29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 Corporate Presentation February 2014 Exhibit 99.2

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 2 This presentation contains and our discussions during this conference may include forward - looking statements about Lipocine Inc. (the “Company”). These forward - looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward - looking statements relate to the Company’s product candidates, clinical and regula tory processes and objectives, potential benefits of the Company’s product candidates, intellectual property and related matters, all of which involve known and unknown risks and uncertainties. Actual results may differ materially from the forward - looking statemen ts discussed in this presentation . Accordingly, the Company cautions investors not to place undue reliance on the forward - looking statements contained in, or made in connection with, this presentation . Several factors may affect the initiation and completion of clinical trials, the potential advantages of the Company’s product candidates and the Company’s capital needs. Among other things, the projected commencement and completion of the Company’s clinical trials may be affected by difficulties or delays. In addition, the Com pan y’s results may be affected by its ability to manage its financial resources, difficulties or delays in developing manufacturing pro cesses for its product candidates, preclinical and toxicology testing and regulatory developments. Delays in clinical programs, whe the r caused by competitive developments, adverse events, patient enrollment rates, regulatory issues or other factors, could adver sel y affect the Company’s financial position and prospects. Prior clinical trial program designs and results are not necessarily pre dictive of future clinical trial designs or results. If the Company’s product candidates do not meet safety or efficacy endpoints in cl inical evaluations, they will not receive regulatory approval and the Company will not be able to market them. The Company may not b e able to enter into any strategic partnership agreements. Operating expense and cash flow projections involve a high degree of uncertainty, including variances in future spending rates due to changes in corporate priorities, the timing and outcomes of cli nical trials, competitive developments and the impact on expenditures and available capital from licensing and strategic collaborat ion opportunities. If the Company is unable to raise additional capital when required or on acceptable terms, it may have to sig nif icantly delay, scale back or discontinue one or more of its drug development or discovery research programs. The Company is at an ea rly stage of development and may not ever have any products that generate significant revenue. The forward - looking statements contained in this presentation are further qualified by the detailed discussion of risks and uncertainties set forth in the d ocu ments filed by the Company with the Securities and Exchange Commission, all of which can be obtained on the Company’s website at www.lipocine.com or on the SEC website at www.sec.gov . The forward - looking statements contained in this document represent the Company’s estimates and assumptions only as of the date of this presentation and the Company undertakes no duty or obligation to update or revise publicly any forward - looking statements contained in this presentation as a result of new information, future events or changes in the Company’s expectations. Forward Looking Statements

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 3 Focused on developing innovative orally - available treatment alternatives in the areas of men’s and women’s health Pipeline of well - known molecules with 505(b)(2) strategy Lead asset currently in Phase 3, addresses an unmet need in large and growing market Several near term value drivers with pipeline products Diverse patent portfolio • U.S.: Six issued and 14 pending applications • Foreign: 31 total issued and pending Lipocine Investment Highlights

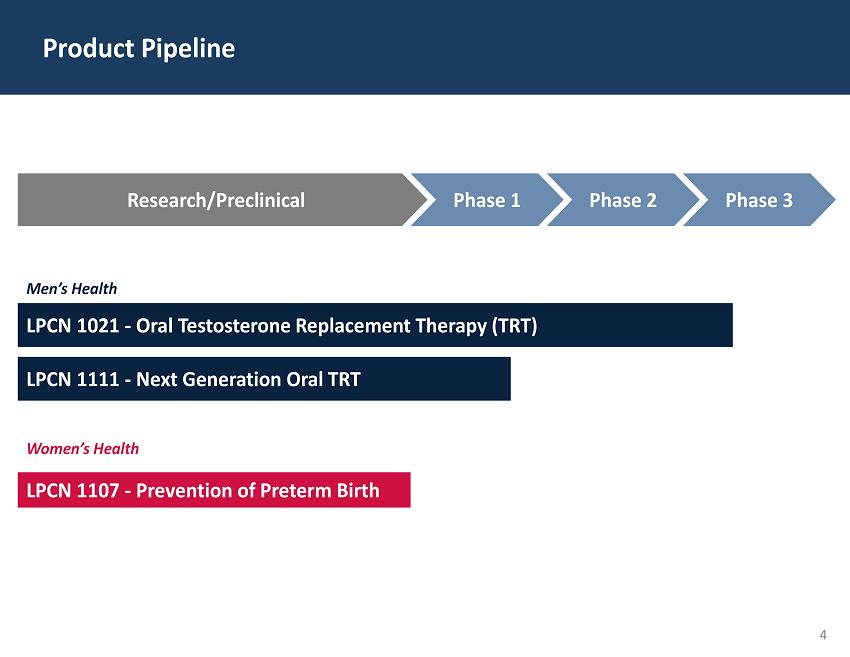

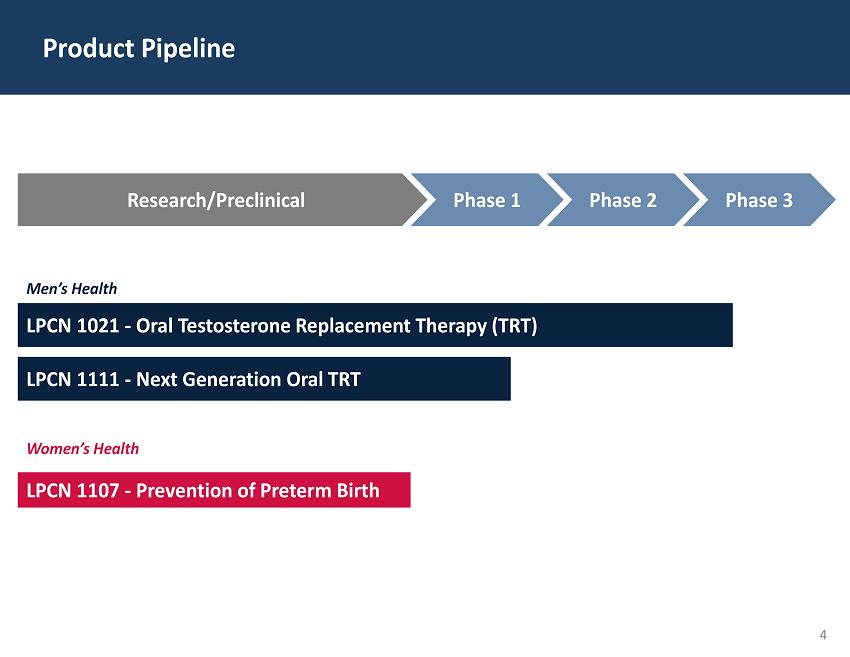

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 4 LPCN 1021 - Oral Testosterone Replacement Therapy (TRT) Product Pipeline Men’s Health LPCN 1111 - Next Generation Oral TRT Women’s Health LPCN 1107 - Prevention of Preterm Birth Research/Preclinical Phase 1 Phase 2 Phase 3

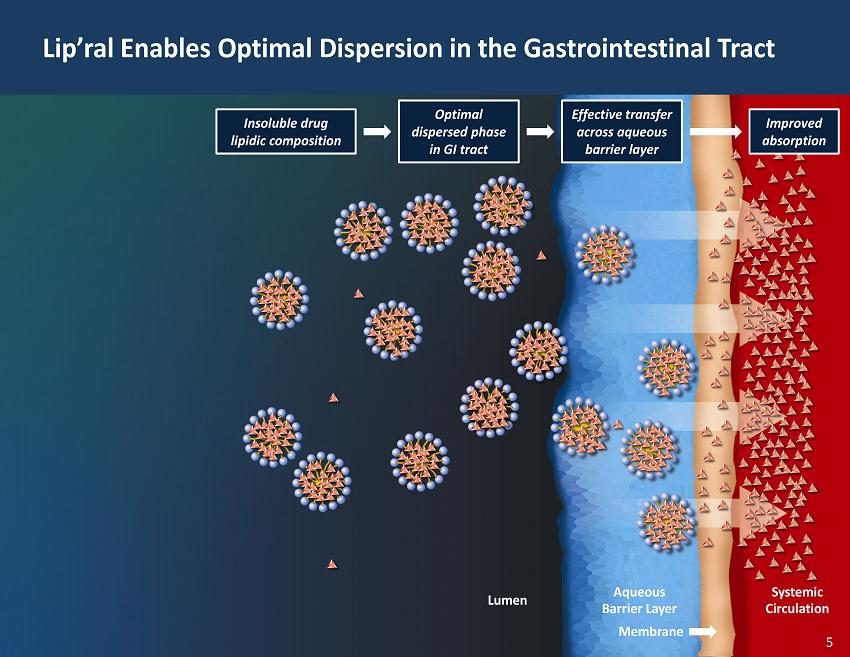

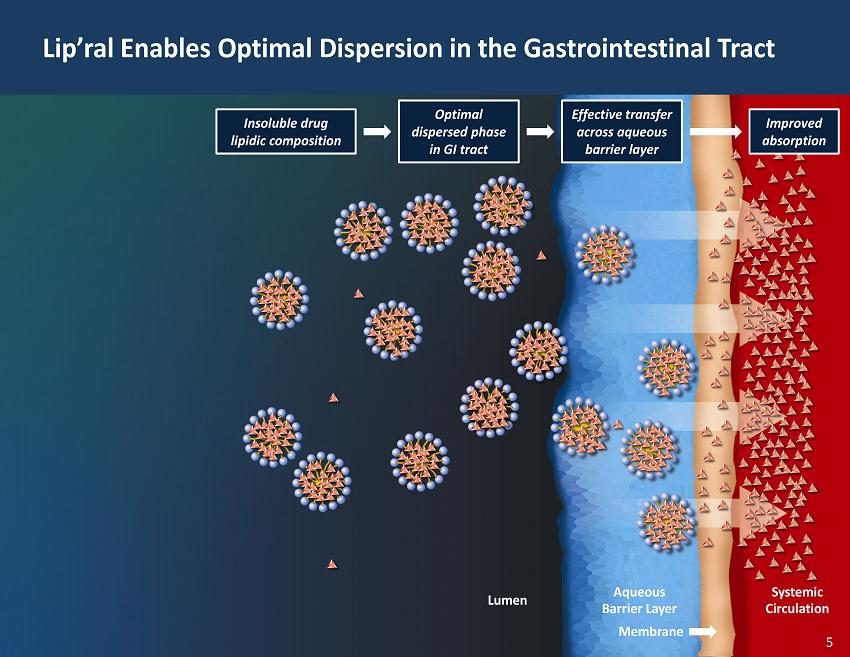

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 5 Lip’ral Enables Optimal Dispersion in the Gastrointestinal Tract Lumen Aqueous Barrier Layer Membrane Systemic Circulation Improved absorption Effective transfer across aqueous barrier layer Optimal dispersed phase in GI tract Insoluble drug lipidic composition 5

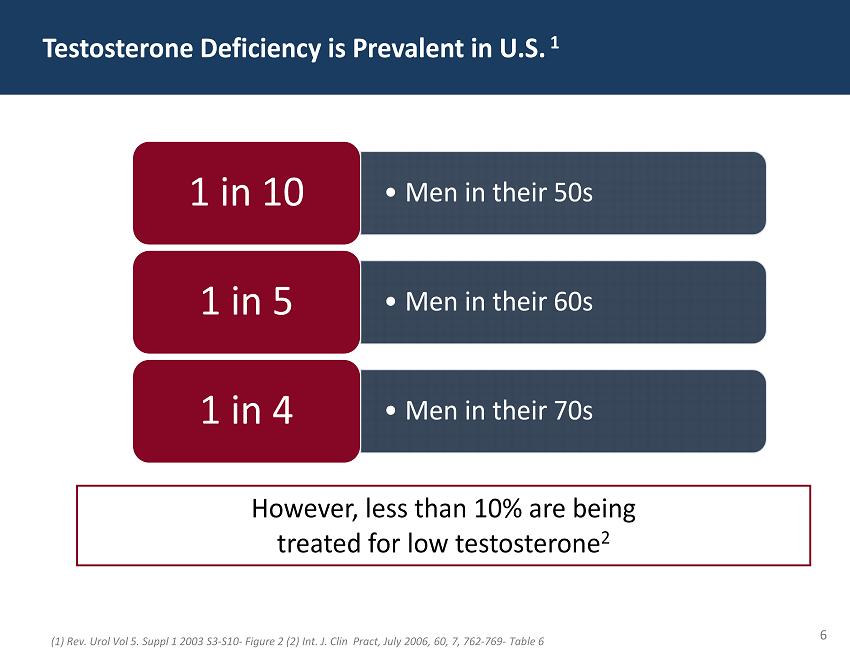

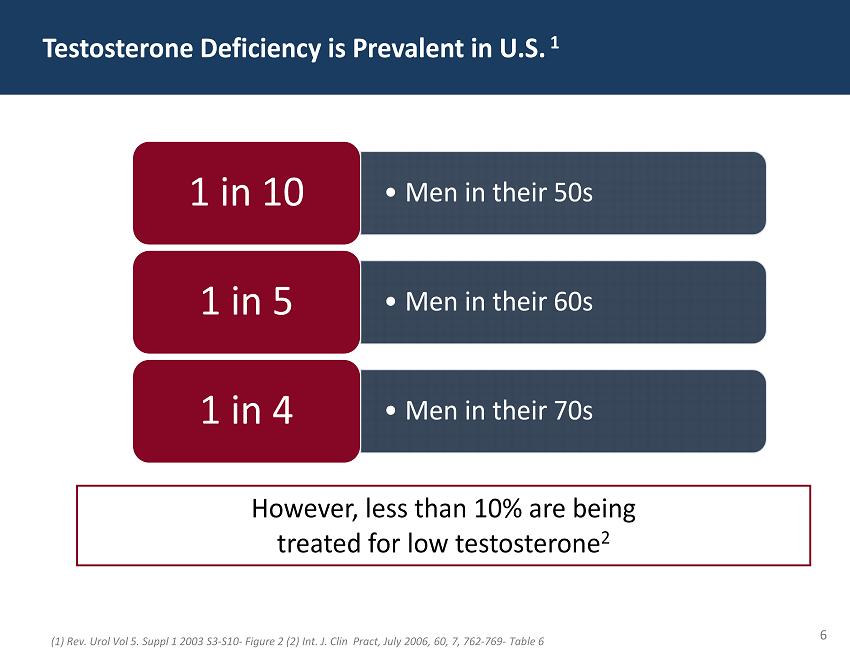

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 6 Testosterone Deficiency is Prevalent in U.S. 1 (1) Rev. Urol Vol 5. Suppl 1 2003 S3 - S10 - Figure 2 (2) Int. J. Clin Pract , July 2006, 60, 7, 762 - 769 - Table 6 • Men in their 50s 1 in 10 • Men in their 60s 1 in 5 • Men in their 70s 1 in 4 However, less than 10% are being treated for low testosterone 2

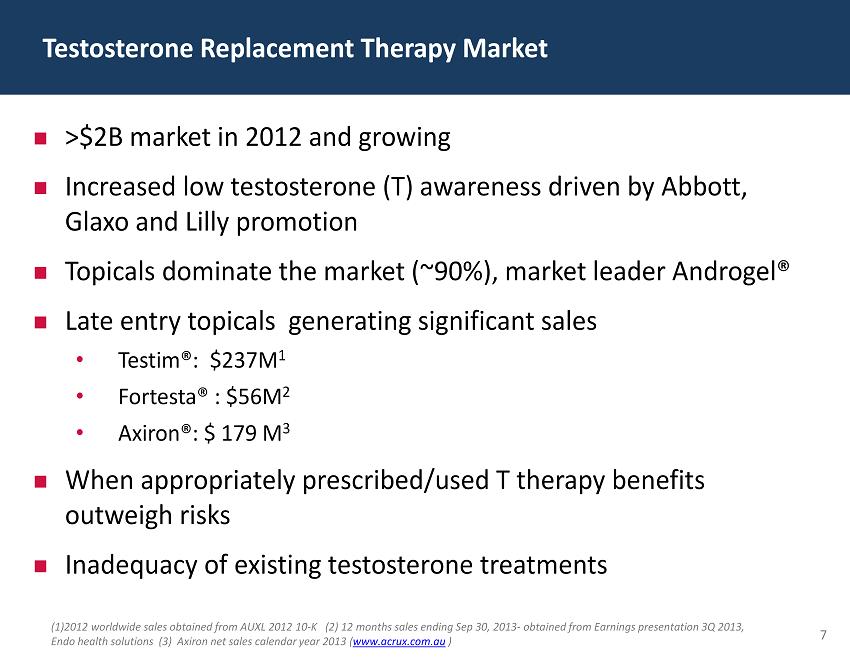

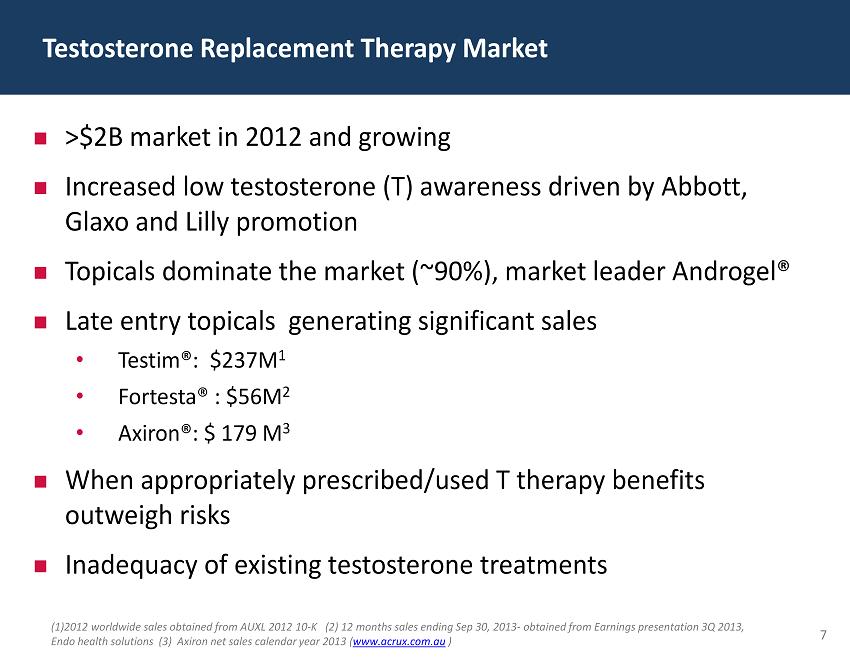

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 7 >$2B market in 2012 and growing Increased low testosterone (T) awareness driven by Abbott, Glaxo and Lilly promotion Topicals dominate the market (~90%), market leader Androgel ® Late entry topicals generating significant sales • Testim ®: $237M 1 • Fortesta ® : $56M 2 • Axiron ®: $ 179 M 3 When appropriately prescribed/used T therapy benefits outweigh risks Inadequacy of existing testosterone treatments Testosterone Replacement Therapy Market (1)2012 worldwide sales obtained from AUXL 2012 10 - K (2) 12 months sales ending Sep 30, 2013 - obtained from Earnings presentat ion 3Q 2013, Endo health solutions (3) Axiron net sales calendar year 2013 ( www.acrux.com.au )

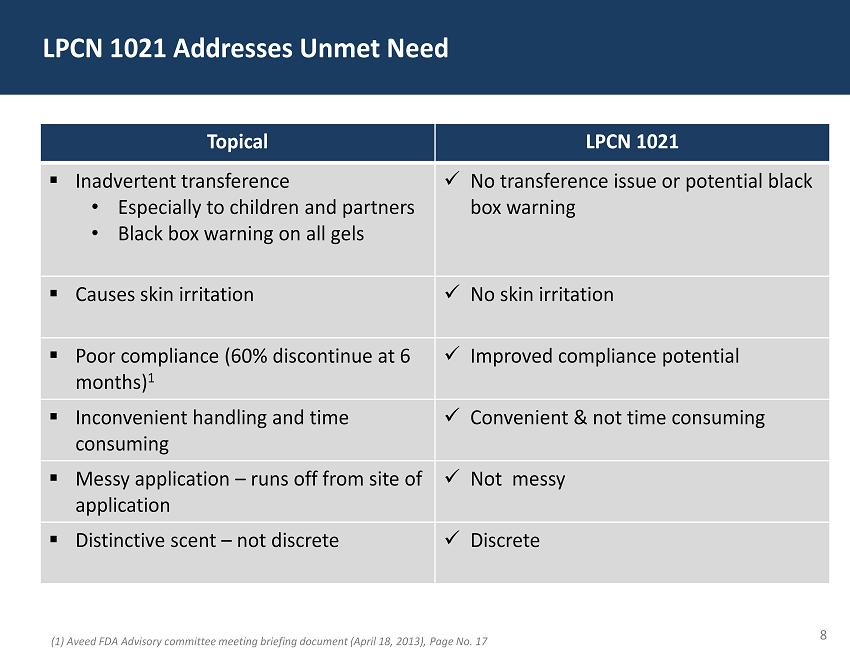

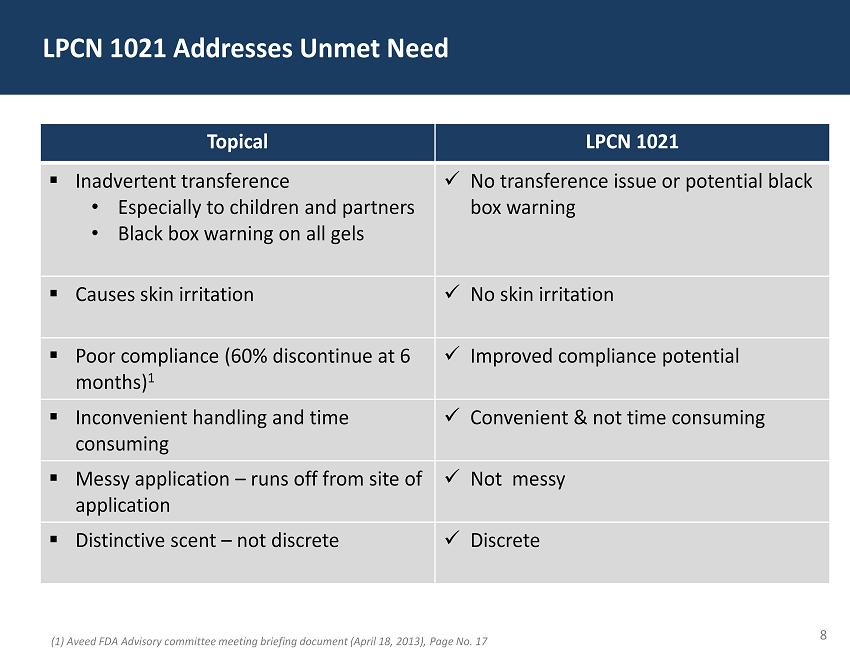

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 8 LPCN 1021 Addresses Unmet Need 8 Topical LPCN 1021 ▪ Inadvertent transference • Especially to children and partners • Black box warning on all gels x No transference issue or potential black box warning ▪ Causes skin irritation x No skin irritation ▪ Poor compliance (60% discontinue at 6 months ) 1 x Improved compliance potential ▪ Inconvenient handling and time consuming x Convenient & not time consuming ▪ Messy application – runs off from site of a pplication x Not messy ▪ Distinctive scent – not discrete x Discrete (1) Aveed FDA Advisory committee meeting briefing document (April 18, 2013), Page No. 17

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 9 Survey of 28 leading endocrinologist and urologist about oral testosterone compliance 1 • In your opinion, will oral testosterone improve patient compliance compared to existing options? Oral Should Improve Compliance 93.80% 0.00% 6.20% Yes No Not Sure (1) Lipocine Survey 2014

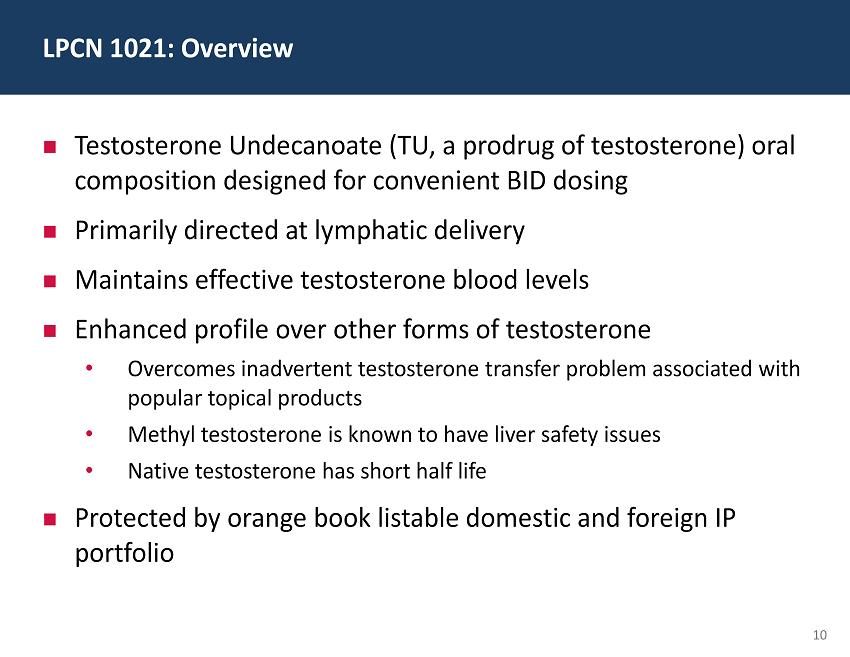

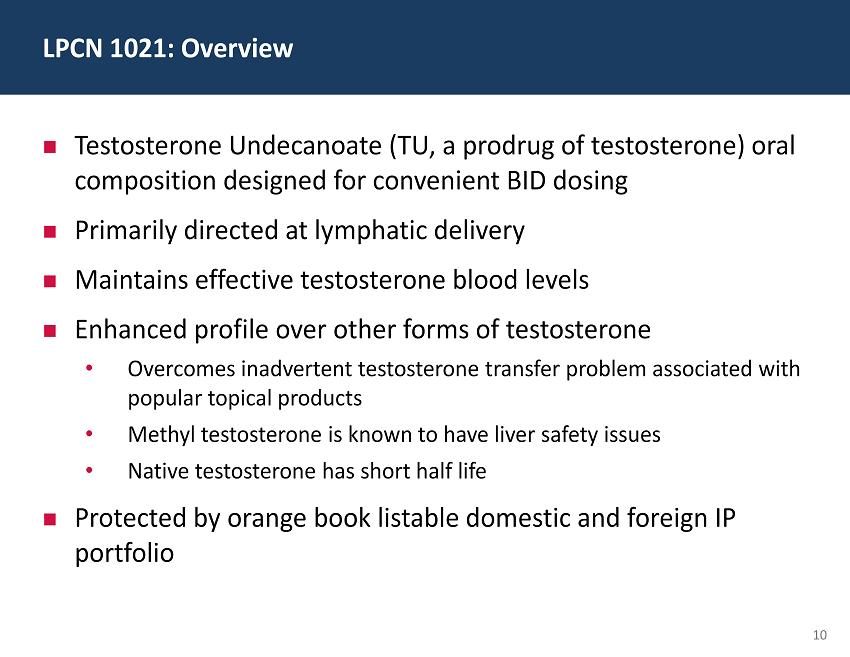

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 10 Testosterone Undecanoate (TU, a prodrug of testosterone) oral composition designed for convenient BID dosing Primarily directed at lymphatic delivery Maintains effective testosterone blood levels Enhanced profile over other forms of testosterone • Overcomes inadvertent testosterone transfer problem associated with popular topical products • Methyl testosterone is known to have liver safety issues • Native testosterone has short half life Protected by orange book listable domestic and foreign IP portfolio LPCN 1021: Overview

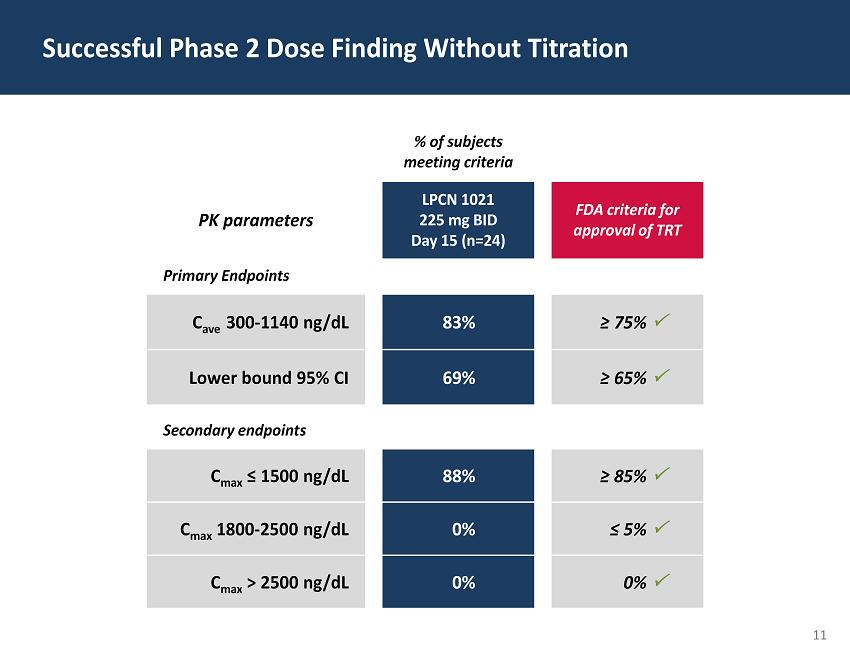

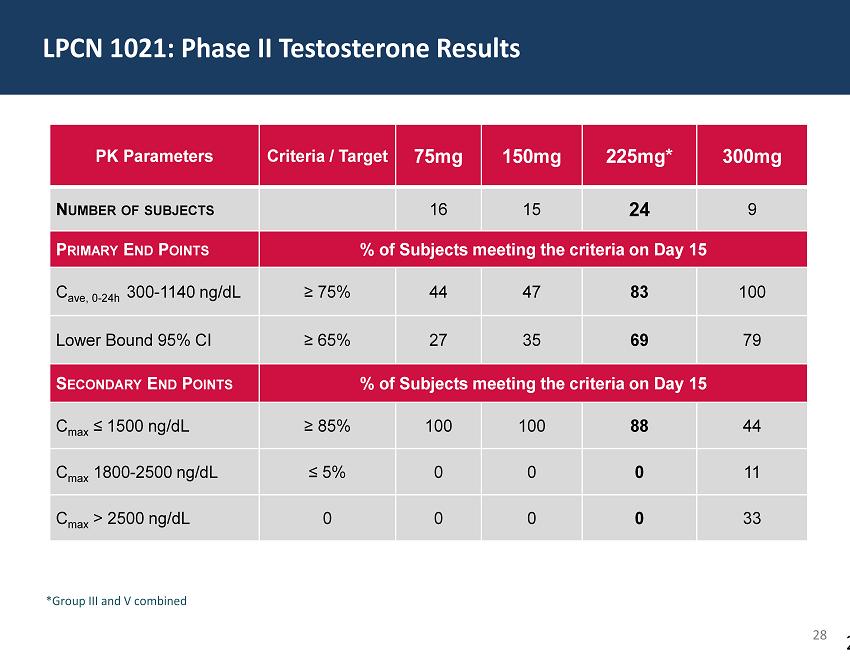

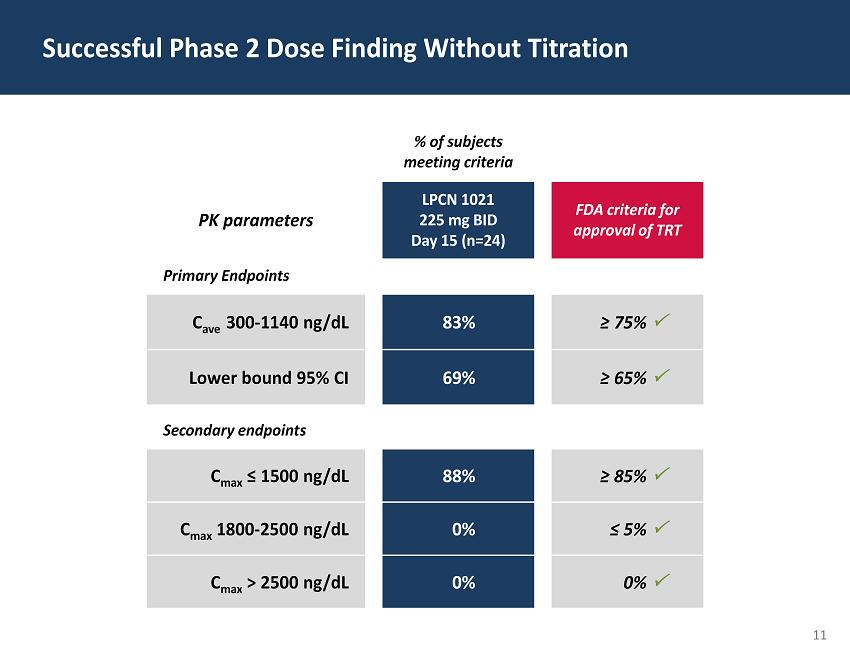

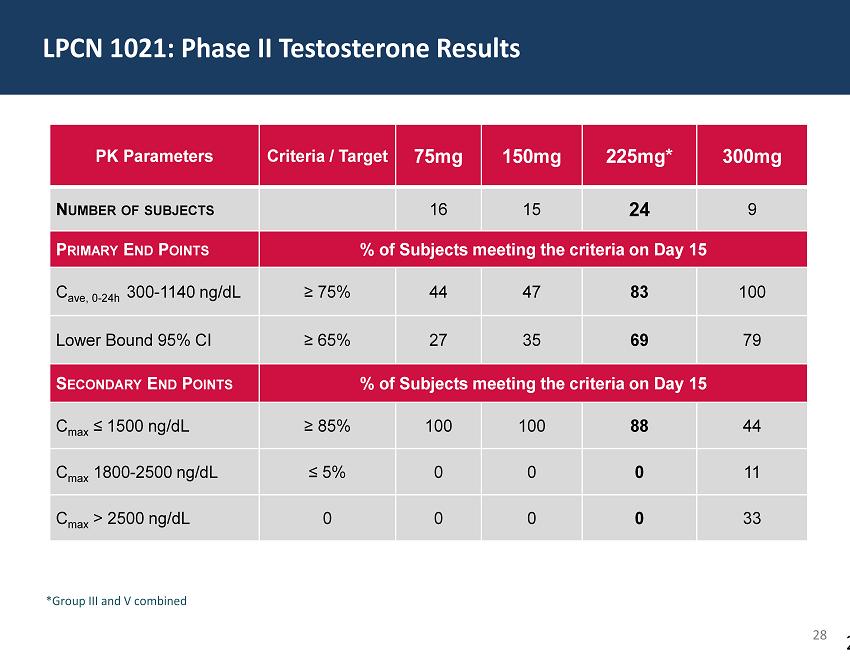

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 11 Successful Phase 2 Dose Finding Without Titration % of subjects meeting criteria PK parameters LPCN 1021 225 mg BID Da y 15 (n=24) FDA criteria for approval of TRT Primary Endpoints C ave 300 - 1140 ng/dL 83% ≥ 75 % Lower bound 95% CI 69% ≥ 65 % Secondary endpoints C max ≤ 1500 ng/dL 88% ≥ 85 % C max 1800 - 2500 ng/dL 0% ≤ 5 % C max > 2500 ng/dL 0% 0%

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 12 No significant adverse events DHT/T and E2/T ratios observed with LPCN 1021 are in the normal range HDL changes with LPCN 1021 in the range of other approved TRT products No significant change in LDL levels No significant changes in liver enzymes Phase 2 Study Safety Summary

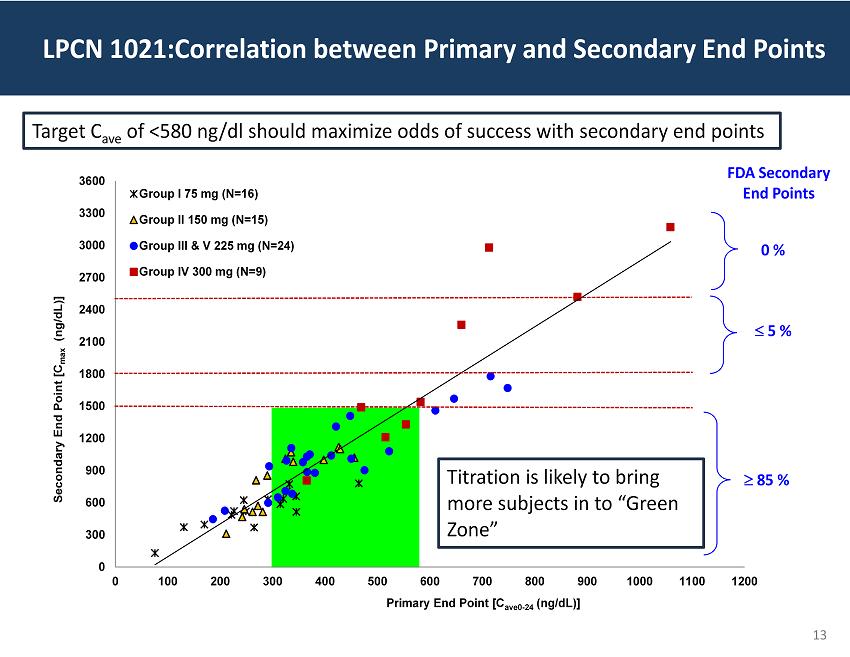

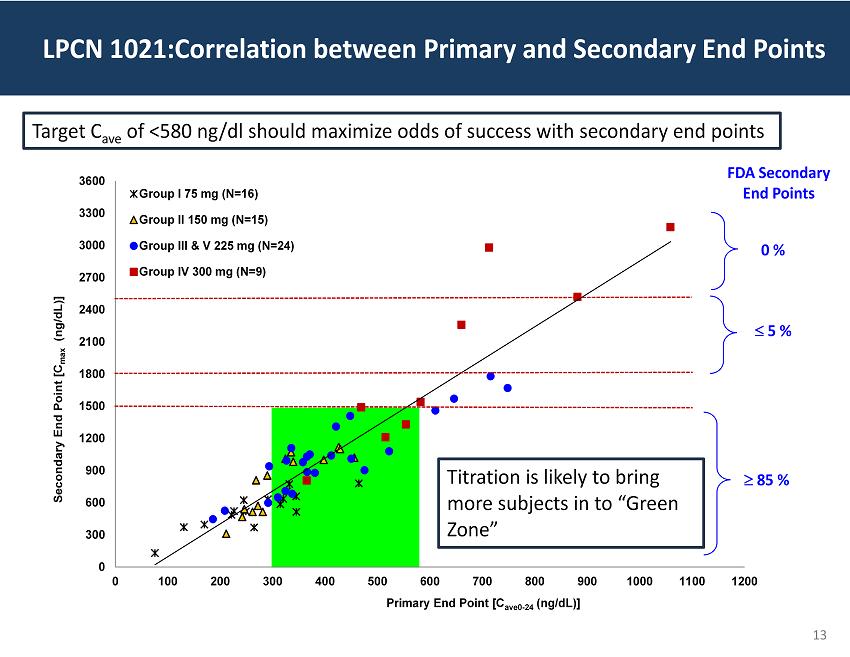

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 13 0 300 600 900 1200 1500 1800 2100 2400 2700 3000 3300 3600 0 100 200 300 400 500 600 700 800 900 1000 1100 1200 Secondary End Point [C max (ng/dL )] Primary End Point [C ave0 - 24 (ng/dL )] Group I 75 mg (N=16) Group II 150 mg (N=15) Group III & V 225 mg (N=24) Group IV 300 mg (N=9) FDA Secondary End Points 85 % 5 % 0 % LPCN 1021:Correlation between Primary and Secondary End Points Titration is likely to bring more subjects in to “Green Zone” Target C ave of <580 ng/dl should maximize odds of success with secondary end points

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 14 Phase 3 study underway • First patient dosed early February • 200 patients in active TRT arm • Multicenter (~55 sites) in US FDA concurrence on single pivotal phase III trial for approval No additional pre - clinical studies required LPCN 1021 Development Update

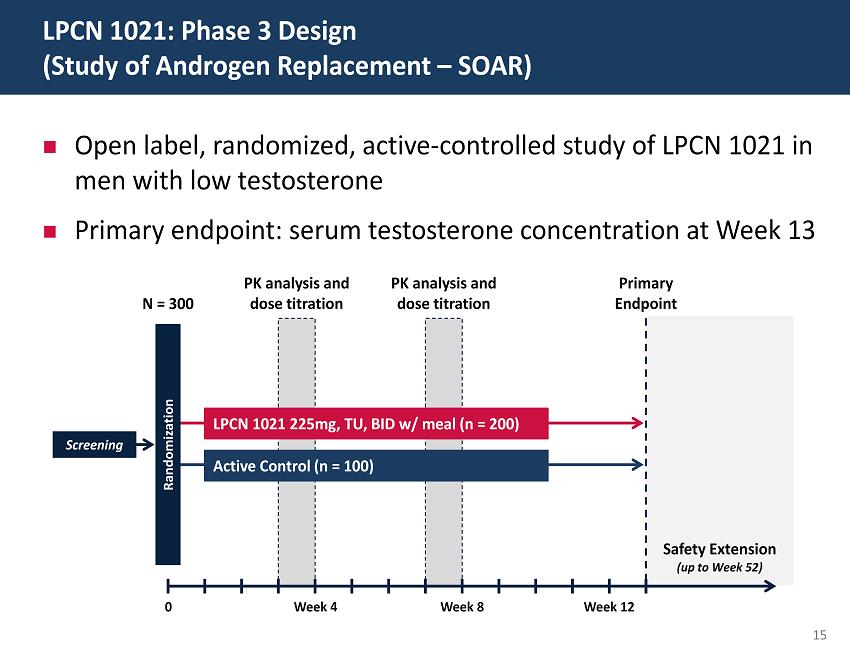

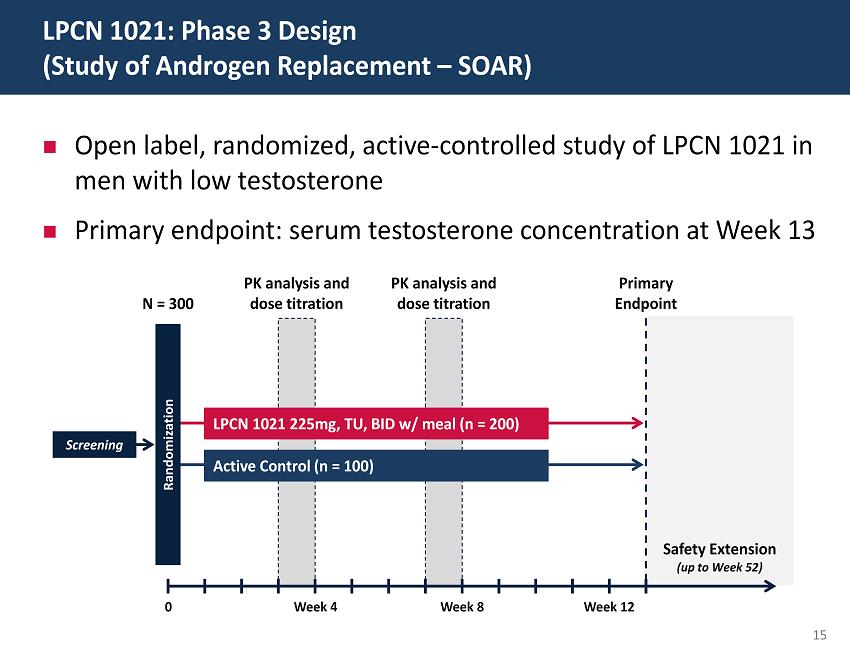

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 15 Open label, randomized, active - controlled study of LPCN 1021 in men with low testosterone Primary endpoint: serum testosterone concentration at Week 13 LPCN 1021: Phase 3 Design (Study of Androgen Replacement – SOAR) Safety Extension (up to Week 52) Screening N = 300 Primary Endpoint 0 Week 4 Week 8 Week 12 Randomization LPCN 1021 225mg, TU, BID w/ meal (n = 200) Active Control (n = 100) PK analysis and dose titration PK analysis and dose titration

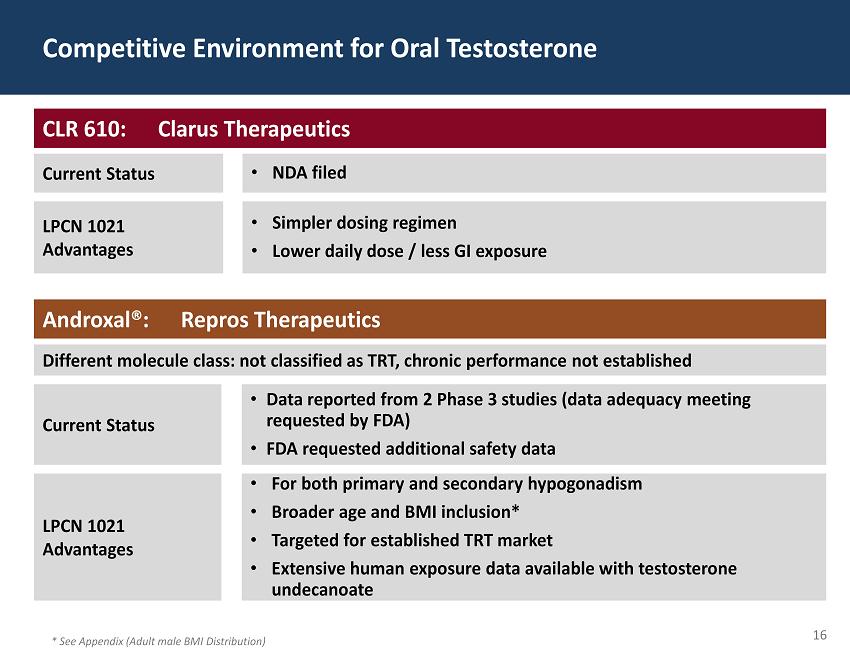

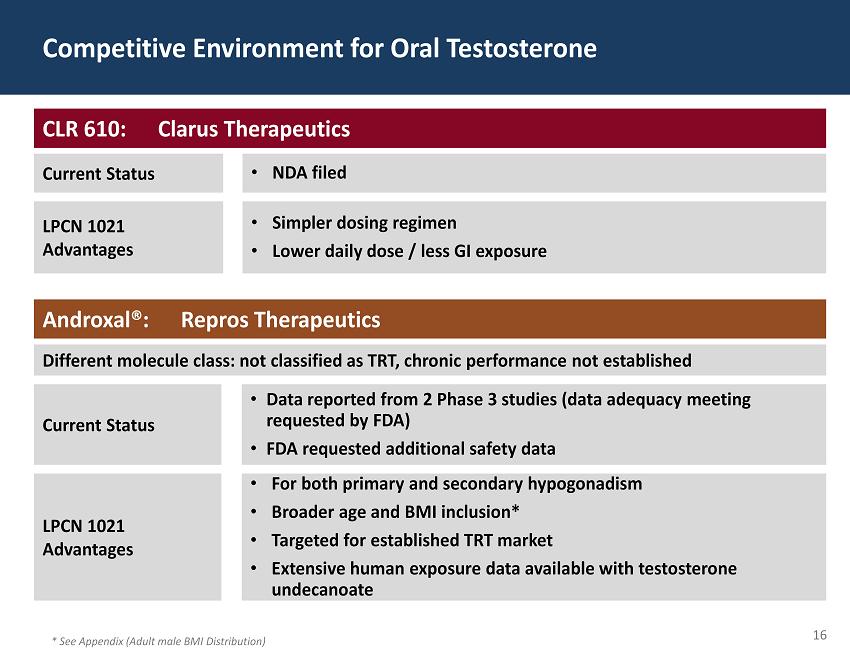

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 16 Competitive Environment for Oral Testosterone * See Appendix (Adult male BMI Distribution) CLR 610: Clarus Therapeutics Current Status • NDA filed LPCN 1021 Advantages • Simpler dosing regimen • Lower daily dose / less GI exposure Androxal®: Repros Therapeutics Different molecule class: not classified as TRT, chronic performance not established Current Status • Data reported from 2 Phase 3 studies (data adequacy meeting requested by FDA) • FDA requested additional safety data LPCN 1021 Advantages • For both primary and secondary hypogonadism • Broader age and BMI inclusion* • Targeted for established TRT market • Extensive human exposure data available with testosterone undecanoate

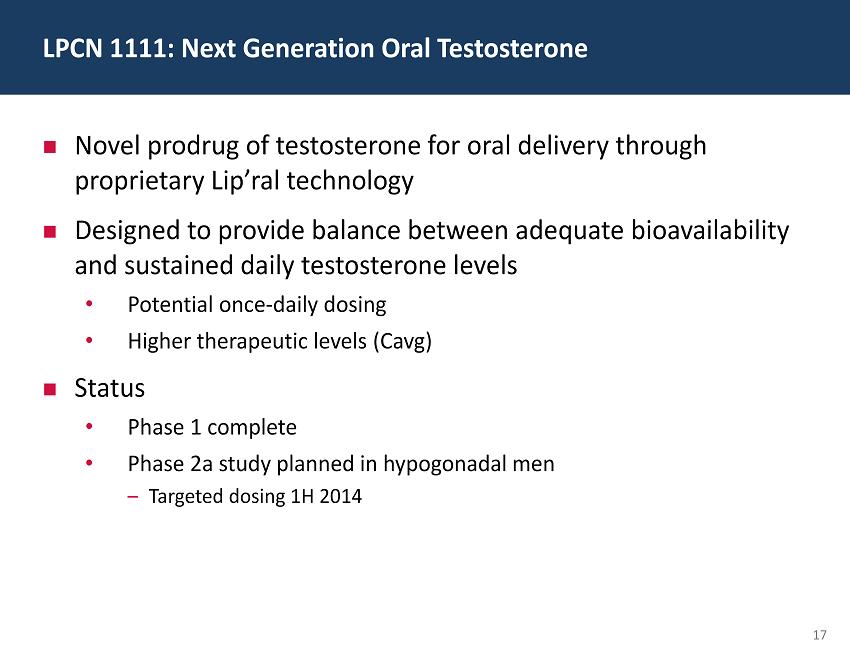

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 17 Novel prodrug of testosterone for oral delivery through proprietary Lip’ral technology Designed to provide balance between adequate bioavailability and sustained daily testosterone levels • Potential once - daily dosing • Higher therapeutic levels (Cavg) Status • Phase 1 complete • Phase 2a study planned in hypogonadal men – Targeted dosing 1H 2014 LPCN 1111: Next Generation Oral Testosterone

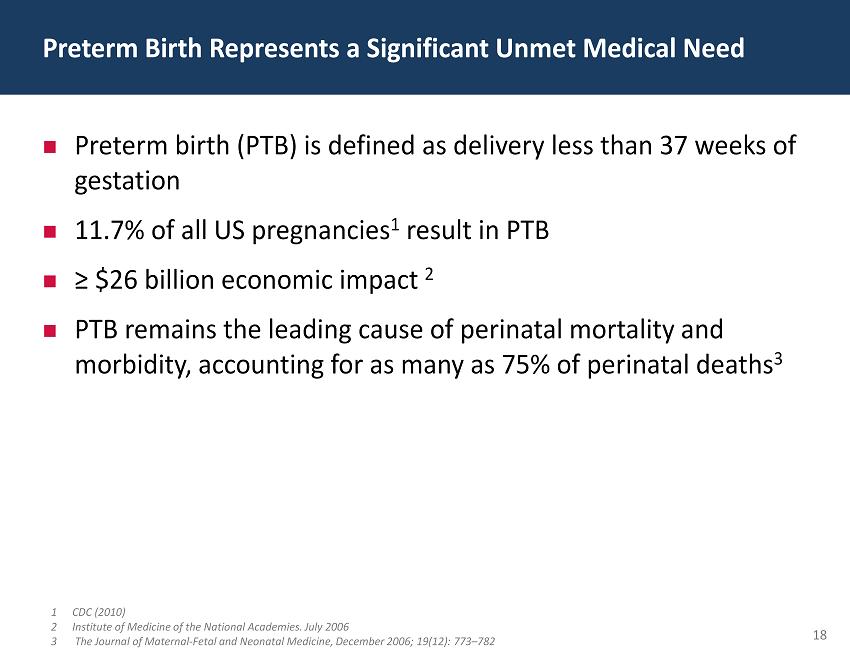

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 18 Preterm birth (PTB) is defined as delivery less than 37 weeks of gestation 11.7% of all US pregnancies 1 result in PTB ≥ $26 billion economic impact 2 PTB remains the leading cause of perinatal mortality and morbidity, accounting for as many as 75% of perinatal deaths 3 Preterm Birth Represents a Significant Unmet Medical Need 1 CDC (2010) 2 Institute of Medicine of the National Academies. July 2006 3 The Journal of Maternal - Fetal and Neonatal Medicine, December 2006; 19(12): 773 – 782

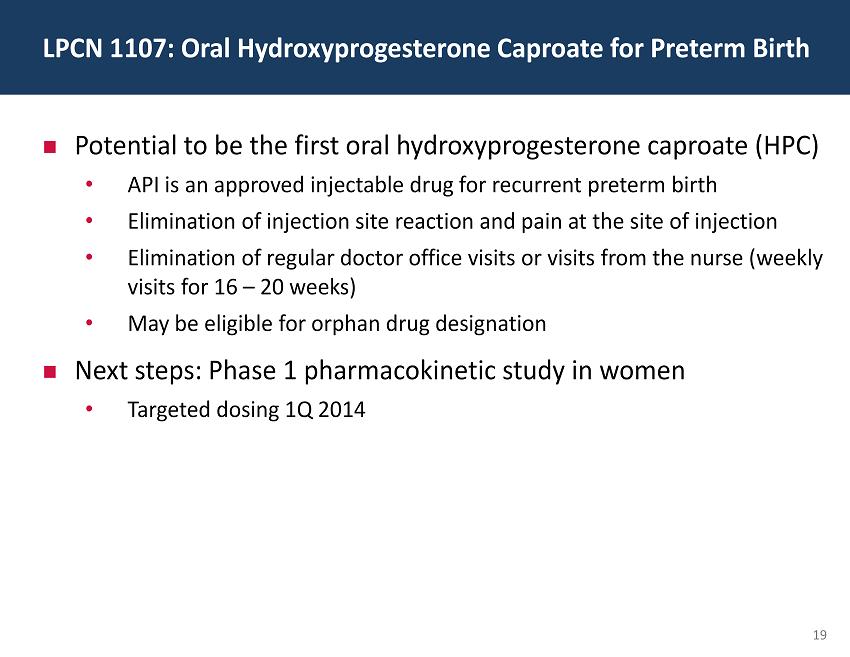

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 19 Potential to be the first oral hydroxyprogesterone caproate (HPC) • API is an approved injectable drug for recurrent preterm birth • Elimination of injection site reaction and pain at the site of injection • Elimination of regular doctor office visits or visits from the nurse (weekly visits for 16 – 20 weeks) • May be eligible for orphan drug designation Next steps: Phase 1 pharmacokinetic study in women • Targeted dosing 1Q 2014 LPCN 1107 : Oral Hydroxyprogesterone Caproate for P reterm B irth

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 20 Top - line Phase 3 efficacy results for – 2H 2014 Complete Phase 3 with safety data – 2H 2015 File NDA – 2H 2015 Significant Value Driving Milestones for LPCN 1021

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 21 Mahesh Patel, Ph.D.: President, CEO & Co - Founder • Director, Specialty products, Pharmacia and Upjohn Morgan Brown, CPA: Executive Vice President & CFO • CFO, Innovus Pharmaceuticals, World Heart Corporation, Lifetree Clinical Research; Vice President Finance & Treasurer, NPS Pharmaceuticals Srinivasan Venkateshwaran, Ph.D.: CTO & VP R&D • Executive Director, TheraTech Jerry Simmons: Corporate Business Development Officer • CEO, Cellegy; various corporate business positions, Ciba Geigy; and various corporate marketing positions, Schering Plough William Higuchi, Ph.D.: Co - founder, Chief Scientific Advisor • Chairman & Co - founder, TheraTech Experienced Management Team

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 22 Focused on developing innovative orally - available treatment alternatives in the areas of men’s and women’s health Pipeline of well - known molecules with 505(b)(2) strategy Lead asset currently in Phase 3, addresses an unmet need in large and growing market Several near term value drivers with pipeline products Diverse patent portfolio • U.S.: Six issued and 14 pending applications • Foreign: 31 total issued and pending Lipocine Investment Highlights

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 Appendix

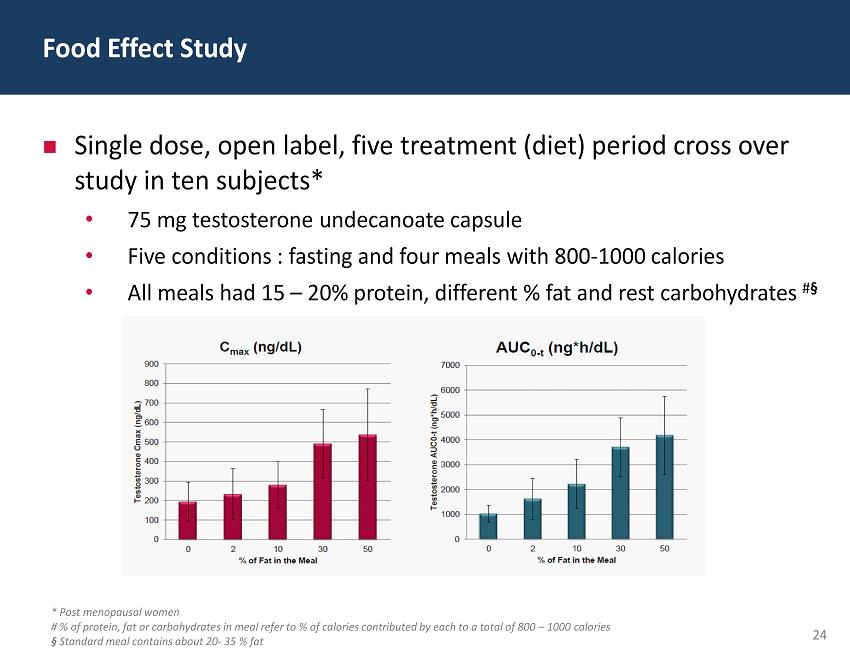

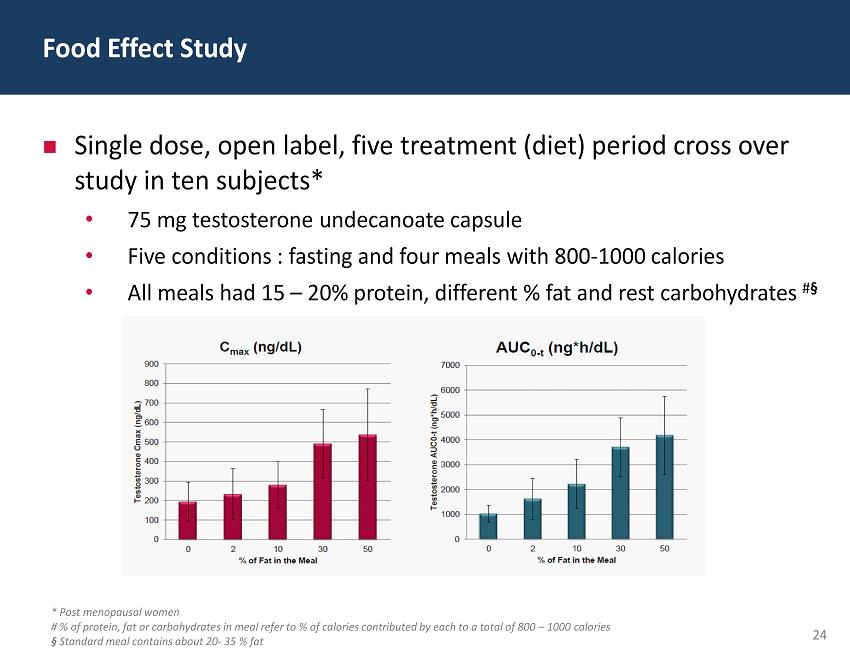

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 24 Single dose, open label, five treatment (diet) period cross over study in ten subjects* • 75 mg testosterone undecanoate capsule • Five conditions : fasting and four meals with 800 - 1000 calories • All meals had 15 – 20% protein, different % fat and rest carbohydrates # § Food Effect Study * Post menopausal women # % of protein, fat or carbohydrates in meal refer to % of calories contributed by each to a total of 800 – 1000 calories § Standard meal contains about 20 - 35 % fat

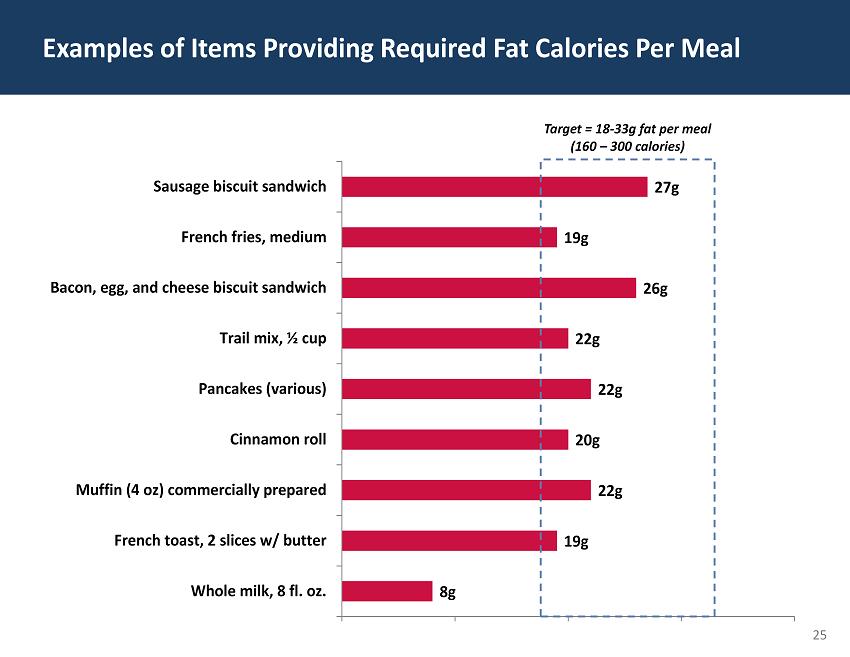

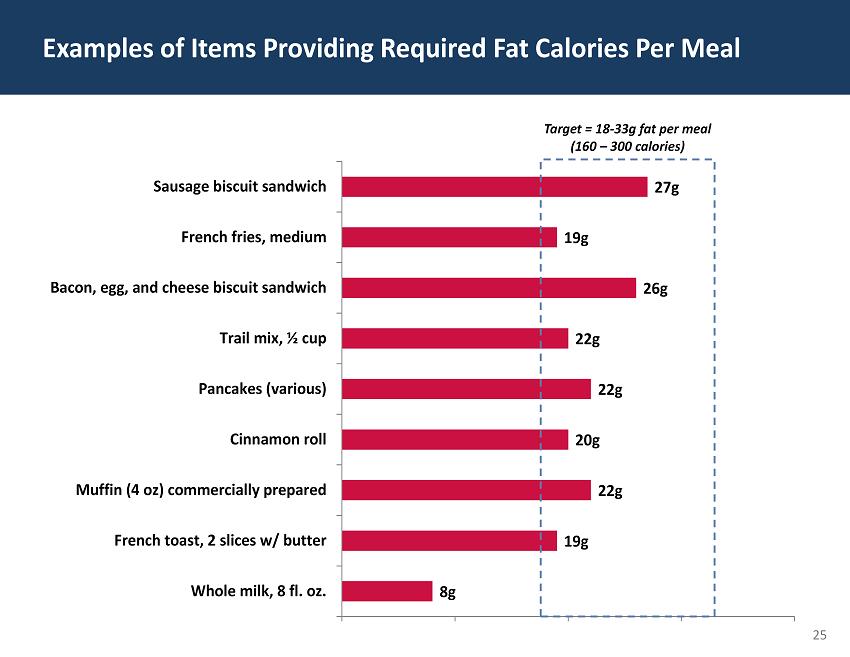

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 25 8g 19g 22g 20g 22g 22g 26g 19g 27g Whole milk, 8 fl. oz. French toast, 2 slices w/ butter Muffin (4 oz) commercially prepared Cinnamon roll Pancakes (various) Trail mix, ½ cup Bacon, egg, and cheese biscuit sandwich French fries, medium Sausage biscuit sandwich Examples of Items Providing Required Fat Calories Per Meal Target = 18 - 33g fat per meal (160 – 300 calories)

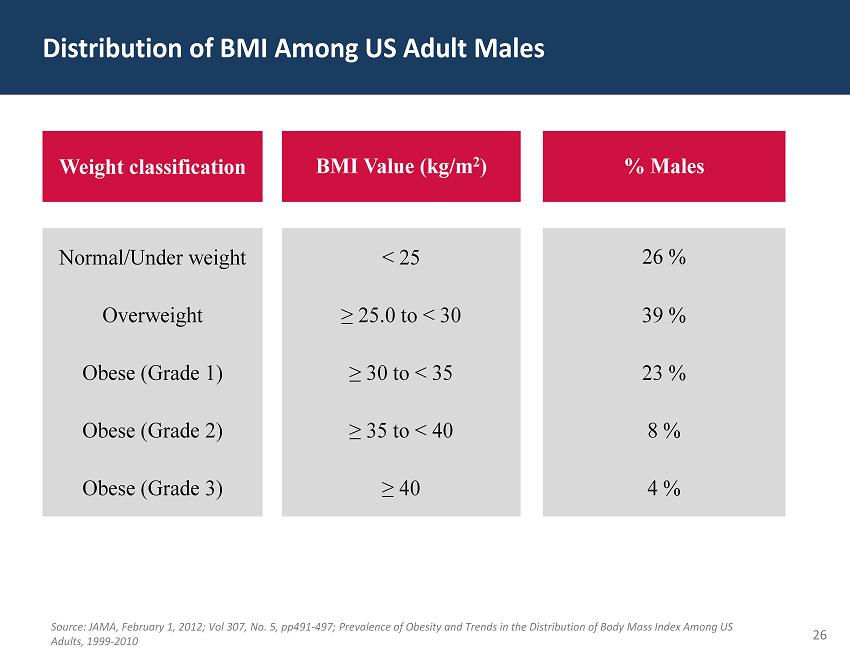

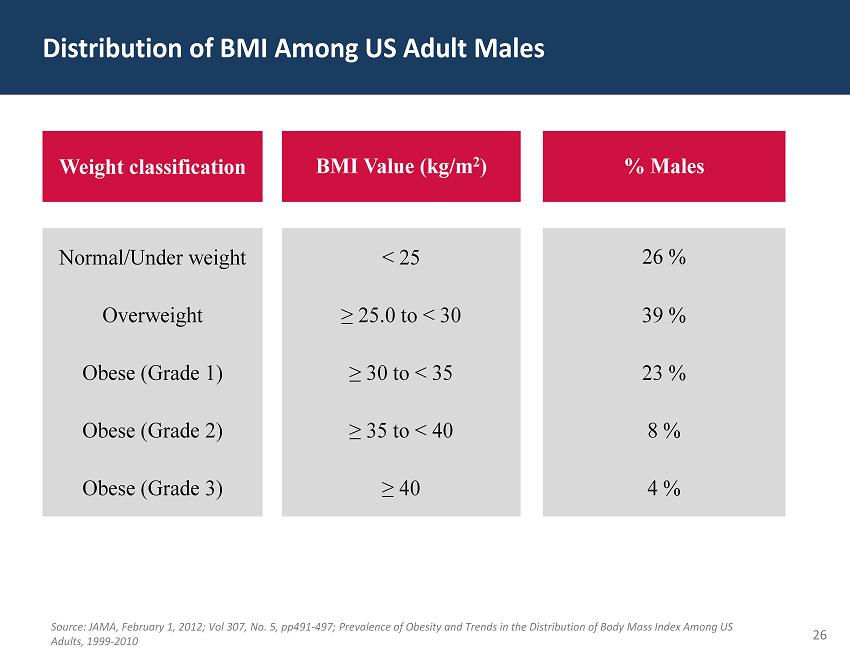

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 26 Distribution of BMI Among US Adult Males Source: JAMA, February 1, 2012; Vol 307, No. 5, pp491 - 497; Prevalence of Obesity and Trends in the Distribution of Body Mass Ind ex Among US Adults, 1999 - 2010 Weight classification BMI Value (kg/m 2 ) % Males Normal/Under weight < 25 26 % Overweight ≥ 25.0 to < 30 39 % Obese (Grade 1) ≥ 30 to < 35 23 % Obese (Grade 2) ≥ 35 to < 40 8 % Obese (Grade 3) ≥ 40 4 %

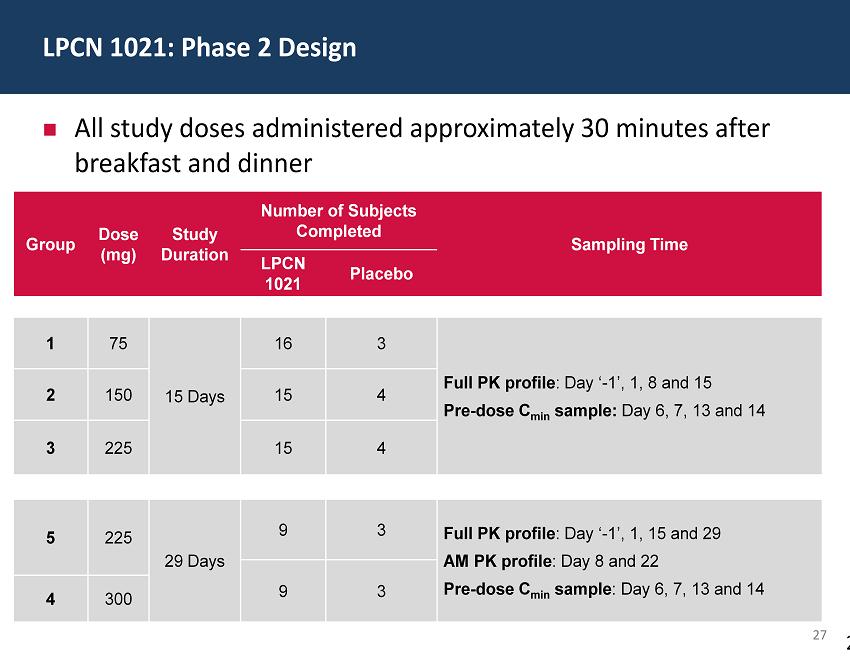

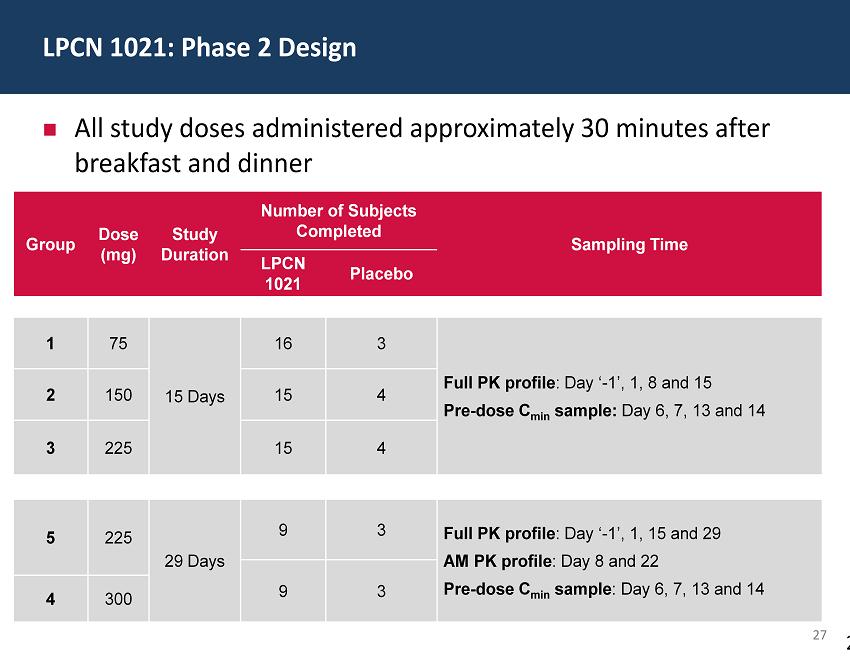

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 27 Group Dose (mg) Study Duration Number of Subjects Completed Sampling Time LPCN 1021 Placebo 1 75 15 Days 16 3 Full PK profile : Day ‘ - 1’, 1, 8 and 15 Pre - dose C min sample: Day 6, 7, 13 and 14 2 150 15 4 3 225 15 4 5 225 29 Days 9 3 Full PK profile : Day ‘ - 1’, 1, 15 and 29 AM PK profile : Day 8 and 22 Pre - dose C min sample : Day 6, 7, 13 and 14 9 3 4 300 All study doses administered approximately 30 minutes after breakfast and dinner LPCN 1021: Phase 2 Design 2 7

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 28 PK Parameters Criteria / Target 75mg 150mg 225mg* 300mg N UMBER OF SUBJECTS 16 15 24 9 P RIMARY E ND P OINTS % of Subjects meeting the criteria on Day 15 C ave, 0 - 24h 300 - 1140 ng/dL ≥ 75% 44 47 83 100 Lower Bound 95% CI ≥ 65% 27 35 69 79 S ECONDARY E ND P OINTS % of Subjects meeting the criteria on Day 15 C max ≤ 1500 ng/dL ≥ 85% 100 100 88 44 C max 1800 - 2500 ng/dL ≤ 5% 0 0 0 11 C max > 2500 ng/dL 0 0 0 0 33 *Group III and V combined LPCN 1021: Phase II Testosterone Results 2 8

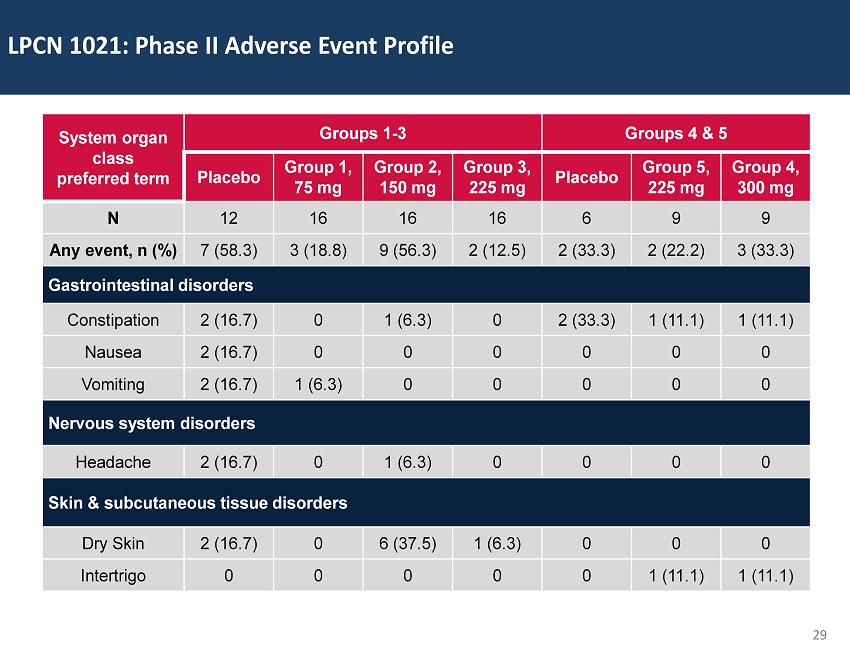

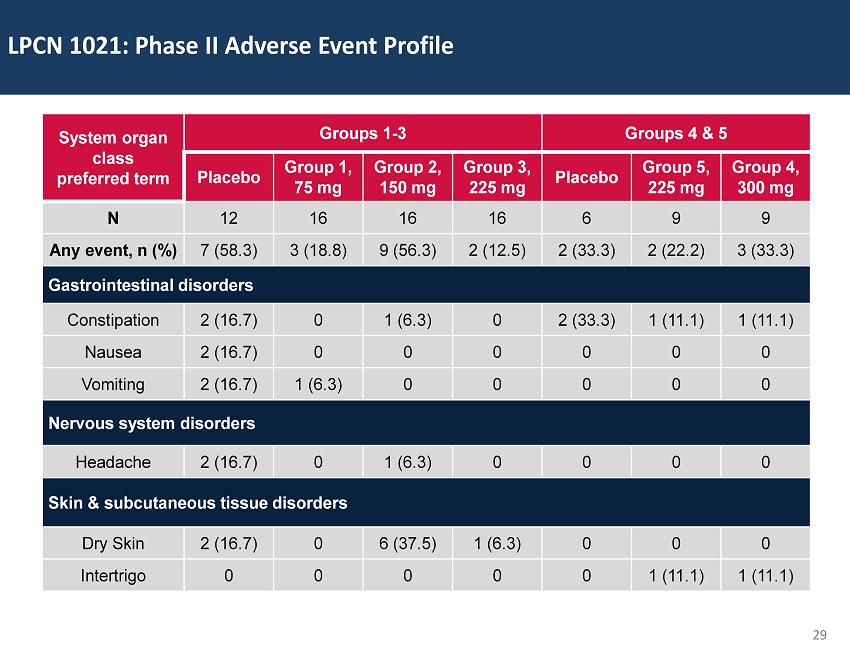

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 29 LPCN 1021: Phase II Adverse Event Profile System organ class preferred term Groups 1 - 3 Groups 4 & 5 Placebo Group 1, 75 mg Group 2, 150 mg Group 3, 225 mg Placebo Group 5, 225 mg Group 4, 300 mg N 12 16 16 16 6 9 9 Any event, n (%) 7 (58.3) 3 (18.8) 9 (56.3) 2 (12.5) 2 (33.3) 2 (22.2) 3 (33.3) Gastrointestinal disorders Constipation 2 (16.7) 0 1 (6.3) 0 2 (33.3) 1 (11.1) 1 (11.1) Nausea 2 (16.7) 0 0 0 0 0 0 Vomiting 2 (16.7) 1 (6.3) 0 0 0 0 0 Nervous system disorders Headache 2 (16.7) 0 1 (6.3) 0 0 0 0 Skin & subcutaneous tissue disorders Dry Skin 2 (16.7) 0 6 (37.5) 1 (6.3) 0 0 0 Intertrigo 0 0 0 0 0 1 (11.1) 1 (11.1)

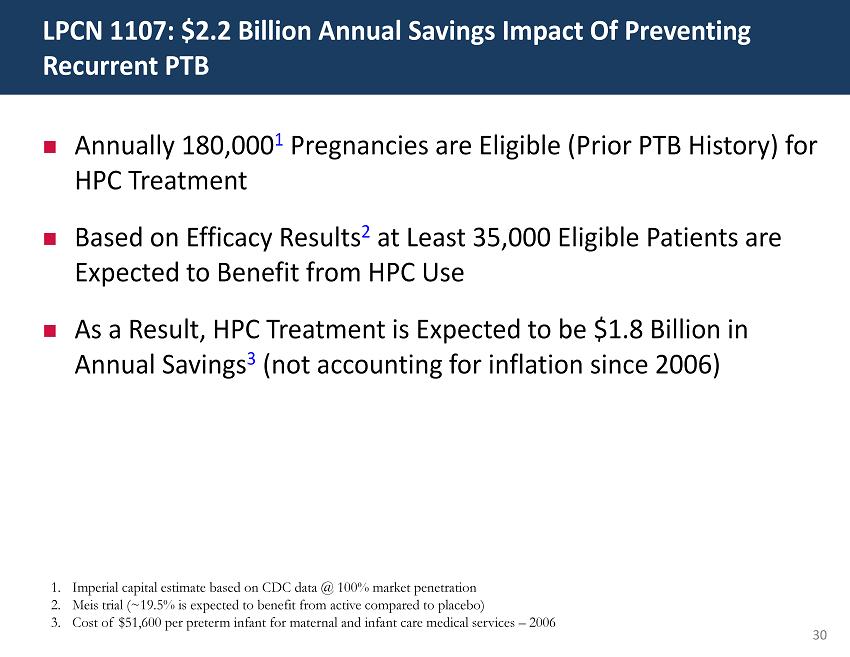

29 60 97 206 17 65 9 34 63 35 52 73 108 139 176 93 126 176 155 48 75 134 6 38 148 76 35 202 128 86 127 127 127 217 217 217 30 Annually 180,000 1 Pregnancies are Eligible (Prior PTB History) for HPC Treatment Based on Efficacy Results 2 at Least 35,000 Eligible Patients are Expected to Benefit from HPC Use As a Result, HPC Treatment is Expected to be $1.8 Billion in Annual Savings 3 (not accounting for inflation since 2006) LPCN 1107: $2.2 Billion Annual Savings Impact Of Preventing Recurrent PTB 1. Imperial capital estimate based on CDC data @ 100% market penetration 2. Meis trial (~19.5% is expected to benefit from active compared to placebo) 3. Cost of $51,600 per preterm infant for maternal and infant care medical services – 2006