NASDAQ: TGEN 3Q 2015 Earnings

Participants John Hatsopoulos •Co-Chief Executive Officer, Director Benjamin Locke •Co-Chief Executive Officer Robert Panora •President & Chief Operating Officer David Garrison •Chief Financial Officer Ariel Babcock •Director, Investor Relations 2 3Q 2015 Earnings Call

Safe Harbor Statement This presentation includes forward-looking statements within the meaning of Section 27-A of the Securities Act of 1933, and Section 21-E of the Securities Exchange Act of 1934. Such statements include declarations regarding the intent, belief, or current expectations of the Company and its management. Prospective investors are cautioned that any such forward looking statements are not guarantees of future performance, and involve a number of risks and uncertainties that can materially and adversely affect actual results as identified from time to time in the Company‘s SEC filings. Forward looking statements provided herein as of a specified date are not hereby reaffirmed or updated. 3 3Q 2015 Earnings Call

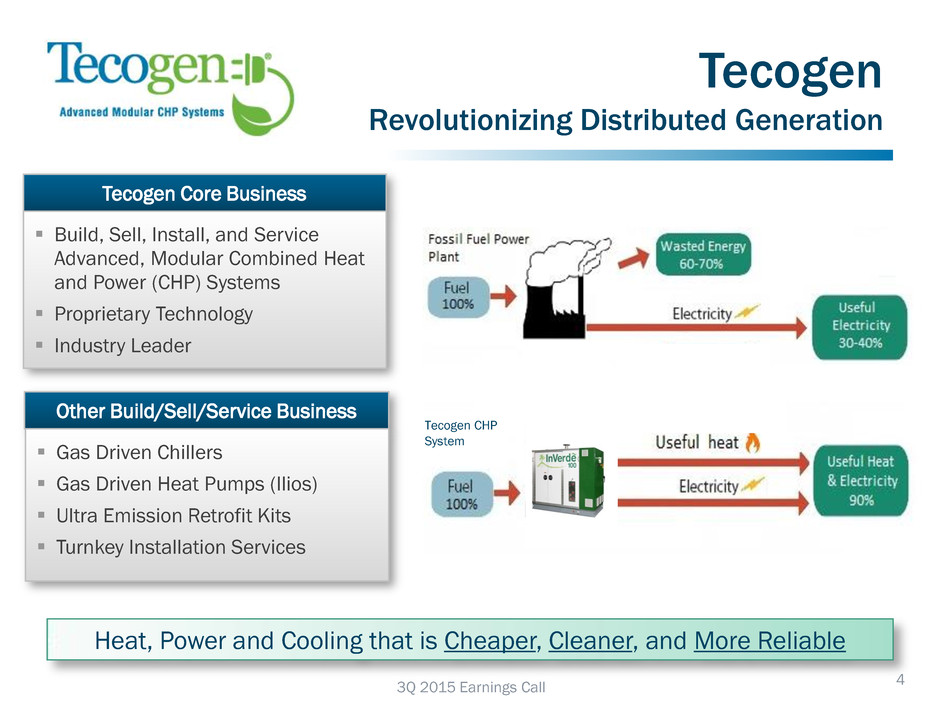

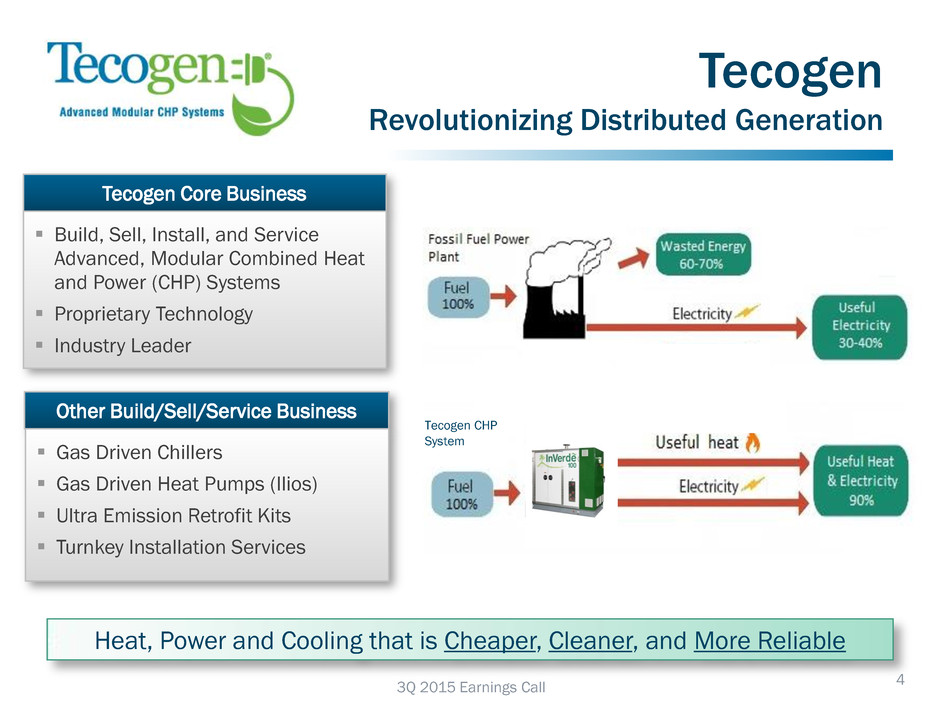

Tecogen Revolutionizing Distributed Generation 4 Other Build/Sell/Service Business Gas Driven Chillers Gas Driven Heat Pumps (Ilios) Ultra Emission Retrofit Kits Turnkey Installation Services Tecogen Core Business Build, Sell, Install, and Service Advanced, Modular Combined Heat and Power (CHP) Systems Proprietary Technology Industry Leader Tecogen CHP System Heat, Power and Cooling that is Cheaper, Cleaner, and More Reliable 3Q 2015 Earnings Call

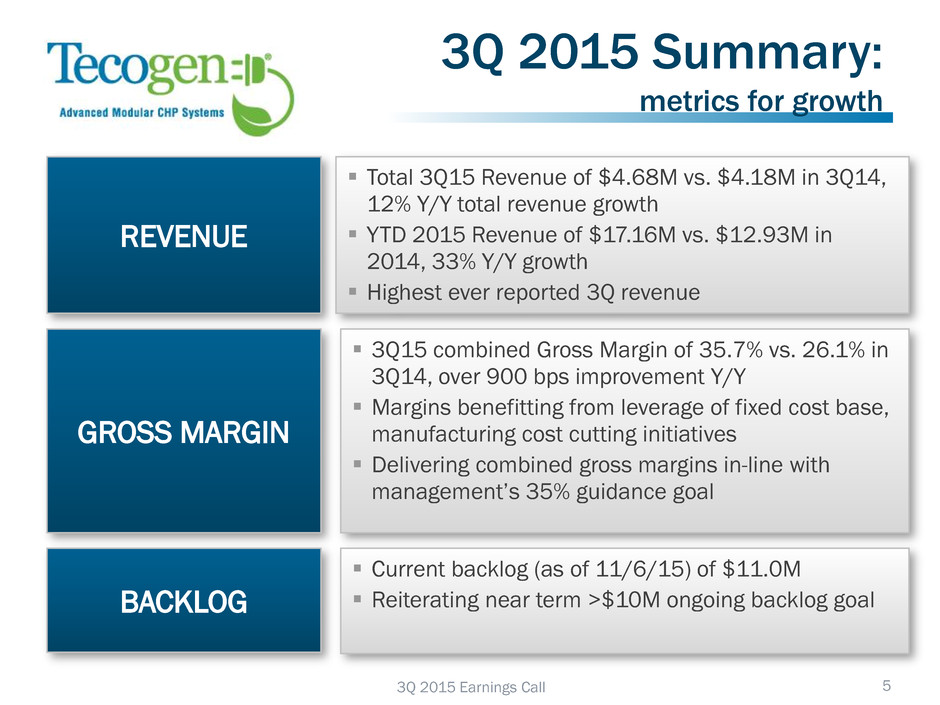

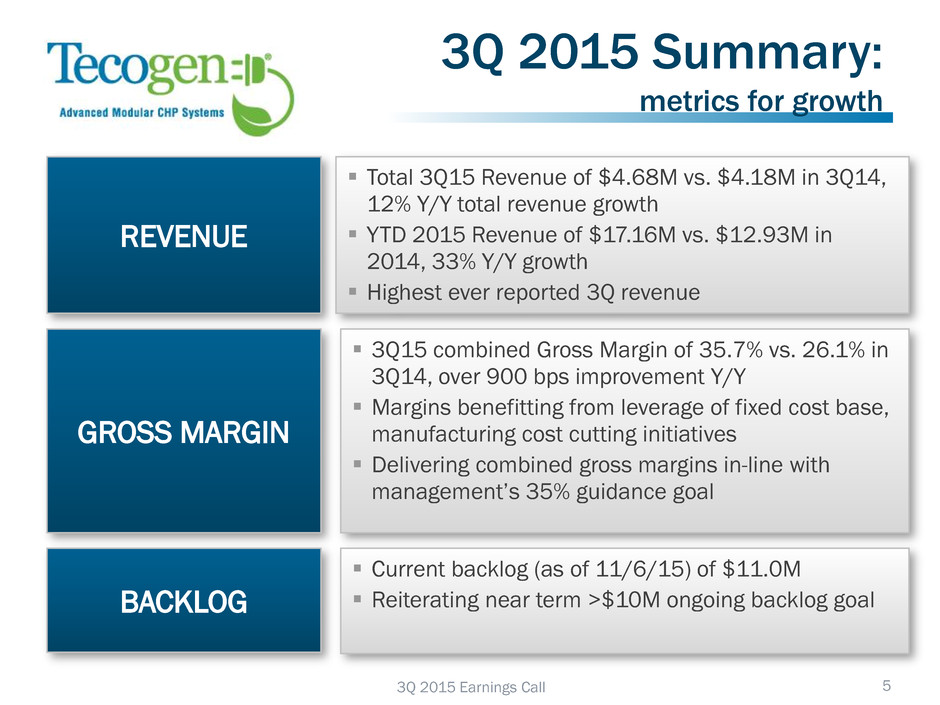

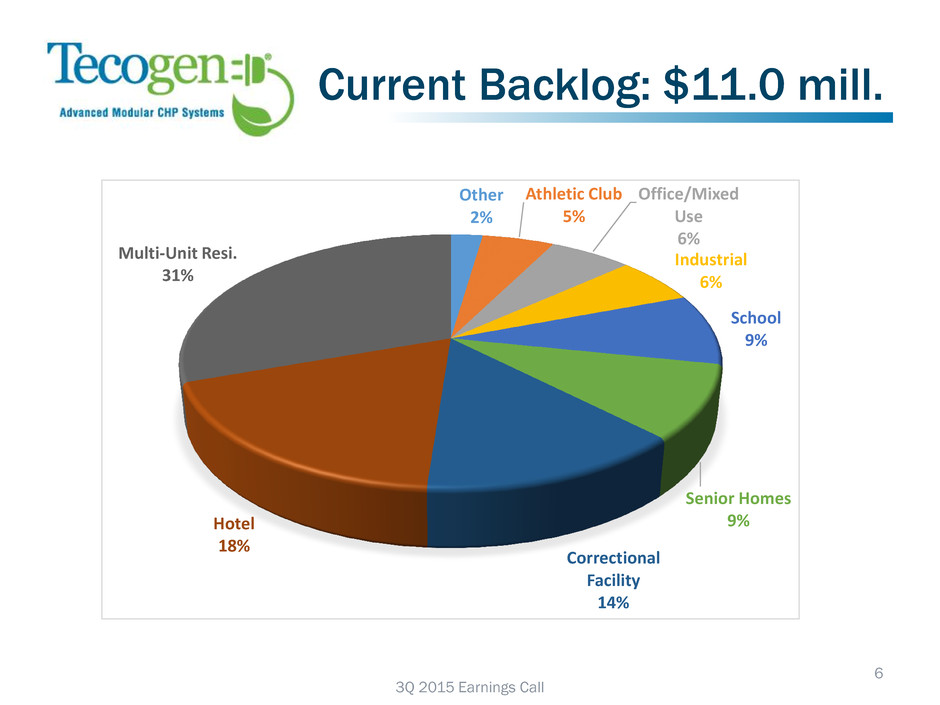

3Q 2015 Summary: metrics for growth REVENUE Total 3Q15 Revenue of $4.68M vs. $4.18M in 3Q14, 12% Y/Y total revenue growth YTD 2015 Revenue of $17.16M vs. $12.93M in 2014, 33% Y/Y growth Highest ever reported 3Q revenue GROSS MARGIN 3Q15 combined Gross Margin of 35.7% vs. 26.1% in 3Q14, over 900 bps improvement Y/Y Margins benefitting from leverage of fixed cost base, manufacturing cost cutting initiatives Delivering combined gross margins in-line with management’s 35% guidance goal BACKLOG Current backlog (as of 11/6/15) of $11.0M Reiterating near term >$10M ongoing backlog goal 5 3Q 2015 Earnings Call

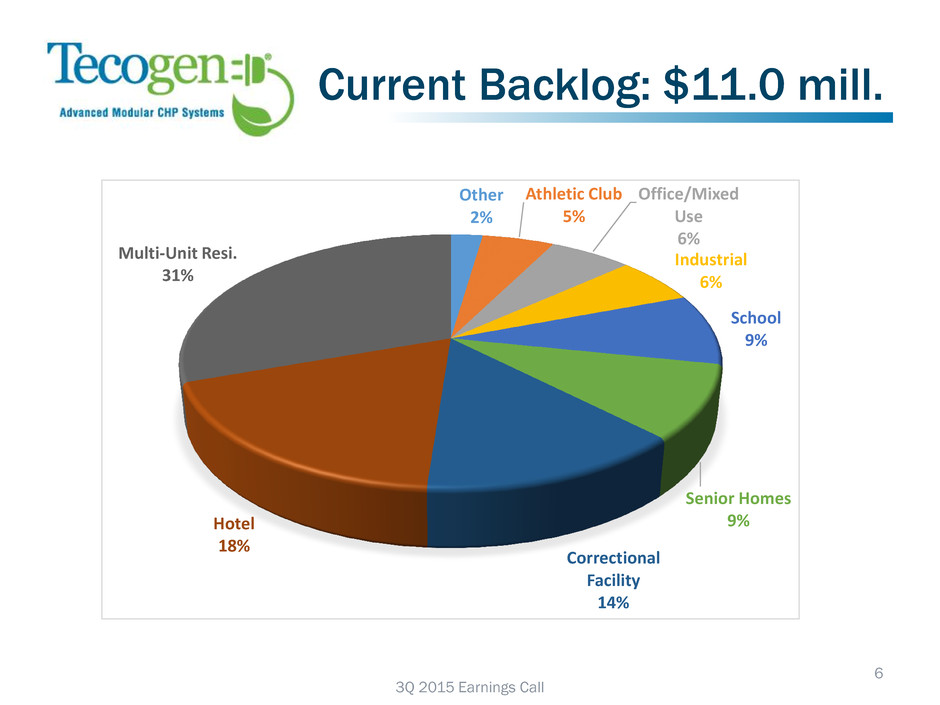

Current Backlog: $11.0 mill. 6 3Q 2015 Earnings Call Other 2% Athletic Club 5% Office/Mixed Use 6% Industrial 6% School 9% Senior Homes 9% Correctional Facility 14% Hotel 18% Multi-Unit Resi. 31%

Executing on Growth Strategy ILIOS UPDATE First sales to new Atlanta market Added sales reps in Atlanta and Chicago Successfully commissioned the largest (7 unit) Ilios installation to-date Ultera™ EMISSIONS Rebranding of emissions technology to strengthen the system as a stand-alone product and better differentiate Tecogen’s valuable intellectual property SALES TEAM New England sales agent added Tecogen direct sales force added 2 new members Remains a priority for growth DREXEL HAMILTON MICRO CAP INVESTOR FORUM John Hatsopoulos, co-CEO, presenting to investors in New York City on Thursday November 12th at 10:00 am EST. Updated investor presentation will be posted at www.investors.tecogen.com INVESTOR RELATIONS Addition of in-house investor relations department completed as discussed on the 2Q15 conference call 7 3Q 2015 Earnings Call

Ultera™ Emissions • BioFuel Application Success– – Retrofit kit installed on 50L Caterpillar engine – Initial results show successful emissions reduction at Southern California wastewater treatment plant – BioFuel engines must comply with stricter emissions regulations in So. Cal. beginning in 2017 – Discussions initiated with other industry representatives for similar orders – American BioGas Council estimates there are over 1800 operational biogas fueled engines nationwide • Standby Generator Retrofits – – Southern California Phase 2 order received, initial units expected to be operational in 1Q16 – Following 30 days of operation and emission results verification, air permit expected to be issued making Tecogen Ultera retrofitted engine the first engine to comply with the new emissions standards without heat recovery benefit • Other Natural Gas Applications – – Industry group proposal submitted – Formal evaluation of application of Ultera technology proposal to the natural gas small mobile engine category scheduled for 1Q16 • Emissions Advisory Group – – Examining current regulatory climate for gasoline vehicles – Held multiple meetings that included committee members and industry experts – Determination that the chemistry is similar for natural gas and gasoline – Will continue to update the investment community as the group makes progress 3Q 2015 Earnings Call 8

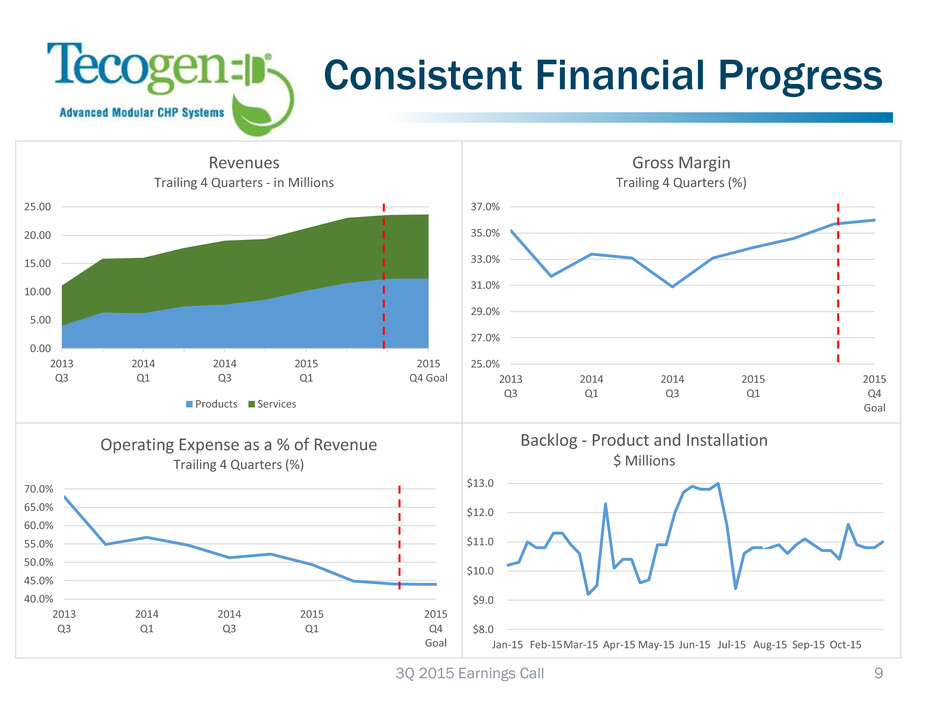

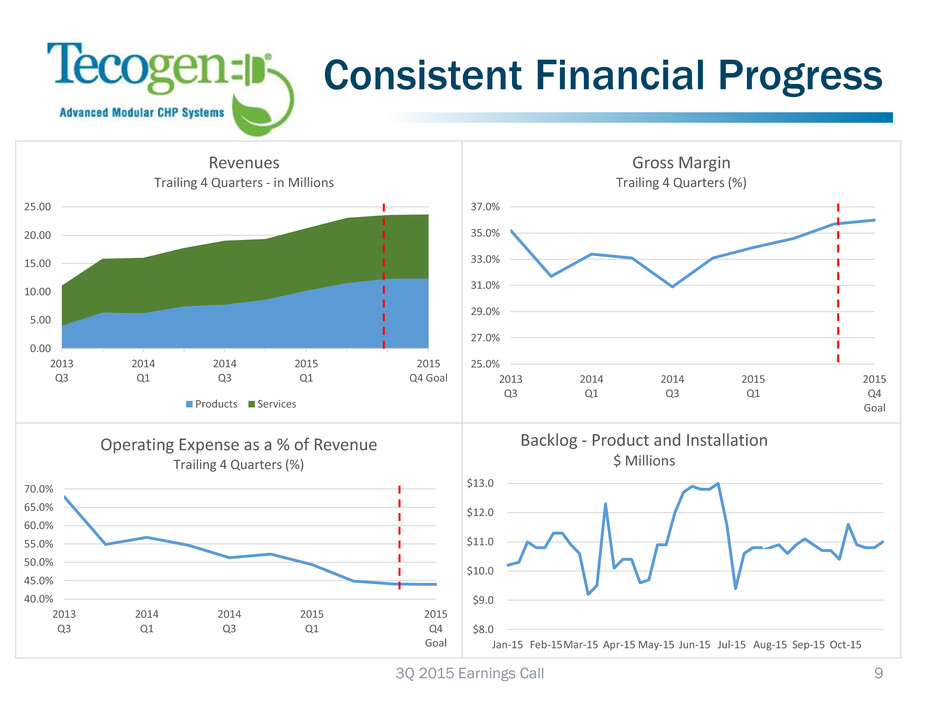

Consistent Financial Progress 9 3Q 2015 Earnings Call 0.00 5.00 10.00 15.00 20.00 25.00 2013 Q3 2014 Q1 2014 Q3 2015 Q1 2015 Q4 Goal Revenues Trailing 4 Quarters - in Millions Products Services 25.0% 27.0% 29.0% 31.0% 33.0% 35.0% 37.0% 2013 Q3 2014 Q1 2014 Q3 2015 Q1 2015 Q4 Goal Gross Margin Trailing 4 Quarters (%) 40.0% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% 2013 Q3 2014 Q1 2014 Q3 2015 Q1 2015 Q4 Goal Operating Expense as a % of Revenue Trailing 4 Quarters (%) $8.0 $9.0 $10.0 $11.0 $12.0 $13.0 Jan-15 Feb-15Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Backlog - Product and Installation $ Millions

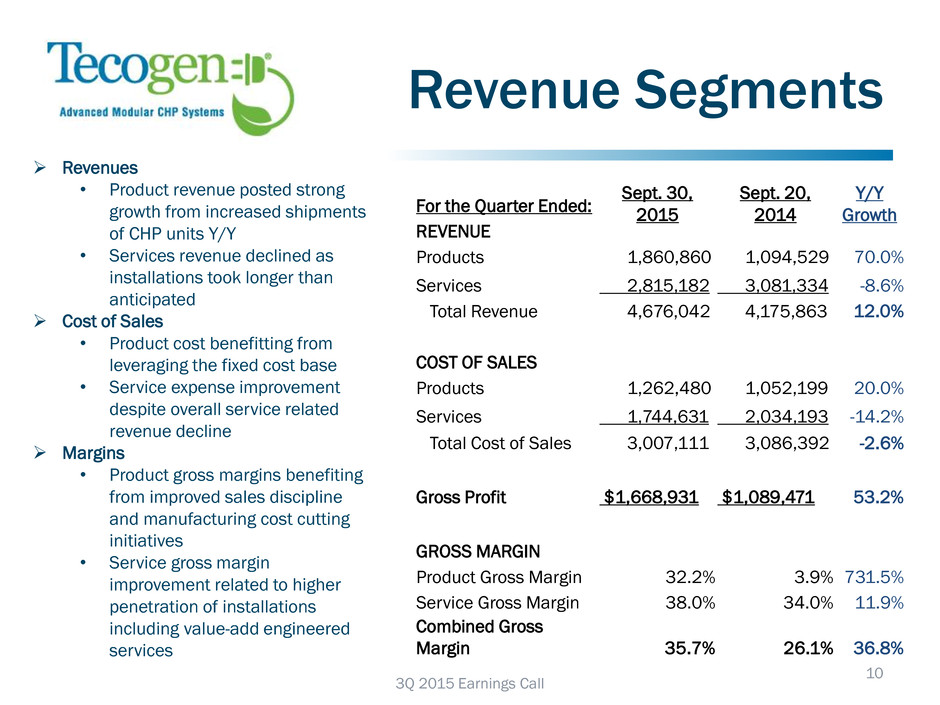

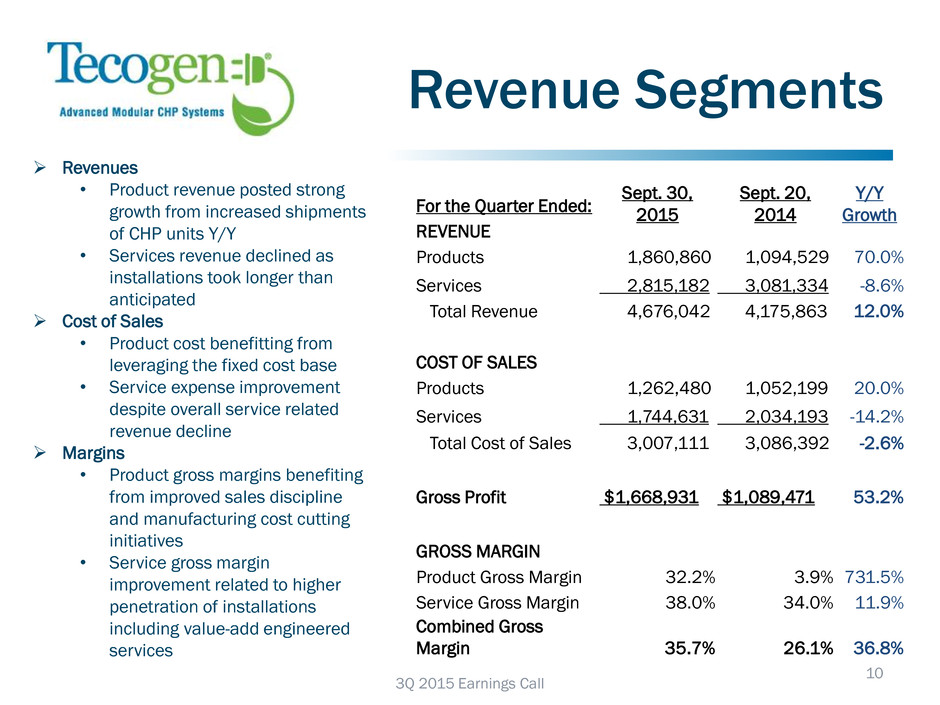

Revenue Segments 10 3Q 2015 Earnings Call Revenues • Product revenue posted strong growth from increased shipments of CHP units Y/Y • Services revenue declined as installations took longer than anticipated Cost of Sales • Product cost benefitting from leveraging the fixed cost base • Service expense improvement despite overall service related revenue decline Margins • Product gross margins benefiting from improved sales discipline and manufacturing cost cutting initiatives • Service gross margin improvement related to higher penetration of installations including value-add engineered services Sept. 30, 2015 Sept. 20, 2014 Y/Y Growth For the Quarter Ended: REVENUE Products 1,860,860 1,094,529 70.0% Services 2,815,182 3,081,334 -8.6% Total Revenue 4,676,042 4,175,863 12.0% COST OF SALES Products 1,262,480 1,052,199 20.0% Services 1,744,631 2,034,193 -14.2% Total Cost of Sales 3,007,111 3,086,392 -2.6% Gross Profit $1,668,931 $1,089,471 53.2% GROSS MARGIN Product Gross Margin 32.2% 3.9% 731.5% Service Gross Margin 38.0% 34.0% 11.9% Combined Gross Margin 35.7% 26.1% 36.8%

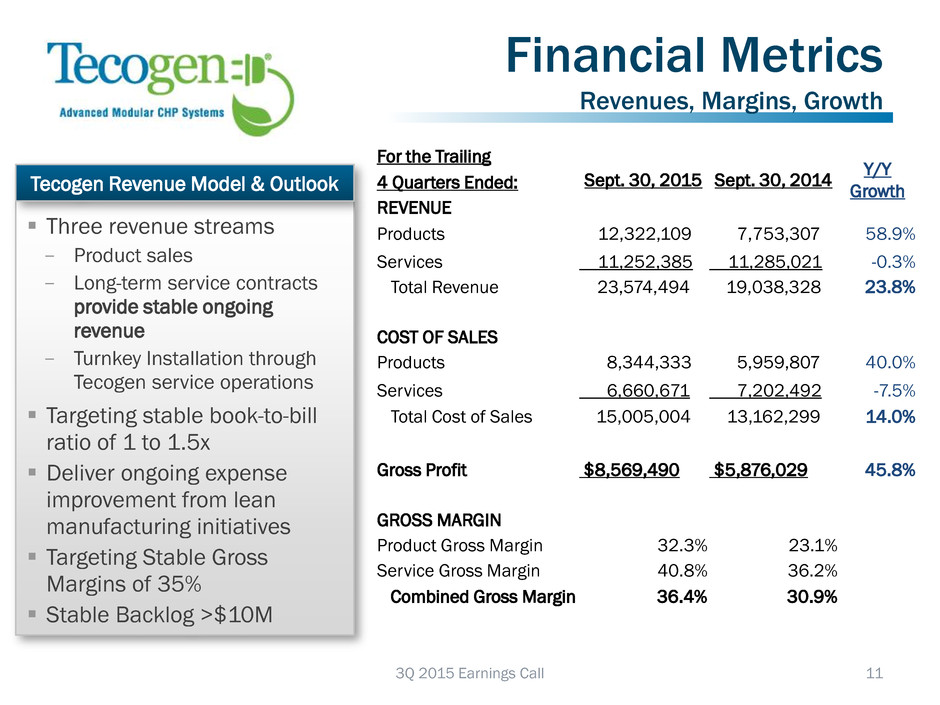

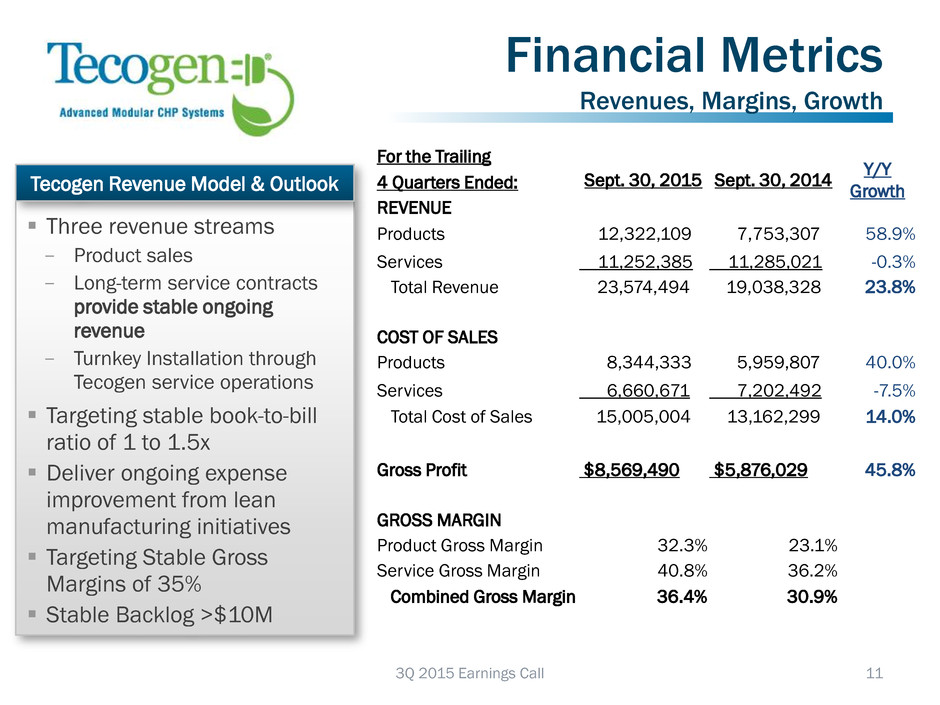

Financial Metrics Revenues, Margins, Growth Three revenue streams − Product sales − Long-term service contracts provide stable ongoing revenue − Turnkey Installation through Tecogen service operations Targeting stable book-to-bill ratio of 1 to 1.5x Deliver ongoing expense improvement from lean manufacturing initiatives Targeting Stable Gross Margins of 35% Stable Backlog >$10M Tecogen Revenue Model & Outlook 11 3Q 2015 Earnings Call For the Trailing Sept. 30, 2015 Sept. 30, 2014 Y/Y Growth 4 Quarters Ended: REVENUE Products 12,322,109 7,753,307 58.9% Services 11,252,385 11,285,021 -0.3% Total Revenue 23,574,494 19,038,328 23.8% COST OF SALES Products 8,344,333 5,959,807 40.0% Services 6,660,671 7,202,492 -7.5% Total Cost of Sales 15,005,004 13,162,299 14.0% Gross Profit $8,569,490 $5,876,029 45.8% GROSS MARGIN Product Gross Margin 32.3% 23.1% Service Gross Margin 40.8% 36.2% Combined Gross Margin 36.4% 30.9%

Trends Going Forward 3Q 2015 Earnings Call 12 Demand for CHP Systems Remain Strong o Fundamental economics persist (high electricity prices, low cost natural gas, grid resiliency concerns) o Sales team expansion will grow markets, geographies o Ilios continues to grow Ultera Emissions Technology Advancing o Progress on retrofit projects o Advisory group developing plan for gas vehicles Continue Growing Patents and Intellectual Property Base o New patents filed o Expand to overseas patents In summary: Tecogen in Prime Position for Continued Growth

Q & A NASDAQ: TGEN 13 3Q 2015 Earnings Call

Appendix • Management Bios • Contacts 14 3Q 2015 Earnings Call

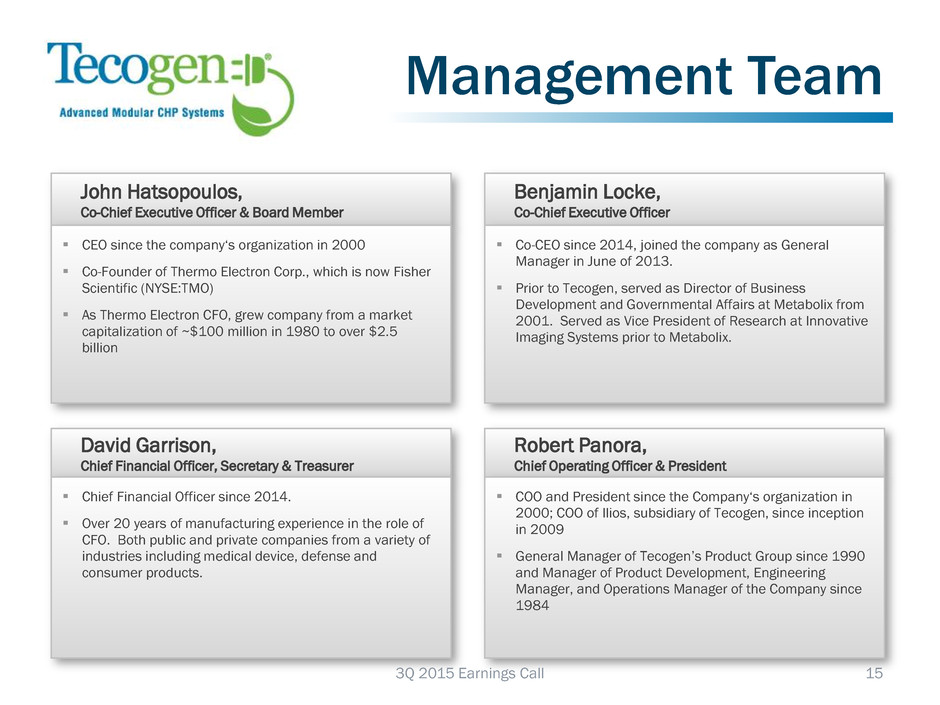

Management Team 15 John Hatsopoulos, Co-Chief Executive Officer & Board Member CEO since the company‘s organization in 2000 Co-Founder of Thermo Electron Corp., which is now Fisher Scientific (NYSE:TMO) As Thermo Electron CFO, grew company from a market capitalization of ~$100 million in 1980 to over $2.5 billion Benjamin Locke, Co-Chief Executive Officer Co-CEO since 2014, joined the company as General Manager in June of 2013. Prior to Tecogen, served as Director of Business Development and Governmental Affairs at Metabolix from 2001. Served as Vice President of Research at Innovative Imaging Systems prior to Metabolix. Robert Panora, Chief Operating Officer & President COO and President since the Company‘s organization in 2000; COO of Ilios, subsidiary of Tecogen, since inception in 2009 General Manager of Tecogen’s Product Group since 1990 and Manager of Product Development, Engineering Manager, and Operations Manager of the Company since 1984 David Garrison, Chief Financial Officer, Secretary & Treasurer Chief Financial Officer since 2014. Over 20 years of manufacturing experience in the role of CFO. Both public and private companies from a variety of industries including medical device, defense and consumer products. 3Q 2015 Earnings Call

Contact Information 16 Company Information Tecogen Inc. 45 First Avenue Waltham, MA 02451 www.tecogen.com Contact John Hatsopoulos, Co-CEO 781.622.1122 John.Hatsopoulos@tecogen.com Ariel Babcock CFA, Director of Investor Relations 781.466.6413 Ariel.Babcock@tecogen.com 3Q 2015 Earnings Call