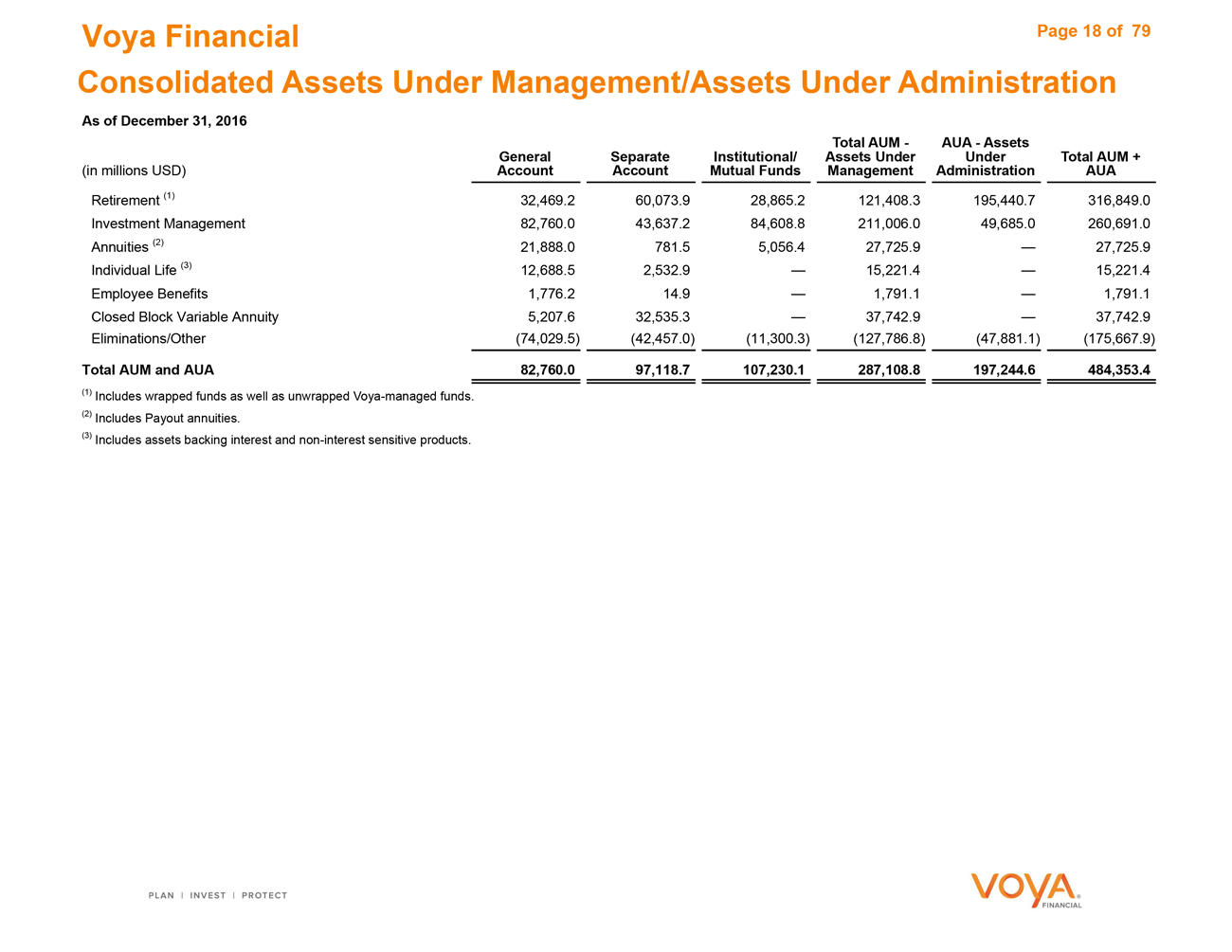

Voya Financial Page 18 of 79 Consolidated Assets Under Management/Assets Under Administration As of December 31, 2016 Total AUM -AUA—Assets GeneralSeparateInstitutional/Assets UnderUnderTotal AUM + (in millions USD)Account AccountMutual FundsManagementAdministrationAUA Retirement (1)32,469.2 60,073.928,865.2121,408.3195,440.7316,849.0 Investment Management82,760.0 43,637.284,608.8211,006.049,685.0260,691.0 Annuities (2)21,888.0 781.55,056.427,725.9—27,725.9 Individual Life (3)12,688.5 2,532.9—15,221.4—15,221.4 Employee Benefits1,776.2 14.9—1,791.1—1,791.1 Closed Block Variable Annuity5,207.6 32,535.3—37,742.9—37,742.9 Eliminations/Other(74,029.5) (42,457.0)(11,300.3)(127,786.8)(47,881.1)(175,667.9) Total AUM and AUA82,760.0 97,118.7107,230.1287,108.8197,244.6484,353.4 (1) Includes wrapped funds as well as unwrapped Voya-managed funds. (2) Includes Payout annuities. (3) Includes assets backing interest and non-interest sensitive products.

Retirement

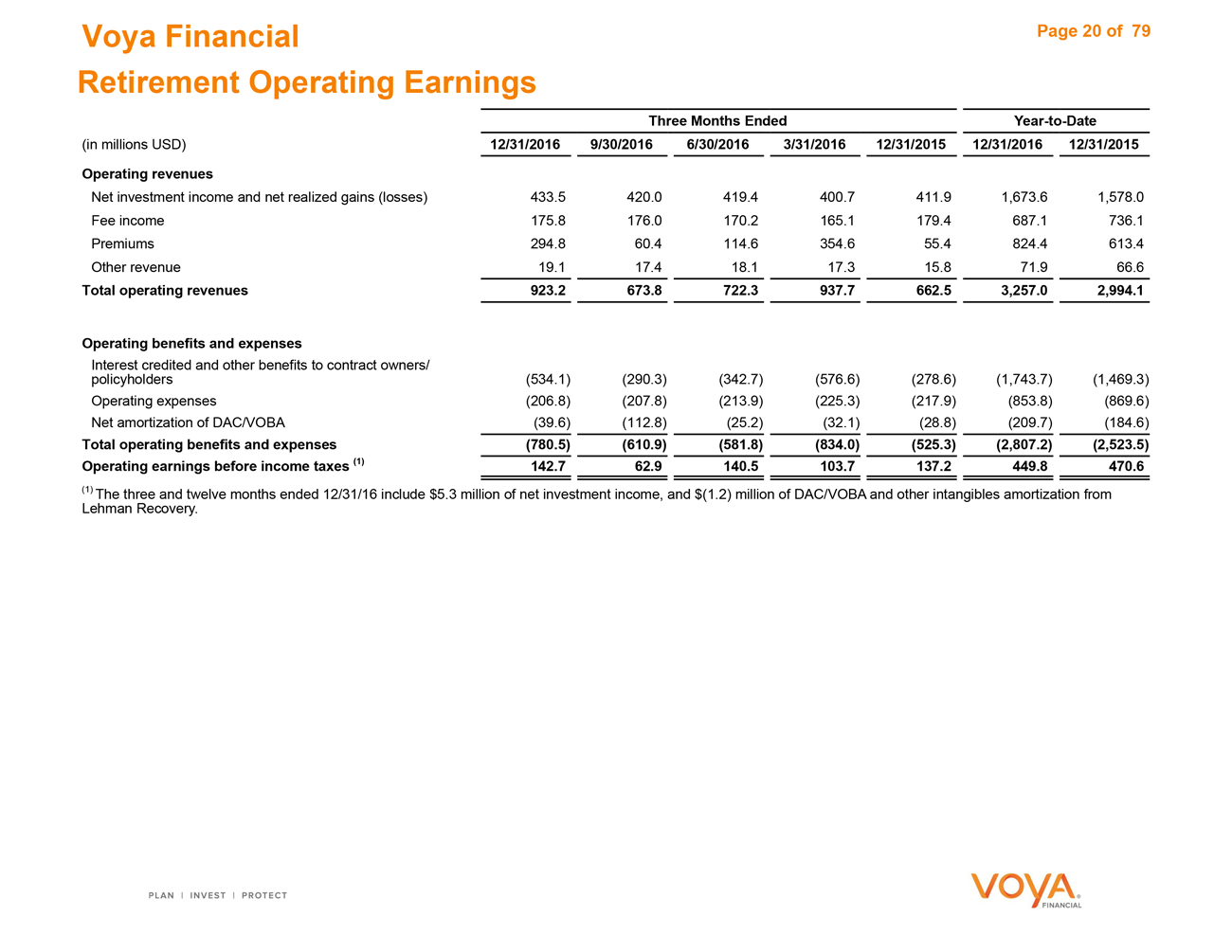

Voya Financial Page 20 of 79

Retirement Operating Earnings

Three MonthsEndedYear-to-Date

(in millions USD) 12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015

Operating revenues

Net investment income and net realized gains (losses) 433.5 420.0419.4400.7411.91,673.61,578.0

Fee income 175.8 176.0170.2165.1179.4687.1736.1

Premiums 294.8 60.4114.6354.655.4824.4613.4

Other revenue 19.1 17.418.117.315.871.966.6

Total operating revenues 923.2 673.8722.3937.7662.53,257.02,994.1

Operating benefits and expenses

Interest credited and other benefits to contract owners/

policyholders (534.1) (290.3)(342.7)(576.6)(278.6)(1,743.7)(1,469.3)

Operating expenses (206.8) (207.8)(213.9)(225.3)(217.9)(853.8)(869.6)

Net amortization of DAC/VOBA (39.6) (112.8)(25.2)(32.1)(28.8)(209.7)(184.6)

Total operating benefits and expenses (780.5) (610.9)(581.8)(834.0)(525.3)(2,807.2)(2,523.5)

Operating earnings before income taxes (1) 142.7 62.9140.5103.7137.2449.8470.6

(1) The three and twelve months ended 12/31/16 include $5.3 million of net investment income, and $(1.2) million of DAC/VOBA and other intangibles amortization from

Lehman Recovery.

|

|

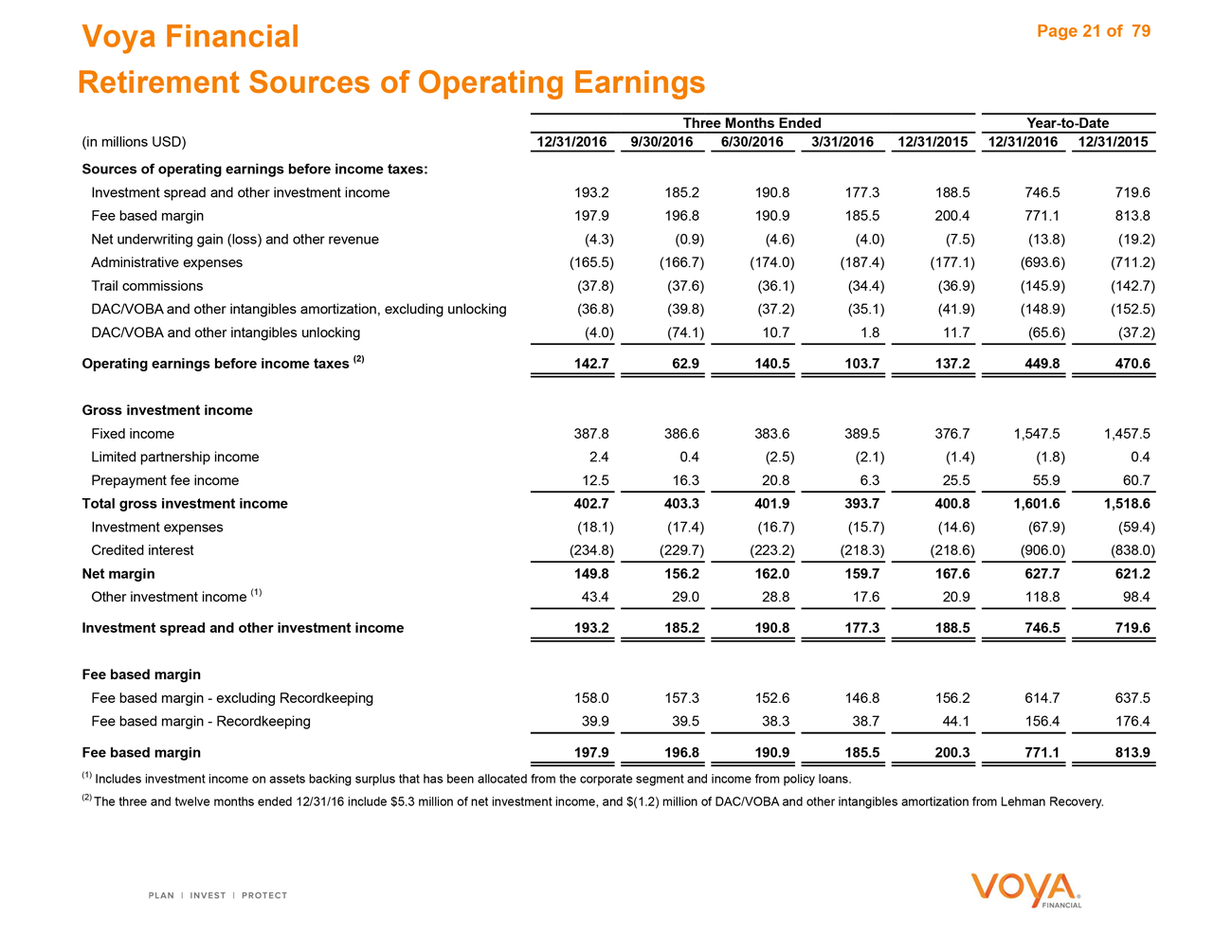

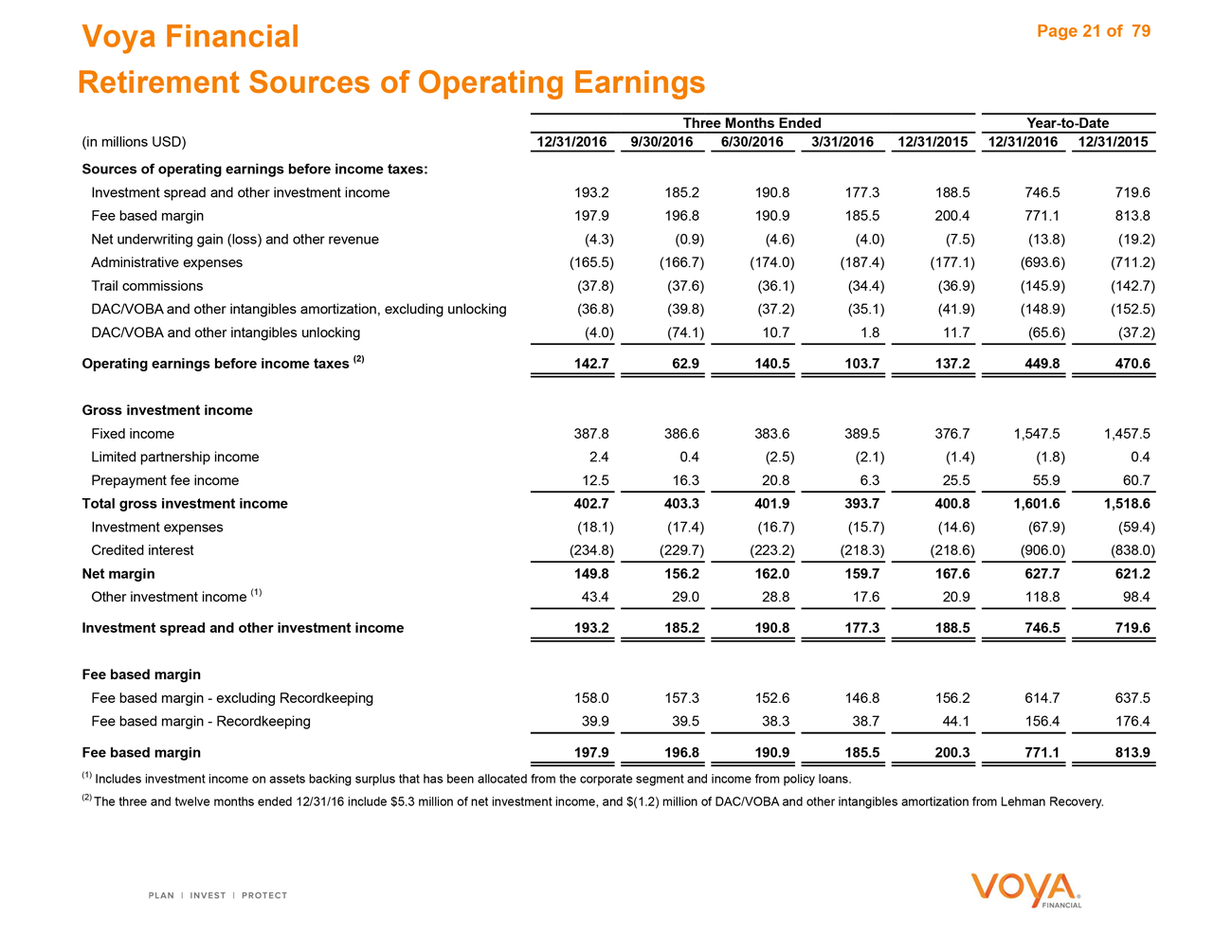

Voya Financial Page 21 of 79 Retirement Sources of Operating Earnings Three Months EndedYear-to-Date (in millions USD)12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Sources of operating earnings before income taxes: Investment spread and other investment income193.2 185.2190.8177.3188.5746.5719.6 Fee based margin197.9 196.8190.9185.5200.4771.1813.8 Net underwriting gain (loss) and other revenue(4.3) (0.9)(4.6)(4.0)(7.5)(13.8)(19.2) Administrative expenses(165.5) (166.7)(174.0)(187.4)(177.1)(693.6)(711.2) Trail commissions(37.8) (37.6)(36.1)(34.4)(36.9)(145.9)(142.7) DAC/VOBA and other intangibles amortization, excluding unlocking(36.8) (39.8)(37.2)(35.1)(41.9)(148.9)(152.5) DAC/VOBA and other intangibles unlocking(4.0) (74.1)10.71.811.7(65.6)(37.2) Operating earnings before income taxes (2)142.7 62.9140.5103.7137.2449.8470.6 Gross investment income Fixed income387.8 386.6383.6389.5376.71,547.51,457.5 Limited partnership income2.4 0.4(2.5)(2.1)(1.4)(1.8)0.4 Prepayment fee income12.5 16.320.86.325.555.960.7 Total gross investment income402.7 403.3401.9393.7400.81,601.61,518.6 Investment expenses(18.1) (17.4)(16.7)(15.7)(14.6)(67.9)(59.4) Credited interest(234.8) (229.7)(223.2)(218.3)(218.6)(906.0)(838.0) Net margin149.8 156.2162.0159.7167.6627.7621.2 Other investment income (1)43.4 29.028.817.620.9118.898.4 Investment spread and other investment income193.2 185.2190.8177.3188.5746.5719.6 Fee based margin Fee based margin—excluding Recordkeeping158.0 157.3152.6146.8156.2614.7637.5 Fee based margin—Recordkeeping39.9 39.538.338.744.1156.4176.4 Fee based margin197.9 196.8190.9185.5200.3771.1813.9 (1) Includes investment income on assets backing surplus that has been allocated from the corporate segment and income from policy loans. (2) The three and twelve months ended 12/31/16 include $5.3 million of net investment income, and $(1.2) million of DAC/VOBA and other intangibles amortization from Lehman Recovery.

|

|

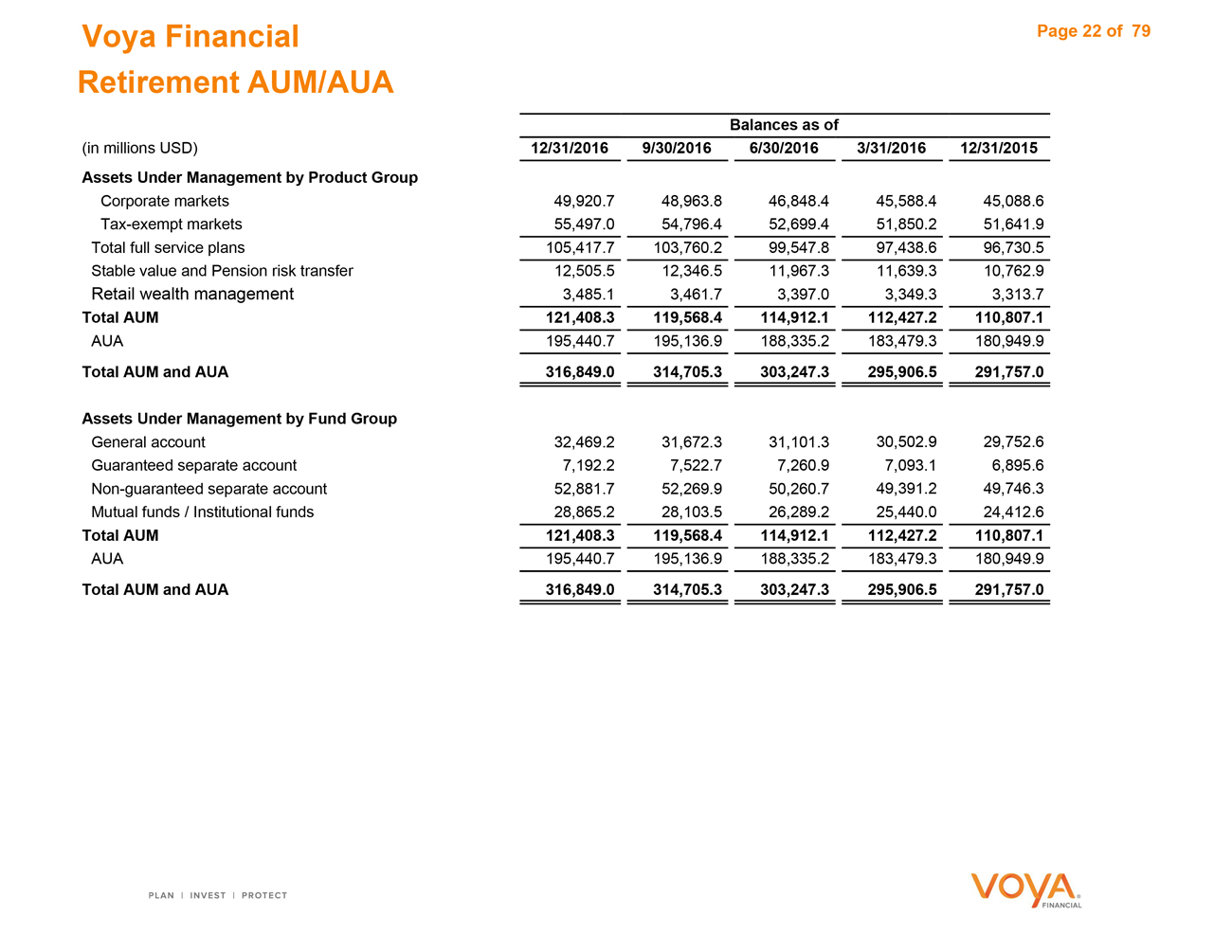

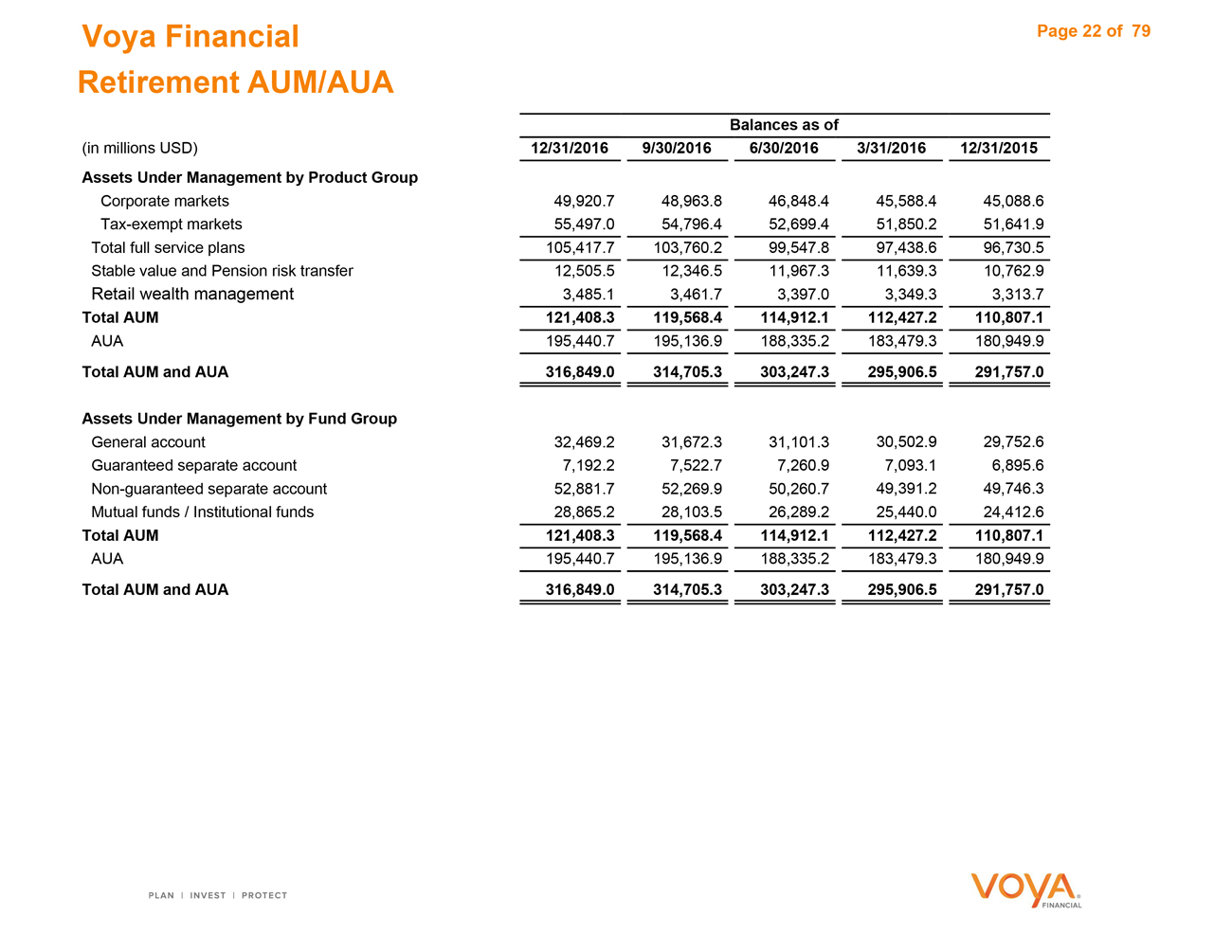

Voya Financial Page 22 of79

Retirement AUM/AUA

Balances as of

(in millions USD) 12/31/2016 9/30/20166/30/20163/31/201612/31/2015

Assets Under Management by Product Group

Corporate markets 49,920.7 48,963.846,848.445,588.445,088.6

Tax-exempt markets 55,497.0 54,796.452,699.451,850.251,641.9

Total full service plans 105,417.7 103,760.299,547.897,438.696,730.5

Stable value and Pension risk transfer 12,505.5 12,346.511,967.311,639.310,762.9

Retail wealth management 3,485.1 3,461.73,397.03,349.33,313.7

Total AUM 121,408.3 119,568.4114,912.1112,427.2110,807.1

AUA 195,440.7 195,136.9188,335.2183,479.3180,949.9

Total AUM and AUA 316,849.0 314,705.3303,247.3295,906.5291,757.0

Assets Under Management by Fund Group

General account 32,469.2 31,672.331,101.330,502.929,752.6

Guaranteed separate account 7,192.2 7,522.77,260.97,093.16,895.6

Non-guaranteed separate account 52,881.7 52,269.950,260.749,391.249,746.3

Mutual funds / Institutional funds 28,865.2 28,103.526,289.225,440.024,412.6

Total AUM 121,408.3 119,568.4114,912.1112,427.2110,807.1

AUA 195,440.7 195,136.9188,335.2183,479.3180,949.9

Total AUM and AUA 316,849.0 314,705.3303,247.3295,906.5291,757.0

|

|

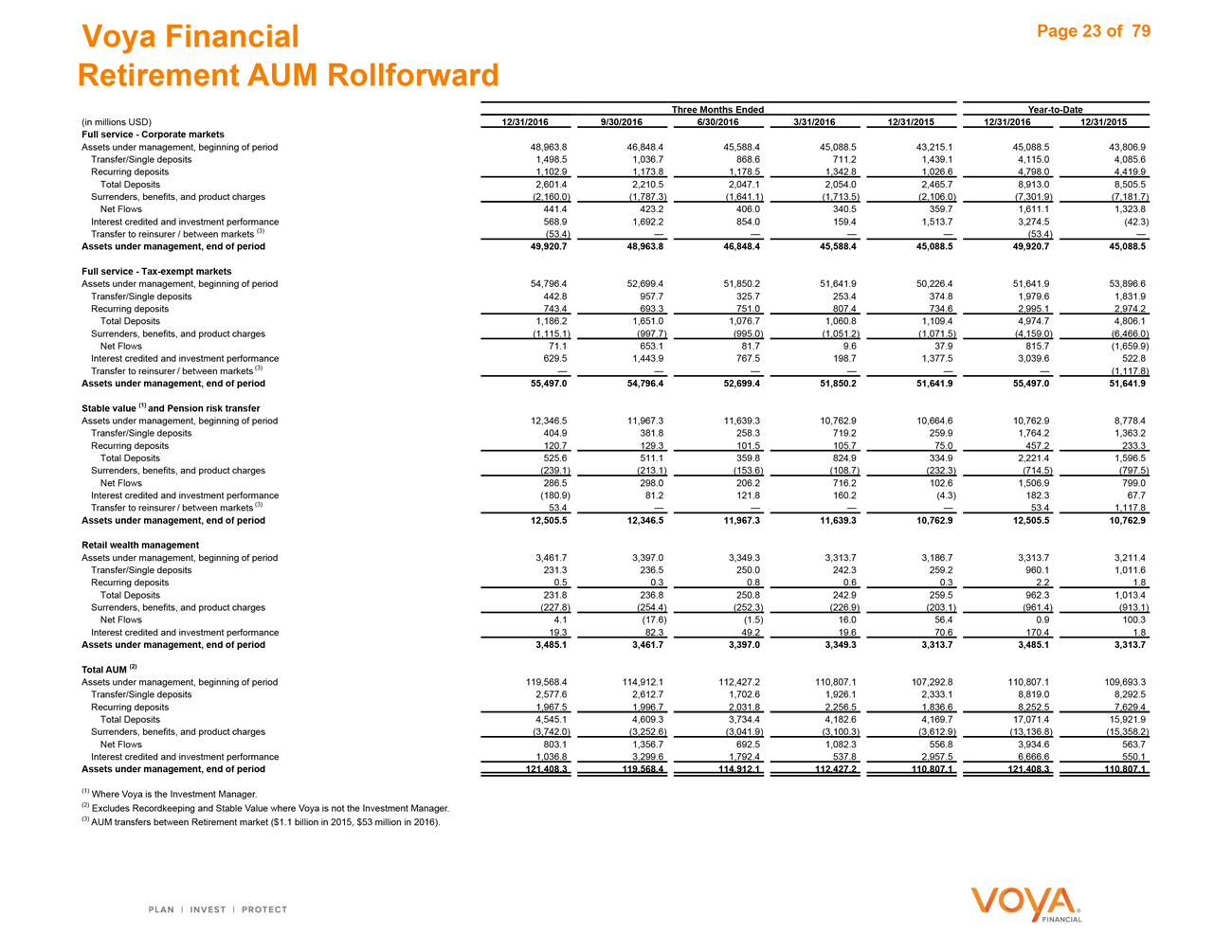

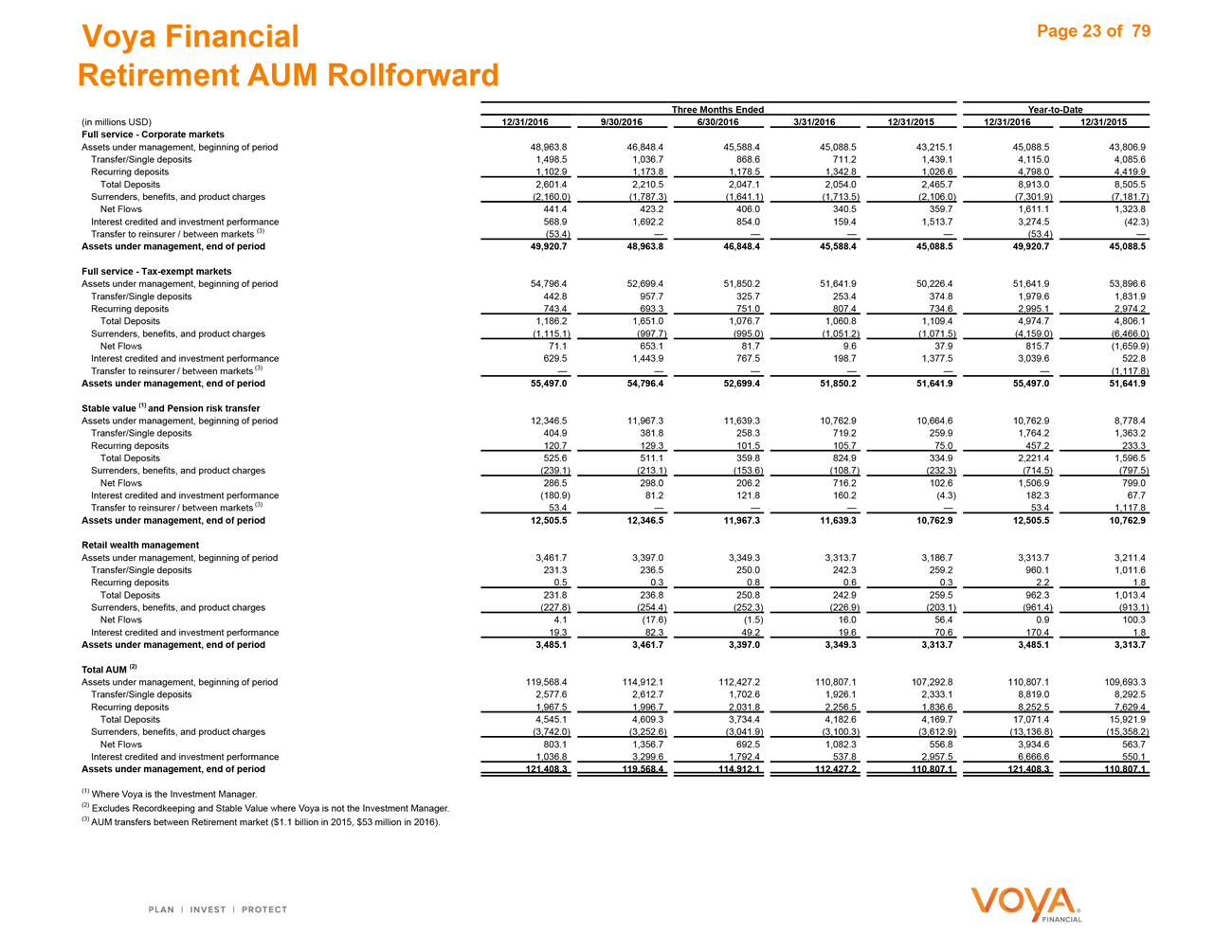

Voya Financial Page 23 of 79 Retirement AUM Rollforward Three Months EndedYear-to-Date (in millions USD)12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Full service—Corporate markets Assets under management, beginning of period48,963.8 46,848.445,588.445,088.543,215.145,088.543,806.9 Transfer/Single deposits1,498.5 1,036.7868.6711.21,439.14,115.04,085.6 Recurring deposits1,102.9 1,173.81,178.51,342.81,026.64,798.04,419.9 Total Deposits2,601.4 2,210.52,047.12,054.02,465.78,913.08,505.5 Surrenders, benefits, and product charges(2,160.0) (1,787.3)(1,641.1)(1,713.5)(2,106.0)(7,301.9)(7,181.7) Net Flows441.4 423.2406.0340.5359.71,611.11,323.8 Interest credited and investment performance568.9 1,692.2854.0159.41,513.73,274.5(42.3) Transfer to reinsurer / between markets (3)(53.4) ————(53.4)— Assets under management, end of period49,920.7 48,963.846,848.445,588.445,088.549,920.745,088.5 Full service—Tax-exempt markets Assets under management, beginning of period54,796.4 52,699.451,850.251,641.950,226.451,641.953,896.6 Transfer/Single deposits442.8 957.7325.7253.4374.81,979.61,831.9 Recurring deposits743.4 693.3751.0807.4734.62,995.12,974.2 Total Deposits1,186.2 1,651.01,076.71,060.81,109.44,974.74,806.1 Surrenders, benefits, and product charges(1,115.1) (997.7)(995.0)(1,051.2)(1,071.5)(4,159.0)(6,466.0) Net Flows71.1 653.181.79.637.9815.7(1,659.9) Interest credited and investment performance629.5 1,443.9767.5198.71,377.53,039.6522.8 Transfer to reinsurer / between markets (3)— —————(1,117.8) Assets under management, end of period55,497.0 54,796.452,699.451,850.251,641.955,497.051,641.9 Stable value (1) and Pension risk transfer Assets under management, beginning of period12,346.5 11,967.311,639.310,762.910,664.610,762.98,778.4 Transfer/Single deposits404.9 381.8258.3719.2259.91,764.21,363.2 Recurring deposits120.7 129.3101.5105.775.0457.2233.3 Total Deposits525.6 511.1359.8824.9334.92,221.41,596.5 Surrenders, benefits, and product charges(239.1) (213.1)(153.6)(108.7)(232.3)(714.5)(797.5) Net Flows286.5 298.0206.2716.2102.61,506.9799.0 Interest credited and investment performance(180.9) 81.2121.8160.2(4.3)182.367.7 Transfer to reinsurer / between markets (3)53.4 ————53.41,117.8 Assets under management, end of period12,505.5 12,346.511,967.311,639.310,762.912,505.510,762.9 Retail wealth management Assets under management, beginning of period3,461.7 3,397.03,349.33,313.73,186.73,313.73,211.4 Transfer/Single deposits231.3 236.5250.0242.3259.2960.11,011.6 Recurring deposits0.5 0.30.80.60.32.21.8 Total Deposits231.8 236.8250.8242.9259.5962.31,013.4 Surrenders, benefits, and product charges(227.8) (254.4)(252.3)(226.9)(203.1)(961.4)(913.1) Net Flows4.1 (17.6)(1.5)16.056.40.9100.3 Interest credited and investment performance19.3 82.349.219.670.6170.41.8 Assets under management, end of period3,485.1 3,461.73,397.03,349.33,313.73,485.13,313.7 Total AUM (2) Assets under management, beginning of period119,568.4 114,912.1112,427.2110,807.1107,292.8110,807.1109,693.3 Transfer/Single deposits2,577.6 2,612.71,702.61,926.12,333.18,819.08,292.5 Recurring deposits1,967.5 1,996.72,031.82,256.51,836.68,252.57,629.4 Total Deposits4,545.1 4,609.33,734.44,182.64,169.717,071.415,921.9 Surrenders, benefits, and product charges(3,742.0) (3,252.6)(3,041.9)(3,100.3)(3,612.9)(13,136.8)(15,358.2) Net Flows803.1 1,356.7692.51,082.3556.83,934.6563.7 Interest credited and investment performance1,036.8 3,299.61,792.4537.82,957.56,666.6550.1 Assets under management, end of period121,408.3 119,568.4114,912.1112,427.2110,807.1121,408.3110,807.1 (1) Where Voya is the Investment Manager. (2) Excludes Recordkeeping and Stable Value where Voya is not the Investment Manager. (3) AUM transfers between Retirement market ($1.1 billion in 2015, $53 million in 2016).

|

|

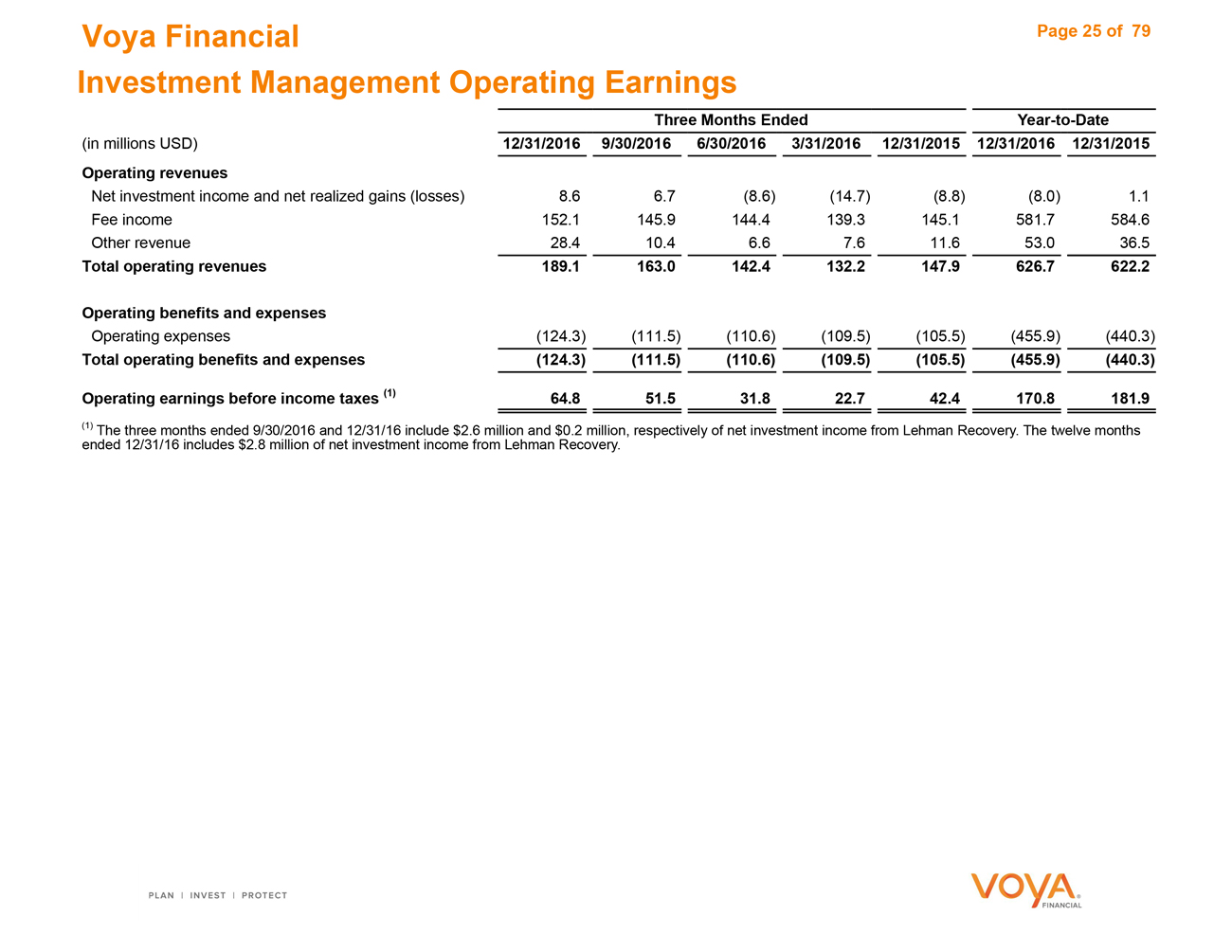

Investment Management

Voya Financial Page 25 of 79

Investment Management Operating Earnings

Three MonthsEndedYear-to-Date

(in millions USD) 12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015

Operating revenues

Net investment income and net realized gains (losses) 8.6 6.7(8.6)(14.7)(8.8)(8.0)1.1

Fee income 152.1 145.9144.4139.3145.1581.7584.6

Other revenue 28.4 10.46.67.611.653.036.5

Total operating revenues 189.1 163.0142.4132.2147.9626.7622.2

Operating benefits and expenses

Operating expenses (124.3) (111.5)(110.6)(109.5)(105.5)(455.9)(440.3)

Total operating benefits and expenses (124.3) (111.5)(110.6)(109.5)(105.5)(455.9)(440.3)

Operating earnings before income taxes (1) 64.8 51.531.822.742.4170.8181.9

(1) The three months ended 9/30/2016 and 12/31/16 include $2.6 million and $0.2 million, respectively of net investment income from Lehman Recovery. The twelve months

ended 12/31/16 includes $2.8 million of net investment income from Lehman Recovery.

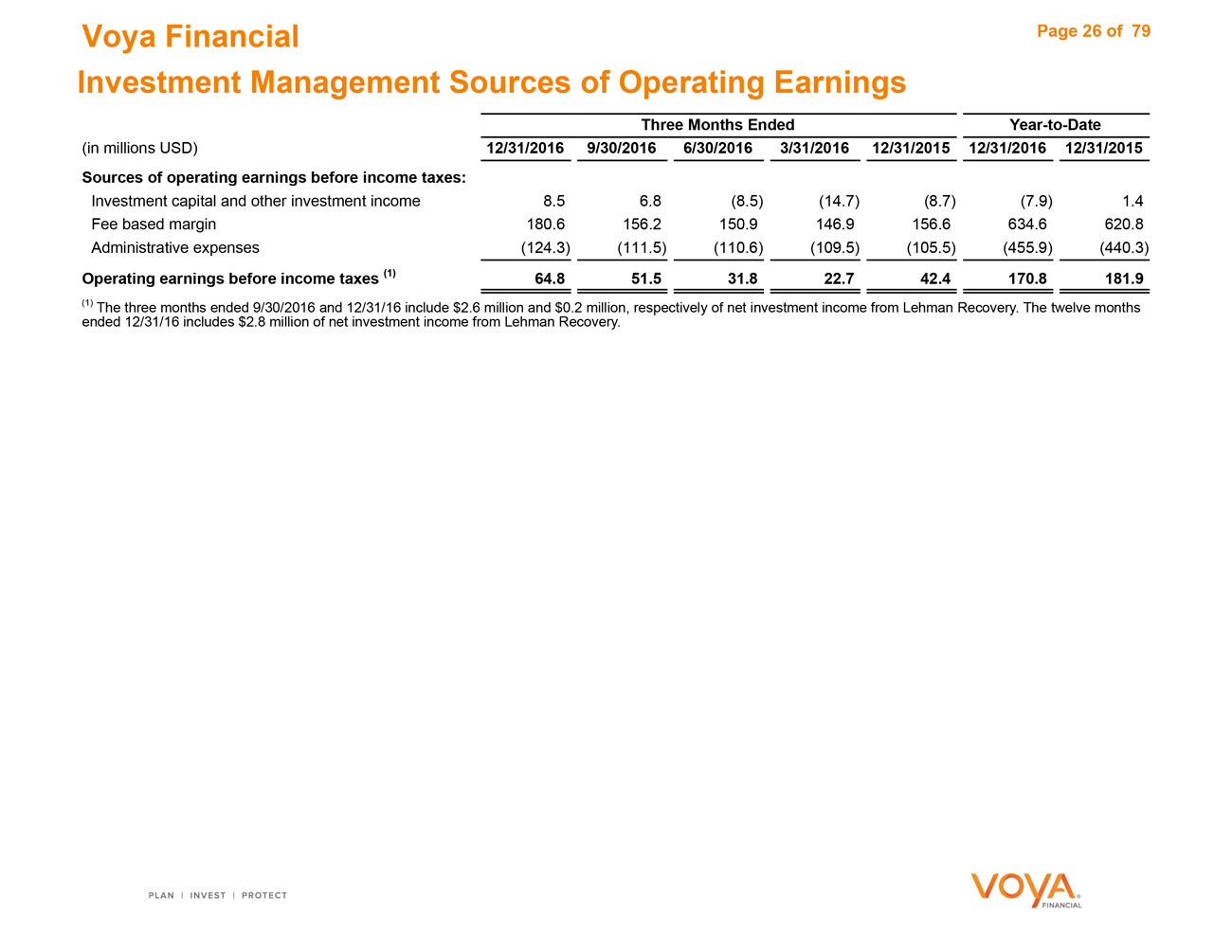

Voya Financial Page 26 of 79 Investment Management Sources of Operating Earnings Three MonthsEndedYear-to-Date (in millions USD) 12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Sources of operating earnings before income taxes: Investment capital and other investment income 8.5 6.8(8.5)(14.7)(8.7)(7.9)1.4 Fee based margin 180.6 156.2150.9146.9156.6634.6620.8 Administrative expenses (124.3) (111.5)(110.6)(109.5)(105.5)(455.9)(440.3) Operating earnings before income taxes (1) 64.8 51.531.822.742.4170.8181.9 (1) The three months ended 9/30/2016 and 12/31/16 include $2.6 million and $0.2 million, respectively of net investment income from Lehman Recovery. The twelve months ended 12/31/16 includes $2.8 million of net investment income from Lehman Recovery.

|

|

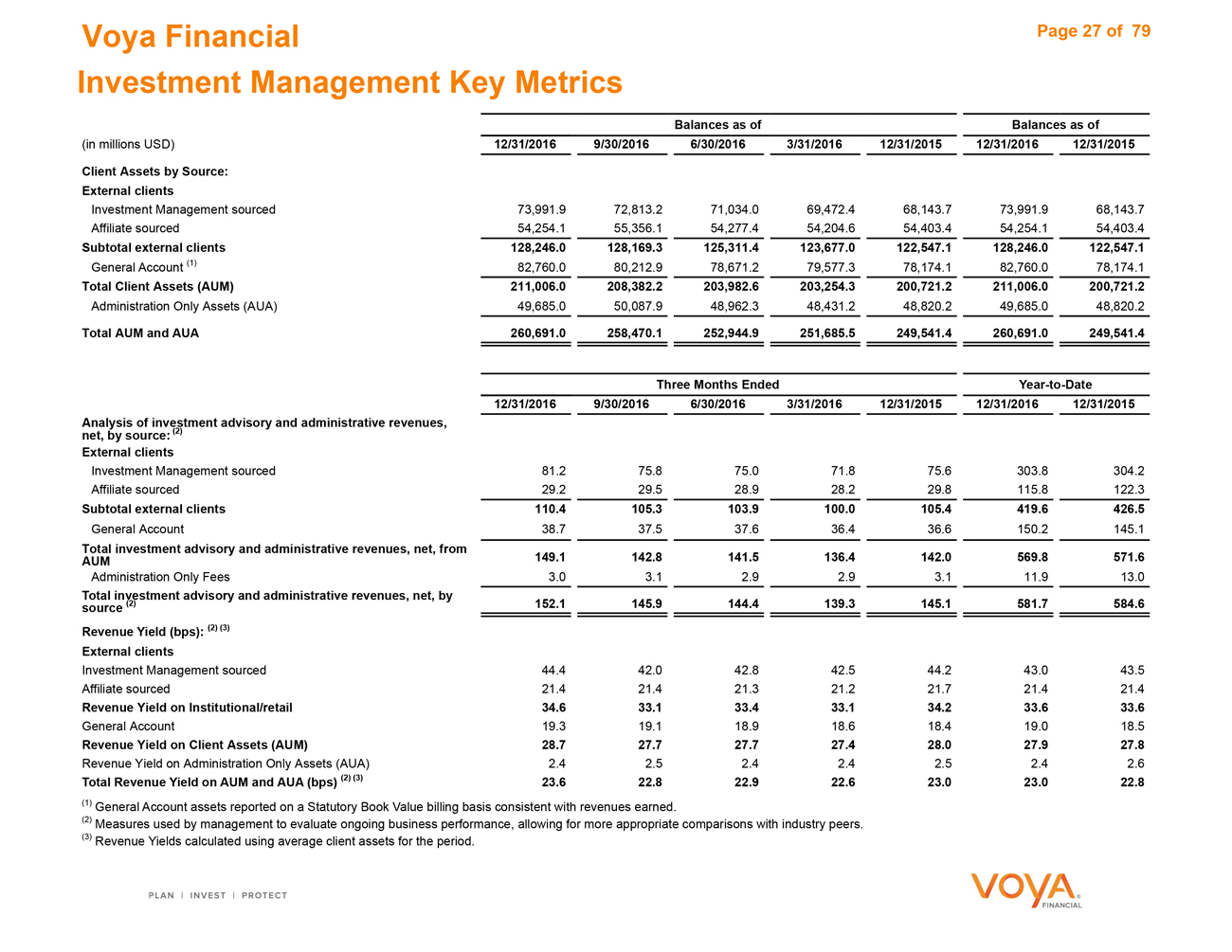

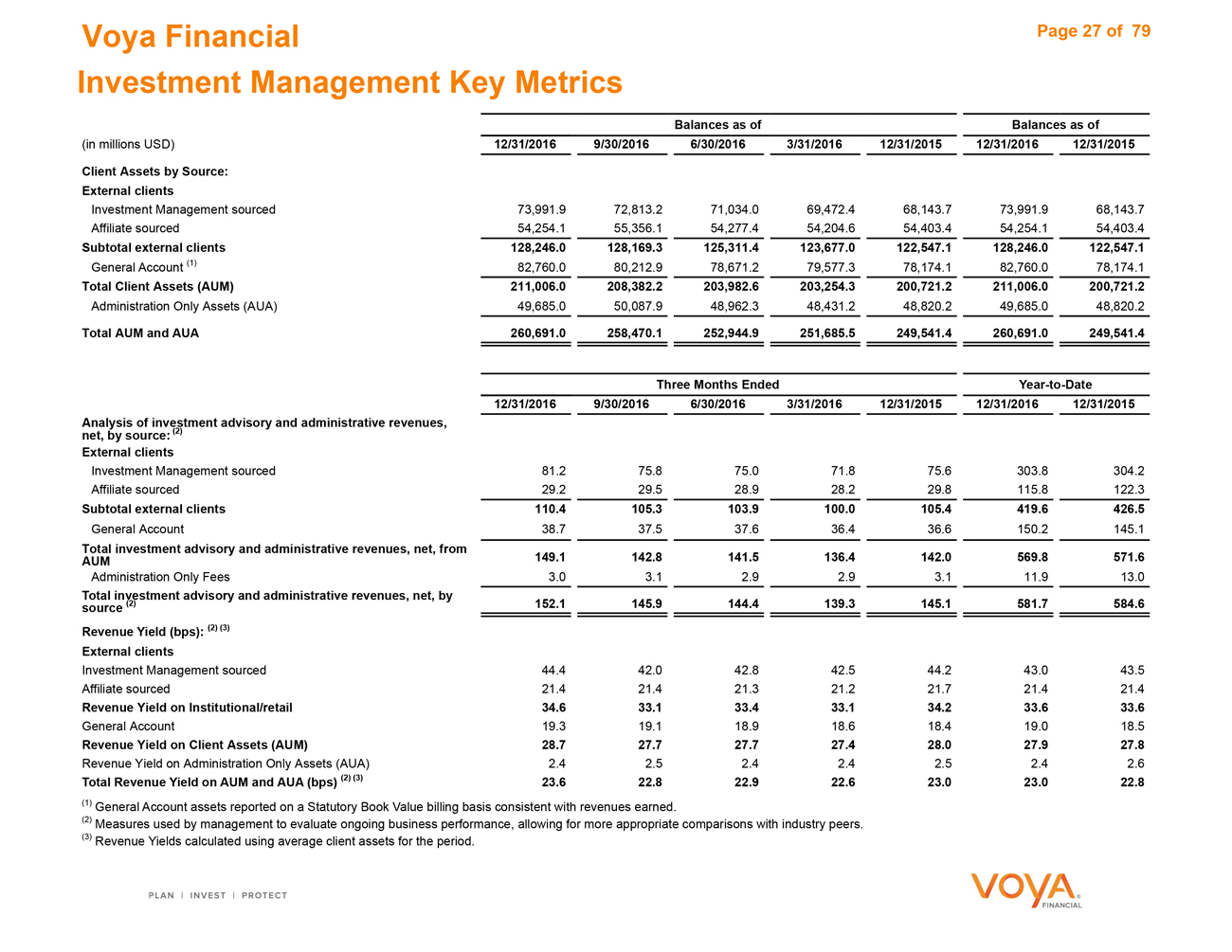

Voya Financial Page 27 of 79 Investment Management Key Metrics Balances as ofBalances as of (in millions USD)12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Client Assets by Source: External clients Investment Management sourced73,991.9 72,813.271,034.069,472.468,143.773,991.968,143.7 Affiliate sourced54,254.1 55,356.154,277.454,204.654,403.454,254.154,403.4 Subtotal external clients128,246.0 128,169.3125,311.4123,677.0122,547.1128,246.0122,547.1 General Account (1)82,760.0 80,212.978,671.279,577.378,174.182,760.078,174.1 Total Client Assets (AUM)211,006.0 208,382.2203,982.6203,254.3200,721.2211,006.0200,721.2 Administration Only Assets (AUA)49,685.0 50,087.948,962.348,431.248,820.249,685.048,820.2 Total AUM and AUA260,691.0 258,470.1252,944.9251,685.5249,541.4260,691.0249,541.4 Three Months EndedYear-to-Date 12/31/20169/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Analysis of investment advisory and administrative revenues, net, by source: (2) External clients Investment Management sourced81.2 75.875.071.875.6303.8304.2 Affiliate sourced29.2 29.528.928.229.8115.8122.3 Subtotal external clients110.4 105.3103.9100.0105.4419.6426.5 General Account38.7 37.537.636.436.6150.2145.1 Total investment advisory and administrative revenues, net, from149.1 142.8141.5136.4 AUM 142.0569.8571.6 Administration Only Fees3.0 3.12.92.93.111.913.0 Total investment advisory and administrative revenues, net, by source (2)152.1 145.9144.4139.3145.1581.7584.6 Revenue Yield (bps): (2) (3) External clients Investment Management sourced44.4 42.042.842.544.243.043.5 Affiliate sourced21.4 21.421.321.221.721.421.4 Revenue Yield on Institutional/retail34.6 33.133.433.134.233.633.6 General Account19.3 19.118.918.618.419.018.5 Revenue Yield on Client Assets (AUM)28.7 27.727.727.428.027.927.8 Revenue Yield on Administration Only Assets (AUA)2.4 2.52.42.42.52.42.6 Total Revenue Yield on AUM and AUA (bps) (2) (3)23.6 22.822.922.623.023.022.8 (1) General Account assets reported on a Statutory Book Value billing basis consistent with revenues earned. (2) Measures used by management to evaluate ongoing business performance, allowing for more appropriate comparisons with industry peers. (3) Revenue Yields calculated using average client assets for the period.

|

|

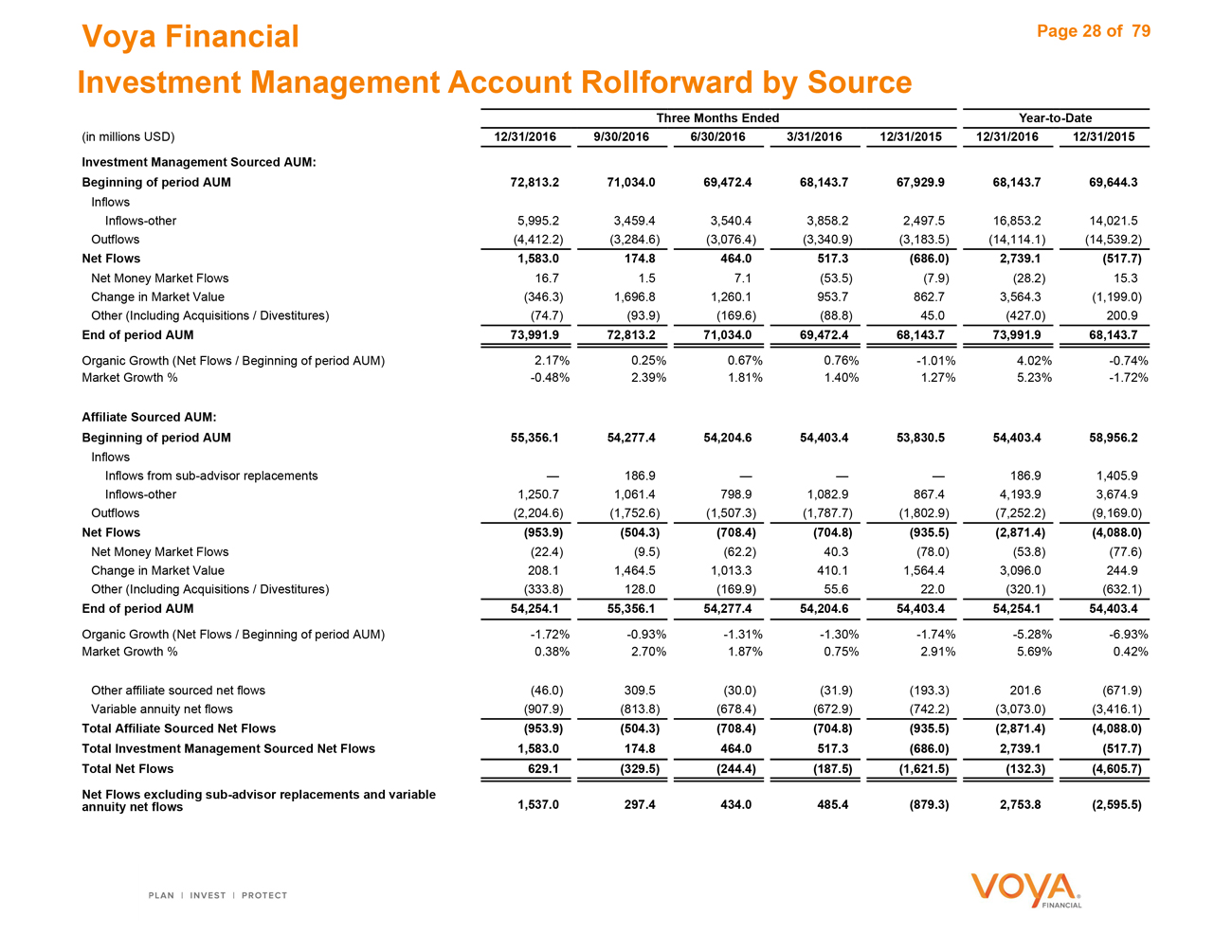

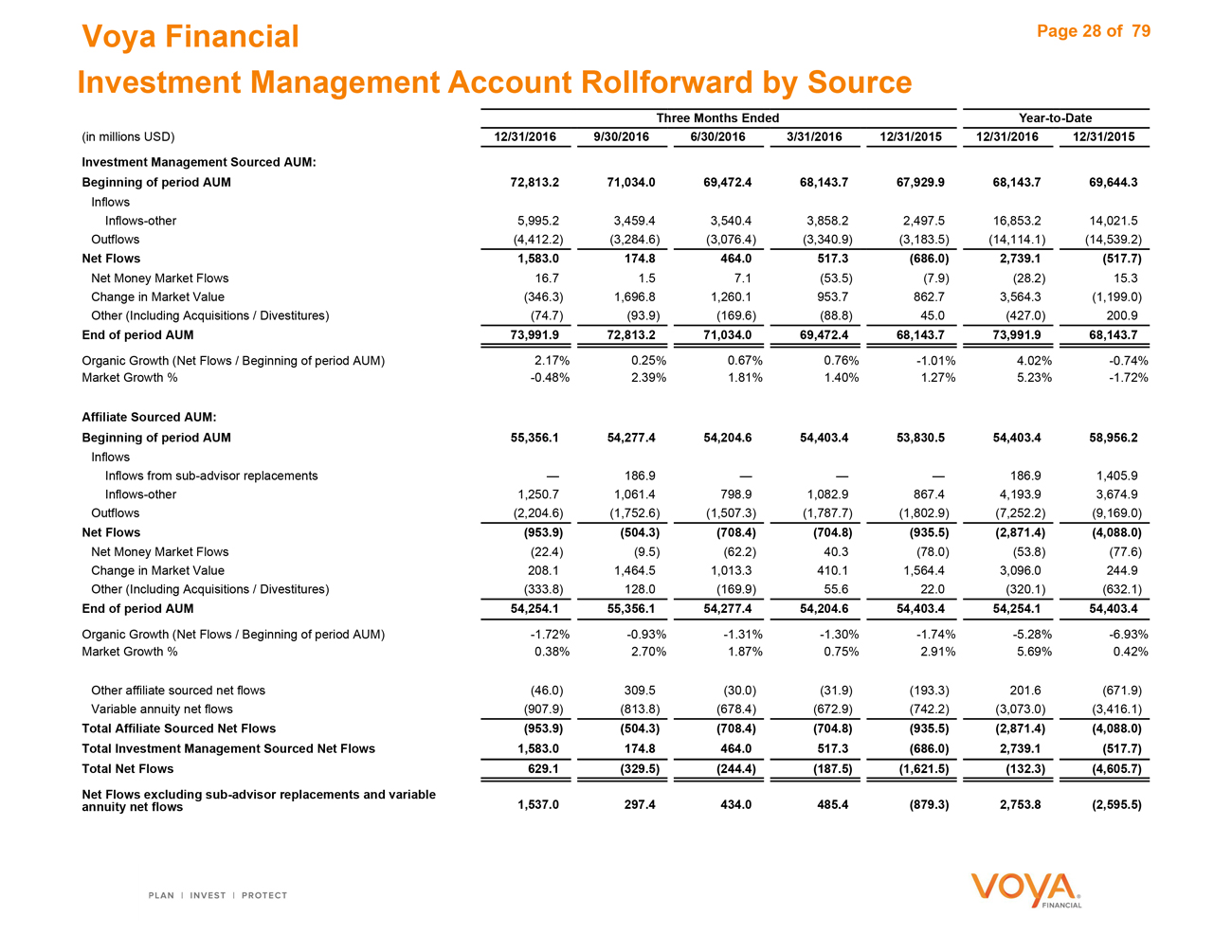

Voya Financial Page 28 of 79 Investment Management Account Rollforward by Source Three Months EndedYear-to-Date (in millions USD)12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Investment Management Sourced AUM: Beginning of period AUM72,813.2 71,034.069,472.468,143.767,929.968,143.769,644.3 Inflows Inflows-other5,995.2 3,459.43,540.43,858.22,497.516,853.214,021.5 Outflows(4,412.2) (3,284.6)(3,076.4)(3,340.9)(3,183.5)(14,114.1)(14,539.2) Net Flows1,583.0 174.8464.0517.3(686.0)2,739.1(517.7) Net Money Market Flows16.7 1.57.1(53.5)(7.9)(28.2)15.3 Change in Market Value(346.3) 1,696.81,260.1953.7862.73,564.3(1,199.0) Other (Including Acquisitions / Divestitures)(74.7) (93.9)(169.6)(88.8)45.0(427.0)200.9 End of period AUM73,991.9 72,813.271,034.069,472.468,143.773,991.968,143.7 Organic Growth (Net Flows / Beginning of period AUM)2.17% 0.25%0.67%0.76%-1.01%4.02%-0.74% Market Growth %-0.48% 2.39%1.81%1.40%1.27%5.23%-1.72% Affiliate Sourced AUM: Beginning of period AUM55,356.1 54,277.454,204.654,403.453,830.554,403.458,956.2 Inflows Inflows from sub-advisor replacements— 186.9———186.91,405.9 Inflows-other1,250.7 1,061.4798.91,082.9867.44,193.93,674.9 Outflows(2,204.6) (1,752.6)(1,507.3)(1,787.7)(1,802.9)(7,252.2)(9,169.0) Net Flows(953.9) (504.3)(708.4)(704.8)(935.5)(2,871.4)(4,088.0) Net Money Market Flows(22.4) (9.5)(62.2)40.3(78.0)(53.8)(77.6) Change in Market Value208.1 1,464.51,013.3410.11,564.43,096.0244.9 Other (Including Acquisitions / Divestitures)(333.8) 128.0(169.9)55.622.0(320.1)(632.1) End of period AUM54,254.1 55,356.154,277.454,204.654,403.454,254.154,403.4 Organic Growth (Net Flows / Beginning of period AUM)-1.72% -0.93%-1.31%-1.30%-1.74%-5.28%-6.93% Market Growth %0.38% 2.70%1.87%0.75%2.91%5.69%0.42% Other affiliate sourced net flows(46.0) 309.5(30.0)(31.9)(193.3)201.6(671.9) Variable annuity net flows(907.9) (813.8)(678.4)(672.9)(742.2)(3,073.0)(3,416.1) Total Affiliate Sourced Net Flows(953.9) (504.3)(708.4)(704.8)(935.5)(2,871.4)(4,088.0) Total Investment Management Sourced Net Flows1,583.0 174.8464.0517.3(686.0)2,739.1(517.7) Total Net Flows629.1 (329.5)(244.4)(187.5)(1,621.5)(132.3)(4,605.7) Net Flows excluding sub-advisor replacements and variable annuity net flows1,537.0 297.4434.0485.4(879.3)2,753.8(2,595.5)

|

|

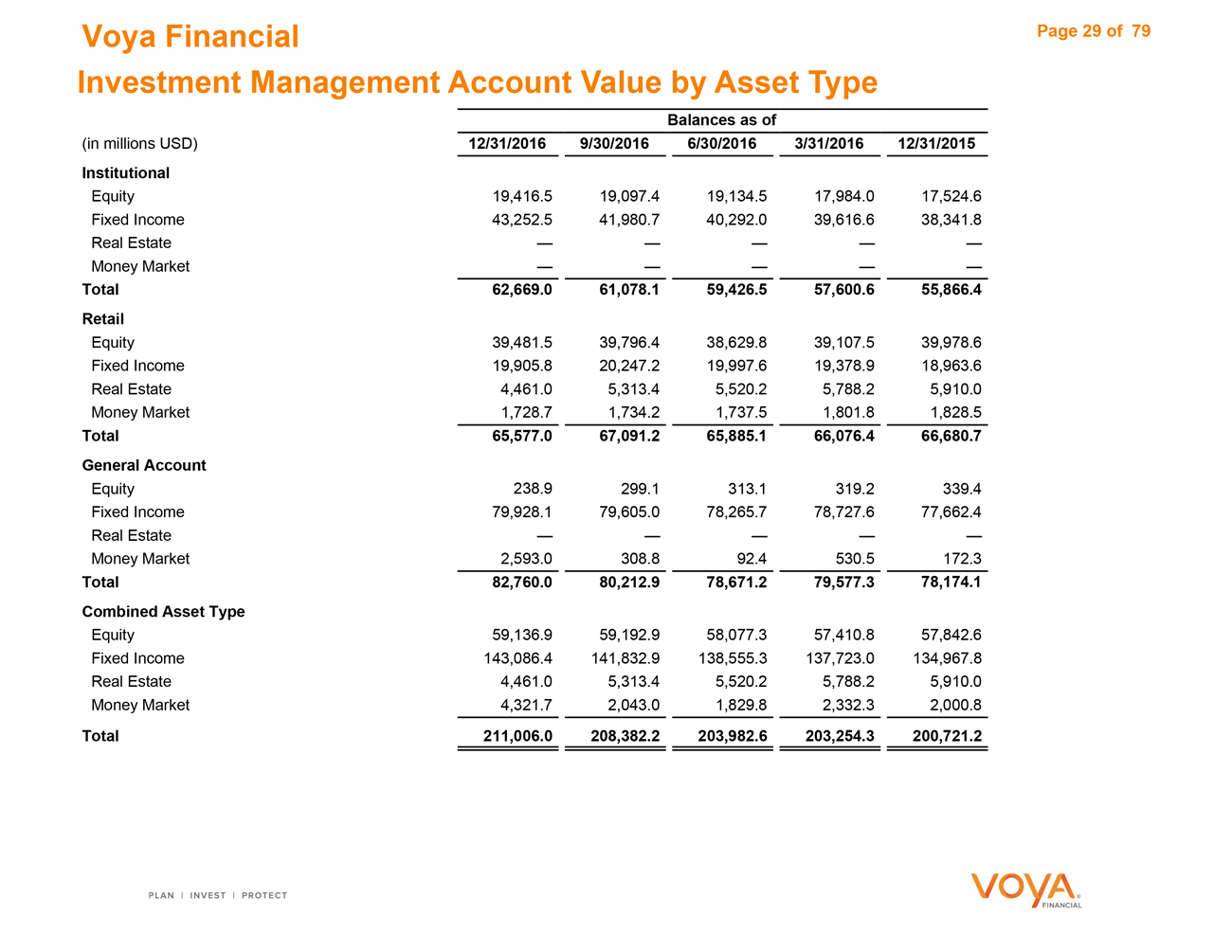

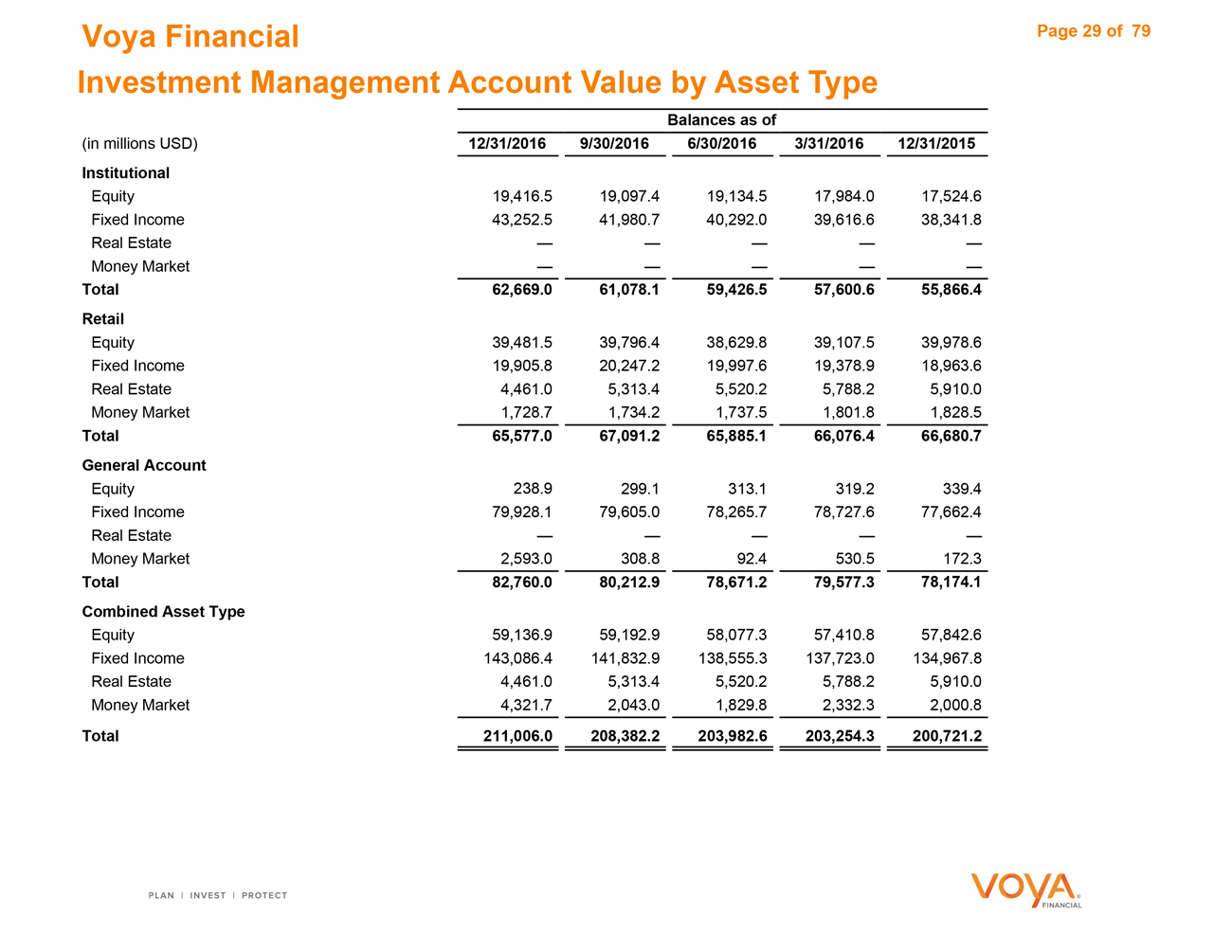

Voya Financial Page 29 of79

Investment Management Account Value by Asset Type

Balances as of

(in millions USD) 12/31/2016 9/30/20166/30/20163/31/201612/31/2015

Institutional

Equity 19,416.5 19,097.419,134.517,984.017,524.6

Fixed Income 43,252.5 41,980.740,292.039,616.638,341.8

Real Estate — ————

Money Market — ————

Total 62,669.0 61,078.159,426.557,600.655,866.4

Retail

Equity 39,481.5 39,796.438,629.839,107.539,978.6

Fixed Income 19,905.8 20,247.219,997.619,378.918,963.6

Real Estate 4,461.0 5,313.45,520.25,788.25,910.0

Money Market 1,728.7 1,734.21,737.51,801.81,828.5

Total 65,577.0 67,091.265,885.166,076.466,680.7

General Account

Equity 238.9 299.1313.1319.2339.4

Fixed Income 79,928.1 79,605.078,265.778,727.677,662.4

Real Estate — ————

Money Market 2,593.0 308.892.4530.5172.3

Total 82,760.0 80,212.978,671.279,577.378,174.1

Combined Asset Type

Equity 59,136.9 59,192.958,077.357,410.857,842.6

Fixed Income 143,086.4 141,832.9138,555.3137,723.0134,967.8

Real Estate 4,461.0 5,313.45,520.25,788.25,910.0

Money Market 4,321.7 2,043.01,829.82,332.32,000.8

Total 211,006.0 208,382.2203,982.6203,254.3200,721.2

Annuities

Voya Financial Page 31 of 79

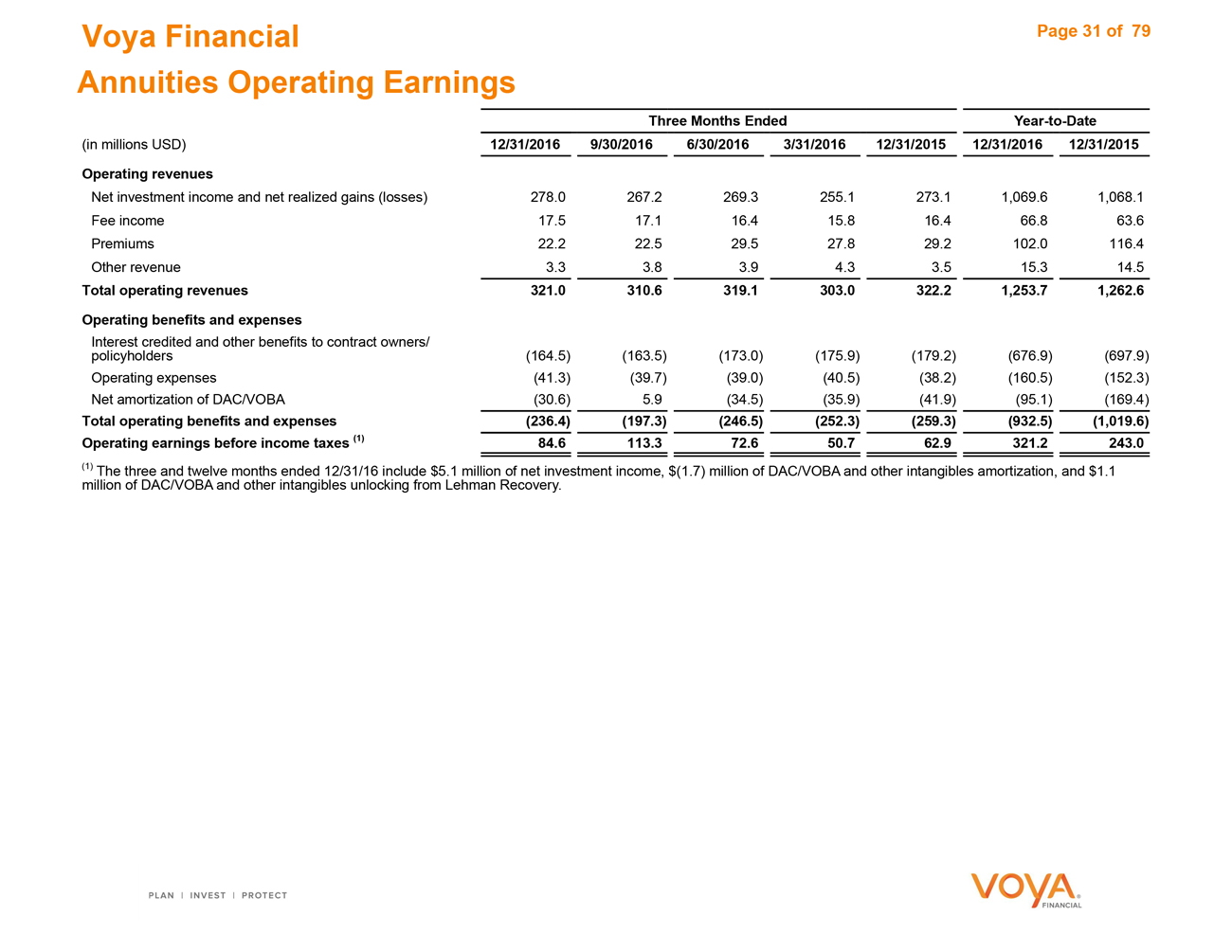

Annuities Operating Earnings

Three MonthsEndedYear-to-Date

(in millions USD) 12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015

Operating revenues

Net investment income and net realized gains (losses) 278.0 267.2269.3255.1273.11,069.61,068.1

Fee income 17.5 17.116.415.816.466.863.6

Premiums 22.2 22.529.527.829.2102.0116.4

Other revenue 3.3 3.83.94.33.515.314.5

Total operating revenues 321.0 310.6319.1303.0322.21,253.71,262.6

Operating benefits and expenses

Interest credited and other benefits to contract owners/

policyholders (164.5) (163.5)(173.0)(175.9)(179.2)(676.9)(697.9)

Operating expenses (41.3) (39.7)(39.0)(40.5)(38.2)(160.5)(152.3)

Net amortization of DAC/VOBA (30.6) 5.9(34.5)(35.9)(41.9)(95.1)(169.4)

Total operating benefits and expenses (236.4) (197.3)(246.5)(252.3)(259.3)(932.5)(1,019.6)

Operating earnings before income taxes (1) 84.6 113.372.650.762.9321.2243.0

(1) The three and twelve months ended 12/31/16 include $5.1 million of net investment income, $(1.7) million of DAC/VOBA and other intangibles amortization, and $1.1

million of DAC/VOBA and other intangibles unlocking from Lehman Recovery.

Voya Financial

|

|

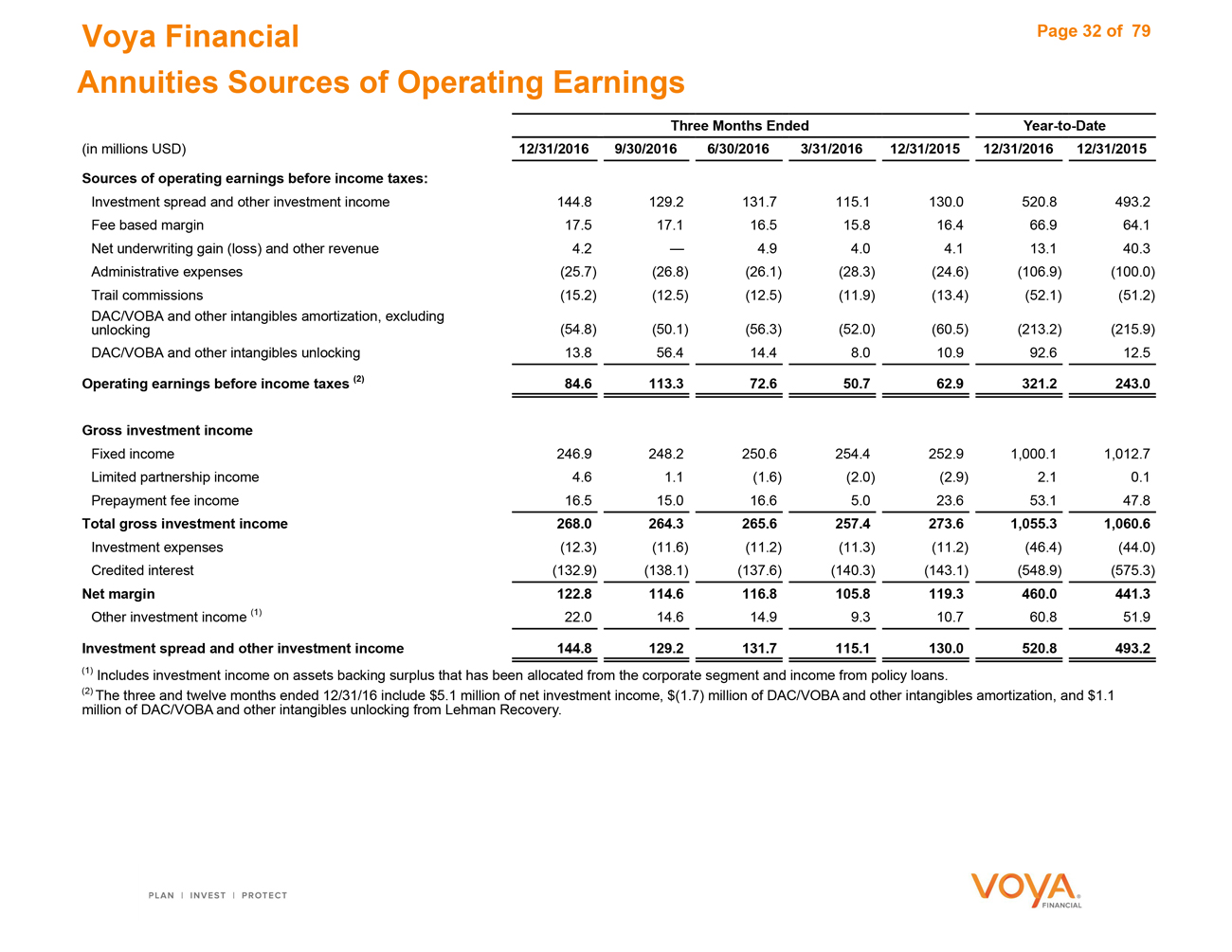

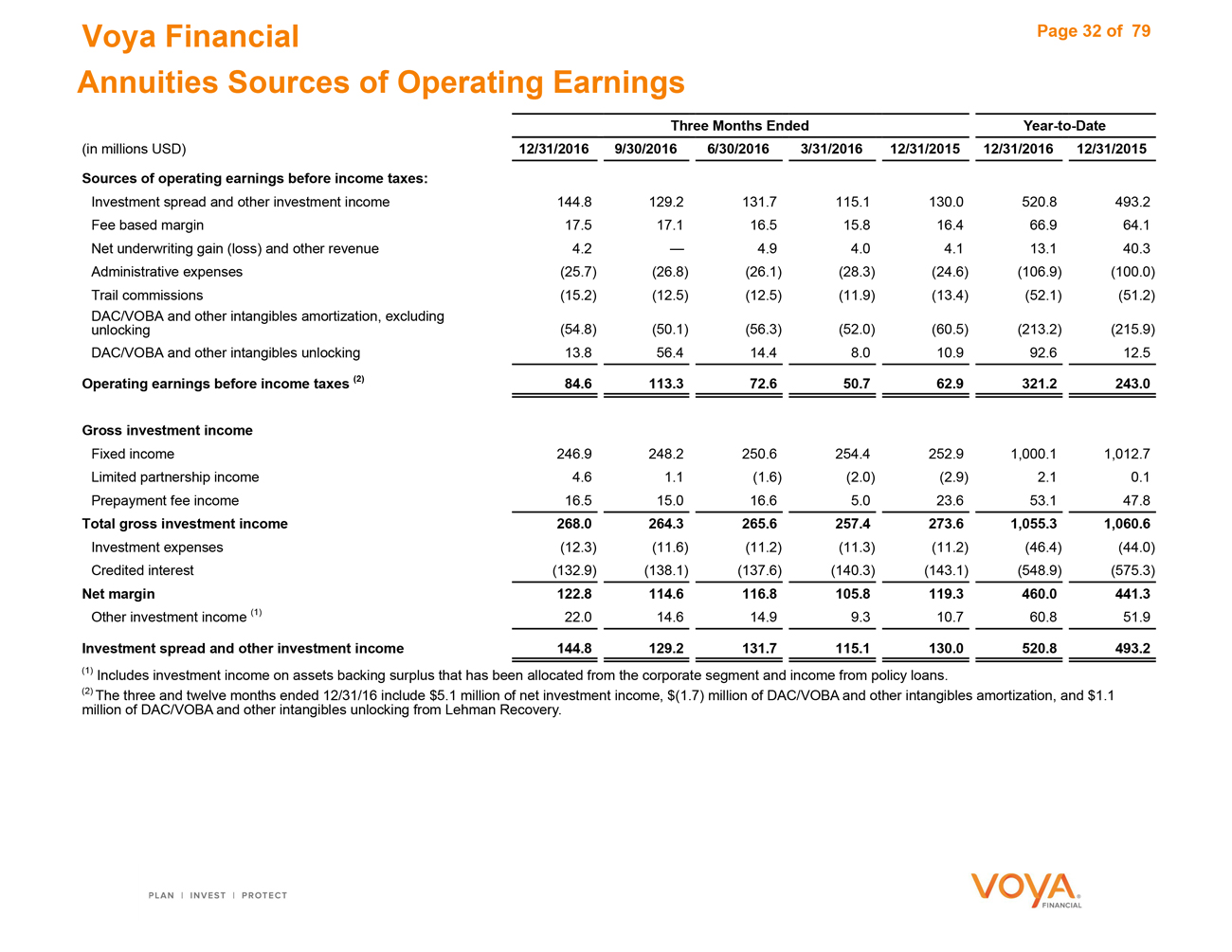

Page 32 of 79 Annuities Sources of Operating Earnings Three Months Ended Year-to-Date (in millions USD) 12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 12/31/2016 12/31/2015 Sources of operating earnings before income taxes: Investment spread and other investment income 144.8 129.2 131.7 115.1 130.0 520.8 493.2 Fee based margin 17.5 17.1 16.5 15.8 16.4 66.9 64.1 Net underwriting gain (loss) and other revenue 4.2 —— 4.9 4.0 4.1 13.1 40.3 Administrative expenses (25.7) (26.8) (26.1) (28.3) (24.6) (106.9) (100.0) Trail commissions (15.2) (12.5) (12.5) (11.9) (13.4) (52.1) (51.2) DAC/VOBA and other intangibles amortization, excluding unlocking (54.8) (50.1) (56.3) (52.0) (60.5) (213.2) (215.9) DAC/VOBA and other intangibles unlocking 13.8 56.4 14.4 8.0 10.9 92.6 12.5 Operating earnings before income taxes (2) 84.6 113.3 72.6 50.7 62.9 321.2 243.0 Gross investment income Fixed income 246.9 248.2 250.6 254.4 252.9 1,000.1 1,012.7 Limited partnership income 4.6 1.1 (1.6) (2.0) (2.9) 2.1 0.1 Prepayment fee income 16.5 15.0 16.6 5.0 23.6 53.1 47.8 Total gross investment income 268.0 264.3 265.6 257.4 273.6 1,055.3 1,060.6 Investment expenses (12.3) (11.6) (11.2) (11.3) (11.2) (46.4) (44.0) Credited interest (132.9) (138.1) (137.6) (140.3) (143.1) (548.9) (575.3) Net margin 122.8 114.6 116.8 105.8 119.3 460.0 441.3 Other investment income (1) 22.0 14.6 14.9 9.3 10.7 60.8 51.9 Investment spread and other investment income 144.8 129.2 131.7 115.1 130.0 520.8 493.2 (1) Includes investment income on assets backing surplus that has been allocated from the corporate segment and income from policy loans. (2) The three and twelve months ended 12/31/16 include $5.1 million of net investment income, $(1.7) million of DAC/VOBA and other intangibles amortization, and $1.1 million of DAC/VOBA and other intangibles unlocking from Lehman Recovery.

|

|

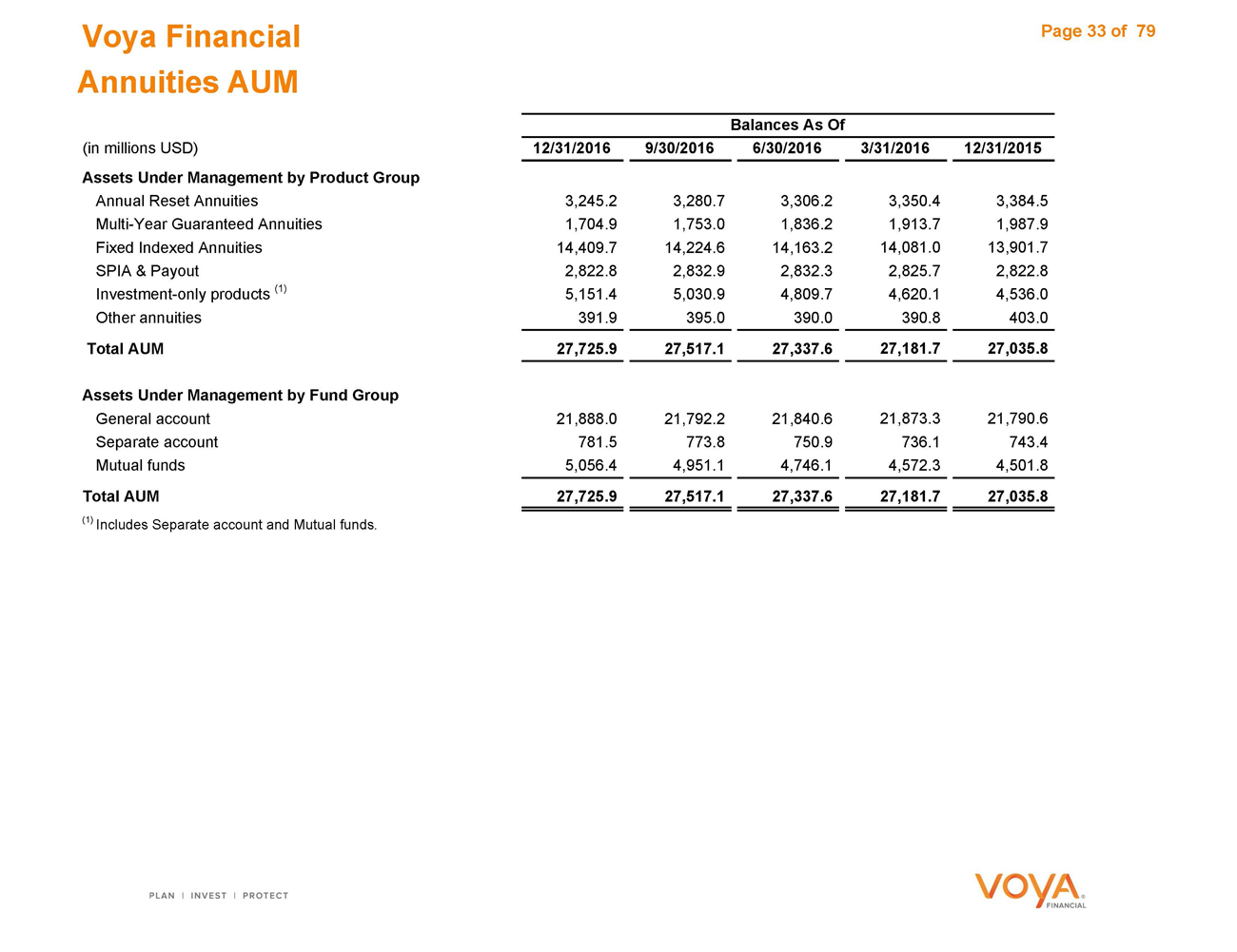

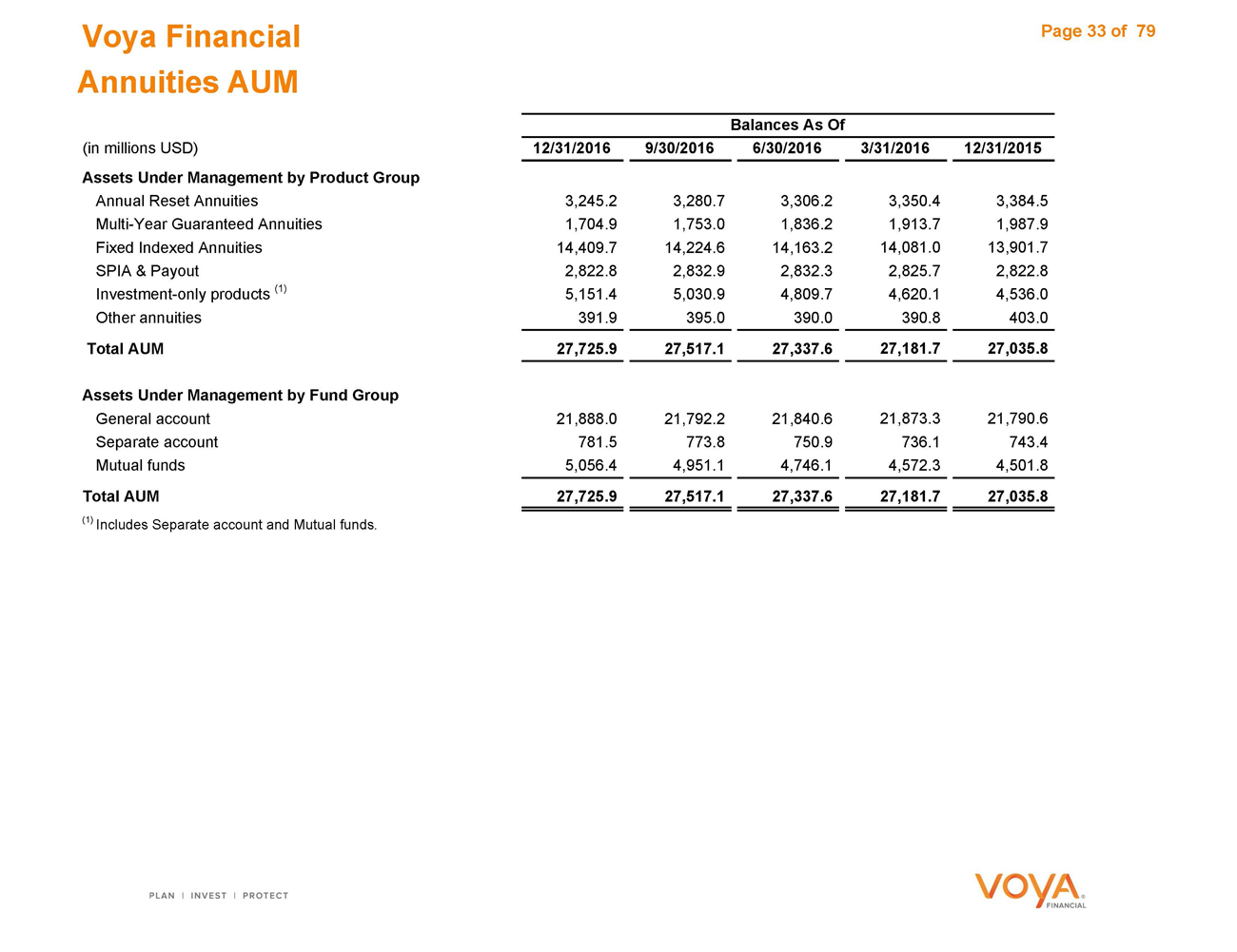

Voya Financial Page 33 of 79 Annuities AUM Balances As Of (in millions USD) 12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 Assets Under Management by Product Group Annual Reset Annuities 3,245.2 3,280.7 3,306.2 3,350.4 3,384.5 Multi-Year Guaranteed Annuities 1,704.9 1,753.0 1,836.2 1,913.7 1,987.9 Fixed Indexed Annuities 14,409.7 14,224.6 14,163.2 14,081.0 13,901.7 SPIA & Payout 2,822.8 2,832.9 2,832.3 2,825.7 2,822.8 Investment-only products (1) 5,151.4 5,030.9 4,809.7 4,620.1 4,536.0 Other annuities 391.9 395.0 390.0 390.8 403.0 Total AUM 27,725.9 27,517.1 27,337.6 27,181.7 27,035.8 Assets Under Management by Fund Group General account 21,888.0 21,792.2 21,840.6 21,873.3 21,790.6 Separate account 781.5 773.8 750.9 736.1 743.4 Mutual funds 5,056.4 4,951.1 4,746.1 4,572.3 4,501.8 Total AUM 27,725.9 27,517.1 27,337.6 27,181.7 27,035.8 (1) Includes Separate account and Mutual funds.

|

|

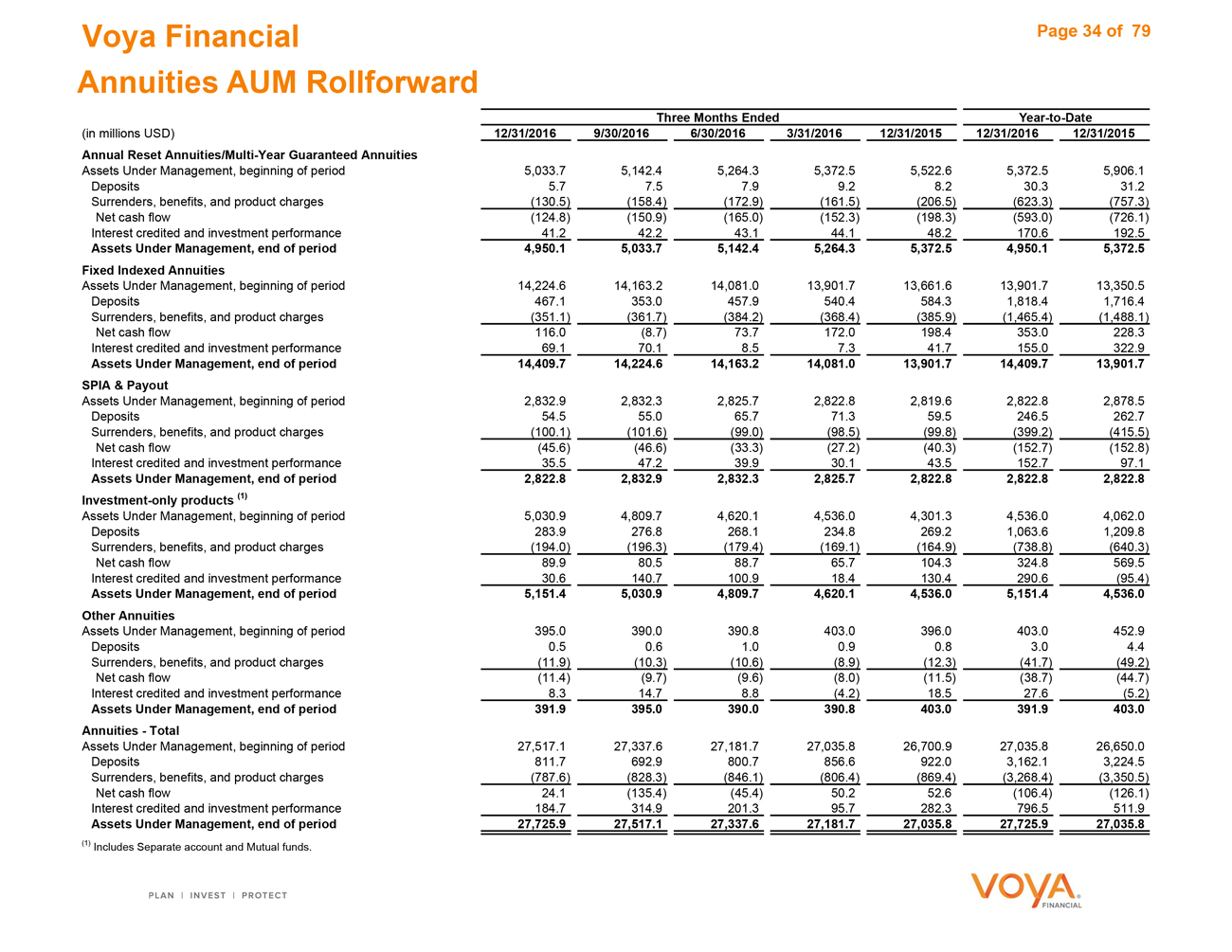

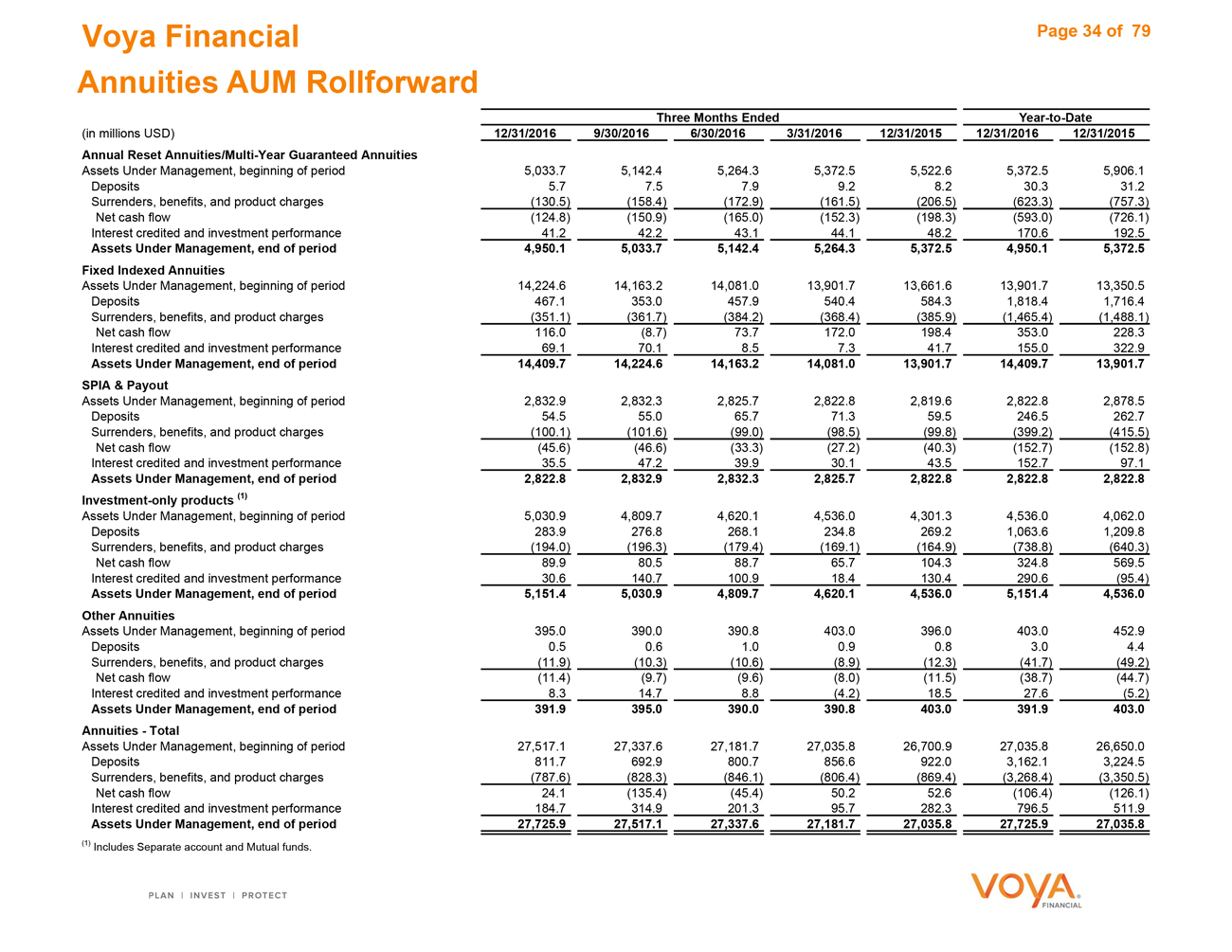

Voya Financial Page 34 of 79 Annuities AUM Rollforward Three Months EndedYear-to-Date (in millions USD)12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Annual Reset Annuities/Multi-Year Guaranteed Annuities Assets Under Management, beginning of period5,033.7 5,142.45,264.35,372.55,522.65,372.55,906.1 Deposits5.7 7.57.99.28.230.331.2 Surrenders, benefits, and product charges(130.5) (158.4)(172.9)(161.5)(206.5)(623.3)(757.3) Net cash flow(124.8) (150.9)(165.0)(152.3)(198.3)(593.0)(726.1) Interest credited and investment performance41.2 42.243.144.148.2170.6192.5 Assets Under Management, end of period4,950.1 5,033.75,142.45,264.35,372.54,950.15,372.5 Fixed Indexed Annuities Assets Under Management, beginning of period14,224.6 14,163.214,081.013,901.713,661.613,901.713,350.5 Deposits467.1 353.0457.9540.4584.31,818.41,716.4 Surrenders, benefits, and product charges(351.1) (361.7)(384.2)(368.4)(385.9)(1,465.4)(1,488.1) Net cash flow116.0 (8.7)73.7172.0198.4353.0228.3 Interest credited and investment performance69.1 70.18.57.341.7155.0322.9 Assets Under Management, end of period14,409.7 14,224.614,163.214,081.013,901.714,409.713,901.7 SPIA & Payout Assets Under Management, beginning of period2,832.9 2,832.32,825.72,822.82,819.62,822.82,878.5 Deposits54.5 55.065.771.359.5246.5262.7 Surrenders, benefits, and product charges(100.1) (101.6)(99.0)(98.5)(99.8)(399.2)(415.5) Net cash flow(45.6) (46.6)(33.3)(27.2)(40.3)(152.7)(152.8) Interest credited and investment performance35.5 47.239.930.143.5152.797.1 Assets Under Management, end of period2,822.8 2,832.92,832.32,825.72,822.82,822.82,822.8 Investment-only products (1) Assets Under Management, beginning of period5,030.9 4,809.74,620.14,536.04,301.34,536.04,062.0 Deposits283.9 276.8268.1234.8269.21,063.61,209.8 Surrenders, benefits, and product charges(194.0) (196.3)(179.4)(169.1)(164.9)(738.8)(640.3) Net cash flow89.9 80.588.765.7104.3324.8569.5 Interest credited and investment performance30.6 140.7100.918.4130.4290.6(95.4) Assets Under Management, end of period5,151.4 5,030.94,809.74,620.14,536.05,151.44,536.0 Other Annuities Assets Under Management, beginning of period395.0 390.0390.8403.0396.0403.0452.9 Deposits0.5 0.61.00.90.83.04.4 Surrenders, benefits, and product charges(11.9) (10.3)(10.6)(8.9)(12.3)(41.7)(49.2) Net cash flow(11.4) (9.7)(9.6)(8.0)(11.5)(38.7)(44.7) Interest credited and investment performance8.3 14.78.8(4.2)18.527.6(5.2) Assets Under Management, end of period391.9 395.0390.0390.8403.0391.9403.0 Annuities—Total Assets Under Management, beginning of period27,517.1 27,337.627,181.727,035.826,700.927,035.826,650.0 Deposits811.7 692.9800.7856.6922.03,162.13,224.5 Surrenders, benefits, and product charges(787.6) (828.3)(846.1)(806.4)(869.4)(3,268.4)(3,350.5) Net cash flow24.1 (135.4)(45.4)50.252.6(106.4)(126.1) Interest credited and investment performance184.7 314.9201.395.7282.3796.5511.9 Assets Under Management, end of period27,725.9 27,517.127,337.627,181.727,035.827,725.927,035.8 (1) Includes Separate account and Mutual funds.

|

|

Individual Life

Voya Financial Page 36 of 79

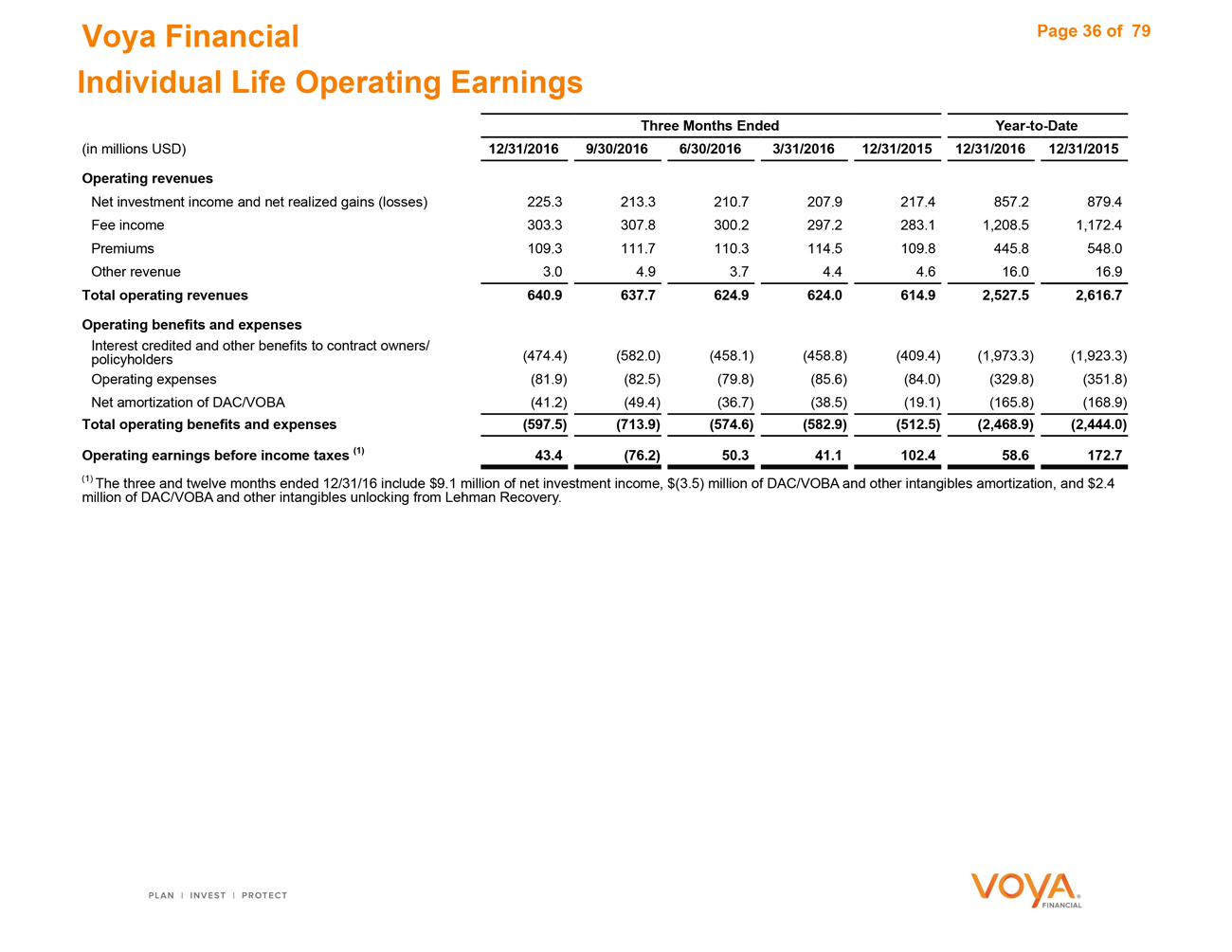

Individual Life Operating Earnings

Three MonthsEndedYear-to-Date

(in millions USD) 12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015

Operating revenues

Net investment income and net realized gains (losses) 225.3 213.3210.7207.9217.4857.2879.4

Fee income 303.3 307.8300.2297.2283.11,208.51,172.4

Premiums 109.3 111.7110.3114.5109.8445.8548.0

Other revenue 3.0 4.93.74.44.616.016.9

Total operating revenues 640.9 637.7624.9624.0614.92,527.52,616.7

Operating benefits and expenses

Interest credited and other benefits to contract owners/

policyholders (474.4) (582.0)(458.1)(458.8)(409.4)(1,973.3)(1,923.3)

Operating expenses (81.9) (82.5)(79.8)(85.6)(84.0)(329.8)(351.8)

Net amortization of DAC/VOBA (41.2) (49.4)(36.7)(38.5)(19.1)(165.8)(168.9)

Total operating benefits and expenses (597.5) (713.9)(574.6)(582.9)(512.5)(2,468.9)(2,444.0)

Operating earnings before income taxes (1) 43.4 (76.2)50.341.1102.458.6172.7

(1) The three and twelve months ended 12/31/16 include $9.1 million of net investment income, $(3.5) million of DAC/VOBA and other intangibles amortization, and $2.4

million of DAC/VOBA and other intangibles unlocking from Lehman Recovery.

|

|

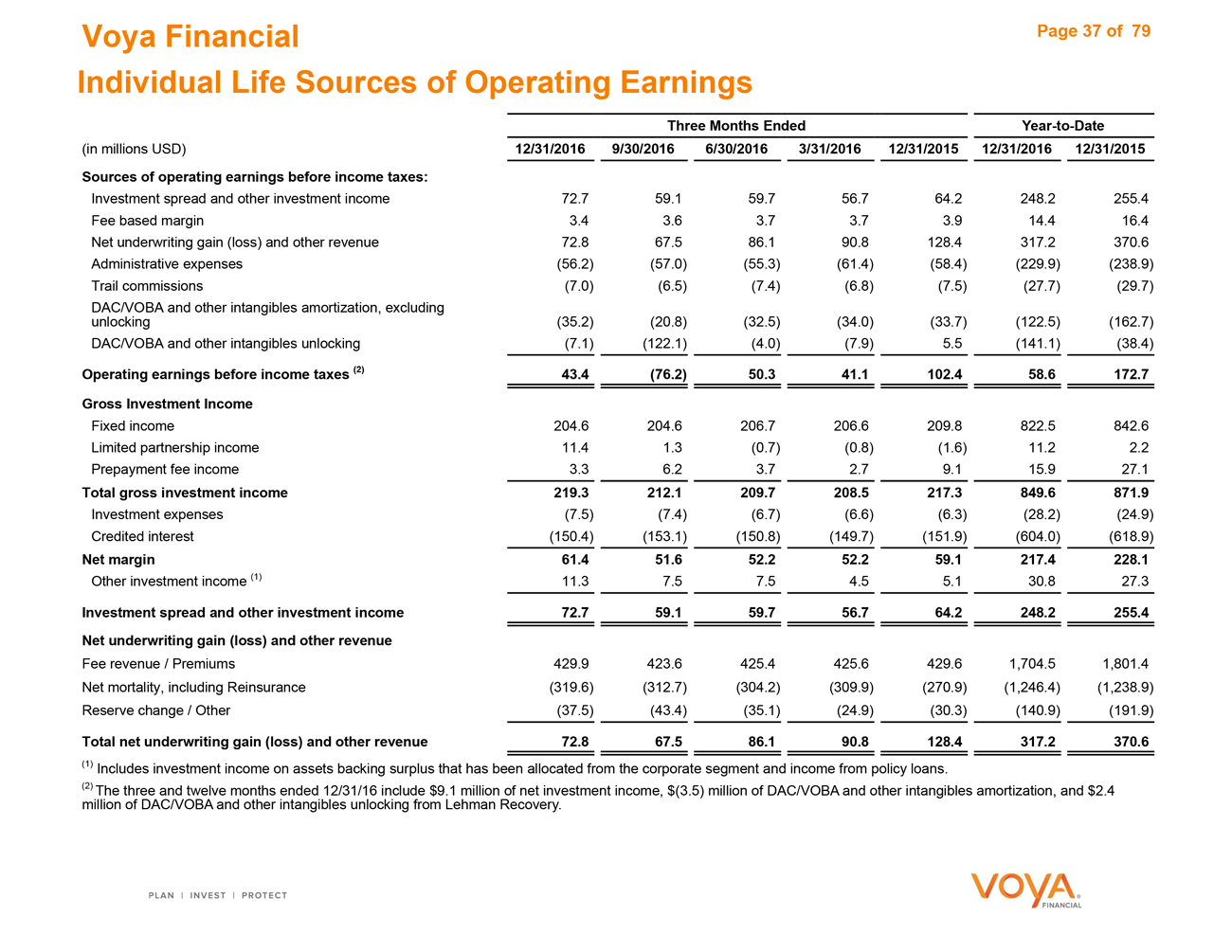

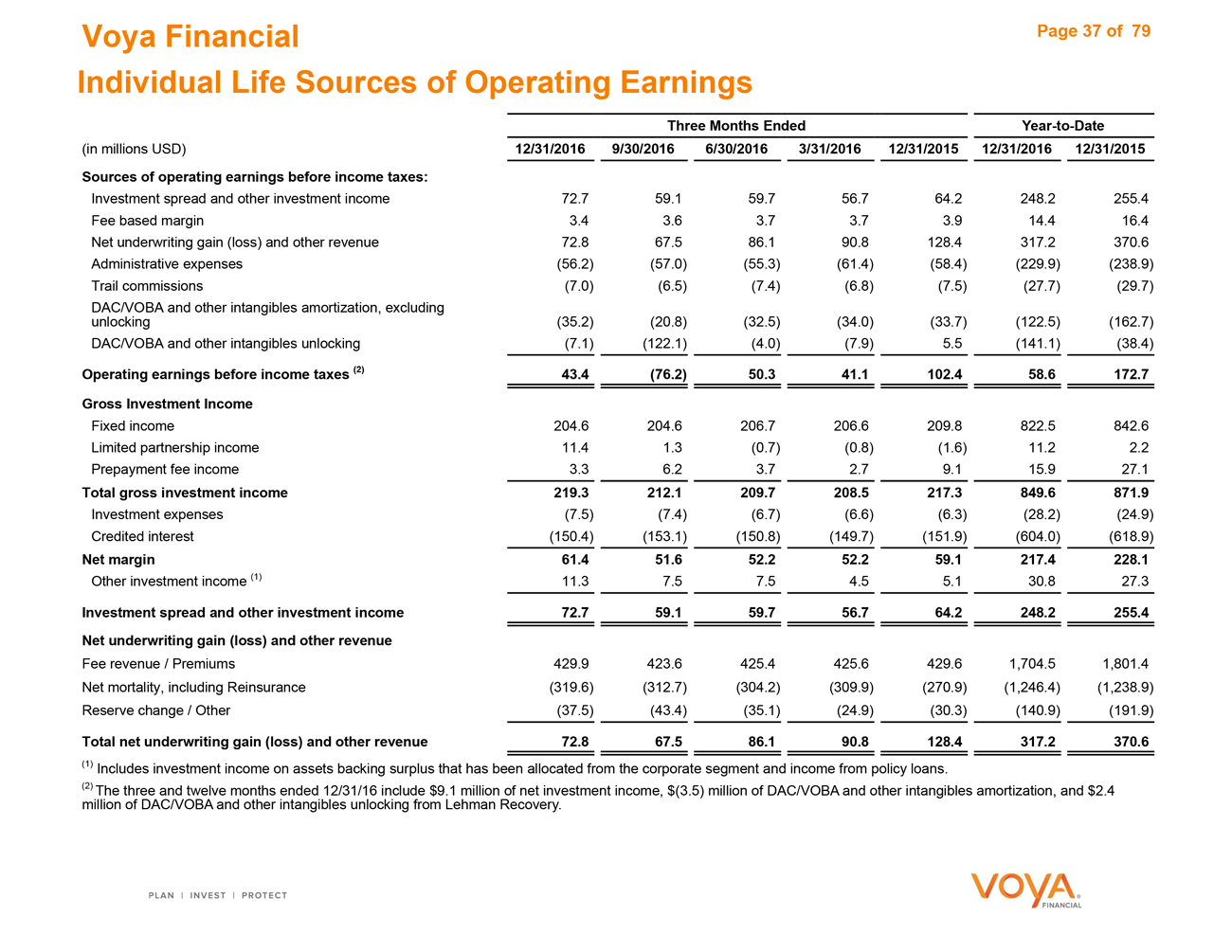

Voya Financial Page 37 of 79 Individual Life Sources of Operating Earnings Three Months EndedYear-to-Date (in millions USD)12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Sources of operating earnings before income taxes: Investment spread and other investment income72.7 59.159.756.764.2248.2255.4 Fee based margin3.4 3.63.73.73.914.416.4 Net underwriting gain (loss) and other revenue72.8 67.586.190.8128.4317.2370.6 Administrative expenses(56.2) (57.0)(55.3)(61.4)(58.4)(229.9)(238.9) Trail commissions(7.0) (6.5)(7.4)(6.8)(7.5)(27.7)(29.7) DAC/VOBA and other intangibles amortization, excluding unlocking(35.2) (20.8)(32.5)(34.0)(33.7)(122.5)(162.7) DAC/VOBA and other intangibles unlocking(7.1) (122.1)(4.0)(7.9)5.5(141.1)(38.4) Operating earnings before income taxes (2)43.4 (76.2)50.341.1102.458.6172.7 Gross Investment Income Fixed income204.6 204.6206.7206.6209.8822.5842.6 Limited partnership income11.4 1.3(0.7)(0.8)(1.6)11.22.2 Prepayment fee income3.3 6.23.72.79.115.927.1 Total gross investment income219.3 212.1209.7208.5217.3849.6871.9 Investment expenses(7.5) (7.4)(6.7)(6.6)(6.3)(28.2)(24.9) Credited interest(150.4) (153.1)(150.8)(149.7)(151.9)(604.0)(618.9) Net margin61.4 51.652.252.259.1217.4228.1 Other investment income (1)11.3 7.57.54.55.130.827.3 Investment spread and other investment income72.7 59.159.756.764.2248.2255.4 Net underwriting gain (loss) and other revenue Fee revenue / Premiums429.9 423.6425.4425.6429.61,704.51,801.4 Net mortality, including Reinsurance(319.6) (312.7)(304.2)(309.9)(270.9)(1,246.4)(1,238.9) Reserve change / Other(37.5) (43.4)(35.1)(24.9)(30.3)(140.9)(191.9) Total net underwriting gain (loss) and other revenue72.8 67.586.190.8128.4317.2370.6 (1) Includes investment income on assets backing surplus that has been allocated from the corporate segment and income from policy loans. (2) The three and twelve months ended 12/31/16 include $9.1 million of net investment income, $(3.5) million of DAC/VOBA and other intangibles amortization, and $2.4 million of DAC/VOBA and other intangibles unlocking from Lehman Recovery.

|

|

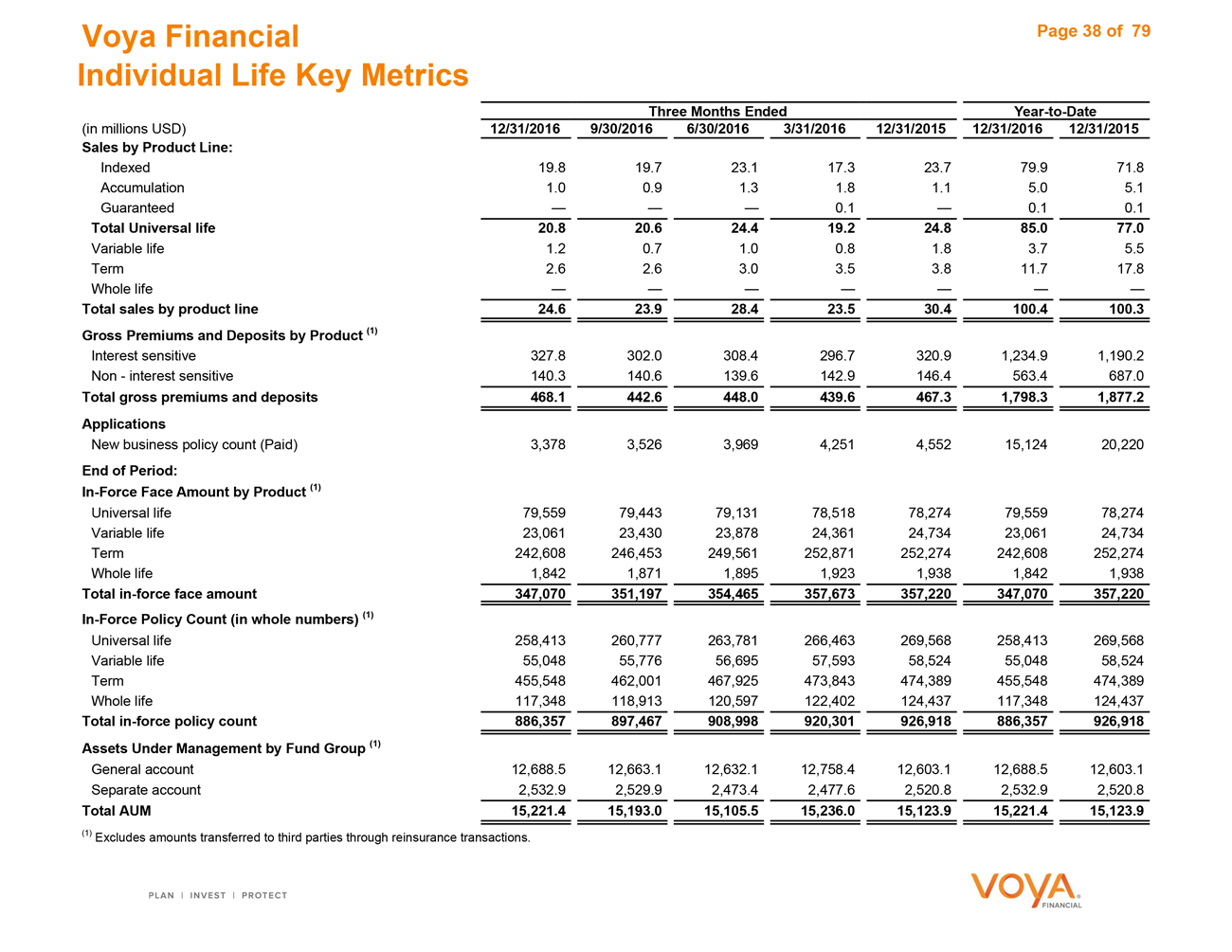

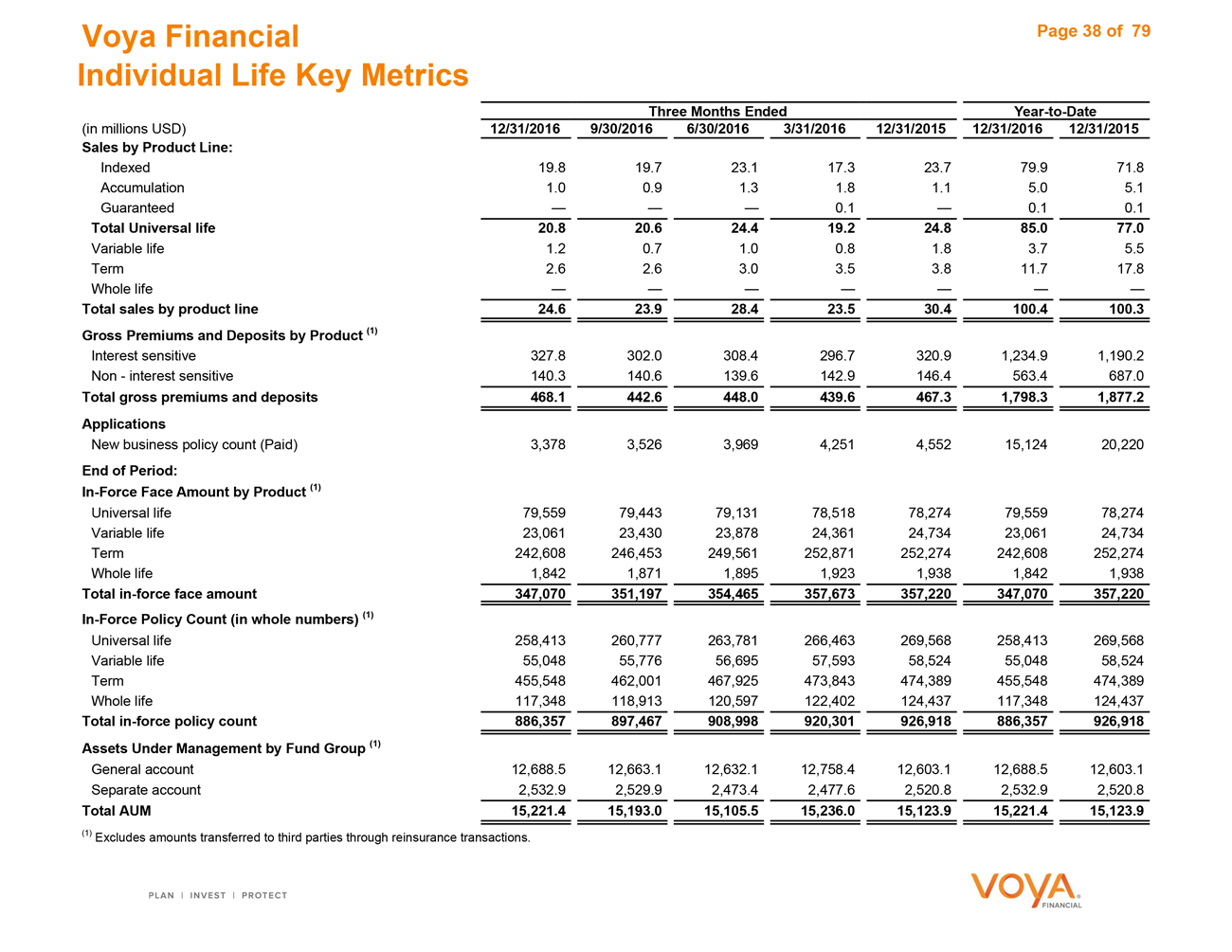

Voya Financial Page 38 of 79

Individual Life Key Metrics

Three MonthsEndedYear-to-Date

(in millions USD) 12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015

Sales by Product Line:

Indexed 19.8 19.723.117.323.779.971.8

Accumulation 1.0 0.91.31.81.15.05.1

Guaranteed — ——0.1—0.10.1

Total Universal life 20.8 20.624.419.224.885.077.0

Variable life 1.2 0.71.00.81.83.75.5

Term 2.6 2.63.03.53.811.717.8

Whole life — ——————

Total sales by product line 24.6 23.928.423.530.4100.4100.3

Gross Premiums and Deposits by Product (1)

Interest sensitive 327.8 302.0308.4296.7320.91,234.91,190.2

Non—interest sensitive 140.3 140.6139.6142.9146.4563.4687.0

Total gross premiums and deposits 468.1 442.6448.0439.6467.31,798.31,877.2

Applications

New business policy count (Paid) 3,378 3,5263,9694,2514,55215,12420,220

End of Period:

In-Force Face Amount by Product (1)

Universal life 79,559 79,44379,13178,51878,27479,55978,274

Variable life 23,061 23,43023,87824,36124,73423,06124,734

Term 242,608 246,453249,561252,871252,274242,608252,274

Whole life 1,842 1,8711,8951,9231,9381,8421,938

Totalin-force face amount 347,070 351,197354,465357,673357,220347,070357,220

In-Force Policy Count (in whole numbers) (1)

Universal life 258,413 260,777263,781266,463269,568258,413269,568

Variable life 55,048 55,77656,69557,59358,52455,04858,524

Term 455,548 462,001467,925473,843474,389455,548474,389

Whole life 117,348 118,913120,597122,402124,437117,348124,437

Totalin-force policy count 886,357 897,467908,998920,301926,918886,357926,918

Assets Under Management by Fund Group (1)

General account 12,688.5 12,663.112,632.112,758.412,603.112,688.512,603.1

Separate account 2,532.9 2,529.92,473.42,477.62,520.82,532.92,520.8

Total AUM 15,221.4 15,193.015,105.515,236.015,123.915,221.415,123.9

(1) Excludes amounts transferred to third parties through reinsurance transactions.

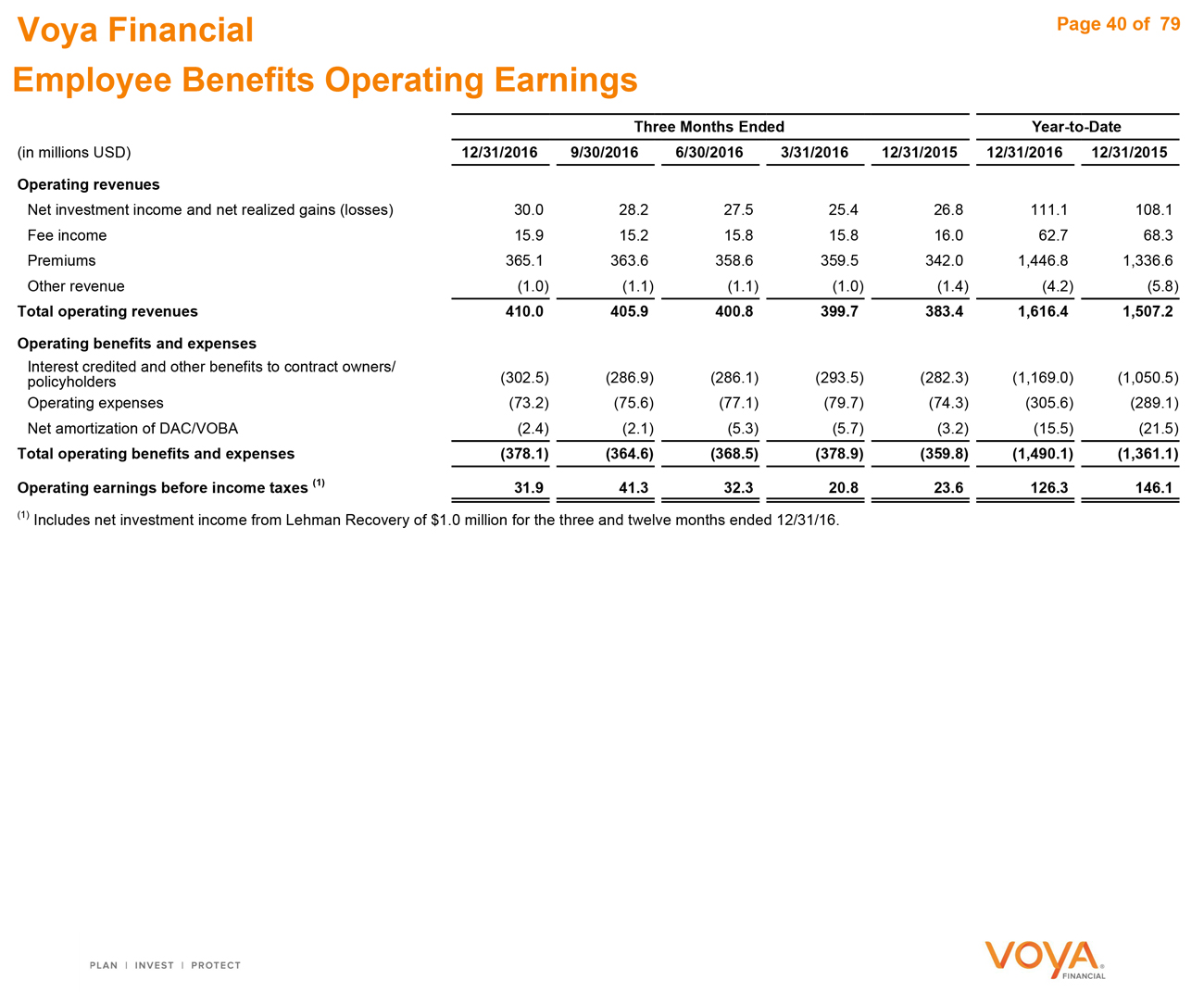

Employee Benefits

Voya Financial

Employee Benefits Operating Earnings

Page 40 of 79

Three Months Ended Year-to-Date

(in millions USD) 12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 12/31/2016 12/31/2015

Operating revenues

Net investment income and net realized gains (losses) 30.0 28.2 27.5 25.4 26.8 111.1 108.1

Fee income 15.9 15.2 15.8 15.8 16.0 62.7 68.3

Premiums 365.1 363.6 358.6 359.5 342.0 1,446.8 1,336.6

Other revenue (1.0) (1.1) (1.1) (1.0) (1.4) (4.2) (5.8)

Total operating revenues 410.0 405.9 400.8 399.7 383.4 1,616.4 1,507.2

Operating benefits and expenses

Interest credited and other benefits to contract owners/

policyholders (302.5) (286.9) (286.1) (293.5) (282.3) (1,169.0) (1,050.5)

Operating expenses (73.2) (75.6) (77.1) (79.7) (74.3) (305.6) (289.1)

Net amortization of DAC/VOBA (2.4) (2.1) (5.3) (5.7) (3.2) (15.5) (21.5)

Total operating benefits and expenses (378.1) (364.6) (368.5) (378.9) (359.8) (1,490.1) (1,361.1)

Operating earnings before income taxes (1) 31.9 41.3 32.3 20.8 23.6 126.3 146.1

(1) Includes net investment income from Lehman Recovery of $1.0 million for the three and twelve months ended 12/31/16.

|

|

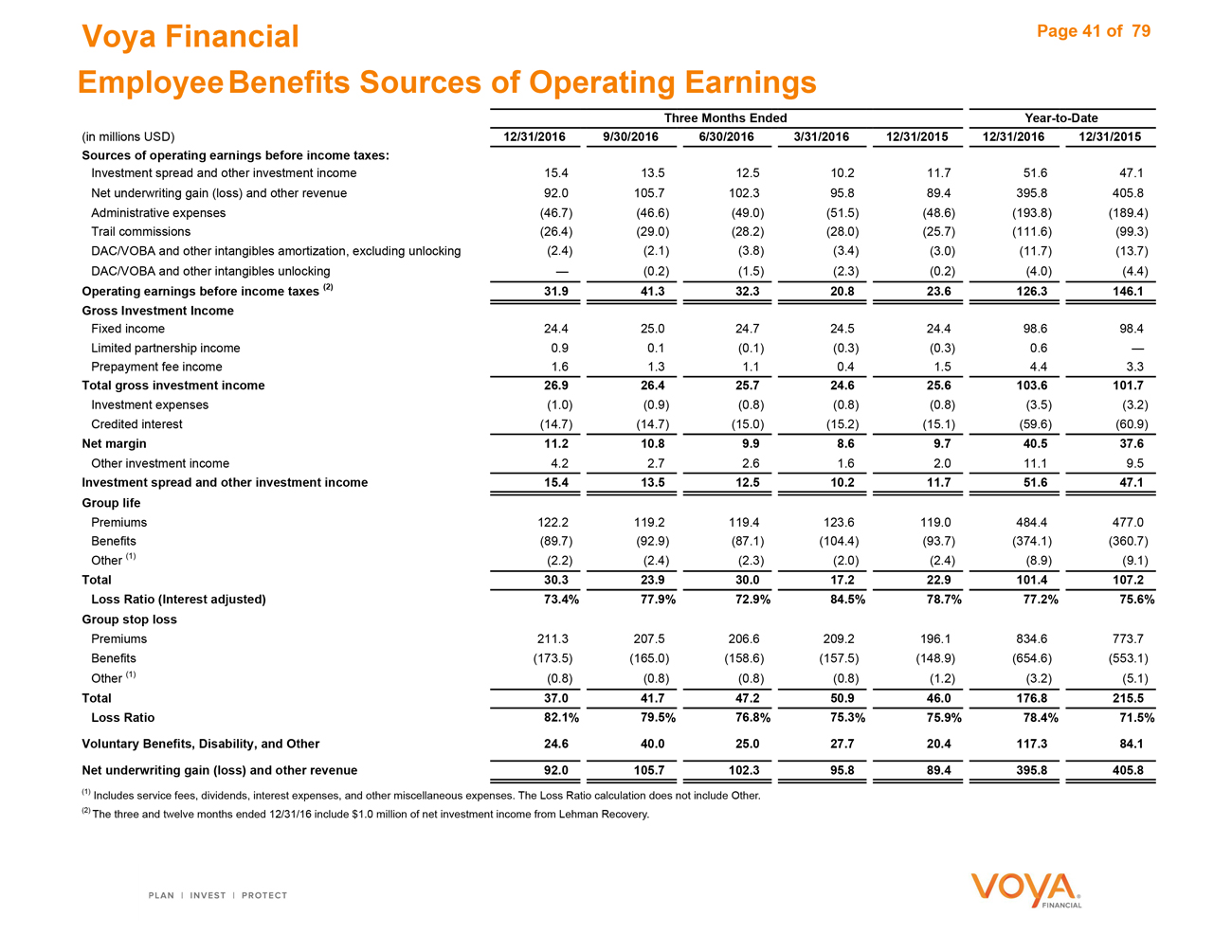

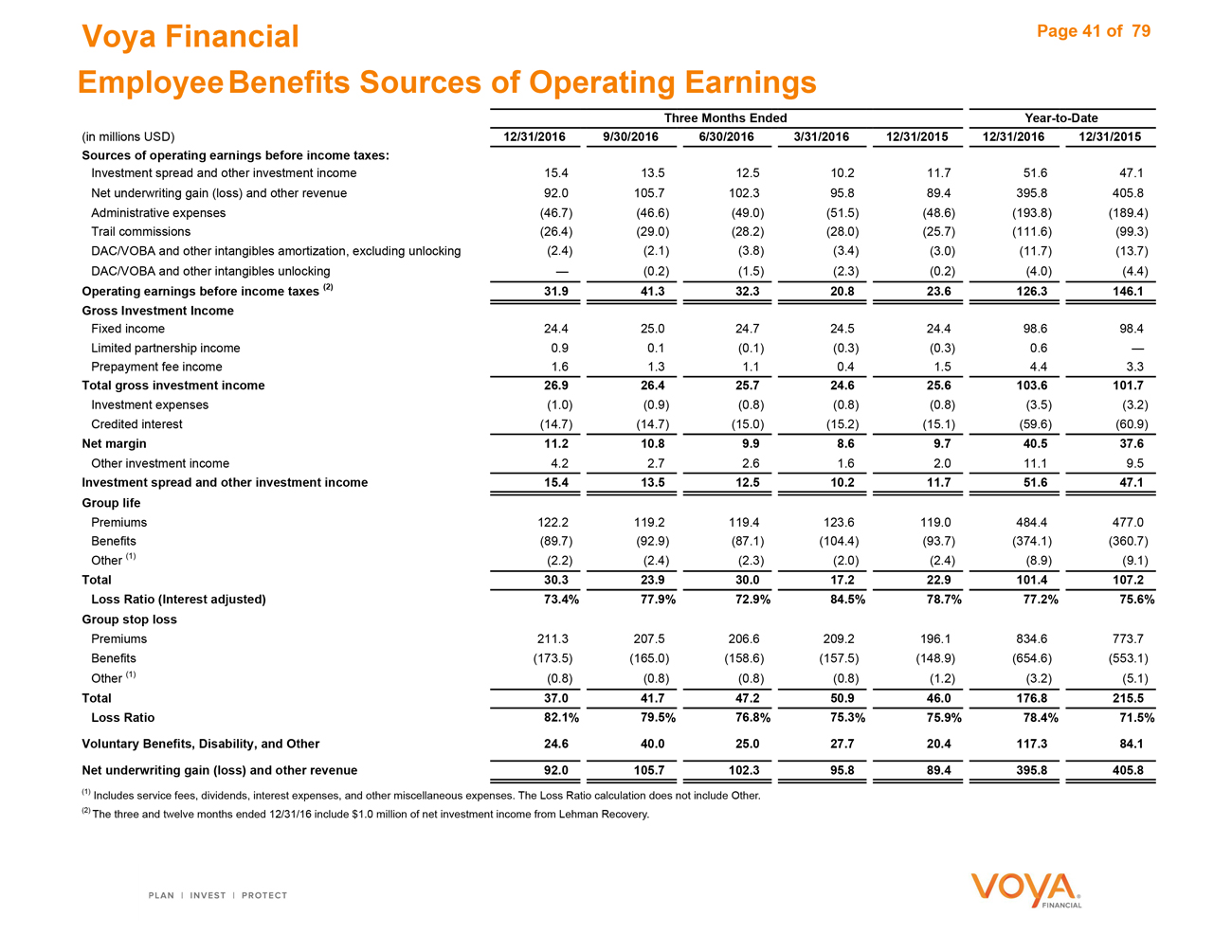

Voya Financial Page 41 of 79 Employee Benefits Sources of Operating Earnings Three Months EndedYear-to-Date (in millions USD)12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015 Sources of operating earnings before income taxes: Investment spread and other investment income15.4 13.512.510.211.751.647.1 Net underwriting gain (loss) and other revenue92.0 105.7102.395.889.4395.8405.8 Administrative expenses(46.7) (46.6)(49.0)(51.5)(48.6)(193.8)(189.4) Trail commissions(26.4) (29.0)(28.2)(28.0)(25.7)(111.6)(99.3) DAC/VOBA and other intangibles amortization, excluding unlocking(2.4) (2.1)(3.8)(3.4)(3.0)(11.7)(13.7) DAC/VOBA and other intangibles unlocking— (0.2)(1.5)(2.3)(0.2)(4.0)(4.4) Operating earnings before income taxes (2)31.9 41.332.320.823.6126.3146.1 Gross Investment Income Fixed income24.4 25.024.724.524.498.698.4 Limited partnership income0.9 0.1(0.1)(0.3)(0.3)0.6— Prepayment fee income1.6 1.31.10.41.54.43.3 Total gross investment income26.9 26.425.724.625.6103.6101.7 Investment expenses(1.0) (0.9)(0.8)(0.8)(0.8)(3.5)(3.2) Credited interest(14.7) (14.7)(15.0)(15.2)(15.1)(59.6)(60.9) Net margin11.2 10.89.98.69.740.537.6 Other investment income4.2 2.72.61.62.011.19.5 Investment spread and other investment income15.4 13.512.510.211.751.647.1 Group life Premiums122.2 119.2119.4123.6119.0484.4477.0 Benefits(89.7) (92.9)(87.1)(104.4)(93.7)(374.1)(360.7) Other (1)(2.2) (2.4)(2.3)(2.0)(2.4)(8.9)(9.1) Total30.3 23.930.017.222.9101.4107.2 Loss Ratio (Interest adjusted)73.4% 77.9%72.9%84.5%78.7%77.2%75.6% Group stop loss Premiums211.3 207.5206.6209.2196.1834.6773.7 Benefits(173.5) (165.0)(158.6)(157.5)(148.9)(654.6)(553.1) Other (1)(0.8) (0.8)(0.8)(0.8)(1.2)(3.2)(5.1) Total37.0 41.747.250.946.0176.8215.5 Loss Ratio82.1% 79.5%76.8%75.3%75.9%78.4%71.5% Voluntary Benefits, Disability, and Other24.6 40.025.027.720.4117.384.1 Net underwriting gain (loss) and other revenue92.0 105.7102.395.889.4395.8405.8 (1) Includes service fees, dividends, interest expenses, and other miscellaneous expenses. The Loss Ratio calculation does not include Other. (2) The three and twelve months ended 12/31/16 include $1.0 million of net investment income from Lehman Recovery.

|

|

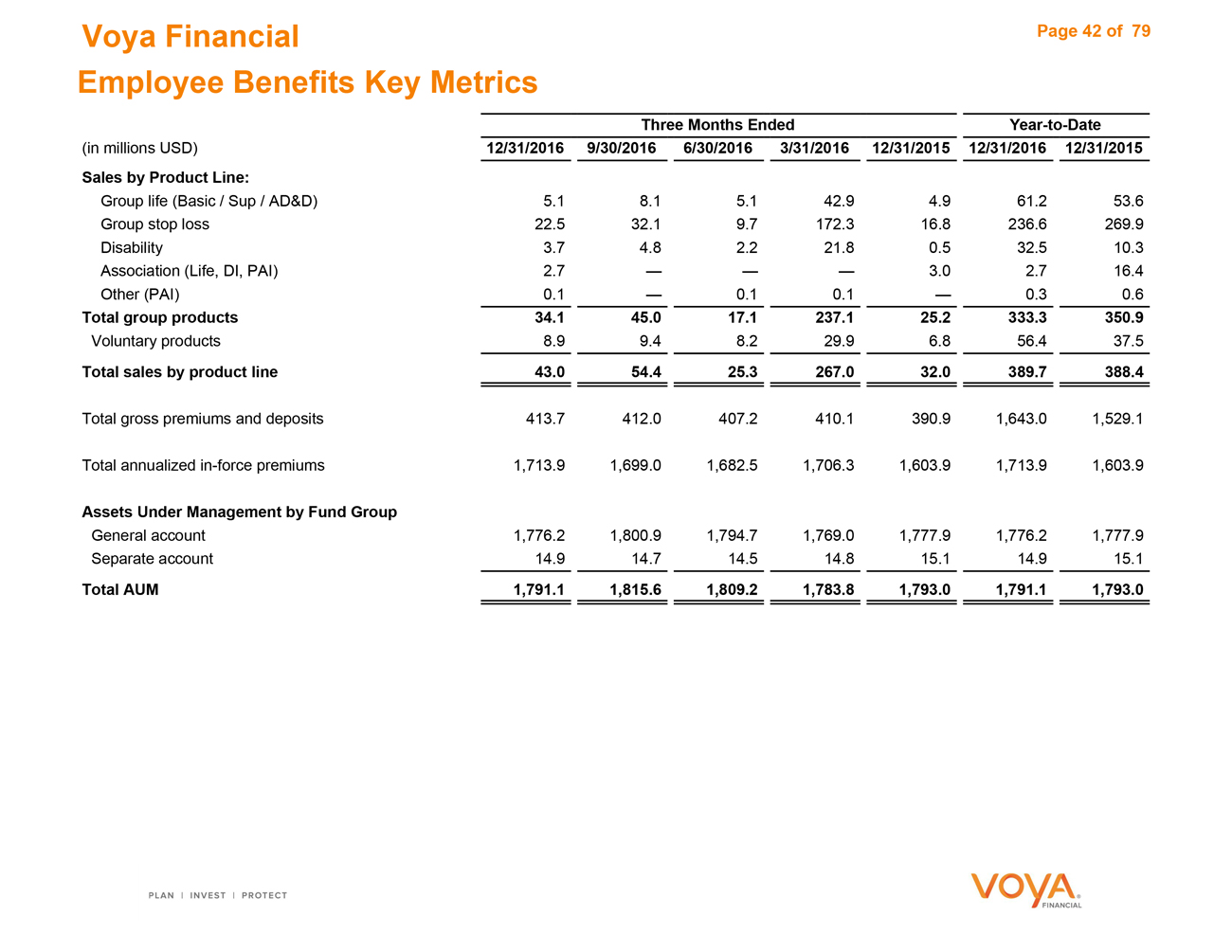

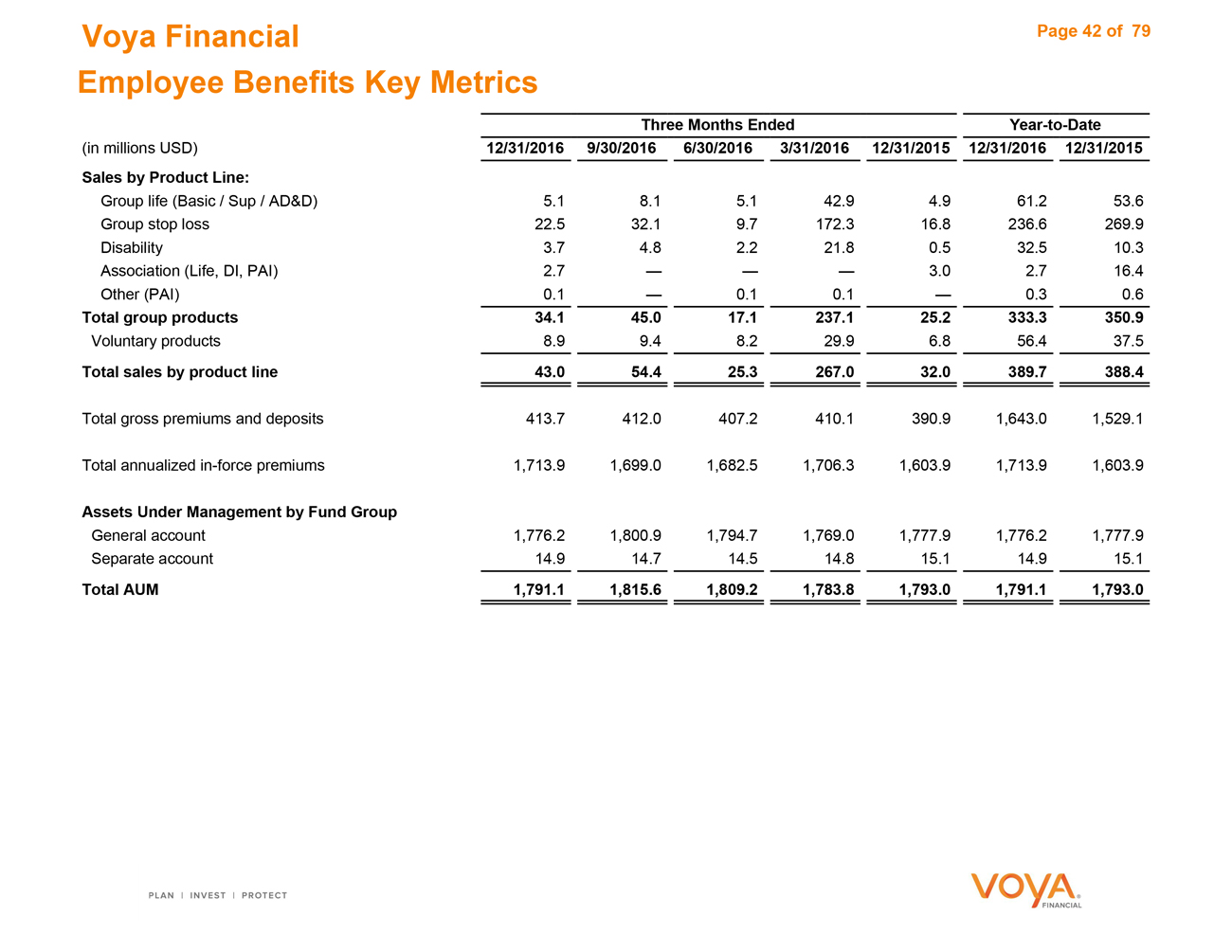

Voya Financial Page 42 of 79

Employee Benefits Key Metrics

Three MonthsEndedYear-to-Date

(in millions USD) 12/31/2016 9/30/20166/30/20163/31/201612/31/201512/31/201612/31/2015

Sales by Product Line:

Group life (Basic / Sup / AD&D) 5.1 8.15.142.94.961.253.6

Group stop loss 22.5 32.19.7172.316.8236.6269.9

Disability 3.7 4.82.221.80.532.510.3

Association (Life, DI, PAI) 2.7 ———3.02.716.4

Other (PAI) 0.1 —0.10.1—0.30.6