SCIENTIFIC AND TECHNICAL INFORMATION

The scientific and technical information contained in this MD&A has been reviewed and approved by Steve Ross, P. Geol., VP Resource Development of the Company, who is a “qualified person” as defined in NI 43-101.

OVERALL PERFORMANCE

Revenue

As at March 31, 2024, the Company has not generated revenue.

Operating loss

The Company incurred an operating loss of $10,358 for the three months ended March 31, 2024 and $30,289 for the nine months ended March 31, 2024, as compared to $7,101 for the three months ended and $15,539 for the nine months ended March 31, 2023. The increase in operating loss relates to costs in share-based payments, salaries and benefits, management fees, consulting fees, and office and administration fees.

General and administrative

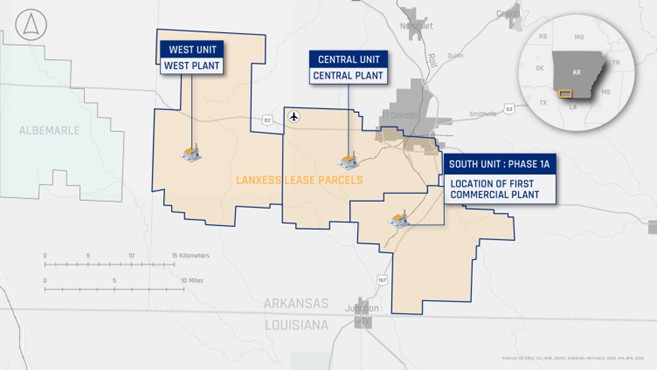

General and administrative costs (“G&A”) are associated with the Company’s Vancouver, BC corporate head office, the El Dorado office in Arkansas and related professional and corporate costs.

The G&A costs were $1,164 for the three months ended March 31, 2024, and $3,322 for the nine months ended March 31, 2024, as compared to $820 for the three months ended March 31, 2023 and $2,459 for the nine months ended March 31, 2023. The year-to-date increase is mainly due to higher insurance costs, information technology costs, the Vancouver head office lease, and costs associated with the growth of the El Dorado office in Arkansas as we continue to further expand our back office operations to support potential near term commercial production.

Demonstration Plant operations (formerly Pilot Plant operations)

Demonstration Plant operating costs relate to personnel, supplies, reagents, site office, utilities, repairs and maintenance, vehicle, waste and disposal recycling fees, and ongoing testing of the production end product. The overall costs decreased for the three months ended March 31, 2024, by $2,453 from $4,428 three months March 31, 2023, and the nine months ended March 31, 2024, by $3,226 or 31.0% to $7,177 from $10,403 for the nine months ended March 31, 2023. The main reasons are as follows: 1) there was no updates to the operation in Q3-2024 compared to Q3-2023 when the Company was testing the LSS columns and reconfiguring the plant; 2) The reagent costs were lower as the Company stopped running LiSTR and moved to LSS; and 3) the personnel costs decreased over nine months as all the plant employees were hired directly by the Company which reduced the billable rates paid to the intermediary companies.

Foreign exchange gain

The Company recorded a foreign exchange gain of $167 for the three months ended March 31, 2024, as compared to a foreign exchange loss of $38 for three months ended March 31, 2023, and a foreign exchange gain of $727 for the nine months ended March 31, 2024, as compared to a foreign exchange gain of $5,192 for the nine months ended March 31, 2023. The United States Dollar (“USD”) spot rate strengthened by 3.54% quarter over quarter. A stronger USD created a foreign exchange gain on the Company’s income statement due to held cash on hand in USD. The decrease in the amount of the gain is due to less USD held at March 31, 2024.