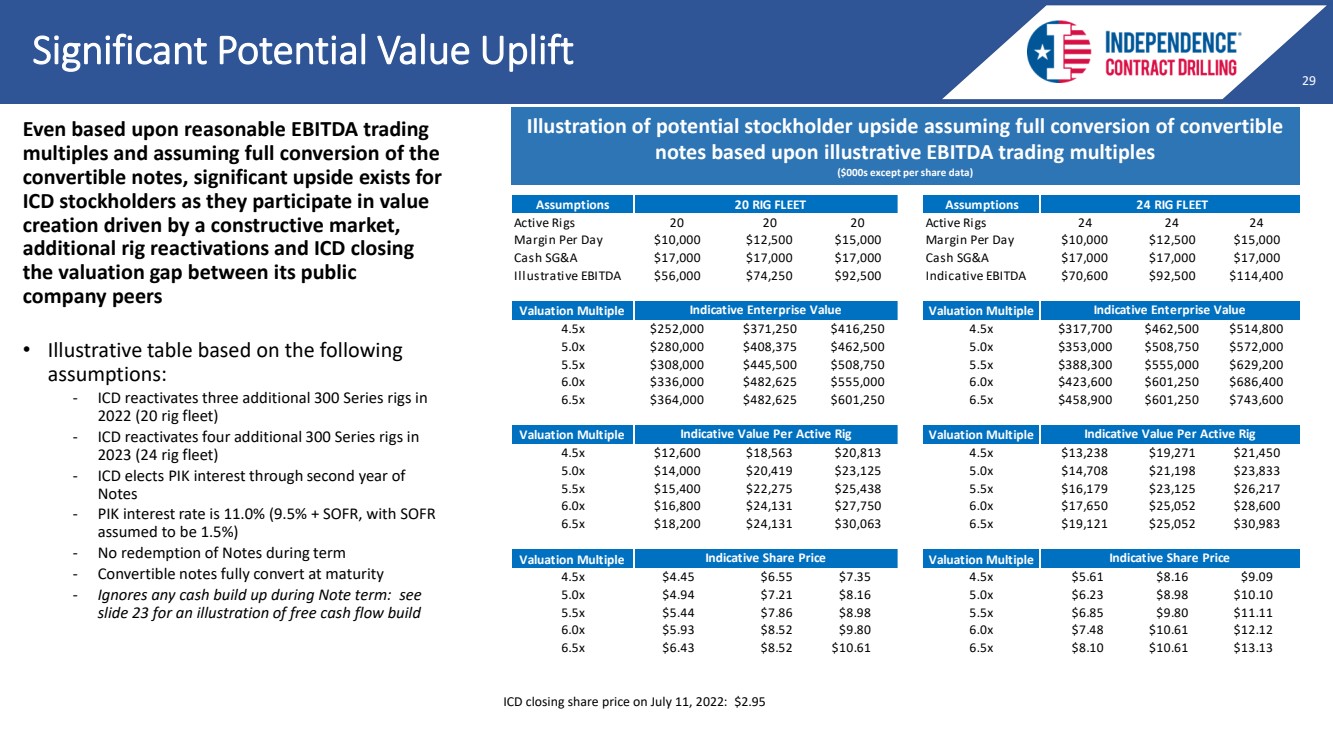

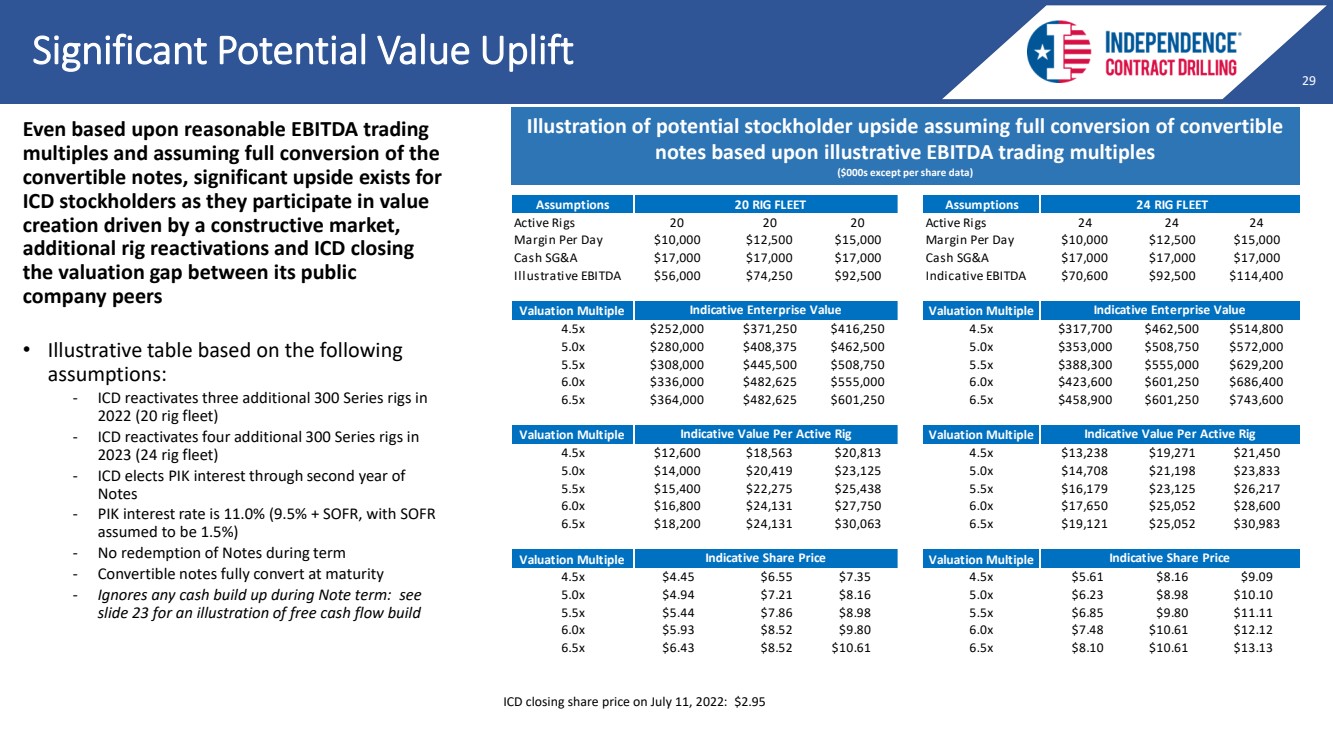

| 29 29 29 Significant Potential Value Uplift Illustration of potential stockholder upside assuming full conversion of convertible notes based upon illustrative EBITDA trading multiples ($000s except per share data) Even based upon reasonable EBITDA trading multiples and assuming full conversion of the convertible notes, significant upside exists for ICD stockholders as they participate in value creation driven by a constructive market, additional rig reactivations and ICD closing the valuation gap between its public company peers • Illustrative table based on the following assumptions: - ICD reactivates three additional 300 Series rigs in 2022 (20 rig fleet) - ICD reactivates four additional 300 Series rigs in 2023 (24 rig fleet) - ICD elects PIK interest through second year of Notes - PIK interest rate is 11.0% (9.5% + SOFR, with SOFR assumed to be 1.5%) - No redemption of Notes during term - Convertible notes fully convert at maturity - Ignores any cash build up during Note term: see slide 23 for an illustration of free cash flow build Assumptions 20 RIG FLEET Active Rigs 20 20 20 Margin Per Day $10,000 $12,500 $15,000 Cash SG&A $17,000 $17,000 $17,000 Illustrative EBITDA $56,000 $74,250 $92,500 Valuation Multiple 4.5x $252,000 $371,250 $416,250 5.0x $280,000 $408,375 $462,500 5.5x $308,000 $445,500 $508,750 6.0x $336,000 $482,625 $555,000 6.5x $364,000 $482,625 $601,250 Valuation Multiple 4.5x $12,600 $18,563 $20,813 5.0x $14,000 $20,419 $23,125 5.5x $15,400 $22,275 $25,438 6.0x $16,800 $24,131 $27,750 6.5x $18,200 $24,131 $30,063 Valuation Multiple 4.5x $4.45 $6.55 $7.35 5.0x $4.94 $7.21 $8.16 5.5x $5.44 $7.86 $8.98 6.0x $5.93 $8.52 $9.80 6.5x $6.43 $8.52 $10.61 Indicative Value Per Active Rig Indicative Share Price Indicative Enterprise Value Assumptions 24 RIG FLEET Active Rigs 24 24 24 Margin Per Day $10,000 $12,500 $15,000 Cash SG&A $17,000 $17,000 $17,000 Indicative EBITDA $70,600 $92,500 $114,400 Valuation Multiple 4.5x $317,700 $462,500 $514,800 5.0x $353,000 $508,750 $572,000 5.5x $388,300 $555,000 $629,200 6.0x $423,600 $601,250 $686,400 6.5x $458,900 $601,250 $743,600 Valuation Multiple 4.5x $13,238 $19,271 $21,450 5.0x $14,708 $21,198 $23,833 5.5x $16,179 $23,125 $26,217 6.0x $17,650 $25,052 $28,600 6.5x $19,121 $25,052 $30,983 Valuation Multiple 4.5x $5.61 $8.16 $9.09 5.0x $6.23 $8.98 $10.10 5.5x $6.85 $9.80 $11.11 6.0x $7.48 $10.61 $12.12 6.5x $8.10 $10.61 $13.13 Indicative Enterprise Value Indicative Value Per Active Rig Indicative Share Price ICD closing share price on July 11, 2022: $ 2.95 |