- GOGO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Gogo (GOGO) 8-KRegulation FD Disclosure

Filed: 14 Aug 13, 12:00am

Investor Presentation August 2013 Exhibit 99.1 |

DISCLAIMER

Safe Harbor Statement

This presentation contains “forward-looking statements” that are based on management’s beliefs and assumptions and on information currently available to management. Most forward-looking statements contain words that identify them as forward-looking, such as “anticipates,” “believes,” “continues,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms that relate to future events. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Gogo’s actual results, performance or achievements to be materially different from any projected results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent the beliefs and assumptions of Gogo only as of the date of this presentation and Gogo undertakes no obligation to update or revise publicly any such forward-looking statements, whether as a result of new information, future events or otherwise. As such, Gogo’s future results may vary from any expectations or goals expressed in, or implied by, the forward-looking statements included in this presentation, possibly to a material degree.

Gogo cannot assure you that the assumptions made in preparing any of the forward-looking statements will prove accurate or that any long-term financial or operational goals and targets will be realized. In particular, the availability and performance of certain technology solutions yet to be implemented by the Company set forth in this presentation represent aspirational long-term goals based on current expectations. For a discussion of some of the important factors that could cause Gogo’s results to differ materially from those expressed in, or implied by, the forward-looking statements included in this presentation, investors should refer to the disclosure contained under the heading “Risk Factors” and “Special Note Regarding Forward-Looking Statements” in the Company’s prospectus relating to its initial public offering of common stock as filed with the SEC on June 24 2013 and the Company’s Quarterly Report on Form 10-Q as filed with the SEC on August 7, 2013.

Note to Certain Operating and Financial Data

In addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles (“GAAP”), Gogo also discloses in this presentation certain non-GAAP financial information, including Adjusted EBITDA and Cash CapEx. These financial measures are not recognized measures under GAAP and are not intended to be, and should not be considered, in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. In addition, this presentation contains various customer metrics and operating data, including numbers of aircraft or units online, that are based on internal company data, as well as information relating to the commercial and business aviation markets, and our position within those markets. While management believes such information and data are reliable, they have not been verified by an independent source and there are inherent challenges and limitations involved in compiling data across various geographies and from various sources.

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 2

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 3 2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 3 BUSINESS OVERVIEW |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 4 WHY INVEST IN GOGO LARGE GROWTH OPPORTUNITY ATTRACTIVE ECONOMICS EXPERIENCE & SCALE PIONEER AND LEADER |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 5 GOGO TRANSFORMED THE FLYING EXPERIENCE FOREVER 2006-2008 2009-2013 BEFORE GOGO 40+ Million Sessions |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 6 • ~2,000 aircraft online • > 7,000 daily flights • ~81% market share • 2 international carriers aircraft awards received • Global sales organization established • Satellite and terminals contracts secured COMMERCIAL AVIATION NORTH AMERICA BUSINESS AVIATION GLOBAL • ~ 6,800 systems operating • 63% market share in Narrowband (1) • 93% market share in Broadband (2) GOGO LEADERSHIP SPANS ALL MARKET SEGMENTS (1) Business Aviation Iridium market share, based on management estimates. (2) Business Aviation ATG market share, based on management estimates. COMMERCIAL AVIATION REST OF WORLD |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 7 OUR VERSATILE, PROPRIETARY PLATFORM Gogo Vision Gogo Signature Services Operations-Oriented Communication Services Gogo Connectivity & Gogo Biz AIRCRAFT OPERATORS TRAVELERS, AIRLINES & MEDIA PARTNERS TRAVELERS |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 8 WE PRIDE OURSELVES ON ENDURING PARTNERSHIPS INTERNATIONAL NORTH AMERICA Doug Parker, Chairman and CEO, US Airways Group, Inc. Subsidiary of “We have a lot of anecdotal evidence, including ourselves, of people switching airlines because of whether or not there’s Wi-Fi on the airplane.” |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 9 WE PRIDE OURSELVES ON ENDURING PARTNERSHIPS WE PRIDE OURSELVES ON ENDURING PARTNERSHIPS ORIGINAL EQUIPMENT MANUFACTURERS FRACTIONAL JET OPERATORS Alex Wilcox, CEO, JetSuite “We know people will pay more for Wi-Fi equipped airplanes.” |

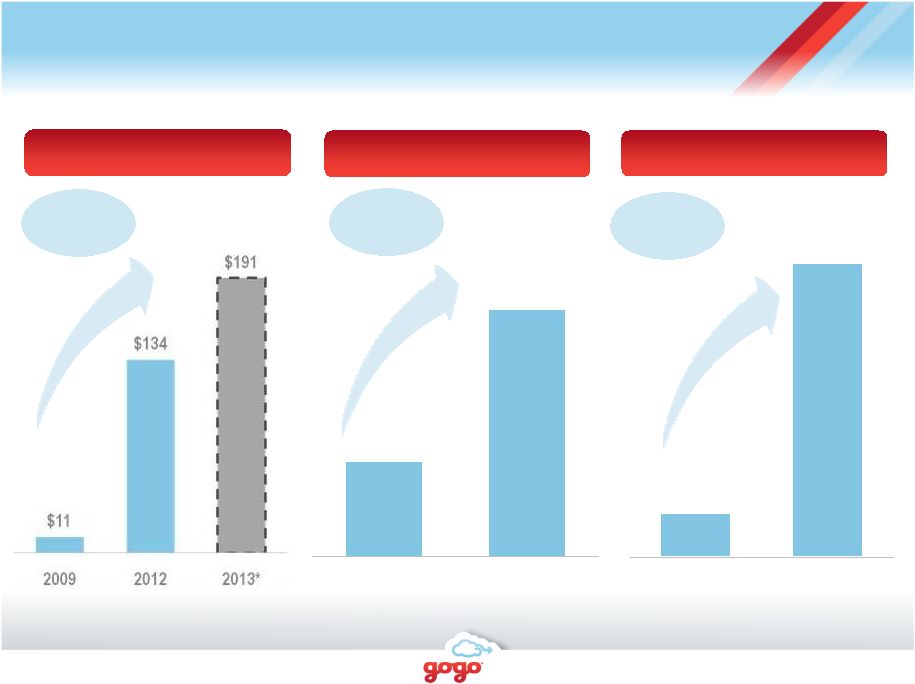

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 10 MORE PLANES, MORE SESSIONS, MORE CA REVENUE 692 1,811 2009 2012 AIRCRAFT ONLINE REVENUE ($MM) 38% CAGR 132% CAGR *Mid point of 2013 guidance 2 13 2009 2012 SESSIONS (MM) 91% CAGR |

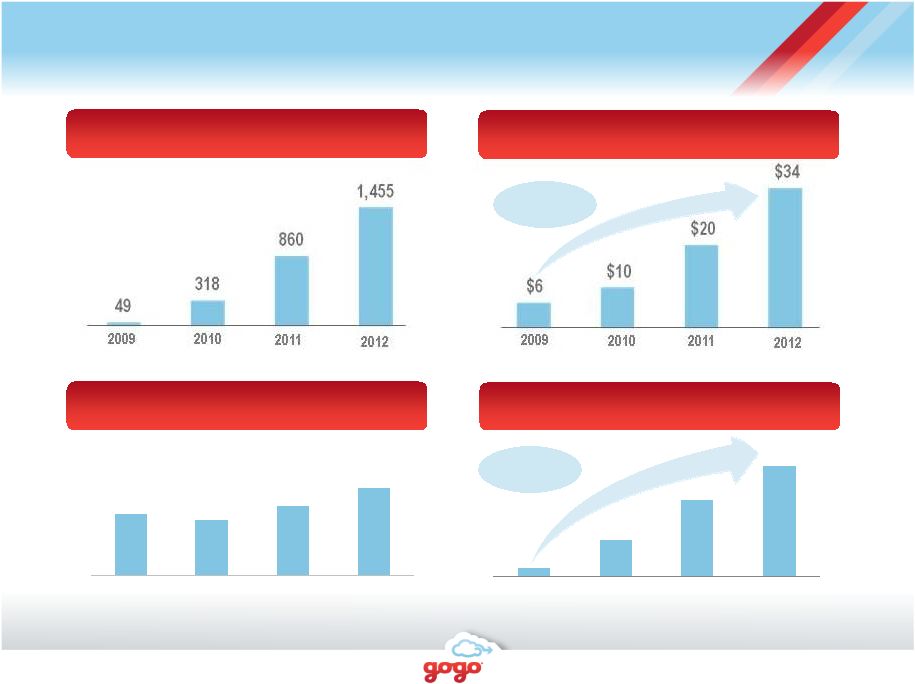

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 11 HIGH-GROWTH, HIGH-MARGIN SERVICE REVENUE ANNUITY IN BA 49 1,455 2009 2012 139 687 2009 2012 ATG AIRCRAFT ONLINE ATG UNITS SHIPPED 210% CAGR 70% CAGR REVENUE ($MM) *Mid point of 2013 guidance 56% CAGR 2009 2012 2013* $26 $98 $118 |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 12 ATTACKING A LARGE AND EXPANDING GLOBAL OPPORTUNITY Sources: (1) Derived from Boeing Current Market Outlook 2011 – 2031, excludes: cargo aircraft, RJs < than 50 seats. Wide-body aircraft is included as part of Rest of World market; (2) JetNet iQ Report Q4 2012, excludes turboprop aircraft. North America Rest of World 12,000 16,000 7,000 11,000 19,000 27,000 2012 2022F 4,000 6,000 13,000 30,000 17,000 36,000 2011 2031F 2.1x 1.4x COMMERCIAL AIRCRAFT (1) BUSINESS AIRCRAFT (2) |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 13 OUR 5X5 STRATEGY Today Tomorrow INCREASE AIRCRAFT INCREASE REVENUE PER AIRCRAFT Long-term goal North America Global Business Passengers All Passengers Media Partners Aircraft Operators In-Flight Connectivity In-Flight Connectivity Gogo Vision Gogo Text Messaging Gogo Signature Services Gogo Operations-Oriented Communications Services 5x 5x |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 14 GOGO IS THE ONLY MULTI-TECHNOLOGY PLATFORM 9.8 Mbps 3.1 Mbps Peak Data Rates 2006-2011 2012 2013 2014 2015 2016 2017 Next Generation Technology 40 Mbps to 50 Mbps ATG EvDO Rev A ATG-4 EvDO Rev B Ku-Band Hybrid Solutions Global Xpress Ka-Band GOGO TODAY GOGO TODAY |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 15 HOW WE WIN INTERNATIONALLY MULTIPLE TECHNOLOGY SOLUTIONS TURNKEY SERVICE MODEL SCALE TRACK RECORD OF SUCCESS |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 16 2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 16 FINANCIAL REVIEW |

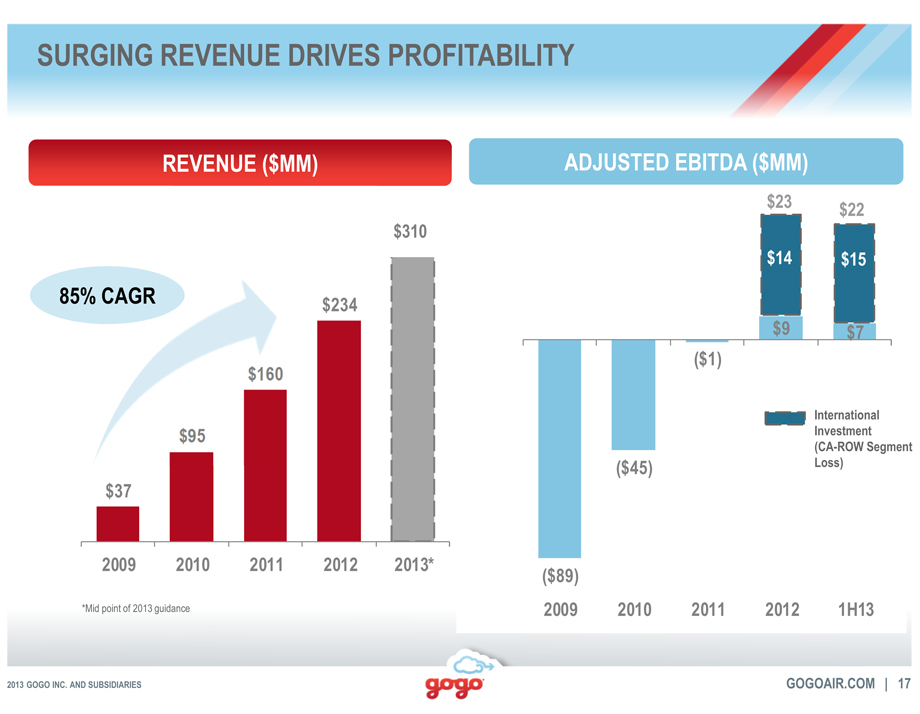

SURGING REVENUE DRIVES PROFITABILITY

\REVENUE ($MM)

$310

85% CAGR

$234

$37

2009 2010 2011 2012 2013*

*Mid point of 2013 guidance

ADJUSTED EBITDA ($MM)

$23 $22

$14 $15

$9 $7

($1)

International Investment (CA-ROW Segment

($45) Loss)

($89)

2009 2010 2011 2012 1H13

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 17

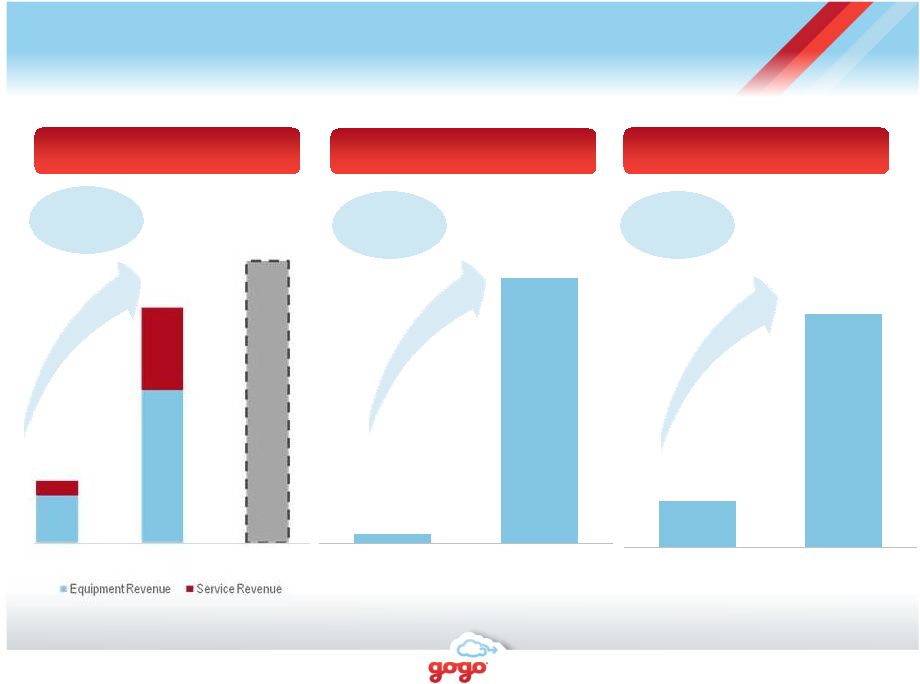

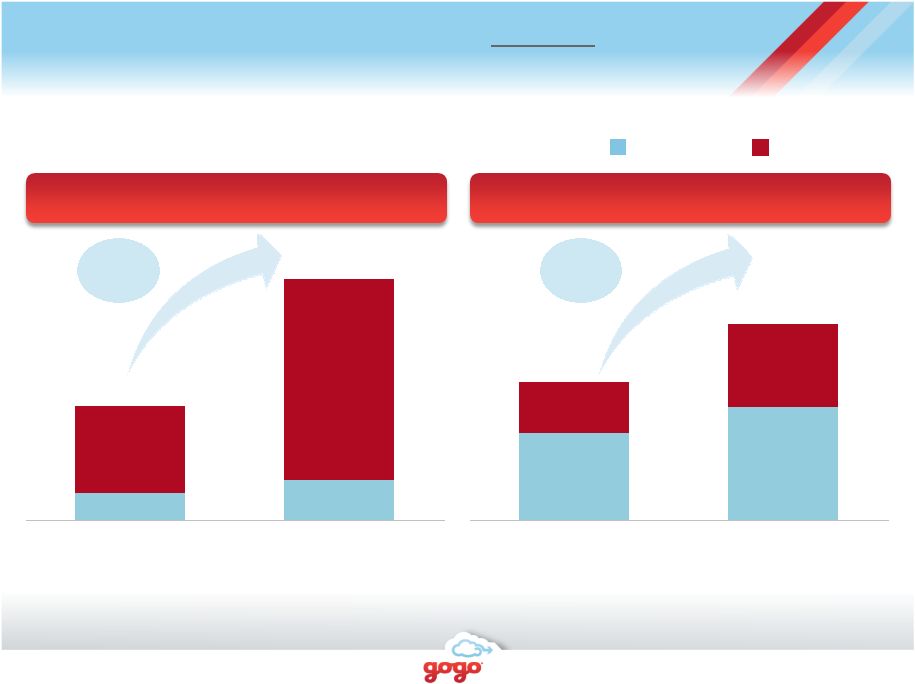

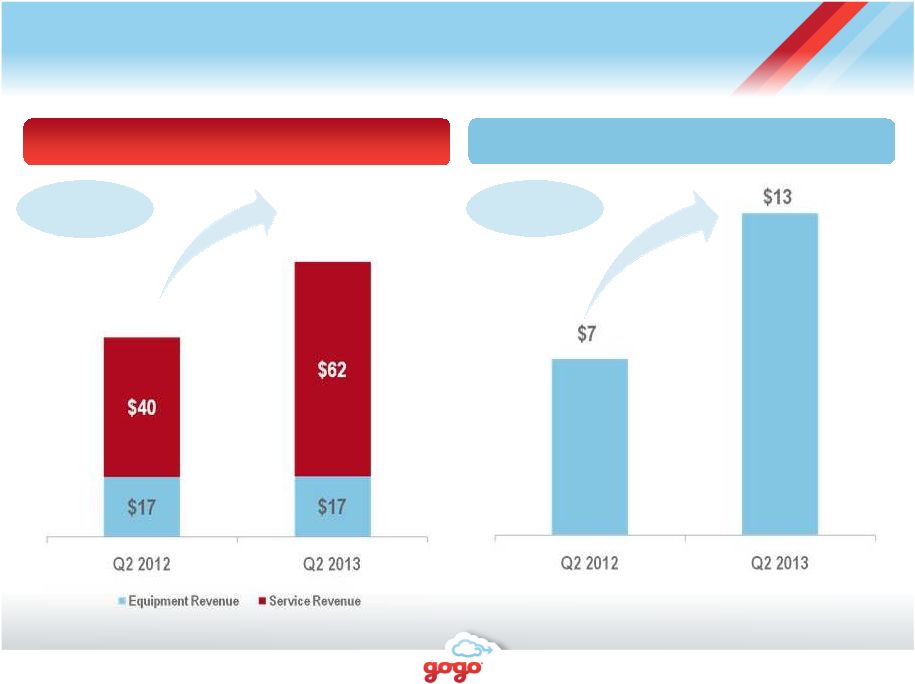

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 18 CA-NA AND BA SEGMENT PROFIT ($MM) CA-NA AND BA REVENUE ($MM) +55% Service Revenue STRONG GROWTH IN NORTH AMERICA BUSINESS SECOND QUARTER $57 $79 +82% |

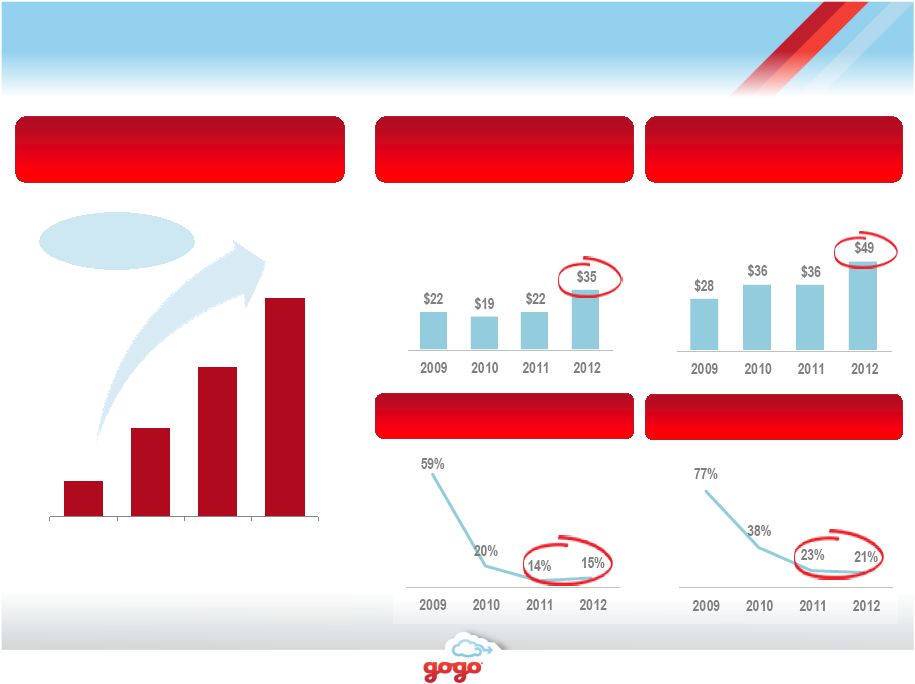

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 19 HISTORICAL DATA ILLUSTRATES CA’s MOMENTUM 692 1,056 1,345 1,811 2009 2010 2011 2012 $0.15 $0.32 $0.43 $0.53 2009 2010 2011 2012 $11 $49 $86 $134 2009 2010 2011 2012 132% CAGR REVENUE ($MM) 38% CAGR AIRCRAFT ONLINE 60 153 192 250 2009 2010 2011 2012 Sessions (MM): 1.9 7.2 9.0 13.3 61% CAGR 52% CAGR GPO (MM) ARPP ($) |

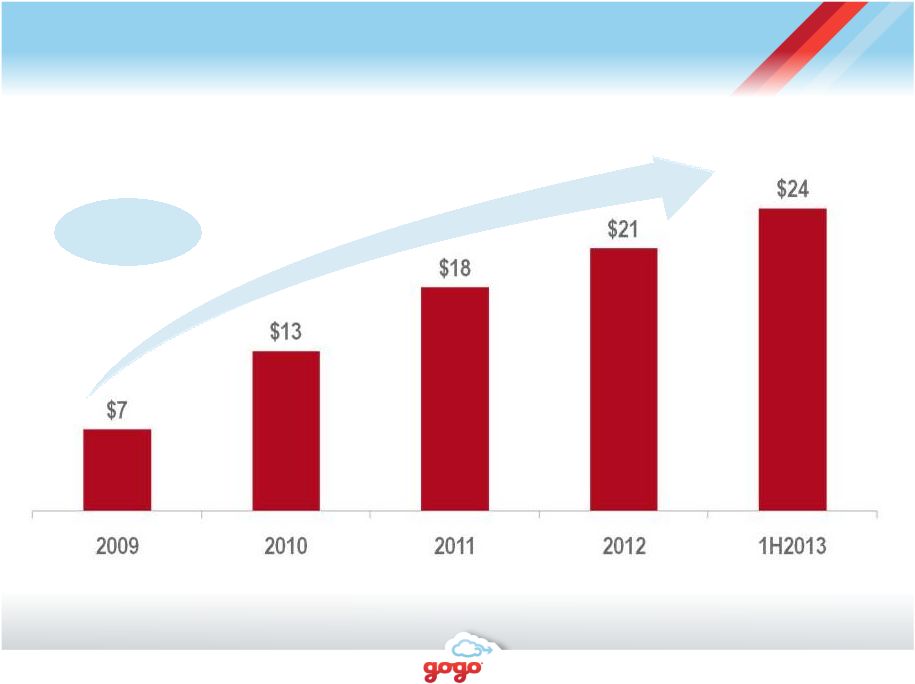

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 20 STRONG GROWTH IN REVENUE PER AIRCRAFT($ ‘000) +3.4x |

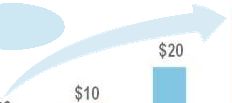

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 21 BUSINESS AVIATION IS A VALUABLE ASSET $3 $12 $25 $36 2009 2010 2011 2012 ATG AIRCRAFT ONLINE SEGMENT PROFIT EXPANDS ($MM) 129% CAGR 24% 22% 28% 35% 2009 2010 2011 2012 % OF RECURRING SERVICE REVENUE GROWS (1) (1) Recurring revenue defined as BA Service Revenue. SERVICE REVENUE ($MM) 76% CAGR |

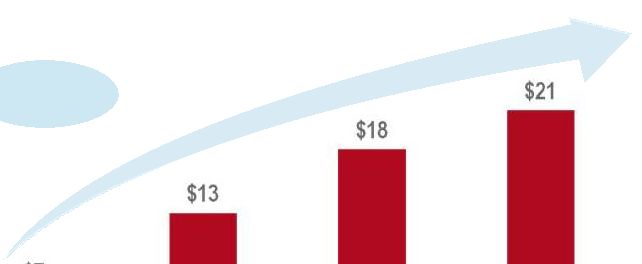

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 22 ENGINEERING, DESIGN AND DEVELOPMENT ($MM) GENERAL & ADMINISTRATIVE ($MM) AS % OF REVENUE AS % OF REVENUE INVESTING FOR A DECADE+ OF GROWTH REVENUE ($MM) $37 $95 $160 $234 2009 2010 2011 2012 85% CAGR |

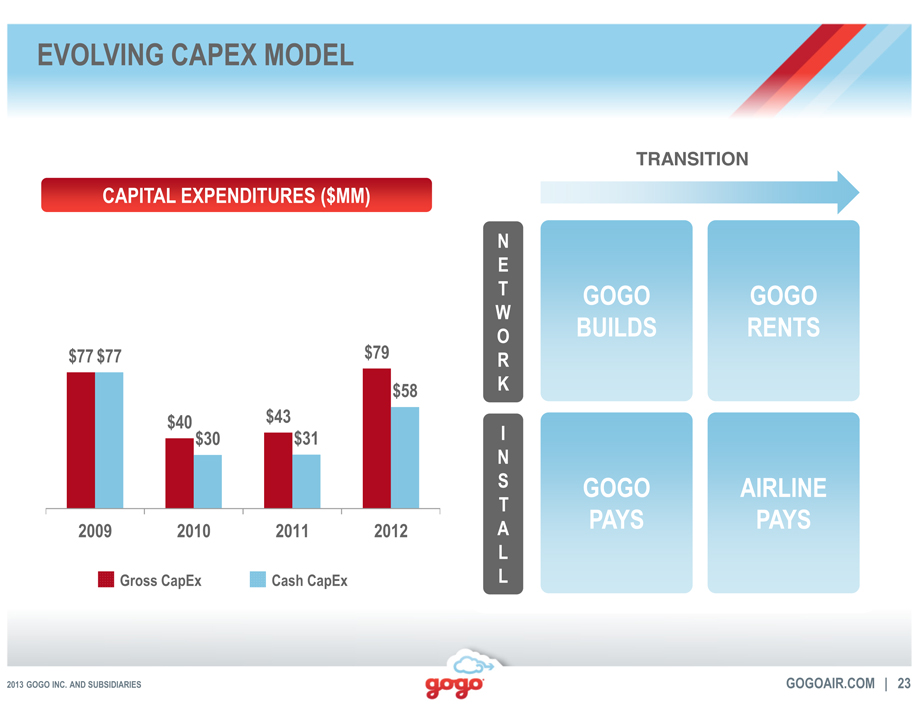

EVOLVING CAPEX MODEL

CAPITAL EXPENDITURES ($MM)

$77 $77 $79 $58

$40 $43

$30 $31

2009 2010 2011 2012

Gross CapEx Cash CapEx

N E T W O R K

I N S T A L L

TRANSITION

GOGO BUILDS

GOGO RENTS

GOGO PAYS

AIRLINE PAYS

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 23

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 24 WHY INVEST IN GOGO LARGE GROWTH OPPORTUNITY ATTRACTIVE ECONOMICS EXPERIENCE & SCALE PIONEER AND LEADER |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 25 2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 25 APPENDIX |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 26 RECONCILIATION OF ADJUSTED EBITDA ($MM) 2009 2010 2011 2012 Q1 2013 Q2 2013 1H2013 Net Income (142) (140) (18) (96) (32) (73) (105) Interest Income (0) (0) (0) (0) (0) (0) (0) Interest Expense 30 – 1 9 4 10 14 Income Tax Provision – 3 1 1 1 1 1 Depreciation & Amortization 22 31 33 37 14 14 28 EBITDA (91) (106) 16 (49) (14) (48) (63) Fair Value Derivative Adjustments – 33 (59) (10) – 36 36 Class A and Class B Senior Convertible Preferred Stock Return – 18 31 52 15 14 29 Accretion of Preferred Stock – 9 10 10 3 3 5 Stock-based Compensation Expense 1 2 2 4 1 1 2 Loss on Extinguishment of Debt 2 – – – – – – Write Off of Deferred Equity Financing Costs – – – 5 – – – Amortization of Deferred Airborne Lease Incentives – (1) (2) (4) (2) (2) (3) Adjusted EBITDA (89) (45) (1) 9 3 4 7 Minor differences exist due to rounding. |

2013 GOGO INC. AND SUBSIDIARIES GOGOAIR.COM | 27 RECONCILIATION OF CASH CAPEX ($MM) 2009 2010 2011 2012 Q1 2013 Q2 2013 1H 2013 Purchases of Property and Equipment (69) (33) (33) (67) (29) (29) (59) Acquisition of Intangible Assets (Capitalized Software) (8) (7) (10) (12) (4) (3) (7) Gross CapEx (77) (40) (43) (79) (33) (33) (66) Change in Deferred Airborne Lease Incentives – 9 11 18 5 2 7 Amortization of Deferred Airborne Lease Incentives – 1 1 4 2 2 3 Cash CapEx (77) (30) (31) (58) (27) (29) (56) Minor differences exist due to rounding. |