Investor Presentation July 18-19, 2017 www.icdrilling.com

Preliminary Matters Various statements contained in this presentation, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward- looking statements may include projections and estimates concerning the timing and success of specific projects and our future revenues, income and capital spending. Our forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “plan,” “goal,” “will” or other words that convey the uncertainty of future events or outcomes. The forward-looking statements in this presentation speak only as of the date of this presentation; we disclaim any obligation to update these statements unless required by law, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including those discussed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. These risks, contingencies and uncertainties include, but are not limited to, the following: • our inability to implement our business and growth strategy; • a sustained decrease in domestic spending by the oil and natural gas exploration and production industry; • decline in or substantial volatility of crude oil and natural gas commodity prices; • fluctuation of our operating results and volatility of our industry; • inability to maintain or increase pricing on our contract drilling services; • delays in construction or deliveries of reactivated, upgraded, converted or new-build land drilling rigs; • the loss of material customers, financial distress or management changes of potential customers or failure to obtain contract renewals and additional customer contracts for our drilling services; • an increase in interest rates and deterioration in the credit markets; • our inability to raise sufficient funds through debt financing and equity issuances needed to fund future rig construction projects; • additional leverage associated with borrowings to fund rig conversions and additional newbuild rigs; • our inability to comply with the financial and other covenants in debt agreements that we may enter into as a result of reduced revenues and financial performance; • a substantial reduction in borrowing base under our revolving credit facility as a result of a decline in the appraised value of our drilling rigs or substantial reduction in our rig utilization; • overcapacity and competition in our industry; unanticipated costs, delays and other difficulties in executing our long-term growth strategy; • the loss of key management personnel; • new technology that may cause our drilling methods or equipment to become less competitive; • labor costs or shortages of skilled workers; • the loss of or interruption in operations of one or more key vendors; • the effect of operating hazards and severe weather on our rigs, facilities, business, operations and financial results, and limitations on our insurance coverage; • increased regulation of drilling in unconventional formations; • the incurrence of significant costs and liabilities in the future resulting from our failure to comply with new or existing environmental regulations or an accidental release of hazardous substances into the environment; • the potential failure by us to establish and maintain effective internal control over financial reporting; • lack of operating history as a contract drilling company; and • uncertainties associated with any registration statement, including financial statements, we may be required to file with the SEC. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this presentation and in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K. Further, any forward-looking statement speaks only as of the date of this presentation, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Adjusted Net Loss, EBITDA and adjusted EBITDA are supplemental non-GAAP financial measures that are used by management and external users of the Company’s financial statements, such as industry analysts, investors, lenders and rating agencies. The Company’s management believes adjusted Net Loss, EBITDA and adjusted EBITDA are useful because such measures allow the Company and its stockholders to more effectively evaluate its operating performance and compare the results of its operations from period to period and against its peers without regard to its financing methods or capital structure. See non-GAAP financial measures at the end of this presentation for a full reconciliation of Net Loss to adjusted Net Loss, EBITDA and adjusted EBITDA. 2

ICD Rig Location 1. Based upon date of initial drilling operations for newbuild 200 Series rig or converted 100 series rig. 2. Market data as of 7/14/17. Credit facility, debt, shares oustanding and cash balances as of 3/31/17. Debt balance excludes $0.5 million of long-term vehicle capital lease obligations. 3. Total credit facility commitment less outstanding borrowings @ 3/31/17. Estimated net debt balance @ 6/30/17: $33.5 million (excluding capitalized leases) Corporate Snapshot Sectors only pure play, pad-optimal growth story • Fleet composed of fourteen 200 Series ShaleDriller® rigs: ‒ 100% of fleet contracted ‒ Two additional 200 Series newbuilds expected to be delivered with incremental investment of ~ 50% of historical cost of equivalent newbuild 200 Series rigs • The speed, efficiency and safety offered by ICD’s rigs dramatically reduce drilling times, thereby saving significant capex dollars for E&P operators Established reputation for operational excellence and safety • Safety focused operations (SEMS II compliant) • Average 200 Series ShaleDriller® fleet age: ~2.8 years(1) • Best-in-class operating stats • Industry leading utilization • Established, experienced and well-known management team • Work with well-known customers who pay for quality Current Operational Footprint Current Capitalization & Liquidity (2) US$MM, unless otherwise noted Share Price ($/Share) 3.92 Share Outstanding (MM) 37.8 Equity Value 148.2 Long-term debt – Credit Facility 36.6 Cash 7.3 Aggregate Value 192.1 Credit Facility Unused Capacity(3) 48.4 Cash 7.3 Total Current Liquidity 55.7 Book Value of Equity 251.5 Total Capitalization 288.1 3 Texas Oklahoma Arkansas Louisiana New Mexico Target Areas of Growth Texas, Louisiana, Oklahoma and New Mexico July 14, 2017

• Fleet Status: - All rigs under contract: 14th rig mobilizing to Permian and begins multi-year contract at end of July 2017 - Optimized diversification: currently: 64% oil, 36% gas • Contract Extensions: - At time of 1Q’17 conference call: five rigs with scheduled contract expirations during 3Q’17 - Since 1Q’17 conference call: - Executed two term contracts and are at signature stage on third contract. Terms range from six months to one year. Upon execution of this third contract, all oil-directed rigs under contract until at least mid 1Q’18 - Ongoing negotiations on extensions for remaining two rigs with scheduled contract expirations at the end of 3Q’17 Operational & Financial Update 4

• Newbuilds: - Still evaluating opportunities, with estimated delivery between 4-6 months from contract execution - Estimated incremental capex: $22 million for next two 200 series newbuilds for which ICD already has already made significant investment • 2Q’17 Quarter Update: - Recent extension of revolving credit facility maturity to November 2020. Aggregate commitments remain at $85 million, plus $65 million uncommitted accordion - June 30, 2017 Total Debt: $39 million(1); Net Debt: $33.5(1) - June 30, 2017 Borrowing Base: $89.7 million; proforma for credit facility amendments: $95.4 million - Revenue days: 1,111 days (low end of guidance range due to transition of rig between customers at quarter-end) - Increased new hire recruiting, training and mentoring initiatives to combat tightening entry-level labor market Operational & Financial Update 5 1. Excluding capitalized leases.

✓ICD does not work at the margin: pad-optimal equipment essential for development of core E&P acreage in lower commodity price environment ✓Systems flexibility to partner with E&P and other service companies to achieve full systems optimization from technology / data integration ✓Standardized fleet supports lower capital intensity ✓By driving faster cycle times and drilling efficiencies, ICD’s rigs materially bend the E&P cost curve down – justifying a larger piece of the “pie” Key Differentiators Driving ICD’s Compelling Value Proposition 6

Land Drilling Overview 7 As E&P operators continue shifting towards a wellbore manufacturing model, they focus on the safest operations and rigs that consistently eliminate non-productive time and drive operating efficiencies • Pad-optimal rigs represent equipment that is best suited for wellbore manufacturing • Drill more wells per year and accelerate E&P operators’ production profiles and cash flows • Eliminate substantial spread costs As lateral length and pad size and complexity continue to expand, the value proposition of pad-optimal rig technology increases significantly Market access to pad-optimal rigs is extremely limited, with ICD and competitor pad-optimal fleets at full effective utilization • AC is no longer a differentiating technology • Bolt-on/after-thought upgrades not fit-for-purpose, and do not deliver value proposition of true pad- optimal rigs ShaleDriller® rigs eliminate non-productive time, drill longer laterals faster and for less cost, and materially reduce spread costs/cycle times

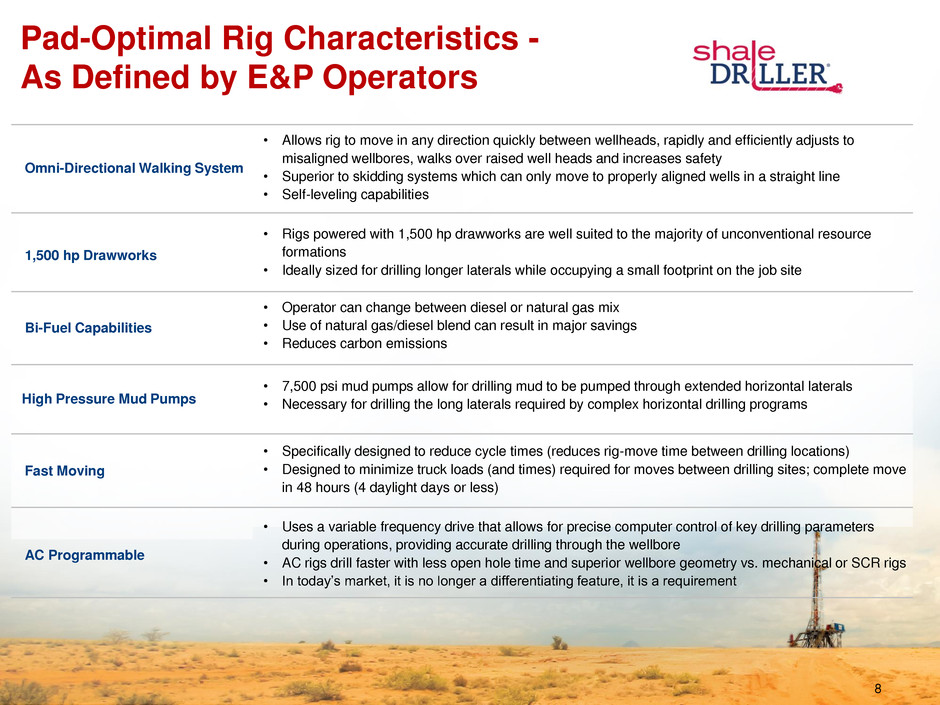

High Pressure Mud Pumps Pad-Optimal Rig Characteristics - As Defined by E&P Operators Omni-Directional Walking System • Allows rig to move in any direction quickly between wellheads, rapidly and efficiently adjusts to misaligned wellbores, walks over raised well heads and increases safety • Superior to skidding systems which can only move to properly aligned wells in a straight line • Self-leveling capabilities 1,500 hp Drawworks • Rigs powered with 1,500 hp drawworks are well suited to the majority of unconventional resource formations • Ideally sized for drilling longer laterals while occupying a small footprint on the job site Bi-Fuel Capabilities • Operator can change between diesel or natural gas mix • Use of natural gas/diesel blend can result in major savings • Reduces carbon emissions • 7,500 psi mud pumps allow for drilling mud to be pumped through extended horizontal laterals • Necessary for drilling the long laterals required by complex horizontal drilling programs 8 Fast Moving • Specifically designed to reduce cycle times (reduces rig-move time between drilling locations) • Designed to minimize truck loads (and times) required for moves between drilling sites; complete move in 48 hours (4 daylight days or less) AC Programmable • Uses a variable frequency drive that allows for precise computer control of key drilling parameters during operations, providing accurate drilling through the wellbore • AC rigs drill faster with less open hole time and superior wellbore geometry vs. mechanical or SCR rigs • In today’s market, it is no longer a differentiating feature, it is a requirement

0.0 1.0 2.0 3.0 4.0 5.0 6.0 0 10 20 30 40 50 60 70 $ M M Drilling Program Days Saved Cutting only 39 days off a 295 day drilling program justifies the incremental cost of a $25k/day pad- optimal rig $16,000 Dayrate$20,000 Dayrate$25,000 Dayrate Incremental Cost of a Pad-Optimal Rig (2) AFE Savings Examples of ICD Delivering Significant Value for E&P Operators Cutting Cycle Times - Illustrative Savings vs Legacy Rigs 1. Assumes $75,000 operator spread cost over 70 days 2. Based on $12,000 dayrate for legacy rig for a 295 day program; incremental cost calculated as Pad-Optimal Rig Cost * (295 – Days Saved) – Legacy Rig Cost * 295 days 9 Case Study: Multi-Well Pad Drilling Program The industry’s unconventional resource development techniques are rapidly trending towards multi-well pad development • An operator drilling multi-well pads benefits from ICD’s pad-optimal technology (vs. 1 – 2 wells per pad), by reducing cycle times as the number of moves and move durations decline ‒ Non-pad-optimal rigs, with legacy skidding or slow walking systems, are effective on 1-2 wells per pad but cannot efficiently prosecute larger well pads that are rapidly becoming the industry norm today • Results in major cost savings for E&P operators • In an environment where total operator spread costs can approach $75,000/day on a wellsite, the incremental dayrate for a pad-optimal rig is marginal In 2015, for a large E&P operator utilizing a pad drilling program, ICD cut 70 days and $5.3MM off their original AFE drilling budgets $5.3MM (1)

Current or past ICD customers High-Quality Customer Base ICD Customers Include Some of the Highest Quality, Most Active Players in ICD Target MarketsICD has established a deep and high-quality customer base composed of some of the most active players in ICD target markets • All rigs operating on term contracts • ICD’s fleet standardization provides several benefits for customers including consistent branding, predictability in performance and quick understanding of the rig’s capabilities • ICD is focused on strategically expanding its customer base – Target markets are Texas and the contiguous states – Target customers with significant investments and willingness to drill through industry cycles – Target operators who value safety and efficient operations – Focus on customers willing to enter into long-term contractual relationships 10 ICD Customer Base Breakdown(1) Source: Wall Street Consensus Estimates and Company Guidance 64% 36% Public Private (1) Percentage of rigs contracted with publicly-traded and private customers as of July 14, 2017. Company 2017E Total Capex ($MM) Pioneer Natural Resources (PXD) 4,800 Concho Resources (CXO) 4,600 Devon Energy Corporation (DVN) 2,300 Apache Corporation (APA) 2,000 Anadarko Petroleum Corporation (APC) 1,380 Occidental (OXY) 1,200 Cimarex Energy (XEC) 1,200 Parsley Energy (PE) 1,150 Energen Resources (EGN) 1,040 Newfield Exploration (NFX) 1,000 Diamondback Energy (FANG) 800 Encana (ECA) 925 SM Energy (SM) 700 RSP P rmian-SHEP (RSPP) 625 Laredo Petroleum (LPI) 530 Callon Petroleum (CPE) 500 WPX 415 GeoSouthern (GEP Haynesville) NA BHP Billiton (BHP) 400

Financial Flexibility ICD backlog expanding, with contract tenors and dayrates increasing for all contracts signed since 12/31/16 As of 3/31/17: ICD remaining capital budget for 2017 was $13.5 million and includes costs to complete final rig conversion, which is scheduled for mobilization early Q3’17 ICD has already made significant investment towards next two newbuild ShaleDriller® rigs - following completion of these projects, ICD fleet would be comprised of sixteen 200 Series ShaleDriller® rigs ICD is ideally positioned to complete these next two newbuild capital projects when market conditions dictate while still maintaining a strong liquidity position ICD in preferential tax position 11 Financial Flexibility and Liquidity $MM Cash @ 3/31/17 $7.3 Plus: Revolving Credit Facility Capacity @ 3/31/17 85.0 Less: Outstanding Borrowings @ 3/31/17 (36.6) Total Liquidity $55.7 Less: Remaining 2017 capex budget(1) (13.5) 2017 planned asset sales(1) 3.9 Potential incremental growth capex(1) (22.0) Total Liquidity Adjusted(2) $ 24.1 (1) As of March 31, 2017. Planned assets sales = estimated fair value, less selling costs, of assets held for sale as of March 31, 2017. Growth capex = estimated incremental investment for final two newbuild rigs,. Actual costs may differ based upon final rig configuration and contractual requirements. (2) Assumes all budgeted capex, planned asset sales and potential growth capex occurred 3/31/17, and funded through additional borrowings under existing credit facility. Excludes debt associated with vehicle capital leases.

✓$50 oil long term ✓Peak rig count – but high grading within ✓Evolutionary changes in equipment specifications ✓Full data integration / systems optimization ✓End of the dayrate model – shift towards risk- sharing, performance-based economics What does the future hold? 12

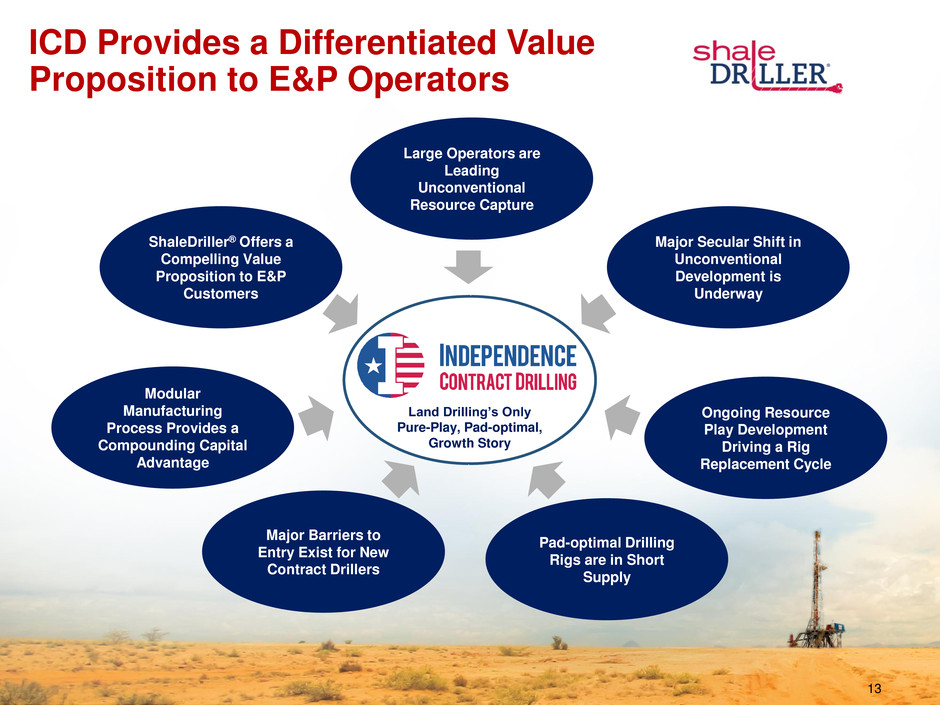

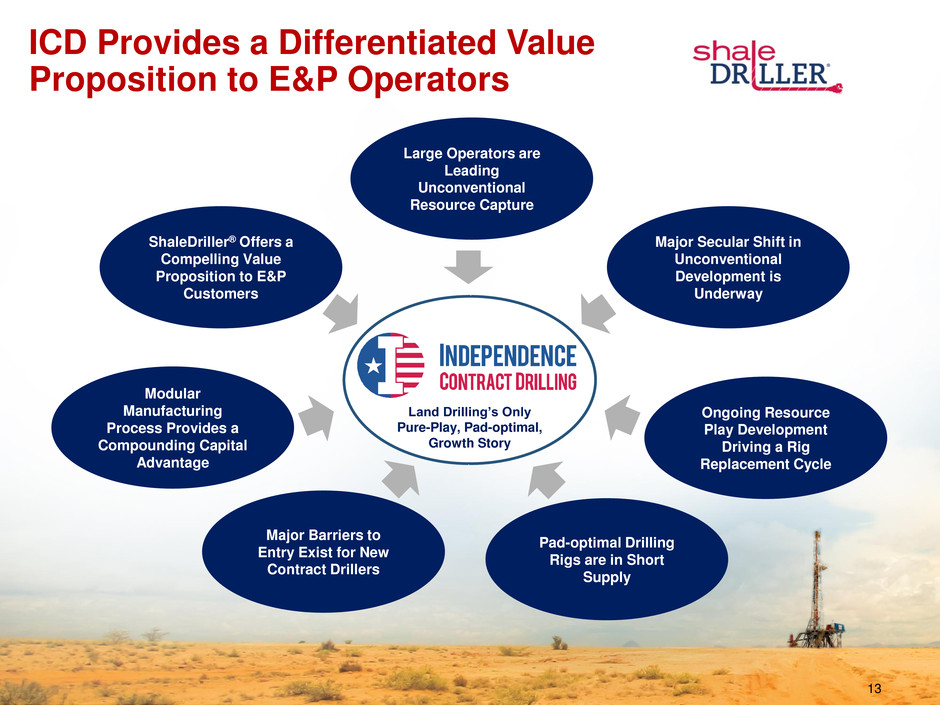

Land Drilling’s Only Pure-Play, Pad-optimal, Growth Story Large Operators are Leading Unconventional Resource Capture Major Secular Shift in Unconventional Development is Underway Ongoing Resource Play Development Driving a Rig Replacement Cycle Pad-optimal Drilling Rigs are in Short Supply Major Barriers to Entry Exist for New Contract Drillers Modular Manufacturing Process Provides a Compounding Capital Advantage ShaleDriller® Offers a Compelling Value Proposition to E&P Customers ICD Provides a Differentiated Value Proposition to E&P Operators 13

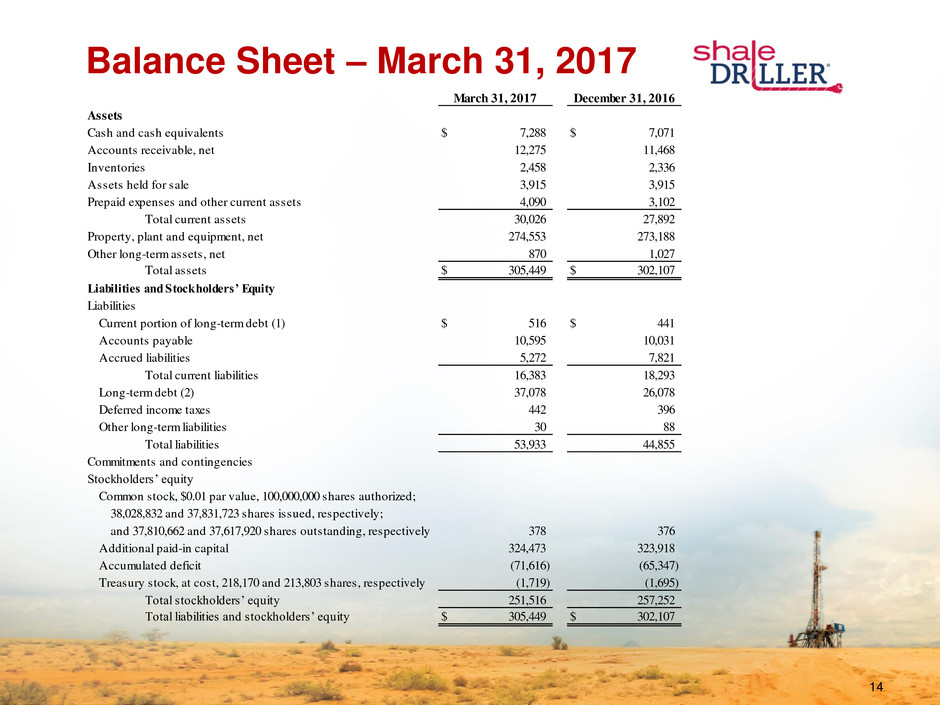

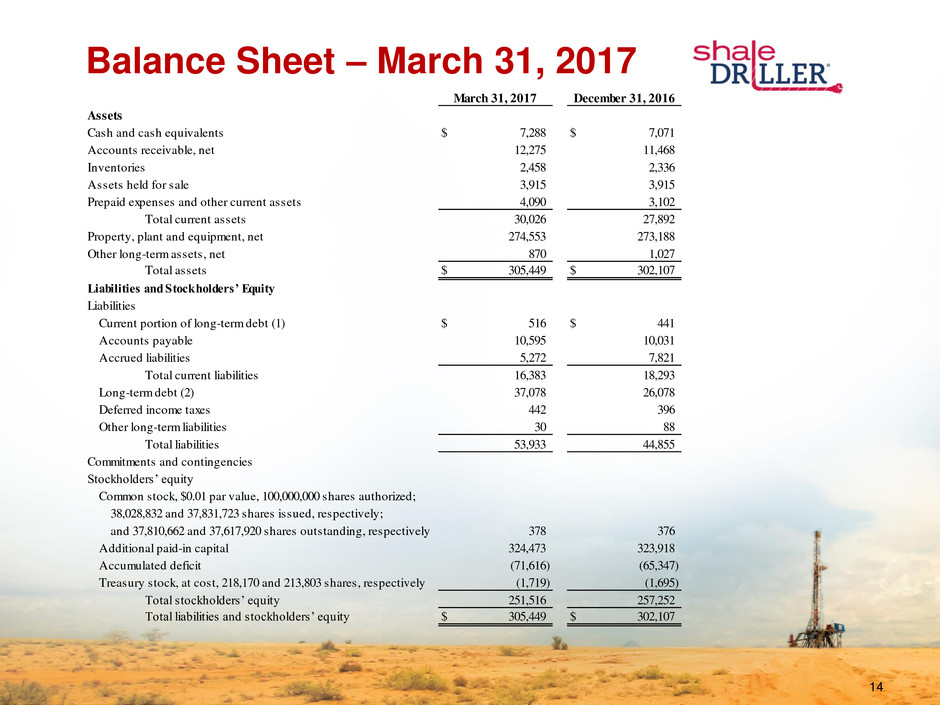

Balance Sheet – March 31, 2017 14 March 31, 2017 December 31, 2016 Assets Cash and cash equivalents 7,288$ 7,071$ Accounts receivable, net 12,275 11,468 Inventories 2,458 2,336 Assets held for sale 3,915 3,915 Prepaid expenses and other current assets 4,090 3,102 Total current assets 30,026 27,892 Property, plant and equipment, net 274,553 273,188 Other long-term assets, net 870 1,027 Total assets 305,449$ 302,107$ Liabilities and Stockholders’ Equity Liabilities Current portion of long-term debt (1) 516$ 441$ Accounts payable 10,595 10,031 Accrued liabilities 5,272 7,821 Total current liabilities 16,383 18,293 Long-term debt (2) 37,078 26,078 Deferred income taxes 442 396 Other long-term liabilities 30 88 Total liabilities 53,933 44,855 Commitments and contingencies Stockholders’ equity Common stock, $0.01 par value, 100,000,000 shares authorized; 38,028,832 and 37,831,723 shares issued, respectively; and 37,810,662 and 37,617,920 shares outstanding, respectively 378 376 Additional paid-in capital 324,473 323,918 Accumulated deficit (71,616) (65,347) Treasury stock, at cost, 218,170 and 213,803 shares, respectively (1,719) (1,695) Total stockholders’ equity 251,516 257,252 Total liabilities and stockholders’ equity 305,449$ 302,107$

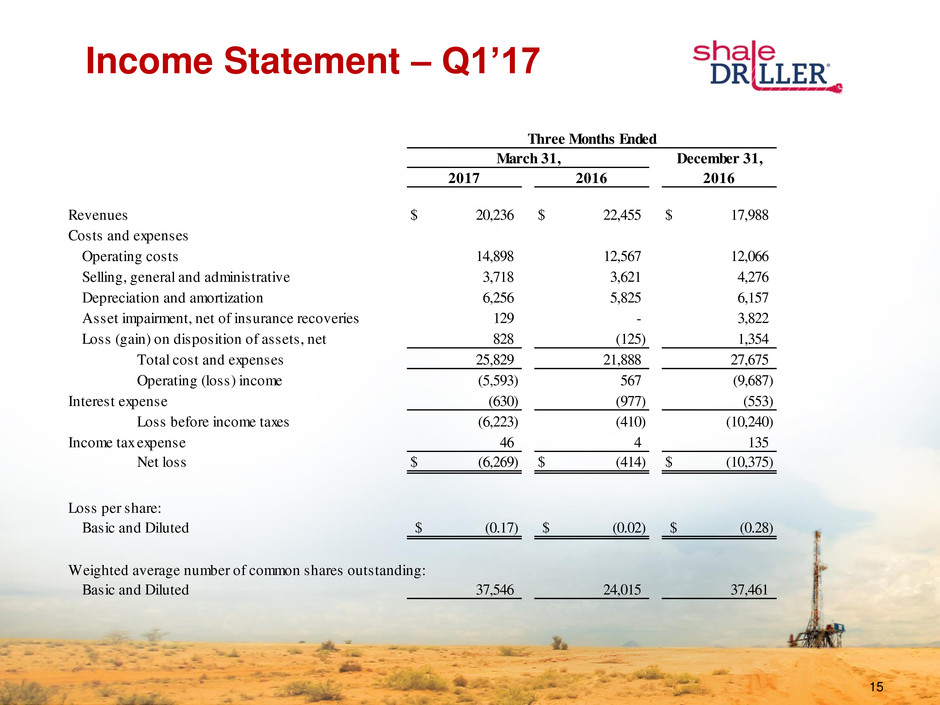

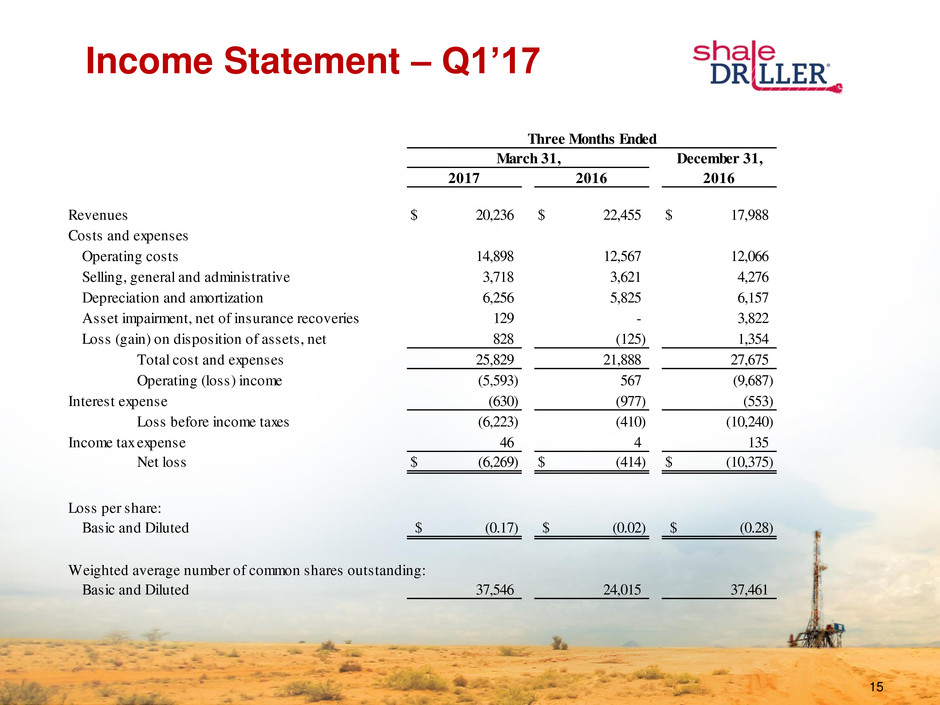

Income Statement – Q1’17 15 December 31, 2017 2016 2016 Revenues 20,236$ 22,455$ 17,988$ Costs and expenses Operating costs 14,898 12,567 12,066 Selling, general and administrative 3,718 3,621 4,276 Depreciation and amortization 6,256 5,825 6,157 Asset impairment, net of insurance recoveries 129 - 3,822 Loss (gain) on disposition of assets, net 828 (125) 1,354 Total cost and expenses 25,829 21,888 27,675 Operating (loss) income (5,593) 567 (9,687) Interest expense (630) (977) (553) Loss before income taxes (6,223) (410) (10,240) Income tax expense 46 4 135 Net loss (6,269)$ (414)$ (10,375)$ Loss per share: Basic and Diluted (0.17)$ (0.02)$ (0.28)$ Weighted average number of common shares outstanding: Basic and Diluted 37,546 24,015 37,461 Three Months Ended March 31,

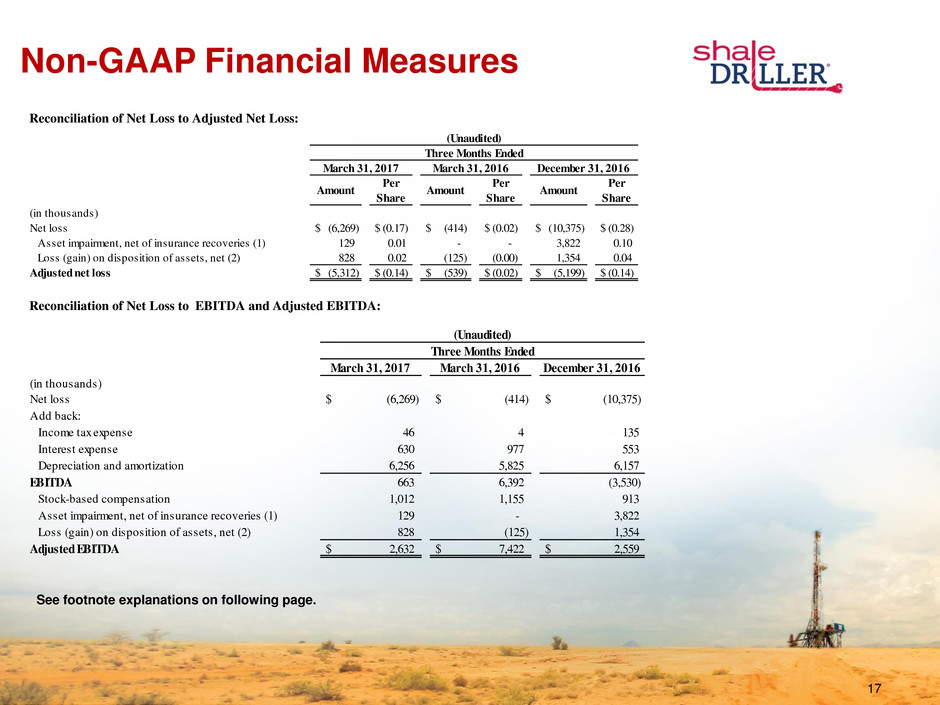

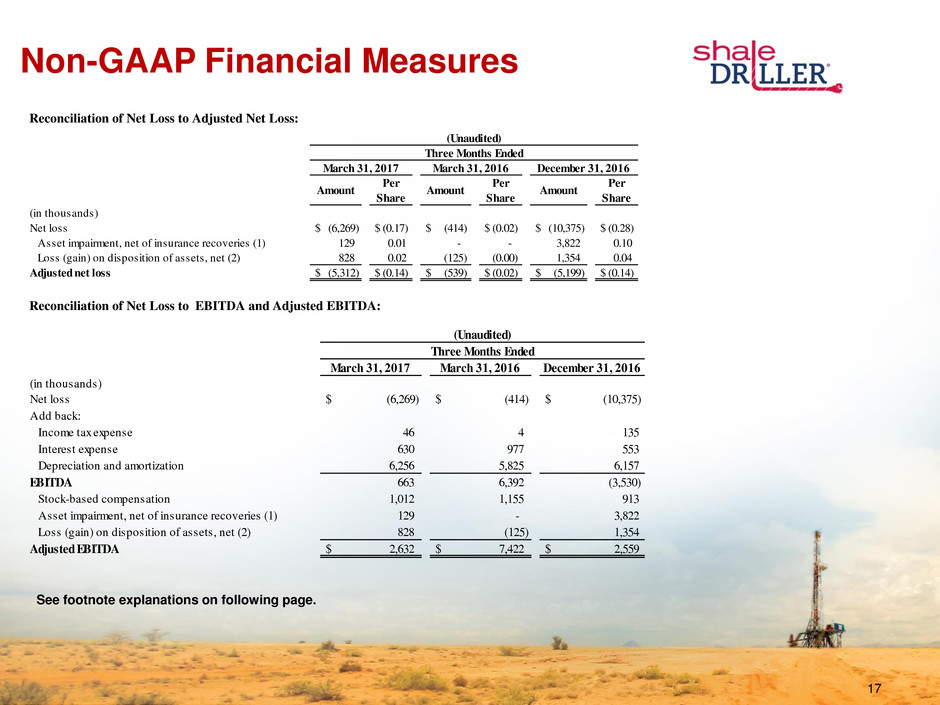

Non-GAAP Financial Measures 16 Adjusted net loss, EBITDA and adjusted EBITDA are supplemental non-GAAP financial measure that are used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. In addition, adjusted EBITDA is consistent with how EBITDA is calculated under our revolving credit facility for purposes of determining our compliance with various financial covenants. We define “EBITDA” as earnings (or loss) before interest, taxes, depreciation, and amortization, and we define “adjusted EBITDA” as EBITDA before stock-based compensation, non-cash asset impairments, gains or losses on disposition of assets, and other non-recurring items added back to, or subtracted from, net income for purposes of calculating EBITDA under our revolving credit facility. Neither adjusted net loss, EBITDA or adjusted EBITDA is a measure of net income as determined by U.S. generally accepted accounting principles (“GAAP”). Management believes adjusted net loss, EBITDA and adjusted EBITDA are useful because they allow our stockholders to more effectively evaluate our operating performance and compliance with various financial covenants under our revolving credit facility and compare the results of our operations from period to period and against our peers without regard to our financing methods or capital structure or non-recurring, non-cash transactions. We exclude the items listed above from net income (loss) in calculating adjusted net loss, EBITDA and adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. None of adjusted net loss, EBITDA or adjusted EBITDA should be considered an alternative to, or more meaningful than, net income (loss), the most closely comparable financial measure calculated in accordance with GAAP or as an indicator of our operating performance or liquidity. Certain items excluded from adjusted net loss, EBITDA and adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s return of assets, cost of capital and tax structure. Our presentation of adjusted net loss, EBITDA and adjusted EBITDA should not be construed as an inference that our results will be unaffected by unusual or non-recurring items. Our computations of adjusted net loss, EBITDA and adjusted EBITDA may not be comparable to other similarly titled measures of other companies. The table on the following page present a reconciliation of net loss to adjusted net loss, EBITDA and adjusted EBITDA.

Non-GAAP Financial Measures 17 Reconciliation of Net Loss to Adjusted Net Loss: Reconciliation of Net Loss to EBITDA and Adjusted EBITDA: See footnote explanations on following page. March 31, 2017 March 31, 2016 December 31, 2016 (in thousands) Net loss $ (6,269) $ (414) $ (10,375) Add back: Income tax expense 46 4 135 Interest expense 630 977 553 Depreciation and amortization 6,256 5,825 6,157 EBITDA 663 6,392 (3,530) Stock-based compensation 1,012 1,155 913 Asset impairment, net of insurance recoveries (1) 129 - 3,822 Loss (gain) on disposition of assets, net (2) 828 (125) 1,354 Adjusted EBITDA $ 2,632 $ 7,422 $ 2,559 Three Months Ended (Unaudited) Amount Per Share Amount Per Share Amount Per Share (in thousands) Net loss $ (6,269) $ (0.17) $ (414) $ (0.02) $ (10,375) $ (0.28) Asset impairment, net of insurance recoveries (1) 129 0.01 - - 3,822 0.10 Loss (gain) on disposition of assets, net (2) 828 0.02 (125) (0.00) 1,354 0.04 Adjusted net loss $ (5,312) $ (0.14) $ (539) $ (0.02) $ (5,199) $ (0.14) Three Months Ended (Unaudited) March 31, 2017 March 31, 2016 December 31, 2016

Non-GAAP Financial Measures 18 (1) In the first quarter of 2017, we recorded a $0.1 million, or $0.01 per share, non-cash impairment representing the estimated damage to the mast of one of our rigs, net of insurance recoveries. In the fourth quarter of 2016, we recorded a $3.8 million, or $0.10 per share, non-cash write-down of assets held for sale to reflect their current fair value less estimated selling costs. (2) In the first quarter of 2017, we recorded a loss on disposition of assets of $0.8 million, or $0.02 per share, primarily due to non-cash disposal of equipment in connection with the upgrade to 7,500 psi mud systems. In the first quarter of 2016, we recorded net proceeds on the sale of drilling equipment of $0.1 million. In the fourth quarter of 2016, we recorded a loss on disposition of assets of $1.4 million, or $0.04 per share, primarily due to non-cash disposal of equipment in connection with the upgrade to 7,500 psi mud systems.

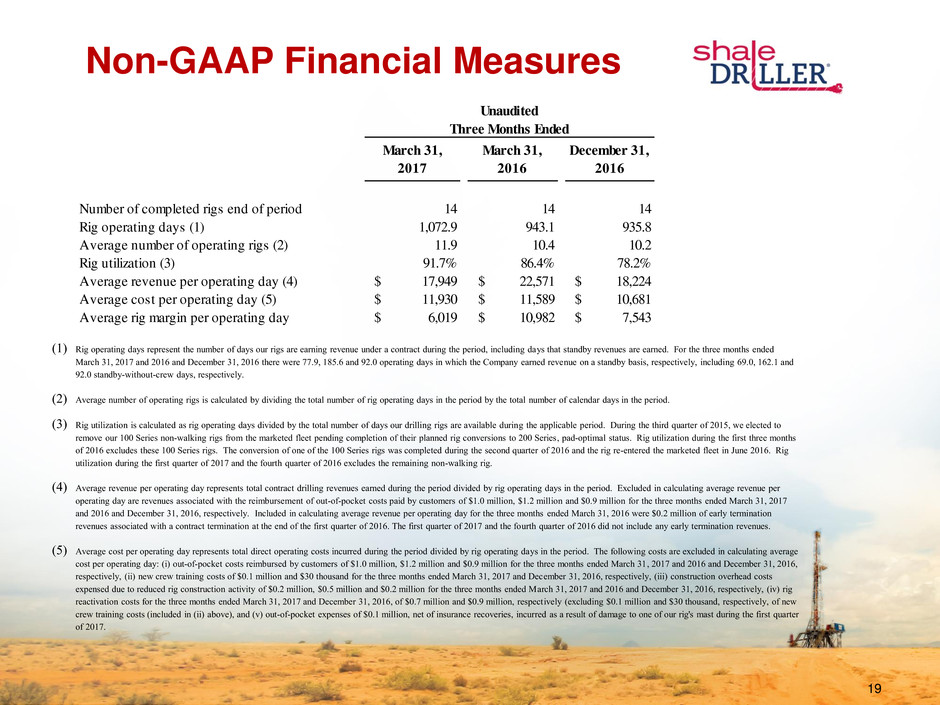

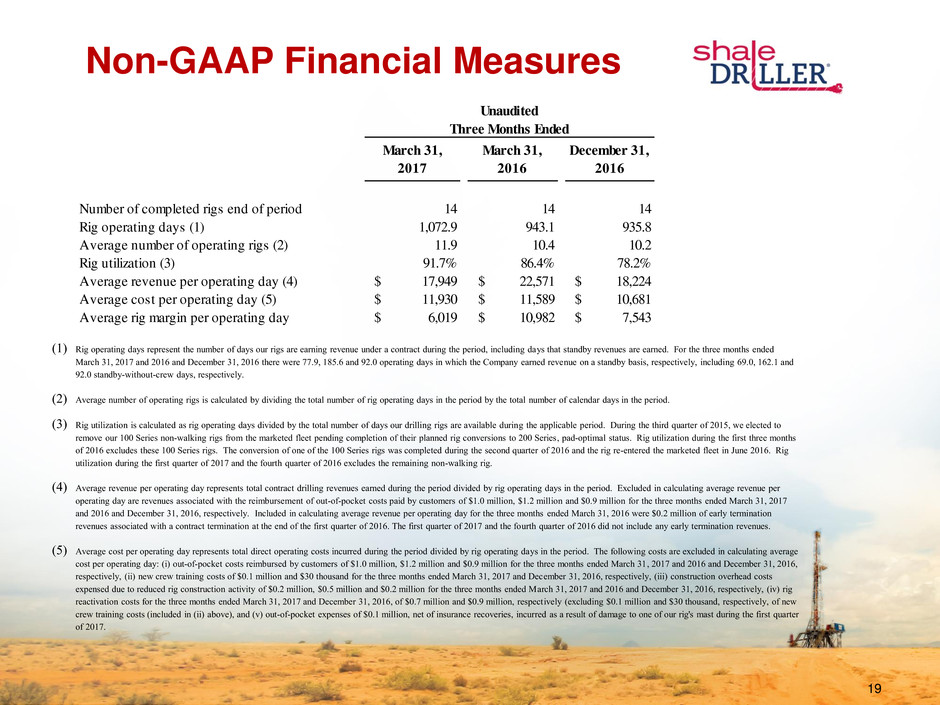

Non-GAAP Financial Measures 19 March 31, 2017 March 31, 2016 December 31, 2016 Number of completed rigs end of period 14 14 14 Rig operating days (1) 1,072.9 943.1 935.8 Average number of operating rigs (2) 11.9 10.4 10.2 Rig utilization (3) 91.7% 86.4% 78.2% Average revenue per operating day (4) $ 17,949 $ 22,571 $ 18,224 Average cost per operating day (5) $ 11,930 $ 11,589 $ 10,681 Average rig margin per operating day $ 6,019 $ 10,982 $ 7,543 Three Months Ended Unaudited (1) Rig operating days represent the number of days our rigs are earning revenue under a contract during the period, including days that standby revenues are earned. For the three months ended March 31, 2017 and 2016 and December 31, 2016 there were 77.9, 185.6 and 92.0 operating days in which the Company earned revenue on a standby basis, respectively, including 69.0, 162.1 and 92.0 standby-without-crew days, respectively. (2) Average number of operating rigs is calculated by dividing the total number of rig operating days in the period by the total number of calendar days in the period. (3) Rig utilization is calculated as rig operating days divided by the total number of days our drilling rigs are available during the applicable period. During the third quarter of 2015, we elected to remove our 100 Series non-walking rigs from the marketed fleet pending completion of their planned rig conversions to 200 Series, pad-optimal status. Rig utilization during the first three months of 2016 excludes these 100 Series rigs. The conversion of one of the 100 Series rigs was completed during the second quarter of 2016 and the rig re-entered the marketed fleet in June 2016. Rig utilization during the first quarter of 2017 and the fourth quarter of 2016 excludes the remaining non-walking rig. (4) Average revenue per operating day represents total contract drilling revenues earned during the period divided by rig operating days in the period. Excluded in calculating average revenue per operating day are revenues associated with the reimbursement of out-of-pocket costs paid by customers of $1.0 million, $1.2 million and $0.9 million for the three months ended March 31, 2017 and 2016 and December 31, 2016, respectively. Included in calculating average revenue per operating day for the three months ended March 31, 2016 were $0.2 million of early termination revenues associated with a contract termination at the end of the first quarter of 2016. The first quarter of 2017 and the fourth quarter of 2016 did not include any early termination revenues. (5) Average cost per operating day represents total direct operating costs incurred during the period divided by rig operating days in the period. The following costs are excluded in calculating average cost per operating day: (i) out-of-pocket costs reimbursed by customers of $1.0 million, $1.2 million and $0.9 million for the three months ended March 31, 2017 and 2016 and December 31, 2016, respectively, (ii) new crew training costs of $0.1 million and $30 thousand for the three months ended March 31, 2017 and December 31, 2016, respectively, (iii) construction overhead costs expensed due to reduced rig construction activity of $0.2 million, $0.5 million and $0.2 million for the three months ended March 31, 2017 and 2016 and December 31, 2016, respectively, (iv) rig reactivation costs for the three months ended March 31, 2017 and December 31, 2016, of $0.7 million and $0.9 million, respectively (excluding $0.1 million and $30 thousand, respectively, of new crew training costs (included in (ii) above), and (v) out-of-pocket expenses of $0.1 million, net of insurance recoveries, incurred as a result of damage to one of our rig's mast during the first quarter of 2017.

20