Exhibit 99.2

1 1 Independence Contract Drilling, Inc. March 21, 2022 Independence Contract Drilling, Inc. Transformative Refinancing Overview

2 2 2 Various statements contained in this presentation, including those that express a belief, expectation or intention, as well a s t hose that are not statements of historical fact, are forward - looking statements. These forward - looking statements may include projections and estimates concerning the timing and success of specific projects and our future revenues, income and capital spe nding. Our forward - looking statements are generally accompanied by words such as “ estimate, ” “ project, ” “ predict, ” “ believe, ” “ expect, ” “ anticipate, ” “ potential, ” “ plan, ” “ goal, ” “ will ” or other words that convey the uncertainty of future events or outcomes. The forward - looking statements in this presentation sp eak only as of the date of this presentation; we disclaim any obligation to update these statements unless required by law, and we caution you not to rely on them unduly. We hav e based these forward - looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business , e conomic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including those discussed under “ Risk Factors ” and “ Management ’ s Discussion and Analysis of Financial Condition and Results of Operations ” included in the Company ’ s filings with the Securities and Exchange Commission, including the Company ’ s Annual Report on Form 10 - K, may cause our actual results, performance or achievements to differ materially from any future res ults, performance or achievements expressed or implied by these forward - looking statements. These risks, contingencies and uncertainties include, but are not limi ted to, the following: • inability to predict the duration or magnitude of the effects of the COVID - 19 pandemic on our business, operations, and financial condition and when or if worldwide oil demand will stabilize and begin to improve ; • decline in or substantial volatility of crude oil and natural gas commodity prices • a sustained decrease in domestic spending by the oil and natural gas exploration and production industry ; • fluctuation of our operating results and volatility of our industry ; • inability to maintain or increase pricing of our contract drilling services, or early termination of any term contract for which early termination compensation is not paid ; • our backlog of term contracts declining rapidly ; • the loss of any of our customers, financial distress or management changes of potential customers or failure to obtain contract renewals and additional customer contracts for our drilling services ; • overcapacity and competition in our industry ; • an increase in interest rates and deterioration in the credit markets ; • our inability to comply with the financial and other covenants in debt agreements that we may enter into as a result of reduced revenues and financial performance ; • unanticipated costs, delays and other difficulties in executing our long - term growth strategy ; • the loss of key management personnel ; • new technology that may cause our drilling methods or equipment to become less competitive ; • labor costs or shortages of skilled workers ; • the loss of or interruption in operations of one or more key vendors ; • the effect of operating hazards and severe weather on our rigs, facilities, business, operations and financial results, and limitations on our insurance coverage ; • increased regulation of drilling in unconventional formations ; • the incurrence of significant costs and liabilities in the future resulting from our failure to comply with new or existing environmental regulations or an accidental release of hazardous substances into the environment ; and • the potential failure by us to establish and maintain effective internal control over financial reporting . All forward - looking statements are necessarily only estimates of future results, and there can be no assurance that actual resul ts will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward - looking statements are qualified in their entirety by reference to the factors discussed throughout this presentation and in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10 - K. Further, any forward - looking statement speaks only as of the date of this presentation, and we undertake no obligation to update any forward - looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Adjusted Net Income or Loss, EBITDA and adjusted EBITDA are supplemental non - GAAP financial measures that are used by management and external users of the Company’s financial statements, such as industry analysts, investors, lenders and rating agencies. The Company’s management believes adjusted Net Income or Loss, EBITDA and adjusted EBITDA are useful because such mea sures allow the Company and its stockholders to more effectively evaluate its operating performance and compare the results of its operations from period to period and against its peers without regard to its financing methods or capital str ucture. See non - GAAP financial measures at the end of this presentation for a full reconciliation of Net Income or Loss to adjusted Net Income or Loss, EBITDA and adjusted EBITDA. Preliminary Matters

3 3 3 Introduction: ICD Best - in - Class Asset Quality and Geographic Focus • Marketed fleet comprised entirely of pad - optimal, super - spec rigs • Established presence in oil rich Permian and Eagle Ford plays • Leading presence in natural gas rich Haynesville and East Texas regions • Fit - for - purpose rigs engineered/outfitted to address particular basin drivers • All rigs software - optimization - capable High Quality Customer Base Supported by Industry Leading Customer Service and Operations • #1 ranked land contract driller for service and professionalism by Energy Point Research past four years: 2018 - 2021 • Established relationships with publics and well - capitalized private operators • Industry - leading and scalable safety, maintenance and financial systems Returns & Free Cash Flow Generation • Steadily increasing utilization and spot dayrates as market recovers from COVID - 19 impacts drives potential for significant free cash flow generation and yields • Increasing market penetration of 300 Series rigs • Scalable cost structure for organic growth / M&A opportunities ESG Focus • Marketed fleet 100% dual - fuel and hi - line power capable • Omni - directional walking reduces operational footprints and environmental impacts • Increasingly diverse workforce: over 25% from under - represented groups • Shareholder alignment: executive comp substantially at - risk / performance based • Leading presence in natural - gas - rich Haynesville and East Texas regions Sector’s only publicly - traded, pure - play, pad - optimal, super - spec drilling contractor focused solely on North America’s most attractive oil and natural gas basins

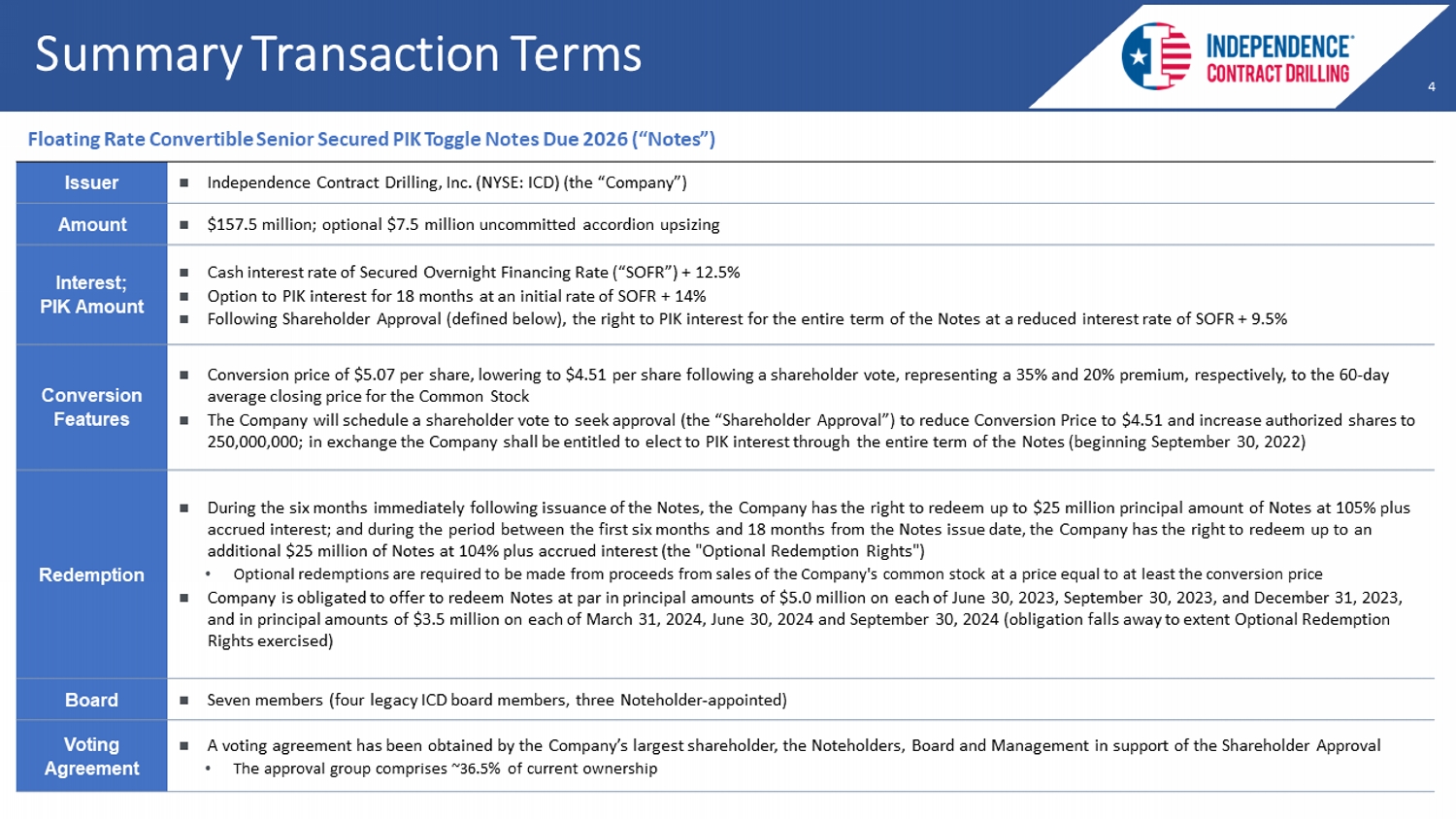

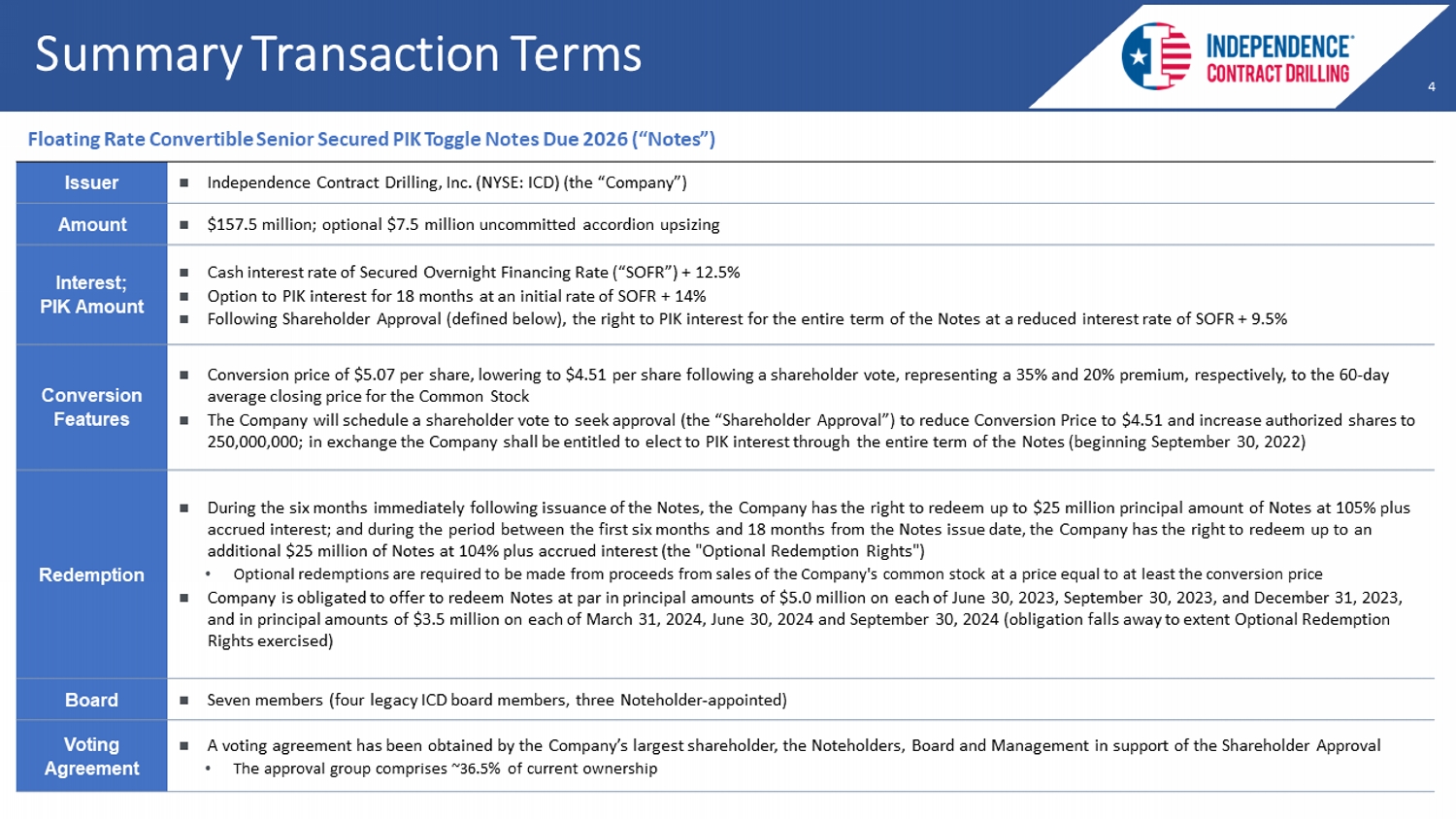

4 4 4 Summary Transaction Terms Floating Rate Convertible Senior Secured PIK Toggle Notes Due 2026 (“Notes”) Issuer Independence Contract Drilling, Inc. (NYSE: ICD) (the “Company”) Amount $157.5 million; optional $7.5 million uncommitted accordion upsizing Interest; PIK Amount Cash interest rate of Secured Overnight Financing Rate (“SOFR”) + 12.5% Option to PIK interest for 18 months at an initial rate of SOFR + 14% Following Shareholder Approval (defined below), the right to PIK interest for the entire term of the Notes at a reduced inter est rate of SOFR + 9.5% Conversion Features Conversion price of $5.07 per share, lowering to $4.51 per share following a shareholder vote, representing a 35% and 20% pre miu m, respectively, to the 60 - day average closing price for the Common Stock The Company will schedule a shareholder vote to seek approval (the “Shareholder Approval”) to reduce Conversion Price to $4.5 1 a nd increase authorized shares to 250,000,000; in exchange the Company shall be entitled to elect to PIK interest through the entire term of the Notes (beginni ng September 30, 2022) Redemption During the six months immediately following issuance of the Notes, the Company has the right to redeem up to $25 million prin cip al amount of Notes at 105% plus accrued interest; and during the period between the first six months and 18 months from the Notes issue date, the Company has th e right to redeem up to an additional $25 million of Notes at 104% plus accrued interest (the "Optional Redemption Rights") • Optional redemptions are required to be made from proceeds from sales of the Company's common stock at a price equal to at le ast the conversion price Company is obligated to offer to redeem Notes at par in principal amounts of $5.0 million on each of June 30, 2023, September 30 , 2023, and December 31, 2023, and in principal amounts of $3.5 million on each of March 31, 2024, June 30, 2024 and September 30, 2024 (obligation falls aw ay to extent Optional Redemption Rights exercised) Board Seven members (four legacy ICD board members, three Noteholder - appointed) Voting Agreement A voting agreement has been obtained by the Company’s largest shareholder, the Noteholders, Board and Management in support o f t he Shareholder Approval • The approval group comprises ~36.5% of current ownership

5 5 5 Approximate Sources and Uses Sources Uses New Notes 157.5$ Repay Term Loan and Accrued Interest (1) 141.7$ Third Term Loan Amendment Payment 1.0 Sidewinder Merger Consideration due June 2022 4.3 Cash Transaction Expenses 6.0 Cash to Balance Sheet 4.5 Total Sources 157.5$ Total Uses 157.5$ Approximate Sources and Uses ($ in millions) 1) Prior term loan had been due to become a current liability in October 2022

6 6 6 The refinancing checks all the boxes to ensure that ICD has the runway to achieve its financial and operational goals Strategic Merits Eliminates Near - Term Maturities No Cash Interest Expense Option Operational Flexibility Facilitates Path to Deleveraging Protects Shareholder Value Extends debt maturity from October 2023 to March 2026 Enables meaningful cash savings over time compared to prior cash interest expense obligation $7.5 million uncommitted accordion and minimal covenants with new facility, including generous capital expenditure allowance to enable fleet re - activations and expansion to capitalize on market strength Optional early redemption feature combined with conversion option eliminates major obstacles to longer - term refinancing and de - leveraging Conversion price in line with market price ensures minimal dilution compared to alternative equity capital raise options, with few proxies for a refinancing of this magnitude

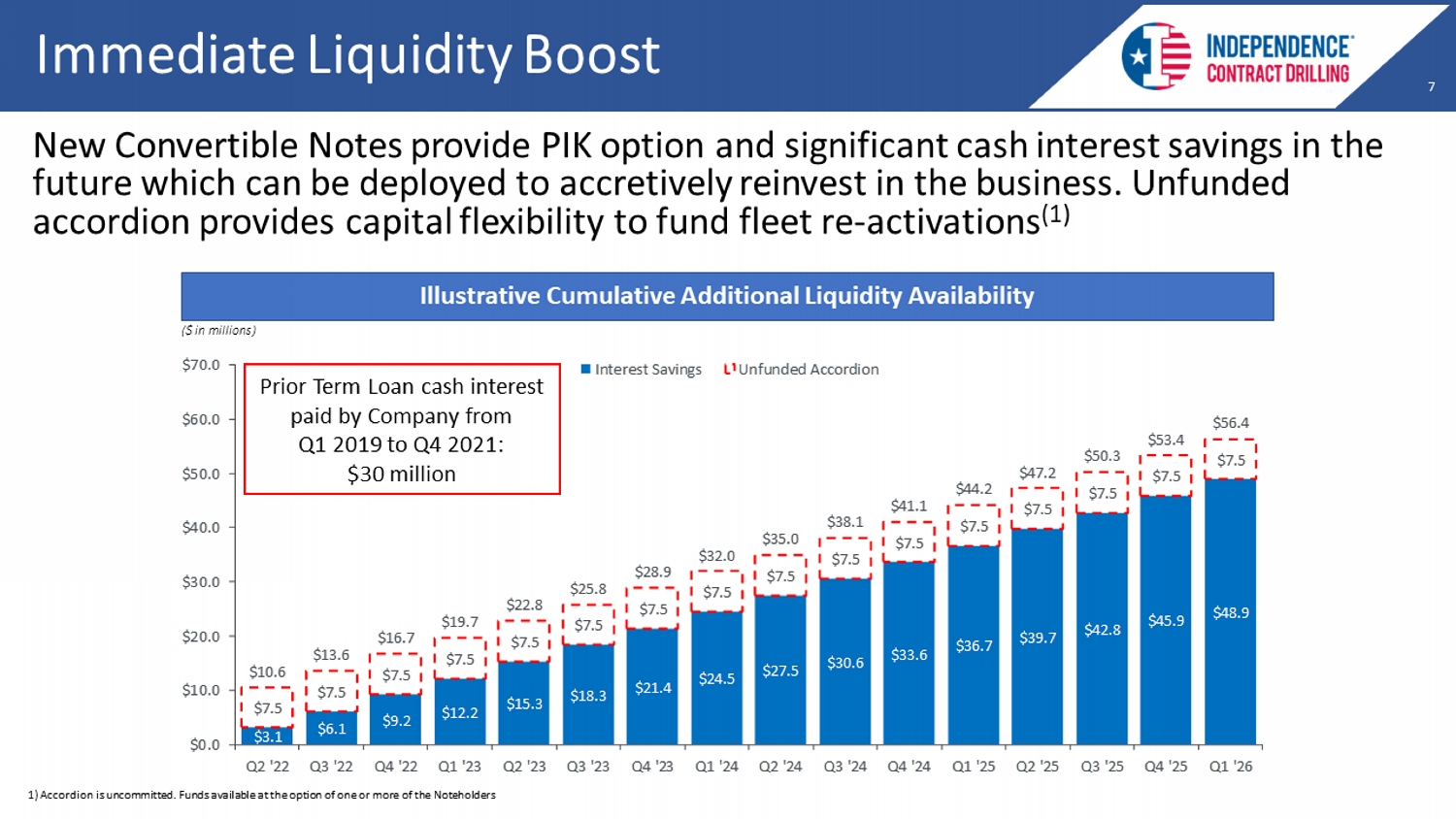

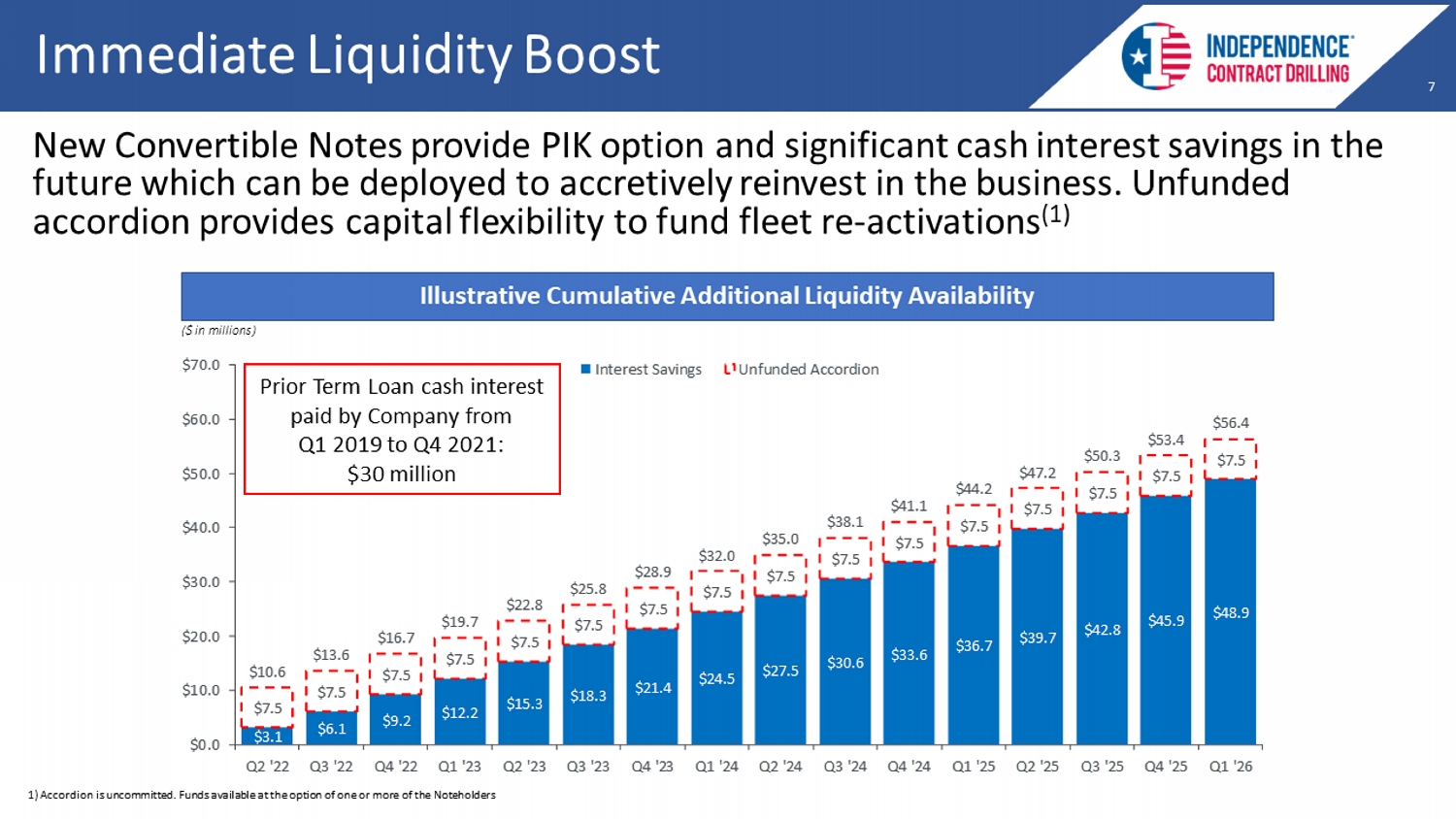

7 7 7 $3.1 $6.1 $9.2 $12.2 $15.3 $18.3 $21.4 $24.5 $27.5 $30.6 $33.6 $36.7 $39.7 $42.8 $45.9 $48.9 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $7.5 $10.6 $13.6 $16.7 $19.7 $22.8 $25.8 $28.9 $32.0 $35.0 $38.1 $41.1 $44.2 $47.2 $50.3 $53.4 $56.4 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Q1 '26 Interest Savings Unfunded Accordion New Convertible Notes provide PIK option and significant cash interest savings in the future which can be deployed to accretively reinvest in the business. Unfunded accordion provides capital flexibility to fund fleet re - activations (1) Immediate Liquidity Boost ($ in millions) Illustrative Cumulative Additional Liquidity Availability Prior Term Loan cash interest paid by Company from Q1 2019 to Q4 2021: $ 30 million 1) Accordion is uncommitted. Funds available at the option of one or more of the Noteholders

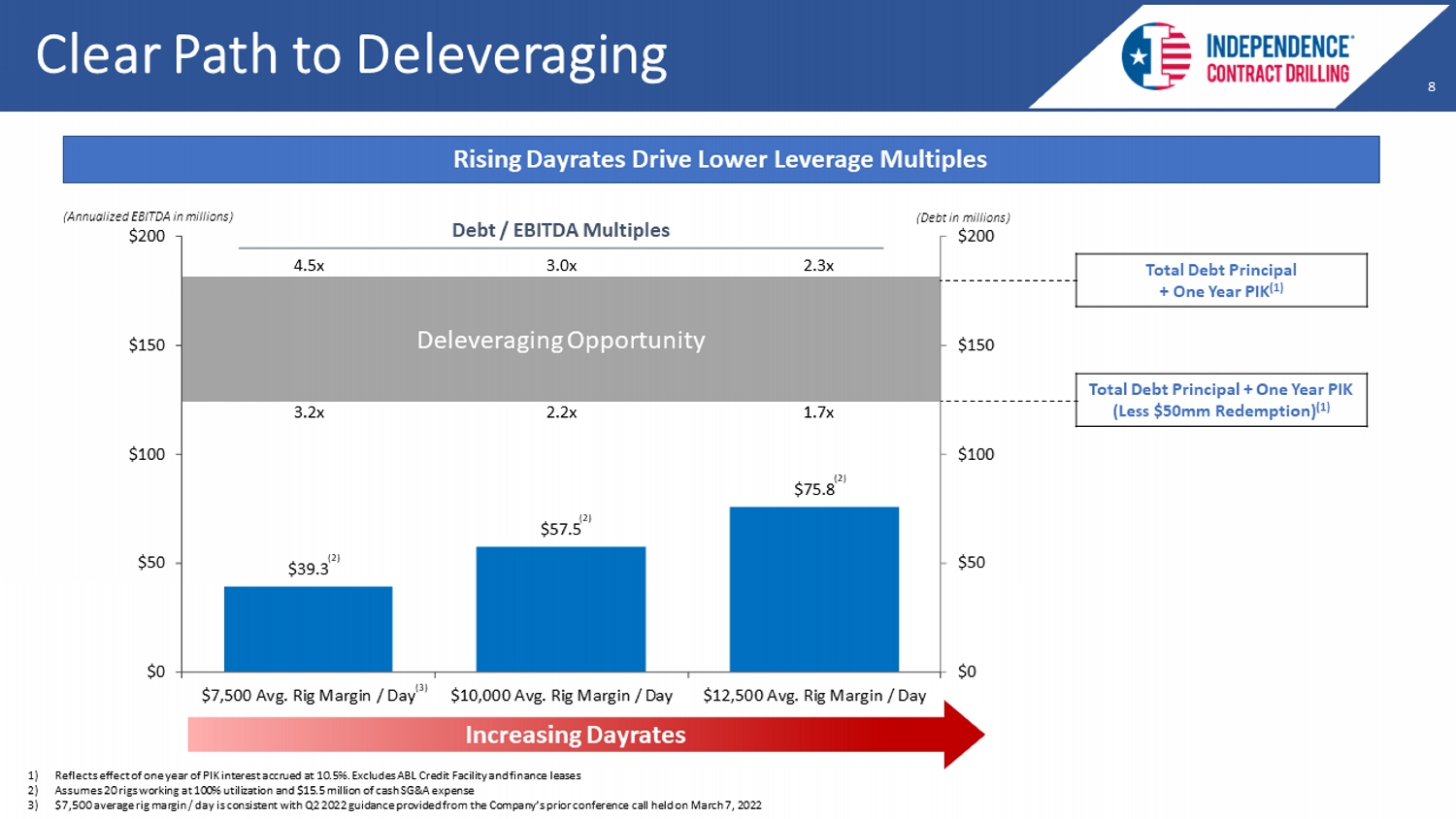

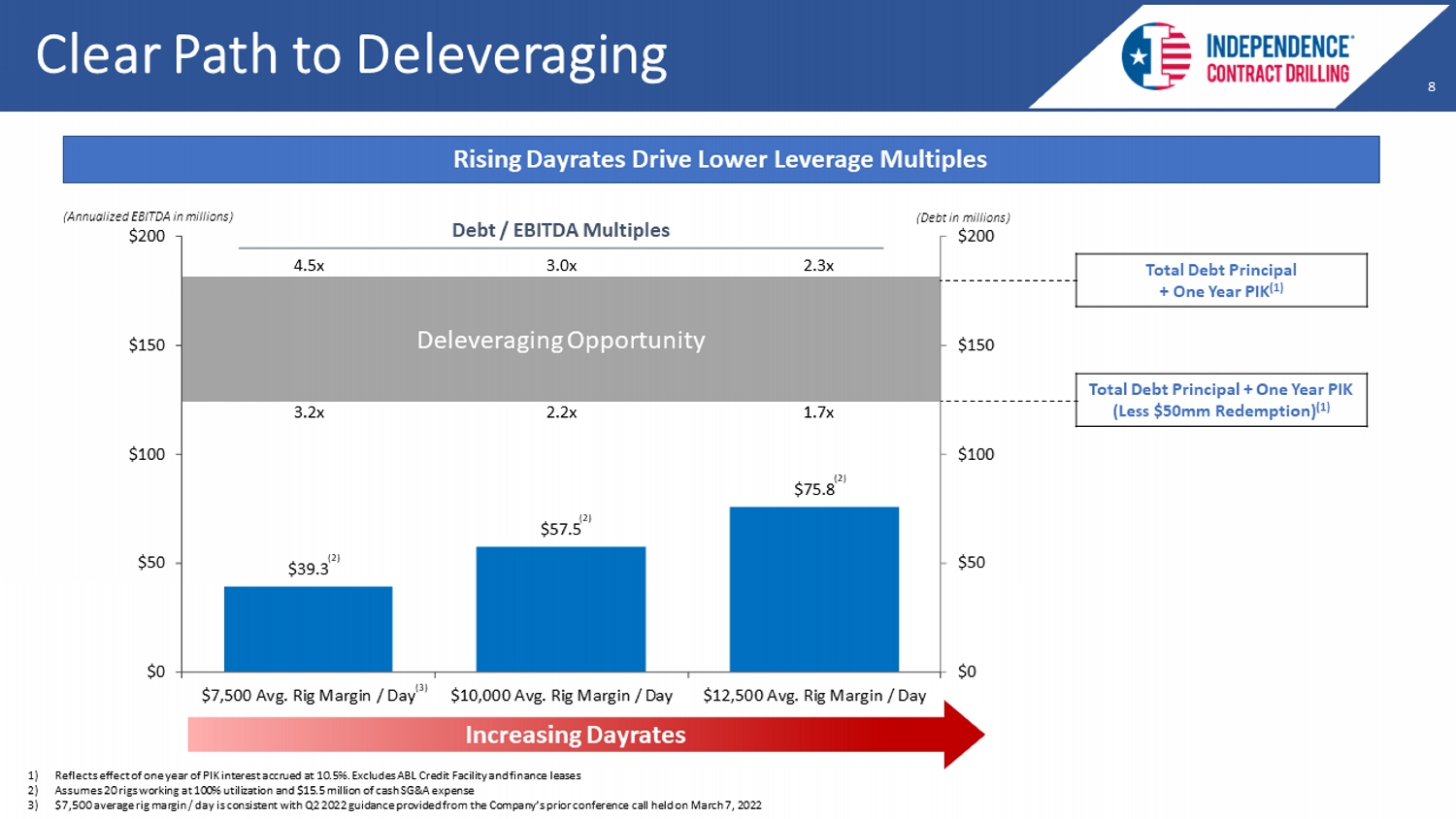

8 8 8 $39.3 $57.5 $75.8 $0 $50 $100 $150 $200 $0 $50 $100 $150 $200 $7,500 Avg. Rig Margin / Day $10,000 Avg. Rig Margin / Day $12,500 Avg. Rig Margin / Day Total Debt Principal + One Year PIK (Less $50mm Redemption) (1) Clear Path to Deleveraging Rising Dayrates Drive Lower Leverage Multiples Increasing Dayrates 1) Reflects effect of one year of PIK interest accrued at 10.5%. Excludes ABL Credit Facility and finance leases 2) Assumes 20 rigs working at 100% utilization and $15.5 million of cash SG&A expense 3) $7,500 average rig margin / day is consistent with Q2 2022 guidance provided from the Company’s prior conference call held on Ma rch 7, 2022 Total Debt Principal + One Year PIK (1) Debt / EBITDA Multiples Deleveraging Opportunity 4.5x 3.2x 3.0x 2.2x 2.3x 1.7x (Annualized EBITDA in millions) (Debt in millions) (2) (2) (2) (3)

9 9 9 Dilution Analysis Existing Shareholders as Percent of Enterprise Value (1) 1) Source: Capital IQ and public filings. Excludes cash transaction expenses 2) Pre - transaction enterprise value is based on balance sheet data as of December 31, 2021 and 60 day average share price as of March 17, 2022 21.2% 22.2% 4.4% 78.8% 73.4% As of 12/31/21 Today (Fully Diluted) Pre-Deal Common Equity Noteholders' Equity Debt or Convertible Notes (2)

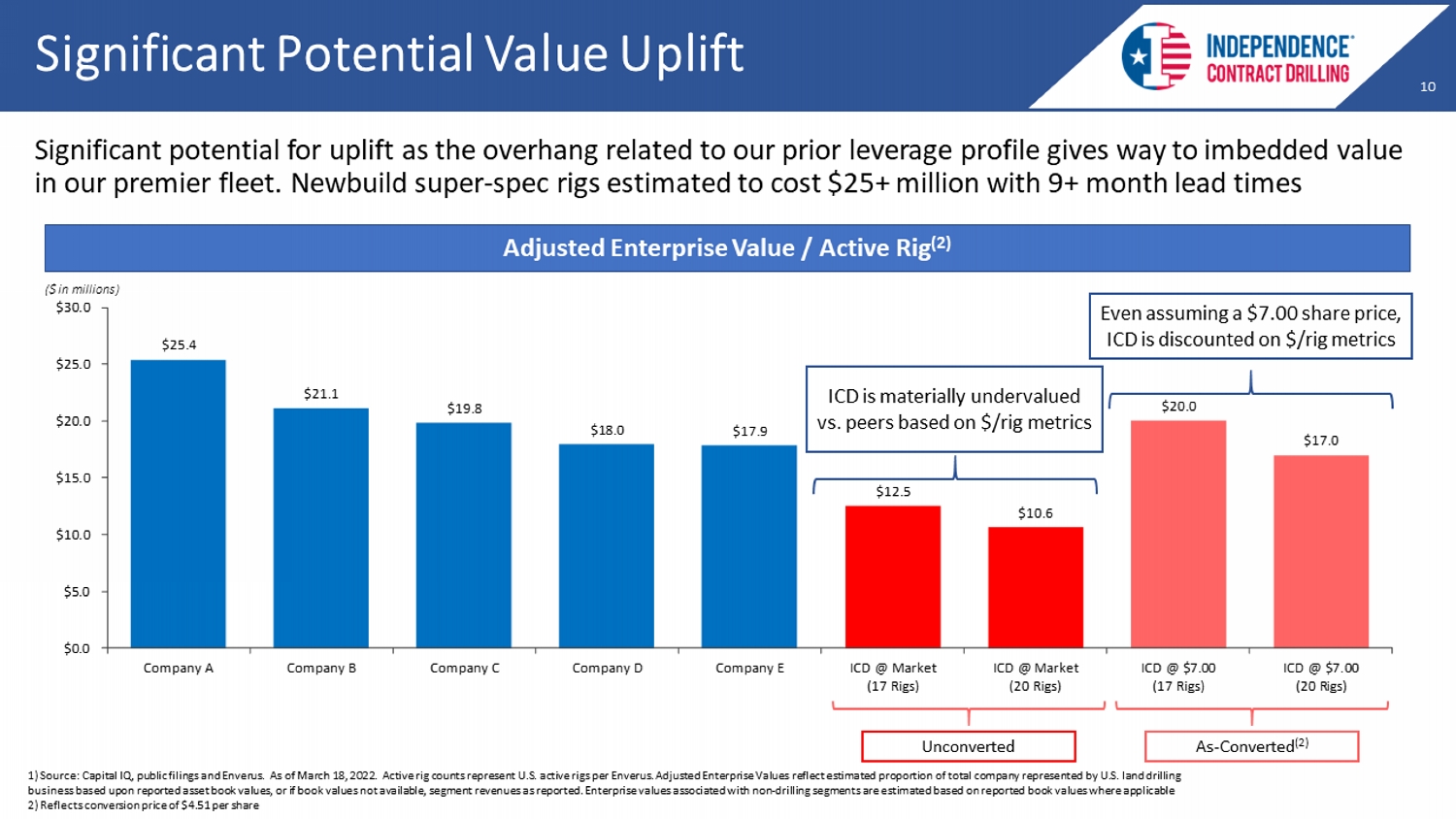

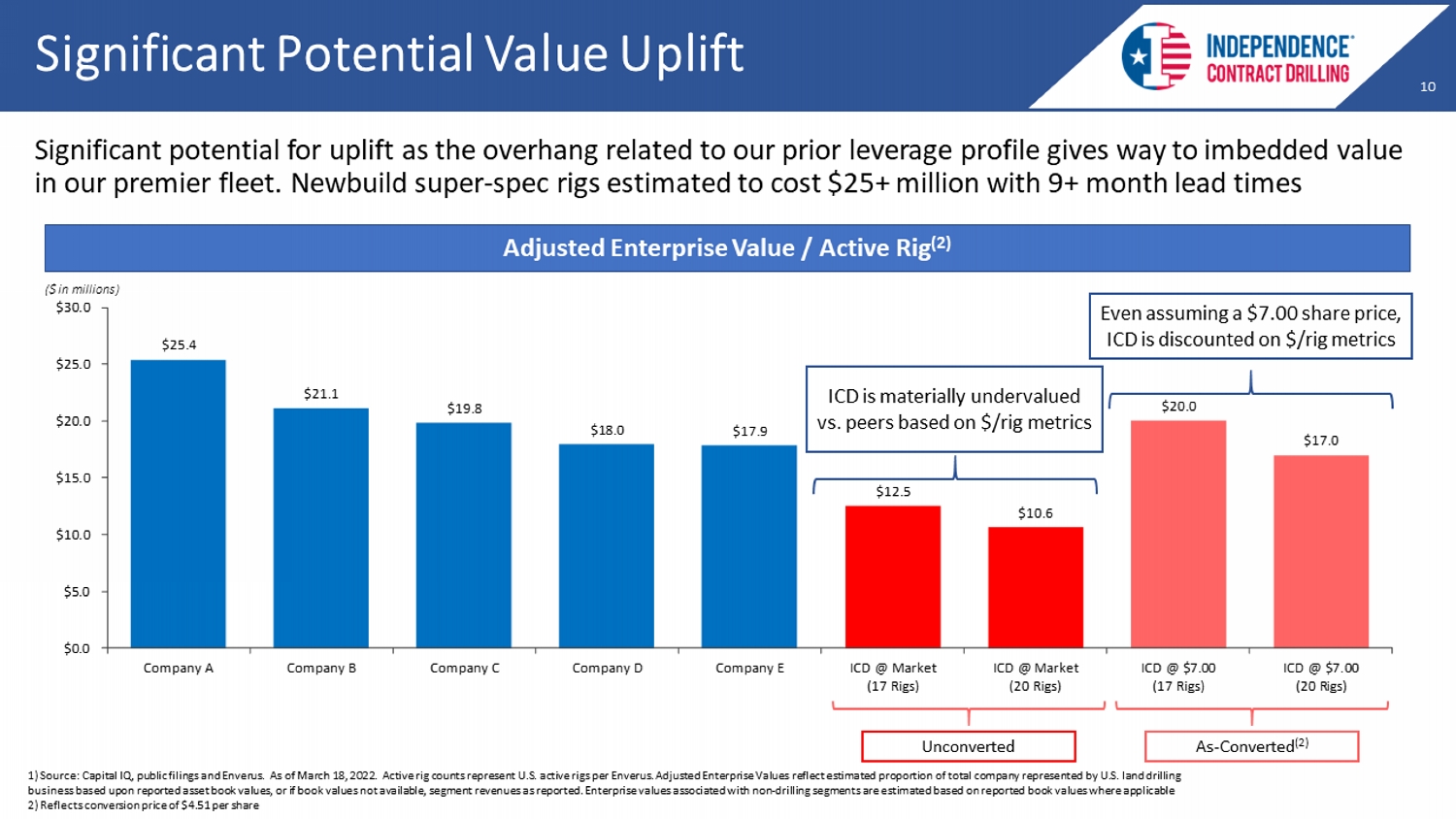

10 10 10 $25.4 $21.1 $19.8 $18.0 $17.9 $12.5 $10.6 $20.0 $17.0 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 Company A Company B Company C Company D Company E ICD @ Market (17 Rigs) ICD @ Market (20 Rigs) ICD @ $7.00 (17 Rigs) ICD @ $7.00 (20 Rigs) Significant potential for uplift as the overhang related to our prior leverage profile gives way to imbedded value in our premier fleet. Newbuild super - spec rigs estimated to cost $25+ million with 9+ month lead times Adjusted Enterprise Value / Active Rig (2) ($ in millions) Significant Potential Value Uplift 1) Source: Capital IQ, public filings and Enverus. As of March 18, 2022. Active rig counts represent U.S. active rigs per E nve rus. Adjusted Enterprise Values reflect estimated proportion of total company represented by U.S. land drilling business based upon reported asset book values, or if book values not available, segment revenues as reported. Enterprise val ues associated with non - drilling segments are estimated based on reported book values where applicable 2) Reflects conversion price of $4.51 per share ICD is materially undervalued vs. peers based on $/rig metrics Unconverted As - Converted (2) Even assuming a $7.00 share price, ICD is discounted on $/rig metrics

11 11 11 Flexibility Positions the Company for Continued Growth • No near term maturity • Ability to convert with conversion prices in line with market price • Other equity offering of this magnitude would have been impossible and any sizable offering would have likely been at a significant discount to market • Ability to retire up to $50mm over the next 18 months provides flexibility not often seen in similar structures • Ability to PIK interest and at a more favorable rate following shareholder vote Market opportunity is surging and this refinancing enables the company to capitalize on its full potential with rig redeployments at very attractive rates that would have been challenged with the significant debt maturity and overhang from the prior term loan

12 12 12 US Land Drilling’s Only Publicly - Traded, Pure - Play, Pad - Optimal, Super - Spec, Growth Story Highest Asset Quality 100% Super Spec - Pad Optimal Marketed Fleet with Best Geographic Focus Improving Dayrates & Utilization Driven by Market Fundamentals Market Share Gains Driven By 300 Series Rigs and Overall Market Consolidation Poised for Significant Free Cash Flow Yields Fleet 100% Dual - Fuel Enabled / Electric Hi - Line Capable: Substantial GHG Reduction / Elimination Customer Focused and Proven Operational Excellence Geographic Locations Focused on Most Prolific Oil and Natural Gas Producing Regions