Accounting Impact of Business Model Changes and New Revenue Recognition Standard on Commercial Aviation February 22, 2018 Exhibit 99.1

Safe harbor statement Safe Harbor Statement This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are based on management’s beliefs and assumptions and on information currently available to management. Most forward-looking statements contain words that identify them as forward-looking, such as “anticipates,” “believes,” “continues,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms that relate to future events. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Gogo’s actual results, performance or achievements to be materially different from any projected results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent the beliefs and assumptions of Gogo Inc. (“Gogo”) only as of the date of this presentation and Gogo undertakes no obligation to update or revise publicly any such forward-looking statements, whether as a result of new information, future events or otherwise. As such, Gogo’s future results may vary from any expectations or goals expressed in, or implied by, the forward-looking statements included in this presentation, possibly to a material degree. Gogo cannot assure you that the assumptions made in preparing any of the forward-looking statements will prove accurate or that any long-term financial or operational goals and targets will be realized. In particular, the actual accounting or financial impact of the airline-directed model, as compared to the turnkey model, may vary significantly from that presented in this presentation, even with comparable economics, due to, among other things, changes in accounting or tax rules. For a discussion of some of the important factors that could cause Gogo’s results to differ materially from those expressed in, or implied by, the forward-looking statements included in this presentation, investors should refer to the disclosures contained under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Gogo’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. This presentation is being provided for the exclusive purpose of providing an illustrative overview of the expected impact on Gogo’s financial statements of the transition to the airline-directed model by certain of Gogo’s commercial aviation airline partners and Gogo’s adopting of revenue recognition standard, ASC 606 (“ASC 606”). For further information on the airline-directed model, as compared to the turnkey model, and ASC 606, as compared to Gogo’s historical revenue recognition standard, ASC 605 (“ASC 605”), see Gogo’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 22, 2018. In addition, (i) this presentation may not be relied upon as a projection or expectation of Gogo’s future financial results under any particular business model, (ii) for comparative purposes only, this presentation, in certain instances, reflects as assumptions identical economics to Gogo under each business model, including with respect to equipment costs and service revenues, and Gogo makes no representation regarding the actual economic comparability between such models (as they may differ significantly) and such comparability in no way reflects Gogo’s existing contracts or expected performance under these contracts, (iii) this presentation illustrates the primary line items from Gogo’s financial statements that are expected to be impacted solely as a result of the application of the airline-directed model as compared with the turnkey model and/or ASC 606 as compared to ASC 605, and does not represent a complete or audited presentation of Gogo’s financial statements for any period, and (iv) the contract term and economic assumptions included in this presentation, including cost of service revenue, equipment cost, contract term and service revenue, are not intended to be projections or expectations and are provided solely for illustrative purposes.

Agenda Commercial airline arrangements and business model discussion New revenue recognition accounting standard

Commercial Airline Arrangements

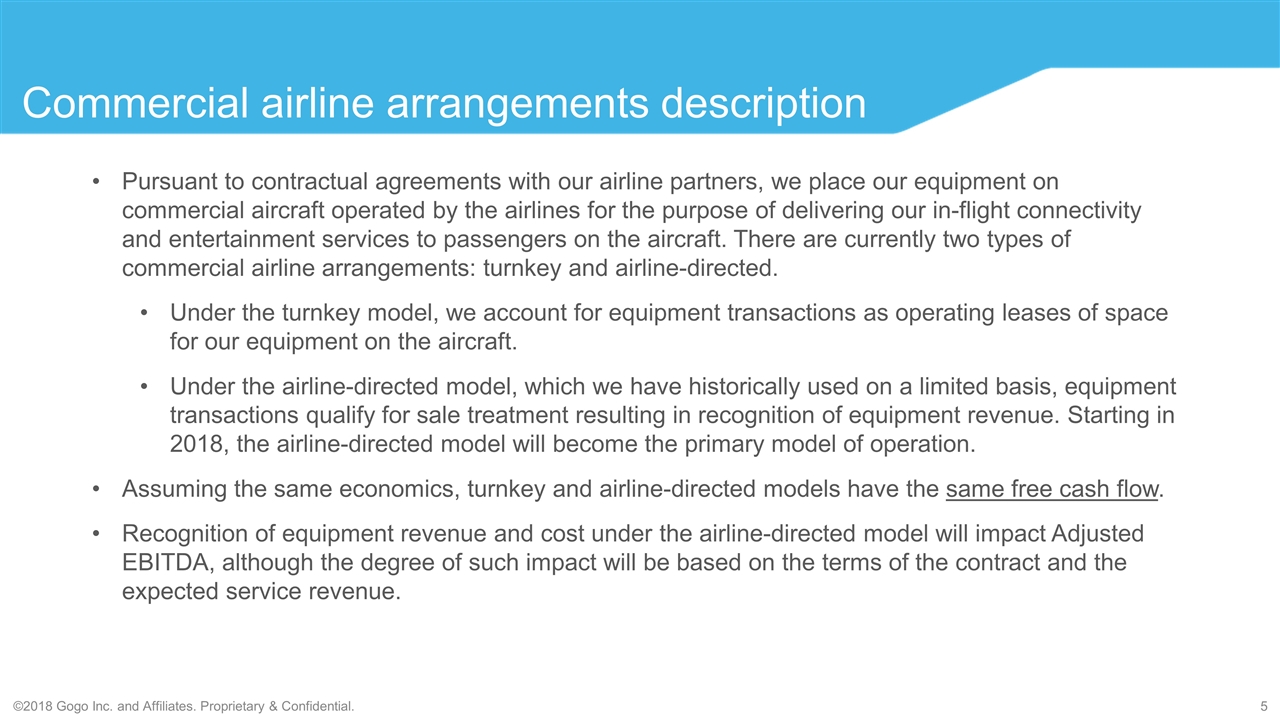

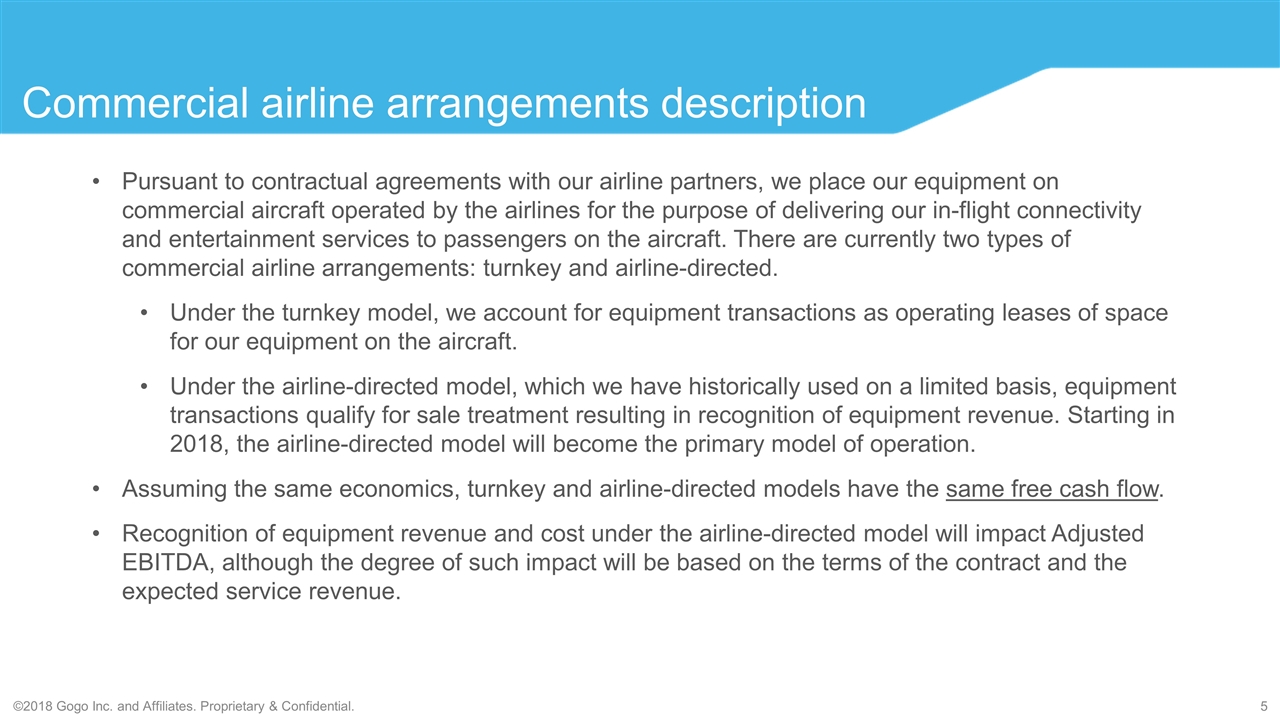

Commercial airline arrangements description Pursuant to contractual agreements with our airline partners, we place our equipment on commercial aircraft operated by the airlines for the purpose of delivering our in-flight connectivity and entertainment services to passengers on the aircraft. There are currently two types of commercial airline arrangements: turnkey and airline-directed. Under the turnkey model, we account for equipment transactions as operating leases of space for our equipment on the aircraft. Under the airline-directed model, which we have historically used on a limited basis, equipment transactions qualify for sale treatment resulting in recognition of equipment revenue. Starting in 2018, the airline-directed model will become the primary model of operation. Assuming the same economics, turnkey and airline-directed models have the same free cash flow. Recognition of equipment revenue and cost under the airline-directed model will impact Adjusted EBITDA, although the degree of such impact will be based on the terms of the contract and the expected service revenue.

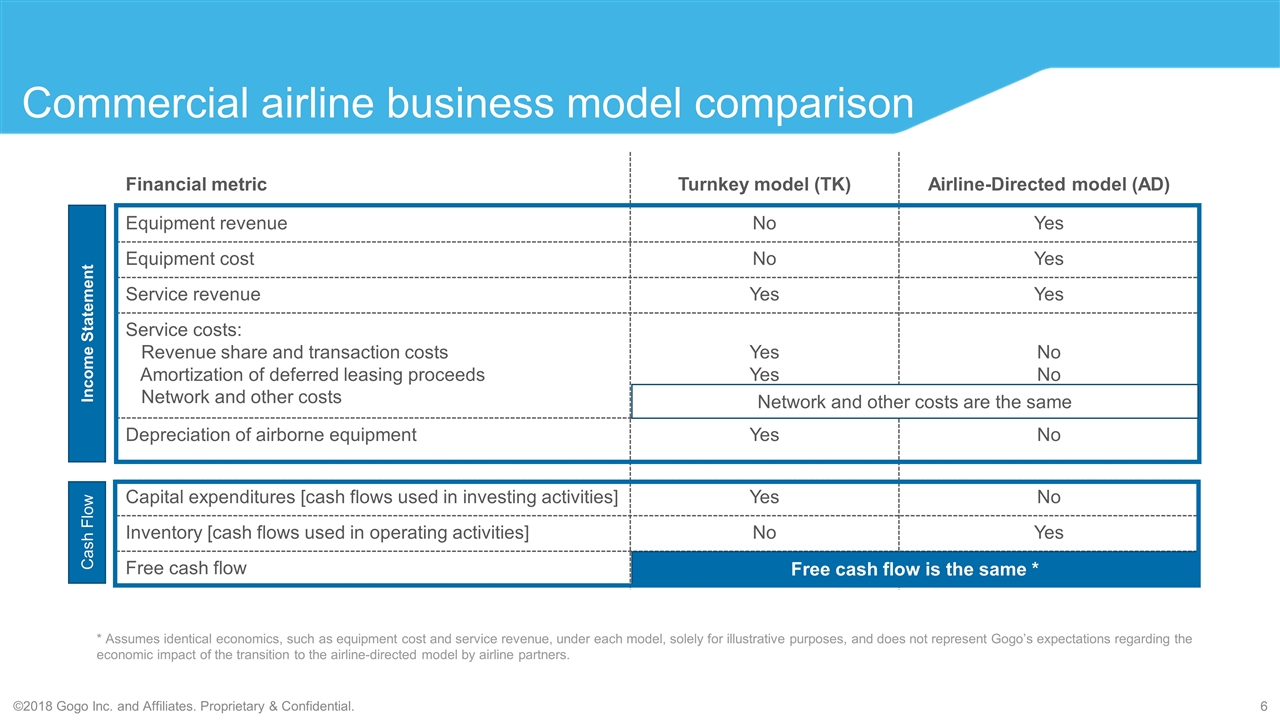

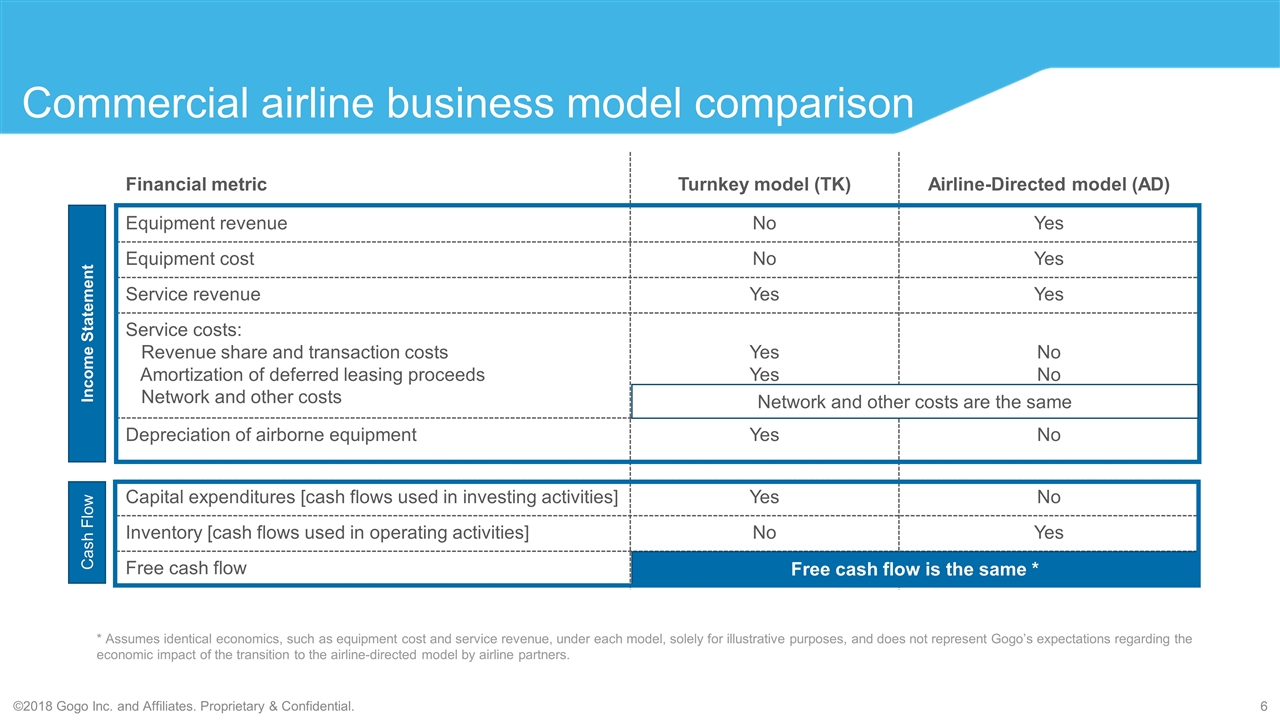

Commercial airline business model comparison Financial metric Turnkey model (TK) Airline-Directed model (AD) Equipment revenue No Yes Equipment cost No Yes Service revenue Yes Yes Service costs: Revenue share and transaction costs Amortization of deferred leasing proceeds Network and other costs Yes Yes No No Depreciation of airborne equipment Yes No Capital expenditures [cash flows used in investing activities] Yes No Inventory [cash flows used in operating activities] No Yes Free cash flow Income Statement Network and other costs are the same Free cash flow is the same * Cash Flow * Assumes identical economics, such as equipment cost and service revenue, under each model, solely for illustrative purposes, and does not represent Gogo’s expectations regarding the economic impact of the transition to the airline-directed model by airline partners.

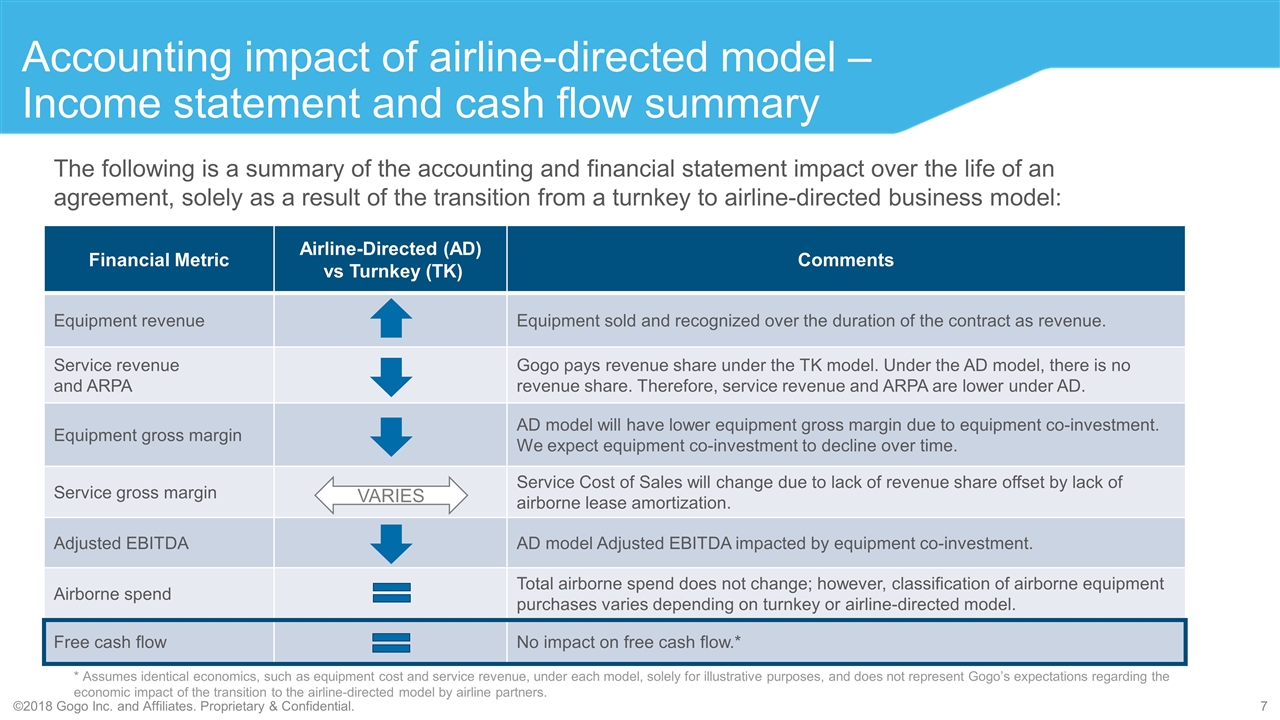

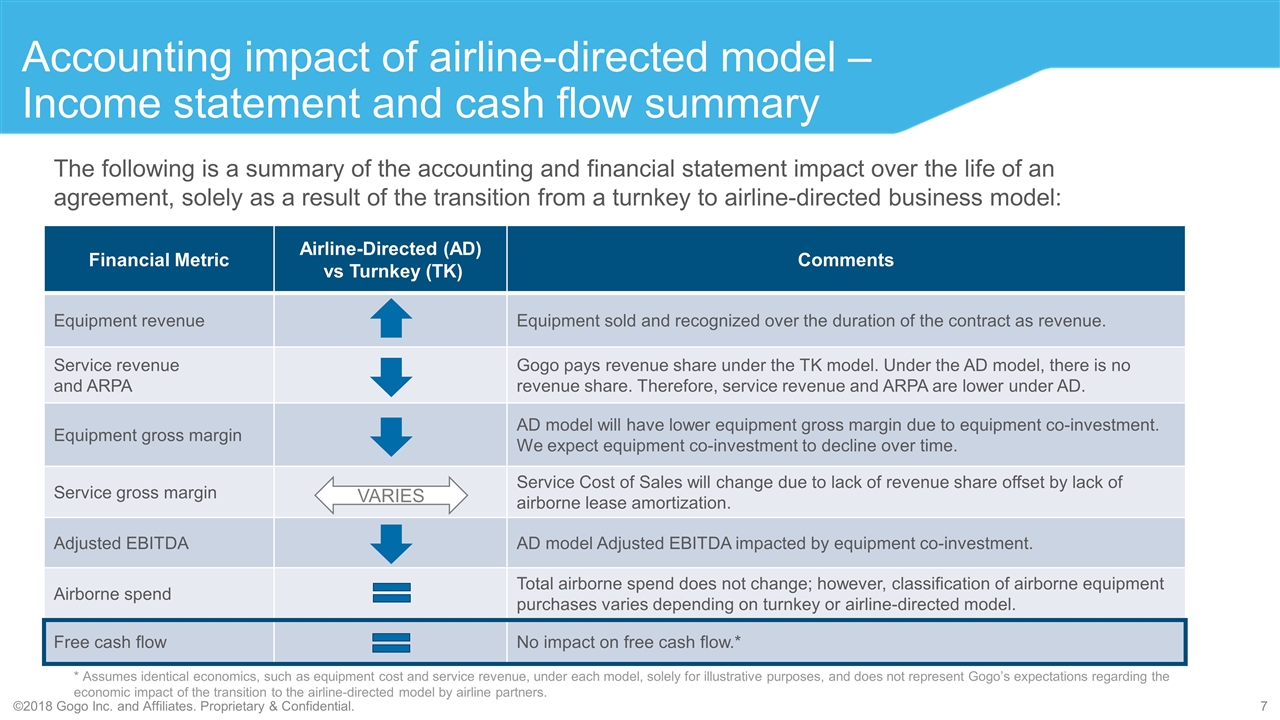

Accounting impact of airline-directed model – Income statement and cash flow summary The following is a summary of the accounting and financial statement impact over the life of an agreement, solely as a result of the transition from a turnkey to airline-directed business model: Financial Metric Airline-Directed (AD) vs Turnkey (TK) Comments Equipment revenue Equipment sold and recognized over the duration of the contract as revenue. Service revenue and ARPA Gogo pays revenue share under the TK model. Under the AD model, there is no revenue share. Therefore, service revenue and ARPA are lower under AD. Equipment gross margin AD model will have lower equipment gross margin due to equipment co-investment. We expect equipment co-investment to decline over time. Service gross margin Service Cost of Sales will change due to lack of revenue share offset by lack of airborne lease amortization. Adjusted EBITDA AD model Adjusted EBITDA impacted by equipment co-investment. Airborne spend Total airborne spend does not change; however, classification of airborne equipment purchases varies depending on turnkey or airline-directed model. Free cash flow No impact on free cash flow.* VARIES * Assumes identical economics, such as equipment cost and service revenue, under each model, solely for illustrative purposes, and does not represent Gogo’s expectations regarding the economic impact of the transition to the airline-directed model by airline partners.

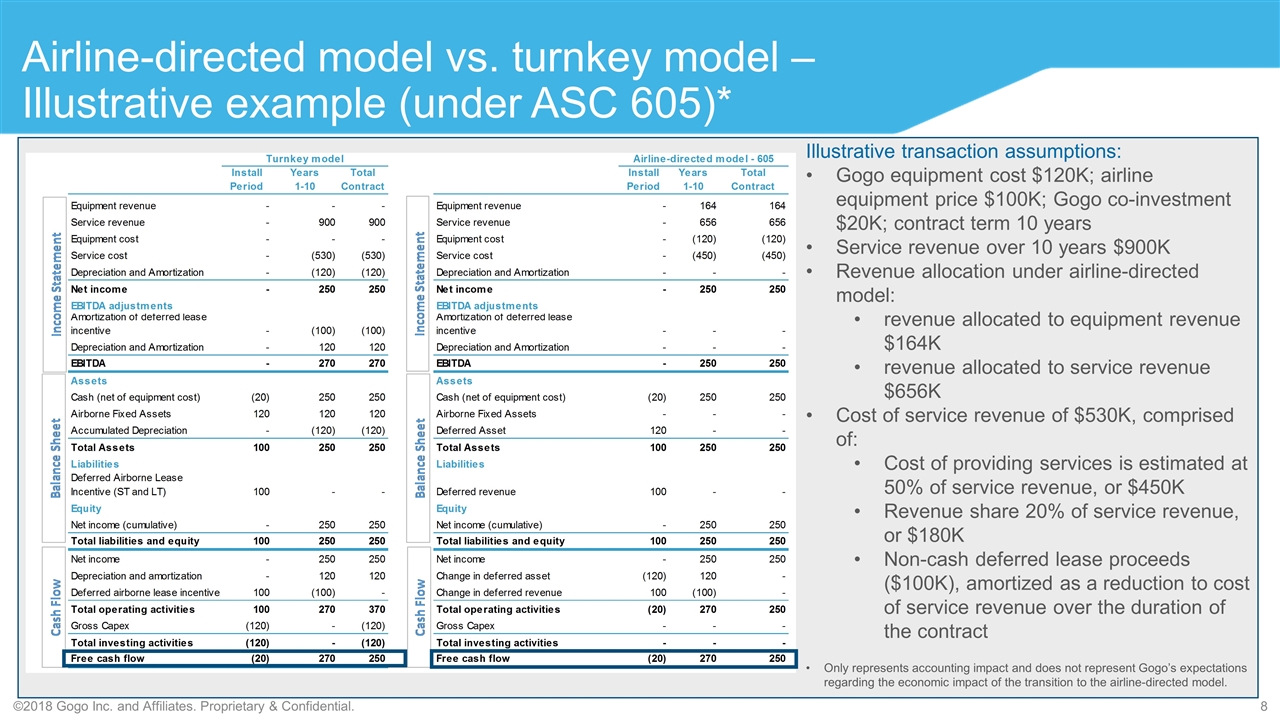

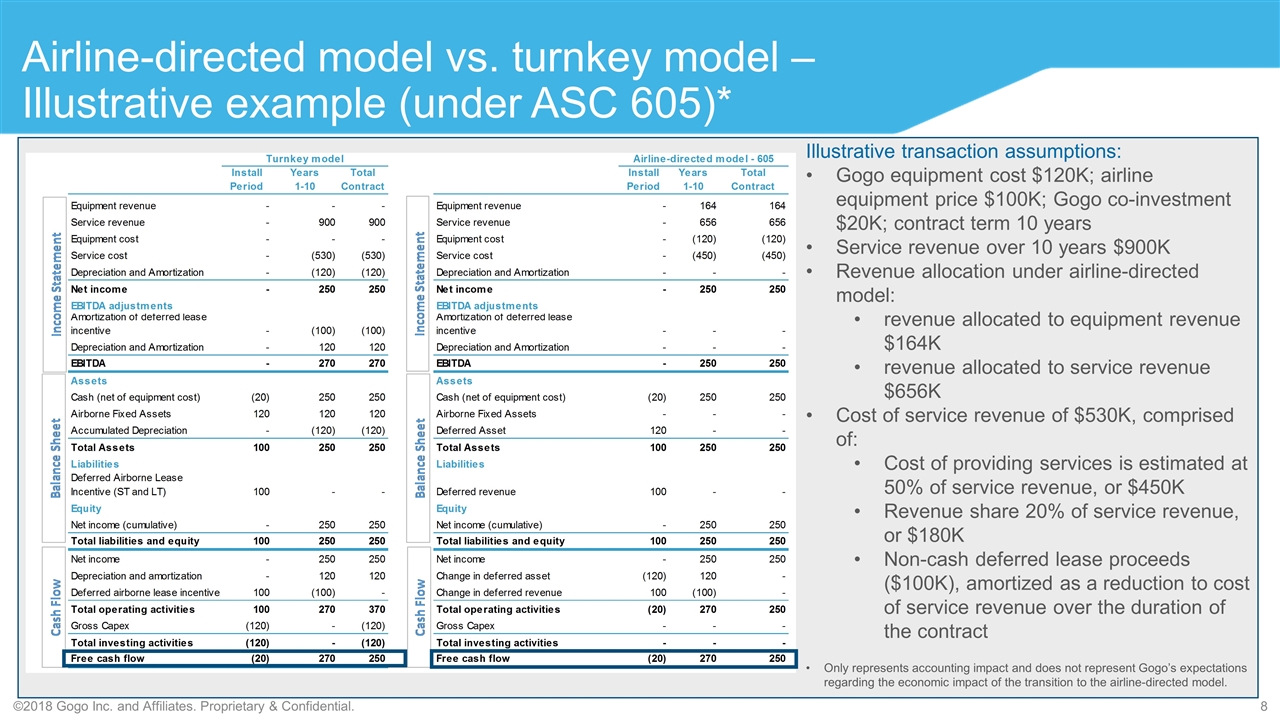

Airline-directed model vs. turnkey model –Illustrative example (under ASC 605)* Illustrative transaction assumptions: Gogo equipment cost $120K; airline equipment price $100K; Gogo co-investment $20K; contract term 10 years Service revenue over 10 years $900K Revenue allocation under airline-directed model: revenue allocated to equipment revenue $164K revenue allocated to service revenue $656K Cost of service revenue of $530K, comprised of: Cost of providing services is estimated at 50% of service revenue, or $450K Revenue share 20% of service revenue, or $180K Non-cash deferred lease proceeds ($100K), amortized as a reduction to cost of service revenue over the duration of the contract Only represents accounting impact and does not represent Gogo’s expectations regarding the economic impact of the transition to the airline-directed model.

New revenue recognition accounting standard (ASC 606)

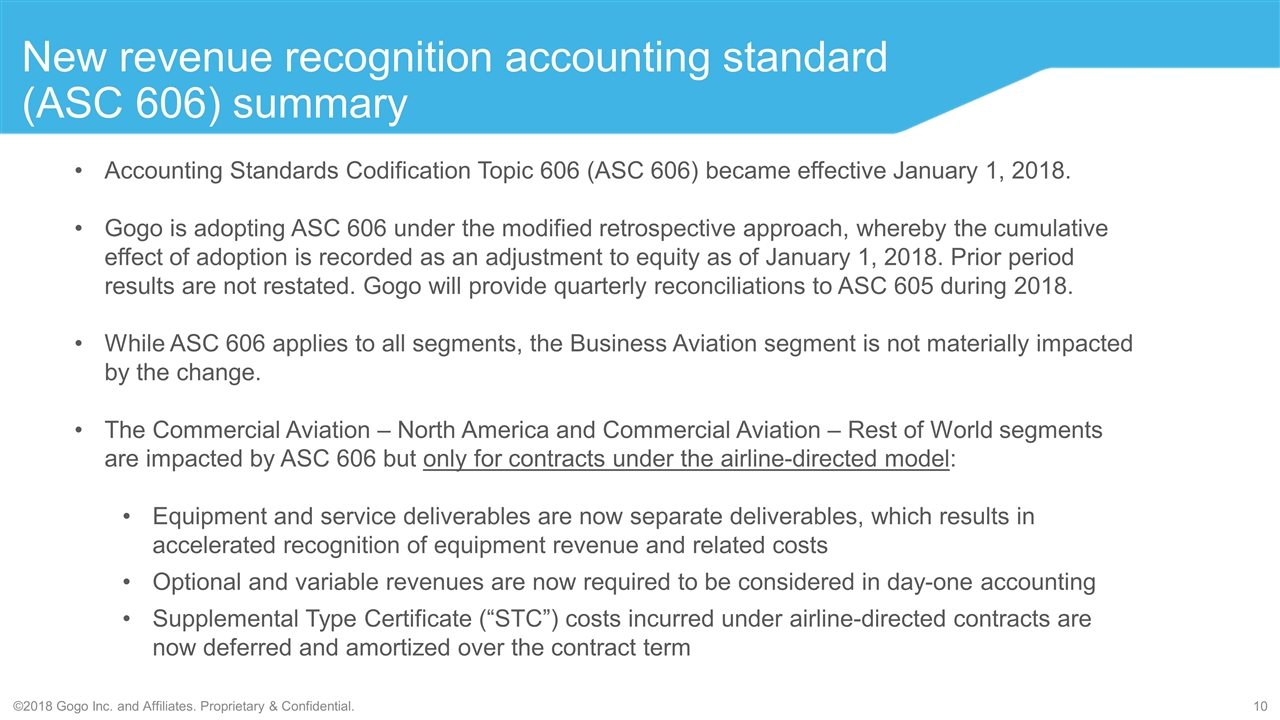

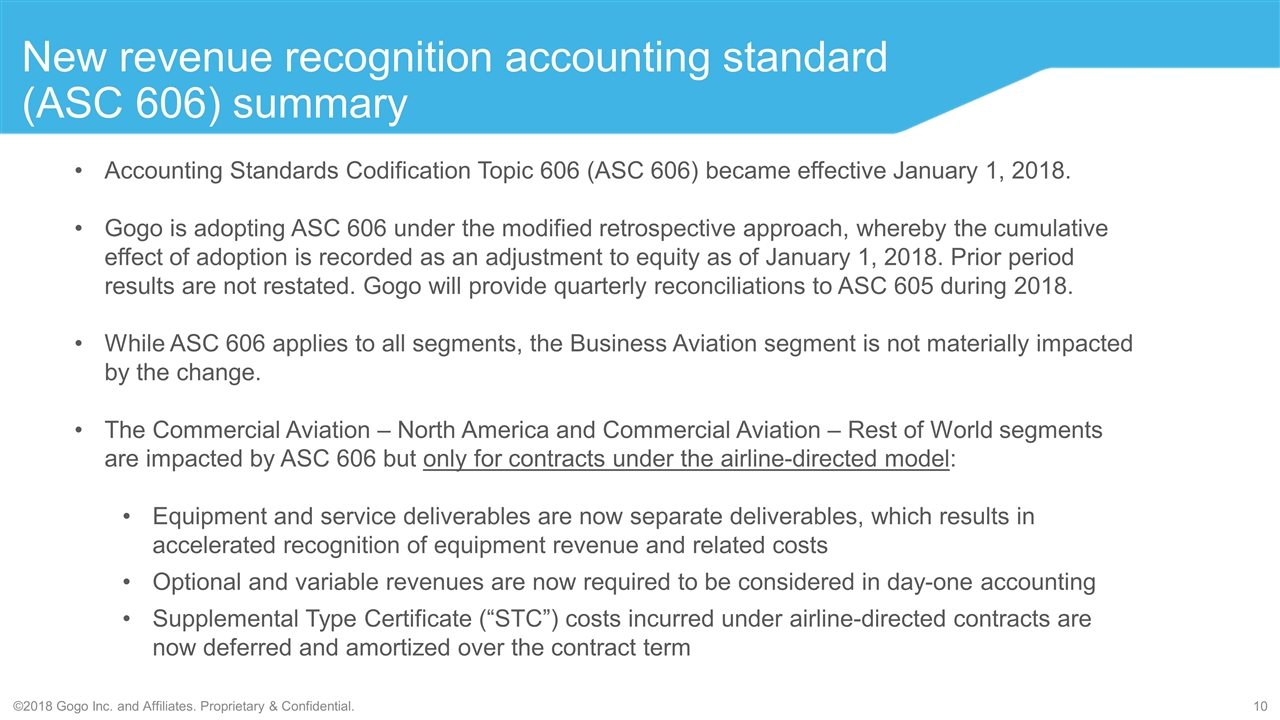

New revenue recognition accounting standard (ASC 606) summary Accounting Standards Codification Topic 606 (ASC 606) became effective January 1, 2018. Gogo is adopting ASC 606 under the modified retrospective approach, whereby the cumulative effect of adoption is recorded as an adjustment to equity as of January 1, 2018. Prior period results are not restated. Gogo will provide quarterly reconciliations to ASC 605 during 2018. While ASC 606 applies to all segments, the Business Aviation segment is not materially impacted by the change. The Commercial Aviation – North America and Commercial Aviation – Rest of World segments are impacted by ASC 606 but only for contracts under the airline-directed model: Equipment and service deliverables are now separate deliverables, which results in accelerated recognition of equipment revenue and related costs Optional and variable revenues are now required to be considered in day-one accounting Supplemental Type Certificate (“STC”) costs incurred under airline-directed contracts are now deferred and amortized over the contract term

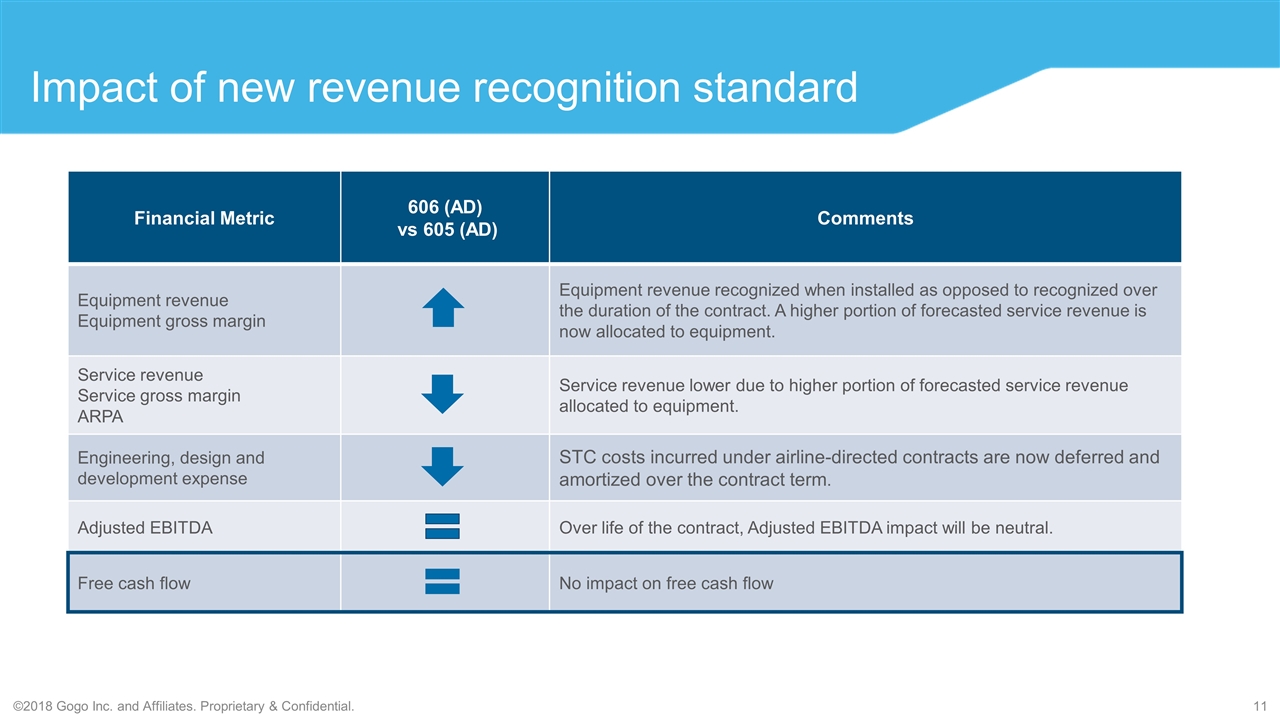

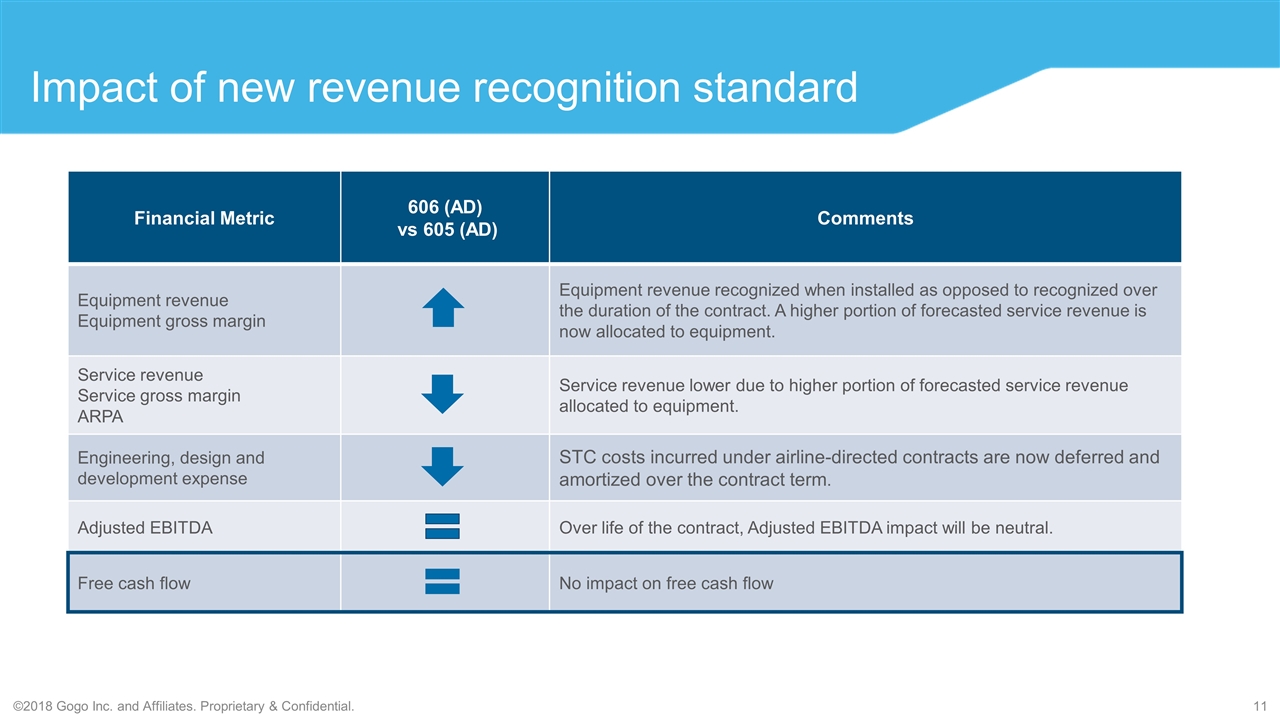

Impact of new revenue recognition standard Financial Metric 606 (AD) vs 605 (AD) Comments Equipment revenue Equipment gross margin Equipment revenue recognized when installed as opposed to recognized over the duration of the contract. A higher portion of forecasted service revenue is now allocated to equipment. Service revenue Service gross margin ARPA Service revenue lower due to higher portion of forecasted service revenue allocated to equipment. Engineering, design and development expense STC costs incurred under airline-directed contracts are now deferred and amortized over the contract term. Adjusted EBITDA Over life of the contract, Adjusted EBITDA impact will be neutral. Free cash flow No impact on free cash flow

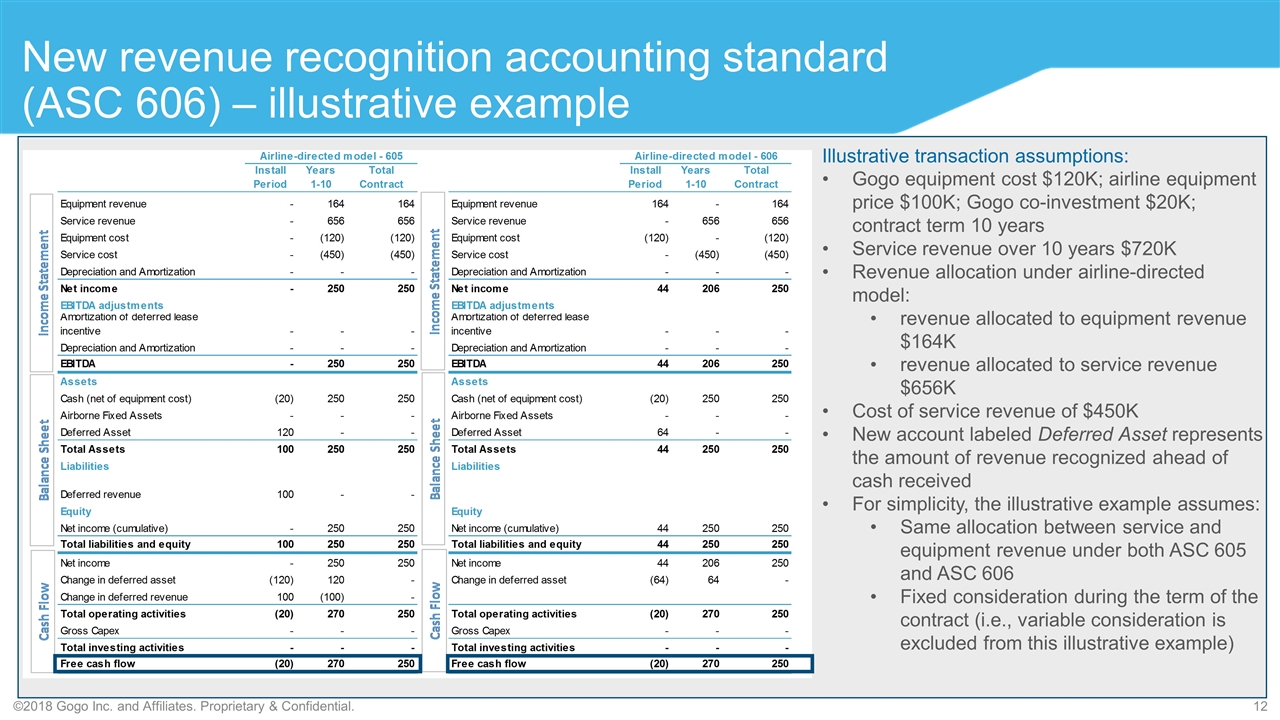

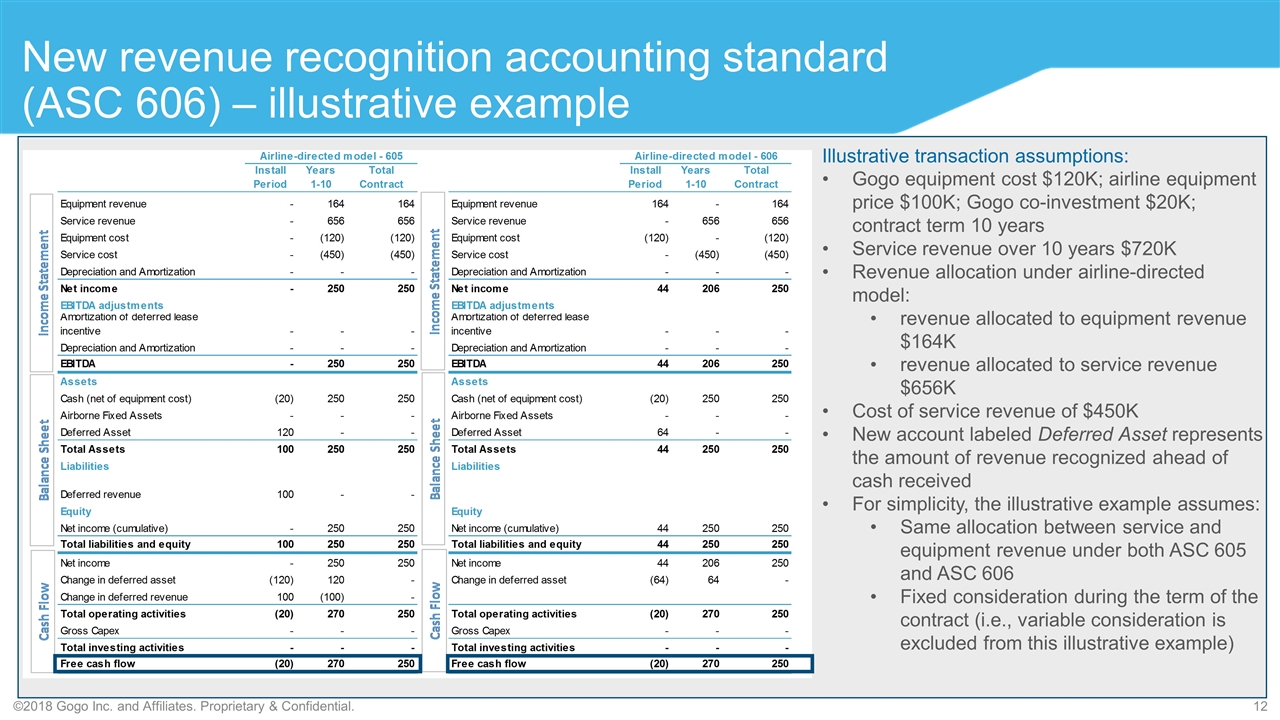

New revenue recognition accounting standard (ASC 606) – illustrative example Illustrative transaction assumptions: Gogo equipment cost $120K; airline equipment price $100K; Gogo co-investment $20K; contract term 10 years Service revenue over 10 years $720K Revenue allocation under airline-directed model: revenue allocated to equipment revenue $164K revenue allocated to service revenue $656K Cost of service revenue of $450K New account labeled Deferred Asset represents the amount of revenue recognized ahead of cash received For simplicity, the illustrative example assumes: Same allocation between service and equipment revenue under both ASC 605 and ASC 606 Fixed consideration during the term of the contract (i.e., variable consideration is excluded from this illustrative example)