Exhibit 99.2 Voya Financial Announces Transaction with Allianz Global Investors June 13, 2022

Forward-Looking and Other Cautionary Statements This presentation and the remarks made orally contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The company does not assume any obligation to revise or update these statements to reflect new information, subsequent events or changes in strategy. Forward-looking statements include statements relating to future developments in our business or expectations for our future financial performance and any statement not involving a historical fact. Forward-looking statements use words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and other words and terms of similar meaning in connection with a discussion of future operating or financial performance. Actual results, performance or events may differ materially from those projected in any forward-looking statement due to, among other things, (i) general economic conditions, particularly economic conditions in our core markets, (ii) performance of financial markets, (iii) the frequency and severity of insured loss events, (iv) the effects of natural or man-made disasters, including pandemic events and specifically the current COVID-19 pandemic event, (v) mortality and morbidity levels, (vi) persistency and lapse levels, (vii) interest rates, (viii) currency exchange rates, (ix) general competitive factors, (x) changes in laws and regulations, such as those relating to Federal taxation, state insurance regulations and NAIC regulations and guidelines, (xi) changes in the policies of governments and/or regulatory authorities, (xii) our ability to successfully manage the separation of our individual life business on the expected timeline and economic terms, and (xiii) our ability to successfully complete a strategic partnership transaction with AllianzGI on the expected economic terms or at all. Factors that may cause actual results to differ from those in any forward-looking statement also include those described under “Risk Factors” and “Management’s Discussion and Analysis of Results of Operations and Financial Condition (“MD&A”) – Trends and Uncertainties” in our Annual Report on Form 10-K for the year ended Dec. 31, 2021, as filed with the Securities and Exchange Commission (“SEC”) on Feb. 22, 2022 and in our Quarterly Report on Form 10-Q for the three months ended March 31, 2022, filed with the SEC on May 5, 2022. This presentation and the remarks made orally contain certain non-GAAP financial measures. Non-GAAP measures include Adjusted Operating Earnings, Adjusted Operating Return on Capital, Adjusted Operating Margin, and Adjusted debt-to-capital ratio. Information regarding these and other non-GAAP financial measures, including reconciliations to the most directly comparable GAAP financial measures, is provided in our quarterly earnings press releases and in our quarterly investor supplements, all of which are available at the Investor Relations section of Voya Financial’s website at investors.voya.com. 2

Transaction with Allianz Global Investors is Highly Strategic Expands international distribution through long-term strategic partnership with Allianz Global Investors (AllianzGI) Addition of complementary strategies and scale that diversifies client mix across retail and institutional, and U.S. and international 1 Immediately cash accretive to Voya, 6% - 8% 2 Improves margin profile for Voya IM to 30% - 32% 1 Estimation to 2023 EPS on a cash basis. 2 Excluding notable items. 3

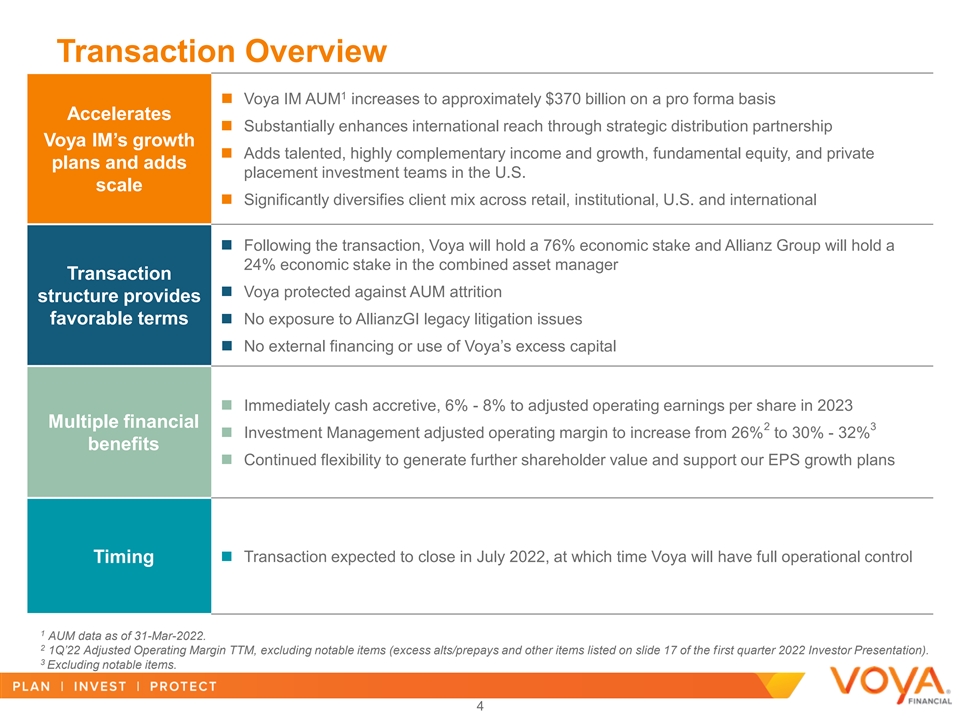

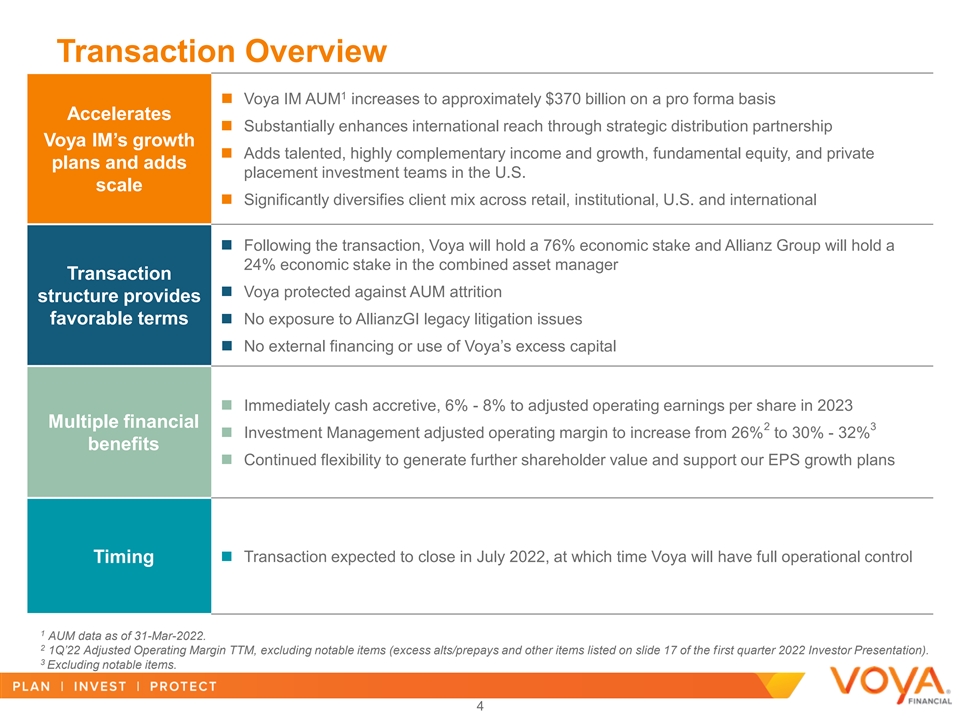

Transaction Overview 1 ◼ Voya IM AUM increases to approximately $370 billion on a pro forma basis Accelerates ◼ Substantially enhances international reach through strategic distribution partnership Voya IM’s growth ◼ Adds talented, highly complementary income and growth, fundamental equity, and private plans and adds placement investment teams in the U.S. scale ◼ Significantly diversifies client mix across retail, institutional, U.S. and international ◼ Following the transaction, Voya will hold a 76% economic stake and Allianz Group will hold a 24% economic stake in the combined asset manager Transaction ◼ Voya protected against AUM attrition structure provides ◼ No exposure to AllianzGI legacy litigation issues favorable terms ◼ No external financing or use of Voya’s excess capital ◼ Immediately cash accretive, 6% - 8% to adjusted operating earnings per share in 2023 Multiple financial 2 3 ◼ Investment Management adjusted operating margin to increase from 26% to 30% - 32% benefits ◼ Continued flexibility to generate further shareholder value and support our EPS growth plans Timing◼ Transaction expected to close in July 2022, at which time Voya will have full operational control 1 AUM data as of 31-Mar-2022. 2 1Q’22 Adjusted Operating Margin TTM, excluding notable items (excess alts/prepays and other items listed on slide 17 of the first quarter 2022 Investor Presentation). 3 Excluding notable items. 4

Financially Compelling Transaction ($ in millions, unless otherwise stated) 1 6% to 8% Highly Accretive to ◼ Immediately accretive to cash EPS Key Financial Metrics EPS Accretion Voya IM Adjusted Operating Margin 2 3 Attractive Pro Forma ◼ Transaction improves Margin profile 26% 30% to 32% Operating Margin for Voya IM Pro Forma ◼ Preserves excess capital position and $0.9 Billion Maintain Financial no impact to share repurchase Q1 2022 Excess Capital Flexibility program 1 Estimation to 2023 EPS on a cash basis. 2 1Q’22 Adjusted Operating Margin TTM, excluding notable items (excess alts/prepays and other items listed on slide 17 of the first quarter 2022 Investor Presentation). 3 Excluding notable items. 5

Appendix 6

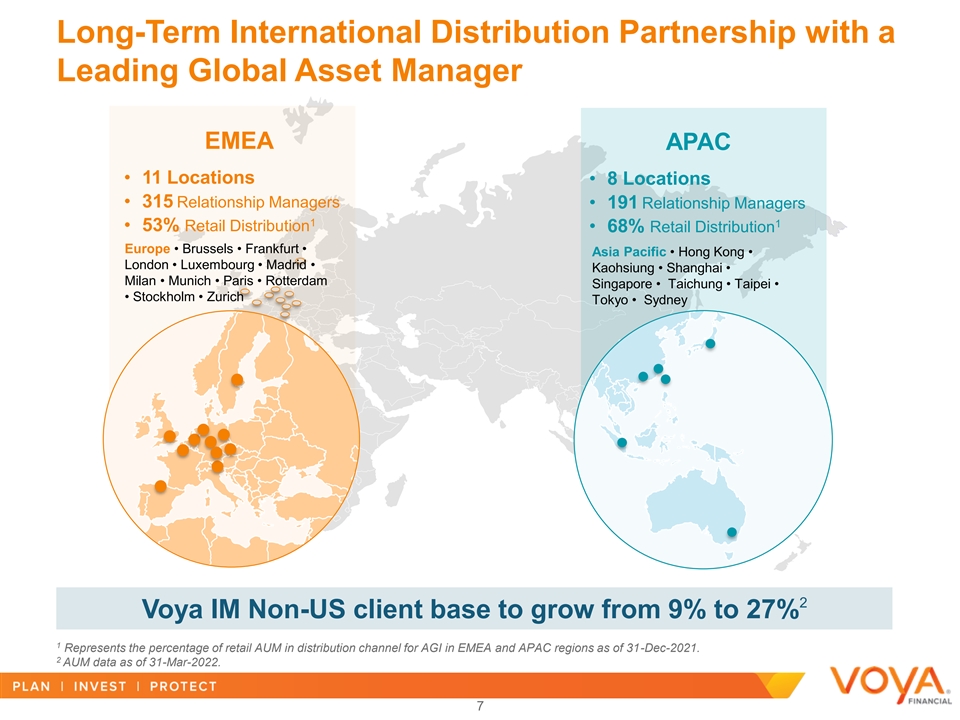

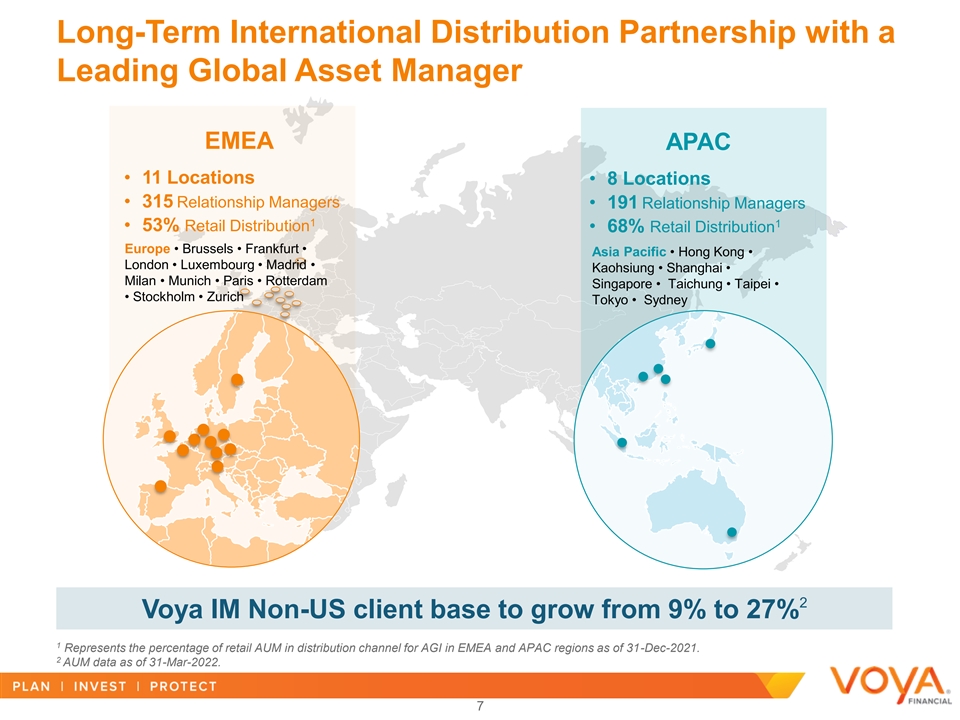

Long-Term International Distribution Partnership with a Leading Global Asset Manager EMEA APAC • 11 Locations • 8 Locations • 315 Relationship Managers • 191 Relationship Managers 1 1 • 53% Retail Distribution • 68% Retail Distribution Europe • Brussels • Frankfurt • Asia Pacific • Hong Kong • London • Luxembourg • Madrid • Kaohsiung • Shanghai • Milan • Munich • Paris • Rotterdam Singapore • Taichung • Taipei • • Stockholm • Zurich Tokyo • Sydney 2 Voya IM Non-US client base to grow from 9% to 27% 1 Represents the percentage of retail AUM in distribution channel for AGI in EMEA and APAC regions as of 31-Dec-2021. 2 AUM data as of 31-Mar-2022. 7

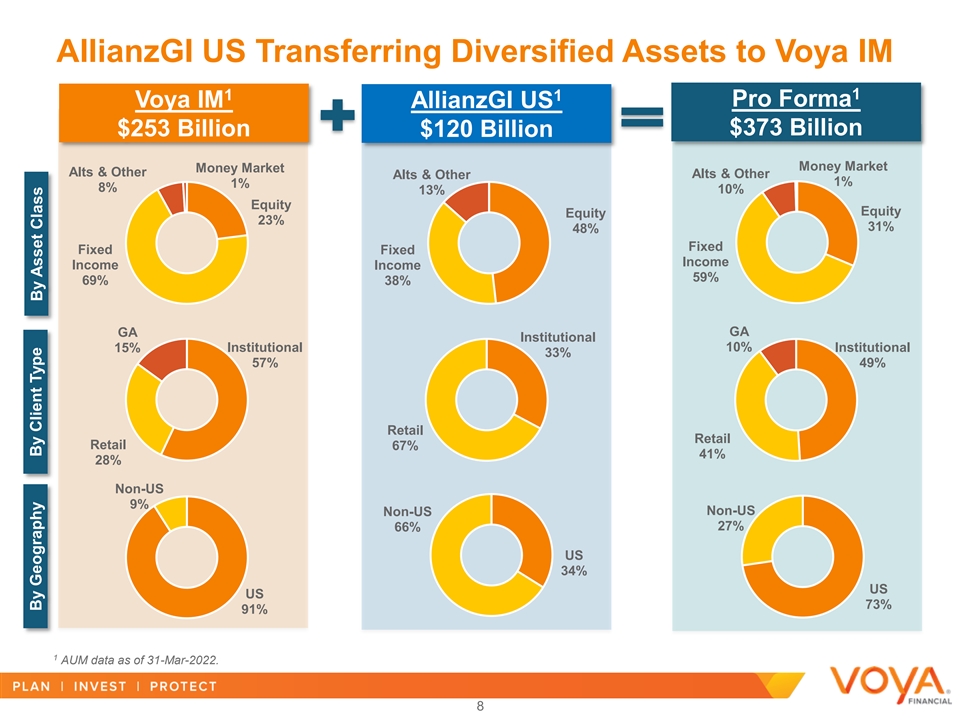

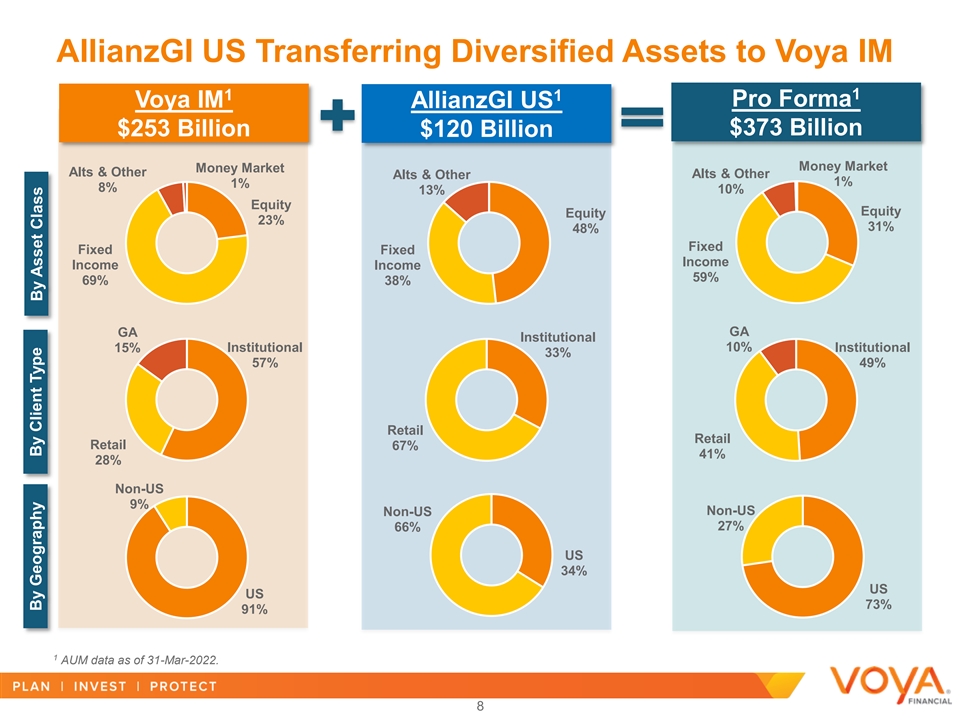

AllianzGI US Transferring Diversified Assets to Voya IM 1 1 1 Pro Forma Voya IM AllianzGI US $253 Billion $373 Billion $120 Billion Money Market Money Market Alts & Other Alts & Other Alts & Other 1% 1% 8% 10% 13% Equity Equity Equity 23% 31% 48% Fixed Fixed Fixed Income Income Income 59% 69% 38% GA GA Institutional 15% Institutional 10% Institutional 33% 57% 49% Retail Retail Retail 67% 41% 28% Non-US 9% Non-US Non-US 27% 66% US 34% US US 73% 91% 1 AUM data as of 31-Mar-2022. 8 By Geography By Client Type By Asset Class