|

Exhibit 99.2

|

Voya Financial Positioned for Leadership – Sale of CBVA & Annuities December 20, 2017

|

|

Forward-Looking and Other Cautionary Statements This presentation and the remarks made orally contain forward-looking statements. Forward-looking statements include statements relating to future developments in our business or expectations for our future financial performance and any statement not involving a historical fact. Forward-looking statements use words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “projected”, “target,” and other words and terms of similar meaning in connection with a discussion of future operating or financial performance. In particular, all statements about our financial targets and expectations are forward-looking statements. Actual results, performance or events may differ materially from those projected in any forward-looking statement due to, among other things, (i) general economic conditions, particularly economic conditions in our core markets, (ii) performance of financial markets, including emerging markets, (iii) the frequency and severity of insured loss events, (iv) mortality and morbidity levels, (v) persistency and lapse levels, (vi) interest rates, (vii) currency exchange rates, (viii) general competitive factors, (ix) changes in laws and regulations and (x) changes in the policies of governments and/or regulatory authorities. Factors that may cause actual results to differ from those in any forward-looking statement also include those described in “Risk Factors,” “Management’s Discussion and Analysis of Results of Operations and Financial Condition-Trends and Uncertainties” and “Business-Closed Blocks-Closed Block Variable Annuity” in our Annual Report on Form 10-K for the year ended December 31, 2016 as filed with the Securities and Exchange Commission (“SEC”) on February 23, 2017, and our Quarterly Report on Form 10-Q for the three months ended September 30, 2017, as filed with the SEC on November 1, 2017. This presentation and the remarks made orally contain certain non-GAAP financial measures. Non-GAAP measures include Operating Earnings, Adjusted Operating Earnings, Ongoing Business Adjusted Operating Earnings, Ongoing Business Adjusted Operating Return on Equity, Adjusted Operating Return on Capital, Ongoing Business Adjusted Return on Capital, Operating Margin, and debt-to-capital ratio. Information regarding these and other non-GAAP financial measures, including reconciliations to the most directly comparable GAAP financial measures, is provided in our quarterly earnings press releases and in our quarterly investor supplements, all of which are available at the Investor Relations section of Voya Financial’s website at investors.voya.com.

|

|

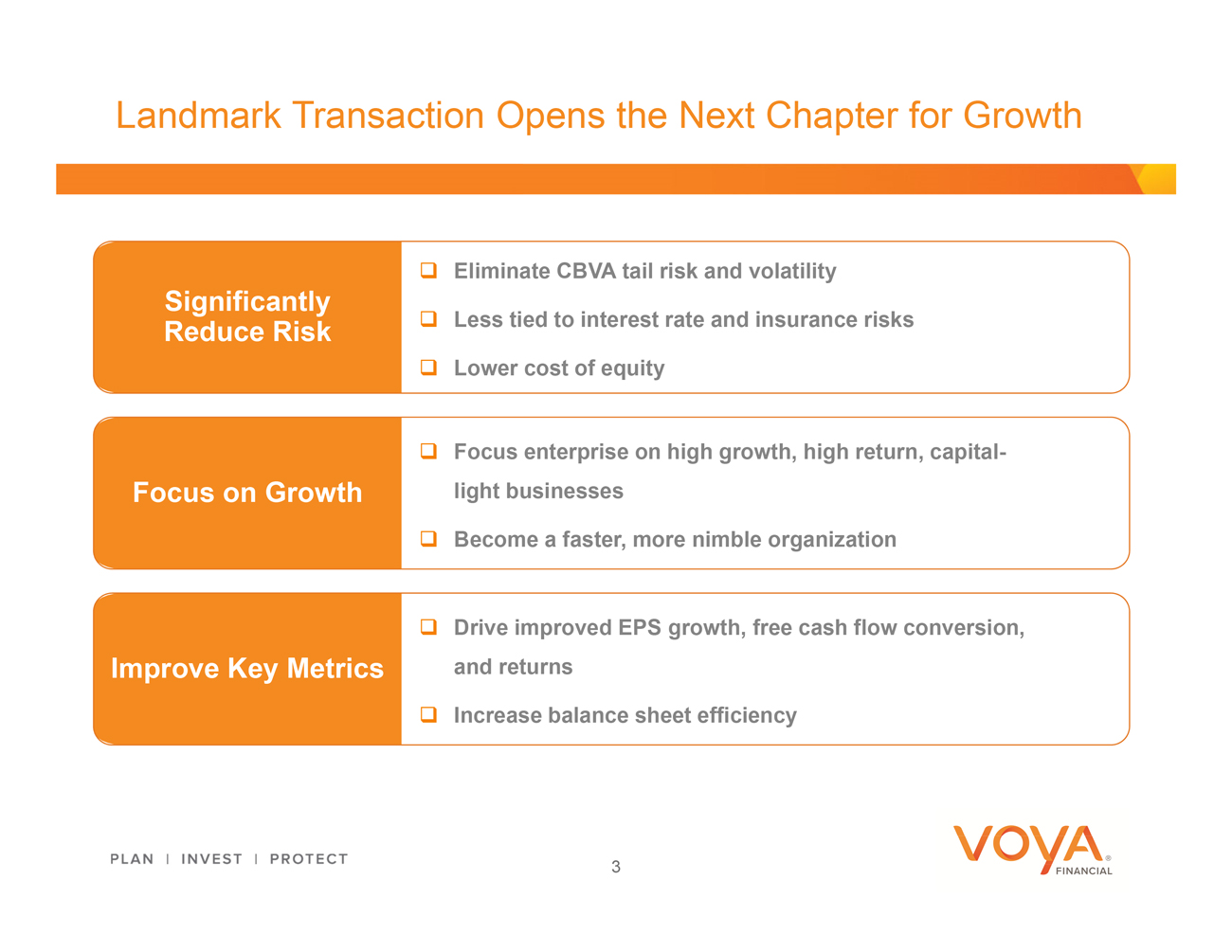

Landmark Transaction Opens the Next Chapter for Growth Eliminate CBVA tail risk and volatility Significantly Reduce Risk Less tied to interest rate and insurance risks Lower cost of equity Focus enterprise on high growth, high return, capital-Focus on Growth light businesses Become a faster, more nimble organization Drive improved EPS growth, free cash flow conversion, Improve Key Metrics and returns Increase balance sheet efficiency 3

|

|

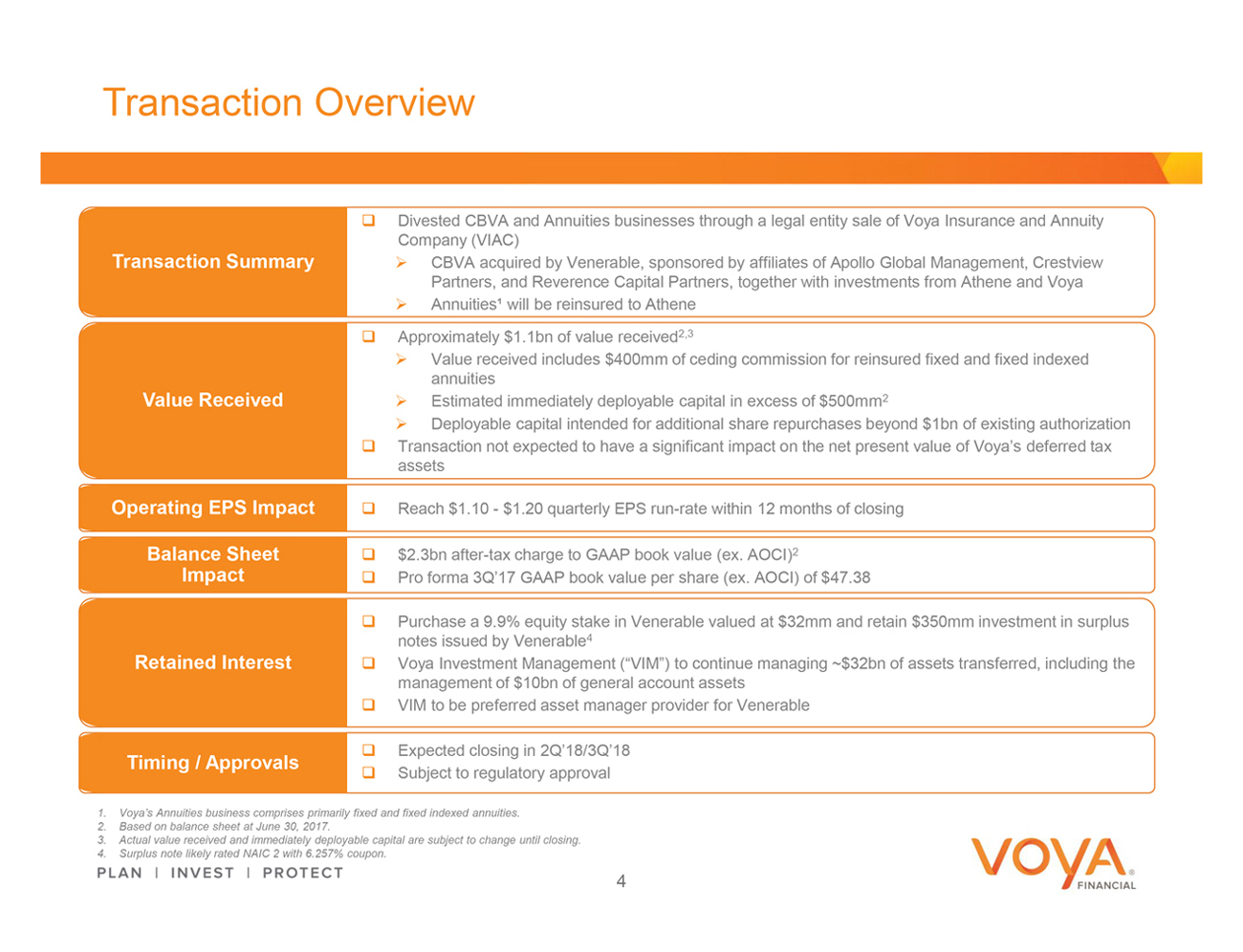

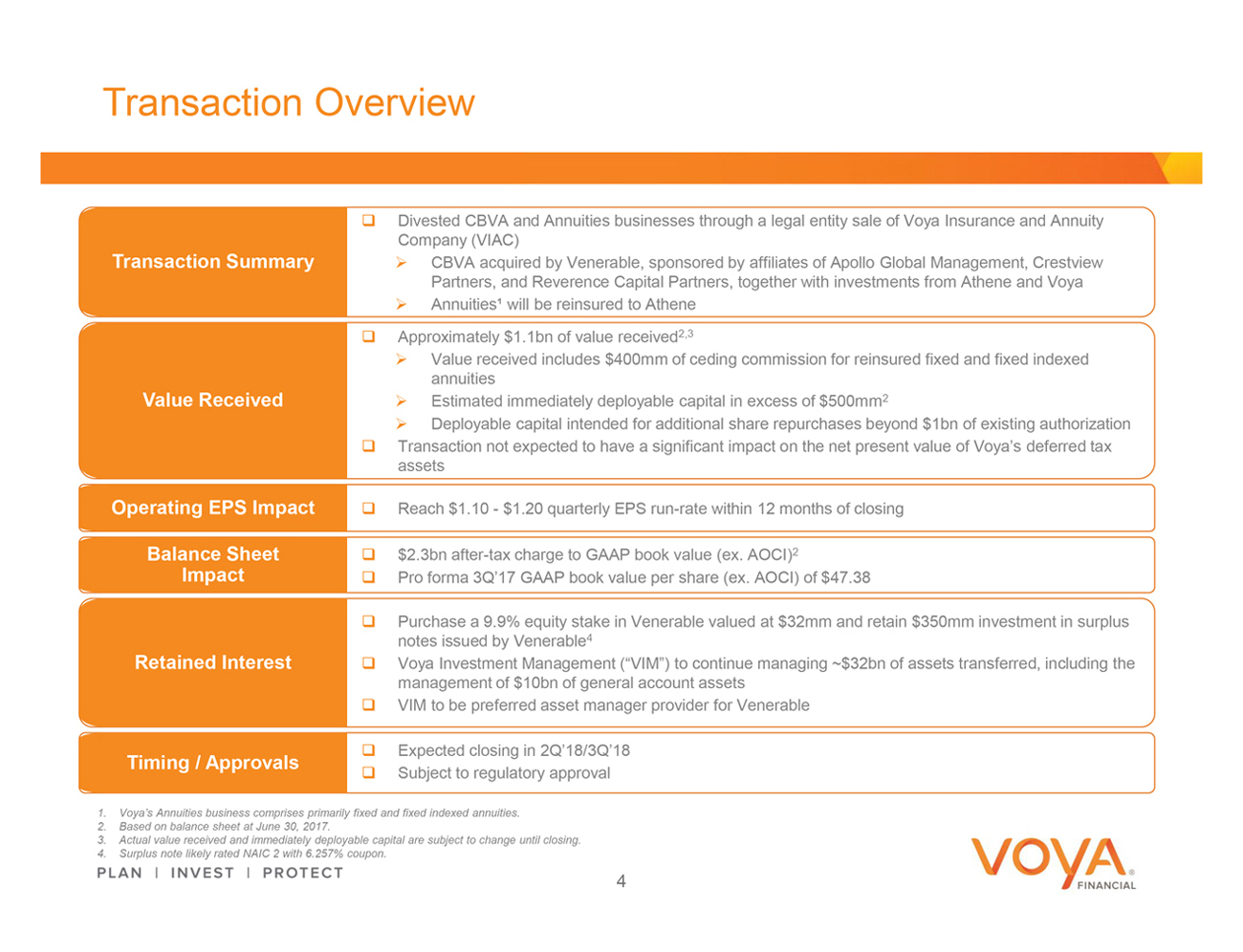

Transaction Overview Transaction Summary Value Received Operating EPS Impact Balance Sheet Impact Retained Interest Timing / Approvals Divested CBVA and Annuities businesses through a legal entity sale of Voya Insurance and Annuity Company (VIAC) CBVA acquired by Venerable, sponsored by affiliates of Apollo Global Management, Crestview Partners, and Reverence Capital Partners, together with investments from Athene and Voya Annuities¹ will be reinsured to Athene Approximately $1.1bn of value received2,3 Value received includes $400mm of ceding commission for reinsured fixed and fixed indexed annuities Estimated immediately deployable capital in excess of $500mm2 Deployable capital intended for additional share repurchases beyond $1bn of existing authorization Transaction not expected to have a significant impact on the net present value of Voya’s deferred tax assets Reach $1.10 - $1.20 quarterly EPS run-rate within 12 months of closing $2.3bn after-tax charge to GAAP book value (ex. AOCI)2 Pro forma 3Q’17 GAAP book value per share (ex. AOCI) of $47.38 Purchase a 9.9% equity stake in Venerable valued at $32mm and retain $350mm investment in surplus notes issued by Venerable4 Voya Investment Management (“VIM”) to continue managing ~$32bn of assets transferred, including the management of $10bn of general account assets VIM to be preferred asset manager provider for Venerable Expected closing in 2Q’18/3Q’18 Subject to regulatory approval 1. Voya’s Annuities business comprises primarily fixed and fixed indexed annuities. 2. Based on balance sheet at June 30, 2017. 3. Actual value received and immediately deployable capital are subject to change until closing. 4. Surplus note likely rated NAIC 2 with 6.257% coupon. 4

|

|

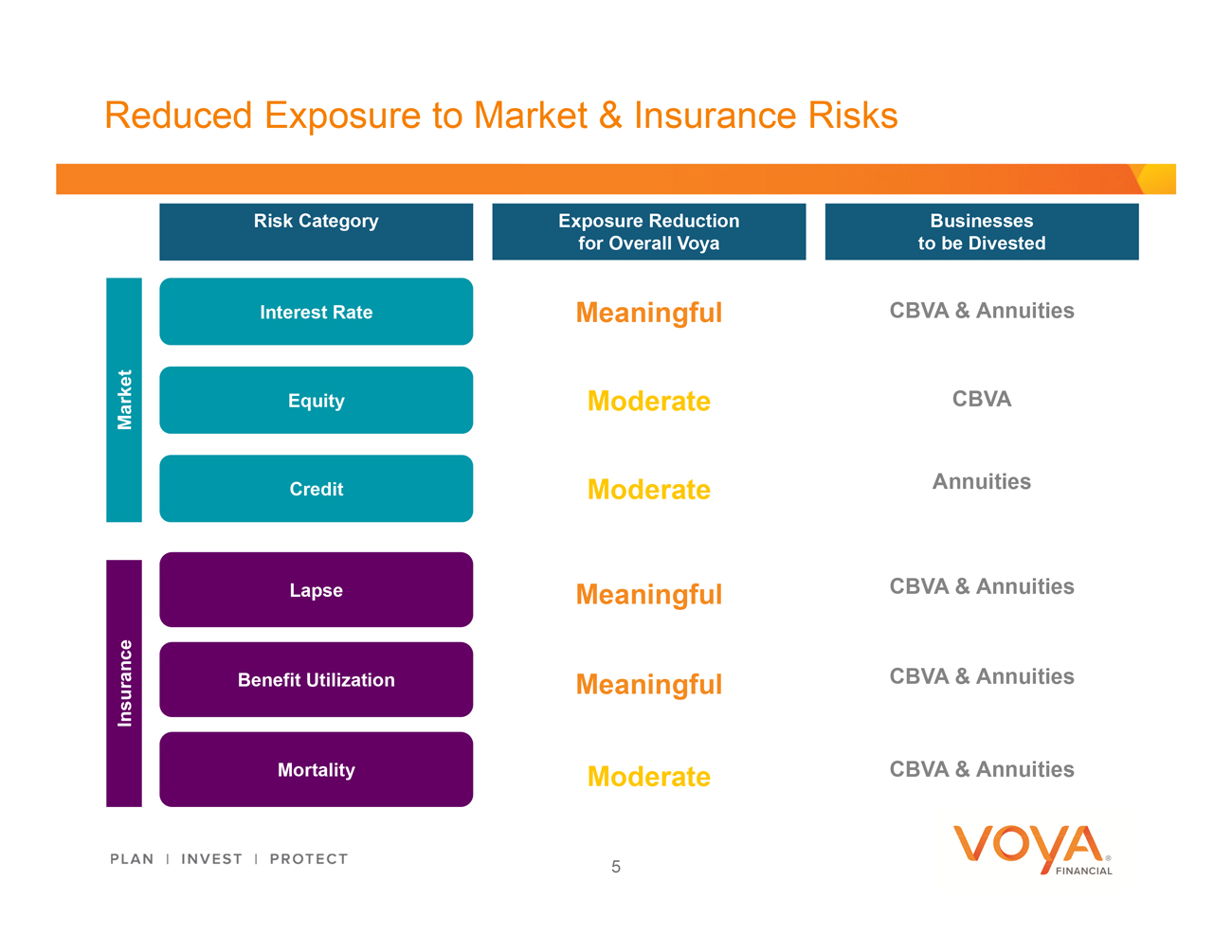

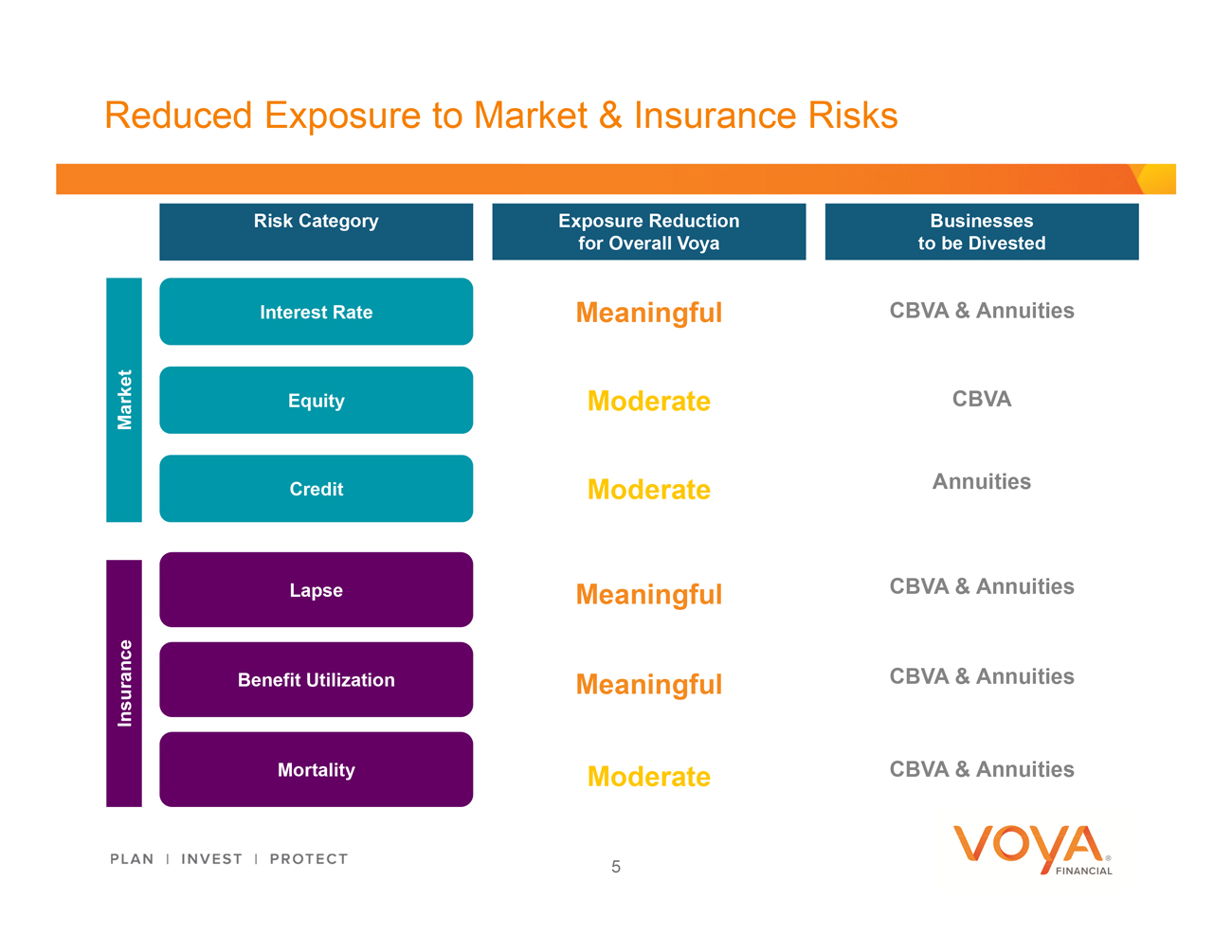

Reduced Exposure to Market & Insurance Risks Risk Category Exposure Reduction Businesses for Overall Voya to be Divested Interest Rate Meaningful CBVA & Annuities Market Equity Moderate CBVA Credit Moderate Annuities Lapse Meaningful CBVA & Annuities Insurance Benefit Utilization Meaningful CBVA & Annuities Mortality Moderate CBVA & Annuities 5

Leading Retirement, Investment, and Benefits Franchise 1 Focus on high growth, high return, capital-light businesses High free cash flow generation with strong balance 2 sheet Diverse management team with a track record of driving 3 growth and rapid improvement in financial results 6

|

|

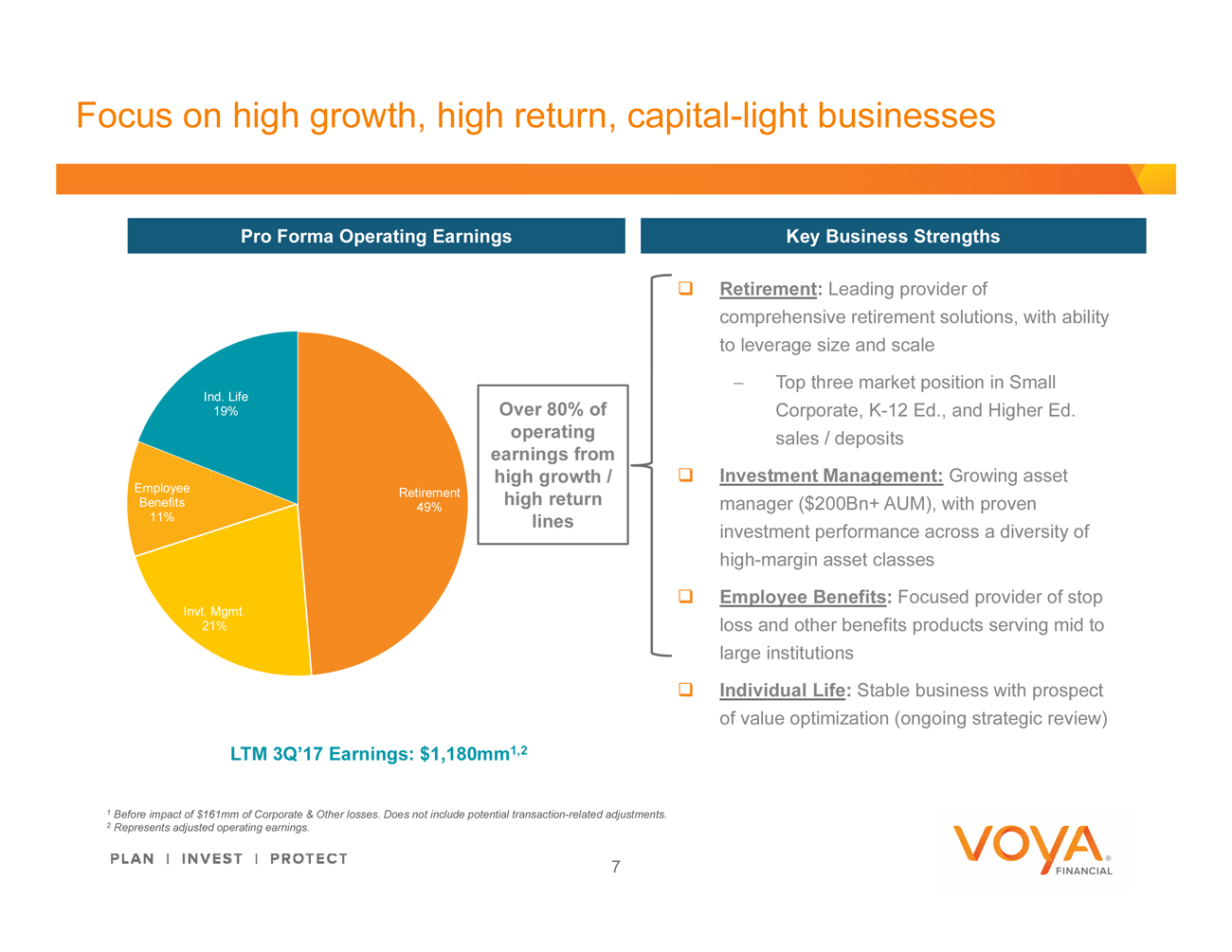

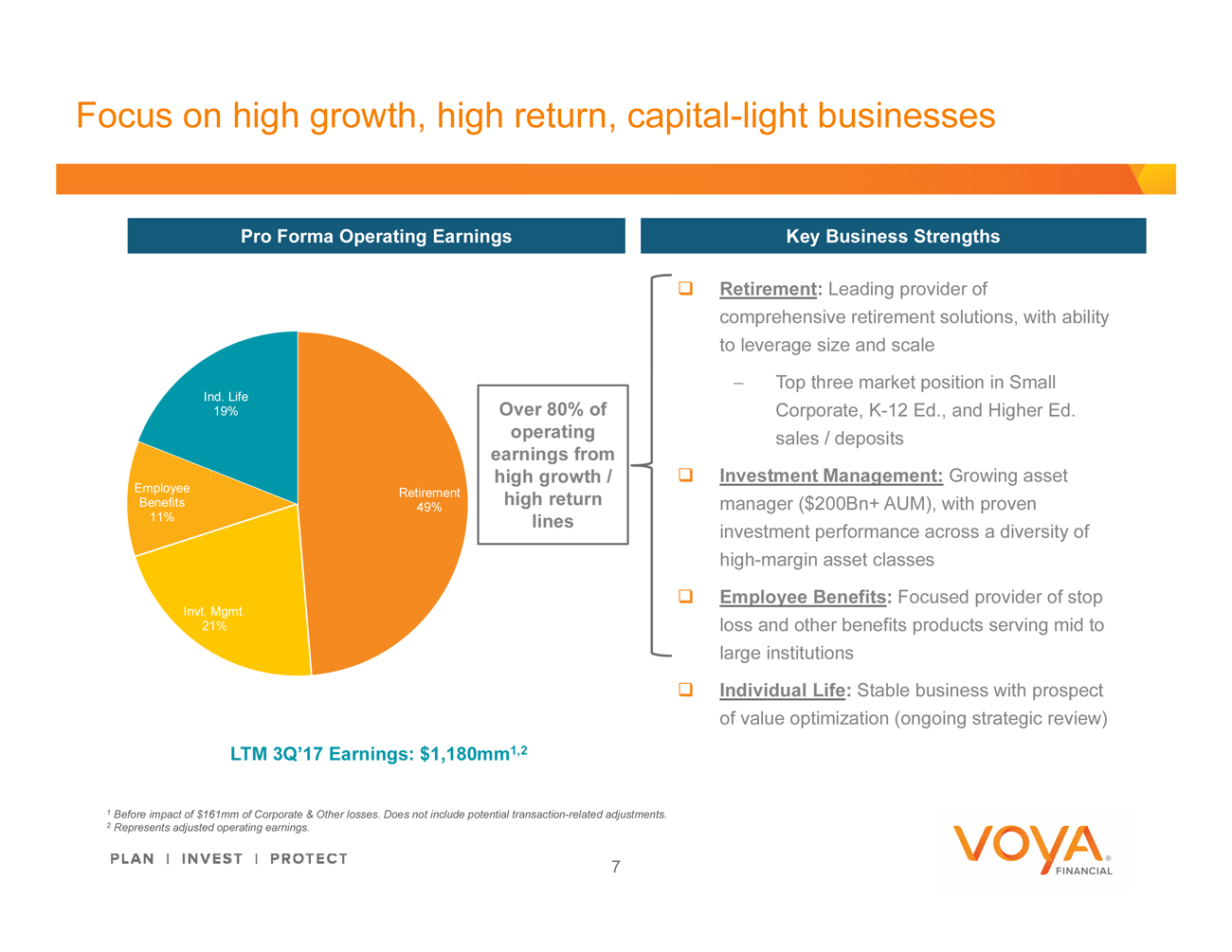

Focus on high growth, high return, capital-light businesses Pro Forma Operating Earnings Key Business Strengths Over 80% of operating earnings from high growth / high return lines Retirement: Leading provider of comprehensive retirement solutions, with ability to leverage size and scale Top three market position in Small Corporate, K-12 Ed., and Higher Ed. sales / deposits Investment Management: Growing asset manager ($200Bn+ AUM), with proven investment performance across a diversity of high-margin asset classes Employee Benefits: Focused provider of stop loss and other benefits products serving mid to large institutions Individual Life: Stable business with prospect of value optimization (ongoing strategic review) LTM 3Q’17 Earnings: $1,180mm1,2 1 Before impact of $161mm of Corporate & Other losses. Does not include potential transaction-related adjustments. 2 Represents adjusted operating earnings.

|

|

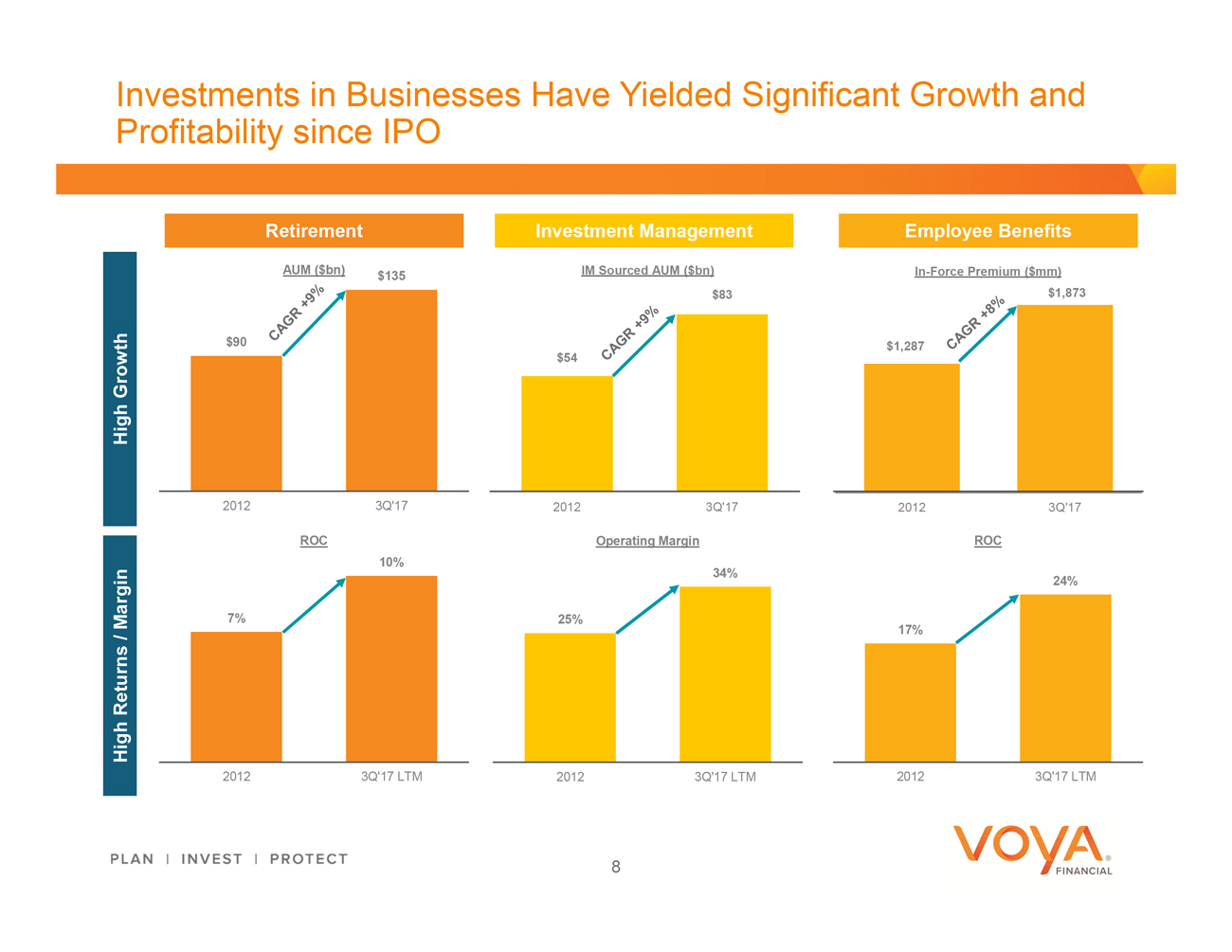

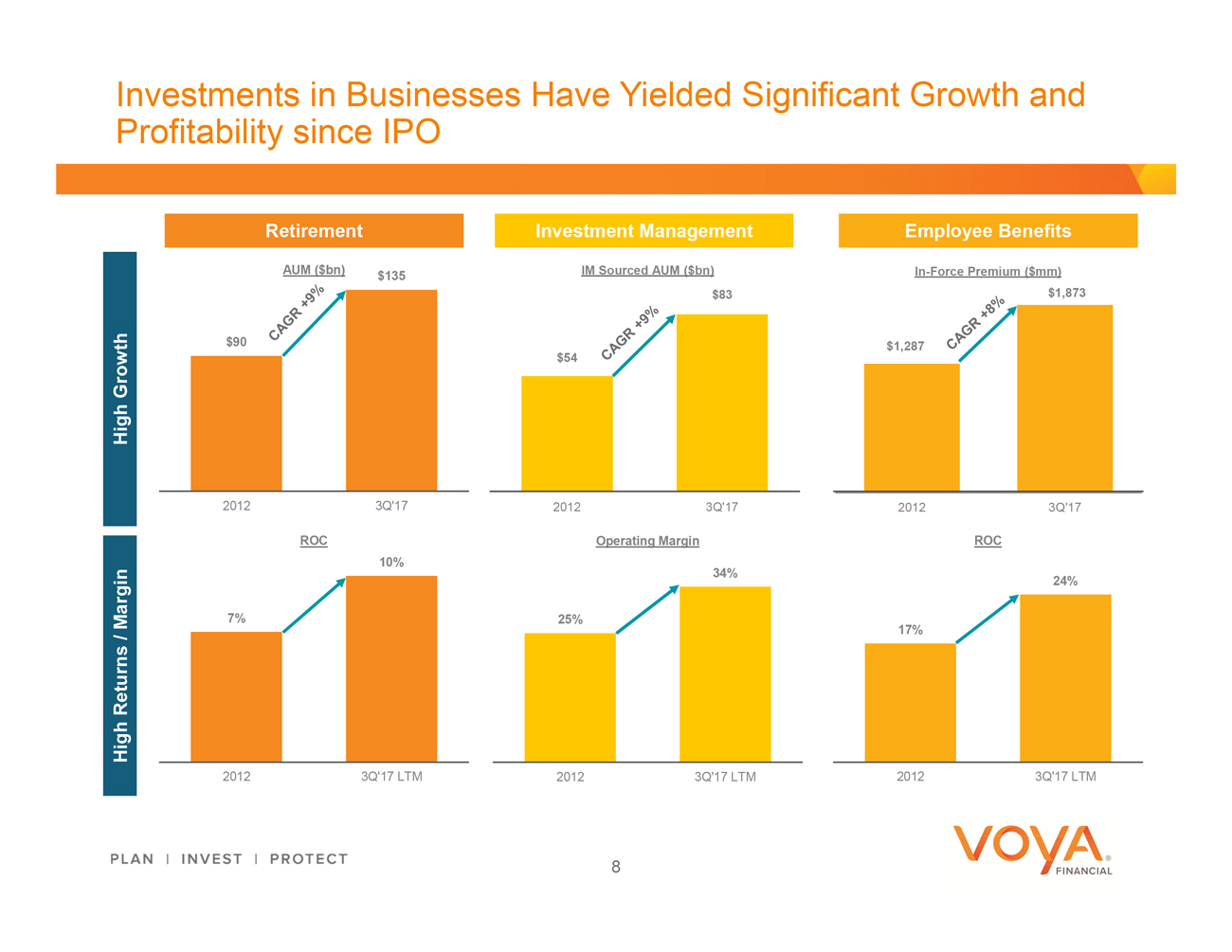

Investments in Businesses Have Yielded Significant Growth and Profitability since IPO Retirement Investment Management Employee Benefits AUM ($bn) $135 IM Sourced AUM ($bn)In-Force Premium ($mm) $83 $1,873 $90 $1,287 Growth $54 High 2012 3Q’17 2012 3Q’17 2012 3Q’17 ROC Operating Margin ROC 10% 34% 24% Margin 7% 25% 17% / Returns High 2012 3Q’17 LTM 2012 3Q’17 LTM 2012 3Q’17 LTM 8

|

|

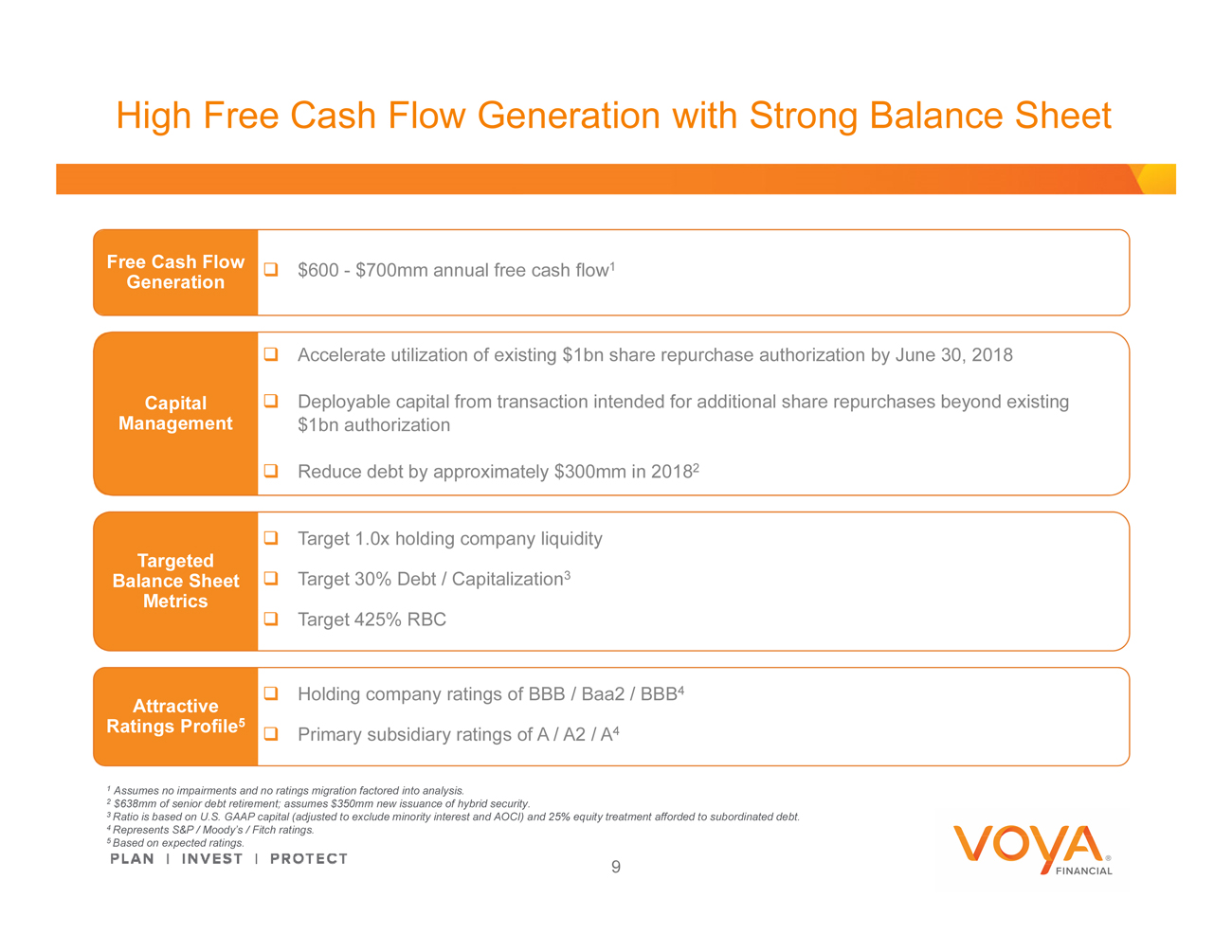

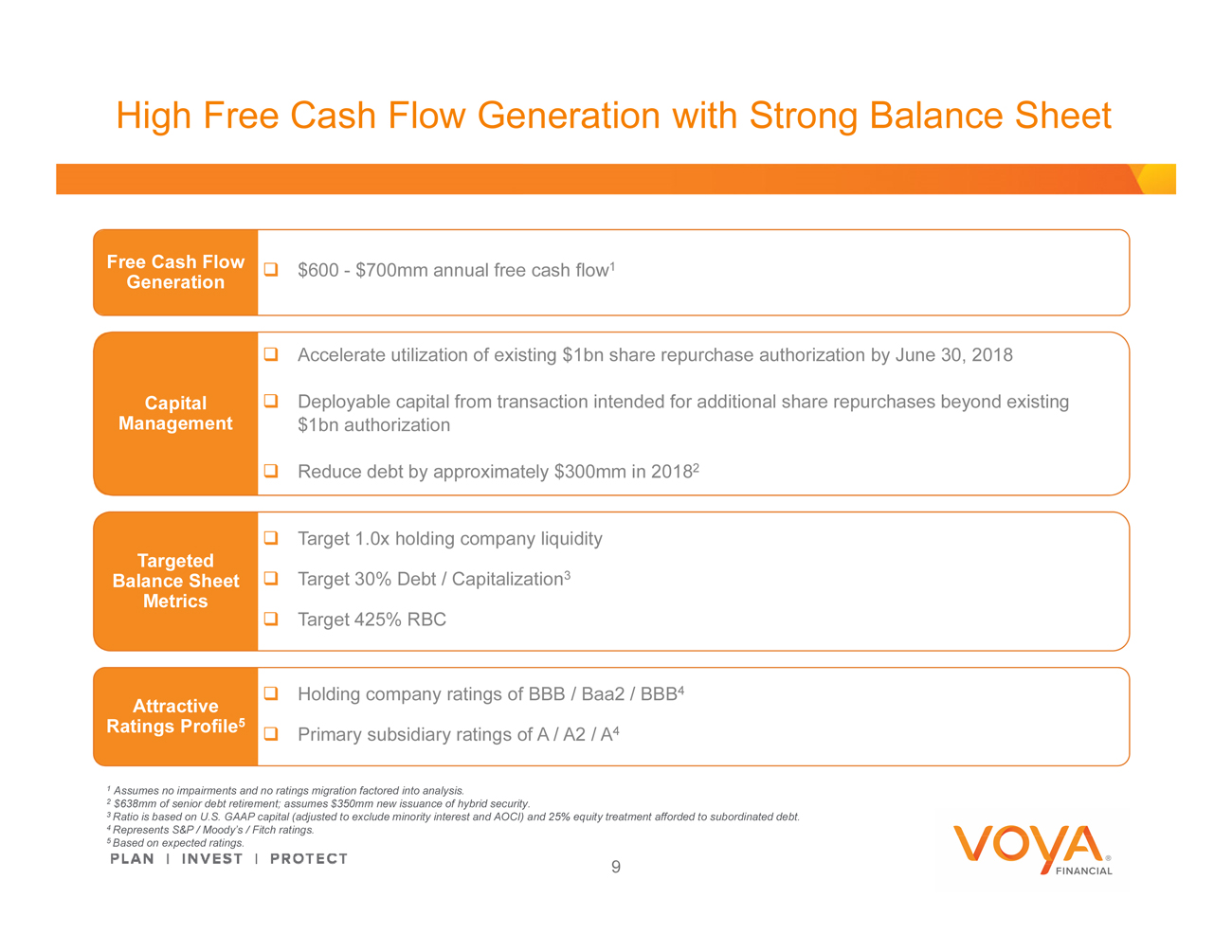

High Free Cash Flow Generation with Strong Balance Sheet Free Cash Flow Generation $600 - $700mm annual free cash flow1 Capital Management Accelerate utilization of existing $1bn share repurchase authorization by June 30, 2018 Deployable capital from transaction intended for additional share repurchases beyond existing $1bn authorization Reduce debt by approximately $300mm in 20182 Targeted Balance Sheet Metrics Target 1.0x holding company liquidity Target 30% Debt / Capitalization3 Target 425% RBC Attractive Ratings Profile5 Holding company ratings of BBB / Baa2 / BBB4 Primary subsidiary ratings of A / A2 / A4 1 Assumes no impairments and no ratings migration factored into analysis. 2 $638mm of senior debt retirement; assumes $350mm new issuance of hybrid security. 3 Ratio is based on U.S. GAAP capital (adjusted to exclude minority interest and AOCI) and 25% equity treatment afforded to subordinated debt. 4 Represents S&P / Moody’s / Fitch ratings. 5 Based on expected ratings. 9

|

|

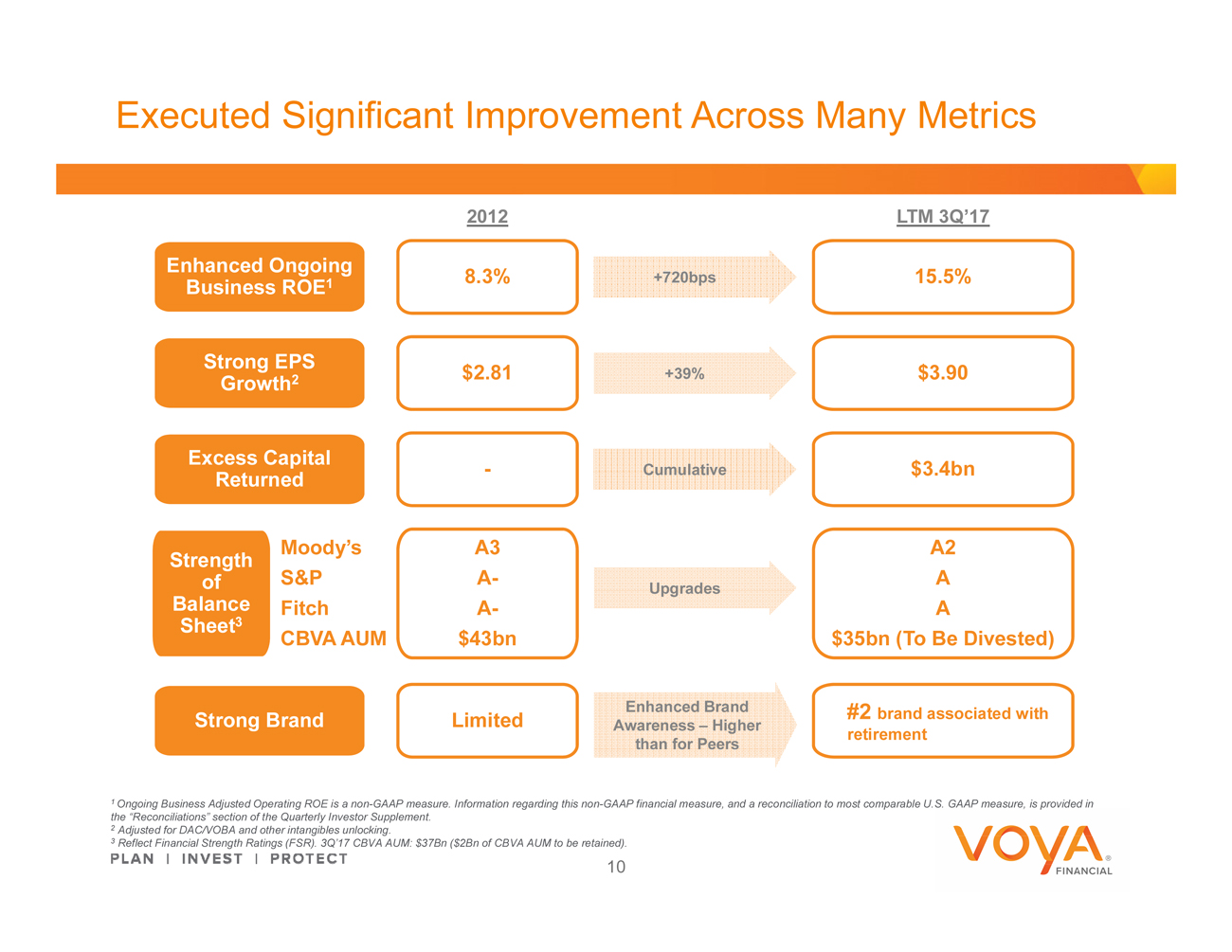

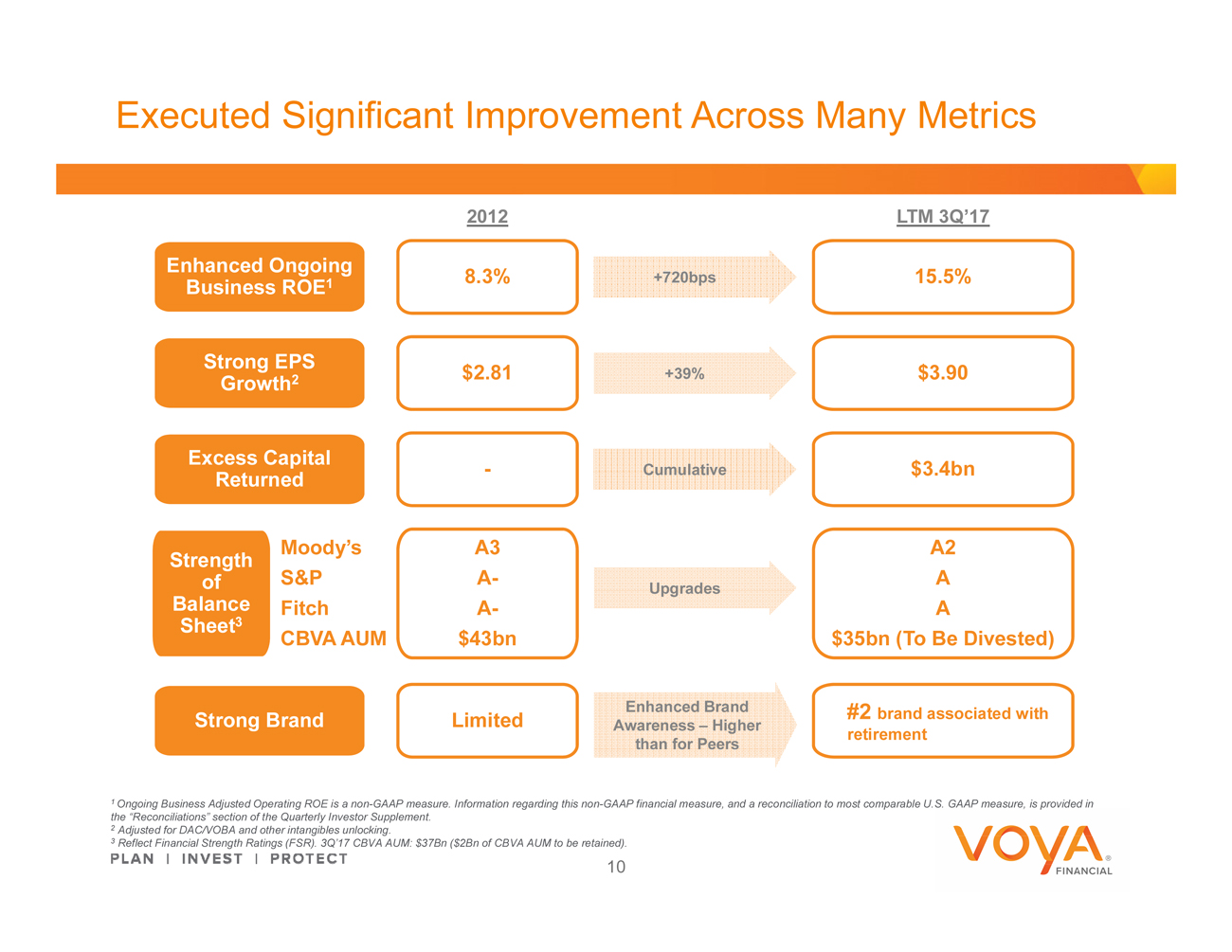

Executed Significant Improvement Across Many Metrics 2012 LTM 3Q’17 Enhanced Ongoing Business ROE1 8.3% +720bps 15.5% Strong EPS Growth2 $2.81 +39% $3.90 Excess Capital Returned - Cumulative $3.4bn Strength of Balance Sheet3 Moody’s S&P Fitch CBVA AUM A3 A- A- $43bn Upgrades A2 A A $35bn (To Be Divested) Strong Brand Limited Enhanced Brand Awareness - Higher than for Peers #2 brand associated with retirement 1 Ongoing Business Adjusted Operating ROE is a non-GAAP measure. Information regarding this non-GAAP financial measure, and a reconciliation to most comparable U.S. GAAP measure, is provided in the “Reconciliations” section of the Quarterly Investor Supplement. 2 Adjusted for DAC/VOBA and other intangibles unlocking. 3 Reflect Financial Strength Ratings (FSR). 3Q’17 CBVA AUM: $37Bn ($2Bn of CBVA AUM to be retained). 10

|

|

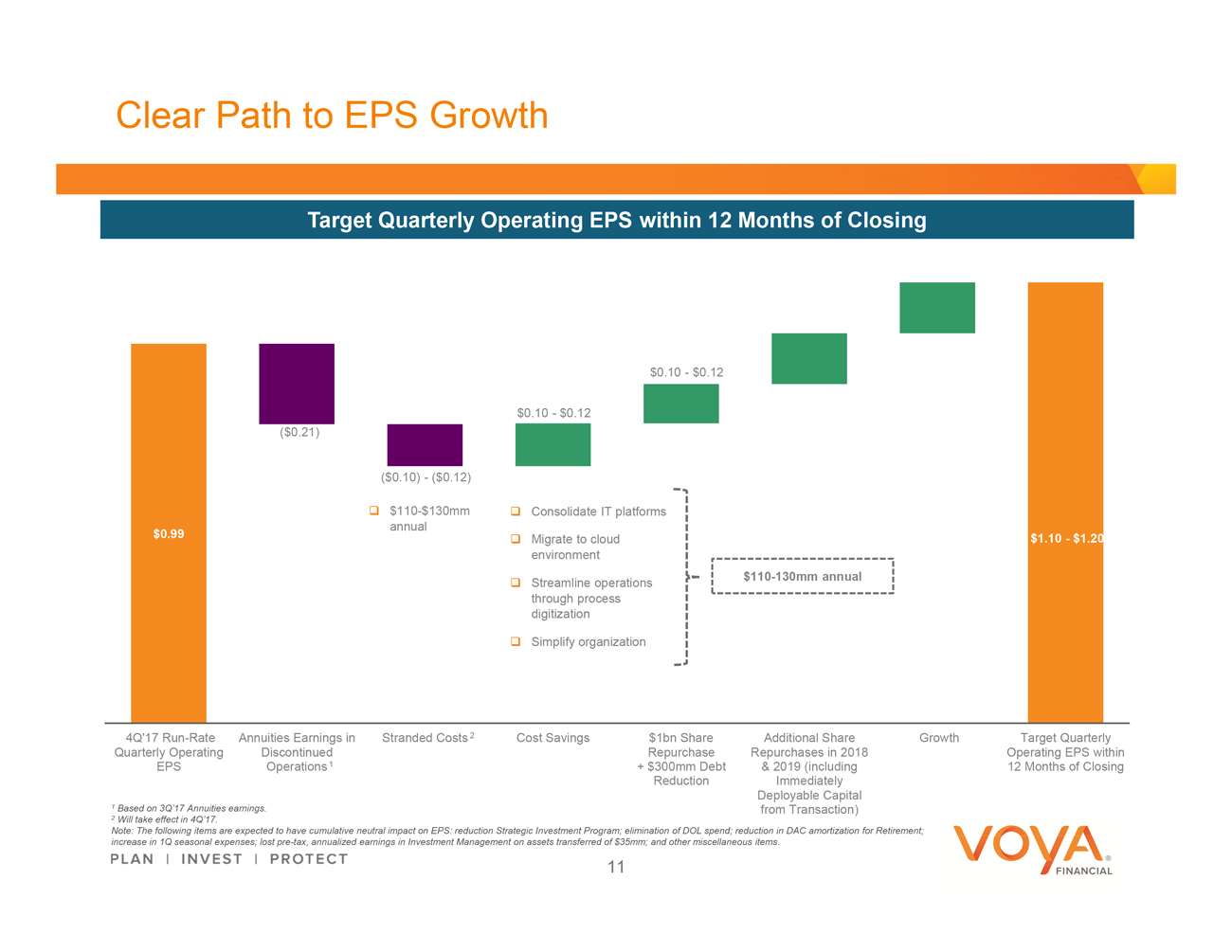

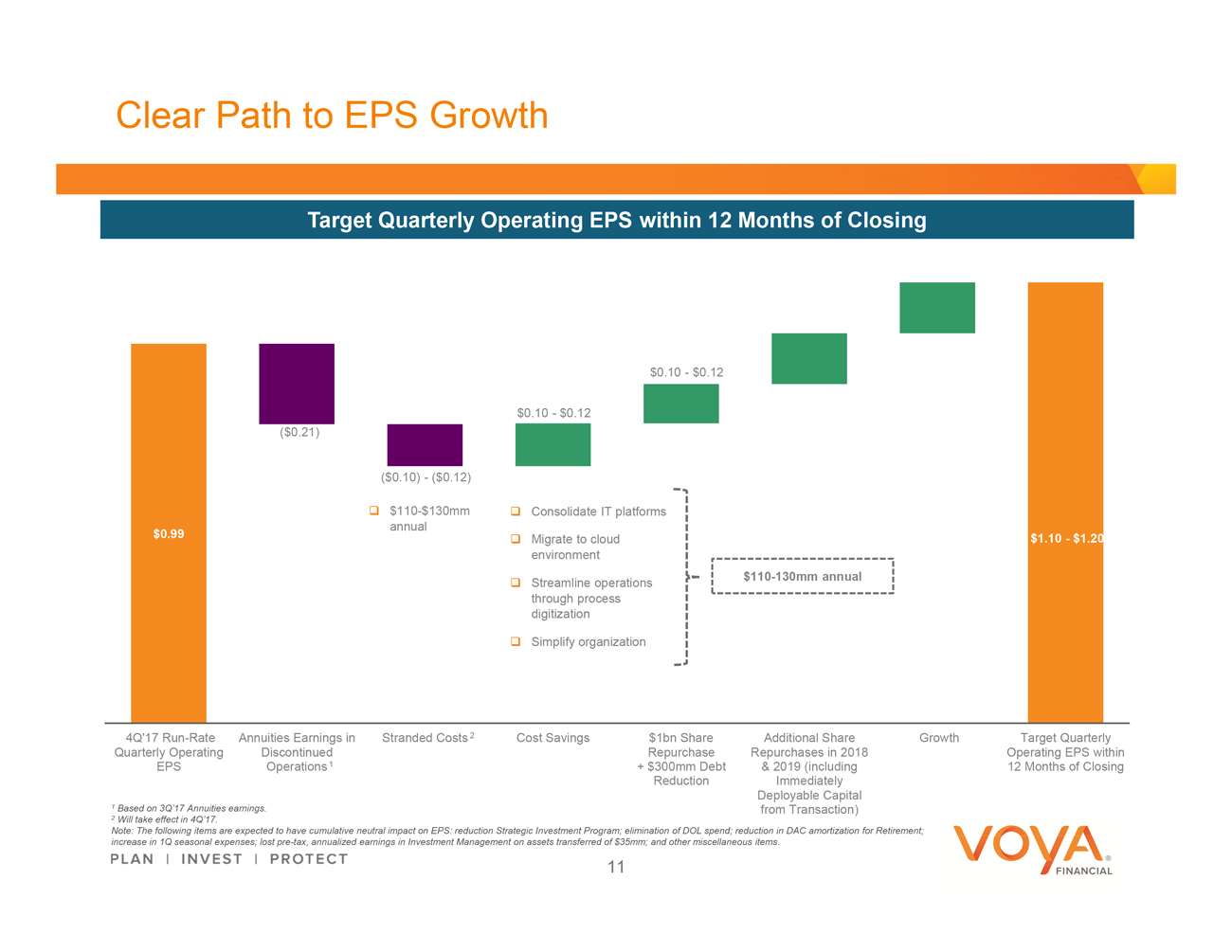

Clear Path to EPS Growth Target Quarterly Operating EPS within 12 Months ofClosing $0.10—$0.12 $0.10—$0.12 ($0.21) ($0.10)—($0.12) $110-$130mm Consolidate IT platforms annual $0.99 Migrate to cloud $1.10—$1.20 environment Streamline operations$110-130mm annual through process digitization Simplify organization 4Q’17Run-Rate Annuities Earnings in Stranded Costs 2 Cost Savings $1bn Share Additional Share Growth Target Quarterly Quarterly Operating Discontinued Repurchase Repurchases in 2018 Operating EPS within EPS Operations 1 + $300mm Debt & 2019 (including 12 Months of Closing Reduction Immediately Deployable Capital 1 Based on 3Q’17 Annuities earnings. from Transaction) 2 Will take effect in 4Q’17. Note: The following items are expected to have cumulative neutral impact on EPS: reduction Strategic Investment Program; elimination of DOL spend; reduction in DAC amortization for Retirement; increase in 1Q seasonal expenses; lostpre-tax, annualized earnings in Investment Management on assets transferred of $35mm; and other miscellaneous items. 11

|

|

Leading Retirement, Investment, and Benefits Franchise 1 Focus on high growth, high return, capital-light businesses High free cash flow generation with strong balance 2 sheet Diverse management team with a track record of driving 3 growth and rapid improvement in financial results 12

Appendix

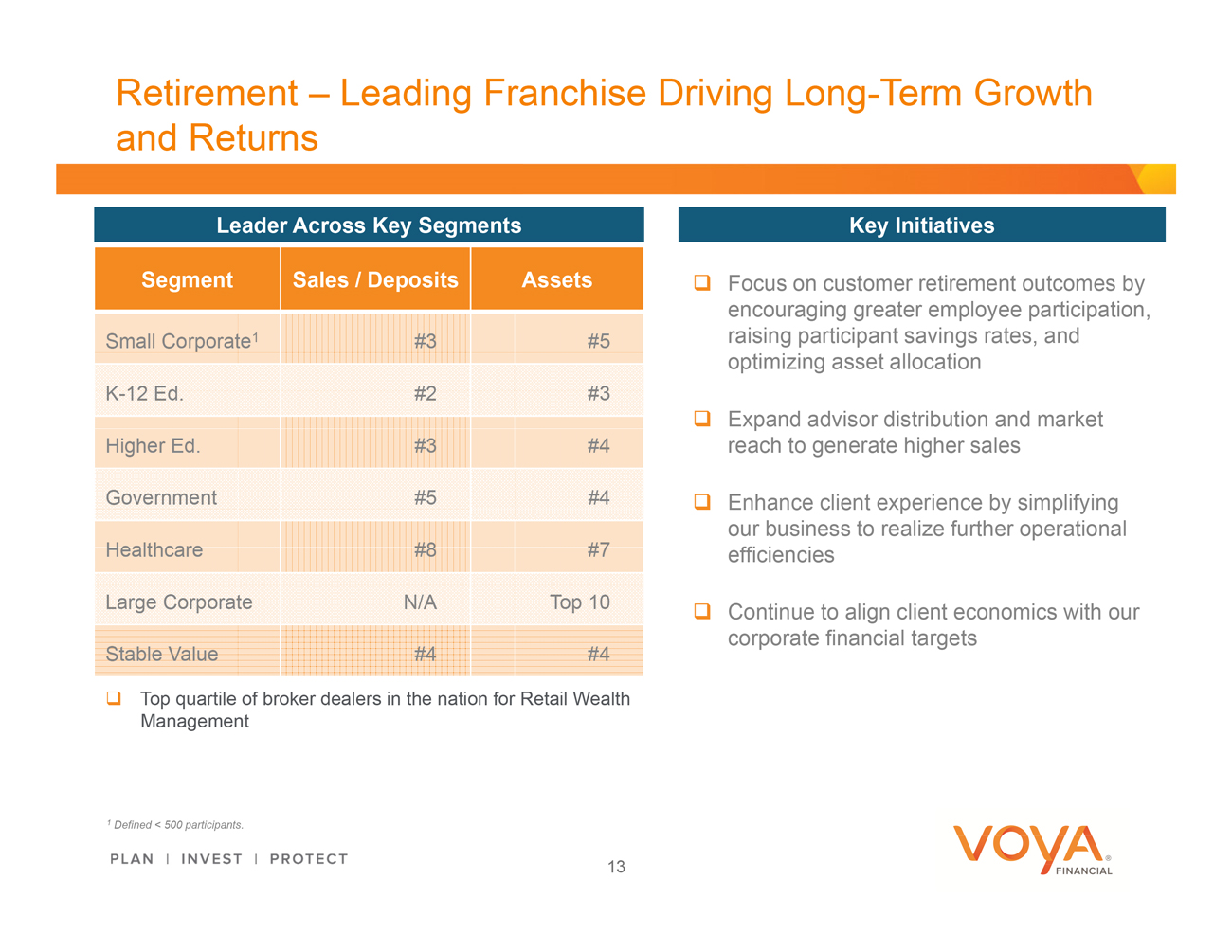

Retirement – Leading Franchise Driving Long-Term Growth and Returns Leader Across Key Segments Key Initiatives Segment Sales / Deposits Assets Focus on customer retirement outcomes by encouraging greater employee participation, Small Corporate1 #3 #5 raising participant savings rates, and optimizing asset allocationK-12 Ed. #2 #3 Expand advisor distribution and market Higher Ed. #3 #4 reach to generate higher sales Government #5 #4 Enhance client experience by simplifying our business to realize further operational Healthcare #8 #7 efficiencies Large Corporate N/A Top 10 Continue to align client economics with our corporate financial targets Stable Value #4 #4 Top quartile of broker dealers in the nation for Retail Wealth Management 1 Defined < 500 participants. 13

|

|

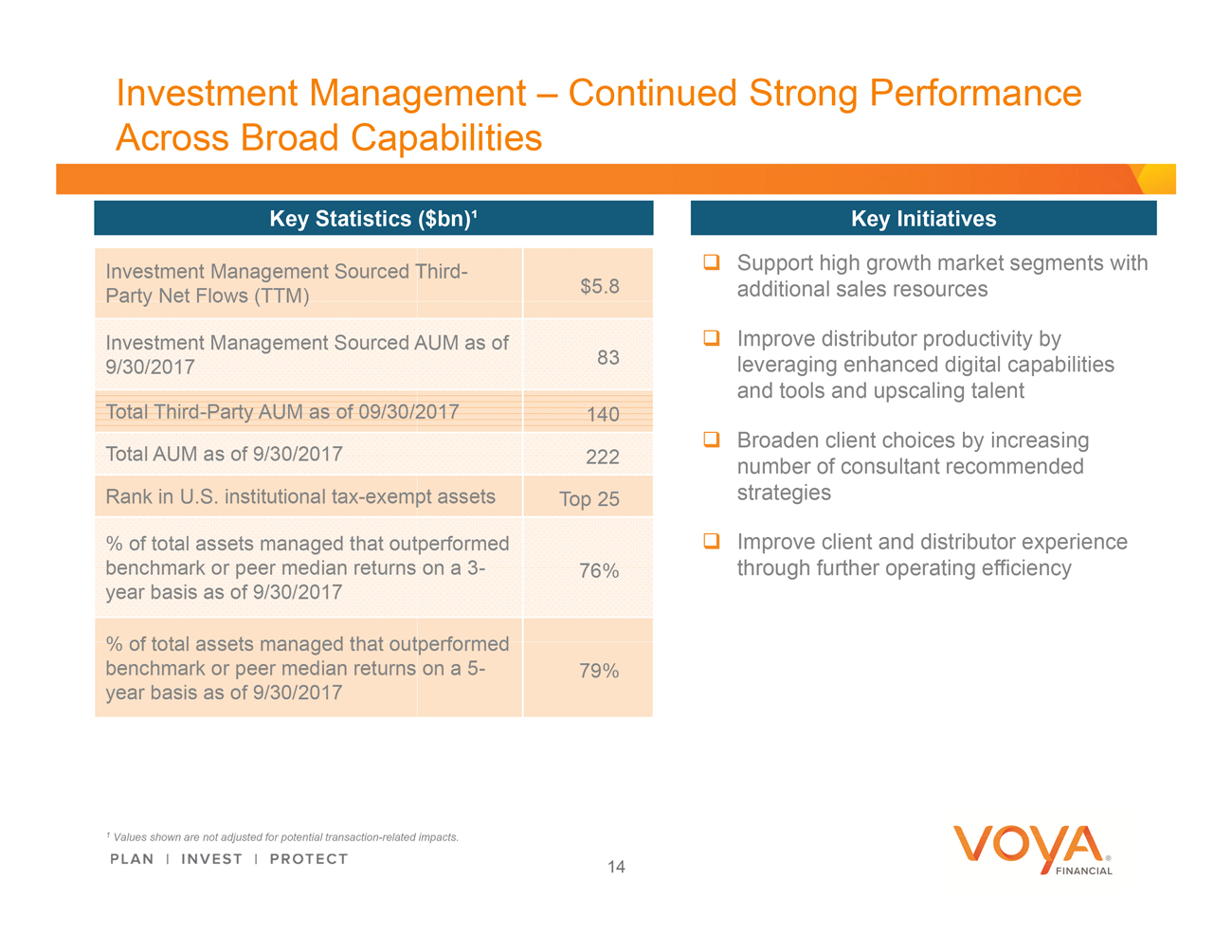

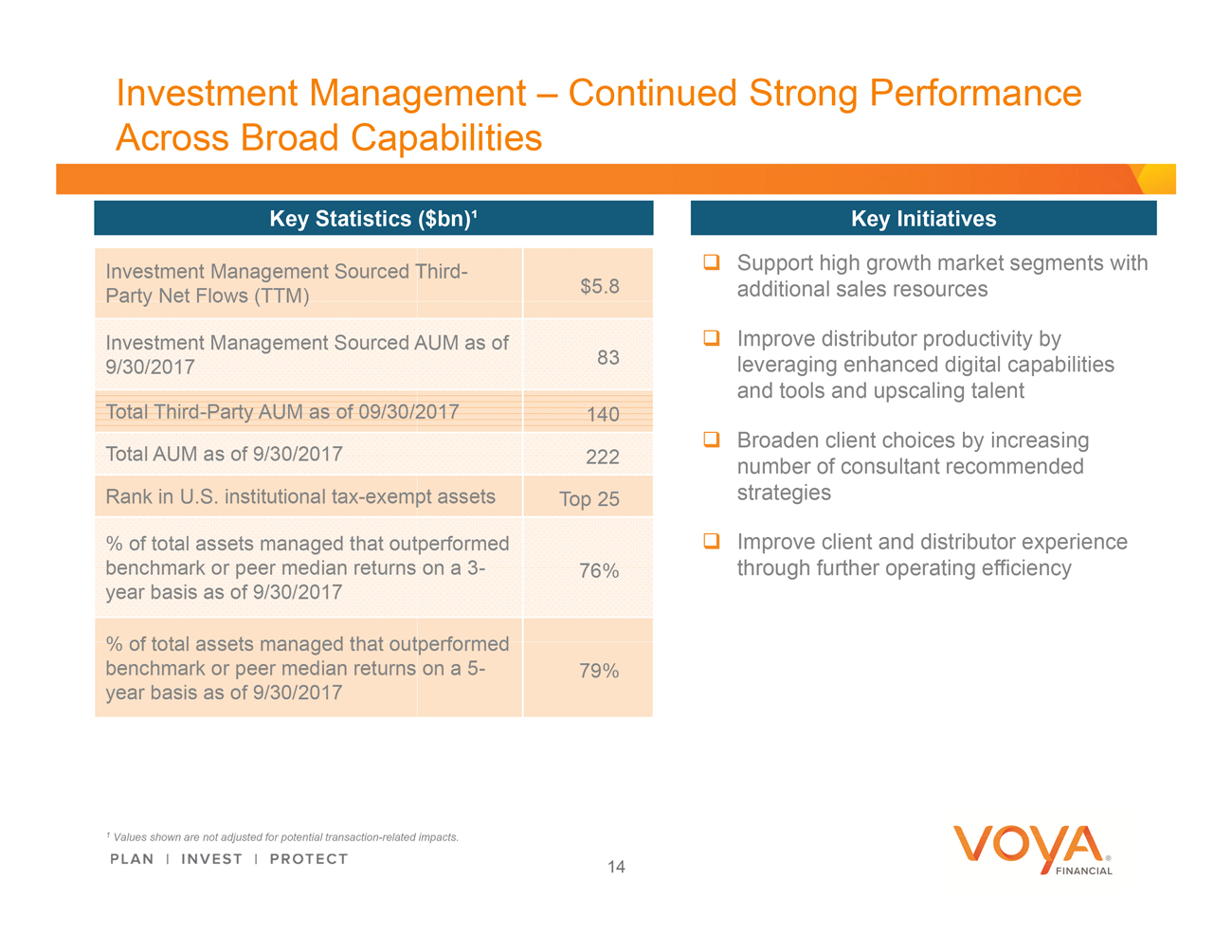

Investment Management – Continued Strong Performance Across Broad Capabilities Key Statistics ($bn)¹ Key Initiatives Investment Management Sourced Third- Support high growth market segments with Party Net Flows (TTM) $5.8 additional sales resources Investment Management Sourced AUM as of Improve distributor productivity by 9/30/2017 83 leveraging enhanced digital capabilities and tools and upscaling talent Total Third-Party AUM as of 09/30/2017 140 Broaden client choices by increasing Total AUM as of 9/30/2017 222 number of consultant recommended Rank in U.S. institutionaltax-exempt assets Top 25 strategies % of total assets managed that outperformed Improve client and distributor experience benchmark or peer median returns on a3- 76% through further operating efficiency year basis as of 9/30/2017 % of total assets managed that outperformed benchmark or peer median returns on a5- 79% year basis as of 9/30/2017 1 Values shown are not adjusted for potential transaction-related impacts. 14

|

|

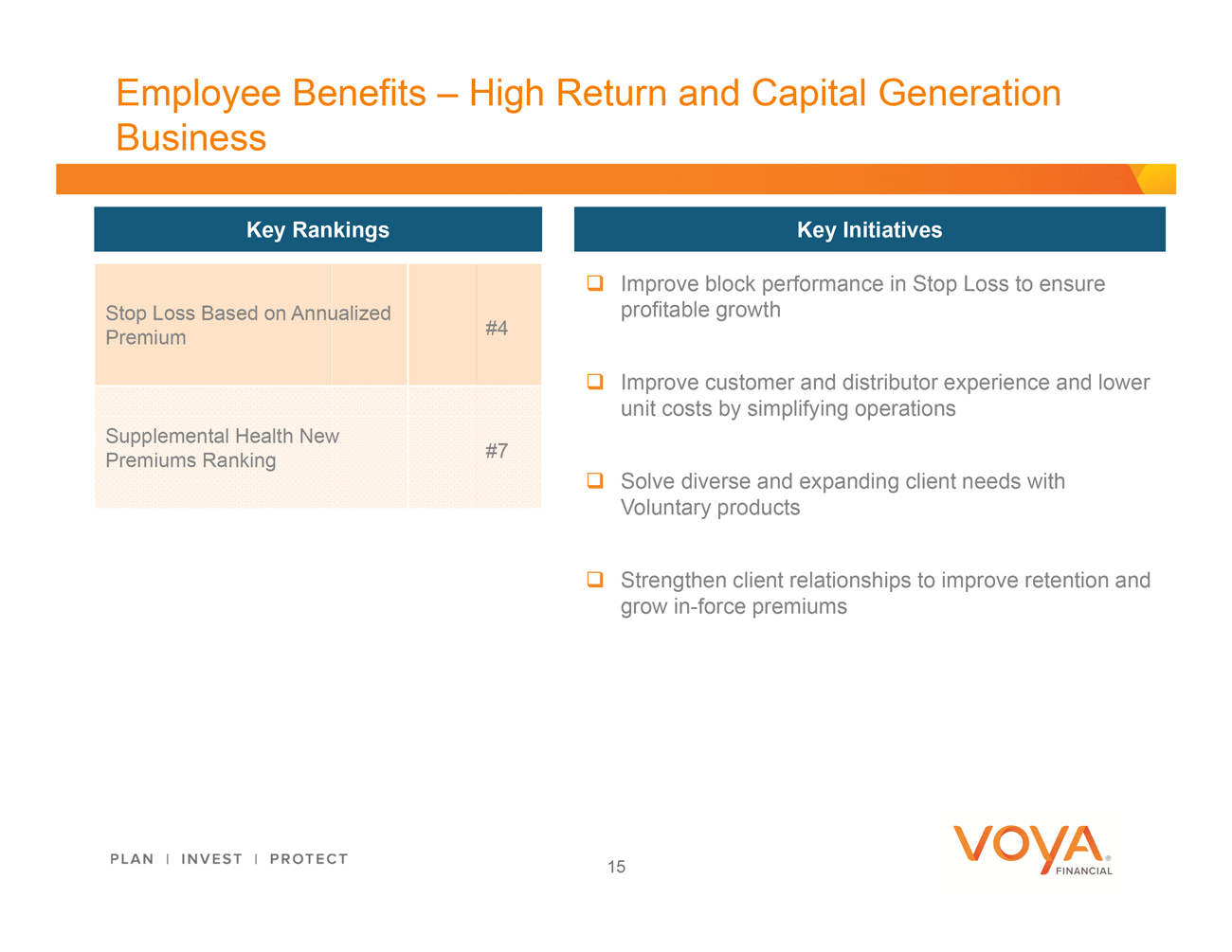

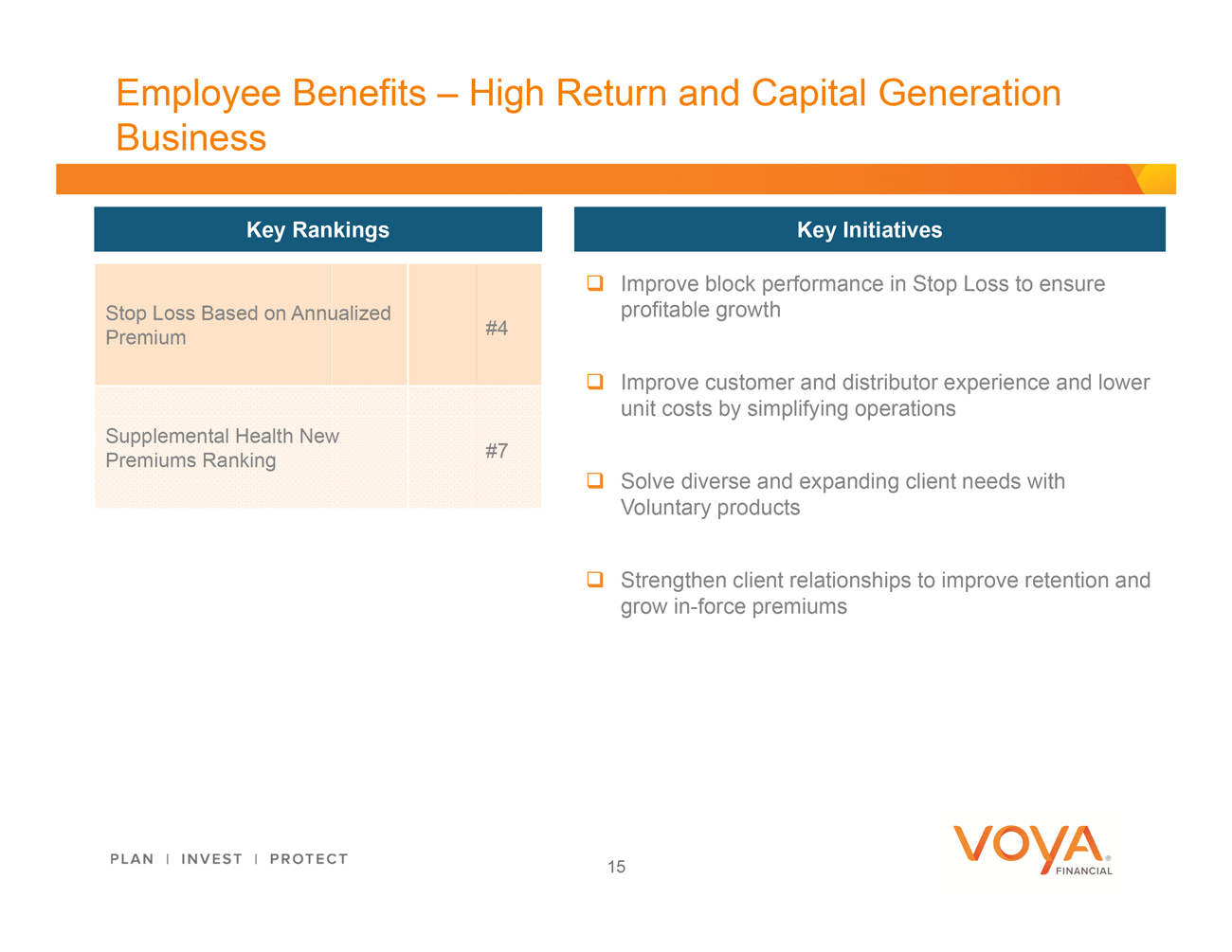

Employee Benefits – High Return and Capital Generation Business Key Rankings Key Initiatives Improve block performance in Stop Loss to ensure Stop Loss Based on Annualized profitable growth Premium #4 Improve customer and distributor experience and lower unit costs by simplifying operations Supplemental Health New Premiums Ranking #7 Solve diverse and expanding client needs with Voluntary products Strengthen client relationships to improve retention and growin-force premiums 15

|

|

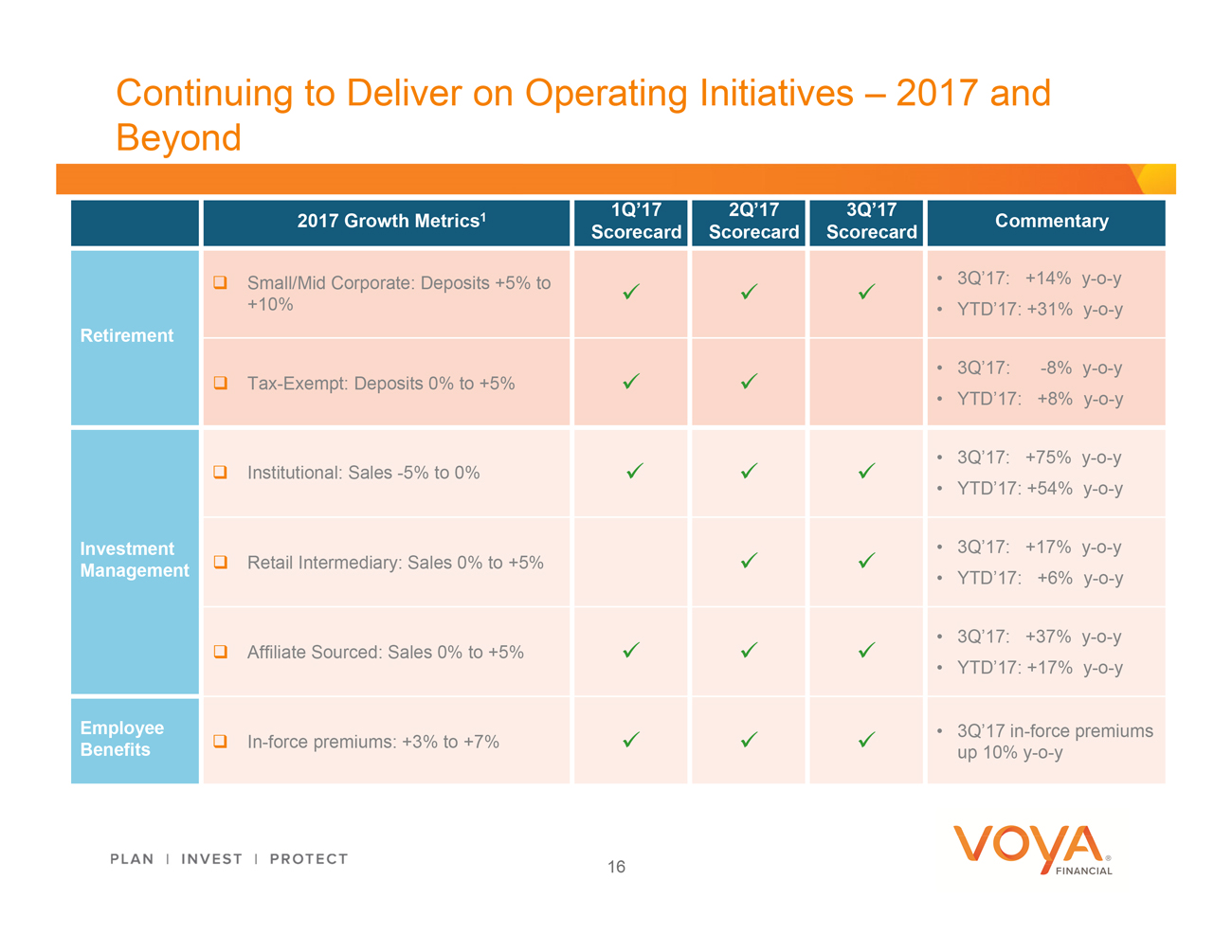

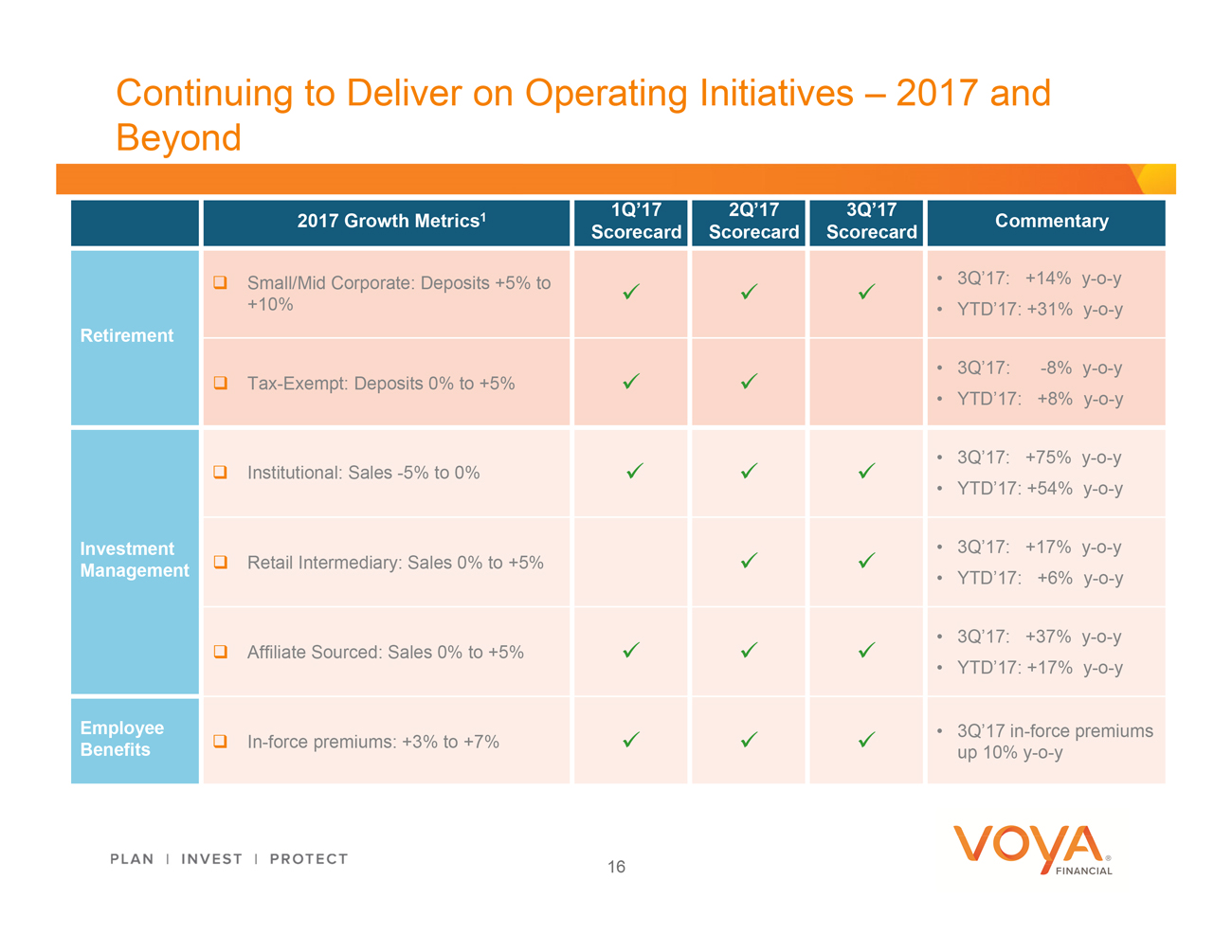

Continuing to Deliver on Operating Initiatives – 2017 and Beyond 1Q’17 2Q’17 3Q’17 2017 Growth Metrics1 Commentary Scorecard Scorecard Scorecard Small/Mid Corporate: Deposits +5% to 3Q’17: +14%y-o-y +10% YTD’17: +31%y-o-y Retirement 3Q’17:-8%y-o-y Tax-Exempt: Deposits 0% to +5% YTD’17: +8%y-o-y 3Q’17: +75%y-o-y Institutional: Sales-5% to 0% YTD’17: +54%y-o-y Investment 3Q’17: +17%y-o-y Management Retail Intermediary: Sales 0% to +5% YTD’17: +6%y-o-y 3Q’17: +37%y-o-y Affiliate Sourced: Sales 0% to +5% YTD’17: +17%y-o-y Employee 3Q’17in-force premiumsBenefits In-force premiums: +3% to +7% up 10%y-o-y 16

|

|

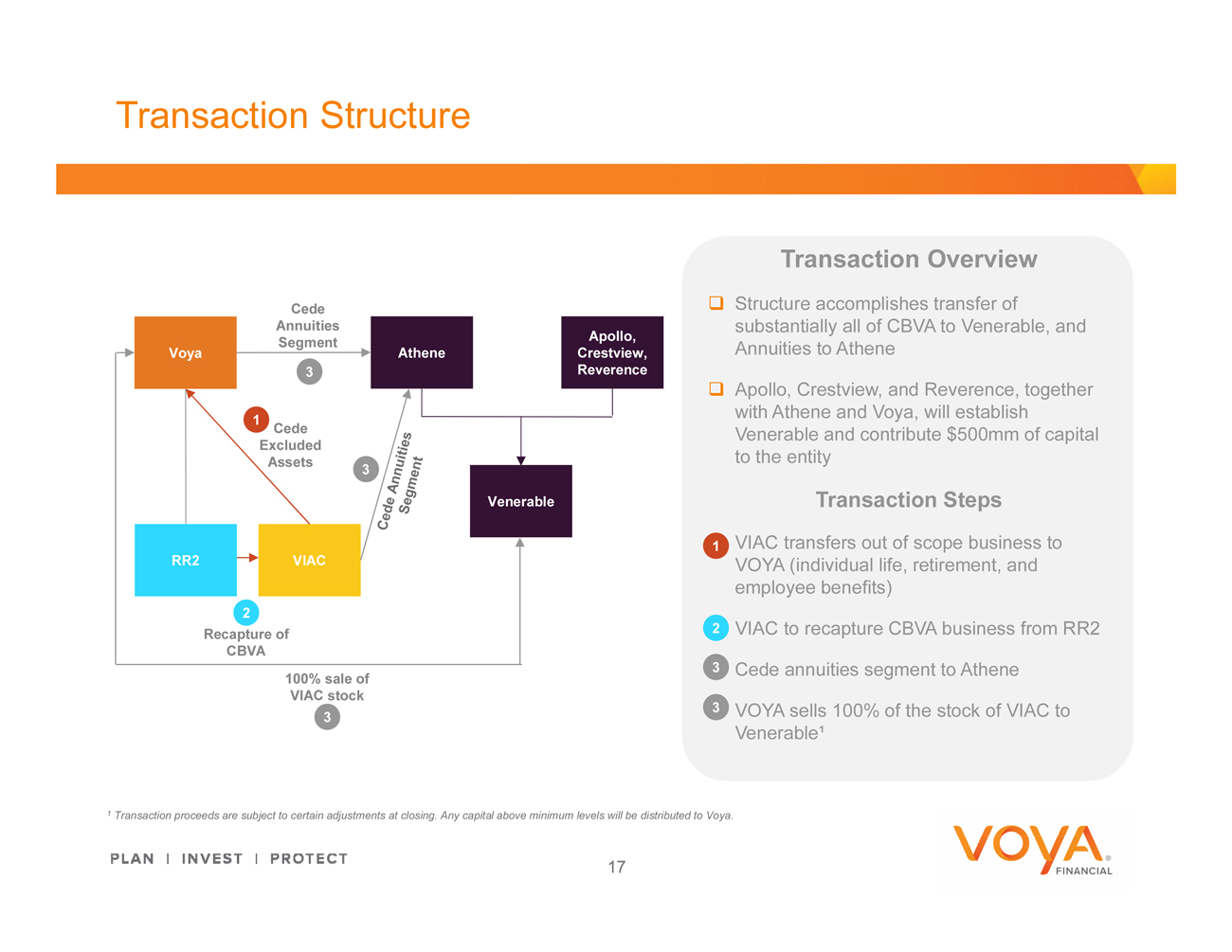

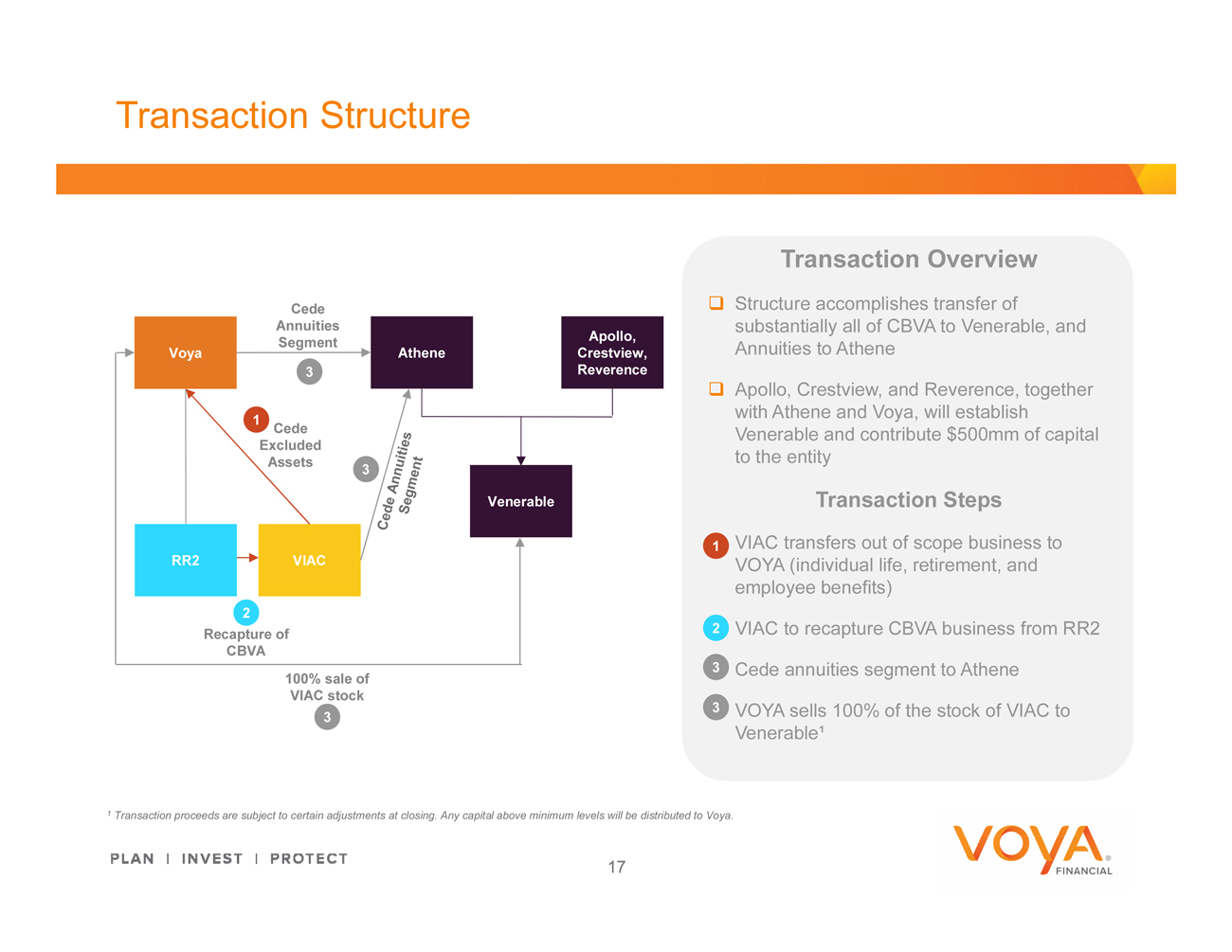

Transaction Structure Cede Annuities Segment Cede Excluded Assets Recapture of CBVA 100% sale of VIAC stock Cede Annuities Segment Voya RR2 VIAC Athene Apollo, Crestview, Reverence Venerable Transaction Overview Structure accomplishes transfer of substantially all of CBVA to Venerable, and Annuities to Athene Apollo, Crestview, and Reverence, together with Athene and Voya, will establish Venerable and contribute $500mm of capital to the entity Transaction Steps VIAC transfers out of scope business to VOYA (individual life, retirement, and employee benefits) VIAC to recapture CBVA business from RR2 Cede annuities segment to Athene VOYA sells 100% of the stock of VIAC to Venerable¹ 1 Transaction proceeds are subject to certain adjustments at closing. Any capital above minimum levels will be distributed to Voya. 17