- LPCN Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Lipocine (LPCN) DEF 14ADefinitive proxy

Filed: 27 Mar 23, 4:05pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

LIPOCINE INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

March 28, 2023

Dear Stockholder:

You are cordially invited to attend Lipocine Inc.’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 10, 2023. The meeting will be held at Lipocine’s offices located at 675 Arapeen Drive, Suite 202, Salt Lake City, Utah 84108 at 10:00 a.m. Mountain Daylight Time. The formal meeting notice and Proxy Statement for the Annual Meeting are attached.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. One of the proposals on which stockholders will be voting requires the approval of the holders of a majority of our outstanding shares. Therefore, we urge you to vote as promptly as possible. Returning your completed proxy card or voting via the instructions provided on your proxy card will ensure your representation at the Annual Meeting. If you later decide to attend the Annual Meeting and wish to change your vote, you may do so simply by voting in person at the meeting.

We look forward to seeing you at the Annual Meeting.

Sincerely,

Mahesh V. Patel, Ph.D.

President and Chief Executive Officer

LIPOCINE INC.

675 Arapeen Drive, Suite 202

Salt Lake City, Utah

(801) 994-7383

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 10, 2023

TO THE STOCKHOLDERS OF LIPOCINE INC.:

On behalf of the Board of Directors of Lipocine Inc., a Delaware corporation (“Lipocine” or the “Company”), Lipocine is pleased to deliver the accompanying Proxy Statement in connection with the annual meeting of stockholders of Lipocine (“Annual Meeting”) which will be held on May 10, 2023, at 10:00 a.m. Mountain Daylight Time, at the offices of Lipocine, located at 675 Arapeen Drive, Suite 202, Salt Lake City, Utah 84108.

The Annual Meeting will be held for the following purposes, as more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders (the “Notice”):

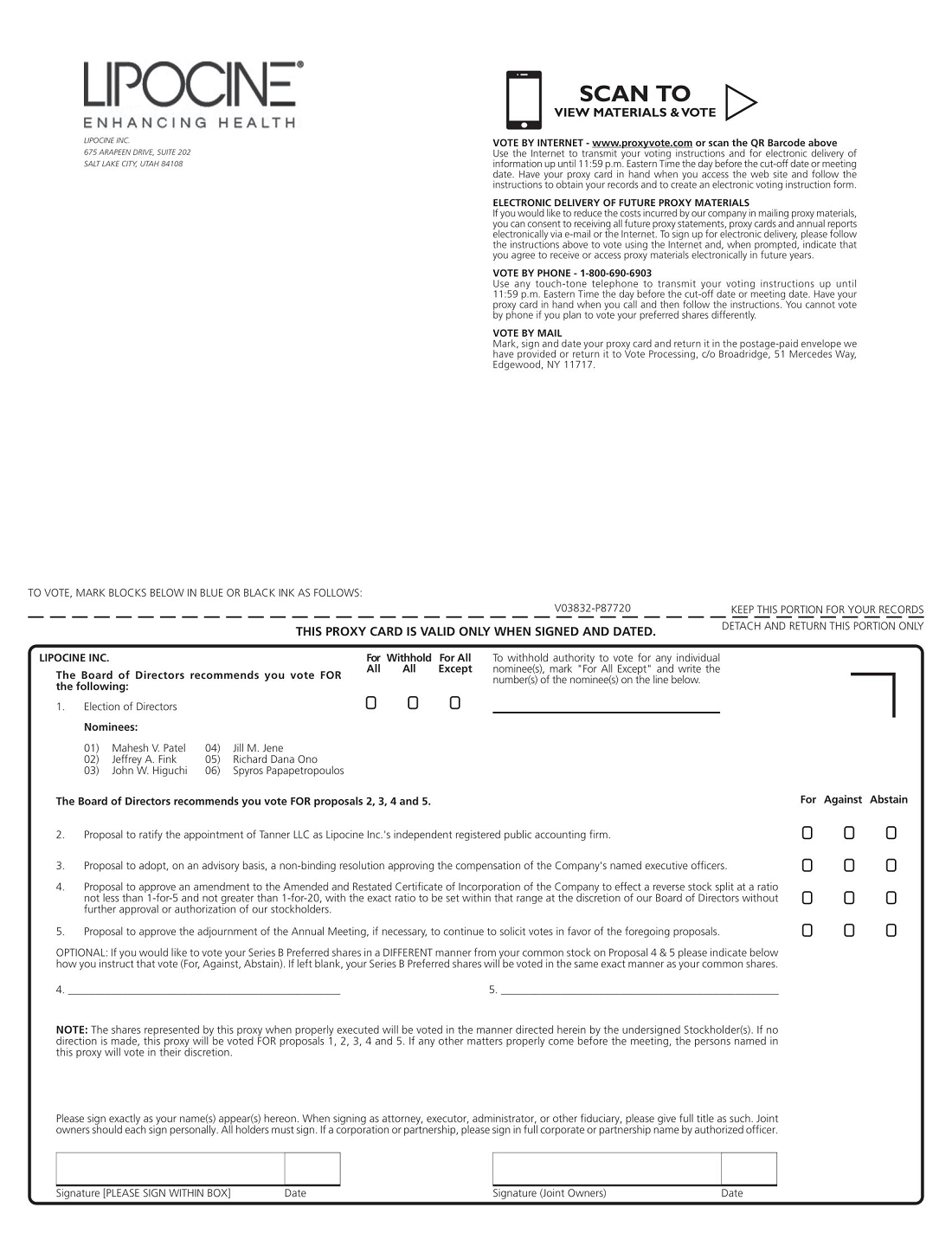

| 1. | To elect six (6) directors to our Board of Directors, to serve until the next annual meeting or until their successors are duly elected and qualified; | |

| 2. | To ratify the appointment of Tanner LLC as the independent registered public accounting firm of Lipocine for the year ending December 31, 2023; | |

| 3. | To adopt, on an advisory basis, a non-binding resolution approving the compensation of the Company’s named executive officers, as described in the Proxy Statement under “Executive Compensation”; | |

| 4. | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect a reverse stock split at a ratio not less than 1-for-5 and not greater than 1-for-20, with the exact ratio to be set within that range at the discretion of our Board of Directors without further approval or authorization of our stockholders; | |

| 5. | To approve the adjournment of the Annual Meeting, if necessary, to continue to solicit votes in favor of the foregoing proposals; and

| |

| 6. | To conduct any other business properly brought before the Annual Meeting and any adjournment or postponement thereof. |

The proposals are described in more detail in this Proxy Statement, which Lipocine encourages you to read carefully and in its entirety before voting. The Proxy Statement, this Notice and the accompanying form of proxy, along with our annual report on Form 10-K for the year ended December 31, 2022, are first being mailed to stockholders of the Company on or about March 28, 2023.

Only stockholders of record at the close of business on March 24, 2023 are entitled to receive notice of and, except with respect to any shares of Series B Preferred Stock, par value $0.0001 per share (the “Series B Preferred Stock”), of the Company or fractions thereof automatically redeemed in the Initial Redemption (as defined below), to vote at the Annual Meeting and any adjournments or postponements thereof. Our stock transfer books will remain open between the record date and the date of the meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at our principal executive offices and at the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to assure your representation at the Annual Meeting, you are urged to vote as promptly as possible in accordance with the instructions provided on your proxy card, or sign, date and promptly return the proxy card. To ensure that all your shares are voted, please vote once for each proxy card you receive.

You may revoke your proxy at any time prior to the Annual Meeting. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the Annual Meeting will be counted. If your shares are held in the name of a bank, broker, or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record in order to be able to vote in person at the Annual Meeting.

Your vote is important. Proposal 4 requires the approval of the holders of a majority of our outstanding common stock. Accordingly, we urge you to vote promptly, which may save us the expense and effort of additional solicitation. As a result of the dividend of the shares of Series B Preferred Stock declared on March 24, 2023, each holder of shares of our common stock also holds a number of one one-thousandth of a share of our Series B Preferred Stock equal to the whole number of shares of common stock held by such holder. Because any one one-thousandth of a share of Series B Preferred Stock that are not present in person or by proxy at the Annual Meeting as of immediately prior to the opening of the polls at the Annual Meeting will be automatically redeemed as of such time (the “Initial Redemption”), if you fail to submit a proxy to vote your shares or attend the Annual Meeting in order to do so, your shares of Series B Preferred Stock will be redeemed immediately prior to the opening of the polls at the Annual Meeting and will not be entitled to vote at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 10, 2023: This notice of annual meeting of stockholders, the Proxy Statement, and our Annual Report on Form 10-K for 2022 are available at https://materials.proxyvote.com/53630X.

Sincerely,

Mahesh V. Patel, Ph.D.

President and Chief Executive Officer

Salt Lake City, Utah

March 28, 2023

YOUR VOTE IS VERY IMPORTANT.

IN ORDER TO ASSURE YOUR REPRESENTATION AT THE MEETING, WE URGE YOU TO VOTE BY COMPLETING, SIGNING, DATING AND RETURNING THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE.

LIPOCINE INC.

675 Arapeen Drive, Suite 202

Salt Lake City, Utah

(801) 994-7383

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board��) of Lipocine Inc., a Delaware corporation, to be used at its 2023 Annual Meeting of Stockholders (the “Annual Meeting”), and which will be held at 675 Arapeen Drive, Suite 202, Salt Lake City, Utah 84108, at 10:00 a.m. Mountain Daylight Time on May 10, 2023, and at any adjournments or postponements thereof. Directions to the Annual Meeting may be obtained by calling (801) 994-7383, for stockholders who plan to attend the Annual Meeting in person.

The Notice of Annual Meeting of Stockholders (this “Notice”), this Proxy Statement and the enclosed proxy card are first being sent or given to our stockholders on or about March 28, 2023, along with our Annual Report for the fiscal year ended December 31, 2022 (the “Annual Report”). We will bear the cost of the solicitation of proxies. The Proxy Statement and the Annual Report both are available online at: www.proxyvote.com. Web links and addresses contained in this Proxy Statement are provided for convenience only, and the content on the referenced websites does not constitute a part of this Proxy Statement.

Only stockholders of record at the close of business on March 24, 2023 (the “Record Date”) are entitled to receive notice of and, except with respect to any shares of Series B Preferred Stock, par value $0.0001 per share (the “Series B Preferred Stock”), of the Company or fractions thereof automatically redeemed in the Initial Redemption (as defined below), to vote at the Annual Meeting and any adjournments or postponements thereof. On the Record Date, there were 88,510,791 shares of common stock outstanding, 88,511 shares of preferred stock outstanding and approximately 95 stockholders of record according to information provided by our transfer agent.

As a result of the dividend of the shares of Series B Preferred Stock declared on March 24, 2023, each holder of shares of our common stock also holds a number of one one-thousandth of a share of our Series B Preferred Stock equal to the whole number of shares of common stock held by such holder. Because any one one-thousandth of a share of Series B Preferred Stock that are not present in person or by proxy at the Annual Meeting as of immediately prior to the opening of the polls at the Annual Meeting will be automatically redeemed as of such time (the “Initial Redemption”), if you fail to submit a proxy to vote your shares or attend the Annual Meeting in order to do so, your shares of Series B Preferred Stock will be redeemed immediately prior to the opening of the polls at the Annual Meeting and will not be entitled to vote at the Annual Meeting.

We will provide without charge to any person from whom a Proxy is solicited by the Board of Directors, upon the written request of such person, a copy of our 2022 Annual Report on Form 10-K, including the financial statements and schedules thereto (as well as exhibits thereto, if specifically requested), required to be filed with the Securities and Exchange Commission. Written requests for such information should be directed to Lipocine Inc., 675 Arapeen Drive, Suite 202, Salt Lake City, Utah 84108, Attention: Stephanie Sorensen.

References to the “Company,” “Lipocine,” “our,” “us” or “we” mean Lipocine Inc.

TABLE OF CONTENTS

ANNUAL MEETING OF STOCKHOLDERS

We have sent you this Proxy Statement and the enclosed proxy card because the Board is soliciting your proxy to vote at our 2023 Annual Meeting of Stockholders to be held on Wednesday, May 10, 2023 at our offices at 675 Arapeen Drive, Suite 202, Salt Lake City, Utah 84108, at 10:00 a.m., Mountain Daylight Time, and at any adjournments or postponements thereof.

| ● | This Proxy Statement summarizes information about the proposals to be considered at the Annual Meeting and other information you may find useful in determining how to vote. | |

| ● | The proxy card is the means by which you actually authorize another person to vote your shares in accordance with your instructions. |

Information About the Annual Meeting

Why am I receiving these materials?

The purposes of the Annual Meeting are:

| 1. | To elect six (6) directors to our Board of Directors, to serve until the next annual meeting and until their successors are duly elected and qualified;

|

| 2. | To ratify the appointment of Tanner LLC as the independent registered public accounting firm of Lipocine for the year ending December 31, 2023; |

| 3. | To adopt, on an advisory basis, a non-binding resolution approving the compensation of the Company’s named executive officers, as described in the Proxy Statement under “Executive Compensation”; |

| 4. | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect a reverse stock split at a ratio of not less than 1-for-5 and not greater than 1-for-20 (the “Reverse Stock Split”), with the exact ratio to be set within that range at the discretion of our Board of Directors without further approval or authorization of our stockholders (the “Reverse Stock Split Proposal”); |

| 5. | To approve the adjournment of the Annual Meeting, if necessary, to continue to solicit votes in favor of the foregoing proposals (the “Adjournment Proposal”); and |

| To conduct any other business properly brought before the Annual Meeting and any adjournment or postponement thereof. |

You are receiving this Proxy Statement as a stockholder of the Company as of the Record Date, March 24, 2023, for purposes of determining the stockholders entitled to receive notice of and vote at the Annual Meeting. As further described below, we request that you vote promptly.

THE BOARD UNANIMOUSLY RECOMMENDS VOTING FOR THE ELECTION OF EACH OF THE BOARD’S NOMINEES ON PROPOSAL NO. 1 AND FOR PROPOSAL NOS. 2, 3, 4, AND 5.

When is the Annual Meeting?

The Annual Meeting will be held at 10:00 a.m., Mountain Daylight Time, on Wednesday, May 10, 2023.

Where is the Annual Meeting?

The Annual Meeting will be held at our offices at 675 Arapeen Drive, Suite 202, Salt Lake City, Utah 84108.

| 2 |

Who can attend the Annual Meeting?

All stockholders as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting. Each stockholder may be asked to present valid picture identification, such as a driver’s license or passport. If you hold your shares through a broker or other nominee, you must bring a copy of a brokerage statement reflecting your stock ownership as of the Record Date. All stockholders must check in at the registration desk at the Annual Meeting.

What constitutes a quorum?

A quorum of stockholders is necessary to hold a valid meeting for the transaction of business. The presence at the Annual Meeting, in person or by proxy duly authorized, of the holders of one-third of the outstanding shares of common stock entitled to vote as of the Record Date will constitute a quorum. Broker non-votes, abstentions and votes withheld count as shares present at the Annual Meeting for purposes of calculating whether a quorum is present. On the Record Date, there were 88,510,791 shares of our common stock outstanding.

What are the recommendations of the Board?

The Board’s recommendations are set forth below.

| 1. | FOR the election of each Board nominee; | |

| 2. | FOR the ratification of the appointment of Tanner LLC as our independent registered public accounting firm for the year ending December 31, 2023; | |

| 3. | FOR the approval, on an advisory basis, of a non-binding resolution approving the compensation of the Company’s named executive officers, as described in the Proxy Statement under “Executive Compensation”; | |

| 4. | FOR the approval to amend the Certificate of Incorporation to effect a reverse stock split at a ratio not less than 1-for-5 and not greater than 1-for-20, with the exact ratio to be set within that range at the discretion of our Board of Directors without further approval or authorization of our stockholders; and | |

| 5. | FOR the adjournment of the Annual Meeting, if necessary, to continue to solicit votes in favor of the foregoing proposals |

If you submit a valid proxy, the persons named as proxy holders will vote your shares as you instruct and, in the absence of any instructions, in accordance with the recommendations of the Board. The proxy holders will vote in their own discretion with respect to any other matter that properly comes before the Annual Meeting or any adjournments or postponements thereof.

Information About Voting

Who can vote at the Annual Meeting?

Only stockholders of record as of the Record Date, are entitled to receive notice of the Annual Meeting and, except with respect to any shares of Series B Preferred Stock of the Company or fractions thereof automatically redeemed in the Initial Redemption, to vote the shares of capital stock of the Company that they held on that date at the meeting, or any postponement or adjournment of the meeting. Holders of our common stock are entitled to one vote per share on each matter to be voted upon. Notwithstanding the foregoing, holders of our outstanding shares of Series B Preferred Stock will only be entitled to vote such shares on Proposals 4 and 5 and will only be able to vote such shares of Series B Preferred Stock on such proposals to the extent that such shares have not been automatically redeemed in the Initial Redemption as described below.

| 3 |

How many votes are allocated to each share of common stock and each share of Series B Preferred Stock?

Each share of our common stock outstanding as of the Record Date is entitled to one vote per share on all matters properly brought before our annual meeting. As previously announced on March 10, 2023, the Board declared a dividend of one one-thousandth of a share of Series B Preferred Stock for each outstanding share of common stock to stockholders of record of common stock as of 5:00 p.m. Eastern Time on March 24, 2023. The holders of Series B Preferred Stock have 1,000,000 votes per whole share of Series B Preferred Stock (i.e., 1,000 votes per one one-thousandth of a share of Series B Preferred Stock) and are entitled to vote with the common stock, together as a single class, on the Reverse Stock Split Proposal and the Adjournment Proposal, but are not otherwise entitled to vote on the other proposals to be presented at the Annual Meeting. Notwithstanding the foregoing, each share of Series B Preferred Stock redeemed pursuant to the Initial Redemption will have no voting power with respect to the Reverse Stock Split Proposal, the Adjournment Proposal, or any other matter. When a holder of common stock submits a vote or proxy with respect to the voting on the Reverse Stock Split Proposal or the Adjournment Proposal, the corresponding number of fractional shares of Series B Preferred Stock held by such holder will be automatically voted in a mirrored fashion unless otherwise indicated. For example, if a stockholder holds 10 shares of common stock (entitled to one vote per share) and votes in favor of the Reverse Stock Split Proposal, then 10,010 votes will be recorded in favor of the Reverse Stock Split Proposal, because the stockholder’s shares of Series B Preferred Stock will automatically be voted in favor of the Reverse Stock Split Proposal alongside such stockholder’s shares of common stock.

All shares of Series B Preferred Stock that are not present in person or by proxy at the Annual Meeting as of immediately prior to the opening of the polls at the Annual Meeting will be automatically redeemed as of the Initial Redemption. Any outstanding shares of Series B Preferred Stock that have not been redeemed pursuant to the Initial Redemption will be redeemed in whole, but not in part, (i) if and when ordered by our Board or (ii) upon the effectiveness of the amendment to the Certificate of Incorporation to effect the Reverse Split.

What are the voting rights of the holders of the common stock?

Holders of our common stock will vote on all matters to be acted upon by the stockholders at the Annual Meeting. Each outstanding share of common stock will be entitled to one vote on each matter to be voted upon at the Annual Meeting.

How do I vote?

You may attend the Annual Meeting and vote in person. You may submit your proxy by mail, telephone, or the Internet. If you are submitting your proxy by mail, you should complete, sign, and date your proxy card and return it in the envelope provided. Sign your name exactly as it appears on the proxy card. If you plan to vote by telephone or the Internet, voting instructions are printed on your proxy card. If you provide specific voting instructions, your shares will be voted as you have instructed. Proxy cards submitted by mail must be received by our voting tabulator no later than May 9, 2023, to be voted at the Annual Meeting. Please note that by casting your vote by proxy you are authorizing the individuals named as proxy holders to vote your shares in accordance with your instructions and in their discretion with respect to any other matter that properly comes before the Annual Meeting or any adjournments or postponements thereof.

If you hold shares of our common stock in street name, you should follow the instructions in your proxy card or your broker’s instructions to vote your shares. In these cases, you may vote by Internet or mail, as applicable. You may vote shares held through your broker in person at the Annual Meeting only if you obtain a valid proxy from your broker giving you the legal right to vote the shares at the Annual Meeting.

When a holder of common stock submits a vote or proxy with respect to the voting on the Reverse Stock Split Proposal or the Adjournment Proposal, the corresponding number of fractional shares of Series B Preferred Stock held by such holder will be automatically voted in a mirrored fashion unless otherwise indicated. For example, if a stockholder holds 10 shares of common stock (entitled to one vote per share) and votes in favor of the Reverse Stock Split Proposal, then 10,010 votes will be recorded in favor of the Reverse Stock Split Proposal, because the stockholder’s shares of Series B Preferred Stock will automatically be voted in favor of the Reverse Stock Split Proposal alongside such stockholder’s shares of common stock.

Is my vote confidential?

Yes. Proxy cards, ballots and voting tabulations that identify stockholders are kept confidential except in certain circumstances where it is important to protect the interests of Lipocine and its stockholders.

What happens if I do not vote my shares?

If you are a stockholder of record and you do not vote by proxy card, by telephone or the Internet, or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting. All shares of Series B Preferred Stock that are not present in person or by proxy at the Annual Meeting as of immediately prior to the opening of the polls at the Annual Meeting will be automatically redeemed as of such time of the Initial Redemption. Each share of Series B Preferred Stock redeemed pursuant to the Initial Redemption will have no voting power with respect to the Reverse Stock Split Proposal, the Adjournment Proposal, or any other matter.

| 4 |

If you hold shares of our common stock in street name and you do not direct your broker or nominee how to vote your shares, your broker or nominee may vote your shares only on those proposals for which it has discretion to vote. Under the rules of the New York Stock Exchange, your broker or nominee does not have discretion to vote your shares on non-routine matters such as Proposals 1 and 3. We believe that Proposals 2, 4, and 5 are routine matters on which brokers and nominees can vote on behalf of their clients if clients do not furnish voting instructions.

Can I change my vote after I vote or return my proxy card?

Yes. Even after you have voted or submitted your proxy card, you may change your vote at any time before the proxy is exercised by filing a notice of revocation with the Secretary of Lipocine. You may also change your vote at any time before the proxy is exercised by either casting a new vote by phone or over the Internet, or sending a duly executed proxy card bearing a later date. The powers of the proxy holders will be suspended if you attend the Annual Meeting in person and request to recast your vote. Attendance at the Annual Meeting will not, by itself, revoke a previously granted proxy. For information regarding how to vote in person, see “How do I vote?” above.

What vote is required to approve each proposal?

Proposal No. 1, the election of six directors to our Board, will require approval of a plurality of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote, meaning that the nominees receiving the highest numbers of “for” votes of the shares entitled to be voted for them, up to the number of directors to be elected by such shares, will be elected, provided a quorum is present in person or by proxy. As a result, the six director nominees receiving the most “for” votes at the Annual Meeting will be elected. The proxy card enables a stockholder to vote “FOR” or “WITHHOLD” from voting as to each person nominated by the Board.

Proposal Nos. 2, 3, and 5 will be decided by the affirmative vote of the majority of shares of common stock that are present or represented by proxy and entitled to vote at the Annual Meeting.

Proposal No. 4, the approval to amend our Certificate of Incorporation to effect the Reverse Stock Split, requires the affirmative vote of holders of a majority in voting power of the issued and outstanding shares of common stock and Series B Preferred Stock entitled to vote on the Reverse Stock Split Proposal, voting together as a single class. When a holder of common stock submits a vote or proxy with respect to the voting on the Reverse Stock Split Proposal or the Adjournment Proposal, the corresponding number of fractional shares of Series B Preferred Stock held by such holder will be automatically voted in a mirrored fashion unless otherwise indicated. For example, if a stockholder holds 10 shares of common stock (entitled to one vote per share) and votes in favor of the Reverse Stock Split Proposal, then 10,010 votes will be recorded in favor of the Reverse Stock Split Proposal, because the stockholder’s shares of Series B Preferred Stock will automatically be voted in favor of the Reverse Stock Split Proposal alongside such stockholder’s shares of common stock.

A stockholder may vote “FOR”, “AGAINST” or “ABSTAIN” on Proposal Nos. 2, 3, 4 and 5.

What is a broker non-vote?

A broker non-vote occurs when a broker does not vote on a particular proposal with respect to shares of common stock held in a fiduciary capacity (typically referred to as being held in “street name”) because the broker has not received voting instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Routine matters include the ratification of our auditors and the approval of the proposed amendment to our certificate of incorporation. Non-routine matters include matters such as the election of directors and the approval of, and amendments to, stock plans. Therefore, if you do not give your broker or nominee specific instructions, your shares will not be voted on non-routine matters and may not be voted on routine matters. However, shares represented by such “broker non-votes” will be counted in determining whether there is a quorum present at the Annual Meeting for the purpose of transacting business.

| 5 |

Who can help answer my other questions?

If you have more questions about the Annual Meeting or require assistance in submitting your proxy or voting your shares, please contact Krista Fogarty, our Principal Accounting Officer, at 1-801-534-6951 or by email at kf@lipocine.com. If your broker, dealer, commercial bank, trust company or other nominee holds your shares, you should also call your broker, dealer, commercial bank, trust company or other nominee for additional information.

Voting Procedures

As a stockholder of Lipocine, you have a right to vote on certain business matters affecting us. The proposals that will be presented at the Annual Meeting and upon which you are being asked to vote are discussed below in the “Proposals” section. Each share of Lipocine common stock you owned as of the Record Date entitles you to one vote on each proposal presented at the Annual Meeting.

Methods of Voting

You may vote over the Internet, by mail or in person at the Annual Meeting. Please be aware that if you vote over the Internet, you may incur costs such as Internet access charges for which you will be responsible.

Voting by Telephone or over the Internet. Lipocine has established telephone and Internet voting procedures for registered shareholders. These procedures are designed to authenticate your identity, to allow you to give your voting instructions and to confirm that those instructions have been properly recorded.

You can vote by calling the toll-free telephone number on your proxy card. Please have your proxy card handy when you call. Easy-to-follow voice prompts will allow you to vote your shares and confirm that your instructions have been properly recorded.

You may also vote your shares over the Internet by following the Internet voting instructions printed on your proxy card. Please have your notice, proxy card or electronic notification handy when you go to the website. As with telephone voting, you can confirm that your instructions have been properly recorded.

Telephone and Internet voting facilities for registered stockholders will be available until 11:59 p.m. Eastern Time on May 9, 2023. If you vote by telephone or via the Internet, you do not need to return a proxy card.

If you hold shares of common stock in street name, the availability of telephone and Internet voting will depend on the voting processes of your broker, bank or other holder of record. We, therefore, recommend that you follow the voting instructions in the materials you receive.

Voting by Mail. You may vote by mail by completing, signing, and dating your proxy card and returning it to us on or prior to May 9, 2023 (proxy cards received after May 9, 2023 (i.e., on or after the Annual Meeting date) will not be counted). Please promptly mail your proxy card to ensure that it is received prior to the deadline.

Voting in Person at the Meeting. If you attend the Annual Meeting and plan to vote in person, we will provide you with a ballot at the Annual Meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the Annual Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the Annual Meeting, you will need to bring to the Annual Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

Series B Preferred Stock

The holders of Series B Preferred Stock have 1,000,000 votes per whole share of Series B Preferred Stock (i.e., 1,000 votes per one one-thousandth of a share of Series B Preferred Stock) and are entitled to vote with the common stock, together as a single class, on the Reverse Stock Split Proposal and the Adjournment Proposal, but are not otherwise entitled to vote on the other proposals to be presented at the Annual Meeting. Notwithstanding the foregoing, each share of Series B Preferred Stock redeemed pursuant to the Initial Redemption will have no voting power with respect to the Reverse Stock Split Proposal, the Adjournment Proposal, or any other matter. When a holder of common stock submits a vote or proxy with respect to the voting on the Reverse Stock Split Proposal or the Adjournment Proposal, the corresponding number of fractional shares of Series B Preferred Stock held by such holder will be automatically voted in a mirrored fashion unless otherwise indicated. For example, if a stockholder holds 10 shares of common stock (entitled to one vote per share) and votes in favor of the Reverse Stock Split Proposal, then 10,010 votes will be recorded in favor of the Reverse Stock Split Proposal, because the stockholder’s shares of Series B Preferred Stock will automatically be voted in favor of the Reverse Stock Split Proposal alongside such stockholder’s shares of common stock.

| 6 |

Revoking Your Proxy

You may revoke your proxy at any time before it is voted at the Annual Meeting. To do this, you must:

| ● | enter a new vote over the Internet or by telephone, or by signing and returning a replacement proxy card; | |

| ● | provide written notice of the revocation to our Principal Accounting Officer at our principal executive office, 675 Arapeen Drive, Suite 202, Salt Lake City, Utah 84108; or | |

| ● | attend the Annual Meeting and vote in person. |

Quorum and Voting Requirements

Stockholders of record at the close of business on the Record Date, are entitled to receive notice and vote at the meeting. On the Record Date, there were 88,510,791 issued and outstanding shares of our common stock. Each holder of common stock voting at the meeting, either in person or by proxy, may cast one vote per share of common stock held on the Record Date on all matters to be voted on at the meeting. Stockholders may not cumulate votes in the election of directors.

The presence, in person or by proxy duly authorized, of the holders of one-third of the outstanding shares of common stock entitled to vote as of the Record Date constitutes a quorum for the transaction of business at the meeting. Assuming that a quorum is present:

| (1) | For Proposal No. 1 a plurality of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors will be required to elect Board nominees; | |

| (2) | Proposal Nos. 2, 3, and 5 require the affirmative vote of a majority of the shares of common stock that are present or represented by proxy and entitled to vote at the Annual Meeting. A stockholder may vote “FOR”, “AGAINST” or “ABSTAIN” on Proposal Nos. 2, 3, and 5; and | |

| (3) | Proposal No. 4 requires the affirmative vote of a majority in voting power of the issued and outstanding shares of common stock and Series B Preferred Stock entitled to vote on the Reverse Stock Split Proposal, voting together as a single class. A stockholder may vote “FOR”, “AGAINST” or “ABSTAIN” on Proposal No. 4. When a holder of common stock submits a vote or proxy with respect to the voting on the Reverse Stock Split Proposal or the Adjournment Proposal, the corresponding number of fractional shares of Series B Preferred Stock held by such holder will be automatically voted in a mirrored fashion unless otherwise indicated. For example, if a stockholder holds 10 shares of common stock (entitled to one vote per share) and votes in favor of the Reverse Stock Split Proposal, then 10,010 votes will be recorded in favor of the Reverse Stock Split Proposal, because the stockholder’s shares of Series B Preferred Stock will automatically be voted in favor of the Reverse Stock Split Proposal alongside such stockholder’s shares of common stock. |

Votes cast by proxy or in person at the meeting will be tabulated by the election inspectors appointed for the meeting who will determine whether a quorum is present. The election inspectors will treat abstentions and broker non-votes (i.e., shares held by a broker or nominee that are represented at the Annual Meeting, but with respect to which such broker or nominee is not instructed to vote on a particular proposal and does not have discretionary voting power) as shares that are present for purposes of determining the presence of a quorum. With regard to Proposal 1, broker non-votes and votes marked “withheld” will not be counted towards the tabulations of votes cast on such proposal presented to the stockholders, will not have the effect of negative votes and will not affect the outcome of the vote. With regard to Proposals 2, 3, 4, and 5, abstentions will be counted towards the tabulations of votes cast on such proposal presented to the stockholders and will have the same effect as negative votes. Because we believe that Proposals 2, 4, and 5, are routine matters, we do not expect any broker non-votes with respect to Proposals 2, 4, and 5. For Proposal 3, broker non-votes will not be counted for purposes of determining whether such proposal has been approved and will not have the effect of negative votes.

If your shares are held by a bank or broker in street name, it is important that you cast your vote if you want it to count in the election of directors and other non-routine matters as determined by the New York Stock Exchange. Voting rules may prevent your bank or broker from voting your uninstructed shares on a discretionary basis in the election of directors and other non-routine matters. Accordingly, if your shares are held by a bank or broker in street name and you do not instruct your bank or broker how to vote in the election of directors or any other non-routine matters, no votes will be cast on your behalf.

| 7 |

Voting of Proxies

When a vote is properly cast via proxy card, the shares it represents will be voted at the meeting as directed. If no specification is indicated, the shares will be voted:

| (1) | “FOR” the election of each Board nominee set forth in this Proxy Statement; | |

| (2) | “FOR” the ratification of the Audit Committee’s appointment of Tanner LLC as our independent registered accounting firm for the year ending December 31, 2023; | |

| (3) | “FOR” the approval, on an advisory basis, of a non-binding resolution approving the compensation of the Company’s named executive officers, as described in the Proxy Statement under “Executive Compensation”; | |

| (4) | “FOR” the approval of an amendment to the Certificate of Incorporation to effect a reverse stock split at a ratio not less than 1-for-5 and not greater than 1-for-20, with the exact ratio to be set within that range at the discretion of our Board of Directors without further approval or authorization of our stockholders; | |

| (5) | “FOR” the adjournment of the Annual Meeting, if necessary, to continue to solicit votes in favor of the foregoing proposals; and | |

| (6) | at the discretion of your proxy holder, on any other matter that may be properly brought before the Annual Meeting. |

Voting Results

Voting results will be announced at the Annual Meeting and published in a Current Report on Form 8-K that will be filed with the SEC within four business days after the Annual Meeting.

Householding of Proxy Materials

We are sending only one copy of these materials to certain street-name stockholders who share a single address, unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if you are residing at such an address and wish to receive a separate copy of these materials in the future, you may contact our Principal Accounting Officer at (801) 534-6951, by email at kf@lipocine.com or write to Krista Fogarty at Lipocine Inc., 675 Arapeen Drive, Suite 202, Salt Lake City, Utah 84108. If you are receiving multiple copies of these materials, you may request householding by contacting the Principal Accounting Officer in the same manner.

Proxy Solicitation

We will bear the cost of this solicitation. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for reasonable expenses incurred in forwarding solicitation materials to such beneficial owners. Proxies also may be solicited by our directors, officers, or employees, personally, by telephone, facsimile, Internet or other means, without additional compensation. We have engaged Alliance Advisors, LLC to assist in the solicitation of proxies and provide related advice and information support for a services fee and the reimbursement of customary disbursements, which aggregate amount is not expected to exceed $75,000 in total.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 10, 2023: The Notice of Annual Meeting of Stockholders, this Proxy Statement, and our Annual Report on Form 10-K for 2022 are available at https://materials.proxyvote.com/53630X.

| 8 |

| PROPOSAL NO. 1: |

| ELECTION OF DIRECTORS |

Overview

There are currently six members of our Board. The terms of all of our directors are scheduled to expire at the 2023 Annual Meeting of Stockholders, at which time the incumbents will stand for re-election. The six director nominees, if elected, will serve a one-year term until the 2024 Annual Meeting of Stockholders and until their successors are duly elected and qualified.

Nominees

The Board has nominated the following individuals to serve on the Board of Directors.

| ● | Dr. Mahesh V. Patel, Ph.D. | |

| ● | Jeffrey A. Fink, M.B.A. | |

| ● | John W. Higuchi, M.B.A. | |

| ● | Dr. Jill M. Jene, Ph.D., M.B.A. | |

| ● | Dr. Richard Dana Ono, Ph.D. | |

| ● | Dr. Spyros Papapetropoulos, M.D., Ph.D. |

Nominees

Information with respect to the number of shares of common stock beneficially owned by each director as of February 28, 2023, appears under the heading “Security Ownership of Certain Beneficial Owners, Directors and Management”. The name, age, years of service on our Board of Directors, and principal occupation and business experience of each director nominee is set forth below.

| Name | Age | Position(s) | Director Since | |||

| Dr. Mahesh V. Patel, Ph.D.* | 66 | President, Chief Executive Officer and Director | 1997 | |||

| Jeffrey A. Fink, M.B.A.*+ † | 65 | Director | 2014 | |||

| John W. Higuchi, M.B.A.* | 55 | Director | 2003 | |||

| Dr. Jill M. Jene, Ph.D., M.B.A.*+ | 50 | Director | 2022 | |||

| Dr. Richard Dana Ono, Ph.D.*+† | 70 | Director | 2014 | |||

| Dr. Spyros Papapetropoulos, M.D., Ph.D.*† | 50 | Lead Independent Director and Chairman of the Board | 2022 |

| * | Nominee for election to Board |

| + | Member of the Audit Committee |

| † | Member of the Compensation Committee |

| 9 |

Business Experience of Nominees

Mahesh V. Patel, Ph.D. has served as our President and Chief Executive Officer and as a member of our Board of Directors since 1997. Dr. Patel has more than 30 years of experience in strategic planning, technology assessment/development, technical management and product research and development in the area of drug discovery support, drug delivery and product line extensions. Prior to co-founding Lipocine in 1997, he led drug delivery research and development at Pharmacia and Upjohn. Dr. Patel received a B.Pharm from Karnataka University in India, a M.S. in Physical Pharmacy at the University of Cincinnati and a Ph.D. in Pharmaceutics from the University of Utah. We believe Dr. Patel’s dual role as an executive officer and director gives him unique insights into the day-to-day operations of our company and our strategic planning and clinical development.

Jeffrey A. Fink, M.B.A., has served as a member of our Board of Directors since January 2014 and has over 20 years of finance and strategy experience within the life science and healthcare industry. Mr. Fink is currently the managing director of Gambel Oaks Advisors, a strategic and financial advisory firm dedicated to the life sciences and allied industries, where he has worked since 2010. Mr. Fink spent over twenty years in the investment banking industry advising life science clients in the U.S. and Europe on the full range of financing and strategic advisory assignments. He was head of Healthcare Investment Banking for Robert W. Baird & Co. in Chicago until he retired in 2007, and prior to that was a partner in the Healthcare Group at Dresdner Kleinwort Wasserstein (the successor firm to Wasserstein Perella) and head of Mergers and Acquisitions for Prudential Vector Healthcare, a dedicated biotechnology and life sciences investment bank. Mr. Fink received a BA in Economics, cum laude, from Kalamazoo College and holds an MBA in finance, with distinction, from the University of Michigan. We believe that Mr. Fink’s knowledge of accounting and finance and his extensive experience in the life science industry greatly benefits the Board.

John W. Higuchi, M.B.A. has served as a member of our Board of Directors since 2003. Mr. Higuchi served as Chief Executive Officer of Aciont Inc., an ocular therapeutics company in Utah from 2003 to 2022. Mr. Higuchi also is a co-founder and serves on the Board of Directors on Spriaso, LLC, a specialty pharmaceutical company in Utah. From 1997 to 2003, Mr. Higuchi served as our Vice President of Business Development and Corporate Treasurer. Mr. Higuchi received a B.S. in Chemistry from Hope College and an M.B.A. and Master of Science in Information Systems from The George Washington University. We believe that Mr. Higuchi’s business development and management experience in the therapeutics industry, together with his significant knowledge of our Company obtained while serving as a director of our Company, greatly benefits our Board of Directors.

Dr. Richard Dana Ono, Ph.D. has served as a director of the Company since January 2014 and has over 35 years of experience managing public and private life science companies as well as venture capital. Since 2013, he has been an executive-in-residence to several universities in the United States advising their licensing offices in spin-outs and new company formation from promising technologies. Throughout his career, he has been engaged in strategic planning, product management, technology acquisition, and commercial development of life science start-ups and has been involved in a number of pioneering milestones in biotechnology. Dr. Ono has founded several biotech companies in the U.S. Dr. Ono is a founding director of the Massachusetts Biotechnology Council, Inc. (MassBio) and served on the Board of Trustees of the Marine Biological Laboratory in Woods Hole, Massachusetts. He is a Fellow of the Linnean Society of London and a National Member of the Explorers Club. Dr. Ono received his AB in Earth & Planetary Sciences from The Johns Hopkins University and his AM and Ph.D in Biology from Harvard University, where he also completed a program in business administration. We believe that Dr. Ono’s extensive experience with life science companies at each phase of development greatly benefits the Board of Directors.

Dr. Jill Jene, Ph.D., M.B.A., has served as a director of the Company since April 2022 and brings more than 20 years of biopharmaceutical strategy, leadership and deal making experience to the Company’s Board of Directors. Dr. Jene has amassed a deal sheet of over $6 billion of closed transactions and she is currently the Founder and Principal of Jene Advisors, a biopharmaceutical advisory firm, a position she has held since November 2021. Dr. Jene was the Vice President and Head of Corporate Development, Strategy, Portfolio Planning and Alliance Management at Adamas from August 2020, until the company was sold to Supernus in November of 2021. Before joining Adamas, Dr. Jene was Vice President of Business Development for PDL from May 2018 to August 2020, a publicly traded biotechnology company where she was responsible for executing deal-making to maximize value for shareholders. Before PDL, Dr. Jene led Business Development at twoXAR from May 2017 to May 2018, where she led deal-making, resulting in closing 6 new partnerships and securing Series A funding from Softbank and A16z. Prior to twoXAR, Dr. Jene was at Depomed (now Assertio) from April 2006 to May 2017, where she led over 36 transactions including licensing and M&A deals including acquiring 4 commercial franchises. Earlier in her career, she held positions of increasing responsibility at Baxter International, the 3M Company (Pharmaceutical Division now part of Valeant) and Cell Genesys (acquired by Biosante). Dr. Jene earned a BS from Bradley University, a MS and PhD in Chemistry from Northwestern University, and an MBA in strategic management from DePaul University. We believe that Dr. Jene’s extensive experience in biopharmaceutical business greatly benefits our Board of Directors.

| 10 |

Dr. Spyros Papapetropoulos, M.D., Ph.D. has served as a director of the Company since April 2022, and Chairman of the Board of Directors and Lead Independent Director since November 2022. Dr. Papapetropoulos is an experienced biopharmaceutical executive, recognized neuroscientist, neurodegenerative disease clinician and change agent. Since January 2023, Dr. Papapetropolous has served as President, Chief Executive Officer and as a Board Director of Bionomics Inc (NASDAQ: BNOX). Prior to Bionomics, he served as Chief Medical Officer at Vigil, a position he has held since September 2020, where he oversaw all the clinical development and medical functions. Prior to Vigil, Dr. Papapetropoulos served as SVP, Head of Development (CDO) at Acadia Pharmaceuticals Inc. from November 2019 to September 2020, CEO at SwanBio Therapeutics from March 2019 to October 2020, and Head of Research & Development and Chief Medical Officer at Cavion from June 2017 to March 2019. Before Cavion, he held senior/executive positions at Biogen Inc., Allergan plc, Pfizer Inc., and Teva Pharmaceuticals Inc. Dr. Papapetropoulos has overseen a broad spectrum of biopharmaceutical development programs including small molecules, biologics, and gene therapy leading to successful regulatory filings and new product launches worldwide. He holds appointments as Consultant with Massachusetts General Hospital and has been involved in research that led to the characterization of genetic forms of Parkinson’s disease and development of methodologies relating to the quantification of neuromotor function in clinical research settings. Dr. Papapetropoulos has published more than 170 peer reviewed articles and authored several book chapters and patents. Dr. Papapetropoulos received his M.D. and Ph.D. in Greece from the University of Patras, School of Medicine. We believe that Dr. Papapetropoulos’ extensive experience with clinical research and development greatly benefits our Board of Directors.

There are no family relationships between any of our director nominees or executive officers.

Vote Required

A plurality of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors will be required to elect Board nominees. The six nominees receiving the highest number of affirmative votes cast at the Annual Meeting will be elected as our directors. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Recommendation

The Board recommends that stockholders vote “FOR” the election of each of the above-listed nominees.

Unless marked otherwise, proxies received will be voted “FOR” the election of each of these director nominees.

| 11 |

| CORPORATE GOVERNANCE |

BOARD OF DIRECTORS

Overview

Our Amended and Restated Bylaws (the “Bylaws”) provide that the size of our Board is to be determined by resolution of the Board. Our Board has currently fixed the number of directors at six. Our Board currently consists of six members.

Our common stock is listed on The NASDAQ Capital Market and we comply with The NASDAQ Capital Market’s listing standards on determining the independence of directors. Under these standards, an independent director means a person other than an executive officer or one of our employees or any other individual having a relationship which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In evaluating the independence of Mr. John W. Higuchi, we considered the transactions described under “Certain Relationships and Related Transactions – Spriaso LLC Assignment and Services Agreements.”

The Board has nominated Dr. Mahesh V. Patel, Mr. Jeffrey A. Fink, Dr. Richard Dana Ono, Mr. John W. Higuchi. Dr. Jill Jene, and Dr. Spyros Papapetropoulos for election at the Annual Meeting. Mr. Fink, Dr. Ono, Dr. Jene, and Dr. Papapetropoulos are serving as independent directors. The nominees have agreed to serve if elected, and management has no reason to believe that the nominees will be unavailable for service. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting or any adjournment or postponement thereof, the proxies will be voted for such other nominees as may be designated by the present Board.

We are subject to a number of technological, regulatory, product, legal and other types of risks. The Board and its constituent committees are responsible for overseeing these risks, and we employ a number of procedures to help them carry out that duty. For example, Board members regularly consult with executive management about pending issues and expected challenges, and at each Board meeting directors receive updates from, and have an opportunity to interview and ask questions of, key personnel and management. Furthermore, because our Chief Executive Officer serves as a member of our Board, we believe that the Board has a direct channel and better access to insights into our performance, business and challenges.

Board Leadership Structure

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interests of the Company to make that determination based upon the position and direction of the Company and the membership of the Board.

The Board currently believes that it is in the best interests of the Company and its stockholders to have a person other than our Chief Executive Officer serve as Chairman of the Board. Our Board believes that separating these roles at this time provides the appropriate balance between strategy development, flow of information between management and the Board, and oversight of management. We believe this structure currently provides guidance for our Board, while also positioning our Chief Executive Officer as the leader of the Company in the eyes of our customers, employees and other stakeholders. The Board has the discretion to modify this approach as circumstances change.

The Board has also instituted the Lead Independent Director position to provide an additional measure of balance, ensure the Board’s independence and enhance its ability to fulfill its management oversight responsibilities. The Chairman and Lead Independent Director:

| ● | presides over all meetings of the directors, including executive sessions of the independent directors; | |

| ● | frequently consults with the CEO about strategic policies; | |

| ● | provides the CEO with input regarding Board meetings; | |

| ● | serves as a liaison between the CEO and the independent directors; and | |

| ● | otherwise assumes such responsibilities as may be assigned to him by the independent directors. |

| 12 |

No single leadership model is right for all companies at all times. The Board recognizes that depending on the circumstances, other leadership models, such as a separate independent chairman of the Board, might be appropriate. Accordingly, the Board periodically reviews its leadership structure.

Board Role in Risk Oversight

Our Board of Directors is responsible for overseeing the Company’s management of risk. The Board strives to effectively oversee the Company’s enterprise-wide risk management in a way that balances managing risks while enhancing the long-term value of the Company for the benefit of the stockholders. The Board of Directors understands that its focus on effective risk oversight is critical to setting the Company’s tone and culture towards effective risk management. To administer its oversight function, the Board seeks to understand the Company’s risk philosophy by having discussions with management to establish a mutual understanding of the Company’s overall appetite for risk. Our Board of Directors maintains an active dialogue with management about existing risk management processes and how management identifies, assesses, and manages the Company’s most significant risk exposures. Our Board expects frequent updates from management about the Company’s most significant risks to enable it to evaluate whether management is responding appropriately.

Our Board relies on each of its committees to help oversee the risk management responsibilities relating to the functions performed by such committees. Our Audit Committee periodically discusses with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies. Our Compensation Committee helps the Board to identify the Company’s exposure to any risks potentially created by our compensation programs and practices. Each of these committees is required to make regular reports of its actions and any recommendations to the Board, including recommendations to assist the Board with its overall risk oversight function.

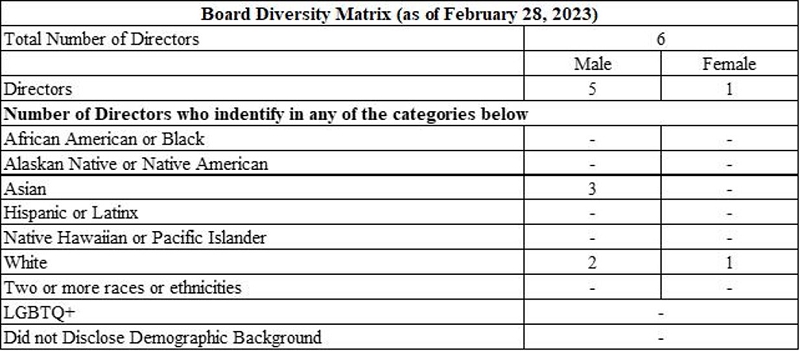

Board Diversity Matrix

The Company is committed to diversity and inclusion, and believes it is important that the Board is composed of individuals representing the diversity of our communities. The Company seeks nominees with a broad diversity of experience, professions, skills and backgrounds. The Board Diversity Matrix set forth below reports self-identified diversity statistics for the Board, as constituted prior to the Annual Meeting, in the format required by Nasdaq’s rules.

Committees of the Board of Directors

The Board has established an Audit Committee and a Compensation Committee. Each committee operates pursuant to a written charter that may be viewed on our website at www.lipocine.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement. The Board does not have a Nominating Committee or other committee of the Board that performs similar functions.

| 13 |

Audit Committee. Our Audit Committee oversees our accounting and financial reporting processes and is responsible for (i) retaining, evaluating and, if appropriate, recommending the termination of our independent registered public accounting firm, (ii) approving the services performed by our independent registered public accounting firm and (iii) reviewing and evaluating our accounting principles, financial reporting practices, and system of internal accounting controls. The Audit Committee is also responsible for maintaining communication between the Board and our independent registered public accounting firm, and has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, and for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. In addition, all related person transactions are reviewed and approved by the Audit Committee.

Our Audit Committee currently consists of Mr. Fink, Dr. Ono, and Dr. Jene with Mr. Fink serving as the Audit Committee Chairman. The Board has determined that all members of our Audit Committee are independent under the rules of the SEC, The NASDAQ Stock Market Rules and the standards adopted by our Board and that Mr. Fink qualifies as an “audit committee financial expert,” as defined by the rules of the SEC. During the fiscal year ended December 31, 2022, the Audit Committee held five meetings.

Compensation Committee. Our Compensation Committee assists our Board in determining the compensation of our executive officers and directors. The Compensation Committee is responsible for approving the compensation package of each executive officer and recommending each executive officer’s compensation to the Board. The Compensation Committee currently administers our Fourth Amended and Restated 2014 Stock and Incentive Plan. The Compensation Committee may form and delegate any of its responsibilities to subcommittees when appropriate. The Compensation Committee is entitled, at its discretion, to engage a compensation consultant to advise the Compensation Committee. Dr. Patel makes recommendations to the Compensation Committee regarding the compensation of the other executive officers.

Our Compensation Committee currently consists of Dr. Ono, Mr. Fink and Dr. Papapetropoulos with Dr. Ono serving as the Compensation Committee Chairman. The Board has determined that all members of our Compensation Committee are independent under the rules of the SEC, The NASDAQ Stock Market Rules and the standards adopted by our Board. During the fiscal year ended December 31, 2022, the Compensation Committee held one meeting and had multiple informal discussions amongst themselves.

Nominating Committee Functions. Given the relatively small size of our Board of Directors and the desire to involve the entire Board of Directors in nominating decisions, we have elected not to have a separate Nominating Committee. Since we do not have a Nominating Committee, our independent directors, who currently constitute a majority of the Board of Directors, determine the director nominees and recommend the director nominees to the Board of Directors, after which all of the members of the Board of Directors participate in the consideration of director nominees. Our Board of Directors may employ a variety of methods for identifying and evaluating director nominees. If vacancies are anticipated or arise, our Board of Directors considers various potential candidates who may come to our attention through current Board members, professional search firms, stockholders or other persons. These candidates may be evaluated by our Board of Directors at any time during the year.

In evaluating a director candidate, our Board of Directors will review his or her qualifications including capability, availability to serve, conflicts of interest, general understanding of business, understanding of the Company’s business and technology, educational and professional background, personal accomplishments and other relevant factors. Our Board of Directors has not established any specific qualification standards for director nominees, and we do not have a formal diversity policy relating to the identification and evaluation of nominees for director, although from time to time the Board of Directors may identify certain skills or attributes as being particularly desirable to help meet specific needs that have arisen. Our Board of Directors may also interview prospective nominees in person or by telephone. After completing this evaluation, the Board of Directors will determine the nominees.

The Board has not adopted a formal process for considering director candidates who may be recommended by stockholders. However, our policy is to give due consideration to any and all such candidates. A stockholder may submit a recommendation for director candidates to us at our corporate offices, to the attention of Krista Fogarty. During 2021 and 2022, fees totaling $169,000 for the combined two-year period were paid to a third-party search firm for their services in identifying potential nominees and the successful appointment of two Directors in 2022.

Board Meetings and Attendance at Annual Meetings

The Board held a total of three meetings during 2022. Each incumbent director attended more than 75% of the aggregate of the total number of meetings of the Board held during 2022 and the total number of meetings of all committees of the Board on which that director served during the periods of such service, except for Dr. Jene and Dr. Papapetropoulos who were appointed to the Board in April 2022. Although we do not have a formal policy regarding attendance by directors at our Annual Meeting, we encourage directors to attend.

| 14 |

Codes of Ethics and Business Conduct

We have adopted a corporate Code of Ethics and Business Conduct, which may be viewed on our website at www.lipocine.com. In addition, a copy of the Code of Ethics and Business Conduct will be provided by us without charge upon request. The Code of Ethics and Business Conduct applies to all our officers, directors and employees, including our principal executive officer, principal financial and accounting officer and controller, or persons performing similar functions. If we effect an amendment to, or waiver from, a provision of our Code of Ethics and Business Conduct, we intend to satisfy our disclosure requirements by posting a description of such amendment or waiver on the website above. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

Stockholder Communications with Directors

Stockholders wishing to communicate with the Board or with a particular member or committee of the Board should address communications to the Board, or to an individual member or committee as follows: c/o Lipocine Inc., Attention: Corporate Secretary, Lipocine Inc., 675 Arapeen Drive, Suite 202, Salt Lake City, Utah 84108. All communications will be relayed to the addressee. From time to time, the Board may change the process through which stockholders communicate with the Board or its members or committees. There were no changes in this process in 2022. Please refer to our website at www.lipocine.com for any future changes in this process. The Board or the particular director or committee of the Board to which a communication is addressed will, if it deems appropriate, promptly refer the matter either to management or to the full Board depending on the nature of the communication. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

| DIRECTOR COMPENSATION |

The following table provides information regarding compensation of non-employee directors who served during 2022. In 2022, each non-employee director received an annual retainer of $35,000; members of the Audit Committee received an additional $5,000 for such service and members of the Compensation Committee received an additional $5,000 for such service. Also, in 2022, the Lead Independent Director received an additional $6,250 for the prorated portion of the year the Lead Independent Director served as such, the Chair of the Audit Committee received $16,500, and the Chair of the Compensation Committee received $10,000. Finally, we reimbursed our directors for reasonable travel expenses incurred in attending the meetings of the Board of Directors during 2022. On June 8, 2022, directors received a stock option award of 22,000 shares of common stock. Each new director appointed in 2022 also received an initial stock option grant to purchase 10,000 shares of common stock of the Company at an exercise price per share equal to the closing price of our common stock on the date of grant.

Director Compensation for 2022

| Name | Fees Earned ($) | Stock ($) | Option Awards ($)(6) | Other Compensation ($) | Total ($) | |||||||||||||||

| Jeffrey A. Fink (1) | 57,750 | - | 15,687 | - | 73,435 | |||||||||||||||

| John W. Higuchi (2) | 35,000 | - | 15,687 | - | 50,687 | |||||||||||||||

| Jill Jene (3) | 30,000 | - | 25,010 | - | 55,010 | |||||||||||||||

| R. Dana Ono (4) | 51,250 | - | 15,687 | - | 66,937 | |||||||||||||||

| Spyros Papapetropoulos (5) | 36,250 | - | 25,010 | - | 61,260 | |||||||||||||||

| (1) | As of December 31, 2022, Mr. Fink had 136,000 option awards outstanding. |

| (2) | As of December 31, 2022, Mr. Higuchi had 307,490 option awards outstanding. |

| (3) | Reflects pro-rata payment of fees for Dr. Jene who joined the Board on April 11, 2022. As of December 31, 2022, Dr. Jene had 32,000 option awards outstanding. |

| (4) | As of December 31, 2022, Dr. Ono had 136,000 option awards outstanding. |

| (5) | Reflects pro-rata payment of fees for Dr. Papapetropoulos who joined the Board on April 11, 2022. As of December 31, 2022, Dr. Papapetropoulos had 32,000 option awards outstanding. |

| (6) | The amounts in this column do not reflect compensation actually received by our non-employee directors nor do they reflect the actual value that will be recognized by the non-employee directors. Instead, the amounts reflect the aggregate grant date fair value computed in accordance with Accounting Standards Codification (“ASC”) 718 of awards of stock options made to non-employee directors for the fiscal year ended December 31, 2022 but excludes an estimate for forfeitures. The fair value of each option award is estimated on the date of grant using the Black-Scholes option-pricing model. Additional information about the assumptions used in the calculation of these amounts is included in footnote 2 to our audited financial statements for the fiscal year ended December 31, 2022 included in our Annual Report on Form 10-K filed with the SEC on March 10, 2022. |

For the 2023 fiscal year, the Board of Directors has determined that each non-employee director will receive an annual retainer of $55,000, plus an additional $7,500 for members of the Audit Committee and Compensation Committee. Chairs of the Audit Committee and Compensation Committee will also receive an additional $16,500 and $12,500, respectively, and the Lead Independent Director will receive an additional $30,000. In addition to the cash retainers, the Board of Directors also approved a director stock option award of 30,000 shares of common stock to each non-employee director, which the Company expects to grant following the Annual Meeting. In addition, the Board of Directors has authorized an additional payment to Mr. Higuchi in the amount of $6,000 to compensate Mr. Higuchi for his services advising the Board of Directors and the Compensation Committee in connection with their evaluation of the Company’s compensation policies and practices.

| 15 |

| PROPOSAL NO. 2 |

| RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

Overview

The Audit Committee has engaged the registered public accounting firm of Tanner LLC (“Tanner”) as our independent registered public accounting firm to audit our financial statements for the year ending December 31, 2023. Tanner began auditing our financial statements in the year ended December 31, 2018. Stockholder ratification of such selection is not required by our Bylaws or other applicable legal requirement. However, our Board is submitting the selection of Tanner to stockholders for ratification as a matter of good corporate practice. In the event that stockholders fail to ratify the selection, our Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, our Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if our Audit Committee believes that such a change would be in our and our stockholders’ best interests.

PRINCIPAL ACCOUNTANTS

Principal Accountant Fees and Services

The following table sets forth the aggregate fees billed to the Company by Tanner for the fiscal years ended December 31, 2022 and 2021:

| 2022 | 2021 | |||||||

| Audit fees | $ | 191,031 | $ | 178,678 | ||||

| Audit-related fees | - | - | ||||||

| Tax fees | - | - | ||||||

| All other fees | - | - | ||||||

| Total audit and tax fees | $ | 191,031 | $ | 178,678 | ||||

Audit fees consist of Tanner’s fees for services related to their audits of our annual financial statements, audit of effectiveness of internal control over financial reporting, their review of financial statements included in our quarterly reports on Form 10-Q, their review of SEC filed registration statements, and fees for services that are normally incurred in connection with statutory and regulatory filings or engagements, such as the issuance of consents and comfort letters.

Audit-related fees consist of fees for assurance related services by Tanner that are reasonably related to the performance of the audit or review of our consolidated financial statements but are not considered “audit fees.” We did not incur any fees under this category in 2022 and 2021.

Tax fees consist of advisory services consisting primarily of tax advice rendered by Tanner. We did not incur any fees under this category in 2022 and 2021.

All other fees consist of fees for professional services rendered by our independent registered public accounting firm for permissible non-audit services, if any. We did not incur any fees under this category in 2022 and 2021.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee charter provides that the Audit Committee will pre-approve all audit services and non-audit services to be provided by our independent auditors before the accountant is engaged to render these services. The Audit Committee may consult with management in the decision-making process but may not delegate this authority to management. The Audit Committee may delegate its authority to pre-approve services to one or more committee members, provided that the designees present the pre-approvals to the full committee at the next committee meeting. In 2022, all audit services performed by our independent accountants were pre-approved by our Audit Committee to assure that such services did not impair the auditors’ independence from us.

| 16 |

Determination of Independence

There were no fees billed by Tanner for non-audit services.

Attendance at Annual Meeting

Representatives from Tanner are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

Vote Required

The proposal to ratify the appointment of Tanner as our independent registered public accounting firm to audit our financial statements for the year ending December 31, 2023, will be approved if a majority of the shares of common stock outstanding as of the Record Date that are present or represented by proxy and entitled to vote at the Annual Meeting vote in favor of the proposal. Abstentions will have the same effect as negative votes. Because Proposal 2 is a routine matter, we do not expect any broker non-votes with respect to Proposal 2.

Recommendation

The Board recommends that stockholders vote “FOR” the proposal to ratify the appointment of Tanner as our independent registered public accounting firm to audit our financial statements for the year ending December 31, 2023.

Unless marked otherwise, proxies received will be voted “FOR” Proposal No. 2.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee has reviewed and discussed our audited financial statements with our management and has discussed with Tanner the matters required to be discussed by the requirements of the Public Company Accounting Oversight Board.

The Audit Committee has received the written disclosures and the letter from Tanner required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and has discussed with Tanner its independence from us.

Based on its review and the discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements for our fiscal year ended December 31, 2022, be included in our Annual Report on Form 10-K for our fiscal year ended December 31, 2022, which was filed on March 10, 2023.

| Members of the Audit Committee | |

| Jeffrey A. Fink Dr. Richard Dana Ono Dr. Jill Jene |

| 17 |

| PROPOSAL NO. 3 |

| ADVISORY VOTE ON EXECUTIVE COMPENSATION (“SAY-ON-PAY”) |

Background

The Dodd-Frank Wall Street Reform and Consumer Protection Act requires that stockholders have the opportunity to cast an advisory (non-binding) vote on executive compensation (a so-called “say-on-pay” vote), as well as an advisory vote with respect to whether future “say-on-pay” votes will be held every one, two, or three years (a so-called “say-on-frequency” vote).

Our executive compensation programs are designed to attract, motivate and retain our named executive officers (“NEOs”), who are critical to our success. Under these programs, our NEOs are rewarded for the achievement of both specific financial and strategic goals, which are expected to result in increased stockholder value. Please read the tables and narrative disclosure that follow for additional details about our executive compensation programs, including information about the year ended December 31, 2022, compensation of our NEOs.

The Compensation Committee regularly reviews the compensation programs for our NEOs to ensure that they achieve the desired goals of aligning our executive compensation structure with our stockholders’ interests and with current market practices. This includes establishing corporate target goals and objectives based on our strategic and operating plans. In addition, from time to time, the Compensation Committee may, including with the assistance of outside compensation consultants, analyze compensation programs and pay levels of executives at peer companies to ensure that our compensation program is within the norm of general market practices and competitive to attract and retain executive talent.