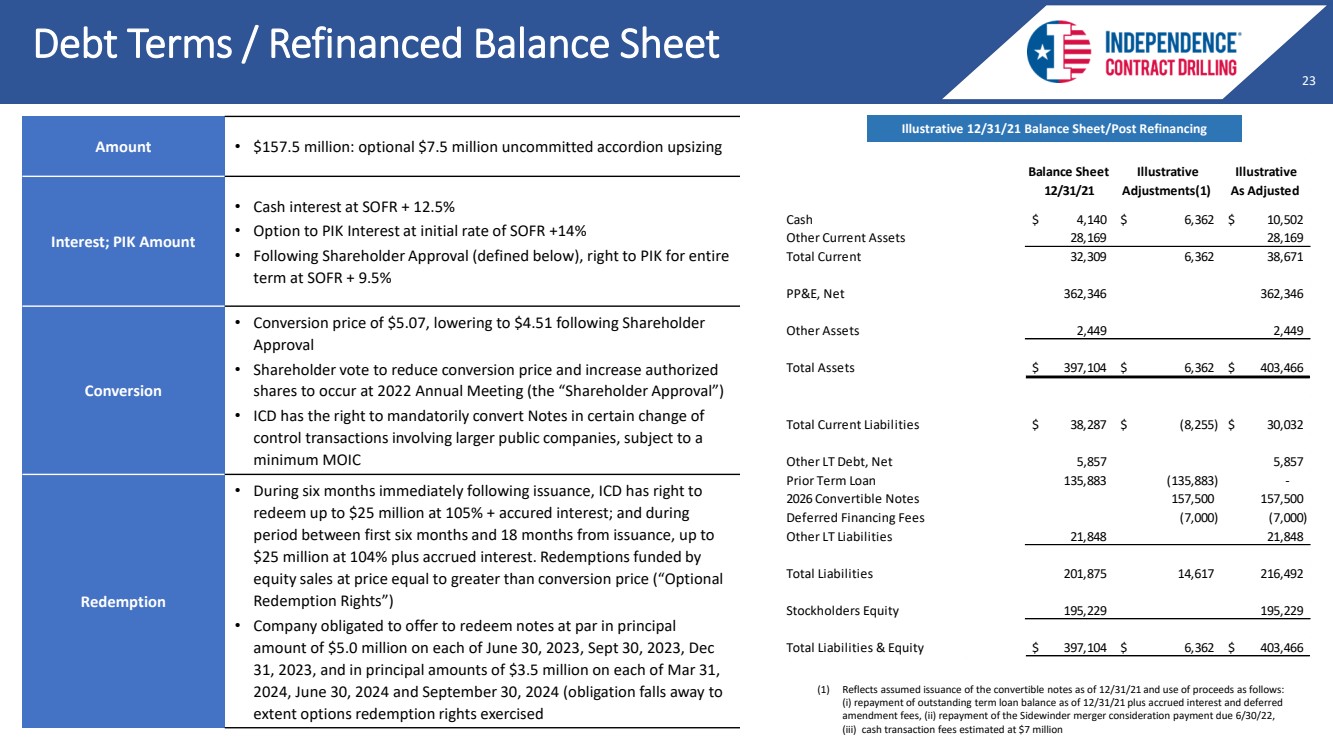

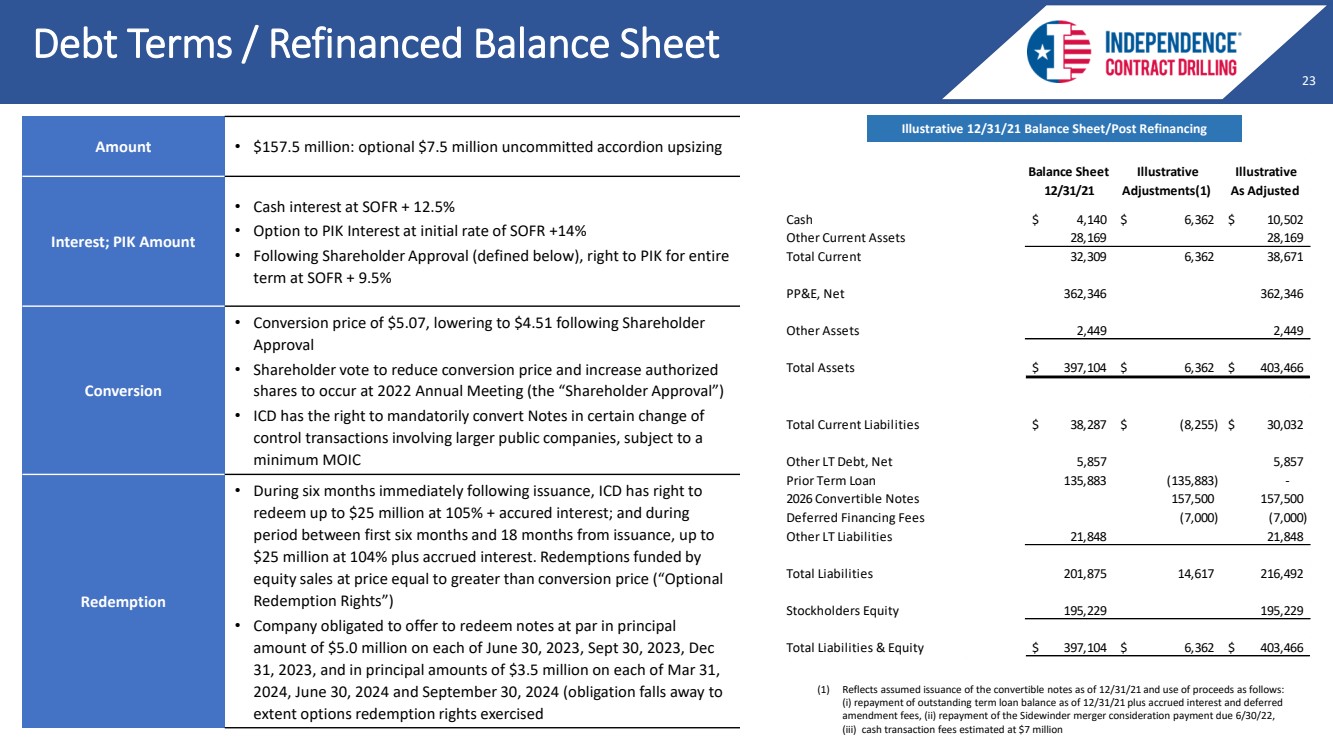

| 23 23 23 Debt Terms / Refinanced Balance Sheet Amount • $157.5 million: optional $7.5 million uncommitted accordion upsizing Interest; PIK Amount • Cash interest at SOFR + 12.5% • Option to PIK Interest at initial rate of SOFR +14% • Following Shareholder Approval (defined below), right to PIK for entire term at SOFR + 9.5% Conversion • Conversion price of $5.07, lowering to $4.51 following Shareholder Approval • Shareholder vote to reduce conversion price and increase authorized shares to occur at 2022 Annual Meeting (the “Shareholder Approval”) • ICD has the right to mandatorily convert Notes in certain change of control transactions involving larger public companies, subject to a minimum MOIC Redemption • During six months immediately following issuance, ICD has right to redeem up to $25 million at 105% + accured interest; and during period between first six months and 18 months from issuance, up to $25 million at 104% plus accrued interest. Redemptions funded by equity sales at price equal to greater than conversion price (“Optional Redemption Rights”) • Company obligated to offer to redeem notes at par in principal amount of $5.0 million on each of June 30, 2023, Sept 30, 2023, Dec 31, 2023, and in principal amounts of $3.5 million on each of Mar 31, 2024, June 30, 2024 and September 30, 2024 (obligation falls away to extent options redemption rights exercised Illustrative 12/31/21 Balance Sheet/Post Refinancing Cash 4,140 $ 6,362 $ 10,502 $ Other Current Assets 28,169 28,169 Total Current 32,309 6,362 38,671 PP&E, Net 362,346 362,346 Other Assets 2,449 2,449 Total Assets 397,104 $ 6,362 $ 403,466 $ Total Current Liabilities 38,287 $ (8,255) $ 30,032 $ Other LT Debt, Net 5,857 5,857 Prior Term Loan 135,883 (135,883) - 2026 Convertible Notes 157,500 157,500 Deferred Financing Fees (7,000) (7,000) Other LT Liabilities 21,848 21,848 Total Liabilities 201,875 14,617 216,492 Stockholders Equity 195,229 195,229 Total Liabilities & Equity 397,104 $ 6,362 $ 403,466 $ Balance Sheet 12/31/21 Illustrative Adjustments(1) Illustrative As Adjusted (1) Reflects assumed issuance of the convertible notes as of 12/31/21 and use of proceeds as follows: (i) repayment of outstanding term loan balance as of 12/31/21 plus accrued interest and deferred amendment fees, (ii) repayment of the Sidewinder merger consideration payment due 6/30/22, (iii) cash transaction fees estimated at $7 million |