1Information contained herein is proprietary, confidential and non-public and is not for public release. Supplemental Stop Loss Slides Voya Financial December 9, 2024

Key messages Loss ratio for January 2024 Stop Loss policy year expected to be between 90-105%, as a result of claims experience through November 2024 Higher premium rates with focus on margin over in-force premium growth expected to meaningfully improve loss ratio in 2025 and lower annualized in-force premiums by 10-20% Excess capital usage in 1Q’25 primarily focused on acquisition of OneAmerica 2

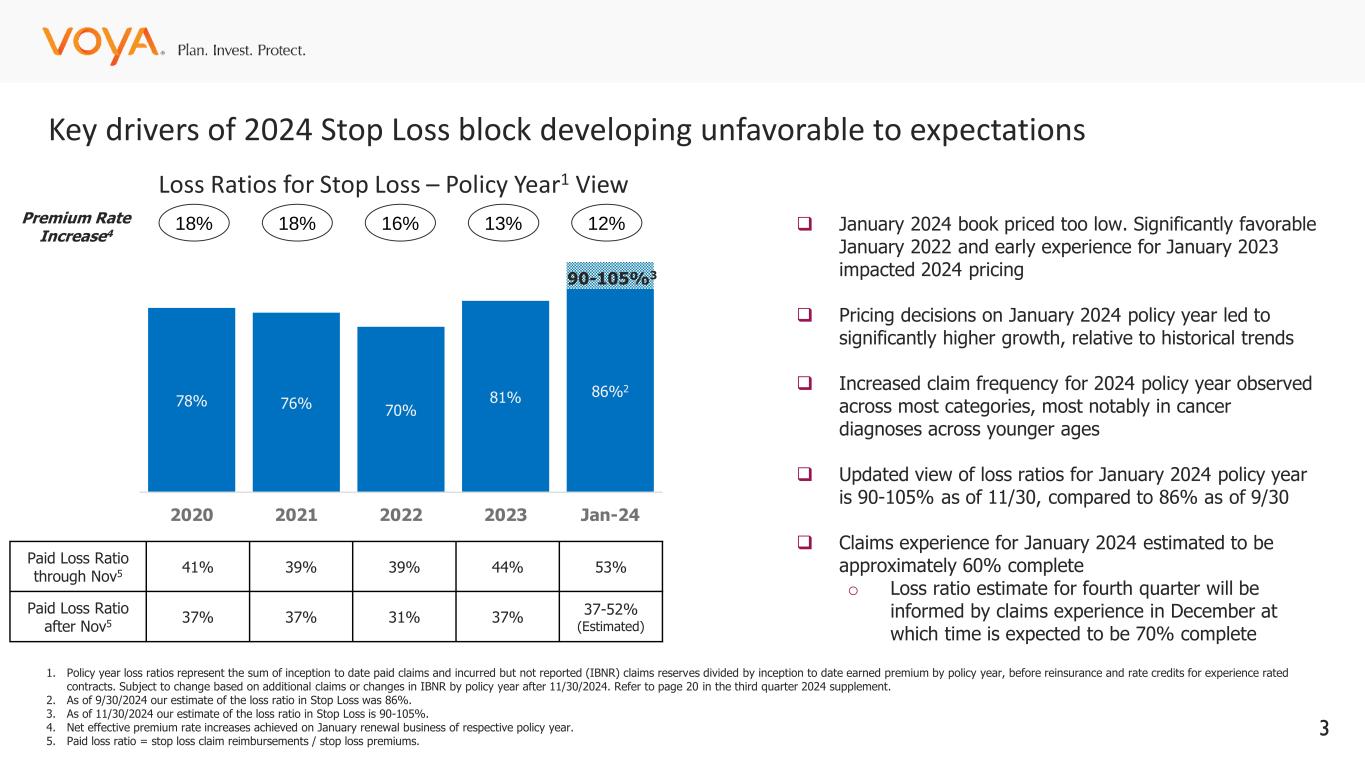

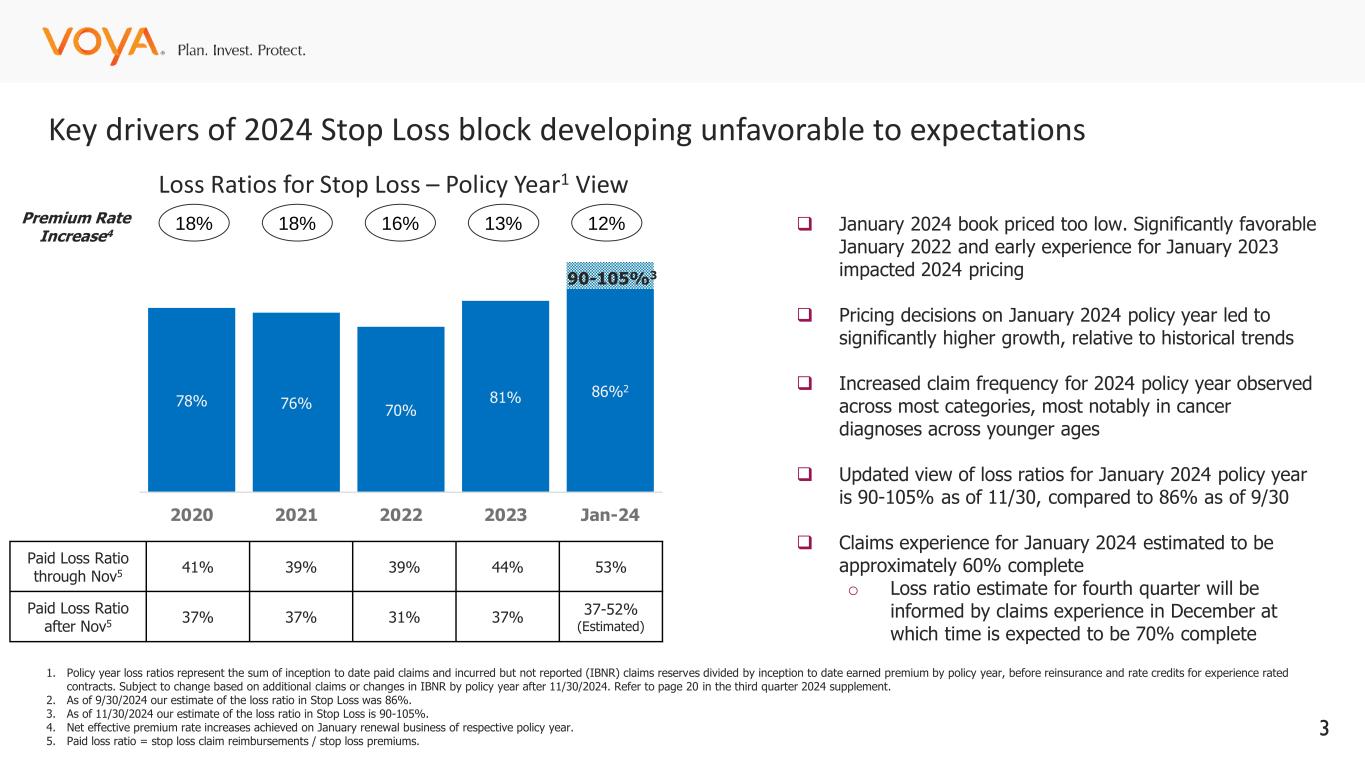

❑ January 2024 book priced too low. Significantly favorable January 2022 and early experience for January 2023 impacted 2024 pricing ❑ Pricing decisions on January 2024 policy year led to significantly higher growth, relative to historical trends ❑ Increased claim frequency for 2024 policy year observed across most categories, most notably in cancer diagnoses across younger ages ❑ Updated view of loss ratios for January 2024 policy year is 90-105% as of 11/30, compared to 86% as of 9/30 ❑ Claims experience for January 2024 estimated to be approximately 60% complete o Loss ratio estimate for fourth quarter will be informed by claims experience in December at which time is expected to be 70% complete Loss Ratios for Stop Loss – Policy Year1 View Key drivers of 2024 Stop Loss block developing unfavorable to expectations 1. Policy year loss ratios represent the sum of inception to date paid claims and incurred but not reported (IBNR) claims reserves divided by inception to date earned premium by policy year, before reinsurance and rate credits for experience rated contracts. Subject to change based on additional claims or changes in IBNR by policy year after 11/30/2024. Refer to page 20 in the third quarter 2024 supplement. 2. As of 9/30/2024 our estimate of the loss ratio in Stop Loss was 86%. 3. As of 11/30/2024 our estimate of the loss ratio in Stop Loss is 90-105%. 4. Net effective premium rate increases achieved on January renewal business of respective policy year. 5. Paid loss ratio = stop loss claim reimbursements / stop loss premiums. Paid Loss Ratio through Nov5 41% 39% 39% 44% 53% Paid Loss Ratio after Nov5 37% 37% 31% 37% 37-52% (Estimated) 3 Premium Rate Increase4 18% 18% 16% 13% 12% 78% 76% 70% 81% 86%2 90-105%3 2020 2021 2022 2023 Jan-24 90-

12% 17% 20-24% Jan '24 Non Jan '24 Jan '25 Expected Significant premium rate increases on January 2025 renewal business, with greater increases on underperforming cases1 Focus on improving margin over premium growth 1. Voya assumes first dollar trend to be 8%, 8%, and 9% for January 2024, Non-January 2024, and 2025, respectively; consistent with industry expectations. $- $100 $200 $300 $400 $500 $600 Non Jan'23 Non Jan'24 Jan '23 Jan '24 Jan '25 Expected Lower new sales reflect increased focus on margin Jan 2025 new sales expected to be 40-50% lower YoY Jan 2025 new sales expected to be 5-10% lower vs. Jan 2023 4 Non Jan 2024 new sales 40% lower YoY

Expect loss ratios for Stop Loss in 2025 to meaningfully improve from 2024 1. 2025 loss ratio for Stop Loss expected to be above long-term target of 77-80%. 2. Chart not to scale. 5 Expected 2024 Loss Ratio Net premium rate increase, less expected increase in medical claims cost in 2025 Improved Risk Selection Expected 2025 Loss Ratio1,2 90-105% Net effect of premium rate increase of 20-24%, and expected increase in medical costs Improved risk selection on 2025 business reflected in our forecast for 10-20% lower annualized in-force premium in 2025 ❑ Focused on renewing a healthy book of business at increased average rates while addressing underperforming sub-segments of the block ❑ The 20-24% premium rate increase expected on January 2025 business is a weighted average across the entire book of business. Underperforming cases will be significantly above 20-24% ❑ Sales and renewals for January 2025 in-force premium to be nearly complete by end of December

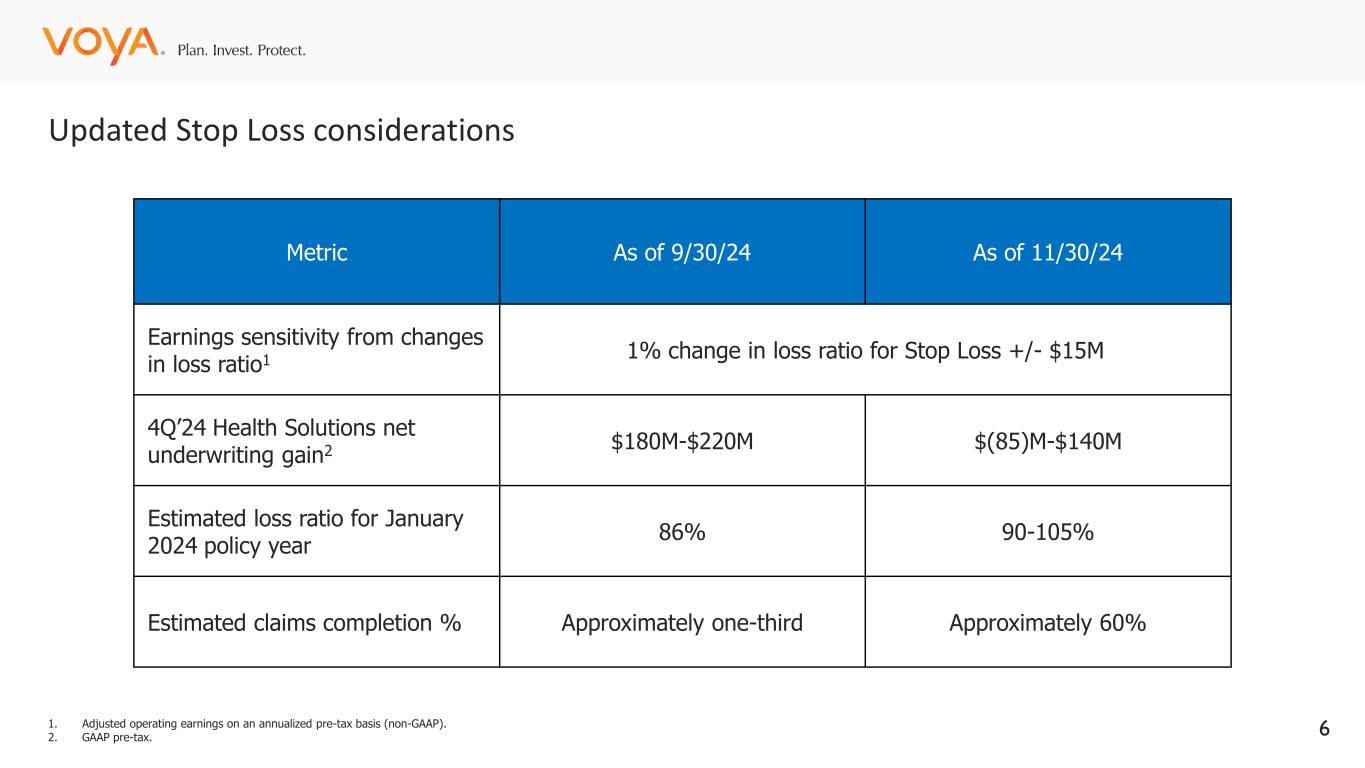

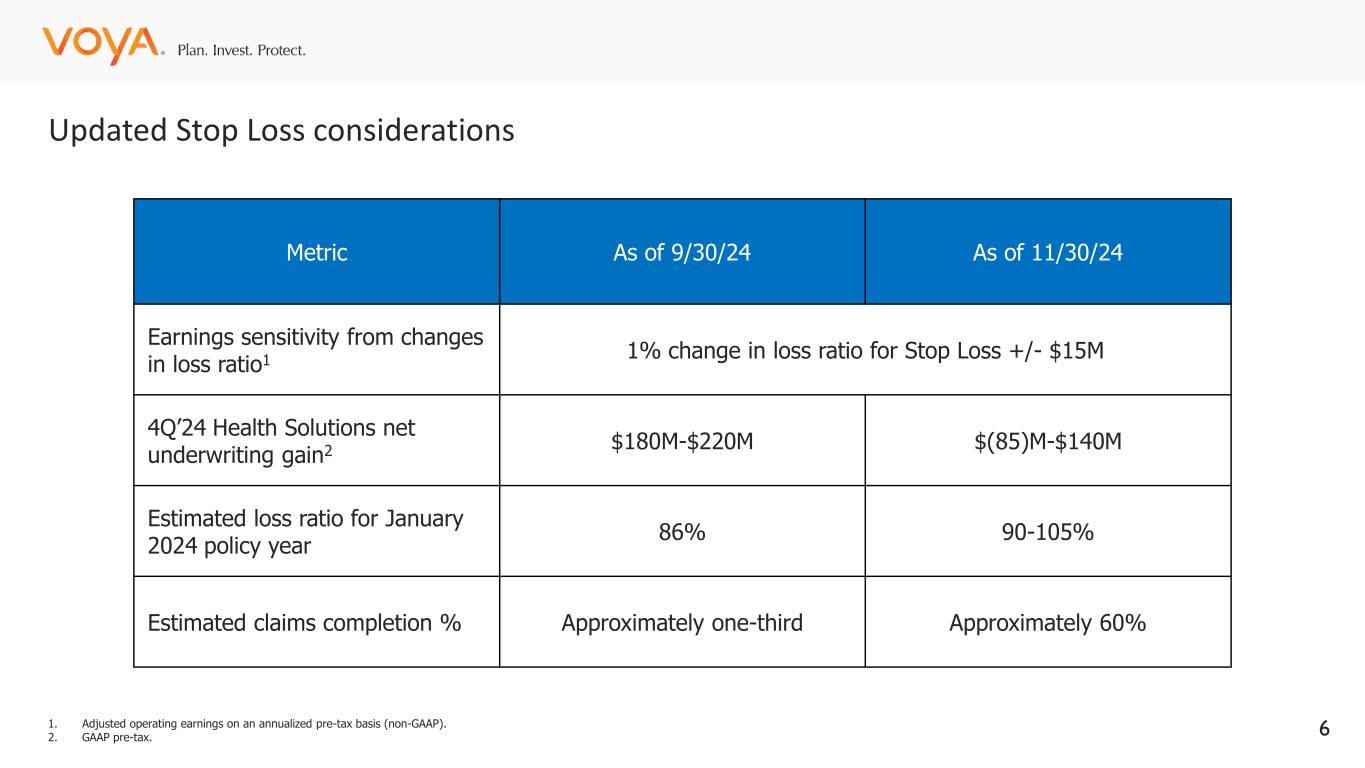

Updated Stop Loss considerations 6 Metric As of 9/30/24 As of 11/30/24 Earnings sensitivity from changes in loss ratio1 1% change in loss ratio for Stop Loss +/- $15M 4Q’24 Health Solutions net underwriting gain2 $180M-$220M $(85)M-$140M Estimated loss ratio for January 2024 policy year 86% 90-105% Estimated claims completion % Approximately one-third Approximately 60% 1. Adjusted operating earnings on an annualized pre-tax basis (non-GAAP). 2. GAAP pre-tax.

Forward-Looking and Other Cautionary Statements 7 These interim estimates incorporate projections of future claims based on historical known claims, involve the exercise of considerable judgment, and are subject to further adjustment based on additional claims experience after November 30, 2024. As a result, Voya Financial, Inc.’s (the Company) reported loss ratios for the fourth quarter and full year 2024 could be materially different from these estimates. The information and exhibits in this presentation include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The Company does not assume any obligation to revise or update these statements to reflect new information, subsequent events or changes in strategy. Factors that may cause actual results to differ from those in any forward-looking statement also include those described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Trends and Uncertainties” in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in other documents filed from time to time with the SEC, as applicable, all of which are available at www.sec.gov.