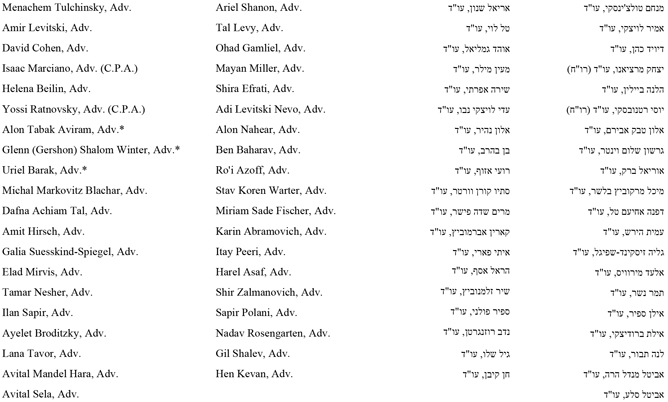

TULCHINSKY MARCIANO COHEN LEVITSKI & CO.

Statement on Form S-3 (the “Registration Statement”) by Teva, Teva Pharmaceutical Finance IV, LLC, a Delaware limited liability company (“Teva Finance IV LLC”), Teva Pharmaceutical Finance V, LLC, a Delaware limited liability company (“Teva Finance V LLC”), Teva Pharmaceutical Finance VI, LLC, a Delaware limited liability company (“Teva Finance VI LLC” and, together with Teva Finance IV LLC and Teva Finance V LLC, the “LLCs”); Teva Pharmaceutical Finance Netherlands II B.V., a Dutch private limited liability company (“Teva Netherlands II”), Teva Pharmaceutical Finance Netherlands III B.V., a Dutch private limited liability company (“Teva Netherlands III”), and Teva Pharmaceutical Finance Netherlands IV B.V., a Dutch private limited liability company (“Teva Netherlands IV” and, together with Teva Netherlands II and Teva Netherlands III, the “Netherlands BVs” and, together with the Teva BVs, Teva Finance NV and the LLCs, the “Finance Subsidiaries”) relating to the registration of the sale from time to time of:

(A) by Teva, (i) American Depositary Shares (“ADSs”), each representing one ordinary share, par value NIS 0.10 per share, of Teva (the “Ordinary Shares”); (ii) senior debt securities (the “Teva Senior Debt Securities”), which may be issued pursuant to an indenture (the “Teva Senior Indenture”) to be executed by Teva and The Bank of New York Mellon, as trustee; and (iii) subordinated debt securities (the “Teva Subordinated Debt Securities” and, together with the Teva Senior Debt Securities, the “Teva Debt Securities”), which may be issued pursuant to an indenture (the “Teva Subordinated Indenture” and, together with the Teva Senior Indenture, the “Teva Indentures”) to be executed by Teva and The Bank of New York Mellon, as trustee; (iv) purchase contracts (the “Purchase Contracts”) for the purchase and sale of Teva’s securities or securities of third parties, a basket of such securities, an index or indices of such securities or any combination of the above; and (v) units (the “Units”) consisting of one or more Purchase Contracts, Teva Debt Securities, Subsidiary Debt Securities, Ordinary Shares, ADSs, other equity securities or any combination of such securities; and

(B) by each of the Finance Subsidiaries, (i) senior debt securities (the “Subsidiary Senior Debt Securities”), guaranteed by Teva, which may be issued pursuant to an indenture (each, a “Subsidiary Senior Indenture”) to be executed by the applicable Finance Subsidiary, Teva and The Bank of New York Mellon, as trustee; and (ii) subordinated debt securities (the “Subsidiary Subordinated Debt Securities”, and together with the Subsidiary Senior Debt Securities, the “Subsidiary Debt Securities”), guaranteed by Teva, which may be issued pursuant to an indenture (each, a “Subsidiary Subordinated Indenture” and together with the Subsidiary Senior Indentures, the “Subsidiary Indentures”) to be executed by the applicable Finance Subsidiary, Teva, as guarantor and The Bank of New York Mellon, as trustee.

For purposes of the opinions hereinafter expressed, we have examined originals or copies, certified and otherwise identified to our satisfaction, of such documents, corporate records, certificates of public officials and other instruments as we have deemed necessary as a basis for the opinions expressed herein. Insofar as the opinions expressed herein involve factual matters, we have relied (without independent factual investigation), to the extent we deemed proper or necessary, upon certificates of, and other communications with, officers and employees of Teva and upon certificates of public officials. We have also considered such questions of Israeli law as we have deemed relevant and necessary as a basis for the opinions hereinafter expressed.

In making our examination, we have assumed, without any investigation, the genuineness of all signatures, the legal capacity of natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as certified, photostatic or facsimile copies and the authenticity of the originals of such copies and the legal capacity and due authenticity of all persons executing such documents, that the documents examined by us have not been amended, supplemented or otherwise modified, or determined by a court of competent jurisdiction to be illegal or void, revoked, annulled, terminated or otherwise modified and that there are no agreements or understandings among the parties, written or oral, and that there is no usage of trade or course of prior dealing among the parties that would, in either case, expand, modify, supplant or qualify or otherwise effect or be inconsistent with the terms of the Registration Statement or the respective rights or obligations of the parties thereunder. We have assumed, without any investigation, the same to have been properly given and to be accurate, and we have assumed the truth of all facts communicated to us by the Company, and have assumed that all consents, minutes and protocols of meetings of the Company’s board of directors and shareholders which have been provided to us are true, accurate and have been properly prepared in accordance with the Company’s incorporation documents and all applicable laws.

- 2 -