| | |

| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response. . . . . . .20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22646

PRIVATE ADVISORS ALTERNATIVE STRATEGIES MASTER FUND

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: March 31

Date of reporting period: March 31, 2014

| Item 1. | Reports to Stockholders. |

Private Advisors Alternative

Strategies Master Fund

Annual Report

March 31, 2014

This page intentionally left blank

Message from the President

We are pleased to present the annual report for Private Advisors Alternative Strategies Master Fund.

The annual report contains specific information about the market events, macroeconomic trends and investment decisions that shaped the Fund during the reporting period. We encourage you to read the following material carefully and to make thoughtful use of the information it contains.

We thank you for choosing Private Advisors Alternative Strategies Master Fund, and we look forward to serving your investment needs for many years to come.

Sincerely,

Stephen P. Fisher

President

Not part of the Annual Report

Table of Contents

Certain material in this report may include statements that constitute “forward-looking” statements under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates and information about possible or future results or events related to the Fund, market or regulatory developments. The views expressed herein are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause the actual outcomes and results to differ materially from the views expressed herein. The views expressed herein are subject to change at any time based upon economic, market, or other conditions and the Fund undertakes no obligation to update the views expressed herein.

Fund Data1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Index performance shown is for illustration purposes only. You cannot invest directly into an index. Investment return and principal value will fluctuate, and as a result, when shares are sold, they may be worth more or less than their original cost. For more updated performance information, please visit mainstayinvestments.com/privateadvisors or call 1-888-207-6176.

Average Annual Total Returns for the Year Ended March 31, 2014

| | | | | | | | | | | | | | | | |

| Fund | | Sales Charge | | | | One Year | | | Since Inception | | | Gross

Expense

Ratio2 | |

| Private Advisors Alternative Strategies Fund | | Maximum 3% Initial Sales Charge | | With sales charges Excluding sales charges | |

| 3.17

6.37 | %

| |

| 5.13

6.82 | %

| |

| 56.49

56.49 | %

|

| Private Advisors Alternative Strategies Master Fund | | No Sales Charge | | | | | 7.12 | | | | 7.54 | | | | 8.36 | |

| | | | | | | | | | |

| Benchmark Performance | | One Year | | | Since Inception | |

HFRI Fund of Funds Diversified Index3 | | | 5.73 | % | | | 5.77 | % |

S&P 500® Index4 | | | | | 21.86 | | | | 19.08 | |

Barclays U.S. Aggregate Bond Index5 | | | | | –0.10 | | | | 1.32 | |

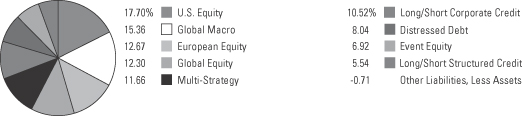

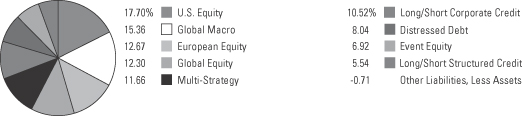

Strategy Allocations as of March 31, 2014 (Unaudited)

Top Ten Holdings as of March 31, 2014 (Unaudited)

| 2. | Fir Tree International Value Fund II, Ltd. |

| 4. | Pelham Long/Short Fund, Ltd. |

| 5. | Adelphi Europe Fund (The) |

| 7. | Luxor Capital Partners Offshore, Ltd. |

| 8. | Miura Global Fund, Ltd. |

| 9. | HBK Offshore Fund II L.P. |

| 10. | Hoplite Offshore Fund, Ltd. |

| 1. | The performance table does not reflect the deduction of taxes that a shareholder would pay on distributions or Fund-share redemptions. Total returns reflect the maximum applicable sales charge as indicated in the table above, changes in share price, and reinvestment of dividend and capital gain distributions. Performance figures reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on current fee waivers and/or expense limitations, please refer to the notes to the financial statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | The HFRI Fund of Funds Diversified Index is a non-investable product of diversified fund of funds. The index is weighted (fund weighted) with an inception of January 1990. An investment cannot be made directly in an index. |

| 4. | “S&P 500®” is a trademark of the McGraw-Hill Companies, Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 5. | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasurys, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. Results assume reinvestment of all income and capital gains. An investment cannot be made directly in an index. |

| | | | |

| mainstayinvestments.com/privateadvisors | | | 5 | |

Portfolio Management Discussion and Analysis (Unaudited)

For the 12 months ended March 31, 2014, Private Advisors Alternative Strategies Master Fund (“Master Fund”) returned 7.12%. Private Advisors Alternative Strategies Fund (“Feeder Fund”) returned 6.37%, excluding all sales charges. See page 5 for Feeder Fund returns with applicable sales charges. The Master Fund and the Feeder Fund are collectively referred to herein as “Funds.” The Funds outperformed the 5.73% return of the HFRI Fund of Funds Diversified Index1 and underperformed the 21.86% return of the S&P 500® Index.2

The Funds underperformed the S&P 500® Index for the period given the Index’s remarkably strong performance. However, the Funds outperformed the S&P 500® Index during the difficult months of June and August in 2013 and January in 2014.

The Private Advisors Alternative Strategies Fund is a “feeder” fund in what is known in the investment company industry as a master-feeder structure. The Feeder Fund invests substantially all of its assets, net of reserves maintained for reasonably anticipated expenses, in the Master Fund. The Master Fund, which has the same investment objective as the Feeder Fund, seeks to achieve its investment objective by investing principally in private investment funds or “hedge funds” managed by third-party portfolio managers who employ diverse styles and strategies.

Market Summary

Equity markets have had an exceptional year of performance with the exception of only three negative months. June and August of 2013 put a slight damper on performance and equity markets struggled again in January of 2014.

Equities

The S&P 500® Index started the 12-month period strongly, but the seven-month streak of consecutive gains ended in June of 2013 as the U.S. Federal Reserve announced a pending pullback in their easy monetary policy. As expected, the Master Fund preserved capital relative to traditional and hedge fund indices during the difficult month of June. August was a tough month for the global equity markets, as the growing likelihood of U.S. military intervention in Syria and lackluster quarterly earnings news weighed on investors. Stocks rebounded again in September as peace negotiations with Syria gained a foothold. In January of 2014, volatility returned as the U.S. Federal Reserve announced that it would reduce its bond buying program by $10 billion in January as planned. Furthermore, emerging market countries experienced major turmoil in January as their currencies came under significant pressure due to

a combination of factors, which included investors’ flight to safety. Equities rebounded sharply in February and managed to finish March in positive territory in spite of a mid-month sell-off.

Fixed Income

The Barclays U.S. Aggregate Bond Index3 fell 0.1% for the 12-month period ending March 31, 2014. Overall, fixed income performance has been mixed over the last year as supposedly safer, longer-dated Treasurys have performed poorly primarily due to rising interest rates. Meanwhile, non-investment grade and distressed credit has generated strong returns as the trend of investors taking on more risk despite low yields has persisted. Over the last 12 months, the BofA Merrill Lynch Current 10-Year U.S. Treasury Index4 has lost 4.4%, and the yield has risen nearly 100 basis points. Conversely, the BofA Merrill Lynch U.S. High Yield Master II Index5 returned 7.6%, and the BofA Merrill Lynch CCC & Lower U.S. High Yield Index6 gained 10.5%.

Strong demand and low default rates for high yield and leveraged loans persisted over the last year. High yield spreads have continued to tighten, ending the first quarter of 2014 at 377 basis points versus 486 basis points at the end of the first quarter of 2013. According to Thomson Reuters, U.S. leveraged loan issuance in 2014 achieved a record of $287 billion, which outranks issuance in the fourth quarter of 2012 of $232.8 billion. Refinancings from institutional borrowers made up the majority of the total issuance, as the potential for rising rates has kept demand strong.

Contributors & Detractors

The portfolio’s long/short equity managers performed well for the period, despite volatility in June and August of 2013 and January of 2014. Long/short equity managers were by far the largest contributors to positive performance during the reporting period, particularly in global and European equity. (Contributions take weightings and total returns into account.) SRS, Pelham and LAE were three of the top contributors to performance for the period and all three underlying funds have recorded returns of more than 20% since March 2013. SRS and Pelham generated alpha in both their long and short books and minimized losses in more volatile months. Pelham had solid results in its European retail positions and has benefitted from its overall higher net market exposure. Conversely, Sheffield lagged other long/short equity managers but remained positive for the period.

| 1. | See footnote on page 5 for more information on the HFRI Fund of Funds Diversified Index. |

| 2. | See footnote on page 5 for more information on the S&P 500® Index. |

| 3. | See footnote on page 5 for more information on the Barclays U.S. Aggregate Bond Index. |

| 4. | The BofA Merrill Lynch Current 10-Year U.S. Treasury Index is a one-security index comprised of the most recently issued 10-year Treasury note. An investment cannot be made directly in an index. |

| 5. | The BofA Merrill Lynch High Yield Master II Index monitors the performance of below investment-grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. An investment cannot be made directly in an index. |

| 6. | The BofA Merrill Lynch CCC & Lower U.S. High Yield Index tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market including all securities rated CCC or lower. An investment cannot be made directly in an index. |

The Master Fund’s allocation to event-driven strategies includes distressed debt, event equity and event driven multi-strategy. During the 12-month period, event-driven strategies had positive results. Distressed debt added to performance as liquidations continued to be profitable for managers operating within the strategy. The Master Fund’s three distressed debt managers, Contrarian, Redwood and Aurelius, all posted double-digit gains for the period.

The event equity strategy was also a positive contributor for the 12-month period as both Luxor and Mason achieved positive returns. Mason posted strong returns in 2013 as some of its long, event-oriented positions performed well, while the short book added materially during down months. Mason has struggled slightly in 2014. Mergers and acquisitions (M&A) activity increased in the first quarter of 2014, after a quiet year in 2013. Deal activity has been concentrated in larger transactions recently; among those deals were competing bids from Comcast and Charter Communications to acquire Time Warner Cable and Facebook’s deal to acquire WhatsApp, a mobile messaging service. The most active buyers in the market during the first quarter were The Carlyle Group, Google and Berkshire Hathaway. Our event equity managers seek to identify investments through fundamental analysis that will benefit from identifiable, catalyst-driven situations.

Global macro performance was positive for the period overall, and all but one manager had positive results for the 12-month period. Each manager’s performance varied based on their individual positioning in rates, currencies, equities and emerging markets. Autonomy was a strong performer and has opportunistically traded its book in 2014, gaining credit, interest rate and currency exposure at attractive prices, which was beneficial as markets stabilized. Conversely, Anderson has struggled over the last 12 months, and most recently had negative performance in February as the manager was net short equities during a month when the markets rebounded sharply.

Long/short corporate credit and structured credit strategies were positive during the reporting period. Structured credit managers were solid performers with Marathon Securitized Credit leading returns for the 12-month period. Marathon has a slightly higher market exposure but is focused on idiosyncratic positions based on its fundamental credit and structural research. Of the Master Fund’s three long/short corporate credit managers, Archer and Panning posted returns of over 9% for the 12-month period, while Saba had negative results. Saba’s underperformance was due partially to the fact that its large short position via CDS (credit default swaps) suffered as the CDS market has rallied and outperformed cash bonds. Saba has a long volatility profile; therefore, we expect it to underperform when there is lower volatility in the market. Saba has slightly adjusted its portfolio composition in order to capture more upside and managed to generate a positive return in the first quarter of 2014. However, Saba remains defensively positioned and should protect capital during market reversals. Saba’s negative performance was more than offset by other managers

at the strategy level for the 12-month period, which is one of the benefits of having managers with differentiated exposures that can benefit in different market environments.

The only strategy that detracted from performance for the 12-month period was convertible arbitrage. Waterstone was the Master Fund’s worst performer in 2013, suffering losses related to its market hedges as well as idiosyncratic short positions. We redeemed from Waterstone at the end of September, but it remains the Master Fund’s largest detractor for the reporting period.

Portfolio Activity

There were six manager additions and three exits in the Master Fund during the 12-month reporting period. In January 2014, we added Davidson Kempner to the portfolio as a 3% position. Davidson Kempner is a diversified, event-driven multi-strategy manager with a strong track record of preserving capital and unlocking value from unforeseen corporate events. The manager focuses primarily on distressed corporate credit, long/short structured credit, merger arbitrage and event equity strategies. The team is highly experienced and has worked together over multiple market cycles. Their approach is conservative in nature and their portfolio has historically displayed less volatility than peers.

Other additions in 2013 included long/short equity manager Adelphi, global macro managers Autonomy, Anderson and Stone Milliner and long/short credit manager Panning. The three manager exits in the Master Fund included global macro managers Moore and Emerging Sovereign Group (both the Treasury Opportunities Fund and Credit Macro Event Fund) and convertible arbitrage manager Waterstone.

We are currently in various stages of due diligence with several managers. Additionally, we continue to re-evaluate the investment and operational merits of our existing managers. The Master Fund was invested in 29 active holdings as of March 31, 2014. Given the current asset allocation and manager line-up, we believe that the Master Fund is in a position that we expect will generate attractive absolute returns.

Outlook

We believe that the portfolio is well-positioned to weather both equity and fixed-income market volatility and generate steady performance in calm markets. We prefer long/short equity strategies that generate alpha in both their long and short portfolios through deep fundamental research. We also believe that smaller, more nimble managers that are disciplined regarding asset growth have a larger investment opportunity set and greater short alpha potential relative to larger managers.

In spite of recent performance, we continue to have a positive view of global macro as divergent central bank actions should result in trading opportunities for managers in currencies and rates. Global macro’s historic lack of correlation to other asset classes could prove helpful if global deleveraging or a reversion to the mean in rates causes market dislocations.

| | | | |

| mainstayinvestments.com/privateadvisors | | | 7 | |

We find event-driven strategies, specifically event equity, attractive in the current environment. We prefer event equity strategies that focus on near-term catalysts to increase value and profitability. We expect the event equity strategy to continue to benefit from an increase in activism and a potential increase in M&A activity in 2014. The level of cash on corporate balance sheets has increased significantly in the last year, and companies and their shareholders will be looking for opportunities to drive future growth. We are not adding activist strategies or other high equity beta strategies but prefer managers who benefit from idiosyncratic risk in a hedged format.

While we do not find credit market beta compelling today, we continue to appreciate the idiosyncratic and event driven opportunities across corporate capital structures. We are encouraged that the environment may be improving for shorting credit and equity. We continue to monitor Europe and the emerging markets from a stressed or distressed standpoint, but remain

patient around the opportunity sets. We have intentionally allocated to managers that are: 1) process or event driven (i.e. liquidations and litigations), 2) deep value focused (therefore less impacted by the rate environment due to price/yield cushion) or 3) hedged with alpha shorts or an arbitrage/relative value focus.

Given the uncertain outlook for both equity and fixed income, we believe that an allocation to a diversified hedge fund program can help provide investors with protection if markets begin to falter.

Thank you for your continued support.

Tim Berry

Portfolio Manager

Charles Honey

Portfolio Manager

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Private Advisors Alternative Strategies Master Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations, of changes in net assets, and of cash flows and the financial highlights present fairly, in all material respects, the financial position of Private Advisors Alternative Strategies Master Fund (the “Fund”) at March 31, 2014, the results of its operations and its cash flows for the year then ended, and the changes in its net assets and the financial highlights for the year then ended and for the period May 1, 2012 (commencement of operations) through March 31, 2013, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at March 31, 2014 by correspondence with the custodian and underlying portfolio funds, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

May 29, 2014

| | | | |

| mainstayinvestments.com/privateadvisors | | | 9 | |

Private Advisors Alternative Strategies Master Fund

Schedule of Investments as of March 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | First

Acquisition

Date | | | Cost | | | Fair Value | | | Percent of

Net Assets | | | Next

Available

Redemption

Date* | | | Liquidity** | |

Investments in Hedge Funds Bermuda Domiciled | | | | | | | | | | | | | | | | | | | | | | | | |

European Equity

Europe | | | | | | | | | | | | | | | | | | | | | | | | |

Pelham Long/Short Fund, Ltd. | | | 5/1/2012 | | | $ | 1,890,000 | | | $ | 2,625,550 | | | | 4.26 | % | | | 4/30/2014 | | | | Monthly | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Bermuda Domiciled | | | | | | | 1,890,000 | | | | 2,625,550 | | | | 4.26 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| British Virgin Islands Domiciled | | | | | | | | | | | | | | | | | | | | | | | | |

Global Equity

Global | | | | | | | | | | | | | | | | | | | | | | | | |

Miura Global Fund, Ltd. | | | 2/1/2013 | | | | 2,100,000 | | | | 2,442,887 | | | | 3.97 | | | | 4/30/2014 | | | | Monthly | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Multi-Strategy

Global | | | | | | | | | | | | | | | | | | | | | | | | |

Davidson Kempner International (BVI), Ltd. | | | 1/1/2014 | | | | 2,000,000 | | | | 2,057,632 | | | | 3.34 | | | | 6/30/2014 | | | | Quarterly | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total British Virgin Islands Domiciled | | | | | | | 4,100,000 | | | | 4,500,519 | | | | 7.31 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Cayman Islands Domiciled | | | | | | | | | | | | | | | | | | | | | | | | |

Distressed Debt

Global | | | | | | | | | | | | | | | | | | | | | | | | |

Redwood Offshore Fund, Ltd. | | | 5/1/2012 | | | | 1,200,000 | | | | 1,603,696 | | | | 2.60 | | | | 6/30/2014 | | | | Bi-Annually | |

North America | | | | | | | | | | | | | | | | | | | | | | | | |

Aurelius Capital International, Ltd. | | | 5/1/2012 | | | | 1,600,000 | | | | 2,057,736 | | | | 3.34 | | | | 6/30/2014 | | | | Semi-Annually | |

Contrarian Capital Trade Claims Offshore, Ltd. | | | 5/1/2012 | | | | 1,050,000 | | | | 1,290,154 | | | | 2.10 | | | | 4/30/2014 | | | | Annually | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Distressed Debt | | | | | | | 3,850,000 | | | | 4,951,586 | | | | 8.04 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

European Equity

Europe | | | | | | | | | | | | | | | | | | | | | | | | |

Adelphi Europe Fund (The) | | | 5/1/2013 | | | | 2,250,000 | | | | 2,548,395 | | | | 4.14 | | | | 6/30/2014 | | | | Quarterly | |

LAE Fund, Ltd. | | | 5/1/2012 | | | | 2,010,000 | | | | 2,633,263 | | | | 4.27 | | | | 6/30/2014 | | | | Quarterly | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total European Equity | | | | | | | 4,260,000 | | | | 5,181,658 | | | | 8.41 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Event Equity

North America | | | | | | | | | | | | | | | | | | | | | | | | |

Luxor Capital Partners Offshore, Ltd. | | | 5/1/2012 | | | | 2,160,000 | | | | 2,445,326 | | | | 3.97 | | | | 6/30/2014 | | | | Quarterly | |

Global | | | | | | | | | | | | | | | | | | | | | | | | |

Mason Capital, Ltd. | | | 5/1/2012 | | | | 1,600,000 | | | | 1,820,194 | | | | 2.95 | | | | 4/30/2014 | | | | Annually | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Event Equity | | | | | | | 3,760,000 | | | | 4,265,520 | | | | 6.92 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Global Equity

Global | | | | | | | | | | | | | | | | | | | | | | | | |

Sheffield International Partners, Ltd. | | | 5/1/2012 | | | | 1,960,000 | | | | 2,223,337 | | | | 3.61 | | | | 6/30/2014 | | | | Quarterly | |

SRS Partners, Ltd. | | | 5/1/2012 | | | | 2,140,000 | | | | 2,909,586 | | | | 4.72 | | | | 6/30/2014 | | | | Quarterly | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Global Equity | | | | | | | 4,100,000 | | | | 5,132,923 | | | | 8.33 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| 10 | | Private Advisors Alternative Strategies Master Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | First

Acquisition

Date | | | Cost | | | Fair Value | | | Percent of

Net Assets | | | Next

Available

Redemption

Date* | | | Liquidity** | |

| Cayman Islands Domiciled (continued) | | | | | | | | | | | | | | | | | | | | | | | | |

Global Macro

Global | | | | | | | | | | | | | | | | | | | | | | | | |

Anderson Global Macro Fund, Ltd. | | | 7/1/2013 | | | $ | 1,700,000 | | | $ | 1,636,004 | | | | 2.66 | % | | | 6/30/2014 | | | | Quarterly | |

Autonomy Global Macro Fund Limited | | | 6/1/2013 | | | | 2,200,000 | | | | 2,353,626 | | | | 3.82 | | | | 5/31/2014 | | | | Monthly | |

MKP Opportunity Offshore, Ltd. | | | 5/1/2012 | | | | 1,700,000 | | | | 1,782,519 | | | | 2.89 | | | | 4/30/2014 | | | | Monthly | |

Stone Milliner Macro Fund Inc. | | | 12/1/2013 | | | | 1,800,000 | | | | 1,839,549 | | | | 2.99 | | | | 4/30/2014 | | | | Monthly | |

Tudor BVI Global Fund, Ltd. (The) | | | 5/1/2012 | | | | 1,600,000 | | | | 1,849,196 | | | | 3.00 | | | | 6/30/2014 | | | | Quarterly | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Global Macro | | | | | | | 9,000,000 | | | | 9,460,894 | | | | 15.36 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Long/Short Corporate Credit

North America | | | | | | | | | | | | | | | | | | | | | | | | |

Archer Capital Offshore Fund, Ltd. | | | 5/1/2012 | | | | 2,020,000 | | | | 2,353,233 | | | | 3.82 | | | | 6/30/2014 | | | | Quarterly | |

Panning Overseas Fund, Ltd. | | | 6/1/2013 | | | | 1,980,000 | | | | 2,113,534 | | | | 3.43 | | | | 6/30/2015 | | | | Quarterly | |

Saba Capital Offshore Fund, Ltd. | | | 7/1/2012 | | | | 2,320,000 | | | | 2,014,047 | | | | 3.27 | | | | 6/30/2014 | | | | Quarterly | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Long/Short Corporate Credit | | | | | | | 6,320,000 | | | | 6,480,814 | | | | 10.52 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Long/Short Structured Credit

North America | | | | | | | | | | | | | | | | | | | | | | | | |

Marathon Securitized Credit Fund, Ltd. | | | 5/1/2012 | | | | 1,200,000 | | | | 1,677,569 | | | | 2.72 | | | | 6/30/2014 | | | | Quarterly | |

One William Street Capital Offshore Fund, Ltd. | | | 5/1/2012 | | | | 1,470,000 | | | | 1,738,189 | | | | 2.82 | | | | 6/30/2014 | | | | Quarterly | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Long/Short Structured Credit | | | | | | | 2,670,000 | | | | 3,415,758 | | | | 5.54 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Multi-Strategy

Global | | | | | | | | | | | | | | | | | | | | | | | | |

Fir Tree International Value Fund II, Ltd. | | | 5/1/2012 | | | | 2,210,000 | | | | 2,731,198 | | | | 4.43 | | | | 4/30/2014 | | | | Annually | |

HBK Multi-Strategy Offshore Fund, Ltd. | | | 5/1/2012 | | | | 2,140,000 | | | | 2,395,024 | | | | 3.89 | | | | 6/30/2014 | | | | Quarterly | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Multi-Strategy | | | | | | | 4,350,000 | | | | 5,126,222 | | | | 8.32 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

US Equity

North America | | | | | | | | | | | | | | | | | | | | | | | | |

Hoplite Offshore Fund, Ltd. | | | 5/1/2012 | | | | 2,140,000 | | | | 2,386,614 | | | | 3.87 | | | | 6/30/2014 | | | | Quarterly | |

Impala Fund Ltd. | | | 5/1/2012 | | | | 2,010,000 | | | | 2,542,111 | | | | 4.13 | | | | 6/30/2014 | | | | Quarterly | |

Marble Arch Offshore Partners, Ltd. | | | 7/1/2012 | | | | 1,600,000 | | | | 1,804,304 | | | | 2.93 | | | | 6/30/2014 | | | | Quarterly | |

North Run Offshore Partners, Ltd. | | | 5/1/2012 | | | | 1,950,000 | | | | 2,288,433 | | | | 3.72 | | | | 6/30/2014 | | | | Quarterly | |

Southpoint Qualified Offshore Fund, Ltd. | | | 5/1/2012 | | | | 1,600,000 | | | | 1,881,243 | | | | 3.05 | | | | 6/30/2014 | | | | Quarterly | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total US Equity | | | | | | | 9,300,000 | | | | 10,902,705 | | | | 17.70 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Cayman Islands Domiciled | | | | | | | 47,610,000 | | | | 54,918,080 | | | | 89.14 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Investments in Hedge Funds | | | | | | $ | 53,600,000 | | | | 62,044,149 | | | | 100.71 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other Liabilities, less Assets | | | | | | | | | | | (438,760 | ) | | | (0.71 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets | | | | | | | | | | $ | 61,605,389 | | | | 100.00 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| * | Investments in Hedge Funds may be composed of multiple series. The Next Available Redemption Date relates to the earliest date after March 31, 2014 that redemption from a series is available. Other series may have an available redemption date that is after the Next Available Redemption Date. Redemptions from Hedge Funds may be subject to fees. |

| ** | Available frequency of redemption after initial lock-up period, if any. Different series may have different liquidity terms. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com/privateadvisors | | | 11 | |

Private Advisors Alternative Strategies Master Fund

Statement of Assets and Liabilities as of March 31, 2014

| | | | |

| Assets | | | | |

Investments in Hedge Funds, at fair value

(identified cost $53,600,000) | | $ | 62,044,149 | |

Cash | | | 3,053,183 | |

Prepaid assets | | | 33,919 | |

| | | | |

Total assets | | | 65,131,251 | |

| | | | |

| |

| Liabilities | | | | |

Redemptions payable | | | 2,007,659 | |

Subscriptions received in advance | | | 1,350,000 | |

Management fee payable (see Note 5) | | | 52,442 | |

Accrued expenses | | | 115,761 | |

| | | | |

Total liabilities | | | 3,525,862 | |

| | | | |

Net Assets | | $ | 61,605,389 | |

| | | | |

| |

| Composition of Net Assets: | | | | |

Paid-in capital | | $ | 60,204,922 | |

Distributions in excess of net investment income | | | (6,729,281 | ) |

Accumulated net realized gain (loss) from investments in Hedge Funds | | | (314,401 | ) |

Net unrealized appreciation (depreciation) on investments in Hedge Funds | | | 8,444,149 | |

| | | | |

Net Assets | | $ | 61,605,389 | |

| | | | |

| |

| Net Asset Value Per Share: | | | | |

59,167.15 Shares issued and outstanding, par value $0.001 per share 450,000 registered shares of beneficial interest | | $ | 1,041.21 | |

| | | | |

| | | | |

| 12 | | Private Advisors Alternative Strategies Master Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Private Advisors Alternative Strategies Master Fund

Statement of Operations for the year ended March 31, 2014

| | | | |

Expenses | | | | |

Management Fee (See Note 5) | | $ | 626,233 | |

Administration fees | | | 203,283 | |

Professional fees | | | 151,828 | |

Offering costs | | | 58,486 | |

Insurance fees | | | 46,260 | |

Shareholder communication | | | 37,259 | |

Custodian | | | 24,081 | |

Transfer agent | | | 21,742 | |

Trustees | | | 1,305 | |

Miscellaneous | | | 7,909 | |

| | | | |

Total expenses before waiver/reimbursement | | | 1,178,386 | |

Expense waiver/reimbursement from Manager | | | (324,407 | ) |

| | | | |

Net expenses | | | 853,979 | |

| | | | |

Net investment income (loss) | | | (853,979 | ) |

| | | | |

| |

Net realized and unrealized gain (loss)

on investments | | | | |

Net realized gain (loss) from investments in Hedge Funds | | | (88,079 | ) |

Net change in unrealized appreciation (depreciation) on investments in Hedge Funds | | | 4,894,037 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 3,951,979 | |

| | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com/privateadvisors | | | 13 | |

Private Advisors Alternative Strategies Master Fund

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year

ended

March 31,

2014 | | | May 1, 2012

(commencement

of operations)

through

March 31,

2013 | |

| Increase (decrease) in net assets resulting from operations: | |

Net investment income (loss) | | $ | (853,979 | ) | | $ | (562,811 | ) |

Net realized gain (loss) from investments in Hedge Funds | | | (88,079 | ) | | | — | |

Net change in unrealized appreciation (depreciation) on investments in Hedge Funds | | | 4,894,037 | | | | 3,550,112 | |

| | | | | | | | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 3,951,979 | | | | 2,987,301 | |

| | | | | | | | |

Distributions to shareholders from: | | | | | | | | |

Net investment income | | | (4,835,426 | ) | | | (703,387 | ) |

| | | | | | | | |

Capital share transactions: | | | | | | | | |

Subscriptions (representing 17,847.76 and 2,052.87 Shares, respectively) | | | 19,005,252 | | | | 2,100,000 | |

Redemptions (representing 5,868.23 Shares) | | | (6,153,184 | ) | | | — | |

Distributions reinvested (representing 4,535.94 and 698.81 Shares, respectively) | | | 4,649,467 | | | | 703,387 | |

| | | | | | | | |

Increase (decrease) in net assets derived from capital share transactions | | | 17,501,535 | | | | 2,803,387 | |

| | | | | | | | |

Net increase (decrease) in net assets | | | 16,618,088 | | | | 5,087,301 | |

Net assets, beginning of year/period (representing 42,651.68 and 39,900 Shares, respectively) | | | 44,987,301 | | | | 39,900,000 | |

| | | | | | | | |

Net assets, end of year/period (representing 59,167.15 and 42,651.68 Shares, respectively) | | $ | 61,605,389 | | | $ | 44,987,301 | |

| | | | | | | | |

Distributions in excess of net investment income at end of year/period | | $ | (6,729,281 | ) | | $ | (1,266,198 | ) |

| | | | | | | | |

| | | | |

| 14 | | Private Advisors Alternative Strategies Master Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Private Advisors Alternative Strategies Master Fund

Statement of Cash Flows for the year ended March 31, 2014

| | | | |

| Cash flows from operating activities | |

Net increase (decrease) in net assets resulting from operations | | $ | 3,951,979 | |

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by (used in) operating activities: | | | | |

Purchases of investments in Hedge Funds | | | (19,309,311 | ) |

Proceeds from sales of investments in Hedge Funds | | | 5,121,232 | |

Net realized (gain) loss from investments in Hedge Funds | | | 88,079 | |

Net change in unrealized (appreciation) depreciation on investments in Hedge Funds | | | (4,894,037 | ) |

Changes in operating assets and liabilities: | | | | |

Due from Manager | | | 11,083 | |

Prepaid assets | | | 55,365 | |

Due from Feeder Fund | | | 100,000 | |

Management Fee | | | 52,442 | |

Accrued expenses | | | (56,661 | ) |

| | | | |

Net cash provided by (used in) operating activities | | | (14,879,829 | ) |

| | | | |

| |

| Cash flows from financing activities | | | | |

Subscriptions | | | 20,255,252 | |

Redemptions | | | (4,145,525 | ) |

Distributions paid | | | (185,959 | ) |

| | | | |

Net cash provided by (used in) financing activities | | | 15,923,768 | |

| | | | |

Net increase (decrease) in cash | | | 1,043,939 | |

Cash, beginning of year | | | 2,009,244 | |

| | | | |

Cash, end of year | | $ | 3,053,183 | |

| | | | |

Supplemental disclosure of cash flow information: | | | | |

Distributions reinvested | | $ | 4,649,467 | |

| | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com/privateadvisors | | | 15 | |

Private Advisors Alternative Strategies Master Fund

Financial Highlights selected per share data and ratios

| | | | | | | | |

| | | Year ended

March 31, | | | May 1, 2012

(commencement

of operations)

through

March 31, | |

| | | 2014 | | | 2013 | |

Per Share operating performance: | | | | | | | | |

Net asset value at beginning of year/period | | $ | 1,054.76 | | | $ | 1,000.00 | |

Net investment income (loss) (a) | | | (16.35 | ) | | | (13.87 | ) |

Net realized and unrealized gain (loss) on investments in Hedge Funds | | | 90.05 | | | | 86.21 | |

| | | | | | | | |

Net increase (decrease) resulting from operations | | | 73.70 | | | | 72.34 | |

| | | | | | | | |

Distributions paid | | | | | | | | |

Net investment income | | | (87.25 | ) | | | (17.58 | ) |

| | | | | | | | |

Net asset value at end of year/period | | $ | 1,041.21 | | | $ | 1,054.76 | |

| | | | | | | | |

Total investment return (b) | | | 7.12 | % | | | 7.32 | % (c) |

Ratios (to average net assets)/Supplemental Data: | | | | | | | | |

Net investment income (loss) (d) | | | (1.50 | %) | | | (1.50 | %)†† |

Net expenses (d) | | | 1.50 | % | | | 1.50 | % †† |

Expenses (before waiver/reimbursement) (d) | | | 2.12 | % | | | 2.84 | % †† |

Portfolio turnover rate (e) | | | 10 | % | | | 0 | % (f) |

Net assets at end of year/period (in 000’s) | | $ | 61,605 | | | $ | 44,987 | |

| (a) | Per share data based on average shares outstanding during the year/period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. |

| (c) | Total investment return is not annualized. |

| (d) | Ratios of expenses and net investment income (loss) do not include the impact of expenses and incentive allocations or incentive fees related to the Underlying Hedge Funds. |

| (e) | The portfolio turnover rate reflects the investment activities of the Master Fund. |

| (f) | Portfolio turnover was calculated at 0.00% as no securities were sold during the year from May 1, 2012 (commencement of operations) through March 31, 2013. |

The above ratios and total return have been calculated for the Shareholders taken as a whole. An individual Shareholder’s ratios and total return may vary from these due to the timing of capital share transactions.

| | | | |

| 16 | | Private Advisors Alternative Strategies Master Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Notes to Private Advisors Alternative Strategies Master Fund

Financial Statements

1. Organization and Business

Private Advisors Alternative Strategies Master Fund (the “Master Fund”) was organized on December 15, 2011 as a Delaware statutory trust pursuant to an Agreement and Declaration of Trust (“Declaration of Trust”) dated December 14, 2011. The Master Fund is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Master Fund commenced investment operations on May 1, 2012 (“Commencement of Operations”).

The Master Fund is a “Master” fund within what is known in the investment company industry as a “master-feeder” structure. Within this structure, another closed-end, non-diversified management company, Private Advisors Alternative Strategies Fund (the “Feeder Fund”), invests substantially all of its assets, net of reserves maintained for reasonably anticipated expenses, in the Master Fund. The Master Fund may also accept investments from certain other investors as well, including, among others, investors purchasing shares through (i) certain “wrap fee” or other programs sponsored by financial intermediary firms and (ii) certain non-broker/dealer registered investment advisory firms.

The investment objective of the Master Fund is to seek long-term capital appreciation above equity returns over a full market cycle with volatility that is lower than that of the equity market and returns that demonstrate a low correlation to both traditional equity and fixed income markets. The Master Fund seeks to achieve this investment objective by investing principally in private investment funds or “hedge funds” managed by third-party portfolio managers (“Portfolio Managers”) who employ diverse styles and strategies (“Hedge Funds”). The Master Fund generally seeks to invest in Hedge Funds managed by Portfolio Managers who have proven investment management experience and who invest in the Hedge Funds they manage alongside their clients’ capital. The investment strategies employed by the Portfolio Managers selected may include, among others, credit, event-driven, distressed, global macro, income, long/short equity and relative value/arbitrage strategies.

New York Life Investment Management LLC (“New York Life Investments” or the “Manager”), a Delaware limited liability company, is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (“Advisers Act”), and serves as the Master Fund’s investment manager. New York Life Investments has in turn delegated its portfolio management responsibilities to Private Advisors LLC, a Virginia limited liability company, (“Private Advisors”), who serves as the Master Fund’s subadvisor (together with New York Life Investments, the “Advisors”). New York Life Investments also serves as the investment manager to the Feeder Fund and Private Advisors also serves as the subadvisor to the Feeder Fund. Subject to policies adopted by the Funds’ Board of Trustees (“Board”), Private Advisors, among other things, (i) manages the day-to-day investment operations of the Funds, (ii) seeks investment opportunities for the Funds and (iii) monitors the performance of and makes investment and trading decisions with respect to the Funds’ investment portfolio.

The Board has overall responsibility for monitoring and overseeing the Funds’ investment program and its management and operations. A majority of the Trustees are “Independent Trustees” who are not “interested persons” (as defined by the 1940 Act) of the Funds.

As of March 31, 2014, the Feeder Fund represented $18,268,657 or 29.65% of the Master Fund’s net assets.

2. Significant Accounting Policies

The Master Fund prepares its financial statements, which are expressed in U.S. dollars, in accordance with generally accepted accounting principles in the United States of America (“GAAP”) and follows significant accounting policies described below.

Investment in the Fund

NYLIFE Distributors LLC (“Distributor”), an affiliate of the Advisors, acts as the distributor of the Master Fund’s shares of beneficial interest (“Shares”). The Distributor may enter into selected dealer arrangements with various brokers, dealers, banks and other financial intermediaries (“Financial Intermediaries”) to sell Shares.

Although Shares are registered under the Securities Act of 1933, as amended (“Securities Act”), investments in the Master Fund generally may be made only by investors that satisfy the definition of “accredited investors” as defined in Rule 501(a) of Regulation D under the Securities Act (“Eligible Investors”). Eligible Investors who subscribe for Shares and are admitted to the Master Fund become shareholders (“Shareholders”) of the Master Fund. Generally, Shares will be continuously offered on a monthly basis at a price equal to their then current net asset value (“NAV”) per Share. The minimum initial subscription for Shares is $50,000, and the minimum subsequent subscriptions are $10,000. The Master Fund may accept subscriptions for lesser amounts at the discretion of the Advisors. Shares are offered for purchase as of the first business day of each month or at such other times as determined in the discretion of the Board. Shares are subject to substantial restrictions on transferability and resale, and may not be transferred or resold except as permitted under the Master Fund’s Declaration of Trust. As described below, the Master Fund may, however, offer to repurchase Shares pursuant to written tenders by Shareholders.

No Shareholder or other person holding Shares acquired from a Shareholder has the right to require the Master Fund to redeem Shares. However, the Master Fund may from time to time offer to repurchase Shares from its Shareholders in accordance with written tenders by Shareholders. Each tender offer may be limited and will generally apply to up to 20% of the net assets of the Master Fund at those times, in those amounts, and on such terms and conditions as the Board may determine in its sole discretion. If a tender offer is oversubscribed, the Master Fund will, in its sole discretion, either (a) accept the additional Shares permitted to be accepted pursuant to Rule 13e-4(f)(1) under the Securities Exchange Act of 1934, as amended; (b) extend the tender offer, if necessary, and increase the number of Shares that the Master Fund is offering to repurchase to a number it believes sufficient to accommodate the excess Shares tendered as well as any Shares tendered during the extended offer; or (c) accept Shares tendered on or before the expiration date for payment on a pro rata basis based on the number of tendered Shares. In determining whether the Master Fund should offer to repurchase Shares from Shareholders, the Board will consider the recommendations of the Advisors as to the timing of such an offer, as well as a variety of operational, business and economic

| | | | |

| mainstayinvestments.com/privateadvisors | | | 17 | |

Notes to Private Advisors Alternative Strategies Master Fund

Financial Statements (continued)

factors. In the event that the Master Fund does not at least once during any 24 consecutive month period beginning after January 1, 2013, offer to repurchase Shares tendered in accordance with such terms and conditions as the Board may determine in its sole discretion, the Board will be required to call a meeting of Shareholders for the purposes of considering whether to dissolve the Master Fund.

The Advisors expect that they will generally recommend to the Board that the Master Fund offer to repurchase Shares from Shareholders quarterly on the last business day of March, June, September and December. However, the Master Fund is not required to conduct a tender offer and may be less likely to conduct tenders during periods of exceptional tender conditions or when Hedge Funds suspend redemptions. The Master Fund will require that each tendering Shareholder tender a minimum of $25,000 worth of Shares, subject to the Board’s ability to permit a Shareholder to tender a lesser amount in its discretion.

A 5.00% early repurchase fee (“Repurchase Fee”) will be assessed to any Shareholder that tenders his or her Shares to the Master Fund prior to the business day immediately preceding the one-year anniversary of the Shareholder’s purchase of the respective Shares. The Repurchase Fee applies separately to each purchase of Shares made by a Shareholder. The purpose of the Repurchase Fee is to, among other things, discourage short-term investments, which are generally disruptive to the Master Fund’s investment program.

Valuation of Investments

Private Advisors has designed ongoing due diligence processes with respect to the Hedge Funds and their Portfolio Managers, which assist Private Advisors in assessing the quality of information provided by, or on behalf of, each Hedge Fund and in determining whether such information continues to be reliable or whether further investigation is necessary. Such investigation, as applicable, may or may not require Private Advisors to forego their normal reliance on the value supplied by, or on behalf of, such Hedge Fund and to determine independently a fair valuation of the Master Fund’s interest in such Hedge Fund, consistent with the Master Fund’s fair valuation procedures.

The Board has adopted procedures for the valuation of each of the Hedge Funds and has delegated the responsibility for valuation determination under those procedures to the Valuation Committee of the Master Fund (the “Valuation Committee”). The Board has also authorized the Valuation Committee to appoint a Sub-Committee (“Valuation Sub-Committee”) to deal in the first instance with questions that arise or cannot be resolved under these procedures. The Valuation Sub-Committee will meet (in person, via electronic mail or via teleconference) on an as-needed basis. Determinations of the Valuation Committee and the Valuation Sub-Committee are subject to review and ratification and are subject to review and ratification by the Board at its next regularly scheduled meeting after the fair valuations are determined. The procedures recognize that, subject to the oversight of the Board and unless otherwise noted, primary responsibility for the monthly valuation of portfolio assets (including Hedge Funds for which market prices are not readily available) rests with Private Advisors and/or New York Life Investments.

Investments in Hedge Funds

The Board has approved procedures pursuant to which the Master Fund values its investments in Hedge Funds at fair value, which ordinarily will be the amount equal to the Master Fund’s pro rata interest in the net assets of each such Hedge Fund, as such value is supplied by, or on behalf of, the Hedge Fund’s portfolio manager from time to time, usually monthly. The Master Fund complies with the authoritative guidance under GAAP for estimating the fair value of investments in the Hedge Funds that have calculated net asset value in accordance with the specialized accounting guidance for investment companies (the “practical expedient”). Investments in Hedge Funds are generally valued, as a practical expedient, utilizing the net asset valuations provided by the Hedge Funds when the net asset valuations of the investments are calculated without further adjustment (or adjusted by the Master Fund if the NAV is deemed to be not reflective of fair value). The Master Fund applies the practical expedient to its investments in Hedge Funds on an investment-by-investment basis and consistently with the Master Fund’s entire position in a particular investment unless it is probable that the Master Fund will sell an investment at an amount different from the net asset valuation or in other situations where the practical expedient is not available. When the Master Fund believes alternative valuation techniques are more appropriate, the Master Fund considers other factors in addition to the net asset valuation, such as, but not limited to, features of the investment, including subscription and redemption rights, expected discounted cash flows, transactions in the secondary market, bids received from potential buyers, and overall market conditions in its determination of fair value. Certain financial statements of the Hedge Funds were either not available or excluded details of investment securities portfolios. As of March 31, 2014, the Master Fund’s Advisors were unaware of any significant issuer concentration in the Hedge Funds.

The valuations reported by the Portfolio Managers, upon which the Master Fund primarily relies in calculating its month-end NAV and NAV per Share, may be subject to later adjustment, based on information reasonably available at that time. The Master Fund will pay repurchase proceeds, as well as calculate management and other fees, on the basis of net asset valuations determined using the best information available as of the valuation date. In the event that a Hedge Fund, in accordance with its valuation procedures, subsequently corrects, revises or adjusts an unaudited estimated or final value that was properly relied upon by the Master Fund, the Master Fund will generally not make any retroactive adjustments to its NAV, or to any amounts paid based upon such NAV, to reflect a revised valuation. If, after the Master Fund pays repurchase proceeds, or one or more of the valuations used to determine the NAV on which the repurchase payment is based are revised, the repurchasing Shareholders (if the valuations are revised upward) or the remaining Shareholders (if the valuations are revised downward) will bear the risk of such revisions. A repurchasing Shareholder will neither receive distributions from, nor will it be required to reimburse, the Master Fund in such circumstances. This may have the effect of diluting or increasing the economic interests of other Shareholders. Such adjustments or revisions, whether increasing or decreasing the NAV at the time they occur, because they relate to information available only at the time of the adjustment or revision, will

| | |

| 18 | | Private Advisors Alternative Strategies Master Fund |

not affect the amount of the repurchase proceeds received by Shareholders who had their Shares repurchased prior to such adjustments and received their repurchase proceeds. As a result, to the extent that such subsequently adjusted valuations from Portfolio Managers or revisions to NAV of a Hedge Fund adversely affect the Master Fund’s NAV, the outstanding Shares of the Master Fund will be adversely affected by prior repurchases to the benefit of Shareholders who had their Shares repurchased at an NAV per Share higher than the adjusted amount. Conversely, any increases in the NAV per Share resulting from such subsequently adjusted valuations will be entirely for the benefit of the holders of the outstanding Shares and to the detriment of Shareholders who previously had their Shares repurchased at an NAV per Share lower than the adjusted amount. New Shareholders, as well as Shareholders purchasing additional Shares, may be affected in a similar way because the same principles apply to the subscription for Shares.

Because of the inherent uncertainty of valuation, the estimated value of Hedge Funds for which no ready market exists may differ significantly from the value that would be used had a ready market for the security existed, and the differences could be material. When market quotations may not be available, investments such as complex or unique financial instruments may be priced pursuant to a number of methodologies, such as computer-based analytical modeling or individual security evaluations. These methodologies generate approximations of market values, and there may be significant professional disagreement about the best methodology for a particular type of financial instruments or different methodologies that might be used under different circumstances. In the absence of an actual market transaction, reliance on such methodologies is essential, but may introduce significant variances in the ultimate valuation of Hedge Funds.

The following are descriptions of the various strategies utilized by the underlying Hedge Funds.

Distressed Debt

Portfolio Managers seek to purchase securities (typically debt) of companies experiencing financial or operating difficulties due to excessive debt burdens or temporary liquidity problems. Often these companies are in or about to enter bankruptcy. Understanding the complexities of the bankruptcy process allows experienced distressed Portfolio Managers to profit by buying the securities at a deep discount to intrinsic value.

European Equity

This strategy involves taking both long and short positions primarily in public equities with a geographic focus in Europe.

Event Equity

This strategy involves a long and short fundamental approach to equity investments that have a visible catalyst that can enhance value in a short to intermediate term horizon. Situations can also offer underpriced positive optionality. Portfolio managers who utilize this strategy seek to limit the macro, market and/or industry risk that accompanies the holdings, such that the event drives the ultimate profitability of the investment.

Global Equity

This strategy involves taking both long and short positions primarily in public equities with a global geographic focus.

Global Macro

This strategy relies on the assessment of relative valuations at a macroeconomic level across multiple geographies and asset classes based on economic indicators, trend and factor analysis and flow of funds data. Investments can span the fixed income, currency, commodity and equity markets. Macro investing is generally a liquid, high frequency trading strategy.

Long/Short Corporate Credit

This strategy involves taking both long and short positions in distinct corporate debt instruments.

Long/Short Structured Credit

This strategy attempts to isolate returns by trading in tranches of various types of structured credit instruments. This may include multiple tranches of collateralized debt obligations (CDOs), collateralized loan obligations (CLOs), residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS), credit default swaps (CDS), credit default swap index (CDX), asset-backed securities index (ABX) and commercial mortgage-backed securities index (CMBX).

Multi-Strategy

This strategy grants Portfolio Managers the ability to invest across strategies.

US Equity

This strategy involves taking both long and short positions primarily in public equities with a geographic focus in the United States.

Distribution of Income and Gains

The Master Fund intends to distribute all of its net investment income, and net short-term and long-term capital gain, if any, to Shareholders each year as required to maintain regulated investment company (“RIC”) status. Distributions will be made annually to each Shareholder pro rata based upon the number of Shares held by such Shareholder on the record date and will be net of expenses. Dividends and distributions are recorded on the ex-dividend date. Dividends and distributions to shareholders are determined in accordance with federal income tax regulations and may differ from GAAP. Dividends from net investment income for the year ended March 31, 2014 and for the period May 1, 2012 through March 31, 2013 represent distributions from ordinary income for tax purposes arising primarily from mark-to-market adjustments relating to passive foreign investment companies.

In order to satisfy the diversification requirements under Subchapter M of the Internal Revenue Code, the Master Fund generally invests its assets in Hedge Funds organized outside the United States that are treated as corporations for U.S. tax purposes and are expected to be classified as passive foreign investment companies (“PFICs”). As such,

| | | | |

| mainstayinvestments.com/privateadvisors | | | 19 | |

Notes to Private Advisors Alternative Strategies Master Fund

Financial Statements (continued)

the Master Fund expects that its distributions generally will be taxable as ordinary income to the Shareholders.

Pursuant to the dividend reinvestment plan established by the Master Fund (“DRIP”), each Shareholder whose Shares are registered in its own name will automatically be a participant under the DRIP and have all income, dividends and/or capital gains distributions automatically reinvested in additional Shares unless such Shareholder specifically elects to receive all income, dividends and capital gain distributions in cash.

Statement of Cash Flows

The cash amount shown in the Statement of Cash Flows of the Master Fund is the amount included in the Master Fund’s Statement of Assets and Liabilities and represents the cash on hand at its custodian and does not include any short-term investments, or restricted cash.

Income and Operating Expenses

The Master Fund bears its own expenses including, but not limited to, legal expenses, accounting expenses (including third-party accounting services), auditing and other professional expenses, administration expenses and custody expenses. Interest income and interest expense are recorded on an accrual basis. Operating expenses are recorded as incurred.

In addition, the Master Fund bears a pro rata share of the fees and expenses of the Hedge Funds in which it invests. Because the Hedge Funds have varied expense and fee levels and the Master Fund may own different proportions of the Hedge Funds at different times, the amount of fees and expenses incurred indirectly by the Master Fund may vary. These indirect expenses of the Hedge Funds are not included in net realized gain/(loss) from investments in Hedge Funds and net change in unrealized appreciation/(depreciation) on investments in Hedge Funds on the Master Fund’s Statement of Operations.

Recognition of Gains and Losses

Changes in unrealized appreciation or depreciation from each Hedge Fund are included in the Master Fund’s Statement of Operations as net change in unrealized appreciation (depreciation) on investments in Hedge Funds.

Purchases of investments in the Portfolio Funds are recorded as of the first day of legal ownership of a Portfolio Fund. Sales are recorded as of the last day of legal ownership or participation in a Portfolio Fund. Any proceeds received from Hedge Fund redemptions that are in excess of the Hedge Funds’ cost basis are classified as net realized gain from investments in Hedge Funds on the Master Fund’s Statement of Operations. Any proceeds received from Hedge Fund redemptions that are less than the Hedge Funds’ cost basis are classified as net realized loss from investments in Hedge Funds on the Master Fund’s Statement of Operations. Realized gains and losses from investments in Hedge Funds are calculated based on specific identification.

Use of Estimates

In preparing financial statements in conformity with GAAP, management makes estimates and assumptions that affect the reported amounts and disclosures in the financial statements, such as valuation of its investments. Actual results could differ from those estimates.

3. Income Taxes

Federal Income Taxes

The Master Fund intends to comply with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies (“RICs”) and to distribute substantially all of its taxable income to its Shareholders. Therefore, no provision for federal income taxes is required. The Master Fund has adopted a tax year-end of October 31. Unless otherwise indicated, all applicable disclosures reflect tax adjusted balances as of October 31, 2013. The Master Fund files tax returns with the U.S. Internal Revenue Service and various states. The Master Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income earned or gains realized or repatriated. Taxes are accrued and applied to net investment income, net realized capital gains and net unrealized appreciation, as applicable, as the income is earned or capital gains are recorded. Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. Management has analyzed the Master Fund’s tax positions taken on federal, state and local income tax returns for the open tax year (for up to three tax years), and has concluded that no provision for federal, state and local income tax are required in the Master Fund’s financial statements. The Master Fund’s federal, state and local tax returns for tax years for which the applicable statutes of limitation have not expired are subject to examination by the Internal Revenue Service and state and local departments of revenue.

A permanent difference, primarily due to passive foreign investment companies (PFICs) as of October 31, 2013, the Fund’s tax year, resulted in the following reclassification amongst the Master Fund’s components of net assets as of March 31, 2014:

| | | | |

Accumulated net investment income (loss) | | $ | 226,322 | |

Accumulated net realized gain (loss) | | | (226,322 | ) |

Paid-in capital | | | — | |

The tax character of distributions paid for the period May 1, 2012 through March 31, 2013 of $703,387 was ordinary income. The tax character of distributions for the year ended March 31, 2014 of $4,835,425 was ordinary income, and is subject to recharacterization until the Fund’s tax year end of October 31, 2014.

As of October 31, 2013, the components of distributable earnings on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 4,835,424 | |

Unrealized appreciation (depreciation) | | | (316,841 | ) |

Capital loss carryforward | | | (314,400 | ) |

Accumulated net realized gain (loss) | | | — | |

As of October 31, 2013, capital loss carryforwards available for federal income tax purposes were $22,439 for short-term and $291,961 for long-term. These amounts have no expiration.

| | |

| 20 | | Private Advisors Alternative Strategies Master Fund |

As of October 31, 2013, the cost and related gross unrealized appreciation and depreciation for tax purposes were as follows:

| | | | |

Cost of investments for tax purposes | | $ | 56,141,874 | |

Gross tax unrealized appreciation | | $ | — | |

Gross tax unrealized depreciation | | | (316,841 | ) |

Net tax unrealized appreciation (depreciation) on investments | | $ | (316,841 | ) |

Temporary differences are due to the different treatment for book and tax of the Master Fund’s investment in PFICs.

4. Fair Value of Financial Instruments

“Fair value” is defined as the price that the Master Fund would receive upon selling an investment or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

In determining fair value, the Master Fund uses the practical expedient. A fair value hierarchy for inputs is used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that most observable inputs are to be used when available. The fair value hierarchy is categorized into three levels based on the inputs as follows:

The fair value hierarchy categorizes asset and liability positions into one of three levels, as summarized below, based on the inputs and assumptions used in deriving fair value.

| • | | Level 1—Unadjusted quoted prices in active markets for identical, unrestricted investments that the Master Fund has the ability to access at the measurement date; |

| • | | Level 2—Quoted prices which are not active, quoted prices for similar investments in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability. Investments in Hedge Funds that are redeemable at net asset value without penalties within 3 months of period-end are considered Level 2 assets and represent the net asset values as reported by the Hedge Funds; and |

| • | | Level 3—Significant unobservable prices or inputs (including the Master Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the investment at the measurement date. Investments in Hedge Funds that are not redeemable at net asset value within 3 months of period-end, or are subject to a redemption penalty extending past three months are considered Level 3 assets and represent the net asset values as reported by the Hedge Funds. |

Fair value is a market-based measure, based on assumptions of prices and inputs considered from the perspective of a market participant that are current as of the measurement date, rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, the Master Fund’s own assumptions are set to reflect those that market participants would use in pricing the asset or liability at the measurement date.

The availability of valuation techniques and observable inputs can vary from investment to investment and are affected by a wide variety of factors, including the type of investment, whether the investment is new and not yet established in the market place, the liquidity of markets and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Because of the inherent uncertainty of valuation, those estimated values may be materially higher or lower than the values that would have been used had a ready market for the investments existed, and the differences could be material. Accordingly, the degree of judgment exercised by the Master Fund in determining fair value is greatest for investments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

Investments in Hedge Funds are included in Level 2 or 3 of the fair value hierarchy. In determining the level, the Master Fund considers the length of time until the investment is redeemable, including notice and lock-up periods or any other restrictions on the disposition of the investment. The Master Fund also considers the nature of the portfolios of the underlying Hedge Funds and their ability to liquidate their underlying investments. If the Master Fund does not know when it will have the ability to redeem its investment in the near term, the investment is included in Level 3 of the fair value hierarchy.

The valuation techniques used by the Master Fund to measure fair value maximizes the use of observable inputs and minimizes the use of unobservable inputs.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| | | | |

| mainstayinvestments.com/privateadvisors | | | 21 | |

Notes to Private Advisors Alternative Strategies Master Fund

Financial Statements (continued)

The following is a summary of the fair value inputs used as of March 31, 2014 in valuing the Master Fund’s investments in Hedge Funds.

| | | | | | | | | | | | | | | | |

| | | Assets at Fair Value as of March 31, 2014 | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Hedge Funds | | | | | | | | | | | | | | | | |

Bermuda Domiciled | | | | | | | | | | | | | | | | |

European Equity | | $ | — | | | $ | 2,297,163 | | | $ | 328,387 | | | $ | 2,625,550 | |

British Virgin Islands Domiciled | | | | | | | | | | | | | | | | |

Global Equity | | | | | | | 2,442,887 | | | | — | | | | 2,442,887 | |

Multi-Strategy | | | — | | | | 2,057,632 | | | | — | | | | 2,057,632 | |

Cayman Islands Domiciled | | | | | | | | | | | | | | | | |

Distressed Debt | | | — | | | | 4,683,207 | | | | 268,379 | | | | 4,951,586 | |

European Equity | | | — | | | | 5,181,658 | | | | — | | | | 5,181,658 | |

Event Equity | | | — | | | | 4,265,520 | | | | — | | | | 4,265,520 | |

Global Equity | | | — | | | | 4,087,530 | | | | 1,045,393 | | | | 5,132,923 | |

Global Macro | | | — | | | | 8,461,262 | | | | 999,632 | | | | 9,460,894 | |

Long/Short Corporate Credit | | | — | | | | 3,727,327 | | | | 2,753,487 | | | | 6,480,814 | |

Long/Short Structured Credit | | | — | | | | 3,134,413 | | | | 281,345 | | | | 3,415,758 | |

Multi-Strategy | | | — | | | | 4,898,685 | | | | 227,537 | | | | 5,126,222 | |

US Equity | | | — | | | | 9,511,180 | | | | 1,391,525 | | | | 10,902,705 | |

| | | | | | | | |

Total investments in Hedge Funds | | $ | — | | | $ | 54,748,464 | | | $ | 7,295,685 | | | $ | 62,044,149 | |

| | | | |

The Master Fund recognizes transfers between levels as of the beginning of the year.

Level 2 and Level 3 investments at March 31, 2014 were valued using the practical expedient.

The following is a reconciliation of investments in Hedge Funds in which significant unobservable inputs (Level 3) were used in determining value:

| | | | | | | | | | | | | | | | |

| | | Bermuda

Domiciled | | | Cayman Islands Domiciled | |

| | | European Equity | | | Distressed

Debt | | | Global

Equity | | | Global

Macro | |

Balance as of April 1, 2013 | | $ | — | | | $ | 3,236,492 | | | $ | 3,494,355 | | | $ | — | |

| Net realized gains (losses) | | | — | | | | — | | | | — | | | | — | |

| Net change in unrealized appreciation (depreciation) | | | 38,387 | | | | 18,379 | | | | 145,393 | | | | 99,632 | |

| Purchases | | | 290,000 | | | | 250,000 | | | | 900,000 | | | | 900,000 | |

| Sales | | | — | | | | — | | | | — | | | | — | |

| Transfers into Level 3 (a) | | | — | | | | — | | | | — | | | | — | |

| Transfers out of Level 3 (a) | | | — | | | | (3,236,492 | ) | | | (3,494,355 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Balance as of March 31, 2014 | | $ | 328,387 | | | $ | 268,379 | | | $ | 1,045,393 | | | $ | 999,632 | |

| | | | | | | | | | | | | | | | |

Net change in unrealized appreciation (depreciation) on Level 3 investments in Hedge Funds still held as of March 31, 2014 | | $ | 38,387 | | | $ | 18,379 | | | $ | 145,393 | | | $ | 99,632 | |

| | | | | | | | | | | | | | | | |

| | |

| 22 | | Private Advisors Alternative Strategies Master Fund |

| | | | | | | | | | | | | | | | | | | | |

| | | Cayman Islands Domiciled | |

| | | Long/Short

Corporate

Credit | | | Long/Short

Structured

Credit | | | Multi-

Strategy | | | US Equity | | | Total | |

Balance as of April 1, 2013 | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 6,730,847 | |

| Net realized gains (losses) | | | — | | | | — | | | | — | | | | — | | | | | |

| Net change in unrealized appreciation (depreciation) | | | 53,487 | | | | 11,345 | | | | 17,537 | | | | 91,525 | | | | 475,685 | |

| Purchases | | | 2,700,000 | | | | 270,000 | | | | 210,000 | | | | 1,300,000 | | | | 6,820,000 | |

| Sales | | | — | | | | — | | | | — | | | | — | | | | — | |

| Transfers into Level 3 (a) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Transfers out of Level 3 (a) | | | — | | | | — | | | | — | | | | — | | | | (6,730,847 | ) |

| | | | | | | | | | | | | | | | | | | | |