March 2023 Investor Presentation Exhibit 99.2

Various statements contained in this presentation, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning the timing and success of specific projects and our future revenues, income and capital spending. Our forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “plan,” “goal,” “will” or other words that convey the uncertainty of future events or outcomes. The forward-looking statements in this presentation speak only as of the date of this presentation; we disclaim any obligation to update these statements unless required by law, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including those discussed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. These risks, contingencies and uncertainties include, but are not limited to, the following: decline in or substantial volatility of crude oil and natural gas commodity prices; a decrease in domestic spending by the oil and natural gas exploration and production industry; fluctuation of our operating results and volatility of our industry; inability to maintain or increase pricing of our contract drilling services, or early termination of any term contract for which early termination compensation is not paid; our backlog of term contracts declining rapidly; the loss of any of our customers, financial distress or management changes of potential customers or failure to obtain contract renewals and additional customer contracts for our drilling services; overcapacity and competition in our industry; an increase in interest rates and deterioration in the credit markets; our inability to comply with the financial and other covenants in debt agreements that we may enter into as a result of reduced revenues, financial performance or financial requirements; unanticipated costs, delays and other difficulties in executing our long-term growth strategy; the loss of key management personnel; new technology that may cause our drilling methods or equipment to become less competitive; labor costs or shortages of skilled workers; the loss of or interruption in operations of one or more key vendors; the effect of operating hazards and severe weather on our rigs, facilities, business, operations and financial results, and limitations on our insurance coverage; increased regulation of drilling in unconventional formations; the incurrence of significant costs and liabilities in the future resulting from our failure to comply with new or existing environmental regulations or an accidental release of hazardous substances into the environment; and the potential failure by us to establish and maintain effective internal control over financial reporting. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this presentation and in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K. Further, any forward-looking statement speaks only as of the date of this presentation, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Adjusted Net Income or Loss, EBITDA and adjusted EBITDA are supplemental non-GAAP financial measures that are used by management and external users of the Company’s financial statements, such as industry analysts, investors, lenders and rating agencies. The Company’s management believes adjusted Net Income or Loss, EBITDA and adjusted EBITDA are useful because such measures allow the Company and its stockholders to more effectively evaluate its operating performance and compare the results of its operations from period to period and against its peers without regard to its financing methods or capital structure. See non-GAAP financial measures at the end of this presentation for a full reconciliation of Net Income or Loss to adjusted Net Income or Loss, EBITDA and adjusted EBITDA. Preliminary Matters

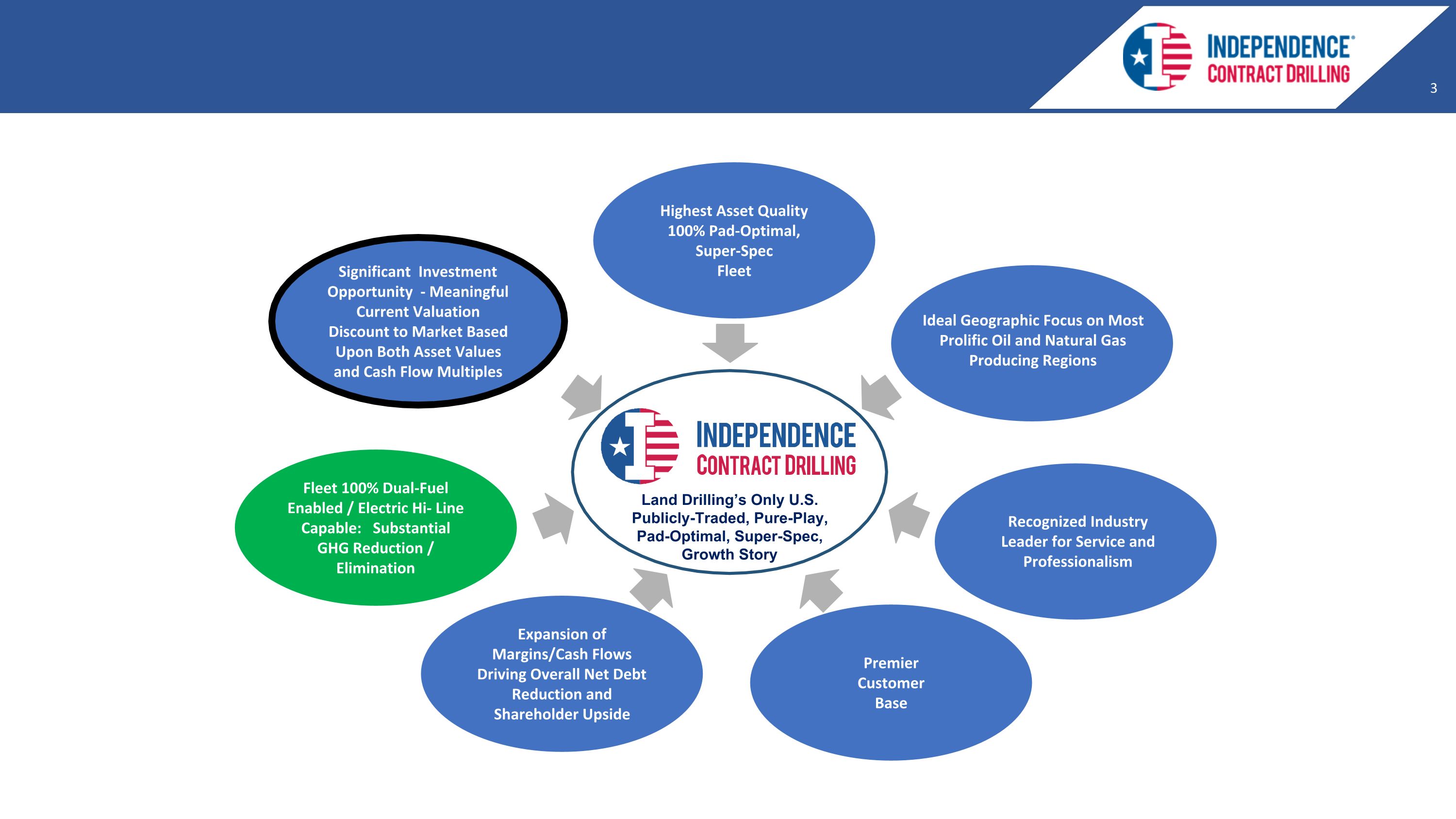

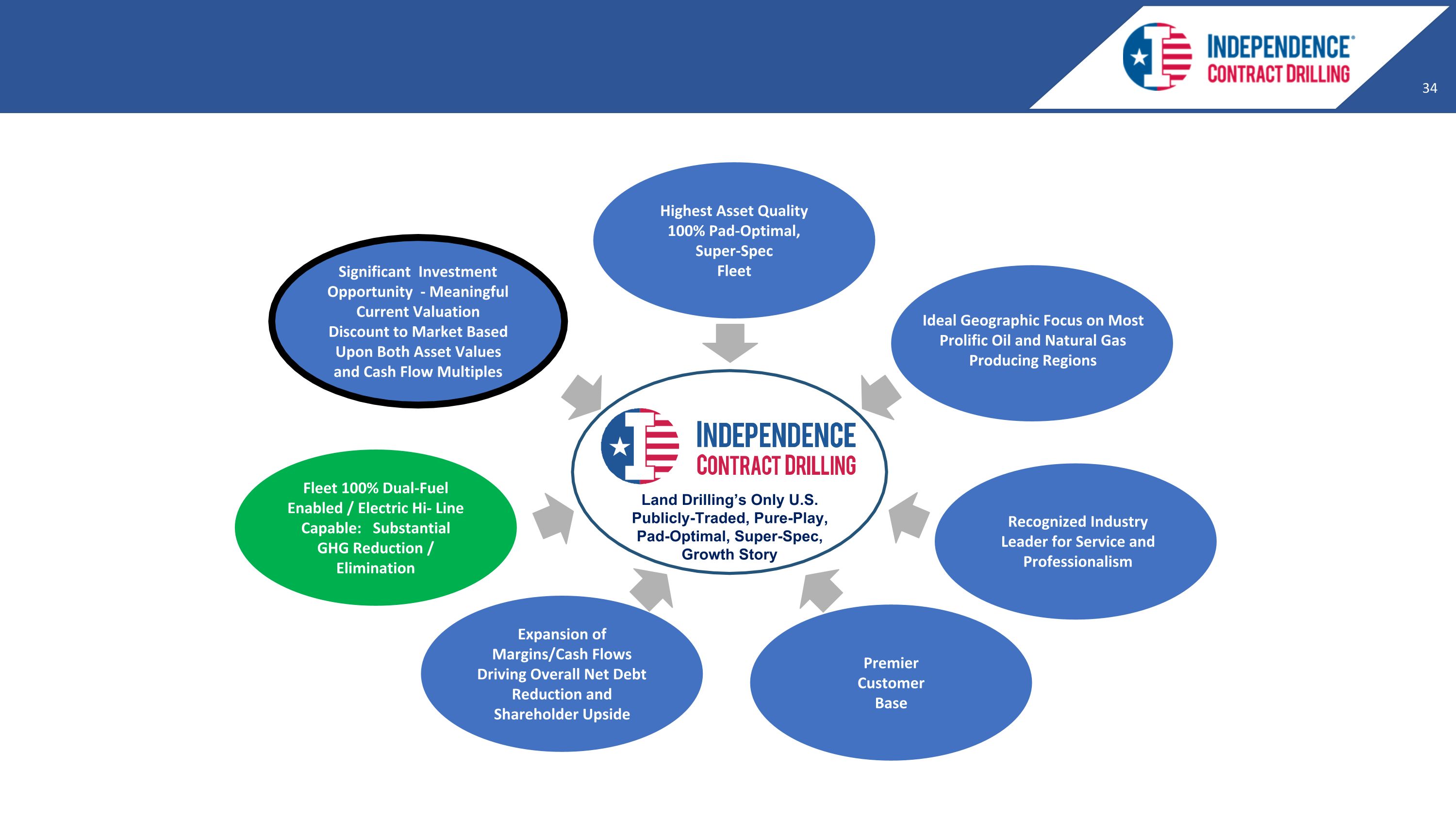

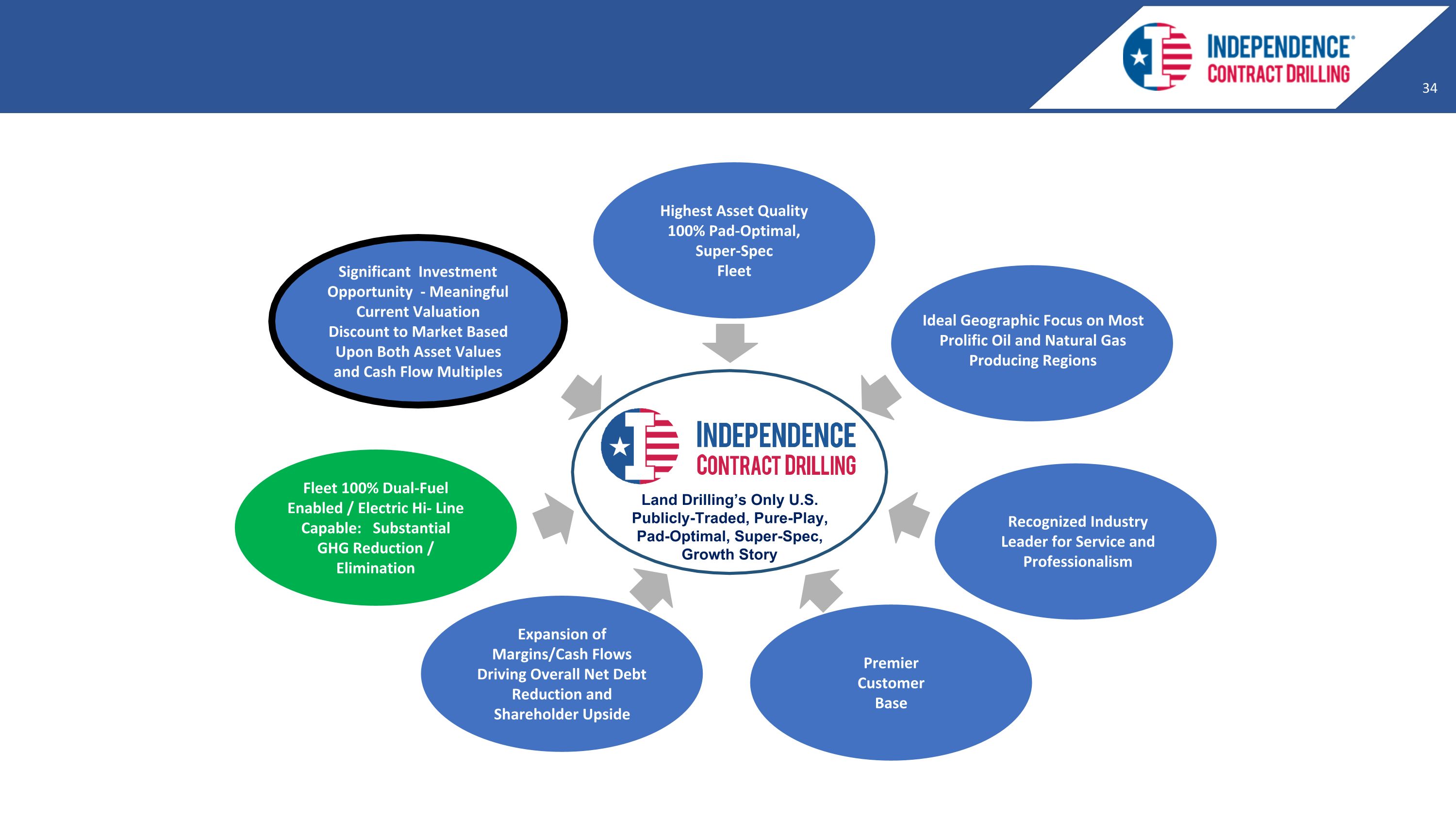

Land Drilling’s Only U.S. Publicly-Traded, Pure-Play, Pad-Optimal, Super-Spec, Growth Story Highest Asset Quality 100% Pad-Optimal, Super-Spec Fleet Premier Customer Base Expansion of Margins/Cash Flows Driving Overall Net Debt Reduction and Shareholder Upside Significant Investment Opportunity - Meaningful Current Valuation Discount to Market Based Upon Both Asset Values and Cash Flow Multiples Fleet 100% Dual-Fuel Enabled / Electric Hi- Line Capable: Substantial GHG Reduction / Elimination Recognized Industry Leader for Service and Professionalism Ideal Geographic Focus on Most Prolific Oil and Natural Gas Producing Regions

Company Background: Pure-Play, 100% Pad-Optimal, Super-Spec U.S. Land Contract Driller Market Dynamics and Outlook Drivers of Returns and Free Cash Flow in Current Market Drivers of Debt Reduction and Imbedded Value ESG Appendices Presentation Outline

COMPANY BACKGROUND Pure-Play, 100% Pad-Optimal, Super-Spec U.S. Land Contract Driller

20 rigs operating at December 31, 2022 4Q’22 Financial Results Adjusted EBITDA: $18.5 million, representing an approximate 48% sequential increase Margin per day: $14,517, representing an approximate 28% sequential increase, and exceeding prior margin guidance by approximately 14% 18.5 average rigs working Forward-Looking Guidance 1Q’23: margin per day: $15,000 to $15,500, exceeding prior guidance Expect Haynesville market softness based upon decline in natural gas prices Currently expect overall rig count in Haynesville to fall 25 to 35 rigs Currently expect to relocate five to six rigs from Haynesville market to Permian market during 2Q’23 and 3Q’23 Pausing rig reactivation program in light of natural gas softness: accelerating strategic focus on free cash flow and net debt reduction 21st rig: early to mid 2Q’23 commencement of contract 22nd rig +: postponed due to natural gas market softness Financial & Operating Rig Update

Introduction: ICD Best-in-Class Asset Quality and Geographic Focus Marketed fleet comprised entirely of Pad-Optimal, Super-Spec rigs Established presence in oil rich Permian play Leading presence in natural gas rich Haynesville and East Texas regions Fit-for-purpose rigs engineered/outfitted to address particular basin drivers All rigs software-optimization-capable High Quality Customer Base Supported by Industry Leading Customer Service and Operations #1 ranked land contract driller for service and professionalism past five years: 2018 - 2022 Established relationships with publics and well-capitalized private operators Constructive Market, Asset Quality Driving Incremental Cash Flows and Shareholder Upside Strength of Permian market and ICD customer base expected to fully-absorb ICD pad-optimal rigs relocating from Haynesville Pause in rig reactivations in response to recent natural gas weakness accelerates ICD free cash flow and net reduction goals as cash flows redirected away from reactivation capex ESG Focus Marketed fleet 100% dual-fuel and hi-line power capable Omni-directional walking reduces operational footprints and environmental impacts Increasingly diverse workforce: 38% from under-represented groups Leading percentage concentration of rigs directed at natural gas production Sector’s only U.S. publicly-traded, pure-play, Pad-Optimal, Super-Spec drilling contractor focused solely on North America’s most attractive oil and natural gas basins

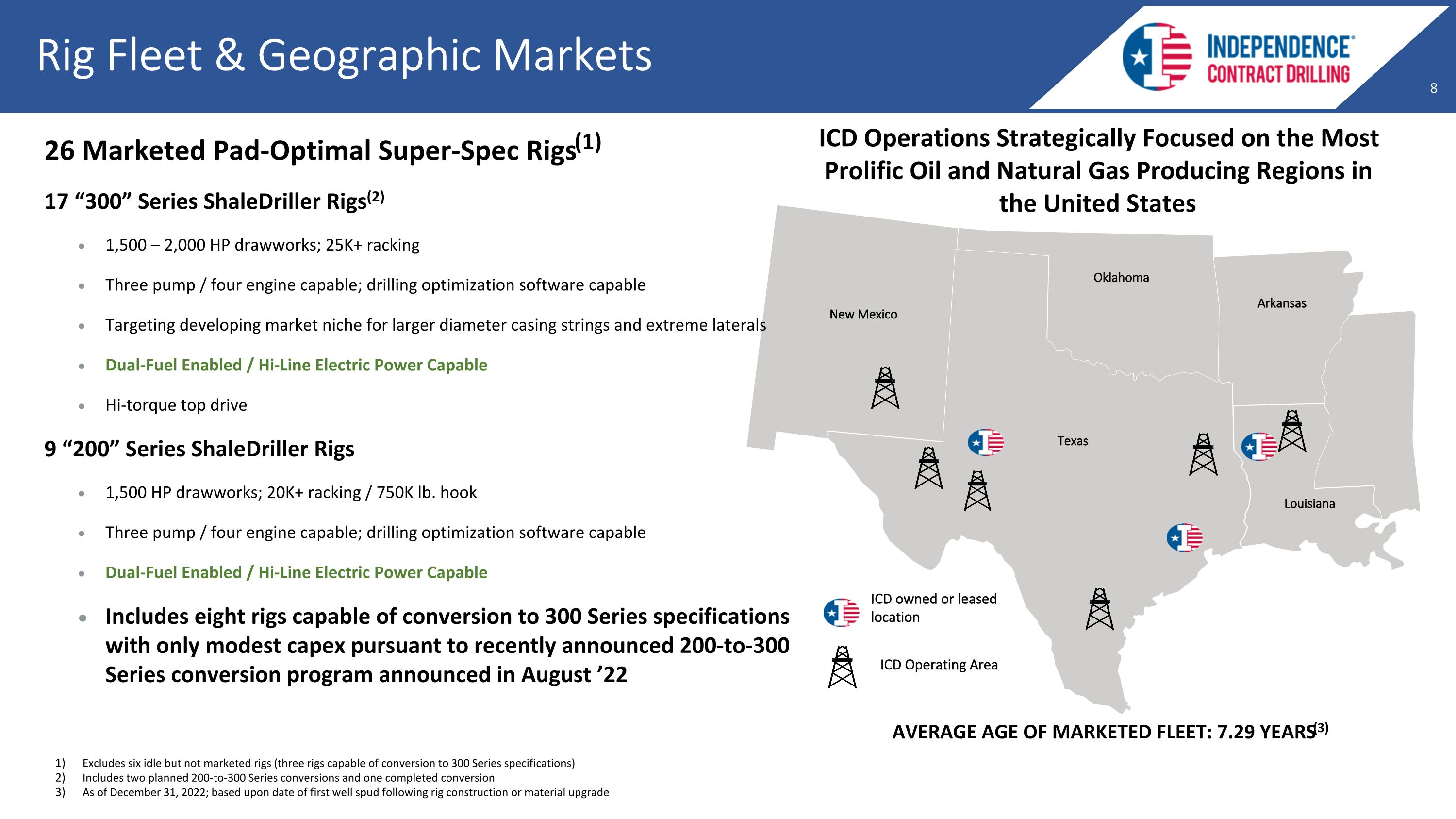

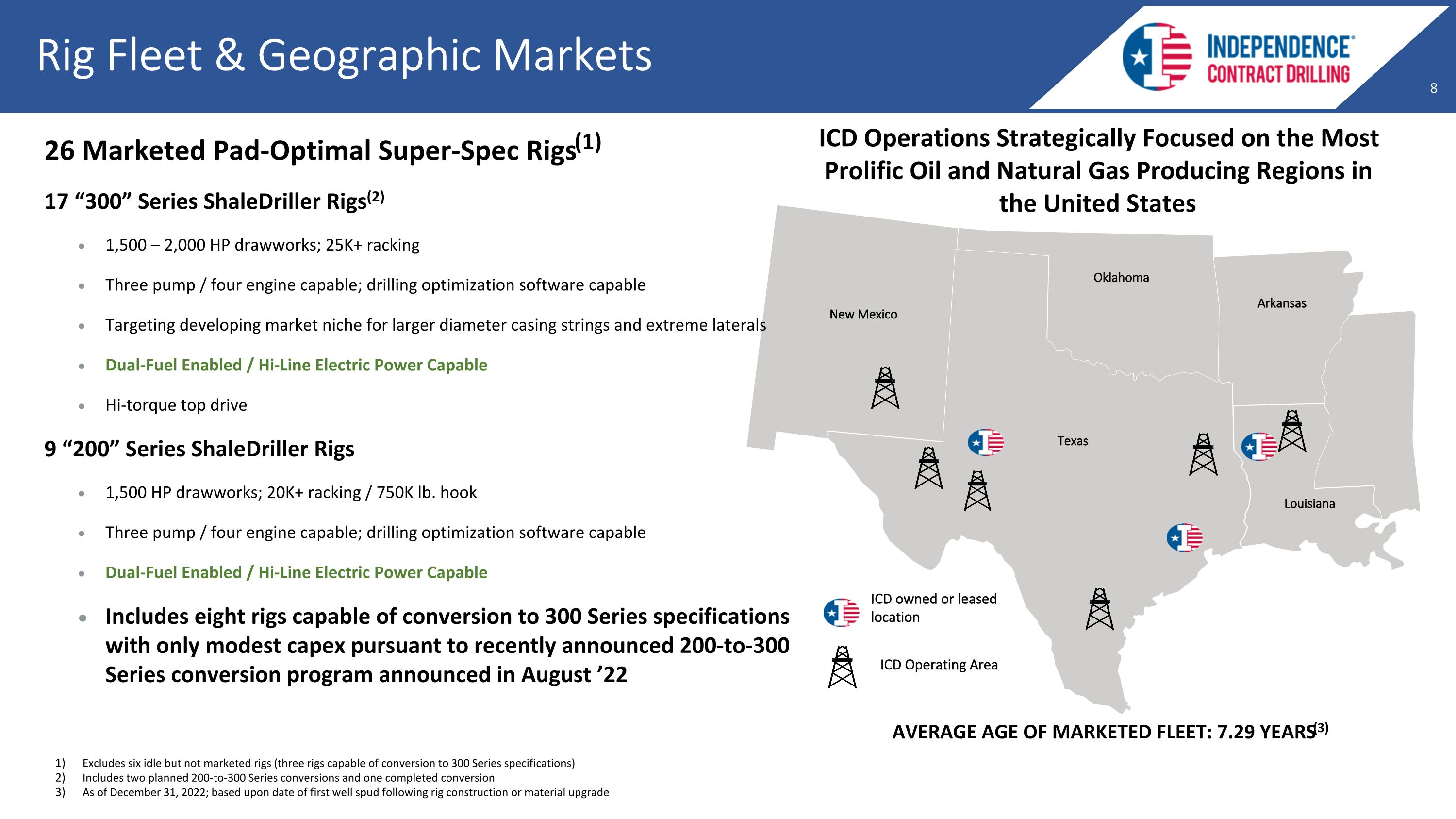

Rig Fleet & Geographic Markets Texas Oklahoma Arkansas Louisiana New Mexico ICD owned or leased location ICD Operating Area AVERAGE AGE OF MARKETED FLEET: 7.29 YEARS(3) 26 Marketed Pad-Optimal Super-Spec Rigs(1) 17 “300” Series ShaleDriller Rigs(2) 1,500 – 2,000 HP drawworks; 25K+ racking Three pump / four engine capable; drilling optimization software capable Targeting developing market niche for larger diameter casing strings and extreme laterals Dual-Fuel Enabled / Hi-Line Electric Power Capable Hi-torque top drive 9 “200” Series ShaleDriller Rigs 1,500 HP drawworks; 20K+ racking / 750K lb. hook Three pump / four engine capable; drilling optimization software capable Dual-Fuel Enabled / Hi-Line Electric Power Capable Includes eight rigs capable of conversion to 300 Series specifications with only modest capex pursuant to recently announced 200-to-300 Series conversion program announced in August ’22 Excludes six idle but not marketed rigs (three rigs capable of conversion to 300 Series specifications) Includes two planned 200-to-300 Series conversions and one completed conversion As of December 31, 2022; based upon date of first well spud following rig construction or material upgrade ICD Operations Strategically Focused on the Most Prolific Oil and Natural Gas Producing Regions in the United States

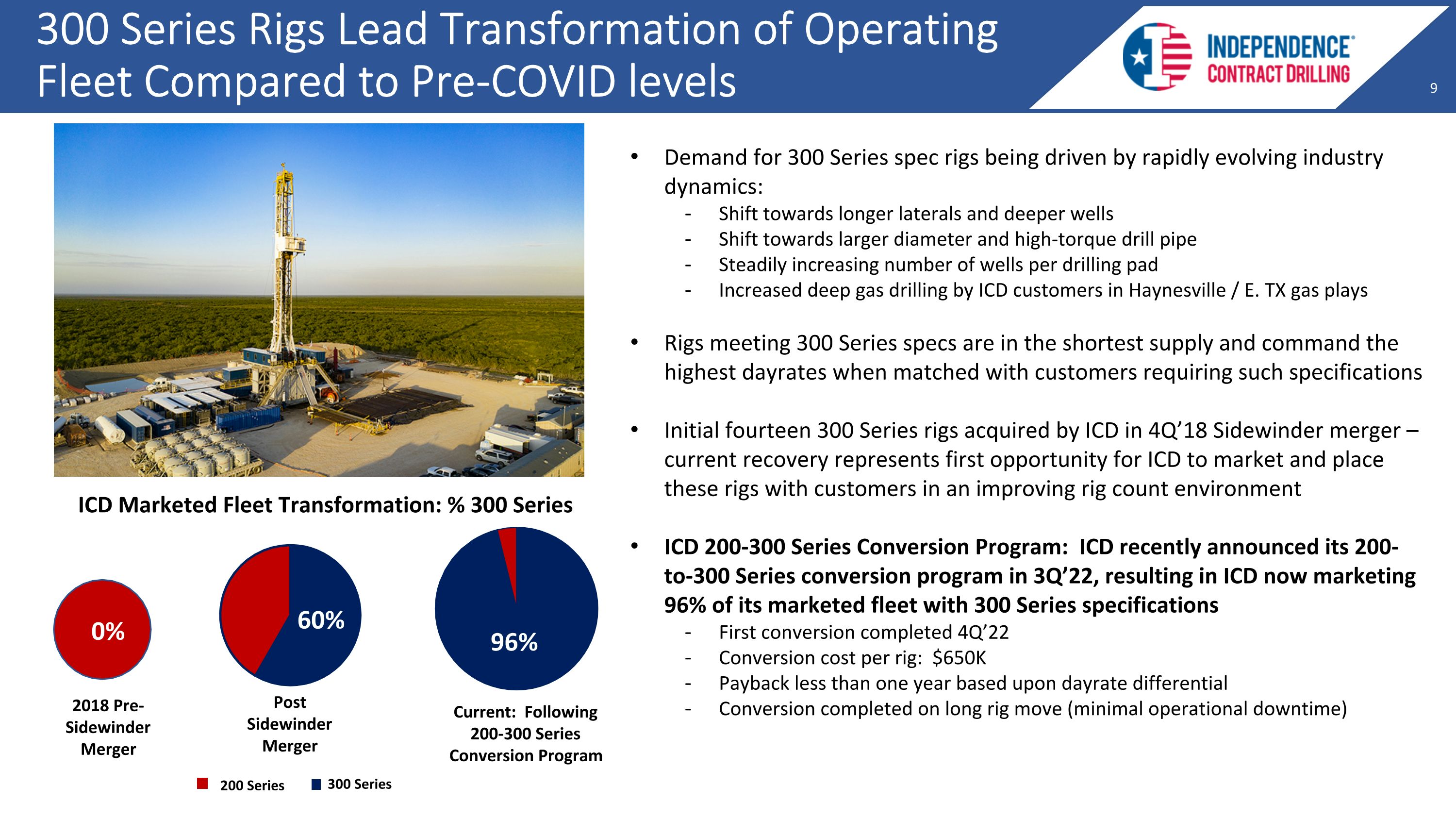

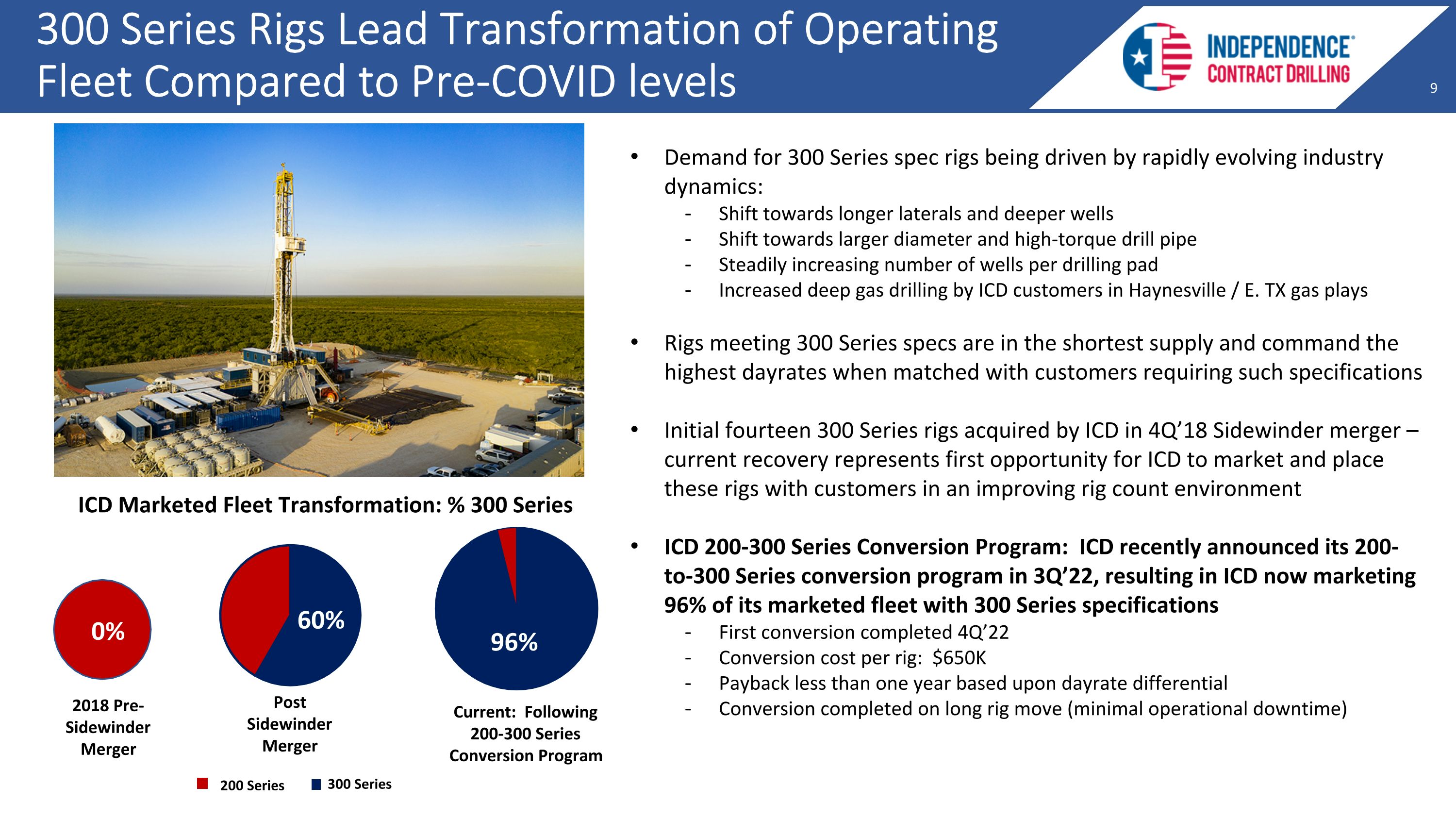

300 Series Rigs Lead Transformation of Operating Fleet Compared to Pre-COVID levels Demand for 300 Series spec rigs being driven by rapidly evolving industry dynamics: Shift towards longer laterals and deeper wells Shift towards larger diameter and high-torque drill pipe Steadily increasing number of wells per drilling pad Increased deep gas drilling by ICD customers in Haynesville / E. TX gas plays Rigs meeting 300 Series specs are in the shortest supply and command the highest dayrates when matched with customers requiring such specifications Initial fourteen 300 Series rigs acquired by ICD in 4Q’18 Sidewinder merger – current recovery represents first opportunity for ICD to market and place these rigs with customers in an improving rig count environment ICD 200-300 Series Conversion Program: ICD recently announced its 200-to-300 Series conversion program in 3Q’22, resulting in ICD now marketing 96% of its marketed fleet with 300 Series specifications First conversion completed 4Q’22 Conversion cost per rig: $650K Payback less than one year based upon dayrate differential Conversion completed on long rig move (minimal operational downtime) 2018 Pre-Sidewinder Merger Post Sidewinder Merger Current: Following 200-300 Series Conversion Program 0% 60% 96% ICD Marketed Fleet Transformation: % 300 Series 200 Series 300 Series

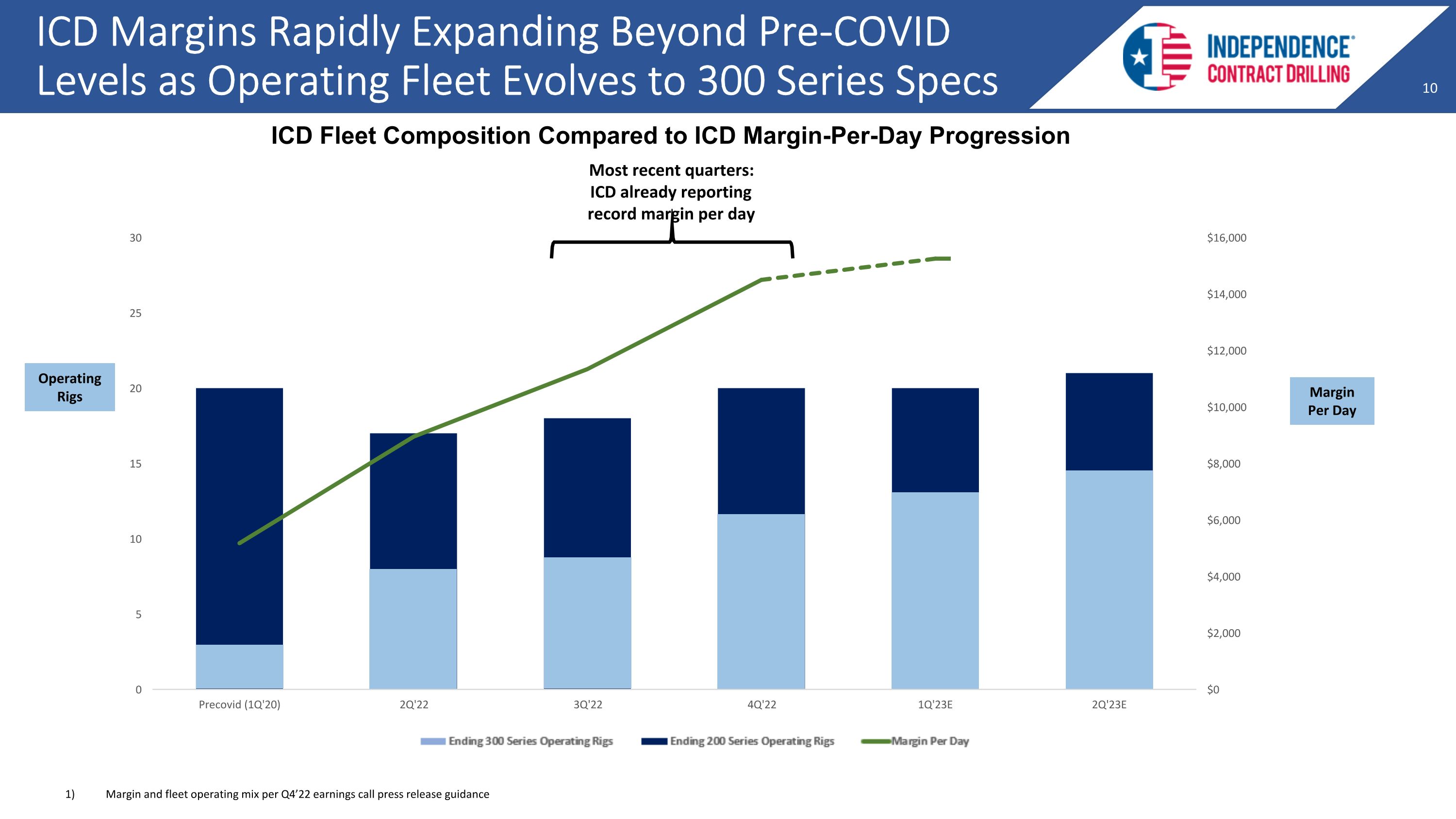

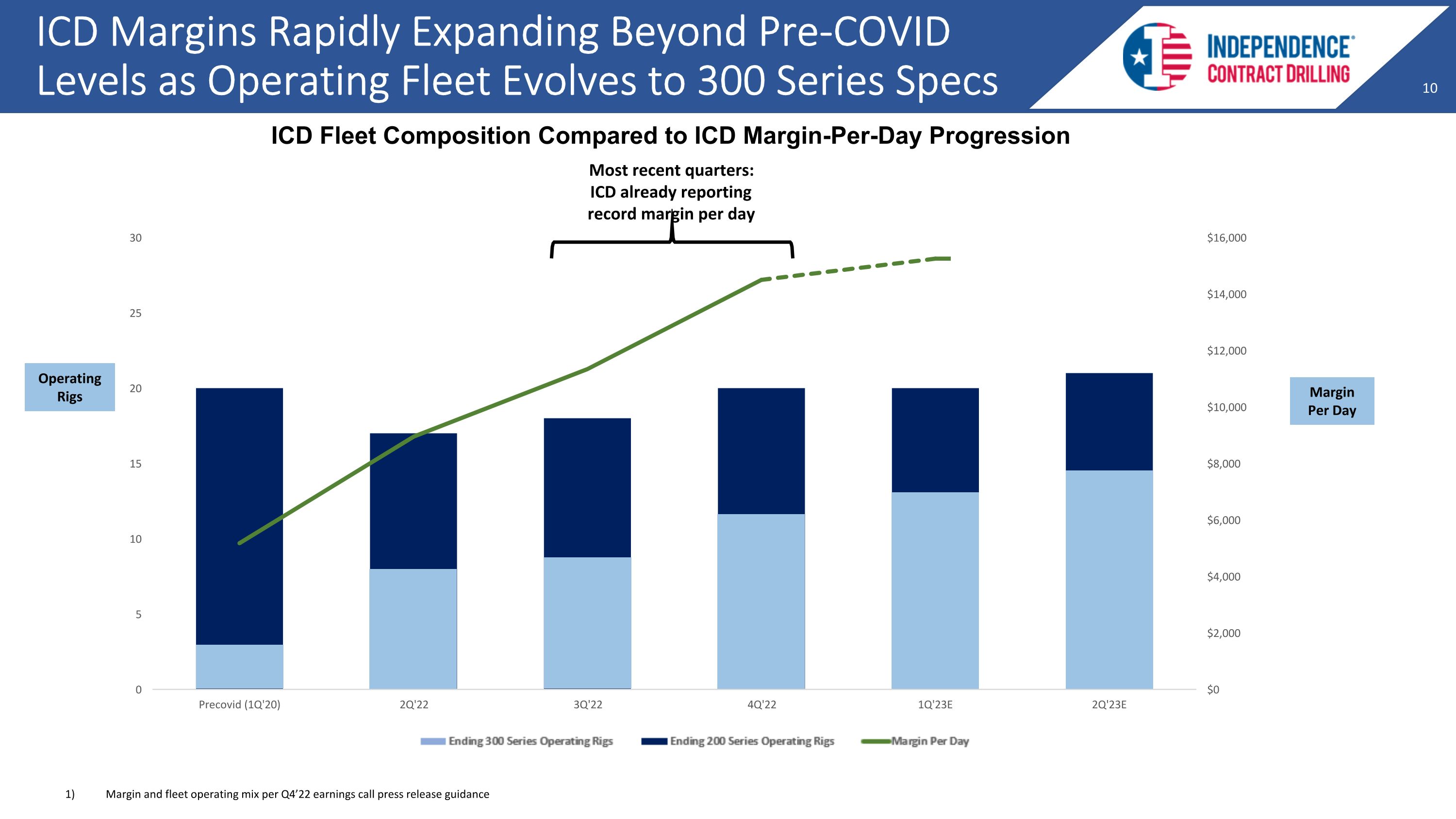

ICD Margins Rapidly Expanding Beyond Pre-COVID Levels as Operating Fleet Evolves to 300 Series Specs ICD Fleet Composition Compared to ICD Margin-Per-Day Progression 1) Margin and fleet operating mix per Q4’22 earnings call press release guidance Margin Per Day Operating Rigs Most recent quarters: ICD already reporting record margin per day

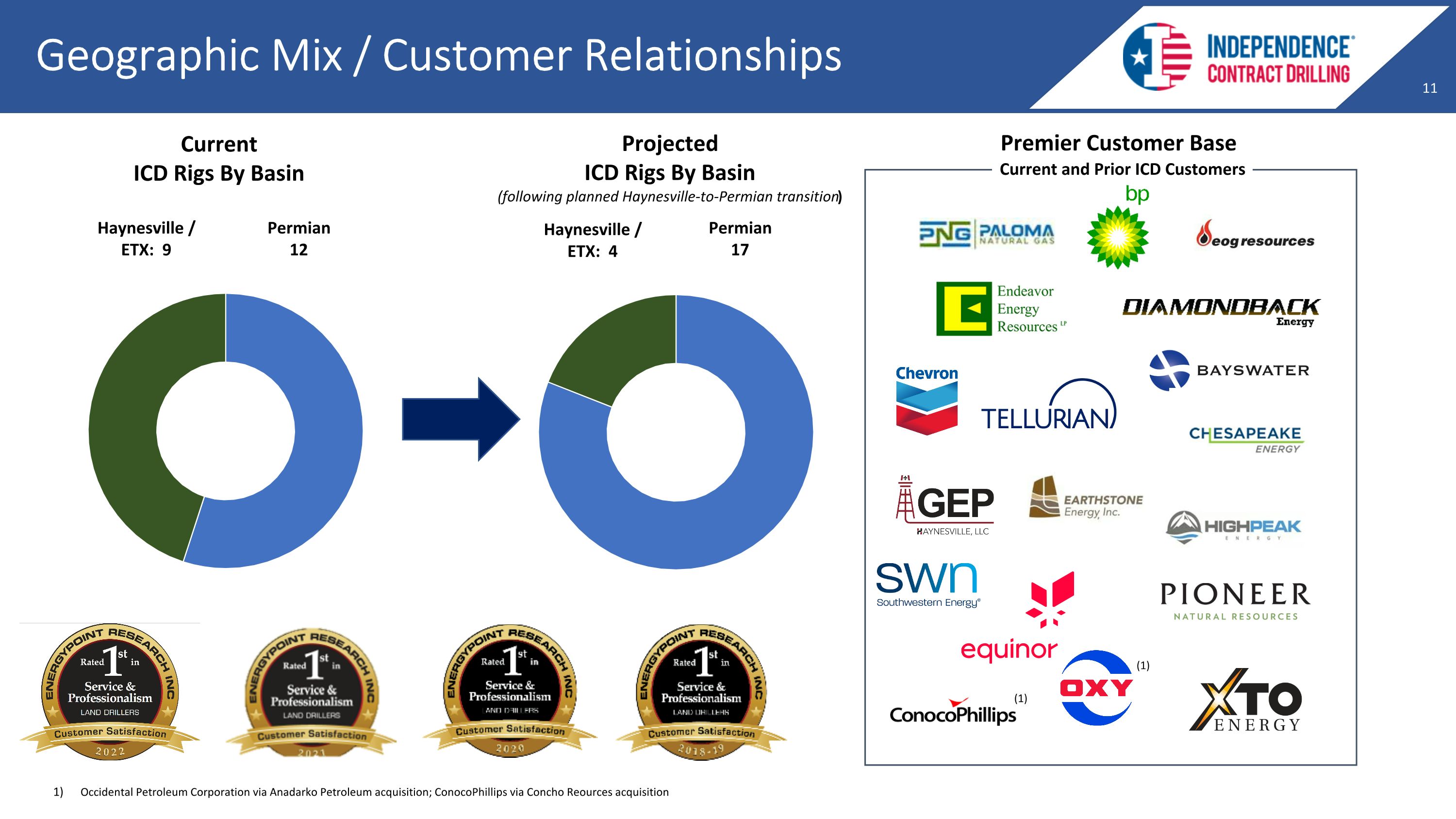

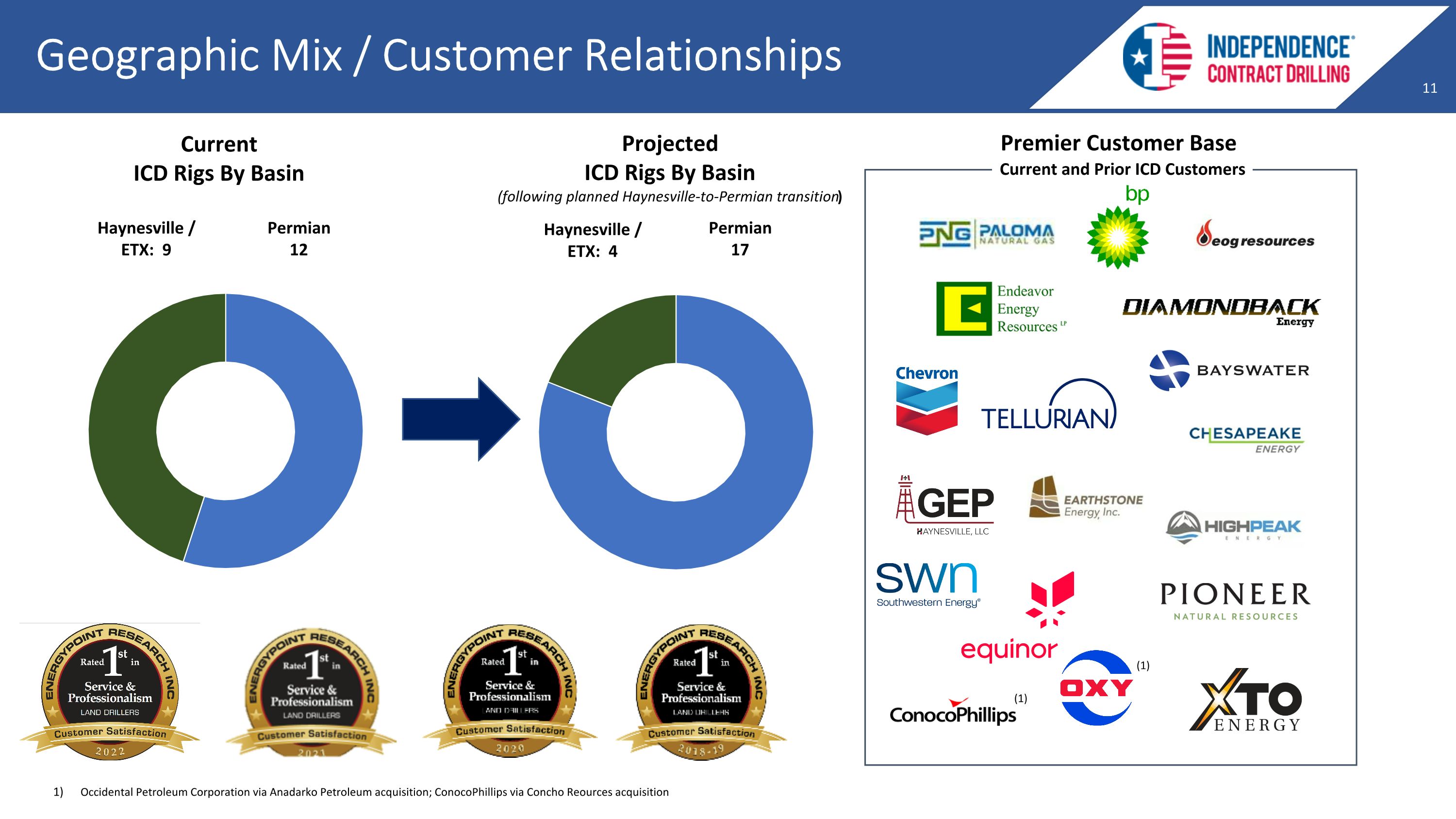

Projected ICD Rigs By Basin (following planned Haynesville-to-Permian transition) Geographic Mix / Customer Relationships Current and Prior ICD Customers Premier Customer Base Current ICD Rigs By Basin Occidental Petroleum Corporation via Anadarko Petroleum acquisition; ConocoPhillips via Concho Reources acquisition Permian 12 Haynesville / ETX: 9 (1) (1) Permian 17 Haynesville / ETX: 4

Market Dynamics and Outlook

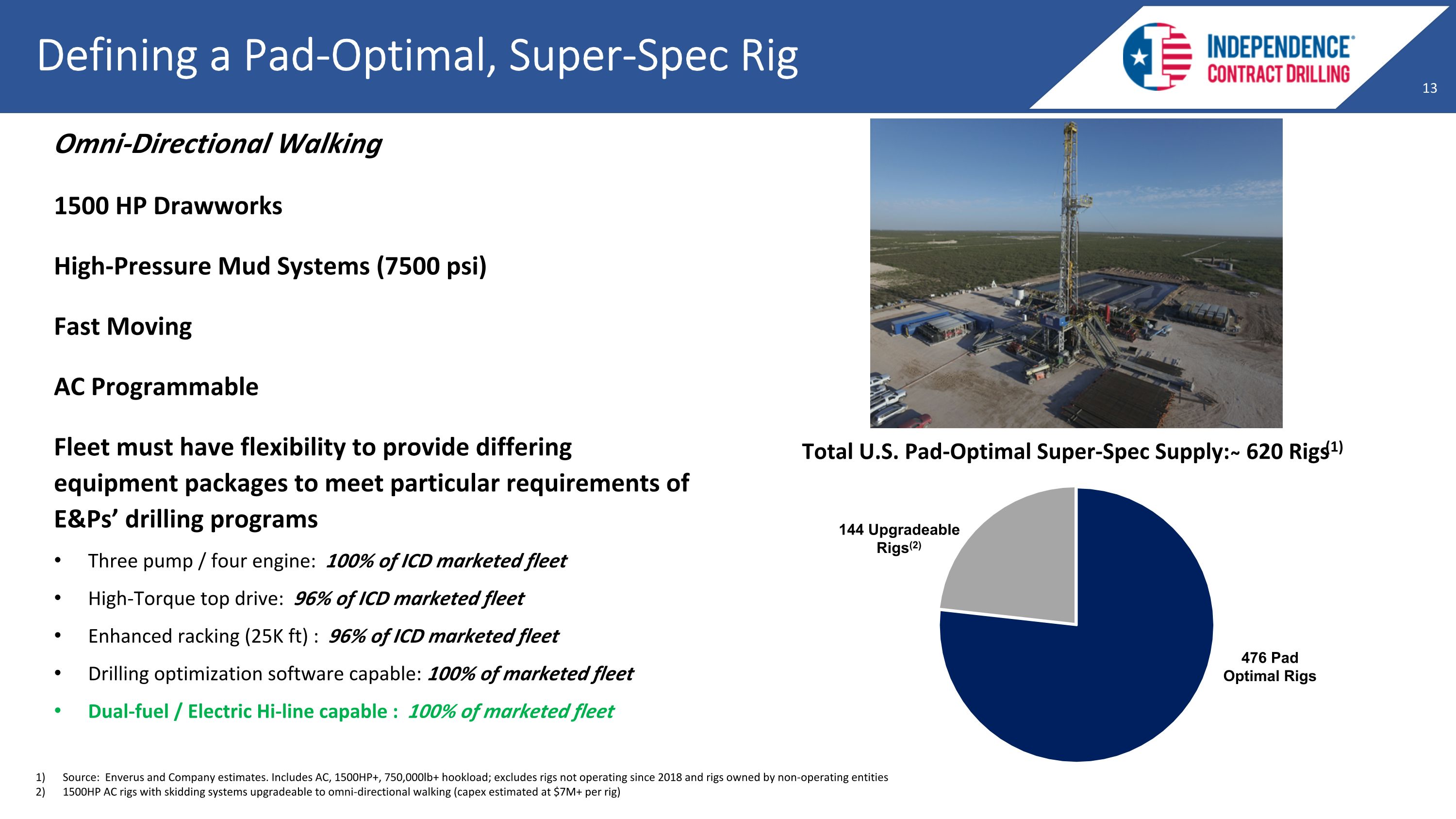

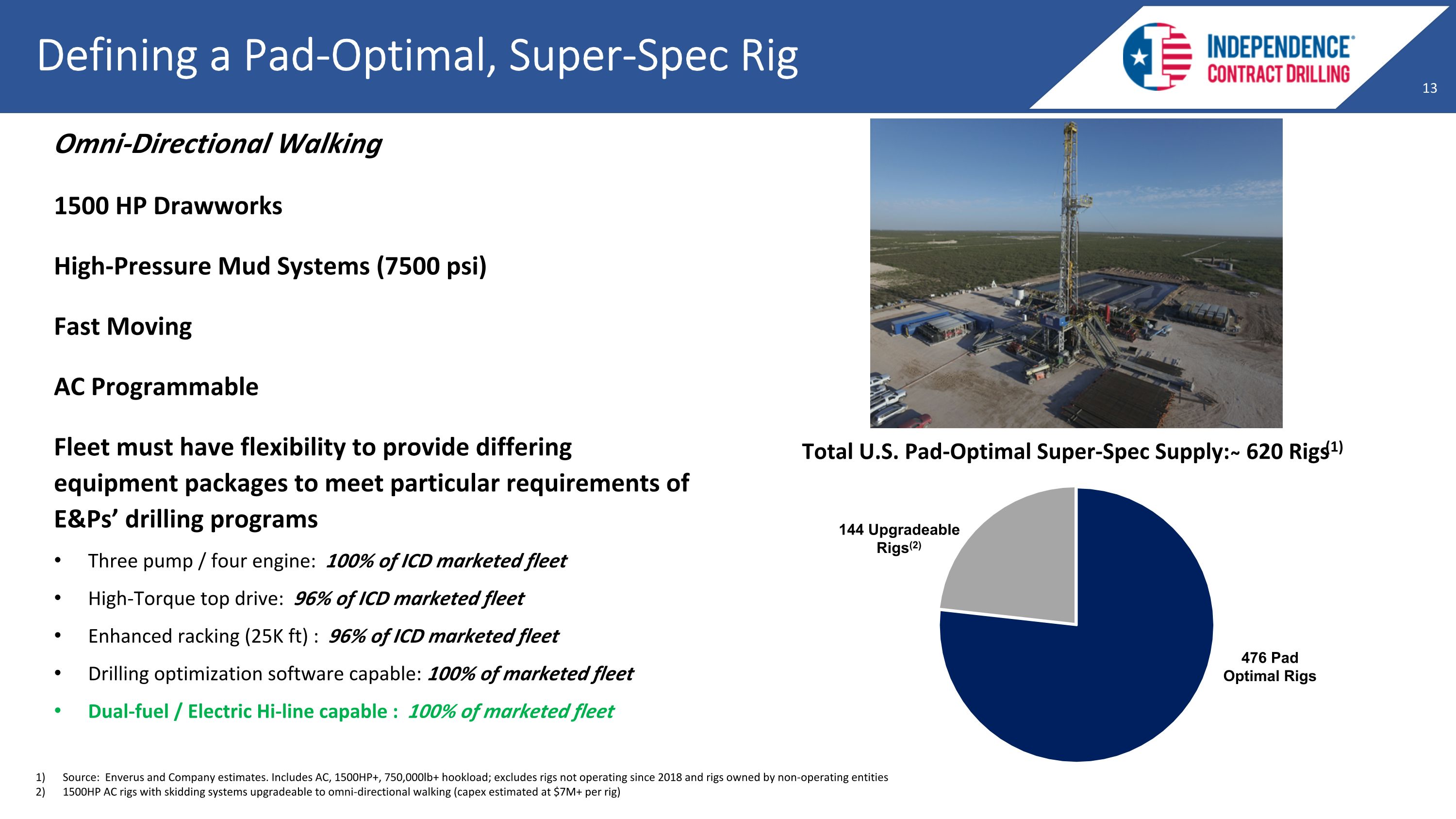

Defining a Pad-Optimal, Super-Spec Rig Omni-Directional Walking 1500 HP Drawworks High-Pressure Mud Systems (7500 psi) Fast Moving AC Programmable Fleet must have flexibility to provide differing equipment packages to meet particular requirements of E&Ps’ drilling programs Three pump / four engine: 100% of ICD marketed fleet High-Torque top drive: 96% of ICD marketed fleet Enhanced racking (25K ft) : 96% of ICD marketed fleet Drilling optimization software capable: 100% of marketed fleet Dual-fuel / Electric Hi-line capable : 100% of marketed fleet 476 Pad Optimal Rigs 144 Upgradeable Rigs(2) 1) Source: Enverus and Company estimates. Includes AC, 1500HP+, 750,000lb+ hookload; excludes rigs not operating since 2018 and rigs owned by non-operating entities 2) 1500HP AC rigs with skidding systems upgradeable to omni-directional walking (capex estimated at $7M+ per rig)

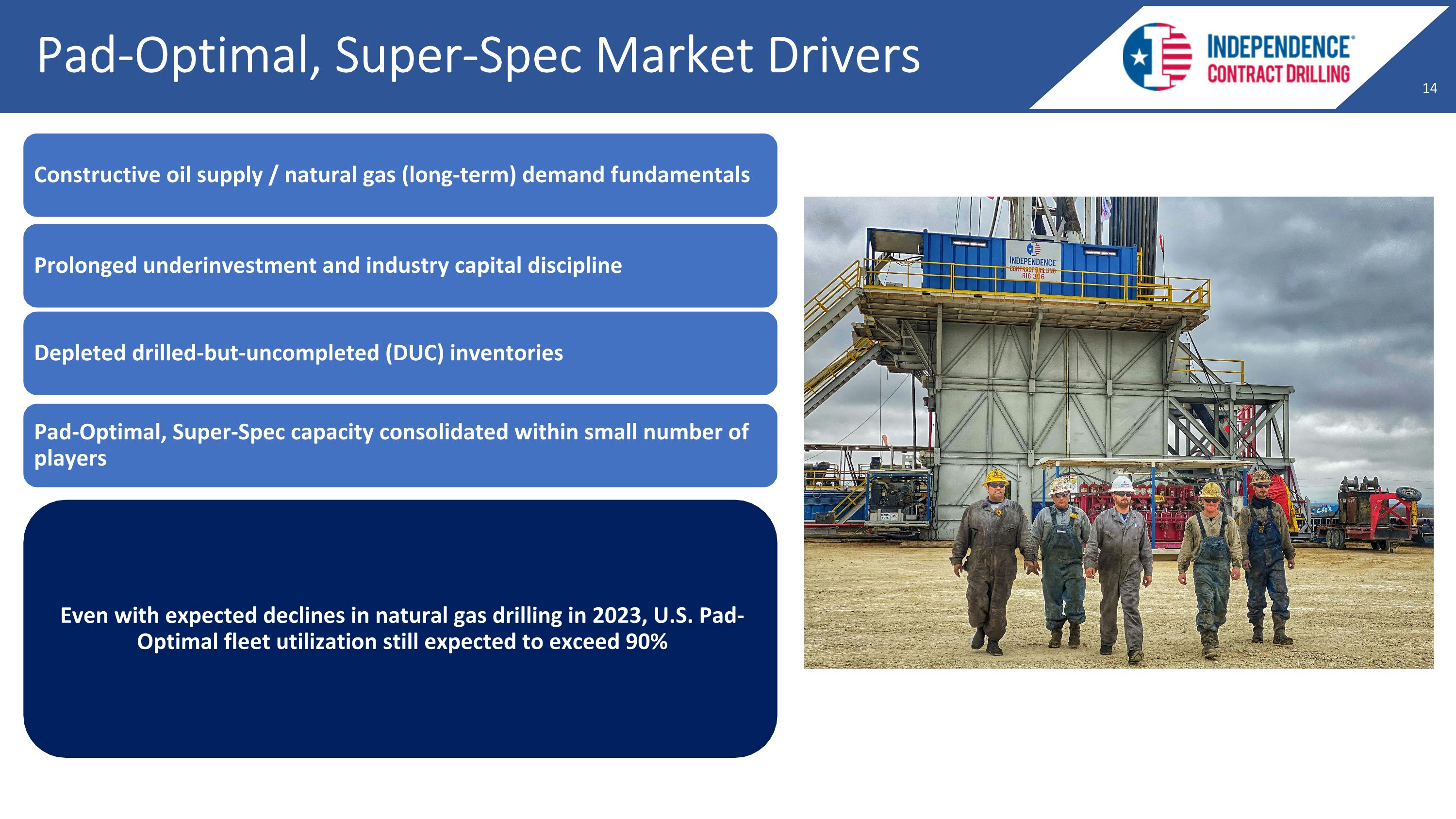

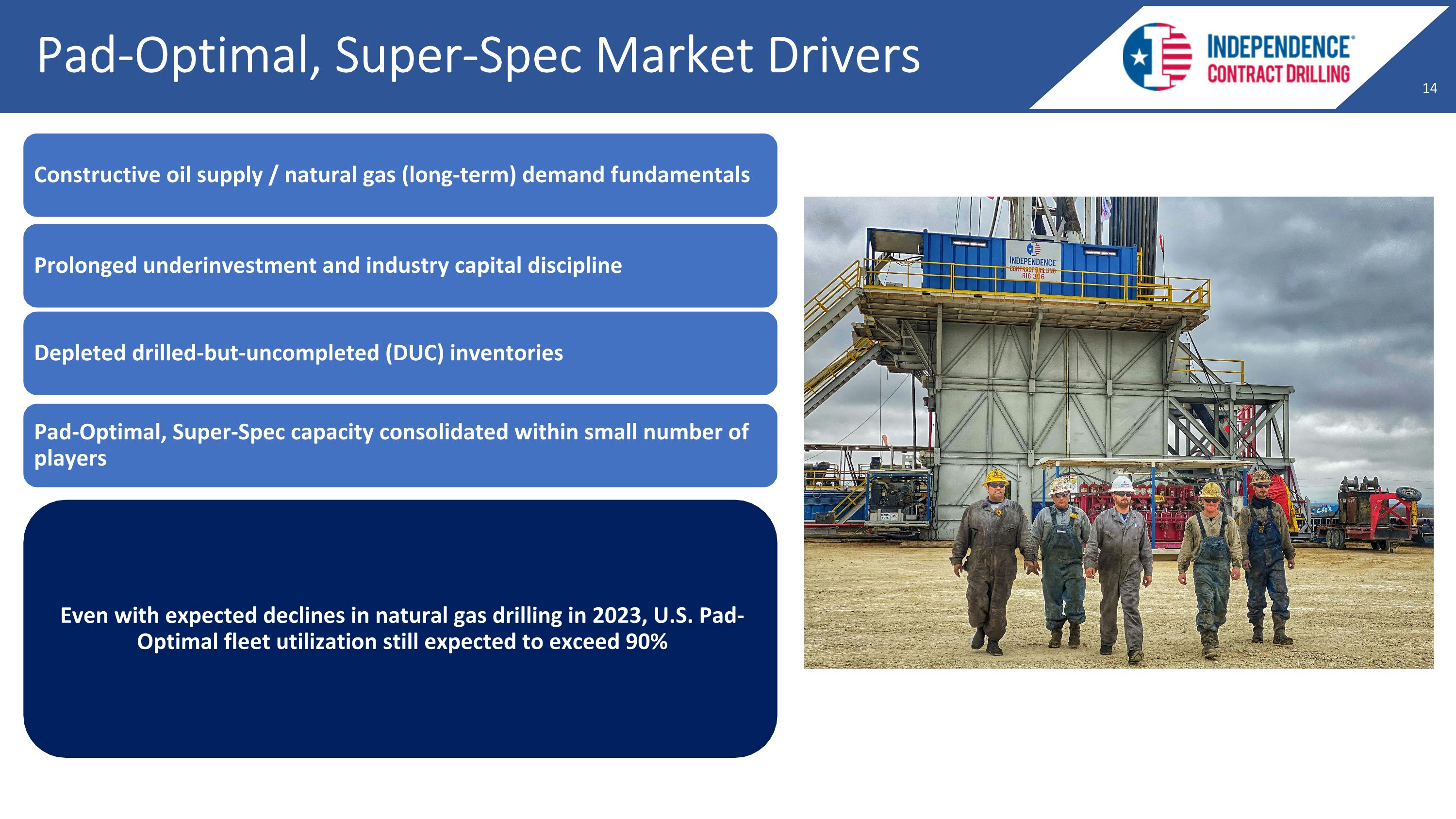

Constructive oil supply / natural gas (long-term) demand fundamentals Prolonged underinvestment and industry capital discipline Depleted drilled-but-uncompleted (DUC) inventories Pad-Optimal, Super-Spec capacity consolidated within small number of players Even with expected declines in natural gas drilling in 2023, U.S. Pad-Optimal fleet utilization still expected to exceed 90% Pad-Optimal, Super-Spec Market Drivers

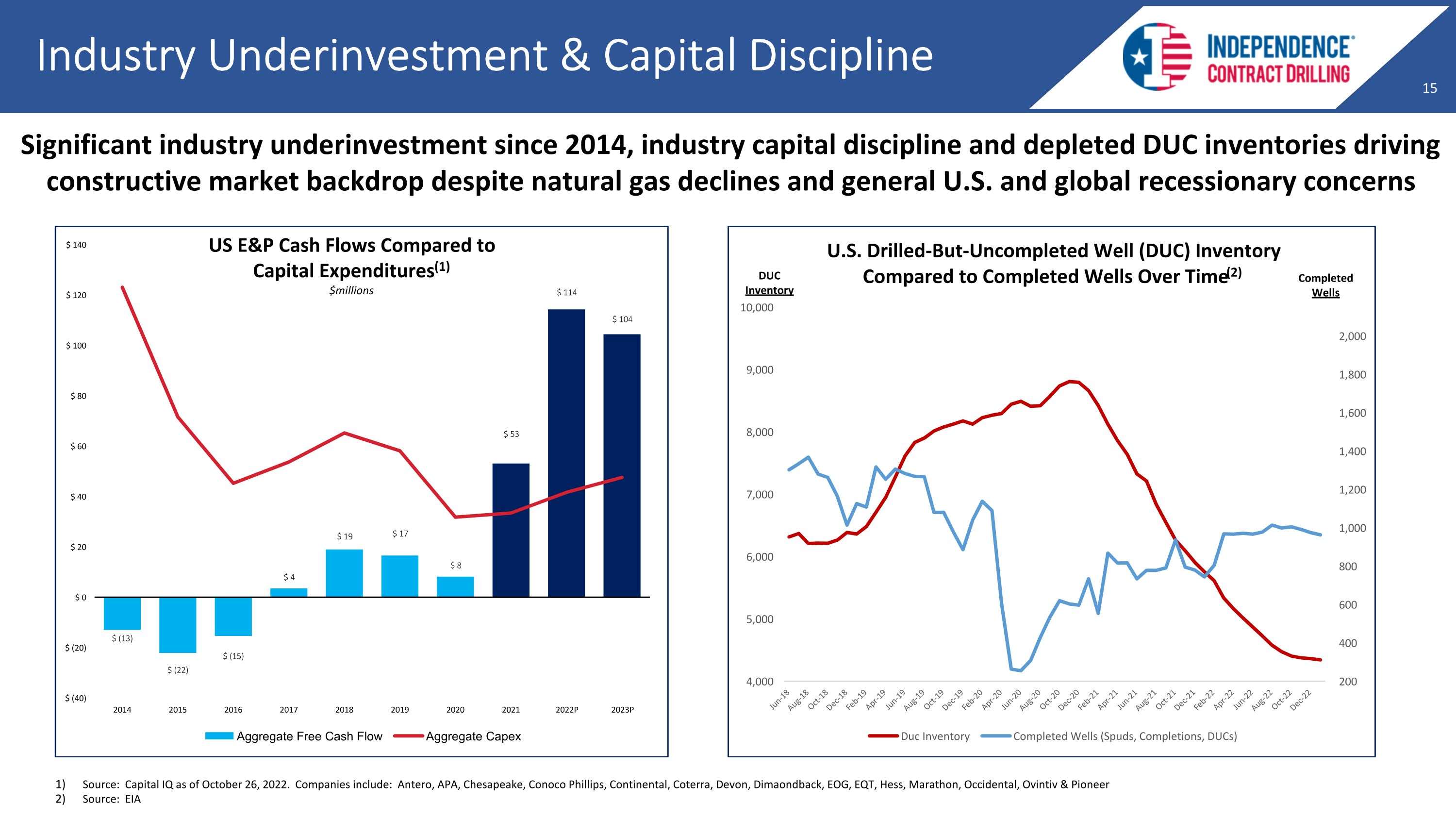

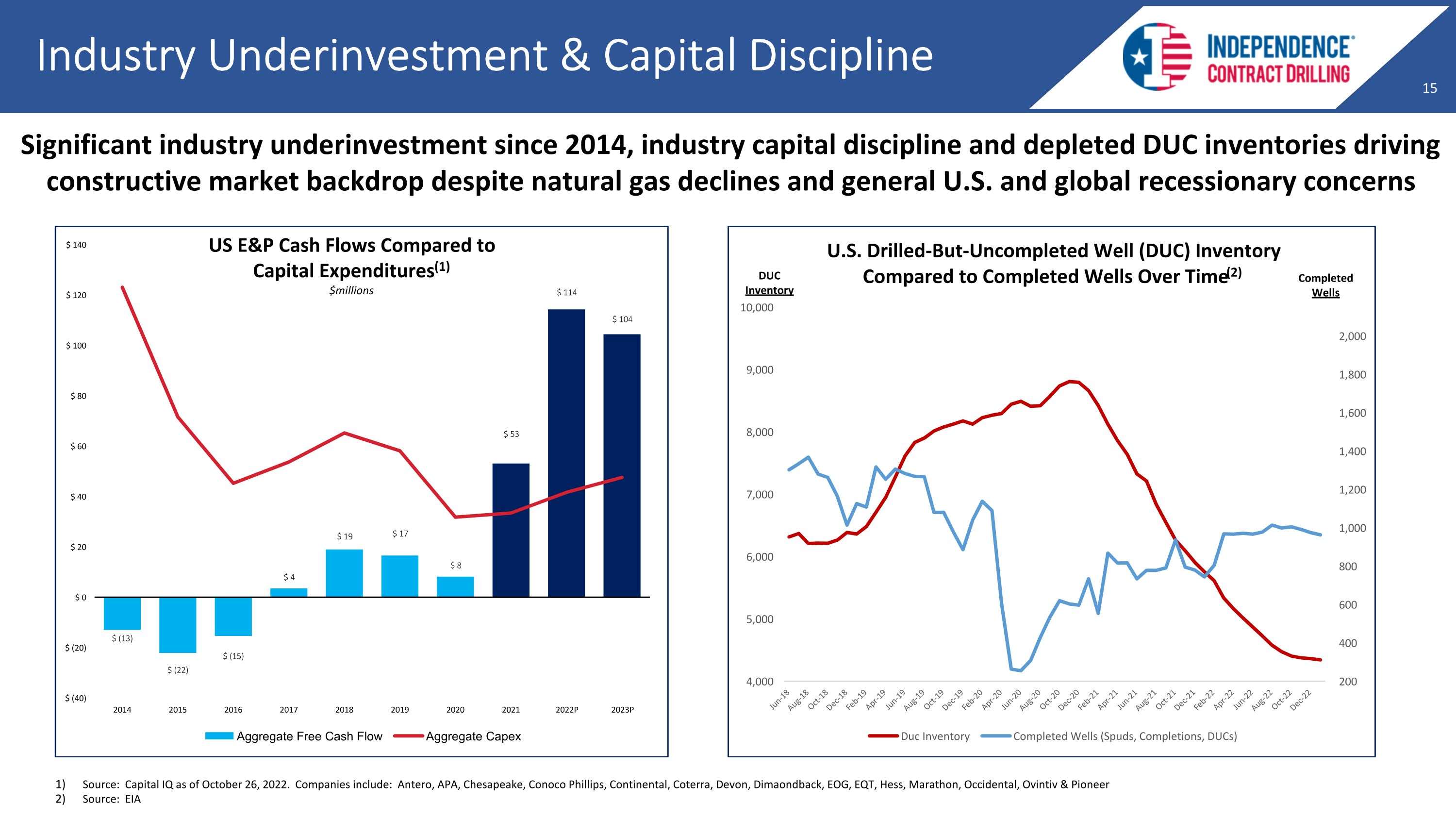

Industry Underinvestment & Capital Discipline Source: Capital IQ as of October 26, 2022. Companies include: Antero, APA, Chesapeake, Conoco Phillips, Continental, Coterra, Devon, Dimaondback, EOG, EQT, Hess, Marathon, Occidental, Ovintiv & Pioneer Source: EIA DUC Inventory Completed Wells US E&P Cash Flows Compared to Capital Expenditures(1) $millions Significant industry underinvestment since 2014, industry capital discipline and depleted DUC inventories driving constructive market backdrop despite natural gas declines and general U.S. and global recessionary concerns

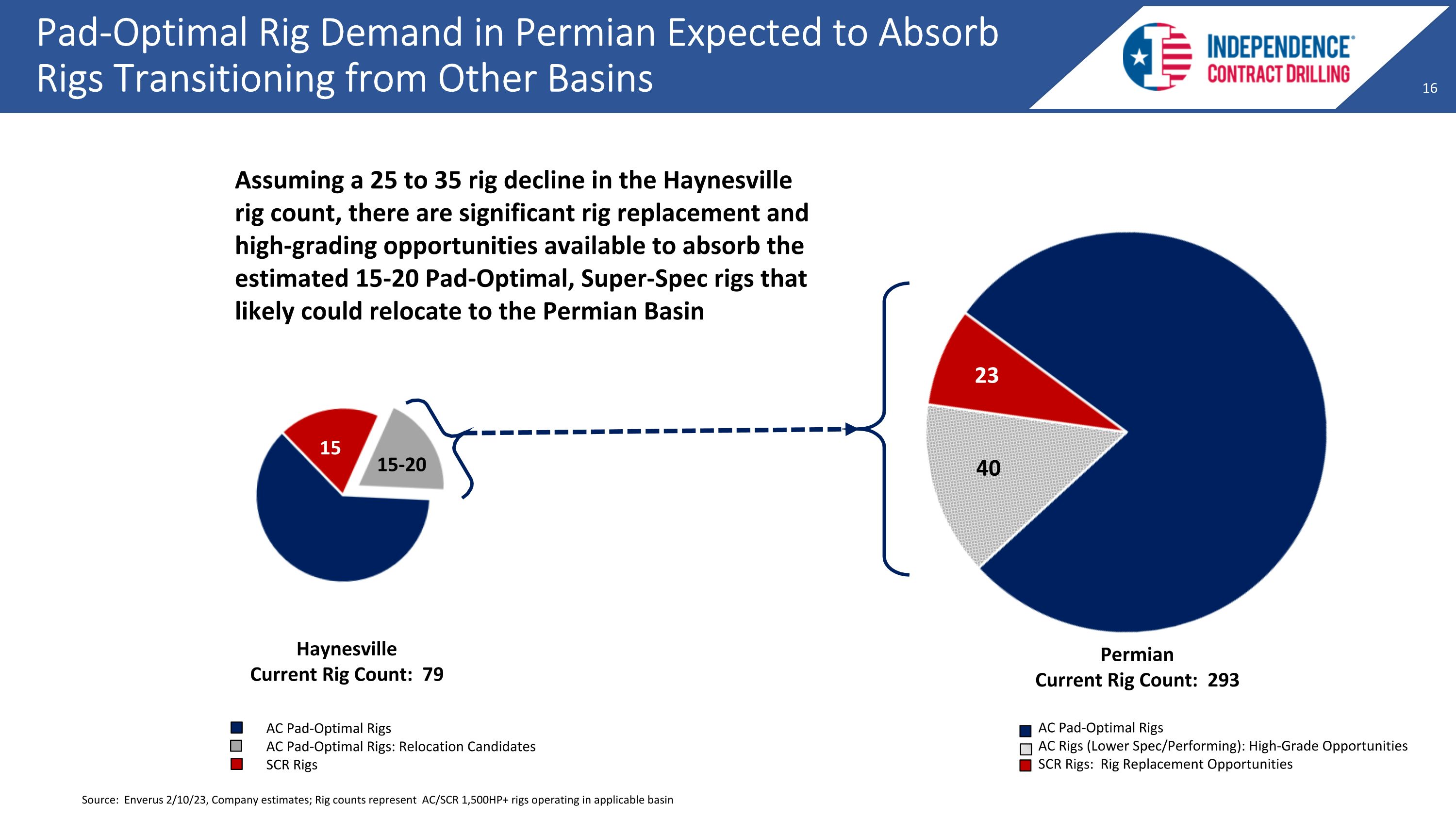

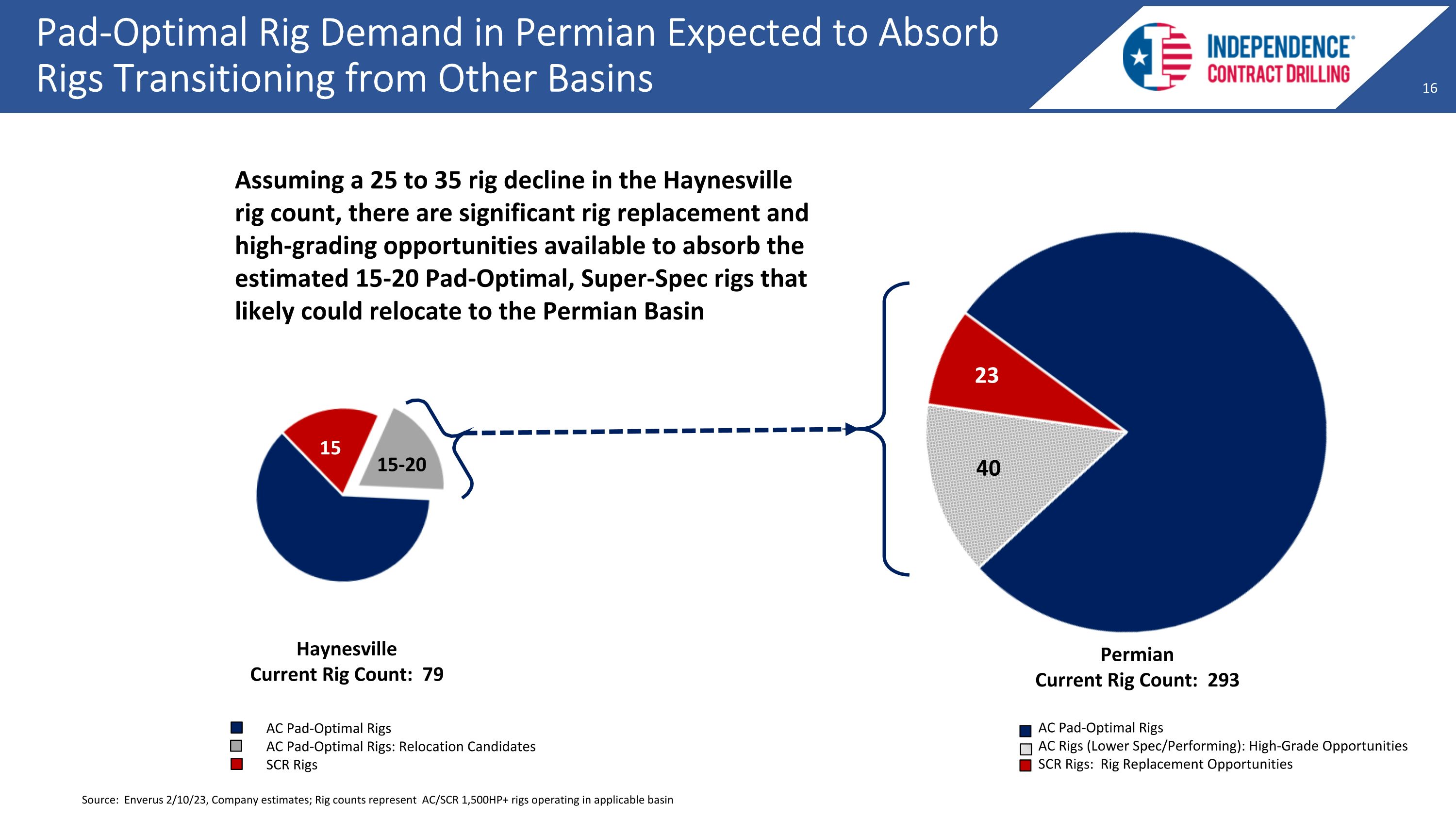

Pad-Optimal Rig Demand in Permian Expected to Absorb Rigs Transitioning from Other Basins AC Pad-Optimal Rigs AC Pad-Optimal Rigs: Relocation Candidates SCR Rigs Permian Current Rig Count: 293 Haynesville Current Rig Count: 79 Assuming a 25 to 35 rig decline in the Haynesville rig count, there are significant rig replacement and high-grading opportunities available to absorb the estimated 15-20 Pad-Optimal, Super-Spec rigs that likely could relocate to the Permian Basin AC Pad-Optimal Rigs AC Rigs (Lower Spec/Performing): High-Grade Opportunities SCR Rigs: Rig Replacement Opportunities 15 15-20 23 40 Source: Enverus 2/10/23, Company estimates; Rig counts represent AC/SCR 1,500HP+ rigs operating in applicable basin

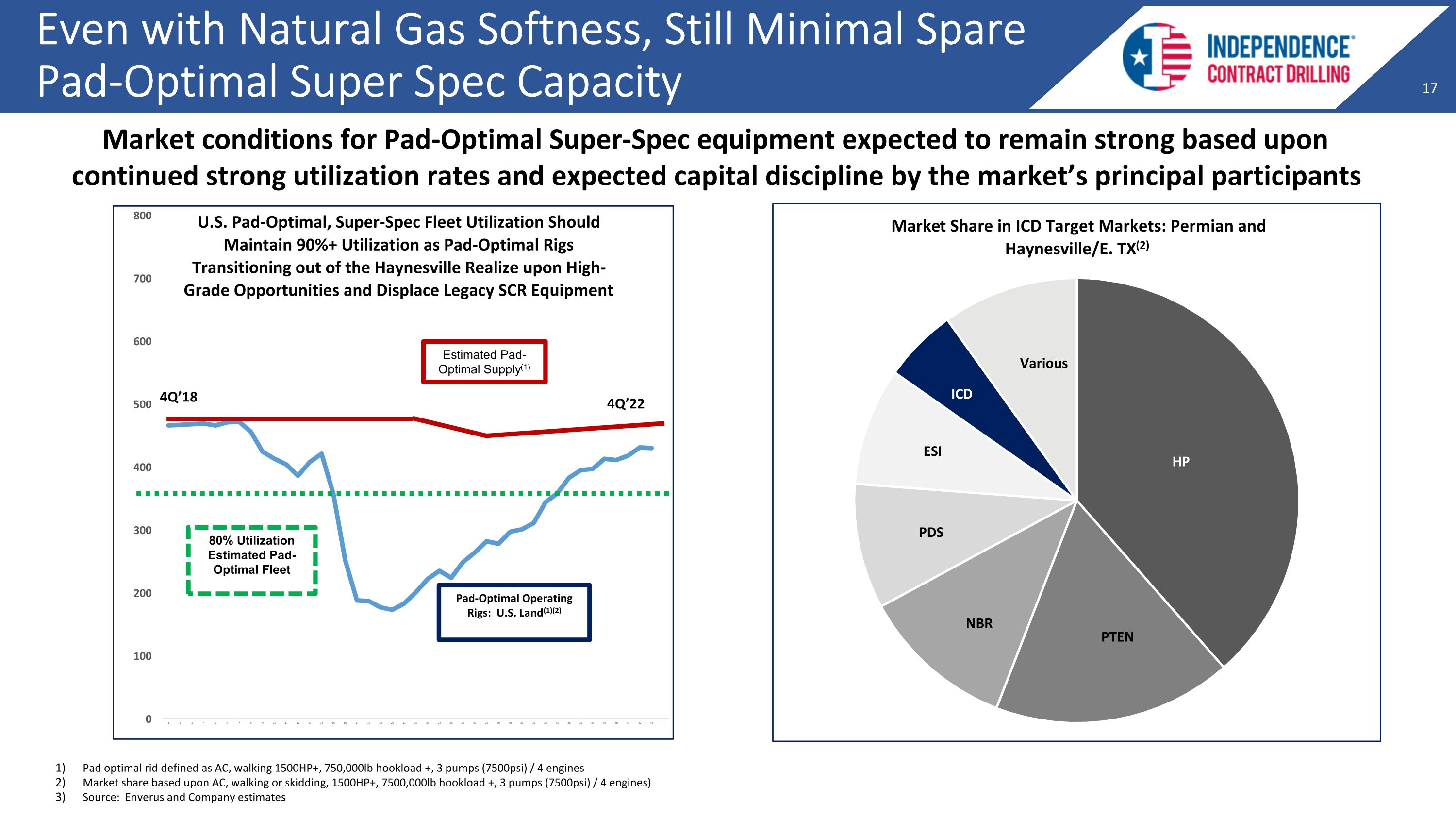

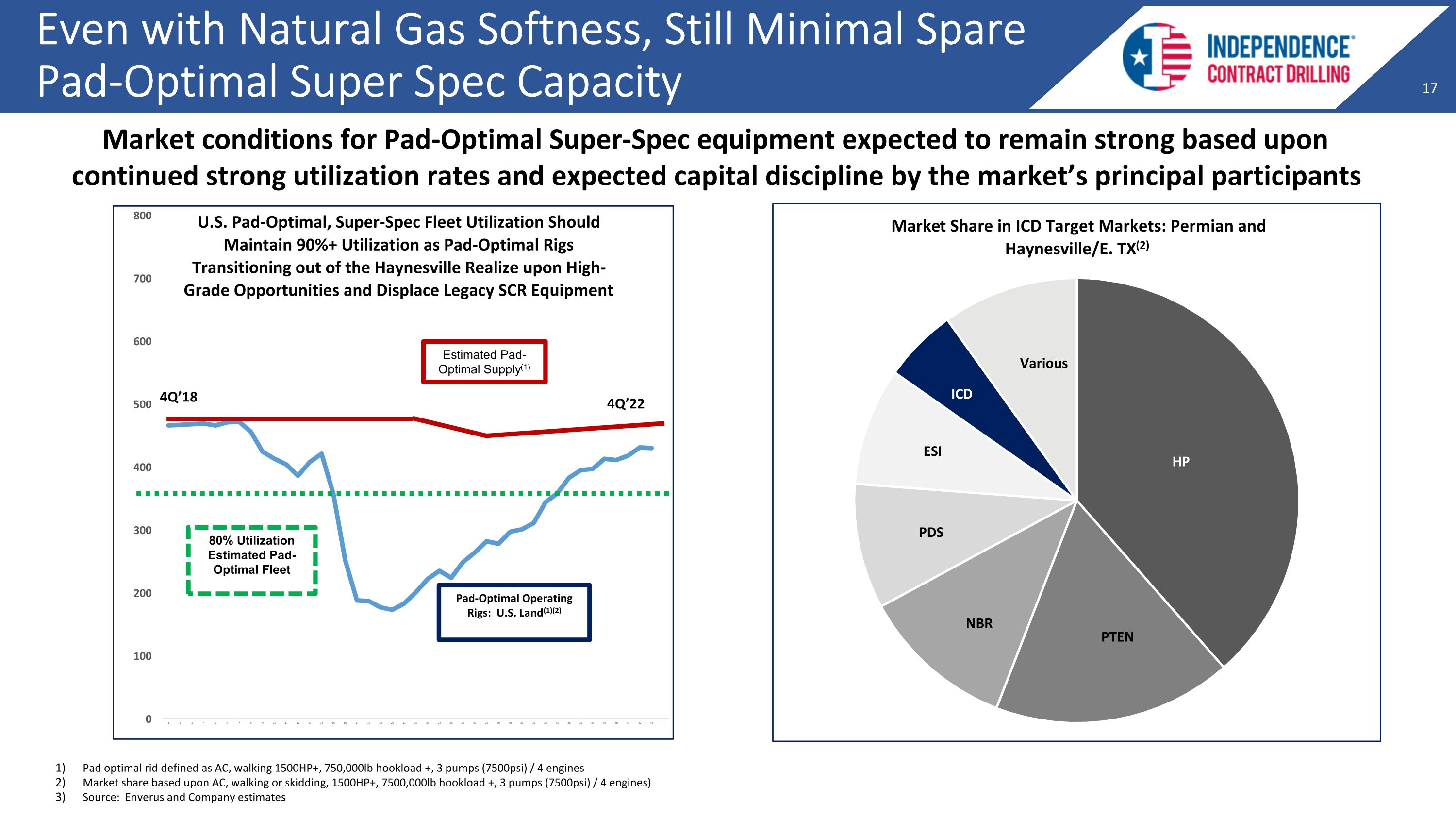

Even with Natural Gas Softness, Still Minimal Spare Pad-Optimal Super Spec Capacity Pad optimal rid defined as AC, walking 1500HP+, 750,000lb hookload +, 3 pumps (7500psi) / 4 engines Market share based upon AC, walking or skidding, 1500HP+, 7500,000lb hookload +, 3 pumps (7500psi) / 4 engines) Source: Enverus and Company estimates 80% Utilization Estimated Pad- Optimal Fleet Estimated Pad- Optimal Supply(1) Pad-Optimal Operating Rigs: U.S. Land(1)(2) 4Q’22 Market conditions for Pad-Optimal Super-Spec equipment expected to remain strong based upon continued strong utilization rates and expected capital discipline by the market’s principal participants 4Q’18

Drivers of Returns and Free Cash Flow in Current Market

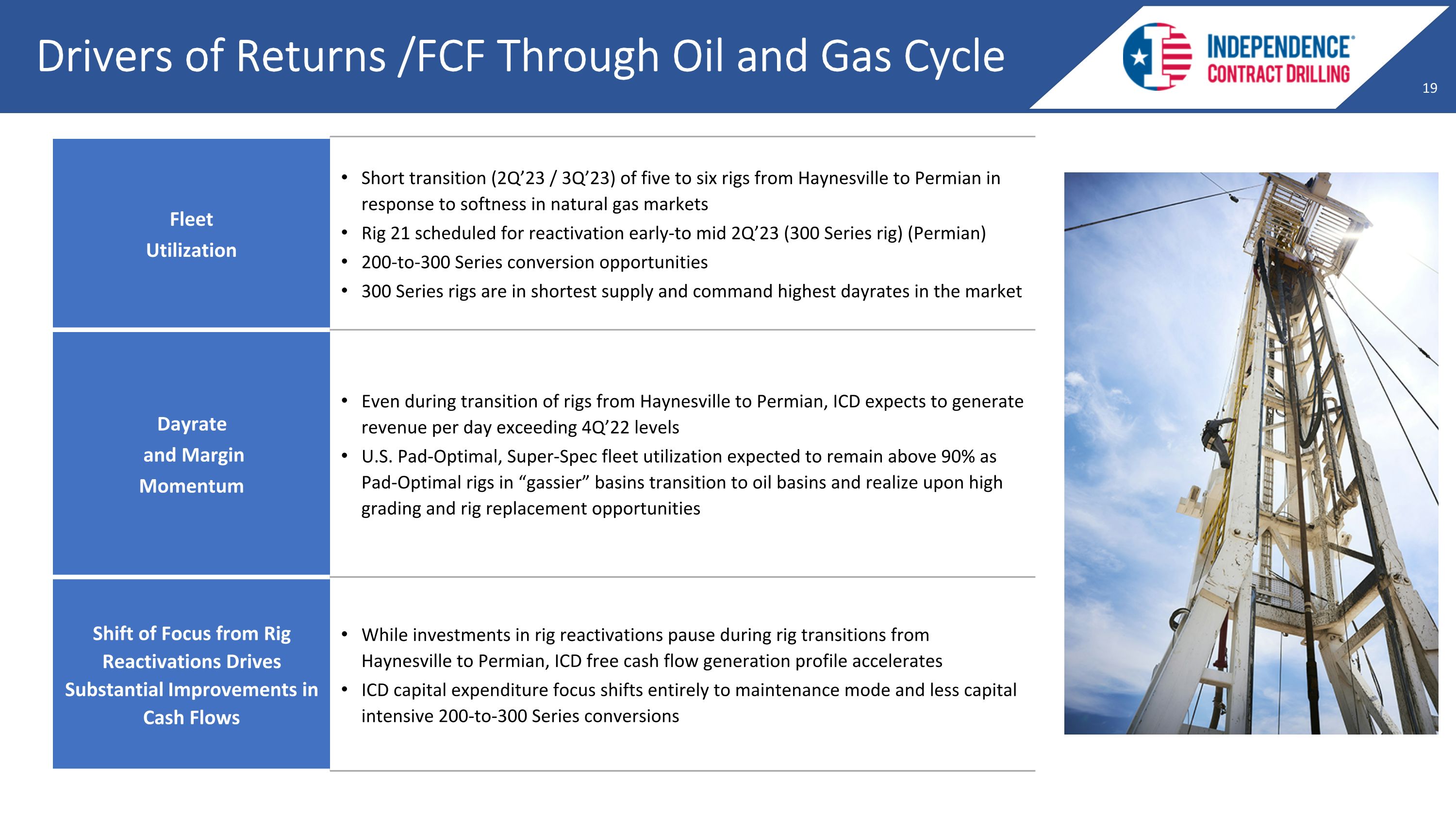

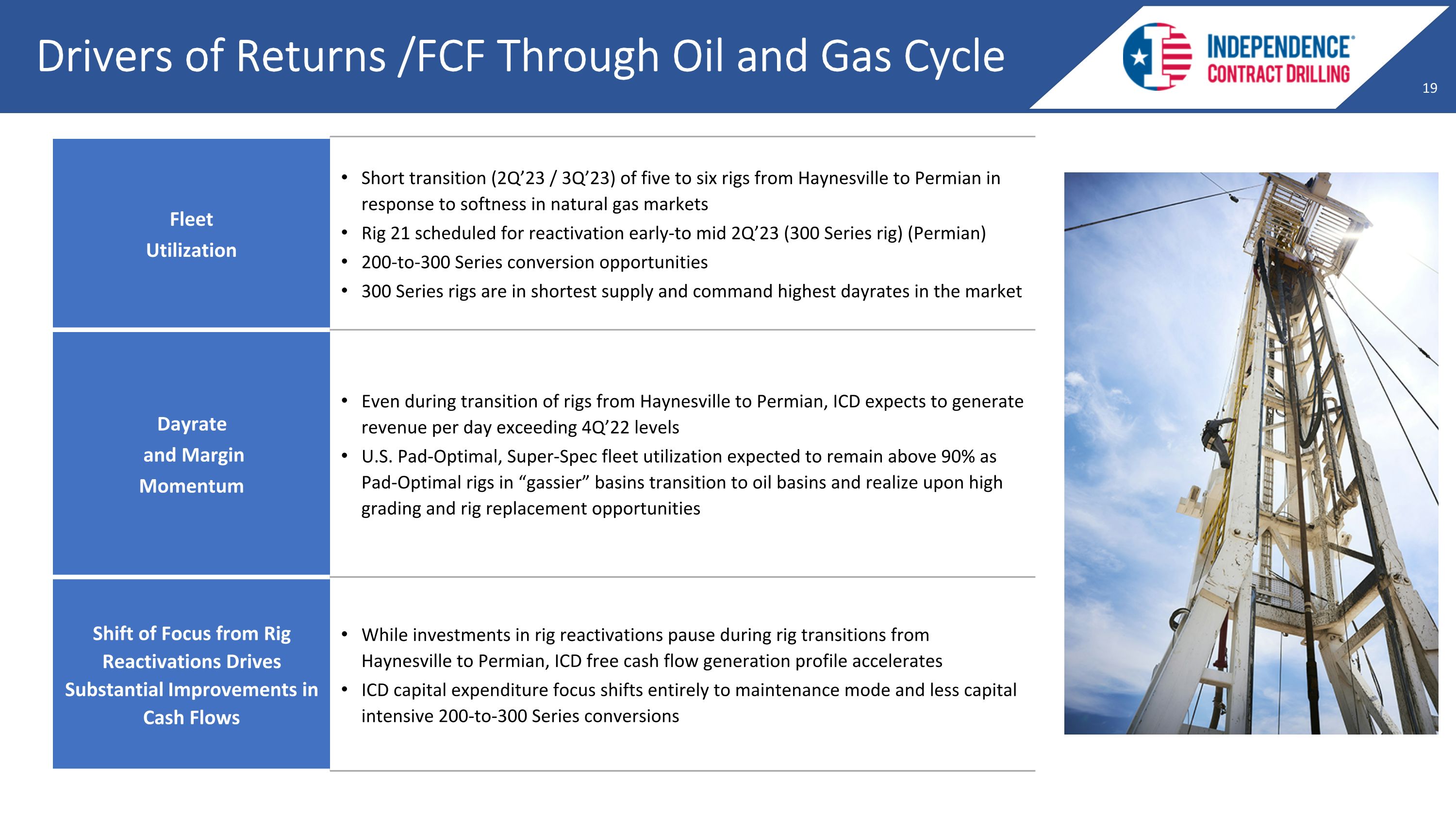

Drivers of Returns /FCF Through Oil and Gas Cycle Fleet Utilization Short transition (2Q’23 / 3Q’23) of five to six rigs from Haynesville to Permian in response to softness in natural gas markets Rig 21 scheduled for reactivation early-to mid 2Q’23 (300 Series rig) (Permian) 200-to-300 Series conversion opportunities 300 Series rigs are in shortest supply and command highest dayrates in the market Dayrate and Margin Momentum Even during transition of rigs from Haynesville to Permian, ICD expects to generate revenue per day exceeding 4Q’22 levels U.S. Pad-Optimal, Super-Spec fleet utilization expected to remain above 90% as Pad-Optimal rigs in “gassier” basins transition to oil basins and realize upon high grading and rig replacement opportunities Shift of Focus from Rig Reactivations Drives Substantial Improvements in Cash Flows While investments in rig reactivations pause during rig transitions from Haynesville to Permian, ICD free cash flow generation profile accelerates ICD capital expenditure focus shifts entirely to maintenance mode and less capital intensive 200-to-300 Series conversions

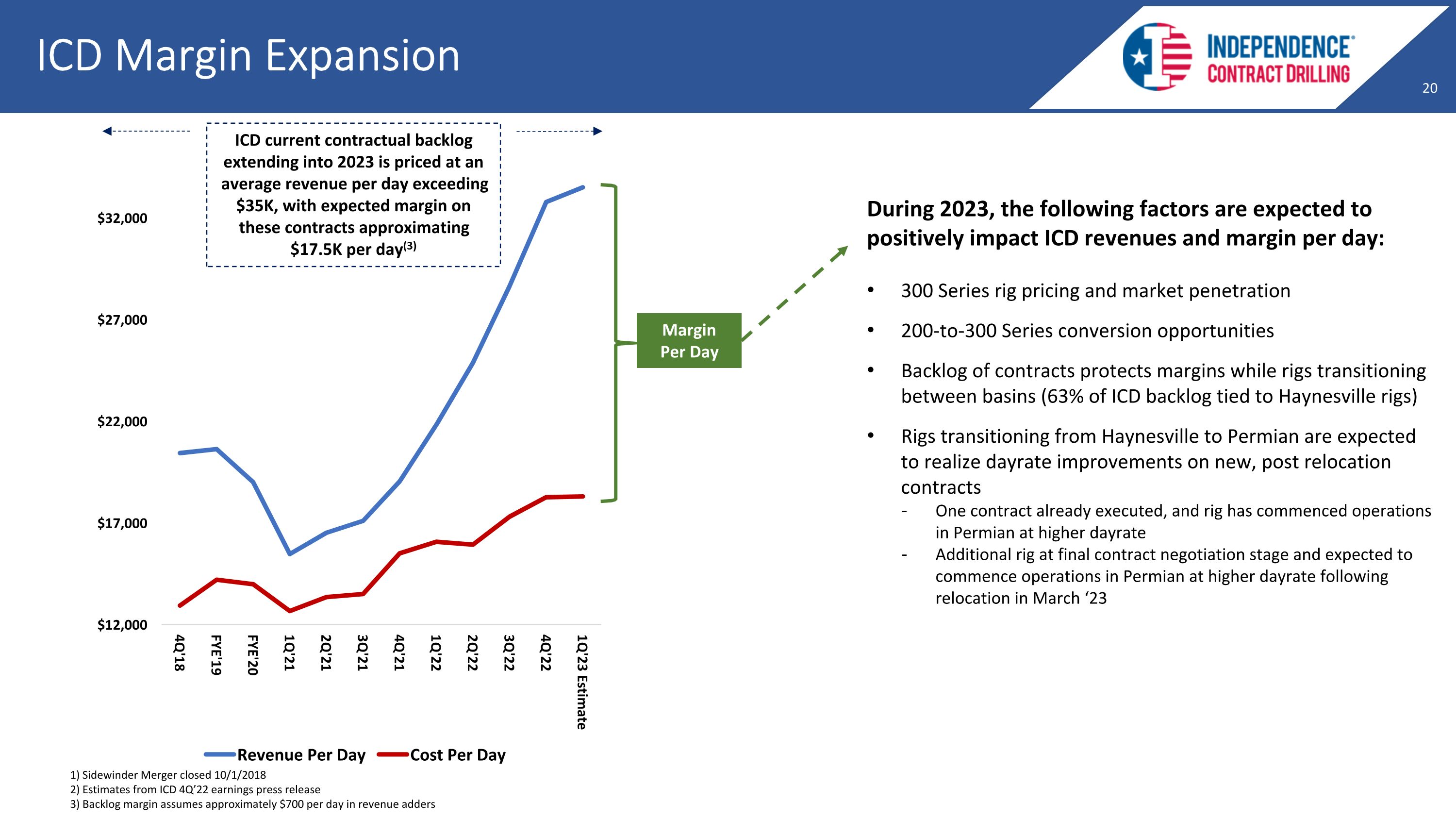

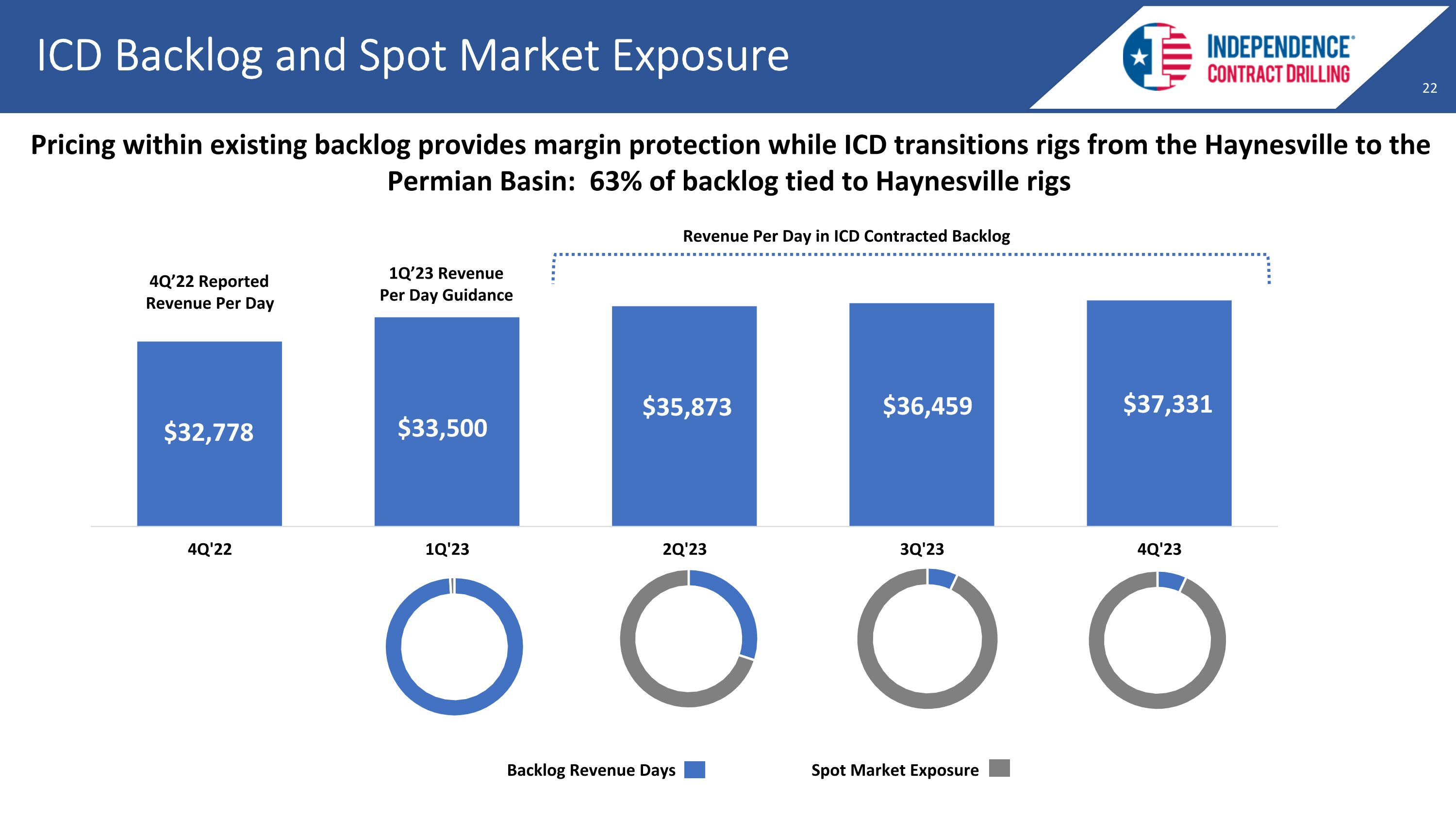

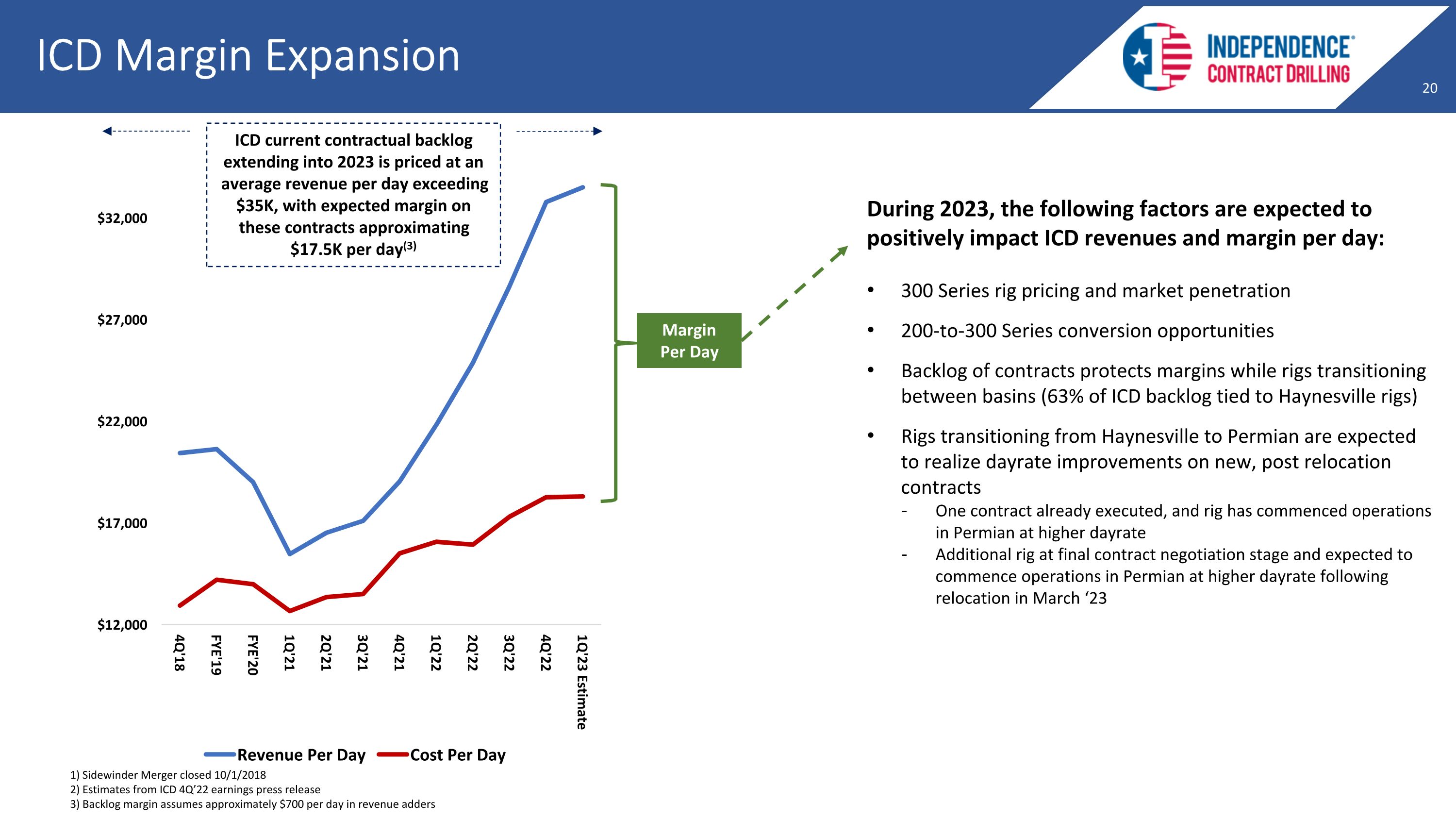

ICD Margin Expansion During 2023, the following factors are expected to positively impact ICD revenues and margin per day: 300 Series rig pricing and market penetration 200-to-300 Series conversion opportunities Backlog of contracts protects margins while rigs transitioning between basins (63% of ICD backlog tied to Haynesville rigs) Rigs transitioning from Haynesville to Permian are expected to realize dayrate improvements on new, post relocation contracts One contract already executed, and rig has commenced operations in Permian at higher dayrate Additional rig at final contract negotiation stage and expected to commence operations in Permian at higher dayrate following relocation in March ‘23 1) Sidewinder Merger closed 10/1/2018 2) Estimates from ICD 4Q’22 earnings press release 3) Backlog margin assumes approximately $700 per day in revenue adders Margin Per Day ICD current contractual backlog extending into 2023 is priced at an average revenue per day exceeding $35K, with expected margin on these contracts approximating $17.5K per day(3)

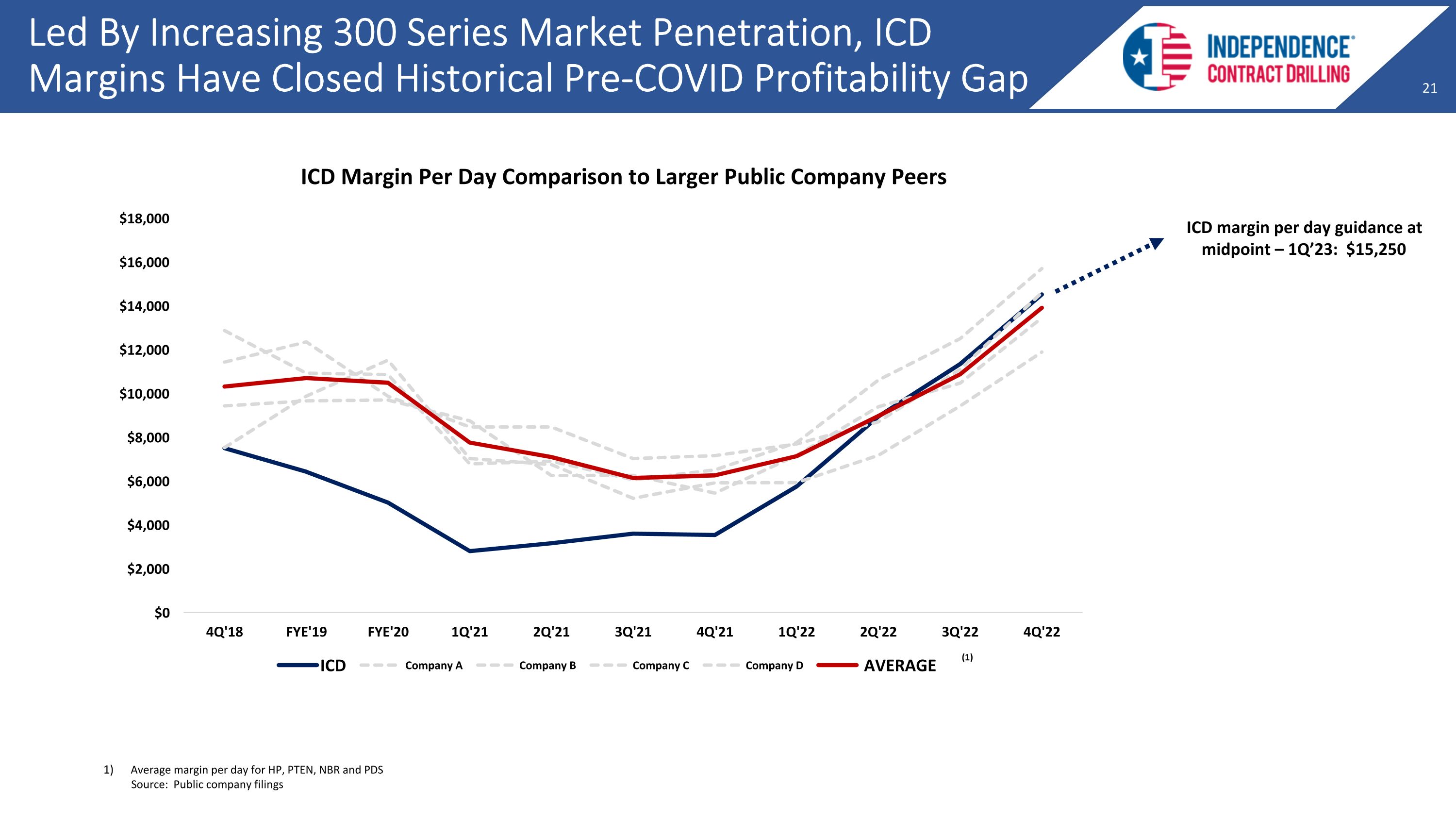

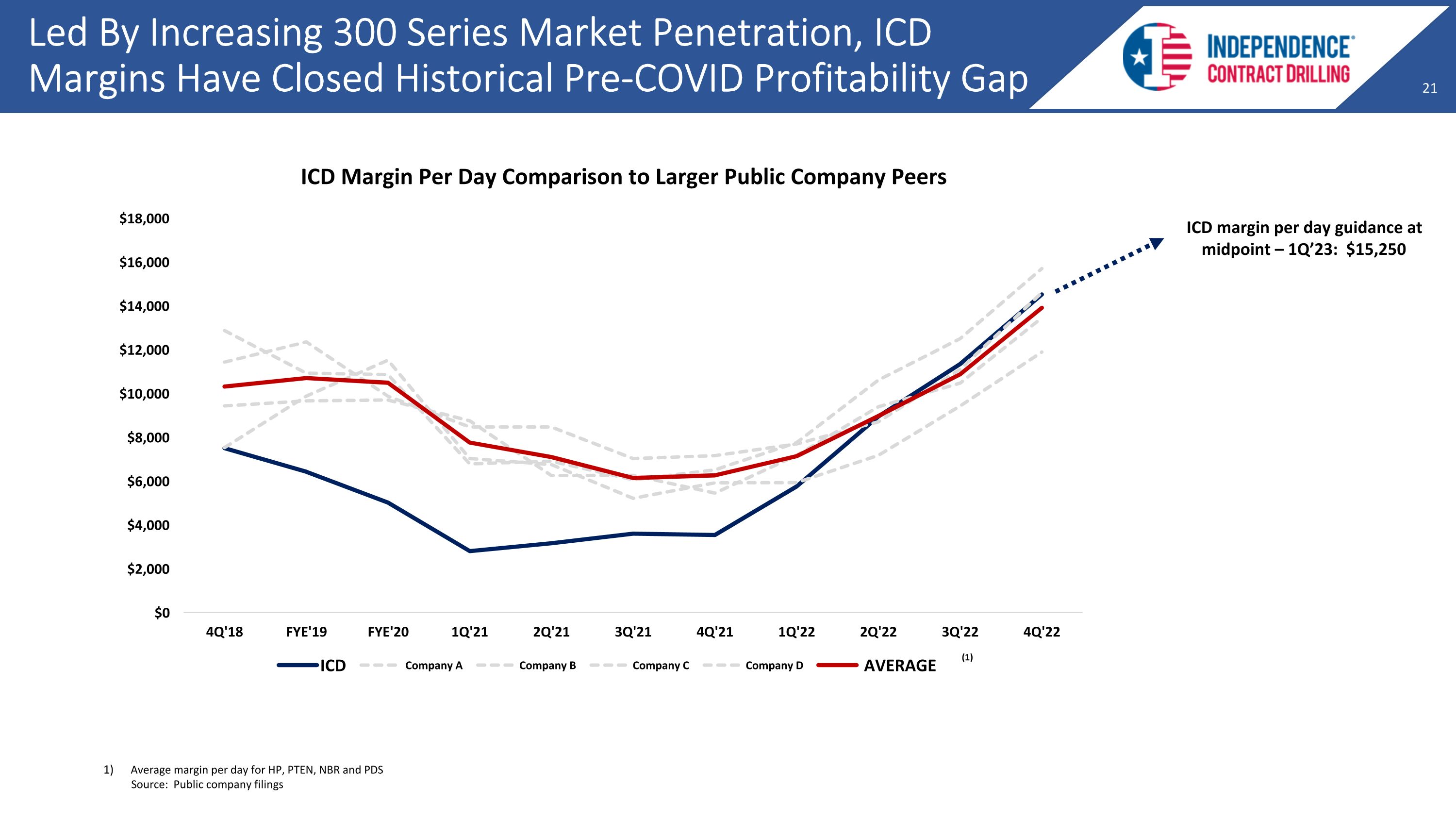

Led By Increasing 300 Series Market Penetration, ICD Margins Have Closed Historical Pre-COVID Profitability Gap (1) Average margin per day for HP, PTEN, NBR and PDS Source: Public company filings ICD margin per day guidance at midpoint – 1Q’23: $15,250

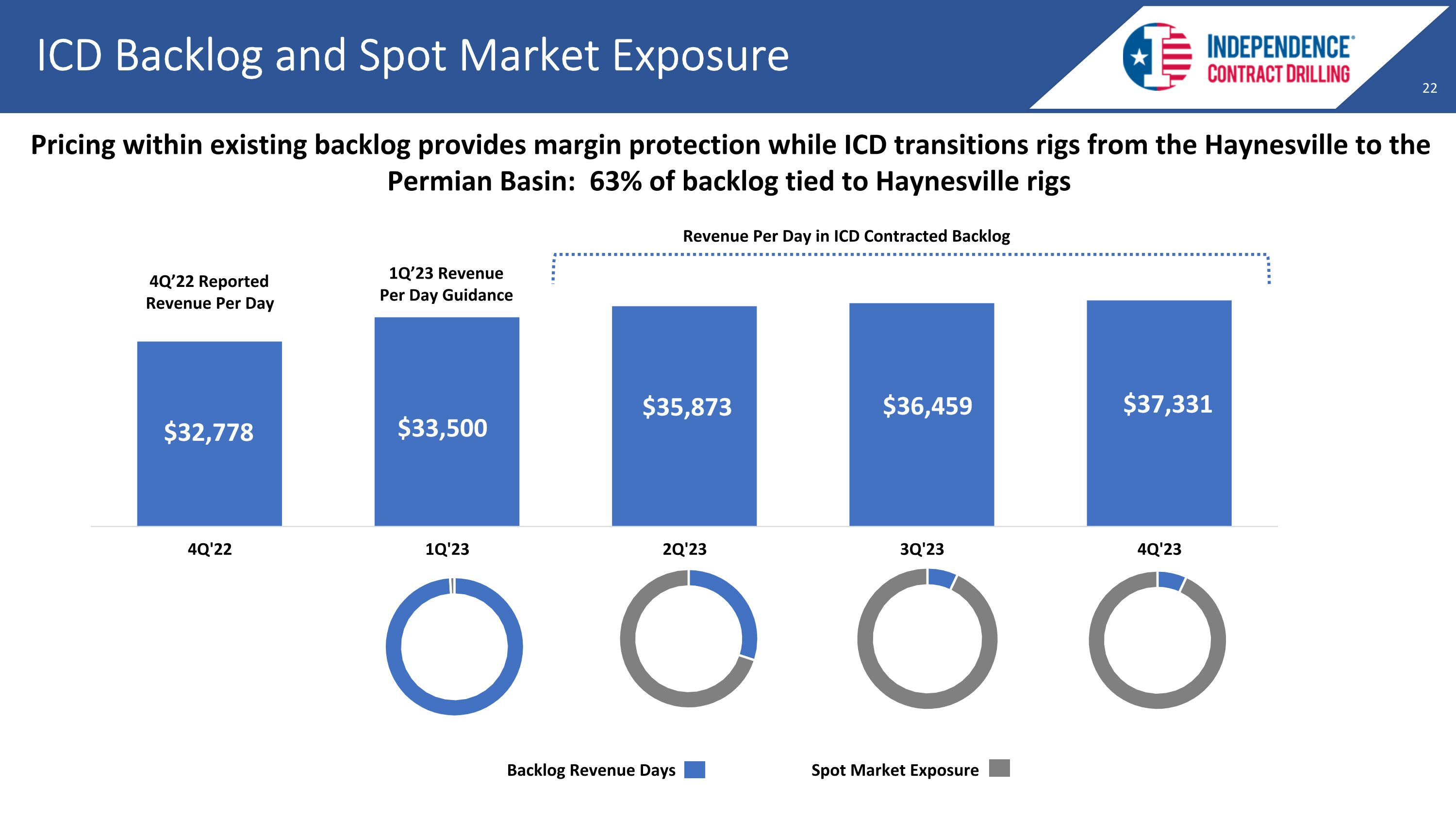

ICD Backlog and Spot Market Exposure 4Q’22 Reported Revenue Per Day Pricing within existing backlog provides margin protection while ICD transitions rigs from the Haynesville to the Permian Basin: 63% of backlog tied to Haynesville rigs Backlog Revenue Days Spot Market Exposure Revenue Per Day in ICD Contracted Backlog 1Q’23 Revenue Per Day Guidance $33,500 $35,873 $36,459 $37,331 $32,778

Drivers of Debt Reduction and Imbedded Value

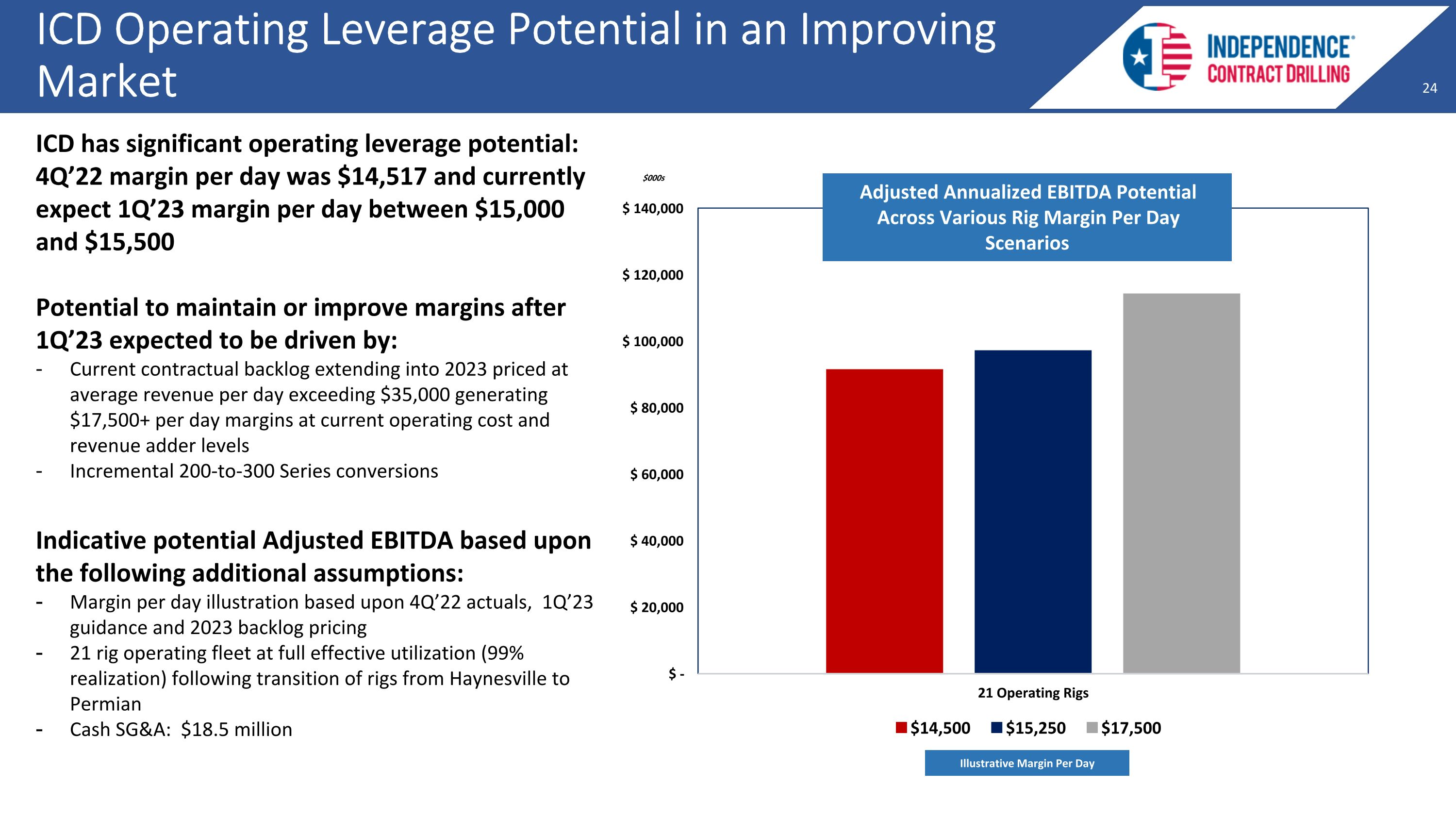

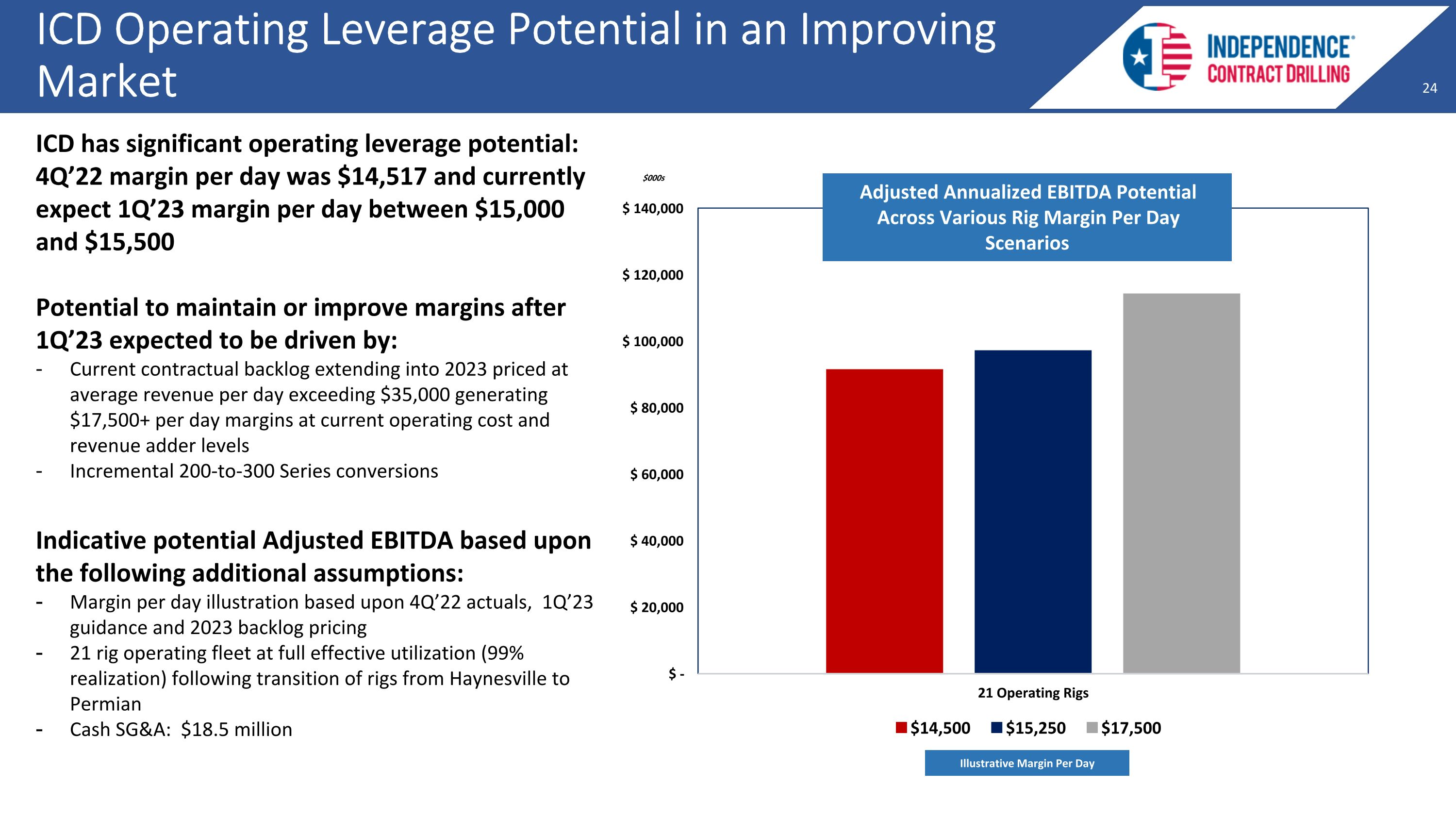

ICD Operating Leverage Potential in an Improving Market Adjusted Annualized EBITDA Potential Across Various Rig Margin Per Day Scenarios ICD has significant operating leverage potential: 4Q’22 margin per day was $14,517 and currently expect 1Q’23 margin per day between $15,000 and $15,500 Potential to maintain or improve margins after 1Q’23 expected to be driven by: Current contractual backlog extending into 2023 priced at average revenue per day exceeding $35,000 generating $17,500+ per day margins at current operating cost and revenue adder levels Incremental 200-to-300 Series conversions Indicative potential Adjusted EBITDA based upon the following additional assumptions: Margin per day illustration based upon 4Q’22 actuals, 1Q’23 guidance and 2023 backlog pricing 21 rig operating fleet at full effective utilization (99% realization) following transition of rigs from Haynesville to Permian Cash SG&A: $18.5 million $000s Illustrative Margin Per Day

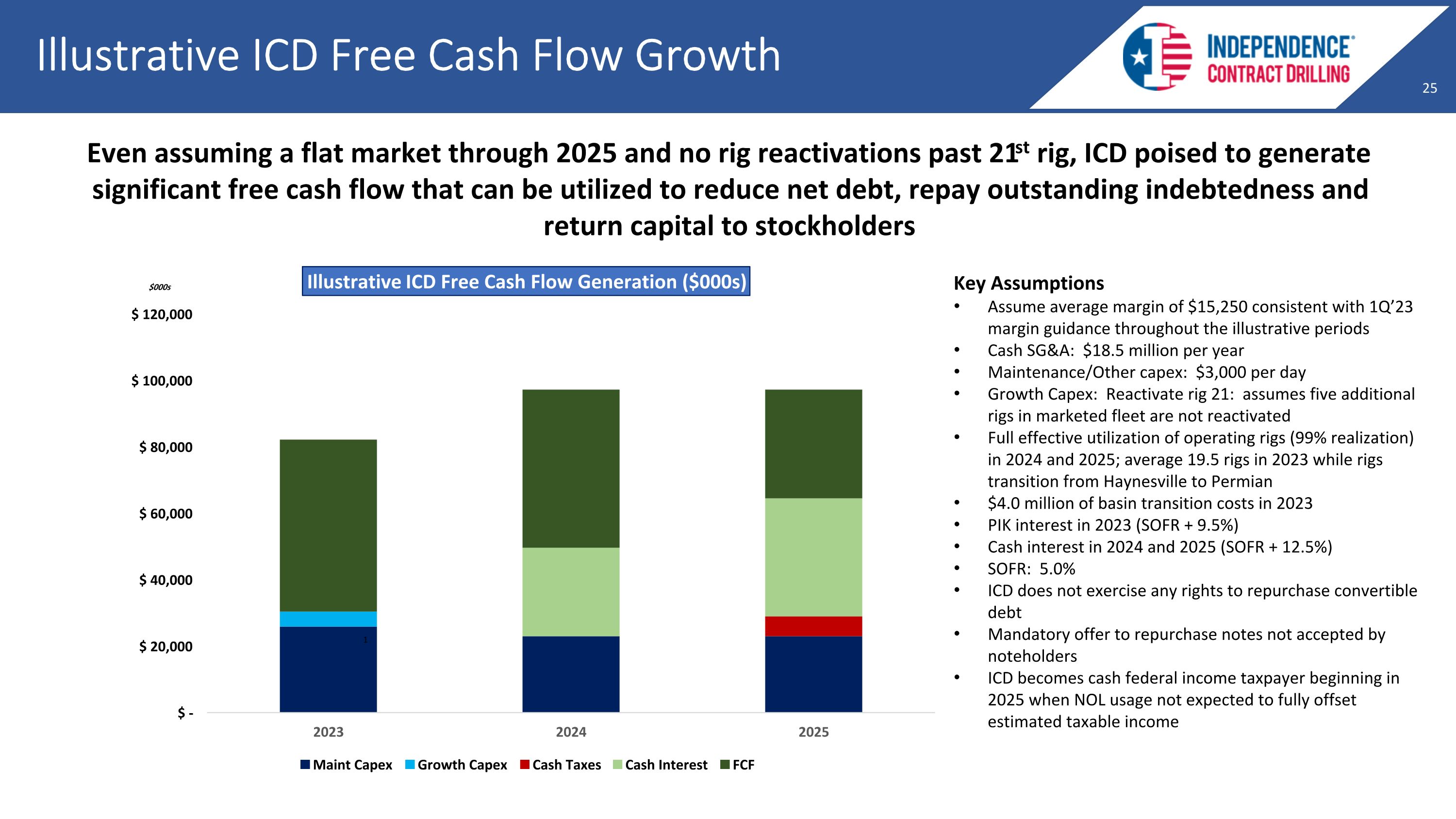

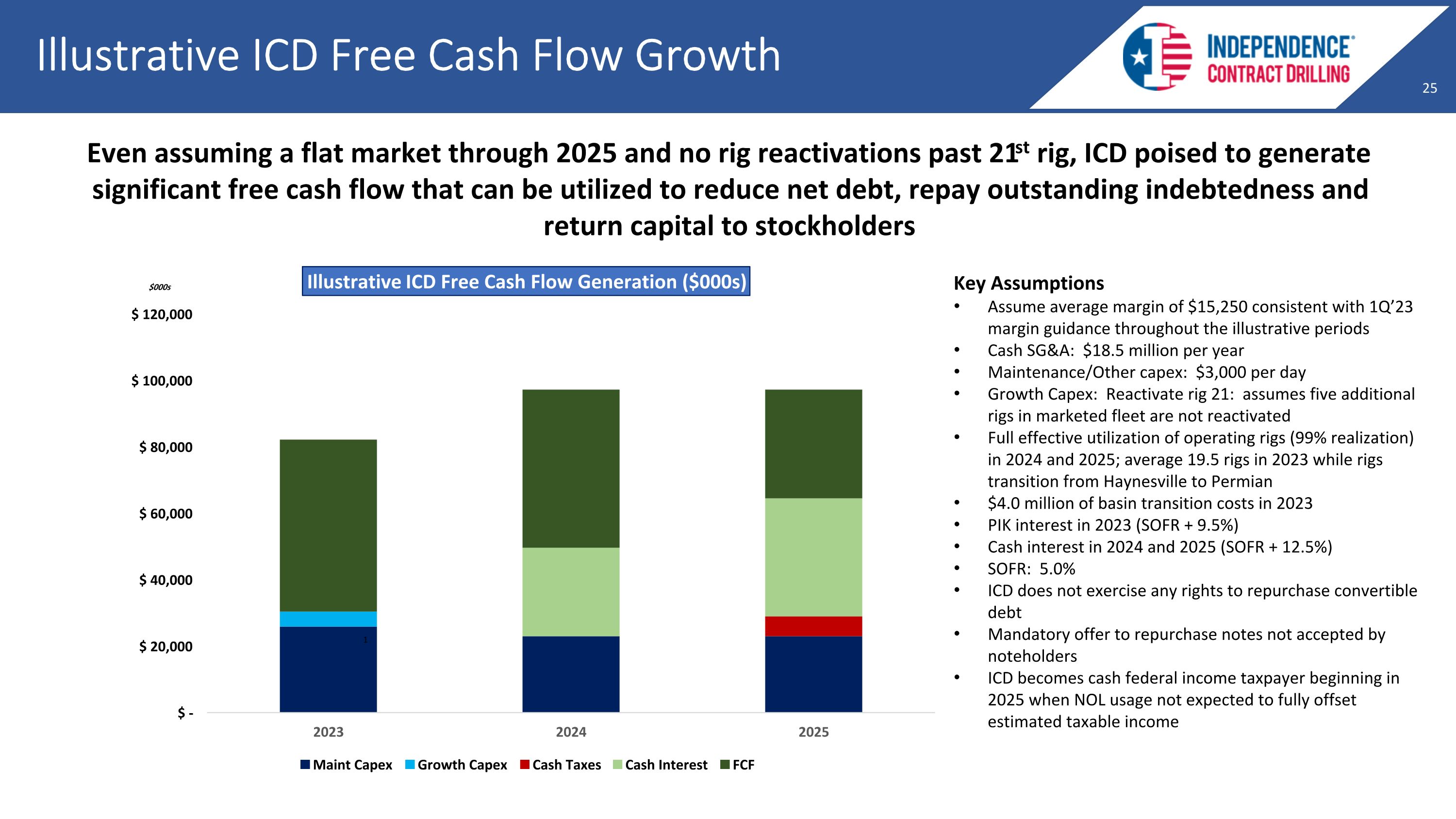

Illustrative ICD Free Cash Flow Growth $000s Key Assumptions Assume average margin of $15,250 consistent with 1Q’23 margin guidance throughout the illustrative periods Cash SG&A: $18.5 million per year Maintenance/Other capex: $3,000 per day Growth Capex: Reactivate rig 21: assumes five additional rigs in marketed fleet are not reactivated Full effective utilization of operating rigs (99% realization) in 2024 and 2025; average 19.5 rigs in 2023 while rigs transition from Haynesville to Permian $4.0 million of basin transition costs in 2023 PIK interest in 2023 (SOFR + 9.5%) Cash interest in 2024 and 2025 (SOFR + 12.5%) SOFR: 5.0% ICD does not exercise any rights to repurchase convertible debt Mandatory offer to repurchase notes not accepted by noteholders ICD becomes cash federal income taxpayer beginning in 2025 when NOL usage not expected to fully offset estimated taxable income 1 Even assuming a flat market through 2025 and no rig reactivations past 21st rig, ICD poised to generate significant free cash flow that can be utilized to reduce net debt, repay outstanding indebtedness and return capital to stockholders

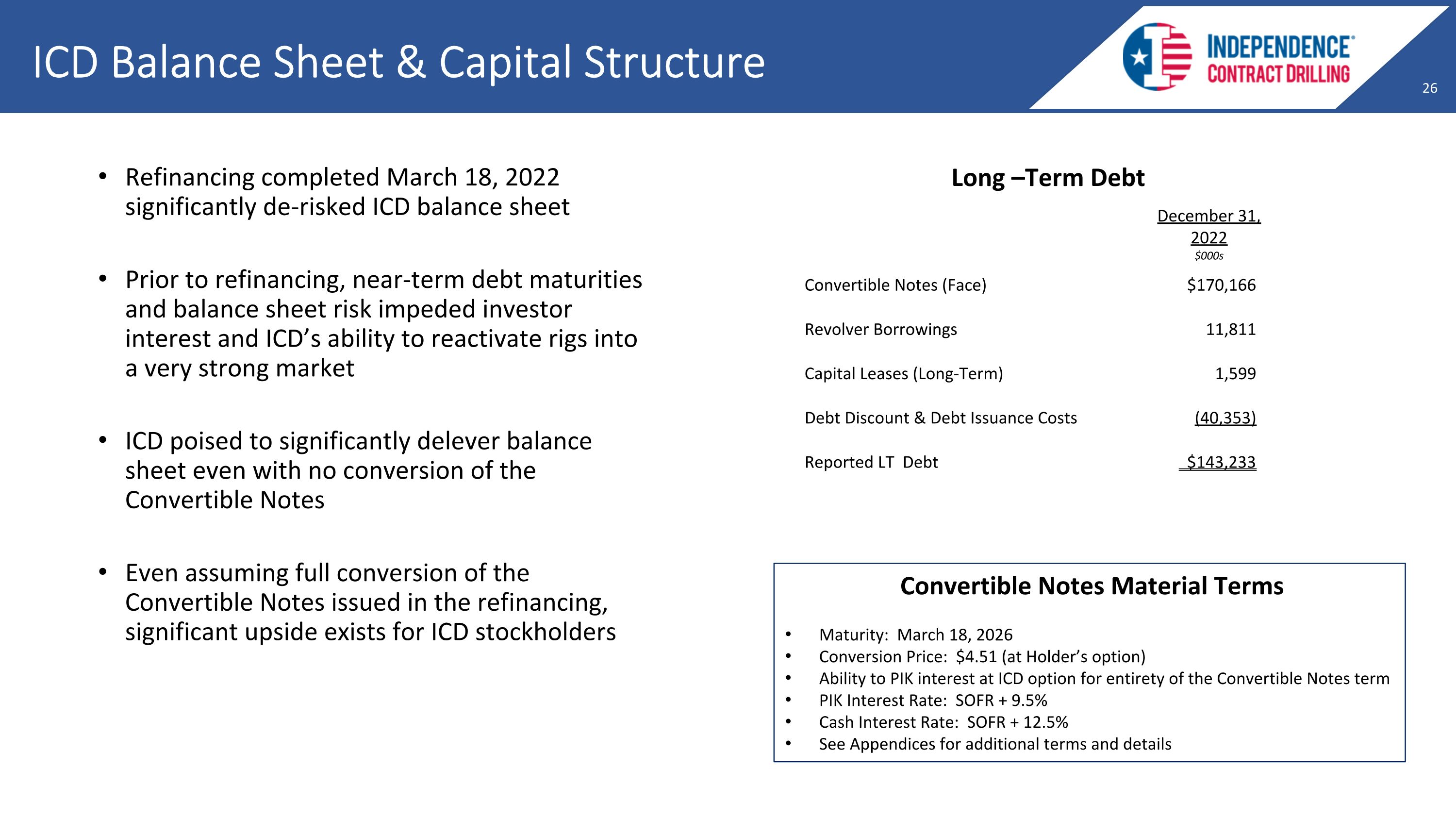

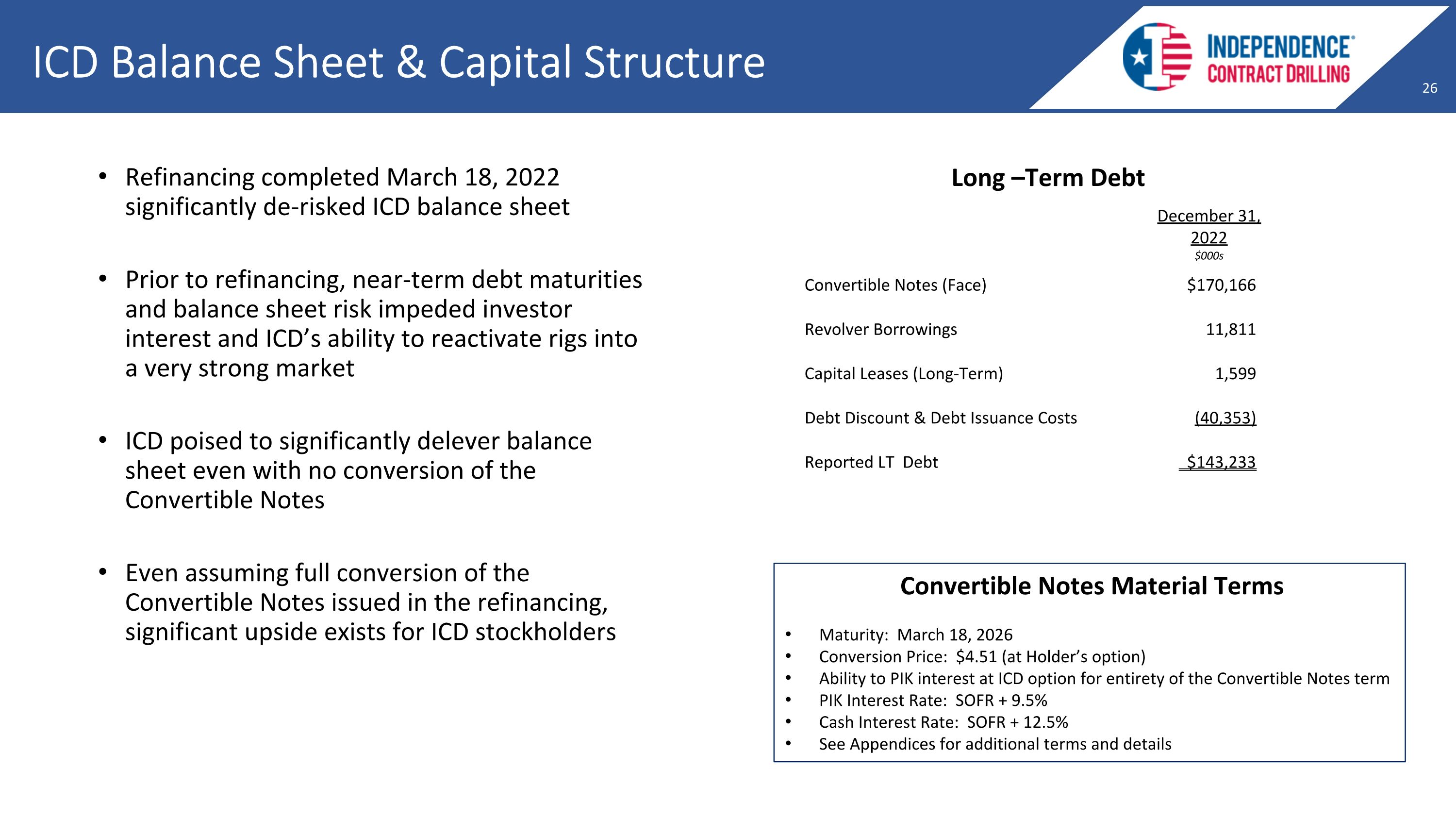

ICD Balance Sheet & Capital Structure Refinancing completed March 18, 2022 significantly de-risked ICD balance sheet Prior to refinancing, near-term debt maturities and balance sheet risk impeded investor interest and ICD’s ability to reactivate rigs into a very strong market ICD poised to significantly delever balance sheet even with no conversion of the Convertible Notes Even assuming full conversion of the Convertible Notes issued in the refinancing, significant upside exists for ICD stockholders Long –Term Debt December 31, 2022 $000s Convertible Notes (Face) $170,166 Revolver Borrowings 11,811 Capital Leases (Long-Term) 1,599 Debt Discount & Debt Issuance Costs (40,353) Reported LT Debt $143,233 Convertible Notes Material Terms Maturity: March 18, 2026 Conversion Price: $4.51 (at Holder’s option) Ability to PIK interest at ICD option for entirety of the Convertible Notes term PIK Interest Rate: SOFR + 9.5% Cash Interest Rate: SOFR + 12.5% See Appendices for additional terms and details

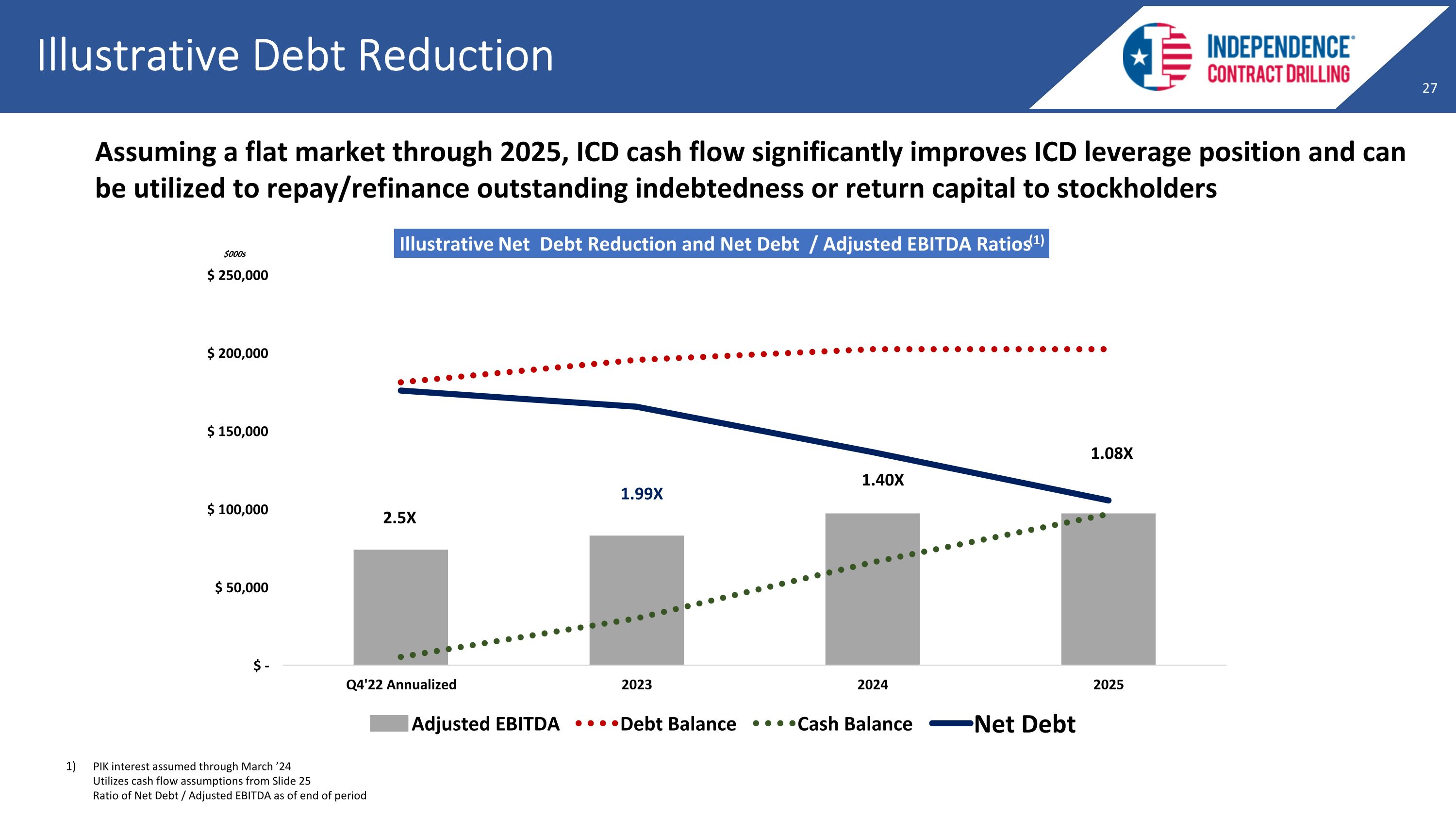

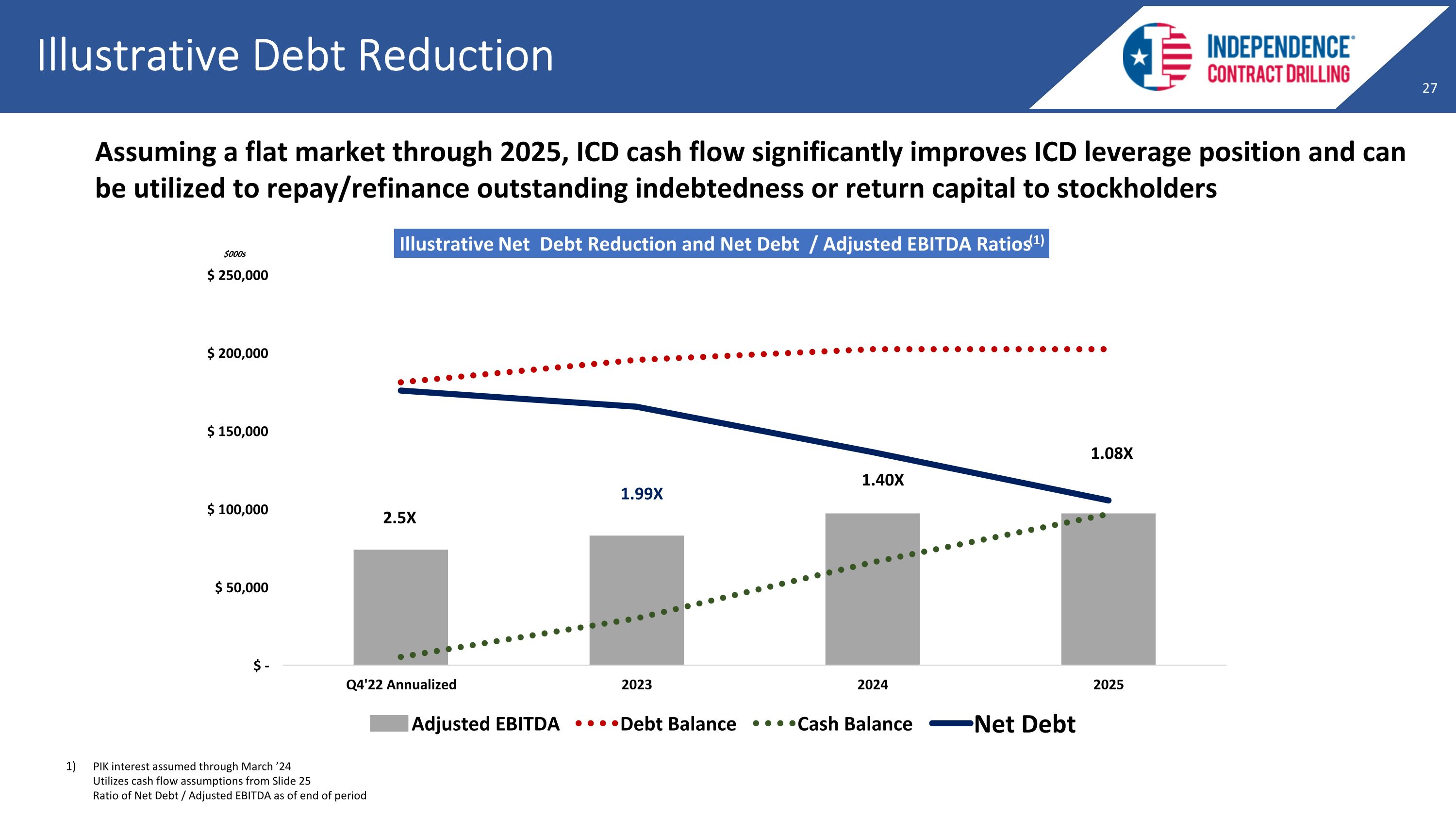

Illustrative Debt Reduction 1.40X 1.99X 2.5X Assuming a flat market through 2025, ICD cash flow significantly improves ICD leverage position and can be utilized to repay/refinance outstanding indebtedness or return capital to stockholders PIK interest assumed through March ’24 Utilizes cash flow assumptions from Slide 25 Ratio of Net Debt / Adjusted EBITDA as of end of period 1.08X $000s

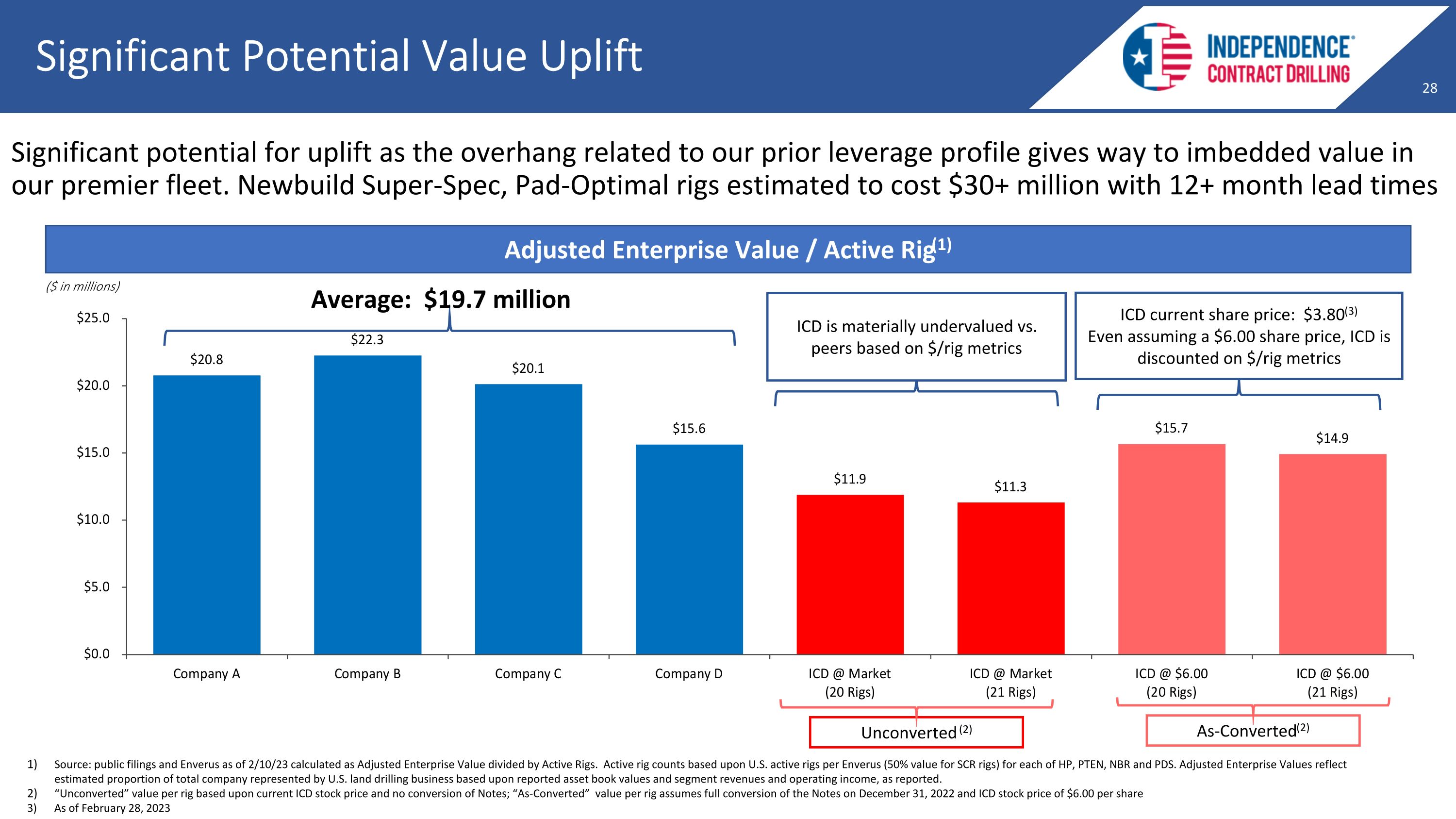

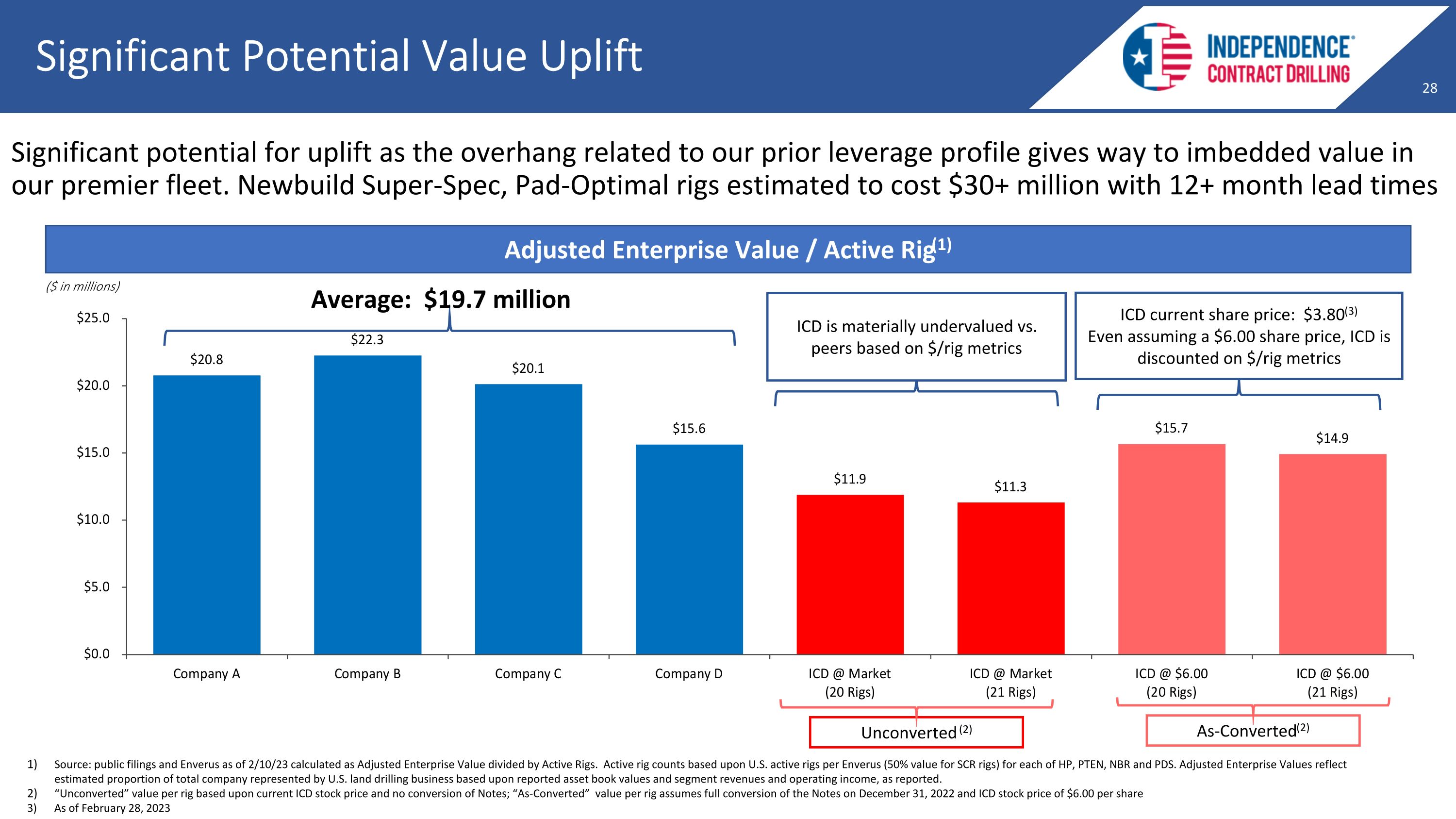

Significant potential for uplift as the overhang related to our prior leverage profile gives way to imbedded value in our premier fleet. Newbuild Super-Spec, Pad-Optimal rigs estimated to cost $30+ million with 12+ month lead times Adjusted Enterprise Value / Active Rig(1) ($ in millions) Significant Potential Value Uplift Source: public filings and Enverus as of 2/10/23 calculated as Adjusted Enterprise Value divided by Active Rigs. Active rig counts based upon U.S. active rigs per Enverus (50% value for SCR rigs) for each of HP, PTEN, NBR and PDS. Adjusted Enterprise Values reflect estimated proportion of total company represented by U.S. land drilling business based upon reported asset book values and segment revenues and operating income, as reported. “Unconverted” value per rig based upon current ICD stock price and no conversion of Notes; “As-Converted” value per rig assumes full conversion of the Notes on December 31, 2022 and ICD stock price of $6.00 per share 3) As of February 28, 2023 Unconverted (2) As-Converted(2) ICD current share price: $3.80(3) Even assuming a $6.00 share price, ICD is discounted on $/rig metrics ICD is materially undervalued vs. peers based on $/rig metrics Average: $19.7 million

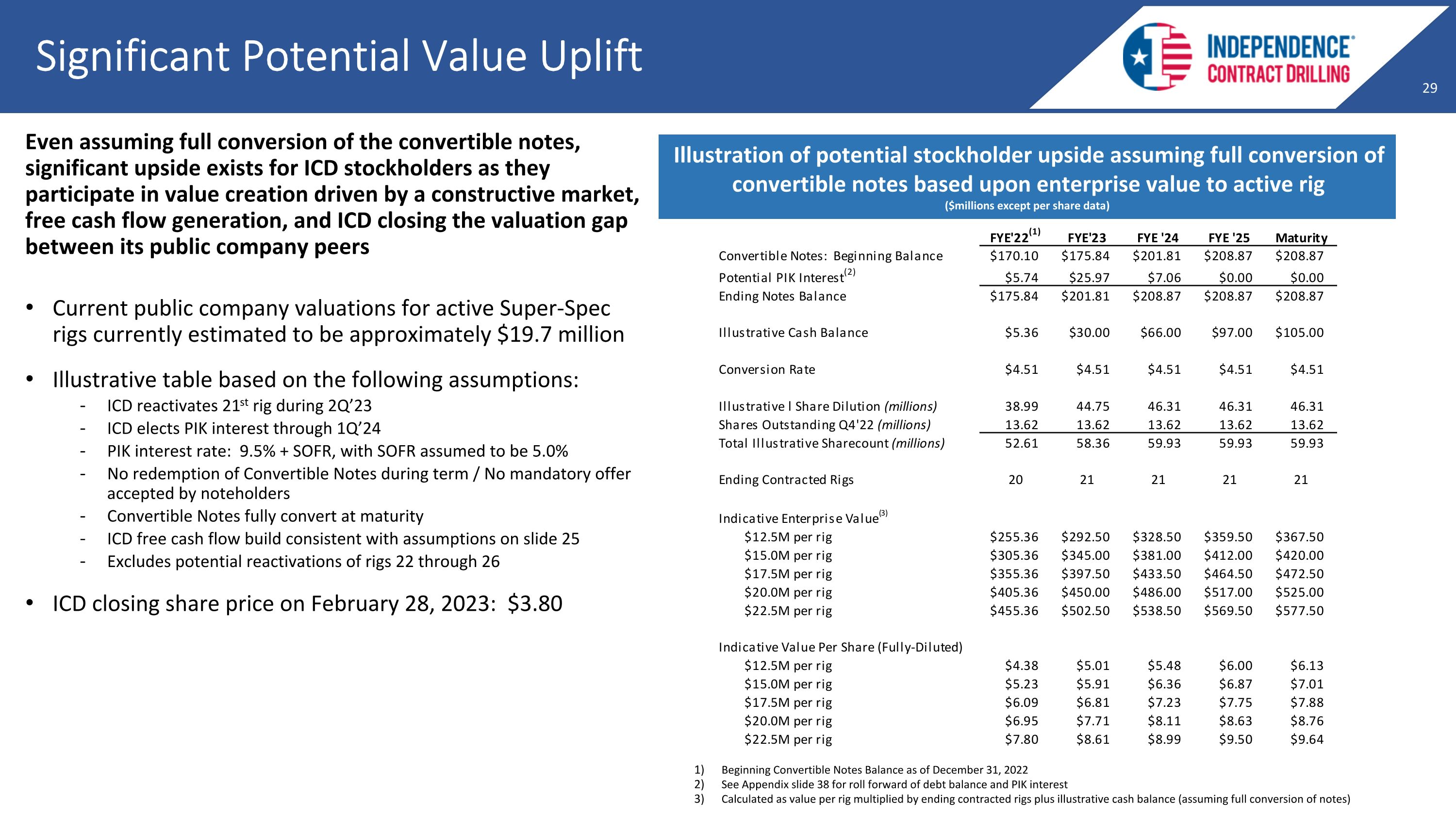

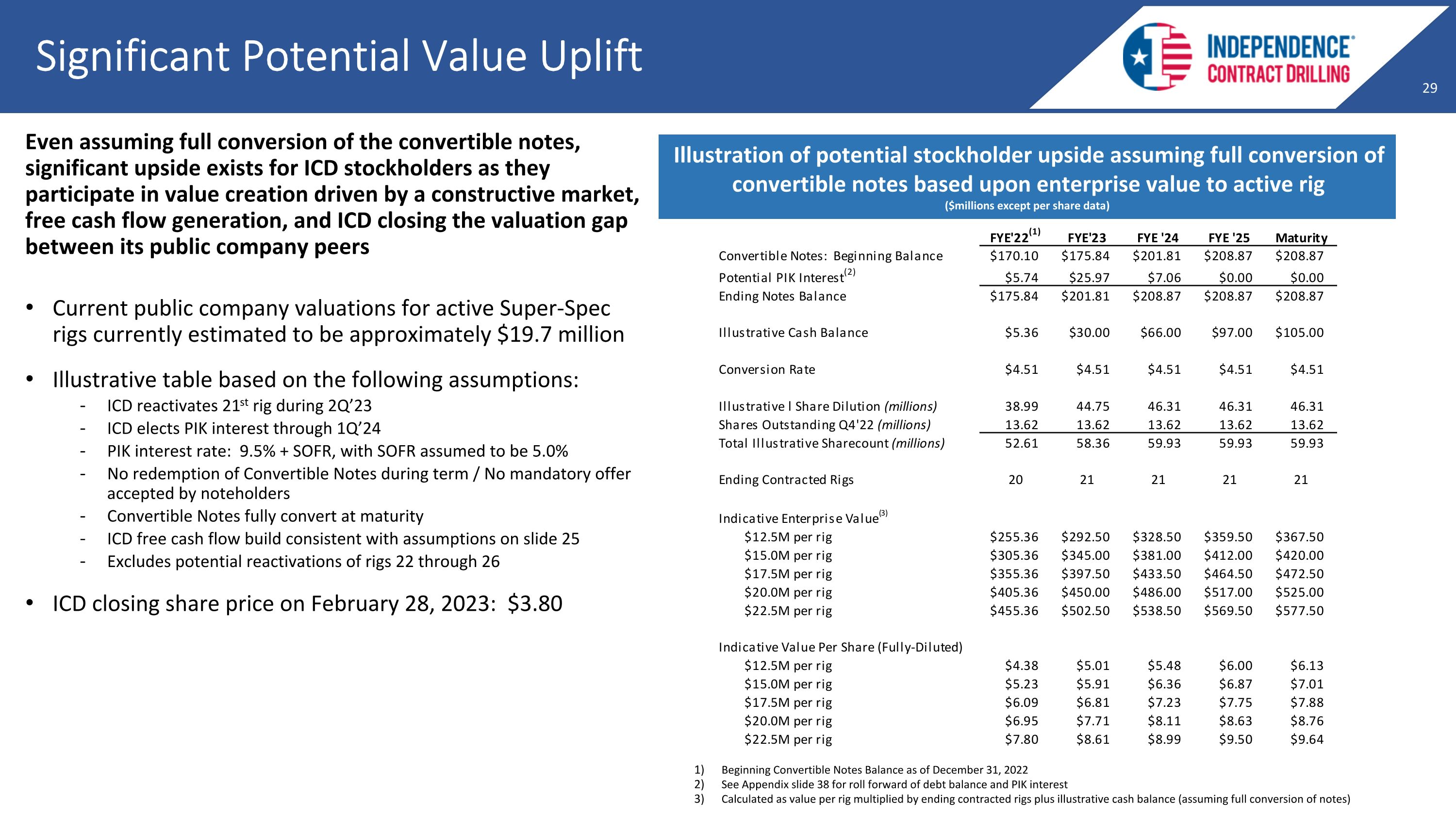

Even assuming full conversion of the convertible notes, significant upside exists for ICD stockholders as they participate in value creation driven by a constructive market, free cash flow generation, and ICD closing the valuation gap between its public company peers Current public company valuations for active Super-Spec rigs currently estimated to be approximately $19.7 million Illustrative table based on the following assumptions: ICD reactivates 21st rig during 2Q’23 ICD elects PIK interest through 1Q’24 PIK interest rate: 9.5% + SOFR, with SOFR assumed to be 5.0% No redemption of Convertible Notes during term / No mandatory offer accepted by noteholders Convertible Notes fully convert at maturity ICD free cash flow build consistent with assumptions on slide 25 Excludes potential reactivations of rigs 22 through 26 ICD closing share price on February 28, 2023: $3.80 Significant Potential Value Uplift Illustration of potential stockholder upside assuming full conversion of convertible notes based upon enterprise value to active rig ($millions except per share data) Beginning Convertible Notes Balance as of December 31, 2022 See Appendix slide 38 for roll forward of debt balance and PIK interest Calculated as value per rig multiplied by ending contracted rigs plus illustrative cash balance (assuming full conversion of notes)

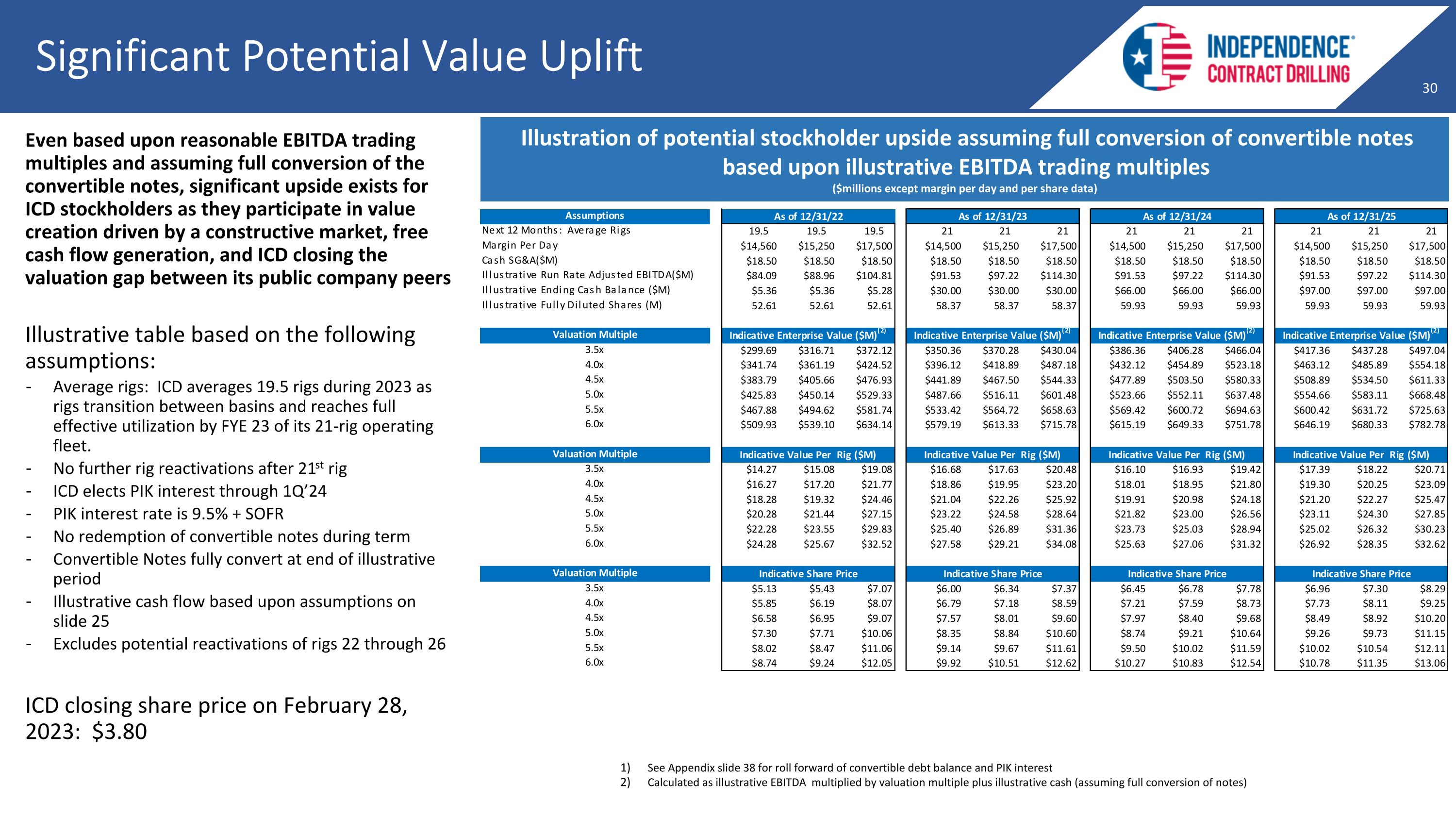

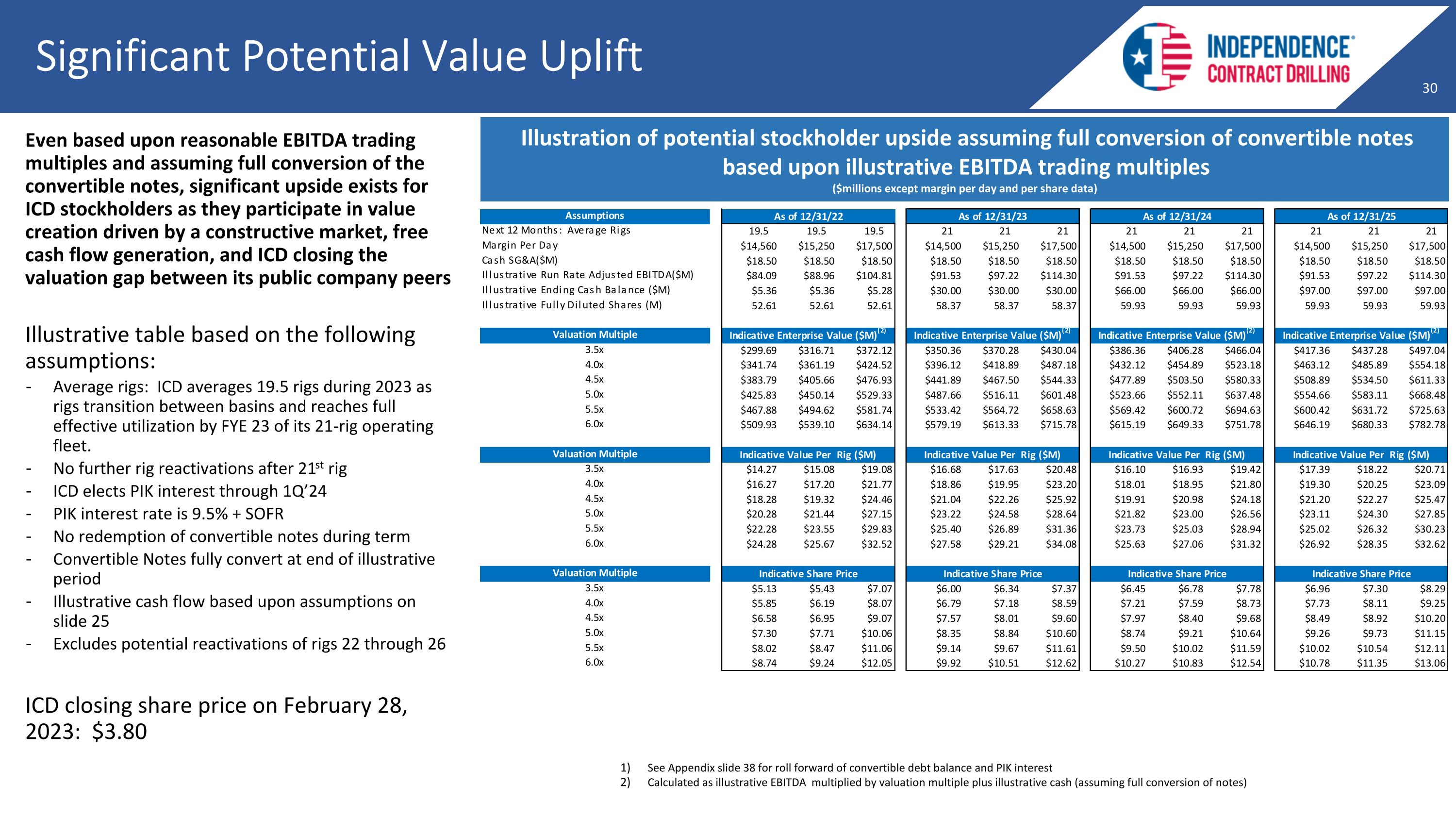

Significant Potential Value Uplift Illustration of potential stockholder upside assuming full conversion of convertible notes based upon illustrative EBITDA trading multiples ($millions except margin per day and per share data) Even based upon reasonable EBITDA trading multiples and assuming full conversion of the convertible notes, significant upside exists for ICD stockholders as they participate in value creation driven by a constructive market, free cash flow generation, and ICD closing the valuation gap between its public company peers Illustrative table based on the following assumptions: Average rigs: ICD averages 19.5 rigs during 2023 as rigs transition between basins and reaches full effective utilization by FYE 23 of its 21-rig operating fleet. No further rig reactivations after 21st rig ICD elects PIK interest through 1Q’24 PIK interest rate is 9.5% + SOFR No redemption of convertible notes during term Convertible Notes fully convert at end of illustrative period Illustrative cash flow based upon assumptions on slide 25 Excludes potential reactivations of rigs 22 through 26 ICD closing share price on February 28, 2023: $3.80 See Appendix slide 38 for roll forward of convertible debt balance and PIK interest Calculated as illustrative EBITDA multiplied by valuation multiple plus illustrative cash (assuming full conversion of notes)

ESG

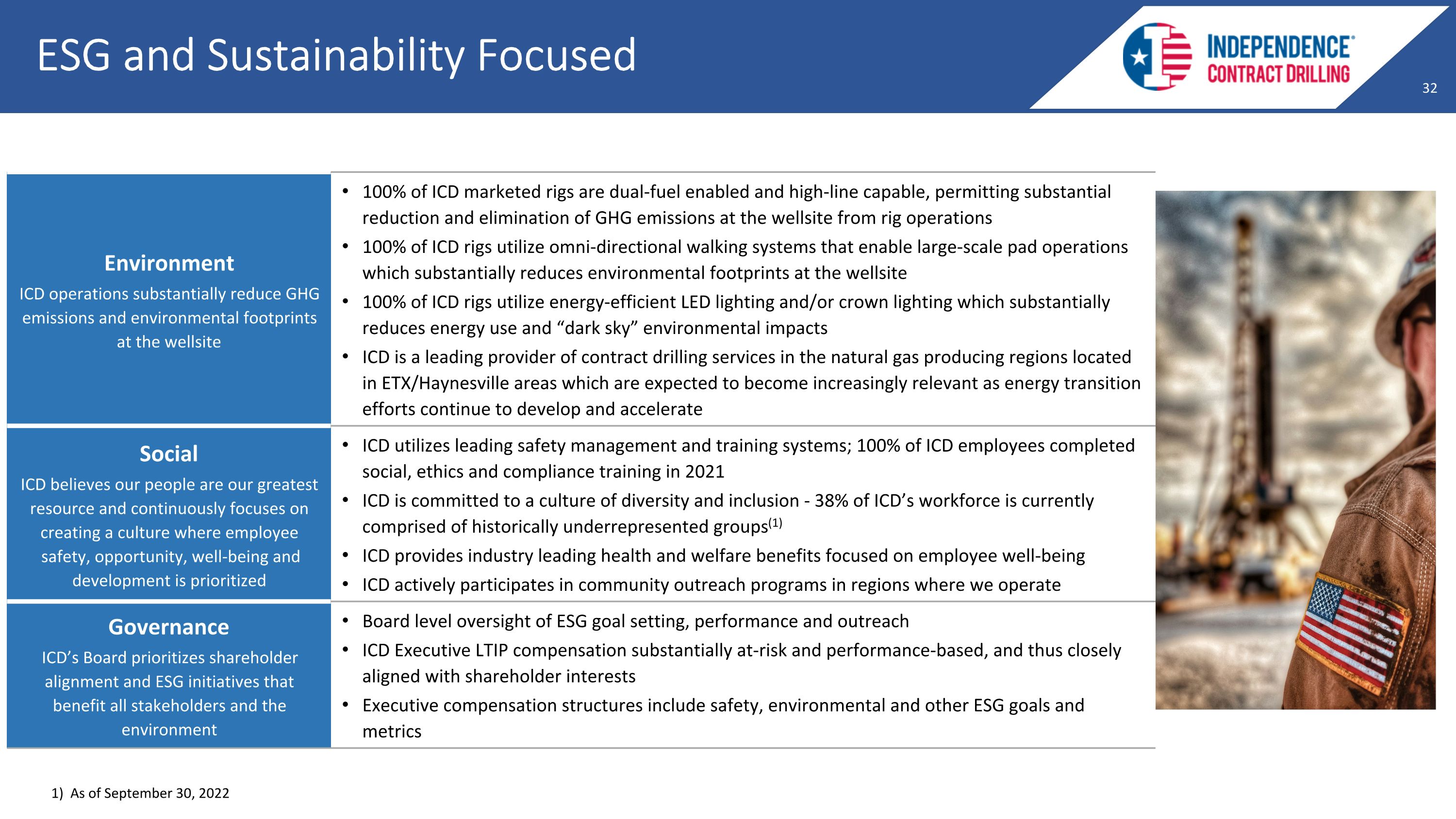

ESG and Sustainability Focused Environment ICD operations substantially reduce GHG emissions and environmental footprints at the wellsite 100% of ICD marketed rigs are dual-fuel enabled and high-line capable, permitting substantial reduction and elimination of GHG emissions at the wellsite from rig operations 100% of ICD rigs utilize omni-directional walking systems that enable large-scale pad operations which substantially reduces environmental footprints at the wellsite 100% of ICD rigs utilize energy-efficient LED lighting and/or crown lighting which substantially reduces energy use and “dark sky” environmental impacts ICD is a leading provider of contract drilling services in the natural gas producing regions located in ETX/Haynesville areas which are expected to become increasingly relevant as energy transition efforts continue to develop and accelerate Social ICD believes our people are our greatest resource and continuously focuses on creating a culture where employee safety, opportunity, well-being and development is prioritized ICD utilizes leading safety management and training systems; 100% of ICD employees completed social, ethics and compliance training in 2021 ICD is committed to a culture of diversity and inclusion - 38% of ICD’s workforce is currently comprised of historically underrepresented groups(1) ICD provides industry leading health and welfare benefits focused on employee well-being ICD actively participates in community outreach programs in regions where we operate Governance ICD’s Board prioritizes shareholder alignment and ESG initiatives that benefit all stakeholders and the environment Board level oversight of ESG goal setting, performance and outreach ICD Executive LTIP compensation substantially at-risk and performance-based, and thus closely aligned with shareholder interests Executive compensation structures include safety, environmental and other ESG goals and metrics 1) As of September 30, 2022

ICD ShaleDriller Rigs Substantially Reduce and Eliminate GHG Emissions at the Wellsite Utilizing natural gas rather than diesel substantially reduces GHG emissions. ICD customers routinely use field natural gas to power our rigs, providing even more significant positive impacts on the environment. The first rig ICD built in 2012 was equipped with Dual-Fuel engines and today 100% of ICD’s marketed fleet is equipped with Dual- Fuel capabilities. Dual-Fuel Equipped 100% of ICD’s Rigs Similar to an electric car, utilizing the electric grid to power a rig’s engines substantially eliminates GHG emissions at the wellsite. All ICD rigs are capable of running on Hi-Line Electric Power. ICD began operating rigs on Hi-Line Electric power in 2019 and continually markets this option to its customers where operational infrastructure permits. Hi-Line Electric Power Capable 100% of ICD’s Rigs LED/CROWN LIGHTING 100% of ICD’s Rigs In 2019, ICD converted all of its rigs from fluorescent lighting to LED lighting and is in process of converting all of its rigs from traditional lighting to crown lighting systems. LED and crown lighting systems substantially reduce energy use and eliminate light pollution, in particular in environmentally sensitive areas where “dark sky” environmental issues exist.

Land Drilling’s Only U.S. Publicly-Traded, Pure-Play, Pad-Optimal, Super-Spec, Growth Story Highest Asset Quality 100% Pad-Optimal, Super-Spec Fleet Premier Customer Base Expansion of Margins/Cash Flows Driving Overall Net Debt Reduction and Shareholder Upside Significant Investment Opportunity - Meaningful Current Valuation Discount to Market Based Upon Both Asset Values and Cash Flow Multiples Fleet 100% Dual-Fuel Enabled / Electric Hi- Line Capable: Substantial GHG Reduction / Elimination Recognized Industry Leader for Service and Professionalism Ideal Geographic Focus on Most Prolific Oil and Natural Gas Producing Regions

Investor Contact Information Email inquiries: investor.relations@icdrilling.com Phone inquiries: (281) 878-8710

APPENDICES

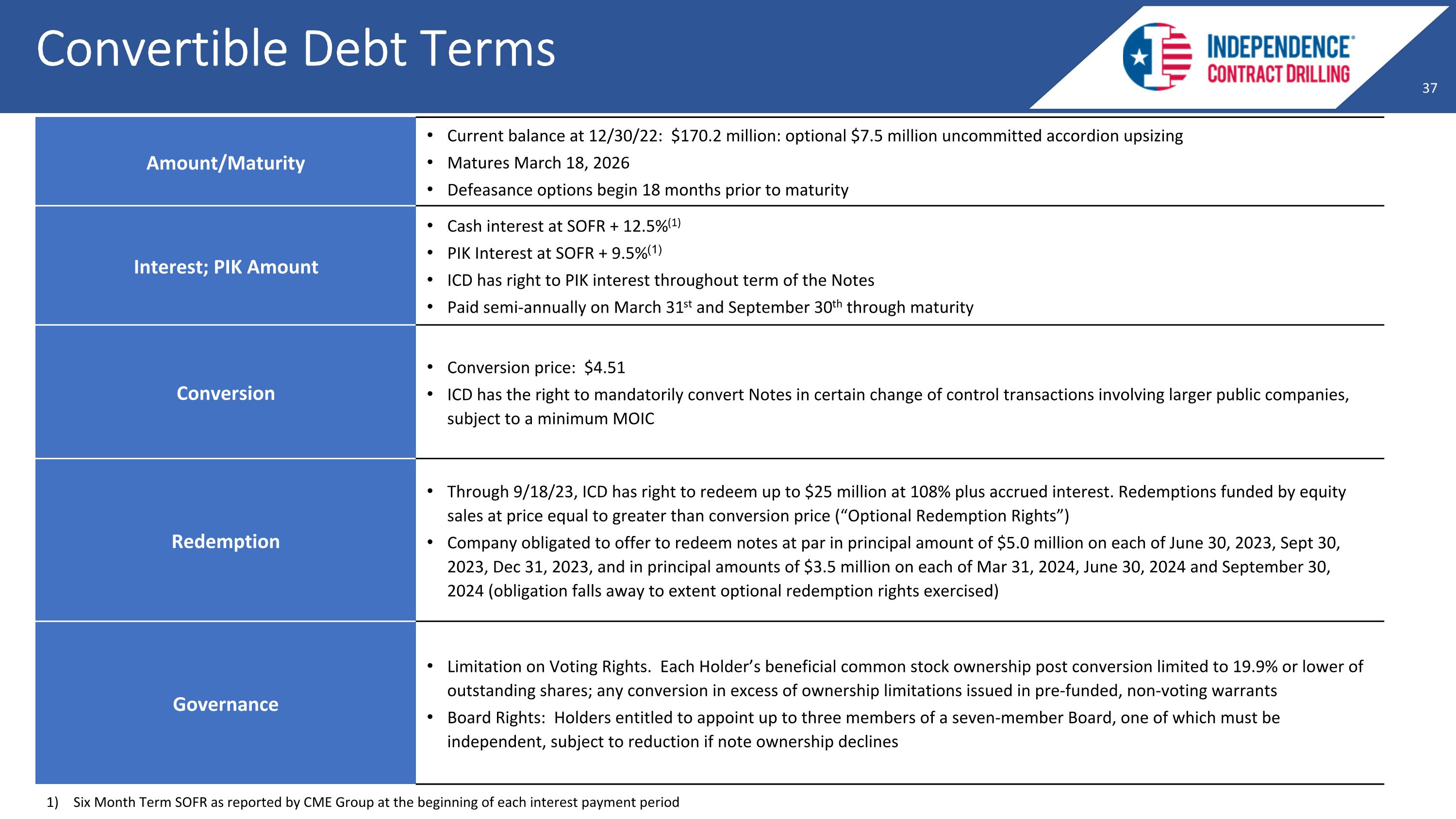

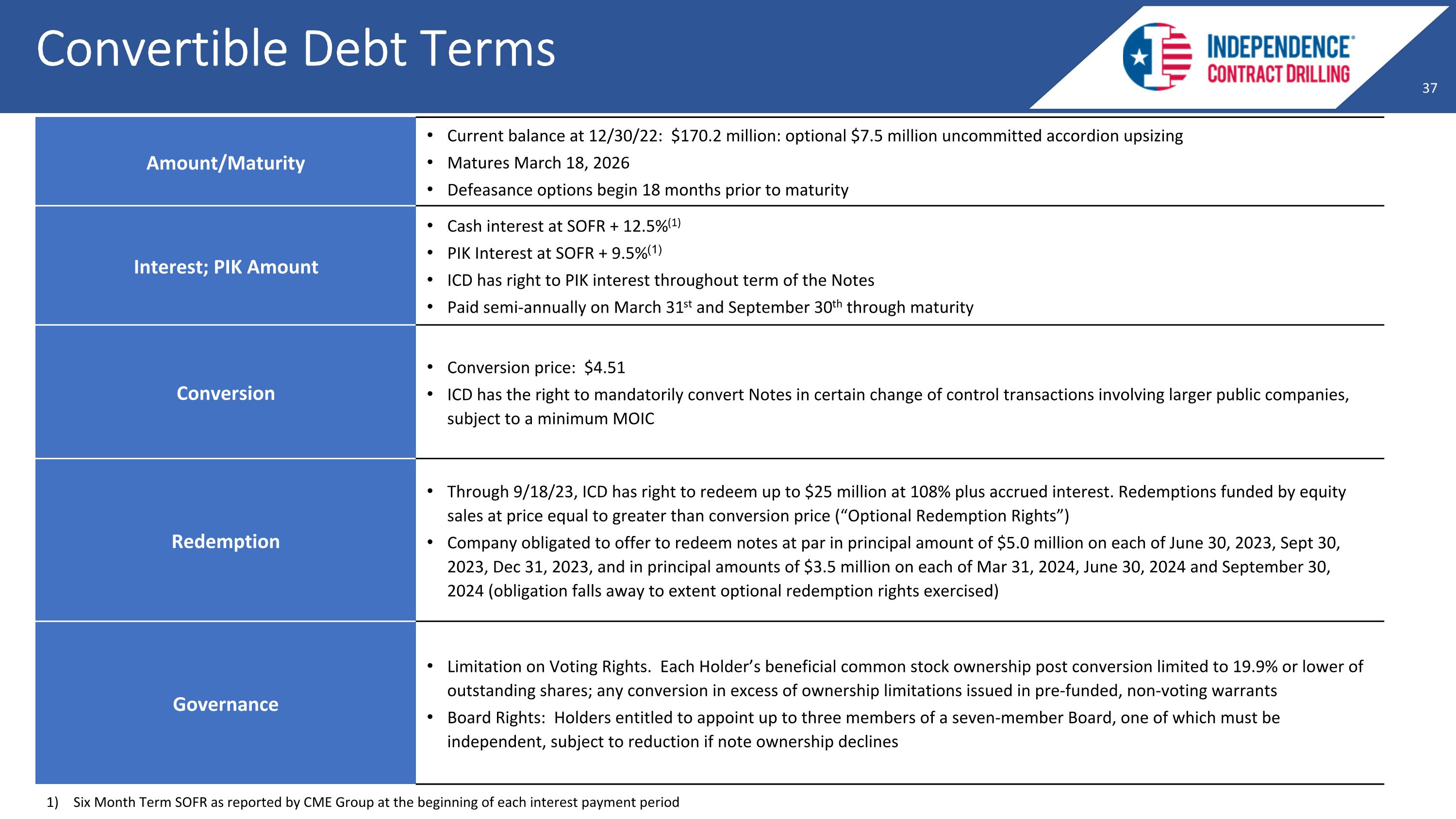

Convertible Debt Terms Amount/Maturity Current balance at 12/30/22: $170.2 million: optional $7.5 million uncommitted accordion upsizing Matures March 18, 2026 Defeasance options begin 18 months prior to maturity Interest; PIK Amount Cash interest at SOFR + 12.5%(1) PIK Interest at SOFR + 9.5%(1) ICD has right to PIK interest throughout term of the Notes Paid semi-annually on March 31st and September 30th through maturity Conversion Conversion price: $4.51 ICD has the right to mandatorily convert Notes in certain change of control transactions involving larger public companies, subject to a minimum MOIC Redemption Through 9/18/23, ICD has right to redeem up to $25 million at 108% plus accrued interest. Redemptions funded by equity sales at price equal to greater than conversion price (“Optional Redemption Rights”) Company obligated to offer to redeem notes at par in principal amount of $5.0 million on each of June 30, 2023, Sept 30, 2023, Dec 31, 2023, and in principal amounts of $3.5 million on each of Mar 31, 2024, June 30, 2024 and September 30, 2024 (obligation falls away to extent optional redemption rights exercised) Governance Limitation on Voting Rights. Each Holder’s beneficial common stock ownership post conversion limited to 19.9% or lower of outstanding shares; any conversion in excess of ownership limitations issued in pre-funded, non-voting warrants Board Rights: Holders entitled to appoint up to three members of a seven-member Board, one of which must be independent, subject to reduction if note ownership declines 1) Six Month Term SOFR as reported by CME Group at the beginning of each interest payment period

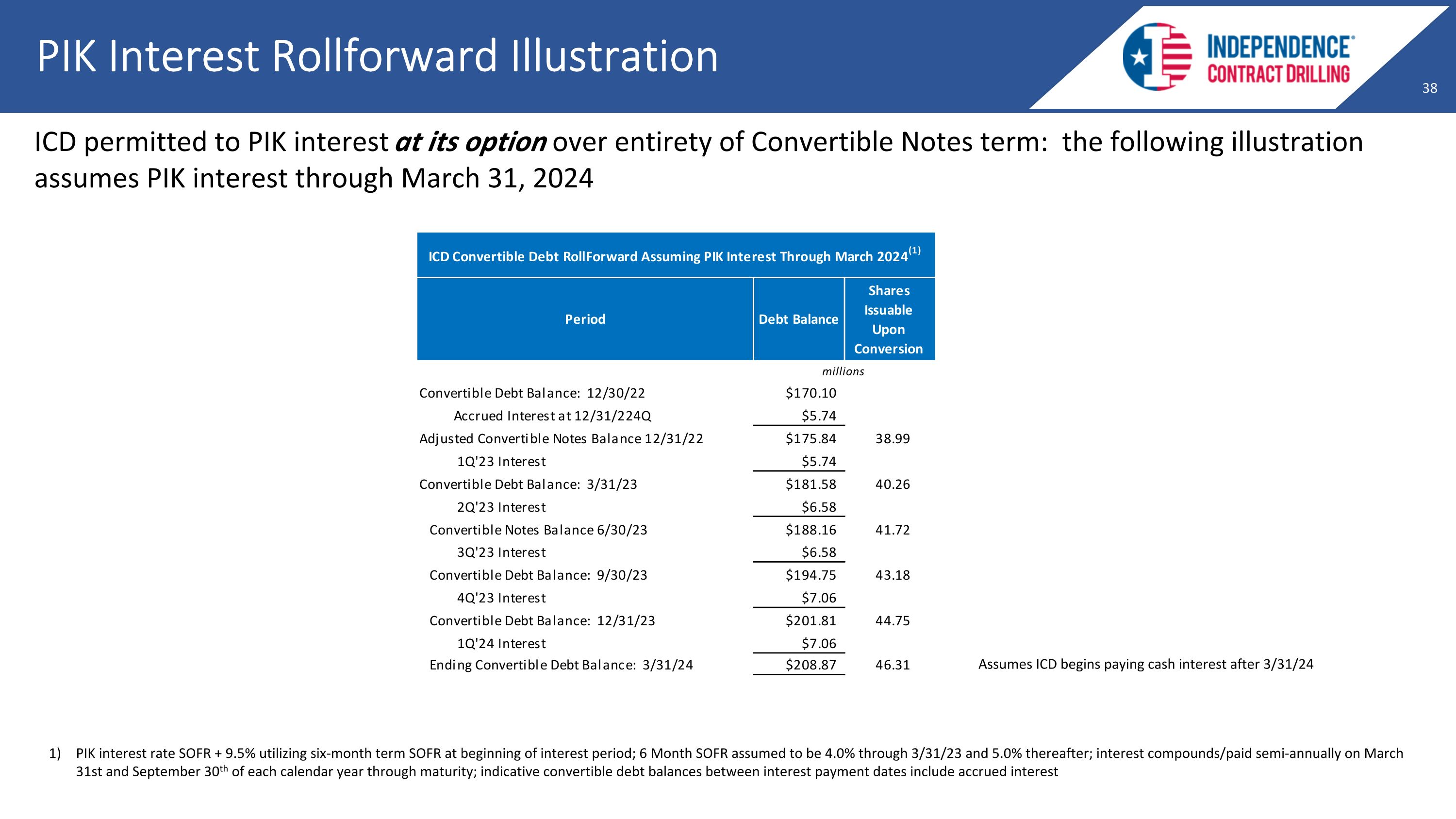

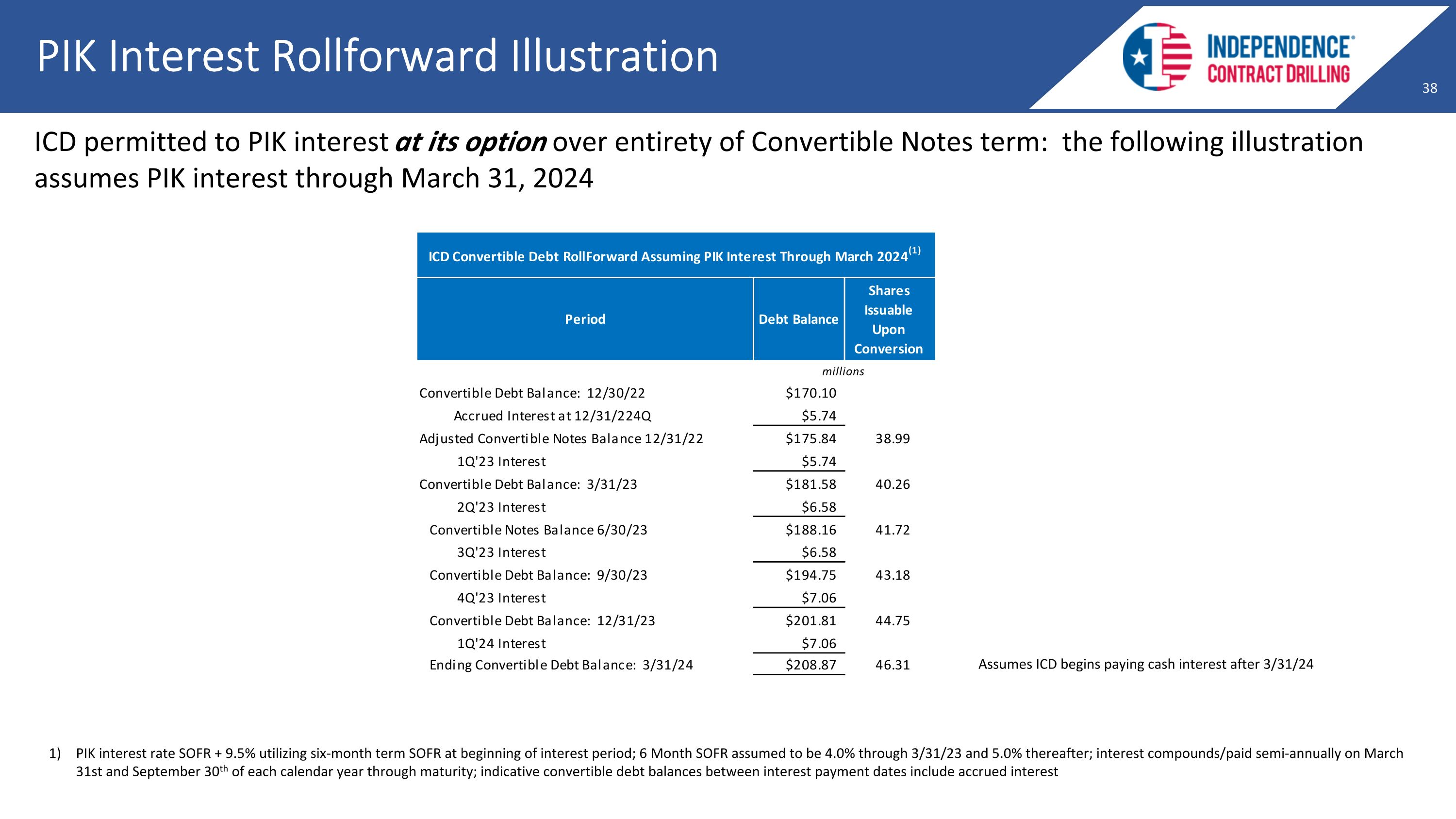

PIK Interest Rollforward Illustration ICD permitted to PIK interest at its option over entirety of Convertible Notes term: the following illustration assumes PIK interest through March 31, 2024 1) PIK interest rate SOFR + 9.5% utilizing six-month term SOFR at beginning of interest period; 6 Month SOFR assumed to be 4.0% through 3/31/23 and 5.0% thereafter; interest compounds/paid semi-annually on March 31st and September 30th of each calendar year through maturity; indicative convertible debt balances between interest payment dates include accrued interest Assumes ICD begins paying cash interest after 3/31/24

Maximizing Returns By Strategically Marketing ICD Fleet Across Target Markets Texas Oklahoma Arkansas Louisiana New Mexico Permian – Midland Basin 200 Series Target Market Eagle Ford/STX 200 Series Target Market Haynesville/ETX 300 Series Target Market Permian – Delaware Basin 300 Series Target Market

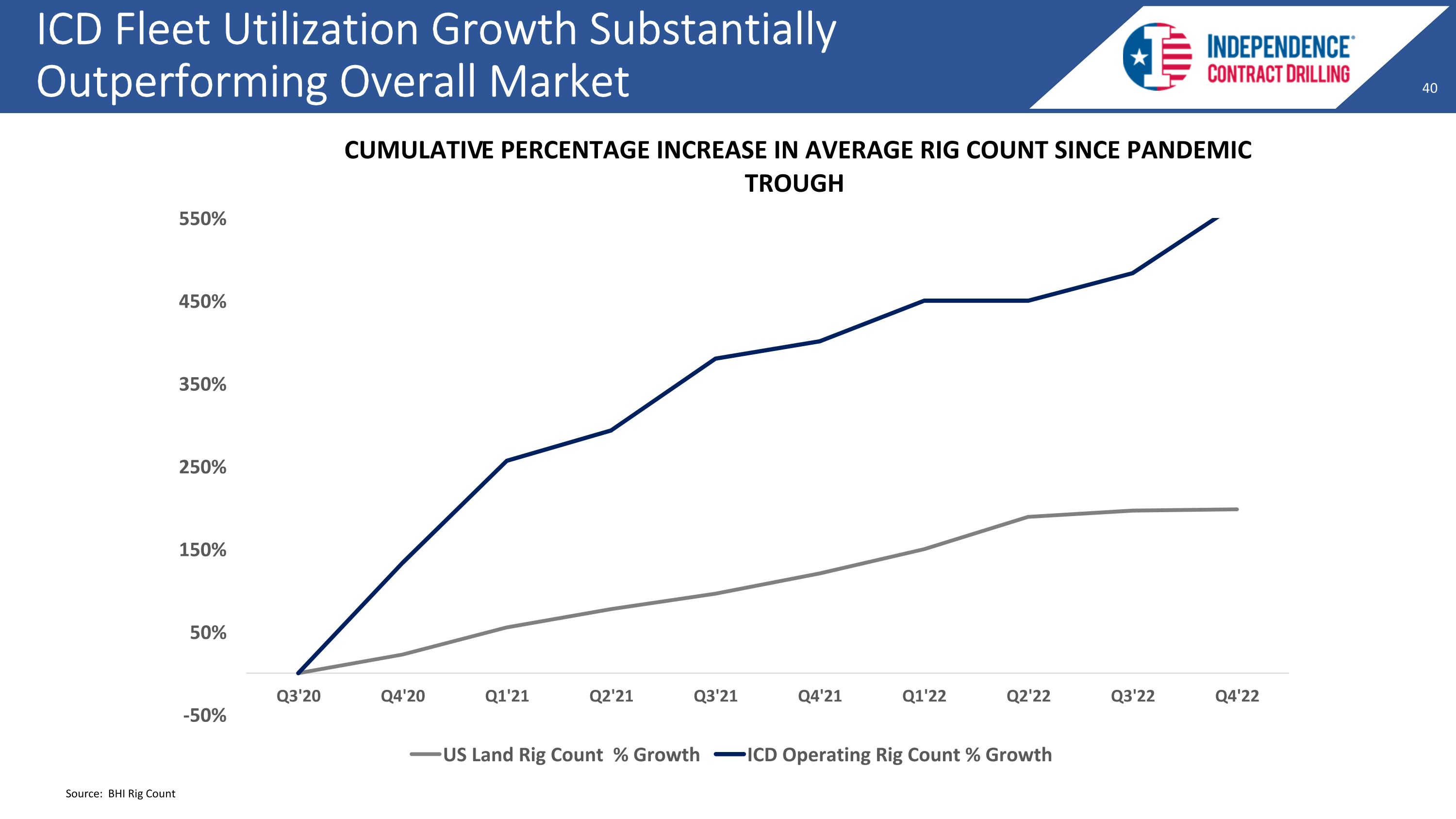

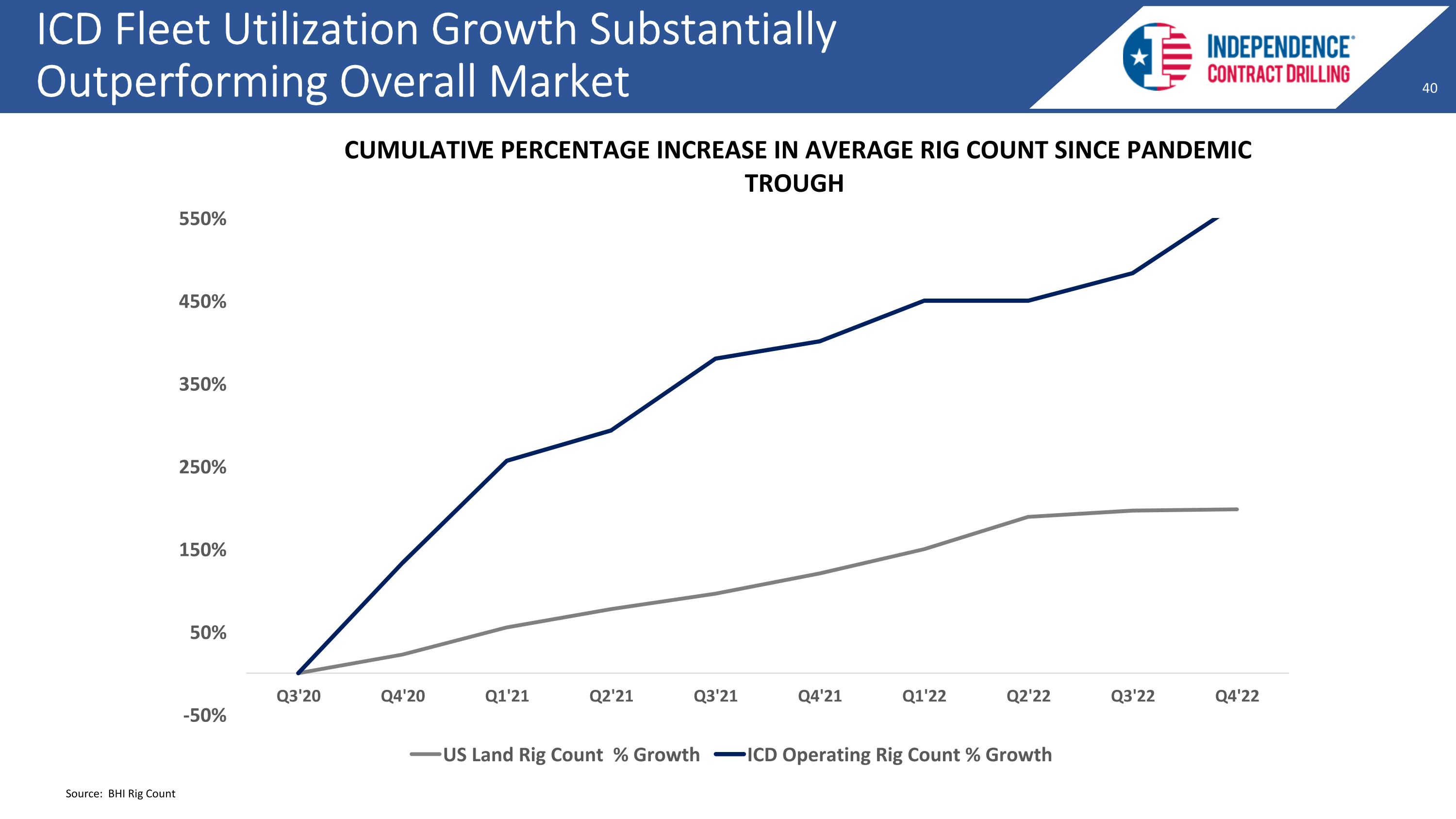

ICD Fleet Utilization Growth Substantially Outperforming Overall Market Source: BHI Rig Count

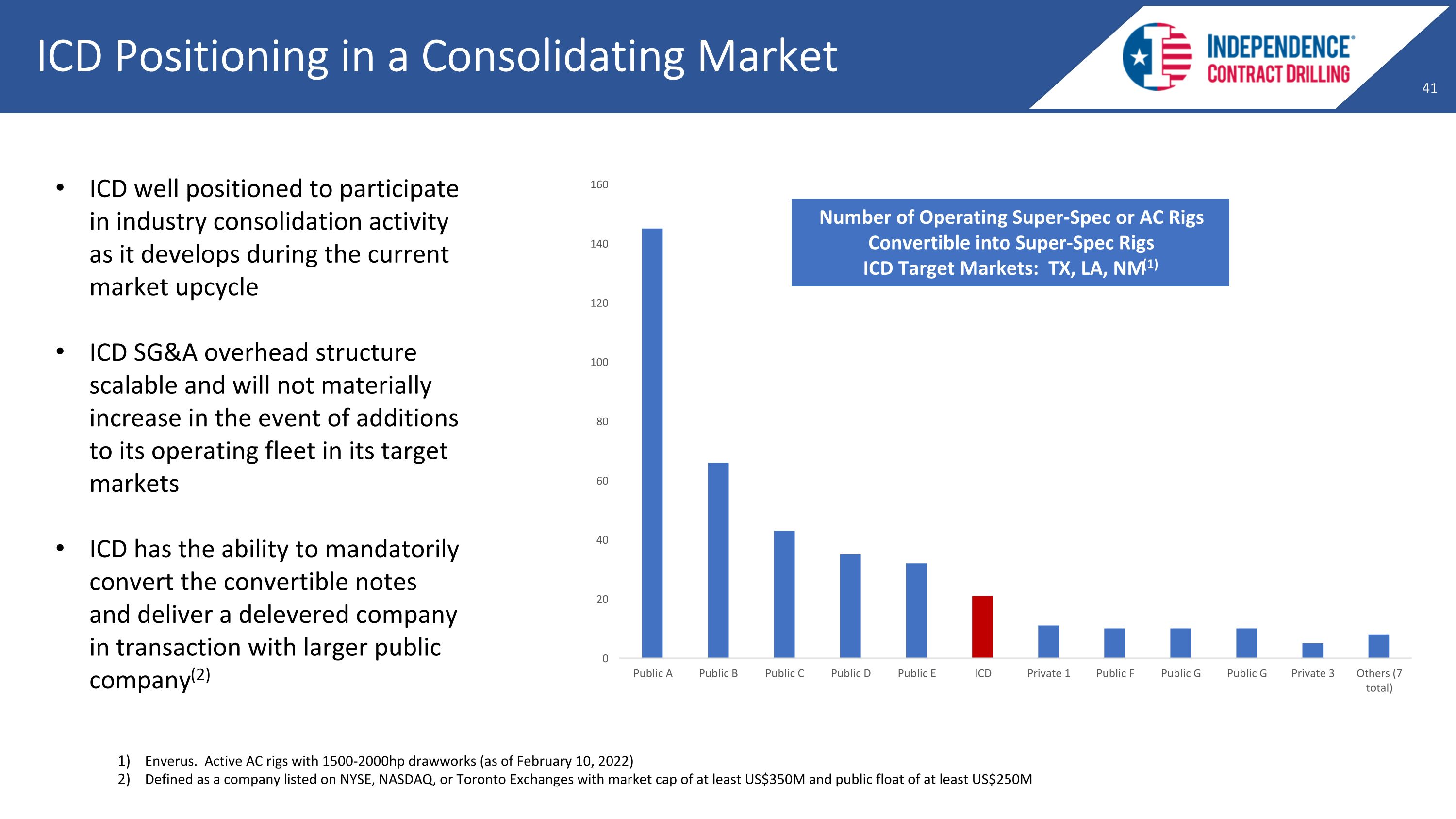

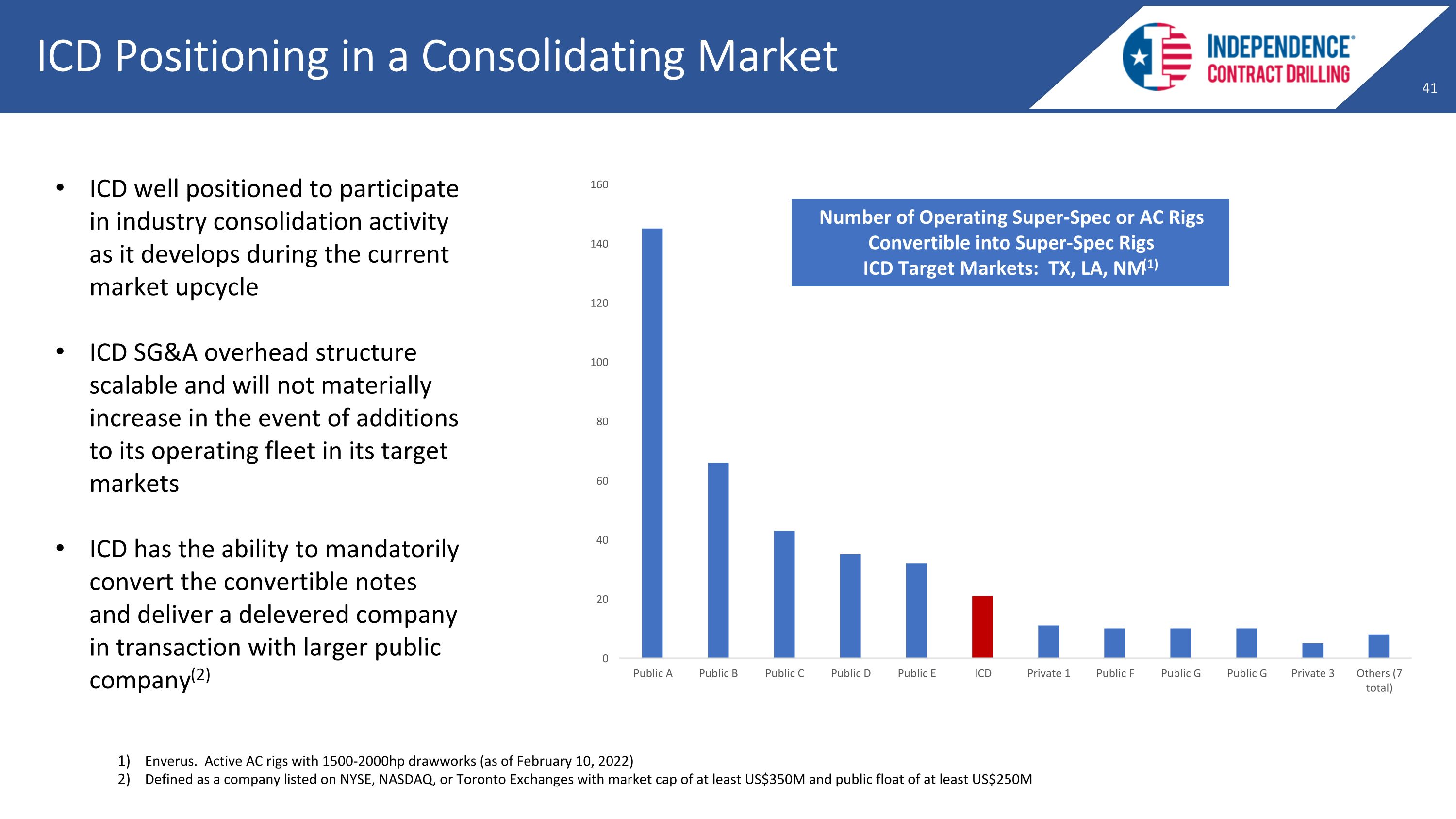

ICD Positioning in a Consolidating Market Number of Operating Super-Spec or AC Rigs Convertible into Super-Spec Rigs ICD Target Markets: TX, LA, NM(1) Enverus. Active AC rigs with 1500-2000hp drawworks (as of February 10, 2022) Defined as a company listed on NYSE, NASDAQ, or Toronto Exchanges with market cap of at least US$350M and public float of at least US$250M ICD well positioned to participate in industry consolidation activity as it develops during the current market upcycle ICD SG&A overhead structure scalable and will not materially increase in the event of additions to its operating fleet in its target markets ICD has the ability to mandatorily convert the convertible notes and deliver a delevered company in transaction with larger public company(2)