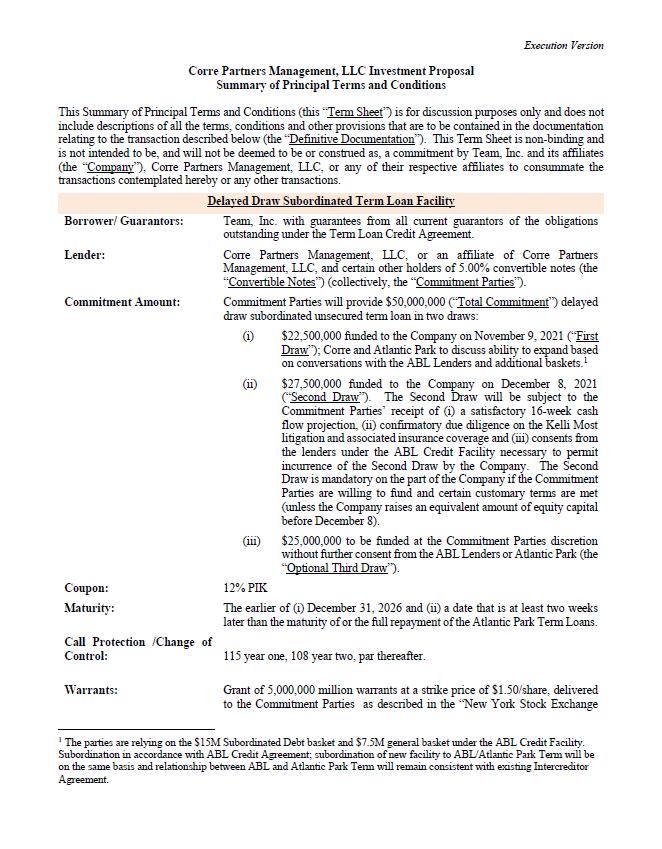

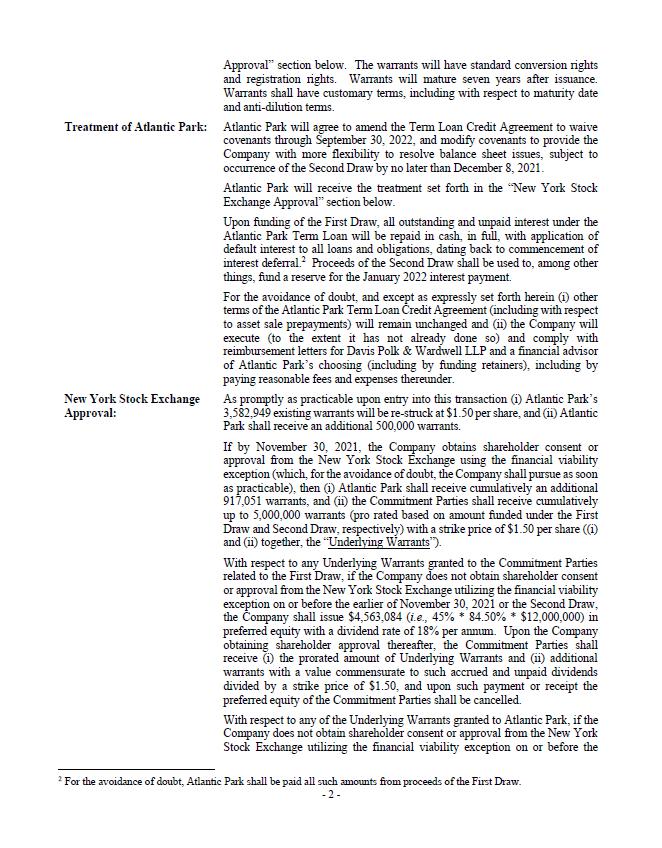

| | The Reporting Persons originally acquired the Shares for investment purposes. In light of recent developments regarding the Issuer, including the events disclosed by the Issuer in its Report on Form 8-K filed with the SEC on October 25, 2021, the Reporting Persons have communicated with the Issuer on a number of key issues, including operational and balance sheet strategy. The Reporting Persons have also entered into a confidentiality agreement with the Issuer dated October 29, 2021 to assist the Issuer evaluate its options. In addition, the Reporting Persons entered into a credit agreement with the Issuer on November 9, 2021 pursuant to which private investment vehicles managed by the Investment Adviser, including the Fund, agreed to provide the Issuer with an unsecured $50.0 million delayed draw subordinated term loan facility. Under the credit agreement, the Issuer is required to, among other things, (i) subject to certain conditions, issue the lenders a warrant providing for the purchase of an aggregate of 5,000,000 Shares, exercisable at the Reporting Persons’ option at any time, in whole or in part, until the seventh anniversary of the issue date, at an exercise price of $1.50 per share, or, if shareholder approval to issue the warrants or an exception therefrom is not obtained by November 30, 2021, issue the lenders their pro rata portion of $12.0 million in liquidation preference of newly issued preferred stock (ii) amend the Issuer’s charter, bylaws, and all other necessary corporate governance documents to reduce the size of the Issuer’s Board of Directors to seven directors, and (iii) reconstitute the Board of Directors. Further, the Reporting Persons entered into a commitment letter agreement with the Issuer on November 9, 2021 pursuant to which the Issuer will, among other things, (i) appoint two Directors to the Board of Directors selected by the Investment Adviser after consultation with Atlantic Park Strategic Capital Fund, L.P. (“APSC”), (ii) appoint one Director selected by the Investment Adviser to the Board of Directors’ Independent Subcommittee selected by the Investment Adviser and one Director selected by APSC, (iii) provide the Investment Adviser and APSC with Board of Director observation rights, (iv) launch a strategic alternatives process and present results of the review to the Board of Directors, and (v) directly pay certain advisor fees on behalf of the Reporting Persons and APSC. The Reporting Persons intend to review their investment in the Issuer on a continuing basis. Depending on various factors, including the Issuer’s financial position and strategic direction, actions taken by the Board, price levels of the Shares, other investment opportunities available to the Reporting Persons, conditions in the securities market and general economic and industry conditions, the Reporting Persons may take such actions with respect to their investment in the Issuer as they deem appropriate including, without limitation, purchasing additional Shares, other securities or derivative instruments related thereto or selling or entering into other transactions with respect to some or all of their Shares, other securities or derivative instruments, engaging in hedging or similar transactions with respect to the Shares and, alone or with others, may engage in communications with directors and officers of the Issuer, other stockholders of the Issuer or other third parties or may take steps to implement a course of action, including, without limitation, engaging advisors, including legal, financial, regulatory, technical and/or industry advisors, to assist in any review. Such discussions and other actions may relate to various alternative courses of action, including, without limitation, those related to an extraordinary corporate transaction (including, but not limited to a merger, reorganization or liquidation) involving the Issuer or any of its subsidiaries; business combinations involving the Issuer or its subsidiaries, a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; material asset purchases; the formation of joint ventures with the Issuer or its subsidiaries or the entry into other material projects; changes in the present business, operations, strategy, future plans or prospects of the Issuer, financial or governance matters; changes to the Board (including Board composition) or management of the Issuer; acting as a participant to support any potential capital funding need of the Issuer or its subsidiaries; changes to the capitalization, ownership structure, dividend policy, business or corporate structure or governance documents of the Issuer; de-listing or de-registration of the Issuer’s securities, or any action similar to those enumerated above. | |